| | |

OMB APPROVAL |

OMB Number: | | 3235-0570 |

Expires: | | August 31, 2010 |

Estimated average burden |

hours per response: | | 18.9 |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

Investment Company Act file number: 811-05371

Russell Investment Funds

|

| (Exact name of registrant as specified in charter) |

909 A Street, Tacoma Washington 98402

(Address of principal executive offices) (Zip code)

Gregory J. Lyons, Assistant Secretary

Russell Investment Funds

909 A Street

Tacoma, Washington 98402

253-439-2406

|

| (Name and address of agent for service) |

Registrant’s telephone number, including area code: 253-572-9500

Date of fiscal year end: December 31

Date of reporting period: January 1, 2008 to December 31, 2008

| Item 1. | Reports to Stockholders |

2008 ANNUAL REPORT

Russell Investment Funds

LifePoints® Funds Variable Target Portfolio Series

DECEMBER 31, 2008

FUND

Moderate Strategy Fund

Balanced Strategy Fund

Growth Strategy Fund

Equity Growth Strategy Fund

Russell Investment Funds

Russell Investment Funds is a series investment company with nine different investment portfolios referred to as Funds. These financial statements report on four of these Funds.

Russell Investment Funds

LifePoints® Funds

Variable Target Portfolio Series

Annual Report

December 31, 2008

Table of Contents

Russell Investment Funds - LifePoints® Funds Variable Target Portfolio Series

Copyright© Russell Investments 2009. All rights reserved.

Russell Investments is a Washington, USA corporation, which operates through subsidiaries worldwide and is a subsidiary of The Northwestern Mutual Life Insurance Company.

Fund objectives, risks, charges and expenses should be carefully considered before investing. A prospectus containing this and other important information must precede or accompany this material. Please read the prospectus carefully before investing.

Securities products and services offered through Russell Financial Services, Inc. (effective June 2, 2008, the name changed from Russell Fund Distributors, Inc.), member FINRA, part of Russell Investments.

Indices and benchmarks are unmanaged and cannot be invested in directly. Returns represent past performance, are not a guarantee of future performance, and are not indicative of any specific investment. Index return information is provided by vendors and although deemed reliable, is not guaranteed by Russell Investments or its affiliates.

Russell Investments is the owner of the trademarks, service marks, and copyrights related to its respective indexes.

Performance quoted represents past performance and does not guarantee future results. The investment return and principal value of an investment will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted.

To Our Shareholders

We are pleased to provide you with the Russell Investment Funds 2008 Annual Report. It includes portfolio management discussions and fund-specific details that will give you an in-depth understanding of fund performance for the fiscal year ended December 31, 2008.

It would be an understatement to say that 2008 has been a difficult year and the market crisis of the past couple of months has defied all predictions. Virtually no sector of the financial industry or the economy has been spared.

All of us at Russell want you to know that we are sensitive to investor concerns. While market events have impacted the performance of the funds, we believe that investors are well-served by remaining focused on long-term disciplined investing in well-diversified, asset allocated portfolios.

The Russell Investments team has years of experience in managing people’s money through various market cycles, trends and turnarounds. As always, we are monitoring our investment managers closely to ensure their adherence to their long-term strategies despite the recent disruptions.

As we all collectively weather this storm, we believe now is the perfect time for you to talk with your financial advisor to ensure that your portfolio remains aligned with your long term goals.

Each and every day we strive to improve financial security for people. We will not waiver in that commitment and sincerely appreciate your continued support.

Best regards,

Greg Stark

Chief Executive Officer, Chairman and President

Russell Investment Management Company

Russell Investment Funds

Market Summary as of December 31, 2008 (Unaudited)

U.S. Equity Markets

For the fiscal year ending December 31, 2008, U.S. equity markets were remarkably weak, with the broad market Russell 3000® Index posting a 37.3% drop amid the worst financial crisis in almost a century. Major bankruptcies, the freezing of credit markets, and the widespread global recession fears which ensued — particularly during the third quarter and first half of the fourth quarter — drove investors to sell riskier assets as fear and panic pervaded the market.

The economic crisis stemmed from issues in the financial sector. The U.S. housing market stood at the center of the financial sector’s problems. The housing slowdown that began in the summer of 2006 and continued in 2007 intensified throughout this fiscal year and led to rising loan default rates and home foreclosures which, in turn, led to further housing weakness. As home prices dropped and default rates increased, the value of derivative instruments, such as mortgage-backed securities, whose values were based on these mortgages, plummeted. This forced banks to take massive write-downs of book values as required by mark-to-market accounting. With the lack of certainty about the real book value of assets on the balance sheets of banks, banks have been unable and/or hesitant to lend funds to other banks. Despite aggressive interest rate cuts by the Federal Reserve Board (the “Federal Reserve”), which took the Federal Funds rate from 5.25% (in third quarter 2007) to a range between 0% and 0.25% (at fiscal year end), mortgage and other lending rates did not come down as quickly as banks used the wider lending spread to offset their substantial write-downs on book values. Over the last month and a half of the year, however, these rates did start to drop sharply. In addition to higher interest rates, banks having stricter lending standards had a profound impact on the availability of affordable credit for potential homebuyers, small businesses, and other borrowers.

Due to write-downs, dwindling capital bases and a crisis of confidence in their businesses, several large banks, brokers, mortgage companies and insurance companies filed for bankruptcy, were seized by the federal government and resold, or were bailed out by the government during the fiscal year, with the most notable ones being Countrywide Financial, Bear Stearns, IndyMac Bancorp, Lehman Brothers, Federal National Mortgage Association (Fannie Mae), Federal Home Loan Mortgage Corporation (Freddie Mac), American International Group (AIG), Washington Mutual and Wachovia. Amid concerns of additional bankruptcies and uncertainty surrounding which institutions may be bailed out by the government, the fear-driven environment has persisted. In addition, there have been a number of problems at hedge funds, leading to massive deleveraging, or forced selling of assets, in order to meet client redemptions. This forced selling of assets has put severe downward pressure on many securities, particularly the highly-liquid larger cap U.S. stocks, regardless of those securities’ fundamentals.

After more than four years of strong growth, corporate profits had dipped fairly sharply by the end of 2008, especially in the financial services sector. The growth rate of gross domestic product also fell, although it stayed marginally positive until the third quarter report which showed a contraction of 0.5%, the worst since the 2001 recession. There was significant deterioration since then, as fourth quarter GDP estimates are -4.2% on average. A significant reduction in consumer spending had the most substantial negative impact on the GDP number, as consumers became fearful due to rising unemployment levels, declining home values and increased difficulty in getting loans. The Consumer Confidence Index released by the Conference Board decreased to 38 in October — the lowest value in the history of the Index (started in February 1967). It increased slightly in November, before dropping back to the all-time low of 38 in December. The first half of the year also featured the negative impact of higher energy prices on consumer spending. Oil prices reached $147/barrel in mid-July before dropping sharply to below $40/barrel in December.

Although the domestic economy slowed during the fiscal year, some segments of the U.S. equity market were helped in the first half of the year by strong exports to faster-growing, developing, non-U.S. economies. With approximately 40% of U.S. corporations’ revenues derived from international customers, the declining U.S. dollar in the first half of 2008 provided increased demand for U.S. products abroad. During the second half of the year, however, the U.S. dollar rallied and the global economy slowed considerably. After being rewarded in the first half of 2008, exposure to companies tied to the global economy underwent a strong reversal that began in July 2008 and has been swift and dramatic. Higher valuation cyclical (more linked to the economic cycle) companies and those with more debt on their balance sheets were among the most negatively impacted over the course of the year. Companies that have high forecasted growth rates have also been hit hard as investors have become less confident that these growth rates can be sustained going forward.

Russell Investment Funds

In the wake of these powerful macroeconomic forces, the fiscal year presented a very difficult active management environment which was marked by three distinct themes: 1) largely indiscriminate selling of U.S. stocks by panic-driven, risk-averse investors concerned first about a U.S. recession and then about a global recession, 2) intense selling of financial stocks for a majority of the period, and 3) the strength of global companies for roughly the first half of the fiscal year as multinational companies with exposure to developing markets outpaced domestically-driven companies and commodity-related companies (especially energy) outperformed the general market by a wide margin.

The weakening of the global economy over the last half of the year caused oil prices to fall from their record highs and led the other energy sector to sell off sharply. Over the course of the year, the worst performing sectors in the Russell 3000® Index were other energy -53.6%, financial services -51.1%, the other sector (which is dominated by GE and contains other large conglomerates, (-50.9%), and materials & processing -47.3%. Meanwhile, the best performing sectors in the Russell 3000® Index were those that are considered to be more defensive. The slower-growing, less economically-sensitive consumer staples sector was the best relative performer -17.7%, followed by integrated oils -21.7%, health care -22.4%, and utilities -29%.

Weakness was experienced across investment styles as well as the capitalization spectrum. While both the growth and value investment styles were down substantially, value outperformed growth in the small cap segment (Russell 2000® Value -28.9%, Russell 2000® Growth -38.5%) and to a lesser degree in the large cap segment (Russell 1000® Value -36.9%, Russell 1000® Growth -38.4%). In general, small cap stocks outperformed large caps (-33.8% and -37.6% for the Russell 2000® Index and Russell 1000® Index, respectively). Midcap and microcap stocks underperformed by the widest margins with the Russell Midcap® Index down 41.5%, and the Russell Microcap® Index down 39.8%.

During 2008, the market environment was largely hostile for active management as investors sold stocks regardless of fundamentals, the basic determinants of a stock’s value. Small cap fund managers had the most difficult time relative to their benchmark. Growth managers across the capitalization spectrum also struggled as the shift away from higher growth stocks came quickly and sharply. Core, or market-oriented, managers struggled less than style-focused managers in fiscal year 2008. The Lipper® Small Cap Core Funds Average trailed the Russell 2000® Index by 2.7%, the Lipper® Small Cap Growth Funds Average underperformed the Russell 2000® Growth Index by 3.6% and the Lipper® Small Cap Value Funds Average underperformed the Russell 2000® Value Index by 4.9%. The Lipper® Large Cap Core Funds Average outperformed the Russell 1000® Index by 0.1%, the Lipper® Large Cap Growth Funds Average underperformed the Russell 1000® Growth Index by 1.8% and the Lipper® Large Cap Value Funds Average underperformed the Russell 1000® Value Index by 0.6%.

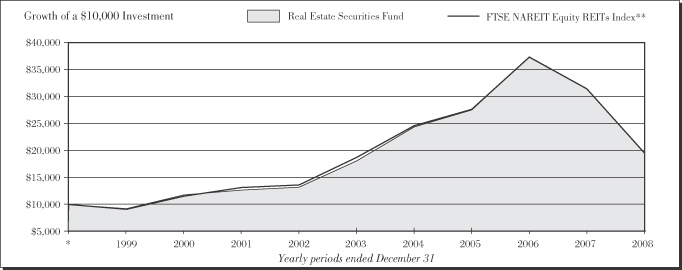

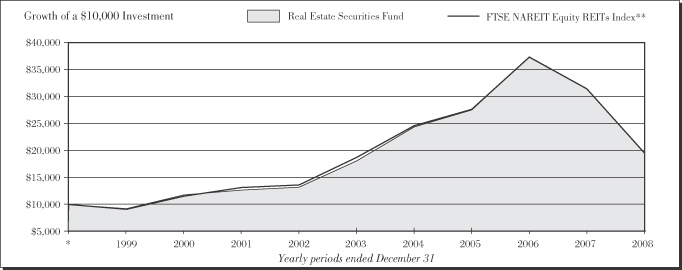

Real Estate Securities Market

For the fiscal year ending December 31, 2008, U.S. real estate investment trusts (REITs) generated a 37.7% loss, as measured by the FTSE NAREIT Equity Index (Index). During this period, REITs performed slightly better than the broader equity market, which finished down 37.3% as measured by the Russell 3000 Index. The negative REIT performance was accompanied by an unprecedented amount of volatility during the period. Not only were monthly returns erratic, demonstrated by the worst and best monthly returns in the history of the Index occurring in October -31.7% and December 16.4%, respectively, but the largest percentage gain and loss achieved in a single day also both occurred during the year.

Following the sharp decline in the commercial mortgage-backed securities market and escalating problems in the credit market, investors began 2008 more risk averse. As recessionary fears began to emerge, the Federal Reserve became active in an attempt to stave off concerns of a recession by cutting rates aggressively, twice in January alone, and injecting liquidity into the financial markets through a variety of initiatives. First and second quarter REIT earnings held up well, although many companies took the opportunity to revise 2009 estimates downwards.

By September 2008, consumer spending had slowed, the unemployment rate was climbing and both corporate and consumer credit markets remained tight. The collapse of Lehman Brothers Holdings Inc. on September 15 sparked panic within the financial markets and REITs were heavily sold off over the ensuing weeks. Mirroring the broader equity market, REITs traded down sharply through October and most of November. A marked change in investor sentiment occurred in December as investors became less defensive and REITs staged a modest recovery as the year closed.

An overriding theme during the year was the elevated correlation between REITs and the financial services sector of the broader equity market. This is due to the fact that most broad equity indexes include REITs in the financial services sector. This weighed heavily on REIT performance during the period, as many general equity investors avoided financial services stocks and other investors took short positions in individual stocks and exchange traded funds in the financial

Russell Investment Funds

services sector. This was also a contributing factor to the exceptionally high volatility observed in the REIT market during the fiscal year.

Another key trend during the year was a flight towards quality REIT names, with the market especially rewarding companies that have made a concerted effort to mitigate risk. Companies with the lowest leverage levels, limited near term refinancing needs and limited development pipelines held up the best. Neither dividend yield nor market capitalization appeared to be contributing factors to differences in individual company performance.

During the year, returns were disappointing across all property sectors. The poorest performing sectors were industrial and regional malls. Leverage ratios for the industrial and regional malls companies tend to be higher than the overall REIT universe, which has negatively impacted those stocks. In addition, meaningful development pipelines in the leading industrial companies have put added pressure on earnings forecasts due to weaker leasing market conditions. Two of the better performing property sectors were self storage and health care. Due to the stable nature of the cash flows embedded in many health care leases, investors sought out this defensive sector given the slowing economy. The self storage sector is generally driven by the performance of one company that dominates the sector, Public Storage, which was one of the few stocks to post a positive return for the year. Public Storage held up well due to its strong balance sheet, including minimal leverage and high levels of cash.

The U.S. REIT market outperformed relative to the international real estate securities market by a wide margin during the fiscal year. The largest price correction occurred in the Asia Pacific region, with smaller corrections taking place in Continental Europe and the United Kingdom. While the effects of the global economic slowdown and credit crisis have spread to the other regions, the U.S. REIT market has fared relatively better, mirroring trends in the broader global equity markets.

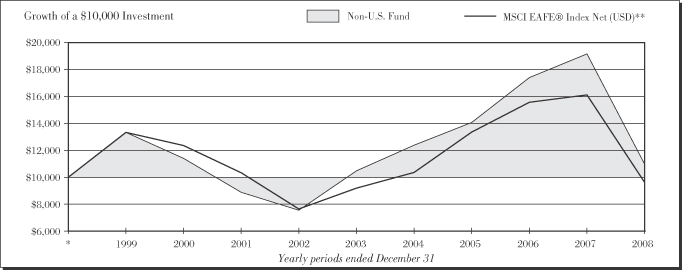

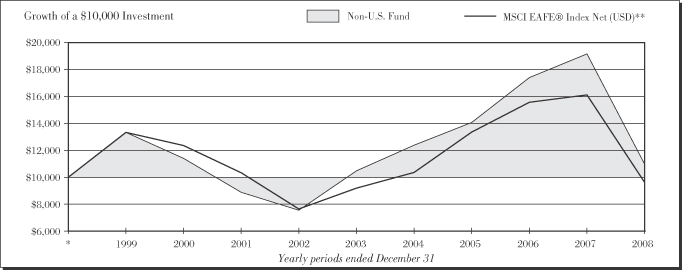

Non-U.S. Developed Equity Markets

Non-U.S. developed stocks fell 43.38% as measured by the MSCI EAFE® Index for the fiscal year ended December 31, 2008. Appreciation of the U.S. dollar relative to foreign currencies, mainly as a result of the flight to safety in the second half of the fiscal year ended, exacerbated already weak non-U.S. equity returns. In local currencies, the MSCI EAFE® Index fell 40.27% over the 12-month period.

The market struggled under increasing concern over the health of the global financial system. While these concerns affected markets for nearly the full 12 months, most of the decline in equity values came in September and October 2008, as several prominent financial companies in the U.S. and Europe encountered financial distress. In nearly all cases, government “bailouts” were necessary for these companies to avoid bankruptcy.

The additional impact of already declining global economic growth increasingly weighed on markets during the period. Expectations for global economic growth were revised downwards throughout the year. The latter part of the fiscal year experienced contraction in economic output in Europe and Asia. Output growth of 5% in 2007 slowed sharply for 2008 with abbreviated expectations for growth in developed economies in 2009.

The change in market conditions was evident in a marked increase in market volatility as investors’ complacency towards risk was quickly replaced by acute risk aversion. Stocks with prices most directly tied to high, long-term growth prospects suffered some of the steepest declines, as investors doubted the ability of these companies to post strong growth in a decelerating economic environment. However, due to the sharp declines of financials, the largest sector of the value index, value lagged growth by 1.39% in the period (the MCSI EAFE Growth Index lost 42.70% and the MSCI EAFE Value Index lost 44.09%).

Market sectors most leveraged to global economic growth or in the nexus of the financial sector meltdown were the most severely impacted, though no areas of the market were immune. Financials ended the 12-month period down 55.21% (as measured by the MSCI EAFE Index financials sector grouping). The strong gains of materials early in the period were quickly reversed. The sector ended the period down nearly 53.02% as measured by the MSCI EAFE materials sector grouping. Energy stocks also fell sharply as the price of a barrel of oil fell from a high of more than $145 to below $36. However, the sector’s one-year stock price decline of 38.18% (as measured by the MSCI EAFE energy sector) was better than all but the traditionally defensive sectors. Among the defensive sectors of the market, health care, led by pharmaceutical stocks, held up best with a decline of 18.95% as measured by the MSCI EAFE health care sector. Utilities and consumer staples, down 28.16% and 31.33% as measured by the MSCI EAFE utilities and MSCI EAFE consumer staples sector groupings, respectively, were the next best performers. Sector groupings are based on the Global Industry Classification Standard definitions.

Russell Investment Funds

Regional results were generally tied to sensitivity to global economic conditions. The MSCI Pacific ex-Japan® Index declined the most, down 50.50%. MSCI Europe ex-United Kingdom® Index fell 45.54%, while the MSCI United Kingdom® Index fell 48.34%. In all three regions, currency impact had a pronounced impact on returns with the regions down 42.17%, 43.24%, and 28.48%, respectively, in local currencies. MSCI Japan® Index fell 42.56% in yen, but had one of the few currencies that managed to appreciate versus the U.S. dollar and fell only 29.21% in U.S. Dollars.

Emerging Markets

During 2008, the MSCI Emerging Markets Index (“Index”) declined 53.18%, the biggest calendar year decline in the history of the asset class with large return dispersions across sectors and countries. The turmoil in the world’s financial system meant increasing risk aversion, growing macro risks and heightened levels of volatility and dispersion across countries, sectors and currencies. Emerging Markets in general may be better positioned and more resilient to a downturn than developed economies, however, as the crisis changed from financial to economic, emerging markets faced massive asset de-leveraging and indiscriminate selling as investors adopted a zero tolerance to risk. Price momentum (i.e. stocks exhibiting trending relative price appreciation) benefited from the continued rally of commodity-related sectors through the latter part of 2007 and well into 2008 but this reversed as global equity markets began falling sharply. The faltering global economy and the steep pull-back in commodity prices affected cyclical areas of the market including industrials, materials and energy sectors while defensive sectors such as healthcare, consumer staples and utilities were relative safe havens during the period. From a country perspective, smaller markets in general held up relatively better than the larger markets. In addition to the weak equity returns, most emerging markets currencies depreciated against the U.S. Dollar with some, such as the South African Rand, Korean Won, Turkish Lira and Brazilian Real, losing in excess of 30% over the course of the year as investors fled to quality and more liquid currencies.

In terms of regions, Latin America was the top performer, down 51.28% (as measured by the MSCI EM Latin America Index), supported by the relative outperformance from Mexico and the smaller Latin countries. The Asia region (-52.77% as measured by the MSCI EM Asia Index) finished behind Latin America but ahead of the broader market. The Europe, Middle East and Africa region (-55.60% as measured by the MSCI EM Europe, Middle East and Africa Index) underperformed the broader market due in large part to the significant underperformance from Russia. The BRIC (Brazil, Russia, India and China) economies, with the exception of China, underperformed the broader Index. China held up reasonably well over the period due to favorable monetary and fiscal policies during the latter half of the year in an effort to shore up its slowing economy. Other notable relative underperformers included Pakistan (-74.05% as measured by the MSCI Pakistan Index) and Turkey (-62.10% as measured by the MSCI Turkey Index).

U.S. Fixed Income Markets

The Barclays Capital U.S. Aggregate Bond Index, a broad measure of U.S. investment grade fixed income securities, returned 5.24% for the year ended December 31, 2008. Similar to the prior year, the index and its major sectors trailed equivalent-duration U.S. Treasuries, as the subprime mortgage crisis that started in the summer of 2007 deepened and developed into a severe liquidity crisis, the size and scope of which had not been seen since the U.S. Great Depression of the 1930s. During 2008, investors moved their capital away from riskier investments to the safest possible investments (i.e., U.S. Treasuries), continuing the “flight to quality” trend started in the prior period.

Throughout 2008, in an effort to deal with credit market illiquidity and a slowing economy, the Federal Reserve lowered the target Federal Funds rate eight times, including two non-scheduled “surprise” cuts of 0.75% in January and 0.50% in October. The target rate started the year at 4.25% and ended at a 0.00% to 0.25% range after the eighth rate cut on December 16, 2008.

The downward shift in the yield curve started in 2007 and continued in earnest in 2008, with the curve “steepening” significantly below the 10-year mark; i.e., yields on shorter-maturity Treasuries declined by a greater degree than longer-maturity Treasuries, resulting in a steeper, upward sloping curve. The change was driven by the Federal Reserve’s lowering of rates (affecting the short end) and investors’ increasing demand for safe haven U.S. Treasuries (driving down longer-maturity yields). In 2008, yields on 2-year Treasuries declined by 2.28% to 0.76% while 10-year Treasuries declined by 1.81% to 2.21%.

The subprime mortgage crisis and deflating housing market were still major issues throughout the year. Home price depreciation continued to accelerate. By the end of October, the average U.S. national home price as tracked by the S&P/Case-Shiller Composite 20 Index, had declined 18% from the end of 2007, reaching a level that was down 23% from its July 2006 peak. Subprime mortgage foreclosures increased from 8.65% at the end of December 2007 to 12.55% at the end of September 2008, the most recent available data from the Mortgage Bankers Association. Total foreclosures increased from 2.04% to 2.97% during the same period. Writedowns on the values of mortgages had a large negative

Russell Investment Funds

impact on bank balance sheets. During the year, writedowns at financial institutions world-wide amounted to approximately $930.3 billion, bringing total writedowns since the start of the subprime crisis to approximately $997.4 billion.

During the early months of 2008 the market continued its downward trend, which was capped in mid-March by Bear Stearns receiving emergency funding from the Federal Reserve and JPMorgan Chase as a three-day run on the bank depleted its cash reserves. Two days later JPMorgan Chase acquired Bear Stearns for seven percent of its market value in a sale brokered by the Federal Reserve and the U.S. Department of the Treasury (U.S. Treasury). Investors took this as a sign that the U.S. government would stand behind financial institutions and credit markets rallied for the next few months.

During the first part of the year, the U.S. government had become increasingly concerned that the credit crisis would significantly slow the U.S. economy — particularly the spending of consumers, who account for approximately two-thirds of GDP. In April, the U.S. Internal Revenue Service started distributing tax rebates as part of a $168 billion economic stimulus plan.

However, markets continued to weaken as illiquidity reached extreme levels and the financial crisis became global in scope. In July, IndyMac Bancorp, the then-second-biggest independent U.S. mortgage lender, was seized by federal regulators after a run by depositors depleted its cash. In August, Commerzbank AG agreed to buy Allianz SE’s Dresdner Bank for 9.8 billion euros in Germany’s biggest banking takeover in three years.

September started with the U.S. government seizing control of Fannie Mae and Freddie Mac, the largest U.S. mortgage-finance companies. In the middle of the month, the U.S. government did not arrange a deal or otherwise bail out Lehman Brothers, and the 158-year old firm filed the largest bankruptcy in U.S. history. This was followed by the bankruptcy of 119-year old Washington Mutual. AIG accepted an $85 billion loan from the Federal Reserve to avert what would have been the worst financial collapse in history, with the U.S. government taking a substantial ownership stake in AIG.

In the same month, the investment banking business model fundamentally changed, with Goldman Sachs and Morgan Stanley receiving approval to become deposit-taking commercial banks regulated by the Federal Reserve, as tight credit markets forced Wall Street’s two remaining independent investment banks to widen their sources of funding. Similar events occurred in Europe and throughout the world, with large financial institutions either merging or with governments providing support in return for equity stakes.

September finally ended with the U.S. Treasury proposing the Financial Market Rescue Bill, including the Troubled Asset Relief Program (TARP), which authorized the U.S. Treasury to spend up to $700 billion to buy mortgages and other distressed assets. The House initially rejected the bill, but subsequently passed it. The bill was signed into law in early October.

The events of September contributed to the extreme market illiquidity in October, evidenced by spikes in overnight and three-month LIBOR (the rates at which banks lend to one another). The Federal Reserve took significant steps to improve liquidity in the short duration markets, which included the creation of the Commercial Paper Funding Facility (CPFF) and the Money Market Investor Funding Facility (MMIFF).

In November, the U.S. Treasury gave additional support to AIG by announcing the purchase of $40 billion in new preferred stock. The U.S. Treasury then guaranteed $306 billion in residential and commercial mortgage-backed securities of Citi® in exchange for $7 billion in preferred stock. In addition, the U.S. Treasury purchased another $20 billion in preferred stocks from Citi. Shortly thereafter, the Government Sponsored Enterprise (GSE) Debt and Mortgage-Backed Security Purchase Program was announced stating that the Federal Reserve will buy $100 billion in Fannie Mae, Freddie Mac and the Federal Home Loan Bank debentures and $500 billion in agency mortgage-backed securities. Simultaneously, the Term Asset-Backed Securities Loan Facility (TALF) was announced by the U.S. Treasury offering to provide $200 billion in three-year loans to U.S. companies who can provide high quality AAA-rated auto loans, student loans, credit card loans or small business loans as collateral.

This trend continued in December as Congress agreed to provide $13.4 billion in short term loans to General Motors and $4 billion to Chrysler in an effort to aid the suffering auto industry.

December ended on an up note with a majority of fixed income sectors outperforming equivalent-duration Treasuries. Most notably, the commercial mortgage-backed securities sector (CMBS) returned 16.98% (15.14% above equivalent-duration Treasuries) during the month. The year ended with the Barclays Capital U.S. Aggregate Bond Index returning 5.24%, underperforming by 7.10% U.S. Treasuries.

(This page intentionally left blank)

Russell Investment Funds

Moderate Strategy Fund

Portfolio Management Discussion and Analysis — December 31, 2008 (Unaudited)

| | | | | |

| |

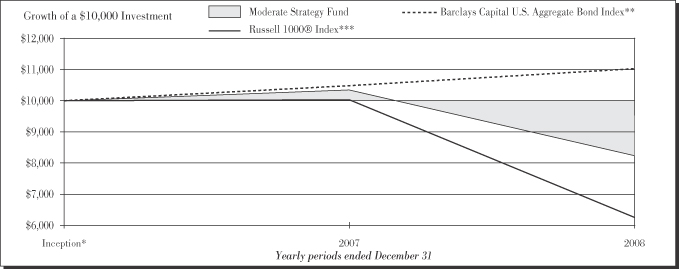

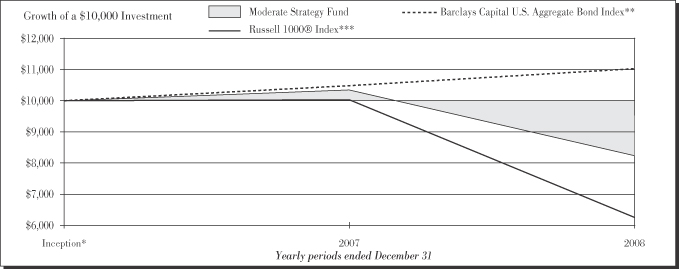

| Moderate Strategy Fund | | | |

| | | Total

Return | |

1 Year | | | | (20.39 | )% |

Inception* | | | | (10.92 | )%§ |

| | | | | |

|

| Barclays Capital U.S. Aggregate Bond Index ** | |

| | | Total

Return | |

1 Year | | | | 5.24 | % |

Inception * | | | | 6.05 | %§ |

| | | | | |

|

| Russell 1000® Index*** | |

| | | Total

Return | |

1 Year | | | | (37.60 | )% |

Inception * | | | | (24.45 | )%§ |

| * | | The Fund commenced operation on April 30, 2007. |

| ** | | On October 31, 2008, Barclays Capital, which acquired the Lehman family of indexes in September 2008, announced that it would be re-branding Lehman indexes under the Barclays Capital name; the underlying index structures are to remain unchanged. As a result, the Lehman Brothers Aggregate Bond Index has been renamed the Barclays Capital U.S. Aggregate Bond Index. |

Barclays Capital U.S. Aggregate Bond Index is composed of securities from Barclays Capital U.S. Government/Corporate Bond Index, Mortgage-Backed Securities Index, and the Asset-Backed Securities Index. Total return comprises price appreciation/depreciation and income as a percentage of the original investment. Indexes are rebalanced monthly by market capitalization.

*** | | Russell 1000® Index includes the 1,000 largest companies in the Russell 3000® Index. The Russell 1000® Index represents the universe of stocks from which most active money managers typically select. The Russell 1000® Index return reflects adjustments from income dividends and capital gain distributions reinvested as of the ex-dividend dates. |

The performance shown in this section does not reflect any Insurance Company Separate Account or Policy Charges. Performance is historical and assumes reinvestment of all dividends and capital gains. Investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than when purchased. Past performance is not indicative of future results.

| | |

| 10 | | Moderate Strategy Fund |

Russell Investment Funds

Moderate Strategy Fund

Portfolio Management Discussion and Analysis — December 31, 2008 (Unaudited)

The Fund is a fund of funds that invests in other Russell Investment Funds and Russell Investment Company mutual funds (the “Underlying Funds”). The Underlying Funds allocate most of their assets among multiple money managers. Russell Investment Management Company (“RIMCo”), as the Underlying Funds' advisor, may change the allocation of the Underlying Funds' assets among money managers at any time. An exemptive order from the Securities and Exchange Commission (SEC) permits RIMCo to engage or terminate a money manager in an Underlying Fund at any time, subject to the approval by the Underlying Fund’s Board without a shareholder vote.

What is the Fund’s investment objective?

The Moderate Strategy Fund (“Fund”) seeks to provide high current income and moderate long term capital appreciation.

How did the Fund perform relative to its benchmark for the fiscal year ended December 31, 2008?

For the fiscal year ended December 31, 2008, the Moderate Strategy Fund lost 20.39%. This compared to the Barclays Capital U.S. Aggregate Bond Index, which gained 5.24% during the same period. The Fund’s performance includes operating expenses, whereas the Index returns are unmanaged and do not include expenses of any kind. The Fund was negatively impacted by its allocation to all equity Underlying Funds and the fixed income Underlying Fund’s overweight to non-Treasury sectors.

For the year ended December 31, 2008, the Moderate Strategy Lipper Composite – lost 20.53%. This result serves as a peer comparison and is expressed net of operating expenses.

Each Underlying Fund has a benchmark reflective of its respective asset class. These benchmarks may be different than the Fund’s benchmark. The Fund’s benchmark represents the largest asset class of the Underlying Funds in which it invests.

How did the market conditions described in the Market Summary report affect the Fund’s performance?

The Fund is a fund of funds and its performance is based on the performance of the Underlying Funds in which it invests. The Fund’s performance was negatively impacted by the financial crisis that affected virtually all asset classes during the fiscal year. The Fund’s benchmark relative performance was negatively impacted by the fixed income Underlying Fund’s overweight to non-treasury sectors.

The largest impact on the Fund’s underperformance relative to its benchmark was from its exposure to large cap U.S. equities and non-U.S. developed market equities. The performance of the equity Underlying Funds (approximately 40% of the Fund) detracted from returns relative to the Fund’s all-fixed income benchmark, the Barclays Capital U.S. Aggregate Bond Index.

The extreme volatility of the financial markets during the fiscal period created a headwind for most active managers. In this challenging environment, all underlying equity asset class funds lagged their respective benchmarks but one; yet, four of

eight Underlying Funds outperformed their peers within their asset classes as measured by their respective Lipper® Averages. The Barclays Capital U.S. Aggregate Bond Index, the benchmark for the RIF Core Bond Underlying Fund, was the only Underlying Fund benchmark with a positive absolute return. The returns of this index benefited from the inclusion of Treasuries. The RIF Core Bond Underlying Fund held a significant underweight to Treasuries relative to the benchmark. In absolute terms, bonds as measured by the Barclays Capital U.S. Aggregate Bond Index performed better than equities.

How did the investment strategies and techniques employed by the Fund and its money managers of the Underlying Funds affect the Fund’s performance?

At the Fund level, all Underlying Funds contributed negatively to the Fund’s returns relative to the Barclays Capital U.S. Aggregate Bond Index. The RIF Core Bond Underlying Fund, however, detracted less from the Fund’s benchmark-relative performance than the equity Underlying Funds.

By far, the largest affect on the fixed income Underlying Fund’s underperformance relative to its benchmark was from the re-pricing of risk (i.e., the market demanding increased compensation for assuming a given level of risk), the fundamental concern regarding the consumer’s ability to make mortgage payments, and the negative impact that market and credit issues had on virtually all non-Treasury segments of the fixed income markets. This Underlying Fund had a material overweight to mortgage-backed securities. This contributed significantly to this Underlying Fund’s benchmark-relative underperformance. The decrease in interest rates across the yield curve had little impact on that Underlying Fund’s performance as its money managers implemented offsetting duration strategies. Yet, as the Federal Reserve decreased the federal funds target rate, short-term yields declined relative to intermediate- and long-term yields resulting in a yield curve “steepening.” Several of the Underlying Fund’s money managers anticipated the change and varied the maturities of their securities accordingly, positioning their portfolios to benefit from these changes.

The U.S. equity Underlying Funds maintained an overall preference for companies with above-average growth rates and attractive valuations. This positioning was not rewarded in 2008 where investors were driven by fear, looking for relative safety and selling stocks regardless of fundamentals. U.S. large cap managers in the Underlying Fund using quantitative investment strategies added to returns by shorting several of the financial stocks that underperformed in the fiscal period. Yet, this was offset by managers employing growth and momentum strategies, which underperformed in this environment.

Managers in the small cap U.S. equity Underlying Fund negatively impacted the Fund by underweighting the financials sector and overweighting the other energy sector. Small cap financials rebounded from their lows as the Federal Reserve and Treasury offered wide ranging forms of financial support. The prices of other energy stocks fell as the price of oil fell.

| | |

| Moderate Strategy Fund | | 11 |

Russell Investment Funds

Moderate Strategy Fund

Portfolio Management Discussion and Analysis — December 31, 2008 (Unaudited)

Managers in non-U.S. developed markets Underlying Fund performed better than managers in global equity and emerging markets Underlying Funds. Yet the Fund’s higher allocation to the Non-U.S. developed markets Underlying Fund resulted in larger negative impact on the Fund’s benchmark relative performance. This Underlying Fund’s multi-style discipline provided some risk control during the fiscal period given the extreme variability in investment style and market leadership. More defensive strategies helped moderate the negative impact of strategies more focused on deteriorating economic conditions.

In emerging markets, the returns of emerging markets Underlying Fund declined along with the returns of the asset class, which experienced its biggest calendar year decline in the history of the asset class. The asset class endured massive asset deleveraging and extreme levels of market volatility. Commodity-related sectors suffered most as the global economic slowdown cut demand.

The real estate Underlying Fund focused primarily on the larger and more liquid REITs during the fiscal year. With the exceptional volatility experienced during the period due to the global economic crisis and cash outflows, this positioning hurt Fund performance. The Underlying Fund’s exposure to non-U.S. REITs, though beneficial in the last quarter of the fiscal period, negatively impacted returns for the year.

The Funds’ performance shown throughout this report was based on the Underlying Funds’ valuations calculated in accordance with Generally Accepted Accounting Principles (GAAP) and in accordance with a newly effective accounting statement (SFAS 157), reflects the December 31, 2008 market value of the pooled investment vehicle in which the Underlying Funds invested their cash collateral received in securities lending transactions. The market value was lower than the vehicle’s amortized cost per unit. This had a negative impact on the Fund’s benchmark relative performance.

Describe any changes to the Fund’s structure or allocation to the Underlying Funds.

In September, 2008, certain of the Underlying Funds in which the Fund invested (the “Former Underlying Funds”) changed as set forth below as the result of the reorganization (the “Reorganizations”) of the Former Underlying Funds into other Russell Investment Company Funds (the “New Underlying Funds”).

| | |

| |

| Former Underlying Fund | | New Underlying Fund |

Quantitative Equity Fund | | Russell U.S. Quantitative Equity Fund |

The New Underlying Fund has the same investment objective, principal investment strategies, investment policies and principal risks as the Former Underlying Fund which it replaced and the allocation of the Fund’s assets to the New Underlying Fund is the same as it was to the Former Underlying Fund.

The views expressed in this report reflect those of the portfolio managers only through the end of the period covered by the report. These views do not necessarily represent the views of RIMCo, or any other person in RIMCo or any other affiliated organization. These views are subject to change at any time based upon market conditions or other events, and RIMCo disclaims any responsibility to update the views contained herein. These views should not be relied on as investment advice and, because investment decisions for a Russell Investment Fund (RIF) or Russell Investment Company (RIC) Fund are based on numerous factors, should not be relied on as an indication of investment decisions of any RIF or RIC Fund.

| | |

| 12 | | Moderate Strategy Fund |

Russell Investment Funds

Moderate Strategy Fund

Shareholder Expense Example — December 31, 2008 (Unaudited)

Fund Expenses

The following disclosure provides important information regarding each Fund’s Expense Example, which appears on each Fund’s individual page in this Annual Report. Please refer to this information when reviewing the Expense Example for a Fund.

Example

As a shareholder of the Fund, you incur two types of costs: (1) transaction costs, and (2) ongoing costs, including management fees and other Fund expenses. The Example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds. The Example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period indicated, which for this Fund is from July 1, 2008 to December 31, 2008.

Actual Expenses

The information in the table under the heading “Actual Performance” provides information about actual account values and actual expenses. You may use the information in this column, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first column in the row entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

The information in the table under the heading “Hypothetical Performance (5% return before expenses)” provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs. Therefore, the information under the heading “Hypothetical Performance (5% return before expenses)” is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher. The fee and expenses shown in this section do not reflect any Insurance Company Separate Account or Policy Charges.

| | | | | | |

| | | Actual

Performance | | Hypothetical

Performance

(5% return

before expenses) |

| | | | | | |

Beginning Account Value | | | | | | |

July 1, 2008 | | $ | 1,000.00 | | $ | 1,000.00 |

Ending Account Value | | | | | | |

December 31, 2008 | | $ | 834.70 | | $ | 1,024.58 |

Expenses Paid During | | | | | | |

Period* | | $ | 0.51 | | $ | 0.56 |

| * | Expenses are equal to the Fund’s annualized expense ratio of 0.11% (representing the one-half year period annualized), multiplied by the average account value over the period, multiplied by 184/366 (to reflect the one-half year period). Reflects amounts waived and/or reimbursed. Without the waiver and/or reimbursement, expenses would have been higher. |

| | |

| Moderate Strategy Fund | | 13 |

Russell Investment Funds

Moderate Strategy Fund

Schedule of Investments — December 31, 2008

Amounts in thousands (except share amounts)

| | | | | |

| | | Shares | | Market

Value

$ | |

| | | | | |

| Investments -100.1% | | | | | |

Other Russell Investment Funds

(“RIF”) and Russell Investment

Company (“RIC”) Series Mutual

Funds | | | |

| | |

| Bonds - 60.2% | | | | | |

RIF Core Bond Fund | | 1,244,532 | | 11,616 | |

| | | | | |

| | |

| Domestic Equities - 26.0% | | | | | |

RIF Aggressive Equity Fund | | 79,710 | | 572 | |

RIF Multi-Style Equity Fund | | 213,609 | | 1,923 | |

RIF Real Estate Securities Fund | | 62,369 | | 580 | |

RIC Russell U.S. Quantitative Equity Fund | | 91,374 | | 1,942 | |

| | | | | |

| | | | 5,017 | |

| | | | | |

| | |

| International Equities - 13.9% | | | | | |

RIF Non-U.S. Fund | | 230,326 | | 1,724 | |

RIC Russell Emerging Markets Fund | | 38,863 | | 383 | |

RIC Russell Global Equity Fund | | 100,888 | | 579 | |

| | | | | |

| | | | 2,686 | |

| | | | | |

| | |

Total Investments - 100.1%

(identified cost $23,496) | | | | 19,319 | |

| | |

Other Assets and Liabilities,

Net - (0.1%) | | | | (11 | ) |

| | | | | |

| | |

| Net Assets - 100.0% | | | | 19,308 | |

| | | | | |

See accompanying notes which are an integral part of the financial statements.

| | |

| 14 | | Moderate Strategy Fund |

(This page intentionally left blank)

Russell Investment Funds

Balanced Strategy Fund

Portfolio Management Discussion and Analysis — December 31, 2008 (Unaudited)

| | | | | |

|

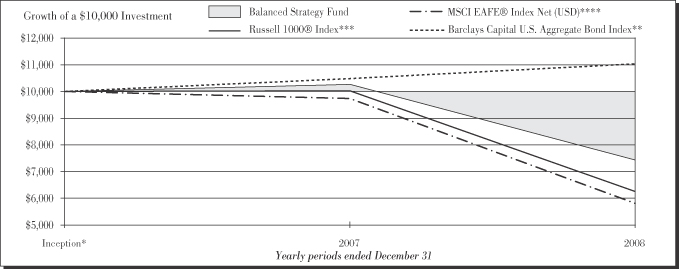

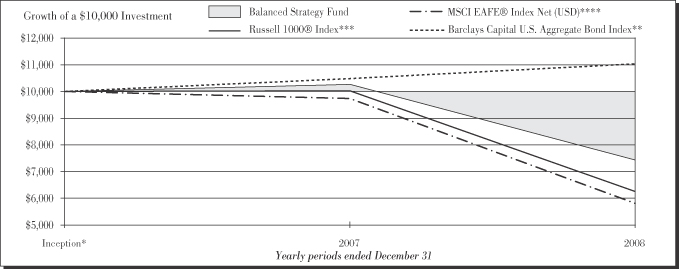

| Balanced Strategy Fund | |

| | | Total

Return | |

1 Year | | | | (27.70 | )% |

Inception* | | | | (16.30 | )%§ |

| | | | | |

|

| Barclays Capital U.S. Aggregate Bond Index** | |

| | | Total

Return | |

1 Year | | | | 5.24 | % |

Inception* | | | | 6.05 | %§ |

| | | | | |

|

| Russell 1000® Index*** | |

| | | Total

Return | |

1 Year | | | | (37.60 | )% |

Inception* | | | | (24.45 | )%§ |

| | | | | |

|

| MSCI EAFE® Index Net (USD)**** | |

| | | Total

Return | |

1 Year | | | | (43.38 | )% |

Inception* | | | | (27.88 | )%§ |

| * | | The Fund commenced operation on April 30, 2007. |

| ** | | On October 31, 2008, Barclays Capital, which acquired the Lehman family of indexes in September 2008, announced that it would be re-branding Lehman indexes under the Barclays Capital name; the underlying index structures are to remain unchanged. As a result, the Lehman Brothers Aggregate Bond Index has been renamed the Barclays Capital U.S. Aggregate Bond Index. |

| | | Barclays Capital U.S. Aggregate Bond Index is composed of securities from Barclays Capital U.S. Government/Corporate Bond Index, Mortgage-Backed Securities Index, and the Asset-Backed Securities Index. Total return comprises price appreciation/depreciation and income as a percentage of the original investment. Indexes are rebalanced monthly by market capitalization. |

*** | | Russell 1000® Index includes the 1,000 largest companies in the Russell 3000® Index. The Russell 1000® Index represents the universe of stocks from which most active money managers typically select. The Russell 1000® Index return reflects adjustments from income dividends and capital gain distributions reinvested as of the ex-dividend dates. |

| **** | | Morgan Stanley Capital International Europe, Australia, Far East (MSCI EAFE) Index is an index composed of an arithmetic, market value-weighted average of the performance of approximately 1,600 securities listed on the stock exchange of the countries of Europe, Australia, and the Far East. The index is calculated on a total-return basis, which included reinvestment of gross dividends before deduction of withholding taxes. |

The performance shown in this section does not reflect any Insurance Company Separate Account or Policy Charges. Performance is historical and assumes reinvestment of all dividends and capital gains. Investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than when purchased. Past performance is not indicative of future results.

| | |

| 16 | | Balanced Strategy Fund |

Russell Investment Funds

Balanced Strategy Fund

Portfolio Management Discussion and Analysis — December 31, 2008 (Unaudited)

The Fund is a fund of funds that invests in other Russell Investment Funds and Russell Investment Company mutual funds (the “Underlying Funds”). The Underlying Funds allocate most of their assets among multiple money managers. Russell Investment Management Company (“RIMCo”), as the Underlying Funds' advisor, may change the allocation of the Underlying Funds' assets among money managers at any time. An exemptive order from the Securities and Exchange Commission (SEC) permits RIMCo to engage or terminate a money manager in an Underlying Fund at any time, subject to the approval by the Underlying Fund’s Board without a shareholder vote.

What is the Fund’s investment objective?

The Balanced Strategy Fund (“Fund”) seeks to provide above average capital appreciation and a moderate level of current income.

How did the Fund perform relative to its benchmark for the fiscal year ended December 31, 2008?

For the fiscal year ended December 31, 2008, the Balanced Strategy Fund lost 27.70%. This compared to the Barclays Capital U.S. Aggregate Bond Index, which gained 5.24% during the same period. The Fund’s performance includes operating expenses, whereas the Index returns are unmanaged and do not include expenses of any kind. The Fund was negatively impacted by its allocation to all equity Underlying Funds and the fixed income Underlying Fund’s overweight to non-Treasury sectors.

For the year ended December 31, 2008, the Balanced Strategy Lipper Composite lost 27.65%. This result serves as a peer comparison and is expressed net of operating expenses.

Each Underlying Fund has a benchmark reflective of its respective asset class. These benchmarks may be different than the Fund’s benchmark. The Fund’s benchmark represents the largest asset class of the Underlying Funds in which it invests.

How did the market conditions described in the Market Summary report affect the Fund’s performance?

The Fund is a fund of funds and its performance is based on the performance of the Underlying Funds in which it invests. The Fund’s performance was negatively impacted by the financial crisis that affected virtually all asset classes during the fiscal year. The largest impact on the Fund’s underperformance relative to its benchmark was from its exposure to large cap U.S. equities and non-U.S. developed market equities. The performance of the equity Underlying Funds (approximately 60% of the Fund) detracted from returns relative to the Fund’s all-fixed income benchmark the Barclays Capital U.S. Aggregate Bond Index.

The extreme volatility of the financial markets during the fiscal period created a headwind for most active managers. In this challenging environment, all but one underlying equity asset class funds lagged their respective benchmarks; yet, four of eight Underlying Funds outperformed their peers within their asset classes as measured by their respective Lipper®

Averages. The Barclays Capital U.S. Aggregate Bond Index, the benchmark for the RIF Core Bond Underlying Fund, was the only Underlying Fund benchmark with a positive return. The returns of this index benefited from the inclusion of Treasuries. The RIF Core Bond Underlying Fund held a significant underweight to Treasuries relative to the benchmark. In absolute terms, bonds as measured by the Barclays Capital U.S. Aggregate Bond Index performed better than equities.

How did the investment strategies and techniques employed by the Fund and its money managers of the Underlying Funds affect the Fund’s performance?

At the Fund level, all Underlying Funds contributed negatively to the Fund’s returns relative to the Barclays Capital U.S. Aggregate Bond Index. The RIF Core Bond, however, detracted less from the Fund’s benchmark-relative performance than the equity Underlying Funds.

The U.S. equity Underlying Funds maintained an overall preference for companies with above-average growth rates and attractive valuations. This positioning was not rewarded in 2008 where investors were driven by fear, looking for relative safety and selling stocks regardless of fundamentals. U.S. large cap managers in the Underlying Fund using quantitative investment strategies added to returns by shorting several of the financial stocks that underperformed in the fiscal period. Yet, this was offset by managers employing growth and momentum strategies, which underperformed in this environment.

Managers in the small cap U.S. equity Underlying Fund negatively impacted the Fund by underweighting the financials sector and overweighting the other energy sector. Small cap financials rebounded from their lows as the Federal Reserve and Treasury offered wide ranging forms of financial support. The prices of other energy stocks fell as the price of oil fell.

Managers in the non-U.S. developed market Underlying Fund performed better than managers in global equity and emerging markets Underlying Funds. Yet the Fund’s higher allocation to the Non-U.S. developed markets Underlying Fund resulted in a larger negative impact on the Fund’s benchmark relative performance. This Underlying Fund’s multi-style discipline provided some risk control during the fiscal period given the extreme variability in investment style and market leadership. More defensive strategies helped moderate the negative impact of strategies more focused on deteriorating economic conditions.

In emerging markets, the returns of emerging markets Underlying Fund declined along with the returns of the asset class, which experienced its biggest calendar year decline in the history of the asset class. The asset class endured massive asset deleveraging and extreme levels of market volatility. Commodity-related sectors suffered most as the global economic slowdown cut demand.

The real estate Underlying Fund focused primarily on the larger and more liquid REITs during the fiscal year. With the exceptional volatility experienced during the period due to the

| | |

| Balanced Strategy Fund | | 17 |

Russell Investment Funds

Balanced Strategy Fund

Portfolio Management Discussion and Analysis — December 31, 2008 (Unaudited)

global economic crisis and cash outflows, this positioning hurt Fund performance. The Underlying Fund’s exposure to non-U.S. REITs, though beneficial in the last quarter of the fiscal period, negatively impacted returns for the year.

By far, the largest affect on the fixed income Underlying Fund’s underperformance relative to its benchmark was from the re-pricing of risk (i.e., the market demanding increased compensation for assuming a given level of risk), the fundamental concern regarding the consumer’s ability to make mortgage payments, and the negative impact that market and credit issues had on virtually all non-Treasury segments of the fixed income markets. This Underlying Fund had a material overweight to mortgage-backed securities. This contributed significantly to this Underlying Fund’s benchmark-relative underperformance. The decrease in interest rates across the yield curve had little impact on that Underlying Fund’s performance as its money managers implemented offsetting duration strategies. Yet, as the Federal Reserve decreased the federal funds target rate, short-term yields declined relative to intermediate- and long-term yields resulting in a yield curve “steepening.” Several of the Underlying Fund’s money managers anticipated the change and varied the maturities of their securities accordingly, positioning their portfolios to benefit from these changes

The Funds’ performance shown throughout this report was based on the Underlying Funds’ valuations calculated in accordance with Generally Accepted Accounting Principles (GAAP) and in accordance with a newly effective accounting statement (SFAS 157), reflects the December 31, 2008 market value of the pooled investment vehicle in which the Underlying Funds invested their cash collateral received in securities lending transactions. The market value was lower than the vehicle’s amortized cost per unit. This had a negative impact on the Fund’s benchmark relative performance.

Describe any changes to the Fund’s structure or allocation to the Underlying Funds.

In September, 2008, certain of the Underlying Funds in which the Fund invested (the “Former Underlying Funds”) changed as set forth below as the result of the reorganization (the “Reorganizations”) of the Former Underlying Funds into other Russell Investment Company Funds (the “New Underlying Funds”).

| | |

| |

| Former Underlying Fund | | New Underlying Fund |

Quantitative Equity Fund | | Russell U.S. Quantitative Equity Fund |

The New Underlying Fund has the same investment objective, principal investment strategies, investment policies and principal risks as the Former Underlying Fund which it replaced and the allocation of the Fund’s assets to the New Underlying Fund is the same as it was to the Former Underlying Fund.

The views expressed in this report reflect those of the portfolio managers only through the end of the period covered by the report. These views do not necessarily represent the views of RIMCo, or any other person in RIMCo or any other affiliated organization. These views are subject to change at any time based upon market conditions or other events, and RIMCo disclaims any responsibility to update the views contained herein. These views should not be relied on as investment advice and, because investment decisions for a Russell Investment Fund (RIF) or Russell Investment Company (RIC) Fund are based on numerous factors, should not be relied on as an indication of investment decisions of any RIF or RIC Fund.

| | |

| 18 | | Balanced Strategy Fund |

Russell Investment Funds

Balanced Strategy Fund

Shareholder Expense Example — December 31, 2008 (Unaudited)

Fund Expenses

The following disclosure provides important information regarding each Fund’s Expense Example, which appears on each Fund’s individual page in this Annual Report. Please refer to this information when reviewing the Expense Example for a Fund.

Example

As a shareholder of the Fund, you incur two types of costs: (1) transaction costs, and (2) ongoing costs, including management fees and other Fund expenses. The Example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds. The Example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period indicated, which for this Fund is from July 1, 2008 to December 31, 2008.

Actual Expenses

The information in the table under the heading “Actual Performance” provides information about actual account values and actual expenses. You may use the information in this column, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first column in the row entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

The information in the table under the heading “Hypothetical Performance (5% return before expenses)” provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate

of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs. Therefore, the information under the heading “Hypothetical Performance (5% return before expenses)” is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher. The fee and expenses shown in this section do not reflect any Insurance Company Separate Account or Policy Charges.

| | | | | | |

| | | Actual

Performance | | Hypothetical

Performance

(5% return

before expenses) |

Beginning Account Value | | | | | | |

July 1, 2008 | | $ | 1,000.00 | | $ | 1,000.00 |

Ending Account Value | | | | | | |

December 31, 2008 | | $ | 773.77 | | $ | 1,024.73 |

Expenses Paid During | | | | | | |

Period* | | $ | 0.36 | | $ | 0.41 |

| * | Expenses are equal to the Fund’s annualized expense ratio of 0.08% (representing the one-half year period annualized), multiplied by the average account value over the period, multiplied by 184/366 (to reflect the one-half year period). Reflects amounts waived and/or reimbursed. Without the waiver and/or reimbursement, expenses would have been higher. |

| | |

| Balanced Strategy Fund | | 19 |

Russell Investment Funds

Balanced Strategy Fund

Schedule of Investments — December 31, 2008

Amounts in thousands (except share amounts)

| | | | | |

| | | Shares | | Market

Value

$ | |

| | | | | |

| Investments - 100.0% | | | | | |

Other Russell Investment Funds

(“RIF”) and Russell Investment

Company (“RIC”) Series Mutual

Funds | | | |

| | |

| Bonds - 39.3% | | | | | |

RIF Core Bond Fund | | 2,535,119 | | 23,663 | |

| | | | | |

| | |

| Domestic Equities - 39.6% | | | | | |

RIF Aggressive Equity Fund | | 337,912 | | 2,427 | |

RIF Multi-Style Equity Fund | | 1,007,644 | | 9,069 | |

RIF Real Estate Securities Fund | | 337,627 | | 3,138 | |

RIC Russell U.S. Quantitative Equity Fund | | 431,619 | | 9,172 | |

| | | | | |

| | | | 23,806 | |

| | | | | |

| | |

| International Equities - 21.1% | | | | | |

RIF Non-U.S. Fund | | 1,131,869 | | 8,472 | |

RIC Russell Emerging Markets Fund | | 183,498 | | 1,808 | |

RIC Russell Global Equity Fund | | 422,530 | | 2,425 | |

| | | | | |

| | | | 12,705 | |

| | | | | |

| | |

Total Investments - 100.0%

(identified cost $81,252) | | | | 60,174 | |

| | |

Other Assets and Liabilities,

Net - (0.0%) | | | | (16 | ) |

| | | | | |

| | |

| Net Assets - 100.0% | | | | 60,158 | |

| | | | | |

See accompanying notes which are an integral part of the financial statements.

| | |

| 20 | | Balanced Strategy Fund |

(This page intentionally left blank)

Russell Investment Funds

Growth Strategy Fund

Portfolio Management Discussion and Analysis — December 31, 2008 (Unaudited)

| | | | | |

| |

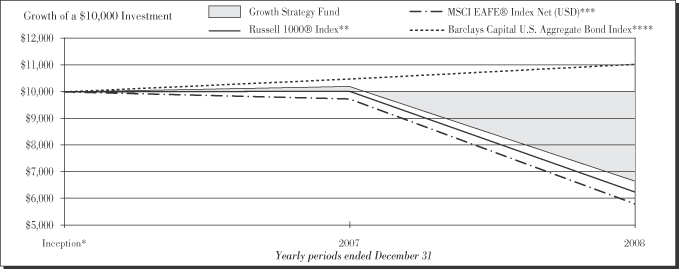

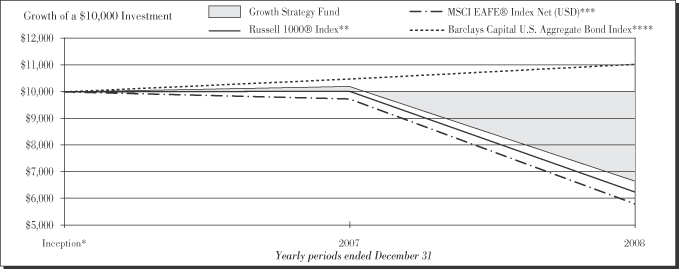

| Growth Strategy Fund | | | |

| | | Total

Return | |

1 Year | | | | (34.73 | )% |

Inception* | | | | (21.55 | )%§ |

| | | | | |

| |

| Russell 1000® Index** | | | |

| | | Total

Return | |

1 Year | | | | (37.60 | )% |

Inception* | | | | (24.45 | )%§ |

| | | | | |

| |

| MSCI EAFE® Index Net (USD)*** | | | |

| | | Total

Return | |

1 Year | | | | (43.38 | )% |

Inception* | | | | (27.88 | )%§ |

| | | | | |

|

| Barclays Capital U.S. Aggregate Bond Index**** | |

| | | Total

Return | |

1 Year | | | | 5.24 | % |

Inception* | | | | 6.05 | %§ |

| * | | The Fund commenced operation on April 30, 2007. |

** | | Russell 1000® Index includes the 1,000 largest companies in the Russell 3000® Index. The Russell 1000® Index represents the universe of stocks from which most active money managers typically select. The Russell 1000® Index return reflects adjustments from income dividends and capital gain distributions reinvested as of the ex-dividend dates. |

| *** | | Morgan Stanley Capital International Europe, Australia, Far East (MSCI EAFE) Index is an index composed of an arithmetic, market value-weighted average of the performance of approximately 1,600 securities listed on the stock exchange of the countries of Europe, Australia, and the Far East. The index is calculated on a total-return basis, which included reinvestment of gross dividends before deduction of withholding taxes. |

| **** | | On October 31, 2008, Barclays Capital, which acquired the Lehman family of indexes in September 2008, announced that it would be re-branding Lehman indexes under the Barclays Capital name; the underlying index structures are to remain unchanged. As a result, the Lehman Brothers Aggregate Bond Index has been renamed the Barclays Capital U.S. Aggregate Bond Index. |

| | | Barclays Capital U.S. Aggregate Bond Index is composed of securities from Barclays Capital U.S. Government/Corporate Bond Index, Mortgage-Backed Securities Index, and the Asset-Backed Securities Index. Total return comprises price appreciation/depreciation and income as a percentage of the original investment. Indexes are rebalanced monthly by market capitalization. |

The performance shown in this section does not reflect any Insurance Company Separate Account or Policy Charges. Performance is historical and assumes reinvestment of all dividends and capital gains. Investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than when purchased. Past performance is not indicative of future results.

Russell Investment Funds

Growth Strategy Fund

Portfolio Management Discussion and Analysis — December 31, 2008 (Unaudited)

The Fund is a fund of funds that invests in other Russell Investment Funds and Russell Investment Company mutual funds (the “Underlying Funds”). The Underlying Funds allocate most of their assets among multiple money managers. Russell Investment Management Company (“RIMCo”), as the Underlying Funds' advisor, may change the allocation of the Underlying Funds' assets among money managers at any time. An exemptive order from the Securities and Exchange Commission (SEC) permits RIMCo to engage or terminate a money manager in an Underlying Fund at any time, subject to the approval by the Underlying Fund’s Board without a shareholder vote.

What is the Fund’s investment objective?

The Growth Strategy Fund (“Fund”) seeks to provide high long term capital appreciation with low current income.

How did the Fund perform relative to its benchmark for the fiscal year ended December 31, 2008?

For the fiscal year ended December 31, 2008, the Growth Strategy Fund lost 34.73%. This compared to the Russell 1000® Index, which lost 37.60% during the same period. The Fund’s performance includes operating expenses, whereas the Index returns are unmanaged and do not include expenses of any kind. The Fund’s performance was negatively impacted mostly by its allocation to all equities. This was partly offset by the Fund’s allocation to fixed income.

For the year ended December 31, 2008, the Growth Strategy Lipper Composite lost 34.19%. This result serves as a peer comparison and is expressed net of operating expenses.

Each Underlying Fund has a benchmark reflective of its respective asset class. These benchmarks may be different than the Fund’s benchmark. The Fund’s benchmark represents the largest asset class of the Underlying Funds in which it invests.

How did the market conditions described in the Market Summary report affect the Fund’s performance?

The Fund is a fund of funds and its performance is based on the performance of the Underlying Funds in which it invests. The Fund’s performance was negatively impacted by the financial crisis that affected virtually all asset classes during the fiscal year. The largest positive contribution to the Fund’s performance relative to its all-equity benchmark was from its exposure to fixed income through its investment in the RIF Core Bond Underlying Fund. The performance of the equity Underlying Funds (approximately 80% of the Fund) detracted from returns relative to the Fund’s benchmark, the Russell 1000® Index.

The extreme volatility of the financial markets during the fiscal period created a headwind for most active managers. In this challenging environment, all but one underlying equity asset class funds lagged their respective benchmarks; yet, four of eight Underlying Funds outperformed their peers within their asset classes as measured by their respective Lipper® Averages. The Barclays Capital U.S. Aggregate Bond Index, the

benchmark for the RIF Core Bond Underlying Fund, was the only Underlying Fund benchmark with a positive absolute return. The returns of this index benefited from the inclusion of Treasuries. The RIF Core Bond Underlying Fund held a significant underweight to Treasuries relative to the benchmark. In absolute terms, bonds as measured by the Barclays Capital U.S. Aggregate Bond Index performed better than equities.

How did the investment strategies and techniques employed by the Fund and its money managers of the Underlying Funds affect the Fund’s performance?

At the Fund level, exposure to the RIF Multi-Style Equity, RIF Non-U.S. and Russell U.S. Quantitative Equity Underlying Funds dampened returns relative to the Russell 1000® Index. The RIF Core Bond Underlying Fund contributed positively to the Fund’s benchmark-relative performance.

The U.S. equity Underlying Funds maintained an overall preference for companies with above-average growth rates and attractive valuations. This positioning was not rewarded in 2008 where investors were driven by fear, looking for relative safety and selling stocks regardless of fundamentals. U.S. large cap managers in the Underlying Fund using quantitative investment strategies added to returns by shorting several of the financial stocks that underperformed in the fiscal period. Yet, this was offset by managers employing growth and momentum strategies, which underperformed in this environment.

Managers in the small cap U.S. equity Underlying Fund negatively impacted the Fund by underweighting the financials sector and overweighting the other energy sector. Small cap financials rebounded from their lows as the Federal Reserve and Treasury offered wide ranging forms of financial support. The prices of other energy stocks fell as the price of oil fell.

Managers in the non-U.S. developed markets Underlying Fund performed better than managers in global equity and emerging markets Underlying Funds. Yet the Fund’s higher allocation to the Non-U.S. developed markets Underlying Fund resulted in a larger negative impact on the Fund’s benchmark relative performance. This Underlying Fund’s multi-style discipline provided some risk control during the fiscal period given the extreme variability in investment style and market leadership. More defensive strategies helped moderate the negative impact of strategies more focused on deteriorating economic conditions.

In emerging markets, the returns of emerging markets Underlying Fund declined along with the returns of the asset class, which experienced its biggest calendar year decline in the history of the asset class. The asset class endured massive asset deleveraging and extreme levels of market volatility. Commodity-related sectors suffered most as the global economic slowdown cut demand.

The real estate Underlying Fund focused primarily on the larger and more liquid REITs during the fiscal year. With the exceptional volatility experienced during the period due to the

Russell Investment Funds

Growth Strategy Fund

Portfolio Management Discussion and Analysis — December 31, 2008 (Unaudited)

global economic crisis and cash outflows, this positioning hurt Fund performance. The Underlying Fund’s exposure to non-U.S. REITs added to the Fund excess weighted performance relative to the benchmark for the year.

While the fixed income Underlying Fund contributed positively to the Fund’s benchmark relative performance, this Underlying Fund underperformed its benchmark. By far, the largest affect on the Underlying Fund’s underperformance relative to its benchmark was from the re-pricing of risk (i.e., the market demanding increased compensation for assuming a given level of risk), the fundamental concern regarding the consumer’s ability to make mortgage payments, and the negative impact that market and credit issues had on virtually all non-Treasury segments of the fixed income markets. This Underlying Fund had a material overweight to mortgage-backed securities. This contributed significantly to this Underlying Fund’s benchmark-relative underperformance. The decrease in interest rates across the yield curve had little impact on that Underlying Fund’s performance as its money managers implemented offsetting duration strategies. Yet, as the Federal Reserve decreased the federal funds target rate, short-term yields declined relative to intermediate- and long-term yields resulting in a yield curve “steepening.” Several of the Underlying Fund’s money managers anticipated the change and varied the maturities of their securities accordingly, positioning their portfolios to benefit from these changes.

The Funds’ performance shown throughout this report was based on the Underlying Funds’ valuations calculated in accordance with Generally Accepted Accounting Principles (GAAP) and in accordance with a newly effective accounting statement (SFAS 157), reflects the December 31, 2008 market value of the pooled investment vehicle in which the Underlying Funds invested their cash collateral received in securities lending transactions. The market value was lower than the vehicle’s amortized cost per unit. This had a negative impact on the Fund’s benchmark relative performance.

Describe any changes to the Fund’s structure or allocation to the Underlying Funds.

In September, 2008, certain of the Underlying Funds in which the Fund invested (the “Former Underlying Funds”) changed as set forth below as the result of the reorganization (the “Reorganizations”) of the Former Underlying Funds into other Russell Investment Company Funds (the “New Underlying Funds”).

| | |

| |

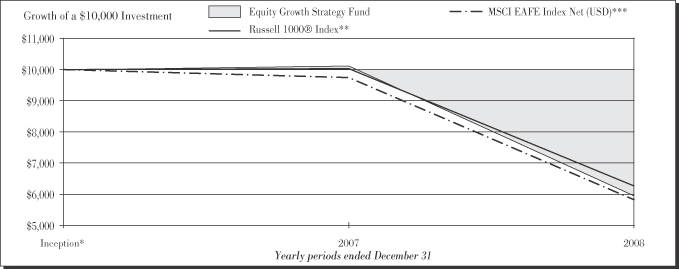

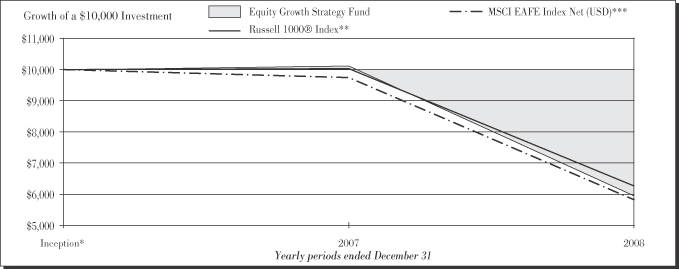

| Former Underlying Fund | | New Underlying Fund |