UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-05398

ALLIANCEBERNSTEIN VARIABLE PRODUCTS SERIES FUND, INC.

(Exact name of registrant as specified in charter)

1345 Avenue of the Americas, New York, New York 10105

(Address of principal executive offices) (Zip code)

Joseph J. Mantineo

AllianceBernstein L.P.

1345 Avenue of the Americas

New York, New York 10105

(Name and address of agent for service)

Registrant’s telephone number, including area code: (800) 221-5672

Date of fiscal year end: December 31, 2014

Date of reporting period: December 31, 2014

ITEM 1. REPORTS TO STOCKHOLDERS.

DEC 12.31.14

ANNUAL REPORT

ALLIANCEBERNSTEIN VARIABLE PRODUCTS SERIES FUND, INC.

| + | | BALANCED WEALTH STRATEGY PORTFOLIO |

Investment Products Offered

| | Ø | | Are Not Bank Guaranteed |

AllianceBernstein Investments, Inc. (ABI) is the distributor of the AB family of mutual funds. ABI is a member of FINRA and is an affiliate of AllianceBernstein L.P., the Adviser of the funds.

You may obtain a description of the Fund’s proxy voting policies and procedures, and information regarding how the Fund voted proxies relating to portfolio securities during the most recent 12-month period ended June 30, without charge. Simply visit AB’s website at www.abglobal.com or go to the Securities and Exchange Commission’s (the “Commission”) website at www.sec.gov, or call AB at (800) 227-4618.

The Fund files its complete schedule of portfolio holdings with the Commission for the first and third quarters of each fiscal year on Form N-Q. The Fund’s Forms N-Q are available on the Commission’s website at www.sec.gov. The Fund’s Forms N-Q may also be reviewed and copied at the Commission’s Public Reference Room in Washington, DC; information on the operation of the Public Reference Room may be obtained by calling (800) SEC-0330.

The [A/B] logo is a service mark of AllianceBernstein and AllianceBernstein® is a registered trademark used by permission of the owner, AllianceBernstein L.P.

| | |

| | |

| BALANCED WEALTH STRATEGY | | |

| PORTFOLIO | | AllianceBernstein Variable Products Series Fund |

LETTER TO INVESTORS

February 10, 2015

The following is an update of AllianceBernstein Variable Products Series Fund—Balanced Wealth Strategy Portfolio (the “Portfolio”) for the annual reporting period ended December 31, 2014.

INVESTMENT OBJECTIVE AND POLICIES

The Portfolio’s investment objective is to maximize total return consistent with the determination of reasonable risk as determined by AllianceBernstein L.P. (the “Adviser”). The Portfolio invests in a portfolio of equity and debt securities that is designed as a solution for investors who seek a moderate tilt toward equity returns but also want the risk diversification offered by debt securities and the broad diversification of their equity risk across styles, capitalization ranges and geographic regions. The Portfolio targets a weighting of 60% equity securities and 40% debt securities with a goal of providing moderate upside potential without excessive volatility. In managing the Portfolio, the Adviser efficiently diversifies between the debt and equity components to produce the desired risk/return profile. Investments in real estate investment trusts, or REITs, are deemed to be 50% equity and 50% fixed-income for purposes of the overall target blend of the Portfolio.

The Portfolio’s equity component is diversified between growth and value equity investment styles, and between U.S. and non-U.S. markets. The Adviser’s targeted blend for the non-REIT portion of the Portfolio’s equity component is an equal weighting of growth and value stocks (50% each). In addition to blending growth and value styles, the Adviser blends each style-based portion of the Portfolio’s equity component across U.S. and non-U.S. issuers and various capitalization ranges. Within each of the value and growth portions of the Portfolio, the Adviser normally targets a blend of approximately 70% in equities of U.S. companies and the remaining 30% in equities of companies outside the United States. The Adviser will allow the relative weightings of the Portfolio’s investments in equity and debt, growth and value, and U.S. and non-U.S. components to vary in response to market conditions, but ordinarily, only by ±5% of the Portfolio’s net assets. Beyond those ranges, the Adviser will rebalance the Portfolio toward the targeted blend. However, under extraordinary circumstances, such as when market conditions favoring one investment style are compelling, the range may expand to ±10% of the Portfolio’s net assets. The Portfolio’s targeted blend may change from time to time without notice to shareholders based on the Adviser’s assessment of underlying market conditions.

The Portfolio’s debt securities will primarily be investment-grade debt securities, but are expected to include lower-rated securities (“junk bonds”) and preferred stock. The Portfolio will not invest more than 25% of its total assets in securities rated, at the time of purchase, below investment grade.

The Portfolio also may enter into forward commitments, make short sales of securities or maintain a short position and invest in rights or warrants.

Currencies can have a dramatic impact on equity returns, significantly adding to returns in some years and greatly diminishing them in others. Currency and equity positions are evaluated separately. The Adviser may seek to hedge the currency exposure resulting from securities positions when it finds the currency exposure unattractive. To hedge all or a portion of its currency risk, the Portfolio may, from time to time, invest in currency-related derivatives, including forward currency exchange contracts, futures, options on futures, swaps and options. The Adviser may also seek investment opportunities by taking long or short positions in currencies through the use of currency-related derivatives. The Portfolio may enter into other derivatives transactions, such as options, futures contracts, forwards and swaps.

INVESTMENT RESULTS

The table on page 5 shows the Portfolio’s performance compared to its primary benchmark, the Standard & Poor’s (“S&P”) 500 Index, its secondary benchmark, the Barclays U.S. Aggregate Bond Index and its blended benchmark, the 60% / 40% blend of the S&P 500 Index and the Barclays U.S. Aggregate Bond Index, respectively, for the one-, five- and 10-year periods ended December 31, 2014.

For the annual period, all share classes of the Portfolio underperformed the primary and blended benchmarks, and outperformed the secondary benchmark. The Portfolio’s U.S. growth and U.S. value holdings contributed, helped by the strong performance of U.S. equities in 2014. Conversely, non-U.S. value and non-U.S. growth holdings detracted, hurt by geopolitical concerns, the strong return of the U.S. dollar and the declining price of oil. Fixed-income holdings contributed to relative performance, as did REITs.

The Portfolio utilized derivatives, including futures, credit default swaps and interest rate swaps, for hedging and investment purposes, which had no material impact on performance. Currencies were utilized for hedging purposes and had no material impact on performance.

1

| | |

| | | AllianceBernstein Variable Products Series Fund |

MARKET REVIEW AND INVESTMENT STRATEGY

U.S. large-cap stocks led the gains in 2014 as a resilient economic recovery fueled earnings growth. Emerging markets trailed developed markets, and investors favored defensive stocks, while resources stocks fell as plunging oil prices dragged down shares of energy companies. Bond markets turned more volatile as growth trends and monetary policies in the world’s largest economies headed in different directions. Despite the best efforts of policymakers, inflation continued to fall throughout the developed world, reaching especially worrisome levels in Europe and Japan. Global economic growth continued at a slow and uneven pace. In the U.S., manufacturing indicators rose, and unemployment fell from 6.6% at the beginning of the year to 5.8% in November, bolstering consumer confidence and increasing the chances of a Fed rate hike in 2015 by the U.S. Federal Reserve.

The Portfolio is well positioned to invest opportunistically across a wide range of asset classes and market circumstances. In equities, the Multi-Assets Solutions Team (the “Team”) is confident that its continued focus on companies with strong fundamentals will enable the Team to navigate current market conditions and, more importantly, to construct portfolios that outperform as macroeconomic conditions improve. Meanwhile, in fixed-income, the Team continues to emphasize corporate bonds and commercial mortgage-backed securities over U.S. Treasuries.

2

| | |

| | |

| BALANCED WEALTH STRATEGY PORTFOLIO |

| DISCLOSURESAND RISKS | | AllianceBernstein Variable Products Series Fund |

Benchmark Disclosure

The unmanaged S&P® 500 Index and the unmanaged Barclays U.S. Aggregate Bond Index do not reflect fees and expenses associated with the active management of a mutual fund portfolio. The S&P 500 Index includes 500 U.S. stocks and is a common representation of the performance of the overall U.S. stock market. The Barclays U.S. Aggregate Bond Index represents the performance of securities within the U.S. investment grade fixed rate bond market, with index components for government and corporate securities, mortgage pass-through securities, asset-backed securities, and commercial mortgage backed securities. An investor cannot invest directly in an index, and its results are not indicative of the performance for any specific investment, including the Portfolio.

A Word About Risk

Market Risk: The value of the Portfolio’s assets will fluctuate as the stock or bond market fluctuates. The value of its investments may decline, sometimes rapidly and unpredictably, simply because of economic changes or other events that affect large portions of the market.

Interest Rate Risk: Changes in interest rates will affect the value of investments in fixed-income securities. When interest rates-rise, the value of investments in fixed-income securities tends to fall and this decrease in value may not be offset by higher income from new investments. Interest rate risk is generally greater for fixed-income securities with longer maturities or durations.

Credit Risk: An issuer or guarantor of a fixed-income security, or the counterparty to a derivatives or other contract, may be unable or unwilling to make timely payments of interest or principal, or to otherwise honor its obligations. The issuer or guarantor may default, causing a loss of the full principal amount of a security. The degree of risk for a particular security may be reflected in its credit rating. There is the possibility that the credit rating of a fixed-income security may be downgraded after purchase, which may adversely affect the value of the security.

Below Investment Grade Security Risk: Investments in fixed-income securities with lower ratings (“junk bonds”) tend to have a higher probability that an issuer will default or fail to meet its payment obligations. These securities may be subject to greater price volatility due to such factors as specific corporate developments, interest rate sensitivity, negative perceptions of the junk bond market generally and less secondary market liquidity.

Foreign (Non-U.S.) Risk: Investments in securities of non-U.S. issuers may involve more risk than those of U.S. issuers. These securities may fluctuate more widely in price and may be less liquid due to adverse market, economic, political, regulatory or other factors.

Currency Risk: Fluctuations in currency exchange rates may negatively affect the value of the Portfolio’s investments or reduce its returns.

Allocation Risk: The allocation of investments among the different investment styles, such as growth or value, equity or debt securities, or U.S. or non-U.S. securities may have a more significant effect on the Portfolio’s net asset value (“NAV”) when one of these investment strategies is performing more poorly than others.

Capitalization Risk: Investments in small- and mid-capitalization companies may be more volatile than investments in large-capitalization companies. Investments in small-capitalization companies may have additional risks because these companies have limited product lines, markets or financial resources.

Derivatives Risk: Derivatives may be illiquid, difficult to price, and leveraged so that small changes may produce disproportionate losses for the Portfolio, and may be subject to counterparty risk to a greater degree than more traditional investments.

Real Estate Risk: The Portfolio’s investments in the real estate market have many of the same risks as direct ownership of real estate, including the risk that the value of real estate could decline due to a variety of factors that affect the real estate market generally. Investments in REITs may have additional risks. REITs are dependent on the capability of their managers, may have limited diversification, and could be significantly affected by changes in tax laws.

(Disclosures, Risks and Note about Historical Performance continued on next page)

3

| | |

| BALANCED WEALTH STRATEGY PORTFOLIO |

| DISCLOSURESAND RISKS | | |

| (continued from previous page) | | AllianceBernstein Variable Products Series Fund |

Management Risk: The Portfolio is subject to management risk because it is an actively managed investment fund. The Adviser will apply its investment techniques and risk analyses in making investment decisions for the Portfolio, but there is no guarantee that its techniques will produce the intended results.

These risks are fully discussed in the Variable Products prospectus.

An Important Note About Historical Performance

The investment return and principal value of an investment in the Portfolio will fluctuate, so that shares, when redeemed, may be worth more or less than their original cost. Performance shown on the following page represents past performance and does not guarantee future results. Current performance may be lower or higher than the performance information shown. Please contact your Financial Advisor or Insurance Agent Representative at your financial institution to obtain portfolio performance information current to the most recent month end.

Investors should consider the investment objectives, risks, charges and expenses of the Portfolio carefully before investing. For additional copies of the Portfolio’s prospectus or summary prospectus, which contains this and other information, call your financial advisor or 800.984.7654. Please read the prospectus and/or summary prospectus carefully before investing.

All fees and expenses related to the operation of the Portfolio have been deducted, but no adjustment has been made for insurance company separate account or annuity contract charges, which would reduce total return to a contract owner. Performance assumes reinvestment of distributions and does not account for taxes.

There are additional fees and expenses associated with all Variable Products. These fees can include mortality and expense risk charges, administrative charges, and other charges that can significantly reduce investment returns. Those fees and expenses are not reflected in this annual report. You should consult your Variable Products prospectus for a description of those fees and expenses and speak to your insurance agent or financial representative if you have any questions. You should read the prospectus before investing or sending money.

4

| | |

| | |

| BALANCED WEALTH STRATEGY PORTFOLIO |

| HISTORICAL PERFORMANCE | | AllianceBernstein Variable Products Series Fund |

| | | | | | | | | | | | |

| THE PORTFOLIO VS. ITS BENCHMARKS | | NAV Returns | |

| PERIODS ENDED DECEMBER 31, 2014 (unaudited) | | 1 Year | | | 5 Years* | | | 10 Years* | |

Balanced Wealth Strategy Portfolio Class A† | | | 7.37% | | | | 8.85% | | | | 5.59% | |

Balanced Wealth Strategy Portfolio Class B† | | | 7.11% | | | | 8.59% | | | | 5.33% | |

Primary Benchmark: S&P 500 Index | | | 13.69% | | | | 15.45% | | | | 7.67% | |

Secondary Benchmark: Barclays U.S. Aggregate Bond Index | | | 5.97% | | | | 4.45% | | | | 4.71% | |

Blended Benchmark: 60% S&P 500 Index / 40% Barclays U.S. Aggregate Bond Index | | | 10.62% | | | | 11.18% | | | | 6.77% | |

* Average annual returns. | | | | | | | | | | | | |

† Includes the impact of proceeds received and credited to the Portfolio resulting from class action settlements, which enhanced the performance of all share classes of the Portfolio for the annual period ended December 31, 2014, by 0.01%. | |

The Portfolio’s current prospectus fee table shows the Portfolio’s total annual operating expense ratios as 0.65% and 0.90% for Class A and Class B shares, respectively, gross of any fee waivers or expense reimbursements. These waivers/ reimbursements extend through the Portfolio’s current fiscal year and may be extended by the Adviser for additional one-year terms.

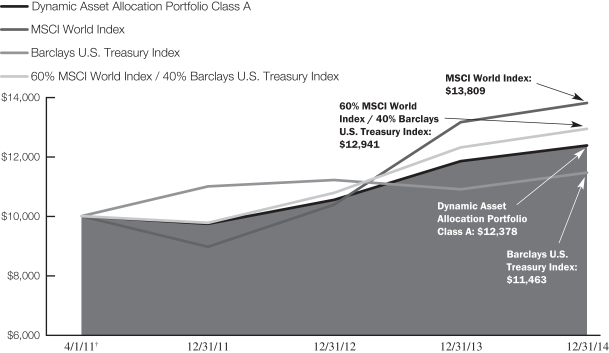

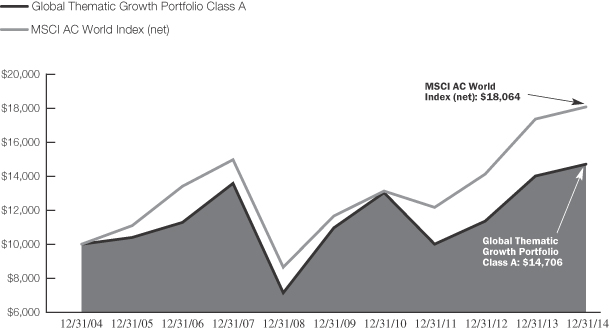

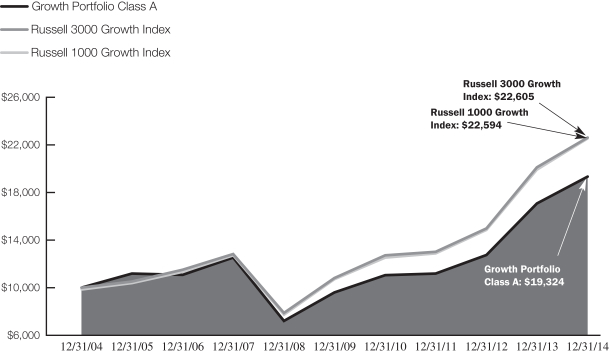

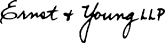

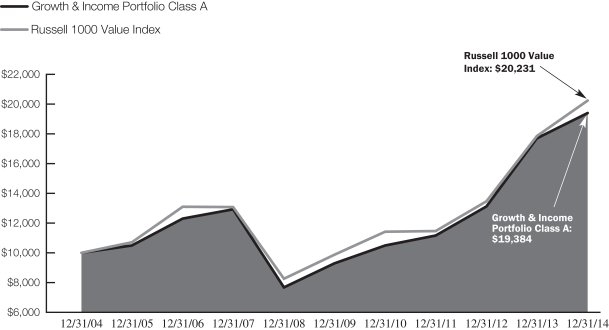

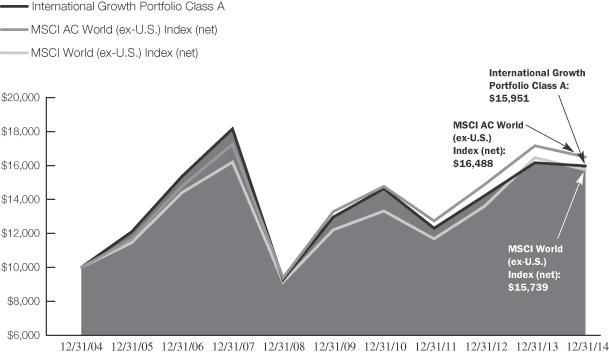

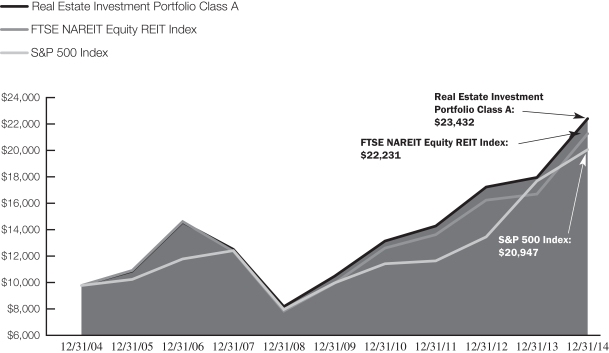

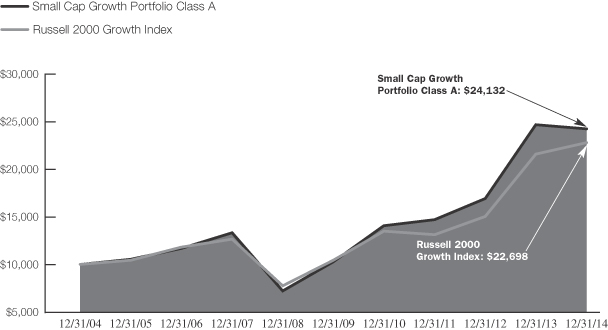

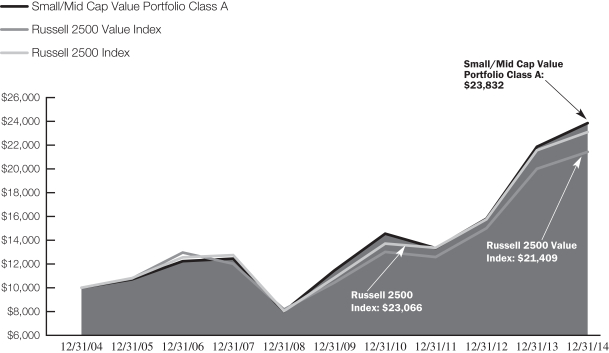

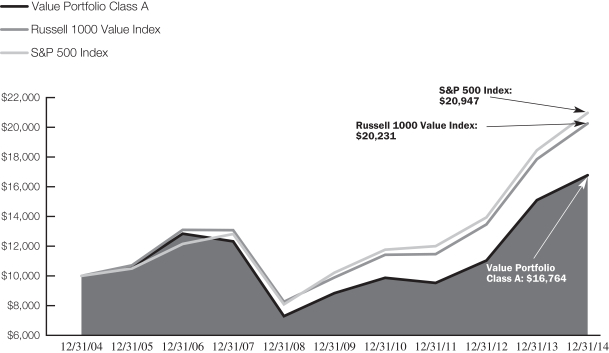

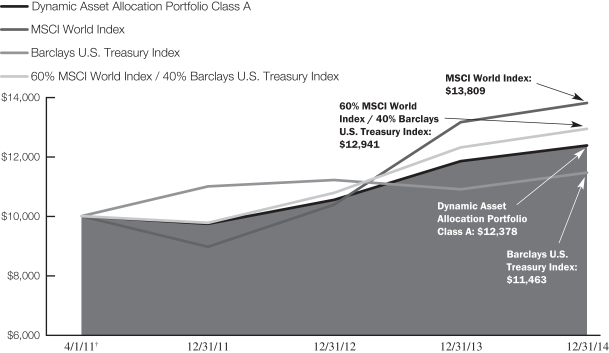

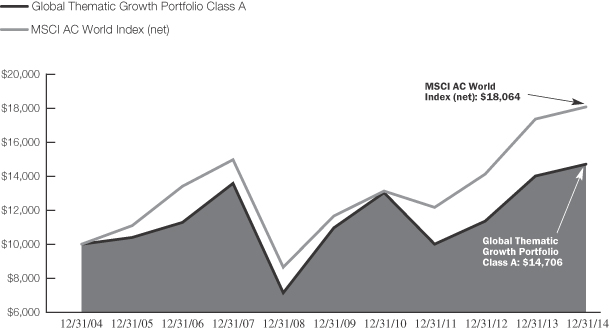

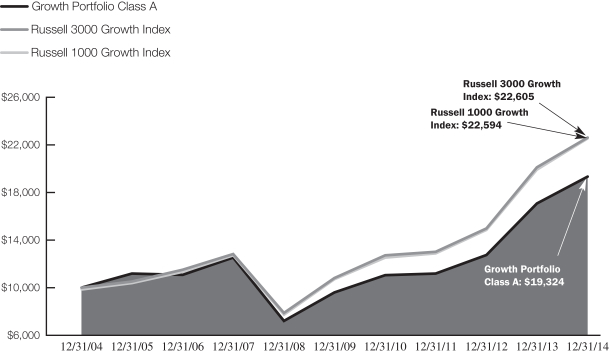

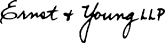

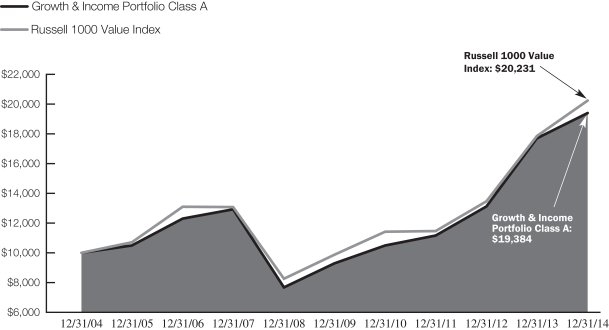

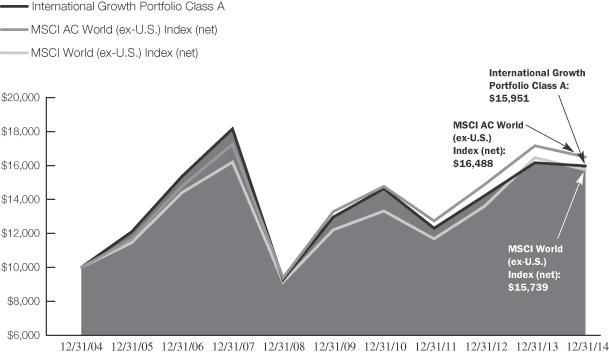

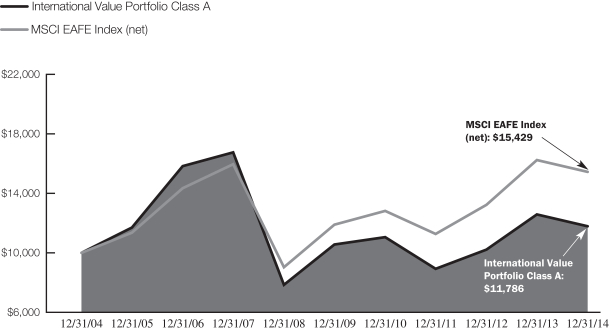

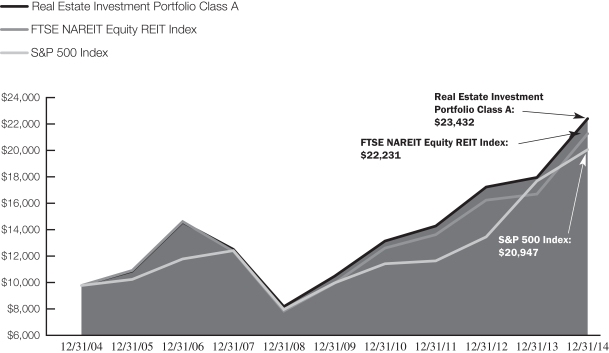

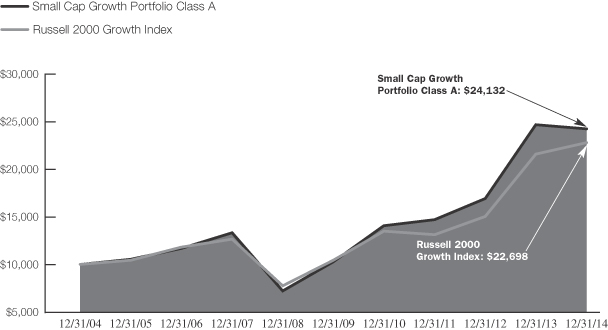

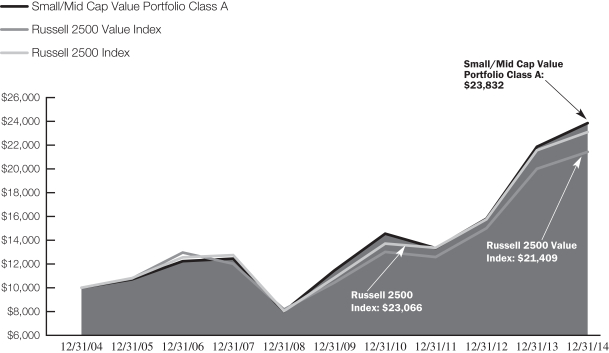

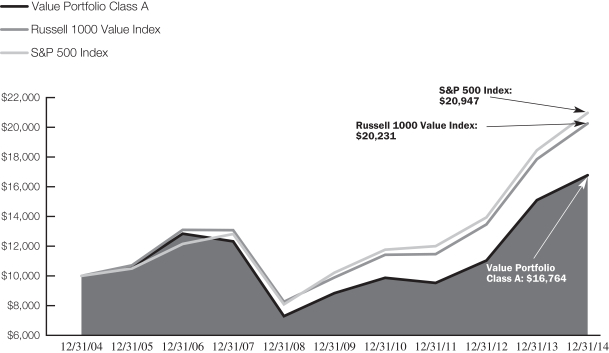

BALANCED WEALTH STRATEGY PORTFOLIO CLASS A GROWTH OF A $10,000 INVESTMENT

12/21/04 – 12/31/14 (unaudited)

This chart illustrates the total value of an assumed $10,000 investment in the Balanced Wealth Strategy Portfolio Class A shares (from 12/31/04 to 12/31/14) as compared to the performance of the Portfolio’s primary, secondary and blended benchmarks. The chart assumes the reinvestment of dividends and capital gains distributions.

See Disclosures, Risks and Note about Historical Performance on pages 3-4.

5

| | |

| | |

| BALANCED WEALTH STRATEGY PORTFOLIO |

| EXPENSE EXAMPLE (unaudited) | | AllianceBernstein Variable Products Series Fund |

As a shareholder of the Fund, you incur two types of costs: (1) transaction costs, including sales charges (loads) on purchase payments, contingent deferred sales charges on redemptions and (2) ongoing costs, including management fees; distribution (12b-1) fees; and other Fund expenses. This example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds.

The Example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period as indicated below.

Actual Expenses

The table below provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period. The estimate of expenses does not include fees or other expenses of any variable insurance product. If such expenses were included, the estimate of expenses you paid during the period would be higher and your ending account value would be lower.

Hypothetical Example for Comparison Purposes

The table below provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed annual rate of return of 5% before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds by comparing this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of other funds. The estimate of expenses does not include fees or other expenses of any variable insurance product. If such expenses were included, the estimate of expenses you paid during the period would be higher and your ending account value would be lower.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as sales charges (loads), or contingent deferred sales charges on redemptions. Therefore, the second line of each class’ table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

| | | | | | | | | | | | | | | | |

| | | Beginning

Account Value

July 1, 2014 | | | Ending

Account Value

December 31, 2014 | | | Expenses Paid

During Period* | | | Annualized

Expense Ratio* | |

Class A | | | | | | | | | |

Actual | | $ | 1,000 | | | $ | 1,013.40 | | | $ | 3.65 | | | | 0.72 | % |

Hypothetical (5% annual return before expenses) | | $ | 1,000 | | | $ | 1,021.58 | | | $ | 3.67 | | | | 0.72 | % |

| | | | | | | | | | | | | | | | |

Class B | | | | | | | | | |

Actual | | $ | 1,000 | | | $ | 1,012.50 | | | $ | 4.92 | | | | 0.97 | % |

Hypothetical (5% annual return before expenses) | | $ | 1,000 | | | $ | 1,020.32 | | | $ | 4.94 | | | | 0.97 | % |

| * | | Expenses are equal to each classes’ annualized expense ratios, multiplied by the average account value over the period, multiplied by 184/365 (to reflect the one-half year period). |

6

| | |

| BALANCED WEALTH STRATEGY PORTFOLIO |

| TEN LARGEST HOLDINGS* | | |

| December 31, 2014 (unaudited) | | AllianceBernstein Variable Products Series Fund |

| | | | | | | | |

| COMPANY | | U.S. $ VALUE | | | PERCENT OF NET ASSETS | |

U.S. Treasury Bonds & Notes | | $ | 22,357,833 | | | | 6.1 | % |

Federal National Mortgage Association | | | 20,633,625 | | | | 5.7 | |

Apple, Inc. | | | 4,176,779 | | | | 1.2 | |

Inflation-Linked Securities | | | 4,095,017 | | | | 1.1 | |

CVS Health Corp. | | | 3,443,082 | | | | 1.0 | |

UnitedHealth Group, Inc. | | | 2,701,226 | | | | 0.7 | |

Visa, Inc.—Class A | | | 2,687,550 | | | | 0.7 | |

Google, Inc. | | | 2,621,424 | | | | 0.7 | |

Gilead Sciences, Inc. | | | 2,604,404 | | | | 0.7 | |

Comcast Corp. | | | 2,561,421 | | | | 0.7 | |

| | | | | | | | | |

| | | $ | 67,882,361 | | | | 18.6 | % |

SECURITY TYPE BREAKDOWN†

December 31, 2014 (unaudited)

| | | | | | | | |

| SECURITY TYPE | | U.S. $ VALUE | | | PERCENT OF TOTAL INVESTMENTS | |

Common Stocks | | $ | 230,223,280 | | | | 60.9 | % |

Corporates—Investment Grades | | | 32,511,189 | | | | 8.6 | |

Governments—Treasuries | | | 23,950,984 | | | | 6.3 | |

Mortgage Pass-Throughs | | | 23,074,342 | | | | 6.1 | |

Asset-Backed Securities | | | 18,379,019 | | | | 4.9 | |

Commercial Mortgage-Backed Securities | | | 12,510,137 | | | | 3.3 | |

Corporates—Non-Investment Grades | | | 5,484,568 | | | | 1.5 | |

Inflation-Linked Securities | | | 4,095,017 | | | | 1.1 | |

Collateralized Mortgage Obligations | | | 4,019,176 | | | | 1.1 | |

Quasi-Sovereigns | | | 2,160,770 | | | | 0.6 | |

Governments—Sovereign Agencies | | | 536,070 | | | | 0.1 | |

Local Governments—Municipal Bonds | | | 529,575 | | | | 0.1 | |

Emerging Markets—Corporate Bonds | | | 406,450 | | | | 0.1 | |

Preferred Stocks | | | 169,711 | | | | 0.1 | |

Short-Term Investments | | | 19,799,895 | | | | 5.2 | |

| | | | | | | | | |

Total Investments | | $ | 377,850,183 | | | | 100.0 | % |

| † | | The Portfolio’s security type breakdown is expressed as a percentage of total investments (excluding security lending collateral) and may vary over time. The Portfolio also enters into derivative transactions, which may be used for hedging or investment purposes (see “Portfolio of Investments” section of the report for additional details). |

7

| | |

| BALANCED WEALTH STRATEGY PORTFOLIO |

| PORTFOLIOOF INVESTMENTS | | |

| December 31, 2014 | | AllianceBernstein Variable Products Series Fund |

| | | | | | | | |

| Company | |

Shares | | | U.S. $ Value | |

| | | | | | | | |

COMMON STOCKS–63.0% | | | | | | | | |

| | | | | | | | |

FINANCIALS–10.0% | | | | | | | | |

BANKS–3.2% | | | | | | | | |

Bank Hapoalim BM | | | 29,100 | | | $ | 136,832 | |

Bank of America Corp. | | | 118,300 | | | | 2,116,387 | |

Bank of Baroda | | | 6,420 | | | | 109,748 | |

Bank of China Ltd.–Class H | | | 334,000 | | | | 187,464 | |

Bank of Queensland Ltd. | | | 20,940 | | | | 206,299 | |

Citigroup, Inc. | | | 9,900 | | | | 535,689 | |

Comerica, Inc. | | | 9,600 | | | | 449,664 | |

Commerzbank AG(a) | | | 15,500 | | | | 203,307 | |

Danske Bank A/S | | | 15,960 | | | | 431,492 | |

Fifth Third Bancorp | | | 13,200 | | | | 268,950 | |

HSBC Holdings PLC | | | 68,170 | | | | 644,190 | |

ICICI Bank Ltd. | | | 23,100 | | | | 128,241 | |

ING Groep NV(a) | | | 24,680 | | | | 318,857 | |

Intesa Sanpaolo SpA | | | 78,950 | | | | 229,026 | |

Itausa-Investimentos Itau SA (Preference Shares) | | | 25,500 | | | | 90,078 | |

JPMorgan Chase & Co. | | | 24,300 | | | | 1,520,694 | |

KeyCorp | | | 5,836 | | | | 81,120 | |

Mitsubishi UFJ Financial Group, Inc. | | | 69,100 | | | | 379,651 | |

PNC Financial Services Group, Inc. (The) | | | 3,700 | | | | 337,551 | |

Shinhan Financial Group Co., Ltd.(a) | | | 2,130 | | | | 85,616 | |

Societe Generale SA | | | 9,762 | | | | 408,541 | |

Sumitomo Mitsui Financial Group, Inc. | | | 7,300 | | | | 263,915 | |

UniCredit SpA | | | 82,770 | | | | 530,192 | |

Wells Fargo & Co. | | | 37,200 | | | | 2,039,304 | |

| | | | | | | | |

| | | | | | | 11,702,808 | |

| | | | | | | | |

CAPITAL MARKETS–1.6% | | | | | | | | |

Affiliated Managers Group, Inc.(a) | | | 4,842 | | | | 1,027,666 | |

Bank of New York Mellon Corp. (The) | | | 8,000 | | | | 324,560 | |

BlackRock, Inc.–Class A | | | 3,120 | | | | 1,115,587 | |

Daiwa Securities Group, Inc. | | | 117,000 | | | | 916,126 | |

Goldman Sachs Group, Inc. (The) | | | 2,374 | | | | 460,152 | |

Morgan Stanley | | | 10,587 | | | | 410,776 | |

Partners Group Holding AG | | | 760 | | | | 221,112 | |

State Street Corp. | | | 4,100 | | | | 321,850 | |

UBS Group AG(a) | | | 64,842 | | | | 1,114,615 | |

| | | | | | | | |

| | | | | | | 5,912,444 | |

| | | | | | | | |

CONSUMER FINANCE–0.8% | | | | | | | | |

Capital One Financial Corp. | | | 16,800 | | | | 1,386,840 | |

Discover Financial Services | | | 13,500 | | | | 884,115 | |

Muthoot Finance Ltd. | | | 39,211 | | | | 118,958 | |

Shriram Transport Finance Co., Ltd. | | | 2,305 | | | | 40,207 | |

SLM Corp. | | | 58,900 | | | | 600,191 | |

| | | | | | | | |

| | | | | | | 3,030,311 | |

| | | | | | | | |

| | | | | | | | |

DIVERSIFIED FINANCIAL SERVICES–0.8% | | | | | | | | |

Berkshire Hathaway, Inc.–

Class B(a) | | | 5,300 | | | $ | 795,795 | |

Cerved Information Solutions

SpA(a)(b) | | | 14,060 | | | | 74,250 | |

Challenger Ltd./Australia | | | 38,980 | | | | 205,913 | |

Friends Life Group Ltd. | | | 36,030 | | | | 204,623 | |

Intercontinental Exchange, Inc. | | | 5,053 | | | | 1,108,073 | |

ORIX Corp. | | | 40,600 | | | | 510,861 | |

| | | | | | | | |

| | | | | | | 2,899,515 | |

| | | | | | | | |

INSURANCE–2.9% | | | | | | | | |

ACE Ltd. | | | 2,100 | | | | 241,248 | |

Admiral Group PLC | | | 34,790 | | | | 713,720 | |

AIA Group Ltd. | | | 227,600 | | | | 1,250,956 | |

Allstate Corp. (The) | | | 19,600 | | | | 1,376,900 | |

American Financial Group, Inc./OH | | | 11,700 | | | | 710,424 | |

American International Group, Inc. | | | 20,200 | | | | 1,131,402 | |

Aon PLC | | | 9,440 | | | | 895,195 | |

Aspen Insurance Holdings Ltd. | | | 4,700 | | | | 205,719 | |

Assurant, Inc. | | | 3,028 | | | | 207,206 | |

Chubb Corp. (The) | | | 3,418 | | | | 353,661 | |

Direct Line Insurance Group PLC | | | 32,790 | | | | 148,329 | |

Hanover Insurance Group, Inc. (The) | | | 5,700 | | | | 406,524 | |

Muenchener Rueckversicherungs-Gesellschaft AG in Muenchen | | | 3,190 | | | | 635,248 | |

PartnerRe Ltd. | | | 6,602 | | | | 753,486 | |

Progressive Corp. (The) | | | 4,200 | | | | 113,358 | |

Prudential PLC | | | 34,820 | | | | 805,020 | |

Suncorp Group Ltd. | | | 11,430 | | | | 130,574 | |

Travelers Cos., Inc. (The) | | | 3,700 | | | | 391,645 | |

Unum Group | | | 2,300 | | | | 80,224 | |

XL Group PLC | | | 3,000 | | | | 103,110 | |

| | | | | | | | |

| | | | | | | 10,653,949 | |

| | | | | | | | |

REAL ESTATE MANAGEMENT & DEVELOPMENT–0.5% | | | | | | | | |

Ayala Land, Inc. | | | 21,100 | | | | 15,734 | |

Daito Trust Construction Co., Ltd. | | | 7,200 | | | | 816,752 | |

Global Logistic Properties Ltd. | | | 439,000 | | | | 818,472 | |

| | | | | | | | |

| | | | | | | 1,650,958 | |

| | | | | | | | |

THRIFTS & MORTGAGE FINANCE–0.2% | | | | | | | | |

Housing Development Finance Corp. Ltd. | | | 26,340 | | | | 471,111 | |

LIC Housing Finance Ltd. | | | 17,210 | | | | 118,293 | |

| | | | | | | | |

| | | | | | | 589,404 | |

| | | | | | | | |

| | | | | | | 36,439,389 | |

| | | | | | | | |

8

| | |

| | | AllianceBernstein Variable Products Series Fund |

| | | | | | | | |

| Company | |

Shares | | | U.S. $ Value | |

| | | | | | | | |

CONSUMER DISCRETIONARY–9.0% | | | | | | | | |

AUTO COMPONENTS–0.9% | | | | | | | | |

Aisin Seiki Co., Ltd. | | | 8,700 | | | $ | 312,577 | |

Bridgestone Corp. | | | 6,300 | | | | 218,496 | |

Cie Generale des Etablissements Michelin–Class B | | | 4,520 | | | | 408,006 | |

GKN PLC | | | 35,560 | | | | 189,277 | |

Lear Corp. | | | 5,200 | | | | 510,016 | |

Magna International, Inc. (New York)–Class A | | | 4,600 | | | | 499,974 | |

Plastic Omnium SA | | | 6,870 | | | | 186,437 | |

Sumitomo Electric Industries Ltd. | | | 27,200 | | | | 339,708 | |

Valeo SA | | | 3,680 | | | | 457,903 | |

| | | | | | | | |

| | | | | | | 3,122,394 | |

| | | | | | | | |

AUTOMOBILES–1.0% | | | | | | | | |

Bayerische Motoren Werke AG | | | 2,060 | | | | 222,312 | |

Ford Motor Co. | | | 77,600 | | | | 1,202,800 | |

Great Wall Motor Co., Ltd.–Class H | | | 38,500 | | | | 218,515 | |

Honda Motor Co., Ltd. | | | 18,000 | | | | 528,089 | |

Renault SA | | | 2,030 | | | | 147,858 | |

Tata Motors Ltd. | | | 17,050 | | | | 133,307 | |

Toyota Motor Corp. | | | 16,100 | | | | 1,003,309 | |

Volkswagen AG (Preference Shares) | | | 900 | | | | 200,030 | |

| | | | | | | | |

| | | | | | | 3,656,220 | |

| | | | | | | | |

DIVERSIFIED CONSUMER SERVICES–0.2% | | | | | | | | |

Estacio Participacoes SA | | | 37,100 | | | | 332,451 | |

Kroton Educacional SA | | | 43,600 | | | | 254,232 | |

TAL Education Group (ADR)(a) | | | 1,900 | | | | 53,371 | |

| | | | | | | | |

| | | | | | | 640,054 | |

| | | | | | | | |

HOTELS, RESTAURANTS & LEISURE–0.9% | | | | | | | | |

Galaxy Entertainment Group Ltd. | | | 13,000 | | | | 72,237 | |

Melco International Development Ltd.(b) | | | 113,000 | | | | 247,660 | |

Merlin Entertainments PLC(c) | | | 64,969 | | | | 402,005 | |

Sands China Ltd. | | | 18,000 | | | | 87,741 | |

Sodexo SA | | | 5,229 | | | | 511,837 | |

Starbucks Corp. | | | 20,550 | | | | 1,686,127 | |

Yum! Brands, Inc. | | | 2,150 | | | | 156,628 | |

| | | | | | | | |

| | | | | | | 3,164,235 | |

| | | | | | | | |

HOUSEHOLD

DURABLES–0.1% | | | | | | | | |

PulteGroup, Inc. | | | 20,806 | | | | 446,497 | |

| | | | | | | | |

INTERNET & CATALOG

RETAIL–0.6% | | | | | | | | |

Just Eat PLC(a) | | | 51,305 | | | | 247,649 | |

Priceline Group, Inc. (The)(a) | | | 1,690 | | | | 1,926,955 | |

| | | | | | | | |

| | | | | | | 2,174,604 | |

| | | | | | | | |

| | | | | | | | |

LEISURE PRODUCTS–0.3% | | | | | | | | |

Polaris Industries, Inc. | | | 6,690 | | | $ | 1,011,796 | |

| | | | | | | | |

MEDIA–1.8% | | | | | | | | |

Comcast Corp.–Class A | | | 35,350 | | | | 2,050,654 | |

CTS Eventim AG & Co. KGaA | | | 2,450 | | | | 72,181 | |

Liberty Global PLC–Class A(a) | | | 899 | | | | 45,134 | |

Liberty Global PLC–Series C(a) | | | 28,318 | | | | 1,368,043 | |

Naspers Ltd.–Class N | | | 3,700 | | | | 478,614 | |

Smiles SA | | | 5,700 | | | | 98,745 | |

Thomson Reuters Corp. | | | 2,453 | | | | 98,954 | |

Time Warner, Inc. | | | 14,665 | | | | 1,252,684 | |

Walt Disney Co. (The) | | | 13,448 | | | | 1,266,667 | |

| | | | | | | | |

| | | | | | | 6,731,676 | |

| | | | | | | | |

MULTILINE RETAIL–0.5% | | | | | | | | |

B&M European Value Retail SA | | | 139,637 | | | | 620,269 | |

Dillard’s, Inc.–Class A | | | 3,000 | | | | 375,540 | |

Dollar General Corp.(a) | | | 10,300 | | | | 728,210 | |

Poundland Group PLC(a) | | | 59,110 | | | | 302,367 | |

| | | | | | | | |

| | | | | | | 2,026,386 | |

| | | | | | | | |

SPECIALTY RETAIL–1.7% | | | | | | | | |

Foot Locker, Inc. | | | 14,078 | | | | 790,902 | |

GameStop Corp.–Class A(b) | | | 17,900 | | | | 605,020 | |

Home Depot, Inc. (The) | | | 19,330 | | | | 2,029,070 | |

Kingfisher PLC | | | 29,490 | | | | 155,888 | |

L’Occitane International SA | | | 3,500 | | | | 8,846 | |

O’Reilly Automotive, Inc.(a) | | | 2,900 | | | | 558,598 | |

Office Depot, Inc.(a) | | | 73,337 | | | | 628,865 | |

Shimamura Co., Ltd. | | | 1,700 | | | | 146,705 | |

Sports Direct International PLC(a) | | | 51,549 | | | | 567,076 | |

Ulta Salon Cosmetics & Fragrance, Inc.(a) | | | 5,370 | | | | 686,501 | |

Yamada Denki Co., Ltd.(b) | | | 68,600 | | | | 230,161 | |

| | | | | | | | |

| | | | | | | 6,407,632 | |

| | | | | | | | |

TEXTILES, APPAREL & LUXURY GOODS–1.0% | | | | | | | | |

Cie Financiere Richemont SA | | | 11,400 | | | | 1,010,708 | |

Global Brands Group Holding Ltd.(a) | | | 600,000 | | | | 117,163 | |

HUGO BOSS AG | | | 2,956 | | | | 361,612 | |

Kering | | | 590 | | | | 113,381 | |

NIKE, Inc.–Class B | | | 14,471 | | | | 1,391,387 | |

Samsonite International SA | | | 147,900 | | | | 438,293 | |

Titan Co., Ltd. | | | 14,370 | | | | 86,562 | |

| | | | | | | | |

| | | | | | | 3,519,106 | |

| | | | | | | | |

| | | | | | | 32,900,600 | |

| | | | | | | | |

INFORMATION TECHNOLOGY–8.8% | | | | | | | | |

COMMUNICATIONS EQUIPMENT–0.7% | | | | | | | | |

Brocade Communications Systems, Inc. | | | 64,600 | | | | 764,864 | |

Cisco Systems, Inc. | | | 32,740 | | | | 910,663 | |

9

| | |

| BALANCED WEALTH STRATEGY PORTFOLIO |

| PORTFOLIOOF INVESTMENTS | | |

| (continued) | | AllianceBernstein Variable Products Series Fund |

| | | | | | | | |

| Company | |

Shares | | | U.S. $ Value | |

| | | | | | | | |

F5 Networks, Inc.(a) | | | 4,310 | | | $ | 562,304 | |

Harris Corp. | | | 5,601 | | | | 402,264 | |

| | | | | | | | |

| | | | | | | 2,640,095 | |

| | | | | | | | |

ELECTRONIC EQUIPMENT, INSTRUMENTS &

COMPONENTS–0.3% | | | | | | | | |

Amphenol Corp–Class A | | | 16,231 | | | | 873,390 | |

Arrow Electronics, Inc.(a) | | | 4,300 | | | | 248,927 | |

| | | | | | | | |

| | | | | | | 1,122,317 | |

| | | | | | | | |

INTERNET SOFTWARE & SERVICES–1.6% | | | | | | | | |

Baidu, Inc. (Sponsored ADR)(a) | | | 1,920 | | | | 437,702 | |

Facebook, Inc.–Class A(a) | | | 22,334 | | | | 1,742,499 | |

Google, Inc.–Class A(a) | | | 2,460 | | | | 1,305,424 | |

Google, Inc.–Class C(a) | | | 2,500 | | | | 1,316,000 | |

LinkedIn Corp.–Class A(a) | | | 2,330 | | | | 535,224 | |

Telecity Group PLC | | | 45,783 | | | | 571,820 | |

| | | | | | | | |

| | | | | | | 5,908,669 | |

| | | | | | | | |

IT SERVICES–1.2% | | | | | | | | |

Booz Allen Hamilton Holding Corp. | | | 8,600 | | | | 228,158 | |

Cap Gemini SA | | | 2,270 | | | | 162,344 | |

HCL Technologies Ltd. | | | 1,840 | | | | 46,677 | |

Tata Consultancy Services Ltd. | | | 4,340 | | | | 176,288 | |

Visa, Inc.–Class A | | | 10,250 | | | | 2,687,550 | |

Xerox Corp. | | | 67,600 | | | | 936,936 | |

| | | | | | | | |

| | | | | | | 4,237,953 | |

| | | | | | | | |

SEMICONDUCTORS & SEMICONDUCTOR EQUIPMENT–1.4% | | | | | | | | |

Advanced Semiconductor Engineering, Inc. | | | 131,000 | | | | 155,579 | |

Altera Corp. | | | 17,410 | | | | 643,125 | |

Applied Materials, Inc. | | | 23,664 | | | | 589,707 | |

ASM International NV | | | 4,020 | | | | 170,242 | |

Infineon Technologies AG | | | 11,794 | | | | 124,802 | |

Intel Corp. | | | 31,800 | | | | 1,154,022 | |

Linear Technology Corp. | | | 12,850 | | | | 585,960 | |

Micron Technology, Inc.(a) | | | 8,300 | | | | 290,583 | |

Novatek Microelectronics Corp. | | | 37,000 | | | | 206,760 | |

NXP Semiconductors NV(a) | | | 8,486 | | | | 648,330 | |

Sumco Corp.(b) | | | 18,500 | | | | 264,848 | |

Tokyo Electron Ltd. | | | 2,600 | | | | 197,159 | |

| | | | | | | | |

| | | | | | | 5,031,117 | |

| | | | | | | | |

SOFTWARE–1.7% | | | | | | | | |

ANSYS, Inc.(a) | | | 15,835 | | | | 1,298,470 | |

Aspen Technology, Inc.(a) | | | 12,230 | | | | 428,295 | |

Dassault Systemes | | | 6,673 | | | | 406,922 | |

Electronic Arts, Inc.(a) | | | 15,538 | | | | 730,519 | |

Microsoft Corp. | | | 34,300 | | | | 1,593,235 | |

Mobileye NV(a) | | | 6,120 | | | | 248,227 | |

NetSuite, Inc.(a) | | | 5,020 | | | | 548,033 | |

Oracle Corp. | | | 11,712 | | | | 526,689 | |

ServiceNow, Inc.(a) | | | 8,065 | | | | 547,210 | |

| | | | | | | | |

| | | | | | | 6,327,600 | |

| | | | | | | | |

| | | | | | | | |

TECHNOLOGY HARDWARE, STORAGE &

PERIPHERALS–0.1% | | | | | | | | |

Samsung Electronics Co., Ltd. | | | 320 | | | $ | 384,718 | |

| | | | | | | | |

TECHNOLOGY HARDWARE, STORAGE &

PERIPHERALS–1.8% | | | | | | | | |

Apple, Inc. | | | 37,840 | | | | 4,176,779 | |

Asustek Computer, Inc. | | | 16,000 | | | | 174,576 | |

Casetek Holdings Ltd. | | | 32,000 | | | | 180,192 | |

Catcher Technology Co., Ltd. | | | 33,000 | | | | 254,840 | |

Hewlett-Packard Co. | | | 43,000 | | | | 1,725,590 | |

| | | | | | | | |

| | | | | | | 6,511,977 | |

| | | | | | | | |

| | | | | | | 32,164,446 | |

| | | | | | | | |

HEALTH CARE–7.4% | | | | | | | | |

BIOTECHNOLOGY–1.4% | | | | | | | | |

Actelion Ltd. (REG)(a) | | | 5,070 | | | | 583,664 | |

Biogen Idec, Inc.(a) | | | 5,612 | | | | 1,904,993 | |

Gilead Sciences, Inc.(a) | | | 27,630 | | | | 2,604,404 | |

| | | | | | | | |

| | | | | | | 5,093,061 | |

| | | | | | | | |

HEALTH CARE EQUIPMENT &

SUPPLIES–0.5% | | | | | | | | |

Align Technology, Inc.(a) | | | 7,204 | | | | 402,776 | |

Intuitive Surgical, Inc.(a) | | | 2,600 | | | | 1,375,244 | |

| | | | | | | | |

| | | | | | | 1,778,020 | |

| | | | | | | | |

HEALTH CARE PROVIDERS & SERVICES–1.8% | | | | | | | | |

Aetna, Inc. | | | 11,500 | | | | 1,021,545 | |

Anthem, Inc. | | | 11,700 | | | | 1,470,339 | |

Express Scripts Holding Co.(a) | | | 5,300 | | | | 448,751 | |

McKesson Corp. | | | 3,070 | | | | 637,270 | |

Premier, Inc.–Class A(a) | | | 13,538 | | | | 453,929 | |

UnitedHealth Group, Inc. | | | 26,721 | | | | 2,701,226 | |

| | | | | | | | |

| | | | | | | 6,733,060 | |

| | | | | | | | |

LIFE SCIENCES TOOLS & SERVICES–0.8% | | | | | | | | |

Eurofins Scientific SE | | | 5,059 | | | | 1,291,320 | |

Illumina, Inc.(a) | | | 541 | | | | 99,858 | |

Mettler-Toledo International, Inc.(a) | | | 2,169 | | | | 656,036 | |

Quintiles Transnational Holdings, Inc.(a) | | | 14,843 | | | | 873,807 | |

| | | | | | | | |

| | | | | | | 2,921,021 | |

| | | | | | | | |

PHARMACEUTICALS–2.9% | | | | | | | | |

Allergan, Inc./United States | | | 11,743 | | | | 2,496,444 | |

Astellas Pharma, Inc. | | | 23,400 | | | | 325,777 | |

GlaxoSmithKline PLC | | | 37,120 | | | | 796,358 | |

Indivior PLC(a) | | | 2,780 | | | | 6,473 | |

Johnson & Johnson | | | 18,000 | | | | 1,882,260 | |

Merck & Co., Inc. | | | 18,700 | | | | 1,061,973 | |

Novo Nordisk A/S–Class B | | | 12,820 | | | | 542,283 | |

Pfizer, Inc. | | | 68,600 | | | | 2,136,890 | |

Roche Holding AG | | | 3,040 | | | | 823,664 | |

10

| | |

| | | AllianceBernstein Variable Products Series Fund |

| | | | | | | | |

| Company | |

Shares | | | U.S. $ Value | |

| | | | | | | | |

Sun Pharmaceutical Industries Ltd. | | | 11,420 | | | $ | 149,321 | |

Teva Pharmaceutical Industries Ltd. | | | 2,770 | | | | 158,790 | |

Teva Pharmaceutical Industries Ltd. (Sponsored ADR) | | | 1,570 | | | | 90,291 | |

| | | | | | | | |

| | | | | | | 10,470,524 | |

| | | | | | | | |

| | | | | | | 26,995,686 | |

| | | | | | | | |

INDUSTRIALS–6.2% | | | | | | | | |

AEROSPACE &

DEFENSE–1.1% | | | | | | | | |

Airbus Group NV | | | 13,520 | | | | 668,402 | |

Boeing Co. (The) | | | 7,470 | | | | 970,950 | |

General Dynamics Corp. | | | 2,100 | | | | 289,002 | |

L-3 Communications Holdings, Inc. | | | 5,064 | | | | 639,127 | |

Precision Castparts Corp. | | | 2,434 | | | | 586,302 | |

Rockwell Collins, Inc. | | | 2,816 | | | | 237,896 | |

Safran SA | | | 4,340 | | | | 267,756 | |

Zodiac Aerospace | | | 12,989 | | | | 437,311 | |

| | | | | | | | |

| | | | | | | 4,096,746 | |

| | | | | | | | |

AIRLINES–0.5% | | | | | | | | |

Delta Air Lines, Inc. | | | 25,600 | | | | 1,259,264 | |

International Consolidated Airlines Group SA(a) | | | 58,500 | | | | 440,392 | |

Japan Airlines Co., Ltd. | | | 4,000 | | | | 118,596 | |

Qantas Airways Ltd.(a) | | | 127,940 | | | | 248,500 | |

| | | | | | | | |

| | | | | | | 2,066,752 | |

| | | | | | | | |

COMMERCIAL SERVICES & SUPPLIES–0.3% | | | | | | | | |

Babcock International Group PLC | | | 45,125 | | | | 739,250 | |

Edenred | | | 15,104 | | | | 417,716 | |

Regus PLC | | | 26,718 | | | | 86,264 | |

| | | | | | | | |

| | | | | | | 1,243,230 | |

| | | | | | | | |

ELECTRICAL

EQUIPMENT–0.3% | | | | | | | | |

AMETEK, Inc. | | | 18,892 | | | | 994,286 | |

| | | | | | | | |

INDUSTRIAL CONGLOMERATES–0.9% | | | | | | | | |

Bidvest Group Ltd. (The) | | | 4,750 | | | | 124,183 | |

Danaher Corp. | | | 22,309 | | | | 1,912,105 | |

General Electric Co. | | | 30,300 | | | | 765,681 | |

Hutchison Whampoa Ltd. | | | 18,000 | | | | 205,999 | |

Toshiba Corp. | | | 74,000 | | | | 312,080 | |

| | | | | | | | |

| | | | | | | 3,320,048 | |

| | | | | | | | |

INDUSTRIAL WAREHOUSE DISTRIBUTION–0.5% | | | | | | | | |

DCT Industrial Trust, Inc. | | | 5,480 | | | | 195,417 | |

Granite Real Estate Investment Trust | | | 10,292 | | | | 365,881 | |

Hansteen Holdings PLC | | | 68,120 | | | | 114,241 | |

Japan Logistics Fund, Inc. | | | 57 | | | | 128,200 | |

Mapletree Industrial Trust | | | 159,000 | | | | 177,901 | |

| | | | | | | | |

Mapletree Logistics Trust | | | 231,389 | | | $ | 206,602 | |

Mexico Real Estate Management SA de CV(a) | | | 59,400 | | | | 98,921 | |

Prologis, Inc. | | | 2,153 | | | | 92,643 | |

STAG Industrial, Inc. | | | 16,410 | | | | 402,045 | |

| | | | | | | | |

| | | | | | | 1,781,851 | |

| | | | | | | | |

MACHINERY–1.1% | | | | | | | | |

Caterpillar, Inc. | | | 7,000 | | | | 640,710 | |

ITT Corp. | | | 13,651 | | | | 552,319 | |

JTEKT Corp. | | | 19,000 | | | | 319,766 | |

Pall Corp. | | | 11,620 | | | | 1,176,060 | |

Parker-Hannifin Corp. | | | 1,200 | | | | 154,740 | |

Wabtec Corp./DE | | | 12,930 | | | | 1,123,488 | |

| | | | | | | | |

| | | | | | | 3,967,083 | |

| | | | | | | | |

MARINE–0.1% | | | | | | | | |

AP Moeller-Maersk A/S–

Class B | | | 65 | | | | 129,282 | |

Nippon Yusen KK | | | 97,000 | | | | 273,977 | |

| | | | | | | | |

| | | | | | | 403,259 | |

| | | | | | | | |

MIXED OFFICE

INDUSTRIAL–0.1% | | | | | | | | |

Goodman Group(b) | | | 56,240 | | | | 259,766 | |

| | | | | | | | |

PROFESSIONAL

SERVICES–0.9% | | | | | | | | |

Applus Services SA(a) | | | 19,095 | | | | 210,322 | |

Bureau Veritas SA | | | 37,429 | | | | 829,275 | |

Capita PLC | | | 66,411 | | | | 1,113,559 | |

Intertek Group PLC | | | 23,452 | | | | 848,775 | |

Teleperformance | | | 4,250 | | | | 289,298 | |

| | | | | | | | |

| | | | | | | 3,291,229 | |

| | | | | | | | |

ROAD & RAIL–0.2% | | | | | | | | |

Central Japan Railway Co. | | | 2,000 | | | | 299,752 | |

JB Hunt Transport Services, Inc. | | | 4,527 | | | | 381,400 | |

| | | | | | | | |

| | | | | | | 681,152 | |

| | | | | | | | |

TRADING COMPANIES & DISTRIBUTORS–0.2% | | | | | | | | |

Brenntag AG | | | 5,810 | | | | 324,837 | |

Bunzl PLC | | | 5,720 | | | | 156,369 | |

Rexel SA | | | 8,477 | | | | 151,875 | |

| | | | | | | | |

| | | | | | | 633,081 | |

| | | | | | | | |

| | | | | | | 22,738,483 | |

| | | | | | | | |

CONSUMER STAPLES–4.3% | | | | | | | | |

BEVERAGES–0.6% | | | | | | | | |

Asahi Group Holdings Ltd. | | | 4,100 | | | | 126,843 | |

Molson Coors Brewing Co.–

Class B | | | 1,000 | | | | 74,520 | |

Monster Beverage Corp.(a) | | | 20,771 | | | | 2,250,538 | |

| | | | | | | | |

| | | | | | | 2,451,901 | |

| | | | | | | | |

FOOD & STAPLES

RETAILING–1.8% | | | | | | | | |

Costco Wholesale Corp. | | | 8,670 | | | | 1,228,972 | |

CVS Health Corp. | | | 35,750 | | | | 3,443,082 | |

11

| | |

| BALANCED WEALTH STRATEGY PORTFOLIO |

| PORTFOLIOOF INVESTMENTS | | |

| (continued) | | AllianceBernstein Variable Products Series Fund |

| | | | | | | | |

| Company | |

Shares | | | U.S. $ Value | |

| | | | | | | | |

Koninklijke Ahold NV | | | 26,435 | | | $ | 469,825 | |

Kroger Co. (The) | | | 12,800 | | | | 821,888 | |

Lenta Ltd. (GDR)(a)(c) | | | 6,510 | | | | 44,008 | |

Olam International Ltd. | | | 179,412 | | | | 272,272 | |

Sugi Holdings Co., Ltd.(b) | | | 2,100 | | | | 85,721 | |

Tsuruha Holdings, Inc. | | | 1,800 | | | | 104,154 | |

| | | | | | | | |

| | | | | | | 6,469,922 | |

| | | | | | | | |

FOOD PRODUCTS–0.6% | | | | | | | | |

Archer-Daniels-Midland Co. | | | 4,200 | | | | 218,400 | |

Bunge Ltd. | | | 1,020 | | | | 92,729 | |

Ingredion, Inc. | | | 6,874 | | | | 583,190 | |

Keurig Green Mountain, Inc. | | | 2,970 | | | | 393,213 | |

Mead Johnson Nutrition Co.–Class A | | | 8,950 | | | | 899,833 | |

| | | | | | | | |

| | | | | | | 2,187,365 | |

| | | | | | | | |

HOUSEHOLD

PRODUCTS–0.2% | | | | | | | | |

Procter & Gamble Co. (The) | | | 5,000 | | | | 455,450 | |

Reckitt Benckiser Group PLC | | | 2,780 | | | | 225,163 | |

| | | | | | | | |

| | | | | | | 680,613 | |

| | | | | | | | |

PERSONAL PRODUCTS–0.1% | | | | | | | | |

Estee Lauder Cos., Inc. (The)–Class A | | | 5,590 | | | | 425,958 | |

| | | | | | | | |

TOBACCO–1.0% | | | | | | | | |

British American Tobacco PLC | | | 21,389 | | | | 1,159,090 | |

Imperial Tobacco Group PLC | | | 8,140 | | | | 358,319 | |

Philip Morris International, Inc. | | | 25,075 | | | | 2,042,359 | |

| | | | | | | | |

| | | | | | | 3,559,768 | |

| | | | | | | | |

| | | | | | | 15,775,527 | |

| | | | | | | | |

EQUITY: OTHER–3.5% | | | | | | | | |

DIVERSIFIED/

SPECIALTY–2.9% | | | | | | | | |

British Land Co. PLC(The) | | | 46,823 | | | | 564,622 | |

Buzzi Unicem SpA | | | 12,990 | | | | 164,416 | |

CA Immobilien Anlagen

AG(a)(b) | | | 15,980 | | | | 298,861 | |

CBRE Group, Inc.–Class A(a) | | | 10,990 | | | | 376,407 | |

Cheung Kong Holdings Ltd. | | | 21,000 | | | | 352,223 | |

ClubCorp Holdings, Inc. | | | 19,904 | | | | 356,879 | |

Cofinimmo SA | | | 2,140 | | | | 248,005 | |

CSR Ltd. | | | 57,960 | | | | 183,121 | |

Duke Realty Corp. | | | 15,080 | | | | 304,616 | |

East Japan Railway Co. | | | 2,500 | | | | 188,427 | |

Fibra Uno Administracion SA de CV | | | 77,830 | | | | 229,474 | |

Folkestone Education Trust | | | 51,780 | | | | 84,124 | |

Fukuoka REIT Corp. | | | 55 | | | | 101,832 | |

GPT Group (The) | | | 28,970 | | | | 102,526 | |

Gramercy Property Trust, Inc. | | | 59,970 | | | | 413,793 | |

Hemfosa Fastigheter AB(a) | | | 14,480 | | | | 305,534 | |

Henderson Land Development Co., Ltd. | | | 18,340 | | | | 127,233 | |

Kennedy Wilson Europe Real Estate PLC | | | 22,084 | | | | 363,133 | |

Kennedy-Wilson Holdings, Inc. | | | 14,040 | | | | 355,212 | |

| | | | | | | | |

Lend Lease Group | | | 26,276 | | | $ | 349,966 | |

Merlin Properties Socimi SA(a) | | | 34,250 | | | | 415,685 | |

Mitsubishi Estate Co., Ltd. | | | 31,000 | | | | 653,197 | |

Mitsui Fudosan Co., Ltd. | | | 21,100 | | | | 565,808 | |

Nomura Real Estate Master Fund, Inc.(b) | | | 87 | | | | 112,665 | |

Orix JREIT, Inc.(b) | | | 189 | | | | 265,788 | |

PLA Administradora Industrial S de RL de CV(a) | | | 71,170 | | | | 149,250 | |

Regal Entertainment Group–Class A | | | 16,800 | | | | 358,848 | |

Royal Mail PLC | | | 53,190 | | | | 354,456 | |

Spirit Realty Capital, Inc. | | | 10,661 | | | | 126,759 | |

Sumitomo Realty & Development Co., Ltd. | | | 17,000 | | | | 579,175 | |

Sun Hung Kai Properties Ltd. | | | 38,600 | | | | 584,807 | |

Taiheiyo Cement Corp. | | | 23,000 | | | | 72,160 | |

Tokyu Fudosan Holdings Corp. | | | 13,700 | | | | 95,055 | |

Top REIT, Inc. | | | 26 | | | | 116,661 | |

Vornado Realty Trust | | | 1,530 | | | | 180,096 | |

Wharf Holdings Ltd. (The) | | | 85,000 | | | | 610,223 | |

| | | | | | | | |

| | | | | | | 10,711,037 | |

| | | | | | | | |

HEALTH CARE–0.6% | | | | | | | | |

Chartwell Retirement Residences | | | 20,060 | | | | 205,642 | |

HCP, Inc. | | | 14,170 | | | | 623,905 | |

LTC Properties, Inc. | | | 10,130 | | | | 437,312 | |

Medical Properties Trust, Inc. | | | 35,175 | | | | 484,711 | |

Ventas, Inc. | | | 5,970 | | | | 428,049 | |

| | | | | | | | |

| | | | | | | 2,179,619 | |

| | | | | | | | |

| | | | | | | 12,890,656 | |

| | | | | | | | |

ENERGY–3.3% | | | | | | | | |

ENERGY EQUIPMENT & SERVICES–0.6% | | | | | | | | |

Aker Solutions ASA(a)(c) | | | 14,840 | | | | 82,544 | |

FMC Technologies, Inc.(a) | | | 18,670 | | | | 874,503 | |

National Oilwell Varco, Inc. | | | 2,700 | | | | 176,931 | |

Schlumberger Ltd. | | | 14,394 | | | | 1,229,391 | |

| | | | | | | | |

| | | | | | | 2,363,369 | |

| | | | | | | | |

OIL, GAS & CONSUMABLE FUELS–2.7% | | | | | | | | |

BG Group PLC | | | 37,120 | | | | 496,729 | |

Chesapeake Energy Corp. | | | 7,200 | | | | 140,904 | |

Chevron Corp. | | | 10,700 | | | | 1,200,326 | |

Exxon Mobil Corp. | | | 24,000 | | | | 2,218,800 | |

Hess Corp. | | | 14,000 | | | | 1,033,480 | |

JX Holdings, Inc. | | | 112,800 | | | | 438,973 | |

Marathon Petroleum Corp. | | | 6,577 | | | | 593,640 | |

Murphy Oil Corp. | | | 12,167 | | | | 614,677 | |

Occidental Petroleum Corp. | | | 15,000 | | | | 1,209,150 | |

Petroleo Brasileiro SA (Sponsored ADR) | | | 16,210 | | | | 122,872 | |

Royal Dutch Shell PLC (Euronext Amsterdam)–Class A | | | 10,595 | | | | 353,122 | |

Total SA | | | 11,080 | | | | 567,650 | |

12

| | |

| | | AllianceBernstein Variable Products Series Fund |

| | | | | | | | |

| Company | |

Shares | | | U.S. $ Value | |

| | | | | | | | |

Valero Energy Corp. | | | 16,800 | | | $ | 831,600 | |

| | | | | | | | |

| | | | | | | 9,821,923 | |

| | | | | | | | |

| | | | | | | 12,185,292 | |

| | | | | | | | |

RETAIL–2.3% | | | | | | | | |

REGIONAL MALL–0.9% | | | | | | | | |

General Growth Properties, Inc. | | | 14,630 | | | | 411,542 | |

Macerich Co. (The) | | | 8,440 | | | | 703,980 | |

Pennsylvania Real Estate Investment Trust | | | 17,510 | | | | 410,785 | |

Simon Property Group, Inc. | | | 5,616 | | | | 1,022,730 | |

Taubman Centers, Inc. | | | 1,240 | | | | 94,761 | |

Washington Prime Group, Inc. | | | 27,728 | | | | 477,476 | |

Westfield Corp. | | | 33,280 | | | | 243,954 | |

| | | | | | | | |

| | | | | | | 3,365,228 | |

| | | | | | | | |

SHOPPING CENTER/OTHER RETAIL–1.4% | | | | | | | | |

Aeon Mall Co., Ltd. | | | 17,500 | | | | 310,117 | |

Charter Hall Retail REIT | | | 35,870 | | | | 119,986 | |

Citycon OYJ | | | 31,860 | | | | 98,267 | |

DDR Corp. | | | 18,030 | | | | 331,031 | |

Federation Centres | | | 82,840 | | | | 192,873 | |

Hammerson PLC | | | 22,530 | | | | 210,992 | |

Japan Retail Fund Investment Corp. | | | 103 | | | | 217,668 | |

JB Hi-Fi Ltd.(b) | | | 13,790 | | | | 176,969 | |

Klepierre | | | 9,553 | | | | 410,188 | |

Link REIT (The) | | | 16,768 | | | | 104,872 | |

Ramco-Gershenson Properties Trust | | | 22,770 | | | | 426,710 | |

Regency Centers Corp. | | | 2,630 | | | | 167,741 | |

Retail Opportunity Investments Corp. | | | 24,170 | | | | 405,814 | |

RioCan Real Estate Investment Trust (Toronto) | | | 4,973 | | | | 113,132 | |

Scentre Group(a) | | | 188,849 | | | | 535,042 | |

Unibail-Rodamco SE | | | 2,569 | | | | 659,040 | |

Vastned Retail NV | | | 6,634 | | | | 299,971 | |

Weingarten Realty Investors | | | 8,570 | | | | 299,264 | |

| | | | | | | | |

| | | | | | | 5,079,677 | |

| | | | | | | | |

| | | | | | | 8,444,905 | |

| | | | | | | | |

RESIDENTIAL–1.8% | | | | | | | | |

MULTI-FAMILY–1.6% | | | | | | | | |

Associated Estates Realty Corp. | | | 24,750 | | | | 574,447 | |

AvalonBay Communities, Inc. | | | 3,020 | | | | 493,438 | |

Barratt Developments PLC | | | 28,200 | | | | 205,243 | |

China Overseas Land & Investment Ltd. | | | 150,000 | | | | 444,697 | |

China Vanke Co., Ltd.–

Class H(a)(b) | | | 127,560 | | | | 282,318 | |

CIFI Holdings Group Co., Ltd. | | | 640,000 | | | | 128,257 | |

Comforia Residential REIT, Inc.(b) | | | 63 | | | | 137,726 | |

Equity Residential | | | 3,560 | | | | 255,750 | |

Essex Property Trust, Inc. | | | 505 | | | | 104,333 | |

Even Construtora e Incorporadora SA | | | 32,100 | | | | 65,692 | |

| | | | | | | | |

GAGFAH SA(a) | | | 20,863 | | | $ | 465,920 | |

Ichigo Real Estate Investment Corp. | | | 158 | | | | 122,897 | |

Irish Residential Properties REIT PLC(a) | | | 81,000 | | | | 103,797 | |

Kaisa Group Holdings Ltd.(b)(d)(e) | | | 409,000 | | | | 83,861 | |

Kenedix Residential Investment Corp. | | | 43 | | | | 129,062 | |

KWG Property Holding Ltd. | | | 239,000 | | | | 162,748 | |

LEG Immobilien AG(a) | | | 4,789 | | | | 356,750 | |

Meritage Homes Corp.(a) | | | 4,920 | | | | 177,071 | |

Mid-America Apartment Communities, Inc. | | | 6,520 | | | | 486,914 | |

Stockland(b) | | | 137,209 | | | | 458,536 | |

Sun Communities, Inc. | | | 5,621 | | | | 339,846 | |

Wing Tai Holdings Ltd. | | | 125,000 | | | | 153,913 | |

| | | | | | | | |

| | | | | | | 5,733,216 | |

| | | | | | | | |

SELF STORAGE–0.1% | | | | | | | | |

Public Storage | | | 500 | | | | 92,425 | |

Safestore Holdings PLC | | | 53,910 | | | | 194,936 | |

| | | | | | | | |

| | | | | | | 287,361 | |

| | | | | | | | |

SINGLE FAMILY–0.1% | | | | | | | | |

Fortune Brands Home & Security, Inc. | | | 7,450 | | | | 337,261 | |

| | | | | | | | |

| | | | | | | 6,357,838 | |

| | | | | | | | |

UTILITIES–1.5% | | | | | | | | |

ELECTRIC UTILITIES–0.8% | | | | | | | | |

American Electric Power Co., Inc. | | | 10,800 | | | | 655,776 | |

Edison International | | | 16,900 | | | | 1,106,612 | |

EDP–Energias de Portugal SA | | | 37,090 | | | | 143,821 | |

Electricite de France SA | | | 9,370 | | | | 257,941 | |

Enel SpA | | | 40,691 | | | | 181,381 | |

Westar Energy, Inc. | | | 10,000 | | | | 412,400 | |

| | | | | | | | |

| | | | | | | 2,757,931 | |

| | | | | | | | |

GAS UTILITIES–0.2% | | | | | | | | |

Atmos Energy Corp. | | | 1,800 | | | | 100,332 | |

UGI Corp. | | | 20,700 | | | | 786,186 | |

| | | | | | | | |

| | | | | | | 886,518 | |

| | | | | | | | |

INDEPENDENT POWER PRODUCERS & ENERGY TRADERS–0.3% | | | | | | | | |

APR Energy PLC | | | 29,787 | | | | 85,944 | |

Calpine Corp.(a) | | | 36,286 | | | | 803,009 | |

NRG Energy, Inc. | | | 9,608 | | | | 258,936 | |

| | | | | | | | |

| | | | | | | 1,147,889 | |

| | | | | | | | |

MULTI-UTILITIES–0.2% | | | | | | | | |

CenterPoint Energy, Inc. | | | 19,800 | | | | 463,914 | |

DTE Energy Co. | | | 1,200 | | | | 103,644 | |

Public Service Enterprise Group, Inc. | | | 3,500 | | | | 144,935 | |

| | | | | | | | |

| | | | | | | 712,493 | |

| | | | | | | | |

| | | | | | | 5,504,831 | |

| | | | | | | | |

13

| | |

| BALANCED WEALTH STRATEGY PORTFOLIO |

| PORTFOLIOOF INVESTMENTS | | |

| (continued) | | AllianceBernstein Variable Products Series Fund |

| | | | | | | | |

| Company | |

Shares | | | U.S. $ Value | |

| | | | | | | | |

MATERIALS–1.5% | | | | | | | | |

CHEMICALS–1.3% | | | | | | | | |

Arkema SA(b) | | | 3,556 | | | $ | 235,183 | |

BASF SE | | | 1,060 | | | | 88,914 | |

CF Industries Holdings, Inc. | | | 425 | | | | 115,829 | |

Chr Hansen Holding A/S | | | 7,710 | | | | 341,579 | |

Denki Kagaku Kogyo KK | | | 45,000 | | | | 164,816 | |

Eastman Chemical Co. | | | 6,319 | | | | 479,359 | |

Essentra PLC | | | 92,674 | | | | 1,050,561 | |

IMCD Group NV(a) | | | 2,670 | | | | 91,110 | |

Incitec Pivot Ltd. | | | 51,516 | | | | 133,257 | |

JSR Corp. | | | 22,300 | | | | 382,763 | |

Koninklijke DSM NV | | | 5,238 | | | | 319,481 | |

LyondellBasell Industries NV–Class A | | | 8,300 | | | | 658,937 | |

Mitsubishi Gas Chemical Co., Inc. | | | 26,000 | | | | 130,491 | |

Monsanto Co. | | | 4,149 | | | | 495,681 | |

| | | | | | | | |

| | | | | | | 4,687,961 | |

| | | | | | | | |

METALS & MINING–0.1% | | | | | | | | |

Alcoa, Inc. | | | 8,700 | | | | 137,373 | |

Dowa Holdings Co., Ltd. | | | 12,000 | | | | 95,340 | |

Rio Tinto PLC | | | 5,900 | | | | 271,973 | |

Tata Steel Ltd. | | | 13,680 | | | | 86,112 | |

| | | | | | | | |

| | | | | | | 590,798 | |

| | | | | | | | |

PAPER & FOREST

PRODUCTS–0.1% | | | | | | | | |

Mondi PLC | | | 13,260 | | | | 215,415 | |

| | | | | | | | |

| | | | | | | 5,494,174 | |

| | | | | | | | |

TELECOMMUNICATION SERVICES–1.4% | | | | | | | | |

DIVERSIFIED TELECOMMUNICATION SERVICES–0.8% | | | | | | | | |

AT&T, Inc. | | | 39,900 | | | | 1,340,241 | |

Bezeq The Israeli Telecommunication Corp., Ltd. | | | 63,518 | | | | 112,669 | |

CenturyLink, Inc. | | | 3,700 | | | | 146,446 | |

Nippon Telegraph & Telephone Corp. | | | 10,200 | | | | 521,043 | |

Telecom Italia SpA (savings shares) | | | 363,220 | | | | 303,668 | |

Telenor ASA | | | 6,620 | | | | 133,913 | |

Vivendi SA(a) | | | 17,484 | | | | 435,186 | |

| | | | | | | | |

| | | | | | | 2,993,166 | |

| | | | | | | | |

WIRELESS TELECOMMUNICATION SERVICES–0.6% | | | | | | | | |

China Mobile Ltd. | | | 17,000 | | | | 199,557 | |

SoftBank Corp. | | | 11,000 | | | | 654,756 | |

Turkcell Iletisim Hizmetleri AS(a) | | | 21,330 | | | | 130,166 | |

Vodafone Group PLC | | | 155,343 | | | | 532,613 | |

| | | | | | | | |

Vodafone Group PLC (Sponsored ADR) | | | 16,900 | | | $ | 577,473 | |

| | | | | | | | |

| | | | | | | 2,094,565 | |

| | | | | | | | |

| | | | | | | 5,087,731 | |

| | | | | | | | |

OFFICE–1.1% | | | | | | | | |

OFFICE–1.1% | | | | | | | | |

Allied Properties Real Estate Investment Trust | | | 7,776 | | | | 250,588 | |

Boston Properties, Inc. | | | 1,764 | | | | 227,009 | |

Columbia Property Trust, Inc. | | | 14,500 | | | | 367,575 | |

Cousins Properties, Inc. | | | 8,040 | | | | 91,817 | |

Dream Office Real Estate Investment Trust | | | 9,836 | | | | 212,924 | |

Entra ASA(a)(c) | | | 18,146 | | | | 186,256 | |

Fabege AB | | | 21,670 | | | | 278,212 | |

Hongkong Land Holdings Ltd. | | | 70,000 | | | | 471,627 | |

Hudson Pacific Properties, Inc. | | | 6,170 | | | | 185,470 | |

Investa Office Fund | | | 50,000 | | | | 147,611 | |

Japan Excellent, Inc. | | | 186 | | | | 247,975 | |

Japan Real Estate Investment Corp. | | | 51 | | | | 245,732 | |

Kenedix Office Investment Corp.–Class A | | | 59 | | | | 333,949 | |

Kilroy Realty Corp. | | | 1,320 | | | | 91,172 | |

NTT Urban Development Corp. | | | 11,000 | | | | 110,777 | |

Parkway Properties, Inc./Md | | | 22,648 | | | | 416,497 | |

Workspace Group PLC | | | 20,120 | | | | 237,829 | |

| | | | | | | | |

| | | | | | | 4,103,020 | |

| | | | | | | | |

LODGING–0.7% | | | | | | | | |

LODGING–0.7% | | | | | | | | |

Ashford Hospitality Prime, Inc. | | | 21,984 | | | | 377,245 | |

Ashford Hospitality Trust, Inc. | | | 35,531 | | | | 372,365 | |

Ashford, Inc.(a) | | | 408 | | | | 38,352 | |

Chatham Lodging Trust | | | 12,709 | | | | 368,180 | |

Hersha Hospitality Trust | | | 54,290 | | | | 381,659 | |

Japan Hotel REIT Investment Corp. | | | 252 | | | | 161,666 | |

Pebblebrook Hotel Trust | | | 2,240 | | | | 102,211 | |

Starwood Hotels & Resorts Worldwide, Inc. | | | 4,790 | | | | 388,325 | |

Wyndham Worldwide Corp. | | | 5,520 | | | | 473,395 | |

| | | | | | | | |

| | | | | | | 2,663,398 | |

| | | | | | | | |

FINANCIAL: OTHER–0.1% | | | | | | | | |

FINANCIAL: OTHER–0.1% | | | | | | | | |

HFF, Inc.–Class A | | | 8,480 | | | | 304,602 | |

| | | | | | | | |

MORTGAGE–0.1% | | | | | | | | |

MORTGAGE–0.1% | | | | | | | | |

Concentradora Hipotecaria SAPI de CV(a) | | | 104,000 | | | | 172,702 | |

| | | | | | | | |

Total Common Stocks

(cost $187,529,465) | | | | | | | 230,223,280 | |

| | | | | | | | |

14

| | |

| | | AllianceBernstein Variable Products Series Fund |

| | | | | | | | | | | | |

| | | | | |

Principal

Amount

(000) | | | U.S. $ Value | |

| | | | | | | | | | | | |

CORPORATES–

INVESTMENT

GRADE–8.9% | | | | | | | | | | | | |

INDUSTRIAL–5.6% | | | | | | | | | | | | |

BASIC–0.6% | | | | | | | | | | | | |

Barrick Gold Corp.

4.10%, 5/01/23 | | | U.S.$ | | | | 45 | | | $ | 43,794 | |

Basell Finance Co. BV

8.10%, 3/15/27(c) | | | | | | | 145 | | | | 194,309 | |

Cia Minera Milpo SAA

4.625%, 3/28/23(c) | | | | | | | 240 | | | | 235,543 | |

Dow Chemical Co. (The)

4.125%, 11/15/21 | | | | | | | 165 | | | | 174,340 | |

Glencore Funding LLC

4.125%, 5/30/23(c) | | | | | | | 126 | | | | 122,946 | |

International Paper Co.

3.65%, 6/15/24 | | | | | | | 48 | | | | 47,966 | |

LyondellBasell Industries NV

5.75%, 4/15/24 | | | | | | | 435 | | | | 497,506 | |

Minsur SA

6.25%, 2/07/24(c) | | | | | | | 333 | | | | 359,546 | |

Sociedad Quimica y Minera de Chile SA

3.625%, 4/03/23(c) | | | | | | | 237 | | | | 227,547 | |

Vale SA

5.625%, 9/11/42 | | | | | | | 51 | | | | 47,502 | |

Yamana Gold, Inc.

4.95%, 7/15/24 | | | | | | | 277 | | | | 270,346 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 2,221,345 | |

| | | | | | | | | | | | |

CAPITAL GOODS–0.1% | | | | | | | | | | | | |

Odebrecht Finance Ltd.

5.25%, 6/27/29(c) | | | | | | | 217 | | | | 189,766 | |

Owens Corning

6.50%, 12/01/16(f) | | | | | | | 11 | | | | 11,985 | |

Republic Services, Inc.

3.80%, 5/15/18 | | | | | | | 17 | | | | 17,986 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 219,737 | |

| | | | | | | | | | | | |

COMMUNICATIONS–

MEDIA–1.0% | | | | | | | | | | | | |

21st Century Fox America, Inc.

3.00%, 9/15/22 | | | | | | | 400 | | | | 397,302 | |

6.15%, 2/15/41 | | | | | | | 130 | | | | 165,444 | |

CBS Corp.

5.75%, 4/15/20 | | | | | | | 250 | | | | 284,942 | |

Comcast Corp.

5.15%, 3/01/20 | | | | | | | 451 | | | | 510,767 | |

DIRECTV Holdings LLC/DIRECTV Financing Co., Inc.

3.80%, 3/15/22 | | | | | | | 75 | | | | 76,303 | |

4.45%, 4/01/24 | | | | | | | 107 | | | | 111,955 | |

5.00%, 3/01/21 | | | | | | | 290 | | | | 316,245 | |

Globo Comunicacao e Participacoes SA

5.307%, 5/11/22(c)(g) | | | | | | | 221 | | | | 231,055 | |

| | | | | | | | | | | | |

NBCUniversal Enterprise, Inc.

5.25%, 3/19/21(c)(h) | | | U.S.$ | | | | 233 | | | $ | 241,737 | |

Omnicom Group, Inc.

3.625%, 5/01/22 | | | | | | | 165 | | | | 169,388 | |

Reed Elsevier Capital, Inc.

8.625%, 1/15/19 | | | | | | | 435 | | | | 532,062 | |

Time Warner Cable, Inc.

4.125%, 2/15/21 | | | | | | | 165 | | | | 176,581 | |

Time Warner, Inc.

4.70%, 1/15/21 | | | | | | | 123 | | | | 134,632 | |

7.625%, 4/15/31 | | | | | | | 110 | | | | 153,355 | |

Viacom, Inc.

3.875%, 4/01/24 | | | | | | | 110 | | | | 110,423 | |

5.625%, 9/15/19 | | | | | | | 83 | | | | 93,214 | |

WPP Finance 2010

4.75%, 11/21/21 | | | | | | | 77 | | | | 84,192 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 3,789,597 | |

| | | | | | | | | | | | |

COMMUNICATIONS–

TELE-COMMUNICATIONS–0.6% | | | | | | | | | | | | |

American Tower Corp.

5.05%, 9/01/20 | | | | | | | 380 | | | | 412,278 | |

Deutsche Telekom International Finance BV

4.875%, 3/06/42(c) | | | | | | | 490 | | | | 523,776 | |

Rogers Communications, Inc.

4.00%, 6/06/22 | | | CAD | | | | 46 | | | | 41,790 | |

SBA Tower Trust

2.898%, 10/15/19(c) | | | U.S.$ | | | | 251 | | | | 251,658 | |

Telefonica Emisiones SAU 5.462%, 2/16/21 | | | | | | | 185 | | | | 206,274 | |

Verizon Communications, Inc. 3.50%, 11/01/24 | | | | | | | 418 | | | | 410,685 | |

6.55%, 9/15/43 | | | | | | | 297 | | | | 380,501 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 2,226,962 | |

| | | | | | | | | | | | |

CONSUMER CYCLICAL–

AUTOMOTIVE–0.3% | | | | | | | | | |

Ford Motor Credit Co. LLC 5.875%, 8/02/21 | | | | | | | 915 | | | | 1,059,376 | |

| | | | | | | | | | | | |

CONSUMER CYCLICAL–

RETAILERS–0.1% | | | | | | | | | |

Macy’s Retail Holdings, Inc. 3.875%, 1/15/22 | | | | | | | 201 | | | | 208,914 | |

Walgreens Boots Alliance, Inc./old

3.80%, 11/18/24 | | | | | | | 320 | | | | 326,368 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 535,282 | |

| | | | | | | | | | | | |

CONSUMER NON-CYCLICAL–0.8% | | | | | | | | | | | | |

Actavis Funding SCS

3.85%, 6/15/24 | | | | | | | 89 | | | | 89,455 | |

Altria Group, Inc.

2.625%, 1/14/20 | | | | | | | 320 | | | | 320,929 | |

Bayer US Finance LLC 3.375%, 10/08/24(c) | | | | | | | 321 | | | | 326,641 | |

15

| | |

| BALANCED WEALTH STRATEGY PORTFOLIO |

| PORTFOLIOOF INVESTMENTS | | |

| (continued) | | AllianceBernstein Variable Products Series Fund |

| | | | | | | | | | | | |

| | | | | |

Principal

Amount

(000) | | | U.S. $ Value | |

| | | | | | | | | | | | |

Becton Dickinson and Co. 3.734%, 12/15/24 | | | U.S.$ | | | | 141 | | | $ | 145,170 | |

Bunge Ltd. Finance Corp. 5.10%, 7/15/15 | | | | | | | 69 | | | | 70,498 | |

8.50%, 6/15/19 | | | | | | | 153 | | | | 187,508 | |

Grupo Bimbo SAB de CV 3.875%, 6/27/24(c) | | | | | | | 339 | | | | 340,332 | |

Medtronic, Inc.

3.50%, 3/15/25(c) | | | | | | | 320 | | | | 327,350 | |

Perrigo Finance PLC

3.50%, 12/15/21 | | | | | | | 300 | | | | 303,499 | |

Reynolds American, Inc. 3.25%, 11/01/22 | | | | | | | 220 | | | | 214,289 | |

Thermo Fisher Scientific, Inc.

4.15%, 2/01/24 | | | | | | | 121 | | | | 127,605 | |

Tyson Foods, Inc.

2.65%, 8/15/19 | | | | | | | 64 | | | | 64,583 | |

3.95%, 8/15/24 | | | | | | | 206 | | | | 212,947 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 2,730,806 | |

| | | | | | | | | | | | |

ENERGY–1.3% | | | | | | | | | | | | |

Diamond Offshore Drilling, Inc.

4.875%, 11/01/43 | | | | | | | 111 | | | | 94,563 | |

Encana Corp.

3.90%, 11/15/21 | | | | | | | 140 | | | | 137,974 | |

Energy Transfer Partners LP

7.50%, 7/01/38 | | | | | | | 248 | | | | 307,801 | |

Enterprise Products Operating LLC

5.20%, 9/01/20 | | | | | | | 185 | | | | 204,034 | |

Kinder Morgan Energy Partners LP

2.65%, 2/01/19 | | | | | | | 302 | | | | 297,565 | |

3.95%, 9/01/22 | | | | | | | 424 | | | | 420,422 | |

6.85%, 2/15/20 | | | | | | | 330 | | | | 379,046 | |

Marathon Petroleum Corp.

5.125%, 3/01/21 | | | | | | | 163 | | | | 178,165 | |

Nabors Industries, Inc.

5.10%, 9/15/23 | | | | | | | 168 | | | | 159,508 | |

Noble Energy, Inc.

3.90%, 11/15/24 | | | | | | | 170 | | | | 168,019 | |

8.25%, 3/01/19 | | | | | | | 374 | | | | 448,389 | |

Noble Holding International Ltd.

3.95%, 3/15/22 | | | | | | | 202 | | | | 176,963 | |

4.90%, 8/01/20 | | | | | | | 36 | | | | 33,732 | |

Reliance Holding USA, Inc. 5.40%, 2/14/22(c) | | | | | | | 315 | | | | 340,990 | |

Sunoco Logistics Partners Operations LP

5.30%, 4/01/44 | | | | | | | 295 | | | | 297,346 | |

TransCanada PipeLines Ltd.

6.35%, 5/15/67 | | | | | | | 120 | | | | 116,400 | |

Transocean, Inc.

6.375%, 12/15/21 | | | | | | | 2 | | | | 1,845 | |

6.50%, 11/15/20 | | | | | | | 300 | | | | 282,890 | |

| | | | | | | | | | | | |

Valero Energy Corp.

6.125%, 2/01/20 | | | U.S.$ | | | | 175 | | | $ | 198,469 | |

Weatherford International Ltd./Bermuda

9.625%, 3/01/19 | | | | | | | 285 | | | | 338,033 | |

Williams Partners LP

4.125%, 11/15/20 | | | | | | | 155 | | | | 158,797 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 4,740,951 | |

| | | | | | | | | | | | |

OTHER

INDUSTRIAL–0.1% | | | | | | | | | | | | |

Hutchison Whampoa International 14 Ltd.

1.625%, 10/31/17(c) | | | | | | | 320 | | | | 317,363 | |

| | | | | | | | | | | | |

TECHNOLOGY–0.5% | | | | | | | | | | | | |

Agilent Technologies, Inc.

5.00%, 7/15/20 | | | | | | | 71 | | | | 77,236 | |

Hewlett-Packard Co.

4.65%, 12/09/21 | | | | | | | 114 | | | | 122,067 | |

KLA-Tencor Corp.

4.65%, 11/01/24 | | | | | | | 320 | | | | 331,279 | |

Motorola Solutions, Inc.

3.50%, 3/01/23 | | | | | | | 300 | | | | 295,305 | |

7.50%, 5/15/25 | | | | | | | 35 | | | | 43,078 | |

Seagate HDD Cayman

4.75%, 1/01/25(c) | | | | | | | 127 | | | | 130,831 | |

Telefonaktiebolaget LM Ericsson

4.125%, 5/15/22 | | | | | | | 108 | | | | 112,967 | |

Tencent Holdings Ltd.

3.375%, 5/02/19(c) | | | | | | | 335 | | | | 340,506 | |

Total System Services, Inc.

2.375%, 6/01/18 | | | | | | | 141 | | | | 139,793 | |

3.75%, 6/01/23 | | | | | | | 139 | | | | 136,208 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 1,729,270 | |

| | | | | | | | | | | | |

TRANSPORTATION–

AIRLINES–0.0% | | | | | | | | | | | | |

Southwest Airlines Co. 5.75%, 12/15/16 | | | | | | | 155 | | | | 167,470 | |

| | | | | | | | | | | | |

TRANSPORTATION–

SERVICES–0.2% | | | | | | | | | | | | |

Asciano Finance Ltd. | | | | | | | | | | | | |

3.125%, 9/23/15(c) | | | | | | | 237 | | | | 239,769 | |

5.00%, 4/07/18(c) | | | | | | | 230 | | | | 247,263 | |

Ryder System, Inc. | | | | | | | | | | | | |

5.85%, 11/01/16 | | | | | | | 127 | | | | 137,145 | |

7.20%, 9/01/15 | | | | | | | 127 | | | | 132,347 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 756,524 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 20,494,683 | |

| | | | | | | | | | | | |

FINANCIAL INSTITUTIONS–2.7% | | | | | | | | | | | | |

BANKING–1.7% | | | | | | | | | | | | |

Barclays Bank PLC

6.625%, 3/30/22(c) | | | EUR | | | | 160 | | | | 249,776 | |

Compass Bank

5.50%, 4/01/20 | | | U.S.$ | | | | 314 | | | | 341,670 | |

16

| | |

| | | AllianceBernstein Variable Products Series Fund |

| | | | | | | | | | | | |

| | | | | |

Principal

Amount

(000) | | | U.S. $ Value | |

| | | | | | | | | | | | |

Countrywide Financial Corp.

6.25%, 5/15/16 | | U.S.$ | | | | | 92 | | | $ | 97,643 | |

Credit Suisse AG

6.50%, 8/08/23(c) | | | | | | | 267 | | | | 290,517 | |

Goldman Sachs Group, Inc. (The) | | | | | | | | | | | | |

5.75%, 1/24/22 | | | | | | | 335 | | | | 387,524 | |

Series D

6.00%, 6/15/20 | | | | | | | 440 | | | | 508,652 | |

ING Bank NV

2.00%, 9/25/15(c) | | | | | | | 480 | | | | 483,846 | |

Macquarie Bank Ltd.

5.00%, 2/22/17(c) | | | | | | | 90 | | | | 95,994 | |

Macquarie Group Ltd.

4.875%, 8/10/17(c) | | | | | | | 194 | | | | 207,442 | |

Morgan Stanley

5.625%, 9/23/19 | | | | | | | 168 | | | | 189,637 | |

Series G

5.50%, 7/24/20 | | | | | | | 189 | | | | 213,235 | |

Murray Street Investment Trust I

4.647%, 3/09/17 | | | | | | | 44 | | | | 46,437 | |

National Capital Trust II Delaware

5.486%, 3/23/15(c)(h) | | | | | | | 91 | | | | 91,455 | |

Nationwide Building Society

6.25%, 2/25/20(c) | | | | | | | 465 | | | | 545,456 | |

Nordea Bank AB

6.125%, 9/23/24(c)(h) | | | | | | | 200 | | | | 197,850 | |

PNC Bank NA

3.80%, 7/25/23 | | | | | | | 685 | | | | 706,096 | |

Rabobank Capital Funding Trust III

5.254%, 10/21/16(c)(h) | | | | | | | 190 | | | | 197,220 | |

Standard Chartered PLC

4.00%, 7/12/22(c) | | | | | | | 470 | | | | 477,868 | |

UBS AG/Stamford CT

7.625%, 8/17/22 | | | | | | | 380 | | | | 447,395 | |

Wells Fargo Bank NA

6.18%, 2/15/36 | | | | | | | 250 | | | | 325,339 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 6,101,052 | |

| | | | | | | | | | | | |

BROKERAGE–0.1% | | | | | | | | | | | | |

Nomura Holdings, Inc.

2.00%, 9/13/16 | | | | | | | 468 | | | | 471,775 | |

| | | | | | | | | | | | |

FINANCE–0.1% | | | | | | | | | | | | |

Aviation Capital Group Corp.

7.125%, 10/15/20(c) | | | | | | | 173 | | | | 198,318 | |

| | | | | | | | | | | | |

INSURANCE–0.6% | | | | | | | | | | | | |

Allied World Assurance Co. Holdings Ltd.

7.50%, 8/01/16 | | | | | | | 160 | | | | 174,665 | |

| | | | | | | | | | | | |

American International Group, Inc.

4.875%, 6/01/22 | | U.S.$ | | | | | 155 | | | $ | 174,118 | |

6.40%, 12/15/20 | | | | | | | 300 | | | | 357,741 | |

Dai-ichi Life Insurance Co., Ltd. (The)

5.10%, 10/28/24(c)(h) | | | | | | | 320 | | | | 332,800 | |

Hartford Financial Services Group, Inc. (The)

4.00%, 3/30/15 | | | | | | | 95 | | | | 95,751 | |

5.125%, 4/15/22 | | | | | | | 180 | | | | 202,336 | |

5.50%, 3/30/20 | | | | | | | 242 | | | | 273,481 | |

Lincoln National Corp.

8.75%, 7/01/19 | | | | | | | 98 | | | | 122,454 | |

MetLife, Inc.

10.75%, 8/01/39 | | | | | | | 70 | | | | 113,750 | |

Prudential Financial, Inc.

5.625%, 6/15/43 | | | | | | | 200 | | | | 204,460 | |

XLIT Ltd.

6.375%, 11/15/24 | | | | | | | 157 | | | | 186,786 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 2,238,342 | |

| | | | | | | | | | | | |

OTHER FINANCE–0.1% | | | | | | | | | | | | |