UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-05398

AB VARIABLE PRODUCTS SERIES FUND, INC.

(Exact name of registrant as specified in charter)

1345 Avenue of the Americas, New York, New York 10105

(Address of principal executive offices) (Zip code)

Joseph J. Mantineo

AllianceBernstein L.P.

1345 Avenue of the Americas

New York, New York 10105

(Name and address of agent for service)

Registrant’s telephone number, including area code: (800) 221-5672

Date of fiscal year end: December 31, 2017

Date of reporting period: December 31, 2017

| ITEM 1. | REPORTS TO STOCKHOLDERS. |

DEC 12.31.17

ANNUAL REPORT

AB VARIABLE PRODUCTS

SERIES FUND, INC.

| + | | BALANCED WEALTH STRATEGY PORTFOLIO |

Investment Products Offered

| | • | | Are Not Bank Guaranteed |

AllianceBernstein Investments, Inc. (ABI) is the distributor of the AB family of mutual funds. ABI is a member of FINRA and is an affiliate of AllianceBernstein L.P., the Adviser of the funds.

You may obtain a description of the Fund’s proxy voting policies and procedures, and information regarding how the Fund voted proxies relating to portfolio securities during the most recent 12-month period ended June 30, without charge. Simply visit AB’s website at www.abfunds.com or go to the Securities and Exchange Commission’s (the “Commission”) website at www.sec.gov, or call AB at (800) 227 4618.

The Fund files its complete schedule of portfolio holdings with the Commission for the first and third quarters of each fiscal year on Form N-Q. The Fund’s Forms N-Q are available on the Commission’s website at www.sec.gov. The Fund’s Forms N-Q may also be reviewed and copied at the Commission’s Public Reference Room in Washington, DC; information on the operation of the Public Reference Room may be obtained by calling (800) SEC 0330.

The [A/B] logo is a registered service mark of AllianceBernstein and AllianceBernstein® is a registered service mark used by permission of the owner, AllianceBernstein L.P.

| | |

| | |

| | |

| BALANCED WEALTH STRATEGY PORTFOLIO | | AB Variable Products Series Fund |

LETTER TO INVESTORS

February 14, 2018

The following is an update of AB Variable Products Series Fund—Balanced Wealth Strategy Portfolio (the “Portfolio”) for the annual reporting period ended December 31, 2017.

INVESTMENT OBJECTIVE AND POLICIES

The Portfolio’s investment objective is to maximize total return consistent with the Adviser’s determination of reasonable risk. The Portfolio invests in a portfolio of equity and debt securities that is designed as a solution for investors who seek a moderate tilt toward equity returns but also want the risk diversification offered by debt securities and the broad diversification of their equity risk across styles, capitalization ranges and geographic regions. The Portfolio targets a weighting of 60% equity securities and 40% debt securities with a goal of providing moderate upside potential without excessive volatility. In managing the Portfolio, the Adviser efficiently diversifies between the debt and equity components to produce the desired risk/return profile. Investments in real estate investment trusts (“REITs”) are deemed to be 50% equity and 50% fixed-income for purposes of the overall target blend of the Portfolio.

The Portfolio’s equity component is diversified between growth and value equity investment styles, and between US and non-US markets.

The Adviser’s targeted blend for the non-REIT portion of the Portfolio’s equity component is an equal weighting of growth and value stocks (50% each).

In addition to blending growth and value styles, the Adviser blends each style-based portion of the Portfolio’s equity component across US and non-US issuers and various capitalization ranges. Within each of the value and growth portions of the Portfolio, the Adviser normally targets a blend of approximately 70% in equities of US companies and the remaining 30% in equities of companies outside the United States. The Adviser will allow the relative weightings of the Portfolio’s investments in equity and debt, growth and value, and US and non-US components to vary in response to market conditions, but ordinarily, only by ±5% of the Portfolio’s net assets. Beyond those ranges, the Adviser will rebalance the Portfolio toward the targeted blend. However, under extraordinary circumstances, such as when market conditions favoring one investment style are compelling, the range may expand to ±10% of the Portfolio’s net assets. The Portfolio’s targeted blend may change from time to time without notice to shareholders based on the Adviser’s assessment of underlying market conditions.

The Portfolio’s fixed-income securities will primarily be investment-grade debt securities, but are expected to include lower-rated securities (“junk bonds”) and preferred stock. The Portfolio will not invest more than 25% of its total assets in securities rated, at the time of purchase, below investment-grade.

The Portfolio also may enter into forward commitments, make short sales of securities or maintain a short position and invest in rights or warrants.

Currencies can have a dramatic impact on equity returns, significantly adding to returns in some years and greatly diminishing them in others. Currency and equity positions are evaluated separately. The Adviser may seek to hedge the currency exposure resulting from securities positions when it finds the currency exposure unattractive. To hedge all or a portion of its currency risk, the Portfolio may, from time to time, invest in currency-related derivatives, including forward currency exchange contracts, futures contracts, options on futures, swaps and options. The Adviser may also seek investment opportunities by taking long or short positions in currencies through the use of currency-related derivatives. The Portfolio may enter into other derivatives transactions, such as options, futures contracts, forwards and swaps.

At meetings held on February 6-7, 2018, the Board of Directors approved the following changes to the Portfolio’s principal strategies, which do not require stockholder approval and will take effect on or about May 1, 2018.

The Portfolio invests in a portfolio of equity and fixed-income securities that is designed as a solution for investors who seek a moderate tilt toward equity returns but also want the risk diversification offered by fixed-income securities and the broad diversification of their equity risk across styles, capitalization ranges and geographic regions. Under normal circumstances, the Portfolio will invest at least 25% of its total assets in equity securities and at least 25% of its total assets in fixed-income securities with a goal of providing moderate upside potential without excessive volatility. The Portfolio also seeks exposure to real assets by investing in real estate-related equity securities (including REITs), natural resource equity securities and inflation-sensitive equity securities. The Portfolio pursues a global strategy, typically investing in securities of issuers located in the United States and in other countries throughout the world, including emerging-market countries.

The Adviser expects that the Portfolio will normally invest a greater percentage of its total assets in equity securities than in fixed-income securities, and will generally invest in equity securities both directly and through underlying

1

| | |

| | |

| BALANCED WEALTH STRATEGY PORTFOLIO |

| (continued) | | AB Variable Products Series Fund |

investment companies advised by the Adviser (“Underlying Portfolios”). A significant portion of the Portfolio’s assets are expected to be invested directly in US large-cap equity securities, primarily common stocks, in accordance with the Adviser’s US Strategic Equities investment strategy (“US Strategic Equities”). Under US Strategic Equities, portfolio managers of the Adviser that specialize in various investment disciplines identify high-conviction large-cap equity securities based on their fundamental investment research for potential investment by the Portfolio. These securities are then assessed in terms of both this fundamental research and quantitative analysis in creating the equity portion of the Portfolio’s portfolio. In applying the quantitative analysis, the Adviser considers a number of metrics that historically have provided some indication of favorable future returns, including metrics related to valuation, quality, investor behavior and corporate behavior.

In addition, the Portfolio seeks to achieve exposure to international large-cap equity securities through investments in the International Strategic Equities Portfolio of Bernstein Fund, Inc. (“Bernstein International Strategic Equities Portfolio”) and the International Portfolio of Sanford C. Bernstein Fund, Inc. (“SCB International Portfolio”), each a registered investment company advised by the Adviser. The Portfolio also invests in other Underlying Portfolios to efficiently gain exposure to certain other types of equity securities, including small- and mid-cap and emerging-market equity securities. The Adviser selects an Underlying Portfolio based on the segment of the equity market to which the Underlying Portfolio provides exposure, its investment philosophy, and how it complements and diversifies the Portfolio’s overall portfolio. Bernstein International Strategic Equities Portfolio and SCB International Portfolio focus on investing in non-US large-cap and mid-cap equity securities. Bernstein International Strategic Equities Portfolio follows a strategy similar to US Strategic Equities, but in the international context. In managing SCB International Portfolio, the Adviser selects stocks by drawing on the capabilities of its separate investment teams specializing in different investment disciplines, including value, growth, stability and others.

In selecting fixed-income investments, the Adviser may draw on the capabilities of separate investment teams that specialize in different areas that are generally defined by the maturity of the debt securities and/or their ratings, and which may include subspecialties (such as inflation-indexed securities). These fixed-income teams draw on the resources and expertise of the Adviser’s internal fixed-income research staff, which includes over 50 dedicated fixed- income research analysts and economists. The Portfolio’s fixed-income securities will primarily be investment-grade debt securities, but are expected to include lower-rated securities (“junk bonds”) and preferred stock.

The Portfolio expects to enter into derivative transactions, such as options, futures contracts, forwards and swaps. Derivatives may provide a more efficient and economical exposure to market segments than direct investments, and may also be a more efficient way to alter the Portfolio’s exposure. The Portfolio may, for example, use credit default, interest rate and total return swaps to establish exposure to the fixed-income markets or particular fixed-income securities and, as noted below, may use currency derivatives to hedge foreign currency exposure.

Fluctuations in currency exchange rates can have a dramatic impact on the returns of foreign securities. The Adviser may employ currency hedging strategies in the Portfolio or the Underlying Portfolios, including the use of currency- related derivatives, to seek to reduce currency risk in the Portfolio or the Underlying Portfolios, but it is not required to do so. The Adviser will generally employ currency hedging strategies more frequently in the fixed-income portion of the Portfolio than in the equity portion.

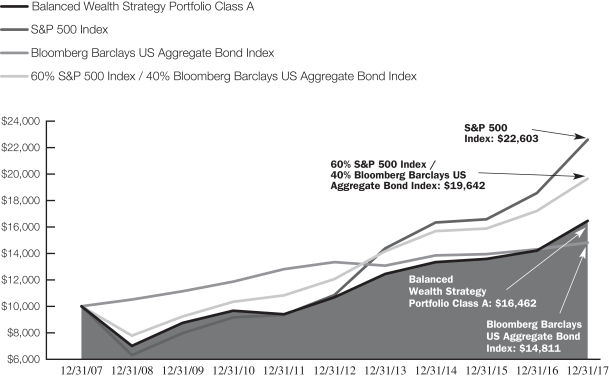

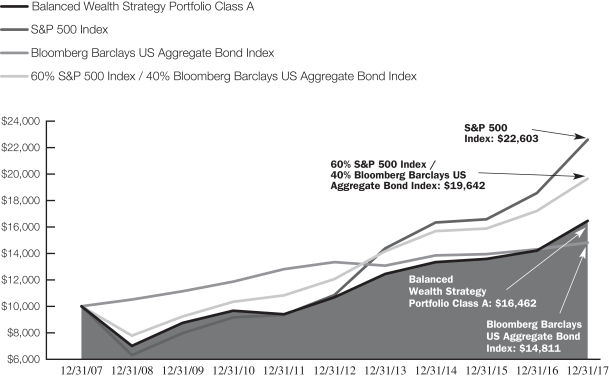

INVESTMENT RESULTS

The table on page 6 shows the Portfolio’s performance compared to its primary benchmark, the Standard & Poor’s (“S&P”) 500 Index, the Bloomberg Barclays US Aggregate Bond Index, and its blended benchmark, a 60% / 40% blend of the S&P 500 Index and the Bloomberg Barclays US Aggregate Bond Index, for the one-, five- and 10-year periods ended December 31, 2017.

For the annual period, all share classes of the Portfolio underperformed the primary benchmark and outperformed the Bloomberg Barclays US Aggregate Bond Index and the blended benchmark. The Portfolio’s US value, non-US value, US growth, REIT and fixed-income holdings contributed relative to their respective style benchmarks. Conversely, non-US growth holdings detracted from performance.

During the annual period, the Portfolio utilized derivatives for hedging and investment purposes, including futures, forwards, credit default swaps, interest rate swaps, as well as purchased and written swaptions. Futures, interest rate swaps and written swaptions added to absolute performance; forwards, credit default swaps and purchased swaptions detracted from returns.

MARKET REVIEW AND INVESTMENT STRATEGY

The annual period ended December 31, 2017 marked one of the strongest years for global stock market performance

2

| | |

| | | AB Variable Products Series Fund |

since the 2008 financial crisis. Emerging-market equities outperformed, followed by non-US stocks. US large-cap stocks outperformed their small-cap peers, and growth outperformed value, in terms of style. Equity performance was driven by strong economic data, synchronized global growth and robust corporate earnings. Investor enthusiasm was tempered early in the period by questions around the timeliness of the Trump administration’s pro-growth agenda and concerns regarding the election cycle in Europe. Geopolitical tensions and a significant decline in the price of oil weighed on the market midperiod. However, global growth trends proved strong and oil rallied back to two-and-a-half-year highs, pushing stocks higher, especially in emerging markets. In December, tax reform was passed in the US Congress, buoying market sentiment globally.

Global bonds generally rallied over the period. Emerging-market local-currency government bonds rose, performing in line with investment-grade credit securities and outperforming the positive returns of developed-market treasuries, but lagging the robust returns of global high yield. Developed-market treasury yields were mixed: yields in the US, Canada, UK and Australia flattened, with the short end of the curve rising, while longer maturities moved lower. Japanese yields generally ended the period higher, and yield curves in the eurozone moved in different directions (bond yields move inversely to price).

In the view of the Portfolio’s Senior Investment Management Team (the “Team”), the Portfolio is well positioned to invest opportunistically across a wide range of asset classes and market circumstances. In equities, the Team is confident that its continued focus on companies with strong fundamentals will enable the Team to navigate current market conditions and, more importantly, to seek to outperform as macroeconomic conditions improve. Meanwhile, in fixed income, the Team continues to emphasize corporate bonds and commercial mortgage-backed securities over US Treasuries.

3

| | |

| | |

| BALANCED WEALTH STRATEGY PORTFOLIO |

| DISCLOSURES AND RISKS | | AB Variable Products Series Fund |

Benchmark Disclosure

The S&P® 500 Index and the Bloomberg Barclays US Aggregate Bond Index are unmanaged and do not reflect fees and expenses associated with the active management of a mutual fund portfolio. The S&P 500 Index includes 500 US stocks and is a common representation of the performance of the overall US stock market. The Bloomberg Barclays US Aggregate Bond Index represents the performance of securities within the US investment-grade fixed-rate bond market, with index components for government and corporate securities, mortgage pass-through securities, asset-backed securities and commercial mortgage-backed securities. An investor cannot invest directly in an index, and its results are not indicative of the performance for any specific investment, including the Portfolio.

A Word About Risk

Market Risk: The value of the Portfolio’s assets will fluctuate as the stock or bond market fluctuates. The value of its investments may decline, sometimes rapidly and unpredictably, simply because of economic changes or other events that affect large portions of the market.

Interest Rate Risk: Changes in interest rates will affect the value of investments in fixed-income securities. When interest rates rise, the value of investments in fixed-income securities tends to fall and this decrease in value may not be offset by higher income from new investments. The Portfolio may be subject to heightened interest rate risk due to rising rates as the current period of historically low interest rates may be ending. Interest rate risk is generally greater for fixed-income securities with longer maturities or durations.

Credit Risk: An issuer or guarantor of a fixed-income security, or the counterparty to a derivatives or other contract, may be unable or unwilling to make timely payments of interest or principal, or to otherwise honor its obligations. The issuer or guarantor may default, causing a loss of the full principal amount of a security. The degree of risk for a particular security may be reflected in its credit rating. There is the possibility that the credit rating of a fixed-income security may be downgraded after purchase, which may adversely affect the value of the security.

Below Investment Grade Security Risk: Investments in fixed-income securities with lower ratings (“junk bonds”) tend to have a higher probability that an issuer will default or fail to meet its payment obligations. These securities may be subject to greater price volatility due to such factors as specific corporate developments, interest rate sensitivity, negative perceptions of the junk bond market generally and less secondary market liquidity.

Foreign (Non-US) Risk: Investments in securities of non-US issuers may involve more risk than those of US issuers. These securities may fluctuate more widely in price and may be less liquid due to adverse market, economic, political, regulatory or other factors.

Currency Risk: Fluctuations in currency exchange rates may negatively affect the value of the Portfolio’s investments or reduce its returns.

Allocation Risk: The allocation of investments among the different investment styles, such as growth or value, equity or debt securities, or US or non-US securities may have a more significant effect on the Portfolio’s net asset value (“NAV”) when one of these investment strategies is performing more poorly than others.

Capitalization Risk: Investments in small- and mid-capitalization companies may be more volatile than investments in large-capitalization companies. Investments in small-capitalization companies may have additional risks because these companies have limited product lines, markets or financial resources.

Derivatives Risk: Derivatives may be illiquid, difficult to price, and leveraged so that small changes may produce disproportionate losses for the Portfolio, and may be subject to counterparty risk to a greater degree than more traditional investments.

Real Assets Risk: The Portfolio’s investments in securities linked to real assets involve significant risks, including financial, operating and competitive risks. Investments in securities linked to real assets expose the Portfolio to adverse macroeconomic conditions, such as a rise in interest rates or a downturn in the economy in which the asset is located. The Portfolio’s investments in real estate securities have many of the same risks as direct ownership of real estate, including the risk that the value of real estate could decline due to a variety of factors that affect the real estate market generally. Investments in REITs may have additional risks. REITs are dependent on the capability of their managers, may have limited diversification, and could be significantly affected by changes in tax laws.

(Disclosures and Risks continued on next page)

4

| | |

| | |

| | |

| | | AB Variable Products Series Fund |

Investment in Other Investment Companies Risk: As with other investments, investments in other investment companies are subject to market and selection risk. In addition, Contractholders invested in the Portfolio bear both their proportionate share of expenses in the Portfolio (including management fees) and, indirectly, the expenses of the investment companies (to the extent these expenses are not waived or reimbursed by the Adviser).

Management Risk: The Portfolio is subject to management risk because it is an actively managed investment fund. The Adviser will apply its investment techniques and risk analyses in making investment decisions for the Portfolio, but there is no guarantee that its techniques will produce the intended results.

These risks are fully discussed in the Variable Products prospectus. As with all investments, you may lose money by investing in the Portfolio.

An Important Note About Historical Performance

The investment return and principal value of an investment in the Portfolio will fluctuate, so that shares, when redeemed, may be worth more or less than their original cost. Performance shown in this report represents past performance and does not guarantee future results. Current performance may be lower or higher than the performance information shown. Please contact your Financial Advisor or Insurance Agent Representative at your financial institution to obtain portfolio performance information current to the most recent month end.

Investors should consider the investment objectives, risks, charges and expenses of the Portfolio carefully before investing. For additional copies of the Portfolio’s prospectus or summary prospectus, which contains this and other information, call your financial advisor or (800) 227 4618. Please read the prospectus and/or summary prospectus carefully before investing.

All fees and expenses related to the operation of the Portfolio have been deducted, but no adjustment has been made for insurance company separate account or annuity contract charges, which would reduce total return to a contract owner. Performance assumes reinvestment of distributions and does not account for taxes.

There are additional fees and expenses associated with all Variable Products. These fees can include mortality and expense risk charges, administrative charges, and other charges that can significantly reduce investment returns. Those fees and expenses are not reflected in this annual report. You should consult your Variable Products prospectus for a description of those fees and expenses and speak to your insurance agent or financial representative if you have any questions. You should read the prospectus before investing or sending money.

5

| | |

| | |

| BALANCED WEALTH STRATEGY PORTFOLIO |

| HISTORICAL PERFORMANCE | | AB Variable Products Series Fund |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

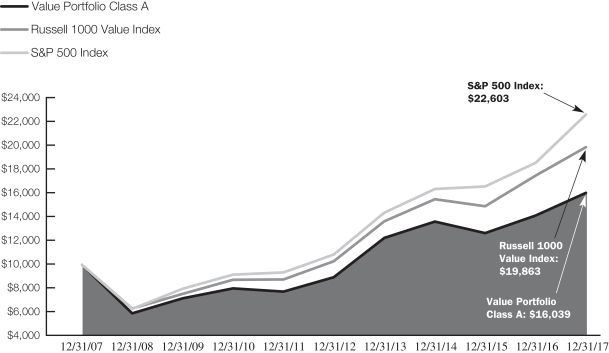

| THE PORTFOLIO VS. ITS BENCHMARKS | | Net Asset Value Returns | |

| PERIODS ENDED DECEMBER 31, 2017 (unaudited) | | 1 Year | | | 5 Years1 | | | 10 Years1 | |

| Balanced Wealth Strategy Portfolio Class A2 | | | 15.84% | | | | 9.05% | | | | 5.11% | |

| Balanced Wealth Strategy Portfolio Class B2 | | | 15.62% | | | | 8.78% | | | | 4.84% | |

| Primary Benchmark: S&P 500 Index | | | 21.83% | | | | 15.79% | | | | 8.50% | |

| Bloomberg Barclays US Aggregate Bond Index | | | 3.54% | | | | 2.10% | | | | 4.01% | |

Blended Benchmark: 60% S&P 500 Index /

40% Bloomberg Barclays US Aggregate Bond Index | | | 14.21% | | | | 10.25% | | | | 6.98% | |

1 Average annual returns. 2 Includes the impact of proceeds received and credited to the Portfolio resulting from class-action settlements, which enhanced the performance of all share classes of the Portfolio for the annual period ended December 31, 2017, by 0.02%. Please keep in mind that high, double-digit returns are highly unusual and cannot be sustained. Investors should also be aware that these returns were primarily achieved during favorable market conditions. | |

| | | | | | | | | | | | |

The Portfolio’s current prospectus fee table shows the Portfolio’s total annual operating expense ratios as 0.73% and 0.98% for Class A and Class B shares, respectively. The Financial Highlights section of this report sets forth expense ratio data for the current reporting period; the expense ratios shown above may differ from the expense ratios in the Financial Highlights section since they are based on different time periods.

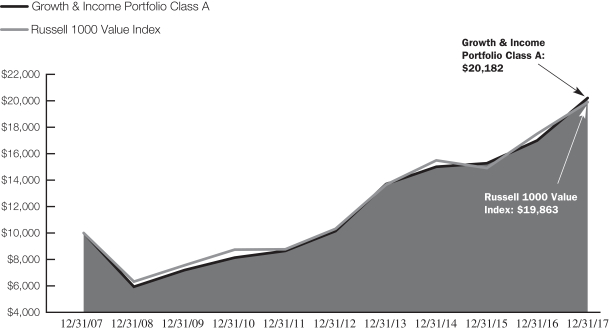

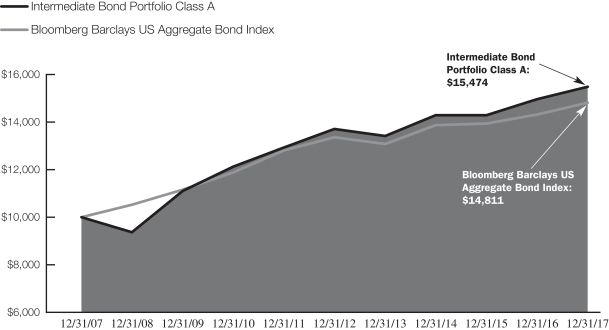

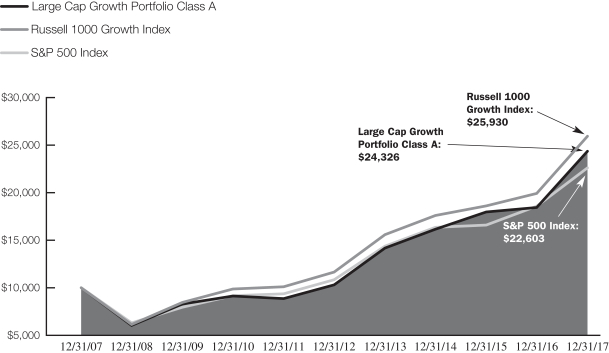

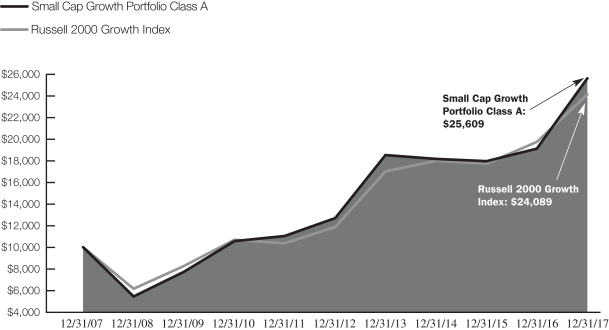

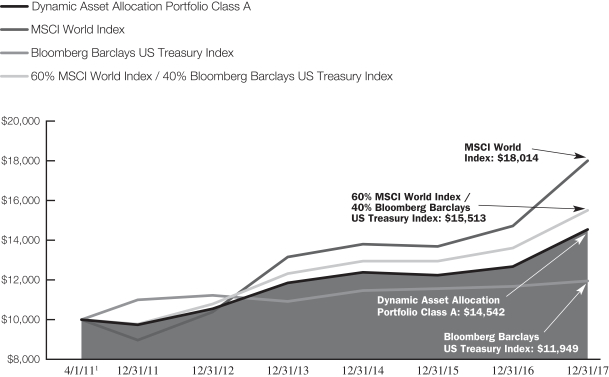

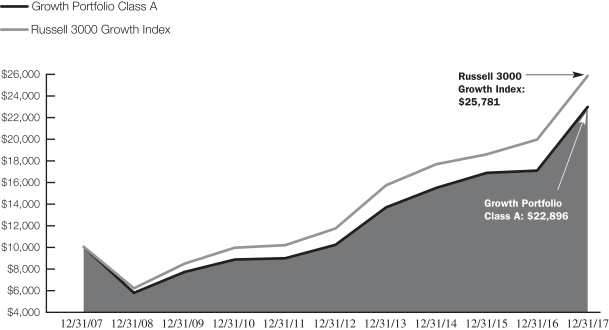

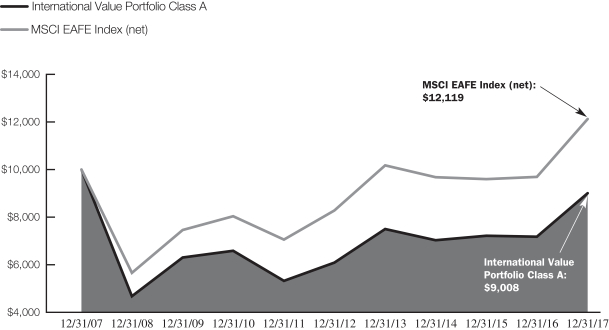

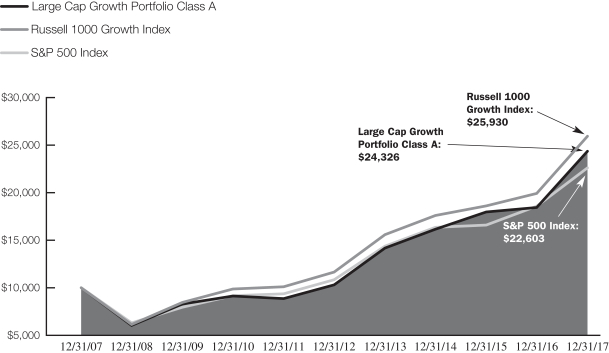

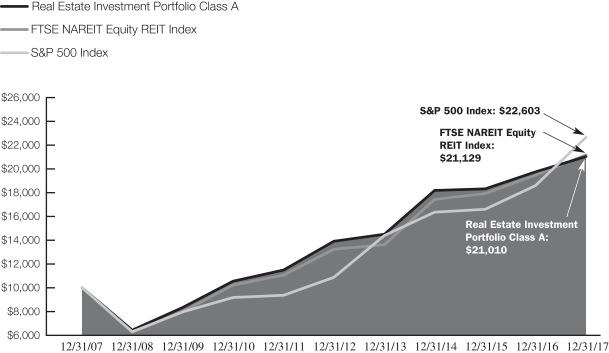

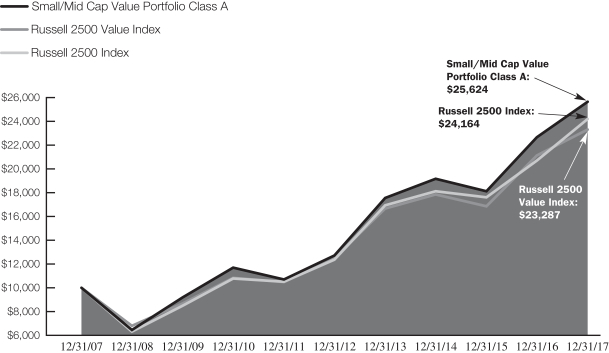

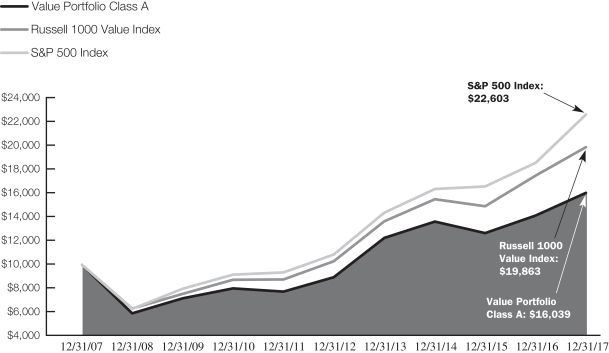

BALANCED WEALTH STRATEGY PORTFOLIO CLASS A

GROWTH OF A $10,000 INVESTMENT

12/31/2007 to 12/31/2017 (unaudited)

This chart illustrates the total value of an assumed $10,000 investment in the Balanced Wealth Strategy Portfolio Class A shares (from 12/31/2007 to 12/31/2017) as compared to the performance of the Portfolio’s benchmarks. The chart assumes the reinvestment of dividends and capital gains distributions.

See Disclosures, Risks and Note about Historical Performance on pages 4-5.

6

| | |

| | |

| BALANCED WEALTH STRATEGY PORTFOLIO |

| EXPENSE EXAMPLE (unaudited) | | AB Variable Products Series Fund |

As a shareholder of the Fund, you incur two types of costs: (1) transaction costs, including sales charges (loads) on purchase payments, contingent deferred sales charges on redemptions and (2) ongoing costs, including management fees; distribution (12b-1) fees; and other Fund expenses. This example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds.

The Example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period as indicated below.

Actual Expenses

The table below provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period. The estimate of expenses does not include fees or other expenses of any variable insurance product. If such expenses were included, the estimate of expenses you paid during the period would be higher and your ending account value would be lower.

Hypothetical Example for Comparison Purposes

The table below provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed annual rate of return of 5% before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds by comparing this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of other funds. The estimate of expenses does not include fees or other expenses of any variable insurance product. If such expenses were included, the estimate of expenses you paid during the period would be higher and your ending account value would be lower.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as sales charges (loads), or contingent deferred sales charges on redemptions. Therefore, the second line of each class’ table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

| | | | | | | | | | | | | | | | |

| | | Beginning

Account Value

July 1, 2017 | | | Ending

Account Value

December 31, 2017 | | | Expenses Paid

During Period* | | | Annualized

Expense Ratio* | |

Class A | | | | | | | | | | | | | | | | |

Actual | | $ | 1,000 | | | $ | 1,070.10 | | | $ | 3.81 | | | | 0.73 | % |

Hypothetical (5% annual return before expenses) | | $ | 1,000 | | | $ | 1,021.53 | | | $ | 3.72 | | | | 0.73 | % |

| | | | | | | | | | | | | | | | |

Class B | | | | | | | | | | | | | | | | |

Actual | | $ | 1,000 | | | $ | 1,069.00 | | | $ | 5.11 | | | | 0.98 | % |

Hypothetical (5% annual return before expenses) | | $ | 1,000 | | | $ | 1,020.27 | | | $ | 4.99 | | | | 0.98 | % |

| * | | Expenses are equal to each classes’ annualized expense ratios, multiplied by the average account value over the period, multiplied by 184/365 (to reflect the one-half year period). |

7

| | |

| BALANCED WEALTH STRATEGY PORTFOLIO |

| TEN LARGEST HOLDINGS1 | | |

| December 31, 2017 (unaudited) | | AB Variable Products Series Fund |

| | | | | | | | |

| SECURITY | | U.S. $ VALUE | | | PERCENT OF NET ASSETS | |

Federal National Mortgage Association | | $ | 19,495,666 | | | | 6.4 | % |

U.S. Treasury Bonds & Notes | | | 12,938,460 | | | | 4.3 | |

Inflation-Linked Securities | | | 6,099,588 | | | | 2.0 | |

Alphabet, Inc.—Class A & Class C | | | 5,108,049 | | | | 1.7 | |

Facebook, Inc.—Class A | | | 4,058,580 | | | | 1.3 | |

Bank of America Corp. Series Z | | | 3,189,315 | | | | 1.1 | |

Visa, Inc.—Class A | | | 2,908,650 | | | | 1.0 | |

Government National Mortgage Association | | | 2,859,655 | | | | 0.9 | |

JPMorgan Chase & Co. | | | 2,761,458 | | | | 0.9 | |

Biogen, Inc. | | | 2,681,184 | | | | 0.9 | |

| | | | | | | | | |

| | | $ | 62,100,605 | | | | 20.5 | % |

SECURITY TYPE BREAKDOWN2

December 31, 2017 (unaudited)

| | | | | | | | |

| SECURITY TYPE | | U.S. $ VALUE | | | PERCENT OF TOTAL

INVESTMENTS | |

Common Stocks | | $ | 190,713,151 | | | | 60.4 | % |

Mortgage Pass-Throughs | | | 23,253,186 | | | | 7.4 | |

Corporates—Investment Grade | | | 22,563,565 | | | | 7.1 | |

Governments—Treasuries | | | 12,938,460 | | | | 4.1 | |

Asset-Backed Securities | | | 9,691,042 | | | | 3.1 | |

Commercial Mortgage-Backed Securities | | | 8,336,177 | | | | 2.6 | |

Collateralized Mortgage Obligations | | | 6,440,424 | | | | 2.0 | |

Inflation-Linked Securities | | | 6,099,588 | | | | 1.9 | |

Corporates—Non-Investment Grade | | | 3,663,337 | | | | 1.2 | |

Emerging Markets—Treasuries | | | 772,430 | | | | 0.2 | |

Quasi-Sovereigns | | | 607,284 | | | | 0.2 | |

Local Governments—US Municipal Bonds | | | 539,735 | | | | 0.2 | |

Emerging Markets—Corporate Bonds | | | 403,453 | | | | 0.1 | |

Governments—Sovereign Bonds | | | 207,950 | | | | 0.1 | |

Short-Term Investments | | | 29,578,909 | | | | 9.4 | |

| | | | | | | | | |

Total Investments | | $ | 315,808,691 | | | | 100.0 | % |

| 2 | | The Portfolio’s security type breakdown is expressed as a percentage of total investments and may vary over time. The Portfolio also enters into derivative transactions, which may be used for hedging or investment purposes (see “Portfolio of Investments” section of the report for additional details). |

8

| | |

| BALANCED WEALTH STRATEGY PORTFOLIO |

| COUNTRY BREAKDOWN1 | | |

| December 31, 2017 (unaudited) | | AB Variable Products Series Fund |

| | | | | | | | |

| COUNTRY | | U.S. $ VALUE | | | PERCENT OF TOTAL

INVESTMENTS | |

United States | | $ | 209,019,334 | | | | 66.2 | % |

Japan | | | 14,168,292 | | | | 4.5 | |

United Kingdom | | | 11,143,497 | | | | 3.5 | |

France | | | 7,428,348 | | | | 2.3 | |

Germany | | | 5,131,939 | | | | 1.6 | |

Hong Kong | | | 4,119,263 | | | | 1.3 | |

Switzerland | | | 3,443,240 | | | | 1.1 | |

Canada | | | 3,377,927 | | | | 1.1 | |

Australia | | | 2,764,914 | | | | 0.9 | |

India | | | 2,644,801 | | | | 0.8 | |

China | | | 2,385,815 | | | | 0.8 | |

Brazil | | | 2,099,194 | | | | 0.7 | |

Netherlands | | | 2,037,773 | | | | 0.6 | |

Other | | | 16,465,445 | | | | 5.2 | |

Short-Term Investments | | | 29,578,909 | | | | 9.4 | |

| | | | | | | | | |

Total Investments | | $ | 315,808,691 | | | | 100.0 | % |

| 1 | | All data are as of December 31, 2017. The Portfolio’s country breakdown is expressed as a percentage of total investments and may vary over time. “Other” country weightings represent 0.5% or less in the following countries: Argentina, Austria, Belgium, Bermuda, Chile, Colombia, Denmark, Finland, Indonesia, Ireland, Israel, Italy, Mexico, New Zealand, Norway, Peru, Philippines, Portugal, Singapore, South Korea, Spain, Sweden, Taiwan and Turkey. |

9

| | |

| BALANCED WEALTH STRATEGY PORTFOLIO |

| PORTFOLIO OF INVESTMENTS | | |

| December 31, 2017 | | AB Variable Products Series Fund |

| | | | | | | | | | | | |

Company | | | | | Shares | | | U.S. $ Value | |

| | | | | | | | | | | | |

COMMON STOCKS–62.9% | | | | | | | | | | | | |

| | | | | | | | | | | | |

INFORMATION TECHNOLOGY–11.6% | | | | | | | | | | | | |

COMMUNICATIONS EQUIPMENT–0.4% | | | | | | | | | | | | |

Arista Networks, Inc.(a) | | | | | | | 1,540 | | | $ | 362,793 | |

Nokia Oyj | | | | | | | 72,750 | | | | 339,913 | |

Nokia Oyj (Sponsored ADR)–Class A | | | | | | | 122,979 | | | | 573,082 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 1,275,788 | |

| | | | | | | | | | | | |

ELECTRONIC EQUIPMENT, INSTRUMENTS & COMPONENTS–0.5% | | | | | | | | | | | | |

Amphenol Corp.–Class A | | | | | | | 4,744 | | | | 416,523 | |

Corning, Inc. | | | | | | | 5,906 | | | | 188,933 | |

Halma PLC | | | | | | | 13,560 | | | | 230,400 | |

Horiba Ltd. | | | | | | | 4,200 | | | | 252,862 | |

Ingenico Group SA | | | | | | | 2,290 | | | | 244,569 | |

Keyence Corp. | | | | | | | 400 | | | | 223,453 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 1,556,740 | |

| | | | | | | | | | | | |

INTERNET SOFTWARE & SERVICES–3.6% | | | | | | | | | | | | |

Alibaba Group Holding Ltd. (ADR)(a) | | | | | | | 2,930 | | | | 505,220 | |

Alphabet, Inc.–Class A(a) | | | | | | | 530 | | | | 558,302 | |

Alphabet, Inc.–Class C(a) | | | | | | | 4,348 | | | | 4,549,747 | |

eBay, Inc.(a) | | | | | | | 4,940 | | | | 186,436 | |

Facebook, Inc.–Class A(a) | | | | | | | 23,000 | | | | 4,058,580 | |

Tencent Holdings Ltd. | | | | | | | 12,700 | | | | 657,325 | |

Yahoo Japan Corp. | | | | | | | 102,200 | | | | 468,228 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 10,983,838 | |

| | | | | | | | | | | | |

IT SERVICES–2.1% | | | | | | | | | | | | |

Booz Allen Hamilton Holding Corp. | | | | | | | 11,531 | | | | 439,677 | |

Capgemini SE | | | | | | | 2,100 | | | | 248,728 | |

Cognizant Technology Solutions Corp.–Class A | | | | | | | 15,445 | | | | 1,096,904 | |

Fiserv, Inc.(a) | | | | | | | 4,540 | | | | 595,330 | |

Fujitsu Ltd. | | | | | | | 18,000 | | | | 127,612 | |

PayPal Holdings, Inc.(a) | | | | | | | 10,860 | | | | 799,513 | |

Visa, Inc.–Class A | | | | | | | 25,510 | | | | 2,908,650 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 6,216,414 | |

| | | | | | | | | | | | |

SEMICONDUCTORS & SEMICONDUCTOR EQUIPMENT–2.2% | | | | | | | | | | | | |

ams AG(a) | | | | | | | 4,620 | | | | 418,534 | |

Applied Materials, Inc. | | | | | | | 1,594 | | | | 81,485 | |

ASM International NV | | | | | | | 2,690 | | | | 181,662 | |

ASML Holding NV | | | | | | | 3,161 | | | | 549,566 | |

Disco Corp. | | | | | | | 800 | | | | 177,312 | |

Infineon Technologies AG | | | | | | | 18,040 | | | | 491,304 | |

Intel Corp. | | | | | | | 32,193 | | | | 1,486,029 | |

NVIDIA Corp. | | | | | | | 1,709 | | | | 330,691 | |

SCREEN Holdings Co., Ltd. | | | | | | | 2,500 | | | | 203,329 | |

Siltronic AG(a) | | | | | | | 2,590 | | | | 374,442 | |

| | | | | | | | | | | | |

SUMCO Corp. | | | | | | | 10,300 | | | $ | 261,483 | |

Taiwan Semiconductor Manufacturing Co., Ltd. | | | | | | | 39,000 | | | | 298,626 | |

Texas Instruments, Inc. | | | | | | | 3,250 | | | | 339,430 | |

Tokyo Electron Ltd. | | | | | | | 800 | | | | 144,311 | |

Xilinx, Inc. | | | | | | | 20,247 | | | | 1,365,053 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 6,703,257 | |

| | | | | | | | | | | | |

SOFTWARE–1.4% | | | | | | | | | | | | |

Adobe Systems, Inc.(a) | | | | | | | 9,890 | | | | 1,733,124 | |

Electronic Arts, Inc.(a) | | | | | | | 6,530 | | | | 686,042 | |

Nintendo Co., Ltd. | | | | | | | 700 | | | | 252,067 | |

Oracle Corp. | | | | | | | 30,263 | | | | 1,430,835 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 4,102,068 | |

| | | | | | | | | | | | |

TECHNOLOGY HARDWARE, STORAGE & PERIPHERALS–1.4% | | | | | | | | | | | | |

Apple, Inc. | | | | | | | 13,560 | | | | 2,294,759 | |

Hewlett Packard Enterprise Co. | | | | | | | 8,190 | | | | 117,608 | |

HP, Inc. | | | | | | | 38,674 | | | | 812,540 | |

NCR Corp.(a) | | | | | | | 9,220 | | | | 313,388 | |

Samsung Electronics Co., Ltd. | | | | | | | 80 | | | | 190,073 | |

Xerox Corp. | | | | | | | 19,206 | | | | 559,855 | |

| | | | | | | | | | | 4,288,223 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 35,126,328 | |

| | | | | | | | | | | | |

REAL ESTATE–10.0% | | | | | | | | | | | | |

DIVERSIFIED REAL ESTATE ACTIVITIES–0.7% | | | | | | | | | | | | |

City Developments Ltd. | | | | | | | 35,600 | | | | 331,084 | |

Kerry Properties Ltd. | | | | | | | 36,500 | | | | 163,969 | |

Leopalace21 Corp. | | | | | | | 34,400 | | | | 267,137 | |

Mitsui Fudosan Co., Ltd. | | | | | | | 30,500 | | | | 682,147 | |

Sumitomo Realty & Development Co., Ltd. | | | | | | | 8,000 | | | | 262,552 | |

Sun Hung Kai Properties Ltd. | | | | | | | 9,000 | | | | 149,841 | |

Wharf Holdings Ltd. (The) | | | | | | | 41,000 | | | | 141,388 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 1,998,118 | |

| | | | | | | | | | | | |

DIVERSIFIED REITS–1.4% | | | | | | | | | | | | |

Activia Properties, Inc. | | | | | | | 44 | | | | 184,170 | |

Armada Hoffler Properties, Inc. | | | | | | | 15,800 | | | | 245,374 | |

Dream Global Real Estate Investment Trust | | | | | | | 16,220 | | | | 157,684 | |

Empire State Realty Trust, Inc.–Class A | | | | | | | 17,600 | | | | 361,328 | |

GPT Group (The) | | | | | | | 93,640 | | | | 372,483 | |

Gramercy Property Trust | | | | | | | 11,427 | | | | 304,644 | |

H&R Real Estate Investment Trust | | | | | | | 11,960 | | | | 203,234 | |

Hispania Activos Inmobiliarios SOCIMI SA | | | | | | | 16,570 | | | | 312,140 | |

Hulic Reit, Inc. | | | | | | | 125 | | | | 181,939 | |

ICADE | | | | | | | 3,175 | | | | 312,114 | |

Kenedix Office Investment Corp.–Class A | | | | | | | 33 | | | | 187,442 | |

Land Securities Group PLC | | | | | | | 21,650 | | | | 294,153 | |

Liberty Property Trust | | | | | | | 6,500 | | | | 279,565 | |

10

| | |

| | | AB Variable Products Series Fund |

| | | | | | | | | | | | |

Company | | | | | Shares | | | U.S. $ Value | |

| | | | | | | | | | | | |

Merlin Properties Socimi SA | | | | | | | 15,764 | | | $ | 213,509 | |

Mirvac Group | | | | | | | 168,110 | | | | 307,440 | |

Washington Real Estate Investment Trust | | | | | | | 11,260 | | | | 350,411 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 4,267,630 | |

| | | | | | | | | �� | | | |

EQUITY REAL ESTATE INVESTMENT TRUSTS (REITs)–0.3% | | | | | | | | | | | | |

Mid-America Apartment Communities, Inc. | | | | | | | 9,561 | | | | 961,454 | |

| | | | | | | | | | | | |

HEALTH CARE REITS–0.5% | | | | | | | | | | | | |

Healthcare Realty Trust, Inc. | | | | | | | 9,200 | | | | 295,504 | |

Medical Properties Trust, Inc. | | | | | | | 22,270 | | | | 306,881 | |

Sabra Health Care REIT, Inc. | | | | | | | 14,390 | | | | 270,100 | |

Welltower, Inc. | | | | | | | 12,120 | | | | 772,892 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 1,645,377 | |

| | | | | | | | | | | | |

HOTEL & RESORT REITS–0.4% | | | | | | | | | | | | |

MGM Growth Properties LLC–Class A | | | | | | | 10,260 | | | | 299,079 | |

Park Hotels & Resorts, Inc. | | | | | | | 9,400 | | | | 270,250 | |

RLJ Lodging Trust | | | | | | | 16,860 | | | | 370,414 | |

Summit Hotel Properties, Inc. | | | | | | | 10,620 | | | | 161,743 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 1,101,486 | |

| | | | | | | | | | | | |

INDUSTRIAL REITS–0.7% | | | | | | | | | | | | |

Goodman Group | | | | | | | 27,870 | | | | 182,618 | |

LaSalle Logiport REIT | | | | | | | 151 | | | | 154,518 | |

Mapletree Logistics Trust | | | | | | | 218,000 | | | | 215,156 | |

PLA Administradora Industrial S de RL de CV(a) | | | | | | | 46,200 | | | | 70,043 | |

Prologis, Inc. | | | | | | | 3,260 | | | | 210,302 | |

Rexford Industrial Realty, Inc. | | | | | | | 13,250 | | | | 386,370 | |

Segro PLC | | | | | | | 36,880 | | | | 291,925 | |

STAG Industrial, Inc. | | | | | | | 15,310 | | | | 418,422 | |

Tritax Big Box REIT PLC | | | | | | | 93,590 | | | | 188,151 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 2,117,505 | |

| | | | | | | | | | | | |

OFFICE REITS–1.3% | | | | | | | | | | | | |

Alexandria Real Estate Equities, Inc. | | | | | | | 3,440 | | | | 449,230 | |

Allied Properties Real Estate Investment Trust | | | | | | | 6,776 | | | | 226,837 | |

Boston Properties, Inc. | | | | | | | 2,044 | | | | 265,781 | |

Brandywine Realty Trust | | | | | | | 16,620 | | | | 302,318 | |

Champion REIT | | | | | | | 196,000 | | | | 143,748 | |

Columbia Property Trust, Inc. | | | | | | | 11,444 | | | | 262,640 | |

Corporate Office Properties Trust | | | | | | | 6,570 | | | | 191,844 | |

Derwent London PLC | | | | | | | 7,330 | | | | 308,576 | |

Hibernia REIT PLC | | | | | | | 54,390 | | | | 99,456 | |

Investa Office Fund | | | | | | | 53,120 | | | | 187,957 | |

Kilroy Realty Corp. | | | | | | | 4,070 | | | | 303,826 | |

Mack-Cali Realty Corp. | | | | | | | 8,320 | | | | 179,379 | |

Nippon Building Fund, Inc. | | | | | | | 61 | | | | 298,300 | |

SL Green Realty Corp. | | | | | | | 3,450 | | | | 348,208 | |

Workspace Group PLC | | | | | | | 21,046 | | | | 284,721 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 3,852,821 | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

REAL ESTATE DEVELOPMENT–0.3% | | | | | | | | | | | | |

CK Asset Holdings Ltd. | | | | | | | 93,500 | | | | 815,055 | |

| | | | | | | | | | | | |

REAL ESTATE MANAGEMENT & DEVELOPMENT–0.4% | | | | | | | | | | | | |

SM Prime Holdings, Inc. | | | | | | | 425,400 | | | | 319,561 | |

Vonovia SE | | | | | | | 15,552 | | | | 770,559 | |

Wharf Real Estate Investment Co., Ltd.(a) | | | | | | | 38,000 | | | | 252,917 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 1,343,037 | |

| | | | | | | | | | | | |

REAL ESTATE OPERATING COMPANIES–0.6% | | | | | | | | | | | | |

Aroundtown SA | | | | | | | 32,350 | | | | 249,038 | |

BUWOG AG(a) | | | | | | | 4,466 | | | | 153,908 | |

CA Immobilien Anlagen AG | | | | | | | 9,140 | | | | 282,994 | |

Deutsche Wohnen SE | | | | | | | 7,150 | | | | 311,860 | |

Entra ASA(b) | | | | | | | 18,398 | | | | 273,373 | |

Hongkong Land Holdings Ltd. | | | | | | | 42,100 | | | | 296,124 | |

TLG Immobilien AG | | | | | | | 6,290 | | | | 166,813 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 1,734,110 | |

| | | | | | | | | | | | |

RESIDENTIAL REITS–1.0% | | | | | | | | | | | | |

American Campus Communities, Inc. | | | | | | | 5,220 | | | | 214,177 | |

American Homes 4 Rent–Class A | | | | | | | 18,320 | | | | 400,109 | |

Camden Property Trust | | | | | | | 4,060 | | | | 373,764 | |

Emlak Konut Gayrimenkul Yatirim Ortakligi AS(a) | | | | | | | 202,130 | | | | 149,678 | |

Essex Property Trust, Inc. | | | | | | | 2,350 | | | | 567,219 | |

Independence Realty Trust, Inc. | | | | | | | 21,620 | | | | 218,146 | |

Japan Rental Housing Investments, Inc. | | | | | | | 253 | | | | 184,571 | |

Killam Apartment Real Estate Investment Trust | | | | | | | 27,790 | | | | 314,378 | |

Sun Communities, Inc. | | | | | | | 5,111 | | | | 474,199 | |

UNITE Group PLC (The) | | | | | | | 27,650 | | | | 300,520 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 3,196,761 | |

| | | | | | | | | | | | |

RETAIL REITS–1.8% | | | | | | | | | | | | |

Charter Hall Retail REIT | | | | | | | 69,220 | | | | 224,337 | |

Frontier Real Estate Investment Corp. | | | | | | | 39 | | | | 151,604 | |

Fukuoka REIT Corp. | | | | | | | 123 | | | | 183,613 | |

Kenedix Retail REIT Corp. | | | | | | | 74 | | | | 152,849 | |

Klepierre SA | | | | | | | 9,173 | | | | 403,193 | |

Link REIT | | | | | | | 70,768 | | | | 654,732 | |

National Retail Properties, Inc. | | | | | | | 10,350 | | | | 446,396 | |

Realty Income Corp. | | | | | | | 11,210 | | | | 639,194 | |

Regency Centers Corp. | | | | | | | 6,460 | | | | 446,903 | |

Retail Opportunity Investments Corp. | | | | | | | 12,600 | | | | 251,370 | |

Simon Property Group, Inc. | | | | | | | 8,056 | | | | 1,383,538 | |

Unibail-Rodamco SE | | | | | | | 960 | | | | 241,586 | |

Urban Edge Properties | | | | | | | 10,880 | | | | 277,331 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 5,456,646 | |

| | | | | | | | | | | | |

11

| | |

| BALANCED WEALTH STRATEGY PORTFOLIO |

| PORTFOLIO OF INVESTMENTS | | |

| (continued) | | AB Variable Products Series Fund |

| | | | | | | | | | | | |

Company | | | | | Shares | | | U.S. $ Value | |

| | | | | | | | | | | | |

SPECIALIZED REITS–0.6% | | | | | | | | | | | | |

CubeSmart | | | | | | | 8,990 | | | $ | 259,991 | |

Digital Realty Trust, Inc. | | | | | | | 5,320 | | | | 605,948 | |

Equinix, Inc. | | | | | | | 500 | | | | 226,610 | |

National Storage Affiliates Trust | | | | | | | 12,710 | | | | 346,474 | |

Public Storage | | | | | | | 1,360 | | | | 284,240 | |

| | | | | | | | | | | 1,723,263 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 30,213,263 | |

| | | | | | | | | | | | |

FINANCIALS–9.5% | | | | | | | | | | | | |

BANKS–4.6% | | | | | | | | | | | | |

ABN AMRO Group NV (GDR)(b) | | | | | | | 6,180 | | | | 199,249 | |

Australia & New Zealand Banking Group Ltd. | | | | | | | 8,610 | | | | 192,081 | |

Bank of America Corp. | | | | | | | 79,314 | | | | 2,341,349 | |

Barclays PLC | | | | | | | 92,180 | | | | 252,331 | |

BNP Paribas SA | | | | | | | 4,960 | | | | 368,967 | |

BOC Hong Kong Holdings Ltd. | | | | | | | 59,000 | | | | 298,173 | |

Citigroup, Inc. | | | | | | | 14,051 | | | | 1,045,535 | |

Citizens Financial Group, Inc. | | | | | | | 1,635 | | | | 68,637 | |

Comerica, Inc. | | | | | | | 5,967 | | | | 517,995 | |

Credicorp Ltd. | | | | | | | 2,040 | | | | 423,157 | |

Danske Bank A/S | | | | | | | 4,085 | | | | 158,996 | |

DNB ASA | | | | | | | 15,090 | | | | 279,337 | |

Erste Group Bank AG(a) | | | | | | | 7,840 | | | | 339,751 | |

Fifth Third Bancorp | | | | | | | 5,234 | | | | 158,800 | |

HDFC Bank Ltd. | | | | | | | 27,900 | | | | 827,460 | |

ING Groep NV | | | | | | | 15,660 | | | | 287,466 | |

Intesa Sanpaolo SpA | | | | | | | 50,340 | | | | 167,021 | |

Itau Unibanco Holding SA (Preference Shares) | | | | | | | 8,250 | | | | 105,795 | |

JPMorgan Chase & Co. | | | | | | | 18,724 | | | | 2,002,345 | |

KB Financial Group, Inc. | | | | | | | 2,170 | | | | 128,427 | |

Mitsubishi UFJ Financial Group, Inc. | | | | | | | 63,500 | | | | 462,151 | |

PNC Financial Services Group, Inc. (The) | | | | | | | 2,996 | | | | 432,293 | |

Svenska Handelsbanken AB–Class A | | | | | | | 26,120 | | | | 356,957 | |

Swedbank AB–Class A | | | | | | | 16,710 | | | | 403,125 | |

Wells Fargo & Co. | | | | | | | 35,732 | | | | 2,167,860 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 13,985,258 | |

| | | | | | | | | | | | |

CAPITAL MARKETS–1.5% | | | | | | | | | | | | |

Azimut Holding SpA | | | | | | | 10,760 | | | | 205,851 | |

Credit Suisse Group AG (REG)(a) | | | | | | | 23,088 | | | | 411,791 | |

Franklin Resources, Inc. | | | | | | | 1,564 | | | | 67,768 | |

Goldman Sachs Group, Inc. (The) | | | | | | | 3,676 | | | | 936,498 | |

MarketAxess Holdings, Inc. | | | | | | | 4,759 | | | | 960,128 | |

Morgan Stanley | | | | | | | 8,180 | | | | 429,205 | |

Partners Group Holding AG | | | | | | | 880 | | | | 602,969 | |

S&P Global, Inc. | | | | | | | 5,450 | | | | 923,230 | |

Thomson Reuters Corp. | | | | | | | 2,453 | | | | 106,926 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 4,644,366 | |

| | | | | | | | | | | | |

CONSUMER FINANCE–0.9% | | | | | | | | | | | | |

Bharat Financial Inclusion Ltd.(a) | | | | | | | 22,630 | | | | 354,620 | |

Capital One Financial Corp. | | | | | | | 6,790 | | | | 676,148 | |

| | | | | | | | | | | | |

Discover Financial Services | | | | | | | 1,591 | | | | 122,380 | |

Hitachi Capital Corp. | | | | | | | 7,400 | | | | 185,569 | |

OneMain Holdings, Inc.(a) | | | | | | | 10,982 | | | | 285,422 | |

Synchrony Financial | | | | | | | 23,834 | | | | 920,231 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 2,544,370 | |

| | | | | | | | | | | | |

DIVERSIFIED FINANCIAL SERVICES–0.3% | | | | | | | | | | | | |

Berkshire Hathaway, Inc.–Class B(a) | | | | | | | 4,127 | | | | 818,054 | |

ORIX Corp. | | | | | | | 10,900 | | | | 183,784 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 1,001,838 | |

| | | | | | | | | | | | |

INSURANCE–2.0% | | | | | | | | | | | | |

AIA Group Ltd. | | | | | | | 80,400 | | | | 683,853 | |

Allianz SE (REG) | | | | | | | 1,820 | | | | 416,503 | |

Allstate Corp. (The) | | | | | | | 8,598 | | | | 900,297 | |

American International Group, Inc. | | | | | | | 17,683 | | | | 1,053,553 | |

Aviva PLC | | | | | | | 19,640 | | | | 133,951 | |

Everest Re Group Ltd. | | | | | | | 327 | | | | 72,352 | |

First American Financial Corp. | | | | | | | 11,689 | | | | 655,052 | |

FNF Group | | | | | | | 16,512 | | | | 647,931 | |

Hartford Financial Services Group, Inc. (The) | | | | | | | 2,784 | | | | 156,683 | |

Loews Corp. | | | | | | | 1,598 | | | | 79,948 | |

MetLife, Inc. | | | | | | | 4,482 | | | | 226,610 | |

PICC Property & Casualty Co., Ltd.–Class H | | | | | | | 68,000 | | | | 130,273 | |

Principal Financial Group, Inc. | | | | | | | 1,371 | | | | 96,738 | |

Prudential Financial, Inc. | | | | | | | 1,932 | | | | 222,141 | |

Prudential PLC | | | | | | | 25,530 | | | | 653,831 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 6,129,716 | |

| | | | | | | | | | | | |

THRIFTS & MORTGAGE FINANCE–0.2% | | | | | | | | | | | | |

Housing Development Finance Corp., Ltd. | | | | | | | 15,120 | | | | 404,917 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 28,710,465 | |

| | | | | | | | | | | | |

HEALTH CARE–7.6% | | | | | | | | | | | | |

BIOTECHNOLOGY–1.1% | | | | | | | | | | | | |

Biogen, Inc.(a) | | | | | | | 7,582 | | | | 2,415,398 | |

Genmab A/S(a) | | | | | | | 1,100 | | | | 182,426 | |

Gilead Sciences, Inc. | | | | | | | 7,281 | | | | 521,611 | |

Grifols SA (ADR) | | | | | | | 7,890 | | | | 180,839 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 3,300,274 | |

| | | | | | | | | | | | |

HEALTH CARE EQUIPMENT & SUPPLIES–1.6% | | | | | | | | | | | | |

Align Technology, Inc.(a) | | | | | | | 1,385 | | | | 307,733 | |

Danaher Corp. | | | | | | | 2,369 | | | | 219,891 | |

Edwards Lifesciences Corp.(a) | | | | | | | 18,605 | | | | 2,096,970 | |

Essilor International Cie Generale d'Optique SA | | | | | | | 2,830 | | | | 389,808 | |

Intuitive Surgical, Inc.(a) | | | | | | | 4,862 | | | | 1,774,338 | |

Sartorius AG (Preference Shares) | | | | | | | 1,296 | | | | 123,110 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 4,911,850 | |

| | | | | | | | | | | | |

12

| | |

| | | AB Variable Products Series Fund |

| | | | | | | | | | | | |

Company | | | | | Shares | | | U.S. $ Value | |

| | | | | | | | | | | | |

HEALTH CARE PROVIDERS & SERVICES–1.8% | | | | | | | | | | | | |

Aetna, Inc. | | | | | | | 4,027 | | | $ | 726,431 | |

Anthem, Inc. | | | | | | | 1,305 | | | | 293,638 | |

Apollo Hospitals Enterprise Ltd. | | | | | | | 29,930 | | | | 564,227 | |

Cigna Corp. | | | | | | | 3,007 | | | | 610,692 | |

McKesson Corp. | | | | | | | 4,750 | | | | 740,762 | |

Quest Diagnostics, Inc. | | | | | | | 3,584 | | | | 352,988 | |

UnitedHealth Group, Inc. | | | | | | | 10,251 | | | | 2,259,935 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 5,548,673 | |

| | | | | | | | | | | | |

HEALTH CARE TECHNOLOGY–0.3% | | | | | | | | | | | | |

Cerner Corp.(a) | | | | | | | 12,529 | | | | 844,329 | |

| | | | | | | | | | | | |

LIFE SCIENCES TOOLS & SERVICES–0.4% | | | | | | | | | | | | |

Eurofins Scientific SE | | | | | | | 716 | | | | 435,195 | |

Gerresheimer AG | | | | | | | 2,190 | | | | 181,126 | |

Mettler-Toledo International, Inc.(a) | | | | | | | 509 | | | | 315,336 | |

Thermo Fisher Scientific, Inc. | | | | | | | 1,098 | | | | 208,488 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 1,140,145 | |

| | | | | | | | | | | | |

PHARMACEUTICALS–2.4% | | | | | | | | | | | | |

Allergan PLC | | | | | | | 568 | | | | 92,914 | |

Bristol-Myers Squibb Co. | | | | | | | 4,094 | | | | 250,880 | |

Johnson & Johnson | | | | | | | 7,946 | | | | 1,110,215 | |

Mallinckrodt PLC(a) (c) | | | | | | | 14,204 | | | | 320,442 | |

Novo Nordisk A/S–Class B | | | | | | | 5,090 | | | | 273,514 | |

Ono Pharmaceutical Co., Ltd. | | | | | | | 6,100 | | | | 141,896 | |

Pfizer, Inc. | | | | | | | 27,914 | | | | 1,011,045 | |

Roche Holding AG | | | | | | | 3,880 | | | | 981,079 | |

Sanofi | | | | | | | 5,040 | | | | 433,903 | |

Teva Pharmaceutical Industries Ltd. | | | | | | | 1,680 | | | | 31,773 | |

Teva Pharmaceutical Industries Ltd. (Sponsored ADR) | | | | | | | 30,549 | | | | 578,904 | |

Vectura Group PLC(a) | | | | | | | 86,610 | | | | 137,634 | |

Zoetis, Inc. | | | | | | | 28,560 | | | | 2,057,462 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 7,421,661 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 23,166,932 | |

| | | | | | | | | | | | |

CONSUMER DISCRETIONARY–6.1% | | | | | | | | | | | | |

AUTO COMPONENTS–1.1% | | | | | | | | | | | | |

Aptiv PLC | | | | | | | 4,440 | | | | 376,645 | |

Bridgestone Corp. | | | | | | | 2,800 | | | | 129,590 | |

Cie Generale des Etablissements Michelin–Class B | | | | | | | 920 | | | | 131,611 | |

Continental AG | | | | | | | 700 | | | | 188,216 | |

Delphi Technologies PLC(a) | | | | | | | 2,820 | | | | 147,965 | |

Faurecia | | | | | | | 3,915 | | | | 305,116 | |

Hankook Tire Co., Ltd.(a) | | | | | | | 2,360 | | | | 120,236 | |

Lear Corp. | | | | | | | 2,621 | | | | 463,026 | |

Magna International, Inc.– Class A | | | | | | | 15,980 | | | | 905,587 | |

Sumitomo Electric Industries Ltd. | | | | | | | 9,500 | | | | 160,144 | |

Valeo SA | | | | | | | 4,680 | | | | 348,617 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 3,276,753 | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

AUTOMOBILES–0.4% | | | | | | | | | | | | |

Ford Motor Co. | | | | | | | 14,115 | | | | 176,296 | |

General Motors Co. | | | | | | | 6,743 | | | | 276,396 | |

Honda Motor Co., Ltd. | | | | | | | 9,500 | | | | 324,211 | |

Peugeot SA | | | | | | | 13,800 | | | | 280,295 | |

Subaru Corp. | | | | | | | 2,700 | | | | 85,611 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 1,142,809 | |

| | | | | | | | | | | | |

Hotels, Restaurants & Leisure–0.3% | | | | | | | | | | | | |

Carnival Corp. | | | | | | | 2,091 | | | | 138,780 | |

InterContinental Hotels Group PLC | | | | | | | 3,560 | | | | 226,433 | |

Merlin Entertainments PLC(b) | | | | | | | 29,979 | | | | 146,868 | |

Royal Caribbean Cruises Ltd. | | | | | | | 863 | | | | 102,938 | |

Starbucks Corp. | | | | | | | 7,230 | | | | 415,219 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 1,030,238 | |

| | | | | | | | | | | | |

HOUSEHOLD DURABLES–0.3% | | | | | | | | | | | | |

Nikon Corp. | | | | | | | 10,600 | | | | 213,306 | |

Panasonic Corp. | | | | | | | 47,700 | | | | 696,129 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 909,435 | |

| | | | | | | | | | | | |

INTERNET & DIRECT MARKETING RETAIL–0.2% | | | | | | | | | | | | |

Ctrip.com International Ltd. (ADR)(a) | | | | | | | 4,230 | | | | 186,543 | |

Priceline Group, Inc. (The)(a) | | | | | | | 280 | | | | 486,567 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 673,110 | |

| | | | | | | | | | | | |

LEISURE PRODUCTS–0.1% | | | | | | | | | | | | |

Amer Sports Oyj(a) | | | | | | | 6,590 | | | | 182,399 | |

| | | | | | | | | | | | |

MEDIA–0.9% | | | | | | | | | | | | |

Charter Communications, Inc.–Class A(a) | | | | | | | 319 | | | | 107,171 | |

Comcast Corp.–Class A | | | | | | | 36,941 | | | | 1,479,487 | |

Twenty-First Century Fox, Inc.–Class A | | | | | | | 24,194 | | | | 835,419 | |

Walt Disney Co. (The) | | | | | | | 2,058 | | | | 221,256 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 2,643,333 | |

| | | | | | | | | | | | |

MULTILINE RETAIL–0.4% | | | | | | | | | | | | |

B&M European Value Retail SA | | | | | | | 43,300 | | | | 247,091 | |

Dollar Tree, Inc.(a) | | | | | | | 6,281 | | | | 674,014 | |

Target Corp. | | | | | | | 3,136 | | | | 204,624 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 1,125,729 | |

| | | | | | | | | | | | |

SPECIALTY RETAIL–1.7% | | | | | | | | | | | | |

Best Buy Co., Inc. | | | | | | | 1,291 | | | | 88,395 | |

Gap, Inc. (The) | | | | | | | 6,477 | | | | 220,607 | |

Home Depot, Inc. (The) | | | | | | | 12,081 | | | | 2,289,712 | |

Michaels Cos., Inc. (The)(a) | | | | | | | 20,754 | | | | 502,039 | |

Signet Jewelers Ltd.(c) | | | | | | | 5,798 | | | | 327,877 | |

TJX Cos., Inc. (The) | | | | | | | 14,478 | | | | 1,106,988 | |

Ulta Salon Cosmetics & Fragrance, Inc.(a) | | | | | | | 3,570 | | | | 798,466 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 5,334,084 | |

| | | | | | | | | | | | |

13

| | |

| BALANCED WEALTH STRATEGY PORTFOLIO |

| PORTFOLIO OF INVESTMENTS | | |

| (continued) | | AB Variable Products Series Fund |

| | | | | | | | | | | | |

Company | | | | | Shares | | | U.S. $ Value | |

| | | | | | | | | | | | |

TEXTILES, APPAREL & LUXURY GOODS–0.7% | | | | | | | | | | | | |

Crystal International Group Ltd.(a)(b) | | | | | | | 92,000 | | | $ | 89,023 | |

HUGO BOSS AG | | | | | | | 3,090 | | | | 262,212 | |

Kering | | | | | | | 420 | | | | 197,705 | |

LVMH Moet Hennessy Louis Vuitton SE | | | | | | | 730 | | | | 214,259 | |

NIKE, Inc.–Class B | | | | | | | 15,282 | | | | 955,889 | |

Pandora A/S | | | | | | | 3,194 | | | | 347,183 | |

Samsonite International SA | | | | | | | 41,100 | | | | 188,854 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 2,255,125 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 18,573,015 | |

| | | | | | | | | | | | |

CONSUMER STAPLES–5.3% | | | | | | | | | | | | |

BEVERAGES–1.5% | | | | | | | | | | | | |

Asahi Group Holdings Ltd. | | | | | | | 2,500 | | | | 124,049 | |

Coca-Cola Bottlers Japan, Inc. | | | | | | | 5,000 | | | | 182,443 | |

Constellation Brands, Inc.–Class A | | | | | | | 5,010 | | | | 1,145,136 | |

Monster Beverage Corp.(a) | | | | | | | 27,021 | | | | 1,710,159 | |

PepsiCo, Inc. | | | | | | | 6,097 | | | | 731,152 | |

Pernod Ricard SA | | | | | | | 1,530 | | | | 241,977 | |

Treasury Wine Estates Ltd. | | | | | | | 23,810 | | | | 295,457 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 4,430,373 | |

| | | | | | | | | | | | |

FOOD & STAPLES RETAILING–0.9% | | | | | | | | | | | | |

Costco Wholesale Corp. | | | | | | | 8,760 | | | | 1,630,411 | |

CVS Health Corp. | | | | | | | 2,294 | | | | 166,315 | |

Tsuruha Holdings, Inc. | | | | | | | 2,500 | | | | 339,575 | |

Wal-Mart Stores, Inc. | | | | | | | 7,088 | | | | 699,940 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 2,836,241 | |

| | | | | | | | | | | | |

FOOD PRODUCTS–0.9% | | | | | | | | | | | | |

Archer-Daniels-Midland Co. | | | | | | | 4,072 | | | | 163,206 | |

BRF SA(a) | | | | | | | 8,500 | | | | 93,787 | |

Calbee, Inc. | | | | | | | 3,400 | | | | 110,492 | |

Glanbia PLC | | | | | | | 18,830 | | | | 336,638 | |

Kerry Group PLC–Class A | | | | | | | 3,310 | | | | 371,335 | |

Nestle SA (REG) | | | | | | | 4,570 | | | | 392,911 | |

Orkla ASA | | | | | | | 30,610 | | | | 324,377 | |

Tyson Foods, Inc.–Class A | | | | | | | 8,297 | | | | 672,638 | |

WH Group Ltd.(b) | | | | | | | 214,000 | | | | 241,586 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 2,706,970 | |

| | | | | | | | | | | | |

HOUSEHOLD PRODUCTS–0.8% | | | | | | | | | |

Colgate-Palmolive Co. | | | | | | | 3,537 | | | | 266,866 | |

Henkel AG & Co. KGaA (Preference Shares) | | | | | | | 2,430 | | | | 320,894 | |

Procter & Gamble Co. (The) | | | | | | | 11,786 | | | | 1,082,898 | |

Reckitt Benckiser Group PLC | | | | | | | 5,110 | | | | 476,730 | |

Unicharm Corp. | | | | | | | 13,100 | | | | 340,169 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 2,487,557 | |

| | | | | | | | | | | | |

PERSONAL PRODUCTS–0.2% | | | | | | | | | | | | |

Godrej Consumer Products Ltd. | | | | | | | 18,510 | | | | 289,577 | |

Kose Corp. | | | | | | | 1,700 | | | | 264,906 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 554,483 | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

TOBACCO–1.0% | | | | | | | | | | | | |

British American Tobacco PLC | | | | | | | 9,660 | | | | 653,005 | |

British American Tobacco PLC (Sponsored ADR) | | | | | | | 9,400 | | | | 629,706 | |

Imperial Brands PLC | | | | | | | 4,060 | | | | 173,178 | |

Japan Tobacco, Inc. | | | | | | | 11,400 | | | | 367,115 | |

Philip Morris International, Inc. | | | | | | | 11,740 | | | | 1,240,331 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 3,063,335 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 16,078,959 | |

| | | | | | | | | | | | |

INDUSTRIALS–4.5% | | | | | | | | | | | | |

AEROSPACE & DEFENSE–0.6% | | | | | | | | | |

Airbus SE | | | | | | | 4,230 | | | | 420,406 | |

BAE Systems PLC | | | | | | | 39,660 | | | | 306,426 | |

Raytheon Co. | | | | | | | 3,985 | | | | 748,582 | |

Saab AB–Class B | | | | | | | 3,600 | | | | 175,082 | |

United Technologies Corp. | | | | | | | 2,541 | | | | 324,155 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 1,974,651 | |

| | | | | | | | | | | | |

AIRLINES–0.4% | | | | | | | | | | | | |

Japan Airlines Co., Ltd. | | | | | | | 10,000 | | | | 390,699 | |

JetBlue Airways Corp.(a) | | | | | | | 22,157 | | | | 494,987 | |

Qantas Airways Ltd. | | | | | | | 79,944 | | | | 313,464 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 1,199,150 | |

| | | | | | | | | | | | |

BUILDING PRODUCTS–0.8% | | | | | | | | | | | | |

Allegion PLC | | | | | | | 10,472 | | | | 833,152 | |

AO Smith Corp. | | | | | | | 10,484 | | | | 642,460 | |

Assa Abloy AB–Class B | | | | | | | 8,500 | | | | 176,217 | |

Cie de Saint-Gobain | | | | | | | 4,460 | | | | 245,462 | |

Kingspan Group PLC | | | | | | | 9,110 | | | | 399,182 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 2,296,473 | |

| | | | | | | | | | | | |

COMMERCIAL SERVICES & SUPPLIES–0.4% | | | | | | | | | | | | |

China Everbright International Ltd. | | | | | | | 226,000 | | | | 322,422 | |

Copart, Inc.(a) | | | | | | | 20,171 | | | | 871,185 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 1,193,607 | |

| | | | | | | | | | | | |

CONSTRUCTION & ENGINEERING–0.1% | | | | | | | | | | | | |

AECOM(a) | | | | | | | 5,381 | | | | 199,904 | |

| | | | | | | | | | | | |

ELECTRICAL EQUIPMENT–0.6% | | | | | | | | | | | | |

Eaton Corp. PLC | | | | | | | 7,562 | | | | 597,474 | |

Emerson Electric Co. | | | | | | | 2,696 | | | | 187,884 | |

Nidec Corp. | | | | | | | 1,900 | | | | 266,032 | |

Philips Lighting NV(b) | | | | | | | 4,997 | | | | 183,274 | |

Schneider Electric SE (Paris)(a) | | | | | | | 4,900 | | | | 415,424 | |

TKH Group NV | | | | | | | 2,160 | | | | 137,194 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 1,787,282 | |

| | | | | | | | | | | | |

INDUSTRIAL CONGLOMERATES–0.6% | | | | | | | | | | | | |

General Electric Co. | | | | | | | 8,392 | | | | 146,440 | |

Roper Technologies, Inc. | | | | | | | 4,465 | | | | 1,156,435 | |

Siemens AG (REG) | | | | | | | 3,780 | | | | 523,370 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 1,826,245 | |

| | | | | | | | | | | | |

14

| | |

| | | AB Variable Products Series Fund |

| | | | | | | | | | | | |

Company | | | | | Shares | | | U.S. $ Value | |

| | | | | | | | | | | | |

MACHINERY–0.6% | | | | | | | | | | | | |

FANUC Corp. | | | | | | | 1,000 | | | $ | 239,896 | |

Hoshizaki Corp. | | | | | | | 1,500 | | | | 132,893 | |

IDEX Corp. | | | | | | | 1,910 | | | | 252,063 | |

IHI Corp. | | | | | | | 7,700 | | | | 255,381 | |

Oshkosh Corp. | | | | | | | 5,088 | | | | 462,448 | |

WABCO Holdings, Inc.(a) | | | | | | | 4,050 | | | | 581,175 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 1,923,856 | |

| | | | | | | | | | | | |

PROFESSIONAL SERVICES–0.2% | | | | | | | | | | | | |

Adecco Group AG (REG) | | | | | | | 2,710 | | | | 207,099 | |

Recruit Holdings Co., Ltd. | | | | | | | 9,500 | | | | 235,885 | |

RELX NV | | | | | | | 8,370 | | | | 192,379 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 635,363 | |

| | | | | | | | | | | | |

ROAD & RAIL–0.2% | | | | | | | | | | | | |

Norfolk Southern Corp. | | | | | | | 602 | | | | 87,230 | |

Ryder System, Inc. | | | | | | | 2,277 | | | | 191,655 | |

Union Pacific Corp. | | | | | | | 2,580 | | | | 345,978 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 624,863 | |

| | | | | | | | | | | | |

TRADING COMPANIES & DISTRIBUTORS–0.0% | | | | | | | | | | | | |

United Rentals, Inc.(a) | | | | | | | 380 | | | | 65,326 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 13,726,720 | |

| | | | | | | | | | | | |

ENERGY–2.8% | | | | | | | | | | | | |

ENERGY EQUIPMENT & SERVICES–0.2% | | | | | | | | | | | | |

RPC, Inc.(c) | | | | | | | 18,654 | | | | 476,237 | |

| | | | | | | | | | | | |

OIL, GAS & CONSUMABLE FUELS–2.6% | | | | | | | | | | | | |

Canadian Natural Resources Ltd. | | | | | | | 16,240 | | | | 580,093 | |

Canadian Natural Resources Ltd. (Toronto) | | | | | | | 5,580 | | | | 199,406 | |

Chevron Corp. | | | | | | | 6,492 | | | | 812,733 | |

ConocoPhillips | | | | | | | 3,545 | | | | 194,585 | |

Devon Energy Corp. | | | | | | | 13,363 | | | | 553,228 | |

EOG Resources, Inc. | | | | | | | 8,525 | | | | 919,933 | |

Exxon Mobil Corp. | | | | | | | 13,492 | | | | 1,128,471 | |

Hess Corp. | | | | | | | 10,872 | | | | 516,094 | |

HollyFrontier Corp. | | | | | | | 5,962 | | | | 305,374 | |

JXTG Holdings, Inc. | | | | | | | 58,000 | | | | 372,726 | |

Marathon Oil Corp. | | | | | | | 4,332 | | | | 73,341 | |

Marathon Petroleum Corp. | | | | | | | 11,896 | | | | 784,898 | |

QEP Resources, Inc.(a) | | | | | | | 26,098 | | | | 249,758 | |

Royal Dutch Shell PLC (Euronext Amsterdam)–Class A | | | | | | | 24,795 | | | | 826,293 | |

Valero Energy Corp. | | | | | | | 2,806 | | | | 257,899 | |

YPF SA (Sponsored ADR) | | | | | | | 5,353 | | | | 122,637 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 7,897,469 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 8,373,706 | |

| | | | | | | | | | | | |

MATERIALS–2.4% | | | | | | | | | | | | |

CHEMICALS–1.4% | | | | | | | | | | | | |

Air Water, Inc. | | | | | | | 8,400 | | | | 176,829 | |

Arkema SA | | | | | | | 2,356 | | | | 287,066 | |

CF Industries Holdings, Inc. | | | | | | | 11,767 | | | | 500,568 | |

| | | | | | | | | | | | |

Chr Hansen Holding A/S | | | | | | | 2,690 | | | | 252,322 | |

Eastman Chemical Co. | | | | | | | 4,166 | | | | 385,938 | |

Ecolab, Inc. | | | | | | | 3,290 | | | | 441,452 | |

Incitec Pivot Ltd. | | | | | | | 65,980 | | | | 199,924 | |

Johnson Matthey PLC | | | | | | | 7,028 | | | | 291,229 | |

Koninklijke DSM NV | | | | | | | 1,688 | | | | 161,244 | |

LyondellBasell Industries NV–Class A | | | | | | | 3,895 | | | | 429,696 | |

Mosaic Co. (The) | | | | | | | 1,842 | | | | 47,266 | |

Nippon Shokubai Co., Ltd. | | | | | | | 3,300 | | | | 222,454 | |

Sherwin-Williams Co. (The) | | | | | | | 980 | | | | 401,839 | |

Umicore SA | | | | | | | 7,480 | | | | 354,170 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 4,151,997 | |

| | | | | | | | | | | | |

CONSTRUCTION MATERIALS–0.3% | | | | | | | | | | | | |

Anhui Conch Cement Co., Ltd.–Class H | | | | | | | 19,500 | | | | 91,528 | |

Buzzi Unicem SpA | | | | | | | 5,080 | | | | 137,043 | |

CRH PLC (London) | | | | | | | 7,580 | | | | 272,047 | |

Fletcher Building Ltd. | | | | | | | 25,910 | | | | 139,555 | |

Grupo Cementos de Chihuahua SAB de CV | | | | | | | 39,050 | | | | 182,157 | |

HeidelbergCement AG | | | | | | | 1,590 | | | | 171,442 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 993,772 | |

| | | | | | | | | | | | |

CONTAINERS & PACKAGING–0.0% | | | | | | | | | | | | |

WestRock Co. | | | | | | | 1,282 | | | | 81,035 | |

| | | | | | | | | | | | |

METALS & MINING–0.7% | | | | | | | | | | | | |

Alcoa Corp.(a) | | | | | | | 11,626 | | | | 626,293 | |

BlueScope Steel Ltd. | | | | | | | 9,318 | | | | 110,982 | |

Boliden AB | | | | | | | 4,880 | | | | 166,885 | |

First Quantum Minerals Ltd. | | | | | | | 10,380 | | | | 145,419 | |

Gerdau SA (Preference Shares) | | | | | | | 40,300 | | | | 150,212 | |

Glencore PLC(a) | | | | | | | 39,480 | | | | 206,637 | |

Newmont Mining Corp. | | | | | | | 3,210 | | | | 120,439 | |

Norsk Hydro ASA | | | | | | | 36,750 | | | | 278,595 | |

Sumitomo Metal Mining Co., Ltd. | | | | | | | 4,900 | | | | 224,176 | |

Yamato Kogyo Co., Ltd. | | | | | | | 6,300 | | | | 182,482 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 2,212,120 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 7,438,924 | |

| | | | | | | | | | | | |

UTILITIES–1.4% | | | | | | | | | | | | |

ELECTRIC UTILITIES–0.7% | | | | | | | | | | | | |

American Electric Power Co., Inc. | | | | | | | 10,829 | | | | 796,690 | |

Edison International | | | | | | | 7,026 | | | | 444,324 | |

EDP–Energias de Portugal SA | | | | | | | 43,550 | | | | 150,751 | |

Enel SpA | | | | | | | 30,961 | | | | 190,387 | |

Eversource Energy | | | | | | | 1,154 | | | | 72,910 | |

NextEra Energy, Inc. | | | | | | | 1,258 | | | | 196,487 | |

Portland General Electric Co. | | | | | | | 6,024 | | | | 274,574 | |

Xcel Energy, Inc. | | | | | | | 2,341 | | | | 112,625 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 2,238,748 | |

| | | | | | | | | | | | |

MULTI-UTILITIES–0.5% | | | | | | | | | | | | |

Ameren Corp. | | | | | | | 1,182 | | | | 69,726 | |

CMS Energy Corp. | | | | | | | 1,661 | | | | 78,565 | |

15

| | |

| BALANCED WEALTH STRATEGY PORTFOLIO |

| PORTFOLIO OF INVESTMENTS | | |

| (continued) | | AB Variable Products Series Fund |

| | | | | | | | | | | | |

Company | | | | | Shares | | | U.S. $ Value | |

| | | | | | | | | | | | |

DTE Energy Co. | | | | | | | 1,111 | | | $ | 121,610 | |

NiSource, Inc. | | | | | | | 22,229 | | | | 570,619 | |

Public Service Enterprise Group, Inc. | | | | | | | 3,500 | | | | 180,250 | |

Suez | | | | | | | 18,980 | | | | 333,433 | |

WEC Energy Group, Inc. | | | | | | | 1,887 | | | | 125,354 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 1,479,557 | |

| | | | | | | | | | | | |

WATER UTILITIES–0.2% | | | | | | | | | | | | |

Beijing Enterprises Water Group Ltd.(a) | | | | | | | 424,000 | | | | 327,562 | |

Cia de Saneamento Basico do Estado de Sao Paulo | | | | | | | 21,700 | | | | 224,582 | |

Pennon Group PLC | | | | | | | 2,516 | | | | 26,562 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 578,706 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 4,297,011 | |

| | | | | | | | | | | | |

TELECOMMUNICATION SERVICES–1.4% | | | | | | | | | | | | |

DIVERSIFIED TELECOMMUNICATION SERVICES–0.9% | | | | | | | | | | | | |

AT&T, Inc. | | | | | | | 20,559 | | | | 799,334 | |

BT Group PLC | | | | | | | 124,420 | | | | 456,417 | |

China Unicom Hong Kong Ltd.(a) | | | | | | | 122,000 | | | | 164,942 | |

Deutsche Telekom AG (REG) | | | | | | | 19,180 | | | | 339,034 | |

Nippon Telegraph & Telephone Corp. | | | | | | | 14,200 | | | | 667,600 | |

TDC A/S | | | | | | | 30,860 | | | | 189,645 | |

Telekomunikasi Indonesia Persero Tbk PT | | | | | | | 520,000 | | | | 170,193 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 2,787,165 | |

| | | | | | | | | | | | |

WIRELESS TELECOMMUNICATION SERVICES–0.5% | | | | | | | | | | | | |

T-Mobile US, Inc.(a) | | | | | | | 14,426 | | | | 916,195 | |

Vodafone Group PLC | | | | | | | 125,993 | | | | 398,263 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 1,314,458 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 4,101,623 | |

| | | | | | | | | | | | |

TRANSPORTATION–0.2% | | | | | | | | | | | | |

AIRPORT SERVICES–0.1% | | | | | | | | | | | | |

Sydney Airport | | | | | | | 38,260 | | | | 209,937 | |

| | | | | | | | | | | | |

HIGHWAYS & RAILTRACKS–0.1% | | | | | | | | | | | | |

Transurban Group | | | | | | | 17,383 | | | | 168,234 | |

| | | | | | | | | | | | |

RAILROADS–0.0% | | | | | | | | | | | | |

East Japan Railway Co. | | | | | | | 1,600 | | | | 156,029 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 534,200 | |

| | | | | | | | | | | | |

BANKS–0.1% | | | | | | | | | | | | |

DIVERSIFIED BANKS–0.0% | | | | | | | | | | | | |

Banco Comercial Portugues SA(a) | | | | | | | 399,360 | | | | 129,989 | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

THRIFTS & MORTGAGE FINANCE–0.1% | | | | | | | | | | | | |

Aareal Bank AG | | | | | | | 5,360 | | | | 242,016 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 372,005 | |

| | | | | | | | | | | | |

Total Common Stocks (cost $143,976,392) | | | | | | | | | | | 190,713,151 | |

| | | | | | | | | | | | |

| | | Principal

Amount

(000) | | | | |

MORTGAGE PASS-THROUGHS–7.7% | | | | | | | | | | | | |

AGENCY FIXED RATE 15-YEAR–0.8% | | | | | | | | | | | | |

Federal National Mortgage Association

Series 2016 | | | | | | | | | | | | |

2.50%, 11/01/31 | | U.S.$ | | | | | 748 | | | | 747,581 | |

2.50%, 12/01/31-1/01/32 | | | | | | | 1,546 | | | | 1,544,528 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 2,292,109 | |

| | | | | | | | | | | | |

AGENCY FIXED RATE 30-YEAR–6.9% | | | | | | | | | | | | |

Federal Home Loan Mortgage Corp. Gold

Series 2017 | | | | | | | | | | | | |

4.00%, 7/01/44 | | | | | | | 379 | | | | 398,900 | |

4.00%, 2/01/46 | | | | | | | 487 | | | | 513,579 | |

Series 2007

5.50%, 7/01/35 | | | | | | | 18 | | | | 19,957 | |

Series 2005

5.50%, 1/01/35 | | | | | | | 176 | | | | 194,816 | |

Federal National Mortgage Association

4.00%, 12/01/40-10/01/43 | | | | | | | 1,208 | | | | 1,272,728 | |

4.00%, 1/01/48, TBA | | | | | | | 3,383 | | | | 3,538,407 | |