| | | | |

OMB APPROVAL |

| OMB Number: | | 3235-0570 |

| Expires: | | January 31, 2017 |

| Estimated average burden |

| hours per response: | | 20.6 |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-05426

AIM Investment Funds (Invesco Investment Funds)*

(Exact name of registrant as specified in charter)

11 Greenway Plaza, Suite 1000

Houston, Texas 77046

(Address of principal executive offices) (Zip code)

Philip A. Taylor

11 Greenway Plaza, Suite 1000

Houston, Texas 77046

(Name and address of agent for service)

Registrant’s telephone number, including area code: (713) 626-1919

Date of fiscal year end: 10/31

Date of reporting period: 10/31/15

| * | Funds included are: Invesco Strategic Income Fund and Invesco Unconstrained Bond Fund. |

Item 1. Report to Stockholders.

Letters to Shareholders

| | |

Philip Taylor | | Dear Shareholders: |

| | This annual report includes information about your Fund, including performance data and a complete list of its investments as of the close of the reporting period. Inside is a discussion of how your Fund was managed and the factors that affected its performance during the reporting period. I hope you find this report of interest. |

| | The US economy expanded and unemployment declined throughout the reporting period. Continuing low energy prices benefited consumers, but a strong US dollar crimped corporate profits. The US Federal Reserve signaled that it was increasingly likely to raise interest rates, based on generally positive economic data, but uncertainty remained about when it might act. Overseas, the story was much different. Low energy prices hurt the economies of some oil-producing nations, such as Brazil and Russia. During the reporting period, the European |

| Central Bank as well as central banks in China and Japan – among other countries – either instituted or maintained extraordinarily accommodative monetary policies in response to economic weakness. |

Investor uncertainty, such as we saw for much of the reporting period – and market volatility, such as we saw at the end of the reporting period – are unfortunate facts of life when it comes to investing. Some investors use these things as excuses to delay saving and investing for their long-term financial goals. That’s why Invesco encourages investors to work with a professional financial adviser who can stress the importance of starting to save and invest early and the importance of adhering to a disciplined investment plan – when times are good and when they’re uncertain. A financial adviser who knows your unique financial situation, investment goals and risk tolerance can be an invaluable partner as you seek to achieve your financial goals. He or she can offer a long-term perspective when markets are volatile and time-tested advice and guidance when your financial situation or investment goals change. |

Timely information when and where you want it

Invesco’s efforts to help investors achieve their financial objectives include providing individual investors and financial professionals with timely information about the markets, the economy and investing – whenever and wherever they want it.

Our website, invesco.com/us, offers a wide range of market insights and investment perspectives. On the website, you’ll find detailed information about our funds, including prices, performance, holdings and portfolio manager commentaries. You can access information about your account by completing a simple, secure online registration. Click on the “Need to register” link in the “Account Access” box on our homepage to get started.

Invesco’s mobile apps for iPhone® and iPad® (both available free from the App StoreSM) allow you to obtain the same detailed information, monitor your account and create customizable watch lists. Also, they allow you to access investment insights from our investment leaders, market strategists, economists and retirement experts. You can sign up to be alerted when new commentary is added, and you can watch portfolio manager videos and have instant access to Invesco news and updates wherever you may be.

In addition to the resources accessible on our website and through our mobile app, you can obtain timely updates to help you stay informed about the markets, the economy and investing by connecting with Invesco on Twitter, LinkedIn or Facebook. You can access our blog at blog.invesco.us.com. Our goal is to provide you the information you want, when and where you want it.

Have questions?

For questions about your account, feel free to contact an Invesco client services representative at 800 959 4246. For Invesco-related questions or comments, please email me directly at phil@invesco.com.

All of us at Invesco look forward to serving your investment management needs for many years to come. Thank you for investing with us.

|

| Sincerely, |

|

| Philip Taylor |

| Senior Managing Director, Invesco Ltd. |

iPhone and iPad are trademarks of Apple Inc., registered in the US and other countries. App Store is a service mark of Apple Inc. Invesco Distributors, Inc. is not affiliated with Apple Inc.

| | |

| 2 | | Invesco Strategic Income Fund |

| | | | |

Bruce Crockett | | Dear Fellow Shareholders: |

| | Among the many important lessons I’ve learned in more than 40 years in a variety of business endeavors is the value of a trusted advocate. |

| | As independent chair of the Invesco Funds Board, I can assure you that the members of the Board are strong advocates for the interests of investors in Invesco’s mutual funds. We work hard to represent your interests through oversight of the quality of the investment management services your funds receive and other matters important to your investment, including but not limited to: |

| | n | | Ensuring that Invesco offers a diverse lineup of mutual funds that your financial adviser can use to strive to meet your financial needs as your investment goals change over time. |

| | n | | Monitoring how the portfolio management teams of the Invesco funds are performing in light of changing economic and market conditions. |

| n | | Assessing each portfolio management team’s investment performance within the context of the investment strategy described in the fund’s prospectus. |

| n | | Monitoring for potential conflicts of interests that may impact the nature of the services that your funds receive. |

We believe one of the most important services we provide our fund shareholders is the annual review of the funds’ advisory and sub-advisory contracts with Invesco Advisers and its affiliates. This review is required by the Investment Company Act of 1940 and focuses on the nature and quality of the services Invesco provides as the adviser to the Invesco funds and the reasonableness of the fees that it charges for those services. Each year, we spend months carefully reviewing information received from Invesco and a variety of independent sources, such as performance and fee data prepared by Lipper Inc., an independent, third-party firm widely recognized as a leader in its field. We also meet with our independent legal counsel and other independent advisers to review and help us assess the information that we have received. Our goal is to assure that you receive quality investment management services for a reasonable fee.

I trust the measures outlined above provide assurance that you have a worthy advocate when it comes to choosing the Invesco Funds.

As always, please contact me at bruce@brucecrockett.com with any questions or concerns you may have. On behalf of the Board, we look forward to continuing to represent your interests and serving your needs.

|

| Sincerely, |

|

Bruce L. Crockett |

| Independent Chair |

| Invesco Funds Board of Trustees |

| | |

| 3 | | Invesco Strategic Income Fund |

Management’s Discussion of Fund Performance

|

Performance summary |

For the fiscal year ended October 31, 2015, Class A shares of Invesco Strategic Income Fund (the Fund), at net asset value (NAV), performed in line with the Barclays U.S. Aggregate Index, the Fund’s broad market/style-specific benchmark. Your Fund’s long-term performance appears later in this report. |

| | | | |

Fund vs. Indexes | |

| Total returns, 10/31/14 to 10/31/15, at net asset value (NAV). Performance shown does not include applicable contingent deferred sales charges (CDSC) or front-end sales charges, which would have reduced performance. | |

Class A Shares | | | 1.96 | % |

| Class C Shares | | | 1.20 | |

| Class R Shares | | | 1.71 | |

| Class Y Shares | | | 2.33 | |

| Class R5 Shares | | | 2.33 | |

| Class R6 Shares | | | 2.33 | |

| Barclays U.S. Aggregate Indexq (Broad Market/Style-Specific Index) | | | 1.96 | |

| Lipper Multi-Sector Income Funds Indexn (Peer Group Index) | | | -1.12 | |

Source(s): qFactSet Research Systems Inc.; nLipper Inc. | | | | |

Market conditions and your Fund

Global divergence with respect to growth, inflation and economic policy dominated global bond markets during the fiscal year ended October 31, 2015. Moderate growth in the US and UK led to the beginnings of tighter monetary policy, starting with the end of the US Federal Reserve’s (the Fed) quantitative easing (QE) program in addition to speculation on whether both regions’ central banks would lift short-term interest rates for the first time since before the onset of the 2007-2011 financial crisis. In the rest of the world, particularly in the eurozone and Asia, slowing growth and deflationary trends kept economic policies accommodative in an effort to foster growth.

Tepid global growth, together with deflationary concerns, weighed on long-term interest rates and supported government bond prices. Even in the US and UK, a bias toward central bank tightening had the effect of only flattening yield curves, with short-term government yields rising, while long-dated yields declined, weighed down by slower growth and strong investor demand for high quality yields that both countries offered.

Though developed market yields broadly declined, the fiscal year was marked by considerable interest rate volatility. The fiscal year began on the back of a US bond market rally as slowing global growth and lower inflation helped to push US Treasury yields lower and subsequently, bond prices higher. The downtrend

| | | | |

| Portfolio Composition* | |

| By security type | | % of total investments | |

| |

Mortgage-Backed Securities | | | 36.2% | |

U.S. Dollar Denominated Bonds & Notes | | | 31.2 | |

Asset-Backed Securities | | | 20.8 | |

Non- U.S. Dollar Denominated Bonds & Notes | | | 6.4 | |

U.S. Treasury Securities | | | 2.5 | |

Credit-Linked Securities | | | 1.5 | |

Municipal Obligations | | | 1.0 | |

U.S. Government Sponsored Agency Mortgage-Backed Securities | | | 0.4 | |

| | | | |

Total Net Assets | | $ | 38.8 million | |

| |

Total Number of Holdings* | | | 149 | |

| | | | | | |

| Top 10 Debt Issuers* | |

| | | % of total net assets | |

| | |

1. | | Wells Fargo Mortgage Backed Securities Trust | | | 5.4% | |

2. | | JPMBB Commercial Mortgage Securities Trust | | | 3.9 | |

3. | | COMM Mortgage Trust | | | 3.6 | |

4. | | U.S. Treasury | | | 2.6 | |

5. | | Carlyle Global Market Strategies CLO Ltd. | | | 2.5 | |

6. | | International Lease Finance Corp. | | | 2.3 | |

7. | | JP Morgan Mortgage Trust | | | 2.2 | |

8. | | Seneca Park CLO Ltd. | | | 2.1 | |

9. | | Ally Financial Inc. | | | 1.8 | |

10. | | Fannie Mae Connecticut Avenue Securities | | | 1.6 | |

The Fund’s holdings are subject to change, and there is no assurance that the Fund will continue to hold any particular security.

*Excluding options purchased and money market fund holdings.

Data presented here are as of October 31, 2015.

accelerated through the end of 2014 as oil prices hit lows not seen since the height of the financial crisis and as global deflationary fears began to set in. As quickly as US Treasury yields declined in 2014, they snapped back even faster during the first half of 2015. Helping to drive developed market interest rates higher following the implementation of the European Central Bank’s (ECB) version of the Fed’s QE program (commitment by the ECB to purchase longer-dated euro-area fixed income instruments in an effort to lower long-term interest rates to help spur economic growth) was stronger-than-expected economic data and market players’ notions that the rally was overdone. Also supporting higher US interest rates was the end of the Fed’s QE program purchasing long-dated Treasury bonds, coupled with supportive US economic data in the form of stronger economic growth and employment. The volatility within global interest rate markets ensued as the reporting period drew to a close with concerns over Chinese economic growth, in addition to broader market volatility helping drive global interest rates back down. Ten-year US Treasury yields ended 20 basis points lower at 2.14%, having begun the fiscal year at 2.34%.1 A basis point is one one-hundredth of a percentage point.

Within global credit markets, the investment-grade corporate credit, high yield and emerging market debt sectors were weighed down by slower global growth, increased risk aversion stemming from broader financial market volatility, and credit markets’ fundamental relationship to oil – the price of which declined significantly during the reporting period. Credit spreads across these sectors widened relative to their respective government counterparts, while valuations weakened. Falling oil prices brought into question the credit quality and even the long-term solvency of many high yield issuers, while bonds of oil-producing emerging market countries also experienced market stress. As the reporting period drew to a close, global equity market volatility stemming from concerns over China’s economic slowdown sent credit market spreads and yields to their highest levels since 2012, creating investing opportunities in some segments of the credit markets.

The Fund, at NAV, generated a positive return for the reporting period and performed in line with its broad market/style-specific benchmark. One of the largest contributors to the Fund’s performance was sector rotation into both high-yield bonds and bank loans toward the end of

| | |

| 4 | | Invesco Strategic Income Fund |

the reporting period, as these sectors benefited greatly from reduced volatility and a greater appetite for risk by investors. Exposure to structured products, particularly non-agency residential mortgage-backed securities (RMBS) and collateralized loan obligations (CLO) was positive for the Fund’s performance. RMBS benefited from the ongoing improvement in the US housing market while CLO gained in value given institutional demand for their structures and the underlying assets (primarily bank loans) within them. Long US dollar positions versus short developed market currencies, particularly Asian currencies expressed via forward contracts, added value within the Fund as volatile markets led investors to less volatile US dollar-based assets.

One of the greatest detractors from Fund performance for the reporting period was holdings of municipal bonds issued by Puerto Rico. Though these issues were senior in the capital structure and carried less credit risk than much of the commonwealth’s other municipal debt, these issues were stressed and experienced price declines due in part to Puerto Rico’s overall credit default. Exposure to global investment grade (IG) corporate bonds also weighed down on Fund performance. IG corporate bonds were hurt by ongoing strong new issuance as a result of continued heavy mergers and acquisitions, in addition to increased market volatility over the fiscal year. Exposure to emerging market corporate and sovereign bonds also hurt the Fund’s performance as emerging market debt struggled amid the increase in overall market volatility and a decline in risk appetite by investors.

The Fund may use active duration and yield curve positioning for risk management and for attempting to generate excess return versus its broad market/ style-specific benchmark. Duration measures a portfolio’s price sensitivity to interest rate changes. Yield curve positioning refers to actively emphasizing particular points (maturities) along the yield curve with favorable risk-return expectations. Duration of the portfolio was largely maintained between two and three years, and the tactical changes made to duration provided a small boost to Fund returns. Buying and selling US Treasury futures and interest rate swaptions were important tools used for the management of interest rate risk and to maintain the Fund’s targeted portfolio duration.

Part of the Fund’s strategy to manage credit and currency risk in the portfolio entailed purchasing and selling credit and

currency derivatives. We attempted to manage credit risk by purchasing and selling protection through credit default swaps at various points throughout the fiscal year. We attempted to manage currency risk by utilizing currency forwards and options on an as-needed and tactical basis. As a result, some of the performance of the strategy, both positive and negative, can be attributed to these instruments. Derivatives can be a cost-effective way to gain exposure to asset classes. However, derivatives may amplify traditional investment risks through the creation of leverage and may be less liquid than traditional securities.

We wish to remind you that the Fund is subject to interest rate risk, meaning when interest rates rise, the value of fixed income securities tends to fall. The risk may be greater in the current market environment because interest rates are at or near historic lows. The degree to which the value of fixed income securities may decline due to rising interest rates may vary depending on the speed and magnitude of the increase in interest rates, as well as individual security characteristics such as price, maturity, duration and coupon and market forces such as supply and demand for similar securities. The Fund may also invest in senior secured loans, which are an asset class that behaves differently from many traditional fixed income investments. The interest income generated by a portfolio of CLO or asset-backed securities (ABS) structured with, or comprised of senior loans is usually determined by a fixed credit spread over the London Interbank Offered Rate (Libor). Because senior secured loans generally have a very short duration and the coupons or interest rates are usually adjusted every 30 to 90 days as Libor changes, the yield on the portfolio adjusts. Interest rate risk refers to the tendency for traditional fixed income prices to decline when interest rates rise. For senior secured loans, however, interest rates and income are variable and the prices of loans are therefore less sensitive to interest rate changes than traditional fixed income bonds – and senior secured loans provide a natural hedge against rising interest rates. We are monitoring interest rates, and the market, economic and geopolitical factors that may impact the direction, speed and magnitude of changes to interest rates across the maturity spectrum, including the potential impact of monetary policy changes by the Fed and certain foreign central banks. If interest rates rise, markets may experience increased volatility, which may affect the value

and/or liquidity of certain of the Fund’s investments.

Thank you for investing in Invesco Strategic Income Fund and for sharing our long-term investment horizon.

1 Source: Bloomberg LP

The views and opinions expressed in management’s discussion of Fund performance are those of Invesco Advisers, Inc. These views and opinions are subject to change at any time based on factors such as market and economic conditions. These views and opinions may not be relied upon as investment advice or recommendations, or as an offer for a particular security. The information is not a complete analysis of every aspect of any market, country, industry, security or the Fund. Statements of fact are from sources considered reliable, but Invesco Advisers, Inc. makes no representation or warranty as to their completeness or accuracy. Although historical performance is no guarantee of future results, these insights may help you understand our investment management philosophy.

See important Fund and, if applicable, index disclosures later in this report.

| | |

| | Ivan Bakrac Portfolio Manager and Head of Multi-Sector Portfolio Management for Invesco Fixed Income, is manager of |

| Invesco Strategic Income Fund. He joined Invesco in 2014. Mr. Bakrac earned a BBA in finance and investments from Baruch College and an MS in financial engineering from Polytechnic Institute of New York University. |

| |

| | Ken Hill Chartered Financial Analyst, Portfolio Manager, is manager of Invesco Strategic Income Fund. He joined |

| Invesco in 2013. Mr. Hill graduated summa cum laude with a BSBA in corporate finance and economics from Western Carolina University. He earned his MS in mathematics from Florida State University. |

| |

| | Robert Waldner Chartered Financial Analyst, Portfolio Manager, is manager of Invesco Strategic Income Fund. He |

| joined Invesco in 2013. Mr. Waldner earned a BSE degree in civil engineering from Princeton University. |

| | |

| 5 | | Invesco Strategic Income Fund |

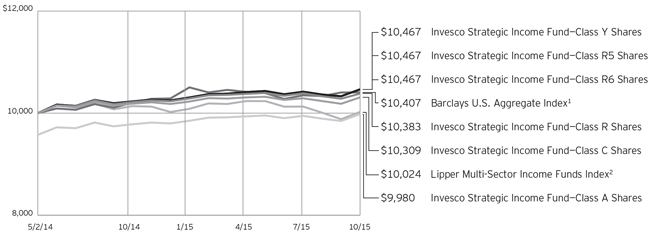

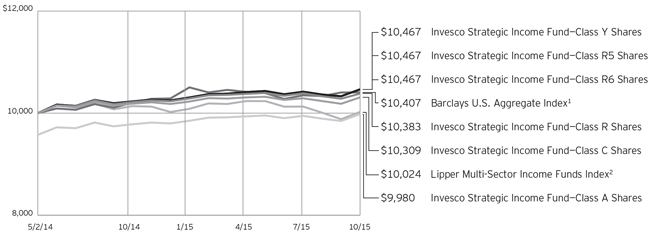

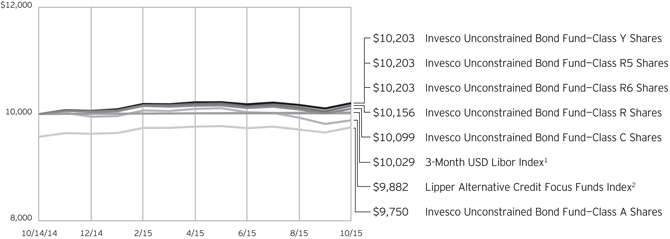

Your Fund’s Long-Term Performance

Results of a $10,000 Investment – Oldest Share Class(es) since Inception

Fund and index data from 5/2/14

1 Source: FactSet Research Systems Inc.

2 Source: Lipper Inc.

Past performance cannot guarantee comparable future results.

The data shown in the chart include reinvested distributions, applicable sales charges and Fund expenses including

management fees. Index results include reinvested dividends, but they do not reflect sales charges. Performance of the peer group, if applicable, reflects fund expenses and management fees;

performance of a market index does not. Performance shown in the chart and table(s) does not reflect deduction of taxes a shareholder would pay on Fund distributions or sale of Fund shares.

continued from page 10

in a loss. In a rising market, the Fund’s short positions will cause the Fund to underperform the overall market and its peers that do not engage in shorting. If the Fund holds both long and short positions, and both positions decline simultaneously, the short positions will not provide any buffer (hedge) from declines in value of the Fund’s long positions. Certain types of short positions involve leverage, which may exaggerate any losses, potentially more than the actual cost of the investment, and will increase the volatility of the Fund’s returns.

| n | | TBA transactions risk. TBA transactions involve the risk of loss if the securities received are less favorable than what was anticipated by the Fund when entering into the TBA transaction, or if the counterparty fails to deliver the securities. When the Fund enters into a short sale of a TBA mortgage it does not own, the Fund may have to purchase deliverable mortgages to settle the short sale at a higher price than anticipated, thereby causing a loss. As there is no limit on how much the price of mortgage securities can increase, the Fund’s exposure is unlimited. The |

| | | Fund may not always be able to purchase mortgage securities to close out the short position at a particular time or at an acceptable price. In addition, taking short positions results in a form of leverage, which could increase the volatility of the Fund’s share price. |

| n | | U.S. government obligations risk. Obligations of U.S. government agencies and authorities receive varying levels of support and may not be backed by the full faith and credit of the U.S. government, which could affect the Fund’s ability to recover should they default. No assurance can be given that the U.S. government will provide financial support to its agencies and authorities if it is not obligated by law to do so. |

| n | | When-issued, delayed delivery and forward commitment risks. When-issued and delayed delivery transactions subject the Fund to market risk because the value or yield of a security at delivery may be more or less than the purchase price or yield generally available when delivery occurs, and counterparty risk because the Fund relies on the buyer or seller, as the case may be, to consummate the transaction. These transactions also have a |

| | | leveraging effect on the Fund because the Fund commits to purchase securities that it does not have to pay for until a later date, which increases the Fund’s overall investment exposure and, as a result, its volatility. |

| n | | zero coupon or pay-in-kind securities risk. The value, interest rates, and liquidity of non-cash paying instruments, such as zero coupon and pay-in-kind securities, are subject to greater fluctuation than other types of securities. The higher yields and interest rates on pay-in-kind securities reflect the payment deferral and increased credit risk associated with such instruments and that such investments may represent a higher credit risk than loans that periodically pay interest. |

About indexes used in this report

| n | | The Barclays U.S. Aggregate Index is an unmanaged index considered representative of the US investment-grade, fixed-rate bond market. |

| n | | The Lipper Multi-Sector Income Funds Index is an unmanaged index considered representative of multi-sector income funds tracked by Lipper. |

continued on page 7

| | |

| 6 | | Invesco Strategic Income Fund |

| | | | |

| Average Annual Total Returns | |

| As of 10/31/15, including maximum applicable sales charges | |

| |

Class A Shares | | | | |

Inception (5/2/14) | | | -0.13 | % |

1 Year | | | -2.40 | |

| |

Class C Shares | | | | |

Inception (5/2/14) | | | 2.05 | % |

1 Year | | | 0.23 | |

| |

Class R Shares | | | | |

Inception (5/2/14) | | | 2.54 | % |

1 Year | | | 1.71 | |

| |

Class Y Shares | | | | |

Inception (5/2/14) | | | 3.09 | % |

1 Year | | | 2.33 | |

| |

Class R5 Shares | | | | |

Inception (5/2/14) | | | 3.09 | % |

1 Year | | | 2.33 | |

| |

Class R6 Shares | | | | |

Inception (5/2/14) | | | 3.09 | % |

1 Year | | | 2.33 | |

The performance data quoted represent past performance and cannot guarantee comparable future results; current performance may be lower or higher. Please visit invesco.com/performance for the most recent month-end performance. Performance figures reflect reinvested distributions, changes in net asset value and the effect of the maximum sales charge unless otherwise stated. Investment return and principal value will fluctuate so that you may have a gain or loss when you sell shares.

| | | | |

| Average Annual Total Returns | |

| As of 9/30/15, the most recent calendar quarter end, including maximum applicable sales charges | |

| |

Class A Shares | | | | |

Inception (5/2/14) | | | -1.05 | % |

1 Year | | | -3.25 | |

| |

Class C Shares | | | | |

Inception (5/2/14) | | | 1.30 | % |

1 Year | | | -0.63 | |

| |

Class R Shares | | | | |

Inception (5/2/14) | | | 1.78 | % |

1 Year | | | 0.84 | |

| |

Class Y Shares | | | | |

Inception (5/2/14) | | | 2.33 | % |

1 Year | | | 1.35 | |

| |

Class R5 Shares | | | | |

Inception (5/2/14) | | | 2.33 | % |

1 Year | | | 1.35 | |

| |

Class R6 Shares | | | | |

Inception (5/2/14) | | | 2.33 | % |

1 Year | | | 1.35 | |

The net annual Fund operating expense ratio set forth in the most recent Fund prospectus as of the date of this report for Class A, Class C, Class R, Class Y, Class R5 and Class R6 shares was 0.94%, 1.69%, 1.19%, 0.69%, 0.69% and 0.69%, respectively.1,2 The total annual Fund operating expense ratio set forth in the most recent Fund prospectus as of the date of this report for Class A, Class C, Class R, Class Y, Class R5 and Class R6 shares 2.31%, 3.06%, 2.56%, 2.06%, 2.13% and 2.13%,

respectively. The expense ratios presented above may vary from the expense ratios presented in other sections of this report that are based on expenses incurred during the period covered by this report.

Class A share performance reflects the maximum 4.25% sales charge, and Class C share performance reflects the applicable contingent deferred sales charge (CDSC) for the period involved. The CDSC on Class C shares is 1% for the first year after purchase. Class R, Class Y, Class R5 and Class R6 shares do not have a front-end sales charge or a CDSC; therefore, performance is at net asset value.

The performance of the Fund’s share classes will differ primarily due to different sales charge structures and class expenses.

Fund performance reflects any applicable fee waivers and/or expense reimbursements. Had the adviser not waived fees and/or reimbursed expenses currently or in the past, returns would have been lower. See current prospectus for more information.

| 1 | Total annual Fund operating expenses after any contractual fee waivers and/or expense reimbursements by the adviser in effect through at least February 28, 2017. See current prospectus for more information. |

| 2 | Total annual Fund operating expenses after any contractual fee waivers and/or expense reimbursements by the adviser in effect through at least June 30, 2017. See current prospectus for more information. |

continued from page 6

| n | | The Fund is not managed to track the performance of any particular index, including the index(es) described here, and consequently, the performance of the Fund may deviate significantly from the performance of the index(es). |

| n | | A direct investment cannot be made in an index. Unless otherwise indicated, index results include reinvested dividends, and they do not reflect sales charges. Performance of the peer group, if applicable, reflects fund expenses; performance of a market index does not. |

Other information

| n | | The returns shown in management’s discussion of Fund performance are based on net asset values (NAVs) calculated for shareholder transactions. Generally accepted accounting principles require adjustments to be made to the net assets of the Fund at period end for financial reporting purposes, and as such, the NAVs for shareholder transactions and the returns based on those NAVs may differ from the NAVs and returns reported in the Financial Highlights. |

| n | | Industry classifications used in this report are generally according to the Global Industry Classification Standard, which was developed by and is the exclusive property and a service mark of MSCI Inc. and Standard & Poor’s. |

| | |

| 7 | | Invesco Strategic Income Fund |

Invesco Strategic Income Fund’s investment objective is to provide current income and, secondarily, long-term growth of capital.

| n | | Unless otherwise stated, information presented in this report is as of October 31, 2015, and is based on total net assets. |

| n | | Unless otherwise noted, all data provided by Invesco. |

| n | | To access your Fund’s reports/prospectus, visit invesco.com/fundreports. |

About share classes

| n | | Class R shares are generally available only to employer sponsored retirement and benefit plans. Please see the prospectus for more information. |

| n | | Class Y shares are available only to certain investors. Please see the prospectus for more information. |

| n | | Class R5 shares and Class R6 shares are primarily intended for employer sponsored retirement and benefit plans that meet certain standards and for institutional investors. Please see the prospectus for more information. |

Principal risks of investing in the Fund

| n | | Active trading risk. Active trading of portfolio securities may result in added expenses, a lower return and increased tax liability. |

| n | | Bank loan risk. There are a number of risks associated with an investment in bank loans including credit risk, interest rate risk, liquidity risk and prepayment risk. Lack of an active trading market, restrictions on resale, irregular trading activity, wide bid/ask spreads and extended trade settlement periods may impair the Fund’s ability to sell bank loans within its desired time frame or at an acceptable price and its ability to accurately value existing and prospective investments. Extended trade settlement periods may result in cash not being immediately available to the Fund. As a result of such illiquidity, the Fund may have to sell other investments or engage in borrowing transactions to raise cash to meet its obligations. The risk of holding bank loans is also directly tied to the risk of insolvency or bankruptcy of the issuing banks. These risks could cause the Fund to lose income or principal on a particular investment, which in turn could affect the Fund’s returns. The value of bank loans can be affected by and sensitive to changes in government regulation and to economic downturns in the United States and abroad. Bank loans generally |

| | | are floating rate loans, which are subject to interest rate risk as the interest paid on the floating rate loans adjusts periodically based on changes in widely accepted reference rates. |

| n | | Changing fixed income market conditions risk. The current historically low interest rate environment was created in part by the Federal Reserve Board (FRB) and certain foreign central banks keeping the federal funds and equivalent foreign rates at or near zero. There is a risk that interest rates will rise when the FRB and central banks raise these rates. This risk is heightened due to the completion of the FRB’s quantitative easing program and the “tapering” of other similar foreign central bank actions. This eventual increase in the federal funds and equivalent foreign rates may expose fixed income markets to heightened volatility and reduced liquidity for certain fixed income investments, particularly those with longer maturities. In addition, decreases in fixed income dealer market-making capacity may also potentially lead to heightened volatility and reduced liquidity in the fixed income markets. As a result, the value of the Fund’s investments and share price may decline. Changes in central bank policies could also result in higher than normal shareholder redemptions, which could potentially increase portfolio turnover and the Fund’s transaction costs. |

| n | | Collateralized loan obligations risk. CLOs are subject to the risks of substantial losses due to actual defaults by underlying borrowers, which will be greater during periods of economic or financial stress. CLOs may also lose value due to collateral defaults and disappearance of subordinate tranches, market anticipation of defaults, and investor aversion to CLO securities as a class. The risks of CLOs will be greater if the Fund invests in CLOs that hold loans of uncreditworthy borrowers or if the Fund holds subordinate tranches of the CLO that absorbs losses from the |

| | | defaults before senior tranches. In addition, CLOs are subject to interest rate risk and credit risk. The risks related to investments in CLOs are greater for this Fund than for many other mutual funds because the Fund maintains the ability to invest, at any time and from time to time, up to 100% of its assets in such securities. If the Fund’s portfolio managers increase the Fund’s investments in CLOs at an inopportune time, the Fund could suffer significant losses. |

| n | | Convertible securities risk. The market values of convertible securities are affected by market interest rates, the risk of actual issuer default on interest or principal payments and the value of the underlying common stock into which the convertible security may be converted. Additionally, a convertible security is subject to the same types of market and issuer risks as apply to the underlying common stock. In addition, certain convertible securities are subject to involuntary conversions and may undergo principal writedowns upon the occurrence of certain triggering events, and, as a result, are subject to an increased risk of loss. |

| n | | Debt securities risk. The prices of debt securities held by the Fund will be affected by changes in interest rates, the creditworthiness of the issuer and other factors. An increase in prevailing interest rates typically causes the value of existing debt securities to fall and often has a greater impact on longer-duration debt securities and higher quality debt securities. Falling interest rates will cause the Fund to reinvest the proceeds of debt securities that have been repaid by the issuer at lower interest rates. Falling interest rates may also reduce the Fund’s distributable income because interest payments on floating rate debt instruments held by the Fund will decline. The Fund could lose money on investments in debt securities if the issuer or borrower fails to meet its obligations to make interest payments and/or to repay principal in a timely manner. Changes in an issuer’s financial strength, the market’s perception of such strength or in the credit rating of the issuer or the security may affect the value of debt securities. The Adviser’s credit analysis may fail to anticipate |

| | |

This report must be accompanied or preceded by a currently effective Fund prospectus, which contains more complete information, including sales charges and expenses. Investors should read it carefully before investing. | | |

NOT FDIC INSURED | MAY LOSE VALUE | NO BANK GUARANTEE

| | |

| 8 | | Invesco Strategic Income Fund |

such changes, which could result in buying a debt security at an inopportune time or failing to sell a debt security in advance of a price decline or other credit event.

| n | | Derivatives risk. The value of a derivative instrument depends largely on (and is derived from) the value of an underlying security, currency, commodity, interest rate, index or other asset (each referred to as an underlying asset). In addition to risks relating to the underlying assets, the use of derivatives may include other, possibly greater, risks, including counterparty, leverage and liquidity risks. Counterparty risk is the risk that the counterparty to the derivative contract will default on its obligation to pay the Fund the amount owed or otherwise perform under the derivative contract. Derivatives create leverage risk because they do not require payment up front equal to the economic exposure created by owning the derivative. As a result, an adverse change in the value of the underlying asset could result in the Fund sustaining a loss that is substantially greater than the amount invested in the derivative, which may make the Fund’s returns more volatile and increase the risk of loss. Derivative instruments may also be less liquid than more traditional investments and the Fund may be unable to sell or close out its derivative positions at a desirable time or price. This risk may be more acute under adverse market conditions, during which the Fund may be most in need of liquidating its derivative positions. Derivatives may also be harder to value, less tax efficient and subject to changing government regulation that could impact the Fund’s ability to use certain derivatives or their cost. Also, derivatives used for hedging or to gain or limit exposure to a particular market segment may not provide the expected benefits, particularly during adverse market conditions. These risks are greater for the Fund than mutual funds that do not use derivative instruments or that use derivative instruments to a lesser extent than the Fund to implement their investment strategy. |

| n | | Emerging markets securities risk. Emerging markets (also referred to as developing markets) are generally subject to greater market volatility, political, |

| | | social and economic instability, uncertain trading markets and more governmental limitations on foreign investment than more developed markets. In addition, companies operating in emerging markets may be subject to lower trading volume and greater price fluctuations than companies in more developed markets. Securities law and the enforcement of systems of taxation in many emerging market countries may change quickly and unpredictably. In addition, investments in emerging markets securities may also be subject to additional transaction costs, delays in settlement procedures, and lack of timely information. |

| n | | Exchange-traded funds risk. In addition to the risks associated with the underlying assets held by the exchange-traded fund, investments in exchange-traded funds are subject to the following additional risks: (1) an exchange-traded fund’s shares may trade above or below its net asset value; (2) an active trading market for the exchange-traded fund’s shares may not develop or be maintained; (3) trading an exchange-traded fund’s shares may be halted by the listing exchange; (4) a passively managed exchange-traded fund may not track the performance of the reference asset; and (5) a passively managed exchange-traded fund may hold troubled securities. Investment in exchange-traded funds may involve duplication of management fees and certain other expenses, as the Fund indirectly bears its proportionate share of any expenses paid by the exchange-traded funds in which it invests. Further, certain exchange-traded funds in which the Fund may invest are leveraged, which may result in economic leverage, permitting the Fund to gain exposure that is greater than would be the case in an unlevered instrument and potentially resulting in greater volatility. |

| n | | Foreign currency tax risk. If the U.S. Treasury Department were to exercise its authority to issue regulations that exclude from the definition of “qualifying income” foreign currency gains not directly related to the Fund’s business of investing in securities, the Fund may be unable to qualify as a regulated investment company for one or more years. In this event, the Fund’s Board of |

| | | Trustees may authorize a significant change in investment strategy or other action. |

| n | | Foreign government debt risk. Investments in foreign government debt securities (sometimes referred to as sovereign debt securities) involve certain risks in addition to those relating to foreign securities or debt securities generally. The issuer of the debt or the governmental authorities that control the repayment of the debt may be unable or unwilling to repay principal or interest when due in accordance with the terms of such debt, and the Fund may have limited recourse in the event of a default against the defaulting government. Without the approval of debt holders, some governmental debtors have in the past been able to reschedule or restructure their debt payments or declare moratoria on payments. |

| n | | Foreign securities risk. The Fund’s foreign investments may be adversely affected by political and social instability, changes in economic or taxation policies, difficulty in enforcing obligations, decreased liquidity or increased volatility. Foreign investments also involve the risk of the possible seizure, nationalization or expropriation of the issuer or foreign deposits (in which the Fund could lose its entire investments in a certain market) and the possible adoption of foreign governmental restrictions such as exchange controls. Unless the Fund has hedged its foreign securities risk, foreign securities risk also involves the risk of negative foreign currency rate fluctuations, which may cause the value of securities denominated in such foreign currency (or other instruments through which the Fund has exposure to foreign currencies) to decline in value. Currency exchange rates may fluctuate significantly over short periods of time. Currency hedging strategies, if used, are not always successful. |

| n | | High yield debt securities (junk bond) risk. Investments in high yield debt securities (“junk bonds”) and other lower-rated securities will subject the Fund to substantial risk of loss. These securities are considered to be speculative with respect to the issuer’s ability to pay interest and principal when due, are more susceptible to default or decline |

continued on page 10

| | |

| 9 | | Invesco Strategic Income Fund |

continued from page 9

in market value and are less liquid than investment grade debt securities. Prices of high yield debt securities tend to be very volatile.

| n | | Inflation-indexed securities risk. The values of inflation-indexed securities generally fluctuate in response to changes in real interest rates, and the Fund’s income from its investments in these securities is likely to fluctuate considerably more than the income distributions of its investments in more traditional fixed-income securities. |

| n | | Investment companies risk. Investing in other investment companies could result in the duplication of certain fees, including management and administrative fees, and may expose the Fund to the risks of owning the underlying investments that the other investment company holds. |

| n | | Liquidity risk. The Fund may be unable to sell illiquid investments at the time or price it desires and, as a result, could lose its entire investment in such investments. Liquid securities can become illiquid during periods of market stress. If a significant amount of the Fund’s securities become illiquid, the Fund may not be able to timely pay redemption proceeds and may need to sell securities at significantly reduced prices. |

| n | | Management risk. The Fund is actively managed and depends heavily on the Adviser’s judgment about markets, interest rates or the attractiveness, relative values, liquidity, or potential appreciation of particular investments made for the Fund’s portfolio. The Fund could experience losses if these judgments prove to be incorrect. Because the Fund’s investment process relies heavily on its asset allocation process, market movements that are counter to the portfolio managers’ expectations may have a significant adverse effect on the Fund’s net asset value. Additionally, legislative, regulatory, or tax developments may adversely affect management of the Fund and, therefore, the ability of the Fund to achieve its investment objective. |

| n | | Market risk. The market values of the Fund’s investments, and therefore the value of the Fund’s shares, will go up and down, sometimes rapidly or unpredictably. Market risk may affect a single issuer, industry or section of the economy, or it may affect the market as a whole. Individual stock prices tend to go up and down more dramatically than those of certain other types of investments, such as bonds. During a general |

| | | downturn in the financial markets, multiple asset classes may decline in value. When markets perform well, there can be no assurance that specific investments held by the Fund will rise in value. |

| n | | Mortgage- and asset-backed securities risk. Mortgage- and asset-backed securities, including collateralized debt obligations and collateralized mortgage obligations, are subject to prepayment or call risk, which is the risk that a borrower’s payments may be received earlier or later than expected due to changes in prepayment rates on underlying loans. This could result in the Fund reinvesting these early payments at lower interest rates, thereby reducing the Fund’s income. Mortgage- and asset-backed securities also are subject to extension risk, which is the risk that an unexpected rise in interest rates could reduce the rate of prepayments, causing the price of the mortgage- and asset-backed securities and the Fund’s share price to fall. An unexpectedly high rate of defaults on the mortgages held by a mortgage pool may adversely affect the value of mortgage-backed securities and could result in losses to the Fund. The Fund may invest in mortgage pools that include subprime mortgages, which are loans made to borrowers with weakened credit histories or with lower capacity to make timely payments on their mortgages. Privately issued mortgage-related securities are not subject to the same underwriting requirements as those with government or government-sponsored entity guarantee and, therefore, mortgage loans underlying privately issued mortgage-related securities may have less favorable collateral, credit risk or other underwriting characteristics, and wider variances in interest rate, term, size, purpose and borrower characteristics. The risks related to investments in agency and non-agency mortgage-backed securities and CMOs are greater for this Fund than for many other mutual funds because the Fund maintains the ability to invest, at any time and from time to time, up to 100% of its assets in such securities. If the Fund’s portfolio managers increase the Fund’s investments in agency and non-agency mortgage-backed securities at an inopportune time, the Fund could suffer significant losses. |

| n | | Municipal securities risk. The risk of a municipal obligation generally depends on the financial and credit status of the issuer. Constitutional amendments, legislative enactments, executive orders, |

| | | administrative regulations, voter initiatives, and the issuer’s regional economic conditions may affect the municipal security’s value, interest payments, repayment of principal and the Fund’s ability to sell the security. Failure of a municipal security issuer to comply with applicable tax requirements may make income paid thereon taxable, resulting in a decline in the security’s value. In addition, there could be changes in applicable tax laws or tax treatments that reduce or eliminate the current federal income tax exemption on municipal securities or otherwise adversely affect the current federal or state tax status of municipal securities. |

| n | | Non-diversification risk. The Fund is non-diversified and can invest a greater portion of its assets in the obligations or securities of a small number of issuers or any single issuer than a diversified fund can. A change in the value of one or a few issuers’ securities will therefore affect the value of the Fund more than if it was a diversified fund. |

| n | | Reverse repurchase agreement risk. If the market value of securities to be repurchased declines below the repurchase price, or the other party defaults on its obligation, the Fund may be delayed or prevented from completing the transaction. In the event the buyer of securities under a reverse repurchase agreement files for bankruptcy or becomes insolvent, the Fund’s use of the proceeds from the sale of the securities may be restricted. When the Fund engages in reverse repurchase agreements, changes in the value of the Fund’s investments will have a larger effect on its share price than if it did not engage in these transactions due to the effect of leverage, which will make the Fund’s returns more volatile and increase the risk of loss. Additionally, interest expenses related to reverse repurchase agreements could exceed the rate of return on other investments held by the Fund, thereby reducing returns to shareholders. |

| n | | Short position risk. Because a Fund’s potential loss on a short position arises from increases in the value of the asset sold short, the Fund will incur a loss on a short position, which is theoretically unlimited, if the price of the asset sold short increases from the short sale price. The counterparty to a short position or other market factors may prevent the Fund from closing out a short position at a desirable time or price and may reduce or eliminate any gain or result |

continued on page 6

| | |

| 10 | | Invesco Strategic Income Fund |

Schedule of Investments(a)

October 31, 2015

| | | | | | | | |

| | | Principal

Amount | | | Value | |

Asset-Backed Securities–57.22% | |

Adjustable Rate Mortgage Trust, Series 2005-11, Class 2A41, Floating Rate Pass Through Ctfs., 2.82%, 02/25/36(b) | | $ | 145,467 | | | $ | 144,307 | |

ARES XI CLO Ltd., Series 2007-11A, Class E, Floating Rate Pass Through Ctfs., 6.29%,

10/11/21(b)(c) | | | 250,000 | | | | 250,827 | |

Babson Euro CLO 2014-2 B.V. (Netherlands), Series 2014-2A, Class D, Floating Rate Pass Through Ctfs., 3.27%,

11/25/27(c)(d) | | EUR | 250,000 | | | | 260,130 | |

BAMLL Commercial Mortgage Securities Trust, Series 2014-ICTS, Class C, Floating Rate Pass Through Ctfs., 1.60%,

06/15/28(b)(c) | | | 200,000 | | | | 199,523 | |

Banc of America Commercial Mortgage Trust,

Series 2015-UBS7, Class C, Variable Rate Pass Through Ctfs., 4.51%, 09/15/48(b) | | | 250,000 | | | | 247,301 | |

Series 2015-UBS7, Class XA, IO Variable Rate Pass Through Ctfs., 1.09%, 09/15/48(b) | | | 1,878,244 | | | | 123,938 | |

Banc of America Funding Trust, Series 2006-3, Class 5A5, Pass Through Ctfs., 5.50%, 03/25/36 | | | 165,352 | | | | 157,112 | |

Banc of America Mortgage Trust, Series 2005-H, Class 2A1, Floating Rate Pass Through Ctfs., 2.85%, 09/25/35(b) | | | 263,270 | | | | 243,130 | |

BBCMS Trust, Series 2015-RRI, Class D, Floating Rate Pass Through Ctfs., 3.10%, 05/15/32(b)(c) | | | 210,000 | | | | 207,942 | |

BCAP LLC Trust, Series 2009-RR13, Class 15A2, Pass Through Ctfs., 6.00%, 07/26/37(c) | | | 166,804 | | | | 166,182 | |

Bear Stearns Adjustable Rate Mortgage Trust, Series 2005-2, Class A1, Floating Rate Pass Through Ctfs., 2.68%, 03/25/35(b) | | | 221,354 | | | | 222,740 | |

Bear Stearns Commercial Mortgage Securities Trust, Series 2005-PWR9, Class AJ, Variable Rate Pass Through Ctfs., 4.99%, 09/11/42(b) | | | 47,733 | | | | 47,853 | |

Carlyle Global Market Strategies CLO Ltd. (Cayman Islands), Series 2012-2A, Class ER, Floating Rate Pass Through Ctfs., 6.42%, 07/20/23(b)(c) | | | 500,000 | | | | 488,784 | |

Series 2012-3A, Class D, Floating Rate Pass Through Ctfs., 5.82%, 10/04/24(b)(c) | | | 500,000 | | | | 473,843 | |

Cent CLO Ltd. (Cayman Islands), Series 2013-19A, Class C, Floating Rate Pass Through Ctfs., 3.62%, 10/29/25(b)(c) | | | 250,000 | | | | 228,356 | |

Chase Mortgage Finance Trust, Series 2005-A1, Class 3A1, Floating Rate Pass Through Ctfs., 2.45%, 12/25/35(b) | | | 159,946 | | | | 145,910 | |

Series 2007-A1, Class 13A1, Floating Rate Pass Through Ctfs., 4.90%, 03/25/37(b) | | | 261,248 | | | | 245,037 | |

| | | | | | | | |

| | | Principal

Amount | | | Value | |

Citigroup Mortgage Loan Trust, Inc., Series 2005-11, Class A2A, Floating Rate Pass Through Ctfs., 2.73%, 10/25/35(b) | | $ | 80,563 | | | $ | 80,018 | |

Series 2006-AR2, Class 1A2, Floating Rate Pass Through Ctfs., 2.64%, 03/25/36(b) | | | 175,848 | | | | 165,787 | |

COMM Mortgage Trust,

Series 2015-CR23, Class CMD, Variable Rate Pass Through Ctfs., 3.81%, 05/10/48(b)(c) | | | 300,000 | | | | 290,771 | |

Series 2015-CR24, Class B, Variable Rate Pass Through Ctfs., 4.52%, 08/10/55(b)(c) | | | 300,000 | | | | 309,781 | |

Series 2015-CR24, Class XA, IO Variable Rate Pass Through Ctfs., 1.04%, 08/10/55(b) | | | 5,390,645 | | | | 336,482 | |

Series 2015-CR25, Class B, Variable Rate Pass Through Ctfs., 4.70%, 08/10/48(b) | | | 170,000 | | | | 176,366 | |

Series 2015-PC1, Class XA, IO Variable Rate Pass Through Ctfs., 0.95%, 07/10/50(b)(c) | | | 5,990,953 | | | | 294,528 | |

CSAIL Commercial Mortgage Trust, Series 2015-C1, Class B, Pass Through Ctfs., 4.04%, 04/15/50 | | | 165,000 | | | | 166,537 | |

Dryden XI-Leveraged Loan CDO, Series 2006-11A, Class A3, Floating Rate Pass Through Ctfs., 0.70%, 04/12/20(b)(c)(e) | | | 500,000 | | | | 489,174 | |

Eaton Vance CDO VIII Ltd. (Cayman Islands),

Series 2006-8A, Class D, Floating Rate Pass Through Ctfs., 3.74%, 08/15/22(b)(c) | | | 400,000 | | | | 387,282 | |

Fannie Mae Connecticut Avenue Securities, Series 2015-C01, Class 1M2, Floating Rate Pass Through Ctfs., 4.50%, 02/25/25(b) | | | 160,000 | | | | 154,551 | |

Series 2015-C02, Class 2M2, Floating Rate Pass Through Ctfs., 4.20%, 05/25/25(b) | | | 500,000 | | | | 474,550 | |

Foothill CLO Ltd. (Cayman Islands), Series 2007-1A, Class C, Floating Rate Pass Through Ctfs., 1.04%, 02/22/21(b)(c)(e) | | | 250,000 | | | | 247,955 | |

GMACM Mortgage Loan Trust,

Series 2006-AR1, Class 1A1, Floating Rate Pass Through Ctfs., 3.08%, 04/19/36(b) | | | 209,516 | | | | 189,480 | |

GS Mortgage Securities Trust, Series 2015-GC32, Class B, Variable Rate Pass Through Ctfs., 4.55%, 07/10/48(b) | | | 350,000 | | | | 369,301 | |

GSAA Home Equity Trust, Series 2007-7, Class A4, Floating Rate Pass Through Ctfs., 0.47%, 07/25/37(b) | | | 211,838 | | | | 181,751 | |

GSR Mortgage Loan Trust, Series 2006-1F, Class 1A11, Pass Through Ctfs., 5.50%, 02/25/36 | | | 236,593 | | | | 227,026 | |

H/2 Asset Funding (Cayman Islands), Series 2015-1A, Class BFL, Pass Through Ctfs., 2.50%, 06/24/49(c) | | | 400,000 | | | | 391,911 | |

Hamlet II Ltd. (Cayman Islands), Series 2006-2A, Class A2B, Floating Rate Pass Through Ctfs., 0.64%, 05/11/21(b)(c)(e) | | | 500,000 | | | | 482,411 | |

See accompanying Notes to Financial Statements which are an integral part of the financial statements.

11 Invesco Strategic Income Fund

| | | | | | | | |

| | | Principal

Amount | | | Value | |

Highbridge Loan Management Ltd. (Cayman Islands), Series 2015-6A, Class D, Floating Rate Pass Through Ctfs., 3.95%, 05/05/27(b)(c) | | $ | 250,000 | | | $ | 227,816 | |

JP Morgan Chase Commercial Mortgage Securities Trust, Series 2014-FL5, Class B, Floating Rate Pass Through Ctfs., 1.55%, 07/15/31(b)(c) | | | 250,000 | | | | 250,511 | |

JP Morgan Mortgage Trust, Series 2005-A1, Class IB2, Floating Rate Pass Through Ctfs., 2.66%, 02/25/35(b) | | | 161,088 | | | | 138,632 | |

Series 2005-A3, Class 7CA1, Floating Rate Pass Through Ctfs., 2.60%, 06/25/35(b) | | | 152,659 | | | | 148,954 | |

Series 2006-A2, Class 1A1, Floating Rate Pass Through Ctfs., 2.79%, 04/25/36(b) | | | 106,548 | | | | 97,586 | |

Series 2007-A1, Class 2A2, Floating Rate Pass Through Ctfs., 2.68%, 07/25/35(b) | | | 268,537 | | | | 263,889 | |

Series 2007-A4, Class 3A1, Floating Rate Pass Through Ctfs., 5.34%, 06/25/37(b) | | | 219,074 | | | | 199,454 | |

JPMBB Commercial Mortgage Securities Trust,

Series 2013-C17, Class C, Variable Rate Pass Through Ctfs., 5.05%, 01/15/47(b) | | | 380,000 | | | | 391,791 | |

Series 2015-C29, Class C, Variable Rate Pass Through Ctfs., 4.34%, 05/15/48(b) | | | 302,000 | | | | 285,467 | |

Series 2015-C32, Class B, Variable Rate Pass Through Ctfs., 4.39%, 11/15/48(b) | | | 800,000 | | | | 843,989 | |

Magnetite XV Ltd. (Cayman Islands), Series 2015-15A, Class D, Floating Rate Pass Through Ctfs., 4.54%, 10/25/27(b)(c) | | | 250,000 | | | | 237,345 | |

Merrill Lynch Mortgage Investors Trust, Series 2005-3, Class 3A, Floating Rate Pass Through Ctfs., 2.29%, 11/25/35(b) | | | 151,083 | | | | 148,426 | |

Series 2005-A9, Class 2A1C, Floating Rate Pass Through Ctfs., 2.66%, 12/25/35(b) | | | 200,000 | | | | 193,568 | |

Morgan Stanley Bank of America Merrill Lynch Trust,

Series 2014-C18, Class B, Variable Rate Pass Through Ctfs., 4.59%, 10/15/47(b) | | | 250,000 | | | | 264,697 | |

Series 2015-C22, Class XA, IO Variable Rate Pass Through Ctfs., 1.19%, 04/15/48(b) | | | 2,139,916 | | | | 160,166 | |

Series 2015-C26, Class C, Pass Through Ctfs., 4.41%, 11/15/48 | | | 190,000 | | | | 189,280 | |

Morgan Stanley Mortgage Loan Trust, Series 2005-10, Class 1A1, Floating Rate Pass Through Ctfs., 0.90%, 12/25/35(b) | | | 276,611 | | | | 225,123 | |

Series 2005-3AR, Class 3A, Floating Rate Pass Through Ctfs., 2.57%, 07/25/35(b) | | | 266,446 | | | | 230,679 | |

Neuberger Berman CLO XV (Cayman Islands), Series 2013-15A, Class D, Floating Rate Pass Through Ctfs. 3.57%, 10/15/25(b)(c) | | | 250,000 | | | | 229,091 | |

| | | | | | | | |

| | | Principal

Amount | | | Value | |

Neuberger Berman CLO XVII Ltd. (Cayman Islands), Series 2014-17A, Class E1, Floating Rate Pass Through Ctfs., 5.06%, 08/04/25(b)(c) | | $ | 480,000 | | | $ | 377,334 | |

Northwoods Capital X Ltd. (Cayman Islands), Series 2013-10A, Class D, Floating Rate Pass Through Ctfs. 3.91%, 11/04/25(b)(c) | | | 250,000 | | | | 228,449 | |

Octagon Investment Partners XVIII Ltd. (Cayman Islands), Series 2013-1A, Class D, Floating Rate Pass Through Ctfs., 5.57%, 12/16/24(b)(c) | | | 350,000 | | | | 305,271 | |

Octagon Investment Partners XXI Ltd. (Cayman Islands), Series 2014-1A, Class D, Floating Rate Pass Through Ctfs., 6.88%, 11/14/26(b)(c) | | | 250,000 | | | | 235,437 | |

PFP Ltd. (Cayman Islands), Series 2015-2, Class B, Floating Rate Pass Through Ctfs., 2.89%, 07/14/34(b)(c) | | | 230,000 | | | | 229,586 | |

RAIT Trust, Series 2015-FL4, Class B, Floating Rate Pass Through Ctfs., 2.50%, 12/15/31(b)(c) | | | 341,176 | | | | 341,636 | |

Regatta IV Funding Ltd. (Cayman Islands), Series 2014-1A, Class D, Floating Rate Pass Through Ctfs. 3.80%, 07/25/26(b)(c) | | | 290,000 | | | | 262,850 | |

Seneca Park CLO Ltd. (Cayman Islands), Series 2014-1A, Class B2, Pass Through Ctfs., 4.35%, 07/17/26(c) | | | 600,000 | | | | 606,167 | |

Series 2014-1A, Class E, Floating Rate Pass Through Ctfs., 4.99%, 07/17/26(b)(c) | | | 250,000 | | | | 214,750 | |

Stone Tower CLO VII Ltd. (Cayman Islands), Series 2007-7A, Class C, Floating Rate Pass Through Ctfs. 4.54%, 08/30/21(b)(c) | | | 250,000 | | | | 249,103 | |

Structured Adjustable Rate Mortgage Loan Trust,

Series 2004-20, Class 3A1, Floating Rate Pass Through Ctfs., 2.45%, 01/25/35(b) | | | 479,762 | | | | 458,683 | |

Series 2004-8, Class 3A, Floating Rate Pass Through Ctfs., 2.50%, 07/25/34(b) | | | 105,499 | | | | 105,782 | |

Structured Asset Securities Corp., Series 2002-21A, Class B1II, Floating Rate Pass Through Ctfs., 2.57%, 11/25/32(b) | | | 157,116 | | | | 142,739 | |

Symphony CLO XI Ltd. (Cayman Islands), Series 2013-11A, Class C, Floating Rate Pass Through Ctfs., 3.47%, 01/17/25(b)(c) | | | 250,000 | | | | 247,757 | |

Series 2013-11A, Class D, Floating Rate Pass Through Ctfs., 4.32%, 01/17/25(b)(c) | | | 250,000 | | | | 239,364 | |

Symphony CLO XIV Ltd. (Cayman Islands), Series 2014-14A, Class E, Floating Rate Pass Through Ctfs., 4.92%, 07/14/26(b)(c) | | | 250,000 | | | | 213,097 | |

Thornburg Mortgage Securities Trust, Series 2007-2, Class A2A, Floating Rate Pass Through Ctfs. 2.08%, 06/25/37(b) | | | 341,601 | | | | 327,671 | |

Trimaran CLO VII Ltd. (Cayman Islands), Series 2007-1A, Class B2L, Floating Rate Pass Through Ctfs., 3.74%, 06/15/21(b)(c) | | | 350,000 | | | | 340,109 | |

See accompanying Notes to Financial Statements which are an integral part of the financial statements.

12 Invesco Strategic Income Fund

| | | | | | | | |

| | | Principal

Amount | | | Value | |

WaMu Mortgage Trust,

Series 2005-AR12, Class 1A8, Floating Rate Pass Through Ctfs., 2.43%, 10/25/35(b) | | $ | 232,045 | | | $ | 224,025 | |

Series 2006-AR10, Class 3A2, Floating Rate Pass Through Ctfs., 5.88%, 08/25/46(b) | | | 197,965 | | | | 182,771 | |

Series 2006-AR18, Class 1A1, Floating Rate Pass Through Ctfs., 1.79%, 01/25/37(b) | | | 154,256 | | | | 132,169 | |

Wells Fargo Alternative Loan Trust, Series 2007-PA5, Class 1A1, Pass Through Ctfs., 6.25%, 11/25/37 | | | 202,334 | | | | 196,859 | |

Wells Fargo Mortgage Backed Securities Trust,

Series 2005-AR10, Class 2A4, Floating Rate Pass Through Ctfs., 2.71%, 06/25/35(b) | | | 285,097 | | | | 287,757 | |

Series 2005-AR12, Class 2A11, Floating Rate Pass Through Ctfs., 2.69%, 06/25/35(b) | | | 174,377 | | | | 175,939 | |

Series 2005-AR14, Class A1, Floating Rate Pass Through Ctfs., 2.74%, 08/25/35(b) | | | 133,105 | | | | 131,856 | |

Series 2005-AR2, Class 2A2, Floating Rate Pass Through Ctfs., 2.63%, 03/25/35(b) | | | 241,562 | | | | 246,334 | |

Series 2005-AR7, Class 1A1, Floating Rate Pass Through Ctfs., 2.74%, 05/25/35(b) | | | 156,752 | | | | 157,236 | |

Series 2005-AR8, Class 3A3, Floating Rate Pass Through Ctfs., 2.72%, 06/25/35(b) | | | 321,530 | | | | 313,357 | |

Series 2006-AR10, Class 4A1, Floating Rate Pass Through Ctfs., 2.61%, 07/25/36(b) | | | 206,252 | | | | 195,274 | |

Series 2006-AR8, Class 2A3, Floating Rate Pass Through Ctfs., 2.74%, 04/25/36(b) | | | 192,604 | | | | 188,786 | |

Series 2007-7, Class A1, Pass Through Ctfs., 6.00%, 06/25/37 | | | 143,969 | | | | 144,658 | |

Series 2015 LC22, Class B, Variable Rate Pass Through Ctfs., 4.69%, 09/15/58(b) | | | 230,000 | | | | 241,756 | |

WFRBS Commercial Mortgage Trust, Series 2014-C24, Class B, Variable Rate Pass Through Ctfs., 4.20%, 11/15/47(b) | | | 250,000 | | | | 255,467 | |

Total Asset-Backed Securities (Cost $22,318,143) | | | | | | | 22,195,070 | |

|

U.S. Dollar Denominated Bonds & Notes–31.32% | |

| Aerospace & Defense–0.44% | | | | | | | | |

Embraer S.A. (Brazil), Sr. Unsec. Global Notes, 5.15%, 06/15/22 | | | 170,000 | | | | 168,670 | |

|

| Agricultural Products–0.10% | |

Darling Ingredients, Inc., Sr. Unsec. Gtd. Global Notes, 5.38%, 01/15/22 | | | 40,000 | | | | 40,000 | |

|

| Apparel Retail–0.43% | |

Hot Topic, Inc., Sr. Sec. Gtd. First Lien Notes, 9.25%, 06/15/21(c) | | | 170,000 | | | | 164,475 | |

|

| Automotive Retail–1.09% | |

CST Brands, Inc., Sr. Unsec. Gtd. Global Notes, 5.00%, 05/01/23 | | | 415,000 | | | | 422,781 | |

| | | | | | | | |

| | | Principal

Amount | | | Value | |

| Building Products–0.04% | |

Builders FirstSource, Inc., Sr. Sec. First Lien Notes, 7.63%, 06/01/21(c) | | $ | 15,000 | | | $ | 15,994 | |

|

| Cable & Satellite–1.70% | |

CCO Safari II, LLC,

Sr. Sec. First Lien Notes, 3.58%, 07/23/20(c) | | | 98,000 | | | | 98,702 | |

Sr. Sec. Gtd. First Lien Notes, 4.91%, 07/23/25(c) | | | 170,000 | | | | 173,378 | |

VTR Finance B.V. (Chile), Sr. Sec. First Lien Notes, 6.88%, 01/15/24(c) | | | 400,000 | | | | 388,000 | |

| | | | | | | | 660,080 | |

|

| Communications Equipment–0.23% | |

Avaya Inc., Sr. Sec. Gtd. First Lien Notes, 7.00%, 04/01/19(c) | | | 110,000 | | | | 89,925 | |

|

| Consumer Finance–2.88% | |

Ally Financial Inc., Sr. Unsec. Global Notes, 4.13%, 03/30/20 | | | 670,000 | | | | 694,287 | |

Synchrony Financial, Sr. Unsec. Global Notes, 4.50%, 07/23/25 | | | 415,000 | | | | 422,650 | |

| | | | | | | | 1,116,937 | |

|

| Diversified Banks–5.14% | |

Citigroup Inc., Series Q, Jr. Unsec. Sub. Global Notes, 5.95%(f) | | | 170,000 | | | | 170,425 | |

Industrial & Commercial Bank of China Ltd. (China), Unsec. Sub. Notes, 4.88%, 09/21/25(c) | | | 340,000 | | | | 345,162 | |

JPMorgan Chase & Co., Series Z, Jr. Unsec. Sub. Global Notes, 5.30%(f) | | | 300,000 | | | | 301,875 | |

Skandinaviska Enskilda Banken AB (Sweden), REGS, Jr. Unsec. Sub. Medium-Term Euro Notes, 5.75%(c)(f) | | | 400,000 | | | | 394,000 | |

Svenska Handelsbanken AB (Sweden), REGS, Jr. Unsec. Sub. Euro Bonds, 5.25%(c)(f) | | | 400,000 | | | | 387,088 | |

Swedbank AB (Sweden), REGS, Jr. Unsec. Sub. Euro Bonds, 5.50%(c)(f) | | | 400,000 | | | | 397,000 | |

| | | | | | | | 1,995,550 | |

|

| Health Care Facilities–0.83% | |

HCA, Inc., Sr. Sec. Gtd. First Lien Notes, 5.25%, 04/15/25 | | | 310,000 | | | | 322,400 | |

|

| Home Furnishings–1.14% | |

Tempur Sealy International, Inc., Sr. Unsec. Gtd. Notes, 5.63%, 10/15/23(c) | | | 420,000 | | | | 441,000 | |

|

| Homebuilding–2.12% | |

K. Hovnanian Enterprises Inc., Sr. Sec. Gtd. First Lien Notes, 7.25%,

10/15/20(c) | | | 510,000 | | | | 480,675 | |

KB Home, Sr. Unsec. Gtd. Notes, 7.00%, 12/15/21 | | | 335,000 | | | | 341,281 | |

| | | | | | | | 821,956 | |

|

| Independent Power Producers & Energy Traders–1.12% | |

AES Corp., Sr. Unsec. Global Notes, 7.38%, 07/01/21 | | | 40,000 | | | | 42,800 | |

Calpine Corp., Sr. Unsec. Global Notes, 5.38%, 01/15/23 | | | 48,000 | | | | 45,840 | |

5.75%, 01/15/25 | | | 360,000 | | | | 344,700 | |

| | | | | | | | 433,340 | |

See accompanying Notes to Financial Statements which are an integral part of the financial statements.

13 Invesco Strategic Income Fund

| | | | | | | | |

| | | Principal

Amount | | | Value | |

| Integrated Oil & Gas–0.41% | |

Ecopetrol S.A. (Colombia), Sr. Unsec. Global Notes, 5.38%, 06/26/26 | | $ | 170,000 | | | $ | 158,738 | |

|

| Internet Software & Services–0.91% | |

Equinix Inc., Sr. Unsec. Notes, 5.38%, 01/01/22 | | | 337,000 | | | | 353,007 | |

|

| Investment Banking & Brokerage–0.36% | |

Morgan Stanley, Sr. Unsec. Medium-Term Global Notes, 4.00%, 07/23/25 | | | 135,000 | | | | 138,935 | |

|

| Metal & Glass Containers–0.91% | |

Berry Plastics Corp., Sec. Gtd. Second Lien Notes, 6.00%, 10/15/22(c) | | | 337,000 | | | | 354,271 | |

|

| Oil & Gas Exploration & Production–0.31% | |

Pacific Exploration and Production Corp. (Colombia), Sr. Unsec. Gtd. Notes, 5.13%, 03/28/23(c) | | | 320,000 | | | | 120,000 | |

|

| Packaged Foods & Meats–0.51% | |

BRF S.A. (Brazil), Sr. Unsec. Notes, 4.75%, 05/22/24(c) | | | 200,000 | | | | 199,125 | |

|

| Paper Products–0.88% | |

Clearwater Paper Corp., Sr. Unsec. Gtd. Notes, 5.38%, 02/01/25(c) | | | 340,000 | | | | 340,850 | |

|

| Pharmaceuticals–0.49% | |

Valeant Pharmaceuticals International, Inc., Sr. Unsec. Gtd. Notes, 5.50%,

03/01/23(c) | | | 225,000 | | | | 190,125 | |

|

| Railroads–0.52% | |

Lima Metro Line 2 Finance Ltd. (Peru), Sr. Sec. First Lien Bonds, 5.88%, 07/05/34(c) | | | 200,000 | | | | 202,000 | |

|

| Regional Banks–2.29% | |

Branch Banking & Trust Co., Unsec. Sub. Notes, 3.63%, 09/16/25 | | | 340,000 | | | | 342,924 | |

CIT Group Inc., Sr. Unsec. Global Notes, 5.00%, 08/15/22 | | | 336,000 | | | | 355,320 | |

Fifth Third Bancorp, Series J, Jr. Unsec. Sub. Bonds, 4.90%(f) | | | 200,000 | | | | 190,000 | |

| | | | | | | | 888,244 | |

|

| Security & Alarm Services–1.11% | |

ADT Corp. (The), Sr. Unsec. Global Notes, 6.25%, 10/15/21 | | | 400,000 | | | | 432,000 | |

|

| Semiconductors–0.34% | |

NXP B.V./NXP Funding LLC (Netherlands), Sr. Unsec. Gtd. Notes, 5.75%,

02/15/21(c) | | | 125,000 | | | | 132,656 | |

|

| Specialized REIT’s–0.17% | |

Corrections Corp. of America, Sr. Unsec. Gtd. Notes, 5.00%, 10/15/22 | | | 63,000 | | | | 64,162 | |

|

| Tires & Rubber–1.10% | |

Goodyear Tire & Rubber Co. (The), Sr. Unsec. Gtd. Notes, 7.00%, 05/15/22 | | | 390,000 | | | | 425,588 | |

|

| Trading Companies & Distributors–3.35% | |

AerCap Ireland Capital Ltd./AerCap Global Aviation Trust (Netherlands), Sr. Unsec. Gtd. Global Notes, 4.50%, 05/15/21 | | | 400,000 | | | | 409,000 | |

| | | | | | | | |

| | | Principal

Amount | | | Value | |

| Trading Companies & Distributors–(continued) | |

International Lease Finance Corp., Sr. Unsec. Notes, 8.25%, 12/15/20 | | $ | 740,000 | | | $ | 891,700 | |

| | | | | | | | 1,300,700 | |

|

| Wireless Telecommunication Services–0.40% | |

Sprint Corp., Sr. Unsec. Gtd. Global Notes, 7.88%, 09/15/23 | | | 165,000 | | | | 153,863 | |

Total U.S. Dollar Denominated Bonds & Notes

(Cost $12,036,497) | | | | 12,147,372 | |

|

Non-U.S. Dollar Denominated Bonds & Notes–6.43%(d) | |

| Automobile Manufacturers–0.91% | |

Volkswagen International Finance N.V. (Germany), REGS, Jr. Unsec. Sub. Gtd. Bonds, 3.88%(c)(f) | | EUR | 330,000 | | | | 352,563 | |

|

| Diversified Banks–0.90% | |

Bankia S.A. (Spain), REGS, Sr. Unsec. Euro Bonds, 3.50%, 01/17/19(c) | | EUR | 300,000 | | | | 348,855 | |

|

| Electric Utilities–0.80% | |

EDP Finance B.V. (Portugal), REGS, Sr. Unsec. Medium-Term Euro Notes, 2.00%, 04/22/25(c) | | EUR | 300,000 | | | | 309,904 | |

|

| Integrated Telecommunication Services–0.87% | |

Telefonica Europe, B.V. (Spain), REGS, Jr. Unsec. Sub. Gtd. Euro Bonds, 5.00%(c)(f) | | EUR | 300,000 | | | | 337,355 | |

|

| Life & Health Insurance–0.40% | |

Delta Lloyd Levensverzekering N.V. (Netherlands), REGS, Unsec. Sub. Euro Notes, 9.00%, 08/29/42(c) | | EUR | 120,000 | | | | 154,707 | |

|

| Marine–0.34% | |

CMA CGM S.A. (France), Sr. Unsec. Notes, 7.75%, 01/15/21(c) | | EUR | 130,000 | | | | 132,589 | |

|

| Multi-Utilities–0.86% | |

ENGIE (France), REGS, Series NC5, Jr. Unsec. Sub. Euro Notes, 3.00%(c)(f) | | EUR | 300,000 | | | | 333,153 | |

|

| Sovereign Debt–0.51% | |

Brazil Notas do Tesouro Nacional (Brazil), Series F, Unsec. Notes, 10.00%, 01/01/23 | | BRL | 1,000,000 | | | | 199,050 | |

|

| Specialized Finance–0.84% | |

Redexis Gas Finance B.V. (Spain), REGS, Sr. Unsec. Gtd. Medium-Term Euro Notes, 2.75%, 04/08/21(c) | | EUR | 280,000 | | | | 327,801 | |

Total Non-U.S. Dollar Denominated Bonds & Notes

(Cost $2,554,193) | | | | 2,495,977 | |

|

U.S. Treasury Securities–2.55% | |

| U.S. Treasury Bills–1.45%(g) | |

0.00%, 05/26/16(h) | | $ | 115,000 | | | | 114,849 | |

0.03%, 05/26/16(h) | | | 25,000 | | | | 24,967 | |

0.04%, 05/26/16(h) | | | 55,000 | | | | 54,928 | |

0.07%, 05/26/16(h) | | | 20,000 | | | | 19,974 | |

0.09%, 05/26/16(h) | | | 15,000 | | | | 14,980 | |

See accompanying Notes to Financial Statements which are an integral part of the financial statements.

14 Invesco Strategic Income Fund

| | | | | | | | |

| | | Principal

Amount | | | Value | |

| U.S. Treasury Bills–(continued) | |

0.22%, 05/26/16(h) | | $ | 120,000 | | | $ | 119,842 | |

0.23%, 05/26/16(h) | | | 90,000 | | | | 89,881 | |

0.28%, 05/26/16(h) | | | 95,000 | | | | 94,875 | |

0.29%, 05/26/16(h) | | | 30,000 | | | | 29,960 | |

| | | | | | | | 564,256 | |

|

| U.S. Treasury Inflation-Indexed Bonds–1.10% | |

1.38%, 02/15/44 | | | 409,060 | (i) | | | 425,420 | |

Total U.S. Treasury Securities

(Cost $988,580) | | | | 989,676 | |

|

Credit-Linked Securities–1.48% | |

Standard Chartered Bank (United Kingdom), Sr. Unsec. Medium-Term Euro Notes, 8.40%, 07/30/24 (Credit-Linked to India Government Bonds, 8.40%, 07/28/24) (Cost $593,619)(c)(d) | | INR | 36,000,000 | | | | 573,772 | |

|

Municipal Obligations–0.99% | |

Chicago (City of), Illinois; Series 2012 B, Ref. Unlimited Tax GO Bonds, 5.43%, 01/01/42 | | $ | 35,000 | | | | 30,239 | |

Series 2014 B, Ref. Unlimited Tax GO Bonds, 6.31%, 01/01/44 | | | 150,000 | | | | 141,580 | |

Puerto Rico (Commonwealth of); Series 2014 A, Unlimited Tax GO Bonds, 8.00%, 07/01/35 | | | 290,000 | | | | 212,135 | |

Total Municipal Obligations

(Cost $392,373) | | | | 383,954 | |

| | | | | | | | |

| | | Principal

Amount | | | Value | |

U.S. Government Sponsored Agency Mortgage-Backed Securities–0.43% | |

| Collateralized Mortgage Obligations–0.43% | |

Fannie Mae REMICs, IO, 3.00%, 06/25/27(b) | | $ | 852,119 | | | $ | 82,076 | |

Freddie Mac REMICs, IO, 3.00%, 05/15/28(b) | | | 812,887 | | | | 85,101 | |

Total U.S. Government Sponsored Agency Mortgage-Backed Securities

(Cost $181,898) | | | | 167,177 | |

| | |

| | | Shares | | | | |

Money Market Funds–0.17% | |

Liquid Assets Portfolio, Institutional Class, 0.16%(j) | | | 32,117 | | | | 32,117 | |

Premier Portfolio, Institutional Class, 0.12%(j) | | | 32,116 | | | | 32,116 | |

Total Money Market Funds (Cost $64,233) | | | | | | | 64,233 | |

|

Options Purchased–1.50%(k) | |

(Cost $779,612) | | | | | | | 581,311 | |

TOTAL INVESTMENTS–102.09%

(Cost $39,909,148) | | | | 39,598,542 | |

OTHER ASSETS LESS LIABILITIES–(2.09)% | | | | (812,494 | ) |

NET ASSETS–100.00% | | | | | | $ | 38,786,048 | |

Investment Abbreviations:

| | |

| BRL | | – Brazilian Real |

| CDO | | – Collateralized Debt Obligation |

| CLO | | – Collateralized Loan Obligation |

| Ctfs. | | – Certificates |

| EUR | | – Euro |

| GO | | – General Obligation |

| | |

| Gtd. | | – Guaranteed |

| INR | | – Indian Rupee |

| IO | | – Interest Only |

| Jr. | | – Junior |

| Ref. | | – Refunding |

| REGS | | – Regulation S |

| | |

| REIT | | – Real Estate Investment Trust |

| REMICs | | – Real Estate Investment Conduits |

| Sec. | | – Secured |

| Sr. | | – Senior |

| Sub. | | – Subordinated |

| Unsec. | | – Unsecured |

Notes to Schedule of Investments:

| (a) | Industry and/or sector classifications used in this report are generally according to the Global Industry Classification Standard, which was developed by and is the exclusive property and a service mark of MSCI Inc. and Standard & Poor’s. |

| (b) | Interest or dividend rate is redetermined periodically. Rate shown is the rate in effect on October 31, 2015. |

| (c) | Security purchased or received in a transaction exempt from registration under the Securities Act of 1933, as amended (the “1933 Act”). The security may be resold pursuant to an exemption from registration under the 1933 Act, typically to qualified institutional buyers. The aggregate value of these securities at October 31, 2015 was $17,990,198, which represented 46.38% of the Fund’s Net Assets. |

| (d) | Foreign denominated security. Principal amount is denominated in the currency indicated. |