|

OMB APPROVAL |

OMB Number: 3235-0570 Expires: January 31, 2017 Estimated average burden hours per response: 20.6 |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

| | |

| Investment Company Act file number | | 811-05426 |

| | |

|

| AIM Investment Funds (Invesco Investment Funds)* |

| (Exact name of registrant as specified in charter) |

|

| 11 Greenway Plaza, Suite 1000 Houston, Texas 77046 |

| (Address of principal executive offices) (Zip code) |

|

| Philip A. Taylor 11 Greenway Plaza, Suite 1000 Houston, Texas 77046 |

| (Name and address of agent for service) |

| | | | | | |

| Registrant’s telephone number, including area code: (713) 626-1919 |

| | | | |

| | |

| Date of fiscal year end: | | 10/31 | | |

| | |

| Date of reporting period: | | 10/31/15 | | |

*Funds included are: Invesco All Cap Market Neutral Fund, Invesco Balanced-Risk Allocation Fund, Invesco Balanced-Risk Commodity Strategy Fund, Invesco Developing Markets Fund, Invesco Emerging Market Local Currency Debt Fund, Invesco Emerging Markets Equity Fund, Invesco Endeavor Fund, Invesco Global Health Care Fund, Invesco Global Infrastructure Fund, Invesco Global Market Neutral Fund, Invesco Global Markets Strategy Fund, Invesco Global Targeted Returns Fund, Invesco Greater China Fund, Invesco International Total Return Fund, Invesco Long/Short Equity Fund, Invesco Low Volatility Emerging Markets Fund, Invesco Macro International Equity Fund, Invesco Macro Long/Short Fund, Invesco MLP Fund, Invesco Pacific Growth Fund, Invesco Premium Income Fund and Invesco Select Companies Fund.

Item 1. Report to Stockholders.

| | | | |

| | |

| | Annual Report to Shareholders | | October 31, 2015 |

| | |

| | Invesco All Cap Market Neutral Fund |

| | Nasdaq: |

| | A: CPNAX n C: CPNCX n R: CPNRX n Y: CPNYX n R5: CPNFX n R6: CPNSX |

Letters to Shareholders

| | |

Philip Taylor | | Dear Shareholders: This annual report includes information about your Fund, including performance data and a complete list of its investments as of the close of the reporting period. Inside is a discussion of how your Fund was managed and the factors that affected its performance during the reporting period. I hope you find this report of interest. The US economy expanded and unemployment declined throughout the reporting period. Continuing low energy prices benefited consumers, but a strong US dollar crimped corporate profits. The US Federal Reserve signaled that it was increasingly likely to raise interest rates, based on generally positive economic data, but uncertainty remained about when it might act. Overseas, the story was much different. Low energy prices hurt the economies of some oil-producing nations, such as Brazil and Russia. During the reporting period, the European |

| Central Bank as well as central banks in China and Japan – among other countries – either instituted or maintained extraordinarily accommodative monetary policies in response to economic weakness. |

Investor uncertainty, such as we saw for much of the reporting period – and market volatility, such as we saw at the end of the reporting period – are unfortunate facts of life when it comes to investing. Some investors use these things as excuses to delay saving and investing for their long-term financial goals. That’s why Invesco encourages investors to work with a professional financial adviser who can stress the importance of starting to save and invest early and the importance of adhering to a disciplined investment plan – when times are good and when they’re uncertain. A financial adviser who knows your unique financial situation, investment goals and risk tolerance can be an invaluable partner as you seek to achieve your financial goals. He or she can offer a long-term perspective when markets are volatile and time-tested advice and guidance when your financial situation or investment goals change.

Timely information when and where you want it

Invesco’s efforts to help investors achieve their financial objectives include providing individual investors and financial professionals with timely information about the markets, the economy and investing – whenever and wherever they want it.

Our website, invesco.com/us, offers a wide range of market insights and investment perspectives. On the website, you’ll find detailed information about our funds, including prices, performance, holdings and portfolio manager commentaries. You can access information about your account by completing a simple, secure online registration. Click on the “Need to register” link in the “Account Access” box on our homepage to get started.

Invesco’s mobile apps for iPhone® and iPad® (both available free from the App StoreSM) allow you to obtain the same detailed information, monitor your account and create customizable watch lists. Also, they allow you to access investment insights from our investment leaders, market strategists, economists and retirement experts. You can sign up to be alerted when new commentary is added, and you can watch portfolio manager videos and have instant access to Invesco news and updates wherever you may be.

In addition to the resources accessible on our website and through our mobile app, you can obtain timely updates to help you stay informed about the markets, the economy and investing by connecting with Invesco on Twitter, LinkedIn or Facebook. You can access our blog at blog.invesco.us.com. Our goal is to provide you the information you want, when and where you want it.

Have questions?

For questions about your account, feel free to contact an Invesco client services representative at 800 959 4246. For Invesco-related questions or comments, please email me directly at phil@invesco.com.

All of us at Invesco look forward to serving your investment management needs for many years to come. Thank you for investing with us.

Sincerely,

Philip Taylor

Senior Managing Director, Invesco Ltd.

iPhone and iPad are trademarks of Apple Inc., registered in the US and other countries. App Store is a service mark of Apple Inc. Invesco Distributors, Inc. is not affiliated with Apple Inc.

2 Invesco All Cap Market Neutral Fund

| | |

Bruce Crockett | | Dear Fellow Shareholders: Among the many important lessons I’ve learned in more than 40 years in a variety of business endeavors is the value of a trusted advocate. As independent chair of the Invesco Funds Board, I can assure you that the members of the Board are strong advocates for the interests of investors in Invesco’s mutual funds. We work hard to represent your interests through oversight of the quality of the investment management services your funds receive and other matters important to your investment, including but not limited to: n Ensuring that Invesco offers a diverse lineup of mutual funds that your financial adviser can use to strive to meet your financial needs as your investment goals change over time. n Monitoring how the portfolio management teams of the Invesco funds are performing in light of changing economic and market conditions. |

| n | | Assessing each portfolio management team’s investment performance within the context of the investment strategy described in the fund’s prospectus. |

| n | | Monitoring for potential conflicts of interests that may impact the nature of the services that your funds receive. |

We believe one of the most important services we provide our fund shareholders is the annual review of the funds’ advisory and sub-advisory contracts with Invesco Advisers and its affiliates. This review is required by the Investment Company Act of 1940 and focuses on the nature and quality of the services Invesco provides as the adviser to the Invesco funds and the reasonableness of the fees that it charges for those services. Each year, we spend months carefully reviewing information received from Invesco and a variety of independent sources, such as performance and fee data prepared by Lipper Inc., an independent, third-party firm widely recognized as a leader in its field. We also meet with our independent legal counsel and other independent advisers to review and help us assess the information that we have received. Our goal is to assure that you receive quality investment management services for a reasonable fee.

I trust the measures outlined above provide assurance that you have a worthy advocate when it comes to choosing the Invesco Funds.

As always, please contact me at bruce@brucecrockett.com with any questions or concerns you may have. On behalf of the Board, we look forward to continuing to represent your interests and serving your needs.

Sincerely,

Bruce L. Crockett

Independent Chair

Invesco Funds Board of Trustees

3 Invesco All Cap Market Neutral Fund

Management’s Discussion of Fund Performance

Performance summary

For the fiscal year ended October 31, 2015, Invesco All Cap Market Neutral Fund (the Fund), at net asset value (NAV), outperformed the Citigroup 90-Day Treasury Bill Index, the Fund’s broad market/style-specific benchmark.

Your Fund’s long-term performance appears later in this report.

Fund vs. Indexes

Total returns, 10/31/14 to 10/31/15, at net asset value (NAV). Performance shown does not include applicable contingent deferred sales charges (CDSC) or front-end sales charges, which would have reduced performance.

| | | | |

Class A Shares | | | 11.40 | % |

Class C Shares | | | 10.53 | |

Class R Shares | | | 11.05 | |

Class Y Shares | | | 11.66 | |

Class R5 Shares | | | 11.75 | |

Class R6 Shares | | | 11.66 | |

Citigroup 90-Day Treasury Bill Indexq (Broad Market/Style-Specific Index) | | | 0.02 | |

| Lipper Alternative Equity Market Neutral Indexn (Peer Group Index) | | | -1.72 | |

Source(s): qFactSet Research Systems Inc.; nLipper Inc.

Market conditions and your Fund

For the first half of the fiscal year ended October 31, 2015, US equity markets delivered positive returns as a strong domestic economy and successful exit from the US Federal Reserve’s (the Fed) quantitative easing made for an attractive investment backdrop. During the second half of the reporting period, equity markets cooled, given macroeconomic distractions. Market-moving headlines during the fiscal year included the rapid decline in oil prices, the strengthening US dollar given the potential for higher interest rates in the US, and slowing economic growth in China, which

had negative implications for growth globally. Toward the end of the fiscal year, the Fed’s continued delay on raising interest rates increased investor uncertainty and market volatility.

Despite solid economic growth in the US, the performance of individual economic sectors varied dramatically during the fiscal year. The information technology (IT) sector performed well, especially the Internet software and services industry. The consumer discretionary sector also performed well, led by retail and consumer services industries (such as entertainment, restaurants and leisure). This was due to lower gas prices, continued

low interest rates and increasing availability of credit, which boosted consumer confidence. The worst-performing sector was energy, due to an increased supply/ demand imbalance, followed by materials, which was hurt by concerns of slowing global demand.

The Fund generally follows a market neutral strategy, which is designed to produce a portfolio that experiences minimal influence from the return patterns of the general US stock market. The Fund implements its strategy by purchasing investments (long positions) with equity exposure that we believe to be undervalued, and selling short investments (short positions) with equity exposure that we believe to be overvalued. Stock selection is the primary source of return for the Fund, which uses offsetting long and short positions to generate return and manage risk.

As part of the investment process, the Fund evaluates fundamental and behavioral factors to forecast individual securities’ returns and risks, and ranks these securities based on their attractiveness relative to industry peers. In a market neutral construct, a positive spread between the top- and bottom-ranked stocks (long and short candidates for the portfolio) typically leads to outperformance relative to the Citigroup 90-Day Treasury Bill Index.

During the fiscal year, the Fund benefited most from a positive long/short spread in eight of 10 sectors. Overall, the

| | | | | | | | | | | | | | | | |

| Portfolio Composition | | | | | | | | | | | | | | | | |

| By sector, based on total net assets | | | | | | | | | | | | | | | | |

| | | Equity Securities | | | Gross | | | Net | |

| | | Long1 | | | Short2 | | | Exposure3 | | | Exposure4 | |

Health Care | | | 21.1 | % | | | 21.2 | % | | | 42.3 | % | | | -0.1 | % |

Information Technology | | | 16.5 | | | | 15.0 | | | | 31.5 | | | | 1.5 | |

Energy | | | 15.8 | | | | 15.1 | | | | 30.9 | | | | 0.7 | |

Financials | | | 7.6 | | | | 9.2 | | | | 16.8 | | | | -1.6 | |

Consumer Discretionary | | | 7.5 | | | | 8.6 | | | | 16.1 | | | | -1.1 | |

Industrials | | | 7.1 | | | | 4.4 | | | | 11.5 | | | | 2.7 | |

Materials | | | 4.9 | | | | 5.7 | | | | 10.6 | | | | -0.8 | |

Consumer Staples | | | 3.7 | | | | 3.5 | | | | 7.2 | | | | 0.2 | |

Telecommunication Services | | | 0.7 | | | | 1.2 | | | | 1.9 | | | | -0.5 | |

Utilities | | | 0.1 | | | | 1.0 | | | | 1.1 | | | | -0.9 | |

Money Market Funds Plus Other Assets Less Liabilities | | | 15.0 | | | | – | | | | 15.0 | | | | 15.0 | |

Total | | | 100.0 | | | | 84.9 | | | | 184.9 | | | | 15.1 | |

| 1 | Represents the value of the equity securities in the portfolio. |

| 2 | Represents the value of the equity securities underlying the Fund’s equity short portfolio swap. |

| 3 | Represents the cumulative exposure of the Fund’s long and short positions. |

| 4 | Represents the net exposure of the Fund’s long and short positions. |

| | | | |

Total Net Assets | | | $32.9 million | |

Data presented here are as of October 31, 2015.

4 Invesco All Cap Market Neutral Fund

best results came from the IT, health care, industrials and financials sectors. Modestly detracting from overall performance was the long/short spread in the consumer discretionary and energy sectors.

In the IT sector, the Fund’s short holdings within the computers/electronics industry declined more in price than the long holdings of its industry peers, while both long and short holdings in the semiconductor industry contributed to Fund performance. Strong Fund results for the fiscal year in the health care sector resulted primarily from short holdings in the biotechnology industry and long holdings in the health care equipment and services industry. Within the industrials sector, long and short positions in the airline industry and short positions in the commercial and professional services industry generated a positive spread and contributed to Fund performance for the reporting period. Strong results from the financials sector were due to short positions in the diversified financials industry and long positions in the insurance industry.

In the energy sector, the Fund’s long holdings underperformed its short holdings, specifically within the oil and gas exploration and production industry. The Fund’s short holdings within the consumer discretionary sector outperformed its long holdings in that sector, specifically within the media industry.

At the end of the reporting period, the Fund’s largest gross sector exposures were in the health care, IT, energy and consumer discretionary sectors.

Please note that the Fund may utilize derivative instruments that include equity total return swaps and futures contracts. During the reporting period, the Fund utilized equity total return swaps to efficiently implement its strategy, but did not use future contracts. The implementation impact of using equity total return swaps is a component of transaction costs. Derivatives may amplify traditional investment risks through the creation of leverage and may be less liquid than traditional securities.

Thank you for your investment in Invesco All Cap Market Neutral Fund.

The views and opinions expressed in management’s discussion of Fund performance are those of Invesco Advisers, Inc. These views and opinions are subject to change at any time based on factors such as market and economic conditions. These views and opinions may not be relied upon as investment advice or recommendations, or as an offer for a particular security. The information is not a complete analysis of every aspect of any market, country, industry, security or the Fund. Statements of fact are from sources considered reliable, but Invesco Advisers, Inc. makes no representation or warranty as to their completeness or accuracy. Although historical performance is no guarantee of future results, these insights may help you understand our investment management philosophy.

See important Fund and, if applicable, index disclosures later in this report.

| | |

| | Michael Abata Chartered Financial Analyst, Portfolio Manager, is manager of Invesco All Cap |

| Market Neutral Fund. He joined Invesco in 2011. Mr. Abata earned a BA in economics from Binghamton University. |

| |

| | Charles Ko Chartered Financial Analyst, Portfolio Manager, is manager of Invesco All Cap |

| Market Neutral Fund. He joined Invesco in 2012. Mr. Ko earned a BS from MIT and an MBA from Yale University. |

| |

| | Anthony Munchak Chartered Financial Analyst, Portfolio Manager, is manager of Invesco All Cap |

| Market Neutral Fund. He joined Invesco in 2000. Mr. Munchak earned a BS and an MS in finance from Boston College and an MBA from Bentley College. |

| |

| | Glen Murphy Chartered Financial Analyst, Portfolio Manager, is manager of Invesco All Cap |

| Market Neutral Fund. He joined Invesco in 1995. Mr. Murphy earned a BA in business administration from the University of Massachusetts Amherst and an MS in finance from Boston College. |

| |

| | Francis Orlando Chartered Financial Analyst, Portfolio Manager, is manager of Invesco All Cap |

| Market Neutral Fund. He joined Invesco in 1987. Mr. Orlando earned a BA in business administration from Merrimack College and an MBA from Boston University. |

| |

| | Andrew Waisburd Portfolio Manager, is manager of Invesco All Cap Market Neutral Fund. He joined |

| Invesco in 2008. Mr. Waisburd earned a BS in statistics from Cornell University and an MS and a PhD in finance from Indiana University. |

5 Invesco All Cap Market Neutral Fund

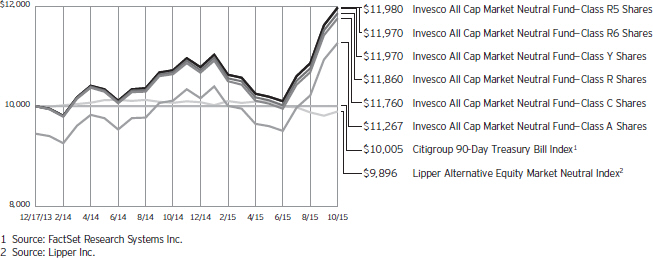

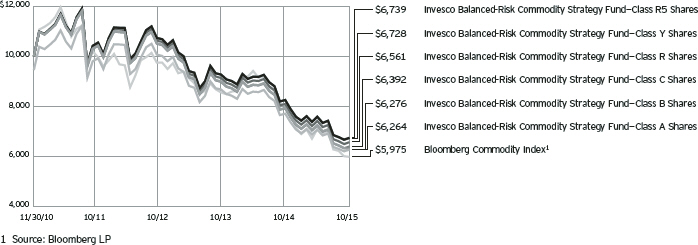

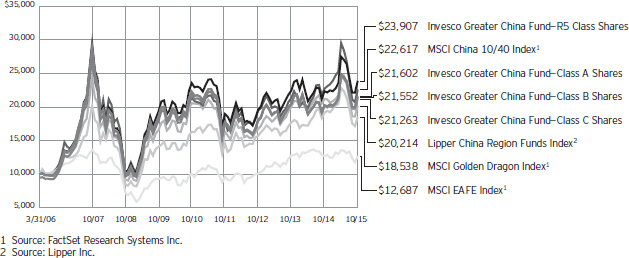

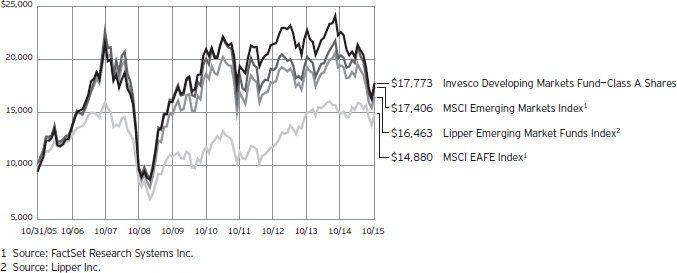

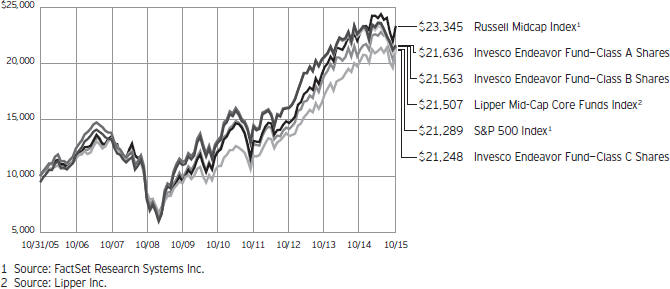

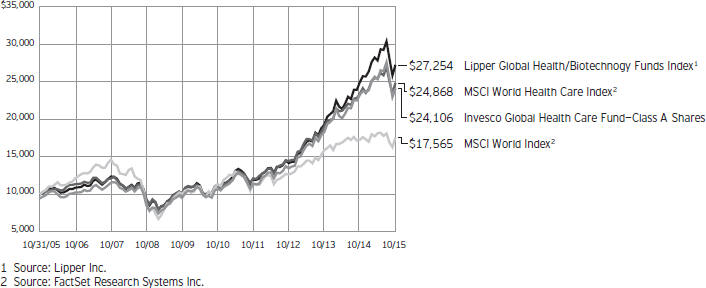

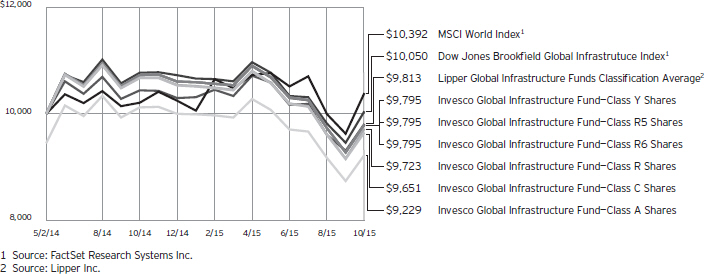

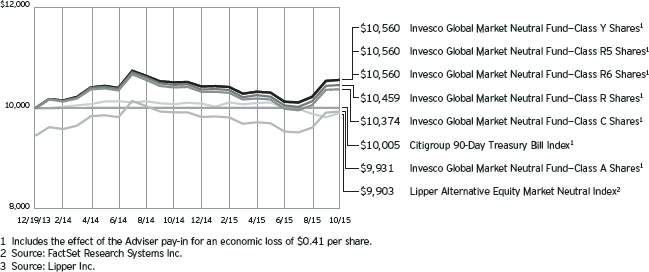

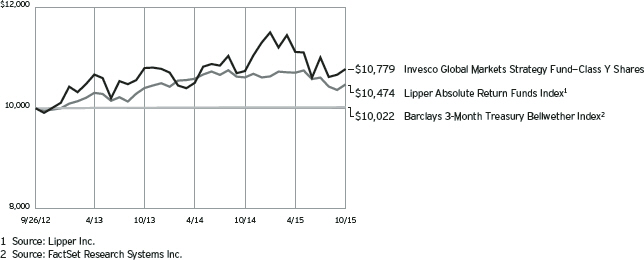

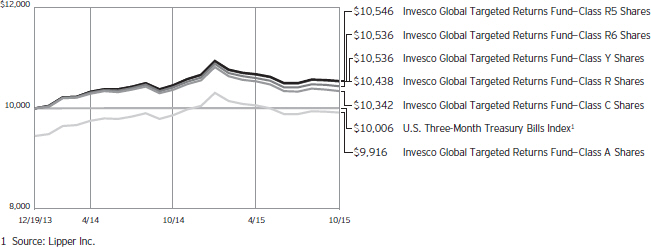

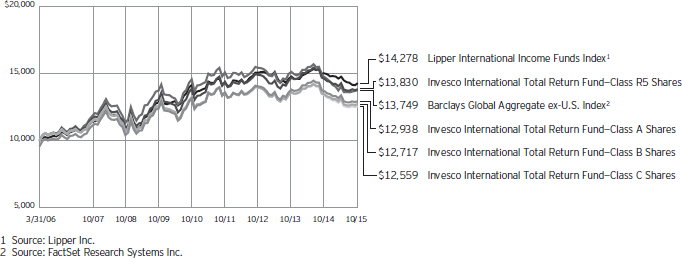

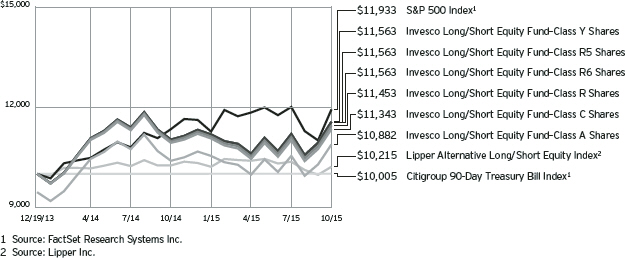

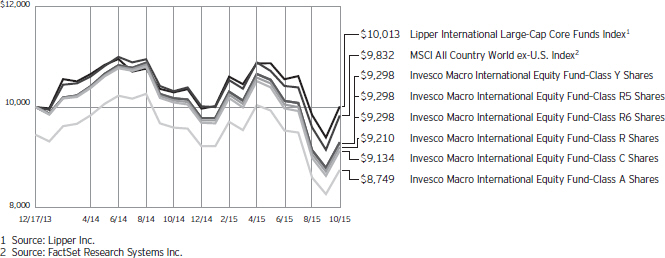

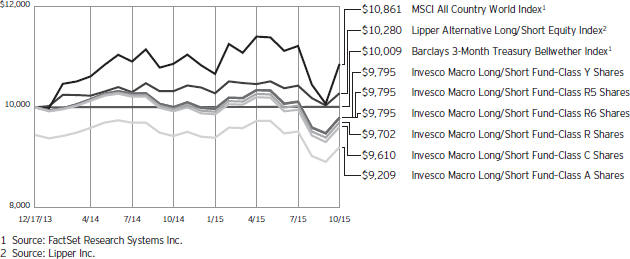

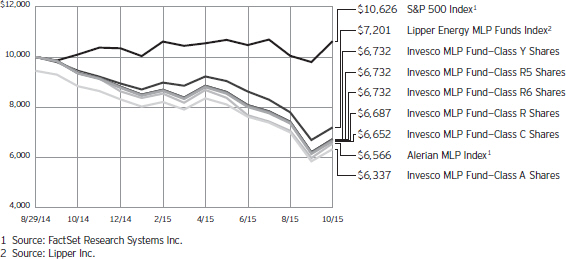

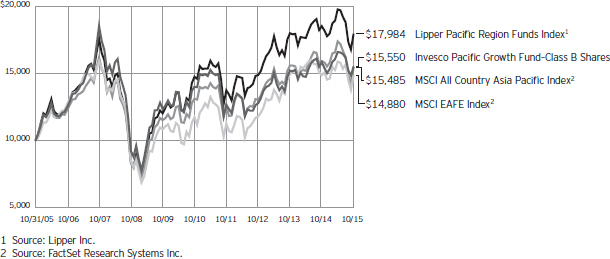

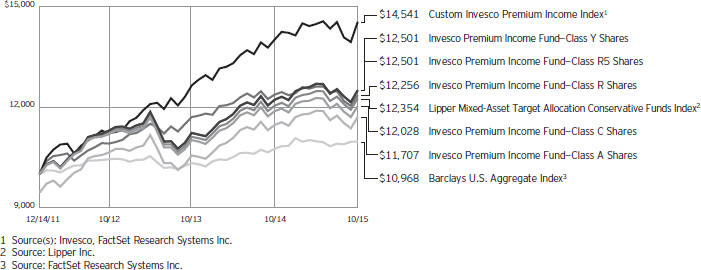

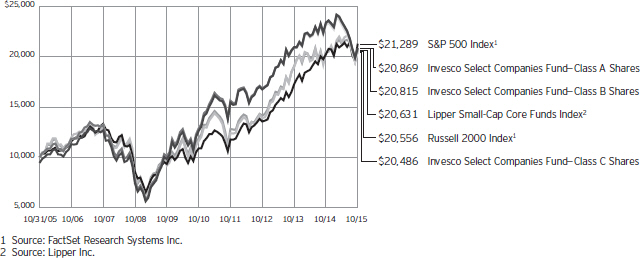

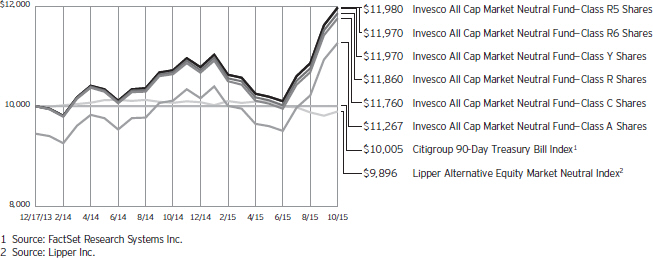

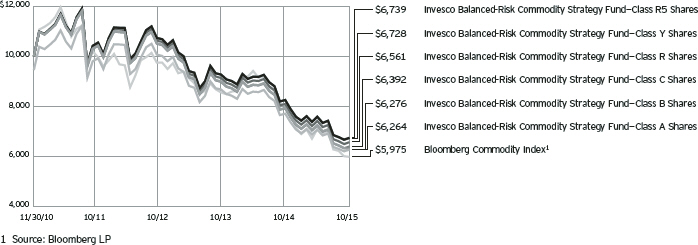

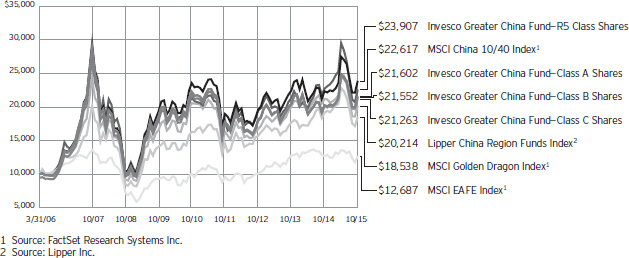

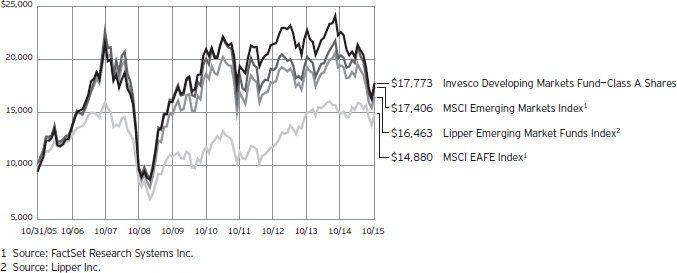

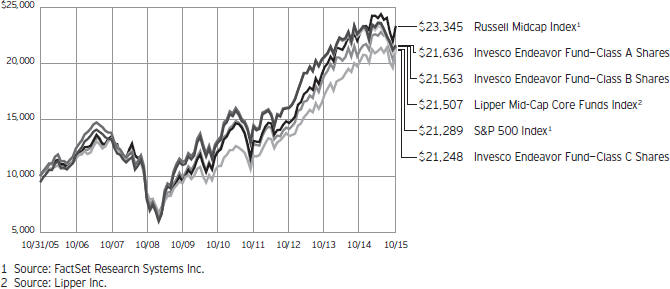

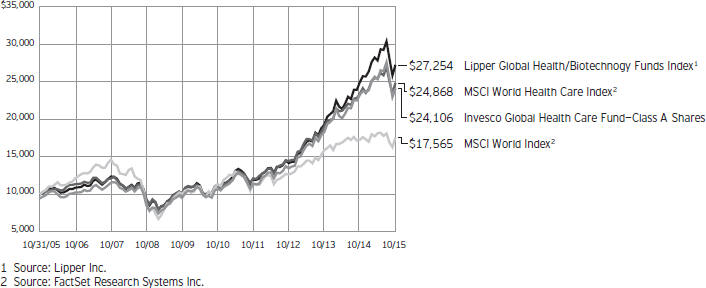

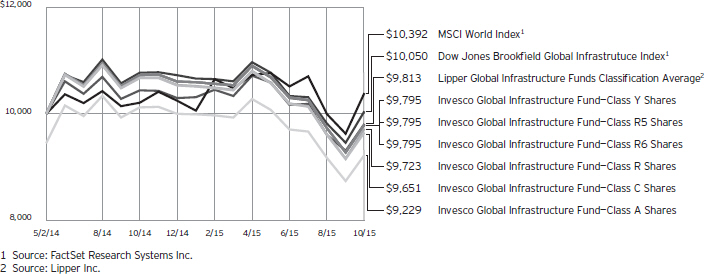

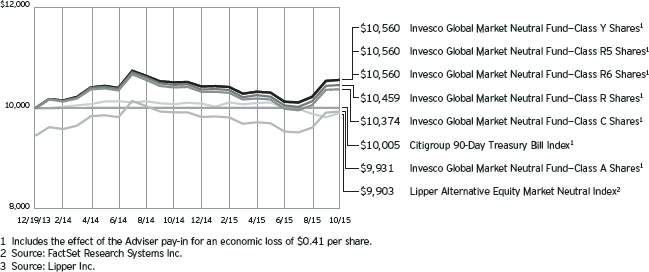

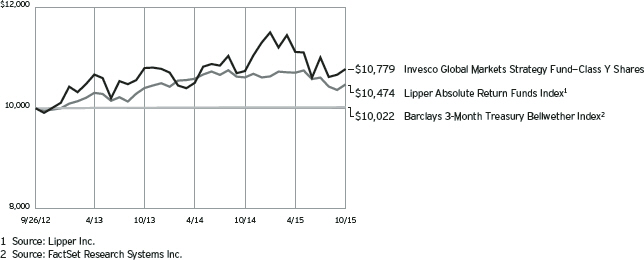

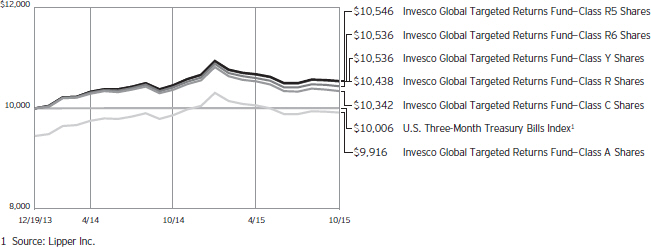

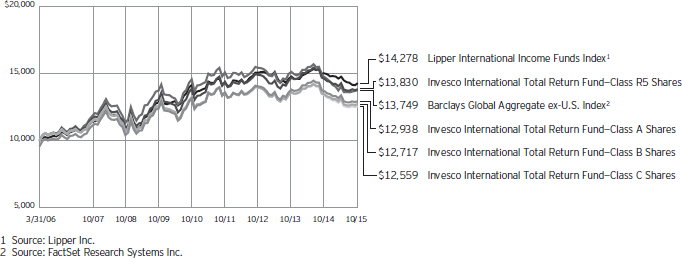

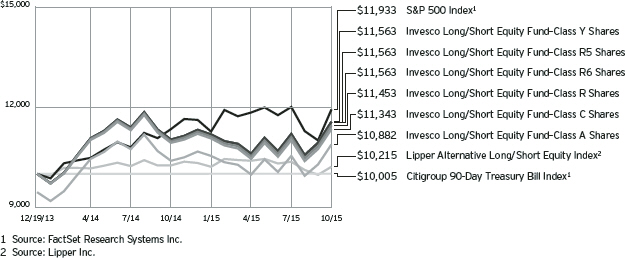

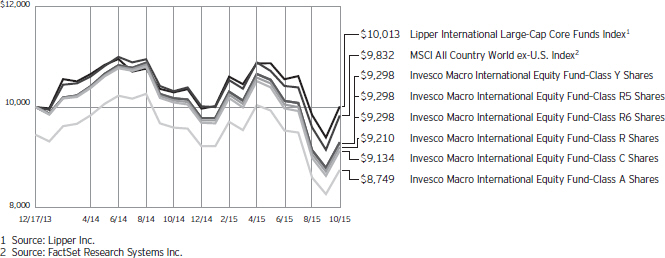

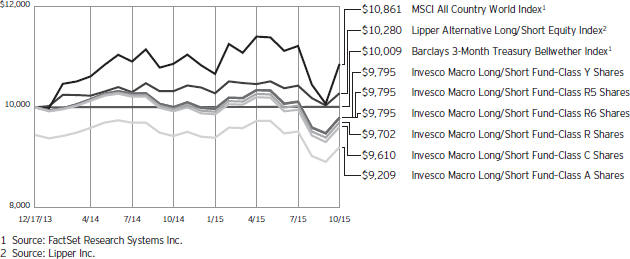

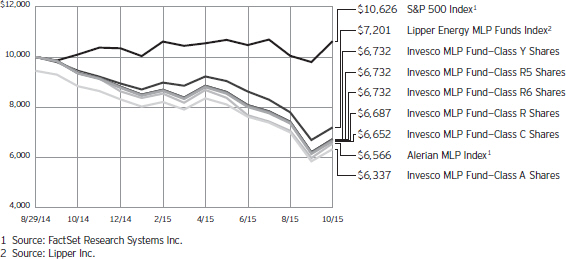

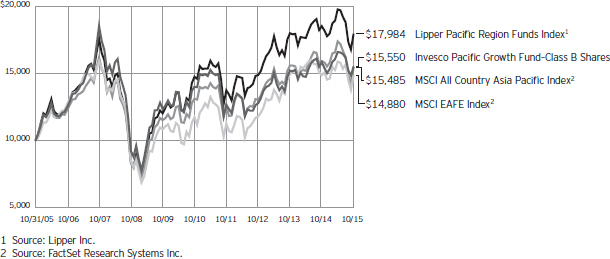

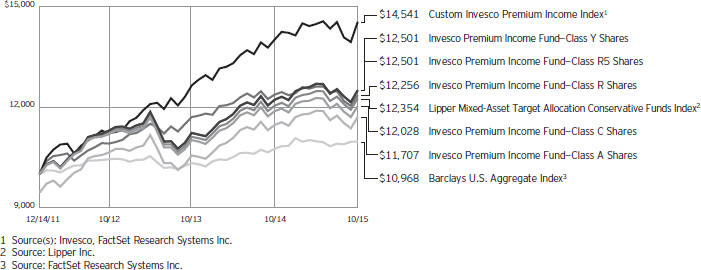

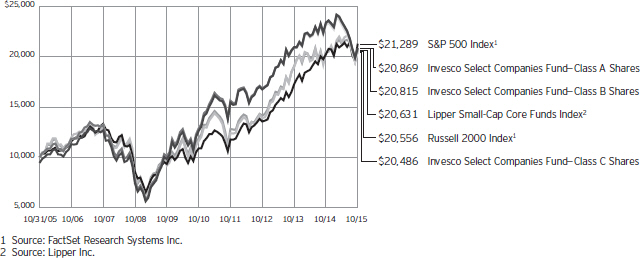

Your Fund’s Long-Term Performance

Results of a $10,000 Investment – Oldest Share Class(es) Since Inception

Fund and index data from 12/17/13

Past performance cannot guarantee comparable future results.

The data shown in the chart include reinvested distributions, applicable sales charges and Fund expenses including

management fees. Index results include reinvested dividends, but they do not reflect sales charges. Performance of the peer group, if applicable, reflects fund expenses and management fees;

performance of a market index does not. Performance shown in the chart and table(s) does not reflect deduction of taxes a shareholder would pay on Fund distributions or sale of Fund shares.

continued from page 8

| n | | The Fund is not managed to track the performance of any particular index, including the index(es) described here, and consequently, the performance of the Fund may deviate significantly from the performance of the index(es). |

| n | | A direct investment cannot be made in an index. Unless otherwise indicated, index results include reinvested dividends, and they do not reflect sales charges. Performance of the peer group, if applicable, reflects fund expenses; performance of a market index does not. |

Other information

| n | | The returns shown in management’s discussion of Fund performance are based on net asset values (NAVs) calculated for shareholder transactions. Generally accepted accounting principles require adjustments to be made to the net assets of the Fund at period end for financial reporting purposes, and as such, the NAVs for shareholder transactions and the returns based on those NAVs may differ from the NAVs and returns reported in the Financial Highlights. |

| n | | Industry classifications used in this report are generally according to the Global Industry Classification Standard, which was developed by and is the exclusive property and a service mark of MSCI Inc. and Standard & Poor’s. |

6 Invesco All Cap Market Neutral Fund

| | | | |

| Average Annual Total Returns | |

| As of 10/31/15, including maximum applicable sales charges | |

| |

Class A Shares | | | | |

Inception (12/17/13) | | | 6.58 | % |

1 Year | | | 5.30 | |

| |

Class C Shares | | | | |

Inception (12/17/13) | | | 9.05 | % |

1 Year | | | 9.53 | |

| |

Class R Shares | | | | |

Inception (12/17/13) | | | 9.54 | % |

1 Year | | | 11.05 | |

| |

Class Y Shares | | | | |

Inception (12/17/13) | | | 10.09 | % |

1 Year | | | 11.66 | |

| |

Class R5 Shares | | | | |

Inception (12/17/13) | | | 10.14 | % |

1 Year | | | 11.75 | |

| |

Class R6 Shares | | | | |

Inception (12/17/13) | | | 10.09 | % |

1 Year | | | 11.66 | |

The performance data quoted represent past performance and cannot guarantee comparable future results; current performance may be lower or higher. Please visit invesco.com/performance for the most recent month-end performance. Performance figures reflect reinvested distributions, changes in net asset value and the effect of the maximum sales charge unless otherwise stated. Investment return and principal value will fluctuate so that you may have a gain or loss when you sell shares.

The net annual Fund operating expense ratio set forth in the most recent Fund prospectus as of the date of this report for Class A, Class C, Class R, Class Y, Class R5 and Class R6 shares was 1.62%, 2.37%, 1.87%, 1.37%, 1.37% and 1.37%, respectively.1,2 The total annual Fund operating expense ratio set forth in the most recent Fund prospectus as of the date of this report for Class A, Class C, Class R, Class Y, Class R5 and Class R6 shares was 4.37%, 5.12%, 4.62%, 4.12%, 4.09% and 4.08%, respectively. The expense ratios presented above may vary from the expense ratios presented in other sections of this report that are based on expenses incurred during the period covered by this report.

Class A share performance reflects the maximum 5.50% sales charge, and Class C share performance reflects the

| | | | |

| Average Annual Total Returns | |

| As of 9/30/15, the most recent calendar quarter end, including maximum applicable sales charges | |

| |

Class A Shares | | | | |

Inception (12/17/13) | | | 5.14 | % |

1 Year | | | 2.66 | |

| |

Class C Shares | | | | |

Inception (12/17/13) | | | 7.72 | % |

1 Year | | | 6.74 | |

| |

Class R Shares | | | | |

Inception (12/17/13) | | | 8.24 | % |

1 Year | | | 8.37 | |

| |

Class Y Shares | | | | |

Inception (12/17/13) | | | 8.77 | % |

1 Year | | | 8.90 | |

| |

Class R5 Shares | | | | |

Inception (12/17/13) | | | 8.77 | % |

1 Year | | | 8.80 | |

| |

Class R6 Shares | | | | |

Inception (12/17/13) | | | 8.77 | % |

1 Year | | | 8.90 | |

applicable contingent deferred sales charge (CDSC) for the period involved. The CDSC on Class C shares is 1% for the first year after purchase. Class R, Class Y, Class R5 and Class R6 class shares do not have a front-end sales charge or a CDSC; therefore, performance is at net asset value.

The performance of the Fund’s share classes will differ primarily due to different sales charge structures and class expenses.

Fund performance reflects any applicable fee waivers and/or expense reimbursements. Had the adviser not waived fees and/or reimbursed expenses currently or in the past, returns would have been lower. See current prospectus for more information.

| 1 | Total annual Fund operating expenses after any contractual fee waivers and/or expense reimbursements by the adviser in effect through at least February 28, 2017. See current prospectus for more information. |

| 2 | Total annual Fund operating expenses after any contractual fee waivers and/or expense reimbursements by the adviser in effect through at least June 30, 2017. See current prospectus for more information. |

7 Invesco All Cap Market Neutral Fund

Invesco All Cap Market Neutral Fund’s investment objective is to seek to provide a positive return over a full market cycle from a broadly diversified portfolio of stocks while seeking to limit exposure to the general risks associated with stock market investing.

| n | | Unless otherwise stated, information presented in this report is as of October 31, 2015, and is based on total net assets. |

| n | | Unless otherwise noted, all data provided by Invesco. |

| n | | To access your Fund’s reports/prospectus, visit invesco.com/fundreports. |

About share classes

| n | | Class R shares are generally available only to employer sponsored retirement and benefit plans. Please see the prospectus for more information. |

| n | | Class Y shares are available only to certain investors. Please see the prospectus for more information. |

| n | | Class R5 shares and Class R6 shares are primarily intended for employer sponsored retirement and benefit plans that meet certain standards and for institutional investors. Please see the prospectus for more information. |

Principal risks of investing

in the Fund

| n | | Active trading risk. The Fund engages in frequent trading of portfolio securities. Active trading results in added expenses and may result in a lower return and increased tax liability. |

| n | | Derivatives risk. The value of a derivative instrument depends largely on (and is derived from) the value of an underlying security, currency, commodity, interest rate, index or other asset (each referred to as an underlying asset). In addition to risks relating to the underlying assets, the use of derivatives may include other, possibly greater, risks, including counterparty, leverage and liquidity risks. Counterparty risk is the risk that the counterparty to the derivative contract will default on its obligation to pay the Fund the amount owed or otherwise perform under the derivative contract. Derivatives create leverage risk because they do not require payment up front equal to the economic exposure created by owning the derivative. As a result, an adverse change in the value of the underlying asset could result in the Fund sustaining a loss that is substantially greater than the amount invested in the derivative, which may make the Fund’s returns more volatile and increase the risk of loss. Derivative instruments may also be less liquid than more traditional investments and the Fund |

| | | may be unable to sell or close out its derivative positions at a desirable time or price. This risk may be more acute under adverse market conditions, during which the Fund may be most in need of liquidating its derivative positions. Derivatives may also be harder to value, less tax efficient and subject to changing government regulation that could impact the Fund’s ability to use certain derivatives or their cost. Also, derivatives used for hedging or to gain or limit exposure to a particular market segment may not provide the expected benefits, particularly during adverse market conditions. These risks are greater for the Fund than mutual funds that do not use derivative instruments or that use derivative instruments to a lesser extent than the Fund to implement their investment strategy. |

| n | | Management risk. The investment techniques and risk analysis used by the Fund’s portfolio managers may not produce the desired results. In particular, there is no guarantee that the portfolio manager’s stock selection process will produce a market neutral portfolio that reduces or eliminates the Fund’s exposure to general US stock market risk, sector or industry-specific risk or market capitalization risk. In addition, the Fund’s market neutral investment strategy will likely cause the Fund to underperform the broader US equity market during market rallies. Such underperformance could be significant during sudden or significant market rallies. Although the Fund seeks to provide a positive return, investors may lose money by investing in the Fund. |

| n | | Market risk. The prices of and the income generated by the Fund’s securities may decline in response to, among other things, investor sentiment, general economic and market conditions, regional or global instability, and currency and interest rate fluctuations. |

| n | | Short sales risk. Short sales may cause the Fund to repurchase a security at a higher price, thereby causing the Fund to incur a loss. A short position in a security poses |

| | | more risk than holding the same security long. As there is no limit on how much the price of the security can increase, the Fund’s exposure is unlimited. In order to establish a short position in a security, the Fund must borrow the security from a broker. The Fund may not always be able to borrow a security the Fund seeks to sell short at a particular time or at an acceptable price. The Fund also may not always be able to close out the short position by replacing the borrowed securities at a particular time or at an acceptable price. The Fund will incur increased transaction costs associated with selling securities short. In addition, taking short positions in securities results in a form of leverage which may cause the Fund to be volatile. |

| n | | Small- and mid-capitalization risks. Stocks of small- and mid-sized companies tend to be more vulnerable to adverse developments and may have little or no operating history or track record of success, and limited product lines, markets, management and financial resources. The securities of small- and mid-sized companies may be more volatile due to less market interest and less publicly available information about the issuer. They also may be illiquid or restricted as to resale, or may trade less frequently and in smaller volumes, all of which may cause difficulty when establishing or closing a position at a desirable price. |

About indexes used in this report

| n | | The Citigroup 90-Day Treasury Bill Index is an unmanaged index representative of three-month Treasury bills. |

| n | | The Lipper Alternative Equity Market Neutral Index is an unmanaged index considered representative of funds that employ portfolio strategies generating consistent returns in both up and down markets by selecting positions with a total net market exposure of zero. |

| | |

This report must be accompanied or preceded by a currently effective Fund prospectus, which contains more complete information, including sales charges and expenses. Investors should read it carefully before investing. | | continued on page 6 |

NOT FDIC INSURED | MAY LOSE VALUE | NO BANK GUARANTEE | | |

8 Invesco All Cap Market Neutral Fund

Schedule of Investments(a)

October 31, 2015

| | | | | | | | |

| | | Shares | | | Value | |

Common Stocks & Other Equity Interests–85.04% | |

| Aerospace & Defense–1.34% | | | | | | | | |

Ducommun Inc.(b) | | | 4,000 | | | $ | 86,560 | |

Huntington Ingalls Industries, Inc. | | | 2,950 | | | | 353,823 | |

| | | | | | | | 440,383 | |

|

| Agricultural & Farm Machinery–0.28% | |

AGCO Corp. | | | 1,900 | | | | 91,941 | |

|

| Agricultural Products–0.90% | |

Bunge Ltd. | | | 4,050 | | | | 295,488 | |

|

| Air Freight & Logistics–0.49% | |

Atlas Air Worldwide Holdings, Inc.(b) | | | 3,900 | | | | 160,836 | |

|

| Airlines–0.88% | |

JetBlue Airways Corp.(b) | | | 11,650 | | | | 289,386 | |

|

| Alternative Carriers–0.64% | |

Inteliquent, Inc. | | | 10,200 | | | | 211,344 | |

|

| Application Software–0.04% | |

Aware, Inc. | | | 4,000 | | | | 12,920 | |

|

| Auto Parts & Equipment–0.74% | |

China Automotive Systems, Inc. (China) | | | 9,900 | | | | 59,400 | |

Tower International Inc.(b) | | | 6,700 | | | | 184,049 | |

| | | | | | | | 243,449 | |

|

| Biotechnology–11.97% | |

Adamas Pharmaceuticals, Inc.(b) | | | 7,200 | | | | 106,272 | |

Anacor Pharmaceuticals, Inc.(b) | | | 3,050 | | | | 342,850 | |

Applied Genetic Technologies Corp.(b) | | | 2,250 | | | | 27,000 | |

BioSpecifics Technologies Corp.(b) | | | 3,150 | | | | 183,992 | |

China Biologic Products Inc. (China)(b) | | | 150 | | | | 17,091 | |

Concert Pharmaceuticals, Inc.(b) | | | 8,850 | | | | 200,984 | |

Cytokinetics, Inc.(b) | | | 17,950 | | | | 154,550 | |

Eagle Pharmaceuticals, Inc.(b) | | | 4,850 | | | | 308,993 | |

Infinity Pharmaceuticals, Inc.(b) | | | 21,800 | | | | 225,630 | |

MacroGenics, Inc.(b) | | | 11,050 | | | | 343,323 | |

Myriad Genetics, Inc.(b) | | | 9,850 | | | | 397,644 | |

NewLink Genetics Corp.(b) | | | 8,100 | | | | 309,987 | |

PDL BioPharma Inc. | | | 23,900 | | | | 109,462 | |

Pfenex Inc.(b) | | | 10,150 | | | | 183,512 | |

Progenics Pharmaceuticals, Inc.(b) | | | 33,750 | | | | 247,725 | |

Repligen Corp.(b) | | | 12,300 | | | | 408,852 | |

United Therapeutics Corp.(b) | | | 2,500 | | | | 366,575 | |

| | | | | | | | 3,934,442 | |

|

| Broadcasting–0.12% | |

TEGNA Inc. | | | 1,450 | | | | 39,208 | |

|

| Building Products–0.45% | |

Owens Corning | | | 3,250 | | | | 147,973 | |

| | | | | | | | |

| | | Shares | | | Value | |

| Cable & Satellite–1.33% | |

Comcast Corp.–Class A | | | 7,000 | | | $ | 438,340 | |

|

| Casinos & Gaming–1.15% | |

Isle of Capri Casinos, Inc.(b) | | | 19,700 | | | | 376,861 | |

|

| Coal & Consumable Fuels–0.07% | |

Peabody Energy Corp.(b) | | | 1,893 | | | | 24,211 | |

|

| Commercial Printing–0.76% | |

Ennis Inc. | | | 12,500 | | | | 250,375 | |

|

| Commodity Chemicals–1.33% | |

LyondellBasell Industries N.V.–Class A | | | 4,700 | | | | 436,677 | |

|

| Communications Equipment–0.82% | |

Black Box Corp. | | | 3,450 | | | | 42,124 | |

Cisco Systems, Inc. | | | 450 | | | | 12,983 | |

Polycom, Inc.(b) | | | 15,650 | | | | 215,657 | |

| | | | | | | | 270,764 | |

|

| Computer & Electronics Retail–1.02% | |

Best Buy Co., Inc. | | | 9,600 | | | | 336,288 | |

|

| Consumer Electronics–0.33% | |

ZAGG Inc.(b) | | | 12,850 | | | | 108,968 | |

|

| Consumer Finance–0.53% | |

Nelnet, Inc.–Class A | | | 2,300 | | | | 82,294 | |

Santander Consumer USA Holdings Inc. | | | 5,150 | | | | 92,752 | |

| | | | | | | | 175,046 | |

|

| Data Processing & Outsourced Services–1.32% | |

Global Payments Inc. | | | 700 | | | | 95,487 | |

Information Services Group, Inc. | | | 14,750 | | | | 54,133 | |

NeuStar, Inc.–Class A(b) | | | 7,650 | | | | 208,003 | |

Planet Payment Inc.(b) | | | 25,500 | | | | 76,500 | |

| | | | | | | | 434,123 | |

|

| Distillers & Vintners–0.09% | |

MGP Ingredients, Inc. | | | 1,650 | | | | 28,595 | |

|

| Diversified Banks–0.79% | |

Citigroup Inc. | | | 4,900 | | | | 260,533 | |

|

| Diversified Chemicals–0.08% | |

Chemours Co. (The) | | | 3,850 | | | | 26,681 | |

|

| Diversified Metals & Mining–0.37% | |

Turquoise Hill Resources Ltd. (Canada)(b) | | | 44,200 | | | | 120,224 | |

|

| Drug Retail–0.35% | |

CVS Health Corp. | | | 1,150 | | | | 113,597 | |

|

| Education Services–0.33% | |

Cambium Learning Group Inc.(b) | | | 10,250 | | | | 49,303 | |

K12 Inc.(b) | | | 5,950 | | | | 57,774 | |

| | | | | | | | 107,077 | |

See accompanying Notes to Financial Statements which are an integral part of the financial statements.

9 Invesco All Cap Market Neutral Fund

| | | | | | | | |

| | | Shares | | | Value | |

| Electric Utilities–0.08% | |

Exelon Corp. | | | 950 | | | $ | 26,524 | |

|

| Electrical Components & Equipment–0.32% | |

General Cable Corp. | | | 6,800 | | | | 104,652 | |

|

| Electronic Manufacturing Services–0.95% | |

Celestica Inc. (Canada)(b) | | | 8,100 | | | | 90,882 | |

Multi-Fineline Electronix, Inc.(b) | | | 11,850 | | | | 220,173 | |

| | | | | | | | 311,055 | |

|

| Footwear–0.06% | |

Rocky Brands, Inc. | | | 1,600 | | | | 20,400 | |

|

| Gold–1.35% | |

Newmont Mining Corp. | | | 22,700 | | | | 441,742 | |

|

| Health Care Equipment–0.72% | |

Hologic, Inc.(b) | | | 5,350 | | | | 207,901 | |

LeMaitre Vascular, Inc. | | | 2,250 | | | | 29,970 | |

| | | | 237,871 | |

| | |

| Health Care REIT’s–0.10% | | | | | | | | |

Care Capital Properties, Inc. | | | 1,000 | | | | 32,950 | |

| | |

| Health Care Services–0.94% | | | | | | | | |

Almost Family Inc.(b) | | | 1,750 | | | | 72,415 | |

LHC Group Inc.(b) | | | 3,800 | | | | 171,247 | |

Premier Inc.–Class A(b) | | | 1,550 | | | | 52,405 | |

RadNet, Inc.(b) | | | 1,900 | | | | 12,559 | |

| | | | 308,626 | |

| | |

| Homebuilding–0.09% | | | | | | | | |

TopBuild Corp.(b) | | | 1,050 | | | | 29,537 | |

| | |

| Hotel and Resort REIT’s–0.33% | | | | | | | | |

Summit Hotel Properties, Inc. | | | 8,400 | | | | 109,872 | |

| | |

| Household Products–0.35% | | | | | | | | |

Central Garden & Pet Co.–Class A(b) | | | 6,800 | | | | 114,784 | |

|

| Human Resource & Employment Services–0.99% | |

Insperity, Inc. | | | 7,000 | | | | 325,220 | |

|

| Independent Power Producers & Energy Traders–0.05% | |

Talen Energy Corp.(b) | | | 1,950 | | | | 16,926 | |

| | |

| Integrated Oil & Gas–2.42% | | | | | | | | |

Cenovus Energy Inc. (Canada) | | | 24,200 | | | | 360,822 | |

Suncor Energy, Inc. (Canada) | | | 14,550 | | | | 432,571 | |

| | | | 793,393 | |

|

| Integrated Telecommunication Services–0.07% | |

Windstream Holdings Inc. | | | 3,750 | | | | 24,413 | |

| | |

| Internet Retail–0.73% | | | | | | | | |

Nutrisystem, Inc. | | | 10,400 | | | | 240,552 | |

| | |

| Internet Software & Services–2.73% | | | | | | | | |

Demand Media, Inc.(b) | | | 6,750 | | | | 29,363 | |

DHI Group, Inc.(b) | | | 21,500 | | | | 194,575 | |

| | | | | | | | |

| | | Shares | | | Value | |

| Internet Software & Services–(continued) | | | | | |

Earthlink Holdings Corp. | | | 50,300 | | | $ | 430,065 | |

Monster Worldwide, Inc.(b) | | | 20,950 | | | | 131,356 | |

TechTarget, Inc.(b) | | | 5,000 | | | | 46,650 | |

United Online, Inc.(b) | | | 5,650 | | | | 65,992 | |

| | | | 898,001 | |

|

| IT Consulting & Other Services–2.17% | |

Hackett Group, Inc. (The) | | | 10,750 | | | | 159,960 | |

Leidos Holdings, Inc. | | | 9,200 | | | | 483,644 | |

NCI, Inc.–Class A | | | 4,550 | | | | 70,707 | |

| | | | 714,311 | |

| | |

| Leisure Products–0.20% | | | | | | | | |

Nautilus, Inc.(b) | | | 3,900 | | | | 66,456 | |

|

| Life Sciences Tools & Services–1.26% | |

Cambrex Corp.(b) | | | 9,000 | | | | 413,730 | |

| | |

| Managed Health Care–1.29% | | | | | | | | |

Molina Healthcare, Inc.(b) | | | 5,650 | | | | 350,300 | |

Triple-S Management Corp.–Class B (Puerto Rico)(b) | | | 3,550 | | | | 73,094 | |

| | | | 423,394 | |

| | |

| Mortgage REIT’s–0.55% | | | | | | | | |

Annaly Capital Management Inc. | | | 18,000 | | | | 179,100 | |

| | |

| Movies & Entertainment–0.16% | | | | | | | | |

Walt Disney Co. (The) | | | 450 | | | | 51,183 | |

| | |

| Oil & Gas Drilling–1.62% | | | | | | | | |

Noble Corp. PLC | | | 35,200 | | | | 474,144 | |

Pioneer Energy Services Corp.(b) | | | 25,100 | | | | 57,981 | |

| | | | 532,125 | |

| |

| Oil & Gas Equipment & Services–0.95% | | | | | |

Superior Energy Services, Inc. | | | 21,950 | | | | 310,812 | |

|

| Oil & Gas Exploration & Production–5.16% | |

Baytex Energy Corp. (Canada) | | | 29,950 | | | | 121,896 | |

Canadian Natural Resources Ltd. (Canada) | | | 19,000 | | | | 441,180 | |

Clayton Williams Energy, Inc.(b) | | | 5,950 | | | | 354,441 | |

Denbury Resources Inc. | | | 41,800 | | | | 147,972 | |

Enerplus Corp. (Canada) | | | 28,700 | | | | 135,177 | |

Newfield Exploration Co.(b) | | | 8,000 | | | | 321,520 | |

Panhandle Oil & Gas, Inc.–Class A | | | 5,950 | | | | 109,361 | |

Penn West Petroleum Ltd. (Canada) | | | 54,650 | | | | 63,941 | |

| | | | 1,695,488 | |

| |

| Oil & Gas Refining & Marketing–5.56% | | | | | |

Adams Resources & Energy, Inc. | | | 1,150 | | | | 51,129 | |

Alon USA Energy, Inc. | | | 17,950 | | | | 300,662 | |

REX American Resources Corp.(b) | | | 3,550 | | | | 194,931 | |

Tesoro Corp. | | | 4,100 | | | | 438,413 | |

Valero Energy Corp. | | | 7,000 | | | | 461,440 | |

Western Refining, Inc. | | | 9,150 | | | | 380,823 | |

| | | | | | | | 1,827,398 | |

See accompanying Notes to Financial Statements which are an integral part of the financial statements.

10 Invesco All Cap Market Neutral Fund

| | | | | | | | |

| | | Shares | | | Value | |

| Packaged Foods & Meats–2.02% | | | | | | | | |

Dean Foods Co. | | | 13,700 | | | $ | 248,107 | |

Pilgrim’s Pride Corp. | | | 21,900 | | | | 415,881 | |

| | | | | | | | 663,988 | |

| | |

| Paper Packaging–1.25% | | | | | | | | |

AEP Industries Inc.(b) | | | 800 | | | | 64,000 | |

Avery Dennison Corp. | | | 5,350 | | | | 347,589 | |

| | | | | | | | 411,589 | |

| | |

| Paper Products–0.27% | | | | | | | | |

Mercer International, Inc. (Canada)(b) | | | 8,200 | | | | 88,560 | |

| | |

| Pharmaceuticals–4.93% | | | | | | | | |

Cumberland Pharmaceuticals Inc.(b) | | | 3,450 | | | | 21,390 | |

Heska Corp.(b) | | | 3,050 | | | | 93,818 | |

Lannett Co., Inc.(b) | | | 2,100 | | | | 94,017 | |

Pfizer Inc. | | | 11,700 | | | | 395,694 | |

Sagent Pharmaceuticals Inc.(b) | | | 8,600 | | | | 144,566 | |

SciClone Pharmaceuticals, Inc.(b) | | | 23,300 | | | | 177,546 | |

Sucampo Pharmaceuticals, Inc.–Class A(b) | | | 20,800 | | | | 402,688 | |

Supernus Pharmaceuticals Inc.(b) | | | 17,650 | | | | 291,225 | |

| | | | | | | | 1,620,944 | |

| |

| Property & Casualty Insurance–3.28% | | | | | |

Ambac Financial Group, Inc.(b) | | | 21,800 | | | | 352,070 | |

Assured Guaranty Ltd. | | | 15,500 | | | | 425,320 | |

Universal Insurance Holdings, Inc. | | | 9,500 | | | | 299,725 | |

| | | | | | | | 1,077,115 | |

| | |

| Real Estate Services–0.76% | | | | | | | | |

Altisource Portfolio Solutions S.A.(b) | | | 9,350 | | | | 250,673 | |

| | |

| Regional Banks–0.04% | | | | | | | | |

Century Bancorp, Inc.–Class A | | | 300 | | | | 13,335 | |

| | |

| Restaurants–1.01% | | | | | | | | |

Darden Restaurants, Inc. | | | 5,350 | | | | 331,111 | |

| | |

| Semiconductors–4.78% | | | | | | | | |

Integrated Device Technology, Inc.(b) | | | 19,100 | | | | 487,050 | |

Intel Corp. | | | 14,150 | | | | 479,119 | |

| | | | | | | | |

| | | Shares | | | Value | |

| Semiconductors–(continued) | | | | | | | | |

NeoPhotonics Corp.(b) | | | 18,750 | | | $ | 155,063 | |

NVIDIA Corp. | | | 15,850 | | | | 449,664 | |

| | | | | | | | 1,570,896 | |

| | |

| Specialized REIT’s–1.23% | | | | | | | | |

CoreSite Realty Corp. | | | 7,350 | | | | 403,882 | |

| | |

| Steel–0.30% | | | | | | | | |

Steel Dynamics, Inc. | | | 5,350 | | | | 98,815 | |

| |

| Technology Distributors–1.13% | | | | | |

Tech Data Corp.(b) | | | 5,100 | | | | 371,229 | |

|

| Technology Hardware, Storage & Peripherals–2.51% | |

Apple Inc. | | | 3,550 | | | | 424,225 | |

NetApp, Inc. | | | 11,750 | | | | 399,500 | |

| | | | | | | | 823,725 | |

| | |

| Tires & Rubber–0.32% | | | | | | | | |

Cooper Tire & Rubber Co. | | | 2,500 | | | | 104,475 | |

|

| Trading Companies & Distributors–0.39% | |

Titan Machinery, Inc.(b) | | | 10,450 | | | | 127,804 | |

| | |

| Trucking–1.10% | | | | | | | | |

P.A.M. Transportation Services, Inc.(b) | | | 260 | | | | 9,285 | |

USA Truck Inc.(b) | | | 3,350 | | | | 60,903 | |

YRC Worldwide, Inc.(b) | | | 15,850 | | | | 289,421 | |

| | | | | | | | 359,609 | |

Total Common Stocks & Other Equity Interests

(Cost $26,932,692) | | | | 27,943,995 | |

|

Money Market Funds–12.03% | |

Liquid Assets Portfolio–Institutional Class, 0.16%(c) | | | 1,975,990 | | | | 1,975,990 | |

Premier Portfolio–Institutional Class, 0.12%(c) | | | 1,975,989 | | | | 1,975,989 | |

Total Money Market Funds

(Cost $3,951,979) | | | | 3,951,979 | |

TOTAL INVESTMENTS–97.07%

(Cost $30,884,671) | | | | 31,895,974 | |

OTHER ASSETS LESS LIABILITIES–2.93% | | | | 961,425 | |

NET ASSETS–100.00% | | | | | | $ | 32,857,399 | |

Investment Abbreviations:

| | |

| REIT | | – Real Estate Investment Trust |

Notes to Schedule of Investments:

| (a) | Industry and/or sector classifications used in this report are generally according to the Global Industry Classification Standard, which was developed by and is the exclusive property and a service mark of MSCI Inc. and Standard & Poor’s. |

| (b) | Non-income producing security. |

| (c) | The money market fund and the Fund are affiliated by having the same investment adviser. The rate shown is the 7-day SEC standardized yield as of October 31, 2015. |

| | | | | | | | | | | | | | | | | | | | | | | | |

| Open Total Return Swap Agreements | |

| Reference Entity | | Counterparty | | | Expiration Date | | | Floating Rate

Index(1) | | | Notional

Value | | | Unrealized Appreciation

(Depreciation) | | | Net Value of

Reference

Entities | |

Equity Securities — Short | | | Morgan Stanley & Co. LLC | | | | 04/24/17 | | | | Federal Funds floating rate | | | $ | (28,270,746 | ) | | $ | 353,475 | (2) | | $ | (27,899,314 | ) |

| (1) | The Fund receives or pays the total return on the short positions underlying the total return swap and receives a specific Federal Funds floating rate. |

| (2) | Amount includes $(17,957) of dividends payable long and financing fees payable from the Fund to the Counterparty. |

See accompanying Notes to Financial Statements which are an integral part of the financial statements.

11 Invesco All Cap Market Neutral Fund

The following table represents the individual short positions and related values of equity securities underlying the total return swap with Morgan Stanley & Co. LLC as of October 31, 2015.

| | | | | | | | |

| | | Shares | | | Value | |

Equity Securities — Short | | | | | | | | |

| Airlines | | | | | | | | |

Copa Holdings S.A. (Panama)–Class A | | | (1,550 | ) | | $ | (78,306 | ) |

Spirit Airlines Inc. | | | (10,450 | ) | | | (387,904 | ) |

| | | | | (466,210 | ) |

| | |

| Airport Services | | | | | | | | |

Macquarie Infrastructure Corp. | | | (3,050 | ) | | | (242,627 | ) |

| |

| Apparel, Accessories & Luxury Goods | | | | | |

Kate Spade & Co. | | | (18,350 | ) | | | (329,750 | ) |

Michael Kors Holdings Ltd. | | | (800 | ) | | | (30,912 | ) |

| | | | | (360,662 | ) |

| | |

| Application Software | | | | | | | | |

Datawatch Corp. | | | (3,200 | ) | | | (17,472 | ) |

Digital Turbine, Inc. | | | (17,550 | ) | | | (29,133 | ) |

Guidewire Software , Inc. | | | (1,150 | ) | | | (66,964 | ) |

| | | | | (113,569 | ) |

| |

| Asset Management & Custody Banks | | | | | |

Financial Engines Inc. | | | (7,400 | ) | | | (237,984 | ) |

| | |

| Automobile Manufacturers | | | | | | | | |

Tesla Motors, Inc. | | | (1,250 | ) | | | (258,662 | ) |

| | |

| Biotechnology | | | | | | | | |

Abeona Therapeutics, Inc. | | | (4,500 | ) | | | (17,775 | ) |

Advaxis, Inc. | | | (11,950 | ) | | | (132,526 | ) |

Agios Pharmaceuticals, Inc. | | | (5,450 | ) | | | (397,087 | ) |

Amicus Therapeutics, Inc. | | | (57,650 | ) | | | (432,375 | ) |

Aquinox Pharmaceuticals, Inc. (Canada) | | | (7,900 | ) | | | (120,791 | ) |

ARCA biopharma, Inc. | | | (4,350 | ) | | | (22,272 | ) |

Arrowhead Research Corp. | | | (22,550 | ) | | | (116,133 | ) |

Caladrius Biosciences, Inc. | | | (12,550 | ) | | | (15,562 | ) |

CorMedix Inc. | | | (10,300 | ) | | | (26,162 | ) |

CytRx Corp. | | | (21,150 | ) | | | (58,797 | ) |

Exact Sciences Corp. | | | (11,300 | ) | | | (94,129 | ) |

Fibrocell Science, Inc. | | | (20,400 | ) | | | (77,928 | ) |

Galectin Therapeutics Inc. | | | (4,310 | ) | | | (11,766 | ) |

Genocea Biosciences, Inc. | | | (13,600 | ) | | | (65,144 | ) |

Ignyta, Inc. | | | (9,800 | ) | | | (100,000 | ) |

Intercept Pharmaceuticals, Inc. | | | (2,550 | ) | | | (400,860 | ) |

Keryx Biopharmaceuticals, Inc. | | | (34,550 | ) | | | (154,784 | ) |

La Jolla Pharmaceutical Co. | | | (8,400 | ) | | | (209,916 | ) |

Medgenics, Inc. (Israel) | | | (11,600 | ) | | | (75,980 | ) |

Mirati Therapeutics, Inc. | | | (9,050 | ) | | | (320,189 | ) |

Navidea Biopharmaceuticals Inc. | | | (41,350 | ) | | | (83,527 | ) |

Northwest Biotherapeutics, Inc. | | | (17,650 | ) | | | (86,132 | ) |

Ohr Pharmaceutical, Inc. | | | (7,000 | ) | | | (20,510 | ) |

Ovascience Inc. | | | (10,350 | ) | | | (134,240 | ) |

Puma Biotechnology, Inc. | | | (4,700 | ) | | | (387,374 | ) |

| | | | | | | | |

| | | Shares | | | Value | |

| Biotechnology–(continued) | | | | | | | | |

TG Therapeutics, Inc. | | | (2,950 | ) | | $ | (36,491 | ) |

Trovagene, Inc. | | | (11,650 | ) | | | (50,211 | ) |

| | | | | (3,648,661 | ) |

| | |

| Casinos & Gaming | | | | | | | | |

Empire Resorts, Inc. | | | (2,200 | ) | | | (10,208 | ) |

Wynn Resorts Ltd. | | | (6,250 | ) | | | (437,188 | ) |

| | | | | (447,396 | ) |

| | |

| Coal & Consumable Fuels | | | | | | | | |

CONSOL Energy Inc. | | | (32,550 | ) | | | (216,783 | ) |

Solazyme Inc. | | | (22,850 | ) | | | (74,948 | ) |

| | | | | (291,731 | ) |

| | |

| Commodity Chemicals | | | | | | | | |

Methanex Corp. (Canada) | | | (3,600 | ) | | | (143,748 | ) |

| | |

| Communications Equipment | | | | | | | | |

NetScout Systems, Inc. | | | (5,650 | ) | | | (202,666 | ) |

ViaSat, Inc. | | | (3,350 | ) | | | (220,966 | ) |

| | | | | (423,632 | ) |

| | |

| Computer & Electronics Retail | | | | | | | | |

Conn’s, Inc. | | | (2,500 | ) | | | (47,425 | ) |

| | |

| Construction & Engineering | | | | | | | | |

HC2 Holdings, Inc. | | | (4,250 | ) | | | (32,130 | ) |

MasTec, Inc. | | | (9,650 | ) | | | (161,830 | ) |

| | | | | (193,960 | ) |

| | |

| Construction Materials | | | | | | | | |

Eagle Materials Inc. | | | (6,350 | ) | | | (419,291 | ) |

Martin Marietta Materials, Inc. | | | (950 | ) | | | (147,392 | ) |

| | | | | (566,683 | ) |

| | |

| Consumer Electronics | | | | | | | | |

Turtle Beach Corp. | | | (6,670 | ) | | | (15,674 | ) |

| | |

| Diversified Metals & Mining | | | | | | | | |

Freeport-McMoRan Inc. | | | (34,850 | ) | | | (410,185 | ) |

| | |

| Diversified REIT’s | | | | | | | | |

NorthStar Realty Finance Corp. | | | (36,300 | ) | | | (435,963 | ) |

VEREIT, Inc. | | | (40,000 | ) | | | (330,400 | ) |

| | | | | (766,363 | ) |

| | |

| Education Services | | | | | | | | |

2U, Inc. | | | (2,600 | ) | | | (54,548 | ) |

| |

| Electrical Components & Equipment | | | | | |

American Superconductor Corp. | | | (6,800 | ) | | | (36,924 | ) |

SolarCity Corp. | | | (6,050 | ) | | | (179,382 | ) |

| | | | | (216,306 | ) |

See accompanying Notes to Financial Statements which are an integral part of the financial statements.

12 Invesco All Cap Market Neutral Fund

| | | | | | | | |

| | | Shares | | | Value | |

| Electronic Equipment Manufacturers | | | | | |

CUI Global, Inc. | | | (9,700 | ) | | $ | (60,722 | ) |

Zebra Technologies Corp.–Class A | | | (5,350 | ) | | | (411,415 | ) |

| | | | | (472,137 | ) |

| | |

| Fertilizers & Agricultural Chemicals | | | | | | | | |

AgroFresh Solutions, Inc. | | | (7,150 | ) | | | (50,550 | ) |

| | |

| Food Distributors | | | | | | | | |

United Natural Foods, Inc. | | | (7,350 | ) | | | (370,808 | ) |

| | |

| Food Retail | | | | | | | | |

Sprouts Farmers Market, Inc. | | | (1,450 | ) | | | (29,551 | ) |

| | |

| Gold | | | | | | | | |

Franco-Nevada Corp. (Canada) | | | (7,450 | ) | | | (377,641 | ) |

| | |

| Health Care Equipment | | | | | | | | |

CytoSorbents Corp. | | | (12,150 | ) | | | (90,396 | ) |

GenMark Diagnostics Inc. | | | (16,950 | ) | | | (107,802 | ) |

OncoSec Medical Inc. | | | (5,950 | ) | | | (25,347 | ) |

Tandem Diabetes Care, Inc. | | | (14,400 | ) | | | (130,608 | ) |

TriVascular Technologies, Inc. | | | (3,800 | ) | | | (25,688 | ) |

Veracyte, Inc. | | | (12,850 | ) | | | (83,654 | ) |

| | | | | (463,495 | ) |

| | |

| Health Care Supplies | | | | | | | | |

Cerus Corp. | | | (37,550 | ) | | | (179,114 | ) |

Cooper Cos., Inc. (The) | | | (2,800 | ) | | | (426,608 | ) |

STAAR Surgical Co. | | | (7,950 | ) | | | (64,793 | ) |

TearLab Corp. | | | (7,410 | ) | | | (14,449 | ) |

| | | | | (684,964 | ) |

| | |

| Homebuilding | | | | | | | | |

New Home Co. Inc. (The) | | | (1,150 | ) | | | (16,456 | ) |

|

| Independent Power Producers & Energy Traders | |

Dynegy Inc. | | | (17,200 | ) | | | (334,196 | ) |

| | |

| Industrial Machinery | | | | | | | | |

ARC Group Worldwide, Inc. | | | (5,150 | ) | | | (10,403 | ) |

Chart Industries, Inc. | | | (3,350 | ) | | | (57,586 | ) |

| | | | | (67,989 | ) |

| | |

| Insurance Brokers | | | | | | | | |

eHealth, Inc. | | | (7,100 | ) | | | (84,845 | ) |

| | |

| Integrated Oil & Gas | | | | | | | | |

Chevron Corp. | | | (4,700 | ) | | | (427,136 | ) |

| | |

| Internet Retail | | | | | | | | |

Amazon.com, Inc. | | | (640 | ) | | | (400,576 | ) |

| | |

| Internet Software & Services | | | | | | | | |

Alphabet Inc.–Class A | | | (560 | ) | | | (412,938 | ) |

TrueCar, Inc. | | | (32,250 | ) | | | (198,015 | ) |

| | | | | (610,953 | ) |

| | | | | | | | |

| | | Shares | | | Value | |

| Life Sciences Tools & Services | | | | | | | | |

Accelerate Diagnostics, Inc. | | | (12,700 | ) | | $ | (212,979 | ) |

Illumina, Inc. | | | (800 | ) | | | (114,624 | ) |

NanoString Technologies, Inc. | | | (6,000 | ) | | | (87,060 | ) |

| | | | | (414,663 | ) |

| | |

| Marine | | | | | | | | |

Kirby Corp. | | | (900 | ) | | | (58,761 | ) |

| | |

| Mortgage REIT’s | | | | | | | | |

Altisource Residential Corp. | | | (16,200 | ) | | | (233,118 | ) |

Orchid Island Capital Inc. | | | (2,600 | ) | | | (23,088 | ) |

| | | | | (256,206 | ) |

| | |

| Motorcycle Manufacturers | | | | | | | | |

Kandi Technologies Group Inc. (China) | | | (17,800 | ) | | | (167,498 | ) |

| | |

| Movies & Entertainment | | | | | | | | |

IMAX Corp. | | | (4,250 | ) | | | (163,157 | ) |

Lions Gate Entertainment Corp. | | | (10,450 | ) | | | (407,237 | ) |

| | | | | (570,394 | ) |

| | |

| Oil & Gas Drilling | | | | | | | | |

Diamond Offshore Drilling, Inc. | | | (1,650 | ) | | | (32,802 | ) |

Unit Corp. | | | (7,000 | ) | | | (88,270 | ) |

| | | | | (121,072 | ) |

| | |

| Oil & Gas Equipment & Services | | | | | | | | |

Bristow Group, Inc. | | | (5,050 | ) | | | (175,387 | ) |

CARBO Ceramics Inc. | | | (2,200 | ) | | | (38,544 | ) |

Geospace Technologies Corp. | | | (1,150 | ) | | | (17,664 | ) |

Helix Energy Solutions Group Inc. | | | (14,800 | ) | | | (85,544 | ) |

McDermott International, Inc. | | | (28,800 | ) | | | (132,768 | ) |

| | | | | (449,907 | ) |

| |

| Oil & Gas Exploration & Production | | | | | |

Antero Resources Corp. | | | (2,400 | ) | | | (56,568 | ) |

Eclipse Resources Corp. | | | (62,700 | ) | | | (134,805 | ) |

Gulfport Energy Corp. | | | (13,750 | ) | | | (418,963 | ) |

Laredo Petroleum Inc. | | | (25,250 | ) | | | (289,870 | ) |

Memorial Resource Development Corp. | | | (10,800 | ) | | | (191,052 | ) |

Oasis Petroleum Inc. | | | (19,350 | ) | | | (225,041 | ) |

SM Energy Co. | | | (3,750 | ) | | | (125,062 | ) |

Southwestern Energy Co. | | | (39,350 | ) | | | (434,424 | ) |

Whiting Petroleum Corp. | | | (24,800 | ) | | | (427,304 | ) |

| | | | | (2,303,089 | ) |

| |

| Oil & Gas Storage & Transportation | | | | | |

Cheniere Energy, Inc. | | | (8,900 | ) | | | (440,728 | ) |

GasLog Ltd. (Monaco) | | | (16,200 | ) | | | (187,434 | ) |

Golar LNG Ltd. (Bermuda) | | | (13,500 | ) | | | (391,635 | ) |

Pembina Pipeline Corp. (Canada) | | | (1,750 | ) | | | (43,960 | ) |

SemGroup Corp–Class A | | | (6,400 | ) | | | (291,520 | ) |

| | | | | (1,355,277 | ) |

See accompanying Notes to Financial Statements which are an integral part of the financial statements.

13 Invesco All Cap Market Neutral Fund

| | | | | | | | |

| | | Shares | | | Value | |

| Packaged Foods & Meats | | | | | | | | |

Inventure Foods, Inc. | | | (2,950 | ) | | $ | (25,547 | ) |

Keurig Green Mountain Inc. | | | (7,250 | ) | | | (367,938 | ) |

| | | | | (393,485 | ) |

| | |

| Personal Products | | | | | | | | |

Elizabeth Arden, Inc. | | | (2,850 | ) | | | (35,739 | ) |

| | |

| Pharmaceuticals | | | | | | | | |

Aerie Pharmaceuticals, Inc. | | | (10,950 | ) | | | (249,770 | ) |

Agile Therapeutics, Inc. | | | (1,600 | ) | | | (12,704 | ) |

Akorn, Inc. | | | (16,250 | ) | | | (434,525 | ) |

Alimera Sciences Inc. | | | (14,300 | ) | | | (43,043 | ) |

Ampio Pharmaceuticals, Inc. | | | (13,550 | ) | | | (47,289 | ) |

Assembly Biosciences, Inc. | | | (6,400 | ) | | | (61,440 | ) |

BioDelivery Sciences International, Inc. | | | (24,450 | ) | | | (131,541 | ) |

Egalet Corp. | | | (6,350 | ) | | | (52,705 | ) |

Omeros Corp. | | | (4,550 | ) | | | (57,011 | ) |

Pacira Pharmaceuticals, Inc. | | | (5,250 | ) | | | (262,238 | ) |

TherapeuticsMD, Inc. | | | (39,750 | ) | | | (233,333 | ) |

XenoPort Inc. | | | (30,650 | ) | | | (187,271 | ) |

| | | | | (1,772,870 | ) |

| | |

| Property & Casualty Insurance | | | | | | | | |

Mercury General Corp. | | | (850 | ) | | | (45,909 | ) |

White Mountains Insurance Group, Ltd. | | | (535 | ) | | | (422,650 | ) |

| | | | | | | | (468,559 | ) |

| | |

| Real Estate Development | | | | | | | | |

Howard Hughes Corp. (The) | | | (3,350 | ) | | | (413,993 | ) |

| | |

| Real Estate Services | | | | | | | | |

Kennedy-Wilson Holdings Inc. | | | (13,300 | ) | | | (326,116 | ) |

| | |

| Reinsurance | | | | | | | | |

Greenlight Capital Re, Ltd.–Class A | | | (14,800 | ) | | | (325,008 | ) |

| | |

| Restaurants | | | | | | | | |

Kona Grill, Inc. | | | (5,450 | ) | | | (74,937 | ) |

| | |

| Semiconductor Equipment | | | | | | | | |

Rubicon Technology, Inc. | | | (7,700 | ) | | | (8,470 | ) |

SunEdison, Inc. | | | (45,250 | ) | | | (330,325 | ) |

| | | | | (338,795 | ) |

| | |

| Semiconductors | | | | | | | | |

Micron Technology, Inc. | | | (25,000 | ) | | | (414,000 | ) |

Qorvo, Inc. | | | (9,350 | ) | | | (410,746 | ) |

QuickLogic Corp. | | | (15,200 | ) | | | (20,976 | ) |

SunPower Corp. | | | (11,150 | ) | | | (299,266 | ) |

| | | | | (1,144,988 | ) |

| | |

| Soft Drinks | | | | | | | | |

Coca-Cola Co. (The) | | | (7,650 | ) | | | (323,977 | ) |

| | |

| Specialty Chemicals | | | | | | | | |

Platform Specialty Products Corp. | | | (18,350 | ) | | | (191,574 | ) |

Senomyx, Inc. | | | (20,400 | ) | | | (100,980 | ) |

| | | | | (292,554 | ) |

| | | | | | | | |

| | | Shares | | | Value | |

| Specialty Stores | | | | | | | | |

Cabela’s Inc. | | | (10,100 | ) | | $ | (395,617 | ) |

| | |

| Steel | | | | | | | | |

A. M. Castle & Co. | | | (7,400 | ) | | | (17,686 | ) |

| | |

| Systems Software | | | | | | | | |

CommVault Systems, Inc. | | | (3,850 | ) | | | (156,002 | ) |

NetSuite Inc. | | | (4,900 | ) | | | (416,843 | ) |

Tableau Software Inc.–Class A | | | (4,850 | ) | | | (407,206 | ) |

| | | | | (980,051 | ) |

|

| Technology Hardware, Storage & Peripherals | |

3D Systems Corp. | | | (12,750 | ) | | | (128,265 | ) |

Nimble Storage, Inc. | | | (11,450 | ) | | | (258,770 | ) |

Silicon Graphics International Corp. | | | (17,250 | ) | | | (75,383 | ) |

Stratasys, Ltd | | | (13,300 | ) | | | (339,150 | ) |

Violin Memory, Inc. | | | (34,550 | ) | | | (55,625 | ) |

| | | | | (857,193 | ) |

| | |

| Thrifts & Mortgage Finance | | | | | | | | |

Nationstar Mortgage Holdings, Inc. | | | (11,650 | ) | | | (154,595 | ) |

| |

| Trading Companies & Distributors | | | | | |

NOW Inc. | | | (11,450 | ) | | | (189,039 | ) |

| |

| Wireless Telecommunication Services | | | | | |

Sprint Corp. | | | (84,550 | ) | | | (399,922 | ) |

Total Equity Securities — Short | | | $ | (27,899,314 | ) |

See accompanying Notes to Financial Statements which are an integral part of the financial statements.

14 Invesco All Cap Market Neutral Fund

Statement of Assets and Liabilities

October 31, 2015

| | | | |

Assets: | |

Investments, at value (Cost $26,932,692) | | $ | 27,943,995 | |

Investments in affiliated money market funds, at value and cost | | | 3,951,979 | |

Total investments, at value (Cost $30,884,671) | | | 31,895,974 | |

Receivable for: | | | | |

Deposits with brokers for swap agreements | | | 30,523 | |

Investments sold | | | 1,949,841 | |

Fund shares sold | | | 453,015 | |

Dividends | | | 18,975 | |

Investment for trustee deferred compensation and retirement plans | | | 4,298 | |

Unrealized appreciation on swap agreements — OTC | | | 371,213 | |

Other assets | | | 8,193 | |

Total assets | | | 34,732,032 | |

|

Liabilities: | |

Payable for: | | | | |

Investments purchased | | | 1,735,731 | |

Fund shares reacquired | | | 75 | |

Swaps payable | | | 27,826 | |

Accrued fees to affiliates | | | 28,604 | |

Accrued trustees’ and officers’ fees and benefits | | | 1,562 | |

Accrued other operating expenses | | | 58,799 | |

Trustee deferred compensation and retirement plans | | | 4,298 | |

Unrealized depreciation on swap agreements — OTC | | | 17,738 | |

Total liabilities | | | 1,874,633 | |

Net assets applicable to shares outstanding | | $ | 32,857,399 | |

|

Net assets consist of: | |

Shares of beneficial interest | | $ | 29,419,453 | |

Undistributed net investment income | | | 4,240,112 | |

Undistributed net realized gain (loss) | | | (2,166,944 | ) |

Net unrealized appreciation | | | 1,364,778 | |

| | | $ | 32,857,399 | |

| | | | |

Net Assets: | |

Class A | | $ | 12,811,787 | |

Class C | | $ | 1,772,118 | |

Class R | | $ | 22,693 | |

Class Y | | $ | 16,906,880 | |

Class R5 | | $ | 598,754 | |

Class R6 | | $ | 745,167 | |

|

Shares outstanding, $0.01 par value per share,

with an unlimited number of shares authorized: | |

Class A | | | 1,075,002 | |

Class C | | | 150,706 | |

Class R | | | 1,913 | |

Class Y | | | 1,412,044 | |

Class R5 | | | 50,001 | |

Class R6 | | | 62,235 | |

Class A: | | | | |

Net asset value per share | | $ | 11.92 | |

Maximum offering price per share | | | | |

(Net asset value of $11.92 ¸ 94.50%) | | $ | 12.61 | |

Class C: | | | | |

Net asset value and offering price per share | | $ | 11.76 | |

Class R: | | | | |

Net asset value and offering price per share | | $ | 11.86 | |

Class Y: | | | | |

Net asset value and offering price per share | | $ | 11.97 | |

Class R5: | | | | |

Net asset value and offering price per share | | $ | 11.97 | |

Class R6: | | | | |

Net asset value and offering price per share | | $ | 11.97 | |

See accompanying Notes to Financial Statements which are an integral part of the financial statements.

15 Invesco All Cap Market Neutral Fund

Statement of Operations

For the year ended October 31, 2015

| | | | |

Investment income: | |

Dividends (net of foreign withholding taxes of $4,325) | | $ | 420,834 | |

Dividends from affiliated money market funds | | | 2,368 | |

Interest | | | 82,160 | |

Total investment income | | | 505,362 | |

| |

Expenses: | | | | |

Advisory fees | | | 343,246 | |

Administrative services fees | | | 50,000 | |

Custodian fees | | | 11,190 | |

Distribution fees: | | | | |

Class A | | | 26,495 | |

Class C | | | 10,528 | |

Class R | | | 1,288 | |

Dividends on short sales | | | 89,368 | |

Interest, facilities and maintenance fees | | | 484,166 | |

Transfer agent fees — A, C, R and Y | | | 28,236 | |

Transfer agent fees — R5 | | | 89 | |

Transfer agent fees — R6 | | | 73 | |

Trustees’ and officers’ fees and benefits | | | 19,117 | |

Registration and filing fees | | | 81,262 | |

Professional services fees | | | 63,633 | |

Other | | | 29,585 | |

Total expenses | | | 1,238,276 | |

Less: Fees waived and expenses reimbursed | | | (254,425 | ) |

Net expenses | | | 983,851 | |

Net investment income (loss) | | | (478,489 | ) |

| |

Realized and unrealized gain (loss) from: | | | | |

Net realized gain (loss) from: | | | | |

Investment securities | | | 85,886 | |

Securities sold short | | | (1,859,307 | ) |

Swap agreements | | | 4,716,396 | |

| | | | 2,942,975 | |

Change in net unrealized appreciation (depreciation) of: | | | | |

Investment securities | | | (75,525 | ) |

Securities sold short | | | (501,159 | ) |

Swap agreements | | | 353,475 | |

| | | | (223,209 | ) |

Net realized and unrealized gain | | | 2,719,766 | |

Net increase in net assets resulting from operations | | $ | 2,241,277 | |

See accompanying Notes to Financial Statements which are an integral part of the financial statements.

16 Invesco All Cap Market Neutral Fund

Statement of Changes in Net Assets

For the year ended October 31, 2015 and the period December 17, 2013 (commencement date) through October 31, 2014

| | | | | | | | |

| | | October 31,

2015 | | | December 17, 2013

(commencement date) through

October 31,

2014 | |

Operations: | | | | | |

Net investment income (loss) | | $ | (478,489 | ) | | $ | (315,332 | ) |

Net realized gain (loss) | | | 2,942,975 | | | | (387,164 | ) |

Change in net unrealized appreciation (depreciation) | | | (223,209 | ) | | | 1,587,987 | |

Net increase in net assets resulting from operations | | | 2,241,277 | | | | 885,491 | |

| | |

Share transactions–net: | | | | | | | | |

Class A | | | 2,123,323 | | | | 9,349,083 | |

Class C | | | 837,576 | | | | 848,820 | |

Class R | | | (19,669 | ) | | | 38,619 | |

Class Y | | | 1,182,147 | | | | 14,247,251 | |

Class R5 | | | (112,330 | ) | | | 604,228 | |

Class R6 | | | 83,572 | | | | 548,011 | |

Net increase in net assets resulting from share transactions | | | 4,094,619 | | | | 25,636,012 | |

Net increase in net assets | | | 6,335,896 | | | | 26,521,503 | |

| | |

Net assets: | | | | | | | | |

Beginning of year | | | 26,521,503 | | | | — | |

End of year (includes undistributed net investment income (loss) of $4,240,112 and $(1,547), respectively) | | $ | 32,857,399 | | | $ | 26,521,503 | |

See accompanying Notes to Financial Statements which are an integral part of the financial statements.

17 Invesco All Cap Market Neutral Fund

Statement of Cash Flows

For the year ended October 31, 2015

| | | | |

Cash provided by operating activities: | | | | |

Net increase in net assets resulting from operations | | $ | 2,241,277 | |

|

Adjustments to reconcile the change in net assets applicable from operations to net cash provided by (used in) operating activities: | |

Purchases of investments | | | (50,274,072 | ) |

Net change in unrealized appreciation from swap agreements | | | (353,475 | ) |

Proceeds from sales of investments | | | 42,373,554 | |

Decrease in receivables and other assets | | | 23,915,794 | |

Payments to cover securities sold short | | | (57,983,012 | ) |

Proceeds from securities sold short | | | 31,319,623 | |

Net realized gain (loss) from securities sold short | | | 1,859,307 | |

Net change in unrealized depreciation on securities sold short | | | 501,159 | |

Increase in accrued expenses and other payables | | | 6,265 | |

Net realized gain from investment securities | | | (85,886 | ) |

Net change in unrealized depreciation on investment securities | | | 75,525 | |

Net cash provided by (used in) operating activities | | | (6,403,941 | ) |

| |

Cash provided by financing activities: | | | | |

Proceeds from shares of beneficial interest sold | | | 31,206,307 | |

Disbursements from shares of beneficial interest reacquired | | | (27,674,390 | ) |

Net cash provided by financing activities | | | 3,531,917 | |

Net increase (decrease) in cash and cash equivalents | | | (2,872,024 | ) |

Cash at beginning of year | | | 6,824,003 | |

Cash at end of year | | $ | 3,951,979 | |

Notes to Financial Statements

October 31, 2015

NOTE 1—Significant Accounting Policies

Invesco All Cap Market Neutral Fund (the “Fund”) is a series portfolio of AIM Investment Funds (Invesco Investment Funds) (the “Trust”). The Trust is organized as a Delaware statutory trust and is registered under the Investment Company Act of 1940, as amended (the “1940 Act”), as an open-end series management investment company consisting of twenty-four separate series portfolios, each authorized to issue an unlimited number of shares of beneficial interest. The assets, liabilities and operations of each portfolio are accounted for separately. Information presented in these financial statements pertains only to the Fund. Matters affecting each portfolio or class will be voted on exclusively by the shareholders of such portfolio or class.

The Fund’s investment objective is to provide a positive return over a full market cycle from a broadly diversified portfolio of stocks while seeking to limit exposure to the general risks associated with stock market investing.

The Fund currently consists of six different classes of shares: Class A, Class C, Class R, Class Y, Class R5 and Class R6. Class A shares are sold with a front-end sales charge unless certain waiver criteria are met and under certain circumstances load waived shares may be subject to contingent deferred sales charges (“CDSC”). Class C shares are sold with a CDSC. Class R, Class Y, Class R5 and Class R6 shares are sold at net asset value.

The following is a summary of the significant accounting policies followed by the Fund in the preparation of its financial statements.

| A. | Security Valuations — Securities, including restricted securities, are valued according to the following policy. |

A security listed or traded on an exchange (except convertible securities) is valued at its last sales price or official closing price as of the close of the customary trading session on the exchange where the security is principally traded, or lacking any sales or official closing price on a particular day, the security may be valued at the closing bid price on that day. Securities traded in the over-the-counter market are valued based on prices furnished by independent pricing services or market makers. When such securities are valued by an independent pricing service they may be considered fair valued. Futures contracts are valued at the final settlement price set by an exchange on which they are principally traded. Listed options are valued at the mean between the last bid and asked prices from the exchange on which they are principally traded. Options not listed on an exchange are valued by an independent source at the mean between the last bid and asked prices. For purposes of determining net asset value (“NAV”) per share, futures and option contracts generally are valued 15 minutes after the close of the customary trading session of the New York Stock Exchange (“NYSE”).

Investments in open-end and closed-end registered investment companies that do not trade on an exchange are valued at the end-of-day net asset value per share. Investments in open-end and closed-end registered investment companies that trade on an exchange are valued at the last sales price or official closing price as of the close of the customary trading session on the exchange where the security is principally traded.

Debt obligations (including convertible securities) and unlisted equities are fair valued using an evaluated quote provided by an independent pricing service. Evaluated quotes provided by the pricing service may be determined without exclusive reliance on quoted prices, and may reflect appropriate factors such as institution-size trading in similar groups of securities, developments related to specific securities, dividend rate (for unlisted equities), yield (for debt obligations), quality, type of issue, coupon rate (for debt obligations), maturity (for debt obligations), individual trading characteristics and other market data. Debt obligations are subject to interest rate and credit risks. In addition, all debt obligations involve some risk of default with respect to interest and/or principal payments.

18 Invesco All Cap Market Neutral Fund

Foreign securities’ (including foreign exchange contracts) prices are converted into U.S. dollar amounts using the applicable exchange rates as of the close of the NYSE. If market quotations are available and reliable for foreign exchange-traded equity securities, the securities will be valued at the market quotations. Because trading hours for certain foreign securities end before the close of the NYSE, closing market quotations may become unreliable. If between the time trading ends on a particular security and the close of the customary trading session on the NYSE, events occur that the Adviser determines are significant and make the closing price unreliable, the Fund may fair value the security. If the event is likely to have affected the closing price of the security, the security will be valued at fair value in good faith using procedures approved by the Board of Trustees. Adjustments to closing prices to reflect fair value may also be based on a screening process of an independent pricing service to indicate the degree of certainty, based on historical data, that the closing price in the principal market where a foreign security trades is not the current value as of the close of the NYSE. Foreign securities’ prices meeting the approved degree of certainty that the price is not reflective of current value will be priced at the indication of fair value from the independent pricing service. Multiple factors may be considered by the independent pricing service in determining adjustments to reflect fair value and may include information relating to sector indices, American Depositary Receipts and domestic and foreign index futures. Foreign securities may have additional risks including exchange rate changes, potential for sharply devalued currencies and high inflation, political and economic upheaval, the relative lack of issuer information, relatively low market liquidity and the potential lack of strict financial and accounting controls and standards.

Securities for which market prices are not provided by any of the above methods may be valued based upon quotes furnished by independent sources. The last bid price may be used to value equity securities. The mean between the last bid and asked prices is used to value debt obligations, including corporate loans.