UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-05576

Name of Fund: BlackRock Global Allocation Fund, Inc.

Fund Address: 100 Bellevue Parkway, Wilmington, DE 19809

Name and address of agent for service: John M. Perlowski, Chief Executive Officer, BlackRock Global Allocation Fund, Inc., 55 East 52nd Street, New York, NY 10055

Registrant’s telephone number, including area code: (800) 441-7762

Date of fiscal year end: 10/31/2018

Date of reporting period: 10/31/2018

Item 1 – Report to Stockholders

OCTOBER 31, 2018

| | |

ANNUAL REPORT | |  |

BlackRock Global Allocation Fund, Inc.

|

| Not FDIC Insured • May Lose Value • No Bank Guarantee |

The Markets in Review

Dear Shareholder,

In the 12 months ended October 31, 2018, ongoing strength in corporate profits drove the equity market higher, while rising interest rates constrained bond returns. Though the market’s appetite for risk remained healthy, risk-taking was tempered somewhat, as shorter-term, higher-quality securities led the bond market, and U.S. equities outperformed most international stock markets.

In international markets, the rising value of the U.S. dollar limited U.S. investors’ returns for the reporting period. When the U.S. dollar appreciates relative to foreign currencies, the value of international investments declines in U.S. dollar terms. Volatility rose in emerging market stocks, which are relatively sensitive to changes in the U.S. dollar. U.S.-China trade relations and debt concerns adversely affected the Chinese stock market, while Turkey and Argentina became embroiled in currency crises, largely due to hyperinflation in both countries. An economic slowdown in Europe led to negative performance for European equities.

In fixed income markets, short-term U.S. Treasury interest rates rose the fastest, while longer-term rates slightly increased. This led to a negative return for long-term U.S. Treasuries and a substantial flattening of the yield curve. Many investors are concerned with the flattening yield curve as a harbinger of recession. However, given the extraordinary monetary measures in the last decade, we believe a more accurate barometer for the economy is the returns along the risk spectrums in stock and bond markets. Although the fundamentals in credit markets remained relatively solid, investment-grade bonds declined slightly, and high-yield bonds posted modest returns.

In response to rising growth and inflation, the U.S. Federal Reserve (the “Fed”) increased short-term interest rates four times during the reporting period. The Fed also continued to reduce its balance sheet during the reporting period, gradually reversing the unprecedented stimulus measures it enacted after the financial crisis. We believe the Fed is likely to continue to raise interest rates in the coming year. By our estimation, the Fed’s neutral interest rate, or the theoretical rate that is neither stimulative nor restrictive to the economy, is approximately 3.0%. With that perspective, the Fed’s current policy is still mildly stimulative to the U.S. economy, which leaves room for further Fed rate hikes to arrive at monetary policy that is a neutral factor for economic growth.

The U.S. economy continued to gain momentum despite the Fed’s modest reduction of economic stimulus; unemployment declined to 3.7%, the lowest rate of unemployment in almost 50 years. The number of job openings reached a record high of more than 7 million, which exceeded the total number of unemployed workers. Strong economic performance has justified the Fed’s somewhat faster pace of rate hikes, as several inflation measures and investors’ expectations for inflation have already surpassed the Fed’s target of 2.0% per year.

While markets have recently focused on the risk of rising long-term interest rates, we continue to believe the primary risk to economic expansion is trade protectionism that could lead to slower global trade and unintended consequences for the globalized supply chain. So far, U.S. tariffs have only had a modest negative impact on economic growth, but the fear of an escalating trade war has stifled market optimism somewhat, leading to higher volatility in risk assets. The outcome of trade negotiations between the United States and China is likely to influence the global growth trajectory and set the tone for free trade in many other nations. Easing of tensions could lead to greater upside for markets, while additional tariffs could adversely affect investor sentiment.

In this environment, investors need to think globally, extend their scope across a broad array of asset classes, and be nimble as market conditions change. We encourage you to talk with your financial advisor and visit blackrock.com for further insight about investing in today’s markets.

Sincerely,

Rob Kapito

President, BlackRock Advisors, LLC

Rob Kapito

President, BlackRock Advisors, LLC

| | | | |

| Total Returns as of October 31, 2018 |

| | | 6-month | | 12-month |

U.S. large cap equities

(S&P 500® Index) | | 3.40% | | 7.35% |

U.S. small cap equities

(Russell 2000® Index) | | (1.37) | | 1.85 |

International equities

(MSCI Europe, Australasia, Far East Index) | | (9.92) | | (6.85) |

Emerging market equities

(MSCI Emerging Markets Index) | | (16.53) | | (12.52) |

3-month Treasury bills

(ICE BofAML 3-Month U.S. Treasury Bill Index) | | 0.99 | | 1.68 |

U.S. Treasury securities

(ICE BofAML 10-Year U.S. Treasury Index) | | (0.60) | | (4.37) |

U.S. investment grade bonds

(Bloomberg Barclays U.S. Aggregate Bond Index) | | (0.19) | | (2.05) |

Tax-exempt municipal bonds

(S&P Municipal Bond Index) | | 0.45 | | (0.31) |

U.S. high yield bonds

(Bloomberg Barclays U.S. Corporate High Yield 2% Issuer Capped Index) | | 1.14 | | 0.98 |

| Past performance is no guarantee of future results. Index performance is shown for illustrative purposes only. You cannot invest directly in an index. |

| | |

| 2 | | THIS PAGEISNOT PARTOF YOUR FUND REPORT |

Table of Contents

| | |

| Fund Summary as of October 31, 2018 | | BlackRock Global Allocation Fund, Inc. |

Investment Objective

BlackRock Global Allocation Fund, Inc.’s (the “Fund”) investment objective is to provide high total investment return through a fully managed investment policy utilizing United States and foreign equity securities, debt and money market securities, the combination of which will be varied from time to time both with respect to types of securities and markets in response to changing market and economic trends. Total return means the combination of capital growth and investment income.

Portfolio Management Commentary

How did the Fund perform?

For the 12-month period ended October 31, 2018, the Fund underperformed both its reference benchmark, which is comprised of the S&P 500® Index (36%), FTSE World (ex-US) Index (24%), ICE BofAML Current 5-Year U.S. Treasury Index (24%), and FTSE Non-U.S. Dollar World Government Bond Index (16%) (the “Reference Benchmark”), and the broad-based all-equity benchmark, the FTSE World Index. The Fund invests in both equities and bonds; therefore, Fund management believes that the Reference Benchmark provides a more accurate representation of the Fund’s composition and a more comparable means for measurement. The following discussion of relative performance pertains to the Reference Benchmark. The following commentary (and referenced allocation percentages) are based on the economic exposures of the Fund, which reflect adjustments for futures, swaps and options (except with respect to fixed income securities) and convertible bonds, and may vary relative to the market value.

What factors influenced performance?

Within equities, an overweight allocation to Asia and Europe and an underweight allocation to the United States detracted from the Fund’s performance. From a sector perspective, stock selection in consumer discretionary, materials, energy, and information technology (“IT”) weighed negatively on returns. Within fixed income, an overweight allocation to select emerging market government bonds negatively affected performance. Currency exposure to the Indian rupee and the Brazilian real also detracted from performance, as did holdings of commodity-related securities, especially gold.

Underweight exposure to industrials as well as stock selection in utilities positively contributed to performance within equities. Underweight currency exposure to the euro and the Australian dollar were also notable contributors. Within fixed income, exposure to high yield credit and an underweight allocation to Italian sovereign debt were also additive. Exposure to cash and cash equivalents also contributed to relative performance.

The Fund uses derivatives, which may include options, futures, swaps, and forward contracts both to seek to enhance returns of the Fund and to hedge (or protect) against adverse movements in currency exchange rates, interest rates, and movements in the securities markets. During the period, the Fund’s use of derivatives detracted from its performance.

Describe recent portfolio activity.

During the 12-month period, the Fund’s overall equity allocation decreased from 62% to 60% of net assets. Within equities, the Fund increased exposure to the United States and Asia, and decreased exposure to Europe. From a sector perspective, the Fund increased exposure to health care, communication services, consumer staples, and energy, and it reduced exposure to industrials, consumer discretionary, financials, IT, utilities, and materials.

The Fund’s allocation to fixed income remained essentially unchanged during the period at 31% of net assets. Within fixed income, the Fund decreased exposure to government debt, notably in Brazil, Australia, and Poland, and increased exposure to corporate bonds.

The Fund’s exposure to commodity-related securities decreased from 4% to 1% of net assets.

Reflecting the changes in the Fund’s overall allocations to the equity, fixed income and commodity-related asset classes during the period, the Fund’s exposure to cash and cash equivalent holdings increased from 3% to 8% of net assets. During the 12-month period, cash helped mitigate portfolio volatility and served as a source of funds for new investments and redemptions.

Describe portfolio positioning at period end.

Relative to its Reference Benchmark, the Fund ended the period with a relatively neutral allocation to equities, underweight exposure to fixed income, and an overweight position in commodity-related securities and cash and cash equivalents. Within the equity segment, the Fund was overweight in Asia while being underweight in Europe and the United States. Within Asia, the Fund was overweight Japan, China, and India, while having an underweight allocation to Australia. From a sector perspective, the Fund had overweight allocations to communication services, financials, energy, IT, and consumer discretionary, while being underweight in materials, industrials, real estate, consumer staples, healthcare, and utilities.

Within fixed income, the Fund was underweight in developed European sovereign debt, U.S. Treasuries, and Japanese government bonds, and overweight in government bonds in Mexico and Argentina. In addition, the Fund had overweight allocations to corporate debt.

With respect to currency exposure, the Fund was overweight in the U.S. dollar, Indian rupee, and Hong Kong dollar, and was underweight in the euro, British pound sterling, and Australian dollar.

The views expressed reflect the opinions of BlackRock as of the date of this report and are subject to change based on changes in market, economic or other conditions. These views are not intended to be a forecast of future events and are no guarantee of future results.

| | |

| 4 | | 2018 BLACKROCK ANNUAL REPORTTO SHAREHOLDERS |

| | |

| Fund Summary as of October 31, 2018 (continued) | | BlackRock Global Allocation Fund, Inc. |

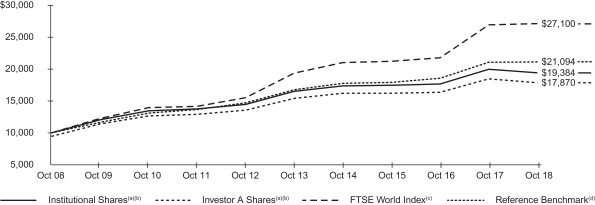

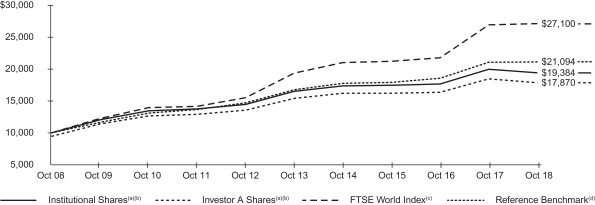

TOTAL RETURN BASED ON A $10,000 INVESTMENT

| (a) | Assuming maximum sales charges, if any, transaction costs and other operating expenses, including advisory fees. Institutional Shares do not have a sales charge. |

| (b) | The Fund invests in a portfolio of U.S. and foreign equity securities, debt and money market securities, the combination of which will be varied from time to time with respect to types of securities and markets in response to changing market and economic trends. |

| (c) | This unmanaged capitalization-weighted index is comprised of 2,620 equities from 35 countries in 4 regions, including the United States. |

| (d) | The Reference Benchmark is an unmanaged weighted index comprised as follows: 36% S&P 500® Index; 24% FTSE World (ex-U.S.) Index; 24% ICE BofAML 5-Year U.S. Treasury Index; and 16% FTSE Non-U.S. Dollar World Government Bond Index. |

Performance Summary for the Period Ended October 31, 2018

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | Average Annual Total Returns (a) | |

| | | | | | | | | 1 Year | | | | | | 5 Years | | | | | | 10 Years | |

| | | 6-Month Total Returns | | | | | | w/o sales charge | | | w/sales charge | | | | | | w/o sales charge | | | w/sales charge | | | | | | w/o sales charge | | | w/sales charge | |

Institutional | | | (3.76 | )% | | | | | | | (2.94 | )% | | | N/A | | | | | | | | 3.29 | % | | | N/A | | | | | | | | 6.84 | % | | | N/A | |

Investor A | | | (3.91 | ) | | | | | | | (3.24 | ) | | | (8.32 | )% | | | | | | | 3.00 | | | | 1.89 | % | | | | | | | 6.55 | | | | 5.98 | % |

Investor C | | | (4.27 | ) | | | | | | | (3.95 | ) | | | (4.86 | ) | | | | | | | 2.24 | | | | 2.24 | | | | | | | | 5.75 | | | | 5.75 | |

Class K | | | (3.77 | ) | | | | | | | (2.91 | ) | | | N/A | | | | | | | | 3.32 | | | | N/A | | | | | | | | 6.86 | | | | N/A | |

Class R | | | (4.12 | ) | | | | | | | (3.56 | ) | | | N/A | | | | | | | | 2.66 | | | | N/A | | | | | | | | 6.19 | | | | N/A | |

FTSE World Index | | | (3.04 | ) | | | | | | | 0.73 | | | | N/A | | | | | | | | 6.95 | | | | N/A | | | | | | | | 10.48 | | | | N/A | |

Reference Benchmark | | | (2.16 | ) | | | | | | | 0.27 | | | | N/A | | | | | | | | 4.73 | | | | N/A | | | | | | | | 7.75 | | | | N/A | |

U.S. Stocks: S&P 500® Index(b) | | | 3.40 | | | | | | | | 7.35 | | | | N/A | | | | | | | | 11.34 | | | | N/A | | | | | | | | 13.24 | | | | N/A | |

Non-U.S. Stocks: FTSE World (ex-U.S.) Index(c) | | | (10.37 | ) | | | | | | | (6.94 | ) | | | N/A | | | | | | | | 2.26 | | | | N/A | | | | | | | | 7.52 | | | | N/A | |

Non-U.S. Bonds: FTSE Non-U.S. Dollar World Government Bond Index(d) | | | (6.26 | ) | | | | | | | (2.26 | ) | | | N/A | | | | | | | | (0.76 | ) | | | N/A | | | | | | | | 2.11 | | | | N/A | |

U.S. Bonds: ICE BofAML Current 5-Year U.S. Treasury Index(e) | | | 0.59 | | | | | | | | (1.71 | ) | | | N/A | | | | | | | | 0.59 | | | | N/A | | | | | | | | 2.51 | | | | N/A | |

| | (a) | Assuming maximum sales charges, if any. Average annual total returns with and without sales charges reflect reductions for distribution and service fees. See “About Fund Performance” on page 7 for a detailed description of share classes, including any related sales charges and fees, and how performance was calculated for certain share classes. | |

| | (b) | This unmanaged index covers 500 leading companies and captures approximately 80% coverage of available market capitalization. | |

| | (c) | This unmanaged capitalization-weighted index is comprised of 1,985 equities from 34 countries, excluding the United States. | |

| | (d) | This unmanaged market capitalization-weighted index tracks 22 government bond indexes, excluding the United States. | |

| | (e) | This unmanaged index is designed to track the total return of the current coupon five-year U.S. Treasury bond. | |

N/A — Not applicable as share class and index do not have a sales charge.

Past performance is not indicative of future results.

Performance results may include adjustments made for financial reporting purposes in accordance with U.S. generally accepted accounting principles.

| | |

| Fund Summary as of October 31, 2018 (continued) | | BlackRock Global Allocation Fund, Inc. |

Portfolio Information

OVERALL ASSET EXPOSURE

| | | | | | | | | | | | |

| | | Percent of Fund’s

Net Assets (a) | | | Reference

Benchmark (b) Percentages | |

| | | 10/31/2018 | | | 10/31/2017 | |

US Equities | | | 35 | % | | | 31 | % | | | 35 | % |

European Equities | | | 8 | | | | 16 | | | | 13 | |

Asia Pacific Equities | | | 15 | | | | 14 | | | | 9 | |

Other Equities | | | 2 | | | | 1 | | | | 3 | |

Total Equities | | | 60 | | | | 62 | | | | 60 | |

| | | | | | | | | | | | |

US Dollar Denominated Fixed Income Securities | | | 28 | | | | 22 | | | | 24 | |

| | | | | | | | | | | | |

U.S. Issuers | | | 26 | | | | 19 | | | | — | |

Non-U.S. Issuers | | | 2 | | | | 3 | | | | — | |

Non-U.S. Dollar Denominated Fixed Income Securities | | | 3 | | | | 9 | | | | 16 | |

| | | | | | | | | | | | |

Total Fixed Income Securities | | | 31 | | | | 31 | | | | 40 | |

| | | | | | | | | | | | |

Commodity-Related | | | 1 | | | | 4 | | | | — | |

| | | | | | | | | | | | |

Cash & Short-Term Securities | | | 8 | | | | 3 | | | | — | |

| | | | | | | | | | | | |

| | (a) | Exposure based on market value and adjusted for the economic value of futures, swaps and options (except with respect to fixed income securities), and convertible bonds. | |

| | (b) | The Reference Benchmark is an unmanaged weighted index comprised as follows: 36% of the S&P 500 Index®; 24% FTSE World (ex U.S.) Index; 24% ICE BofAML 5-Year U.S. Treasury Index; and 16% FTSE Non-U.S. Dollar World Government Bond Index. Descriptions of these indexes are found on page 5 of this report to shareholders in the “Performance Summary” section. | |

GEOGRAPHIC ALLOCATION

| | | | | | | | | | | | |

| | | Percent of

Total Investments (a) | |

| Country | | Long | | | Short | | | Total | |

United States | | | 65 | % | | | 1 | % | | | 66 | % |

Japan | | | 10 | | | | 0 | | | | 10 | |

United Kingdom | | | 3 | | | | 0 | | | | 3 | |

France | | | 3 | | | | 0 | | | | 3 | |

Germany | | | 2 | | | | 0 | | | | 2 | |

China | | | 2 | | | | 0 | | | | 2 | |

Canada | | | 1 | | | | 0 | | | | 1 | |

Netherlands | | | 1 | | | | 0 | | | | 1 | |

Switzerland | | | 1 | | | | 0 | | | | 1 | |

India | | | 1 | | | | 0 | | | | 1 | |

Mexico | | | 1 | | | | 0 | | | | 1 | |

Italy | | | 1 | | | | 0 | | | | 1 | |

Taiwan | | | 1 | | | | 0 | | | | 1 | |

Australia | | | 1 | | | | 0 | | | | 1 | |

Argentina | | | 1 | | | | 0 | | | | 1 | |

Hong Kong | | | 1 | | | | 0 | | | | 1 | |

South Korea | | | 1 | | | | 0 | | | | 1 | |

Brazil | | | 1 | | | | 0 | | | | 1 | |

Singapore | | | 1 | | | | 0 | | | | 1 | |

Other(b) | | | 1 | | | | 0 | | | | 1 | |

| | (a) | Total investments include the gross notional values of long and short equity securities of the underlying derivative contracts utilized by the Fund and exclude short-term securities. | |

| | (b) | Includes holdings within countries representing 1% or less of long-term investments. Please refer to the Consolidated Schedule of Investments for such countries. | |

TEN LARGEST HOLDINGS (EQUITY INVESTMENTS)

| | | | |

| Security | | Percent of Total Investments (a) | |

Apple, Inc. | | | 2 | % |

Microsoft Corp. | | | 2 | |

Alphabet, Inc. | | | 2 | |

Comcast Corp. | | | 2 | |

CVS Health Corp. | | | 1 | |

Johnson & Johnson | | | 1 | |

Amazon.com, Inc. | | | 1 | |

Charter Communications, Inc. | | | 1 | |

iShares Gold Trust | | | 1 | |

Wells Fargo & Co. | | | 1 | |

| | (a) | Excludes short-term securities, options purchased, options written and investments sold short. | |

| | |

| 6 | | 2018 BLACKROCK ANNUAL REPORTTO SHAREHOLDERS |

About Fund Performance

Institutional and Class K Shares are not subject to any sales charge. These shares bear no ongoing distribution or service fees and are available only to certain eligible investors. Class K Shares performance shown prior to the June 8, 2016 inception date is that of Institutional Shares. The performance of the Fund’s Class K Shares would be substantially similar to Institutional Shares because Class K Shares and Institutional Shares invest in the same portfolio of securities and performance would only differ to the extent that Class K Shares and Institutional Shares have different expenses. The actual returns of Class K Shares would have been higher than those of the Institutional Shares because Class K Shares have lower expenses than the Institutional Shares.

Investor A Shares are subject to a maximum initial sales charge (front-end load) of 5.25% and a service fee of 0.25% per year (but no distribution fee). Certain redemptions of these shares may be subject to a contingent deferred sales charge (“CDSC”) where no initial sales charge was paid at the time of purchase. These shares are generally available through financial intermediaries. On December 27, 2017, all issued and outstanding Investor B Shares were converted into Investor A Shares with the same relative aggregate net asset value (“NAV”).

Investor C Shares are subject to a 1.00% CDSC if redeemed within one year of purchase. In addition, these shares are subject to a distribution fee of 0.75% per year and a service fee of 0.25% per year. These shares are generally available through financial intermediaries. Effective November 8, 2018, the Fund will adopt an automatic conversion feature whereby Investor C Shares will be automatically converted into Investor A Shares after a conversion period of approximately ten years, and, thereafter, investors will be subject to lower ongoing fees.

Class R Shares are not subject to any sales charge. These shares are subject to a distribution fee of 0.25% per year and a service fee of 0.25% per year. These shares are available only to certain employer-sponsored retirement plans.

Performance information reflects past performance and does not guarantee future results. Current performance may be lower or higher than the performance data quoted. Refer to www.blackrock.com to obtain performance data current to the most recent month end. Performance results do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. Figures shown in the performance table on the previous page assume reinvestment of all distributions, if any, at NAV on the ex-dividend date. Investment return and principal value of shares will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. Distributions paid to each class of shares will vary because of the different levels of service, distribution and transfer agency fees applicable to each class, which are deducted from the income available to be paid to shareholders.

BlackRock Advisors, LLC (the “Manager”), the Fund’s investment adviser, voluntarily waived and/or reimbursed a portion of its expenses. Without such waiver and/or reimbursement, the Fund’s performance would have been lower. The Manager is under no obligation to waive and/or reimburse or to continue waiving and/or reimbursing its fees and such voluntary waiver and/or reimbursement may be reduced or discontinued at any time. See Note 6 of the Notes to Consolidated Financial Statements for additional information on waivers and/or reimbursements.

| | |

| Disclosure of Expenses | | BlackRock Global Allocation Fund, Inc. |

Shareholders of the Fund may incur the following charges: (a) transactional expenses, such as sales charges; and (b) operating expenses, including investment advisory fees, service and distribution fees, including 12b-1 fees, acquired fund fees and expenses, and other fund expenses. The expense example shown below (which is based on a hypothetical investment of $1,000 invested on May 1, 2018 and held through October 31, 2018), is intended to assist shareholders both in calculating expenses based on an investment in the Fund and in comparing these expenses with similar costs of investing in other mutual funds.

The expense example provides information about actual account values and actual expenses. In order to estimate the expenses a shareholder paid during the period covered by this report, shareholders can divide their account value by $1,000 and then multiply the result by the number corresponding to their share class under the heading entitled “Expenses Paid During the Period.”

The expense example also provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses. In order to assist shareholders in comparing the ongoing expenses of investing in the Fund and other funds, compare the 5% hypothetical example with the 5% hypothetical examples that appear in shareholder reports of other funds.

The expenses shown in the expense example are intended to highlight shareholders’ ongoing costs only and do not reflect transactional expenses, such as sales charges, if any. Therefore, the hypothetical example is useful in comparing ongoing expenses only, and will not help shareholders determine the relative total expenses of owning different funds. If these transactional expenses were included, shareholder expenses would have been higher.

Expense Example

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Actual | | | | | | Hypothetical (c) | |

| | | | | | | | | Expenses Paid During the Period | | | | | | | | | Including Dividend Expense

and Broker Fees and

Expenses on Short Sales | | | Excluding Dividend Expense

and Broker Fees and

Expenses on Short Sales | |

| | | Beginning

Account Value

(5/01/18) | | | Ending

Account Value

(10/31/18) | | | Including

Dividend

Expense and

Broker Fees and

Expenses on

Short Sales (a) | | | Excluding

Dividend

Expense and

Broker Fees and

Expenses on

Short Sales (b) | | | | | | Beginning

Account Value

(5/01/18) | | | Ending

Account Value

(10/31/18) | | | Expenses

Paid During

the

Period (a) | | | Ending

Account Value

(10/31/18) | | | Expenses

Paid During

the

Period (b) | |

Institutional | | $ | 1,000.00 | | | $ | 962.40 | | | $ | 3.96 | | | $ | 3.86 | | | | | | | $ | 1,000.00 | | | $ | 1,021.17 | | | $ | 4.08 | | | $ | 1,021.27 | | | $ | 3.97 | |

Investor A | | | 1,000.00 | | | | 960.90 | | | | 5.34 | | | | 5.24 | | | | | | | | 1,000.00 | | | | 1,019.76 | | | | 5.50 | | | | 1,019.86 | | | | 5.40 | |

Investor C | | | 1,000.00 | | | | 957.30 | | | | 8.98 | | | | 8.88 | | | | | | | | 1,000.00 | | | | 1,016.03 | | | | 9.25 | | | | 1,016.13 | | | | 9.15 | |

Class K | | | 1,000.00 | | | | 962.30 | | | | 3.66 | | | | 3.51 | | | | | | | | 1,000.00 | | | | 1,021.47 | | | | 3.77 | | | | 1,021.47 | | | | 3.51 | |

Class R | | | 1,000.00 | | | | 958.80 | | | | 6.96 | | | | 6.86 | | | | | | | | 1,000.00 | | | | 1,018.10 | | | | 7.17 | | | | 1,018.20 | | | | 7.07 | |

| | (a) | For each class of the Fund, expenses are equal to the annualized net expense ratio for the class (0.80% for Institutional, 1.08% for Investor A, 1.82% for Investor C, 0.74% for Class K and 1.41% for Class R), multiplied by the average account value over the period, multiplied by 184/365 (to reflect the one-half year period shown). | |

| | (b) | For each class of the Fund, expenses are equal to the annualized net expense ratio for the class (0.78% for Institutional, 1.06% for Investor A, 1.80% for Investor C, 0.71% for Class K and 1.39% for Class R), multiplied by the average account value over the period, multiplied by 184/365 (to reflect the one-half year period shown). | |

| | (c) | Hypothetical 5% annual return before expenses is calculated by prorating the number of days in the most recent fiscal half year divided by 365. | |

Derivative Financial Instruments

The Fund may invest in various derivative financial instruments. These instruments are used to obtain exposure to a security, commodity, index, market, and/or other assets without owning or taking physical custody of securities, commodities and/or other referenced assets or to manage market, equity, credit, interest rate, foreign currency exchange rate, commodity and/or other risks. Derivative financial instruments may give rise to a form of economic leverage and involve risks, including the imperfect correlation between the value of a derivative financial instrument and the underlying asset, possible default of the counterparty to the transaction or illiquidity of the instrument. The Fund’s successful use of a derivative financial instrument depends on the investment adviser’s ability to predict pertinent market movements accurately, which cannot be assured. The use of these instruments may result in losses greater than if they had not been used, may limit the amount of appreciation the Fund can realize on an investment and/or may result in lower distributions paid to shareholders. The Fund’s investments in these instruments, if any, are discussed in detail in the Notes to Consolidated Financial Statements.

| | |

| 8 | | 2018 BLACKROCK ANNUAL REPORTTO SHAREHOLDERS |

| | |

Consolidated Schedule of Investments October 31, 2018 | | BlackRock Global Allocation Fund, Inc. (Percentages shown are based on Net Assets) |

| | | | | | | | | | | | |

| Security | | | Shares | | | Value | |

| Common Stocks — 63.6% | |

|

Australia — 0.1% | |

AGL Energy Ltd. | | | | | | | 221,326 | | | $ | 2,826,432 | |

BHP Billiton Ltd. | | | | | | | 5,313 | | | | 122,590 | |

Newcrest Mining Ltd. | | | | | | | 12,486 | | | | 182,773 | |

Quintis Ltd. (Acquired 10/22/18, Cost $22,839,011)(a)(b)(v) | | | | | | | 45,776,155 | | | | 20,422,325 | |

Rio Tinto Ltd. | | | | | | | 28,824 | | | | 1,568,380 | |

Stockland | | | | | | | 453,464 | | | | 1,160,012 | |

Wesfarmers Ltd. | | | | | | | 19,201 | | | | 635,893 | |

Woolworths Group Ltd. | | | | | | | 88,254 | | | | 1,781,266 | |

| | | | | | | | | | | | |

| | | | 28,699,671 | |

| Belgium — 0.3% | |

Anheuser-Busch InBev SA | | | | | | | 1,064,254 | | | | 78,713,621 | |

| | | | | | | | | | | | |

| Brazil — 0.7% | |

Azul SA — ADR(c)(d) | | | | | | | 4,778,909 | | | | 116,509,801 | |

Banco do Brasil SA | | | | | | | 191,419 | | | | 2,198,888 | |

Banco Santander Brasil SA | | | | | | | 46,843 | | | | 531,177 | |

Centrais Eletricas Brasileiras SA(c) | | | | | | | 40,506 | | | | 255,781 | |

Hapvida Participacoes e Investimentos SA(c)(e) | | | | | | | 4,865,926 | | | | 33,315,543 | |

Itau Unibanco Holding SA, Preference Shares | | | | | | | 1,162,771 | | | | 15,388,008 | |

Notre Dame Intermedica Participacoes SA(c) | | | | | | | 5,890,661 | | | | 38,194,720 | |

Suzano Papel e Celulose SA | | | | | | | 86,864 | | | | 883,462 | |

TIM Participacoes SA | | | | | | | 105,146 | | | | 327,460 | |

Vale SA | | | | | | | 1 | | | | 13 | |

| | | | | | | | | | | | |

| | | | 207,604,853 | |

| Canada — 1.3% | |

Canadian Natural Resources Ltd. | | | | | | | 45,014 | | | | 1,235,068 | |

Canadian Pacific Railway Ltd. | | | | | | | 4,504 | | | | 923,654 | |

Enbridge, Inc. | | | | | | | 3,125,568 | | | | 97,391,317 | |

Encana Corp. | | | | | | | 10,217,638 | | | | 104,628,613 | |

Goldcorp, Inc. | | | | | | | 7,686 | | | | 69,419 | |

Husky Energy, Inc. | | | | | | | 137,977 | | | | 1,950,512 | |

Imperial Oil Ltd. | | | | | | | 52,507 | | | | 1,640,084 | |

Manulife Financial Corp. | | | | | | | 181,440 | | | | 2,857,117 | |

Nutrien Ltd. | | | | | | | 56,085 | | | | 2,969,018 | |

Rogers Communications, Inc., Class B | | | | | | | 25,458 | | | | 1,310,948 | |

Suncor Energy, Inc. | | | | | | | 2,503,471 | | | | 83,978,335 | |

Teck Resources Ltd., Class B | | | | | | | 34,789 | | | | 719,062 | |

TransCanada Corp. | | | | | | | 2,852,531 | | | | 107,561,730 | |

| | | | | | | | | | | | |

| | | | 407,234,877 | |

| China — 1.5% | |

Agile Group Holdings Ltd. | | | | | | | 982,000 | | | | 1,128,264 | |

Agricultural Bank of China Ltd., Class H | | | | | | | 1,789,000 | | | | 787,482 | |

Alibaba Group Holding Ltd. — ADR(d) | | | | | | | 781,480 | | | | 111,188,974 | |

Angang Steel Co. Ltd., Class H | | | | | | | 844,000 | | | | 721,752 | |

Anhui Conch Cement Co. Ltd., Class H | | | | | | | 179,000 | | | | 927,782 | |

BAIC Motor Corp. Ltd., Class H(e) | | | | | | | 133,000 | | | | 75,082 | |

Baidu, Inc. — ADR(c) | | | | | | | 1,972 | | | | 374,798 | |

Bank of China Ltd., Class H | | | | | | | 574,000 | | | | 244,548 | |

Beijing Capital International Airport Co. Ltd., Class H | | | | | | | 14,102,000 | | | | 15,309,800 | |

China CITIC Bank Corp. Ltd., Class H | | | | | | | 1,976,000 | | | | 1,224,792 | |

China Communications Construction Co. Ltd., Class H | | | | | | | 194,000 | | | | 177,880 | |

China Construction Bank Corp., Class H | | | | | | | 940,000 | | | | 745,934 | |

China Mobile Ltd. | | | | | | | 284,000 | | | | 2,660,477 | |

China National Building Material Co. Ltd., Class H | | | | | | | 708,000 | | | | 509,027 | |

China Petroleum & Chemical Corp., Class H | | | | | | | 5,294,000 | | | | 4,312,364 | |

China Resources Cement Holdings Ltd. | | | | | | | 2,702,000 | | | | 2,398,506 | |

China Resources Gas Group Ltd. | | | | | | | 278,000 | | | | 1,065,560 | |

China Shenhua Energy Co. Ltd., Class H | | | | | | | 938,500 | | | | 2,123,308 | |

CLP Holdings Ltd. | | | | | | | 1,423,000 | | | | 15,945,323 | |

CNOOC Ltd. | | | | | | | 2,565,000 | | | | 4,368,141 | |

Country Garden Holdings Co. Ltd. | | | | | | | 625,000 | | | | 672,599 | |

| | | | | | | | | | | | |

| Security | | | Shares | | | Value | |

| China (continued) | |

Country Garden Services Holdings Co., Ltd.(c) | | | | | | | 493,298 | | | $ | 643,153 | |

Dongfeng Motor Group Co. Ltd., Class H | | | | | | | 468,000 | | | | 462,436 | |

Fosun International Ltd. | | | | | | | 1,547,500 | | | | 2,270,397 | |

Guangzhou Automobile Group Co. Ltd., Class H | | | | | | | 1,096,800 | | | | 1,111,655 | |

Industrial & Commercial Bank of China Ltd., Class H | | | | | | | 5,912,000 | | | | 4,011,130 | |

Jiangsu Expressway Co. Ltd., Class H | | | | | | | 212,000 | | | | 284,395 | |

Jiangsu Yanghe Brewery Joint-Stock Co. Ltd., Class A | | | | | | | 405,816 | | | | 5,171,190 | |

Kweichow Moutai Co. Ltd., Class A | | | | | | | 209,408 | | | | 16,473,765 | |

Luzhou Laojiao Co., Ltd., Class A | | | | | | | 1,099,382 | | | | 6,027,904 | |

Meituan Dianping, Class B(c) | | | | | | | 4,474,808 | | | | 28,930,657 | |

New Oriental Education & Technology Group, Inc. — ADR(c) | | | | | | | 26,105 | | | | 1,527,404 | |

PetroChina Co. Ltd., Class H | | | | | | | 116,000 | | | | 83,407 | |

Ping An Healthcare and Technology Co. Ltd.(c)(e) | | | | | | | 2,364,700 | | | | 11,382,805 | |

Ping An Healthcare and Technology Co. Ltd., (Aquired 05/03/18, Cost $42,661,343)(b)(c)(e) | | | | | | | 6,048,342 | | | | 28,968,619 | |

Ping An Insurance Group Co. of China Ltd., Class H | | | | | | | 41,500 | | | | 392,342 | |

SINA Corp.(c) | | | | | | | 60,732 | | | | 3,844,943 | |

Sinopec Shanghai Petrochemical Co. Ltd., Class H | | | | | | | 2,020,000 | | | | 887,676 | |

Tencent Holdings Ltd. | | | | | | | 4,540,700 | | | | 155,604,616 | |

Tingyi Cayman Islands Holding Corp. | | | | | | | 444,000 | | | | 657,852 | |

Want Want China Holdings Ltd. | | | | | | | 14,563,000 | | | | 10,418,649 | |

Wuliangye Yibin Co. Ltd., Class A | | | | | | | 767,166 | | | | 5,325,005 | |

Yanzhou Coal Mining Co. Ltd., Class H | | | | | | | 576,000 | | | | 547,823 | |

Yum China Holdings, Inc. | | | | | | | 27,968 | | | | 1,009,085 | |

Zhejiang Expressway Co. Ltd., Class H | | | | | | | 1,022,000 | | | | 859,388 | |

Zijin Mining Group Co. Ltd., Class H | | | | | | | 986,000 | | | | 368,826 | |

| | | | | | | | | | | | |

| | | | 454,227,515 | |

| Czech Republic — 0.0% | |

CEZ AS | | | | | | | 559,157 | | | | 13,304,350 | |

| | | | | | | | | | | | |

| Denmark — 0.1% | |

Carlsberg A/S, Class B | | | | | | | 44,328 | | | | 4,890,113 | |

Danske Bank A/S | | | | | | | 110,434 | | | | 2,113,555 | |

Novo Nordisk A/S, Class B | | | | | | | 458,709 | | | | 19,810,062 | |

| | | | | | | | | | | | |

| | | | 26,813,730 | |

| Finland — 0.0% | |

Nokia OYJ | | | | | | | 446,314 | | | | 2,521,042 | |

| | | | | | | | | | | | |

| France — 2.7% | |

AXA SA | | | | | | | 2,570,192 | | | | 64,323,357 | |

BNP Paribas SA | | | | | | | 17,017 | | | | 886,825 | |

Cie de Saint-Gobain | | | | | | | 123,244 | | | | 4,642,778 | |

Cie Generale des Etablissements Michelin SCA | | | | | | | 29,182 | | | | 2,987,494 | |

Danone SA | | | | | | | 3,249,392 | | | | 230,100,346 | |

Dassault Aviation SA | | | | | | | 35,339 | | | | 58,639,160 | |

Eiffage SA | | | | | | | 265,607 | | | | 25,939,694 | |

Engie SA | | | | | | | 170,006 | | | | 2,258,903 | |

Eutelsat Communications SA | | | | | | | 725,468 | | | | 14,694,056 | |

Kering SA | | | | | | | 12,792 | | | | 5,685,896 | |

Publicis Groupe SA | | | | | | | 51,103 | | | | 2,958,195 | |

Safran SA | | | | | | | 1,213,699 | | | | 156,843,724 | |

Sanofi | | | | | | | 235,154 | | | | 21,013,496 | |

Societe Generale SA | | | | | | | 128,934 | | | | 4,726,429 | |

Sodexo SA | | | | | | | 1,656,121 | | | | 169,051,694 | |

TOTAL SA — ADR | | | | | | | 47,392 | | | | 2,777,171 | |

Unibail-Rodamco-Westfield | | | | | | | 354,365 | | | | 64,125,534 | |

| | | | | | | | | | | | |

| | | | 831,654,752 | |

| Germany — 1.5% | |

adidas AG | | | | | | | 998 | | | | 234,693 | |

Allianz SE, Registered Shares | | | | | | | 27,595 | | | | 5,748,586 | |

Bayer AG, Registered Shares | | | | | | | 1,856,544 | | | | 142,308,605 | |

Evonik Industries AG | | | | | | | 159,179 | | | | 4,924,326 | |

| | | | |

| CONSOLIDATED SCHEDULE OF INVESTMENTS | | | 9 | |

| | |

Consolidated Schedule of Investments (continued) October 31, 2018 | | BlackRock Global Allocation Fund, Inc. (Percentages shown are based on Net Assets) |

| | | | | | | | | | | | |

| Security | | | Shares | | | Value | |

| Germany (continued) | |

Fraport AG Frankfurt Airport Services Worldwide | | | | | | | 221,722 | | | $ | 17,122,607 | |

Fresenius SE & Co. KGaA | | | | | | | 2,983,183 | | | | 189,598,553 | |

Knorr-Bremse AG(c) | | | | | | | 1,078,575 | | | | 97,731,868 | |

Muenchener Rueckversicherungs-Gesellschaft AG, Registered Shares | | | | | | | 6,638 | | | | 1,425,746 | |

SAP SE | | | | | | | 26,617 | | | | 2,849,974 | |

Vonovia SE | | | | | | | 166,270 | | | | 7,597,954 | |

| | | | | | | | | | | | |

| | | | 469,542,912 | |

| Hong Kong — 0.8% | |

Beijing Enterprises Holdings Ltd. | | | | | | | 287,500 | | | | 1,558,813 | |

China Resources Beer Holdings Co. Ltd. | | | | | | | 278,000 | | | | 968,725 | |

CITIC Ltd. | | | | | | | 1,658,000 | | | | 2,491,160 | |

CK Asset Holdings Ltd. | | | | | | | 61,000 | | | | 396,972 | |

CK Infrastructure Holdings Ltd. | | | | | | | 1,782,500 | | | | 13,045,453 | |

Galaxy Entertainment Group Ltd. | | | | | | | 208,000 | | | | 1,129,259 | |

Hang Lung Properties Ltd. | | | | | | | 7,519,000 | | | | 13,629,479 | |

HKT Trust & HKT Ltd.(f) | | | | | | | 6,618,000 | | | | 9,127,335 | |

Hong Kong Exchanges & Clearing Ltd. | | | | | | | 8,100 | | | | 215,677 | |

Hongkong Land Holdings Ltd. | | | | | | | 336,700 | | | | 1,993,924 | |

I-CABLE Communications Ltd.(c)(d) | | | | | | | 1,370,132 | | | | 23,632 | |

Jardine Matheson Holdings Ltd. | | | | | | | 274,600 | | | | 15,856,341 | |

Link REIT | | | | | | | 1,502,000 | | | | 13,348,406 | |

Nine Dragons Paper Holdings Ltd. | | | | | | | 228,000 | | | | 218,353 | |

Power Assets Holdings Ltd. | | | | | | | 549,000 | | | | 3,666,174 | |

Sino Land Co. Ltd. | | | | | | | 4,610,000 | | | | 7,242,325 | |

Sun Hung Kai Properties Ltd. | | | | | | | 10,522,166 | | | | 136,747,953 | |

Swire Pacific Ltd., Class A | | | | | | | 972,500 | | | | 10,102,996 | |

WH Group Ltd.(e) | | | | | | | 4,673,500 | | | | 3,282,033 | |

Wharf Real Estate Investment Co. Ltd. | | | | | | | 1,566,000 | | | | 9,731,328 | |

| | | | | | | | | | | | |

| | | | 244,776,338 | |

| India — 1.2% | |

Coal India Ltd. | | | | | | | 3,374,601 | | | | 12,162,320 | |

HCL Technologies Ltd. | | | | | | | 68,132 | | | | 974,018 | |

Hero MotoCorp Ltd. | | | | | | | 209,871 | | | | 7,835,291 | |

Hindustan Petroleum Corp. Ltd. | | | | | | | 1,172,275 | | | | 3,567,398 | |

Hindustan Unilever Ltd. | | | | | | | 7,040 | | | | 154,560 | |

Housing Development Finance Corp. Ltd. | | | | | | | 3,530,895 | | | | 84,471,467 | |

Indian Oil Corp. Ltd. | | | | | | | 148,716 | | | | 279,030 | |

Infosys Ltd. | | | | | | | 122,835 | | | | 1,135,125 | |

JSW Steel Ltd. | | | | | | | 162,737 | | | | 747,146 | |

Kotak Mahindra Bank Ltd. | | | | | | | 2,327,193 | | | | 35,216,615 | |

Maruti Suzuki India Ltd. | | | | | | | 345,899 | | | | 30,950,640 | |

Oil & Natural Gas Corp. Ltd. | | | | | | | 3,580,512 | | | | 7,416,852 | |

Reliance Industries Ltd. | | | | | | | 10,923,151 | | | | 156,815,758 | |

State Bank of India(c) | | | | | | | 7,722,007 | | | | 29,387,043 | |

Tata Consultancy Services Ltd. | | | | | | | 49,663 | | | | 1,301,937 | |

Tata Steel Ltd. | | | | | | | 8,039 | | | | 60,280 | |

| | | | | | | | | | | | |

| | | | 372,475,480 | |

| Indonesia — 0.0% | |

Bank Central Asia Tbk PT | | | | | | | 6,041,400 | | | | 9,406,826 | |

Siloam International Hospitals Tbk PT(c) | | | | | | | 1 | | | | — | |

| | | | | | | | | | | | |

| | | | 9,406,826 | |

| Ireland — 0.1% | |

Accenture PLC, Class A | | | | | | | 42,648 | | | | 6,722,178 | |

Medtronic PLC | | | | | | | 107,088 | | | | 9,618,644 | |

| | | | | | | | | | | | |

| | | | 16,340,822 | |

| Italy — 0.9% | |

Enel SpA | | | | | | | 13,347,330 | | | | 65,442,818 | |

Eni SpA | | | | | | | 169,929 | | | | 3,017,897 | |

Luxottica Group SpA | | | | | | | 1,646,322 | | | | 103,394,370 | |

RAI Way SpA(e) | | | | | | | 6,704,564 | | | | 34,742,215 | |

Snam SpA | | | | | | | 6,139,440 | | | | 25,383,862 | |

| | | | | | | | | | | | |

| Security | | | Shares | | | Value | |

| Italy (continued) | |

Telecom Italia SpA(c) | | | | | | | 48,625,036 | | | $ | 28,598,990 | |

Telecom Italia SpA, Non-Convertible Savings Shares | | | | | | | 2,351,862 | | | | 1,188,157 | |

UniCredit SpA | | | | | | | 63,370 | | | | 810,195 | |

| | | | | | | | | | | | |

| | | | 262,578,504 | |

| Japan — 8.3% | |

Aeon Co. Ltd. | | | | | | | 10,000 | | | | 229,521 | |

Ajinomoto Co., Inc. | | | | | | | 6,421,600 | | | | 103,743,824 | |

Alfresa Holdings Corp. | | | | | | | 343,100 | | | | 9,151,049 | |

Alpine Electronics, Inc. | | | | | | | 256,500 | | | | 4,353,710 | |

Asahi Kasei Corp. | | | | | | | 4,105,600 | | | | 49,260,832 | |

Astellas Pharma, Inc. | | | | | | | 6,258,650 | | | | 96,697,352 | |

Bridgestone Corp. | | | | | | | 486,300 | | | | 18,751,376 | |

Canon Marketing Japan, Inc. | | | | | | | 303,300 | | | | 5,739,354 | |

Daicel Corp. | | | | | | | 1,239,200 | | | | 13,109,515 | |

Daikin Industries Ltd. | | | | | | | 449,600 | | | | 52,113,986 | |

Daiwa House Industry Co. Ltd. | | | | | | | 28,100 | | | | 848,460 | |

Denso Corp. | | | | | | | 3,226,180 | | | | 143,906,114 | |

Dowa Holdings Co. Ltd. | | | | | | | 174,400 | | | | 5,075,603 | |

East Japan Railway Co. | | | | | | | 1,832,873 | | | | 160,078,863 | |

Eisai Co. Ltd. | | | | | | | 39,400 | | | | 3,281,246 | |

Exedy Corp. | | | | | | | 210,000 | | | | 5,172,457 | |

Fujitsu Ltd. | | | | | | | 27,600 | | | | 1,679,139 | |

GS Yuasa Corp. | | | | | | | 407,100 | | | | 8,356,621 | |

Hino Motors Ltd. | | | | | | | 592,100 | | | | 5,667,747 | |

Hitachi Chemical Co. Ltd. | | | | | | | 451,100 | | | | 7,110,251 | |

Hitachi Ltd. | | | | | | | 174,100 | | | | 5,322,271 | |

Hoya Corp. | | | | | | | 1,741,117 | | | | 98,505,018 | |

Japan Airlines Co. Ltd. | | | | | | | 4,848,300 | | | | 172,071,734 | |

Japan Aviation Electronics Industry Ltd. | | | | | | | 586,200 | | | | 7,762,431 | |

JFE Holdings, Inc. | | | | | | | 35,400 | | | | 665,222 | |

Kajima Corp. | | | | | | | 63,000 | | | | 811,221 | |

Kamigumi Co. Ltd. | | | | | | | 309,600 | | | | 6,388,485 | |

KDDI Corp. | | | | | | | 446,000 | | | | 10,793,127 | |

Keyence Corp. | | | | | | | 22,200 | | | | 10,845,133 | |

Kinden Corp. | | | | | | | 1,194,900 | | | | 19,158,815 | |

Koito Manufacturing Co. Ltd. | | | | | | | 1,534,500 | | | | 73,051,558 | |

Kuraray Co. Ltd. | | | | | | | 451,400 | | | | 6,200,211 | |

Kyowa Hakko Kirin Co. Ltd. | | | | | | | 58,700 | | | | 1,136,834 | |

Kyudenko Corp. | | | | | | | 168,300 | | | | 6,123,352 | |

Mabuchi Motor Co. Ltd. | | | | | | | 323,700 | | | | 11,514,433 | |

Maeda Road Construction Co. Ltd. | | | | | | | 305,000 | | | | 5,555,247 | |

Medipal Holdings Corp. | | | | | | | 395,800 | | | | 8,472,528 | |

Mitsubishi Electric Corp. | | | | | | | 13,062,500 | | | | 165,363,811 | |

Mitsubishi Estate Co. Ltd. | | | | | | | 390,000 | | | | 6,232,902 | |

Mitsubishi Heavy Industries Ltd. | | | | | | | 63,300 | | | | 2,231,434 | |

Mitsubishi Tanabe Pharma Corp. | | | | | | | 18,400 | | | | 271,785 | |

Mitsubishi UFJ Financial Group, Inc. | | | | | | | 84,400 | | | | 510,830 | |

Mitsui & Co. Ltd. | | | | | | | 16,300 | | | | 272,350 | |

Mitsui Fudosan Co. Ltd. | | | | | | | 71,300 | | | | 1,605,835 | |

Murata Manufacturing Co. Ltd. | | | | | | | 915,140 | | | | 142,428,011 | |

Nexon Co. Ltd.(c) | | | | | | | 26,300 | | | | 300,011 | |

Nichias Corp. | | | | | | | 342,700 | | | | 7,467,495 | |

Nintendo Co. Ltd. | | | | | | | 2,800 | | | | 874,168 | |

Nippo Corp. | | | | | | | 282,400 | | | | 4,630,006 | |

Nippon Telegraph & Telephone Corp. | | | | | | | 231,000 | | | | 9,526,116 | |

Nippon Television Holdings, Inc. | | | | | | | 746,000 | | | | 11,902,575 | |

Nitto Denko Corp. | | | | | | | 2,423,800 | | | | 151,427,119 | |

Okumura Corp. | | | | | | | 378,024 | | | | 11,930,519 | |

Ono Pharmaceutical Co. Ltd. | | | | | | | 22,100 | | | | 501,529 | |

Oracle Corp. Japan | | | | | | | 28,000 | | | | 1,895,292 | |

Otsuka Holdings Co. Ltd. | | | | | | | 24,100 | | | | 1,152,653 | |

Panasonic Corp. | | | | | | | 270,300 | | | | 2,900,710 | |

Rohm Co. Ltd. | | | | | | | 909,900 | | | | 63,969,857 | |

Seino Holdings Co Ltd. | | | | | | | 438,000 | | | | 6,065,582 | |

| | |

| 10 | | 2018 BLACKROCK ANNUAL REPORTTO SHAREHOLDERS |

| | |

Consolidated Schedule of Investments (continued) October 31, 2018 | | BlackRock Global Allocation Fund, Inc. (Percentages shown are based on Net Assets) |

| | | | | | | | | | | | |

| Security | | | Shares | | | Value | |

| Japan (continued) | |

Seven & i Holdings Co. Ltd. | | | | | | | 144,400 | | | $ | 6,252,517 | |

Shimamura Co. Ltd. | | | | | | | 63,700 | | | | 5,358,095 | |

Shin-Etsu Chemical Co. Ltd. | | | | | | | 1,513,440 | | | | 126,463,795 | |

Shiseido Co. Ltd. | | | | | | | 28,700 | | | | 1,810,840 | |

Sony Corp. | | | | | | | 33,000 | | | | 1,785,852 | |

Stanley Electric Co. Ltd. | | | | | | | 201,300 | | | | 5,954,517 | |

Subaru Corp. | | | | | | | 6,426,090 | | | | 173,341,740 | |

Sumitomo Chemical Co. Ltd. | | | | | | | 451,000 | | | | 2,259,234 | |

Sumitomo Mitsui Financial Group, Inc. | | | | | | | 2,400 | | | | 93,444 | |

Suzuken Co. Ltd. | | | | | | | 169,900 | | | | 8,599,552 | |

Suzuki Motor Corp. | | | | | | | 2,928,008 | | | | 146,010,138 | |

Taisei Corp. | | | | | | | 37,100 | | | | 1,586,710 | |

Takeda Pharmaceutical Co. Ltd. | | | | | | | 438,800 | | | | 18,192,438 | |

Toagosei Co. Ltd. | | | | | | | 652,800 | | | | 6,703,116 | |

Toda Corp. | | | | | | | 1,524,100 | | | | 10,255,943 | |

Tokyo Gas Co. Ltd. | | | | | | | 4,266,857 | | | | 104,934,400 | |

Tokyo Steel Manufacturing Co. Ltd. | | | | | | | 1,565,100 | | | | 12,340,162 | |

Toray Industries, Inc. | | | | | | | 7,056,800 | | | | 50,055,941 | |

Toshiba Corp.(c) | | | | | | | 159,900 | | | | 4,792,612 | |

Toyota Industries Corp. | | | | | | | 1,690,880 | | | | 83,059,637 | |

TV Asahi Holdings Corp. | | | | | | | 542,700 | | | | 10,131,600 | |

Ube Industries Ltd. | | | | | | | 2,264,550 | | | | 49,327,927 | |

Unicharm Corp. | | | | | | | 40,300 | | | | 1,093,288 | |

Yamato Kogyo Co. Ltd. | | | | | | | 239,200 | | | | 6,303,832 | |

| | | | | | | | | | | | |

| | | | 2,568,872,560 | |

| Macau — 0.0% | |

Sands China Ltd. | | | | | | | 35,200 | | | | 139,199 | |

| | | | | | | | | | | | |

| Malaysia — 0.0% | |

Malaysia Airports Holdings Bhd | | | | | | | 2,585,600 | | | | 5,139,365 | |

| | | | | | | | | | | | |

| Mexico — 0.0% | |

America Movil SAB de CV, Series L | | | | | | | 141,069 | | | | 102,156 | |

Cemex SAB de CV(c) | | | | | | | 1,221,922 | | | | 609,961 | |

| | | | | | | | | | | | |

| | | | 712,117 | |

| Netherlands — 1.0% | |

ABN AMRO Group NV CVA(e) | | | | | | | 2,261,902 | | | | 55,478,994 | |

Koninklijke Ahold Delhaize NV | | | | | | | 5,431 | | | | 124,318 | |

Koninklijke Philips NV | | | | | | | 7,202,227 | | | | 268,613,068 | |

| | | | | | | | | | | | |

| | | | 324,216,380 | |

| Norway — 0.0% | |

Equinor ASA | | | | | | | 26,982 | | | | 697,924 | |

| | | | | | | | | | | | |

| Poland — 0.0% | |

Polski Koncern Naftowy ORLEN SA | | | | | | | 16,612 | | | | 399,475 | |

Polskie Gornictwo Naftowe i Gazownictwo SA(c) | | | | | | | 356,604 | | | | 581,721 | |

| | | | | | | | | | | | |

| | | | 981,196 | |

| Portugal — 0.1% | |

Jeronimo Martins SGPS SA | | | | | | | 560,798 | | | | 6,883,221 | |

NOS SGPS SA | | | | | | | 4,228,375 | | | | 23,716,558 | |

| | | | | | | | | | | | |

| | | | 30,599,779 | |

| Singapore — 0.5% | |

CapitaLand Ltd. | | | | | | | 58,248,900 | | | | 132,311,568 | |

ComfortDelGro Corp. Ltd. | | | | | | | 6,191,300 | | | | 10,081,054 | |

Genting Singapore Ltd. | | | | | | | 3,408,900 | | | | 2,169,305 | |

Singapore Telecommunications Ltd. | | | | | | | 5,253,000 | | | | 11,998,900 | |

United Overseas Bank Ltd. | | | | | | | 176,000 | | | | 3,111,765 | |

| | | | | | | | | | | | |

| | | | 159,672,592 | |

| South Africa — 0.0% | |

Aspen Pharmacare Holdings Ltd. | | | | | | | 72,139 | | | | 762,869 | |

Kumba Iron Ore Ltd. | | | | | | | 4,491 | | | | 88,054 | |

MTN Group Ltd. | | | | | | | 67,013 | | | | 389,140 | |

Old Mutual Ltd. | | | | | | | 985,505 | | | | 1,515,138 | |

| | | | | | | | | | | | |

| Security | | | Shares | | | Value | |

| South Africa (continued) | |

Tiger Brands Ltd. | | | | | | | 6,635 | | | $ | 118,844 | |

| | | | | | | | | | | | |

| | | | 2,874,045 | |

| South Korea — 0.7% | |

Coway Co. Ltd. | | | | | | | 134,490 | | | | 8,299,190 | |

Doosan Bobcat, Inc. | | | | | | | 1,366,590 | | | | 42,382,527 | |

E-MART Inc. | | | | | | | 3,327 | | | | 598,519 | |

Hana Financial Group, Inc. | | | | | | | 69,025 | | | | 2,325,150 | |

Industrial Bank of Korea | | | | | | | 110,162 | | | | 1,438,550 | |

KB Financial Group, Inc. | | | | | | | 27,124 | | | | 1,129,557 | |

KT&G Corp. | | | | | | | 952,401 | | | | 84,926,790 | |

LG Chem Ltd. | | | | | | | 47,021 | | | | 14,368,470 | |

Lotte Chemical Corp. | | | | | | | 453 | | | | 104,662 | |

NCSoft Corp. | | | | | | | 25,623 | | | | 9,684,392 | |

POSCO | | | | | | | 67,143 | | | | 15,368,556 | |

S-Oil Corp. | | | | | | | 95,724 | | | | 10,445,622 | |

Samsung Electronics Co. Ltd. | | | | | | | 127,210 | | | | 4,762,207 | |

Samsung SDS Co. Ltd. | | | | | | | 4,848 | | | | 824,661 | |

Shinhan Financial Group Co. Ltd. | | | | | | | 111,177 | | | | 4,140,877 | |

SK Innovation Co. Ltd. | | | | | | | 1,525 | | | | 286,197 | |

SK Telecom Co. Ltd. | | | | | | | 54,460 | | | | 12,795,945 | |

Woori Bank | | | | | | | 94,723 | | | | 1,312,480 | |

| | | | | | | | | | | | |

| | | | 215,194,352 | |

| Spain — 0.3% | |

Banco Bilbao Vizcaya Argentaria SA | | | | | | | 831,692 | | | | 4,590,184 | |

CaixaBank SA | | | | | | | 146,328 | | | | 592,147 | |

Cellnex Telecom SAU(e) | | | | | | | 4,031,258 | | | | 100,282,719 | |

Telefonica SA | | | | | | | 131,433 | | | | 1,078,153 | |

| | | | | | | | | | | | |

| | | | 106,543,203 | |

| Sweden — 0.0% | |

Sandvik AB | | | | | | | 113,537 | | | | 1,794,883 | |

Telefonaktiebolaget LM Ericsson, Class B | | | | | | | 283,110 | | | | 2,464,970 | |

| | | | | | | | | | | | |

| | | | 4,259,853 | |

| Switzerland — 1.3% | |

Chubb Ltd. | | | | | | | 889,359 | | | | 111,089,833 | |

Cie Financiere Richemont SA, Registered Shares | | | | | | | 30,064 | | | | 2,197,395 | |

Garrett Motion, Inc.(c) | | | | | | | 1 | | | | 9 | |

Nestle SA, Registered Shares | | | | | | | 3,278,861 | | | | 276,811,554 | |

Novartis AG, Registered Shares | | | | | | | 27,453 | | | | 2,404,122 | |

Roche Holding AG | | | | | | | 18,214 | | | | 4,432,603 | |

Swatch Group AG, Registered Shares | | | | | | | 8,144 | | | | 543,618 | |

Swiss Re AG | | | | | | | 28,967 | | | | 2,613,771 | |

| | | | | | | | | | | | |

| | | | 400,092,905 | |

| Taiwan — 0.8% | |

Cathay Financial Holding Co. Ltd. | | | | | | | 8,773,000 | | | | 13,928,651 | |

Cheng Shin Rubber Industry Co. Ltd. | | | | | | | 4,273,672 | | | | 6,029,489 | |

Chunghwa Telecom Co. Ltd. | | | | | | | 20,530,000 | | | | 72,515,057 | |

Far EasTone Telecommunications Co. Ltd. | | | | | | | 12,342,000 | | | | 29,410,770 | |

Formosa Chemicals & Fibre Corp. | | | | | | | 2,807,000 | | | | 10,186,761 | |

Formosa Petrochemical Corp. | | | | | | | 2,237,000 | | | | 8,831,175 | |

Formosa Plastics Corp. | | | | | | | 3,265,000 | | | | 10,676,817 | |

Fubon Financial Holding Co. Ltd. | | | | | | | 10,429,000 | | | | 16,362,104 | |

Hon Hai Precision Industry Co. Ltd. | | | | | | | 4,512,760 | | | | 11,487,449 | |

MediaTek, Inc. | | | | | | | 97,000 | | | | 716,504 | |

Nan Ya Plastics Corp. | | | | | | | 4,098,000 | | | | 10,208,150 | |

Nanya Technology Corp. | | | | | | | 629,000 | | | | 1,050,274 | |

Taiwan Cooperative Financial Holding Co. Ltd. | | | | | | | 4,350 | | | | 2,450 | |

Taiwan Mobile Co. Ltd. | | | | | | | 10,048,000 | | | | 35,904,590 | |

Taiwan Semiconductor Manufacturing Co. Ltd. | | | | | | | 2,363,000 | | | | 17,739,944 | |

Uni-President Enterprises Corp. | | | | | | | 6,592,000 | | | | 15,978,035 | |

Yageo Corp. | | | | | | | 67,000 | | | | 687,026 | |

| | | | | | | | | | | | |

| | | | 261,715,246 | |

| | | | |

| CONSOLIDATED SCHEDULE OF INVESTMENTS | | | 11 | |

| | |

Consolidated Schedule of Investments (continued) October 31, 2018 | | BlackRock Global Allocation Fund, Inc. (Percentages shown are based on Net Assets) |

| | | | | | | | | | | | |

| Security | | | Shares | | | Value | |

| Thailand — 0.2% | |

Advanced Info Service PCL, Foreign Registered Shares | | | | | | | 2,776,300 | | | $ | 16,461,873 | |

Intouch Holdings PCL, Class F | | | | | | | 7,124,600 | | | | 11,283,303 | |

PTT Global Chemical PCL, Foreign Registered Shares | | | | | | | 6,145,200 | | | | 14,320,262 | |

Siam Cement PCL, Foreign Registered Shares | | | | | | | 905,700 | | | | 11,413,529 | |

Thai Oil PCL, Foreign Registered Shares — NVDR | | | | | | | 3,988,300 | | | | 10,196,333 | |

| | | | | | | | | | | | |

| | | | 63,675,300 | |

| Turkey — 0.0% | |

Eregli Demir ve Celik Fabrikalari TAS | | | | | | | 37,270 | | | | 60,482 | |

Haci Omer Sabanci Holding AS | | | | | | | 85,508 | | | | 109,070 | |

Turk Hava Yollari AO(c) | | | | | | | 475,375 | | | | 1,197,415 | |

Turkiye Is Bankasi AS, Class C | | | | | | | 724,179 | | | | 518,294 | |

Turkiye Vakiflar Bankasi Tao, Class D | | | | | | | 376,663 | | | | 231,095 | |

| | | | | | | | | | | | |

| | | | 2,116,356 | |

| United Arab Emirates — 0.5% | |

NMC Health PLC | | | | | | | 3,376,810 | | | | 152,258,863 | |

| | | | | | | | | | | | |

| United Kingdom — 2.7% | |

Anglo American PLC | | | | | | | 76,562 | | | | 1,634,092 | |

Barclays PLC | | | | | | | 1,196,193 | | | | 2,635,579 | |

Berkeley Group Holdings PLC | | | | | | | 117,596 | | | | 5,255,750 | |

GlaxoSmithKline PLC | | | | | | | 291,524 | | | | 5,646,166 | |

GW Pharmaceuticals PLC — ADR(c) | | | | | | | 122,199 | | | | 16,801,140 | |

HSBC Holdings PLC | | | | | | | 13,261,996 | | | | 109,140,964 | |

Liberty Global PLC, Class A(c) | | | | | | | 2,742,286 | | | | 70,284,790 | |

Liberty Global PLC, Class C(c) | | | | | | | 91,026 | | | | 2,279,291 | |

National Grid PLC | | | | | | | 522,262 | | | | 5,517,197 | |

Royal Dutch Shell PLC — ADR, Class A | | | | | | | 1,927,556 | | | | 121,802,264 | |

Royal Dutch Shell PLC, Class A | | | | | | | 8,697,956 | | | | 276,267,980 | |

Royal Dutch Shell PLC, Class B | | | | | | | 112,915 | | | | 3,682,488 | |

SSE PLC | | | | | | | 70,629 | | | | 1,029,448 | |

Vodafone Group PLC | | | | | | | 109,052,226 | | | | 205,076,868 | |

| | | | | | | | | | | | |

| | | | 827,054,017 | |

| United States — 36.0% | |

AbbVie, Inc. | | | | | | | 110,598 | | | | 8,610,054 | |

Adobe, Inc.(c) | | | | | | | 47,404 | | | | 11,650,007 | |

AES Corp. | | | | | | | 143,662 | | | | 2,094,592 | |

Aetna, Inc. | | | | | | | 56,052 | | | | 11,120,717 | |

Agilent Technologies, Inc. | | | | | | | 13,727 | | | | 889,372 | |

Air Products & Chemicals, Inc. | | | | | | | 1,294,457 | | | | 199,799,438 | |

Allergan PLC | | | | | | | 14,563 | | | | 2,301,100 | |

Alliance Data Systems Corp. | | | | | | | 7,995 | | | | 1,648,409 | |

Ally Financial, Inc. | | | | | | | 56,785 | | | | 1,442,907 | |

Alphabet, Inc., Class A(c) | | | | | | | 3,802 | | | | 4,146,385 | |

Alphabet, Inc., Class C(c) | | | | | | | 448,706 | | | | 483,153,160 | |

Altria Group, Inc. | | | | | | | 3,166,497 | | | | 205,948,965 | |

Amazon.com, Inc.(c) | | | | | | | 217,938 | | | | 348,267,103 | |

Amdocs Ltd. | | | | | | | 27,057 | | | | 1,711,896 | |

American Airlines Group, Inc. | | | | | | | 2,778 | | | | 97,452 | |

American International Group, Inc. | | | | | | | 14,428 | | | | 595,732 | |

American Tower Corp. | | | | | | | 51,204 | | | | 7,978,095 | |

Ameriprise Financial, Inc. | | | | | | | 33,336 | | | | 4,241,673 | |

Amgen, Inc. | | | | | | | 61,725 | | | | 11,899,963 | |

Anadarko Petroleum Corp. | | | | | | | 4,145,298 | | | | 220,529,854 | |

Anthem, Inc. | | | | | | | 1,155,422 | | | | 318,399,641 | |

Apple, Inc. | | | | | | | 2,658,700 | | | | 581,883,082 | |

Archer-Daniels-Midland Co. | | | | | | | 98,703 | | | | 4,663,717 | |

AT&T, Inc. | | | | | | | 887,349 | | | | 27,223,867 | |

Automatic Data Processing, Inc. | | | | | | | 13,268 | | | | 1,911,653 | |

Bank of America Corp. | | | | | | | 9,968,474 | | | | 274,133,035 | |

Bank of New York Mellon Corp. | | | | | | | 55,593 | | | | 2,631,217 | |

Baxter International, Inc. | | | | | | | 448,781 | | | | 28,053,300 | |

| | | | | | | | | | | | |

| Security | | | Shares | | | Value | |

| United States (continued) | |

Berkshire Hathaway, Inc., Class B(c) | | | | | | | 82,442 | | | $ | 16,923,694 | |

Biogen, Inc.(c) | | | | | | | 246,436 | | | | 74,983,082 | |

Boeing Co. | | | | | | | 40,716 | | | | 14,448,480 | |

Booking Holdings, Inc.(c) | | | | | | | 1,239 | | | | 2,322,605 | |

Bristol-Myers Squibb Co. | | | | | | | 113,346 | | | | 5,728,507 | |

C.H. Robinson Worldwide, Inc. | | | | | | | 53,119 | | | | 4,729,185 | |

Capital One Financial Corp. | | | | | | | 32,443 | | | | 2,897,160 | |

Carnival Corp. | | | | | | | 1,645 | | | | 92,186 | |

Caterpillar, Inc. | | | | | | | 29,934 | | | | 3,631,593 | |

CenterPoint Energy, Inc. | | | | | | | 46,993 | | | | 1,269,281 | |

Charles Schwab Corp. | | | | | | | 4,101,055 | | | | 189,632,783 | |

Charter Communications, Inc., Class A(c) | | | | | | | 1,070,222 | | | | 342,867,022 | |

Chevron Corp. | | | | | | | 85,258 | | | | 9,519,056 | |

Cigna Corp. | | | | | | | 24,190 | | | | 5,172,064 | |

Cisco Systems, Inc. | | | | | | | 222,572 | | | | 10,182,669 | |

Citigroup, Inc. | | | | | | | 1,745,091 | | | | 114,233,657 | |

Cloudera, Inc.(c) | | | | | | | 5,132,387 | | | | 70,621,645 | |

Cognizant Technology Solutions Corp., Class A | | | | | | | 75,325 | | | | 5,199,685 | |

Colgate-Palmolive Co. | | | | | | | 766,453 | | | | 45,642,276 | |

Comcast Corp., Class A(g) | | | | | | | 10,035,683 | | | | 382,760,950 | |

Conagra Brands, Inc. | | | | | | | 63,483 | | | | 2,259,995 | |

ConocoPhillips | | | | | | | 38,483 | | | | 2,689,962 | |

Constellation Brands, Inc., Class A | | | | | | | 11,810 | | | | 2,352,906 | |

Corning, Inc. | | | | | | | 86,297 | | | | 2,757,189 | |

Costco Wholesale Corp. | | | | | | | 16,597 | | | | 3,794,572 | |

CSX Corp. | | | | | | | 112,240 | | | | 7,728,846 | |

CVS Health Corp. | | | | | | | 4,863,894 | | | | 352,097,287 | |

DaVita, Inc.(c) | | | | | | | 707,863 | | | | 47,667,494 | |

Dell Technologies, Inc., Class V(c) | | | | | | | 25,383 | | | | 2,294,369 | |

Delta Air Lines, Inc. | | | | | | | 58,091 | | | | 3,179,320 | |

Discover Financial Services | | | | | | | 50,404 | | | | 3,511,647 | |

Dollar General Corp. | | | | | | | 206,023 | | | | 22,946,842 | |

Domo, Inc., Class B(c)(d) | | | | | | | 1,288,241 | | | | 20,908,151 | |

Domo, Inc., Class B (Acquired 04/01/15, cost $89,772,577),0.00%(b) | | | | | | | 709,811 | | | | 11,341,029 | |

DowDuPont, Inc. | | | | | | | 3,475,713 | | | | 187,410,445 | |

Dropbox, Inc., Class A(c)(d) | | | | | | | 4,635,677 | | | | 108,799,339 | |

Eaton Corp. PLC | | | | | | | 67,495 | | | | 4,837,367 | |

eBay, Inc.(c) | | | | | | | 132,251 | | | | 3,839,247 | |

Edgewell Personal Care Co.(c) | | | | | | | 1,255,002 | | | | 60,214,996 | |

Edwards Lifesciences Corp.(c) | | | | | | | 14,094 | | | | 2,080,274 | |

Entergy Corp. | | | | | | | 1,375 | | | | 115,431 | |

Equity Residential(d) | | | | | | | 793,801 | | | | 51,565,313 | |

Exelon Corp. | | | | | | | 77,836 | | | | 3,409,995 | |

Expedia Group, Inc. | | | | | | | 9,814 | | | | 1,230,970 | |

Express Scripts Holding Co.(c) | | | | | | | 40,722 | | | | 3,948,812 | |

Exxon Mobil Corp. | | | | | | | 2,952,081 | | | | 235,221,814 | |

Facebook, Inc., Class A(c) | | | | | | | 1,925,808 | | | | 292,318,396 | |

Fieldwood Energy, Inc.(a) | | | | | | | 458,081 | | | | 21,529,807 | |

Fifth Third Bancorp | | | | | | | 115,208 | | | | 3,109,464 | |

FleetCor Technologies, Inc.(c) | | | | | | | 756,569 | | | | 151,336,497 | |

Fortune Brands Home & Security, Inc. | | | | | | | 144,230 | | | | 6,465,831 | |

General Electric Co. | | | | | | | 167,479 | | | | 1,691,538 | |

General Motors Co. | | | | | | | 5,369 | | | | 196,452 | |

Gilead Sciences, Inc. | | | | | | | 2,211,394 | | | | 150,772,843 | |

Global Payments, Inc. | | | | | | | 140,276 | | | | 16,023,727 | |

Goldman Sachs Group, Inc. | | | | | | | 45,793 | | | | 10,320,368 | |

Halliburton Co. | | | | | | | 42,178 | | | | 1,462,733 | |

Hartford Financial Services Group, Inc. | | | | | | | 187,577 | | | | 8,519,747 | |

HCA Healthcare, Inc. | | | | | | | 1,232,072 | | | | 164,518,574 | |

Helmerich & Payne, Inc. | | | | | | | 41,998 | | | | 2,616,055 | |

Hewlett Packard Enterprise Co. | | | | | | | 218,890 | | | | 3,338,073 | |

Home Depot, Inc. | | | | | | | 67,336 | | | | 11,843,056 | |

HP, Inc. | | | | | | | 132,709 | | | | 3,203,595 | |

| | |

| 12 | | 2018 BLACKROCK ANNUAL REPORTTO SHAREHOLDERS |

| | |

Consolidated Schedule of Investments (continued) October 31, 2018 | | BlackRock Global Allocation Fund, Inc. (Percentages shown are based on Net Assets) |

| | | | | | | | | | | | |

| Security | | | Shares | | | Value | |

| United States (continued) | |

Humana, Inc. | | | | | | | 9,250 | | | $ | 2,963,793 | |

Huntsman Corp. | | | | | | | 78,513 | | | | 1,717,864 | |

Illumina, Inc.(c) | | | | | | | 8,098 | | | | 2,519,693 | |

Ingersoll-Rand PLC | | | | | | | 24,190 | | | | 2,320,789 | |

Intel Corp. | | | | | | | 217,633 | | | | 10,202,635 | |

International Business Machines Corp. | | | | | | | 82,919 | | | | 9,571,340 | |

Intuit, Inc. | | | | | | | 48,238 | | | | 10,178,218 | |

Intuitive Surgical, Inc.(c) | | | | | | | 4,938 | | | | 2,573,587 | |

Jawbone Health Hub, Inc., (Acquired 01/24/17, Cost $0)(a)(b) | | | | | | | 1,518,232 | | | | 15 | |

Johnson & Johnson | | | | | | | 3,131,979 | | | | 438,445,740 | |

JPMorgan Chase & Co. | | | | | | | 705,838 | | | | 76,950,459 | |

Kinder Morgan, Inc. | | | | | | | 77,822 | | | | 1,324,530 | |

KLA-Tencor Corp. | | | | | | | 26,802 | | | | 2,453,455 | |

Kohl’s Corp. | | | | | | | 49,455 | | | | 3,745,227 | |

Kroger Co. | | | | | | | 96,320 | | | | 2,866,483 | |

Las Vegas Sands Corp. | | | | | | | 92,998 | | | | 4,745,688 | |

Lear Corp. | | | | | | | 11,858 | | | | 1,575,928 | |

Liberty Broadband Corp., Class A(c) | | | | | | | 210,903 | | | | 17,460,659 | |

Liberty Broadband Corp., Class C(c) | | | | | | | 881,569 | | | | 73,108,517 | |

Liberty Media Corp. — Liberty SiriusXM, Class A(c) | | | | | | | 747,249 | | | | 30,816,549 | |

Liberty Media Corp. — Liberty SiriusXM, Class C(c) | | | | | | | 1,232,517 | | | | 50,865,977 | |

Lockheed Martin Corp. | | | | | | | 75,585 | | | | 22,210,652 | |

Lookout, Inc., (Acquired 03/04/15, cost $2,096,082)(a)(b) | | | | | | | 183,495 | | | | 9,175 | |

Lowe’s Cos., Inc. | | | | | | | 187,495 | | | | 17,853,274 | |

Marathon Petroleum Corp. | | | | | | | 573,213 | | | | 40,382,856 | |

Marsh & McLennan Cos., Inc. | | | | | | | 2,348,508 | | | | 199,036,053 | |

Masco Corp. | | | | | | | 520,872 | | | | 15,626,160 | |

Mastercard, Inc., Class A | | | | | | | 182,256 | | | | 36,026,544 | |

McDonald’s Corp. | | | | | | | 23,495 | | | | 4,156,266 | |

McKesson Corp. | | | | | | | 19,457 | | | | 2,427,455 | |

Merck & Co., Inc. | | | | | | | 243,404 | | | | 17,916,968 | |

MetLife, Inc. | | | | | | | 99,781 | | | | 4,109,979 | |

MGM Resorts International | | | | | | | 2,744,614 | | | | 73,226,302 | |

Micron Technology, Inc.(c) | | | | | | | 150,447 | | | | 5,674,861 | |

Microsoft Corp. | | | | | | | 4,870,708 | | | | 520,240,321 | |

Mondelez International, Inc., Class A | | | | | | | 232,959 | | | | 9,779,619 | |

Morgan Stanley | | | | | | | 4,333,681 | | | | 197,875,874 | |

Newmont Mining Corp. | | | | | | | 1,910,079 | | | | 59,059,643 | |

NextEra Energy Partners LP | | | | | | | 1,099,862 | | | | 50,076,717 | |

NextEra Energy, Inc. | | | | | | | 1,525,352 | | | | 263,123,220 | |

NIKE, Inc., Class B | | | | | | | 13,835 | | | | 1,038,178 | |

Norfolk Southern Corp. | | | | | | | 21,046 | | | | 3,532,150 | |

Northrop Grumman Corp. | | | | | | | 29,270 | | | | 7,667,277 | |

NRG Energy, Inc. | | | | | | | 59,239 | | | | 2,143,859 | |

O’Reilly Automotive, Inc.(c) | | | | | | | 194,609 | | | | 62,420,837 | |

Occidental Petroleum Corp. | | | | | | | 53,909 | | | | 3,615,677 | |

Omnicom Group, Inc. | | | | | | | 129,138 | | | | 9,597,536 | |

Oracle Corp. | | | | | | | 811,442 | | | | 39,630,827 | |

Packaging Corp. of America | | | | | | | 27,584 | | | | 2,532,487 | |

Paychex, Inc. | | | | | | | 55,338 | | | | 3,624,086 | |

PayPal Holdings, Inc.(c) | | | | | | | 4,908 | | | | 413,205 | |

PepsiCo, Inc. | | | | | | | 127,917 | | | | 14,375,312 | |

Pfizer, Inc. | | | | | | | 6,333,877 | | | | 272,736,744 | |

Philip Morris International, Inc. | | | | | | | 1,611,691 | | | | 141,941,626 | |

Phillips 66 | | | | | | | 88,750 | | | | 9,125,275 | |

Procter & Gamble Co. | | | | | | | 2,634,052 | | | | 233,587,731 | |

Prudential Financial, Inc. | | | | | | | 26,372 | | | | 2,473,166 | |

Pure Storage, Inc., Class A(c) | | | | | | | 3,305,833 | | | | 66,711,710 | |

PVH Corp. | | | | | | | 19,718 | | | | 2,381,737 | |

QUALCOMM, Inc. | | | | | | | 1,955,168 | | | | 122,960,516 | |

Raytheon Co. | | | | | | | 180,034 | | | | 31,513,151 | |

Red Hat, Inc.(c) | | | | | | | 418,227 | | | | 71,784,482 | |

| | | | | | | | | | | | |

| Security | | | Shares | | | Value | |

| United States (continued) | |

Reinsurance Group of America, Inc. | | | | | | | 30,184 | | | $ | 4,297,296 | |

Resideo Technologies, Inc.(c) | | | | | | | 621 | | | | 13,069 | |

Rockwell Automation, Inc. | | | | | | | 25,313 | | | | 4,169,810 | |

Ross Stores, Inc. | | | | | | | 41,317 | | | | 4,090,383 | |

Royal Caribbean Cruises Ltd. | | | | | | | 19,577 | | | | 2,050,299 | |

Schlumberger Ltd. | | | | | | | 721,782 | | | | 37,034,634 | |

Sempra Energy | | | | | | | 595,123 | | | | 65,534,945 | |

St. Joe Co.(c) | | | | | | | 1,256,050 | | | | 19,079,400 | |

Starbucks Corp. | | | | | | | 3,176,819 | | | | 185,113,243 | |

State Street Corp. | | | | | | | 19,169 | | | | 1,317,869 | |

Stryker Corp. | | | | | | | 62,533 | | | | 10,144,103 | |

SunTrust Banks, Inc. | | | | | | | 1,788,675 | | | | 112,078,375 | |

Sysco Corp. | | | | | | | 40,792 | | | | 2,909,693 | |

Target Corp. | | | | | | | 33,999 | | | | 2,843,336 | |

Tenet Healthcare Corp.(c) | | | | | | | 1,386,141 | | | | 35,665,408 | |

TESARO, Inc.(c)(d) | | | | | | | 395,130 | | | | 11,411,354 | |

Texas Instruments, Inc. | | | | | | | 4,450 | | | | 413,094 | |

Thermo Fisher Scientific, Inc. | | | | | | | 49,969 | | | | 11,675,257 | |

Travelers Cos., Inc. | | | | | | | 103,589 | | | | 12,962,092 | |

Union Pacific Corp. | | | | | | | 16,171 | | | | 2,364,524 | |

United Continental Holdings, Inc.(c) | | | | | | | 1,692,589 | | | | 144,733,285 | |

United Technologies Corp. | | | | | | | 189,657 | | | | 23,557,296 | |

UnitedHealth Group, Inc. | | | | | | | 158,902 | | | | 41,529,038 | |

Valero Energy Corp. | | | | | | | 87,668 | | | | 7,985,678 | |

VanEck Vectors Gold Miners ETF | | | | | | | 1,787,245 | | | | 33,832,548 | |

VeriSign, Inc.(c) | | | | | | | 36,893 | | | | 5,258,728 | |

Verizon Communications, Inc. | | | | | | | 2,027,022 | | | | 115,722,686 | |

VF Corp. | | | | | | | 13,538 | | | | 1,122,029 | |

Visa, Inc., Class A | | | | | | | 123,135 | | | | 16,974,160 | |

Vistra Energy Corp.(c) | | | | | | | 692,087 | | | | 15,661,929 | |

VMware, Inc., Class A(c) | | | | | | | 25,727 | | | | 3,637,541 | |

Vornado Realty Trust | | | | | | | 43,526 | | | | 2,963,250 | |

Walgreens Boots Alliance, Inc. | | | | | | | 3,641 | | | | 290,443 | |

Walmart, Inc. | | | | | | | 247,577 | | | | 24,827,022 | |

Walt Disney Co. | | | | | | | 33,615 | | | | 3,860,010 | |

Waste Management, Inc. | | | | | | | 17,664 | | | | 1,580,398 | |

Wells Fargo & Co. | | | | | | | 5,744,133 | | | | 305,760,200 | |

Western Digital Corp. | | | | | | | 2,366,816 | | | | 101,938,765 | |

Weyerhaeuser Co. | | | | | | | 109,625 | | | | 2,919,314 | |

Williams Cos., Inc. | | | | | | | 10,804,878 | | | | 262,882,682 | |

Wyndham Destinations, Inc. | | | | | | | 54,246 | | | | 1,946,346 | |

Xcel Energy, Inc. | | | | | | | 31,954 | | | | 1,566,066 | |

Yum! Brands, Inc. | | | | | | | 25,988 | | | | 2,349,575 | |

Zoetis, Inc. | | | | | | | 46,176 | | | | 4,162,766 | |

Zynga, Inc., Class A(c) | | | | | | | 16,107,974 | | | | 58,633,025 | |

| | | | | | | | | | | | |

| | | | 11,169,243,952 | |

| | | | | | | | | | | | |

Total Common Stocks — 63.6%

(Cost — $16,628,983,499) | | | | 19,721,954,497 | |

| | | | | | | | | | | | |

| | |

| | | | Par

(000) | | | | |

| Corporate Bonds — 4.6% | |

|

Australia — 0.5% | |

Quintis Ltd.(a)(e)(h)v): | | | | | | | | | | | | |

(7.50% Cash or 8.00% PIK), 7.50%, 10/01/26 | | | USD | | | | 75,261 | | | | 75,260,640 | |

(0.00% Cash), 0.00%, 10/01/28 | | | | | | | 89,251 | | | | 89,251,400 | |

| | | | | | | | | | | | |

| | | | 164,512,040 | |

| Chile — 0.0% | |

Inversiones Alsacia SA, 8.00%, 12/31/18(c)(e)(i) | | | | | | | 34,232 | | | | 996,479 | |

| | | | | | | | | | | | |

| China — 0.0% | |

China Milk Products Group Ltd.,

0.00%, 01/15/49(j) | | | | | | | 39,500 | | | | 395,000 | |

| | | | | | | | | | | | |

| | | | |

| CONSOLIDATED SCHEDULE OF INVESTMENTS | | | 13 | |

| | |

Consolidated Schedule of Investments (continued) October 31, 2018 | | BlackRock Global Allocation Fund, Inc. (Percentages shown are based on Net Assets) |

| | | | | | | | | | | | |

| Security | | | Par

(000) | | | Value | |

| France — 0.1% | |

Danone SA, 2.59%, 11/02/23(e) | | | USD | | | | 25,900 | | | $ | 24,353,957 | |

| | | | | | | | | | | | |

| India — 0.0% | |

REI Agro Ltd.(a)(i) | | | | | | | | | | | | |

5.50%, 11/13/18 | | | | | | | 46,516 | | | | 465 | |

5.50%, 11/13/18 | | | | | | | 8,271 | | | | 1 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 466 | |

| Italy — 0.0% | |

Telecom Italia SpA, 5.30%, 05/30/24(e) | | | | | | | 13,754 | | | | 12,963,145 | |

| | | | | | | | | | | | |

| Japan — 0.2% | |

Sumitomo Mitsui Financial Group, Inc., 3.94%, 10/16/23 | | | | | | | 71,855 | | | | 72,060,400 | |

| | | | | | | | | | | | |

| Luxembourg — 0.1% | |

Intelsat Jackson Holdings SA: | | | | | | | | | | | | |

7.50%, 04/01/21 | | | | | | | 16,371 | | | | 16,575,637 | |

8.00%, 02/15/24(e) | | | | | | | 6,850 | | | | 7,166,813 | |

| | | | | | | | | | | | |

| | | | 23,742,450 | |

| Mexico — 0.0% | |

Petroleos Mexicanos, 5.98%, 03/11/22(l) | | | | | | | 13,087 | | | | 13,577,762 | |

| | | | | | | | | | | | |

| Netherlands — 0.3% | |

Bayer Capital Corp. BV, 5.63%, 11/22/19(e)(k) | | | EUR | | | | 47,400 | | | | 44,832,926 | |

Bio City Development Co. BV, 8.00%, 07/06/20(a)(e)(i)(j)(v) | | | USD | | | | 140,850 | | | | 21,831,750 | |

Cooperatieve Rabobank UA, 3.95%, 11/09/22 | | | | | | | 6,820 | | | | 6,755,905 | |

ING Groep NV, 4.10%, 10/02/23 | | | | | | | 34,140 | | | | 33,911,514 | |

| | | | | | | | | | | | |

| | | | 107,332,095 | |

| Singapore — 0.1% | |

CapitaLand Ltd., 1.95%, 10/17/23(e)(k) | | | SGD | | | | 24,500 | | | | 17,668,760 | |

| | | | | | | | | | | | |

| Switzerland — 0.1% | |

UBS Group Funding Switzerland AG, 4.13%, 09/24/25(e) | | | USD | | | | 15,856 | | | | 15,599,151 | |

| | | | | | | | | | | | |

| United Kingdom — 0.1% | |

HSBC Holdings PLC (3 mo. LIBOR US + 1.06%), 3.26%, 03/13/23(m) | | | | | | | 24,121 | | | | 23,562,056 | |

| | | | | | | | | | | | |

| United States — 3.1% | |

Allergan Sales LLC, 5.00%, 12/15/21(e) | | | | | | | 11,425 | | | | 11,783,962 | |

Allergan Funding SCS, 3.45%, 03/15/22 | | | | | | | 24,070 | | | | 23,670,805 | |

American Express Co., 3.70%, 08/03/23 | | | | | | | 52,240 | | | | 51,777,154 | |

Anheuser-Busch InBev Worldwide, Inc.: | | | | | | | | | | | | |

3.50%, 01/12/24 | | | | | | | 14,577 | | | | 14,202,676 | |

4.00%, 04/13/28 | | | | | | | 24,015 | | | | 23,079,958 | |

Apple, Inc.: | | | | | | | | | | | | |

3.35%, 02/09/27 | | | | | | | 40,899 | | | | 39,392,072 | |

3.20%, 05/11/27 | | | | | | | 40,818 | | | | 38,803,350 | |

AT&T, Inc., 3.60%, 02/17/23 | | | | | | | 24,154 | | | | 23,801,305 | |

AvalonBay Communities, Inc., 3.50%, 11/15/24 | | | | | | | 4,827 | | | | 4,761,343 | |

Bank of America Corp.: | | | | | | | | | | | | |

(3 mo. LIBOR US + 0.66%), 2.37%, 07/21/21(m) | | | | | | | 11,209 | | | | 10,994,011 | |

3.30%, 01/11/23 | | | | | | | 24,154 | | | | 23,613,381 | |

4.00%, 01/22/25 | | | | | | | 13,001 | | | | 12,660,870 | |