UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

Investment Company Act file number 811-06096

The Torray Fund

(Exact name of registrant as specified in charter)

7501 Wisconsin Avenue, Suite 1100

Bethesda, MD 20814-6523

(Address of principal executive offices) (Zip code)

William M Lane

The Torray Corporation

7501 Wisconsin Avenue, Suite 1100

Bethesda, MD 20814-6523

(Name and address of agent for service)

Registrant’s telephone number, including area code: 301-493-4600

Date of fiscal year end: December 31, 2004

Date of reporting period: June 30, 2004

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

Item 1. Reports to Stockholders

The Torray Fund

Letter to Shareholders

July 30, 2004

Dear Fellow Shareholders:

The stock market traded within its narrowest range in over 10 years during the first six months of 2004, with volume and volatility off sharply from levels recorded during last year’s big advance. Other major markets around the world followed similar patterns. We think the likely explanation is that stocks have fully discounted the good economic news, and investors won’t pay more for them until they’re convinced the recovery in earnings is sustainable. Recent signals have been mixed. Even so, we remain optimistic about the prospects for companies in our portfolio, and will be making no changes in direction going forward. The future always brings surprises and, as we shall see, investors’ attempts to anticipate them have failed at great expense.

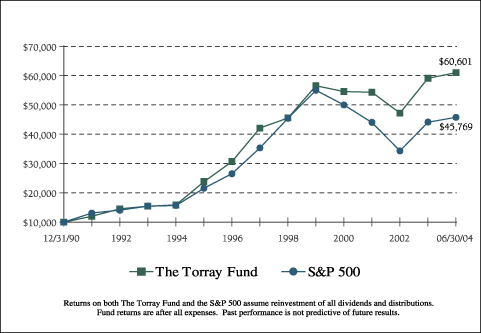

The Torray Fund gained 2.5% through June 30, slightly trailing the S&P 500 which added 3.4%. We are pleased to report the long-term picture is bright. Since inception 13 1/2 years ago, our Fund has earned 14.3% compounded annually, compared to 11.9% for the Index; its 14.7% per year 10-year record carries a 5-Star rating and ranks in the top 5% of all 3,427 funds in business for that period.1

Having said that, we recognize the last five years have been tough sledding for you. This downturn has been the longest and steepest since the 1930’s — a setback few could have imagined as the markets soared during the late 90’s. From top to bottom the market fell about 50%, and even though it has rallied sharply since the spring of 2003, it remains nearly 25% below its peak set more than four years ago. This has seriously eroded investor confidence and probably left a lot of people wondering whether they’re making a mistake continuing to invest in common stocks. Our answer to that is an emphatic “no.” As history reveals, there have always been problems, many of them far worse than those we face today. Yet, each downturn has been followed by recovery, and over time values have risen. The pattern has repeated for more than two centuries, and we see no reason for it to change.

Unfortunately, the average person views things from a different perspective, seeing the future as an extension of the recent past and present. Thus, if the market is caught in the grips of a mania, the tendency is to assume the momentum will continue, regardless of underlying realities. The same applies when the market is falling. And the longer a trend persists, the more people

1

The Torray Fund

Letter to Shareholders

July 30, 2004

believe in it. At this point, a whole raft of negatives is preying on investor psychology, no doubt contributing to the recent weakness in stock prices. However, despite all the uncertainties, we should keep in mind that wars, recessions, inflation and market booms and busts have never produced the dire financial consequences widely forecasted at the time of their occurrence.

For example, The Korean War, which began June 26, 1950, ushered in more than half a century of crises, disturbances and tragedies. These included the assassination of a president, America’s involvement in the Vietnam War starting in the spring of 1965, Watergate, the Arab oil embargo, the market crash of 1973-74 (stocks dropped nearly 50%), inflation, another crash in ‘87 (shares plummeted 21% in a single day), the 2000-2002 collapse, terrorists, wars in Afghanistan and Iraq, corporate malfeasance and gasoline prices. As the lovable Roseanne Roseannadanna used to say on Saturday Night Live, “It’s always something.” There was plenty to think about, but in the end — usually within a few years — the clouds parted and the country moved on. This proved little consolation to a lot of investors, however. Driven by instinct and emotion, they were whipsawed time and again, frightened out on the downturns and lured back on recovery. As we underscored in our last Annual Report, this has slashed returns by staggering amounts.

Meanwhile, prosperity was hiding in plain sight. In 1950, the S&P 500 stood at 18. Today it’s around 1100, well down from a peak of over 1500 set in March 2000. Assuming the reinvestment of dividends, the Index has returned 11.8% compounded annually, turning $1 into $412 — $10,000 into $4.1 million. Since Vietnam, the market has earned 10.3% annually, doubling money every seven years and turning $1 into $47. It’s noteworthy that an extra 15 years and 1.5% of annual return produced nearly nine times the result — $412 vs. $47 — a telling example of how time and small percentages can magnify the outcome. No other investment available to the general public has come remotely close to doing as well. The recent surge in house prices may delude some into thinking otherwise — especially when compared to the stock market’s four-year downturn. But, while the average house in 1950 sold for about $15,000, and today is worth $245,000, the same investment in stocks has grown to $6.2 million. Houses are no match for stocks as a long-term investment.

Getting back to the point, investors all through this period were absorbed, as many are today, in the market’s short-term ups and downs, equating these meaningless fluctuations to

2

The Torray Fund

Letter to Shareholders

July 30, 2004

making or losing money. Their focus was largely on timing — was it “time” to buy or sell this, that, or the other thing? It’s the same today. Meanwhile, those that bought and held on to quality companies or well run mutual funds fared handsomely. Unfortunately, not many did — a testimony to how hard it is for most people to endure bad news for long, especially when it drives down the value of their portfolio.

The media and financial industry shamelessly exploit this weakness, the former blowing negatives out of proportion, the latter responding with “strategies” certain to keep investors off-balance and in constant motion. If it’s inflation and rising interest rates, we’re told to sell bonds and shift equity exposure to commodity-type companies, materials and gold. Never mind that the long-term performance of these assets — every last one of them — has been horrible. It’s time to buy them for one reason — their prices are poised to take off. And, if inflation and rates are expected to fall, we should do the opposite. In this dream world, it’s once again timing, not the intrinsic value of the asset that counts. For investors persuaded there’s profit in all this, the dream will be a bad one. Beyond that, looking at it fatalistically, if a far worse calamity than any on record strikes, virtually all investments will prove disappointing. So, why hold our breath until we practically pass out worrying about things that, over time, history shows won’t make much difference? Far better, we think, to be optimistic, side with the evidence and buy stocks for the long haul. We can just hear the gold bugs howling on this one. Yet, one dollar invested two centuries ago in this popular hedge against disaster — and there have been a lot of disasters — is now worth only $21.44, while in bonds it has grown to $16,451 and, in stocks, to $9,170,000.2

History reveals another reality that should restrain those with runaway imaginations. Over the five years, 1995-99, the U.S. market went up 28% annually — a phenomenal and, to our knowledge, unprecedented performance. Yet, at the time, few seemed to think there was anything out of the ordinary about it. Thoughtful investors might have reconsidered what they were doing had they known the 200-year return on stocks that turned $1 into more than $9 million was 8.3%. This record strongly suggests that the average person is never going to make even 15% a year on stocks, much less more. Betting on beating a two-century return on the best of all assets by a two- to-one margin is like believing you’ll win the Mega Millions lottery against odds that on the last drawing were 135 million-to-one. But, the good news is you don’t need to, as we’ll see in a moment.

| 2 | | Stocks for the Long Run by Jeremy J. Siegel |

3

The Torray Fund

Letter to Shareholders

July 30, 2004

It’s interesting to note that equities performed better between 1925 and 2003 than over the longer period we’ve referenced (10.4% vs. 8.3%)3. However, a higher inflation rate reduced the differential in terms of buying power — the critical measure — to just four-tenths of one percent (7.4% vs. 7%)4. And, although it seems counterintuitive in this age of technological advance, invention, and supposed financial sophistication and innovation, results adjusted for the cost of living fell to 5.9% over the last three decades, even though nominal returns rose to 11%5. The cause was a major surge in inflation during the 70’s and 80’s.

While no one knows what real returns will be going forward, seven percent seems like a fair guess. We hope to do better. But, even that rate after inflation will produce a great outcome over a 40-year working career — say, ages 25 to 65. Assuming an initial $10,000 investment, with additions averaging $500 per month for four decades — a very low number given the long time span — an investor would retire with nearly $1.5 million in today’s purchasing power. And, of course, with larger contributions the outcome would be even better. We imagine a lot of people would be happy with this.

And, they should be, because there are really no competitive alternatives. We have often discredited the notion that returns can be enhanced by trading, market timing, asset allocation, or any other non-fundamental approach, and we do so again here. That leaves only bonds and savings accounts. The after-inflation return on these investments has averaged between one and two percent per year. It takes 72 years to double money at one percent, 36 at two percent, but only 10 years at seven percent.

So, equities have outperformed fixed income investments by gigantic margins. Why is this? Because stockholders benefit from rising earnings, while bondholders receive only a fixed percentage return and the promise of repayment at a set date in the future. A look at Johnson & Johnson, one of our portfolio holdings, will show how this works. Adjusted for splits, the company earned sixteen cents a share in 1983, and its stock closed the year at the equivalent of $2.55 on today’s capitalization. Since then, profits have risen to about $3.00 a share — 120% of the original stock price. Dividends have totaled $7.39 — triple the earlier price — and the shares are up 20-fold, trading in the $50’s as we write. Assuming the reinvestment of dividends, an invest - -

4

| 3 | | Ibbotson Associates, Inc. |

The Torray Fund

Letter to Shareholders

July 30, 2004

ment in 10,000 shares that cost $25,500 in 1983 is now worth $730,000. In sharp contrast, an investor that put $25,500 into 20-year AAA J&J bonds would now have $125,000 if the coupons were reinvested at the average rate prevailing during this period.

Beyond the wide disparity in these results, several observations come to mind. For one thing, taxes took a greater toll on the bond investor than on the J&J stockholder, since the vast majority of his return came from unrealized appreciation. On top of that, inflation hurt more because it represented a larger percentage of the bond coupon than J&J’s far higher total return — 18.2% compounded annually. Making matters worse, bond buyers today are reinvesting at high prices — and near-record low yields — while the J&J stock, despite its stellar performance, trades at about the same valuation (price-to-earnings ratio) it did two decades ago. This is just one of many companies that have produced outstanding long-term results that no bond will ever come close to matching.

Is this a good time to invest? We think so. While stocks are not cheap by historic standards — P.E. ratios are probably 15% above average — they are far more attractive than five years ago. For the long-term investor, timing, as we’ve shown, is irrelevant anyway. The best course is to invest regularly in quality companies or well run mutual funds, ignore the market’s ups and downs, and cover your ears when the “experts” are talking. It takes a long time to make enough money to retire, and rushing the process will only insure failure. Yet many people persist in watching the daily fluctuations of their funds like a dieter jumping on the scales every half hour. If the price climbs for a few weeks or months, they get excited and buy more; if it’s flat or down, they sit on their hands or sell. This utterly ruins any chance of success.

We have observed this disheartening phenomenon in the cash flows of The Torray Fund since the very beginning, and can only hope that the insights and perspectives in these letters will help put a stop to it. Investors should get in, stay in, and add to their positions whenever they can, keeping in mind that the initial commitment will have a relatively small impact on the ultimate outcome. Instead, it is the purchases made along the way over decades, at all sorts of prices, that will determine the end result. This is why it makes no sense to root for your fund to go up as soon as you buy it, when you’re looking at, say, 10 to 40 years of buying more. Market declines and flat periods, such as we’re in now, are a tremendous opportunity for dollar cost averaging. Investors should take advantage of them.

5

The Torray Fund

Letter to Shareholders

July 30, 2004

On behalf of our staff and The Torray Fund’s Board of Trustees, we thank you for your continued confidence and support, and, as always, wish you well.

| | |

| Sincerely, | | |

| |  |

| Robert E. Torray | | Douglas C. Eby |

6

The Torray Fund

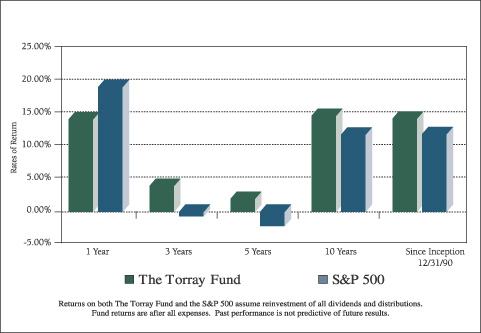

PERFORMANCE DATA

As of June 30, 2004 (unaudited)

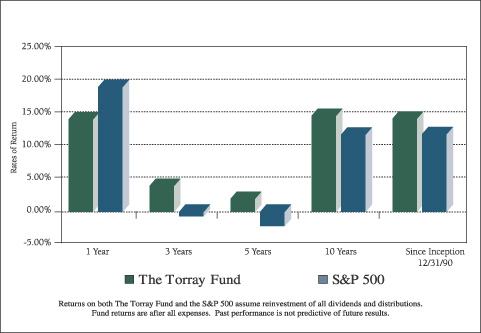

Total Rates of Return on an Investment in The Torray Fund vs. the S&P 500

For the periods ended June 30, 2004:

| | | | | | | | | | |

| | | 1 Year

| | 3 Years

| | 5 Years

| | 10 Years

| | Since

Inception

12/31/90

|

The Torray Fund | | 14.16% | | 3.97% | | 1.99% | | 14.68% | | 14.28% |

S&P 500 | | 19.12% | | -0.65% | | -2.17% | | 11.85% | | 11.93% |

Cumulative Returns for the 13 1/2 years ended June 30, 2004

| | | |

The Torray Fund | | 506.01 | % |

S&P 500 | | 357.69 | % |

7

The Torray Fund

PERFORMANCE DATA

As of June 30, 2004 (unaudited)

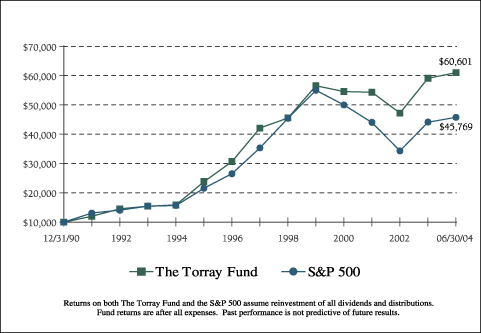

Change in Value of $10,000 Invested on December 31, 1990 (commencement of operations) to:

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | 12/31/90

| | 12/31/92

| | 12/31/94

| | 12/31/96

| | 12/31/98

| | 12/31/00

| | 12/31/02

| | 06/30/04

|

The Torray Fund | | $ | 10,000 | | $ | 14,523 | | $ | 15,821 | | $ | 30,719 | | $ | 45,576 | | $ | 54,609 | | $ | 47,236 | | $ | 60,601 |

S&P 500 | | $ | 10,000 | | $ | 14,047 | | $ | 15,666 | | $ | 26,499 | | $ | 45,438 | | $ | 49,993 | | $ | 34,318 | | $ | 45,769 |

8

The Torray Fund

SCHEDULE OF INVESTMENTS

As of June 30, 2004 (unaudited)

| | | | | | | |

| | | Shares

| | | | Market Value

|

| COMMON STOCK 100.02% | | | |

| |

| 19.51% DIVERSIFIED FINANCIAL SERVICES | | | |

| | | 1,042,300 | | AMBAC Financial Group, Inc. | | $ | 76,546,512 |

| | | 1,405,600 | | Franklin Resources, Inc. | | | 70,392,448 |

| | | 225,405 | | Markel Corporation * | | | 62,549,888 |

| | | 1,220,050 | | JPMorgan Chase & Co. | | | 47,301,339 |

| | | 1,259,600 | | Allied Capital Corporation | | | 30,759,432 |

| | | 411,700 | | American International Group, Inc. | | | 29,345,976 |

| | | 192,000 | | American Express Company | | | 9,864,960 |

| | | 754,200 | | LaBranche & Co Inc. * | | | 6,350,364 |

| | | | | | |

|

|

| | | | | | | | 333,110,919 |

| |

| 12.09% MEDIA & ENTERTAINMENT | | | |

| | | 1,913,200 | | Univision Communications Inc. * | | | 61,088,476 |

| | | 1,868,900 | | The Walt Disney Company | | | 47,638,261 |

| | | 1,231,600 | | Clear Channel Communications, Inc. | | | 45,507,620 |

| | | 875,700 | | Tribune Company | | | 39,879,378 |

| | | 145,000 | | Gannett Co., Inc. | | | 12,303,250 |

| | | | | | |

|

|

| | | | | | | | 206,416,985 |

| |

| 10.63% DIVERSIFIED MANUFACTURING | | | |

| | | 1,048,800 | | Illinois Tool Works Inc. | | | 100,569,432 |

| | | 1,322,300 | | General Electric Company | | | 42,842,520 |

| | | 598,100 | | Emerson Electric Co. | | | 38,009,255 |

| | | | | | |

|

|

| | | | | | | | 181,421,207 |

| |

| 9.62% DATA PROCESSING & MANAGEMENT | | | |

| | | 2,144,700 | | First Data Corporation | | | 95,482,044 |

| | | 1,643,600 | | Automatic Data Processing, Inc. | | | 68,833,968 |

| | | | | | |

|

|

| | | | | | | | 164,316,012 |

| |

| 8.76% PHARMACEUTICALS | | | |

| | | 1,677,900 | | Amgen Inc. * | | | 91,563,003 |

| | | 736,500 | | Merck & Co., Inc. | | | 34,983,750 |

| | | 673,000 | | Pfizer Inc. | | | 23,070,440 |

| | | | | | |

|

|

| | | | | | | | 149,617,193 |

9

The Torray Fund

SCHEDULE OF INVESTMENTS (continued)

As of June 30, 2004 (unaudited)

| | | | | | | |

| | | Shares

| | | | Market Value

|

| |

| 7.06% AEROSPACE & DEFENSE | | | |

| | | 1,531,000 | | Honeywell International Inc. | | $ | 56,080,530 |

| | | 542,800 | | United Technologies Corporation | | | 49,655,344 |

| | | 148,300 | | General Dynamics Corporation | | | 14,726,190 |

| | | | | | |

|

|

| | | | | | | | 120,462,064 |

| |

| 6.01% DIVERSIFIED MEDICAL PRODUCTS | | | |

| | | 1,002,000 | | Boston Scientific Corporation * | | | 42,885,600 |

| | | 1,032,100 | | Abbott Laboratories | | | 42,068,396 |

| | | 317,300 | | Johnson & Johnson | | | 17,673,610 |

| | | | | | |

|

|

| | | | | | | | 102,627,606 |

| |

| 4.86% HEALTH CARE SERVICES | | | |

| | | 1,183,900 | | Cardinal Health, Inc. | | | 82,932,195 |

| |

| 4.61% BEVERAGES | | | |

| | | 1,458,800 | | Anheuser-Busch Cos., Inc. | | | 78,775,200 |

| |

| 4.10% COMMUNICATIONS SERVICES | | | |

| | | 2,798,660 | | The DIRECTV Group, Inc. * | | | 47,857,086 |

| | | 722,400 | | EchoStar Communications Corporation * | | | 22,213,800 |

| | | | | | |

|

|

| | | | | | | | 70,070,886 |

| |

| 3.75% BANKING | | | |

| | | 726,600 | | Bank One Corporation | | | 37,056,600 |

| | | 319,300 | | Bank of America Corporation | | | 27,019,166 |

| | | | | | |

|

|

| | | | | | | | 64,075,766 |

| |

| 2.74% CONSUMER PRODUCTS | | | |

| | | 710,800 | | Kimberly-Clark Corporation | | | 46,827,504 |

| |

| 2.65% DIVERSIFIED TELECOMMUNICATION SERVICES | | | |

| | | 1,865,400 | | SBC Communications Inc. | | | 45,235,950 |

| |

| 1.63% REAL ESTATE | | | |

| | | 922,500 | | CarrAmerica Realty Corporation | | | 27,887,175 |

10

The Torray Fund

SCHEDULE OF INVESTMENTS (continued)

As of June 30, 2004 (unaudited)

| | | | | | | | |

| | | Shares

| | | | Market Value

| |

| |

| 1.26% SPECIALTY RETAIL | | | | |

| | | 474,200 | | O’Reilly Automotive, Inc. * | | $ | 21,433,840 | |

| |

| 0.74% COMPUTER SYSTEMS & INTEGRATION | | | | |

| | | 596,400 | | Hewlett-Packard Company | | | 12,584,040 | |

| | | | | | |

|

|

|

| TOTAL COMMON STOCK 100.02% | | $ | 1,707,794,542 | |

| (cost $1,472,461,461) | | | | |

| SHORT-TERM INVESTMENTS 0.27% | | | | |

| (cost $4,635,900) | | PNC Bank Money Market Account, 0.73% | | | 4,635,900 | |

| | | | | | |

|

|

|

| TOTAL PORTFOLIO SECURITIES 100.29% | | | 1,712,430,442 | |

| (cost $1,477,097,361) | | | | |

| OTHER ASSETS LESS LIABILITIES (0.29%) | | | (4,936,669 | ) |

| | | | | | |

|

|

|

| NET ASSETS 100.00% | | $ | 1,707,493,773 | |

| | | | | | |

|

|

|

TOP 10 HOLDINGS

| | |

1. Illinois Tool Works Inc. | | 6. AMBAC Financial Group, Inc. |

2. First Data Corporation | | 7. Franklin Resources, Inc. |

3. Amgen Inc. * | | 8. Automatic Data Processing, Inc. |

4. Cardinal Health, Inc. | | 9. Markel Corporation * |

5. Anheuser-Busch Cos., Inc. | | 10. Univision Communications Inc. * |

* non-income producing securities

See notes to the financial statements.

11

The Torray Fund

STATEMENT OF ASSETS AND LIABILITIES

As of June 30, 2004 (unaudited)

| | | |

ASSETS | | | |

Investments in securities at value

(cost $1,477,097,361) | | $ | 1,712,430,442 |

Interest and dividends receivable | | | 1,688,269 |

Receivable for fund shares sold | | | 834,665 |

Prepaid insurance | | | 50,411 |

| | |

|

|

TOTAL ASSETS | | | 1,715,003,787 |

| | |

|

|

| |

LIABILITIES | | | |

Payable for fund shares redeemed | | | 5,676,419 |

Payable to advisor | | | 1,410,343 |

Accrued expenses | | | 423,252 |

| | |

|

|

TOTAL LIABILITIES | | | 7,510,014 |

| | |

|

|

| |

NET ASSETS | | $ | 1,707,493,773 |

| | |

|

|

Shares of beneficial interest ($1 stated value,

42,258,921 shares outstanding, unlimited

shares authorized) | | $ | 42,258,921 |

Paid-in-capital in excess of par | | | 1,390,226,169 |

Accumulated net investment income | | | 51,176 |

Accumulated net realized gain | | | 39,624,426 |

Net unrealized appreciation of investments | | | 235,333,081 |

| | |

|

|

| |

TOTAL NET ASSETS | | $ | 1,707,493,773 |

| | |

|

|

Per Share | | $ | 40.41 |

| | |

|

|

See notes to the financial statements.

12

The Torray Fund

STATEMENT OF OPERATIONS

For the six months ended June 30, 2004 (unaudited)

| | | | |

INVESTMENT INCOME | | | | |

Dividend income | | $ | 13,066,273 | |

Interest income | | | 12,613 | |

| | |

|

|

|

Total income | | | 13,078,886 | |

| | |

|

|

|

| |

EXPENSES | | | | |

Management fees | | | 8,515,959 | |

Transfer agent fees & expenses | | | 429,079 | |

Printing, postage & mailing | | | 109,212 | |

Custodian fees | | | 50,526 | |

Trustees' fees | | | 45,589 | |

Insurance | | | 29,557 | |

Registration & filing fees | | | 23,393 | |

Legal fees | | | 42,470 | |

Audit fees | | | 19,390 | |

| | |

|

|

|

Total expenses | | | 9,265,175 | |

| | |

|

|

|

NET INVESTMENT INCOME | | | 3,813,711 | |

| | |

|

|

|

REALIZED AND UNREALIZED GAIN (LOSS)

ON INVESTMENTS | | | | |

Net realized gain on investments | | | 40,569,186 | |

Net change in unrealized depreciation on investments | | | (3,945,045 | ) |

| | |

|

|

|

Net realized and unrealized gain on investments | | | 36,624,141 | |

| | |

|

|

|

NET INCREASE IN NET ASSETS FROM OPERATIONS | | $ | 40,437,852 | |

| | |

|

|

|

See notes to the financial statements.

13

The Torray Fund

STATEMENTS OF CHANGES IN NET ASSETS

For the periods indicated:

| | | | | | | | |

| | | Six months ended

06/30/04

(unaudited)

| | | Year ended

12/31/03

| |

Increase in Net Assets from Operations: | | | | | | | | |

Net investment income | | $ | 3,813,711 | | | $ | 9,116,828 | |

Net realized gain on investments | | | 40,569,186 | | | | 18,020,686 | |

Net change in unrealized appreciation

(depreciation) on investments | | | (3,945,045 | ) | | | 306,757,734 | |

| | |

|

|

| |

|

|

|

Net increase in net assets from operations | | | 40,437,852 | | | | 333,895,248 | |

| | |

|

|

| |

|

|

|

| | |

Distributions to Shareholders from: | | | | | | | | |

Net investment income ($0.090 and

$0.220 per share, respectively) | | | (3,799,270 | ) | | | (9,080,093 | ) |

Net realized gains ($0.454 and $0.124 per

share, respectively) | | | (18,965,446 | ) | | | (5,103,734 | ) |

| | |

|

|

| |

|

|

|

Total distributions | | | (22,764,716 | ) | | | (14,183,827 | ) |

| | |

|

|

| |

|

|

|

| | |

Shares of Beneficial Interest | | | | | | | | |

Increase (decrease) from share transactions | | | 34,542,105 | | | | (31,968,568 | ) |

| | |

|

|

| |

|

|

|

Total increase | | | 52,215,241 | | | | 287,742,853 | |

| | |

Net Assets — Beginning of Period | | | 1,655,278,532 | | | | 1,367,535,679 | |

| | |

|

|

| |

|

|

|

Net Assets — End of Period | | $ | 1,707,493,773 | | | $ | 1,655,278,532 | |

| | |

|

|

| |

|

|

|

Accumulated net investment income | | $ | 14,441 | | | $ | 36,735 | |

| | |

|

|

| |

|

|

|

See notes to the financial statements.

14

The Torray Fund

FINANCIAL HIGHLIGHTS

For a share outstanding:

PER SHARE DATA

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | Six months ended 06/30/04 (unaudited)

| | | Years ended December 31:

| |

| | | | 2003

| | | 2002

| | | 2001

| | | 2000

| | | 1999

| |

Net Asset Value,

Beginning of Period | | $ | 39.980 | | | $ | 32.240 | | | $ | 37.530 | | | $ | 39.790 | | | $ | 44.310 | | | $ | 36.480 | |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

Income from investment operations | | | | | | | | | | | | | | | | | | | | | | | | |

Net investment income | | | 0.090 | | | | 0.220 | | | | 0.205 | | | | 0.172 | | | | 0.265 | | | | 0.073 | |

Net gains (losses) on securities (both realized and unrealized) | | | 0.884 | | | | 7.864 | | | | (5.083 | ) | | | (0.489 | ) | | | (1.730 | ) | | | 8.616 | |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

Total from investment operations | | | 0.974 | | | | 8.084 | | | | (4.878 | ) | | | (0.317 | ) | | | (1.465 | ) | | | 8.689 | |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

Less: distributions | | | | | | | | | | | | | | | | | | | | | | | | |

Dividends (from net investment income) | | | (0.090 | ) | | | (0.220 | ) | | | (0.205 | ) | | | (0.184 | ) | | | (0.253 | ) | | | (0.073 | ) |

Distributions (from capital gains) | | | (0.454 | ) | | | (0.124 | ) | | | (0.207 | ) | | | (1.759 | ) | | | (2.802 | ) | | | (0.786 | ) |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

Total distributions | | | (0.544 | ) | | | (0.344 | ) | | | (0.412 | ) | | | (1.943 | ) | | | (3.055 | ) | | | (0.859 | ) |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

Net Asset Value,

End of Period | | $ | 40.410 | | | $ | 39.980 | | | $ | 32.240 | | | $ | 37.530 | | | $ | 39.790 | | | $ | 44.310 | |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

TOTAL RETURN(1) | | | 2.46 | % | | | 25.19 | % | | | (13.05 | %) | | | (0.52 | %) | | | (3.38 | %) | | | 24.01 | % |

RATIOS/SUPPLEMENTAL DATA | | | | | | | | | | | | | | | | | | | | | | | | |

Net assets, end of period

(000's omitted) | | $ | 1,707,494 | | | $ | 1,655,279 | | | $ | 1,367,536 | | | $ | 1,638,814 | | | $ | 1,820,972 | | | $ | 1,895,538 | |

Ratios of expenses to average net assets | | | 1.09 | %* | | | 1.11 | % | | | 1.07 | % | | | 1.07 | % | | | 1.06 | % | | | 1.07 | % |

Ratios of net income to average net assets | | | 0.45 | %* | | | 0.62 | % | | | 0.58 | % | | | 0.45 | % | | | 0.64 | % | | | 0.18 | % |

Portfolio turnover rate | | | 14.61 | % | | | 37.11 | % | | | 22.52 | % | | | 37.56 | % | | | 45.44 | % | | | 32.55 | % |

| (1) | | Past performance is not predictive of future performance. |

See notes to the financial statements.

15

The Torray Fund

NOTES TO FINANCIAL STATEMENTS

As of June 30, 2004 (unaudited)

NOTE 1 — SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

The Torray Fund (“Fund”) is registered under the Investment Company Act of 1940 as a no-load, diversified, open-end management investment company. The Fund was organized as a business trust under Massachusetts law. The Fund’s primary investment objective is to provide long-term total return. The Fund seeks to meet its objective by investing its assets in a diversified portfolio of common stocks. In order to accomplish these goals, the Fund intends to hold stocks for the long term, as opposed to actively buying and selling. There can be no assurances that the Fund’s investment objectives will be achieved.

The following is a summary of accounting policies followed by the Fund in the preparation of its financial statements. These policies are in conformity with accounting principles generally accepted in the United States of America.

Securities Valuation Portfolio securities for which market quotations are readily available are valued at market value, which is determined by using the last reported sale price, or, if no sales are reported, the last reported bid price. For NASDAQ traded securities, market value may also be determined on the basis of the NASDAQ official closing price (the “NOCP”) instead of the last reported sales price. If a market quote is not available, the security will be valued at fair value as determined in good faith under procedures established by, and under the supervision of, the Fund’s Board of Trustees. Short-term obligations having remaining maturities of 60 days or less are valued at amortized cost, which approximates market value.

Securities Transactions and Investment Income Securities transactions are recorded on a trade date basis. Realized gains and losses from securities transactions are recorded on the specific identification basis. Dividend income and distributions to shareholders are recorded on the ex-dividend date. Interest income, including amortization of discount on short-term investments, is recorded on the accrual basis.

Federal Income Taxes The Fund intends to continue to comply with the requirements of the Internal Revenue Code applicable to regulated investment companies and to distribute all of its taxable income, including any net realized gain on investments to its shareholders. Therefore, no Federal income tax provision is required. Cost of securities for tax purposes is substantially the same as for financial reporting purposes.

Net Asset Value Net asset value per share is determined daily as of the close of trading on the New York Stock Exchange by dividing the value of the Fund’s net assets by the number of shares outstanding.

Use of Estimates In preparing financial statements in accordance with accounting principles generally accepted in the United States of America, management is required to make estimates and assumptions that affect the reported amounts of assets and liabilities and the disclosure of contingent assets and liabilities at the date of the financial statements, and the reported amounts of increases and decreases in net assets from operations during the reporting period. Actual results could differ from those estimates.

16

The Torray Fund

NOTES TO FINANCIAL STATEMENTS

As of June 30, 2004 (unaudited)

NOTE 2 — SHARES OF BENEFICIAL INTEREST TRANSACTIONS

Transactions in shares of beneficial interest were as follows:

| | | | | | | | | | | | | | |

| | | Six months ended

06/30/04

| | | Year ended

12/31/03

| |

| | | Shares

| | | Amount

| | | Shares

| | | Amount

| |

Shares issued | | 3,746,723 | | | $ | 152,663,842 | | | 6,185,253 | | | $ | 219,046,893 | |

Reinvestments of dividends and distributions | | 538,009 | | | | 21,510,977 | | | 367,157 | | | | 13,313,016 | |

Shares redeemed | | (3,427,268 | ) | | | (139,632,714 | ) | | (7,567,966 | ) | | | (264,328,477 | ) |

| | |

|

| |

|

|

| |

|

| |

|

|

|

| | | 857,464 | | | $ | 34,542,105 | | | (1,015,556 | ) | | $ | (31,968,568 | ) |

| | |

|

| |

|

|

| |

|

| |

|

|

|

Officers, Trustees and affiliated persons of The Torray Fund and their families directly or indirectly control 1,773,442 shares or 4.20% of the Fund.

NOTE 3 — INVESTMENT TRANSACTIONS

Purchases and sales of investment securities, other than short-term investments, for the six months ended June 30, 2004, aggregated $267,168,337 and $247,944,677, respectively. Net unrealized appreciation of investments at June 30, 2004, includes aggregate unrealized gains of $267,409,018 and unrealized losses of $32,075,937.

NOTE 4 — MANAGEMENT FEES

Pursuant to the Management Contract, The Torray Corporation provides investment advisory and administrative services to the Fund. The Fund pays The Torray Corporation a management fee, computed daily and payable monthly at the annual rate of one percent of the Fund’s average daily net assets. During the six months ended June 30, 2004, The Torray Fund paid management fees of $8,515,959.

Excluding the management fee, other expenses incurred by the Fund during the six months ended June 30, 2004, totaled $749,216. These expenses include all costs associated with the Fund’s operation including transfer agent fees, Independent Trustees’ fees ($10,000 per annum and $1,000 for each Board meeting attended), taxes, dues, fees and expenses of registering and qualifying the Fund and its shares for distribution, charges of custodian, auditing and legal expenses, insurance premiums, supplies, postage, expenses of issue or redemption of shares, reports to shareholders and Trustees, expenses of printing and mailing prospectuses, proxy statements and proxies to existing shareholders, and other miscellaneous expenses.

Certain officers and Trustees of the Fund are also officers and/or shareholders of The Torray Corporation.

17

TRUSTEES

Douglas C. Eby

Bruce C. Ellis

Patricia Kavanagh

William M Lane

Carl C. MacCartee, Jr.

Robert P. Moltz

Charlene R. Nunley

Roy A. Schotland

Wayne H. Shaner

Robert E. Torray

INVESTMENT ADVISOR

The Torray Corporation

OFFICERS

Robert E. Torray, President

Douglas C. Eby, Vice President

William M Lane, Vice President

AUDITORS

Briggs, Bunting & Dougherty, LLP

Two Penn Center Plaza, Suite 820

Philadelphia, PA 19102-1732

TRANSFER AGENT

PFPC Inc.

760 Moore Road

King of Prussia, PA 19406-1212

LEGAL COUNSEL

Dechert

1775 Eye Street, N.W.

Washington, D.C. 20006

This report is not authorized for distribution to prospective investors unless preceded or accompanied by a current prospectus.

The

TORRAY

FUND

SEMI-ANNUAL REPORT

June 30, 2004

The Torray Fund

Suite 1100

7501 Wisconsin Avenue

Bethesda, Maryland 20814-6523

(301) 493-4600

(800) 443-3036

The Torray Institutional Fund

Letter to Shareholders

July 30, 2004

Dear Fellow Shareholders:

The stock market traded within its narrowest range in over 10 years during the first six months of 2004, with volume and volatility off sharply from levels recorded during last year’s big advance. Other major markets around the world followed similar patterns. We think the likely explanation is that stocks have fully discounted the good economic news, and investors won’t pay more for them until they’re convinced the recovery in earnings is sustainable. Recent signals have been mixed. Even so, we remain optimistic about the prospects for companies in our portfolio, and will be making no changes in direction going forward. The future always brings surprises and, as we shall see, investors’ attempts to anticipate them have failed at great expense.

The Torray Institutional Fund gained 2.5% through June 30, slightly trailing the Standard & Poor’s 500 which added 3.4%. Since inception three years ago, it has earned 5.5% compounded annually, compared to a 0.7% loss for the Index. Because your Fund has been open only a few years, we will once again reference the much longer record of The Torray Fund, which we manage using the same philosophy and approach. That Fund has earned 14.3% per year since it opened 13 1/2 years ago, compared to 11.9% for the S&P 500. Its 14.7% per year record carries a 5-Star rating and ranks in the top 5% of all 3,427 funds in business for that period.1

We realize the last several years have been a patience tester. This downturn has been the longest and steepest since the 1930’s — a setback few could have imagined as the markets soared during the late 90’s. From top to bottom the market fell about 50%, and even though it has rallied sharply since the spring of 2003, it remains nearly 25% below its peak set more than four years ago. This has seriously eroded investor confidence and probably left a lot of people wondering whether they’re making a mistake continuing to invest in common stocks. Our answer to that is an emphatic “no.” As history reveals, there have always been problems, many of them far worse than those we face today. Yet, each downturn has been followed by recovery, and over time values have risen. The pattern has repeated for more than two centuries, and we see no reason for it to change.

Unfortunately, the average person views things from a different perspective, seeing the future as an extension of the recent past and present. Thus, if the market is caught in the grips of a mania, the tendency is to assume the momentum will continue, regardless of underlying realities.

1

The Torray Institutional Fund

Letter to Shareholders

July 30, 2004

The same applies when the market is falling. And the longer a trend persists, the more people believe in it. At this point, a whole raft of negatives is preying on investor psychology, no doubt contributing to the recent weakness in stock prices. However, despite all the uncertainties, we should keep in mind that wars, recessions, inflation and market booms and busts have never produced the dire financial consequences widely forecasted at the time of their occurrence.

For example, The Korean War, which began June 26, 1950, ushered in more than half a century of crises, disturbances and tragedies. These included the assassination of a president, America’s involvement in the Vietnam War starting in the spring of 1965, Watergate, the Arab oil embargo, the market crash of 1973-74 (stocks dropped nearly 50%), inflation, another crash in ’87 (shares plummeted 21% in a single day), the 2000-2002 collapse, terrorists, wars in Afghanistan and Iraq, corporate malfeasance and gasoline prices. As the lovable Roseanne Roseannadanna used to say on Saturday Night Live, “It’s always something.” There was plenty to think about, but in the end — usually within a few years — the clouds parted and the country moved on. This proved little consolation to a lot of investors, however. Driven by instinct and emotion, they were whipsawed time and again, frightened out on the downturns and lured back on recovery. As we underscored in our last Annual Report, this has slashed returns by staggering amounts.

Meanwhile, prosperity was hiding in plain sight. In 1950, the S&P 500 stood at 18. Today it’s around 1100, well down from a peak of over 1500 set in March 2000. Assuming the reinvestment of dividends, the Index has returned 11.8% compounded annually, turning $1 into $412 — $10,000 into $4.1 million. Since Vietnam, the market has earned 10.3% annually, doubling money every seven years and turning $1 into $47. It’s noteworthy that an extra 15 years and 1.5% of annual return produced nearly nine times the result — $412 vs. $47 — a telling example of how time and small percentages can magnify the outcome. No other investment available to the general public has come remotely close to doing as well. The recent surge in house prices may delude some into thinking otherwise – especially when compared to the stock market’s four-year downturn. But, while the average house in 1950 sold for about $15,000, and today is worth $245,000, the same investment in stocks has grown to $6.2 million. Houses are no match for stocks as a long-term investment.

Getting back to the point, investors all through this period were absorbed, as many are today, in the market’s short-term ups and downs, equating these meaningless fluctuations to

2

The Torray Institutional Fund

Letter to Shareholders

July 30, 2004

making or losing money. Their focus was largely on timing — was it “time” to buy or sell this, that, or the other thing? It’s the same today. Meanwhile, those that bought and held on to quality companies or well run mutual funds fared handsomely. Unfortunately, not many did — a testimony to how hard it is for most people to endure bad news for long, especially when it drives down the value of their portfolio.

The media and financial industry shamelessly exploit this weakness, the former blowing negatives out of proportion, the latter responding with “strategies” certain to keep investors off-balance and in constant motion. If it’s inflation and rising interest rates, we’re told to sell bonds and shift equity exposure to commodity-type companies, materials and gold. Never mind that the long-term performance of these assets — every last one of them — has been horrible. It’s time to buy them for one reason — their prices are poised to take off. And, if inflation and rates are expected to fall, we should do the opposite. In this dream world, it’s once again timing, not the intrinsic value of the asset that counts. For investors persuaded there’s profit in all this, the dream will be a bad one. Beyond that, looking at it fatalistically, if a far worse calamity than any on record strikes, virtually all investments will prove disappointing. So, why hold our breath until we practically pass out worrying about things that, over time, history shows won’t make much difference? Far better, we think, to be optimistic, side with the evidence and buy stocks for the long haul. We can just hear the gold bugs howling on this one. Yet, one dollar invested two centuries ago in this popular hedge against disaster — and there have been a lot of disasters — is now worth only $21.44, while in bonds it has grown to $16,451 and, in stocks, to $9,170,000.2

History reveals another reality that should restrain those with runaway imaginations. Over the five years, 1995-99, the U.S. market went up 28% annually — a phenomenal and, to our knowledge, unprecedented performance. Yet, at the time, few seemed to think there was anything out of the ordinary about it. Thoughtful investors might have reconsidered what they were doing had they known the 200-year return on stocks that turned $1 into more than $9 million was 8.3%. This record strongly suggests that the average person is never going to make even 15% a year on stocks, much less more. Betting on beating a two-century return on the best of all assets by a two-to-one margin is like believing you’ll win the Mega Millions lottery against odds that on the last drawing were 135 million-to-one. But, the good news is you don’t need to, as we’ll see in a moment.

| 2 | | Stocks for the Long Run by Jeremy J. Siegel |

3

The Torray Institutional Fund

Letter to Shareholders

July 30, 2004

It’s interesting to note that equities performed better between 1925 and 2003 than over the longer period we’ve referenced (10.4% vs. 8.3%).3 However, a higher inflation rate reduced the differential in terms of buying power — the critical measure — to just four-tenths of one percent (7.4% vs. 7%).4 And, although it seems counterintuitive in this age of technological advance, invention, and supposed financial sophistication and innovation, results adjusted for the cost of living fell to 5.9% over the last three decades, even though nominal returns rose to 11%.5 The cause was a major surge in inflation during the 70’s and 80’s.

While no one knows what real returns will be going forward, seven percent seems like a fair guess. We hope to do better. But, even that rate after inflation will produce a great outcome over a 40-year working career — say, ages 25 to 65. Assuming an initial $10,000 investment, with additions averaging $500 per month for four decades — a very low number given the long time span — an investor would retire with nearly $1.5 million in today’s purchasing power. And, of course, with larger contributions the outcome would be even better. We imagine a lot of people would be happy with this.

And, they should be, because there are really no competitive alternatives. We have often discredited the notion that returns can be enhanced by trading, market timing, asset allocation, or any other non-fundamental approach, and we do so again here. That leaves only bonds and savings accounts. The after-inflation return on these investments has averaged between one and two percent per year. It takes 72 years to double money at one percent, 36 at two percent, but only 10 years at seven percent.

So, equities have outperformed fixed income investments by gigantic margins. Why is this? Because stockholders benefit from rising earnings, while bondholders receive only a fixed percentage return and the promise of repayment at a set date in the future. A look at Johnson & Johnson, one of our portfolio holdings, will show how this works. Adjusted for splits, the company earned sixteen cents a share in 1983, and its stock closed the year at the equivalent of $2.55 on today’s capitalization. Since then, profits have risen to about $3.00 a share — 120% of the original stock price. Dividends have totaled $7.39 — triple the earlier price — and the shares are up 20-fold, trading in the $50’s as we write. Assuming the reinvestment of dividends, an invest-

| 3 | | Ibbotson Associates, Inc. |

4

The Torray Institutional Fund

Letter to Shareholders

July 30, 2004

ment in 10,000 shares that cost $25,500 in 1983 is now worth $730,000. In sharp contrast, an investor that put $25,500 into 20-year AAA J&J bonds would now have $125,000 if the coupons were reinvested at the average rate prevailing during this period.

Beyond the wide disparity in these results, several observations come to mind. For one thing, taxes took a greater toll on the bond investor than on the J&J stockholder, since the vast majority of his return came from unrealized appreciation. On top of that, inflation hurt more because it represented a larger percentage of the bond coupon than J&J’s far higher total return — 18.2% compounded annually. Making matters worse, bond buyers today are reinvesting at high prices — and near-record low yields — while the J&J stock, despite its stellar performance, trades at about the same valuation (price-to-earnings ratio) it did two decades ago. This is just one of many companies that have produced outstanding long-term results that no bond will ever come close to matching.

Is this a good time to invest? We think so. While stocks are not cheap by historic standards — P.E. ratios are probably 15% above average — they are far more attractive than five years ago. For the long-term investor, timing, as we’ve shown, is irrelevant anyway. The best course is to invest regularly in quality companies or mutual funds, ignore the market’s ups and downs, and cover your ears when the “experts” are talking. It takes a long time to make enough money to retire, and rushing the process will only insure failure. Yet many people persist in watching the daily fluctuations of their funds like a dieter jumping on the scales every half hour. If the price trend is up for a few weeks or months, they get excited and buy more; if it’s flat or down, they sit on their hands or sell. This utterly ruins any chance of success.

We have observed this disheartening phenomenon in the cash flows of The Torray Institutional Fund since the very beginning, and can only hope that the insights and perspectives in these letters will help put a stop to it. Investors should get in, stay in, and add to their positions whenever they can, keeping in mind that the initial commitment will have a relatively small impact on the ultimate outcome. Instead, it is the purchases made along the way over decades, at all sorts of prices, that will determine the end result. This is why it makes no sense to root for your fund to go up as soon as you buy it, when you’re looking at, say, 10 to 40 years of buying more. Market declines and flat periods, such as we’re in now, are a tremendous opportunity for dollar cost averaging. Investors should take advantage of them.

5

The Torray Institutional Fund

Letter to Shareholders

July 30, 2004

On behalf of our staff and The Torray Institutional Fund’s Board of Trustees, we thank you for your continued confidence and support and, as always, wish you well.

| | | | |

| Sincerely, | | | | |

| | |

| | | |  |

| Robert E. Torray | | | | Douglas C. Eby |

6

The Torray Institutional Fund

PERFORMANCE DATA

As of June 30, 2004 (unaudited)

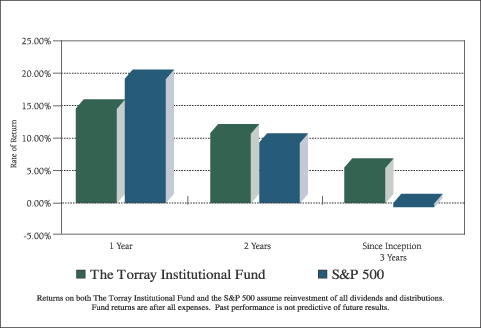

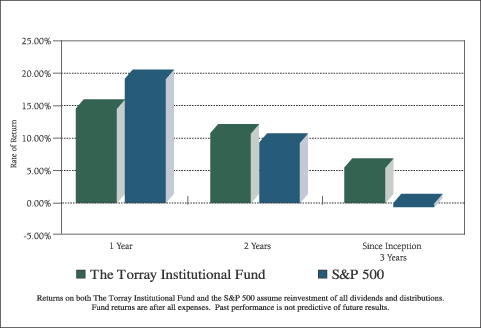

Total Rates of Return on an Investment in The Torray Institutional Fund vs. the S&P 500

For the periods ended June 30, 2004:

| | | | | | | | | |

| | | 1 Year

| | | 2 Years

| | | Since

Inception

06/30/01

3 Years

| |

Torray Institutional Fund | | 14.52 | % | | 10.72 | % | | 5.47 | % |

S&P 500 | | 19.12 | % | | 9.32 | % | | -0.65 | % |

Cumulative Returns for the 3 years ended June 30, 2004

| | | |

The Torray Institutional Fund | | 17.31 | % |

S&P 500 | | -1.94 | % |

7

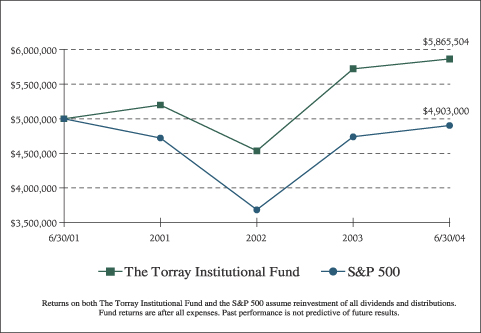

The Torray Institutional Fund

PERFORMANCE DATA

As of June 30, 2004 (unaudited)

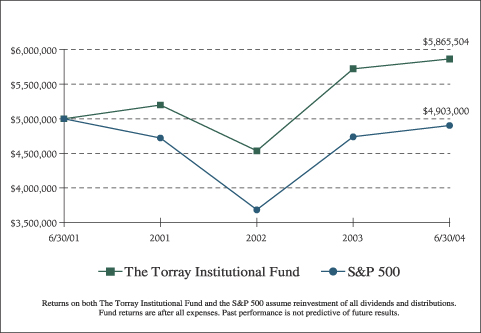

Change in Value of $5,000,000 Invested on June 30, 2001 (commencement of operations) to:

| | | | | | | | | | | | | | | |

| | | 06/30/01

| | 12/31/01

| | 12/31/02

| | 12/31/03

| | 06/30/04

|

Torray Institutional Fund | | $ | 5,000,000 | | $ | 5,199,241 | | $ | 4,537,374 | | $ | 5,724,693 | | $ | 5,865,504 |

S&P 500 | | $ | 5,000,000 | | $ | 4,723,000 | | $ | 3,682,500 | | $ | 4,739,000 | | $ | 4,903,000 |

8

The Torray Institutional Fund

SCHEDULE OF INVESTMENTS

As of June 30, 2004 (unaudited)

| | | | | | | |

| | | Shares

| | | | Market Value

|

| COMMON STOCK 95.65% | | | |

| |

| 19.46% DIVERSIFIED FINANCIAL SERVICES | | | |

| | | 505,000 | | AMBAC Financial Group, Inc. | | $ | 37,087,200 |

| | | 627,600 | | Franklin Resources, Inc. | | | 31,430,208 |

| | | 85,500 | | Markel Corporation * | | | 23,726,250 |

| | | 784,300 | | Allied Capital Corporation | | | 19,152,606 |

| | | 450,700 | | JPMorgan Chase & Co. | | | 17,473,639 |

| | | 205,400 | | American International Group, Inc. | | | 14,640,912 |

| | | 104,500 | | American Express Company | | | 5,369,210 |

| | | 371,800 | | LaBranche & Co Inc. * | | | 3,130,556 |

| | | | | | |

|

|

| | | | | | | | 152,010,581 |

| |

| 12.75% MEDIA & ENTERTAINMENT | | | |

| | | 977,200 | | Univision Communications Inc. * | | | 31,201,996 |

| | | 1,020,300 | | The Walt Disney Company | | | 26,007,447 |

| | | 545,300 | | Clear Channel Communications, Inc. | | | 20,148,835 |

| | | 303,800 | | Tribune Company | | | 13,835,052 |

| | | 98,800 | | Gannett Co., Inc. | | | 8,383,180 |

| | | | | | |

|

|

| | | | | | | | 99,576,510 |

| |

| 9.19% DATA PROCESSING & MANAGEMENT | | | |

| | | 907,700 | | First Data Corporation | | | 40,410,804 |

| | | 749,300 | | Automatic Data Processing, Inc. | | | 31,380,684 |

| | | | | | |

|

|

| | | | | | | | 71,791,488 |

| |

| 8.77% DIVERSIFIED MANUFACTURING | | | |

| | | 369,400 | | Illinois Tool Works Inc. | | | 35,421,766 |

| | | 620,800 | | General Electric Company | | | 20,113,920 |

| | | 204,400 | | Emerson Electric Co. | | | 12,989,620 |

| | | | | | |

|

|

| | | | | | | | 68,525,306 |

| |

| 8.73% PHARMACEUTICALS | | | |

| | | 864,800 | | Amgen Inc. * | | | 47,192,136 |

| | | 237,700 | | Merck & Co., Inc. | | | 11,290,750 |

| | | 284,300 | | Pfizer Inc. | | | 9,745,804 |

| | | | | | |

|

|

| | | | | | | | 68,228,690 |

9

The Torray Institutional Fund

SCHEDULE OF INVESTMENTS (continued)

As of June 30, 2004 (unaudited)

| | | | | | | |

| | | Shares

| | | | Market Value

|

| |

| 7.68% AEROSPACE & DEFENSE | | | |

| | | 222,700 | | General Dynamics Corporation | | $ | 22,114,110 |

| | | 523,200 | | Honeywell International Inc. | | | 19,164,816 |

| | | 204,500 | | United Technologies Corporation | | | 18,707,660 |

| | | | | | |

|

|

| | | | | | | | 59,986,586 |

| |

| 5.17% COMMUNICATIONS SERVICES | | | |

| | | 1,534,944 | | The DIRECTV Group, Inc. * | | | 26,247,542 |

| | | 460,700 | | EchoStar Communications Corporation * | | | 14,166,525 |

| | | | | | |

|

|

| | | | | | | | 40,414,067 |

| |

| 4.75% DIVERSIFIED MEDICAL PRODUCTS | | | |

| | | 353,700 | | Boston Scientific Corporation * | | | 15,138,360 |

| | | 350,800 | | Abbott Laboratories | | | 14,298,608 |

| | | 138,000 | | Johnson & Johnson | | | 7,686,600 |

| | | | | | |

|

|

| | | | | | | | 37,123,568 |

| |

| 4.40% BEVERAGES | | | |

| | | 635,600 | | Anheuser-Busch Cos., Inc. | | | 34,322,400 |

| |

| 4.23% HEALTH CARE SERVICES | | | |

| | | 472,100 | | Cardinal Health, Inc. | | | 33,070,605 |

| |

| 2.81% BANKING | | | |

| | | 254,100 | | Bank One Corporation | | | 12,959,100 |

| | | 106,000 | | Bank of America Corporation | | | 8,969,720 |

| | | | | | |

|

|

| | | | | | | | 21,928,820 |

| |

| 2.71% DIVERSIFIED TELECOMMUNICATION SERVICES | | | |

| | | 870,900 | | SBC Communications Inc. | | | 21,119,325 |

| |

| 2.07% CONSUMER PRODUCTS | | | |

| | | 245,900 | | Kimberly-Clark Corporation | | | 16,199,892 |

| |

| 1.48% SPECIALTY RETAIL | | | |

| | | 255,300 | | O’Reilly Automotive, Inc. * | | | 11,539,560 |

10

The Torray Institutional Fund

SCHEDULE OF INVESTMENTS (continued)

As of June 30, 2004 (unaudited)

| | | | | | | |

| | | Shares

| | | | Market Value

|

| |

| 0.74% COMPUTER SYSTEMS & INTEGRATION | | | |

| | | 272,400 | | Hewlett-Packard Company | | $ | 5,747,640 |

| |

| 0.71% REAL ESTATE | | | |

| | | 184,000 | | CarrAmerica Realty Corporation | | | 5,562,320 |

| | | | | | |

|

|

| TOTAL COMMON STOCK 95.65% | | $ | 747,147,358 |

| (cost $676,617,318) | | | |

| SHORT-TERM INVESTMENTS 0.83% | | | |

| (cost $6,522,300) | | PNC Bank Money Market Account, 0.73% | | | 6,522,300 |

| | | | | | |

|

|

| TOTAL PORTFOLIO SECURITIES 96.48% | | | 753,669,658 |

| (cost $683,139,618) | | | |

| OTHER ASSETS LESS LIABILITIES 3.52% | | | 27,479,272 |

| | | | | | |

|

|

| NET ASSETS 100.00% | | $ | 781,148,930 |

| | | | | | |

|

|

TOP 10 HOLDINGS

| | |

1. Amgen Inc. * | | 6. Cardinal Health, Inc. |

2. First Data Corporation | | 7. Franklin Resources, Inc. |

3. AMBAC Financial Group, Inc. | | 8. Automatic Data Processing, Inc. |

4. Illinois Tool Works Inc. | | 9. Univision Communications Inc. * |

5. Anheuser-Busch Cos., Inc. | | 10. The DIRECTV Group, Inc. * |

* non-income producing securities

See notes to the financial statements.

11

The Torray Institutional Fund

STATEMENT OF ASSETS AND LIABILITIES

As of June 30, 2004 (unaudited)

| | | |

ASSETS | | | |

Investments in securities at value

(cost $683,139,618) | | $ | 753,669,658 |

Interest and dividends receivable | | | 729,668 |

Receivable for fund shares sold | | | 27,523,054 |

| | |

|

|

TOTAL ASSETS | | | 781,922,380 |

| | |

|

|

| |

LIABILITIES | | | |

Payable for fund shares redeemed | | | 256,177 |

Payable to advisor | | | 517,273 |

| | |

|

|

TOTAL LIABILITIES | | | 773,450 |

| | |

|

|

| |

NET ASSETS | | $ | 781,148,930 |

| | |

|

|

Shares of beneficial interest ($1 stated value,

6,940,621 shares outstanding, unlimited

shares authorized) | | $ | 6,940,621 |

Paid-in-capital in excess of par | | | 694,650,945 |

Accumulated net investment income | | | 88,685 |

Accumulated net realized gain | | | 8,938,639 |

Net unrealized appreciation of investments | | | 70,530,040 |

| | |

|

|

| |

TOTAL NET ASSETS | | $ | 781,148,930 |

| | |

|

|

Per Share | | $ | 112.55 |

| | |

|

|

See notes to the financial statements.

12

The Torray Institutional Fund

STATEMENT OF OPERATIONS

For the six months ended June 30, 2004 (unaudited)

| | | |

INVESTMENT INCOME | | | |

Dividend income | | $ | 4,984,216 |

Interest income | | | 12,849 |

| | |

|

|

Total income | | | 4,997,065 |

| | |

|

|

| |

EXPENSES | | | |

Management fees | | | 2,854,952 |

| | |

|

|

Total expenses | | | 2,854,952 |

| | |

|

|

NET INVESTMENT INCOME | | | 2,142,113 |

| | |

|

|

REALIZED AND UNREALIZED GAIN

ON INVESTMENTS | | | |

Net realized gain on investments | | | 9,034,267 |

Net change in unrealized appreciation on investments | | | 4,334,578 |

| | |

|

|

Net realized and unrealized gain on investments | | | 13,368,845 |

| | |

|

|

NET INCREASE IN NET ASSETS FROM OPERATIONS | | $ | 15,510,958 |

| | |

|

|

See notes to the financial statements.

13

The Torray Institutional Fund

STATEMENT OF CHANGES IN NET ASSETS

For the periods indicated:

| | | | | | | | |

| | | Six months ended

06/30/04

(unaudited)

| | | Year ended

12/31/03

| |

Increase in Net Assets from Operations: | | | | | | | | |

Net investment income | | $ | 2,142,113 | | | $ | 2,810,909 | |

Net realized gain on investments | | | 9,034,267 | | | | 10,210,025 | |

Net change in unrealized appreciation

on investments | | | 4,334,578 | | | | 73,157,304 | |

| | |

|

|

| |

|

|

|

Net increase in net assets from operations | | | 15,510,958 | | | | 86,178,238 | |

| | |

|

|

| |

|

|

|

| | |

Distributions to Shareholders from: | | | | | | | | |

Net investment income ($0.327 and

$0.671 per share, respectively) | | | (2,063,080 | ) | | | (2,801,257 | ) |

Net realized gains ($0.352 and

$1.556 per share, respectively) | | | (2,348,741 | ) | | | (7,779,240 | ) |

| | |

|

|

| |

|

|

|

Total distributions | | | (4,411,821 | ) | | | (10,580,497 | ) |

| | |

|

|

| |

|

|

|

| | |

Shares of Beneficial Interest: | | | | | | | | |

Increase from share transactions | | | 171,867,186 | | | | 384,869,414 | |

| | |

|

|

| |

|

|

|

Total increase | | | 182,966,323 | | | | 460,467,155 | |

| | |

Net Assets — Beginning of period | | | 598,182,607 | | | | 137,715,452 | |

| | |

|

|

| |

|

|

|

Net Assets — End of period | | $ | 781,148,930 | | | $ | 598,182,607 | |

| | |

|

|

| |

|

|

|

Accumulated net investment income | | $ | 79,033 | | | $ | 9,652 | |

| | |

|

|

| |

|

|

|

See notes to the financial statements.

14

The Torray Institutional Fund

FINANCIAL HIGHLIGHTS

For a share outstanding:

PER SHARE DATA

| | | | | | | | | | | | | | | | |

| | | Six months

ended

06/30/04 (unaudited)

| | | Years ended December 31:

| | | Period

ended 12/31/01(1)

| |

| | | 2003

| | | 2002

| | |

Net Asset Value,

Beginning of Period | | $ | 110.520 | | | $ | 89.490 | | | $ | 103.300 | | | $ | 100.000 | |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

|

Income from investment operations: | | | | | | | | | | | | | | | | |

Net investment income | | | 0.357 | | | | 0.671 | | | | 0.679 | | | | 0.359 | |

Net gains (losses) on securities (both realized and unrealized) | | | 2.352 | | | | 22.586 | | | | (13.810 | ) | | | 3.555 | |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

|

Total from investment operations | | | 2.709 | | | | 23.257 | | | | (13.131 | ) | | | 3.914 | |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

|

Less: Distributions | | | | | | | | | | | | | | | | |

Dividends (from net investment income) | | | (0.327 | ) | | | (0.671 | ) | | | (0.679 | ) | | | (0.359 | ) |

Distributions (from capital gains) | | | (0.352 | ) | | | (1.556 | ) | | | 0.000 | | | | (0.255 | ) |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

|

Total distributions | | | (0.679 | ) | | | (2.227 | ) | | | (0.679 | ) | | | (0.614 | ) |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

|

Net Asset Value,

End of Period | | $ | 112.550 | | | $ | 110.520 | | | $ | 89.490 | | | $ | 103.300 | |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

|

TOTAL RETURN(2) | | | 2.47 | % | | | 26.16 | % | | | (12.73 | %) | | | 3.99 | % |

RATIOS/SUPPLEMENTAL DATA | | | | | | | | | | | | | | | | |

Net assets, end of period (000’s omitted) | | $ | 781,149 | | | $ | 598,183 | | | $ | 137,715 | | | $ | 50,684 | |

Ratios of expenses to average net assets | | | 0.85 | %* | | | 0.85 | % | | | 0.85 | % | | | 0.85 | %* |

Ratios of net income to average net assets | | | 0.64 | %* | | | 0.80 | % | | | 0.85 | % | | | 0.76 | %* |

Portfolio turnover rate | | | 11.05 | % | | | 22.20 | % | | | 6.87 | % | | | 8.84 | %* |

| (1) | | The Torray Institutional Fund commenced operations on June 30, 2001. |

| (2) | | Past performance is not predictive of future performance. |

See notes to the financial statements.

15

The Torray Institutional Fund

NOTES TO FINANCIAL STATEMENTS

As of June 30, 2004 (unaudited)

NOTE 1 — SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

The Torray Institutional Fund (“Fund”) is registered under the Investment Company Act of 1940 as a no-load, diversified, open-end management investment company. The Fund was organized as a business trust under Massachusetts law and commenced operations on June 30, 2001. The Fund’s primary investment objective is to pro-vide long-term total return. The Fund seeks to meet its objective by investing its assets in a diversified portfolio of common stocks. In order to accomplish these goals, the Fund intends to hold stocks for the long term, as opposed to actively buying and selling. There can be no assurances that the Fund’s investment objectives will be achieved.

The following is a summary of accounting policies followed by the Fund in the preparation of its financial statements. These policies are in conformity with accounting principles generally accepted in the United States of America.

Securities Valuation Portfolio securities for which market quotations are readily available are valued at market value, which is determined by using the last reported sale price, or, if no sales are reported, the last reported bid price. For NASDAQ traded securities, market value may also be determined on the basis of the NASDAQ official closing price (the “NOCP”) instead of the last reported sales price. If a market quote is not available, the security will be valued at fair value as determined in good faith under procedures established by, and under the supervision of, the Fund’s Board of Trustees. Short-term obligations having remaining maturities of 60 days or less are valued at amortized cost, which approximates market value.

Securities Transactions and Investment Income Securities transactions are recorded on a trade date basis. Realized gains and losses from securities transactions are determined by using the identified cost method. Dividend income and distributions to shareholders are recorded on the ex-dividend date. Interest income, including amortization of discount on short-term investments, is recorded on the accrual basis.

Federal Income Taxes The Fund intends to continue to comply with the requirements of the Internal Revenue Code applicable to regulated investment companies and to distribute all of its taxable income, including any net realized gain on investments to its shareholders. Therefore, no Federal income tax provision is required. Cost of securities for tax purposes is substantially the same as for financial reporting purposes.

Net Asset Value Net asset value per share is determined daily as of the close of trading on the New York Stock Exchange by dividing the value of the Fund’s net assets by the number of shares outstanding.

Use of Estimates In preparing financial statements in accordance with accounting principles generally accepted in the United States of America, management is required to make estimates and assumptions that affect the reported amounts of assets and liabilities and the disclosure of contingent assets and liabilities at the date of the financial statements, and the reported amounts of increases and decreases in net assets from operations during the reporting period. Actual results could differ from those estimates.

16

The Torray Institutional Fund

NOTES TO FINANCIAL STATEMENTS

As of June 30, 2004 (unaudited)

NOTE 2 — SHARES OF BENEFICIAL INTEREST TRANSACTIONS

Transactions in shares of beneficial interest were as follows:

| | | | | | | | | | | | | | |

| | | Six months ended 06/30/04

| | | Year ended 12/31/03

| |

| | | Shares

| | | Amount

| | | Shares

| | | Amount

| |

Shares issued | | 1,848,504 | | | $ | 207,868,406 | | | 4,110,543 | | | $ | 408,604,899 | |

Reinvestments of dividends and distributions | | 37,067 | | | | 4,120,834 | | | 92,982 | | | | 9,722,685 | |

Shares redeemed | | (357,320 | ) | | | (40,122,054 | ) | | (330,094 | ) | | | (33,458,170 | ) |

| | |

|

| |

|

|

| |

|

| |

|

|

|

| | | 1,528,251 | | | $ | 171,867,186 | | | 3,873,431 | | | $ | 384,869,414 | |

| | |

|

| |

|

|

| |

|

| |

|

|

|

Officers, Trustees and affiliated persons of The Torray Institutional Fund and their families directly or indirectly control 135,645 shares or 1.95% of the Fund.

NOTE 3 — INVESTMENT TRANSACTIONS

Purchases and sales of investment securities, other than short-term investments, for the six months ended June 30, 2004, aggregated $212,317,606 and $73,817,624, respectively. Net unrealized appreciation of investments at June 30, 2004, includes aggregate unrealized gains of $81,382,293 and unrealized losses of $10,852,253.

NOTE 4 — MANAGEMENT FEES

Pursuant to the Management Contract, The Torray Corporation provides investment advisory and administrative services to the Fund. The Fund pays The Torray Corporation a management fee, computed daily and payable monthly at the annual rate of 0.85% of the Fund’s average daily net assets. During the six months ended June 30, 2004, The Torray Institutional Fund paid comprehensive management fees of $2,854,952. The Fund pays the manager a single comprehensive management fee which covers all operating expenses of the Fund including the investment advisory and administrative services provided by the manager as well as all miscellaneous costs incurred in connection with the ongoing operation of the Fund including transfer agency, custody, professional, and registration fees.

Certain officers and Trustees of the Fund are also officers and/or shareholders of The Torray Corporation.

17

TRUSTEES

Douglas C. Eby

Bruce C. Ellis

Patricia Kavanagh

William M Lane

Carl C. MacCartee, Jr.

Robert P. Moltz

Charlene R. Nunley

Roy A. Schotland

Wayne H. Shaner

Robert E. Torray

INVESTMENT ADVISOR

The Torray Corporation

OFFICERS

Robert E. Torray, President

Douglas C. Eby, Vice President

William M Lane, Vice President

AUDITORS

Briggs, Bunting & Dougherty, LLP

Two Penn Center Plaza, Suite 820

Philadelphia, PA 19102-1732

TRANSFER AGENT

PFPC Inc.

760 Moore Road

King of Prussia, PA 19406-1212

LEGAL COUNSEL

Dechert

1775 Eye Street, N.W.

Washington, D.C. 20006

This report is not authorized for distribution to prospective investors unless preceded or accompanied by a current prospectus.

The

TORRAY

INSTITUTIONAL

FUND

SEMI-ANNUAL REPORT

June 30, 2004

The Torray Institutional Fund

Suite 1100

7501 Wisconsin Avenue

Bethesda, Maryland 20814-6523

(301) 493-4600

(800) 443-3036

Item 2. Code of Ethics.

Not applicable.

Item 3. Audit Committee Financial Expert.

Not applicable.

Item 4. Principal Accountant Fees and Services.

Not applicable.

Item 5. Audit Committee of Listed registrants.

Not applicable.

Item 6. Schedule of Investments

Not applicable.

Item 7. Disclosure of Proxy Voting Policies and Procedures for Closed-End Management Investment Companies.

Not applicable.

Item 8. Purchases of Equity Securities by Closed-End Management Investment Company and Affiliated Purchasers.

Not applicable.

Item 9. Submission of Matters to a Vote of Security Holders.

Not applicable.

Item 10. Controls and Procedures.

| | (a) | The registrant’s principal executive and principal financial officers, have concluded that the registrant’s disclosure controls and procedures (as defined in Rule 30a-3(c) under the Investment Company Act of 1940, as amended (the “1940 Act”) (17 CFR 270.30a-3(c))) are effective, as of a date within 90 days of the filing date of the report that includes the disclosure required by this paragraph, based on their evaluation of these controls and procedures required by Rule 30a-3(b) under the 1940 Act (17 CFR 270.30a-3(b)) and Rules 13a-15(b) or 15d-15(b) under the Securities Exchange Act of 1934, as amended (17 CFR 240.13a-15(b) or 240.15d-15(b)). |

| | (b) | There were no changes in the registrant’s internal control over financial reporting (as defined in Rule 30a-3(d) under the 1940 Act (17 CFR 270.30a-3(d)) that occurred during the registrant’s last fiscal half-year that has materially affected, or is reasonably likely to materially affect, the registrant’s internal control over financial reporting. |

Item 11. Exhibits.

| | |

| (a)(1) | | Not applicable. |

| |

| (a)(2) | | Certifications pursuant to Rule 30a-2(a) under the 1940 Act and Section 302 of the Sarbanes-Oxley Act of 2002 are attached hereto. |

| |

| (a)(3) | | Not applicable. |

| |

| (b) | | Certifications pursuant to Rule 30a-2(b) under the 1940 Act and Section 906 of the Sarbanes-Oxley Act of 2002 are attached hereto. |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| | |

| (registrant) | | The Torray Fund |

| |

By (Signature and Title)* | | /s/ William M Lane, President

|

| | | William M Lane, President |

Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, this report has been signed below by the following persons on behalf of the registrant and in the capacities and on the dates indicated.

| | |

| By (Signature and Title)* | | /s/ William M Lane, President

|

| | | William M Lane, President |

| | |

| By (Signature and Title)* | | /s/ Douglas C. Eby, Treasurer

|

| | | Douglas C. Eby, Treasurer |

| * | Print the name and title of each signing officer under his or her signature. |