UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-06096

Torray Fund

(Exact name of registrant as specified in charter)

| | |

7501 Wisconsin Avenue, Suite 1100 Bethesda, MD | | 20814-6523 |

| (Address of principal executive offices) | | (Zip code) |

William M Lane

Torray LLC

7501 Wisconsin Avenue, Suite 1100

Bethesda, MD 20814-6523

(Name and address of agent for service)

registrant’s telephone number, including area code: 301-493-4600

Date of fiscal year end: December 31

Date of reporting period: December 31, 2006

Item 1. Reports to Stockholders.

The Report to Shareholders is attached herewith.

The Torray Fund

Letter to Shareholders

February 12, 2007

Dear Fellow Shareholders,

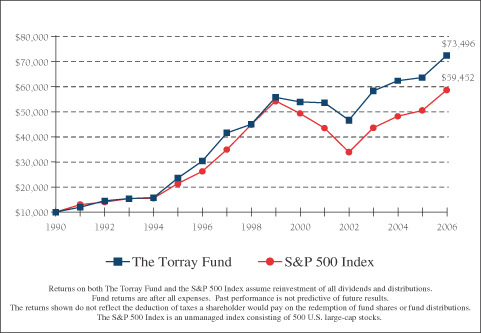

The Torray Fund gained 13.7% during 2006, compared to 15.8% for the Standard & Poor’s 500 Index. The differential came during the first half of the year and reflected continued strength in many cyclical, commodity and low quality stocks, which, as you know, we’ve avoided. Subsequently, their prices have softened, giving our relative results a boost. More to the point, though, the Fund’s long-term performance has been excellent. Since its inception 16 years ago, it has earned 13.3% compounded annually, turning a $10,000 investment into $73,500, while the S&P 500 returned 11.8% and $59,500. We also have outpaced the Index over the last 10 and 15 years, and matched it for the recent five. Wall Street’s mean estimate of earnings growth for our holdings over the next half-decade is 12.2% annually, compared to 8% for the S&P 500. If this proves anywhere close to the mark, The Torray Fund should do quite well going forward.

During 2001, on the heels of the second biggest U.S. bull market on record — one that outran earnings growth by nearly 4-to-1 — investors, in a classic buy-high, sell-low syndrome, slashed their international fund holdings by 68%, putting all of that money and more into domestic funds. The timing was bad. From their peak in 2000, stocks dropped 50% by the fall of 2002. True to form, fund inflows at first tailed off, then fell 40% in 2004, 67% in ‘05, and 91% last year. In the mirror image, investment in foreign funds jumped by the same percentages, and institutions moved money overseas as well. This massive transfer of liquidity helped put a damper on U.S. stocks and, at the same time, sparked a speculative surge in offshore markets that far outpaced gains in economic fundamentals. China, India and Russia soared 143%, 51% and 71%, respectively, during 2006. Venezuelan stocks jumped 111%, despite President Chavez’s announced plans to nationalize the telecommunications, electricity and natural gas industries, seize majority control of oil production and turn the Caracas Golf Club into a low income housing project.

Capital moving into newly emerging markets had an even greater impact due to their tiny size. As U.S. stocks were setting records during the late ‘90s, markets in the 22 countries that comprise the Standard & Poor’s IFC Frontier Index went down, among them Botswana, Bangladesh, Croatia, Ecuador, Jamaica, Lebanon, Namibia, Romania, Trinidad & Tobago and Vietnam. Then, as our market sank, money poured into these obscure exchanges, generating gains for the Frontier Index of 40% in both 2002 and ‘03, 50% in ‘04, 18% in ‘05 and 38% in ‘06 — a cumulative advance of 4.8-to-1. Once again, cash, not fundamentals, proved the controlling feature. Can you imagine the economic underpinnings of these countries, or any others for that matter, justifying, in such a short period, a leap of this magnitude? Meanwhile, despite an increase in corporate earnings from $351 billion to $878 billion, our market, net of dividends, actually declined slightly between early 2000 and the end of last year. Although this was to be expected given the fact it was so inflated to begin with, today it is not. Yet institutions, the financial industry and media continue to harp on the international theme when many of the world’s best values are hiding in plain sight right here. Our Fund’s investments are concentrated in them.

None of this should be taken as an indictment of foreign investing per se. There are plenty of sound companies around the world, a number operating in economies growing two or three times the rate of ours, and money will likely be made in some of them. History, nevertheless, suggests a cautious approach. China, for instance, has captured

1

The Torray Fund

Letter to Shareholders

February 12, 2007

investors’ imagination perhaps more than any other country. Yet, despite its roaring economy, the mainland stock market has rarely generated much public confidence until now. In fact, according to the New York Times, a 2003 poll found 90% of investors had lost money there and, by 2005, half said they wanted out and would not be coming back. Less than two years later, in a frenzy recalling the late 1990’s dot.com boom in the U.S., the Shanghai Composite Index has nearly tripled. Online trading is spreading, and it’s reported that 90,000 trading accounts are opening every day — 35 times the pace a year ago when prices were a fraction of what they are now. In another sign of impending problems, Government investigators reportedly have been examining investors’ pledging of their homes for personal loans to play the market, and also schemes with merchants to borrow on credit cards for the same purpose, no doubt hoping stocks will rise enough to pay off the charges. All of this comes after a five-year slump in Chinese shares, a period during which they were among the world’s worst-performing. Cheng Siwei, Vice Chairman of the National Peoples Congress and an influential figure in Beijing financial circles, was quoted January 30 in the Financial Times as saying, “There is a bubble going on.” He warned investors that “in terms of profits, returns and other indicators (presumably accounting), 70% of listed Chinese companies do not meet international standards.” People speculating in this market, and plenty of others, are headed for trouble.

The 1980’s bull market in Japanese stocks and real estate comes to mind. During the ten years ending 1989, the Nikkei average advanced six-fold to a record 38,916 — about 100 times earnings — almost triple the S&P 500’s inflated valuation in early 2000. Flush with cash from bank loans and soaring stocks, Japanese investors went on a buying spree, acquiring trophy American office buildings, resort properties, and other assets, driving prices up sharply. Many Hawaiians reportedly were forced from their homes by the resulting rise in tax assessments.

Things were different in the U.S. A mania fueled by corporate takeovers and insider trading had propelled the Dow Jones Average in late August 1987 to 2722, an all-time high. But, the balloon burst and the Index nosedived 36%, closing October 19 (Black Monday) at 1739. This is equivalent to a 4700-point drop today. On the 19th alone, the loss was 22.6%. Meanwhile, inflation picked up, the Fed funds rate followed suit, peaking at 10%, and unemployment reached 8% by the middle of 1992, approaching twice the current level. Memories of the ‘87 crash combined with economic uncertainties demoralized the country, and the euphoria in Japan only made things seem worse. Pundits prophesized that if we didn’t adopt the Japanese business model, our future was even bleaker than it appeared. No surprise, just when everyone bought the story, Japan entered a deflationary spiral that drove the Nikkei down 80% over the next 13 years. Japanese banks and real estate took huge hits, and many of the U.S. assets acquired during the run-up were put on the block. Today, the Nikkei stands 56% below where it was in 1989, and the yen is the weakest major currency in the world. By contrast, the S&P 500 and Dow, not counting dividends, are up four and five times, respectively.

Herein lies a timeless lesson: traveling with the crowd is expensive. In the late ‘80s and early ‘90s, when U.S. stocks were relatively cheap, investors put almost no money into them net of what they took out. In fact, it’s likely a high percentage didn’t reinvest until the tech/telecom/dot.com craze was in full swing. We see parallels in many of today’s popular investment themes.

2

The Torray Fund

Letter to Shareholders

February 12, 2007

It all goes to show that performance-chasing investors are their own worst enemies, pouring cash into stocks, funds and markets that have already gone way up, borrowing money and dumping underperformers to pay for them. Breaking this habit would do more for their returns than anything else. It would also help if they quit taking advice from supposed “experts” and forgot about beating the market. A few well-run, high quality funds managed by people that own large stakes in them — or an Index fund — will produce far better results. In turn, the meaning of mutual fund track records — now largely irrelevant since so many shareholders don’t hang on long enough to benefit from them — would be restored. According to John Bogle, founder of Vanguard, the 200 equity funds with the largest in-and-out money flows for the 10 years ending 2005 made an average of 8.85% per year. But, when adjusted to reflect shareholder comings and goings, the typical investor made only 2.40%. The difference quadruples money in about 20 years. While skeptics might respond that perhaps the cash went into other funds that did even better, we doubt it. Chances are these folks jumped from the frying pan into the fire.

As the saying goes, those that repeat the same mistakes over and over shouldn’t expect a different outcome. Unfortunately, evidence suggests a lot of investors don’t believe it. In spite of one disappointment after another, their collective behavior never changes. We consider it an important part of our job to raise your awareness of these realities in the hope it will help you avoid the traps we’ve described.

We thank you, as always, for your continued confidence in our management.

| | | | | | | | |

Sincerely, | | | | |

| | |  | | | | | |  |

| | | Robert E. Torray | | | | | | Douglas C. Eby |

3

The Torray Fund

PERFORMANCE DATA

As of December 31, 2006

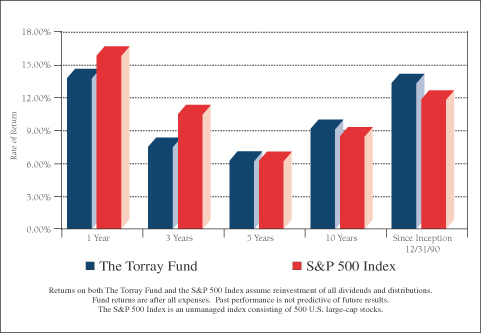

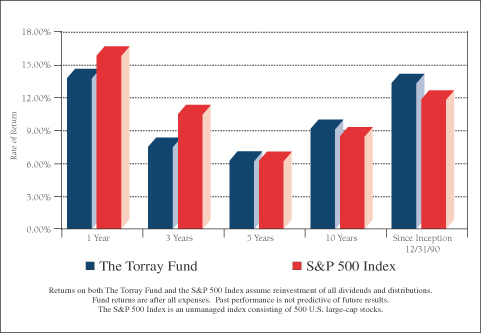

Total Average Annual Returns on an Investment in The Torray Fund vs. the S&P 500 Index

For the periods ended December 31, 2006:

| | | | | | | | | | | | | | | |

| | | 1 Year

| | | 3 Years

| | | 5 Years

| | | 10 Years

| | | Since

Inception

12/31/90

| |

The Torray Fund | | 13.74 | % | | 7.46 | % | | 6.20 | % | | 9.10 | % | | 13.27 | % |

S&P 500 Index | | 15.79 | % | | 10.44 | % | | 6.19 | % | | 8.42 | % | | 11.78 | % |

Cumulative Returns for the 16 years ended December 31, 2006

| | | |

The Torray Fund | | 634.96 | % |

S&P 500 Index | | 494.52 | % |

4

The Torray Fund

PERFORMANCE DATA

As of December 31, 2006

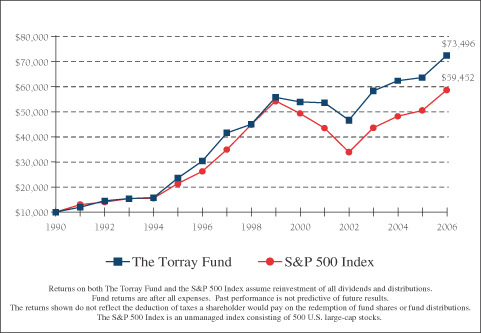

Change in Value of $10,000 Invested on December 31, 1990 (commencement of operations) to:

| | | | | | | | | | | | |

| | | 12/31/94

| | 12/31/98

| | 12/31/02

| | 12/31/06

|

The Torray Fund | | $ | 15,821 | | $ | 45,576 | | $ | 47,236 | | $ | 73,496 |

S&P 500 Index | | $ | 15,666 | | $ | 45,438 | | $ | 34,318 | | $ | 59,452 |

5

The Torray Fund

FUND PROFILE (unaudited)

As of December 31, 2006

| | |

DIVERSIFICATION (% of net assets) | | |

| |

Insurance | | 18.03% |

Pharmaceuticals & Biotech | | 13.21% |

Diversified Financials | | 12.43% |

Health Care Equipment & Services | | 11.63% |

Capital Goods | | 9.36% |

Semiconductors & Semi Equipment | | 7.18% |

Media | | 6.60% |

Telecommunications | | 6.55% |

Software & Services | | 5.29% |

Tech Hardware & Equipment | | 3.57% |

Materials | | 2.71% |

Retailing | | 2.25% |

Food, Beverage & Tobacco | | 1.02% |

Other Assets Less Liabilities | | 0.12% |

Short-Term Investments | | 0.05% |

| | |

|

| | | 100.00% |

| | |

| TOP TEN EQUITY HOLDINGS |

| 1. | | Fairfax Financial Holdings Limited |

| 2. | | Markel Corporation |

| 3. | | Medtronic, Inc. |

| 4. | | Cardinal Health, Inc. |

| 5. | | Amgen Inc. |

| 6. | | Applied Materials, Inc. |

| 7. | | AMBAC Financial Group, Inc. |

| 8. | | EMC Corporation |

| 9. | | Eli Lilly and Company |

| 10. | | Abbott Laboratories |

| | | | |

TOP FIXED INCOME HOLDINGS |

|

Level 3 Communications 10.00% due 2011 |

|

PORTFOLIO CHARACTERISTICS |

| | |

Net Assets (million) | | | | $1,199 |

Number of Holdings | | | | 41 |

Portfolio Turnover | | | | 21.92% |

P/E Multiple (forward) | | | | 16.1x |

Portfolio Yield | | | | 1.10% |

Market Capitalization | | Average | | 54.8 B |

| | | Median | | 28.5 B |

6

The Torray Fund

SCHEDULE OF INVESTMENTS

As of December 31, 2006

| | | | | | | |

| | | Shares

| | | | Market Value

|

| COMMON STOCK 95.03% | | | |

| |

| 8.84% CONSUMER DISCRETIONARY | | | |

| | | 992,600 | | Tribune Company | | $ | 30,552,228 |

| | | 840,400 | | O’Reilly Automotive, Inc. * | | | 26,943,224 |

| | | 328,700 | | Gannett Co., Inc. | | | 19,873,202 |

| | | 466,900 | | The Walt Disney Company | | | 16,000,663 |

| | | 325,000 | | Time Warner Inc. | | | 7,078,500 |

| | | 129,024 | | The McClatchy Company | | | 5,586,739 |

| | | | | | |

|

|

| | | | | | | | 106,034,556 |

| 1.02% CONSUMER STAPLES | | | |

| | | 247,400 | | Anheuser-Busch Cos., Inc. | | | 12,172,080 |

| |

| 30.46% FINANCIALS | | | |

| | | 336,044 | | Fairfax Financial Holdings Limited | | | 66,704,734 |

| | | 131,705 | | Markel Corporation * | | | 63,231,571 |

| | | 574,150 | | AMBAC Financial Group, Inc. | | | 51,139,540 |

| | | 739,262 | | JPMorgan Chase & Co. | | | 35,706,355 |

| | | 1,093,600 | | Marsh & McLennan Companies, Inc. | | | 33,529,776 |

| | | 153,050 | | The Goldman Sachs Group, Inc. | | | 30,510,517 |

| | | 225,700 | | Franklin Resources, Inc. | | | 24,865,369 |

| | | 404,800 | | American Express Company | | | 24,559,216 |

| | | 2,240,200 | | LaBranche & Co Inc. * | | | 22,021,166 |

| | | 423,100 | | Calamos Asset Management, Inc. | | | 11,351,773 |

| | | 22,400 | | American International Group, Inc. | | | 1,605,184 |

| | | | | | |

|

|

| | | | | | | | 365,225,201 |

| 24.84% HEALTH CARE | | | |

| | | 1,039,700 | | Medtronic, Inc. | | | 55,634,347 |

| | | 803,600 | | Cardinal Health, Inc. | | | 51,775,948 |

| | | 756,700 | | Amgen Inc. * | | | 51,690,177 |

| | | 816,500 | | Eli Lilly and Company | | | 42,539,650 |

| | | 807,700 | | Abbott Laboratories | | | 39,343,067 |

| | | 711,500 | | Haemonetics Corporation * | | | 32,031,730 |

| | | 375,900 | | Johnson & Johnson | | | 24,816,918 |

| | | | | | |

|

|

| | | | | | | | 297,831,837 |

See notes to the financial statements.

7

The Torray Fund

SCHEDULE OF INVESTMENTS (continued)

As of December 31, 2006

| | | | | | | |

| | | Shares

| | | | Market Value

|

| |

| 9.36% INDUSTRIALS | | | |

| | | 714,700 | | Illinois Tool Works Inc. | | $ | 33,011,993 |

| | | 337,700 | | General Dynamics Corporation | | | 25,107,995 |

| | | 329,000 | | Danaher Corporation | | | 23,832,760 |

| | | 253,850 | | United Technologies Corporation | | | 15,870,702 |

| | | 205,600 | | Emerson Electric Co. | | | 9,064,904 |

| | | 73,600 | | General Electric Company | | | 2,738,656 |

| | | 58,300 | | Honeywell International Inc. | | | 2,637,492 |

| | | | | | |

|

|

| | | | | | | | 112,264,502 |

| |

| 16.04% INFORMATION TECHNOLOGY | | | |

| | | 2,797,000 | | Applied Materials, Inc. | | | 51,604,650 |

| | | 3,245,200 | | EMC Corporation * | | | 42,836,640 |

| | | 1,703,400 | | Intel Corporation | | | 34,493,850 |

| | | 506,200 | | Automatic Data Processing, Inc. | | | 24,930,350 |

| | | 801,800 | | First Data Corporation | | | 20,461,936 |

| | | 801,800 | | The Western Union Company | | | 17,976,356 |

| | | | | | |

|

|

| | | | | | | | 192,303,782 |

| |

| 2.71% MATERIALS | | | |

| | | 1,639,900 | | W.R. Grace & Co. * | | | 32,470,020 |

| |

| 1.76% TELECOMMUNICATION SERVICES | | | |

| | | 1,114,700 | | Sprint Nextel Corporation | | | 21,056,683 |

| | | | | | |

|

|

| TOTAL COMMON STOCK 95.03% | | | 1,139,358,661 |

| (cost $884,180,356) | | | |

| | | |

| | | Principal Amount ($) | | | | |

| |

| CONVERTIBLE BOND 4.80% | | | |

| | | 31,980,000 | | Level 3 Communications 10.00% due 2011(1) | | | 57,526,392 |

| (cost $33,534,144) | | | |

| |

| SHORT-TERM INVESTMENTS 0.05% | | | |

| | | 602,564 | | PNC Bank Money Market Account 4.67%, due 01/03/07 | | | 602,564 |

| (cost $602,564) | | | |

| | | | | | |

|

|

See notes to the financial statements.

8

The Torray Fund

SCHEDULE OF INVESTMENTS (continued)

As of December 31, 2006

| | | | | | | |

| | | | | | | Market Value

|

| TOTAL PORTFOLIO SECURITIES 99.88% | | $ | 1,197,487,617 |

| (cost $918,317,064) | | | |

| OTHER ASSETS LESS LIABILITIES 0.12% | | | 1,431,701 |

| | | | | | |

|

|

| TOTAL NET ASSETS 100.00% | | $ | 1,198,919,318 |

| | | | | | |

|

|

| * | Non-income producing securities |

(1) | This security is valued at fair value, as determined in good faith by the Advisor under the supervision of the Board of Trustees in accordance with the Fund’s Valuation Procedures. The total fair value of such securities at December 31, 2006 is $57,526,392 which represents 4.80% of net assets. |

See notes to the financial statements.

9

The Torray Fund

STATEMENT OF ASSETS AND LIABILITIES

As of December 31, 2006

| | | | |

ASSETS | | | | |

Investments in securities at value

(amortized cost $918,317,064) | | $ | 1,197,487,617 | |

Receivable for investments sold | | | 1,999,398 | |

Interest and dividends receivable | | | 1,233,099 | |

Receivable for fund shares sold | | | 546,872 | |

Prepaid expenses | | | 6,588 | |

| | |

|

|

|

TOTAL ASSETS | | | 1,201,273,574 | |

| | |

|

|

|

| |

LIABILITIES | | | | |

Payable for fund shares redeemed | | | 1,069,558 | |

Payable to advisor | | | 1,024,473 | |

Accrued expenses | | | 260,225 | |

| | |

|

|

|

TOTAL LIABILITIES | | | 2,354,256 | |

| | |

|

|

|

| |

NET ASSETS | | $ | 1,198,919,318 | |

| | |

|

|

|

Shares of beneficial interest ($1 stated value,

28,844,332 shares outstanding, unlimited shares authorized) | | $ | 28,844,332 | |

Paid-in-capital in excess of par | | | 889,160,176 | |

Distributions in excess of net investment income | | | (399,527 | ) |

Accumulated net realized gain on investments | | | 2,143,784 | |

Net unrealized appreciation of investments | | | 279,170,553 | |

| | |

|

|

|

| |

TOTAL NET ASSETS | | $ | 1,198,919,318 | |

| | |

|

|

|

Net asset value, offering and redemption price per share | | $ | 41.57 | |

| | |

|

|

|

See notes to the financial statements.

10

The Torray Fund

STATEMENT OF OPERATIONS

For the year ended December 31, 2006

| | | |

INVESTMENT INCOME | | | |

Dividend income (net of foreign taxes withheld of $78,990) | | $ | 12,839,893 |

Interest income | | | 2,747,534 |

| | |

|

|

Total income | | | 15,587,427 |

| | |

|

|

| |

EXPENSES | | | |

Management fees | | | 12,165,505 |

Transfer agent fees & expenses | | | 676,148 |

Interest expense | | | 114,782 |

Printing, postage & mailing | | | 97,998 |

Trustees’ fees | | | 67,666 |

Legal fees | | | 60,000 |

Custodian fees | | | 56,952 |

Insurance | | | 42,236 |

Registration & filing fees | | | 36,405 |

Audit fees | | | 36,002 |

| | |

|

|

Total expenses | | | 13,353,694 |

| | |

|

|

NET INVESTMENT INCOME | | | 2,233,733 |

| | |

|

|

REALIZED AND UNREALIZED GAIN

ON INVESTMENTS | | | |

Net realized gain on investments | | | 77,850,871 |

Capital gain distributions from investment companies | | | 537,718 |

Net change in unrealized appreciation on investments | | | 75,047,861 |

| | |

|

|

Net realized and unrealized gain on investments | | | 153,436,450 |

| | |

|

|

NET INCREASE IN NET ASSETS FROM OPERATIONS | | $ | 155,670,183 |

| | |

|

|

See notes to the financial statements.

11

The Torray Fund

STATEMENTS OF CHANGES IN NET ASSETS

For the years indicated:

| | | | | | | | |

| | | Year ended

12/31/06

| | | Year ended

12/31/05

| |

Increase in Net Assets from Operations: | | | | | | | | |

Net investment income | | $ | 2,233,733 | | | $ | 5,029,187 | |

Net realized gain on investments | | | 77,850,871 | | | | 105,058,339 | |

Capital gain distributions from investment companies | | | 537,718 | | | | 1,567,211 | |

Net change in unrealized appreciation

(depreciation) on investments | | | 75,047,861 | | | | (91,069,400 | ) |

| | |

|

|

| |

|

|

|

Net increase in net assets from operations | | | 155,670,183 | | | | 20,585,337 | |

| | |

|

|

| |

|

|

|

Distributions to Shareholders from: | | | | | | | | |

Net investment income ($0.087 and

$0.133 per share, respectively) | | | (2,633,260 | ) | | | (5,029,187 | ) |

Net realized gains ($2.612 and $2.713 per

share, respectively) | | | (73,114,435 | ) | | | (93,175,112 | ) |

| | |

|

|

| |

|

|

|

Total distributions | | | (75,747,695 | ) | | | (98,204,299 | ) |

| | |

|

|

| |

|

|

|

| | |

Shares of Beneficial Interest | | | | | | | | |

Decrease from share transactions | | | (210,953,920 | ) | | | (326,930,702 | ) |

| | |

|

|

| |

|

|

|

Total decrease | | | (131,031,432 | ) | | | (404,549,664 | ) |

| | |

Net Assets — Beginning of Year | | | 1,329,950,750 | | | | 1,734,500,414 | |

| | |

|

|

| |

|

|

|

Net Assets — End of Year | | $ | 1,198,919,318 | | | $ | 1,329,950,750 | |

| | |

|

|

| |

|

|

|

Distributions in Excess of Net Investment Income | | $ | (399,527 | ) | | $ | — | |

| | |

|

|

| |

|

|

|

See notes to the financial statements.

12

The Torray Fund

FINANCIAL HIGHLIGHTS

For a share outstanding:

PER SHARE DATA

| | | | | | | | | | | | | | | | | | | | |

| | | Years ended December 31:

| |

| | | 2006

| | | 2005

| | | 2004

| | | 2003

| | | 2002

| |

Net Asset Value, Beginning of Year | | $ | 39.020 | | | $ | 41.080 | | | $ | 39.980 | | | $ | 32.240 | | | $ | 37.530 | |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

Income from investment operations | | | | | | | | | | | | | | | | | | | | |

Net investment income | | | 0.073 | | | | 0.133 | | | | 0.165 | | | | 0.220 | | | | 0.205 | |

Net gains (losses) on securities (both realized and unrealized) | | | 5.176 | | | | 0.653 | | | | 2.523 | | | | 7.864 | | | | (5.083 | ) |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

Total from investment operations | | | 5.249 | | | | 0.786 | | | | 2.688 | | | | 8.084 | | | | (4.878 | ) |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

Less: distributions | | | | | | | | | | | | | | | | | | | | |

Dividends (from net investment income) | | | (0.087 | ) | | | (0.133 | ) | | | (0.165 | ) | | | (0.220 | ) | | | (0.205 | ) |

Distributions (from capital gains) | | | (2.612 | ) | | | (2.713 | ) | | | (1.423 | ) | | | (0.124 | ) | | | (0.207 | ) |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

Total distributions | | | (2.699 | ) | | | (2.846 | ) | | | (1.588 | ) | | | (0.344 | ) | | | (0.412 | ) |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

Net Asset Value, End of Year | | $ | 41.570 | | | $ | 39.020 | | | $ | 41.080 | | | $ | 39.980 | | | $ | 32.240 | |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

TOTAL RETURN (1) | | | 13.74 | % | | | 2.08 | % | | | 6.90 | % | | | 25.19 | % | | | (13.05 | %) |

RATIOS/SUPPLEMENTAL DATA | | | | | | | | | | | | | | | | | | | | |

Net assets, end of year (000’s omitted) | | $ | 1,198,919 | | | $ | 1,329,951 | | | $ | 1,734,500 | | | $ | 1,655,279 | | | $ | 1,367,536 | |

Ratios of expenses to average net assets | | | 1.10 | % | | | 1.07 | % | | | 1.08 | % | | | 1.11 | % | | | 1.07 | % |

Ratios of net investment income to average net assets | | | 0.18 | % | | | 0.34 | % | | | 0.41 | % | | | 0.62 | % | | | 0.58 | % |

Portfolio turnover rate | | | 21.92 | % | | | 33.16 | % | | | 27.12 | % | | | 37.11 | % | | | 22.52 | % |

(1) | Past performance is not predictive of future performance. |

See notes to the financial statements.

13

The Torray Fund

NOTES TO FINANCIAL STATEMENTS

As of December 31, 2006

NOTE 1 — SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

The Torray Fund (“Fund”) is a separate series of The Torray Fund (“Trust”). The Trust is registered under the Investment Company Act of 1940 as a no-load, diversified, open-end management investment company. The Trust was organized as a business trust under Massachusetts law. The Fund’s primary investment objective is to provide long-term total return. The Fund seeks to meet its objective by investing its assets in a diversified portfolio of common stocks. In order to accomplish these goals, the Fund intends to hold stocks for the long term, as opposed to actively buying and selling. There can be no assurances that the Fund’s investment objectives will be achieved.

The following is a summary of accounting policies followed by the Fund in the preparation of its financial statements. These policies are in conformity with accounting principles generally accepted in the United States of America.

Securities Valuation Portfolio securities for which market quotations are readily available are valued at market value, which is determined by using the last reported sale price, or, if no sales are reported, the last reported bid price. For NASDAQ traded securities, market value is determined on the basis of the NASDAQ official closing price (the “NOCP”) instead of the last reported sales price. Other assets and securities for which no quotations are readily available or for which Torray LLC (the “Advisor”) believes do not reflect market value are valued at fair value as determined in good faith by the Advisor under the supervision of the Board of Trustees in accordance with the Fund’s Valuation Procedures. Short-term obligations having remaining maturities of 60 days or less are valued at amortized cost, which approximates market value.

Securities Transactions and Investment Income Securities transactions are recorded on a trade date basis. Realized gains and losses from securities transactions are recorded on the specific identification basis. Dividend income and distributions to shareholders are recorded on the ex-dividend date. Interest income, including amortization of discount on short-term investments, and expenses are recorded on the accrual basis. Premium and discount amortization is amortized using the effective yield to maturity method.

Federal Income Taxes The Fund intends to continue to comply with the requirements of the Internal Revenue Code applicable to regulated investment companies and to distribute all of its taxable income, including any net realized gain on investments to its shareholders. Therefore, no Federal income tax provision is required.

Net Asset Value The net asset value per share of the Fund is determined daily as of the close of trading on the New York Stock Exchange by dividing the value of the Fund’s net assets by the number of shares outstanding.

Interest Expense When cash balances are overdrawn in the Fund’s custody account, the Fund is charged an overdraft fee equal to 1.25% above the Federal Funds Rate. This amount is shown as “interest expense” in the Statement of Operations. For the fiscal year ended December 31, 2006, the average amount of overdrafts were $2,552,340 and the average rate charged was 4.50%. In December 2006, the Trust entered into a line of credit facility with PNC

14

The Torray Fund

NOTES TO FINANCIAL STATEMENTS (continued)

As of December 31, 2006

Bank. Under the terms of the line of credit, the separate series of the Trust (including the Fund) may borrow up to $20,000,000 on a short term basis with interest accruing at the Federal Funds Rate plus .75%. As of December 31, 2006, the Fund had no outstanding borrowings under this line of credit facility.

Use of Estimates In preparing financial statements in accordance with accounting principles generally accepted in the United States of America, management is required to make estimates and assumptions that affect the reported amounts of assets and liabilities and the disclosure of contingent assets and liabilities at the date of the financial statements, and the reported amounts of increases and decreases in net assets from operations during the reporting period. Actual results could differ from those estimates.

New Accounting Pronouncements In July 2006, the Financial Accounting Standards Board issued Interpretation No. 48, “Accounting for Uncertainty in Income Taxes an Interpretation of FASB Statement No. 109” (the “Interpretation”). The Interpretation establishes for all entities, including pass-through entities such as the Fund, a minimum threshold for financial statement recognition of the benefit of positions taken or expected to be taken in filing tax returns (including whether an entity is taxable in a particular jurisdiction), and requires certain expanded tax disclosures. The Interpretation is to be implemented no later than June 29, 2007, and is to be applied to all open tax years as of the date of effectiveness. Management has recently begun to evaluate the application of the Interpretation to the Fund, and is not in a position at this time to estimate the significance of its impact, if any, on the Fund’s financial statements.

In addition, in September 2006, the Financial Accounting Standards Board (FASB) issued Statement on Financial Accounting Standards (SFAS) No. 157, “Fair Value Measurements” (the “Statement”). This standard establishes a single authoritative definition of fair value, sets out a framework for measuring fair value and requires additional disclosures about fair value measurements. SFAS No. 157 applies to fair value measurements already required or permitted by existing standards. SFAS No. 157 is effective for financial statements issued for fiscal years beginning after November 15, 2007 and interim periods within those fiscal years. The changes to current generally accepted accounting principles from the application of this Statement relate to the definition of fair value, the methods used to measure fair value, and the expanded disclosures about fair value measurements. As of December 31, 2006, the Fund does not believe the adoption of SFAS No. 157 will impact the amounts reported in the financial statements, however, additional disclosures may be required about the inputs used to develop the measurements and the effect of certain of the measurements reported on the statement of changes in net assets for a fiscal period.

15

The Torray Fund

NOTES TO FINANCIAL STATEMENTS (continued)

As of December 31, 2006

NOTE 2 — SHARES OF BENEFICIAL INTEREST TRANSACTIONS

Transactions in shares of beneficial interest were as follows:

| | | | | | | | | | | | | | |

| | | Year ended

12/31/06

| | | Year ended

12/31/05

| |

| | | Shares

| | | Amount

| | | Shares

| | | Amount

| |

Shares issued | | 1,876,465 | | | $ | 75,722,613 | | | 2,892,352 | | | $ | 114,885,220 | |

Reinvestments of dividends and distributions | | 1,806,759 | | | | 72,571,132 | | | 2,426,708 | | | | 93,419,725 | |

Shares redeemed | | (8,920,428 | ) | | | (359,247,665 | ) | | (13,457,168 | ) | | | (535,235,647 | ) |

| | |

|

| |

|

|

| |

|

| |

|

|

|

| | | (5,237,204 | ) | | $ | (210,953,920 | ) | | (8,138,108 | ) | | $ | (326,930,702 | ) |

| | |

|

| |

|

|

| |

|

| |

|

|

|

Officers, Trustees and affiliated persons of The Torray Fund and their families directly or indirectly control 2,242,700 shares or 7.78% of the Fund.

NOTE 3 — INVESTMENT TRANSACTIONS

Purchases and sales of investment securities, other than short-term investments, for the year ended December 31, 2006, aggregated $267,391,378 and $521,290,209, respectively.

NOTE 4 — MANAGEMENT FEES

Pursuant to the Management Contract, Torray LLC provides investment advisory and administrative services to the Fund. The Fund pays Torray LLC a management fee, computed daily and payable monthly at the annual rate of one percent of the Fund’s average daily net assets. For the year ended December 31, 2006, The Torray Fund paid management fees of $12,165,505.

Excluding the management fee, other expenses incurred by the Fund during the year ended December 31, 2006, totaled $1,188,189. These expenses include all costs associated with the Fund’s operations including transfer agent fees, Independent Trustees’ fees ($14,000 per annum and $2,000 for each Board meeting attended), interest expense, taxes, dues, fees and expenses of registering and qualifying the Fund and its shares for distribution, charges of custodian, auditing and legal expenses, insurance premiums, supplies, postage, expenses of issue or redemption of shares, reports to shareholders and Trustees, expenses of printing and mailing prospectuses, proxy statements and proxies to existing shareholders, and other miscellaneous expenses.

Certain officers and Trustees of the Fund are also officers and/or shareholders of Torray LLC.

16

The Torray Fund

NOTES TO FINANCIAL STATEMENTS (continued)

As of December 31, 2006

NOTE 5 — TAX MATTERS

Distributions to shareholders are determined in accordance with federal income tax regulations which may differ from accounting principles generally accepted in the United States of America.

The tax character of distributions paid during 2006 and 2005 were as follows:

| | | | | | |

| | | 2006

| | 2005

|

Distributions paid from: | | | | | | |

Ordinary income | | $ | 2,633,260 | | $ | 5,029,187 |

Long-term capital gain | | | 73,114,435 | | | 93,175,112 |

| | |

|

| |

|

|

| | | $ | 75,747,695 | | $ | 98,204,299 |

| | |

|

| |

|

|

As of December 31, 2006, the components of distributable earnings on a tax basis were as follows:

| | | | | |

Undistributed ordinary income | | $ | 81,943 | | |

Undistributed long-term gain | | | 2,195,893 | | |

Unrealized appreciation | | | 278,636,974 | | |

| | |

|

| | |

| | | $ | 280,914,810 | | |

| | |

|

| | |

The following information is based upon the federal income tax basis of investment securities as of December 31, 2006:

| | | | | | |

Gross unrealized appreciation | | $ | 295,669,408 | | | |

Gross unrealized depreciation | | | (17,032,434 | ) | | |

| | |

|

|

| | |

Net unrealized appreciation | | $ | 278,636,974 | | | |

| | |

|

|

| | |

Federal income tax basis | | $ | 918,850,643 | | | |

| | |

|

|

| | |

The primary difference between book basis and tax basis distributions and distributable earnings is different book and tax treatment of amortization of bond premiums and the tax deferral of losses on wash sales.

17

The Torray Fund

NOTES TO FINANCIAL STATEMENTS (continued)

As of December 31, 2006

NOTE 6 — RECLASSIFICATIONS

Accounting principals generally accepted in the United States require that certain components of net assets be reclassified between financial and tax reporting. These reclassifications have no effect on net assets or net asset value per share. For the year ended December 31, 2006, permanent differences in book and tax accounting have been reclassified to paid-in-capital in excess of par and accumulated net realized gain on investments:

| | | | |

Decrease accumulated net realized gain on investments | | | | $(25,191,617) |

Increase paid-in-capital in excess of par | | | | 25,191,617 |

NOTE 7 — COMMITMENTS AND CONTINGENCIES

The Fund indemnifies its officers and trustees for certain liabilities that may arise from their performance of their duties to the Fund. Additionally, in the normal course of business, the Fund enters into contracts that contain a variety of representations and warranties, which provide general indemnifications. The Fund’s maximum exposure under these arrangements is unknown, as this would involve future claims that may be made against the Fund that have not yet occurred.

18

The Torray Fund

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

As of December 31, 2006

To the Board of Trustees of The Torray Fund

and Shareholders of The Torray Fund

We have audited the statement of assets and liabilities, including the schedule of investments, of The Torray Fund, a series of shares of beneficial interest of The Torray Fund, as of December 31, 2006, and the related statement of operations for the year then ended, the statements of changes in net assets for each of the two years in the period then ended and the financial highlights for each of the five years in the period then ended. These financial statements and financial highlights are the responsibility of the Fund’s management. Our responsibility is to express an opinion on these financial statements and financial highlights based on our audits.

We conducted our audits in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements and financial highlights are free of material misstatement. An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements. Our procedures included confirmation of securities owned as of December 31, 2006 by correspondence with the custodian. An audit also includes assessing the accounting principles used and significant estimates made by management, as well as evaluating the overall financial statement presentation. We believe that our audits provide a reasonable basis for our opinion.

In our opinion, the financial statements and financial highlights referred to above present fairly, in all material respects, the financial position of The Torray Fund as of December 31, 2006, the results of its operations for the year then ended, the changes in its net assets for each of the two years in the period then ended, and the financial highlights for each of the five years in the period then ended in conformity with accounting principles generally accepted in the United States of America.

BRIGGS, BUNTING & DOUGHERTY, LLP

Philadelphia, Pennsylvania

January 24, 2007

19

The Torray Fund

FUND MANAGEMENT (unaudited)

As of December 31, 2006

Information pertaining to the Trustees and Officers of the Trust is set forth below. The Statement of Additional Information (SAI) includes additional information about the Trustees and is available without charge, upon request, by calling (800) 443-3036.

| | | | | | | | |

Name, Birth Date,

Address* and

Positions

with the Trust | | Term of Office

and Length of

Time Served | | Principal Occupation(s)

During Past 5 Years | | Portfolios

Overseen

by Trustee | | Other Trusteeships/

Directorships Held

by Trustee |

| | | | | DISINTERESTED TRUSTEES | | | | |

Bruce C. Ellis 07/20/44 Trustee | | Indefinite Term Since Jun 1993 | | Private Investor

Bethesda, Maryland | | 2 | | |

Robert P. Moltz 10/03/47 Trustee | | Indefinite Term Since Nov 1990 | | President and CEO

Weaver Bros Insurance Assoc.

Bethesda, Maryland | | 2 | | |

Wayne H. Shaner 08/23/47 Trustee | | Indefinite Term Since Jun 1993 | | Managing Partner

Rockledge Partners, L.L.C.

Bethesda, Maryland

Managing Director (through 01/02/04)

Lockheed Martin Investment Management Co.

Bethesda, Maryland | | 2 | | |

Carol T. Crawford 02/25/43 Trustee | | Indefinite Term Since May 2006 | | Attorney

Private Practice

McLean, Virginia | | 2 | | Director

Smithfield Foods, Inc.

Smithfield, Virginia |

Patricia Kavanagh 11/01/49 Trustee | | Indefinite Term Since May 2002 | | Medical Doctor

Private Practice

Brooklyn, New York | | 2 | | |

| | | | | INTERESTED TRUSTEES & FUND OFFICERS | | | | |

William M Lane 05/21/50 Trustee | | Indefinite Term Since Nov 1990 | | President and Secretary, The Torray Fund

Vice President, Torray LLC

Bethesda, Maryland | | 2 | | |

Roy A. Schotland 03/18/33 Trustee | | Indefinite Term Since Nov 1990 | | Professor of Law

Georgetown University Law Center

Washington, D.C. | | 2 | | Director

Custodial Trust Co.,

a Bear Stearns subsidiary |

Douglas C. Eby 07/28/59 | | Since Jun 1993 | | Vice President and Treasurer, The Torray Fund

President, Torray LLC

Bethesda, Maryland | | 2 | | Director

Markel Corporation Richmond, Virginia Director CBRE Realty Finance, Inc. Hartford, Connecticut |

| * | All addresses are c/o The Torray Fund, 7501 Wisconsin Avenue, Suite 1100, Bethesda, MD 20814-6523 |

20

The Torray Fund

FACTORS CONSIDERED BY THE BOARD OF TRUSTEES IN CONNECTION WITH THEIR APPROVAL OF THE CONTINUATION OF THE FUND’S INVESTMENT MANAGEMENT AGREEMENT WITH THE MANAGERS (unaudited)

The Fund has entered into an Investment Management Agreement (the “Agreement”) with Torray LLC (the “Manager”) pursuant to which the Manager provides investment management services to the Fund. In accordance with the Investment Company Act of 1940, the Board of Trustees of the Fund is required, on an annual basis, to consider the continuation of the Agreement with the Manager, and this must take place at an in-person meeting of the Board. The relevant provisions of the Investment Company Act of 1940 specifically provide that it is the duty of the Board to request and evaluate such information as the Board determines is necessary to allow them to properly consider the continuation of the Agreement, and it is the duty of the Manager to furnish the Trustees with such information that is responsive to their request. Set forth below is a discussion of the various factors that the Board of Trustees considered in deciding to approve the continuation of the Agreement with the Manager.

In determining whether to approve the continuation of the Agreement, the Board of Trustees requested, and the Manager provided, information and data relevant to the Board’s consideration. This included materials that provided the Board with information regarding the investment performance of the Fund and information regarding the fees and expenses of the Fund as compared to other similar mutual funds. As part of its deliberations, the Board also considered and relied upon the information about the Fund that had been provided to them throughout the year in connection with their regular Board meetings at which they engage in the ongoing oversight of the Fund and its operations.

The Board met at an in-person meeting on September 26, 2006 in order to consider the proposed continuation of the Agreement. Among the factors the Board considered was the overall performance of the Fund achieved by the Manager relative to the performance of other mutual funds with similar investment objectives on both a long term basis and over shorter time periods. In particular, the Board took note of the favorable performance achieved by the Manager over longer time periods (five years and longer) and they considered the Manager’s particular focus on long-term investment performance, noting that the Fund had outperformed its applicable benchmark index, the S&P 500 Index, over longer time periods. In reviewing the shorter term performance of the Fund, the Trustees took note of the fact that the short term performance (for periods of less than five years) was generally lower than that of the benchmark index and of other funds with similar investment objectives, and the Trustees discussed with the Manager the likely reasons for this, noting that the Manager maintains a particular focus on long-term investment results and as a result, short-term results can, and will, trail comparable averages from time to time. The Board took into consideration the fact that the Manager seeks to achieve investment results for the Fund with less risk than other similar funds, and that the Manager has maintained a low portfolio turnover rate for the Fund which is beneficial to shareholders of the Fund because this results in lower brokerage costs which helps to reduce the operating costs of the Fund. They noted the range of investment advisory and management services provided by the Manager and the level and quality of these services, and in particular, they noted the quality of the personnel providing these services, taking into consideration their finding that the personnel providing these services, and the services provided, were of a very high caliber and quality.

21

The Torray Fund

FACTORS CONSIDERED BY THE BOARD OF TRUSTEES IN CONNECTION WITH THEIR APPROVAL OF THE CONTINUATION OF THE FUND’S INVESTMENT MANAGEMENT AGREEMENT WITH THE MANAGERS (unaudited) (continued)

The Board also compared expenses of the Fund to the expenses of other funds of similar size, noting that the expenses for the Fund compared favorably with industry averages. They also took note of the fact that the Fund is not subject to any sales loads, sales commissions or other similar fees, including Rule 12b-1 distribution fees, which helps to keep the overall expense to shareholders of investing in the Fund lower than the expenses associated with investing in many comparable funds, and they considered the fact that the Manager had informed the Board that it did not intend to propose the introduction of such types of fees for the Fund. The Board also reviewed financial information concerning the Manager, noting its financial soundness as demonstrated by the financial information provided and the level of profitability relating to its services for the Fund, noting that these were reasonable and consistent with industry standards. The Board was also provided with information regarding the fees that the Manager charges other clients for investment advisory services and they noted that the fees were comparable based on the relevant circumstances of the types of accounts involved. The Board reviewed with the Manager the allocation of the portfolio management team’s time between managing the investments of the Fund and managing other accounts. The Board also engaged in a review of the compensation arrangements for the portfolio managers of the Fund.

In addition, the Board reviewed with the Manager information regarding its brokerage practices, including soft dollar matters, and noted that the Manager did not have in place any formal soft dollar arrangements, and the Board also reviewed the Manager’s best execution procedures, which the Board noted were reasonable and consistent with standard industry practice.

Based on their review, the Trustees concluded that the terms of the Agreement were fair and reasonable. In reaching their conclusion with respect to their approval of the continuation of the Agreement, the Trustees did not identify any one single factor as being controlling, rather, the Board took note of a combination of factors that influenced their decision making process. The Board did, however, identify the overall favorable long-term investment performance of the Fund, the commitment of the Manager to the successful operation of the Fund, and the level of expenses of the Fund, as being important elements of their consideration. Based upon their review and consideration of these factors and other matters deemed relevant by the Board in reaching an informed business judgment, the Board of Trustees unanimously concluded that the terms of the Agreement were fair and reasonable and the Board unanimously voted to approve the continuation of the Agreement with the Manager.

22

The Torray Fund

PORTFOLIO HOLDINGS, PROXY VOTING AND PROCEDURES (unaudited)

As of December 31, 2006

The Fund files its complete schedule of portfolio holdings with the Securities and Exchange Commission (the “Commission”) for the first and third quarters of each fiscal year on Form N-Q. The Fund’s Forms N-Q are available on the Commission’s website at http://www.sec.gov. The Fund’s Form N-Q may be reviewed and copied at the Commission’s Public Reference Room in Washington, D.C. Information on the operation of the Commission’s Public Reference Room may be obtained by calling 1-800-SEC-0330.

A description of the policies and procedures that the Fund uses to determine how to vote proxies relating to portfolio securities is available without charge, upon request, by calling 1-800-443-3036; and on the Commission’s website at http://www.sec.gov.

Information regarding how the Fund voted proxies relating to portfolio securities is available without charge, upon request, by calling 1-800-443-3036; and on the Commission’s website at http://www.sec.gov.

23

The Torray Fund

ABOUT YOUR FUND’S EXPENSES (unaudited)

As of December 31, 2006

We believe it is important for you to understand the impact of costs on your investment. All mutual funds have operating expenses. As a shareholder of the Fund, you incur ongoing costs, including management fees, and other fund expenses. Operating expenses, which are deducted directly from the Fund’s gross income, directly reduce the investment return of the Fund.

A fund’s expenses are expressed as a percentage of its average net assets. This figure is known as the expense ratio. The following examples are intended to help you understand the ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds. The examples below are based on an investment of $1,000 made at the beginning of the period shown and held for the entire period.

The table on the next page illustrates the Fund’s cost in two ways:

Actual Fund Return This section helps you estimate the actual expenses that you paid over the period. The “Ending Account Value” shown is derived from the Fund’s actual return, and the third column shows the operating expenses that would have been paid by an investor who started with $1,000 in the Fund. You may use the information here, together with the amount invested, to estimate the expenses that you paid over the period.

To do so, simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number given for the Fund under the heading “Expenses Paid During Period” on the next page.

Hypothetical 5% Return This section is intended to help you compare your Fund’s costs with those of other mutual funds. It assumes that the Fund had an annual return of 5% before expenses, and that the expense ratio is unchanged. In this case, because the return used is not the Fund’s actual return, the results do not apply to your investment. The example is useful in making comparisons because the Securities and Exchange Commission requires all mutual funds to calculate expenses based on a 5% return. You can assess the Fund’s costs by comparing this hypothetical example with the hypothetical examples that appear in shareholder reports of other funds.

Note that expenses shown in the table are meant to highlight and help you compare ongoing costs only. The Fund does not charge transactions fees, such as purchase or redemption fees, nor does it carry a “sales load.”

The calculation assumes no shares were bought or sold during the period. Your actual costs may have been higher or lower, depending on the amount of your investment and the timing of any purchases or redemptions.

24

The Torray Fund

ABOUT YOUR FUND’S EXPENSES (unaudited)

As of December 31, 2006

More information about the Fund’s expenses, including recent annual expense ratios, can be found in this report. For additional information on operating expenses and other shareholder costs, please refer to the Fund’s prospectus.

| | | | | | | | | |

| | | Beginning

Account Value

July 1, 2006

| | Ending

Account Value

December 31, 2006

| | Expenses Paid

During Period *

|

Based on Actual Fund Return | | $ | 1,000.00 | | $ | 1,132.20 | | $ | 6.02 |

Based on Hypothetical 5% Return

(before expenses) | | $ | 1,000.00 | | $ | 1,019.66 | | $ | 5.70 |

| * | Expenses are equal to The Torray Fund’s annualized expense ratio of 1.12% for the period, multiplied by the average account value over the period, multiplied by 184/365 (to reflect the one-half year period). |

25

The Torray Fund

TAX INFORMATION (unaudited)

As of December 31, 2006

We are required to advise you within 60 days of the Fund’s fiscal year-end regarding the federal tax status of certain distributions received by shareholders during such fiscal year. The information below is provided for the Fund’s fiscal year ending December 31, 2006.

During the fiscal year, the Fund paid a long-term capital gain distribution of $80,131,907, including $7,017,472 of equalization debits.

Individual shareholders are eligible for reduced tax rates on qualified dividend income. For purposes of computing this exclusion, all of the dividends paid by the Fund from ordinary income earned during the fiscal year are considered qualified dividend income.

Corporate shareholders may exclude up to 70% of qualifying dividends. For the purposes of computing this exclusion, all of the dividends paid by the Fund from ordinary income earned during the fiscal year represent qualifying dividends.

Dividends and distributions received by retirement plans such as IRA’s, Keogh-type plans and 403(b) plans need not be reported as taxable income. However, many retirement plan trusts may need this information for their annual information reporting.

26

TRUSTEES

Carol Crawford

Bruce C. Ellis

Patricia Kavanagh

William M Lane

Robert P. Moltz

Roy A. Schotland

Wayne H. Shaner

INVESTMENT ADVISOR

Torray LLC

OFFICERS

Robert E. Torray, Chairman

Douglas C. Eby, President

William M Lane, Executive Vice President

Fred M. Fialco, Vice President

Siva Natarajan, Vice President

A. Scott Lamond IV, Vice President

INDEPENDENT REGISTERED PUBLIC

ACCOUNTING FIRM

Briggs, Bunting & Dougherty, LLP

Two Penn Center Plaza, Suite 820

Philadelphia, PA 19102-1732

TRANSFER AGENT

PFPC Inc.

101 Sabin Street

Pawtucket, RI 02860-1427

LEGAL COUNSEL

Dechert LLP

1775 I Street, N.W.

Washington, DC 20006

Distributed by PFPC Distributors, Inc.

760 Moore Road. King of Prussia, PA 19406-1212

Date of first use, February 2007

This report is not authorized for distribution to prospective investors unless preceded or accompanied by a current prospectus. All indices are unmanaged groupings of stocks that are not available for investment.

The

TORRAY

FUND

ANNUAL REPORT

December 31, 2006

The Torray Fund

Suite 1100

7501 Wisconsin Avenue

Bethesda, Maryland 20814-6523

(301) 493-4600

(800) 443-3036

The Torray Institutional Fund

Letter to Shareholders

February 12, 2007

Dear Fellow Shareholders,

The Torray Institutional Fund gained 11.4% during 2006, compared to 15.8% for the Standard & Poor’s 500 Index. Most of the differential came during the first half of the year and reflected continued strength in many cyclical, commodity and low quality stocks, which, as you know, we’ve avoided. Subsequently, their prices have softened somewhat, giving our relative results a boost. Since its inception June 30, 2001, the Fund has returned 6.1% relative to 4.5% for the Index. While the market environment through this period has not been conducive to investment in large high quality growth companies of the type we own, we believe that is changing and feel optimistic about the Fund’s prospects. Wall Street’s mean estimate of earnings growth for our holdings over the next half-decade is 12.2% annually, compared to 8% for the S&P 500. If this proves anywhere close to the mark, the Institutional Fund should do quite well going forward.

During 2001, on the heels of the second biggest U.S. bull market on record — one that outran earnings growth by nearly 4-to-1 — investors, in a classic buy-high, sell-low syndrome, slashed their international fund holdings by 68%, putting all of that money and more into domestic funds. The timing was bad. From their peak in 2000, stocks dropped 50% by the fall of 2002. True to form, fund inflows at first tailed off, then fell 40% in 2004, 67% in ‘05, and 91% last year. In the mirror image, investment in foreign funds jumped by the same percentages, and institutions moved money overseas as well. This massive transfer of liquidity helped put a damper on U.S. stocks and, at the same time, sparked a speculative surge in offshore markets that far outpaced gains in economic fundamentals. China, India and Russia soared 143%, 51% and 71%, respectively, during 2006. Venezuelan stocks jumped 111%, despite President Chavez’s announced plans to nationalize the telecommunications, electricity and natural gas industries, seize majority control of oil production and turn the Caracas Golf Club into a low income housing project.

Capital moving into newly emerging markets had an even greater impact due to their tiny size. As U.S. stocks were setting records during the late ‘90s, markets in the 22 countries that comprise the Standard & Poor’s IFC Frontier Index went down, among them Botswana, Bangladesh, Croatia, Ecuador, Jamaica, Lebanon, Namibia, Romania, Trinidad & Tobago and Vietnam. Then, as our market sank, money poured into these obscure exchanges, generating gains for the Frontier Index of 40% in both 2002 and ‘03, 50% in ‘04, 18% in ‘05 and 38% in ‘06 — a cumulative advance of 4.8-to-1. Once again, cash, not fundamentals, proved the controlling feature. Can you imagine the economic underpinnings of these countries, or any others for that matter, justifying, in such a short period, a leap of this magnitude? Meanwhile, despite an increase in corporate earnings from $351 billion to $878 billion, our market, net of dividends, actually declined slightly between early 2000 and the end of last year. Although this was to be expected given the fact it was so inflated to begin with, today it is not. Yet institutions, the financial industry and media continue to harp on the international theme when many of the world’s best values are hiding in plain sight right here. Our Fund’s investments are concentrated in them.

None of this should be taken as an indictment of foreign investing per se. There are plenty of sound companies around the world, a number operating in economies growing two or three times the rate of ours, and money will likely be made in some of them. History, nevertheless, suggests a cautious approach. China, for instance, has captured

1

The Torray Institutional Fund

Letter to Shareholders

February 12, 2007

investors’ imagination perhaps more than any other country. Yet, despite its roaring economy, the mainland stock market has rarely generated much public confidence until now. In fact, according to the New York Times, a 2003 poll found 90% of investors had lost money there and, by 2005, half said they wanted out and would not be coming back. Less than two years later, in a frenzy recalling the late 1990’s dot.com boom in the U.S., the Shanghai Composite Index has nearly tripled. Online trading is spreading, and it’s reported that 90,000 trading accounts are opening every day — 35 times the pace a year ago when prices were a fraction of what they are now. In another sign of impending problems, Government investigators reportedly have been examining investors’ pledging of their homes for personal loans to play the market, and also schemes with merchants to borrow on credit cards for the same purpose, no doubt hoping stocks will rise enough to pay off the charges. All of this comes after a five-year slump in Chinese shares, a period during which they were among the world’s worst-performing. Cheng Siwei, Vice Chairman of the National Peoples Congress and an influential figure in Beijing financial circles, was quoted January 30 in the Financial Times as saying, “There is a bubble going on.” He warned investors that “in terms of profits, returns and other indicators (presumably accounting), 70% of listed Chinese companies do not meet international standards.” People speculating in this market, and plenty of others, are headed for trouble.

The 1980’s bull market in Japanese stocks and real estate comes to mind. During the ten years ending 1989, the Nikkei average advanced six-fold to a record 38,916 — about 100 times earnings — almost triple the S&P 500’s inflated valuation in early 2000. Flush with cash from bank loans and soaring stocks, Japanese investors went on a buying spree, acquiring trophy American office buildings, resort properties, and other assets, driving prices up sharply. Many Hawaiians reportedly were forced from their homes by the resulting rise in tax assessments.

Things were different in the U.S. A mania fueled by corporate takeovers and insider trading had propelled the Dow Jones Average in late August 1987 to 2722, an all-time high. But, the balloon burst and the Index nosedived 36%, closing October 19 (Black Monday) at 1739. This is equivalent to a 4700-point drop today. On the 19th alone, the loss was 22.6%. Meanwhile, inflation picked up, the Fed funds rate followed suit, peaking at 10%, and unemployment reached 8% by the middle of 1992, approaching twice the current level. Memories of the ‘87 crash combined with economic uncertainties demoralized the country, and the euphoria in Japan only made things seem worse. Pundits prophesized that if we didn’t adopt the Japanese business model, our future was even bleaker than it appeared. No surprise, just when everyone bought the story, Japan entered a deflationary spiral that drove the Nikkei down 80% over the next 13 years. Japanese banks and real estate took huge hits, and many of the U.S. assets acquired during the run-up were put on the block. Today, the Nikkei stands 56% below where it was in 1989, and the yen is the weakest major currency in the world. By contrast, the S&P 500 and Dow, not counting dividends, are up four and five times, respectively.

Herein lies a timeless lesson: traveling with the crowd is expensive. In the late ‘80s and early ‘90s, when U.S. stocks were relatively cheap, investors put almost no money into them net of what they took out. In fact, it’s likely a high percentage didn’t reinvest until the tech/telecom/dot.com craze was in full swing. We see parallels in many of today’s popular investment themes.

2

The Torray Institutional Fund

Letter to Shareholders

February 12, 2007

It all goes to show that performance-chasing investors are their own worst enemies, pouring cash into stocks, funds and markets that have already gone way up, borrowing money and dumping underperformers to pay for them. Breaking this habit would do more for their returns than anything else. It would also help if they quit taking advice from supposed “experts” and forgot about beating the market. A few well-run, high quality funds managed by people that own large stakes in them — or an Index fund — will produce far better results. In turn, the meaning of mutual fund track records — now largely irrelevant since so many shareholders don’t hang on long enough to benefit from them — would be restored. According to John Bogle, founder of Vanguard, the 200 equity funds with the largest in-and-out money flows for the 10 years ending 2005 made an average of 8.85% per year. But, when adjusted to reflect shareholder comings and goings, the typical investor made only 2.40%. The difference quadruples money in about 20 years. While skeptics might respond that perhaps the cash went into other funds that did even better, we doubt it. Chances are these folks jumped from the frying pan into the fire.

As the saying goes, those that repeat the same mistakes over and over shouldn’t expect a different outcome. Unfortunately, evidence suggests a lot of investors don’t believe it. In spite of one disappointment after another, their collective behavior never changes. We consider it an important part of our job to raise your awareness of these realities in the hope it will help you avoid the traps we’ve described.

We thank you, as always, for your continued confidence in our management.

| | | | |

| Sincerely, | | | | |

| | |

| | | |  |

| Robert E. Torray | | | | Douglas C. Eby |

3

The Torray Institutional Fund

PERFORMANCE DATA

As of December 31, 2006

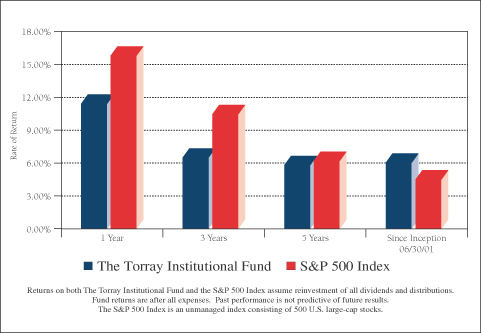

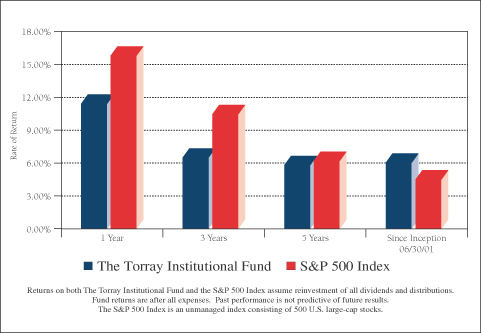

Total Average Annual Returns on an Investment in

The Torray Institutional Fund vs. the S&P 500 Index

For the periods ended December 31, 2006:

| | | | | | | | |

| | | 1 Year

| | 3 Years

| | 5 Years

| | Since

Inception

06/30/01

|

The Torray Institutional Fund | | 11.40% | | 6.47% | | 5.85% | | 6.05% |

S&P 500 Index | | 15.79% | | 10.44% | | 6.19% | | 4.51% |

Cumulative Returns for the 5 1/2 years ended December 31, 2006

| | | |

The Torray Institutional Fund | | 38.18 | % |

S&P 500 Index | | 27.51 | % |

4

The Torray Institutional Fund

PERFORMANCE DATA

As of December 31, 2006

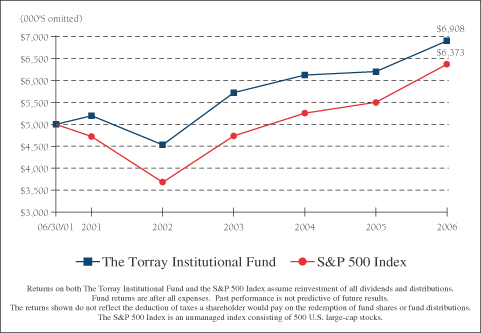

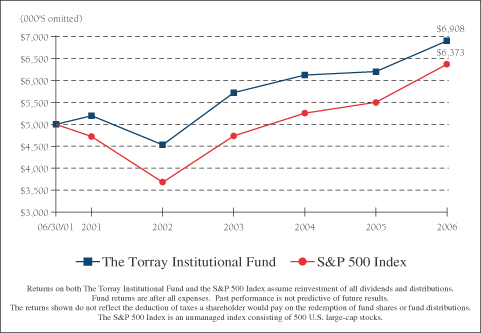

Change in Value of $5,000,000 Invested on June 30, 2001 (commencement of operations) to:

| | | | | | | | | | | | | | | | | | |

| | | 12/31/01

| | 12/31/02

| | 12/31/03

| | 12/31/04

| | 12/31/05

| | 12/31/06

|

The Torray Institutional Fund | | $ | 5,199,000 | | $ | 4,537,500 | | $ | 5,724,500 | | $ | 6,123,000 | | $ | 6,201,000 | | $ | 6,908,000 |

S&P 500 Index | | $ | 4,723,000 | | $ | 3,682,500 | | $ | 4,739,000 | | $ | 5,255,500 | | $ | 5,507,000 | | $ | 6,373,000 |

5

The Torray Institutional Fund

FUND PROFILE (unaudited)

As of December 31, 2006

| | |

DIVERSIFICATION (% of net assets) |

| |

Pharmaceuticals & Biotech | | 13.66% |

Diversified Financials | | 13.51% |

Insurance | | 12.43% |

Health Care Equipment & Services | | 12.31% |

Capital Goods | | 8.75% |

Media | | 8.23% |

Telecommunications | | 7.43% |

Semiconductors & Semi Equipment | | 6.32% |

Software & Services | | 5.00% |

Tech Hardware & Equipment | | 3.93% |

Retailing | | 3.35% |

Materials | | 3.28% |

Food, Beverage & Tobacco | | 1.24% |

Short-Term Investments | | 0.65% |

Other Liabilities Less Assets | | (0.09)% |

| | |

|

| | | 100.00% |

| | |

| TOP TEN EQUITY HOLDINGS |

| 1. | | AMBAC Financial Group, Inc. |

| 2. | | Medtronic, Inc. |

| 3. | | Cardinal Health, Inc. |

| 4. | | Fairfax Financial Holdings Limited |

| 5. | | Amgen Inc. |

| 6. | | EMC Corporation |

| 7. | | Applied Materials, Inc. |

| 8. | | LaBranche & Co Inc. |

| 9. | | Eli Lilly and Company |

| 10. | | Abbott Laboratories |

| | | | |

TOP FIXED INCOME HOLDINGS | | |

Level 3 Communications 10.00% due 2011

| | | | |

PORTFOLIO CHARACTERISTICS | | |

| | |

Net Assets (million) | | | | $206 |

Number of Holdings | | | | 40 |

Portfolio Turnover | | | | 24.26% |

P/E Multiple (forward) | | | | 16.3x |

Portfolio Yield | | | | 1.10% |

Market Capitalization | | Average | | 56.0 B |

| | | Median | | 29.1 B |

6

The Torray Institutional Fund

SCHEDULE OF INVESTMENTS

As of December 31, 2006

| | | | | | | |

| | | Shares

| | | | Market Value

|

| COMMON STOCK 94.53% | | | | | |

| |

| 11.57% CONSUMER DISCRETIONARY | | | |

| | | 214,800 | | O’Reilly Automotive, Inc. * | | $ | 6,886,488 |

| | | 218,414 | | Tribune Company | | | 6,722,783 |

| | | 80,002 | | Gannett Co., Inc. | | | 4,836,921 |

| | | 69,510 | | The Walt Disney Company | | | 2,382,108 |

| | | 36,491 | | The McClatchy Company | | | 1,580,060 |

| | | 65,000 | | Time Warner Inc. | | | 1,415,700 |

| | | | | | |

|

|

| | | | | | | | 23,824,060 |

| |

| 1.24% CONSUMER STAPLES | | | |

| | | 51,790 | | Anheuser-Busch Cos., Inc. | | | 2,548,068 |

| |

| 25.95% FINANCIALS | | | |

| | | 108,435 | | AMBAC Financial Group, Inc. | | | 9,658,306 |

| | | 46,901 | | Fairfax Financial Holdings Limited | | | 9,309,849 |

| | | 753,000 | | LaBranche & Co Inc. * | | | 7,401,990 |

| | | 198,438 | | Marsh & McLennan Companies, Inc. | | | 6,084,109 |

| | | 122,842 | | JPMorgan Chase & Co. | | | 5,933,269 |

| | | 22,957 | | The Goldman Sachs Group, Inc. | | | 4,576,478 |

| | | 58,723 | | American Express Company | | | 3,562,724 |

| | | 123,304 | | Calamos Asset Management, Inc. | | | 3,308,246 |

| | | 27,500 | | Franklin Resources, Inc. | | | 3,029,675 |

| | | 7,600 | | American International Group, Inc. | | | 544,616 |

| | | | | | |

|

|

| | | | | | | | 53,409,262 |

| |

| 25.97% HEALTH CARE | | | |

| | | 180,000 | | Medtronic, Inc. | | | 9,631,800 |

| | | 144,900 | | Cardinal Health, Inc. | | | 9,335,907 |

| | | 127,000 | | Amgen Inc. * | | | 8,675,370 |

| | | 135,400 | | Eli Lilly and Company | | | 7,054,340 |

| | | 143,200 | | Abbott Laboratories | | | 6,975,272 |

| | | 141,600 | | Haemonetics Corporation * | | | 6,374,832 |

| | | 82,000 | | Johnson & Johnson | | | 5,413,640 |

| | | | | | |

|

|

| | | | | | | | 53,461,161 |

See notes to the financial statements.

7

The Torray Institutional Fund

SCHEDULE OF INVESTMENTS (continued)

As of December 31, 2006

| | | | | | | |

| | | Shares

| | | | Market Value

|

| |

| 8.75% INDUSTRIALS | | | |

| | | 101,100 | | Illinois Tool Works Inc. | | $ | 4,669,809 |

| | | 51,957 | | Danaher Corporation | | | 3,763,765 |

| | | 47,611 | | General Dynamics Corporation | | | 3,539,878 |

| | | 46,441 | | United Technologies Corporation | | | 2,903,491 |

| | | 33,946 | | Emerson Electric Co. | | | 1,496,679 |

| | | 26,800 | | Honeywell International Inc. | | | 1,212,432 |

| | | 11,700 | | General Electric Company | | | 435,357 |

| | | | | | |

|

|

| | | | | | | | 18,021,411 |

| |

| 15.25% INFORMATION TECHNOLOGY | | | |

| | | 613,400 | | EMC Corporation * | | | 8,096,880 |

| | | 421,107 | | Applied Materials, Inc. | | | 7,769,424 |

| | | 258,356 | | Intel Corporation | | | 5,231,709 |

| | | 83,716 | | Automatic Data Processing, Inc. | | | 4,123,013 |

| | | 128,739 | | First Data Corporation | | | 3,285,419 |

| | | 128,739 | | The Western Union Company | | | 2,886,328 |

| | | | | | |

|

|

| | | | | | | | 31,392,773 |

| |

| 3.28% MATERIALS | | | |

| | | 340,795 | | W.R. Grace & Co. * | | | 6,747,741 |

| |

| 2.52% TELECOMMUNICATION SERVICES | | | |

| | | 274,868 | | Sprint Nextel Corporation | | | 5,192,257 |

| | | | | | |

|

|

| TOTAL COMMON STOCK 94.53% | | $ | 194,596,733 |

| (cost $163,111,799) | | | |

| | | |

| | | Principal Amount ($)

| | | | |

| CONVERTIBLE BOND 4.91% | | | |

| | | 5,620,000 | | Level 3 Communications 10.00% due 2011(1) | | | 10,109,391 |

| (cost $5,620,000) | | | | | |

| |

| SHORT-TERM INVESTMENTS 0.65% | | | |

| | | 1,341,047 | | PNC Bank Money Market Account 4.67%, due 01/03/07 | | | 1,341,047 |

| (cost $1,341,047) | | | | | |

| | | | | | |

|

|

See notes to the financial statements.

8

The Torray Institutional Fund

SCHEDULE OF INVESTMENTS (continued)

As of December 31, 2006

| | | | | | | | |

| | | | | | | Market Value

| |

| TOTAL PORTFOLIO SECURITIES 100.09% | | $ | 206,047,171 | |

| (cost $170,072,846) | | | | |

| |

| OTHER LIABILITIES LESS ASSETS (0.09)% | | | (195,916 | ) |

| | | | | | |

|

|

|

| TOTAL NET ASSETS 100.00% | | $ | 205,851,255 | |

| | | | | | |

|

|

|

| * | Non-income producing securities |

(1) | This security is valued at fair value, as determined in good faith by the Advisor under the supervision of the Board of Trustees in accordance with the Fund’s Valuation Procedures. The total fair value of such securities at December 31, 2006 is $10,109,391, which represents 4.91% of net assets. |

See notes to the financial statements.

9

The Torray Institutional Fund

STATEMENT OF ASSETS AND LIABILITIES

As of December 31, 2006

| | | | |

ASSETS | | | | |

Investments in securities at value

(amortized cost $170,072,846) | | $ | 206,047,171 | |

Interest and dividends receivable | | | 213,833 | |

Receivable for fund shares sold | | | 11,357 | |

| | |

|

|

|

TOTAL ASSETS | | | 206,272,361 | |

| | |

|

|

|

| |

LIABILITIES | | | | |

Payable for fund shares redeemed | | | 351,044 | |

Payable to advisor | | | 70,062 | |

| | |

|

|

|

TOTAL LIABILITIES | | | 421,106 | |

| | |

|

|

|

| |

NET ASSETS | | $ | 205,851,255 | |

| | |

|

|

|

Shares of beneficial interest ($1 stated value,

1,894,809 shares outstanding, unlimited

shares authorized) | | $ | 1,894,809 | |

Paid-in-capital in excess of par | | | 169,124,039 | |

Accumulated net realized loss on investments | | | (1,141,918 | ) |

Net unrealized appreciation of investments | | | 35,974,325 | |

| | |

|

|

|

| |

TOTAL NET ASSETS | | $ | 205,851,255 | |

| | |

|

|

|

Net asset value, offering and redemption price per share | | $ | 108.64 | |

| | |

|

|

|

See notes to the financial statements.

10

The Torray Institutional Fund

STATEMENT OF OPERATIONS

For the year ended December 31, 2006

| | | | |

INVESTMENT INCOME | | | | |

Dividend income (net of foreign taxes withheld of $25,760) | | $ | 2,798,604 | |

Interest income | | | 1,016,932 | |

| | |

|

|

|

Total income | | | 3,815,536 | |

| | |

|

|

|

| |

EXPENSES | | | | |

Management fees | | | 2,242,959 | |

| | |

|

|

|

Total expenses | | | 2,242,959 | |

| | |

|

|

|

NET INVESTMENT INCOME | | | 1,572,577 | |

| | |

|

|

|

REALIZED AND UNREALIZED GAIN (LOSS)

ON INVESTMENTS | | | | |

Net realized gain on investments | | | 34,297,242 | |

Capital gain distribution from investment companies | | | 190,765 | |

Net change in unrealized appreciation on investments | | | (6,888,801 | ) |

| | |

|

|

|

Net realized and unrealized gain on investments | | | 27,599,206 | |

| | |

|

|

|

NET INCREASE IN NET ASSETS FROM OPERATIONS | | $ | 29,171,783 | |

| | |

|

|

|

See notes to the financial statements.

11

The Torray Institutional Fund

STATEMENTS OF CHANGES IN NET ASSETS

For the years indicated: