UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-06096

The Torray Fund

(Exact name of registrant as specified in charter)

7501 Wisconsin Avenue, Suite 1100

Bethesda, MD 20814-6523

(Address of principal executive offices) (Zip code)

William M Lane

Torray LLC

7501 Wisconsin Avenue, Suite 1100

Bethesda, MD 20814-6523

(Name and address of agent for service)

Registrant’s telephone number, including area code: 301-493-4600

Date of fiscal year end: December 31

Date of reporting period: December 31, 2009

| Item 1. | Reports to Stockholders. |

The Report to Shareholders is attached herewith.

The Torray Fund

Letter to Shareholders

February 3, 2010

Dear Fellow Shareholders,

We are pleased to report The Torray Fund gained 24.8% during 2009. Although the Standard & Poor’s 500 Index was up 1.7 percentage points more, over the last eighteen months, our Fund holds a 1.5 percentage point cumulative advantage. The spread is widening as we write. (This appears to reflect an increasing interest in large, high quality companies of the type we own.) Last year’s difference in results, and then some, is attributable to our 13.4% cash position which generated little or no return due to record low interest rates on short-term balances. It is important for you to know that this reserve is held for investment in stocks that meet our criteria, not as a hedge against the market going down.

When we wrote to you a year ago, stocks had taken a terrible beating and our country was in the midst of the most severe economic turmoil since the 1930s. Despite the gloomy backdrop, our January letter expressed optimism about America’s future, saying, “The damage is done and, in our opinion, largely reflected in stock prices.” Highlighting the risks of expressing such views publicly, the market promptly fell another 25% in about two months, bringing its loss since October 2007 to 57%. (By coincidence, The Wall Street Transcript interviewed Bob on March 9, the day stocks bottomed. That article, published in the March 23 issue, appears on our website, www.torray.com.)

Even though the news was worse by mid-year, shares had rallied to a small gain, and our July letter expressed “room for more optimism than at any time since the financial crisis began.” We emphasized this was a long-term view, not a forecast of where stocks were headed over the next few months or quarters. As it turned out, we would have looked a lot smarter claiming a turnaround was imminent — between March 9 and year’s end, stocks advanced 65%. While this came as a tremendous relief, it was, unfortunately, too late for countless investors that fled the market during the downturn, pouring billions of dollars into Treasury bills, money market funds, CDs, U.S. government bonds and bond funds. By the end of the year, domestic equity funds alone had experienced net withdrawals of $38 billion, while bond funds took in $375 billion — a 10-to-1 ratio. Treasury bills, yielding nothing, have been in such great demand, their prices, on several occasions, have risen above par, meaning holders were paying to ensure they got their money back. Huge sums have also been put into one, two, and five-year government bonds, despite the fact they yield only 0.3%, 0.9% and 2.4%, respectively.

Leaving taxes aside, we believe none of these rates will compensate for inflation, which has averaged 4% for more than 75 years, or the possible negative consequences of our country’s massive deficit and debt issuance. More importantly, they will never produce enough money to retire on. Had the Pilgrims, landing at Plymouth Rock in 1620, bought money market funds at today’s rates, it would have taken until now — nearly four centuries — to double their investment. Better, but still not good, a quality bond portfolio diversified across today’s yield spectrum would probably generate an income in the neighborhood of 3% a year, doubling money in 24 years. By comparison, our Fund, in spite of the last decade, has multiplied in value 5.7 times in 19 years. Over the last 70 years, bonds, net of inflation, turned $1 into $2.70, while $1 in stocks grew to $103.00. Despite this record, untold numbers of investors are positioned today as though they expect the opposite result going forward.

1

The Torray Fund

Letter to Shareholders (continued)

February 3, 2010

Meanwhile, top-quality stocks, many paying dividends exceeding current short-to-intermediate-term interest rates, are now rejected at prices more than 25% below their levels of 2007, a time when investors were loaded with them, often on margin. (They are also 24% lower than they were at the close of 1999.) When the market collapsed last year, those that sold and moved to cash and bonds not only sustained big losses, but also missed the rebound. Victims of the worst timing ended up with 65% less money than if they’d simply stayed put — admittedly a very hard thing to have done under the circumstances. They are now faced with having to nearly triple their money to get even with where they were last March. Assuming a 10% annual return going forward — the stock market’s long-term average — it will take about 12 years to do it. Even this understates the challenge. Investors have come nowhere near matching the market over the long haul, mainly because they persist in jumping in and out of stocks at the wrong time. Having observed this behavior for almost 50 years sustains our conviction that the buy-and-hold approach — declared dead by the pundits at last year’s lows — is the only one that works.

At this point, we feel the average investor is too heavily committed to bonds and cash equivalents — a no-win situation from our perspective. In the early 1980s, investors wouldn’t touch depressed 30-year U.S. governments yielding 15 1/2%. Today, they’re buying them at yields around 4.6%. If history is a guide, when the economy recovers and stocks go up, the money in bonds is certain to shift into equities at prices far higher than they were sold. This illustrates, once again, the problem people have differentiating risk from opportunity. They invariably think risk is low when prices are high, and vice-versa. This applies to stocks, houses, commercial real estate, commodities, and anything else that trades. At critical junctures, investors bet heavily they’re right, and no amount of reasoning can change their minds.

In the present case, we doubt fixed income investors are convinced they’re right; it’s just they’re afraid to do anything else. Recognizing this, we nevertheless believe investors with low stock positions should consider gradually moving back into high quality shares or funds that own them. There’s no need to hurry. The best strategy is to invest amounts one’s comfortable with on a regular basis — monthly or quarterly, for example. When prices fall, (which they did during nine of the 37 years we’ve been in business), each new investment will buy more shares and earn a higher dividend return. Ironically, while this is a big advantage for the long-term investor, the average person tends to associate falling share prices not with opportunity, but with losing money. Some losses, of course, are inevitable, but a well-diversified portfolio should provide a cushion against them.

Stocks, as we all know, can deliver unpleasant surprises. The market has been very volatile in recent weeks, making people that were already nervous even more so. Some may fear a collapse with no recovery. While there are obviously no guarantees, they should keep in mind that it’s never happened before. We remain confident about America’s future based on its record of prosperity and resilience in the face of adversity. Beyond that, we are reassured by the solid, economic fundamentals of companies in The Torray Fund. As we’ve often said, “If the business performs, the stock will take care of itself.” Everything else is guesswork, and we don’t know anyone that’s guessed right for long.

2

The Torray Fund

Letter to Shareholders (continued)

February 3, 2010

These are tough times, the worst any of us have seen. Experts are everywhere. You can’t turn on the television or pick up a newspaper without being inundated with predictions on the market’s direction and what to do about it. They should be ignored. Investors will do far better sticking to the fundamentals, secure in the knowledge that, over time, sound, growing businesses have produced higher returns than any of the alternatives widely available to the general public. Despite the many challenges our country has faced, things have always worked out, and we believe this case will prove no different.

In closing, we want you to know that all of us at The Torray Companies appreciate your investment in our Fund.

| | | | | | |

| | | Sincerely, | | | | |

| | | |

| | |  | | | | |

| | | Robert E. Torray | | | | |

| | |

| | | | |

| | | Fred M. Fialco | | | | |

| | |

| | | | |

| | | Shawn M. Hendon | | | | |

| | | | | | | |

3

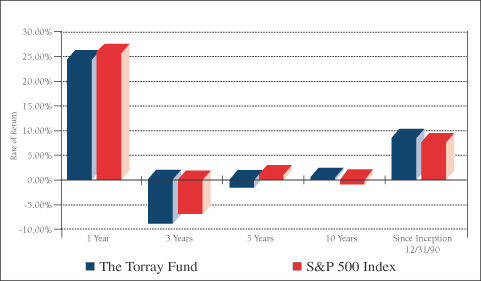

The Torray Fund

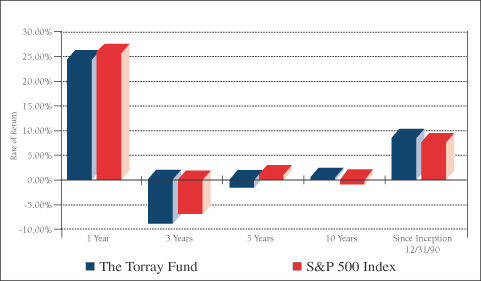

PERFORMANCE DATA

As of December 31, 2009

Average Annual Returns on an Investment in

The Torray Fund vs. the S&P 500 Index

For the periods ended December 31, 2009:

| | | | | | | | | | | | | | | |

| | | 1 Year

| | | 3 Years

| | | 5 Years

| | | 10 Years

| | | Since

Inception

12/31/90

| |

The Torray Fund | | 24.80 | % | | -8.14 | % | | -2.09 | % | | 0.07 | % | | 9.58 | % |

S&P 500 Index | | 26.46 | % | | -5.61 | % | | 0.42 | % | | -0.95 | % | | 8.84 | % |

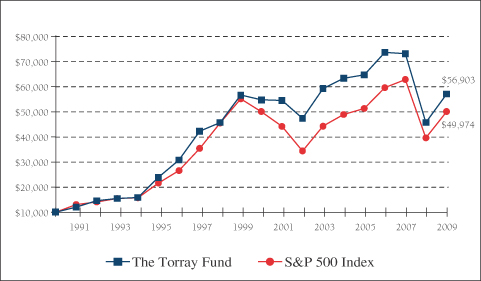

Cumulative Returns for the 19 years ended December 31, 2009

| | | |

The Torray Fund | | 469.03 | % |

S&P 500 Index | | 399.74 | % |

4

The Torray Fund

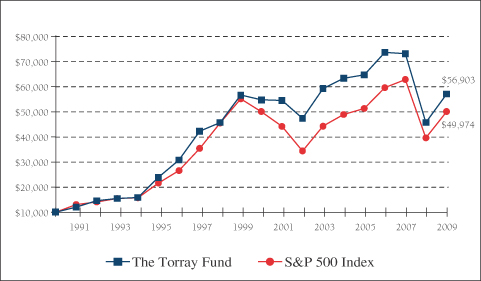

PERFORMANCE DATA (continued)

As of December 31, 2009

Change in Value of $10,000 Invested

on December 31, 1990 (commencement of operations) to:

| | | | | | | | | | | | | | | | | | | | | |

| | | 12/31/91

| | 12/31/94

| | 12/31/97

| | 12/31/00

| | 12/31/03

| | 12/31/06

| | 12/31/09

|

The Torray Fund | | $ | 11,999 | | $ | 15,821 | | $ | 42,122 | | $ | 54,609 | | $ | 59,135 | | $ | 73,496 | | $ | 56,903 |

S&P 500 Index | | $ | 13,048 | | $ | 15,666 | | $ | 35,339 | | $ | 49,993 | | $ | 44,156 | | $ | 59,452 | | $ | 49,974 |

The returns quoted represent past performance and do not guarantee future results. Investment return and principal value will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher. Returns current to the most recent month-end are available at www.torray.com. The returns shown do not reflect the deduction of taxes a shareholder would pay on the redemption of fund shares and distributions. The Fund’s gross annual operating expense ratio, as stated in the current prospectus dated May 1, 2009, is 1.13%. Returns on both The Torray Fund and the S&P 500 Index assume reinvestment of all dividends and distributions. The S&P 500 Index is an unmanaged index consisting of 500 U.S. large-cap stocks.

5

The Torray Fund

FUND PROFILE

As of December 31, 2009 (unaudited)

| | |

DIVERSIFICATION (% of net assets) | | |

| |

Information Technology | | 22.34% |

Health Care | | 16.57% |

Industrials | | 13.22% |

Financials | | 11.57% |

Consumer Discretionary | | 10.59% |

Consumer Staples | | 6.58% |

Telecommunications | | 3.32% |

Materials | | 2.39% |

Short-Term Investments | | 13.50% |

Liabilities Less Other Assets | | (0.08)% |

| | |

|

| | | 100.00% |

| | |

|

| | | | |

TOP TEN EQUITY HOLDINGS (% of net assets) |

| | |

| 1. | | Loews Corp. | | 4.31% |

| 2. | | Walt Disney Co. (The) | | 4.12% |

| 3. | | International Business Machines Corp. | | 3.69% |

| 4. | | WellPoint, Inc. | | 3.65% |

| 5. | | UnitedHealth Group Inc. | | 3.59% |

| 6. | | EMC Corp. | | 3.55% |

| 7. | | Procter & Gamble Co. (The) | | 3.41% |

| 8. | | Johnson & Johnson | | 3.40% |

| 9. | | AT&T Inc. | | 3.31% |

| 10. | | Cisco Systems, Inc. | | 3.31% |

| | | | |

|

| | | | | 36.34% |

| | | | |

|

| | | | |

|

PORTFOLIO CHARACTERISTICS |

| | |

Net Assets (million) | | | | $363 |

Number of Holdings | | | | 29 |

Portfolio Turnover | | | | 15.87% |

P/E Multiple (forward) | | | | 13.3x |

Portfolio Yield | | | | 1.69% |

Market Capitalization (billion) | | Average | | $57.7 |

| | | Median | | $30.4 |

6

The Torray Fund

SCHEDULE OF INVESTMENTS

As of December 31, 2009

| | | | | | | |

| | | Shares

| | | | Market Value

|

| COMMON STOCK 86.58% | | | |

| |

22.34% INFORMATION TECHNOLOGY | | | |

| | | 102,200 | | International Business Machines Corp. | | $ | 13,377,980 |

| | | 737,900 | | EMC Corp. * | | | 12,891,113 |

| | | 501,800 | | Cisco Systems, Inc. * | | | 12,013,092 |

| | | 796,875 | | Applied Materials, Inc. | | | 11,108,438 |

| | | 539,600 | | Intel Corp. | | | 11,007,840 |

| | | 583,900 | | Western Union Co. (The) | | | 11,006,515 |

| | | 226,500 | | Automatic Data Processing, Inc. | | | 9,698,730 |

| | | | | | |

|

|

| | | | | | | | 81,103,708 |

| |

16.57% HEALTH CARE | | | |

| | | 227,200 | | WellPoint, Inc. * | | | 13,243,488 |

| | | 427,000 | | UnitedHealth Group Inc. | | | 13,014,960 |

| | | 191,724 | | Johnson & Johnson | | | 12,348,943 |

| | | 203,800 | | Abbott Laboratories | | | 11,003,162 |

| | | 133,700 | | Becton Dickinson & Co. | | | 10,543,582 |

| | | | | | |

|

|

| | | | | | | | 60,154,135 |

| |

13.22% INDUSTRIALS | | | |

| | | 449,946 | | Cintas Corp. | | | 11,721,093 |

| | | 118,900 | | 3M Co. | | | 9,829,463 |

| | | 134,700 | | General Dynamics Corp. | | | 9,182,499 |

| | | 603,797 | | General Electric Co. | | | 9,135,449 |

| | | 316,137 | | Owens Corning * | | | 8,105,753 |

| | | | | | |

|

|

| | | | | | | | 47,974,257 |

| |

11.57% FINANCIALS | | | |

| | | 430,300 | | Loews Corp. | | | 15,641,405 |

| | | 511,218 | | Marsh & McLennan Cos., Inc. | | | 11,287,693 |

| | | 219,300 | | American Express Co. | | | 8,886,036 |

| | | 2,183,591 | | LaBranche & Co Inc. * | | | 6,201,398 |

| | | | | | |

|

|

| | | | | | | | 42,016,532 |

See notes to the financial statements.

7

The Torray Fund

SCHEDULE OF INVESTMENTS (continued)

As of December 31, 2009

| | | | | | | | |

| | | Shares

| | | | Market Value

| |

| |

10.59% CONSUMER DISCRETIONARY | | | | |

| | | 464,100 | | Walt Disney Co. (The) | | $ | 14,967,225 | |

| | | 332,100 | | McGraw-Hill Cos. Inc. (The) | | | 11,128,671 | |

| | | 169,820 | | O'Reilly Automotive, Inc. * | | | 6,473,538 | |

| | | 394,200 | | Gannett Co., Inc. | | | 5,853,870 | |

| | | | | | |

|

|

|

| | | | | | | | 38,423,304 | |

| |

6.58% CONSUMER STAPLES | | | | |

| | | 204,300 | | Procter & Gamble Co. (The) | | | 12,386,709 | |

| | | 423,300 | | Kraft Foods Inc., Class A | | | 11,505,294 | |

| | | | | | |

|

|

|

| | | | | | | | 23,892,003 | |

| |

3.32% TELECOMMUNICATIONS | | | | |

| | | 429,300 | | AT&T Inc. | | | 12,033,279 | |

| |

2.39% MATERIALS | | | | |

| | | 258,100 | | E.I. du Pont de Nemours & Co. | | | 8,690,227 | |

| | | | | | |

|

|

|

| TOTAL COMMON STOCK 86.58% | | | 314,287,445 | |

(cost $322,312,269) | | | | | | |

| | | |

| | | Principal Amount ($)

| | | | | |

| SHORT-TERM INVESTMENTS 13.50% | | | | |

| | | 49,025,751 | | PNC Bank Money Market Account, 0.05%(1) | | | 49,025,751 | |

(cost $49,025,751) | | | | | | |

| | | | | | |

|

|

|

| TOTAL INVESTMENTS 100.08% | | | 363,313,196 | |

(cost $371,338,020) | | | | | | |

| LIABILITIES LESS OTHER ASSETS (0.08%) | | | (299,646 | ) |

| | | | | | |

|

|

|

| NET ASSETS 100.00% | | $ | 363,013,550 | |

| | |

|

|

|

| * | Non-income producing securities. |

| (1) | Represents current yield at December 31, 2009. |

See notes to the financial statements.

8

The Torray Fund

STATEMENT OF ASSETS AND LIABILITIES

As of December 31, 2009

| | | | |

ASSETS | | | | |

Investments in securities at value

(cost $371,338,020) | | $ | 363,313,196 | |

Interest and dividends receivable | | | 502,359 | |

Receivable for fund shares sold | | | 5,592 | |

Prepaid expenses | | | 38,058 | |

| | |

|

|

|

TOTAL ASSETS | | | 363,859,205 | |

| | |

|

|

|

| |

LIABILITIES | | | | |

Payable for fund shares redeemed | | | 427,181 | |

Payable to advisor | | | 308,849 | |

Accrued expenses | | | 109,625 | |

| | |

|

|

|

TOTAL LIABILITIES | | | 845,655 | |

| | |

|

|

|

| |

NET ASSETS | | $ | 363,013,550 | |

| | |

|

|

|

Shares of beneficial interest ($1 stated value,

13,563,840 shares outstanding, unlimited shares authorized) | | $ | 13,563,840 | |

Paid-in-capital in excess of par | | | 452,123,962 | |

Accumulated net realized loss on investments | | | (94,649,428 | ) |

Net unrealized depreciation of investments | | | (8,024,824 | ) |

| | |

|

|

|

| |

TOTAL NET ASSETS | | $ | 363,013,550 | |

| | |

|

|

|

Net Asset Value, Offering and Redemption Price per Share | | $ | 26.76 | |

| | |

|

|

|

See notes to the financial statements.

9

The Torray Fund

STATEMENT OF OPERATIONS

For the year ended December 31, 2009

| | | | |

INVESTMENT INCOME | | | | |

Dividend income | | $ | 7,020,378 | |

Interest income | | | 13,392 | |

| | |

|

|

|

Total investment income | | | 7,033,770 | |

| | |

|

|

|

| |

EXPENSES | | | | |

Management fees | | | 3,357,297 | |

Transfer agent fees & expenses | | | 348,314 | |

Legal fees | | | 85,000 | |

Insurance expense | | | 67,056 | |

Printing, postage & mailing | | | 55,964 | |

Trustees’ fees | | | 49,000 | |

Audit fees | | | 37,500 | |

Custodian fees | | | 27,648 | |

Registration & filing fees | | | 25,441 | |

| | |

|

|

|

Total expenses | | | 4,053,220 | |

| | |

|

|

|

NET INVESTMENT INCOME | | | 2,980,550 | |

| | |

|

|

|

REALIZED AND UNREALIZED GAIN

(LOSS) ON INVESTMENTS | | | | |

Net realized loss on investments | | | (43,082,102 | ) |

Net change in unrealized appreciation (depreciation) on investments | | | 113,618,716 | |

| | |

|

|

|

Net realized and unrealized gain on investments | | | 70,536,614 | |

| | |

|

|

|

NET INCREASE IN NET ASSETS FROM OPERATIONS | | $ | 73,517,164 | |

| | |

|

|

|

See notes to the financial statements.

10

The Torray Fund

STATEMENTS OF CHANGES IN NET ASSETS

For the years indicated:

| | | | | | | | |

| | | Year ended

12/31/09

| | | Year ended

12/31/08

| |

Increase (Decrease) in Net Assets from Operations: | | | | | | | | |

Net investment income | | $ | 2,980,550 | | | $ | 5,309,667 | |

Net realized loss on investments | | | (43,082,102 | ) | | | (51,558,352 | ) |

Net change in unrealized appreciation

(depreciation) on investments | | | 113,618,716 | | | | (233,567,470 | ) |

| | |

|

|

| |

|

|

|

Net increase (decrease) in net assets from operations | | | 73,517,164 | | | | (279,816,155 | ) |

| | |

|

|

| |

|

|

|

| | |

Distributions to Shareholders from: | | | | | | | | |

Net investment income ($0.204 and

$0.303 per share, respectively) | | | (2,980,744 | ) | | | (6,343,588 | ) |

Net realized gains ($0.000 and

$1.242 per share, respectively) | | | — | | | | (29,816,455 | ) |

Return of capital ($0.000 and

$0.034 per share, respectively) | | | — | | | | (706,904 | ) |

| | |

|

|

| |

|

|

|

Total distributions | | | (2,980,744 | ) | | | (36,866,947 | ) |

| | |

|

|

| |

|

|

|

| | |

Shares of Beneficial Interest | | | | | | | | |

Decrease from share transactions | | | (60,967,912 | ) | | | (330,215,602 | ) |

| | |

|

|

| |

|

|

|

Total increase (decrease) | | | 9,568,508 | | | | (646,898,704 | ) |

| | |

Net Assets — Beginning of Year | | | 353,445,042 | | | | 1,000,343,746 | |

| | |

|

|

| |

|

|

|

Net Assets — End of Year | | $ | 363,013,550 | | | $ | 353,445,042 | |

| | |

|

|

| |

|

|

|

Undistributed Net Investment Income | | $ | — | | | $ | — | |

| | |

|

|

| |

|

|

|

See notes to the financial statements.

11

The Torray Fund

FINANCIAL HIGHLIGHTS

For a share outstanding throughout each year presented:

PER SHARE DATA

| | | | | | | | | | | | | | | | | | | | |

| | | Years ended December 31:

| |

| | | 2009

| | | 2008

| | | 2007

| | | 2006

| | | 2005

| |

Net Asset Value, Beginning of Year | | $ | 21.640 | | | $ | 36.440 | | | $ | 41.570 | | | $ | 39.020 | | | $ | 41.080 | |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

Income/(loss) from investment operations | | | | | | | | | | | | | | | | | | | | |

Net investment income | | | 0.200 | (2) | | | 0.243 | (2) | | | 0.152 | | | | 0.073 | | | | 0.133 | |

Net gains (losses) on securities (both realized and unrealized) | | | 5.124 | | | | (13.464 | ) | | | (0.443 | ) | | | 5.176 | | | | 0.653 | |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

Total from investment operations | | | 5.324 | | | | (13.221 | ) | | | (0.291 | ) | | | 5.249 | | | | 0.786 | |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

Less: distributions | | | | | | | | | | | | | | | | | | | | |

Dividends (from net investment income) | | | (0.204 | ) | | | (0.303 | ) | | | (0.121 | ) | | | (0.087 | ) | | | (0.133 | ) |

Distributions (from capital gains) | | | — | | | | (1.242 | ) | | | (4.718 | ) | | | (2.612 | ) | | | (2.713 | ) |

Distributions (from return of capital) | | | — | | | | (0.034 | ) | | | — | | | | — | | | | — | |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

Total distributions | | | (0.204 | ) | | | (1.579 | ) | | | (4.839 | ) | | | (2.699 | ) | | | (2.846 | ) |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

Net Asset Value, End of Year | | $ | 26.760 | | | $ | 21.640 | | | $ | 36.440 | | | $ | 41.570 | | | $ | 39.020 | |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

TOTAL RETURN(1) | | | 24.80% | | | | (37.39% | ) | | | (0.80% | ) | | | 13.74% | | | | 2.08% | |

RATIOS/SUPPLEMENTAL DATA | | | | | | | | | | | | | | | | | | | | |

Net assets, end of year (000's omitted) | | $ | 363,014 | | | $ | 353,445 | | | $ | 1,000,344 | | | $ | 1,198,919 | | | $ | 1,329,951 | |

Ratios of expenses to average net assets | | | 1.21% | | | | 1.13% | | | | 1.09% | | | | 1.10% | | | | 1.07% | |

Ratios of net investment income to average net assets | | | 0.89% | | | | 0.80% | | | | 0.36% | | | | 0.18% | | | | 0.34% | |

Portfolio turnover rate | | | 15.87% | | | | 28.13% | | | | 50.47% | | | | 21.92% | | | | 33.16% | |

| (1) | Past performance is not predictive of future performance. |

| (2) | Calculated based on the average amount of shares outstanding during the year. |

See notes to the financial statements.

12

The Torray Fund

NOTES TO FINANCIAL STATEMENTS

As of December 31, 2009

NOTE 1 — SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

The Torray Fund (“Fund”) is a separate series of The Torray Fund (“Trust”). The Trust is registered under the Investment Company Act of 1940, as amended, as a no-load, diversified, open-end management investment company. The Trust was organized as a business trust under Massachusetts law. The Fund’s primary investment objective is to provide long-term total return. The Fund seeks to meet its objective by investing its assets in a diversified portfolio of common stocks. In order to accomplish these goals, the Fund intends to hold stocks for the long term, as opposed to actively buying and selling. There can be no assurances that the Fund’s investment objectives will be achieved.

The following is a summary of accounting policies followed by the Fund in the preparation of its financial statements. These policies are in conformity with accounting principles generally accepted in the United States of America.

Securities Valuation Portfolio securities for which market quotations are readily available are valued at market value, which is determined by using the last reported sale price, or, if no sales are reported, the last reported bid price. For NASDAQ traded securities, market value is determined on the basis of the NASDAQ Official Closing Price instead of the last reported sales price. Other assets and securities for which no quotations are readily available or for which Torray LLC (the “Advisor”) believes do not reflect market value are valued at fair value as determined in good faith by the Advisor under the supervision of the Board of Trustees (the “Board” or “Trustees”) in accordance with the Fund’s Valuation Procedures. Short-term obligations having remaining maturities of 60 days or less are valued at amortized cost, which approximates market value.

Fair Value Measurements Various inputs are used in determining the fair value of investments which are as follows:

Level 1 — quoted prices in active markets for identical securities

Level 2 — significant observable inputs (including quoted prices for similar securities, interest rates, prepayment speeds, credit risk, etc.)

Level 3 — significant unobservable inputs (including the Fund’s own assumptions in determining the fair value of investments)

The inputs or methodology used for valuing securities are not necessarily an indication of the risk associated with investing in those securities.

13

The Torray Fund

NOTES TO FINANCIAL STATEMENTS (continued)

As of December 31, 2009

The summary of inputs used to value the Fund’s net assets as of December 31, 2009 is as follows:

| | | |

Valuation Inputs | | | |

Level 1 — Quoted Prices * | | $ | 363,313,196 |

Level 2 — Other Significant Observable Inputs | | | — |

Level 3 — Significant Unobservable Inputs | | | — |

| | |

|

|

Total Market Value of Investments | | $ | 363,313,196 |

| | |

|

|

| * | Security types and industry classifications as defined in the Schedule of Investments. |

In January 2010, the Financial Accounting Standards Board issued Accounting Standards Update (“ASU”) No. 2010-06 “Improving Disclosures about Fair Value Measurements”. ASU 2010-06 clarifies existing disclosure and requires additional disclosures regarding fair value measurements. Effective for interim and annual reporting periods beginning after December 15, 2009, entities will be required to disclose significant transfers into and out of Level 1 and 2 measurements in the fair value hierarchy and the reasons for those transfers. Effective for fiscal years beginning after December 15, 2010, and for interim periods within those fiscal years, entities will need to disclose information about purchases, sales, issuances and settlements of Level 3 securities on a gross basis, rather than as a net number as currently required.

Securities Transactions and Investment Income Securities transactions are recorded on a trade date basis. Realized gains and losses from securities transactions are recorded on the specific identification basis. Dividend income and distributions to shareholders are recorded on the ex-dividend date. Interest income, including amortization of discount on short-term investments, and expenses are recorded on the accrual basis. Premium and discount are amortized using the effective yield to maturity method.

Federal Income Taxes The Fund intends to continue to comply with the requirements of the Internal Revenue Code applicable to regulated investment companies and to distribute all of its taxable income, including any net realized gain on investments to its shareholders. Therefore, no Federal income tax provision is required.

Management has analyzed the Fund’s tax positions taken on federal income tax returns for all open tax years (current and prior three tax years), and has concluded that no provision for federal income tax is required in the Fund’s financial statements. The Fund’s federal and state income and federal excise tax returns for tax years for which the applicable statutes of limitations have not expired are subject to examination by the Internal Revenue Service and state departments of revenue.

Net Asset Value The net asset value per share of the Fund is determined daily as of the close of trading on the New York Stock Exchange by dividing the value of the Fund’s net assets by the number of shares outstanding.

14

The Torray Fund

NOTES TO FINANCIAL STATEMENTS (continued)

As of December 31, 2009

Interest Expense When cash balances are overdrawn in the Fund’s custody account, the Fund is charged an overdraft fee equal to 1.25% above the Federal Funds Rate. In addition, in December 2006, the Trust entered into a line of credit facility with PNC Bank. Under the terms of the line of credit, the separate series of the Trust (including the Fund) may borrow up to $20,000,000 on a short-term basis with interest accruing at the Federal Funds Rate plus 0.75%. As of December 31, 2009, the Fund had no outstanding borrowings under this line of credit facility.

Use of Estimates In preparing financial statements in accordance with accounting principles generally accepted in the United States of America, management is required to make estimates and assumptions that affect the reported amounts of assets and liabilities and the disclosure of contingent assets and liabilities at the date of the financial statements, and the reported amounts of increases and decreases in net assets from operations during the reporting period. Actual results could differ from those estimates.

NOTE 2 — SHARES OF BENEFICIAL INTEREST TRANSACTIONS

Transactions in shares of beneficial interest were as follows:

| | | | | | | | | | | | | | |

| | | Year ended

12/31/09

| | | Year ended

12/31/08

| |

| | | Shares

| | | Amount

| | | Shares

| | | Amount

| |

Shares issued | | 149,751 | | | $ | 3,200,077 | | | 1,640,783 | | | $ | 53,535,920 | |

Reinvestments of dividends and distributions | | 127,284 | | | | 2,811,759 | | | 1,204,731 | | | | 35,559,707 | |

Shares redeemed | | (3,044,625 | ) | | | (66,979,748 | ) | | (13,963,362 | ) | | | (419,311,229 | ) |

| | |

|

| |

|

|

| |

|

| |

|

|

|

| | | (2,767,590 | ) | | $ | (60,967,912 | ) | | (11,117,848 | ) | | $ | (330,215,602 | ) |

| | |

|

| |

|

|

| |

|

| |

|

|

|

As of December 31, 2009, the Trust’s officers, Trustees and affiliated persons and their families directly or indirectly controlled 1,259,873 shares or 9.28% of the Fund.

NOTE 3 — INVESTMENT TRANSACTIONS

Purchases and sales of investment securities, other than short-term investments, for the year ended December 31, 2009, aggregated $48,694,465 and $129,536,893, respectively.

NOTE 4 — MANAGEMENT FEES

Pursuant to the Management Contract, the Advisor provides investment advisory and administrative services to the Fund. The Fund pays the Advisor a management fee, computed daily and payable monthly at the annual rate of 1.00% of the Fund’s average daily net assets. For the year ended December 31, 2009, the Fund incurred management fees of $3,357,297.

15

The Torray Fund

NOTES TO FINANCIAL STATEMENTS (continued)

As of December 31, 2009

Excluding the management fee, other expenses incurred by the Fund during the year ended December 31, 2009, totaled $695,923. These expenses include all costs associated with the Fund’s operations including transfer agent fees, independent trustees’ fees ($14,000 per annum and $2,000 for each Board meeting attended per Trustee), dues, fees and expenses of registering and qualifying the Fund and its shares for distribution, charges of custodian, auditing and legal expenses, insurance premiums, supplies, postage, expenses of issue or redemption of shares, reports to shareholders and Trustees, expenses of printing and mailing prospectuses, proxy statements and proxies to existing shareholders, and other miscellaneous expenses.

Certain officers and Trustees of the Fund are also officers and/or shareholders of the Advisor.

NOTE 5 — TAX MATTERS

Distributions to shareholders are determined in accordance with United States Federal income tax regulations, which may differ from accounting principles generally accepted in the United States of America.

The tax character of distributions paid during the years ended December 31, 2009 and 2008 were as follows:

| | | | | | |

| | | 2009

| | 2008

|

Distributions paid from: | | | | | | |

Ordinary income | | $ | 2,980,744 | | $ | 6,347,372 |

Long-term capital gain | | | — | | | 29,812,671 |

Non-taxable return of capital | | | — | | | 706,904 |

| | |

|

| |

|

|

| | | $ | 2,980,744 | | $ | 36,866,947 |

| | |

|

| |

|

|

As of December 31, 2009, the components of distributable earnings on a tax basis were as follows:

| | | | | | |

Capital loss carry forward | | $ | (91,542,121 | ) | | |

Deferred post-October losses | | | (3,107,307 | ) | | |

Unrealized depreciation | | | (8,024,824 | ) | | |

| | |

|

|

| | |

| | | $ | (102,674,252 | ) | | |

| | |

|

|

| | |

The primary difference between book basis and tax basis distributions is differing book and tax treatment of short-term capital gains.

16

The Torray Fund

NOTES TO FINANCIAL STATEMENTS (continued)

As of December 31, 2009

Permanent book/tax differences are reclassified among the Fund’s components of capital in order to reflect such components of capital on a tax basis. As of December 31, 2009, the Fund reclassified permanent book/tax differences as follows:

| | | | | | |

Increase accumulated undistributed net investment income | | $ | 194 | | | |

Decrease accumulated net realized gain on investments | | | (8,974 | ) | | |

Increase paid-in-capital in excess of par | | | 8,780 | | | |

At December 31, 2009, the Fund had net capital loss carry forward for federal income tax purposes of $561,440 and $90,980,681 which are available to reduce future required distributions of net capital gains to shareholders through 2016 and 2017, respectively.

The following information is based upon the federal tax basis of investment securities as of December 31, 2009:

| | | | | | |

Gross unrealized appreciation | | $ | 43,767,898 | | | |

Gross unrealized depreciation | | | (51,792,722 | ) | | |

| | |

|

|

| |

|

Net unrealized depreciation | | $ | (8,024,824 | ) | | |

| | |

|

|

| |

|

Cost | | $ | 371,338,020 | | | |

| | |

|

|

| |

|

NOTE 6 — COMMITMENTS AND CONTINGENCIES

The Fund indemnifies its officers and Trustees for certain liabilities that may arise from their performance of their duties to the Fund. Additionally, in the normal course of business, the Fund enters into contracts that contain a variety of representations and warranties which provide general indemnifications. The Fund’s maximum exposure under these arrangements is unknown, as this would involve future claims that may be made against the Fund that have not yet occurred.

NOTE 7 — SUBSEQUENT EVENTS

Management has evaluated the impact of all subsequent events on the Fund through February 22, 2010, the date the financial statements were issued, and has determined that there were no subsequent events requiring recognition or disclosure in the financial statements.

17

The Torray Fund

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

To the Board of Trustees of The Torray Fund

and Shareholders of The Torray Fund

We have audited the accompanying statement of assets and liabilities of The Torray Fund, a series of shares of beneficial interest in The Torray Fund, including the schedule of investments, as of December 31, 2009, and the related statement of operations for the year then ended, the statements of changes in net assets for each of the years in the two year period then ended, and the financial highlights for each of the years in the five year period then ended. These financial statements and financial highlights are the responsibility of the Fund’s management. Our responsibility is to express an opinion on these financial statements and financial highlights based on our audits.

We conducted our audits in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audits to obtain reasonable assurance about whether the financial statements and financial highlights are free of material misstatement. An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements. Our procedures included confirmation of securities owned as of December 31, 2009 by correspondence with the custodian. An audit also includes assessing the accounting principles used and significant estimates made by management, as well as evaluating the overall financial statement presentation. We believe that our audits provide a reasonable basis for our opinion.

In our opinion, the financial statements and financial highlights referred to above present fairly, in all material respects, the financial position of The Torray Fund as of December 31, 2009, the results of its operations for the year then ended, the changes in its net assets for each of the years in the two year period then ended, and its financial highlights for each of the years in the five year period then ended, in conformity with accounting principles generally accepted in the United States of America.

BBD, LLP

Philadelphia, Pennsylvania

February 22, 2010

18

The Torray Fund

FUND MANAGEMENT

As of December 31, 2009 (unaudited)

The Trust is overseen by a Board of Trustees (the “Board”), who has delegated the day-to-day management to the officers of the Trust. The Board meets regularly to review the Fund’s activities, contractual arrangements, and per- formance. The Trustees and officers serve until their successors are elected and qualified, or until the Trustee or officer dies, resigns or is removed, or becomes disqualified.

Information pertaining to the Trustees and officers of the Trust is set forth below. The Statement of Additional Information (SAI) includes additional information about the Trustees and is available without charge, upon request, by calling (800) 443-3036.

| | | | | | | | |

Name, Birthdate,

Address* and

Positions with the Trust | | Term of Office

and Length of

Time Served | | Principal Occupation(s) During Past 5 Years | | No. of

Portfolios in

Fund Complex

Overseen by

Trustee | | Other Directorships Held |

| INDEPENDENT TRUSTEES |

Carol T. Crawford 02/25/43 Trustee | | Indefinite Term Since 2006 | | Attorney Private Practice McLean, VA | | 2 | | Director Smithfield Foods, Inc. Smithfield, VA |

Bruce C. Ellis 07/20/44 Trustee | | Indefinite Term Since 1993 | | Private Investor Bethesda, Maryland | | 2 | | None |

Robert P. Moltz 10/03/47 Trustee | | Indefinite Term Since 1990 | | President, CEO Weaver Bros Insurance Associates, Inc. Bethesda, Maryland | | 2 | | None |

| | | | | | | | |

Name, Birthdate,

Address* and

Positions with the Trust | | Term of Office

and Length of

Time Served | | Principal Occupation(s) During Past 5 Years | | No. of

Portfolios in

Fund Complex

Overseen by

Trustee | | Other Directorships Held |

| INTERESTED TRUSTEES AND OFFICERS OF THE TRUST |

William M Lane** 05/21/50 Trustee, Treasurer, Secretary, Chief Compliance Officer and Anti-Money Laundering Officer | | Indefinite Term Since 1990 | | Vice President, Secretary

and Chief Compliance Officer, Torray LLC,

Bethesda, MD (Oct. 2005-Present);

Vice President, Secretary, Treasurer

and Chief Compliance Officer,

Robert E. Torray & Co. Inc.,

Bethesda, MD (Jul. 1984-Oct. 2005);

Vice President, Secretary

and Chief Compliance Officer,

The Torray Corporation, Bethesda, MD

(Jan. 1990-Oct. 2005);

Vice President, Secretary, Treasurer

and Chief Compliance Officer,

TEL Corporation, Bethesda, MD

(Jun. 2005-Oct. 2005).*** | | 2 | | None |

19

The Torray Fund

FUND MANAGEMENT (continued)

As of December 31, 2009 (unaudited)

| | | | | | | | |

Name, Birthdate,

Address* and

Positions

with the Trust | | Term of Office

and Length of

Time Served | | Principal Occupation(s)

During Past 5 Years | | No. of

Portfolios in

Fund Complex

Overseen by

Trustee | | Other

Directorships Held |

| INTERESTED TRUSTEES AND OFFICERS OF THE TRUST (continued) |

Wayne H. Shaner** 08/23/47 Trustee, Chairman of the Board | | Indefinite Term

Since 1993 | | Managing Partner,

Rockledge Partners, LLC,

Investment Advisory Firm,

Easton, MD (Jan. 2004-present);

Vice President, Torray LLC, Bethesda, MD

(Jan. 2008-Jun. 2008) | | 2 | | Director, Van Eck Funds

New York, NY |

Robert E. Torray 04/10/37 President | | Indefinite Term

Since 2007 | | Chairman, Torray LLC,

Bethesda, MD (2005-Present);

President, Torray LLC,

Bethesda, MD (2007-Present); President, Robert E. Torray & Co. Inc.,

Bethesda, MD (May 1972-Oct. 2005);

President, The Torray Corporation,

Bethesda, MD (Jan. 1990-Oct. 2005);

Chairman, TEL Corporation, Bethesda, MD

(Jun. 2005-Oct. 2005).*** | | N/A | | None |

| * | All addresses are c/o The Torray Fund, 7501 Wisconsin Avenue, Suite 1100, Bethesda, MD 20814-6523 |

| ** | Mr. Lane, by virtue of his employment with Torray LLC, the Trust’s investment adviser, is considered an “interested person” of the Trust, as that term is defined in Section 2(a)(19) of the Investment Company Act of 1940, as amended. Mr. Shaner, by virtue of his prior employment with Torray LLC, is currently considered an “interested person” of the Trust. |

| *** | Robert E. Torray & Co. Inc., The Torray Corporation and TEL Corporation have all been succeeded to by Torray LLC. |

20

The Torray Fund

FACTORS CONSIDERED BY THE BOARD OF TRUSTEES IN CONNECTION WITH THEIR APPROVAL OF THE CONTINUATION OF THE FUND’S INVESTMENT MANAGEMENT AGREEMENT WITH THE MANAGERS (unaudited)

The Fund has entered into an Investment Management Agreement (the “Agreement”) with Torray LLC (the “Manager”) pursuant to which the Manager provides investment management services to the Fund. In accordance with the Investment Company Act of 1940, the Board of Trustees of the Fund is required, on an annual basis, to consider the continuation of the Agreement with the Manager, and this must take place at an in-person meeting of the Board. The relevant provisions of the Investment Company Act of 1940 specifically provide that it is the duty of the Board to request and evaluate such information as the Board determines is necessary to allow them to properly consider the continuation of the Agreement, and it is the duty of the Manager to furnish the trustees with such information that is responsive to their request. Set forth below is a discussion of the various factors that the Board of Trustees considered in deciding to approve the continuation of the Agreement with the Manager.

In determining whether to approve the continuation of the Agreement, the Board of Trustees requested, and the Manager provided, information and data relevant to the Board’s consideration. This included materials that provided the Board with information regarding the investment performance of the Fund and information regarding the fees and expenses of the Fund as compared to other similar mutual funds. As part of its deliberations, the Board also considered and relied upon the information about the Fund that had been provided to them throughout the year in connection with their regular Board meetings at which they engage in the ongoing oversight of the Fund and its operations.

The Board met at an in-person meeting on September 30, 2009 in order to consider the proposed continuation of the Agreement. Among the factors the Board considered was the overall performance of the Fund achieved by the Manager relative to the performance of other mutual funds with similar investment objectives on both a long-term basis and over shorter time periods. In particular, the Board took note of the favorable performance achieved by the Manager over longer time periods (five years and longer) and they considered the Manager’s particular focus on long-term investment performance. In reviewing the shorter term performance of the Fund, the trustees took note of the fact that the short-term performance (for periods of less than five years) was generally lower than that of the benchmark index and of other funds with similar investment objectives, and the trustees discussed with the Manager the likely reasons for this, noting that the Manager maintains a particular focus on long-term investment results and as a result, short-term results can, and will, trail comparable averages from time to time. The Board took into consideration the fact that the Manager seeks to achieve investment results for the Fund with less risk than other similar funds, and that the Manager has maintained a low portfolio turnover rate for the Fund which is beneficial to shareholders of the Fund because this results in lower brokerage costs which helps to reduce the operating costs of the Fund. They noted the range of investment advisory and management services provided by the Manager and the level and quality of these services, and in particular, they noted the quality of the personnel providing these services, taking into consideration their finding that the personnel providing these services, and the services provided, were of a very high caliber and quality. The Board also considered the portfolio manager arrangements for the Fund, noting that the Manager had undertaken appropriate measures to provide for the continued management of the Fund by a team of portfolio managers with extensive portfolio management experience.

21

The Torray Fund

FACTORS CONSIDERED BY THE BOARD OF TRUSTEES IN CONNECTION WITH THEIR APPROVAL OF THE CONTINUATION OF THE FUND’S INVESTMENT MANAGEMENT AGREEMENT WITH THE MANAGERS (unaudited) (continued)

The Board also compared expenses of the Fund to the expenses of other funds of similar size, noting that the average expense ratio for the Fund over the past year compared favorably with industry averages. They also took note of the fact that the Fund is not subject to any sales loads, sales commissions or other similar fees, including Rule 12b-1 distribution fees, which helps to keep the overall expense to shareholders of investing in the Fund lower than the expenses associated with investing in many comparable funds, and they considered the fact that the Manager had informed the Board that it did not intend to propose the introduction of such types of fees for the Fund. The Board further considered the overall decline in the level of assets in the Fund over the past year, and they reviewed with the Manager possible actions that the Manager might take in order to respond to the changes in the level of the operating expense of the Fund which may result from the decline in assets. The Board also reviewed financial information concerning the Manager, noting its financial soundness as demonstrated by the financial information provided and the level of profitability relating to its services for the Fund, noting that these were reasonable and consistent with industry standards. The Board was also provided with information regarding the fees that the Manager charges other clients for investment advisory services and they noted that the fees were comparable based on the relevant circumstances of the types of accounts involved. The Board reviewed with the Manager the allocation of the portfolio management team’s time between managing the investments of the Fund and managing other accounts.

In addition, the Board reviewed with the Manager information regarding its brokerage practices, including soft dollar matters, and noted that the Manager did not have in place any formal soft dollar arrangements, and the Board also reviewed the Manager’s best execution procedures, which the Board noted were reasonable and consistent with standard industry practice.

Based on their review, the trustees concluded that the investment management services provided under the Agreement were reasonably worth the full amount of the fee and that the terms of the Agreement were fair and reasonable. In reaching their conclusion with respect to their approval of the continuation of the Agreement, the trustees did not identify any one single factor as being controlling, rather, the Board took note of a combination of factors that influenced their decision making process. The Board did, however, identify the overall favorable long-term investment performance of the Fund, the commitment of the Manager to the successful operation of the Fund, and the level of expenses of the Fund, as being important elements of their consideration. Based upon their review and consideration of these factors and other matters deemed relevant by the Board in reaching an informed business judgment, a majority of the Board of Trustees, including a majority of the Independent Trustees, concluded that the terms of the Agreement were fair and reasonable and the Board voted to approve the continuation of the Agreement with the Manager.

22

The Torray Fund

PORTFOLIO HOLDINGS, PROXY VOTING AND PROCEDURES

As of December 31, 2009 (unaudited)

The Fund files its complete schedule of portfolio holdings with the Securities and Exchange Commission (the “Commission”) for the first and third quarters of each fiscal year on Form N-Q. The Fund’s Forms N-Q are available on the Commission’s website at http://www.sec.gov. The Fund’s Forms N-Q may be reviewed and copied at the Commission’s Public Reference Room in Washington, D.C. Information on the operation of the Commission’s Public Reference Room may be obtained by calling 1-800-SEC-0330.

A description of the policies and procedures that the Fund uses to determine how to vote proxies relating to portfolio securities is available without charge, upon request, by calling 1-800-443-3036; and on the Commission's website at http://www.sec.gov.

Information regarding how the Fund voted proxies relating to portfolio securities is available without charge, upon request, by calling 1-800-443-3036; and on the Commission’s website at http://www.sec.gov.

23

The Torray Fund

ABOUT YOUR FUND’S EXPENSES

As of December 31, 2009 (unaudited)

We believe it is important for you to understand the impact of costs on your investment. All mutual funds have operating expenses. As a shareholder of the Fund, you incur ongoing costs, including management fees, and other fund expenses. Operating expenses, which are deducted directly from the Fund’s gross income, directly reduce the investment return of the Fund.

A mutual fund’s expenses are expressed as a percentage of its average net assets. This figure is known as the expense ratio. The following examples are intended to help you understand the ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds. The examples below are based on an investment of $1,000 made at the beginning of the period shown and held for the entire period.

The table on the next page illustrates the Fund’s cost in two ways:

Actual Fund Return This section helps you estimate the actual expenses that you paid over the period. The “Ending Account Value” shown is derived from the Fund’s actual return, and the third column shows the operating expenses that would have been paid by an investor who started with $1,000 in the Fund. You may use the information here, together with the amount invested, to estimate the expenses that you paid over the period.

To do so, simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number given for the Fund under the heading “Expenses Paid During Period” on the next page.

Hypothetical 5% Return This section is intended to help you compare your Fund’s costs with those of other mutual funds. It assumes that the Fund had an annual return of 5% before expenses, and that the expense ratio is unchanged. In this case, because the return used is not the Fund’s actual return, the results do not apply to your investment. The example is useful in making comparisons because the Commission requires all mutual funds to calculate expenses based on a 5% return. You can assess the Fund’s costs by comparing this hypothetical example with the hypothetical examples that appear in shareholder reports of other funds.

Note that expenses shown in the table are meant to highlight and help you compare ongoing costs only. The Fund does not charge transactions fees, such as purchase or redemption fees, nor does it carry a “sales load.”

The calculation assumes no shares were bought or sold during the period. Your actual costs may have been higher or lower, depending on the amount of your investment and the timing of any purchases or redemptions.

24

The Torray Fund

ABOUT YOUR FUND’S EXPENSES (continued)

As of December 31, 2009 (unaudited)

More information about the Fund’s expenses, including recent annual expense ratios, can be found in this report. For additional information on operating expenses and other shareholder costs, please refer to the Fund’s prospectus.

| | | | | | | | | |

| | | Beginning

Account Value

July 1, 2009

| | Ending

Account Value

December 31, 2009

| | Expenses Paid

During Period *

|

Based on Actual Fund Return | | $ | 1,000.00 | | $ | 1,236.70 | | $ | 6.65 |

Based on Hypothetical 5% Return

(before expenses) | | $ | 1,000.00 | | $ | 1,019.26 | | $ | 6.01 |

| * | Expenses are equal to the Fund’s annualized expense ratio of 1.18% for the period, multiplied by the average account value over the period, multiplied by 184/365 (to reflect the one-half year period). |

25

The Torray Fund

TAX INFORMATION

As of December 31, 2009 (unaudited)

We are required to advise you within 60 days of the Fund’s fiscal year-end regarding the Federal tax status of certain distributions received by shareholders during such fiscal year. The information below is provided for the Fund’s fiscal year ending December 31, 2009. All designations are based on financial information available as of the date of this annual report and, accordingly are subject to change. For each item it is the intention of the Fund to designate the maximum amount permitted under the Internal Revenue Code and the regulations thereunder.

Qualified Interest Income

For the year ended December 31, 2009, 0.19% of the ordinary distributions paid (net investment income plus short-term capital gain) represent the amount of Qualifying Interest Income as created by The American Jobs Creation Act of 2004.

Qualified Dividend Income

For the year ended December 31, 2009, 100% of the distributions paid by the Fund from ordinary income qualifies for a reduced tax rate pursuant to The Jobs and Growth Tax Relief Reconciliation Act of 2003.

Dividends Received Deduction

For the year ended December 31, 2009, 100% of the ordinary income distribution qualifies for the dividends received deduction available to corporations.

Dividends and distributions received by retirement plans such as IRA’s, Keogh-type plans and 403(b) plans need not be reported as taxable income. However, many retirement plan trusts may need this information for their annual information reporting.

26

TRUSTEES

Carol Crawford

Bruce C. Ellis

William M Lane

Robert P. Moltz

Wayne H. Shaner

INVESTMENT ADVISOR

Torray LLC

OFFICERS

Robert E. Torray

William M Lane

Fred M. Fialco

Shawn M. Hendon

INDEPENDENT REGISTERED

PUBLIC ACCOUNTING FIRM

BBD, LLP

1835 Market Street 26th Floor

Philadelphia, PA 19103

TRANSFER AGENT

PNC Global Investment Servicing (U.S) Inc.

101 Sabin Street

Pawtucket, RI 02860-1427

LEGAL COUNSEL

Dechert LLP

1775 I Street, N.W.

Washington, DC 20006

Distributed by PFPC Distributors, Inc.

760 Moore Road, King of Prussia, PA 19406-1212

Date of first use, February 2010

This report is not authorized for distribution to prospective investors unless preceded or accompanied by a current prospectus. All indices are unmanaged groupings of stocks that are not available for investment.

The

TORRAY

FUND

ANNUAL REPORT

December 31, 2009

The Torray Fund

Suite 1100

7501 Wisconsin Avenue

Bethesda, Maryland 20814-6523

(301) 493-4600

(800) 443-3036

The Torray Institutional Fund

Letter to Shareholders

February 3, 2010

Dear Fellow Shareholders:

We are pleased to report The Torray Institutional Fund gained 28.6% during 2009, while the Standard & Poor’s 500 Index was up 26.5%. The difference, and then some, is attributable to proceeds from a lawsuit brought by shareholders, including ourselves, against Cardinal Health, Inc. We owned the stock at the time the suit was filed, but sold it in September 2007 for about $60 a share, slightly above our purchase price. It now trades around $34. As a result of this unexpected windfall, our cash position at year end was 21% of the Fund’s assets. It is important for you to know that this reserve is held for investment in stocks that meet our criteria, not as a hedge against the market going down.

When we wrote to you a year ago, stocks had taken a terrible beating and our country was in the midst of the most severe economic turmoil since the 1930s. Despite the gloomy backdrop, our January letter expressed optimism about America’s future, saying, “The damage is done and, in our opinion, largely reflected in stock prices.” Highlighting the risks of expressing such views publicly, the market promptly fell another 25% in about two months, bringing its loss since October 2007 to 57%. (By coincidence, The Wall Street Transcript interviewed Bob on March 9, the day stocks bottomed. That article, published in the March 23 issue, appears on our website, www.torray.com.)

Even though the news was worse by mid-year, shares had rallied to a small gain, and our July letter expressed “room for more optimism than at any time since the financial crisis began.” We emphasized this was a long-term view, not a forecast of where stocks were headed over the next few months or quarters. As it turned out, we would have looked a lot smarter claiming a turnaround was imminent — between March 9 and year’s end, stocks advanced 65%. While this came as a tremendous relief, it was, unfortunately, too late for countless investors that fled the market during the downturn, pouring billions of dollars into Treasury bills, money market funds, CDs, U.S. government bonds and bond funds. By the end of the year, domestic equity funds alone had experienced net withdrawals of $38 billion, while bond funds took in $375 billion — a 10-to-1 ratio. Treasury bills, yielding nothing, have been in such great demand, their prices, on several occasions, have risen above par, meaning holders were paying to ensure they got their money back. Huge sums have also been put into one, two, and five-year government bonds, despite the fact they yield only 0.3%, 0.9% and 2.4%, respectively.

Leaving taxes aside, we believe none of these rates will compensate for inflation, which has averaged 4% for more than 75 years, or the possible negative consequences of our country’s massive deficit and debt issuance. More importantly, they will never produce enough money to retire on. Had the Pilgrims, landing at Plymouth Rock in 1620, bought money market funds at today’s rates, it would have taken until now — nearly four centuries — to double their investment. Better, but still not good, a quality bond portfolio diversified across today’s yield spectrum would probably generate an income in the neighborhood of 3% a year, doubling money in 24 years. By comparison, our Torray Fund, in spite of the last decade, has multiplied in value 5.7 times in 19 years. Over the last 70 years, bonds, net of inflation, turned $1 into $2.70, while $1 in stocks grew to $103.00. Despite this record, untold numbers of investors are positioned today as though they expect the opposite result going forward.

1

The Torray Institutional Fund

Letter to Shareholders (continued)

February 3, 2010

Meanwhile, top-quality stocks, many paying dividends exceeding current short-to-intermediate-term interest rates, are now rejected at prices more than 25% below their levels of 2007, a time when investors were loaded with them, often on margin. (They are also 24% lower than they were at the close of 1999.) When the market collapsed last year, those that sold and moved to cash and bonds not only sustained big losses, but also missed the rebound. Victims of the worst timing ended up with 65% less money than if they’d simply stayed put — admittedly a very hard thing to have done under the circumstances. They are now faced with having to nearly triple their money to get even with where they were last March. Assuming a 10% annual return going forward — the stock market’s long-term average — it will take about 12 years to do it. Even this understates the challenge. Investors have come nowhere near matching the market over the long haul, mainly because they persist in jumping in and out of stocks at the wrong time. Having observed this behavior for almost 50 years sustains our conviction that the buy-and-hold approach — declared dead by the pundits at last year’s lows — is the only one that works.

At this point, we feel the average investor is too heavily committed to bonds and cash equivalents — a no-win situation from our perspective. In the early 1980s, investors wouldn’t touch depressed 30-year U.S. governments yielding 15 1/2%. Today, they’re buying them at yields around 4.6%. If history is a guide, when the economy recovers and stocks go up, the money in bonds is certain to shift into equities at prices far higher than they were sold. This illustrates, once again, the problem people have differentiating risk from opportunity. They invariably think risk is low when prices are high, and vice-versa. This applies to stocks, houses, commercial real estate, commodities, and anything else that trades. At critical junctures, investors bet heavily they’re right, and no amount of reasoning can change their minds.

In the present case, we doubt fixed income investors are convinced they’re right; it’s just they’re afraid to do anything else. Recognizing this, we nevertheless believe investors with low stock positions should consider gradually moving back into high quality shares or funds that own them. There’s no need to hurry. The best strategy is to invest amounts one’s comfortable with on a regular basis — monthly or quarterly, for example. When prices fall, (which they did during nine of the 37 years we’ve been in business), each new investment will buy more shares and earn a higher dividend return. Ironically, while this is a big advantage for the long-term investor, the average person tends to associate falling share prices not with opportunity, but with losing money. Some losses, of course, are inevitable, but a well-diversified portfolio should provide a cushion against them.

Stocks, as we all know, can deliver unpleasant surprises. The market has been very volatile in recent weeks, making people that were already nervous even more so. Some may fear a collapse with no recovery. While there are obviously no guarantees, they should keep in mind that it’s never happened before. We remain confident about America’s future based on its record of prosperity and resilience in the face of adversity. Beyond that, we are reassured by the solid, economic fundamentals of companies in our Institutional Fund. As we’ve often said, “If the business performs, the stock will take care of itself.” Everything else is guesswork, and we don’t know anyone that’s guessed right for long.

2

The Torray Institutional Fund

Letter to Shareholders (continued)

February 3, 2010

These are tough times, the worst any of us have seen. Experts are everywhere. You can’t turn on the television or pick up a newspaper without being inundated with predictions on the market’s direction and what to do about it. They should be ignored. Investors will do far better sticking to the fundamentals, secure in the knowledge that, over time, sound, growing businesses have produced higher returns than any of the alternatives widely available to the general public. Despite the many challenges our country has faced, things have always worked out, and we believe this case will prove no different.

In closing, we want you to know that all of us at The Torray Companies appreciate your investment in our Fund.

| | | | | | |

| | | Sincerely, | | | | |

| | |  | | | | |

| | | Robert E. Torray | | | | |

| | |

| | | | |

| | | Fred M. Fialco | | | | |

| | |

| | | | |

| | | Shawn M. Hendon | | | | |

| | | | | | | |

3

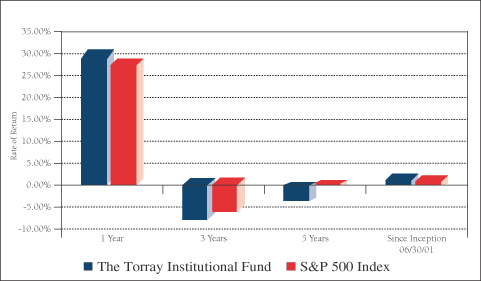

The Torray Institutional Fund

PERFORMANCE DATA

As of December 31, 2009

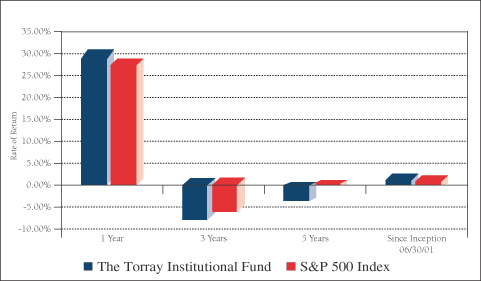

Average Annual Returns on an Investment in

The Torray Institutional Fund vs. the S&P 500 Index

For the periods ended December 31, 2009:

| | | | | | | | | | | | |

| | | 1 Year

| | | 3 Years

| | | 5 Years

| | | Since

Inception

06/30/01

| |

The Torray Institutional Fund | | 28.61 | % | | -7.34 | % | | -2.14 | % | | 1.11 | % |

S&P 500 Index | | 26.46 | % | | -5.61 | % | | 0.42 | % | | 0.82 | % |

Cumulative Returns for the 8½ years ended December 31, 2009

| | | |

The Torray Institutional Fund | | 9.89 | % |

S&P 500 Index | | 7.17 | % |

4

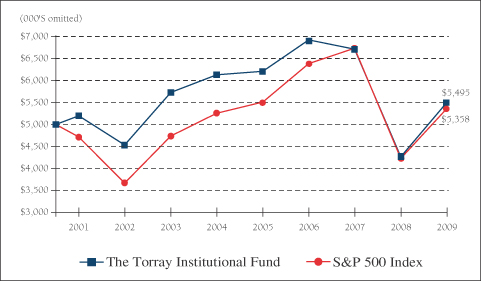

The Torray Institutional Fund

PERFORMANCE DATA (continued)

As of December 31, 2009

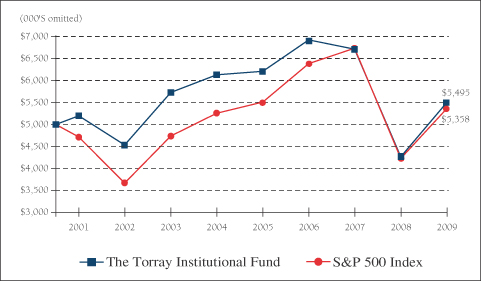

Change in Value of $5,000,000 Invested

on June 30, 2001 (commencement of operations) to:

| | | | | | | | | | | | | | | |

| | | 12/31/01

| | 12/31/03

| | 12/31/05

| | 12/31/07

| | 12/31/09

|

The Torray Institutional Fund | | $ | 5,199,000 | | $ | 5,725,000 | | $ | 6,201,000 | | $ | 6,701,000 | | $ | 5,495,000 |

S&P 500 Index | | $ | 4,723,000 | | $ | 4,739,000 | | $ | 5,507,000 | | $ | 6,726,000 | | $ | 5,358,000 |

The returns quoted represent past performance and do not guarantee future results. Investment return and principal value will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher. Returns current to the most recent month-end are available at www.torray.com. The returns shown do not reflect the deduction of taxes a shareholder would pay on the redemption of fund shares and distributions. The Fund’s gross annual operating expense ratio, as stated in the current prospectus dated May 1, 2009, is 0.85%. Returns on both The Torray Institutional Fund and the S&P 500 Index assume reinvestment of all dividends and distributions. The S&P 500 Index is an unmanaged index consisting of 500 U.S. large-cap stocks.

5

The Torray Institutional Fund

FUND PROFILE

As of December 31, 2009 (unaudited)

| | |

DIVERSIFICATION (% of net assets) |

| |

Information Technology | | 20.26% |

Health Care | | 14.82% |

Industrials | | 12.46% |

Financials | | 10.62% |

Consumer Discretionary | | 9.67% |

Consumer Staples | | 5.88% |

Telecommunications | | 2.97% |

Materials | | 2.15% |

Short-Term Investments | | 21.17% |

Liabilities Less Other Assets | | 0.00% |

| | |

|

| | | 100.00% |

| | |

|

| | | | |

TOP TEN EQUITY HOLDINGS (% of net assets) |

| | |

| 1. | | Loews Corp. | | 3.86% |

| 2. | | Walt Disney Co. (The) | | 3.71% |

| 3. | | WellPoint, Inc. | | 3.30% |

| 4. | | International Business Machines Corp. | | 3.28% |

| 5. | | EMC Corp. | | 3.26% |

| 6. | | UnitedHealth Group Inc. | | 3.16% |

| 7. | | Procter & Gamble Co. (The) | | 3.04% |

| 8. | | Johnson & Johnson | | 3.03% |

| 9. | | Cisco Systems, Inc. | | 2.97% |

| 10. | | AT&T Inc. | | 2.97% |

| | | | |

|

| | | | | 32.58% |

| | | | |

|

| | | | | |

| | |

PORTFOLIO CHARACTERISTICS | | | | | |

| | |

Net Assets (million) | | | | $20 | |

Number of Holdings | | | | 29 | |

Portfolio Turnover | | | | 18.60 | % |

P/E Multiple (forward) | | | | 13.3 | x |

Portfolio Yield | | | | 1.64 | % |

Market Capitalization (billion) | | Average | | $57.7 | |

| | | Median | | $30.4 | |

6

The Torray Institutional Fund

SCHEDULE OF INVESTMENTS

As of December 31, 2009

| | | | | | | |

| | | Shares

| | | | Market Value

|

| COMMON STOCK 78.83% | | | |

| |

20.26% INFORMATION TECHNOLOGY | | | |

| | | 5,100 | | International Business Machines Corp. | | $ | 667,590 |

| | | 37,942 | | EMC Corp. * | | | 662,847 |

| | | 25,200 | | Cisco Systems, Inc. * | | | 603,288 |

| | | 27,956 | | Intel Corp. | | | 570,302 |

| | | 29,400 | | Western Union Co. (The) | | | 554,190 |

| | | 12,616 | | Automatic Data Processing, Inc. | | | 540,217 |

| | | 37,193 | | Applied Materials, Inc. | | | 518,470 |

| | | | | | |

|

|

| | | | | | | | 4,116,904 |

| |

14.82% HEALTH CARE | | | |

| | | 11,500 | | WellPoint, Inc. * | | | 670,335 |

| | | 21,100 | | UnitedHealth Group Inc. | | | 643,128 |

| | | 9,564 | | Johnson & Johnson | | | 616,017 |

| | | 10,100 | | Abbott Laboratories | | | 545,299 |

| | | 6,800 | | Becton Dickinson & Co. | | | 536,248 |

| | | | | | |

|

|

| | | | | | | | 3,011,027 |

| |

12.46% INDUSTRIALS | | | |

| | | 22,692 | | Cintas Corp. | | | 591,127 |

| | | 6,500 | | 3M Co. | | | 537,355 |

| | | 7,400 | | General Dynamics Corp. | | | 504,458 |

| | | 30,319 | | General Electric Co. | | | 458,726 |

| | | 17,218 | | Owens Corning * | | | 441,470 |

| | | | | | |

|

|

| | | | | | | | 2,533,136 |

| |

10.62% FINANCIALS | | | |

| | | 21,600 | | Loews Corp. | | | 785,160 |

| | | 25,617 | | Marsh & McLennan Cos., Inc. | | | 565,623 |

| | | 12,223 | | American Express Co. | | | 495,276 |

| | | 109,875 | | LaBranche & Co Inc. * | | | 312,045 |

| | | | | | |

|

|

| | | | | | | | 2,158,104 |

See notes to the financial statements.

7

The Torray Institutional Fund

SCHEDULE OF INVESTMENTS (continued)

As of December 31, 2009

| | | | | | | | |

| | | Shares

| | | | Market Value

| |

| |

9.67% CONSUMER DISCRETIONARY | | | | |

| | | 23,410 | | Walt Disney Co. (The) | | $ | 754,973 | |

| | | 16,700 | | McGraw-Hill Cos. Inc. (The) | | | 559,617 | |

| | | 22,000 | | Gannett Co., Inc. | | | 326,700 | |

| | | 8,525 | | O’Reilly Automotive, Inc. * | | | 324,973 | |

| | | | | | |

|

|

|

| | | | | | | | 1,966,263 | |

| |

5.88% CONSUMER STAPLES | | | | |

| | | 10,200 | | Procter & Gamble Co. (The) | | | 618,426 | |

| | | 21,200 | | Kraft Foods Inc., Class A | | | 576,216 | |

| | | | | | |

|

|

|

| | | | | | | | 1,194,642 | |

| |

2.97% TELECOMMUNICATIONS | | | | |

| | | 21,500 | | AT&T Inc. | | | 602,645 | |

| |

2.15% MATERIALS | | | | |

| | | 13,000 | | E.I. du Pont de Nemours & Co. | | | 437,710 | |

| | | | | | |

|

|

|

| TOTAL COMMON STOCK 78.83% | | | 16,020,431 | |

(cost $17,065,120) | | | | | | |

| | | |

| | | Principal Amount ($)

| | | | | |

| SHORT-TERM INVESTMENTS 21.17% | | | | |

| | | 4,303,350 | | PNC Bank Money Market Account, 0.05% (1) | | | 4,303,350 | |

| | | | | | |

|

|

|

(cost $4,303,350) | | | | |

| TOTAL INVESTMENTS 100.00% | | | 20,323,781 | |

(cost $21,368,470) | | | | |

| LIABILITIES LESS OTHER ASSETS 0.00% | | | (480 | ) |

| | | | | | |

|

|

|

| NET ASSETS 100.00% | | $ | 20,323,301 | |

| | | | | | |

|

|

|

| * | Non-income producing securities. |

| (1) | Represents current yield at December 31, 2009. |

See notes to the financial statements.

8

The Torray Institutional Fund

STATEMENT OF ASSETS AND LIABILITIES

As of December 31, 2009

| | | | |

ASSETS | | | | |

Investments in securities at value

(cost $21,368,470) | | $ | 20,323,781 | |

Interest and dividends receivable | | | 25,765 | |

| | |

|

|

|

TOTAL ASSETS | | | 20,349,546 | |

| | |

|

|

|

| |

LIABILITIES | | | | |

Payable for fund shares redeemed | | | 9,840 | |

Payable to advisor | | | 16,405 | |

| | |

|

|

|

TOTAL LIABILITIES | | | 26,245 | |

| | |

|

|

|

| |

NET ASSETS | | $ | 20,323,301 | |

| | |

|

|

|

Shares of beneficial interest ($1 stated value,

323,690 shares outstanding, unlimited shares authorized) | | $ | 323,690 | |

Paid-in-capital in excess of par | | | 25,519,004 | |

Accumulated net realized loss on investments | | | (4,474,704 | ) |

Net unrealized depreciation of investments | | | (1,044,689 | ) |

| | |

|

|

|

TOTAL NET ASSETS | | $ | 20,323,301 | |

| | |

|

|

|

Net Asset Value, Offering and Redemption Price per Share | | $ | 62.79 | |

| | |

|

|

|

See notes to the financial statements.

9

The Torray Institutional Fund

STATEMENT OF OPERATIONS

For the year ended December 31, 2009

| | | | |

INVESTMENT INCOME | | | | |

Dividend income | | $ | 351,640 | |

Interest income | | | 890 | |

| | |

|

|

|

Total investment income | | | 352,530 | |

| | |

|

|

|

| |

EXPENSES | | | | |

Management fees | | | 149,382 | |

| | |

|

|

|

Total expenses | | | 149,382 | |

| | |

|

|

|

NET INVESTMENT INCOME | | | 203,148 | |

| | |

|

|

|

REALIZED AND UNREALIZED GAIN (LOSS)

ON INVESTMENTS | | | | |

Net realized loss on investments | | | (1,097,450 | ) |

Net change in unrealized appreciation (depreciation) on investments | | | 5,382,730 | |

| | |

|

|

|

Net realized and unrealized gain on investments | | | 4,285,280 | |

| | |

|

|

|

NET INCREASE IN NET ASSETS FROM OPERATIONS | | $ | 4,488,428 | |

| | |

|

|

|

See notes to the financial statements.

10

The Torray Institutional Fund

STATEMENTS OF CHANGES IN NET ASSETS

For the years indicated:

| | | | | | | | |

| | | Year ended

12/31/09