UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-06096

The Torray Fund

(Exact name of registrant as specified in charter)

| | |

7501 Wisconsin Avenue Suite 1100 Bethesda, | | MD 20814-6523 |

|

| (Address of principal executive offices) | | (Zip code) |

William M Lane

The Torray Corporation

7501 Wisconsin Avenue Suite 1100

Bethesda, MD 20814-6523

(Name and address of agent for service)

registrant’s telephone number, including area code: 301-493-4600

Date of fiscal year end: December 31

Date of reporting period: December 31, 2004

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

Item 1. Reports to Stockholders.

The Report to Shareholders is attached herewith.

The Torray Fund

Letter to Shareholders

February 10, 2005

Dear Fellow Shareholders,

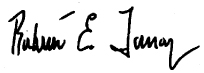

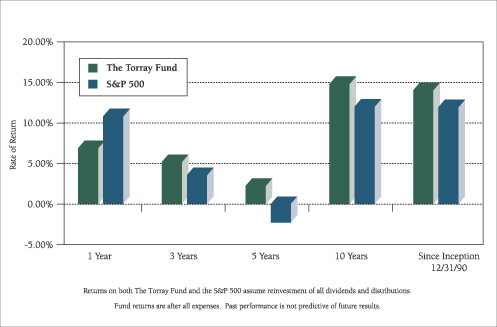

The Torray Fund gained 6.9% during 2004, compared to 10.9% for the Standard & Poor’s 500 Index. This was not the result we were looking for, especially considering the fund industry average earned 11.9%, beating the market for the first time in more than 10 years. However, our long-term record, which we’ll discuss later, continues to outpace both the Index and the vast majority of funds. While we are disappointed not to have done better for you last year, our policy of investing in high quality businesses that generate rising earnings and free cash flow temporarily was out of vogue. Although we believe our approach is the soundest way to succeed over the long term, in the short run, anything can happen and, in 2004, it did.

Strength in the economy, surging oil prices, unusually strong world demand for commodities, and a dramatic recovery in a number of depressed industries were the key elements in the market’s advance. These factors combined to cause extraordinary gains in the stocks of companies in economically sensitive sectors like oil, metals, mining, fertilizer, transportation (except airlines), home building and others. Utilities were bid up by investors looking for income. Overall, there were so many winners, throwing darts at the stock page might have produced a higher return than we did. Nevertheless, having watched these cycles for more than four decades, we are convinced that our philosophy is the best one, and we’re sticking with it.

We will explain why. As a general rule — and this is an observation, not a criticism — the companies to which we have just referred, though important to the economy and their employees, do not have records or prospects that meet our investment criteria. Most are cyclical — meaning their sales and earnings rise and fall with the economy. They are also capital intensive and, in many cases, subject to brutal competition. As a result, profit margins and returns on equity tend to be modest, and growth prospects mediocre. Excluding periods of robust demand for their products and services — the recent experience — they produce limited and, in some instances, no free cash flow. That term refers to money left over after all costs of operating and maintaining the business have been met. It may be used for dividends, share repurchases, acquisitions, debt reduction, and so on. If there is none, the value of the enterprise cannot increase, and the stock will merely move up and down, reflecting fluctuations in underlying fundamentals and investor preferences.

Torray Fund companies are different. As a group they have generated rising earnings and tremendous free cash flow - the only factors that produce long-term appreciation in stocks. Man - -

1

The Torray Fund

Letter to Shareholders

February 10, 2005

agements are sound, balance sheets strong, capital requirements minimal, and the franchises have sustainable competitive advantages.

But, last year, markets were not focused on these aspects. Instead, as noted, attention centered on sectors more closely tied to the economy’s cyclical recovery. If investors, knowing all the facts, were given a choice between owning the companies in our Fund and those described above — the only hitch being they couldn’t sell for 20 years — we think most would select the former. Benjamin Graham, the father of security analysis, observed more than half a century ago that in the short run the market is a voting machine, but in the long run it’s a weighing machine. We believe your investment in The Torray Fund will weigh enough in the future to meet your financial goals.

Some, we know, will say “forget all that, just buy something, anything that will go up.” We sympathize. But, the urge to do this is exactly what gets people into trouble. Besides, we would not know which stocks to choose. It’s always a good idea when you’re tempted to go down this road to ask yourself — and be honest — have I or has anyone I know made money — net of losses and taxes — trying to pick near-term winners? In conclusion on these points, we reaffirm our confidence in the Fund’s portfolio and determination to ride it out pretty much as is.

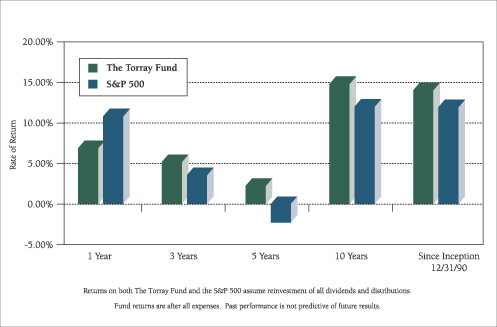

We believe the record supports our persistence. Since its inception 14 years ago, The Torray Fund has earned 14.1% compounded annually, versus 12.0% for the S&P 500. By coincidence, our affiliate Robert E. Torray & Co., a manager of large institutional portfolios, has produced the same annualized return for 32 years, turning $1 into $68. The market, measured by the S&P 500, grew $1 into $29. Over the past decade, the comparison is even more favorable: 14.9% for the Fund, 12.1% for the Index.

At the risk of overkill, we will also mention that our record looks good when compared to mutual fund industry averages. Over the last 10 years, (14 year numbers are not published), The Torray Fund ranks in the top 8% of all domestic stock funds, and the top 3% of those considered to be similar in style and objective. After taxes, it stands among the top 3% and 1%, respectively.

These numbers highlight the importance of maintaining a long-term perspective. However, we realize that during periods like this, it’s only natural for people to become impatient and start switching things around. But, as detailed in our 2003 mid-year report, studies have shown this tendency has substantially slashed returns. As we have said in the past, we think it makes sense

2

The Torray Fund

Letter to Shareholders

February 10, 2005

to stick with a few funds that have competent, experienced management and a good track record, and then be resigned to the fact there will always be others — though not many — performing better. We accept that. Our goal is to provide you with a safe investment that will earn more, net of expenses, than you are likely to make on your own or in an index fund — not every month, every quarter, every year, but over your lifetime. We also endeavor to communicate in plain language what we’re doing and why; and to put important issues in perspective to help you evaluate the crushing oversupply of investment products and the endless, often confusing, barrage of advice from experts.

Beyond that, we want you to know that every officer and employee of The Torray Companies is an investor in the Fund, as are all of our Trustees. Many of us buy more shares each month, regardless of the price or our personal views of the economic and market outlook. We do so, believing that over time the values building in the companies we hold eventually will be reflected in higher share prices. Anyone that owns funds ranking in the top 10% of industry averages over a long period should do exceedingly well.

Thank you once again for entrusting your savings to us. The protection and growth of your investment is our top priority.

| | |

| Sincerely, | | |

| |

| |  |

| Robert E. Torray | | Douglas C. Eby |

3

The Torray Fund

PERFORMANCE DATA

As of December 31, 2004

Total Rates of Return on an Investment in The Torray Fund vs. the S&P 500

For the periods ended December 31, 2004:

| | | | | | | | | | |

| | | 1 Year

| | 3 Years

| | 5 Years

| | 10 Years

| | Since

Inception 12/31/90

|

The Torray Fund | | 6.90% | | 5.18% | | 2.26% | | 14.86% | | 14.08% |

S&P 500 | | 10.87% | | 3.58% | | -2.30% | | 12.07% | | 11.99% |

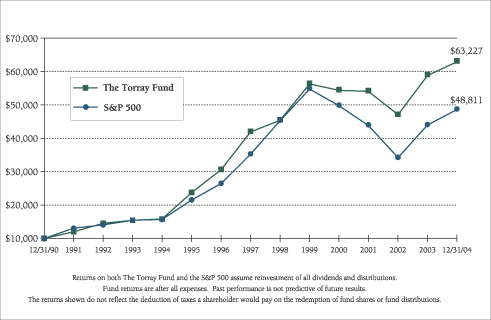

Cumulative Returns for the 14 years ended December 31, 2004

| | | |

The Torray Fund | | 532.27 | % |

S&P 500 | | 388.71 | % |

4

The Torray Fund

PERFORMANCE DATA

As of December 31, 2004

Change in Value of $10,000 Invested on December 31, 1990 (commencement of operations) to:

| | | | | | | | | | | | | | | | | | | | | |

| | | 12/31/92

| | 12/31/94

| | 12/31/96

| | 12/31/98

| | 12/31/00

| | 12/31/02

| | 12/31/04

|

The Torray Fund | | $ | 14,523 | | $ | 15,821 | | $ | 30,719 | | $ | 45,576 | | $ | 54,609 | | $ | 47,236 | | $ | 63,227 |

S&P 500 | | $ | 14,047 | | $ | 15,666 | | $ | 26,499 | | $ | 45,438 | | $ | 49,993 | | $ | 34,318 | | $ | 48,811 |

5

The Torray Fund

FUND PROFILE (unaudited)

As of December 31, 2004

| | |

DIVERSIFICATION (% of net assets) | | |

| |

Diversified Financial Services | | 24.38% |

Media & Entertainment | | 12.05% |

Diversified Manufacturing | | 11.37% |

Data Processing & Management | | 8.36% |

Aerospace & Defense | | 7.86% |

Pharmaceuticals | | 7.06% |

Health Care Services | | 5.58% |

Communications Services | | 4.25% |

Beverages | | 4.21% |

Diversified Medical Products | | 3.94% |

Diversified Telecommunication Services | | 2.57% |

Specialty Retail | | 2.22% |

Real Estate | | 1.76% |

Banking | | 1.67% |

Electronic Equipment | | 1.21% |

Computer Systems & Integration | | 0.72% |

Utilities | | 0.57% |

Energy | | 0.09% |

Other assets less liabilities | | 0.13% |

| | |

|

| | | 100.00% |

| | |

| TOP TEN HOLDINGS |

| |

| 1. | | Amgen Inc. |

| 2. | | Franklin Resources, Inc. |

| 3. | | Cardinal Health, Inc. |

| 4. | | Illinois Tool Works Inc. |

| 5. | | First Data Corporation |

| 6. | | AMBAC Financial Group, Inc. |

| 7. | | Univision Communications Inc. |

| 8. | | Anheuser-Busch Cos., Inc. |

| 9. | | Markel Corporation |

| 10. | | Automatic Data Processing, Inc. |

| | | | |

PORTFOLIO CHARACTERISTICS | | |

| | |

Net Assets (million) | | | | $1,735 |

Number of Stocks | | | | 40 |

Portfolio Turnover | | | | 27.12% |

P/E Multiple (forward) | | | | 17.7x |

Portfolio Yield | | | | 1.40% |

Market Capitalization | | Average | | 55.6 B |

| | | Median | | 25.0 B |

6

The Torray Fund

SCHEDULE OF INVESTMENTS

As of December 31, 2004

| | | | | | | |

| | | Shares

| | | | Market Value

|

| | | | | | | | |

| COMMON STOCK 99.87% | | | |

| |

| 24.38% DIVERSIFIED FINANCIAL SERVICES | | | |

| | | 1,426,600 | | Franklin Resources, Inc. | | $ | 99,362,690 |

| | | 899,000 | | AMBAC Financial Group, Inc. | | | 73,834,870 |

| | | 199,005 | | Markel Corporation * | | | 72,437,820 |

| | | 1,434,962 | | JPMorgan Chase & Co. | | | 55,977,868 |

| | | 1,581,400 | | Allied Capital Corporation | | | 40,863,376 |

| | | 207,900 | | Fairfax Financial Holdings Limited | | | 35,031,150 |

| | | 411,700 | | American International Group, Inc. | | | 27,036,339 |

| | | 192,000 | | American Express Company | | | 10,823,040 |

| | | 829,200 | | LaBranche & Co. Inc. * | | | 7,429,632 |

| | | | | | |

|

|

| | | | | | | | 422,796,785 |

| |

| 12.05% MEDIA & ENTERTAINMENT | | | |

| | | 2,496,000 | | Univision Communications Inc. * | | | 73,057,920 |

| | | 2,178,900 | | The Walt Disney Company | | | 60,573,420 |

| | | 875,700 | | Tribune Company | | | 36,901,998 |

| | | 794,300 | | Clear Channel Communications, Inc. | | | 26,601,107 |

| | | 145,000 | | Gannett Co., Inc. | | | 11,846,500 |

| | | | | | |

|

|

| | | | | | | | 208,980,945 |

| |

| 11.37% DIVERSIFIED MANUFACTURING | | | |

| | | 862,000 | | Illinois Tool Works Inc. | | | 79,890,160 |

| | | 1,322,300 | | General Electric Company | | | 48,263,950 |

| | | 598,100 | | Emerson Electric Co. | | | 41,926,810 |

| | | 472,400 | | Danaher Corporation | | | 27,120,484 |

| | | | | | |

|

|

| | | | | | | | 197,201,404 |

| |

| 8.36% DATA PROCESSING & MANAGEMENT | | | |

| | | 1,836,700 | | First Data Corporation | | | 78,133,218 |

| | | 1,509,600 | | Automatic Data Processing, Inc. | | | 66,950,760 |

| | | | | | |

|

|

| | | | | | | | 145,083,978 |

7

The Torray Fund

SCHEDULE OF INVESTMENTS (continued)

As of December 31, 2004

| | | | | | | |

| | | Shares

| | | | Market Value

|

| | | | | | | | |

| |

| 7.86% AEROSPACE & DEFENSE | | | |

| | | 533,100 | | United Technologies Corporation | | $ | 55,095,885 |

| | | 1,287,400 | | Honeywell International Inc. | | | 45,586,834 |

| | | 341,100 | | General Dynamics Corporation | | | 35,679,060 |

| | | | | | |

|

|

| | | | | | | | 136,361,779 |

| |

| 7.06% PHARMACEUTICALS | | | |

| | | 1,626,300 | | Amgen Inc. * | | | 104,327,145 |

| | | 673,000 | | Pfizer Inc. | | | 18,096,970 |

| | | | | | |

|

|

| | | | | | | | 122,424,115 |

| |

| 5.58% HEALTH CARE SERVICES | | | |

| | | 1,665,200 | | Cardinal Health, Inc. | | | 96,831,380 |

| |

| 4.25% COMMUNICATIONS SERVICES | | | |

| | | 2,975,360 | | The DIRECTV Group, Inc. * | | | 49,807,526 |

| | | 722,400 | | EchoStar Communications Corporation | | | 24,012,576 |

| | | | | | |

|

|

| | | | | | | | 73,820,102 |

| |

| 4.21% BEVERAGES | | | |

| | | 1,439,000 | | Anheuser-Busch Cos., Inc. | | | 73,000,470 |

| |

| 3.94% DIVERSIFIED MEDICAL PRODUCTS | | | |

| | | 1,032,100 | | Abbott Laboratories | | | 48,147,465 |

| | | 317,300 | | Johnson & Johnson | | | 20,123,166 |

| | | | | | |

|

|

| | | | | | | | 68,270,631 |

| |

| 2.57% DIVERSIFIED TELECOMMUNICATION SERVICES | | | |

| | | 1,726,700 | | SBC Communications Inc. | | | 44,497,059 |

| |

| 2.22% SPECIALTY RETAIL | | | |

| | | 854,300 | | O’Reilly Automotive, Inc. * | | | 38,486,215 |

| |

| 1.76% REAL ESTATE | | | |

| | | 922,500 | | CarrAmerica Realty Corporation | | | 30,442,500 |

8

The Torray Fund

SCHEDULE OF INVESTMENTS (continued)

As of December 31, 2004

| | | | | | | |

| | | Shares

| | | | Market Value

|

| | | | | | | | |

| |

| 1.67% BANKING | | | |

| | | 616,800 | | Bank of America Corporation | | $ | 28,983,432 |

| |

| 1.21% ELECTRONIC EQUIPMENT | | | |

| | | 873,200 | | Agilent Technologies, Inc. * | | | 21,044,120 |

| |

| 0.72% COMPUTER SYSTEMS & INTEGRATION | | | |

| | | 596,400 | | Hewlett-Packard Company | | | 12,506,508 |

| |

| 0.57% UTILITIES | | | |

| | | 941,600 | | Sierra Pacific Resources * | | | 9,886,800 |

| |

| 0.09% ENERGY | | | |

| | | 75,000 | | Pengrowth Energy Trust “A” | | | 1,561,500 |

| |

| 0.00% COMMUNICATIONS EQUIPMENT | | | |

| | | 10,255 | | Lucent Technologies Warrants | | | 16,203 |

| | | | | | |

|

|

| TOTAL COMMON STOCK 99.87% | | | 1,732,195,926 |

| (cost $1,437,003,834) | | | |

| SHORT-TERM INVESTMENTS .06% | | | |

| (cost $1,028,819) | | PNC Bank Money Market Account, 1.83% | | | 1,028,819 |

| | | | | | |

|

|

| TOTAL PORTFOLIO SECURITIES 99.93% | | | 1,733,224,745 |

| (amortized cost $1,438,032,653) | | | |

| OTHER ASSETS LESS LIABILITIES 0.07% | | | 1,275,669 |

| | | | | | |

|

|

| NET ASSETS 100.00% | | $ | 1,734,500,414 |

| | | | | | |

|

|

| * | | Non-income producing securities |

See notes to the financial statements.

9

The Torray Fund

STATEMENT OF ASSETS AND LIABILITIES

As of December 31, 2004

| | | |

ASSETS | | | |

Investments in securities at value

(amortized cost $1,438,032,653) | | $ | 1,733,224,745 |

Receivable for investments sold | | | 2,576,880 |

Interest and dividends receivable | | | 1,855,564 |

Receivable for fund shares sold | | | 539,602 |

Prepaid insurance and other | | | 32,744 |

| | |

|

|

TOTAL ASSETS | | | 1,738,229,535 |

| | |

|

|

| |

LIABILITIES | | | |

Payable for fund shares redeemed | | | 1,872,656 |

Payable to advisor | | | 1,464,029 |

Accrued expenses | | | 392,436 |

| | |

|

|

TOTAL LIABILITIES | | | 3,729,121 |

| | |

|

|

| |

NET ASSETS | | $ | 1,734,500,414 |

| | |

|

|

Shares of beneficial interest ($1 stated value,

42,219,644 shares outstanding, unlimited

shares authorized) | | $ | 42,219,644 |

Paid-in-capital in excess of par | | | 1,388,477,869 |

Accumulated net realized gain on investments | | | 8,610,809 |

Net unrealized appreciation of investments | | | 295,192,092 |

| | |

|

|

| |

TOTAL NET ASSETS | | $ | 1,734,500,414 |

| | |

|

|

Per Share | | $ | 41.08 |

| | |

|

|

See notes to the financial statements.

10

The Torray Fund

STATEMENT OF OPERATIONS

For the year ended December 31, 2004

| | | |

INVESTMENT INCOME | | | |

Dividend income | | $ | 25,099,986 |

Interest income | | | 28,262 |

| | |

|

|

Total income | | | 25,128,248 |

| | |

|

|

| |

EXPENSES | | | |

Management fees | | | 16,893,454 |

Transfer agent fees & expenses | | | 825,503 |

Printing, postage & mailing | | | 85,596 |

Custodian fees | | | 107,233 |

Trustees’ fees | | | 98,257 |

Insurance | | | 59,422 |

Registration & filing fees | | | 48,804 |

Legal fees | | | 78,313 |

Audit fees | | | 35,753 |

| | |

|

|

Total expenses | | | 18,232,335 |

| | |

|

|

NET INVESTMENT INCOME | | | 6,895,913 |

| | |

|

|

REALIZED AND UNREALIZED GAIN

ON INVESTMENTS | | | |

Net realized gain on investments | | | 48,800,088 |

Capital gain distributions from investment companies | | | 1,389,124 |

Net change in unrealized appreciation on investments | | | 55,913,967 |

| | |

|

|

Net realized and unrealized gain on investments | | | 106,103,179 |

| | |

|

|

NET INCREASE IN NET ASSETS FROM OPERATIONS | | $ | 112,999,092 |

| | |

|

|

See notes to the financial statements.

11

The Torray Fund

STATEMENTS OF CHANGES IN NET ASSETS

For the years indicated:

| | | | | | | | |

| | | Year ended

12/31/04

| | | Year ended

12/31/03

| |

Increase in Net Assets from Operations: | | | | | | | | |

Net investment income | | $ | 6,895,913 | | | $ | 9,116,828 | |

Net realized gain on investments | | | 48,800,088 | | | | 18,020,686 | |

Capital gain distributions from investment companies | | | 1,389,124 | | | | — | |

Net change in unrealized appreciation on investments | | | 55,913,967 | | | | 306,757,734 | |

| | |

|

|

| |

|

|

|

Net increase in net assets from operations | | | 112,999,092 | | | | 333,895,248 | |

| | |

|

|

| |

|

|

|

| | |

Distributions to Shareholders from: | | | | | | | | |

Net investment income ($0.165 and

$0.220 per share, respectively) | | | (6,932,648 | ) | | | (9,080,093 | ) |

Net realized gains ($1.423 and $0.124 per

share, respectively) | | | (59,599,089 | ) | | | (5,103,734 | ) |

| | |

|

|

| |

|

|

|

Total distributions | | | (66,531,737 | ) | | | (14,183,827 | ) |

| | |

|

|

| |

|

|

|

| | |

Shares of Beneficial Interest | | | | | | | | |

Increase (decrease) from share transactions | | | 32,754,527 | | | | (31,968,568 | ) |

| | |

|

|

| |

|

|

|

Total increase | | | 79,221,882 | | | | 287,742,853 | |

| | |

Net Assets — Beginning of period | | | 1,655,278,532 | | | | 1,367,535,679 | |

| | |

|

|

| |

|

|

|

Net Assets — End of period | | $ | 1,734,500,414 | | | $ | 1,655,278,532 | |

| | |

|

|

| |

|

|

|

Accumulated net investment income | | $ | — | | | $ | 36,735 | |

| | |

|

|

| |

|

|

|

See notes to the financial statements.

12

The Torray Fund

FINANCIAL HIGHLIGHTS

For a share outstanding throughout each year:

PER SHARE DATA

| | | | | | | | | | | | | | | | | | | | |

| | | Years ended December 31:

| |

| | | 2004

| | | 2003

| | | 2002

| | | 2001

| | | 2000

| |

Net Asset Value,

Beginning of Period | | $ | 39.980 | | | $ | 32.240 | | | $ | 37.530 | | | $ | 39.790 | | | $ | 44.310 | |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

Income from investment operations | | | | | | | | | | | | | | | | | | | | |

Net investment income | | | 0.165 | | | | 0.220 | | | | 0.205 | | | | 0.172 | | | | 0.265 | |

Net gains (losses) on securities (both realized and unrealized) | | | 2.523 | | | | 7.864 | | | | (5.083 | ) | | | (0.489 | ) | | | (1.730 | ) |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

Total from investment operations | | | 2.688 | | | | 8.084 | | | | (4.878 | ) | | | (0.317 | ) | | | (1.465 | ) |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

Less: distributions | | | | | | | | | | | | | | | | | | | | |

Dividends (from net investment income) | | | (0.165 | ) | | | (0.220 | ) | | | (0.205 | ) | | | (0.184 | ) | | | (0.253 | ) |

Distributions (from capital gains) | | | (1.423 | ) | | | (0.124 | ) | | | (0.207 | ) | | | (1.759 | ) | | | (2.802 | ) |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

Total distributions | | | (1.588 | ) | | | (0.344 | ) | | | (0.412 | ) | | | (1.943 | ) | | | (3.055 | ) |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

Net Asset Value,

End of Period | | $ | 41.080 | | | $ | 39.980 | | | $ | 32.240 | | | $ | 37.530 | | | $ | 39.790 | |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

TOTAL RETURN(1) | | | 6.90 | % | | | 25.19 | % | | | (13.05 | %) | | | (0.52 | %) | | | (3.38 | %) |

RATIOS/SUPPLEMENTAL DATA | | | | | | | | | | | | | | | | | | | | |

Net assets, end of period (000’s omitted) | | $ | 1,734,500 | | | $ | 1,655,279 | | | $ | 1,367,536 | | | $ | 1,638,814 | | | $ | 1,820,972 | |

Ratios of expenses to average net assets | | | 1.08 | % | | | 1.11 | % | | | 1.07 | % | | | 1.07 | % | | | 1.06 | % |

Ratios of net income to average net assets | | | 0.41 | % | | | 0.62 | % | | | 0.58 | % | | | 0.45 | % | | | 0.64 | % |

Portfolio turnover rate | | | 27.12 | % | | | 37.11 | % | | | 22.52 | % | | | 37.56 | % | | | 45.44 | % |

| (1) | | Past performance is not predictive of future performance. |

See notes to the financial statements.

13

The Torray Fund

NOTES TO FINANCIAL STATEMENTS

As of December 31, 2004

NOTE 1 — SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

The Torray Fund (“Fund”) is a separate series of The Torray Fund (“Trust”). The Trust is registered under the Investment Company Act of 1940 as a no-load, diversified, open-end management investment company. The Trust was organized as a business trust under Massachusetts law. The Fund’s primary investment objective is to provide long-term total return. The Fund seeks to meet its objective by investing its assets in a diversified portfolio of common stocks. In order to accomplish these goals, the Fund intends to hold stocks for the long term, as opposed to actively buying and selling. There can be no assurances that the Fund’s investment objectives will be achieved.

The following is a summary of accounting policies followed by the Fund in the preparation of its financial statements. These policies are in conformity with accounting principles generally accepted in the United States of America.

Securities Valuation Portfolio securities for which market quotations are readily available are valued at market value, which is determined by using the last reported sale price, or, if no sales are reported, the last reported bid price. For NASDAQ traded securities, market value is determined on the basis of the NASDAQ official closing price (the “NOCP”) instead of the last reported sales price. Other assets and securities for which no quotations are readily available or for which The Torray Corporation (the “Advisor”) believes do not reflect market value are valued at fair value as determined in good faith by the Advisor under the supervision of the Board of Trustees. Short-term obligations having remaining maturities of 60 days or less are valued at amortized cost, which approximates market value.

Securities Transactions and Investment Income Securities transactions are recorded on a trade date basis. Realized gains and losses from securities transactions are recorded on the specific identification basis. Dividend income and distributions to shareholders are recorded on the ex-dividend date. Interest income, including amortization of discount on short-term investments, and expenses are recorded on the accrual basis.

Federal Income Taxes The Fund intends to continue to comply with the requirements of the Internal Revenue Code applicable to regulated investment companies and to distribute all of its taxable income, including any net realized gain on investments to its shareholders. Therefore, no Federal income tax provision is required.

Net Asset Value The net asset value per share of the Fund is determined daily as of the close of trading on the New York Stock Exchange by dividing the value of the Fund’s net assets by the number of shares outstanding.

Use of Estimates In preparing financial statements in accordance with accounting principles generally accepted in the United States of America, management is required to make estimates and assumptions that affect the reported amounts of assets and liabilities and the disclosure of contingent assets and liabilities at the date of the financial statements, and the reported amounts of increases and decreases in net assets from operations during the reporting period. Actual results could differ from those estimates.

14

The Torray Fund

NOTES TO FINANCIAL STATEMENTS (continued)

As of December 31, 2004

NOTE 2 — SHARES OF BENEFICIAL INTEREST TRANSACTIONS

Transactions in shares of beneficial interest were as follows:

| | | | | | | | | | | | | | |

| | | Year ended 12/31/04

| | | Year ended 12/31/03

| |

| | | Shares

| | | Amount

| | | Shares

| | | Amount

| |

Shares issued | | 6,330,626 | | | $ | 254,788,909 | | | 6,185,253 | | | $ | 219,046,893 | |

Reinvestments of dividends and distributions | | 1,586,647 | | | | 63,147,856 | | | 367,157 | | | | 13,313,016 | |

Shares redeemed | | (7,099,087 | ) | | | (285,182,238 | ) | | (7,567,966 | ) | | | (264,328,477 | ) |

| | |

|

| |

|

|

| |

|

| |

|

|

|

| | | 818,186 | | | $ | 32,754,527 | | | (1,015,556 | ) | | $ | (31,968,568 | ) |

| | |

|

| |

|

|

| |

|

| |

|

|

|

Officers, Trustees and affiliated persons of The Torray Fund and their families directly or indirectly control 1,893,136 shares or 4.48% of the Fund.

NOTE 3 — INVESTMENT TRANSACTIONS

Purchases and sales of investment securities, other than short-term investments, for the year ended December 31, 2004, aggregated $457,022,698 and $481,037,986, respectively.

NOTE 4 — MANAGEMENT FEES

Pursuant to the Management Contract, The Torray Corporation provides investment advisory and administrative services to the Fund. The Fund pays The Torray Corporation a management fee, computed daily and payable monthly at the annual rate of one percent of the Fund’s average daily net assets. For the year ended December 31, 2004, The Torray Fund paid management fees of $16,893,454.

Excluding the management fee, other expenses incurred by the Fund during the year ended December 31, 2004, totaled $1,338,881. These expenses include all costs associated with the Fund’s operations including transfer agent fees, Independent Trustees’ fees ($10,000 per annum and $1,000 for each Board meeting attended), taxes, dues, fees and expenses of registering and qualifying the Fund and its shares for distribution, charges of custodian, auditing and legal expenses, insurance premiums, supplies, postage, expenses of issue or redemption of shares, re- ports to shareholders and Trustees, expenses of printing and mailing prospectuses, proxy statements and proxies to existing shareholders, and other miscellaneous expenses.

Certain officers and Trustees of the Fund are also officers and/or shareholders of The Torray Corporation.

15

The Torray Fund

NOTES TO FINANCIAL STATEMENTS (continued)

As of December 31, 2004

NOTE 5 — TAX MATTERS

Distributions to shareholders are determined in accordance with federal income tax regulations which may differ from accounting principles generally accepted in the United States of America.

The tax character of distributions paid during 2004 and 2003 were as follows:

| | | | | | |

| | | 2004

| | 2003

|

Distributions paid from: | | | | | | |

Ordinary income | | $ | 13,670,506 | | $ | 14,183,827 |

Long-term capital gain | | | 52,861,231 | | | — |

| | |

|

| |

|

|

| | | $ | 66,531,737 | | $ | 14,183,827 |

| | |

|

| |

|

|

As of December 31, 2004, the components of distributable earnings on a tax basis were as follows:

| | | | | |

Undistributed long-term gain | | $ | 9,555,581 | | |

Unrealized appreciation | | | 294,247,320 | | |

| | |

|

| | |

| | | $ | 303,802,901 | | |

| | |

|

| | |

The following information is based upon the federal income tax basis of investment securities as of December 31, 2004:

| | | | | | |

Gross unrealized appreciation | | $ | 330,408,895 | | | |

Gross unrealized depreciation | | | (36,161,575 | ) | | |

| | |

|

|

| | |

Net unrealized appreciation | | $ | 294,247,320 | | | |

| | |

|

|

| | |

Federal income tax basis | | $ | 1,438,977,425 | | | |

| | |

|

|

| | |

The primary difference between book basis and tax basis distributions and distributable earnings is different book and tax treatment of short-term capital gains and the tax deferral of losses on wash sales.

NOTE 6 — COMMITMENTS AND CONTINGENCIES

The Fund indemnifies its officers and trustees for certain liabilities that may arise from their performance of their duties to the Fund. Additionally, in the normal course of business, the Fund enters into contracts that contain a variety of representations and warranties and which provide general indemnifications. The Fund’s maximum exposure under these arrangements is unknown, as this would involve future claims that may be made against the Fund that have not yet occurred.

16

The Torray Fund

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

As of December 31, 2004

To the Shareholders and Board of Trustees

The Torray Fund

Bethesda, Maryland

We have audited the statement of assets and liabilities of The Torray Fund, a series of shares of beneficial interest of The Torray Fund, including the schedule of investments, as of December 31, 2004, and the related statement of operations for the year then ended, the statements of changes in net assets for each of the two years then ended and the financial highlights for each of the five years then ended. These financial statements and financial highlights are the responsibility of the Fund’s management. Our responsibility is to express an opinion on these financial statements and financial highlights based on our audit.

We conducted our audits in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements and financial highlights are free of material misstatement. An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements. Our procedures included confirmation of securities owned as of December 31, 2004 by correspondence with the custodian. An audit also includes assessing the accounting principles used and significant estimates made by management, as well as evaluating the overall financial statement presentation. We believe that our audit provides a reasonable basis for our opinion.

In our opinion, the financial statements and financial highlights referred to above present fairly, in all material respects, the financial position of The Torray Fund as of December 31, 2004, the results of its operations for the year then ended, the changes in its net assets for each of the two years then ended, and the financial highlights for each of the five years then ended in conformity with accounting principles generally accepted in the United States of America.

BRIGGS, BUNTING & DOUGHERTY, LLP

Philadelphia, Pennsylvania

January 20, 2005

17

The Torray Fund

FUND MANAGEMENT (unaudited)

As of December 31, 2004

Information pertaining to the Trustees and Officers of The Trust is set forth below. The Statement of Additional

Information (SAI) includes additional information about the Trustees and is available without charge, upon request, by calling (800) 443-3036.

| | | | | | | | |

Name, Birthdate,

Address* and

Positions

with the Trust | | Term of Office

and Length of

Time Served | | Principal Occupation(s)

During Past 5 Years | | Portfolios

Overseen

by Trustee | | Other Trusteeships/

Directorships Held

by Trustee |

DISINTERESTED TRUSTEES |

Bruce C. Ellis

07/20/44

Trustee | | Indefinite Term Since Jun 1993 | | Private Investor

Bethesda, Maryland | | 2 | | |

Robert P. Moltz

10/03/47

Trustee | | Indefinite Term Since Nov 1990 | | President, CEO

Weaver Bros Insurance Assoc.

Bethesda, Maryland | | 2 | | |

Roy A. Schotland

03/18/33

Trustee | | Indefinite Term Since Nov 1990 | | Professor of Law

Georgetown University Law Center

Washington, D.C. | | 2 | | Director

Custodial Trust Co.,

a Bear Stearns subsidiary |

Wayne H. Shaner

08/23/47

Trustee | | Indefinite Term Since Jun 1993 | | Managing Partner Rockledge Partners, L.L.C.

Bethesda, Maryland Managing Director (through 1/2/04) Lockheed Martin Investment Management Co. Bethesda, Maryland | | 2 | | |

Dr. Charlene Nunley

09/26/50

Trustee | | Indefinite Term Since May 2002 | | President

Montgomery College

Rockville, Maryland | | 2 | | |

Dr. Carl MacCartee

01/09/41

Trustee | | Indefinite Term Since May 2002 | | Medical Doctor

MacCartee, Haas, Grossman, Connell & Shaffer P.A. Chevy Chase, Maryland | | 2 | | |

Dr. Patricia Kavanagh

11/01/49 Trustee | | Indefinite Term Since May 2002 | | Medical Doctor, Resident Neurological Institute at Columbia Presbyterian New York, New York | | 2 | | |

INTERESTED TRUSTEES |

William M Lane 05/21/50 President, Secretary, Trustee | | Indefinite Term Since Nov 1990 | | President and Trustee, The Torray Fund

Vice President, Robert E. Torray & Co. Inc.

Vice President, The Torray Corporation Bethesda, Maryland | | 2 | | |

Douglas C. Eby 07/28/59 Vice President, Treasurer, Trustee | | Indefinite Term Since May 2002 | | President, Robert E. Torray & Co. Inc.

Vice President and Treasurer

The Torray Corporation

Bethesda, Maryland | | 2 | | Director

Markel Corporation

Richmond, Virginia |

Robert E. Torray 04/10/37 Trustee | | Indefinite Term Since May 2002 | | Chairman, Robert E. Torray & Co. Inc.

President, The Torray Corporation

Bethesda, Maryland | | 2 | | Director

CarrAmerica Realty

Washington, D.C. |

| * | | All addresses are c/o The Torray Fund, 7501 Wisconsin Avenue, Suite 1100, Bethesda, MD 20814-6523 |

18

The Torray Fund

PORTFOLIO HOLDINGS, PROXY VOTING AND PROCEDURES (unaudited)

As of December 31, 2004

The Fund files its complete schedule of portfolio holdings with the Securities and Exchange Commission (the “Commission”) for the first and third quarters of each fiscal year on Form N-Q. The Fund’s Forms N-Q are available on the Commission’s website at http://www.sec.gov. The Fund’s Form N-Q may be reviewed and copied at the Commission’s Public Reference Room in Washington, D.C. Information on the operation of the Commission’s Public Reference Room may be obtained by calling 1-800-SEC-0330.

A description of the policies and procedures that the Fund uses to determine how to vote proxies relating to portfolio securities is available without charge, upon request, by calling 1-800-443-3036; and on the Commission’s website at http://www.sec.gov.

Information regarding how the Fund voted proxies relating to portfolio securities is available without charge, upon request, by calling 1-800-443-3036; and on the Commission’s website at http://www.sec.gov.

19

The Torray Fund

ABOUT YOUR FUND’S EXPENSES (unaudited)

As of December 31, 2004

We believe it is important for you to understand the impact of costs on your investment. All mutual funds have operating expenses. As a shareholder of the Fund, you incur ongoing costs, including management fees, and other fund expenses. Operating expenses, which are deducted directly from the Fund’s gross income, directly reduce the investment return of the Fund.

A fund’s expenses are expressed as a percentage of its average net assets. This figure is known as the expense ratio. The following examples are intended to help you understand the ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds. The examples below are based on an investment of $1,000 made at the beginning of the period shown and held for the entire period.

The table on the next page illustrates the Fund’s cost in two ways:

Actual Fund Return This section helps you estimate the actual expenses that you paid over the period. The “Ending Account Value” shown is derived from the Fund’s actual return, and the third column shows the operating expenses that would have been paid by an investor who started with $1,000 in the Fund. You may use the information here, together with the amount invested, to estimate the expenses that you paid over the period. To do so, simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number given for the Fund under the heading “Expenses Paid During Period” on the next page.

Hypothetical 5% return This section is intended to help you compare your Fund’s costs with those of other mutual funds. It assumes that the Fund had an annual return of 5% before expenses, and that the expense ratio is unchanged. In this case, because the return used is not the Fund’s actual return, the results do not apply to your investment. The example is useful in making comparisons because the Securities and Exchange Commission requires all mutual funds to calculate expenses based on a 5% return. You can assess the Fund’s costs by comparing this hypothetical example with the hypothetical examples that appear in shareholder reports of other funds.

Note that expenses shown in the table are meant to highlight and help you compare ongoing costs only. The Fund does not charge transactions fees, such as purchase or redemption fees, nor does it carry a “sales load.”

The calculation assumes no shares were bought or sold during the period. Your actual costs may have been higher or lower, depending on the amount of your investment and the timing of any purchases or redemptions.

20

The Torray Fund

ABOUT YOUR FUND’S EXPENSES (unaudited)

As of December 31, 2004

More information about the Fund’s expenses, including recent annual expense ratios, can be found in this report. For additional information on operating expenses and other shareholder costs, please refer to the Fund’s prospectus.

| | | | | | | | | |

| | | Beginning

Account Value

June 30, 2004

| | Ending

Account Value

December 31, 2004

| | Expenses Paid

During Period

|

Based on Actual Fund Return | | $ | 1,000.00 | | $ | 1,043.36 | | $ | 5.50 |

Based on Hypothetical 5% Return

(before expenses) | | $ | 1,000.00 | | $ | 1,019.76 | | $ | 5.43 |

21

The Torray Fund

TAX INFORMATION (unaudited)

As of December 31, 2004

We are required to advise you within 60 days of the Fund’s fiscal year-end regarding the federal tax status of certain distributions received by shareholders during such fiscal year. The information below is provided for the Fund’s fiscal year ending December 31, 2004.

During the fiscal year, the Fund paid a long-term capital gain distribution of $13,670,506.

Individual shareholders are eligible for reduced tax rates on qualified dividend income. For purposes of computing this exclusion, all of the dividends paid by the Fund from ordinary income earned during the fiscal year are considered qualified dividend income.

Corporate shareholders may exclude up to 70% of qualifying dividends. For the purposes of computing this exclusion, all of the dividends paid by the Fund from ordinary income earned during the fiscal year represent qualifying dividends.

Dividends and distributions received by retirement plans such as IRA’s, Keogh-type plans and 403(b) plans need not be reported as taxable income. However, many retirement plan trusts may need this information for their annual information reporting.

22

TRUSTEES

Douglas C. Eby

Bruce C. Ellis

Patricia Kavanagh

William M Lane

Carl C. MacCartee, Jr.

Robert P. Moltz

Charlene R. Nunley

Roy A. Schotland

Wayne H. Shaner

Robert E. Torray

INVESTMENT ADVISOR

The Torray Corporation

OFFICERS

Robert E. Torray, President

Douglas C. Eby, Vice President

William M Lane, Vice President

INDEPENDENT REGISTERED PUBLIC

ACCOUNTING FIRM

Briggs, Bunting & Dougherty, LLP

Two Penn Center Plaza, Suite 820

Philadelphia, PA 19102-1732

TRANSFER AGENT

PFPC Inc.

760 Moore Road

King of Prussia, PA 19406-1212

LEGAL COUNSEL

Dechert

1775 Eye Street, N.W.

Washington, D.C. 20006

This report is not authorized for distribution to prospective investors unless preceded or accompanied by a current prospectus.

The

TORRAY

FUND

ANNUAL REPORT

December 31, 2004

The Torray Fund

Suite 1100

7501 Wisconsin Avenue

Bethesda, Maryland 20814-6523

(301) 493-4600

(800) 443-3036

The Torray Institutional Fund

Letter to Shareholders

February 10, 2005

Dear Fellow Shareholders,

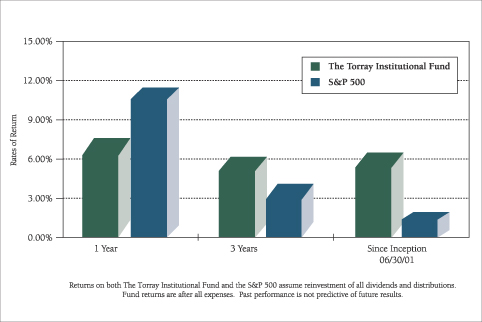

The Torray Institutional Fund gained 7% during 2004, bringing its return since inception three and a half years ago to 6% compounded annually. By comparison, the Standard & Poor’s 500 Index returned 10.9% and 1.4%, respectively. While we are disappointed not to have done better for you last year, our policy of investing in high quality businesses that generate rising earnings and free cash flow was temporarily out of vogue. Although we believe our approach is the soundest way to succeed over the long term, in the short run, anything can happen and, in 2004, it did.

Strength in the economy, surging oil prices, unusually strong world demand for commodities, and a dramatic recovery in a number of depressed industries were the key elements in the market’s advance. These factors combined to cause extraordinary gains in the stocks of companies in economically sensitive sectors like oil, metals, mining, fertilizer, transportation (except airlines), home building and others. Utilities were bid up by investors looking for income. Overall, there were so many winners, throwing darts at the stock page might have produced a higher return than we did. Nevertheless, having watched these cycles for more than four decades, we are convinced that our philosophy is the best one, and we’re sticking with it.

We will explain why. As a general rule — and this is an observation, not a criticism — the companies to which we have just referred, though important to the economy and their employees, do not have records or prospects that meet our investment criteria. Most are cyclical — meaning their sales and earnings rise and fall with the economy. They are also capital intensive and, in many cases, subject to brutal competition. As a result, profit margins and returns on equity tend to be modest, and growth prospects mediocre. Excluding periods of robust demand for their products and services — the recent experience — they produce limited and, in some instances, no free cash flow. That term refers to money left over after all costs of operating and maintaining the business have been met. It may be used for dividends, share repurchases, acquisitions, debt reduction, and so on. If there is none, the value of the enterprise cannot increase, and the stock will merely move up and down, reflecting fluctuations in underlying fundamentals and investor preferences.

Torray Institutional Fund companies are different. As a group they have generated rising earnings and tremendous free cash flow — the only factors that produce long-term appreciation in stocks. Managements are sound, balance sheets strong, capital requirements minimal, and the franchises have sustainable competitive advantages.

1

The Torray Institutional Fund

Letter to Shareholders

February 10, 2005

But, last year, markets were not focused on these aspects. Instead, as noted, attention centered on sectors more closely tied to the economy’s cyclical recovery. If investors, knowing all the facts, were given a choice between owning the companies in our Fund and those described above — the only hitch being they couldn’t sell for 20 years — we think most would select the former. Benjamin Graham, the father of security analysis, observed more than half a century ago that in the short run the market is a voting machine, but in the long run it’s a weighing machine. We believe your investment in The Torray Institutional Fund will weigh enough in the future to meet your financial goals.

Some, we know, will say “forget all that, just buy something, anything that will go up.” We sympathize. But, the urge to do this is exactly what gets people into trouble. Besides, we would not know which stocks to choose. It’s always a good idea when you’re tempted to go down this road to ask yourself — and be honest —have I or has anyone I know made money — net of losses and taxes — trying to pick near-term winners? In conclusion on these points, we reaffirm our confidence in the Fund’s portfolio and determination to ride it out pretty much as is.

We believe the record supports our persistence. The Torray Fund, which we started 14 years ago, has earned 14.1% compounded annually, versus 12.0% for the S&P 500 and, by coincidence, our affiliate Robert E. Torray & Co., a manager of large institutional portfolios, has produced the same annualized return for 32 years, turning $1 into $68. The market, measured by the S&P 500, grew $1 into $29. Over the past decade, the comparison is even more favorable: 14.9% for The Torray Fund, 12.1% for the Index.

At the risk of overkill, we will also mention that our record looks good when compared to mutual fund industry averages. Over the last 10 years, (14 year numbers are not published), The Torray Fund ranks in the top 8% of all domestic stock funds, and the top 3% of those considered to be similar in style and objective. After taxes, it stands among the top 3% and 1%, respectively.

These numbers highlight the importance of maintaining a long-term perspective. However, we realize that during periods like this, it’s only natural for people to become impatient and start switching things around. But, as detailed in our 2003 mid-year report, studies have shown this tendency has substantially slashed returns. As we have said in the past, we think it makes

2

The Torray Institutional Fund

Letter to Shareholders

February 10, 2005

sense to stick with a few funds that have competent, experienced management and a good track record, and then be resigned to the fact there will always be others — though not many — performing better. We accept that. Our goal is to provide you with a safe investment that will earn more, net of expenses, than you are likely to make on your own or in an index fund — not every month, every quarter, every year, but over your lifetime. We also endeavor to communicate in plain language what we’re doing and why; and to put important issues in perspective to help you evaluate the crushing oversupply of investment products and the endless, often confusing, barrage of advice from experts.

Thank you once again for entrusting your savings to us. The protection and growth of your investment is our top priority.

| | | | |

| Sincerely, | | | | |

| | |

| | | |  |

| Robert E. Torray | | | | Douglas C. Eby |

3

The Torray Institutional Fund

PERFORMANCE DATA

As of December 31, 2004

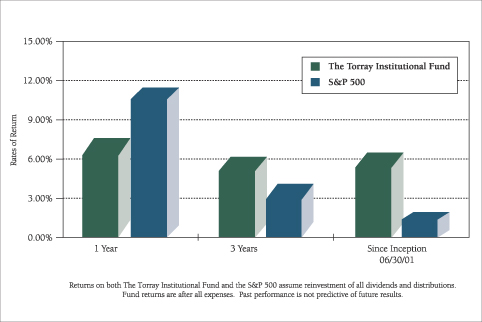

Total Rates of Return on an Investment in The Torray Institutional Fund vs. the S&P 500

For the periods ended December 31, 2004:

| | | | | | |

| | | 1 Year

| | 3 Years

| | Since

Inception

06/30/01

|

The Torray Institutional Fund | | 6.96% | | 5.60% | | 5.96% |

S&P 500 | | 10.87% | | 3.58% | | 1.43% |

Cumulative Returns for the 3.5 years ended December 31, 2004

| | | |

Torray Institutional Fund | | 22.46 | % |

S&P 500 | | 5.11 | % |

4

The Torray Institutional Fund

PERFORMANCE DATA

As of December 31, 2004

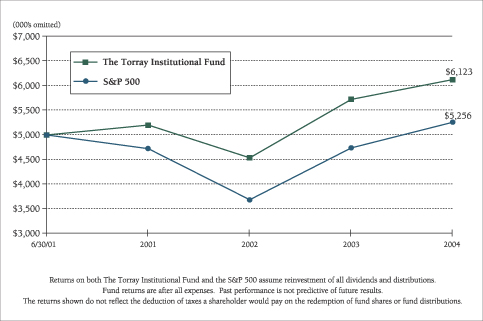

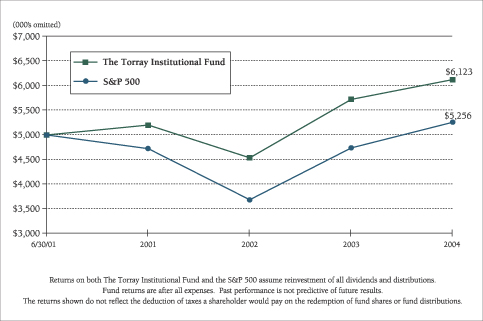

Change in Value of $5,000,000 Invested on June 30, 2001 (commencement of operations) to:

| | | | | | | | | | | | | | | |

| | | 06/30/01

| | 12/31/01

| | 12/31/02

| | 12/31/03

| | 12/31/04

|

The Torray Institutional Fund | | $ | 5,000,000 | | $ | 5,199,000 | | $ | 4,537,500 | | $ | 5,724,500 | | $ | 6,123,000 |

S&P 500 | | $ | 5,000,000 | | $ | 4,723,000 | | $ | 3,682,500 | | $ | 4,739,000 | | $ | 5,255,500 |

5

The Torray Institutional Fund

FUND PROFILE (unaudited)

As of December 31, 2004

DIVERSIFICATION (% of net assets)

| | |

Diversified Financial Services | | 23.80% |

Media & Entertainment | | 14.21% |

Diversified Manufacturing | | 10.19% |

Data Processing & Management | | 7.67% |

Pharmaceuticals | | 7.42% |

Aerospace & Defense | | 7.32% |

Health Care Services | | 5.27% |

Communications Services | | 5.06% |

Diversified Medical Products | | 4.97% |

Beverages | | 3.93% |

Diversified Telecommunication Services | | 2.57% |

Specialty Retail | | 2.31% |

Electronic Equipment | | 1.80% |

Banking | | 0.98% |

Utilities | | 0.68% |

Real Estate | | 0.60% |

Computer Systems & Integration | | 0.57% |

Energy | | 0.15% |

Other Assets Less Liabilities | | 0.50% |

| | |

|

| | | 100.00% |

TOP TEN HOLDINGS

| | |

| 1. | | Amgen Inc. |

| 2. | | Cardinal Health, Inc. |

| 3. | | Franklin Resources, Inc. |

| 4. | | Univision Communications Inc. |

| 5. | | The Walt Disney Company |

| 6. | | First Data Corporation |

| 7. | | AMBAC Financial Group, Inc. |

| 8. | | Anheuser-Busch Cos., Inc. |

| 9. | | Illinois Tool Works Inc. |

| 10. | | The DIRECTV Group, Inc. |

PORTFOLIO CHARACTERISTICS

| | | | |

Net Assets (million) | | | | $1,013 |

Number of Stocks | | | | 39 |

Portfolio Turnover | | | | 16.12% |

P/E Multiple (forward) | | | | 17.8x |

Portfolio Yield | | | | 1.30% |

Market Capitalization | | Average | | 55.6 B |

| | | Median | | 25.0 B |

6

The Torray Institutional Fund

SCHEDULE OF INVESTMENTS

As of December 31, 2004

| | | | | | | |

| | | Shares

| | | | Market Value

|

| COMMON STOCK 99.50 % |

|

| 23.80% DIVERSIFIED FINANCIAL SERVICES |

| | | 701,900 | | Franklin Resources, Inc. | | $ | 48,887,335 |

| | | 518,700 | | AMBAC Financial Group, Inc. | | | 42,600,831 |

| | | 85,500 | | Markel Corporation * | | | 31,122,000 |

| | | 676,412 | | JPMorgan Chase & Co. | | | 26,386,832 |

| | | 385,900 | | American International Group, Inc. | | | 25,342,053 |

| | | 961,300 | | Allied Capital Corporation | | | 24,839,992 |

| | | 136,000 | | Fairfax Financial Holdings Limited | | | 22,916,000 |

| | | 1,446,800 | | LaBranche & Co. Inc. * | | | 12,963,328 |

| | | 104,500 | | American Express Company | | | 5,890,665 |

| | | | | | |

|

|

| | | | | | | | 240,949,036 |

|

| 14.21% MEDIA & ENTERTAINMENT |

| | | 1,619,900 | | Univision Communications Inc. * | | | 47,414,473 |

| | | 1,643,700 | | The Walt Disney Company | | | 45,694,860 |

| | | 512,200 | | Tribune Company | | | 21,584,108 |

| | | 545,300 | | Clear Channel Communications, Inc. | | | 18,262,097 |

| | | 134,300 | | Gannett Co., Inc. | | | 10,972,310 |

| | | | | | |

|

|

| | | | | | | | 143,927,848 |

|

| 10.19% DIVERSIFIED MANUFACTURING |

| | | 402,700 | | Illinois Tool Works Inc. | | | 37,322,236 |

| | | 715,600 | | General Electric Company | | | 26,119,400 |

| | | 345,500 | | Emerson Electric Co. | | | 24,219,550 |

| | | 270,300 | | Danaher Corporation | | | 15,517,923 |

| | | | | | |

|

|

| | | | | | | | 103,179,109 |

|

| 7.67% DATA PROCESSING & MANAGEMENT |

| | | 1,022,500 | | First Data Corporation | | | 43,497,150 |

| | | 769,300 | | Automatic Data Processing, Inc. | | | 34,118,455 |

| | | | | | |

|

|

| | | | | | | | 77,615,605 |

7

The Torray Institutional Fund

SCHEDULE OF INVESTMENTS (continued)

As of December 31, 2004

| | | | | | | |

| | | Shares

| | | | Market Value

|

|

| 7.42% PHARMACEUTICALS |

| | | 931,800 | | Amgen Inc. * | | $ | 59,774,970 |

| | | 570,800 | | Pfizer Inc. | | | 15,348,812 |

| | | | | | |

|

|

| | | | | | | | 75,123,782 |

| |

| 7.32% AEROSPACE & DEFENSE | | | |

| | | 314,200 | | General Dynamics Corporation | | | 32,865,320 |

| | | 220,400 | | United Technologies Corporation | | | 22,778,340 |

| | | 523,200 | | Honeywell International Inc. | | | 18,526,512 |

| | | | | | |

|

|

| | | | | | | | 74,170,172 |

| |

| 5.27% HEALTH CARE SERVICES | | | |

| | | 918,400 | | Cardinal Health, Inc. | | | 53,404,960 |

| |

| 5.06% COMMUNICATIONS SERVICES | | | |

| | | 2,148,544 | | The DIRECTV Group, Inc. * | | | 35,966,627 |

| | | 460,700 | | EchoStar Communications Corporation | | | 15,313,668 |

| | | | | | |

|

|

| | | | | | | | 51,280,295 |

| |

| 4.97% DIVERSIFIED MEDICAL PRODUCTS | | | |

| | | 593,100 | | Abbott Laboratories | | | 27,668,115 |

| | | 356,900 | | Johnson & Johnson | | | 22,634,598 |

| | | | | | |

|

|

| | | | | | | | 50,302,713 |

| |

| 3.93% BEVERAGES | | | |

| | | 783,700 | | Anheuser-Busch Cos., Inc. | | | 39,757,101 |

| |

| 2.57% DIVERSIFIED TELECOMMUNICATION SERVICES | | | |

| | | 1,010,400 | | SBC Communications Inc. | | | 26,038,008 |

| |

| 2.31% SPECIALTY RETAIL | | | |

| | | 518,200 | | O’Reilly Automotive, Inc. * | | | 23,344,910 |

| |

| 1.80% ELECTRONIC EQUIPMENT | | | |

| | | 756,800 | | Agilent Technologies, Inc. * | | | 18,238,880 |

| |

| 0.98% BANKING | | | |

| | | 212,000 | | Bank of America Corporation | | | 9,961,880 |

8

The Torray Institutional Fund

SCHEDULE OF INVESTMENTS (continued)

As of December 31, 2004

| | | | | | | | |

| | | Shares

| | | | Market Value

| |

| |

| 0.68% UTILITIES | | | | |

| | | 655,400 | | Sierra Pacific Resources * | | $ | 6,881,700 | |

| |

| 0.60% REAL ESTATE | | | | |

| | | 184,000 | | CarrAmerica Realty Corporation | | | 6,072,000 | |

| |

| 0.57% COMPUTER SYSTEMS & INTEGRATION | | | | |

| | | 272,400 | | Hewlett-Packard Company | | | 5,712,228 | |

| |

| 0.15% ENERGY | | | | |

| | | 75,000 | | Pengrowth Energy Trust “A” | | | 1,561,500 | |

| | | | | | |

|

|

|

| TOTAL COMMON STOCK 99.50% | | | | |

| (cost $895,164,112) | | | | | 1,007,521,727 | |

| SHORT-TERM INVESTMENTS 1.25% | | | | |

| (cost $12,666,312) | | PNC Bank Money Market Account, 1.83% | | | 12,666,312 | |

| | | | | | |

|

|

|

| TOTAL PORTFOLIO SECURITIES 100.75% | | | | |

| (amortized cost $907,830,424) | | | 1,020,188,039 | |

| LIABILITIES LESS OTHER ASSETS (.75)% | | | (7,621,930 | ) |

| | | | | | |

|

|

|

| NET ASSETS 100.00% | | $ | 1,012,566,109 | |

| | |

|

|

|

| * | | Non-income producing securities |

See notes to the financial statements.

9

The Torray Institutional Fund

STATEMENT OF ASSETS AND LIABILITIES

As of December 31, 2004

| | | |

ASSETS | | | |

Investments in securities at value

(amortized cost $907,830,424) | | $ | 1,020,188,039 |

Receivable for fund shares sold | | | 4,313,524 |

Interest and dividends receivable | | | 1,120,535 |

| | |

|

|

TOTAL ASSETS | | | 1,025,622,098 |

| | |

|

|

| |

LIABILITIES | | | |

Payable for investments purchased | | | 11,738,155 |

Payable to Advisor | | | 708,830 |

Payable for fund shares redeemed | | | 609,004 |

| | |

|

|

TOTAL LIABILITIES | | | 13,055,989 |

| | |

|

|

| |

NET ASSETS | | $ | 1,012,566,109 |

| | |

|

|

Shares of beneficial interest ($1 stated value,

8,707,312 shares outstanding, unlimited

shares authorized) | | $ | 8,707,312 |

Paid-in-capital in excess of par | | | 889,042,205 |

Accumulated net realized gain | | | 2,458,977 |

Net unrealized appreciation of investments | | | 112,357,615 |

| | |

|

|

| |

TOTAL NET ASSETS | | $ | 1,012,566,109 |

| | |

|

|

Per Share | | $ | 116.29 |

| | |

|

|

See notes to the financial statements.

10

The Torray Institutional Fund

STATEMENT OF OPERATIONS

For the year ended December 31, 2004

| | | |

INVESTMENT INCOME | | | |

Dividend income | | $ | 10,896,446 |

Interest income | | | 61,276 |

| | |

|

|

Total income | | | 10,957,722 |

| | |

|

|

| |

EXPENSES | | | |

Management fees | | | 6,600,243 |

| | |

|

|

Total expenses | | | 6,600,243 |

| | |

|

|

NET INVESTMENT INCOME | | | 4,357,479 |

| | |

|

|

REALIZED AND UNREALIZED GAIN

ON INVESTMENTS | | | |

Net realized gain on investments | | | 9,075,617 |

Capital gain distributions from investment companies | | | 809,540 |

Net change in unrealized appreciation on investments | | | 46,162,153 |

| | |

|

|

Net realized and unrealized gain on investments | | | 56,047,310 |

| | |

|

|

NET INCREASE IN NET ASSETS FROM OPERATIONS | | $ | 60,404,789 |

| | |

|

|

See notes to the financial statements.

11

The Torray Institutional Fund

STATEMENTS OF CHANGES IN NET ASSETS

For the years indicated:

| | | | | | | | |

| | | Year ended

12/31/04

| | | Year ended

12/31/03

| |

Increase in Net Assets from Operations: | | | | | | | | |

Net investment income | | $ | 4,357,479 | | | $ | 2,810,909 | |

Net realized gain on investments | | | 9,075,617 | | | | 10,210,025 | |

Capital gain distributions from investment companies | | | 809,540 | | | | | |

Net change in unrealized appreciation on investments | | | 46,162,153 | | | | 73,157,304 | |

| | |

|

|

| |

|

|

|

Net increase in net assets from operations | | | 60,404,789 | | | | 86,178,238 | |

| | |

|

|

| |

|

|

|

| | |

Distributions to Shareholders from: | | | | | | | | |

Net investment income ($0.588 and $0.671 per share, respectively) | | | (4,367,472 | ) | | | (2,801,257 | ) |

Net realized gains ($1.255 and $1.556 per share, respectively) | | | (9,678,951 | ) | | | (7,779,240 | ) |

| | |

|

|

| |

|

|

|

Total distributions | | | (14,046,423 | ) | | | (10,580,497 | ) |

| | |

|

|

| |

|

|

|

| | |

Shares of Beneficial Interest | | | | | | | | |

Increase from share transactions | | | 368,025,136 | | | | 384,869,414 | |

| | |

|

|

| |

|

|

|

Total increase | | | 414,383,502 | | | | 460,467,155 | |

| | |

Net Assets — Beginning of period | | | 598,182,607 | | | | 137,715,452 | |

| | |

|

|

| |

|

|

|

Net Assets — End of period | | $ | 1,012,566,109 | | | $ | 598,182,607 | |

| | |

|

|

| |

|

|

|

Accumulated net investment income | | $ | — | | | $ | 9,652 | |

| | |

|

|

| |

|

|

|

See notes to the financial statements.

12

The Torray Institutional Fund

FINANCIAL HIGHLIGHTS

For a share outstanding throughout each period:

PER SHARE DATA

| | | | | | | | | | | | |

| | | Years ended December 31:

| | | Period

ended

12/31/01(1)

| |

| | | 2004

| | | 2003

| | | 2002

| | |

Net Asset Value,

Beginning of Period | | $110.520 | | | $89.490 | | | $103.300 | | | $100.000 | |

| | |

|

| |

|

| |

|

| |

|

|

Income from investment operations: | | | | | | | | | | | | |

Net investment income | | 0.588 | | | 0.671 | | | 0.679 | | | 0.359 | |

Net gains (losses) on securities (both realized and unrealized) | | 7.025 | | | 22.586 | | | (13.810 | ) | | 3.555 | |

| | |

|

| |

|

| |

|

| |

|

|

Total from investment operations | | 7.613 | | | 23.257 | | | (13.131 | ) | | 3.914 | |

| | |

|

| |

|

| |

|

| |

|

|

Less: distributions | | | | | | | | | | | | |

Dividends (from net investment income) | | (0.588 | ) | | (0.671 | ) | | (0.679 | ) | | (0.359 | ) |

Distributions (from capital gains) | | (1.255 | ) | | (1.556 | ) | | 0.000 | | | (0.255 | ) |

| | |

|

| |

|

| |

|

| |

|

|

Total distributions | | (1.843 | ) | | (2.227 | ) | | (0.679 | ) | | (0.614 | ) |

| | |

|

| |

|

| |

|

| |

|

|

Net Asset Value,

End of Period | | $116.290 | | | $110.520 | | | $89.490 | | | $103.300 | |

| | |

|

| |

|

| |

|

| |

|

|

TOTAL RETURN(2) | | 6.96 | % | | 26.16 | % | | (12.73 | %) | | 3.99 | % ** |

RATIOS/SUPPLEMENTAL DATA | | | | | | | | | | | | |

Net assets, end of period (000’s omitted) | | $1,012,566 | | | $598,183 | | | $137,715 | | | $50,684 | |

Ratios of expenses to average net assets | | 0.85 | % | | 0.85 | % | | 0.85 | % | | 0.85 | % * |

Ratios of net income to average net assets | | 0.56 | % | | 0.80 | % | | 0.85 | % | | 0.76 | % * |

Portfolio turnover rate | | 16.12 | % | | 22.20 | % | | 6.87 | % | | 8.84 | % * |

| (1) | | The Torray Institutional Fund commenced operations on June 30, 2001. |

| (2) | | Past performance is not predictive of future performance. |

See notes to the financial statements.

13

The Torray Institutional Fund

NOTES TO FINANCIAL STATEMENTS

As of December 31, 2004

NOTE 1 — SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

The Torray Institutional Fund (“Fund”) is a separate series of The Torray Fund (“Trust”). The Trust is registered under the Investment Company Act of 1940 as a no-load, diversified, open-end management investment company. The Trust was organized as a business trust under Massachusetts law and commenced operations on June 30, 2001. The Fund’s primary investment objective is to provide long-term total return. The Fund seeks to meet its objective by investing its assets in a diversified portfolio of common stocks. In order to accomplish these goals, the Fund intends to hold stocks for the long term, as opposed to actively buying and selling. There can be no assurances that the Fund’s investment objectives will be achieved.

The following is a summary of accounting policies followed by the Fund in the preparation of its financial statements. These policies are in conformity with accounting principles generally accepted in the United States of America.

Securities Valuation Portfolio securities for which market quotations are readily available are valued at market value, which is determined by using the last reported sale price, or, if no sales are reported, the last reported bid price. For NASDAQ traded securities, market value is determined on the basis of the NASDAQ official closing price (the “NOCP”) instead of the last reported sales price. Other assets and securities for which no quotations are readily available or for which The Torray Corporation (the “Advisor”) believes do not reflect market value are valued at fair value as determined in good faith by the Advisor under the supervision of the Board of Trustees. Short-term obligations having remaining maturities of 60 days or less are valued at amortized cost, which approximates market value.

Securities Transactions and Investment Income Securities transactions are recorded on a trade date basis. Realized gains and losses from securities transactions are recorded on the specific identification basis. Dividend income and distributions to shareholders are recorded on the ex-dividend date. Interest income, including amortization of discount on short-term investments, and expenses are recorded on the accrual basis.

Federal Income Taxes The Fund intends to continue to comply with the requirements of the Internal Revenue Code applicable to regulated investment companies and to distribute all of its taxable income, including any net realized gain on investments to its shareholders. Therefore, no Federal income tax provision is required.

Net Asset Value The net asset value per share of the Fund is determined daily as of the close of trading on the New York Stock Exchange by dividing the value of the Fund’s net assets by the number of shares outstanding.

Use of Estimates In preparing financial statements in accordance with accounting principles generally accepted in the United States of America, management is required to make estimates and assumptions that affect the reported amounts of assets and liabilities and the disclosure of contingent assets and liabilities at the date of the financial statements, and the reported amounts of increases and decreases in net assets from operations during the reporting period. Actual results could differ from those estimates.

14

The Torray Institutional Fund

NOTES TO FINANCIAL STATEMENTS (continued)

As of December 31, 2004

NOTE 2 — SHARES OF BENEFICIAL INTEREST TRANSACTIONS

Transactions in shares of beneficial interest were as follows:

| | | | | | | | | | | | | | |

| | | Year ended 12/31/04

| | | Year ended 12/31/03

| |

| | | Shares

| | | Amount

| | | Shares

| | | Amount

| |

Shares issued | | 3,988,230 | | | $ | 445,562,922 | | | 4,110,543 | | | $ | 408,604,899 | |

Reinvestments of dividends and distributions | | 117,934 | | | | 13,242,686 | | | 92,982 | | | | 9,722,685 | |

Shares redeemed | | (811,222 | ) | | | (90,780,472 | ) | | (330,094 | ) | | | (33,458,170 | ) |

| | |

|

| |

|

|

| |

|

| |

|

|

|

| | | 3,294,942 | | | $ | 368,025,136 | | | 3,873,431 | | | $ | 384,869,414 | |

| | |

|

| |

|

|

| |

|

| |

|

|

|

Officers, Trustees and affiliated persons of The Torray Institutional Fund and their families directly or indirectly control 137,410 shares or 1.58% of the Fund.

NOTE 3 — INVESTMENT TRANSACTIONS

Purchases and sales of investment securities, other than short-term investments, for the year ended December 31, 2004, aggregated $481,147,456 and $124,054,089, respectively.

NOTE 4 — MANAGEMENT FEES

Pursuant to the Management Contract, The Torray Corporation provides investment advisory and administrative services to the Fund. The Fund pays The Torray Corporation a management fee, computed daily and payable monthly at the annual rate of 0.85% of the Fund’s average daily net assets. For the year ended December 31, 2004, The Torray Institutional Fund paid comprehensive management fees of $6,600,243. The Fund pays the manager a single comprehensive management fee which covers all operating expenses of the Fund including the investment advisory and administrative services provided by the manager as well as all miscellaneous costs incurred in connection with the ongoing operation of the Fund including transfer agency, custody, professional and registration fees.

Certain officers and Trustees of the Fund are also officers and/or shareholders of The Torray Corporation.

NOTE 5 — TAX MATTERS

Distributions to shareholders are determined in accordance with federal income tax regulations which may differ from accounting principles generally accepted in the United States of America.

15

The Torray Institutional Fund

NOTES TO FINANCIAL STATEMENTS (continued)

As of December 31, 2004

The tax character of distributions paid during 2004 and 2003 were as follows:

| | | | | | |

| | | 2004

| | 2003

|

Distributions paid from: | | | | | | |

Ordinary income | | $ | 7,577,381 | | $ | 7,511,124 |

Long-term capital gain | | | 6,469,042 | | | 3,069,373 |

| | |

|

| |

|

|

| | | $ | 14,046,423 | | $ | 10,580,497 |

| | |

|

| |

|

|

As of December 31, 2004, the components of distributable earnings on a tax basis were as follows:

| | | |

Undistributed long-term gain | | $ | 2,458,977 |

Unrealized appreciation | | | 112,357,615 |

| | |

|

|

| | | $ | 114,816,592 |

| | |

|

|

The following information is based upon the federal income tax basis of investment securities as of

December 31, 2004:

| | | | |

Gross unrealized appreciation | | $ | 132,552,963 | |

Gross unrealized depreciation | | | (20,195,348 | ) |

| | |

|

|

|

Net unrealized appreciation | | $ | 112,357,615 | |

| | |

|

|

|

Federal income tax basis | | $ | 907,830,424 | |

| | |

|

|

|

The primary difference between book basis and tax basis distributions is different book and tax treatment of short-term capital gains.

NOTE 6 — COMMITMENTS AND CONTINGENCIES

The Fund indemnifies its officers and Trustees for certain liabilities that may arise from their performance of their duties to the Fund. Additionally, in the normal course of business, the Fund enters into contracts that contain a variety of representations and warranties which provide general indemnifications. The Fund’s maximum exposure under these arrangements is unknown, as this would involve future claims that may be made against the Fund that have not yet occurred.

16

The Torray Institutional Fund

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

As of December 31, 2004

To the Shareholders and Board of Trustees

The Torray Institutional Fund

Bethesda, Maryland

We have audited the statement of assets and liabilities of The Torray Institutional Fund, a series of shares of beneficial interest of The Torray Fund, including the schedule of investments, as of December 31, 2004, and the related statement of operations for the year then ended, the statements of changes in net assets for each of the two years then ended and the financial highlights for each of the years or period in the four-year period then ended. These financial statements and financial highlights are the responsibility of the Fund’s management. Our responsibility is to express an opinion on these financial statements and financial highlights based on our audit.

We conducted our audits in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements and financial highlights are free of material misstatement. An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements. Our procedures included confirmation of securities owned as of December 31, 2004 by correspondence with the custodian and brokers. An audit also includes assessing the accounting principles used and significant estimates made by management, as well as evaluating the overall financial statement presentation. We believe that our audit provides a reasonable basis for our opinion.

In our opinion, the financial statements and financial highlights referred to above present fairly, in all material respects, the financial position of The Torray Institutional Fund as of December 31, 2004, the results of its operations for the year then ended, the changes in its net assets for each of the two years then ended, and the financial highlights for each of the years or period in the four-year period then ended in conformity with accounting principles generally accepted in the United States of America.

BRIGGS, BUNTING & DOUGHERTY, LLP

Philadelphia, Pennsylvania

January 20, 2005

17

The Torray Institutional Fund

FUND MANAGEMENT (unaudited)

As of December 31, 2004