Back to Contents

RISK FACTORS

The following describes some of the risks that could affect Rio Tinto. There may be additional risks unknown to Rio Tinto and other risks, currently believed to be immaterial, could turn out to be material. These risks, whether they materialise individually or simultaneously, could significantly affect the Group’s business and financial results. They should also be considered in connection with any forward looking statements in this document and the cautionary statement below.

Economic condition

Commodity prices, and demand for the Group’s products, are influenced strongly by world economic growth, particularly that in the US and Asia. The Group’s normal policy is to sell its products at prevailing market prices. Commodity prices can fluctuate widely and could have a material and adverse impact on the Group’s asset values, revenues, earnings and cash flows. Further discussion can be found on page 14, Business environment and markets, and on page 39, commodity prices.

Exchange rates

The Group’s asset values, earnings and cash flows are influenced by a wide variety of currencies due to the geographic diversity of the Group’s sales and areas of operation. The majority of the Group’s sales are denominated in US dollars. The Australian and US dollars are the most important currencies influencing costs. The relative value of currencies can fluctuate widely and could have a material and adverse impact on the Group’s asset values, costs, earnings and cash flows. Further discussion can be found on page 37, exchange rates, reporting currencies and currency exposure.

Acquisitions

The Group has grown partly through the acquisition of other businesses. Business combinations commonly entail a number of risks and Rio Tinto cannot be sure that management will be able effectively to integrate businesses acquired or generate the cost savings and synergies anticipated. Failure to do so could have a material and adverse impact on the Group’s costs, earnings and cash flows.

Exploration and new projects

The Group seeks to identify new mining properties through an active exploration programme. There is no guarantee, however, that such expenditure will be recouped or that existing mineral reserves will be replaced. Failure to do so could have a material and adverse impact on the Group’s financial results and prospects.

The Group develops new mining properties and expands its existing operations as a means of generating shareholder value. Increasing regulatory, environmental and social approvals are, however, required which can result in significant increases in construction costs and/or significant delays in construction. These increases could materially and adversely affect a project’s economics, the Group’s asset values, costs, earnings and cash flows.

Reserve estimation

There are numerous uncertainties inherent in estimating ore reserves. Reserves that are valid at the time of estimation may change significantly when new information becomes available. Fluctuations in the price of commodities, exchange rates, increased production costs or reduced recovery rates may render lower grade reserves uneconomic and may, ultimately, result in a restatement. A significant restatement could have a material and adverse impact on the Group’s asset values, costs, cash flows and earnings.

Political and community

The Group has operations in jurisdictions having varying degrees of political instability. Political instability can result in civil unrest, expropriation, nationalisation, renegotiation or nullification of existing agreements, mining leases and permits, changes in laws, taxation policies or currency restrictions. Any of these can have a material adverse effect on the profitability or, in extreme cases, the viability of an operation.

Some of the Group’s current and potential operations are located in or near communities that may now, or in the future, regard such an operation as having a detrimental effect on their economic and social circumstances. Should this occur, it might have a material adverse impact on the profitability or, in extreme cases, the viability of an operation. In addition, such an event may adversely affect the Group’s ability to enter into new operations in the country.

Technology

The Group has invested in and implemented information system and operational initiatives. Several technical aspects of these initiatives are still unproven and the eventual operational outcome or viability cannot be assessed with certainty. Accordingly, the costs and benefits from these initiatives and the consequent effects on the Group’s future earnings and financial results may vary widely from present expectations.

Land and resource tenure

The Group operates in several countries where title to land and rights in respect of land and resources (including indigenous title) may be unclear and may lead to disputes over resource development. Such disputes could disrupt relevant mining projects and/or impede the Group’s ability to develop new mining properties.

Health, safety and environment

Rio Tinto operates in an industry that is subject to numerous health, safety and environmental laws and regulations as well as community expectations. Evolving regulatory standards and expectations can result in increased litigation and/or increased costs all of which can have a material and adverse effect on earnings and cash flows.

Mining operations

Mining operations are vulnerable to a number of circumstances beyond the Group’s control, including natural disasters, unexpected geological variations and industrial actions. These can affect costs at particular mines for varying periods. Mining, smelting and refining processes also rely on key inputs, for example fuel and electricity. Appropriate insurance can provide protection from some, but not all, of the costs that may arise from unforeseen events. Disruption to the supply of key inputs, or changes in their pricing, may have a material and adverse impact on the Group’s asset values, costs, earnings and cash flows.

Rio Tinto 2004Form 20-F 9

Back to Contents

Rehabilitation

Costs associated with rehabilitating land disturbed during the mining process and addressing environmental, health and community issues are estimated and provided for based on the most current information available. Estimates may, however, be insufficient and/or further issues may be identified. Any underestimated or unidentified rehabilitation costs will reduce earnings and could materially and adversely affect the Group’s asset values, earnings and cash flows.

Non managed operations

Rio Tinto cannot guarantee that management of mining and processing assets not subject to its management control will comply with the Group’s standards and objectives, nor that effective policies, procedures and controls will be maintained over those assets.

CAUTIONARY STATEMENT ABOUT FORWARD LOOKING STATEMENTS

This document contains certain forward looking statements with respect to the financial condition, results of operations and business of the Rio Tinto Group. The words “intend”, “aim”, “project”, “anticipate”, “estimate”, “plan”, “believes”, “expects”, “may”, “should”, “will”, or similar expressions, commonly identify such forward looking statements. Examples of forward looking statements in this annual report on Form 20-F include those regarding estimated reserves, anticipated production or construction commencement dates, costs, outputs and productive lives of assets or similar factors. Forward looking statements involve known and unknown risks, uncertainties, assumptions and other factors set forth in this document that are beyond the Group’s control. For example, future reserves will be based in part on market prices that may vary significantly from current levels. These may materially affect the timing and feasibility of particular developments. Other factors include the ability to produce and transport products profitably, the effect of foreign currency exchange rates on market prices and operating costs, and activities by governmental authorities, such as changes in taxation or regulation, and political uncertainty.

In light of these risks, uncertainties and assumptions, actual results could be materially different from any future results expressed or implied by these forward looking statements which speak only as at the date of this report. Except as required by applicable regulations or by law, the Group does not undertake any obligation to publicly update or revise any forward looking statements, whether as a result of new information or future events. The Group cannot guarantee that its forward looking statements will not differ materially from actual results.

Item 4. Information on the Company

INTRODUCTION

Rio Tinto Limited and Rio Tinto plc operate as one business organisation, referred to in this report as Rio Tinto, the Rio Tinto Group or, more simply, the Group. These collective expressions are used for convenience only since both Companies, and the individual companies in which they directly or indirectly own investments, are separate and distinct legal entities.

“Limited”, “plc”, “Pty”, “Inc”, “Limitada”, or “SA” has generally been omitted from Group company names, except to distinguish between Rio Tinto plc and Rio Tinto Limited.

Financial data in United States dollars (US$) is derived from, and should be read in conjunction with, the Rio Tinto Group’s consolidated financial statements which are in US$. In general, financial data in pounds sterling (£) and Australian dollars (A$) have been translated from the consolidated financial statements at the rates shown on page 112 and have been provided solely for convenience; exceptions arise where data, such as directors’ remuneration, can be extracted directly from source records.

Rio Tinto Group turnover, profit before tax and net earnings and operating assets for 2003 and 2004 attributable to the Group’s products and geographical areas are shown in Notes 26 and 27 to the consolidated financial statements on pages A-39 to A-43. In the Operational review, operating assets and turnover are consistent with the financial information by business unit on pages A-63 and A-64.

The tables on pages 17 to 20 show production for 2002, 2003 and 2004 and include estimates of proven and probable reserves and mineral resources. The weights and measures used are mainly metric units; conversions into other units are shown on page 112. Words and phrases, often technical, have been used which have particular meanings; definitions of these terms are on pages 109 to 111.

AN OVERVIEW OF RIO TINTO

Rio Tinto is a leading international mining group, combining Rio Tinto plc and Rio Tinto Limited in a dual listed companies (DLC) structure as a single economic entity. Nevertheless, both Companies remain legal entities with separate share listings and registers. Rio Tinto plc is incorporated in England and Wales and Rio Tinto Limited is incorporated in Australia.

Rio Tinto’s international headquarters are in London whilst the Australian representative office in Melbourne provides support for the operations, undertakes external and investor relations and fulfils statutory obligations. The registered office of Rio Tinto plc is at 6 St James’s Square, London, SW1Y 4LD (telephone: +44 20 7930 2399) and the registered office of Rio Tinto Limited is at Level 33, 55 Collins Street, Melbourne, Victoria 3000 (telephone: +61 3 9283 3333).

Rio Tinto 2004Form 20-F 10

Back to Contents

For legal purposes, Rio Tinto’s US agent is Shannon Crompton, Secretary of Rio Tinto’s US holding companies, 8309 West 3595 South, Magna, Utah 84044. Investor relations in the US are provided by Makinson Cowell US Limited, One Penn Plaza, 250 W 34th St, Suite 1935, New York, NY 10119.

| Objective, strategy and management structure |

| Rio Tinto’s fundamental objective is to maximise the overall long term return to its shareholders by operating responsibly and sustainably in areas of proven expertise where the Group has competitive advantage. Its strategy is to maximise the net present value per share by investing in large, long life, cost competitive mines. Investments are driven by the quality of opportunity, not choice of commodity. |

| Rio Tinto’s mining interests are diverse both in geography and product. The Group consists of wholly and partly owned subsidiaries, joint ventures, associated companies and joint arrangements, the principal ones being listed in Notes 31 to 34 of the consolidated financial statements on pages A-52 to A-53. |

| Rio Tinto’s management structure is designed to facilitate a clear focus on business performance and the Group’s objective. The management structure, which is reflected in this report, is based on principal product and global support groups: |

| • | Iron Ore |

| • | Energy |

| • | Industrial Minerals |

| • | Aluminium |

| • | Copper |

| • | Diamonds |

| • | Exploration, and |

| • | Technology |

| The chief executive of each group reports to the chief executive of Rio Tinto. |

2004 financial summary

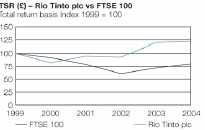

On 31 December 2004, Rio Tinto plc had a market capitalisation of £16.4 billion (US$31.6 billion) and Rio Tinto Limited had a market capitalisation of A$19.5 billion (US$15.2 billion). The combined Group’s market capitalisation in publicly held shares at the end of 2004 was US$41.1 billion.

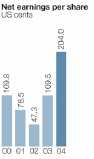

At 31 December 2004, Rio Tinto had consolidated operating assets of US$16.6 billion: 61 per cent were located in Australia and New Zealand and 27 per cent in North America. Group turnover, or sales revenue, in 2004 was US$14.6 billion (or US$11.8 billion excluding Rio Tinto’s share of joint ventures’ and associates’ turnover). Net earnings in 2004 were US$2,813 million.

History

The Rio Tinto Company was formed by investors in 1873 to mine ancient copper workings at Rio Tinto in southern Spain. The Consolidated Zinc Corporation was incorporated in 1905, initially to treat zinc bearing mine waste at Broken Hill, New South Wales, Australia.

The RTZ Corporation (formerly The Rio Tinto-Zinc Corporation) was formed in 1962 by the merger of The Rio Tinto Company and The Consolidated Zinc Corporation. CRA Limited (formerly Conzinc Riotinto of Australia Limited) was formed at the same time by a merger of the Australian interests of The Consolidated Zinc Corporation and The Rio Tinto Company. Between 1962 and 1995, RTZ and CRA discovered important mineral deposits, developed major mining projects and also grew through acquisition.

RTZ and CRA were unified in December 1995 through a DLC structure. Directed by a common board of directors, this is designed to place the shareholders of both companies in substantially the same position as if they held shares in a single enterprise owning all of the assets of both Companies.

In June 1997, The RTZ Corporation became Rio Tinto plc and CRA Limited became Rio Tinto Limited, together known as the Rio Tinto Group. Since the 1995 merger, the Group has continued to invest in developments and acquisitions in keeping with its strategy.

RECENT DEVELOPMENTS

Share buybacks and issues 2004-2005 to date

In April 2004, Rio Tinto plc shareholders renewed approvals for the buyback of up to ten per cent of its own shares and Rio Tinto Limited shareholders renewed approvals to buy back up to 100 per cent of Rio Tinto Limited shares held by Tinto Holdings Australia Pty Limited (a wholly owned subsidiary of Rio Tinto plc) plus, on market, up to ten per cent of the publicly held capital in any 12 month period.

The Group announced on 3 February 2005, its intention to return up to US$1.5 billion of capital to shareholders, therefore, Rio Tinto plc and Rio Tinto Limited obtained renewal of their existing shareholder approvals at their respective annual general meetings in 2005. Both Companies also obtained shareholder approval for Rio Tinto Limited to make off market purchases of its shares within 12 months of the annual general meeting, within the overall limit of ten per cent of publicly held capital described above. This was to be through a tender process at a discount to the market price. The shareholders’ approval obtained would also allow Rio Tinto Limited to buy back its shares from Tinto Holdings Australia, after such an off market tender (at the same price), to maintain the proportional holding of Tinto Holdings Australia following the off market buyback. The number of shares which may eventually be bought back under these authorities will be determined by the directors, based on what they consider to be in the best interests of all shareholders.

Rio Tinto 2004Form 20-F 11

Back to Contents

In the year to 31 December 2004, neither Rio Tinto plc nor Rio Tinto Limited purchased any publicly held shares for cancellation in either Company. However, a further 1,346,874 Rio Tinto plc and 280,332 Rio Tinto Limited shares were issued in respect of the Companies’ employee share plans. During the year, options for a further 1,541,367 Rio Tinto plc and 1,339,834 Rio Tinto Limited shares were granted under Rio Tinto’s share plans.

On 9 May 2005 Rio Tinto Limited announced the successful result of its off market share buy back. A total of approximately 27.3 million shares, representing 8.7 per cent of Rio Tinto Limited’s publicly held issued share capital (2.0 per cent of the Rio Tinto Group), were bought back at A$36.70 per share at a cost of approximately A$1 billion (US$780 million). The buy back price of A$36.70 per share represented a 14 per cent discount to the relevant volume weighted average price of Rio Tinto Limited shares sold on the ASX over the five trading days up to and including the closing date of the buy back. It also represented a discount of 15.6 per cent to the closing price for Rio Tinto Limited shares on 6 May 2005, of A$43.50.

Under a separate buy back, Tinto Holdings Australia accepted the same A$36.70 buy back price for a proportion of its 37.5 per cent holding of Rio Tinto Limited shares so that there was no change in the proportional shareholding in Rio Tinto Limited as a result of the buy back. Rio Tinto Limited therefore bought back a further 16.4 million shares at a cost of approximately A$600 million (US$470 million).

Share buybacks and issues 2002-2003

In 2002, 887,000 Rio Tinto plc and 360,000 Rio Tinto Limited shares were issued under the Companies’ employee share plans and options were granted over 2.6 million Rio Tinto plc shares and 2.2 million Rio Tinto Limited shares. In 2003, 1,193,000 Rio Tinto plc and 240,000 Rio Tinto Limited shares were issued in respect of the Companies’ employee share plans. During 2003, options were granted over 2.7 million Rio Tinto plc and 1.6 million Rio Tinto Limited shares in respect of the Companies’ employee share plans.

In the years 2002 and 2003, neither Rio Tinto plc nor Rio Tinto Limited purchased any publicly held shares for cancellation in either Company.

Operations acquired and divested 2004-2005 to date

In January 2004, Rio Tinto completed the sale of its 100 per cent interest in the nickel mining company Mineração Serra da Fortaleza Ltda to Votorantim Metais, a Brazilian controlled mining company. Including an adjustment for future nickel prices, the total cash consideration was approximately US$80 million.

A 20 per cent interest in the Sepon project in Laos, comprising a gold operation and the Khanong copper project, was sold to Oxiana Limited for a cash consideration of US$85 million.

In March, Rio Tinto completed the sale of its shareholding in Freeport-McMoRan Copper & Gold Inc (FCX). Rio Tinto received net proceeds of US$882 million for its 23,931,100 FCX shares. Rio Tinto retains its 40 per cent joint venture interest in reserves discovered after 1994 at the Grasberg mine which is managed by FCX. The sale of FCX shares does not affect the terms of the joint venture nor the management of the Grasberg mine.

In June, Rio Tinto completed the sale of its 100 per cent interest in Zinkgruvan Mining AB to South Atlantic Ventures. Zinkgruvan was acquired in 2000 as part of North. Rio Tinto received US$101 million in cash plus US$5 million for working capital, and can earn a further US$5 million over the next two years in price participation payments based on zinc, lead and silver prices. Also in June, Rio Tinto’s interest in the Boké bauxite deposit in west Africa was divested for US$12 million.

Rio Tinto and Empresa de Desenvolvimento Mineiro completed the sale of their interests in the Neves Corvo copper mine in Portugal to EuroZinc for a cash consideration and a participation in the average copper price in excess of certain thresholds. Rio Tinto’s share of the consideration for its 49 per cent share of the mine was US$70 million. The remaining price participation rights relating to copper production from Neves Corvo, which was sold in the first half of the year, were themselves sold for US$22 million.

The directors of Rio Tinto Zimbabwe (RioZim) agreed to a restructuring of Rio Tinto’s 56 per cent shareholding in RioZim. The Murowa diamond project in Zimbabwe had been a 50:50 joint venture between Rio Tinto and RioZim. As a result of the restructuring, Rio Tinto owns a direct 78 per cent interest in Murowa and RioZim became an independent Zimbabwean controlled, listed company owning the remaining 22 per cent of Murowa. Rio Tinto ceased to be an ordinary shareholder in RioZim but retains a reduced cash participation in RioZim’s assets other than the Murowa diamond project for a period of ten years. The transaction had no material effect on Rio Tinto.

The sale of the Group’s 51 per cent interest in Rio Paracatu Mineração, the owner of the Morro do Ouro mine in Brazil, was completed on 31 December 2004 for US$250 million, subject to an adjustment for working capital.

The sale to Nippon Steel of an eight per cent interest in the Hail Creek Joint Venture, and the increase in the combined share of the original participants, Marubeni Coal and Sumisho Coal Development, by two per cent was completed in the fourth quarter. Rio Tinto will receive about US$150 million for the sale of these interests in the Hail Creek Joint Venture together with the sale of a 47 per cent interest in the Beasley River iron ore deposit to its joint venture partners in Robe River, which includes Nippon Steel.

In December Kennecott Energy successfully bid for an additional 177 million tonnes of in-situ coal reserves at West Antelope at a cost of US$146 million.

Rio Tinto 2004Form 20-F 12

Back to Contents

In March 2005 the Group announced the sale of its entire holding in the Labrador Iron Ore Royalty Income Fund (LIORIF) for net cash proceeds of US$130 million. LIORIF has an equity interest of 15.1 per cent in, and receives royalties from, the Iron Ore Company of Canada. This transaction has no effect on Rio Tinto’s 59 per cent direct interest in the Iron Ore Company of Canada.

Operations acquired and divested 2002-2003

In January 2002, Kennecott Energy (KEC) purchased the North Jacobs Ranch coal reserves for US$380 million, payable in instalments over a five year period. The reserves are adjacent to KEC’s existing Jacobs Ranch operation and provide a basis for low cost expansion in line with market demand.

Following the purchase of outstanding units in the Western Australian Diamond Trust, Rio Tinto’s interest in Argyle Diamonds increased from 99.8 per cent to 100 per cent.

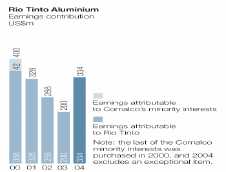

In August 2002, Comalco completed the acquisition of an additional 9.5 per cent interest in reduction lines 1 and 2 of the Boyne Island Smelter for US$80 million. This increased Comalco’s share in lines 1 and 2 of the smelter to 59.5 per cent from 50 per cent. Comalco’s interest in line 3 remains unchanged at 59.25 per cent.

During the first half of 2002, Coal & Allied Industries completed the sale of its interest in the Moura Joint Venture for US$166 million and in Narama and Ravensworth for US$64 million. These were classified as assets held for resale and consequently their disposal had no effect on net earnings. In September, Rio Tinto acquired for cash in the market a further three per cent in Coal & Allied to bring its shareholding to 75.7 per cent.

As a result of a refinancing in December 2002, in which the Labrador Iron Ore Royalty Income Fund (LIORF) chose not to participate, Rio Tinto’s interest in Iron Ore Company of Canada increased from 56.1 to 58.7 per cent.

The sale of Rio Tinto’s 25 per cent interest in Minera Alumbrera Limited in Argentina, acquired as part of North, together with its wholly owned Peak gold mine in New South Wales, Australia, was completed in March 2003. The cash consideration was US$210 million.

Rio Tinto Zimbabwe sold the Patchway gold mine in 2003. The Framework Agreement signed with the Government of Indonesia in 2002 for divestment of 51 per cent of Kaltim Prima Coal (KPC) to Indonesian interests lapsed in 2003 when no assignment of KPC’s offer was made or accepted within the required timeframe.

On 21 July 2003 Rio Tinto and BP announced that they had agreed to sell their interests in KPC for a cash price of US$500 million, including assumed debt, to PT Bumi Resources, a public company listed on the Jakarta and Surabaya Stock Exchanges. The sale was completed on 10 October and each company received 50 per cent of the net proceeds.

Development projects 2004-2005 to date

Rio Tinto invested over US$2.2 billion in 2004 on development projects around the world.

In December 2003, Hamersley Iron announced the US$920 million expansion of its port and mine capacity, with further expenditure on the rail network and power infrastructure being evaluated. In April 2005 a further US$290 million was committed to expand the existing iron ore mines. The partners in the Robe River Joint Venture approved US$214 million (Rio Tinto share US$113 million) to dual track a significant part of the Hamersley Iron rail line. Hamersley Iron will spend a further US$46 million to upgrade power infrastructure in the Pilbara. The port and mine expansions are on track for completion by the end of 2005.

In January 2004, Rio Tinto approved the expansion of QIT-Fer et Titane Inc.’s upgraded slag (UGS) plant in Quebec, Canada. Total investment will be US$76 million and capacity will be increased from 250,000 tonnes per year to 325,000 tonnes per year in 2005.

The owners of the Escondida copper mine in Chile approved expenditure of US$870 million (Rio Tinto share US$270 million) on a sulphide leach project to produce 180,000 tonnes (Rio Tinto share 54,000 tonnes) of copper cathode per annum for more than 25 years starting in the second half of 2006.

Construction of the US$100 million second block cave at the underground Northparkes copper and gold mine in New South Wales, Australia was completed and production commenced in 2004.

Development of the 54 per cent owned Eastern Range iron ore mine in Australia with a capacity of ten million tonnes per year was completed. First shipments started in the first half of 2004.

Expansion of the Weipa bauxite mine in Queensland, Australia, was completed, resulting in an increase in production capacity to 16.5 million tonnes per annum. This supports the requirements of the new Comalco Alumina Refinery. A key component of the US$150 million expenditure is a 9.5 million tonne beneficiation plant for ore from the Andoom deposit. In 2005, a new US$42 million power station will be constructed to service the Weipa mining operations and surrounding communities.

Construction of the first stage of Comalco’s new alumina refinery at Gladstone, Queensland commenced in January 2002 and was completed in late 2004, three months early and in line with its budget of US$750 million. Initial shipments from the 1.4 million tonnes per year plant started in early 2005. There is potential for the refinery capacity to increase to over four million tonnes per year in two additional stages when market conditions allow.

Construction began in January 2003 on an expanded US$200 million HIsmelt® plant at Kwinana in Western Australia. Cold commissioning commenced in late 2004 and the first hot metal was produced in the hot commissioning process during the second quarter of 2005. The full production rate of 800,000 tonnes per year is expected to be achieved in 2007.

Rio Tinto 2004 Form 20-F 13

Back to Contents

Approval was given in 2004 for expansion of the Hail Creek coal mine in Australia to eight million tonnes per year at a cost of US$157 million. At the Diavik diamond mine in Canada construction begins in 2005 of a second dike at a cost of US$190 million to enable mining of a third orebody. Also approved was an optimisation study costing US$75 million including construction of an exploration decline to investigate underground mining.

Kennecott Land’s Project Daybreak in Utah, US, a mixed use land development on a 1,800 hectare site, started in 2003, with the first land sales in 2004 that are expected to ramp up over a period of five to six years.

Further detail on these investments and projects is provided in the operational review on pages 44 to 67.

Development projects have been funded using internally generated funds and proceeds of asset disposals.

Development projects 2002-2003

Work on the Robe River Joint Venture’s US$450 million West Angelas iron ore mine and port facilities in Western Australia was completed in mid-2002 and the first shipments were made.

Freeport Indonesia’s Deep Ore Zone (DOZ) underground block cave project was declared fully operational from 1 October 2002. This achieved design capacity of 25,000 tonnes of ore per day in 2002, a year earlier than originally projected. In the first quarter of 2003, Freeport Indonesia completed a further DOZ expansion to 35,000 tonnes per day at a cost of US$34 million.

The Diavik diamond project in the Northwest Territories, Canada was completed in January 2003 three months early and within budget. Initial production commenced from the contact zone above the orebody with the main orebody accessed during the second half of 2003.

Production ramp up at Palabora’s US$465 million underground copper mine in South Africa started in 2003 but was constrained by an inability to clear drawpoints blocked by poorly fragmented, large rocks.

Development of the Escondida Norte satellite deposit at the 30 per cent owned Escondida copper mine in Chile was started in June 2003 to provide mill feed to keep Escondida’s capacity above 1.2 million tonnes of copper per year to the end of 2008. First production is expected by the end of 2005. Commissioning of the new US$1,045 million, 110,000 tonnes of ore per day Laguna Seca concentrator was completed in the second quarter of 2003.

In 2003, Rio Tinto Coal Australia completed development of the US$255 million Hail Creek coking coal project in Queensland, Australia with an initial capacity of 5.5 million tonnes annually.

BUSINESS ENVIRONMENT AND MARKETS

Competitive environment

Rio Tinto is a major producer in all the metals and minerals markets in which it operates. It is generally among the top five global producers by volume. It has market shares for different commodities ranging from five per cent to 40 per cent. The competitive arena is spread across the globe, including eastern Europe, Russia and China.

Most of Rio Tinto’s competitors are private sector companies which are publicly quoted. Several are, like Rio Tinto, diversified in terms of commodity exposure, but others are focused on particular commodity segments. Metal and mineral markets are highly competitive with few barriers to entry. They can be subject to price declines in real terms reflecting large productivity gains, increasing technical sophistication, better management, and advances in information technology.

High quality, long life mineral resources, the basis of good financial returns, are relatively scarce. Rio Tinto’s ownership of or interest in some of the world’s largest deposits enables it to contribute to long term market growth. World production volumes are likely to grow at least in line with global economic activity. The emergence of China and eventually India as economic forces requiring metals and minerals for development could mean even higher market growth.

Economic overview

World economic activity in 2004 grew at the fastest rate since the 1970s, rising to over five per cent from three per cent the year before on a purchasing power parity basis. Trade growth accelerated even faster, to more than eight per cent in real terms, nearly double the rate seen in 2003.

The increase in economic activity was widely based, led by the US and China which grew by 4.3 per cent and nine per cent respectively. Japan benefited from strong exports, which stimulated growth of four per cent. Growth elsewhere in Asia was also stimulated by exports. Latin America grew by five per cent, driven by the boom in demand for metals, oil and some agricultural products. European activity lagged, but higher exports enabled growth to rise to over two per cent.

Inflation remained low by historical standards in spite of the large rise in prices of oil and other commodities. This reflected fierce competition in the manufacturing sector and generally weak labour markets.

The US benefited from very low real interest rates and a loose fiscal policy in the run up to the presidential election. The twin deficits of government finance and trade increased rapidly. The fact that US growth was based on borrowing was underscored by the decline in the value of the US dollar, which fell eight per cent in trade weighted terms, following an 11 per cent fall in 2003. Some currencies are pegged to the US dollar, notably the Chinese renminbi, and the fall against freely traded currencies such as the euro and the Australian dollar was considerably greater.

The other pillar of global growth was China, with GDP rising by nine per cent. This was driven by investment in fixed assets, which rose by more than 25 per cent for the second successive year, and industrial output, which grew more than 16 per cent, also for the second year running.

Rio Tinto 2004 Form 20-F 14

Back to Contents

Growth was strongest in the first half and then slowed. This was most notable in Europe and Japan as their currencies strengthened against the US dollar. The picture in China was less clear. Growth there seems to have slowed from the earlier breakneck pace as the government signalled before the middle of the year that it wanted to reduce growth in investment in fixed assets and introduced curbs. Trade with China in many commodities eased considerably in the second half, but other factors including port congestion also contributed.

Commodity markets had already started to improve in 2003, but the acceleration in economic activity and trade in 2004 tipped many of them into a zone of extreme tightness. Prices soared, aided by a declining US dollar. Fund activity fluctuated through the year, but provided strong support for prices overall. Demand for many products grew considerably faster than the world economy. Chinese growth continued to be very commodity intensive, and there was some rebuilding of stocks in the supply chain. Global steel production grew nine per cent, the fastest since 1973.

Copper benefited more than most non ferrous metals from the acceleration in growth, as it was already in deficit and refined output was held back by a series of disruptions to mine output and by smelter capacity. Demand grew by seven per cent, the deficit in refined copper rose sharply and exchange stocks fell below the levels seen in the mid 1990s. Fund buying intensified pricing in a very tight physical market. The average cash LME price rose to US$1.30 per pound from 80 US cents per pound the year before, only just short of the highest ever price in nominal terms (not adjusted for inflation). In contrast, the copper concentrates market, which had been tight for several years, was well supplied in the second half.

The seaborne iron ore trade continued to grow strongly with China’s iron ore imports nearly 40 per cent above their 2003 level. Price increases of nearly 20 per cent early in the year underlined the tightness of the market. The rapid growth in demand for iron ore caused a shortage of shipping capacity leading to the highest freight rates ever recorded.

Prices for seaborne thermal coal rose by over 60 per cent. Even a rise of this magnitude, however, did not dampen the market and spot prices remained above the contract settlement price throughout the year. World seaborne thermal coal trade is estimated to have grown by about six per cent during 2004. Coking coal prices rose by less than those of thermal coal but significant increases in demand in Asia meant that some spot cargos were trading at very high prices.

The North American aluminium market improved significantly in 2004 with demand growth of around ten per cent. Combined with demand in China, the primary aluminium market moved into deficit for the first time since 2000. The annual average price of aluminium increased accordingly to 78 US cents per pound in 2004 from 65 US cents the previous year. However, the rise was not as strong as for copper because stocks were higher. The spot price for alumina remained very high by historical standards throughout 2004 reflecting general market tightness and strong demand from Chinese aluminium smelters.

The economic recovery in developed countries, the US in particular, benefited the demand for industrial minerals such as borates and titanium minerals. Demand growth for these products, however, generally continued to fall short of that achieved by metal markets. This was partly due to a lower exposure to the present stage of Chinese growth.

Gold averaged US$409 per ounce, a 16 year nominal high, almost entirely driven by the falling US dollar. Many less widely traded metals also benefited from much higher prices, notably molybdenum, which averaged US$14 per pound for trader oxide, a 25 year nominal high, and silver, which averaged US$6.70 per ounce, up 40 per cent year on year.

A discussion of the financial results for the three years to 31 December 2004 is given in the Financial review on pages 31 to 44.

Comments on the financial performance of the individual product groups for the three years to 31 December 2004 are included in the operational review on pages 44 to 67. Details of production, reserves and information on Group mines are given on pages 17 to 20, A-85 to A-95 and 22 to 26, respectively. Analyses of Rio Tinto’s revenues by product group, geographical origin and geographical destination have been set out in Notes 26 to 27 to the consolidated financial statements on pages A-39 to A-43.

Marketing channels

Each business within each product group is responsible for the marketing and sale of their respective metal and mineral production. Consequently, Rio Tinto has numerous marketing channels, which now include electronic marketplaces, with differing characteristics and pricing mechanisms.

In general, Rio Tinto’s businesses contract their metal and mineral production direct to end users under long term supply contracts and at prevailing market prices. Typically, these contracts specify annual volume commitments and an agreed mechanism for determining prices, for example, businesses producing non ferrous metals and minerals reference their sales prices to the London Metal Exchange (LME) or other metal exchanges such as the Commodity Exchange Inc (Comex) in New York. Fluctuations in these prices, particularly for aluminium, copper and gold, inevitably affect the Group’s financial results.

Businesses producing coal and iron ore would typically reference their sales prices to annually negotiated industry benchmarks. In markets where international reference market prices do not exist or are not transparent, businesses negotiate product prices on an individual customer basis.

Rio Tinto’s marketing channels include a network of regional sales offices worldwide. Some products in certain geographical markets are sold via third party agents or to major trading companies.

Rio Tinto 2004Form 20-F 15

Back to Contents

Governmental regulations

Rio Tinto is subject to extensive governmental regulations affecting all aspects of its operations and consistently seeks to apply best practice in all of its activities. Due to Rio Tinto’s product and geographical spread, there is unlikely to be any single governmental regulation that could have a material effect on the Group’s business.

Rio Tinto’s businesses in Australia, New Zealand, Papua New Guinea and Indonesia are subject to state and federal regulations of general application governing mining and processing, land tenure and use, environmental requirements, workplace health and safety, trade and export, corporations, competition, foreign investment and taxation. Some operations are conducted under specific agreements with the respective governments and associated acts of parliament. In addition, Rio Tinto’s uranium operation in the Northern Territory, Australia is subject to specific regulation in relation to its mining and export of uranium.

US and Canada based operations are subject to local and national regulations governing land use, environmental aspects of operations, product and workplace health and safety and trade and export administration.

The South African Mineral and Petroleum Resources Development Act 2002, as read with the Empowerment Charter for the South African Mining Industry, targets the transfer for fair value of 26 per cent ownership of South African mining assets to historically disadvantaged South Africans (HDSAs) within ten years. Attached to the Empowerment Charter is a “scorecard” by which companies will be judged on their progress towards empowerment and the attainment of the target transfer of 26 per cent ownership. The scorecard also provides that 15 per cent ownership should vest in HDSAs within five years of 1 May 2004. The Mineral and Petroleum Royalty Act, proposed for approval in 2005, will govern state royalties and introduce new royalty payments in respect of mining tenements in South Africa. The royalty will be calculated on a gross sales value basis in relation to any minerals extracted, rather than on the basis of profits generated. The South African government has confirmed that any such royalties would become payable only from 2009.

Rio Tinto 2004Form 20-F 16

Back to Contents

METALS AND MINERALS PRODUCTION

| | | | 2002 | | 2003 | | 2004 | |

| | | | Production (a) | | Production (a) | | Production(a) | |

|

|

|

|

|

|

|

| |

| | Rio Tinto | | Total | | Rio Tinto | | Total | | Rio Tinto | | Total | | Rio Tinto | |

| | % share (b) | | | | share | | | | share | | | | share | |

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

| ALUMINA (’000 tonnes) | | | | | | | | | | | | | | |

| Comalco Alumina Refinery (Australia) (c) | 100.0 | | – | | – | | – | | – | | 175 | | 175 | |

| Eurallumina (Italy) | 56.2 | | 1,010 | | 567 | | 1,021 | | 573 | | 1,064 | | 597 | |

| Queensland Alumina (Australia) | 38.6 | | 3,574 | | 1,380 | | 3,731 | | 1,440 | | 3,778 | | 1,459 | |

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

| Rio Tinto total | | | | | 1,947 | | | | 2,014 | | | | 2,231 | |

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

| ALUMINIUM (refined) (’000 tonnes) | | | | | | | | | | | | | | |

| Anglesey (UK) | 51.0 | | 136.8 | | 69.8 | | 141.9 | | 72.4 | | 144.8 | | 73.8 | |

| Bell Bay (Australia) | 100.0 | | 163.9 | | 163.9 | | 166.6 | | 166.6 | | 162.0 | | 162.0 | |

| Boyne Island (Australia) (d) | 59.4 | | 520.2 | | 294.6 | | 520.9 | | 311.1 | | 540.5 | | 321.2 | |

| Tiwai Point (New Zealand) | 79.4 | | 333.9 | | 265.9 | | 334.4 | | 266.5 | | 350.3 | | 279.5 | |

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

| Rio Tinto total | | | | | 794.1 | | | | 816.6 | | | | 836.5 | |

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

| BAUXITE (’000 tonnes) | | | | | | | | | | | | | | |

| Boké (Guinea) (e) | – | | 12,041 | | 482 | | 12,060 | | 418 | | 5,773 | | 179 | |

| Weipa (Australia) | 100.0 | | 11,241 | | 11,241 | | 11,898 | | 11,898 | | 12,649 | | 12,649 | |

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

| Rio Tinto total | | | | | 11,724 | | | | 12,316 | | | | 12,828 | |

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

| BORATES (’000 tonnes)(f) | | | | | | | | | | | | | | |

| Boron mine (US) | 100.0 | | 514 | | 514 | | 541 | | 541 | | 543 | | 543 | |

| Borax Argentina (Argentina) | 100.0 | | 15 | | 15 | | 17 | | 17 | | 22 | | 22 | |

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

| Rio Tinto total | | | | | 528 | | | | 559 | | | | 565 | |

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

| COAL – HARD COKING (’000 tonnes) | | | | | | | | | | | | | | |

| Rio Tinto Coal Australia(g) | | | | | | | | | | | | | | |

| Hail Creek Coal (Australia) (h) | 82.0 | | – | | – | | 883 | | 812 | | 5,104 | | 4,633 | |

| Kestrel Coal (Australia) | 80.0 | | 2,406 | | 1,925 | | 1,873 | | 1,499 | | 2,659 | | 2,127 | |

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

| Rio Tinto total hard coking coal | | | | | 1,925 | | | | 2,311 | | | | 6,760 | |

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

| COAL – OTHER* (’000 tonnes) | | | | | | | | | | | | | | |

| Coal & Allied Industries(i) | | | | | | | | | | | | | | |

| Bengalla (Australia) | 30.3 | | 5,385 | | 1,587 | | 6,203 | | 1,879 | | 5,312 | | 1,609 | |

| Hunter Valley Operations (Australia) | 75.7 | | 12,625 | | 9,287 | | 12,008 | | 9,091 | | 13,269 | | 10,046 | |

| Mount Thorley Operations (Australia) | 60.6 | | 4,292 | | 2,524 | | 3,153 | | 1,910 | | 3,548 | | 2,149 | |

| Moura (Australia) (j) | – | | 2,399 | | 959 | | – | | – | | – | | – | |

| Narama (Australia) (j) | – | | 370 | | 135 | | – | | – | | – | | – | |

| Ravensworth East (Australia) (j) | – | | 387 | | 281 | | – | | – | | – | | – | |

| Warkworth (Australia) | 42.1 | | 6,882 | | 2,817 | | 5,868 | | 2,469 | | 6,954 | | 2,926 | |

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

| Total Coal & Allied Industries other coal | | | | | 17,590 | | | | 15,348 | | | | 16,729 | |

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

| Rio Tinto Coal Australia(g) | | | | | | | | | | | | | | |

| Blair Athol (Australia) | 71.2 | | 11,809 | | 8,412 | | 12,480 | | 8,890 | | 12,229 | | 8,712 | |

| Kestrel Coal (Australia) | 80.0 | | 1,685 | | 1,348 | | 1,449 | | 1,159 | | 623 | | 499 | |

| Tarong Coal (Australia) | 100.0 | | 5,685 | | 5,685 | | 6,538 | | 6,538 | | 7,004 | | 7,004 | |

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

| Total Rio Tinto Coal Australia other coal | | | | | 15,445 | | | | 16,587 | | | | 16,214 | |

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

| Total Australian other coal | | | | | 33,035 | | | | 31,935 | | | | 32,943 | |

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

| Kaltim Prima Coal(Indonesia) (k) | – | | 17,740 | | 8,870 | | 12,655 | | 6,327 | | – | | – | |

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

| Kennecott Energy | | | | | | | | | | | | | | |

| Antelope (US) | 100.0 | | 24,319 | | 24,319 | | 26,806 | | 26,806 | | 26,928 | | 26,928 | |

| Colowyo (US) | (l) | | 4,889 | | 4,889 | | 4,535 | | 4,535 | | 5,788 | | 5,788 | |

| Cordero Rojo (US) | 100.0 | | 34,724 | | 34,724 | | 32,671 | | 32,671 | | 35,233 | | 35,233 | |

| Decker (US) | 50.0 | | 9,021 | | 4,511 | | 7,358 | | 3,679 | | 7,831 | | 3,916 | |

| Jacobs Ranch (US) | 100.0 | | 28,784 | | 28,784 | | 32,418 | | 32,418 | | 34,979 | | 34,979 | |

| Spring Creek (US) | 100.0 | | 8,093 | | 8,093 | | 8,069 | | 8,069 | | 10,892 | | 10,892 | |

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

| Total US coal | | | | | 105,320 | | | | 108,177 | | | | 117,734 | |

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

| Rio Tinto total other coal | | | | | 147,225 | | | | 146,439 | | | | 150,677 | |

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

* Coal – other includes thermal coal, semi-soft coking coal and semi-hard coking coal.

See notes on page 20

Rio Tinto 2004Form 20-F 17

Back to Contents

| | | | 2002 | | 2003 | | 2004 |

| | | | Production (a) | | Production (a) | | Production(a) |

|

|

|

|

|

|

|

|

| | Rio | | Total | | Rio | | Total | | Rio | | Total | | Rio |

| | Tinto | | | | Tinto | | | | Tinto | | | | Tinto |

| | % share (b) | | | | share | | | | share | | | | share |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| COPPER (mined) (’000 tonnes) | | | | | | | | | | | | | |

| Alumbrera (Argentina) (m) | – | | 203.7 | | 50.9 | | 34.9 | | 8.7 | | – | | – |

| Bingham Canyon (US) | 100.0 | | 260.2 | | 260.2 | | 281.8 | | 281.8 | | 263.7 | | 263.7 |

| Escondida (Chile) | 30.0 | | 754.5 | | 226.3 | | 992.7 | | 297.8 | | 1,207.1 | | 362.1 |

| Grasberg – FCX (Indonesia) (n) | – | | 494.4 | | 107.5 | | 444.1 | | 84.5 | | 396.4 | | 5.5 |

| Grasberg – Joint Venture (Indonesia) (n) | 40.0 | | 370.0 | | 148.0 | | 271.7 | | 108.7 | | 120.0 | | 48.0 |

| Neves Corvo (Portugal) (o) | – | | 77.2 | | 37.8 | | 77.5 | | 38.0 | | 46.9 | | 23.0 |

| Northparkes (Australia) | 80.0 | | 38.4 | | 30.7 | | 27.1 | | 21.7 | | 30.0 | | 24.0 |

| Palabora (South Africa) | 49.2 | | 52.2 | | 25.7 | | 52.4 | | 25.8 | | 54.4 | | 26.8 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Rio Tinto total | | | | | 887.1 | | | | 867.0 | | | | 753.1 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| COPPER (refined) (’000 tonnes) | | | | | | | | | | | | | |

| Atlantic Copper (Spain) (n) | – | | 250.5 | | 41.5 | | 247.1 | | 38.1 | | 58.4 | | 7.0 |

| Escondida (Chile) | 30.0 | | 138.7 | | 41.6 | | 147.6 | | 44.3 | | 152.1 | | 45.6 |

| Kennecott Utah Copper (US) | – | | 293.7 | | 293.7 | | 230.6 | | 230.6 | | 246.7 | | 246.7 |

| Palabora (South Africa) | 49.2 | | 81.6 | | 40.2 | | 73.4 | | 36.1 | | 67.5 | | 33.2 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Rio Tinto total | | | | | 416.9 | | | | 349.1 | | | | 332.6 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

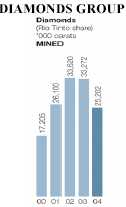

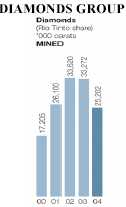

| DIAMONDS (’000 carats) | | | | | | | | | | | | | |

| Argyle (Australia) (p) | 100.0 | | 33,519 | | 33,503 | | 30,910 | | 30,910 | | 20,620 | | 20,620 |

| Diavik (Canada) | 60.0 | | – | | – | | 3,833 | | 2,300 | | 7,575 | | 4,545 |

| Merlin (Australia) | – | | 117 | | 117 | | 62 | | 62 | | – | | – |

| Murowa (Zimbabwe) (q) | 77.8 | | – | | – | | – | | – | | 47 | | 36 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Rio Tinto total | | | | | 33,620 | | | | 33,272 | | | | 25,202 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| GOLD (mined) (’000 ounces) | | | | | | | | | | | | | |

| Alumbrera (Argentina) (m) | – | | 754 | | 188 | | 124 | | 31 | | – | | – |

| Barneys Canyon (US) | 100.0 | | 75 | | 75 | | 35 | | 35 | | 22 | | 22 |

| Bingham Canyon (US) | 100.0 | | 412 | | 412 | | 305 | | 305 | | 308 | | 308 |

| Cortez/Pipeline (US) | 40.0 | | 1,082 | | 433 | | 1,085 | | 434 | | 1,051 | | 421 |

| Escondida (Chile) | 30.0 | | 126 | | 38 | | 184 | | 55 | | 217 | | 65 |

| Grasberg – FCX (Indonesia) (n) | – | | 1,375 | | 355 | | 1,456 | | 354 | | 1,377 | | 14 |

| Grasberg – Joint Venture (Indonesia) (n) | 40.0 | | 1,655 | | 662 | | 1,806 | | 722 | | 207 | | 83 |

| Greens Creek (US) | 70.3 | | 103 | | 72 | | 99 | | 70 | | 86 | | 61 |

| Kelian (Indonesia) | 90.0 | | 539 | | 485 | | 469 | | 422 | | 328 | | 295 |

| Lihir (Papua New Guinea) (r) | 14.5 | | 607 | | 99 | | 551 | | 88 | | 599 | | 87 |

| Morro do Ouro (Brazil) (s) | – | | 225 | | 115 | | 201 | | 103 | | 188 | | 96 |

| Northparkes (Australia) | 80.0 | | 41 | | 33 | | 49 | | 39 | | 79 | | 63 |

| Peak (Australia) (m) | – | | 97 | | 97 | | 20 | | 20 | | – | | – |

| Rawhide (US) | 51.0 | | 82 | | 42 | | 64 | | 32 | | 50 | | 25 |

| Rio Tinto Zimbabwe (Zimbabwe) (t) | – | | 38 | | 21 | | 25 | | 14 | | 11 | | 6 |

| Others | – | | 17 | | 8 | | 14 | | 7 | | 13 | | 7 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Rio Tinto total | | | | | 3,135 | | | | 2,731 | | | | 1,552 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| GOLD (refined) (’000 ounces) | | | | | | | | | | | | | |

| Kennecott Utah Copper (US) | 100.0 | | 488 | | 488 | | 308 | | 308 | | 300 | | 300 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| IRON ORE (’000 tonnes) | | | | | | | | | | | | | |

| Channar (Australia) | 60.0 | | 10,594 | | 6,356 | | 10,347 | | 6,208 | | 9,759 | | 5,855 |

| Corumbá (Brazil) | 100.0 | | 858 | | 858 | | 1,074 | | 1,074 | | 1,301 | | 1,301 |

| Eastern Range (Australia) (u) | – | | – | | – | | – | | – | | 2,970 | | 2,970 |

| Hamersley Iron (Australia) | 100.0 | | 57,563 | | 57,563 | | 63,056 | | 63,056 | | 65,407 | | 65,407 |

| Iron Ore Company of Canada (Canada) (v) | 58.7 | | 12,758 | | 7,168 | | 14,225 | | 8,353 | | 11,139 | | 6,541 |

| Robe River (Australia) | 53.0 | | 35,860 | | 19,006 | | 45,136 | | 23,922 | | 48,459 | | 25,684 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Rio Tinto total | | | | | 90,951 | | | | 102,613 | | | | 107,757 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| | | | | | | | | | | | | | |

| See notes on page 20 | | | | | | | | | | | | | |

Rio Tinto 2004Form 20-F 18

Back to Contents

| | | | 2002 | | 2003 | | 2004 | |

| | | | Production (a) | | Production (a) | | Production(a) | |

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

| | Rio Tinto | | Total | | Rio Tinto | | Total | | Rio Tinto | | Total | | Rio Tinto | |

| | % share (b) | | | | share | | | | share | | | | share | |

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

| LEAD (’000 tonnes) | | | | | | | | | | | | | | |

| Greens Creek (US) | 70.3 | | 22.3 | | 15.7 | | 22.5 | | 15.8 | | 19.8 | | 13.9 | |

| Zinkgruvan (Sweden) (w) | – | | 24.7 | | 24.7 | | 31.8 | | 31.8 | | 11.2 | | 11.2 | |

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

| Rio Tinto total | | | | | 40.4 | | | | 47.6 | | | | 25.1 | |

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

| MOLYBDENUM (’000 tonnes) | | | | | | | | | | | | | | |

| Bingham Canyon (US) | 100.0 | | 6.1 | | 6.1 | | 4.6 | | 4.6 | | 6.8 | | 6.8 | |

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

| NICKEL (mined) (’000 tonnes) | | | | | | | | | | | | | | |

| Fortaleza (Brazil) (x) | – | | 6.3 | | 6.3 | | 6.0 | | 6.0 | | – | | – | |

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

| NICKEL (refined) (’000 tonnes) | | | | | | | | | | | | | | |

| Empress (Zimbabwe) (t) | – | | 6.4 | | 3.6 | | 6.2 | | 3.5 | | 2.9 | | 1.6 | |

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

| SALT (’000 tonnes) | | | | | | | | | | | | | | |

| Dampier Salt (Australia) | 64.9 | | 7,186 | | 4,667 | | 7,135 | | 4,633 | | 7,380 | | 4,792 | |

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

| SILVER (mined) (’000 ounces) | | | | | | | | | | | | | | |

| Bingham Canyon (US) | 100.0 | | 3,663 | | 3,663 | | 3,548 | | 3,548 | | 3,584 | | 3,584 | |

| Escondida (Chile) | 30.0 | | 2,981 | | 894 | | 4,728 | | 1,418 | | 5,747 | | 1,724 | |

| Grasberg – FCX (Indonesia) (n) | – | | 3,795 | | 804 | | 3,659 | | 745 | | 3,077 | | 79 | |

| Grasberg – Joint Venture (Indonesia) (n) | 40.0 | | 2,607 | | 1,043 | | 2,815 | | 1,126 | | 1,961 | | 784 | |

| Greens Creek (US) | 70.3 | | 10,912 | | 7,668 | | 11,707 | | 8,226 | | 9,707 | | 6,821 | |

| Zinkgruvan (Sweden) (w) | – | | 1,554 | | 1,554 | | 1,841 | | 1,841 | | 651 | | 651 | |

| Others | – | | 3,231 | | 1,582 | | 2,511 | | 1,407 | | 2,025 | | 1,187 | |

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

| Rio Tinto total | | | | | 17,207 | | | | 18,311 | | | | 14,830 | |

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

| SILVER (refined) (’000 ounces) | | | | | | | | | | | | | | |

| Kennecott Utah Copper (US) | 100.0 | | 4,037 | | 4,037 | | 2,963 | | 2,963 | | 3,344 | | 3,344 | |

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

| TALC (’000 tonnes) | | | | | | | | | | | | | | |

| Luzenac Group (Australia/Europe/N. America) (y) | 99.9 | | 1,328 | | 1,327 | | 1,358 | | 1,357 | | 1,444 | | 1,443 | |

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

| TIN (tonnes) | | | | | | | | | | | | | | |

| Neves Corvo (Portugal) (o) | – | | 345 | | 169 | | 203 | | 100 | | 120 | | 59 | |

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

| TITANIUM DIOXIDE FEEDSTOCK (‘000 tonnes) | | | | | | | | | | | | | | |

| Rio Tinto Iron & Titanium (Canada/South Africa) (z) | 100.0 | | 1,274 | | 1,274 | | 1,192 | | 1,192 | | 1,192 | | 1,192 | |

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

| URANIUM (tonnes U3O8) | | | | | | | | | | | | | | |

| Energy Resources of Australia (Australia) | 68.4 | | 4,486 | | 3,068 | | 5,134 | | 3,512 | | 5,143 | | 3,517 | |

| Rössing (Namibia) | 68.6 | | 2,751 | | 1,887 | | 2,401 | | 1,647 | | 3,582 | | 2,457 | |

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

| Rio Tinto total | | | | | 4,955 | | | | 5,158 | | | | 5,974 | |

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

| ZINC (mined) (’000 tonnes) | | | | | | | | | | | | | | |

| Greens Creek (US) | 70.3 | | 66.5 | | 46.7 | | 69.1 | | 48.5 | | 62.7 | | 44.1 | |

| Zinkgruvan (Sweden) (w) | – | | 48.0 | | 48.0 | | 64.5 | | 64.5 | | 29.7 | | 29.7 | |

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

| Rio Tinto total | | | | | 94.7 | | | | 113.0 | | | | 73.8 | |

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

| | | | | | | | | | | | | | | |

| See notes on page 20 | | | | | | | | | | | | | | |

Rio Tinto 2004Form 20-F 19

Back to Contents

| Production data notes |

| (a) | Mine production figures for metals refer to the total quantity of metal produced in concentrates or doré bullion irrespective of whether these products are then refined onsite, except for the data for iron ore and bauxite which represent production of saleable quantities of ore. |

| (b) | Rio Tinto percentage share, shown above, is as at the end of 2004 and has applied over the period 2002 – 2004 except for those operations where the share has varied during the year and the weighted average for them is shown below. The Rio Tinto share varies at individual mines and refineries in the “others” category and thus no value is shown. |

| | | | | | | | | |

| | Rio Tinto share % | | | | | | | |

| | Operation | See Note | | 2002 | | 2003 | | 2004 |

| |

|

|

|

|

|

|

|

|

| | Atlantic Copper | (n) | | 16.5 | | 15.4 | | 12.0 |

| | Argyle | (p) | | 99.9 | | 100.0 | | 100.0 |

| | Bengalla | (i) | | 29.4 | | 30.3 | | 30.3 |

| | Boyne Island | (d) | | 56.6 | | 59.4 | | 59.4 |

| | Grasberg | (n) | | 15.0 | | 13.9 | | 10.8 |

| | Hail Creek | (h) | | – | | 92.0 | | 90.8 |

| | Hunter Valley Operations | (i) | | 73.6 | | 75.7 | | 75.7 |

| | Iron Ore Company of Canada | (v) | | 56.2 | | 58.7 | | 58.7 |

| | Lihir | (r) | | 16.3 | | 16.0 | | 14.5 |

| | Mount Thorley Operations | (i) | | 58.9 | | 60.6 | | 60.6 |

| | Moura | (i) (j) | | 40.0 | | – | | – |

| | Narama | (i) (j) | | 36.4 | | – | | – |

| | Ravensworth East | (i) (j) | | 72.7 | | – | | – |

| | Warkworth | (i) | | 41.2 | | 42.1 | | 42.1 |

| |

|

|

|

|

|

|

|

|

| | |

| (c) | Comalco Alumina Refinery started production in October 2004. |

| (d) | Rio Tinto acquired an approximately five per cent additional interest in production from the Boyne Island smelter with effect from August 2002. |

| (e) | Rio Tinto completed the sale of its four per cent interest in the Boké mine on 25 June 2004. Production data are shown up to the date of sale. |

| (f) | Borate quantities are expressed as B2O3 |

| (g) | Rio Tinto Coal Australia was previously known as Pacific Coal. |

| (h) | Hail Creek commenced production in the third quarter of 2003. Rio Tinto reduced its shareholding in Hail Creek from 92.0 per cent to 82.0 per cent on 15 November 2004. |

| (i) | Rio Tinto increased its stake in Coal & Allied Industries from 72.7 per cent to 75.7 per cent during September 2002. |

| (j) | On 14 March 2002, Coal & Allied completed the sale of its interests in Narama and Ravensworth. Coal & Allied sold its interest in the Moura coal mine with effect from 24 May 2002. Production data are shown up to the dates of sale. |

| (k) | Rio Tinto had a 50 per cent share in Kaltim Prima and, under the terms of its Coal Agreement, the Indonesian Government was entitled to a 13.5 per cent share of Kaltim Prima’s production. Rio Tinto’s share of production shown is before deduction of the Government share. Rio Tinto completed the sale of its interest in PT Kaltim Prima Coal on 10 October 2003. Production data are shown up to the date of sale. |

| (l) | Kennecott Energy has a partnership interest in the Colowyo mine but, as it is responsible under a management agreement for the operation of the mine, all of Colowyo’s output is included in Rio Tinto’s share of production. |

| (m) | Rio Tinto completed the sale of its 25 per cent interest in Minera Alumbrera together with its wholly owned Peak gold mine on 17 March 2003. Production data are shown up to the date of sale. |

| (n) | From mid 1995 until 30 March 2004, Rio Tinto held 23.93 million shares of Freeport-McMoRan-Copper & Gold (FCX) common stock from which it derived a share of production. This interest was sold on 30 March 2004. Also, through a joint venture agreement with FCX, Rio Tinto is entitled, as shown separately in the above tables, to 40 per cent of additional material mined as a consequence of expansions and developments of the Grasberg facilities since 1998. |

| (o) | Rio Tinto completed the sale of its 49 per cent interest in Somincor on 18 June 2004. Production data are shown up to the date of sale. |

| (p) | Rio Tinto’s interest in Argyle Diamonds increased from 99.8 per cent to 100 per cent on 29 April 2002, following the purchase of the outstanding units in the Western Australian Diamond Trust. |

| (q) | Ore mining and processing at Murowa commenced during the third quarter of 2004. |

| (r) | Following a placement of shares on 13 November 2003, Rio Tinto’s interest in Lihir moved from 16.3 per cent to 14.5 per cent. |

| (s) | Rio Tinto sold its interest in Morro do Ouro on 31 December 2004. Production data are shown up to the date of sale. |

| (t) | As a result of the corporate restructuring completed on 8 July 2004, Rio Tinto has ceased to be an ordinary shareholder in the renamed RioZim but will retain a reduced cash participation in its gold and nickel assets for a period of ten years. |

| (u) | Rio Tinto’s share of production includes 100 per cent of the production from the Eastern Range mine, which commenced production in March 2004. Under the terms of the joint venture agreement, Hamersley Iron manages the operation and is obliged to purchase all mine production from the joint venture. |

| (v) | Rio Tinto increased its shareholding in Iron Ore Company of Canada from 56.1 per cent to 58.7 per cent on 20 December 2002. |

| (w) | Rio Tinto completed the sale of its 100 per cent interest in the Zinkgruvan mine on 2 June 2004. Production data are shown up to the date of sale. |

| (x) | Rio Tinto completed the sale of its 100 per cent interest in the Fortaleza nickel mine on 16 January 2004. This was effective from 1 January 2004. |

| (y) | Talc production includes some products derived from purchased ores. |

| (z) | Quantities comprise 100 per cent of QIT and 50 per cent of Richards Bay Minerals’ production. |

ORE RESERVES

Ore reserves prepared in accordance with Industry Guide 7 under the Unites States Securities Act of 1933 have been set out on pages A-85 to A-95.

Rio Tinto 2004Form 20-F 20

Back to Contents

GROUP OPERATIONS(wholly owned unless stated otherwise)

|

| | ALUMINIUM | | COPPER AND GOLD | | IRON ORE | | TALC |

| | Operating sites | | Operating sites | | Operating sites | | Operating sites |

| 1 | Anglesey Aluminium (51%) | 20 | Bougainville (not operating) | 33 | Corumbá | | (only major sites are |

| 2 | Bell Bay | | (54%) | 34 | Hamersley Iron mines: | | shown) |

| 3 | Boyne Island (59%) | 21 | Cortez/Pipeline (40%) | | Brockman | 44 | Ludlow |

| 3 | Comalco Alumina Refinery | 22 | Escondida (30%) | | Marandoo | 45 | Talc de Luzenac (99.9%) |

| 3 | Gladstone Power Station | 23 | Grasberg joint venture (40%) | | Mt Tom Price | 46 | Yellowstone |

| | (42%) | 24 | Kelian (90%) | | Paraburdoo | 47 | Three Springs |

| 3 | Queensland Alumina (39%) | 19 | Kennecott Utah Copper | | Yandicoogina | | |

| 4 | Eurallumina (56%) | 25 | Lihir (14%) | | Channar (60%) | | TITANIUM DIOXIDE |

| 5 | Tiwai Point (79%) | 26 | Northparkes (80%) | | Eastern Range (54%) | | FEEDSTOCK |

| 6 | Weipa | 27 | Palabora (49%) | 35 | Iron Ore Company of | | Operating sites |

| | | 28 | Rawhide (51%) | | Canada (59%) | 48 | QIT-Fer et Titane Lac Allard |

| | BORATES | | | 34 | Robe River mines: (53%) | 49 | QIT-Fer et Titane Sorel |

| | Operating sites | | Projects | | West Angelas | | Plant |

| 7 | Boron | 29 | Resolution (55%) | | Pannawonica | 50 | Richards Bay Minerals (50%) |

| 8 | Coudekerque Plant | | | | | | |

| 9 | Tincalayu | | DIAMONDS | | Projects | | Projects |

| 10 | Wilmington Plant | | Operating sites | 36 | HIsmelt®(60%) | 51 | QIT Madagascar Minerals |

| | | 30 | Argyle | 37 | IOC Pellet Plant (59%) | | (80%) |

| | COAL | 31 | Diavik (60%) | 38 | Simandou | | |

| | Operating sites | 32 | Murowa (78%) | 39 | Orissa (51%) | | URANIUM |

| 11 | Antelope | | | | | | Operating sites |

| 12 | Bengalla (30%) | | | | NICKEL | 52 | ERA (68%) |

| 13 | Blair Athol (71%) | | | | Projects | 53 | Rössing (69%) |

| 14 | Colowyo (20%) | | | 40 | Eagle | | |

| 11 | Cordero Rojo | | | | | | ZINC, LEAD, SILVER |

| 15 | Decker (50%) | | | | POTASH | | Operating sites |

| 13 | Hail Creek (82%) | | | | Projects | 54 | Greens Creek (70%) |

| 16 | Hunter Valley Operations | | | 41 | Rio Colorado Potash | | |

| | (76%) | | | | | | |

| 11 | Jacobs Ranch | | | | SALT | | |

| 17 | Kestrel (80%) | | | | Operating sites | | |

| 16 | Mt Thorley Operations | | | 42 | Dampier (65%) | | |

| | (61%) | | | 43 | Lake MacLeod (65%) | | |

| 15 | Spring Creek | | | 42 | Port Hedland (65%) | | |

| 18 | Tarong | | | | | | |

| 16 | Warkworth (42%) | | | | |  | Mines and mining projects |

| | | | | | | | |

| | Projects | | | | |  | Smelters, refineries and |

| 13 | Clermont (50%) | | | | | | processing plants remote |

| 12 | Mt Pleasant (76%) | | | | | | from mine |

Rio Tinto 2004Form 20-F 21

Back to Contents

INFORMATION ON GROUP MINES(wholly owned unless stated otherwise)

| Mine | | Location | | Access | | Title/lease |

|

| ALUMINIUM | | | | | | |

|

| Comalco | | Weipa, Queensland, Australia | | Road, air, and port | | Queensland Government lease expires in 2041 with 21 year extension, then two years’ notice of termination |

|

| COPPER | | | | | | |

|

| Escondida(30%) | | Atacama Desert, Chile | | Pipeline and road to deep sea port at Coloso | | Rights conferred by Government under Chilean Mining Code |

|

| Grasberg(40% joint venture) | | Papua, Indonesia | | Pipeline, road and port | | Indonesian Government Contracts of Work expire in 2021 with two ten year extensions |

|

| Kennecott Minerals | | Nevada, US | | Road | | Patented and unpatented mining claims |

| Cortez/Pipeline (40%) |

|

| Kennecott Minerals | | Alaska, US | | Port | | Patented and unpatented mining claims |

| Greens Creek (70%) |

|

| Kennecott Utah Copper | | Near Salt Lake City, Utah, US | | Pipeline, road and rail | | Owned |

| Bingham Canyon |

|

| Northparkes(80%) | | Goonumbla, New South | | Road and rail | | State Government mining lease issued in 1991 for 21 years |

| Wales, Australia |

|

| Palabora(49%) | | Phalaborwa, Northern | | Rail and road | | Lease from South African Government until deposits exhausted and base metal claims owned by Palabora |

| Province, South Africa |

|

| DIAMONDS | | | | | | |

|

| Diavik(60%) | | Northwest Territories, Canada | | Air, ice road in winter | | Mining leases from Canadian federal government |

|

| Argyle Diamonds | | Kimberley Ranges, Western Australia | | Road and air | | Mining tenement held under Diamond (Argyle Diamond Mines Joint Venture) Agreement Act 1981-83; lease extended for 21 years from 2004 |

|

| Murowa(78%) | | Zvishavane, Zimbabwe | | Road and air | | Claims and mining leases |

|

| ENERGY | | | | | | |

|

| Coal & Allied Industries | | New South Wales, Australia | | Road, rail and port | | Leases granted by State |

| (76%) |

| Bengalla (30%) |

| Hunter Valley Operations |

| (76%) |

| Mount Thorley (61%) |

| Warkworth (42%) |

|

| Energy Resources of | | Northern Territory, Australia | | Road | | Leases granted by State |

| Australia(68%) |

| Ranger |

|

|

|

|

|

|

|

Rio Tinto 2004Form 20-F 22

Back to Contents

| Mine | | History | | Type of mine | | Power source |

|

| ALUMINIUM | | | | | | |

|

| Comalco | | Bauxite mining commenced in 1961; Major upgrade completed in 1998 to incorporate Alcan’s adjacent Ely reserve in overall mining plan; Rio Tinto interest increased from 72.4% to 100% in 2000; In 2004 a mine expansion was completed to lift annual capacity to16.5 million tonnes | | Open cut | | On site generation; new power station under construction |

|

| COPPER | | | | | | |

|

| Escondida(30%) | | Production started in 1990 and expanded in phases to 2002 when new concentrator was completed; approval in 2003 for Norte project | | Open pit | | Supplied from SING grid under two contracts with Norgener to 2008 |

|

| Grasberg(40% joint venture) | | Joint venture interest acquired 1995; capacity expanded to over 200,000 tonnes of ore per day in 1998 with addition of underground production of more than 35,000 tonnes per day in 2003 | | Open pit and underground | | Long term contract with US-Indonesian consortium operated, |

|

| Kennecott Minerals | | Gold production started at Cortez in 1969; Pipeline in 1997 | | Open pit | | Public utility |

| Cortez/Pipeline (40%) |

|

| Kennecott Minerals | | Redeveloped in 1997 | | Underground/drift and fill | | On site diesel generators |

| Greens Creek (70%) |

|

Kennecott Utah Copper

Bingham Canyon | | Interest acquired in 1989; modernisation includes smelter complex and expanded tailings dam | | Open pit | | On site generation supplemented by long term contracts with Utah Power and Light |

|

| Northparkes(80%) | | Interest acquired in 2000; production | | Open pit and underground | | Supplied from State grid |

| | | started in 1995 | | | | |

|

| Palabora(49%) | | Development of 20 year underground mine commenced 1996 with open pit closure in 2003 | | Open pit and underground | | Supplied by ESKOM via grid |

|

| DIAMONDS | | | | | | |

|

| Diavik(60%) | | Deposits discovered 1994-1995; construction approved 2000; diamond production started 2003 | | Open pit to underground | | On site diesel generators; installed capacity 27MW |

|

| Argyle Diamonds | | Studies into further development options, including underground mining, continue; interest increased from 59.7% following purchase planned of Ashton Mining in 2000 | | Open pit to underground | | Long term contract with Ord Hydro Consortium and on site generation back up |

|

| Murowa(78%) | | Discovered 1997; small scale production started 2004 Open pit | | | | Supplied by ZESA |

|

| ENERGY | | | | | | |

|

| Coal & Allied Industries | | Lemington acquired late 2000 and integrated with Hunter Valley Operations. Peabody Australian interests acquired in 2001. Moura, Narama and Ravensworth interests divested in 2002 | | Open cut | | State owned grid |

| (76%) |

| Bengalla (30%) |

| Hunter Valley Operations |

| (76%) |

| Mount Thorley (61%) |

| Warkworth (42%) |

|

| Energy Resources of | | Mining commenced 1981; interest acquired through North in 2000 | | Open pit | | On site diesel / steam power generation |

| Australia(68%) |

| Ranger |

|

|

|

|

|

|

|

Rio Tinto 2004Form 20-F 23

Back to Contents

| Mine | | Location | | Access | | Title/lease |

|

| ENERGY | | | | | | |

|

| Kennecott Energy | | Wyoming, Montana and Colorado, US | | Rail and road | | Leases from US and State Governments and private parties, with minimum coal production levels, and adherence to permit requirements and statutes |

| Antelope |

| Colowyo (20%) |

| Cordero Rojo |

| Decker (50%) |

| Jacobs Ranch |

| Spring Creek |

|

| Rio Tinto Coal Australia | | Queensland, Australia | | Conveyor, road, rail and port | | Leases granted by State |

| Blair Athol (71%) |

| Kestrel (80%) |

| Hail Creek (82%) |

| Tarong |

|

| Rössing Uranium(69%) | | Namib Desert, Namibia | | Rail, road and port | | Federal lease |

|

| INDUSTRIAL MINERALS | | | | | | |

|

| Boron | | California, US | | Road, rail and port | | Owned |

|

| Dampier Salt(65%) | | Dampier, Lake MacLeod and Port Hedland, Western Australia | | Road and port | | Mining leases expiring in 2013 at Dampier, 2018 at Port Hedland and2021 at Lake MacLeod with options to renew in each case |

|

| Luzenac | | Trimouns, France (other smaller operations in Australia, Europe and North America) | | Road and rail | | Owner of ground (orebody) and long term lease agreement to 2012 |

|

| QIT-Fer et Titane | | Saguenay County, Quebec ,Canada | | Rail and port (St Lawrence River) | | Mining covered by two Concessions granted by State in 1949 and 1951 which, subject to certain Mining Act restrictions, confer rights and obligations of an owner |

|

Richards Bay Minerals