Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSRS

CERTIFIED SHAREHOLDER REPORT OF

REGISTERED MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: Parnassus Funds (811-04044) and Parnassus Income Funds (811-06673)

Parnassus Funds

Parnassus Income Funds

(Exact name of registrant as specified in charter)

1 Market Street, Suite 1600, San Francisco, California 94105

(Address of principal executive offices) (Zip code)

Marc C. Mahon

Parnassus Funds

Parnassus Income Funds

1 Market Street, Suite 1600, San Francisco, California 94105

(Name and address of agent for service)

Registrant’s telephone number, including area code: (415) 778-0200

Date of fiscal year end: December 31

Date of reporting period: June 30, 2014

Table of Contents

Item 1: Report to Shareholders

Table of Contents

PARNASSUS FUNDS®

SEMIANNUAL REPORT ¡ JUNE 30, 2014

PARNASSUS FUNDS

| Parnassus FundSM | PARNX | |

| Parnassus Core Equity FundSM – Investor Shares | PRBLX | |

| Parnassus Core Equity Fund – Institutional Shares | PRILX | |

| Parnassus Endeavor FundSM | PARWX | |

| Parnassus Mid Cap FundSM | PARMX | |

| Parnassus Small Cap FundSM | PARSX | |

| Parnassus Asia FundSM | PAFSX | |

| Parnassus Fixed Income FundSM | PRFIX | |

Table of Contents

Table of Contents

| PARNASSUS FUNDS | Semiannual Report • 2014 | |||

August 4, 2014

Enclosed are the semiannual reports for all the Parnassus Funds. I think you’ll find them interesting, since they describe how our investment strategy relates to individual companies and how we did during the quarter.

In the last report, I mentioned how I knew all of our shareholders by name 30 years ago, when I started the Parnassus Fund. In those days, we had only a few million dollars in assets, so communication was easy. Today, we have over $12 billion in assets spread over 350,000 shareholders. Although there’s no way I can know each of you by name now, I would like to know more about you and why you chose the Parnassus Funds. You can help me to gain a better understanding of our shareholders by completing a survey that should take you no more than five minutes. Your answers will be completely anonymous and your privacy will be respected.

To participate in the survey, please go to www.parnassus.com/survey.

Another big difference from the early days of the Funds is that instead of investing directly with us, a majority of you now invest through “fund supermarkets” like Schwab, Fidelity and TD Ameritrade. This affects how many reports you receive per year. The Securities and Exchange Commission (SEC) only requires that we send out reports twice a year: the annual and the semiannual. The fund supermarkets have chosen to send out reports only twice a year, but we send out reports four times a year to our direct shareholders. Because our reports are so important to understanding our investment strategy and performance, we would like all of our shareholders to be able to receive four reports a year. Right now, of course, you can still see all the quarterly reports by going to our website, where the reports are usually posted about 35 days after the end of each quarter. Even though you can access the reports on our website, we would like to send the reports directly to your digital mailbox. Since the fund supermarkets don’t tell us who you are, we need your help to enable us to send you the extra two reports a year. If you sign up, we will send you an electronic copy of the shareholder reports four times a year. Just use the following link and fill in your e-mail address www.parnassus.com/Qreports.

Interns

As most of you know, the Parnassus intern program is one of the proudest accomplishments of Parnassus Investments. We offer an opportunity for students and other young people to get hands-on experience in investment analysis and management. Almost all of our analysts and portfolio managers started as interns. Over the years, we have expanded our research analyst intern program to include internships in accounting, information technology, marketing and ESG research (environmental, social and governance).

We have eight excellent interns with us this summer, four of them in investment research and management, one in information technology, two in accounting and one in marketing. Angela Du is a research intern and MBA candidate at the Wharton School of Business at the University of Pennsylvania. Previously, she worked as a private equity associate at TPG Capital and as an analyst at Goldman Sachs. Angela graduated with distinction from Stanford University, where she studied management science and engineering and was inducted into Phi Beta Kappa and Tau Beta Pi. She also studied abroad at Peking University in China. In her free time, Angela enjoys traveling, yoga and cooking.

Alistair Thornton is an MBA candidate at Stanford University’s Graduate School of Business. Previously, he spent five years in Beijing, working as a Senior China Economist at IHS. Alistair is the co-founder of Young China Watchers, a 1,500 member organization with chapters in Beijing, Shanghai, Hong Kong and London. Born in London, he holds masters’ degrees from the University of Edinburgh, the University of Sydney and the University of London. Alistair speaks fluent Mandarin.

Matt Cooper is an MBA candidate at Stanford University’s Graduate School of Business. Previously, he worked at the Boston Consulting Group in Chicago and Bain Capital in Boston. He graduated summa cum laude from the University of Michigan, where he studied industrial and operations engineering as well as economics. Matt enjoys traveling, cooking and doing advanced sports analytics. Originally from Chicago, Matt is happy to have moved to the San Francisco Bay Area where he enjoys the warm weather.

Rebecca Chau is a senior at the University of California, Irvine, where she is majoring in business administration with an emphasis on finance and marketing. She has worked for Lam & Associates, a small business consulting firm for non-profit

4

Table of Contents

| Semiannual Report • 2014 | PARNASSUS FUNDS | |||

organizations based in Orange County, California, and she has also worked at the University Children’s Center in Irvine. Rebecca enjoys traveling, cooking and baking as well as indoor rock-climbing to work up an appetite.

Jordeen Chang, an information technology intern at Parnassus, is a junior at the University of California, Berkeley, where she majors in both computer science and statistics. Jordeen is a member of a web-design team that creates websites for campus organizations. At Parnassus, Jordeen is working on an ESG database. She hopes to have a future in big data. In her free time, she enjoys coding, exploring, eating and good design.

Tess Filbeck Bates is a sales and marketing intern at Parnassus and a senior at Mills College in Oakland, California, where she rows on the crew team. At Mills, she studies both economics and music performance, while she simultaneously pursues an MBA. Tess has also mentored children in sports and music and has interned at Reos Partners, an international relations agency. In her free time, she likes playing the ukulele and composing on the piano.

Andrew Girardi is an accounting intern at Parnassus and is currently a student at Diablo Valley College. He plans to enter California State University in Sacramento next fall where he will pursue a bachelor’s degree in business administration with a minor in history. Andrew enjoys carpentry and wood-working.

Andres Salazar is also an accounting intern at Parnassus. He just completed his first year as an accounting major at St. Mary’s College of California. He has volunteered for Glide Memorial Church in San Francisco. In his free time, Andy plays soccer and spends time with his family and friends.

Below is a photograph of the intern reunion that Parnassus held in June.

5

Table of Contents

| PARNASSUS FUNDS | Semiannual Report • 2014 | |||

Seated (left to right): Romahlo Wilson, Marie Lee, Angela Du, Jessica So, Jerome Dodson, Carrie Lo, Robby Klaber and Iyassu Essayas. Standing (left to right): Dan Beck, Ryan Wilsey, Vikram Gupta, Russ Caprio, Matt Gershuny, Todd Ahlsten, Ben Allen, Kent Chan, Ian Sexsmith, Paul Ebner and Bryan Wong.

New Staff Member

Darlene Ohrman has joined the Parnassus staff as a trade operations associate. She has had over ten years of experience in the financial industry with expertise in trading and operations. Previously, she worked as an associate with two hedge funds: Money Management Group and Armored Wolf LLC. Darlene has also worked as a foreign currency operations analyst for Bank of America. She is a native of Seattle and enjoys traveling and spending time with her family.

Finally, I would like to thank all of you for investing in the Parnassus Funds. We appreciate your support, and we’ll work hard to give you a good return on your investment.

Yours truly,

Jerome L. Dodson

President

P.S. Don’t forget to participate in our shareholder survey, so we can learn more about your thoughts on Parnassus Investments. It will take less than five minutes. Please log on to www.parnassus.com/survey

P.P.S. If you’ve invested with Parnassus through a fund supermarket, and you’re not receiving the quarterly reports for March 31 and September 30 each year, you can request electronic delivery of all four quarterly reports each year, by going to www.parnassus.com/Qreports

6

Table of Contents

| Semiannual Report • 2014 | PARNASSUS FUNDS | |||

Ticker: PARNX

As of June 30, 2014, the net asset value per share (“NAV”) of the Parnassus Fund was $49.57, so the total return for the quarter was 4.80%. This compares to a return of 5.23% for the S&P 500 Index (“S&P 500”) and 4.31% for the Lipper Multi-Cap Core Average, which represents the average return of the multi-cap core funds followed by Lipper (“Lipper average”). For the quarter, we were slightly below the S&P 500, but we were slightly ahead of the Lipper average. For the year-to-date, we are ahead of our benchmarks, as the Fund is up 8.09%, compared to gains of 7.13% for the S&P 500 and 6.29% for the Lipper average.

Below is a table comparing the Parnassus Fund with the S&P 500 and the Lipper average over the past one-, three-, five- and ten-year periods ended June 30, 2014. You will notice that we are ahead of both indices for all time periods.

Company Analysis

Six companies contributed 20¢ or more to the NAV, while only one took 20¢ or more off the value of each Parnassus share. The laggard was Finisar, a company that makes optical equipment for telecommunications networks and data centers. The stock sank 25.5% during the quarter from $26.51 to $19.75, slicing 29¢ off the value of each Fund share. Although earnings were pretty good last quarter, gross margins disappointed investors and guidance for the next quarter was weak. Demand is increasing for Finisar’s products including a 4G build-out in China, but most of the demand has been for the company’s low-margin products, and this has had a big impact on earnings. Trends in the market seem to indicate that demand for telecom products will continue to be strong, and at some point, Finisar’s earnings and margins should improve.

| Parnassus Fund | ||||||||||||||||||||||||

| Average Annual Total Returns (%) | One Year | Three Years | Five Years | Ten Years | Gross Expense Ratio | Net Expense Ratio | ||||||||||||||||||

| for periods ended June 30, 2014 | ||||||||||||||||||||||||

| Parnassus Fund | 28.64 | 20.04 | 20.67 | 9.78 | 0.86 | 0.86 | ||||||||||||||||||

| S&P 500 Index | 24.60 | 16.54 | 18.80 | 7.77 | NA | NA | ||||||||||||||||||

| Lipper Multi-Cap Core Average | 24.28 | 14.32 | 17.67 | 7.58 | NA | NA | ||||||||||||||||||

Performance data quoted represent past performance and are no guarantee of future returns. Current performance may be lower or higher than the performance data quoted. Current performance information to the most recent month-end is available on the Parnassus website (www.parnassus.com). Investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original principal cost. Returns shown in the table do not reflect the deduction of taxes a shareholder may pay on fund distributions or redemption of shares. The S&P 500 Composite Stock Index (also known as the S&P 500) is an unmanaged index of common stocks, and it is not possible to invest directly in an index. Index figures do not take any expenses, fees or taxes into account, but mutual fund returns do.

Before investing, an investor should carefully consider the investment objectives, risks, charges and expenses of the Fund and should carefully read the prospectus or summary prospectus, which contain this and other information. The prospectus or summary prospectus can be obtained on the Parnassus website, or by calling (800) 999-3505.

The big winner for the quarter was C.H. Robinson, a logistics company with an emphasis on serving as a broker between shippers and truckers. The stock soared 21.8% from $52.39 to $63.79 for a gain of 40¢ for each Fund share, as the company reported earnings that beat expectations, and management provided an upbeat outlook for the coming months. Although the economy has been improving and more goods are being shipped, shareholders may remember that in previous quarters, the stock performed poorly, because truckers were firm in keeping up their rates, while shippers were firm in not paying higher prices, so brokers were squeezed. When we invested in 2012, our thesis was that margins would eventually expand, as demand outstripped carrier supply, allowing Robinson to charge shippers more for access to its industry-leading carrier network. It looks as if we might have finally hit that inflection point this quarter.

GenMark Diagnostics, a maker of molecular-diagnostics testing equipment, saw its stock soar 38.2% from $9.79, where we bought it in April, to $13.53 by the end of the quarter, in the process adding 31¢ to the NAV. Strong adoption of the XT-8 testing instrument moved earnings higher. The company also plans to bring out a second-generation product called the NexGen, which should triple the company’s addressable market, because of its advantages in disease identification and time-to-treatment benefits.

7

Table of Contents

| PARNASSUS FUNDS | Semiannual Report • 2014 | |||

Applied Materials, the world’s largest maker of semiconductor-manufacturing-equipment, climbed 10.4% from $20.42 to $22.55, while adding 26¢ to the NAV. The company saw strong demand for its capital equipment, as customers such as Intel, Samsung and Taiwan Semiconductor increase capacity to build more advanced chips.

Like Applied Materials, Lam Research is a global supplier of semiconductor-manufacturing-equipment, and its stock rose 22.9% from $55 to $67.58 for a gain of 20¢ for each Parnassus share. Lam reported strong earnings, driven by increased capital spending and market-share gains with its etch application for semiconductor processing at Intel. The stock moved even higher, when the company initiated a quarterly dividend and expanded its share repurchase program to $850 million.

Equinix provides data centers and Internet connection services to corporations, content providers and Internet-service-providers. Strong demand to move data around the Internet increased revenue and earnings, which boosted the stock by 13.7% from $184.84 to $210.09 for a gain of 20¢ on the NAV.

Homebuilder DR Horton rose 13.5% from $21.65 to $24.58 for a gain of 20¢ to the NAV. Revenue has grown 21% since last year and earnings have grown 18%, but the big move in the stock came at the end of the quarter; pending home sales increased 6.2% from month-to-month, one of the largest increases in decades. As the economy improves, demand for housing will increase, and the stock should move even higher.

Outlook and Strategy

(Note: This section represents the thoughts of Jerome L. Dodson and applies to the Parnassus Fund and the Parnassus Endeavor Fund. Other views appear with the reports on the other Funds.)

By many measures, the stock market is at an all-time high. Although the economy hasn’t fully recovered from the Great Recession of 2008-2010, the stock market has. Most of the time, the market forecasts future economic events, and right now the market is predicting a complete economic recovery.

For my part, I’m inclined to believe that the market is correct. Those of you who have been reading my shareholder reports for a while know that my favorite economic statistic is job creation, since that’s what drives the economy. Until recently, the number of net new jobs per month has averaged between 100,000 and 150,000. By comparison, the number of net new jobs from March to October of 2004 averaged over 200,000. This was the period when the recovery from the 2001-2003 recession really got going. Given the enormous number of jobs lost in the 2008-2010 period, one would have thought that the number of jobs created after that recession would have been much larger. In any case, it looks like things are picking up with 288,000 jobs created in the month of June 2014. The unemployment rate has dropped to 6.1%, which is the lowest since September of 2008. More employed people means more housing demand, and more housing drives the entire economy, which in turn, creates more jobs.

The one concern I have is that the market may have gotten ahead of itself, so it might be vulnerable to an economic shock. It’s impossible to know what this economic shock might be, but my guess is that it would be a big jump in interest rates. The Federal Reserve controls interest rates (especially the short-term ones), and some of the Fed’s members (the “hawks”) are already arguing for an increase in interest rates to head off

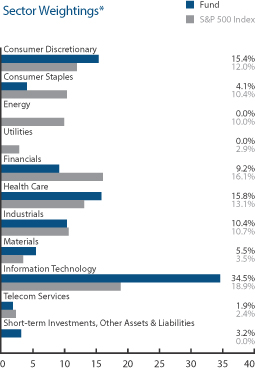

Parnassus Fund as of June 30, 2014 (percentage of net assets) | ||

* For purposes of categorizing securities for diversification requirements under the Investment Company Act, the Fund uses industry classifications that are more specific than those used for the chart.

Top 10 Holdings

(percentage of net assets)

| Applied Materials Inc. | 5.3% | |||

| International Business Machines Corp. | 4.3% | |||

| Ciena Corp. | 4.1% | |||

| C.H. Robinson Worldwide Inc. | 4.1% | |||

| PulteGroup Inc. | 3.7% | |||

| Equinix Inc. | 3.3% | |||

| DR Horton Inc. | 3.3% | |||

| QUALCOMM Inc. | 3.2% | |||

| Air Lease Corp. | 3.1% | |||

| Thomson Reuters Corp. | 2.9% | |||

Portfolio characteristics and holdings are subject to change periodically.

8

Table of Contents

| Semiannual Report • 2014 | PARNASSUS FUNDS | |||

inflation. The “doves” like the Chair, Janet Yellen, maintain that we need to keep interest rates low to help employment and keep the economy moving.

The hawks argue that with more jobs being created, and the unemployment rate dropping, the economic capacity is strained, and this will lead to inflation. At some point, of course, the hawks will be right, and we’ll need to raise rates to stop inflation. Right now, though, I think Janet Yellen is right and I’m one of the doves. Here’s why:

Although job-creation is picking up and unemployment is down, there is still more idle capacity in the economy than the figures would indicate. The unemployment rate is based on the number of people looking for work, and if someone is not working, but not looking, they are not counted as unemployed. Many of the people in this category should not be counted as unemployed, since they probably would not take a job even if it were offered to them. This category includes students, retired people and affluent individuals who don’t need to work. However, there are a lot of other people who would take work if they could find it, but they are so discouraged by their inability to find a job, that they have given up looking. These people are not considered unemployed. However, these discouraged workers would gladly take a job if conditions in the labor market improved.

As more jobs become available, I think we’ll see the unemployment rate stay flat or even tick up a bit, because some of these discouraged workers will start looking again. There’s also the issue of people who are underemployed, meaning they are qualified for a better job or they are working part-time and they really want a full-time job. What this means to me, and I think to Janet Yellen, is that there is a lot more capacity in the economy than meets the eye. This is why I think it’s important to keep interest rates low for a much longer period. I don’t think there’s much danger of the economy over-heating right now given all the excess capacity.

Now, how does all this relate to the stock market? When interest rates move higher, some people will take some of their money out of the stock market and put it in the bank, since they will earn more interest than before. The higher the rate, the more people will put their money in the bank to earn interest. As people sell stock to put their money in the bank, pressure will build on the stock market to move lower.

The other thing that happens when interest rates move higher is that it becomes more expensive to borrow money, so consumers will be more reluctant to borrow to consume and business executives will be more reluctant to borrow to invest in their enterprises. This leads to less economic activity, which is not good for the stock market.

There is, however, one caveat to this analysis. As economic activity picks up, interest rates rise, but this does not necessarily mean that either consumers or businesses will borrow less. If economic activity is such that businesses feel they can still make a profit from borrowed funds, even at higher interest rates, they will still go ahead and borrow, thereby increasing economic activity. Similarly, consumers may still borrow if times are good, even if interest rates are higher, since they will be more confident in their economic prospects.

What all this boils down to is that a modest increase in interest rates probably won’t derail the economy, although a sharp one might do so. As long as Janet Yellen is Chair of the Federal Reserve and has a majority of members on her side, it’s unlikely that there will be such a sharp increase in interest rates. For this reason, I’m pretty optimistic about the economy.

This view of the economy, though, does not mean that the stock market will necessarily go higher. The stock market may stay flat even if the economy steams ahead, because the stock market at current levels is already discounting future economic progress. Stocks may even drop a bit during the traditionally weak summer months. However, as long as Janet Yellen can keep interest rates reasonably low, I think there’s not much risk of a big move to the downside.

In the final analysis, what matters most are the individual stocks in our portfolio, and in my view, they are undervalued and should do well going forward. If the market moves sharply lower, all stocks will go down, including ours, but I think the business prospects of our portfolio companies are such that they will bounce back in time. Right now, I don’t see any big move down in the near future.

Yours truly,

|  |  | ||

| Jerome L. Dodson | Ian Sexsmith | Romahlo Wilson | ||

| Lead Portfolio Manager | Portfolio Manager | Portfolio Manager |

9

Table of Contents

| PARNASSUS FUNDS | Semiannual Report • 2014 | |||

Ticker: Investor Shares - PRBLX

Ticker: Institutional Shares - PRILX

As we announced previously, the new name of the Parnassus Equity Income Fund is the Parnassus Core Equity Fund. The new name better reflects the investment objective of total return and not just income. As of June 30, 2014, the NAV of the Parnassus Core Equity Fund-Investor Shares was $39.52. After taking dividends into account, the total return for the second quarter was 7.44%. This compares to increases of 5.23% for the S&P 500 Index ("S&P 500") and 5.02% for the Lipper Equity Income Fund Average, which represents the average return of the equity income funds followed by Lipper ("Lipper average"). For the first half of 2014, the Fund posted a return of 8.29%, which compares favorably to gains of 7.13% for the S&P 500 and 7.28% for the Lipper average.

Below is a table that summarizes the performance of the Fund, the S&P 500 and the Lipper average. The returns are for the one-, three-, five- and ten-year periods ended June 30, 2014.

| Parnassus Core Equity Fund | ||||||||||||||||||||||||

| Average Annual Total Returns (%) | One Year | Three Years | Five Years | Ten Years | Gross Expense Ratio | Net Expense Ratio | ||||||||||||||||||

| for periods ended June 30, 2014 | ||||||||||||||||||||||||

| Parnassus Core Equity Fund Investor Shares | 26.99 | 18.26 | 18.24 | 10.29 | 0.87 | 0.87 | ||||||||||||||||||

| Parnassus Core Equity Fund Institutional Shares | 27.21 | 18.46 | 18.45 | 10.46 | 0.69 | 0.69 | ||||||||||||||||||

| S&P 500 Index | 24.60 | 16.54 | 18.80 | 7.77 | NA | NA | ||||||||||||||||||

| Lipper Equity Income Fund Average | 20.95 | 14.08 | 17.07 | 8.02 | NA | NA | ||||||||||||||||||

The average annual total return for the Parnassus Core Equity Fund-Institutional Shares from commencement (April 28, 2006) was 10.86%. Performance shown prior to the inception of the Institutional Shares reflects the performance of the Parnassus Core Equity Fund-Investor Shares and includes expenses that are not applicable to and are higher than those of the Institutional Shares. The performance of Institutional Shares differs from that shown for the Investor Shares to the extent that the classes do not have the same expenses. Performance data quoted represent past performance and are no guarantee of future returns. Current performance may be lower or higher than the performance data quoted, and current performance information to the most recent month-end is available on the Parnassus website (www.parnassus.com). Investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original principal cost. Returns shown in the table do not reflect the deduction of taxes a shareholder may pay on fund distributions or redemption of shares. The S&P 500 is an unmanaged index of common stocks, and it is not possible to invest directly in an index. Index figures do not take any expenses, fees or taxes into account, but mutual fund returns do. On March 31, 1998, the Fund changed its investment objective from a balanced portfolio to an equity income portfolio.

Before investing, an investor should carefully consider the investment objectives, risks, charges and expenses of the Fund and should carefully read the prospectus or summary prospectus, which contain this and other information. The prospectus or summary prospectus can be obtained on the Parnassus website, or by calling (800) 999-3505.

Second Quarter Review

The Fund gained 7.4% for the quarter, outpacing the S&P 500 by more than two percentage points. Our sector allocations had a slightly positive impact on our performance, relative to the index. The largest positive allocation effect came from having very little exposure to financials, which was the worst performing sector in the index. This decision contributed 39 basis points (a basis point is 1/100th of 1%) to our relative performance. Energy was the top performing sector in the S&P 500, so our significant underweight in that group hurt the Fund by 19 basis points.

We had terrific stock selection during the quarter, highlighted by the fact that only one security trimmed 10¢ or more from the NAV. That holding was Pentair, a fluid controls company that sells pumps, filters and valves. Its stock dropped 9.1% in the quarter from $79.34 to $72.12, reducing each Fund share by a dime. The stock fell after management reported disappointing sales for the first quarter, including especially weak demand from energy and mining customers. We took advantage of this temporary setback to buy additional Pentair shares, since we still think the company has excellent long-term prospects.

Six stocks each added at least 15¢ to the NAV. The Fund’s biggest winner was Allergan, a pharmaceutical company based in Irvine, California. The stock soared 36.4% from $124.10 to $169.22, adding 49¢ to the NAV. In late April, a large competitor called Valeant Pharmaceuticals teamed up with activist investor Bill Ackman to launch a hostile takeover bid for Allergan. The initial offer was to exchange $48 in cash and 0.83 of one Valeant share, for each Allergan share. The board of the latter company rejected this deal. In response, Valeant improved the cash component

10

Table of Contents

| Semiannual Report • 2014 | PARNASSUS FUNDS | |||

of its offer twice. The latest deal terms are for $72 in cash plus the same 0.83 of one Valeant share, a combination worth $177 per share to Allergan investors as of June 30. Whether a deal with Valeant happens or not, we believe that Allergan remains undervalued at its current price, given its strong competitive position and growth prospects.

Apple had another good quarter, as the stock climbed 21.2% to $92.93 from $76.68, increasing each Fund share by 35¢. Apple continues to do a fantastic job engineering new products, improving its mobile operating system and enhancing its device ecosystem. Given the company’s tremendous cash flow, loyal customer base and prospects for continued innovation, we think that this technology giant still has many good years ahead of it. We’re especially excited about the potential for new product categories, such as wearable devices, which could be released as soon as this fall.

C.H. Robinson, a logistics brokerage company with an emphasis on trucking, added 24¢ to the NAV, as its stock climbed 21.8% from $52.39 to $63.79. The stock rose after the company reported earnings that beat expectations, and management provided an upbeat outlook for its net revenue margin. Since 2010, Robinson’s margin has been shrinking due to tepid demand from shippers and increased competition. We invested in 2012, as we believed that margins would eventually expand when shipping demand outstripped carrier supply, allowing Robinson to charge shippers more for access to its industry-leading carrier network. While we were clearly early in our bullish call on the stock, we’re encouraged that our investment thesis seems finally to be playing out. Given the stock price increase, we trimmed our position in Robinson, but still held a significant investment as of quarter-end.

Iron Mountain, the country’s largest document storage company, rose 28.6% from $27.57 to $35.45, increasing the NAV by 24¢. The key controversy surrounding this stock for the last three years has been whether or not Iron Mountain would become a real estate investment trust (REIT). During the quarter, the company finally announced that the IRS had approved its plan to elect REIT status. Since REITs receive favorable tax treatment, in exchange for agreeing to distribute at least 90% of taxable income to investors, the IRS ruling on Iron Mountain’s application sent the shares up dramatically.

Applied Materials, a leading maker of semiconductor-manufacturing-equipment, rose 10.4% from $20.42 to $22.55, and boosted the NAV by 17¢. The stock went up after management reiterated its 2014 wafer fab equipment (WFE) spending growth outlook of 10-20%. We’re excited about the company’s long-term prospects, because semiconductor manufacturers will require more expensive equipment to build chips, as the latter get smaller and smaller. In addition, Applied Materials’ proposed merger with Tokyo Electron positions the company to accelerate profit growth, due to operational synergies and cross-selling opportunities.

Bay Area biotech company Gilead Sciences rose 17.0% from $70.86 to $82.91 and added 15¢ to the NAV. The company had a great quarter as Sovaldi, its hepatitis C drug, achieved sales of $2.2 billion for the first three months of 2014. This was the fastest known drug launch in history, as measured by revenue dollars. We expect the market for Sovaldi to continue to grow, as Gilead has several advanced clinical trials to combine the drug with other compounds. These programs aim to shorten the duration of treatment and broaden the range of patients

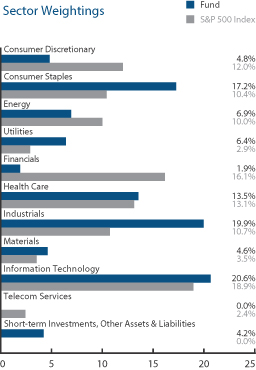

Parnassus Core Equity Fund as of June 30, 2014 (percentage of net assets) | ||

Top 10 Holdings

(percentage of net assets)

| Apple Inc. | 4.4% | |||

| Allergan Inc. | 4.4% | |||

| Applied Materials Inc. | 4.2% | |||

| Procter & Gamble Co. | 3.4% | |||

| Motorola Solutions Inc. | 3.3% | |||

| Mondelez International Inc. | 3.2% | |||

| Xylem Inc. | 3.0% | |||

| QUALCOMM Inc. | 3.0% | |||

| Pentair PLC | 2.9% | |||

| National Oilwell Varco Inc. | 2.8% | |||

Portfolio characteristics and holdings are subject to change periodically.

11

Table of Contents

| PARNASSUS FUNDS | Semiannual Report • 2014 | |||

who could benefit from the drug. Gilead is also investing heavily to improve the tolerability of its market-leading HIV/AIDS therapies and to develop its emerging oncology portfolio.

Outlook & Strategy

For the second quarter in a row, we didn’t add a portfolio company to the Fund. This unusual inactivity speaks to the lofty valuations of most of the high-quality businesses that we’d love to own, but only at lower prices. Our team monitors dozens of companies with attractive secular growth trends, durable competitive advantages and top-notch management teams, so we'll be ready to pounce when we see an attractive risk-reward profile. Since we are patient investors with a long-term investment approach, we don’t mind waiting for the right stock to come along.

We exited two portfolio companies during the quarter, both of which generated modest gains for our shareholders. The first was discount retailer Target, which we bought in 2011. When we purchased the stock, we knew the company would have to work hard to maintain its market share in its notoriously competitive industry. As it turns out, Target has performed relatively well compared to its traditional retailing peers over the last three years. Also during this time, however, the threat to Target’s business from aggressive e-commerce players like Amazon has grown considerably. The risk associated with this secular shift to e-commerce is simply too high for us to keep owning Target's stock, so we sold it.

The second position we exited was W&T Offshore, an oil and natural gas company with operations in West Texas and the Gulf of Mexico. We bought this stock in 2007, on the belief that founder and CEO Tracy Krohn would continue growing the company’s production, in keeping with his then stellar track-record. We decided to sell W&T Offshore, because production growth has lagged our expectations for several years, despite Mr. Krohn's best efforts.

At quarter-end, our portfolio is defensively positioned. Compared to the S&P 500, the Fund is significantly underweighted in three highly cyclical sectors: financials, consumer discretionary and energy. This means that if the soaring market comes back down to earth in the second half, we would expect to protect your investment relatively well. Given that the S&P 500 ended the quarter 190% higher than its March 2009 low, we certainly wouldn’t be surprised to see at least a temporary pullback at some point in 2014.

Whatever happens to the overall market for the balance of 2014, we’re confident that our portfolio will trade higher over the long-term. Our companies have great business prospects and still trade at reasonable valuations. This is why we’re delighted to be invested in the Fund with you.

Thank you for your confidence in us,

|  | |

| Todd C. Ahlsten | Benjamin E. Allen | |

| Lead Portfolio Manager | Portfolio Manager |

12

Table of Contents

| Semiannual Report • 2014 | PARNASSUS FUNDS | |||

Ticker: PARWX

As we announced previously, the new name for the Parnassus Workplace Fund is the Parnassus Endeavor Fund effective May 1, 2014. As of June 30, 2014, the NAV of the Parnassus Endeavor Fund was $29.39, so the total return for the quarter was 5.95%. This compares to 5.23% for the S&P 500 Index (“S&P 500”) and 4.31% for the Lipper Multi-Cap Core Average, which represents the average return of the multi-cap core funds followed by Lipper (“Lipper average”); we beat both our benchmarks for the quarter. For the year-to-date, the Fund is up 8.89%, compared to 7.13% for the S&P 500 and 6.29% for the Lipper average, so we’re well ahead of the year-to-date figures as well.

Below is a table, comparing the Parnassus Endeavor Fund with the S&P 500 and the Lipper average for the past one-, three- and five-year periods and the period since inception on April 29, 2005. The Fund has beaten all benchmarks for all time periods. Most remarkable is the fact that the Endeavor Fund has outperformed the S&P 500 since inception by an average of three-and-a-half percentage points per year.

| Parnassus Endeavor Fund | ||||||||||||||||||||||||

| Average Annual Total Returns (%) | One Year | Three Years | Five Years | Since Inception on 4/29/05 | Gross Expense Ratio | Net Expense Ratio | ||||||||||||||||||

| for periods ended June 30, 2014 | ||||||||||||||||||||||||

| Parnassus Endeavor Fund | 25.89 | 18.39 | 20.03 | 11.73 | 1.07 | 0.95 | ||||||||||||||||||

| S&P 500 Index | 24.60 | 16.54 | 18.80 | 8.17 | NA | NA | ||||||||||||||||||

| Lipper Multi-Cap Core Average | 24.28 | 14.32 | 17.67 | 7.89 | NA | NA | ||||||||||||||||||

Performance data quoted represent past performance and are no guarantee of future returns. Current performance may be lower or higher than the performance data quoted. Current performance information to the most recent month-end is available on the Parnassus website (www.parnassus.com). Investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original principal cost. Returns shown in the table do not reflect the deduction of taxes a shareholder may pay on fund distributions or redemption of shares. The S&P 500 Index is an unmanaged index of common stocks, and it is not possible to invest directly in an index. Index figures do not take any expenses, fees or taxes into account, but mutual fund returns do.

Before investing, an investor should carefully consider the investment objectives, risks, charges and expenses of the Fund and should carefully read the prospectus or summary prospectus, which contain this and other information. The prospectus or summary prospectus can be obtained on the Parnassus website, or by calling (800) 999-3505. As described in the Fund’s current prospectus dated May 1, 2014, Parnassus Investments has contractually agreed to limit total operating expenses to 0.95% of net assets for the Fund. This agreement will not be terminated prior to May 1, 2015, and may be continued indefinitely by the Adviser on a year-to-year basis.

Company Analysis

During the quarter, six companies each added 15¢ or more to the NAV, and there was no company that subtracted 15¢ or more from the value of each Fund share. Three of the companies were semiconductor-related, while two were pharmaceutical companies and one was a logistics company.

The big winner was C.H. Robinson, a logistics company with an emphasis on serving as a broker between shippers and truckers. The stock soared 21.8% from $52.39 to $63.79 for a gain of 29¢ for each Fund share. The company reported earnings that beat expectations, and management provided an upbeat outlook for the coming months. Although the economy has been improving and more goods are being shipped, shareholders may remember that in previous quarters, the stock performed poorly, because truckers were firm in keeping up their rates, while shippers were firm in not paying higher prices, so brokers were squeezed. When we invested in 2012, our thesis was that margins would eventually expand, as demand outstripped carrier supply, allowing Robinson to charge shippers more for access to its industry-leading carrier network. It looks like we may have finally hit that inflection point.

Allergan, a pharmaceutical company based in Irvine, California, contributed 22¢ to the value of each Fund share, as its stock rose 36.4% from $124.10 to $169.22. The stock climbed much higher after Valeant Pharmaceuticals teamed up with activist investor Bill Ackman to make a hostile bid for Allergan. Valeant wants to get control of Allergan’s blockbuster drug, Botox, best known for its cosmetic uses, but also successfully

13

Table of Contents

| PARNASSUS FUNDS | Semiannual Report • 2014 | |||

used in addressing therapeutic problems such as chronic migraines and an overactive bladder. Valeant also believes it can reduce expenses in a combined company by more than $2.7 billion per year. On the other hand, Allergan believes it can create more shareholder value as an independent company. Regardless of the outcome, we think the stock will move higher.

Lam Research is a global supplier of semiconductor-manufacturing-equipment, and its stock rose 22.9% from $55 to $67.58 for a gain of 17¢ for each Fund share. Lam reported strong earnings, driven by increased capital spending and market-share gains with its etch application for semiconductor processing at Intel. The stock moved even higher, when it initiated a quarterly dividend and expanded its share repurchase program to $850 million.

Intel, the giant semiconductor-manufacturer, saw its stock price increase 19.7% during the quarter, climbing from $25.81 to $30.90, while adding 15¢ to the NAV. In June, the company raised its annual sales expectations, based on stronger corporate demand for personal computers. While consumers continue to prefer mobile devices, demand for Intel’s microprocessors is increasing, as companies need to upgrade their aging computer systems.

Gilead Sciences, a biotechnology company specializing in treatments for HIV and liver disease, rose 17.0% from $70.86 to $82.91 for a contribution of 15¢ to each Fund share. Sales of Sovaldi, the company’s breakthrough hepatitis C drug (HCV), were $2.2 billion in the first quarter of 2014, making it one of the most successful drug launches in history. That helped to increase Gilead’s first quarter sales and earnings by 104% and 207%, respectively, on a year-over-year basis. The company also continued to grow its core HIV franchise, capturing about 30% of new patient starts with Stribild, its most advanced therapy. Gilead is also making progress on developing a new cancer therapy called Idelalisib.

Applied Materials, the world’s largest maker of semiconductor-manufacturing-equipment, climbed 10.4% from $20.42 to $22.55, while adding 15¢ to the NAV. The company saw strong demand for its capital equipment, as customers such as Intel, Samsung and Taiwan Semiconductor increase capacity to build more advanced chips.

Yours truly,

Jerome L. Dodson

Portfolio Manager

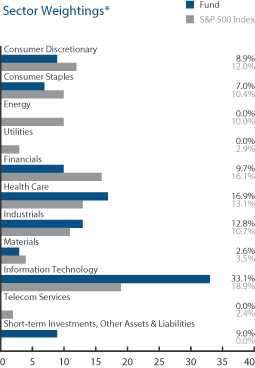

Parnassus Endeavor Fund as of June 30, 2014 (percentage of net assets) |

* For purposes of categorizing securities for diversification requirements under the Investment Company Act, the Fund uses industry classifications that are more specific than those used for the chart.

Top 10 Holdings

(percentage of net assets)

| Applied Materials Inc. | 4.9% | |||

| C.H. Robinson Worldwide Inc. | 4.6% | |||

| International Business Machines Corp. | 4.4% | |||

| Allergan Inc. | 4.1% | |||

| Altera Corp. | 4.1% | |||

| Ciena Corp. | 3.9% | |||

| Target Corp. | 3.7% | |||

| Expeditors International of Washington Inc. | 3.6% | |||

| Wells Fargo & Co. | 3.1% | |||

| Lam Research Corp. | 3.1% | |||

Portfolio characteristics and holdings are subject to change periodically.

14

Table of Contents

| Semiannual Report • 2014 | PARNASSUS FUNDS | |||

Ticker: PARMX

As of June 30, 2014, the NAV of the Parnassus Mid Cap Fund was $26.81, so the total return for the quarter was 6.77%. This is comfortably ahead of the 4.97% return for the Russell Midcap Index (“Russell”) and 4.31% for the Lipper Multi-Cap Core Average, which represents the average multi-cap core fund followed by Lipper (“Lipper average”).

For the year-to-date, we are behind the Russell, but ahead of the Lipper average, as we have gained 6.81%, compared to 8.67% for the Russell and 6.29% for the Lipper average. Though the Fund is still trailing the Russell for the year–to-date, we’re glad that we gained so much ground on our benchmarks during the quarter.

For the three- and five-year periods, the Fund is similarly trailing the Russell but beating the Lipper average. During these periods, the stock market has gone straight up. Since the Fund is focused on downside protection, in addition to outperformance, it’s been difficult to keep pace with the Russell. In more balanced markets, we should do better.

| Parnassus Mid Cap Fund | ||||||||||||||||||||||||

| Average Annual Total Returns (%) | One Year | Three Years | Five Years | Since Inception on 4/29/05 | Gross Expense Ratio | Net Expense Ratio | ||||||||||||||||||

| for periods ended June 30, 2014 | ||||||||||||||||||||||||

| Parnassus Mid Cap Fund | 23.43 | 14.85 | 20.03 | 9.68 | 1.14 | 1.14 | ||||||||||||||||||

| Russell Midcap Index | 26.85 | 16.09 | 22.07 | 10.39 | NA | NA | ||||||||||||||||||

| Lipper Multi-Cap Core Average | 24.28 | 14.32 | 17.67 | 7.89 | NA | NA | ||||||||||||||||||

Performance data quoted represent past performance and are no guarantee of future returns. Current performance may be lower or higher than the performance data quoted. Current performance information to the most recent month-end is available on the Parnassus website (www.parnassus.com). Investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original principal cost. Returns shown in the table do not reflect the deduction of taxes a shareholder may pay on fund distributions or redemption of shares. The Russell Midcap Index is an unmanaged index of common stocks, and it is not possible to invest directly in an index. Index figures do not take any expenses, fees or taxes into account, but mutual fund returns do. Mid-cap companies can be more sensitive to changing economic conditions and have fewer financial resources than large-cap companies.

Before investing, an investor should carefully consider the investment objectives, risks, charges and expenses of the Fund and should carefully read the prospectus or summary prospectus, which contain this and other information. The prospectus or summary prospectus can be obtained on the Parnassus website, or by calling (800) 999-3505.

Below is a table comparing the Parnassus Mid Cap Fund with the Russell and the Lipper average for the one-, three- and five-year periods and for the period since inception on April 29, 2005.

Second Quarter Review

The Fund had a good quarter. It rose almost seven percentage points, about two percentage points above its benchmarks. The Fund’s sector allocations helped performance relative to the index by 39 basis points (a basis point is 1/100th of 1%). Consumer discretionary was the worst-performing sector in the index, so our large underweighting relative to the index in this group helped the Fund. We also benefitted by owning more utility stocks than our index, because this group was one of the best performing sectors.

The lion’s share of the Fund’s outperformance came from excellent stock selection. Industrial stocks helped the most, boosting our performance relative to the Russell by 133 basis points. Good stock picking in the consumer discretionary, information technology and health care sectors added 103 basis points. Our financial sector investments hurt the Fund’s performance by 53 basis points relative to the Russell.

All of the Fund’s industrial stocks helped performance this quarter except for Pentair, a diversified industrial company that sells pumps, filters, valves and thermal solutions. The stock subtracted 8¢ from each Fund share, as it fell 9.1% from $79.34 to $72.12. Soft demand from energy and mining customers drove weaker than expected revenue results. Despite the revenue shortfall, management maintained its operating margin expansion target for the year. We believe that this demonstrates the company’s ability to

15

Table of Contents

| PARNASSUS FUNDS | Semiannual Report • 2014 | |||

execute on its productivity initiatives, despite the short-term weakness in sales. We’re holding onto the shares, because we think that Pentair’s long-term earnings potential is still great.

We only had one other stock that reduced the NAV by more than 1¢. Patterson Companies, a leading distributor of dental, veterinary and medical supplies and equipment, shaved 3¢ off each Fund share, as its stock dropped 5.4% from $41.76 to $39.51. Management reduced its financial guidance after the company experienced sluggish demand for its dental

equipment. We added to our position on the weakness, because we believe sales will rebound as dentists increasingly adopt high-technology equipment. We also think that Patterson’s share gains in the dental market, along with increasing scale advantages in its medical and veterinary supply businesses, will support robust cash flow and earnings growth for many years to come.

Four stocks each added more than 10¢ to the NAV. The stock that helped us the most was Allergan, a pharmaceutical company based in Irvine, California. The stock contributed 28¢ to the NAV, as it jumped 36.4%, from $124.10 to $169.22. Valeant Pharmaceuticals teamed up with activist investor Bill Ackman to announce a hostile bid for Allergan. Valeant’s management is attracted to Allergan’s fast-growing ophthalmology and dermatology products and believes it can cut more than $2.7 billion in costs from the combined company. We think that either Valeant’s offer price will increase even further, or that Allergan will announce its own plan to create additional shareholder value. The stock should react positively to either situation, so we’re holding onto our shares.

Iron Mountain, the nation’s largest document-storage company, surged 28.6% from $27.57 to $35.45, contributing 21¢ to the Fund’s NAV. The key controversy surrounding this stock for the last three years has been whether or not Iron Mountain would become a real estate investment trust (REIT). During the quarter, the company finally announced that the IRS had approved its plan to elect REIT status. Since REITs receive favorable tax treatment, in exchange for agreeing to distribute at least 90% of taxable income to investors, the final ruling on Iron Mountain’s application sent the shares up in dramatic fashion. We’ve maintained our position in the stock, because we like the company’s predictable business model and reasonable valuation.

C. H. Robinson, a logistics company with an emphasis on trucking, added 15¢ to each Fund share, as its stock increased 21.8% from $52.39 to $63.79. The stock rose after the company reported better than expected earnings, and management provided an upbeat outlook for its net revenue margin. Since 2010, Robinson’s margin has been compressing, and the stock has underperformed the market significantly. We initially invested in 2012, because we believed that the margins would eventually expand when shipping demand outstripped carrier supply, allowing Robinson to charge shippers more for access to its industry-leading carrier network. It looks like we may have finally hit that inflection point this quarter, so we remain bullish on the stock.

Compass Minerals, one of the largest salt and fertilizer producers in North America, climbed 16.0% from $82.52 to $95.74, for an increase of 11¢ to the NAV. The stock jumped after management announced that the recent harsh winter depleted salt inventories. This should lead to at least a 10% price increase, as well as a 15% volume increase versus

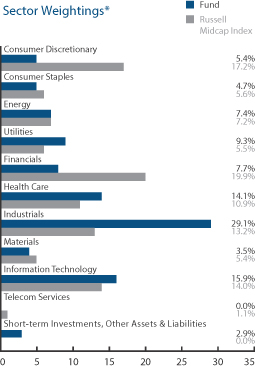

Parnassus Mid Cap Fund as of June 30, 2014 (percentage of net assets) | ||

* For purposes of categorizing securities for diversification requirements under the Investment Company Act, the Fund uses industry classifications that are more specific than those used for the chart.

Top 10 Holdings

(percentage of net assets)

| Applied Materials Inc. | 3.9% | |||

| Insperity Inc. | 3.6% | |||

| Questar Corp. | 3.4% | |||

| Xylem Inc. | 3.4% | |||

| Iron Mountain Inc. | 3.4% | |||

| Allergan Inc. | 3.4% | |||

| Motorola Solutions Inc. | 3.2% | |||

| MDU Resources Group Inc. | 3.2% | |||

| Shaw Communications Inc. | 3.1% | |||

| Expeditors International of Washington Inc. | 3.1% | |||

Portfolio characteristics and holdings are subject to change periodically.

16

Table of Contents

| Semiannual Report • 2014 | PARNASSUS FUNDS | |||

last year. We trimmed our position after the strong run in the stock, but continue to hold a core position in the company, because we believe its long-term prospects are bright.

Outlook and Strategy

The stock market continued its ascent during the quarter, with the Russell reaching another record high. Mid-cap stocks are now up a staggering 288.5% since the 2009 low, well ahead of small- and large-cap issues. We’ve certainly had a good snap-back from the Great Recession, and many quality businesses are thriving, but we are increasingly concerned about valuation. The Russell’s forward price-to-earnings ratio is now at 18.0x, the highest level since 2007.

We don’t know if a correction is looming, but we’re sharpening our pencils to make certain that our portfolio companies will fare better than most in the event of a market downturn. Since lower quality companies tend to underperform in downturns, we spend a lot of time understanding the source and strength of our portfolio companies’ competitive advantages. For example, Verisk Analytics, a provider of risk management and decision support services to clients across multiple industries, has competitive advantages in its core insurance offering based on high barriers to entry, switching costs, network effect and regulation. These “moat” factors should help the companies sustain strong cash flows throughout the business cycle. It will also take many years and a lot of money for competitors to seriously challenge these businesses.

Another way that we prepare for down markets is to avoid businesses with a lot of debt. When interest rates rise, borrowing costs go up. This can reduce earnings, cause management teams to miss important reinvestment or acquisition opportunities, and even lead to bankruptcy. Many of our holdings have no debt, and a good number have modest debt. We do have a few investments with greater debt levels, such as utility Questar and garbage collector and recycler Waste Management, but they each have high recurring revenue and stable sources of cash flow, which materially reduces the risk of default. Overall, however, the portfolio has less debt leverage than the Russell.

Attractive valuation, another core component of our investment process, is also a variable for downside protection. While many portfolio companies are more expensive than they were when we originally invested in them, we didn’t exit any of our positions during the quarter, since all are still showing reasonable three-year return potential.

We continue to maintain our relatively defensive posture, with fewer highly cyclical consumer-discretionary and financial-services stocks than our benchmarks. Our largest concentration of stocks, as of the quarter-end, was in the industrial sector. While this sector is typically considered highly cyclical, many of our industrial stocks are less economically sensitive business service companies with minimal capital requirements and low debt. We’re confident that the Fund’s collection of businesses is positioned to beat the market over the long-run.

Thank you for your investment in the Parnassus Mid Cap Fund.

Yours truly,

|

| |||

| Matthew D. Gershuny | Lori A. Keith | |||

| Lead Portfolio Manager | Portfolio Manager |

17

Table of Contents

| PARNASSUS FUNDS | Semiannual Report • 2014 | |||

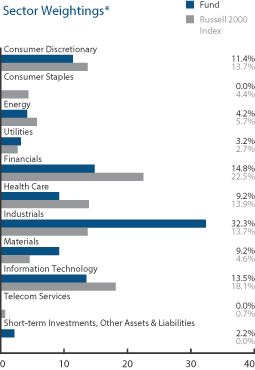

Ticker: PARSX

As of June 30, 2014, the NAV of the Parnassus Small Cap Fund was $29.19, so the total return for the second quarter was a gain of 5.68%. By comparison, the Russell 2000 Index of smaller companies (“Russell 2000”) gained 2.05%, and the Lipper Small-Cap Core Average, which represents the average return of the small cap core funds followed by Lipper (“Lipper average”), gained 2.48%. For the quarter, the Fund beat both the Russell 2000 and the Lipper average.

Year-to-date, the Fund is trailing both benchmarks, up 1.64%, compared to 3.19% for the Russell 2000 and 3.95% for the Lipper average. Below is a table comparing the Parnassus Small Cap Fund with the Russell 2000 and the Lipper average over the past one-, three- and five-year periods ended June 30, 2014 and the period since inception on April 29, 2005.

Company Analysis

Only one company cost the Fund 15¢ or more: Ciena, a manufacturer of optical telecommunications equipment. Ciena declined 10.1%, from $22.74 to our average sale price of $20.45, while slicing 15¢ off the NAV. I exited Ciena because I believe investors have already priced in the company’s future growth, having bid the price of the stock up 75% over the last

| Parnassus Small Cap Fund | ||||||||||||||||||||||||

| Average Annual Total Returns (%) | One Year | Three Years | Five Years | Since Inception on 4/29/05 | Gross Expense Ratio | Net Expense Ratio | ||||||||||||||||||

| for periods ended June 30, 2014 | ||||||||||||||||||||||||

| Parnassus Small Cap Fund | 20.97 | 9.48 | 17.79 | 10.08 | 1.20 | 1.20 | ||||||||||||||||||

| Russell 2000 Index | 23.64 | 14.57 | 20.21 | 9.65 | NA | NA | ||||||||||||||||||

| Lipper Small-Cap Core Average | 23.72 | 13.98 | 19.77 | 9.40 | NA | NA | ||||||||||||||||||

Performance data quoted represent past performance and are no guarantee of future returns. Current performance may be lower or higher than the performance data quoted. Current performance information to the most recent month-end is available on the Parnassus website (www.parnassus.com). Investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original principal cost. Returns shown in the table do not reflect the deduction of taxes a shareholder may pay on fund distributions or redemption of shares. The Russell 2000 Index is an unmanaged index of common stocks, and it is not possible to invest directly in an index. Index figures do not take any expenses, fees or taxes into account, but mutual fund returns do. Small-cap companies can be particularly sensitive to changing economic conditions and have fewer financial resources than large-cap companies.

Before investing, an investor should carefully consider the investment objectives, risks, charges and expenses of the Fund and should carefully read the prospectus or summary prospectus, which contain this and other information. The prospectus or summary prospectus can be obtained on the Parnassus website, or by calling (800) 999-3505. As described in the Fund’s current prospectus dated May 1, 2014, Parnassus Investments has contractually agreed to limit total operating expenses to 1.20% of net assets for the Fund. This agreement will not be terminated prior to May 1, 2015, and may be continued indefinitely by the Adviser on a year-to-year basis.

year and a half. Additionally, I am concerned that with $1.2 billion of debt on the balance sheet, the company has limited room for error.

Fortunately, four companies contributed at least 22¢ to the NAV. The biggest winner was MICROS Systems, a provider of point-of-sale systems for restaurants, hotels and retailers. The stock jumped 18.9%, from $52.93 to our average sale price of $62.93, contributing 24¢ to each Fund share. During the quarter, Oracle announced it was acquiring MICROS Systems for $5.3 billion and, since I do not expect a higher competitive bid, I sold our position.

Blount International, a manufacturer of chainsaw blades and farming equipment, rose 18.6%, from $11.90 to $14.11, adding 23¢ to the NAV. The company exceeded earnings expectations, and management is cautiously optimistic that customer demand is finally improving. I am holding on to our investment, because I expect increased sales will drive significant operating leverage from Blount’s underutilized manufacturing facilities.

Compass Minerals, a salt and fertilizer producer, gained 16.0%, from $82.52 to $95.74, delivering 23¢ to each Fund share. Management announced that the recent harsh winter depleted deicing salt inventories, which will lead to at least a 10% price increase, as well as a 15% volume increase this year. I took advantage of the jump in the stock price to sell a portion of our holdings, but I continue to hold a core position in the company because its low costs should allow it to increase market share over time.

18

Table of Contents

| Semiannual Report • 2014 | PARNASSUS FUNDS | |||

Group 1 Automotive, an automobile retailer, soared 28.4%, from $65.66 to $84.31, increasing the NAV by 22¢. Same store sales increased an impressive 5.9% during the first quarter, despite challenging weather conditions. I am holding our stock, because U.S. new car sales continue to increase, reaching 16.9 million annual sales in June, the highest rate since 2006. The growing number of recently sold cars will lead to high-margin warranty and service revenue for years to come.

Outlook and Strategy

For the second quarter in a row, the Russell 2000 increased modestly. While the index’s price-to-earnings ratio remains near a decade-high level at 20.4x, I do not expect broad valuation multiple or profit margin expansion. Therefore, I prefer out-of-favor companies not currently trading at peak valuation multiples, which also have competitive advantages that allow them to increase prices through the economic cycle.

As of July 1st, I now manage the Parnassus Small Cap Fund without Jerome Dodson. As such, I thought it would be helpful to review how I invest your money. At Parnassus, the entire equity team evaluates investments through four lenses:

| 1. | Relevancy: Is the business becoming more relevant over time? |

| 2. | Moat: Does the company have a sustainable competitive advantage? |

| 3. | Management: Has management made good capital allocation decisions and are its incentives aligned with ours? |

| 4. | Valuation: Does the company trade at a meaningful discount to our estimate of its intrinsic value? |

If a company rates highly on the first three criteria, it screens as a good business, and I will add it to the watch list. I have approximately 300 companies on the watch list for the Parnassus Small Cap Fund, and the team is constantly evaluating new companies to expand this list. When one of the companies on the watch list trades meaningfully below our estimate of intrinsic value, we conduct deep-dive research on the company. This includes a comprehensive, company-specific investment analysis process to determine the intrinsic value of the company based on three criteria: relevancy of the company’s products or services, moats and management. If everything checks out, we add the company to our portfolio. Our intention is to hold our investments for at least three years, in order to benefit from both the valuation moving towards our estimate of intrinsic value, as well as the business’s increasing intrinsic value as it reinvests its cash flows.

I thought it would also be helpful to answer some questions I have received lately:

Q: What changes do you intend to make to the portfolio?

A: I will continue to execute the Parnassus Small Cap Fund through the four lenses discussed earlier because I believe it is the best approach to outperform the market through a full economic cycle. The most significant change to the way the Fund will be managed is that the bar has been raised regarding moats – I require that every company in the portfolio has a moat, regardless of how cheap the opportunity looks. This change is in-line with how my associates Todd C. Ahlsten and Benjamin E. Allen manage our Parnassus Core Equity Fund, which has

Parnassus Small Cap Fund as of June 30, 2014 (percentage of net assets) | ||

* For purposes of categorizing securities for diversification requirements under the Investment Company Act, the Fund uses industry classifications that are more specific than those used for the chart.

Top 10 Holdings

(percentage of net assets)

| Dominion Diamond Corp. | 5.5% | |||

| Blount International Inc. | 5.3% | |||

| UTi Worldwide Inc. | 5.2% | |||

| MRC Global Inc. | 5.0% | |||

| Checkpoint Systems Inc. | 4.9% | |||

| First American Financial Corp. | 4.3% | |||

| Air Lease Corp. | 4.2% | |||

| Compuware Corp. | 4.2% | |||

| Energy XXI (Bermuda) Ltd. | 4.2% | |||

| First Horizon National Corp. | 4.0% | |||

Portfolio characteristics and holdings are subject to change periodically.

19

Table of Contents

| PARNASSUS FUNDS | Semiannual Report • 2014 | |||

been a very successful strategy since Todd took it over in 2001. I view the Fund as the small cap equivalent of the Parnassus Core Equity Fund.

Q: What is your competitive advantage?

A: Equity investing is a competitive industry, where your key resources go home each night. Therefore, successfully hiring and retaining our investment team is critical. Mr. Dodson started the Parnassus internship program over 25 years ago and in that time, we have had more than 200 interns. This program allows us to get to know candidates for three months, as they research in depth and pitch two different investment ideas to the entire investment team. Additionally, it helps the candidates to understand our firm’s culture and investment philosophy, which in turn helps them to make an informed decision on whether Parnassus is the right firm for them. Amazingly, everyone on our equity team has been hired through our internship program (I interned way back in 1998!), and this has led to very low turnover in our team. Since our knowledge and learning lessons compound over time, retaining our team and maintaining consistency within our investment process are strong competitive advantages.

Q: What themes are you investing in right now?

A: I do not invest in themes; each stock purchased is based on bottom-up research conducted on the company and its industry. However, our research often generates new ideas from companies we already own. Let me give you an example:

| • | I purchased Gentex, a manufacturer of auto-dimming car mirrors, in 2012 because it has a dominant market position and we expect auto-dimming mirrors to penetrate down-market into midsize and economy cars. |

| • | While researching Gentex’s rear camera display product, we learned that consumers prefer displays in the center console. This led us to research Harman International, the leading manufacturer of automotive infotainment systems. I purchased Harman in 2013 because we expect infotainment penetration to increase and margins to expand, thanks to the company’s shift from customized to standardized systems. |

| • | While covering Harman International, we noticed that U.S. automotive sales kept exceeding expectations. We researched the automotive value chain and identified that large dealerships have a competitive advantage versus independent dealerships and mechanics. Last February, I purchased Group 1 Automotive, which owns over 150 automotive dealerships, because we expect the strong growth in new car sales will eventually lead to very profitable parts and services revenue. |

I hope this helps you better understand how I manage the Parnassus Small Cap Fund.

Yours truly,

Ryan Wilsey

Portfolio Manager

20

Table of Contents

| Semiannual Report • 2014 | PARNASSUS FUNDS | |||

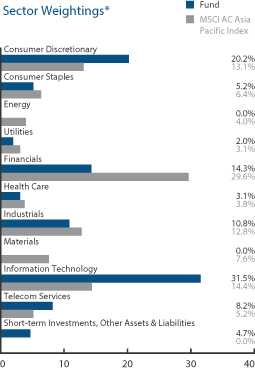

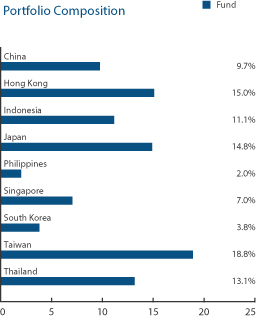

Ticker: PAFSX

As of June 30, 2014, the NAV of the Parnassus Asia Fund was $17.34, so the Fund was up 3.83% for the quarter. This compares to a gain of 6.39% for the MSCI AC Asia Pacific Index (“MSCI Index”) and a gain of 5.35% for the Lipper Asia Pacific Region Average, which represents the average return of the Asia Pacific Region funds followed by Lipper (“Lipper average”). For the quarter, then, we underperformed both benchmarks.

I think our underperformance this quarter was simply a matter of our Asian benchmarks finally starting to catch up with the Parnassus Asia Fund. As shareholders know, the Fund has far outperformed our benchmarks since inception. For the year-to-date, the Fund is up 10.66%, compared to 4.66% for the MSCI Index and 4.55% for the Lipper average. Below you will find a table comparing the Parnassus Asia Fund with the MSCI Index and the Lipper average for the one-year period and for the period since inception on April 30, 2013. You will notice that we are well ahead of both benchmarks for both time periods.

| Parnassus Asia Fund | ||||||||||||||||

| Average Annual Total Returns (%) | One Year | Since Inception on 4/30/13 | Gross Expense Ratio | Net Expense Ratio | ||||||||||||

| for periods ended June 30, 2014 | ||||||||||||||||

| Parnassus Asia Fund | 15.99 | 13.23 | 5.08 | 1.25 | ||||||||||||

| MSCI AC Asia Pacific Index | 14.95 | 5.38 | NA | NA | ||||||||||||

| Lipper Pacific Region Average | 12.32 | 3.02 | NA | NA | ||||||||||||

Performance data quoted represent past performance and are no guarantee of future returns. Current performance may be lower or higher than the performance data quoted. Current performance information to the most recent month-end is available on the Parnassus website (www.parnassus.com). Investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original principal cost. Returns shown in the table do not reflect the deduction of taxes a shareholder may pay on fund distributions or redemption of shares. The MSCI AC Asia Pacific Index is an unmanaged index of Asian stock markets, and it is not possible to invest directly in an index. Index figures do not take any expenses, fees or taxes into account, but mutual fund returns do.

This fund invests primarily in non-U.S. securities. Foreign markets can be more volatile than the U.S. market due to increased risks of adverse issuer, political, regulatory, market or economic developments and can perform differently from the U.S. market.

Before investing, an investor should carefully consider the investment objectives, risks, charges and expenses of the Fund and should carefully read the prospectus or summary prospectus, which contain this and other information. The prospectus or summary prospectus can be obtained on the Parnassus website, or by calling (800) 999-3505. As described in the Fund’s current prospectus dated May 1, 2014, Parnassus Investments has contractually agreed to limit the total operating expenses to 1.25% of net assets for the Fund. This agreement will not be terminated prior to May 1, 2015, and may be continued indefinitely by the Adviser on a year-to-year basis.

Company Analysis

There were three companies that each cut 4¢ or more off the NAV, but there were five companies that each added 7¢ or more to the value of each Fund share. There was no clear pattern of the winners and losers. Each company prospered or wilted based on individual circumstances.

PT Asuransi, an Indonesian insurance company, made the biggest dent in the NAV during the quarter, slicing 5¢ off the NAV, as the stock sank 14.9% from 261 Indonesian Rupiah ($0.0233) to 235 Rupiah ($0.0198). The company sells policies that insure cars, property, cargo, health and human life against sudden misfortune such as accidents, fire, damage, disability and death. Recent political and economic uncertainty in Indonesia rattled investors, who sold stocks ahead of upcoming national elections. Right now, it looks like the pro-business candidate, Joko Widodo, will win the presidential election over Prabowo Subianto, a former general, and this should help Indonesian stocks move higher. Also, we believe sales of third-party liability insurance, Asuransi’s most profitable business, should continue to rise over the long-term.

Biostime International Holdings, a Chinese distributor of foreign-made infant formula, saw its stock sink 19.3% from $6.87 to $5.54 for a loss of 5¢ for each Fund share. The company invested in a new, lower-priced infant-formula brand and other new products including baby diapers. This use of funds caused uncertainty among investors, which drove the stock lower. Despite the high start-up costs for product development and marketing, Biostime’s extensive distribution network, reputation for quality and expertise in the industry should ultimately make the new businesses profitable.

21

Table of Contents

| PARNASSUS FUNDS | Semiannual Report • 2014 | |||

SITC Holdings International, a Hong Kong-based shipping and logistics company, knocked 4¢ off the Fund’s NAV, as its stock slumped 15.2% from 48¢ to 41¢ a share. SITC serves 47 routes connecting 45 major ports across ten countries in the Asian region. A slowdown in the Chinese economy affected the stock, since demand for inter-Asia container-shipping weakened, dragging down freight rates. However, the company’s logistics arm is diversified into both sea- and land-based transportation, and the latter remains strong, so that should drive growth and profits. When the Chinese economy picks up, SITC’s stock should move higher.

The big winner for the quarter was Lenovo, which added 13¢ to the value of each Fund share, as its stock climbed 23.5% from $1.11 to $1.37. This maker of personal computers (PC’s) and other technology products is the number one brand in China, and last year it passed Hewlett-Packard as the largest PC manufacturer in the world. Earlier this year, Lenovo bought portions of Motorola Mobility from Google, so it can now sell smartphones in the United States. The company also announced an agreement to purchase IBM’s low-end server business. Assuming the transaction wins U.S. national security approval, Lenovo’s gains in market share and profitability should send the stock higher.

Applied Materials, the world’s largest maker of semiconductor-manufacturing-equipment, climbed 10.4% from $20.42 to $22.55, while adding 8¢ to the NAV. The company saw strong demand for its capital equipment, as customers such as Intel, Samsung and Taiwan Semiconductor increase capacity to build more advanced chips. Applied’s proposed merger with Tokyo Electron will give the merged company even more dominance in Asia and around the world, fueling earnings and moving the stock price higher.

PT Siloam Hospitals contributed 7¢ to the Fund’s NAV, as its stock soared 34.4% from $0.91 to $1.22. The company is the largest private hospital chain in Indonesia, operating sixteen hospitals with a total capacity of 3,700 beds. Indonesia is the fourth largest country in the world and home to an expanding middle-class population, but its public healthcare infrastructure is still poor. As a result, patients are increasingly turning to Siloam as an alternative, resulting in higher revenue and profits. Given strong demand for Siloam’s services, the company will triple the number of beds in its system, so that it can continue to provide its communities with responsible and high-quality healthcare. When we visited a Siloam hospital in Indonesia, we were impressed with the company’s sense of social responsibility, as well as the quality of care they delivered at a reasonable price.

The stock of Television Broadcast of Hong Kong went up 8.4% from $6.00 to $6.50 for a gain of 7¢ for each Fund share. The company is one of the largest producers and distributors of Chinese-language programming content in the world. The emergence of two new competitors in the free-TV market depressed the stock earlier in the year, since the cost of hiring and retaining talent in the industry increased. Those cost pressures abated in the current quarter, giving the company leeway to invest in and generate profits from content such as the World Cup 2014. With investments in a new online paid video service and the potential for higher growth in China, the company is also well-positioned for the longer term. As demand for Chinese-language television content continues to grow, the company’s library of unparalleled content should increase in value.

Parnassus Asia Fund as of June 30, 2014 (percentage of net assets) | ||

* For purposes of categorizing securities for diversification requirements under the Investment Company Act, the Fund uses industry classifications that are more specific than those used for the chart.

Parnassus Asia Fund as of June 30, 2014 (percentage of net assets) | ||

22

Table of Contents

| Semiannual Report • 2014 | PARNASSUS FUNDS | |||

Sino-Thai Engineering, a leading engineering and construction company in Thailand, saw its stock soar an amazing 41.0% from 50¢ to 70¢, contributing 7¢ to each Fund share. The company manages industrial projects for private firms and infrastructure projects for the government including work on Bangkok’s subway and skytrain. Sino-Thai’s stock price has been whipsawed this year more than at any time since the global financial crisis, because of the country’s military coup and its sensitivity to government-related business. It nearly doubled after Thailand’s army chief announced a commitment to push through long-stalled infrastructure projects. Although Sino-Thai remains an excellent, well-run company, we took some money off the table by selling shares in light of heightened political risk.

Outlook and Strategy