PARNASSUS INCOME FUNDS

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSRS

CERTIFIED SHAREHOLDER REPORT OF

REGISTERED MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-06673

Parnassus Income Funds

(Exact name of registrant as specified in charter)

1 Market Street, Suite 1600, San Francisco, California 94105

(Address of principal executive offices) (Zip code)

Marc C. Mahon

Parnassus Income Funds

1 Market Street, Suite 1600, San Francisco, California 94105

(Name and address of agent for service)

Registrant’s telephone number, including area code: (415) 778-0200

Date of fiscal year end: December 31

Date of reporting period: June 30, 2011

Item 1: Report to Shareholders

PARNASSUS FUNDS®

SEMIANNUAL REPORT ¡ JUNE 30, 2011

PARNASSUS FUNDS

| Parnassus FundSM | PARNX | |

| Parnassus Equity Income FundSM – Investor Shares | PRBLX | |

| Parnassus Equity Income Fund – Institutional Shares | PRILX | |

| Parnassus Mid-Cap FundSM | PARMX | |

| Parnassus Small-Cap FundSM | PARSX | |

| Parnassus Workplace Fund® | PARWX | |

| Parnassus Fixed-Income FundSM | PRFIX | |

Table of Contents

| Letter from Parnassus Investments | 4 | |||

| Fund Performance and Commentary | ||||

| Parnassus Fund | 6 | |||

| Parnassus Equity Income Fund | 9 | |||

| Parnassus Mid-Cap Fund | 13 | |||

| Parnassus Small-Cap Fund | 16 | |||

| Parnassus Workplace Fund | 18 | |||

| Parnassus Fixed-Income Fund | 20 | |||

| Responsible Investing Notes | 22 | |||

| Fund Expenses | 23 | |||

| Portfolios of Investments | ||||

| Parnassus Fund | 24 | |||

| Parnassus Equity Income Fund | 26 | |||

| Parnassus Mid-Cap Fund | 29 | |||

| Parnassus Small-Cap Fund | 31 | |||

| Parnassus Workplace Fund | 33 | |||

| Parnassus Fixed-Income Fund | 35 | |||

| Financial Statements | 38 | |||

| Notes to Financial Statements | 45 | |||

| Financial Highlights | 52 | |||

| Additional Information | 59 | |||

| PARNASSUS FUNDS | Semiannual Report • 2011 | |||

Dear Shareholder:

Enclosed you will find the semiannual reports for all six Parnassus Funds. This has not been a good quarter for our funds. Four of the funds underperformed their benchmarks, while the Mid-Cap Fund and the Fixed-Income Fund beat one benchmark but lost to the other. Despite this quarter’s underperformance, the long-term track record of our funds is excellent. You’ll find all the details in the enclosed reports.

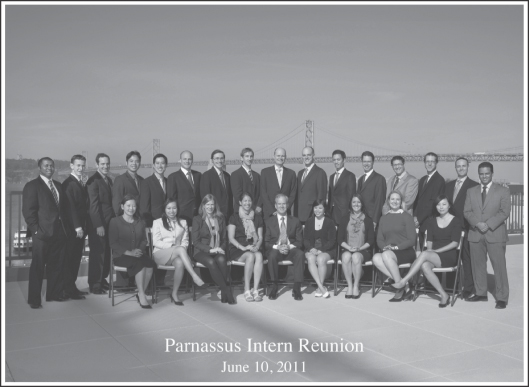

Interns

We have three excellent research interns joining us this summer. Robert Klaber is a Phi Beta Kappa graduate of Brown University, where he won the Joslin Award for leadership and service. He also holds a Master of Philosophy in Modern Society and Global Transformation from Cambridge University in England. He is currently an MBA candidate at Harvard Business School. His previous experience includes working as an asset management strategy analyst at Neuberger Berman and as a venture capital summer associate at City Light Capital.

Rebecca Bailey is a graduate in mathematics and economics from Smith College and is an MBA candidate at the Wharton School at the University of Pennsylvania. Previously, she worked as an investment banker at JP Morgan Securities.

Joshua Harrington is a Magna cum Laude graduate of the University of Missouri and is an MBA candidate at the University of California, Berkeley. His previous experience includes work as an equity research analyst at TIAA-CREF Investment Management and as a senior associate at Headlands Capital Management.

Below you will find a picture of some current and former Parnassus Investments interns at a reunion dinner in San Francisco on June 10.

Standing (left to right): Romahlo Wilson, Robert Klaber, Dan Beck, George Lai, Billy Hwan, Matt Gershuny, Russ Caprio, Ian Sexsmith, Todd Ahlsten, Ben Allen, Minh Bui, Joakim Mahlberg, Andy Rubinson, Joshua Harrington, Ryan Wilsey and Iyassu Essayas.

4

| Semiannual Report • 2011 | PARNASSUS FUNDS | |||

Seated (left to right): Marie Lee, Carrie Lo, Lori Keith, Feliz Fuentes Montpellier, Jerome Dodson, Samantha Seto, Rebecca Bailey, Katherine Loarie and Iris Lee.

Finally, I would like to thank all of you for investing with Parnassus.

Yours truly,

Jerome L. Dodson, President

Parnassus Investments

5

| PARNASSUS FUNDS | Semiannual Report • 2011 | |||

Ticker: PARNX

As of June 30, 2011, the net asset value per share (“NAV”) of the Parnassus Fund was $40.66, so the total return for the quarter was a loss of 4.33%. This compares to a gain of 0.09% for the S&P 500 Index (“S&P 500”) and a loss of 0.08% for the Lipper Multi-Cap Core Average, which represents the average multi-cap core fund followed by Lipper (“Lipper average”). For the quarter, we lagged both indices by about four percentage points.

Although we had a very difficult second quarter, we still have a positive return for the year with a gain of 0.42%. Even though we have a positive return for the year-to-date, we’re quite a bit behind our benchmarks, with the S&P 500 gaining 6.01% and the Lipper average up 6.00%. Things definitely don’t look good right now for the Parnassus Fund, but we have to keep these things in a historical context. Last year at this time, the Fund had just lost 13.32% for the second quarter of 2010, compared to a loss of 11.41% for the S&P 500 and a loss of 11.00% for the Lipper average. Despite a disastrous second quarter last year, the Fund was able to gain 16.71% for all of 2010, beating both the S&P 500 and the Lipper average, which gained 15.08% and 15.91%, respectively. At this point, the regulators will want me to say that past performance is no guarantee of future returns, but all I can say now is that we’re down, but not out.

Below is a table comparing the Parnassus Fund with the S&P 500 and the Lipper average over the past one-, three-, five- and ten-year periods. While we’re behind the benchmarks for the one- and ten-year periods, we’re substantially ahead of both indices for the three- and five-year periods.

| Parnassus Fund | ||||||||||||||||||||||||

| Average Annual Total Returns (%) | One Year | Three Years | Five Years | Ten Years | Gross Expense Ratio | Net Expense Ratio | ||||||||||||||||||

| for periods ended 6/30/2011 | ||||||||||||||||||||||||

| Parnassus Fund | 26.22 | 7.13 | 6.44 | 2.56 | 0.97 | 0.97 | ||||||||||||||||||

| S&P 500 Index | 30.68 | 3.34 | 2.95 | 2.72 | NA | NA | ||||||||||||||||||

| Lipper Multi-Cap Core Average | 30.90 | 3.29 | 2.97 | 3.79 | NA | NA | ||||||||||||||||||

Performance data quoted represent past performance and are no guarantee of future returns. Current performance may be lower or higher than the performance data quoted. Current performance information to the most recent month-end is available on the Parnassus website (www.parnassus.com). Investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original principal cost. Returns shown in the table do not reflect the deduction of taxes a shareholder may pay on fund distributions or redemption of shares. The S&P 500 Composite Stock Index (also known as the S&P 500) is an unmanaged index of common stocks, and it is not possible to invest directly in an index. Index figures do not take any expenses, fees or taxes into account, but mutual fund returns do. Prior to May 1, 2004, the Parnassus Fund charged a sales load (maximum of 3.5%), which is not reflected in the total return calculations. Before investing, an investor should carefully consider the investment objectives, risks, charges and expenses of the Fund and should carefully read the prospectus, which contains this and other information. The prospectus is available on the Parnassus website, or one can be obtained by calling (800) 999-3505. As described in the Fund’s current prospectus dated May 1, 2011, Parnassus Investments has contractually agreed to limit the total operating expenses to 0.99% of net assets, exclusive of acquired fund fees, until May 1, 2012. This limitation may be continued indefinitely by the Adviser on a year-to-year basis.

Company Analysis

For the quarter, five companies each accounted for losses of 21¢ or more for each fund share. Two of them were providers of optical equipment used in telecommunications. Finisar dropped 26.7%, as its stock collapsed from $24.60 to $18.03 for a loss of 58¢ on the NAV. Ciena sank 29.2% from $25.96 to $18.38 for a loss of 56¢ for each Parnassus share.

Both Finisar and Ciena had a similar experience. The stocks rose much higher on improved prospects for spending on telecom equipment, then they overshot their fundamentals and got ahead of themselves, before collapsing when results were not as strong as expected.

In our last quarterly report, we described how over-ordering by Finisar customers led to an inventory correction as customers cut back their orders, using their own inventory supply to meet demand. In addition, there was weakness in the China telecommunications market. These trends continued in the second quarter, pressuring the company’s share price. As we stated in our last report, we think that the inventory correction and the China weakness are temporary problems, and we hope that the stock will recover sometime later this year.

At Ciena, there was no evidence of over-ordering or inventory correction, and the stock did very well in the first quarter, increasing 23.3% and adding 45¢ to each fund share. Like Finisar,

6

| Semiannual Report • 2011 | PARNASSUS FUNDS | |||

though, the stock did get ahead of itself. On June 8, the company issued weak guidance, indicating that demand for its products was softening. We added to our position in Ciena on the weakness in its share price because we think that demand will improve before the end of the year, and the company has excellent products and seems to be gaining market share.

KB Home saw its stock drop 21.4% during the quarter, going from $12.44 to $9.78 while slicing 24¢ off the NAV. On June 29, the company announced that it lost $68.5 million for the quarter ended May 31 compared to a loss of $30.7 million for the quarter ended a year earlier. The loss was more than double what analysts had been expecting. Very slow sales and write-downs of land and housing developments contributed to the loss.

KB Home was the only one of our four homebuilder stocks to suffer such a loss. Shares of Toll Brothers and PulteGroup increased during the quarter, and DR Horton registered a modest loss. Lower sales helped drive down KB’s stock, but an enormous amount of debt on its balance sheet also contributed to the decline. Normally, I avoid companies with a lot of debt, but in this case, I overlooked that factor, believing that KB’s emphasis on lower-cost homes would do well in the current environment. As it turned out, it was an error in judgment. Although I wish I had never bought KB Home, I’m hanging onto the stock because the price is so low, and I expect an improvement in the housing market in the near future. One positive about the KB experience is that it will remind me to focus on avoiding companies with a lot of debt.

Networking giant Cisco’s stock fell 9.0% from $17.15 to $15.61, thereby cutting 21¢ off each fund share. Investors are worried about slowing growth and increased competition in the company’s core switching business. Weak demand from state and local governments also weighed on the stock. Despite these issues, Cisco remains the worldwide leader of equipment used to power internet traffic and data centers. At only nine times forward earnings estimates, the stock is on the bargain table.

Applied Materials, the leading supplier of semiconductor manufacturing equipment, cut 21¢ off the NAV, as its shares dropped 16.7% from $15.62 to $13.01. Some customers deferred orders in the wake of the Middle East turmoil and the disaster in Japan. The company also bought rival Varian Semiconductor for almost $5 billion, a 55% premium over its last trading price before the announcement. Investors drove down the stock because of the high price paid for Varian, and concern that most acquisitions don’t work out as expected.

Despite our difficult quarter, three stocks each contributed 20¢ or more to the NAV. Leading the charge was MasterCard, which added 29¢ to each Parnassus Fund share, as its stock surged 19.7% from $251.72 to $301.34. The stock did well in April and May, when management reported improving business trends here and abroad, but the biggest move came in June when the Federal Reserve softened its original rule limiting the amount companies could charge for debit card processing. Previously, the average charge for a debit card transaction was about 44¢, and the new regulation will bring that down to about 24¢, alleviating a long-time investor concern and enhancing the company’s growth and profitability outlook.

Oil- and gas-producer W&T Offshore climbed 14.6% from $22.79 to $26.12 while contributing 23¢ to each Parnassus Fund share. The stock moved higher after the company announced a sizeable acquisition of onshore assets in the West Texas Permian Basin, which should diversify W&T’s asset base and provide significant future growth.

| Parnassus Fund as of June 30, 2011 (percentage of long-term portfolio) | ||

Top 10 Holdings

(percentage of net assets)

| Intel Corp. | 5.7% | |||

| Wells Fargo & Co. | 5.0% | |||

| Cisco Systems Inc. | 4.8% | |||

| Finisar Corp. | 4.8% | |||

| Ciena Corp. | 4.6% | |||

| W&T Offshore Inc. | 4.4% | |||

| QUALCOMM Inc. | 4.3% | |||

| Hewlett-Packard Company | 4.3% | |||

| PulteGroup Inc. | 4.0% | |||

| JPMorgan Chase & Co. | 3.9% | |||

Portfolio characteristics and holdings are subject to change periodically.

7

| PARNASSUS FUNDS | Semiannual Report • 2011 | |||

Intel added 20¢ to the NAV, as its stock rose 9.9% to $22.16 from $20.17. The shares moved higher after the company reported better than expected quarterly results driven by improved pricing and increased business demand for computers as well as higher demand from consumers in emerging markets.

Outlook and Strategy

This section represents my thoughts and applies to the three funds that I manage: the Parnassus Fund, the Parnassus Small-Cap Fund and the Parnassus Workplace Fund. The other portfolio managers will discuss their thoughts in their respective reports.

The funds that I manage have not done very well this year. It’s the first time in a long while that this has happened. The portfolio manager is the same, the process is the same, but the results are different. I guess that’s why the regulators make us say that past performance is no guarantee of future returns.

If you read through the company analysis for each fund, you will see the sectors in the portfolio that did not do well. In the case of the Parnassus Fund, there was weakness in telecommunications equipment, technology and homebuilders. For the Workplace Fund, the weakness was in telecomm equipment, finance and technology. For the Small-Cap Fund, it was telecomm equipment, technology, finance and homebuilders. The net result is that the companies in all three portfolios are much cheaper than they were in relation to the stock market as a whole. This doesn’t mean that they can’t go down even further, but it does mean that they are trading at bargain levels.

Right now, the economic outlook is not very good. We’ve been out of the recession for two years now (since the middle of 2009), but the recovery has been very slow. Usually, when we come out of a recession, the economy bounces back quickly with strong GDP growth, lots of new jobs being created and a strong housing market. None of that is happening this time.

There are also a lot of clouds in the global economy, which now affects America much more than in the past. Greece, Portugal and Ireland are close to financial insolvency and the whole Euro-zone is weak. Japan’s economy is suffering the after-effects of the tsunami and the nuclear radiation scare. China is over-leveraged and its economy is slowing down. The Middle East is in turmoil. None of this can be good for our economy or the stock market. Although I’m by nature an optimist, I don’t see any promising economic signs in the near future.

If I used only macroeconomic factors to decide on my investment strategy, I might sell many of the stocks in the portfolios and hold a lot of cash. As most of you know, however, I don’t use macroeconomic factors to manage my funds. Over the years, I’ve been most successful when I’ve focused on the company rather than the economy. I try to pick companies that are good businesses and are selling at reasonable prices.

What’s surprising is that some of our best financial gains have come when the economic outlook was the bleakest. For example, in 1988, just after the stock market crash in October of 1987, the Parnassus Fund gained 42.44% to be one of the best-performing funds in the country that year. In 1990, the economy was in recession, the stock market collapsed and Saddam Hussein invaded Kuwait. Yet in the next year, 1991, the Parnassus Fund hit a record with a gain of 52.56%. In 2008, there was a financial meltdown and the economy was in a deep recession, yet in the next year, 2009, the Parnassus Fund gained 47.94%.

Of course, these examples don’t necessarily mean that we’re now ready for our funds to take off. What it does show, though, is that even in economically gloomy times, the stock market can turn around quickly and move sharply higher. For that reason, I’m keeping all three funds fully-invested in good companies trading at attractive valuations.

Yours truly,

Jerome L. Dodson

Portfolio Manager

8

| Semiannual Report • 2011 | PARNASSUS FUNDS | |||

Ticker: Investor Shares - PRBLX

Ticker: Institutional Shares - PRILX

As of June 30, 2011, the NAV of the Parnassus Equity Income Fund-Investor Shares was $27.32. After taking dividends into account, the total return for the second quarter of 2011 was a loss of 0.74%. This compares to gains of 0.09% for the S&P 500 Index (“S&P 500”) and 0.53% for the Lipper Equity Income Fund Average, which represents the average equity income fund followed by Lipper (“Lipper Average”).

For the first half of 2011, the Fund rose 4.46% versus 6.01% for the S&P 500 and 6.36% for the Lipper average. While we have underperformed so far in 2011, our long-term record remains outstanding. Our three-, five- and ten-year trailing returns beat the S&P 500 and the Lipper average by significant margins for every period.

Below is a table that compares the performance of the Fund with that of the S&P 500 and the Lipper average. Average annual total returns are for the one-, three-, five-, and ten-year periods.

| Parnassus Equity Income Fund | ||||||||||||||||||||||||

| Average Annual Total Returns (%) | One Year | Three Years | Five Years | Ten Years | Gross | Net | ||||||||||||||||||

| for periods ended 6/30/2011 | ||||||||||||||||||||||||

Parnassus Equity Income Fund Investor Shares | 23.10 | 5.52 | 7.21 | 6.86 | 0.99 | 0.99 | ||||||||||||||||||

| Parnassus Equity Income Fund Institutional Shares | 23.34 | 5.74 | 7.44 | 6.98 | 0.75 | 0.75 | ||||||||||||||||||

| S&P 500 Index | 30.68 | 3.34 | 2.95 | 2.72 | NA | NA | ||||||||||||||||||

| Lipper Equity Income Fund Average | 29.78 | 3.88 | 3.47 | 4.46 | NA | NA | ||||||||||||||||||

The total return for the Parnassus Equity Income Fund-Institutional Shares from commencement (April 28, 2006) was 6.68%. Performance shown prior to the inception of the Institutional Shares reflects the performance of the Parnassus Equity Income Fund-Investor Shares and includes expenses that are not applicable to and are higher than those of the Institutional Shares. The performance of Institutional Shares differs from that shown for the Investor Shares to the extent that the classes do not have the same expenses. Performance data quoted represent past performance and are no guarantee of future returns. Current performance may be lower or higher than the performance data quoted, and current performance information to the most recent month-end is on the Parnassus website (www.parnassus.com). Investment return and principal value will fluctuate, so that an investor’s shares, when redeemed, may be worth more or less than their original principal cost. Returns shown in the table do not reflect the deduction of taxes a shareholder may pay on fund distributions or redemption of shares. The S&P 500 is an unmanaged index of common stocks, and it is not possible to invest directly in an index. Index figures do not take any expenses, fees or taxes into account, but mutual fund returns do. On March 31, 1998, the Fund changed its investment objective from a balanced portfolio to an equity income portfolio. Before investing, an investor should carefully consider the investment objectives, risk, charges and expenses of the Fund and should carefully read the prospectus, which contains this and other information. The prospectus is on the Parnassus website, or one can be obtained by calling (800) 999-3505. As described in the Fund’s current prospectus dated, May 1, 2011, Parnassus Investments has contractually agreed to limit the total operating expenses to 0.99% and 0.77% of net assets, exclusive of acquired fund fees, through May 1, 2012 for the Investor Shares and Institutional Shares, respectively. These limitations may be continued indefinitely by the Adviser on a year-to-year basis.

Second Quarter Review

I’m disappointed that the Fund registered a modest loss of 0.74% for the second quarter and underperformed the S&P 500. The most significant driver of our underperformance was financials, which trimmed the Fund’s return by 53 basis points versus the benchmark. Bank stocks had a tough quarter, due to concerns about increased regulation, continued mortgage loss exposure, sluggish economic data and fears of Greek government default.

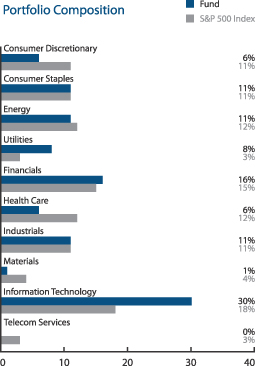

Our 16% exposure to financials was in-line with the index, but our holdings in this sector performed worse, falling on average 9.5% versus 6.0% for their S&P 500 peers. I expect our financial investments to rebound, because they have staying power, formidable competitive advantages and attractive valuations.

Company Analysis

The Fund had four stocks that reduced the NAV by at least 12¢ per share. Energen, a top-20 U.S. producer of oil and natural gas, fell 10.5% during the quarter from $63.12 to $56.50 and trimmed the NAV by 16¢. Energen’s stock struggled because oil prices declined from approximately $110 a barrel to $95 by quarter-end, and a drought in Texas caused fires that disrupted production at some wells.

These are temporary setbacks that don’t change Energen’s long-term fundamentals. At the end of 2010, the company had 303 million barrels worth of proven oil equivalents, which are enough to maintain current production for 15 years. I agree with Lori Keith, our energy analyst, that oil prices will increase long-term due to strong demand, limited supply, and geopolitical risks, so Energen’s reserves should increase in value over time.

9

| PARNASSUS FUNDS | Semiannual Report • 2011 | |||

Google declined 13.6% during the quarter to $506.38 from $586.21 and lowered the NAV by 14¢. Despite reporting strong revenues for its March quarter, Google’s stock fell as earnings were slightly below expectations due to higher expenses. Google also faced increased government scrutiny regarding anti-trust issues, which soured investor sentiment.

Our research director, Ben Allen, thought that Google’s second quarter stock market reaction was misguided. I agreed and made Google our largest holding during the quarter. We think that Google’s extra spending will increase the company’s economic relevance and competitive moat. The company’s three big areas of investment – pay raises for employees, advertising for its Chrome browser and research & development for emerging products – are superb uses of its $37 billion of cash.

JP Morgan’s stock declined 11.2% from $46.10 to $40.94 and trimmed our NAV by 13¢. As mentioned earlier, bank stocks got hit during the quarter for a host of non-company-specific reasons. In a challenged industry, JP Morgan is extremely well positioned. I recently heard CEO Jamie Dimon speak at a New York investment conference and was impressed with his strategy and attention to risk management. I’m confident that the company can make money in a wide range of potential regulatory and economic outcomes, while also minimizing the negative effects of potential European debt crises or a double dip in United States housing prices. Trading at only 7 times our estimated 2012 earnings estimates, JP Morgan is a great investment at its current quote.

Bank of New York Mellon reduced the Fund’s NAV by 12¢ as the stock fell 14.2% to $25.62 from $29.87 per share. The company generates most of its profits from asset management and fee-based custodial and trust services, so Bank of New York Mellon is not a bank in the traditional sense. Earnings are currently depressed because low interest rates prevent the company from charging its normal fee for money market services.

The Fund had four stocks that boosted the NAV by at least 10¢ each. MasterCard, the transaction processing company, jumped 19.7% from $251.72 to $301.34 and added 16¢ to the NAV. The stock jumped late in the quarter, as the Federal Reserve released its final debit-fee rules. Earlier versions of the rule had indicated that the limit on debit card “swipe fees” would be around 12¢ (compared to an average of 44¢ before the rule change) but estimates based on the final rule indicate a limit of 24¢. This higher limit is good for banks, and MasterCard’s stocks moved higher.

In the Spring of 2010, Senator Durbin of Illinois proposed legislation to cut debit fees by as much as 84%. This news pushed MasterCard’s stock down over 20% from around $260 per share to below $200. After a thorough analysis by analyst Matt Gershuny, I bought a significant MasterCard position in May of last year, based on the view that the market was anticipating a worst-case scenario for Durbin’s legislation. We were rewarded when the cut was less than expected, and I remain bullish on the long-term prospects for MasterCard.

Nike had a good quarter, rising 18.9% to $89.98 per share from $75.70, adding 12¢ to the NAV. In late June, the company reported that fiscal 2011 sales increased 10% and earnings grew 14%. In addition, the company updated its long-term business goals, including a target of $28-30 billion of sales by fiscal 2015. The midpoint of this estimate implies an 8% annual growth rate, which should boost earnings and the stock price for years to come.

Gen-Probe, a company that sells molecular diagnostic products that screen blood and detect diseases, increased the NAV by 11¢ per share, as its stock rose 4.2% to $69.15 from $66.35. The company is valuable because several of its products are entrenched industry standards. In addition, Gen-Probe has a full product pipeline, including tests for Human papillomavirus and prostate cancer, along with a new system called Panther, a blood diagnostic machine for small labs.

On April 28, a rumor hit the newswire that several companies were interested in acquiring Gen-Probe. The stock jumped 13% that day and eventually got as high as $87 per share. Given this increase in price, we reduced our Gen-Probe position from 3% of the Fund’s assets to 1.2% at quarter end.

Sysco, the foodservice company, added 10¢ to our NAV as the stock rose 12.6% during the quarter from $27.70 to $31.18. On the strength of its durable competitive advantage, the company has been able to raise prices enough to offset rising commodity costs. This allowed the company to report a 4% year-over-year increase in profits, which exceeded investors’ expectations.

10

| Semiannual Report • 2011 | PARNASSUS FUNDS | |||

Outlook and Strategy

The U.S. began the second quarter adding about 200,000 jobs per month, and the consensus projection for 2011 GDP growth was 2.6%. As of this writing, monthly job growth was 18,000 in June and the expectation for 2011 GDP growth has dropped to around 2.3%. Unfortunately, the economy is still not growing at its full potential.

Since our representatives in Washington have done so much to foster an economic recovery, I’m following events in the capital very closely. It appears that Congress will reduce the deficit as part of the deal to raise the debt ceiling, which would mean less government spending or more taxes, both of which would probably have a negative impact on near-term economic growth. And while the Federal Reserve’s quantitative easing programs (QE1 and QE2) weren’t as potent as some expected them to be, the fact that QE2 is phasing out is also a negative for the economy.

Across the Atlantic, governments are also rolling back stimulation policies. Many countries, such as Ireland and Greece, are cutting spending in return for assistance with their debt crises. Meanwhile, the European Central Bank has already started increasing short-term interest rates because of inflation-related concerns. Usually, an increase in rates puts a damper on economic activity, so these actions are not conducive to growth.

The news from Asia also hints at a potential economic slowdown. China has already raised interest rates three times this year in an effort to check inflation, which is currently running above 6%. In addition, I’ve read a number of troubling reports about risks to Chinese growth, including a potential real estate bubble, faulty accounting, bad loans and excess production capacity. Since this country, along with other emerging economies, has provided a boost to flagging global demand since the 2008 credit crisis, any slowdown there could have consequences for companies in the Fund, most of which do a significant amount of business overseas.

While I see a number of risks to the overall global economy, I’m still confident that our portfolio is well positioned to generate strong returns over time. We invest in companies based on a three-year range of outcomes that incorporate numerous upside and downside scenarios, and my natural tendency is to emphasize the bearish scenario. Nevertheless, I’m happy to report that our portfolio companies’ upside scenarios look very good, especially when compared to their relatively contained downside risks. This is possible, because I favor high-quality businesses with durable economic moats, and these companies should hold up well, even if the economy continues growing at a sub-par rate.

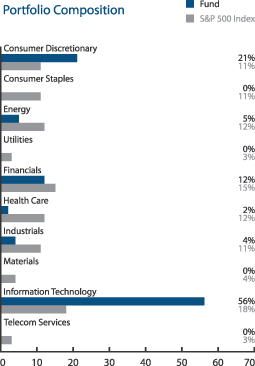

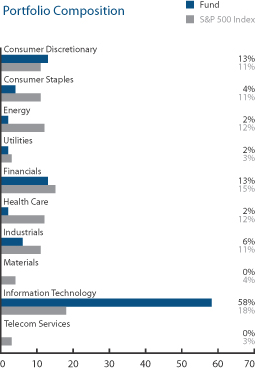

Our largest sector, overweighted relative to the index, is technology, where we own great franchises with good long-term prospects, and whose stocks are trading near all-time low earnings multiples. The Fund is still overweighted in energy and utility companies with valuable, long-lived, low-cost production assets, mostly in the United States.

Our two significant underweighted positions relative to the index are healthcare and consumer discretionary. The consumer underweight was reduced during the second quarter, as we initiated a position in Target after its stock fell to bargain levels. We also initiated positions in CVS

Parnassus Equity Income Fund as of June 30, 2011 (percentage of long-term portfolio) | ||

Top 10 Holdings

(percentage of net assets)

| Google Inc. | 5.2% | |||

| Waste Management Inc. | 4.8% | |||

| Energen Corp. | 4.3% | |||

| Cisco Systems Inc. | 4.3% | |||

| JPMorgan Chase & Co. | 4.1% | |||

| Procter & Gamble Co. | 4.1% | |||

| Teleflex Inc. | 4.0% | |||

| QUALCOMM Inc. | 3.9% | |||

| Plains Exploration & Production Co. | 3.4% | |||

| MasterCard Inc. | 3.2% | |||

Portfolio characteristics and holdings are subject to change periodically.

11

| PARNASSUS FUNDS | Semiannual Report • 2011 | |||

Caremark and United Parcel Service (UPS). These stocks should hold up well if economic growth is subdued, and should thrive if the economic picture ends up being better that my current projection.

Our high-quality portfolio of 40 stocks reflects our time-tested investment approach. This process has generated superior long-term returns, and I expect it to continue to do so. Thank you for your trust and investment in the Parnassus Equity Income Fund.

Highest regards,

Todd C. Ahlsten

Portfolio Manager

12

| Semiannual Report • 2011 | PARNASSUS FUNDS | |||

Ticker: PARMX

As of June 30, 2011, the NAV of the Parnassus Mid-Cap Fund was $20.22, so the total return for the second quarter of 2011 was a gain of 0.10%. This compares to a gain of 0.42% for the Russell Midcap Index (the “Russell”) and a loss of 0.08% for the average multi-cap core fund followed by Lipper (the “Lipper average”). While we fell slightly behind the Russell this quarter, we’re pleased that the Fund beat its Lipper peer group.

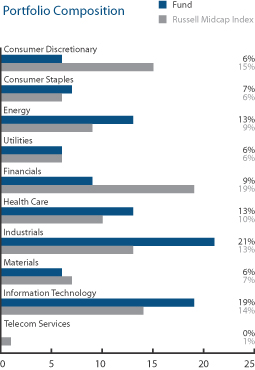

For the first half of 2011, the Fund is well ahead of its benchmarks, rising 10.79% versus a gain of 8.08% for the Russell and a gain of just 6.00% for the Lipper average. Long-term performance remains outstanding; the Fund’s three-year annualized gain is 11.37%, considerably better than the 6.46% gain for the Russell and the 3.29% gain for the Lipper average. The Fund’s five-year annualized return is also significantly ahead of both indices.

Below is a table comparing the Parnassus Mid-Cap Fund with the Russell and the Lipper average for the one-, three- and five-year periods and for the period since inception on April 29, 2005.

| Parnassus Mid-Cap Fund | ||||||||||||||||||||||||

| Average Annual Total Returns (%) | One Year | Three Years | Five Years | Since Inception 4/29/05 | Gross Expense Ratio | Net Expense Ratio | ||||||||||||||||||

| for periods ended 6/30/2011 | ||||||||||||||||||||||||

| Parnassus Mid-Cap Fund | 35.34 | 11.37 | 7.48 | 7.25 | 1.46 | 1.20 | ||||||||||||||||||

| Russell Midcap Index | 38.47 | 6.46 | 5.30 | 7.74 | NA | NA | ||||||||||||||||||

| Lipper Multi-Cap Core Average | 30.90 | 3.29 | 2.97 | 5.01 | NA | NA | ||||||||||||||||||

Performance data quoted represent past performance and are no guarantee of future returns. Current performance may be lower or higher than the performance data quoted. Current performance information to the most recent month-end is on the Parnassus website (www.parnassus.com). Investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original principal cost. Returns shown in the table do not reflect the deduction of taxes a shareholder may pay on fund distributions or redemption of shares. The Russell Midcap Index is an unmanaged index of common stocks, and it is not possible to invest directly in an index. Index figures do not take any expenses, fees or taxes into account, but mutual fund returns do. Mid-cap companies can be more sensitive to changing economic conditions and have fewer financial resources than large-cap companies. Before investing, an investor should carefully consider the investment objectives, risks, charges and expenses of the Fund and should carefully read the prospectus, which contains this and other information. The prospectus is available on the Parnassus website, or one can be obtained by calling (800) 999-3505. As described in the Fund’s current prospectus dated May 1, 2011, Parnassus Investments has contractually agreed to limit the total operating expenses to 1.20% of net assets, exclusive of acquired fund fees, until May 1, 2012. This limitation may be continued indefinitely by the Adviser on a year-to-year basis.

Second Quarter Review

With the exception of underperforming small-cap issues, domestic equity markets were about flat for the second quarter of 2011. Stocks were volatile intra-quarter though, reflecting unease about domestic economic growth and the European debt crisis.

Mid-cap stocks were not immune to this volatility. In April, the Russell rose 3.0% following strong corporate earnings reports. However, it fell 7.4% from its quarterly high by mid-June on sluggish U.S. economic data and Greek instability. When Greece announced a debt restructuring plan in late June, the Russell jumped to end the quarter up 0.42%. This performance compares favorably to the large-cap S&P 500 Index’s 0.09% rise, and the small-cap Russell 2000 Index’s 1.61% drop.

For the quarter, the Fund trailed the Russell by 0.32 percentage points, and beat its Lipper peers by 0.18 percentage points. The Fund tends to invest in companies with higher returns on equity (ROE), an indication of profitability and efficiency. Since these companies did better than companies with lower ROEs during the quarter, this bias contributed positively to our performance.

Regarding sector allocation, the Fund was overweight relative to the Russell in the rising healthcare sector, which was the most positive contributor for the quarter. Conversely, the Fund’s underweight position relative to the index in consumer discretionary issues hurt performance, because these stocks as a group went up the most of any sector. Excellent stock picking in the industrial sector contributed positively to our performance, while poor stock picking in the financial sector was a drag.

13

| PARNASSUS FUNDS | Semiannual Report • 2011 | |||

Company Analysis

Three stocks reduced the Fund’s NAV by 8¢ or more in the quarter, while four stocks added at least 7¢ to the NAV.

The Fund’s biggest loser was Finisar, a provider of optical components used in telecommunication equipment, which sliced 15¢ off the NAV. The stock tumbled 26.7% during the quarter, from $24.60 to $18.03, after management provided weaker-than-expected earnings guidance due to soft demand from key customer, Huawei. The company’s performance should improve given the expanding market for broadband services and Finisar’s strong product offering.

First Horizon National, a Tennessee-based bank, cut 12¢ from the Fund’s NAV as its stock fell 14.9% from $11.21 to $9.54. The stock traded down, along with other financials, given the bank’s exposure to national home equity loans and mortgage securities. We still like the stock, because most national loans should pay off over time, and the company is re-focusing efforts on its high-potential core franchise.

Oil and gas producer Energen dropped 10.5% from $63.12 to $56.50, decreasing the NAV by 8¢. Weather issues and wild fires impacted production in West Texas’ Permian Basin, causing the company to miss expectations. A 10% drop in crude oil’s price also hurt. Despite these issues, we expect a recovery in the stock as the company ramps up its drilling programs and oil prices move higher.

Teradata, a business intelligence software company based in Ohio, was the Fund’s biggest contributor, adding 10¢ to the NAV, as its stock rose 18.7% from $50.70 to $60.20. Enterprises are increasingly adopting the company’s analytics solutions to manage multiple data sources. Management raised its revenue outlook in the quarter reflecting this robust demand. Investors are also excited about Teradata’s two recent acquisitions, which significantly expand the company’s customer base.

Sysco, the Texas-based food service company, added 9¢ to the Fund’s NAV, as its stock jumped 12.6% during the quarter from $27.70 to $31.18. The stock rose after the company successfully raised prices, offsetting the spiking cost of food and other products it sells. Despite the soft economy, clients accepted this price increase because Sysco offers advantages in quality, price and service.

Shares of Minnesota-based Ecolab, the world’s leading producer of cleaning and sanitizing products, increased 10.5% during the quarter, from $51.02 to $56.38, adding 7¢ to the Fund’s NAV. Ecolab was weak earlier in the year, as the cost of raw materials used to make its products went up. The stock recovered this quarter, as management successfully implemented offsetting price increases, indicating that clients are willing to pay for the company’s innovative product portfolio and excellent customer service.

Gen-Probe, a San Diego-based company that sells molecular diagnostic products for blood screening and disease detection, increased the Fund’s NAV by 7¢ as its stock rose 4.2% from $66.35 to $69.15. The stock surged over 20% in April following reports that the company was for sale. We sold most of our position on this news, believing the shares were fairly valued. When a deal didn’t transpire, the stock dropped drastically.

| Parnassus Mid-Cap Fund as of June 30, 2011 (percentage of long-term portfolio) |

Top 10 Holdings

(percentage of net assets)

| Waste Management Inc. | 4.8% | |||

| Teleflex Inc. | 4.1% | |||

| Insperity Inc. | 3.8% | |||

| SEI Investments Co. | 3.7% | |||

| Paychex Inc. | 3.6% | |||

| Ecolab Inc. | 3.4% | |||

| Questar Corp. | 3.4% | |||

| Plains Exploration & Production Co. | 3.3% | |||

| Sysco Corp. | 3.3% | |||

| Equifax Inc. | 3.1% | |||

Portfolio characteristics and holdings are subject to change periodically.

14

| Semiannual Report • 2011 | PARNASSUS FUNDS | |||

Outlook and Strategy

Despite the record stimulus of the past few years, expectations for job and economic growth went down this past quarter. More concerning is the combination of Congress’ reluctance to raise the debt ceiling, demand for spending cuts and the end of the Fed’s second quantitative easing program. In Europe, governments such as Greece and Ireland are removing stimulus and cutting spending to gain support for their debt restructuring plans. In China, reports of a real estate bubble and inflation are also worrisome.

The current economic climate is precarious. Nonetheless, we are hopeful that a firmer recovery, with job growth and controlled inflation, will soon take hold in the United States. In the meantime, given our expectations for a bumpy ride, we are straying little from our strategy of investing with caution.

We are overweighted relative to the Russell in the industrial, information technology and healthcare sectors, owning businesses that are well-positioned to capture increasing share in attractively growing end-markets. We have increased our energy exposure, appreciating the long-term demand trends for these companies’ assets. We remain underweighted in the financial and consumer discretionary sectors, where few companies currently meet our overall investment criteria.

The portfolio is positioned to outperform over the long-term, regardless of the economy. This reflects a commitment to our bottom-up investment process, which results in the Fund’s owning attractively-valued and well-managed companies with above market growth rates and competitive advantages.

Thank you for your investment.

Yours truly,

|  |  | ||

| Matthew D. Gershuny | Benjamin E. Allen | Lori A. Keith | ||

| Portfolio Manager | Portfolio Manager | Portfolio Manager |

15

| PARNASSUS FUNDS | Semiannual Report • 2011 | |||

Ticker: PARSX

As of June 30, 2011, the NAV of the Parnassus Small-Cap Fund was $24.44, so the total return for the second quarter was a loss of 4.12%. By comparison, the Russell 2000 Index of smaller companies (“Russell 2000”) had a loss of 1.61%, and the Lipper Small-Cap Core Average, which represents the average small-cap core fund followed by Lipper (“Lipper average”), had a loss of 1.32%. For the quarter, we underperformed our benchmarks by almost three percentage points each.

For the year-to-date, the Small-Cap Fund is up 2.05 %, compared to a gain of 6.21% for the Russell 2000 and 6.49% for the Lipper average. Below is a table comparing the performance of the Small-Cap Fund with that of the Russell 2000 and the Lipper average for the one-, three- and five-year periods and the period since inception. As you can see, the Fund is behind the indices for the one-year period, but is substantially ahead of all its benchmarks for all other time periods.

| Parnassus Small-Cap Fund | ||||||||||||||||||||||||

| Average Annual Total Returns (%) | One Year | Three Years | Five Years | Since Inception 4/29/05 | Gross Expense Ratio | Net Expense Ratio | ||||||||||||||||||

| for periods ended 6/30/2011 | ||||||||||||||||||||||||

| Parnassus Small-Cap Fund | 34.40 | 13.80 | 8.84 | 10.37 | 1.30 | 1.20 | ||||||||||||||||||

| Russell 2000 Index | 37.41 | 7.77 | 4.08 | 7.35 | NA | NA | ||||||||||||||||||

| Lipper Small-Cap Core Average | 36.29 | 7.32 | 4.00 | 7.12 | NA | NA | ||||||||||||||||||

Performance data quoted represent past performance and are no guarantee of future returns. Current performance may be lower or higher than the performance data quoted. Current performance information to the most recent month-end is available on the Parnassus website (www.parnassus.com). Investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original principal cost. Returns shown in the table do not reflect the deduction of taxes a shareholder may pay on fund distributions or redemption of shares. The Russell 2000 Index is an unmanaged index of common stocks, and it is not possible to invest directly in an index. Index figures do not take any expenses, fees or taxes into account, but mutual fund returns do. Small-cap companies can be particularly sensitive to changing economic conditions and have fewer financial resources than large-cap companies. Before investing, an investor should carefully consider the investment objectives, risks, charges and expenses of the Fund and should carefully read the prospectus, which contains this and other information. The prospectus is on the Parnassus website, or one can be obtained by calling (800) 999-3505. As described in the Fund’s current prospectus dated May 1, 2011, Parnassus Investments has contractually agreed to limit the total operating expenses to 1.20% of net assets, exclusive of acquired fund fees, until May 1, 2012. This limitation may be continued indefinitely by the Adviser on a year-to year basis.

Company Analysis

For the quarter, five companies each accounted for losses of 16¢ or more for each fund share. Two of them were providers of optical equipment used in telecommunications. Finisar dropped 26.7%, as its stock collapsed from $24.60 to $18.03 for a loss of 29¢ on the NAV. Ciena sank 29.2% from $25.96 to $18.38 for a loss of 16¢ for each Small-Cap Fund share.

Both Finisar and Ciena had a similar experience. The stocks rose much higher on improved prospects for spending on telecomm equipment, then they overshoot their fundamentals and got ahead of themselves, before collapsing when results were not as strong as expected.

In our last quarterly report, we described how over-ordering by customers at Finisar lead to an inventory correction with customers cutting back on orders to Finisar, and instead using their own inventory supply to meet production. In addition to the inventory correction, weakness in the China telecommunications market hurt Finisar’s stock in the last quarter. The same thing happened in the second quarter, pressuring the company’s share price. As we stated in the last quarterly report, we think that the inventory correction and the China weakness are temporary problems, and we hope that the stock will recover sometime later this year.

At Ciena, there was no evidence of over-ordering or inventory correction, and the stock did very well in the first quarter, increasing 23.3% and adding 12¢ to each fund share. Like Finisar, though, the stock did get ahead of itself. On June 8, the company issued weak guidance, indicating that demand for its products was softening. We added to our position in Ciena on the weakness in its share price, because we think that demand will improve before the end of the year, and the company has excellent products and seems to be gaining market share.

16

| Semiannual Report • 2011 | PARNASSUS FUNDS | |||

Artio Global Investors, an asset manager that invests primarily in international equities, sank 30.1% from $16.16 to $11.30, slicing 24¢ off the NAV. The company posted a strong investment track record from 1996 through 2008, but has underperformed since then. The stock price has come down quite a bit, so it is now in undervalued territory. The stock should move higher once their investment performance improves, which should happen since the same team is in place from the 1996-2008 era.

MIPS Technologies, a provider of semiconductors for use in consumer electronics, saw its stock plummet 34.1% from $10.49 to $6.91 for a loss of 20¢ for each fund share. The company reported poor quarterly results and a weak outlook for the immediate future because of softness in the home entertainment market. We still like the stock because it has superior technology based on Google’s Android operating system that can be used in smart phones and tablets.

LHC Group, a home healthcare company, cost the Fund 16¢ per share, as its stock fell 23.1% from $30.00 to $23.06. More stringent federal regulations in the home healthcare market and recent political pressure to address the federal budget deficit mean that reimbursements from Medicare and Medicaid will probably be lowered which will hurt the firm’s revenue.

The stock that helped the Small-Cap Fund the most during the quarter was Websense, a provider of software for internet security. It contributed 9¢ to the NAV, as its stock rose 13.1% from $22.97 to $25.97. Strong demand for its enterprise security software, and improved results in its core web-filtering business drove the stock higher.

Oil- and gas-producer W&T Offshore climbed 14.6% from $22.79 to $26.12 while contributing 8¢ to each fund share. The stock moved higher after the company announced a sizeable acquisition of onshore assets in the West Texas Permian Basin, which should diversify W&T’s asset base and provide significant future growth.

EZchip Semiconductor provides semiconductors for use as network processors used in data centers, enterprise networks and telecommunications. The stock contributed 8¢ to the NAV, as it rose 24.7% from $29.65 to $36.97. Orders had been weak in the first quarter because of an inventory correction, but bounced back in the second quarter to normal levels. EZchip also announced that its next generation of high-speed network processors will be ready to ship in the second half of the year.

Yours truly,

Jerome L. Dodson

Portfolio Manager

| Parnassus Small-Cap Fund as of June 30, 2011 (percentage of long-term portfolio) | ||

Top 10 Holdings

(percentage of net assets)

| Finisar Corp. | 5.3% | |||

| Teleflex Inc. | 4.2% | |||

| Tower Group Inc. | 3.7% | |||

| Brocade Communications Systems Inc. | 3.4% | |||

| Quicksilver Resources Inc. | 3.3% | |||

| AGL Resources Inc. | 3.2% | |||

| Calgon Carbon Corp. | 3.2% | |||

| Hanesbrands Inc. | 3.1% | |||

| VCA Antech Inc. | 3.0% | |||

| First Horizon National Corp. | 2.8% | |||

Portfolio characteristics and holdings are subject to change periodically.

17

| PARNASSUS FUNDS | Semiannual Report • 2011 | |||

Ticker: PARWX

As of June 30, 2011, the NAV of the Parnassus Workplace Fund was $21.50, so the total return for the second quarter was a loss of 2.23%. This compares to a gain of 0.09% for the S&P 500 and a loss of 0.17% for the Lipper Large-Cap Core Average, which represents the average large-cap core fund followed by Lipper (“Lipper average”). For the quarter, we lagged both benchmarks by about two percentage points.

For the year-to-date, the Workplace Fund is up 3.32% compared to 6.01% for the S&P 500 and 5.19% for the Lipper average. Below is a table comparing the Workplace Fund with the S&P 500 and the Lipper average for the past one-, three- and five-year periods, as well as the period since inception. We’re behind the S&P 500 for the one-year period, but we’re substantially ahead of both benchmarks for all other periods.

| Parnassus Workplace Fund | ||||||||||||||||||||||||

| Average Annual Total Returns (%) | One Year | Three Years | Five Years | Since Inception 4/29/05 | Gross Expense Ratio | Net Expense Ratio | ||||||||||||||||||

| for periods ended 6/30/2011 | ||||||||||||||||||||||||

| Parnassus Workplace Fund | 28.90 | 12.40 | 9.46 | 8.63 | 1.25 | 1.20 | ||||||||||||||||||

| S&P 500 Index | 30.68 | 3.34 | 2.95 | 4.31 | NA | NA | ||||||||||||||||||

| Lipper Large-Cap Core Average | 28.56 | 2.35 | 2.43 | 4.08 | NA | NA | ||||||||||||||||||

Performance data quoted represent past performance and are no guarantee of future returns. Current performance may be lower or higher than the performance data quoted. Current performance information to the most recent month-end is available on the Parnassus website (www.parnassus.com). Investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original principal cost. Returns shown in the table do not reflect the deduction of taxes a shareholder may pay on fund distributions or redemption of shares. The S&P 500 Index is an unmanaged index of common stocks, and it is not possible to invest directly in an index. Index figures do not take any expenses, fees or taxes into account, but mutual fund returns do. Before investing, an investor should carefully consider the investment objectives, risks, charges and expenses of the Fund and should carefully read the prospectus, which contains this and other information. The prospectus is available on the Parnassus website, or one can be obtained by calling (800) 999-3505. As described in the Fund’s current prospectus dated May 1, 2011, Parnassus Investments has contractually agreed to limit the total operating expenses to 1.20% of net assets, exclusive of acquired fund fees, until May 1, 2012. This limitation may be continued indefinitely by the Adviser on a year-to-year basis.

Company Analysis

Five companies each accounted for losses of 12¢ or more on the NAV. Two of them were banks and three technology companies. The one that hurt us the most was Cisco, which sliced 14¢ off the NAV, as its stock sank 9.0% from $17.15 to $15.61. Investors are worried about slowing growth and increased competition in the company’s core switching business. Weak demand from state and local governments also weighed on the stock. Despite these issues, Cisco remains the worldwide leader of equipment used to power internet traffic and data centers. At only nine times forward earnings estimates, the stock is on the bargain table.

Applied Materials, the leading supplier of semiconductor manufacturing equipment, cut 13¢ off each fund share, with its stock dropping 16.7% from $15.62 to $13.01. Some customers deferred orders in the wake of the Middle East turmoil and the disaster in Japan. The company also bought rival Varian Semiconductor for almost $5 billion, a 55% premium over its last trading price before the announcement. Investors drove down the price of the stock because of the high price paid for Varian, and concern that most acquisitions don’t work out as expected.

Hewlett-Packard dropped 11.2% during the quarter, falling from $40.97 to $36.40, and reducing the NAV by 12¢. Although the company reported double digit profit growth during the quarter, the stock dropped after the company lowered its revenue outlook. Consumers in the developed world are purchasing fewer PCs than expected, hurting HP’s computer business. The company’s decision to increase spending for its consulting services also hurt the stock, as margin growth may be less than expected, at least in the near term. We are holding onto the stock, since it’s now trading at a very low valuation.

18

| Semiannual Report • 2011 | PARNASSUS FUNDS | |||

Shares of San Francisco-based Wells Fargo dropped 11.5% from $31.70 to $28.06 for a loss of 12¢ for each fund share. All large-capitalization bank stocks dropped during the quarter, because of concerns over economic growth and increasing regulation, as well as weak first-quarter earnings reports. Even with all the bad news, we’re optimistic about the future of the bank’s stock. It’s trading at only eight times next year’s expected earnings, and it has the ability to improve performance of all the branches it acquired from Wachovia Bank.

First Horizon, a Tennessee-based bank, cut 12¢ off the NAV, as its stock sank 14.9% from $11.21 to $9.54. The shares are down because of continuing concern about the bank’s exposure to mortgages and home-equity loans in the national market. The bank has solid operations in its home market of Tennessee, but its attempt to establish a national presence had disastrous consequences. It has now retrenched back to its base in Tennessee, where it has profitable, well-managed operations.

Three stocks each helped the Fund by 9¢ or more. The big winner was Nike, which added 19¢ to the Fund’s NAV, as its shares rose 18.9% from $75.70 to $89.98. The stock soared after the company made positive comments about increasing sales in China and other emerging markets. The company also indicated that they would be able to contain costs, so that earnings would grow faster than sales.

MasterCard added 12¢ to each fund share, as its stock surged 19.7% from $251.72 to $301.34. The stock did well in April and May, when management reported improving business trends here and abroad, but the biggest move came in June when the Federal Reserve softened its original rule limiting the amount companies could charge for debit card processing. Previously, the average charge for a debit card transaction was about 44¢, and the new regulation was expected to lower that to about 12¢, but the final regulation came in with an estimate of 24¢. The new ruling alleviated a long-time investor concern and enhanced the company’s growth and profitability outlook.

Intel contributed 9¢ to the NAV, as its stock rose 9.9% to $22.16 from $20.17. The shares moved higher after the company reported better than expected quarterly results driven by improved pricing and increased business demand for computers and better higher demand from consumers in emerging markets.

Yours truly,

Jerome L. Dodson

Portfolio Manager

| Parnassus Workplace Fund as of June 30, 2011 (percentage of long-term portfolio) |

Top 10 Holdings (percentage of net assets)

| Nike Inc. | 5.5% | |||

| Wells Fargo & Co. | 5.5% | |||

| Intel Corp. | 5.3% | |||

| Hewlett-Packard Company | 5.2% | |||

| Cisco Systems Inc. | 5.0% | |||

| Target Corp. | 4.9% | |||

| Brocade Communications Systems Inc. | 4.4% | |||

| SEI Investments Co. | 4.4% | |||

| Google Inc. | 4.1% | |||

| QUALCOMM Inc. | 4.1% | |||

Portfolio characteristics and holdings are subject to change periodically.

19

| PARNASSUS FUNDS | Semiannual Report • 2011 | |||

Ticker: PRFIX

As of June 30, 2011, the NAV of the Parnassus Fixed-Income Fund was $17.10, producing a total return for the quarter of 2.09% (including dividends). This compares to a gain of 2.32% for the Barclays Capital U.S. Government/Credit Bond Index (“Barclays index”) and a gain of 1.93% for the Lipper A-Rated Bond Fund Average, which represents the average return of all A-Rated bond funds followed by Lipper (“Lipper average”). Since the beginning of the year, the total return for the Fund was 2.28% compared to a gain of 2.61% for the Barclays index and a gain of 2.86% for the Lipper average.

Below is a table comparing the performance of the Fund with that of the Barclays index and the Lipper average. Average annual total returns are for the one-, three-, five- and ten-year periods. The 30-day SEC yield for the Fund for June 2011 was 1.06%.

| Parnassus Fixed-Income Fund | ||||||||||||||||||||||||

| Average Annual Total Returns (%) | One Year | Three Years | Five Years | Ten Years | Gross Expense Ratio | Net Expense Ratio | ||||||||||||||||||

| for periods ended 6/30/2011 | ||||||||||||||||||||||||

| Parnassus Fixed-Income Fund | 3.52 | 6.06 | 5.87 | 5.78 | 0.83 | 0.75 | ||||||||||||||||||

| Barclays Capital U.S. Government/Credit Bond Index | 3.68 | 6.17 | 6.35 | 5.74 | NA | NA | ||||||||||||||||||

| Lipper A-Rated Bond Fund Average | 5.09 | 6.44 | 5.64 | 5.17 | NA | NA | ||||||||||||||||||

Performance data quoted represent past performance and are no guarantee of future returns. Current performance may be lower or higher than the performance data quoted. Current performance information to the most recent month-end is available on the Parnassus website (www.parnassus.com). Investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Returns shown in the table do not reflect the deduction of taxes a shareholder would pay in fund distributions or redemption of shares. The Barclays Capital U.S. Government/Credit Bond Index is an unmanaged index of bonds, and it is not possible to invest directly in an index. Index figures do not take any expenses, fees, or taxes into account, but mutual fund returns do. Before investing, an investor should carefully consider the investment objectives, risks, charges and expenses of the Fund and should carefully read the prospectus, which contains this and other information. The prospectus is on the Parnassus website, or one can be obtained by calling (800) 999-3505. As described in the Fund’s current prospectus dated May 1, 2011, Parnassus Investments has contractually agreed to reduce its investment advisory fee to the extent necessary to limit total operating expenses to 0.75% of net assets for the Parnassus Fixed-Income Fund. This limitation continues until May 1, 2012, and may be continued indefinitely by the investment adviser on a year-to-year basis.

Second Quarter Review

Weak economic data during the second quarter curbed investors’ optimism following the positive momentum of the first quarter. In particular, manufacturing surveys pointed to a sharp decline in activity in June compared to May. Also, certain key components of these reports, such as indexes for new orders, shipments and employment, all declined. As a result, most economists revised down their economic growth forecasts. For example, 2011 U.S. GDP is projected to grow at only 2.5%, down from the 3.1% growth forecasted at the end of the first quarter.

Interest rates moved lower because of the weaker economic growth prospects. The middle of the yield curve, 3-year to 5-year maturities, decreased the most. The 3-year bond yield decreased 50 basis points (one basis point equals 0.01%) to 0.80% during the second quarter. The yield on the 5-year bond was down 52 basis points to 1.76%. Since bond prices increase as yields decrease, fixed-income securities had positive returns during the second quarter.

The Fund’s performance benefited from this lower yield environment, with a gain of 2.09% for the quarter. Our Treasury bonds were the biggest winner, adding 25¢ to the NAV. Corporate bonds contributed 13¢, while our convertible bonds increased the NAV by 1¢.

The Fund trailed the Barclays index by 23 basis points, because we had less exposure than the benchmark to the U.S. government bond market. As of the end of the quarter, U.S. government bonds represented 61% of the Barclays index, compared to 50% for the Fund. Also, our Treasury bond holdings didn’t go up as much as the benchmark’s, because we had a lower duration. Duration is a measure of the sensitivity of a bond to interest rates movements.

20

| Semiannual Report • 2011 | PARNASSUS FUNDS | |||

The Fund was ahead of the Lipper average by 16 basis points, primarily due to our higher weighting in the U.S. Treasury market. Most of our peers also owned commercial mortgage-back securities (CMBS), while we don’t currently have any exposure. During the second quarter, CMBS returned only 1.63% compared to 2.39% for U.S. government bonds.

Outlook and Strategy

At the June meeting of the Federal Reserve Open Market Committee, Chairman Ben Bernanke commented that the economic recovery is proceeding at a moderate pace, albeit slower than anticipated. The current debate among investors is whether this slowdown in economic growth is temporary or prolonged.

In my view, the risk is currently tilted to the downside. I think that the economy will continue to grow, but at a much slower pace than is currently expected. Macroeconomic uncertainties abound, not just in the U.S. For example, Brazil, China, and India are all facing rapid inflation, forcing tighter monetary policy to slow down their economic growth. Japan is still recovering from the unfortunate earthquake and nuclear disaster. And the sovereign debt problem in Europe has not been resolved. Excessive indebtedness in the peripheral European countries has more to do with structural imbalances, such as budget deficits and lack of competitiveness. No amount of funding can solve that and current proposals are not sufficient.

| Parnassus Fixed-Income Fund as of June 30, 2011 (percentage of long-term portfolio) |

Portfolio Composition

| U.S. Government Treasury Bonds | 58% | |||

| Corporate Bonds | 38% | |||

| Convertible Bonds | 4% | |||

| 100% | ||||

Portfolio characteristics and holdings are subject to change periodically.

I think that the current expected returns for bonds are too low. They don’t offer adequate compensation for the risks mentioned above. Artificially low interest rates have forced many investors to take on more risk to generate acceptable returns. It seems that they are no longer concerned about the risk of loss. And instead, the risk of missing investment opportunities is their primary worry.

Safety and preservation of capital are essential elements of the Fund’s investment strategy. Given these priorities and current fixed-income market conditions, I think that a defensive positioning is best. I prefer to wait for more attractively priced investments, rather than chase higher yield in riskier investments.

As of the end of the second quarter, U.S. Treasury bonds were our largest holding, representing 50% of the Fund’s total net assets. It is important to note that our Treasury holdings’ duration of 4.5 years is lower than the benchmark’s duration of 5.4 years. Despite my views on the economy, interest rates cannot go much lower given the already low levels. Therefore, longer-dated Treasury bonds are not attractive long-term investments.

While we get a lower yield due to our lower duration, we gain downside protection. Once interest rates rise to levels that appropriately compensate for risks, I will look to extend the portfolio’s duration. The rest of the portfolio consists of corporate bonds (35%), Treasury Inflation-Protected Securities (4%), convertible bonds (3%), and cash and short-term investments (7%).

As always, I remain vigilant to changes in the economic and financial outlook and will position the portfolio accordingly.

Thank you for your trust and investments in the Parnassus Fixed-Income Fund.

Yours truly,

Minh T. Bui

Portfolio Manager

21

| PARNASSUS FUNDS | Semiannual Report • 2011 | |||

By Milton Moskowitz

When Parnassus Investments started operations in 1984, it was not easy to find reliable information about the social performance of companies. Corporations were under no obligation to disclose minority and female participation in management ranks or to report on programs to curb polluting emissions or to highlight their efforts to support communities where they had facilities.

That’s all changed now. Today, analysts at Parnassus have at their fingertips a variety of sources for such information: social responsibility reports by companies, organizations like Business for Social Responsibility, UN Global Compact and CERES, databases developed by Kinder Lydenberg Domini, now a unit of MSCI. And then there are endless lists: Leading Corporate Citizens, 100 Most Ethical Companies, 100 Best Companies for Working Mothers, Fortune’s 100 Best Companies to Work For. The Global Reporting Initiative has laid down clear guidelines on how companies should report information about environmental, social and economic performance – and they are now in use by 2,000 companies across the world. A measure of how far we have come are the current campaigns by two of the largest companies in the world, Walmart and Chevron, to persuade people that they are on the side of the angels.

In the end, it still comes down to the judgment of analysts as to what is substantive and what is public relations puffery. At Parnassus, if we have doubts about a company’s social performance, we go directly to the company to hear what they have to say about challenges.

Speaking of lists, we have a new one, Time 100, introduced last May by Time magazine to recognize people who have changed our lives in the past year. What’s remarkable about the list is the paucity of business leaders – a reflection of the low esteem CEOs have these days. Of the 100 most useful people, only nine hail from the business world: Arianna Huffington (The Huffington Post), Reed Hastings (Netflix), Mark Zuckerberg (Facebook), Charles and David Koch (Koch Industries), John Lassiter (Pixar), Jamie Dimon (JP MorganChase), Sergio Marchionne (Fiat and Chrysler), Larry Page (Google). And of these nine, three come from Parnassus portfolio companies: Jamie Dimon, Larry Page and John Lassiter (Pixar is now a unit of Walt Disney).

Kudos to IBM, a holding of the Parnassus Fund and the Parnassus Workplace Fund, for reaching its 100th birthday in June. There are not many companies in that age bracket but Parnassus has nine of them. In addition to IBM, they are (and their ages): Wells Fargo (159), Corning (160), Walgreens (110), Deere (174), Nordstrom (110), McCormick (122), Procter & Gamble (174) and United Parcel Service (104).

Nike, the king of sportswear, was saluted by CERES (Coalition for Environmentally Responsible Economies) and the Association for Chartered Certified Accountants for the best sustainability report. Nike was one of 98 entries in the competition. CERES said: “Nike’s report addresses the new context within which business must operate – one with a rising global population, decreasing natural resources, and an unstable climate – and reveals how Nike, in an effort to take a competitive advantage, is shifting to more sustainable business model.” Wells Fargo, the nation’s fourth largest bank, ranks as the largest lender to small business. In 2010, the bank made new loans of $14.9 billion to small businesses, defined as a company with less than $20 million in revenues.

Google, the king of internet search, announced that it is investing $100 million in the huge Shepherd’s Flat wind project in Oregon. When it goes online next year, Shepherd’s Flat will become the largest wind farm in the world, capable of generating 845 megawatts and supplying enough energy for 235,000 homes. Located near Arlington, Oregon, the farm occupies 30 square miles.

Milton Moskowitz is the co-author of the Fortune magazine survey, “The 100 Best Companies to Work For,” and the co-originator of the annual Working Mother magazine survey, “The 100 Best Companies for Working Mothers.” Mr. Moskowitz serves as a consultant to Parnassus Investments in evaluating workplaces for potential investments by the Parnassus Workplace Fund. Neither Fortune magazine nor Working Mother magazine has any role in the management of the Funds, and there is no affiliation between Parnassus and either publication.

22

| Semiannual Report • 2011 | PARNASSUS FUNDS | |||

As a shareholder of the funds, you incur ongoing costs, which include portfolio management fees, administrative fees, shareholder reports, and other fund expenses. The funds do not charge transaction fees, so you do not incur transaction costs such as sales charges (loads) on purchase payments, reinvested dividends, or other distributions, redemption fees, and exchange fees. The information on this page is intended to help you understand your ongoing costs of investing in the funds and to compare these costs with the ongoing costs of investing in other mutual funds.

The following example is based on an investment of $1,000 invested at the beginning of the most recent six-month period and held for the period of January 1, 2011 through June 30, 2011.

Actual Expenses

In the example below, the first line for each fund provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

The second line of each fund provides information about hypothetical account values and hypothetical expenses based on the fund’s expense ratio and an assumed rate of return of 5% per year before expenses, which is not the fund’s actual return. You may compare the ongoing costs of investing in the fund with other mutual funds by comparing this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of other funds.

The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period.

Please note that the expenses shown in the table are meant to highlight only your ongoing costs in these funds. Therefore, the second line of each fund is useful in comparing only ongoing costs and will not help you determine the relative total costs of owning other mutual funds, which may include transactional costs such as loads.

| Beginning Account Value January 1, 2011 | Ending Account Value June 30, 2011 | Expenses Paid During Period* | ||||||||||

| Parnassus Fund: Actual | $1,000.00 | $1,004.20 | $4.82 | |||||||||

| Hypothetical (5% before expenses) | $1,000.00 | $1,019.98 | $4.86 | |||||||||

| Parnassus Equity Income Fund – Investor Shares: Actual | $1,000.00 | $1,044.58 | $5.02 | |||||||||

| Hypothetical (5% before expenses) | $1,000.00 | $1,019.89 | $4.96 | |||||||||

| Parnassus Equity Income Fund – Institutional Shares: Actual | $1,000.00 | $1,045.95 | $3.80 | |||||||||

| Hypothetical (5% before expenses) | $1,000.00 | $1,021.08 | $3.76 | |||||||||

| Parnassus Mid-Cap Fund: Actual | $1,000.00 | $1,107.95 | $6.27 | |||||||||

| Hypothetical (5% before expenses) | $1,000.00 | $1,018.84 | $6.01 | |||||||||

| Parnassus Small-Cap Fund: Actual | $1,000.00 | $1,020.46 | $6.01 | |||||||||

| Hypothetical (5% before expenses) | $1,000.00 | $1,018.84 | $6.01 | |||||||||

| Parnassus Workplace Fund: Actual | $1,000.00 | $1,033.16 | $6.05 | |||||||||

| Hypothetical (5% before expenses) | $1,000.00 | $1,018.84 | $6.01 | |||||||||

| Parnassus Fixed-Income Fund: Actual | $1,000.00 | $1,022.76 | $3.76 | |||||||||

| Hypothetical (5% before expenses) | $1,000.00 | $1,021.08 | $3.76 | |||||||||

* Expenses are equal to the fund’s annualized expense ratio of 0.97%, 0.99%, 0.75%, 1.20%, 1.20%, 1.20% and 0.75% for the Parnassus Fund, Parnassus Equity Income Fund – Investor Shares, Parnassus Equity Income Fund – Institutional Shares, Parnassus Mid-Cap Fund, Parnassus Small-Cap Fund, Parnassus Workplace Fund and Parnassus Fixed-Income Fund, respectively, multiplied by the average account value over the period, multiplied by the ratio of days in the period. The ratio of days in the period is 181/365 (to reflect the one-half year period).

23

| PARNASSUS FUNDS | Semiannual Report • 2011 | |||

Portfolio of Investments as of June 30, 2011 (unaudited)

| Shares | Equities | Percent of Net Assets | Market Value ($) | |||||||||

| Communications Equipment | ||||||||||||

| 380,000 | QUALCOMM Inc. | 4.3 | % | 21,580,200 | ||||||||

| Computers | ||||||||||||

| 590,000 | Hewlett-Packard Company | 21,476,000 | ||||||||||

| 30,000 | International Business Machines Corp. | 5,146,500 | ||||||||||

| 5.3 | % | 26,622,500 | ||||||||||

| Data Storage | ||||||||||||

| 2,300,000 | Brocade Communications Systems Inc. q | 2.9 | % | 14,858,000 | ||||||||

| Electronic Components | ||||||||||||

| 750,000 | Corning Inc. | 2.7 | % | 13,612,500 | ||||||||

| Entertainment | ||||||||||||

| 120,000 | The Walt Disney Co. | 0.9 | % | 4,684,800 | ||||||||

| Financial Services | ||||||||||||

| 480,000 | JPMorgan Chase & Co. | 19,651,200 | ||||||||||

| 65,000 | MasterCard Inc. | 19,587,100 | ||||||||||

| 210,000 | SEI Investments Co. | 4,727,100 | ||||||||||

| 900,000 | Wells Fargo & Co. | 25,254,000 | ||||||||||

| 13.7 | % | 69,219,400 | ||||||||||

| Footwear | ||||||||||||

| 175,000 | Nike Inc. | 3.1 | % | 15,746,500 | ||||||||

| Home Builders | ||||||||||||

| 1,300,000 | DR Horton Inc. | 14,976,000 | ||||||||||

| 1,100,000 | KB Home l | 10,758,000 | ||||||||||

| 2,625,000 | PulteGroup Inc. q | 20,107,500 | ||||||||||

| 750,000 | Toll Brothers Inc. q | 15,555,000 | ||||||||||

| 12.2 | % | 61,396,500 | ||||||||||

| Industrial Manufacturing | ||||||||||||

| 149,000 | Teleflex Inc. | 1.8 | % | 9,097,940 | ||||||||

| Insurance | ||||||||||||

| 320,752 | Tower Group Inc. | 7,640,313 | ||||||||||

| 230,000 | Verisk Analytics Inc. q | 7,962,600 | ||||||||||

| 3.1 | % | 15,602,913 | ||||||||||

| Internet | ||||||||||||

| 375,000 | eBay Inc. q | 12,101,250 | ||||||||||

| 32,000 | Google Inc. q | 16,204,160 | ||||||||||

| 5.6 | % | 28,305,410 | ||||||||||

| Natural Gas | ||||||||||||

| 300,000 | Quicksilver Resources Inc. q | 0.9 | % | 4,428,000 | ||||||||

| Networking Products | ||||||||||||

| 1,560,000 | Cisco Systems Inc. | 4.8 | % | 24,351,600 | ||||||||