UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSRS

CERTIFIED SHAREHOLDER REPORT OF

REGISTERED MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: Parnassus Funds (811-04044) and Parnassus Income Funds (811-06673)

Parnassus Funds

Parnassus Income Funds

(Exact name of registrant as specified in charter)

1 Market Street, Suite 1600, San Francisco, California 94105

(Address of principal executive offices) (Zip code)

Marc C. Mahon

Parnassus Funds

Parnassus Income Funds

1 Market Street, Suite 1600, San Francisco, California 94105

(Name and address of agent for service)

Registrant’s telephone number, including area code: (415) 778-0200

Date of fiscal year end: December 31

Date of reporting period: June 30, 2017

Item 1: Report to Shareholders

PARNASSUS FUNDS®

SEMIANNUAL REPORT ◾ JUNE 30, 2017

PARNASSUS FUNDS

| Parnassus FundSM | ||

Investor Shares | PARNX | |

Institutional Shares | PFPRX | |

| Parnassus Core Equity FundSM | ||

Investor Shares | PRBLX | |

Institutional Shares | PRILX | |

| Parnassus Endeavor FundSM | ||

Investor Shares | PARWX | |

Institutional Shares | PFPWX | |

| Parnassus Mid Cap FundSM | ||

Investor Shares | PARMX | |

Institutional Shares | PFPMX | |

| Parnassus Asia FundSM | ||

Investor Shares | PAFSX | |

Institutional Shares | PFPSX | |

| Parnassus Fixed Income FundSM | ||

Investor Shares | PRFIX | |

Institutional Shares | PFPLX | |

Table of Contents

| Letter from Parnassus Investments | 4 | |||

| Fund Performance and Commentary | ||||

| Parnassus Fund | 7 | |||

| Parnassus Core Equity Fund | 10 | |||

| Parnassus Endeavor Fund | 13 | |||

| Parnassus Mid Cap Fund | 16 | |||

| Parnassus Asia Fund | 19 | |||

| Parnassus Fixed Income Fund | 23 | |||

| Responsible Investing Notes | 25 | |||

| Fund Expenses | 26 | |||

| Portfolios of Investments | ||||

| Parnassus Fund | 28 | |||

| Parnassus Core Equity Fund | 30 | |||

| Parnassus Endeavor Fund | 33 | |||

| Parnassus Mid Cap Fund | 35 | |||

| Parnassus Asia Fund | 37 | |||

| Parnassus Fixed Income Fund | 39 | |||

| Financial Statements | 44 | |||

| Notes to Financial Statements | 51 | |||

| Financial Highlights | 62 | |||

| Additional Information | 68 | |||

| PARNASSUS FUNDS | Semiannual Report • 2017 | |||

August 4, 2017

Stocks continued to climb this quarter, with the S&P 500 adding 3.1% to a year-to-date gain that ended June at 9.3%. Technology stocks have been especially strong, as evidenced by the tech-heavy Nasdaq, which closed the first half up 14.8%. New economy giants, including Parnassus holdings Apple and Alphabet (Google’s corporate parent), have been the clear market leaders this year. You’ll read more about these winners, as well as the stocks that detracted from our Funds’ performance, in the reports that follow. You’ll also learn about our portfolio managers’ latest investment outlooks. I hope you’ll find these reports to be informative and interesting.

All but one of our equity funds beat their indexes for the quarter. The only laggard was the Parnassus Core Equity Fund, which came up just short. This Fund did manage to outpace its Lipper peer group for the quarter, and still boasts an excellent long-term track record versus the S&P 500. The Fund with the best quarterly return was the Parnassus Endeavor Fund, which is managed by Jerome Dodson, the founder and longtime leader of Parnassus Investments.*

As part of a deliberate succession plan, I became president of Parnassus Investments this past January. Jerry retained the title of chairman and CEO. In this role, Jerry serves as mentor to me for general management matters. I’ve learned so much from Jerry in the 12 years I’ve worked for him, and I’m eager to learn more in the years to come. In addition to being chairman and CEO, Jerry will continue to manage portfolios for the foreseeable future. Given his incredible track record, I’m grateful for Jerry’s continued service on our investment team.

New Employees

Two new employees joined the firm last quarter. Kelly Brush has also joined our sales and marketing team. In his role as Manager of Advisor Relations, Kelly is the firm’s point person for financial advisors, RIAs and family offices that use our mutual funds. Kelly has prior work experience with SKBA Capital Management and Allianz Global Advisors. He has a B.S. in Finance from Arizona State University.

Julia McCotter, a marketing assistant, helps with a variety of projects within the sales and marketing team. In May, Julia became the youngest person to graduate with an M.B.A. from Mills College. She also earned her B.A. from Mills, with a major in economics and a minor in Studio Art.

Interns

We are enjoying a bumper crop of summer interns this year. We have seven interns helping us on the investment team. Andrew Choi is an M.B.A. candidate at Harvard Business School. His prior experience includes management consulting at Deloitte and serving as Director of Strategy at HUBweek, a Boston-based civic organization focused on innovation and technology. Andrew graduated from Princeton University with an AB in Chemistry. Originally from South Jersey, he enjoys weightlifting, being outdoors and great coffee.

Andrew Chang is an M.B.A. candidate at the University of Pennsylvania’s Wharton School. Previously, he worked at two investment firms: Darlington Partners in the Bay Area and Goldman Sachs Investment Partners in New York. Andrew graduated from Stanford University, where he majored in Management Science & Engineering. In his free time, he enjoys playing tennis, traveling and rooting for the St. Louis Cardinals.

Suniti Sundaram is an M.B.A. candidate at Harvard Business School. She has five years of work experience in the health care industry, most recently as a product manager at Abbott Diabetes Care, where she helped launch the company’s first continuous glucose monitoring device in the U.S. Suniti earned her B.S. in Applied Mathematics and Economics from MIT. In her free time, she enjoys singing and playing volleyball.

Ying Tu will be a senior this fall at the Wharton School, studying Statistics, Finance and Accounting. Previously, she worked as an investment banking summer analyst at China Merchants Securities in Shanghai. Originally from Nanjing, China, Ying loves Chinese calligraphy, literature and table tennis.

4

| Semiannual Report • 2017 | PARNASSUS FUNDS | |||

Isaac Macieira-Kaufmann is entering his third year at McGill University, where he’s majoring in finance and minoring in accounting. Previously, he interned at Acttao, a technology startup in Beijing, China. Prior to that, he was an intern at Kendo Holdings in San Francisco. Isaac enjoys sailing, photography and hiking.

Marisa Lin will be a senior at Stanford University this fall, majoring in Economics and International Relations. Her previous experience includes interning at the City of Palo Alto and being a member of the Cardinal Fund, a student-run investment fund at Stanford. In addition, she is an economics tutor at Stanford and a mentor for local high school students.

Rounding out our research interns is Shelby Fabianac, a rising senior at the University of San Francisco (USF). She earned her associate degree in Music Industry Studies at Diablo Valley College. Her work experience includes stints at a recording studio and a hip-hop management company. She is a member of the USF Finance Committee and enjoys cooking and early morning runs.

Brad Alman is an intern on our accounting team. He is pursuing a bachelor’s degree in Economics at California Polytechnic State University in San Luis Obispo (Cal Poly). Before Cal Poly, Brad earned his associate’s degree in Business Administration from Diablo Valley College, with honors. In his free time, Brad enjoys playing soccer and golf.

Marielle Isla is a software engineering intern at Parnassus. She will be a junior next year at the University of California, Berkeley, where she intends to major in Cognitive Science. She serves as the web editor for Sigma Psi Zeta sorority and enjoys dancing and music.

Lindsay Chan is also working this summer as a software engineering intern. She is a Computer Science major at the University of California, Davis. She is involved in a women’s business organization and is on the planning team for an annual hackathon at Davis.

Thank you all for investing with the Parnassus Funds.

Sincerely,

Benjamin E. Allen

President

* Please see the following pages for more detailed information regarding each Fund’s performance and the risks associated with investing in the Funds.

5

| PARNASSUS FUNDS | Semiannual Report • 2017 | |||

Intern Reunion

Below is a photograph of the people attending the Parnassus Intern Reunion in June.

Front row (left to right): Shelby Fabianac, Lana Ariue, Lillian Zhao, Sonya Gupta, Jerome Dodson, Jeanie Cotter, Lori Keith, Angela Du and Suniti Sundaram.

Back row (left to right): Robert McHenry, Andrew Chang, Andrew Choi, Kareem Hammoud, Viki Jan, Ying Tu, Robert Klaber, Todd Ahlsten, Ben Allen, Matt Gershuny, Minh Bui, Billy Hwan, Lee Tsao, Michael Fernandez and Marie Lee.

6

| Semiannual Report • 2017 | PARNASSUS FUNDS | |||

Ticker: Investor Shares - PARNX

Ticker: Institutional Shares - PFPRX

As of June 30, 2017, the net asset value (“NAV”) of the Parnassus Fund – Investor Shares was $49.23, resulting in a gain of 4.19% for the second quarter. This compares to a gain of 3.09% for the S&P 500 Index (“S&P 500”) and a gain of 2.76% for the Lipper Multi-Cap Core Average, which represents the average return of the multi-cap core funds followed by Lipper (“Lipper average”). For the year-to-date, the Parnassus Fund – Investor Shares is up 9.47%, compared to a gain of 9.33% for the S&P 500 and 8.31% for the Lipper average.

Below is a table comparing the Parnassus Fund with the S&P 500 and the Lipper average over the past one-, three-, five- and ten-year periods. The Fund is ahead of both benchmarks for all time periods. Most striking is the ten-year average return. At 9.66% per year, the Fund’s annualized gain is 2.49% ahead of the S&P 500 and 3.76% ahead of the Lipper average.

| Parnassus Fund | ||||||||||||||||||||||||

| Average Annual Total Returns (%) | One Year | Three Years | Five Years | Ten Years | Gross Expense Ratio | Net Expense Ratio | ||||||||||||||||||

| for period ended June 30, 2017 | ||||||||||||||||||||||||

| Parnassus Fund Investor Shares | 26.26 | 9.73 | 16.66 | 9.66 | 0.86 | 0.86 | ||||||||||||||||||

| Parnassus Fund Institutional Shares | 26.46 | 9.85 | 16.73 | 9.69 | 0.71 | 0.71 | ||||||||||||||||||

| S&P 500 Index | 17.87 | 9.59 | 14.59 | 7.17 | NA | NA | ||||||||||||||||||

| Lipper Multi-Cap Core Average | 17.55 | 6.51 | 13.13 | 5.90 | NA | NA | ||||||||||||||||||

The average annual total return for the Parnassus Fund-Institutional Shares from commencement (April 30, 2015) was 9.41%. Performance shown prior to the inception of the Institutional Shares reflects the performance of the Parnassus Fund-Investor Shares and includes expenses that are not applicable to and are higher than those of the Institutional Shares. The performance of Institutional Shares differs from that shown for the Investor Shares to the extent that the classes do not have the same expenses. Performance data quoted represent past performance and are no guarantee of future returns. Current performance may be lower or higher than the performance data quoted. Current performance information to the most recent month-end is available on the Parnassus website (www.parnassus.com). Investment return and principal value will fluctuate, so an investor’s shares, when redeemed, may be worth more or less than their original principal cost. Returns shown in the table do not reflect the deduction of taxes a shareholder may pay on fund distributions or redemption of shares. The S&P 500 is an unmanaged index of common stocks, and it is not possible to invest directly in an index. Index figures do not take any expenses, fees or taxes into account, but mutual fund returns do.

Before investing, an investor should carefully consider the investment objectives, risks, charges and expenses of the Fund and should carefully read the prospectus or summary prospectus, which contain this and other information. The prospectus or summary prospectus can be obtained on the Parnassus website or by calling (800) 999-3505.

Second Quarter Review

The Parnassus Fund posted a strong gain for the second quarter, beating both of our benchmarks and pulling ahead for the year. Sector allocations helped performance, led by our overweight position in health care, the S&P 500’s best performing sector, and our underweight positions in telecom services and energy, the two worst performing sectors. As a fossil-fuel free fund, we do not invest in energy stocks.

Stock selection added to our performance as well, as our three biggest winners contributed a total of 139 basis points to the Fund’s return, overcoming the 76 basis point drag caused by our three biggest losers. (One basis point is 1/100th of one percent.)

Our worst performer was International Business Machines (IBM), one of the world’s largest providers of information-technology solutions and services. The stock fell 11.7% from $174.14 to $153.83, reducing the Fund’s return by 49 basis points. Investors were disappointed by IBM’s weak quarterly operating margins, and questioned whether the company will be able to meet its annual earnings guidance. The stock fell again when famed investor Warren Buffett sold a third of his shares. While we recognize the near-term challenges, we believe IBM’s transition to a software- and analytics-oriented business will create a lot of value, so we’re holding onto our position.

Semiconductor giant Intel trimmed 14 basis points from the Fund’s return, as the stock dropped 6.5% from $36.07 to $33.74. The stock fell after Intel’s data center business reported lower than expected growth and margins. We expect the second half of 2017 will be better for the data center business, driven by new product

7

| PARNASSUS FUNDS | Semiannual Report • 2017 | |||

launches, healthy demand and cost control. Longer term, the outlook for Intel’s chips is fantastic thanks to a myriad of technological advancements, including cloud computing, artificial intelligence, machine learning, driverless cars and the internet-of-things (IOT).

Credit card issuer Capital One Financial dropped 4.7% from $86.66 to $82.62, reducing the Fund’s return by 13 basis points. The stock fell in April after the company increased its guidance for credit losses. This issue hurt the stock again in June, when Capital One was the only bank required to resubmit its capital plan under the Federal Reserve’s Comprehensive Capital Analysis and Review. We’re disappointed by management’s inaccurate credit loss forecast, but we’re holding onto our position. We believe investors have over-reacted, as Capital One still expects its recent credit card vintages will be among its most profitable ever. Furthermore, the stock is trading at a bargain valuation of less than 10x expected 2018 earnings.

Our best performer was Whole Foods, a leading retailer of organic and natural foods, whose stock soared 41.7% from $29.72 to $42.11, adding 51 basis points to the Fund’s return. The stock jumped in April after activist investor Jana Partners took a nearly 9% stake in the company. Jana demanded management accelerate its turnaround or sell the company. The latter occurred in June, when Amazon announced it would acquire Whole Foods for $42 per share, or $13.7 billion.

Industrial gas supplier Praxair added 45 basis points to the Fund’s return as the stock jumped 11.8% from $118.60 to $132.55. During the quarter, Praxair announced a merger of equals with Linde, a German competitor. The merger will create the world’s largest industrial gas supplier, combining Praxair’s leading position in the Americas with Linde’s strong presence in Europe and Asia. The combination of Praxair’s operational excellence and Linde’s engineering and technology leadership should accelerate earnings growth.

Auto insurer Progressive added 43 basis points to the Fund’s return, as its shares rose 12.5% from $39.18 to $44.09. Progressive’s stock climbed higher as its nascent home insurance product accelerated the company’s revenue growth. As the company predicted, customers are bundling their home and auto policies together to save money and time.

Outlook and Strategy

The U.S. economy continued to chug along during the second quarter, helping the S&P 500 reach record highs. The unemployment rate dropped to 4.3%, its lowest level since 2001, while the Federal Reserve increased its projected 2017 GDP growth rate to 2.2%. As the economy has picked up steam, corporate earnings have also improved. Earnings from S&P 500 companies are expected to have grown an impressive 10% in the second quarter.

We’re now in the ninth year of a bull market, and we believe many of these positives are already reflected in valuations. The S&P 500 has climbed to 17.5 times forward earnings estimates, which is near a 15-year high.

Although the market continues to move higher, we were able to find several undervalued stocks during the quarter. The first new holding is Public Storage, the largest owner of self-storage facilities. While the

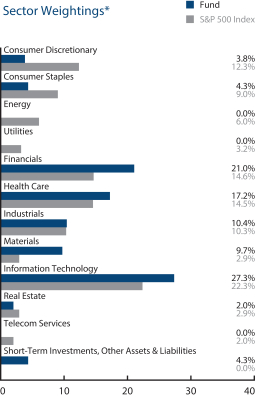

| Parnassus Fund as of June 30, 2017 (percentage of net assets) |

* For purposes of categorizing securities for diversification requirements under the Investment Company Act, the Fund uses industry classifications that are more specific than those used for the chart.

Top 10 Holdings

(percentage of net assets)

| Gilead Sciences Inc. | 4.4% | |||

| Allergan plc | 4.3% | |||

| Motorola Solutions Inc. | 4.2% | |||

| Charles Schwab Corp. | 3.7% | |||

| Praxair Inc. | 3.6% | |||

| Progressive Corp. | 3.6% | |||

| Patterson Companies Inc. | 3.5% | |||

| International Business Machines Corp. | 3.5% | |||

| Pentair plc | 3.0% | |||

| Thomson Reuters Corp. | 2.9% | |||

Portfolio characteristics and holdings are subject to change periodically.

8

| Semiannual Report • 2017 | PARNASSUS FUNDS | |||

short-term outlook isn’t pretty, as new supply is pressuring occupancy and rental rates in several markets, the long-term opportunities are as great as they’ve ever been. Tenants will continue to be attracted to Public Storage’s convenient locations and ubiquitous brand, while its concentration in fast-growing, supply-constrained markets like Los Angeles, San Francisco and Seattle should protect it from the worst of the downturn. The company’s balance sheet is also the gold-standard in the real estate industry, providing Public Storage with the flexibility to opportunistically acquire smaller competitors.

Our second new addition is toy manufacturer Mattel, best known for its iconic brands including Barbie, Hot Wheels and Fisher-Price. Sales declined in each of the past three years, as the company was run by executives who focused on operating margins instead of growth and innovation. In February, new CEO Margaret (Margo) Georgiadis joined from Google, and we believe her new perspective will reinvigorate growth. With the stock trading close to its three-year low, we believe additional downside is limited, while the upside is significant if Georgiadis’ strategy proves successful.

We also invested in PPG Industries, a global paint company with well-known brands such as Glidden and Olympic. We like PPG’s dominant scale, as it ranks #1 or #2 in virtually all of its end markets. The management team also has a strong track record of effectively allocating capital. We’re hopeful that the company’s long-standing focus on innovation will help accelerate organic growth and lead to strong shareholder returns in the future.

The last newcomer to the Parnassus Fund is Hannon Armstrong, a real estate investment trust (REIT) that invests in renewable energy and energy efficiency projects. Every investment the company makes is evaluated on its financial return and the amount of carbon emissions it reduces, a unique focus that reminds us of our own “principles and performance” directive. Hannon Armstrong is investing on the right side of climate change, a generational tailwind that should support earnings and dividend growth for many years to come.

We sold one stock during the quarter, primarily for valuation reasons. After owning the stock for more than a decade, we said goodbye to Ciena, a leading manufacturer of optical equipment used in telecommunications networks. The company recently posted better than expected earnings, causing the stock to jump 16%. The shares had a great run over the past year, so they no longer looked undervalued to us.

At quarter-end, the Parnassus Fund has a nice balance of offense and defense. The portfolio is overweight the financial and technology sectors, which tend to outperform when the economy is humming along. On a combined basis, the Parnassus Fund is 48% invested in these sectors compared to 37% for the S&P 500. Offsetting this, the portfolio is significantly underweight two cyclical sectors: consumer discretionary and energy. These two sectors represent 4% of the Fund compared to 18% for the benchmark. Additionally, the portfolio is overweight health care, a more defensive sector. Given these weightings, we believe the Parnassus Fund is well-positioned for any market environment.

Yours truly,

|

|

| ||

Jerome L. Dodson Lead Portfolio Manager | Robert J. Klaber Portfolio Manager | Ian E. Sexsmith Portfolio Manager |

9

| PARNASSUS FUNDS | Semiannual Report • 2017 | |||

Ticker: Investor Shares - PRBLX

Ticker: Institutional Shares - PRILX

As of June 30, 2017, the NAV of the Parnassus Core Equity Fund – Investor Shares was $41.78. After taking dividends into account, the total return for the second quarter was 2.42%. This compares to an increase of 3.09% for the S&P 500 Index (“S&P 500”) and a gain of 1.77% for the Lipper Equity Income Fund Average, which represents the average equity income funds followed by Lipper (“Lipper average”). For the first half of 2017, the Fund posted a return of 6.91%, which compares to gains of 9.33% for the S&P 500 and 5.70% for the Lipper average.

Below is a table that compares the performance of the Fund with that of the S&P 500 and the Lipper average. Average annual total returns are for the one-, three-, five- and ten-year periods ending June 30, 2017.

| Parnassus Core Equity Fund | ||||||||||||||||||||||||

| Average Annual Total Returns (%) | One Year | Three Years | Five Years | Ten Years | Gross Expense Ratio | Net Expense Ratio | ||||||||||||||||||

| for period ended June 30, 2017 | ||||||||||||||||||||||||

| Parnassus Core Equity Fund Investor Shares | 14.22 | 7.46 | 14.29 | 9.08 | 0.87 | 0.87 | ||||||||||||||||||

| Parnassus Core Equity Fund Institutional Shares | 14.47 | 7.68 | 14.50 | 9.30 | 0.66 | 0.66 | ||||||||||||||||||

| S&P 500 Index | 17.87 | 9.59 | 14.59 | 7.17 | NA | NA | ||||||||||||||||||

| Lipper Equity Income Fund Average | 13.19 | 6.11 | 11.43 | 5.79 | NA | NA | ||||||||||||||||||

The average annual total return for the Parnassus Core Equity Fund-Institutional Shares from commencement (April 28, 2006) was 10.00%. Performance shown prior to the inception of the Institutional Shares reflects the performance of the Parnassus Core Equity Fund – Investor Shares and includes expenses that are not applicable to and are higher than those of the Institutional Shares. The performance of the Institutional Shares differs from that shown for the Investor Shares to the extent that the classes do not have the same expenses. Performance data quoted represent past performance and are no guarantee of future returns. Current performance may be lower or higher than the performance data quoted, and current performance information to the most recent month-end is available on the Parnassus website (www.parnassus.com). Investment return and principal value will fluctuate, so an investor’s shares, when redeemed, may be worth more or less than their original principal cost. Returns shown in the table do not reflect the deduction of taxes a shareholder may pay on fund distributions or redemption of shares. The S&P 500 is an unmanaged index of common stocks, and it is not possible to invest directly in an index. Index figures do not take any expenses, fees or taxes into account, but mutual fund returns do.

Before investing, an investor should carefully consider the investment objectives, risks, charges and expenses of the Fund and should carefully read the prospectus or summary prospectus, which contain this and other information. The prospectus or summary prospectus can be obtained on the Parnassus website or by calling (800) 999-3505.

Second Quarter Review

The Parnassus Core Equity Fund – Investor Shares gained 2.42% for the quarter, but trailed the S&P 500 by 67 basis points (one basis point is 1/100th of one percent). Sector allocation helped our relative performance, with the most beneficial effects coming from our underweight positions in the index’s two worst performing sectors, telecom services and energy. There were no meaningfully negative sector allocation effects.

Unfortunately, the negative impact of our stock selection overwhelmed the positive impact from our sector weightings. The Fund’s worst performer was National Oilwell Varco (NOV), which sells equipment that enables energy companies to drill wells safely and efficiently. The stock fell 17.8% from $40.09 to $32.94, and trimmed 33 basis points off the Fund’s return. Oil prices fell about 10% during the second quarter, and this was the main reason for NOV’s stock drop.

Disney, a global media enterprise, reduced the Fund’s return by 25 basis points, as its stock slipped 6.3% from $113.39 to $106.25. The two main issues dampened investor sentiment for Disney shares. One was a decline in cable television subscribers and the other was weak advertising sales. While we acknowledge these challenges, we think Disney still has several powerful long-term earnings growth drivers. We expect to see better cost control at Disney’s ESPN division, especially as sports rights costs normalize in the coming years. We also think the network’s investments in innovation, including its mobile strategy, will resonate with viewers. We’re also excited about Disney’s upcoming film slate, highlighted by a new Star Wars movie coming out in time for the holidays.

10

| Semiannual Report • 2017 | PARNASSUS FUNDS | |||

Intel fell 6.5% during the quarter from $36.07 to $33.74, trimming 25 basis points off the Fund’s return. Over the past few years, Intel has shed its image as a PC-related company, emphasizing its leadership in data centers and cloud computing. Unfortunately, during the quarter, Intel’s data center (DCG) business reported disappointing growth and margins. We expect DCG’s performance to improve soon, due to product innovation, cost control and robust demand. The key drivers for long-term demand are cloud computing, artificial intelligence, machine learning, driverless cars, 5G-wireless and the internet of things (IOT).

The Fund’s biggest winner was digital payments company PayPal, which rose 24.8% from $43.02 to $53.67, increasing the Fund’s return by 56 basis points. PayPal’s business continues to grow at a rapid clip. Active customers surpassed 200 million in the quarter and payment volumes jumped 23%. While we still think highly of PayPal’s fundamentals, we sold about half our position during the quarter due to valuation.

Praxair, one of the largest industrial gas companies in the world, announced a merger of equals with Linde, a leading German industrial gas company. In response, its stock climbed 11.8% to $132.55 from $118.60, boosting our Fund’s return by 50 basis points. The merger will create the world’s largest industrial gas company, with a combined market value of over $70 billion and revenue of approximately $30 billion. The new company will have more diverse and balanced end-markets, as it combines Praxair’s leading position in the Americas and Linde’s strong presence in Europe and Asia. Additionally, each company brings complementary strengths, highlighted by Praxair’s operational excellence and Linde’s engineering and technology leadership. The deal is expected to close in the second half of 2018.

Novartis, the Swiss pharmaceutical giant, boosted the Fund’s return by 31 basis points, as its stock rose 12.4% from $74.27 to $83.47. The stock popped after the company reported strong results from Entresto, an exciting new heart failure drug. Shares continued to move higher after Novartis announced excellent phase III results for RTH258, a novel eye drug that treats vision loss with fewer injections than rival drugs already on the market.

Outlook and Strategy

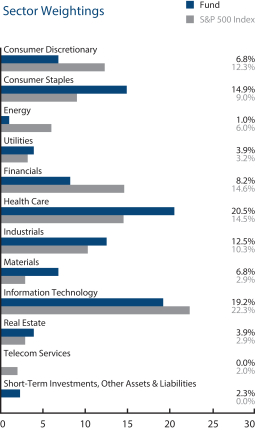

The Fund enters the second half more defensively positioned than it started the year. We trimmed several technology holdings, due to valuation, and are now slightly underweight the benchmark in this sector. This move follows our decision to reduce our exposure to financial stocks during the first quarter. We also have significant underweights in the consumer discretionary and energy sectors. Given our relatively low exposure to these cyclical industries, we consider the Fund to be defensively positioned. This means that if the stock market declines sharply, the Fund should offer good downside protection.

We currently see a lot of opportunities in health care, which is our largest overweight position. The Fund has significant holdings in biotechnology, pharma and drug distribution. Some of these stocks have detracted from our performance over the last couple of years, but we expect them to move into the winner’s column very soon.

We are also overweight consumer staples stocks. We think our companies in this sector have resilient business models that can withstand economic cycles and ward off new threats, including those

Parnassus Core Equity Fund as of June 30, 2017 (percentage of net assets) | ||

Top 10 Holdings

(percentage of net assets)

| Danaher Corp. | 4.9% | |||

| Gilead Sciences Inc. | 4.8% | |||

| Praxair Inc. | 4.4% | |||

| Intel Corp. | 4.1% | |||

| Wells Fargo & Co. | 3.8% | |||

| The Walt Disney Co. | 3.7% | |||

| Allergan plc | 3.5% | |||

| CVS Health Corp. | 3.5% | |||

| VF Corp. | 3.1% | |||

| Alphabet Inc., Class C | 3.0% | |||

Portfolio characteristics and holdings are subject to change periodically.

11

| PARNASSUS FUNDS | Semiannual Report • 2017 | |||

represented by the seemingly ubiquitous Amazon. Our only other significant overweight is in industrial stocks. We think global infrastructure spending is a generational investment theme, and we own several high quality industrial businesses that should benefit from this trend.

Even with the S&P 500 hitting all-time highs last quarter, we found three new stocks to add to the Fund. The first was Sempra Energy, a diversified energy holding company that owns both regulated utilities and unregulated infrastructure businesses. The San Diego-based company serves a diverse set of customers across Southern California, Mexico, Chile and Peru. We like Sempra’s leadership in renewable energy, as it was the first utility to meet California’s goal of delivering 33% energy from renewable resources. We are also attracted to Sempra’s industry leading growth profile. Sempra leverages a stable base of cash flows from its regulated business to fund higher return projects. One such project is the Cameron liquid natural gas (LNG) export terminal near the Gulf of Mexico.

Public Storage is the country’s largest owner of self-storage facilities. While the industry isn’t glamorous, self-storage properties generate attractive returns on capital and resilient cash flows. After hitting an all-time high of $276 in April 2016, the stock fell below $215 during the quarter. This is when we established our position. The stock dropped because new supply in several markets caused occupancy rates to fall and rent increases to slow. Despite this short-term weakness, the company’s long-term prospects are still bright. Public Storage has significant exposure to fast-growing and supply-constrained markets like Los Angeles, San Francisco and Seattle. And very importantly from a risk perspective, the company employs much less debt than other real estate companies.

The final new stock is PPG Industries, a global paint and performance coatings business. We’ve admired this company for a long time. When we finally decided to buy it, the stock was trading at a discount to its historical valuation and the overall stock market. We like the fact that PPG has dominant scale, as it ranks #1 or #2 in virtually all its end markets. We’re optimistic that the company’s long-standing focus on innovation will accelerate organic growth and propel the stock to new highs in the years to come.

Despite our slight underperformance this past quarter, we’re confident that our investment process will lead to strong, risk-adjusted returns over the long-run. Our portfolio holdings have great business prospects and attractive risk-reward profiles based on our long-term investment horizon. Thank you for the trust you’ve put in us and your investment in the Parnassus Core Equity Fund.

Sincerely,

|

| |

Todd C. Ahlsten Lead Portfolio Manager | Benjamin E. Allen Portfolio Manager |

12

| Semiannual Report • 2017 | PARNASSUS FUNDS | |||

Ticker: Investor Shares - PARWX

Ticker: Institutional Shares - PFPWX

As of June 30, 2017, the NAV of the Parnassus Endeavor Fund – Investor Shares was $36.30, so the total return for the quarter was 5.68%. This compares to 3.09% for the S&P 500 Index (“S&P 500”) and 2.76% for the Lipper Multi-Cap Core Average, which represents the average return of the multi-cap core funds followed by Lipper (“Lipper average”). For the year-to-date, the Parnassus Endeavor Fund – Investor Shares is up 10.03% compared to 9.33% for the S&P 500 and 8.31% for the Lipper average. Although we trailed both the S&P 500 and the Lipper average in the first quarter, we had great performance this quarter, so we’re now ahead of both benchmarks for the year-to-date.

| Parnassus Endeavor Fund | ||||||||||||||||||||||||

| Average Annual Total Returns (%) | One Year | Three Years | Five Years | Ten Years | Gross Expense Ratio | Net Expense Ratio | ||||||||||||||||||

| for period ended June 30, 2017 | ||||||||||||||||||||||||

| Parnassus Endeavor Fund Investor Shares | 31.03 | 14.50 | 19.08 | 12.58 | 0.97 | 0.95 | ||||||||||||||||||

| Parnassus Endeavor Fund Institutional Shares | 31.24 | 14.66 | 19.17 | 12.63 | 0.74 | 0.74 | ||||||||||||||||||

| S&P 500 Index | 17.87 | 9.59 | 14.59 | 7.17 | NA | NA | ||||||||||||||||||

| Lipper Multi-Cap Core Average | 17.55 | 6.51 | 13.13 | 5.90 | NA | NA | ||||||||||||||||||

The average annual total return for the Parnassus Endeavor Fund-Institutional Shares from commencement (April 30, 2015) was 14.34%. Performance shown prior to the inception of the Institutional Shares reflects the performance of the Parnassus Endeavor Fund-Investor Shares and includes expenses that are not applicable to and are higher than those of the Institutional Shares. The performance of the Institutional Shares differs from that shown for the Investor Shares to the extent that the classes do not have the same expenses. Performance data quoted represent past performance and are no guarantee of future returns. Current performance may be lower or higher than the performance data quoted. Current performance information to the most recent month-end is available on the Parnassus website (www.parnassus.com). Investment return and principal value will fluctuate, so an investor’s shares, when redeemed, may be worth more or less than their original principal cost. Returns shown in the table do not reflect the deduction of taxes a shareholder may pay on fund distributions or redemption of shares. The S&P 500 is an unmanaged index of common stocks, and it is not possible to invest directly in an index. Index figures do not take any expenses, fees or taxes into account, but mutual fund returns do.

Before investing, an investor should carefully consider the investment objectives, risks, charges and expenses of the Fund and should carefully read the prospectus or summary prospectus, which contain this and other information. The prospectus or summary prospectus can be obtained on the Parnassus website or by calling (800) 999-3505. As described in the Fund’s current prospectus dated May 1, 2017, Parnassus Investments has contractually agreed to limit total operating expenses to 0.95% of net assets for the Parnassus Endeavor Fund-Investor Shares and to 0.83% of net assets for the Parnassus Endeavor Fund-Institutional Shares. This agreement will not be terminated prior to May 1, 2018, and may be continued indefinitely by the Adviser on a year-to-year basis.

Longer-term, we’re also well ahead of both the S&P 500 and Lipper average. To the left is a table, comparing the Parnassus Endeavor Fund with the S&P 500 and the Lipper average for the one-, three-, five- and ten-year periods. As you can see, we’re well ahead of both averages for all time periods. Of special note is the fact that the Parnassus Endeavor Fund is the best-performing of all multi-cap core funds for the three- and ten-year periods: #1 of 651 funds for three years and #1 of 376 funds for ten years.* Over the past ten years, the Parnassus Endeavor Fund has beaten the S&P 500 by an average of over five percentage points per year. This is remarkable, when one considers that most mutual funds underperform the S&P 500. The average multi-cap core funds averaged a gain of 5.90% over the decade, while the Parnassus Endeavor Fund – Investor Shares averaged 12.58% – well over twice what the average fund earned.

(*The Fund is #8 of 760 funds for one year and #6 of 567 funds for five years.)

Company Analysis

The advance in our holdings this quarter was broad-based with seven stocks each contributing 40 basis points or more to the Fund’s return. (One basis point is 1/100th of one percent.) Only one company had a negative impact on the Fund of as much as 40 basis points. IBM reduced the Fund’s return by 52 basis points, as its stock fell 11.7% from $174.14 to $153.83. It dropped quite a bit in April after reporting disappointing earnings driven by weak margins. The stock moved even lower in May when Warren Buffet’s Berkshire Hathaway sold a third of its shares. While we recognize the near-term challenges and weak performance of the company, we believe in the longer-term plan of IBM’s transition to a software-and-services business.

13

| PARNASSUS FUNDS | Semiannual Report • 2017 | |||

Fortunately, the winners overwhelmed the few losers we had in the portfolio. The Fund’s best performer was Whole Foods, a leading retailer of organic and natural foods, as its stock soared 41.7% from $29.72 to $42.11, adding an amazing 127 basis

points to the Fund’s return. In June, Amazon made an offer to purchase the company for $42 a share. It’s now trading over that level in the hope that Amazon will increase its offer or another company will make a bid.

Gilead Sciences, the big biotechnology firm that makes therapies for hepatitis C and HIV, contributed 63 basis points to the Fund’s return, as its stock climbed 4.2% from $67.92 to $70.78. The stock dropped 4.5% during the first two months of the quarter, but moved higher late in the quarter amid speculation that the pending health care bill in the Senate would not have a big negative impact on the pharmaceutical industry.

San Francisco-based McKesson, the nation’s largest drug distributor, increased the Fund’s return by 57 basis points, as the stock rose 11.0% from $148.26 to $164.54. The stock moved higher on a good earnings report and management’s optimism for improved earnings for FY 2018. Even after the move, the company is still undervalued, and we expect its strong cash flow to move it even higher.

Perrigo, the leading producer of store-brand generic drugs, added 56 basis points to the Fund’s return, as the stock climbed 13.8% from $66.39 to $75.52. The company announced the sale of its Tysabri royalty stream for $2.9 billion, and used the proceeds to pay down debt. CEO John Hendrickson will be leaving, and the company is looking for a new leader. Once new leadership is in place, Perrigo’s stock should move higher.

Autodesk, the leading software-provider for architects, engineers and designers, soared 16.6% from $86.47 to $100.82, adding 54 basis points to the Fund’s return. Robust demand for its products drove better-than-expected earnings. Investors also gained greater confidence in the company’s ability to execute its product transition, after industry veteran Andrew Anagnost was named chief executive officer. We believe that Autodesk can deliver higher earnings from further adoption of its subscription offerings, market share gains and better operating leverage.

Novartis, the Swiss pharmaceutical giant, boosted the Fund’s return by 44 basis points, as its stock rose 12.4% from $74.27 to $83.47. The stock climbed after the company reported higher earnings and strong results from Entresto, a new drug that prevents heart failure. Shares continued to move higher, after Novartis announced excellent Phase III results for RTH258, a new eye therapy that treats vision loss with fewer injections than rival drugs now on the market.

Alphabet, the parent of Google, added 42 basis points to the Fund’s return, as its stock increased 9.7% from $847.80 to $929.68. In late April, the company announced a 22% increase in quarterly revenue from the previous year. Mobile search, YouTube and digital advertising were the key growth drivers.

Outlook and Strategy

As I indicated in last quarter’s report, I was surprised when the market moved higher after Donald Trump was elected President. It’s a good thing that I didn’t play my hunch, because the Parnassus Endeavor Fund – Investor Shares went up 10.03% since the first of the year and it climbed another 7.34% in the fourth quarter of last year. On a compounded basis, that’s a gain of over 18% that we would have missed.

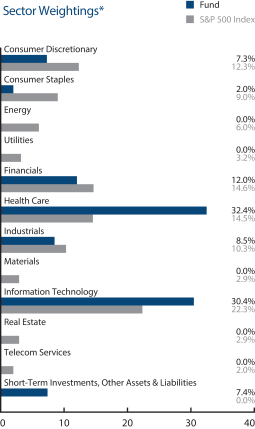

Parnassus Endeavor Fund as of June 30, 2017 (percentage of net assets) | ||

* For purposes of categorizing securities for diversification requirements under the Investment Company Act, the Fund uses industry classifications that are more specific than those used for the chart.

Top 10 Holdings

(percentage of net assets)

| Gilead Sciences Inc. | 12.0% | |||

| QUALCOMM Inc. | 6.1% | |||

| McKesson Corp. | 5.3% | |||

| VF Corp. | 5.0% | |||

| International Business Machines Corp. | 4.9% | |||

| United Parcel Service Inc., Class B | 4.8% | |||

| Allergan plc | 4.6% | |||

| American Express Co. | 4.4% | |||

| Novartis AG (ADR) | 4.2% | |||

| Micron Technology | 3.7% | |||

Portfolio characteristics and holdings are subject to change periodically.

14

| Semiannual Report • 2017 | PARNASSUS FUNDS | |||

Earlier in my career, I tried to time the market, increasing cash and reducing the stock percentage in the portfolio, whenever I thought the market was overvalued. Although this worked for me once, most of the time, it did not. Usually, the market kept moving higher while we held a lot of cash, so we underperformed. After these experiences, I learned my lesson, so now we just stay as fully invested as possible. That has worked much better for us.

The problem is that an overvalued market can keep moving higher and become even more overvalued. Right now, the price/earnings (P/E) ratio of the S&P 500 is 21.5, which means that stocks are selling for 21.5 times earnings. Historically, the P/E ratio of the market has been in the 15-16 range, so by this measure, the market is overvalued.

We can take some comfort in the fact that the P/E ratio of the Parnassus Endeavor Fund is only 13.9, so that should give us a margin of safety in the event of a downturn. However, when the market corrects and stocks move down sharply, our Fund will move lower as well. Hopefully, we won’t go down as much as the market, but the value of our shares will drop. The only sound strategy is to ride out the ups and downs of the market and hope for the best.

Unfortunately, too many investors don’t follow this strategy. They try to time the market, moving in and out, depending on their guess as to the market’s future direction. Lipper and other analytical services have done studies that show that investors in general perform less well than the market as a whole, because they tend to move in and out of the market at the wrong time. Investors can improve their performance by just buying and holding.

The current situation leads to the question of how long can the current high P/E ratios last? If history is any guide, the P/E ratios will ultimately come down to a range of 15-16. There are only two ways that can happen. Either earnings (the “E”) must go up or stock prices (the ”P”) must go down. I hope it’s the former and not the latter. The economy looks reasonably strong right now, so earnings should move higher, and this would correct the high P/E problem. The alternative is a big drop in the market.

In terms of strategy for the Parnassus Endeavor Fund, we don’t focus on these macro issues, since I don’t think it’s productive. What we can do, though, is focus on individual stocks, and buy the good ones when they’re out-of-favor. The reason why the Parnassus Endeavor Fund has done so well over the years, is because we’re able to determine the intrinsic value of a company. Since we have no way of knowing the exact value, this is only an estimate. An estimate is good enough, though, since we only buy a stock when it’s selling for one-third off its intrinsic value, or 67% of its worth. We don’t have to be exact, since we have that 33% margin of safety.

The next question, of course, is why don’t all investors follow this strategy? If they did, the Parnassus Endeavor Fund wouldn’t be able to outperform as it has. The reason everyone doesn’t do this is that when a stock falls one-third below its value, something bad has happened. There has been an earnings miss, there’s more competition, raw material prices have moved much higher, a marketing strategy is no longer working, a key executive has left or any one of dozens of possible reasons. Our job is to determine whether the difficult situation is permanent or temporary. If we think it’s temporary, we buy the stock. One needs to have an even temperament to do this, because it’s emotionally very difficult to buy a stock after it has dropped by a significant amount. Most investors are not able to do this.

Because we invest in stocks with good management, this means that they will usually find a way to bounce back. ESG factors also help (environmental, social and governance). A company with a good environmental policy will be less likely to be fined or sued, and conservation of resources will reduce costs. A company that treats its employees well will have a more productive team. Parnassus has been using ESG factors in its investing policy since its founding 33 years ago. This has definitely helped our performance.

The regulators make us say that past performance is no guarantee of future returns, and this maxim is certainly true. However, we pledge that we will continue to use the strategies that have made us successful over the past 33 years.

Yours truly,

Jerome L. Dodson

Portfolio Manager

15

| PARNASSUS FUNDS | Semiannual Report • 2017 | |||

Ticker: Investor Shares - PARMX

Ticker: Institutional Shares - PFPMX

As of June 30, 2017, the net asset value (“NAV”) of the Parnassus Mid Cap Fund – Investor Shares was $31.38, so the total return for the quarter was a gain of 3.19%. This compares to a gain of 2.70% for the Russell Midcap Index (“Russell”) and a gain of 1.70% for the Lipper Mid-Cap Core Average, which represents the average mid-cap core funds followed by Lipper (“Lipper average”). For the first half of 2017, the Parnassus Mid Cap Fund – Investor Shares is also ahead of its benchmarks, posting a gain of 8.69% compared to a return of 7.99% for the Russell and 5.97% for the Lipper average.

Below is a table comparing the Parnassus Mid Cap Fund with the Russell and the Lipper average for the one-, three-, five- and ten-year periods. We are pleased that the Fund beat its benchmarks in almost all of these periods. The Fund is also ahead of its benchmarks since we began managing the strategy on October 1, 2008.

| Parnassus Mid Cap Fund | ||||||||||||||||||||||||

| Average Annual Total Returns (%) | One Year | Three Years | Five Years | Ten Years | Gross Expense Ratio | Net Expense Ratio | ||||||||||||||||||

| for period ended June 30, 2017 | ||||||||||||||||||||||||

| Parnassus Mid Cap Fund Investor Shares | 16.29 | 9.21 | 13.90 | 8.99 | 1.01 | 0.99 | ||||||||||||||||||

| Parnassus Mid Cap Fund Institutional Shares | 16.56 | 9.40 | 14.01 | 9.04 | 0.80 | 0.80 | ||||||||||||||||||

| Russell Midcap Index | 16.48 | 7.69 | 14.72 | 7.67 | NA | NA | ||||||||||||||||||

| Lipper Mid-Cap Core Average | 16.97 | 5.94 | 13.04 | 6.20 | NA | NA | ||||||||||||||||||

The average annual total return for the Parnassus Mid Cap Fund-Institutional Shares from commencement (April 30, 2015) was 10.81%. Performance shown prior to the inception of the Institutional Shares reflects the performance of the Parnassus Mid Cap Fund-Investor Shares and includes expenses that are not applicable to and are higher than those of the Institutional Shares. The performance of the Institutional Shares differs from that shown for the Investor Shares to the extent that the classes do not have the same expenses. Performance data quoted represent past performance and are no guarantee of future returns. Current performance may be lower or higher than the performance data quoted. Current performance information to the most recent month-end is available on the Parnassus website (www.parnassus.com). Investment return and principal value will fluctuate, so an investor’s shares, when redeemed, may be worth more or less than their original principal cost. Returns shown in the table do not reflect the deduction of taxes a shareholder may pay on fund distributions or redemption of shares. The Russell Midcap Index is an unmanaged index of common stocks, and it is not possible to invest directly in an index. Index figures do not take any expenses, fees or taxes into account, but mutual fund returns do. Mid-cap companies can be more sensitive to changing economic conditions and have fewer financial resources than large-cap companies.

Before investing, an investor should carefully consider the investment objectives, risks, charges and expenses of the Fund and should carefully read the prospectus or summary prospectus, which contain this and other information. The prospectus or summary prospectus can be obtained on the Parnassus website or by calling (800) 999-3505. As described in the Fund’s current prospectus dated May 1, 2017, Parnassus Investments has contractually agreed to limit total operating expenses to 0.99% of net assets for the Parnassus Mid Cap Fund-Investor Shares and to 0.85% of net assets for the Parnassus Mid Cap Fund-Institutional Shares. This agreement will not be terminated prior to May 1, 2018, and may be continued indefinitely by the Adviser on a year-to-year basis.

Second Quarter Review

Mid-cap stocks gained steadily throughout the quarter as corporate earnings grew at a double-digit rate, and the U.S. economy remained relatively healthy. The economic picture is rosy enough that investors largely ignored it when the Federal Reserve raised rates and announced that it will likely start reducing the size of its balance sheet. Investors also overlooked volatile political headlines, including the debate over Obamacare, choosing instead to focus on the possibility of tax reform and significant infrastructure spending.

The Parnassus Mid Cap Fund – Investor Shares did even better than its benchmarks, beating the Russell by 49 basis points and the Lipper average by 149 basis points (one basis point is 1/100th of one percent). From an allocation perspective, the Parnassus Mid Cap Fund benefited from having an underweight position in energy stocks, the worst performing sector in the benchmark. The Parnassus Mid Cap Fund also benefited from having an overweight position in the health care sector, the best-performing sector in the benchmark.

Three stocks took more than ten basis points from the Fund’s return. The worst performer was National Oilwell Varco, a global supplier of equipment and technology that helps companies drill wells safely and efficiently. The stock fell 17.8% from $40.09 to $32.94, reducing the Fund’s return by 47 basis points, as oil prices declined due to oversupply concerns. We remain optimistic about National Oilwell Varco’s long-term prospects, since the company continues to develop new technologies and safety products that enable its customers to operate more cost-effectively and efficiently. We believe the stock will rebound as oil prices recover and the company gains traction with its innovation solutions.

16

| Semiannual Report • 2017 | PARNASSUS FUNDS | |||

First Horizon National, a Tennessee-based regional bank, dropped 5.8% from $18.50 to $17.42, reducing the Fund’s return by 19 basis points. The stock fell after First Horizon announced the acquisition of Capital Bank for $2.2 billion, as investors were disappointed by the high purchase price of 2.0x tangible book value. We’re holding onto our shares, because the deal provides an attractive platform for growth in North Carolina, and extends First Horizon’s market leadership in Tennessee with

significant cost synergies. While we wish First Horizon had our bargain-hunter mentality, we believe the stock will rise over time as Capital Bank is integrated and its return on equity increases.

MDU Resources, a diversified conglomerate with operations in electric and gas utilities, pipelines and construction materials and services, fell 4.3% from $27.37 to $26.20, decreasing the Fund’s return by 11 basis points. The stock dropped after the company delivered weaker than expected earnings, driven by a decline in bookings in the construction materials segment due to weather delays and weak pipeline volumes. Despite these issues, we believe MDU has strong long-term growth prospects, supported by a solid pipeline of high-return investment opportunities at its core utility and construction businesses.

Three stocks added more than 35 basis points to the Fund’s return this quarter. The best performer was Whole Foods, a leading retailer of organic and natural foods, as its stock soared 41.7% from $29.72 to $42.11, adding 66 basis points to the Fund’s return. The stock jumped in April after activist investor Jana Partners took a nearly 9% stake in the company. Jana demanded management accelerate its turnaround or sell the company. The latter occurred in June, when Amazon announced it would acquire Whole Foods for $42 per share, or $13.7 billion. We’re happy with that price, because we believe it represents fair value, especially given the increasingly competitive supermarket environment.

Praxair, one of the largest industrial gas companies in the world, jumped 11.8% from $118.60 to $132.55, contributing 42 basis points to the Fund’s return. The stock rose after the company announced a merger with Linde, a leading German industrial gas company. The merger will create the world’s largest industrial gas company, with a combined market value of over $70 billion and revenue of about $30 billion. The new company will have more diverse end-markets, combining Praxair’s leading position in the Americas with Linde’s strong presence in Europe and Asia. Additionally, each company brings complementary strengths, specifically Praxair’s operational excellence and Linde’s engineering and technology leadership. The deal is expected to close in the second half of 2018.

Xylem, a leading pure-play water infrastructure provider, added 37 basis points to the Fund’s return as the stock rose 10.4% from $50.22 to $55.43. The stock climbed after the company surpassed earnings expectations, as demand for its water infrastructure products grew in both the U.S. and in emerging markets. With margin expansion opportunities; synergies from its acquisition of Sensus, a provider of smart meters and data analytics; and increasing demand for its highly innovative products, we remain excited about Xylem’s long-term earnings prospects.

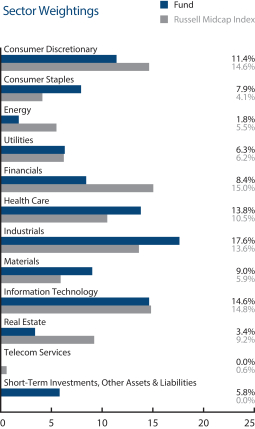

Parnassus Mid Cap Fund as of June 30, 2017 (percentage of net assets) | ||

Top 10 Holdings

(percentage of net assets)

| Motorola Solutions Inc. | 4.1% | |||

| Cardinal Health Inc. | 3.7% | |||

| Patterson Companies | 3.7% | |||

| Verisk Analytics Inc. | 3.6% | |||

| Shaw Communications Inc., Class B | 3.4% | |||

| Xylem Inc. | 3.4% | |||

| Iron Mountain Inc. | 3.4% | |||

| Praxair Inc. | 3.4% | |||

| Dentsply Sirona Inc. | 3.4% | |||

| Pentair plc | 3.4% | |||

Portfolio characteristics and holdings are subject to change periodically.

17

| PARNASSUS FUNDS | Semiannual Report • 2017 | |||

Outlook and Strategy

The Russell reached another all-time high during the quarter and is now up an astounding 324% since the March 2009 low. As we continue in the ninth year of the bull market, the biggest threat to the market appears to be its high valuation. Mid-cap stocks are trading at 18 times forward earnings estimates. This is close to the ten-year high and well above the 15 times multiple at which the Russell was trading in 2009.

Our largest concentration of stocks at the quarter-end remains in the industrial sector. While the overweight allocation is less than it has been in previous quarters, we are still seeing good risk-reward scenarios in this area. Within this sector, we own a lot of business services companies, which should have less downside than many of their industrial peers in the event of a market correction. We continue to own fewer real estate and financial stocks than the benchmarks, because our research shows that the range of outcomes in these sectors is unusually wide and favors the downside. The Fund also has fewer energy stocks than the Russell, which tend to be more volatile than the rest of the index.

Our consumer discretionary exposure went up materially during the quarter, though we still have a much smaller position in this sector than the Russell. We took advantage of consumer sector weakness, initiating a position in Mattel, the largest toy company in the world. The company’s earnings dropped from $2.49 in 2013 to $1.06 in 2016, primarily due to poor execution. Nonetheless, Mattel owns enduring brands like Fisher-Price, Barbie, Hot Wheels and American Girl. We believe that CEO Margaret Georgidas, who recently joined from Google, will be able to lead a turnaround of the business over the next few years. Specifically, we think the company’s renewed focus on brand reinvigoration, product innovation and strategic partnerships will create significant earnings upside over time.

We also increased our exposure to the utilities sector this past quarter, as we initiated a position in Sempra Energy, a San Diego-based diversified energy services holding company. The company has operations in electric and gas utilities, pipelines, renewable projects and LNG facilities that serve a diverse set of customers across Southern California, Mexico, Chile and Peru. We believe Sempra has a fantastic collection of difficult-to-replicate, wide-moat businesses, which are supported by long-term contracts and stable regulated utilities. Furthermore, we think Sempra’s businesses will be increasingly relevant as demand for renewables and low-cost natural gas continues to grow, and the use of electric vehicles picks up over the next decade. We especially like the company’s leadership in renewable energy, as it currently generates over 43% of its electricity from renewable sources such as wind and solar. We believe Sempra is well positioned for sustained earnings growth with limited downside.

We’re pleased that our strategy is providing good results to shareholders. The Fund seeks to own high-quality businesses at good prices that can grow intrinsic value faster than our benchmarks over the long-term. We are confident that this strategy will enable the Fund to outperform the market over the long-term, by participating in up markets, providing downside protection in bear markets and avoiding permanent capital losses in severe market corrections.

Thank you for your investment in the Parnassus Mid Cap Fund.

Yours truly,

|  | |

| Matthew D. Gershuny | Lori A. Keith | |

| Lead Portfolio Manager | Portfolio Manager |

18

| Semiannual Report • 2017 | PARNASSUS FUNDS | |||

Ticker: Investor Shares - PAFSX

Ticker: Institutional Shares - PFPSX

As of June 30, 2017, the net asset value (“NAV”) of the Parnassus Asia Fund – Investor Shares was $19.08, so the Fund gained 7.01% in the second quarter. This compares to a gain of 5.87% for the MSCI AC Asia Pacific Index (“MSCI Index”) and a gain of 6.61% for the Lipper Asia Pacific Region Average, which represents the average return of the Asia Pacific Region funds followed by Lipper (“Lipper average”). We’re pleased that the Parnassus Asia Fund generated both strong absolute and relative returns for our shareholders this quarter, but our work is far from done. For the first half of 2017, the Parnassus Asia Fund – Investor Shares has gained 13.57%, compared to 15.91% for the MSCI Index and 17.21% for the Lipper average.

Below is a table comparing the Parnassus Asia Fund with the MSCI Index and the Lipper average over the past one- and three-year periods, and since inception. The Parnassus Asia Fund – Investor Shares is trailing on a three-year basis, but we

| Parnassus Asia Fund | ||||||||||||||||||||

| Average Annual Total Returns (%) | One Year | Three Years | Since Inception on 4/30/13 | Gross Expense Ratio | Net Expense Ratio | |||||||||||||||

| for period ended June 30, 2017 | ||||||||||||||||||||

| Parnassus Asia Fund Investor Shares | 27.20 | 3.60 | 6.21 | 3.13 | 1.25 | |||||||||||||||

| Parnassus Asia Fund Institutional Shares | 27.42 | 3.80 | NA | 1.10 | 0.96 | |||||||||||||||

| MSCI AC Asia Pacific Index | 23.00 | 4.76 | 4.86 | NA | NA | |||||||||||||||

| Lipper Asia Pacific Region Average | 18.61 | 4.51 | 4.21 | NA | NA | |||||||||||||||

The average annual total return for the Parnassus Asia Fund-Institutional Shares from commencement (April 30, 2015) was 3.24%. Performance shown prior to the inception of the Institutional Shares reflects the performance of the Parnassus Asia Fund-Investor Shares and includes expenses that are not applicable to and are higher than those of the Institutional Shares. The performance of the Institutional Shares differs from that shown for the Investor Shares to the extent that the classes do not have the same expenses. Performance data quoted represent past performance and are no guarantee of future returns. Current performance may be lower or higher than the performance data quoted. Current performance information to the most recent month-end is available on the Parnassus website (www.parnassus.com). Investment return and principal value will fluctuate, so an investor’s shares, when redeemed, may be worth more or less than their original principal cost. Returns shown in the table do not reflect the deduction of taxes a shareholder may pay on fund distributions or redemption of shares. The MSCI AC Asia Pacific Index is an unmanaged index of Asian stock markets, and it is not possible to invest directly in an index. Index figures do not take any expenses, fees or taxes into account, but mutual fund returns do.

The Fund invests primarily in non-U.S. securities. Foreign markets can be more volatile than the U.S. market due to increased risks of adverse issuer, political, regulatory, market or economic developments and can perform differently from the U.S. market.

Before investing, an investor should carefully consider the investment objectives, risks, charges and expenses of the Fund and should carefully read the prospectus or summary prospectus, which contain this and other information. The prospectus or summary prospectus can be obtained on the Parnassus website or by calling (800) 999-3505. As described in the Fund’s current prospectus dated May 1, 2017, Parnassus Investments has contractually agreed to limit the total operating expenses to 1.25% of net assets for the Parnassus Asia Fund-Investor Shares and to 1.22% of net assets for the Parnassus Asia Fund-Institutional Shares. This agreement will not be terminated prior to May 1, 2018, and may be continued indefinitely by the Adviser on a year-to-year basis.

made a strong comeback last year, up 27.20%, soundly beating 23.00% for the MSCI Index and the 18.61% for the Lipper average. The Parnassus Asia Fund - Investor Shares is also outperforming over longer time periods. We have gained an average of 6.21% per year since inception, which is 135 basis points per year ahead of the MSCI Index and 200 basis points per year ahead of the Lipper average. (One basis point is 1/100th of one percent.)

Company Analysis

Our investments in Chinese companies and certain technology stocks contributed the most to the Asia Fund’s outperformance. Six companies contributed 49 basis points or more to the Fund’s return this quarter, while three subtracted 11 basis points or more from the Fund’s return.

The Fund’s worst performer was National Oilwell Varco, which sells equipment that enables energy companies to drill wells safely and efficiently. The stock fell 17.8% from $40.09 to $32.94, reducing the Fund’s return by 51 basis points, as oil prices sunk given over-supply concerns. Rising U.S. production and persistently high stockpiles are undermining investor confidence that cuts from other producers will correct the supply-demand imbalance. Despite the uncertain outlook for the oil industry, the company continues to develop new technologies that customers demand, and we believe that the stock will rebound as oil prices recover.

KLA-Tencor, the leading supplier of inspection equipment to semiconductor manufacturers, subtracted 11 basis points from the Fund’s return, as its stock declined 3.7% from $95.07 to $91.51. The stock initially rose, after delivering better than expected earnings from strong demand for its wafer inspection tools by foundry and logic

19

| PARNASSUS FUNDS | Semiannual Report • 2017 | |||

customers. However, investors became concerned that the company’s order growth could slow down as foundry customers temporarily curtail spending before they move to the development of 7-nanometer semiconductor chips. We continue to believe that KLA is poised to benefit with its innovative products, market share gains and margin expansion opportunities.

The stock of Television Broadcast fell 6.7% from $4.04 to $3.77, reducing the Fund’s return by 11 basis points. The Hong Kong-based company is one of the largest producers and distributors of Chinese-language programming content in the world.

Earlier in 2017, TVB received an unsolicited takeover offer from TLG Movie & Entertainment Group to buy 27% of its shares for a premium of approximately HK$35 per share. The price of TVB’s stock initially surged on the offer, but it subsequently sagged in the second quarter, as regulations restricting foreign ownership of media companies in Hong Kong threatened to derail the transaction. The outcome of the share repurchase offer remains unknown, but a definitive resolution should be forthcoming, and a positive for the stock.

While our worst performers included two companies based in the U.S., international stocks, particularly those from China, dominated our winners list.

The Parnassus Asia Fund’s best performer was Alibaba Group, which added 95 basis points to the Fund’s return, as its stock price surged 30.7% from $107.83 to $140.90. Based in China, Alibaba is the world’s largest online and mobile commerce company by sales volume. Its major marketplaces – Taobao, Tmall and Juhuasuan – together generated gross merchandise volume of over half a trillion dollars last year, more than Amazon and eBay combined. In a presentation to investors, Alibaba upgraded its guidance for 2018 sales growth to nearly 50%, smashing consensus expectations and literally drawing gasps from the crowd. The stock soared 13% in a single day as various metrics demonstrated higher user engagement and personalization in the company’s core ecommerce business. Growing momentum in its cloud business, global expansion, ad targeting tools, mobile platforms, and monetization rates also extended the rally.

The stock price of Rakuten advanced 17.4% from $10.05 to $11.80, adding 85 basis points to the Fund’s return. Based in Japan, Rakuten is an international online shopping mall with tens of thousands of merchants; it is also a major player in online financial services, including securities brokerage and credit cards. Domestic gross merchandise sales registered solid double-digit growth, allaying persistent fears that competition was stiffening. Profits also came in higher than expected, helped by gains from Rakuten’s investments in ridesharing company Lyft. Following several quarters of slowing growth and falling margins at the company, the stock jumped on the belief that the company’s earnings may have finally bottomed out.

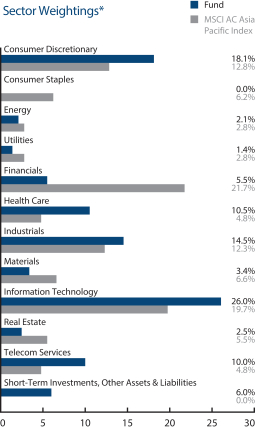

Parnassus Asia Fund as of June 30, 2017 (percentage of net assets) |

* For purposes of categorizing securities for diversification requirements under the Investment Company Act, the Fund uses industry classifications that are more specific than those used for the chart.

Portfolio characteristics and holdings are subject to change periodically.

SITC International Holdings increased the Fund’s return by 68 basis points, as its stock climbed 14.5% from 69¢ to 79¢. The Hong Kong-based integrated shipping-and-logistics company has operations that span Mainland China, Japan, Southeast Asia and the rest of the world, making it the tenth largest container shipping operator in Asia. Both shipping and freight forwarding volumes maintained strong growth momentum and progress toward full-year estimates, driven by a gradual recovery in external demand across the region. Higher liquidity also provided a valuation boost to the stock, following its inclusion in the Shanghai-Hong Kong Stock Connect program.

Perrigo, the leading producer of store-brand generic drugs, added 56 basis points to the Fund’s return as the stock climbed 13.8% from $66.39 to $75.52. The business showed signs of stabilization as the company got back on track with its SEC filings and delivered an in-line earnings report. In addition, the company showed progress with portfolio rationalization –

20

| Semiannual Report • 2017 | PARNASSUS FUNDS | |||

announcing the sale of its Tysabri royalty stream for $2.9 billion and using proceeds to pay down debt. While the news this month of CEO John Hendrickson’s departure came as a surprise, we believe his successor will continue to execute on the strategy to position Perrigo for growth.

The stock of Greatview Aseptic Packaging jumped 24.0% from 50¢ to 62¢, increasing the Fund’s return by 49 basis points. Headquartered in Beijing, Greatview is the second-largest aseptic packaging manufacturer in China. It sells packaging

materials for dairy and noncarbonated soft drink producers globally, with the majority of its customers in China and a production factory in Europe. On June 2, Jardine Strategic Holdings, a company listed on the London Stock Exchange, announced that it had purchased 22% of the issued share capital of Greatview at an average price of HK$5.00 a share, or a 15% premium to Greatview’s stock price on June 1. We liked the company’s steadfast business, debt-free balance sheet, and 5% dividend yield, and weren’t surprised that Jardine sealed the deal.

Samsung Electronics contributed 49 basis points to the Fund’s return, as its stock surged 13.0%, from $1,842.82 to $2,081.57. The South Korean consumer electronics giant ranks number-one in sales of mobile phones and displays worldwide and in June eclipsed Intel for the top spot in semiconductors. Samsung’s semiconductor business again delivered record profits, driven mainly by strong memory prices and robust enterprise and data center demand. Management also indicated that it could return excess cash to shareholders, a move that further powered the stock’s rise ahead of the company’s Galaxy 8 smartphone launch this fall.

Outlook and Strategy

The Parnassus Asia Fund – Investor Shares edged out both of its benchmarks in the second quarter with a gain of 7.01%. The sharp rally in Asian stocks that began in January continued through the first half of the year, building on the back of unusually placid global markets. Remarkably, stocks in Asia lost no more than 1.25% on any single day over the prior quarter, and indeed, in any day in 2017 so far (This compares to 22 such instances in 2016 and 17 in 2015). Stocks effectively had nowhere to go but up this year on rising expectations for a global economic recovery, renewed investor interest in emerging markets, and strengthening foreign currencies, while a reprieve from last year’s geopolitical shocks sent volatility to record lows. Investors in the Parnassus Asia Fund profited from these trends, which lifted our investments in global internet and technology stocks.

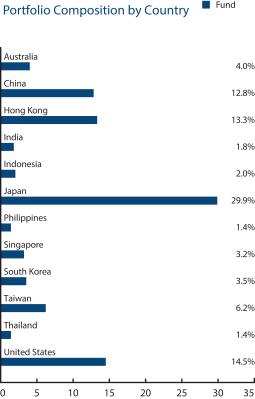

China, Korea and Taiwan were the best performing Asian markets in the quarter, while the three major markets of Japan, India and Australia – all countries where the Parnassus Asia Fund is underweight – lagged behind. Chinese stocks soared 10.7% ahead of the Communist Party’s twice-a-decade leadership reshuffle this autumn, despite a regulatory crackdown against leverage in Asia’s largest economy. The deleveraging didn’t impede Parnassus Asia Fund holding Alibaba, nor the other self-funding internet stocks that now make up half of China’s ten biggest companies. Japan’s economy slowly returned to growth, but could not shake persistently weak inflation expectations. Consequently, the country’s stocks sat out the regional risk rally, but still rose a respectable 5.2%.

Investors should note that MSCI recently made two changes, one immediate and one announced, to the benchmark against which the

Parnassus Asia Fund as of June 30, 2017 (percentage of net assets) |

Parnassus considers companies that do a substantial amount of business in Asia to be Asian companies.

Top 10 Holdings

(percentage of net assets)

| Rakuten Inc. | 5.1% | |||

| Gilead Sciences Inc. | 4.7% | |||

| SITC International Holdings Co., Ltd. | 4.1% | |||

| Brambles Ltd. | 4.0% | |||

| Kakaku.com Inc. | 3.9% | |||

| Perrigo Co. plc | 3.5% | |||

| Samsung Electronics Co., Ltd. | 3.5% | |||

| QUALCOMM Inc. | 3.3% | |||

| M1 Ltd. | 3.2% | |||

| Asics Corp. | 3.1% | |||

Portfolio characteristics and holdings are subject to change periodically.

21

| PARNASSUS FUNDS | Semiannual Report • 2017 | |||

Parnassus Asia Fund is measured. First, Pakistan was upgraded from a frontier to emerging market and is now a small component of the MSCI Index. With land mass about the size of France and the U.K. combined, Pakistan contains an enormous and fast-growing population of approximately 190 million people, the world’s sixth-largest. Pakistan’s problems are many, but so is its potential. Secondly, MSCI will add stocks traded in China’s mainland, commonly referred to as China A-shares, to the index starting in June 2018. The Parnassus Asia Fund already derives exposure to the Chinese markets through stocks listed in Hong Kong and the U.S., but the addition gives us an expanded universe of companies to evaluate.

The addition of a new country or market to an index is significant, akin to inserting an inch to a trusted yardstick. Thankfully, it is also rare. No matter the changes, one thing that remains constant is our commitment to Parnassus’s time-tested investment process and philosophy. With the Parnassus Asia Fund, we search the world for high-quality companies selling at temporarily depressed prices, and invest in them for the long-term. We believe this is the foundation for long-run investment success whether in China, Karachi or California.

Yours truly,

Billy J. Hwan

Portfolio Manager

22

| Semiannual Report • 2017 | PARNASSUS FUNDS | |||

Ticker: Investor Shares - PRFIX

Ticker: Institutional Shares - PFPLX

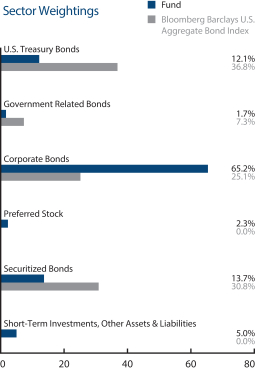

As of June 30, 2017, the NAV of the Parnassus Fixed Income Fund – Investor Shares was $16.62, producing a gain for the quarter of 1.31% (including dividends). This compares to a gain of 1.45% for the Bloomberg Barclays U.S. Aggregate Bond Index (“Barclays Aggregate Index”) and a gain of 1.43% for the Lipper Core Bond Fund Average, which represents the average return of the funds followed by Lipper that invest at least 85% of assets in domestic investment-grade bonds (“Lipper average”). For the first half of 2017, the Parnassus Fixed Income Fund – Investor Shares posted a gain of 2.38%, as compared to a gain of 2.27% for the Barclays Aggregate Index and a gain of 2.40% for the Lipper average.

Below is a table comparing the performance of the Fund with that of the Barclays Aggregate Index and the Lipper average. Average annual total returns are for the one-, three-, five- and ten-year periods. For June 30, the 30-day subsidized SEC yield was 1.97%, and the unsubsidized SEC yield was 1.89%.

| Parnassus Fixed Income Fund | ||||||||||||||||||||||||

| Average Annual Total Returns (%) | One Year | Three Years | Five Years | Ten Years | Gross Expense Ratio | Net Expense Ratio | ||||||||||||||||||

| for period ended June 30, 2017 | ||||||||||||||||||||||||