UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number | 811-06279 |

|

Harris Associates Investment Trust |

(Exact name of registrant as specified in charter) |

|

Two North La Salle Street, Suite 500 Chicago, Illinois | | 60602-3790 |

(Address of principal executive offices) | | (Zip code) |

|

Kristi L. Rowsell Harris Associates L.P. Two North La Salle Street, #500 Chicago, Illinois 60602 | Paulita A. Pike K&L Gates LLP Three First National Plaza, #3100 Chicago, Illinois 60602 |

(Name and address of agent for service) |

|

Registrant’s telephone number, including area code: | (312) 621-0600 | |

|

Date of fiscal year end: | 9/30/14 | |

|

Date of reporting period: | 3/31/14 | |

| | | | | | | | | |

Item 1. Reports to Shareholders.

THE OAKMARK FUNDS

SEMI-ANNUAL REPORT | MARCH 31, 2014

OAKMARK FUND

OAKMARK SELECT FUND

OAKMARK EQUITY AND INCOME FUND

OAKMARK GLOBAL FUND

OAKMARK GLOBAL SELECT FUND

OAKMARK INTERNATIONAL FUND

OAKMARK INTERNATIONAL SMALL CAP FUND

The Oakmark Funds

2014 Semi-Annual Report

TABLE OF CONTENTS

President's Letter | | | 1 | | |

Fund Expenses | | | 3 | | |

Oakmark Fund | |

Summary Information | | | 4 | | |

Portfolio Manager Commentary | | | 5 | | |

Schedule of Investments | | | 6 | | |

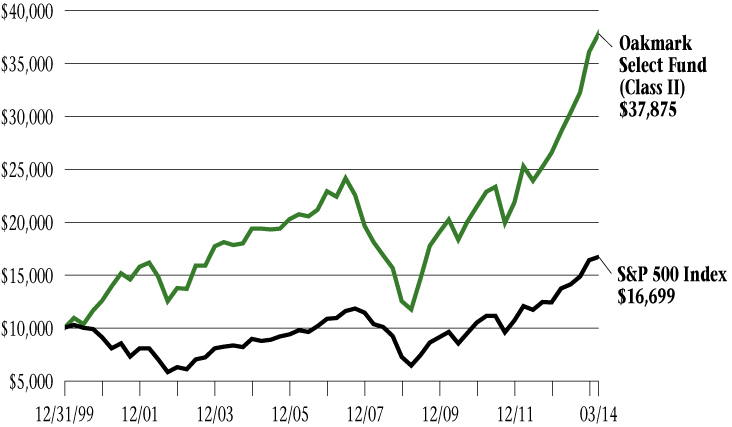

Oakmark Select Fund | |

Summary Information | | | 8 | | |

Portfolio Manager Commentary | | | 9 | | |

Schedule of Investments | | | 10 | | |

Oakmark Equity and Income Fund | |

Summary Information | | | 12 | | |

Portfolio Manager Commentary | | | 13 | | |

Schedule of Investments | | | 15 | | |

Oakmark Global Fund | |

Summary Information | | | 20 | | |

Portfolio Manager Commentary | | | 21 | | |

Schedule of Investments | | | 23 | | |

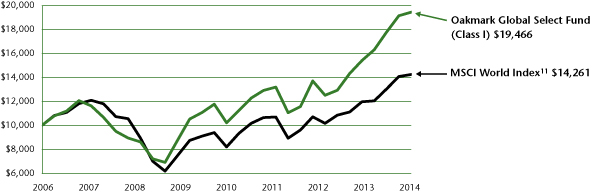

Oakmark Global Select Fund | |

Summary Information | | | 26 | | |

Portfolio Manager Commentary | | | 27 | | |

Schedule of Investments | | | 28 | | |

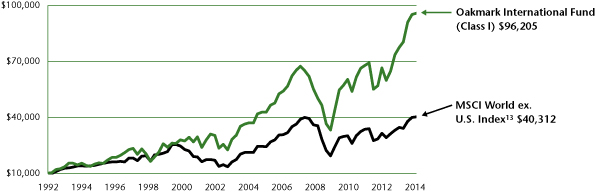

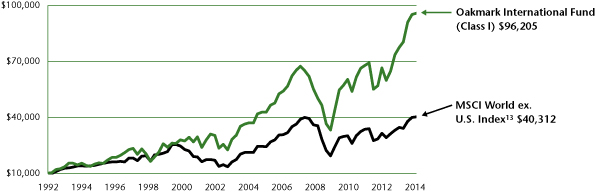

Oakmark International Fund | |

Summary Information | | | 30 | | |

Portfolio Manager Commentary | | | 31 | | |

Schedule of Investments | | | 32 | | |

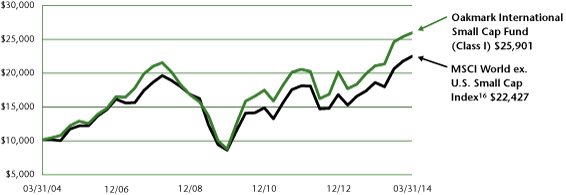

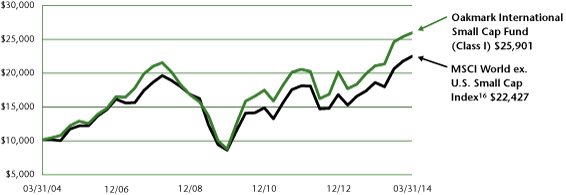

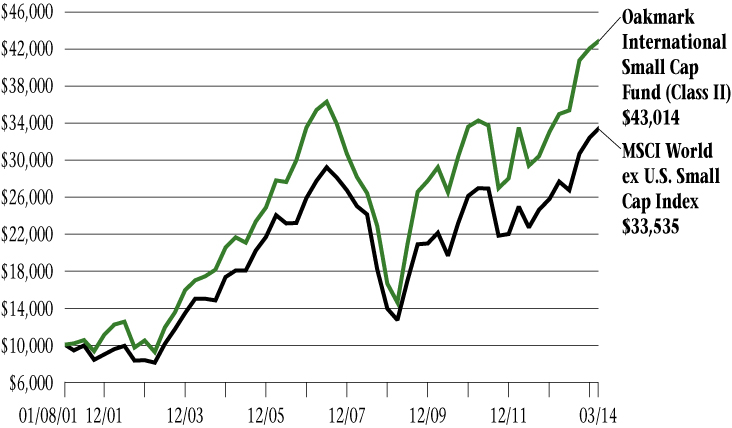

Oakmark International Small Cap Fund | |

Summary Information | | | 36 | | |

Portfolio Manager Commentary | | | 37 | | |

Schedule of Investments | | | 38 | | |

Financial Statements | |

Statements of Assets and Liabilities | | | 40 | | |

Statements of Operations | | | 42 | | |

Statements of Changes in Net Assets | | | 44 | | |

Notes to Financial Statements | | | 51 | | |

Financial Highlights | | | 65 | | |

Disclosure Regarding Investment Advisory

Contract Approval | | | 72 | | |

Disclosures and Endnotes | | | 75 | | |

Trustees and Officers | | | 76 | | |

FORWARD-LOOKING STATEMENT DISCLOSURE

One of our most important responsibilities as mutual fund managers is to communicate with shareholders in an open and direct manner. Some of our comments in our letters to shareholders are based on current management expectations and are considered "forward-looking statements." Actual future results, however, may prove to be different from our expectations. You can identify forward-looking statements by words such as "estimate", "may", "will", "expect", "believe",

"plan" and other similar terms. We cannot promise future returns. Our opinions are a reflection of our best judgment at the time this report is compiled, and we disclaim any obligation to update or alter forward-looking statements as a result of new information, future events, or otherwise.

THE OAKMARK FUNDS

The Oakmark Funds March 31, 2014

President's Letter

Dear Fellow Shareholders,

The markets provided modest positive returns to shareholders during the first quarter of 2014. It is nice to see that investors reacted with relative calm to geopolitical events this quarter, showing a notable resiliency compared to recent years. The U.S. economy is growing moderately, as are corporate earnings, and unemployment levels are slowly continuing to fall. Communications from our new Federal Reserve Chairman reflect a commitment to keeping interest rates low while executing a gentle retreat in quantitative easing. Investors appear more confident that equities are the best asset class for delivering long-term returns.

High Frequency Trading Debate

Michael Lewis published a book last week called Flash Boys that is attracting much media attention to high-frequency trading ("HFT") in the stock markets. It is fascinating to see the spotlight return to this topic. One will recall that the Securities and Exchange Commission spent considerable time researching whether and how the "flash crash" of 2010 was affected by HFT. Computer-based trading and technology failures severely hurt Knight Capital and, separately, the Facebook IPO in the summer of 2012, prompting another discussion of how to manage the vulnerabilities introduced by the speed and capacity of computerized trading. Now, Michael Lewis describes how fast data feeds and special exchange order types have enabled HFT computers to execute trades in microseconds and get ahead of other market participants. The debates between certain exchange participants and Mr. Lewis are becoming highly charged but, indeed, informative. We think it is good that discussions about these issues are putting the spotlight on market health and functionality.

Over the years the traders at Harris Associates have worked diligently to navigate a technologically advanced landscape of broker algorithms, liquidity sources and evolving market structure. The tools they have cultivated assist us in accessing the additional liquidity in electronic markets without revealing too much about the nature of our trades. We think the customizations we've implemented, including using price limits and minimum fill quantities, as well as accessing dark pools and block trading venues, have helped reduce our exposure to predatory HFT strategies. We regularly review broker algorithms, order routing data and venue performance so that we can constantly adjust and improve how our orders are handled. Although we can never be perfectly insulated from HFT exposure, our practices appear to help. We believe our trading costs compare favorably to other investment managers. In fact, in December 2013, Institutional Investor's Transaction Cost Analysis survey1 ranked Harris Associates sixth overall in the Elkins/McSherry universe of asset management firms for exhibiting trading costs below market averages.

We welcome the chance for market participants to gain a better understanding and to have access to more transparency regarding trading behavior. However, let's remember two important elements of context—one applicable to all investors and one especially to Oakmark shareholders. All investors have benefited from the narrower spreads and enormous drop in commissions that markets have seen over the past decade. Trading commissions that once cost seven to ten cents per share—or more—can now be as low as fractions of a penny. The proliferation of algorithmic trading models and dozens of alternative trading venues has made trade execution hugely competitive, delivering benefits to all who own stocks. For shareholders in The Oakmark Funds, note that we are not

oakmark.com 1

The Oakmark Funds March 31, 2014

President's Letter (continued)

actively trading in and out of stocks in your portfolios. Our portfolio turnover is relatively low, implying that we typically hold securities for years at a time. Further, our interest in a company's stock is not driven by trading dynamics. We look for stocks trading at a substantial discount to our estimate of intrinsic value. Our focus on identifying a stock's true economic value and our willingness to patiently own it until that value is realized means that the penny-perfect purchase or sale price does not contribute meaningfully to the total return of the stock for our shareholders. We do, however, eagerly follow all developments in the trading arena, such as broker behavior and technological tools. This is part of good stewardship of shareholder assets. But in our view, market phenomena such as HFT are unlikely to contribute to or detract meaningfully from our success.

Lipper Awards for 2014*

In March, Lipper awarded The Oakmark Funds the "Best Equity Large Fund Group" for 2014. We are pleased to be recognized for our achievements amongst the competitive landscape represented by our peers. Also, The Oakmark Global Fund was recognized by Lipper for excellence in its category for the ten-year period.

We are grateful to receive industry accolades and are even more thankful for your continued trust in The Oakmark Funds. Please email us with your questions and comments at ContactOakmark@Oakmark.com.

* The Oakmark Family of Funds was named Lipper's Best Equity Large Fund Group, an award designed to recognize fund families with strong track records across all of their funds. Oakmark was ranked first out of 46 eligible fund groups due to the performance of all seven of its underlying funds. Each fund group must have at least three funds in Lipper's general U.S.-stock category, one world (global and international), one mixed-asset/balanced (stocks and bonds), two taxable bond and one tax-exempt bond fund. Eligibility requires that the fund group have at least five U.S. fund portfolios and each have at least 36 months of performance history ending at November of the evaluation year. Lipper's Large Fund Group classification is comprised of fund managers with assets under management of $50.7 billion or more as of 11/30/13.

The Oakmark Global Fund won an award in Lipper's Global Multi-Cap Core Funds category for the 10-year period. The Oakmark Global Fund, managed by Clyde McGregor and Rob Taylor, follows Harris Associates' value-oriented process to find opportunities across the globe. The fund was recognized for its consistent, risk-adjusted performance over the long term.

The Lipper Fund Awards are presented annually by Lipper, a mutual fund rating and research firm, to honor funds that it believes have excelled in providing superior performance relative to peers around the world. The awards are part of the broader Thomson Reuters Awards for Excellence program. More information about the Lipper Fund Awards is available at http://excellence.thomsonreuters.com/award/lipper.

2 THE OAKMARK FUNDS

Fund Expenses (Unaudited)

A shareholder of each Fund incurs ongoing costs, including investment advisory fees, transfer agent fees and other Fund expenses. The examples below are intended to help shareholders understand the ongoing costs (in dollars) of investing in each Fund and to compare these costs with the ongoing costs of investing in other funds.

The following table provides information about actual account values and actual Fund expenses as well as hypothetical account values and hypothetical fund expenses for shares of each Fund.

ACTUAL EXPENSES

The following table shows the expenses a shareholder would have paid on a $1,000 investment in each Fund from October 1, 2013 to March 31, 2014, as well as how much a $1,000 investment would be worth at the close of the period, assuming actual Fund returns and expenses. A shareholder can estimate expenses incurred for the period by dividing the account value at March 31, 2014, by $1,000 and multiplying the result by the number in the "Actual—Expenses Paid During Period" column shown below.

Shares of Oakmark International Small Cap Fund, invested for 90 days or less, may be charged a 2% redemption fee upon redemption. Please consult the Funds' prospectus at oakmark.com for more information.

HYPOTHETICAL EXAMPLE FOR COMPARISON PURPOSES

The following table provides information about hypothetical account values and hypothetical expenses for shares of each Fund based on actual expense ratios and an assumed rate of return of 5% per year before expenses, which are not the Funds' actual returns. The hypothetical account values and expenses may not be used to estimate the actual ending account balances or actual expenses shareholders paid for the period. Shareholders may use this information to compare the ongoing costs of investing in a Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transaction costs, such as redemption fees. Therefore, the "Hypothetical—Expenses Paid During Period" column of the table is useful in comparing ongoing costs only and will not help you determine the relative total costs of owning different funds. If these transaction costs were included, the total costs would have been higher.

| | |

| |

ACTUAL | | HYPOTHETICAL

(5% annual return

before expenses) | |

| |

| | Beginning

Account Value

(10/1/13) | | Ending

Account Value

(3/31/14) | | Expenses

Paid During

Period* | | Ending

Account Value

(3/31/14) | | Expenses

Paid During

Period* | | Annualized

Expense

Ratio | |

Oakmark Fund | |

Class I | | $ | 1,000.00 | | | $ | 1,141.20 | | | $ | 4.75 | | | $ | 1,020.49 | | | $ | 4.48 | | | | 0.89 | % | |

Class II | | $ | 1,000.00 | | | $ | 1,139.30 | | | $ | 6.51 | | | $ | 1,018.85 | | | $ | 6.14 | | | | 1.22 | % | |

Oakmark Select Fund | |

Class I | | $ | 1,000.00 | | | $ | 1,174.60 | | | $ | 5.31 | | | $ | 1,020.04 | | | $ | 4.94 | | | | 0.98 | % | |

Class II | | $ | 1,000.00 | | | $ | 1,172.60 | | | $ | 6.93 | | | $ | 1,018.55 | | | $ | 6.44 | | | | 1.28 | % | |

Oakmark Equity and Income Fund | |

Class I | | $ | 1,000.00 | | | $ | 1,090.10 | | | $ | 3.96 | | | $ | 1,021.14 | | | $ | 3.83 | | | | 0.76 | % | |

Class II | | $ | 1,000.00 | | | $ | 1,088.20 | | | $ | 5.57 | | | $ | 1,019.60 | | | $ | 5.39 | | | | 1.07 | % | |

Oakmark Global Fund | |

Class I | | $ | 1,000.00 | | �� | $ | 1,078.30 | | | $ | 5.80 | | | $ | 1,019.35 | | | $ | 5.64 | | | | 1.12 | % | |

Class II | | $ | 1,000.00 | | | $ | 1,076.40 | | | $ | 7.45 | | | $ | 1,017.75 | | | $ | 7.24 | | | | 1.44 | % | |

Oakmark Global Select Fund | |

Class I | | $ | 1,000.00 | | | $ | 1,093.70 | | | $ | 5.90 | | | $ | 1,019.30 | | | $ | 5.69 | | | | 1.13 | % | |

Oakmark International Fund | |

Class I | | $ | 1,000.00 | | | $ | 1,054.00 | | | $ | 4.92 | | | $ | 1,020.14 | | | $ | 4.84 | | | | 0.96 | % | |

Class II | | $ | 1,000.00 | | | $ | 1,052.00 | | | $ | 6.70 | | | $ | 1,018.40 | | | $ | 6.59 | | | | 1.31 | % | |

Oakmark International Small Cap Fund | |

Class I | | $ | 1,000.00 | | | $ | 1,055.70 | | | $ | 6.77 | | | $ | 1,018.35 | | | $ | 6.64 | | | | 1.32 | % | |

Class II | | $ | 1,000.00 | | | $ | 1,053.80 | | | $ | 8.14 | | | $ | 1,017.00 | | | $ | 8.00 | | | | 1.59 | % | |

* Expenses for each share class is equal to the annualized expense ratio, multiplied by the average account value over the period, multiplied by the number of days in the most recent half-year divided by 365 (to reflect one-half year period)

oakmark.com 3

Oakmark Fund March 31, 2014

Summary Information

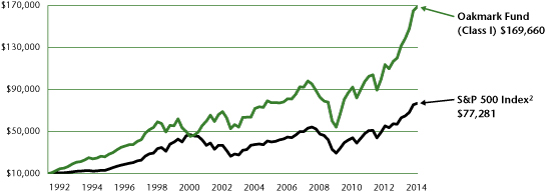

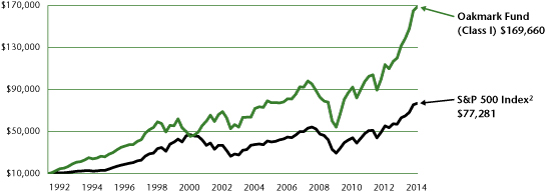

VALUE OF A $10,000 INVESTMENT

Since Inception - 08/05/91 (Unaudited)

PERFORMANCE

| | | | | Average Annual Total Returns (as of 03/31/14)3 | |

| (Unaudited) | | Total Return

Last 3 Months | | 1-year | | 3-year | | 5-year | | 10-year | | Since

Inception

(08/05/91) | |

Oakmark Fund (Class I) | | | 2.31 | % | | | 28.18 | % | | | 18.05 | % | | | 25.46 | % | | | 8.90 | % | | | 13.31 | % | |

S&P 500 Index | | | 1.81 | % | | | 21.86 | % | | | 14.66 | % | | | 21.16 | % | | | 7.42 | % | | | 9.45 | % | |

Dow Jones Industrial Average4 | | | -0.15 | % | | | 15.66 | % | | | 13.05 | % | | | 19.85 | % | | | 7.47 | % | | | 10.40 | % | |

Lipper Large Cap Value Funds Index5 | | | 2.30 | % | | | 22.52 | % | | | 13.44 | % | | | 19.85 | % | | | 6.83 | % | | | 8.97 | % | |

The graph and table above do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

Past Performance is no guarantee of future results. Performance data quoted represents past performance. Current performance may be lower or higher than the performance data quoted. The investment return and principal value vary so that an investor's shares when redeemed may be worth more or less than the original cost. To obtain the most recent month-end performance, please visit oakmark.com.

TOP TEN EQUITY HOLDINGS6 | | % of Net Assets | |

Bank of America Corp. | | | 3.1 | | |

Oracle Corp. | | | 2.2 | | |

Capital One Financial Corp. | | | 2.2 | | |

Apache Corp. | | | 2.1 | | |

DIRECTV | | | 2.1 | | |

UnitedHealth Group, Inc. | | | 2.1 | | |

Medtronic, Inc. | | | 2.1 | | |

TE Connectivity, Ltd. | | | 2.1 | | |

FedEx Corp. | | | 2.1 | | |

American International Group, Inc. | | | 2.1 | | |

SECTOR ALLOCATION | | % of Net Assets | |

Financials | | | 23.6 | | |

Information Technology | | | 20.0 | | |

Consumer Discretionary | | | 15.9 | | |

Industrials | | | 10.0 | | |

Energy | | | 8.9 | | |

Health Care | | | 7.9 | | |

Consumer Staples | | | 6.4 | | |

Short-Term Investments and Other | | | 7.3 | | |

FUND STATISTICS | |

Ticker | | OAKMX | |

Inception | | 08/05/91 | |

Number of Equity Holdings | | 59 | |

Net Assets | | $13.3 billion | |

Benchmark | | S&P 500 Index | |

Weighted Average Market Cap | | $99.9 billion | |

Median Market Cap | | $50.6 billion | |

Portfolio Turnover (for the 6-months ended 03/31/14) | | 4% | |

Expense Ratio - Class I (as of 09/30/13) | | 0.95% | |

4 THE OAKMARK FUNDS

Oakmark Fund March 31, 2014

Portfolio Manager Commentary

The Oakmark Fund increased 2% in the first quarter, fractionally exceeding the S&P 5002 gain, which also rounded to 2%. For the first half of our fiscal year Oakmark Fund was up 14%, compared to 13% for the S&P 500. Additionally, the Fund ended the quarter at an all-time high price. Because our goal is to increase the capital of our shareholders, we are always pleased to report new highs.

After such a strong year for equities in 2013, we are not surprised to see returns moderate as we move into 2014. Stocks certainly aren't as cheap as they were a year ago, but we are still finding attractive companies to add to the portfolio. At Oakmark, we're big fans of the Chicago Blackhawks, so as we approach playoff time, we start to think about some of the best hockey clichés. One of our favorites is, "a two-goal lead is the worst lead in hockey." While we are amused by the fragile logic of this statement, we appreciate the simple message that in a fast-paced, competitive environment, you can't sit on a lead. At Oakmark, we have an amazing team of research analysts who have remained diligent in uncovering attractive investment opportunities. As you will see below, we added four companies to the portfolio during the first quarter that we think are high-quality and attractively priced.

The best performing stock in the quarter was Forest Labs, up 54%. Forest has been an incredibly successful investment for the Oakmark Fund, and we offer our congratulations to the company's board and management team for maximizing per-share value for shareholders. It has only been one year since we first wrote about our purchase of Forest Labs, and since then, the share price has increased 149%. Please refer to the Oakmark Select commentary for a more detailed description of our tax-efficient sale strategy for Forest. Another top performer was our largest position, Bank of America. We still think the financial services sector is attractively valued, and with Bank of America, we are pleased to see investors recognize better visibility of higher future earnings and an enhanced capacity to return excess capital to shareholders. Our worst performer was General Motors, down 15%, due to what we believe was the market's overreaction to GM's handling of a recent product recall. We eliminated our position in Merck as the shares appreciated to our estimate of fair value.

Citigroup Inc. (C-$48)

Like its universal bank peers, we think Citigroup is significantly undervalued relative to its normalized earnings power. Unlike its peers, however, it has two hidden sources of value, neither of which is reflected in GAAP earnings: a deferred tax asset and a larger base of excess capital that is growing at a rapid rate. We have long admired Citigroup's global franchise and its growth potential. One of Citigroup's key competitive advantages is its unique global reach. Citigroup has more than twice as many country banking licenses and direct local payment network connections as its closest competitor. As a result, we think

Citigroup is uniquely positioned to offer corporate clients more visibility into their asset, liability and currency exposures, but requires fewer resources to manage the relationship. We would be remiss not to mention Citigroup's recent Fed stress test results. Although the qualitative results were disappointing, its quantitative stress test results confirm our analysis that the company has significantly more excess capital than its peers. We expect this capital to eventually benefit shareholders either through capital return or smart balance sheet growth.

Diageo PLC (DEO-$125)

Diageo is the world's largest spirits manufacturer. Diageo has a portfolio of spirits brands that is among the best in the industry, including a leading scotch franchise that is nearly impossible to replicate. These strong brands are supported by the company's global scale, which allows for meaningful efficiencies in manufacturing, distribution and marketing. As a result of these advantages, we believe Diageo will maintain its excellent competitive position. At the same time, revenues have grown consistently for years due to a combination of pricing power and emerging markets exposure, and this growth should continue for the foreseeable future. We believe this well-managed company is selling at a large discount to intrinsic value. Further, Diageo has a dividend yield of 2.5%.

General Mills, Inc. (GIS-$52)

We believe General Mills is a high quality, well-managed packaged foods company with exposure to fast-growing product categories. The company has an impressive track record of stable earnings growth, and it has consistently returned most of its strong free cash flow to shareholders in the form of share repurchases and dividends. We think revenue and margins will continue to grow, primarily driven by its international business. The company has an attractive global cereal joint venture with Nestle, which often gets overlooked by investors. With consistent profit growth and a shrinking share base, we like its prospects for per-share value growth. In addition, General Mills has a dividend yield of 3.2%.

Sanofi (SNY-$52)

Sanofi is a pharmaceutical company with a good mix of durable businesses with strong growth characteristics. The company has a strong franchise in diabetes treatments, maintaining dominant market share in this rapidly growing category. Sanofi is a leading player in emerging markets, where sales growth rates are twice that of the overall pharmaceutical market. Sanofi is also a leader in vaccines, and they have a strong footprint in over-the-counter products. We think that margins and profitability should improve as the company leverages fixed R&D spending and enforces good cost controls. The company's balance sheet has more cash than debt, and the shares sell at a substantial discount to our estimate of intrinsic value. Moreover, Sanofi has a dividend yield of 3.7%.

oakmark.com 5

Oakmark Fund March 31, 2014 (Unaudited)

Schedule of Investments (in thousands)

| | | Shares | | Value | |

C0OMMON STOCKS - 93.8% | |

FINANCIALS - 23.6% | |

DIVERSIFIED FINANCIALS - 8.7% | |

Capital One Financial Corp.

Consumer Finance | | | 3,753 | | | $ | 289,566 | | |

Franklin Resources, Inc.

Asset Management & Custody Banks | | | 5,040 | | | | 273,067 | | |

State Street Corp.

Asset Management & Custody Banks | | | 3,000 | | | | 208,650 | | |

The Goldman Sachs Group, Inc.

Investment Banking & Brokerage | | | 1,213 | | | | 198,750 | | |

Bank of New York Mellon Corp.

Asset Management & Custody Banks | | | 5,560 | | | | 196,200 | | |

| | | | | | 1,166,233 | | |

BANKS - 8.2% | |

Bank of America Corp.

Diversified Banks | | | 23,950 | | | | 411,940 | | |

JPMorgan Chase & Co.

Diversified Banks | | | 4,495 | | | | 272,891 | | |

Wells Fargo & Co.

Diversified Banks | | | 4,820 | | | | 239,747 | | |

Citigroup, Inc.

Diversified Banks | | | 3,600 | | | | 171,360 | | |

| | | | | | 1,095,938 | | |

INSURANCE - 6.7% | |

American International Group, Inc.

Multi-line Insurance | | | 5,495 | | | | 274,805 | | |

Aon PLC (b)

Insurance Brokers | | | 2,500 | | | | 210,700 | | |

Principal Financial Group, Inc.

Life & Health Insurance | | | 4,429 | | | | 203,704 | | |

Aflac, Inc.

Life & Health Insurance | | | 3,210 | | | | 202,358 | | |

| | | | | | 891,567 | | |

| | | | | | 3,153,738 | | |

INFORMATION TECHNOLOGY - 20.0% | |

SOFTWARE & SERVICES - 9.5% | |

Oracle Corp.

Systems Software | | | 7,330 | | | | 299,870 | | |

Microsoft Corp.

Systems Software | | | 5,920 | | | | 242,661 | | |

MasterCard, Inc., Class A

Data Processing & Outsourced Services | | | 3,130 | | | | 233,811 | | |

Google, Inc., Class A (a)

Internet Software & Services | | | 196 | | | | 218,444 | | |

Visa, Inc., Class A

Data Processing & Outsourced Services | | | 740 | | | | 159,736 | | |

Automatic Data Processing, Inc.

Data Processing & Outsourced Services | | | 1,430 | | | | 110,482 | | |

| | | | | | 1,265,004 | | |

| | | Shares | | Value | |

TECHNOLOGY HARDWARE & EQUIPMENT - 5.5% | |

TE Connectivity, Ltd. (b)

Electronic Manufacturing Services | | | 4,686 | | | $ | 282,122 | | |

QUALCOMM, Inc.

Communications Equipment | | | 3,050 | | | | 240,523 | | |

Apple, Inc.

Technology Hardware, Storage & Peripherals | | | 401 | | | | 215,233 | | |

| | | | | | 737,878 | | |

SEMICONDUCTORS & SEMICONDUCTOR EQUIPMENT - 5.0% | |

Intel Corp.

Semiconductors | | | 10,050 | | | | 259,391 | | |

Texas Instruments, Inc.

Semiconductors | | | 5,465 | | | | 257,675 | | |

Applied Materials, Inc.

Semiconductor Equipment | | | 7,160 | | | | 146,207 | | |

| | | | | | 663,273 | | |

| | | | | | 2,666,155 | | |

CONSUMER DISCRETIONARY - 15.9% | |

MEDIA - 5.3% | |

DIRECTV (a)

Cable & Satellite | | | 3,739 | | | | 285,746 | | |

Omnicom Group, Inc.

Advertising | | | 3,171 | | | | 230,233 | | |

Comcast Corp., Class A

Cable & Satellite | | | 3,940 | | | | 192,115 | | |

| | | | | | 708,094 | | |

RETAILING - 4.5% | |

Liberty Interactive Corp., Class A (a)

Catalog Retail | | | 8,570 | | | | 247,406 | | |

The Home Depot, Inc.

Home Improvement Retail | | | 2,957 | | | | 233,948 | | |

Kohl's Corp.

Department Stores | | | 2,042 | | | | 115,980 | | |

| | | | | | 597,334 | | |

AUTOMOBILES & COMPONENTS - 4.3% | |

Delphi Automotive PLC (b)

Auto Parts & Equipment | | | 3,984 | | | | 270,354 | | |

General Motors Co.

Automobile Manufacturers | | | 6,800 | | | | 234,056 | | |

Harley-Davidson, Inc.

Motorcycle Manufacturers | | | 1,102 | | | | 73,404 | | |

| | | | | | 577,814 | | |

CONSUMER SERVICES - 1.8% | |

McDonald's Corp.

Restaurants | | | 2,389 | | | | 234,194 | | |

| | | | | | 2,117,436 | | |

See accompanying Notes to Financial Statements.

6 THE OAKMARK FUNDS

Oakmark Fund March 31, 2014 (Unaudited)

Schedule of Investments (in thousands) (continued)

| | | Shares | | Value | |

COMMON STOCKS - 93.8% (continued) | |

INDUSTRIALS - 10.0% | |

CAPITAL GOODS - 6.7% | |

Illinois Tool Works, Inc.

Industrial Machinery | | | 3,060 | | | $ | 248,870 | | |

Parker Hannifin Corp.

Industrial Machinery | | | 1,875 | | | | 224,456 | | |

3M Co.

Industrial Conglomerates | | | 1,643 | | | | 222,890 | | |

Cummins, Inc.

Construction Machinery & Heavy Trucks | | | 1,380 | | | | 205,606 | | |

| | | | | | 901,822 | | |

TRANSPORTATION - 3.3% | |

FedEx Corp.

Air Freight & Logistics | | | 2,100 | | | | 278,376 | | |

Union Pacific Corp.

Railroads | | | 850 | | | | 159,511 | | |

| | | | | | 437,887 | | |

| | | | | | 1,339,709 | | |

HEALTH CARE - 9.0% | |

HEALTH CARE EQUIPMENT & SERVICES - 6.6% | |

UnitedHealth Group, Inc.

Managed Health Care | | | 3,460 | | | | 283,686 | | |

Medtronic, Inc.

Health Care Equipment | | | 4,585 | | | | 282,161 | | |

Covidien PLC (b)

Health Care Equipment | | | 2,708 | | | | 199,471 | | |

Baxter International, Inc.

Health Care Equipment | | | 1,623 | | | | 119,420 | | |

| | | | | | 884,738 | | |

PHARMACEUTICALS, BIOTECHNOLOGY & LIFE SCIENCES - 2.4% | |

Forest Laboratories, Inc. (a)

Pharmaceuticals | | | 1,950 | | | $ | 179,927 | | |

Sanofi (c)

Pharmaceuticals | | | 2,600 | | | | 135,928 | | |

| | | | | | 315,855 | | |

| | | | | | 1,200,593 | | |

ENERGY - 8.9% | |

Apache Corp.

Oil & Gas Exploration & Production | | | 3,450 | | | | 286,177 | | |

Halliburton Co.

Oil & Gas Equipment & Services | | | 3,950 | | | | 232,615 | | |

Exxon Mobil Corp.

Integrated Oil & Gas | | | 2,167 | | | | 211,673 | | |

National Oilwell Varco, Inc.

Oil & Gas Equipment & Services | | | 2,700 | | | | 210,249 | | |

Devon Energy Corp.

Oil & Gas Exploration & Production | | | 2,002 | | | | 133,994 | | |

Cenovus Energy, Inc. (b)

Integrated Oil & Gas | | | 3,930 | | | | 113,813 | | |

| | | | | | 1,188,521 | | |

| | | Shares | | Value | |

CONSUMER STAPLES - 6.4% | |

FOOD, BEVERAGE & TOBACCO - 5.3% | |

Diageo PLC (c)

Distillers & Vintners | | | 1,950 | | | $ | 242,950 | | |

Unilever PLC (c)

Packaged Foods & Meats | | | 5,083 | | | | 217,451 | | |

Nestle SA (c)

Packaged Foods & Meats | | | 1,800 | | | | 135,396 | | |

General Mills, Inc.

Packaged Foods & Meats | | | 2,173 | | | | 112,611 | | |

| | | | | | 708,408 | | |

FOOD & STAPLES RETAILING - 1.1% | |

Wal-Mart Stores, Inc.

Hypermarkets & Super Centers | | | 1,965 | | | | 150,185 | | |

| | | | | | 858,593 | | |

TOTAL COMMON STOCKS - 93.8%

(COST $8,014,352) | | | | | 12,524,745 | | |

COMMON STOCK SOLD SHORT - (1.1)% | |

HEALTH CARE - (1.1)% | |

PHARMACEUTICALS, BIOTECHNOLOGY & LIFE SCIENCES - (1.1)% | |

Actavis, Inc. | | | (693 | ) | | | (142,654 | ) | |

Pharmaceuticals | |

TOTAL COMMON STOCKS SOLD SHORT - (1.1%)

(PROCEEDS $(142,674)) | | | | | (142,654 | ) | |

| | | Par Value | | Value | |

SHORT TERM INVESTMENTS - 6.9% | |

REPURCHASE AGREEMENT - 5.4% | |

Fixed Income Clearing Corp. Repurchase

Agreement, 0.00% dated 03/31/14 due

04/01/14, repurchase price $714,513,

collateralized by Freddie Mac Discount

Notes, 0.000%, 12/02/14 - 12/04/14,

aggregate value plus accrued interest of

$668,833, by a United States Treasury

Note, 0.375%, due 11/15/14, value plus

accrued interest of $59,975 (Cost:

$714,513) | | | 714,513 | | | | 714,513 | | |

U.S. GOVERNMENT BILLS - 1.5% | |

United States Treasury Bills,

0.05%, due 04/17/14 - 04/24/14 (d)

(Cost $199,995) | | | 200,000 | | | | 199,995 | | |

TOTAL SHORT TERM INVESTMENTS - 6.9%

(COST $914,508) | | | | | 914,508 | | |

TOTAL INVESTMENTS - 99.6%

(COST $8,786,186) | | | | | 13,296,599 | | |

Other Assets In Excess of Liabilities - 0.4% | | | | | 50,559 | | |

TOTAL NET ASSETS - 100.0% | | | | $ | 13,347,158 | | |

(a) Non-income producing security

(b) Foreign domiciled corporation

(c) Sponsored American Depositary Receipt

(d) The rate shown represents the annualized yield at the time of purchase; not a coupon rate.

See accompanying Notes to Financial Statements.

oakmark.com 7

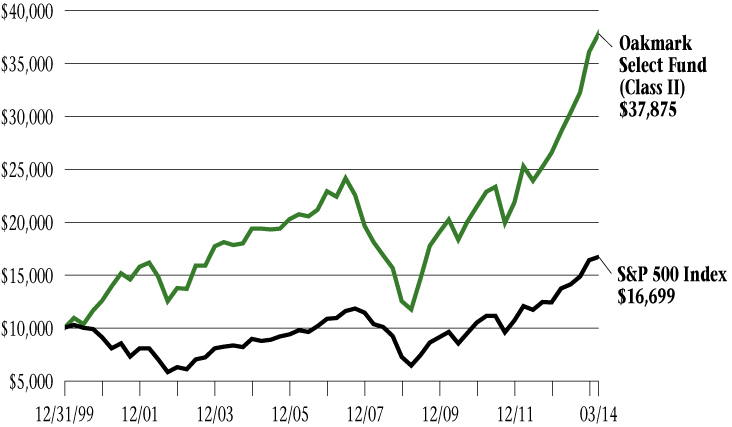

Oakmark Select Fund March 31, 2014

Summary Information

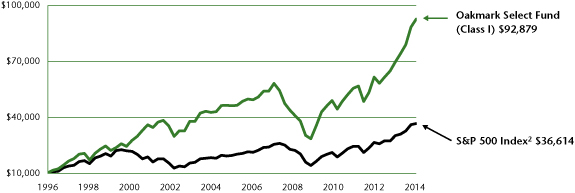

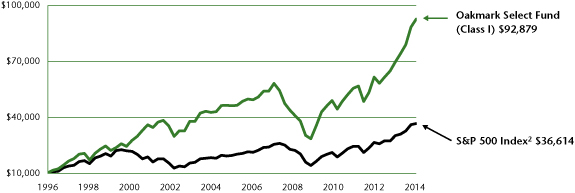

VALUE OF A $10,000 INVESTMENT

Since Inception - 11/01/96 (Unaudited)

PERFORMANCE

| | | | | Average Annual Total Returns (as of 03/31/14)3 | |

| (Unaudited) | | Total Return

Last 3 Months | | 1-year | | 3-year | | 5-year | | 10-year | | Since

Inception

(11/01/96) | |

Oakmark Select Fund (Class I) | | | 4.84 | % | | | 33.12 | % | | | 18.67 | % | | | 26.80 | % | | | 7.95 | % | | | 13.66 | % | |

S&P 500 Index | | | 1.81 | % | | | 21.86 | % | | | 14.66 | % | | | 21.16 | % | | | 7.42 | % | | | 7.74 | % | |

Lipper Multi-Cap Value Funds Index7 | | | 2.46 | % | | | 22.95 | % | | | 13.22 | % | | | 20.54 | % | | | 6.77 | % | | | 7.76 | % | |

The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

Past performance is no guarantee of future results. Performance data quoted represents past performance. Current performance may be lower or higher than the performance data quoted. The investment return and principal value vary so that an investor's shares when redeemed may be worth more or less than the original cost. To obtain the most recent month-end performance data, visit oakmark.com.

TOP TEN EQUITY HOLDINGS6 | | % of Net Assets | |

TRW Automotive Holdings Corp. | | | 7.9 | | |

TE Connectivity, Ltd. | | | 6.5 | | |

Bank of America Corp. | | | 6.1 | | |

Capital One Financial Corp. | | | 5.5 | | |

Apache Corp. | | | 5.4 | | |

Medtronic, Inc. | | | 5.2 | | |

DIRECTV | | | 5.0 | | |

American International Group, Inc. | | | 4.9 | | |

MasterCard, Inc., Class A | | | 4.9 | | |

JPMorgan Chase & Co. | | | 4.8 | | |

FUND STATISTICS | | | |

Ticker | | OAKLX | |

Inception | | 11/01/96 | |

Number of Equity Holdings | | 20 | |

Net Assets | | $4.8 billion | |

Benchmark | | S&P 500 Index | |

Weighted Average Market Cap | | $67.8 billion | |

Median Market Cap | | $39.1 billion | |

Portfolio Turnover (for the 6-months ended 03/31/14) | | 19% | |

Expense Ratio - Class I (as of 09/30/13) | | 1.01% | |

SECTOR ALLOCATION | | % of Net Assets | |

Financials | | | 29.5 | | |

Consumer Discretionary | | | 20.2 | | |

Information Technology | | | 19.2 | | |

Energy | | | 6.9 | | |

Industrials | | | 6.6 | | |

Health Care | | | 5.2 | | |

Utilities | | | 4.3 | | |

Short-Term Investments and Other | | | 8.1 | | |

8 THE OAKMARK FUNDS

Oakmark Select Fund March 31, 2014

Portfolio Manager Commentary

William C. Nygren, CFA

Portfolio Manager

oaklx@oakmark.com

Anthony P. Coniaris, CFA

Portfolio Manager

oaklx@oakmark.com

Win Murray

Portfolio Manager

oaklx@oakmark.com

For the quarter, the Oakmark Select Fund gained 5%, compared to 2% for the S&P 500 Index2. We are pleased to report the Fund ended the quarter at a new all-time high NAV, meaning that as of 03/31/14, all current Select shareholders have unrealized gains in their holdings. These strong absolute and relative results were due in large part to Forest Laboratories (Forest) agreeing to be acquired by Actavis Plc in the quarter. Our relatively large exposure to auto-related cyclicals and financials continued to benefit our results. The largest detractors were MasterCard, Kennametal and FedEx. As discussed below, we eliminated our positions in Forest, Texas Instruments (TI) and Newfield Exploration, and we established new positions in Franklin Resources and CBRE Group (CBRE).

After returning 40% last quarter, Forest returned another 52% in the first quarter as the company agreed to be acquired by Actavis for both cash and stock. We believe the acquisition price was full and fair. While our investment thesis—that Forest's new drug launches would be successful and leverage the company's expenses—did not have the chance to transpire, we are more than pleased that the stock price reached our estimated value in short order. It's not uncommon for the management of companies in transition to resist being acquired before their strategies to create value are fully realized. We applaud the leaders at Forest for their willingness to pull forward this value, even if it denied them the personal satisfaction of seeing their efforts realized in the coming years. We believe this could serve as a lesson for the leadership of other public companies. If someone wants to pay a fair price on a risk-adjusted basis for 'what could be' in your business, you owe it to your shareholders to realize this value so that they can recycle their capital into other attractively valued investments.

At Oakmark, active management means more than just stock selection—it also involves maximizing after-tax returns and managing risk in special situations. As a case in point, we sold our Forest position in a tax-efficient manner throughout the quarter as our shares became long term holdings for tax purposes. To reduce our risk while we sold our shares, we established a short position in Actavis in proportion to the stock component of the transaction. This position was then reduced commensurate with our Forest stake until it was fully eliminated, thereby generating only long-term capital gains. We were comfortable with hedging the stock portion of our Forest position because of our belief that Actavis equity was selling closer to fair value. And unlike that of most acquirers, Actavis'

stock price rose meaningfully upon announcement of the transaction and in the days thereafter. Logic follows that Actavis shares were more likely to fall if the deal was scuttled by another bidder or some other unforeseen reason, thus providing an unusually effective hedge.

We also eliminated the remainder of our investment in TI as the final tranche of shares went long term. TI offers another example of a management team that we believe puts its shareholders first in a situation where many do not. Since its acquisition of National Semiconductor in 2011, TI has been generously returning excess capital to shareholders while maintaining a prudent, but not lazy, balance sheet. This likely contributed to their shares approaching our estimate of fair value. Many large technology companies today simply grow their already immense cash positions and offer little insight into their plans for distributing that excess capital. We believe TI set a terrific example for other companies in the technology sector. Finally, we also sold Newfield Exploration after we came to believe that its effort to transition the company to liquids was a low-return proposition that would limit its ability to grow per-share value.

We established a position in Franklin Resources, one of the world's largest global mutual fund companies, with leading products in both equities and fixed income. For starters, we believe asset management is an attractive business and Franklin has a history of strong fund performance across various asset classes and geographies. The company is selling for less than 14x our estimate of this year's EPS8 and just over 11x adjusting for net cash and securities. In our view, this is a cheap price for a well-run company in such an attractive industry. Management has historically returned capital to shareholders through stock buybacks and dividends, and with insiders owning 35% of outstanding shares, we expect Franklin to continue to be good stewards of shareholders' capital.

As the largest commercial real estate brokerage and property management company in the U.S., CBRE has the geographic reach, scale and breadth of services that very few competitors in this fragmented industry can match. Bundling its services across the globe has led to share gains, which we believe will continue. While certain business lines are more volatile, related commercial real estate activity metrics are improving. At the same time, an increasing proportion of the company's profits are coming from more stable fee-based revenues. Management has a good track record, and we believe this growing company is selling for a substantial discount to value.

oakmark.com 9

Oakmark Select Fund March 31, 2014 (Unaudited)

Schedule of Investments (in thousands)

| | | Shares | | Value | |

COMMON STOCKS - 91.9% | |

FINANCIALS - 29.5% | |

BANKS - 10.9% | |

Bank of America Corp.

Diversified Banks | | | 17,100 | | | $ | 294,120 | | |

JPMorgan Chase & Co.

Diversified Banks | | | 3,800 | | | | 230,698 | | |

| | | | | | 524,818 | | |

DIVERSIFIED FINANCIALS - 9.6% | |

Capital One Financial Corp.

Consumer Finance | | | 3,450 | | | | 266,202 | | |

Franklin Resources, Inc.

Asset Management & Custody Banks | | | 3,700 | | | | 200,466 | | |

| | | | | | 466,668 | | |

INSURANCE - 4.9% | |

American International Group, Inc.

Multi-line Insurance | | | 4,705 | | | | 235,307 | | |

REAL ESTATE - 4.1% | |

CBRE Group, Inc., Class A (a)

Real Estate Services | | | 7,200 | | | | 197,485 | | |

| | | | | | 1,424,278 | | |

CONSUMER DISCRETIONARY - 20.2% | |

AUTOMOBILES & COMPONENTS - 7.9% | |

TRW Automotive Holdings Corp. (a)

Auto Parts & Equipment | | | 4,650 | | | | 379,533 | | |

MEDIA - 7.6% | |

DIRECTV (a)

Cable & Satellite | | | 3,148 | | | | 240,566 | | |

Comcast Corp., Class A

Cable & Satellite | | | 2,650 | | | | 129,214 | | |

| | | | | | 369,780 | | |

RETAILING - 4.7% | |

Liberty Interactive Corp., Class A (a)

Catalog Retail | | | 7,800 | | | | 225,186 | | |

| | | | | | 974,499 | | |

INFORMATION TECHNOLOGY - 19.2% | |

SOFTWARE & SERVICES - 9.3% | |

MasterCard, Inc., Class A

Data Processing & Outsourced Services | | | 3,150 | | | | 235,305 | | |

Oracle Corp.

Systems Software | | | 5,200 | | | | 212,732 | | |

| | | | | | 448,037 | | |

TECHNOLOGY HARDWARE & EQUIPMENT - 6.5% | |

TE Connectivity, Ltd. (b)

Electronic Manufacturing Services | | | 5,194 | | | | 312,727 | | |

SEMICONDUCTORS & SEMICONDUCTOR EQUIPMENT - 3.4% | |

Intel Corp.

Semiconductors | | | 6,447 | | | | 166,397 | | |

| | | | | | 927,161 | | |

| | | Shares | | Value | |

ENERGY - 6.9% | |

Apache Corp.

Oil & Gas Exploration & Production | | | 3,130 | | | $ | 259,634 | | |

Cenovus Energy, Inc. (b)

Integrated Oil & Gas | | | 2,499 | | | | 72,363 | | |

| | | | | | 331,997 | | |

INDUSTRIALS - 6.6% | |

TRANSPORTATION - 4.0% | |

FedEx Corp.

Air Freight & Logistics | | | 1,450 | | | | 192,212 | | |

CAPITAL GOODS - 2.6% | |

Kennametal, Inc.

Industrial Machinery | | | 2,902 | | | | 128,556 | | |

| | | | | | 320,768 | | |

HEALTH CARE - 5.2% | |

HEALTH CARE EQUIPMENT & SERVICES - 5.2% | |

Medtronic, Inc.

Health Care Equipment | | | 4,100 | | | | 252,314 | | |

UTILITIES - 4.3% | |

Calpine Corp. (a) | | | 10,004 | | | | 209,192 | | |

Independent Power Producers & Energy Traders | |

TOTAL COMMON STOCKS - 91.9%

(COST $2,694,543) | | | | | 4,440,209 | | |

| | | Par Value | | Value | |

SHORT TERM INVESTMENTS - 7.7% | |

REPURCHASE AGREEMENT - 7.7% | |

Fixed Income Clearing Corp. Repurchase

Agreement, 0.00% dated 03/31/14

due 04/01/14, repurchase price

$369,621, collateralized by United States

Treasury Notes, 1.375% - 1.750%,

due 09/30/18 - 10/31/18, aggregate

value plus accrued interest of $377,017

(Cost: $369,621) | | | 369,621 | | | | 369,621 | | |

TOTAL SHORT TERM INVESTMENTS - 7.7%

(COST $369,621) | | | | | 369,621 | | |

TOTAL INVESTMENTS - 99.6%

(COST $3,064,164) | | | | | 4,809,830 | | |

Other Assets In Excess of Liabilities - 0.4% | | | | | 19,851 | | |

TOTAL NET ASSETS - 100.0% | | | | $ | 4,829,681 | | |

(a) Non-income producing security

(b) Foreign domiciled corporation

See accompanying Notes to Financial Statements.

10 THE OAKMARK FUNDS

This page intentionally left blank.

oakmark.com 11

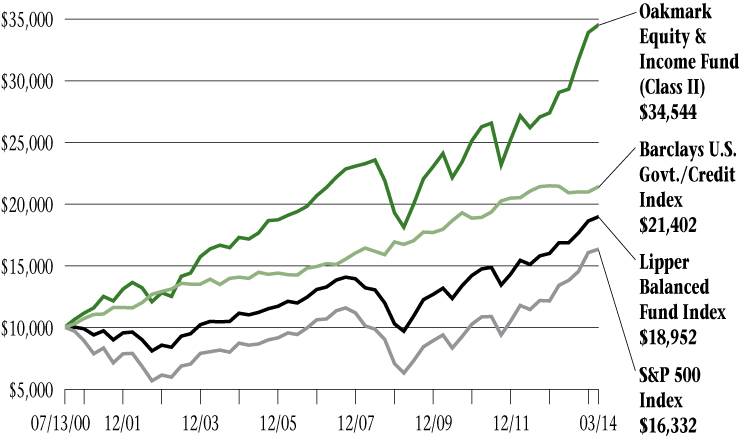

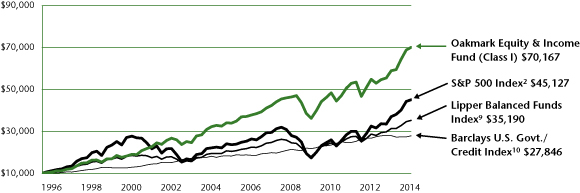

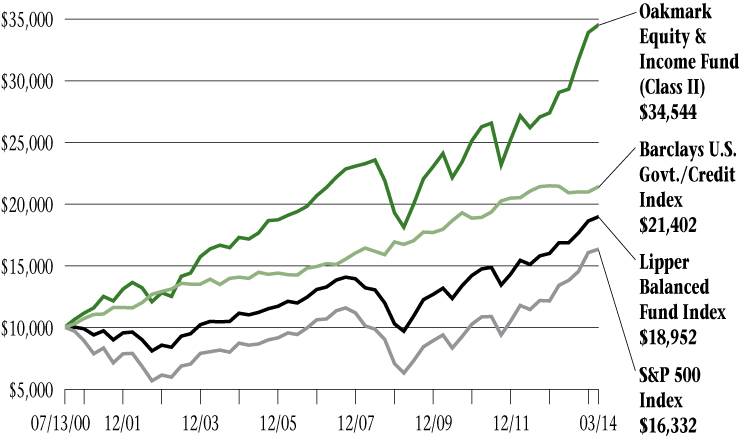

Oakmark Equity and Income Fund March 31, 2014

Summary Information

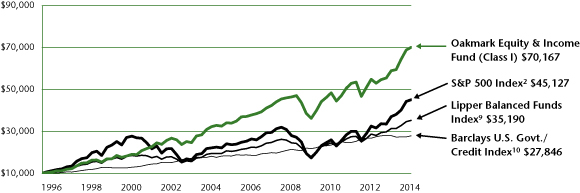

VALUE OF A $10,000 INVESTMENT

Since Inception - 11/01/95 (Unaudited)

PERFORMANCE

| | | | | Average Annual Total Returns (as of 03/31/14)3 | |

| (Unaudited) | | Total Return

Last 3 Months | | 1-year | | 3-year | | 5-year | | 10-year | | Since

Inception

(11/01/95) | |

Oakmark Equity & Income Fund (Class I) | | | 1.78 | % | | | 19.10 | % | | | 9.85 | % | | | 14.15 | % | | | 8.10 | % | | | 11.16 | % | |

Lipper Balanced Funds Index | | | 1.82 | % | | | 12.44 | % | | | 8.76 | % | | | 14.40 | % | | | 6.13 | % | | | 7.07 | % | |

S&P 500 Index | | | 1.81 | % | | | 21.86 | % | | | 14.66 | % | | | 21.16 | % | | | 7.42 | % | | | 8.53 | % | |

Barclays U.S. Govt./Credit Index | | | 1.98 | % | | | -0.26 | % | | | 4.21 | % | | | 5.07 | % | | | 4.41 | % | | | 5.72 | % | |

The graph and table above do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

Past Performance is no guarantee of future results. Performance data quoted represents past performance. Current performance may be lower or higher than the performance data quoted. The investment return and principal value vary so that an investor's shares when redeemed may be worth more or less than the original cost. To obtain the most recent month-end performance, please visit oakmark.com.

TOP TEN EQUITY HOLDINGS6 | | % of Net Assets | |

Oracle Corp. | | | 3.5 | | |

Bank of America Corp. | | | 3.2 | | |

General Motors Co. | | | 3.0 | | |

Dover Corp. | | | 2.7 | | |

FedEx Corp. | | | 2.6 | | |

Nestle SA | | | 2.5 | | |

National Oilwell Varco | | | 2.5 | | |

UnitedHealth Group, Inc. | | | 2.5 | | |

Baker Hughes, Inc. | | | 2.4 | | |

Philip Morris International, Inc. | | | 2.4 | | |

FUND STATISTICS | |

Ticker | | OAKBX | |

Inception | | 11/01/95 | |

Number of Equity Holdings | | 44 | |

Net Assets | | $20.6 billion | |

Benchmark | | Lipper Balanced Funds Index | |

Weighted Average Market Cap | | $66.0 billion | |

Median Market Cap | | $18.3 billion | |

Portfolio Turnover (for the 6-months ended 03/31/14) | | 9% | |

Expense Ratio - Class I (as of 09/30/13) | | 0.77% | |

SECTOR ALLOCATION | | % of Net Assets | |

Equity Investments | |

Industrials | | | 13.5 | | |

Consumer Discretionary | | | 10.7 | | |

Financials | | | 10.4 | | |

Consumer Staples | | | 9.4 | | |

Information Technology | | | 8.9 | | |

Energy | | | 7.0 | | |

Health Care | | | 5.5 | | |

Total Equity Investments | | | 65.4 | | |

Fixed Income Investments | |

Government and Agency Securities | | | 8.9 | | |

Corporate Bonds | | | 2.9 | | |

Asset Backed Securities | | | 0.1 | | |

Total Fixed Income Investments | | | 11.9 | | |

Short-Term Investments and Other | | | 22.7 | | |

12 THE OAKMARK FUNDS

Oakmark Equity and Income Fund March 31, 2014

Portfolio Manager Commentary

Clyde S. McGregor, CFA

Portfolio Manager

oakbx@oakmark.com

M. Colin Hudson, CFA

Portfolio Manager

oakbx@oakmark.com

Matthew A. Logan, CFA

Portfolio Manager

oakbx@oakmark.com

Edward J. Wojciechowski, CFA

Portfolio Manager

oakbx@oakmark.com

Off Target

Former Federal Reserve Chairman Paul Volcker has remarked that the only useful financial innovation over the past few decades is the ATM. While we have a slightly less extreme view, we are sympathetic to his point and are naturally suspect of new financial products and services. A recent "innovation" about which some of our shareholders have asked is the "target-date fund." A target-date fund is a mutual fund that automatically changes its asset allocation over time using a preset "glide path" such that the stock allocation is steadily reduced while the fixed income allocation is increased. The purpose of this is to automate the conventional wisdom that says investors should reduce their equity exposure as they age. We won't challenge this conventional wisdom (though some studies suggest that investors should actually increase their equity allocation throughout retirement), but we are concerned with its incorporation into the target-date model.

In our view, the problem is that a rigid adherence to a "glide path" might be prudent much of the time, but it's not prudent all of the time. Mindlessly shifting from stocks to bonds over time using a static plan fails to account for just how dynamic the world is. Bonds aren't inherently less risky than stocks, and stocks aren't inherently higher returning than bonds. It all depends on price. And as recent experience has shown, prices change a lot. During the tech bubble of the late 1990s, the S&P 500 was priced so high that the return over the next decade was actually lower than that provided by bonds. Conversely, at the start of last year when interest rates were near record lows, bonds not only were priced to offer paltry returns relative to equities, but they also presented considerable risk, as a modest rise in rates would lower the value of bonds and more than offset the income earned.

It's not just this problematic passive approach to asset allocation that concerns us. We are also concerned that target-date funds emphasize asset allocation to the point of distracting investors from focusing on the performance of the assets within the allocation. Investors should pay close attention to the composition of a target-date fund, as the whole will perform no better than the weighted average of the parts (i.e., the equity "sleeve" and the fixed income "sleeve").

Unlike target-date funds, the Oakmark Equity and Income Fund has a flexible asset allocation policy (equities can range from 40% to 75% of the Fund, while fixed income and cash can vary between 25% and 60%); a relentless focus on security selection within each asset class (with a long record of outstanding equity performance); its managers' interests are aligned with shareholders through sizeable personal investments (not typically found in target-date funds); and the Fund's expense ratio

is 15% lower than that of the average target-date fund (based on Morningstar's analysis of the 2012 average). We believe these factors are critical advantages over target-date funds and that they will help us achieve our goal of producing competitive absolute returns over the long run for our shareholders.

Quarter Review

During the quarter, the S&P 5002 was up a modest 2%. While that result hardly seems noteworthy, underlying it was a reasonable amount of volatility, including intra-quarter swings in excess of 5% due largely to geopolitical concerns. As one would expect in this environment, fixed income securities did well. Over this time period, the Equity & Income Fund returned 2%, which was in line with the Lipper Balanced Fund Index's9 return of 2%.

Top contributors to the Fund's return this quarter were Baker Hughes, General Dynamics, Bank of America, Oracle and UnitedHealth Group, while detractors included General Motors, MasterCard, FedEx, Scripps Network and Philip Morris International. Based solely on the individual stock's total return, Ultra Petroleum, Baker Hughes, Bruker, General Dynamics and HNI led the pack with Blount, General Motors, Atlas Air, Scripps Networks and MasterCard bringing up the rear. In the case of both lists, the causes of the stand-out performances were stock specific with no overarching investment themes of note.

GM is one laggard worth touching on, given its size in the portfolio. After advancing sharply in 2013, GM shares fell early in the quarter after management projected 2014 earnings that were lower than many investors were expecting, largely as a result of transient factors. Shares were further pressured in the quarter after it came to light that GM potentially mishandled a recall of discontinued models. While we obviously aren't pleased with either development, we believe GM's low valuation (its shares trade at just seven times consensus estimates for next year's earnings) more than compensates for these issues, and we remain comfortable with it being a top holding of the Fund.

Transaction Activity

After spending much of 2013 with an equity weighting near the Fund's prospectus maximum of 75%, we have moved the equity allocation down to 65%. Following last year's strong upward move in the market, we believe valuations are generally less attractive on a risk-adjusted basis, and we are therefore finding more stocks meeting our sell criteria than our buy criteria.

The Fund eliminated six positions this quarter: three that worked out well (Cimarex Energy, Concho Resources and Crane) and three that didn't (Encana, Hospira and Quest Diagnostics). Cimarex and Concho are oil and gas companies where the Fund invested with what we believe are strong management

oakmark.com 13

Oakmark Equity and Income Fund March 31, 2014

Portfolio Manager Commentary (continued)

teams for long-term and highly successful investments. We would like to thank both management teams for their contributions to the Fund's returns. The last winner—and in this case the least (in terms of weightings)—is Crane. Crane was purchased with the idea that its transition from a holding company with a collection of high quality, niche businesses to a fully integrated, operations-focused business would result in high returns, improved margins and a better stock price. Almost immediately upon initiating a position, the market came to similar conclusions, and we were unable to establish a meaningful position.

Hospira was a longtime holding of the Fund, tracing its roots back to the Fund's investment in Abbott Laboratories, which spun-off Hospira ten years ago. Over the past few years, the company suffered from numerous manufacturing quality issues that caused us to lower our appraisal of value. After management made considerable progress remedying those issues, the stock approached our new, lower sell target, and we exited the position. In the case of Encana and Quest Diagnostics, fundamental underperformance caused us to reexamine our investment cases. We have discussed Encana in previous letters, but a combination of significant management changes, pipeline politics and the exploding growth of North American shale gas production caused us to redeploy the money elsewhere. With Quest, its weakening market share and tougher industry conditions caused us to reduce our exposure to this industry.

We added two new stocks of significance to the portfolio: Knowles and Wells Fargo. With Knowles, a supplier of acoustic solutions to mobile phone makers and hearing aid manufacturers, we didn't buy the shares on the open market, but rather received them through a tax-free spinoff from longtime Oakmark Equity and Income Fund holding Dover Corporation. Even though Dover prides itself on being a diversified industrial company with businesses ranging from drilling equipment for oil and gas companies to refrigerators for retailers, the company decided Knowles could best create shareholder value as a standalone company. Knowles has grown rapidly over the years as consumers demand higher acoustic features in each new generation of smartphones and hearing aids, and we expect this trend to continue, which should drive above average top-line growth. Aided by their Dover experience, Knowles' management team should, in our view, continue to operate the business well and allocate capital wisely.

Our other material addition, Wells Fargo, is the second-largest deposit bank in the United States, holding over 10% of the nation's deposits. We think Wells Fargo has one of the best franchises in retail banking, driven by high local market shares and a relentless focus on cross-selling other banking products like mortgages and credit cards, which increases customer "stickiness." Due to its low-cost deposit base and strong management team, Wells Fargo has earned consistently high returns on equity and, through its purchase of Wachovia (a geographically complementary bank), it was one of the few financial companies able to take advantage of the financial crisis to grow its earning power per share. We believe that its significant capital base and relatively simple business model should enable Wells Fargo to continue to produce strong results.

We thank our shareholders for their support and welcome their questions and comments.

14 THE OAKMARK FUNDS

Oakmark Equity and Income Fund March 31, 2014 (Unaudited)

Schedule of Investments (in thousands)

| | | Shares | | Value | |

COMMON STOCKS - 65.4% | |

INDUSTRIALS - 13.5% | |

CAPITAL GOODS - 8.8% | |

Dover Corp.

Industrial Machinery | | | 6,744 | | | $ | 551,332 | | |

General Dynamics Corp.

Aerospace & Defense | | | 4,226 | | | | 460,279 | | |

Rockwell Automation Inc.

Electrical Components & Equipment | | | 2,620 | | | | 326,259 | | |

Parker Hannifin Corp.

Industrial Machinery | | | 2,122 | | | | 254,079 | | |

Illinois Tool Works, Inc.

Industrial Machinery | | | 2,498 | | | | 203,195 | | |

Blount International, Inc. (a)

Industrial Machinery | | | 2,263 | | | | 26,935 | | |

| | | | | | 1,822,079 | | |

TRANSPORTATION - 4.4% | |

FedEx Corp.

Air Freight & Logistics | | | 4,016 | | | | 532,382 | | |

Union Pacific Corp.

Railroads | | | 1,846 | | | | 346,327 | | |

Atlas Air Worldwide Holdings, Inc. (a)

Air Freight & Logistics | | | 800 | | | | 28,216 | | |

| | | | | | 906,925 | | |

COMMERCIAL & PROFESSIONAL SERVICES - 0.3% | |

Herman Miller, Inc.

Office Services & Supplies | | | 1,402 | | | | 45,033 | | |

HNI Corp.

Office Services & Supplies | | | 198 | | | | 7,246 | | |

| | | | | | 52,279 | | |

| | | | | | 2,781,283 | | |

CONSUMER DISCRETIONARY - 10.7% | |

AUTOMOBILES & COMPONENTS - 6.8% | |

General Motors Co.

Automobile Manufacturers | | | 18,122 | | | | 623,759 | | |

BorgWarner, Inc.

Auto Parts & Equipment | | | 6,457 | | | | 396,936 | | |

Lear Corp. (b)

Auto Parts & Equipment | | | 4,424 | | | | 370,349 | | |

| | | | | | 1,391,044 | | |

RETAILING - 2.3% | |

Foot Locker, Inc. (b)

Apparel Retail | | | 7,711 | | | | 362,253 | | |

HSN, Inc.

Catalog Retail | | | 1,937 | | | | 115,706 | | |

| | | | | | 477,959 | | |

MEDIA - 1.4% | |

Scripps Networks Interactive, Inc., Class A

Broadcasting | | | 3,831 | | | | 290,841 | | |

| | | Shares | | Value | |

CONSUMER DURABLES & APPAREL - 0.2% | |

Carter's, Inc.

Apparel, Accessories & Luxury Goods | | | 664 | | | $ | 51,583 | | |

| | | | | | 2,211,427 | | |

FINANCIALS - 10.4% | |

BANKS - 5.2% | |

Bank of America Corp.

Diversified Banks | | | 38,426 | | | | 660,926 | | |

Wells Fargo & Co.

Diversified Banks | | | 4,326 | | | | 215,175 | | |

U.S. Bancorp

Diversified Banks | | | 4,461 | | | | 191,191 | | |

| | | | | | 1,067,292 | | |

DIVERSIFIED FINANCIALS - 3.1% | |

TD Ameritrade Holding Corp.

Investment Banking & Brokerage | | | 12,006 | | | | 407,618 | | |

Bank of New York Mellon Corp.

Asset Management & Custody Banks | | | 6,851 | | | | 241,770 | | |

| | | | | | 649,388 | | |

INSURANCE - 2.1% | |

Principal Financial Group, Inc.

Life & Health Insurance | | | 5,061 | | | | 232,769 | | |

Aflac, Inc.

Life & Health Insurance | | | 3,130 | | | | 197,334 | | |

| | | | | | 430,103 | | |

| | | | | | 2,146,783 | | |

CONSUMER STAPLES - 9.4% | |

FOOD, BEVERAGE & TOBACCO - 7.3% | |

Nestle SA (c)

Packaged Foods & Meats | | | 6,956 | | | | 523,238 | | |

Philip Morris International, Inc.

Tobacco | | | 5,915 | | | | 484,253 | | |

Diageo PLC (c)

Distillers & Vintners | | | 3,883 | | | | 483,833 | | |

| | | | | | 1,491,324 | | |

FOOD & STAPLES RETAILING - 2.1% | |

CVS Caremark Corp.

Drug Retail | | | 5,842 | | | | 437,306 | | |

| | | | | | 1,928,630 | | |

INFORMATION TECHNOLOGY - 8.9% | |

SOFTWARE & SERVICES - 6.4% | |

Oracle Corp.

Systems Software | | | 17,795 | | | | 727,993 | | |

MasterCard, Inc., Class A

Data Processing & Outsourced Services | | | 5,350 | | | | 399,614 | | |

Broadridge Financial Solutions, Inc.

Data Processing & Outsourced Services | | | 5,082 | | | | 188,753 | | |

| | | | | | 1,316,360 | | |

See accompanying Notes to Financial Statements.

oakmark.com 15

Oakmark Equity and Income Fund March 31, 2014 (Unaudited)

Schedule of Investments (in thousands) (continued)

| | | Shares | | Value | |

COMMON STOCKS - 65.4% (continued) | |

INFORMATION TECHNOLOGY - 8.9% (continued) | |

TECHNOLOGY HARDWARE & EQUIPMENT - 2.5% | |

TE Connectivity, Ltd. (d)

Electronic Manufacturing Services | | | 6,797 | | | $ | 409,223 | | |

Knowles Corp. (a)

Electronic Components | | | 3,372 | | | | 106,456 | | |

| | | | | | 515,679 | | |

| | | | | | 1,832,039 | | |

ENERGY - 7.0% | |

National Oilwell Varco, Inc.

Oil & Gas Equipment & Services | | | 6,662 | | | | 518,789 | | |

Baker Hughes, Inc.

Oil & Gas Equipment & Services | | | 7,487 | | | | 486,785 | | |

Devon Energy Corp.

Oil & Gas Exploration & Production | | | 3,749 | | | | 250,901 | | |

Ultra Petroleum Corp. (a)

Oil & Gas Exploration & Production | | | 5,117 | | | | 137,604 | | |

Rowan Cos. PLC (a)

Oil & Gas Drilling | | | 1,555 | | | | 52,372 | | |

| | | | | | 1,446,451 | | |

HEALTH CARE - 5.5% | |

HEALTH CARE EQUIPMENT & SERVICES - 5.1% | |

UnitedHealth Group, Inc.

Managed Health Care | | | 6,246 | | | | 512,072 | | |

Omnicare, Inc.

Health Care Services | | | 4,720 | | | | 281,666 | | |

Laboratory Corp. of America Holdings (a)

Health Care Services | | | 1,430 | | | | 140,470 | | |

Varian Medical Systems, Inc. (a)

Health Care Equipment | | | 1,390 | | | | 116,722 | | |

| | | | | | 1,050,930 | | |

PHARMACEUTICALS, BIOTECHNOLOGY & LIFE SCIENCES - 0.4% | |

Bruker Corp. (a)

Life Sciences Tools & Services | | | 3,130 | | | | 71,321 | | |

| | | | | | 1,122,251 | | |

TOTAL COMMON STOCKS - 65.4%

(COST $8,247,576) | | | | | 13,468,864 | | |

| | | Par Value | | Value | |

FIXED INCOME - 11.9% | |

GOVERNMENT AND AGENCY SECURITIES - 8.9% | |

U.S. GOVERNMENT NOTES - 7.8% | |

1.375%, due 07/15/18, Inflation Indexed | | | 540,629 | | | | 586,582 | | |

1.25%, due 07/15/20, Inflation Indexed | | | 534,568 | | | | 576,080 | | |

2.125%, due 01/15/19, Inflation Indexed | | | 217,199 | | | | 242,550 | | |

1.00%, due 09/30/16 | | | 199,380 | | | | 201,000 | | |

| | | | | | 1,606,212 | | |

| | | Par Value | | Value | |

U.S. GOVERNMENT AGENCIES - 0.9% | |

Federal Home Loan Bank,

1.65%, due 07/18/19 | | | 29,550 | | | $ | 28,934 | | |

Federal Home Loan Bank,

1.00%, due 03/26/19 | | | 26,350 | | | | 26,143 | | |

Federal National Mortgage Association,

1.25%, due 09/27/18 | | | 24,680 | | | | 24,255 | | |

Federal Home Loan Mortgage Corp.,

2.50%, due 10/17/19 | | | 23,850 | | | | 24,076 | | |

Federal Home Loan Mortgage Corp.,

1.50%, due 02/28/19 | | | 21,750 | | | | 21,619 | | |

Federal National Mortgage Association,

1.125%, due 07/18/18 | | | 9,825 | | | | 9,834 | | |

Federal Home Loan Bank,

0.625%, due 02/14/19 | | | 9,400 | | | | 9,385 | | |

Federal Home Loan Bank,

1.625%, due 02/21/19 | | | 9,400 | | | | 9,354 | | |

Federal National Mortgage Association,

1.00%, due 01/30/20 | | | 9,525 | | | | 9,228 | | |

Federal Home Loan Bank,

1.00%, due 03/27/23 | | | 6,500 | | | | 6,418 | | |

Federal Home Loan Bank,

1.00%, due 04/15/20 | | | 6,500 | | | | 6,391 | | |

| | | | | | 175,637 | | |

CANADIAN GOVERNMENT BONDS - 0.2% | |

4.25%, due 12/01/21,

Inflation Indexed | | CAD | 36,936 | | | | 43,943 | | |

Total Government and Agency Securities

(Cost $1,723,430) | | | | | 1,825,792 | | |

CORPORATE BONDS - 2.9% | |

Kinetic Concepts, Inc.,

10.50%, due 11/01/18 | | | 47,940 | | | | 55,071 | | |

General Motors Co., 144A,

4.875%, due 10/02/23 (e) | | | 41,400 | | | | 42,435 | | |

Fifth & Pacific Cos., Inc.,

10.50%, due 04/15/19 | | | 34,403 | | | | 36,338 | | |

Delphi Corp.,

6.125%, due 05/15/21 | | | 32,016 | | | | 35,618 | | |

Omnicare, Inc.,

7.75%, due 06/01/20 | | | 31,448 | | | | 34,593 | | |

Credit Suisse Group AG, 144A,

7.50%, due 12/31/49 (e) (f) | | | 30,000 | | | | 32,587 | | |

Omnicom Group, Inc.,

3.625%, due 05/01/22 | | | 30,425 | | | | 30,215 | | |

General Motors Co., 144A,

3.50%, due 10/02/18 (e) | | | 29,525 | | | | 30,079 | | |

CVS Caremark Corp.,

4.00%, due 12/05/23 | | | 29,325 | | | | 29,962 | | |

The William Carter Co., 144A,

5.25%, due 08/15/21 (e) | | | 28,002 | | | | 28,807 | | |

Denbury Resources, Inc.,

8.25%, due 02/15/20 | | | 21,771 | | | | 23,676 | | |

Triumph Group, Inc.,

8.625%, due 07/15/18 | | | 21,000 | | | | 22,260 | | |

Penn National Gaming, Inc., 144A,

5.875%, due 11/01/21 (e) | | | 20,000 | | | | 19,650 | | |

The Manitowoc Co., Inc.,

8.50%, due 11/01/20 | | | 17,075 | | | | 19,167 | | |

See accompanying Notes to Financial Statements.

16 THE OAKMARK FUNDS

Oakmark Equity and Income Fund March 31, 2014 (Unaudited)

Schedule of Investments (in thousands) (continued)

| | | Par Value | | Value | |

FIXED INCOME - 11.9% (continued) | |

CORPORATE BONDS - 2.9% (continued) | |

DIRECTV Holdings LLC / DIRECTV

Financing Co., Inc.,

5.00%, due 03/01/21 | | | 16,710 | | | $ | 17,966 | | |

Kinetic Concepts, Inc.,

12.50%, due 11/01/19 | | | 14,360 | | | | 16,693 | | |

GLP Capital, LP / GLP Financing II,

Inc., 144A,

5.375%, due 11/01/23 (e) | | | 12,000 | | | | 12,330 | | |

Howard Hughes Corp., 144A,

6.875%, due 10/01/21 (e) | | | 10,000 | | | | 10,800 | | |

Live Nation Entertainment, Inc., 144A,

7.00%, due 09/01/20 (e) | | | 9,605 | | | | 10,505 | | |

GLP Capital, LP / GLP Financing II, Inc., 144A,

4.875%, due 11/01/20 (e) | | | 10,000 | | | | 10,262 | | |

Six Flags Entertainment Corp., 144A,

5.25%, due 01/15/21 (e) | | | 9,970 | | | | 10,045 | | |

Health Net, Inc.,

6.375%, due 06/01/17 | | | 8,680 | | | | 9,440 | | |

Concho Resources, Inc.,

5.50%, due 10/01/22 | | | 6,980 | | | | 7,277 | | |

Activision Blizzard, Inc., 144A,

5.625%, due 09/15/21 (e) | | | 5,875 | | | | 6,286 | | |

Activision Blizzard, Inc., 144A,

6.125%, due 09/15/23 (e) | | | 5,505 | | | | 5,994 | | |

Scotiabank Peru SA, 144A,

4.50%, due 12/13/27 (e) (f) | | | 6,000 | | | | 5,490 | | |

Serta Simmons Holdings LLC, 144A,

8.125%, due 10/01/20 (e) | | | 4,990 | | | | 5,483 | | |

Quest Diagnostics, Inc.,

4.70%, due 04/01/21 | | | 5,128 | | | | 5,450 | | |

GLP Capital, LP / GLP Financing II, Inc., 144A,

4.375%, due 11/01/18 (e) | | | 5,000 | | | | 5,131 | | |

Walter Energy, Inc.,

9.875%, due 12/15/20 | | | 5,390 | | | | 3,544 | | |

Walter Energy, Inc.,

8.50%, due 04/15/21 | | | 5,000 | | | | 3,150 | | |

Quiksilver, Inc. / QS Wholesale, Inc., 144A,

7.875%, due 08/01/18 (e) | | | 2,000 | | | | 2,175 | | |

Quiksilver, Inc. / QS Wholesale, Inc.,

10.00%, due 08/01/20 | | | 1,000 | | | | 1,138 | | |

Post Holdings, Inc.,

7.375%, due 02/15/22 | | | 1,000 | | | | 1,075 | | |

Post Holdings, Inc., 144A,

6.75%, due 12/01/21 (e) | | | 1,000 | | | | 1,059 | | |

Foot Locker, Inc.,

8.50%, due 01/15/22 (b) | | | 395 | | | | 470 | | |

CNO Financial Group, Inc., 144A,

6.375%, due 10/01/20 (e) | | | 250 | | | | 266 | | |

Hologic, Inc.,

6.25%, due 08/01/20 | | | 250 | | | | 264 | | |

Tempur Sealy International, Inc.,

6.875%, due 12/15/20 | | | 100 | | | | 109 | | |

Total Corporate Bonds (Cost $578,309) | | | | | 592,860 | | |

| | | Par Value | | Value | |

ASSET BACKED SECURITIES - 0.1% | |

Cabela's Master Credit Card Trust, 144A,

0.705%, due 10/15/19 (e) (f)

(Cost $11,450) | | | 11,450 | | | $ | 11,533 | | |

CONVERTIBLE BOND - 0.0%(g) | |

Live Nation Entertainment, Inc.,

2.875%, due 07/15/27

(Cost $834) | | | 828 | | | | 841 | | |

TOTAL FIXED INCOME - 11.9%

(COST $2,314,023) | | | | | 2,431,026 | | |

SHORT TERM INVESTMENTS - 22.4% | |

COMMERCIAL PAPER - 15.8% | |

Toyota Motor Credit Corp.,

0.08% - 0.16%,

due 04/02/14 - 06/20/14 (h) | | | 1,200,000 | | | | 1,199,855 | | |

MetLife, Inc., 144A, 0.10% - 0.15%,

due 04/07/14 - 06/18/14 (e) (h) | | | 523,000 | | | | 522,938 | | |

BMW US Capital LLC, 144A,

0.09% - 0.11%,

due 04/10/14 - 06/17/14 (e) (h) | | | 480,700 | | | | 480,603 | | |

Philip Morris International, Inc., 144A,

0.10% - 0.14%,

due 04/17/14 - 05/15/14 (e) (h) | | | 249,900 | | | | 249,879 | | |

J.P. Morgan Securities LLC, 0.28% - 0.33%,

due 06/16/14 - 08/01/14 (h) | | | 175,000 | | | | 174,896 | | |

Kellogg Co., 144A, 0.13% - 0.20%,

due 04/03/14 - 06/05/14 (e) (h) | | | 163,916 | | | | 163,868 | | |

State Street Corp., 0.13% - 0.14%,

due 05/12/14 - 06/12/14 (h) | | | 150,000 | | | | 149,969 | | |

General Mills Inc., 144A, 0.10%,

due 04/01/14 - 04/04/14 (e) (h) | | | 135,000 | | | | 135,000 | | |

BP Capital Markets PLC, 144A,

0.09% - 0.11%,

due 04/14/14 (e) (h) | | | 78,000 | | | | 77,997 | | |

Wellpoint, Inc., 144A, 0.18% - 0.25%,

due 04/04/14 - 05/06/14 (e) (h) | | | 50,000 | | | | 49,995 | | |

Chevron Corp., 144A, 0.07%,

due 04/01/14 (e) (h) | | | 30,800 | | | | 30,800 | | |

J.P. Morgan Securities LLC, 144A,

0.18% - 0.30%,

due 05/27/14 - 06/19/14 (e) (h) | | | 30,000 | | | | 29,988 | | |

Total Commercial Paper (Cost $3,265,760) | | | | | 3,265,788 | | |

See accompanying Notes to Financial Statements.

oakmark.com 17

Oakmark Equity and Income Fund March 31, 2014 (Unaudited)

Schedule of Investments (in thousands) (continued)

| | | Par Value | | Value | |

SHORT TERM INVESTMENTS - 22.4% (continued) | |

REPURCHASE AGREEMENT - 4.6% | |

Fixed Income Clearing Corp. Repurchase

Agreement, 0.00% dated 03/31/14 due

04/01/14, repurchase price $954,800,

collateralized by a Federal Home Loan

Bank Bond, 0.150%, due 03/30/15,

value plus accrued interest of $150,750,

by a Freddie Mac Discount Note, 0.000%,

due 12/04/14, value plus accrued interest

of $329,917, by a United States Treasury

Bill, 0.000%, due 02/05/15, value plus

accrued interest of $20,979, by United States

Treasury Notes, 0.375% - 4.125%,

due 01/31/15 - 06/30/15, aggregate

value plus accrued interest of $472,252

(Cost: $954,800) | | | 954,800 | | | $ | 954,800 | | |

CORPORATE BONDS - 2.0% | |

Capital One Financial Corp.,

2.13%, due 07/15/14 | | | 75,095 | | | | 75,440 | | |

Citigroup, Inc.,

5.00%, due 09/15/14 | | | 53,700 | | | | 54,740 | | |

Capital One Financial Corp.,

7.38%, due 05/23/14 | | | 46,941 | | | | 47,391 | | |

DIRECTV Holdings LLC / DIRECTV

Financing Co., Inc.,

4.75%, due 10/01/14 | | | 45,459 | | | | 46,348 | | |

Merrill Lynch & Co., Inc.,

5.45%, due 07/15/14 | | | 43,637 | | | | 44,250 | | |

Ford Motor Credit Co. LLC,

3.88%, due 01/15/15 | | | 31,481 | | | | 32,233 | | |

The Goldman Sachs Group, Inc.,

6.00%, due 05/01/14 | | | 26,678 | | | | 26,801 | | |

Ford Motor Credit Co. LLC,

8.00%, due 06/01/14 | | | 24,073 | | | | 24,366 | | |

Anheuser-Busch InBev Worldwide, Inc.,

1.50%, due 07/14/14 | | | 18,200 | | | | 18,251 | | |

BP Capital Markets PLC,

3.63%, due 05/08/14 | | | 14,500 | | | | 14,549 | | |

United Parcel Service, Inc.,

3.88%, due 04/01/14 | | | 13,075 | | | | 13,075 | | |

ConocoPhillips,

4.60%, due 01/15/15 | | | 10,826 | | | | 11,176 | | |

International Lease Finance Corp.,

5.65%, due 06/01/14 | | | 5,425 | | | | 5,460 | | |

Total Corporate Bonds

(Cost $414,132) | | | | | 414,080 | | |

TOTAL SHORT TERM INVESTMENTS - 22.4%

(COST $4,634,692) | | | | | 4,634,668 | | |

TOTAL INVESTMENTS - 99.7%

(COST $15,196,291) | | | | | 20,534,558 | | |

Foreign Currencies (Cost $0) - 0.0% (g) | | | | | 0 | (i) | |

Other Assets In Excess of Liabilities - 0.3% | | | | | 61,757 | | |

NET ASSETS - 100.0% | | | | $ | 20,596,315 | | |

(a) Non-income producing security

(b) See Note 5 in the Notes to Financial Statements regarding investments in affiliated issuers.

(c) Sponsored American Depositary Receipt

(d) Foreign domiciled corporation

(e) See Note 1 in the Notes to Financial Statements regarding restricted securities. These securities may be resold subject to restrictions on resale under federal securities law.

(f) Floating Rate Note. Rate shown is as of March 31, 2014.

(g) Amount rounds to less than 0.1%.

(h) The rate shown represents the annualized yield at the time of purchase; not a coupon rate.

(i) Amount rounds to less than $1,000.

Key to Abbreviations:

CAD Canadian Dollar

See accompanying Notes to Financial Statements.

18 THE OAKMARK FUNDS

This page intentionally left blank.

oakmark.com 19

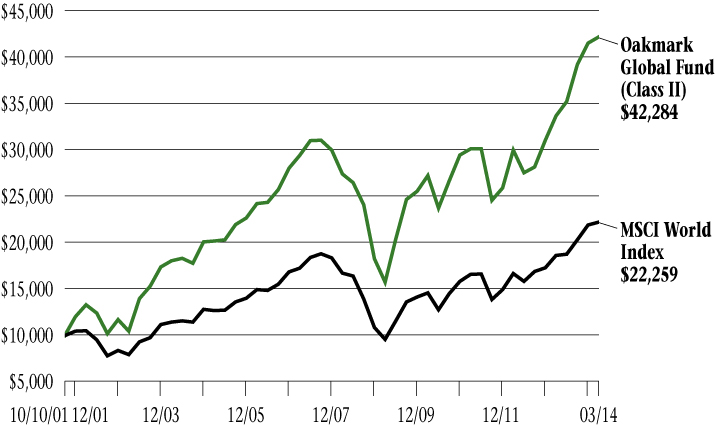

Oakmark Global Fund March 31, 2014

Summary Information

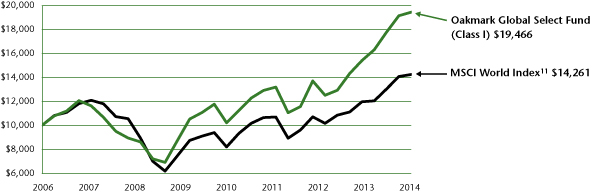

VALUE OF A $10,000 INVESTMENT

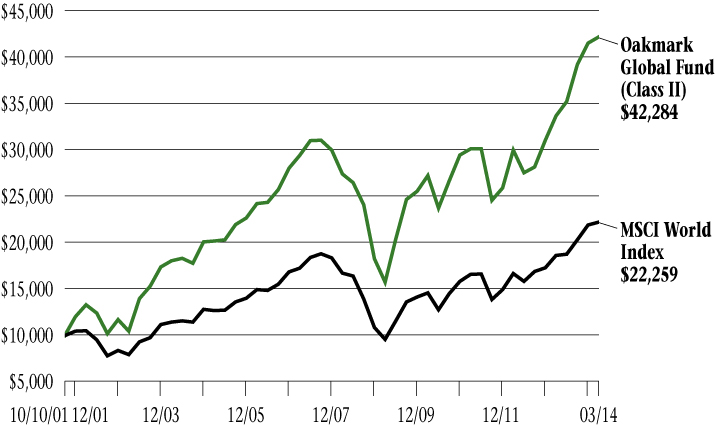

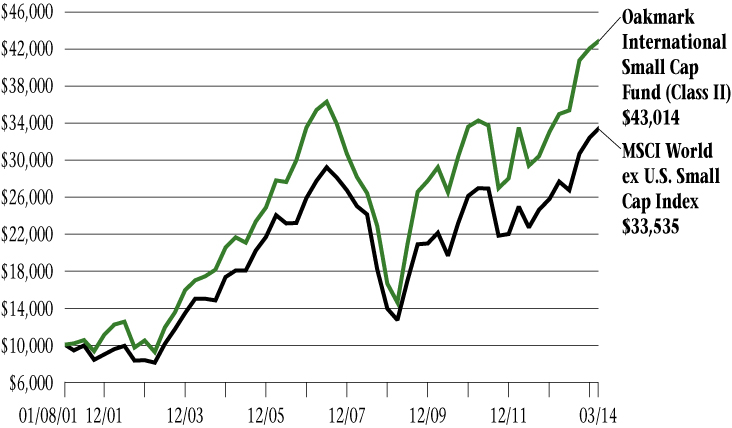

Since Inception - 08/04/99 (Unaudited)

PERFORMANCE

| | | | Average Annual Total Returns (as of 03/31/14)3 | |

| (Unaudited) | | Total Return

Last 3 Months | | 1-year | | 3-year | | 5-year | | 10-year | | Since

Inception

(08/04/99) | |

Oakmark Global Fund (Class I) | | | 1.69 | % | | | 25.78 | % | | | 12.25 | % | | | 22.18 | % | | | 9.22 | % | | | 11.73 | % | |

MSCI World Index | | | 1.26 | % | | | 19.07 | % | | | 10.23 | % | | | 18.28 | % | | | 6.83 | % | | | 4.04 | % | |

Lipper Global Funds Index12 | | | 1.75 | % | | | 19.41 | % | | | 8.38 | % | | | 17.06 | % | | | 6.92 | % | | | 5.07 | % | |

The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

Past performance is no guarantee of future results. Performance data quoted represents past performance. Current performance may be lower or higher than the performance data quoted. The investment return and principal value vary so that an investor's shares when redeemed may be worth more or less than the original cost. To obtain the most recent month-end performance data, visit oakmark.com.

TOP TEN EQUITY HOLDINGS6 | | % of Net Assets | |

Oracle Corp. | | | 5.3 | | |

Credit Suisse Group | | | 5.0 | | |

Julius Baer Group, Ltd. | | | 3.7 | | |

CNH Industrial N.V. | | | 3.6 | | |

TE Connectivity, Ltd. | | | 3.6 | | |

General Motors Co. | | | 3.4 | | |

MasterCard, Inc., Class A | | | 3.3 | | |

Union Pacific Corp. | | | 3.0 | | |

Bank of America Corp. | | | 3.0 | | |

Fugro N.V. | | | 3.0 | | |

FUND STATISTICS | |

Ticker | | OAKGX | |

Inception | | 08/04/99 | |

Number of Equity Holdings | | 43 | |

Net Assets | | $3.4 billion | |

Benchmark | | MSCI World Index | |

Weighted Average Market Cap | | $60.9 billion | |

Median Market Cap | | $24.7 billion | |

Portfolio Turnover (for the 6-months ended 03/31/14) | | 17% | |

Expense Ratio - Class I (as of 09/30/13) | | 1.13% | |

SECTOR ALLOCATION | | % of Net Assets | |

Information Technology | | | 23.4 | | |

Financials | | | 18.6 | | |

Industrials | | | 16.7 | | |

Consumer Discretionary | | | 12.3 | | |

Materials | | | 7.5 | | |

Consumer Staples | | | 7.3 | | |

Energy | | | 7.2 | | |

Health Care | | | 5.9 | | |

Short-Term Investments and Other | | | 1.1 | | |

GEOGRAPHIC ALLOCATION | |

| | | % of Equity | |

North America | | | 42.5 | | |

United States | | | 42.5 | | |

Europe | | | 39.8 | | |

Switzerland | | | 20.3 | | |

Netherlands* | | | 7.8 | | |

U.K. | | | 4.7 | | |

Germany* | | | 4.4 | | |

France* | | | 2.6 | | |

| | | % of Equity | |

Asia | | | 14.9 | | |

Japan | | | 12.4 | | |

South Korea | | | 2.5 | | |

Australasia | | | 2.8 | | |

Australia | | | 2.8 | | |