UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

| Investment Company Act file number: | 811-06324 |

| |

| Exact name of registrant as specified in charter: | Delaware Group® Global & International Funds |

| |

| Address of principal executive offices: | 2005 Market Street |

| Philadelphia, PA 19103 |

| |

| Name and address of agent for service: | David F. Connor, Esq. |

| 2005 Market Street |

| Philadelphia, PA 19103 |

| |

| Registrant’s telephone number, including area code: | (800) 523-1918 |

| |

| Date of fiscal year end: | November 30 |

| |

| Date of reporting period: | November 30, 2012 |

Item 1. Reports to Stockholders

Annual report Delaware Emerging Markets Fund

Delaware Global Value Fund

Delaware International Value Equity Fund November 30, 2012 Global / international equity mutual funds |

Carefully consider the Funds’ investment objectives, risk factors, charges, and expenses before investing. This and other information can be found in the Funds’ prospectuses and, if available, their summary prospectuses, which may be obtained by visiting delawareinvestments.com or calling 800 523-1918. Investors should read the prospectus and, if available, the summary prospectus carefully before investing. |

You can obtain shareholder reports and prospectuses online instead of in the mail.

Visit delawareinvestments.com/edelivery. |

Experience Delaware Investments

Delaware Investments is committed to the pursuit of consistently superior asset management and unparalleled client service. We believe in our investment processes, which seek to deliver consistent results, and in convenient services that help add value for our clients.

If you are interested in learning more about creating an investment plan, contact your financial advisor.

You can learn more about Delaware Investments or obtain a prospectus for Delaware International Value Equity Fund, Delaware Emerging Markets Fund, and Delaware Global Value Fund at delawareinvestments.com.

Manage your investments online

- 24-hour access to your account information

- Obtain share prices

- Check your account balance and recent transactions

- Request statements or literature

- Make purchases and redemptions

Delaware Management Holdings, Inc. and its subsidiaries (collectively known by the marketing name of Delaware Investments) are wholly owned subsidiaries of Macquarie Group Limited, a global provider of banking, financial, advisory, investment and funds management services.

Investments in Delaware International Value Equity Fund, Delaware Emerging Markets Fund, and Delaware Global Value Fund are not and will not be deposits with or liabilities of Macquarie Bank Limited ABN 46 008 583 542 and its holding companies, including their subsidiaries or related companies (Macquarie Group), and are subject to investment risk, including possible delays in repayment and loss of income and capital invested. No Macquarie Group company guarantees or will guarantee the performance of the Funds, the repayment of capital from the Funds, or any particular rate of return.

| Table of contents | |

| Portfolio management review | 1 |

| Performance summaries | 10 |

| Disclosure of Fund expenses | 20 |

| Security type/country and sector allocations | 23 |

| Statements of net assets | 29 |

| Statements of operations | 50 |

| Statements of changes in net assets | 52 |

| Financial highlights | 58 |

| Notes to financial statements | 86 |

| Report of independent registered | |

| public accounting firm | 102 |

| Other Fund information | 103 |

| Board of trustees/directors and | |

| officers addendum | 110 |

| About the organization | 118 |

Unless otherwise noted, views expressed herein are current as of Nov. 30 2012, and subject to change.

Funds are not FDIC insured and are not guaranteed. It is possible to lose the principal amount invested.

Mutual fund advisory services provided by Delaware Management Company, a series of Delaware Management Business Trust, which is a registered investment advisor. Delaware Investments, a member of Macquarie Group, refers to Delaware Management Holdings, Inc. and its subsidiaries, including the Funds’ distributor, Delaware Distributors, L.P. Macquarie Group refers to Macquarie Group Limited and its subsidiaries and affiliates worldwide.

© 2013 Delaware Management Holdings, Inc.

All third-party marks cited are the property of their respective owners.

| Portfolio management review | |

| Delaware International Value Equity Fund | December 11, 2012 |

| Performance preview (for the year ended November 30, 2012) | | | |

| Delaware International Value Equity Fund (Class A shares) | 1-year return | | +10.25 | % |

| MSCI EAFE Index (gross) | 1-year return | | +13.16 | % |

| MSCI EAFE Index (net) | 1-year return | | +12.60 | % |

Past performance does not guarantee future results.

For complete, annualized performance for Delaware International Value Equity Fund, please see the table on page 10.

The performance of Class A shares excludes the applicable sales charge and reflects the reinvestment of all distributions.

Index performance returns do not reflect any management fees, transaction costs, or expenses. Indices are unmanaged and one cannot invest directly in an index.

International equity markets managed solid gains during the Fund’s fiscal year ended Nov. 30, 2012, despite a volatile set of economic and political circumstances. The euro zone in particular lurched from one crisis to another, triggering sharp shifts in investor sentiment and risk aversion. While not as dramatic as the troubles in Europe, the United States nonetheless remained trapped in a slow-growth holding pattern, even as the United Kingdom and Japan flirted with outright recession. Emerging markets countries were not immune to the malaise as China’s struggles to emerge from a growth slowdown adversely affected these countries’ economies.

Unlike most business cycles, when recurrent macroeconomic patterns and company-specific issues affect stock prices, equity markets remained deeply dependent on policy interventions, especially by central banks. As the Fund’s fiscal year began, stocks were slumping amid fears about the future of the European Monetary Union. Those worries soon dissipated, however, when the new president of the European Central Bank (ECB), Mario Draghi, initiated the first of two longer-term funding operations designed to relieve stresses on governments and banks.

After a strong rally stalled and stocks sustained an even more severe downturn during the spring and early summer of 2012, Draghi again calmed the equity waters by proclaiming that the ECB would do whatever it takes to save the euro. Indeed, the broad consensus among policy makers and investors that the euro must be saved supported investor sentiment amid turbulent economic and credit conditions. The U.S. Federal Reserve also did its part, launching a third round of quantitative easing that was open-ended with regard to time. Cash infusions by global central banks mostly overcame the negative impact of continued fiscal imbalances and political dysfunction in many countries, helping international stocks to close the fiscal year near their highs for this period.

Fund performance

For the fiscal year ended Nov. 30, 2012, Delaware International Value Equity Fund (Class A shares) returned +10.25% at net asset value and +3.94% at maximum offer price (both figures reflect all distributions reinvested). The Fund’s benchmark, the MSCI EAFE Index (net), returned +12.60% for the same period. For complete, annualized performance of Delaware International Value Equity Fund, please see the table on page 10.

1

Portfolio management review

Delaware International Value Equity Fund

The unusually policy-driven characteristics of the world economic and political environment played a large role in the Fund’s relative performance. For example, risk-averse investors took refuge in so-called “safe-haven” sectors such as consumer staples and healthcare. Those sectors outperformed their more cyclical, higher-risk counterparts, even during periods when the economic skies seemed to brighten. The sustained demand for perceived safe-haven assets caused valuations within the group to reach levels that we deemed overvalued, given our emphasis on companies whose shares trade below estimates of intrinsic value. Similarly, we remain concerned about the lack of transparency within the financial sector, and continue to hold an underweight position in the sector relative to the benchmark. Our underweight exposure to financials, as well as adverse stock selection in the financial and consumer staples sectors, detracted from performance. Stock selection was an overall contributor to relative performance, particularly within the industrial, consumer discretionary, utility, materials, and energy sectors.

On a regional basis, positive allocation to Japan and the U.K. was more than offset by exposure to Canada and emerging markets. Strong stock selection in the Asia-Pacific region and Japan more than offset adverse stock selection in the U.K. and the Europe ex-eurozone region.

The Fund benefited from paring back exposure to several nonfinancial areas of the euro zone, while still maintaining an allocation to companies in which we maintain a high degree of conviction.

The Fund also benefited from adding several new positions, such as the Danish brewer Carlsberg and the Norwegian offshore energy service business Subsea 7, each of which generated positive relative performance. Techtronic Industries was the Fund’s top performer, climbing approximately 120% during the fiscal year. The company is a Hong Kong-domiciled leader in power tools whose shares were once selling at a steep discount to Black & Decker, its primary competitor. As a major player in the American home improvement market, Techtronic benefited from the recent firming in U.S. housing prices. Though we remain overweight the stock, we nonetheless trimmed the position as it rallied. Our holdings in the French outsourcing company Teleperformance was also a strong contributor. Importantly, the lackluster French market represents only a small portion of the company’s revenues, the bulk of which come from staffing product support centers worldwide for a variety of industries, including telecommunications and banking. We used a broad selloff in the euro zone market to increase exposure to the stock, a move that was rewarded when Teleperformance shares climbed more than 80% during the Fund’s fiscal year. With its strong balance sheet and numerous competitive advantages, we view Teleperformance as a classic example of how market turbulence caused by macroeconomic factors has the potential to create profitable opportunities at the company level.

Not all of our stocks performed well. The Fund’s position in the U.K. supermarket retailer Tesco lagged the benchmark,

2

especially early in the Fund’s fiscal year after management provided earnings guidance that fell short of consensus expectations. Its share price has since stabilized and has begun to inch higher, and we continue to hold the stock. The French wireless provider Vivendi also detracted from relative performance; revenues were severely undermined by the emergence of a fourth competitor. The increased competition sparked a price war in the wireless sector, and we have since exited the position.

Another key player in the wireless space, Nokia, also sharply underperformed — declining more than 57% — as it continued to lose market share to aggressive rivals Samsung and Apple. Given the lack of a clear breakthrough with rollout of its new Windows 8 Smartphone and an alarming falloff in Nokia’s older, lower-margin legacy platform, we decided to liquidate our Nokia position.

As the Fund’s fiscal year ended, the Fund’s largest country allocations were to France, Japan, the U.K., Canada, and Switzerland. Relative to the MSCI EAFE Index, our positions in France and Canada each represented a meaningful overweight while Fund exposures to the U.K., Australia, and Germany were underweights. We emphasize, however, that these allocations are the result of our bottom-up stock selection process. The Fund remains focused on risk management and on our stock selection process that seeks to identify strong businesses whose shares appear attractively priced relative to traditional valuation metrics, regardless of where they are domiciled.

3

| Portfolio management review | | |

| Delaware Emerging Markets Fund | | December 11, 2012 |

| Performance preview (for the year ended November 30, 2012) | | | |

| Delaware Emerging Markets Fund (Class A shares) | 1-year return | | +5.67 | % |

| MSCI Emerging Markets Index (gross) | 1-year return | | +11.73 | % |

| MSCI Emerging Markets Index (net) | 1-year return | | +11.35 | % |

Past performance does not guarantee future results.

For complete, annualized performance for Delaware Emerging Markets Fund, please see the table on page 13.

The performance of Class A shares excludes the applicable sales charge and reflects the reinvestment of all distributions.

Index performance returns do not reflect any management fees, transaction costs, or expenses. Indices are unmanaged and one cannot invest directly in an index.

Emerging markets posted solid overall gains during the Fund’s fiscal year ended Nov. 30, 2012, although the asset class mostly lagged its developed-market counterparts. In a clear reflection of the unsettled global economic and political environment, however, volatility was elevated and returns from individual markets were highly variable. Equity markets in Mexico, Singapore, Thailand, Hong Kong, and India generally performed strongly, while larger developing markets, such as Brazil and China, declined during this period.

As the Fund’s fiscal year began, many investors were shedding risk world-wide amid indications that the 17-country euro zone was on the verge of breaking apart. The failure of the single currency experiment might have triggered a synchronized global recession with highly destabilizing implications for emerging markets. However, after the European Central Bank (ECB) launched the first of two loan programs intended to give governments and banks more breathing room, emerging-market stocks climbed strongly. In early March, another bout of risk aversion and worry focused on slowing growth in the United States, upon which many developing nations depend for customers. China was also a cause for concern, as authorities dealing with a once-a-decade leadership change struggled to restart a slumping economy without triggering inflation or creating a property bubble.

Emerging-market stocks bottomed and began to rally in June 2012 as it became apparent to many that global economic conditions had grown sufficiently dire as to make additional central bank easing inevitable. Although this bull run lost steam in the fall, the combination of abundant liquidity and signs of economic progress in the U.S. helped most emerging markets close the Fund’s fiscal year near their September highs.

Fund performance

For the fiscal year ended Nov. 30, 2012, Delaware Emerging Markets Fund (Class A shares)returned +5.67% at net asset value and -0.43% at maximum offer price (both returns assume reinvestment of all distributions). The Fund’s benchmark, the MSCI Emerging Markets Index (net), advanced by 11.35% for the same period. For complete, annualized performance of Delaware Emerging Markets Fund, please see the table on page 13.

4

With regard to country allocations, the Fund benefited from its positioning in South Korea, Mexico, and Thailand while its allocation in China, Brazil, and South Africa mostly detracted from relative performance. Among individual companies Yahoo! was a contributor to Fund performance. Although Yahoo! shares languished for much of the fiscal year due to investor dissatisfaction with management’s inability to unlock the value of its Chinese internet assets, Yahoo! stock climbed significantly beginning in September 2012 after CEO Carol Bartz was replaced by veteran Google executive Marissa Ann Mayer. The Mexican cement producer Cemex also generated strong outperformance for the Fund on the basis of improved financials and signs of recovery in the U.S. housing market. Finally, the Fund’s position in Hon Hai Precision Industry, a Taiwanese producer of business and consumer electronic goods, contributed to relative performance due to strong end-user demand, especially after the unprecedented monetary easing moves by the ECB in the summer of 2012 seemed to allay fears of a meltdown in the key European export market.

Meanwhile, U.S.-based Avon Products detracted from performance. The company has been the focus of a lengthy Securities and Exchange Commission investigation into foreign bribery charges, as its earnings have consistently fallen short of consensus expectations. Petroleo Brasileiro SA also underperformed; the large Brazil-based integrated oil and gas producer suffered from flat diesel and gasoline prices in its domestic market, tight refining margins, and declining overall output due to heightened maintenance standards the Brazilian government imposed. Lastly, the Argentinian integrated energy company YPF detracted from the Fund’s relative performance after the government nationalized the business in an attempt to increase investment in energy resources. After plunging sharply lower from late January through mid-June 2012, the company’s shares traded roughly flat over the remainder of the fiscal year and are currently valued at only about four times its estimated 2012 earnings.

The Fund’s portfolio turnover remained relatively low — reflecting our investment philosophy that favors companies with long-term franchise sustainability, we nonetheless made several notable transactions.

During the second quarter of 2012, we liquidated the Fund’s position in the OTP Bank, Hungary’s leading banking franchise, because of our concern about the economic outlook for Hungary and the countries where it does business. Unemployment in Hungary is 10% and gross domestic product is expected to fall.

Also in the second quarter, we sold our stake in the Chinese advertising company Focus Media Holdings, due to the economic slowdown in China. We also liquidated the Fund’s position in U.S.-based Archer Daniels Midland after management lowered forward earnings guidance due to flagging demand for its agrochemical products.

Later in the Fund’s fiscal year, we eliminated the Fund’s holdings in Jiayuan.com International, an online Chinese dating service, because of rising competition in this sector. Finally, we liquidated the Fund’s stake in the Malaysian conglomerate Oriental Holdings after the company’s share price attained our estimate of intrinsic value.

5

Portfolio management review

Delaware Emerging Markets Fund

As the fiscal year ended, the Fund’s largest country allocations were in South Korea, Brazil, China, the U.S., Russia, Mexico, Taiwan, South Africa, India, and Thailand. The size of our South Korean and Brazilian holdings represent a large overweight in the MSCI Emerging Markets Index; conversely, we are significantly underweight in Taiwan, South Africa, and India, and maintained a close-to-neutral weighting in China and Russia.

6

| Delaware Global Value Fund | December 11, 2012 |

| Performance preview (for the year ended November 30, 2012) | | | |

| Delaware Global Value Fund (Class A shares) | 1-year return | | +9.65 | % |

| MSCI World Index (gross) | 1-year return | | +14.31 | % |

| MSCI World Index (net) | 1-year return | | +13.62 | % |

Past performance does not guarantee future results.

For complete, annualized performance for Delaware Global Value Fund, please see the table on page 16.

The performance of Class A shares excludes the applicable sales charge and reflects the reinvestment of all distributions.

Index performance returns do not reflect any management fees, transaction costs, or expenses. Indices are unmanaged and one cannot invest directly in an index.

Global equity markets managed solid gains during the Fund’s fiscal year ended Nov. 30, 2012, despite a volatile set of economic and political circumstances. The euro zone in particular lurched from one crisis to another, triggering sharp shifts in investor sentiment and risk aversion. While not as dramatic as the troubles in Europe, the United States nonetheless remained trapped in a slow-growth holding pattern, even as the United Kingdom and Japan flirted with outright recession. Emerging markets were not immune to the malaise as China’s struggles to emerge from a growth slowdown adversely affected these countries’ economies.

Unlike most business cycles, when recurrent macroeconomic patterns and company-specific issues affect stock prices, equity markets remained deeply dependent on policy interventions, especially by central banks. As the Fund’s fiscal year began, stocks were slumping amid fears that Europe’s experiment with monetary union was about to end badly. Those worries soon dissipated, however, when the new president of the European Central Bank (ECB), Mario Draghi, initiated the first of two longer-term funding operations designed to relieve stresses on governments and banks.

After a strong rally stalled and stocks sustained an even more severe downturn during the spring and early summer of 2012, Draghi again calmed the equity waters by proclaiming that the ECB would do “whatever it takes” to save the euro. Indeed, the broad consensus among policy makers and investors that the euro must be saved supported investor sentiment amid turbulent economic and credit conditions. The U.S. Federal Reserve also did its part, launching a third round of quantitative easing, dubbed “QE Infinity” for its open-ended nature. Cash infusions by global central banks mostly overcame the negative impact of continued fiscal imbalances and political dysfunction in many countries, helping international stocks to close the fiscal year near their highs for this period.

Fund performance

For the fiscal year ended Nov. 30, 2012, Delaware Global Value Fund (Class A shares) returned +9.65% at net asset value and +3.31% at maximum offer price (both figures reflect all distributions reinvested). The Fund’s benchmark, the MSCI World Index (net), returned +13.62% for the same period. For complete, annualized performance of Delaware Global Value Fund, please see the table on page 16.

7

Portfolio management review

Delaware Global Value Fund

The unusually policy-driven characteristics of the world economic and political environment played a large role in the Fund’s relative performance. For example, risk-averse investors took refuge in so-called “safe-haven” sectors such as consumer staples and healthcare. Those sectors outperformed their more cyclical, higher-risk counterparts, even during periods when the economic skies seemed to brighten. The sustained demand for perceived safe-haven assets caused valuations within the group to reach levels that we deemed overvalued, given our emphasis on companies whose shares trade below estimates of intrinsic value. Similarly, we remain concerned about the lack of transparency within the financial sector, and continue to hold an underweight position in the sector relative to the benchmark.

Adverse stock selection detracted from the Fund’s relative returns. Strong stock selection in the consumer discretionary, industrials, and utilities sectors was more than offset by weak stock selection in information technology, consumer staples, materials, and financials. Overall sector allocation was positive helped by the energy, consumer discretionary, information technology, utilities, and healthcare sectors, which had a positive effect and offset adverse allocation to the financials, materials, and telecommunication sectors.

The Fund benefited from an underweight exposure to the struggling Japanese equity market and an overweight exposure to the Europe ex-eurozone region, but those gains were offset by an exposure to emerging markets and an underweight allocation to Asia-Pacific stocks (excluding Japan). Strong stock selection in the Asia-Pacific region and Japan more than offset adverse stock selection in the U.S. the U.K., and the Europe ex-eurozone region.

The Fund also benefited from adding several new positions, such as the Danish brewer Carlsberg and the Norwegian offshore energy service business Subsea 7, each of which generated positive relative performance. Techtronic Industries was the Fund’s top performer, climbing approximately 120% during the fiscal year. The company is a Hong Kong-domiciled leader in power tools whose shares were once selling at a steep discount to Black & Decker, its primary competitor. As a major player in the American home improvement market, Techtronic benefited from the recent firming in U.S. housing prices. Following its strong outperformance, we exited the position in late November. Our holdings in the French outsourcing company Teleperformance was also a strong contributor. Importantly, the lackluster French market represents only a small portion of the company’s revenues, the bulk of which come from staffing product support centers worldwide for a variety of industries, including telecommunications and banking. We used a broad selloff in the euro-zone market to increase exposure to the stock, a move that was rewarded when Teleperformance shares climbed more than 80% during the Fund’s fiscal year. With its strong balance sheet and numerous competitive advantages, we view Teleperformance as a classic example of how market turbulence caused by macroeconomic factors has the potential to create profitable opportunities at the company level.

8

Naturally, not all of our stock selections performed well. The Fund’s position in the U.K. supermarket retailer Tesco lagged the benchmark, especially early in the Fund’s fiscal year after management provided earnings guidance that fell short of consensus expectations. A major player in the wireless space, Nokia, also sharply underperformed, declining more than 57% as it continued to lose market share to aggressive rivals Samsung and Apple. Lacking a clear breakthrough from the rollout of its new Windows8 smartphone — in combination with an alarming falloff in Nokia’s older, lower-margin legacy platform — we decided to liquidate the position. Newmont Mining underperformed due to a decline in net income from lower volumes and higher cash costs. The decline was also driven by higher cash taxes and negative working capital, specifically, higher inventories and stockpiles. However, we have learned from other gold mining stocks that we hold that it is not necessarily a bad thing to have a good stockpile on hand to keep operations running smoothly quarter to quarter.

As the Fund’s fiscal year ended, the Fund’s largest country allocations were to the U.S., France, Japan, and the U.K. Relative to the MSCI EAFE Index, our positions in France represented a meaningful overweight. The Fund’s exposure to consumer discretionary stocks relative to the benchmark remains a significant overweight. We emphasize, however, that these allocations are the result of our bottom-up stock selection process. The Fund remains focused on risk management and on our stock selection process that identifies what we view as strong businesses whose shares appear to be attractively priced relative to traditional valuation metrics, regardless of where they are domiciled.

9

Performance summaries

| Delaware International Value Equity Fund | November 30, 2012 |

The performance data quoted represent past performance; past performance does not guarantee future results. Investment return and principal value will fluctuate so your shares, when redeemed, may be worth more or less than their original cost. Please obtain the performance data current for the most recent month end by calling 800 523-1918 or visiting our website at delawareinvestments.com/performance. Current performance may be lower or higher than the performance data quoted.

| Fund performance1,2 | Average annual total returns through November 30, 2012 |

| | | | | | | | | Lifetime | |

| | | | | | | | (if less than | |

| | 1 year | | 5 years | | 10 years | | 10 years) | |

| Class A (Est. Oct. 31, 1991) | | | | | | | | | |

| Excluding sales charge | | +10.25% | | -4.41% | | +6.83% | | n/a | |

| Including sales charge | | +3.94% | | -5.54% | | +6.20% | | n/a | |

| Class B (Est. Sept. 6, 1994) | | | | | | | | | |

| Excluding sales charge | | +9.53% | | -5.09% | | +6.23% | | n/a | |

| Including sales charge | | +5.53% | | -5.48% | | +6.23% | | n/a | |

| Class C (Est. Nov. 29, 1995) | | | | | | | | | |

| Excluding sales charge | | +9.53% | | -5.08% | | +6.10% | | n/a | |

| Including sales charge | | +8.53% | | -5.08% | | +6.10% | | n/a | |

| Class R (Est. June 2, 2003) | | | | | | | | | |

| Excluding sales charge | | +10.13% | | -4.59% | | n/a | | +6.01% | |

| Including sales charge | | +10.13% | | -4.59% | | n/a | | +6.01% | |

| Institutional Class (Est. Nov. 9, 1992) | | | | | | | | | |

| Excluding sales charge | | +10.59% | | -4.13% | | +7.15% | | n/a | |

| Including sales charge | | +10.59% | | -4.13% | | +7.15% | | n/a | |

1 Returns reflect the reinvestment of all distributions and are presented both with and without the applicable sales charges described below. Returns do not reflect the deduction of taxes the shareholder would pay on Fund distributions or redemptions of Fund shares.

Expense limitations were in effect for certain classes during some or all of the periods shown in the “Fund performance” chart. The current expenses for each class are listed on the “Fund expense ratios” table on page 11. Performance would have been lower had expense limitations not been in effect.

Class A shares are sold with a maximum front-end sales charge of 5.75%, and have an annual distribution and service fee of 0.30% of average daily net assets. This fee has been contractually limited to 0.25% of average daily net assets from March 29, 2012 through March 29, 2013. Performance for Class A shares, excluding sales charges, assumes that no front-end sales charge applied.

Class B shares may be purchased only through dividend reinvestment and certain permitted exchanges as described in the prospectus. Please see the prospectus for additional information on Class B shares. Class B shares

10

have a contingent deferred sales charge that declines from 4.00% to zero depending on the period of time the shares are held. They are also subject to an annual distribution and service fee of 1.00% of average daily net assets. Class B shares will automatically convert to Class A shares on a quarterly basis approximately eight years after purchase. Ten-year and lifetime performance figures for Class B shares reflect conversion to Class A shares after approximately eight years.

Class C shares are sold with a contingent deferred sales charge of 1.00% if redeemed during the first 12 months. They are also subject to an annual distribution and service fee of 1.00% of average daily net assets.

Performance for Class B and C shares, excluding sales charges, assumes either that contingent deferred sales charges did not apply or that the investment was not redeemed.

Class R shares are available only for certain retirement plan products. They are sold without a sales charge and have an annual distribution and service fee of 0.60% of average daily net assets, which has been limited contractually to 0.50% from March 29, 2012 through March 29, 2013.

Institutional Class shares are available without sales or asset-based distribution charges only to certain eligible institutional accounts.

The “Fund performance” table and the “Performance of a $10,000 investment” graph do not reflect the deduction of taxes the shareholder would pay on Fund distributions or redemptions of Fund shares.

International investments entail risks not ordinarily associated with U.S. investments including fluctuation in currency values, differences in accounting principles, or economic or political instability in other nations.

Investing in emerging markets can be riskier than investing in established foreign markets due to increased volatility and lower trading volume.

2 The Fund’s expense ratios, as described in the most recent prospectus, are disclosed in the following “Fund expense ratios” table. Delaware Investments has agreed to reimburse certain expenses and/or waive certain fees in order to prevent total fund operating expenses (excluding certain fees and expenses) from exceeding 1.21% of the Fund’s average daily net assets from March 29, 2012 through March 29, 2013. Please see the most recent prospectus and any applicable supplement(s) for additional information on these fee waivers and/or reimbursements.

| Fund expense ratios | | Class A | | Class B | | Class C | | Class R | | Institutional Class |

| Total annual operating expenses | | | | | | | | | | |

| (without fee waivers) | | 1.59% | | 2.29% | | 2.29% | | 1.89% | | 1.29% |

| Net expenses | | | | | | | | | | |

| (including fee waivers, if any) | | 1.46% | | 2.21% | | 2.21% | | 1.71% | | 1.21% |

| Type of waiver | | Contractual | | Contractual | | Contractual | | Contractual | | Contractual |

11

Performance summaries

Delaware International Value Equity Fund

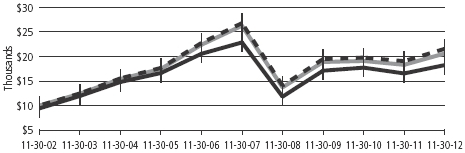

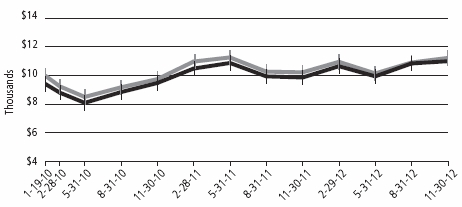

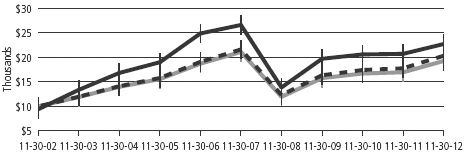

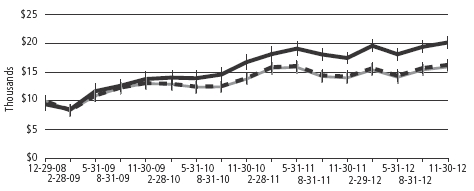

Performance of a $10,000 investment1

Average annual total returns from Nov. 30, 2002, through Nov. 30, 2012

| For period beginning Nov. 30, 2002, through Nov. 30, 2012 | Starting value | Ending value |

| | MSCI EAFE Index (gross) | $10,000 | $21,566 |

| | MSCI EAFE Index (net) | $10,000 | $20,618 |

| | Delaware International Value Equity Fund —

Class A Shares | $9,425 | $18,249 |

1 The “Performance of a $10,000 investment” graph assumes $10,000 invested in Class A shares of the Fund on Nov. 30, 2002, and includes the effect of a 5.75% front-end sales charge and the reinvestment of all distributions. The graph does not reflect the deduction of taxes the shareholders would pay on Fund distributions or redemptions of Fund shares. Expense limitations were in effect for some or all of the periods shown. Performance would have been lower had expense limitations not been in effect. Current expenses are listed in the “Fund expense ratios” table on page 11. Please note additional details on pages 10 through 12.

The chart also assumes $10,000 invested in the MSCI EAFE Index as of Nov. 30, 2002. The MSCI EAFE Index measures equity market performance across developed market countries in Europe, Australasia, and the Far East. Index “gross” return approximates the maximum possible dividend reinvestment. Index “net” return approximates the minimum possible dividend reinvestment, after deduction of withholding tax at the highest possible rate.

Index performance returns do not reflect any management fees, transaction costs, or expenses. Indices are unmanaged and one cannot invest directly in an index. Past performance is not a guarantee of future results.

Performance of other Fund classes will vary due to different charges and expenses.

| | Nasdaq symbols | | CUSIPs | |

| Class A | | | DEGIX | | | 245914106 | |

| Class B | | | DEIEX | | | 245914700 | |

| Class C | | | DEGCX | | | 245914858 | |

| Class R | | | DIVRX | | | 245914577 | |

| Institutional Class | | | DEQIX | | | 245914403 | |

12

| Delaware Emerging Markets Fund | November 30, 2012 |

The performance data quoted represent past performance; past performance does not guarantee future results. Investment return and principal value will fluctuate so your shares, when redeemed, may be worth more or less than their original cost. Please obtain the performance data current for the most recent month end by calling 800 523-1918 or visiting our website at delawareinvestments.com/performance. Current performance may be lower or higher than the performance data quoted.

| Fund performance1,2 | Average annual total returns through November 30, 2012 |

| | | | | | | | Lifetime | |

| | | | | | | | | (if less than | |

| | | 1 year | | 5 years | | 10 years | | 10 years) | |

| Class A (Est. June 10, 1996) | | | | | | | | | |

| Excluding sales charge | | +5.67% | | -1.98% | | +16.14% | | n/a | |

| Including sales charge | | -0.43% | | -3.14% | | +15.46% | | n/a | |

| Class B (Est. June 10, 1996) | | | | | | | | | |

| Excluding sales charge | | +4.84% | | -2.70% | | +15.45% | | n/a | |

| Including sales charge | | +0.84% | | -3.00% | | +15.45% | | n/a | |

| Class C (Est. June 10, 1996) | | | | | | | | | |

| Excluding sales charge | | +4.85% | | -2.71% | | +15.29% | | n/a | |

| Including sales charge | | +3.85% | | -2.71% | | +15.29% | | n/a | |

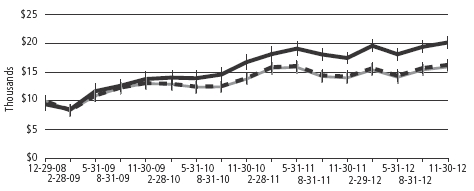

| Class R (Est. Aug. 31, 2009) | | | | | | | | | |

| Excluding sales charge | | +5.41% | | n/a | | n/a | | +5.93% | |

| Including sales charge | | +5.41% | | n/a | | n/a | | +5.93% | |

| Institutional Class (Est. June 10, 1996) | | | | | | | | | |

| Excluding sales charge | | +5.86% | | -1.75% | | +16.43% | | n/a | |

| Including sales charge | | +5.86% | | -1.75% | | +16.43% | | n/a | |

1 Returns reflect the reinvestment of all distributions and are presented both with and without the applicable sales charges described below. Returns do not reflect the deduction of taxes the shareholder would pay on Fund distributions or redemptions of Fund shares.

Expense limitations were in effect for certain classes during some or all of the periods shown in the “Fund performance” chart. The current expenses for each class are listed on the “Fund expense ratios” table on page 14. Performance would have been lower had expense limitations not been in effect.

Class A shares are sold with a maximum front-end sales charge of 5.75%, and have an annual distribution and service fee of 0.30% of average daily net assets. This fee has been contractually limited to 0.25% of average daily net assets from March 29, 2012 through March 29, 2013. Performance for Class A shares, excluding sales charges, assumes that no front-end sales charge applied.

Class B shares may be purchased only through dividend reinvestment and certain permitted exchanges as described in the prospectus. Please see the prospectus for additional information on Class B shares. Class B shares have a contingent deferred sales charge that

13

Performance summaries

Delaware Emerging Markets Fund

declines from 4.00% to zero depending on the period of time the shares are held. They are also subject to an annual distribution and service fee of 1.00% of average daily net assets. Class B shares will automatically convert to Class A shares on a quarterly basis approximately eight years after purchase. Ten-year and lifetime performance figures for Class B shares reflect conversion to Class A shares after approximately eight years.

Class C shares are sold with a contingent deferred sales charge of 1.00% if redeemed during the first 12 months. They are also subject to an annual distribution and service fee of 1.00% of average daily net assets.

Performance for Class B and C shares, excluding sales charges, assumes either that contingent deferred sales charges did not apply or that the investment was not redeemed.

Class R shares are available only for certain retirement plan products. They are sold without a sales charge and have an annual distribution and service fee of 0.60% of average daily net assets, which has been limited contractually to 0.50% from March 29, 2012 through March 29, 2013.

Institutional Class shares are available without sales or asset-based distribution charges only to certain eligible institutional accounts.

The “Fund performance” table and the “Performance of a $10,000 investment” graph do not reflect the deduction of taxes the shareholder would pay on Fund distributions or redemptions of Fund shares.

International investments entail risks not ordinarily associated with U.S. investments including fluctuation in currency values, differences in accounting principles, or economic or political instability in other nations.

Investing in emerging markets can be riskier than investing in established foreign markets due to increased volatility and lower trading volume.

Investments in small and/or medium-sized companies typically exhibit greater risk and higher volatility than larger, more established companies.

2 The Fund’s expense ratios, as described in the most recent prospectus, are disclosed in the following “Fund expense ratios” table.

| Fund expense ratios | | Class A | | Class B | | Class C | | Class R | | Institutional Class |

| Total annual operating expenses | | 1.83% | | 2.53% | | 2.53% | | 2.13% | | 1.53% |

| (without fee waivers) | | | | | | | | | | |

| Net expenses | | 1.78% | | 2.53% | | 2.53% | | 2.03% | | 1.53% |

| (including fee waivers, if any) | | | | | | | | | | |

| Type of waiver | | Contractual | | n/a | | n/a | | Contractual | | n/a |

14

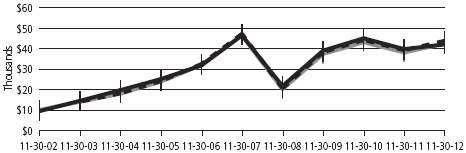

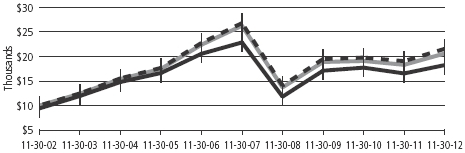

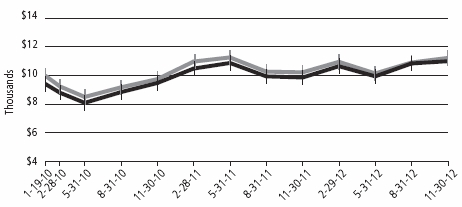

Performance of a $10,000 investment1

Average annual total returns from Nov. 30, 2002, through Nov. 30, 2012

| For period beginning Nov. 30, 2002, through Nov. 30, 2012 | Starting value | Ending value |

| | MSCI Emerging Markets Index (gross) | $10,000 | $43,868 |

| | MSCI Emerging Markets Index (net) | $10,000 | $42,509 |

| | Delaware Emerging Markets Fund — Class A Shares | $9,425 | $42,077 |

1 The “Performance of a $10,000 investment” graph assumes $10,000 invested in Class A shares of the Fund on Nov. 30, 2002, and includes the effect of a 5.75% front-end sales charge and the reinvestment of all distributions. The graph does not reflect the deduction of taxes the shareholders would pay on Fund distributions or redemptions of Fund shares. Expense limitations were in effect for some or all of the periods shown. Performance would have been lower had expense limitations not been in effect. Current expenses are listed in the “Fund expense ratios” table on page 14. Please note additional details on pages 13 through 15.

The chart also assumes $10,000 invested in the MSCI Emerging Markets Index as of Nov. 30, 2002. The MSCI Emerging Markets Index measures equity market performance across emerging market countries worldwide. Index “gross” return approximates the maximum possible dividend reinvestment. Index “net” return approximates the minimum possible dividend reinvestment, after deduction of withholding tax at the highest possible rate.

Index performance returns do not reflect any management fees, transaction costs, or expenses. Indices are unmanaged and one cannot invest directly in an index. Past performance is not a guarantee of future results.

Performance of other Fund classes will vary due to different charges and expenses.

| | Nasdaq symbols | | CUSIPs | |

| Class A | | | DEMAX | | | 245914841 | |

| Class B | | | DEMBX | | | 245914833 | |

| Class C | | | DEMCX | | | 245914825 | |

| Class R | | | DEMRX | | | 245914569 | |

| Institutional Class | | | DEMIX | | | 245914817 | |

15

Performance summaries

| Delaware Global Value Fund | November 30, 2012 |

The performance data quoted represent past performance; past performance does not guarantee future results. Investment return and principal value will fluctuate so your shares, when redeemed, may be worth more or less than their original cost. Please obtain the performance data current for the most recent month end by calling 800 523-1918 or visiting our website at delawareinvestments.com/performance. Current performance may be lower or higher than the performance data quoted.

| Fund performance1,2 | | Average annual total returns through November 30, 2012 |

| | | 1 year | | 5 years | | 10 years | |

| Class A (Est. Dec. 19, 1997) | | | | | | | | |

| Excluding sales charge | | | +9.65% | | -3.11% | | +9.19% | |

| Including sales charge | | | +3.31% | | -4.24% | | +8.55% | |

| Class B (Est. Sept. 28, 2001) | | | | | | | | |

| Excluding sales charge | | | +8.82% | | -3.81% | | +8.54% | |

| Including sales charge | | | +4.82% | | -4.21% | | +8.54% | |

| Class C (Est. Sept. 28, 2001) | | | | | | | | |

| Excluding sales charge | | | +8.94% | | -3.82% | | +8.39% | |

| Including sales charge | | | +7.94% | | -3.82% | | +8.39% | |

| Institutional Class (Est. Dec. 19, 1997) | | | | | | | | |

| Excluding sales charge | | | +10.03% | | -2.85% | | +9.49% | |

| Including sales charge | | | +10.03% | | -2.85% | | +9.49% | |

1 Returns reflect the reinvestment of all distributions and are presented both with and without the applicable sales charges described below. Returns do not reflect the deduction of taxes the shareholder would pay on Fund distributions or redemptions of Fund shares.

Expense limitations were in effect for certain classes during some or all of the periods shown in the “Fund performance” chart. The current expenses for each class are listed on the “Fund expense ratios” table on page 17. Performance would have been lower had expense limitations not been in effect.

Class A shares are sold with a maximum front-end sales charge of 5.75%, and have an annual distribution and service fee of 0.30% of average daily net assets. This fee has been contractually limited to 0.25% of average daily net assets from March 29, 2012 through March 29, 2013. Performance for Class A shares, excluding sales charges, assumes that no front-end sales charge applied.

Class B shares may be purchased only through dividend reinvestment and certain permitted exchanges as described in the prospectus. Please see the prospectus for additional information on Class B shares. Class B shares have a contingent deferred sales charge that declines from 4.00% to zero depending on the period of time the shares are held. They are also subject to an annual distribution and service fee of 1.00% of average daily net assets. Class B shares will automatically convert to Class A shares on a quarterly basis

16

approximately eight years after purchase. Ten-year and lifetime performance figures for Class B shares reflect conversion to Class A shares after approximately eight years.

Class C shares are sold with a contingent deferred sales charge of 1.00% if redeemed during the first 12 months. They are also subject to an annual distribution and service fee of 1.00% of average daily net assets.

Performance for Class B and C shares, excluding sales charges, assumes either that contingent deferred sales charges did not apply or that the investment was not redeemed.

Institutional Class shares are available without sales or asset-based distribution charges only to certain eligible institutional accounts.

The “Fund performance” table and the “Performance of a $10,000 investment” graph do not reflect the deduction of taxes the shareholder would pay on Fund distributions or redemptions of Fund shares.

International investments entail risks not ordinarily associated with U.S. investments including fluctuation in currency values, differences in accounting principles, or economic or political instability in other nations.

Investing in emerging markets can be riskier than investing in established foreign markets due to increased volatility and lower trading volume.

Investments in small and/or medium-sized companies typically exhibit greater risk and higher volatility than larger, more established companies.

2 The Fund’s expense ratios, as described in the most recent prospectus, are disclosed in the following “Fund expense ratios” table. Delaware Investments has agreed to reimburse certain expenses and/or waive certain fees in order to prevent total fund operating expenses (excluding certain fees and expenses) from exceeding 1.30% of the Fund’s average daily net assets from March 29, 2012 through March 29, 2013. Please see the most recent prospectus and any applicable supplement(s) for additional information on these fee waivers and/or reimbursements.

| Fund expense ratios | | Class A | | Class B | | Class C | | Institutional Class |

| Total annual operating expenses | | 1.88% | | 2.58% | | 2.58% | | 1.58% |

| (without fee waivers) | | | | | | | | |

| Net expenses | | 1.55% | | 2.30% | | 2.30% | | 1.30% |

| (including fee waivers, if any) | | | | | | | | |

| Type of waiver | | Contractual | | Contractual | | Contractual | | Contractual |

17

Performance summaries

Delaware Global Value Fund

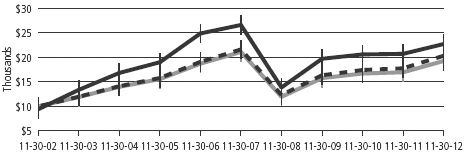

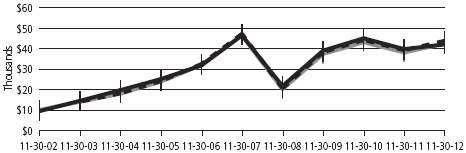

Performance of a $10,000 investment1

Average annual total returns from Nov. 30, 2002, through Nov. 30, 2012

| For period beginning Nov. 30, 2002, through Nov. 30, 2012 | Starting value | Ending value |

| | Delaware Global Value Fund — Class A Shares | $9,425 | $22,711 |

| | MSCI World Index (gross) | $10,000 | $20,314 |

| | MSCI World Index (net) | $10,000 | $19,262 |

1 The “Performance of a $10,000 investment” graph assumes $10,000 invested in Class A shares of the Fund on Nov. 30, 2002, and includes the effect of a 5.75% front-end sales charge and the reinvestment of all distributions. The graph does not reflect the deduction of taxes the shareholders would pay on Fund distributions or redemptions of Fund shares. Expense limitations were in effect for some or all of the periods shown. Performance would have been lower had expense limitations not been in effect. Current expenses are listed in the “Fund expense ratios” table on page 17. Please note additional details on pages 16 through 18.

The chart also assumes $10,000 invested in the MSCI World Index as of Nov. 30, 2002. The MSCI World Index is a free float-adjusted market capitalization weighted index designed to measure equity market performance across developed markets worldwide. Index “gross” return approximates the maximum possible dividend reinvestment. Index “net” return approximates the minimum possible dividend reinvestment, after deduction of withholding tax at the highest possible rate.

Index performance returns do not reflect any management fees, transaction costs, or expenses. Indices are unmanaged and one cannot invest directly in an index. Past performance is not a guarantee of future results.

Performance of other Fund classes will vary due to different charges and expenses.

| | Nasdaq symbols | | CUSIPs | |

| Class A | | | DABAX | | | 245914718 | |

| Class B | | | DABBX | | | 245914692 | |

| Class C | | | DABCX | | | 245914684 | |

| Institutional Class | | | DABIX | | | 245914676 | |

18

Disclosure of Fund expenses

For the six-month period from June 1, 2012 to November 30, 2012 (Unaudited)

As a shareholder of a Fund, you incur two types of costs: (1) transaction costs, including sales charges (loads) on purchase payments, reinvested dividends, or other distributions; redemption fees; and exchange fees; and (2) ongoing costs, including management fees; distribution and/or service (12b-1) fees; and other Fund expenses. These following examples are intended to help you understand your ongoing costs (in dollars) of investing in a Fund and to compare these costs with the ongoing costs of investing in other mutual funds.

The examples are based on an investment of $1,000 invested at the beginning of the period and held for the entire six-month period from June 1, 2012 to November 30, 2012.

Actual expenses

The first section of the tables shown, “Actual Fund return,” provides information about actual account values and actual expenses. You may use the information in this section of the table, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first section under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

Hypothetical example for comparison purposes

The second section of the tables shown, “Hypothetical 5% return,” provides information about hypothetical account values and hypothetical expenses based on the Funds’ actual expense ratios and an assumed rate of return of 5% per year before expenses, which is not the Funds’ actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in a Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the tables are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as sales charges (loads), redemption fees, or exchange fees. Therefore, the second section of each table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher. The Funds’ expenses shown in the tables reflect fee waivers in effect. The expenses shown in each table assume reinvestment of all dividends and distributions.

20

Delaware International Value Equity Fund

Expense analysis of an investment of $1,000

| Beginning

Account Value

6/1/12 | | Ending

Account Value

11/30/12 | | Annualized

Expense Ratio | | Expenses

Paid During Period

6/1/12 to 11/30/12* |

| Actual Fund return† | | | | | | | | | | | | | | | | | | | |

| Class A | | $ | 1,000.00 | | | | $ | 1,140.70 | | | | 1.39 | % | | | | $ | 7.44 | |

| Class B | | | 1,000.00 | | | | | 1,135.50 | | | | 2.13 | % | | | | | 11.37 | |

| Class C | | | 1,000.00 | | | | | 1,136.70 | | | | 2.13 | % | | | | | 11.38 | |

| Class R | | | 1,000.00 | | | | | 1,139.00 | | | | 1.63 | % | | | | | 8.72 | |

| Institutional Class | | | 1,000.00 | | | | | 1,142.20 | | | | 1.13 | % | | | | | 6.05 | |

| Hypothetical 5% return (5% return before expenses) | | | | | | | | | | | |

| Class A | | $ | 1,000.00 | | | | $ | 1,018.05 | | | | 1.39 | % | | | | $ | 7.01 | |

| Class B | | | 1,000.00 | | | | | 1,014.35 | | | | 2.13 | % | | | | | 10.73 | |

| Class C | | | 1,000.00 | | | | | 1,014.35 | | | | 2.13 | % | | | | | 10.73 | |

| Class R | | | 1,000.00 | | | | | 1,016.85 | | | | 1.63 | % | | | | | 8.22 | |

| Institutional Class | | | 1,000.00 | | | | | 1,019.35 | | | | 1.13 | % | | | | | 5.70 | |

Delaware Emerging Markets Fund

Expense analysis of an investment of $1,000

| Beginning

Account Value

6/1/12 | | Ending

Account Value

11/30/12 | | Annualized

Expense Ratio | | Expenses

Paid During Period

6/1/12 to 11/30/12* |

| Actual Fund return† | | | | | | | | | | | | | | | | | | | |

| Class A | | $ | 1,000.00 | | | | $ | 1,151.90 | | | | 1.71 | % | | | | $ | 9.20 | |

| Class B | | | 1,000.00 | | | | | 1,147.30 | | | | 2.46 | % | | | | | 13.21 | |

| Class C | | | 1,000.00 | | | | | 1,147.70 | | | | 2.46 | % | | | | | 13.21 | |

| Class R | | | 1,000.00 | | | | | 1,149.60 | | | | 1.96 | % | | | | | 10.53 | |

| Institutional Class | | | 1,000.00 | | | | | 1,152.50 | | | | 1.46 | % | | | | | 7.86 | |

| Hypothetical 5% return (5% return before expenses) | | | | | | | | | | | | | | | | | | | |

| Class A | | $ | 1,000.00 | | | | $ | 1,016.45 | | | | 1.71 | % | | | | $ | 8.62 | |

| Class B | | | 1,000.00 | | | | | 1,012.70 | | | | 2.46 | % | | | | | 12.38 | |

| Class C | | | 1,000.00 | | | | | 1,012.70 | | | | 2.46 | % | | | | | 12.38 | |

| Class R | | | 1,000.00 | | | | | 1,015.20 | | | | 1.96 | % | | | | | 9.87 | |

| Institutional Class | | | 1,000.00 | | | | | 1,017.70 | | | | 1.46 | % | | | | | 7.36 | |

21

Disclosure of Fund expenses

Delaware Global Value Fund

Expense analysis of an investment of $1,000

| Beginning

Account Value

6/1/12 | | Ending

Account Value

11/30/12 | | Annualized

Expense Ratio | | Expenses

Paid During Period

6/1/12 to 11/30/12* |

| Actual Fund return† | | | | | | | | | | | | | | | | | | | |

| Class A | | $ | 1,000.00 | | | | $ | 1,115.10 | | | | 1.55 | % | | | | $ | 8.20 | |

| Class B | | | 1,000.00 | | | | | 1,110.60 | | | | 2.30 | % | | | | | 12.14 | |

| Class C | | | 1,000.00 | | | | | 1,111.80 | | | | 2.30 | % | | | | | 12.14 | |

| Institutional Class | | | 1,000.00 | | | | | 1,117.30 | | | | 1.30 | % | | | | | 6.88 | |

| Hypothetical 5% return (5% return before expenses) |

| Class A | | $ | 1,000.00 | | | | $ | 1,017.25 | | | | 1.55 | % | | | | $ | 7.82 | |

| Class B | | | 1,000.00 | | | | | 1,013.50 | | | | 2.30 | % | | | | | 11.58 | |

| Class C | | | 1,000.00 | | | | | 1,013.50 | | | | 2.30 | % | | | | | 11.58 | |

| Institutional Class | | | 1,000.00 | | | | | 1,018.50 | | | | 1.30 | % | | | | | 6.56 | |

*“Expenses Paid During Period” are equal to the relevant Fund’s annualized expense ratio, multiplied by the average account value over the period, multiplied by 183/366 (to reflect the one-half year period). |

| |

†Because actual returns reflect only the most recent six-month period, the returns shown may differ significantly from fiscal year returns. |

22

| Security type/country and sector allocations |

Delaware International Value Equity Fund | As of November 30, 2012 (Unaudited) |

Sector designations may be different than the sector designations presented in other Fund materials. The sector designations may represent the investment manager’s internal sector classifications, which may result in the sector designations for one fund being different than another fund’s sector designations.

| Security type/country | Percentage of net assets |

| Common Stock by Country | | 99.33 | % | |

| Australia | | 1.52 | % | |

| Canada | | 9.26 | % | |

| China/Hong Kong | | 6.58 | % | |

| Denmark | | 1.85 | % | |

| France | | 19.95 | % | |

| Germany | | 3.77 | % | |

| Israel | | 4.10 | % | |

| Japan | | 17.53 | % | |

| Netherlands | | 1.97 | % | |

| Norway | | 2.38 | % | |

| Panama | | 1.92 | % | |

| Republic of Korea | | 1.51 | % | |

| Russia | | 1.45 | % | |

| Sweden | | 3.27 | % | |

| Switzerland | | 8.42 | % | |

| United Kingdom | | 13.85 | % | |

| Short-Term Investments | | 1.35 | % | |

| Securities Lending Collateral | | 6.14 | % | |

| Total Value of Securities | | 106.82 | % | |

| Obligation to Return Securities Lending Collateral | | (6.77 | %) | |

| Other Liabilities Net of Receivables and Other Assets | | (0.05 | %) | |

| Total Net Assets | | 100.00 | % | |

23

Security type/country and sector allocations

Delaware International Value Equity Fund

| Common Stock by Sector | Percentage of net assets |

| Consumer Discretionary | | 20.07 | % | |

| Consumer Staples | | 11.06 | % | |

| Energy | | 9.40 | % | |

| Financials | | 9.59 | % | |

| Healthcare | | 10.70 | % | |

| Industrials | | 17.23 | % | |

| Information Technology | | 3.51 | % | |

| Materials | | 11.56 | % | |

| Telecommunication Services | | 4.16 | % | |

| Utilities | | 2.05 | % | |

| Total | | 99.33 | % | |

24

| Delaware Emerging Market Fund | As of November 30, 2012 (Unaudited) |

Sector designations may be different than the sector designations presented in other Fund materials. The sector designations may represent the investment manager’s internal sector classifications, which may result in the sector designations for one fund being different than another fund’s sector designations.

| Security type/country | Percentage of net assets |

| Common Stock by Country | | 95.77 | % | |

| Argentina | | 1.56 | % | |

| Australia | | 0.11 | % | |

| Brazil | | 15.24 | % | |

| China/Hong Kong | | 17.44 | % | |

| India | | 2.34 | % | |

| Kingdom of Bahrain | | 0.08 | % | |

| Malaysia | | 1.60 | % | |

| Mexico | | 5.58 | % | |

| Poland | | 0.85 | % | |

| Republic of Korea | | 20.62 | % | |

| Russia | | 6.98 | % | |

| South Africa | | 4.27 | % | |

| Taiwan | | 5.02 | % | |

| Thailand | | 1.94 | % | |

| Turkey | | 1.38 | % | |

| United Kingdom | | 0.08 | % | |

| United States | | 10.68 | % | |

| Participation Notes | | 0.00 | % | |

| Preferred Stock | | 3.60 | % | |

| Securities Lending Collateral | | 10.46 | % | |

| Total Value of Securities | | 109.83 | % | |

| Obligation to Return Securities Lending Collateral | | (10.48 | %) | |

| Receivables and Other Assets Net of Other Liabilities | | 0.65 | % | |

| Total Net Assets | | 100.00 | % | |

25

Security type/country and sector allocations

Delaware Emerging Market Fund

| Commons Stock, Participation Notes and Preferred Stock by Sector | Percentage of net assets |

| Consumer Discretionary | | 4.49 | % | |

| Consumer Staples | | 15.67 | % | |

| Energy | | 15.30 | % | |

| Financials | | 13.76 | % | |

| Industrials | | 5.44 | % | |

| Information Technology | | 23.28 | % | |

| Materials | | 8.17 | % | |

| Telecommunication Services | | 11.82 | % | |

| Utilities | | 1.44 | % | |

| Total | | 99.37 | % | |

26

| Delaware Global Value Fund | As of November 30, 2012 (Unaudited) |

Sector designations may be different than the sector designations presented in other Fund materials. The sector designations may represent the investment manager’s internal sector classifications, which may result in the sector designations for one fund being different than another fund’s sector designations.

| Sector type/country | | Percentage of net assets |

| Common Stock by Country | | 100.03 | % |

| Canada | | 4.56 | % |

| China/Hong Kong | | 3.35 | % |

| Denmark | | 1.88 | % |

| France | | 10.20 | % |

| Germany | | 1.11 | % |

| Israel | | 2.36 | % |

| Japan | | 9.85 | % |

| Netherlands | | 1.48 | % |

| Norway | | 1.65 | % |

| Panama | | 1.62 | % |

| Russia | | 1.27 | % |

| Switzerland | | 4.39 | % |

| United Kingdom | | 8.61 | % |

| United States | | 47.70 | % |

| Short-Term Investments | | 1.50 | % |

| Securities Lending Collateral | | 2.34 | % |

| Total Value of Securities | | 103.87 | % |

| Obligation to Return Securities Lending Collateral | | (2.89 | %) |

| Other Liabilities Net of Receivables and Other Assets | | (0.98 | %) |

| Total Net Assets | | 100.00 | % |

27

Security type/country and sector allocations

Delaware Global Value Fund

| Common Stock by Sector | | Percentage of net assets |

| Consumer Discretionary | | 20.52 | % |

| Consumer Staples | | 6.07 | % |

| Energy | | 9.03 | % |

| Financials | | 16.81 | % |

| Healthcare | | 12.34 | % |

| Industrials | | 14.53 | % |

| Information Technology | | 6.73 | % |

| Materials | | 8.45 | % |

| Telecommunication Services | | 4.20 | % |

| Utilities | | 1.35 | % |

| Total | | 100.03 | % |

28

| Statements of net assets | |

| Delaware International Value Equity Fund | November 30, 2012 |

| | | | Number of shares | | Value (U.S. $) |

| ΔCommon Stock – 99.33% | | | | | | | |

| Australia – 1.52% | | | | | | | |

| | Coca-Cola Amatil | | | 251,725 | | | $ | 3,609,847 |

| | | | | | | | 3,609,847 |

| Canada – 9.26% | | | | | | | |

| † | AuRico Gold | | | 653,441 | | | | 5,163,851 |

| † | CGI Group Class A | | | 362,509 | | | | 8,320,537 |

| Yamana Gold | | | 449,401 | | | | 8,469,107 |

| | | | | | | | 21,953,495 |

| China/Hong Kong – 6.58% | | | | | | | |

| CNOOC | | | 2,377,000 | | | | 5,085,115 |

| Techtronic Industries | | | 1,964,000 | | | | 3,867,080 |

| Yue Yuen Industrial Holdings | | | 1,895,000 | | | | 6,638,441 |

| | | | | | | | 15,590,636 |

| Denmark – 1.85% | | | | | | | |

| Carlsberg Class B | | | 45,129 | | | | 4,393,868 |

| | | | | | | | 4,393,868 |

| France – 19.95% | | | | | | | |

| Alstom | | | 103,257 | | | | 3,758,130 |

| AXA | | | 344,137 | | | | 5,655,014 |

| Cie de Saint-Gobain | | | 61,483 | | | | 2,453,225 |

| Lafarge | | | 52,121 | | | | 3,027,999 |

| PPR | | | 30,282 | | | | 5,647,559 |

| Publicis Groupe | | | 55,775 | | | | 3,155,048 |

| Sanofi | | | 80,078 | | | | 7,150,626 |

| Teleperformance | | | 271,059 | | | | 9,433,590 |

| * | Total | | | 140,094 | | | | 7,010,116 |

| | | | | | | | 47,291,307 |

| Germany – 3.77% | | | | | | | |

| Bayerische Motoren Werke | | | 46,666 | | | | 4,138,551 |

| Deutsche Post | | | 230,690 | | | | 4,788,381 |

| | | | | | | | 8,926,932 |

| Israel – 4.10% | | | | | | | |

| Teva Pharmaceutical Industries ADR | | | 240,800 | | | | 9,716,280 |

| | | | | | | | 9,716,280 |

| Japan – 17.53% | | | | | | | |

| Don Quijote | | | 154,700 | | | | 6,015,329 |

| East Japan Railway | | | 88,744 | | | | 5,824,750 |

29

Statements of net assets

Delaware International Value Equity Fund

| | | | Number of shares | | | Value (U.S. $) |

| ΔCommon Stock (continued) | | | | | | | |

| Japan (continued) | | | | | | | |

| ITOCHU | | | 535,660 | | | $ | 5,354,975 |

| KDDI | | | 46,700 | | | | 3,456,112 |

| | Mitsubishi UFJ Financial Group | | | 1,394,057 | | | | 6,376,215 |

| Nitori Holdings | | | 48,697 | | | | 3,621,627 |

| Sumitomo Rubber Industries | | | 214,583 | | | | 2,530,478 |

| Toyota Motor | | | 195,400 | | | | 8,380,213 |

| | | | | | | | 41,559,699 |

| Netherlands – 1.97% | | | | | | | |

| Koninklijke Philips Electronics | | | 181,139 | | | | 4,678,625 |

| | | | | | | | 4,678,625 |

| Norway – 2.38% | | | | | | | |

| * | Subsea 7 | | | 246,603 | | | | 5,637,361 |

| | | | | | | | 5,637,361 |

| Panama – 1.92% | | | | | | | |

| Copa Holdings Class A | | | 48,100 | | | | 4,561,804 |

| | | | | | | | 4,561,804 |

| Republic of Korea – 1.51% | | | | | | | |

| Hyundai Home Shopping Network | | | 31,876 | | | | 3,577,768 |

| | | | | | | | 3,577,768 |

| Russia – 1.45% | | | | | | | |

| Mobile Telesystems ADR | | | 196,600 | | | | 3,426,738 |

| | | | | | | | 3,426,738 |

| Sweden – 3.27% | | | | | | | |

| * | Meda Class A | | | 175,781 | | | | 1,809,846 |

| Nordea Bank | | | 649,589 | | | | 5,946,141 |

| | | | | | | | 7,755,987 |

| Switzerland – 8.42% | | | | | | | |

| *† | Aryzta | | | 172,496 | | | | 8,720,662 |

| Novartis | | | 108,275 | | | | 6,700,735 |

| Transocean | | | 98,400 | | | | 4,546,080 |

| | | | | | | | 19,967,477 |

| United Kingdom – 13.85% | | | | | | | |

| Greggs | | | 477,265 | | | | 3,676,323 |

| * | National Grid | | | 429,655 | | | | 4,852,869 |

| Rexam | | | 899,515 | | | | 6,307,753 |

30

| | | | Number of shares | | Value (U.S. $) |

| ΔCommon Stock (continued) | | | | | | |

| United Kingdom (continued) | | | | | | |

| Rio Tinto | | | 89,384 | | $ | 4,429,957 |

| Standard Chartered | | | 204,090 | | | 4,757,451 |

| TESCO | | | 1,116,340 | | | 5,814,375 |

| Vodafone Group | | | 1,156,828 | | | 2,986,680 |

| | | | | | | 32,825,408 |

| Total Common Stock (cost $221,170,556) | | | | | | 235,473,232 |

| | | | Principal | | |

| | | amount (U.S. $) | | |

| Short-Term Investments – 1.35% | | | | | |

| ≠Discount Notes – 0.69% | | | | | |

| Federal Home Loan Bank | | | | | |

| 0.10% 1/18/13 | | $ | 327,903 | | 327,878 |

| 0.10% 1/23/13 | | | 257,848 | | 257,826 |

| 0.13% 2/6/13 | | | 862,902 | | 862,793 |

| 0.135% 2/15/13 | | | 189,838 | | 189,811 |

| | | | | | 1,638,308 |

| Repurchase Agreements – 0.66% | | | | | |

| Bank of America 0.19%, dated 11/30/12, to | | | | | |

| be repurchased on 12/3/12, repurchase price | | | | | |

| $557,276 (collateralized by U.S. government | | | | | |

| obligations 0.00%-0.25% 1/3/13-11/30/14; | | | | | |

| market value $568,412) | | | 557,267 | | 557,267 |

| BNP Paribas 0.20%, dated 11/30/12, to be | | | | | |

| repurchased on 12/3/12, repurchase price | | | | | |

| $997,750 (collateralized by U.S. government | | | | | |

| obligations 0.25%-2.50% 3/31/14-11/30/17; | | | | | |

| market value $1,018,446) | | | 997,733 | | 997,733 |

| | | | | | 1,555,000 |

| Total Short-Term Investments (cost $3,193,147) | | | | | 3,193,308 |

| |

| Total Value of Securities Before Securities | | | | | |

| Lending Collateral – 100.68% (cost $224,363,703) | | | | | 238,666,540 |

31

Statements of net assets

Delaware International Value Equity Fund

| | | | Number of shares | | | Value (U.S. $) | |

| **Securities Lending Collateral – 6.14% | | | | | | | | |

| Investment Companies | | | | | | | | |

| Delaware Investments Collateral Fund No. 1 | | | 14,562,511 | | | $ | 14,562,511 | |

| @†Mellon GSL Reinvestment Trust II | | | 1,475,413 | | | | 0 | |

| Total Securities Lending Collateral | | | | | | | | |

| (cost $16,037,924) | | | | | | | 14,562,511 | |

| |

| Total Value of Securities – 106.82% | | | | | | | | |

| (cost $240,401,627) | | | | | | | 253,229,051 | © |

| **Obligation to Return Securities | | | | | | | | |

| Lending Collateral – (6.77%) | | | | | | | (16,037,924 | ) |

| Other Liabilities Net of Receivables and | | | | | | | | |

| Other Assets – (0.05%) | | | | | | | (127,381 | ) |

| Net Assets Applicable to 20,462,311 | | | | | | | | |

| Shares Outstanding – 100.00% | | | | | | $ | 237,063,746 | |

| | | | | | | | | | |

| Net Asset Value – Delaware International Value Equity Fund | | | | | | | | |

| Class A ($93,439,555 / 8,062,222 Shares) | | | | | | | | $11.59 | |

| Net Asset Value – Delaware International Value Equity Fund | | | | | | | | |

| Class B ($3,008,655 / 263,901 Shares) | | | | | | | | $11.40 | |

| Net Asset Value – Delaware International Value Equity Fund | | | | | | | | |

| Class C ($30,510,088 / 2,679,958 Shares) | | | | | | | | $11.38 | |

| Net Asset Value – Delaware International Value Equity Fund | | | | | | | | |

| Class R ($2,288,088 / 198,190 Shares) | | | | | | | | $11.54 | |

| Net Asset Value – Delaware International Value Equity Fund | | | | | | | | |

| Institutional Class ($107,817,360 / 9,258,040 Shares) | | | | | | | | $11.65 | |

| |

| Components of Net Assets at November 30, 2012: | | | | | | | | |

| Shares of beneficial interest (unlimited authorization – no par) | | | | | | $ | 440,419,603 | |

| Undistributed net investment income | | | | | | | 2,975,693 | |

| Accumulated net realized loss on investments and derivatives | | | | | | | (219,147,711 | ) |

| Net unrealized appreciation of investments and derivatives | | | | | | | 12,816,161 | |

| Total net assets | | | | | | $ | 237,063,746 | |

32

| | |

| | |

| Δ | Securities have been classified by country of origin. Classification by type of business has been presented on page 24 in “Security type/country and sector allocations.” |

| † | Non income producing security. |

| * | Fully or partially on loan. |

| ≠ | The rate shown is the effective yield at the time of purchase. |

| ** | See Note 9 in “Notes to financial statements” for additional information on securities lending collateral. |

| @ | Illiquid security. At November 30, 2012, the aggregate value of illiquid securities was $0, which represented 0.00% of the Fund’s net assets. See Note 10 in “Notes to financial statements.” |

| © | Includes $15,191,362 of securities loaned. |

| Net Asset Value and Offering Price Per Share – | | | |

| Delaware International Value Equity Fund | | | |

| Net asset value Class A (A) | | $ | 11.59 |

| Sales charge (5.75% of offering price) (B) | | | 0.71 |

| Offering price | | $ | 12.30 |

| (A) | Net asset value per share, as illustrated, is the amount which would be paid upon redemption or repurchase of shares. |

| (B) | See the current prospectus for purchases of $50,000 or more. |

The following foreign currency exchange contracts were outstanding at November 30, 2012:1

Foreign Currency Exchange Contracts

| | | | | | | | | | | | | | | | | Unrealized |

| | | | | | | | | | | | | | | | Appreciation |

| Counterparty | | | Contract to Receive (Deliver) | | In Exchange For | | Settlement Date | | (Depreciation) |

| MNB | | | EUR | | (1,371,542 | ) | | | USD | | 1,786,296 | | | 12/4/12 | | | $ | 2,457 | | |

| MNB | | | EUR | | 2,196,765 | | | | USD | | (2,861,067 | ) | | 12/5/12 | | | | (3,903 | ) | |

| MNB | | | GBP | | (482,978 | ) | | | USD | | 772,475 | | | 12/5/12 | | | | (1,299 | ) | |

| | | | | | | | | | | | | | | | | $ | (2,745 | ) | |

The use of foreign currency exchange contracts involves elements of market risk and risks in excess of the amount recognized in the financial statements. The foreign currency exchange contracts presented above represent the Fund’s total exposure in such contracts, whereas only the net unrealized appreciation (depreciation) is reflected in the Fund’s net assets.

1See Note 8 in “Notes to financial statements.”

33

Statements of net assets

Delaware International Value Equity Fund

Summary of abbreviations:

ADR — American Depositary Receipt

EUR — European Monetary Unit

GBP — British Pound

MNB — Mellon National Bank

USD — United States Dollar

See accompanying notes, which are an integral part of the financial statements.

34

| Delaware Emerging Markets Fund | November 30, 2012 |

| | | | Number of shares | | Value (U.S. $) |

| ΔCommon Stock – 95.77% | | | | | | | |

| Argentina – 1.56% | | | | | | | |

| @* | Cresud ADR | | | 1,442,769 | | | $ | 12,378,958 |

| # | Grupo Clarin Class B GDR 144A | | | 353,200 | | | | 1,022,973 |

| @ | IRSA Inversiones y Representaciones ADR | | | 867,000 | | | | 6,181,710 |

| @†* | Pampa Energia ADR | | | 95,300 | | | | 300,195 |

| YPF ADR | | | 800,000 | | | | 9,096,000 |

| | | | | | | | 28,979,836 |

| Australia – 0.11% | | | | | | | |

| * | Alumina ADR | | | 500,000 | | | | 1,960,000 |

| | | | | | | | 1,960,000 |

| Brazil – 15.24% | | | | | | | |

| AES Tiete | | | 597,480 | | | | 5,608,105 |

| † | B2W Cia Global Do Varejo | | | 1,117,800 | | | | 8,006,339 |

| Banco Santander Brasil ADR | | | 2,150,000 | | | | 14,383,500 |

| *† | Brasil Foods ADR | | | 1,450,000 | | | | 26,607,500 |

| * | Braskem ADR | | | 161,000 | | | | 2,096,220 |

| Centrais Eletricas Brasileiras | | | 2,140,204 | | | | 7,664,698 |

| * | Cia Brasileira de Distribuicao Grupo | | | | | | | |

| Pao de Acucar ADR | | | 400,000 | | | | 17,312,000 |

| * | Cia Siderurgica Nacional ADR | | | 935,600 | | | | 4,518,948 |

| *† | Fibria Celulose ADR | | | 3,800,000 | | | | 38,418,000 |

| @ | Gerdau | | | 2,764,900 | | | | 19,169,594 |

| *† | Gol Linhas Aereas Inteligentes ADR | | | 2,732,300 | | | | 13,142,363 |

| † | Hypermarcas | | | 4,000,000 | | | | 28,837,601 |

| Itau Unibanco Holding ADR | | | 1,700,000 | | | | 25,755,000 |

| Petroleo Brasileiro SA ADR | | | 3,400,000 | | | | 61,098,000 |

| Tim Participacoes ADR | | | 568,604 | | | | 10,081,349 |

| | | | | | | | 282,699,217 |

| China/Hong Kong – 17.44% | | | | | | | |

| † | Baidu ADR | | | 100,000 | | | | 9,631,000 |

| Bank of China | | | 30,000,000 | | | | 12,657,738 |

| @† | Bitauto Holdings ADR | | | 205,400 | | | | 1,359,748 |

| China Construction Bank | | | 28,000,000 | | | | 21,460,091 |

| @* | China Huiyuan Juice Group | | | 9,998,000 | | | | 3,547,586 |

| * | China Mengniu Dairy | | | 4,860,000 | | | | 13,607,649 |

| China Mobile ADR | | | 440,000 | | | | 25,044,800 |

| China Petroleum & Chemical | | | 12,166,500 | | | | 12,904,006 |

| * | China Unicom Hong Kong ADR | | | 1,088,334 | | | | 16,901,827 |

35

Statements of net assets

Delaware Emerging Market Fund

| | | | Number of shares | | Value (U.S. $) |

| ΔCommon Stock (continued) | | | | | | | |

| China/Hong Kong (continued) | | | | | | | |

| * | CNOOC ADR | | | 144,000 | | | $ | 30,695,040 |

| First Pacific | | | 4,071,002 | | | | 4,275,755 |

| Fosun International | | | 2,886,500 | | | | 1,709,509 |

| *† | Foxconn International Holdings | | | 14,370,000 | | | | 7,268,251 |

| @* | Guangshen Railway | | | 11,000,000 | | | | 3,647,648 |

| †* | Hollysys Automation Technologies | | | 550,000 | | | | 5,973,000 |

| *† | Huadian Power International | | | 19,166,000 | | | | 5,712,557 |

| Industrial & Commercial Bank of China | | | 20,000,000 | | | | 13,496,426 |

| Kunlun Energy | | | 10,000,000 | | | | 20,360,765 |

| @ | Shanda Games ADR | | | 2,122,400 | | | | 6,579,440 |

| † | Sina | | | 350,000 | | | | 15,932,000 |

| @ | Sinotrans | | | 15,326,332 | | | | 2,353,273 |

| *† | Sohu.com | | | 780,000 | | | | 31,067,400 |

| @† | Tianjin Development Holdings | | | 15,559,550 | | | | 7,528,620 |