UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549 |

|

FORM N-CSR |

|

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT INVESTMENT COMPANIES |

|

Investment Company Act file number_811-06336 |

|

__Franklin Templeton International Trust

(Exact name of registrant as specified in charter) |

|

One Franklin Parkway, San Mateo, CA 94403-1906

(Address of principal executive offices) (Zip code) |

|

Craig S. Tyle, One Franklin Parkway, San Mateo, CA 94403-1906

(Name and address of agent for service) |

|

Registrant's telephone number, including area code: _650 312-2000 |

|

Date of fiscal year end: 10/31 |

|

Date of reporting period: _10/31/13 |

|

Item 1. Reports to Stockholders. |

| 1

Annual Report

Franklin India Growth Fund

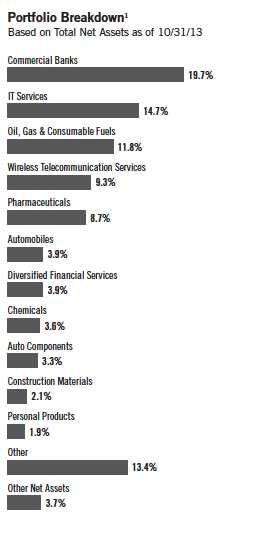

Your Fund’s Goal and Main Investments: Franklin India Growth Fund seeks long-term capital appreciation by investing under normal market conditions at least 80% of its net assets in securities of “Indian companies,” which are defined as those organized under the laws of, with a principal office in, or for which the principal trading market for their securities is in India, that derive 50% or more of total revenue or profit from goods or services produced or sales made in India, or that have 50% or more of their assets in India.1

Performance data represent

past performance, which does

not guarantee future results.

Investment return and principal

value will fluctuate, and you may

have a gain or loss when you sell

your shares. Current performance

may differ from figures shown.

Please visit franklintempleton.com

or call (800) 342-5236 for most

recent month-end performance.

This annual report for Franklin India Growth Fund covers the fiscal year ended October 31, 2013.

Performance Overview

Franklin India Growth Fund – Class A had a -2.06% cumulative total return for the 12 months ended October 31, 2013. In comparison, the MSCI India Index posted a +0.65% total return.2 You can find more of the Fund’s performance data in the Performance Summary beginning on page 7.

Economic and Market Overview

During the period under review, India’s economic growth, as measured by gross domestic product (GDP), continued to moderate as a combination of cyclical and policy issues weighed on investment spending, and consumer spending decreased in the wake of sustained high inflation. Real GDP grew 4.4% year-over-year in the second quarter of 2013, compared to 4.8% for the first quarter.3 For the fiscal year ended March 31, 2013, real GDP grew an estimated 5.0%, compared to 6.2% in the previous fiscal year.3 In recent months, exports recovered strongly and good monsoons improved prospects for a rise in farm production. Even as growth moderated, inflation levels remained

1. The Fund currently invests indirectly in Indian companies through FT (Mauritius) Offshore Investments Limited, a wholly owned, collective investment vehicle registered in the Republic of Mauritius.

2. Source: © 2013 Morningstar. All Rights Reserved. The information contained herein: (1) is proprietary to Morningstar and/or its content providers; (2) may not be copied or distributed; and (3) is not warranted to be accurate, complete or timely. Neither Morningstar nor its content providers are responsible for any damages or losses arising from any use of this information. The index is unmanaged and includes reinvested dividends. One cannot invest directly in an index, and an index is not representative of the Fund’s portfolio.

3. Source: Central Statistical Organization.

The dollar value, number of shares or principal amount, and names of all portfolio holdings are listed in the Fund’s Statement of Investments (SOI). The SOI begins on page 18.

Annual Report | 3

What is a current account?

A current account is that part of the balance of payments where all of one country’s international transactions in goods and services are recorded.

What is balance of payments?

Balance of payments is a record of all of a country’s exports and imports of goods and services, borrowing and lending with the rest of the world during a particular time period. It helps a country evaluate its competitive strengths and weaknesses and forecast the strength of its currency.

elevated, especially for consumers who struggled with higher food prices and the pass-through effects of currency depreciation on imports as the rupee fell 12.46% against the U.S. dollar.4

India’s central bank, the Reserve Bank of India (RBI), implemented a range of measures in an effort to curb rupee volatility and contain the current account deficit. These included tightening rupee liquidity, raising short-term borrowing costs, setting up currency swap facilities and increasing import costs for gold. The combination of domestic policy support and a return of global risk appetite helped the rupee rebound somewhat. Toward the end of the period, the RBI gradually unwound most of the extraordinary measures it had taken to help boost the currency. The RBI, however, remained cautious about inflation and instituted two 25-basis-point (100 basis points equal one percentage point) increases to its benchmark repo rate after having previously cut rates.

The policy environment was broadly supportive of economic growth and development. During the period, the government approved reforms aimed at simplification of India’s foreign investment regime, fiscal consolidation and the repeal of archaic land acquisition laws, among others. The government also sought to expedite approvals for high value infrastructure projects in its effort to bolster investment spending and strengthen business confidence.

Significant divergence in global equity market performance characterized the period under review. Generally, while equity markets in developed economies climbed higher, emerging market equities lost ground based on concerns about a protracted economic slowdown and potential reduction in global liquidity if the U.S. Federal Reserve Board were to begin withdrawing stimulus. Indian equities were also subject to heightened volatility and made little gain over the 12-month period.

Investment Strategy

We are research-driven, fundamental investors pursuing a growth strategy. As bottom-up investors focusing primarily on individual securities, we seek to invest in companies whose current market price, in our opinion, does not reflect future growth prospects. We look for companies that have identifiable drivers of future earnings growth and that present, in our opinion, the best trade-off between potential earnings growth, business and financial risk, and valuation. Our philosophy includes favoring companies that have competitive advantages through leading-edge products, intellectual property, product positioning, unique market niches, brand identity, solid management teams, strong

4. Source: IDC/Exshare.

4 | Annual Report

balance sheets, above-average or rising margins, and strong returns on capital invested in the business. In choosing equity investments, we also consider such factors as the company’s financial strength, management’s expertise, the company’s growth potential within the industry, and the industry’s growth potential.

Manager’s Discussion

During the 12 months under review, a key contributor to the Fund’s absolute performance was Bharti Airtel, one of India’s leading telecommunications companies. Improved earnings growth trends and positive regulatory news-flow contributed to the stock’s strong gain. The company also raised equity from Qatar Foundation Endowment and used the funds to reduce debt. In our view, the Indian telecommunication services sector is on the cusp of consolidation as small, unprofitable companies exit and large, well-established firms such as Bharti Airtel continue to acquire market share.

Other significant contributors to the Fund’s absolute performance were information technology (IT) consulting services providers Infosys and Cognizant Technology Solutions (CTS). In general, currency depreciation and an improved outlook for demand bolstered IT stocks. In our view, Infosys and CTS are well positioned to capitalize on the longer term trend of developed world corporations increasingly outsourcing work to Indian IT consulting firms.

In contrast, key detractors from the Fund’s absolute performance included Gujarat Mineral Development Corporation (GMDC), one of India’s largest lignite producers, Cadila Healthcare, a pharmaceutical company, and Cummins India, the local arm of U.S. engine manufacturer Cummins. GMDC stock declined as investors remained cautious about the outlook for the Indian economy and particularly, the investment cycle. Lower volume growth also weighed on the company’s earnings in the past few quarters. Given its strong operational base and pricing power, the company, in our view, may be poised to benefit from structural growth in demand for resources as India expands.

Slower-than-expected earnings growth led to stock price declines for Cadila Healthcare and Cummins India. In our view, both companies represent quality franchises and at period-end we remained positive about their long-term growth potential.

It is important to recognize the effect of currency movements on the Fund’s performance. In general, if the value of the U.S. dollar goes up compared with a foreign currency, an investment traded in that foreign currency will go down in value because it will be worth fewer U.S. dollars. This can have a negative

Annual Report | 5

| | |

| Top 10 Equity Holdings1 | | |

| 10/31/13 | | |

| |

| Company | % of Total | |

| Sector/Industry | Net Assets | |

| Bharti Airtel Ltd. | 7.9 | % |

| Wireless Telecommunication Services | |

| HDFC Bank Ltd. | 6.6 | % |

| Commercial Banks | | |

| Infosys Ltd. | 6.5 | % |

| IT Services | | |

| ICICI Bank Ltd. | 6.3 | % |

| Commercial Banks | | |

| Reliance Industries Ltd. | 5.5 | % |

| Oil, Gas & Consumable Fuels | | |

| Dr. Reddy’s Laboratories Ltd. | 3.5 | % |

| Pharmaceuticals | | |

| Oil & Natural Gas Corp. Ltd. | 3.0 | % |

| Oil, Gas & Consumable Fuels | | |

| IndusInd Bank Ltd. | 2.9 | % |

| Commercial Banks | | |

| Asian Paints Ltd. | 2.5 | % |

| Chemicals | | |

| Yes Bank Ltd. | 2.4 | % |

| Commercial Banks | | |

effect on Fund performance. Conversely, when the U.S. dollar weakens in relation to a foreign currency, an investment traded in that foreign currency will increase in value, which can contribute to Fund performance. For the 12 months ended October 31, 2013, the U.S. dollar rose in value relative to the Indian rupee. As a result, the Fund’s performance was negatively affected by the portfolio’s investment predominantly in securities denominated in the Indian rupee.

Thank you for your continued participation in Franklin India Growth Fund.

We look forward to serving your future investment needs.

Stephen H. Dover, CFA

Purav A. Jhaveri, CFA, FRM

Portfolio Management Team

Franklin India Growth Fund

CFA® is a trademark owned by CFA Institute.

The foregoing information reflects our analysis, opinions and portfolio holdings as of October 31, 2013, the end of the reporting period. The way we implement our main investment strategies and the resulting portfolio holdings may change depending on factors such as market and economic conditions. These opinions may not be relied upon as investment advice or an offer for a particular security. The information is not a complete analysis of every aspect of any market, country, industry, security or the Fund. Statements of fact are from sources considered reliable, but the investment manager makes no representation or warranty as to their completeness or accuracy. Although historical performance is no guarantee of future results, these insights may help you understand our investment management philosophy.

6 | Annual Report

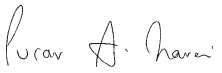

Performance Summary as of 10/31/13

Your dividend income will vary depending on dividends or interest paid by securities in the Fund’s portfolio, adjusted for operating expenses of each class. Capital gain distributions are net profits realized from the sale of portfolio securities. The performance table and graphs do not reflect any taxes that a shareholder would pay on Fund dividends, capital gain distributions, if any, or any realized gains on the sale of Fund shares. Total return reflects reinvestment of the Fund’s dividends and capital gain distributions, if any, and any unrealized gains or losses.

| | | | | | |

| Price Information | | | | | | |

| Class A (Symbol: FINGX) | | Change | | 10/31/13 | | 10/31/12 |

| Net Asset Value (NAV) | -$ | 0.18 | $ | 8.55 | $ | 8.73 |

| Class C (Symbol: FINDX) | | Change | | 10/31/13 | | 10/31/12 |

| Net Asset Value (NAV) | -$ | 0.23 | $ | 8.22 | $ | 8.45 |

| Class R6 (Symbol: n/a) | | Change | | 10/31/13 | | 5/1/13 |

| Net Asset Value (NAV) | -$ | 0.67 | $ | 8.68 | $ | 9.35 |

| Advisor Class (Symbol: FIGZX) | | Change | | 10/31/13 | | 10/31/12 |

| Net Asset Value (NAV) | -$ | 0.15 | $ | 8.68 | $ | 8.83 |

Annual Report | 7

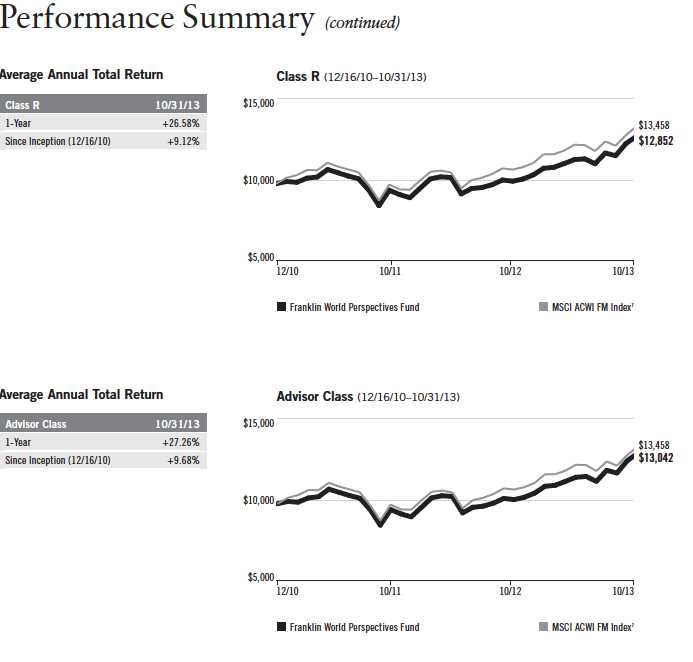

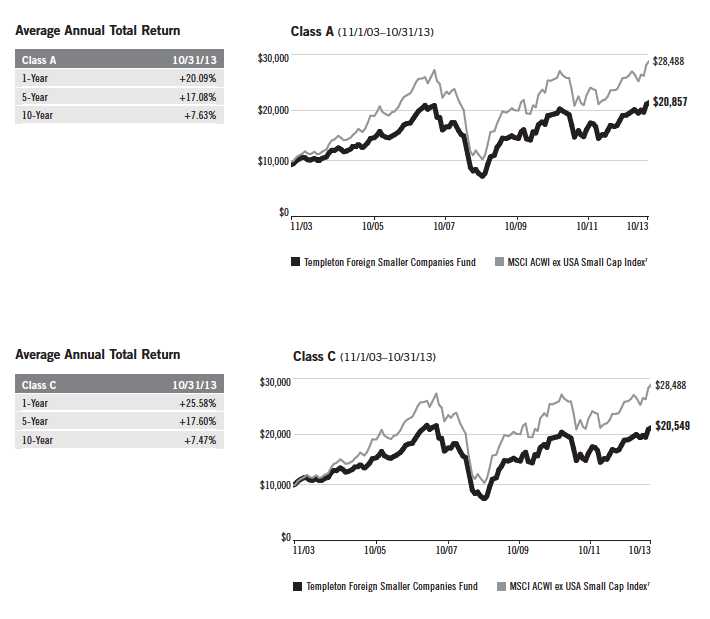

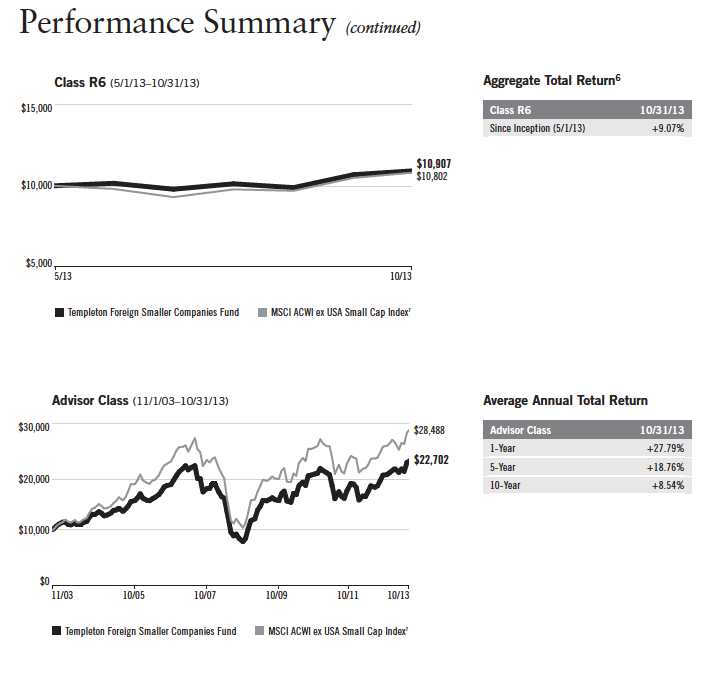

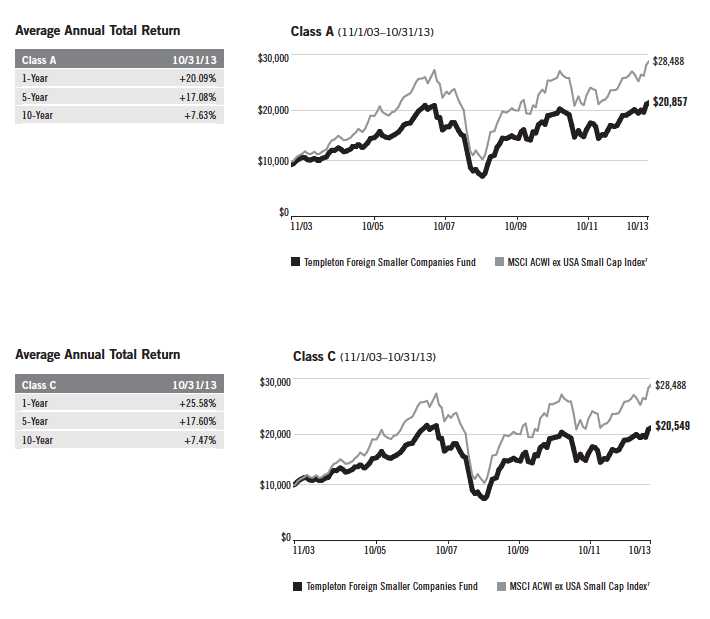

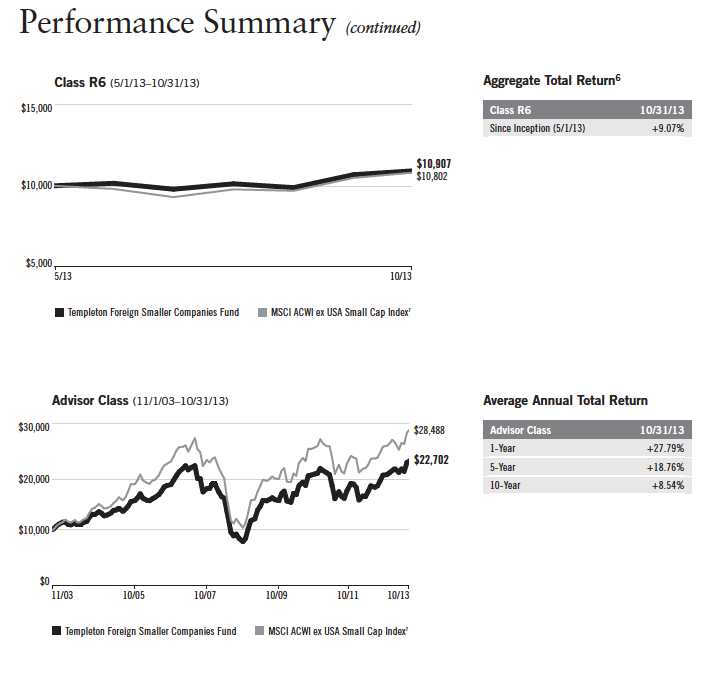

Performance Summary (continued)

Performance1

Cumulative total return excludes sales charges. Aggregate and average annual total returns and value of $10,000 investment include maximum sales charges. Class A: 5.75% maximum initial sales charge; Class C: 1% contingent deferred sales charge in first year only; Class R6/Advisor Class: no sales charges.

| | | | | | | | | |

| Class A | | 1-Year | | | 5-Year | | | Inception (1/31/08) | |

| Cumulative Total Return2 | | -2.06 | % | + | 79.27 | % | | -10.72 | % |

| Average Annual Total Return3 | | -7.69 | % | + | 11.08 | % | | -2.96 | % |

| Value of $10,000 Investment4 | $ | 9,231 | | $ | 16,909 | | $ | 8,414 | |

| Avg. Ann. Total Return (9/30/13)5 | | -18.80 | % | + | 2.92 | % | | -4.61 | % |

| Total Annual Operating Expenses6 | | 1.68% (with waiver) | | | | | | 2.21% (without waiver) | |

| Class C | | 1-Year | | | 5-Year | | | Inception (1/31/08) | |

| Cumulative Total Return2 | | -2.72 | % | + | 72.92 | % | | -14.23 | % |

| Average Annual Total Return3 | | -3.72 | % | + | 11.58 | % | | -2.63 | % |

| Value of $10,000 Investment4 | $ | 9,628 | | $ | 17,292 | | $ | 8,577 | |

| Avg. Ann. Total Return (9/30/13)5 | | -15.24 | % | + | 3.40 | % | | -4.29 | % |

| Total Annual Operating Expenses6 | | 2.40% (with waiver) | | | | | | 2.93% (without waiver) | |

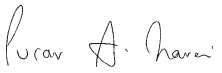

| Class R6 | | | | | | | | Inception (5/1/13) | |

| Cumulative Total Return2 | | | | | | | | -7.17 | % |

| Aggregate Annual Total Return7 | | | | | | | | -7.17 | % |

| Value of $10,000 Investment4 | | | | | | | $ | 9,283 | |

| Aggregate Total Return (9/30/13)5,7 | | | | | | | | -16.04 | % |

| Total Annual Operating Expenses6 | | 1.21% (with waiver) | | | | | | 1.74% (without waiver) | |

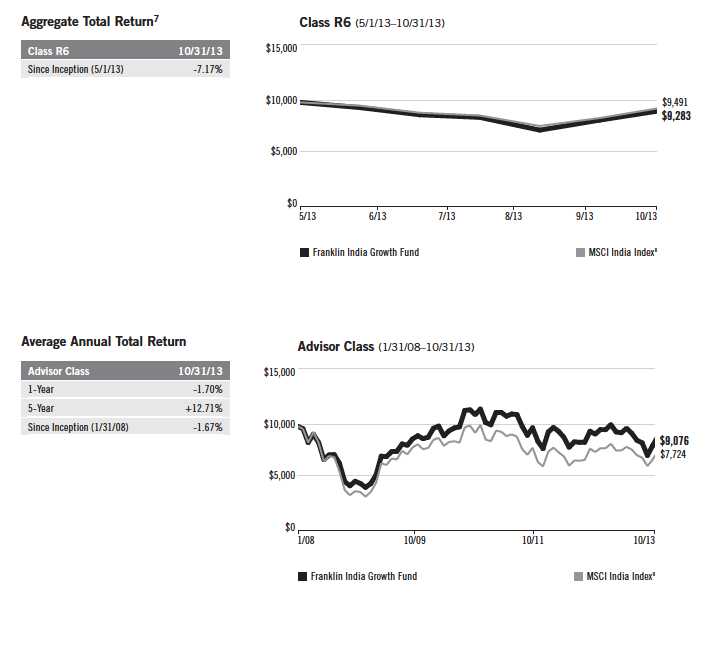

| Advisor Class | | 1-Year | | | 5-Year | | | Inception (1/31/08) | |

| Cumulative Total Return2 | | -1.70 | % | + | 81.88 | % | | -9.24 | % |

| Average Annual Total Return3 | | -1.70 | % | + | 12.71 | % | | -1.67 | % |

| Value of $10,000 Investment4 | $ | 9,830 | | $ | 18,188 | | $ | 9,076 | |

| Avg. Ann. Total Return (9/30/13)5 | | -13.66 | % | + | 4.42 | % | | -3.35 | % |

| Total Annual Operating Expenses6 | | 1.40% (with waiver) | | | | | | 1.93% (without waiver) | |

Performance data represent past performance, which does not guarantee future results. Investment return and principal value will fluctuate, and you may have a gain or loss when you sell your shares. Current performance may differ from figures shown. For most recent month-end performance, go to franklintempleton.com or call (800) 342-5236.

8 | Annual Report

Performance Summary (continued)

Total Return Index Comparison for a Hypothetical $10,000 Investment1

Total return represents the change in value of an investment over the periods shown. It includes any applicable maximum sales charge, Fund expenses, account fees and reinvested distributions. The unmanaged index includes reinvestment of any income or distributions. It differs from the Fund in composition and does not pay management fees or expenses. One cannot invest directly in an index.

Annual Report | 9

Performance Summary (continued)

10 | Annual Report

Performance Summary (continued)

Endnotes

All investments involve risks, including possible loss of principal. Special risks are associated with foreign investing, including currency fluctuations, economic instability and political developments. Investments in developing markets involve heightened risks related to the same factors, in addition to risks associated with these companies’ smaller size, lesser liquidity and the potential lack of established legal, political, business and social frameworks to support securities markets in the countries in which they operate. The Fund may also experience greater volatility than a fund that is more broadly diversified geographically. The Fund is designed for the aggressive portion of a well-diversified portfolio. The Fund is actively managed but there is no guarantee that the manager’s investment decisions will produce the desired results. The Fund’s prospectus also includes a description of the main investment risks.

| |

Class C: Class R6: Advisor Class: | These shares have higher annual fees and expenses than Class A shares. Shares are available to certain eligible investors as described in the prospectus. Shares are available to certain eligible investors as described in the prospectus. |

1. The Fund has an expense reduction contractually guaranteed through at least 2/28/14 and a fee waiver associated with its investments in a Franklin Templeton money fund, contractually guaranteed through at least its current fiscal year end. Fund investment results reflect the expense reduction and fee waiver, to the extent applicable; without these reductions, the results would have been lower.

2. Cumulative total return represents the change in value of an investment over the periods indicated.

3. Average annual total return represents the average annual change in value of an investment over the periods indicated. 4. These figures represent the value of a hypothetical $10,000 investment in the Fund over the periods indicated.

5. In accordance with SEC rules, we provide standardized average annual total return information through the latest calendar quarter.

6. Figures are as stated in the Fund’s current prospectus. In periods of market volatility, assets may decline significantly, causing total annual Fund operating expenses to become higher than the figures shown.

7. Aggregate total return represents the change in value of an investment for the period indicated. Since Class R6 shares have existed for less than one year, average annual total return is not available.

8. Source: © 2013 Morningstar. The MSCI India Index is a free float-adjusted, market capitalization-weighted index designed to measure equity market performance in India.

Annual Report | 11

Your Fund’s Expenses

As a Fund shareholder, you can incur two types of costs:

- Transaction costs, including sales charges (loads) on Fund purchases; and

- Ongoing Fund costs, including management fees, distribution and service (12b-1) fees, and other Fund expenses. All mutual funds have ongoing costs, sometimes referred to as operating expenses.

The following table shows ongoing costs of investing in the Fund and can help you understand these costs and compare them with those of other mutual funds. The table assumes a $1,000 investment held for the six months indicated.

Actual Fund Expenses

The first line (Actual) for each share class listed in the table provides actual account values and expenses. The “Ending Account Value” is derived from the Fund’s actual return, which includes the effect of Fund expenses.

You can estimate the expenses you paid during the period by following these steps. Of course, your account value and expenses will differ from those in this illustration:

| 1. | Divide your account value by $1,000. |

| | If an account had an $8,600 value, then $8,600 ÷ $1,000 = 8.6. |

| 2. | Multiply the result by the number under the heading “Expenses Paid During Period.” |

| | If Expenses Paid During Period were $7.50, then 8.6 x $7.50 = $64.50. |

In this illustration, the estimated expenses paid this period are $64.50.

Hypothetical Example for Comparison with Other Funds

Information in the second line (Hypothetical) for each class in the table can help you compare ongoing costs of investing in the Fund with those of other mutual funds. This information may not be used to estimate the actual ending account balance or expenses you paid during the period. The hypothetical “Ending Account Value” is based on the actual expense ratio for each class and an assumed 5% annual rate of return before expenses, which does not represent the Fund’s actual return. The figure under the heading “Expenses Paid During Period” shows the hypothetical expenses your account would have incurred under this scenario. You can compare this figure with the 5% hypothetical examples that appear in shareholder reports of other funds.

12 | Annual Report

Your Fund’s Expenses (continued)

Please note that expenses shown in the table are meant to highlight ongoing costs and do not reflect any transaction costs, such as sales charges. Therefore, the second line for each class is useful in comparing ongoing costs only, and will not help you compare total costs of owning different funds. In addition, if transaction costs were included, your total costs would have been higher. Please refer to the Fund prospectus for additional information on operating expenses.

| | | | | | |

| | | Beginning Account | | Ending Account | | Expenses Paid During |

| Class A | | Value 5/1/13 | | Value 10/31/13 | | Period* 5/1/13–10/31/13 |

| Actual | $ | 1,000 | $ | 927.30 | $ | 8.16 |

| Hypothetical (5% return before expenses) | $ | 1,000 | $ | 1,016.74 | $ | 8.54 |

| Class C | | | | | | |

| Actual | $ | 1,000 | $ | 923.60 | $ | 11.64 |

| Hypothetical (5% return before expenses) | $ | 1,000 | $ | 1,013.11 | $ | 12.18 |

| Class R6 | | | | | | |

| Actual | $ | 1,000 | $ | 928.30 | $ | 5.83 |

| Hypothetical (5% return before expenses) | $ | 1,000 | $ | 1,019.16 | $ | 6.11 |

| Advisor Class | | | | | | |

| Actual | $ | 1,000 | $ | 928.30 | $ | 6.80 |

| Hypothetical (5% return before expenses) | $ | 1,000 | $ | 1,018.15 | $ | 7.12 |

*Expenses are calculated using the most recent six-month expense ratio, net of expense waivers, annualized for each class (A: 1.68%; C: 2.40%; R6: 1.20%; Advisor: 1.40%), multiplied by the average account value over the period, multiplied by 184/365 to reflect the one-half year period.

Annual Report | 13

Franklin Templeton International Trust

Financial Highlights

| | | | | | | | | | | | | | | |

| Franklin India Growth Fund | | | | | | | | | | | | | | | |

| | | | | | Year Ended October 31, | | | | |

| Class A | | 2013 | | | 2012 | | | 2011 | | | 2010 | | | 2009 | |

| Per share operating performancea | | | | | | | | | | | | | | | |

| (for a share outstanding throughout the year) | | | | | | | | | | | | | | | |

| Net asset value, beginning of year | $ | 8.73 | | $ | 9.45 | | $ | 11.34 | | $ | 8.24 | | $ | 4.98 | |

| Income from investment operationsb: | | | | | | | | | | | | | | | |

| Net investment income (loss)c | | (0.01 | ) | | (0.04 | ) | | (0.06 | ) | | (0.03 | ) | | (0.02 | ) |

| Net realized and unrealized gains (losses) | | (0.17 | ) | | (0.55 | ) | | (1.56 | ) | | 3.19 | | | 3.28 | |

| Total from investment operations | | (0.18 | ) | | (0.59 | ) | | (1.62 | ) | | 3.16 | | | 3.26 | |

| Less distributions from: | | | | | | | | | | | | | | | |

| Net investment income | | — | | | — | | | — | | | (0.04 | ) | | — | |

| Net realized gains | | — | | | (0.13 | ) | | (0.27 | ) | | (0.02 | ) | | — | |

| Total distributions | | — | | | (0.13 | ) | | (0.27 | ) | | (0.06 | ) | | — | |

| Net asset value, end of year | $ | 8.55 | | $ | 8.73 | | $ | 9.45 | | $ | 11.34 | | $ | 8.24 | |

| |

| Total returnd | | (2.06 | )% | | (6.02 | )% | | (14.53 | )% | | 38.54 | % | | 65.46 | % |

| |

| Ratios to average net assetsa | | | | | | | | | | | | | | | |

| Expenses before waiver and payments by affiliates | | 2.26 | % | | 2.21 | % | | 2.25 | % | | 2.27 | % | | 2.55 | % |

| Expenses net of waiver and payments by affiliates | | 1.68 | % | | 1.68 | % | | 1.70 | % | | 1.70 | % | | 1.70 | %e |

| Net investment income (loss) | | (0.07 | )% | | (0.43 | )% | | (0.62 | )% | | (0.31 | )% | | (0.40 | )% |

| |

| Supplemental data | | | | | | | | | | | | | | | |

| Net assets, end of year (000’s) | $ | 25,025 | | $ | 31,555 | | $ | 38,079 | | $ | 37,392 | | $ | 11,310 | |

| Portfolio turnover ratef | | 16.95 | % | | 41.30 | % | | 39.07 | % | | 83.21 | % | | 72.23 | % |

aThe per share amounts and ratios reflect income and expenses of the Portfolio.

bThe amount shown for a share outstanding throughout the period may not correlate with the Statement of Operations for the period due to the timing of sales and repurchases of

the Fund shares in relation to income earned and/or fluctuating market value of the investments of the Fund.

cBased on average daily shares outstanding.

dTotal return does not reflect sales commissions or contingent deferred sales charges, if applicable.

eBenefit of expense reduction rounds to less than 0.01%.

fRepresents the Portfolio’s rate of turnover.

14 | The accompanying notes are an integral part of these financial statements. | Annual Report

Franklin Templeton International Trust

Financial Highlights (continued)

| | | | | | | | | | | | | | | |

| Franklin India Growth Fund | | | | | | | | | | | | | | | |

| | | | | | Year Ended October 31, | | | | |

| Class C | | 2013 | | | 2012 | | | 2011 | | | 2010 | | | 2009 | |

| Per share operating performancea | | | | | | | | | | | | | | | |

| (for a share outstanding throughout the year) | | | | | | | | | | | | | | | |

| Net asset value, beginning of year | $ | 8.45 | | $ | 9.22 | | $ | 11.15 | | $ | 8.14 | | $ | 4.96 | |

| Income from investment operationsb: | | | | | | | | | | | | | | | |

| Net investment income (loss)c | | (0.07 | ) | | (0.09 | ) | | (0.13 | ) | | (0.09 | ) | | (0.06 | ) |

| Net realized and unrealized gains (losses) | | (0.16 | ) | | (0.55 | ) | | (1.53 | ) | | 3.14 | | | 3.24 | |

| Total from investment operations | | (0.23 | ) | | (0.64 | ) | | (1.66 | ) | | 3.05 | | | 3.18 | |

| Less distributions from: | | | | | | | | | | | | | | | |

| Net investment income | | — | | | — | | | — | | | (0.02 | ) | | — | |

| Net realized gains | | — | | | (0.13 | ) | | (0.27 | ) | | (0.02 | ) | | — | |

| Total distributions | | — | | | (0.13 | ) | | (0.27 | ) | | (0.04 | ) | | — | |

| Net asset value, end of year | $ | 8.22 | | $ | 8.45 | | $ | 9.22 | | $ | 11.15 | | $ | 8.14 | |

| |

| Total returnd | | (2.72 | )% | | (6.71 | )% | | (15.06 | )% | | 37.53 | % | | 64.11 | % |

| |

| Ratios to average net assetsa | | | | | | | | | | | | | | | |

| Expenses before waiver and payments by affiliates | | 2.98 | % | | 2.93 | % | | 2.95 | % | | 2.97 | % | | 3.25 | % |

| Expenses net of waiver and payments by affiliates | | 2.40 | % | | 2.40 | % | | 2.40 | % | | 2.40 | % | | 2.40 | %e |

| Net investment income (loss) | | (0.79 | )% | | (1.15 | )% | | (1.32 | )% | | (1.01 | )% | | (1.10 | )% |

| |

| Supplemental data | | | | | | | | | | | | | | | |

| Net assets, end of year (000’s) | $ | 6,078 | | $ | 9,201 | | $ | 11,192 | | $ | 10,878 | | $ | 3,768 | |

| Portfolio turnover ratef | | 16.95 | % | | 41.30 | % | | 39.07 | % | | 83.21 | % | | 72.23 | % |

aThe per share amounts and ratios reflect income and expenses of the Portfolio.

bThe amount shown for a share outstanding throughout the period may not correlate with the Statement of Operations for the period due to the timing of sales and repurchases of

the Fund shares in relation to income earned and/or fluctuating market value of the investments of the Fund.

cBased on average daily shares outstanding.

dTotal return does not reflect sales commissions or contingent deferred sales charges, if applicable.

eBenefit of expense reduction rounds to less than 0.01%.

fRepresents the Portfolio’s rate of turnover.

Annual Report | The accompanying notes are an integral part of these financial statements. | 15

Franklin Templeton International Trust

Financial Highlights (continued)

| | | |

| Franklin India Growth Fund | | | |

| | | Period Ended | |

| | | October 31, | |

| Class R6 | | 2013 | a |

| Per share operating performanceb | | | |

| (for a share outstanding throughout the period) | | | |

| Net asset value, beginning of period | $ | 9.35 | |

| Income from investment operationsc: | | | |

| Net investment income (loss)d | | 0.02 | |

| Net realized and unrealized gains (losses) | | (0.69 | ) |

| Total from investment operations | | (0.67 | ) |

| Net asset value, end of period | $ | 8.68 | |

| |

| Total returne | | (7.17 | )% |

| |

| Ratios to average net assetsb,f | | | |

| Expenses before waiver and payments by affiliates | | 1.78 | % |

| Expenses net of waiver and payments by affiliates | | 1.20 | % |

| Net investment income (loss) | | 0.41 | % |

| |

| Supplemental data | | | |

| Net assets, end of period (000’s) | $ | 459 | |

| Portfolio turnover rateg | | 16.95 | % |

aFor the period May 1, 2013 (effective date) to October 31, 2013.

bThe per share amounts and ratios reflect income and expenses of the Portfolio.

cThe amount shown for a share outstanding throughout the period may not correlate with the Statement of Operations for the period due to the timing of sales and repurchases of

the Fund shares in relation to income earned and/or fluctuating market value of the investments of the Fund.

dBased on average daily shares outstanding.

eTotal return is not annualized for periods less than one year.

fRatios are annualized for periods less than one year.

gRepresents the Portfolio’s rate of turnover.

16 | The accompanying notes are an integral part of these financial statements. | Annual Report

Franklin Templeton International Trust

Financial Highlights (continued)

| | | | | | | | | | | | | | | |

| Franklin India Growth Fund | | | | | | | | | | | | | | | |

| | | | | | Year Ended October 31, | | | | |

| Advisor Class | | 2013 | | | 2012 | | | 2011 | | | 2010 | | | 2009 | |

| Per share operating performancea | | | | | | | | | | | | | | | |

| (for a share outstanding throughout the year) | | | | | | | | | | | | | | | |

| Net asset value, beginning of year | $ | 8.83 | | $ | 9.54 | | $ | 11.41 | | $ | 8.28 | | $ | 4.99 | |

| Income from investment operationsb: | | | | | | | | | | | | | | | |

| Net investment income (loss)c | | 0.02 | | | (0.01 | ) | | (0.03 | ) | | —d | | | —d | |

| Net realized and unrealized gains (losses) | | (0.17 | ) | | (0.57 | ) | | (1.57 | ) | | 3.20 | | | 3.29 | |

| Total from investment operations | | (0.15 | ) | | (0.58 | ) | | (1.60 | ) | | 3.20 | | | 3.29 | |

| Less distributions from: | | | | | | | | | | | | | | | |

| Net investment income | | — | | | — | | | — | | | (0.05 | ) | | — | |

| Net realized gains | | — | | | (0.13 | ) | | (0.27 | ) | | (0.02 | ) | | — | |

| Total distributions | | — | | | (0.13 | ) | | (0.27 | ) | | (0.07 | ) | | — | |

| Net asset value, end of year | $ | 8.68 | | $ | 8.83 | | $ | 9.54 | | $ | 11.41 | | $ | 8.28 | |

| |

| Total return | | (1.70 | )% | | (5.75 | )% | | (14.26 | )% | | 38.91 | % | | 65.97 | % |

| |

| Ratios to average net assetsa | | | | | | | | | | | | | | | |

| Expenses before waiver and payments by affiliates | | 1.98 | % | | 1.93 | % | | 1.95 | % | | 1.97 | % | | 2.25 | % |

| Expenses net of waiver and payments by affiliates | | 1.40 | % | | 1.40 | % | | 1.40 | % | | 1.40 | % | | 1.40 | %e |

| Net investment income (loss) | | 0.21 | % | | (0.15 | )% | | (0.32 | )% | | (0.01 | )% | | (0.10 | )% |

| |

| Supplemental data | | | | | | | | | | | | | | | |

| Net assets, end of year (000’s) | $ | 28,340 | | $ | 30,642 | | $ | 42,915 | | $ | 40,493 | | $ | 57,337 | |

| Portfolio turnover ratef | | 16.95 | % | | 41.30 | % | | 39.07 | % | | 83.21 | % | | 72.23 | % |

aThe per share amounts and ratios reflect income and expenses of the Portfolio.

bThe amount shown for a share outstanding throughout the period may not correlate with the Statement of Operations for the period due to the timing of sales and repurchases of

the Fund shares in relation to income earned and/or fluctuating market value of the investments of the Fund.

cBased on average daily shares outstanding.

dAmount rounds to less than $0.01 per share.

eBenefit of expense reduction rounds to less than 0.01%.

fRepresents the Portfolio’s rate of turnover.

Annual Report | The accompanying notes are an integral part of these financial statements. | 17

Franklin Templeton International Trust

Statement of Investments, October 31, 2013

| | | | |

| Franklin India Growth Fund | Shares | | Value | |

| Common Stocks (Cost $1,505,544) 2.9% | | | | |

| IT Services 2.9% | | | | |

| aCognizant Technology Solutions Corp., A (United States) | 20,000 | $ | 1,738,600 | |

| Mutual Funds (Cost $51,659,672) 97.2% | | | | |

| Diversified Financial Services 97.2% | | | | |

| aFT (Mauritius) Offshore Investments Ltd. (India) | 6,336,361 | | 58,205,719 | |

| Total Investments (Cost $53,165,216) 100.1% | | | 59,944,319 | |

| Other Assets, less Liabilities (0.1)% | | | (42,851 | ) |

| Net Assets 100.0% | | $ | 59,901,468 | |

| |

| |

| aNon-income producing. | | | | |

18 | The accompanying notes are an integral part of these financial statements. | Annual Report

Franklin Templeton International Trust

Financial Statements

Statement of Assets and Liabilities

October 31, 2013

| | | |

| | | Franklin | |

| | | India Growth | |

| | | Fund | |

| Assets: | | | |

| Investments in securities: | | | |

| Cost | $ | 1,505,544 | |

| Value | $ | 1,738,600 | |

| Investments in FT (Mauritius) Offshore Investments Limited (Note 1) | | 58,205,719 | |

| Total value of investments | $ | 59,944,319 | |

| Receivables: | | | |

| Investment securities sold | | 253,717 | |

| Capital shares sold | | 37,072 | |

| Affiliates | | 36,500 | |

| Other assets | | 8 | |

| Total assets | | 60,271,616 | |

| Liabilities: | | | |

| Payables: | | | |

| Capital shares redeemed | | 105,598 | |

| Distribution fees | | 10,854 | |

| Transfer agent fees | | 22,151 | |

| Funds advanced by custodian | | 203,717 | |

| Accrued expenses and other liabilities | | 27,828 | |

| Total liabilities | | 370,148 | |

| Net assets, at value | $ | 59,901,468 | |

| Net assets consist of: | | | |

| Paid-in capital | $ | 65,445,868 | |

| Undistributed net investment income (loss) | | (196,552 | ) |

| Net unrealized appreciation (depreciation) | | 5,329,144 | |

| Accumulated net realized gain (loss) | | (10,676,992 | ) |

| Net assets, at value | $ | 59,901,468 | |

Annual Report | The accompanying notes are an integral part of these financial statements. | 19

Franklin Templeton International Trust

Financial Statements (continued)

Statement of Assets and Liabilities (continued)

October 31, 2013

| | | |

| | | | Franklin |

| | | | India Growth |

| | | | Fund |

| Class A: | | | |

| Net assets, at value | $ | | 25,025,086 |

| Shares outstanding | | | 2,926,903 |

| Net asset value per sharea | | $ | 8.55 |

| Maximum offering price per share (net asset value per share ÷ 94.25%) | | $ | 9.07 |

| Class C: | | | |

| Net assets, at value | $ | | 6,077,529 |

| Shares outstanding | | | 739,298 |

| Net asset value and maximum offering price per sharea | | $ | 8.22 |

| Class R6: | | | |

| Net assets, at value | $ | | 459,171 |

| Shares outstanding | | | 52,876 |

| Net asset value and maximum offering price per share | | $ | 8.68 |

| Advisor Class: | | | |

| Net assets, at value | $ | | 28,339,682 |

| Shares outstanding | | | 3,266,273 |

| Net asset value and maximum offering price per share | | $ | 8.68 |

| |

| |

| aRedemption price is equal to net asset value less contingent deferred sales charges, if applicable. | | | |

20 | The accompanying notes are an integral part of these financial statements. | Annual Report

Franklin Templeton International Trust

Financial Statements (continued)

Statement of Operations

for the year ended October 31, 2013

| | | |

| | | Franklin | |

| | | India Growth | |

| | | Fund | |

| Net investment income allocated from FT (Mauritius) Offshore Investments Limited: | | | |

| Dividends | $ | 1,096,459 | |

| Expenses | | (726,144 | ) |

| Net investment income allocated from FT Mauritius) Offshore Investments Limited | | 370,315 | |

| Expenses: | | | |

| Management fees (Note 3a) | | 212,258 | |

| Administrative fees (Note 3b) | | 73,305 | |

| Distribution fees: (Note 3c) | | | |

| Class A | | 81,292 | |

| Class C | | 78,469 | |

| Transfer agent fees: (Note 3e) | | | |

| Class A | | 60,475 | |

| Class C | | 16,415 | |

| Class R6 | | 22 | |

| Advisor Class | | 64,492 | |

| Custodian fees (Note 4) | | 1,564 | |

| Reports to shareholders | | 30,206 | |

| Registration and filing fees | | 93,314 | |

| Professional fees | | 47,031 | |

| Trustees’ fees and expenses | | 3,797 | |

| Other | | 14,048 | |

| Total expenses | | 776,688 | |

| Expenses waived/paid by affiliates (Note 3f) | | (392,965 | ) |

| Net expenses | | 383,723 | |

| Net investment income (loss) | | (13,408 | ) |

| Realized and unrealized gains (losses) on investments allocated from FT (Mauritius) Offshore Investments Limited: | | | |

| Net realized gain (loss) from: | | | |

| Investments | | (1,584,622 | ) |

| Foreign currency transactions | | (255,385 | ) |

| Net realized gain (loss) | | (1,840,007 | ) |

| Net change in unrealized appreciation (depreciation) on: | | | |

| Investmentsa | | (281,142 | ) |

| Translation of assets and liabilities denominated in foreign currencies | | (68,654 | ) |

| Net change in unrealized appreciation (depreciation) | | (349,796 | ) |

| Net realized and unrealized gain (loss) | | (2,189,803 | ) |

| Net increase (decrease) in net assets resulting from operations | $ | (2,203,211 | ) |

| |

| |

| |

| aIncludes $405,600 of change in unrealized appreciation on other investments held by the India Growth Fund. | | | |

Annual Report | The accompanying notes are an integral part of these financial statements. | 21

Franklin Templeton International Trust

Financial Statements (continued)

| | | | | | |

| Statements of Changes in Net Assets | | | | | | |

| |

| |

| | | Franklin India Growth Fund | |

| | | Year Ended October 31, | |

| | | 2013 | | | 2012 | |

| Increase (decrease) in net assets: | | | | | | |

| Operations: | | | | | | |

| Net investment income (loss) | $ | (13,408 | ) | $ | (305,789 | ) |

| Net realized gain (loss) from investments and foreign currency transactions | | (1,840,007 | ) | | (9,017,855 | ) |

| Net change in unrealized appreciation (depreciation) on investments and translation of other | | | | | | |

| assets and liabilities denominated in foreign currencies | | (349,796 | ) | | 1,514,805 | |

| Net increase (decrease) in net assets resulting from operations | | (2,203,211 | ) | | (7,808,839 | ) |

| Distributions to shareholders from net realized gains: | | | | | | |

| Class A | | — | | | (528,432 | ) |

| Class C | | — | | | (153,932 | ) |

| Advisor Class | | — | | | (402,851 | ) |

| Total distributions to shareholders | | — | | | (1,085,215 | ) |

| Capital share transactions: (Note 2) | | | | | | |

| Class A | | (5,863,006 | ) | | (3,247,269 | ) |

| Class C | | (2,839,742 | ) | | (996,785 | ) |

| Class R6 | | 484,286 | | | — | |

| Advisor Class | | (1,074,575 | ) | | (7,650,661 | ) |

| Total capital share transactions | | (9,293,037 | ) | | (11,894,715 | ) |

| Net increase (decrease) in net assets | | (11,496,248 | ) | | (20,788,769 | ) |

| Net assets: | | | | | | |

| Beginning of year | | 71,397,716 | | | 92,186,485 | |

| End of year | $ | 59,901,468 | | $ | 71,397,716 | |

| Undistributed net investment income (loss) included in net assets: | | | | | | |

| End of year | $ | (196,552 | ) | $ | (163,609 | ) |

22 | The accompanying notes are an integral part of these financial statements. | Annual Report

Franklin Templeton International Trust

Notes to Financial Statements

Franklin India Growth Fund

1. ORGANIZATION AND SIGNIFICANT ACCOUNTING POLICIES

Franklin Templeton International Trust (Trust) is registered under the Investment Company Act of 1940, as amended, (1940 Act) as an open-end investment company, consisting of four separate funds. The Franklin India Growth Fund (Fund) is included in this report. The financial statements of the remaining funds in the Trust are presented separately. The Fund offers four classes of shares: Class A, Class C, Class R6, and Advisor Class. Effective May 1, 2013, the Fund began offering a new class of shares, Class R6. Each class of shares differs by its initial sales load, contingent deferred sales charges, voting rights on matters affecting a single class, its exchange privilege and fees primarily due to differing arrangements for distribution and transfer agent fees.

The Fund operates using a “master fund/feeder fund” structure and primarily invests indirectly in the securities of Indian companies through FT (Mauritius) Offshore Investments Limited (Portfolio), an entity registered with and regulated by the Mauritius Financial Services Commission, which shares the same investment objective as the Fund. The accounting policies of the Portfolio, including the Portfolio’s security valuation policies, will directly affect the recorded value of the Fund’s investment in the Portfolio. The financial statements of the Portfolio, including the Statement of Investments, are included elsewhere in this report and should be read in conjunction with the Fund’s financial statements. At October 31, 2013, the Fund owned 100% of the outstanding shares of the Portfolio.

The following summarizes the Fund’s significant accounting policies.

a. Financial Instrument Valuation

The Fund’s investments in financial instruments are carried at fair value daily. Fair value is the price that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants on the measurement date. Under procedures approved by the Fund’s Board of Trustees (the Board), the Fund’s administrator, investment manager and other affiliates have formed the Valuation and Liquidity Oversight Committee (VLOC). The VLOC provides administration and oversight of the Fund’s valuation policies and procedures, which are approved annually by the Board. Among other things, these procedures allow the Fund to utilize independent pricing services, quotations from securities and financial instrument dealers, and other market sources to determine fair value.

Equity securities listed on an exchange or on the NASDAQ National Market System are valued at the last quoted sale price or the official closing price of the day, respectively. Over-the-counter (OTC) securities are valued within the range of the most recent quoted bid and ask prices. Securities that trade in multiple markets or on multiple exchanges are valued according to the broadest and most representative market. Certain equity securities are valued based upon fundamental characteristics or relationships to similar securities.

Annual Report | 23

Franklin Templeton International Trust

Notes to Financial Statements (continued)

Franklin India Growth Fund

| 1. | ORGANIZATION AND SIGNIFICANT ACCOUNTING POLICIES (continued) |

| a. | Financial Instrument Valuation (continued) |

The Fund has procedures to determine the fair value of financial instruments for which market prices are not reliable or readily available. Under these procedures, the VLOC convenes on a regular basis to review such financial instruments and considers a number of factors, including significant unobservable valuation inputs, when arriving at fair value. The VLOC primarily employs a market-based approach which may use related or comparable assets or liabilities, recent transactions, market multiples, book values, and other relevant information for the investment to determine the fair value of the investment. An income-based valuation approach may also be used in which the anticipated future cash flows of the investment are discounted to calculate fair value. Discounts may also be applied due to the nature or duration of any restrictions on the disposition of the investments. Due to the inherent uncertainty of valuations of such investments, the fair values may differ significantly from the values that would have been used had an active market existed. The VLOC employs various methods for calibrating these valuation approaches including a regular review of key inputs and assumptions, transactional back-testing or disposition analysis, and reviews of any related market activity.

The Fund’s investment in the Portfolio shares is valued at the Portfolio’s net asset value per share. Valuation of securities by the Portfolio is discussed in Note 1(a) of the Portfolio’s Notes to Financial Statements, which are included elsewhere in this report.

b. Income Taxes

It is the Fund’s policy to qualify as a regulated investment company under the Internal Revenue Code. The Fund intends to distribute to shareholders substantially all of its taxable income and net realized gains to relieve it from federal income and excise taxes. As a result, no provision for U.S. federal income taxes is required.

The Fund recognizes the tax benefits of uncertain tax positions only when the position is “more likely than not” to be sustained upon examination by the tax authorities based on the technical merits of the tax position. As of October 31, 2013, and for all open tax years, the Fund has determined that no liability for unrecognized tax benefits is required in the Fund’s financial statements related to uncertain tax positions taken on a tax return (or expected to be taken on future tax returns). Open tax years are those that remain subject to examination and are based on each tax jurisdiction statute of limitation.

The Fund’s investment in the Portfolio may be subject to income and withholding taxes in Mauritius and/or India which are discussed in Note 1(c) of the Portfolio’s Notes to Financial Statements.

24 | Annual Report

Franklin Templeton International Trust

Notes to Financial Statements (continued)

Franklin India Growth Fund

| 1. | ORGANIZATION AND SIGNIFICANT ACCOUNTING POLICIES (continued) |

| c. | Security Transactions, Investment Income, Expenses and Distributions |

Security transactions, including investments in the Portfolio, are accounted for on trade date. Realized gains and losses on security transactions are determined on a specific identification basis. Estimated expenses are accrued daily. Dividend income is recorded on the ex-dividend date. Distributions to shareholders are recorded on the ex-dividend date and are determined according to income tax regulations (tax basis). Distributable earnings determined on a tax basis may differ from earnings recorded in accordance with accounting principles generally accepted in the United States of America. These differences may be permanent or temporary. Permanent differences are reclassified among capital accounts to reflect their tax character. These reclassifications have no impact on net assets or the results of operations. Temporary differences are not reclassified, as they may reverse in subsequent periods.

Common expenses incurred by the Trust are allocated among the funds based on the ratio of net assets of each fund to the combined net assets of the Trust. Fund specific expenses are charged directly to the fund that incurred the expense.

Realized and unrealized gains and losses and net investment income, not including class specific expenses, are allocated daily to each class of shares based upon the relative proportion of net assets of each class. Differences in per share distributions, by class, are generally due to differences in class specific expenses.

The Fund records its proportionate share of the Portfolio’s income, expenses and realized and unrealized gains and losses daily. In addition, the Fund accrues its own expenses.

d. Accounting Estimates

The preparation of financial statements in accordance with accounting principles generally accepted in the United States of America requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities at the date of the financial statements and the amounts of income and expenses during the reporting period. Actual results could differ from those estimates.

e. Guarantees and Indemnifications

Under the Trust’s organizational documents, its officers and directors are indemnified by the Trust against certain liabilities arising out of the performance of their duties to the Trust. Additionally, in the normal course of business, the Trust, on behalf of the Fund, enters into contracts with service providers that contain general indemnification clauses. The Trust’s maximum exposure under these arrangements is unknown as this would involve future claims that may be made against the Trust that have not yet occurred. Currently, the Trust expects the risk of loss to be remote.

Annual Report | 25

Franklin Templeton International Trust

Notes to Financial Statements (continued)

Franklin India Growth Fund

2. SHARES OF BENEFICIAL INTEREST

At October 31, 2013, there were an unlimited number of shares authorized (without par value).

Transactions in the Fund’s shares were as follows:

| | | | | | | | | | |

| | | | | Year Ended October 31, | | | | |

| | | | 2013 | | | | | 2012 | |

| | Shares | | | Amount | | Shares | | | Amount | |

| Class A Shares: | | | | | | | | | | |

| Shares sold | 950,756 | | $ | 8,160,865 | | 1,389,531 | | $ | 11,855,139 | |

| Shares issued in reinvestment of | | | | | | | | | | |

| distributions | — | | | — | | 65,570 | | | 500,298 | |

| Shares redeemed | (1,638,554 | ) | | (14,023,871 | ) | (1,869,329 | ) | | (15,602,706 | ) |

| Net increase (decrease) | (687,798 | ) | $ | (5,863,006 | ) | (414,228 | ) | $ | (3,247,269 | ) |

| Class C Shares: | | | | | | | | | | |

| Shares sold | 270,061 | | $ | 2,210,327 | | 464,263 | | $ | 3,862,124 | |

| Shares issued in reinvestment of | | | | | | | | | | |

| distributions | — | | | — | | 18,926 | | | 140,810 | |

| Shares redeemed | (619,059 | ) | | (5,050,069 | ) | (608,397 | ) | | (4,999,719 | ) |

| Net increase (decrease) | (348,998 | ) | $ | (2,839,742 | ) | (125,208 | ) | $ | (996,785 | ) |

| Class R6 Sharesa: | | | | | | | | | | |

| Shares soldb | 53,411 | | $ | 488,400 | | | | | | |

| Shares redeemed | (535 | ) | | (4,114 | ) | | | | | |

| Net increase (decrease) | 52,876 | | $ | 484,286 | | | | | | |

| Advisor Class Shares: | | | | | | | | | | |

| Shares sold | 830,148 | | $ | 7,447,876 | | 2,633,731 | | $ | 22,670,281 | |

| Shares issued in reinvestment of | | | | | | | | | | |

| distributions | — | | | — | | 47,810 | | | 368,617 | |

| Shares redeemedb | (1,032,537 | ) | | (8,522,451 | ) | (3,711,720 | ) | | (30,689,559 | ) |

| Net increase (decrease) | (202,389 | ) | $ | (1,074,575 | ) | (1,030,179 | ) | $ | (7,650,661 | ) |

| |

| aFor the period May 1, 2013 (effective date) to September 30, 2013. | | | | | | | | | |

| bEffective May 1, 2013, a portion of Advisor Class shares were exchanged into Class R6. | | | | | | |

3. TRANSACTIONS WITH AFFILIATES

Franklin Resources, Inc. is the holding company for various subsidiaries that together are referred to as Franklin Templeton Investments. Certain officers and trustees of the Trust are also officers, and/or directors of the Portfolio and of the following subsidiaries:

| | | |

| | | Subsidiary | Affiliation |

| | | Franklin Advisers, Inc. (Advisers) | Investment manager |

| | | Franklin Templeton Asset Management (India) Private Limited (FT India) | Investment manager |

| | | Franklin Templeton Services, LLC (FT Services) | Administrative manager |

| | | Franklin Templeton Distributors, Inc. (Distributors) | Principal underwriter |

| | | Franklin Templeton Investor Services, LLC (Investor Services) | Transfer agent |

| |

| 26 | | | Annual Report | |

Franklin Templeton International Trust

Notes to Financial Statements (continued)

Franklin India Growth Fund

| 3. | TRANSACTIONS WITH AFFILIATES (continued) |

| a. | Management Fees |

The Fund pays an investment management fee to Advisers. The total management fee is paid based on the average daily net assets of the Fund as follows:

| | |

| Annualized Fee Rate | | Net Assets |

| 1.300 | % | Up to and including $1 billion |

| 1.250 | % | Over $1 billion, up to and including $5 billion |

| 1.200 | % | Over $5 billion, up to and including $10 billion |

| 1.150 | % | Over $10 billion, up to and including $15 billion |

| 1.100 | % | Over $15 billion, up to and including $20 billion |

| 1.050 | % | In excess of $20 billion |

Effective May 1, 2013, the Fund combined its investment management and administration agreements as approved by the Board. The fees paid under the combined agreement do not exceed the aggregate fees that were paid under the separate agreements.

The Portfolio will pay Advisers a fee equal to 80% of the difference between the total management fee and the fee paid by Advisers to FT Services for its administrative services to the Fund.

Prior to May 1, 2013, the Fund paid fees to Advisers equal to 20% of the total management fee with the remainder to be paid by the Portfolio. The total management fee is paid based on the average daily net assets of the Fund as follows:

| | |

| Annualized Fee Rate | | Net Assets |

| 1.100 | % | Up to and including $1 billion |

| 1.050 | % | Over $1 billion, up to and including $5 billion |

| 1.000 | % | Over $5 billion, up to and including $10 billion |

| 0.950 | % | Over $10 billion, up to and including $15 billion |

| 0.900 | % | Over $15 billion, up to and including $20 billion |

| 0.850 | % | In excess of $20 billion |

Under a subadvisory agreement, FT India, an affiliate of Advisers, provides subadvisory services to the Fund. The subadvisory fee is paid by Advisers based on the average daily net assets, and is not an additional expense of the Fund.

b. Administrative Fees

Effective May 1, 2013, under an agreement with Advisers, FT Services provides administrative services to the Fund. The fee is paid by Advisers based on the Fund’s average daily net assets, and is not an additional expense of the Fund.

Prior to May 1, 2013, the Fund paid administrative fees to FT Services of 0.20% per year of the average daily net assets of the Fund.

Annual Report | 27

Franklin Templeton International Trust

Notes to Financial Statements (continued)

Franklin India Growth Fund

| 3. | TRANSACTIONS WITH AFFILIATES (continued) |

| c. | Distribution Fees |

The Board has adopted distribution plans for each share class, with the exception of Class R6 and Advisor Class shares, pursuant to Rule 12b-1 under the 1940 Act. Distribution fees are not charged on shares held by affiliates. Under the Fund’s Class A reimbursement distribution plan, the Fund reimburses Distributors for costs incurred in connection with the servicing, sale and distribution of the Fund’s shares up to the maximum annual plan rate. Under the Class A reimbursement distribution plan, costs exceeding the maximum for the current plan year cannot be reimbursed in subsequent periods. In addition, under the Fund’s Class C compensation distribution plan, the Fund pays Distributors for costs incurred in connection with the servicing, sale and distribution of the Fund’s shares up to the maximum annual plan rate. The plan year, for purposes of monitoring compliance with the maximum annual plan rate, is February 1 through January 31.

The maximum annual plan rates, based on the average daily net assets, for each class, are as follows:

The Board has set the current rate at 0.30% per year for Class A shares until further notice and approval by the Board.

d. Sales Charges/Underwriting Agreements

Front-end sales charges and contingent deferred sales charges (CDSC) do not represent expenses of the Fund. These charges are deducted from the proceeds of sales of Fund shares prior to investment or from redemption proceeds prior to remittance, as applicable. Distributors has advised the Fund of the following commission transactions related to the sales and redemptions of the Fund’s shares for the year:

| | |

| Sales charges retained net of commissions paid to unaffiliated | | |

| broker/dealers | $ | 18,051 |

| CDSC retained | $ | 6,412 |

e. Transfer Agent Fees

Each class of shares, except for Class R6, pays transfer agent fees to Investor Services for its performance of shareholder servicing obligations and reimburses Investor Services for out of pocket expenses incurred, including shareholding servicing fees paid to third parties. These fees are allocated daily based upon their relative proportion of such classes’ aggregate net assets. Class R6 pays Investor Services transfer agent fees specific to that class.

28 | Annual Report

Franklin Templeton International Trust

Notes to Financial Statements (continued)

Franklin India Growth Fund

| 3. | TRANSACTIONS WITH AFFILIATES (continued) |

| e. | Transfer Agent Fees (continued) |

For the year ended October 31, 2013, the Fund paid transfer agent fees of $141,404, of which $76,078 was retained by Investor Services.

f. Waiver and Expense Reimbursements

Advisers and FT Services have contractually agreed in advance to waive or limit their respective fees and to assume as their own expense certain expenses otherwise payable by the Fund so that the expenses, including the Fund’s share of the Portfolio’s allocated expenses, (excluding distribution fees, and acquired fund fees and expenses) for Class A, Class C and Advisor Class of the Fund do not exceed 1.40%, and Class R6 does not exceed 1.21% based on the average net assets of each class (other than certain non-routine expenses or costs, including those relating to litigation, indemnification, reorganizations, and liquidations) until February 28, 2014.

4. EXPENSE OFFSET ARRANGEMENT

The Fund has entered into an arrangement with its custodian whereby credits realized as a result of uninvested cash balances are used to reduce a portion of the Fund’s custodian expenses. During the year ended October 31, 2013, there were no credits earned.

5. INCOME TAXES

For tax purposes, capital losses may be carried over to offset future capital gains, if any. At October 31, 2013, the capital loss carryforwards were as follows:

| | |

| Capital loss carryforwards: | | |

| Short term | $ | 2,097,737 |

| Long term | | 6,945,165 |

| Total capital loss carryforwards | $ | 9,042,902 |

For tax purposes, the Fund may elect to defer any portion of a late-year ordinary loss to the first day of the following fiscal year. At October 31, 2013, the Fund deferred late-year ordinary losses of $144,603.

At October 31, 2013, the cost of investments, net unrealized appreciation (depreciation) including the holdings of the Portfolio for income tax purposes were as follows:

| | | |

| Cost of investments | $ | 53,939,372 | |

| |

| Unrealized appreciation | $ | 9,181,324 | |

| Unrealized depreciation | | (5,480,895 | ) |

| Net unrealized appreciation (depreciation) | $ | 3,700,429 | |

Annual Report | 29

Franklin Templeton International Trust

Notes to Financial Statements (continued)

Franklin India Growth Fund

5. INCOME TAXES (continued)

The Portfolio is a disregarded entity for United States Federal income tax purposes.

Differences between income and/or capital gains as determined on a book basis and a tax basis are primarily due to differing treatments of foreign currency transactions, passive foreign investment company shares, organization costs and wash sales.

6. INVESTMENT TRANSACTIONS

Purchases and sales of investments including transactions from the Portfolio (excluding short term securities) for the year ended October 31, 2013, aggregated $11,012,849 and $19,748,207, respectively.

7. CONCENTRATION OF RISK

Investing in Indian equity securities through the Portfolio may include certain risks and considerations not typically associated with investing in U.S. securities, such as fluctuating currency values, less liquidity, expropriation, confiscatory taxation, nationalization, exchange control regulations (including currency blockage), differing legal standards and changing local and regional economic, political and social conditions, which may result in greater market volatility.

8. CREDIT FACILITY

The Fund, together with other U.S. registered and foreign investment funds (collectively, Borrowers), managed by Franklin Templeton Investments, are borrowers in a joint syndicated senior unsecured credit facility totaling $1.5 billion (Global Credit Facility) which matures on January 17, 2014. This Global Credit Facility provides a source of funds to the Borrowers for temporary and emergency purposes, including the ability to meet future unanticipated or unusually large redemption requests.

Under the terms of the Global Credit Facility, the Fund shall, in addition to interest charged on any borrowings made by the Fund and other costs incurred by the Fund, pay its share of fees and expenses incurred in connection with the implementation and maintenance of the Global Credit Facility, based upon its relative share of the aggregate net assets of all of the Borrowers, including an annual commitment fee of 0.07% based upon the unused portion of the Global Credit Facility. These fees are reflected in other expenses on the Statement of Operations. During the year ended October 31, 2013, the Fund did not use the Global Credit Facility.

30 | Annual Report

Franklin Templeton International Trust

Notes to Financial Statements (continued)

Franklin India Growth Fund

9. FAIR VALUE MEASUREMENTS

The Fund follows a fair value hierarchy that distinguishes between market data obtained from independent sources (observable inputs) and the Fund’s own market assumptions (unobservable inputs). These inputs are used in determining the value of the Fund’s financial instruments and are summarized in the following fair value hierarchy:

- Level 1 – quoted prices in active markets for identical financial instruments

- Level 2 – other significant observable inputs (including quoted prices for similar financial instruments, interest rates, prepayment speed, credit risk, etc.)

- Level 3 – significant unobservable inputs (including the Fund’s own assumptions in determining the fair value of financial instruments)

The input levels are not necessarily an indication of the risk or liquidity associated with financial instruments at that level.

For movements between the levels within the fair value hierarchy, the Fund has adopted a policy of recognizing the transfers as of the date of the underlying event which caused the movement.

At October 31, 2013, all of the Fund’s investments in financial instruments carried at fair value were valued using Level 1 inputs. For detailed categories, see the accompanying Statement of Investments.

10. NEW ACCOUNTING PRONOUNCEMENTS

In December 2011, the Financial Accounting Standards Board (FASB) issued Accounting Standards Update (ASU) No. 2011-11, Balance Sheet (Topic 210): Disclosures about Offsetting Assets and Liabilities. The amendments in the ASU enhance disclosures about offsetting of financial assets and liabilities to enable investors to understand the effect of these arrangements on a fund’s financial position. In January 2013, FASB issued ASU No. 2013-01, Balance Sheet (Topic 210): Clarifying the Scope of Disclosures about Offsetting Assets and Liabilities. The amendments in ASU No. 2013-01 clarify the intended scope of disclosures required by ASU No. 2011-11. These ASUs are effective for interim and annual reporting periods beginning on or after January 1, 2013. The Fund believes the adoption of these ASUs will not have a material impact on its financial statements.

Annual Report | 31

Franklin Templeton International Trust

Notes to Financial Statements (continued)

Franklin India Growth Fund

10. NEW ACCOUNTING PRONOUNCEMENTS (continued)

In June 2013, FASB issued ASU No. 2013-08, Investment Companies (Topic 946): Amendments to the Scope, Measurement, and Disclosure Requirements. The ASU modifies the criteria used in defining an investment company under U.S. Generally Accepted Accounting Principles and also sets forth certain measurement and disclosure requirements. Under the ASU, an entity that is registered under the 1940 Act automatically qualifies as an investment company. The ASU is effective for interim and annual reporting periods beginning after December 15, 2013. The Fund is currently reviewing the requirements and believes the adoption of this ASU will not have a material impact on its financial statements.

11. SUBSEQUENT EVENTS

The Fund has evaluated subsequent events through the issuance of the financial statements and determined that no events have occurred that require disclosure.

32 | Annual Report

Franklin Templeton International Trust

Report of Independent Registered Public Accounting Firm

To the Board of Directors and Shareholders of Franklin India Growth Fund

In our opinion, the accompanying statement of assets and liabilities, including the statement of investments, and the related statements of operations and of changes in net assets and the financial highlights present fairly, in all material respects, the financial position of Franklin India Growth Fund (the “Fund”) at October 31, 2013, the results of its operations for the year then ended, the changes in its net assets for each of the two years in the period then ended and the financial highlights for each of the periods presented, in conformity with accounting principles generally accepted in the United States of America. These financial statements and financial highlights (hereafter referred to as “financial statements”) are the responsibility of the Fund’s management. Our responsibility is to express an opinion on these financial statements based on our audits. We conducted our audits of these financial statements in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement. An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements, assessing the accounting principles used and significant estimates made by management, and evaluating the overall financial statement presentation. We believe that our audits, which included confirmation of securities at October 31, 2013 by correspondence with the custodian, transfer agent and brokers, provide a reasonable basis for our opinion.

PricewaterhouseCoopers LLP

San Francisco, California

December 17, 2013

Annual Report | 33

Franklin Templeton International Trust

Tax Information (unaudited)

Franklin India Growth Fund

Under Section 854(b)(1)(B) of the Internal Revenue Code (Code), the Fund hereby reports the maximum amount allowable but no less than $902,554 as qualified dividends for purposes of the maximum rate under Section 1(h)(11) of the Code for the fiscal year ended October 31, 2013. Distributions, including qualified dividend income, paid during calendar year 2013 will be reported to shareholders on Form 1099-DIV by mid-February 2014. Shareholders are advised to check with their tax advisors for information on the treatment of these amounts on their individual income tax returns.

34 | Annual Report

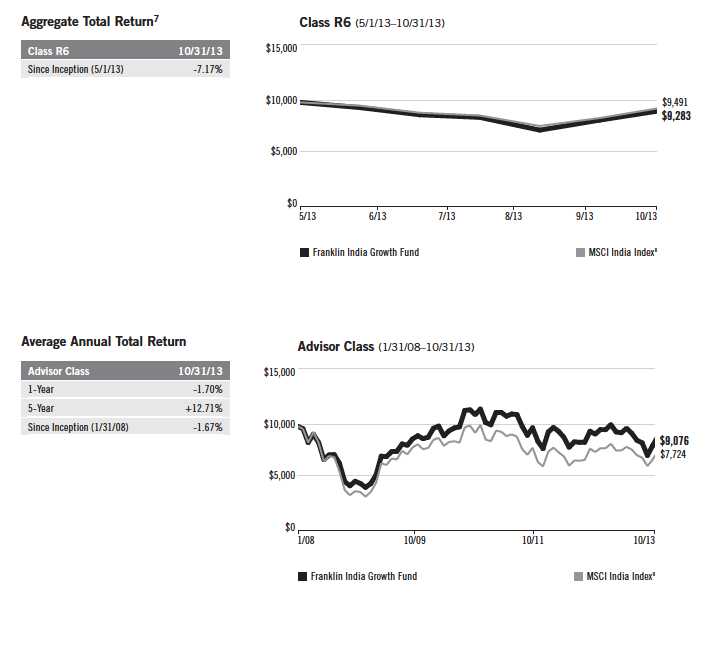

Franklin Templeton International Trust

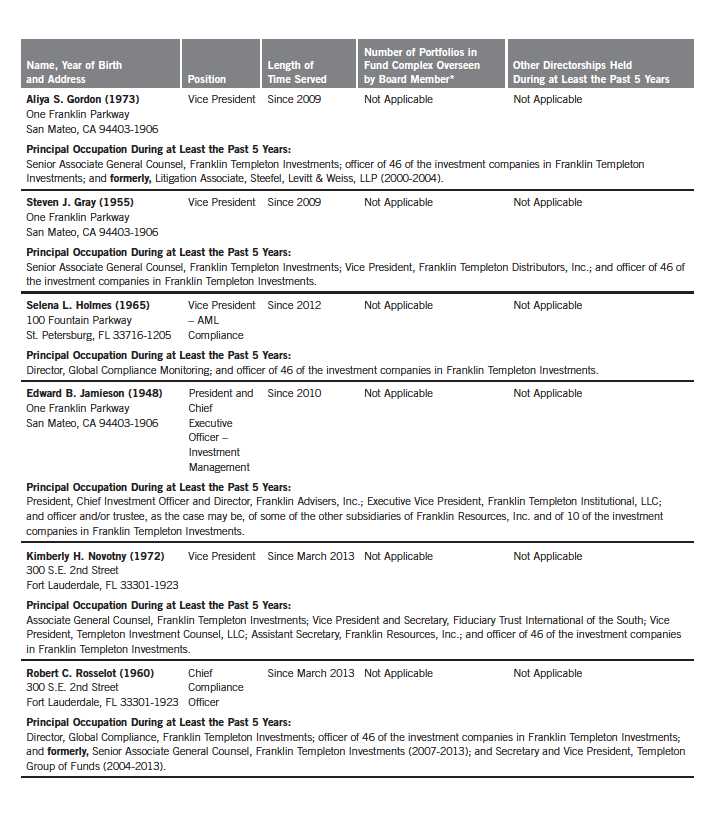

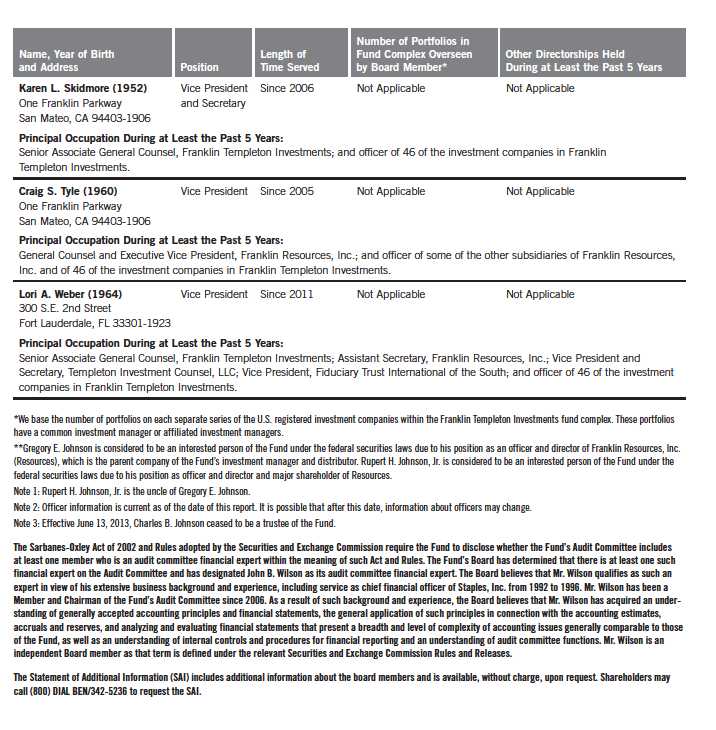

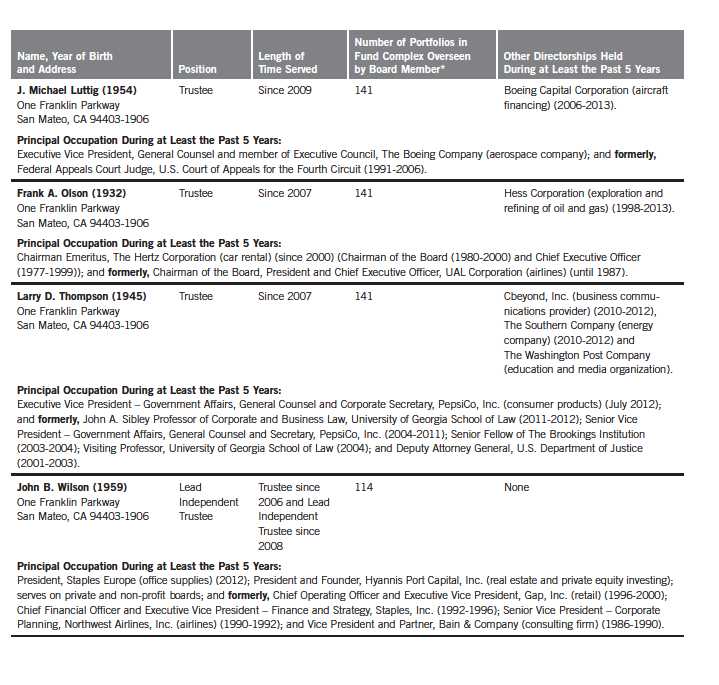

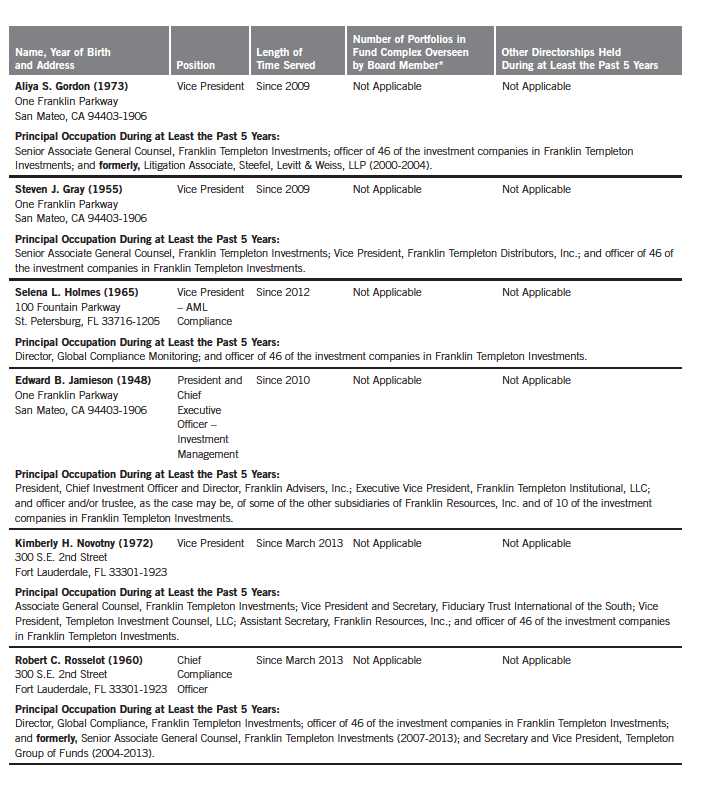

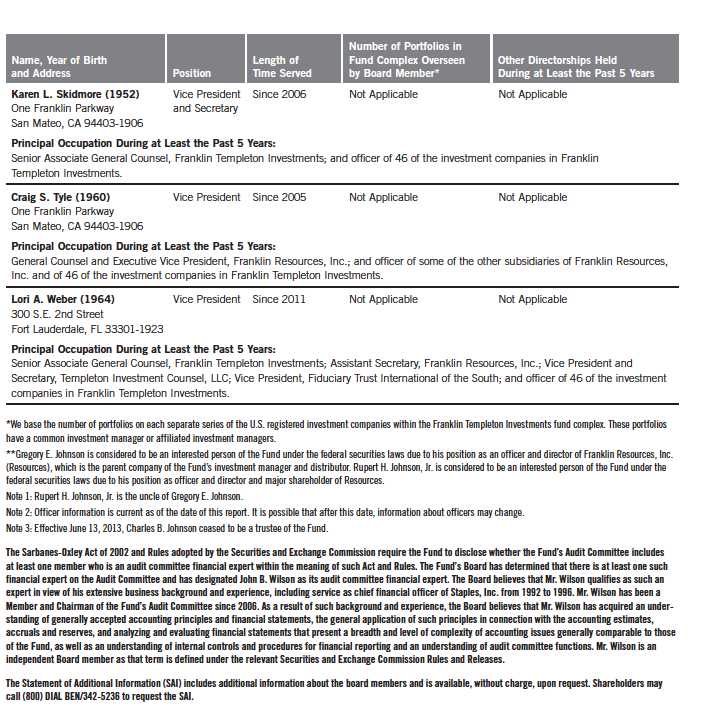

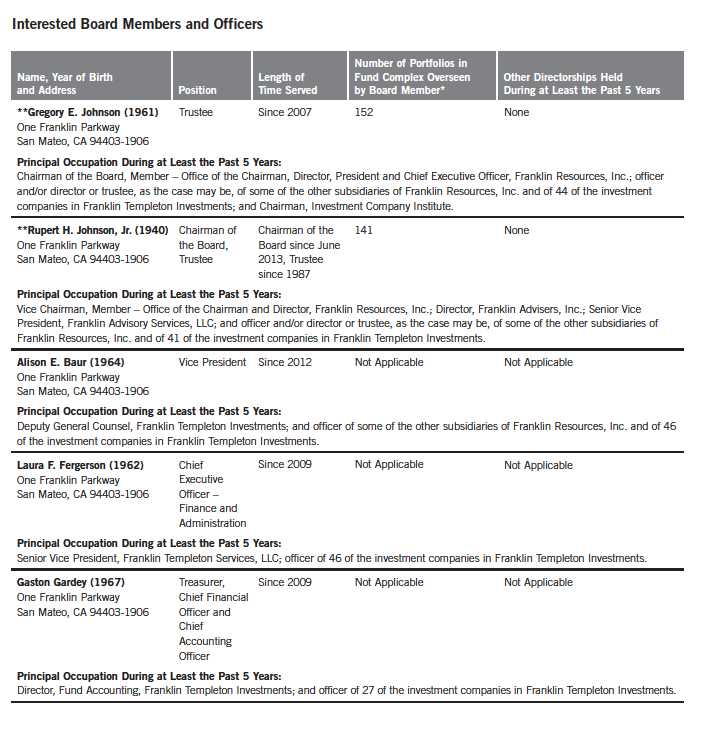

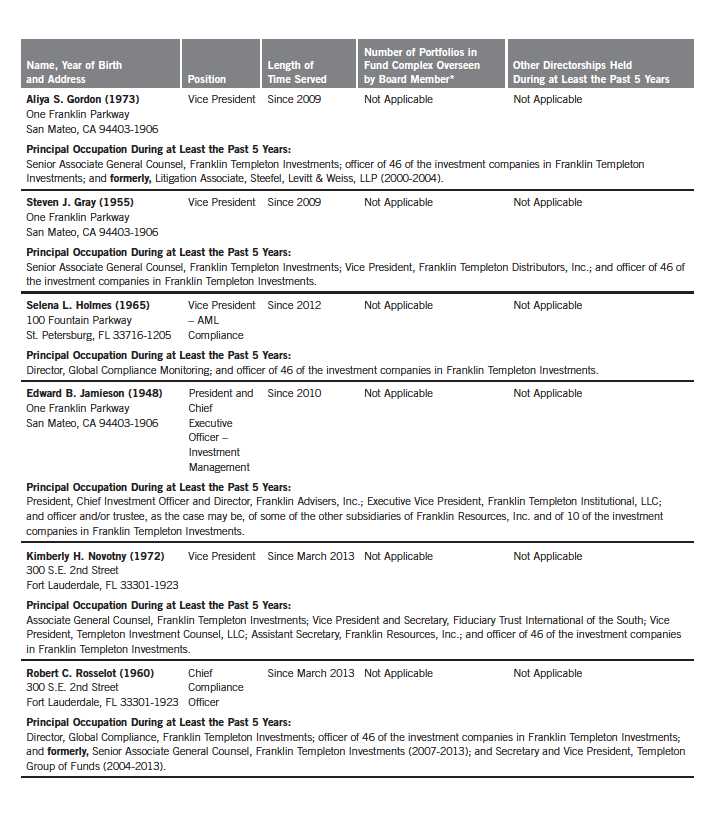

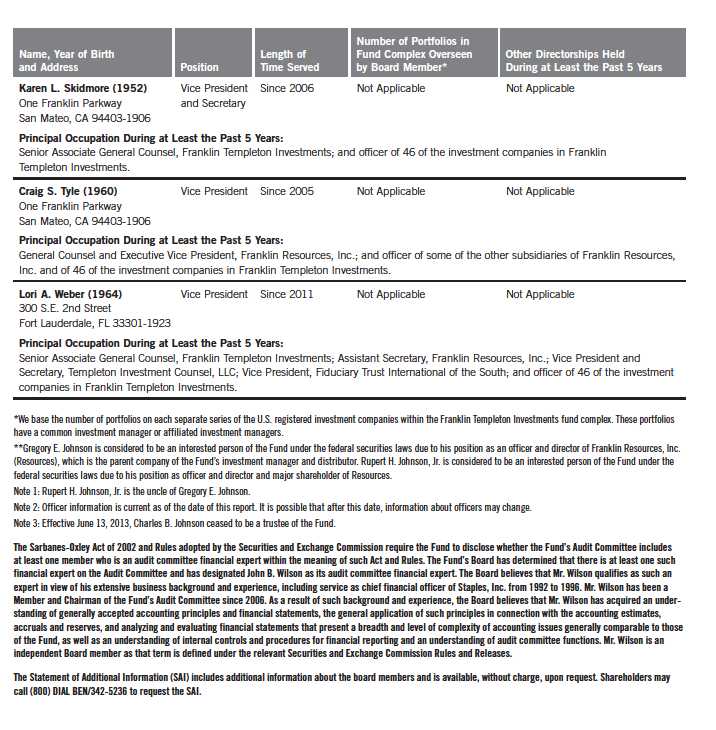

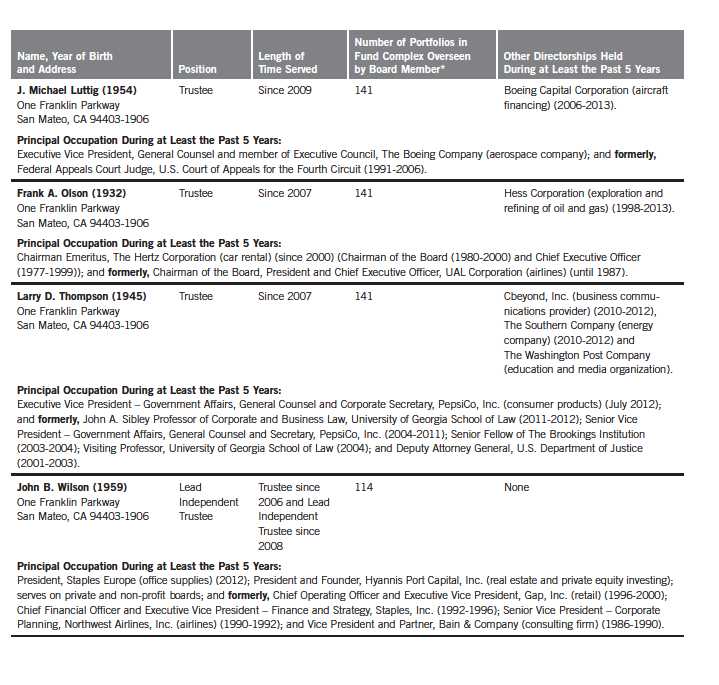

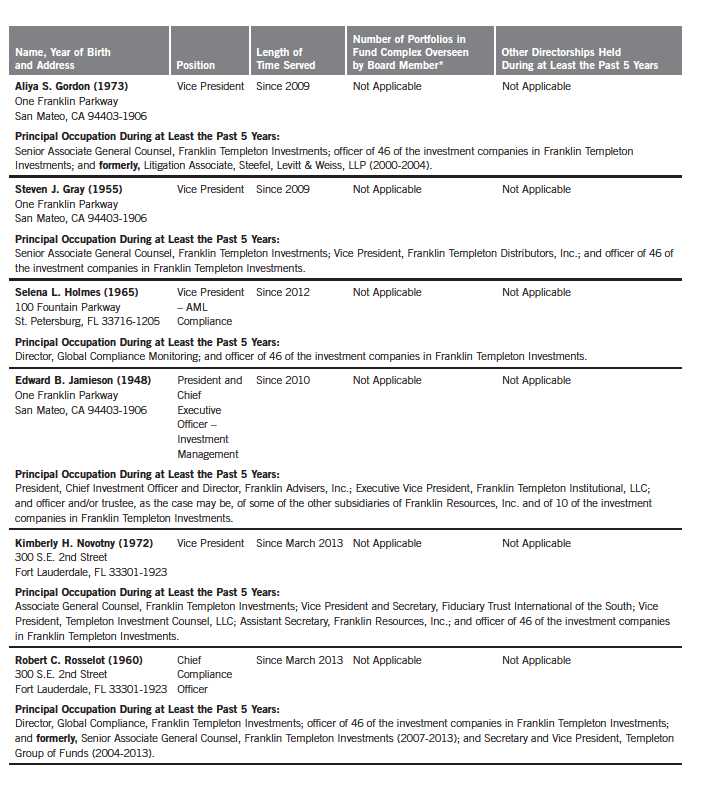

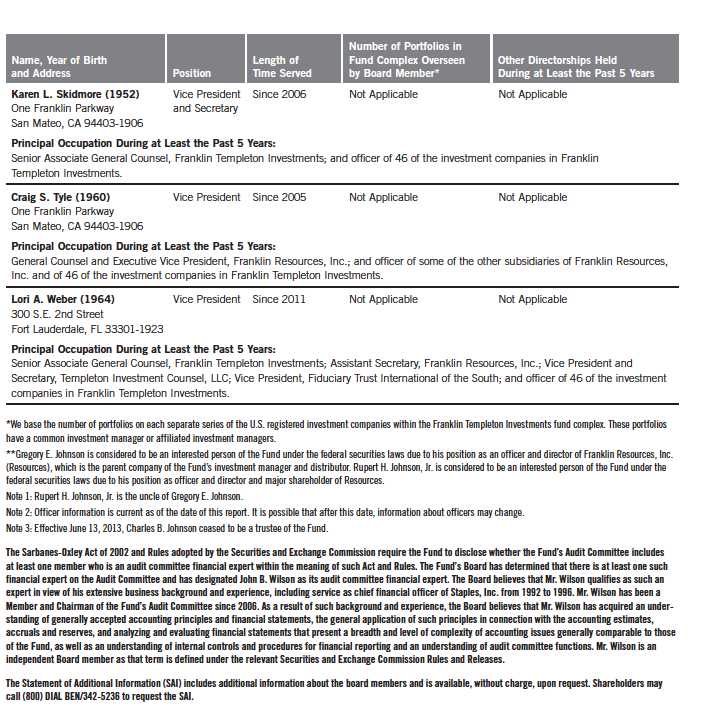

Board Members and Officers

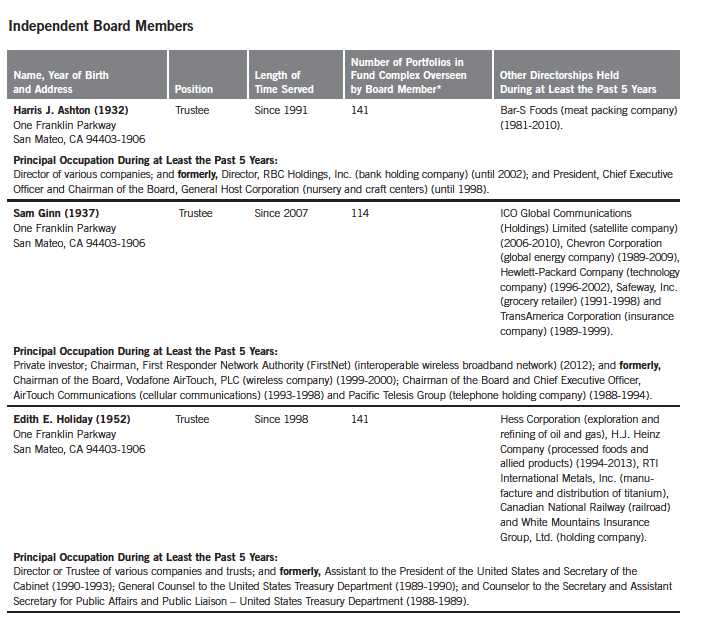

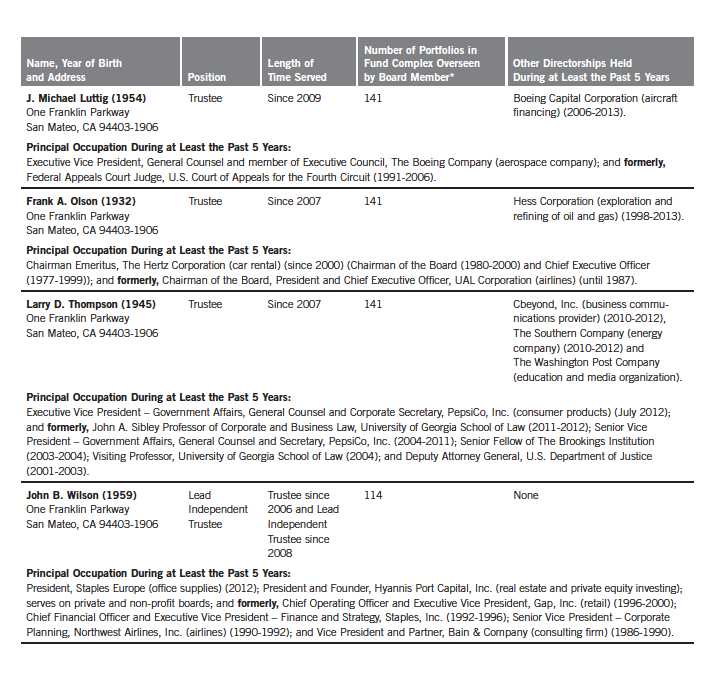

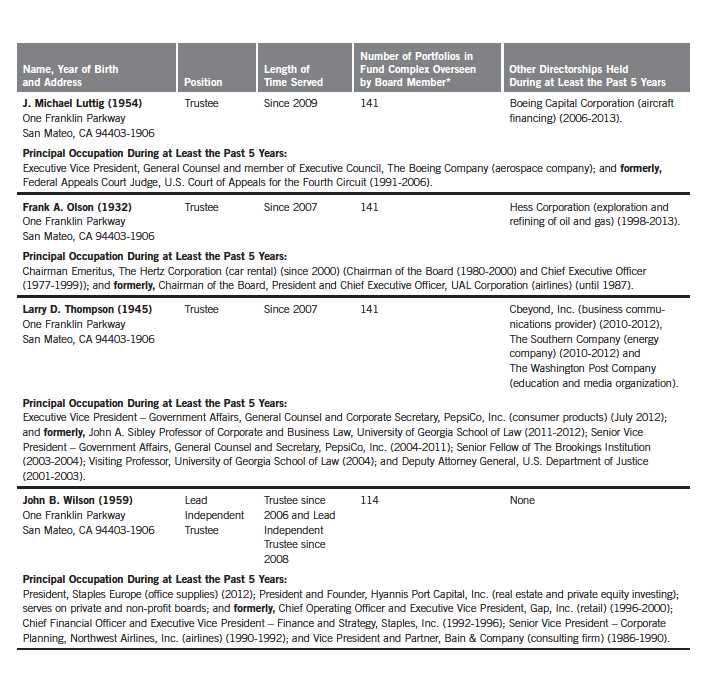

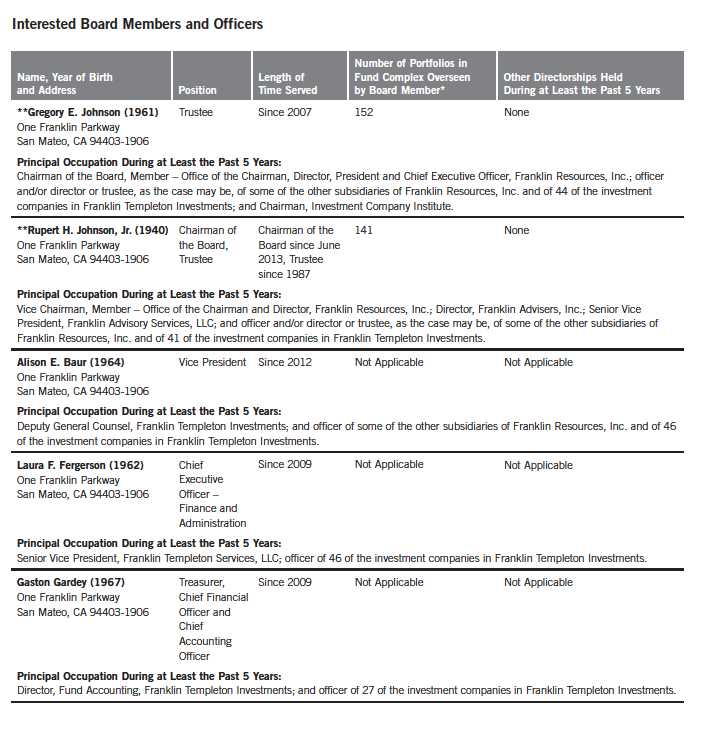

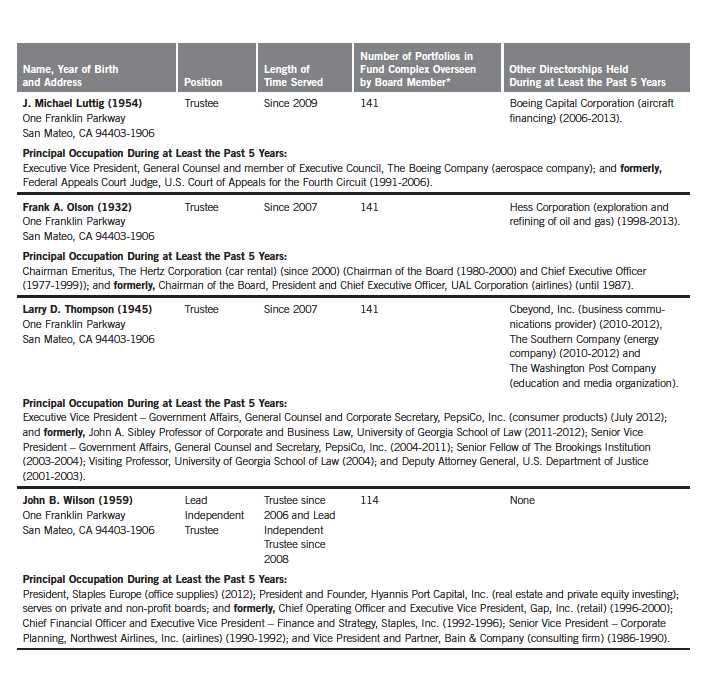

The name, year of birth and address of the officers and board members, as well as their affiliations, positions held with the Trust, principal occupations during at least the past five years and number of portfolios overseen in the Franklin Templeton Investments fund complex are shown below. Generally, each board member serves until that person’s successor is elected and qualified.

Annual Report | 35

36 | Annual Report

Annual Report | 37

38 | Annual Report

Annual Report | 39

FT (Mauritius) Offshore Investments Limited

Financial Highlights

(Expressed in U.S. Dollars)

| | | | | | | | | | | | | | | |

| | | | | | Year Ended October 31, | | | | |

| | | 2013 | | | 2012 | | | 2011 | | | 2010 | | | 2009 | |

| Per share operating performance | | | | | | | | | | | | | | | |

| (for a share outstanding throughout the year) | | | | | | | | | | | | | | | |

| Net asset value, beginning of year | $ | 9.37 | | $ | 9.88 | | $ | 11.52 | | $ | 8.26 | | $ | 4.97 | |

| Income from investment operationsa: | | | | | | | | | | | | | | | |

| Net investment income (loss)b | | 0.06 | | | 0.02 | | | (0.01 | ) | | 0.02 | | | —c | |

| Net realized and unrealized gains (losses) | | (0.24 | ) | | (0.53 | ) | | (1.63 | ) | | 3.24 | | | 3.29 | |

| Total from investment operations | | (0.18 | ) | | (0.51 | ) | | (1.64 | ) | | 3.26 | | | 3.29 | |

| Net asset value, end of year | $ | 9.19 | | $ | 9.37 | | $ | 9.88 | | $ | 11.52 | | $ | 8.26 | |

| |

| Total return | | (1.92 | )% | | (5.16 | )% | | (14.24 | )% | | 39.47 | % | | 66.20 | % |

| |

| Ratios to average net assets | | | | | | | | | | | | | | | |

| Expenses | | 1.07 | % | | 1.08 | % | | 1.17 | % | | 1.22 | % | | 1.37 | % |

| Net investment income (loss) | | 0.54 | % | | 0.19 | % | | (0.08 | )% | | 0.18 | % | | (0.06 | )% |

| |

| Supplemental data | | | | | | | | | | | | | | | |

| Net assets, end of year (000’s) | $ | 58,206 | | $ | 70,010 | | $ | 90,257 | | $ | 88,225 | | $ | 72,271 | |

| Portfolio turnover rate | | 16.95 | % | | 41.30 | % | | 39.07 | % | | 83.21 | % | | 72.23 | % |

aThe amount shown for a share outstanding throughout the period may not correlate with the Statement of Operations for the period due to the timing of sales and repurchases of

the Fund shares in relation to income earned and/or fluctuating market value of the investments of the Fund.

bBased on average daily shares outstanding.

cAmount rounds to less than $0.01 per share.

40 | The accompanying notes are an integral part of these financial statements. | Annual Report

FT (Mauritius) Offshore Investments Limited

Statement of Investments, October 31, 2013

(Expressed in U.S. Dollars)

| | | |

| | Shares | | Value |

| Common Stocks 96.0% | | | |

| India 96.0% | | | |

| Auto Components 3.3% | | | |

| Balkrishna Industries Ltd. | 88,000 | $ | 393,279 |

| Bosch Ltd. | 5,937 | | 840,674 |

| Exide Industries Ltd. | 356,000 | | 715,487 |

| | | | 1,949,440 |

| Automobiles 4.0% | | | |

| Bajaj Auto Ltd. | 25,000 | | 857,486 |

| Mahindra & Mahindra Ltd. | 80,000 | | 1,144,947 |

| Tata Motors Ltd., A | 113,000 | | 351,537 |

| | | | 2,353,970 |

| Chemicals 3.7% | | | |

| Asian Paints Ltd. | 170,000 | | 1,474,569 |

| Pidilite Industries Ltd. | 145,000 | | 673,012 |

| | | | 2,147,581 |

| Commercial Banks 20.2% | | | |

| Axis Bank Ltd. | 44,000 | | 866,872 |

| HDFC Bank Ltd. | 360,000 | | 3,940,681 |

| ICICI Bank Ltd. | 210,000 | | 3,792,761 |

| IndusInd Bank Ltd. | 245,000 | | 1,760,601 |

| Yes Bank Ltd. | 239,000 | | 1,420,038 |

| | | | 11,780,953 |

| Construction & Engineering 2.0% | | | |

| Larsen & Toubro Ltd. | 74,000 | | 1,159,458 |

| Construction Materials 2.1% | | | |

| Grasim Industries Ltd. | 16,000 | | 726,304 |

| Ramco Cements Ltd. | 69,300 | | 199,121 |

| Shree Cements Ltd. | 4,500 | | 321,164 |

| | | | 1,246,589 |

| Diversified Financial Services 4.0% | | | |

| Credit Analysis and Research Ltd. | 40,000 | | 427,221 |

| Crisil Ltd. | 44,250 | | 800,686 |

| Kotak Mahindra Bank Ltd. | 91,000 | | 1,100,500 |

| | | | 2,328,407 |

| Food Products 1.5% | | | |

| Nestle India Ltd. | 9,500 | | 855,927 |

| Gas Utilities 0.2% | | | |

| GAIL India Ltd. | 24,352 | | 138,432 |

| Independent Power Producers & Energy Traders 1.8% | | | |

| NTPC Ltd. | 437,000 | | 1,046,896 |

Annual Report | 41

FT (Mauritius) Offshore Investments Limited

Statement of Investments, October 31, 2013 (continued)

(Expressed in U.S. Dollars)

| | | |

| | Shares | | Value |

| Common Stocks (continued) | | | |

| India (continued) | | | |

| IT Services 12.1% | | | |

| HCL Technologies Ltd. | 50,163 | $ | 883,516 |

| Infosys Ltd. | 72,500 | | 3,864,560 |

| Tata Consultancy Services Ltd. | 36,000 | | 1,222,745 |

| Wipro Ltd. | 140,000 | | 1,075,752 |

| | | | 7,046,573 |

| Machinery 1.4% | | | |

| Cummins India Ltd. | 123,000 | | 784,021 |

| Media 1.6% | | | |

| Jagran Prakashan Ltd. | 455,000 | | 629,674 |

| aTV18 Broadcast Ltd. | 800,000 | | 299,657 |

| | | | 929,331 |

| Metals & Mining 1.8% | | | |

| Gujarat Mineral Development Corp. Ltd. | 410,000 | | 683,322 |

| Hindalco Industries Ltd. | 182,000 | | 337,195 |

| | | | 1,020,517 |

| Oil, Gas & Consumable Fuels 12.2% | | | |

| Bharat Petroleum Corp. Ltd. | 100,500 | | 582,152 |

| Coal India Ltd. | 166,000 | | 768,477 |

| Great Eastern Shipping Co. Ltd. | 135,000 | | 605,065 |

| Oil & Natural Gas Corp. Ltd. | 385,000 | | 1,818,595 |

| Reliance Industries Ltd. | 225,000 | | 3,307,160 |

| | | | 7,081,449 |

| Personal Products 2.0% | | | |

| Marico Ltd. | 340,000 | | 1,163,716 |

| Pharmaceuticals 8.9% | | | |

| Cadila Healthcare Ltd. | 83,000 | | 886,616 |

| Dr. Reddy’s Laboratories Ltd. | 53,000 | | 2,097,040 |

| Lupin Ltd. | 40,000 | | 571,700 |

| Pfizer Ltd. | 31,305 | | 541,840 |

| Torrent Pharmaceuticals Ltd. | 151,000 | | 1,088,754 |

| | | | 5,185,950 |

| Textiles, Apparel & Luxury Goods 1.1% | | | |

| Titan Industries Ltd. | 143,778 | | 616,843 |

| Thrifts & Mortgage Finance 1.5% | | | |

| Housing Development Finance Corp. Ltd. | 64,000 | | 879,200 |

| Transportation Infrastructure 1.1% | | | |

| aGujarat Pipavav Port Ltd. | 780,000 | | 631,454 |

42 | Annual Report

FT (Mauritius) Offshore Investments Limited

Statement of Investments, October 31, 2013 (continued)

(Expressed in U.S. Dollars)

| | | |

| | Shares | | Value |

| Common Stocks (continued) | | | |

| India (continued) | | | |

| Wireless Telecommunication Services 9.5% | | | |

| Bharti Airtel Ltd. | 810,000 | $ | 4,758,527 |

| Idea Cellular Ltd. | 286,000 | | 795,967 |

| | | | 5,554,494 |

| Total Common Stocks (Cost $50,780,205) | | | 55,901,201 |

| Other Assets, less Liabilities 4.0% | | | 2,304,518 |

| Net Assets 100.0% | | $ | 58,205,719 |

| |

| |

| aNon-income producing. | | | |

Annual Report | The accompanying notes are an integral part of these financial statements. | 43

FT (Mauritius) Offshore Investments Limited

Financial Statements

(Expressed in U.S. Dollars)

Statement of Assets and Liabilities

October 31, 2013

| | |

| Assets: | | |

| Investments in securities: | | |

| Cost | $ | 50,780,205 |

| Value | $ | 55,901,201 |

| Cash | | 266,009 |

| Foreign currency, at value (cost $2,376,347) | | 2,351,470 |

| Receivables from dividends | | 4,715 |

| Total assets | | 58,523,395 |

| Liabilities: | | |

| Payables: | | |

| Capital shares redeemed | | 253,717 |

| Management fees | | 43,731 |

| Administrative fees | | 2,950 |