UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number_811-06336

__Franklin Templeton International Trust

(Exact name of registrant as specified in charter)

One Franklin Parkway, San Mateo, CA 94403-1906

(Address of principal executive offices) (Zip code)

Craig S. Tyle, One Franklin Parkway, San Mateo, CA 94403-1906

(Name and address of agent for service)

Registrant's telephone number, including area code:_650 312-2000

Date of fiscal year end: 5/31

Date of reporting period:_5/31/14

Item 1. Reports to Stockholders.

| | | | | | | |

| | Contents | | | | | |

| |

| |

| Shareholder Letter | 1 | Annual Report | | Consolidated Financial | | Report of Independent | |

| | | Franklin Templeton | | Highlights and Consolidated | | Registered Public | |

| | | Global Allocation Fund | 3 | Statement of Investments | 16 | Accounting Firm | 62 |

| | | | | | | | |

| | | | | Consolidated Financial | | Tax Information | 63 |

| | | Performance Summary | 9 | | | | |

| | | | | Statements | 38 | | |

| | | | | | | Board Members and Officers | 65 |

| | | Your Fund’s Expenses | 14 | | | | |

| | | | | Notes to Consolidated | | | |

| | | | | Financial Statements | 42 | Shareholder Information | 70 |

| | | | | | | | |

| 1

Annual Report

Franklin Templeton Global Allocation Fund

Your Fund’s Goal and Main Investments: Franklin Templeton Global Allocation Fund seeks total return. Under normal market conditions, the Fund strategically invests in a diversified core portfolio of equity and fixed income investments, and tactically adjusts the Fund’s exposure to certain asset classes, regions, currencies and sectors independent of the investment processes of the core portfolio’s investment strategies.

This annual report for Franklin Templeton Global Allocation Fund covers the fiscal year ended May 31, 2014.

Performance Overview

Franklin Templeton Global Allocation Fund – Class A delivered a cumulative total return of +8.35% for the 12 months under review. In comparison, the Fund’s benchmark generated a +10.89% total return. The benchmark is a combination of MSCI All Country World Index (ACWI),2, 3 which measures stock performance in developed and emerging markets; Citigroup World Government Bond Index (WGBI),2, 4 which measures performance of investment-grade world government bonds; Dow Jones-UBS Commodity Index Total ReturnSM (DJ-UBSCITRSM),2, 5 which measures performance of fully collateralized positions of underlying commodity futures; and Payden & Rygel (P&R) 90 Day U.S. Treasury Bill (T-Bill) Index,6 a proxy for short-term investments and other net assets. You can find more of the Fund’s performance data in the Performance Summary beginning on page 9.

Performance data represent past performance, which does not guarantee future results. Investment return and principal value will fluctuate, and you may have a gain or loss when you sell your shares. Current performance may differ from figures shown. Please visit franklintempleton.com or call (800) 342-5236 for most recent month-end performance.

| | |

| Geographic Breakdown* | | |

| 5/31/14 | | |

| | % of Total | |

| Country | Net Assets | |

| North America | 57.5 | % |

| Europe | 18.1 | % |

| Australia & New Zealand | 6.0 | % |

| Latin America & Caribbean | 5.8 | % |

| Middle-East & Africa | 1.9 | % |

| Asia | -10.9 | % |

| Short-Term Investments & | | |

| Other Net Assets | 21.6 | % |

| |

| *The figures shown reflect derivatives held in the | |

| portfolio. See footnote 1. | | |

Economic and Market Overview

The global economy grew moderately during the 12 months under review as many developed markets continued to recover and many emerging markets showed growth. Major developed market central banks reaffirmed their accommodative monetary policies in an effort to support the ongoing recovery. In emerging markets, many central banks cut interest rates to boost economic growth, while others raised rates to control inflation and currency depreciation.

The dollar value, number of shares or principal amount, and names of all portfolio holdings are listed in the Fund’s Consolidated Statement of Investments (SOI). The SOI begins on page 20.

Annual Report | 3

U.S. economic growth and employment trends were generally encouraging during the period, despite severe weather across many states in early 2014 that suppressed economic activity. In October 2013, a budget impasse resulted in a temporary federal government shutdown. However, Congress passed a spending bill in January to fund the federal government through September 2014. Congress also approved the suspension of the debt ceiling until March 2015. The U.S. Federal Reserve Board (Fed) began reducing bond purchases by $10 billion a month in January 2014, based on continued favorable economic and employment data.

Outside the U.S., growth rose in the U.K., supported by the services and manufacturing sectors. Economic activity was slower in Japan, although business sentiment and private consumption improved and unemployment reached its lowest level since 2007. Despite a relatively weak yen, export growth slowed toward period-end, resulting partly from lower shipments to the U.S. and China. The Bank of Japan kept its monetary policy unchanged as it maintained an upbeat inflation forecast and reiterated that the economy continued to recover moderately, despite challenges resulting from a sales tax increase in April. Although out of recession, the eurozone experienced weak employment trends and deflationary risks. German Chancellor Angela Merkel’s reelection and the European Central Bank’s (ECB’s) highly accommodative monetary policy contributed to investor confidence in the region. However, economic growth remained subdued, and near period-end the ECB announced that it would provide additional stimulus should deflationary risks increase.

In several emerging markets, including China, growth remained solid though moderating, as domestic demand and exports were relatively soft. Emerging market equities generally rose for the 12-month period, despite volatility resulting from concerns about moderating economic growth, geopolitical tensions in certain regions and the potential impact of the Fed’s tapering its asset purchases. Many emerging market currencies depreciated against the U.S. dollar, leading central banks in several countries, including Brazil, India, Turkey, South Africa and Russia, to raise interest rates in an effort to curb inflation and support their currencies.

Stocks in developed markets rallied during the period amid a generally accommodative monetary policy environment, continued strength in corporate earnings and signs of an economic recovery. Global government and corporate bonds delivered solid performance as interest rates in many developed market countries remained low. Gold prices declined notably for the period despite rallying in early 2014, while oil prices generally rose amid supply concerns related to geopolitical tensions.

4 | Annual Report

Investment Strategy

We manage the Fund using a multi-manager approach. While we are responsible for the Fund’s overall investments, we consult with various other investment managers within Franklin Templeton Investments (subadvisors) who independently manage separate portions of the Fund’s core equity and fixed income portfolio in accordance with the following strategies: all-cap U.S. growth equity, non-U.S. growth equity, deep value equity, non-U.S. value equity, emerging markets equity, global fixed income and global low duration fixed income. The allocations to each strategy may change from time to time and are subject to periodic rebalancing as market values of the portfolio’s securities change or at our discretion.

Under normal market conditions, the Fund’s baseline allocation between broad asset classes is 50% global equity (U.S./international/emerging), 35% global fixed income (U.S./international/emerging), 5% commodity-linked instruments, and 10% cash and derivative instruments. We manage portions of the Fund’s core portfolio, as well as the Fund’s tactical allocation portion, and rebalance the Fund’s portfolio to maintain the baseline strategic allocation to various asset classes and investment strategies. We may change the baseline strategic allocation from time to time.

For purposes of its investment goal, the Fund regularly enters into various transactions involving derivative instruments. For the Fund’s tactical asset allocation, we primarily use stock index futures, government bond futures, equity total return swaps and currency forwards and futures contracts. We make tactical investment decisions based on quantitative research and a systematic investment strategy driven by bottom-up fundamental analysis, top-down macroeconomic analysis and short-term sentiment indicators. The tactical allocation portion of the Fund is intended to adjust the Fund’s equity, fixed income, country/regional, and currency exposures. Although we do not attempt to time the entire market’s direction, we keep the flexibility to shift the Fund’s net exposure (the value of securities held long less the value of securities held short) depending on which market opportunities look more attractive. The Fund may, from time to time, have a net short position in certain asset classes, regions, currencies and sectors.

What is a currency forward contract?

A currency forward contract, or a currency forward, is an agreement between the Fund and a counterparty to buy or sell a foreign currency at a specific exchange rate on a future date.

What is a futures contract?

A futures contract, or a future, is an agreement between the Fund and a counterparty made through a U.S. or foreign futures exchange to buy or sell a security at a specific price on a future date.

What is an equity swap?

A swap agreement, such as an equity total return swap, is a contract between the Fund and a counterparty to exchange on a future date the returns, or differentials in rates of return, that would have been earned or realized if a notional amount were invested in specific instruments.

Manager’s Discussion

For the fiscal year ended May 31, 2014, the cumulative total return of the Fund’s multi-asset portfolio trailed that of its blended benchmark. Security selection in the fixed income and currency markets, where positions under-performed the benchmark despite providing positive absolute contributions to return, detracted from relative performance. An overweighted equity allocation contributed to relative results.

Annual Report | 5

| | |

| Portfolio Breakdown* | | |

| 5/31/14 | | |

| % of Total | |

| Net Assets | |

| Stocks, Equity Index Futures | | |

| & Total Return Swaps | 72.4 | % |

| Energy | 8.0 | % |

| Pharmaceuticals, Biotechnology | | |

| & Life Sciences | 5.5 | % |

| Banks | 5.3 | % |

| Software & Services | 4.8 | % |

| Capital Goods | 4.7 | % |

| Materials | 4.6 | % |

| Diversified Financials | 2.9 | % |

| Technology Hardware & Equipment | 2.6 | % |

| Health Care Equipment & Services | 2.5 | % |

| Insurance | 2.2 | % |

| Equity Index Futures | 10.7 | % |

| Total Return Swaps | 1.9 | % |

| Other | 16.7 | % |

| Bonds, Interest Rate Futures | | |

| & Interest Rate Swaps | 12.0 | % |

| Foreign Government & Agency Securities | 18.8 | % |

| U.S. Government & Agency Securities | 5.9 | % |

| Corporate Bonds | 5.6 | % |

| Interest Rate Futures – U.S. Government | 3.1 | % |

| Interest Rate Swaps | -0.7 | % |

| Interest Rate Futures – | | |

| Foreign Government | -20.7 | % |

| Commodities | 2.7 | % |

| Exchange Traded Notes | 2.7 | % |

| Money Market Funds | | |

| & Other Net Assets | 12.9 | % |

*The figures shown reflect derivatives held in the

portfolio. See footnote 1.

Baseline Strategic Allocation

At period-end, the Fund’s largest asset class exposure was to global equities, which was consistent with their significant structural weight in the baseline strategic allocation. Regionally, the largest equity weightings were in North America and Europe, with the U.S. as the largest country weighting, followed by the U.K. and Switzerland. Relative to the blended benchmark, the largest country overweightings were in the U.K., China and the Netherlands, while the U.S. and Japan represented the largest underweightings. Within the fixed income allocation, the largest regional weightings at period-end were in North America and Europe, and the largest country exposures were in the U.S., South Korea and Mexico. Relative to the blended benchmark, the largest country overweightings were in South Korea, which is not part of the Citigroup WGBI, Mexico and Poland. The most significant fixed income underweightings were in Japan, Italy and Germany.

Tactical Asset Allocation

At period-end, the tactical asset allocation included allocations to global equities and fixed income in developed markets, in addition to currency positions. Equity allocations, through the use of index futures, included long positions in German, French and Swiss stocks.7 Short positions in German and U.K. government bonds, achieved through the use of index futures, reduced the Fund’s overall exposure to fixed income.8 The currency component of the tactical asset allocation included long positions in the U.S. dollar and short exposures to the British pound, euro and Japanese yen, which we achieved through the use of currency forwards.

Equity

For the overall portfolio, the equity portion contributed to relative performance, resulting from the Fund’s overweighted allocation to European equities as slow but steady growth supported European markets. Despite the overall positive contribution of stocks, some equity allocations weighed on relative performance. A tactical short to developing equity market stocks, initiated in mid-2013, hampered relative performance as those markets performed well during the broad equity rally in September and October 2013. The Fund’s underweighting in the U.S. also weighed on performance, although security selection in the U.S. limited the impact.

Fixed Income

For the overall portfolio, fixed income holdings contributed to performance relative to the blended benchmark. However, a tactical short position against rising global interest rates was a significant detractor as the fixed income markets rallied amid continued accommodation from the major developed country

6 | Annual Report

central banks and periods of heightened political risk. A focus on shorter duration assets also limited Fund performance as these issues had smaller gains relative to the benchmark. Conversely, exposure to several emerging debt markets, which are not part of the Citigroup WGBI, including Poland, Mexico and Hungary, helped relative results as bonds from those countries offered higher yields.

Currencies

Overall, currency positions contributed to performance in absolute terms, but detracted from performance relative to the blended benchmark. A significant underweighting in the euro weighed on relative results as the euro strengthened against the U.S. dollar. An underweighting in the British pound also hurt relative performance, although to a lesser extent. On an absolute performance basis, a short Japanese yen position, achieved via currency forward contracts, was a key driver of positive performance. An overweighting in several emerging market currencies, including long positions in the South Korean won and Polish zloty, added value.

Thank you for your continued participation in Franklin Templeton Global Allocation Fund. We look forward to serving your future investment needs.

Annual Report | 7

The foregoing information reflects our analysis, opinions and portfolio holdings as of May 31, 2014, the end of the

reporting period. The way we implement our main investment strategies and the resulting portfolio holdings may

change depending on factors such as market and economic conditions. These opinions may not be relied upon as

investment advice or an offer for a particular security. The information is not a complete analysis of every aspect

of any market, country, industry, security or the Fund. Statements of fact are from sources considered reliable,

but the investment manager makes no representation or warranty as to their completeness or accuracy. Although

historical performance is no guarantee of future results, these insights may help you understand our investment

management philosophy.

1. Breakdown figures are intended to illustrate the Fund’s estimated exposure to various asset classes, countries, cur-

rencies, sectors, or other categories as a percentage of the Fund’s total exposure, and reflect both direct and indirect

(long and short) exposures through the Fund’s use of derivatives, such as swaps, forwards, futures and options.

Figures may not equal 100% or be negative due to rounding, use of derivatives, unsettled trades or other factors. The

use of derivative instruments may allow tactical adjustments to be made quickly and efficiently, and the historical

data provided may differ significantly from the Fund’s current allocations.

2. Source: © 2014 Morningstar. All Rights Reserved. The information contained herein: (1) is proprietary to Morningstar

and/or its content providers; (2) may not be copied or distributed; and (3) is not warranted to be accurate, complete or

timely. Neither Morningstar nor its content providers are responsible for any damages or losses arising from any use of

this information. The Fund’s blended benchmark is currently weighted 50% for the MSCI ACWI, 35% for the Citigroup

WGBI, 5% for the DJ-UBSCITR and 10% for the P&R 90 Day U.S. T-Bill Index. For the period from 5/31/13 through

5/31/14, the MSCI ACWI had a +17.75% total return, the Citigroup WGBI had a +5.39% total return, the DJ-UBSCITR

had a +2.50% total return, and the P&R 90 Day U.S. T-Bill Index had a +0.04% total return. The indexes are unman-

aged and include reinvestment of any income or distributions. One cannot invest directly in an index, and an index is

not representative of the Fund’s portfolio.

3. Source: MSCI.

4. © Citigroup Index LLC 2014. All rights reserved.

5. The Dow Jones-UBS Commodity IndicesSM are a joint product of DJI Opco, LLC, a subsidiary of S&P Dow Jones Indices

LLC, and UBS Securities LLC (“UBS”) and have been licensed for use to S&P Opco, LLC and Franklin Templeton

Companies, LLC. S&P® is a registered trademark of Standard & Poor’s Financial Services LLC, Dow Jones® and DJ are

registered trademarks of Dow Jones Trademark Holdings LLC, and “UBS” is a registered trademark of UBS AG. All con-

tent of the Dow Jones-UBS Commodity IndicesSM © S&P Dow Jones Indices LLC and UBS and their respective affiliates

2014. Reproduction of Dow Jones-UBS Commodity IndicesSM in any form is prohibited except with the prior written per-

mission of S&P. S&P does not guarantee the accuracy, adequacy, completeness or availability of any information and

is not responsible for any errors or omissions, regardless of the cause or for the results obtained from the use of such

information. S&P DISCLAIMS ANY AND ALL EXPRESS OR IMPLIED WARRANTIES, INCLUDING, BUT NOT LIMITED TO, ANY

WARRANTIES OF MERCHANTABILITY OR FITNESS FOR A PARTICULAR PURPOSE OR USE. In no event shall S&P be liable

for any direct, indirect, special or consequential damages, costs, expenses, legal fees, or losses (including lost income

or lost profit and opportunity costs) in connection with subscriber’s or others’ use of Dow Jones-UBS Commodity IndicesSM.

6. Source: Payden & Rygel. All information contained herein was obtained from sources P&R regards as reliable, but

P&R does not guarantee its accuracy.

7. A long position involves borrowing a security, commodity or currency with the expectation that the asset will

subsequently rise in value.

8. A short position involves the sale of a borrowed security, commodity or currency with the expectation that the asset

will subsequently fall in value.

8 | Annual Report

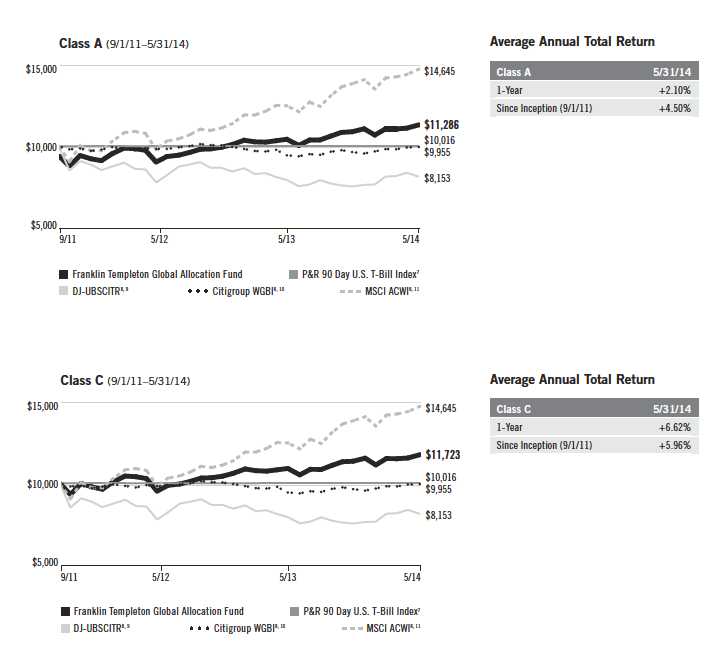

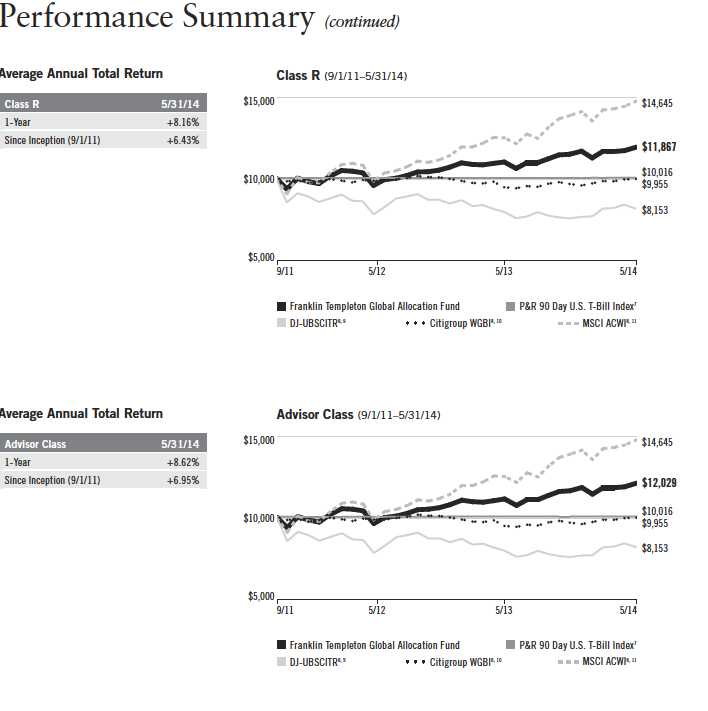

Performance Summary as of 5/31/14

Your dividend income will vary depending on dividends or interest paid by securities in the Fund’s portfolio, adjusted for operating expenses of each class. Capital gain distributions are net profits realized from the sale of portfolio securities. The performance table and graphs do not reflect any taxes that a shareholder would pay on Fund dividends, capital gain distributions, if any, or any realized gains on the sale of Fund shares. Total return reflects reinvestment of the Fund’s dividends and capital gain distributions, if any, and any unrealized gains or losses.

| | | |

| Net Asset Value | | | |

| Share Class | 5/31/14 | 5/31/13 | Change |

| A (FGAAX) | $11.38 | $10.78 | +$0.60 |

| C (n/a) | $11.27 | $10.72 | +$0.55 |

| R (n/a) | $11.35 | $10.76 | +$0.59 |

| Advisor (FGAZX) | $11.41 | $10.79 | +$0.62 |

| | |

| Distributions | | |

| Share Class | | Dividend Income |

| A (6/1/13–5/31/14) | $ | 0.2866 |

| C (6/1/13–5/31/14) | $ | 0.2549 |

| R (6/1/13–5/31/14) | $ | 0.2744 |

| Advisor (6/1/13–5/31/14) | $ | 0.2954 |

Annual Report | 9

Performance Summary (continued)

Performance as of 5/31/141

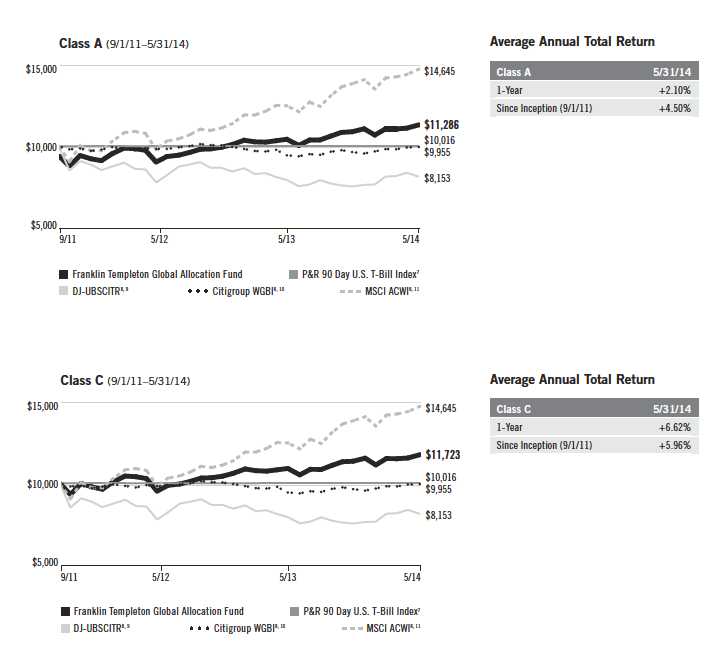

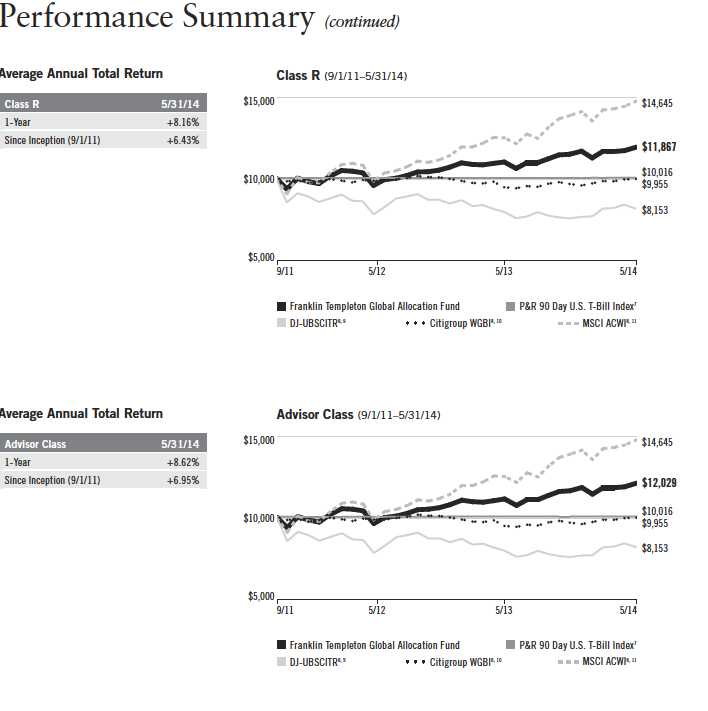

Cumulative total return excludes sales charges. Average annual total returns and value of $10,000 investment include maximum sales charges.

Class A: 5.75% maximum initial sales charge; Class C: 1% contingent deferred sales charge in first year only; Class R/Advisor Class: no sales charges.

| | | | | | | | | | | |

| | | | | | Value of | Average Annual | | | | | |

| | Cumulative | | Average Annual | | $10,000 | Total Return | | Total Annual Operating Expenses6 | |

| Share Class | Total Return2 | | Total Return3 | | Investment4 | (6/30/14)5 | | (with waiver) | | (without waiver) | |

| A | | | | | | | | 1.32 | % | 1.59 | % |

| 1-Year | +8.35 | % | +2.10 | % | $10,210 | +7.11 | % | | | | |

| Since Inception (9/1/11) | +19.74 | % | +4.50 | % | $11,286 | +4.79 | % | | | | |

| C | | | | | | | | 2.02 | % | 2.29 | % |

| 1-Year | +7.62 | % | +6.62 | % | $10,662 | +11.86 | % | | | | |

| Since Inception (9/1/11) | +17.23 | % | +5.96 | % | $11,723 | +6.21 | % | | | | |

| R | | | | | | | | 1.52 | % | 1.79 | % |

| 1-Year | +8.16 | % | +8.16 | % | $10,816 | +13.30 | % | | | | |

| Since Inception (9/1/11) | +18.67 | % | +6.43 | % | $11,867 | +6.63 | % | | | | |

| Advisor | | | | | | | | 1.02 | % | 1.29 | % |

| 1-Year | +8.62 | % | +8.62 | % | $10,862 | +13.87 | % | | | | |

| Since Inception (9/1/11) | +20.29 | % | +6.95 | % | $12,029 | +7.17 | % | | | | |

Performance data represent past performance, which does not guarantee future results. Investment return and principal value will fluctuate, and

you may have a gain or loss when you sell your shares. Current performance may differ from figures shown. For most recent month-end performance,

go to franklintempleton.com or call (800) 342-5236.

10 | Annual Report

Performance Summary (continued)

Total Return Index Comparison for a Hypothetical $10,000 Investment1

Total return represents the change in value of an investment over the periods shown. It includes any applicable, maximum sales charge, Fund expenses, account fees and reinvested distributions. The unmanaged indexes include reinvestment of any income or distributions. They differ from the Fund in composition and do not pay management fees or expenses. One cannot invest directly in an index.

Annual Report | 11

12 | Annual Report

Performance Summary (continued)

All investments involve risks, including possible loss of principal. Generally, investors should be comfortable with fluctuation in the value of their investments, especially over the short term. Stock prices fluctuate, sometimes rapidly and dramatically, due to factors affecting individual companies, particular industries or sectors, or general market conditions. Bond prices generally move in the opposite direction of interest rates. Thus, as the prices of bonds in the Fund adjust to a rise in interest rates, the Fund’s share price may decline. Changes in the financial strength of a bond issuer or in a bond’s credit rating may affect its value. Foreign investing carries additional risks such as currency and market volatility and political or social instability; risks that are heightened in developing countries. Derivatives, including currency management strategies, involve costs and can create economic leverage in the portfolio that may result in significant volatility and cause the Fund to participate in losses (as well as enable gains) on an amount that exceeds the Fund’s initial investment. The Fund may not achieve the anticipated benefits and may realize losses when a counterparty fails to perform as promised. Because the Fund allocates assets to a variety of investment strategies involving certain risks, it may be subject to those same risks. These risks are described more fully in the Fund’s prospectus. The Fund is actively managed, but there is no guarantee that the manager’s investment decisions will produce the desired results.

| |

| Class C: | These shares have higher annual fees and expenses than Class A shares. |

| Class R: | Shares are available to certain eligible investors as described in the prospectus. These shares have higher annual fees and expenses |

| | than Class A shares. |

| Advisor Class: | Shares are available to certain eligible investors as described in the prospectus. |

1. The Fund has an expense reduction contractually guaranteed through at least 9/30/14, a fee waiver related to the management fee paid by a sub-

sidiary and a fee waiver associated with its investments in a Franklin Templeton money fund, contractually guaranteed through at least its current

fiscal year-end. Fund investment results reflect the expense reductions and fee waiver, to the extent applicable; without these reductions, the results

would have been lower.

2. Cumulative total return represents the change in value of an investment over the periods indicated.

3. Average annual total return represents the average annual change in value of an investment over the periods indicated.

4. These figures represent the value of a hypothetical $10,000 investment in the Fund over the periods indicated.

5. In accordance with SEC rules, we provide standardized average annual total return information through the latest calendar quarter.

6. Figures are as stated in the Fund’s current prospectus. In periods of market volatility, assets may decline significantly, causing total annual

Fund operating expenses to become higher than the figures shown.

7. Source: Payden & Rygel. All information contained herein was obtained from sources P&R regards as reliable, but P&R does not guarantee

its accuracy.

8. Source: © 2014 Morningstar. The MSCI ACWI is a free float-adjusted, market capitalization-weighted index designed to measure equity market

performance in global developed and emerging markets. The Citigroup WGBI is a market capitalization-weighted index consisting of investment-

grade world government bond markets. The P&R 90 Day U.S. T-Bill Index is a total return index based on a constant maturity instrument. P&R

includes both accrued interest and change in market price in its monthly total return calculation. The DJ-UBSCITR is a broadly diversified index

designed to allow investors to track commodity futures through a single, simple measure. The index reflects the return on fully collateralized posi-

tions in the underlying futures contracts on physical commodities, which are reweighted and rebalanced annually on a price-percentage basis.

9. The Dow Jones-UBS Commodity IndicesSM are a joint product of DJI Opco, LLC, a subsidiary of S&P Dow Jones Indices LLC, and UBS Securities LLC

(“UBS”) and have been licensed for use to S&P Opco, LLC and Franklin Templeton Companies, LLC. S&P® is a registered trademark of Standard &

Poor’s Financial Services LLC, Dow Jones® and DJ are registered trademarks of Dow Jones Trademark Holdings LLC, and “UBS” is a registered trade-

mark of UBS AG. All content of the Dow Jones-UBS Commodity IndicesSM © S&P Dow Jones Indices LLC and UBS and their respective affiliates 2014.

Reproduction of Dow Jones-UBS Commodity IndicesSM in any form is prohibited except with the prior written permission of S&P. S&P does not guaran-

tee the accuracy, adequacy, completeness or availability of any information and is not responsible for any errors or omissions, regardless of the

cause or for the results obtained from the use of such information. S&P DISCLAIMS ANY AND ALL EXPRESS OR IMPLIED WARRANTIES, INCLUDING, BUT

NOT LIMITED TO, ANY WARRANTIES OF MERCHANTABILITY OR FITNESS FOR A PARTICULAR PURPOSE OR USE. In no event shall S&P be liable for any

direct, indirect, special or consequential damages, costs, expenses, legal fees, or losses (including lost income or lost profit and opportunity costs) in

connection with subscriber’s or others’ use of Dow Jones-UBS Commodity IndicesSM.

10. © Citigroup Index LLC 2014. All rights reserved.

11. Source: MSCI.

Annual Report | 13

Your Fund’s Expenses

As a Fund shareholder, you can incur two types of costs:

- Transaction costs, including sales charges (loads) on Fund purchases; and

- Ongoing Fund costs, including management fees, distribution and service (12b-1) fees, and other Fund expenses. All mutual funds have ongoing costs, sometimes referred to as operating expenses.

The following table shows ongoing costs of investing in the Fund and can help you understand these costs and compare them with those of other mutual funds. The table assumes a $1,000 investment held for the six months indicated.

Actual Fund Expenses

The first line (Actual) for each share class listed in the table provides actual account values and expenses. The “Ending Account Value” is derived from the Fund’s actual return, which includes the effect of Fund expenses.

You can estimate the expenses you paid during the period by following these steps. Of course, your account value and expenses will differ from those in this illustration:

| 1. | Divide your account value by $1,000. |

| | If an account had an $8,600 value, then $8,600 ÷ $1,000 = 8.6. |

| 2. | Multiply the result by the number under the heading “Expenses Paid During Period.” |

| | If Expenses Paid During Period were $7.50, then 8.6 x $7.50 = $64.50. |

In this illustration, the estimated expenses paid this period are $64.50.

Hypothetical Example for Comparison with Other Funds

Information in the second line (Hypothetical) for each class in the table can help you compare ongoing costs of investing in the Fund with those of other mutual funds. This information may not be used to estimate the actual ending account balance or expenses you paid during the period. The hypothetical “Ending Account Value” is based on the actual expense ratio for each class and an assumed 5% annual rate of return before expenses, which does not represent the Fund’s actual return. The figure under the heading “Expenses Paid During Period” shows the hypothetical expenses your account would have incurred under this scenario. You can compare this figure with the 5% hypothetical examples that appear in shareholder reports of other funds.

14 | Annual Report

Your Fund’s Expenses (continued)

Please note that expenses shown in the table are meant to highlight ongoing costs and do not reflect any transaction costs, such as sales charges. Therefore, the second line for each class is useful in comparing ongoing costs only, and will not help you compare total costs of owning different funds. In addition, if transaction costs were included, your total costs would have been higher. Please refer to the Fund prospectus for additional information on operating expenses.

| | | | | | |

| | | Beginning Account | | Ending Account | | Expenses Paid During |

| Share Class | | Value 12/1/13 | | Value 5/31/14 | | Period* 12/1/13–5/31/14 |

| A | | | | | | |

| Actual | $ | 1,000 | $ | 1,038.30 | $ | 6.15 |

| Hypothetical (5% return before expenses) | $ | 1,000 | $ | 1,018.90 | $ | 6.09 |

| C | | | | | | |

| Actual | $ | 1,000 | $ | 1,034.70 | $ | 9.79 |

| Hypothetical (5% return before expenses) | $ | 1,000 | $ | 1,015.31 | $ | 9.70 |

| R | | | | | | |

| Actual | $ | 1,000 | $ | 1,037.20 | $ | 7.62 |

| Hypothetical (5% return before expenses) | $ | 1,000 | $ | 1,017.45 | $ | 7.54 |

| Advisor | | | | | | |

| Actual | $ | 1,000 | $ | 1,039.90 | $ | 5.09 |

| Hypothetical (5% return before expenses) | $ | 1,000 | $ | 1,019.95 | $ | 5.04 |

*Expenses are calculated using the most recent six-month expense ratio, net of expense waivers, annualized for each class (A: 1.21%; C: 1.93%;

R: 1.50%; and Advisor: 1.00%), multiplied by the average account value over the period, multiplied by 182/365 to reflect the one-half year period.

Annual Report | 15

Franklin Templeton International Trust

Consolidated Financial Highlights

| | | | | | |

| Franklin Templeton Global Allocation Fund | | | | | | |

| | Year Ended May 31, | |

| Class A | 2014 | | 2013 | | 2012a | |

| Per share operating performance | | | | | | |

| (for a share outstanding throughout the year) | | | | | | |

| Net asset value, beginning of year | $10.78 | | $9.53 | | $10.00 | |

| Income from investment operationsb: | | | | | | |

| Net investment incomec | 0.10 | d | 0.08 | | 0.06 | |

| Net realized and unrealized gains (losses) | 0.79 | | 1.36 | | (0.47 | ) |

| Total from investment operations | 0.89 | | 1.44 | | (0.41 | ) |

| Less distributions from net investment income and net foreign currency gains | (0.29 | ) | (0.19 | ) | (0.06 | ) |

| Net asset value, end of year | $11.38 | | $10.78 | | $9.53 | |

| |

| Total returne | 8.35 | % | 15.22 | % | (4.09 | )% |

| |

| Ratios to average net assetsf | | | | | | |

| Expenses before waiver and payments by affiliates | 1.89 | % | 2.10 | % | 2.85 | % |

| Expenses net of waiver and payments by affiliates | 1.20 | %g | 1.16 | % | 1.08 | % |

| Net investment income | 0.92 | %d | 0.76 | % | 0.79 | % |

| |

| Supplemental data | | | | | | |

| Net assets, end of year (000’s) | $23,509 | | $23,472 | | $18,055 | |

| Portfolio turnover rate | 39.58 | % | 47.73 | % | 15.34 | % |

aFor the period September 1, 2011 (commencement of operations) to May 31, 2012.

bThe amount shown for a share outstanding throughout the period may not correlate with the Consolidated Statement of Operations for the period due to the timing of sales and

repurchases of the Fund shares in relation to income earned and/or fluctuating fair value of the investments of the Fund.

cBased on average daily shares outstanding.

dNet investment income per share includes approximately $0.03 per share received in the form of a special dividend paid in connection with certain Fund holdings. Excluding this

amount, the ratio of net investment income to average net assets would have been 0.68%.

eTotal return does not reflect sales commissions or contingent deferred sales charges, if applicable, and is not annualized for periods less than one year.

fRatios are annualized for periods less than one year.

gBenefit of expense reduction rounds to less than 0.01%.

16 | The accompanying notes are an integral part of these consolidated financial statements. | Annual Report

Franklin Templeton International Trust

Consolidated Financial Highlights (continued)

| | | | | | |

| Franklin Templeton Global Allocation Fund | | | | | | |

| | Year Ended May 31, | |

| Class C | 2014 | | 2013 | | 2012a | |

| Per share operating performance | | | | | | |

| (for a share outstanding throughout the year) | | | | | | |

| Net asset value, beginning of year | $10.72 | | $$9.49 | | $10.00 | |

| Income from investment operationsb: | | | | | | |

| Net investment incomec | 0.02 | d | —e | | —e | |

| Net realized and unrealized gains (losses) | 0.78 | | 1.36 | | (0.48 | ) |

| Total from investment operations | 0.80 | | 1.36 | | (0.48 | ) |

| Less distributions from net investment income and net foreign currency gains | (0.25 | ) | (0.13 | ) | (0.03 | ) |

| Net asset value, end of year | $11.27 | | $$10.72 | | $9.49 | |

| |

| Total returnf | 7.62 | % | 14.40 | % | (4.77 | )% |

| |

| Ratios to average net assetsg | | | | | | |

| Expenses before waiver and payments by affiliates | 2.62 | % | 2.86 | % | 3.69 | % |

| Expenses net of waiver and payments by affiliates | 1.93 | %h | 1.92 | % | 1.92 | % |

| Net investment income (loss) | 0.19 | %d | —%i | | (0.05 | )% |

| |

| Supplemental data | | | | | | |

| Net assets, end of year (000’s) | $5,557 | | $$6,315 | | $3,639 | |

| Portfolio turnover rate | 39.58 | % | 47.73 | % | 15.34 | % |

aFor the period September 1, 2011 (commencement of operations) to May 31, 2012.

bThe amount shown for a share outstanding throughout the period may not correlate with the Consolidated Statement of Operations for the period due to the timing of sales and

repurchases of the Fund shares in relation to income earned and/or fluctuating fair value of the investments of the Fund.

cBased on average daily shares outstanding.

dNet investment income per share includes approximately $0.03 per share received in the form of a special dividend paid in connection with certain Fund holdings. Excluding this

amount, the ratio of net investment income to average net assets would have been (0.05)%.

eAmount rounds to less than $0.01 per share.

fTotal return does not reflect sales commissions or contingent deferred sales charges, if applicable, and is not annualized for periods less than one year.

gRatios are annualized for periods less than one year.

hBenefit of expense reduction rounds to less than 0.01%.

iRounds to less than 0.01%.

Annual Report | The accompanying notes are an integral part of these consolidated financial statements. | 17

Franklin Templeton International Trust

Consolidated Financial Highlights (continued)

| | | | | | |

| Franklin Templeton Global Allocation Fund | | | | | | |

| | Year Ended May 31, | |

| Class R | 2014 | | 2013 | | 2012a | |

| Per share operating performance | | | | | | |

| (for a share outstanding throughout the year) | | | | | | |

| Net asset value, beginning of year | $10.76 | | $9.51 | | $10.00 | |

| Income from investment operationsb: | | | | | | |

| Net investment incomec | 0.07 | d | 0.04 | | 0.02 | |

| Net realized and unrealized gains (losses) | 0.79 | | 1.37 | | (0.47 | ) |

| Total from investment operations | 0.86 | | 1.41 | | (0.45 | ) |

| Less distributions from net investment income and net foreign currency gains | (0.27 | ) | (0.16 | ) | (0.04 | ) |

| Net asset value, end of year | $11.35 | | $10.76 | | $9.51 | |

| |

| Total returne | 8.16 | % | 14.84 | % | (4.45 | )% |

| |

| Ratios to average net assetsf | | | | | | |

| Expenses before waiver and payments by affiliates | 2.19 | % | 2.44 | % | 3.27 | % |

| Expenses net of waiver and payments by affiliates | 1.50 | %g | 1.50 | % | 1.50 | % |

| Net investment income | 0.62 | %d | 0.42 | % | 0.37 | % |

| |

| Supplemental data | | | | | | |

| Net assets, end of year (000’s) | $2,297 | | $2,155 | | $1,903 | |

| Portfolio turnover rate | 39.58 | % | 47.73 | % | 15.34 | % |

aFor the period September 1, 2011 (commencement of operations) to May 31, 2012.

bThe amount shown for a share outstanding throughout the period may not correlate with the Consolidated Statement of Operations for the period due to the timing of sales and

repurchases of the Fund shares in relation to income earned and/or fluctuating fair value of the investments of the Fund.

cBased on average daily shares outstanding.

dNet investment income per share includes approximately $0.03 per share received in the form of a special dividend paid in connection with certain Fund holdings. Excluding this

amount, the ratio of net investment income to average net assets would have been 0.38%.

eTotal return is not annualized for periods less than one year.

fRatios are annualized for periods less than one year.

gBenefit of expense reduction rounds to less than 0.01%.

18 | The accompanying notes are an integral part of these consolidated financial statements. | Annual Report

Franklin Templeton International Trust

Consolidated Financial Highlights (continued)

| | | | | | |

| Franklin Templeton Global Allocation Fund | | | | | | |

| | Year Ended May 31, | |

| Advisor Class | 2014 | | 2013 | | 2012a | |

| Per share operating performance | | | | | | |

| (for a share outstanding throughout the year) | | | | | | |

| Net asset value, beginning of year | $10.79 | | $9.53 | | $10.00 | |

| Income from investment operationsb: | | | | | | |

| Net investment incomec | 0.12 | d | 0.09 | | 0.06 | |

| Net realized and unrealized gains (losses) | 0.80 | | 1.38 | | (0.47 | ) |

| Total from investment operations | 0.92 | | 1.47 | | (0.41 | ) |

| Less distributions from net investment income and net foreign currency gains | (0.30 | ) | (0.21 | ) | (0.06 | ) |

| Net asset value, end of year | $11.41 | | $10.79 | | $9.53 | |

| |

| Total returne | 8.62 | % | 15.47 | % | (4.09 | )% |

| |

| Ratios to average net assetsf | | | | | | |

| Expenses before waiver and payments by affiliates | 1.69 | % | 1.94 | % | 2.77 | % |

| Expenses net of waiver and payments by affiliates | 1.00 | %g | 1.00 | % | 1.00 | % |

| Net investment income | 1.12 | %d | 0.92 | % | 0.87 | % |

| |

| Supplemental data | | | | | | |

| Net assets, end of year (000’s) | $12,441 | | $14,511 | | $12,654 | |

| Portfolio turnover rate | 39.58 | % | 47.73 | % | 15.34 | % |

aFor the period September 1, 2011 (commencement of operations) to May 31, 2012.

bThe amount shown for a share outstanding throughout the period may not correlate with the Consolidated Statement of Operations for the period due to the timing of sales and

repurchases of the Fund shares in relation to income earned and/or fluctuating fair value of the investments of the Fund.

cBased on average daily shares outstanding.

dNet investment income per share includes approximately $0.03 per share received in the form of a special dividend paid in connection with certain Fund holdings. Excluding this

amount, the ratio of net investment income to average net assets would have been 0.88%.

eTotal return is not annualized for periods less than one year.

fRatios are annualized for periods less than one year.

gBenefit of expense reduction rounds to less than 0.01%.

Annual Report | The accompanying notes are an integral part of these consolidated financial statements. | 19

Franklin Templeton International Trust

Consolidated Statement of Investments, May 31, 2014

| | | | |

| Franklin Templeton Global Allocation Fund | Country | Shares/Warrants | | Value |

| Common Stocks and Other Equity Interests 55.6% | | | | |

| Automobiles & Components 1.4% | | | | |

| BorgWarner Inc. | United States | 910 | $ | 57,230 |

| Brilliance China Automotive Holdings Ltd. | China | 114,000 | | 188,798 |

| Cie Generale des Etablissements Michelin, B | France | 380 | | 46,830 |

| General Motors Co. | United States | 2,114 | | 73,102 |

| Guangzhou Automobile Group Co. Ltd., H | China | 54,000 | | 56,695 |

| Hyundai Mobis | South Korea | 216 | | 60,947 |

| Nissan Motor Co. Ltd. | Japan | 6,100 | | 55,081 |

| Toyota Motor Corp. | Japan | 1,300 | | 73,587 |

| | | | | 612,270 |

| Banks 4.8% | | | | |

| Bangkok Bank PCL, fgn. | Thailand | 2,900 | | 16,332 |

| Bank Danamon Indonesia Tbk PT | Indonesia | 121,000 | | 43,114 |

| Bank of Nova Scotia | Canada | 2,000 | | 128,439 |

| Barclays PLC | United Kingdom | 5,940 | | 24,592 |

| BNP Paribas SA | France | 2,500 | | 175,075 |

| China Merchants Bank Co. Ltd., H | China | 72,201 | | 132,984 |

| CIT Group Inc. | United States | 778 | | 34,605 |

| Citigroup Inc. | United States | 1,301 | | 61,889 |

| Columbia Banking System Inc. | United States | 512 | | 12,682 |

| Hana Financial Group Inc. | South Korea | 3,090 | | 112,163 |

| HSBC Holdings PLC | United Kingdom | 6,640 | | 70,028 |

| Itau Unibanco Holding SA, ADR | Brazil | 6,160 | | 95,480 |

| JPMorgan Chase & Co. | United States | 1,331 | | 73,964 |

| KB Financial Group Inc. | South Korea | 3,740 | | 127,329 |

| PNC Financial Services Group Inc. | United States | 1,286 | | 109,657 |

| Siam Commercial Bank PCL, fgn. | Thailand | 5,700 | | 27,589 |

| a Signature Bank/New York NY | United States | 900 | | 104,238 |

| Societe Generale SA | France | 1,096 | | 63,149 |

| SunTrust Banks Inc. | United States | 1,336 | | 51,196 |

| a SVB Financial Group | United States | 670 | | 70,652 |

| UniCredit SpA | Italy | 17,391 | | 151,614 |

| United Bank Ltd. | Pakistan | 101,700 | | 187,055 |

| United Overseas Bank Ltd. | Singapore | 7,600 | | 136,793 |

| Wells Fargo & Co. | United States | 1,937 | | 98,361 |

| | | | | 2,108,980 |

| Capital Goods 4.4% | | | | |

| a B/E Aerospace Inc. | United States | 325 | | 31,444 |

| BAE Systems PLC | United Kingdom | 7,680 | | 54,465 |

| The Boeing Co. | United States | 500 | | 67,625 |

| Carillion PLC | United Kingdom | 7,990 | | 47,436 |

| Caterpillar Inc. | United States | 415 | | 42,425 |

| a Chart Industries Inc. | United States | 400 | | 28,756 |

| CNH Industrial NV | United Kingdom | 1,280 | | 14,012 |

| CNH Industrial NV (Qualifying Common Shares) | United Kingdom | 1,929 | | 21,117 |

| a Colfax Corp. | United States | 780 | | 56,776 |

| Compagnie de Saint-Gobain | France | 450 | | 25,640 |

| Cummins Inc. | United States | 180 | | 27,527 |

20 | Annual Report

Franklin Templeton International Trust

Consolidated Statement of Investments, May 31, 2014 (continued)

| | | | |

| Franklin Templeton Global Allocation Fund | Country | Shares/Warrants | | Value |

| Common Stocks and Other Equity Interests (continued) | | | | |

| Capital Goods (continued) | | | | |

| a HD Supply Holdings Inc. | United States | 900 | $ | 23,643 |

| Honeywell International Inc. | United States | 650 | | 60,547 |

| Huntington Ingalls Industries Inc. | United States | 579 | | 57,802 |

| Hyundai Development Co. | South Korea | 5,880 | | 164,757 |

| Industries Qatar QSC | Qatar | 2,050 | | 106,330 |

| ITOCHU Corp. | Japan | 8,200 | | 96,926 |

| a Kloeckner & Co. SE | Germany | 2,110 | | 35,510 |

| MTU Aero Engines AG | Germany | 1,700 | | 158,472 |

| Noble Group Ltd. | Hong Kong | 179,000 | | 197,707 |

| Pall Corp. | United States | 700 | | 59,318 |

| Precision Castparts Corp. | United States | 360 | | 91,073 |

| Rockwell Automation Inc. | United States | 220 | | 26,638 |

| Roper Industries Inc. | United States | 510 | | 72,257 |

| SembCorp Marine Ltd. | Singapore | 25,000 | | 82,140 |

| Shanghai Electric Group Co. Ltd., H | China | 50,000 | | 17,993 |

| Siemens AG | Germany | 420 | | 55,802 |

| a United Rentals Inc. | United States | 680 | | 68,714 |

| Weir Group PLC | United Kingdom | 3,300 | | 144,920 |

| | | | | 1,937,772 |

| Commercial & Professional Services 1.0% | | | | |

| Experian PLC | United Kingdom | 9,500 | | 165,126 |

| Nielsen NV | United States | 620 | | 29,921 |

| Serco Group PLC | United Kingdom | 2,650 | | 16,506 |

| SGS SA | Switzerland | 65 | | 162,972 |

| a Stericycle Inc. | United States | 500 | | 57,185 |

| | | | | 431,710 |

| Consumer Durables & Apparel 1.1% | | | | |

| Burberry Group PLC | United Kingdom | 5,600 | | 143,894 |

| Luxottica Group SpA | Italy | 2,600 | | 148,512 |

| a Michael Kors Holdings Ltd. | United States | 450 | | 42,471 |

| Namco Bandai Holdings Inc. | Japan | 1,600 | | 34,869 |

| NIKE Inc., B | United States | 570 | | 43,839 |

| Nikon Corp. | Japan | 1,300 | | 20,591 |

| a Under Armour Inc., A | United States | 1,010 | | 51,298 |

| | | | | 485,474 |

| Consumer Services 0.7% | | | | |

| a Hilton Worldwide Holdings Inc. | United States | 800 | | 18,096 |

| Starbucks Corp. | United States | 760 | | 55,663 |

| Whitbread PLC | United Kingdom | 2,300 | | 161,376 |

| Wynn Resorts Ltd. | United States | 400 | | 85,988 |

| | | | | 321,123 |

| Diversified Financials 2.7% | | | | |

| Aberdeen Asset Management PLC | United Kingdom | 22,500 | | 167,862 |

| AGF Management Ltd. | Canada | 1,200 | | 14,233 |

| a Ally Financial Inc. | United States | 1,200 | | 28,272 |

| Azimut Holding SpA | Italy | 6,400 | | 175,194 |

Annual Report | 21

Franklin Templeton International Trust

Consolidated Statement of Investments, May 31, 2014 (continued)

| | | | | | |

| | | Franklin Templeton Global Allocation Fund | Country | Shares/Warrants | | Value |

| | | Common Stocks and Other Equity Interests (continued) | | | | |

| | | Diversified Financials (continued) | | | | |

| | | BM&F BOVESPA SA | Brazil | 5,000 | $ | 24,498 |

| | | Credit Suisse Group AG | Switzerland | 4,512 | | 134,141 |

| | | Deutsche Boerse AG | Germany | 2,270 | | 173,296 |

| | | Discover Financial Services | United States | 1,530 | | 90,469 |

| | | a GAM Holding Ltd. | Switzerland | 1,100 | | 20,270 |

| | | a ING Groep NV, IDR | Netherlands | 8,040 | | 112,620 |

| | | IntercontinentalExchange Group Inc. | United States | 300 | | 58,920 |

| | | KIWOOM Securities Co. Ltd. | South Korea | 398 | | 16,143 |

| | | Korea Investment Holdings Co. Ltd. | South Korea | 600 | | 22,749 |

| | | Man Group PLC | United Kingdom | 19,944 | | 33,529 |

| | | MLP AG | Germany | 3,630 | | 25,139 |

| | | Morgan Stanley | United States | 719 | | 22,188 |

| | | T. Rowe Price Group Inc. | United States | 930 | | 75,823 |

| | | Value Partners Group Ltd. | Hong Kong | 9,400 | | 5,941 |

| | | | | | | 1,201,287 |

| | | Energy 7.2% | | | | |

| | | Anadarko Petroleum Corp. | United States | 700 | | 72,002 |

| | | Apache Corp. | United States | 1,093 | | 101,889 |

| | | Baker Hughes Inc. | United States | 1,891 | | 133,353 |

| | | BG Group PLC | United Kingdom | 2,155 | | 44,104 |

| | | BP PLC | United Kingdom | 19,214 | | 161,994 |

| | | China Shenhua Energy Co. Ltd., H | China | 18,500 | | 50,587 |

| | | CNOOC Ltd. | China | 55,000 | | 94,066 |

| | | CONSOL Energy Inc. | United States | 915 | | 40,416 |

| | | Dragon Oil PLC | Turkmenistan | 1,590 | | 16,177 |

| | | Eni SpA | Italy | 3,041 | | 77,482 |

| | | Ensco PLC, A | United States | 437 | | 23,012 |

| | | Ensign Energy Services Inc. | Canada | 6,000 | | 89,813 |

| | | Fugro NV, IDR | Netherlands | 3,116 | | 179,792 |

| | | Gazprom OAO, ADR | Russia | 23,800 | | 193,994 |

| | | Inner Mongolia Yitai Coal Co. Ltd., B | China | 58,200 | | 73,972 |

| | | Kunlun Energy Co. Ltd. | China | 10,000 | | 16,277 |

| | | b LUKOIL Holdings, ADR (London Stock Exchange) | Russia | 2,178 | | 123,231 |

| | | Marathon Oil Corp. | United States | 2,590 | | 94,949 |

| | | Murphy Oil Corp. | United States | 584 | | 36,015 |

| | | National Oilwell Varco Inc. | United States | 350 | | 28,654 |

| | | Noble Corp. PLC | United States | 1,380 | | 43,415 |

| | | Noble Energy Inc. | United States | 570 | | 41,080 |

| | | Oceaneering International Inc. | United States | 700 | | 50,435 |

| | | PetroChina Co. Ltd., H | China | 78,000 | | 92,859 |

| | | Petroleo Brasileiro SA, ADR | Brazil | 1,487 | | 20,967 |

| | | c Reliance Industries Ltd., GDR, 144A | India | 3,600 | | 128,772 |

| | | Royal Dutch Shell PLC, A | United Kingdom | 2,487 | | 97,796 |

| | | Royal Dutch Shell PLC, B | United Kingdom | 2,630 | | 107,341 |

| | | Saipem SpA | Italy | 623 | | 16,239 |

| | | a SBM Offshore NV | Netherlands | 1,411 | | 22,958 |

| | | Schlumberger Ltd. | United States | 850 | | 88,434 |

| | | Statoil ASA | Norway | 1,990 | | 60,973 |

| |

| 22 | | | Annual Report | | | | |

Franklin Templeton International Trust

Consolidated Statement of Investments, May 31, 2014 (continued)

| | | | |

| Franklin Templeton Global Allocation Fund | Country | Shares/Warrants | | Value |

| Common Stocks and Other Equity Interests (continued) | | | | |

| Energy (continued) | | | | |

| Suncor Energy Inc. | Canada | 2,100 | $ | 80,824 |

| Talisman Energy Inc. (CAD Traded) | Canada | 6,911 | | 71,389 |

| Talisman Energy Inc. (USD Traded) | Canada | 3,096 | | 31,951 |

| Technip SA | France | 160 | | 17,183 |

| d TMK OAO, GDR, Reg S | Russia | 12,200 | | 114,009 |

| Total SA, B | France | 1,950 | | 136,851 |

| Transocean Ltd. | United States | 1,202 | | 51,073 |

| Trican Well Service Ltd. | Canada | 6,100 | | 93,504 |

| WorleyParsons Ltd. | Australia | 10,300 | | 153,955 |

| a WPX Energy Inc. | United States | 14 | | 297 |

| | | | | 3,174,084 |

| Food & Staples Retailing 1.0% | | | | |

| CVS Caremark Corp. | United States | 649 | | 50,830 |

| The Kroger Co. | United States | 1,670 | | 79,726 |

| Metro AG | Germany | 1,052 | | 43,913 |

| Tesco PLC | United Kingdom | 38,191 | | 194,314 |

| Walgreen Co. | United States | 814 | | 58,535 |

| Whole Foods Market Inc. | United States | 750 | | 28,680 |

| | | | | 455,998 |

| Food, Beverage & Tobacco 1.4% | | | | |

| Altria Group Inc. | United States | 1,492 | | 62,008 |

| British American Tobacco PLC | United Kingdom | 1,632 | | 98,491 |

| Coca-Cola Enterprises Inc. | United States | 592 | | 27,019 |

| Imperial Tobacco Group PLC | United Kingdom | 1,321 | | 59,606 |

| Lorillard Inc. | United States | 1,217 | | 75,661 |

| Mead Johnson Nutrition Co., A | United States | 400 | | 35,788 |

| a Monster Beverage Corp. | United States | 500 | | 34,690 |

| PepsiCo Inc. | United States | 501 | | 44,253 |

| Pernod Ricard SA | France | 151 | | 18,516 |

| Philip Morris International Inc. | United States | 353 | | 31,255 |

| Suntory Beverage & Food Ltd. | Japan | 800 | | 30,538 |

| Unilever PLC | United Kingdom | 2,381 | | 106,956 |

| | | | | 624,781 |

| Health Care Equipment & Services 2.3% | | | | |

| a Cerner Corp. | United States | 800 | | 43,240 |

| Cigna Corp. | United States | 1,284 | | 115,277 |

| Cochlear Ltd. | Australia | 3,000 | | 167,163 |

| a DaVita HealthCare Partners Inc. | United States | 750 | | 52,942 |

| Elekta AB, B | Sweden | 11,500 | | 148,648 |

| Essilor International SA | France | 550 | | 57,779 |

| Getinge AB, B | Sweden | 1,157 | | 29,738 |

| GN Store Nord AS | Denmark | 1,000 | | 27,489 |

| McKesson Corp. | United States | 330 | | 62,581 |

| Medtronic Inc. | United States | 2,692 | | 164,293 |

| Nobel Biocare Holding AG | Switzerland | 2,886 | | 43,029 |

| Shanghai Pharmaceuticals Holding Co. Ltd., H | China | 18,600 | | 34,882 |

Annual Report | 23

Franklin Templeton International Trust

Consolidated Statement of Investments, May 31, 2014 (continued)

| | | | |

| Franklin Templeton Global Allocation Fund | Country | Shares/Warrants | | Value |

| Common Stocks and Other Equity Interests (continued) | | | | |

| Health Care Equipment & Services (continued) | | | | |

| Sinopharm Group Co. | China | 5,700 | $ | 15,439 |

| Stryker Corp. | United States | 348 | | 29,402 |

| WellPoint Inc. | United States | 303 | | 32,833 |

| | | | | 1,024,735 |

| Household & Personal Products 0.5% | | | | |

| Avon Products Inc. | United States | 3,047 | | 43,542 |

| Reckitt Benckiser Group PLC | United Kingdom | 1,900 | | 162,419 |

| | | | | 205,961 |

| Insurance 2.1% | | | | |

| ACE Ltd. | United States | 875 | | 90,746 |

| Aegon NV | Netherlands | 9,953 | | 86,349 |

| Aflac Inc. | United States | 600 | | 36,738 |

| a Alleghany Corp. | United States | 140 | | 58,957 |

| The Allstate Corp. | United States | 823 | | 47,948 |

| American International Group Inc. | United States | 1,951 | | 105,491 |

| Aviva PLC | United Kingdom | 18,710 | | 164,330 |

| AXA SA | France | 4,600 | | 113,567 |

| China Life Insurance Co. Ltd., H | China | 11,000 | | 30,149 |

| MetLife Inc. | United States | 1,129 | | 57,500 |

| Muenchener Rueckversicherungs-Gesellschaft AG | Germany | 210 | | 46,550 |

| Swiss Re AG | Switzerland | 330 | | 29,355 |

| Zurich Insurance Group AG | Switzerland | 125 | | 37,511 |

| | | | | 905,191 |

| Materials 4.0% | | | | |

| Akzo Nobel NV | Netherlands | 1,020 | | 76,450 |

| Anglo American PLC | United Kingdom | 1,510 | | 36,889 |

| Arab Potash Co. PLC | Jordan | 2,244 | | 84,255 |

| Compania de Minas Buenaventura SA, ADR | Peru | 1,640 | | 17,532 |

| CRH PLC | Ireland | 2,220 | | 60,770 |

| Cytec Industries Inc. | United States | 1,250 | | 124,187 |

| Ecolab Inc. | United States | 1,300 | | 141,947 |

| Freeport-McMoRan Copper & Gold Inc., B | United States | 2,213 | | 75,353 |

| HudBay Minerals Inc. | Canada | 6,200 | | 54,666 |

| Impala Platinum Holdings Ltd. | South Africa | 9,100 | | 95,215 |

| International Paper Co. | United States | 1,666 | | 79,352 |

| MeadWestvaco Corp. | United States | 1,310 | | 53,160 |

| Mining and Metallurgical Co. Norilsk Nickel OJSC, ADR | Russia | 1,065 | | 20,416 |

| POSCO | South Korea | 288 | | 81,544 |

| Praxair Inc. | United States | 420 | | 55,541 |

| Rexam PLC | United Kingdom | 3,850 | | 34,299 |

| Sika AG | Switzerland | 33 | | 130,798 |

| Symrise AG | Germany | 2,400 | | 130,103 |

| Syngenta AG | Switzerland | 420 | | 161,593 |

| a ThyssenKrupp AG | Germany | 1,516 | | 45,529 |

| Umicore SA | Belgium | 3,700 | | 177,953 |

| | | | | 1,737,552 |

24 | Annual Report

Franklin Templeton International Trust

Consolidated Statement of Investments, May 31, 2014 (continued)

| | | | |

| Franklin Templeton Global Allocation Fund | Country | Shares/Warrants | | Value |

| Common Stocks and Other Equity Interests (continued) | | | | |

| Media 2.0% | | | | |

| CBS Corp., B | United States | 1,112 | $ | 66,286 |

| a Charter Communications Inc., A | United States | 390 | | 55,825 |

| Comcast Corp., Special A | United States | 323 | | 16,744 |

| a Discovery Communications Inc., C | United States | 670 | | 50,217 |

| ITV PLC | United Kingdom | 55,000 | | 167,875 |

| Reed Elsevier PLC | United Kingdom | 5,651 | | 90,078 |

| a Sirius XM Holdings Inc. | United States | 18,170 | | 59,598 |

| Time Warner Cable Inc. | United States | 653 | | 92,177 |

| Twenty-First Century Fox Inc., A | United States | 1,900 | | 67,279 |

| Twenty-First Century Fox Inc., B | United States | 3,287 | | 113,270 |

| The Walt Disney Co. | United States | 900 | | 75,609 |

| | | | | 854,958 |

| Pharmaceuticals, Biotechnology & Life Sciences 5.2% | | | | |

| a Actavis PLC | United States | 700 | | 148,078 |

| a Alkermes PLC | United States | 3,600 | | 164,916 |

| AstraZeneca PLC | United Kingdom | 630 | | 45,233 |

| AstraZeneca PLC, ADR | United Kingdom | 267 | | 19,277 |

| a Biogen Idec Inc. | United States | 330 | | 105,392 |

| Bristol-Myers Squibb Co. | United States | 1,670 | | 83,066 |

| a Celgene Corp. | United States | 530 | | 81,106 |

| CSL Ltd. | Australia | 2,600 | | 170,815 |

| Eli Lilly & Co. | United States | 721 | | 43,159 |

| Gerresheimer AG | Germany | 520 | | 34,998 |

| a Gilead Sciences Inc. | United States | 1,700 | | 138,057 |

| GlaxoSmithKline PLC | United Kingdom | 5,360 | | 143,836 |

| a Hospira Inc. | United States | 993 | | 48,826 |

| a Illumina Inc. | United States | 530 | | 83,873 |

| Ipsen SA | France | 720 | | 35,331 |

| Lonza Group AG | Switzerland | 290 | | 31,173 |

| Merck & Co. Inc. | United States | 2,778 | | 160,735 |

| Novartis AG | Switzerland | 530 | | 47,531 |

| Perrigo Co. PLC | United States | 190 | | 26,258 |

| a QIAGEN NV | Netherlands | 600 | | 13,766 |

| a Quintiles Transnational Holdings Inc. | United States | 810 | | 41,294 |

| Roche Holding AG | Switzerland | 970 | | 285,453 |

| Sanofi | France | 1,550 | | 165,747 |

| Teva Pharmaceutical Industries Ltd., ADR | Israel | 3,201 | | 161,618 |

| UCB SA | Belgium | 140 | | 11,161 |

| | | | | 2,290,699 |

| Real Estate 0.4% | | | | |

| American Tower Corp. | United States | 600 | | 53,778 |

| Brookfield Property Partners LP | United States | 234 | | 4,687 |

| Land and Houses PCL, fgn. | Thailand | 282,800 | | 83,506 |

| a,e Land and Houses PCL, fgn., wts., 5/05/17 | Thailand | 56,560 | | 10,072 |

| | | | | 152,043 |

Annual Report | 25

Franklin Templeton International Trust

Consolidated Statement of Investments, May 31, 2014 (continued)

| | | | |

| Franklin Templeton Global Allocation Fund | Country | Shares/Warrants | | Value |

| Common Stocks and Other Equity Interests (continued) | | | | |

| Retailing 2.0% | | | | |

| a Amazon.com Inc. | United States | 270 | $ | 84,389 |

| Dollarama Inc. | Canada | 1,800 | | 151,852 |

| a HomeAway Inc. | United States | 810 | | 24,948 |

| Kingfisher PLC | United Kingdom | 10,060 | | 66,099 |

| Kohl’s Corp. | United States | 795 | | 43,280 |

| a Liberty Ventures, A | United States | 650 | | 43,160 |

| Marks & Spencer Group PLC | United Kingdom | 7,240 | | 54,512 |

| a The Priceline Group Inc. | United States | 100 | | 127,863 |

| Ross Stores Inc. | United States | 350 | | 23,958 |

| Start Today Co. Ltd. | Japan | 6,200 | | 154,246 |

| Tractor Supply Co. | United States | 550 | | 35,761 |

| a Vipshop Holdings Ltd., ADR | China | 400 | | 65,064 |

| | | | | 875,132 |

| Semiconductors & Semiconductor Equipment 1.7% | | | | |

| ARM Holdings PLC | United Kingdom | 10,000 | | 154,206 |

| ASML Holding NV | Netherlands | 2,100 | | 180,243 |

| Microchip Technology Inc. | United States | 1,820 | | 86,632 |

| Samsung Electronics Co. Ltd. | South Korea | 144 | | 203,578 |

| a Trina Solar Ltd., ADR | China | 3,286 | | 44,920 |

| Xilinx Inc. | United States | 1,500 | | 70,440 |

| | | | | 740,019 |

| Software & Services 4.6% | | | | |

| a ANSYS Inc. | United States | 350 | | 25,707 |

| Capcom Co. Ltd. | Japan | 2,100 | | 35,511 |

| a Check Point Software Technologies Ltd. | Israel | 2,200 | | 141,856 |

| Dassault Systemes SA | France | 1,200 | | 152,204 |

| Daum Communication Corp. | South Korea | 199 | | 19,068 |

| a eBay Inc. | United States | 550 | | 27,901 |

| a Facebook Inc., A | United States | 2,200 | | 139,260 |

| a Google Inc., A | United States | 250 | | 142,912 |

| a Google Inc., C | United States | 170 | | 95,367 |

| Infosys Ltd., ADR | India | 2,110 | | 108,517 |

| a LinkedIn Corp., A | United States | 140 | | 22,413 |

| MasterCard Inc., A | United States | 2,000 | | 152,900 |

| MercadoLibre Inc. | Argentina | 1,700 | | 144,619 |

| Microsoft Corp. | United States | 4,074 | | 166,790 |

| a NetSuite Inc. | United States | 450 | | 36,220 |

| The Sage Group PLC | United Kingdom | 23,000 | | 157,984 |

| a Salesforce.com Inc. | United States | 910 | | 47,893 |

| SAP AG | Germany | 180 | | 13,781 |

| a ServiceNow Inc. | United States | 600 | | 31,386 |

| Symantec Corp. | United States | 3,794 | | 83,430 |

| Visa Inc., A | United States | 560 | | 120,305 |

| Xerox Corp. | United States | 7,191 | | 88,809 |

| a Yahoo! Inc. | United States | 1,340 | | 46,431 |

| | | | | 2,001,264 |

26 | Annual Report

Franklin Templeton International Trust

Consolidated Statement of Investments, May 31, 2014 (continued)

| | | | |

| Franklin Templeton Global Allocation Fund | Country | Shares/Warrants | | Value |

| Common Stocks and Other Equity Interests (continued) | | | | |

| Technology Hardware & Equipment 2.5% | | | | |

| Apple Inc. | United States | 539 | $ | 341,187 |

| CANON Inc. | Japan | 600 | | 19,679 |

| Cisco Systems Inc. | United States | 6,972 | | 171,650 |

| e Digital China Holdings Ltd. | China | 22,000 | | 19,557 |

| Ericsson, B | Sweden | 2,400 | | 30,072 |

| a Flextronics International Ltd. | Singapore | 5,200 | | 52,884 |

| Hewlett-Packard Co. | United States | 1,622 | | 54,337 |

| Kingboard Chemical Holdings Ltd. | Hong Kong | 24,700 | | 46,386 |

| QUALCOMM Inc. | United States | 1,100 | | 88,495 |

| SanDisk Corp. | United States | 400 | | 38,652 |

| TE Connectivity Ltd. | United States | 264 | | 15,697 |

| a Trimble Navigation Ltd. | United States | 1,440 | | 51,941 |

| YASKAWA Electric Corp. | Japan | 12,000 | | 147,030 |

| | | | | 1,077,567 |

| Telecommunication Services 1.2% | | | | |

| China Mobile Ltd. | China | 4,500 | | 43,996 |

| China Telecom Corp. Ltd., H | China | 120,000 | | 60,518 |

| a Koninklijke KPN NV | Netherlands | 7,880 | | 29,123 |

| Mobile TeleSystems, ADR | Russia | 702 | | 12,980 |

| Orange SA | France | 1,950 | | 32,604 |

| a SBA Communications Corp. | United States | 550 | | 55,825 |

| Telefonica SA | Spain | 5,231 | | 87,784 |

| Telenor ASA | Norway | 2,400 | | 56,877 |

| Vivendi SA | France | 1,265 | | 33,180 |

| Vodafone Group PLC | United Kingdom | 35,423 | | 124,389 |

| | | | | 537,276 |

| Transportation 1.2% | | | | |

| A.P. Moeller-Maersk AS, B | Denmark | 33 | | 85,951 |

| Canadian Pacific Railway Ltd. | Canada | 280 | | 46,905 |

| Deutsche Lufthansa AG | Germany | 2,600 | | 68,585 |

| DSV AS, B | Denmark | 4,800 | | 159,912 |

| a Hub Group Inc., A | United States | 860 | | 40,446 |

| Kansas City Southern | United States | 280 | | 30,106 |

| Union Pacific Corp. | United States | 390 | | 77,715 |

| | | | | 509,620 |

| Utilities 0.2% | | | | |

| Centrais Eletricas Brasileiras SA | Brazil | 3,800 | | 11,174 |

| Centrais Eletricas Brasileiras SA (Eletrobras), ADR | Brazil | 2,405 | | 7,167 |

| Entergy Corp. | United States | 307 | | 23,154 |

| NRG Energy Inc. | United States | 1,697 | | 60,481 |

| | | | | 101,976 |

| Total Common Stocks and Other Equity Interests | | | | |

| (Cost $18,796,118) | | | | 24,367,472 |

Annual Report | 27

Franklin Templeton International Trust

Consolidated Statement of Investments, May 31, 2014 (continued)

| | | | | |

| Franklin Templeton Global Allocation Fund | Country | Shares | | | Value |

| Preferred Stocks 0.9% | | | | | |

| Banks 0.2% | | | | | |

| Banco Bradesco SA, ADR, pfd. | Brazil | 6,900 | | $ | 96,255 |

| Energy 0.3% | | | | | |

| Petroleo Brasileiro SA, ADR, pfd. | Brazil | 8,404 | | | 125,472 |

| Materials 0.4% | | | | | |

| Vale SA, ADR, pfd., A | Brazil | 15,400 | | | 176,792 |

| Total Preferred Stocks (Cost $554,080) | | | | | 398,519 |

| |

| | | Principal Amount* | | |

| Corporate Bonds 5.3% | | | | | |

| Automobiles & Components 0.6% | | | | | |

| f BMW Finance NV, senior note, FRN, 0.508%, 9/05/16 | Germany | 130,000 | EUR | | 177,199 |

| BMW US Capital LLC, senior note, 1.25%, 7/20/16 | Germany | 65,000 | EUR | | 89,810 |

| | | | | | 267,009 |

| Banks 1.4% | | | | | |

| Bank of Montreal, senior note, 1.45%, 4/09/18 | Canada | 100,000 | | | 99,428 |

| HSBC USA Inc., senior note, 2.375%, 2/13/15 | United States | 120,000 | | | 121,718 |

| Royal Bank of Canada, senior note, 1.20%, 1/23/17 | Canada | 65,000 | | | 65,404 |

| d,f Societe Generale SA, senior note, Reg S, FRN, 0.677%, 4/17/15 | France | 100,000 | EUR | | 136,500 |

| Toyota Motor Credit Corp., senior note, 2.10%, 1/17/19 | Japan | 65,000 | | | 65,935 |

| d,f Volkswagen Bank GmbH, senior note, Reg S, FRN, 0.738%, | | | | | |

| 5/09/16 | Germany | 100,000 | EUR | | 136,626 |

| | | | | | 625,611 |

| Capital Goods 0.2% | | | | | |

| John Deere Capital Corp., 0.70%, 9/04/15 | United States | 90,000 | | | 90,382 |

| Diversified Financials 0.6% | | | | | |

| d Abbey National Treasury Services PLC, senior note, Reg S, 2.00%, | | | | | |

| 1/14/19 | United Kingdom | 100,000 | EUR | | 140,900 |

| Caterpillar International Finance Ltd., senior note, 1.375%, | | | | | |

| 5/18/15 | United States | 100,000 | EUR | | 137,510 |

| | | | | | 278,410 |

| Energy 0.4% | | | | | |

| Chevron Corp., senior note, 0.889%, 6/24/16 | United States | 150,000 | | | 151,133 |

| c NGPL PipeCo LLC, | | | | | |

| secured note, 144A, 7.119%, 12/15/17 | United States | 6,000 | | | 6,030 |

| senior secured note, 144A, 9.625%, 6/01/19 | United States | 25,000 | | | 27,250 |

| | | | | | 184,413 |

| Food & Staples Retailing 0.3% | | | | | |

| Costco Wholesale Corp., senior note, 1.125%, 12/15/17 | United States | 150,000 | | | 149,454 |

| Food, Beverage & Tobacco 0.8% | | | | | |

| Anheuser-Busch InBev Finance, senior note, 0.80%, 1/15/16 | Belgium | 150,000 | | | 150,869 |

| d Anheuser-Busch InBev NV, senior note, Reg S, 1.25%, 3/24/17 | Belgium | 130,000 | EUR | | 180,575 |

| | | | | | 331,444 |

28 | Annual Report

Franklin Templeton International Trust

Consolidated Statement of Investments, May 31, 2014 (continued)

| | | | | |

| Franklin Templeton Global Allocation Fund | Country | Principal Amount* | | Value |

| Corporate Bonds (continued) | | | | | |

| Media 0.4% | | | | | |

| Clear Channel Communications Inc., senior secured note, first lien, | | | | | |

| 9.00%, 12/15/19 | United States | 65,000 | | $ | 69,550 |

| The Walt Disney Co., senior note, 1.10%, 12/01/17 | United States | 110,000 | | | 109,622 |

| | | | | | 179,172 |

| Pharmaceuticals, Biotechnology & Life Sciences 0.2% | | | | | |

| Johnson & Johnson, senior note, 1.65%, 12/05/18 | United States | 65,000 | | | 65,554 |

| Software & Services 0.1% | | | | | |

| First Data Corp., | | | | | |

| senior bond, 12.625%, 1/15/21 | United States | 8,000 | | | 9,640 |

| senior note, 11.75%, 8/15/21 | United States | 22,000 | | | 24,530 |

| c senior secured bond, 144A, 8.25%, 1/15/21 | United States | 5,000 | | | 5,450 |

| c,g First Data Holdings Inc., 144A, PIK, 14.50%, 9/24/19 | United States | 10,479 | | | 10,330 |

| | | | | | 49,950 |

| Technology Hardware & Equipment 0.2% | | | | | |

| c Avaya Inc., | | | | | |

| senior note, 144A, 10.50%, 3/01/21 | United States | 17,000 | | | 15,470 |

| senior secured note, 144A, 7.00%, 4/01/19 | United States | 17,000 | | | 16,915 |

| Hewlett-Packard Co., senior note, 2.35%, 3/15/15 | United States | 50,000 | | | 50,720 |

| | | | | | 83,105 |

| Transportation 0.1% | | | | | |

| c American Airlines Inc., senior secured note, 144A, 7.50%, 3/15/16 | United States | 23,000 | | | 23,905 |

| Total Corporate Bonds (Cost $2,308,472) | | | | | 2,328,409 |

| f,hSenior Floating Rate Interests 0.1% | | | | | |

| Technology Hardware & Equipment 0.1% | | | | | |

| Avaya Inc., | | | | | |

| Tranche B-3 Term Loan, 4.727%, 10/26/17 | United States | 20,768 | | | 20,142 |

| Tranche B6 Term Loan, 6.50%, 3/31/18 | United States | 4,942 | | | 4,920 |

| Total Senior Floating Rate Interests (Cost $23,629) | | | | | 25,062 |

| |

| | | Units | | | |

| iExchange Traded Notes (Cost $1,061,866) 2.5% | | | | | |

| Energy 2.5% | | | | | |

| a,j,k iPATH Dow Jones-UBS Commodity Index Total Return ETN, 6/12/36 | United States | 28,200 | | | 1,105,158 |

| |

| | | Principal Amount* | | |

| Foreign Government and Agency Securities 14.7% | | | | | |

| France Treasury Note, 2.25%, 2/25/16 | France | 65,000 | EUR | | 91,857 |

| Government of Canada, | | | | | |

| 2.25%, 8/01/14 | Canada | 38,000 | CAD | | 35,125 |

| 1.00%, 11/01/14 | Canada | 50,000 | CAD | | 46,118 |

| 2.00%, 12/01/14 | Canada | 48,000 | CAD | | 44,500 |

| 1.00%, 2/01/15 | Canada | 132,000 | CAD | | 121,775 |

| 1.25%, 9/01/18 | Canada | 130,000 | CAD | | 118,989 |

Annual Report | 29

Franklin Templeton International Trust

Consolidated Statement of Investments, May 31, 2014 (continued)

| | | | | |

| Franklin Templeton Global Allocation Fund | Country | Principal Amount* | | Value |

| Foreign Government and Agency Securities (continued) | | | | | |

| Government of France, | | | | | |

| 3.25%, 4/25/16 | France | 125,000 | EUR | $ | 180,416 |

| c senior note, 144A, 1.375%, 1/29/18 | France | 152,000 | | | 152,627 |

| Government of Germany, 0.25%, 3/11/16 | Germany | 65,000 | EUR | | 88,910 |

| Government of Hungary, | | | | | |

| 5.50%, 12/22/16 | Hungary | 350,000 | HUF | | 1,678 |

| 4.125%, 2/19/18 | Hungary | 50,000 | | | 51,781 |

| 4.00%, 4/25/18 | Hungary | 1,060,000 | HUF | | 4,889 |

| 5.375%, 2/21/23 | Hungary | 80,000 | | | 85,602 |

| A, 6.75%, 11/24/17 | Hungary | 5,540,000 | HUF | | 27,838 |

| A, 7.00%, 6/24/22 | Hungary | 9,950,000 | HUF | | 52,286 |

| A, 6.00%, 11/24/23 | Hungary | 5,760,000 | HUF | | 28,729 |

| B, 6.75%, 2/24/17 | Hungary | 3,260,000 | HUF | | 16,123 |

| B, 5.50%, 6/24/25 | Hungary | 29,850,000 | HUF | | 143,386 |

| senior note, 6.25%, 1/29/20 | Hungary | 32,000 | | | 36,040 |

| senior note, 6.375%, 3/29/21 | Hungary | 6,000 | | | 6,840 |

| d senior note, Reg S, 4.375%, 7/04/17 | Hungary | 95,000 | EUR | | 137,655 |

| d senior note, Reg S, 5.75%, 6/11/18 | Hungary | 10,000 | EUR | | 15,285 |

| Government of Ireland, | | | | | |

| 5.50%, 10/18/17 | Ireland | 40,300 | EUR | | 63,757 |

| 5.90%, 10/18/19 | Ireland | 26,000 | EUR | | 43,865 |

| 4.50%, 4/18/20 | Ireland | 40,000 | EUR | | 63,465 |

| 5.00%, 10/18/20 | Ireland | 123,000 | EUR | | 201,031 |

| senior bond, 4.50%, 10/18/18 | Ireland | 11,000 | EUR | | 17,274 |

| senior bond, 4.40%, 6/18/19 | Ireland | 37,000 | EUR | | 58,270 |

| senior bond, 5.40%, 3/13/25 | Ireland | 131,670 | EUR | | 222,486 |

| Government of Malaysia, | | | | | |

| 3.434%, 8/15/14 | Malaysia | 960,000 | MYR | | 298,806 |

| 3.741%, 2/27/15 | Malaysia | 120,000 | MYR | | 37,493 |

| 3.835%, 8/12/15 | Malaysia | 70,000 | MYR | | 21,929 |

| 4.72%, 9/30/15 | Malaysia | 507,000 | MYR | | 160,708 |

| 3.197%, 10/15/15 | Malaysia | 40,000 | MYR | | 12,434 |

| Government of Mexico, | | | | | |

| 9.50%, 12/18/14 | Mexico | 23,700l MXN | | 190,260 |

| 6.00%, 6/18/15 | Mexico | 4,720l MXN | | 37,589 |

| 8.00%, 12/17/15 | Mexico | 10,770l MXN | | 89,091 |

| 6.25%, 6/16/16 | Mexico | 290l MXN | | 2,360 |

| Government of Poland, | | | | | |

| 5.50%, 4/25/15 | Poland | 235,000 | PLN | | 79,380 |

| 6.25%, 10/24/15 | Poland | 6,000 | PLN | | 2,071 |

| 5.00%, 4/25/16 | Poland | 325,000 | PLN | | 111,496 |

| 4.75%, 10/25/16 | Poland | 1,175,000 | PLN | | 404,366 |

| Strip, 7/25/14 | Poland | 90,000 | PLN | | 29,546 |

| Strip, 7/25/15 | Poland | 491,000 | PLN | | 157,096 |

| Strip, 1/25/16 | Poland | 555,000 | PLN | | 174,934 |

30 | Annual Report

Franklin Templeton International Trust

Consolidated Statement of Investments, May 31, 2014 (continued)

| | | | | | |

| Franklin Templeton Global Allocation Fund | Country | Principal Amount* | | Value |

| Foreign Government and Agency Securities (continued) | | | | | | |

| c Government of Slovenia, senior note, 144A, 5.85%, 5/10/23 | Slovenia | 200,000 | | | $ | 224,529 |

| c Government of the Netherlands, 144A, Strip, 4/15/16 | Netherlands | 120,000 | | EUR | | 163,203 |

| c Government of Ukraine, 144A, 7.75%, 9/23/20 | Ukraine | 280,000 | | | | 264,530 |

| Korea Monetary Stabilization Bond, | | | | | | |

| senior bond, 2.47%, 4/02/15 | South Korea | 38,900,000 | | KRW | | 38,056 |

| senior bond, 2.80%, 8/02/15 | South Korea | 181,710,000 | | KRW | | 178,259 |

| senior note, 2.78%, 10/02/14 | South Korea | 71,000,000 | | KRW | | 69,603 |

| senior note, 2.84%, 12/02/14 | South Korea | 14,730,000 | | KRW | | 14,448 |