Exhibit 99.2

Strategic Overview

Dynegy Inc.

Roadmap to Recovery...

The Path Traveled

Focused attention and dedicated efforts by 4,200 employees over the past two years…

on an extensive “To Do” list… while adhering to our Guiding Principles… on our Core Businesses…

… has cleared the roadway for future growth

Dynegy Inc. 2

Roadmap to Recovery...

Dedicated efforts to attack an extended “to do” list

Established a game plan. . . Then we executed

Dynegy Inc. 3

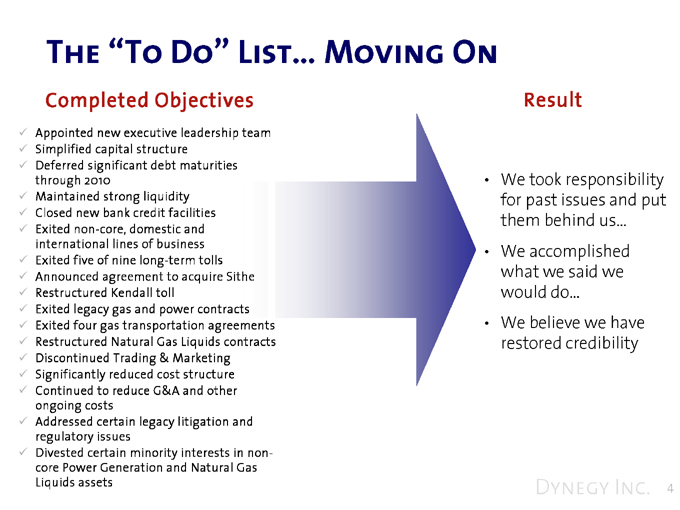

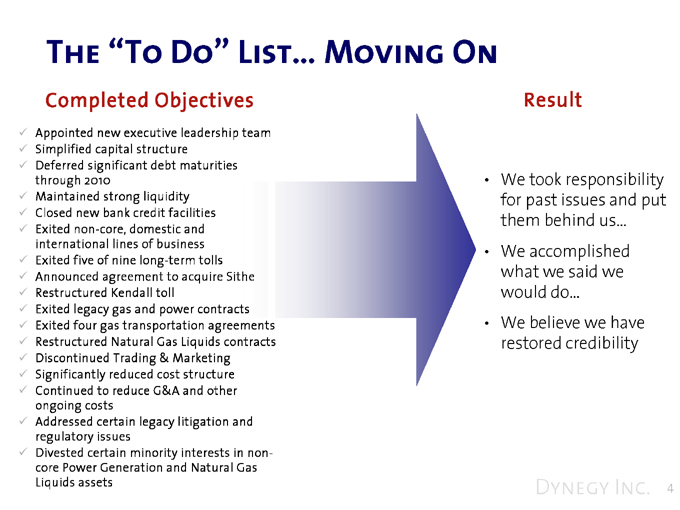

The “To Do” List… Moving On

Completed Objectives Result

Appointed new executive leadership team Simplified capital structure Deferred significant debt maturities through 2010 Maintained strong liquidity Closed new bank credit facilities Exited non-core, domestic and international lines of business Exited five of nine long-term tolls Announced agreement to acquire Sithe Restructured Kendall toll Exited legacy gas and power contracts Exited four gas transportation agreements Restructured Natural Gas Liquids contracts Discontinued Trading & Marketing Significantly reduced cost structure Continued to reduce G&A and other ongoing costs Addressed certain legacy litigation and regulatory issues Divested certain minority interests in non-core Power Generation and Natural Gas Liquids assets

We took responsibility for past issues and put them behind us… We accomplished what we said we would do… We believe we have restored credibility

Dynegy Inc. 4

Roadmap to Recovery…

Dedicated efforts to attack an extended “to do” list

Adherence to our Guiding Principles

Respect all investors and their position in our capital structure

Dynegy Inc. 5

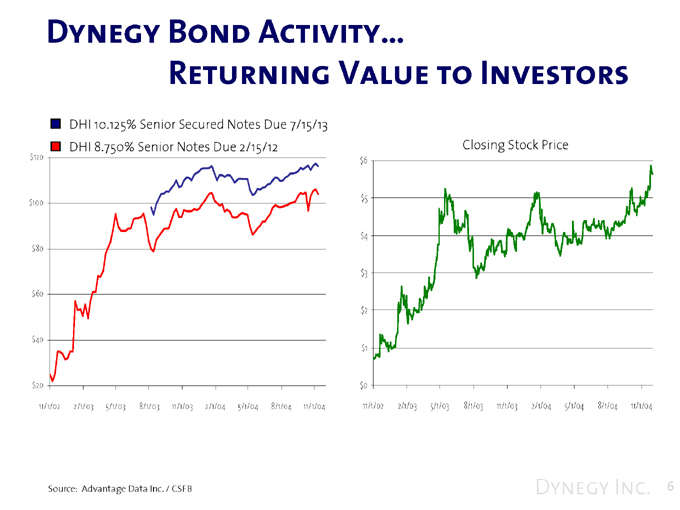

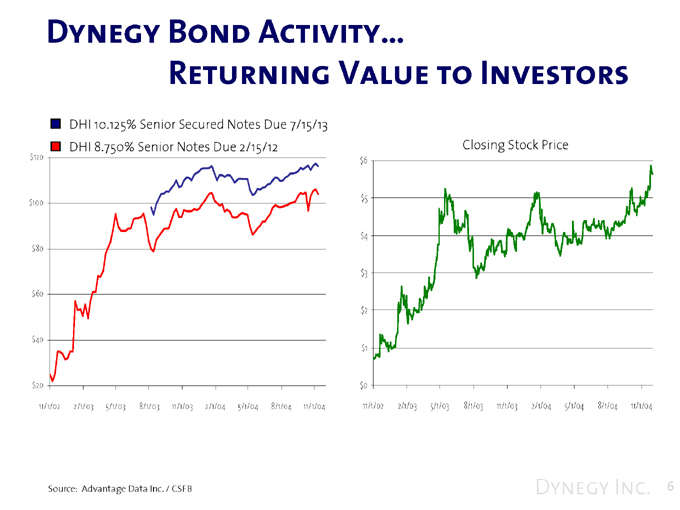

Dynegy Bond Activity…

Returning Value to Investors

DHI 10.125% Senior Secured Notes Due 7/15/13 DHI 8.750% Senior Notes Due 2/15/12

$120 $100 $80 $60 $40 $20

11/1/02 2/1/03 5/1/03 8/1/03 11/1/03 2/1/04 5/1/04 8/1/04 11/1/04

Closing Stock Price

$6 $5 $4 $3 $2 $1 $0

11/1/02 2/1/03 5/1/03 8/1/03 11/1/03 2/1/04 5/1/04 8/1/04 11/1/04

Source: Advantage Data Inc. / CSFB

Dynegy Inc. 6

Roadmap to Recovery…

Dedicated efforts to attack an extended “to do” list

Adherence to our Guiding Principles

Respect all investor rights and position in capital structure

Work to restore value to all investors

Extend debt maturities, creating a real option “runway”

Create a near term “synthetic investment grade” balance sheet

Dynegy Inc. 7

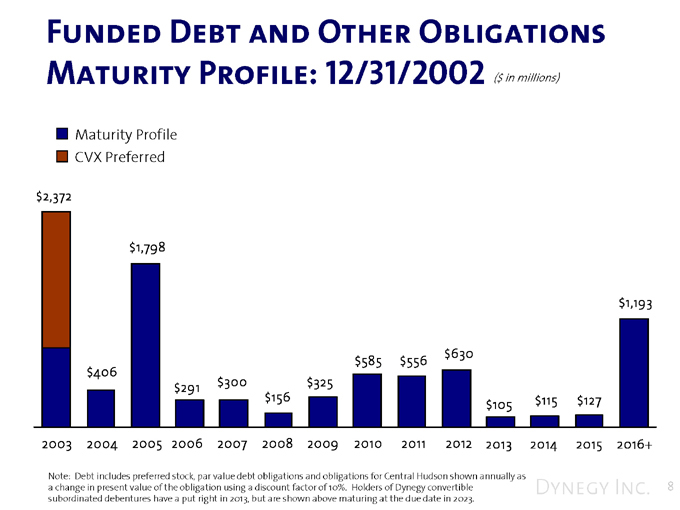

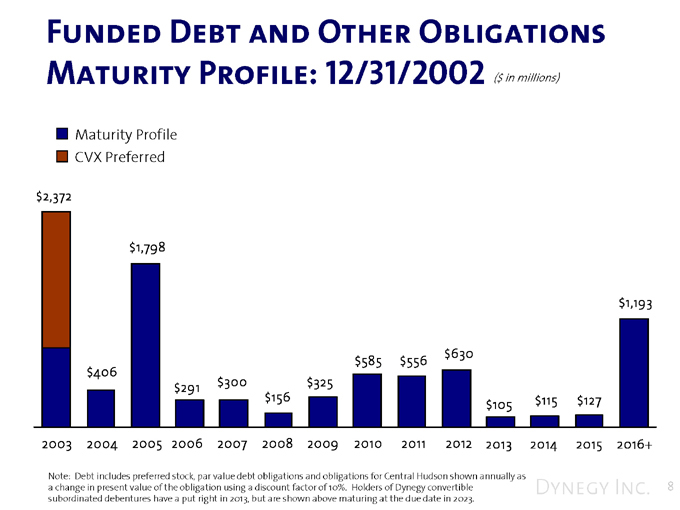

Funded Debt and Other Obligations Maturity Profile: 12/31/2002 ($ in millions)

Maturity Profile CVX Preferred

$2,372 $1,798 $1,193

$585 $556 $630 $406 $291 $300 $325 $156 $105 $115 $127

2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016+

Note: Debt includes preferred stock, par value debt obligations and obligations for Central Hudson shown annually as a change in present value of the obligation using a discount factor of 10%. Holders of Dynegy convertible subordinated debentures have a put right in 2013, but are shown above maturing at the due date in 2023.

Dynegy Inc. 8

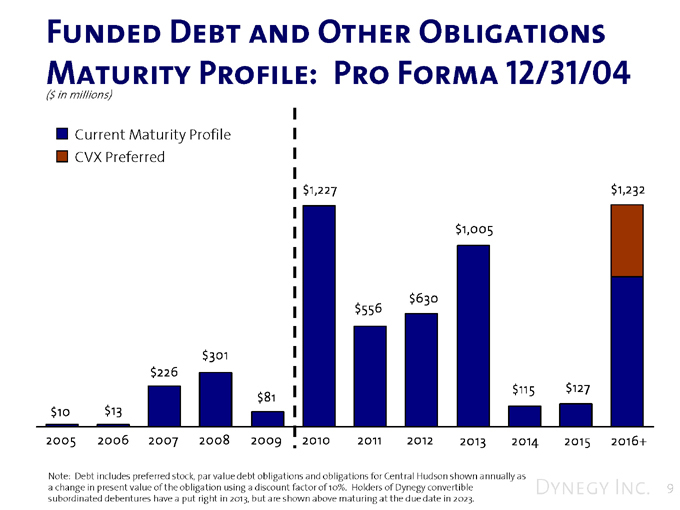

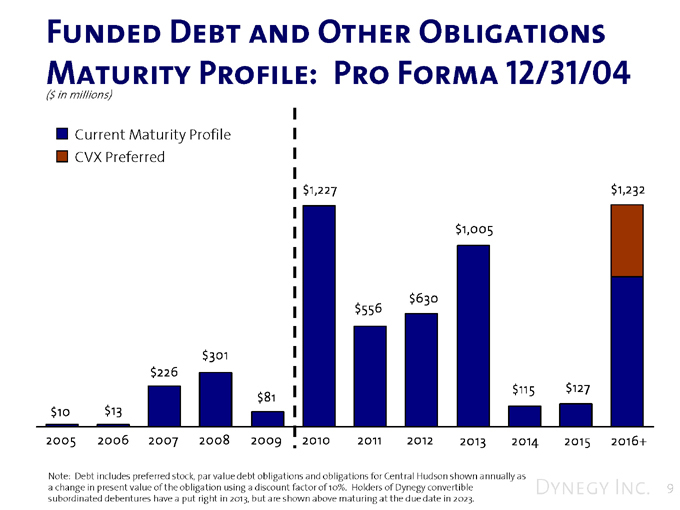

Funded Debt and Other Obligations Maturity Profile: Pro Forma 12/31/04

($ in millions)

Current Maturity Profile CVX Preferred

$301 $226 $81

$10 $13

$1,227

$630 $556

$1,232

$1,005

$115 $127

2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016+

Note: Debt includes preferred stock, par value debt obligations and obligations for Central Hudson shown annually as a change in present value of the obligation using a discount factor of 10%. Holders of Dynegy convertible subordinated debentures have a put right in 2013, but are shown above maturing at the due date in 2023.

Dynegy Inc. 9

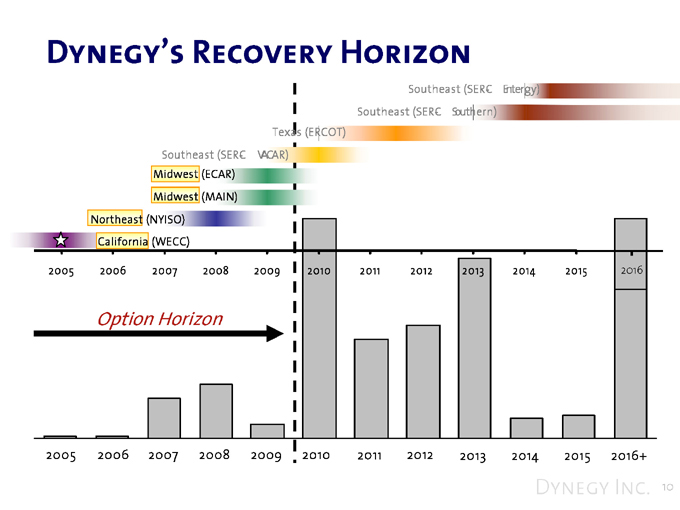

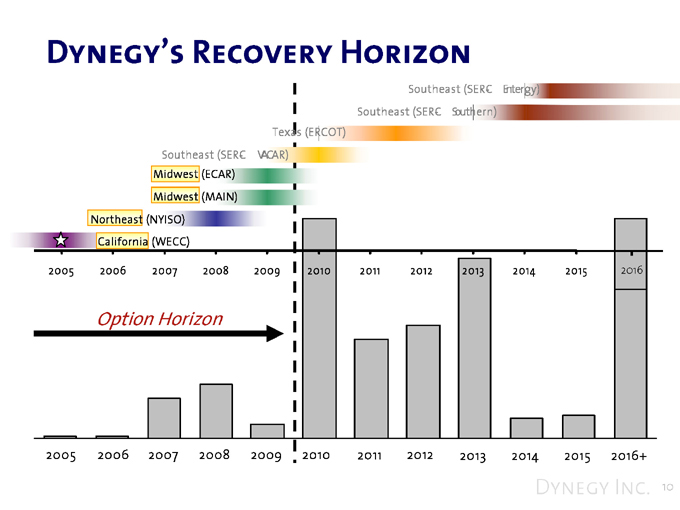

Dynegy’s Recovery Horizon

Southeast (SERC-Entergy) Southeast (SERC-Southern) Texas (ERCOT) Southeast (SERC-VACAR) Midwest (ECAR) Midwest (MAIN) Northeast (NYISO) California (WECC)

2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016

Option Horizon

2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016+

Dynegy Inc. 10

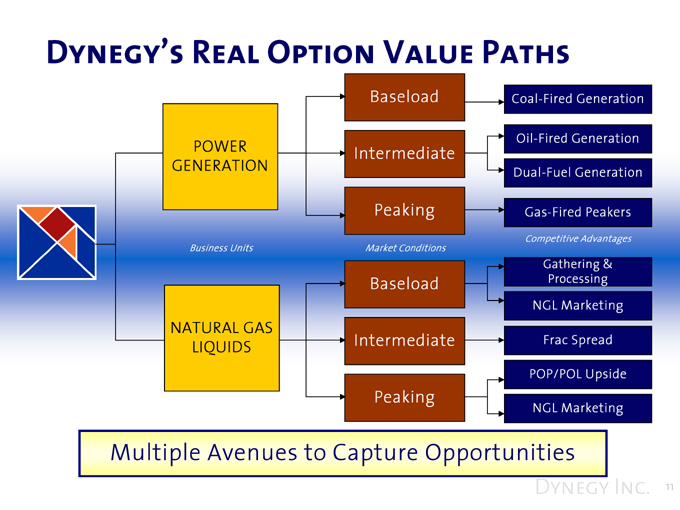

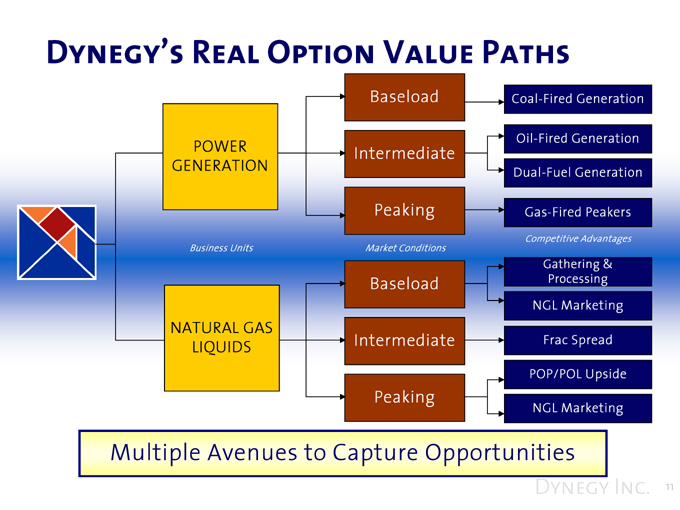

Dynegy’s Real Option Value Paths

Baseload Coal-Fired Generation POWER Oil-Fired Generation

Intermediate

GENERATION Dual-Fuel Generation Peaking Gas-Fired Peakers

Competitive Advantages Business Units Market Conditions

Gathering & Processing Baseload

NGL Marketing

NATURAL GAS

LIQUIDS Intermediate Frac Spread

POP/POL Upside

Peaking

NGL Marketing

Multiple Avenues to Capture Opportunities

Dynegy Inc. 11

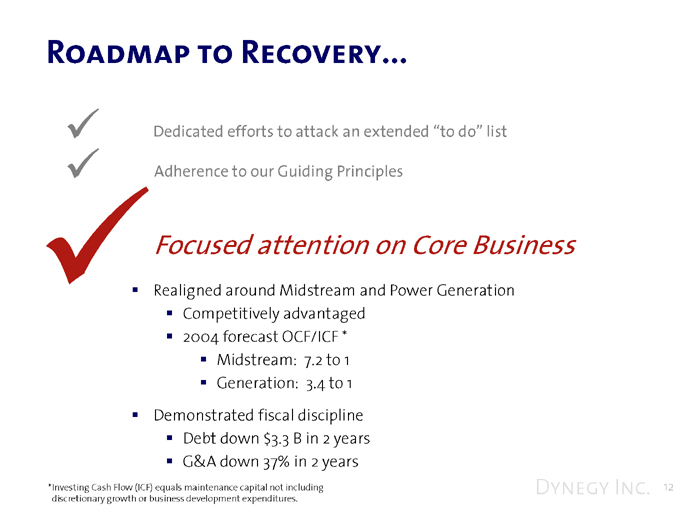

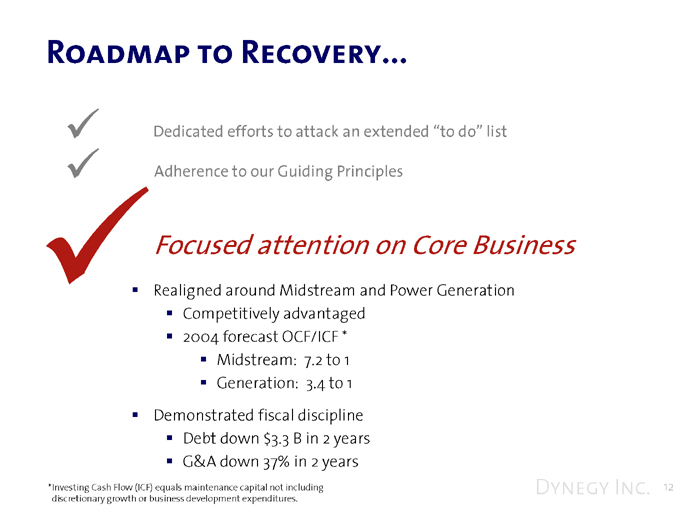

Roadmap to Recovery

Dedicated efforts to attack an extended “to do” list Adherence to our Guiding Principles

Focused attention on Core Business

Realigned around Midstream and Power Generation

Competitively advantaged 2004 forecast OCF/ICF *

Midstream: 7.2 to 1 Generation: 3.4 to 1

Demonstrated fiscal discipline

Debt down $3.3 B in 2 years G&A down 37% in 2 years

*Investing Cash Flow (ICF) equals maintenance capital not including discretionary growth or business development expenditures.

Dynegy Inc. 12

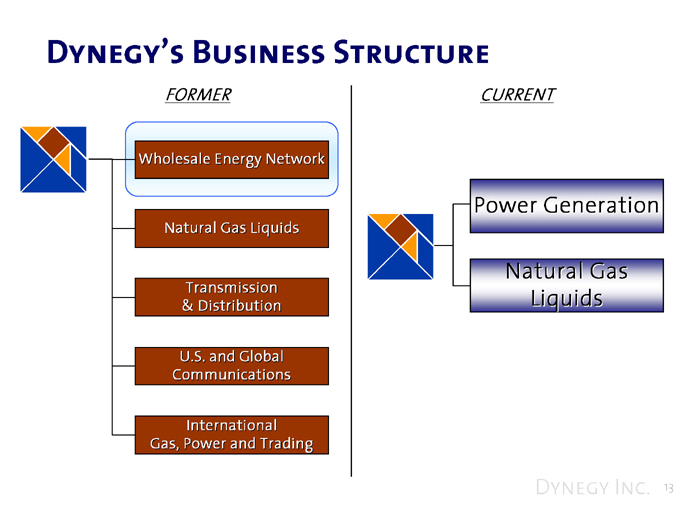

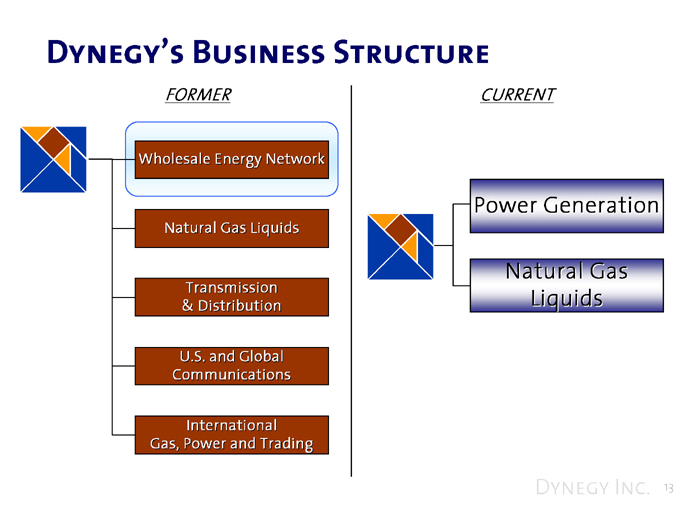

Dynegy’s Business Structure

FORMER CURRENT

Wholesale Energy Network

Power Generation

Natural Gas Liquids

Natural Gas Liquids

Transmission & Distribution

U.S. and Global Communications

International Gas, Power and Trading

Dynegy Inc. 13

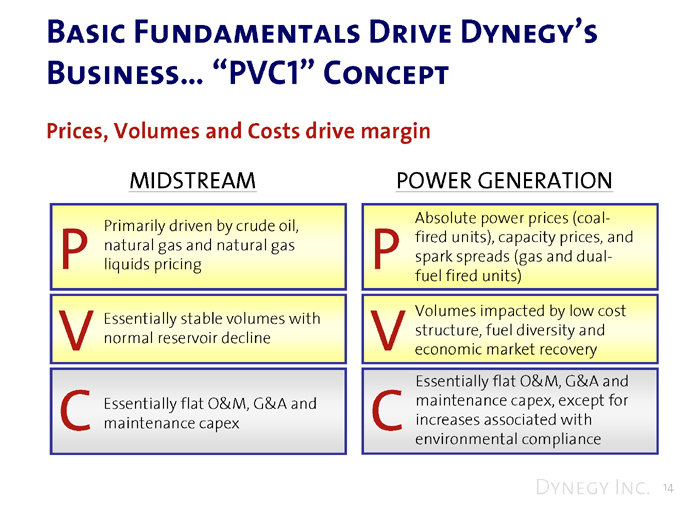

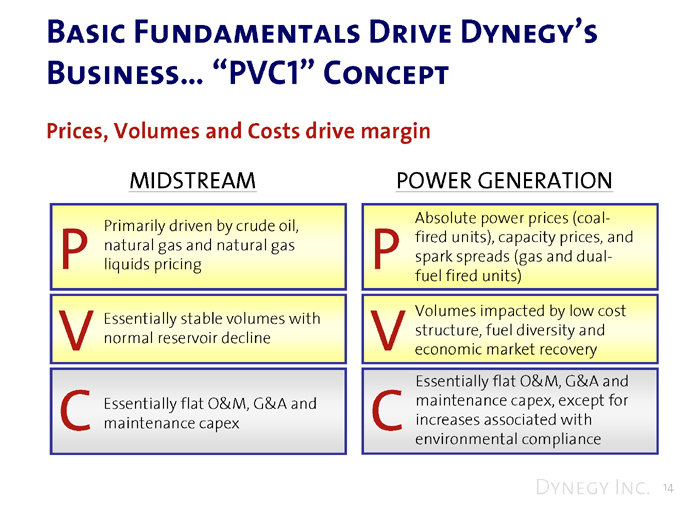

Basic Fundamentals Drive Dynegy’s Business… “PVC1” Concept

Prices, Volumes and Costs drive margin

MIDSTREAM

P Primarily driven by crude oil, natural gas and natural gas liquids pricing

V

C Essentially flat O&M, G&A and maintenance capex

POWER GENERATION

P Absolute power prices (coal-fired units), capacity prices, and spark spreads (gas and dual-fuel fired units)

V Volumes impacted by low cost structure, fuel diversity and economic market recovery

C Essentially flat O&M, G&A and maintenance capex, except for increases associated with environmental compliance

Dynegy Inc. 14

Accomplishments…

Clearing the Roadblocks for the Future

Dedicated efforts to attack an extended “To Do” list

Adherence to our Guiding Principles

Focused attention on Core Business

… The Road Ahead

Dynegy Inc. 15

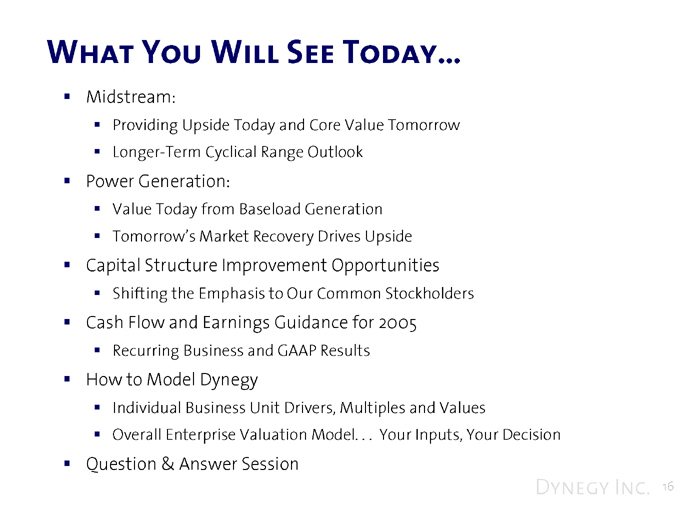

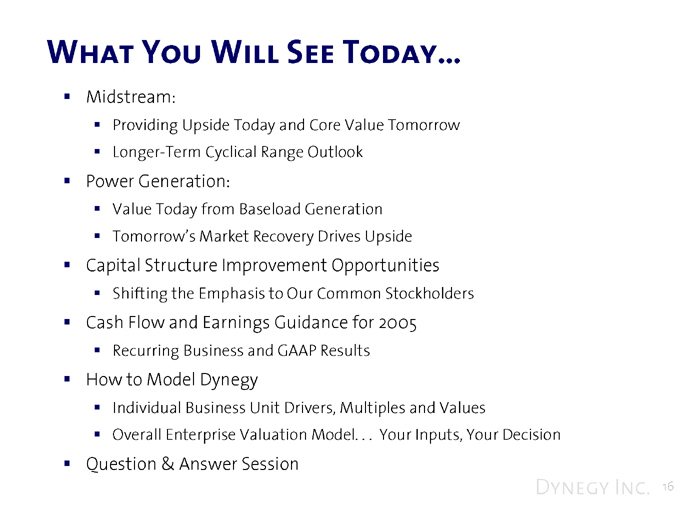

What You Will See Today…

Midstream:

Providing Upside Today and Core Value Tomorrow

Longer-Term Cyclical Range Outlook

Power Generation:

Value Today from Baseload Generation

Tomorrow’s Market Recovery Drives Upside

Capital Structure Improvement Opportunities

Shifting the Emphasis to Our Common Stockholders

Cash Flow and Earnings Guidance for 2005

Recurring Business and GAAP Results

How to Model Dynegy

Individual Business Unit Drivers, Multiples and Values

Overall Enterprise Valuation Model. . . Your Inputs, Your Decision

Question & Answer Session

Dynegy Inc. 16