Exhibit 99.3

Upside Today…

And Core Value Tomorrow

Dynegy Analyst Day Steve Furbacher, EVP

Natural Gas Liquids

Dynegy Inc.

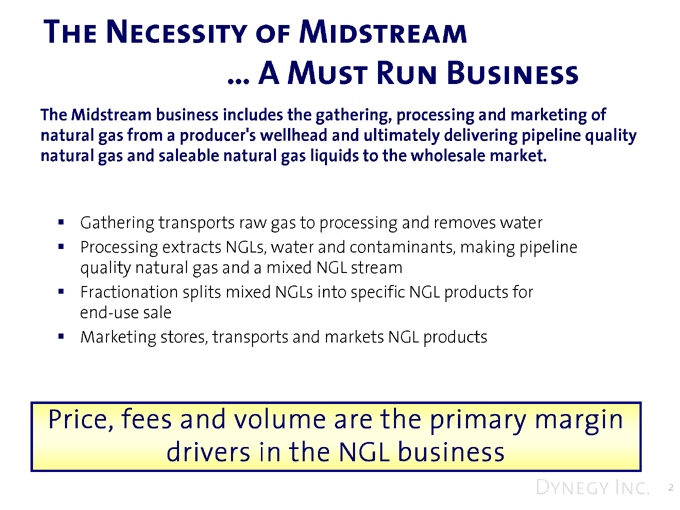

The Necessity of Midstream

… A Must Run Business

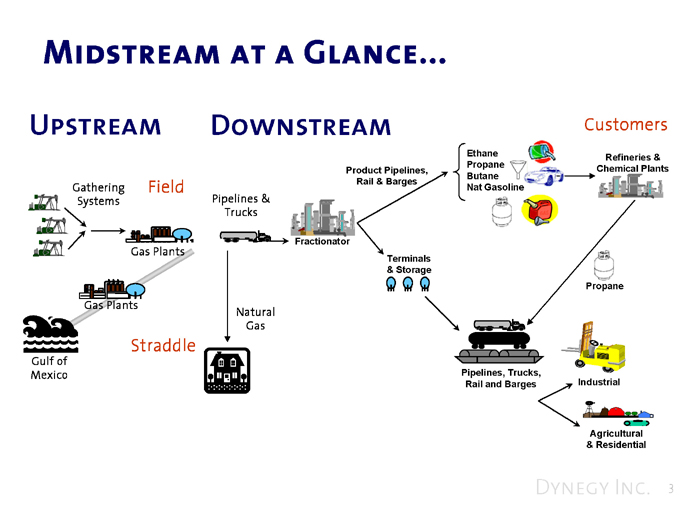

The Midstream business includes the gathering, processing and marketing of natural gas from a producer’s wellhead and ultimately delivering pipeline quality natural gas and saleable natural gas liquids to the wholesale market.

Gathering transports raw gas to processing and removes water

Processing extracts NGLs, water and contaminants, making pipeline quality natural gas and a mixed NGL stream

Fractionation splits mixed NGLs into specific NGL products for end-use sale

Marketing stores, transports and markets NGL products

Price, fees and volume are the primary margin drivers in the NGL business

Dynegy Inc. 2

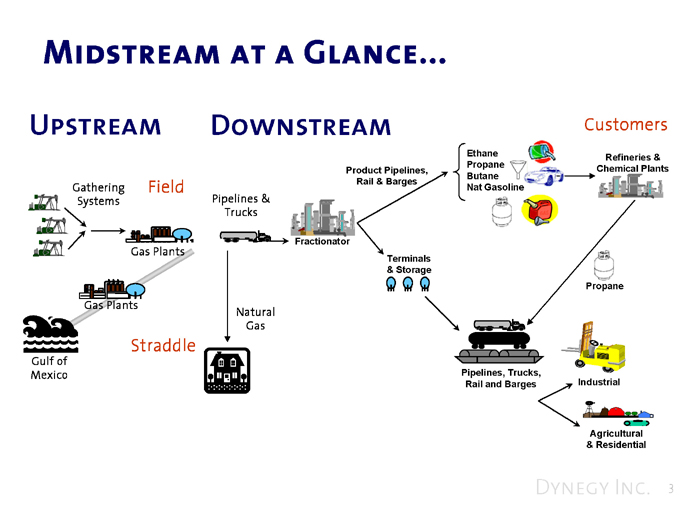

Midstream at a Glance

Upstream

Downstream

Gathering Systems

Field

Pipelines & Trucks

Product Pipelines, Rail & Barges

Ethane Propane Butane Nat Gasoline

Customers

Refineries & Chemical Plants

Gas Plants

Fractionator

Terminals & Storage

Propane

Gas Plants

Gulf of Mexico

Straddle

Natural Gas

Pipelines, Trucks, Rail and Barges

Industrial

Agricultural & Residential

Dynegy Inc. 3

Business Segment Value Propositions

Field Processing Plants:

Natural gas gathering and processing “service” business Processing to meet pipeline quality specifications

Payment for services made as a fee or as a percentage of both the liquids and gas Customers – Primarily independent producers with a few remaining major oils

Settlement percentage, asset runtime and reliability, gathering pressure, fuel efficiency, product stewardship and market access are primary value drivers

Straddle Processing Plants:

Historically a “processing option”

Processing becoming a “service” business similar to field processing Payment for services made as a fee or as a percentage of the liquids

Customers – Primarily major oils and an emerging group of independent producers

Settlement percentage, asset runtime and reliability, fuel efficiency, product stewardship and market access are primary value drivers

Liquids Assets:

All are “service” businesses

Payment made as either a fee, a fee with fuel cost adjustment or a percentage of netback Customers – Producers, petrochemical companies and refiners Fees, reliability, product quality, commitment fulfillment and flexibility are primary value drivers

Wholesale Propane, Refinery Services and Marketing:

Revenue generated from margins on sales

Logistics and reliability “service” businesses

Customers – Multi-state and independent propane retailers, petrochemical companies and refiners Reliability, commitment fulfillment and flexibility are primary value drivers

Success driven by service and reliability

Dynegy Inc. 4

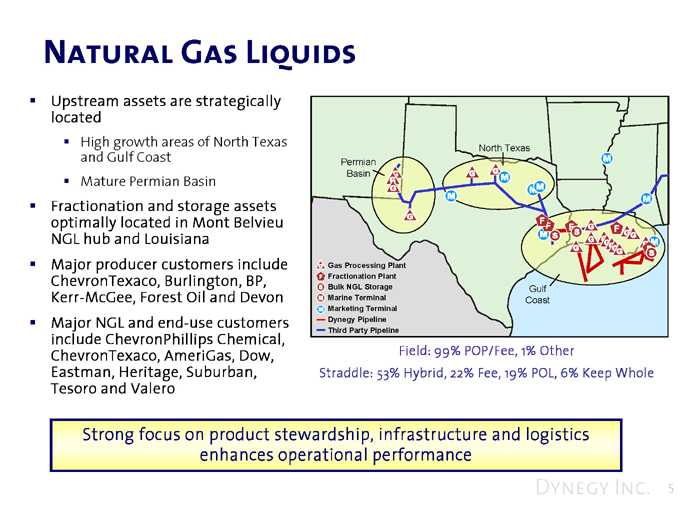

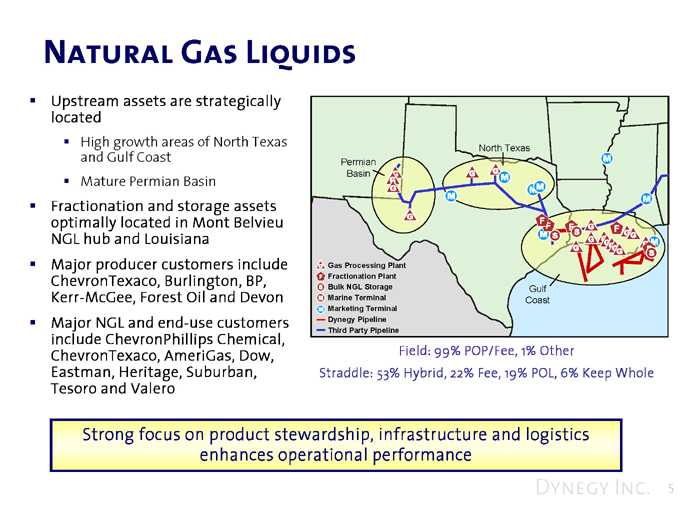

Natural Gas Liquids

Upstream assets are strategically located

High growth areas of North Texas and Gulf Coast Permian Mature Permian Basin Basin

Fractionation and storage assets optimally located in Mont Belvieu NGL hub and Louisiana

Major producer customers Gas Processing Plant

Fractionation Plant

include ChevronTexaco, Bulk NGL Storage Gulf Burlington, BP, Kerr-McGee, Marine Terminal Coast

Marketing Terminal

Forest Oil and Devon Dynegy Pipeline

Third Party Pipeline

Major NGL and end-use Field: 99% POP/Fee, 1% Other customers include Straddle: 53% Hybrid, 22% Fee, 19% POL, 6% Keep Whole

ChevronPhillips Chemical, ChevronTexaco, AmeriGas, Dow, Eastman, Heritage, Suburban, Tesoro and Valero

Strong focus on product stewardship, infrastructure and logistics enhances operational performance

Dynegy Inc. 5

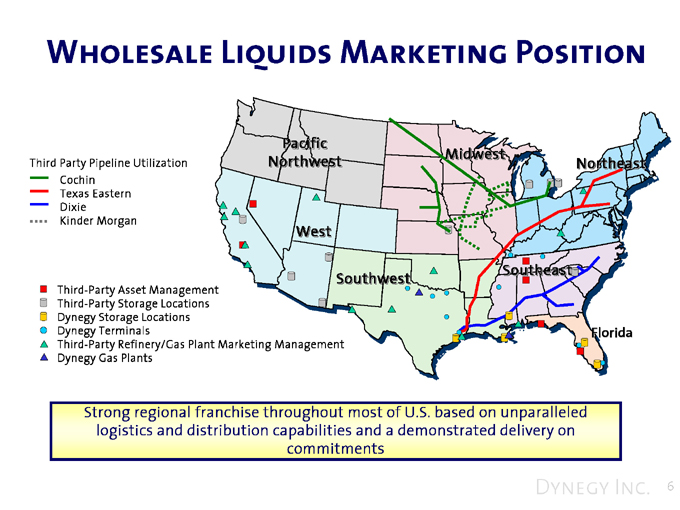

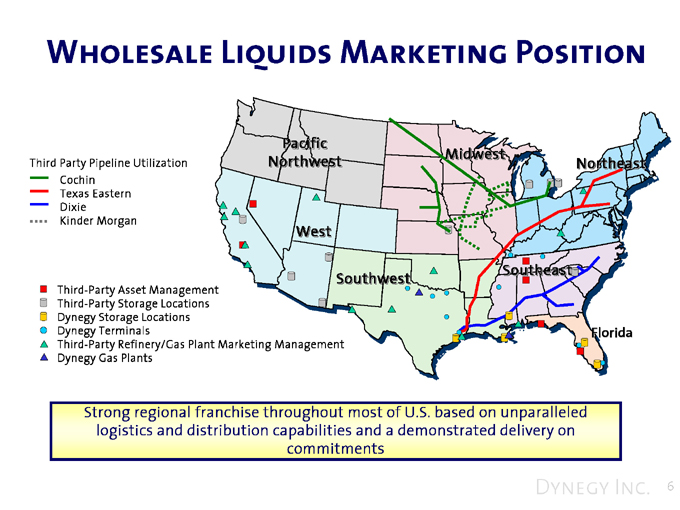

Wholesale Liquids Marketing Position

Pacific

Northwest Midwest

Third Party Pipeline Utilization Northeast Cochin Texas Eastern Dixie Kinder Morgan

West

Southwest Southeast

Third-Party Asset Management Third-Party Storage Locations Dynegy Storage Locations

Dynegy Terminals Florida Third-Party Refinery/Gas Plant Marketing Management Dynegy Gas Plants

Strong regional franchise throughout most of U.S. based on unparalleled logistics and distribution capabilities and a demonstrated delivery on commitments

Dynegy Inc. 6

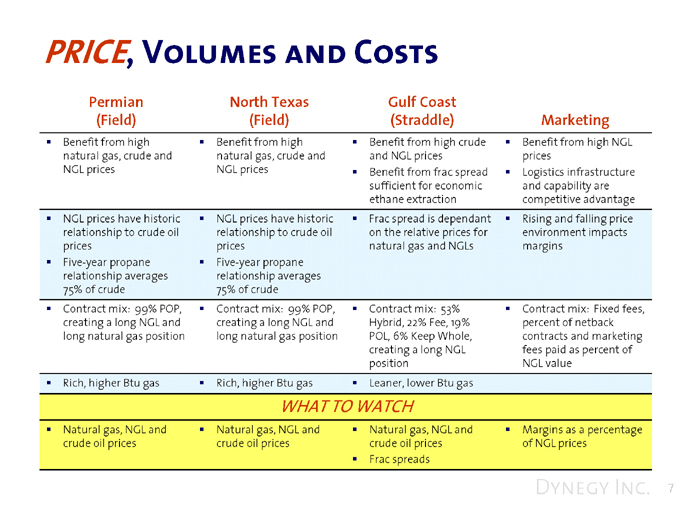

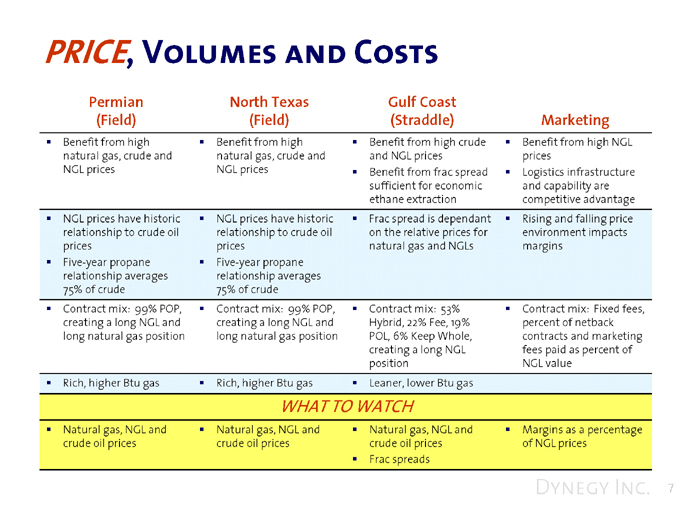

PRICE, Volumes and Costs

Permian (Field)

Benefit from high natural gas, crude and NGL prices

NGL prices have historic relationship to crude oil prices

Five-year propane relationship averages 75% of crude

Contract mix: 99% POP, creating a long NGL and long natural gas position

Rich, higher Btu gas

North Texas (Field)

Benefit from high natural gas, crude and NGL prices

NGL prices have historic relationship to crude oil prices

Five-year propane relationship averages 75% of crude

Contract mix: 99% POP, creating a long NGL and long natural gas position

Rich, higher Btu gas

Gulf Coast (Straddle)

Benefit from high crude and NGL prices

Benefit from frac spread sufficient for economic ethane extraction

Frac spread is dependant on the relative prices for natural gas and NGLs

Contract mix: 53% Hybrid, 22% Fee, 19% POL, 6% Keep Whole, creating a long NGL position

Leaner, lower Btu gas

Marketing

Benefit from high NGL prices

Logistics infrastructure and capability are competitive advantage

Rising and falling price environment impacts margins

Contract mix: Fixed fees, percent of netback contracts and marketing fees paid as percent of NGL value

WHAT TO WATCH

Natural gas, NGL and crude oil prices

Natural gas, NGL and crude oil prices

Natural gas, NGL and crude oil prices Frac spreads

Margins as a percentage of NGL prices

Dynegy Inc. 7

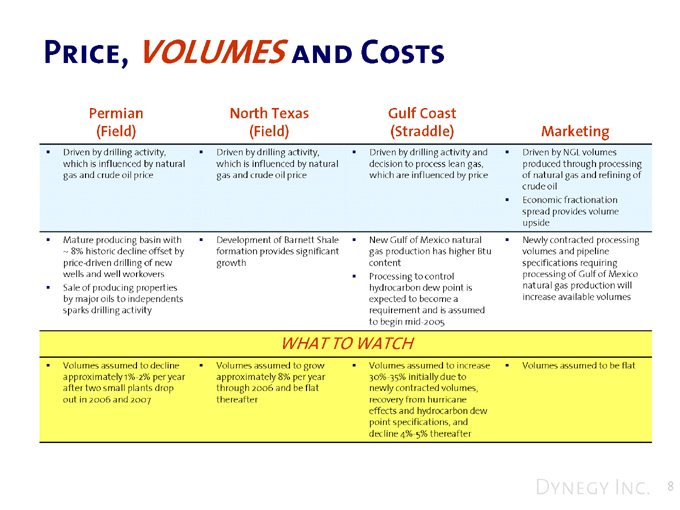

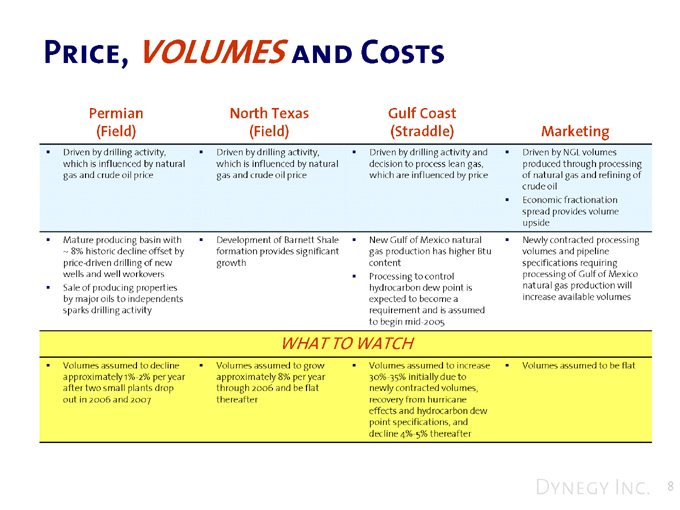

Price, VOLUMES and Costs

Driven by drilling activity, Driven by drilling activity, Driven by drilling activity and Driven by NGL volumes

which is influenced by natural which is influenced by natural decision to process lean gas, produced through processing

gas and crude oil price gas and crude oil price which are influenced by price of natural gas and refining of

crude oil

Economic fractionation

spread provides volume

upside

Mature producing basin with Development of Barnett Shale New Gulf of Mexico natural Newly contracted processing

~ 8% historic decline offset by formation provides significant gas production has higher Btu volumes and pipeline

price-driven drilling of new growth content specifications requiring

wells and well workovers Processing to control processing of Gulf of Mexico

Sale of producing properties hydrocarbon dew point is natural gas production will

by major oils to independents expected to become a increase available volumes

sparks drilling activity requirement and is assumed

to begin mid-2005

Volumes assumed to decline

Volumes assumed to grow

Volumes assumed to increase

Volumes assumed to be flat

approximately 1%-2% per year approximately 8% per year 30%-35% initially due to

after two small plants drop through 2006 and be flat newly contracted volumes,

out in 2006 and 2007 thereafter recovery from hurricane

effects and hydrocarbon dew

point specifications, and

decline 4%-5% thereafter

Dynegy Inc. 8

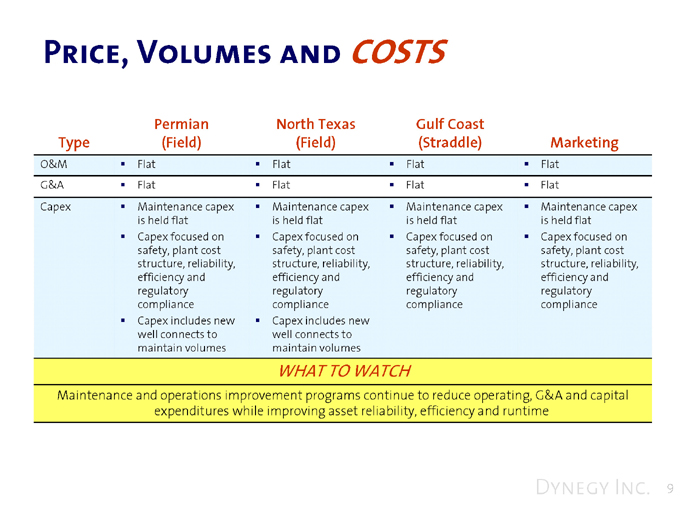

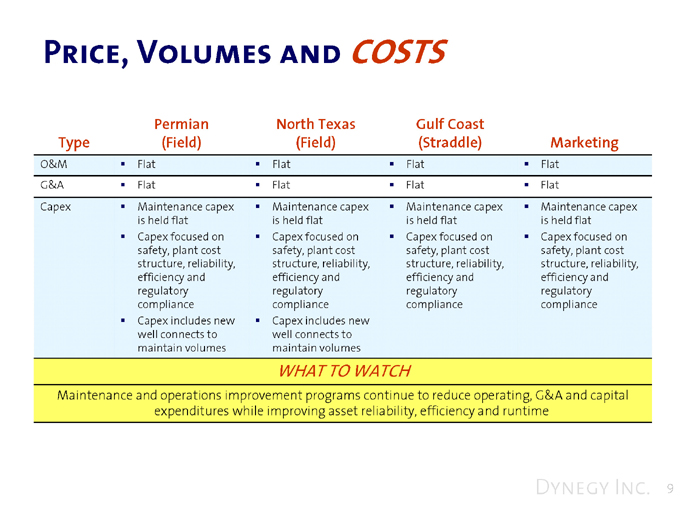

Price, Volumes and COSTS

Type

Permian (Field)

North Texas (Field)

Gulf Coast (Straddle)

Marketing

O&M Flat Flat Flat Flat

G&A Flat Flat Flat Flat

Capex

Maintenance capex is held flat

Capex focused on safety, plant cost structure, reliability, efficiency and regulatory compliance

Capex includes new well connects to maintain volumes

Maintenance capex is held flat

Capex focused on safety, plant cost structure, reliability, efficiency and regulatory compliance

Capex includes new well connects to maintain volumes

Maintenance capex is held flat

Capex focused on safety, plant cost structure, reliability, efficiency and regulatory compliance

Maintenance capex is held flat

Capex focused on safety, plant cost structure, reliability, efficiency and regulatory compliance

WHAT TO WATCH

Maintenance and operations improvement programs continue to reduce operating, G&A and capital expenditures while improving asset reliability, efficiency and runtime

Dynegy Inc. 9

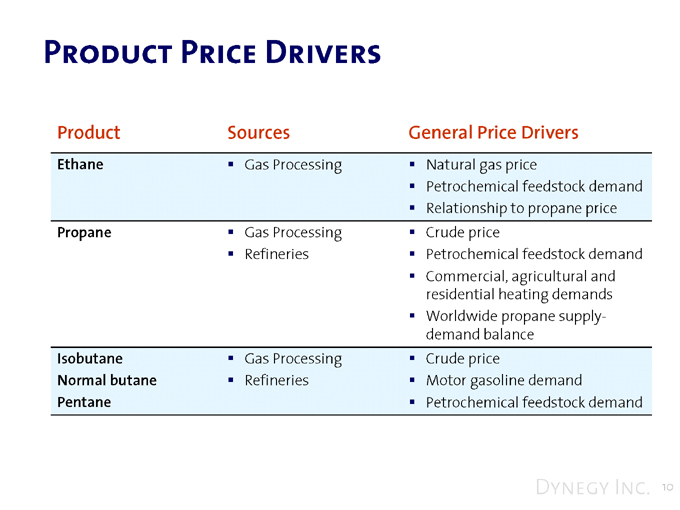

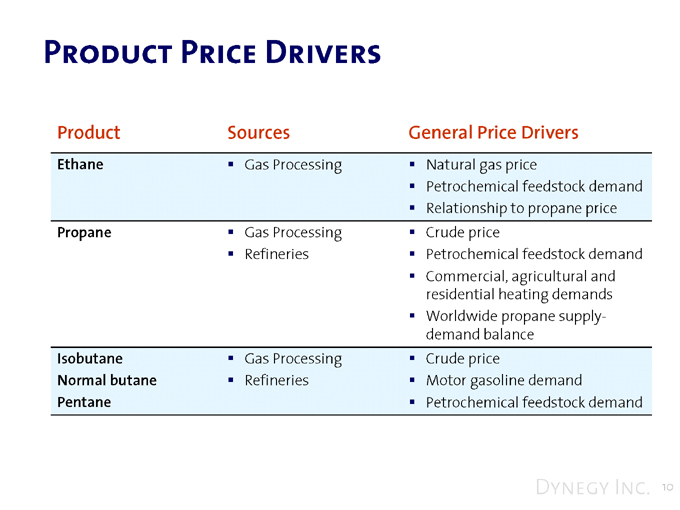

Product Price Drivers

Product Sources General Price Drivers

Ethane

Gas Processing

Natural gas price

Petrochemical feedstock demand Relationship to propane price

Propane

Gas Processing Refineries

Crude price

Petrochemical feedstock demand Commercial, agricultural and residential heating demands Worldwide propane supply-demand balance

Isobutane Normal butane Pentane

Gas Processing Refineries

Crude price

Motor gasoline demand

Petrochemical feedstock demand

Dynegy Inc. 10

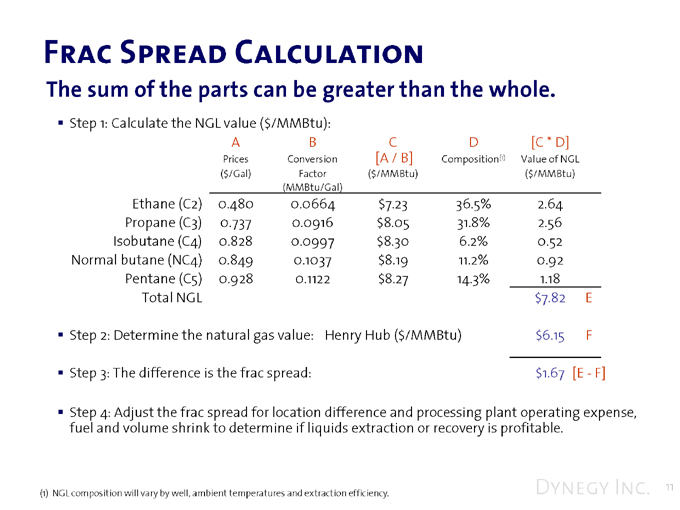

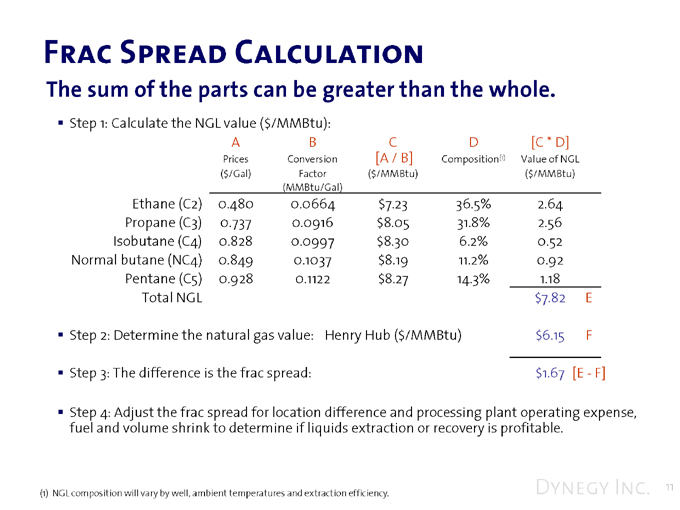

Frac Spread Calculation

The sum of the parts can be greater than the whole.

Step 1: Calculate the NGL value ($/MMBtu):

A

Prices

B Conversion Factor (MMBtu/Gal)

C [A / B]

D

Composition(1)

[C * D]

Value of NGL

Ethane (C2) 0.480 0.0664 $7.23 36.5% 2.64

Propane (C3) 0.737 0.0916 $8.05 31.8% 2.56

Isobutane (C4) 0.828 0.0997 $8.30 6.2% 0.52

Normal butane (NC4) 0.849 0.1037 $8.19 11.2% 0.92

Pentane (C5) 0.928 0.1122 $8.27 14.3% 1.18

Total NGL $7.82 E

Step 2: Determine the natural gas value: Henry Hub ($/MMBtu) $6.15 F

Step 3: The difference is the frac spread: $1.67 [E—F]

Step 4: Adjust the frac spread for location difference and processing plant operating expense, fuel and volume shrink to determine if liquids extraction or recovery is profitable.

(1) NGL composition will vary by well, ambient temperatures and extraction efficiency.

Dynegy Inc. 11

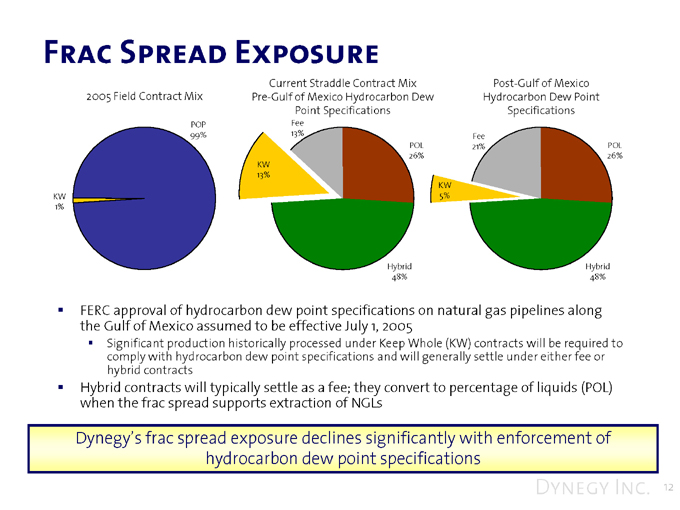

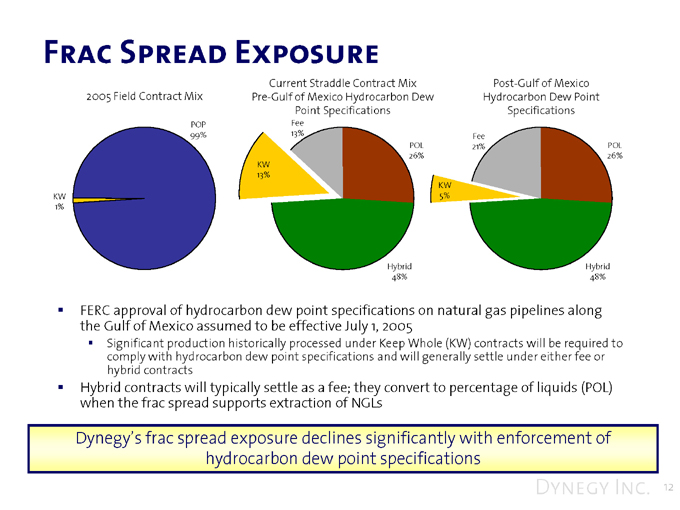

Frac Spread Exposure

Current Straddle Contract Mix Post-Gulf of Mexico 2005 Field Contract Mix Pre-Gulf of Mexico Hydrocarbon Dew Hydrocarbon Dew Point Point Specifications Specifications

POP Fee

99% 13% Fee

POL 21% POL 26% 26% KW

13%

KW KW 5% 1%

Hybrid Hybrid 48% 48%

FERC approval of hydrocarbon dew point specifications on natural gas pipelines along the Gulf of Mexico assumed to be effective July 1, 2005

Significant production historically processed under Keep Whole (KW) contracts will be required to comply with hydrocarbon dew point specifications and will generally settle under either fee or hybrid contracts

Hybrid contracts will typically settle as a fee; they convert to percentage of liquids (POL) when the frac spread supports extraction of NGLs

Dynegy’s frac spread exposure declines significantly with enforcement of hydrocarbon dew point specifications

Dynegy Inc. 12

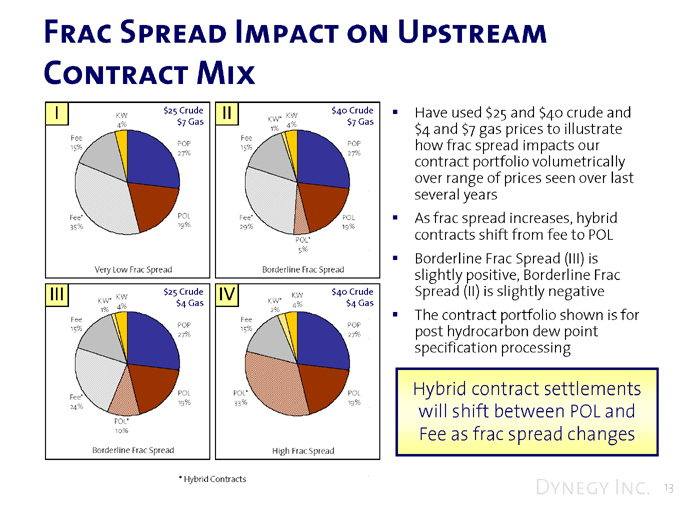

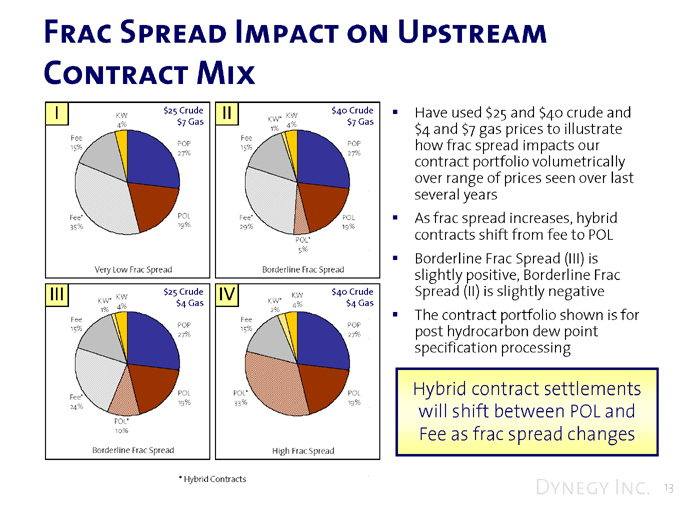

Frac Spread Impact on Upstream Contract Mix

I

II

KW KW* KW

4% 4% $7 Gas

1% Fee Fee

15% POP 15% POP

27% 27%

Fee* POL 35% 19%

Very Low Frac Spread Borderline Frac Spread

III KW $25 Crude IV KW $40 Crude KW* $4 Gas KW* 4% $4 Gas

1% 4% 2% Fee Fee

15% POP 15% POP

27% 27%

Fee* POL POL* POL 24% 19% 33% 19% POL* 10%

Borderline Frac Spread High Frac Spread

* Hybrid Contracts

Have used $25 and $40 crude and $4 and $7 gas prices to illustrate how frac spread impacts our contract portfolio volumetrically over range of prices seen over last several years As frac spread increases, hybrid contracts shift from fee to POL Borderline Frac Spread (III) is slightly positive, Borderline Frac Spread (II) is slightly negative The contract portfolio shown is for post hydrocarbon dew point specification processing

Hybrid contract settlements will shift between POL and Fee as frac spread changes

Dynegy Inc. 13

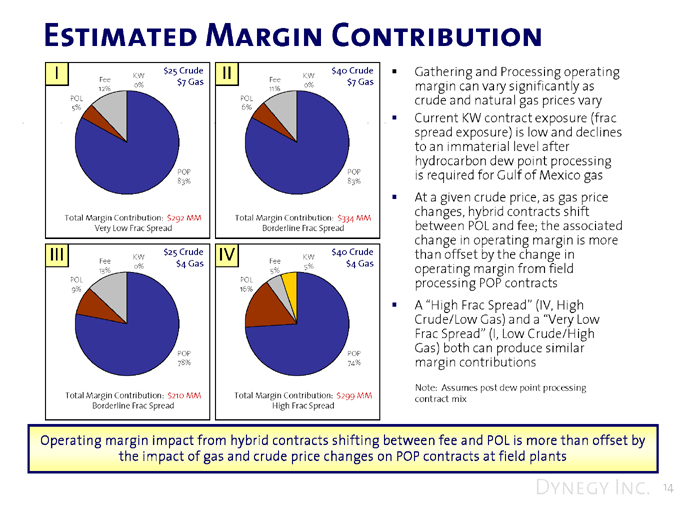

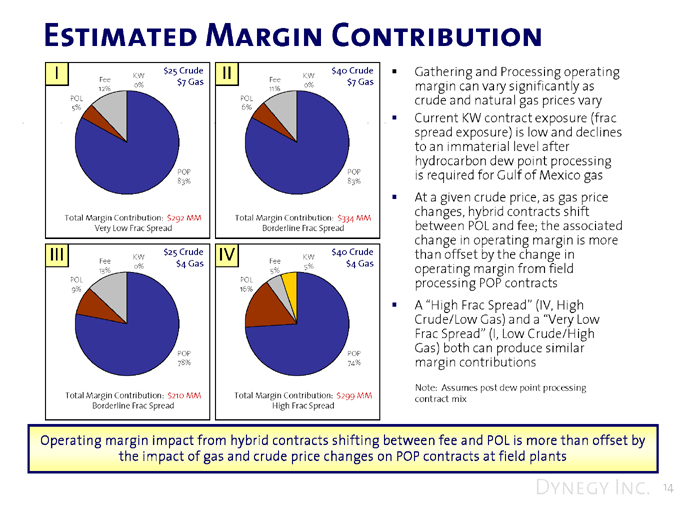

Estimated Margin Contribution

I II III IV

Fee KW Fee KW 12% 0% 11% 0% POL POL

5% 6%

POP POP 83% 83%

Total Margin Contribution: $292 MM Total Margin Contribution: $334 MM

Very Low Frac Spread Borderline Frac Spread

Fee KW Fee KW 13% 0% 5% 5% POL POL

9% 16%

POP POP 78% 74%

Total Margin Contribution: $210 MM Total Margin Contribution: $299 MM

Borderline Frac Spread High Frac Spread

Gathering and Processing operating margin can vary significantly as crude and natural gas prices vary Current KW contract exposure (frac spread exposure) is low and declines to an immaterial level after hydrocarbon dew point processing is required for Gulf of Mexico gas At a given crude price, as gas price changes, hybrid contracts shift between POL and fee; the associated change in operating margin is more than offset by the change in operating margin from field processing POP contracts A “High Frac Spread” (IV, High Crude/Low Gas) and a “Very Low Frac Spread” (I, Low Crude/High Gas) both can produce similar margin contributions

Note: Assumes post dew point processing contract mix

Operating margin impact from hybrid contracts shifting between fee and POL is more than offset by the impact of gas and crude price changes on POP contracts at field plants

Dynegy Inc. 14

Contract Portfolio and Frac Spread

Key ‘Takeaways’

Exposure to frac spread significantly mitigated under fee and hybrid settlement structure The pending FERC decision on hydrocarbon dew point specifications expected to reduce processors’ exposure to frac spread risk and increase straddle processing volumes The frac spread varies with natural gas price, NGL price and NGL content The economic frac spread varies by processing plant The major operating margin driver for Dynegy’s upstream processing business is the field processing POP contract mix

Dynegy Inc. 15

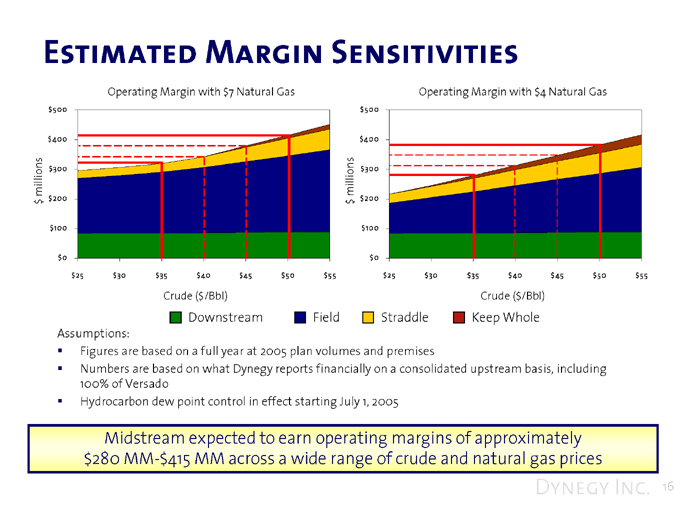

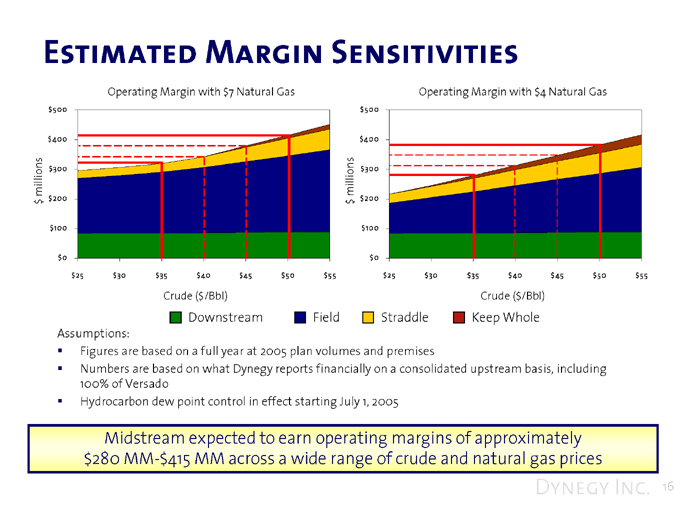

Estimated Margin Sensitivities

Operating Margin with $7 Natural Gas

$500 $400 $300 $200 $100 $0

$ millions

$25 $30 $35 $40 $45 $50 $55

Operating Margin with $4 Natural Gas

$500 $400 $300 $200 $100 $0

$ millions

$25 $30 $35 $40 $45 $50 $55

Crude ($/Bbl) Crude ($/Bbl)

Downstream Field Straddle Keep Whole

Assumptions:

Figures are based on a full year at 2005 plan volumes and premises

Numbers are based on what Dynegy reports financially on a consolidated upstream basis, including 100% of Versado Hydrocarbon dew point control in effect starting July 1, 2005

Midstream expected to earn operating margins of approximately $280 MM-$415 MM across a wide range of crude and natural gas prices

Dynegy Inc. 16

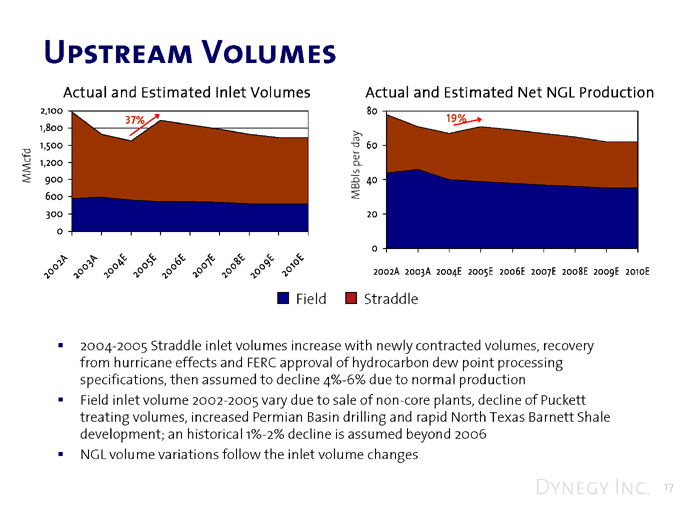

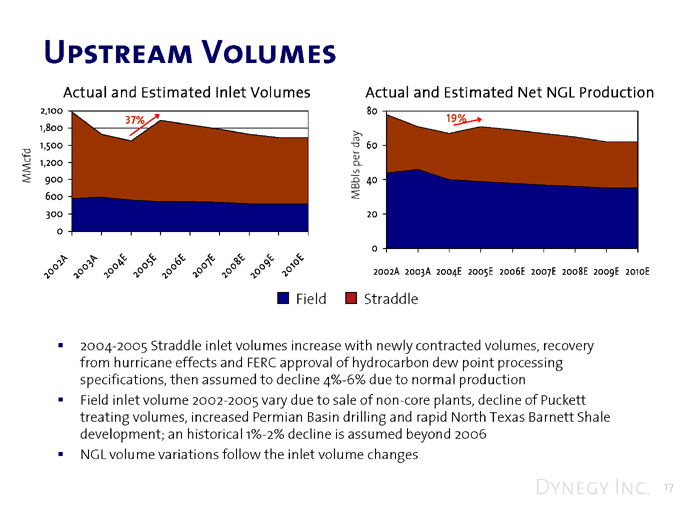

Upstream Volumes

Actual and Estimated Inlet Volumes

2,100 1,800 1,500 1,200 900 600 300 0

37%

MMcfd

2002A

2003A

2004A

2005A

2006A

2007A

2009A

2010A

Actual and Estimated Net NGL Production

MBbls per day

80 60 40 20 0

19%

2002A 2003A 2004E 2005E 2006E 2007E 2008E 2009E 2010E

Field Straddle

2004-2005 Straddle inlet volumes increase with newly contracted volumes, recovery from hurricane effects and FERC approval of hydrocarbon dew point processing specifications, then assumed to decline 4%-6% due to normal production Field inlet volume 2002-2005 vary due to sale of non-core plants, decline of Puckett treating volumes, increased Permian Basin drilling and rapid North Texas Barnett Shale development; an historical 1%-2% decline is assumed beyond 2006 NGL volume variations follow the inlet volume changes

Dynegy Inc. 17

Downstream Net Volumes

Actual and Estimated Volumes

MBbls per day

220 200 180 160 140 120 100

-18%

2002A 2003A 2004E 2005E 2006E 2007E 2008E 2009E 2010E

Fractionation

Actual and Estimated Volumes

MBbls per day

450 400 350 300 250 200 150 100 50 0

2002A 2003A 2004E 2005E 2006E 2007E 2008E 2009E 2010E

Refinery Svcs Wholesale Propane NGL Mktg

2002-2004 fractionation volumes vary due to NGL processing, frac spreads and curtailed trading of NGLs

2004-2005 fractionation decline due to loss of a large term contract in 3Q 2004, which is assumed to be replaced over the longer-term All other refinery services and wholesale volumes remain relatively flat

* Please see Appendix for more details.

Dynegy Inc. 18

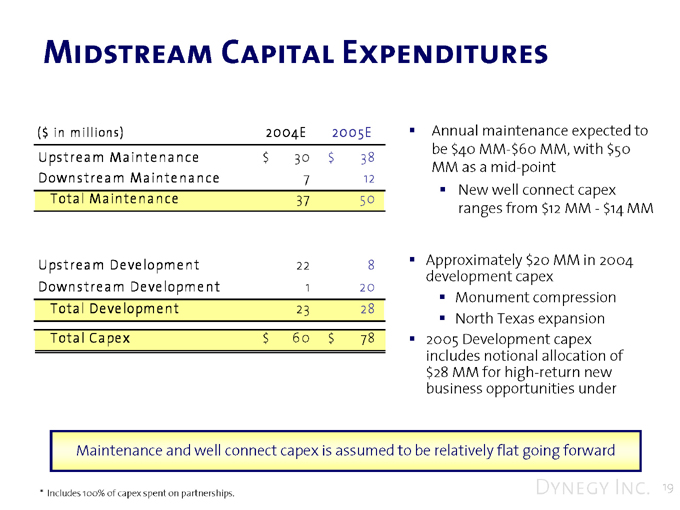

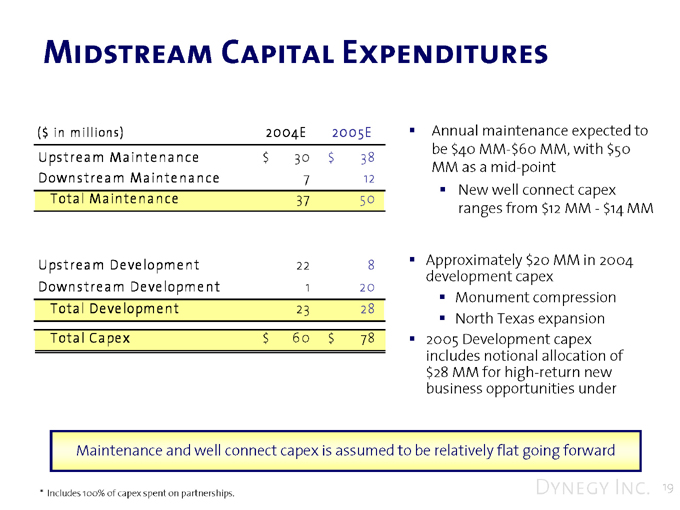

Midstream Capital Expenditures

($ in millions) 2004E 2005E Upstream Maintenance $30 $38 Downstream Maintenance 7 12 Total Maintenance 37 50

Upstream Development 22 8 Downstream Development 1 20 Total Development 23 28 Total Capex $60 $78

Annual maintenance expected to be $40 MM-$60 MM, with $50 MM as a mid-point New well connect capex ranges from $12 MM - $14 MM

Approximately $20 MM in 2004 development capex Monument compression North Texas expansion 2005 Development capex includes notional allocation of $28 MM for high-return new business opportunities under

Maintenance and well connect capex is assumed to be relatively flat going forward

* Includes 100% of capex spent on partnerships.

Dynegy Inc. 19

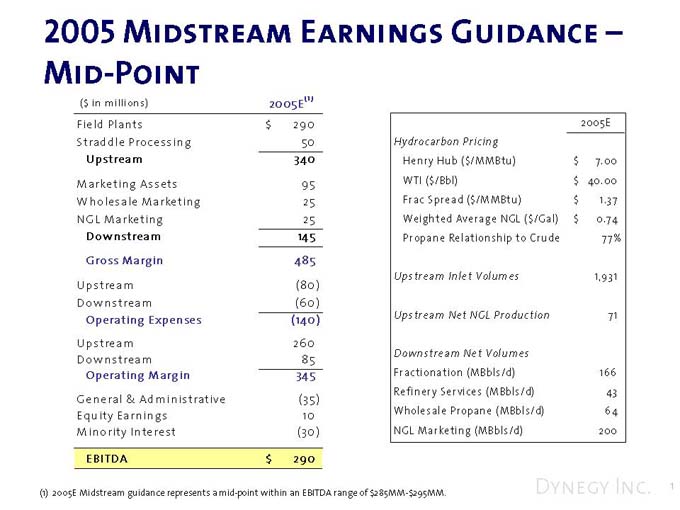

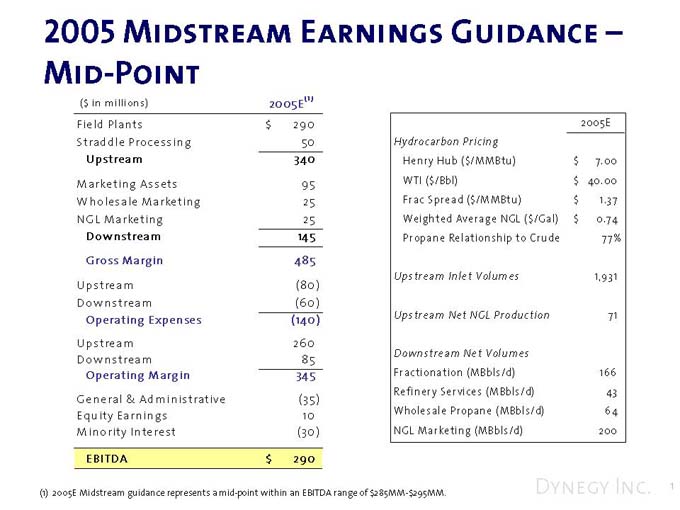

2005 Midstream Earnings Guidance –Mid-Point

($ in millions) 2005E(1)

Field Plants $290 Straddle Processing 50

Upstream 340 Marketing Assets 95 Wholesale Marketing 25 NGL Marketing 25

Downstream 145 Gross Margin 485 Upstream (80) Downstream (60)

Operating Expenses (140) Upstream 260 Downstream 85 Operating Margin 345 General & Administrative (35) Equity Earnings 10 Minority Interest (30) EBITDA $290

2005E

Hydrocarbon Pricing

Henry Hub ($/MMBtu) $7.00 WTI ($/Bbl) $40.00 Frac Spread ($/MMBtu) $1.37 Weighted Average NGL ($/Gal) $0.74 Propane Relationship to Crude 77%

Upstream Inlet Volumes 1,931

Upstream Net NGL Production 71

Downstream Net Volumes

Fractionation (MBbls/d) 166 Refinery Services (MBbls/d) 43 Wholesale Propane (MBbls/d) 64 NGL Marketing (MBbls/d) 200

(1) 2005E Midstream guidance represents a mid-point within an EBITDA range of $285MM-$295MM.

Dynegy Inc. 20

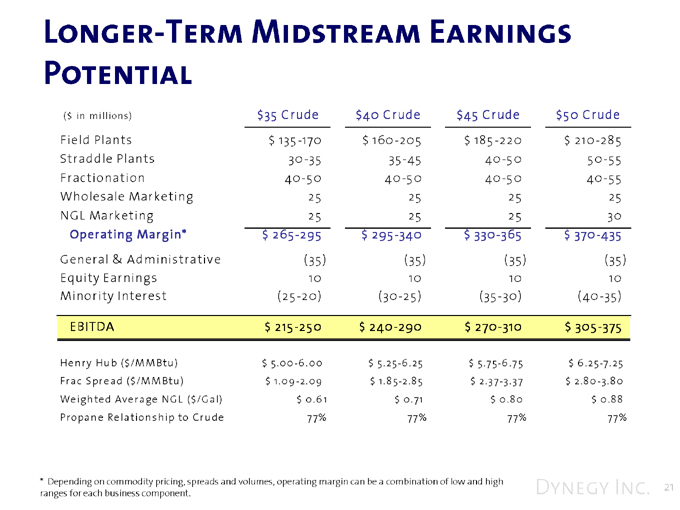

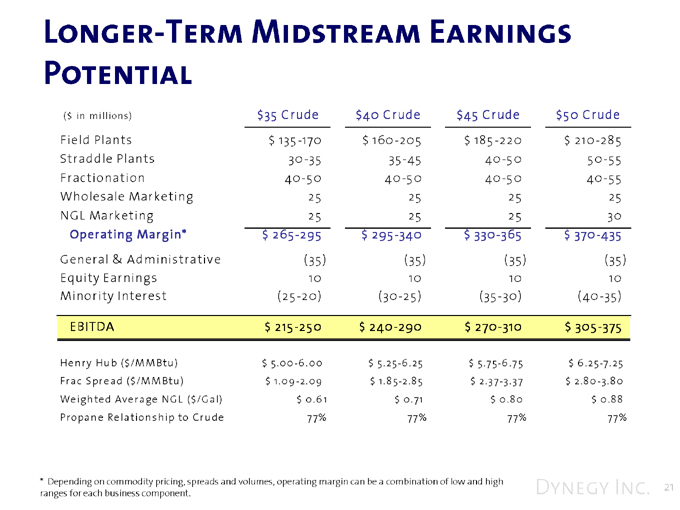

Longer-Term Midstream Earnings Potential

($ in millions) $35 Crude $40 Crude $45 Crude $50 Crude Field Plants $135-170 $160-205 $185-220 $210-285 Straddle Plants 30-35 35-45 40-50 50-55 Fractionation 40-50 40-50 40-50 40-55 Wholesale Marketing 25 25 25 25 NGL Marketing 25 25 25 30 Operating Margin* $265-295 $295-340 $330-365 $370-435 General & Administrative (35) (35) (35) (35) Equity Earnings 10 10 10 10 Minority Interest (25-20) (30-25) (35-30) (40-35) EBITDA $215-250 $240-290 $270-310 $305-375

Henry Hub ($/MMBtu ) $5.00-6.00 $5.25-6.25 $5.75-6.75 $6.25-7.25 Frac Spread ($/MM Btu) $1.09-2.09 $1.85-2.85 $2.37-3.37 $2.80-3.80 Weighted Average NGL ($/Gal) $0.61 $0.71 $0.80 $0.88 Propane Relationship to Crude 77% 77% 77% 77%

* Depending on commodity pricing, spreads and volumes, operating margin can be a combination of low and high ranges for each business component.

Dynegy Inc. 21

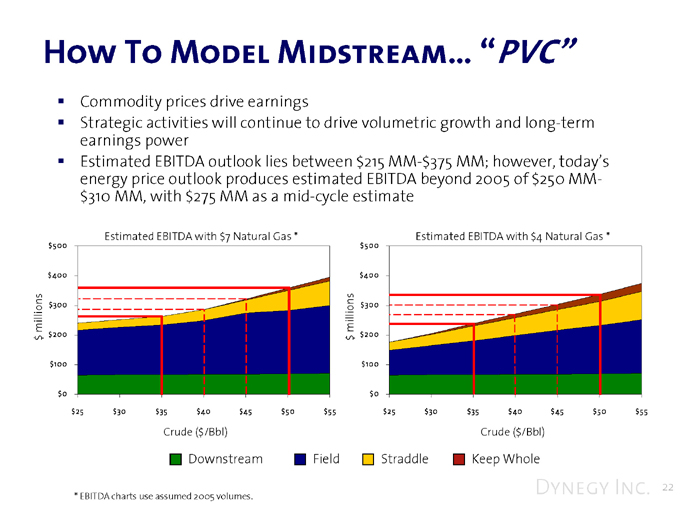

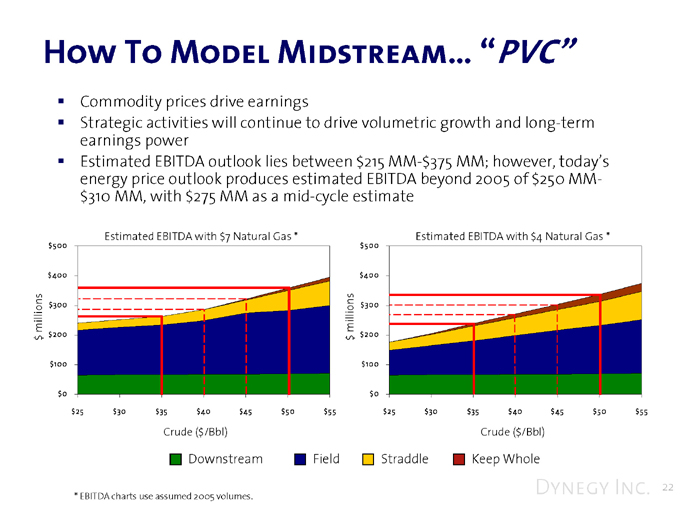

How To Model Midstream… “PVC”

Commodity prices drive earnings

Strategic activities will continue to drive volumetric growth and long-term earnings power Estimated EBITDA outlook lies between $215 MM-$375 MM; however, today’s energy price outlook produces estimated EBITDA beyond 2005 of $250 MM-$310 MM, with $275 MM as a mid-cycle estimate

Estimated EBITDA with $7 Natural Gas *

$ millions

$500 $400 $300 $200 $100 $0

$25 $30 $35 $40 $45 $50 $55

Crude ($/Bbl)

$ millions

Estimated EBITDA with $4 Natural Gas *

$500 $400 $300 $200 $100 $0

$25 $30 $35 $40 $45 $50 $55

Crude ($/Bbl)

Downstream

Field

Straddle Keep Whole

* EBITDA charts use assumed 2005 volumes.

Dynegy Inc. 22