Exhibit 99.4

Generation

Value Today…

And Upside Tomorrow

Dynegy Analyst Day Alec Dreyer, EVP

Generation

Dynegy Inc.

The Advantage of Dynegy Generation

… A diversified Power Play

A track record of operational excellence

Baseload, intermediate and peaking facilities well-positioned to provide a broad array of products at various demand levels Significant fuel diversity (coal, oil and natural gas) that provides a competitive advantage in an excess capacity market…and significant upside for the future

Power prices/spreads and volumes are the primary margin drivers for Dynegy Generation

Dynegy Inc. 2

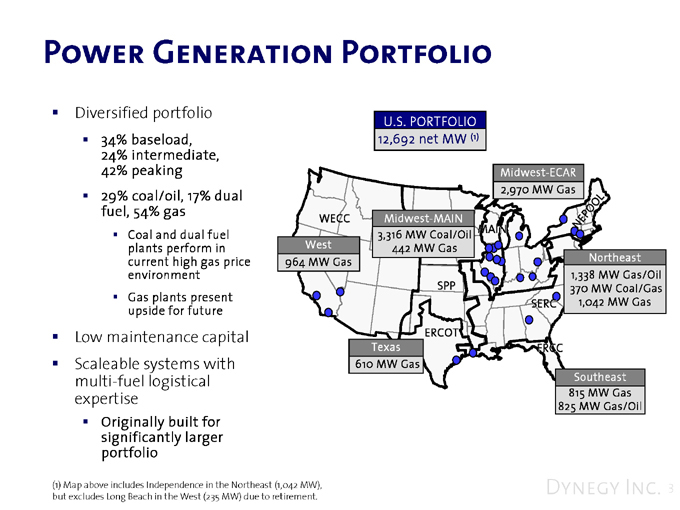

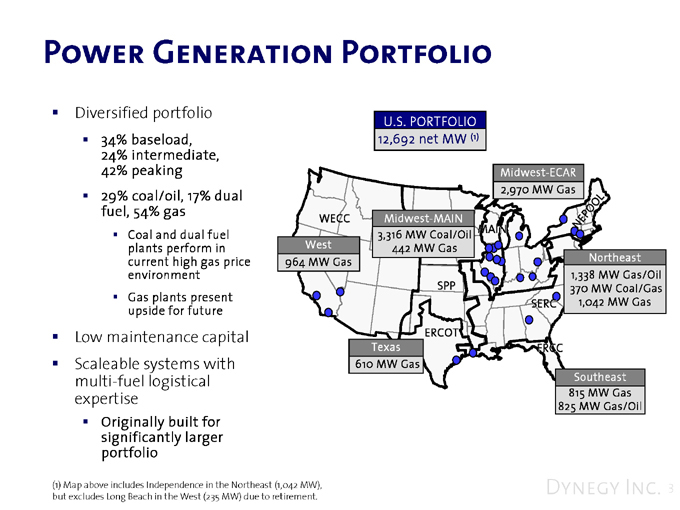

Power Generation Portfolio

Diversified portfolio

34% baseload, 24% intermediate, 42% peaking ??29% coal/oil, 17% dual fuel, 54% gas

Coal and dual fuel plants perform in current high gas price environment Gas plants present upside for future

Low maintenance capital Scaleable systems with multi-fuel logistical expertise

Originally built for significantly larger portfolio

U.S. PORTFOLIO 12,692 net MW (1)

Midwest-ECAR 2,970 MW Gas

NEPOOL

WECC Midwest-MAIN

MAIN 3,316 MW Coal/Oil 442 MW Gas SPP

West 964 MW Gas Northeast 1,338 MW Gas/Oil 370 MW Coal/Gas SERC 1,042 MW Gas ERCOT

Texas 610 MW Gas FRCC

Southeast 815 MW Gas 825 MW Gas/Oil

(1) Map above includes Independence in the Northeast (1,042 MW), but excludes Long Beach in the West (235 MW) due to retirement.

Dynegy Inc. 3

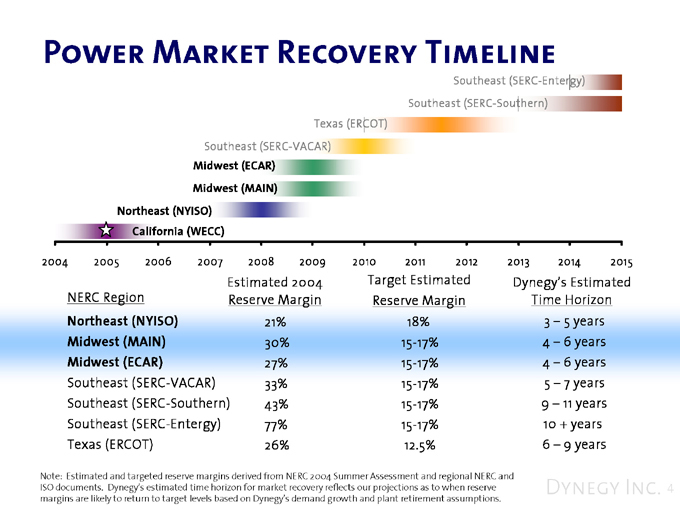

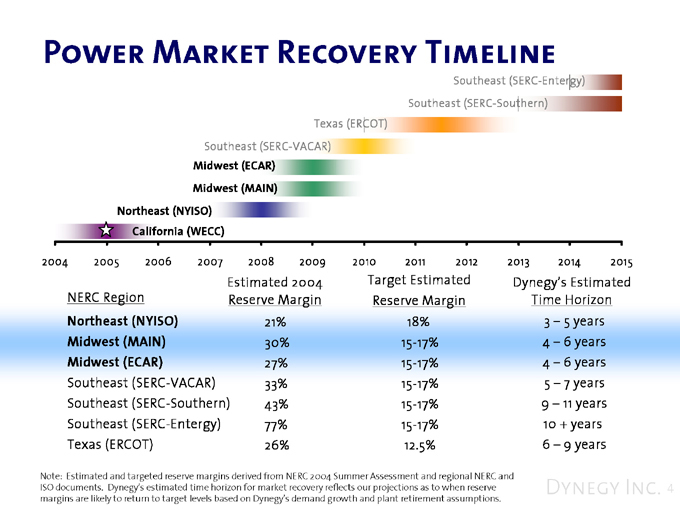

Power Market Recovery Timeline

Southeast (SERC-Entergy) Southeast (SERC-Southern) Texas (ERCOT) Southeast (SERC-VACAR)

Midwest (ECAR) Midwest (MAIN) Northeast (NYISO) California (WECC)

2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015

Estimated 2004 Target Estimated Dynegy’s Estimated NERC Region Reserve Margin Reserve Margin Time Horizon

Northeast (NYISO) 21% 18% 3 – 5 years

Midwest (MAIN) 30% 15-17% 4 – 6 years Midwest (ECAR) 27% 15-17% 4 – 6 years Southeast (SERC-VACAR) 33% 15-17% 5 – 7 years Southeast (SERC-Southern) 43% 15-17% 9 – 11 years Southeast (SERC-Entergy) 77% 15-17% 10 + years Texas (ERCOT) 26% 12.5% 6 – 9 years

Note: Estimated and targeted reserve margins derived from NERC 2004 Summer Assessment and regional NERC and ISO documents. Dynegy’s estimated time horizon for market recovery reflects our projections as to when reserve margins are likely to return to target levels based on Dynegy’s demand growth and plant retirement assumptions.

Dynegy Inc. 4

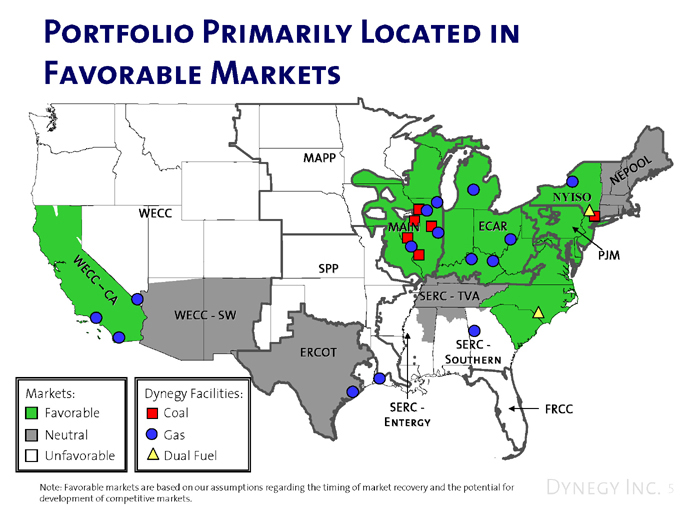

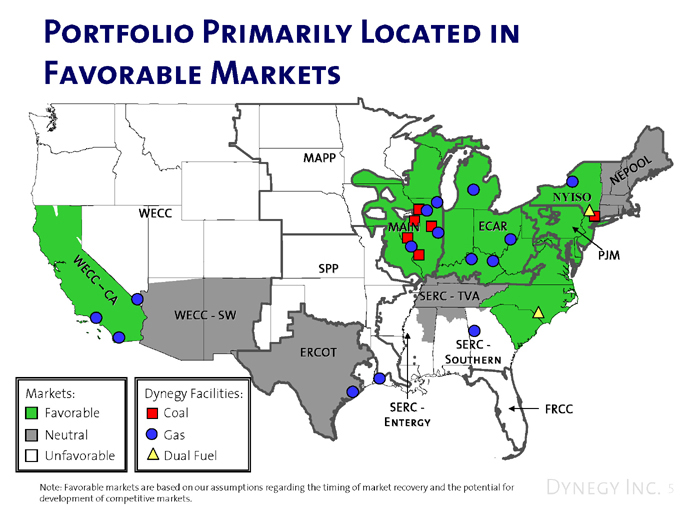

Portfolio Primarily Located in

Favorable Markets

MAPP

NEPOOL

NYISO

WECC

MAIN ECAR

WEEC – CA PJM SPP

SERC—TVA

WECC—SW

SERC—Southern ERCOT

SERC—Entergy FRCC

Markets: Dynegy Facilities:

Favorable

Neutral

Unfavorable

Coal

Gas

Dual Fuel

Note: Favorable markets are based on our assumptions regarding the timing of market recovery and the potential for development of competitive markets.

Dynegy Inc. 5

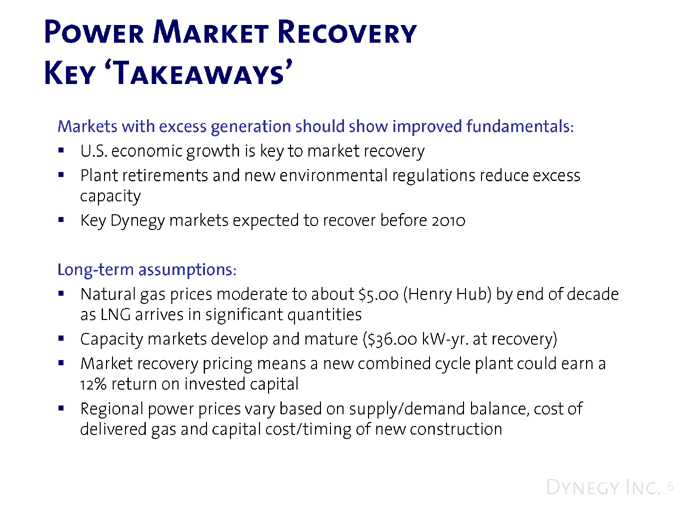

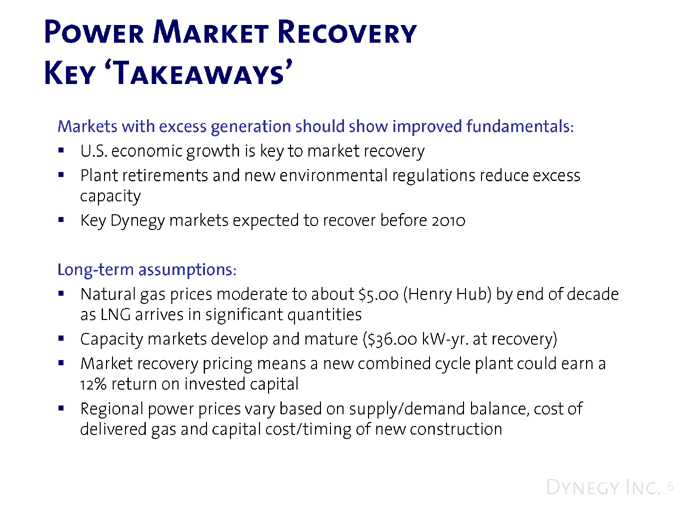

Power Market Recovery

Key ‘Takeaways’

Markets with excess generation should show improved fundamentals:

U.S. economic growth is key to market recovery

Plant retirements and new environmental regulations reduce excess capacity Key Dynegy markets expected to recover before 2010

Long-term assumptions:

Natural gas prices moderate to about $5.00 (Henry Hub) by end of decade as LNG arrives in significant quantities Capacity markets develop and mature ($36.00 kW-yr. at recovery) Market recovery pricing means a new combined cycle plant could earn a 12% return on invested capital Regional power prices vary based on supply/demand balance, cost of delivered gas and capital cost/timing of new construction

Dynegy Inc. 6

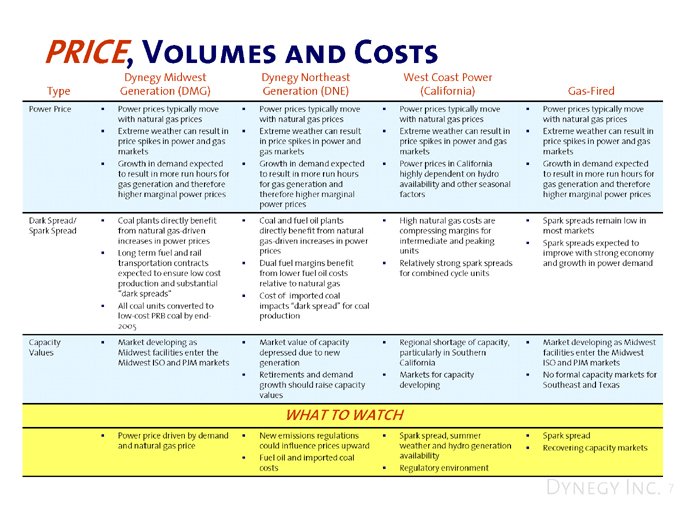

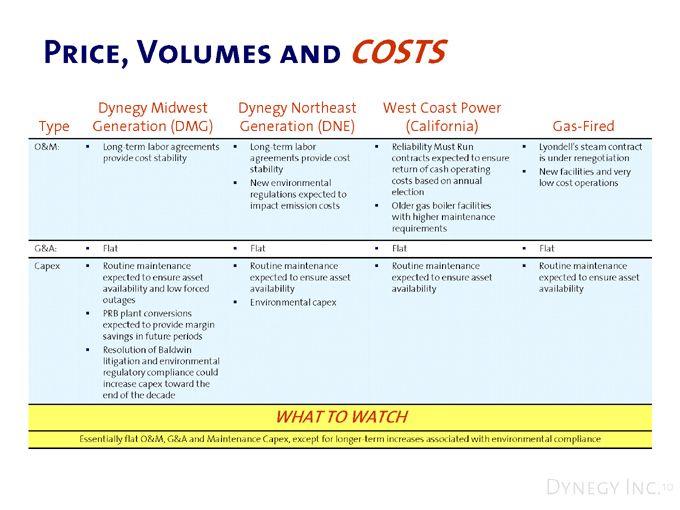

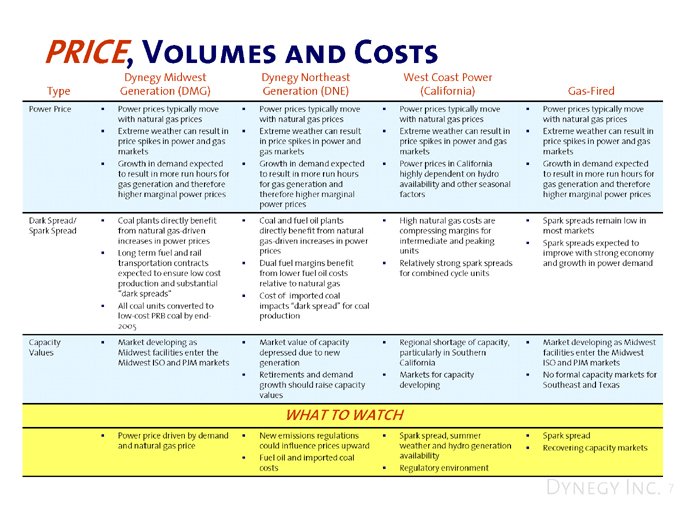

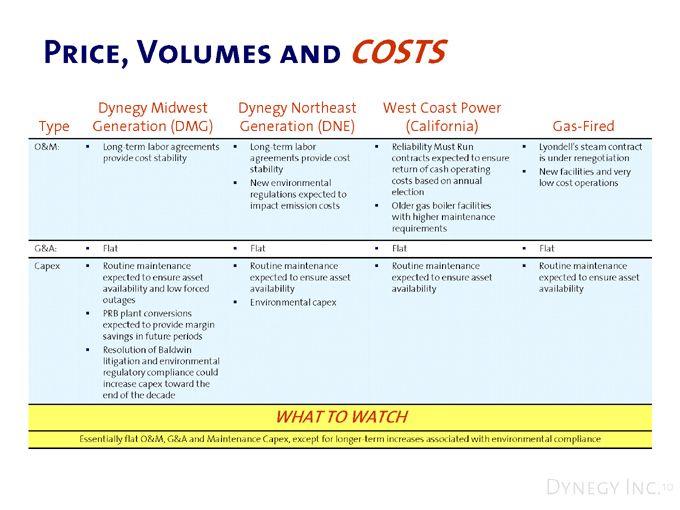

PRICE, Volumes and Costs

Type

Dynegy Midwest Generation (DMG)

Dynegy Northeast Generation (DNE)

West Coast Power (California)

Gas-Fired

Power Price

Power prices typically move with natural gas prices Extreme weather can result in price spikes in power and gas markets Growth in demand expected to result in more run hours for gas generation and therefore higher marginal power prices

Power prices typically move with natural gas prices Extreme weather can result in price spikes in power and gas markets Growth in demand expected to result in more run hours for gas generation and therefore higher marginal power prices

Power prices typically move with natural gas prices Extreme weather can result in price spikes in power and gas markets Power prices in California highly dependent on hydro availability and other seasonal factors

Power prices typically move with natural gas prices Extreme weather can result in price spikes in power and gas markets Growth in demand expected to result in more run hours for gas generation and therefore higher marginal power prices

Dark Spread/ Spark Spread

Coal plants directly benefit from natural gas-driven increases in power prices Long term fuel and rail transportation contracts expected to ensure low cost production and substantial “dark spreads” All coal units converted to low-cost PRB coal by end-2005

Coal and fuel oil plants directly benefit from natural gas-driven increases in power prices Dual fuel margins benefit from lower fuel oil costs relative to natural gas Cost of imported coal impacts “dark spread” for coal production

High natural gas costs are compressing margins for intermediate and peaking units Relatively strong spark spreads for combined cycle units

Spark spreads remain low in most markets Spark spreads expected to improve with strong economy and growth in power demand

Capacity Values

Market developing as Midwest facilities enter the Midwest ISO and PJM markets

Market value of capacity depressed due to new generation Retirements and demand growth should raise capacity values

Regional shortage of capacity, particularly in Southern California Markets for capacity developing

Market developing as Midwest facilities enter the Midwest ISO and PJM markets No formal capacity markets for Southeast and Texas

WHAT TO WATCH

Power price driven by demand and natural gas price

New emissions regulations could influence prices upward Fuel oil and imported coal costs

Spark spread, summer weather and hydro generation availability Regulatory environment

Spark spread

Recovering capacity markets

Dynegy Inc. 7

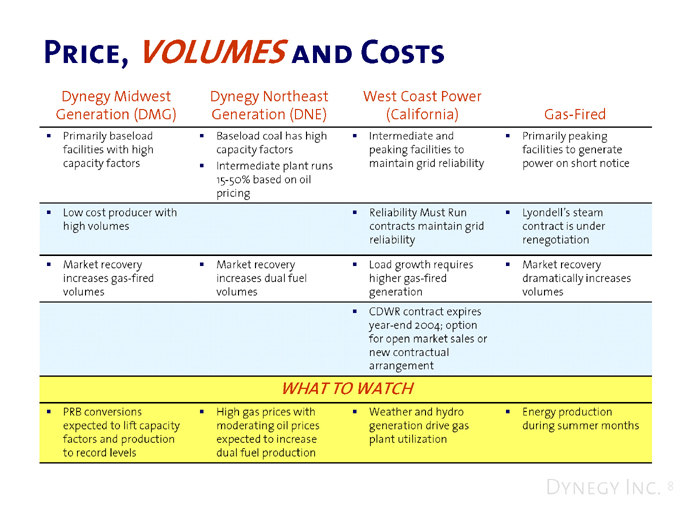

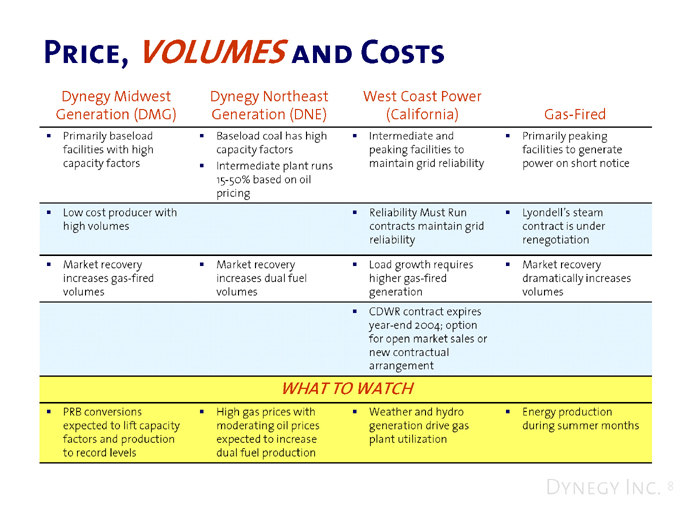

Price, VOLUMES and Costs

Dynegy Midwest Generation (DMG)

Dynegy Northeast Generation (DNE)

West Coast Power (California)

Gas-Fired

Primarily baseload facilities with high capacity factors

Baseload coal has high capacity factors Intermediate plant runs 15-50% based on oil pricing

Intermediate and peaking facilities to maintain grid reliability

Primarily peaking facilities to generate power on short notice

Low cost producer with high volumes

Reliability Must Run contracts maintain grid reliability

Lyondell’s steam contract is under renegotiation

Market recovery increases gas-fired volumes

Market recovery increases dual fuel volumes

Load growth requires higher gas-fired generation

Market recovery dramatically increases volumes

CDWR contract expires year-end 2004; option for open market sales or new contractual arrangement

WHAT TO WATCH

PRB conversions expected to lift capacity factors and production to record levels

High gas prices with moderating oil prices expected to increase dual fuel production

Weather and hydro generation drive gas plant utilization

Energy production during summer months

Dynegy Inc. 8

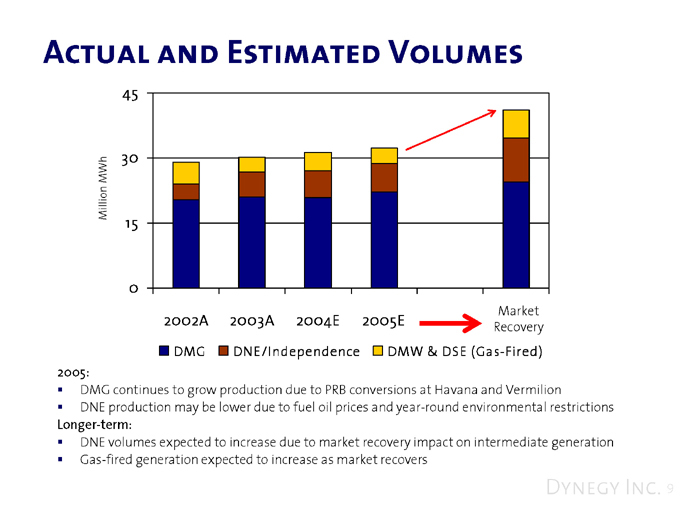

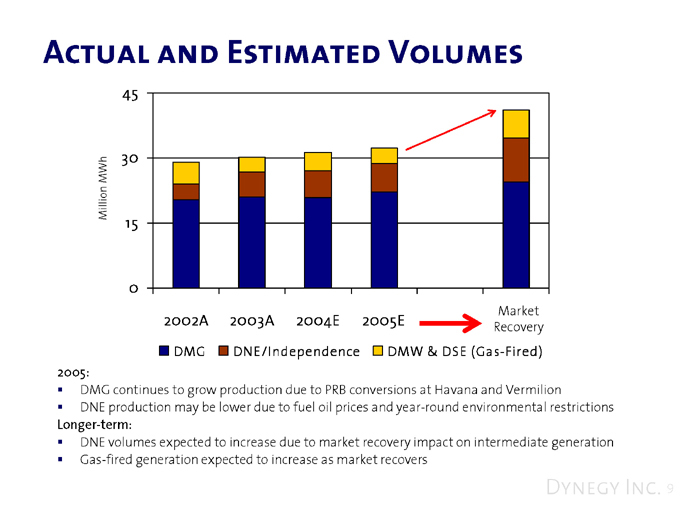

Actual and Estimated Volumes

Million MWh

45 30 15 0

Market

2002A 2003A 2004E 2005E Recovery

DMG DNE/Independence DMW & DSE (Gas-Fired)

2005:

DMG continues to grow production due to PRB conversions at Havana and Vermilion

DNE production may be lower due to fuel oil prices and year-round environmental restrictions

Longer-term:

DNE volumes expected to increase due to market recovery impact on intermediate generation Gas-fired generation expected to increase as market recovers

Dynegy Inc. 9

Price, Volumes and

COSTS

Type

Dynegy Midwest Generation (DMG)

Dynegy Northeast Generation (DNE)

West Coast Power (California)

Gas-Fired

O&M:

Long-term labor agreements provide cost stability

Long-term labor agreements provide cost stability New environmental regulations expected to impact emission costs

Reliability Must Run contracts expected to ensure return of cash operating costs based on annual election Older gas boiler facilities with higher maintenance requirements

Lyondell’s steam contract is under renegotiation New facilities and very low cost operations

G&A: Flat Flat Flat Flat Capex

Routine maintenance expected to ensure asset availability and low forced outages PRB plant conversions expected to provide margin savings in future periods Resolution of Baldwin litigation and environmental regulatory compliance could increase capex toward the end of the decade

Routine maintenance expected to ensure asset availability Environmental capex

Routine maintenance expected to ensure asset availability

Routine maintenance expected to ensure asset availability

WHAT TO WATCH

Essentially flat O&M, G&A and Maintenance Capex, except for longer-term increases associated with environmental compliance

Dynegy Inc.10

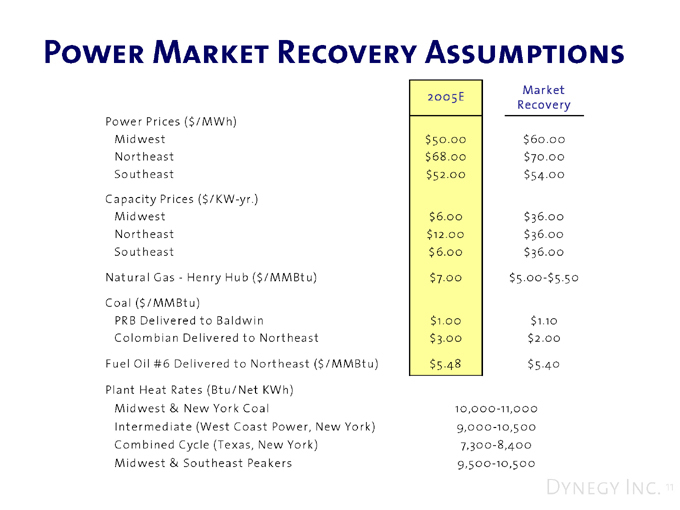

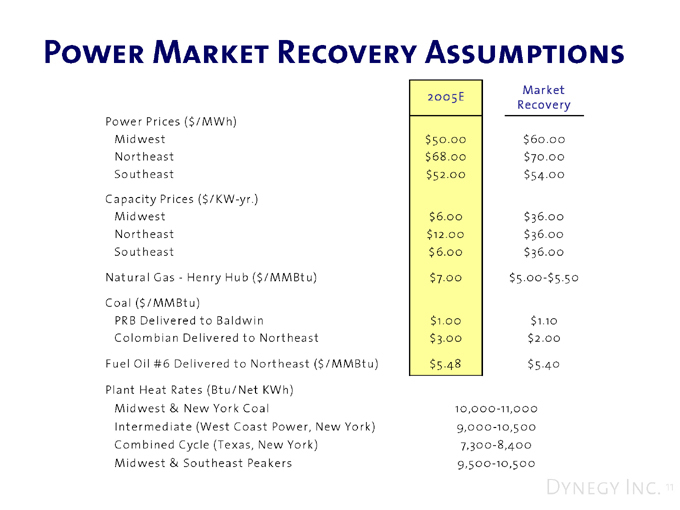

Power Market Recovery Assumptions

2005E Market Recovery Power Prices ($/MWh) Midwest $50.00 $60.00 Northeast $68.00 $70.00 Southeast $52.00 $54.00 Capacity Prices ($/KW-yr.) Midwest $6.00 $36.00 Northeast $12.00 $36.00 Southeast $6.00 $36.00 Natural Gas—Henry Hub ($/MMBtu) $7.00 $5.00-$5.50 Coal ($/MMBtu) PRB Delivered to Baldwin $1.00 $1.10 Colombian Delivered to Northeast $3.00 $2.00 Fuel Oil #6 Delivered to Northeast ($/MMBtu) $5.48 $5.40 Plant Heat Rates (Btu/Net KWh) Midwest & New York Coal 10,000-11,000 Intermediate (West Coast Power, New York) 9,000-10,500 Combined Cycle (Texas, New York) 7,300-8,400 Midwest & Southeast Peakers 9,500-10,500

Dynegy Inc. 11

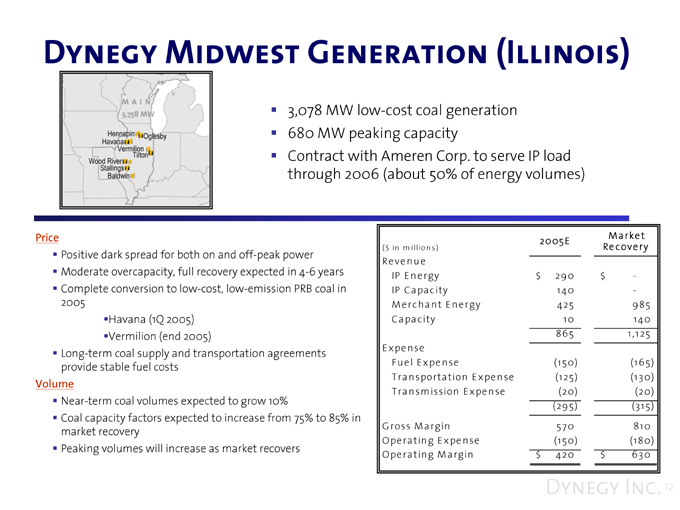

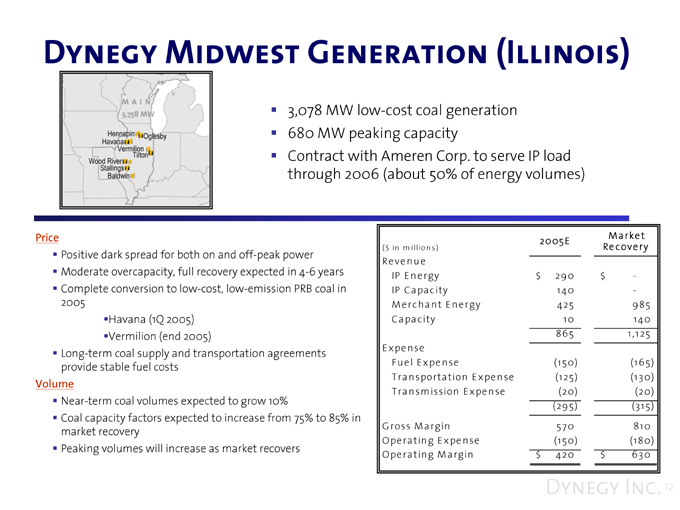

Dynegy Midwest Generation (Illinois)

Main 3,758 MW

Hennepin

Oglesby

Havana

Vermilion

Tilton

Wood River

Stallings

Baldwin

3,078 MW low-cost coal generation 680 MW peaking capacity

Contract with Ameren Corp. to serve IP load through 2006 (about 50% of energy volumes)

Price

Positive dark spread for both on and off-peak power Moderate overcapacity, full recovery expected in 4-6 years Complete conversion to low-cost, low-emission PRB coal in 2005 Havana (1Q 2005) Vermilion (end 2005) Long-term coal supply and transportation agreements provide stable fuel costs

Volume

Near-term coal volumes expected to grow 10%

Coal capacity factors expected to increase from 75% to 85% in market recovery Peaking volumes will increase as market recovers

2005E Market

($ in millions) Recovery

Revenue

IP Energy $290 $-

IP Capacity 140 -

Merchant Energy 425 985

Capacity 10 140

865 1,125

Expense

Fuel Expense (150) (165)

Transportation Expense (125) (130)

Transmission Expense (20) (20)

(295) (315)

Gross Margin 570 810

Operating Expense (150) (180)

Operating Margin $420 $630

Dynegy Inc. 12

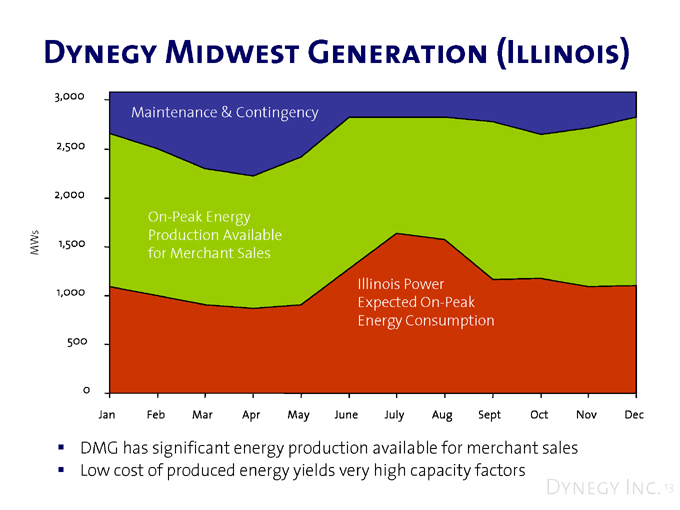

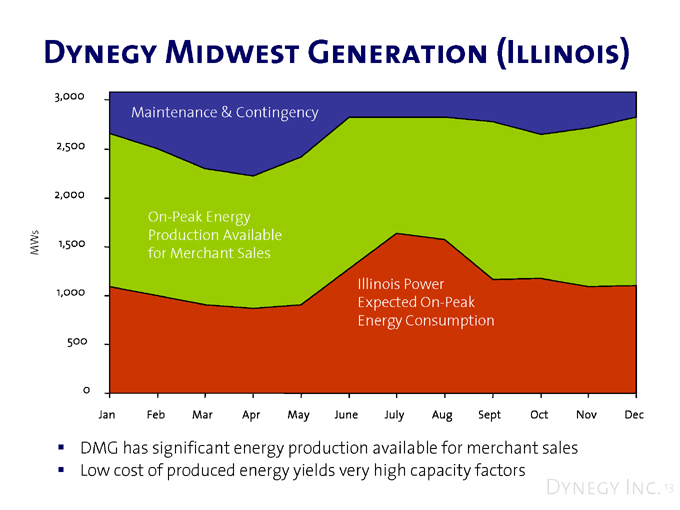

MWs

3,000 2,500 2,000 1,500 1,000 500 0

Maintenance & Contingency

On-Peak Energy Production Available for Merchant Sales

Illinois Power Expected On-Peak Energy Consumption

Jan Feb Mar Apr May June July Aug Sept Oct Nov Dec

DMG has significant energy production available for merchant sales Low cost of produced energy yields very high capacity factors

Dynegy Inc. 13

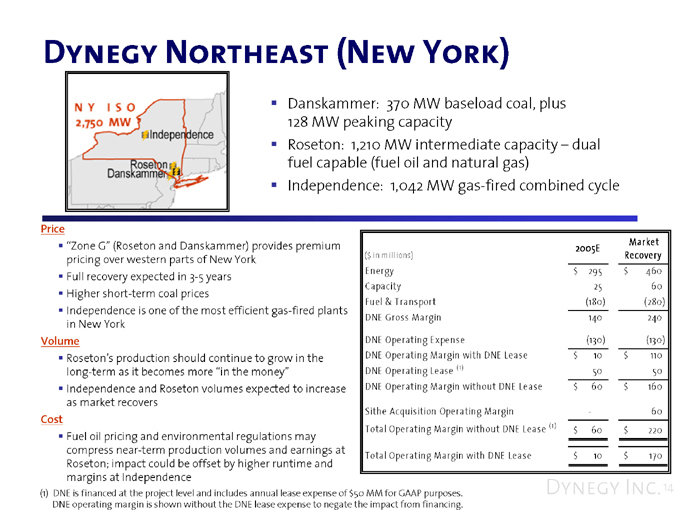

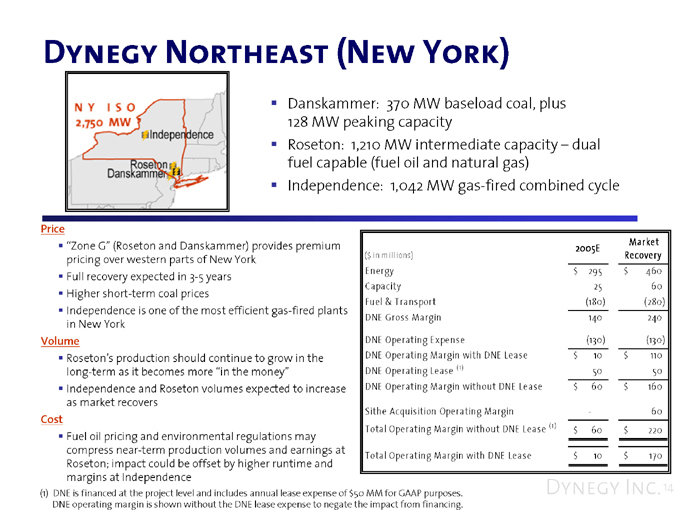

Dynegy Northeast (New York)

NY 2,750

ISO MW

Independence

Roseton

Danskammer

Danskammer: 370 MW baseload coal, plus 128 MW peaking capacity Roseton: 1,210 MW intermediate capacity – dual fuel capable (fuel oil and natural gas) Independence: 1,042 MW gas-fired combined cycle

Price

“Zone G” (Roseton and Danskammer) provides premium pricing over western parts of New York Full recovery expected in 3-5 years Higher short-term coal prices Independence is one of the most efficient gas-fired plants in New York

Volume

Roseton’s production should continue to grow in the long-term as it becomes more “in the money” Independence and Roseton volumes expected to increase as market recovers

Cost

Fuel oil pricing and environmental regulations may compress near-term production volumes and earnings at Roseton; impact could be offset by higher runtime and margins at Independence

(1) DNE is financed at the project level and includes annual lease expense of $50 MM for GAAP purposes.

DNE operating margin is shown without the DNE lease expense to negate the impact from financing.

2005E Market

($ in millions) Recovery

Energy $295 $460

Capacity 25 60

Fuel & Transport (180) (280)

DNE Gross Margin 140 240

DNE Operating Expense (130) (130)

DNE Operating Margin with DNE Lease $10 $110

DNE Operating Lease (1) 50 50

DNE Operating Margin without DNE Lease $60 $160

Sithe Acquisition Operating Margin - 60

Total Operating Margin without DNE Lease (1) $60 $220

Total Operating Margin with DNE Lease $10 $170

Dynegy Inc. 14

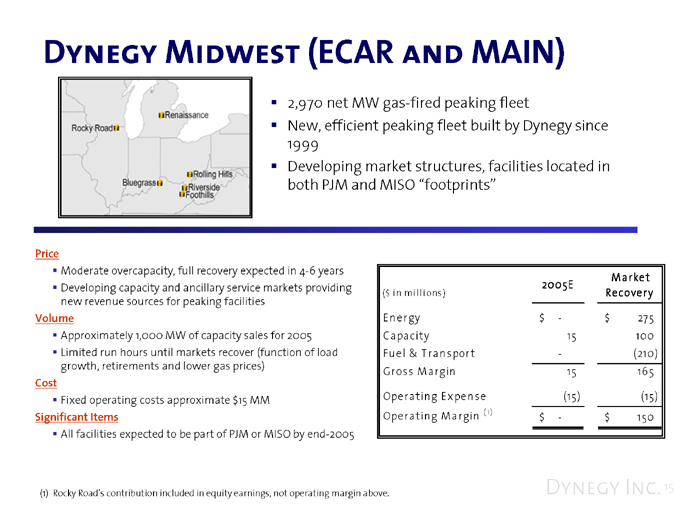

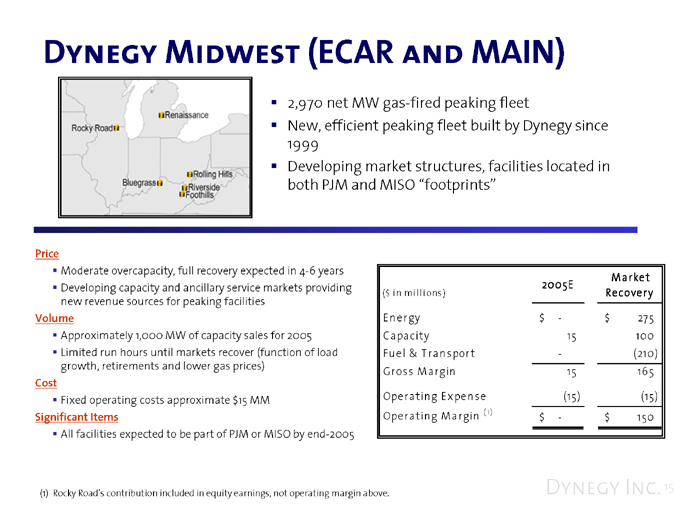

Dynegy Midwest (ECAR and MAIN)

Rocky Road

Renaissance

Bluegrass

Rolling Hills

Riverside

Foothills

2,970 net MW gas-fired peaking fleet

New, efficient peaking fleet built by Dynegy since 1999 Developing market structures, facilities located in both PJM and MISO “footprints”

Price

Moderate overcapacity, full recovery expected in 4-6 years Developing capacity and ancillary service markets providing new revenue sources for peaking facilities

Volume

Approximately 1,000 MW of capacity sales for 2005 Limited run hours until markets recover (function of load growth, retirements and lower gas prices)

Cost

Fixed operating costs approximate $15 MM

Significant Items

All facilities expected to be part of PJM or MISO by end-2005

2005E Market

($ in millions) Recovery

Energy $- $275

Capacity 15 100

Fuel & Transport - (210)

Gross Margin 15 165

Operating Expense (15) (15)

Operating Margin (1) $- $150

(1) Rocky Road’s contribution included in equity earnings, not operating margin above.

Dynegy Inc. 15

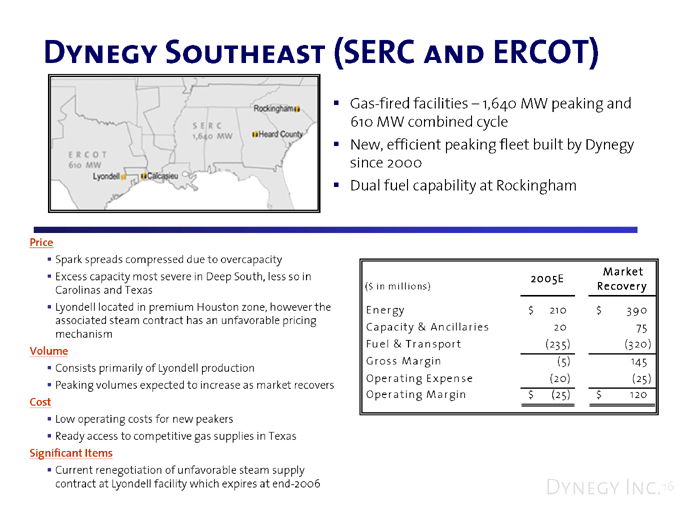

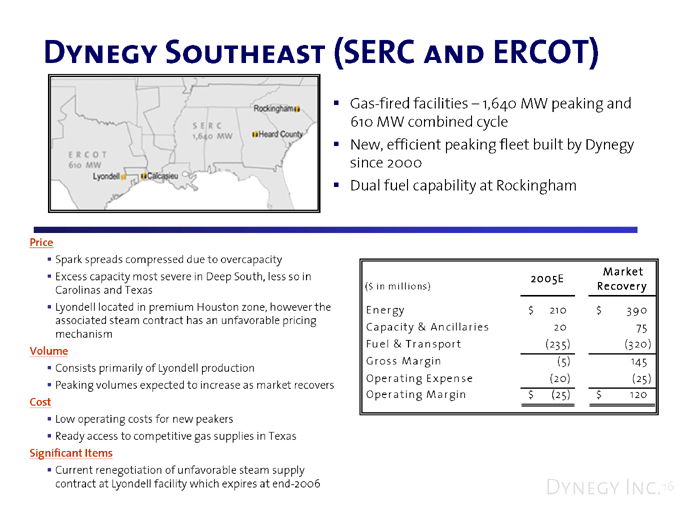

Dynegy Southeast (SERC and ERCOT)

Rockingham

Heard County

Lyondell

Calcasieu

SERC 1,640 MW

ERCOT 610 MW

Gas-fired facilities – 1,640 MW peaking and 610 MW combined cycle New, efficient peaking fleet built by Dynegy since 2000 Dual fuel capability at Rockingham

Price

Spark spreads compressed due to overcapacity Excess capacity most severe in Deep South, less so in Carolinas and Texas Lyondell located in premium Houston zone, however the associated steam contract has an unfavorable pricing mechanism

Volume

Consists primarily of Lyondell production

Peaking volumes expected to increase as market recovers

Cost

Low operating costs for new peakers

Ready access to competitive gas supplies in Texas

Significant Items

Current renegotiation of unfavorable steam supply contract at Lyondell facility which expires at end-2006

2005E Market

($ in millions) Recovery

Energy $210 $390

Capacity & Ancillaries 20 75

Fuel & Transport (235) (320)

Gross Margin (5) 145

Operating Expense (20) (25)

Operating Margin $(25) $120

Dynegy Inc.16

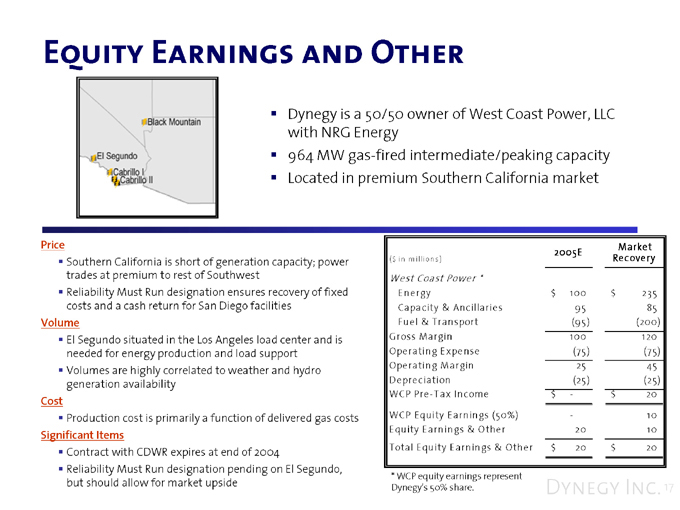

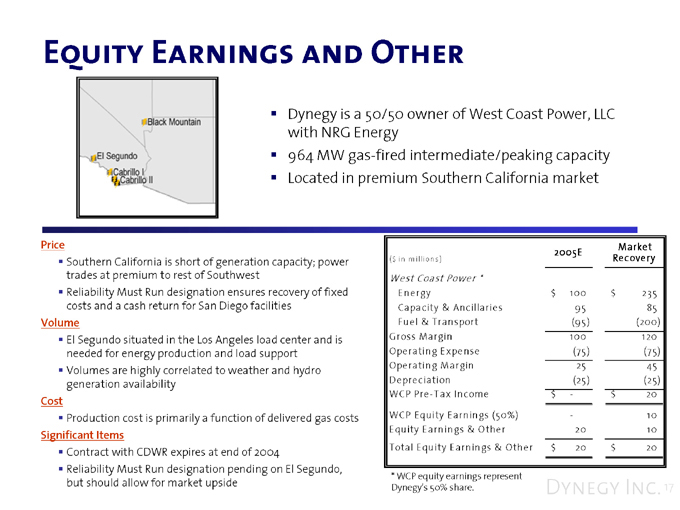

Equity Earnings and Other

Black Mountain

El Segundo

Cabrillo I

Cabrillo II

Dynegy is a 50/50 owner of West Coast Power, LLC with NRG Energy 964 MW gas-fired intermediate/peaking capacity Located in premium Southern California market

Price

Southern California is short of generation capacity; power trades at premium to rest of Southwest Reliability Must Run designation ensures recovery of fixed costs and a cash return for San Diego facilities

Volume

El Segundo situated in the Los Angeles load center and is needed for energy production and load support Volumes are highly correlated to weather and hydro generation availability

Cost

Production cost is primarily a function of delivered gas costs

Significant Items

Contract with CDWR expires at end of 2004

Reliability Must Run designation pending on El Segundo, but should allow for market upside

2005E Market

($ in millions) Recovery

West Coast Power *

Energy $100 $235

Capacity & Ancillaries 95 85

Fuel & Transport (95) (200)

Gross Margin 100 120

Operating Expense (75) (75)

Operating Margin 25 45

Depreciation (25) (25)

WCP Pre-Tax Income $- $20

WCP Equity Earnings (50%) - 10

Equity Earnings & Other 20 10

Total Equity Earnings & Other $20 $20

* WCP equity earnings represent Dynegy’s 50% share.

Dynegy Inc. 17

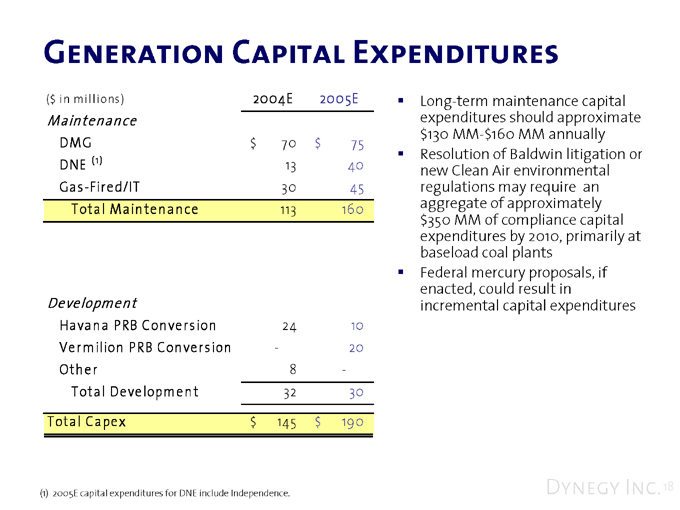

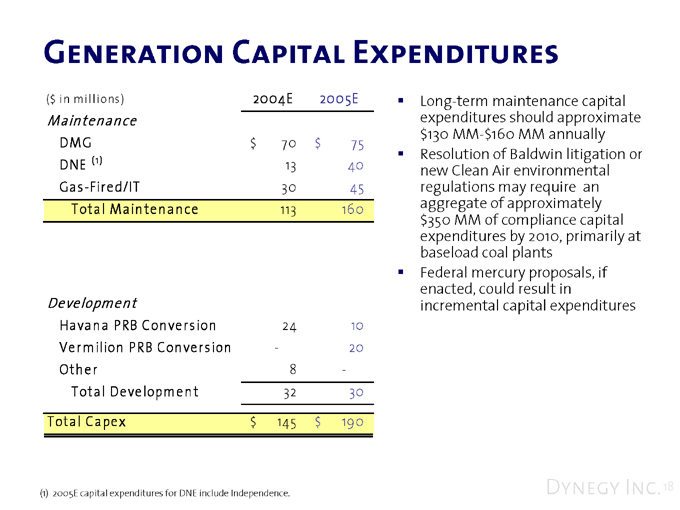

Generation Capital Expenditures

($ in millions ) 2004E 2005E

Maintenance

DMG $70 $75 DNE (1) 13 40 Gas-Fired/IT 30 45 Total Maintenance 113 160

Development

Havana PRB Conversion 24 10 Vermilion PRB Conversion - 20 Other 8 -Total Development 32 30 Total Capex $145 $190

Long-term maintenance capital expenditures should approximate $130 MM-$160 MM annually Resolution of Baldwin litigation or new Clean Air environmental regulations may require an aggregate of approximately $350 MM of compliance capital expenditures by 2010, primarily at baseload coal plants Federal mercury proposals, if enacted, could result in incremental capital expenditures

(1) 2005E capital expenditures for DNE include Independence.

Dynegy Inc. 18

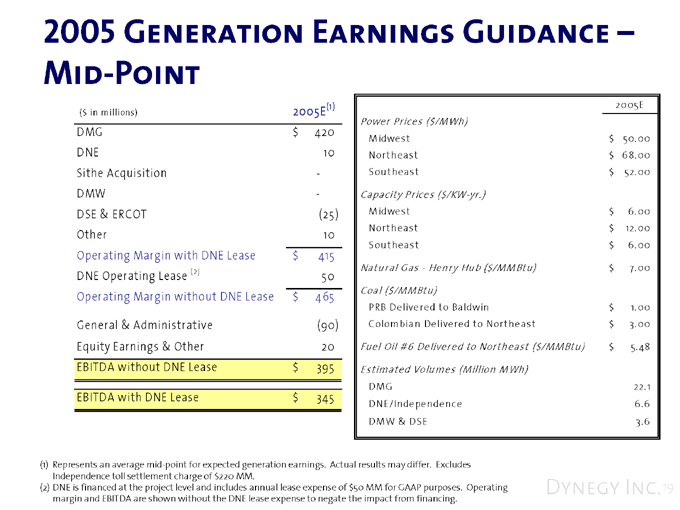

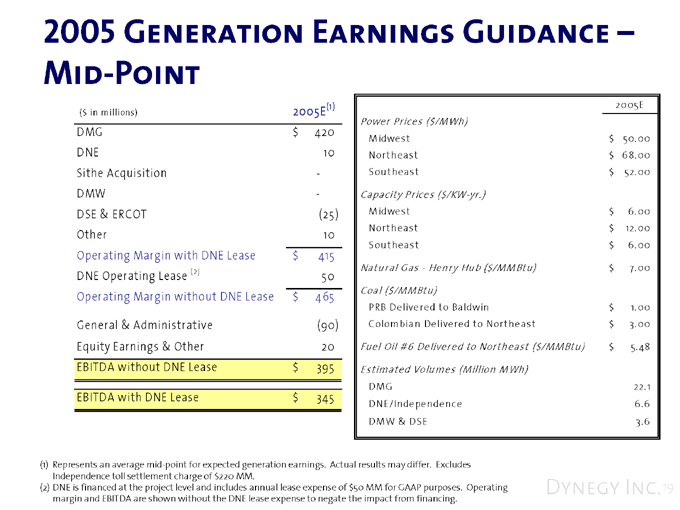

2005 Generation Earnings Guidance –Mid-Point

($ in millions) 2005E(1)

DMG $420 DNE 10 Sithe Acquisition -DMW -DSE & ERCOT (25) Other 10 Operating Margin with DNE Lease $415 DNE Operating Lease (2) 50 Operating Margin without DNE Lease $465 General & Administrative (90) Equity Earnings & Other 20 EBITDA without DNE Lease $395 EBITDA with DNE Lease $345

2005E

Power Prices ($/MWh)

Midwest $50.00

Northeast $68.00

Southeast $52.00

Capacity Prices ($/KW-yr.)

Midwest $6.00

Northeast $12.00

Southeast $6.00

Natural Gas - Henry Hub ($/MMBtu) $7.00

Coal ($/MMBtu)

PRB Delivered to Baldwin $1.00

Colombian Delivered to Northeast $3.00

Fuel Oil #6 Delivered to Northeast ($/MMBtu) $5.48

Estimated Volumes (Million MWh)

DMG 22.1

DNE/Independence 6.6

DMW & DSE 3.6

(1) Represents an average mid-point for expected generation earnings. Actual results may differ. Excludes Independence toll settlement charge of $220 MM.

(2) DNE is financed at the project level and includes annual lease expense of $50 MM for GAAP purposes. Operating margin and EBITDA are shown without the DNE lease expense to negate the impact from financing.

Dynegy Inc. 19

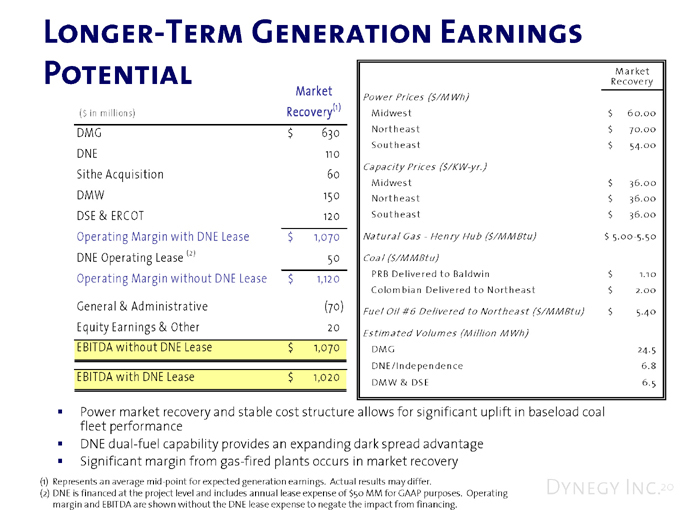

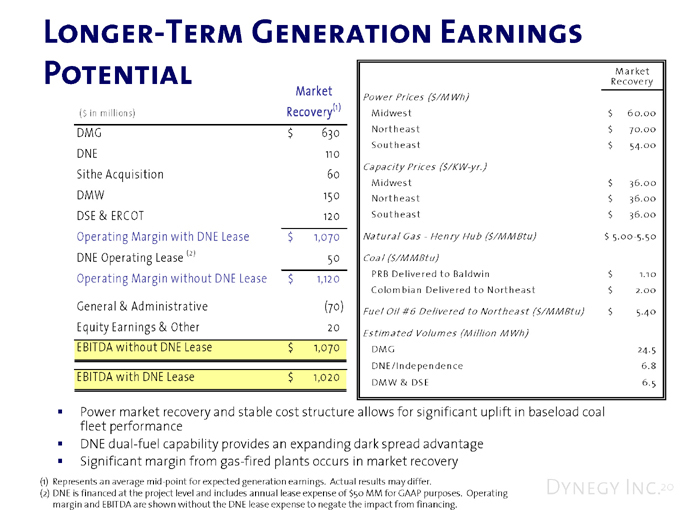

Longer-Term Generation Earnings

Potential

($ in millions)

Market Recovery(1 )

DMG

DNE

Sithe Acquisition

DMW

DSE & ERCOT

Operating Margin with DNE Lease DNE Operating Lease (2) Operating Margin without DNE Lease General & Administrative Equity Earnings & Other EBITDA without DNE Lease EBITDA with DNE Lease

$630

110

60

150

120

$1,070

50

$1,120

(70)

20

$1,070

$1,020

Power Prices ($/MWh)

Market Recovery

Midwest $60.00

Northeast $70.00

Southeast $54.00

Capacity Prices ($/KW-yr.)

Midwest $36.00

Northeast $36.00

Southeast $36.00

Natural Gas—Henry Hub ($/MMBtu) $5.00-5.50

Coal ($/MMBtu)

PRB Delivered to Baldwin $1.10

Colombian Delivered to Northeast $2.00

Fuel Oil #6 Delivered to Northeast ($/MMBtu) $5.40

Estimated Volumes (Million MWh)

DMG 24.5

DNE/Independence 6.8

DMW & DSE 6.5

Power market recovery and stable cost structure allows for significant uplift in baseload coal fleet performance DNE dual-fuel capability provides an expanding dark spread advantage Significant margin from gas-fired plants occurs in market recovery

(1) Represents an average mid-point for expected generation earnings. Actual results may differ.

(2) DNE is financed at the project level and includes annual lease expense of $50 MM for GAAP purposes. Operating margin and EBITDA are shown without the DNE lease expense to negate the impact from financing.

Dynegy Inc. 20

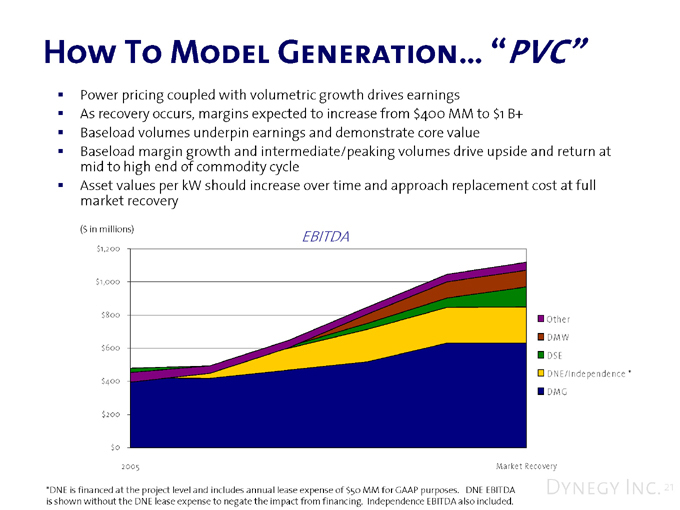

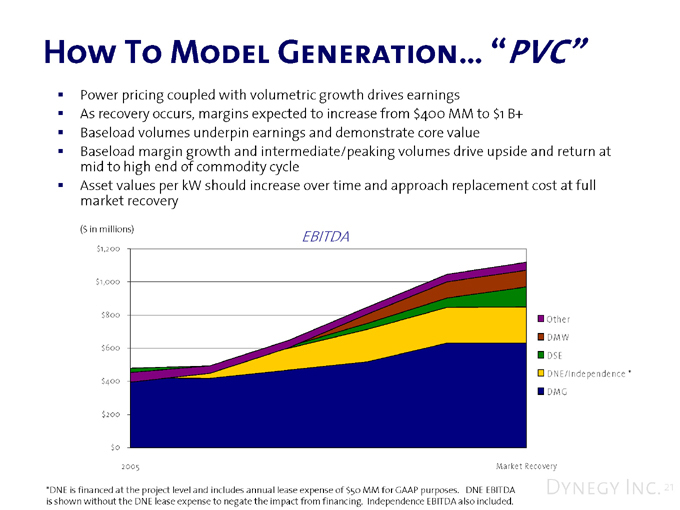

How To Model Generation… “PVC”

Power pricing coupled with volumetric growth drives earnings

As recovery occurs, margins expected to increase from $400 MM to $1 B+ Baseload volumes underpin earnings and demonstrate core value

Baseload margin growth and intermediate/peaking volumes drive upside and return at mid to high end of commodity cycle Asset values per kW should increase over time and approach replacement cost at full market recovery

($ in millions)

$1,200 $1,000 $800 $600 $400 $200

$0 2005

EBITDA

Other DMW DSE

DNE/Independence * DMG

Market Recovery

*DNE is financed at the project level and includes annual lease expense of $50 MM for GAAP purposes. DNE EBITDA is shown without the DNE lease expense to negate the impact from financing. Independence EBITDA also included.

Dynegy Inc. 21