Exhibit 99.6

Bruce Williamson

The Dynegy Value Proposition

Dynegy Inc.

Dynegy’s Directions

Guiding Principles

Self-restructure, accept responsibility and restore credibility Continue to work for all investors in capital structure

Business Strategy

Reposition capital structure to create real option horizon

Ability to capture upside in commodity-cyclical businesses

Financial Strategy

Maintain adequate liquidity, be fiscally disciplined and reduce debt Shift emphasis to the common shareholder

Dynegy Inc. 2

Dynegy Business Value

Metrics, Methodology & Mission

Dynegy Inc.

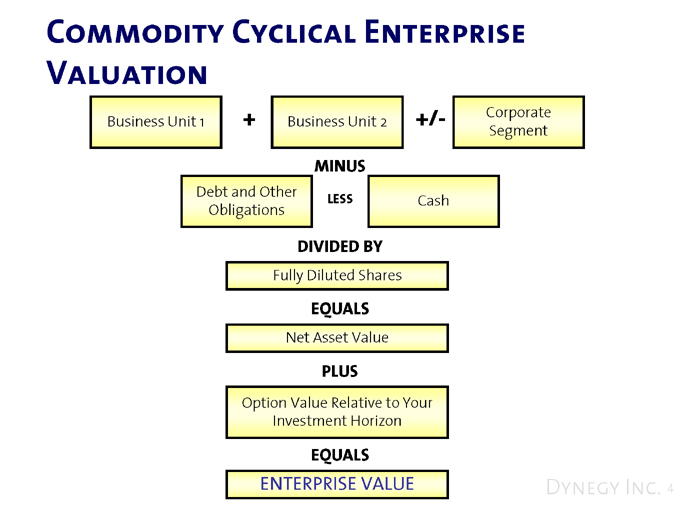

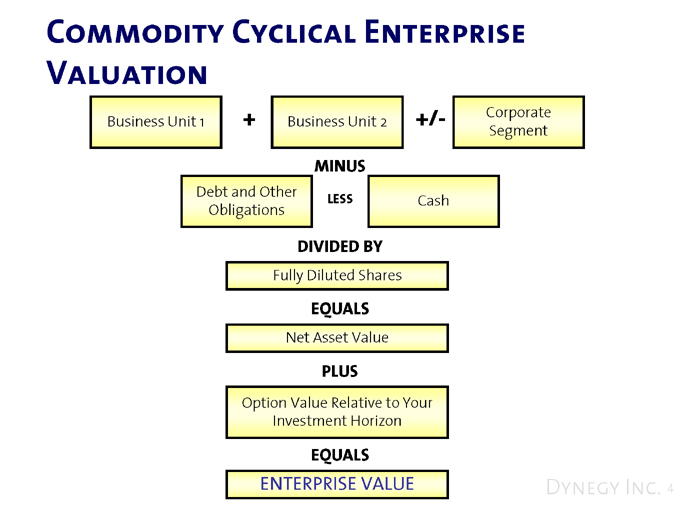

Commodity Cyclical Enterprise Valuation

Business Unit 1 + Business Unit 2 +/- Corporate Segment

MINUS

Debt and Other Obligations

LESS

Cash

DIVIDED BY

Fully Diluted Shares

EQUALS

Net Asset Value

PLUS

Option Value Relative to Your Investment Horizon

EQUALS

ENTERPRISE VALUE

Dynegy Inc. 4

Business Valuation Model: Midstream

Midstream is a commodity-cyclical business at or near the top of its range EBITDA expected to cycle between $250 MM and $325 MM

Valuation typically done on the basis of last 12 months EBITDA multiples Historical data suggests multiple range of 8-10 times

Transaction Value/LTM EBITDA

15.0x 10.0x 5.0x 0.0x

10.3x

9.6x 9.4x

8.3x 8.5x 7.7x

1999 2000 2001 2002 2003 2004

Number of Transactions 4 7 12 19 29 15

Dynegy Inc. 5

Source: JPMorgan

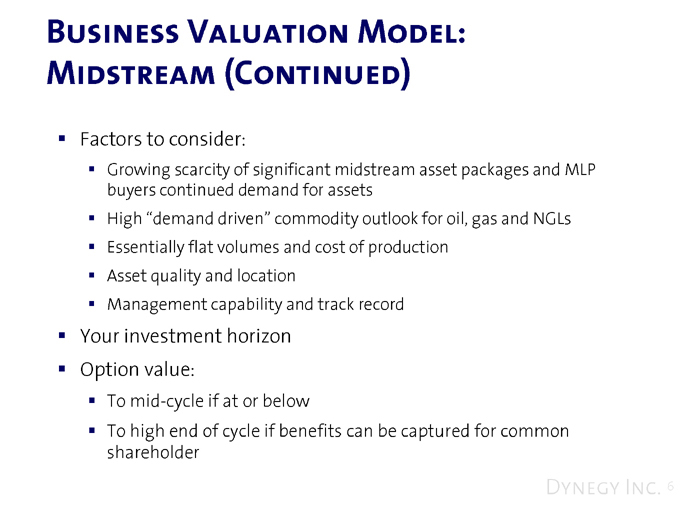

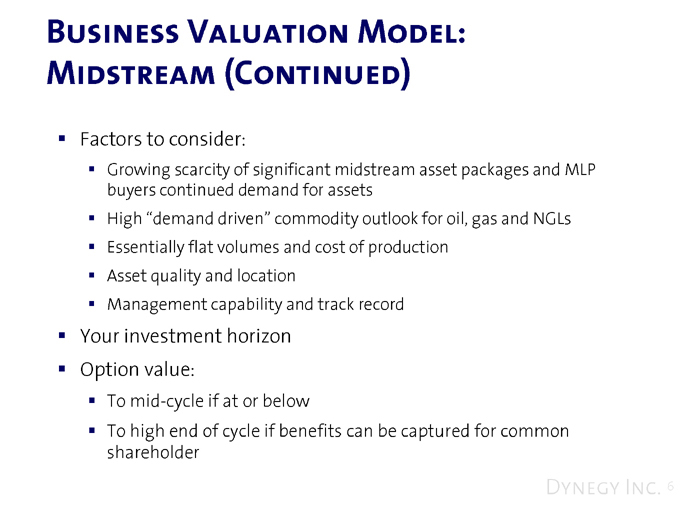

Business Valuation Model: Midstream (Continued)

Factors to consider:

Growing scarcity of significant midstream asset packages and MLP buyers continued demand for assets High “demand driven” commodity outlook for oil, gas and NGLs Essentially flat volumes and cost of production Asset quality and location Management capability and track record

Your investment horizon Option value:

To mid-cycle if at or below

To high end of cycle if benefits can be captured for common shareholder

Dynegy Inc. 6

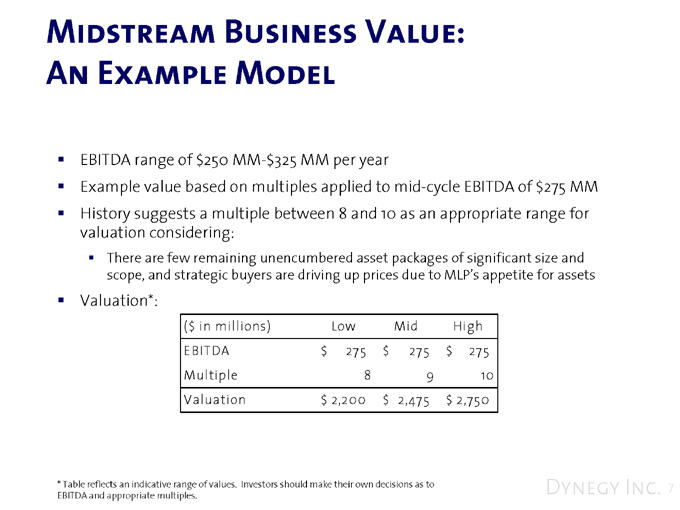

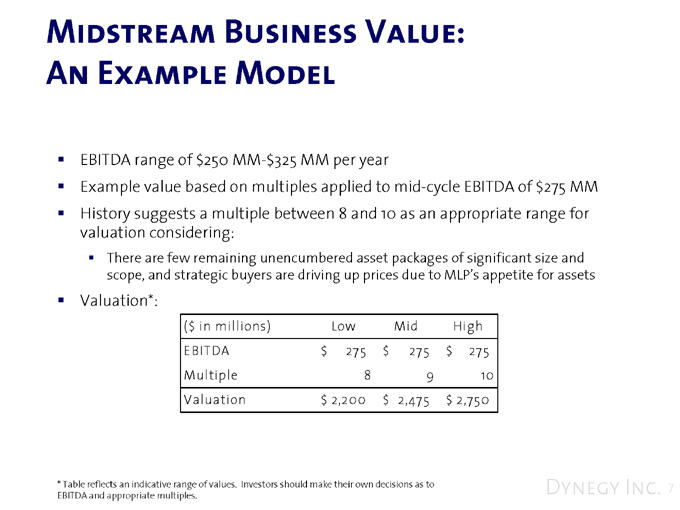

Midstream Business Value: An Example Model

EBITDA range of $250 MM-$325 MM per year

Example value based on multiples applied to mid-cycle EBITDA of $275 MM History suggests a multiple between 8 and 10 as an appropriate range for valuation considering:

There are few remaining unencumbered asset packages of significant size and scope, and strategic buyers are driving up prices due to MLP’s appetite for assets

Valuation*:

($ in millions) Low Mid High

EBITDA $275 $275 $275

Multiple 8 9 10

Valuation $2,200 $2,475 $2,750

Table reflects an indicative range of values. Investors should make their own decisions as to EBITDA and appropriate multiples.

Dynegy Inc. 7

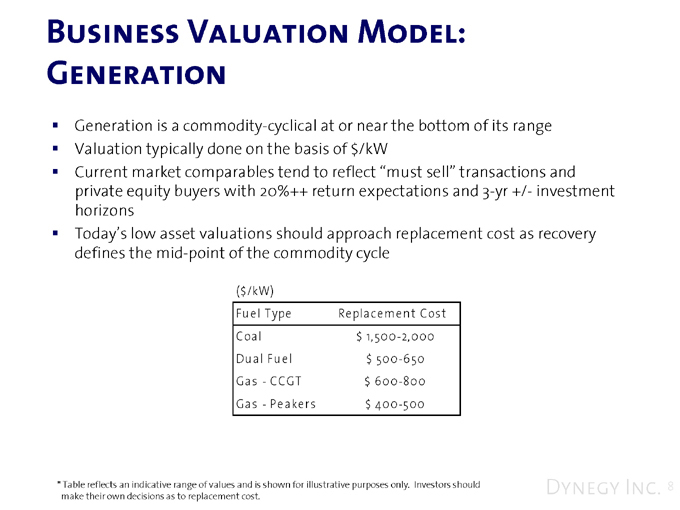

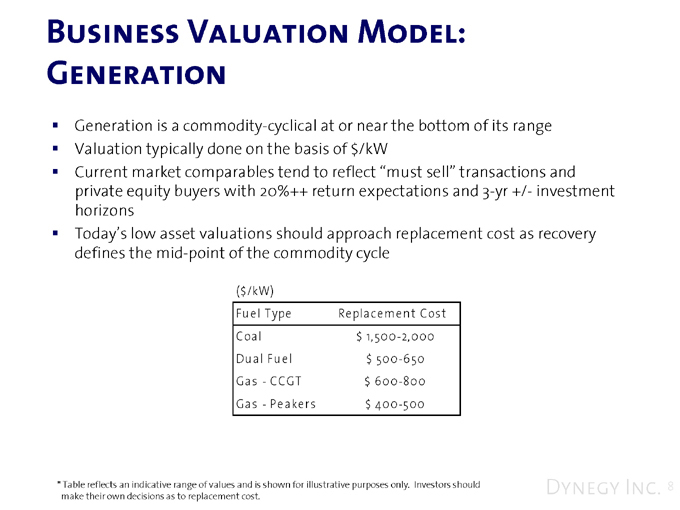

Business Valuation Model: Generation

Generation is a commodity-cyclical at or near the bottom of its range Valuation typically done on the basis of $/kW Current market comparables tend to reflect “must sell” transactions and private equity buyers with 20%++ return expectations and 3-yr +/- investment horizons Today’s low asset valuations should approach replacement cost as recovery defines the mid-point of the commodity cycle

($/kW)

Fuel Type Replacement Cost Coal $1,500-2,000 Dual Fuel $500-650 Gas - CCGT $600-800 Gas - Peakers $400-500

Table reflects an indicative range of values and is shown for illustrative purposes only. Investors should make their own decisions as to replacement cost.

Dynegy Inc. 8

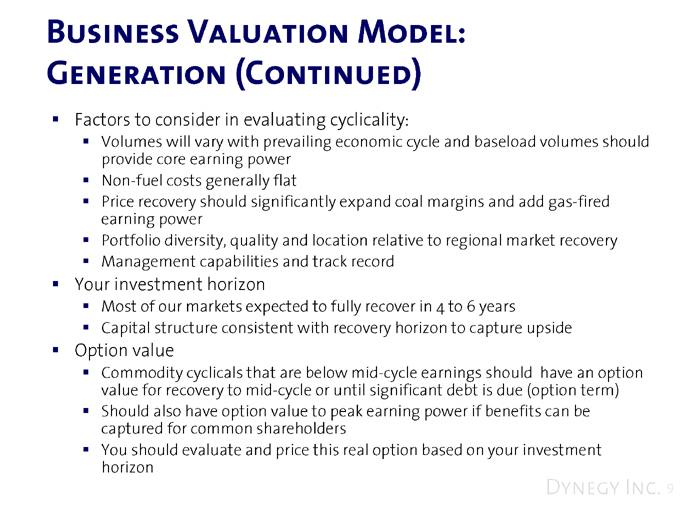

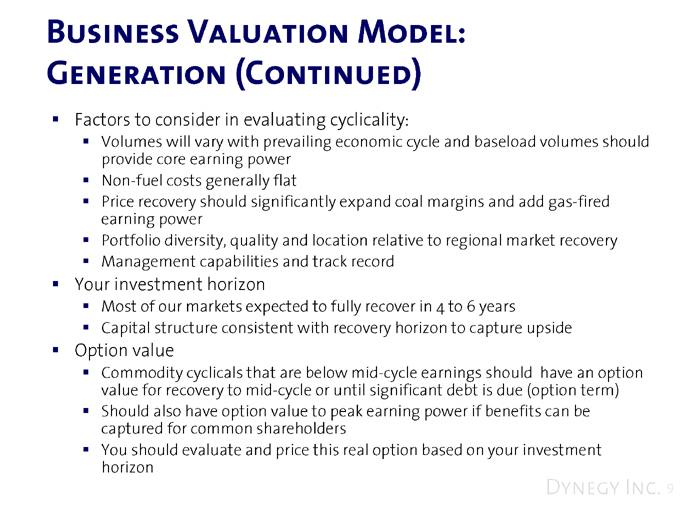

Business Valuation Model: Generation (Continued)

Factors to consider in evaluating cyclicality:

Volumes will vary with prevailing economic cycle and baseload volumes should provide core earning power Non-fuel costs generally flat Price recovery should significantly expand coal margins and add gas-fired earning power Portfolio diversity, quality and location relative to regional market recovery Management capabilities and track record

Your investment horizon

Most of our markets expected to fully recover in 4 to 6 years

Capital structure consistent with recovery horizon to capture upside

Option value

Commodity cyclicals that are below mid-cycle earnings should have an option value for recovery to mid-cycle or until significant debt is due (option term) Should also have option value to peak earning power if benefits can be captured for common shareholders You should evaluate and price this real option based on your investment horizon

Dynegy Inc. 9

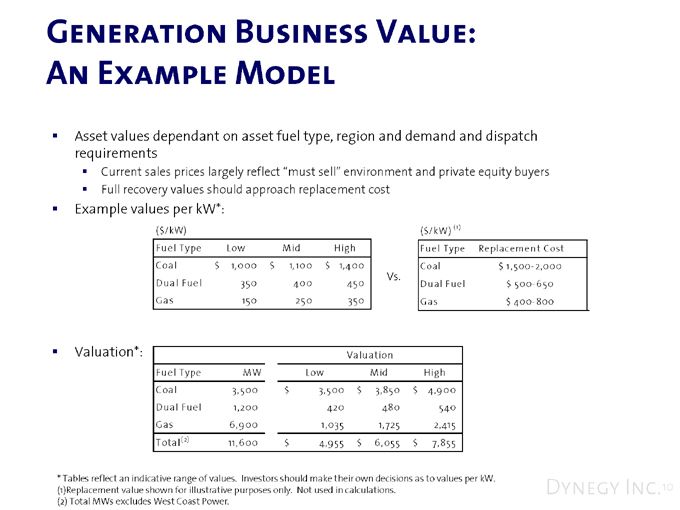

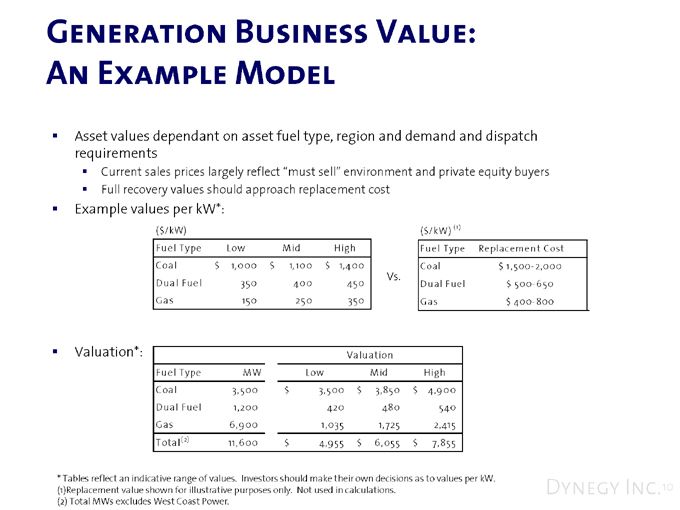

Generation Business Value: An Example Model

Asset values dependant on asset fuel type, region and demand and dispatch requirements

Current sales prices largely reflect “must sell” environment and private equity buyers Full recovery values should approach replacement cost

Example values per kW*:

($/kW)

Fuel Type Low Mid High

Coal $1,000 $1,100 $1,400

Dual Fuel 350 400 450

Gas 150 250 350

Vs.

($/kW) (1)

Fuel Type Replacement Cost

Coal $1,500- 2,000

Dual Fuel $500- 650

Gas $400- 800

Valuation*:

Valuation

Fuel Type MW Low Mid High

Coal 3,500 $3,500 $3,850 $4,9 00

Dual Fuel 1,200 420 480 540

Gas 6 ,9 00 1,035 1,725 2,415

Total(2) 11,6 00 $4,9 55 $6 ,055 $7,855

Tables reflect an indicative range of values. Investors should make their own decisions as to values per kW.

(1)Replacement value shown for illustrative purposes only. Not used in calculations. (2) Total MWs excludes West Coast Power.

Dynegy Inc.10

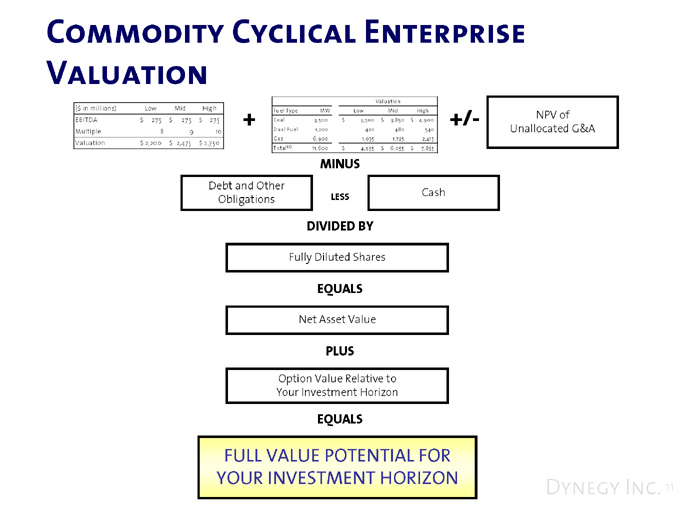

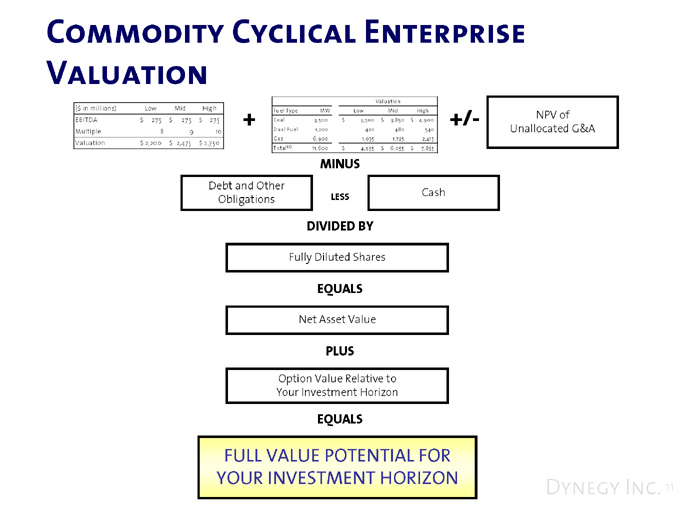

Commodity Cyclical Enterprise Valuation

($ in millions) Low Mid High

EBITDA $275 $275 $275

Multiple 8 9 10

Valuation $2,200 $2,475 $2,750

Valuation

Fuel Type MW L ow Mid High

Coal 3,500 $3,500 $3,850 $4,900

Dual Fuel 1,200 420 480 540

Gas 6,900 1,035 1,725 2,415

Total(2) 11,600 $4,955 $6,055 $7,855

NPV of Unallocated G&A

MINUS

Debt and Other

LESS Cash Obligations

DIVIDED BY

Fully Diluted Shares

EQUALS

Net Asset Value

PLUS

Option Value Relative to Your Investment Horizon

EQUALS

FULL VALUE POTENTIAL FOR YOUR INVESTMENT HORIZON

Dynegy Inc. 11

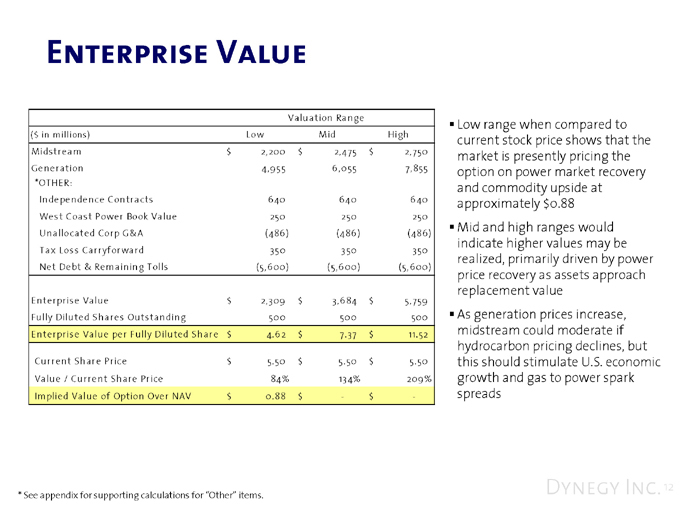

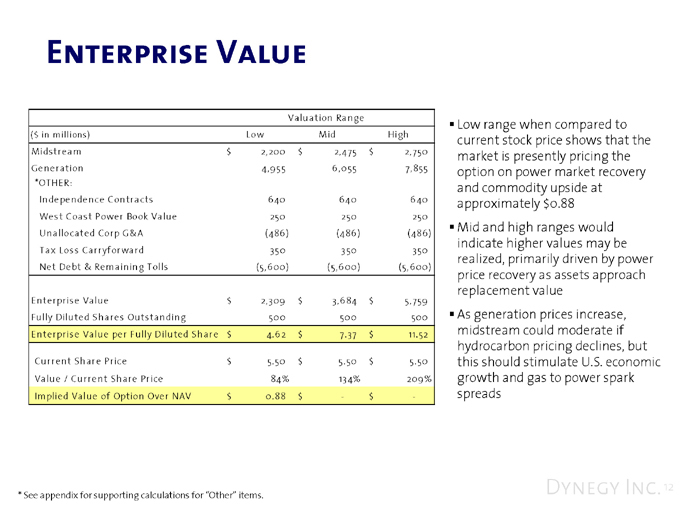

Enterprise Value

Valuation Range

($ in millions) Low Mid High

Midstream $2,200 $2,475 $2,750

Generation 4,955 6,055 7,855

*OTHER:

Independence Contracts 640 640 640

West Coast Power Book Value 250 250 250

Unallocated Corp G&A (486) (486) (486)

Tax Loss Carryforward 350 350 350

Net Debt & Remaining Tolls (5,600) (5,6 00) (5,6 00)

Enterprise Value $2,309 $3,684 $5,759

Fully Diluted Shares Outstanding 500 500 500

Enterprise Value per Fully Diluted Share $4.62 $7.37 $11.52

Current Share Price $5.50 $5.50 $5.50

Value/Current Share Price 84% 134% 209%

Implied Value of Option Over NAV $0.88 $- $-

Low range when compared to current stock price shows that the market is presently pricing the option on power market recovery and commodity upside at approximately $0.88 Mid and high ranges would indicate higher values may be realized, primarily driven by power price recovery as assets approach replacement value As generation prices increase, midstream could moderate if hydrocarbon pricing declines, but this should stimulate U.S. economic growth and gas to power spark spreads

See appendix for supporting calculations for “Other” items.

Dynegy Inc. 12

Sum-of-the-Parts Net Asset Value

(Eliminate Unallocated Corporate G&A)

Valuation Range

($ in millions) Low Mid High

Midstream $2,200 $2,475 $2,750

Generation 4,955 6,055 7,855

*OTHER:

Independence Contracts 640 640 640

West Coast Power Book Value 250 250 250

Unallocated Corp G&A - - -

Tax Loss Carryforward 350 350 350

Net Debt & Remaining Tolls (5,600) (5,600) (5,600)

Net Asset Value $2,795 $4,170 $6,245

Fully Diluted Shares Outstanding 500 500 500

Net Asset Value per Fully Diluted Share $5.59 $8.34 $12.49

Current Share Price $5.50 $5.50 $5.50

Value / Current Share Price 102% 152% 227%

Implied Value of Option Over NAV $- $- $-

Sum-of-the-parts value implies a free option on power market recovery and commodity upside Mid and high ranges would indicate higher values may be realized, primarily driven by power price recovery as assets approach replacement value As generation prices increase, midstream could moderate if hydrocarbon pricing declines, but this should stimulate U.S. economic growth and gas to power spark spreads

See appendix for supporting calculations for “Other” items.

Dynegy Inc. 13

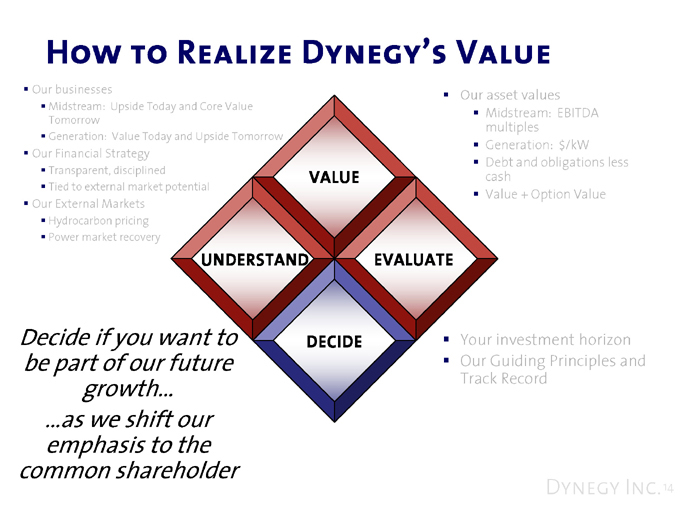

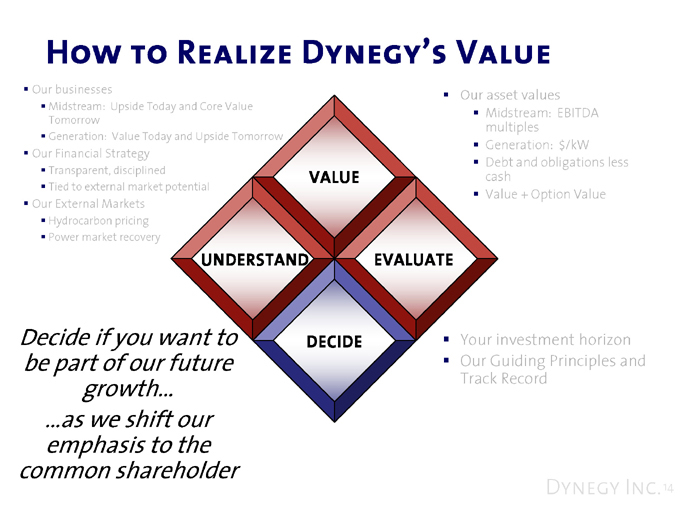

How to Realize Dynegy’s Value

Our businesses

Midstream: Upside Today and Core Value Tomorrow Generation: Value Today and Upside Tomorrow

Our Financial Strategy

Transparent, disciplined

Tied to external market potential

Our External Markets

Hydrocarbon pricing Power market recovery

VALUE

UNDERSTAND

DECIDE

EVALUATE

Decide if you want to be part of our future growth… …as we shift our emphasis to the common shareholder

Our asset values

Midstream: EBITDA multiples Generation: $/kW Debt and obligations less cash Value + Option Value

Your investment horizon Our Guiding Principles and Track Record

Dynegy Inc. 14