Exhibit 99.5

Nick Caruso

Financial Update

Dynegy Inc.

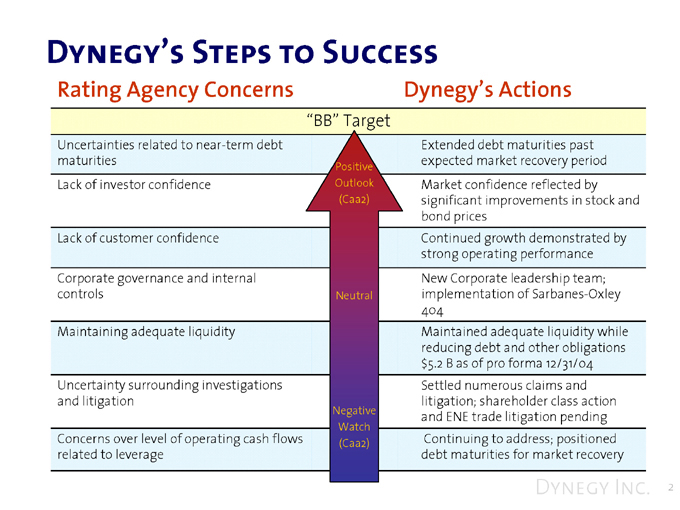

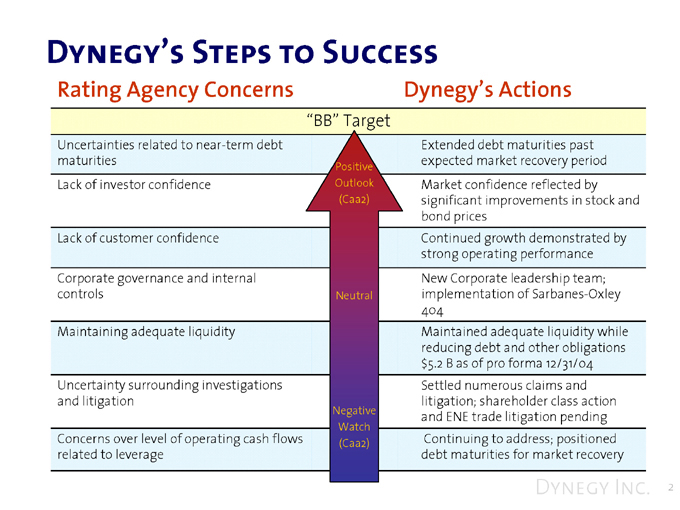

Dynegy’s Steps to Success

Rating Agency Concerns

“BB” Target

Uncertainties related to near-term debt maturities Lack of investor confidence

Lack of customer confidence

Corporate governance and internal controls

Maintaining adequate liquidity

Uncertainty surrounding investigations and litigation

Concerns over level of operating cash flows related to leverage

Positive Outlook (Caa2)

Neutral

Negative Watch (Caa2)

Dynegy’s Actions

Extended debt maturities past expected market recovery period Market confidence reflected by significant improvements in stock and bond prices Continued growth demonstrated by strong operating performance New Corporate leadership team; implementation of Sarbanes-Oxley 404 Maintained adequate liquidity while reducing debt and other obligations $5.2 B as of pro forma 12/31/04 Settled numerous claims and litigation; shareholder class action and ENE trade litigation pending Continuing to address; positioned debt maturities for market recovery

Dynegy Inc. 2

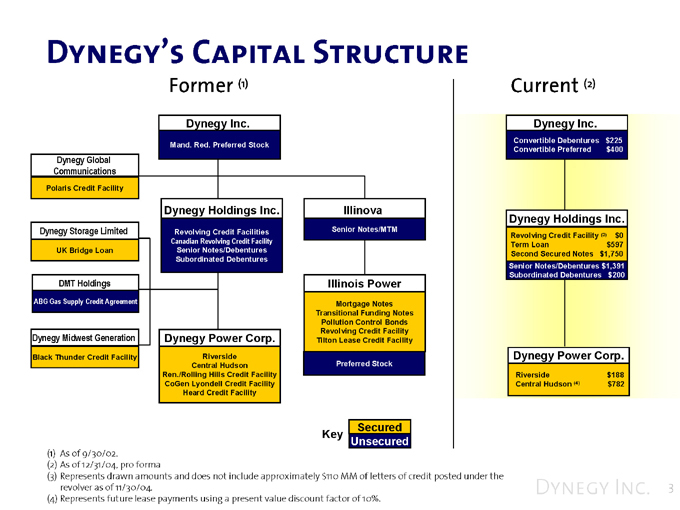

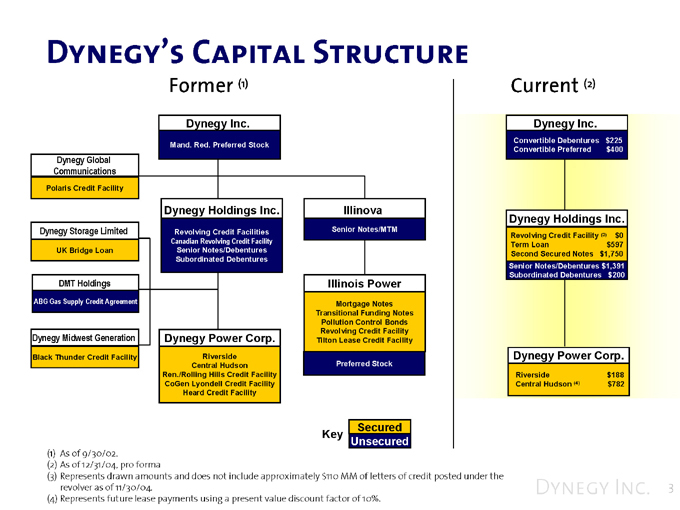

Dynegy’s Capital Structure

Former (1)

Dynegy Inc

Mand. Red. Preferred Stock

Dynegy Global Communications

Polaris Credit Facility

Dynegy Storage Limited

UK Bridge Loan

Dynegy Holdings Inc.

Revolving Credit Facilities

Canadian Revolving Credit Facility

Senior Notes/Debentures Subordinated Debentures

Illinova

Senior Notes/MTM

DMT Holdings

ABG Gas Supply Credit Agreement

Dynegy Midwest Generation

Black Thunder Credit Facility

Dynegy Power Corp.

Riverside Central Hudson Ren./Rolling Hills Credit Facility CoGen Lyondell Credit Facility Heard Credit Facility

Illinois Power

Mortgage Notes Transitional Funding Notes Pollution Control Bonds Revolving Credit Facility Tilton Lease Credit Facility

Preferred Stock

Key

Secured Unsecured

Current (2)

Dynegy Inc

Convertible Debentures $225

Convertible Preferred $400

Dynegy Holdings Inc.

Revolving Credit Facility (3) $0

Term Loan $597

Second Secured Notes $1,750

Senior Notes/Debentures $1,391

Subordinated Debentures $200

Dynegy Power Corp.

Riverside $188

Central Hudson (4) $782

(1) As of 9/30/02.

(2) As of 12/31/04, pro forma

(3) Represents drawn amounts and does not include approximately $110 MM of letters of credit posted under the revolver as of 11/30/04.

(4) Represents future lease payments using a present value discount factor of 10%.

Dynegy Inc. 3

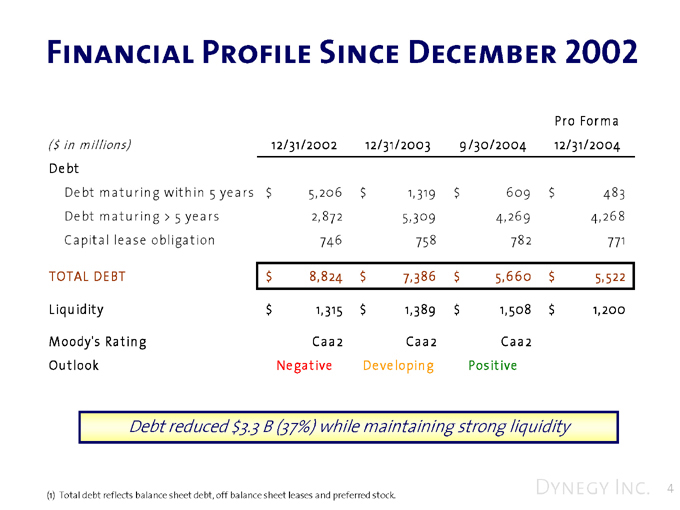

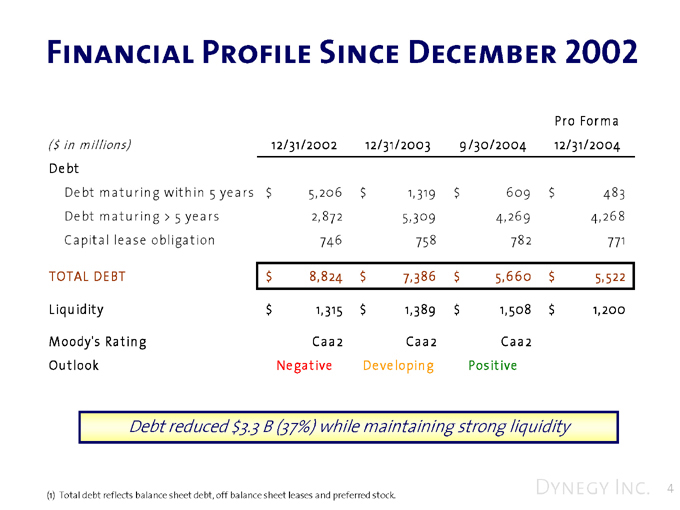

Financial Profile Since December 2002

Pro Forma

($ in millions) 12/31/2002 12/31/2003 9/30/2004 12/31/2004

Debt

Debt maturing within 5 years $5,206 $1,319 $609 $483

Debt maturing > 5 years 2,872 5,309 4,269 4,268

Capital lease obligation 746 758 782 771

TOTAL DEBT $8,824 $7,386 $5,660 $5,522

Liquidity $1,315 $1,389 $1,508 $1,200

Moody’s Rating Caa2 Caa2 Caa2

Outlook Negative Developing Positive

Debt reduced $3.3 B (37%) while maintaining strong liquidity

(1) Total debt reflects balance sheet debt, off balance sheet leases and preferred stock.

Dynegy Inc. 4

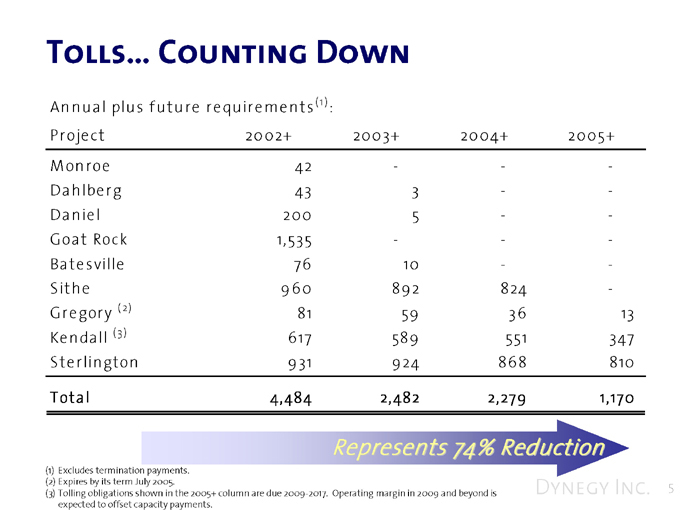

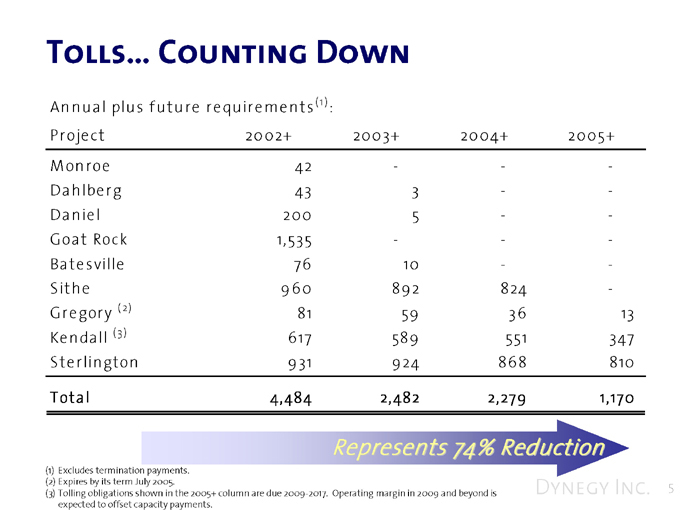

Tolls… Counting Down

Annual plus future requirements(1):

Project 2002+ 2003+ 2004+ 2005+

Monroe 42 - - -

Dahlberg 43 3 - -

Daniel 200 5 - -

Goat Rock 1,535 - - -

Batesville 76 10 - -

Sithe 960 892 824 -

Gregory (2) 81 59 36 13

Kendall (3) 617 589 551 347

Sterlington 931 924 868 810

Total 4,484 2,482 2,279 1,170

Represents 74% Reduction

(1) Excludes termination

(2) Expires by its term July 2005.

(3) Tolling obligations shown in the 2005+ column are due 2009-2017. Operating margin in 2009 and beyond is expected to offset capacity payments.

Dynegy Inc. 5

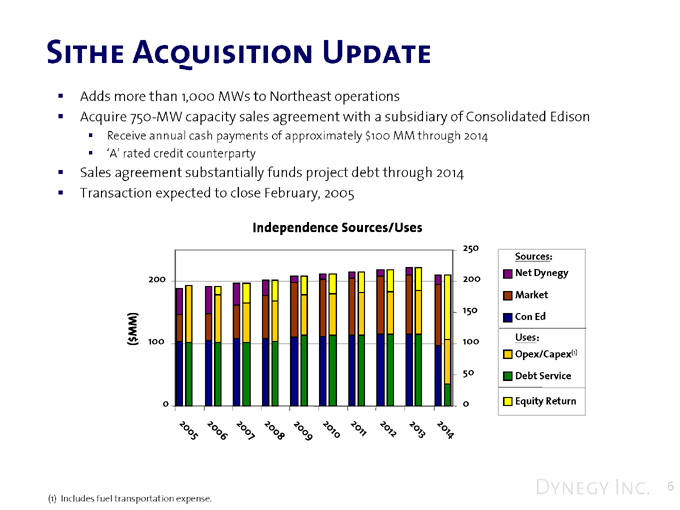

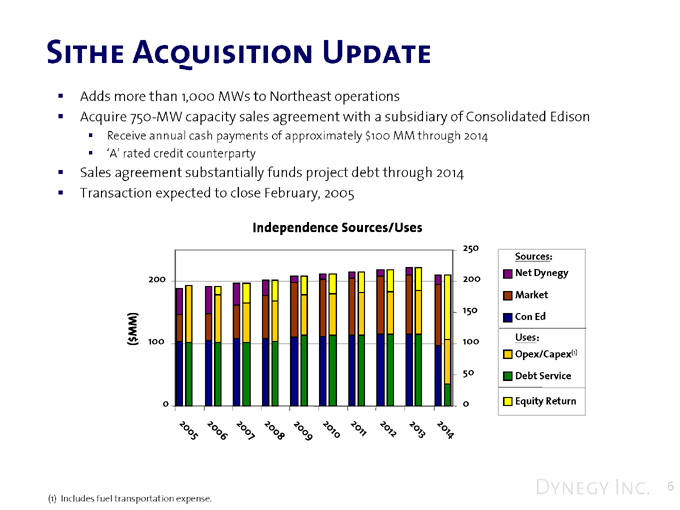

Sithe Acquisition Update

Adds more than 1,000 MWs to Northeast operations

Acquire 750-MW capacity sales agreement with a subsidiary of Consolidated Edison

Receive annual cash payments of approximately $100 MM through 2014 ‘A’ rated credit counterparty

Sales agreement substantially funds project debt through 2014 Transaction expected to close February, 2005

Independence Sources/Uses

($MM)

200 100 0

2014

2013

2012

2011

2010

2009

2008

2007

2006

2005

250 200 150 100 50 0

Sources: Net Dynegy Market Con Ed Uses: Opex/Capex(1) Debt Service Equity Return

(1) Includes fuel transportation expense.

Dynegy Inc. 6

Collateral Posted

($ in millions) $1,200 $1,000 $800 $600 $400 $200 $0

Jan. ‘03 Mar. ‘03 June. ‘03 Sept. ‘03 Jan. ‘04 Mar. ‘04 June. ‘04 Sept. ‘04 Dec ‘04

Peaking Season

Peaking Season

Forecasted 2005

12/31/03 12/31/04 Average

CRM $121 $115-120 $9 0-95

GEN 136 230-240 200-205

NGL 179 165-170 160-165

REG 38 10 0

Other 8 5-10 5-10

Total $482 $525-550 $455-475

Cash $294 $430-440

LCs 188 95-110

Total $482 $525-550

Sensitivity to commodity prices can cause changes in collateral 2005 expectations:

REG requirement is eliminated

CRM should decline due to continued maturities from legacy business GEN to be driven by commodity prices NGL to be driven by propane prices

Dynegy Inc. 7

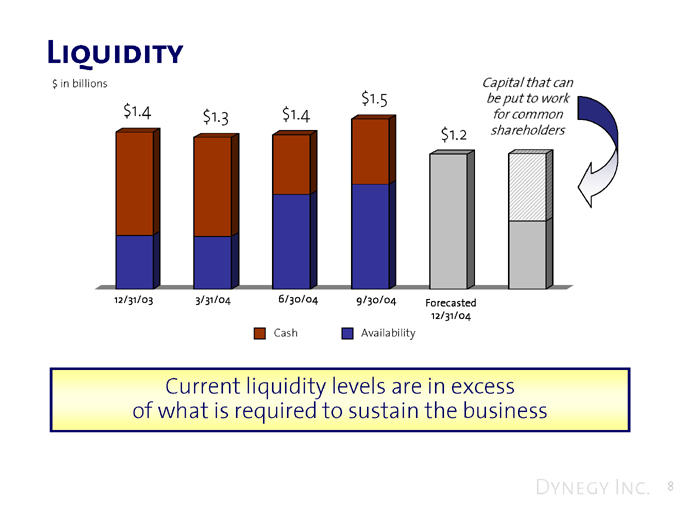

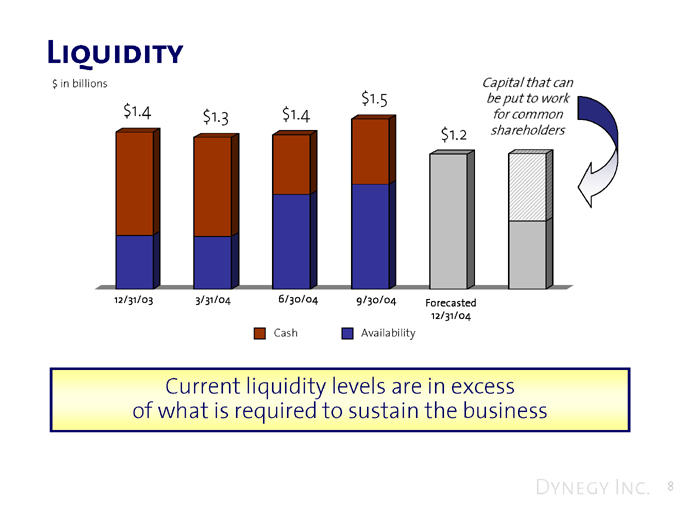

Liquidity

$ in billions $1.5 $1.4 $1.3 $1.4 $1.2

Capital that can be put to work for common shareholders

12/31/03 3/31/04 6/30/04 9/30/04

Forecasted 12/31/04

Cash

Availability

Current liquidity levels are in excess of what is required to sustain the business

Dynegy Inc. 8

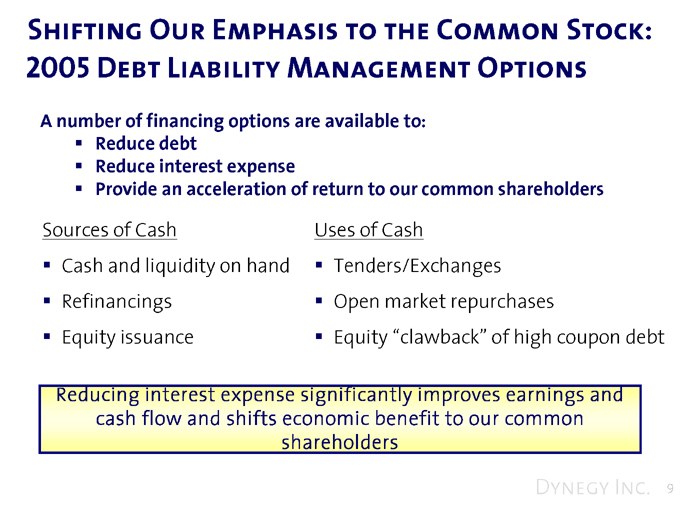

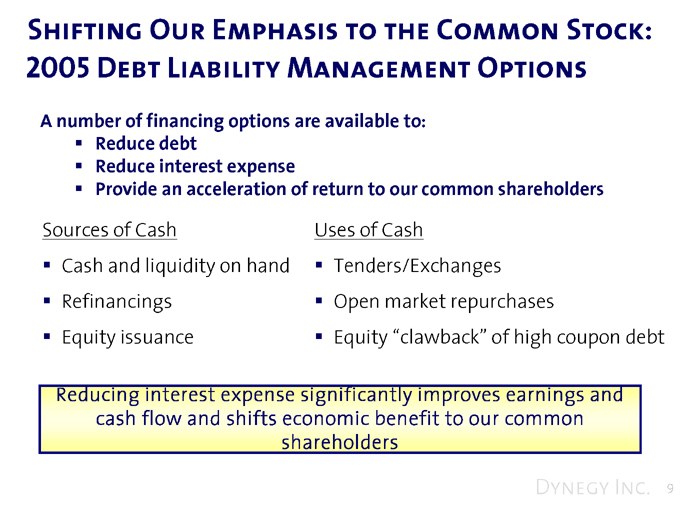

Shifting Our Emphasis to the Common Stock: 2005 Debt Liability Management Options

A number of financing options are available to:

Reduce debt

Reduce interest expense

Provide an acceleration of return to our common shareholders

Sources of Cash

Cash and liquidity on hand Refinancings Equity issuance

Uses of Cash

Tenders/Exchanges Open market repurchases

Equity “clawback” of high coupon debt

Reducing interest expense significantly improves earnings and cash flow and shifts economic benefit to our common shareholders

Dynegy Inc. 9

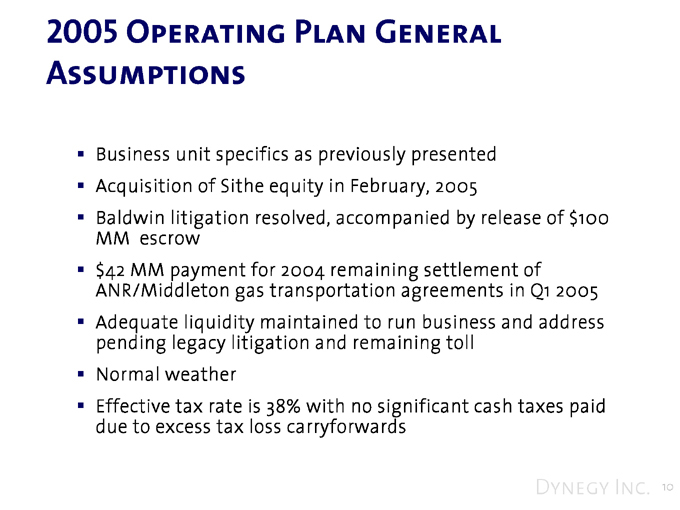

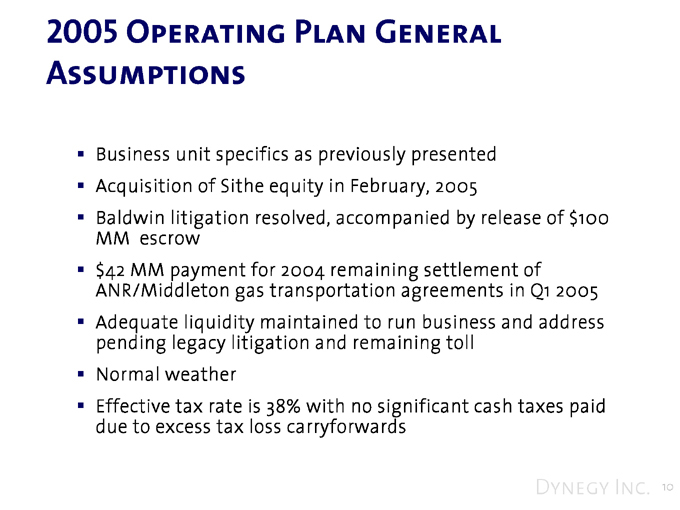

2005 Operating Plan General Assumptions

Business unit specifics as previously presented Acquisition of Sithe equity in February, 2005

Baldwin litigation resolved, accompanied by release of $100 MM escrow $42 MM payment for 2004 remaining settlement of ANR/Middleton gas transportation agreements in Q1 2005 Adequate liquidity maintained to run business and address pending legacy litigation and remaining toll Normal weather Effective tax rate is 38% with no significant cash taxes paid due to excess tax loss carryforwards

Dynegy Inc. 10

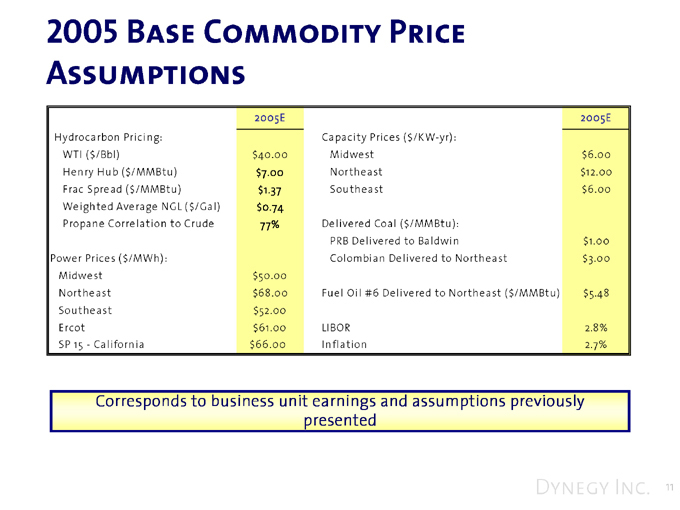

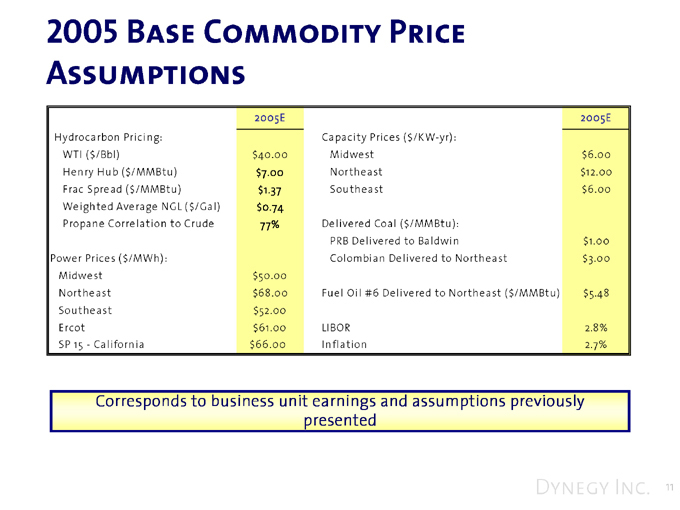

2005 Base Commodity Price Assumptions

2005E

Hydrocarbon Pricing:

WTI ($/Bbl) $40.00

Henry Hub ($/MMBtu) $7.00

Frac Spread ($/MMBtu) $1.37

Weighted Average NGL ($/Gal) $0.74

Propane Correlation to Crude 77%

Power Prices ($/MWh):

Midwest $50.00

Northeast $68.00

Southeast $52.00

Ercot $61.00

SP 15—California $66.00

2005E

Capacity Prices ($/KW-yr):

Midwest $6.00

Northeast $12.00

Southeast $6.00

Delivered Coal ($/MMBtu):

PRB Delivered to Baldwin $1.00

Colombian Delivered to Northeast $3.00

Fuel Oil #6 Delivered to Northeast ($/MMBtu) $5.48

LIBOR 2.8%

Inflation 2.7%

Corresponds to business unit earnings and assumptions previously presented

Dynegy Inc. 11

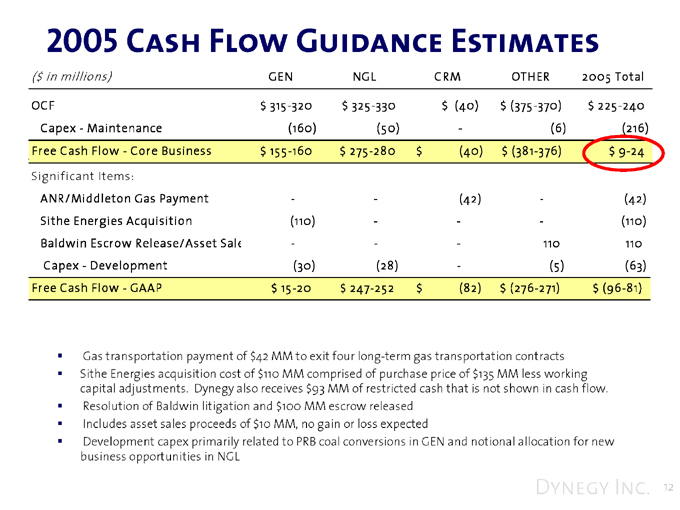

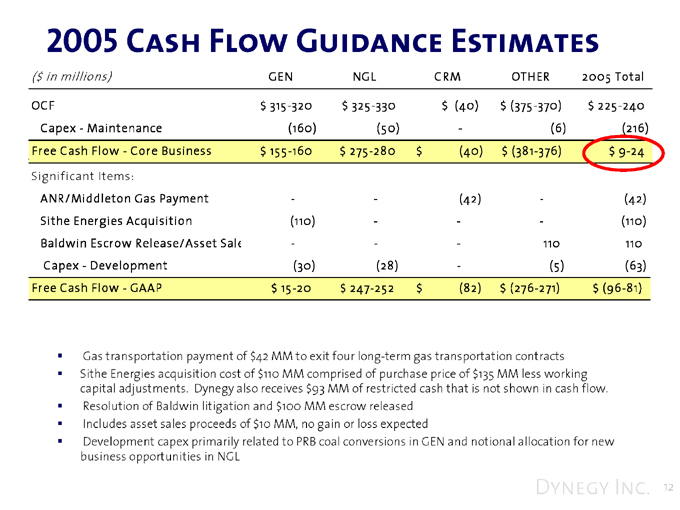

2005 Cash Flow Guidance Estimates

($ in millions) GEN NGL CRM OTHER 2005 Total

OCF $315-320 $325-330 $(40) $(375-370) $225-240

Capex—Maintenance (160) (50) - (6) (216)

Free Cash Flow—Core Business $155-160 $275-280 $(40) $(381-376) $9-24

Significant Items:

ANR/Middleton Gas Payment - - (42) - (42)

Sithe Energies Acquisition (110) - - - (110)

Baldwin Escrow Release/Asset Sal - - - 110 110

Capex—Development (30) (28) - (5) (63)

Free Cash Flow—GAAP $15-20 $247-252 $(82) $(276-271) $(96-81)

Gas transportation payment of $42 MM to exit four long-term gas transportation contracts Sithe Energies acquisition cost of $110 MM comprised of purchase price of $135 MM less working capital adjustments. Dynegy also receives $93 MM of restricted cash that is not shown in cash flow. Resolution of Baldwin litigation and $100 MM escrow released Includes asset sales proceeds of $10 MM, no gain or loss expected Development capex primarily related to PRB coal conversions in GEN and notional allocation for new business opportunities in NGL

Dynegy Inc. 12

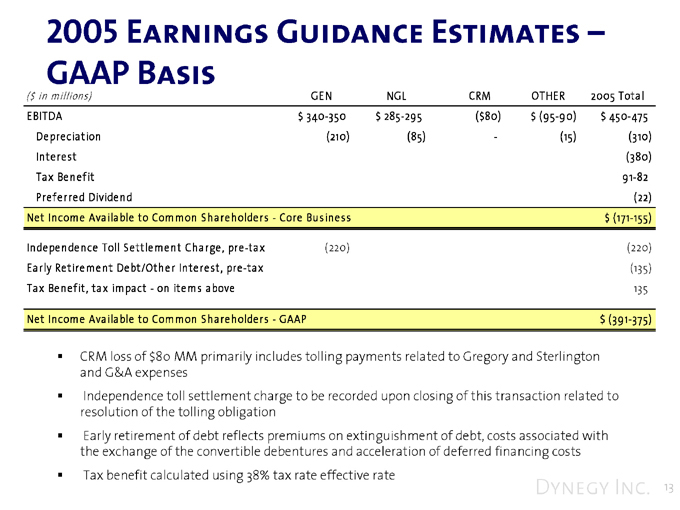

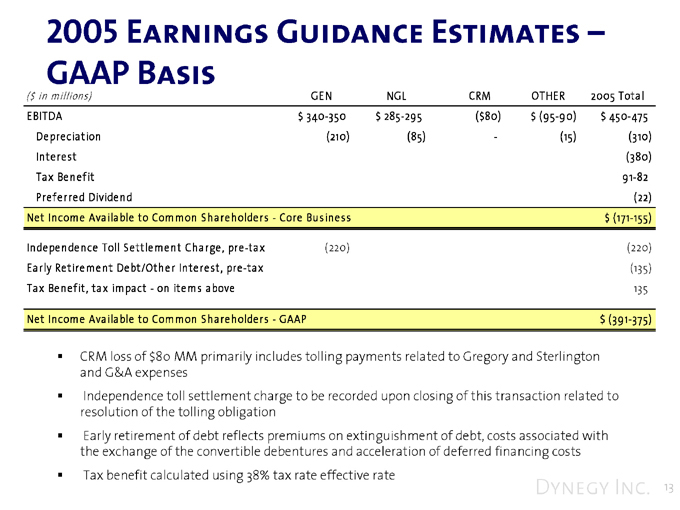

2005 Earnings Guidance Estimates –GAAP Basis

($ in millions) GEN NGL CRM OTHER 2005 Total

EBITDA $340-350 $285-295 ($80) $(95-90) $450-475

Depreciation (210) (85) - (15) (310)

Interest (380)

Tax Benefit 91-82

Preferred Dividend (22)

Net Income Available to Common Shareholders - Core Business $(171-155)

Independence Toll Settlement Charge, pre -tax (220) (220)

Early Retirement Debt/Other Interest, pre -tax (135)

Tax Benefit, tax impact – on items above 135

Net Income Available to Common Shareholders - GAAP $(39 1-375)

CRM loss of $80 MM primarily includes tolling payments related to Gregory and Sterlington and G&A expenses Independence toll settlement charge to be recorded upon closing of this transaction related to resolution of the tolling obligation Early retirement of debt reflects premiums on extinguishment of debt, costs associated with the exchange of the convertible debentures and acceleration of deferred financing costs Tax benefit calculated using 38% tax rate effective rate

Dynegy Inc. 13

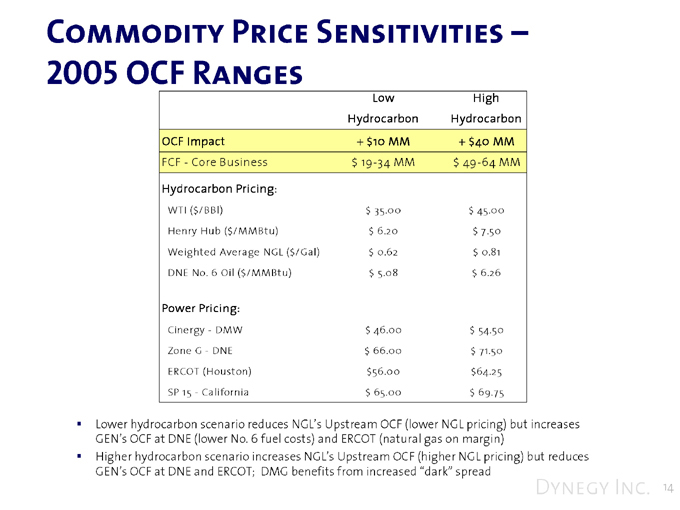

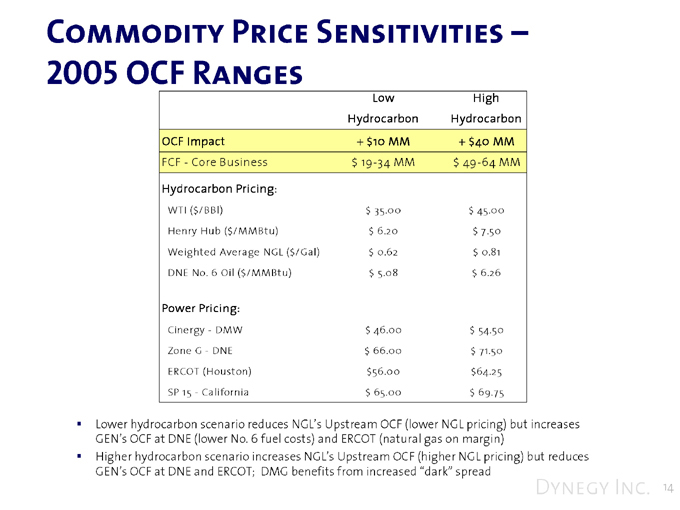

Commodity Price Sensitivities –2005 OCF Ranges

Low Hydrocarbon High Hydrocarbon

OCF Impact + $10 MM + $40MM

FCF—Core Business $19-34 MM $49-64MM

Hydrocarbon Pricing:

WTI ($/BBl) $35.00 $45.00

Henry Hub ($/MMBtu) $6.20 $7.50

Weighted Average NGL ($/Gal) $0.62 $0.81

DNE No. 6 Oil ($/MMBtu) $5.08 $6.26

Power Pricing:

Cinergy—DMW $46.00 $54.50

Zone G—DNE $66.00 $71.50

ERCOT (Houston) $56.00 $64.25

SP 15—California $65.00 $69.75

Lower hydrocarbon scenario reduces NGL’s Upstream OCF (lower NGL pricing) but increases GEN’s OCF at DNE (lower No. 6 fuel costs) and ERCOT (natural gas on margin) Higher hydrocarbon scenario increases NGL’s Upstream OCF (higher NGL pricing) but reduces GEN’s OCF at DNE and ERCOT; DMG benefits from increased “dark” spread

Dynegy Inc. 14

To Summarize Our Financial Journey…

Improved relationship and credibility

Rating agencies, financial institutions and investors

Simplified our debt structure

Significantly reduced debt and other obligations Maintained strong liquidity Cleared maturity runway Extended credit facilities…twice Provided 2005 cash flow and earnings guidance Provided modeling data for your use Did the right thing for all of our investors

… Driving toward cash flow positive in 2005

Dynegy Inc. 15