UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSRS

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-06431

MANAGERS TRUST II

|

| (Exact name of registrant as specified in charter) |

| | |

| 800 Connecticut Avenue, Norwalk, Connecticut | | 06854 |

| (Address of principal executive offices) | | (Zip code) |

Managers Investment Group LLC

800 Connecticut Avenue, Norwalk, Connecticut 06854

|

| (Name and address of agent for service) |

Registrant’s telephone number, including area code: (203) 299-3500

Date of fiscal year end: DECEMBER 31

Date of reporting period: JANUARY 1, 2007 – JUNE 30, 2007 (Semi-Annual Shareholder Report)

| Item 1. | Reports to Shareholders |

SEMI-ANNUAL REPORT

Managers Trust II Funds

June 30, 2007

| | • | | Managers AMG Chicago Equity Partners Mid-Cap Fund |

| | • | | Managers AMG Chicago Equity Partners Balanced Fund |

| | • | | Managers High Yield Fund |

| | • | | Managers Fixed Income Fund |

The Managers Funds

Semi-Annual Report — June 30, 2007 (unaudited)

TABLE OF CONTENTS

Nothing contained herein is to be considered an offer, sale or solicitation of an offer to buy shares of The Managers Funds or Managers AMG Funds. Such offering is made only by Prospectus, which includes details as to offering price and other material information.

Letter to Shareholders

Dear Fellow Shareholder:

As most investors expected, the U.S. economy slowed over the course of the past six months and the rest of the world continued on a generally stable growth trajectory. Underpinned by a global economy performing generally within expectations, and, aside from a sharp and short-lived market correction beginning in late February, the domestic and foreign stock markets climbed steadily, providing strong gains for the period. For example, most domestic equity indices rose 7% or more during the period and international stocks provided stronger returns. Meanwhile, the bond market became increasingly volatile as the melt-down in the sub-prime lending sector caused a liquidity squeeze across other higher-risk sectors. This led investors to balance the perception that the growing global economy is putting pressure on inflation against the extent to which the liquidity squeeze will impede investment spending, acquisition activity and ultimately the U.S. and global economies.

Against this backdrop, your Funds produced positive results during the six-month period, as shown in the accompanying semiannual report.

While the strong equity market return may seem counterintuitive in the face of slowing earnings, a significantly deteriorating housing market and the stress fractures among the mortgage lending industry, there are several positive trends that lead to these results. First, because of widespread belief that the economy would be slowing, investors’ expectations for earnings growth were relatively conservative, and most companies exceeded these modest expectations during the period. Furthermore, although the U.S. economy is slowing, we believe the global economy is healthy, and global growth is a significant contributor to U.S. companies’ earnings. Another important factor has been the relatively high amount of liquidity searching for return in a relatively low interest rate environment. A clear illustration of this is the enormous amount of money committed to private equity pools that are searching for and buying up public companies on a regular basis. Low volatility and low interest rates have encouraged investors to increase leverage, which has thus far been rewarding.

Speaking of interest rates, at the beginning of the year investors were confidently predicting and wishing that the Fed would reduce rates in the near future—consistent with the expectations for a real slowdown in the economy. Over the course of the first half of 2007, however, expectations for a near-term rate cut evolved into uncertainty over the outlook for any rate cut at all, as the Fed has been satisfied to stand pat and communicate concerns balanced between too much inflation risk versus a slowing economy. Again, while the economy has slowed, we believe it does not appear to be falling into recession, and in fact improved during the second quarter. Although credit spreads remained tight into late May because of a high demand for yield and historically low default rates, spreads have widened significantly since then as the domino effect started by sub-prime lending defaults has prompted investors to rapidly reduce their risk exposure. Prices of high-yield bonds across all sectors have declined, the yield premium for credit default swaps (CDS) has expanded, and prices for investment grade corporate bonds have suffered, even without a deterioration in fundamental quality.

The extent and duration of this recent liquidity squeeze will be the key to the direction of the financial markets over the second half of the year. If this sharp sell off of risk is brief, as it was in February, and markets reach equilibrium within the third quarter, then we think the relatively sound fundamentals of the U.S. and global economies should only be mildly affected. Equity markets, which appear to us to be fairly valued under that scenario, will be free to move higher, default rates will remain low, and bond prices will recover. However, price declines in a leveraged marketplace have an ability to create a viscous cycle. If dominos continue to fall, forcing more investors to sell or hedge risky assets, even relatively liquid and high quality debt securities will trade lower. If the ample liquidity that has been driving profitability, acquisitions, and the equity markets higher is restricted, the rise in cost of capital will hinder profitability, increase default rates and significantly deter investment spending which will, in our opinion, in time, weaken the U.S. economy.

Noting these risks and known stresses, we believe that the current strength of many foreign economies, the continued full U.S. employment picture, and the continued high levels of corporate free cash flow will all help to pull the U.S. economy through this technical liquidity squeeze. In addition, if the credit markets continue to deteriorate, we expect that the Fed will be inclined to add liquidity by reducing rates to mitigate the problem. Hence, we continue to believe that investors should maintain their portfolios with allocations near their long-run targets, rebalance if necessary and take full advantage of opportunities to participate in the growth of the global economy. In any event, investors will be well served by an appropriately balanced and globally diversified portfolio.

1

Letter to Shareholders (continued)

One of our foremost goals at Managers Investment Group is to structure and manage mutual funds that will help our shareholders and clients become more successful in reaching their investment goals and objectives. Each of our Funds is geared to provide you with exposure to a specific asset class or segment of the market. Investors tend to use our Funds as part of their overall asset allocation in order to structure a well-diversified portfolio intended to meet individual needs. Most of our Funds, like the Managers Money Market Fund, are therefore designed to be building blocks.

The following report contains details for each of the Funds and covers the six-month period ended June 30, 2007. Should you have any questions about this report, or if you’d like to receive a Prospectus and additional information, including fees and expenses, for these or any of the other Funds in our family, please feel free to contact us at 1-800-835-3879, or visit our website at www.managersinvest.com. As always, please read the Prospectus carefully before you invest or send money.

If you are curious about how you can better diversify your investment program, visit the Knowledge Center on our Web site and view our articles in the investment strategies section. You can rest assured that under all market conditions our team is focused on delivering excellent investment management services for your benefit.

We thank you for your continued confidence and investment in The Managers Funds.

Sincerely,

| | |

| |  |

| John Streur | | Thomas G. Hoffman, CFA |

| Senior Managing Partner | | Executive Vice President |

| Managers Investment Group LLC | | Chief Investment Officer |

| | Managers Investment Group LLC |

2

About Your Fund's Expenses (unaudited)

As a shareholder of the Fund, you incur two types of costs: (1) transaction costs, including sales charges (loads) on purchase payments; reinvested dividends or other distributions; redemption fees; and exchange fees; and (2) ongoing costs, including management fees; distribution (12b-1) fees; and other Fund expenses. This Example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds. The Example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period as indicated below.

Actual Fund Return

The first line of the table below provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

The second line of the table below provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as sales charges (loads), redemption fees, or exchange fees. Therefore, the second line of the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

| | | | | | | | | |

Six Months Ended June 30, 2007 | | Beginning

Account Value

1/1/2007 | | Ending

Account Value

6/30/2007 | | Expenses

Paid During

Period* |

Mid-Cap Fund Class A | | | | | | | | | |

Based on Actual Fund Return | | $ | 1,000 | | $ | 1,121 | | $ | 6.52 |

Based on Hypothetical 5% Annual Return | | $ | 1,000 | | $ | 1,019 | | $ | 6.21 |

Mid-Cap Fund Class B | | | | | | | | | |

Based on Actual Fund Return | | $ | 1,000 | | $ | 1,120 | | $ | 10.46 |

Based on Hypothetical 5% Annual Return | | $ | 1,000 | | $ | 1,015 | | $ | 9.94 |

Mid-Cap Fund Class C | | | | | | | | | |

Based on Actual Fund Return | | $ | 1,000 | | $ | 1,117 | | $ | 10.45 |

Based on Hypothetical 5% Annual Return | | $ | 1,000 | | $ | 1,015 | | $ | 9.94 |

Mid-Cap Fund Institutional Class | | | | | | | | | |

Based on Actual Fund Return | | $ | 1,000 | | $ | 1,123 | | $ | 5.21 |

Based on Hypothetical 5% Annual Return | | $ | 1,000 | | $ | 1,020 | | $ | 4.96 |

Balanced Fund Class A | | | | | | | | | |

Based on Actual Fund Return | | $ | 1,000 | | $ | 1,043 | | $ | 6.33 |

Based on Hypothetical 5% Annual Return | | $ | 1,000 | | $ | 1,019 | | $ | 6.26 |

Balanced Fund Class B | | | | | | | | | |

Based on Actual Fund Return | | $ | 1,000 | | $ | 1,039 | | $ | 10.11 |

Based on Hypothetical 5% Annual Return | | $ | 1,000 | | $ | 1,015 | | $ | 9.99 |

Balanced Fund Class C | | | | | | | | | |

Based on Actual Fund Return | | $ | 1,000 | | $ | 1,039 | | $ | 10.11 |

Based on Hypothetical 5% Annual Return | | $ | 1,000 | | $ | 1,015 | | $ | 9.99 |

Balanced Fund Institutional Class | | | | | | | | | |

Based on Actual Fund Return | | $ | 1,000 | | $ | 1,044 | | $ | 5.07 |

Based on Hypothetical 5% Annual Return | | $ | 1,000 | | $ | 1,020 | | $ | 5.01 |

High Yield Fund Class A | | | | | | | | | |

Based on Actual Fund Return | | $ | 1,000 | | $ | 1,028 | | $ | 5.78 |

Based on Hypothetical 5% Annual Return | | $ | 1,000 | | $ | 1,019 | | $ | 5.76 |

High Yield Fund Class B | | | | | | | | | |

Based on Actual Fund Return | | $ | 1,000 | | $ | 1,024 | | $ | 9.54 |

Based on Hypothetical 5% Annual Return | | $ | 1,000 | | $ | 1,015 | | $ | 9.49 |

High Yield Fund Class C | | | | | | | | | |

Based on Actual Fund Return | | $ | 1,000 | | $ | 1,024 | | $ | 9.54 |

Based on Hypothetical 5% Annual Return | | $ | 1,000 | | $ | 1,015 | | $ | 9.49 |

High Yield Fund Institutional Class | | | | | | | | | |

Based on Actual Fund Return | | $ | 1,000 | | $ | 1,029 | | $ | 4.53 |

Based on Hypothetical 5% Annual Return | | $ | 1,000 | | $ | 1,020 | | $ | 4.51 |

Fixed Income Fund Class A | | | | | | | | | |

Based on Actual Fund Return | | $ | 1,000 | | $ | 1,011 | | $ | 4.19 |

Based on Hypothetical 5% Annual Return | | $ | 1,000 | | $ | 1,021 | | $ | 4.21 |

Fixed Income Fund Class B | | | | | | | | | |

Based on Actual Fund Return | | $ | 1,000 | | $ | 1,007 | | $ | 7.91 |

Based on Hypothetical 5% Annual Return | | $ | 1,000 | | $ | 1,017 | | $ | 7.95 |

Fixed Income Fund Class C | | | | | | | | | |

Based on Actual Fund Return | | $ | 1,000 | | $ | 1,008 | | $ | 7.91 |

Based on Hypothetical 5% Annual Return | | $ | 1,000 | | $ | 1,017 | | $ | 7.95 |

Fixed Income Fund Institutional Class | | | | | | | | | |

Based on Actual Fund Return | | $ | 1,000 | | $ | 1,012 | | $ | 2.94 |

Based on Hypothetical 5% Annual Return | | $ | 1,000 | | $ | 1,022 | | $ | 2.96 |

| * | Expenses are equal to the Fund’s annualized expense ratio multiplied by the average account value over the period, multiplied by the number of days in the most recent fiscal half-year (181), then divided by 365. |

3

Funds Performance

All periods ended June 30, 2007 (unaudited)

| | | | | | | | | | | | | | | | | | |

Average Annual Total Returns 1 | | | | | | Six

Months | | | 1

Year | | | 5

Years | | | Since

Inception | | | Inception

Date |

Mid-Cap 3 | | -Class A | | No Load | | 12.12 | % | | 18.01 | % | | 13.62 | % | | 13.87 | % | | 01/02/97 |

| | -Class A | | With Load | | 5.68 | % | | 11.21 | % | | 12.28 | % | | 13.23 | % | | 01/02/97 |

| | -Class B | | No Load | | 11.96 | % | | 17.40 | % | | 13.01 | % | | 12.45 | % | | 01/28/98 |

| | -Class B | | With Load | | 6.96 | % | | 12.40 | % | | 12.77 | % | | 12.45 | % | | 01/28/98 |

| | -Class C | | No Load | | 11.74 | % | | 17.16 | % | | 12.96 | % | | 11.65 | % | | 02/19/98 |

| | -Class C | | With Load | | 10.74 | % | | 16.16 | % | | 12.96 | % | | 11.65 | % | | 02/19/98 |

| | -Institutional Class | | No Load | | 12.26 | % | | 18.32 | % | | 14.07 | % | | 14.40 | % | | 01/02/97 |

S&P Mid Cap 400 Index 4 | | | | | | 11.98 | % | | 18.51 | % | | 14.17 | % | | 14.17 | %a | | |

| | | | | | | |

Balanced 2 | | -Class A | | No Load | | 4.32 | % | | 15.43 | % | | 9.66 | % | | 9.19 | % | | 01/02/97 |

| | -Class A | | With Load | | (1.64 | )% | | 8.78 | % | | 8.37 | % | | 8.58 | % | | 01/02/97 |

| | -Class B | | No Load | | 3.92 | % | | 14.56 | % | | 9.01 | % | | 7.35 | % | | 02/10/98 |

| | -Class B | | With Load | | (1.08 | )% | | 9.56 | % | | 8.72 | % | | 7.35 | % | | 02/10/98 |

| | -Class C | | No Load | | 3.88 | % | | 14.60 | % | | 8.99 | % | | 7.28 | % | | 02/13/98 |

| | -Class C | | With Load | | 2.88 | % | | 13.60 | % | | 8.99 | % | | 7.28 | % | | 02/13/98 |

| | -Institutional Class | | No Load | | 4.42 | % | | 15.79 | % | | 10.09 | % | | 9.69 | % | | 01/02/97 |

60% S&P 500 Index & 40% Lehman Brothers Aggregate Bond Index 5 | | | | | | 4.61 | % | | 14.72 | % | | 8.53 | % | | 8.13 | %b | | |

| | | | | | | |

High Yield 2,8 | | -Class A | | No Load | | 2.78 | % | | 10.75 | % | | 12.51 | % | | 6.73 | % | | 01/02/98 |

| | -Class A | | With Load | | (1.55 | )% | | 6.02 | % | | 11.54 | % | | 6.25 | % | | 01/02/98 |

| | -Class B | | No Load | | 2.40 | % | | 9.87 | % | | 11.80 | % | | 5.67 | % | | 02/19/98 |

| | -Class B | | With Load | | (2.57 | )% | | 4.87 | % | | 11.54 | % | | 5.67 | % | | 02/19/98 |

| | -Class C | | No Load | | 2.42 | % | | 9.91 | % | | 11.81 | % | | 5.67 | % | | 02/19/98 |

| | -Class C | | With Load | | 1.42 | % | | 8.91 | % | | 11.81 | % | | 5.67 | % | | 02/19/98 |

| | -Institutional Class | | No Load | | 2.89 | % | | 11.08 | % | | 12.96 | % | | 6.74 | % | | 03/02/98 |

Lehman Brothers U.S. Corporate High Yield Bond Index 6 | | | | | | 2.87 | % | | 11.55 | % | | 11.91 | % | | 5.92 | %c | | |

| | | | | | | |

Fixed Income 2,9 | | -Class A | | No Load | | 1.12 | % | | 9.02 | % | | 6.18 | % | | 6.34 | % | | 01/02/97 |

| | -Class A | | With Load | | (3.20 | )% | | 4.35 | % | | 5.27 | % | | 5.90 | % | | 01/02/97 |

| | -Class B | | No Load | | 0.74 | % | | 8.27 | % | | 5.52 | % | | 5.45 | % | | 03/20/98 |

| | -Class B | | With Load | | (4.19 | )% | | 3.27 | % | | 5.20 | % | | 5.45 | % | | 03/20/98 |

| | -Class C | | No Load | | 0.75 | % | | 8.23 | % | | 5.52 | % | | 5.58 | % | | 03/05/98 |

| | -Class C | | With Load | | (0.24 | )% | | 7.23 | % | | 5.52 | % | | 5.58 | % | | 03/05/98 |

| | -Institutional Class | | No Load | | 1.24 | % | | 9.26 | % | | 6.58 | % | | 6.85 | % | | 01/02/97 |

Lehman Brothers Aggregate Bond Index 7 | | | | | | 0.98 | % | | 6.12 | % | | 4.48 | % | | 6.07 | %d | | |

a | Performance for the S&P Mid Cap 400 Index reflects an inception date of January 2, 1997. |

b | Performance for the 60% S&P 500 Index & 40% Lehman Brothers Aggregate Bond Index reflects an inception date of January 2, 1997. |

c | Performance for the Lehman Brothers U.S. Corporate High Yield Bond Index reflects an inception date of December 31, 1997. |

d | Performance for the Lehman Brothers Aggregate Bond Index reflects an inception date of January 2, 1997. |

The performance data shown represents past performance. Past performance is not a guarantee of future results. Current performance may be lower or higher than the performance data quoted. The investment return and the principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. For performance information through the most recent month end please call (800) 835-3879 or visit our Web site at www.managersinvest.com.

4

Managers Funds Performance

All periods ended June 30, 2007 (continued)

Performance differences among the share classes are due to differences in sales charge structures and class expenses. Returns shown reflect maximum sales charge of 5.75% on Class A (4.25% maximum for Managers High Yield and Fixed Income Funds), as well as the applicable contingent deferred sales charge (CDSC) on both Class B and C shares. The Class B shares’ CDSC declines annually between years 1 through 6 according to the following schedule: 5, 4, 3, 3, 2, 1%. No sales charge is assessed after year six. Class C shares held for less than one year are subject to a 1% CDSC.

The Fund share classes differ with regard to sales charges and Fund expenses. In choosing a Fund and class(es), investors should consider the amount they plan to invest, their investment objectives, the Fund’s investment objectives, risks, charges, and expenses carefully before investing, and how long they intend to keep their money invested in the Fund and class(es). Each Fund’s prospectus contains information concerning the Fund’s investment objective, risk, charges, and expenses and other information. Additional risks are associated with investing in high yield securities and such securities may be considered speculative. There are also risks associated with investing in small-cap companies, such as increased volatility, and bonds, such as rising interest rates. More specifically, the value of debt instruments held in bond funds declines when interest rates rise and longer-term bonds are more vulnerable to interest rate risk. To obtain a prospectus, please call 800-835-3879 or visit our website at www.managersinvest.com. Please read the Prospectus carefully before you invest in a Fund or send money. Investors should discuss their goals and choices with a registered financial professional in order to determine which share class is appropriate for them.

Distributed by Managers Distributors, Inc., member FINRA.

1 | Total return equals income yield plus share price change and assumes reinvestment of all dividends and capital gain distributions. Returns are net of fees and may reflect offsets of Fund expenses as described in the Prospectus. No adjustment has been made for taxes payable by shareholders on their reinvested dividends and capital gain distributions. Returns for periods greater than one year are annualized. |

2 | Changing interest rates may adversely affect the value of an investment. An increase in interest rates typically causes the value of bonds and other fixed-income securities to fall. |

3 | The Fund is subject to risks associated with investments in mid-capitalization companies, such as erratic earnings patterns, competitive conditions, limited earnings history, and a reliance on a limited number of products. |

4 | The S&P MidCap 400 Index is the most widely used index for mid-size companies and covers approximately 7% of the U.S. equities market. Unlike the Fund, the S&P Mid Cap 400 Index is unmanaged, is not available for investment, and does not incur expenses. |

5 | The benchmark is composed of 60% S&P 500 Index and 40% Lehman Brothers Aggregate Bond Index. |

6 | The Lehman Brothers U.S. Corporate High Yield Bond Index is a total return performance benchmark for fixed income securities having a maximum quality rating of Ba1 (as determined by Moody’s Investors Service). Unlike the Fund, the Lehman Brothers U.S. Corporate High Yield Bond Index is unmanaged, is not available for investment, and does not incur expenses. |

7 | The Lehman Brothers Aggregate Bond Index is an index of the U.S. investment-grade fixed-rate bond market, including both government and corporate bonds. Unlike the Fund, the Lehman Brothers Aggregate Bond Index is unmanaged, is not available for investment, and does not incur expenses. |

8 | The Fund holds securities in which the issuer of the security may default or otherwise be unable to honor a financial obligation. The Fund holds securities rated below investment grade that are especially susceptible to this risk. These issuers may be involved in bankruptcy proceedings, reorganizations, or financial restructurings, and are not as strong financially as higher rated issuers. |

9 | Fixed-income funds are subject to the risks associated with investments in debt securities, such as default risk and fluctuations in the perception of the debtors ability to pay its creditors. |

5

Mid-Cap

Fund Snapshots

June 30, 2007 (unaudited)

Portfolio Breakdown

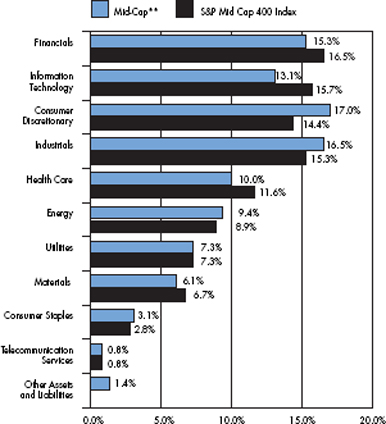

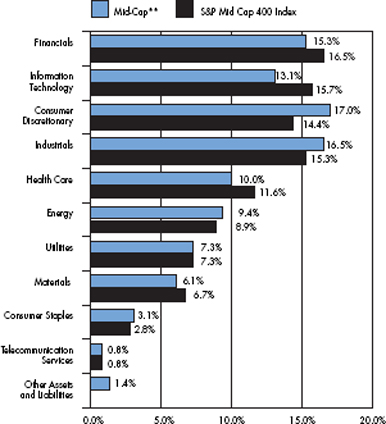

| | | | | | | | |

| | Industry | | Mid-Cap** | | | S&P Mid Cap

400 Index | |

| | Financials | | 15.3 | % | | 16.5 | % |

| | Information Technology | | 13.1 | % | | 15.7 | % |

| | Consumer Discretionary | | 17.0 | % | | 14.4 | % |

| | Industrials | | 16.5 | % | | 15.3 | % |

| | Health Care | | 10.0 | % | | 11.6 | % |

| | Energy | | 9.4 | % | | 8.9 | % |

| | Utilities | | 7.3 | % | | 7.3 | % |

| | Materials | | 6.1 | % | | 6.7 | % |

| | Consumer Staples | | 3.1 | % | | 2.8 | % |

| | Telecommunication Services | | 0.8 | % | | 0.8 | % |

| | Other Assets and Liabilities | | 1.4 | % | | 0.0 | % |

| ** | As a percentage of net assets |

Top Ten Holdings

| | | |

Top Ten Holdings | | % of

Net Assets | |

Cummins, Inc.* | | 2.7 | % |

Everest Re Group Ltd. | | 2.6 | |

Tidewater, Inc. | | 2.5 | |

Family Dollar Stores, Inc. | | 2.0 | |

Terex Corp.* | | 1.9 | |

ITT Educational Services, Inc. | | 1.8 | |

Tesoro Corp.* | | 1.8 | |

American Financial Group, Inc. | | 1.8 | |

Ross Stores, Inc. | | 1.7 | |

Alliant Energy Corp. | | 1.6 | |

| | | |

Top Ten as a Group | | 20.4 | % |

| | | |

| * | Top Ten Holding at December 31, 2006 |

Any sectors, industries, or securities discussed should not be perceived as investment recommendations. Mention of a specific security should not be considered a recommendation to buy or solicitation to sell that security.

6

Mid-Cap

Schedule of Portfolio Investments

June 30, 2007 (unaudited)

| | | | | | |

| | | Shares | | | Value |

Common Stocks—98.6% | | | | | | |

Consumer Discretionary—17.0% | | | | | | |

Aeropostale, Inc.* | | 27,800 | | | $ | 1,158,704 |

American Greetings Corp., Class A | | 18,500 | | | | 524,105 |

AnnTaylor Stores Corp.* | | 7,700 | | | | 272,734 |

ArvinMeritor, Inc. | | 38,700 | 2 | | | 859,140 |

Big Lots, Inc.* | | 12,600 | 2 | | | 370,692 |

Blyth, Inc. | | 9,900 | | | | 263,142 |

Brinker International, Inc. | | 16,700 | 2 | | | 488,809 |

Darden Restaurants, Inc. | | 5,600 | 2 | | | 246,344 |

DeVry, Inc. | | 17,400 | 2 | | | 591,948 |

Dollar Tree Stores, Inc.* | | 10,000 | | | | 435,500 |

Expedia, Inc.* | | 12,900 | | | | 377,841 |

Family Dollar Stores, Inc. | | 52,100 | 2 | | | 1,788,072 |

Goodyear Tire & Rubber Co.* | | 11,900 | 2 | | | 413,644 |

Hasbro, Inc. | | 30,000 | | | | 942,300 |

ITT Educational Services, Inc.* | | 14,400 | | | | 1,690,272 |

Jack in the Box, Inc.* | | 3,200 | | | | 227,008 |

Marvel Entertainment, Inc.* | | 19,200 | 2 | | | 489,216 |

NVR, Inc.* | | 900 | 2 | | | 611,775 |

Polo Ralph Lauren Corp. | | 1,600 | | | | 156,976 |

RadioShack Corp. | | 5,300 | 2 | | | 175,642 |

Ross Stores, Inc. | | 49,700 | | | | 1,530,760 |

Service Corp. International | | 15,100 | | | | 192,978 |

Sherwin-Williams Co., The | | 17,400 | | | | 1,156,578 |

Whirlpool Corp. | | 5,000 | 2 | | | 556,000 |

Total Consumer Discretionary | | | | | | 15,520,180 |

Consumer Staples—3.1% | | | | | | |

Energizer Holdings, Inc.* | | 9,100 | 2 | | | 906,360 |

Estee Lauder Co., Class A | | 4,500 | 2 | | | 204,795 |

McCormick & Co., Inc. | | 3,700 | 2 | | | 141,266 |

NBTY, Inc.* | | 12,300 | | | | 531,360 |

Tyson Foods, Inc., Class A | | 47,500 | 2 | | | 1,094,400 |

Total Consumer Staples | | | | | | 2,878,181 |

Energy—9.4% | | | | | | |

Frontier Oil Corp. | | 16,400 | | | | 717,828 |

Holly Corp. | | 11,700 | 2 | | | 868,023 |

Noble Energy, Inc. | | 14,600 | | | | 910,894 |

Overseas Shipholding Group, Inc. | | 15,700 | | | | 1,277,980 |

Patterson-UTI Energy, Inc. | | 16,000 | | | | 419,360 |

Tesoro Corp. | | 29,400 | 2 | | | 1,680,210 |

Tidewater, Inc. | | 32,100 | 2 | | | 2,275,248 |

Unit Corp.* | | 7,800 | 2 | | | 490,698 |

Total Energy | | | | | | 8,640,241 |

Financials—15.3% | | | | | | |

AG Edwards, Inc. | | 7,600 | | | | 642,580 |

American Financial Group, Inc. | | 47,300 | | | | 1,615,295 |

AmeriCredit Corp.* | | 6,100 | 2 | | | 161,955 |

Associates Bank Corp. | | 19,900 | 2 | | | 650,730 |

CB Richard Ellis Group, Inc.* | | 3,300 | | | | 120,450 |

City National Corp. | | 8,300 | 2 | | | 631,547 |

Eaton Vance Corp. | | 4,600 | 2 | | | 203,228 |

Everest Re Group Ltd. | | 21,800 | | | | 2,368,352 |

First Industrial Realty Trust, Inc. | | 11,900 | | | | 461,244 |

First Marblehead Corp., The | | 4,450 | 2 | | | 171,948 |

Highwoods Properties, Inc. | | 22,500 | | | | 843,750 |

Hospitality Properties Trust | | 22,600 | 2 | | | 937,674 |

HRPT Properties Trust | | 20,300 | | | | 211,120 |

Investors Financial Services Corp. | | 4,100 | | | | 252,847 |

Leucadia National Corp. | | 4,500 | | | | 158,625 |

PMI Group, Inc. | | 32,400 | | | | 1,447,308 |

Potlatch Corp. | | 16,500 | | | | 710,325 |

Radian Group, Inc. | | 21,500 | | | | 1,161,000 |

Raymond James Financial, Inc. | | 15,700 | 2 | | | 485,130 |

Wilmington Trust Corp. | | 18,500 | | | | 767,935 |

Total Financials | | | | | | 14,003,043 |

Health Care—10.0% | | | | | | |

Applera Corp—Applied Biosystems Group | | 37,900 | | | | 1,157,466 |

Charles River Laboratories International, Inc.* | | 12,400 | | | | 640,088 |

Coventry Health Care, Inc.* | | 18,425 | | | | 1,062,201 |

CR Bard, Inc. | | 2,200 | 2 | | | 181,786 |

Health Net, Inc.* | | 18,900 | | | | 997,920 |

Hillenbrand Industries, Inc. | | 11,100 | | | | 721,500 |

ImClone Systems, Inc.* | | 9,700 | | | | 342,992 |

Invitrogen Corp.* | | 1,900 | 2 | | | 140,125 |

Kinetic Concepts, Inc.* | | 7,900 | | | | 410,563 |

King Pharmaceuticals, Inc.* | | 26,100 | 2 | | | 534,006 |

Manor Care, Inc. | | 7,600 | | | | 496,204 |

Millennium Pharmaceuticals, Inc.* | | 43,500 | | | | 459,795 |

Pediatrix Medical Group, Inc.* | | 3,000 | | | | 165,450 |

Steris Corp. | | 9,400 | | | | 287,640 |

Techne Corp.* | | 14,800 | | | | 846,708 |

Universal Health Services, Inc., Class B | | 4,600 | | | | 282,900 |

The accompanying notes are an integral part of these financial statements.

7

Mid-Cap

Schedule of Portfolio Investments (continued)

| | | | | | | |

| | | Shares | | | Value | |

Health Care—10.0% (continued) | | | | | | | |

WellCare Health Plans, Inc.* | | 4,800 | | | $ | 434,448 | |

Total Health Care | | | | | | 9,161,792 | |

Industrials—16.5% | | | | | | | |

Acuity Brands, Inc. | | 8,000 | 2 | | | 482,240 | |

Belden CDT, Inc. | | 12,100 | | | | 669,735 | |

Continental Airlines, Inc.* | | 16,900 | | | | 572,403 | |

Cummins, Inc. | | 24,600 | | | | 2,489,767 | |

Deluxe Corp. | | 17,400 | 2 | | | 706,614 | |

Dun & Bradstreet Corp. | | 6,700 | | | | 689,966 | |

Equifax, Inc. | | 24,800 | 2 | | | 1,101,616 | |

Granite Construction, Inc. | | 11,300 | | | | 725,234 | |

IKON Office Solutions, Inc. | | 22,900 | 2 | | | 357,469 | |

Jacobs Engineering Group, Inc.* | | 8,500 | 2 | | | 488,835 | |

Korn/Ferry International* | | 9,800 | | | | 257,348 | |

Lennox International, Inc. | | 15,000 | | | | 513,450 | |

Manitowoc Co., The | | 5,400 | | | | 434,052 | |

Manpower, Inc. | | 9,200 | 2 | | | 848,608 | |

Precision Castparts Corp. | | 2,000 | | | | 242,720 | |

R.R. Donnelley & Sons Co. | | 6,000 | | | | 261,060 | |

Republic Services, Inc. | | 18,750 | | | | 574,500 | |

Rollins, Inc. | | 6,000 | | | | 136,620 | |

SPX Corp. | | 5,000 | | | | 439,050 | |

Teleflex, Inc. | | 3,700 | | | | 302,586 | |

Terex Corp.* | | 21,600 | | | | 1,756,080 | |

US Airways Group, Inc.* | | 25,200 | 2 | | | 762,804 | |

YRC Worldwide, Inc.* | | 7,100 | | | | 261,280 | |

Total Industrials | | | | | | 15,074,037 | |

Information Technology—13.1% | | | | | | | |

Avnet, Inc.* | | 28,900 | 2 | | | 1,145,596 | |

BMC Software, Inc.* | | 24,900 | | | | 754,470 | |

Cadence Design Systems, Inc.* | | 16,000 | | | | 351,360 | |

CommScope, Inc.* | | 11,700 | | | | 682,695 | |

Compuware Corp.* | | 26,000 | | | | 308,360 | |

CSG Systems International, Inc.* | | 13,200 | | | | 349,932 | |

Factset Research Systems, Inc. | | 11,350 | | | | 775,772 | |

Gartner, Inc.* | | 21,600 | 2 | | | 531,144 | |

Ingram Micro, Inc., Class A* | | 46,800 | | | | 1,016,028 | |

International Rectifier Corp* | | 19,400 | 2 | | | 722,844 | |

Intersil Corp., Class A | | 37,300 | | | | 1,173,458 | |

Lexmark International, Inc.* | | 6,200 | | | | 305,722 | |

McAfee, Inc.* | | 24,900 | | | | 876,480 | |

Polycom, Inc.* | | 28,900 | | | | 971,040 | |

Semtech Corp.* | | 31,500 | | | | 545,895 | |

Teradyne, Inc.* | | 19,800 | 2 | | | 348,084 | |

Vishay Intertechnology, Inc.* | | 48,600 | | | | 768,852 | |

Western Digital Corp.* | | 17,700 | 2 | | | 342,495 | |

Total Information Technology | | | | | | 11,970,227 | |

Materials—6.1% | | | | | | | |

Ashland, Inc. | | 11,900 | | | | 761,005 | |

Celanese Corp. | | 26,300 | | | | 1,019,914 | |

CF Industries Holdings, Inc. | | 16,100 | | | | 964,229 | |

Chaparral Steel Co. | | 19,200 | | | | 1,379,904 | |

Lubrizol Corp. | | 2,600 | | | | 167,830 | |

Olin Corp. | | 29,800 | 2 | | | 625,800 | |

Pactiv Corp.* | | 6,100 | | | | 194,529 | |

Sonoco Products Co. | | 10,300 | | | | 440,943 | |

Total Materials | | | | | | 5,554,154 | |

Telecommunication Services—0.8% | | | | | | | |

Centurytel, Inc. | | 11,300 | 2 | | | 554,265 | |

Telephone & Data Systems, Inc. | | 2,200 | | | | 137,654 | |

Total Telecommunication Services | | | | | | 691,919 | |

Utilities—7.3% | | | | | | | |

Alliant Energy Corp. | | 38,600 | | | | 1,499,610 | |

Energy East Corp | | 17,200 | | | | 448,748 | |

MDU Resources Group, Inc. | | 42,950 | 2 | | | 1,204,318 | |

Nicor, Inc. | | 6,700 | | | | 287,564 | |

OGE Energy Corp. | | 34,100 | | | | 1,249,765 | |

Oneok, Inc. | | 9,900 | | | | 499,059 | |

Reliant Resources, Inc.* | | 38,400 | | | | 1,034,880 | |

WGL Holdings, Inc. | | 14,600 | 2 | | | 476,544 | |

Total Utilities | | | | | | 6,700,488 | |

Total Common Stocks (cost $78,203,600) | | | | | | 90,194,262 | |

Other Investment Companies—23.2%1 | | | | | | | |

Bank of New York Institutional Cash Reserves Fund, 5.33%3 | | 19,577,790 | | | | 19,577,790 | |

JPMorgan Prime Money Market Fund, Institutional Class Shares, 5.19% | | 1,668,215 | | | | 1,668,215 | |

Total Other Investment Companies (cost $21,246,005) | | | | | | 21,246,005 | |

Total Investments—121.8% (cost $99,449,605) | | | | | | 111,440,267 | |

Other Assets, less Liabilities—(21.8)% | | | | | | (19,942,947 | ) |

Net Assets—100% | | | | | $ | 91,497,320 | |

The accompanying notes are an integral part of these financial statements.

8

Balanced

Fund Snapshots

June 30, 2007 (unaudited)

Portfolio Breakdown

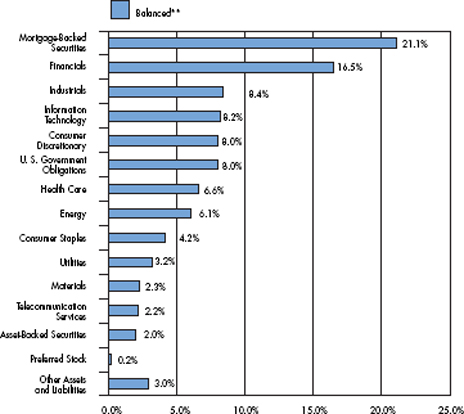

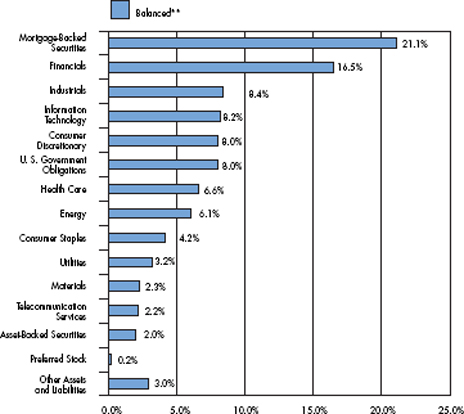

| | | | | |

| | Industry | | Balanced** | |

| | Mortgage-Backed Securities | | 21.1 | % |

| | Financials | | 16.5 | % |

| | Industrials | | 8.4 | % |

| | Information Technology | | 8.2 | % |

| | Consumer Discretionary | | 8.0 | % |

| | U. S. Government Obligations | | 8.0 | % |

| | Health Care | | 6.6 | % |

| | Energy | | 6.1 | % |

| | Consumer Staples | | 4.2 | % |

| | Utilities | | 3.2 | % |

| | Materials | | 2.3 | % |

| | Telecommunication Services | | 2.2 | % |

| | Asset-Backed Securities | | 2.0 | % |

| | Preferred Stock | | 0.2 | % |

| | Other Assets and Liabilities | | 3.0 | % |

| ** | As a percentage of net assets |

Top Ten Holdings

| | | |

Top Ten Holdings | | % of

Net Assets | |

FNMA, 5.000%, 02/01/22 to 06/01/37 | | 4.8 | % |

FNMA, 5.500%, 02/01/22 to 06/01/37 | | 4.8 | |

FNMA, 6.000%, 03/01/12 to 04/01/37 | | 3.4 | |

FNMA, 4.500%, 07/01/18 to 09/01/35 | | 3.0 | |

USTB, 5.250%, 11/15/28 | | 2.5 | |

AT&T, Inc. | | 2.2 | |

FNMA, 5.375%, 11/15/11 | | 2.1 | |

Bank of America Corp.* | | 1.9 | |

JPMorgan Chase & Co.* | | 1.9 | |

Johnson & Johnson Co.* | | 1.7 | |

| | | |

Top Ten as a Group | | 28.3 | % |

| | | |

| * | Top Ten Holding at December 31, 2006 |

Any sectors, industries, or securities discussed should not be perceived as investment recommendations. Mention of a specific security should not be considered a recommendation to buy or solicitation to sell that security.

9

Balanced

Schedule of Portfolio Investments

June 30, 2007 (unaudited)

| | | | | | |

Security Description | | Shares | | | Value |

Common Stocks—58.4% | | | | | | |

Consumer Discretionary—8.0% | | | | | | |

CBS Corp., Class B | | 6,300 | 2 | | $ | 209,916 |

Citadel Broadcasting Corp. | | 176 | 2 | | | 1,135 |

Expedia, Inc.* | | 1,000 | 2 | | | 29,290 |

Family Dollar Stores, Inc. | | 2,700 | | | | 92,664 |

Goodyear Tire & Rubber Co.* | | 700 | 2 | | | 24,332 |

IAC/InterActive Corp.* | | 4,600 | | | | 159,206 |

ITT Educational Services, Inc.* | | 200 | | | | 23,476 |

J.C. Penney Co., Inc. | | 1,200 | 2 | | | 86,856 |

Kohl’s Corp.* | | 700 | | | | 49,721 |

Mattel, Inc. | | 1,500 | | | | 37,935 |

McDonald’s Corp. | | 5,100 | | | | 258,876 |

McGraw-Hill Companies, Inc., The | | 600 | 2 | | | 40,848 |

Nike, Inc. | | 400 | | | | 23,316 |

Omnicom Group, Inc. | | 3,200 | | | | 169,344 |

RadioShack Corp. | | 7,900 | 2 | | | 261,806 |

Ross Stores, Inc. | | 2,400 | | | | 73,920 |

Sherwin-Williams Co., The | | 2,100 | | | | 139,587 |

Walt Disney Co., The | | 2,100 | | | | 71,694 |

Total Consumer Discretionary | | | | | | 1,753,922 |

Consumer Staples—4.2% | | | | | | |

Altria Group, Inc. | | 2,020 | | | | 141,683 |

Avon Products, Inc. | | 3,100 | | | | 113,925 |

Kraft Foods, Inc. | | 4,836 | 2 | | | 170,469 |

Kroger Co. | | 6,200 | | | | 174,406 |

PepsiCo, Inc. | | 3,200 | | | | 207,520 |

Procter & Gamble Co. | | 2,112 | | | | 129,233 |

Total Consumer Staples | | | | | | 937,236 |

Energy—6.1% | | | | | | |

ConocoPhillips Co. | | 1,000 | | | | 78,500 |

Devon Energy Corp. | | 1,200 | | | | 93,948 |

Exxon Mobil Corp. | | 3,820 | | | | 320,422 |

Global Industries, Ltd.* | | 1,500 | | | | 40,230 |

Marathon Oil Corp. | | 4,700 | | | | 281,812 |

Overseas Shipholding Group, Inc. | | 800 | 2 | | | 65,120 |

Tesoro Corp. | | 2,800 | 2 | | | 160,020 |

Tidewater, Inc. | | 3,900 | 2 | | | 276,432 |

Valero Energy Corp. | | 400 | | | | 29,544 |

Total Energy | | | | | | 1,346,028 |

Financials—12.0% | | | | | | |

Assurant, Inc. | | 1,900 | | | | 111,948 |

Bank of America Corp. | | 8,600 | | | | 420,454 |

The accompanying notes are an integral part of these financial statements.

10

Balanced

Schedule of Portfolio Investments (continued)

| | | | | | |

Security Description | | Shares | | | Value |

Financials—12.0% (continued) | | | | | | |

CBL & Associates Properties, Inc. | | 3,700 | 2 | | $ | 133,385 |

Chubb Corp. | | 3,800 | | | | 205,732 |

Citigroup, Inc. | | 2,300 | | | | 117,967 |

Goldman Sachs Group, Inc. | | 1,650 | 2 | | | 357,637 |

Hospitality Properties Trust | | 1,000 | 2 | | | 41,490 |

JPMorgan Chase & Co. | | 8,448 | | | | 409,306 |

Lehman Brothers Holdings, Inc. | | 400 | 2 | | | 29,808 |

Loews Corp. | | 1,000 | | | | 50,980 |

Merrill Lynch & Co., Inc. | | 2,600 | | | | 217,308 |

PMI Group, Inc. | | 2,600 | 2 | | | 116,142 |

Radian Group, Inc. | | 900 | 2 | | | 48,600 |

SunTrust Banks, Inc. | | 1,800 | | | | 154,332 |

Travelers Companies, Inc., The | | 4,100 | | | | 219,350 |

Total Financials | | | | | | 2,634,439 |

Health Care—6.6% | | | | | | |

AmerisourceBergen Corp. | | 2,200 | 2 | | | 108,834 |

Baxter International, Inc. | | 1,500 | | | | 84,510 |

Biogen Idec, Inc.* | | 3,200 | | | | 171,200 |

CIGNA Corp. | | 4,500 | | | | 234,990 |

Johnson & Johnson Co. | | 6,180 | | | | 380,812 |

McKesson Corp. | | 4,500 | | | | 268,380 |

Medco Health Solutions, Inc.* | | 800 | | | | 62,392 |

Pfizer, Inc. | | 5,540 | | | | 141,658 |

Total Health Care | | | | | | 1,452,776 |

Industrials—6.3% | | | | | | |

American Standard Companies, Inc. | | 800 | | | | 47,184 |

Continental Airlines, Inc.* | | 3,800 | | | | 128,706 |

Con-Way, Inc. | | 1,000 | 2 | | | 50,240 |

CSX Corp. | | 800 | | | | 36,064 |

Cummins, Inc. | | 2,450 | | | | 247,964 |

Dun & Bradstreet Corp. | | 700 | | | | 72,086 |

Emerson Electric Co. | | 4,100 | | | | 191,880 |

General Electric Co. | | 3,800 | | | | 145,464 |

Manpower, Inc. | | 600 | 2 | | | 55,344 |

Northrop Grumman Corp. | | 3,100 | | | | 241,397 |

Terex Corp.* | | 600 | | | | 48,780 |

Textron, Inc. | | 1,200 | | | | 132,132 |

Total Industrials | | | | | | 1,397,241 |

Information Technology—8.2% | | | | | | |

Applied Materials, Inc. | | 1,000 | 2 | | | 19,870 |

Avnet, Inc.* | | 1,900 | 2 | | | 75,316 |

BEA Systems, Inc.* | | 2,300 | 2 | | | 31,487 |

The accompanying notes are an integral part of these financial statements.

11

Balanced

Schedule of Portfolio Investments (continued)

| | | | | | | |

Security Description | | Shares | | | Value |

Information Technology—8.2% (continued) | | | | | | | |

BMC Software, Inc.* | | | 1,400 | | | $ | 42,420 |

Cisco Systems, Inc.* | | | 9,240 | | | | 257,334 |

CommScope, Inc.* | | | 1,000 | | | | 58,350 |

Computer Sciences Corp.* | | | 2,000 | | | | 118,300 |

Hewlett-Packard Co. | | | 8,000 | | | | 356,960 |

International Business Machines Corp. | | | 1,400 | 2 | | | 147,350 |

International Rectifier Corp.* | | | 3,100 | 2 | | | 115,506 |

Intersil Corp., Class A | | | 700 | 2 | | | 22,022 |

LSI Logic Corp.* | | | 2,100 | 2 | | | 15,771 |

Mastercard, Inc. | | | 200 | | | | 33,174 |

McAfee, Inc.* | | | 1,800 | | | | 63,360 |

Microsoft Corp. | | | 9,500 | | | | 279,965 |

Nvidia Corp.* | | | 3,200 | | | | 132,192 |

Vishay Intertechnology, Inc.* | | | 1,700 | | | | 26,894 |

Total Information Technology | | | | | | | 1,796,271 |

Materials—2.3% | | | | | | | |

Celanese Corp. | | | 6,100 | | | | 236,558 |

International Paper Co. | | | 1,000 | | | | 39,050 |

Lubrizol Corp. | | | 700 | | | | 45,185 |

Nucor Corp. | | | 1,200 | 2 | | | 70,380 |

Pactiv Corp.* | | | 1,400 | 2 | | | 44,646 |

United States Steel Corp. | | | 700 | 2 | | | 76,125 |

Total Materials | | | | | | | 511,944 |

Telecommunication Services—2.2% | | | | | | | |

AT&T, Inc. | | | 11,770 | | | | 488,455 |

Utilities—2.5% | | | | | | | |

Constellation Energy Group, Inc. | | | 2,300 | 2 | | | 200,491 |

Edison International | | | 3,700 | 2 | | | 207,644 |

Northeast Utilities | | | 2,200 | | | | 62,392 |

Reliant Resources, Inc.* | | | 900 | | | | 24,255 |

Sempra Energy | | | 1,100 | 2 | | | 65,153 |

Total Utilities | | | | | | | 559,935 |

Total Common Stocks (cost $10,673,818) | | | | | | | 12,878,247 |

| | |

| | | Principal

Amount | | | |

Mortgage-Backed Securities—21.1% | | | | | | | |

Bank of America Corp., 4.875%, 06/10/39 | | $ | 100,000 | | | | 98,615 |

FHLMC, 5.000%, 12/15/22 | | | 188,691 | | | | 185,537 |

FNMA, 3.500%, 10/01/10 | | | 94,846 | | | | 90,852 |

FNMA, 4.000%, 10/01/20 to 12/01/21 | | | 83,634 | | | | 77,403 |

FNMA, 4.375%, 04/15/15 | | | 62,013 | | | | 60,278 |

FNMA, 4.500%, 07/01/18 to 09/01/35 | | | 704,862 | | | | 658,504 |

FNMA, 5.000%, 02/01/22 to 06/01/37 | | | 1,122,212 | | | | 1,065,093 |

FNMA, 5.500%, 02/01/22 to 06/01/37 | | | 1,086,678 | | | | 1,052,926 |

The accompanying notes are an integral part of these financial statements.

12

Balanced

Schedule of Portfolio Investments (continued)

| | | | | | | |

Security Description | | Principal

Amount | | | Value |

Mortgage-Backed Securities—21.1% (continued) | | | | | | | |

FNMA, 6.000%, 03/01/12 to 04/01/37 | | $ | 744,305 | | | $ | 737,845 |

FNMA, 6.500%, 11/01/36 to 12/01/36 | | | 359,621 | | | | 363,174 |

GE Capital Commercial Mortgage Corp., 4.970%, 08/11/36 | | | 42,425 | | | | 41,991 |

Greenwich Capital Commercial Funding Corp., Series 2005-GG5, Class A2, 5.117%, 04/10/37 | | | 90,000 | | | | 89,057 |

GS Mortgage Securities Corp. II Series 2005-GG4, 4.751%, 07/10/39 | | | 50,000 | | | | 46,767 |

Morgan Stanley Capital I, Series 2005-T19, 4.890%, 06/12/47 | | | 75,000 | | | | 70,664 |

Total Mortgage-Backed Securities (cost $4,719,991) | | | | | | | 4,638,706 |

U.S. Government and Agency Obligations—8.0% | | | | | | | |

FHLB, 3.875%, 01/15/10 | | | 150,000 | 2 | | | 145,453 |

FHLMC, 5.625%, 03/15/11 | | | 300,000 | | | | 304,259 |

FNMA, 4.250%, 08/15/10 | | | 300,000 | 2 | | | 292,085 |

FNMA, 5.375%, 11/15/11 | | | 450,000 | 2 | | | 452,702 |

USTB, 5.250%, 11/15/28 | | | 555,000 | 2 | | | 558,989 |

Total U.S. Government and Agency Obligations (cost $1,769,212) | | | | | | | 1,753,488 |

Corporate Bonds—7.3% | | | | | | | |

Finance—4.5% | | | | | | | |

Allstate Corp., The, 7.200%, 12/01/09 | | | 75,000 | | | | 77,981 |

American International Group, Inc., 6.250%, 05/01/36 (a) | | | 35,000 | | | | 35,442 |

Bank of America Corp., 5.625%, 10/14/16 | | | 95,000 | | | | 93,686 |

Berkshire Hathaway Finance Corp., 4.850%, 01/15/15 | | | 150,000 | | | | 142,722 |

Citigroup, Inc., 6.500%, 01/18/11 | | | 95,000 | | | | 98,048 |

JPMorgan Chase & Co., 4.750%, 03/01/15 | | | 95,000 | | | | 88,848 |

Marshall & Ilsley Corp., 4.375%, 08/01/09 | | | 75,000 | | | | 73,713 |

Travelers Companies, Inc. (The), 5.375%, 06/15/12 | | | 95,000 | | | | 94,065 |

U.S. Bank NA, 4.950%, 10/30/14 | | | 95,000 | | | | 90,857 |

Wachovia Corp., 5.300%, 10/15/11 | | | 95,000 | | | | 94,105 |

Wells Fargo Co., 4.200%, 01/15/10 | | | 95,000 | | | | 92,649 |

Total Finance | | | | | | | 982,116 |

Industrials—2.1% | | | | | | | |

Bellsouth Capital Funding Corp., 7.750%, 02/15/10 | | | 75,000 | | | | 79,050 |

IBM Corp., 4.750%, 11/29/12 | | | 95,000 | | | | 91,935 |

Lockheed Martin Corp., 7.650%, 05/01/16 | | | 75,000 | | | | 84,594 |

Merck & Co., Inc., 4.750%, 03/01/15 | | | 90,000 | | | | 84,808 |

Wal-Mart Stores, Inc., 5.250%, 09/01/35 | | | 40,000 | | | | 35,086 |

Walt Disney Co., The, 6.375%, 03/01/12 | | | 95,000 | | | | 98,503 |

Total Industrials | | | | | | | 473,976 |

Utilities—0.7% | | | | | | | |

Consolidated Edison, Inc., 5.375%, 12/15/15 | | | 75,000 | 2 | | | 72,844 |

Florida Power & Light Co., 4.850%, 02/01/13 | | | 95,000 | | | | 91,362 |

Total Utilities | | | | | | | 164,206 |

Total Corporate Bonds (cost $1,634,670) | | | | | | | 1,620,298 |

The accompanying notes are an integral part of these financial statements.

13

Balanced

Schedule of Portfolio Investments (continued)

| | | | | | | | |

Security Description | | Principal

Amount | | | Value | |

Asset-Backed Securities—2.0% | | | | | | | | |

Capital One Multi-Asset Execution Trust, 5.300%, 02/18/14 | | $ | 150,000 | 2 | | $ | 149,702 | |

Harley-Davidson Motorcycle Trust, 5.350%, 03/15/13 | | | 185,000 | | | | 185,209 | |

John Deere Corp., 5.070%, 04/15/14 | | | 100,000 | | | | 98,905 | |

Total Asset-Backed Securities (cost $436,477) | | | | | | | 433,816 | |

| | |

| | | Shares | | | | |

Preferred Stock—0.2% | | | | | | | | |

Newell Financial Trust I, 5.250% (cost $39,878) | | | 925 | | | | 45,788 | |

Other Investment Companies—21.2%1 | | | | | | | | |

Bank of New York Institutional Cash Reserves Fund, 5.33%3 | | | 4,074,205 | | | | 4,074,205 | |

JPMorgan Prime Money Market Fund, Institutional Class Shares, 5.19% | | | 597,731 | | | | 597,731 | |

Total Other Investment Companies (cost $4,671,936) | | | | | | | 4,671,936 | |

Total Investments—118.2% (cost $23,945,982) | | | | | | | 26,042,279 | |

Other Assets, less Liabilities—(18.2)% | | | | | | | (4,018,971 | ) |

Net Assets—100% | | | | | | $ | 22,023,308 | |

The accompanying notes are an integral part of these financial statements.

14

High Yield

Fund Snapshots

June 30, 2007 (unaudited)

Portfolio Breakdown

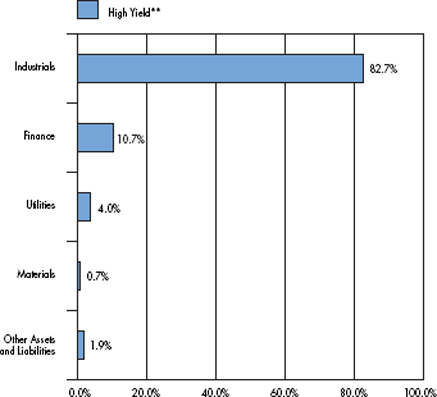

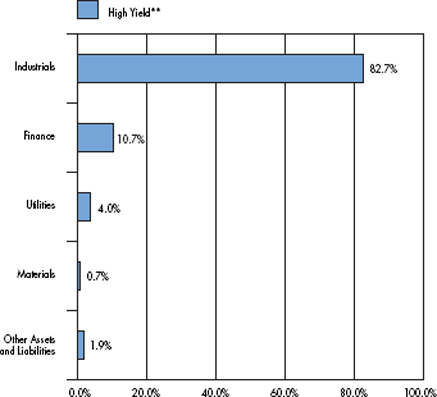

| | | | | |

| | Industry | | High Yield** | |

| | Industrials | | 82.7 | % |

| | Finance | | 10.7 | % |

| | Utilities | | 4.0 | % |

| | Materials | | 0.7 | % |

| | Other Assets and Liabilities | | 1.9 | % |

| ** | As a percentage of net assets |

Top Ten Holdings

| | | |

Top Ten Holdings | | % of

Net Assets | |

General Motors Acceptance Corp., 6.875%, 08/28/12* | | 1.8 | % |

DirecTV Holdings LLC, 6.375%, 06/15/15* | | 1.6 | |

Dex Media, Inc., 7.754%, 11/15/13* | | 1.4 | |

EchoStar Communications Corp., 7.125%, 02/01/16* | | 1.3 | |

Visant Holding Corp., 9.071%, 12/01/13* | | 1.3 | |

Arch Western Finance, LLC, 6.750%, 07/01/13* | | 1.3 | |

HCA, Inc., 9.250%, 11/15/16* | | 1.3 | |

Playtex Products, Inc., 9.375%, 06/01/11 | | 1.2 | |

HCA, Inc., 9.625%, 11/15/16 | | 1.1 | |

MetroPCS Wireless, Inc., 9.250%, 11/01/14 | | 1.1 | |

| | | |

Top Ten as a Group | | 13.4 | % |

| | | |

| * | Top Ten Holding at December 31, 2006 |

Any sectors, industries, or securities discussed should not be perceived as investment recommendations. Mention of a specific security should not be considered a recommendation to buy or solicitation to sell that security.

15

High Yield

Schedule of Portfolio Investments

June 30, 2007 (unaudited)

| | | | | | | |

Security Description | | Principal

Amount | | | Value |

Corporate Bonds—97.4% | | | | | | | |

Finance—10.7% | | | | | | | |

AAC Group Holding Corp., 9.669%, 10/01/12 (b) 4 | | $ | 140,000 | 2 | | $ | 126,700 |

Arch Western Finance, LLC, 6.750%, 07/01/13 | | | 610,000 | | | | 588,650 |

Consolidated Communications Holdings, Inc., 9.750%, 04/01/12 | | | 384,000 | | | | 404,160 |

Dresser, Inc., 1st Lien Term Loan, 5.385%, 05/04/14 | | | 100,000 | | | | 100,552 |

Dresser, Inc., 2nd Lien Term Loan, 6.110%, 05/04/15 | | | 100,000 | | | | 101,463 |

Ford Motor Credit Co., | | | | | | | |

6.930%, 01/15/10, (10/15/07) 5 | | | 320,000 | | | | 315,964 |

7.000%, 10/01/13 | | | 400,000 | | | | 371,053 |

7.800%, 06/01/12 | | | 215,000 | | | | 209,948 |

8.000%, 12/15/16 | | | 280,000 | | | | 268,631 |

General Motors Acceptance Corp., 6.875%, 08/28/12 | | | 845,000 | | | | 826,717 |

GMAC, | | | | | | | |

6.625%, 05/15/12 | | | 175,000 | | | | 169,166 |

6.750%, 12/01/14 | | | 25,000 | 2 | | | 23,976 |

Hawker Beechcraft Acquisition Co., 8.500%, 04/01/15 (a) | | | 40,000 | | | | 41,400 |

Idearc, Inc., 8.000%, 11/15/16 | | | 180,000 | | | | 182,700 |

KAR Holdings, Inc., 8.750%, 05/01/14 (a) | | | 115,000 | | | | 113,275 |

Petroplus Finance Ltd., | | | | | | | |

6.750%, 05/01/14 (a) | | | 75,000 | 2 | | | 72,562 |

7.000%, 05/01/17 (a) | | | 85,000 | | | | 82,238 |

Pilgrim’s Pride Corp., 7.625%, 05/01/15 | | | 65,000 | | | | 65,162 |

Rainbow National Services LLC, 8.750%, 09/01/12 (a) | | | 100,000 | | | | 104,500 |

Sally Holdings LLC, | | | | | | | |

9.250%, 11/15/14 (a) | | | 225,000 | 2 | | | 226,688 |

10.500%, 11/15/16 (a) | | | 30,000 | | | | 30,300 |

Simmons Holdco., Inc. 5.398%, 02/15/12, (08/15/07) 5,6 | | | 120,000 | | | | 118,300 |

UCI Holdco, Inc., 12.360%, 12/15/13, (09/17/07) (a) 5 | | | 111,402 | | | | 113,630 |

Wind Acquisition Loan, 12.620%, 12/07/11 6 | | | 207,313 | | | | 213,273 |

Total Finance | | | | | | | 4,871,008 |

Industrials—82.7% | | | | | | | |

Acco Brands Corp., 7.625%, 08/15/15 | | | 480,000 | | | | 474,000 |

Actuant Corp., 6.875%, 06/15/17 (a) | | | 80,000 | | | | 79,600 |

Advanced Micro Devices, Inc., 7.750%, 11/01/12 | | | 170,000 | 2 | | | 160,650 |

Alliance Laundry Corp., 8.500%, 01/15/13 | | | 235,000 | | | | 234,412 |

Allied Waste North America, Inc., | | | | | | | |

7.250%, 03/15/15 | | | 165,000 | 2 | | | 164,175 |

7.375%, 04/15/14 | | | 245,000 | 2 | | | 243,162 |

Ames True Temper, Inc., | | | | | | | |

9.360%, 01/15/12, (10/15/07) 5 | | | 240,000 | | | | 243,000 |

10.000%, 07/15/12 | | | 150,000 | 2 | | | 142,500 |

ArvinMeritor, Inc., 8.750%, 03/01/12 | | | 235,000 | 2 | | | 238,525 |

The accompanying notes are an integral part of these financial statements.

16

High Yield

Schedule of Portfolio Investments (continued)

| | | | | | | |

Security Description | | Principal

Amount | | | Value |

Industrials—82.7% (continued) | | | | | | | |

Ashtead Capital, Inc., 9.000%, 08/15/16 (a) | | $ | 170,000 | | | $ | 178,925 |

Axtel SAB de CV, 7.625%, 02/01/17 (a) | | | 255,000 | | | | 253,089 |

Beazer Homes USA, | | | | | | | |

6.500%, 11/15/13 | | | 165,000 | 2 | | | 142,725 |

8.375%, 04/15/12 | | | 180,000 | | | | 171,000 |

8.675%, 05/15/11 | | | 40,000 | | | | 38,600 |

Bristow Group, Inc., 7.500%, 09/15/17 (a) | | | 80,000 | | | | 80,600 |

Brookstone Co., Inc., 12.000%, 10/15/12 | | | 200,000 | 2 | | | 206,000 |

CCO Holdings LLC, 8.750%, 11/15/13 | | | 315,000 | | | | 322,088 |

Charter Communications, Inc., 11.000%, 10/01/15 | | | 355,000 | | | | 372,306 |

Chesapeake Energy Corp., | | | | | | | |

6.500%, 08/15/17 | | | 80,000 | | | | 76,200 |

7.000%, 08/15/14 | | | 275,000 | | | | 274,312 |

Citizens Communications Co., 6.625%, 03/15/15 | | | 50,000 | | | | 47,750 |

Claire’s Stores, Inc., 9.625%, 06/01/15 (a) | | | 205,000 | 2 | | | 190,650 |

Clarke American Corp., | | | | | | | |

9.500%, 05/15/15 (a) | | | 25,000 | | | | 24,062 |

10.106%, 05/15/15, (08/15/07) (a) 5 | | | 25,000 | 2 | | | 24,188 |

Community Health Systems, 8.875%, 07/15/15 (a) | | | 145,000 | | | | 147,719 |

Constellation Brands, Inc., 7.125%, 09/01/16 | | | 460,000 | | | | 450,800 |

The Cooper Companies, Inc., 7.125%, 02/15/15 (a) | | | 140,000 | | | | 139,300 |

Corrections Corp. of America, 6.250%, 03/15/13 | | | 160,000 | | | | 154,400 |

Cricket Communications I, 9.375%, 11/01/14 | | | 415,000 | | | | 430,562 |

Crown Americas LLC, 7.750%, 11/15/15 | | | 120,000 | | | | 121,200 |

Del Laboratories, Inc., | | | | | | | |

8.000%, 02/01/12 | | | 270,000 | 2 | | | 260,550 |

10.356%, 11/01/11, (08/01/07) 5 | | | 145,000 | | | | 149,350 |

Del Monte Corp., 6.750%, 02/15/15 | | | 145,000 | | | | 138,838 |

Denbury Resources, Inc., 7.500%, 04/01/13 | | | 370,000 | | | | 371,850 |

Dex Media East, LLC, 12.125%, 11/15/12 | | | 125,000 | | | | 134,844 |

Dex Media West LLC, 9.875%, 08/15/13 | | | 60,000 | | | | 64,500 |

Dex Media, Inc., 7.754%, 11/15/13 (b) 4 | | | 670,000 | | | | 633,989 |

Digicel Group, Ltd., | | | | | | | |

8.875%, 01/15/15 (a) | | | 100,000 | 2 | | | 98,250 |

9.125%, 01/15/15 (a) | | | 100,000 | 2 | | | 98,875 |

9.250%, 09/01/12 (a) | | | 250,000 | | | | 264,688 |

DirecTV Holdings LLC, | | | | | | | |

6.375%, 06/15/15 | | | 780,000 | | | | 735,150 |

8.375%, 03/15/13 | | | 30,000 | | | | 31,538 |

Dobson Cellular Systems, Inc., 9.875%, 11/01/12 | | | 115,000 | | | | 124,488 |

Dobson Communications Corp., | | | | | | | |

8.875%, 10/01/13 | | | 220,000 | 2 | | | 231,000 |

9.610%,10/15/12, (10/15/07) 5 | | | 235,000 | | | | 240,875 |

The accompanying notes are an integral part of these financial statements.

17

High Yield

Schedule of Portfolio Investments (continued)

| | | | | | | |

Security Description | | Principal

Amount | | | Value |

Industrials—82.7% (continued) | | | | | | | |

EchoStar Communications Corp., 7.125%, 02/01/16 | | $ | 615,000 | | | $ | 604,238 |

El Paso Corp., 7.000%, 06/15/17 | | | 200,000 | | | | 198,809 |

Energy XXI Gulf Coast Inc., 10.000%, 06/15/13 (a) | | | 115,000 | | | | 112,412 |

Esco Corp, 8.625%, 12/15/13 (a) | | | 140,000 | | | | 147,700 |

Flextronics International Ltd., 1.000%, 08/01/10 | | | 225,000 | | | | 210,375 |

FMC Finance III SA, 6.875%, 07/15/17 (a) | | | 150,000 | | | | 147,750 |

FMG Finance Pty, Ltd., 10.625%, 09/01/16 (a) | | | 225,000 | | | | 268,875 |

Ford Motor Co., 6.500%, 08/01/18 | | | 255,000 | 2 | | | 207,825 |

Forest Oil Corp., 7.250%, 06/15/19 (a) | | | 70,000 | | | | 68,250 |

Freescale Semiconductor, | | | | | | | |

9.125%, 12/15/14 (a) | | | 320,000 | | | | 302,400 |

10.125%, 12/15/16 (a) | | | 100,000 | 2 | | | 94,500 |

Fresenius Medical Care Capital Trust II, 7.875%, 02/01/08 | | | 220,000 | | | | 221,650 |

Fresenius Medical Core Capital Trust IV, 7.875%, 06/15/11 (a) | | | 120,000 | | | | 124,800 |

Frigstad Discoverer Invest, Ltd., 11.500%, 02/21/12 (a) | | | 100,000 | | | | 101,343 |

General Cable Corp., 7.125%, 04/01/17 (a) | | | 60,000 | 2 | | | 59,700 |

General Motors Corp., | | | | | | | |

7.125%, 07/15/13 | | | 225,000 | 2 | | | 211,781 |

8.375%, 07/15/33 | | | 235,000 | 2 | | | 215,612 |

Georgia-Pacifi c Corp., | | | | | | | |

7.000%, 01/15/15 (a) | | | 140,000 | | | | 135,450 |

7.125%, 01/15/17 (a) | | | 100,000 | | | | 96,500 |

7.700%, 06/15/15 | | | 325,000 | | | | 323,375 |

Goodman Global Holdings Co., Inc., 7.875%, 12/15/12 | | | 135,000 | 2 | | | 134,325 |

Goodyear Tire & Rubber Co., 8.625%, 12/01/11 (a) | | | 83,000 | | | | 87,772 |

Graham Packaging Co., L.P., 9.875%, 10/15/14 | | | 375,000 | 2 | | | 381,094 |

Gregg Appliances Inc., 9.000%, 02/01/13 | | | 330,000 | | | | 353,100 |

Hanesbrands, Inc., 8.784%, 12/15/14, (12/17/07) 5 | | | 295,000 | 2 | | | 300,900 |

Hanover Compressor Co., 9.000%, 06/01/14 | | | 140,000 | | | | 148,750 |

HCA, Inc., | | | | | | | |

8.750%, 09/01/10 | | | 35,000 | | | | 36,619 |

9.250%, 11/15/16 (a) | | | 550,000 | | | | 587,125 |

9.625%, 11/15/16 (a) | | | 480,000 | | | | 517,200 |

Host Marriott LP, 6.750%, 06/01/16 | | | 335,000 | | | | 329,975 |

Huntsman International LLC, 7.875%, 11/15/14 | | | 155,000 | 2 | | | 166,819 |

Ineos Group Holdings PLC, 8.500%, 02/15/16 (a) | | | 365,000 | 2 | |

|

358,612 |

Insight Communications Co., Inc., 12.250%, 02/15/11 (b) | | | 10,000 | | | | 10,475 |

Intelsat Bermuda, Ltd., | | | | | | | |

8.886%, 01/15/15, (01/15/08) 5 | | | 150,000 | | | | 153,938 |

11.250%, 06/15/16 | | | 380,000 | | | | 427,500 |

Interline Brands Inc., 8.125%, 06/15/14 | | | 145,000 | | | | 146,812 |

The accompanying notes are an integral part of these financial statements.

18

High Yield

Schedule of Portfolio Investments (continued)

| | | | | | | |

Security Description | | Principal

Amount | | | Value |

Industrials—82.% (continued) | | | | | | | |

IPCS, Inc., | | | | | | | |

7.480%, 05/01/13, (08/01/07) 5 | | $ | 90,000 | | | $ | 90,562 |

8.605%, 05/01/14, (08/01/07) 5 | | | 145,000 | | | | 146,088 |

Iron Mountain Inc., | | | | | | | |

6.625%, 01/01/16 | | | 315,000 | | | | 290,588 |

7.750%, 01/15/15 | | | 175,000 | | | | 171,500 |

Jarden Corp., 7.500%, 05/01/17 | | | 325,000 | | | | 322,562 |

K. Hovnanian Enterprises, Inc., 8.625%, 01/15/17 | | | 250,000 | 2 | | | 241,250 |

L-3 Communications Corp., | | | | | | | |

5.875%, 01/15/15 | | | 265,000 | 2 | | | 247,112 |

6.125%, 07/15/13 | | | 50,000 | | | | 47,500 |

6.375%, 10/15/15 | | | 100,000 | | | | 95,000 |

Level 3 Financing, Inc., | | | | | | | |

8.750%, 02/15/17 (a) | | | 150,000 | 2 | | | 149,062 |

9.250%, 11/01/14 | | | 240,000 | 2 | | | 243,600 |

MetroPCS Wireless, Inc., 9.250%, 11/01/14 (a) | | | 500,000 | 2 | | | 518,750 |

MGM Mirage, Inc., | | | | | | | |

6.750%, 04/01/13 (a) | | | 305,000 | | | | 291,275 |

6.875%, 04/01/16 (a) | | | 155,000 | | | | 143,375 |

7.500%, 06/01/16 | | | 360,000 | | | | 343,350 |

Nalco Company, | | | | | | | |

7.750%, 11/15/11 | | | 185,000 | | | | 187,312 |

8.875%, 11/15/13 | | | 125,000 | | | | 130,312 |

Newfield Exploration Co., 6.625%, 04/15/16 | | | 215,000 | 2 | | | 208,012 |

Nexstar Finance Holdings, Inc., 9.791%, 04/01/13 (b) 4 | | | 200,000 | | | | 197,500 |

Nordic Telephone Co., 8.875%, 05/01/16 (a) | | | 315,000 | | | | 335,475 |

NXP BV, 9.500%, 10/15/15 | | | 505,000 | 2 | | | 499,950 |

Open Solutions, Inc., 9.750%, 02/01/15 (a) | | | 420,000 | | | | 426,300 |

OPTI Canada, Inc., | | | | | | | |

7.875%, 12/15/14 (a) | | | 90,000 | | | | 90,450 |

8.250%, 12/15/14 (a) | | | 155,000 | | | | 158,100 |

Owens-Brockway Glass Container, Inc., | | | | | | | |

6.750%, 12/01/14 | | | 65,000 | | | | 63,700 |

8.250%, 05/15/13 | | | 225,000 | | | | 234,000 |

P.H. Glatfelter, 7.125%, 05/01/16 | | | 215,000 | | | | 217,688 |

Packaging Dynamics, Inc., 10.000%, 05/11/16 (a) | | | 185,000 | | | | 185,925 |

Paetec Holding Corp., 9.500%, 07/15/15 (a) | | | 125,000 | | | | 125,000 |

Penhall International, 12.000%, 08/01/14 (a) | | | 75,000 | | | | 81,375 |

Petrohawk Energy Corp., 9.125%, 07/15/13 | | | 225,000 | | | | 239,062 |

Petroprod Ltd., 10.850%, 05/24/13 (a) | | | 100,000 | | | | 102,250 |

Playtex Products, Inc., 9.375%, 06/01/11 | | | 535,000 | 2 | | | 552,388 |

PolyOne Corp., 8.875%, 05/01/12 | | | 400,000 | 2 | | | 399,000 |

The accompanying notes are an integral part of these financial statements.

19

High Yield

Schedule of Portfolio Investments (continued)

| | | | | | | |

Security Description | | Principal

Amount | | | Value |

Industrials—82.7% (continued) | | | | | | | |

Quebecor World, Inc., 8.750%, 03/15/16 (a) | | $ | 425,000 | | | $ | 420,750 |

Qwest Communications International, Inc., 8.860%, 02/15/09, (08/15/07) 5 | | | 400,000 | | | | 406,000 |

Qwest Corp., 7.500%, 10/01/14 | | | 105,000 | | | | 108,150 |

R.H. Donnelley Corp., 6.875%, 01/15/13 | | | 85,000 | | | | 80,962 |

R.H. Donnelley Financial Corp., 10.875%, 12/15/12 (a) | | | 290,000 | | | | 310,662 |

RBS Global & Rexnord Corp., 8.875%, 09/01/16 | | | 160,000 | 2 | | | 161,200 |

Reichhold Industries, Inc., 9.000%, 08/15/14 (a) | | | 175,000 | | | | 181,125 |

Rental Services Corp., 9.500%, 02/01/14 (a) | | | 145,000 | | | | 148,625 |

Rite Aid Escrow Corp., 9.500%, 06/15/17 (a) | | | 150,000 | | | | 144,750 |

Rockwood Specialties GRP., 7.500%, 11/15/14 | | | 155,000 | | | | 156,550 |

Rural Cellular Corp., | | | | | | | |

8.250%, 03/15/12 | | | 305,000 | | | | 313,388 |

8.360%, 06/01/13, (09/04/07) (a) 5 | | | 110,000 | | | | 110,000 |

Sealy Mattress Co., 8.250%, 06/15/04 | | | 360,000 | | | | 370,800 |

Select Medical Corp., 7.625%, 02/01/15 | | | 130,000 | 2 | | | 117,000 |

SemGroup LP, 8.750%, 11/15/15 (a) | | | 125,000 | 2 | | | 126,250 |

Sensata Technologies BV, 8.000%, 05/01/14 | | | 260,000 | | | | 252,200 |

Service Corp. International, | | | | | | | |

6.750%, 04/01/15 (a) | | | 125,000 | | | | 121,094 |

7.375%, 10/01/14 | | | 195,000 | | | | 196,950 |

Simmons Co., 10.000%, 12/15/14 (b) | | | 545,000 | | | | 460,525 |

Spectrum Brands, Inc., 7.375%, 02/01/15 | | | 245,000 | 2 | | | 198,144 |

Steinway Musical Instruments, Inc., 7.000%, 03/01/14 (a) | | | 275,000 | | | | 269,500 |

Sun Media Corp., 7.625%, 02/15/13 | | | 315,000 | | | | 318,150 |

Sungard Data Systems, Inc., 10.250%, 08/15/15 | | | 430,000 | 2 | | | 456,875 |

Sunstate Equipment Co., 10.500%, 04/01/13 (a) | | | 95,000 | | | | 98,325 |

Surgical Care Affiliates, Inc., 8.875%, 07/15/15 (a) | | | 100,000 | | | | 100,000 |

Tenet Healthcare Corp., 9.250%, 02/01/15 | | | 515,000 | | | | 491,825 |

Tenneco Automotive, Inc., 8.625%, 11/15/14 | | | 295,000 | 2 | | | 305,325 |

Terex Corp., 7.375%, 01/15/14 | | | 185,000 | | | | 185,925 |

Terra Capital, Inc., 7.000%, 02/01/17 | | | 400,000 | | | | 388,000 |

Titan International, Inc., 8.000%, 01/15/12 | | | 200,000 | | | | 206,500 |

Travelport LLC, | | | | | | | |

9.875%, 09/01/14 | | | 100,000 | | | | 106,500 |

9.985%, 09/01/14, (09/04/07) 5 | | | 65,000 | | | | 66,950 |

11.875%, 09/01/16 | | | 165,000 | 2 | | | 182,944 |

Triad Hospitals, Inc., 7.000%, 11/15/13 | | | 405,000 | | | | 426,748 |

TRW Automotive, Inc., | | | | | | | |

7.000%, 03/15/14 (a) | | | 150,000 | | | | 143,625 |

7.250%, 03/15/17 (a) | | | 250,000 | | | | 239,375 |

United Components, Inc., 9.375%, 06/15/13 | | | 60,000 | | | | 62,250 |

United Rentals (North America), Inc., 6.500%, 02/15/12 | | | 355,000 | | | | 350,562 |

The accompanying notes are an integral part of these financial statements.

20

High Yield

Schedule of Portfolio Investments (continued)

| | | | | | | | |

Security Description | | Principal

Amount | | | Value | |

Industrials—82.7% (continued) | | | | | | | | |

United Surgical Partners, | | | | | | | | |

8.875%, 05/01/17 (a) | | $ | 55,000 | 2 | | $ | 55,412 | |

9.250%, 05/01/17 (a) | | | 185,000 | | | | 186,388 | |

Vail Resorts, Inc., 6.750%, 02/15/14 | | | 325,000 | | | | 318,094 | |

Venoco, Inc., 8.750%, 12/15/11 (a) | | | 190,000 | | | | 197,125 | |

Videotron Ltee, 6.875%, 01/15/14 (a) | | | 148,000 | | | | 145,780 | |

Visant Holding Corp., 9.071%, 12/01/13 (b) 4 | | | 655,000 | | | | 604,238 | |

Vitro S.A., 9.125%, 02/01/17 (a) | | | 225,000 | | | | 231,750 | |

Warner Music Group, 7.375%, 04/15/14 | | | 230,000 | | | | 215,050 | |

West Corp., 9.500%, 10/15/14 | | | 430,000 | | | | 442,900 | |

Whiting Petroleum Corp. 7.000%, 02/01/14 | | | 110,000 | | | | 103,950 | |

Williams Partners L.P., 7.250%, 02/01/17 | | | 235,000 | | | | 237,350 | |

Wind Acquisition Fin SA, 10.750%, 12/01/15 (a) | | | 150,000 | | | | 172,875 | |

Windstream Corp, | | | | | | | | |

7.000%, 03/15/19 | | | 50,000 | | | | 48,000 | |

8.125%, 08/01/13 | | | 60,000 | | | | 63,000 | |

8.625%, 08/01/16 | | | 245,000 | | | | 260,312 | |

WMG Holdings Corp., 10.132%, 12/15/14 (b) 4 | | | 266,000 | | | | 203,490 | |

Total Industrials | | | | | | | 37,445,237 | |

Utilities—4.0% | | | | | | | | |

AES Corp., 8.875%, 2/15/11 | | | 230,000 | | | | 243,512 | |

Dynegy Holdings, Inc., | | | | | | | | |

7.500%, 06/01/15 (a) | | | 50,000 | | | | 47,312 | |

7.750%, 06/01/19 (a) | | | 145,000 | | | | 135,575 | |

Edison Mission Energy, 7.000%, 05/15/17 (a) | | | 310,000 | | | | 293,725 | |

Mirant North America LLC, 7.375%, 12/31/13 | | | 275,000 | | | | 282,562 | |

NRG Energy, Inc., | | | | | | | | |

7.250% 02/01/14 | | | 245,000 | | | | 246,225 | |

7.375%, 02/01/16 | | | 45,000 | | | | 45,225 | |

7.375%, 01/15/17 | | | 235,000 | | | | 236,469 | |

Reliant Energy, Inc., 7.625%, 06/15/14 | | | 300,000 | 2 | | | 294,000 | |

Total Utilities | | | | | | | 1,824,605 | |

Total Corporate Bonds (cost $43,807,055) | | | | | | | 44,140,850 | |

| | |

| | | Shares | | | | |

Common Stock—0.7% | | | | | | | | |

Materials—0.7% | | | | | | | | |

Huntsman Corp. (cost $94,073) | | | 12,603 | | | | 306,381 | |

Other Investment Companies—18.7%1 | | | | | | | | |

Bank of New York Institutional Cash Reserves Fund, 5.33% (cost $8,457,501) 3 | | | 8,457,501 | | | | 8,457,501 | |

Total Investments—116.8% (cost $52,358,629) | | | | | | | 52,904,732 | |

Other Assets, less Liabilities—(16.8)% | | | | | | | (7,610,567 | ) |

Net Assets—100% | | | | | | $ | 45,294,165 | |

The accompanying notes are an integral part of these financial statements.

21

Fixed Income

Fund Snapshots

June 30, 2007 (unaudited)

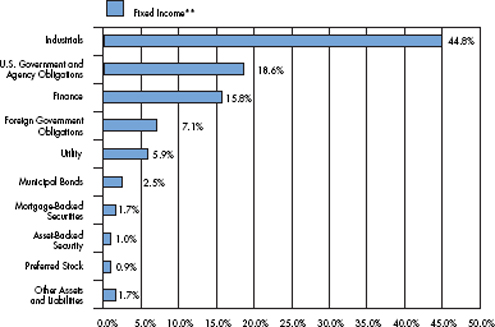

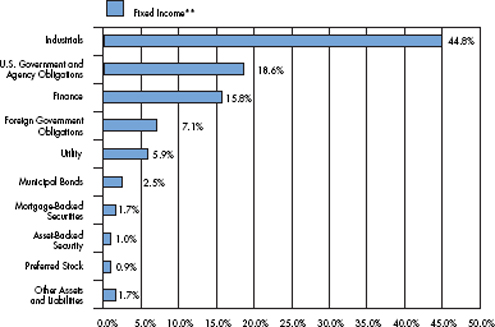

Portfolio Breakdown

| | | | | |

| | Industry | | Fixed

Income** | |

| | Industrials | | 44.8 | % |

| | U.S. Government and Agency Obligations | | 18.6 | % |

| | Finance | | 15.8 | % |

| | Foreign Government Obligations | | 7.1 | % |

| | Utility | | 5.9 | % |

| | Municipal Bonds | | 2.5 | % |

| | Mortgage-Backed Securities | | 1.7 | % |

| | Asset-Backed Securities | | 1.0 | % |

| | Preferred Stock | | 0.9 | % |

| | Other Assets and Liabilities | | 1.7 | % |

** As a percentage of net assets

Top Ten Holdings

| | | |

Top Ten Holdings | | % of

Net Assets | |

USTN, 4.875%, 05/31/09 | | 13.3 | % |

Inter-American Development Bank, 6.000%, 12/15/17* | | 3.3 | |

Telefonica Emisiones SAU, 7.045%, 06/20/36* | | 2.0 | |

USTB, 5.375%, 02/15/31* | | 2.0 | |

Qantas Airways, Ltd., 6.050%, 04/15/16* | | 2.0 | |

Wells Fargo Co., 5.106%, 05/01/33* | | 1.6 | |

Mexican Government, 9.000%, 12/20/12* | | 1.6 | |

Pulte Homes, Inc., 6.000%, 02/15/35* | | 1.4 | |

Verizon Global Funding Corp., 5.850%, 09/15/35* | | 1.3 | |

Empresa Nacional de Electricidad, Yankee, 7.875%, 02/01/27* | | 1.3 | |

| | | |

Top Ten as a Group | | 29.8 | % |

| | | |

| * | Top Ten Holding at December 31, 2006 |

Any sectors, industries, or securities discussed should not be perceived as investment recommendations. Mention of a specific security should not be considered a recommendation to buy or solicitation to sell that security.

22

Fixed Income

Schedule of Portfolio Investments

June 30, 2007 (unaudited)

| | | | | | | | | |

Security Description | | | | Principal

Amount | | | Value |

Corporate Bonds—66.5% | | | | | | | | | |

Finance—15.8% | | | | | | | | | |

ASIF Global Financial, 2.380%, 02/26/09 (a) | | SGD | | $ | 1,000,000 | | | $ | 646,903 |

Bank of America Capital Trust VI, 5.625%, 03/08/35 | | | | | 295,000 | | | | 264,139 |

Barclays Capital Corp., 4.160%, 02/22/10 (a) | | THB | | | 6,000,000 | | | | 176,793 |

Boeing Capital Corp., 4.750%, 08/25/08 | | | | | 230,000 | | | | 228,484 |

Cigna Corp., 6.150%, 11/15/36 | | | | | 240,000 | | | | 229,366 |

Colonial Realty LP, | | | | | | | | | |

4.800%, 04/01/11 | | | | | 625,000 | | | | 602,996 |

5.500%, 10/01/15 | | | | | 190,000 | | | | 182,912 |

Developers Divers Realty Corp., 3.875%, 01/30/09 | | | | | 200,000 | | | | 194,906 |

Equity One, Inc., 3.875%, 04/15/09 | | | | | 150,000 | | | | 145,363 |

Ford Motor Credit Co., | | | | | | | | | |

7.000%, 10/01/13 | | | | | 125,000 | | | | 115,954 |

9.750%, 09/15/10 | | | | | 309,000 | | | | 322,873 |

GMAC, 6.125%, 08/28/07 | | | | | 450,000 | | | | 450,323 |

Health Care, Inc., 7.500%, 08/15/07 | | | | | 67,000 | | | | 67,129 |

Highwoods Properties, Inc., 7.500%, 04/15/18 | | | | | 350,000 | | | | 379,688 |

Hospitality Properties Trust, 6.750%, 02/15/13 | | | | | 465,000 | | | | 480,142 |

HSBC Bank, 3.626%, 04/18/12 (a) 4 | | MYR | | | 665,000 | | | | 162,085 |

JPMorgan Chase & Co., 4.000%, 02/01/08 | | | | | 350,000 | | | | 347,077 |

Kinder Morgan Finance Co., | | | | | | | | | |

5.150%, 03/01/15 | | | | | 75,000 | 2 | | | 68,474 |

5.700%, 01/05/16 | | | | | 165,000 | | | | 152,326 |

6.400%, 01/05/36 | | | | | 110,000 | | | | 97,505 |

Korea Development Bank, 3.875%, 03/02/09 | | | | | 425,000 | | | | 414,400 |

Lehman Brothers Holdings, 3.600%, 03/13/09 | | | | | 150,000 | | | | 145,427 |

Mack-Cali Realty L.P., 7.250%, 03/15/09 | | | | | 250,000 | | | | 256,815 |

Marsh & McLennan Companies, Inc., | | | | | | | | | |

5.375%, 07/15/14 | | | | | 410,000 | | | | 384,129 |

5.750%, 09/15/15 | | | | | 200,000 | | | | 189,289 |

5.875%, 08/01/33 | | | | | 730,000 | | | | 616,484 |

Morgan Stanley & Co., Inc., 3.625%, 04/01/08 | | | | | 650,000 | | | | 641,230 |

Mutual of Omaha Insurance Co., 6.800%, 06/15/36 (a) | | | | | 620,000 | | | | 643,675 |

Sovereign Bank, 5.125%, 03/15/13 | | | | | 335,000 | | | | 323,507 |

Toll Brothers Finance Corp., 5.150%, 05/15/15 | | | | | 555,000 | 2 | | | 501,539 |

Travelers Companies, Inc., 6.250%, 06/15/37 | | | | | 755,000 | | | | 733,532 |

Travelers Property Casualty Corp., 6.375%, 03/15/33 | | | | | 330,000 | | | | 328,428 |

Wells Fargo Co., 5.106%, 05/01/33, (08/01/07) 5 | | | | | 1,175,000 | 2 | | | 1,180,758 |

XL Capital (Europe) PLC, 6.500%, 01/15/12 | | | | | 105,000 | | | | 107,928 |

Total Finance | | | | | | | | | 11,782,579 |

The accompanying notes are an integral part of these financial statements.

23

Fixed Income

Schedule of Portfolio Investments (continued)

| | | | | | | |

Security Description | | Principal

Amount | | | Value |

Industrials—44.8% | | | | | | | |

Anadarko Petroleum Corp., | | | | | | | |

5.950%, 09/15/06 | | $ | 485,000 | | | $ | 474,391 |

6.450%, 09/15/36 | | | 360,000 | | | | 347,368 |

Apache Corp., 6.000%, 01/15/37 | | | 630,000 | | | | 602,763 |

AT&T, Inc., | | | | | | | |

6.150%, 09/15/34 | | | 185,000 | | | | 177,951 |

6.500%, 03/15/29 | | | 775,000 | | | | 748,043 |

AT&T Wireless Services, Inc., 8.750%, 03/01/31 | | | 310,000 | | | | 387,540 |

Avnet, Inc., | | | | | | | |

2.000%, 03/15/34 | | | 100,000 | | | | 127,000 |

6.000%, 09/01/15 | | | 720,000 | | | | 694,989 |

6.625%, 09/15/16 | | | 140,000 | | | | 142,098 |

BellSouth Corp., 6.000%, 11/15/34 | | | 990,000 | 2 | | | 929,621 |

Bowater, Inc., 6.500%, 06/15/13 | | | 170,000 | 2 | | | 148,538 |

Bristol-Myers Squibb, 4.860%, 09/15/23, (09/17/07) 5 | | | 910,000 | | | | 925,925 |

Canadian Pacific RR & Co., 5.950%, 05/15/37 | | | 410,000 | | | | 386,669 |

Cardinal Health, Inc., 4.000%, 06/15/15 | | | 320,000 | | | | 278,308 |

Charter Communications, Inc., 8.000%, 04/30/12 (a) | | | 245,000 | | | | 249,288 |

Chartered Semiconductor Manufacturing, 6.250%, 04/04/13 | | | 715,000 | | | | 719,878 |

Clear Channel Communications, Inc., 6.625%, 06/15/08 | | | 191,000 | | | | 191,785 |

Coca-Cola HBC Finance BV, 5.125%, 09/17/13 | | | 265,000 | | | | 257,270 |

Comcast Corp., | | | | | | | |

5.650%, 06/15/35 | | | 235,000 | | | | 205,117 |

6.450%, 03/15/37 | | | 815,000 | | | | 787,970 |

6.500%, 11/15/35 | | | 405,000 | 2 | | | 393,832 |

Corning, Inc., 6.850%, 03/01/29 | | | 600,000 | | | | 606,362 |

Cox Enterprises, Inc., 4.375%, 05/01/08 (a) | | | 410,000 | | | | 405,971 |

CSX Corp., 6.000%, 10/01/36 | | | 570,000 | | | | 533,899 |

Cummins, Inc., 6.750%, 02/15/27 | | | 153,000 | | | | 149,336 |

D.R. Horton, Inc., 5.250%, 02/15/15 | | | 420,000 | | | | 376,408 |

Desarrolladora Homex SA de C.V., 7.500%, 09/28/15 | | | 245,000 | 2 | | | 254,800 |

El Paso Corp., 6.950%, 06/01/28 | | | 165,000 | 2 | | | 154,128 |

Energy Transfer Partners LP, | | | | | | | |

6.125%, 02/15/17 | | | 65,000 | | | | 64,299 |

6.625%, 10/15/36 | | | 145,000 | | | | 142,046 |

Equifax, Inc., 7.000%, 07/01/37 | | | 115,000 | | | | 116,371 |

Federated Retail Holdings, 6.375%, 03/15/37 | | | 760,000 | | | | 733,453 |

Georgia-Pacific Corp., 7.250%, 06/01/28 | | | 70,000 | | | | 64,750 |

HCA, Inc., | | | | | | | |

7.050%, 12/01/27 | | | 750,000 | | | | 613,193 |

7.500%, 11/06/33 | | | 75,000 | 2 | | | 63,938 |

7.690%, 06/15/25 | | | 300,000 | | | | 262,438 |

8.750%, 09/01/10 | | | 625,000 | | | | 653,906 |

The accompanying notes are an integral part of these financial statements.

24

Fixed Income

Schedule of Portfolio Investments (continued)

| | | | | | | |

Security Description | | Principal

Amount | | | Value |

Industrials—44.8% (continued) | | | | | | | |

International Paper Co., | | | | | | | |

4.000%, 04/01/10 | | $ | 300,000 | | | $ | 288,136 |

4.250%, 01/15/09 | | | 300,000 | | | | 294,092 |

Intuit, Inc., 5.750%, 03/15/17 | | | 210,000 | | | | 202,502 |

JC Penney Corp., Inc., 6.375%, 10/15/36 | | | 310,000 | | | | 296,164 |

KN Capital Trust III, 7.630%, 04/15/28 | | | 10,000 | | | | 9,426 |

Kraft Foods, Inc., 6.500%, 11/01/31 | | | 270,000 | | | | 261,800 |

Kroger Co., 7.000%, 05/01/18 | | | 460,000 | | | | 472,402 |

Lennar Corp., | | | | | | | |

5.600%, 05/31/15 | | | 400,000 | | | | 375,410 |

6.500%, 04/15/16 | | | 280,000 | 2 | | | 271,606 |

Liberty Media Corp., 5.700%, 05/15/13 | | | 190,000 | 2 | | | 179,534 |

Lubrizol Corp., 6.500%, 10/01/34 | | | 750,000 | 2 | | | 726,222 |

Masco Corp., 5.850%, 03/15/17 | | | 350,000 | | | | 337,069 |

Medco Health Solutions, 7.250%, 08/15/13 | | | 420,000 | | | | 442,486 |

Missouri Pacific Railroad, 5.000%, 01/01/45 | | | 200,000 | | | | 152,502 |

New England Telephone & Telegraph Co., 7.875%, 11/15/29 | | | 95,000 | | | | 104,221 |

News America, Inc., | | | | | | | |

6.200%, 12/15/34 | | | 350,000 | | | | 327,299 |