UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-06431

MANAGERS TRUST II

(Exact name of registrant as specified in charter)

800 Connecticut Avenue, Norwalk, Connecticut 06854

(Address of principal executive offices, including zip code)

Managers Investment Group LLC

800 Connecticut Avenue, Norwalk, Connecticut 06854

(Name and address of agent for service)

| | |

| Registrant’s telephone number, including area code: (203) 299-3500 |

| |

| Date of fiscal year end: | | DECEMBER 31 |

| |

| Date of reporting period: | | JANUARY 1, 2009 – DECEMBER 31, 2009 |

| | (Annual Shareholder Report) |

| Item 1. | Reports to Shareholders |

ANNUAL REPORT

Managers Trust II Funds

December 31, 2009

Managers AMG Chicago Equity Partners Mid-Cap Fund

Managers AMG Chicago Equity Partners Balanced Fund

Managers High Yield Fund

Managers Fixed Income Fund

Managers Short Duration Government Fund

Managers Intermediate Duration Government Fund

AR002-1209

Managers Trust II Funds

Annual Report — December 31, 2009

TABLE OF CONTENTS

| | |

| | | Page |

| |

LETTER TO SHAREHOLDERS | | 1 |

| |

ABOUT YOUR FUND’S EXPENSES | | 4 |

| |

INVESTMENT MANAGER’S COMMENTS, FUND SNAPSHOTS, AND SCHEDULES OF PORTFOLIO INVESTMENTS | | |

| |

Managers AMG Chicago Equity Partners Mid-Cap Fund | | 6 |

| |

Managers AMG Chicago Equity Partners Balanced Fund | | 12 |

| |

Managers High Yield Fund | | 21 |

| |

Managers Fixed Income Fund | | 32 |

| |

Managers Short Duration Government Fund | | 42 |

| |

Managers Intermediate Duration Government Fund | | 51 |

| |

NOTES TO SCHEDULES OF PORTFOLIO INVESTMENTS | | 58 |

| |

FINANCIAL STATEMENTS: | | |

| |

Statements of Assets and Liabilities | | 60 |

| |

Fund balance sheets, net asset value (NAV) per share computations and cumulative undistributed amounts | | |

| |

Statements of Operations | | 62 |

| |

Detail of sources of income, Fund expenses, and realized and unrealized gains (losses) during the year | | |

| |

Statements of Changes in Net Assets | | 63 |

| |

Detail of changes in Fund assets for the past two years | | |

| |

FINANCIAL HIGHLIGHTS | | 66 |

| |

Historical net asset values per share, distributions, total returns, expense ratios, turnover ratios and net assets | | |

| |

NOTES TO FINANCIAL STATEMENTS | | 76 |

| |

Accounting and distribution policies, details of agreements and transactions with Fund management and affiliates, and descriptions of certain investment risks | | |

| |

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM | | 92 |

| |

TRUSTEES AND OFFICERS | | 93 |

Nothing contained herein is to be considered an offer, sale or solicitation of an offer to buy shares of any series of the Managers Family of Funds. Such offering is made only by Prospectus, which includes details as to offering price and other material information.

Letter to Shareholders

Dear Shareholder:

Our foremost goal at Managers Investment Group (“MIG”) is to structure and manage mutual funds that will help our shareholders and clients successfully reach their investment goals and objectives.

Each of our Funds is geared to provide you with exposure to a specific asset class or style of investing. Investors tend to use our Funds as part of their broader portfolio in order to tailor their asset allocation to meet their individual needs. Most of our Funds, like those detailed in this report, are therefore designed to be building blocks.

At MIG, we have overall responsibility for the investment management and administration of the Funds. As a “manager of managers,” we work with external investment managers that make the day-to-day investment decisions in the Funds (the “Portfolio Managers”). We devote considerable resources to our disciplined process of identifying and selecting Portfolio Managers for the Funds. As a manager of managers, MIG performs many activities to monitor the ongoing investment, compliance, and administrative aspects of all of the Funds, which gives our shareholders added confidence in their investments.

Our parent company, Affiliated Managers Group (“AMG”) is a global asset management company with ownership interests in a diverse group of boutique investment management firms (its “Affiliates”). MIG has the unique opportunity to access the investment skills and acumen of some of AMG’s Affiliates. The set of our Funds managed by these proprietary firms also benefit from our activities to monitor the investment, compliance, and administrative aspects of the Funds.

Below is a brief overview of the securities markets and the performance results for the Funds. Following this letter, we also provide the Portfolio Managers’ discussion of their investment management approach, performance results, and market outlook.

The year 2009 will go down in the history books as one in which securities markets sank to unimaginable levels and some investors briefly questioned the viability of capitalism. As it turned out, capitalism did not cease to exist and equities, as well as credit-sensitive fixed income securities, managed to regroup and record one of the most impressive rebounds in the history of the capital markets. The government’s unprecedented efforts with respect to healing the economy and stabilizing the securities markets via programs such as the Troubled Asset Relief Program (“TARP”), the Public-Private Investment Program (“PPIP”) and the Term Asset-Backed Securities Loan Facility (“TALF”) seem to have achieved their desired short-term effects, although some would argue that the programs played a minor role in the stabilization of the markets and that free market forces simply corrected oversold conditions, just as they have on numerous occasions in the past.

Against this backdrop, the Managers AMG Chicago Equity Partners Mid-Cap Fund, Managers AMG Chicago Equity Partners Balanced Fund, Managers High Yield Fund, Managers Fixed Income Fund, Managers Short Duration Government Fund and the Managers Intermediate Duration Government Fund (each a “Fund” and collectively the “Funds”), generated strong absolute returns in this historic environment, as detailed below.

| | | | | | | | | | | | | | | | | | | | | | |

Periods Ended 12/31/09 | | | | 6 Months | | | 1 Year | | | 3 Years | | | 5 Years | | | 10 Years | | | Since

Inception | | | Inception

Date |

| | | | | | | |

Managers AMG Chicago Equity Partners Mid-Cap Fund | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | |

-Class A | | No Load | | 26.43 | % | | 39.20 | % | | (6.77 | )% | | (0.40 | )% | | 2.36 | % | | 8.31 | % | | 1/2/1997 |

| | | | | | | | |

-Class A | | With Load | | 19.10 | % | | 31.15 | % | | (8.59 | )% | | (1.57 | )% | | 1.76 | % | | 7.82 | % | | 1/2/1997 |

| | | | | | | | |

-Class B | | No Load | | 25.87 | % | | 38.06 | % | | (7.51 | )% | | (1.14 | )% | | 1.73 | % | | 6.56 | % | | 1/28/1998 |

| | | | | | | | |

-Class B | | With Load | | 20.87 | % | | 33.06 | % | | (8.37 | )% | | (1.51 | )% | | 1.73 | % | | 6.56 | % | | 1/28/1998 |

| | | | | | | | |

-Class C | | No Load | | 25.96 | % | | 38.18 | % | | (7.55 | )% | | (1.17 | )% | | 1.73 | % | | 5.95 | % | | 2/19/1998 |

| | | | | | | | |

-Class C | | With Load | | 24.96 | % | | 37.18 | % | | (7.55 | )% | | (1.17 | )% | | 1.73 | % | | 5.95 | % | | 2/19/1998 |

| | | | | | | | |

-Institutional Class | | | | 26.54 | % | | 39.59 | % | | (6.63 | )% | | (0.18 | )% | | 2.74 | % | | 8.75 | % | | 1/2/1997 |

| | | | | | | | |

Russell Midcap® Index | | | | 27.76 | % | | 40.48 | % | | (4.59 | )% | | 2.43 | % | | 4.98 | % | | 8.13 | % | | |

| | | | | | | |

S&P Mid Cap 400 Index (former benchmark) | | 26.65 | % | | 37.38 | % | | (1.83 | )% | | 3.27 | % | | 6.36 | % | | 9.85 | % | | |

1

Letter to Shareholders (continued)

| | | | | | | | | | | | | | | | | | | | | | |

Periods Ended 12/31/09 | | | | 6 Months | | | 1 Year | | | 3 Years | | | 5 Years | | | 10 Years | | | Since

Inception | | | Inception

Date |

| | | | | | | |

Managers AMG Chicago Equity Partners Balanced Fund | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | |

-Class A | | No Load | | 13.84 | % | | 20.06 | % | | 0.71 | % | | 3.90 | % | | 3.74 | % | | 7.19 | % | | 1/2/1997 |

| | | | | | | | |

-Class A | | With Load | | 7.26 | % | | 13.14 | % | | (1.25 | )% | | 2.67 | % | | 3.13 | % | | 6.70 | % | | 1/2/1997 |

| | | | | | | | |

-Class B | | No Load | | 13.42 | % | | 19.42 | % | | (0.00 | )% | | 3.16 | % | | 3.13 | % | | 5.42 | % | | 2/10/1998 |

| | | | | | | | |

-Class B | | With Load | | 8.42 | % | | 14.42 | % | | (0.97 | )% | | 2.80 | % | | 3.13 | % | | 5.42 | % | | 2/10/1998 |

| | | | | | | | |

-Class C | | No Load | | 13.43 | % | | 19.33 | % | | (0.02 | )% | | 3.14 | % | | 3.12 | % | | 5.36 | % | | 2/13/1998 |

| | | | | | | | |

-Class C | | With Load | | 12.43 | % | | 18.33 | % | | (0.02 | )% | | 3.14 | % | | 3.12 | % | | 5.36 | % | | 2/13/1998 |

| | | | | | | | |

-Institutional Class | | | | 14.00 | % | | 20.44 | % | | 0.97 | % | | 4.17 | % | | 4.14 | % | | 7.63 | % | | 1/2/1997 |

| | | | | | | | |

60% Russell 1000® Index/40% Barclays Capital | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | |

U.S. Aggregate Bond Index | | | | 15.31 | % | | 20.12 | % | | 0.24 | % | | 3.23 | % | | 2.87 | % | | 6.31 | % | | |

| | | | | | | | |

60% S&P 500 Index/40% Barclays Capital U.S. | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | |

Aggregate Bond Index (former benchmark) | | 15.01 | % | | 19.00 | % | | 0.07 | % | | 3.00 | % | | 2.58 | % | | 6.16 | % | | |

| | | | | | | | |

Managers High Yield Fund | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | |

-Class A | | No Load | | 21.39 | % | | 53.38 | % | | 3.28 | % | | 4.61 | % | | 5.53 | % | | 5.90 | % | | 1/2/1998 |

| | | | | | | | |

-Class A | | With Load | | 16.24 | % | | 46.97 | % | | 1.81 | % | | 3.71 | % | | 5.07 | % | | 5.52 | % | | 1/2/1998 |

| | | | | | | | |

-Class B | | No Load | | 20.82 | % | | 51.64 | % | | 2.34 | % | | 3.72 | % | | 4.80 | % | | 4.85 | % | | 2/19/1998 |

| | | | | | | | |

-Class B | | With Load | | 15.82 | % | | 46.64 | % | | 1.52 | % | | 3.42 | % | | 4.80 | % | | 4.85 | % | | 2/19/1998 |

| | | | | | | | |

-Class C | | No Load | | 20.84 | % | | 51.98 | % | | 2.40 | % | | 3.76 | % | | 4.84 | % | | 4.86 | % | | 2/19/1998 |

| | | | | | | | |

-Class C | | With Load | | 19.84 | % | | 50.98 | % | | 2.40 | % | | 3.76 | % | | 4.84 | % | | 4.86 | % | | 2/19/1998 |

| | | | | | | | |

-Institutional Class | | | | 21.35 | % | | 54.06 | % | | 3.59 | % | | 4.90 | % | | 5.97 | % | | 5.97 | % | | 3/2/1998 |

| | | | | | | |

Barclays Capital U.S. Corporate High Yield Index | | 21.29 | % | | 58.21 | % | | 5.97 | % | | 6.46 | % | | 6.71 | % | | N/A | | | |

| | | | | | | | |

Managers Fixed Income Fund | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | |

-Class A | | No Load | | 11.19 | % | | 23.14 | % | | 5.18 | % | | 5.05 | % | | 6.52 | % | | 6.23 | % | | 1/2/1997 |

| | | | | | | | |

-Class A | | With Load | | 6.43 | % | | 17.86 | % | | 3.66 | % | | 4.15 | % | | 6.06 | % | | 5.88 | % | | 1/2/1997 |

| | | | | | | | |

-Class B | | No Load | | 10.83 | % | | 22.22 | % | | 4.39 | % | | 4.28 | % | | 5.87 | % | | 5.35 | % | | 3/20/1998 |

| | | | | | | | |

-Class B | | With Load | | 5.83 | % | | 17.22 | % | | 3.48 | % | | 3.94 | % | | 5.87 | % | | 5.35 | % | | 3/20/1998 |

| | | | | | | | |

-Class C | | No Load | | 10.79 | % | | 22.13 | % | | 4.38 | % | | 4.26 | % | | 5.86 | % | | 5.45 | % | | 3/5/1998 |

| | | | | | | | |

-Class C | | With Load | | 9.79 | % | | 21.13 | % | | 4.38 | % | | 4.26 | % | | 5.86 | % | | 5.45 | % | | 3/5/1998 |

| | | | | | | | |

-Institutional Class | | | | 11.42 | % | | 23.39 | % | | 5.44 | % | | 5.31 | % | | 6.94 | % | | 6.70 | % | | 1/2/1997 |

| | | | | | | |

Barclays Capital U.S. Aggregate Bond Index | | 3.95 | % | | 5.93 | % | | 6.04 | % | | 4.97 | % | | 6.33 | % | | 6.23 | % | | |

| | | | | | | | |

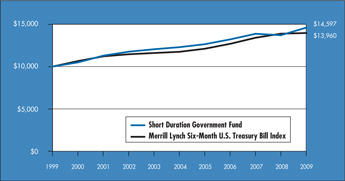

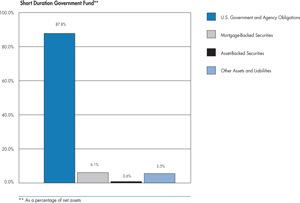

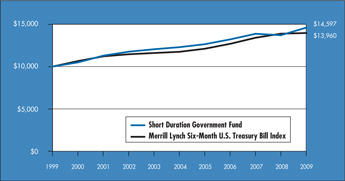

Short Duration Government Fund | | | | 2.45 | % | | 6.54 | % | | 3.39 | % | | 3.50 | % | | 3.85 | % | | 4.48 | % | | 3/31/1992 |

| | | | | | | |

Merrill Lynch Six-Month U.S. Treasury Bill Index | | 0.27 | % | | 0.58 | % | | 3.24 | % | | 3.52 | % | | 3.39 | % | | 4.06 | % | | |

| | | | | | | |

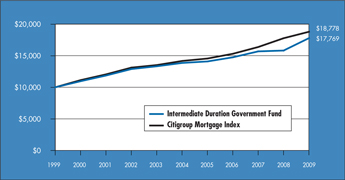

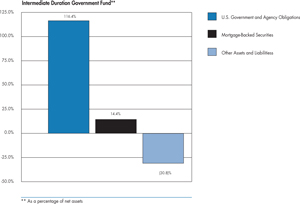

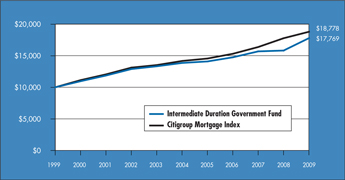

Intermediate Duration Government Fund | | 6.47 | % | | 12.40 | % | | 6.43 | % | | 5.12 | % | | 5.92 | % | | 6.53 | % | | 3/31/1992 |

| | | | | | | | |

Citigroup Mortgage Index | | | | 2.98 | % | | 5.76 | % | | 7.07 | % | | 5.81 | % | | 6.50 | % | | 6.64 | % | | |

For the year ended December 31, 2009, the Managers AMG Chicago Equity Partners Mid-Cap Fund (Institutional Class) returned 39.59%, modestly trailing the 40.48% return for the Russell Midcap® Index. Over the last several quarters, we discussed the difficult market environment we experienced since the latter part of 2007, and this past year was no different. The riskiest stocks with the weakest fundamentals performed the best and did so by a substantial margin, making stock picking difficult. The Fund’s relative performance was driven primarily by strong stock selection within the industrials and materials sectors. These gains were somewhat offset by negative stock selection results in the information technology sector.

2

Letter to Shareholders (continued)

For the year ended December 31, 2009, the Managers AMG Chicago Equity Partners Balanced Fund (Institutional Class) returned 20.44%, marginally outpacing the 20.12% return for the hypothetical benchmark, which consists of 60% of the return of the Russell 1000® Index and 40% of the return of the Barclays Capital U.S. Aggregate Bond Index. The equity portion of the Fund slightly underperformed the benchmark for the year. While the Fund’s holdings in the financial sector contributed positively to relative results for the second consecutive year, holdings within the consumer discretionary and technology sectors detracted most from relative performance during the year. Within the fixed income portion of the Fund, sector allocation and security selection were the biggest contributors to excess returns for the one-year period.

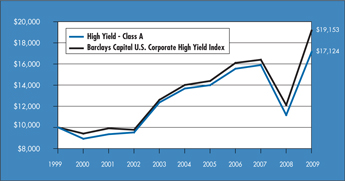

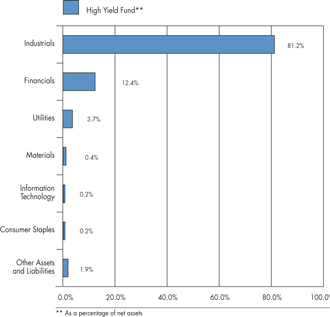

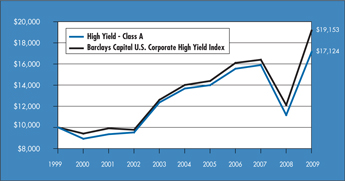

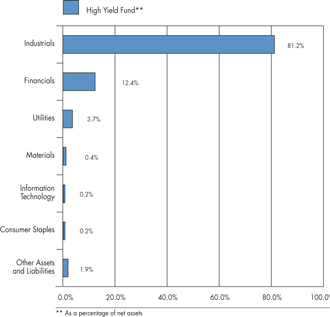

For the year ended December 31, 2009, the Managers High Yield Fund (Institutional Class) returned 54.06%, while the Barclays Capital U.S. Corporate High Yield Index returned 58.21%. It was the best year on record for both the Fund and the high-yield market. The Fund’s modest underperformance is not atypical since fixed income indexes often invest in very illiquid investments, which are not accessible to most investors, and indexes don’t incur fees or trading costs. Nevertheless, the Fund did lag during the year. Its underperformance is attributable to some poor security selection and a drag from cash.

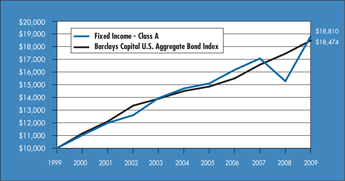

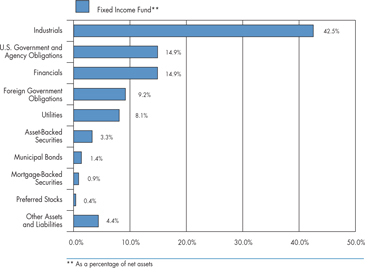

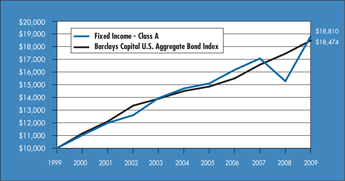

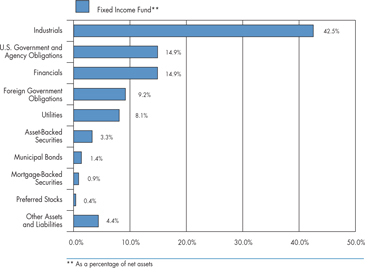

For the year ended December 31, 2009, Managers Fixed Income Fund (Institutional Class) returned 23.39%, easily outpacing the 5.93% return for the Barclays Capital U.S. Aggregate Bond Index (the “Index”). Much of the Fund’s solid performance, both absolute and relative to the Index, was driven by a greater than benchmark exposure to investment-grade corporate bonds and the related underweight to U.S. Treasuries. After widening to historic levels during the 2008 crisis, yield spreads on corporate bonds narrowed throughout 2009, driving prices on these bonds higher. This trend was the primary driver of the Fund’s performance during the period.

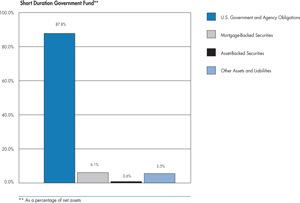

For the year ended December 31, 2009, the Managers Short Duration Government Fund returned 6.54%, well outperforming its benchmark, the Merrill Lynch Six-Month U.S. Treasury Bill Index, which returned 0.58%. In 2009, spreads tightened substantially across almost all fixed income sectors, including agency mortgage backed securities (“MBS”), which is the primary investment segment for the Fund. The primary driver of the Fund’s strong absolute and relative performance was its exposure to agency MBS, which rallied for most of the year, partly as a result of attractive values at the beginning of the year and the Federal Reserve’s purchase programs. To a lesser extent, other contributors to performance included the Fund’s exposure to commercial mortgage backed securities (“CMBS”) as well as its yield curve positioning.

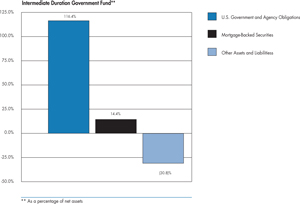

For the year ended December 31, 2009, the Managers Intermediate Duration Government Fund returned 12.40%, compared to 5.76% for its benchmark, the Citigroup Mortgage Index. As noted above, in 2009, spreads tightened substantially across almost all fixed income sectors, including agency MBS, which is the primary investment segment for this Fund as well. Similarly, the Fund also benefited from its exposure to agency MBS but unlike the Managers Short Duration Government Fund, there were other significant drivers of performance. Most notably, the Fund’s exposures to non-agency MBS and CMBS were key contributors. The management team at Smith Breeden Associates, Inc, the Fund’s subadvisor, added CMBS securities in the second quarter to take advantage of their wide spreads.

The following report covers the one-year period ended December 31, 2009. Should you have any questions about this report, or if you’d like to receive a prospectus and additional information, including fees and expenses for these or any of the other Funds in our family, please feel free to contact us at 1-800-835-3879, or visit our Web site at www.managersinvest.com. As always, please read the prospectus carefully before you invest or send money.

If you are curious about how you can better diversify your investment program, visit the Knowledge Center on our Web site and view our articles in the investment strategies section. You can rest assured that under all market conditions our team is focused on delivering excellent investment management services for your benefit. We thank you for your continued confidence and investment in The Managers Funds.

Respectfully,

John H. Streur

Senior Managing Partner

Managers Investment Group LLC

3

About Your Fund’s Expenses

As a shareholder of a Fund, you may incur two types of costs: (1) transaction costs, which may include sales charges (loads) on purchase payments; redemption fees; and exchange fees; and (2) ongoing costs, including management fees; distribution (12b-1) fees; and other Fund expenses. This example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds. The example is based on $1,000 invested at the beginning of the period and held for the entire period as indicated below.

Actual Expenses

The first line of the following table provides information about the actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

The second line of the following table provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed annual rate of return of 5% before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds by comparing this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as sales charges (loads), redemption fees, or exchange fees. Therefore, the second line of the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds.

| | | | | | | | | | | | |

Six Months Ended December 31, 2009 | | Expense

Ratio for

the Period | | | Beginning

Account Value

07/01/2009 | | Ending

Account Value

12/31/2009 | | Expenses

Paid During

Period* |

| | | | |

Managers AMG Chicago Equity Partners Mid-Cap Fund Class A | | | | | | | | | | | | |

| | | | |

Based on Actual Fund Return | | 1.24 | % | | $ | 1,000 | | $ | 1,264 | | $ | 7.08 |

| | | | |

Based on Hypothetical 5% Annual Return | | 1.24 | % | | $ | 1,000 | | $ | 1,019 | | $ | 6.31 |

| | | | |

Managers AMG Chicago Equity Partners Mid-Cap Fund Class B | | | | | | | | | | | | |

| | | | |

Based on Actual Fund Return | | 1.99 | % | | $ | 1,000 | | $ | 1,259 | | $ | 11.33 |

| | | | |

Based on Hypothetical 5% Annual Return | | 1.99 | % | | $ | 1,000 | | $ | 1,015 | | $ | 10.11 |

| | | | |

Managers AMG Chicago Equity Partners Mid-Cap Fund Class C | | | | | | | | | | | | |

| | | | |

Based on Actual Fund Return | | 1.99 | % | | $ | 1,000 | | $ | 1,260 | | $ | 11.33 |

| | | | |

Based on Hypothetical 5% Annual Return | | 1.99 | % | | $ | 1,000 | | $ | 1,015 | | $ | 10.11 |

| | | | |

Managers AMG Chicago Equity Partners Mid-Cap Fund Institutional Class | | | | | | | | | | | | |

| | | | |

Based on Actual Fund Return | | 0.99 | % | | $ | 1,000 | | $ | 1,265 | | $ | 5.65 |

| | | | |

Based on Hypothetical 5% Annual Return | | 0.99 | % | | $ | 1,000 | | $ | 1,020 | | $ | 5.04 |

| | | | |

Managers AMG Chicago Equity Partners Balanced Fund Class A | | | | | | | | | | | | |

| | | | |

Based on Actual Fund Return | | 1.25 | % | | $ | 1,000 | | $ | 1,138 | | $ | 6.74 |

| | | | |

Based on Hypothetical 5% Annual Return | | 1.25 | % | | $ | 1,000 | | $ | 1,019 | | $ | 6.36 |

| | | | |

Managers AMG Chicago Equity Partners Balanced Fund Class B | | | | | | | | | | | | |

| | | | |

Based on Actual Fund Return | | 2.00 | % | | $ | 1,000 | | $ | 1,134 | | $ | 10.76 |

| | | | |

Based on Hypothetical 5% Annual Return | | 2.00 | % | | $ | 1,000 | | $ | 1,015 | | $ | 10.16 |

| | | | |

Managers AMG Chicago Equity Partners Balanced Fund Class C | | | | | | | | | | | | |

| | | | |

Based on Actual Fund Return | | 2.00 | % | | $ | 1,000 | | $ | 1,134 | | $ | 10.76 |

| | | | |

Based on Hypothetical 5% Annual Return | | 2.00 | % | | $ | 1,000 | | $ | 1,015 | | $ | 10.16 |

| | | | |

Managers AMG Chicago Equity Partners Balanced Fund Institutional Class | | | | | | | | | | | | |

| | | | |

Based on Actual Fund Return | | 1.00 | % | | $ | 1,000 | | $ | 1,140 | | $ | 5.39 |

| | | | |

Based on Hypothetical 5% Annual Return | | 1.00 | % | | $ | 1,000 | | $ | 1,020 | | $ | 5.09 |

| * | Expenses are equal to the Fund’s annualized expense ratio multiplied by the average account value over the period, multiplied by the number of days in the most recent fiscal half-year (184), then divided by 365. |

4

About Your Fund’s Expenses (continued)

| | | | | | | | | | | | |

Six Months Ended December 31, 2009 | | Expense

Ratio for

the Period | | | Beginning

Account Value

07/01/2009 | | Ending

Account Value

12/31/2009 | | Expenses

Paid During

Period* |

| | | | |

Managers High Yield Fund Class A | | | | | | | | | | | | |

| | | | |

Based on Actual Fund Return | | 1.15 | % | | $ | 1,000 | | $ | 1,214 | | $ | 6.42 |

| | | | |

Based on Hypothetical 5% Annual Return | | 1.15 | % | | $ | 1,000 | | $ | 1,019 | | $ | 5.85 |

| | | | |

Managers High Yield Fund Class B | | | | | | | | | | | | |

| | | | |

Based on Actual Fund Return | | 1.90 | % | | $ | 1,000 | | $ | 1,208 | | $ | 10.58 |

| | | | |

Based on Hypothetical 5% Annual Return | | 1.90 | % | | $ | 1,000 | | $ | 1,016 | | $ | 9.65 |

| | | | |

Managers High Yield Fund Class C | | | | | | | | | | | | |

| | | | |

Based on Actual Fund Return | | 1.90 | % | | $ | 1,000 | | $ | 1,208 | | $ | 10.58 |

| | | | |

Based on Hypothetical 5% Annual Return | | 1.90 | % | | $ | 1,000 | | $ | 1,016 | | $ | 9.65 |

| | | | |

Managers High Yield Fund Institutional Class | | | | | | | | | | | | |

| | | | |

Based on Actual Fund Return | | 0.90 | % | | $ | 1,000 | | $ | 1,214 | | $ | 5.02 |

| | | | |

Based on Hypothetical 5% Annual Return | | 0.90 | % | | $ | 1,000 | | $ | 1,021 | | $ | 4.58 |

| | | | |

Managers Fixed Income Fund Class A | | | | | | | | | | | | |

| | | | |

Based on Actual Fund Return | | 0.84 | % | | $ | 1,000 | | $ | 1,112 | | $ | 4.47 |

| | | | |

Based on Hypothetical 5% Annual Return | | 0.84 | % | | $ | 1,000 | | $ | 1,021 | | $ | 4.28 |

| | | | |

Managers Fixed Income Fund Class B | | | | | | | | | | | | |

| | | | |

Based on Actual Fund Return | | 1.59 | % | | $ | 1,000 | | $ | 1,108 | | $ | 8.45 |

| | | | |

Based on Hypothetical 5% Annual Return | | 1.59 | % | | $ | 1,000 | | $ | 1,017 | | $ | 8.08 |

| | | | |

Managers Fixed Income Fund Class C | | | | | | | | | | | | |

| | | | |

Based on Actual Fund Return | | 1.59 | % | | $ | 1,000 | | $ | 1,108 | | $ | 8.45 |

| | | | |

Based on Hypothetical 5% Annual Return | | 1.59 | % | | $ | 1,000 | | $ | 1,017 | | $ | 8.08 |

| | | | |

Managers Fixed Income Fund Institutional Class | | | | | | | | | | | | |

| | | | |

Based on Actual Fund Return | | 0.59 | % | | $ | 1,000 | | $ | 1,114 | | $ | 3.14 |

| | | | |

Based on Hypothetical 5% Annual Return | | 0.59 | % | | $ | 1,000 | | $ | 1,022 | | $ | 3.01 |

| | | | |

Managers Short Duration Government Fund | | | | | | | | | | | | |

| | | | |

Based on Actual Fund Return | | 0.85 | % | | $ | 1,000 | | $ | 1,025 | | $ | 4.34 |

| | | | |

Based on Hypothetical 5% Annual Return | | 0.85 | % | | $ | 1,000 | | $ | 1,021 | | $ | 4.33 |

| | | | |

Managers Intermediate Duration Government Fund | | | | | | | | | | | | |

| | | | |

Based on Actual Fund Return | | 0.89 | % | | $ | 1,000 | | $ | 1,065 | | $ | 4.63 |

| | | | |

Based on Hypothetical 5% Annual Return | | 0.89 | % | | $ | 1,000 | | $ | 1,021 | | $ | 4.53 |

| * | Expenses are equal to the Fund’s annualized expense ratio multiplied by the average account value over the period, multiplied by the number of days in the most recent fiscal half-year (184), then divided by 365. |

5

Managers AMG Chicago Equity Partners Mid-Cap Fund

Investment Manager’s Comments

The Year in Review

The Managers AMG Chicago Equity Partners Mid-Cap Fund’s Institutional class returned 39.59% for 2009, versus the Russell Midcap® Index at 40.48%. The Fund’s benchmark was changed effective December 31, 2009 from the previously used S&P Mid-cap 400 Index, which returned 37.38% during the period. After continuing the decline of 2008 early in the year, markets bounced back sharply during the remainder of 2009, providing investors with solid double-digit returns across most asset classes.

The Fund finished the year modestly trailing the Russell Midcap® Index, while outpacing the S&P Midcap Index. Given the extreme returns experienced throughout the year, we believe this result was a success. Over the last several quarters, we discussed the difficult market environment we experienced since the latter part of 2007, and this past year was no different. The riskiest stocks with the weakest fundamentals performed the best and did so by a substantial margin. This made stock picking difficult, witnessed by the poor performance of Warren Buffett’s company, Berkshire Hathaway, which lagged the S&P 500 by the most in a decade (since the tech bubble of 1999). This speaks to the disconnect between established fundamentals and price performance. In summary, despite the tough environment of 2009, we were able to add excess return. Although our performance improved significantly last year, we are optimistic about the outlook for 2010 and thereafter. Here is why:

During a recession, value factors tend to work well, while momentum factors generally do not provide any significant information. This is especially true in the last three months of a recession, when the market begins to anticipate a recovery. Stocks with the weakest near-term fundamentals tend to lead stock market rallies that occur during the end of an economic recession. In particular, the value factor of price-to-book performs extremely well in these time periods, at the expense of all the other factors that consider near-term company information like earnings and balance sheet quality. We experienced this in 2009; the outperformance of low-quality stocks as described by quality ratings highlighted this inversion. This behavior tends to be short-lived, however, and the past has shown that as economic expansion sets in following a value-led rally, consideration for near-term company metrics returns to favor.

History has shown that a period of broad-based factors providing strong excess returns typically follows the initial rally and continues for an extended period of time. While value continues to be relevant, price-to-book is less effective, and the price-to-earnings ratio usually becomes the most powerful value factor both six and twelve months post recession as investors return their focus to near-term expectations. Likewise, all of the momentum factors typically work in the post recession period — particularly price momentum and earnings revisions — because earnings matter again. We are beginning to see this as our factors have broadened out over the last several months.

The Fund’s positive relative performance was driven primarily by strong stock selection within the industrials and materials sectors. Within industrials, Oshkosh Corp and Joy Global Inc. were among the top contributors to performance, while Ashland Inc. and Terra Industries were among the Fund’s best performers in the materials sector. These gains were somewhat offset by negative stock selection results in the information technology sector, where NCR Corp. and InterDigital Inc. were among the leading detractors.

Looking Forward

Overall, our philosophy will not change based on short-term trends or conditions in the market. Our goal is to add value through security selection, while attempting to neutralize other risk factors, such as market timing and sector rotation, for which there is not adequate compensation by the market. Quantitative investing has faced a challenging period over the last several quarters, including significant and dramatic rotations in factor preference as well as style preference. We believe this trend is reversing, which will be beneficial for fundamental based quantitative investing. We will continue to use our disciplined approach to provide added value at controlled levels of risk.

This commentary reflects the viewpoints of the portfolio manager, Chicago Equity Partners, as of January 26, 2010.

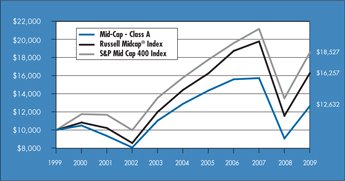

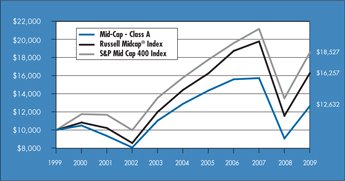

Cumulative Total Return Performance

Mid-Cap’s cumulative total return is based on the daily change in net asset value (NAV), and assumes that all dividends and distributions were reinvested. The Russell Midcap® Index measures the performance of the mid-cap segment of the U.S. equity universe. The Russell Midcap® Index is a subset of the Russell 1000® Index and measures the performance of the 800 smallest companies in the Russell 1000® Index, which represent approximately 27% of the total market capitalization of the Russell 1000® Index. The S&P Mid Cap 400 Index is the most widely used index for mid-size companies and covers approximately 7% of the U.S. equity market. Both indices assume reinvestment of dividends. Unlike the Fund, the indices are unmanaged, are not available for investment and do not incur expenses. This chart compares a hypothetical $10,000

6

Managers AMG Chicago Equity Partners Mid-Cap Fund

Investment Manager’s Comments (continued)

Cumulative Total Return Performance (continued)

investment made in the Fund’s Class A Shares on December 31, 1999, with a $10,000 investment made in the Russell Midcap® Index and the S&P Mid Cap 400 Index for the same time periods. Performance for periods longer than one year is annualized. The graph and table do not reflect the deduction of taxes that a shareholder would pay on a Fund distribution or redemption of shares. Past performance is not indicative of future results. The listed returns for the Fund are net of expenses and the returns for the indices exclude expenses.

The table below shows the average annualized total returns for the Mid-Cap Fund, the Russell Midcap® Index and the S&P Mid Cap 400 Index from December 31, 1999 through December 31, 2009.

| | | | | | | | | | | | | |

Average Annual Total Returns1 | | | | | | 1 Year | | | 5 Years | | | 10 Years | |

Mid-Cap2,3 | | -Class A | | No Load | | 39.20 | % | | (0.40 | )% | | 2.36 | % |

| | -Class A | | With Load | | 31.15 | % | | (1.57 | )% | | 1.76 | % |

| | -Class B | | No Load | | 38.06 | % | | (1.14 | )% | | 1.73 | % |

| | -Class B | | With Load | | 33.06 | % | | (1.51 | )% | | 1.73 | % |

| | -Class C | | No Load | | 38.18 | % | | (1.17 | )% | | 1.73 | % |

| | -Class C | | With Load | | 37.18 | % | | (1.17 | )% | | 1.73 | % |

| | -Institutional Class | | No Load | | 39.59 | % | | (0.18 | )% | | 2.74 | % |

Russell Midcap® Index | | | | | | 40.48 | % | | 2.43 | % | | 4.98 | % |

S&P Mid Cap 400 Index (former benchmark) | | | | 37.38 | % | | 3.27 | % | | 6.36 | % |

The performance data shown represents past performance. Past performance is not a guarantee of future results. Current performance may be lower or higher than the performance data quoted. The investment return and the principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. For performance information through the most recent month end please call (800) 835-3879 or visit our Web site at www.managersinvest.com.

Performance differences among the share classes are due to differences in sales charge structures and class expenses. Returns shown reflect maximum sales charge of 5.75% on Class A, as well as the applicable contingent deferred sales charge (CDSC) on both Class B and C shares. The Class B shares’ CDSC declines annually between years 1 through 6 according to the following schedule: 5, 4, 3, 3, 2, 1%. No sales charge is assessed after year six. Class C shares held for less than one year are subject to a 1% CDSC.

In choosing a Fund, investors should carefully consider the amount they plan to invest, their investment objectives, the Fund’s investment objectives, risks, charges and expenses before investing. For this and other information, please call (800) 835-3879 or visit www.managersinvest.com for a free prospectus. Read it carefully before investing or sending money. Distributed by Managers Distributors, Inc., member FINRA.

| 1 | Total return equals income yield plus share price change and assumes reinvestment of all dividends and capital gain distributions. Returns are net of fees and may reflect offsets of Fund expenses as described in the Prospectus. No adjustment has been made for taxes payable by shareholders on their reinvested dividends and capital gain distributions. Returns for periods greater than one year are annualized. The listed returns on the Fund are net of expenses and based on the published NAV as of December 31, 2009. All returns are in U.S. dollars($). |

| 2 | The Fund is subject to risks associated with investments in mid-capitalization companies, such as erratic earnings patterns, competitive conditions, limited earnings history, and a reliance on one or a limited number of products. |

| 3 | From time to time, the Fund’s advisor has waived its fees and/or absorbed Fund expenses, which has resulted in higher returns. |

The Russell Midcap® Index is a registered trademark of Russell Investments. Russell® is a trademark of Russell Investments.

Not FDIC insured, nor bank guaranteed. May lose value.

7

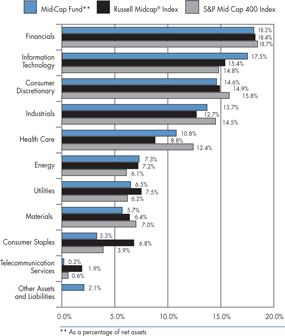

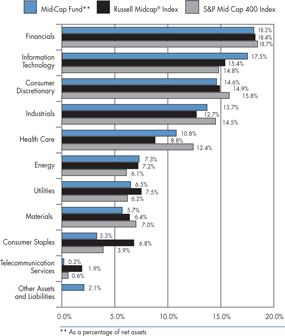

Managers AMG Chicago Equity Partners Mid-Cap Fund

Fund Snapshots

December 31, 2009

Portfolio Breakdown

| | | | | | | | | |

Industry | | Mid-Cap

Fund** | | | Russell Midcap®

Index | | | S&P Mid Cap

400 Index | |

| | | |

Financials | | 18.3 | % | | 18.4 | % | | 18.7 | % |

| | | |

Information Technology | | 17.5 | % | | 15.4 | % | | 14.8 | % |

| | | |

Consumer Discretionary | | 14.6 | % | | 14.9 | % | | 15.8 | % |

| | | |

Industrials | | 13.7 | % | | 12.7 | % | | 14.5 | % |

| | | |

Health Care | | 10.8 | % | | 8.8 | % | | 12.4 | % |

| | | |

Energy | | 7.3 | % | | 7.2 | % | | 6.1 | % |

| | | |

Utilities | | 6.5 | % | | 7.5 | % | | 6.2 | % |

| | | |

Materials | | 5.7 | % | | 6.4 | % | | 7.0 | % |

| | | |

Consumer Staples | | 3.3 | % | | 6.8 | % | | 3.9 | % |

| | | |

Telecommunication Services | | 0.2 | % | | 1.9 | % | | 0.6 | % |

| | | |

Other Assets and Liabilities | | 2.1 | % | | 0.0 | % | | 0.0 | % |

Top Ten Holdings

| | | |

Top Ten Holdings | | % of

Net Assets | |

Health Net, Inc.* | | 2.1 | % |

Sybase, Inc.* | | 2.0 | |

Ross Stores, Inc.* | | 1.7 | |

Hewitt Associates, Inc., Class A* | | 1.7 | |

Kennametal, Inc. | | 1.6 | |

Tech Data Corp. | | 1.6 | |

Patterson-UTI Energy, Inc. | | 1.5 | |

Timken Co. | | 1.4 | |

NVR, Inc. | | 1.4 | |

Bank of Hawaii Corp. | | 1.3 | |

| | | |

Top Ten as a Group | | 16.3 | % |

| | | |

| * | Top Ten Holding at June 30, 2009 |

Any sectors, industries, or securities discussed should not be perceived as investment recommendations. Mention of a specific security should not be considered a recommendation to buy or solicitation to sell that security. Specific securities mentioned in this report may have been sold from the Fund’s portfolio of investments by the time you receive this report.

8

Managers AMG Chicago Equity Partners Mid-Cap Fund

Schedule of Portfolio Investments

December 31, 2009

| | | | | | |

| | | Shares | | | Value |

Common Stocks - 97.9% | | | | | | |

Consumer Discretionary - 14.6% | | | | | | |

Aeropostale, Inc.* | | 6,200 | | | $ | 211,110 |

American Greetings Corp., Class A | | 2,500 | | | | 54,475 |

AnnTaylor Stores Corp.* | | 6,500 | | | | 88,660 |

Autonation, Inc.* | | 11,000 | 2 | | | 210,650 |

Bob Evans Farms, Inc. | | 5,800 | | | | 167,910 |

Brinker International, Inc. | | 8,000 | | | | 119,360 |

Cheesecake Factory, Inc., The* | | 8,500 | | | | 183,515 |

Chico’s FAS, Inc.* | | 18,500 | | | | 259,925 |

Chipotle Mexican Grill, Inc.* | | 1,200 | | | | 105,792 |

Corinthian Colleges, Inc.* | | 11,200 | 2 | | | 154,224 |

Dollar Tree, Inc.* | | 8,200 | | | | 396,060 |

ITT Educational Services, Inc.* | | 1,600 | | | | 153,536 |

Jones Apparel Group, Inc. | | 5,100 | | | | 81,906 |

Leggett & Platt, Inc. | | 8,800 | | | | 179,520 |

Liberty Media Corp. - Capital, Series A* | | 4,900 | | | | 117,012 |

Marvel Entertainment, Inc.* | | 2,300 | | | | 124,384 |

Netflix, Inc.* | | 4,700 | 2 | | | 259,158 |

NVR, Inc.* | | 685 | | | | 486,836 |

Panera Bread Co., Class A* | | 2,800 | | | | 187,516 |

priceline.com, Inc.* | | 1,100 | | | | 240,350 |

Ross Stores, Inc. | | 13,900 | | | | 593,669 |

Strayer Education, Inc. | | 505 | 2 | | | 107,307 |

TRW Automotive Holdings Corp.* | | 8,100 | | | | 193,428 |

Timberland Co., Class A* | | 5,200 | | | | 93,236 |

Tupperware Brands Corp. | | 5,600 | | | | 260,792 |

Warnaco Group, Inc., The* | | 3,700 | | | | 156,103 |

Total Consumer Discretionary | | | | | | 5,186,434 |

Consumer Staples - 3.3% | | | | | | |

Constellation Brands, Inc., Class A* | | 12,700 | | | | 202,311 |

Del Monte Foods Co. | | 6,800 | | | | 77,112 |

Hormel Foods Corp. | | 7,700 | | | | 296,065 |

Lancaster Colony Corp. | | 8,900 | | | | 442,330 |

SUPERVALU, Inc. | | 11,100 | | | | 141,081 |

Total Consumer Staples | | | | | | 1,158,899 |

Energy - 7.3% | | | | | | |

Cimarex Energy Co. | | 5,800 | | | | 307,226 |

Encore Acquisition Co.* | | 2,300 | | | | 110,446 |

FMC Technologies, Inc.* | | 5,000 | | | | 289,200 |

Newfield Exploration Co.* | | 7,000 | | | | 337,610 |

Oil States International, Inc.* | | 5,800 | | | $ | 227,882 |

Patterson-UTI Energy, Inc. | | 34,700 | | | | 532,645 |

Whiting Petroleum Corp.* | | 5,500 | | | | 392,975 |

World Fuel Services Corp. | | 14,800 | | | | 396,492 |

Total Energy | | | | | | 2,594,476 |

Financials - 18.3% | | | | | | |

AmeriCredit Corp.* | | 11,100 | 2 | | | 211,344 |

Annaly Capital Management, Inc. | | 11,800 | | | | 204,730 |

Bank of Hawaii Corp. | | 10,100 | | | | 475,306 |

Equity One, Inc. | | 14,500 | 2 | | | 234,465 |

Federal Realty Investment Trust | | 2,700 | 2 | | | 182,844 |

First American Corp. | | 6,100 | | | | 201,971 |

Fulton Financial Corp. | | 33,200 | | | | 289,504 |

Hospitality Properties Trust | | 16,300 | | | | 386,473 |

HRPT Properties Trust | | 42,100 | | | | 272,387 |

International Bancshares Corp. | | 10,200 | 2 | | | 193,086 |

Jefferies Group, Inc.* | | 2,300 | 2 | | | 54,579 |

Liberty Property Trust | | 7,900 | | | | 252,879 |

Mack-Cali Realty Corp. | | 12,400 | | | | 428,668 |

MFA Financial, Inc. | | 30,800 | | | | 226,380 |

National Retail Properties, Inc. | | 11,600 | 2 | | | 246,152 |

Nationwide Health Properties, Inc. | | 5,800 | | | | 204,044 |

New York Community Bancorp, Inc. | | 12,000 | 2 | | | 174,120 |

Omega Healthcare Investors, Inc. | | 16,400 | | | | 318,980 |

Platinum Underwriter Holdings, Ltd. | | 7,200 | | | | 275,688 |

Raymond James Financial, Inc. | | 9,600 | | | | 228,192 |

Reinsurance Group of America, Inc. | | 7,400 | | | | 352,610 |

RenaissanceRe Holdings, Ltd. | | 4,900 | | | | 260,435 |

SVB Financial Group* | | 8,800 | | | | 366,872 |

Unitrin, Inc. | | 12,200 | | | | 269,010 |

Waddell & Reed Financial, Inc. | | 6,000 | | | | 183,240 |

Total Financials | | | | | | 6,493,959 |

Health Care - 10.8% | | | | | | |

Alexion Pharmaceuticals, Inc.* | | 2,700 | | | | 131,814 |

Beckman Coulter, Inc. | | 1,900 | | | | 124,336 |

Charles River Laboratories International, Inc.* | | 7,100 | | | | 239,199 |

Coventry Health Care, Inc.* | | 8,900 | | | | 216,181 |

Health Net, Inc.* | | 32,600 | | | | 759,254 |

Hill-Rom Holdings, Inc. | | 13,700 | | | | 328,663 |

Kindred Healthcare, Inc.* | | 10,700 | | | | 197,522 |

Life Technologies Corp. | | 4,106 | | | | 214,456 |

The accompanying notes are an integral part of these financial statements.

9

Managers AMG Chicago Equity Partners Mid-Cap Fund

Schedule of Portfolio Investments (continued)

| | | | | | |

| | | Shares | | | Value |

Health Care - 10.8% (continued) | | | | | | |

Owens & Minor, Inc. | | 10,700 | | | $ | 459,351 |

PDL BioPharma, Inc. | | 5,900 | | | | 40,474 |

Perrigo Co. | | 9,000 | | | | 358,560 |

Steris Corp. | | 13,500 | | | | 377,595 |

Techne Corp. | | 2,500 | | | | 171,400 |

Universal Health Services, Inc., Class B | | 4,000 | | | | 122,000 |

Valeant Pharmaceuticals International* | | 3,100 | 2 | | | 98,549 |

Total Health Care | | | | | | 3,839,354 |

Industrials - 13.7% | | | | | | |

Alaska Airgroup, Inc.* | | 5,300 | | | | 183,168 |

Alliant Techsystems, Inc.* | | 800 | | | | 70,616 |

Avery Dennison Corp. | | 2,200 | | | | 80,278 |

Carlisle Cos., Inc. | | 7,700 | | | | 263,802 |

Crane Co. | | 6,500 | | | | 199,030 |

EMCOR Group, Inc.* | | 10,200 | | | | 274,380 |

GrafTech International, Ltd.* | | 5,700 | | | | 88,635 |

Harsco Corp. | | 4,000 | | | | 128,920 |

Hertz Global Holdings, Inc.* | | 15,800 | | | | 188,336 |

Hubbell, Inc., Class B | | 8,100 | | | | 383,130 |

Joy Global, Inc. | | 1,400 | | | | 72,226 |

KBR, Inc. | | 6,400 | | | | 121,600 |

Kennametal, Inc. | | 22,300 | | | | 578,016 |

Landstar System, Inc. | | 9,100 | | | | 352,807 |

Lincoln Electric Holdings, Inc. | | 3,800 | | | | 203,148 |

Manpower, Inc. | | 3,100 | | | | 169,198 |

Nordson Corp. | | 5,100 | | | | 312,018 |

Oshkosh Truck Corp. | | 11,400 | | | | 422,142 |

R.R. Donnelley & Sons Co. | | 3,200 | | | | 71,264 |

Timken Co. | | 21,300 | | | | 505,023 |

Werner Enterprises, Inc. | | 10,200 | | | | 201,858 |

Total Industrials | | | | | | 4,869,595 |

Information Technology - 17.5% | | | | | | |

3Com Corp.* | | 15,300 | | | | 114,750 |

Advanced Micro Devices, Inc.* | | 14,900 | | | | 144,232 |

Arris Group, Inc.* | | 12,200 | | | | 139,446 |

Arrow Electronics, Inc.* | | 5,000 | | | | 148,050 |

Avnet, Inc.* | | 7,100 | | | | 214,136 |

Broadridge Financial Solutions, Inc. | | 8,300 | | | | 187,248 |

CommScope, Inc.* | | 1,800 | | | | 47,754 |

Convergys Corp.* | | 25,100 | | | | 269,825 |

Cree, Inc.* | | 2,600 | | | $ | 146,562 |

Fairchild Semiconductor International, Inc.* | | 8,400 | | | | 83,916 |

F5 Networks, Inc.* | | 1,300 | | | | 68,874 |

Gartner, Inc.* | | 10,300 | | | | 185,812 |

Hewitt Associates, Inc., Class A* | | 13,900 | | | | 587,414 |

Informatica Corp.* | | 6,300 | | | | 162,918 |

Ingram Micro, Inc., Class A* | | 10,100 | | | | 176,245 |

JDS Uniphase Corp.* | | 7,900 | | | | 65,175 |

LSI Logic Corp.* | | 28,500 | | | | 171,285 |

Lender Processing Services, Inc. | | 6,400 | | | | 260,224 |

NeuStar, Inc., Class A* | | 9,900 | | | | 228,096 |

Novellus Systems, Inc.* | | 8,600 | | | | 200,724 |

Plantronics, Inc. | | 5,800 | | | | 150,684 |

Quest Software, Inc.* | | 13,700 | | | | 252,080 |

RF Micro Devices, Inc.* | | 50,500 | | | | 240,885 |

SAIC, Inc.* | | 16,200 | | | | 306,828 |

Solera Holdings, Inc. | | 1,600 | | | | 57,616 |

Sybase, Inc.* | | 16,000 | | | | 694,400 |

Tech Data Corp.* | | 12,300 | | | | 573,918 |

TIBCO Software, Inc.* | | 5,600 | | | | 53,928 |

Western Digital Corp.* | | 6,500 | | | | 286,975 |

Total Information Technology | | | | | | 6,220,000 |

Materials - 5.7% | | | | | | |

Cabot Corp. | | 9,800 | | | | 257,054 |

Cliffs Natural Resources, Inc. | | 2,400 | | | | 110,616 |

Louisana-Pacific Corp.* | | 16,700 | | | | 116,566 |

Lubrizol Corp. | | 4,400 | | | | 320,980 |

MeadWestvaco Corp. | | 13,900 | | | | 397,957 |

Reliance Steel & Aluminum Co. | | 2,500 | | | | 108,050 |

Terra Industries, Inc. | | 3,900 | | | | 125,541 |

Valspar Corp., The | | 3,200 | | | | 86,848 |

Westlake Chemical Corp. | | 7,200 | 2 | | | 179,496 |

Worthington Industries, Inc. | | 24,700 | | | | 322,829 |

Total Materials | | | | | | 2,025,937 |

Telecommunication Services - 0.2% | | | | | | |

NII Holdings, Inc.* | | 2,100 | | | | 70,518 |

Utilities - 6.5% | | | | | | |

Atmos Energy Corp. | | 11,100 | | | | 326,340 |

Hawaiian Electric Industries, Inc. | | 11,400 | 2 | | | 238,260 |

Integrys Energy Group, Inc. | | 2,500 | | | | 104,975 |

MDU Resources Group, Inc. | | 13,300 | | | | 313,880 |

The accompanying notes are an integral part of these financial statements.

10

Managers AMG Chicago Equity Partners Mid-Cap Fund

Schedule of Portfolio Investments (continued)

| | | | | | |

| | | Shares | | Value | |

Utilities -6.5% (continued) | | | | | | |

Mirant Corp.* | | 16,900 | | $ | 258,063 | |

New Jersey Resources Corp. | | 3,800 | | | 142,120 | |

NiSource, Inc. | | 23,500 | | | 361,430 | |

NSTAR | | 4,800 | | | 176,640 | |

PNM Resources, Inc. | | 31,200 | | | 394,680 | |

Total Utilities | | | | | 2,316,388 | |

Total Common Stocks

(cost $30,472,039) | | | | | 34,775,560 | |

Short-Term Investments - 7.9%1 | | | | | | |

BNY Institutional Cash Reserves Fund, Series A, 0.05%3 | | 1,889,000 | | | 1,889,000 | |

BNY Institutional Cash Reserves Fund, Series B*3,10 | | 159,721 | | | 31,146 | |

Dreyfus Cash Management Fund, Institutional Class Shares, 0.08% | | 890,556 | | | 890,556 | |

Total Short-Term Investments

(cost $2,939,277) | | | | | 2,810,702 | |

Total Investments - 105.8%

(cost $33,411,316) | | | | | 37,586,262 | |

Other Assets, less Liabilities - (5.8)% | | | | | (2,072,420 | ) |

Net Assets - 100.0% | | | | $ | 35,513,842 | |

The accompanying notes are an integral part of these financial statements.

11

Managers AMG Chicago Equity Partners Balanced Fund

Investment Manager’s Comments

The Year in Review

For the 12-month period ending December 31, 2009, the Managers AMG Chicago Equity Partners Balanced Fund returned 20.44%, marginally outpacing the 20.12% return for its hypothetical benchmark, which consists of 60% of the return of the Russell 1000® Index and 40% of the return of the Barclays Capital U.S. Aggregate Bond Index. The Fund’s benchmark was changed, effective December 31, 2009, from the previously used hypothetical benchmark consisting of 60% of the return of the S&P 500 Index and 40% of the return of the Barclays Capital U.S. Aggregate Bond Index. The previous hypothetical benchmark returned 19% for the 12-month period.

After declining nearly 24% to begin 2009, the Russell 1000® Index rallied 68.0% from its March 9th bottom through December 31st. The Index returned 6.1% in the fourth quarter and 28.4% for the year. The equity portion of the Fund slightly underperformed the benchmark for the year and for the quarter. The Fund’s holdings in the financial sector contributed positively to relative results for the second consecutive year, but much of that performance was achieved during the first half of the year. Holdings within the consumer discretionary and technology sectors detracted most from relative performance during the year.

From our model perspective, only the value factors have been rewarded throughout most of the year. We began to see this dissipate during the last several months of the year. This behavior is typical when risk appetites increase in anticipation of an economic recovery (late recession periods), and investors seek the cheapest stocks without regard to other fundamental metrics. This time period of extremely narrow factor performance is unusual. In fact, over the last twenty years, a scarce 8% of the time is only one factor group working. A vast majority of the time (92%), the markets reward multiple factor groups.

Fixed income market conditions improved dramatically in 2009. Spreads tightened more than 400 basis points, but still remained somewhat wide on a historical basis. Although interest rates were historically low, they increased during the year. After bottoming at 2.1% in December 2008, the 10-year Treasury yield finished 2009 at 3.8%. The corporate and commercial mortgage-backed sectors, two of the most impaired areas of the market in 2008, rebounded dramatically returning 18.7% and 28.5%, respectively, and significantly outperforming the 3.6% return from the U.S. Treasury sector. Within the corporate sector, lower-ranked securities were the best performers, with the BBB sector up 27.5%. Corporate investment-grade and high-yield debt issuance was estimated to be $1.2 trillion in 2009, after virtually drying up in mid- to late-2008. Issuance increased across all credit rating categories. The yield curve steepened dramatically in 2009, with long-term rates rising and short-term rates pinned down due to the historically low federal funds target rate. Long-term rates increased due to inflationary concerns and are now at levels similar to those at late 2007.

Within the fixed income portion of the Fund, sector allocation and security selection were the biggest contributors to excess returns for the one-year period. We overweighted corporate securities, with industrials representing our largest industry overweight. We significantly reduced our overweight in agency-backed mortgage securities due to the Federal Reserve’s significant purchases in the marketplace. We have benefited from improving market conditions, but we maintain our risk awareness in our portfolio structure and holdings. We anticipate increasing exposure to shorter-maturity, lower-quality corporates while decreasing allocations to agency debt. We will be diligent in monitoring exposures and will be prepared to reduce risky assets later in the year based on valuations or economic outlook.

Looking Forward

Overall, our philosophy will not change based on short-term trends or conditions in the market. Our goal is to add value through security selection while attempting to neutralize other risk factors, such as market timing and sector rotation, for which there is not adequate compensation by the market. Quantitative investing has faced a challenging period over the last several quarters, including significant and dramatic rotations in factor preference as well as style preference. We believe this trend is reversing, which will be beneficial for fundamental-based quantitative investing. We will continue to use our disciplined approach to provide added value at controlled levels of risk.

This commentary reflects the viewpoints of the portfolio manager, Chicago Equity Partners, as of January 26, 2010.

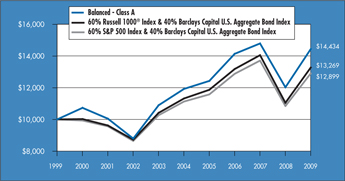

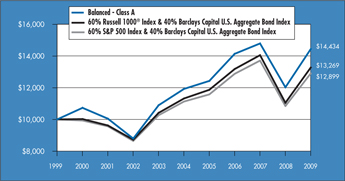

Cumulative Total Return Performance

The Fund’s cumulative total return is based on the daily change in net asset value (NAV), and assumes that all dividends and distributions were reinvested. The Barclays Capital U.S. Aggregate Bond Index is an index of the U.S. investment-grade fixed-rate bond market, including both government and corporate bonds. The Russell 1000® Index measures the performance of the large-cap segment of the U.S. equity universe. It is a subset of the Russell 3000® Index and includes approximately 1000 of the largest securities based on a combination of their market cap and current index membership. The Russell 1000® Index represents approximately 90% of the U.S. market. The S&P 500 Index is a capitalization-weighted index of 500 stocks. The S&P 500 Index is designed to measure performance of the broad domestic economy through changes in the aggregate market value of 500 stocks representing all major industries. Unlike the Fund, the Russell 1000® Index, the S&P 500 Index, and the Barclays Capital U.S. Aggregate Bond Index are unmanaged, are not available for investment, and do not incur expenses. The chart illustrates the performance of a hypothetical $10,000 investment made in the Fund’s Class A Shares on December 31, 1999, to a $10,000 investment made in the benchmarks for the same time periods. The graph and table do not reflect the deduction of taxes that a shareholder would pay on a Fund distribution or redemption of shares. Performance for periods longer than

12

Managers AMG Chicago Equity Partners Balanced Fund

Investment Manager’s Comments (continued)

Cumulative Total Return Performance (continued)

one year is annualized. The listed returns for the Fund are net of expenses and the returns for the indices exclude expenses. Total returns for the Fund would have been lower had certain expenses not been reduced.

The table below shows the average annualized total returns for the Fund, 60% Russell 1000® Index & 40% Barclays Capital U.S. Aggregate Bond Index, and 60% S&P 500 & 40% Barclays Capital U.S. Aggregate Bond Index from December 31, 1999 through December 31, 2009.

| | | | | | | | | | | | | |

Average Annual Total Returns1 | | | | | | 1 Year | | | 5 Years | | | 10 Years | |

Balanced2,3 | | -Class A | | No Load | | 20.06 | % | | 3.90 | % | | 3.74 | % |

| | -Class A | | With Load | | 13.14 | % | | 2.67 | % | | 3.13 | % |

| | -Class B | | No Load | | 19.42 | % | | 3.16 | % | | 3.13 | % |

| | -Class B | | With Load | | 14.42 | % | | 2.80 | % | | 3.13 | % |

| | -Class C | | No Load | | 19.33 | % | | 3.14 | % | | 3.12 | % |

| | -Class C | | With Load | | 18.33 | % | | 3.14 | % | | 3.12 | % |

| | -Institutional Class | | No Load | | 20.44 | % | | 4.17 | % | | 4.14 | % |

60% Russell 1000® Index & | | | | | | | | | | | | | |

40% Barclays Capital U.S. Aggregate Bond Index | | | | 20.12 | % | | 3.23 | % | | 2.87 | % |

60% S&P 500 Index & | | | | | | | | | | | | | |

40% Barclays Capital U.S. Aggregate Bond Index (former benchmark) | | 19.00 | % | | 3.00 | % | | 2.58 | % |

The performance data shown represents past performance. Past performance is not a guarantee of future results. Current performance may be lower or higher than the performance data quoted. The investment return and the principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. For performance information through the most recent month end please call (800) 835-3879 or visit our Web site at www.managersinvest.com.

Performance differences among the share classes are due to differences in sales charge structures and class expenses. Returns shown reflect maximum sales charge of 5.75% on Class A, as well as the applicable contingent deferred sales charge (CDSC) on both Class B and C shares. The Class B shares’ CDSC declines annually between years 1 through 6 according to the following schedule: 5, 4, 3, 3, 2, 1%. No sales charge is assessed after year six. Class C shares held for less than one year are subject to a 1% CDSC.

In choosing a Fund, investors should carefully consider the amount they plan to invest, their investment objectives, the Fund’s investment objectives, risks, charges and expenses before investing. For this and other information, please call (800) 835-3879 or visit www.managersinvest.com for a free prospectus. Read it carefully before investing or sending money. Distributed by Managers Distributors, Inc., member FINRA.

| 1 | Total return equals income yield plus share price change and assumes reinvestment of all dividends and capital gain distributions. Returns are net of fees and may reflect offsets of Fund expenses as described in the Prospectus. No adjustment has been made for taxes payable by shareholders on their reinvested dividends and capital gain distributions. Returns for periods greater than one year are annualized. The listed returns on the Fund are net of expenses and based on the published NAV as of December 31, 2009. All returns are in U.S. dollars($). |

| 2 | The Fund is subject to risks associated with investments in debt securities, such as default risk and fluctuations in the perception of the debtors’ ability to pay their creditors. |

| 3 | From time to time, the Fund’s advisor has waived its fees and/or absorbed Fund expenses, which has resulted in higher returns. |

The Russell 1000® Index is a registered trademark of Russell Investments. Russell® is a trademark of Russell Investments.

Not FDIC insured, nor bank guaranteed. May lose value.

13

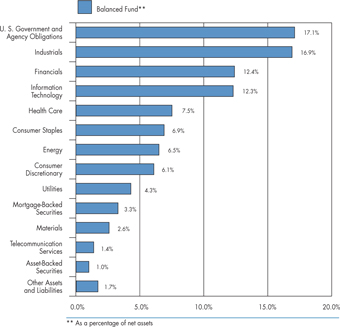

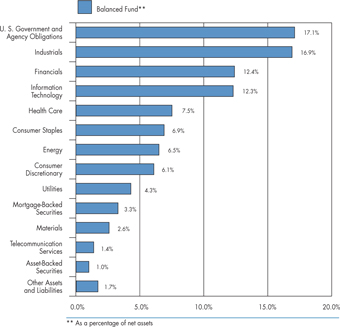

Managers AMG Chicago Equity Partners Balanced Fund

Fund Snapshots

December 31, 2009

Portfolio Breakdown

| | | |

Industry | | Balanced

Fund** | |

U. S. Government and Agency Obligations | | 17.1 | % |

Industrials | | 16.9 | % |

Financials | | 12.4 | % |

Information Technology | | 12.3 | % |

Health Care | | 7.5 | % |

Consumer Staples | | 6.9 | % |

Energy | | 6.5 | % |

Consumer Discretionary | | 6.1 | % |

Utilities | | 4.3 | % |

Mortgage-Backed Securities | | 3.3 | % |

Materials | | 2.6 | % |

Telecommunication Services | | 1.4 | % |

Asset-Backed Securities | | 1.0 | % |

Other Assets and Liabilities | | 1.7 | % |

Top Ten Holdings

| | | |

Top Ten Holdings | | % of

Net Assets | |

FNMA, 4.500%, 12/01/24 | | 2.2 | % |

FNMA, 5.500%, 02/01/37* | | 1.9 | |

Johnson & Johnson* | | 1.7 | |

FNMA, 4.500%, 09/01/20 | | 1.7 | |

FNMA, 5.500%, 08/01/37 | | 1.7 | |

JPMorgan Chase & Co. | | 1.6 | |

Pfizer, Inc.* | | 1.5 | |

FNMA, 5.000%, 09/01/33 | | 1.5 | |

Microsoft Corp. | | 1.5 | |

Exxon Mobil Corp.* | | 1.4 | |

| | | |

Top Ten as a Group | | 16.7 | % |

| | | |

| * | Top Ten Holding at June 30, 2009 |

Any sectors, industries, or securities discussed should not be perceived as investment recommendations. Mention of a specific security should not be considered a recommendation to buy or solicitation to sell that security. Specific securities mentioned in this report may have been sold from the Fund’s portfolio of investments by the time you receive this report.

14

Managers AMG Chicago Equity Partners Balanced Fund

Schedule of Portfolio Investments

December 31, 2009

| | | | | |

Security Description | | Shares | | Value |

Common Stocks - 60.1% | | | | | |

Consumer Discretionary - 6.1% | | | | | |

Amazon.com, Inc.* | | 800 | | $ | 107,616 |

Ford Motor Co.* | | 11,300 | | | 113,000 |

Leggett & Platt, Inc. | | 2,800 | | | 57,120 |

Liberty Media Corp., Interactive Group, Class A* | | 4,300 | | | 46,612 |

Macy’s, Inc. | | 8,300 | | | 139,108 |

McDonald’s Corp. | | 2,500 | | | 156,100 |

NVR, Inc.* | | 75 | | | 53,303 |

Polo Ralph Lauren Corp. | | 700 | | | 56,686 |

Ross Stores, Inc. | | 2,600 | | | 111,046 |

Time Warner, Inc. | | 2,600 | | | 75,764 |

Virgin Media, Inc. | | 6,100 | | | 102,663 |

Walt Disney Co., The | | 2,950 | | | 95,138 |

Total Consumer Discretionary | | | | | 1,114,156 |

Consumer Staples - 6.9% | | | | | |

Altria Group, Inc. | | 3,720 | | | 73,023 |

Archer-Daniels-Midland Co. | | 3,300 | | | 103,323 |

Avon Products, Inc. | | 2,450 | | | 77,175 |

Coca-Cola Enterprises, Inc. | | 5,500 | | | 116,600 |

Colgate-Palmolive Co. | | 900 | | | 73,935 |

Constellation Brands, Inc., Class A* | | 2,800 | | | 44,604 |

Estee Lauder Co., Class A | | 800 | | | 38,688 |

Kimberly-Clark Corp. | | 1,300 | | | 82,823 |

Lorillard, Inc. | | 600 | | | 48,138 |

PepsiCo, Inc. | | 2,350 | | | 142,880 |

Philip Morris International, Inc. | | 1,020 | | | 49,154 |

Sysco Corp. | | 3,900 | | | 108,966 |

Wal-Mart Stores, Inc. | | 3,600 | | | 192,420 |

Walgreen Co. | | 2,700 | | | 99,144 |

Total Consumer Staples | | | | | 1,250,873 |

Energy - 6.5% | | | | | |

Apache Corp. | | 1,800 | | | 185,706 |

Chevron Corp. | | 1,400 | | | 107,786 |

ConocoPhillips Co. | | 4,800 | | | 245,136 |

Devon Energy Corp. | | 2,300 | | | 169,050 |

Ensco International PLC, Sponsored ADR | | 1,500 | | | 59,910 |

Exxon Mobil Corp. | | 3,620 | | | 246,848 |

FMC Technologies, Inc.* | | 1,900 | | | 109,896 |

Patterson-UTI Energy, Inc. | | 3,200 | | | 49,120 |

Total Energy | | | | | 1,173,452 |

The accompanying notes are an integral part of these financial statements.

15

Managers AMG Chicago Equity Partners Balanced Fund

Schedule of Portfolio Investments (continued)

| | | | | |

Security Description | | Shares | | Value |

Financials - 8.5% | | | | | |

American Financial Group, Inc. | | 4,900 | | $ | 122,255 |

Annaly Capital Management, Inc. | | 4,300 | | | 74,605 |

Bank of New York Mellon Corp. | | 2,300 | | | 64,331 |

Blackrock, Inc. | | 410 | | | 95,202 |

Goldman Sachs Group, Inc. | | 1,110 | | | 187,413 |

HRPT Properties Trust | | 13,900 | | | 89,933 |

JPMorgan Chase & Co. | | 6,948 | | | 289,523 |

PNC Financial Services Group, Inc., The | | 3,100 | | | 163,649 |

Prudential Financial, Inc. | | 2,800 | | | 139,328 |

Raymond James Financial, Inc. | | 3,400 | | | 80,818 |

SL Green Realty Corp. | | 1,300 | | | 65,312 |

U.S. Bancorp | | 4,400 | | | 99,044 |

Wells Fargo & Co. | | 2,400 | | | 64,776 |

Total Financials | | | | | 1,536,189 |

Health Care - 7.5% | | | | | |

Abbott Laboratories | | 2,500 | | | 134,975 |

AmerisourceBergen Corp. | | 6,600 | | | 172,062 |

Amgen, Inc.* | | 1,700 | | | 96,169 |

CR Bard, Inc. | | 500 | | | 38,950 |

Gilead Sciences, Inc.* | | 1,900 | | | 82,232 |

Humana, Inc.* | | 2,200 | | | 96,558 |

Johnson & Johnson | | 4,880 | | | 314,321 |

Medco Health Solutions, Inc.* | | 2,300 | | | 146,993 |

Pfizer, Inc. | | 15,257 | | | 277,525 |

Total Health Care | | | | | 1,359,785 |

Industrials - 5.9% | | | | | |

3M Co. | | 1,200 | | | 99,204 |

Burlington Northern Santa Fe Corp. | | 200 | | | 19,724 |

CH Robinson Worldwide, Inc. | | 1,000 | | | 58,730 |

Cintas Corp. | | 1,900 | | | 49,495 |

Cooper Industries PLC | | 2,500 | | | 106,600 |

General Dynamics Corp. | | 1,600 | | | 109,072 |

General Electric Co. | | 11,400 | | | 172,482 |

Grainger (W.W.), Inc. | | 400 | | | 38,732 |

Hertz Global Holdings, Inc.* | | 7,100 | | | 84,632 |

Joy Global, Inc. | | 600 | | | 30,954 |

Northrop Grumman Corp. | | 1,600 | | | 89,360 |

Raytheon Co. | | 1,800 | | | 92,736 |

Timken Co. | | 2,900 | | | 68,759 |

United Parcel Service, Inc., Class B | | 700 | | | 40,159 |

Total Industrials | | | | | 1,060,639 |

The accompanying notes are an integral part of these financial statements.

16

Managers AMG Chicago Equity Partners Balanced Fund

Schedule of Portfolio Investments (continued)

| | | | | | |

Security Description | | Shares | | Value |

Information Technology - 12.3% | | | | | | |

Adobe Systems, Inc.* | | | 2,800 | | $ | 102,984 |

AOL, Inc.* | | | 254 | | | 5,913 |

Apple, Inc.* | | | 865 | | | 182,394 |

BMC Software, Inc.* | | | 1,200 | | | 48,120 |

Cisco Systems, Inc.* | | | 6,400 | | | 153,216 |

Computer Sciences Corp.* | | | 3,900 | | | 224,367 |

F5 Networks, Inc.* | | | 1,800 | | | 95,364 |

Hewitt Associates, Inc., Class A* | | | 2,300 | | | 97,198 |

Hewlett-Packard Co. | | | 1,000 | | | 51,510 |

Ingram Micro, Inc., Class A* | | | 3,800 | | | 66,310 |

International Business Machines Corp. | | | 1,400 | | | 183,260 |

LSI Logic Corp.* | | | 20,500 | | | 123,205 |

MasterCard, Inc., Class A | | | 365 | | | 93,433 |

Microsoft Corp. | | | 8,650 | | | 263,738 |

NeuStar, Inc., Class A* | | | 2,700 | | | 62,208 |

Novellus Systems, Inc.* | | | 2,600 | | | 60,684 |

Sandisk Corp.* | | | 3,500 | | | 101,465 |

Seagate Technology, Inc. | | | 6,100 | | | 110,959 |

Tech Data Corp.* | | | 600 | | | 27,996 |

Tellabs, Inc.* | | | 8,900 | | | 50,552 |

Texas Instruments, Inc. | | | 5,100 | | | 132,906 |

Total Information Technology | | | | | | 2,237,782 |

Materials - 2.6% | | | | | | |

Freeport McMoRan Copper & Gold, Inc.* | | | 1,300 | | | 104,377 |

Lubrizol Corp. | | | 2,900 | | | 211,555 |

MeadWestvaco Corp. | | | 3,200 | | | 91,616 |

Reliance Steel & Aluminum Co. | | | 1,500 | | | 64,830 |

Total Materials | | | | | | 472,378 |

Telecommunication Services - 1.4% | | | | | | |

AT&T, Inc. | | | 6,600 | | | 184,998 |

Qwest Communications International, Inc. | | | 18,300 | | | 77,043 |

Total Telecommunication Services | | | | | | 262,041 |

Utilities - 2.4% | | | | | | |

Edison International | | | 6,500 | | | 226,070 |

NiSource, Inc. | | | 2,800 | | | 43,064 |

PG&E Corp. | | | 3,700 | | | 165,205 |

Total Utilities | | | | | | 434,339 |

Total Common Stocks

(cost $9,098,000) | | | | | | 10,901,634 |

| | | Principal Amount | | |

Asset-Backed Securities - 1.0% | | | | | | |

Harley-Davidson Motorcycle Trust 2006-2, Class A2, 5.350%, 03/15/13 | | $ | 84,039 | | | 86,498 |

John Deere Owner Trust 2007, Class A4, 5.070%, 04/15/14 | | | 94,825 | | | 97,343 |

Total Asset-Backed Securities

(cost $178,796) | | | | | | 183,841 |

The accompanying notes are an integral part of these financial statements.

17

Managers AMG Chicago Equity Partners Balanced Fund

Schedule of Portfolio Investments (continued)

| | | | | | | |

Security Description | | Principal Amount | | | Value |

Mortgage-Backed Securities - 3.3% | | | | | | | |

Bank of America Commercial Mortgage, Inc., Series 2005-6, Class A4, 5.179%, 09/10/47 7 | | $ | 96,000 | | | $ | 94,433 |

CSFB Mortgage Securities Corp., Series 2005-C2, Class A3, 4.691%, 04/15/37 | | | 70,000 | | | | 68,698 |

GE Capital Commercial Mortgage Corp., Series 2002-2A, Class A2, 4.970%, 08/11/36 | | | 17,953 | | | | 18,602 |

Greenwich Capital Commercial Funding Corp., Series 2004-GG1, Class A7, 5.317%, 06/10/36 7 | | | 80,000 | | | | 81,297 |

Greenwich Capital Commercial Funding Corp., Series 2005-GG5, Class A2, 5.117%, 04/10/37 | | | 140,000 | | | | 140,584 |

JP Morgan Chase Mortgage Securities Corp., Series 2002-C2, Class A2, 5.050%, 12/12/34 | | | 90,000 | | | | 92,802 |

Wachovia Bank Commercial Mortgage Trust, Series 2005-C16, Class A4, 4.847%, 10/15/41 7 | | | 70,000 | | | | 67,606 |

Wachovia Bank Commercial Mortgage Trust, Series 2005-C19, Class A2, 4.516%, 05/15/44 | | | 34,452 | | | | 34,451 |

Total Mortgage-Backed Securities

(cost $568,683) | | | | | | | 598,473 |

U.S. Government and Agency Obligations - 17.1% | | | | | | | |

Federal Home Loan Mortgage Corporation - 0.9% | | | | | | | |

FHLMC, 5.000%, 12/01/20 | | | 92,096 | | | | 96,842 |

FHLMC Gold Pool, 6.000%, 04/01/38 | | | 69,243 | | | | 73,502 |

Total Federal Home Loan Mortgage Corporation | | | | | | | 170,344 |

Federal National Mortgage Association - 15.2% | | | | | | | |

FNMA, 4.000%, 10/01/20 to 12/01/21 | | | 65,056 | | | | 62,610 |

FNMA, 4.500%, 11/01/19 to 11/01/39 | | | 891,673 | | | | 922,398 |

FNMA, 5.000%, 03/01/23 to 02/01/36 | | | 557,819 | | | | 575,880 |

FNMA, 5.500%, 02/01/22 to 08/01/37 | | | 668,714 | | | | 702,517 |

FNMA, 6.000%, 05/15/11 to 08/01/37 | | | 454,077 | | | | 484,335 |

Total Federal National Mortgage Association | | | | | | | 2,747,740 |

United States Treasury Securities - 1.0% | | | | | | | |

U.S. Treasury Bonds, 4.250%, 05/15/39 | | | 175,000 | 2 | | | 164,226 |

U.S. Treasury, Principal Only Strip, 08/15/39 | | | 50,000 | | | | 12,261 |

Total United States Treasury Securities | | | | | | | 176,487 |

Total U.S. Government and Agency Obligations

(cost $3,047,548) | | | | | | | 3,094,571 |

Corporate Bonds - 16.8% | | | | | | | |

Financials - 3.9% | | | | | | | |

American Express Co., 7.250%, 05/20/14 | | | 50,000 | | | | 56,472 |

Bank of America Corp., 5.750%, 12/01/17 | | | 65,000 | | | | 66,666 |

Berkshire Hathaway Finance Corp., 4.850%, 01/15/15 | | | 50,000 | | | | 53,592 |

CME Group, Inc., 5.750%, 02/15/14 | | | 35,000 | | | | 38,317 |

Chubb Corp., The, 6.500%, 05/15/38 | | | 25,000 | | | | 27,624 |

Citigroup, Inc., 5.500%, 04/11/13 | | | 60,000 | | | | 62,252 |

General Electric Capital Corp., MTN, Series A, 6.750%, 03/15/32 | | | 35,000 | | | | 35,788 |

Goldman Sachs Group, Inc., 5.950%, 01/18/18 | | | 60,000 | | | | 63,460 |

JPMorgan Chase & Co., 6.000%, 01/15/18 | | | 45,000 | | | | 48,452 |

Marsh & McLennan Companies, Inc., 5.375%, 07/15/14 | | | 45,000 | | | | 46,068 |

Morgan Stanley, 5.950%, 12/28/17 | | | 30,000 | | | | 30,992 |

National Rural Utilities Cooperative Finance Corp., 10.375%, 11/01/18 | | | 45,000 | | | | 59,721 |

Prudential Financial, Inc., 4.750%, 09/17/15 | | | 50,000 | | | | 50,764 |

The accompanying notes are an integral part of these financial statements.

18

Managers AMG Chicago Equity Partners Balanced Fund

Schedule of Portfolio Investments (continued)

| | | | | | |

Security Description | | Principal Amount | | Value |

Financials - 3.9% (continued) | | | | | | |

Travelers Cos., Inc., 5.375%, 06/15/12 | | $ | 40,000 | | $ | 42,373 |

Wachovia Bank, N.A., 5.850%, 02/01/37 | | | 25,000 | | | 23,994 |

Total Financials | | | | | | 706,535 |

Industrials - 11.0% | | | | | | |

Abbott Laboratories, 5.875%, 05/15/16 | | | 68,000 | | | 75,103 |

Altria Group, Inc., 8.500%, 11/10/13 | | | 25,000 | | | 28,915 |

Altria Group, Inc., 9.700%, 11/10/18 | | | 23,000 | | | 28,476 |

Archer-Daniels-Midland Co., 5.450%, 03/15/18 | | | 55,000 | | | 58,679 |

AT&T, Inc., 5.100%, 09/15/14 | | | 80,000 | | | 86,143 |

Boeing Co., 3.750%, 11/20/16 | | | 50,000 | | | 48,408 |

Burlington Northern Santa Fe Corp., 5.650%, 05/01/17 | | | 20,000 | | | 21,320 |

Burlington Northern Santa Fe Corp., 5.900%, 07/01/12 | | | 35,000 | | | 37,970 |

Cardinal Health, Inc., 5.500%, 06/15/13 | | | 25,000 | | | 26,592 |

Cisco Systems, Inc., 5.900%, 02/15/39 | | | 20,000 | | | 20,292 |

Coca-Cola Enterprises, Inc., 7.375%, 03/03/14 | | | 50,000 | | | 58,033 |

Comcast Corp., 5.875%, 02/15/18 | | | 35,000 | | | 37,215 |

Devon Energy Corp., 6.300%, 01/15/19 | | | 70,000 | | | 78,078 |

Dow Chemical Co., The, 7.600%, 05/15/14 | | | 30,000 | | | 34,169 |

E.I. du Pont de Nemours & Company, 5.000%, 01/15/13 | | | 40,000 | | | 42,868 |

General Mills, Inc., 5.200%, 03/17/15 | | | 80,000 | | | 85,469 |

GlaxoSmithKline Capital, Inc., 6.380%, 05/15/38 | | | 35,000 | | | 38,909 |

Hess Corp., 8.125%, 02/15/19 | | | 40,000 | | | 48,319 |

Hewlett-Packard Co., 4.500%, 03/01/13 | | | 55,000 | | | 58,352 |

Honeywell International, Inc., 4.250%, 03/01/13 | | | 55,000 | | | 57,784 |

IBM Corp., 4.750%, 11/29/12 | | | 75,000 | | | 80,631 |

Kellogg Co., 7.450%, 04/01/31 | | | 35,000 | | | 42,557 |

Kimberly-Clark Corp., 6.125%, 08/01/17 | | | 40,000 | | | 44,411 |

Kraft Foods, Inc., 6.875%, 01/26/39 | | | 35,000 | | | 36,868 |

Kroger Co., The, 5.500%, 02/01/13 | | | 25,000 | | | 26,718 |

Kroger Co., The, 6.750%, 04/15/12 | | | 40,000 | | | 43,711 |

Lockheed Martin Corp., 7.650%, 05/01/16 | | | 65,000 | | | 77,389 |

McDonald’s Corp., 4.300%, 03/01/13 | | | 40,000 | | | 42,346 |

McDonald’s Corp., 6.300%, 10/15/37 | | | 40,000 | | | 43,528 |

McKesson Corp., 7.500%, 02/15/19 | | | 40,000 | | | 47,516 |

Norfolk Southern Corp., 5.640%, 05/17/29 | | | 25,000 | | | 24,275 |

Northrop Grumman Corp., 7.750%, 02/15/31 | | | 25,000 | | | 30,977 |

PACCAR, Inc., 6.875%, 02/15/14 | | | 50,000 | | | 56,454 |

Spectra Energy Capital LLC, 6.200%, 04/15/18 | | | 40,000 | | | 42,550 |

Telecom Italia Capital SA, 5.250%, 11/15/13 | | | 45,000 | | | 47,372 |

Time Warner Cable, Inc., 5.850%, 05/01/17 | | | 40,000 | | | 42,089 |

Time Warner Cable, Inc., 6.750%, 07/01/18 | | | 45,000 | | | 49,516 |

The accompanying notes are an integral part of these financial statements.

19

Managers AMG Chicago Equity Partners Balanced Fund

Schedule of Portfolio Investments (continued)

| | | | | | |

Security Description | | Principal Amount | | Value |

Industrials - 11.0% (continued) | | | | | | |

TransCanada Pipelines, Ltd., 4.875%, 01/15/15 | | $ | 45,000 | | $ | 47,261 |

TransCanada Pipelines, Ltd., 7.125%, 01/15/19 | | | 15,000 | | | 17,568 |

Union Pacific Corp., 6.250%, 05/01/34 | | | 23,000 | | | 23,893 |

United Parcel Service, Inc., 6.200%, 01/15/38 | | | 25,000 | | | 27,813 |

Verizon Communications, Inc., 6.400%, 02/15/38 | | | 35,000 | | | 36,711 |

Wal-Mart Stores, Inc., 6.500%, 08/15/37 | | | 40,000 | | | 45,675 |

Wyeth Co., 5.250%, 03/15/13 | | | 40,000 | | | 43,524 |

Total Industrials | | | | | | 1,992,447 |

Utilities - 1.9% | | | | | | |

Consolidated Edison, Inc., 5.375%, 12/15/15 | | | 75,000 | | | 81,154 |

Exelon Generation Co., LLC, 6.200%, 10/01/17 | | | 45,000 | | | 48,312 |

Florida Power & Light Co., 4.850%, 02/01/13 | | | 45,000 | | | 47,670 |

Midamerican Energy Co., 5.750%, 11/01/35 | | | 25,000 | | | 25,112 |

NiSource Finance Corp., 6.800%, 01/15/19 | | | 25,000 | | | 26,782 |

Pacific Gas & Electric, 8.250%, 10/15/18 | | | 65,000 | | | 79,497 |

Virginia Electric and Power Co., 8.875%, 11/15/38 | | | 25,000 | | | 35,403 |

Total Utilities | | | | | | 343,930 |

Total Corporate Bonds

(cost $2,848,171) | | | | | | 3,042,912 |

| | |

| | | Shares | | |

Short-Term Investments - 1.6%1 | | | | | | |

BNY Institutional Cash Reserves Fund, Series A, 0.05%3 | | | 1,000 | | | 1,000 |

BNY Institutional Cash Reserves Fund, Series B*3,10 | | | 28,392 | | | 5,536 |

Dreyfus Cash Management Fund, Institutional Class Shares, 0.08% | | | 287,974 | | | 287,974 |

Total Short-Term Investments (cost $317,366) | | | | | | 294,510 |

Total Investments - 99.9%