UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-06431

MANAGERS TRUST II

(Exact name of registrant as specified in charter)

800 Connecticut Avenue, Norwalk, Connecticut 06854

(Address of principal executive offices) (Zip code)

Managers Investment Group LLC

800 Connecticut Avenue, Norwalk, Connecticut 06854

(Name and address of agent for service)

Registrant’s telephone number, including area code: (203) 299-3500

Date of fiscal year end: DECEMBER 31

| | |

| Date of reporting period: | | JANUARY 1, 2011 – DECEMBER 31, 2011 (Annual Shareholder Report) |

Item 1. Reports to Shareholders

Managers Funds

Annual Report — December 31, 2011

| | | | |

| |

TABLE OF CONTENTS | | Page | |

| |

LETTER TO SHAREHOLDERS | | | 1 | |

| |

ABOUT YOUR FUND’S EXPENSES | | | 4 | |

| |

INVESTMENT MANAGER’S COMMENTS, FUND SNAPSHOTS, AND SCHEDULES OF PORTFOLIO INVESTMENTS | | | | |

| |

Managers AMG Chicago Equity Partners Mid-Cap Fund | | | 6 | |

| |

Managers AMG Chicago Equity Partners Balanced Fund | | | 11 | |

| |

Managers High Yield Fund | | | 20 | |

| |

Managers Fixed Income Fund | | | 34 | |

| |

NOTES TO SCHEDULES OF PORTFOLIO INVESTMENTS | | | 44 | |

| |

FINANCIAL STATEMENTS: | | | | |

| |

Statements of Assets and Liabilities | | | 47 | |

Funds’ balance sheets, net asset value (NAV) per share computations and cumulative undistributed amounts | | | | |

| |

Statements of Operations | | | 49 | |

Detail of sources of income, Fund expenses, and realized and unrealized gains (losses) during the year | | | | |

| |

Statements of Changes in Net Assets | | | 50 | |

Detail of changes in Fund assets for the past two years | | | | |

| |

FINANCIAL HIGHLIGHTS | | | 52 | |

Historical net asset values per share, distributions, total returns, expense ratios, turnover ratios and net assets | | | | |

| |

NOTES TO FINANCIAL HIGHLIGHTS | | | 60 | |

| |

NOTES TO FINANCIAL STATEMENTS | | | 61 | |

Accounting and distribution policies, details of agreements and transactions with Fund management and affiliates, and descriptions of certain investment risks | | | | |

| |

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM | | | 69 | |

| |

TRUSTEES AND OFFICERS | | | 70 | |

Nothing contained herein is to be considered an offer, sale or solicitation of an offer to buy shares of any series of the Managers Family of Funds. Such offering is made only by Prospectus, which includes details as to offering price and other material information.

Letter to Shareholders

Dear Shareholder:

Our foremost goal at Managers Investment Group (“MIG”) is to structure and manage mutual funds that will help our shareholders and clients successfully reach their investment goals and objectives.

Each of our Funds is geared to provide you with exposure to a specific asset class or style of investing. Investors tend to use our Funds as part of their broader portfolio in order to tailor their asset allocation to meet their individual needs. Most of our Funds, like those detailed in this report, are therefore designed to be building blocks.

At MIG, we have overall responsibility for the investment management and administration of the Funds. As a “manager of managers,” we work with external investment managers that make the day-to-day investment decisions in the Funds (the “Portfolio Managers”). We devote considerable resources to our disciplined process of identifying and selecting unaffiliated Portfolio Managers for the Funds. As a manager of managers, MIG performs many activities to monitor the ongoing investment, compliance, and administrative aspects of all of the Funds, which gives our shareholders added confidence in their investments.

Our parent company, Affiliated Managers Group (“AMG”), is a global asset management company with ownership interests in a diverse group of boutique investment management firms (its “Affiliates”). MIG has the unique opportunity to access the investment skills and acumen of some of AMG’s Affiliates. The set of our Funds managed by these proprietary firms also benefit from our activities to monitor the investment, compliance, and administrative aspects of the Funds.

Below is a brief overview of the securities markets and the performance results for the Funds. Following this letter, we also provide the Portfolio Managers’ discussion of their investment management approach, performance results, and market outlook.

Although U.S. equity markets generally ended the year flat or modestly negative, investors in those markets certainly experienced high levels of volatility along the way. After markets shook off macroeconomic events in the first half of the year such as the Arab Spring and the devastating consequences of the Japanese tsunami, markets were not nearly as resilient in the summer months as the political stalemate in Washington involving the U.S. debt ceiling, the S&P downgrade of U.S. sovereign credit rating, and the fear of European sovereign debt contagion shook equity markets. The end of September and into the fourth quarter, however, featured almost a complete reversal of the “risk off” trade from the summer months with markets responding positively both to the coordinated efforts of European policymakers to head off issues surrounding their collective sovereign debt crisis as well as to generally positive earnings reports at the company level in the U.S. Meanwhile fixed income markets generally rose for the year amid the turbulence as the uncertainty boosted fixed income returns. After a solid start to the first half of the year, the summer months were highlighted by bond gains as a sharp decline in treasury yields amid a flight to safety boosted demand for treasuries. This reversed in October as risk aversion began to ease across global markets amid optimism that the European debt crisis could be contained. As a result, U.S. treasury yields rose during October and riskier areas of the fixed income market, such as high yield and credit, outperformed. This reversed again during November, before markets normalized during December. Overall, fixed income securities generated decent absolute returns, but it was a volatile year with multiple shifts in market leadership.

1

Letter to Shareholders (continued)

Against this backdrop, the Managers AMG Chicago Equity Partners Mid Cap Fund (Institutional Class), Managers AMG Chicago Equity Partners Balanced Fund (Institutional Class), Managers High Yield Fund (Institutional Class), and the Managers Fixed Income Fund (Institutional Class) generated the following returns as detailed below:

| | | | | | | | | | | | | | | | | | | | |

Periods Ended 12/31/2011 | | Six Months | | | One Year | | | Three Years | | | Five Years | | | Ten Years | |

Managers AMG Chicago Equity Partners

Mid-Cap Fund | | | | | | | | | | | | | | | | | | | | |

Institutional Class | | | (10.59 | )% | | | 1.08 | % | | | 21.77 | % | | | 1.04 | % | | | 6.01 | % |

Russell Midcap® Index | | | (8.91 | )% | | | (1.55 | )% | | | 20.17 | % | | | 1.41 | % | | | 6.99 | % |

Managers AMG Chicago Equity Partners Balanced Fund | | | | | | | | | | | | | | | | | | | | |

Institutional Class | | | (0.26 | )% | | | 6.77 | % | | | 12.73 | % | | | 4.13 | % | | | 5.81 | % |

60% Russell 1000® Index/40% Barclays Capital U.S. Aggregate Bond Index | | | (0.18 | )% | | | 4.84 | % | | | 12.39 | % | | | 3.55 | % | | | 5.01 | % |

Managers High Yield Fund | | | | | | | | | | | | | | | | | | | | |

Institutional Class | | | 0.55 | % | | | 4.83 | % | | | 22.77 | % | | | 5.95 | % | | | 8.54 | % |

Barclays Capital U.S. Corporate High Yield Bond Index | | | 0.01 | % | | | 4.98 | % | | | 24.12 | % | | | 7.54 | % | | | 8.85 | % |

Managers Fixed Income Fund | | | | | | | | | | | | | | | | | | | | |

Institutional Class | | | 0.35 | % | | | 4.79 | % | | | 12.56 | % | | | 6.26 | % | | | 6.43 | % |

Barclays Capital U.S. Aggregate Bond Index | | | 4.98 | % | | | 7.84 | % | | | 6.77 | % | | | 6.50 | % | | | 5.78 | % |

For the year ended December 31, 2011, the Managers AMG Chicago Equity Partners Mid-Cap Fund’s Institutional Class returned 1.08% for 2011, versus -1.55% for the benchmark Russell Midcap® Index. The Fund experienced solid outperformance during the year with the outperformance being achieved from holdings in eight out of ten sectors. Momentum factors were also beneficial to the Fund for the year.

For the year ended December 31, 2011, the Managers AMG Chicago Equity Partners Balanced Fund’s Institutional Class returned 6.77%, outperforming the 4.84% return for its hypothetical benchmark, which consists of 60% of the return of the Russell 1000® Index and 40% of the return of the Barclays Capital U.S. Aggregate Bond Index. The equity portion of the Fund experienced solid outperformance during the year, while the fixed income portion of the Fund had another successful year. Within fixed income, an underweight to corporate bonds, an emphasis on quality, attractive yield-curve positioning, and income from government mortgages were the primary sources of excess return.

For the year ended December 31, 2011, the Managers High Yield Fund’s Institutional Class returned 4.83%, compared to 4.98% for the Barclays Capital U.S. Corporate High Yield Index. The Fund slightly underperformed its primary benchmark during 2011 due to exposure to the chemicals, retailers, and consumer services sectors. On the upside, performance was aided by security selection in the financials, real estate investment trusts, and transportation services sectors.

For the year ended December 31, 2011, Managers Fixed Income Fund’s Institutional Class returned 4.79%, lagging the 7.84% return for the Barclays Capital U.S. Aggregate Bond Index. The primary driver of the Fund’s underperformance relative to the Index during 2011 was its emphasis on convertibles, below investment grade bonds, and its underweight to the U.S. Treasury sector.

The following report covers the one-year period ended December 31, 2011. Should you have any questions about this report, or if you’d like to receive a prospectus and additional information, including fees and expenses for this or any of the other Funds in our family, please feel free to contact us at 1-800-835-3879, or visit our Web site at www.managersinvest.com. As always, please read the prospectus carefully before you invest or send money.

2

Letter to Shareholders (continued)

If you are curious about how you can better diversify your investment program, visit our web site for information on other MIG product offerings. You can rest assured that under all market conditions our team is focused on delivering excellent investment management services for your benefit.

We thank you for your continued confidence and investment in The Managers Funds.

Respectfully,

Keitha Kinne

Managing Partner

Managers Investment Group LLC

3

About Your Fund’s Expenses

As a shareholder of a Fund, you may incur two types of costs: (1) transaction costs, which may include sales charges (loads) on purchase payments; redemption fees; and exchange fees; and (2) ongoing costs, including management fees; distribution (12b-1) fees; and other Fund expenses. This example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds. The example is based on $1,000 invested at the beginning of the period and held for the entire period as indicated below.

Actual Expenses

The first line of the following table provides information about the actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

The second line of the following table provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed annual rate of return of 5% before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds by comparing this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as sales charges (loads), redemption fees, or exchange fees. Therefore, the second line of the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds.

| | | | | | | | | | | | | | | | |

Six Months Ended December 31, 2011 | | Expense

Ratio for

the Period | | | Beginning

Account Value

07/01/2011 | | | Ending

Account Value

12/31/2011 | | | Expenses

Paid During

the Period* | |

Managers AMG Chicago Equity Partners

Mid-Cap Fund | | | | | | | | | | | | | |

Class A | | | | | | | | | | | | | | | | |

Based on Actual Fund Return | | | 1.24 | % | | $ | 1,000 | | | $ | 893 | | | $ | 5.92 | |

Hypothetical (5% return before expenses) | | | 1.24 | % | | $ | 1,000 | | | $ | 1,019 | | | $ | 6.31 | |

Class C | | | | | | | | | | | | | | | | |

Based on Actual Fund Return | | | 1.99 | % | | $ | 1,000 | | | $ | 890 | | | $ | 9.48 | |

Hypothetical (5% return before expenses) | | | 1.99 | % | | $ | 1,000 | | | $ | 1,015 | | | $ | 10.11 | |

Institutional Class | | | | | | | | | | | | | | | | |

Based on Actual Fund Return | | | 0.99 | % | | $ | 1,000 | | | $ | 894 | | | $ | 4.73 | |

Hypothetical (5% return before expenses) | | | 0.99 | % | | $ | 1,000 | | | $ | 1,020 | | | $ | 5.04 | |

Managers AMG Chicago Equity Partners Balanced Fund | | | | | | | | | | | | | | | | |

Class A | | | | | | | | | | | | | | | | |

Based on Actual Fund Return | | | 1.25 | % | | $ | 1,000 | | | $ | 996 | | | $ | 6.29 | |

Hypothetical (5% return before expenses) | | | 1.25 | % | | $ | 1,000 | | | $ | 1,019 | | | $ | 6.36 | |

Class C | | | | | | | | | | | | | | | | |

Based on Actual Fund Return | | | 2.00 | % | | $ | 1,000 | | | $ | 992 | | | $ | 10.04 | |

Hypothetical (5% return before expenses) | | | 2.00 | % | | $ | 1,000 | | | $ | 1,015 | | | $ | 10.16 | |

Institutional Class | | | | | | | | | | | | | | | | |

Based on Actual Fund Return | | | 1.00 | % | | $ | 1,000 | | | $ | 997 | | | $ | 5.03 | |

Hypothetical (5% return before expenses) | | | 1.00 | % | | $ | 1,000 | | | $ | 1,020 | | | $ | 5.09 | |

Managers High Yield Fund | | | | | | | | | | | | | | | | |

Class A | | | | | | | | | | | | | | | | |

Based on Actual Fund Return | | | 1.15 | % | | $ | 1,000 | | | $ | 1,004 | | | $ | 5.81 | |

Hypothetical (5% return before expenses) | | | 1.15 | % | | $ | 1,000 | | | $ | 1,019 | | | $ | 5.85 | |

Class C | | | | | | | | | | | | | | | | |

Based on Actual Fund Return | | | 1.90 | % | | $ | 1,000 | | | $ | 1,001 | | | $ | 9.58 | |

Hypothetical (5% return before expenses) | | | 1.90 | % | | $ | 1,000 | | | $ | 1,016 | | | $ | 9.65 | |

Institutional Class | | | | | | | | | | | | | | | | |

Based on Actual Fund Return | | | 0.90 | % | | $ | 1,000 | | | $ | 1,006 | | | $ | 4.55 | |

Hypothetical (5% return before expenses) | | | 0.90 | % | | $ | 1,000 | | | $ | 1,021 | | | $ | 4.58 | |

4

About Your Fund’s Expenses

| | | | | | | | | | | | | | | | |

Six Months Ended December 31, 2011 | | Expense

Ratio for

the Period | | | Beginning

Account Value

07/01/2011 | | | Ending

Account Value

12/31/2011 | | | Expenses

Paid During

the Period* | |

Managers Fixed Income Fund | | | | | | | | | | | | | | | | |

Class A | | | | | | | | | | | | | | | | |

Based on Actual Fund Return | | | 0.84 | % | | $ | 1,000 | | | $ | 1,002 | | | $ | 4.24 | |

Hypothetical (5% return before expenses) | | | 0.84 | % | | $ | 1,000 | | | $ | 1,021 | | | $ | 4.28 | |

Class B1 | | | | | | | | | | | | | | | | |

Based on Actual Fund Return | | | 1.59 | % | | $ | 1,000 | | | $ | 1,001 | | | $ | 8.02 | |

Hypothetical (5% return before expenses) | | | 1.59 | % | | $ | 1,000 | | | $ | 1,017 | | | $ | 8.08 | |

Class C | | | | | | | | | | | | | | | | |

Based on Actual Fund Return | | | 1.59 | % | | $ | 1,000 | | | $ | 1,002 | | | $ | 8.02 | |

Hypothetical (5% return before expenses) | | | 1.59 | % | | $ | 1,000 | | | $ | 1,017 | | | $ | 8.08 | |

Institutional Class | | | | | | | | | | | | | | | | |

Based on Actual Fund Return | | | 0.59 | % | | $ | 1,000 | | | $ | 1,004 | | | $ | 2.98 | |

Hypothetical (5% return before expenses) | | | 0.59 | % | | $ | 1,000 | | | $ | 1,022 | | | $ | 3.01 | |

| * | Expenses are equal to the Fund’s annualized expense ratio multiplied by the average account value over the period, multiplied by the number of days in the most recent fiscal half-year (184), then divided by 365. |

| 1 | Effective at the close of business on June 30, 2011, shares are no longer available for purchase. |

5

Managers AMG Chicago Equity Partners Mid-Cap Fund

Investment Manager’s Comments

THE YEAR IN REVIEW

For the year ended December 31, 2011 the Managers AMG Chicago Equity Partners Mid-Cap Fund’s Institutional class returned 1.08%, versus the Russell Midcap® Index at -1.55%. Overall, a broad set of our proprietary quantitative factors did well in 2011, and as a result, the top-ranked stocks (in our model) outperformed the bottom-ranked stocks. This led to consistent value-added excess return for the Fund.

If you were going to forecast tomorrow’s weather, a decent rule of thumb would be to use today’s actual temperature as your prediction — unless you are in Chicago, of course! If you were trying to forecast equity returns for the coming year, you would expect a more sophisticated approach would be warranted. But that was not the case in 2011. The Russell 1000® Index finished the year close to where it started, falling 3 points from 696 to 693. Dividends resulted in the year being positive. The mid-cap indices were negative for the year, underperforming the large-cap stocks.

Equity markets began with a strong start during the first part of the year peaking near the end of April. Performance then headed south as the Russell 1000® experienced seven consecutive weeks of negative performance. A strong rally during the final four days of June resulted in a quarter that was marginally positive. After an angst-filled third quarter, markets quickly regained their footing, and rebounded in the early part of the fourth quarter. Pessimism about an impending economic deceleration receded, and investors shifted their focus toward corporations, with strong balance sheets and attractive valuations that continued to deliver strong earnings. But worries remain unresolved, and many investors expect the pace of earnings growth to decline. The latest headlines coming out of Europe will continue to influence market movements. While references to green shoots are no longer part of the lexicon, encouraging data with respect to construction, manufacturing and auto and retail sales suggest the economy continues to make progress. But will that progress be sufficient to win over the non-believers?

The Fund experienced solid outperformance during the year. Year-to-date we saw broad and balanced outperformance with eight out of ten sectors providing returns in excess of the benchmark. From our factor groups, the Momentum factors performed the best; Quality was also strong while Growth and Value groups were flat. For the year, the model ranks provided strong discrimination as the top-ranked stocks performed the best and the lowest-ranked stocks showed the weakest performance. Overall, our philosophy will not change based on short-term trends or conditions in the market. Our goal is to add value through security selection, while attempting to neutralize other risk factors, such as market timing and sector rotation, for which there is not adequate compensation by the market. We will continue to use our disciplined approach to provide added value at controlled levels of risk.

This commentary reflects the viewpoints of the portfolio manager, Chicago Equity Partners, as of December 31, 2011, and is not intended as a forecast or guarantee of future results.

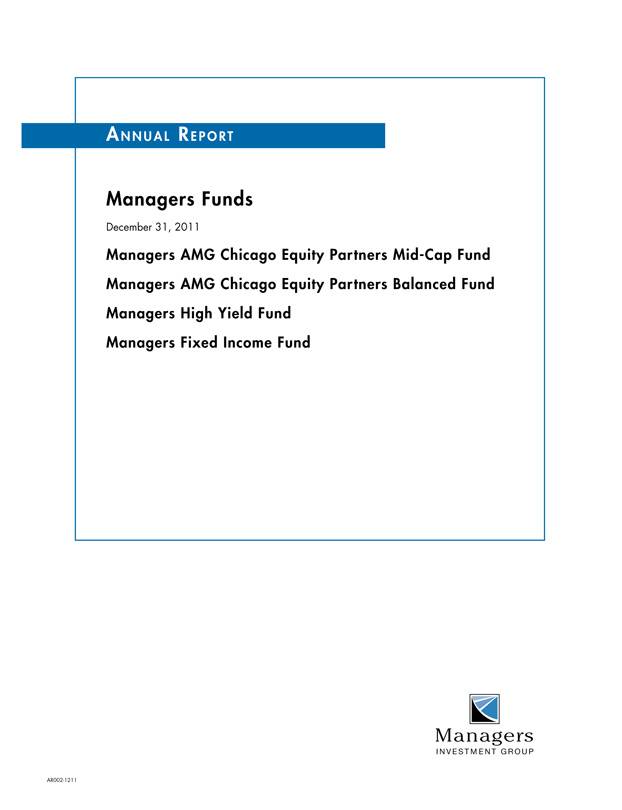

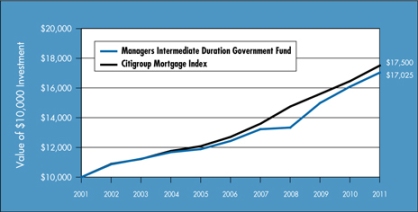

CUMULATIVE TOTAL RETURN PERFORMANCE

Managers AMG Chicago Equity Partners Mid-Cap Fund’s (“Managers Mid-Cap Fund”) cumulative total return is based on the daily change in net asset value (NAV), and assumes that all dividends and distributions were reinvested. This chart compares a hypothetical $10,000 investment made in the Fund’s Class A Shares (with load) on December 31, 2001, with a $10,000 investment made in the Rus-sell Midcap® Index for the same time period. Performance for periods longer than one year is annualized. The graph and table do not reflect the deduction of taxes that a shareholder would pay on a Fund distribution or redemption of shares. Past performance is not indicative of future results. The listed returns for the Fund are net of expenses and the returns for the indices exclude expenses.

6

Managers AMG Chicago Equity Partners Mid-Cap Fund

Investment Manager’s Comments (continued)

CUMULATIVE TOTAL RETURN PERFORMANCE (continued)

The table below shows the average annual total returns for the Managers Mid-Cap Fund and the Russell Midcap® Index from December 31, 2001 through December 31, 2011.

| | | | | | | | | | | | | | |

| | | | | Average Annual Total Returns1 | |

| | | | | One Year | | | Five Years | | | Ten Years | |

Managers AMG CEP Mid-Cap Fund 2,3 | | | | | | | | | |

-Class A | | No Load | | | 0.86 | % | | | 0.91 | % | | | 5.73 | % |

-Class A | | With Load | | | (4.94) | % | | | (0.27) | % | | | 5.10 | % |

-Class C | | No Load | | | 0.08 | % | | | 0.04 | % | | | 4.96 | % |

-Class C | | With Load | | | (0.92) | % | | | 0.04 | % | | | 4.96 | % |

-Institutional Class | | No Load | | | 1.08 | % | | | 1.04 | % | | | 6.01 | % |

Russell Midcap® Index4 | | | | | (1.55) | % | | | 1.41 | % | | | 6.99 | % |

The performance data shown represents past performance. Past performance is not a guarantee of future results. Current performance may be lower or higher than the performance data quoted. The investment return and principal value of an investment in the Fund will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. For performance information through the most recent month end, please call (800) 835-3879 or visit our Web site at www.managersinvest.com.

Performance differences among the share classes are due to differences in sales charge structures and class expenses. Returns shown reflect maximum sales charge of 5.75% on Class A, as well as the applicable contingent deferred sales charge (CDSC) on Class C shares. Class C shares held for less than one year are subject to a 1% CDSC.

Investors should carefully consider the Fund’s investment objectives, risks, charges, and expenses before investing. For this and other information, please call 800.835.3879 or visit www.managersinvest.com for a free prospectus. Read it carefully before investing or sending money. Funds are distributed by Managers Distributors, Inc., a member of FINRA.

|

1 Total return equals income yield plus share price change and assumes reinvestment of all dividends and capital gain distributions. Returns are net of fees and may reflect offsets of Fund expenses as described in the Prospectus. No adjustment has been made for taxes payable by shareholders on their reinvested dividends and capital gain distributions. Returns for periods greater than one year are annualized. The listed returns on the Fund are net of expenses and based on the published NAV as of December 31, 2011. All returns are in U.S. dollars ($). 2 The Fund is subject to risks associated with investments in mid-capitalization companies, such as erratic earnings patterns, competitive conditions, limited earnings history, and a reliance on one or a limited number of products. 3 From time to time, the Fund’s advisor has waived its fees and/or absorbed Fund expenses, which has resulted in higher returns. 4 The Russell Midcap® Index is a subset of the Russell 1000® Index and measures the performance of the 800 smallest companies in the Russell 1000® Index. The index is unmanaged, is not available for investment and does not incur expenses. The Russell Midcap® Index is a registered trademark of Russell Investments. Russell® is a trademark of Russell Investments. Not FDIC insured, nor bank guaranteed. May lose value. |

7

Managers AMG Chicago Equity Partners Mid-Cap Fund

Fund Snapshots (unaudited)

December 31, 2011

Portfolio Breakdown

| | | | | | | | |

Industry | | Managers AMG CEP

Mid-Cap Fund** | | | Russell

Midcap® Index | |

Financials | | | 19.0 | % | | | 19.1 | % |

Information Technology | | | 16.8 | % | | | 13.0 | % |

Industrials | | | 15.5 | % | | | 12.7 | % |

Consumer Discretionary | | | 14.6 | % | | | 15.6 | % |

Health Care | | | 9.6 | % | | | 9.6 | % |

Energy | | | 6.5 | % | | | 8.2 | % |

Materials | | | 6.1 | % | | | 6.6 | % |

Utilities | | | 6.1 | % | | | 7.5 | % |

Consumer Staples | | | 4.6 | % | | | 6.5 | % |

Telecommunication Services | | | 0.9 | % | | | 1.2 | % |

Other Assets and Liabilities | | | 0.3 | % | | | 0.0 | % |

| ** | As a percentage of net assets |

Top Ten Holdings

| | | | |

Security Name | | % of

Net Assets | |

National Retail Properties, Inc.* | | | 2.0 | % |

PetSmart, Inc. | | | 1.9 | |

Alliance Data Systems Corp. | | | 1.9 | |

Rayonier, Inc.* | | | 1.8 | |

Tractor Supply Co. | | | 1.8 | |

Kennametal, Inc.* | | | 1.8 | |

Convergys Corp. | | | 1.7 | |

Domtar Corp.* | | | 1.7 | |

Cadence Design Systems, Inc. | | | 1.6 | |

AMERIGROUP Corp.* | | | 1.6 | |

| | | | |

Top Ten as a Group | | | 17.8 | % |

| | | | |

| * | Top Ten Holding at June 30, 2011 |

|

| Any sectors, industries, or securities discussed should not be perceived as investment recommendations. Mention of a specific security should not be considered a recommendation to buy or solicitation to sell that security. Specific securities mentioned in this report may have been sold from the Fund’s portfolio of investments by the time you receive this report. |

8

Managers AMG Chicago Equity Partners Mid-Cap Fund

Schedule of Portfolio Investments

December 31, 2011

| | | | | | | | |

| | | Shares | | | Value | |

| | | | | | | | |

Common Stocks - 99.7% | | | | | | | | |

Consumer

Discretionary - 14.6% | | | | | | | | |

AMC Networks, Inc.,

Class A* | | | 3,000 | | | $ | 112,740 | |

Columbia Sportswear Co.1 | | | 3,900 | | | | 181,545 | |

Dana Holding Corp.* | | | 7,000 | | | | 85,050 | |

Dollar Tree, Inc.* | | | 4,250 | | | | 353,218 | |

Foot Locker, Inc. | | | 7,700 | | | | 183,568 | |

Fossil, Inc.* | | | 1,350 | | | | 107,136 | |

Gannett Co., Inc. | | | 13,300 | | | | 177,821 | |

Garmin, Ltd.1 | | | 7,300 | | | | 290,613 | |

Goodyear Tire & Rubber Co., The* | | | 4,300 | | | | 60,931 | |

H&R Block, Inc. | | | 21,500 | | | | 351,095 | |

Harman International Industries, Inc. | | | 5,200 | | | | 197,808 | |

Interpublic Group of Cos., Inc., The | | | 20,900 | | | | 203,357 | |

ITT Educational Services, Inc.*1 | | | 3,100 | | | | 176,359 | |

PetSmart, Inc. | | | 15,100 | | | | 774,479 | |

Polaris Industries, Inc. | | | 11,050 | | | | 618,579 | |

PVH Corp. | | | 4,400 | | | | 310,156 | |

Scripps Networks Interactive, Inc., Class A | | | 1,900 | | | | 80,598 | |

Tempur-Pedic International, Inc.* | | | 4,700 | | | | 246,891 | |

Tractor Supply Co. | | | 10,400 | | | | 729,560 | |

TRW Automotive Holdings Corp.* | | | 4,300 | | | | 140,180 | |

Weight Watchers International, Inc.1 | | | 4,400 | | | | 242,044 | |

Wyndham Worldwide Corp. | | | 6,600 | | | | 249,678 | |

Total Consumer Discretionary | | | | | | | 5,873,406 | |

Consumer Staples - 4.6% | | | | | | | | |

Church & Dwight Co., Inc. | | | 6,500 | | | | 297,440 | |

Constellation Brands, Inc., Class A* | | | 3,300 | | | | 68,211 | |

Corn Products International, Inc. | | | 4,300 | | | | 226,137 | |

Hansen Natural Corp.* | | | 3,550 | | | | 327,097 | |

Herbalife, Ltd. | | | 4,300 | | | | 222,181 | |

Hormel Foods Corp. | | | 9,500 | | | | 278,255 | |

Ralcorp Holdings, Inc.* | | | 2,200 | | | | 188,100 | |

Smithfield Foods, Inc.* | | | 5,600 | | | | 135,968 | |

Tyson Foods, Inc. | | | 5,500 | | | | 113,520 | |

Total Consumer Staples | | | | | | | 1,856,909 | |

Energy - 6.5% | | | | | | | | |

Atwood Oceanics, Inc.* | | | 1,500 | | | | 59,685 | |

CVR Energy, Inc. | | | 6,100 | | | | 114,253 | |

Energy XXI Bermuda, Ltd.* | | | 5,200 | | | | 165,776 | |

Exterran Holdings, Inc.* | | | 8,200 | | | | 74,620 | |

Forest Oil Corp.* | | | 12,600 | | | | 170,730 | |

Golar LNG, Ltd. | | | 6,800 | | | | 302,260 | |

Helix Energy Solutions Group, Inc.* | | | 25,100 | | | | 396,580 | |

| | | | | | | | |

| | | Shares | | | Value | |

| | | | | | | | |

Rosetta Resources, Inc.* | | | 6,400 | | | $ | 278,400 | |

SEACOR Holdings, Inc.* | | | 4,800 | | | | 427,008 | |

Southern Union Co. | | | 4,500 | | | | 189,495 | |

Tesoro Corp.* | | | 6,600 | | | | 154,176 | |

Unit Corp.* | | | 6,300 | | | | 292,320 | |

Total Energy | | | | | | | 2,625,303 | |

Financials - 19.0% | | | | | | | | |

Allied World Assurance Co. Holdings, AG | | | 5,500 | | | | 346,115 | |

American Campus Communities, Inc. | | | 11,600 | | | | 486,736 | |

American Capital Agency Corp. | | | 11,200 | | | | 314,496 | |

Arch Capital Group, Ltd.* | | | 12,100 | | | | 450,483 | |

Assurant, Inc. | | | 13,100 | | | | 537,886 | |

BOK Financial Corp. | | | 4,400 | | | | 241,692 | |

Camden Property Trust | | | 2,700 | | | | 168,048 | |

Cathay General Bancorp | | | 18,900 | | | | 282,177 | |

CBL & Associates Properties, Inc. | | | 11,800 | | | | 185,260 | |

Chimera Investment Corp. | | | 72,500 | | | | 181,975 | |

Commerce Bancshares, Inc. | | | 6,657 | | | | 253,765 | |

CommonWealth REIT | | | 15,200 | | | | 252,928 | |

East West Bancorp, Inc. | | | 13,700 | | | | 270,575 | |

Eaton Vance Corp. | | | 4,300 | | | | 101,652 | |

Federal Realty Investment Trust | | | 1,500 | | | | 136,125 | |

Highwoods Properties, Inc. | | | 4,700 | | | | 139,449 | |

Hospitality Properties Trust | | | 14,900 | | | | 342,402 | |

MFA Financial, Inc. | | | 28,400 | | | | 190,848 | |

NASDAQ OMX Group, Inc., The* | | | 9,900 | | | | 242,649 | |

National Retail Properties, Inc. | | | 31,100 | | | | 820,418 | |

Prosperity Bancshares, Inc. | | | 6,100 | | | | 246,135 | |

Raymond James Financial, Inc. | | | 2,100 | | | | 65,016 | |

Rayonier, Inc. | | | 16,500 | | | | 736,395 | |

Tanger Factory Outlet Centers | | | 7,000 | | | | 205,240 | |

Torchmark Corp. | | | 4,500 | | | | 195,255 | |

Transatlantic Holdings, Inc. | | | 2,300 | | | | 125,879 | |

Webster Financial Corp. | | | 4,400 | | | | 89,716 | |

Total Financials | | | | | | | 7,609,315 | |

Health Care - 9.6% | | | | | | | | |

AMERIGROUP Corp.* | | | 10,800 | | | | 638,064 | |

Charles River Laboratories International, Inc.* | | | 7,300 | | | | 199,509 | |

Community Health Systems, Inc.* | | | 10,100 | | | | 176,245 | |

Cooper Cos., Inc., The | | | 5,300 | | | | 373,756 | |

DENTSPLY International, Inc. | | | 12,300 | | | | 430,377 | |

Health Net, Inc.* | | | 19,900 | | | | 605,358 | |

Hill-Rom Holdings, Inc. | | | 3,500 | | | | 117,915 | |

Medicis Pharmaceutical Corp., Class A | | | 8,900 | | | | 295,925 | |

The accompanying notes are an integral part of these financial statements.

9

Managers AMG Chicago Equity Partners Mid-Cap Fund

Schedule of Portfolio Investments (continued)

| | | | | | | | |

| | | Shares | | | Value | |

| | | | | | | | |

Health Care - 9.6% (continued) | | | | | | | | |

PerkinElmer, Inc. | | | 10,600 | | | $ | 212,000 | |

Thoratec Corp.* | | | 2,300 | | | | 77,188 | |

United Therapeutics Corp.* | | | 11,500 | | | | 543,375 | |

WellCare Health Plans, Inc.* | | | 3,200 | | | | 168,000 | |

Total Health Care | | | | | | | 3,837,712 | |

Industrials - 15.5% | | | | | | | | |

AGCO Corp.* | | | 10,800 | | | | 464,076 | |

Alaska Air Group, Inc.* | | | 4,800 | | | | 360,432 | |

Chicago Bridge & Iron Co., NV | | | 6,500 | | | | 245,700 | |

Crane Co. | | | 8,700 | | | | 406,377 | |

EMCOR Group, Inc. | | | 10,500 | | | | 281,505 | |

Gardner Denver, Inc. | | | 4,700 | | | | 362,182 | |

Granite Construction, Inc. | | | 15,300 | | | | 362,916 | |

Herman Miller, Inc. | | | 7,300 | | | | 134,685 | |

Hexcel Corp.* | | | 14,500 | | | | 351,045 | |

Hubbell, Inc., Class B | | | 7,200 | | | | 481,392 | |

Huntington Ingalls Industries, Inc.* | | | 4,900 | | | | 153,272 | |

Kennametal, Inc. | | | 19,600 | | | | 715,792 | |

Landstar System, Inc. | | | 9,800 | | | | 469,616 | |

Lennox International, Inc. | | | 3,100 | | | | 104,625 | |

Manpower, Inc. | | | 13,900 | | | | 496,925 | |

Timken Co. | | | 12,400 | | | | 480,004 | |

TransDigm Group, Inc.* | | | 1,400 | | | | 133,952 | |

URS Corp.* | | | 5,600 | | | | 196,672 | |

Total Industrials | | | | | | | 6,201,168 | |

Information

Technology - 16.8% | | | | | | | | |

Advanced Micro Devices, Inc.*1 | | | 20,600 | | | | 111,240 | |

Alliance Data Systems Corp.* | | | 7,200 | | | | 747,648 | |

Anixter International, Inc.* | | | 5,400 | | | | 322,056 | |

AOL, Inc.* | | | 5,800 | | | | 87,580 | |

Atmel Corp.* | | | 13,200 | | | | 106,920 | |

Booz Allen Hamilton Holding Corp.* | | | 8,600 | | | | 148,350 | |

Cadence Design Systems, Inc.* | | | 63,100 | | | | 656,240 | |

Convergys Corp.* | | | 52,700 | | | | 672,979 | |

Cypress Semiconductor Corp.* | | | 9,300 | | | | 157,077 | |

Fairchild Semiconductor International, Inc.* | | | 19,400 | | | | 233,576 | |

Gartner, Inc.* | | | 10,300 | | | | 358,131 | |

Global Payments, Inc. | | | 4,500 | | | | 213,210 | |

IAC/InterActiveCorp | | | 11,000 | | | | 468,600 | |

Integrated Device Technology, Inc.* | | | 10,500 | | | | 57,330 | |

Jabil Circuit, Inc. | | | 12,100 | | | | 237,886 | |

LSI Corp.* | | | 20,200 | | | | 120,190 | |

Mentor Graphics Corp.* | | | 16,200 | | | | 219,672 | |

| | | | | | | | |

| | | Shares | | | Value | |

| | | | | | | | |

MICROS Systems, Inc.* | | | 5,100 | | | $ | 237,558 | |

NCR Corp.* | | | 25,000 | | | | 411,500 | |

NeuStar, Inc., Class A* | | | 1,700 | | | | 58,089 | |

Plantronics, Inc. | | | 4,800 | | | | 171,072 | |

Riverbed Technology, Inc.* | | | 12,400 | | | | 291,400 | |

Teradyne, Inc.* | | | 12,000 | | | | 163,560 | |

TIBCO Software, Inc.* | | | 11,800 | | | | 282,138 | |

Vishay Intertechnology, Inc.* | | | 22,900 | | | | 205,871 | |

Total Information Technology | | | | | | | 6,739,873 | |

Materials - 6.1% | | | | | | | | |

Albemarle Corp. | | | 3,600 | | | | 185,436 | |

Ashland, Inc. | | | 6,600 | | | | 377,256 | |

Cabot Corp. | | | 14,600 | | | | 469,244 | |

Coeur d’Alene Mines Corp.* | | | 5,200 | | | | 125,528 | |

Domtar Corp. | | | 8,325 | | | | 665,667 | |

Temple-Inland, Inc. | | | 4,300 | | | | 136,353 | |

Worthington Industries, Inc. | | | 30,600 | | | | 501,228 | |

Total Materials | | | | | | | 2,460,712 | |

Telecommunication Services - 0.9% | | | | | | | | |

Telephone & Data Systems, Inc. | | | 6,600 | | | | 170,874 | |

tw telecom, Inc.* | | | 5,700 | | | | 110,466 | |

United States Cellular Corp.* | | | 1,400 | | | | 61,082 | |

Total Telecommunication Services | | | | | | | 342,422 | |

Utilities - 6.1% | | | | | | | | |

Cleco Corp. | | | 12,300 | | | | 468,630 | |

IDACORP, Inc. | | | 11,500 | | | | 487,715 | |

NiSource, Inc. | | | 25,300 | | | | 602,393 | |

NRG Energy, Inc.* | | | 7,900 | | | | 143,148 | |

PNM Resources, Inc. | | | 26,000 | | | | 473,980 | |

Questar Corp. | | | 12,700 | | | | 252,222 | |

Total Utilities | | | | | | | 2,428,088 | |

Total Common Stocks

(cost $37,488,015) | | | | | | | 39,974,908 | |

Other Investment

Companies - 2.5%2 | | | | | | | | |

BNY Mellon Overnight Government Fund, 0.04%3 | | | 828,080 | | | | 828,080 | |

Dreyfus Cash Management Fund, Institutional Class Shares, 0.05% | | | 167,586 | | | | 167,586 | |

Total Other Investment Companies

(cost $995,666) | | | | | | | 995,666 | |

Total Investments - 102.2%

(cost $38,483,681) | | | | | | | 40,970,574 | |

Other Assets, less

Liabilities - (2.2)% | | | | | | | (873,938 | ) |

Net Assets 100.0% | | | | | | $ | 40,096,636 | |

The accompanying notes are an integral part of these financial statements.

10

Managers AMG Chicago Equity Partners Balanced Fund

Investment Manager’s Comments

THE YEAR IN REVIEW

For the year ended December 31, 2011, the Managers AMG Chicago Equity Partners Balanced Fund returned 6.77%, outperforming the 4.84% return for its benchmark, which consists of 60% of the return of the Russell 1000® Index and 40% of the return of the Barclays Capital U.S. Aggregate Bond Index. For the year, excess return came from out performance in both the equity and fixed income portions of the Fund.

If you were going to forecast tomorrow’s weather, a decent rule of thumb would be to use today’s actual temperature as your prediction, unless you are in Chicago, of course! If you were trying to forecast equity returns for the coming year, you would expect a more sophisticated approach would be warranted. But that was not the case in 2011. The Russell 1000® Index finished the year close to where it started, falling 3 points from 696 to 693. Dividends resulted in the year being positive.

Equity markets began with a strong start during the first part of the year peaking near the end of April. Performance then headed south as the Russell 1000® experienced seven consecutive weeks of negative performance. A strong rally during the final four days of June resulted in a quarter that was marginally positive. After an angst-filled third quarter, markets quickly regained their footing, and rebounded in the early part of the fourth quarter. Pessimism about an impending economic deceleration receded, and investors shifted their focus toward corporations with strong balance sheets and attractive valuations that continued to deliver strong earnings. But worries remain unresolved, and many investors expect the pace of earnings growth to decline. The latest headlines coming out of Europe will continue to influence market movements. While references to green shoots are no longer part of the lexicon, encouraging data with respect to construction, manufacturing and auto and retail sales suggest the economy continues to make progress. But will that progress be sufficient to win over the non-believers?

The equity portion of the Fund experienced solid out performance during the year. Year-to-date, the Portfolio experienced broad and balanced out performance with all ten sectors registering above benchmark returns. From our factor groups, the momentum factors performed the best; the quality and growth factor groups were also strong while the value group was flat. For the year, the model ranks provided strong discrimination as the top ranked stocks performed the best and the lowest ranked stocks showed the weakest performance. Overall, our philosophy will not change based on short-term trends or conditions in the market. We will continue to use our disciplined approach to provide added value at controlled levels of risk.

Headlines regarding the European sovereign debt crisis greatly influenced capital markets throughout the world in 2011. While policymakers have yet to achieve a lasting solution, attempts to calm markets, restore confidence, and put government budgets on a more-sound trajectory threaten the growth outlook for the world’s largest economic region in 2012. The combination of increasing risk and slowing growth resulted in lower rates and higher risk premiums in the United States. After starting the year at historically low levels,

interest rates on U.S. Treasury securities fell further, even as Standard & Poor’s downgraded the U.S.’s credit rating. Corporate bonds, after starting the year with strong performance, were unable to keep pace with government bonds, as the outlook for a sustained U.S. recovery remains uncertain. Elevated levels of unemployment and household debt, combined with continued weakness in the housing market, are preventing the U.S. economy from achieving the desired momentum. Attempts by federal, state, and local governments to trim spending and boost revenues will further challenge the U.S. economy in 2012.

U.S. Treasuries represented the best-performing sector of the fixed income market in 2011, with a total return of 9.81%. On a duration-adjusted basis, agency debentures represented the best-performing non-treasury sector, followed by agency mortgage-backed securities (MBS). While investment-grade corporate bonds had attractive total returns for the year, the sector’s relative return trailed the Treasury Index by more than 3.5%.

The fixed income portion of the Fund had another successful year. An underweight to corporate bonds, an emphasis on quality, attractive yield-curve positioning, and income from government mortgages were the primary sources of excess return. 2011 marks the fifth-consecutive year in which our core Strategy outperformed the Barclays Capital U.S. Aggregate Bond Index. The combination of research, risk management, and a commitment to a disciplined decision-making process has led to out performance by the fixed income portion of the Fund versus the index for our core product in nine of the last 10 years. A consistent track record through meaningfully different economic environments and difficult market climates demonstrates the value of our fixed income management approach. Portfolios remain positioned to benefit from an environment characterized by a lower appetite for risk. As always, we will be diligent in monitoring exposures and will adjust the portfolio accordingly as we monitor the market conditions.

This commentary reflects the viewpoints of the portfolio manager, Chicago Equity Partners, as of December 31, 2011, and is not intended as a forecast or guarantee of future results.

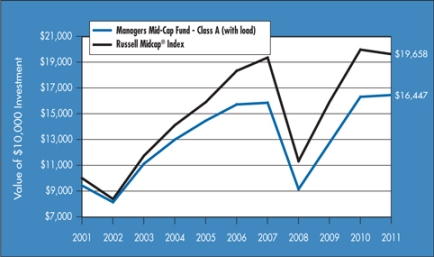

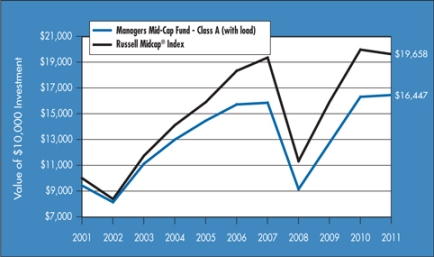

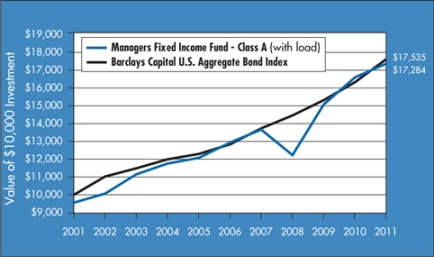

CUMULATIVE TOTAL RETURN PERFORMANCE

The Managers AMG Chicago Equity Partners Balanced Fund’s (“Managers Balanced Fund”) cumulative total return is based on the daily change in net asset value (NAV), and assumes that all dividends and distributions were reinvested. The chart illustrates the performance of a hypothetical $10,000 investment made in the Fund’s Class A Shares (with load) on December 31, 2001, to a $10,000 investment made in the benchmarks for the same time period. The graph and table do not reflect the deduction of taxes that a shareholder would pay on a Fund distribution or redemption of shares. Performance for periods longer than one year is annualized. The listed returns for the Fund are net of expenses and the returns for the indices exclude expenses. Total returns for the Fund would have been lower had certain expenses not been reduced.

Managers AMG Chicago Equity Partners Balanced Fund

Investment Manager’s Comments (continued)

CUMULATIVE TOTAL RETURN PERFORMANCE (continued)

The table below shows the average annual total returns for the Managers Balanced Fund, the Russell 1000® Index & the Barclays Capital U.S. Aggregate Bond Index from December 31, 2001 through December 31, 2011.

| | | | | | | | | | | | | | |

| | | | | Average Annual Total Returns1 | |

| | | | | One Year | | | Five Years | | | Ten Years | |

Managers AMG CEP Balanced Fund2,3 | |

-Class A | | No Load | | | 6.45 | % | | | 3.86 | % | | | 5.45 | % |

-Class A | | With Load | | | 0.35 | % | | | 2.64 | % | | | 4.82 | % |

-Class C | | No Load | | | 5.73 | % | | | 3.11 | % | | | 4.76 | % |

-Class C | | With Load | | | 4.73 | % | | | 3.11 | % | | | 4.76 | % |

-Institutional Class | | No Load | | | 6.77 | % | | | 4.13 | % | | | 5.81 | % |

60% Russell 1000® Index4/40% Barclays Capital U.S. Aggregate Index5 | | | 4.84 | % | | | 3.55 | % | | | 5.01 | % |

The performance data shown represents past performance. Past performance is not a guarantee of future results. Current performance may be lower or higher than the performance data quoted. The investment return and principal value of an investment in the Fund will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. For performance information through the most recent month end, please call (800) 835-3879 or visit our Web site at www.managersinvest.com.

Performance differences among the share classes are due to differences in sales charge structures and class expenses. Returns shown reflect maximum sales charge of 5.75% on Class A, as well as the applicable contingent deferred sales charge (CDSC) on Class C shares. Class C shares held for less than one year are subject to a 1% CDSC.

Investors should carefully consider the Fund’s investment objectives, risks, charges and expenses before investing. For this and other information, please call 800.835.3879 or visit www.managersinvest.com for a free prospectus. Read it carefully before investing or sending money. Funds are distributed by Managers Distributors, Inc., a member of FINRA.

|

1 Total return equals income yield plus share price change and assumes reinvestment of all dividends and capital gain distributions. Returns are net of fees and may reflect offsets of Fund expenses as described in the Prospectus. No adjustment has been made for taxes payable by shareholders on their reinvested dividends and capital gain distributions. Returns for periods greater than one year are annualized. The listed returns on the Fund are net of expenses and based on the published NAV as of December 31, 2011. All returns are in U.S. dollars ($). 2 The Fund is subject to risks associated with investments in debt securities, such as default risk and fluctuations in the perception of the debtors’ ability to pay their creditors. 3 From time to time, the Fund’s advisor has waived its fees and/or absorbed Fund expenses, which has resulted in higher returns. 4 The Russell 1000® Index measures the performance of approximately 1,000 of the largest securities based on a combination of their market cap and current index membership. The Russell 1000® represents approximately 92% of the U.S. market. The Russell 1000® Index is unmanaged, is not available for investment, and does not incur expenses. 5 The Barclays Capital U.S. Aggregate Bond Index is an index of the U.S. investment grade fixed-rate bond market, including both government and corporate bonds. The Barclays Capital U.S. Aggregate Bond Index is unmanaged, is not available for investment, and does not incur expenses. The Russell 1000® Index is a registered trademark of Russell Investments. Russell® is a trademark of Russell Investments. Not FDIC insured, nor bank guaranteed. May lose value. |

12

Managers AMG Chicago Equity Partners Balanced Fund

Fund Snapshots (unaudited)

December 31, 2011

Portfolio Breakdown

| | | | | | | | |

Industry | | Managers AMG CEP

Balanced Fund** | | | 60% Russell 1000® Index/

40% Barclays Capital

U.S. Aggregate

Bond Index | |

U.S. Government and Agency Obligations | | | 34.2 | % | | | 29.0 | % |

Information Technology | | | 12.5 | % | | | 11.0 | % |

Financials | | | 8.8 | % | | | 11.2 | % |

Industrials | | | 8.2 | % | | | 11.0 | % |

Health Care | | | 7.1 | % | | | 7.1 | % |

Energy | | | 6.5 | % | | | 7.0 | % |

Consumer Discretionary | | | 6.2 | % | | | 6.9 | % |

Consumer Staples | | | 6.2 | % | | | 6.3 | % |

Utilities | | | 3.3 | % | | | 3.3 | % |

Materials | | | 2.5 | % | | | 2.4 | % |

Telecommunication Services | | | 1.9 | % | | | 1.7 | % |

Mortgage-Backed Securities | | | 0.8 | % | | | 0.9 | % |

Asset-Backed Securities | | | 0.0 | % | | | 0.1 | % |

Foreign Government Obligations | | | 0.0 | % | | | 2.1 | % |

Other Assets and Liabilities | | | 1.8 | % | | | 0.0 | % |

| ** | As a percentage of net assets |

| | | | |

Top Ten Holdings | | | | |

Security Name | | % of

Net Assets | |

U.S. Treasury Bonds, 3.500%, 02/15/39 | | | 3.1 | % |

U.S. Treasury Notes, 2.625%, 08/15/20* | | | 2.2 | |

Verizon Communications, Inc.* | | | 1.7 | |

Johnson & Johnson* | | | 1.7 | |

U.S. Treasury Bonds, 3.125%, 05/15/21 | | | 1.7 | |

FHLB, 5.375%, 05/18/16 | | | 1.6 | |

FNMA, 5.375%, 06/12/17 | | | 1.5 | |

U.S. Treasury Notes, 2.750%, 02/28/18* | | | 1.5 | |

Apple, Inc.* | | | 1.5 | |

FHLB, 5.000%, 11/17/17 | | | 1.5 | |

| | | | |

Top Ten as a Group | | | 18.0 | % |

| | | | |

| * | Top Ten Holding at June 30, 2011 |

|

| Any sectors, industries, or securities discussed should not be perceived as investment recommendations. Mention of a specific security should not be considered a recommendation to buy or solicitation to sell that security. Specific securities mentioned in this report may have been sold from the Fund’s portfolio of investments by the time you receive this report. |

13

Managers AMG Chicago Equity Partners Balanced Fund

Schedule of Portfolio Investments

December 31, 2011

| | | | | | | | |

| | | Shares | | | Value | |

| | | | | | | | |

Common Stocks - 60.0% | | | | | | | | |

Consumer Discretionary - 6.2% | | | | | | | | |

CBS Corp., Class B | | | 7,150 | | | $ | 194,051 | |

Macy’s, Inc. | | | 3,950 | | | | 127,111 | |

Polaris Industries, Inc. | | | 3,200 | | | | 179,136 | |

Ross Stores, Inc. | | | 3,100 | | | | 147,343 | |

Signet Jewelers, Ltd. | | | 2,775 | | | | 121,989 | |

Starbucks Corp. | | | 4,500 | | | | 207,045 | |

Time Warner, Inc. | | | 5,100 | | | | 184,314 | |

TJX Cos., Inc. | | | 2,700 | | | | 174,285 | |

TRW Automotive Holdings Corp.* | | | 5,550 | | | | 180,930 | |

VF Corp. | | | 800 | | | | 101,592 | |

Viacom, Inc., Class B | | | 3,950 | | | | 179,370 | |

Total Consumer Discretionary | | | | | | | 1,797,166 | |

Consumer Staples - 6.2% | | | | | | | | |

Brown-Forman Corp., Class B | | | 1,300 | | | | 104,663 | |

Coca-Cola Enterprises, Inc. | | | 4,900 | | | | 126,322 | |

Colgate-Palmolive Co. | | | 2,400 | | | | 221,736 | |

Constellation Brands, Inc., Class A* | | | 7,300 | | | | 150,891 | |

Costco Wholesale Corp. | | | 1,650 | | | | 137,478 | |

Dean Foods Co.* | | | 7,300 | | | | 81,760 | |

Estee Lauder Cos. Inc., The, Class A | | | 825 | | | | 92,664 | |

Herbalife, Ltd. | | | 1,850 | | | | 95,589 | |

Hormel Foods Corp. | | | 6,100 | | | | 178,669 | |

Kroger Co., The | | | 6,450 | | | | 156,219 | |

Lorillard, Inc. | | | 825 | | | | 94,050 | |

Mead Johnson Nutrition Co. | | | 1,500 | | | | 103,095 | |

Philip Morris International, Inc. | | | 3,300 | | | | 258,984 | |

Total Consumer Staples | | | | | | | 1,802,120 | |

Energy - 6.5% | | | | | | | | |

Cabot Oil & Gas Corp. | | | 2,350 | | | | 178,365 | |

Chevron Corp. | | | 3,700 | | | | 393,680 | |

ConocoPhillips | | | 4,250 | | | | 309,698 | |

Devon Energy Corp. | | | 1,350 | | | | 83,700 | |

Diamond Offshore Drilling, Inc. | | | 2,000 | | | | 110,520 | |

Exxon Mobil Corp. | | | 4,595 | | | | 389,472 | |

Helmerich & Payne, Inc. | | | 1,000 | | | | 58,360 | |

National Oilwell Varco, Inc. | | | 2,500 | | | | 169,975 | |

Tesoro Corp.* | | | 2,900 | | | | 67,744 | |

Valero Energy Corp. | | | 5,000 | | | | 105,250 | |

Total Energy | | | | | | | 1,866,764 | |

Financials - 8.4% | | | | | | | | |

ACE, Ltd. | | | 2,700 | | | | 189,324 | |

American Financial Group, Inc. | | | 5,500 | | | | 202,895 | |

The accompanying notes are an integral part of these financial statements.

14

Managers AMG Chicago Equity Partners Balanced Fund

Schedule of Portfolio Investments (continued)

| | | | | | | | |

| | | Shares | | | Value | |

| | | | | | | | |

Financials - 8.4% (continued) | | | | | | | | |

Annaly Capital Management, Inc. | | | 7,750 | | | $ | 123,690 | |

Bank of America Corp. | | | 17,300 | | | | 96,188 | |

Berkshire Hathaway, Inc., Class B* | | | 1,300 | | | | 99,190 | |

Capital One Financial Corp. | | | 3,200 | | | | 135,328 | |

Chubb Corp., The | | | 2,400 | | | | 166,128 | |

Citigroup, Inc. | | | 6,530 | | | | 171,804 | |

CommonWealth REIT | | | 9,600 | | | | 159,744 | |

Discover Financial Services | | | 4,100 | | | | 98,400 | |

Interactive Brokers Group, Inc. | | | 4,400 | | | | 65,736 | |

JPMorgan Chase & Co. | | | 7,148 | | | | 237,671 | |

KeyCorp | | | 28,900 | | | | 222,241 | |

Public Storage | | | 2,050 | | | | 275,643 | |

SLM Corp. | | | 4,000 | | | | 53,600 | |

Wells Fargo & Co. | | | 5,100 | | | | 140,556 | |

Total Financials | | | | | | | 2,438,138 | |

Health Care - 7.1% | | | | | | | | |

Abbott Laboratories | | | 3,700 | | | | 208,051 | |

Aetna, Inc. | | | 2,600 | | | | 109,694 | |

Alexion Pharmaceuticals, Inc.* | | | 1,150 | | | | 82,225 | |

Amgen, Inc. | | | 1,153 | | | | 74,034 | |

Bristol-Myers Squibb Co. | | | 5,700 | | | | 200,868 | |

Humana, Inc. | | | 2,025 | | | | 177,410 | |

Johnson & Johnson | | | 7,350 | | | | 482,013 | |

Medco Health Solutions, Inc.* | | | 1,400 | | | | 78,260 | |

PerkinElmer, Inc. | | | 3,400 | | | | 68,000 | |

Pfizer, Inc. | | | 18,257 | | | | 395,081 | |

United Therapeutics Corp.* | | | 3,900 | | | | 184,275 | |

Total Health Care | | | | | | | 2,059,911 | |

Industrials - 6.0% | | | | | | | | |

Caterpillar, Inc. | | | 1,825 | | | | 165,345 | |

Fluor Corp. | | | 1,800 | | | | 90,450 | |

General Dynamics Corp. | | | 2,400 | | | | 159,384 | |

General Electric Co. | | | 15,150 | | | | 271,337 | |

Norfolk Southern Corp. | | | 2,450 | | | | 178,507 | |

Northrop Grumman Corp. | | | 3,300 | | | | 192,984 | |

Timken Co. | | | 6,050 | | | | 234,196 | |

United Parcel Service, Inc., Class B | | | 2,425 | | | | 177,486 | |

WW Grainger, Inc. | | | 1,400 | | | | 262,066 | |

Total Industrials | | | | | | | 1,731,755 | |

Information Technology - 12.5% | | | | | | | | |

Accenture PLC, Class A | | | 4,900 | | | | 260,827 | |

Altera Corp. | | | 4,725 | | | | 175,297 | |

Apple, Inc.* | | | 1,090 | | | | 441,450 | |

Automatic Data Processing, Inc. | | | 3,425 | | | | 184,984 | |

|

The accompanying notes are an integral part of these financial statements. 15 |

Managers AMG Chicago Equity Partners Balanced Fund

Schedule of Portfolio Investments (continued)

| | | | | | | | |

| | | Shares | | | Value | |

| | | | | | | | |

Information Technology - 12.5% (continued) | | | | | | | | |

Avago Technologies, Ltd. | | | 3,200 | | | $ | 92,352 | |

Cadence Design Systems, Inc.* | | | 16,900 | | | | 175,760 | |

Cognizant Technology Solutions Corp.* | | | 2,075 | | | | 133,443 | |

Dell, Inc.* | | | 7,450 | | | | 108,994 | |

F5 Networks, Inc.* | | | 1,100 | | | | 116,732 | |

Google, Inc., Class A* | | | 270 | | | | 174,393 | |

Intel Corp. | | | 7,600 | | | | 184,300 | |

International Business Machines Corp. | | | 2,160 | | | | 397,181 | |

Jabil Circuit, Inc. | | | 3,800 | | | | 74,708 | |

Microsoft Corp. | | | 4,650 | | | | 120,714 | |

NCR Corp.* | | | 4,450 | | | | 73,247 | |

Oracle Corp. | | | 12,125 | | | | 311,006 | |

QUALCOMM, Inc. | | | 4,700 | | | | 257,090 | |

Visa, Inc., Class A | | | 2,725 | | | | 276,669 | |

VistaPrint N.V.*1 | | | 1,600 | | | | 48,960 | |

Total Information Technology | | | | | | | 3,608,107 | |

Materials - 2.5% | | | | | | | | |

Alcoa, Inc. | | | 14,900 | | | | 128,885 | |

CF Industries Holdings, Inc. | | | 1,200 | | | | 173,976 | |

Domtar Corp. | | | 1,775 | | | | 141,929 | |

Freeport-McMoRan Copper & Gold, Inc., Class B | | | 1,575 | | | | 57,944 | |

PPG Industries, Inc. | | | 2,475 | | | | 206,638 | |

Total Materials | | | | | | | 709,372 | |

Telecommunication Services - 1.9% | | | | | | | | |

Telephone & Data Systems, Inc. | | | 2,100 | | | | 54,369 | |

Verizon Communications, Inc. | | | 12,400 | | | | 497,488 | |

Total Telecommunication Services | | | | | | | 551,857 | |

Utilities - 2.7% | | | | | | | | |

Ameren Corp. | | | 5,250 | | | | 173,933 | |

Consolidated Edison, Inc. | | | 2,700 | | | | 167,481 | |

Duke Energy Corp. | | | 11,600 | | | | 255,200 | |

NiSource, Inc. | | | 8,050 | | | | 191,671 | |

Total Utilities | | | | | | | 788,285 | |

Total Common Stocks

| | | | | | | 17,353,475 | |

(cost $15,957,528) | | | | | | | | |

| | | Principal Amount | | | | |

Corporate Bonds and Notes - 3.2% | | | | | | | | |

Financials - 0.4% | | | | | | | | |

American Express Co., 7.250%, 05/20/14 | | $ | 40,000 | | | | 44,696 | |

General Electric Capital Corp.: | | | | | | | | |

2.950%, 05/09/16 | | | 30,000 | | | | 30,886 | |

MTN, Series A, 6.750%, 03/15/32 | | | 10,000 | | | | 11,744 | |

The accompanying notes are an integral part of these financial statements.

16

Managers AMG Chicago Equity Partners Balanced Fund

Schedule of Portfolio Investments (continued)

| | | | | | | | |

| | | Principal Amount | | | Value | |

| | | | | | | | |

Financials - 0.4% (continued) | | | | | | | | |

JPMorgan Chase & Co.: | | | | | | | | |

6.000%, 01/15/18 | | $ | 15,000 | | | $ | 16,757 | |

4.625%, 05/10/21 | | | 15,000 | | | | 15,549 | |

Total Financials | | | | | | | 119,632 | |

Industrials - 2.2% | | | | | | | | |

Altria Group, Inc., 9.700%, 11/10/18 | | | 18,000 | | | | 24,250 | |

Amgen, Inc., 4.100%, 06/15/21 | | | 20,000 | | | | 20,556 | |

Anheuser-Busch InBev Worldwide, Inc., 5.375%, 01/15/20 | | | 20,000 | | | | 23,495 | |

AT&T, Inc., 5.100%, 09/15/14 | | | 70,000 | | | | 77,150 | |

Coca-Cola Refreshments USA, Inc., 7.375%, 03/03/14 | | | 40,000 | | | | 45,456 | |

ConocoPhillips, 4.600%, 01/15/15 | | | 15,000 | | | | 16,602 | |

EI du Pont de Nemours & Company, 5.000%, 01/15/13 | | | 6,000 | | | | 6,260 | |

Honeywell International, Inc., 4.250%, 03/01/13 | | | 45,000 | | | | 46,959 | |

International Business Machines Corp., 5.600%, 11/30/39 | | | 15,000 | | | | 19,346 | |

Kellogg Co., Series B, 7.450%, 04/01/31 | | | 15,000 | | | | 20,515 | |

Kraft Foods, Inc., 5.375%, 02/10/20 | | | 20,000 | | | | 23,116 | |

Kroger Co., The: | | | | | | | | |

5.500%, 02/01/13 | | | 20,000 | | | | 20,866 | |

6.750%, 04/15/12 | | | 40,000 | | | | 40,669 | |

McDonald’s Corp.: | | | | | | | | |

6.300%, 10/15/37 | | | 15,000 | | | | 21,038 | |

Series MTN, 4.300%, 03/01/13 | | | 35,000 | | | | 36,466 | |

PepsiCo, Inc., 2.500%, 05/10/16 | | | 35,000 | | | | 36,449 | |

Pfizer, Inc., 6.200%, 03/15/19 | | | 20,000 | | | | 24,715 | |

United Parcel Service, Inc., 6.200%, 01/15/38 | | | 20,000 | | | | 27,001 | |

Verizon Communications, Inc., 3.000%, 04/01/16 | | | 35,000 | | | | 36,688 | |

Wal-Mart Stores, Inc., 6.500%, 08/15/37 | | | 20,000 | | | | 27,729 | |

Wyeth, 5.500%, 03/15/13 | | | 35,000 | | | | 37,009 | |

Total Industrials | | | | | | | 632,335 | |

Utilities - 0.6% | | | | | | | | |

Consolidated Edison Co of New York, Inc., Series 08-B, 6.750%, 04/01/38 | | | 15,000 | | | | 21,079 | |

Dominion Resources, Inc., 4.450%, 03/15/21 | | | 10,000 | | | | 11,159 | |

Duke Energy Corp., 3.550%, 09/15/21 | | | 20,000 | | | | 20,498 | |

Florida Power & Light Co., 4.850%, 02/01/13 | | | 40,000 | | | | 41,741 | |

Georgia Power Co., 5.400%, 06/01/40 | | | 15,000 | | | | 18,142 | |

TransCanada PipeLines, Ltd.: | | | | | | | | |

3.800%, 10/01/20 | | | 20,000 | | | | 21,625 | |

4.875%, 01/15/15 | | | 40,000 | | | | 44,069 | |

Total Utilities | | | | | | | 178,313 | |

Total Corporate Bonds and Notes (cost $870,360) | | | | | | | 930,280 | |

|

The accompanying notes are an integral part of these financial statements. 17 |

Managers AMG Chicago Equity Partners Balanced Fund

Schedule of Portfolio Investments (continued)

| | | | | | | | |

| | | Principal Amount | | | Value | |

| | | | | | | | |

Mortgage-Backed Securities - 0.8% | | | | | | | | |

Credit Suisse First Boston Mortgage Securities Corp., Series 2005-C2, Class C2, 4.691%, 04/15/37 | | $ | 63,885 | | | $ | 66,181 | |

Greenwich Capital Commercial Funding Corp., Series 2005-GG5, Class A2, 5.117%, 04/10/37 | | | 89,050 | | | | 89,460 | |

JPMorgan Chase Commercial Mortgage Securities Corp., Series 2002-C2, Class A2, 5.050%, 12/12/34 | | | 75,992 | | | | 77,687 | |

Total Mortgage-Backed Securities (cost $229,217) | | | | | | | 233,328 | |

| | |

U.S. Government and Agency Obligations - 34.2% | | | | | | | | |

Federal Home Loan Banks - 3.9% | | | | | | | | |

FHLB, 1.625%, 11/21/12 | | | 10,000 | | | | 10,123 | |

FHLB, 5.000%, 11/17/17 | | | 365,000 | | | | 438,606 | |

FHLB, 5.250%, 06/18/14 | | | 190,000 | | | | 211,592 | |

FHLB, 5.375%, 05/18/16 | | | 385,000 | | | | 457,062 | |

Total Federal Home Loan Banks | | | | | | | 1,117,383 | |

Federal Home Loan Mortgage Corporation - 6.0% | | | | | | | | |

FHLMC, 2.500%, 05/27/16 | | | 310,000 | | | | 328,656 | |

FHLMC, 3.750%, 03/27/19 | | | 370,000 | | | | 423,044 | |

FHLMC, 4.375%, 07/17/15 | | | 235,000 | | | | 264,387 | |

FHLMC, 4.500%, 11/01/24 | | | 30,807 | | | | 32,674 | |

FHLMC, 4.750%, 11/17/15 | | | 115,000 | | | | 131,815 | |

FHLMC, 5.000%, 12/01/20 | | | 44,342 | | | | 47,803 | |

FHLMC, 5.500%, 04/01/38 | | | 226,490 | | | | 246,104 | |

FHLMC, 6.000%, 01/01/38 | | | 46,101 | | | | 50,713 | |

FHLMC, 6.000%, 04/01/38 | | | 34,583 | | | | 38,032 | |

FHLMC, 6.000%, 06/01/38 | | | 157,622 | | | | 173,755 | |

Total Federal Home Loan Mortgage Corporation | | | | | | | 1,736,983 | |

Federal National Mortgage Association - 13.3% | | | | | | | | |

FNMA, 4.000%, 08/01/19 | | | 145,640 | | | | 153,829 | |

FNMA, 4.000%, 10/01/20 | | | 4,557 | | | | 4,846 | |

FNMA, 4.000%, 03/01/21 | | | 66,075 | | | | 69,790 | |

FNMA, 4.000%, 05/01/21 | | | 151,692 | | | | 160,221 | |

FNMA, 4.000%, 12/01/21 | | | 33,686 | | | | 35,632 | |

FNMA, 4.000%, 02/01/25 | | | 20,850 | | | | 22,003 | |

FNMA, 4.000%, 07/01/25 | | | 53,655 | | | | 56,621 | |

FNMA, 4.000%, 10/01/40 | | | 85,761 | | | | 90,198 | |

FNMA, 4.000%, 11/01/40 | | | 37,617 | | | | 39,563 | |

FNMA, 4.500%, 11/01/19 | | | 47,023 | | | | 50,335 | |

FNMA, 4.500%, 06/01/24 | | | 21,884 | | | | 23,344 | |

FNMA, 4.500%, 08/01/40 | | | 83,553 | | | | 89,009 | |

FNMA, 4.500%, 09/01/40 | | | 83,317 | | | | 88,700 | |

FNMA, 4.500%, 10/01/40 | | | 209,410 | | | | 223,082 | |

FNMA, 4.500%, 11/01/40 | | | 96,370 | | | | 102,663 | |

FNMA, 4.500%, 05/01/41 | | | 156,875 | | | | 167,118 | |

FNMA, 5.000%, 05/11/17 | | | 335,000 | | | | 398,111 | |

FNMA, 5.000%, 03/01/23 | | | 36,647 | | | | 39,576 | |

FNMA, 5.000%, 09/01/33 | | | 151,113 | | | | 163,443 | |

|

The accompanying notes are an integral part of these financial statements. 18 |

Managers AMG Chicago Equity Partners Balanced Fund

Schedule of Portfolio Investments (continued)

| | | | | | | | |

| | | Principal Amount | | | Value | |

| | | | | | | | |

Federal National Mortgage Association - 13.3% (continued) | | | | | | | | |

FNMA, 5.000%, 05/01/35 | | $ | 81,695 | | | $ | 88,336 | |

FNMA, 5.000%, 02/01/36 | | | 121,175 | | | | 131,025 | |

FNMA, 5.000%, 08/01/40 | | | 111,145 | | | | 120,214 | |

FNMA, 5.000%, 08/01/41 | | | 238,856 | | | | 258,719 | |

FNMA, 5.375%, 07/15/16 | | | 190,000 | | | | 226,428 | |

FNMA, 5.375%, 06/12/17 | | | 370,000 | | | | 447,583 | |

FNMA, 5.500%, 02/01/22 | | | 7,750 | | | | 8,421 | |

FNMA, 5.500%, 03/01/22 | | | 14,578 | | | | 15,971 | |

FNMA, 5.500%, 06/01/22 | | | 13,024 | | | | 14,269 | |

FNMA, 5.500%, 11/01/35 | | | 60,482 | | | | 66,050 | |

FNMA, 5.500%, 02/01/37 | | | 158,154 | | | | 172,567 | |

FNMA, 5.500%, 06/01/38 | | | 101,163 | | | | 110,255 | |

FNMA, 6.000%, 03/01/37 | | | 55,021 | | | | 60,870 | |

FNMA, 6.000%, 08/01/37 | | | 52,952 | | | | 58,373 | |

FNMA, 6.000%, 06/01/38 | | | 34,180 | | | | 38,182 | |

FNMA, 6.500%, 03/01/37 | | | 39,583 | | | | 44,464 | |

Total Federal National Mortgage Association | | | | | | | 3,839,811 | |

United States Treasury Securities - 11.0% | | | | | | | | |

U.S. Treasury Bonds, 0.625%, 07/31/12 | | | 335,000 | | | | 336,086 | |

U.S. Treasury Bonds, 3.125%, 05/15/21 | | | 430,000 | | | | 480,189 | |

U.S. Treasury Bonds, 3.125%, 11/15/41 | | | 225,000 | | | | 235,758 | |

U.S. Treasury Bonds, 3.500%, 02/15/39 | | | 790,000 | | | | 888,750 | |

U.S. Treasury Notes, 2.625%, 08/15/20 | | | 590,000 | | | | 636,416 | |

U.S. Treasury Notes, 2.750%, 02/28/18 | | | 405,000 | | | | 444,108 | |

U.S. Treasury Notes, 3.500%, 02/15/18 | | | 150,000 | | | | 171,035 | |

Total United States Treasury Securities | | | | | | | 3,192,342 | |

Total U.S. Government and Agency Obligations (cost $9,588,884) | | | | | | | 9,886,519 | |

| | |

| | | Shares | | | | |

Other Investment Companies - 2.2%2 | | | | | | | | |

BNY Mellon Overnight Government Fund, 0.04%3 | | | 50,240 | | | | 50,240 | |

Dreyfus Cash Management Fund, Institutional Class Shares, 0.05% | | | 593,002 | | | | 593,002 | |

Total Other Investment Companies (cost $643,242) | | | | | | | 643,242 | |

Total Investments - 100.4% (cost $27,289,231) | | | | | | | 29,046,844 | |

Other Assets, less Liabilities - (0.4)% | | | | | | | (109,146 | ) |

Net Assets - 100.0% | | | | | | $ | 28,937,698 | |

The accompanying notes are an integral part of these financial statements.

19

Managers High Yield Fund

Investment Manager’s Comments

THE YEAR IN REVIEW

The Managers High Yield Fund (Institutional Class) returned 4.83% for the year ended December 31, 2011, compared with 4.98% for the Barclays Capital U.S. Corporate High Yield Index (the “Index”). Solid corporate fundamentals, modest economic growth, healthy primary market conditions, ample mutual fund inflows and a negligible default environment were all conducive to producing strong returns in the high yield market in the first half of the year. However, the onslaught of macroeconomic events overshadowed this backdrop, leading to a more volatile environment in the second half of the year. In the end, the Barclays Capital U.S. Corporate High Yield Bond Index posted a one-year return of 4.98%, closing the year on a positive note. At December 31, high-yield spreads (as measured by the Barclays Capital U.S. Corporate High Yield Bond Index) were 750 basis points (7.50%), 172 bps (1.72%) wider for the 12-month period, while yields rose from 7.51% (at December 31, 2010) to 8.36%.

In 2011, the high-yield market experienced distinct periods of increased volatility: (1) in early March, resulting from the global events that ranged from unrest in the Middle East/North Africa to a devastating earthquake and tsunami in Japan; (2) in May/June due to deteriorating global economic data and ongoing fears surrounding the European sovereign crisis; and (3) starting in late-July/early-August with the U.S. debt-ceiling debate, escalation in the Eurozone sovereign debt crisis and the reporting of disappointing and weakening economic data. In all of these challenging periods, investor risk appetite waned as sentiment weakened, leading to a steady stream of retail outflows and slowdown to new-issue activity. None of these developments afflicting the markets pertained directly to high-yield credit fundamentals, but each was influential in shaping investor confidence and risk appetite. In the final quarter of the year, the high-yield broad market vacillated between risk on and risk off. Improving conditions and a recovery initiated in October came to a halt in mid-November as the market struggled with unpredictable economic news and global events. In December, however, the market volatility subsided as news from Europe was more positive and the tone of U.S. economic data was somewhat better.

As expected during periods of volatility and the resulting flight-to-quality movements, higher-rated credits outperformed their lower-quality counterparts for the year. Supermarkets, pipelines and pharmaceuticals led performance in the year as nearly all sectors posted positive returns (as measured by the Barclays Capital U.S. Corporate High Yield Index). The lowest-performing sectors for the year were transportation, home construction and wireless telecommunications.

Primary market conditions were favorable, which enabled companies to amend terms or extend maturities. Issuer refinancing needs dominated more than 55% of the activity in 2011. Record-low bond yields, minimal default risk and attractive relative valuations contributed to healthy capital market conditions. Despite a significant slowdown in June, new-issuance volumes were strong as high-yield issuers priced a total of $228.3B in 2011, the second-highest total on record. Positive mutual fund flows into the asset class from multiple channels fueled the tightening from market lows.

Default activity was negligible in the first half before slightly accelerating in the final months of 2011. At December 31, the 12-month par-weighted default rate of 1.72% was well below historical averages of 4%.

PERFORMANCE

The Fund slightly underperformed its primary benchmark during 2011, due to exposure to the chemicals, retailers and consumer services sectors. Performance was hindered by relative weightings in Reichhold Industries, Sprint Capital Corporation, First Data Corporation, Huntsman International and Flextronics. On the upside, performance was aided by security selection in the financials, real estate investment trusts and transportation services sectors, with the largest contributions coming from DISH DBS Corporation, Ceasar’s Entertainment, HCA, Texas Competitive Electric Holdings and Royal Bank of Scotland.

LOOKING FORWARD

In 2012, we expect a more stable economic environment and still-solid corporate fundamentals to underpin a strong high-yield environment. We anticipate that U.S. economic growth will improve slightly, averaging between 2-3%. Global growth will remain positive but be slightly impacted by weak economic conditions in the Eurozone and slowing conditions in parts of Asia. Given the continued uncertainty in the global environment, we expect corporations to remain conservative in their use of capital and cash generation. This should result in continued improvement in overall credit metrics for much of the high-yield universe. Although defaults will likely rise modestly in 2012 from their sub-2% level in 2011, we think they will remain in the low single digits. As a result, we expect overall high-yield broad market spreads to tighten from current levels of approximately 740 basis points (7.40%) to the 600-650 basis point (6.0%-6.5%) range by the end of 2012. In this credit environment, we will continue to rely on our individual security selection as the primary driver of performance.

This commentary reflects the viewpoints of the Fund’s subadvisor, JP Morgan Asset Management as of December 31, 2011, and is not intended as a forecast or guarantee of future results.

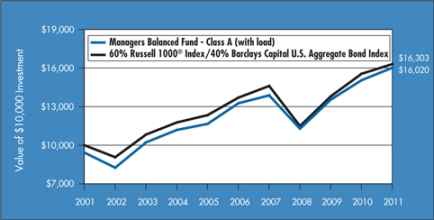

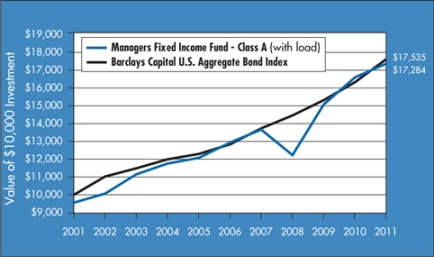

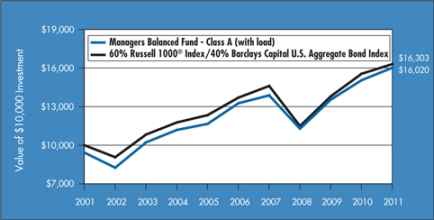

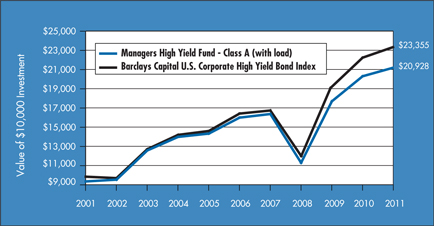

CUMULATIVE TOTAL RETURN PERFORMANCE

Managers High Yield Fund’s cumulative total return is based on the daily change in net asset value (NAV), and assumes that all distributions were reinvested. The chart illustrates the performance of a hypothetical $10,000 investment made in the Fund’s Class A Shares (with load) on December 31, 2001 to a $10,000 investment made in the Barclays Capital U.S. Corporate High Yield Bond Index for the same time period. The graph and table do not reflect the deduction of taxes that a shareholder would pay on a Fund distribution or redemption of shares. Performance for periods longer than one year is annualized. The listed returns for the Fund are net of expenses and the returns for the index exclude expenses. Total returns for the Fund would have been lower had certain expenses not been reduced.

20

Managers High Yield Fund

Investment Manager’s Comments (continued)

CUMULATIVE TOTAL RETURN PERFORMANCE (continued)

The table below shows the average annual total returns for the Managers High Yield Fund and the Barclays Capital U.S. Corporate High Yield Bond Index from December 31, 2001 through December 31, 2011.

| | | | | | | | | | | | | | |

| | | | | Average Annual Total Returns1 | |

| | | | | One Year | | | Five Years | | | Ten Years | |

Managers High Yield Fund2,3 | |

-Class A | | No Load | | | 4.54 | % | | | 5.63 | % | | | 8.13 | % |

-Class A | | With Load | | | 0.14 | % | | | 4.73 | % | | | 7.67 | % |

-Class C | | No Load | | | 3.69 | % | | | 4.78 | % | | | 7.38 | % |

-Class C | | With Load | | | 2.72 | % | | | 4.78 | % | | | 7.38 | % |

-Institutional Class | | No Load | | | 4.83 | % | | | 5.95 | % | | | 8.54 | % |

Barclays Capital U.S Corporate High Yield Bond Index4 | | | 4.98 | % | | | 7.54 | % | | | 8.85 | % |

The performance data shown represents past performance, which is not a guarantee of future results. Current performance may be lower or higher than the performance data quoted. The investment return and principal value of an investment in the Fund will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. For performance information through the most recent month end please call (800) 835-3879 or visit our Web site at www.managersinvest.com.

Performance differences among the share classes are due to differences in sales charge structures and class expenses. Returns shown reflect maximum sales charge of 4.25% on Class A, as well as the applicable contingent deferred sales charge (CDSC) on Class C shares. Class C shares held for less than one year are subject to a 1% CDSC.

Investors should carefully consider the Fund’s investment objectives, risks, charges and expenses before investing. For this and other information, please call 800.835.3879 or visit ww.managersinvest.com for a free prospectus. Read it carefully before investing or sending money. Funds are distributed by Managers Distributors, Inc., a member of FINRA.

|

1 Total return equals income yield plus share price change and assumes reinvestment of all dividends and capital gain distributions. Returns are net of fees and may reflect offsets of Fund expenses as described in the Prospectus. No adjustment has been made for taxes payable by shareholders on their reinvested dividends and capital gain distributions. Returns for periods greater than one year are the average annual returns. The listed returns on the Fund are net of expenses and based on the published NAV as of December 31, 2011. All returns are in U.S. dollars ($). 2 The Fund is subject to the risks associated with investments in debt securities, such as default risk and fluctuations in the perception of the debtors’ ability to pay their creditors. 3 From time to time, the Fund’s advisor has waived its fees and/or absorbed Fund expenses, which has resulted in higher returns. 4 The Barclays Capital U.S. Corporate High Yield Bond Index is a total return performance benchmark for fixed income securities having a maximum quality rating of Ba1 (as determined by Moody’s Investors Service). The Barclays Capital U.S. Corporate High Yield Bond Index is unmanaged, is not available for investment, and does not incur expenses. Not FDIC insured, nor bank guaranteed. May lose value. |

21

Managers High Yield Fund

Fund Snapshots (unaudited)

December 31, 2011

Portfolio Breakdown

| | | | |

Industry | | Managers High

Yield Fund** | |

Industrials | | | 80.9 | % |

Financials | | | 10.4 | % |