UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-06431

MANAGERS TRUST II

(Exact name of registrant as specified in charter)

800 Connecticut Avenue, Norwalk, Connecticut 06854

(Address of principal executive offices) (Zip code)

Managers Investment Group LLC

800 Connecticut Avenue,

Norwalk, Connecticut 06854

(Name and address of agent for service)

Registrant’s telephone number, including area code: (203) 299-3500

Date of fiscal year end: DECEMBER 31

Date of reporting period: JANUARY 1, 2013 – DECEMBER 31, 2013

(Annual Shareholder Report)

| Item 1. | Reports to Shareholders |

AR070-1213

Managers Funds

Annual Report—December 31, 2013

| | | | |

TABLE OF CONTENTS | | Page | |

| |

LETTER TO SHAREHOLDERS | | | 2 | |

| |

ABOUT YOUR FUND’S EXPENSES | | | 3 | |

| |

PORTFOLIO MANAGER’S COMMENTS, FUND SNAPSHOTS, AND SCHEDULES OF PORTFOLIO INVESTMENTS | | | | |

| |

Managers Short Duration Government Fund | | | 4 | |

| |

Managers Intermediate Duration Government Fund | | | 16 | |

| |

NOTES TO SCHEDULES OF PORTFOLIO INVESTMENTS | | | 24 | |

| |

FINANCIAL STATEMENTS | | | | |

| |

Statement of Assets and Liabilities | | | 28 | |

Balance sheets, net asset value (NAV) per share computations and cumulative undistributed amounts | | | | |

| |

Statement of Operations | | | 29 | |

Detail of sources of income, expenses, and realized and unrealized gains (losses) during the year | | | | |

| |

Statements of Changes in Net Assets | | | 30 | |

Detail of changes in assets for the past two years | | | | |

| |

FINANCIAL HIGHLIGHTS | | | 31 | |

Historical net asset values per share, distributions, total returns, income and expense ratios, turnover ratios and net assets | | | | |

| |

NOTES TO FINANCIAL STATEMENTS | | | 33 | |

Accounting and distribution policies, details of agreements and transactions with Fund management and affiliates, and descriptions of certain investment risks | | | | |

| |

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM | | | 40 | |

| |

TRUSTEES AND OFFICERS | | | 41 | |

| |

ANNUAL RENEWAL OF INVESTMENT MANAGEMENT AND SUBADVISORY AGREEMENTS | | | 43 | |

Nothing contained herein is to be considered an offer, sale or solicitation of an offer to buy shares of any series of the Managers Family of Funds. Such offering is made only by Prospectus, which includes details as to offering price and other material information.

Letter to Shareholders

Dear Shareholder:

Thank you for your investment in The Managers Funds. Our foremost goal at Managers Investment Group (“MIG”) is to provide investment products and solutions that help our shareholders and clients successfully reach their investment goals and objectives. We do this by offering a broad selection of Funds managed by a collection of Affiliated Managers Group’s (“AMG”) Affiliate investment boutiques, along with a complementary series of open-architecture mutual funds.

The past year has been an exciting one for us at MIG. We were pleased to welcome the Brandywine Funds into the Managers Fund Family several months ago. We are excited to begin this new chapter in the 27-year history of the Brandywine Funds, while maintaining shareholders’ access to the same investment process that has guided the Brandywine Funds since their inception using the research-driven investment approach of Friess Associates.

We announced effective November 1, 2013, that the GW&K Small Cap Equity Fund would be closed to new investors with certain limited exceptions. The team at GW&K manages a total of $2.5 billion (as of December 31, 2013) in small-capitalization equities and closing the Fund to new investors allows the team to continue to execute on the investment process that has been effective for more than a decade. We also announced effective December 31, 2013, that Yacktman Fund and Yacktman Focused Fund will be closed to new investors with certain limited exceptions. The team at Yacktman Asset Management manages over $30 billion in U.S. equities and closing these Funds to new investors allows the team to continue to execute on the investment process that has been effective for more than two decades. We will continue to make decisions such as these that we believe are in the best interest of our shareholders.

Risky assets did well in 2013, with U.S. equity markets surpassing all-time highs. Ongoing global monetary easing, a low-yield environment, and healthy U.S. economic growth are supporting investor appetite for risk assets. Despite improving investor sentiment, risks remain, including uncertainty surrounding the Fed’s eventual exit from its ultra-accommodative monetary policy, ongoing fiscal headwinds in the U.S. and slower growth in Emerging Markets. Nevertheless, we are cautiously optimistic about the prospects for the upcoming year and we are confident that our Funds are well positioned to weather an uncertain economic environment.

We thank you for your continued confidence and investment in The Managers Funds. You can rest assured that under all market conditions our team is focused on delivering excellent investment management services for your benefit.

Respectfully,

Keitha Kinne

President

Managers Investment Group LLC

2

About Your Fund’s Expenses

As a shareholder of a Fund, you may incur two types of costs: (1) transaction costs, which may include sales charges (loads) on purchase payments; redemption fees; and exchange fees; and (2) ongoing costs, including management fees; distribution (12b-1) fees; and other Fund expenses. This example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds. The example is based on $1,000 invested at the beginning of the period and held for the entire period as indicated below.

Actual Expenses

The first line of the following table provides information about the actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

The second line of the following table provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed annual rate of return of 5% before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds by comparing this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as sales charges (loads), redemption fees, or exchange fees. Therefore, the second line of the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds.

| | | | | | | | | | | | | | | | |

Six Months Ended

December 31, 2013 | | Expense

Ratio for

the Period | | | Beginning

Account

Value

07/01/13 | | | Ending

Account

Value

12/31/13 | | | Expenses

Paid During

the Period* | |

Managers Short Duration Government Fund | | | | | | | | | | | | | | | | |

Based on Actual Fund Return | | | 0.78 | % | | $ | 1,000 | | | $ | 1,006 | | | $ | 3.94 | |

Hypothetical (5% return before expenses) | | | 0.78 | % | | $ | 1,000 | | | $ | 1,021 | | | $ | 3.97 | |

| | | | |

Managers Intermediate Duration Government Fund | | | | | | | | | | | | | | | | |

Based on Actual Fund Return | | | 0.89 | % | | $ | 1,000 | | | $ | 1,010 | | | $ | 4.51 | |

Hypothetical (5% return before expenses) | | | 0.89 | % | | $ | 1,000 | | | $ | 1,021 | | | $ | 4.53 | |

| * | Expenses are equal to the Fund’s annualized expense ratio multiplied by the average account value over the period, multiplied by the number of days in the most recent half-year (184), then divided by 365. |

3

Managers Short Duration Government Fund

Portfolio Manager’s Comments

The Managers Short Duration Government Bond Fund (“the Fund”) seeks to provide investors with a high level of current income, consistent with a low volatility of net asset value.

The Fund seeks to achieve its objective by matching the duration, or interest-rate risk, of a portfolio that invests exclusively in six-month U.S. Treasury securities on a constant maturity basis. Under normal circumstances, the Fund will invest at least 80% of its net assets, plus the amount of any borrowings for investment purposes, in debt securities issued by the U.S. government or its agencies and instrumentalities and synthetic instruments or derivatives having economic characteristics similar to such debt securities.

The Fund typically employs hedging techniques using instruments such as interest rate futures, options, floors, caps and swaps, designed to reduce the interest-rate risk of their fixed-income securities. The Fund’s benchmark is the six-month U.S. Treasury bill.

THE PORTFOLIO MANAGER

Amundi Smith Breeden LLC

Effective September 30, 2013, Amundi Group indirectly acquired 100% ownership of Smith Breeden Associates, Inc. (“Smith Breeden”), the Fund’s subadvisor (the “Acquisition”). Pursuant to the Acquisition, Smith Breeden converted to a Delaware limited liability company named Amundi Smith Breeden LLC (“Amundi Smith Breeden”). Amundi Group is a leading European asset management firm with over $1 trillion in assets under management as of June 30, 2013. Amundi Smith Breeden remains the subadvisor for the Fund and is located at 280 South Mangum Street, Suite 301, Durham, NC and was founded in 1982. Amundi Smith Breeden is an investment management firm for a client base including corporate and public pension plans, central and supranational banks, endowments and foundations, private banks and financial institutions, insurance companies, and other institutional investors. Specializing in fixed income portfolios, the firm offers separate accounts, commingled funds, and serves as a subadvisor to ‘40 Act funds.

Amundi Smith Breeden believes that innovative research provides critical insights into the fixed income market. The firm’s experienced investment professionals apply these research insights to the management of investment portfolios designed to achieve their clients’ objectives. The key tenets of this market-tested investment philosophy are:

| | • | | Over a market cycle, a portfolio of fixed income securities with wide risk-adjusted spreads produces an attractive total return in comparison to the market return. |

| | • | | The incremental return available from security selection and sector allocation, based on careful relative value analysis, quantitative research and experienced market judgment, is more consistent than the incremental return from predicting the direction of interest rates or other macro-factor trading strategies. |

| | • | | Within the investment-grade fixed income market, the spread sectors, e.g., corporate bonds, mortgage-backed securities (MBS), commercial MBS (CMBS), and asset-backed securities (ABS), will tend to outperform Treasury securities over a market cycle. The corporate, mortgage, CMBS, and ABS sectors also offer the |

| | | greatest active management opportunity for adding value through security selection. |

The portfolio management team at Amundi Smith Breeden specializes in analyzing and investing in mortgage securities. Through careful analysis and comparison of the characteristics of these securities, such as type of issuer, coupon, maturity, geographic structure and prepayment rates, the portfolio manager seeks to structure a portfolio with similar risk characteristics to six-month U.S. Treasury securities and slightly higher returns. Because there is less certainty about the timing of principal payments to individual mortgage securities than for U.S. Treasury securities, they tend to carry a slightly higher yield. A properly structured portfolio of mortgage securities, however, can have a highly predictable cash flow while maintaining a yield advantage over treasuries. Although the portfolio management team often purchases securities with maturities longer than six months, it does not attempt to increase returns by actively positioning the interest rate sensitivity of the Portfolio. Instead, the team typically manages the weighted average duration of the Portfolio so that it remains close to the Index.

The ideal investment exhibits many of the following traits:

| | • | | Yield advantage over treasuries |

| | • | | Very high quality (Government or AAA) |

| | • | | Attractive value relative to other MBS opportunities |

The Portfolio:

| | • | | Seeks to optimize return per unit of risk |

| | • | | Maintains minimal exposure to credit risk and interest rate risk |

| | • | | Consists of high-quality MBS, CMBS, and ABS securities |

| | • | | Will tend to have an interest-rate sensitivity similar to a six-month Treasury bill |

The investment team will make a sell decision when:

| | • | | They no longer view the bonds as attractive |

| | • | | They deem it necessary to reallocate the Portfolio |

| | • | | They need to maintain the Portfolio’s target duration |

THE YEAR IN REVIEW

During the year ended December 31, 2013, the Fund returned 0.20%, while the Bank of America (BofA) Merrill Lynch 6-Month U.S Treasury Bill Index returned 0.18%.

This year saw the natural transition of belt-tightening shift away from the private sector and towards the public sector. The Federal Reserve (“the Fed”) became the primary source of uncertainty as market participants began re-pricing assets ahead of the expected tapering. By the end of the year, we saw the long end of the yield curve begin to move towards a reasonable level. However, by our estimation, rates in the three- to five-year portion of the curve are likely to rise as tapering progresses through 2014.

Heading into 2013, political and economic news had not been particularly positive; however, the recovery continued in textbook fashion. Agency mortgage-backed securities (MBS) began the first quarter under pressure as the Federal Open Market Committee (“FOMC”) released commentary regarding its third round of Quantitative Easing (“QE3”) with a more hawkish tone than

4

Managers Short Duration Government Fund

Portfolio Manager’s Comments (continued)

anticipated by the market. Lower coupon MBS continued to lag during the quarter as the market absorbed economic data and attempted to synthesize the various comments coming from members of the FOMC. MBS rallied into the end of the quarter as fears of an imminent end to QE3 waned. Agency MBS in sectors that the Fed is not purchasing performed well during the quarter, which allowed the Fund to outperform the index returns.

The second quarter began with some weak economic data, driving strong performance from production coupon mortgages as the market adjusted its expectations to reflect an extension of the Fed’s large scale asset purchase program. Higher coupon mortgages suffered from the rally in rates amid concerns about increased prepayment speeds. The MBS sector was punished significantly in the middle of the quarter as stronger employment data and talk of slowing purchases by several Fed members led expectations of reduced demand. In response, the market discounted mortgage prices significantly. By the end of the quarter, a higher and steeper yield curve drove MBS servicers and Real Estate Investment Trusts (“REITS”) to sell duration, further pressuring the agency MBS market. Relative value buyers did emerge at the end of the quarter to take advantage of the sell-off. Despite our bias towards MBS sectors that the FOMC was not purchasing, spreads throughout MBS widened, causing underperformance of the Fund for the second quarter.

MBS began July with significant volatility. MBS benefited as increased rates reduced the supply of new mortgages. However, demand for MBS from banks and REITS was also muted which left the Fed as the only major buyer of mortgages. As the quarter progressed, the production of new mortgages remained anemic. Demand from the Fed overwhelmed supply, helping mortgage performance. High rates led to lower prepayments, which also helped MBS performance through the middle of the third quarter. After months of QE3 tapering discussions, the Fed surprised the market in September by continuing its purchases at the same levels which led to significantly stronger performance from MBS into the end of the quarter. Mortgage spreads tightened upon this news which benefitted performance of the Fund.

MBS spreads continued to tighten into the fourth quarter, led by the lower coupon 30-year mortgages where the Fed continued to focus its purchases. Mortgage prepayments stayed low, despite lower mortgage rates as banks significantly cut their mortgage workforce, hampering their ability to process applications. By the middle of the quarter, concerns about tapering of QE3 weighed on mortgages. By the time the FOMC announced tapering, the market had effectively fully priced in the impact of tapering. Our bias towards non-FOMC purchased mortgages (i.e., higher coupon fixed-rate MBS, seasoned 15-year MBS, and adjustable rate mortgages (“ARMs”)) drove the outperformance for the quarter.

Most of the Portfolio outperformance for 2013 was attributable to our positioning in agency MBS (specifically, avoiding the parts of the market where the Fed was focused). Our positioning relative to the yield curve benefitted the portfolio. ARMs, fixed-rate mortgages (“FRMs”), and collateralized mortgage obligations (“CMOs”) all benefitted from the reduced production of mortgages and the slowdown in prepayments attributable to the higher interest rates in the latter half of the year.

Derivatives, such are financial futures, options, and mortgage derivatives, are used for portfolio duration and convexity risk management. We continue to find value in mortgage derivatives with beneficial underlying collateral characteristics.

At the end of the year, the Fund held the majority of its exposure in 15-year agency FRMs. We increased our exposure to 15-year agency FRMs by 12.8% during the year, while adding 2.2% of active exposure to Agency ARMs. We maintained our exposure to commercial mortgage-backed securities. The Fund also slightly reduced its small allocation to Interest-Only securities. We continue to see opportunities in high quality spread assets and remain positive on our 2014 outlook for the MBS sector.

Looking Forward

Amundi Smith Breeden believes that 2014 will pick up where 2013 left off. The short-term technicals for MBS remain positive. Even with tapering, the Fed is still purchasing more MBS than net new production. The real challenge will come in the second half of the year when the marginal buyer once again becomes private capital. Current large scale holders include the Government Sponsored Enterprises, banks, money managers, REITs, and overseas buyers. Excluding the agencies, all of these entities could buy mortgages under the right circumstances, but each has its own unique obstacles to overcome. We expect that money managers will buy, but will likely require wider spread levels than what the market is currently offering. On the other hand, prepayment rates should remain low through the year, and the additional carry that MBS provides will likely more than offset any spread widening. Despite some shorter-term headwinds, agency MBS continue to be an attractive asset class longer-term.

This commentary reflects the viewpoints of Amundi Smith Breeden as of December 31, 2013 and is not intended as a forecast or guarantee of future results.

Managers Short Duration Government Fund

Portfolio Manager’s Comments (continued)

CUMULATIVE TOTAL RETURN PERFORMANCE

Managers Short Duration Government Fund’s cumulative total return is based on the daily change in net asset value (NAV), and assumes that all distributions were reinvested. This graph compares a hypothetical $10,000 investment made in the Managers Short Duration Government Fund on December 31, 2003 to a $10,000 investment made in the BofA Merrill Lynch 6-Month U.S. Treasury Bill Index for the same time period. Performance for periods longer than one year is annualized. The graph and table do not reflect the deduction of taxes that a shareholder would pay on a Fund distribution or redemption of shares. The listed returns for the Fund are net of expenses and the returns for the index exclude expenses. Past performance is not indicative of future results. Total returns would have been lower had certain expenses not been reduced.

The table below shows the average annual total returns for the Managers Short Duration Government Fund and the BofA Merrill Lynch 6-Month U.S. Treasury Bill Index for the same time periods ended December 31, 2013.

| | | | | | | | | | | | |

| | | Average Annual Total Returns1 | |

| | | One Year | | | Five Years | | | Ten Years | |

Managers Short Duration Government Fund2,3,4,5 | | | 0.20 | % | | | 2.13 | % | | | 2.37 | % |

BofA Merrill Lynch 6-Month Treasury Bill Index6 | | | 0.18 | % | | | 0.31 | % | | | 1.97 | % |

The performance data shown represents past performance. Past performance is not a guarantee of future results. Current performance may be lower or higher than the performance data quoted. The investment return and principal value of an investment in the Fund will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. For performance information through the most recent month end, please call (800) 835-3879 or visit our Web site at www.managersinvest.com. Current net asset values, per share for each Fund are available on the Funds’ Web site at www.managersinvest.com.

Investors should carefully consider the Fund’s investment objectives, risks, charges, and expenses before investing. For this and other information, please call (800) 835-3879 or visit our Web site at www.managersinvest.com for a free prospectus. Read it carefully before investing or sending money. Funds are distributed by Managers Distributors, Inc., member FINRA.

| 1 | Total return equals income yield plus share price change and assumes reinvestment of all dividends and capital gain distributions. Returns are net of fees and may reflect offsets of Fund expenses as described in the Prospectus. No adjustment has been made for taxes payable by shareholders on their reinvested dividends and capital gain distributions. Returns for periods greater than one year are annualized. The listed returns on the Fund are net of expenses and based on the published NAV as of December 31, 2013. All returns are in U.S. dollars ($). |

| 2 | Changing interest rates may adversely affect the value of an investment. An increase in interest rates typically causes the value of bonds and other fixed-income securities to fall. |

| 3 | The Fund is subject to the risks associated with investments in debt securities, such as default risk and fluctuations in the perception of the debtors’ ability to pay their creditors. |

| 4 | The Fund may use derivative instruments for hedging purposes or as part of its investment strategy. There is a risk that a derivative intended as a hedge may not perform as expected. The main risks with derivatives is that some types can amplify a gain or loss, potentially earning or losing substantially more money than the actual cost of the derivative; or that the counterparty may fail to honor its contract terms, causing a loss for the Fund. Use of these instruments may also involve certain costs and risks such as liquidity risk, interest rate risk, market risk, credit risk, management risk and the risk that a fund could not close out a position when it would be most advantageous to do so. |

| 5 | Many bonds have call provisions which allow the debtors to pay them back before maturity. This is especially true with mortgage securities, which can be paid back anytime. Typically debtors prepay their debt when it is to their advantage (when interest rates drop making a new loan at current rates more attractive), and thus likely to the disadvantage of bondholders, who may have to reinvest prepayment proceeds in securities with lower yields. Prepayment risk will vary depending on the provisions of the security and current interest rates relative to the interest rate of the debt. |

| 6 | The BofA Merrill Lynch 6-Month U.S. Treasury Bill Index is an unmanaged index that measures returns of 6-month Treasury Bills. Unlike the Fund, the BofA Merrill Lynch 6-Month Treasury Bill Index is unmanaged, is not available for investment, and does not incur expenses. |

Not FDIC insured, nor bank guaranteed. May lose value.

6

Managers Short Duration Government Fund

Fund Snapshots

December 31, 2013

Portfolio Breakdown (unaudited)

| | | | |

Portfolio Breakdown | | Managers Short

Duration

Government Fund** | |

U.S. Government and Agency Obligations | | | 87.9 | % |

Mortgage-Backed Securities | | | 9.2 | % |

Asset-Backed Securities | | | 0.0 | %# |

Other Assets and Liabilities | | | 2.9 | % |

| ** | As a percentage of net assets. |

| # | Rounds to less than 0.1%. |

| | | | |

Rating | | Managers Short

Duration

Government Fund† | |

U.S. Treasury & Agency | | | 90.9 | % |

Aaa | | | 8.9 | % |

Aa | | | 0.0 | % |

A | | | 0.1 | % |

Baa | | | 0.0 | % |

Ba & lower | | | 0.1 | % |

| † | As a percentage of market value of fixed income securities. Chart does not include equity securities. |

Top Ten Holdings (unaudited)

| | | | |

Security Name | | % of

Net Assets | |

FHLMC Gold Pool, 3.500%, TBA 15yr | | | 3.7 | % |

U.S. Treasury Inflation Indexed Bonds, 0.375%, 07/15/23 | | | 2.0 | |

FNMA, 1.915%, 02/01/35* | | | 1.6 | |

FNMA, 2.485%, 11/01/34* | | | 1.3 | |

FHLMC Gold Pool, 4.500%, 10/01/24 | | | 1.3 | |

FNMA, 2.513%, 01/01/36* | | | 1.3 | |

FHLMC Gold Pool, 4.500%, 03/01/25 | | | 1.2 | |

FHLMC Gold Pool, 6.000%, 01/01/24 | | | 1.1 | |

FNMA, 6.000%, 11/01/22* | | | 1.0 | |

FNMA, 5.500%, 12/01/17* | | | 1.0 | |

| | | | |

Top Ten as a Group | | | 15.5 | % |

| | | | |

| * | Top Ten Holding at June 30, 2013 |

Any sectors, industries, or securities discussed should not be perceived as investment recommendations. Mention of a specific security should not be considered a recommendation to buy or solicitation to sell that security. Specific securities mentioned in this report may have been sold from the Fund’s portfolio of investments by the time you receive this report.

7

Managers Short Duration Government Fund

Schedule of Portfolio Investments

December 31, 2013

| | | | | | | | |

| | | Principal Amount | | | Value | |

Asset-Backed Securities—0.0%# | | | | | | | | |

Structured Asset Investment Loan Trust, Series 2004-BNC2, Class A5, 1.245%, 12/25/34 (01/27/14)1,2

(cost $186,993) | | $ | 186,650 | | | $ | 184,085 | |

Mortgage-Backed Securities—9.2% | | | | | | | | |

Bank of America Commercial Mortgage Trust, Series 2006-6, Class A2, 5.309%, 10/10/45 | | | 32,328 | | | | 32,398 | |

Bank of America Merrill Lynch Commercial Mortgage, Inc., | | | | | | | | |

Series 2004-6, Class A5, 4.811%, 12/10/42 | | | 3,540,000 | | | | 3,625,162 | |

Series 2005-6, Class A4, 5.184%, 09/10/473 | | | 2,351,000 | | | | 2,502,724 | |

Bear Stearns Commercial Mortgage Securities Trust, | | | | | | | | |

Series 2004-PWR3, Class A4, 4.715%, 02/11/41 | | | 63,928 | | | | 63,897 | |

Series 2004-PWR4, Class A3, 5.468%, 06/11/413 | | | 2,434,655 | | | | 2,448,574 | |

Series 2004-T14, Class A4, 5.200%, 01/12/413 | | | 323,452 | | | | 323,432 | |

Series 2004-T16, Class A6, 4.750%, 02/13/463 | | | 3,149,630 | | | | 3,217,268 | |

Series 2005-PWR7, Class A3, 5.116%, 02/11/413 | | | 1,375,000 | | | | 1,423,954 | |

Series 2006-PW11, Class A2, 5.391%, 03/11/393 | | | 989 | | | | 996 | |

Citigroup Commercial Mortgage Trust, Series 2005-C3, Class A4, 4.860%, 05/15/43 | | | 506,000 | | | | 523,379 | |

Commercial Mortgage Trust, Series 2004-LB3A, Class A5, 5.364%, 07/10/373 | | | 394,556 | | | | 397,035 | |

Countrywide Home Loan Mortgage Pass Through Trust, Series 2004-25, Class 2A4, 0.665%, 02/25/35 (01/27/14)1,2,4 | | | 724,474 | | | | 264,448 | |

Credit Suisse First Boston Mortgage Securities Corp., | | | | | | | | |

Series 2004-C2, Class A2, 5.416%, 05/15/363 | | | 1,389,734 | | | | 1,391,973 | |

Series 2004-C5, Class A3, 4.499%, 11/15/37 | | | 323,797 | | | | 323,263 | |

GE Capital Commercial Mortgage Corp., | | | | | | | | |

Series 2004-C2, Class A4, 4.893%, 03/10/40 | | | 223,745 | | | | 223,979 | |

Series 2004-C2, Class B, 4.983%, 03/10/403 | | | 2,275,000 | | | | 2,288,657 | |

GMAC Commercial Mortgage Securities, Inc., Series 2004-C1, Class A4, 4.908%, 03/10/38 | | | 494,751 | | | | 494,726 | |

Greenwich Capital Commercial Funding Corp., | | | | | | | | |

Series 2004-GG1, Class A7, 5.317%, 06/10/363 | | | 217,265 | | | | 218,405 | |

Series 2005-GG3, Class A3, 4.569%, 08/10/42 | | | 477,753 | | | | 477,347 | |

GS Mortgage Securities Corp. II, Series 2005-GG4, Class A4A, 4.751%, 07/10/395 | | | 2,352,198 | | | | 2,436,743 | |

JPMorgan Chase Commercial Mortgage Securities Corp., | | | | | | | | |

Series 2004-C2, Class A3, 5.250%, 05/15/413 | | | 798,024 | | | | 800,973 | |

Series 2004-C3, Class A5, 4.878%, 01/15/42 | | | 3,870,000 | | | | 3,972,950 | |

JPMorgan Chase Commercial Mortgage Securities Trust, | | | | | | | | |

Series 2004-PNC1, Class A4, 5.357%, 06/12/413 | | | 807,103 | | | | 817,192 | |

Series 2005-LDP1, Class A2, 4.625%, 03/15/46 | | | 720,183 | | | | 720,272 | |

LB-UBS Commercial Mortgage Trust, | | | | | | | | |

Series 2004-C6, Class A6, 5.020%, 08/15/293 | | | 560,874 | | | | 567,981 | |

Series 2004-C8, Class A6, 4.799%, 12/15/293 | | | 305,780 | | | | 310,968 | |

Merrill Lynch Mortgage Investors Trust, Series 1998-C1, Class A3, 6.720%, 11/15/263 | | | 1,296,117 | | | | 1,374,634 | |

Merrill Lynch Mortgage Trust, Series 2005-MKB2, Class A4, 5.204%, 09/12/423 | | | 2,500,000 | | | | 2,572,763 | |

Morgan Stanley Capital I Trust, Series 2005-HQ5, Class A4, 5.168%, 01/14/42 | | | 1,038,861 | | | | 1,064,343 | |

The accompanying notes are an integral part of these financial statements.

8

Managers Short Duration Government Fund

Schedule of Portfolio Investments (continued)

| | | | | | | | |

| | | Principal Amount | | | Value | |

Mortgage-Backed Securities—9.2% (continued) | | | | | | | | |

Wachovia Bank Commercial Mortgage Trust, | | | | | | | | |

Series 2005-C20, Class A7, 5.118%, 07/15/423 | | $ | 1,895,653 | | | $ | 1,997,672 | |

Series 2005-C22, Class A4, 5.289%, 12/15/443 | | | 1,505,000 | | | | 1,602,074 | |

WaMu Mortgage Pass Through Certificates, Series 2005-AR2, Class 2A3, 0.515%, 01/25/45 (01/25/14)1 | | | 508,716 | | | | 458,270 | |

Total Mortgage-Backed Securities (cost $40,017,925) | | | | | | | 38,938,452 | |

U.S. Government and Agency Obligations—87.9% | | | | | | | | |

Federal Home Loan Mortgage Corporation—37.8% | | | | | | | | |

FHLMC, | | | | | | | | |

2.007%, 09/01/35 (03/15/14)1,2 | | | 2,227,613 | | | | 2,334,761 | |

2.125%, 11/01/33 (03/15/14)1,2 | | | 1,106,296 | | | | 1,153,191 | |

2.340%, 10/01/28 (03/15/14)1 | | | 58,558 | | | | 61,228 | |

2.344%, 10/01/33 (03/15/14)1,2 | | | 1,458,014 | | | | 1,546,208 | |

2.350%, 10/01/33 to 11/01/33 (03/15/14)1,2 | | | 3,790,170 | | | | 4,025,055 | |

2.355%, 12/01/33 (03/15/14)1,2 | | | 2,058,957 | | | | 2,172,777 | |

2.357%, 07/01/34 (03/15/14)1,2 | | | 354,498 | | | | 368,219 | |

2.375%, 12/01/32 to 05/01/34 (03/15/14)1,2 | | | 3,997,918 | | | | 4,239,261 | |

2.380%, 03/01/34 (03/15/14)1,2 | | | 3,306,998 | | | | 3,491,802 | |

2.575%, 02/01/23 (03/15/14)1 | | | 393,739 | | | | 406,515 | |

2.591%, 09/01/33 (03/15/14)1,2 | | | 2,976,919 | | | | 3,155,656 | |

2.620%, 06/01/35 (03/15/14)1,2 | | | 898,535 | | | | 964,178 | |

3.029%, 02/01/37 (03/15/14)1,2 | | | 879,347 | | | | 926,233 | |

FHLMC Gold Pool, | | | | | | | | |

3.000%, TBA 15yr6 | | | 1,800,000 | | | | 1,833,328 | |

3.500%, TBA 15yr6 | | | 15,000,000 | | | | 15,637,500 | |

4.000%, 05/01/24 to 11/01/26 | | | 11,064,023 | | | | 11,700,111 | |

4.500%, 07/01/18 to 08/01/302 | | | 33,177,855 | | | | 35,544,672 | |

5.000%, 09/01/17 to 06/01/262 | | | 16,249,879 | | | | 17,293,484 | |

5.500%, 05/01/17 to 05/01/382 | | | 21,589,013 | | | | 23,247,765 | |

6.000%, 06/01/16 to 01/01/242 | | | 8,450,104 | | | | 9,128,887 | |

6.500%, 03/01/18 to 10/01/232 | | | 802,025 | | | | 869,800 | |

7.000%, 06/01/17 to 07/01/192 | | | 512,444 | | | | 539,762 | |

7.500%, 04/01/15 to 03/01/33 | | | 487,013 | | | | 559,668 | |

FHLMC REMICS, | | | | | | | | |

Series 2091, Class PG, 6.000%, 11/15/28 | | | 317,013 | | | | 353,099 | |

Series 2132, Class PE, 6.000%, 03/15/29 | | | 502,865 | | | | 558,000 | |

Series 2429, Class HB, 6.500%, 12/15/23 | | | 724,324 | | | | 808,985 | |

Series 2554, Class HA, 4.500%, 04/15/32 | | | 555,509 | | | | 565,584 | |

Series 2627, Class BM, 4.500%, 06/15/18 | | | 270,096 | | | | 285,503 | |

Series 2628, Class GQ, 3.140%, 11/15/17 | | | 47,942 | | | | 48,046 | |

Series 2631, Class PD, 4.500%, 06/15/18 | | | 90,730 | | | | 95,892 | |

Series 2635, Class DG, 4.500%, 01/15/18 | | | 126,138 | | | | 128,041 | |

Series 2654, Class OG, 5.000%, 02/15/32 | | | 91,666 | | | | 92,191 | |

The accompanying notes are an integral part of these financial statements.

9

Managers Short Duration Government Fund

Schedule of Portfolio Investments (continued)

| | | | | | | | |

| | | Principal Amount | | | Value | |

Federal Home Loan Mortgage Corporation—37.8% (continued) | | | | | | | | |

FHLMC REMICS, | | | | | | | | |

Series 2682, Class LC, 4.500%, 07/15/32 | | $ | 1,337,004 | | | $ | 1,388,845 | |

Series 2683, Class JB, 4.000%, 09/15/18 | | | 472,896 | | | | 492,267 | |

Series 2709, Class PE, 5.000%, 12/15/22 | | | 237,994 | | | | 245,045 | |

Series 2751, Class NE, 5.000%, 06/15/32 | | | 982,386 | | | | 985,855 | |

Series 2763, Class JD, 3.500%, 10/15/18 | | | 332,157 | | | | 340,127 | |

Series 2786, Class BC, 4.000%, 04/15/19 | | | 296,176 | | | | 312,830 | |

Series 2809, Class UC, 4.000%, 06/15/19 | | | 322,667 | | | | 339,929 | |

Series 2877, Class PA, 5.500%, 07/15/33 | | | 287,202 | | | | 302,936 | |

Series 2890, Class KC, 4.500%, 02/15/19 | | | 93,022 | | | | 93,568 | |

Series 2935, Class LM, 4.500%, 02/15/35 | | | 1,042,709 | | | | 1,104,772 | |

Series 2986, Class KL, 4.570%, 11/15/19 | | | 1,228,083 | | | | 1,243,506 | |

Series 3000, Class PB, 3.900%, 01/15/23 | | | 93,938 | | | | 96,043 | |

Series 3033, Class CI, 5.500%, 01/15/35 | | | 583,170 | | | | 612,515 | |

Series 3117, Class PL, 5.000%, 08/15/34 | | | 918,783 | | | | 937,162 | |

Series 3535, Class CA, 4.000%, 05/15/24 | | | 297,731 | | | | 312,574 | |

Series 3609, Class LA, 4.000%, 12/15/24 | | | 425,401 | | | | 449,743 | |

Series 3632, Class AG, 4.000%, 06/15/38 | | | 449,067 | | | | 471,665 | |

Series 3640, Class JA, 1.500%, 03/15/15 | | | 663,849 | | | | 666,074 | |

Series 3643, Class BX, 0.850%, 12/15/24 | | | 10,756 | | | | 10,753 | |

Series 3653, Class JK, 5.000%, 11/15/38 | | | 413,961 | | | | 450,429 | |

Series 3683, Class AD, 2.250%, 06/15/20 | | | 1,563,318 | | | | 1,587,078 | |

Series 3756, Class DA, 1.200%, 11/15/18 | | | 1,146,359 | | | | 1,152,163 | |

Series 3846, Class CK, 1.500%, 09/15/20 | | | 492,987 | | | | 500,327 | |

Series 3876, Class GA, 1.000%, 06/15/26 | | | 1,289,428 | | | | 1,300,357 | |

Total Federal Home Loan Mortgage Corporation | | | | | | | 159,531,965 | |

Federal National Mortgage Association—41.2% | | | | | | | | |

FNMA, | | | | | | | | |

1.874%, 08/01/34 (02/25/14)1 | | | 431,953 | | | | 452,631 | |

1.875%, 02/01/33 (02/25/14)1 | | | 1,764,435 | | | | 1,853,754 | |

1.895%, 01/01/24 (02/25/14)1,2 | | | 942,952 | | | | 961,973 | |

1.898%, 01/01/35 (02/25/14)1 | | | 1,122,621 | | | | 1,187,861 | |

1.915%, 02/01/35 (02/25/14)1 | | | 6,420,020 | | | | 6,781,921 | |

1.916%, 01/01/35 (02/25/14)1 | | | 1,851,586 | | | | 1,955,343 | |

1.925%, 05/01/34 to 03/01/36 (02/25/14)1 | | | 3,054,951 | | | | 3,230,085 | |

1.934%, 11/01/34 (02/25/14)1 | | | 649,858 | | | | 686,632 | |

1.935%, 08/01/33 (02/25/14)1 | | | 680,464 | | | | 717,629 | |

1.936%, 01/01/35 (02/25/14)1 | | | 3,737,300 | | | | 3,963,609 | |

1.964%, 10/01/34 (02/25/14)1 | | | 1,257,594 | | | | 1,329,639 | |

1.975%, 06/01/34 (02/25/14)1 | | | 1,204,427 | | | | 1,271,443 | |

2.050%, 09/01/33 (02/25/14)1,2 | | | 952,421 | | | | 990,036 | |

2.152%, 08/01/35 (02/25/14)1 | | | 671,722 | | | | 706,351 | |

2.165%, 02/01/36 (02/25/14)1 | | | 3,698,985 | | | | 3,946,262 | |

The accompanying notes are an integral part of these financial statements.

10

Managers Short Duration Government Fund

Schedule of Portfolio Investments (continued)

| | | | | | | | |

| | | Principal Amount | | | Value | |

Federal National Mortgage Association—41.2% (continued) | | | | | | | | |

FNMA, | | | | | | | | |

2.210%, 01/01/34 (02/25/14)1 | | $ | 884,671 | | | $ | 925,007 | |

2.211%, 12/01/33 (02/25/14)1 | | | 787,359 | | | | 841,979 | |

2.238%, 01/01/36 (02/25/14)1 | | | 94,028 | | | | 99,190 | |

2.244%, 05/01/33 (02/25/14)1 | | | 2,695,389 | | | | 2,844,974 | |

2.275%, 10/01/35 (02/25/14)1 | | | 2,032,273 | | | | 2,151,356 | |

2.296%, 07/01/34 (02/25/14)1 | | | 1,938,180 | | | | 2,050,468 | |

2.304%, 12/01/34 (02/25/14)1 | | | 3,347,454 | | | | 3,556,220 | |

2.308%, 09/01/33 (02/25/14)1 | | | 868,226 | | | | 915,963 | |

2.317%, 06/01/33 (02/25/14)1 | | | 560,510 | | | | 593,501 | |

2.320%, 01/01/33 to 03/01/33 (02/25/14)1 | | | 707,800 | | | | 751,487 | |

2.337%, 01/01/26 (02/25/14)1 | | | 382,109 | | | | 396,675 | |

2.340%, 02/01/37 (02/25/14)1 | | | 532,017 | | | | 567,016 | |

2.347%, 08/01/35 (02/25/14)1 | | | 1,834,844 | | | | 1,951,953 | |

2.359%, 03/01/34 (02/25/14)1 | | | 346,978 | | | | 369,177 | |

2.369%, 08/01/34 (02/25/14)1 | | | 461,696 | | | | 488,510 | |

2.370%, 01/01/25 to 05/01/34 (02/25/14)1 | | | 3,026,308 | | | | 3,207,929 | |

2.380%, 08/01/36 (02/25/14)1 | | | 269,751 | | | | 285,992 | |

2.427%, 12/01/34 to 09/01/37 (02/25/14)1 | | | 3,096,153 | | | | 3,283,592 | |

2.478%, 04/01/34 (02/25/14)1 | | | 758,551 | | | | 811,449 | |

2.480%, 06/01/35 (02/25/14)1 | | | 207,435 | | | | 219,806 | |

2.482%, 06/01/35 (02/25/14)1 | | | 227,821 | | | | 243,136 | |

2.485%, 11/01/34 (02/25/14)1 | | | 5,140,459 | | | | 5,492,402 | |

2.491%, 04/01/34 (02/25/14)1 | | | 902,597 | | | | 967,472 | |

2.505%, 05/01/36 (02/25/14)1 | | | 114,967 | | | | 121,237 | |

2.513%, 01/01/36 (02/25/14)1 | | | 4,968,354 | | | | 5,309,664 | |

2.559%, 01/01/36 (02/25/14)1 | | | 65,322 | | | | 69,549 | |

2.636%, 06/01/34 (02/25/14)1 | | | 3,212,042 | | | | 3,419,818 | |

2.669%, 01/01/33 (02/25/14)1 | | | 1,205,965 | | | | 1,281,444 | |

2.674%, 01/01/34 (02/25/14)1 | | | 2,782,782 | | | | 2,949,997 | |

3.000%, TBA 15yr6 | | | 3,000,000 | | | | 3,061,523 | |

3.500%, TBA 15yr6 | | | 400,000 | | | | 418,297 | |

4.000%, 10/01/21 to 12/01/26 | | | 720,389 | | | | 764,478 | |

4.000%, TBA 15yr6 | | | 1,000,000 | | | | 1,059,609 | |

4.500%, 04/01/19 to 11/01/29 | | | 6,204,706 | | | | 6,672,139 | |

5.000%, 03/01/18 to 03/01/252 | | | 13,783,364 | | | | 14,768,455 | |

5.500%, 10/01/17 to 07/01/262 | | | 23,963,323 | | | | 25,876,883 | |

6.000%, 03/01/17 to 07/01/252 | | | 12,594,093 | | | | 13,648,334 | |

6.500%, 04/01/17 to 08/01/322 | | | 1,290,656 | | | | 1,397,660 | |

7.000%, 09/01/14 to 11/01/22 | | | 3,477,699 | | | | 3,866,713 | |

7.500%, 08/01/33 to 09/01/33 | | | 108,502 | | | | 127,094 | |

The accompanying notes are an integral part of these financial statements.

11

Managers Short Duration Government Fund

Schedule of Portfolio Investments (continued)

| | | | | | | | |

| | | Principal Amount | | | Value | |

Federal National Mortgage Association—41.2% (continued) | | | | | | | | |

FNMA Grantor Trust, | | | | | | | | |

Series 2002-T5, Class A1, 0.405%, 05/25/32 (01/27/14)1 | | $ | 372,800 | | | $ | 366,291 | |

Series 2003-T4, Class 1A, 0.385%, 09/26/33 (01/27/14)1 | | | 15,014 | | | | 14,865 | |

FNMA REMICS, | | | | | | | | |

Series 1994-76, Class J, 5.000%, 04/25/24 | | | 307,515 | | | | 321,725 | |

Series 2001-63, Class FA, 0.715%, 12/18/31 (01/18/14)1,4 | | | 721,632 | | | | 726,818 | |

Series 2002-47, Class FD, 0.565%, 08/25/32 (01/25/14)1,4 | | | 695,134 | | | | 695,792 | |

Series 2002-56, Class UC, 5.500%, 09/25/17 | | | 532,069 | | | | 564,281 | |

Series 2002-74, Class FV, 0.615%, 11/25/32 (01/25/14)1 | | | 1,246,019 | | | | 1,247,679 | |

Series 2003-2, Class FA, 0.665%, 02/25/33 (01/25/14)1 | | | 706,929 | | | | 710,834 | |

Series 2003-3, Class HJ, 5.000%, 02/25/18 | | | 266,718 | | | | 283,298 | |

Series 2003-64, Class YA, 3.000%, 05/25/23 | | | 281,007 | | | | 288,693 | |

Series 2004-1, Class AC, 4.000%, 02/25/19 | | | 183,702 | | | | 192,943 | |

Series 2004-21, Class AE, 4.000%, 04/25/19 | | | 692,982 | | | | 729,164 | |

Series 2004-27, Class HB, 4.000%, 05/25/19 | | | 358,525 | | | | 378,604 | |

Series 2004-78, Class AC, 5.000%, 05/25/32 | | | 514,834 | | | | 524,611 | |

Series 2005-8, Class EB, 4.500%, 07/25/19 | | | 127,810 | | | | 128,191 | |

Series 2005-13, Class AF, 0.565%, 03/25/35 (01/25/14)1,2 | | | 1,109,568 | | | | 1,110,636 | |

Series 2005-19, Class PA, 5.500%, 07/25/34 | | | 222,652 | | | | 243,764 | |

Series 2005-29, Class TC, 5.000%, 04/25/35 | | | 187,247 | | | | 192,183 | |

Series 2005-51, Class ND, 5.500%, 11/25/33 | | | 462,140 | | | | 468,641 | |

Series 2005-58, Class EP, 5.500%, 07/25/35 | | | 545,681 | | | | 596,621 | |

Series 2005-68, Class PB, 5.750%, 07/25/35 | | | 142,573 | | | | 154,954 | |

Series 2005-68, Class PC, 5.500%, 07/25/35 | | | 491,298 | | | | 531,374 | |

Series 2005-93, Class HD, 4.500%, 11/25/19 | | | 28,064 | | | | 28,099 | |

Series 2005-100, Class GC, 5.000%, 12/25/34 | | | 1,026,048 | | | | 1,054,732 | |

Series 2006-18, Class PD, 5.500%, 08/25/34 | | | 193,987 | | | | 201,538 | |

Series 2007-56, Class FN, 0.535%, 06/25/37 (01/25/14)1 | | | 409,645 | | | | 408,620 | |

Series 2007-65, Class GB, 5.000%, 10/25/33 | | | 546,366 | | | | 555,195 | |

Series 2007-69, Class AB, 5.500%, 12/25/32 | | | 248,435 | | | | 256,717 | |

Series 2008-18, Class HD, 4.000%, 12/25/18 | | | 2,247,878 | | | | 2,354,980 | |

Series 2008-59, Class KB, 4.500%, 07/25/23 | | | 350,510 | | | | 372,263 | |

Series 2008-81, Class KA, 5.000%, 10/25/22 | | | 92,085 | | | | 94,136 | |

Series 2009-55, Class PC, 5.000%, 09/25/36 | | | 193,791 | | | | 195,994 | |

Series 2010-12, Class AC, 2.500%, 12/25/18 | | | 272,306 | | | | 279,455 | |

Series 2010-67, Class LP, 3.250%, 10/25/37 | | | 255,460 | | | | 257,692 | |

Series 2011-40, Class DK, 4.000%, 11/25/37 | | | 867,201 | | | | 885,556 | |

Series 2011-44, Class AG, 1.500%, 02/25/21 | | | 605,794 | | | | 605,854 | |

Series 2011-60, Class UC, 2.500%, 09/25/39 | | | 702,077 | | | | 713,722 | |

Series 2011-60, Class UE, 3.000%, 09/25/39 | | | 1,704,633 | | | | 1,751,659 | |

FNMA Whole Loan, | | | | | | | | |

Series 2003-W1, Class 2A, 6.716%, 12/25/423 | | | 22,930 | | | | 26,449 | |

Series 2003-W4, Class 4A, 7.085%, 10/25/422,3 | | | 608,904 | | | | 698,975 | |

Series 2003-W13, Class AV2, 0.445%, 10/25/33 (01/27/14)1,4 | | | 42,334 | | | | 40,351 | |

The accompanying notes are an integral part of these financial statements.

12

Managers Short Duration Government Fund

Schedule of Portfolio Investments (continued)

| | | | | | | | |

| | | Principal Amount | | | Value | |

Federal National Mortgage Association - 41.2% (continued) | | | | | | | | |

FNMA Whole Loan, | | | | | | | | |

Series 2004-W5, Class F1, 0.615%, 02/25/47 (01/25/14)1 | | $ | 608,148 | | | $ | 609,596 | |

Series 2004-W14, Class 1AF, 0.565%, 07/25/44 (01/25/14)1,2 | | | 2,456,075 | | | | 2,406,639 | |

Series 2005-W2, Class A1, 0.365%, 05/25/35 (01/25/14)1,2 | | | 2,098,124 | | | | 2,074,920 | |

Total Federal National Mortgage Association | | | | | | | 174,208,421 | |

Government National Mortgage Association - 3.7% | | | | | | | | |

GNMA, | | | | | | | | |

0.717%, 11/16/30 to 01/16/40 (01/16/14)1 | | | 2,448,513 | | | | 2,474,664 | |

1.625%, 12/20/21 to 03/20/37 (02/20/14)1,2 | | | 7,108,338 | | | | 7,377,440 | |

2.000%, 06/20/22 (02/20/14)1 | | | 65,707 | | | | 68,546 | |

2.500%, 07/20/18 to 08/20/21 (02/20/14)1 | | | 63,218 | | | | 66,003 | |

2.750%, 10/20/17 (02/20/14)1,2 | | | 22,954 | | | | 23,940 | |

3.000%, 11/20/17 to 03/20/21 (02/20/14)1 | | | 86,122 | | | | 89,969 | |

3.500%, 07/20/18 (02/20/14)1 | | | 28,138 | | | | 29,519 | |

4.000%, 09/15/18 | | | 442,076 | | | | 467,240 | |

4.500%, 04/15/18 to 07/15/24 | | | 2,617,856 | | | | 2,790,760 | |

5.000%, 06/20/19 to 04/20/20 | | | 572,778 | | | | 612,632 | |

5.500%, 03/15/17 to 06/15/18 | | | 1,548,616 | | | | 1,660,501 | |

9.500%, 12/15/17 | | | 3,895 | | | | 4,146 | |

Total Government National Mortgage Association | | | | | | | 15,665,360 | |

Interest Only Strips - 2.3% | | | | | | | | |

FHLMC, | | | | | | | | |

Series 215, Class IO, 8.000%, 06/15/314 | | | 154,665 | | | | 31,755 | |

Series 233, Class 5, 4.500%, 09/15/35 | | | 81,210 | | | | 13,970 | |

FHLMC REMICS, | | | | | | | | |

Series 2530, Class QI, 6.833%, 01/15/32 (01/15/14)1 | | | 208,690 | | | | 36,219 | |

Series 2637, Class SI, 5.833%, 06/15/18 (01/15/14)1 | | | 188,238 | | | | 13,481 | |

Series 2649, Class IM, 7.000%, 07/15/33 | | | 417,972 | | | | 103,031 | |

Series 2763, Class KS, 6.483%, 10/15/18 (01/15/14)1 | | | 407,474 | | | | 22,088 | |

Series 2877, Class GS, 6.533%, 11/15/18 (01/15/14)1,4 | | | 44,395 | | | | 327 | |

Series 2922, Class SE, 6.583%, 02/15/35 (01/15/14)1 | | | 373,644 | | | | 65,438 | |

Series 2934, Class HI, 5.000%, 02/15/20 | | | 137,869 | | | | 14,570 | |

Series 2934, Class KI, 5.000%, 02/15/20 | | | 90,005 | | | | 8,637 | |

Series 2965, Class SA, 5.883%, 05/15/32 (01/15/14)1 | | | 912,759 | | | | 141,521 | |

Series 2967, Class JI, 5.000%, 04/15/20 | | | 427,619 | | | | 44,793 | |

Series 2980, Class SL, 6.533%, 11/15/34 (01/15/14)1 | | | 485,892 | | | | 91,822 | |

Series 2981, Class SU, 7.633%, 05/15/30 (01/15/14)1 | | | 431,731 | | | | 80,547 | |

Series 3031, Class BI, 6.523%, 08/15/35 (01/15/14)1 | | | 1,162,202 | | | | 244,872 | |

Series 3065, Class DI, 6.453%, 04/15/35 (01/15/14)1 | | | 1,018,140 | | | | 211,893 | |

Series 3114, Class GI, 6.433%, 02/15/36 (01/15/14)1 | | | 1,748,904 | | | | 360,468 | |

Series 3308, Class S, 7.033%, 03/15/32 (01/15/14)1 | | | 852,034 | | | | 151,217 | |

Series 3424, Class XI, 6.403%, 05/15/36 (01/15/14)1 | | | 911,754 | | | | 165,284 | |

Series 3489, Class SD, 7.633%, 06/15/32 (01/15/14)1 | | | 457,893 | | | | 87,908 | |

Series 3606, Class SN, 6.083%, 12/15/39 (01/15/14)1 | | | 1,259,530 | | | | 185,829 | |

The accompanying notes are an integral part of these financial statements.

13

Managers Short Duration Government Fund

Schedule of Portfolio Investments (continued)

| | | | | | | | |

| | | Principal Amount | | | Value | |

Interest Only Strips - 2.3% (continued) | | | | | | | | |

FHLMC REMICS, | | | | | | | | |

Series 3685, Class EI, 5.000%, 03/15/19 | | $ | 1,492,089 | | | $ | 108,399 | |

Series 3731, Class IO, 5.000%, 07/15/19 | | | 696,054 | | | | 49,597 | |

Series 3882, Class AI, 5.000%, 06/15/26 | | | 321,247 | | | | 28,000 | |

Series 3995, Class KI, 3.500%, 02/15/27 | | | 1,410,905 | | | | 180,841 | |

FNMA, | | | | | | | | |

Series 92, Class 2, 9.000%, 12/15/164 | | | 10,344 | | | | 1,322 | |

Series 306, Class IO, 8.000%, 05/01/304 | | | 111,862 | | | | 22,792 | |

Series 365, Class 4, 5.000%, 04/01/36 | | | 117,048 | | | | 23,254 | |

FNMA REMICS, | | | | | | | | |

Series 2001-82, Class S, 7.665%, 05/25/28 (01/25/14)1,4 | | | 389,576 | | | | 89,221 | |

Series 2003-48, Class SJ, 5.835%, 06/25/18 (01/25/14)1 | | | 244,619 | | | | 17,940 | |

Series 2003-73, Class SM, 6.435%, 04/25/18 (01/25/14)1 | | | 225,184 | | | | 13,948 | |

Series 2004-49, Class SQ, 6.885%, 07/25/34 (01/25/14)1 | | | 304,779 | | | | 57,103 | |

Series 2004-51, Class SX, 6.955%, 07/25/34 (01/25/14)1 | | | 528,538 | | | | 103,863 | |

Series 2004-64, Class SW, 6.885%, 08/25/34 (01/25/14)1 | | | 1,370,510 | | | | 249,771 | |

Series 2004-66, Class SE, 6.335%, 09/25/34 (01/25/14)1 | | | 218,473 | | | | 36,945 | |

Series 2005-5, Class SD, 6.535%, 01/25/35 (01/25/14)1 | | | 425,362 | | | | 74,526 | |

Series 2005-12, Class SC, 6.585%, 03/25/35 (01/25/14)1 | | | 512,616 | | | | 89,659 | |

Series 2005-45, Class SR, 6.555%, 06/25/35 (01/25/14)1 | | | 1,197,633 | | | | 191,286 | |

Series 2005-65, Class KI, 6.835%, 08/25/35 (01/25/14)1 | | | 2,747,248 | | | | 511,465 | |

Series 2005-66, Class GS, 6.685%, 07/25/20 (01/25/14)1 | | | 239,379 | | | | 28,914 | |

Series 2005-67, Class SM, 5.985%, 08/25/35 (01/25/14)1 | | | 230,992 | | | | 34,608 | |

Series 2006-3, Class SA, 5.985%, 03/25/36 (01/25/14)1 | | | 545,147 | | | | 92,277 | |

Series 2007-75, Class JI, 6.380%, 08/25/37 (01/25/14)1 | | | 305,573 | | | | 47,866 | |

Series 2007-85, Class SI, 6.295%, 09/25/37 (01/25/14)1 | | | 589,440 | | | | 92,650 | |

Series 2008-86, Class IO, 4.500%, 03/25/23 | | | 1,429,137 | | | | 104,226 | |

Series 2008-87, Class AS, 7.485%, 07/25/33 (01/25/14)1 | | | 1,739,182 | | | | 304,516 | |

Series 2010-37, Class GI, 5.000%, 04/25/25 | | | 2,045,109 | | | | 138,251 | |

Series 2010-65, Class IO, 5.000%, 09/25/20 | | | 1,953,459 | | | | 166,551 | |

Series 2010-68, Class SJ, 6.385%, 07/25/40 (01/25/14)1 | | | 569,666 | | | | 97,973 | |

Series 2010-105, Class IO, 5.000%, 08/25/20 | | | 966,826 | | | | 92,173 | |

Series 2010-121, Class IO, 5.000%, 10/25/25 | | | 789,074 | | | | 64,577 | |

Series 2011-69, Class AI, 5.000%, 05/25/18 | | | 2,375,560 | | | | 164,844 | |

Series 2011-88, Class WI, 3.500%, 09/25/26 | | | 1,610,952 | | | | 224,384 | |

Series 2011-124, Class IC, 3.500%, 09/25/21 | | | 2,753,100 | | | | 217,548 | |

Series 2012-126, Class SJ, 4.835%, 11/25/42 (01/25/14)1 | | | 5,945,908 | | | | 930,784 | |

GNMA, | | | | | | | | |

Series 1999-40, Class TW, 6.836%, 02/17/29 (01/17/14)1 | | | 597,651 | | | | 110,763 | |

Series 2002-7, Class ST, 7.336%, 08/17/27 (01/17/14)1 | | | 521,254 | | | | 106,180 | |

Series 2011-32, Class KS, 11.767%, 06/16/34 (01/16/14)1 | | | 1,093,481 | | | | 267,802 | |

Series 2011-94, Class IS, 6.533%, 06/16/36 (01/16/14)1 | | | 775,692 | | | | 135,223 | |

Series 2011-146, Class EI, 5.000%, 11/16/41 | | | 464,259 | | | | 113,743 | |

The accompanying notes are an integral part of these financial statements.

14

Managers Short Duration Government Fund

Schedule of Portfolio Investments (continued)

| | | | | | | | |

| | | Principal Amount | | | Value | |

Interest Only Strips - 2.3% (continued) | | | | | | | | |

GNMA, | | | | | | | | |

Series 2011-157, Class SG, 6.433%, 12/20/41 (01/20/14)1 | | $ | 1,579,704 | | | $ | 364,681 | |

Series 2011-167, Class IO, 5.000%, 12/16/20 | | | 3,696,775 | | | | 299,854 | |

Series 2012-34, Class KS, 5.883%, 03/16/42 (01/16/14)1 | | | 3,904,833 | | | | 832,034 | |

Series 2012-69, Class QI, 4.000%, 03/16/41 | | | 2,077,843 | | | | 374,435 | |

Series 2012-96, Class IC, 3.000%, 08/20/27 | | | 1,280,530 | | | | 158,927 | |

Series 2012-101, Class AI, 3.500%, 08/20/27 | | | 1,101,767 | | | | 134,626 | |

Series 2012-103, Class IB, 3.500%, 04/20/40 | | | 1,463,789 | | | | 213,696 | |

Total Interest Only Strips | | | | | | | 9,839,708 | |

U.S. Government Obligations - 2.9% | | | | | | | | |

U.S. Treasury Inflation Indexed Bonds, 0.375%, 07/15/23 | | | 8,831,328 | | | | 8,517,401 | |

U.S. Treasury Inflation Linked Notes, 2.375%, 01/15/25 | | | 3,221,374 | | | | 3,702,818 | |

Total U.S. Government Obligations | | | | | | | 12,220,219 | |

Total U.S. Government and Agency Obligations (cost $365,848,451) | | | | | | | 371,465,673 | |

Short-Term Investments - 8.4% | | | | | | | | |

Repurchase Agreements - 0.5%7 | | | | | | | | |

Citigroup Global Markets, Inc., dated 12/31/13, due 01/02/14, 0.020%, total to be received $1,000,001 (collateralized by various U.S. Government Agency Obligations, 2.080% - 11.000%, 12/15/15 - 08/15/53, totaling $1,020,000) | | | 1,000,000 | | | | 1,000,000 | |

Mizuho Securities USA, Inc., dated 12/31/13, due 01/02/14, 0.020%, total to be received $876,614 (collateralized by various U.S. Government Agency Obligations, 0.000%—10.750%, 01/02/14 - 03/01/47, totaling $894,145) | | | 876,613 | | | | 876,613 | |

Total Repurchase Agreements | | | | | | | 1,876,613 | |

U.S. Government and Agency Discount Notes - 4.2% | | | | | | | | |

FHLMC, 0.08%, 02/11/148 | | | 2,300,000 | | | | 2,299,924 | |

FHLMC, 0.13%, 06/04/148 | | | 2,483,000 | | | | 2,482,156 | |

FNMA, 0.04%, 01/27/148 | | | 13,085,000 | | | | 13,084,817 | |

Total U.S. Government and Agency Discount Notes | | | | | | | 17,866,897 | |

U.S. Treasury Bills - 0.2% | | | | | | | | |

U.S. Treasury Bills, 0.04%, 04/17/148,9 | | | 1,000,000 | | | | 999,891 | |

| | |

| | | Shares | | | | |

Other Investment Companies - 3.5%10 | | | | | | | | |

Dreyfus Institutional Cash Advantage Fund, Institutional Class Shares, 0.06% | | | 14,523,557 | | | | 14,523,557 | |

Total Short-Term Investments

(cost $35,265,330) | | | | | | | 35,266,958 | |

Total Investments - 105.5% (cost $441,318,699) | | | | | | | 445,855,168 | |

Other Assets, less Liabilities - (5.5)% | | | | | | | (23,367,033 | ) |

Net Assets - 100.0% | | | | | | $ | 422,488,135 | |

The accompanying notes are an integral part of these financial statements.

15

Managers Intermediate Duration Government Fund

Portfolio Manager’s Comments

The Managers Intermediate Duration Government Fund’s objective is to achieve total return in excess of the total return of the major market indices for mortgage-backed securities.

The Managers Intermediate Duration Government Fund seeks to achieve its objective by matching the duration, or interest-rate risk, of a portfolio that invests exclusively in mortgage-backed securities, as weighted in the major market indices for mortgage-backed securities. These indices currently include the Citigroup Mortgage Index and the Barclays Capital Mortgage Index, each of which includes all outstanding government sponsored fixed-rate mortgage-backed securities, weighted in proportion to their current market capitalization. The duration of these indices is generally similar to that of intermediate-term U.S. Treasury notes, and typically will range between three and five years.

Under normal circumstances, the Fund will invest at least 80% of its assets in debt securities issued by the U.S. Government, its agencies and instrumentalities, and synthetic instruments or derivatives, or securities having economic characteristics similar to such debt securities. The Fund’s benchmark is the Citigroup Mortgage Index.

THE PORTFOLIO MANAGER

Amundi Smith Breeden LLC

Effective September 30, 2013, Amundi Group indirectly acquired 100% ownership of Smith Breeden Associates, Inc. (“Smith Breeden”), the Fund’s subadvisor (the “Acquisition”). Pursuant to the Acquisition, Smith Breeden converted to a Delaware limited liability company named Amundi Smith Breeden LLC (“Amundi Smith Breeden”). Amundi Group is a leading European asset management firm with over $1 trillion in assets under management as of June 30, 2013. Amundi Smith Breeden remains the subadvisor for the Fund and is located at 280 South Mangum Street, Suite 301, Durham, NC and was founded in 1982. Amundi Smith Breeden is an investment management firm for a client base including corporate and public pension plans, central and supranational banks, endowments and foundations, private banks and financial institutions, insurance companies, and other institutional investors. Specializing in fixed income portfolios, the firm offers separate accounts, commingled funds, and serves as a subadvisor to ‘40 Act funds.

Amundi Smith Breeden believes that innovative research provides critical insights into the fixed-income market. The firm’s experienced investment professionals apply these research insights to the management of investment portfolios designed to achieve their clients’ objectives. The key tenets of this market-tested investment philosophy are:

| | • | | Over a market cycle, a portfolio of fixed income securities with wide risk-adjusted spreads produces an attractive total return in comparison to the market return. |

| | • | | The incremental return available from security selection and sector allocation, based on careful relative value analysis, quantitative research, and experienced market judgment, is more consistent than the incremental return from predicting the direction of interest rates or other macro-factor trading strategies. |

| | • | | Within the investment-grade fixed-income market, the spread sectors, e.g., corporate bonds, mortgage-backed securities (MBS), commercial MBS (CMBS), and asset-backed securities (ABS), will tend to outperform Treasury securities over a market cycle. The corporate, mortgage, CMBS, and ABS sectors also offer the greatest active management opportunity for adding value through security selection. |

The portfolio management team at Amundi Smith Breeden specializes in analyzing and investing in mortgage-backed securities. Through careful analysis and comparison of the characteristics of these securities, such as type of issuer, coupon, maturity, geographic structure, and historic and prospective prepayment rates, the team seeks to structure a portfolio that will outperform the Citigroup Mortgage Index. While the portfolio managers will purchase securities of any maturity or duration, they do not attempt to add value by actively positioning the interest-rate sensitivity of the Portfolio. Instead, they typically manage the weighted average duration of the Portfolio so that it is similar to that of the duration of the Citigroup Mortgage Index.

The ideal investment exhibits the following traits:

| | • | | Very high quality (AAA or Government) |

| | • | | Attractive value relative to other MBS opportunities |

The portfolio managers limit purchases to securities from the following asset classes:

| | • | | Securities issued directly or guaranteed by the U.S. Government or its agencies or instrumentalities |

| | • | | Mortgage-backed securities rated AAA by Standard & Poor’s Corporation (“S&P”) or Aaa by Moody’s Investors Service, Inc. (“Moody’s”) |

| | • | | Securities fully collateralized by assets in either of the above classes |

| | • | | Assets that would qualify as liquidity items under federal regulations (which may change from time to time) if held by a commercial bank or savings institution; and hedge instruments |

| | • | | Stripped mortgage-backed securities, which may only be used for risk management purposes |

The investment team will make a sell decision when:

| | • | | They no longer view the bonds as attractive |

| | • | | They need to maintain the Portfolio’s target duration |

| | • | | They deem it necessary for Portfolio allocation purposes |

THE YEAR IN REVIEW

During the year ended December 31, 2013, the Fund returned (1.15)%, compared to (1.52)% for its benchmark, the Citigroup MortgageIndex.

This year saw the natural transition of belt-tightening shift away from the private sector and towards the public sector. The Federal Reserve became the primary source of uncertainty as market participants began re-pricing assets ahead of the expected tapering. By the end of the year, we saw the long end of the yield curve begin to move towards a reasonable level. However, by our estimation,

16

Managers Intermediate Duration Government Fund

Portfolio Manager’s Comments (continued)

rates in the three- to five-year portion of the curve are likely to rise as tapering progresses through 2014.

Heading into 2013, political and economic news had not been particularly positive; however, the recovery continued in textbook fashion. Agency mortgage-backed securities (“MBS”) began the first quarter under pressure as the Federal Open Market Committee (“FOMC”) released commentary regarding its third round of Quantitative Easing (“QE3”) with a more hawkish tone than the market had anticipated. Lower coupon MBS continued to lag during the quarter as the market continued to watch the economic data and attempted to synthesize the various comments from members of the FOMC. MBS rallied into the end of the quarter as fears of an imminent end to QE3 waned. Our tilt towards higher coupon MBS drove outperformance during the period. Portfolio exposures in non-agency MBS also contributed positively to performance.

The second quarter began with some weak economic data, and the market adjusted its expectations to reflect an extension of the Fed’s large scale asset purchase program. Higher coupon mortgages suffered from the rally in rates amid concerns on increased prepayment speeds. MBS was punished significantly in the middle of the quarter as stronger employment data and talk of slowing purchases by several Fed members led expectations of reduced demand. In response, the market discounted mortgage prices significantly. By the end of the quarter, higher and steeper yield curves drove mortgage servicers and Real Estate Investment Trusts (“REITS”) to sell duration, further pressuring the agency MBS market. Relative value buyers did emerge at the end of the quarter to take advantage of the sell-off. Once again, our bias towards coupons that the FOMC was not purchasing drove the outperformance for the Fund in the second quarter.

MBS began July with significant volatility. MBS benefited as increased rates reduced the supply of new mortgages. However, demand for MBS from banks and REITS was also muted which left the Fed as the only major buyer of mortgages. As the quarter progressed, the production of new mortgages remained anemic. Demand from the Fed overwhelmed supply, helping mortgage performance. High rates led to lower prepayments, which also helped MBS performance through the middle of the third quarter. After months of QE3 tapering discussions, the Fed surprised the market in September by maintaining its purchases at the same levels which led to significantly stronger performance from MBS into the end of the quarter. Our increased exposure to 15-year mortgages relative to 30-year mortgages over the quarter benefited the Fund.

MBS spreads continued to tighten into the fourth quarter, led by the lower coupon 30-year mortgages where the Fed continued to focus its purchases. Mortgage prepayments stayed low, despite lower mortgage rates as banks significantly cut their mortgage workforce, hampering their ability to process applications. By the middle of the quarter, concerns about tapering of QE3 weighed on mortgages. By the time the FOMC announced the beginning of tapering, the market had effectively fully priced in the impact of tapering. Our bias towards non-FOMC purchased mortgages (i.e., higher coupon fixed-rate MBS, seasoned 15-year MBS, and Collateralized Mortgage Obligations (“CMOs”)) drove the outperformance for the quarter.

Most of the Portfolio outperformance for 2013 was attributable to our security selection in agency MBS (specifically, avoiding the parts of the market where the Fed was focused). Our exposures to non-agency mortgages also benefited the Portfolio, as did our positioning relative to the yield curve. Adjustable-Rate Mortgages, Fixed-Rate Mortgages (“FRMs”) and CMOs all benefitted from the reduced production of mortgages and the slowdown in prepayments attributable to the higher interest rates in the latter half of the year.

Derivatives, such as financial futures, options, and mortgage derivatives, are used for portfolio duration and convexity risk management. We continue to find value in mortgage derivatives with beneficial underlying collateral characteristics.

At the end of the year, the Fund held the majority of its exposure in 15-year and 30-year agency FRMs. We increased the active exposure to 30-year agency FRMs by 19.6% during the year, while adding 5.5% of active exposure to 15-year agency FRMs. We decreased our active exposure to CMBS by 2.2%. The Fund also maintained its small allocation to Interest-Only strips and CMOs. We continue to see opportunities in high quality spread assets and are positive on our 2014 outlook for the MBS sector.

LOOKING FORWARD

Amundi Smith Breeden believes that 2014 will begin in very much the same way that 2013 ended. The short-term technicals for MBS remain positive. Even with tapering, the Fed is still purchasing more MBS than net new production. The real challenge will come in the second half of the year when the marginal buyer once again becomes private capital. Current large scale holders include the Government Sponsored Enterprises (GSEs), banks, money managers, REITs and overseas buyers. Excluding the agencies, all of these entities could buy mortgages under the right circumstances, but each has its own unique obstacles to overcome. We expect that money managers will buy, but will likely require wider spread levels than what the market is currently offering. On the other hand, prepayment rates should remain low through the year, and the additional carry that MBS provides will likely more than offset any spread widening. Despite some shorter-term headwinds, agency MBS continue to be an attractive asset class longer-term.

This commentary reflects the viewpoints of Amundi Smith Breeden LLC as of December 31, 2013 and is not intended as a forecast or guarantee of future results.

Managers Intermediate Duration Government Fund

Portfolio Manager’s Comments (continued)

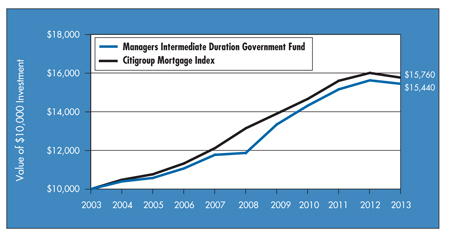

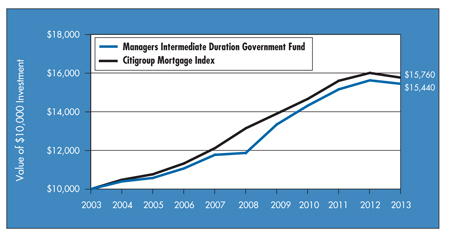

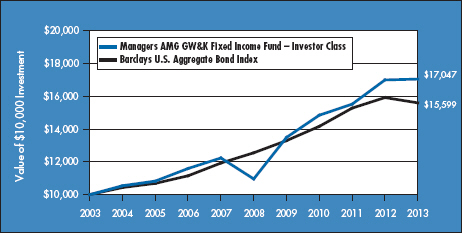

CUMULATIVE TOTAL RETURN PERFORMANCE

Managers Intermediate Duration Government Fund’s cumulative total return is based on the daily change in net asset value (NAV), and assumes that all distributions were reinvested. The graph compares a hypothetical $10,000 investment made in the Managers Intermediate Duration Government Fund on December 31, 2003 to a $10,000 investment made in the Citigroup Mortgage Index for the same time period. Performance for periods longer than one year is annualized. The graph and table do not reflect the deduction of taxes that a shareholder would pay on a Fund distribution or redemption of shares. The listed returns for the Fund are net of expenses and the returns for the index exclude expenses. Past performance is not indicative of future results. Total returns would have been lower had certain expenses not been reduced.

The table below shows the average annual total returns for the Managers Intermediate Duration Government Fund and the Citigroup Mortgage Index for the same time periods ended December 31, 2013.

| | | | | | | | | | | | |

| | | Average Annual Total Returns1 | |

| | | One

Year | | | Five

Years | | | Ten

Years | |

Managers Intermediate Duration Government Fund2,3,4,5,6 | | | (1.15 | )% | | | 5.40 | % | | | 4.44 | % |

Citigroup Mortgage Index7 | | | (1.52 | )% | | | 3.70 | % | | | 4.65 | % |

The performance data shown represents past performance. Past performance is not a guarantee of future results. Current performance may be lower or higher than the performance data quoted. The investment return and principal value of an investment in the Fund will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. For performance information through the most recent month end, please call (800) 835-3879 or visit our Web site at www.managersinvest.com. Current net asset values per share for each Fund are available on the Funds’ Web site at www.managersinvest.com.

Investors should carefully consider the Fund’s investment objectives, risks, charges, and expenses before investing. For this and other information, please call (800) 835-3879 or visit our Web site at www.managersinvest.com for a free prospectus. Read it carefully before investing or sending money. Funds are distributed by Managers Distributors, Inc., member FINRA.

| 1 | Total return equals income yield plus share price change and assumes reinvestment of all dividends and capital gain distributions. Returns are net of fees and may reflect offsets of Fund expenses as described in the Prospectus. No adjustment has been made for taxes payable by shareholders on their reinvested dividends and capital gain distributions. Returns for periods greater than one year are annualized. The listed returns on the Fund are net of expenses and based on the published NAV as of December 31, 2013. All returns are in U.S. dollars ($). |

| 2 | From time to time the Fund’s advisor has waived its fees and/or absorbed Fund expenses, which has resulted in higher returns. |

| 3 | Changing interest rates may adversely affect the value of an investment. An increase in interest rates typically casuses the value of bonds and other fixed-income securities to fall. |

| 4 | The Fund is subject to the risks associated with investments in debt securities, such as default risk, fluctuations in the debtor’s perceived ability to pay their creditors. |

| 5 | The Fund may use derivative instruments for hedging purposes or as part of its investment strategy. There is a risk that a derivative intended as a hedge may not perform as expected. The main risk with derivatives is that some types can amplify a gain or loss, potentially earning or losing substantially more money than the actual cost of the derivative or that the counterparty may fail to honor its contract terms, causing a loss for the Fund. Use of these instruments may also involve certain costs and risks such as liquidity risk, interest rate risk, market risk, credit risk, management risk and the risk that a fund could not close out a position when it would be most advantageous to do so. |

| 6 | Many bonds have call provisions which allow the debtors to pay them back before maturity. This is especially true with mortgage securities, which can be paid back anytime. Typically debtors prepay their debt when it is to their advantage (when interest rates drop making a new loan at current rates more attractive), and thus likely to the disadvantage of bondholders, who may have to reinvest prepayment proceeds in securities with lower yields. Prepayment risk will vary depending on the provisions of the security and current interest rates relative to the interest rate of the debt. |

| 7 | The Citigroup Mortgage Index includes all outstanding government sponsored fixed-rate mortgage-backed securities, weighted in proportion to their current market capitalization. The Index reflects no deductions for fees, expenses, or taxes. Unlike the Fund, the Citigroup Mortgage Index is unmanaged, is not available for investment, and does not incur expenses. |

Not FDIC insured, nor bank guaranteed. May lose value.

18

Managers Intermediate Duration Government Fund

Fund Snapshots

December 31, 2013

Portfolio Breakdown (unaudited)

| | | | |

Category | | Managers Intermediate

Duration

Government Fund** | |

U.S. Government and Agency Obligations | | | 129.4 | % |

Mortgage-Backed Securities | | | 5.7 | % |

Other Assets and Liabilities | | | (35.1 | )% |

| ** | As a percentage of net assets. |

| | | | |

Rating | | Managers Intermediate

Duration

Government Fund† | |

U.S. Treasury & Agency | | | 95.7 | % |

Aaa | | | 1.8 | % |

Aa | | | 0.0 | % |

A | | | 0.0 | % |

Baa | | | 0.5 | % |

Ba & lower | | | 2.0 | % |

| † | As a percentage of market value of fixed income securities. Chart does not include equity securities. |

Top Ten Holdings (unaudited)

| | | | |

Security Name | | % of Net Assets | |

FHLMC Gold Pool, 4.000%, TBA 30yr* | | | 20.3 | % |

FNMA, 3.500%, TBA 30yr* | | | 10.3 | |

FHLMC Gold Pool, 4.500%, TBA 30yr* | | | 5.1 | |

FNMA, 4.000%, TBA 15yr* | | | 3.9 | |

FHLMC Gold Pool, 3.500%, TBA 30yr* | | | 3.6 | |

FNMA, 4.000%, TBA 30yr* | | | 3.4 | |

FHLMC Gold Pool, 5.000%, 10/01/36* | | | 2.4 | |

FHLMC Gold Pool, 3.500%, 04/01/32* | | | 1.9 | |

FHLMC Gold Pool, 3.500%, TBA 15yr* | | | 1.9 | |

FNMA, 4.500%, 10/01/40* | | | 1.9 | |

Top Ten as a Group | | | 54.7 | % |

| | | | |

| * | Top Ten Holding at June 30, 2013 |

Any sectors, industries, or securities discussed should not be perceived as investment recommendations. Mention of a specific security should not be considered a recommendation to buy or solicitation to sell that security. Specific securities mentioned in this report may have been sold from the Fund’s portfolio of investments by the time you receive this report.

19

Managers Intermediate Duration Government Fund

Schedule of Portfolio Investments

December 31, 2013

| | | | | | | | |

| | | Principal Amount | | | Value | |

Mortgage-Backed Securities - 5.7% | | | | | | | | |

American Home Mortgage Assets LLC, Series 2005-1, Class 1A1, 2.571%, 11/25/35 (02/25/14)1 | | $ | 89,298 | | | $ | 70,538 | |

American Home Mortgage Investment Trust, | | | | | | | | |

Series 2004-1, Class 4A, 2.349%, 04/25/44 (02/25/14)1 | | | 138,550 | | | | 132,049 | |

Series 2005-1, Class 5A1, 2.349%, 06/25/45 (02/25/14)1 | | | 57,628 | | | | 55,965 | |

Series 2005-1, Class 6A, 2.349%, 06/25/45 (02/25/14)1 | | | 1,127,818 | | | | 1,050,204 | |

Bank of America Commercial Mortgage Trust, | | | | | | | | |

Series 2006-6, Class A2, 5.309%, 10/10/45 | | | 146,626 | | | | 146,946 | |

Series 2007-3, Class A2, 5.649%, 06/10/493 | | | 102,717 | | | | 102,616 | |

Bank of America Funding Corp., Series 2004-B, Class 1A2, 2.700%, 12/20/34 (02/20/14)1 | | | 133,334 | | | | 107,134 | |

Bear Stearns Alt-A Trust, Series 2005-3, Class 2A3, 2.557%, 04/25/35 (02/25/14)1 | | | 138,779 | | | | 118,313 | |

Bear Stearns Commercial Mortgage Securities Trust, | | | | | | | | |

Series 2005-PWR9, Class A3, 4.868%, 09/11/42 | | | 1,000,000 | | | | 1,005,678 | |

Series 2006-PW11, Class A2, 5.391%, 03/11/393 | | | 413 | | | | 416 | |

Citigroup/Deutsche Bank Commercial Mortgage Trust, Series 2006-CD3, Class A4, 5.658%, 10/15/48 | | | 951,026 | | | | 962,263 | |

Countrywide Alternative Loan Trust, Series 2005-J5, Class 1A1, 0.465%, 05/25/35 (01/25/14)1 | | | 44,327 | | | | 43,754 | |

Countrywide Home Loan Mortgage Pass Through Trust, | | | | | | | | |

Series 2004-R2, Class 1AF1, 0.585%, 11/25/34 (01/25/14) (a)1,4 | | | 174,210 | | | | 150,866 | |

Series 2005-HYB2, Class 1A4, 3.027%, 05/20/35 (02/20/14)1 | | | 108,868 | | | | 101,324 | |

Series 2005-HYB8, Class 1A1, 2.498%, 12/20/35 (02/20/14)1 | | | 113,386 | | | | 90,416 | |

Credit Suisse First Boston Mortgage Securities Corp., Series 2005-C3, Class A3, 4.645%, 07/15/37 | | | 243,087 | | | | 243,985 | |

GMAC Commercial Mortgage Securities, Inc., Series 2005-C1, Class A3, 4.538%, 05/10/43 | | | 16,645 | | | | 16,647 | |

GSMPS Mortgage Loan Trust, Series 2005-RP2, Class 1AF, 0.515%, 03/25/35 (01/25/14) (a)1,4 | | | 217,044 | | | | 183,986 | |

GSR Mortgage Loan Trust, Series 2004-5, Class 1A3, 1.883%, 05/25/34 (02/25/14)1 | | | 50,674 | | | | 45,780 | |

Harborview Mortgage Loan Trust, Series 2004-7, Class 2A2, 2.368%, 11/19/34 (02/19/14)1 | | | 84,968 | | | | 74,784 | |

JPMorgan Chase Commercial Mortgage Securities Trust, | | | | | | | | |

Series 2005-LDP1, Class A2, 4.625%, 03/15/46 | | | 15,699 | | | | 15,701 | |

Series 2006-LDP7, Class A3B, 5.863%, 04/15/453 | | | 686,514 | | | | 685,525 | |

Master Alternative Loans Trust, Series 2005-2, Class 2A1, 6.000%, 01/25/352 | | | 684,933 | | | | 693,478 | |