UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORMN-CSR

CERTIFIED SHAREHOLDER REPORT OF

REGISTERED MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number:811-06431

AMG Funds II

(Exact name of registrant as specified in charter)

600 Steamboat Road, Suite 300, Greenwich, Connecticut 06830

(Address of principal executive offices) (Zip code)

AMG Funds LLC

600 Steamboat Road, Suite 300, Greenwich, Connecticut 06830

(Name and address of agent for service)

Registrant’s telephone number, including area code: (203)299-3500

Date of fiscal year end: DECEMBER 31

Date of reporting period: JANUARY 1, 2019 – DECEMBER 31, 2019

(Annual Shareholder Report)

| Item 1. | Reports to Shareholders |

| | |

| | ANNUAL REPORT |

| | |

| | | AMG Funds December 31, 2019 AMG Chicago Equity Partners Balanced Fund Class N:MBEAX | Class I:MBESX | Class Z:MBEYX |

Beginning on January 1, 2021, as permitted by regulations adopted by the Securities and Exchange Commission, paper copies of the Fund’s shareholder reports like this one will no longer be sent by mail, unless you specifically request paper copies of the reports from the Fund or from your financial intermediary, such as a broker-dealer or bank. Instead, the reports will be made available on the Fund’s website (https://www.amgfunds.com/resources/order_literature.html), and you will be notified by mail each time a report is posted and provided with a website link to access the report.

If you already elected to receive shareholder reports electronically, you will not be affected by this change and you need not take any action. You may elect to receive shareholder reports and other communications from the Fund electronically at any time by contacting your financial intermediary or, if you invest directly with the Fund, by logging into your account at www.amgfunds.com.

You may elect to receive all future reports in paper free of charge. If you invest through a financial intermediary, you can contact your financial intermediary to request that you continue to receive paper copies of your shareholder reports. If you invest directly with the Fund, you can call 1.800.548.4539 to inform the Fund that you wish to continue receiving paper copies of your shareholder reports. Your election to receive reports in paper will apply to all funds in the AMG Funds Family of Funds held in your account if you invest through your financial intermediary or all funds in the AMG Funds Family of Funds held with the fund complex if you invest directly with the Fund.

| | | | | | |

amgfunds.com | | | | 123119 | | AR009 |

| | |

| | | AMG Funds Annual Report — December 31, 2019 |

| | | | |

TABLE OF CONTENTS | | PAGE | |

LETTER TO SHAREHOLDERS | | | 2 | |

| |

ABOUT YOUR FUND’S EXPENSES | | | 3 | |

| |

| PORTFOLIO MANAGER’S COMMENTS, FUND SNAPSHOTS AND SCHEDULE OF PORTFOLIO INVESTMENTS | | | | |

| |

AMG Chicago Equity Partners Balanced Fund | | | 4 | |

| |

FINANCIAL STATEMENTS | | | | |

| |

Statement of Assets and Liabilities | | | 22 | |

| |

Balance sheet, net asset value (NAV) per share computations and cumulative distributable earnings (loss) | | | | |

| |

Statement of Operations | | | 24 | |

| |

Detail of sources of income, expenses, and realized and unrealized gains (losses) during the fiscal year | | | | |

| |

Statements of Changes in Net Assets | | | 25 | |

| |

Detail of changes in assets for the past two fiscal years | | | | |

| |

Financial Highlights | | | 26 | |

| |

Historical net asset values per share, distributions, total returns, income and expense ratios, turnover ratios and net assets | | | | |

| |

Notes to Financial Statements | | | 29 | |

| |

Accounting and distribution policies, details of agreements and transactions with Fund management and affiliates, and descriptions of certain investment risks | | | | |

| |

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM | | | 35 | |

| |

OTHER INFORMATION | | | 36 | |

| |

TRUSTEES AND OFFICERS | | | 37 | |

Nothing contained herein is to be considered an offer, sale or solicitation of an offer to buy shares of any series of the AMG Funds Family of Funds. Such offering is made only by prospectus, which includes details as to offering price and other material information.

| | | | |

| | Letter to Shareholders | | |

Dear Shareholder:

The U.S. bull market celebrated its10-year anniversary during the fiscal year ended December 31, 2019, as stocks proved resilient in the face of global economic weakness, rising geopolitical tensions, and the ongoing trade war. After a painful selloff in late 2018, a dovish pivot from global central banks rescued investors and fueled a strong rebound early in 2019. The rally picked up steam in the final months of the year, as trade tensions eased when the U.S. and China agreed to a limited “phase one” deal in December following months of tenseback-and-forth negotiations. The yield curve, which had inverted earlier in the year and raised investor anxiety given its track record for predicting an impending recession, was no longer inverted byyear-end as the U.S. Federal Reserve (the Fed) cut short-term rates. Worries over a near-term recession lifted while the yield curve steepened and trade developments improved, leading to a wave of investor confidence and strong equity returns, with the S&P 500® Index returning 31.49%. International equities were also resistant to pressures facing the global economy and generated a 21.51% return as measured by the MSCI All Country World ex USA Index.

In total, all eleven sectors of the S&P 500® Index were strongly positive during the prior twelve months, each producing double-digit returns. The higher growth information technology sector led the way with a 50.31% return while the communication services and financial sectors followed closely behind. Energy was the worst performing sector during the fiscal year, yet still produced a very respectable 11.81% return. Growth stocks outperformed Value stocks for the full fiscal year with returns of 36.39% and 26.54% for the Russell 1000® Growth and Russell 1000® Value Indexes, respectively. The cycle of U.S. outperformance over international equities continued but international developed and emerging markets still produced solid positive returns, with the MSCI EAFE and MSCI Emerging Markets Index returning 22.01% and 18.42%, respectively.

Interest rates fell dramatically over the fiscal year and led to strong returns for bond investors as the Fed shifted to a more dovish policy stance early in 2019 and eventually cut short-term rates three times during the year. The10-year Treasury yield fell from its recent high of 3.24% last November to a low of 1.47% in early September and then edged slightly higher to finish the year at 1.92%. The plunge in long-term interest rates caused the yield curve to briefly invert with2-year yields rising higher than the10-year yields. The Bloomberg Barclays U.S. Aggregate Bond Index, a broad measure of U.S. bond market performance, ended the fiscal year with an 8.72% return. High yield bonds outperformed the broader bond market and returned 14.32% as measured by the return of the Bloomberg Barclays U.S. Corporate High Yield Bond Index. Municipal bonds also performed strongly with a 7.54% return for the Bloomberg Barclays Municipal Bond Index.

AMG Funds appreciates the privilege of providing investment tools to you and your clients. Our foremost goal is to provide investment solutions that help our shareholders successfully reach their long-term investment goals. AMG Funds provides access to a distinctive array of actively managed return-oriented investment strategies. We thank you for your continued confidence and investment in AMG Funds. You can rest assured that under all market conditions our team is focused on delivering excellent investment management services for your benefit.

Respectfully,

Keitha Kinne

President

AMG Funds

| | | | | | | | | | | | | | |

Average Annual Total Returns | | Periods ended

December 31, 2019* | |

Stocks: | | | | 1 Year | | | 3 Years | | | 5 Years | |

Large Cap | | (S&P 500® Index) | | | 31.49 | % | | | 15.27 | % | | | 11.70 | % |

Small Cap | | (Russell 2000® Index) | | | 25.52 | % | | | 8.59 | % | | | 8.23 | % |

International | | (MSCI All Country World ex USA Index) | | | 21.51 | % | | | 9.87 | % | | | 5.51 | % |

| | | | | | | | | | | | | | |

| | | | |

Bonds: | | | | | | | | | | | |

Investment Grade | | (Bloomberg Barclays U.S. Aggregate Bond Index) | | | 8.72 | % | | | 4.03 | % | | | 3.05 | % |

High Yield | | (Bloomberg Barclays U.S. Corporate High Yield Bond Index) | | | 14.32 | % | | | 6.37 | % | | | 6.13 | % |

Tax-exempt | | (Bloomberg Barclays Municipal Bond Index) | | | 7.54 | % | | | 4.72 | % | | | 3.53 | % |

Treasury Bills | | (ICE BofAML U.S.6-Month Treasury Bill Index) | | | 2.57 | % | | | 1.81 | % | | | 1.26 | % |

| | | | | | | | | | | | | | |

| * | Source: FactSet. Past performance is no guarantee of future results. |

2

| | |

| | | About Your Fund’s Expenses |

As a shareholder of a Fund, you may incur two types of costs: (1) transaction costs, which may include sales charges (loads) on purchase payments; redemption fees; and exchange fees; and (2) ongoing costs, including management fees; distribution(12b-1) fees; and other Fund expenses. This example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds. The example is based on $1,000 invested at the beginning of the period and held for the entire period as indicated below.

ACTUAL EXPENSES

The first line of the following table provides information about the actual account values and

actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

HYPOTHETICAL EXAMPLE FOR COMPARISON PURPOSES

The second line of the following table provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed annual rate of return of 5% before expenses, which is not the Fund’s

actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds by comparing this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as sales charges (loads), redemption fees, or exchange fees. Therefore, the second line of the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds.

| | | | | | | | | | | | | | | | |

Six Months Ended December 31, 2019 | | Expense

Ratio for the Period | | | Beginning

Account

Value

07/01/19 | | | Ending

Account

Value

12/31/19 | | | Expenses

Paid

During

the Period* | |

AMG Chicago Equity Partners Balanced Fund | |

Based on Actual Fund Return | |

Class N | | | 1.09 | % | | $ | 1,000 | | | $ | 1,055 | | | $ | 5.64 | |

Class I | | | 0.94 | % | | $ | 1,000 | | | $ | 1,055 | | | $ | 4.87 | |

Class Z | | | 0.84 | % | | $ | 1,000 | | | $ | 1,055 | | | $ | 4.35 | |

| | | | | | | | | | | | | | | | |

Based on Hypothetical 5% Annual Return | |

Class N | | | 1.09 | % | | $ | 1,000 | | | $ | 1,020 | | | $ | 5.55 | |

Class I | | | 0.94 | % | | $ | 1,000 | | | $ | 1,020 | | | $ | 4.79 | |

Class Z | | | 0.84 | % | | $ | 1,000 | | | $ | 1,021 | | | $ | 4.28 | |

| | | | | | | | | | | | | | | | |

| * | Expenses are equal to the Fund’s annualized expense ratio multiplied by the average account value over the period, multiplied by the number of days in the most recent fiscal half-year (184), then divided by 365. |

3

| | |

| | | AMG Chicago Equity Partners Balanced Fund Portfolio Manager’s Comments(unaudited) |

THE YEAR IN REVIEW

For the year ended December 31, 2019, AMG Chicago Equity Partners Balanced Fund (Class N shares) (the “Fund”) returned 16.96%, compared to the 22.13% return for its benchmark, which consists of 60% the return of the Russell 1000® Index and 40% the return of the Bloomberg Barclays U.S. Aggregate Bond Index.

CEP’s Market Phase Identification (MPI) model signaled a downturn phase throughout much of the year which resulted in varied underweight equity allocations in the Fund throughout much of 2019. It was not until the fourth quarter that the model shifted to a rebound phase, causing the asset allocation to change from 55% equity/45% fixed income to 65% equity/35% fixed income in the last quarter of the year. The prevalent underweight in equities during 2019 was a primary driver of the Fund’s overall underperformance.

At the beginning of the year, the equity portion of the Fund shifted its style preference to Value from Growth, its factor preference from Momentum to Quality, and risk profile from neutral to lower volatility. In the fourth quarter, the factor preference moved from Quality to Value and continued to maintain its style preference for Value. The equity portfolio underperformed the Russell 1000® Index for the year due to this positioning as Growth stocks outperformed Value stocks.

Stocks had a great year in 2019 with all major U.S indices posting double-digit positive returns. The Russell 1000® Index repeatedly set new record highs, finishing the year with a 31.43% return, the best yearly performance since 2013. The optimism over the U.S.-China trade talks combined with the U.S. Federal Reserve (Fed) cutting interest rates three times this year contributed to the strong equity performance as stock prices rose substantially despite negative earnings revisions. The slowing U.S. economy has been supported by consumers as unemployment hit historic lows and consumer spending remained solid while manufacturing has been weak.

The equity segment of the Fund underperformed this year relative to the Russell 1000® Index. The year’s underperformance was mostly due to weakness in the first and fourth quarters. In the first and fourth quarters the rank performance of our quantitative model performed poorly, with the stocks we had ranked highly underperforming those that we had ranked lower.

The fixed income segment of the Fund outperformed the Bloomberg Barclays U.S. Aggregate Bond Index every quarter in 2019 with strong results in the 4th quarter. While duration, curve exposure and the

mortgage-backed securities (MBS) allocation are closely aligned with benchmark weightings, an overweight to corporate bonds has benefited the portfolio throughout the year as a result of the narrowing of corporate spreads and falling interest rates across the maturity spectrum. Specific security selection and an overweight to BBB rated issuers also helped performance.

Expectations for next year are for corporate earnings to improve along with an increasing investor preference for stocks with quality balance sheets. Our research has shown that constructing a well-diversified portfolio of companies with attractive valuations ratios, quality balance sheets, and positive growth and momentum expectations built through a disciplined, risk-controlled process delivers consistent long-term excess returns. Overall, our philosophy will not change based on short-term trends or conditions in the market. We will continue to use our disciplined approach to provide added value at controlled levels of risk.

This commentary reflects the viewpoints of Chicago Equity Partners, LLC and is not intended as a forecast or guarantee of future results.

4

| | |

| | | AMG Chicago Equity Partners Balanced Fund Portfolio Manager’s Comments(continued) |

CUMULATIVE TOTAL RETURN PERFORMANCE

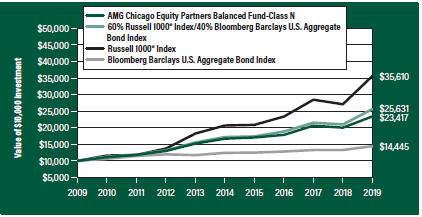

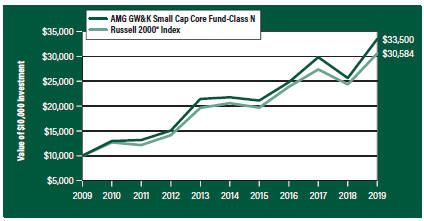

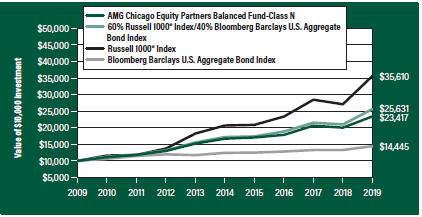

AMG Chicago Equity Partners Balanced Fund’s cumulative total return is based on the daily change in net asset value (NAV), and assumes that all dividends and distributions were reinvested. This graph compares a hypothetical $10,000 investment made in the AMG Chicago Equity Partners Balanced Fund’s Class N shares on December 31, 2009, to a $10,000 investment made in the 60% Russell 1000® Index/40% Bloomberg Barclays U.S. Aggregate Bond Index, Russell 1000® Index and the Bloomberg Barclays U.S. Aggregate Bond Index for the same time period. The graph and table do not reflect the deduction of taxes that a shareholder would pay on a Fund distribution or redemption of shares. The listed returns for the Fund are net of expenses and the returns for the index exclude expenses. Total returns would have been lower had certain expenses not been reduced.

The table below shows the average annual total returns for the AMG Chicago Equity Partners Balanced Fund, the 60% Russell 1000® Index/40% Bloomberg Barclays U.S. Aggregate Bond Index, the Russell 1000® Index and the Bloomberg Barclays U.S. Aggregate Bond Index for the same time periods ended December 31, 2019.

| | | | | | | | | | | | | | | | | | | | |

| Average Annual Total Returns1 | | One

Year | | | Five

Years | | | Ten

Years | | | Since

Inception | | | Inception

Date | |

AMG Chicago Equity Partners Balanced Fund2, 3, 4, 5, 6, 7 | | | | | |

Class N | | | 16.96 | % | | | 7.00 | % | | | 8.88 | % | | | 7.92 | % | | | 01/02/97 | |

Class I | | | 17.17 | % | | | 7.16 | % | | | — | | | | 8.80 | % | | | 11/30/12 | |

Class Z | | | 17.21 | % | | | 7.26 | % | | | 9.16 | % | | | 8.29 | % | | | 01/02/97 | |

| | | | | | | | | | | | | | | | | | | | |

60% Russell 1000® Index/40% Bloomberg Barclays U.S. Aggregate Bond Index8, 9 | | | 22.13 | % | | | 8.31 | % | | | 9.87 | % | | | 7.84 | % | | | 01/02/97 | † |

Russell 1000® Index8 | | | 31.43 | % | | | 11.48 | % | | | 13.54 | % | | | 8.80 | % | | | 01/02/97 | † |

Bloomberg Barclays U.S. Aggregate Bond Index9 | | | 8.72 | % | | | 3.05 | % | | | 3.75 | % | | | 5.14 | % | | | 01/02/97 | † |

| | | | | | | | | | | | | | | | | | | | |

The performance data shown represents past performance. Past performance is not a guarantee of future results. Current performance may be lower or higher than the performance data quoted. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost.

Investors should carefully consider the Fund’s investment objectives, risks, charges and expenses before investing. For performance information through the most recent month end, current net asset values per share for the Fund and other information, please call 800.548.4539 or visit our website at amgfunds.com for a free prospectus. Read it carefully before investing or sending money.

Distributed by AMG Distributors, Inc., member FINRA/SIPC.

| † | Date reflects inception date of the Fund, not the index. |

| 1 | Total return equals income yield plus share price change and assumes reinvestment of all dividends and capital gain distributions. Returns are net of fees and may reflect offsets of Fund expenses as described in the prospectus. No adjustment has been made for taxes payable by shareholders on their reinvested dividends and capital gain distributions. Returns for periods greater than one year are annualized. The listed returns on the Fund are net of expenses and based on the published NAV as of December 31, 2019. All returns are in U.S. dollars ($). |

| 2 | From time to time, the Fund’s advisor has waived its fees and/or absorbed Fund expenses, which has resulted in higher returns. |

| 3 | To the extent that the Fund invests in asset-backed or mortgage-backed securities, its exposure to prepayment and extension risks may be greater than investments in other fixed income securities. |

| 4 | The Fund is subject to the risks associated with investments in debt securities, such as default risk and fluctuations in the perception of the debtor’s ability to pay its creditors. Changing interest rates may adversely affect the value of an investment. An increase in interest rates typically causes the value of bonds and other fixed income securities to fall. |

| 5 | Investments in international securities are subject to certain risks of overseas investing including currency fluctuations and changes in political and economic conditions, which could result in significant market fluctuations. These risks are magnified in emerging markets. |

| 6 | The Fund is subject to risks associated with investments inmid-capitalization companies such as greater price volatility, lower trading volume, and less liquidity than the stocks of larger, more established companies. |

| 7 | The Fund invests in value stocks, which may perform differently from the market as a whole and may be undervalued by the market for a long period of time. |

| 8 | The Russell 1000® Index measures the performance of approximately 1,000 of the largest securities based on a combination of their market cap and current index membership. The Russell 1000® represents approximately 92% of the U.S. market. Unlike the Fund, the Russell 1000® Index is unmanaged, is not available for investment, and does not incur expenses. |

| 9 | The Bloomberg Barclays U.S. Aggregate Bond Index represents securities that are Securities and Exchange Commission-registered, taxable, and dollar denominated. The index covers the U.S. investment grade fixed rate bond market, with index components for government and corporate securities, mortgage pass-through securities, and asset-backed securities. Unlike the Fund, the Bloomberg Barclays |

5

| | |

| | | AMG Chicago Equity Partners Balanced Fund Portfolio Manager’s Comments(continued) |

| | U.S. Aggregate Bond Index is unmanaged, is not available for investment, and does not incur expenses. |

The Russell 1000® Index is a trademark of the London Stock Exchange Group companies.

Bloomberg Index Services Limited. BLOOMBERG® is a trademark and service mark of Bloomberg Finance L.P. and its affiliates (collectively “Bloomberg”).

BARCLAYS® is a trademark and service mark of Barclays Bank Plc (collectively with its affiliates, “Barclays”), used under license. Bloomberg or Bloomberg’s licensors, including Barclays, own all proprietary rights in the Bloomberg Barclays Indices. Neither Bloomberg nor Barclays approves or endorses this material, or guarantees the accuracy or completeness of any information herein, or makes

any warranty, express or implied, as to the results to be obtained therefrom and, to the maximum extent allowed by law, neither shall have any liability or responsibility for injury or damages arising in connection therewith.

Not FDIC insured, nor bank guaranteed. May lose value.

6

| | |

| | | AMG Chicago Equity Partners Balanced Fund Fund Snapshots(unaudited) December 31, 2019 |

PORTFOLIO BREAKDOWN

| | | | |

Sector | | % of

Net Assets | |

U.S. Government and Agency Obligations | | | 18.5 | |

Industrials | | | 16.3 | |

Financials | | | 14.4 | |

Information Technology | | | 10.8 | |

Health Care | | | 7.9 | |

Communication Services | | | 5.7 | |

Consumer Discretionary | | | 5.7 | |

Utilities | | | 5.2 | |

Consumer Staples | | | 4.8 | |

Real Estate | | | 3.2 | |

Energy | | | 3.1 | |

Materials | | | 2.2 | |

Exchange Traded Funds | | | 1.0 | |

Short-Term Investments | | | 4.0 | |

Other Assets Less Liabilities | | | (2.8 | ) |

| | | | |

Rating | | % of

Market Value1

| |

U.S. Government and Agency Obligations | | | 54.7 | |

Aa/AA | | | 0.1 | |

A | | | 12.9 | |

Baa/BBB | | | 32.3 | |

| 1 | Includes market value of long-term fixed-income securities only. |

TOP TEN HOLDINGS

| | | | |

Security Name | | % of

Net Assets | |

Apple, Inc. | | | 2.0 | |

Microsoft Corp. | | | 1.6 | |

Johnson & Johnson | | | 1.0 | |

U.S. Treasury Notes, 1.750%, 09/30/22 | | | 1.0 | |

U.S. Treasury Notes, 1.875%, 08/31/22 | | | 1.0 | |

The Procter & Gamble Co. | | | 1.0 | |

Amazon.com, Inc. | | | 0.9 | |

Berkshire Hathaway, Inc., Class B | | | 0.9 | |

JPMorgan Chase & Co. | | | 0.9 | |

Alphabet, Inc., Class A | | | 0.9 | |

| | | | |

Top Ten as a Group | | | 11.2 | |

| | | | |

Credit quality ratings shown above reflect the highest rating assigned by either Standard & Poor’s (“S&P”), Moody’s Investors Service, Inc. (“Moody’s”) or Fitch’s. These rating agencies are independent, nationally recognized statistical rating organizations and are widely used. Investment grade ratings are credit ratings of BBB/Baa or higher. Below investment grade ratings are credit ratings of BB/Ba or lower. Investments designated N/R are not rated by either rating agency. Unrated investments do not necessarily indicate low credit quality. Credit quality ratings are subject to change.

Because a fund’s strategy may result in multiple investments in particular sectors of the economy, its performance may depend on the performance of those sectors and may fluctuate more widely than investments diversified across more sectors. For additional information on these and other risk considerations, please see the Fund’s prospectus.

Any sectors, industries, or securities discussed should not be perceived as investment recommendations. Mention of a specific security should not be considered a recommendation to buy or solicitation to sell that security. Specific securities mentioned in this report may have been sold from the Fund’s portfolio of investments by the time you receive this report.

7

| | |

| | | AMG Chicago Equity Partners Balanced Fund Schedule of Portfolio Investments December 31, 2019 |

| | | | | | | | |

| | | Shares | | | Value | |

Common Stocks - 64.0% | | | | | | | | |

Communication Services - 5.7% | |

Activision Blizzard, Inc. | | | 1,300 | | | $ | 77,246 | |

Alphabet, Inc., Class A* | | | 1,680 | | | | 2,250,175 | |

AT&T, Inc. | | | 27,049 | | | | 1,057,075 | |

Avex, Inc. (Japan) | | | 3,300 | | | | 38,012 | |

Borussia Dortmund GmbH & Co. KGaA (Germany) | | | 1,000 | | | | 9,871 | |

Cinemark Holdings, Inc.1 | | | 9,680 | | | | 327,668 | |

Comcast Corp., Class A | | | 10,305 | | | | 463,416 | |

CTS Eventim AG & Co. KGaA (Germany) | | | 900 | | | | 56,469 | |

Electronic Arts, Inc.* | | | 490 | | | | 52,680 | |

Facebook, Inc., Class A* | | | 6,625 | | | | 1,359,781 | |

Freenet AG (Germany) | | | 700 | | | | 16,049 | |

Gree, Inc. (Japan) | | | 12,200 | | | | 55,123 | |

HKBN, Ltd. (Hong Kong) | | | 15,400 | | | | 25,822 | |

Infrastrutture Wireless Italiane S.P.A. (Italy)2 | | | 1,300 | | | | 12,730 | |

Kadokawa Corp. (Japan) | | | 4,900 | | | | 93,667 | |

Lagardere SCA (France) | | | 3,700 | | | | 80,640 | |

Live Nation Entertainment, Inc.*,1 | | | 1,590 | | | | 113,637 | |

Match Group, Inc.*,1 | | | 1,035 | | | | 84,984 | |

Metropole Television, S.A. (France) | | | 3,600 | | | | 67,760 | |

Mixi, Inc. (Japan) | | | 1,500 | | | | 28,439 | |

MTI, Ltd. (Japan) | | | 1,800 | | | | 11,771 | |

Netflix, Inc.* | | | 715 | | | | 231,353 | |

Omnicom Group, Inc.1 | | | 6,290 | | | | 509,616 | |

Proto Corp. (Japan) | | | 4,200 | | | | 46,209 | |

RAI Way S.P.A. (Italy)2 | | | 3,400 | | | | 23,383 | |

Rightmove PLC (United Kingdom) | | | 2,300 | | | | 19,300 | |

Rovio Entertainment Oyj (Finland)1,2 | | | 6,300 | | | | 31,207 | |

Sinclair Broadcast Group, Inc., Class A1 | | | 4,520 | | | | 150,697 | |

SmarTone Telecommunications Holdings, Ltd. (Hong Kong) | | | 10,700 | | | | 8,241 | |

Spotify Technology S.A. (Sweden)* | | | 785 | | | | 117,397 | |

Sunrise Communications Group AG (Switzerland)2 | | | 300 | | | | 23,569 | |

Take-Two Interactive Software, Inc.* | | | 17,600 | | | | 2,154,768 | |

Telephone & Data Systems, Inc. | | | 10,060 | | | | 255,826 | |

Television Francaise 1 (France) | | | 1,500 | | | | 12,503 | |

T-Mobile US, Inc.* | | | 2,955 | | | | 231,731 | |

TripAdvisor, Inc. | | | 7,495 | | | | 227,698 | |

TV Asahi Holdings Corp. (Japan) | | | 2,300 | | | | 42,469 | |

Verizon Communications, Inc. | | | 32,065 | | | | 1,968,791 | |

ViacomCBS, Inc., Class B | | | 20,942 | | | | 878,936 | |

| | | | | | | | |

| | | Shares | | | Value | |

The Walt Disney Co. | | | 8,384 | | | $ | 1,212,578 | |

Total Communication Services | | | | | | | 14,429,287 | |

Consumer Discretionary - 5.7% | |

888 Holdings PLC (Gibraltar) | | | 21,800 | | | | 47,646 | |

Accent Group, Ltd. (Australia) | | | 55,700 | | | | 72,939 | |

Adient PLC* | | | 18,085 | | | | 384,306 | |

Amazon.com, Inc.* | | | 1,295 | | | | 2,392,953 | |

Autogrill S.P.A. (Italy) | | | 1,600 | | | | 16,750 | |

AutoZone, Inc.* | | | 125 | | | | 148,914 | |

boohoo Group PLC (United Kingdom)* | | | 6,800 | | | | 26,833 | |

Booking Holdings, Inc.* | | | 155 | | | | 318,328 | |

BorgWarner, Inc. | | | 4,535 | | | | 196,728 | |

Chipotle Mexican Grill, Inc.* | | | 330 | | | | 276,246 | |

Darden Restaurants, Inc. | | | 790 | | | | 86,118 | |

DFS Furniture PLC (United Kingdom) | | | 19,700 | | | | 75,414 | |

D’ieteren, S.A. (Belgium) | | | 500 | | | | 35,109 | |

Dollar General Corp. | | | 1,690 | | | | 263,606 | |

Dollar Tree, Inc.*,1 | | | 1,305 | | | | 122,735 | |

Doutor Nichires Holdings Co., Ltd. (Japan) | | | 1,800 | | | | 35,728 | |

Dunkin’ Brands Group, Inc. | | | 2,955 | | | | 223,221 | |

eBay, Inc. | | | 15,435 | | | | 557,358 | |

ES-Con Japan, Ltd. (Japan) | | | 1,800 | | | | 15,448 | |

Evolution Gaming Group AB (Sweden)2 | | | 1,800 | | | | 54,322 | |

Exedy Corp. (Japan) | | | 500 | | | | 11,311 | |

Expedia Group, Inc. | | | 680 | | | | 73,535 | |

Extended Stay America, Inc. | | | 26,235 | | | | 389,852 | |

Floor & Decor Holdings, Inc., Class A*,1 | | | 4,075 | | | | 207,051 | |

Ford Motor Co. | | | 68,335 | | | | 635,516 | |

Foster Electric Co., Ltd. (Japan) | | | 2,300 | | | | 40,400 | |

France Bed Holdings Co., Ltd. (Japan) | | | 1,800 | | | | 15,929 | |

Games Workshop Group PLC (United Kingdom) | | | 200 | | | | 16,174 | |

Garrett Motion, Inc. (Switzerland)* | | | 1 | | | | 10 | |

General Motors Co. | | | 22,390 | | | | 819,474 | |

Grand Canyon Education, Inc.*,1 | | | 1,740 | | | | 166,675 | |

Greggs PLC (United Kingdom) | | | 2,100 | | | | 64,056 | |

G-Tekt Corp. (Japan) | | | 1,500 | | | | 23,840 | |

Harley-Davidson, Inc.1 | | | 12,380 | | | | 460,412 | |

Heiwa Corp. (Japan) | | | 2,800 | | | | 58,635 | |

The Home Depot, Inc. | | | 480 | | | | 104,822 | |

IDP Education, Ltd. (Australia) | | | 5,000 | | | | 60,272 | |

Jumbo Interactive, Ltd. (Australia) | | | 1,500 | | | | 15,730 | |

Just Eat PLC (United Kingdom)* | | | 3,400 | | | | 37,617 | |

Kasai Kogyo Co., Ltd. (Japan) | | | 1,100 | | | | 8,628 | |

The accompanying notes are an integral part of these financial statements.

8

| | |

| | | AMG Chicago Equity Partners Balanced Fund Schedule of Portfolio Investments(continued) |

| | | | | | | | |

| | | Shares | | | Value | |

Consumer Discretionary - 5.7%(continued) | | | | | | | | |

Kaufman & Broad, S.A. (France) | | | 1,100 | | | $ | 45,653 | |

Kohl’s Corp.1 | | | 5,380 | | | | 274,111 | |

Kurabo Industries, Ltd. (Japan) | | | 1,100 | | | | 25,499 | |

Macy’s, Inc.1 | | | 18,185 | | | | 309,145 | |

Mars Group Holdings Corp. (Japan) | | | 700 | | | | 13,106 | |

Marston’s PLC (United Kingdom) | | | 27,100 | | | | 45,661 | |

Matas A/S (Denmark) | | | 5,400 | | | | 44,663 | |

Mattel, Inc.*,1 | | | 11,805 | | | | 159,958 | |

Mitchells & Butlers PLC (United Kingdom)* | | | 5,200 | | | | 31,650 | |

Mizuno Corp. (Japan) | | | 700 | | | | 17,685 | |

Mobilezone Holding AG (Switzerland) | | | 3,900 | | | | 43,772 | |

Newell Brands, Inc. | | | 47,235 | | | | 907,857 | |

Nordstrom, Inc.1 | | | 4,895 | | | | 200,352 | |

Norwegian Cruise Line Holdings, Ltd.* | | | 5,115 | | | | 298,767 | |

Pets at Home Group PLC (United Kingdom)1 | | | 21,900 | | | | 81,109 | |

Piolax, Inc. (Japan) | | | 1,300 | | | | 25,060 | |

Pool Corp. | | | 725 | | | | 153,976 | |

Redrow PLC (United Kingdom) | | | 2,400 | | | | 23,689 | |

Ross Stores, Inc. | | | 2,450 | | | | 285,229 | |

Seiko Holdings Corp. (Japan) | | | 2,000 | | | | 53,336 | |

ServiceMaster Global Holdings, Inc.* | | | 1,700 | | | | 65,722 | |

SSP Group PLC (United Kingdom) | | | 7,359 | | | | 63,357 | |

Starts Corp., Inc. (Japan) | | | 1,200 | | | | 30,535 | |

The Gap, Inc.1 | | | 13,200 | | | | 233,376 | |

The TJX Cos., Inc. | | | 5,700 | | | | 348,042 | |

Tokai Rika Co., Ltd. (Japan) | | | 2,900 | | | | 56,513 | |

Tokmanni Group Corp. (Finland) | | | 3,100 | | | | 43,883 | |

Tractor Supply Co. | | | 1,535 | | | | 143,430 | |

VF Corp. | | | 6,165 | | | | 614,404 | |

The Wendy’s Co.1 | | | 41,230 | | | | 915,718 | |

Xebio Holdings Co., Ltd. (Japan) | | | 4,400 | | | | 53,132 | |

Xinyi Glass Holdings, Ltd. (Hong Kong) | | | 59,300 | | | | 78,571 | |

Yorozu Corp. (Japan) | | | 1,300 | | | | 17,451 | |

Zojirushi Corp. (Japan) | | | 1,500 | | | | 28,143 | |

Total Consumer Discretionary | | | | | | | 14,293,196 | |

Consumer Staples - 4.8% | |

Axfood AB (Sweden) | | | 2,800 | | | | 62,356 | |

Bunge, Ltd. | | | 11,025 | | | | 634,489 | |

C&C Group PLC (Ireland) | | | 10,700 | | | | 57,615 | |

Campbell Soup Co.1 | | | 2,970 | | | | 146,777 | |

Cawachi, Ltd. (Japan) | | | 700 | | | | 14,183 | |

Cloetta AB, Class B (Sweden) | | | 22,300 | | | | 75,623 | |

| | | | | | | | |

| | | Shares | | | Value | |

The Coca-Cola Co. | | | 18,705 | | | $ | 1,035,322 | |

Colgate-Palmolive Co. | | | 2,695 | | | | 185,524 | |

Constellation Brands, Inc., Class A | | | 1,625 | | | | 308,344 | |

Costco Wholesale Corp. | | | 1,460 | | | | 429,123 | |

Edgewell Personal Care Co.* | | | 9,895 | | | | 306,349 | |

General Mills, Inc. | | | 13,965 | | | | 747,965 | |

Kato Sangyo Co., Ltd. (Japan) | | | 700 | | | | 22,938 | |

Keurig Dr Pepper, Inc.1 | | | 10,935 | | | | 316,568 | |

Kimberly-Clark Corp. | | | 4,275 | | | | 588,026 | |

The Kroger Co. | | | 8,905 | | | | 258,156 | |

McCormick & Co., Inc.,Non-Voting Shares | | | 5,310 | | | | 901,266 | |

Metcash Ltd. (Australia) | | | 9,800 | | | | 17,663 | |

Monster Beverage Corp.* | | | 9,315 | | | | 591,968 | |

Nippon Beet Sugar Manufacturing Co., Ltd. (Japan) | | | 700 | | | | 13,045 | |

Nissin Foods Co. Ltd. (Hong Kong) | | | 34,300 | | | | 27,259 | |

Ontex Group N.V. (Belgium) | | | 2,000 | | | | 42,097 | |

Origin Enterprises PLC (Ireland) | | | 13,500 | | | | 56,181 | |

PepsiCo, Inc. | | | 4,945 | | | | 675,833 | |

Philip Morris International, Inc. | | | 4,415 | | | | 375,672 | |

The Procter & Gamble Co. | | | 19,530 | | | | 2,439,297 | |

Rami Levy Chain Stores Hashikma Marketing 2006, Ltd. (Israel) | | | 1,100 | | | | 63,292 | |

Scandi Standard AB (Sweden) | | | 4,600 | | | | 36,539 | |

Sheng Siong Group, Ltd. (Singapore) | | | 14,300 | | | | 13,184 | |

Sprouts Farmers Market, Inc.* | | | 11,180 | | | | 216,333 | |

Starzen Co., Ltd. (Japan) | | | 300 | | | | 12,137 | |

Stock Spirits Group PLC (United Kingdom) | | | 20,800 | | | | 56,760 | |

Tate & Lyle PLC (United Kingdom) | | | 5,700 | | | | 57,433 | |

Walmart, Inc. | | | 10,780 | | | | 1,281,095 | |

Total Consumer Staples | | | | | | | 12,066,412 | |

Energy - 3.1% | |

Anglo Pacific Group PLC (United Kingdom) | | | 14,100 | | | | 35,860 | |

Cabot Oil & Gas Corp. | | | 8,660 | | | | 150,771 | |

Chevron Corp. | | | 13,025 | | | | 1,569,643 | |

China Aviation Oil Singapore Corp., Ltd. (Singapore) | | | 23,700 | | | | 22,399 | |

ConocoPhillips | | | 14,205 | | | | 923,751 | |

Continental Resources, Inc. | | | 3,330 | | | | 114,219 | |

Devon Energy Corp. | | | 14,610 | | | | 379,422 | |

DNO A.S.A. (Norway) | | | 3,700 | | | | 4,880 | |

Exxon Mobil Corp. | | | 26,815 | | | | 1,871,151 | |

Gaztransport Et Technigaz, S.A. (France) | | | 1,300 | | | | 125,212 | |

HollyFrontier Corp. | | | 3,975 | | | | 201,572 | |

The accompanying notes are an integral part of these financial statements.

9

| | |

| | | AMG Chicago Equity Partners Balanced Fund Schedule of Portfolio Investments(continued) |

| | | | | | | | |

| | | Shares | | | Value | |

Energy - 3.1%(continued) | |

Japan Petroleum Exploration Co., Ltd. (Japan) | | | 1,000 | | | $ | 26,929 | |

Naphtha Israel Petroleum Corp., Ltd. (Israel) | | | 11,400 | | | | 68,226 | |

National Oilwell Varco, Inc.1 | | | 12,890 | | | | 322,894 | |

Occidental Petroleum Corp. | | | 4,320 | | | | 178,027 | |

Parsley Energy, Inc., Class A | | | 8,990 | | | | 170,001 | |

PBF Energy, Inc., Class A | | | 3,865 | | | | 121,245 | |

Pioneer Natural Resources Co. | | | 4,275 | | | | 647,107 | |

Schlumberger, Ltd. | | | 16,265 | | | | 653,853 | |

TGS NOPEC Geophysical Co., A.S.A. (Norway) | | | 2,100 | | | | 63,891 | |

Washington H Soul Pattinson & Co., Ltd. (Australia) | | | 800 | | | | 12,069 | |

Whitehaven Coal, Ltd. (Australia) | | | 25,200 | | | | 46,734 | |

Total Energy | | | | | | | 7,709,856 | |

Financials - 10.6% | |

Aflac, Inc. | | | 8,835 | | | | 467,371 | |

The Allstate Corp. | | | 4,855 | | | | 545,945 | |

Ally Financial, Inc. | | | 39,410 | | | | 1,204,370 | |

Ameriprise Financial, Inc. | | | 4,910 | | | | 817,908 | |

Aon PLC (United Kingdom) | | | 425 | | | | 88,523 | |

Bank of America Corp. | | | 34,385 | | | | 1,211,040 | |

Bank of Georgia Group PLC (Georgia) | | | 2,400 | | | | 51,660 | |

BAWAG Group AG (Austria)2 | | | 1,000 | | | | 45,197 | |

Berkshire Hathaway, Inc., Class B* | | | 10,150 | | | | 2,298,975 | |

Brewin Dolphin Holdings PLC (United Kingdom) | | | 8,500 | | | | 41,929 | |

Cboe Global Markets, Inc. | | | 1,475 | | | | 177,000 | |

Cembra Money Bank AG (Switzerland) | | | 1,100 | | | | 120,350 | |

Cerved Group S.P.A. (Italy) | | | 2,100 | | | | 20,493 | |

Chimera Investment Corp., REIT1 | | | 28,160 | | | | 578,970 | |

CIT Group, Inc. | | | 27,360 | | | | 1,248,437 | |

Citigroup, Inc. | | | 27,825 | | | | 2,222,939 | |

Citizens Financial Group, Inc. | | | 10,660 | | | | 432,903 | |

Coface, S.A. (France)* | | | 5,200 | | | | 63,987 | |

Deutsche Pfandbriefbank AG (Germany)2 | | | 7,500 | | | | 122,150 | |

FactSet Research Systems, Inc.1 | | | 655 | | | | 175,736 | |

Franklin Resources, Inc.1 | | | 7,555 | | | | 196,279 | |

Globe Life, Inc. | | | 2,530 | | | | 266,282 | |

IG Group Holdings PLC (United Kingdom) | | | 3,600 | | | | 33,142 | |

Intermediate Capital Group PLC (United Kingdom) | | | 5,900 | | | | 125,842 | |

J Trust Co., Ltd. (Japan) | | | 5,900 | | | | 23,121 | |

Jafco Co., Ltd. (Japan) | | | 1,500 | | | | 58,800 | |

Japan Securities Finance Co., Ltd. (Japan) | | | 15,000 | | | | 71,579 | |

| | | | | | | | |

| | | Shares | | | Value | |

JPMorgan Chase & Co. | | | 16,248 | | | $ | 2,264,971 | |

KBC Ancora (Belgium) | | | 1,100 | | | | 55,339 | |

Legg Mason, Inc. | | | 45,400 | | | | 1,630,314 | |

Lincoln National Corp. | | | 10,200 | | | | 601,902 | |

M&T Bank Corp. | | | 5,030 | | | | 853,842 | |

Man Group PLC (United Kingdom) | | | 5,400 | | | | 11,310 | |

Marusan Securities Co., Ltd. (Japan) | | | 6,300 | | | | 28,115 | |

MetLife, Inc. | | | 20,720 | | | | 1,056,098 | |

Navient Corp.1 | | | 87,395 | | | | 1,195,564 | |

Okasan Securities Group, Inc. (Japan) | | | 17,200 | | | | 61,639 | |

OneSavings Bank PLC (United Kingdom) | | | 3,700 | | | | 21,241 | |

The Phoenix Holdings Ltd (Israel) | | | 3,700 | | | | 22,389 | |

Popular, Inc. (Puerto Rico) | | | 7,096 | | | | 416,890 | |

The Progressive Corp. | | | 900 | | | | 65,151 | |

Prudential Financial, Inc. | | | 1,795 | | | | 168,263 | |

Reinsurance Group of America, Inc. | | | 2,155 | | | | 351,394 | |

S&P Global, Inc. | | | 670 | | | | 182,943 | |

SEI Investments Co. | | | 4,120 | | | | 269,778 | |

Senshu Ikeda Holdings, Inc. (Japan) | | | 8,800 | | | | 16,732 | |

SpareBank 1 Nord Norge (Norway) | | | 8,800 | | | | 78,685 | |

Sparebank 1 Oestlandet (Norway) | | | 3,400 | | | | 35,823 | |

SpareBank 1 SMN (Norway) | | | 1,000 | | | | 11,421 | |

Storebrand A.S.A. (Norway) | | | 300 | | | | 2,363 | |

TCF Financial Corp. | | | 8,105 | | | | 379,314 | |

Tokai Tokyo Financial Holdings, Inc. (Japan) | | | 20,500 | | | | 61,147 | |

Tokyo Kiraboshi Financial Group, Inc. (Japan) | | | 3,400 | | | | 47,344 | |

Topdanmark A/S (Denmark) | | | 1,300 | | | | 64,084 | |

The Travelers Cos., Inc. | | | 8,325 | | | | 1,140,109 | |

Truist Financial Corp. | | | 14,660 | | | | 825,651 | |

U.S. Bancorp | | | 12,960 | | | | 768,398 | |

Unipol Gruppo S.P.A. (Italy) | | | 9,800 | | | | 56,263 | |

Wells Fargo & Co. | | | 19,470 | | | | 1,047,486 | |

White Mountains Insurance Group, Ltd. | | | 182 | | | | 203,023 | |

Wuestenrot & Wuerttembergische AG (Germany) | | | 500 | | | | 10,858 | |

Total Financials | | | | | | | 26,716,772 | |

Health Care - 7.9% | |

AbbVie, Inc. | | | 7,590 | | | | 672,019 | |

ABIOMED, Inc.* | | | 565 | | | | 96,383 | |

Agilent Technologies, Inc. | | | 1,395 | | | | 119,007 | |

Alexion Pharmaceuticals, Inc.* | | | 950 | | | | 102,743 | |

Align Technology, Inc.* | | | 330 | | | | 92,083 | |

Alliance Pharma PLC (United Kingdom) | | | 26,700 | | | | 29,660 | |

AmerisourceBergen Corp. | | | 800 | | | | 68,016 | |

The accompanying notes are an integral part of these financial statements.

10

| | |

| | | AMG Chicago Equity Partners Balanced Fund Schedule of Portfolio Investments(continued) |

| | | | | | | | |

| | | Shares | | | Value | |

Health Care - 7.9%(continued) | |

Amgen, Inc. | | | 2,005 | | | $ | 483,345 | |

Baxter International, Inc. | | | 4,980 | | | | 416,428 | |

Bristol-Myers Squibb Co. | | | 4,720 | | | | 302,977 | |

Cerner Corp. | | | 3,745 | | | | 274,846 | |

Cigna Corp. | | | 2,039 | | | | 416,955 | |

ConvaTec Group PLC (United Kingdom)2 | | | 28,300 | | | | 74,479 | |

Eli Lilly & Co. | | | 2,215 | | | | 291,118 | |

EMIS Group PLC (United Kingdom) | | | 5,700 | | | | 83,657 | |

Exelixis, Inc.* | | | 31,920 | | | | 562,430 | |

Faes Farma, S.A. (Spain) | | | 6,000 | | | | 33,768 | |

Galenica AG (Switzerland)2 | | | 1,550 | | | | 95,730 | |

Gilead Sciences, Inc. | | | 3,850 | | | | 250,173 | |

GN Store Nord A/S (Denmark) | | | 300 | | | | 14,112 | |

Henry Schein, Inc.*,1 | | | 19,235 | | | | 1,283,359 | |

Hogy Medical Co., Ltd. (Japan) | | | 300 | | | | 9,788 | |

Humana, Inc. | | | 795 | | | | 291,383 | |

Illumina, Inc.* | | | 945 | | | | 313,494 | |

Indivior PLC (United Kingdom)* | | | 24,400 | | | | 12,605 | |

Johnson & Johnson | | | 17,455 | | | | 2,546,161 | |

Kaken Pharmaceutical Co., Ltd. (Japan) | | | 1,500 | | | | 82,763 | |

Kissei Pharmaceutical Co., Ltd. (Japan) | | | 600 | | | | 17,046 | |

KYORIN Holdings, Inc. (Japan) | | | 1,000 | | | | 17,428 | |

Laboratory Corp. of America Holdings* | | | 4,555 | | | | 770,569 | |

McKesson Corp. | | | 3,335 | | | | 461,297 | |

MEDNAX, Inc.* | | | 4,850 | | | | 134,782 | |

Medtronic PLC (Ireland) | | | 14,805 | | | | 1,679,627 | |

Merck & Co., Inc. | | | 11,770 | | | | 1,070,482 | |

Mylan N.V.* | | | 13,880 | | | | 278,988 | |

Nanosonics, Ltd. (Australia)* | | | 9,800 | | | | 43,751 | |

Nichi-iko Pharmaceutical Co., Ltd. (Japan) | | | 1,500 | | | | 18,646 | |

Paramount Bed Holdings Co., Ltd. (Japan) | | | 700 | | | | 29,121 | |

Pfizer, Inc. | | | 33,187 | | | | 1,300,267 | |

Pro Medicus, Ltd. (Australia) | | | 1,100 | | | | 17,228 | |

Regis Healthcare, Ltd. (Australia) | | | 5,700 | | | | 9,854 | |

ResMed, Inc. | | | 1,355 | | | | 209,984 | |

STERIS PLC | | | 6,145 | | | | 936,621 | |

Stryker Corp. | | | 615 | | | | 129,113 | |

Toho Holdings Co., Ltd. (Japan) | | | 3,600 | | | | 79,761 | |

Tokai Corp. (Japan) | | | 500 | | | | 12,883 | |

Torii Pharmaceutical Co., Ltd. (Japan) | | | 700 | | | | 19,599 | |

The United Laboratories International Holdings Ltd (Hong Kong) | | | 47,900 | | | | 34,903 | |

| | | | | | | | |

| | | Shares | | | Value | |

UnitedHealth Group, Inc. | | | 1,800 | | | $ | 529,164 | |

Veeva Systems, Inc., Class A* | | | 2,060 | | | | 289,760 | |

Vertex Pharmaceuticals, Inc.* | | | 7,100 | | | | 1,554,545 | |

Vital KSK Holdings, Inc. (Japan) | | | 1,000 | | | | 9,603 | |

Vitrolife AB (Sweden) | | | 1,800 | | | | 38,052 | |

Zimmer Biomet Holdings, Inc. | | | 7,085 | | | | 1,060,483 | |

Total Health Care | | | | | | | 19,773,039 | |

Industrials - 6.9% | |

Aeon Delight Co., Ltd. (Japan) | | | 700 | | | | 25,135 | |

Aichi Corp. (Japan) | | | 2,600 | | | | 17,709 | |

Aida Engineering, Ltd. (Japan) | | | 7,800 | | | | 69,754 | |

ALS, Ltd. (Australia) | | | 5,600 | | | | 36,055 | |

Amadeus Fire AG (Germany) | | | 500 | | | | 83,072 | |

Applus Services, S.A. (Spain) | | | 1,500 | | | | 19,209 | |

Armstrong World Industries, Inc. | | | 2,655 | | | | 249,490 | |

ASTM S.P.A. (Italy) | | | 1,600 | | | | 48,386 | |

The Boeing Co. | | | 1,330 | | | | 433,261 | |

bpost, S.A. (Belgium) | | | 5,000 | | | | 57,808 | |

Bunka Shutter Co., Ltd. (Japan) | | | 8,100 | | | | 71,374 | |

Carlisle Cos., Inc.1 | | | 1,740 | | | | 281,602 | |

CH Robinson Worldwide, Inc.1 | | | 1,835 | | | | 143,497 | |

Chiyoda Integre Co., Ltd. (Japan) | | | 700 | | | | 14,678 | |

Chudenko Corp. (Japan) | | | 1,500 | | | | 34,677 | |

Cintas Corp. | | | 1,575 | | | | 423,801 | |

CTT-Correios de Portugal, S.A. (Portugal) | | | 9,100 | | | | 32,664 | |

Daiichi Jitsugyo Co., Ltd. (Japan) | | | 500 | | | | 17,562 | |

Daiwa Industries, Ltd. (Japan) | | | 1,100 | | | | 12,198 | |

Dart Group PLC (United Kingdom) | | | 4,700 | | | | 105,463 | |

Denyo Co., Ltd. (Japan) | | | 1,300 | | | | 24,625 | |

Diploma PLC (United Kingdom) | | | 300 | | | | 8,043 | |

Dover Corp. | | | 8,080 | | | | 931,301 | |

Enav S.P.A. (Italy)2 | | | 1,300 | | | | 7,758 | |

Expeditors International of Washington, Inc. | | | 2,080 | | | | 162,282 | |

Fujitec Co., Ltd. (Japan) | | | 1,100 | | | | 17,809 | |

Fukuda Corp. (Japan) | | | 330 | | | | 14,817 | |

Furukawa Co., Ltd. (Japan) | | | 1,100 | | | | 14,489 | |

General Electric Co. | | | 84,460 | | | | 942,574 | |

GL Events (France) | | | 500 | | | | 13,488 | |

Glory, Ltd. (Japan) | | | 3,900 | | | | 117,854 | |

TheGo-Ahead Group PLC (United Kingdom) | | | 800 | | | | 23,443 | |

Grupo Empresarial San Jose, S.A. (Spain)* | | | 1,500 | | | | 10,095 | |

HEICO Corp. | | | 621 | | | | 70,887 | |

Hibiya Engineering, Ltd. (Japan) | | | 500 | | | | 9,067 | |

The accompanying notes are an integral part of these financial statements.

11

| | |

| | | AMG Chicago Equity Partners Balanced Fund Schedule of Portfolio Investments(continued) |

| | | | | | | | |

| | | Shares | | | Value | |

Industrials - 6.9%(continued) | |

Honeywell International, Inc. | | | 3,965 | | | $ | 701,805 | |

Inaba Denki Sangyo Co., Ltd. (Japan) | | | 1,000 | | | | 25,363 | |

Intertrust, N.V. (Netherlands)2 | | | 200 | | | | 3,883 | |

Inwido AB (Sweden) | | | 3,400 | | | | 26,187 | |

IPH, Ltd. (Australia) | | | 3,100 | | | | 17,825 | |

Italmobiliare S.P.A. (Italy) | | | 1,300 | | | | 35,216 | |

JetBlue Airways Corp.* | | | 11,800 | | | | 220,896 | |

Johnson Controls International PLC | | | 25,160 | | | | 1,024,264 | |

Johnson Electric Holdings, Ltd. (Hong Kong) | | | 26,500 | | | | 60,280 | |

JOST Werke AG (Germany)2 | | | 1,100 | | | | 46,024 | |

Kandenko Co., Ltd. (Japan) | | | 1,100 | | | | 10,544 | |

Kanematsu Corp. (Japan) | | | 5,500 | | | | 73,903 | |

Kardex AG (Switzerland) | | | 300 | | | | 50,527 | |

Kokuyo Co., Ltd. (Japan) | | | 2,300 | | | | 34,313 | |

Komori Corp. (Japan) | | | 5,900 | | | | 60,734 | |

Koninklijke Volkerwessels, N.V. (Netherlands) | | | 1,100 | | | | 27,084 | |

L3Harris Technologies, Inc. | | | 390 | | | | 77,169 | |

Landstar System, Inc. | | | 12,765 | | | | 1,453,551 | |

Lockheed Martin Corp. | | | 1,225 | | | | 476,990 | |

Lyft, Inc., Class A*,1 | | | 2,185 | | | | 93,999 | |

Macquarie Infrastructure Corp. | | | 9,330 | | | | 399,697 | |

Meisei Industrial Co., Ltd. (Japan) | | | 1,600 | | | | 14,280 | |

Mersen, S.A. (France) | | | 1,800 | | | | 69,072 | |

Mitie Group PLC (United Kingdom)1 | | | 8,300 | | | | 15,942 | |

Mitsuboshi Belting, Ltd. (Japan) | | | 700 | | | | 13,453 | |

Morgan Advanced Materials PLC (United Kingdom) | | | 25,200 | | | | 105,815 | |

Morgan Sindall Group PLC (United Kingdom) | | | 2,600 | | | | 55,792 | |

Nibe Industrier AB, Class B (Sweden) | | | 4,600 | | | | 79,807 | |

Nichiden Corp. (Japan) | | | 800 | | | | 15,230 | |

The Nippon Road Co. Ltd (Japan) | | | 300 | | | | 18,759 | |

Nitto Kohki Co., Ltd. (Japan) | | | 500 | | | | 10,736 | |

Norfolk Southern Corp. | | | 2,150 | | | | 417,379 | |

nVent Electric PLC (United Kingdom) | | | 15,360 | | | | 392,909 | |

PACCAR, Inc. | | | 5,605 | | | | 443,355 | |

Parker-Hannifin Corp. | | | 3,245 | | | | 667,886 | |

QinetiQ Group PLC (United Kingdom) | | | 26,000 | | | | 123,226 | |

Raytheon Co. | | | 1,775 | | | | 390,038 | |

Robert Half International, Inc. | | | 3,445 | | | | 217,552 | |

Ryobi Ltd. (Japan) | | | 3,300 | | | | 58,648 | |

Sanki Engineering Co., Ltd. (Japan) | | | 5,900 | | | | 83,090 | |

Service Stream, Ltd. (Australia) | | | 33,300 | | | | 62,058 | |

| | | | | | | | |

| | | Shares | | | Value | |

Shikun & Binui, Ltd. (Israel) | | | 18,200 | | | $ | 83,794 | |

Signify, N.V. (Netherlands)2 | | | 200 | | | | 6,260 | |

Sintokogio, Ltd. (Japan) | | | 1,500 | | | | 14,493 | |

SITC International Holdings Co., Ltd. (Hong Kong) | | | 91,700 | | | | 111,908 | |

Snap-on, Inc.1 | | | 2,980 | | | | 504,812 | |

Sodick Co., Ltd. (Japan) | | | 3,100 | | | | 27,383 | |

Sojitz Corp. (Japan) | | | 39,000 | | | | 125,701 | |

Southwest Airlines Co. | | | 35,210 | | | | 1,900,636 | |

Spirit AeroSystems Holdings, Inc., Class A | | | 2,540 | | | | 185,115 | |

Stagecoach Group PLC (United Kingdom) | | | 22,800 | | | | 48,322 | |

Stanley Black & Decker, Inc. | | | 1,475 | | | | 244,466 | |

Sumitomo Mitsui Construction Co., Ltd. (Japan) | | | 5,000 | | | | 28,951 | |

Teledyne Technologies, Inc.* | | | 1,990 | | | | 689,615 | |

Textron, Inc. | | | 3,210 | | | | 143,166 | |

Toenec Corp. (Japan) | | | 400 | | | | 14,153 | |

Tonami Holdings Co., Ltd. (Japan) | | | 300 | | | | 14,868 | |

Toppan Forms Co., Ltd. (Japan) | | | 3,100 | | | | 34,710 | |

Toyo Construction Co., Ltd. (Japan) | | | 8,500 | | | | 40,638 | |

Trinity Industries, Inc.1 | | | 6,000 | | | | 132,900 | |

Valmet OYJ (Finland) | | | 1,600 | | | | 38,368 | |

WW Grainger, Inc. | | | 680 | | | | 230,194 | |

Yurtec Corp. (Japan) | | | 2,600 | | | | 16,403 | |

Total Industrials | | | | | | | 17,358,064 | |

Information Technology - 10.8% | |

Accenture PLC, Class A (Ireland) | | | 2,750 | | | | 579,067 | |

Alliance Data Systems Corp. | | | 9,820 | | | | 1,101,804 | |

ALSO Holding AG (Switzerland) | | | 300 | | | | 50,506 | |

Analog Devices, Inc. | | | 11,270 | | | | 1,339,327 | |

Anaplan, Inc.* | | | 2,655 | | | | 139,122 | |

Apple, Inc. | | | 17,070 | | | | 5,012,605 | |

ASM International N.V. (Netherlands) | | | 200 | | | | 22,575 | |

Aubay (France) | | | 500 | | | | 18,761 | |

Autodesk, Inc.* | | | 1,435 | | | | 263,265 | |

Automatic Data Processing, Inc. | | | 1,245 | | | | 212,272 | |

Avalara, Inc.* | | | 585 | | | | 42,851 | |

Avast PLC (United Kingdom)2 | | | 12,500 | | | | 75,120 | |

Barco N.V. (Belgium) | | | 200 | | | | 49,191 | |

BE Semiconductor Industries, N.V. (Netherlands) | | | 2,100 | | | | 81,529 | |

Broadridge Financial Solutions, Inc. | | | 1,530 | | | | 189,016 | |

Canon Marketing Japan, Inc. (Japan) | | | 1,800 | | | | 41,650 | |

CDW Corp. | | | 1,350 | | | | 192,834 | |

Cisco Systems, Inc. | | | 23,315 | | | | 1,118,187 | |

Citrix Systems, Inc. | | | 2,980 | | | | 330,482 | |

The accompanying notes are an integral part of these financial statements.

12

| | |

| | | AMG Chicago Equity Partners Balanced Fund Schedule of Portfolio Investments(continued) |

| | | | | | | | |

| | | Shares | | | Value | |

Information Technology - 10.8%(continued) | | | | | | | | |

Computer Engineering & Consulting, Ltd. (Japan) | | | 800 | | | $ | 14,996 | |

Cree, Inc.* | | | 1,650 | | | | 76,148 | |

Dell Technologies, Inc., Class C* | | | 1,645 | | | | 84,537 | |

Denki Kogyo Co., Ltd. (Japan) | | | 700 | | | | 20,895 | |

Dialog Semiconductor PLC (United Kingdom)* | | | 1,800 | | | | 91,417 | |

Dicker Data, Ltd. (Australia) | | | 3,900 | | | | 18,880 | |

Dynatrace, Inc.*,1 | | | 4,120 | | | | 104,236 | |

Elastic, N.V.* | | | 3,015 | | | | 193,864 | |

Electrocomponents PLC (United Kingdom) | | | 2,600 | | | | 23,385 | |

Elematec Corp. (Japan) | | | 1,300 | | | | 13,720 | |

Fortinet, Inc.* | | | 10,545 | | | | 1,125,784 | |

Fortnox AB (Sweden) | | | 2,800 | | | | 50,222 | |

GoDaddy, Inc., Class A* | | | 2,765 | | | | 187,799 | |

Hosiden Corp. (Japan) | | | 6,700 | | | | 84,651 | |

HP, Inc. | | | 20,285 | | | | 416,857 | |

Ines Corp. (Japan) | | | 4,600 | | | | 57,478 | |

Integrated Research, Ltd. (Australia) | | | 12,400 | | | | 28,370 | |

Intel Corp. | | | 15,520 | | | | 928,872 | |

International Business Machines Corp. | | | 6,600 | | | | 884,664 | |

Intuit, Inc. | | | 520 | | | | 136,204 | |

Juniper Networks, Inc. | | | 18,010 | | | | 443,586 | |

Kanematsu Electronics, Ltd. (Japan) | | | 500 | | | | 16,687 | |

Keysight Technologies, Inc.* | | | 965 | | | | 99,038 | |

Lam Research Corp. | | | 400 | | | | 116,960 | |

Manhattan Associates, Inc.* | | | 1,920 | | | | 153,120 | |

Mastercard, Inc., Class A | | | 710 | | | | 211,999 | |

Maxim Integrated Products, Inc. | | | 6,575 | | | | 404,428 | |

Medallia, Inc.*,1 | | | 3,180 | | | | 98,930 | |

Microsoft Corp. | | | 25,305 | | | | 3,990,598 | |

NEC Networks & System Integration Corp. (Japan) | | | 300 | | | | 10,625 | |

NortonLifeLock, Inc. | | | 8,890 | | | | 226,873 | |

Oracle Corp. | | | 7,185 | | | | 380,661 | |

PagerDuty, Inc.*,1 | | | 4,780 | | | | 111,804 | |

Palo Alto Networks, Inc.* | | | 2,305 | | | | 533,031 | |

PayPal Holdings, Inc.* | | | 1,560 | | | | 168,745 | |

Quadient (France) | | | 1,500 | | | | 36,346 | |

QUALCOMM, Inc. | | | 5,870 | | | | 517,910 | |

Ryosan Co. Ltd. (Japan) | | | 1,800 | | | | 46,359 | |

Sabre Corp. | | | 5,475 | | | | 122,859 | |

Sesa S.P.A. (Italy) | | | 1,000 | | | | 53,449 | |

| | | | | | | | |

| | | Shares | | | Value | |

Siltronic AG (Germany) | | | 500 | | | $ | 50,237 | |

Softcat PLC (United Kingdom) | | | 8,800 | | | | 134,462 | |

Spectris PLC (United Kingdom) | | | 700 | | | | 26,977 | |

Splunk, Inc.* | | | 2,605 | | | | 390,151 | |

Texas Instruments, Inc. | | | 3,890 | | | | 499,048 | |

VeriSign, Inc.* | | | 4,110 | | | | 791,915 | |

Visa, Inc., Class A | | | 8,565 | | | | 1,609,363 | |

VSTECS Holdings, Ltd. (Hong Kong) | | | 22,100 | | | | 11,359 | |

VTech Holdings, Ltd. (Hong Kong) | | | 1,000 | | | | 9,883 | |

The Western Union Co.1 | | | 10,720 | | | | 287,082 | |

Xilinx, Inc. | | | 1,610 | | | | 157,410 | |

Zendesk, Inc.* | | | 1,290 | | | | 98,853 | |

Zscaler, Inc.*,1 | | | 2,100 | | | | 97,650 | |

Total Information Technology | | | | | | | 27,311,541 | |

Materials - 2.2% | | | | | | | | |

Axalta Coating Systems Ltd.* | | | 3,325 | | | | 101,080 | |

APERAM, S.A. (Luxembourg) | | | 300 | | | | 9,637 | |

CF Industries Holdings, Inc. | | | 2,660 | | | | 126,988 | |

The Chemours Co.1 | | | 10,675 | | | | 193,111 | |

Coronado Global Resources, Inc. (Australia)2 | | | 13,200 | | | | 20,486 | |

Corteva, Inc. | | | 14,350 | | | | 424,186 | |

Daiken Corp. (Japan) | | | 1,000 | | | | 18,136 | |

Domtar Corp.1 | | | 12,020 | | | | 459,645 | |

Eagle Materials, Inc. | | | 3,460 | | | | 313,684 | |

Ecolab, Inc. | | | 920 | | | | 177,551 | |

Elkem A.S.A. (Norway)2 | | | 17,200 | | | | 48,503 | |

Ercros, S.A. (Spain) | | | 7,800 | | | | 22,398 | |

Ferrexpo PLC (Switzerland) | | | 10,700 | | | | 22,515 | |

Kemira OYJ (Finland) | | | 1,100 | | | | 16,369 | |

Kyoei Steel, Ltd. (Japan) | | | 1,100 | | | | 21,435 | |

Linde PLC (United Kingdom) | | | 3,345 | | | | 712,151 | |

Lintec Corp. (Japan) | | | 2,800 | | | | 62,335 | |

Metsa Board OYJ (Finland)1 | | | 6,800 | | | | 45,744 | |

Mount Gibson Iron, Ltd. (Australia) | | | 56,900 | | | | 38,212 | |

The Navigator Co., S.A. (Portugal) | | | 10,200 | | | | 41,152 | |

Neturen Co., Ltd. (Japan) | | | 1,500 | | | | 12,256 | |

Nittetsu Mining Co., Ltd. (Japan) | | | 500 | | | | 23,060 | |

O-I Glass, Inc. | | | 47,695 | | | | 569,001 | |

PPG Industries, Inc. | | | 3,815 | | | | 509,264 | |

Regis Resources, Ltd. (Australia) | | | 4,700 | | | | 14,221 | |

Reliance Steel &Aluminum Co. | | | 4,680 | | | | 560,477 | |

Royal Gold, Inc. | | | 3,080 | | | | 376,530 | |

Salzgitter AG (Germany) | | | 300 | | | | 6,622 | |

The accompanying notes are an integral part of these financial statements.

13

| | |

| | | AMG Chicago Equity Partners Balanced Fund Schedule of Portfolio Investments(continued) |

| | | | | | | | |

| | | Shares | | | Value | |

Materials - 2.2%(continued) | | | | | | | | |

The Scotts Miracle-Gro Co.1 | | | 1,285 | | | $ | 136,441 | |

Silgan Holdings, Inc. | | | 6,745 | | | | 209,635 | |

Toagosei Co., Ltd. (Japan) | | | 3,900 | | | | 44,963 | |

Toyo Ink SC Holdings Co., Ltd. (Japan) | | | 1,800 | | | | 43,652 | |

Yodogawa Steel Works, Ltd. (Japan) | | | 2,600 | | | | 48,318 | |

Total Materials | | | | | | | 5,429,758 | |

Real Estate - 3.2% | | | | | | | | |

alstria officeREIT-AG (Germany) | | | 2,300 | | | | 43,214 | |

Argosy Property, Ltd. (New Zealand) | | | 68,100 | | | | 63,304 | |

Aventus Group, REIT (Australia) | | | 18,000 | | | | 35,973 | |

Bayside Land Corp. (Israel) | | | 50 | | | | 38,459 | |

Brookfield Property REIT, Inc., Class A1 | | | 11,505 | | | | 212,210 | |

CapitaLand Retail China Trust, REIT (Singapore) | | | 35,200 | | | | 42,163 | |

Champion REIT (Hong Kong) | | | 15,800 | | | | 10,442 | |

Charter Hall Group, REIT (Australia) | | | 2,600 | | | | 20,250 | |

Corestate Capital Holding, S.A. (Luxembourg)1 | | | 1,000 | | | | 42,064 | |

Corporate Office Properties Trust, REIT | | | 12,625 | | | | 370,923 | |

DIC Asset AG (Germany) | | | 1,500 | | | | 26,753 | |

Fabege AB (Sweden) | | | 2,900 | | | | 48,172 | |

Far East Hospitality Trust (Singapore) | | | 67,800 | | | | 37,342 | |

First Real Estate Investment Trust, REIT (Singapore) | | | 33,600 | | | | 24,866 | |

Frasers Commercial Trust, REIT (Singapore) | | | 47,100 | | | | 58,133 | |

GDI Property Group, REIT (Australia) | | | 78,000 | | | | 80,736 | |

Goldcrest Co., Ltd. (Japan) | | | 1,800 | | | | 34,337 | |

Intervest Offices & Warehouses, N.V., REIT (Belgium) | | | 2,400 | | | | 68,998 | |

K Wah International Holdings, Ltd. (Hong Kong) | | | 22,800 | | | | 12,727 | |

Kenedix Retail REIT Corp. (Japan) | | | 20 | | | | 50,895 | |

Kungsleden AB (Sweden) | | | 11,200 | | | | 117,664 | |

Lar Espana Real Estate Socimi S.A., REIT (Spain) | | | 8,800 | | | | 70,084 | |

Life Storage, Inc., REIT | | | 2,675 | | | | 289,649 | |

Mapletree North Asia Commercial Trust, REIT (Singapore) | | | 40,600 | | | | 35,056 | |

Mori Trust Sogo Reit, Inc. (Japan) | | | 70 | | | | 125,498 | |

NewRiver REIT PLC (United Kingdom) | | | 20,500 | | | | 54,445 | |

Norstar Holdings, Inc. (Israel) | | | 2,800 | | | | 60,015 | |

NSI, N.V., REIT (Netherlands) | | | 1,200 | | | | 58,418 | |

Omega Healthcare Investors, Inc., REIT | | | 2,440 | | | | 103,334 | |

Outfront Media, Inc., REIT | | | 6,070 | | | | 162,797 | |

Park Hotels & Resorts, Inc., REIT1 | | | 55,705 | | | | 1,441,088 | |

Piedmont Office Realty Trust, Inc., Class A, REIT | | | 31,285 | | | | 695,778 | |

Public Storage, REIT | | | 2,470 | | | | 526,011 | |

| | | | | | | | |

| | | Shares | | | Value | |

Raysum Co., Ltd. (Japan) | | | 3,100 | | | $ | 30,469 | |

RDI REIT PLC (United Kingdom) | | | 26,600 | | | | 46,157 | |

Regional REIT, Ltd. (United Kingdom)2 | | | 13,000 | | | | 19,469 | |

Retail Value, Inc., REIT | | | 2,729 | | | | 100,427 | |

S IMMO AG (Austria) | | | 1,800 | | | | 45,025 | |

Selvaag Bolig A.S.A. (Norway) | �� | | 8,300 | | | | 69,816 | |

Service Properties Trust, REIT | | | 34,125 | | | | 830,261 | |

Simon Property Group, Inc., REIT | | | 1,310 | | | | 195,138 | |

Sunlight Real Estate Investment Trust (Hong Kong) | | | 43,100 | | | | 27,880 | |

Takara Leben Co., Ltd. (Japan) | | | 13,800 | | | | 63,988 | |

Tanger Factory Outlet Centers, Inc., REIT1 | | | 11,900 | | | | 175,287 | |

Taubman Centers, Inc., REIT1 | | | 1,540 | | | | 47,879 | |

TOC Co., Ltd. (Japan) | | | 1,500 | | | | 12,328 | |

Tokyo Tatemono Co., Ltd. (Japan) | | | 800 | | | | 12,487 | |

Tosei Corp. (Japan) | | | 500 | | | | 6,826 | |

Vastned Retail, N.V., REIT (Netherlands) | | | 200 | | | | 5,990 | |

Ventas, Inc., REIT | | | 6,595 | | | | 380,795 | |

Weingarten Realty Investors, REIT | | | 21,820 | | | | 681,657 | |

WP Carey, Inc., REIT | | | 2,585 | | | | 206,903 | |

Yanlord Land Group, Ltd. (Singapore) | | | 41,900 | | | | 37,722 | |

Total Real Estate | | | | | | | 8,058,302 | |

Utilities - 3.1% | | | | | | | | |

Acciona, S.A. (Spain) | | | 700 | | | | 73,806 | |

ACEA S.P.A. (Italy) | | | 1,600 | | | | 33,110 | |

Alliant Energy Corp. | | | 12,730 | | | | 696,586 | |

American Electric Power Co., Inc. | | | 9,530 | | | | 900,680 | |

Atmos Energy Corp. | | | 8,140 | | | | 910,540 | |

Avangrid, Inc.1 | | | 6,525 | | | | 333,819 | |

Consolidated Edison, Inc. | | | 8,385 | | | | 758,591 | |

Eversource Energy1 | | | 8,340 | | | | 709,484 | |

Kenon Holdings, Ltd. (Singapore) | | | 2,800 | | | | 59,869 | |

OGE Energy Corp. | | | 11,980 | | | | 532,751 | |

The Okinawa Electric Power Co., Inc. (Japan) | | | 5,000 | | | | 93,825 | |

Pinnacle West Capital Corp. | | | 5,195 | | | | 467,186 | |

REN- Redes Energeticas Nacionais SGPS, S.A. (Portugal) | | | 18,000 | | | | 54,919 | |

Shizuoka Gas Co., Ltd. (Japan) | | | 1,300 | | | | 11,261 | |

The Southern Co. | | | 10,590 | | | | 674,583 | |

WEC Energy Group, Inc. | | | 8,230 | | | | 759,053 | |

Xcel Energy, Inc. | | | 12,150 | | | | 771,404 | |

Total Utilities | | | | | | | 7,841,467 | |

Total Common Stocks

(Cost $141,588,409) | | | | | | | 160,987,694 | |

The accompanying notes are an integral part of these financial statements.

14

| | |

| | | AMG Chicago Equity Partners Balanced Fund Schedule of Portfolio Investments(continued) |

| | | | | | | | |

| | | Principal

Amount | | | Value | |

Corporate Bonds and Notes - 15.3% | | | | | | | | |

Financials - 3.8% | | | | | | | | |

Air Lease Corp.

4.250%, 09/15/24 | | $ | 35,000 | | | $ | 37,520 | |

American Financial Group, Inc.

3.500%, 08/15/26 | | | 25,000 | | | | 25,776 | |

Athene Holding, Ltd. (Bermuda)

4.125%, 01/12/28 | | | 450,000 | | | | 466,353 | |

AXA Equitable Holdings, Inc. | | | | | | | | |

4.350%, 04/20/28 | | | 30,000 | | | | 32,608 | |

5.000%, 04/20/48 | | | 375,000 | | | | 404,239 | |

AXIS Specialty Finance LLC

3.900%, 07/15/29 | | | 30,000 | | | | 31,443 | |

Bank of America Corp., GMTN

(3 month LIBOR + 1.370%)

3.593%, 07/21/283 | | | 1,040,000 | | | | 1,103,321 | |

The Bank of New York Mellon Corp., MTN

3.250%, 09/11/24 | | | 45,000 | | | | 47,322 | |

Brighthouse Financial, Inc.

3.700%, 06/22/271 | | | 485,000 | | | | 484,308 | |

Capital One Financial Corp.

3.800%, 01/31/28 | | | 475,000 | | | | 511,268 | |

Cincinnati Financial Corp.

6.920%, 05/15/28 | | | 20,000 | | | | 25,893 | |

Citigroup, Inc.

(3 month LIBOR + 1.338%)

3.980%, 03/20/303 | | | 60,000 | | | | 65,740 | |

E*TRADE Financial Corp.

4.500%, 06/20/28 | | | 330,000 | | | | 359,291 | |

Enstar Group, Ltd. (Bermuda)

4.500%, 03/10/22 | | | 10,000 | | | | 10,372 | |

EPR Properties

4.750%, 12/15/26 | | | 25,000 | | | | 27,307 | |

Globe Life, Inc.

4.550%, 09/15/28 | | | 380,000 | | | | 422,771 | |

The Goldman Sachs Group, Inc.

(3 month LIBOR + 1.510%), | | | | | | | | |

3.691%, 06/05/283 | | | 115,000 | | | | 122,454 | |

3.850%, 01/26/27 | | | 700,000 | | | | 745,729 | |

Lazard Group LLC

3.750%, 02/13/25 | | | 30,000 | | | | 31,712 | |

Legg Mason, Inc.

4.750%, 03/15/26 | | | 25,000 | | | | 27,390 | |

LifeStorage LP

3.500%, 07/01/26 | | | 30,000 | | | | 30,857 | |

Lincoln National Corp.

7.000%, 06/15/40 | | | 25,000 | | | | 35,625 | |

Mercury General Corp.

4.400%, 03/15/27 | | | 445,000 | | | | 468,258 | |

| | | | | | | | |

| | | Principal

Amount | | | Value | |

Morgan Stanley

(3 month LIBOR + 1.340%)

3.591%, 07/22/283 | | $ | 620,000 | | | $ | 659,757 | |

MUFG Americas Holdings Corp.

3.000%, 02/10/25 | | | 30,000 | | | | 30,624 | |

Office Properties Income Trust | | | | | | | | |

4.250%, 05/15/24 | | | 380,000 | | | | 395,231 | |

4.500%, 02/01/25 | | | 10,000 | | | | 10,461 | |

Omega Healthcare Investors, Inc.

5.250%, 01/15/26 | | | 480,000 | | | | 534,404 | |

People’s United Financial, Inc.

3.650%, 12/06/22 | | | 30,000 | | | | 31,180 | |

Piedmont Operating Partnership LP

4.450%, 03/15/24 | | | 25,000 | | | | 26,676 | |

Prudential Financial, Inc., MTN | | | | | | | | |

4.600%, 05/15/44 | | | 10,000 | | | | 11,826 | |

6.625%, 06/21/40 | | | 20,000 | | | | 28,155 | |

Realty Income Corp.

4.125%, 10/15/26 | | | 470,000 | | | | 516,176 | |

Sabra Health Care LP / Sabra Capital Corp.

4.800%, 06/01/24 | | | 10,000 | | | | 10,661 | |

Santander Holdings USA, Inc.

4.400%, 07/13/27 | | | 470,000 | | | | 507,956 | |

Selective Insurance Group, Inc.

5.375%, 03/01/49 | | | 25,000 | | | | 29,797 | |

Service Properties Trust

5.250%, 02/15/26 | | | 30,000 | | | | 31,603 | |

Tanger Properties LP

3.125%, 09/01/261 | | | 30,000 | | | | 29,767 | |

Transatlantic Holdings, Inc.

8.000%, 11/30/39 | | | 20,000 | | | | 29,809 | |

Webster Financial Corp.

4.100%, 03/25/29 | | | 425,000 | | | | 451,277 | |

Welltower, Inc.

6.500%, 03/15/41 | | | 220,000 | | | | 298,626 | |

The Western Union Co.

6.200%, 11/17/36 | | | 260,000 | | | | 297,020 | |

Weyerhaeuser Co.

7.375%, 03/15/32 | | | 25,000 | | | | 34,595 | |

Total Financials | | | | | | | 9,483,158 | |

Industrials - 9.4% | | | | | | | | |

AbbVie, Inc.

4.400%, 11/06/42 | | | 575,000 | | | | 619,306 | |

Ahold Finance USA LLC

6.875%, 05/01/29 | | | 20,000 | | | | 25,887 | |

Albemarle Corp.

5.450%, 12/01/44 | | | 405,000 | | | | 465,143 | |

Altria Group, Inc.

4.800%, 02/14/29 | | | 505,000 | | | | 563,358 | |

The accompanying notes are an integral part of these financial statements.

15

| | |

| | | AMG Chicago Equity Partners Balanced Fund Schedule of Portfolio Investments(continued) |

| | | | | | | | |

| | | Principal

Amount | | | Value | |

Industrials - 9.4%(continued) | | | | | | | | |

Amcor Finance USA, Inc.

3.625%, 04/28/262 | | $ | 15,000 | | | $ | 15,435 | |

AmerisourceBergen Corp. | | | | | | | | |

4.250%, 03/01/45 | | | 30,000 | | | | 30,941 | |

4.300%, 12/15/47 | | | 500,000 | | | | 520,211 | |

Amgen, Inc.

4.950%, 10/01/41 | | | 495,000 | | | | 590,695 | |

Anheuser-Busch InBev Worldwide Inc.

8.200%, 01/15/39 | | | 60,000 | | | | 95,022 | |

AT&T Inc.

5.550%, 08/15/41 | | | 30,000 | | | | 36,776 | |

Autodesk, Inc.

3.500%, 06/15/27 | | | 30,000 | | | | 31,480 | |

AutoNation, Inc.

3.800%, 11/15/27 | | | 30,000 | | | | 30,519 | |

Avery Dennison Corp.

4.875%, 12/06/28 | | | 25,000 | | | | 28,336 | |

Avnet, Inc.

4.625%, 04/15/26 | | | 30,000 | | | | 31,771 | |

BAT Capital Corp.

3.557%, 08/15/27 | | | 585,000 | | | | 597,821 | |

Bemis Co., Inc.

4.500%, 10/15/212 | | | 15,000 | | | | 15,461 | |

Best Buy Co., Inc.

4.450%, 10/01/28 | | | 25,000 | | | | 27,461 | |

Biogen, Inc.

5.200%, 09/15/45 | | | 410,000 | | | | 495,886 | |

BorgWarner, Inc.

4.375%, 03/15/45 | | | 455,000 | | | | 473,637 | |

Broadcom Corp./Broadcom Cayman Finance, Ltd.

3.500%, 01/15/28 | | | 55,000 | | | | 55,396 | |

Broadridge Financial Solutions, Inc.

3.400%, 06/27/26 | | | 25,000 | | | | 26,156 | |

Bunge, Ltd. Finance Corp.

3.750%, 09/25/27 | | | 30,000 | | | | 30,696 | |

Burlington Northern Santa Fe LLC

5.400%, 06/01/41 | | | 40,000 | | | | 51,841 | |

Campbell Soup Co.

4.150%, 03/15/28 | | | 25,000 | | | | 27,166 | |

Cardinal Health, Inc.

3.410%, 06/15/271 | | | 490,000 | | | | 501,647 | |

Cenovus Energy, Inc. (Canada)

4.250%, 04/15/271 | | | 30,000 | | | | 31,810 | |

Citrix Systems, Inc.

4.500%, 12/01/27 | | | 420,000 | | | | 455,541 | |

CNH Industrial, N.V. (United Kingdom)

3.850%, 11/15/27 | | | 30,000 | | | | 31,343 | |

| | | | | | | | |

| | | Principal

Amount | | | Value | |

Coca-Cola Consolidated, Inc.

3.800%, 11/25/251 | | $ | 25,000 | | | $ | 26,207 | |

Corning, Inc.

4.750%, 03/15/42 | | | 390,000 | | | | 443,895 | |

Crane Co.

4.200%, 03/15/48 | | | 10,000 | | | | 9,969 | |

Cummins, Inc.

4.875%, 10/01/43 | | | 25,000 | | | | 30,883 | |

Darden Restaurants, Inc.

4.550%, 02/15/48 | | | 30,000 | | | | 30,493 | |

Delta Air Lines, Inc.

4.375%, 04/19/281 | | | 470,000 | | | | 496,657 | |

Deutsche Telekom International Finance, B.V. (Netherlands) | | | | | | | | |

8.750%, 06/15/304 | | | 10,000 | | | | 14,742 | |

9.250%, 06/01/32 | | | 265,000 | | | | 421,832 | |

Devon Energy Corp.

7.875%, 09/30/31 | | | 25,000 | | | | 34,861 | |

Discovery Communications LLC

6.350%, 06/01/40 | | | 435,000 | | | | 554,492 | |

Dollar General Corp.

3.875%, 04/15/27 | | | 30,000 | | | | 32,150 | |

The Dow Chemical Co.

5.250%, 11/15/41 | | | 240,000 | | | | 280,269 | |

DR Horton, Inc.

5.750%, 08/15/23 | | | 425,000 | | | | 470,092 | |

Eastman Chemical Co.

3.800%, 03/15/25 | | | 30,000 | | | | 31,669 | |

Embraer Netherlands Finance BV (Netherlands)

5.400%, 02/01/27 | | | 340,000 | | | | 383,642 | |

Eni USA, Inc.

7.300%, 11/15/27 | | | 180,000 | | | | 232,395 | |

Enterprise Products Operating LLC | | | | | | | | |

5.700%, 02/15/42 | | | 420,000 | | | | 542,872 | |

5.950%, 02/01/41 | | | 45,000 | | | | 58,168 | |

EQT Corp.

4.875%, 11/15/21 | | | 230,000 | | | | 237,533 | |

Expedia, Inc.

3.800%, 02/15/28 | | | 30,000 | | | | 30,712 | |

General Electric Co., GMTN | | | | | | | | |

3.450%, 05/15/24 | | | 25,000 | | | | 25,966 | |

4.125%, 10/09/42 | | | 48,000 | | | | 49,625 | |

5.875%, 01/14/38 | | | 440,000 | | | | 535,635 | |

Gilead Sciences, Inc.

5.650%, 12/01/41 | | | 40,000 | | | | 52,653 | |

GLP Capital, LP/GLP Financing II, Inc.

5.300%, 01/15/29 | | | 15,000 | | | | 16,695 | |

Halliburton Co.

4.500%, 11/15/41 | | | 40,000 | | | | 42,586 | |

Harley-Davidson, Inc.

4.625%, 07/28/45 | | | 30,000 | | | | 31,150 | |

The accompanying notes are an integral part of these financial statements.

16

| | |

| | | AMG Chicago Equity Partners Balanced Fund Schedule of Portfolio Investments(continued) |

| | | | | | | | |

| | | Principal

Amount | | | Value | |

Industrials - 9.4%(continued) | | | | | | | | |

Hasbro, Inc.

3.500%, 09/15/27 | | $ | 470,000 | | | $ | 468,504 | |

HCA, Inc.

5.250%, 06/15/26 | | | 30,000 | | | | 33,653 | |

Helmerich & Payne, Inc.

4.650%, 03/15/25 | | | 25,000 | | | | 27,327 | |

Hewlett Packard Enterprise Co.

4.900%, 10/15/254 | | | 495,000 | | | | 550,622 | |

Hillenbrand, Inc.

4.500%, 09/15/26 | | | 210,000 | | | | 219,841 | |

HollyFrontier Corp.

5.875%, 04/01/26 | | | 180,000 | | | | 203,209 | |

Hubbell, Inc.

3.500%, 02/15/28 | | | 25,000 | | | | 25,716 | |

Hyatt Hotels Corp.

4.375%, 09/15/28 | | | 415,000 | | | | 450,967 | |

Ingersoll-Rand Global Holding Co., Ltd.

5.750%, 06/15/43 | | | 10,000 | | | | 12,780 | |

Ingersoll-Rand Luxembourg Finance, S.A. (Luxembourg)

3.500%, 03/21/26 | | | 400,000 | | | | 418,813 | |

Ingredion, Inc.

3.200%, 10/01/26 | | | 30,000 | | | | 30,358 | |

Jabil, Inc.

3.950%, 01/12/28 | | | 30,000 | | | | 30,851 | |

JB Hunt Transport Services, Inc.

3.875%, 03/01/26 | | | 30,000 | | | | 32,264 | |

Kennametal, Inc.

4.625%, 06/15/28 | | | 435,000 | | | | 461,780 | |

Keurig Dr Pepper, Inc.

4.597%, 05/25/28 | | | 35,000 | | | | 39,371 | |

Keysight Technologies, Inc.

4.600%, 04/06/27 | | | 430,000 | | | | 477,307 | |

Kinder Morgan, Inc.

4.300%, 03/01/28 | | | 50,000 | | | | 54,565 | |

KLA Corp. | | | | | | | | |

4.125%, 11/01/21 | | | 25,000 | | | | 25,861 | |

5.000%, 03/15/49 | | | 390,000 | | | | 480,498 | |

Kohl’s Corp.

4.250%, 07/17/25 | | | 450,000 | | | | 478,699 | |

Lowe’s Cos., Inc.

4.650%, 04/15/42 | | | 350,000 | | | | 402,044 | |

LYB International Finance BV (Netherlands)

5.250%, 07/15/43 | | | 20,000 | | | | 23,669 | |

Macy’s Retail Holdings, Inc.

3.625%, 06/01/241 | | | 470,000 | | | | 475,133 | |

Marathon Oil Corp.

4.400%, 07/15/27 | | | 455,000 | | | | 495,249 | |

| | | | | | | | |

| | | Principal

Amount | | | Value | |

Marvell Technology Group, Ltd.

4.875%, 06/22/28 | | $ | 425,000 | | | $ | 470,022 | |

Maxim Integrated Products, Inc.

3.450%, 06/15/27 | | | 30,000 | | | | 30,921 | |

McKesson Corp. | | | | | | | | |

3.950%, 02/16/28 | | | 435,000 | | | | 464,483 | |

4.750%, 05/30/29 | | | 30,000 | | | | 33,763 | |

Methanex Corp. (Canada)

5.250%, 12/15/29 | | | 30,000 | | | | 31,060 | |

Micron Technology, Inc.

5.327%, 02/06/29 | | | 420,000 | | | | 482,337 | |

Mylan, Inc.

4.550%, 04/15/28 | | | 280,000 | | | | 301,704 | |

Noble Energy, Inc.

3.850%, 01/15/28 | | | 35,000 | | | | 37,015 | |

Nvent Finance Sarl (Luxembourg)

4.550%, 04/15/28 | | | 460,000 | | | | 477,913 | |

NVR, Inc.

3.950%, 09/15/22 | | | 25,000 | | | | 26,057 | |

NXP, B.V. / NXP Funding LLC (Netherlands)

5.550%, 12/01/282 | | | 30,000 | | | | 35,128 | |

Occidental Petroleum Corp.

4.625%, 06/15/45 | | | 220,000 | | | | 228,035 | |

Omnicom Group, Inc. / Omnicom Capital, Inc.