UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-06520

AMG Funds I

(Exact name of registrant as specified in charter)

600 Steamboat Road, Suite 300, Greenwich, Connecticut 06830

(Address of principal executive offices) (Zip code)

AMG Funds LLC

600 Steamboat Road, Suite 300, Greenwich, Connecticut 06830

(Name and address of agent for service)

Registrant’s telephone number, including area code: (203) 299-3500

Date of fiscal year end: OCTOBER 31

Date of reporting period: NOVEMBER 1, 2014 – OCTOBER 31, 2015

(Annual Shareholder Report)

Item 1. Reports to Shareholders

| | |

| | ANNUAL REPORT |

AMG Funds

October 31, 2015

AMG FQ Tax-Managed U.S. Equity Fund

Investor Class: MFQAX | Institutional Class: MFQTX

AMG FQ U.S. Equity Fund

Investor Class: FQUAX | Institutional Class: MEQFX

AMG FQ Global Risk-Balanced Fund

Investor Class: MMAVX | Service Class: MMASX | Institutional Class: MMAFX

| | |

| www.amgfunds.com | | | AR014-1015 |

AMG Funds

Annual Report—October 31, 2015

| | | | |

TABLE OF CONTENTS | | PAGE | |

LETTER TO SHAREHOLDERS | | | 2 | |

| |

ABOUT YOUR FUND’S EXPENSES | | | 3 | |

| |

PORTFOLIO MANAGER’S COMMENTS, FUND SNAPSHOTS, AND SCHEDULES OF PORTFOLIO INVESTMENTS | | | | |

| |

AMG FQ Tax-Managed U.S. Equity Fund | | | 4 | |

AMG FQ U.S. Equity Fund | | | 10 | |

AMG FQ Global Risk-Balanced Fund | | | 16 | |

| |

NOTES TO SCHEDULES OF PORTFOLIO INVESTMENTS | | | 21 | |

| |

FINANCIAL STATEMENTS | | | | |

| |

Statement of Assets and Liabilities | | | 28 | |

Balance sheets, net asset value (NAV) per share computations and cumulative undistributed amounts | | | | |

| |

Statement of Operations | | | 30 | |

Detail of sources of income, expenses, and realized and unrealized gains (losses) during the fiscal year | | | | |

| |

Statements of Changes in Net Assets | | | 31 | |

Detail of changes in assets for the past two fiscal years | | | | |

| |

Financial Highlights | | | 33 | |

Historical net asset values per share, distributions, total returns, income and expense ratios, turnover ratios and net assets | | | | |

| |

Notes to Financial Statements | | | 37 | |

Accounting and distribution policies, details of agreements and transactions with Fund management and affiliates, and descriptions of certain investment risks | | | | |

| |

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM | | | 46 | |

| |

TRUSTEES AND OFFICERS | | | 47 | |

| |

ANNUAL RENEWAL OF INVESTMENT MANAGEMENT AND SUBADVISORY AGREEMENTS | | | 49 | |

Nothing contained herein is to be considered an offer, sale or solicitation of an offer to buy shares of any series of the AMG Funds family of mutual funds. Such offering is made only by prospectus, which includes details as to offering price and other material information.

| | |

| | Letter to Shareholders |

DEAR SHAREHOLDER:

Overall, U.S. equity investors were rewarded with positive, albeit modest, returns despite increasing market volatility for the fiscal year ended October 31, 2015. The S&P 500 Index, a widely followed barometer of the U.S. equity market, returned 5.2% during the past twelve months. However, the U.S. equity market did experience its first correction in four years in August as investors worried about slowing China growth and the potential impact of a U.S. Federal Reserve (the Fed) rate hike on the slow recovery in the U.S. During the year, there was significant dispersion in performance across sectors with consumer discretionary stocks returning more than 21% while companies within the energy sector fell (19)%, driven in large part by the precipitous fall in oil prices. Meanwhile, international stocks fell during the prior year, returning (4.7)%, as measured by the MSCI ACWI ex USA (in U.S. Dollar terms). International investment returns in U.S. Dollar terms were negatively impacted by continued strengthening in the U.S. Dollar. Despite the more recent difficult performance for equities, it’s worth noting that the first quarter of 2015 marked the six-year anniversary of the equity bull market.

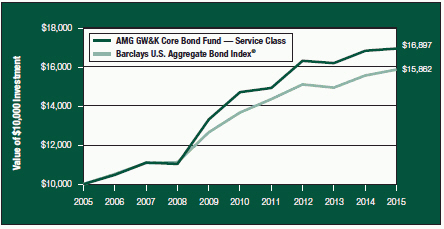

The Barclays U.S. Aggregate Bond Index, a broad U.S. bond market benchmark, returned 2.0% for the fiscal year ended October 31, 2015. Interest rates fell throughout much of 2014 and for periods throughout the past fiscal year, lending positive support to bond prices. Investors, however, enter the new fiscal year with a close watch on the strength of the underlying U.S. economy and its potential impact on the Fed’s zero-interest-rate policy (and its subsequent impact on bond prices).

Our foremost goal at AMG Funds is to provide investment solutions that help our shareholders successfully reach their long-term investment goals. By partnering with AMG’s affiliated investment boutiques, AMG Funds provides access to a distinctive array of actively-managed, return-oriented investment strategies. Additionally, we oversee and distribute a number of complementary open-architecture mutual funds subadvised by unaffiliated investment managers. We thank you for your continued confidence and investment in AMG Funds. You can rest assured that under all market conditions our team is focused on delivering excellent investment management services for your benefit.

Respectfully,

Jeffery Cerutti

President

AMG Funds

| | | | | | | | | | | | | | |

Average Annual Total Returns | | Periods ended October 31, 2015 | |

| | | | | 1 Year | | | 3 Years | | | 5 Years | |

Stocks: | | | | | | | | | | | | | | |

Large Caps | | (S&P 500 Index) | | | 5.20 | % | | | 16.20 | % | | | 14.33 | % |

Small Caps | | (Russell 2000® Index) | | | 0.34 | % | | | 13.90 | % | | | 12.06 | % |

International | | (MSCI All Country World Index ex USA Index) | | | (4.68 | )% | | | 4.69 | % | | | 2.60 | % |

Bonds: | | | | | | | | | | | | | | |

Investment Grade | | (Barclays U.S. Aggregate Bond Index) | | | 1.96 | % | | | 1.65 | % | | | 3.03 | % |

High Yield | | (Barclays U.S. Corporate High Yield Bond Index) | | | (1.94 | )% | | | 4.15 | % | | | 6.18 | % |

Tax-exempt | | (Barclays Municipal Bond Index) | | | 2.87 | % | | | 2.91 | % | | | 4.28 | % |

Treasury Bills | | (BofA Merrill Lynch 6-month U.S. Treasury Bill) | | | 0.20 | % | | | 0.18 | % | | | 0.19 | % |

2

About Your Fund’s Expenses

As a shareholder of a Fund, you may incur two types of costs: (1) transaction costs, which may include sales charges (loads) on purchase payments; redemption fees; and exchange fees; and (2) ongoing costs, including management fees; distribution (12b-1) fees; and other Fund expenses. This example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds. The example is based on $1,000 invested at the beginning of the period and held for the entire period as indicated below.

ACTUAL EXPENSES

The first line of the following table provides information about the actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

HYPOTHETICAL EXAMPLE FOR COMPARISON PURPOSES

The second line of the following table provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed annual rate of return of 5% before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds by comparing this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as sales charges (loads), redemption fees, or exchange fees. Therefore, the second line of the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds.

| | | | | | | | | | | | | | | | |

| | | Expense | | | Beginning | | | Ending | | | Expenses | |

| | | Ratio for | | | Account Value | | | Account Value | | | Paid During | |

Six Months Ended October 31, 2015 | | the Period | | | 5/01/15 | | | 10/31/15 | | | the Period* | |

AMG FQ Tax-Managed U.S. Equity Fund | | | | | | | | | | | | | | | | |

Investor Class Shares | | | | | | | | | | | | | | | | |

Based on Actual Fund Return | | | 1.17 | % | | $ | 1,000 | | | $ | 984 | | | $ | 5.85 | |

Hypothetical (5% return before expenses) | | | 1.17 | % | | $ | 1,000 | | | $ | 1,019 | | | $ | 5.95 | |

Institutional Class Shares | | | | | | | | | | | | | | | | |

Based on Actual Fund Return | | | 0.92 | % | | $ | 1,000 | | | $ | 985 | | | $ | 4.60 | |

Hypothetical (5% return before expenses) | | | 0.92 | % | | $ | 1,000 | | | $ | 1,021 | | | $ | 4.69 | |

AMG FQ U.S. Equity Fund | | | | | | | | | | | | | | | | |

Investor Class Shares | | | | | | | | | | | | | | | | |

Based on Actual Fund Return | | | 1.04 | % | | $ | 1,000 | | | $ | 1,000 | | | $ | 5.24 | |

Hypothetical (5% return before expenses) | | | 1.04 | % | | $ | 1,000 | | | $ | 1,020 | | | $ | 5.30 | |

Institutional Class Shares | | | | | | | | | | | | | | | | |

Based on Actual Fund Return | | | 0.79 | % | | $ | 1,000 | | | $ | 1,001 | | | $ | 3.98 | |

Hypothetical (5% return before expenses) | | | 0.79 | % | | $ | 1,000 | | | $ | 1,021 | | | $ | 4.02 | |

AMG FQ Global Risk-Balanced Fund | | | | | | | | | | | | | | | | |

Investor Class Shares | | | | | | | | | | | | | | | | |

Based on Actual Fund Return | | | 1.39 | % | | $ | 1,000 | | | $ | 914 | | | $ | 6.71 | |

Hypothetical (5% return before expenses) | | | 1.39 | % | | $ | 1,000 | | | $ | 1,018 | | | $ | 7.07 | |

Service Class Shares | | | | | | | | | | | | | | | | |

Based on Actual Fund Return | | | 0.98 | % | | $ | 1,000 | | | $ | 916 | | | $ | 4.73 | |

Hypothetical (5% return before expenses) | | | 0.98 | % | | $ | 1,000 | | | $ | 1,020 | | | $ | 4.99 | |

Institutional Class Shares | | | | | | | | | | | | | | | | |

Based on Actual Fund Return | | | 0.89 | % | | $ | 1,000 | | | $ | 916 | | | $ | 4.30 | |

Hypothetical (5% return before expenses) | | | 0.89 | % | | $ | 1,000 | | | $ | 1,021 | | | $ | 4.53 | |

| * | Expenses are equal to the Fund’s annualized expense ratio multiplied by the average account value over the period, multiplied by the number of days in the most recent fiscal half-year (184), then divided by 365. |

3

AMG FQ Tax-Managed U.S. Equity Fund

Portfolio Manager’s Comments (unaudited)

For the fiscal year ended October 31, 2015, the AMG FQ Tax-Managed U.S. Equity Fund (Institutional Class) (the “Fund”) returned 4.03%, compared to 4.49% for its benchmark, the Russell 3000® Index.

U.S. equity returns were positive yet subdued for the period. Several macro themes along with full valuations weighed on the market. With respect to macro, the sharp drop in oil prices damaged the prospects for many energy companies. Also, U.S. Dollar appreciation reduced earnings for exporters. U.S. and global economic growth have been disappointing and inflation has been below target, which have kept interest rates in check. In this environment, both corporate earnings and equity returns have been modest.

While broad index returns have been tepid, there have been notable movements in a number of market segments. Growth stocks outperformed value as, in the midst of lackluster earnings, investors were drawn to those companies exhibiting growth. Large-capitalization stocks outperformed small caps. Sector returns reflected macro themes, with energy and commodity-related sectors underperforming, while consumer sectors performed well. Further reflecting the cautious tone in the market, investors preferred low-volatility stocks.

The Fund underperformed the benchmark, with negative contributions from stock selection

outweighing positive contributions from industry positions and from exposures to common risk factors. The industry positions that contributed most to performance were overweights to airlines and insurance – other, and an underweight to oil extraction. The industry positions that had the greatest negative impact were the underweights to tobacco and electronics and the overweight to oil-integrated majors.

With respect to common risk factors, the greatest positive contributions were from price momentum and exposure to companies with relatively low earnings variability. The main negative contributor was exposure to stocks with above-average price volatility.

POSITIONING

The outlook for growth stocks has improved somewhat relative to value, mainly because of increased risk aversion due to concerns about global growth. At times when investors are concerned about prospects for growth, they tend to seek solvent companies with visible earnings. Such companies are typically more growth than value oriented.

Price momentum: We are cautious on the outlook for price momentum. In Q3, we had reduced the weight of momentum as concerns deepened about economic growth and as volatility increased. Moreover, momentum had become something of a crowded trade – there were signs of above-

average inflows into the strategy. More recently, broad market volatility has moderated but the volatility of the momentum factor itself is above average. Going into Q4, we increased the weight of price momentum slightly, though it remains below the strategic average.

This commentary reflects the viewpoints of the portfolio manager, First Quadrant, L.P., as of October 31, 2015 and is not intended as a forecast or guarantee of future results, and is subject to change without notice.

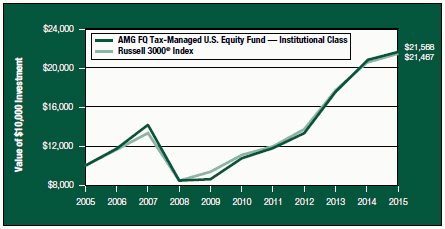

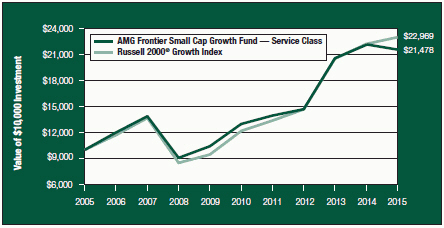

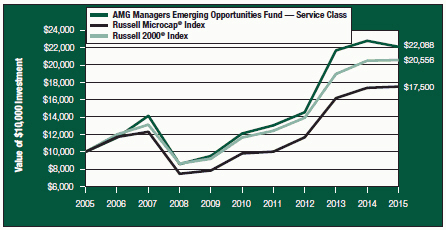

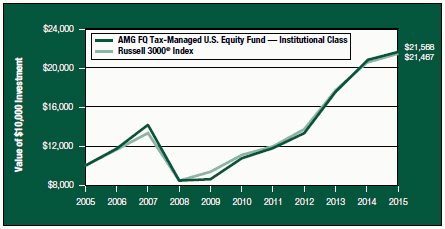

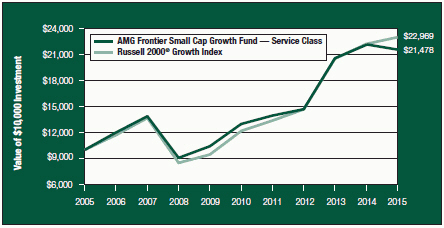

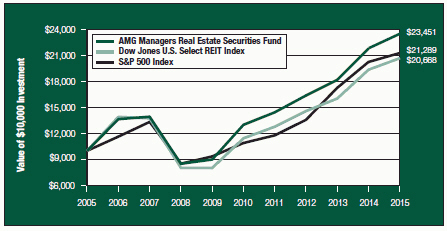

CUMULATIVE TOTAL RETURN PERFORMANCE

AMG FQ Tax-Managed U.S. Equity Fund’s cumulative total return is based on the daily change in net asset value (NAV), and assumes that all distributions were reinvested. This graph compares a hypothetical $10,000 investment made in the Institutional Class Shares of the Fund on October 31, 2005 with a $10,000 investment made in the Russell 3000® Index for the same time period. Performance for periods longer than one year is annualized. The graph and table do not reflect the deduction of taxes that a shareholder would pay on a Fund distribution or redemption of shares. The listed returns for the Fund are net of expenses and the returns for the index exclude expenses. Total returns would have been lower had certain expenses not been reduced.

4

AMG FQ Tax-Managed U.S. Equity Fund

Portfolio Manager’s Comments (continued)

CUMULATIVE TOTAL RETURN PERFORMANCE (continued)

The table below shows the average annual total returns for the AMG FQ Tax-Managed U.S. Equity Fund and the Russell 3000® Index for the same time periods ended October 31, 2015.

| | | | | | | | | | | | | | | | | | | | |

| | | One | | | Five | | | Ten | | | Since | | | Inception | |

| Average Annual Total Returns1 | | Year | | | Years | | | Years | | | Inception | | | Date | |

AMG FQ Tax-Managed U.S. Equity Fund2,3,4,5 | | | | | | | | | | | | | |

Investor Class | | | 3.79 | % | | | 14.67 | % | | | — | | | | 7.04 | % | | | 03/01/06 | |

Institutional Class | | | 4.03 | % | | | 14.95 | % | | | 7.99 | % | | | 6.70 | % | | | 12/18/00 | |

Russell 3000® Index6,7 | | | 4.49 | % | | | 14.14 | % | | | 7.94 | % | | | 5.55 | % | | | 12/18/00 | |

Return After Taxes on Distributions:8 | | | | | | | | | | | | | | | | | | | | |

Investor Class | | | 3.74 | % | | | 14.62 | % | | | — | | | | 6.99 | % | | | 03/01/06 | |

Institutional Class | | | 3.94 | % | | | 14.86 | % | | | 7.90 | % | | | 6.60 | % | | | 12/18/00 | |

Return After Taxes on Distributions & Sale of Fund Shares:8 | | | | | | | | | | | | | | | | | | | | |

Investor Class | | | 2.19 | % | | | 11.83 | % | | | — | | | | 5.69 | % | | | 03/01/06 | |

Institutional Class | | | 2.36 | % | | | 12.06 | % | | | 6.51 | % | | | 5.53 | % | | | 12/18/00 | |

The performance data shown represents past performance. Past performance is not a guarantee of future results. Current performance may be lower or higher than the performance data quoted. The investment return and principal value of an investment in the Fund will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost.

Investors should carefully consider the Fund’s investment objectives, risks, charges, and expenses before investing. For performance information through the most recent month end, current net asset per share for the Fund and other information, please call (800) 835-3879 or visit our website at www.amgfunds.com for a free prospectus. Read it carefully before investing or sending money.

Distributed by AMG Distributors, Inc., member FINRA/SIPC.

| 1 | Total return equals income yield plus share price change and assumes reinvestment of all dividends and capital gain distributions. Returns are net of fees and may reflect offsets of Fund expenses as described in the prospectus. No adjustment has been made for taxes payable by shareholders on their reinvested dividends and capital gain distributions. Returns for periods greater than one year are the average annual returns. The listed returns on the Fund are net of expenses and based on the published NAV as of October 31, 2015. All returns are in U.S. dollars ($). |

| 2 | From time to time, the Fund’s advisor has waived its fees and/or absorbed Fund expenses, which has resulted in higher returns. |

| 3 | The Fund invests in large-capitalization companies that may underperform other stock funds (such as funds that focus on small- and medium-capitalization companies) when stocks of large-capitalization companies are out of favor. |

| 4 | The Fund is managed to minimize taxable distributions, it may not be able to avoid taxable distributions. |

| 5 | The Fund may invest in derivatives; the complexity and rapidly changing structure of derivatives markets may increase the possibility of market losses. |

| 6 | The Russell 3000® Index is composed of the 3,000 largest U.S. companies as measured by market capitalization, and represents approximately 98% of the U.S. stock market. Unlike the Fund, the Russell 3000® Index is unmanaged, is not available for investment, and does not incur expenses. |

| 7 | Date reflects the inception date of the Fund, not the index. |

| 8 | After-tax returns are calculated using the historical highest individual federal marginal income tax rates and do not reflect the impact of state and local taxes. Actual after-tax returns depend on an investor’s tax situation and may differ from those shown, and after-tax returns are not relevant to investors who hold their Fund shares through tax-deferred arrangements, such as 401(k) plans or individual retirement accounts. |

The Russell 3000® Index is a trademark of Russell Investments. Russell is a trademark of Russell Investments.

Not FDIC insured, nor bank guaranteed. May lose value.

5

AMG FQ Tax-Managed U.S. Equity Fund

Fund Snapshots (unaudited)

October 31, 2015

PORTFOLIO BREAKDOWN

| | | | | | | | |

| | | AMG FQ | | | | |

| | | Tax-Managed | | | Russell 3000® | |

Sector | | U.S.Equity Fund** | | | Index | |

Information Technology | | | 19.9 | % | | | 19.9 | % |

Health Care | | | 15.2 | % | | | 14.2 | % |

Financials | | | 13.1 | % | | | 17.9 | % |

Consumer Discretionary | | | 11.9 | % | | | 13.7 | % |

Industrials | | | 11.1 | % | | | 10.8 | % |

Consumer Staples | | | 9.6 | % | | | 8.5 | % |

Energy | | | 7.2 | % | | | 6.6 | % |

Materials | | | 3.5 | % | | | 3.3 | % |

Telecommunication Services | | | 3.3 | % | | | 2.1 | % |

Utilities | | | 2.2 | % | | | 3.0 | % |

Other Assets and Liabilities | | | 3.0 | % | | | 0.0 | % |

| ** | As a percentage of net assets. |

TOP TEN HOLDINGS

| | | | |

| | | %of | |

Security Name | | Net Assets | |

Apple, Inc.* | | | 4.1 | % |

Exxon Mobil Corp.* | | | 2.3 | |

Visa, Inc., Class A* | | | 2.1 | |

Alaska Air Group, Inc.* | | | 2.0 | |

MasterCard, Inc., Class A* | | | 1.9 | |

Berkshire Hathaway, Inc., Class B* | | | 1.7 | |

Gilead Sciences, Inc. | | | 1.6 | |

Microsoft Corp.* | | | 1.5 | |

UnitedHealth Group, Inc. | | | 1.5 | |

Amgen, Inc. | | | 1.4 | |

| | | | |

Top Ten as a Group | | | 20.1 | % |

| | | | |

| * | Top Ten Holdings as of April 30, 2015. |

Because a fund’s strategy may result in multiple investments in particular sectors of the economy, its performance may depend on the performance of those sectors and may fluctuate more widely than investments diversified across more sectors. For additional information on these and other risk considerations, please see the Fund’s prospectus.

Any sectors, industries, or securities discussed should not be perceived as investment recommendations. Mention of a specific security should not be considered a recommendation to buy or solicitation to sell that security. Specific securities mentioned in this report may have been sold from the Fund’s portfolio of investments by the time you receive this report.

6

AMG FQ Tax-Managed U.S. Equity Fund

Schedule of Portfolio Investments

October 31, 2015

| | | | | | | | |

| | | Shares | | | Value | |

Common Stocks - 97.0% | | | | | | | | |

Consumer Discretionary - 11.9% | | | | | |

Aaron’s, Inc. | | | 20,700 | | | $ | 510,669 | |

Citi Trends, Inc. | | | 4,900 | | | | 130,193 | |

Comcast Corp., Class A | | | 11,300 | | | | 707,606 | |

Denny’s Corp.* | | | 41,300 | | | | 452,648 | |

Dick’s Sporting Goods, Inc. | | | 14,100 | | | | 628,155 | |

Dillard’s, Inc., Class A | | | 8,900 | | | | 796,372 | |

DISH Network Corp., Class A* | | | 11,300 | | | | 711,561 | |

Dollar General Corp. | | | 8,400 | | | | 569,268 | |

Express, Inc.* | | | 10,400 | | | | 200,720 | |

Isle of Capri Casinos, Inc.* | | | 27,000 | | | | 516,510 | |

Jack in the Box, Inc. | | | 12,200 | | | | 909,266 | |

K12, Inc.* | | | 18,100 | | | | 175,751 | |

Lowe’s Cos., Inc. | | | 8,400 | | | | 620,172 | |

Marriott Vacations Worldwide Corp. | | | 9,100 | | | | 586,040 | |

Morningstar, Inc. | | | 1,100 | | | | 90,321 | |

Outerwall, Inc.1 | | | 11,600 | | | | 696,000 | |

Ruth’s Hospitality Group, Inc. | | | 8,300 | | | | 128,733 | |

ServiceMaster Global Holdings, Inc.* | | | 1,300 | | | | 46,345 | |

Shoe Carnival, Inc. | | | 2,400 | | | | 53,928 | |

Skechers U.S.A., Inc., Class A* | | | 3,700 | | | | 115,440 | |

Target Corp. | | | 900 | | | | 69,462 | |

The TJX Cos., Inc. | | | 11,600 | | | | 849,004 | |

The Walt Disney Co. | | | 1,100 | | | | 125,114 | |

Total Consumer Discretionary | | | | | | | 9,689,278 | |

Consumer Staples - 9.6% | | | | | | | | |

Archer-Daniels-Midland Co. | | | 9,000 | | | | 410,940 | |

Bunge, Ltd. | | | 1,100 | | | | 80,256 | |

Central Garden and Pet Co., Class A* | | | 46,800 | | | | 789,984 | |

Coca-Cola Enterprises, Inc. | | | 16,300 | | | | 836,842 | |

CVS Health Corp. | | | 10,100 | | | | 997,678 | |

The Estee Lauder Cos., Inc., Class A | | | 2,000 | | | | 160,920 | |

Herbalife, Ltd.*,1 | | | 6,900 | | | | 386,676 | |

Hormel Foods Corp. | | | 13,700 | | | | 925,435 | |

Mead Johnson Nutrition Co. | | | 4,600 | | | | 377,200 | |

National Beverage Corp.*,1 | | | 5,800 | | | | 218,312 | |

Pilgrim’s Pride Corp.1 | | | 36,800 | | | | 698,832 | |

The Procter & Gamble Co. | | | 4,500 | | | | 343,710 | |

Sanderson Farms, Inc.1 | | | 3,400 | | | | 236,334 | |

| | | | | | | | |

| | | Shares | | | Value | |

Tyson Foods, Inc., Class A | | | 14,900 | | | $ | 660,964 | |

Wal-Mart Stores, Inc. | | | 11,400 | | | | 652,536 | |

Total Consumer Staples | | | | | | | 7,776,619 | |

Energy - 7.2% | | | | | | | | |

Chevron Corp. | | | 2,000 | | | | 181,760 | |

Dril-Quip, Inc.* | | | 11,300 | | | | 695,628 | |

Exxon Mobil Corp. | | | 22,200 | | | | 1,836,828 | |

FMC Technologies, Inc.* | | | 8,200 | | | | 277,406 | |

Marathon Petroleum Corp. | | | 9,400 | | | | 486,920 | |

Oil States International, Inc.* | | | 17,100 | | | | 513,171 | |

Par Pacific Holdings, Inc.* | | | 4,000 | | | | 91,200 | |

Phillips 66 | | | 4,600 | | | | 409,630 | |

Schlumberger, Ltd. | | | 10,100 | | | | 789,416 | |

Valero Energy Corp. | | | 9,100 | | | | 599,872 | |

Total Energy | | | | | | | 5,881,831 | |

Financials - 13.1% | | | | | | | | |

Alleghany Corp.* | | | 1,297 | | | | 643,662 | |

American Financial Group, Inc. | | | 1,800 | | | | 129,942 | |

American International Group, Inc. | | | 4,900 | | | | 308,994 | |

American Tower Corp. | | | 800 | | | | 81,784 | |

Arch Capital Group, Ltd.*,1 | | | 11,700 | | | | 876,213 | |

Argo Group International Holdings, Ltd. | | | 1,000 | | | | 62,520 | |

Bank of America Corp. | | | 13,700 | | | | 229,886 | |

Berkshire Hathaway, Inc., Class A* | | | 1 | | | | 204,596 | |

Berkshire Hathaway, Inc., Class B* | | | 10,287 | | | | 1,399,238 | |

CenterState Banks, Inc. | | | 5,600 | | | | 81,648 | |

The Chubb Corp. | | | 2,000 | | | | 258,700 | |

Citigroup, Inc. | | | 6,700 | | | | 356,239 | |

Discover Financial Services | | | 10,500 | | | | 590,310 | |

Erie Indemnity Co., Class A | | | 2,000 | | | | 174,920 | |

Everest Re Group, Ltd. | | | 2,200 | | | | 391,534 | |

FelCor Lodging Trust, Inc. | | | 7,300 | | | | 58,765 | |

First Defiance Financial Corp. | | | 1,500 | | | | 57,450 | |

Franklin Resources, Inc. | | | 1,800 | | | | 73,368 | |

GAMCO Investors, Inc., Class A | | | 3,900 | | | | 224,952 | |

Great Southern Bancorp, Inc. | | | 1,200 | | | | 57,996 | |

Guaranty Bancorp | | | 6,800 | | | | 112,064 | |

Heritage Insurance Holdings, Inc.* | | | 8,700 | | | | 192,444 | |

JPMorgan Chase & Co. | | | 4,600 | | | | 295,550 | |

The accompanying notes are an integral part of these financial statements.

7

AMG FQ Tax-Managed U.S. Equity Fund

Schedule of Portfolio Investments (continued)

| | | | | | | | |

| | | Shares | | | Value | |

Financials - 13.1% (continued) | | | | | |

KeyCorp | | | 25,800 | | | $ | 320,436 | |

Metro Bancorp, Inc. | | | 2,400 | | | | 74,352 | |

PrivateBancorp, Inc. | | | 15,300 | | | | 639,999 | |

SEI Investments Co. | | | 9,400 | | | | 487,108 | |

Stonegate Bank | | | 1,700 | | | | 53,057 | |

SunTrust Banks, Inc. | | | 10,300 | | | | 427,656 | |

Third Point Reinsurance, Ltd.* | | | 8,200 | | | | 112,094 | |

Universal Insurance Holdings, Inc. | | | 16,800 | | | | 530,040 | |

Voya Financial, Inc. | | | 16,800 | | | | 681,576 | |

Wells Fargo & Co. | | | 7,400 | | | | 400,636 | |

WR Berkley Corp. | | | 1,300 | | | | 72,579 | |

Total Financials | | | | | | | 10,662,308 | |

Health Care - 15.2% | | | | | | | | |

Air Methods Corp.* | | | 1,400 | | | | 57,302 | |

Amgen, Inc. | | | 7,300 | | | | 1,154,714 | |

Anika Therapeutics, Inc.* | | | 10,300 | | | | 396,756 | |

Atrion Corp. | | | 251 | | | | 92,619 | |

Biogen, Inc.* | | | 2,352 | | | | 683,280 | |

Cambrex Corp.* | | | 14,400 | | | | 661,968 | |

Charles River Laboratories International, Inc.* | | | 12,700 | | | | 828,548 | |

CorVel Corp.* | | | 4,800 | | | | 159,360 | |

CR Bard, Inc. | | | 1,746 | | | | 325,367 | |

Gilead Sciences, Inc. | | | 11,700 | | | | 1,265,121 | |

HCA Holdings, Inc.* | | | 10,200 | | | | 701,658 | |

Hologic, Inc.* | | | 10,200 | | | | 396,372 | |

Humana, Inc. | | | 1,600 | | | | 285,808 | |

IMS Health Holdings, Inc.* | | | 25,700 | | | | 699,554 | |

Johnson & Johnson | | | 9,800 | | | | 990,094 | |

Lannett Co., Inc.*,1 | | | 8,900 | | | | 398,453 | |

LHC Group, Inc.* | | | 4,000 | | | | 180,260 | |

LifePoint Hospitals, Inc.* | | | 5,800 | | | | 399,504 | |

McKesson Corp. | | | 1,200 | | | | 214,560 | |

Pfizer, Inc. | | | 5,200 | | | | 175,864 | |

SciClone Pharmaceuticals, Inc.* | | | 13,200 | | | | 100,584 | |

SurModics, Inc.* | | | 10,800 | | | | 230,364 | |

UnitedHealth Group, Inc. | | | 10,100 | | | | 1,189,578 | |

Universal Health Services, Inc.,

Class B | | | 6,200 | | | | 756,958 | |

Total Health Care | | | | | | | 12,344,646 | |

| | | | | | | | |

| | | Shares | | | Value | |

Industrials - 11.1% | | | | | | | | |

Air Transport Services Group, Inc.* | | | 22,900 | | | $ | 224,191 | |

Alaska Air Group, Inc. | | | 21,100 | | | | 1,608,875 | |

AMERCO | | | 500 | | | | 203,155 | |

Delta Air Lines, Inc. | | | 20,650 | | | | 1,049,846 | |

Deluxe Corp. | | | 1,300 | | | | 77,415 | |

FedEx Corp. | | | 700 | | | | 109,235 | |

General Dynamics Corp. | | | 5,900 | | | | 876,622 | |

General Electric Co. | | | 17,300 | | | | 500,316 | |

Huntington Ingalls Industries, Inc. | | | 5,800 | | | | 695,652 | |

Jacobs Engineering Group, Inc.* | | | 1,900 | | | | 76,266 | |

JetBlue Airways Corp.* | | | 2,500 | | | | 62,100 | |

Landstar System, Inc. | | | 9,900 | | | | 624,096 | |

PAM Transportation Services, Inc.* | | | 1,300 | | | | 46,423 | |

Southwest Airlines Co. | | | 4,500 | | | | 208,305 | |

Spirit AeroSystems Holdings, Inc., Class A* | | | 15,000 | | | | 791,100 | |

UniFirst Corp. | | | 4,000 | | | | 420,280 | |

Union Pacific Corp. | | | 7,600 | | | | 679,060 | |

USA Truck, Inc.* | | | 3,100 | | | | 56,358 | |

Wabash National Corp.* | | | 56,600 | | | | 677,502 | |

Total Industrials | | | | | | | 8,986,797 | |

Information Technology - 19.9% | | | | | | | | |

Activision Blizzard, Inc. | | | 2,600 | | | | 90,376 | |

Alphabet, Inc., Class A* | | | 816 | | | | 601,710 | |

Alphabet, Inc., Class C* | | | 400 | | | | 284,324 | |

Apple, Inc. | | | 27,741 | | | | 3,315,049 | |

Electronic Arts, Inc.* | | | 12,900 | | | | 929,703 | |

EMC Corp. | | | 2,800 | | | | 73,416 | |

ePlus, Inc.* | | | 9,200 | | | | 776,664 | |

F5 Networks, Inc.* | | | 5,600 | | | | 617,120 | |

II-VI, Inc.* | | | 20,200 | | | | 366,024 | |

International Business Machines Corp. | | | 3,600 | | | | 504,288 | |

Intuit, Inc. | | | 7,700 | | | | 750,211 | |

Ixia* | | | 36,400 | | | | 524,524 | |

Jabil Circuit, Inc. | | | 6,100 | | | | 140,178 | |

MasterCard, Inc., Class A | | | 15,580 | | | | 1,542,264 | |

Microsoft Corp. | | | 23,400 | | | | 1,231,776 | |

MicroStrategy, Inc., Class A* | | | 4,500 | | | | 774,315 | |

NeuStar, Inc., Class A*,1 | | | 28,800 | | | | 783,072 | |

The accompanying notes are an integral part of these financial statements.

8

AMG FQ Tax-Managed U.S. Equity Fund

Schedule of Portfolio Investments (continued)

| | | | | | | | |

| | | Shares | | | Value | |

Information Technology - 19.9% (continued) | |

Nuance Communications, Inc.* | | | 3,200 | | | $ | 54,304 | |

Oracle Corp. | | | 22,900 | | | | 889,436 | |

PC Connection, Inc. | | | 4,800 | | | | 111,552 | |

Tessera Technologies, Inc. | | | 2,500 | | | | 87,425 | |

Visa, Inc., Class A | | | 22,400 | | | | 1,737,792 | |

Total Information Technology | | | | | | | 16,185,523 | |

Materials - 3.5% | | | | | | | | |

AEP Industries, Inc.* | | | 2,600 | | | | 208,000 | |

Bemis Co., Inc. | | | 3,800 | | | | 173,964 | |

Celanese Corp., Series A | | | 2,000 | | | | 142,100 | |

Graphic Packaging Holding Co. | | | 25,300 | | | | 358,248 | |

LyondellBasell Industries N.V., Class A | | | 8,100 | | | | 752,571 | |

Reliance Steel & Aluminum Co. | | | 700 | | | | 41,972 | |

Sealed Air Corp. | | | 12,900 | | | | 633,648 | |

The Sherwin-Williams Co. | | | 930 | | | | 248,152 | |

Westlake Chemical Corp. | | | 4,900 | | | | 295,323 | |

Total Materials | | | | | | | 2,853,978 | |

Telecommunication Services - 3.3% | | | | | | | | |

AT&T, Inc. | | | 34,201 | | | | 1,146,076 | |

Telephone & Data Systems, Inc. | | | 27,100 | | | | 776,144 | |

T-Mobile US, Inc.* | | | 1,850 | | | | 70,096 | |

Verizon Communications, Inc. | | | 15,500 | | | | 726,640 | |

Total Telecommunication Services | | | | | | | 2,718,956 | |

Utilities - 2.2% | | | | | | | | |

American Electric Power Co., Inc. | | | 2,400 | | | | 135,960 | |

American Water Works Co, Inc. | | | 12,400 | | | | 711,264 | |

Ormat Technologies, Inc.1 | | | 3,600 | | | | 135,792 | |

Public Service Enterprise Group, Inc. | | | 19,700 | | | | 813,413 | |

Total Utilities | | | | | | | 1,796,429 | |

Total Common Stocks

(cost $60,188,816) | | | | | | | 78,896,365 | |

| | | | | | | | |

| | | Principal Amount | | | Value | |

Short-Term Investments - 6.0% | |

Repurchase Agreements - 3.1%2 | |

Daiwa Capital Markets America, dated 10/30/15, due 11/02/15, 0.090%, total to be received $1,000,008 (collateralized by various U.S. Government Agency Obligations, 0.000% - 7.500%, 11/05/15 - 02/01/49,totaling $1,020,000) | | $ | 1,000,000 | | | $ | 1,000,000 | |

HSBC Securities USA Inc., dated 10/30/15, due 11/02/15, 0.070%, total to be received $537,949 (collateralized by various U.S. Government Agency Obligations, 2.500% - 8.000%, 05/01/22 - 10/01/45,totaling $548,706) | | | 537,946 | | | | 537,946 | |

Nomura Securities International Inc., dated 10/30/15, due 11/02/15, 0.080%, total to be received $1,000,007 (collateralized by various U.S. Government Agency Obligations, 0.000% - 10.500%, 11/04/15 - 09/20/65,totaling $1,020,000) | | | 1,000,000 | | | | 1,000,000 | |

Total Repurchase Agreements | | | | | | | 2,537,946 | |

| | |

| | | Shares | | | | |

Other Investment Companies - 2.9%3 | |

Dreyfus Institutional Cash Advantage Fund, Institutional Class Shares, 0.09% | | | 2,357,460 | | | | 2,357,460 | |

Total Short-Term Investments

(cost $4,895,406) | | | | | | | 4,895,406 | |

Total Investments - 103.0%

(cost $65,084,222) | | | | | | | 83,791,771 | |

Other Assets, less Liabilities - (3.0)% | | | | (2,473,968 | ) |

Net Assets - 100.0% | | | | | | $ | 81,317,803 | |

The accompanying notes are an integral part of these financial statements.

9

AMG FQ U.S. Equity Fund

Portfolio Manager’s Comments (unaudited)

For the fiscal year ended October 31, 2015, the AMG FQ U.S. Equity Fund (Institutional Class) (the “Fund”) returned 2.16%, compared to 4.49% for its benchmark, the Russell 3000® Index.

U.S. equity returns were positive yet subdued for the period. Several macro themes plus full valuations weighed on the market. With respect to macro, the sharp drop in oil prices damaged the prospects for many energy companies. Also, U.S. Dollar appreciation reduced earnings for exporters. U.S. and global economic growth have been disappointing and inflation has been below target, which have kept interest rates in check. In this environment, both corporate earnings and equity returns have been modest.

While broad index returns have been tepid, there have been notable movements in a number of market segments. Growth stocks outperformed value as, in the midst of lackluster earnings, investors were drawn to those companies exhibiting growth. Large-capitalization stocks outperformed small caps. Sector returns reflected macro themes, with energy and commodity-related sectors underperforming, while consumer sectors performed well. Further reflecting the cautious tone in the market, investors preferred low-volatility stocks.

The Fund underperformed the benchmark, with most of the underperformance coming from the protective options strategy. The options mitigate downside risk but also restrain returns when the

Index has positive returns, which was the case in this fiscal year. The equity component added to the underperformance, with negative contributions from stock selection outweighing positive contributions from industry positions and from exposures to common risk factors. The industry positions that contributed most to performance were overweights to airlines and oil refining and sales, and an underweight to oil extraction. The industry positions that had the greatest negative impact were the underweights to tobacco and drugs and the overweight to oil services. With respect to common risk factors, the greatest positive contributions were from price momentum and exposure to companies with relatively low earnings variability. The main negative contributor was exposure to stocks with above-average price volatility.

POSITIONING

The outlook for growth stocks has improved somewhat relative to value, mainly because of increased risk aversion due to concerns about global growth. At times when investors are concerned about prospects for growth, they tend to seek solvent companies with visible earnings. Such companies are typically more growth than value oriented.

Price momentum: We are cautious on the outlook for price momentum. In Q3, we had reduced the weight of momentum as concerns deepened about economic growth and as volatility increased. Moreover, momentum had become something of a

crowded trade – there were signs of above-average inflows into the strategy. More recently, broad market volatility has moderated but the volatility of the momentum factor itself is above average. Going into Q4, we increased the weight of price momentum slightly, though it remains below the strategic average.

This commentary reflects the viewpoints of the portfolio manager, First Quadrant, L.P., as of October 31, 2015 and is not intended as a forecast or guarantee of future results, and is subject to change without notice.

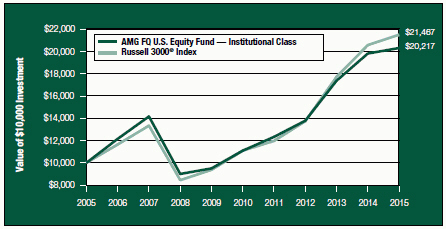

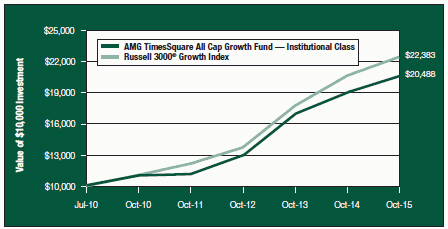

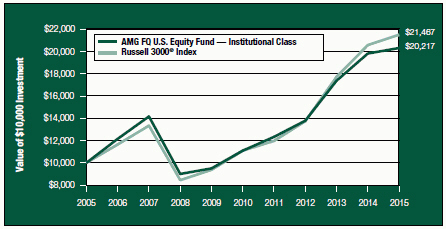

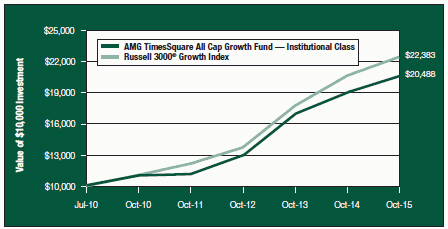

CUMULATIVE TOTAL RETURN PERFORMANCE

AMG FQ U.S. Equity Fund’s cumulative total return is based on the daily change in net asset value (NAV), and assumes that all distributions were reinvested. This graph compares a hypothetical $10,000 investment made in the Institutional Class Shares of the Fund on October 31, 2005 with a $10,000 investment made in the Russell 3000® Index for the same time period.

Performance for periods longer than one year is annualized. The graph and table do not reflect the deduction of taxes that a shareholder would pay on a Fund distribution or redemption of shares. The listed returns for the Fund are net of expenses and the returns for the index exclude expenses. Total returns would have been lower had certain expenses not been reduced.

10

AMG FQ U.S. Equity Fund

Portfolio Manager’s Comments (continued)

CUMULATIVE TOTAL RETURN PERFORMANCE (continued)

The table below shows the average annual total returns for the AMG FQ U.S. Equity Fund and the Russell 3000® Index for the same time periods ended October 31, 2015.

| | | | | | | | | | | | | | | | | | | | |

| | | One | | | Five | | | Ten | | | Since | | | Inception | |

| Average Annual Total Returns1 | | Year | | | Years | | | Years | | | Inception | | | Date | |

AMG FQ U.S. Equity Fund2,3,4 | | | | | | | | | | | | | | | | | | | | |

Investor Class | | | 1.90 | % | | | 12.45 | % | | | — | | | | 6.19 | % | | | 03/01/06 | |

Institutional Class | | | 2.16 | % | | | 12.77 | % | | | 7.29 | % | | | 8.18 | % | | | 08/14/92 | |

Russell 3000® Index5,6 | | | 4.49 | % | | | 14.14 | % | | | 7.94 | % | | | 9.42 | % | | | 08/14/92 | |

The performance data shown represents past performance. Past performance is not a guarantee of future results. Current performance may be lower or higher than the performance data quoted. The investment return and principal value of an investment in the Fund will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost.

Investors should carefully consider the Fund’s investment objectives, risks, charges and expenses before investing. For performance information through the most recent month end, current net asset values per share for the Fund and other information, please call (800) 835-3879 or visit our website at www.amgfunds.com for a free prospectus. Read it carefully before investing or sending money.

Distributed by AMG Distributors, Inc., member FINRA/SIPC.

| 1 | Total return equals income yield plus share price change and assumes reinvestment of all dividends and capital gain distributions. Returns are net of fees and may reflect offsets of Fund expenses as described in the prospectus. No adjustment has been made for taxes payable by shareholders on their reinvested dividends and capital gain distributions. Returns for periods greater than one year are the average annual returns. The listed returns on the Fund are net of expenses and based on the published NAV as of October 31, 2015. All returns are in U.S. dollars ($). |

| 2 | From time to time, the Fund’s advisor has waived its fees and/or absorbed Fund expenses, which has resulted in higher returns. |

| 3 | The Fund invests in large-capitalization companies that may underperform other stock funds (such as funds that focus on small- and medium-capitalization companies) when stocks of large-capitalization companies are out of favor. |

| 4 | The Fund may invest in derivatives; the complexity and rapidly changing structure of derivatives markets may increase the possibility of market losses. |

| 5 | The Russell 3000® Index is composed of the 3,000 largest U.S. companies as measured by market capitalization, and represents approximately 98% of the U.S. stock market. Unlike the Fund, the Russell 3000® Index is unmanaged, is not available for investment, and does not incur expenses. |

| 6 | Date reflects the inception date of the Fund, not the index. |

The Russell 3000® Index is a trademark of Russell Investments. Russell is a trademark of Russell Investments.

Not FDIC insured, nor bank guaranteed. May lose value.

11

AMG FQ U.S. Equity Fund

Fund Snapshots (unaudited)

October 31, 2015

PORTFOLIO BREAKDOWN

| | | | | | | | |

| | | AMG FQ | | | | |

| | | U.S. | | | Russell 3000® | |

Sector | | Equity Fund** | | | Index | |

Financials | | | 18.4 | % | | | 17.9 | % |

Information Technology | | | 18.0 | % | | | 19.9 | % |

Health Care | | | 14.6 | % | | | 14.2 | % |

Consumer Discretionary | | | 12.6 | % | | | 13.7 | % |

Industrials | | | 10.9 | % | | | 10.8 | % |

Consumer Staples | | | 9.2 | % | | | 8.5 | % |

Energy | | | 7.2 | % | | | 6.6 | % |

Materials | | | 4.7 | % | | | 3.3 | % |

Telecommunication Services | | | 2.9 | % | | | 2.1 | % |

Utilities | | | 1.8 | % | | | 3.0 | % |

Purchased Options | | | 0.3 | % | | | 0.0 | % |

Other Assets and Liabilities | | | (0.6 | )% | | | 0.0 | % |

| ** | As a percentage of net assets. |

TOP TEN HOLDINGS

| | | | |

| | | %of | |

Security Name | | Net Assets | |

Apple, Inc.* | | | 4.1 | % |

Berkshire Hathaway, Inc., Class B* | | | 2.3 | |

JPMorgan Chase & Co.* | | | 2.3 | |

Verizon Communications, Inc. | | | 2.0 | |

The Home Depot, Inc. | | | 2.0 | |

Gilead Sciences, Inc. | | | 1.9 | |

UnitedHealth Group, Inc.* | | | 1.8 | |

Citigroup, Inc. | | | 1.8 | |

Bank of America Corp. | | | 1.8 | |

Amgen, Inc. | | | 1.7 | |

| | | | |

Top Ten as a Group | | | 21.7 | % |

| | | | |

| * | Top Ten Holdings as of April 30, 2015. |

Because a fund’s strategy may result in multiple investments in particular sectors of the economy, its performance may depend on the performance of those sectors and may fluctuate more widely than investments diversified across more sectors. For additional information on these and other risk considerations, please see the Fund’s prospectus.

Any sectors, industries, or securities discussed should not be perceived as investment recommendations. Mention of a specific security should not be considered a recommendation to buy or solicitation to sell that security. Specific securities mentioned in this report may have been sold from the Fund’s portfolio of investments by the time you receive this report.

12

AMG FQ U.S. Equity Fund

Schedule of Portfolio Investments

October 31, 2015

| | | | | | | | |

| | | Shares | | | Value | |

Common Stocks - 100.3% | | | | | |

Consumer Discretionary - 12.6% | | | | | |

Amazon.com, Inc.* | | | 270 | | | $ | 168,993 | |

Comcast Corp., Class A4 | | | 13,100 | | | | 820,322 | |

Denny’s Corp.* | | | 34,500 | | | | 378,120 | |

DISH Network Corp., Class A* | | | 12,340 | | | | 777,050 | |

Dollar General Corp.4 | | | 11,400 | | | | 772,578 | |

Entravision Communications Corp., Class A | | | 7,500 | | | | 65,700 | |

Expedia, Inc. | | | 600 | | | | 81,780 | |

Foot Locker, Inc.4 | | | 12,100 | | | | 819,775 | |

The Goodyear Tire & Rubber Co. | | | 17,900 | | | | 587,836 | |

The Home Depot, Inc.4 | | | 11,000 | | | | 1,360,040 | |

Isle of Capri Casinos, Inc.* | | | 13,600 | | | | 260,168 | |

Liberty Interactive Corp. QVC Group, Class A* | | | 9,910 | | | | 271,237 | |

Morningstar, Inc. | | | 500 | | | | 41,055 | |

Outerwall, Inc.1 | | | 900 | | | | 54,000 | |

PetMed Express, Inc. | | | 20,400 | | | | 343,128 | |

Ruby Tuesday, Inc.* | | | 13,600 | | | | 71,128 | |

Ruth’s Hospitality Group, Inc. | | | 5,400 | | | | 83,754 | |

Starbucks Corp. | | | 6,400 | | | | 400,448 | |

Target Corp. | | | 6,000 | | | | 463,080 | |

The Walt Disney Co. | | | 1,400 | | | | 159,236 | |

Winnebago Industries, Inc.1 | | | 25,300 | | | | 531,047 | |

Total Consumer Discretionary | | | | | | | 8,510,475 | |

Consumer Staples - 9.2% | | | | | | | | |

Brown-Forman Corp., Class B | | | 450 | | | | 47,781 | |

Central Garden and Pet Co., Class A* | | | 11,300 | | | | 190,744 | |

Church & Dwight Co., Inc. | | | 700 | | | | 60,263 | |

The Clorox Co. | | | 400 | | | | 48,776 | |

Coca-Cola Enterprises, Inc. | | | 15,500 | | | | 795,770 | |

Coty, Inc., Class A | | | 26,900 | | | | 778,755 | |

CVS Health Corp.4 | | | 8,600 | | | | 849,508 | |

The Estee Lauder Cos., Inc., Class A | | | 5,400 | | | | 434,484 | |

Flowers Foods, Inc. | | | 2,700 | | | | 72,900 | |

Hormel Foods Corp. | | | 10,820 | | | | 730,891 | |

The Kroger Co. | | | 1,800 | | | | 68,040 | |

Mead Johnson Nutrition Co. | | | 1,000 | | | | 82,000 | |

PepsiCo, Inc.4 | | | 6,180 | | | | 631,534 | |

Philip Morris International, Inc. | | | 7,000 | | | | 618,800 | |

Pilgrim’s Pride Corp.1 | | | 18,900 | | | | 358,911 | |

| | | | | | | | |

| | | Shares | | | Value | |

The Procter & Gamble Co.4 | | | 5,300 | | | $ | 404,814 | |

Total Consumer Staples | | | | | | | 6,173,971 | |

Energy - 7.2% | | | | | | | | |

Chevron Corp.4 | | | 800 | | | | 72,704 | |

CVR Energy, Inc.1 | | | 12,000 | | | | 533,520 | |

Dril-Quip, Inc.* | | | 1,000 | | | | 61,560 | |

Exxon Mobil Corp.4 | | | 7,300 | | | | 604,002 | |

Frank’s International NV | | | 6,700 | | | | 114,972 | |

Marathon Petroleum Corp.4 | | | 18,400 | | | | 953,120 | |

Phillips 66 | | | 800 | | | | 71,240 | |

Schlumberger, Ltd.4 | | | 13,700 | | | | 1,070,792 | |

Tesoro Corp. | | | 3,500 | | | | 374,255 | |

Valero Energy Corp.4 | | | 14,900 | | | | 982,208 | |

Total Energy | | | | | | | 4,838,373 | |

Financials - 18.4% | | | | | | | | |

The Allstate Corp. | | | 7,900 | | | | 488,852 | |

Altisource Portfolio Solutions, S.A.* | | | 2,400 | | | | 64,344 | |

American Express Co.4 | | | 8,400 | | | | 615,384 | |

Ameriprise Financial, Inc. | | | 500 | | | | 57,680 | |

Arch Capital Group, Ltd.* | | | 1,100 | | | | 82,379 | |

Bank of America Corp.4 | | | 70,450 | | | | 1,182,151 | |

The Bank of New York Mellon Corp. | | | 3,600 | | | | 149,940 | |

Berkshire Hathaway, Inc., Class B*,4 | | | 11,300 | | | | 1,537,026 | |

CBL & Associates Properties, Inc. | | | 28,000 | | | | 408,240 | |

Citigroup, Inc. | | | 22,310 | | | | 1,186,223 | |

Erie Indemnity Co., Class A | | | 700 | | | | 61,222 | |

Everest Re Group, Ltd. | | | 1,300 | | | | 231,361 | |

Flagstar Bancorp, Inc.* | | | 7,900 | | | | 175,696 | |

Franklin Resources, Inc. | | | 6,200 | | | | 252,712 | |

GAMCO Investors, Inc., Class A | | | 2,700 | | | | 155,736 | |

The Hanover Insurance Group, Inc. | | | 800 | | | | 67,400 | |

Host Hotels & Resorts, Inc. | | | 2,900 | | | | 50,257 | |

JPMorgan Chase & Co.4 | | | 23,700 | | | | 1,522,725 | |

LaSalle Hotel Properties | | | 1,600 | | | | 47,056 | |

Lazard, Ltd., Class A | | | 8,300 | | | | 384,456 | |

Morgan Stanley | | | 1,900 | | | | 62,643 | |

Northern Trust Corp. | | | 2,940 | | | | 206,947 | |

OFG Bancorp | | | 4,800 | | | | 44,208 | |

Paramount Group, Inc. | | | 3,300 | | | | 58,641 | |

The Progressive Corp. | | | 2,600 | | | | 86,138 | |

The accompanying notes are an integral part of these financial statements.

13

AMG FQ U.S. Equity Fund

Schedule of Portfolio Investments (continued)

| | | | | | | | |

| | | Shares | | | Value | |

Financials - 18.4% (continued) | |

Public Storage | | | 300 | | | $ | 68,838 | |

SEI Investments Co. | | | 1,700 | | | | 88,094 | |

Simon Property Group, Inc. | | | 3,510 | | | | 707,125 | |

Synovus Financial Corp. | | | 1,480 | | | | 46,812 | |

Taubman Centers, Inc. | | | 800 | | | | 61,584 | |

The Travelers Cos., Inc. | | | 8,100 | | | | 914,409 | |

Voya Financial, Inc. | | | 15,300 | | | | 620,721 | |

Wells Fargo & Co.4 | | | 13,200 | | | | 714,648 | |

Total Financials | | | | | | | 12,401,648 | |

Health Care - 14.6% | | | | | | | | |

Agilent Technologies, Inc. | | | 1,470 | | | | 55,507 | |

Alliance HealthCare Services, Inc.* | | | 2,600 | | | | 21,996 | |

Amgen, Inc.4 | | | 7,100 | | | | 1,123,078 | |

Biogen, Inc.* | | | 2,100 | | | | 610,071 | |

Charles River Laboratories International, Inc.* | | | 1,000 | | | | 65,240 | |

Chemed Corp. | | | 2,100 | | | | 330,309 | |

CR Bard, Inc. | | | 4,100 | | | | 764,035 | |

Gilead Sciences, Inc.4 | | | 11,700 | | | | 1,265,121 | |

HCA Holdings, Inc.* | | | 3,800 | | | | 261,402 | |

Hologic, Inc.* | | | 5,600 | | | | 217,616 | |

Johnson & Johnson4 | | | 9,700 | | | | 979,991 | |

LifePoint Hospitals, Inc.* | | | 3,300 | | | | 227,304 | |

McKesson Corp. | | | 800 | | | | 143,040 | |

Merck & Co., Inc.4 | | | 6,600 | | | | 360,756 | |

PDL BioPharma, Inc.1 | | | 38,000 | | | | 174,040 | |

Pfizer, Inc. | | | 13,100 | | | | 443,042 | |

SciClone Pharmaceuticals, Inc.* | | | 4,700 | | | | 35,814 | |

St. Jude Medical, Inc. | | | 7,000 | | | | 446,670 | |

Sucampo Pharmaceuticals, Inc.,

Class A* | | | 1,700 | | | | 32,912 | |

UnitedHealth Group, Inc.4 | | | 10,300 | | | | 1,213,134 | |

Universal Health Services, Inc.,

Class B | | | 6,900 | | | | 842,421 | |

Waters Corp.* | | | 200 | | | | 25,560 | |

Zoetis, Inc. | | | 4,000 | | | | 172,040 | |

Total Health Care | | | | | | | 9,811,099 | |

Industrials - 10.9% | | | | | | | | |

3M Co. | | | 1,400 | | | | 220,094 | |

Air Transport Services Group, Inc.* | | | 10,500 | | | | 102,795 | |

Alaska Air Group, Inc. | | | 4,700 | | | | 358,375 | |

Atlas Air Worldwide Holdings, Inc.* | | | 12,800 | | | | 527,872 | |

| | | | | | | | |

| | | Shares | | | Value | |

The Boeing Co. | | | 1,100 | | | $ | 162,877 | |

Delta Air Lines, Inc. | | | 9,700 | | | | 493,148 | |

Ennis, Inc. | | | 11,200 | | | | 224,336 | |

Expeditors International of Washington, Inc. | | | 4,300 | | | | 214,097 | |

General Dynamics Corp.4 | | | 6,800 | | | | 1,010,344 | |

General Electric Co.4 | | | 22,600 | | | | 653,592 | |

Illinois Tool Works, Inc. | | | 2,700 | | | | 248,238 | |

JetBlue Airways Corp.* | | | 3,100 | | | | 77,004 | |

Roper Technologies, Inc. | | | 1,200 | | | | 223,620 | |

Southwest Airlines Co. | | | 21,400 | | | | 990,606 | |

Spirit AeroSystems Holdings, Inc., Class A* | | | 15,100 | | | | 796,374 | |

United Parcel Service, Inc., Class B4 | | | 9,530 | | | | 981,781 | |

WABCO Holdings, Inc.* | | | 500 | | | | 56,115 | |

Total Industrials | | | | | | | 7,341,268 | |

Information Technology - 18.0% | | | | | | | | |

Activision Blizzard, Inc. | | | 30,400 | | | | 1,056,704 | |

Alphabet, Inc., Class A*,4 | | | 882 | | | | 650,378 | |

Alphabet, Inc., Class C*,4 | | | 382 | | | | 271,529 | |

Apple, Inc.4 | | | 23,307 | | | | 2,785,186 | |

eBay, Inc.* | | | 1,390 | | | | 38,781 | |

ePlus, Inc.* | | | 4,000 | | | | 337,680 | |

F5 Networks, Inc.* | | | 6,900 | | | | 760,380 | |

FEI Co. | | | 8,800 | | | | 635,272 | |

II-VI, Inc.* | | | 10,400 | | | | 188,448 | |

Intuit, Inc. | | | 690 | | | | 67,227 | |

Jabil Circuit, Inc. | | | 37,140 | | | | 853,477 | |

Leidos Holdings, Inc. | | | 2,800 | | | | 147,196 | |

Marchex, Inc., Class B | | | 9,800 | | | | 42,336 | |

Mercury Systems, Inc.* | | | 4,200 | | | | 72,072 | |

Microsoft Corp.4 | | | 17,300 | | | | 910,672 | |

MicroStrategy, Inc., Class A* | | | 4,100 | | | | 705,487 | |

NeuStar, Inc., Class A*,1 | | | 11,000 | | | | 299,090 | |

PayPal Holdings, Inc.* | | | 1,000 | | | | 36,010 | |

Plantronics, Inc. | | | 700 | | | | 37,534 | |

QLogic Corp.* | | | 3,800 | | | | 47,120 | |

Tessera Technologies, Inc. | | | 4,500 | | | | 157,365 | |

Texas Instruments, Inc.4 | | | 18,100 | | | | 1,026,632 | |

Visa, Inc., Class A | | | 10,800 | | | | 837,864 | |

Web.com Group, Inc.* | | | 2,900 | | | | 68,063 | |

The accompanying notes are an integral part of these financial statements.

14

AMG FQ U.S. Equity Fund

Schedule of Portfolio Investments (continued)

| | | | | | | | |

| | | Shares | | | Value | |

Information Technology - 18.0% (continued) | |

Xerox Corp. | | | 7,700 | | | $ | 72,303 | |

Total Information Technology | | | | | | | 12,104,806 | |

Materials - 4.7% | | | | | | | | |

Bemis Co., Inc. | | | 8,700 | | | | 398,286 | |

Domtar Corp. | | | 19,000 | | | | 783,560 | |

FutureFuel Corp. | | | 3,100 | | | | 47,771 | |

LyondellBasell Industries N.V., Class A | | | 9,900 | | | | 919,809 | |

Reliance Steel & Aluminum Co. | | | 12,300 | | | | 737,508 | |

Sealed Air Corp. | | | 4,800 | | | | 235,776 | |

SunCoke Energy, Inc. | | | 15,100 | | | | 74,896 | |

Total Materials | | | | | | | 3,197,606 | |

Telecommunication Services - 2.9% | | | | | | | | |

AT&T, Inc. | | | 4,381 | | | | 146,807 | |

CenturyLink, Inc.1 | | | 1,300 | | | | 36,673 | |

Telephone & Data Systems, Inc. | | | 13,800 | | | | 395,232 | |

Verizon Communications, Inc.4 | | | 29,200 | | �� | | 1,368,896 | |

Total Telecommunication Services | | | | | | | 1,947,608 | |

Utilities - 1.8% | | | | | | | | |

AES Corp. | | | 5,000 | | | | 54,750 | |

American Electric Power Co., Inc. | | | 3,600 | | | | 203,940 | |

American Water Works Co, Inc. | | | 1,200 | | | | 68,832 | |

NextEra Energy, Inc. | | | 600 | | | | 61,596 | |

Public Service Enterprise Group, Inc. | | | 20,000 | | | | 825,800 | |

Total Utilities | | | | | | | 1,214,918 | |

Total Common Stocks

(cost $62,688,206) | | | | | | | 67,541,772 | |

| | | | | | | | |

| | | Contracts | | | Value | |

Purchased Options - 0.3% | | | | | | | | |

S&P 500 Puts, 1,825 Strike Price, Expiration 12/19/15 | | | 119 | | | $ | 55,335 | |

S&P 500 Puts, 1,875 Strike Price, Expiration 11/20/15 | | | 108 | | | | 17,820 | |

S&P 500 Puts, 1,885 Strike Price, Expiration 01/15/16 | | | 101 | | | | 141,400 | |

Total Purchased Options

(cost $1,211,992) | | | | | | | 214,555 | |

| | |

| | | Principal

Amount | | | | |

Short-Term Investments - 2.6% | | | | | | | | |

Repurchase Agreements - 2.2%2 | | | | | | | | |

Daiwa Capital Markets America, dated 10/30/15, due 11/02/15, 0.090%, total to be received $479,783 (collateralized by various U.S. Government Agency Obligations, 0.000% - 7.500%, 11/05/15 - 02/01/49,totaling $489,374) | | $ | 479,779 | | | | 479,779 | |

Nomura Securities International Inc., dated 10/30/15, due 11/02/15, 0.080%, total to be received $1,000,007 (collateralized by various U.S. Government Agency Obligations, 0.000% - 10.500%, 11/04/15 - 09/20/65,totaling $1,020,000) | | | 1,000,000 | | | | 1,000,000 | |

Total Repurchase Agreements | | | | | | | 1,479,779 | |

| | |

| | | Shares | | | | |

Other Investment Companies - 0.4%3 | | | | | |

Dreyfus Institutional Cash Advantage Fund, Institutional Class Shares, 0.09% | | | 271,926 | | | | 271,926 | |

Total Short-Term Investments

(cost $1,751,705) | | | | | | | 1,751,705 | |

Total Investments - 103.2%

(cost $65,651,903) | | | | | | | 69,508,032 | |

Other Assets, less Liabilities - (3.2)% | | | | | | | (2,152,042 | ) |

Net Assets - 100.0% | | | | | | $ | 67,355,990 | |

The accompanying notes are an integral part of these financial statements.

15

AMG FQ Global Risk-Balanced Fund

Portfolio Manager’s Comments (unaudited)

The AMG FQ Global Risk-Balanced Fund (the Fund) (Institutional Class) returned (3.92)%, while its benchmark, which consists of 60% of the return of MSCI World (hedged) Index and 40% of the return of the Citigroup World Government Bond (hedged) Index, returned 3.87% for the fiscal year ending October 31, 2015.

Primarily, the negative performance was limited to commodities and Emerging Markets. Energy prices fell dramatically in late 2014 and into 2015 as increasing supply followed by the OPEC decision not to take action sent oil prices plummeting. Industrial metals also suffered due to a stronger U.S. Dollar and a slowdown in China. Most Emerging Market securities followed suit. Meanwhile, the Greek crisis, combined with deflationary pressures in Europe, caused a selloff in European equities. In the end, sovereign bonds, which many perceived as being the weak asset class, rallied during the period even though the prospect of increased U.S. interest rates loomed on the horizon. Expectations of higher rates in the U.S. also drove the U.S. Dollar higher, putting further pressure on commodities and Emerging Markets. So while equities and bonds turned in positive performance, negative returns from commodities and Emerging Markets eroded those returns for the period.

While market uncertainty feels high, the Market Risk Index only recently went to levels consistent with a fragile market state. The Market Risk Index began the 2014 year at its lowest reading, but in December 2014 moved up slightly. It remained at that level until early September 2015, when stock market sentiment, as measured by the implied volatility of index options, crossed its long-term median. This signaled a shift from resilient markets to fragile markets. Resilient markets are characterized by low volatility, low “tail” risk and an environment where risk is rewarded by return. Fragile markets, by contrast, have high volatility,

frequent large events (both positive and negative) and an environment where risk is not necessarily rewarded with return. The shift to a fragile market state means that the investing landscape is likely to be quite different in the coming months than it has been in the last few years.

Early 2015, markets rallied as there was optimism that the European Central Bank would be able to stimulate the European economy and the U.S. economy was strengthening. However, that changed in Q2 as uncertainty increased, primarily because of political risks associated with Greece. As expected, resolution of the Greek situation in July helped markets stabilize in the short term however, the market focus then moved to the real issue, China.

China has been a drag on Emerging Markets and industrial commodities throughout 2015. While the Fund does not have a direct investment in China, the speculative bubble of the last year appears to be deflating. The Chinese government is already embarking on a series of actions which will likely make the situation worse rather than better. How China will deal with the aftermath of their market retrenchment is unknown though their recent actions were not encouraging and caused a significant stock market decline in August.

Deflationary pressures were felt in the inflation hedging components in the Fund. Oversupply in both the industrial and agricultural sectors weighed on commodities. While we reduced commodity positions in early July to reflect their higher risk, commodities were the biggest drag on the Fund. In a similar vein, inflation-linked bonds were also a drag on returns.

In the coming year there are many issues that investors will face. In the U.S., monetary policy is likely to become more restrictive, though in the grand scheme of things the U.S. Federal Reserve remains accommodative. Unfortunately, their plan

to raise interest rates soon will complicate efforts throughout the globe to combat deflationary pressures by causing a continued rise in the U.S. Dollar. The rise in the Dollar will inhibit the earnings of multi-national companies and U.S. exports. The situations in Europe and China remain unresolved and could cause future market volatility in 2016. The Market Risk Index is likely to decline to a moderate stance in the near future. While lower, we would still be in the fragile market environment. The Fund is positioned for growth but also has protective measures in place to seek to minimize risk and maximize the opportunity for returns.

This commentary reflects the viewpoints of the portfolio manager, First Quadrant, L.P., as of October 31, 2015 and is not intended as a forecast or guarantee of future results, and is subject to change without notice.

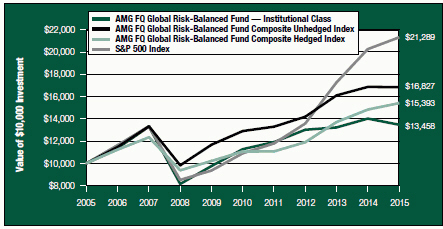

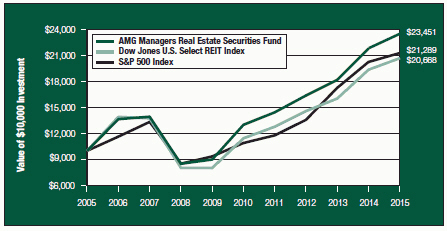

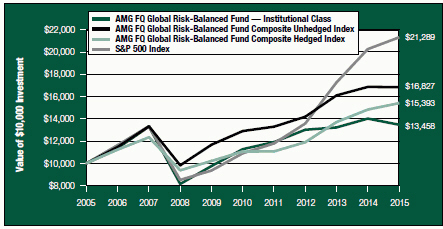

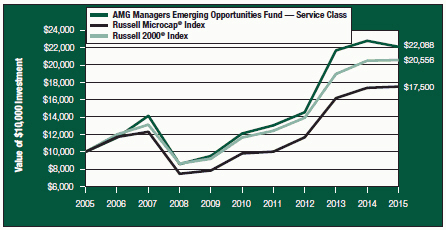

CUMULATIVE TOTAL RETURN PERFORMANCE

AMG FQ Global Risk-Balanced Fund’s cumulative total return is based on the daily change in net asset value (NAV), and assumes that all distributions were reinvested. This graph compares a hypothetical $10,000 investment made in the Institutional Class Shares of the Fund on October 31, 2005, to a $10,000 investment made in the Hedged Index and the Unhedged Index for the same time period. Figures include reinvestment of capital gains and dividends. The listed returns for the Fund are net of expenses and the returns for the index exclude expenses. Performance for periods longer than one year is annualized. The graph and table do not reflect the deduction of taxes that a shareholder would pay on a Fund distribution or redemption of shares. The listed returns for the Fund are net of expenses and the returns for the index exclude expenses. Total returns would have been lower had certain expenses not been reduced.

16

AMG FQ Global Risk-Balanced Fund

Portfolio Manager’s Comments (continued)

CUMULATIVE TOTAL RETURN PERFORMANCE (continued)

The table below shows the average annual total returns for the AMG FQ Global Risk-Balanced Fund and the AMG FQ Global Risk-Balanced Fund Composite Hedged and Unhedged Indexes for the same time periods ended October 31, 2015.

| | | | | | | | | | | | | | | | | | | | |

| | | One | | | Five | | | Ten | | | Since | | | Inception | |

| Average Annual Total Returns1 | | Year | | | Years | | | Years | | | Inception | | | Date | |

AMG FQ Global Risk-Balanced Fund2,3,4,5,6,7,8,9,10 | | | | | | | | | | | | | |

Investor Class | | | (4.31 | )% | | | 3.10 | % | | | — | | | | 4.69 | % | | | 01/01/10 | |

Service Class | | | (3.98 | )% | | | 3.50 | % | | | — | | | | 5.09 | % | | | 01/01/10 | |

Institutional Class | | | (3.92 | )% | | | 3.61 | % | | | 3.01 | % | | | 5.81 | % | | | 11/18/88 | |

AMG FQ Global Risk-Balanced Fund

Composite Hedged Index11,12 | | | 3.87 | % | | | 6.84 | % | | | 4.41 | % | | | 5.78 | % | | | 11/30/88 | |

AMG FQ Global Risk-Balanced Fund

Composite Unhedged Index11,12 | | | (0.12 | )% | | | 5.47 | % | | | 5.34 | % | | | 6.63 | % | | | 11/30/88 | |

S&P 500 Index13 | | | 5.20 | % | | | 14.33 | % | | | 7.85 | % | | | 10.30 | % | | | 11/18/88 | † |

The performance data shown represents past performance. Past performance is not a guarantee of future results. Current performance may be lower or higher than the performance data quoted. The investment return and principal value of an investment in the Fund will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost.

Investors should carefully consider the Fund’s investment objectives, risks, charges and expenses before investing. For performance information through the most recent month end, current net asset values per share for the Fund and other information, please call (800) 835-3879 or visit our website at www.amgfunds.com for a free prospectus. Read it carefully before investing or sending money.

Distributed by AMG Distributors, Inc., member FINRA/SIPC.

| † | Date reflects inception date of the Fund, not the index. |

| 1 | Total return equals income yield plus share price change and assumes reinvestment of all dividends and capital gain distributions. Returns are net of fees and may reflect offsets of Fund expenses as described in the prospectus. No adjustment has been made for taxes payable by shareholders on their reinvested dividends and capital gain distributions. Returns for periods greater than one year are the average annual returns. The listed returns on the Fund are net of expenses and based on the published NAV as of October 31, 2015. All returns are in U.S. dollars ($). |

| 2 | From time to time, the Fund’s advisor has waived its fees and/or absorbed Fund expenses, which has resulted in higher returns. |

| 3 | Investments in foreign securities, even though publicly traded in the United States, may involve risks which are in addition to those inherent in domestic investments. |

| 4 | The use of leverage in a Fund’s strategy can magnify relatively small market movements into relatively larger losses for the Fund. |

| 5 | The Fund is subject to special risk considerations similar to those associated with the direct ownership of real estate. Real estate valuations may be subject to factors such as changing general and local economic, financial, competitive and environmental conditions. |

| 6 | Because the Fund invests in exchange traded funds (ETFs) which incur their own costs, investing in them could result in a higher cost to the investor. Additionally, the Fund will be indirectly exposed to all the risks of securities held by the ETFs. |

| 7 | Obligations of certain government agencies are not backed by the full faith and credit of the U.S. Government. If one of these agencies defaulted on a loan, there is no guarantee that the U.S. Government will provide financial support. Additionally, debt securities of the U.S. Government may be affected by changing interest rates and subject to prepayment risk. |

| 8 | The Fund is subject to risks associated with investments in small- and mid-capitalization companies, such as erratic earnings patterns, competitive conditions, limited earnings history, and a reliance on one or a limited number of products. |

| 9 | The Fund is subject to the risks associated with investments in debt securities, such as default risk and fluctuations in the perception of the debtor’s ability to pay its creditors. Changing interest rates may adversely affect the value of an investment. An increase in interest rates typically causes the value of bonds and other fixed-income securities to fall. |

17

AMG FQ Global Risk-Balanced Fund

Portfolio Manager’s Comments (continued)

CUMULATIVE TOTAL RETURN PERFORMANCE (continued)

| 10 | The Fund may invest in derivatives such as options and futures; the complexity and rapidly changing structure of derivatives markets may increase the possibility of market losses. |

| 11 | The Fund’s index is comprised of 60% MSCI World Index and 40% Citigroup World Government Index (Composite Index). The MSCI World Index is a free float-adjusted market capitalization weighted index that is designed to measure the equity market performance of developed and emerging markets. The MSCI World Index consists of 23 developed country indices. The Citigroup World Government Bond Index is a market capitalization weighted index consisting of the government bond markets. Country eligibility is determined based on market capitalization and investability criteria. All issues have a remaining maturity of at least one year. Unlike the Fund, the Composite Index is unmanaged, is not available for investment, and does not incur fees. All MSCI data is provided ’as is.’ The products described herein are not sponsored or endorsed and have not been reviewed or passed on by MSCI. In no event shall MSCI, its affiliates, or any MSCI data provider have any liability of any kind in connection with the MSCI data or the products described herein. Copying or redistributing the MSCI data is strictly prohibited. |

| 12 | The date reflects the closest available index date to the Fund’s inception date. |

| 13 | The S&P 500 Index is capitalization-weighted index of 500 stocks. The S&P 500 Index is designed to measure performance of the broad domestic economy through changes in the aggregate market value of 500 stocks representing all major industries. |

The S&P 500 Index is proprietary data of Standard & Poor’s, a division of McGraw-Hill Companies, Inc.

Not FDIC insured, nor bank guaranteed. May lose value.

18

AMG FQ Global Risk-Balanced Fund

Schedule of Portfolio Investments

October 31, 2015

| | | | | | | | |

| | | Shares | | | Value | |

Exchange Traded Funds—46.6% | | | | | | | | |

iShares Barclays TIPS Bond Fund4 | | | 123,196 | | | $ | 13,669,828 | |

iShares iBoxx $ Investment Grade Corporate Bond4 | | | 74,262 | | | | 8,645,582 | |

Jefferies TR/J CRB Global Commodity Equity Index Fund | | | 20,609 | | | | 657,841 | |

Market Vectors Gold Miners1 | | | 44,461 | | | | 665,137 | |

Market Vectors Natural Resources1 | | | 22,929 | | | | 672,278 | |

Materials Select Sector SPDR Fund1 | | | 15,412 | | | | 697,855 | |

SPDR DB International Government Inflation-Protected Bond4 | | | 62,563 | | | | 3,292,691 | |

Vanguard REIT4 | | | 37,831 | | | | 3,022,319 | |

Total Exchange Traded Funds

(cost $32,345,488) | | | | | | | 31,323,531 | |

| | |

| | | Notes | | | | |

Exchange Traded Notes—11.2% | | | | | | | | |

Barclays, Inc., iPath Bloomberg Agriculture Subindex Total Return, 10/22/37 | | | 20,148 | | | | 723,112 | |

Barclays, Inc., iPath Dow Jones-UBS Copper Subindex Total Return, 10/22/371 | | | 42,417 | | | | 1,149,501 | |

Barclays, Inc., iPath Dow Jones-UBS Grains Subindex Total Return, 10/22/37 | | | 20,323 | | | | 669,236 | |

Deutsche Bank AG, PowerShares DB Gold Double Long, 02/15/38 | | | 62,828 | | | | 1,333,210 | |

Goldman Sachs, Connect S&P GSCI Enhanced Commodity Index Total Return, 5/8/37 | | | 42,775 | | | | 1,021,039 | |

Swedish Export Credit Corp., ELEMENTS Linked to the Rogers International Commodity Index Total Return, 10/24/22 | | | 511,920 | | | | 2,677,342 | |

Total Exchange Traded Notes

(cost $10,301,886) | | | | | | | 7,573,440 | |

| | |

| | | Number of

Contracts | | | | |

Purchased Options—0.2% | | | | | | | | |

EURO STOXX 50 Puts, 2,850 Strike Price, Expiration 12/18/15 | | | 27 | | | | 1,871 | |

EURO STOXX 50 Puts, 2,900 Strike Price, Expiration 03/18/16 | | | 70 | | | | 31,252 | |

EURO STOXX 50 Puts, 2,900 Strike Price, Expiration 12/18/15 | | | 40 | | | | 3,475 | |

EURO STOXX 50 Puts, 2,975 Strike Price, Expiration 12/18/15 | | | 1 | | | | 124 | |

EURO STOXX 50 Puts, 3,000 Strike Price, Expiration 11/20/15 | | | 67 | | | | 1,768 | |

S&P 500 Puts, 1,825 Strike Price, Expiration 12/19/15 | | | 49 | | | | 22,785 | |

S&P 500 Puts, 1,875 Strike Price, Expiration 11/20/15 | | | 50 | | | | 8,250 | |

S&P 500 Puts, 1,885 Strike Price, Expiration 01/15/16 | | | 49 | | | | 68,600 | |

S&P 500 Puts, 1,910 Strike Price, Expiration 12/19/15 | | | 1 | | | | 960 | |

Total Purchased Options

(cost $729,628) | | | | | | | 139,085 | |

| | |

| | | Principal Amount | | | | |

U.S. Government Obligations—13.4% | | | | | | | | |

United States Treasury Bills, 0.003%, 11/27/155,6 (cost $8,999,448) | | $ | 9,000,000 | | | | 8,999,910 | |

Short-Term Investments—30.8% | | | | | | | | |

Repurchase Agreements—1.3%2 | | | | | | | | |

Nomura Securities International Inc., dated 10/30/15, due 11/02/15, 0.080%, total to be received $888,407 (collateralized by various U.S. Government Agency Obligations, 0.000%—10.500%, 11/04/15—09/20/65,totaling $906,169) | | | 888,401 | | | | 888,401 | |

The accompanying notes are an integral part of these financial statements.

19

AMG FQ Global Risk-Balanced Fund

Schedule of Portfolio Investments (continued)

| | | | | | | | |

| | | Shares | | | Value | |

Other Investment Companies—29.5%3 | | | | | | | | |

Dreyfus Cash Management Fund, Institutional Class Shares, 0.05% | | | 5,891,000 | | | $ | 5,891,000 | |

Dreyfus Institutional Cash Advantage Fund, Institutional Class Shares, 0.09% | | | 5,262,814 | | | | 5,262,814 | |

JPMorgan Liquid Assets Money Market Fund, Capital Shares, 0.12% | | | 4,351,113 | | | | 4,351,113 | |

JPMorgan Prime Money Market Fund, Capital Shares, 0.11% | | | 4,300,840 | | | | 4,300,840 | |

Total Other Investment Companies | | | | | | | 19,805,767 | |

Total Short-Term Investments

(cost $20,694,168) | | | | | | | 20,694,168 | |

Total Investments—102.2%

(cost $73,070,618) | | | | | | | 68,730,134 | |

Other Assets, less Liabilities—(2.2)% | | | | | | | (1,509,367 | ) |

Net Assets—100.0% | | | | | | $ | 67,220,767 | |

The accompanying notes are an integral part of these financial statements.

20

Notes to Schedule of Portfolio Investments

The following footnotes should be read in conjunction with each of the Schedules of Portfolio Investments previously presented in this report.

At October 31, 2015, the approximate cost of investments for federal income tax purposes and the aggregate gross unrealized appreciation and depreciation based on tax cost were as follows:

| | | | | | | | | | | | | | | | |

| Fund | | Cost | | | Appreciation | | | Depreciation | | | Net | |

AMG FQ Tax-Managed U.S. Equity Fund | | $ | 65,083,447 | | | $ | 20,663,730 | | | $ | (1,955,406 | ) | | $ | 18,708,324 | |

AMG FQ U.S. Equity Fund | | | 65,671,175 | | | | 6,890,197 | | | | (3,053,340 | ) | | | 3,836,857 | |

AMG FQ Global Risk-Balanced Fund | | | 74,613,849 | | | | 311,452 | | | | (6,195,167 | ) | | | (5,883,715 | ) |

| * | Non-income producing security. |

| 1 | Some or all of these shares were out on loan to various brokers as of October 31, 2015, amounting to the following: |

| | | | | | | | |

| Fund | | Market Value | | | % of Net Assets | |

AMG FQ Tax-Managed U.S. Equity Fund | | $ | 2,500,165 | | | | 3.1 | % |

AMG FQ U.S. Equity Fund | | | 1,454,130 | | | | 2.2 | % |

AMG FQ Global Risk-Balanced Fund | | | 867,248 | | | | 1.3 | % |

| 2 | Collateral received from brokers for securities lending was invested in these joint repurchase agreements. |

| 3 | Yield shown represents the October 31, 2015, seven-day average yield, which refers to the sum of the previous seven days’ dividends paid, expressed as an annual percentage. |

| 4 | Some or all of these securities were held as collateral for options written as of October 31, 2015, amounting to the following: |

| | | | | | | | |

| Fund | | Market Value | | | % of Net Assets | |

AMG FQ U.S. Equity Fund | | $ | 29,514,421 | | | | 43.8 | % |

AMG FQ Global Risk-Balanced Fund | | | 28,630,420 | | | | 42.6 | % |

| 5 | Represents effective yield at the time of purchase. |

| 6 | Some or all of these securities were held as collateral for futures contracts as of October 31, 2015, amounting to the following: |

| | | | | | | | |

| Fund | | Market Value | | | % of Net Assets | |

AMG FQ Global Risk-Balanced Fund | | $ | 8,999,910 | | | | 13.4 | % |

The following tables summarize the inputs used to value the Funds’ investments by the fair value hierarchy levels as of October 31, 2015: (See Note 1(a) in the Notes to Financial Statements.)

| | | | | | | | | | | | | | | | |

| | | Quoted Prices in Active Markets for

Identical

Investments

Level 1 | | | Significant Other

Observable