UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF

REGISTERED MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-06520

AMG Funds I

(Exact name of registrant as specified in charter)

800 Connecticut Avenue, Norwalk, Connecticut 06854

(Address of principal executive offices) (Zip code)

AMG Funds LLC

800 Connecticut Avenue, Norwalk, Connecticut 06854

(Name and address of agent for service)

Registrant’s telephone number, including area code: (203) 299-3500

Date of fiscal year end: OCTOBER 31

Date of reporting period: NOVEMBER 1, 2013 – OCTOBER 31, 2014

(Annual Shareholder Report)

Item 1. Reports to Shareholders

| | | | |

| | AMG Funds | | ANNUAL REPORT |

AMG Funds

October 31, 2014

| | |

| AMG FQ Tax-Managed U.S. Equity Fund | | |

| Investor Class: MFQAX | Institutional Class: MFQTX | | |

| |

| AMG FQ U.S. Equity Fund | | |

| Investor Class: FQUAX | Institutional Class: MEQFX | | |

| |

| AMG FQ Global Alternatives Fund | | |

| Investor Class: MGAAX | Service Class: MGASX | Institutional Class: MGAIX | | |

| |

| AMG FQ Global Risk-Balanced Fund | | |

| (formerly Managers AMG FQ Global Essentials Fund) | | |

| |

| Investor Class: MMAVX | Service Class: MMASX | Institutional Class: MMAFX | | |

| | |

| www.amgfunds.com | | | AR014-1014 |

AMG Funds

Annual Report—October 31, 2014

| | | | |

TABLE OF CONTENTS | | PAGE | |

LETTER TO SHAREHOLDERS | | | 2 | |

| |

ABOUT YOUR FUND’S EXPENSES | | | 3 | |

| |

PORTFOLIO MANAGER’S COMMENTS, FUND SNAPSHOTS, | | | | |

AND SCHEDULES OF PORTFOLIO INVESTMENTS | | | | |

| |

AMG FQ Tax-Managed U.S. Equity Fund | | | 4 | |

AMG FQ U.S. Equity Fund | | | 10 | |

AMG FQ Global Alternatives Fund | | | 16 | |

AMG FQ Global Risk-Balanced Fund | | | 19 | |

| |

NOTES TO SCHEDULES OF PORTFOLIO INVESTMENTS | | | 24 | |

| |

FINANCIAL STATEMENTS | | | | |

| |

Statement of Assets and Liabilities | | | 35 | |

Balance sheets, net asset value (NAV) per share computations and cumulative undistributed amounts | | | | |

| |

Statement of Operations | | | 37 | |

Detail of sources of income, expenses, and realized and unrealized gains (losses) during the fiscal year | | | | |

| |

Statements of Changes in Net Assets | | | 38 | |

Detail of changes in assets for the past two fiscal years | | | | |

| |

Financial Highlights | | | 40 | |

Historical net asset values per share, distributions, total returns, income and expense ratios, turnover ratios and net assets | | | | |

| |

Notes to Financial Highlights | | | 46 | |

| |

Notes to Financial Statements | | | 47 | |

Accounting and distribution policies, details of agreements and transactions with Fund management and affiliates, and descriptions of certain investment risks | | | | |

| |

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM | | | 58 | |

| |

TRUSTEES AND OFFICERS | | | 59 | |

| |

ANNUAL RENEWAL OF INVESTMENT MANAGEMENT AND SUBADVISORY AGREEMENTS | | | 61 | |

Nothing contained herein is to be considered an offer, sale or solicitation of an offer to buy shares of any series of the AMG Funds Family of mutual funds. Such offering is made only by Prospectus, which includes details as to offering price and other material information.

| | | | |

| | AMG Funds | | Letter to Shareholders |

DEAR SHAREHOLDER:

The fiscal year ended October 31, 2014 was another period of strong equity returns. The S&P 500 Index, a widely followed barometer of the U.S. equity market, rose more than 17% during the past 12 months. International stocks, by comparison, had flat performance, as measured by the MSCI ACWI ex USA Index (in U.S. Dollar terms). The first quarter of 2014 marked the five-year anniversary of the equity bull market. Despite a few bouts of volatility and persistent doubts about the strength of the economic recovery since the beginning of the bull market, the S&P 500 Index has a cumulative gain of 236% (including reinvestment of dividends) since the market bottom on March 9, 2009, through October 31, 2014.

Meanwhile, the Barclays U.S. Aggregate Bond Index, a broad U.S. bond market benchmark, returned 4% for the 12 months ended October 31. Bond markets have performed strongly during this period, to the surprise of many, despite the unwinding of the U.S. Federal Reserve’s bond-buying program known as QE3.

Earlier this year, Managers Investment Group rebranded as AMG Funds. Our new name helps align our fund family more closely with our parent company, Affiliated Managers Group (“AMG”). While the names of funds branded under AMG changed slightly, the ticker symbols remain the same. There was no change to the legal or ownership structure of the funds and the name change will have no impact on their management.

Our foremost goal at AMG Funds is to provide investment products and solutions that help our shareholders and clients successfully reach their long-term investment goals. We do this by partnering with many of AMG’s Affiliate investment boutiques to offer a distinctive array of actively managed, return-oriented funds. In addition, we oversee and distribute a number of complementary mutual funds sub-advised by unaffiliated investment managers. We thank you for your continued confidence and investment in AMG Funds. You can rest assured that, under all market conditions, our team is focused on delivering excellent investment management services for your benefit.

Respectfully,

Jeffery Cerutti

President

AMG Funds

| | | | | | | | | | | | | | |

Average Annual Total Returns | | Periods ended

October 31, 2014 | |

Stocks: | | | | 1 Year | | | 3 Years | | | 5 Years | |

Large Caps | | (S&P 500 Index) | | | 17.27 | % | | | 19.77 | % | | | 16.69 | % |

Small Caps | | (Russell 2000® Index) | | | 8.06 | % | | | 18.18 | % | | | 17.39 | % |

International | | (MSCI All Country World Index ex USA Index) | | | 0.06 | % | | | 7.76 | % | | | 6.09 | % |

Bonds: | | | | | | | | | | | | | | |

Investment Grade | | (Barclays U.S. Aggregate Bond Index) | | | 4.14 | % | | | 2.73 | % | | | 4.22 | % |

High Yield | | (Barclays U.S. High Yield Bond Index) | | | 5.82 | % | | | 9.39 | % | | | 10.44 | % |

Tax-exempt | | (Barclays Municipal Bond Index) | | | 7.82 | % | | | 4.93 | % | | | 5.26 | % |

Treasury Bills | | (BofAML U.S. Treasury Bill 6 Month Index) | | | 0.14 | % | | | 0.16 | % | | | 0.23 | % |

2

About Your Fund’s Expenses

As a shareholder of a Fund, you may incur two types of costs: (1) transaction costs, which may include sales charges (loads) on purchase payments; redemption fees; and exchange fees; and (2) ongoing costs, including management fees; distribution (12b-1) fees; and other Fund expenses. This example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds. The example is based on $1,000 invested at the beginning of the period and held for the entire period as indicated below.

ACTUAL EXPENSES

The first line of the following table provides information about the actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

HYPOTHETICAL EXAMPLE FOR COMPARISON PURPOSES

The second line of the following table provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed annual rate of return of 5% before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds by comparing this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as sales charges (loads), redemption fees, or exchange fees. Therefore, the second line of the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds.

| | | | | | | | | | | | | | | | |

| Six Months Ended October 31, 2014 | | Expense

Ratio for

the Period | | | Beginning

Account Value

5/01/14 | | | Ending

Account Value

10/31/14 | | | Expenses

Paid During

the Period* | |

AMG FQ Tax-Managed U.S. Equity Fund | | | | | | | | | | | | | | | | |

Investor Class Shares | | | | | | | | | | | | | | | | |

Based on Actual Fund Return | | | 1.24 | % | | $ | 1,000 | | | $ | 1,069 | | | $ | 6.47 | |

Hypothetical (5% return before expenses) | | | 1.24 | % | | $ | 1,000 | | | $ | 1,019 | | | $ | 6.31 | |

Institutional Class Shares | | | | | | | | | | | | | | | | |

Based on Actual Fund Return | | | 0.99 | % | | $ | 1,000 | | | $ | 1,070 | | | $ | 5.17 | |

Hypothetical (5% return before expenses) | | | 0.99 | % | | $ | 1,000 | | | $ | 1,020 | | | $ | 5.04 | |

AMG FQ U.S. Equity Fund | | | | | | | | | | | | | | | | |

Investor Class Shares | | | | | | | | | | | | | | | | |

Based on Actual Fund Return | | | 1.04 | % | | $ | 1,000 | | | $ | 1,054 | | | $ | 5.38 | |

Hypothetical (5% return before expenses) | | | 1.04 | % | | $ | 1,000 | | | $ | 1,020 | | | $ | 5.30 | |

Institutional Class Shares | | | | | | | | | | | | | | | | |

Based on Actual Fund Return | | | 0.79 | % | | $ | 1,000 | | | $ | 1,056 | | | $ | 4.09 | |

Hypothetical (5% return before expenses) | | | 0.79 | % | | $ | 1,000 | | | $ | 1,021 | | | $ | 4.02 | |

AMG FQ Global Alternatives Fund | | | | | | | | | | | | | | | | |

Investor Class Shares | | | | | | | | | | | | | | | | |

Based on Actual Fund Return | | | 1.89 | % | | $ | 1,000 | | | $ | 1,000 | | | $ | 9.53 | |

Hypothetical (5% return before expenses) | | | 1.89 | % | | $ | 1,000 | | | $ | 1,016 | | | $ | 9.60 | |

Service Class Shares | | | | | | | | | | | | | | | | |

Based on Actual Fund Return | | | 1.58 | % | | $ | 1,000 | | | $ | 1,001 | | | $ | 7.97 | |

Hypothetical (5% return before expenses) | | | 1.58 | % | | $ | 1,000 | | | $ | 1,017 | | | $ | 8.03 | |

Institutional Class Shares | | | | | | | | | | | | | | | | |

Based on Actual Fund Return | | | 1.44 | % | | $ | 1,000 | | | $ | 1,002 | | | $ | 7.27 | |

Hypothetical (5% return before expenses) | | | 1.44 | % | | $ | 1,000 | | | $ | 1,017 | | | $ | 7.32 | |

AMG FQ Global Risk-Balanced Fund | | | | | | | | | | | | | | | | |

Investor Class Shares | | | | | | | | | | | | | | | | |

Based on Actual Fund Return | | | 1.39 | % | | $ | 1,000 | | | $ | 1,012 | | | $ | 7.05 | |

Hypothetical (5% return before expenses) | | | 1.39 | % | | $ | 1,000 | | | $ | 1,018 | | | $ | 7.07 | |

Service Class Shares | | | | | | | | | | | | | | | | |

Based on Actual Fund Return | | | 1.02 | % | | $ | 1,000 | | | $ | 1,015 | | | $ | 5.18 | |

Hypothetical (5% return before expenses) | | | 1.02 | % | | $ | 1,000 | | | $ | 1,020 | | | $ | 5.19 | |

Institutional Class Shares | | | | | | | | | | | | | | | | |

Based on Actual Fund Return | | | 0.89 | % | | $ | 1,000 | | | $ | 1,015 | | | $ | 4.52 | |

Hypothetical (5% return before expenses) | | | 0.89 | % | | $ | 1,000 | | | $ | 1,021 | | | $ | 4.53 | |

| * | Expenses are equal to the Fund’s annualized expense ratio multiplied by the average account value over the period, multiplied by the number of days in the most recent fiscal half-year (184), then divided by 365. |

3

AMG FQ Tax-Managed U.S. Equity Fund

Portfolio Manager’s Comments

For the fiscal year ended October 31, 2014, the AMG FQ Tax-Managed U.S. Equity Fund (Institutional Class) returned 18.16%, compared to 16.07% for its benchmark, the Russell 3000®Index. Please refer to the table on page 5 or returns for various classes of shares.

U.S. equities continued their multi-year rally over the prior fiscal year as the equity bull market hit its fifth birthday with new market highs hit seemingly on a daily basis. Even periods of fear and pessimism, as experienced during late September and early October, were quickly erased with equities retracing losses. The impact of low short-and long-term interest rates continued to have their desired impact on risk-based assets, such as U.S. equities, although the U.S. Federal Reserve did end their explicit efforts to hold down long-term rates by winding down their quantitative easing program in October. For the entire one-year period ended October 31, 2014, larger-cap equities generally outperformed their smaller-cap brethren, with the Russell 1000® (large cap), Russell 2000® (small cap), Russell 3000® (all cap) and the Russell Microcap® indices returning 16.8%, 8.1%, 16.1%, and 7.3%, respectively.

The Fund delivered positive absolute returns for the prior fiscal year while outperforming the

benchmark Russell 3000® Index. Stock selection added value during the year, with gains primarily concentrated in the consumer discretionary, consumer staples and industrials sectors. Meanwhile, sector positioning relative to the benchmark was close to neutral throughout the year, consistent with the Fund’s investment process and, therefore, failed to add or detract significant value. Exposure to top-down factors offered mixed results relative to the benchmark throughout the year as well.

The Fund’s subadvisor, First Quadrant, L.P. (“First Quadrant”) maintains neutral positioning on both market capitalization and valuation entering the new fiscal year. The outlook for price momentum is more favorable than usual, however, and the Fund has an above average exposure. At the sector level, the Fund maintains modest overweights to the industrials and information technology sectors relative to the benchmark Russell 3000® Index but enters the new fiscal year with sector weightings broadly in-line with the benchmark. As a tax advantaged fund, the portfolio is managed to seek positive pre-tax and after-tax alpha. For this reason, First Quadrant employs tax-aware optimization which uses losses to offset gains as the portfolio is repositioned. Currently, most of the portfolio is locked up in gains; however, the Fund

continues to maintain a tax loss carry-forward, all of which is currently scheduled to expire in 2017.

This commentary reflects the viewpoints of the portfolio manager, First Quadrant, L.P., as of October 31, 2014 and is not intended as a forecast or guarantee of future results, and is subject to change without notice.

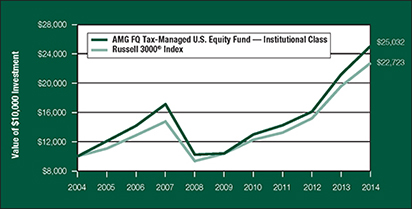

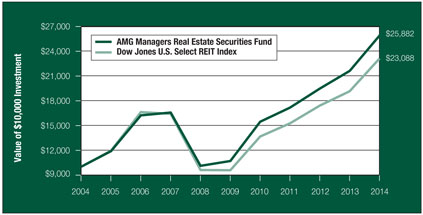

CUMULATIVE TOTAL RETURN PERFORMANCE

AMG FQ Tax-Managed U.S. Equity Fund’s cumulative total return is based on the daily change in net asset value (NAV), and assumes that all distributions were reinvested. This graph compares a hypothetical $10,000 investment made in the Institutional Class Shares of the Fund on October 31, 2004 with a $10,000 investment made in the Russell 3000® Index for the same time period. Performance for periods longer than one year is annualized. The graph and table do not reflect the deduction of taxes that a shareholder would pay on a Fund distribution or redemption of shares. The listed returns for the Fund are net of expenses and the returns for the index exclude expenses. Total returns would have been lower had certain expenses not been reduced.

4

AMG FQ Tax-Managed U.S. Equity Fund

Portfolio Manager’s Comments (continued)

CUMULATIVE TOTAL RETURN PERFORMANCE (continued)

The table below shows the average annual total returns for the AMG FQ Tax-Managed U.S. Equity Fund and the Russell 3000® Index for the same time periods ended October 31, 2014.

| | | | | | | | | | | | | | | | | | | | |

| Average Annual Total Returns1 | | One

Year | | | Five

Years | | | Ten

Years | | | Since

Inception | | | Inception

Date | |

AMG FQ Tax-Managed U.S. Equity Fund2,3 | | | | | |

Investor Class | | | 17.91 | % | | | 18.93 | % | | | — | | | | 7.42 | % | | | 03/01/06 | |

Institutional Class | | | 18.16 | % | | | 19.24 | % | | | 9.61 | % | | | 6.89 | % | | | 12/18/00 | |

Russell 3000® Index4 | | | 16.07 | % | | | 17.01 | % | | | 8.55 | % | | | 5.63 | % | | | 12/18/00 | † |

Return After Taxes on Distributions:5 | | | | | | | | | |

Investor Class | | | 17.88 | % | | | 18.89 | % | | | — | | | | 7.37 | % | | | 03/01/06 | |

Institutional Class | | | 18.07 | % | | | 19.15 | % | | | 9.51 | % | | | 6.80 | % | | | 12/18/00 | |

Return After Taxes on Distributions & Sale of Fund Shares:5 | | | | | |

Investor Class | | | 10.16 | % | | | 15.46 | % | | | — | | | | 5.98 | % | | | 03/01/06 | |

Institutional Class | | | 10.34 | % | | | 15.71 | % | | | 7.92 | % | | | 5.67 | % | | | 12/18/00 | |

The performance data shown represents past performance. Past performance is not a guarantee of future results. Current performance may be lower or higher than the performance data quoted. The investment return and principal value of an investment in the Fund will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost.

Investors should carefully consider the Fund’s investment objectives, risks, charges, and expenses before investing. For performance information through the most recent month end, current net asset per share for the Fund and other information, please call (800) 835-3879 or visit our website at www.amgfunds.com for a free prospectus. Read it carefully before investing or sending money.

Distributed by AMG Distributors, Inc., member FINRA.

| † | Date reflects the inception date of the Fund, not the index. |

| 1 | Total return equals income yield plus share price change and assumes reinvestment of all dividends and capital gain distributions. Returns are net of fees and may reflect offsets of Fund expenses as described in the prospectus. No adjustment has been made for taxes payable by shareholders on their reinvested dividends and capital gain distributions. Returns for periods greater than one year are the average annual returns. The listed returns on the Fund are net of expenses and based on the published NAV as of October 31, 2014. All returns are in U.S. dollars ($). |

| 2 | From time to time, the Fund’s advisor has waived its fees and/or absorbed Fund expenses, which has resulted in higher returns. |

| 3 | The Fund invests in large-capitalization companies that may underperform other stock funds (such as funds that focus on small and medium capitalization companies) when stocks of large-capitalization companies are out of favor. Although the Fund is managed to minimize taxable distributions, it may not be able to avoid taxable distributions. |

| 4 | The Russell 3000® Index is composed of the 3,000 largest U.S. companies as measured by market capitalization, and represents approximately 98% of the U.S. stock market. Unlike the Fund, the Russell 3000® Index is unmanaged, is not available for investment, and does not incur expenses. |

| 5 | After-tax returns are calculated using the historical highest individual federal marginal income tax rates and do not reflect the impact of state and local taxes. Actual after-tax returns depend on an investor’s tax situation and may differ from those shown, and after-tax returns are not relevant to investors who hold their Fund shares through tax-deferred arrangements, such as 401(k) plans or individual retirement accounts. |

The Russell 3000® Index is a trademark of Russell Investments. Russell is a trademark of Russell Investments.

Not FDIC insured, nor bank guaranteed. May lose value.

5

AMG FQ Tax-Managed U.S. Equity Fund

Fund Snapshots (unaudited)

October 31, 2014

PORTFOLIO BREAKDOWN

| | | | | | | | |

Sector | | AMG FQ

Tax-Managed

U.S. Equity

Fund** | | | Russell 3000®

Index | |

Information Technology | | | 21.2 | % | | | 18.8 | % |

Financials | | | 14.4 | % | | | 17.7 | % |

Health Care | | | 14.1 | % | | | 14.0 | % |

Industrials | | | 12.2 | % | | | 11.3 | % |

Consumer Discretionary | | | 11.7 | % | | | 12.3 | % |

Energy | | | 8.8 | % | | | 8.4 | % |

Consumer Staples | | | 7.5 | % | | | 8.4 | % |

Materials | | | 3.5 | % | | | 3.7 | % |

Telecommunication Services | | | 2.7 | % | | | 2.2 | % |

Utilities | | | 1.8 | % | | | 3.2 | % |

Other Assets and Liabilities | | | 2.1 | % | | | 0.0 | % |

| ** | As a percentage of net assets. |

TOP TEN HOLDINGS

| | | | |

Security Name | | % of Net Assets | |

Apple, Inc.* | | | 3.7 | % |

Exxon Mobil Corp.* | | | 2.3 | |

Berkshire Hathaway, Inc., Class B* | | | 2.3 | |

Visa, Inc., Class A* | | | 2.1 | |

MasterCard, Inc., Class A* | | | 2.1 | |

DIRECTV* | | | 2.0 | |

Alaska Air Group, Inc.* | | | 1.9 | |

Chevron Corp.* | | | 1.8 | |

International Business Machines Corp.* | | | 1.8 | |

Pfizer, Inc. | | | 1.7 | |

| | | | |

Top Ten as a Group | | | 21.7 | % |

| | | | |

| * | Top Ten Holding at April 30, 2014. |

Because a fund’s strategy may result in multiple investments in particular sectors of the economy, its performance may depend on the performance of those sectors and may fluctuate more widely than investments diversified across more sectors. For additional information on these and other risk considerations, please see the Fund’s prospectus.

Any sectors, industries, or securities discussed should not be perceived as investment recommendations. Mention of a specific security should not be considered a recommendation to buy or solicitation to sell that security. Specific securities mentioned in this report may have been sold from the Fund’s portfolio of investments by the time you receive this report.

6

AMG FQ Tax-Managed U.S. Equity Fund

Schedule of Portfolio Investments

October 31, 2014

| | | | | | | | |

| | | Shares | | | Value | |

Common Stocks - 97.9% | | | | | | | | |

Consumer Discretionary - 11.7% | | | | | | | | |

1-800-Flowers.com, Inc., Class A* | | | 9,500 | | | $ | 76,285 | |

Bed Bath & Beyond, Inc.* | | | 3,400 | | | | 228,956 | |

Cablevision Systems Corp., Class A1 | | | 2,200 | | | | 40,964 | |

Dillard’s, Inc., Class A | | | 8,900 | | | | 941,264 | |

DIRECTV* | | | 14,800 | | | | 1,284,492 | |

Discovery Communications, Inc., Class A* | | | 1,400 | | | | 49,490 | |

Discovery Communications, Inc., Class C* | | | 1,400 | | | | 48,986 | |

The Gap, Inc. | | | 14,000 | | | | 530,460 | |

Jack in the Box, Inc. | | | 12,200 | | | | 866,688 | |

Lowe’s Cos., Inc. | | | 7,000 | | | | 400,400 | |

Macy’s, Inc. | | | 11,300 | | | | 653,366 | |

Marriott Vacations Worldwide Corp. | | | 9,100 | | | | 631,904 | |

Thor Industries, Inc. | | | 5,900 | | | | 312,051 | |

The TJX Cos., Inc. | | | 11,600 | | | | 734,512 | |

Twenty-First Century Fox, Inc., Class A | | | 1,000 | | | | 34,480 | |

Visteon Corp.* | | | 900 | | | | 84,510 | |

Wyndham Worldwide Corp. | | | 6,100 | | | | 473,787 | |

Total Consumer Discretionary | | | | | | | 7,392,595 | |

Consumer Staples - 7.5% | | | | | | | | |

Archer-Daniels-Midland Co. | | | 6,300 | | | | 296,100 | |

Cal-Maine Foods, Inc. | | | 2,900 | | | | 254,591 | |

Central Garden and Pet Co., Class A* | | | 17,000 | | | | 146,030 | |

CVS Health Corp. | | | 9,200 | | | | 789,452 | |

Dr Pepper Snapple Group, Inc. | | | 600 | | | | 41,550 | |

PepsiCo, Inc. | | | 2,300 | | | | 221,191 | |

Pilgrim’s Pride Corp.*,1 | | | 35,800 | | | | 1,017,078 | |

The Procter & Gamble Co. | | | 3,100 | | | | 270,537 | |

Sanderson Farms, Inc.1 | | | 6,400 | | | | 537,472 | |

Tyson Foods, Inc., Class A | | | 16,200 | | | | 653,670 | |

Wal-Mart Stores, Inc. | | | 6,500 | | | | 495,755 | |

Total Consumer Staples | | | | | | | 4,723,426 | |

Energy - 8.8% | | | | | | | | |

Adams Resources & Energy, Inc. | | | 1,000 | | | | 42,050 | |

Chevron Corp. | | | 9,400 | | | | 1,127,530 | |

ConocoPhillips | | | 10,800 | | | | 779,220 | |

Exxon Mobil Corp. | | | 15,200 | | | | 1,469,992 | |

Kosmos Energy, Ltd.* | | | 3,500 | | | | 32,655 | |

Marathon Petroleum Corp. | | | 6,200 | | | | 563,580 | |

Occidental Petroleum Corp. | | | 3,500 | | | | 311,255 | |

| | | | | | | | |

| | | Shares | | | Value | |

Phillips 66 | | | 4,600 | | | $ | 361,100 | |

REX American Resources Corp.* | | | 5,700 | | | | 414,732 | |

Schlumberger, Ltd. | | | 2,900 | | | | 286,114 | |

VAALCO Energy, Inc.* | | | 24,400 | | | | 181,048 | |

Total Energy | | | | | | | 5,569,276 | |

Financials - 14.4% | | | | | | | | |

American Financial Group, Inc. | | | 1,800 | | | | 107,694 | |

American International Group, Inc. | | | 4,900 | | | | 262,493 | |

American Tower Corp. | | | 800 | | | | 78,000 | |

Arch Capital Group, Ltd.* | | | 11,700 | | | | 658,944 | |

Aspen Insurance Holdings, Ltd. | | | 1,200 | | | | 52,356 | |

Bank of America Corp. | | | 22,500 | | | | 386,100 | |

Berkshire Hathaway, Inc., Class A* | | | 1 | | | | 210,000 | |

Berkshire Hathaway, Inc., Class B* | | | 10,287 | | | | 1,441,826 | |

BOK Financial Corp. | | | 2,400 | | | | 164,544 | |

The Chubb Corp. | | | 2,200 | | | | 218,592 | |

Citigroup, Inc. | | | 3,600 | | | | 192,708 | |

Crawford & Co., Class B | | | 6,000 | | | | 61,080 | |

Discover Financial Services | | | 10,500 | | | | 669,690 | |

Everest Re Group, Ltd. | | | 3,300 | | | | 563,145 | |

FelCor Lodging Trust, Inc. | | | 7,300 | | | | 78,329 | |

First Bancorp | | | 1,900 | | | | 34,428 | |

First Interstate BancSystem, Inc., Class A | | | 6,700 | | | | 196,578 | |

Franklin Resources, Inc. | | | 1,800 | | | | 100,098 | |

GAMCO Investors, Inc., Class A | | | 7,000 | | | | 578,340 | |

JPMorgan Chase & Co. | | | 4,600 | | | | 278,208 | |

KeyCorp | | | 25,800 | | | | 340,560 | |

MidSouth Bancorp, Inc. | | | 1,800 | | | | 34,092 | |

Montpelier Re Holdings, Ltd. | | | 4,400 | | | | 145,816 | |

Morgan Stanley | | | 18,900 | | | | 660,555 | |

OFG Bancorp | | | 4,100 | | | | 63,837 | |

The PNC Financial Services Group, Inc. | | | 800 | | | | 69,112 | |

PrivateBancorp, Inc. | | | 15,300 | | | | 494,496 | |

Pzena Investment Management, Inc., Class A | | | 7,300 | | | | 73,365 | |

SunTrust Banks, Inc. | | | 15,800 | | | | 618,412 | |

The Travelers Cos., Inc. | | | 1,000 | | | | 100,800 | |

Wells Fargo & Co. | | | 3,400 | | | | 180,506 | |

Total Financials | | | | | | | 9,114,704 | |

Health Care - 14.1% | | | | | | | | |

Alliance HealthCare Services, Inc.* | | | 3,500 | | | | 84,455 | |

The accompanying notes are an integral part of these financial statements.

7

AMG FQ Tax-Managed U.S. Equity Fund

Schedule of Portfolio Investments (continued)

| | | | | | | | |

| | | Shares | | | Value | |

Health Care - 14.1% (continued) | | | | | | | | |

Amgen, Inc. | | | 6,300 | | | $ | 1,021,734 | |

Anika Therapeutics, Inc.* | | | 9,800 | | | | 393,372 | |

Atrion Corp. | | | 251 | | | | 82,833 | |

Becton, Dickinson and Co. | | | 1,800 | | | | 231,660 | |

Biogen Idec, Inc.* | | | 2,430 | | | | 780,224 | |

CareFusion Corp.* | | | 13,900 | | | | 797,443 | |

Depomed, Inc.* | | | 3,400 | | | | 52,360 | |

Edwards Lifesciences Corp.* | | | 2,500 | | | | 302,300 | |

Exactech, Inc.* | | | 4,000 | | | | 85,200 | |

Gilead Sciences, Inc.* | | | 1,800 | | | | 201,600 | |

HealthSouth Corp. | | | 900 | | | | 36,297 | |

Humana, Inc. | | | 1,800 | | | | 249,930 | |

Johnson & Johnson | | | 4,600 | | | | 495,788 | |

Lannett Co., Inc.* | | | 8,900 | | | | 504,808 | |

McKesson Corp. | | | 1,600 | | | | 325,456 | |

Medtronic, Inc. | | | 1,500 | | | | 102,240 | |

Merck & Co., Inc. | | | 700 | | | | 40,558 | |

PAREXEL International Corp.* | | | 2,500 | | | | 135,775 | |

Pfizer, Inc. | | | 36,700 | | | | 1,099,165 | |

SurModics, Inc.* | | | 13,600 | | | | 294,440 | |

UnitedHealth Group, Inc. | | | 10,100 | | | | 959,601 | |

Universal Health Services, Inc., Class B | | | 5,800 | | | | 601,518 | |

WellPoint, Inc. | | | 300 | | | | 38,007 | |

Total Health Care | | | | | | | 8,916,764 | |

Industrials - 12.2% | | | | | | | | |

Alaska Air Group, Inc. | | | 22,400 | | | | 1,192,352 | |

AMERCO | | | 1,400 | | | | 379,568 | |

Argan, Inc. | | | 1,800 | | | | 62,658 | |

Delta Air Lines, Inc. | | | 20,650 | | | | 830,749 | |

Deluxe Corp. | | | 10,300 | | | | 626,240 | |

FedEx Corp. | | | 700 | | | | 117,180 | |

General Dynamics Corp. | | | 5,900 | | | | 824,584 | |

General Electric Co. | | | 16,800 | | | | 433,608 | |

Huntington Ingalls Industries, Inc. | | | 5,900 | | | | 624,338 | |

Kimball International, Inc., Class B | | | 4,300 | | | | 77,314 | |

Multi-Color Corp. | | | 900 | | | | 44,370 | |

Oshkosh Corp. | | | 1,700 | | | | 76,092 | |

Southwest Airlines Co. | | | 4,500 | | | | 155,160 | |

Teledyne Technologies, Inc.* | | | 4,700 | | | | 487,061 | |

UniFirst Corp. | | | 5,000 | | | | 557,800 | |

| | | | | | | | |

| | | Shares | | | Value | |

Union Pacific Corp. | | | 7,600 | | | $ | 885,020 | |

United Technologies Corp. | | | 1,400 | | | | 149,800 | |

VSE Corp. | | | 3,100 | | | | 186,868 | |

Total Industrials | | | | | | | 7,710,762 | |

Information Technology - 21.2% | | | | | | | | |

Advanced Energy Industries, Inc.* | | | 2,700 | | | | 53,406 | |

Apple, Inc. | | | 21,641 | | | | 2,337,228 | |

Aspen Technology, Inc.* | | | 13,200 | | | | 487,476 | |

Benchmark Electronics, Inc.* | | | 17,000 | | | | 403,240 | |

Brocade Communications Systems, Inc. | | | 26,600 | | | | 285,418 | |

Cisco Systems, Inc. | | | 6,300 | | | | 154,161 | |

EMC Corp. | | | 2,800 | | | | 80,444 | |

Google, Inc., Class A* | | | 301 | | | | 170,929 | |

Google, Inc., Class C* | | | 301 | | | | 168,283 | |

Harris Corp. | | | 600 | | | | 41,760 | |

Hewlett-Packard Co. | | | 22,500 | | | | 807,300 | |

Insight Enterprises, Inc.* | | | 8,400 | | | | 191,100 | |

International Business Machines Corp. | | | 6,800 | | | | 1,117,920 | |

Lattice Semiconductor Corp.* | | | 14,600 | | | | 97,966 | |

MasterCard, Inc., Class A | | | 15,580 | | | | 1,304,825 | |

Microsoft Corp. | | | 22,700 | | | | 1,065,765 | |

NetScout Systems, Inc.* | | | 4,400 | | | | 162,184 | |

Oracle Corp. | | | 24,900 | | | | 972,345 | |

PC Connection, Inc. | | | 6,900 | | | | 164,565 | |

Progress Software Corp.* | | | 2,200 | | | | 56,980 | |

QUALCOMM, Inc. | | | 7,300 | | | | 573,123 | |

Sanmina Corp.* | | | 2,200 | | | | 55,154 | |

Skyworks Solutions, Inc. | | | 10,400 | | | | 605,696 | |

VASCO Data Security International, Inc.* | | | 17,600 | | | | 445,632 | |

Visa, Inc., Class A | | | 5,600 | | | | 1,352,008 | |

Xerox Corp. | | | 20,900 | | | | 277,552 | |

Total Information Technology | | | | | | | 13,432,460 | |

Materials - 3.5% | | | | | | | | |

CF Industries Holdings, Inc. | | | 2,005 | | | | 521,300 | |

Graphic Packaging Holding Co.* | | | 25,300 | | | | 306,889 | |

KapStone Paper and Packaging Corp.* | | | 2,100 | | | | 64,596 | |

LyondellBasell Industries N.V., Class A | | | 8,100 | | | | 742,203 | |

United States Steel Corp.1 | | | 3,600 | | | | 144,144 | |

Westlake Chemical Corp. | | | 6,200 | | | | 437,410 | |

Total Materials | | | | | | | 2,216,542 | |

The accompanying notes are an integral part of these financial statements.

8

AMG FQ Tax-Managed U.S. Equity Fund

Schedule of Portfolio Investments (continued)

| | | | | | | | |

| | | Shares | | | Value | |

Telecommunication

Services - 2.7% | | | | | | | | |

AT&T, Inc. | | | 17,600 | | | $ | 613,184 | |

Cincinnati Bell, Inc.* | | | 121,000 | | | | 444,070 | |

Spok Holdings, Inc. | | | 4,000 | | | | 64,960 | |

T-Mobile US, Inc.* | | | 1,850 | | | | 54,001 | |

Verizon Communications, Inc. | | | 9,400 | | | | 472,350 | |

Windstream Holdings, Inc. | | | 5,700 | | | | 59,736 | |

Total Telecommunication Services | | | | | | | 1,708,301 | |

Utilities - 1.8% | | | | | | | | |

AES Corp. | | | 27,000 | | | | 379,890 | |

American Electric Power Co., Inc. | | | 4,400 | | | | 256,696 | |

Ormat Technologies, Inc. | | | 1,100 | | | | 31,845 | |

The Southern Co. | | | 9,100 | | | | 421,876 | |

UGI Corp. | | | 900 | | | | 33,921 | |

Total Utilities | | | | | | | 1,124,228 | |

Total Common Stocks

(cost $41,238,953) | | | | | | | 61,909,058 | |

| | | | | | | | |

| | | Principal Amount | | | Value | |

Short-Term Investments - 4.0% | | | | | | | | |

Repurchase

Agreements - 2.1%2 | | | | | | | | |

Cantor Fitzgerald Securities, Inc., dated 10/31/14, due 11/03/14, 0.130%, total to be received $1,000,011 (collateralized by various U.S. Government Agency Obligations, 0.000% - 10.500%, 01/01/15 - 09/20/64, totaling $1,020,000) | | $ | 1,000,000 | | | $ | 1,000,000 | |

Nomura Securities International, Inc., dated 10/31/14, due 11/03/14, 0.110%, total to be received $285,540 (collateralized by various U.S. Government Agency Obligations, 0.000% - 7.250%, 11/03/14 -11/01/44 totaling $291,248) | | | 285,537 | | | | 285,537 | |

Total Repurchase Agreements | | | | | | | 1,285,537 | |

| | |

| | | Shares | | | | |

Other Investment Companies - 1.9%3 | | | | | | | | |

Dreyfus Institutional Cash Advantage Fund, Institutional Class Shares, 0.06% | | | 1,204,064 | | | | 1,204,064 | |

Total Short-Term Investments

(cost $2,489,601) | | | | | | | 2,489,601 | |

Total Investments - 101.9%

(cost $43,728,554) | | | | | | | 64,398,659 | |

Other Assets, less

Liabilities - (1.9)% | | | | | | | (1,172,170 | ) |

Net Assets - 100.0% | | | | | | $ | 63,226,489 | |

The accompanying notes are an integral part of these financial statements.

9

AMG FQ U.S. Equity Fund

Portfolio Manager’s Comments

For the fiscal year ended October 31, 2014, the AMG FQ U.S. Equity Fund (Institutional Class) returned 14.05%, compared to 16.07% for its benchmark, the Russell 3000® Index. Please refer to the table on page 11 for returns for various classes of shares.

U.S. equities continued their multi-year rally over the prior fiscal year as the equity bull market hit its fifth birthday with new market highs hit seemingly on a daily basis. Even periods of fear and pessimism, as experienced during late September and early October, were quickly erased with equities retracing losses. The impact of low short-and long-term interest rates continued to have their desired impact on risk-based assets, such as U.S. equities, although the U.S. Federal Reserve did end their explicit efforts to hold down long-term rates by winding down their quantitative easing program in October. For the entire one-year period ended October 31, 2014, larger-cap equities generally outperformed their smaller-cap brethren with the Russell 1000® (large cap), Russell 2000® (small cap), Russell 3000® (all cap), and the Russell Microcap® indices returning 16.8%, 8.1%, 16.1%, and 7.3%, respectively.

The Fund delivered strong positive absolute returns for the prior fiscal year but trailed the

benchmark during this time. The Fund detracted value from both the equity-only portion of its portfolio as well as from its put-spread collar options (protection strategy) positions. Stock selection weakness within the health care and information technology sectors detracted from performance throughout the year, although the Fund did benefit from strong selection within the industrials sector. Meanwhile, sector positioning relative to the benchmark was close to neutral throughout the year, consistent with the Fund’s investment process and, therefore, failed to add or detract significant value. Exposure to top-down factors offered mixed results relative to the benchmark throughout the year. The Fund’s protection strategy, as expected, detracted from performance, as equity markets generally moved upward during this period.

The Fund’s subadvisor, First Quadrant, L.P. (“First Quadrant”) maintains neutral positioning on both market capitalization and valuation entering the new fiscal year. The outlook for price momentum is more favorable than usual, however, and the Fund has an above average exposure. At the sector level, the Fund maintains modest overweights to the financials and industrials sectors relative to the benchmark Russell 3000® Index, but enters the

new fiscal year with sector weightings broadly in-line with the benchmark.

This commentary reflects the viewpoints of the portfolio manager, First Quadrant, L.P., as of October 31, 2014 and is not intended as a forecast or guarantee of future results, and is subject to change without notice.

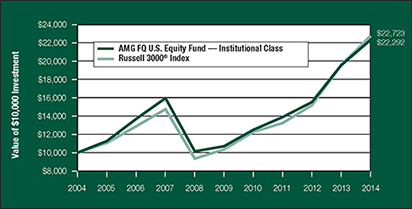

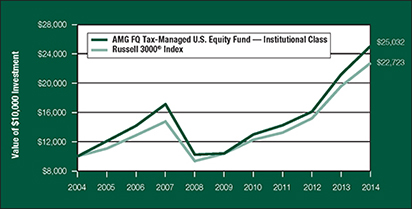

CUMULATIVE TOTAL RETURN PERFORMANCE

AMG FQ U.S. Equity Fund’s cumulative total return is based on the daily change in net asset value (NAV), and assumes that all distributions were reinvested. This graph compares a hypothetical $10,000 investment made in the Institutional Class Shares of the Fund on October 31, 2004 with a $10,000 investment made in the Russell 3000® Index for the same time period. Performance for periods longer than one year is annualized. The graph and table do not reflect the deduction of taxes that a shareholder would pay on a Fund distribution or redemption of shares. The listed returns for the Fund are net of expenses and the returns for the index exclude expenses. Total returns would have been lower had certain expenses not been reduced.

10

AMG FQ U.S. Equity Fund

Portfolio Manager’s Comments (continued)

CUMULATIVE TOTAL RETURN PERFORMANCE (continued)

The table below shows the average annual total returns for the AMG FQ U.S. Equity Fund and the Russell 3000® Index for the same time periods ended October 31, 2014.

| | | | | | | | | | | | | | | | | | | | |

| Average Annual Total Returns1 | | One

Year | | | Five

Years | | | Ten

Years | | | Since

Inception | | | Inception

Date | |

AMG FQ U.S. Equity Fund2,3 | | | | | | | | | | | | | | | | | | | | |

Investor Class | | | 13.76 | % | | | 15.52 | % | | | — | | | | 6.69 | % | | | 03/01/06 | |

Institutional Class | | | 14.05 | % | | | 15.82 | % | | | 8.35 | % | | | 8.46 | % | | | 08/14/92 | |

Russell 3000® Index4,5 | | | 16.07 | % | | | 17.01 | % | | | 8.55 | % | | | 9.65 | % | | | 08/14/92 | |

The performance data shown represents past performance. Past performance is not a guarantee of future results. Current performance may be lower or higher than the performance data quoted. The investment return and principal value of an investment in the Fund will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost.

Investors should carefully consider the Fund’s investment objectives, risks, charges and expenses before investing. For performance information through the most recent month end, current net asset values per share for the Fund and other information, please call (800) 835-3879 or visit our website at www.amgfunds.com for a free prospectus. Read it carefully before investing or sending money.

Distributed by AMG Distributors, Inc., member FINRA.

| 1 | Total return equals income yield plus share price change and assumes reinvestment of all dividends and capital gain distributions. Returns are net of fees and may reflect offsets of Fund expenses as described in the prospectus. No adjustment has been made for taxes payable by shareholders on their reinvested dividends and capital gain distributions. Returns for periods greater than one year are the average annual returns. The listed returns on the Fund are net of expenses and based on the published NAV as of October 31, 2014. All returns are in U.S. dollars ($). |

| 2 | From time to time, the Fund’s advisor has waived its fees and/or absorbed Fund expenses, which has resulted in higher returns. |

| 3 | The Fund invests in large-capitalization companies that may underperform other stock funds (such as funds that focus on small and medium capitalization companies) when stocks of large-capitalization companies are out of favor. Also, the Fund may invest in derivatives; the complexity and rapidly changing structure of derivatives markets may increase the possibility of market losses. |

| 4 | The Russell 3000® Index is composed of the 3,000 largest U.S. companies as measured by market capitalization, and represents approximately 98% of the U.S. stock market. Unlike the Fund, the Russell 3000® Index is unmanaged, is not available for investment, and does not incur expenses. |

| 5 | The date reflects the inception date of the Fund, not the index. |

The Russell 3000® Index is a trademark of Russell Investments. Russell is a trademark of Russell Investments.

Not FDIC insured, nor bank guaranteed. May lose value.

11

AMG FQ U.S. Equity Fund

Fund Snapshots (unaudited)

October 31, 2014

PORTFOLIO BREAKDOWN

| | | | | | | | |

Sector | | AMG FQ U.S.

Equity

Fund** | | | Russell 3000®

Index | |

Information Technology | | | 19.0 | % | | | 18.8 | % |

Financials | | | 17.8 | % | | | 17.7 | % |

Health Care | | | 14.4 | % | | | 14.0 | % |

Consumer Discretionary | | | 12.8 | % | | | 12.3 | % |

Industrials | | | 10.6 | % | | | 11.3 | % |

Energy | | | 8.9 | % | | | 8.4 | % |

Consumer Staples | | | 8.3 | % | | | 8.4 | % |

Materials | | | 3.8 | % | | | 3.7 | % |

Telecommunication Services | | | 3.5 | % | | | 2.2 | % |

Utilities | | | 1.4 | % | | | 3.2 | % |

Other Assets and Liabilities | | | (0.5 | )% | | | 0.0 | % |

| ** | As a percentage of net assets. |

TOP TEN HOLDINGS

| | | | |

Security Name | | % of Net Assets | |

Exxon Mobil Corp.* | | | 2.7 | % |

Johnson & Johnson | | | 2.5 | |

Apple, Inc.* | | | 2.5 | |

Microsoft Corp.* | | | 2.4 | |

Berkshire Hathaway, Inc., Class B* | | | 2.3 | |

Pfizer, Inc.* | | | 2.0 | |

Bank of America Corp.* | | | 2.0 | |

AT&T, Inc.* | | | 1.8 | |

QUALCOMM, Inc.* | | | 1.8 | |

Merck & Co., Inc. | | | 1.7 | |

| | | | |

Top Ten as a Group | | | 21.7 | % |

| | | | |

| * | Top Ten Holding at April 30, 2014. |

Because a fund’s strategy may result in multiple investments in particular sectors of the economy, its performance may depend on the performance of those sectors and may fluctuate more widely than investments diversified across more sectors. For additional information on these and other risk considerations, please see the Fund’s prospectus.

Any sectors, industries, or securities discussed should not be perceived as investment recommendations. Mention of a specific security should not be considered a recommendation to buy or solicitation to sell that security. Specific securities mentioned in this report may have been sold from the Fund’s portfolio of investments by the time you receive this report.

12

AMG FQ U.S. Equity Fund

Schedule of Portfolio Investments

October 31, 2014

| | | | | | | | |

| | | Shares | | | Value | |

Common Stocks - 100.5% | | | | | | | | |

Consumer Discretionary - 12.8% | | | | | | | | |

Comcast Corp., Class A | | | 21,100 | | | $ | 1,167,885 | |

DIRECTV* | | | 5,700 | | | | 494,703 | |

Domino’s Pizza, Inc. | | | 7,900 | | | | 701,441 | |

Expedia, Inc. | | | 8,800 | | | | 747,736 | |

Foot Locker, Inc. | | | 6,400 | | | | 358,464 | |

The Gap, Inc. | | | 15,100 | | | | 572,139 | |

The Home Depot, Inc.4 | | | 9,100 | | | | 887,432 | |

Las Vegas Sands Corp. | | | 9,100 | | | | 566,566 | |

Macy’s, Inc. | | | 10,600 | | | | 612,892 | |

The McClatchy Co., Class A* | | | 23,400 | | | | 83,304 | |

PetMed Express, Inc.1 | | | 2,800 | | | | 36,988 | |

Pool Corp. | | | 1,000 | | | | 59,700 | |

Scripps Networks Interactive, Inc., Class A | | | 2,300 | | | | 177,652 | |

Thor Industries, Inc. | | | 5,000 | | | | 264,450 | |

TripAdvisor, Inc.* | | | 700 | | | | 62,062 | |

Twenty-First Century Fox, Inc., Class A | | | 20,600 | | | | 710,288 | |

The Walt Disney Co. | | | 4,500 | | | | 411,210 | |

Wyndham Worldwide Corp. | | | 9,700 | | | | 753,399 | |

Total Consumer Discretionary | | | | | | | 8,668,311 | |

Consumer Staples - 8.3% | | | | | | | | |

Archer-Daniels-Midland Co. | | | 17,300 | | | | 813,100 | |

Brown-Forman Corp., Class B | | | 450 | | | | 41,702 | |

Cal-Maine Foods, Inc.1 | | | 700 | | | | 61,453 | |

Central Garden and Pet Co., Class A* | | | 17,000 | | | | 146,030 | |

Church & Dwight Co., Inc. | | | 600 | | | | 43,446 | |

The Clorox Co. | | | 500 | | | | 49,750 | |

Costco Wholesale Corp. | | | 500 | | | | 66,685 | |

CVS Health Corp. | | | 5,700 | | | | 489,117 | |

Dr Pepper Snapple Group, Inc. | | | 10,100 | | | | 699,425 | |

The Kroger Co. | | | 900 | | | | 50,139 | |

PepsiCo, Inc. | | | 10,500 | | | | 1,009,785 | |

Pilgrim’s Pride Corp.*,1 | | | 23,800 | | | | 676,158 | |

The Procter & Gamble Co.4 | | | 6,200 | | | | 541,074 | |

Sanderson Farms, Inc.1 | | | 1,900 | | | | 159,562 | |

Tyson Foods, Inc., Class A4 | | | 14,800 | | | | 597,180 | |

Wal-Mart Stores, Inc. | | | 1,100 | | | | 83,897 | |

WD-40 Co. | | | 600 | | | | 46,002 | |

Total Consumer Staples | | | | | | | 5,574,505 | |

| | | | | | | | |

| | | Shares | | | Value | |

Energy - 8.9% | | | | | | | | |

Chevron Corp.4 | | | 2,600 | | | $ | 311,870 | |

ConocoPhillips4 | | | 12,900 | | | | 930,735 | |

Exxon Mobil Corp.4 | | | 18,900 | | | | 1,827,819 | |

Helix Energy Solutions Group, Inc.* | | | 11,800 | | | | 314,352 | |

Marathon Petroleum Corp. | | | 9,200 | | | | 836,280 | |

Occidental Petroleum Corp.4 | | | 3,000 | | | | 266,790 | |

Phillips 66 | | | 800 | | | | 62,800 | |

Schlumberger, Ltd. | | | 11,800 | | | | 1,164,188 | |

Valero Energy Corp. | | | 5,300 | | | | 265,477 | |

Total Energy | | | | | | | 5,980,311 | |

Financials - 17.8% | | | | | | | | |

1st Source Corp. | | | 4,800 | | | | 150,192 | |

Aflac, Inc. | | | 6,200 | | | | 370,326 | |

Alexander’s, Inc. | | | 200 | | | | 88,400 | |

The Allstate Corp. | | | 7,900 | | | | 512,315 | |

Altisource Portfolio Solutions, S.A.*,1 | | | 800 | | | | 59,728 | |

American Capital Agency Corp. | | | 3,400 | | | | 77,316 | |

American Express Co.4 | | | 8,400 | | | | 755,580 | |

AmTrust Financial Services, Inc. | | | 3,900 | | | | 174,993 | |

Aspen Insurance Holdings, Ltd. | | | 16,400 | | | | 715,532 | |

AvalonBay Communities, Inc. | | | 400 | | | | 62,336 | |

Bank of America Corp.4 | | | 77,800 | | | | 1,335,048 | |

Berkshire Hathaway, Inc., Class B*,4 | | | 11,300 | | | | 1,583,808 | |

Central Pacific Financial Corp. | | | 2,400 | | | | 45,360 | |

The Chubb Corp. | | | 1,900 | | | | 188,784 | |

Discover Financial Services | | | 1,300 | | | | 82,914 | |

Eagle Bancorp, Inc.* | | | 1,500 | | | | 53,895 | |

Everest Re Group, Ltd. | | | 900 | | | | 153,585 | |

FelCor Lodging Trust, Inc. | | | 6,900 | | | | 74,037 | |

Franklin Resources, Inc. | | | 5,000 | | | | 278,050 | |

GAMCO Investors, Inc., Class A | | | 3,800 | | | | 313,956 | |

The Geo Group, Inc. | | | 1,400 | | | | 55,916 | |

Health Care REIT, Inc. | | | 700 | | | | 49,777 | |

Host Hotels & Resorts, Inc. | | | 2,900 | | | | 67,599 | |

International Bancshares Corp. | | | 5,200 | | | | 147,524 | |

Janus Capital Group, Inc.1 | | | 6,100 | | | | 91,439 | |

JPMorgan Chase & Co.4 | | | 18,200 | | | | 1,100,736 | |

Lazard, Ltd., Class A | | | 6,300 | | | | 310,023 | |

Morgan Stanley | | | 4,000 | | | | 139,800 | |

The accompanying notes are an integral part of these financial statements.

13

AMG FQ U.S. Equity Fund

Schedule of Portfolio Investments (continued)

| | | | | | | | |

| | | Shares | | | Value | |

Financials - 17.8% (continued) | | | | | | | | |

PartnerRe, Ltd. | | | 900 | | | $ | 104,121 | |

Potlatch Corp. | | | 12,300 | | | | 541,077 | |

PrivateBancorp, Inc. | | | 8,800 | | | | 284,416 | |

SunTrust Banks, Inc. | | | 8,300 | | | | 324,862 | |

The Travelers Cos., Inc. | | | 2,900 | | | | 292,320 | |

Universal Insurance Holdings, Inc. | | | 5,400 | | | | 94,500 | |

Waddell & Reed Financial, Inc., Class A | | | 3,300 | | | | 157,542 | |

Washington Federal, Inc. | | | 1,900 | | | | 41,477 | |

Wells Fargo & Co.4 | | | 20,900 | | | | 1,109,581 | |

Total Financials | | | | | | | 11,988,865 | |

Health Care - 14.4% | | | | | | | | |

Aetna, Inc. | | | 1,500 | | | | 123,765 | |

Alliance HealthCare Services, Inc.* | | | 4,700 | | | | 113,411 | |

Amsurg Corp.* | | | 2,200 | | | | 118,822 | |

Biogen Idec, Inc.* | | | 2,100 | | | | 674,268 | |

CR Bard, Inc. | | | 4,700 | | | | 770,659 | |

Edwards Lifesciences Corp.* | | | 7,900 | | | | 955,268 | |

The Ensign Group, Inc. | | | 1,500 | | | | 58,080 | |

Express Scripts Holding Co.* | | | 900 | | | | 69,138 | |

Gilead Sciences, Inc.* | | | 7,900 | | | | 884,800 | |

Greatbatch, Inc.* | | | 1,400 | | | | 70,266 | |

Johnson & Johnson4 | | | 15,700 | | | | 1,692,146 | |

Ligand Pharmaceuticals, Inc.* | | | 5,400 | | | | 298,458 | |

Merck & Co., Inc. | | | 20,300 | | | | 1,176,182 | |

Natus Medical, Inc.* | | | 2,300 | | | | 78,200 | |

PAREXEL International Corp.* | | | 1,900 | | | | 103,189 | |

Pfizer, Inc.4 | | | 45,300 | | | | 1,356,735 | |

St Jude Medical, Inc. | | | 600 | | | | 38,502 | |

Thoratec Corp.* | | | 2,300 | | | | 62,514 | |

UnitedHealth Group, Inc.4 | | | 4,500 | | | | 427,545 | |

Universal Health Services, Inc., Class B | | | 1,100 | | | | 114,081 | |

WellPoint, Inc. | | | 3,600 | | | | 456,084 | |

Zimmer Holdings, Inc. | | | 600 | | | | 66,744 | |

Total Health Care | | | | | | | 9,708,857 | |

Industrials - 10.6% | | | | | | | | |

Delta Air Lines, Inc. | | | 19,400 | | | | 780,462 | |

Deluxe Corp. | | | 12,700 | | | | 772,160 | |

Emerson Electric Co. | | | 600 | | | | 38,436 | |

FedEx Corp. | | | 300 | | | | 50,220 | |

Fluor Corp. | | | 1,200 | | | | 79,608 | |

| | | | | | | | |

| | | Shares | | | Value | |

General Dynamics Corp. | | | 6,400 | | | $ | 894,464 | |

General Electric Co. | | | 2,500 | | | | 64,525 | |

Huntington Ingalls Industries, Inc. | | | 5,400 | | | | 571,428 | |

Hyster-Yale Materials Handling, Inc. | | | 600 | | | | 47,094 | |

Lockheed Martin Corp.4 | | | 5,600 | | | | 1,067,192 | |

Northrop Grumman Corp.4 | | | 4,700 | | | | 648,412 | |

Parker Hannifin Corp. | | | 300 | | | | 38,109 | |

RR Donnelley & Sons Co. | | | 2,972 | | | | 51,858 | |

Southwest Airlines Co. | | | 27,800 | | | | 958,544 | |

UniFirst Corp. | | | 800 | | | | 89,248 | |

Union Pacific Corp.4 | | | 7,800 | | | | 908,310 | |

United Parcel Service, Inc., Class B | | | 700 | | | | 73,437 | |

WABCO Holdings, Inc.* | | | 500 | | | | 48,690 | |

Total Industrials | | | | | | | 7,182,197 | |

Information Technology - 19.0% | | | | | | | | |

Advanced Energy Industries, Inc.* | | | 9,400 | | | | 185,932 | |

Apple, Inc.4 | | | 15,407 | | | | 1,663,956 | |

Aspen Technology, Inc.* | | | 5,100 | | | | 188,343 | |

Benchmark Electronics, Inc.* | | | 23,400 | | | | 555,048 | |

Brocade Communications Systems, Inc. | | | 26,500 | | | | 284,345 | |

Cisco Systems, Inc.4 | | | 9,200 | | | | 225,124 | |

eBay, Inc.* | | | 4,400 | | | | 231,000 | |

Facebook, Inc., Class A* | | | 2,600 | | | | 194,974 | |

Fairchild Semiconductor International, Inc.* | | | 4,700 | | | | 72,145 | |

Google, Inc., Class A*,4 | | | 882 | | | | 500,861 | |

Google, Inc., Class C*,4 | | | 782 | | | | 437,201 | |

Harris Corp. | | | 11,100 | | | | 772,560 | |

Hewlett-Packard Co. | | | 26,800 | | | | 961,584 | |

Insight Enterprises, Inc.* | | | 2,800 | | | | 63,700 | |

Integrated Device Technology, Inc.* | | | 15,500 | | | | 254,355 | |

Intel Corp. | | | 6,500 | | | | 221,065 | |

Marchex, Inc., Class B | | | 14,500 | | | | 55,535 | |

Microsoft Corp.4 | | | 34,400 | | | | 1,615,080 | |

Oracle Corp.4 | | | 16,200 | | | | 632,610 | |

Progress Software Corp.* | | | 5,600 | | | | 145,040 | |

QUALCOMM, Inc.4 | | | 15,100 | | | | 1,185,501 | |

Skyworks Solutions, Inc. | | | 13,500 | | | | 786,240 | |

Synopsys, Inc.* | | | 7,400 | | | | 303,252 | |

Texas Instruments, Inc. | | | 2,700 | | | | 134,082 | |

Visa, Inc., Class A | | | 2,700 | | | | 651,861 | |

WebMD Health Corp.*,1 | | | 1,700 | | | | 72,556 | |

The accompanying notes are an integral part of these financial statements.

14

AMG FQ U.S. Equity Fund

Schedule of Portfolio Investments (continued)

| | | | | | | | |

| | | Shares | | | Value | |

Information Technology - 19.0% (continued) | | | | | | | | |

Western Digital Corp. | | | 3,000 | | | $ | 295,110 | |

Xerox Corp. | | | 12,800 | | | | 169,984 | |

Total Information Technology | | | | | | | 12,859,044 | |

Materials - 3.8% | | | | | | | | |

Avery Dennison Corp. | | | 1,400 | | | | 65,590 | |

Celanese Corp., Series A | | | 9,300 | | | | 546,189 | |

CF Industries Holdings, Inc. | | | 200 | | | | 52,000 | |

Clearwater Paper Corp.* | | | 3,300 | | | | 212,355 | |

E.I. du Pont de Nemours & Co. | | | 1,300 | | | | 89,895 | |

LyondellBasell Industries N.V., Class A | | | 9,100 | | | | 833,833 | |

Monsanto Co. | | | 500 | | | | 57,520 | |

Schweitzer-Mauduit International, Inc. | | | 900 | | | | 38,754 | |

United States Steel Corp.1 | | | 5,000 | | | | 200,200 | |

Worthington Industries, Inc. | | | 12,000 | | | | 463,800 | |

Total Materials | | | | | | | 2,560,136 | |

Telecommunication Services - 3.5% | | | | | | | | |

AT&T, Inc.4 | | | 35,100 | | | | 1,222,884 | |

Cincinnati Bell, Inc.* | | | 65,600 | | | | 240,752 | |

Frontier Communications Corp. | | | 39,900 | | | | 260,946 | |

Inteliquent, Inc. | | | 4,600 | | | | 77,418 | |

United States Cellular Corp.* | | | 1,500 | | | | 54,630 | |

Verizon Communications, Inc. | | | 10,700 | | | | 537,675 | |

Total Telecommunication Services | | | | | | | 2,394,305 | |

Utilities - 1.4% | | | | | | | | |

AES Corp. | | | 5,000 | | | | 70,350 | |

AGL Resources, Inc. | | | 1,900 | | | | 102,429 | |

American Electric Power Co., Inc. | | | 9,100 | | | | 530,894 | |

Consolidated Edison, Inc. | | | 3,400 | | | | 215,424 | |

Public Service Enterprise Group, Inc. | | | 1,000 | | | | 41,310 | |

Total Utilities | | | | | | | 960,407 | |

Total Common Stocks

(cost $56,251,440) | | | | | | | 67,876,938 | |

| | | | | | | | |

| | | Contracts | | | Value | |

Purchased Options - 0.2% | | | | | | | | |

S&P 500 Puts, 1700 Strike Price, Expiration 01/17/15 | | | 174 | | | $ | 88,740 | |

S&P 500 Puts, 1825 Strike Price, Expiration 11/22/14 | | | 101 | | | | 12,928 | |

S&P 500 Puts, 1875 Strike Price, Expiration 12/20/14 | | | 67 | | | | 67,000 | |

Total Purchased Options

(cost $699,813) | | | | | | | 168,668 | |

| | |

| | | Principal

Amount | | | | |

Short-Term Investments - 2.3% | | | | | | | | |

Repurchase Agreements - 1.5%2 | | | | | | | | |

Cantor Fitzgerald Securities, Inc., dated 10/31/14, due 11/03/14, 0.130%, total to be received $1,000,011 (collateralized by various U.S. Government Agency Obligations, 0.000% - 10.500%, 01/01/15 - 09/20/64, totaling $1,020,000) | | $ | 1,000,000 | | | | 1,000,000 | |

Nomura Securities International, Inc., dated 10/31/14, due 11/03/14, 0.110%, total to be received $33,368 (collateralized by various U.S. Government Agency Obligations, 0.000% - 7.250%, 11/03/14 -11/01/44 totaling $34,035) | | | 33,368 | | | | 33,368 | |

Total Repurchase Agreements | | | | | | | 1,033,368 | |

| | |

| | | Shares | | | | |

Other Investment

Companies - 0.8%3 | | | | | | | | |

Dreyfus Institutional Cash Advantage Fund, Institutional Class Shares, 0.06% | | | 530,546 | | | | 530,546 | |

Total Short-Term Investments

(cost $1,563,914) | | | | | | | 1,563,914 | |

Total Investments - 103.0%

(cost $58,515,167) | | | | | | | 69,609,520 | |

Other Assets, less Liabilities - (3.0)% | | | | | | | (2,042,900 | ) |

Net Assets - 100.0% | | | | | | $ | 67,566,620 | |

The accompanying notes are an integral part of these financial statements.

15

AMG FQ Global Alternatives Fund

Portfolio Manager’s Comments

The AMG FQ Global Alternatives Fund (“Global Alternatives” or the “Fund”) delivered slightly negative returns for the past fiscal year ended October 31, 2014. The Fund (Investor Class) returned (1.84)% while the benchmark, the Citigroup 1-Month Treasury Bill Index, returned 0.03% during this time. Please refer to the table on page 17 for the returns of the other share classes.

The year witnessed a gradually widening array of economic and geopolitical risk, namely sluggish global growth, the developments surrounding the Islamic State, Russia/Ukraine conflict, Scottish independence referendum, unrest in Hong Kong, and the Ebola scare. Despite those risks, volatility across asset classes remained relatively subdued for most of the year, lulled by continued accommodative monetary policies of global central banks and close-to-record-low interest rates. That changed towards the fiscal year-end when the combination of the same risk factors, coupled with the end of the Federal Reserve’s (the Fed) bond purchases and the uncertainty about the U.S. future rate increases, changed the markets’ mood from nonchalant indifference to deep concern.

Volatility came back to life in September, which saw a shifting economic landscape marked by a stronger U.S. economy and meek growth elsewhere, especially in the Euro Zone, which introduced the prospect of monetary policy divergence between the leading developed economies. October brought more volatility into the markets in the approach to the Fed announcement. The Fed’s somewhat hawkish stance, as it ended quantitative easing and gave a more upbeat assessment of the U.S. economy, led to a significant increase in the U.S. Dollar against its major counterparties. Also contributing to the U.S. Dollar rally was the weakness in the Japanese Yen, as the Bank of Japan unexpectedly increased

monetary stimulus. Most global equities posted gains for the year, but more divergence in performance across countries could be observed towards the period-end as global economies embarked on varying economic paths. Global bonds also ended up benefiting from muted inflation in the U.S., continued disinflation in the Euro Zone and increased risk aversion at the fiscal year end.

The Fund’s modest loss was primarily driven by underperformance within the bond country selection strategy. The outperformance of German Bunds over U.S. Treasuries emphasized the two regions’ divergent economic paths and caught the fair value model, driven by relative attractiveness of bond risk premiums, on the wrong side of both markets. The loss from bond country selection was offset by solid gains from the currency strategy, which delivered positive returns in both the low-and higher-volatility environments. The Fund’s asset class selection strategy maintained a modest long position throughout the year which contributed positively to performance. The stock country selection strategy, on the other hand, was slightly down. The model attempting to capture expected risk and its effect on markets was mostly unsuccessful, as equity markets continued to be influenced to a large degree by central bank actions and not necessarily by convincing economic facts on the ground.

Going forward, global economic environment remains uncertain as the vulnerabilities evident in many global economies, such as Europe and Japan, remain unresolved. The scale of those problems is currently still masked by low interest rates, suppressed volatility and the positive impact of central banks’ quantitative easing policies ex-U.S. While the ending of the U.S. quantitative easing was well telegraphed, now investors will be trying to get a sense of the timing of the Fed’s first

rate rise and the pace of monetary tightening, as they try to establish the extent of the European Central Bank’s and Bank of Japan’s monetary stimulus and, possibly, new fiscal measures. More market volatility seems a relatively likely consequence. At the same time, a continued divergence in the economic fortunes of the world’s economies should encourage investors to pay more attention to fundamentals and to adopt a more nuanced view of the world.

This commentary reflects the viewpoints of the portfolio manager, First Quadrant, L.P., as of October 31, 2014 and is not intended as a forecast or guarantee of future results, and is subject to change without notice.

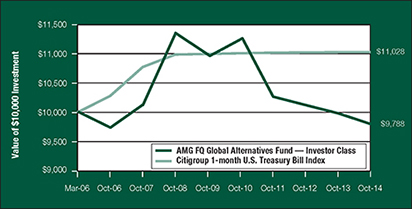

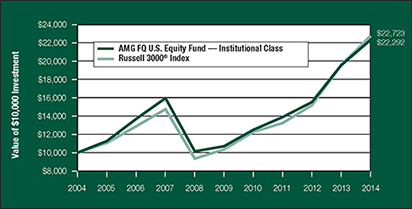

CUMULATIVE TOTAL RETURN PERFORMANCE

AMG FQ Global Alternatives Fund’s cumulative total return is based on the daily change in net asset value (NAV), and assumes that all distributions were reinvested. This graph compares a hypothetical $10,000 investment made in the Investor Class of the Fund on March 30, 2006 (commencement of operations), to a $10,000 investment made in the Citigroup 1-month U.S. Treasury Index for the same time period. Figures include reinvestment of capital gains and dividends. The listed returns for the Fund are net of expenses and the returns for the index exclude expenses. Performance for periods longer than one year is annualized. The graph and table do not reflect the deduction of taxes that a shareholder would pay on a Fund distribution or redemption of shares. The listed returns for the Fund are net of expenses and the returns for the index exclude expenses. Total returns would have been lower had certain expenses not been reduced.

16

AMG FQ Global Alternatives Fund

Portfolio Manager’s Comments (continued)

CUMULATIVE TOTAL RETURN PERFORMANCE (continued)

The table below shows the average annual total returns for the AMG FQ Global Alternatives Fund and the Citigroup 1-month U.S. Treasury Bill Index for the same time periods ended October 31, 2014.

| | | | | | | | | | | | | | | | |

| Average Annual Total Returns1 | | One

Year | | | Five

Years | | | Since

Inception | | | Inception

Date | |

AMG FQ Global Alternatives Fund2,3,4,5,6 | | | | | | | | | | | | | | | | |

Investor Class | | | (1.84 | )% | | | (2.28 | )% | | | (0.25 | )% | | | 03/30/06 | |

Service Class | | | (1.57 | )% | | | — | | | | (2.07 | )% | | | 01/01/10 | |

Institutional Class | | | (1.39 | )% | | | — | | | | (1.94 | )% | | | 01/01/10 | |

Citigroup 1-month U.S. Treasury Bill Index7 | | | 0.03 | % | | | 0.06 | % | | | 1.19 | % | | | 03/31/06 | |

The performance data shown represents past performance. Past performance is not a guarantee of future results. Current performance may be lower or higher than the performance data quoted. The investment return and principal value of an investment in the Fund will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost.

Investors should carefully consider the Fund’s investment objectives, risks, charges and expenses before investing. For performance information through the most recent month end, current net asset values per share for the Fund and other information, please call (800) 835-3879 or visit our website at www.amgfunds for a free prospectus. Read it carefully before investing or sending money.

Distributed by AMG Distributors, Inc., member FINRA.

| 1 | Total return equals income yield plus share price change and assumes reinvestment of all dividends and capital gain distributions. Returns are net of fees and may reflect offsets of Fund expenses as described in the prospectus. No adjustment has been made for taxes payable by shareholders on their reinvested dividends and capital gain distributions. Returns for periods greater than one year are the average annual returns. The listed returns on the Fund are net of expenses and based on the published NAV as of October 31, 2014. All returns are in U.S. dollars ($). |

| 2 | From time to time, the Fund’s advisor has waived its fees and/or absorbed Fund expenses, which has resulted in higher returns. |

| 3 | Changing interest rates may adversely affect the value of an investment. An increase in interest rates typically causes the value of bonds and other fixed-income securities to fall. |

| 4 | The Fund may use derivative instruments for hedging purposes or as part of its investment strategy. There is a risk that a derivative intended as a hedge may not perform as expected. The main risk with derivatives is that some types can amplify a gain or loss, potentially earning or losing substantially more money than the actual cost of the derivative or that the counterparty may fail to honor its contract terms, causing a loss for the Fund. Use of these instruments may also involve certain costs and risks such as liquidity risk, interest rate risk, market risk, credit risk, management risk, and the risk that a fund could not close out a position when it would be most advantageous to do so. The Fund is subject to currency risk resulting from fluctuations in exchange rates that may affect the total loss or gain on a non-U.S. Dollar security when converted back to U.S. Dollars. |

| 5 | Investments in foreign securities and currency instruments are subject to additional risks such as erratic market conditions, economic and political instability, and currency exchange rate fluctuations. |

| 6 | Because the Fund invests in exchange traded funds (ETFs) which incur their own costs, investing in them could result in a higher cost to the investor. Additionally, the Fund will be indirectly exposed to all the risks of securities held by the ETFs. |

| 7 | Performance for the Citigroup 1-month U.S. Treasury Bill Index reflects an inception date of March 31, 2006. The Citigroup 1-month U.S. Treasury Bill Index is a market value-weighted index of public obligations of the U.S. Treasury with maturities of one month. Unlike the Fund, the Citigroup 1-month U.S. Treasury Bill Index is unmanaged, is not available for investment, and does not incur expenses. |

Not FDIC insured, nor bank guaranteed. May lose value.

17

AMG FQ Global Alternatives Fund

Schedule of Portfolio Investments

October 31, 2014

| | | | | | | | |

| | | Shares | | | Value | |

Exchange Traded Funds - 26.9% | | | | | | | | |

SPDR S&P 500 ETF Trust (cost $10,160,765) | | | 85,818 | | | $ | 17,306,058 | |

| | |

| | | Principal Amount | | | | |

U.S. Government Obligations - 55.3% | | | | | | | | |

U.S. Treasury Bills, | | | | | | | | |

0.003%, 11/28/14 to 12/04/145,6 | | $ | 34,605,000 | | | | 34,604,880 | |

0.038%, 03/26/155,6 | | | 1,000,000 | | | | 999,821 | |

Total U.S. Government Obligations (cost $35,603,888) | | | | | | | 35,604,701 | |

| | |

| | | Shares | | | | |

Other Investment Companies - 13.9%3 | | | | | | | | |

Dreyfus Institutional Cash Advantage Fund, Institutional Class Shares, 0.06%

(cost $8,965,849) | | | 8,965,849 | | | | 8,965,849 | |

Total Investments - 96.1% (cost $54,730,502) | | | | | | | 61,876,608 | |

Other Assets, less Liabilities - 3.9% | | | | | | | 2,513,577 | |

Net Assets - 100.0% | | | | | | $ | 64,390,185 | |

The accompanying notes are an integral part of these financial statements.

18

AMG FQ Global Risk-Balanced Fund

Portfolio Manager’s Comments

The AMG FQ Global Risk-Balanced Fund (formerly Managers AMG FQ Global Essentials Fund) (“the Fund”) posted positive absolute but negative relative returns for the past fiscal year ended October 31, 2014. The Fund (Institutional Class shares) returned 5.97%, while its benchmark, which consists of 60% of the return of MSCI World (hedged) Index and 40% of the return of the Citigroup World Government Bond (hedged) Index, returned 8.19% during this time, the difference predominantly attributable to the strong U.S. Dollar. Both global stocks and bonds contributed positively to the portfolio, but commodities were down.

The year was one of conflicting developments and a gradually widening array of economic and geopolitical risks, namely the sluggish global growth, deteriorating situation in the Middle East, Russia/Ukraine conflict, Scottish independence referendum, unrest in Hong Kong and the Ebola scare. Despite those risks, volatility across asset classes remained relatively subdued for most of the year, lulled by continued accommodative monetary policies and close-to-record-low interest rates. Although the global economy grew, albeit at a subdued pace, divergence in growth between the leading economies could be observed. While the U.S. economy continued to strengthen, there were areas of weakness, such as the Euro Zone and China. The Euro Zone, especially, continued to experience more deflationary pressures as the outcome of cuts in government spending after the financial crisis to “restore confidence” backfired and led, instead, to a stagnant economy. In addition, Russian sanctions had a visible negative impact on the region’s economy. In Japan, despite the monetary largesse of the Abe government and

significant optimism that this would pull Japan out of its decades-long deflation malaise, the economy seems to be stalling again.

The environment of weak global growth and increased geopolitical risks resulted in a surprising combination of low market volatility and a flight to safe-haven assets. As a result, the U.S. Dollar strengthened significantly and a flight to sovereign bonds could be observed in the second half of the fiscal year. The greenback was further supported by the prospect of monetary policy divergence between the leading developed economies. The Federal Reserve, having ended their bond purchasing program, is expected to start raising short-term interest rates earlier-than-expected next year in sharp contrast to central bank ex-U.S. that are still pursuing aggressive quantitative easing. The flight to quality resulted in strong performance of United Kingdom’s (U.K.) sovereign bonds portfolio, at the time when most commentators were proclaiming an imminent bear market for bonds. The strong U.S. Dollar, on the other hand, had a negative effect on commodity prices, driving down precious metals as well as oil and grains, which were already pressured by oversupply. The central bank-induced low-volatility environment supported U.K.’s equity exposure, which moved up and down in a fairly narrow range, but ended strongly positive by the fiscal year-end, mostly due to a very strong performance by the U.S. and Japan, with the Euro Zone posting only modest gains. Small-caps and property stocks also posted solid gains.

The asset allocation of the Fund remained constant over the year as the Market Risk Index continued to signal that we are in a low volatility

environment where most risky assets tend to be resilient. As seen over the fiscal year, pullbacks due to the Ukrainian situation in January or market weakness in September and October were followed by strong rallies. This sort of market resilience can be expected to continue into next year.

This commentary reflects the viewpoints of the portfolio manager, First Quadrant, L.P., as of October 31, 2014 and is not intended as a forecast or guarantee of future results, and is subject to change without notice.

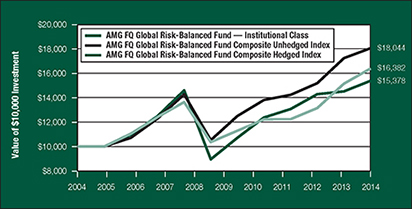

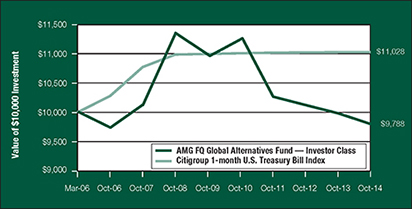

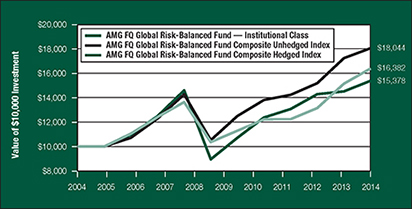

CUMULATIVE TOTAL RETURN PERFORMANCE

AMG FQ Global Risk-Balanced Fund’s cumulative total return is based on the daily change in net asset value (NAV), and assumes that all distributions were reinvested. This graph compares a hypothetical $10,000 investment made in the Institutional Class Shares of the Fund on October 31, 2004, to a $10,000 investment made in the Hedged Index and the Unhedged Index for the same time period. Figures include reinvestment of capital gains and dividends. The listed returns for the Fund are net of expenses and the returns for the index exclude expenses. Performance for periods longer than one year is annualized. The graph and table do not reflect the deduction of taxes that a shareholder would pay on a Fund distribution or redemption of shares. The listed returns for the Fund are net of expenses and the returns for the index exclude expenses. Total returns would have been lower had certain expenses not been reduced.

19

AMG FQ Global Risk-Balanced Fund

Portfolio Manager’s Comments (continued)

CUMULATIVE TOTAL RETURN PERFORMANCE (continued)

The table below shows the average annual total returns for the AMG FQ Global Risk-Balanced Fund and the AMG FQ Global Risk-Balanced Fund Composite Hedged and Unhedged Indexes for the same time periods ended October 31, 2014.

| | | | | | | | | | | | | | | | | | | | |

| Average Annual Total Returns1 | | One

Year | | | Five

Years | | | Ten

Years | | | Since

Inception | | | Inception

Date | |

AMG FQ Global Risk-Balanced Fund2,3,4,5,6,7 | | | | | | | | | | | | | |

Investor Class | | | 5.33 | % | | | — | | | | — | | | | 6.66 | % | | | 01/01/10 | |

Service Class | | | 5.83 | % | | | — | | | | — | | | | 7.07 | % | | | 01/01/10 | |

Institutional Class | | | 5.97 | % | | | 7.50 | % | | | 4.40 | % | | | 6.21 | % | | | 11/18/88 | |

AMG FQ Global Risk-Balanced Fund Composite Hedged Index8,9,10 | | | 8.19 | % | | | 7.73 | % | | | 5.06 | % | | | 5.87 | % | | | 11/30/88 | |

AMG FQ Global Risk-Balanced Fund Composite Unhedged Index8,9,10 | | | 4.72 | % | | | 7.63 | % | | | 6.08 | % | | | 6.90 | % | | | 11/30/88 | |

The performance data shown represents past performance. Past performance is not a guarantee of future results. Current performance may be lower or higher than the performance data quoted. The investment return and principal value of an investment in the Fund will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost.

Investors should carefully consider the Fund’s investment objectives, risks, charges and expenses before investing. For performance information through the most recent month end, current net asset values per share for the Fund and other information, please call (800) 835-3879 or visit our website at www.amgfunds.com for a free prospectus. Read it carefully before investing or sending money.

Distributed by AMG Distributors, Inc., member FINRA.

| 1 | Total return equals income yield plus share price change and assumes reinvestment of all dividends and capital gain distributions. Returns are net of fees and may reflect offsets of Fund expenses as described in the prospectus. No adjustment has been made for taxes payable by shareholders on their reinvested dividends and capital gain distributions. Returns for periods greater than one year are the average annual returns. The listed returns on the Fund are net of expenses and based on the published NAV as of October 31, 2014. All returns are in U.S. dollars ($). |

| 2 | From time to time, the Fund’s advisor has waived its fees and/or absorbed Fund expenses, which has resulted in higher returns. |

| 3 | Investments in foreign securities, even though publicly traded in the United States, may involve risks which are in addition to those inherent in domestic investments. The use of leverage in a Fund’s strategy can magnify relatively small market movements into relatively larger losses for the Fund. |

| 4 | The Fund is subject to special risk considerations similar to those associated with the direct ownership of real estate. Real estate valuations may be subject to factors such as changing general and local economic, financial, competitive and environmental conditions. |

| 5 | Because the Fund invests in exchange traded funds (ETFs) which incur their own costs, investing in them could result in a higher cost to the investor. Additionally, the Fund will be indirectly exposed to all the risks of securities held by the ETFs. |

| 6 | Obligations of certain government agencies are not backed by the full faith and credit of the U.S. Government. If one of these agencies defaulted on a loan, there is no guarantee that the U.S. Government will provide financial support. Additionally, debt securities of the U.S. Government may be affected by changing interest rates and subject to prepayment risk. |