UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-06520

MANAGERS TRUST I

(Exact name of registrant as specified in charter)

800 Connecticut Avenue, Norwalk, Connecticut 06854

(Address of principal executive offices) (Zip code)

Managers Investment Group LLC

800 Connecticut Avenue, Norwalk, Connecticut 06854

(Name and address of agent for service)

Registrant’s telephone number, including area code: (203) 299-3500

Date of fiscal year end: OCTOBER 31

Date of reporting period: NOVEMBER 1, 2012 – OCTOBER 31, 2013

(Annual Shareholder Report)

| Item 1. | Reports to Shareholders |

Managers AMG FQ Funds

Annual Report — October 31, 2013

| | | | |

| TABLE OF CONTENTS | | Page | |

| |

LETTER TO SHAREHOLDERS | | | 2 | |

| |

ABOUT YOUR FUND’S EXPENSES | | | 3 | |

| |

PORTFOLIO MANAGER’S COMMENTS, FUND SNAPSHOTS, AND SCHEDULES OF PORTFOLIO INVESTMENTS | | | | |

| |

Managers AMG FQ Tax-Managed U.S. Equity Fund | | | 4 | |

| |

Managers AMG FQ U.S. Equity Fund | | | 9 | |

| |

Managers AMG FQ Global Alternatives Fund | | | 15 | |

| |

Managers AMG FQ Global Essentials Fund | | | 18 | |

| |

NOTES TO SCHEDULES OF PORTFOLIO INVESTMENTS | | | 22 | |

| |

FINANCIAL STATEMENTS | | | | |

| |

Statement of Assets and Liabilities | | | 32 | |

Balance sheets, net asset value (NAV) per share computations and cumulative undistributed amounts | | | | |

| |

Statement of Operations | | | 34 | |

Detail of sources of income, expenses, and realized and unrealized gains (losses) during the fiscal year | | | | |

| |

Statements of Changes in Net Assets | | | 35 | |

Detail of changes in assets for the past two fiscal years | | | | |

| |

FINANCIAL HIGHLIGHTS | | | 37 | |

Historical net asset values per share, distributions, total returns, income and expense ratios, turnover ratios and net assets | | | | |

| |

NOTES TO FINANCIAL HIGHLIGHTS | | | 43 | |

| |

NOTES TO FINANCIAL STATEMENTS | | | 44 | |

Accounting and distribution policies, details of agreements and transactions with Fund management and affiliates, and descriptions of certain investment risks | | | | |

| |

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM | | | 54 | |

| |

TRUSTEES AND OFFICERS | | | 55 | |

| |

ANNUAL RENEWAL OF INVESTMENT MANAGEMENT AND SUBADVISORY AGREEMENTS | | | 57 | |

Nothing contained herein is to be considered an offer, sale or solicitation of an offer to buy shares of any series of the Managers Family of Funds. Such offering is made only by Prospectus, which includes details as to offering price and other material information.

Letter to Shareholders

Dear Shareholder:

Thank you for your investment in The Managers Funds. Our foremost goal at Managers Investment Group is to provide investment products and solutions that help our shareholders and clients successfully reach their investment goals and objectives. We do this by offering a broad selection of Funds managed by a collection of Affiliated Managers Group’s (“AMG”) affiliate investment boutiques, along with a complementary series of open-architecture mutual funds.

The past year has been an exciting one for us at MIG. We were pleased to welcome the Brandywine Funds into the Managers Fund family several months ago. We have been excited to begin this new chapter in the 27-year history of the Brandywine Funds, while maintaining shareholders’ access to the same investment team that has guided the Brandywine Funds since inception using its research-driven investment approach.

We announced effective November 1, 2013 that the GW&K Small Cap Equity Fund would be closed to new investors with certain limited exceptions. The team at GW&K manages a total of $2.3 billion (as of October 31, 2013) in small-capitalization equities and closing the Fund to new investors allows the team to continue to execute on the investment process that has been effective for the team for more than a decade. We will continue to make decisions such as these that we believe are in the best interest of our shareholders.

Risky assets have done quite well thus far in 2013, with U.S. equity markets surpassing all-time highs. Ongoing global monetary easing, a low-yield environment, and healthy U.S. economic growth are supporting investor appetite for risk assets. Despite improving investor sentiment, risks remain, including uncertainty surrounding the Fed’s eventual exit from its ultra-accommodative monetary policy, ongoing fiscal headwinds in the U.S. and slower growth in emerging markets. Nevertheless, we are optimistic about the prospects for the upcoming year and we are confident that our Funds are well positioned to weather an uncertain economic environment.

We thank you for your continued confidence and investment in The Managers Funds. You can rest assured that under all market conditions our team is focused on delivering excellent investment management services for your benefit.

Respectfully,

Keitha Kinne

President

The Managers Funds

2

About Your Fund’s Expenses

As a shareholder of a Fund, you may incur two types of costs: (1) transaction costs, which may include sales charges (loads) on purchase payments; redemption fees; and exchange fees; and (2) ongoing costs, including management fees; distribution (12b-1) fees; and other Fund expenses. This example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds. The example is based on $1,000 invested at the beginning of the period and held for the entire period as indicated below.

Actual Expenses

The first line of the following table provides information about the actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

The second line of the following table provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed annual rate of return of 5% before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds by comparing this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of other funds.

Please note that the expenses shown in the table are meant to highlight your on going costs only and do not reflect any transactional costs, such as sales charges (loads), redemption fees, or exchange fees. Therefore, the second line of the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds.

| | | | | | | | | | | | | | | | | | |

| | | Six Months Ended October 31, 2013 | | Expense

Ratio for

the Period | | | Beginning

Account

Value

5/01/13 | | | Ending

Account

Value

10/31/13 | | | Expenses

Paid

During

the Period* | |

| | Managers AMG FQ Tax-Managed U.S. Equity Fund | | | | | | | | | | | | | | | | |

| | Investor Class Shares** | | | | | | | | | | | | | | | | |

| | Based on Actual Fund Return | | | 1.24 | % | | $ | 1,000 | | | $ | 1,141 | | | $ | 6.69 | |

| | Hypothetical (5% return before expenses) | | | 1.24 | % | | $ | 1,000 | | | $ | 1,019 | | | $ | 6.31 | |

| | Institutional Class Shares | | | | | | | | | | | | | | | | |

| | Based on Actual Fund Return | | | 0.99 | % | | $ | 1,000 | | | $ | 1,144 | | | $ | 5.35 | |

| | Hypothetical (5% return before expenses) | | | 0.99 | % | | $ | 1,000 | | | $ | 1,020 | | | $ | 5.04 | |

| | Managers AMG FQ U.S. Equity Fund | | | | | | | | | | | | | | | | |

| | Investor Class Shares** | | | | | | | | | | | | | | | | |

| | Based on Actual Fund Return | | | 1.04 | % | | $ | 1,000 | | | $ | 1,105 | | | $ | 5.52 | |

| | Hypothetical (5% return before expenses) | | | 1.04 | % | | $ | 1,000 | | | $ | 1,020 | | | $ | 5.30 | |

| | Institutional Class Shares | | | | | | | | | | | | | | | | |

| | Based on Actual Fund Return | | | 0.79 | % | | $ | 1,000 | | | $ | 1,107 | | | $ | 4.20 | |

| | Hypothetical (5% return before expenses) | | | 0.79 | % | | $ | 1,000 | | | $ | 1,021 | | | $ | 4.02 | |

| | Managers AMG FQ Global Alternatives Fund | | | | | | | | | | | | | | | | |

| | Investor Class Shares** | | | | | | | | | | | | | | | | |

| | Based on Actual Fund Return | | | 1.88 | % | | $ | 1,000 | | | $ | 1,005 | | | $ | 9.50 | |

| | Hypothetical (5% return before expenses) | | | 1.88 | % | | $ | 1,000 | | | $ | 1,016 | | | $ | 9.55 | |

| | Service Class Shares | | | | | | | | | | | | | | | | |

| | Based on Actual Fund Return | | | 1.57 | % | | $ | 1,000 | | | $ | 1,007 | | | $ | 7.94 | |

| | Hypothetical (5% return before expenses) | | | 1.57 | % | | $ | 1,000 | | | $ | 1,017 | | | $ | 7.98 | |

| | Institutional Class Shares | | | | | | | | | | | | | | | | |

| | Based on Actual Fund Return | | | 1.44 | % | | $ | 1,000 | | | $ | 1,007 | | | $ | 7.28 | |

| | Hypothetical (5% return before expenses) | | | 1.44 | % | | $ | 1,000 | | | $ | 1,018 | | | $ | 7.32 | |

| | Managers AMG FQ Global Essentials Fund | | | | | | | | | | | | | | | | |

| | Investor Class Shares | | | | | | | | | | | | | | | | |

| | Based on Actual Fund Return | | | 1.39 | % | | $ | 1,000 | | | $ | 953 | | | $ | 6.84 | |

| | Hypothetical (5% return before expenses) | | | 1.39 | % | | $ | 1,000 | | | $ | 1,018 | | | $ | 7.07 | |

| | Service Class Shares | | | | | | | | | | | | | | | | |

| | Based on Actual Fund Return | | | 0.92 | % | | $ | 1,000 | | | $ | 956 | | | $ | 4.54 | |

| | Hypothetical (5% return before expenses) | | | 0.92 | % | | $ | 1,000 | | | $ | 1,021 | | | $ | 4.69 | |

| | Institutional Class Shares | | | | | | | | | | | | | | | | |

| | Based on Actual Fund Return | | | 0.89 | % | | $ | 1,000 | | | $ | 955 | | | $ | 4.39 | |

| | Hypothetical (5% return before expenses) | | | 0.89 | % | | $ | 1,000 | | | $ | 1,021 | | | $ | 4.53 | |

| | * Expenses are equal to the Fund’s annualized expense ratio multiplied by the average account value over the period, multiplied by the number of days in the most recent fiscal half-year (184), then divided by 365. ** Effective as of the close of business November 30, 2012, all Class A shares were renamed Investor Class shares and Class C shares converted to Investor Class shares. | |

Managers AMG FQ Tax-Managed U.S. Equity Fund

Portfolio Manager’s Comments

THE YEAR IN REVIEW

For the fiscal year ended October 31, 2013, the Managers AMG FQ Tax-Managed U.S. Equity Fund (Investor Class) returned 31.31%, compared to 28.99% for its benchmark, the Russell 3000® Index. Please refer to the table on page 36 for returns for various classes of shares.

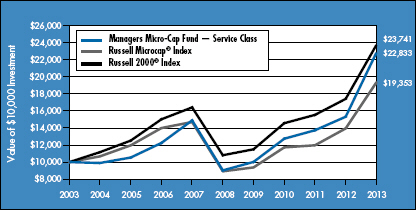

U.S. equities continued their multi-year rally over the prior fiscal year as the Federal Reserve (the “Fed”) continued to fuel the rally with a combination of its easy money short- and long-term interest rate policies. With the exception of the May/June time period when investors became skittish about the prospects of the Federal Reserve pulling back on its third round of quantitative easing, equities moved ahead steadily and consistently throughout the year while frequently reaching new all-time highs. Investors’ skepticism generally remains, however, as both macro and micro conditions have only shown modest improvement throughout the year. While the likelihood appears that we are not headed for another recession in the near-future, prospects for a tepid recovery remain high and investors now fear the combination of high valuations for equities and the inevitable withdrawal of bond-buying from the Fed. For the entire one-year period ended October 31, 2013, smaller-cap equities generally outperformed their larger-cap brethren with the Russell 1000® (large cap), Russell 2000® (small cap), Russell 3000® (all cap), and the Russell Microcap® Indices returning 28.40%, 36.28%, 28.99%, and 38.72%, respectively.

The Fund delivered positive absolute returns for the prior fiscal year while outperforming the benchmark Russell 3000® Index as well. Stock selection added value during the year with a majority of gains concentrated within the industrials sector. Meanwhile sector positioning relative to the benchmark was close to neutral throughout the year consistent with the Fund’s investment process and, therefore, failed to add or detract significant value. Exposure to top-down factors offered mixed results relative to the benchmark throughout the year as well.

The Fund’s subadvisor, First Quadrant L.P. (“First Quadrant”) maintains a neutral positioning on market capitalization as it has for most of the past year. The indicators First Quadrant tracks have been biased towards small stocks, but not sufficiently to overcome a threshold First Quadrant imposes to control transaction costs. The outlook for price momentum is moderately positive as the economy continues to advance, which is positive for momentum. The Fund also maintains a modest value bias but one somewhat reduced from earlier in the year. At the sector level, the Fund maintains modest overweights to the information technology and telecomm sectors relative to the benchmark Russell 3000® Index but enters the new fiscal year with sector weightings broadly in-line with the benchmark. As a tax advantaged Fund, the Portfolio is managed to seek positive pre-tax and after-tax alpha. For this reason, First Quadrant employs tax-aware optimization which uses losses to offset gains as the Portfolio is repositioned. Currently most of the Portfolio is locked up in gains, however, the Fund continues to maintain a large tax loss carry-forward, all of which will expire in 2017.

This commentary reflects the viewpoints of the portfolio manager, First Quadrant L.P, as of October 31, 2013 and is not intended as a forecast or guarantee of future results, and is subject to change without notice.

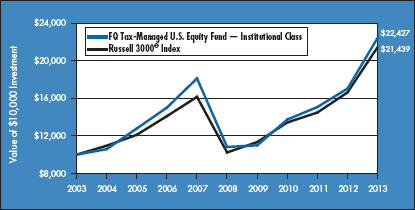

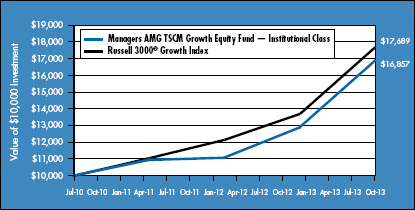

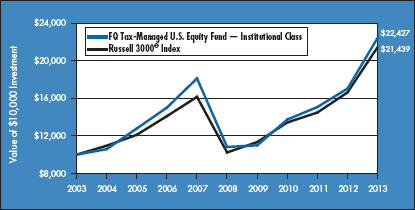

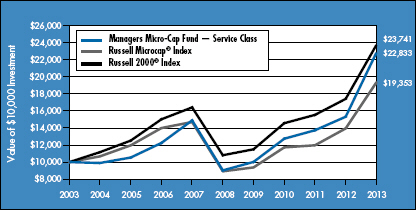

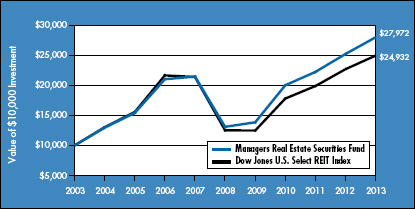

CUMULATIVE TOTAL RETURN PERFORMANCE

Managers AMG FQ Tax-Managed U.S. Equity Fund’s cumulative total return is based on the daily change in net asset value (NAV), and assumes that all distributions were reinvested. This chart compares a hypothetical $10,000 investment made in the Institutional Class Shares of the Fund on October 31, 2003 with a $10,000 investment made in the Russell 3000® Index for the same time period. Performance for periods longer than one year is annualized. The graph and table do not reflect the deduction of taxes that a shareholder would pay on a Fund distribution or redemption of shares. The listed returns for the Fund are net of expenses and the returns for the index exclude expenses. Past performance is not indicative of future results. Total returns would have been lower had certain expenses not been reduced.

4

Managers AMG FQ Tax-Managed U.S. Equity Fund

Portfolio Manager’s Comments (continued)

CUMULATIVE TOTAL RETURN PERFORMANCE (continued)

The table below shows the average annual total returns for the Managers AMG FQ Tax-Managed U.S. Equity Fund and the Russell 3000® Index for the same time periods ended October 31, 2013.

| | | | | | | | | | | | | | | | | | | | |

| | | Average Annual Total Returns1 | |

| | | One Year | | | Five Years | | | Ten Years | | | Since

Inception | | | Inception Date | |

Managers AMG FQ Tax-Managed U.S. Equity Fund 2,3 | |

Investor Class* | | | 31.31 | % | | | 15.43 | % | | | — | | | | 6.12 | % | | | 03/01/06 | |

Institutional Class | | | 31.72 | % | | | 15.70 | % | | | 8.41 | % | | | 6.06 | % | | | 12/18/00 | |

Russell 3000® Index 4 | | | 28.99 | % | | | 15.94 | % | | | 7.92 | % | | | 4.92 | % | | | 12/18/00 | |

Return After Tax on Distributions:5 | | | | | | | | | | | | | |

Investor Class* | | | 31.15 | % | | | 15.35 | % | | | — | | | | 6.07 | % | | | 03/01/06 | |

Institutional Class | | | 31.53 | % | | | 15.57 | % | | | 8.32 | % | | | 5.96 | % | | | 12/18/00 | |

Return After Tax on Distribution & Sale of Shares:5 | |

Investor Class* | | | 17.93 | % | | | 12.45 | % | | | — | | | | 4.86 | % | | | 03/01/06 | |

Institutional Class | | | 18.20 | % | | | 12.68 | % | | | 6.88 | % | | | 4.93 | % | | | 12/18/00 | |

The performance data shown represents past performance. Past performance is not a guarantee of future results. Current performance may be lower or higher than the performance data quoted. The investment return and principal value of an investment in the Fund will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. For performance information through the most recent month end, please call (800) 835-3879 or visit our Web site at www.managersinvest.com. Current net asset values per share for each Fund are available on the Fund’s Web site at www.managersinvest.com.

Investors should carefully consider the Fund’s investment objectives, risks, charges, and expenses before investing. For this and other information, please call (800) 835-3879 or visit our Web site at www.managersinvest.com for a free prospectus. Read it carefully before investing or sending money. Funds are distributed by Managers Distributors, Inc., member FINRA.

| * | The performance information for the Fund’s Investor Class shares (formerly Class A shares, were renamed Investor Class shares as of December 1, 2012) for periods prior to December 1, 2012 does not reflect the impact of the front-end and deferred sales charges (loads) that were in effect until December 1, 2012. |

| | |

1 | | Total return equals income yield plus share price change and assumes reinvestment of all dividends and capital gain distributions. Returns are net of fees and may reflect offsets of Fund expenses as described in the Prospectus. No adjustment has been made for taxes payable by shareholders on their reinvested dividends and capital gain distributions. Returns for periods greater than one year are the average annual returns. The listed returns on the Fund are net of expenses and based on the published NAV as of October 31, 2013. All returns are in U.S. dollars ($). |

2 | | From time to time, the Fund’s advisor has waived its fees and/or absorbed Fund expenses, which has resulted in higher returns. |

3 | | The Fund invests in large-capitalization companies that may underperform other stock funds (such as funds that focus on small and medium capitalization companies) when stocks of large-capitalization companies are out of favor. Although the Fund is managed to minimize taxable distributions, it may not be able to avoid taxable distributions. |

4 | | The Russell 3000® Index is composed of the 3,000 largest U.S. companies as measured by market capitalization, and represents approximately 98% of the U.S. stock market. Unlike the Fund, the Russell 3000® Index is unmanaged, is not available for investment, and does not incur expenses. |

5 | | After-tax returns are calculated using the historical highest individual federal marginal income tax rates and do not reflect the impact of state and local taxes. Actual after-tax returns depend on an investor’s tax situation and may differ from those shown, and after-tax returns are not relevant to investors who hold their Fund shares through tax-deferred arrangements, such as 401(k) plans or individual retirement accounts. |

| Not FDIC insured, nor bank guaranteed. May lose value. |

5

Managers AMG FQ Tax-Managed U.S. Equity Fund

Fund Snapshots

October 31, 2013

Portfolio Breakdown (unaudited)

| | | | | | | | |

Industry | | Managers AMG FQ

Tax-Managed

U.S. Equity Fund** | | | Russell 3000®

Index | |

Information Technology | | | 21.3 | % | | | 17.8 | % |

Financials | | | 14.9 | % | | | 17.3 | % |

Industrials | | | 12.8 | % | | | 11.5 | % |

Health Care | | | 12.2 | % | | | 12.5 | % |

Consumer Discretionary | | | 11.1 | % | | | 13.4 | % |

Energy | | | 9.5 | % | | | 9.5 | % |

Consumer Staples | | | 8.7 | % | | | 8.8 | % |

Materials | | | 3.7 | % | | | 3.8 | % |

Telecommunication Services | | | 3.3 | % | | | 2.2 | % |

Utilities | | | 0.8 | % | | | 3.2 | % |

Other Assets and Liabilities | | | 1.7 | % | | | 0.0 | % |

| ** | As a percentage of net assets |

Top Ten Holdings (unaudited)

| | | | |

Security Name | | %of

Net Assets | |

Chevron Corp.* | | | 3.0 | % |

Exxon Mobil Corp.* | | | 3.0 | |

Apple, Inc.* | | | 2.6 | |

International Business Machines Corp.* | | | 2.5 | |

Berkshire Hathaway, Inc., Class B* | | | 2.4 | |

MasterCard, Inc., Class A* | | | 2.3 | |

Visa, Inc., Class A* | | | 2.2 | |

DIRECTV* | | | 2.0 | |

Kroger Co., The | | | 1.7 | |

Microsoft Corp. | | | 1.6 | |

| | | | |

Top Ten as a Group | | | 23.3 | % |

| | | | |

| * | Top Ten Holding at April 30, 2013 |

Any sectors, industries, or securities discussed should not be perceived as investment recommendations. Mention of a specific security should not be considered a recommendation to buy or solicitation to sell that security. Specific securities mentioned in this report may have been sold from the Fund’s portfolio of investments by the time you receive this report.

6

Managers AMG FQ Tax-Managed U.S. Equity Fund

Schedule of Portfolio Investments

October 31, 2013

| | | | | | | | |

| | | Shares | | | Value | |

Common Stocks - 98.3% | | | | | | | | |

Consumer

Discretionary - 1.1% | | | | | | | | |

Aaron’s, Inc.* | | | 3,300 | | | $ | 93,621 | |

Bed Bath & Beyond, Inc.* | | | 6,400 | | | | 494,848 | |

Dillard’s, Inc., Class A | | | 8,900 | | | | 729,622 | |

DIRECTV* | | | 16,100 | | | | 1,006,089 | |

Discovery Communications, Inc., Class A* | | | 1,400 | | | | 124,488 | |

Gap, Inc., The | | | 14,000 | | | | 517,860 | |

Home Depot, Inc., The | | | 500 | | | | 38,945 | |

Jack in the Box, Inc.* | | | 12,200 | | | | 496,296 | |

Johnson Outdoors, Inc., Class A | | | 1,500 | | | | 41,145 | |

Liberty Global PLC, Class A* | | | 900 | | | | 70,533 | |

Lowe’s Cos., Inc. | | | 7,000 | | | | 348,460 | |

Macy’s, Inc. | | | 9,700 | | | | 447,267 | |

Ross Stores, Inc. | | | 700 | | | | 54,145 | |

Target Corp. | | | 2,000 | | | | 129,580 | |

TJX Cos., Inc. | | | 11,600 | | | | 705,164 | |

Visteon Corp.* | | | 2,800 | | | | 215,852 | |

Total Consumer Discretionary | | | | | | | 5,513,915 | |

Consumer Staples - 8.7% | | | | | | | | |

Archer-Daniels-Midland Co. | | | 2,300 | | | | 94,070 | |

CVS Caremark Corp. | | | 9,200 | | | | 572,792 | |

Hershey Co., The | | | 1,900 | | | | 188,556 | |

Kroger Co., The | | | 19,500 | | | | 835,380 | |

Oil-Dri Corp. of America | | | 1,400 | | | | 49,686 | |

Philip Morris International, Inc. | | | 6,400 | | | | 570,368 | |

Pilgrim’s Pride Corp.* | | | 34,500 | | | | 488,865 | |

Procter & Gamble Co., The | | | 3,400 | | | | 274,550 | |

Safeway, Inc. | | | 5,800 | | | | 202,420 | |

Tyson Foods, Inc., Class A | | | 16,200 | | | | 448,254 | |

Wal-Mart Stores, Inc. | | | 7,400 | | | | 567,950 | |

Total Consumer Staples | | | | | | | 4,292,891 | |

Energy - 9.5% | | | | | | | | |

Chevron Corp. | | | 12,300 | | | | 1,475,508 | |

ConocoPhillips | | | 10,800 | | | | 791,640 | |

Exxon Mobil Corp. | | | 16,400 | | | | 1,469,768 | |

Marathon Petroleum Corp. | | | 4,700 | | | | 336,802 | |

Occidental Petroleum Corp. | | | 3,500 | | | | 336,280 | |

Phillips 66 | | | 4,600 | | | | 296,378 | |

Total Energy | | | | | | | 4,706,376 | |

Financials - 14.9% | | | | | | | | |

American Financial Group, Inc. | | | 1,800 | | | | 101,268 | |

American International Group, Inc. | | | 4,900 | | | | 253,085 | |

American Tower Corp. | | | 800 | | | | 63,480 | |

| | | | | | | | |

| | | Shares | | | Value | |

Arch Capital Group, Ltd.* | | | 11,700 | | | $ | 678,132 | |

Bank of America Corp. | | | 7,100 | | | | 99,116 | |

Berkshire Hathaway, Inc., Class A* | | | 1 | | | | 172,995 | |

Berkshire Hathaway, Inc., Class B* | | | 10,287 | | | | 1,183,828 | |

Central Pacific Financial Corp. | | | 7,800 | | | | 143,676 | |

Chubb Corp., The | | | 2,200 | | | | 202,576 | |

Citigroup, Inc. | | | 3,600 | | | | 175,608 | |

Crawford & Co., Class B | | | 4,700 | | | | 51,653 | |

Discover Financial Services | | | 10,500 | | | | 544,740 | |

Everest Re Group, Ltd. | | | 2,200 | | | | 338,228 | |

FelCor Lodging Trust, Inc.* | | | 7,300 | | | | 49,056 | |

First Defiance Financial Corp. | | | 1,000 | | | | 25,820 | |

Franklin Resources, Inc. | | | 1,800 | | | | 96,948 | |

GAMCO Investors, Inc., Class A | | | 3,300 | | | | 235,983 | |

Goldman Sachs Group, Inc., The | | | 900 | | | | 144,774 | |

Hanmi Financial Corp. | | | 18,900 | | | | 330,372 | |

JPMorgan Chase & Co. | | | 10,400 | | | | 536,016 | |

KeyCorp | | | 25,800 | | | | 323,274 | |

Morgan Stanley | | | 1,200 | | | | 34,476 | |

PNC Financial Services Group, Inc., The | | | 2,300 | | | | 169,119 | |

PrivateBancorp, Inc. | | | 15,300 | | | | 372,708 | |

Provident Financial Holdings, Inc. | | | 1,900 | | | | 28,804 | |

SunTrust Banks, Inc. | | | 15,800 | | | | 531,512 | |

United Community Banks, Inc.* | | | 15,400 | | | | 240,086 | |

World Acceptance Corp.*,1 | | | 2,500 | | | | 260,300 | |

Total Financials | | | | | | | 7,387,633 | |

Health Care - 12.2% | | | | | | | | |

Actavis PLC* | | | 2,924 | | | | 451,992 | |

Amgen, Inc. | | | 6,300 | | | | 730,800 | |

Anika Therapeutics, Inc.* | | | 9,800 | | | | 292,726 | |

ArthroCare Corp.* | | | 3,700 | | | | 138,528 | |

Atrion Corp. | | | 251 | | | | 67,062 | |

Biogen Idec, Inc.* | | | 2,350 | | | | 573,846 | |

Cantel Medical Corp. | | | 2,250 | | | | 78,975 | |

CareFusion Corp.* | | | 14,600 | | | | 566,042 | |

Cyberonics, Inc.* | | | 2,400 | | | | 138,624 | |

Depomed, Inc.* | | | 3,500 | | | | 25,200 | |

Emergent Biosolutions, Inc.* | | | 1,300 | | | | 25,389 | |

Humana, Inc. | | | 1,800 | | | | 165,870 | |

Johnson & Johnson | | | 3,200 | | | | 296,352 | |

Lannett Co., Inc.* | | | 8,900 | | | | 210,129 | |

McKesson Corp. | | | 1,800 | | | | 281,412 | |

Medtronic, Inc. | | | 11,500 | | | | 660,100 | |

Pfizer, Inc. | | | 5,200 | | | | 159,536 | |

The accompanying notes are an integral part of these financial statements.

7

Managers AMG FQ Tax-Managed U.S. Equity Fund

Schedule of Portfolio Investments (continued)

| | | | | | | | |

| | | Shares | | | Value | |

Health Care - 12.2% (continued) | | | | | | | | |

Sciclone Pharmaceuticals, Inc.* | | | 10,800 | | | $ | 51,084 | |

SurModics, Inc.* | | | 19,000 | | | | 448,020 | |

UnitedHealth Group, Inc. | | | 10,100 | | | | 689,426 | |

Total Health Care | | | | | | | 6,051,113 | |

Industrials - 12.8% | | | | | | | | |

Alaska Air Group, Inc. | | | 11,200 | | | | 791,392 | |

AMERCO | | | 2,600 | | | | 525,018 | |

Consolidated Graphics, Inc.* | | | 7,200 | | | | 461,448 | |

Delta Air Lines, Inc. | | | 20,650 | | | | 544,747 | |

FedEx Corp. | | | 5,500 | | | | 720,500 | |

General Electric Co. | | | 7,800 | | | | 203,892 | |

Navigant Consulting, Inc.* | | | 8,700 | | | | 150,945 | |

Oshkosh Corp.* | | | 9,800 | | | | 466,382 | |

RPX Corp.* | | | 23,700 | | | | 423,282 | |

Swift Transportation Co.*,1 | | | 32,100 | | | | 699,459 | |

Towers Watson & Co., Class A | | | 2,200 | | | | 252,582 | |

UniFirst Corp. | | | 4,800 | | | | 493,536 | |

Union Pacific Corp. | | | 3,800 | | | | 575,320 | |

VSE Corp. | | | 600 | | | | 26,280 | |

Total Industrials | | | | | | | 6,334,783 | |

Information

Technology - 21.3% | | | | | | | | |

Activision Blizzard, Inc. | | | 28,000 | | | | 465,920 | |

Aeroflex Holding Corp.* | | | 5,700 | | | | 44,175 | |

Anaren, Inc.* | | | 5,100 | | | | 127,398 | |

Apple, Inc. | | | 2,513 | | | | 1,312,665 | |

Avnet, Inc. | | | 8,000 | | | | 317,600 | |

Benchmark Electronics, Inc.* | | | 17,000 | | | | 386,410 | |

Brocade Communications Systems, Inc.* | | | 5,100 | | | | 40,902 | |

Cisco Systems, Inc. | | | 21,500 | | | | 483,750 | |

EMC Corp. | | | 6,500 | | | | 156,455 | |

Google, Inc., Class A* | | | 301 | | | | 310,205 | |

International Business Machines Corp. | | | 6,800 | | | | 1,218,628 | |

MasterCard, Inc., Class A | | | 1,558 | | | | 1,117,242 | |

Microsoft Corp. | | | 22,700 | | | | 802,445 | |

Oracle Corp. | | | 23,600 | | | | 790,600 | |

PC Connection, Inc. | | | 13,900 | | | | 277,861 | |

Sanmina Corp.* | | | 19,900 | | | | 289,744 | |

SYNNEX Corp.* | | | 9,400 | | | | 576,220 | |

TiVo, Inc.* | | | 39,100 | | | | 519,639 | |

Visa, Inc., Class A | | | 5,600 | | | | 1,101,352 | |

| | | | | | | | |

| | | Shares | | | Value | |

Xerox Corp. | | | 20,900 | | | $ | 207,746 | |

Total Information Technology | | | | | | | 10,546,957 | |

Materials - 3.7% | | | | | | | | |

CF Industries Holdings, Inc. | | | 2,205 | | �� | | 475,398 | |

Graphic Packaging Holding Co.* | | | 25,300 | | | | 212,520 | |

KapStone Paper and Packaging Corp. | | | 2,500 | | | | 129,900 | |

LyondellBasell Industries N.V., Class A | | | 8,100 | | | | 604,260 | |

Westlake Chemical Corp. | | | 4,000 | | | | 429,680 | |

Total Materials | | | | | | | 1,851,758 | |

Telecommunication

Services - 3.3% | | | | | | | | |

AT&T, Inc. | | | 14,900 | | | | 539,380 | |

T-Mobile US, Inc.* | | | 13,450 | | | | 372,969 | |

United States Cellular Corp. | | | 4,300 | | | | 208,120 | |

Verizon Communications, Inc. | | | 10,300 | | | | 520,253 | |

Total

Telecommunication

Services | | | | | | | 1,640,722 | |

Utilities - 0.8% | | | | | | | | |

AES Corp., The | | | 27,000 | | | | 380,430 | |

Total Common Stocks (cost $32,794,778) | | | | | | | 48,706,578 | |

| | | Principal

Amount | | | | |

Short-Term

Investments - 3.0% | | | | | | | | |

Repurchase

Agreements - 1.3%2 | | | | | | | | |

BNP Paribas Securities Corp., dated 10/31/13, due 11/01/13, 0.090%, total to be received $642,544 (collateralized by various U.S. Government Agency Obligations, 0.250% - 3.125%, 02/28/14 - 02/15/43, totaling $655,393) | | $ | 642,542 | | | | 642,542 | |

| | | Shares | | | | |

Other Investment

Companies - 1.7%3 | | | | | | | | |

Dreyfus Institutional Cash Advantage Fund, Institutional Class Shares, 0.06% | | | 830,073 | | | | 830,073 | |

Total Short-Term Investments

(cost $1,472,615) | | | | | | | 1,472,615 | |

Total Investments - 101.3% (cost $34,267,393) | | | | | | | 50,179,193 | |

Other Assets, less

Liabilities - (1.3)% | | | | | | | (647,341 | ) |

Net Assets - 100.0% | | | | | | $ | 49,531,852 | |

The accompanying notes are an integral part of these financial statements.

8

Managers AMG FQ U.S. Equity Fund

Portfolio Manager’s Comments

THE YEAR IN REVIEW

For the fiscal year ended October 31, 2013, the Managers AMG FQ U.S. Equity Fund (Investor Class) returned 25.66%, compared to 28.99% for its benchmark, the Russell 3000® Index. Please refer to the table on page 37 for returns for various classes of shares.

U.S. equities continued their multi-year rally over the prior fiscal year as the Federal Reserve (the “Fed”) continued to fuel the rally with a combination of its easy money short- and long-term interest rate policies. With the exception of the May/June time period when investors became skittish about the prospects of the Federal Reserve pulling back on its third round of quantitative easing, equities moved ahead steadily and consistently throughout the year while frequently reaching new all-time highs. Investors skepticism generally remains, however, as both macro and micro conditions have only shown modest improvement throughout the year. While the likelihood appears that we are not headed for another recession in the near-future, prospects for a tepid recovery remain high and investors now fear the combination of high valuations for equities and the inevitable withdrawal of bond-buying from the Fed. For the entire one-year period ended October 31, 2013, smaller-cap equities generally outperformed their larger-cap brethren with the Russell 1000® (large cap), Russell 2000® (small cap), Russell 3000® (all cap), and the Russell Microcap® Indices returning 28.40%, 36.28%, 28.99%, and 38.72%, respectively.

The Fund delivered strong positive absolute returns for the prior fiscal year but trailed the benchmark during this time. The Fund detracted value from both the equity-only portion of its portfolio as well as from its put-spread collar options (protection strategy) positions. Stock selection weakness within the financials and health care sectors detracted from performance throughout the year although the Fund did benefit from strong selection within the industrials sector. Meanwhile, sector positioning relative to the benchmark was close to neutral throughout the year consistent with the Fund’s investment process and, therefore, failed to add or detract significant value. Exposure to top-down factors offered mixed results relative to the benchmark throughout the year. The

Fund’s protection strategy, an enhancement added to the Fund the prior fiscal year, as expected, detracted from performance as equity markets generally moved upward during this period.

The Fund’s subadvisor, First Quadrant L.P. (“First Quadrant”) maintains a neutral positioning on market capitalization as it has for most of the past year. The indicators First Quadrant tracks have been biased towards small stocks, but not sufficiently to overcome a threshold First Quadrant imposes to control transaction costs. The outlook for price momentum is moderately positive as the economy continues to advance, which is positive for momentum. The Fund also maintains a modest value bias but one somewhat reduced from earlier in the year. At the sector level, the Fund maintains modest overweights to the financials and information technology sectors relative to the benchmark Russell 3000® Index but enters the new fiscal year with sector weightings broadly in-line with the benchmark.

This commentary reflects the viewpoints of the portfolio manager, First Quadrant L.P, as of October 31, 2013 and is not intended as a forecast or guarantee of future results, and is subject to change without notice.

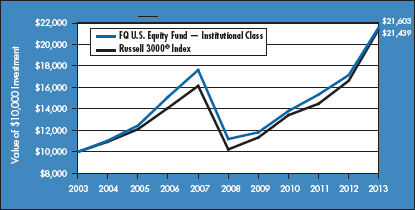

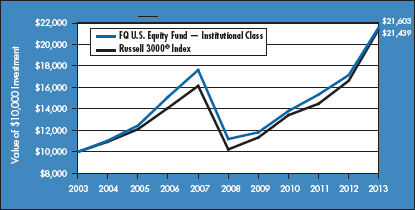

CUMULATIVE TOTAL RETURN PERFORMANCE

Managers AMG FQ U.S. Equity Fund’s cumulative total return is based on the daily change in net asset value (NAV), and assumes that all distributions were reinvested. This chart compares a hypothetical $10,000 investment made in the Institutional Class Shares of the Fund on October 31, 2003 with a $10,000 investment made in the Russell 3000® Index for the same time period. Performance for periods longer than one year is annualized. The graph and table do not reflect the deduction of taxes that a shareholder would pay on a Fund distribution or redemption of shares. The listed returns for the Fund are net of expenses and the returns for the index exclude expenses. Past performance is not indicative of future results. Total returns would have been lower had certain expenses not been reduced.

Managers AMG FQ U.S. Equity Fund

Portfolio Manager’s Comments (continued)

CUMULATIVE TOTAL RETURN PERFORMANCE (continued)

The table below shows the average annual total returns for the Managers AMG FQ U.S. Equity Fund and the Russell 3000® Index for the same time periods ended October 31, 2013.

| | | | | | | | | | | | | | | | | | | | |

| | | Average Annual Total Returns1 | |

| | One Year | | | Five Years | | | Ten Years | | | Since

Inception | | | Inception Date | |

Managers AMG FQ U.S. Equity Fund 2,3 | |

Investor Class* | | | 25.66 | % | | | 13.73 | % | | | — | | | | 5.80 | % | | | 03/01/06 | |

Institutional Class | | | 26.00 | % | | | 14.04 | % | | | 8.01 | % | | | 8.20 | % | | | 08/14/92 | |

Russell 3000® Index4,5 | | | 28.99 | % | | | 15.94 | % | | | 7.92 | % | | | 9.45 | % | | | 08/31/92 | |

The performance data shown represents past performance. Past performance is not a guarantee of future results. Current performance may be lower or higher than the performance data quoted. The investment return and principal value of an investment in the Fund will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. For performance information through the most recent month end, please call (800) 835-3879 or visit our Web site at www.managersinvest.com. Current net asset values per share for each Fund are available on the Fund’s Web site at www.managersinvest.com.

Investors should carefully consider the Fund’s investment objectives, risks, charges and expenses before investing. For this and other information, please call (800) 835-3879 or visit our Web site at www.managersinvest.com for a free prospectus. Read it carefully before investing or sending money. Funds are distributed by Managers Distributors, Inc., member FINRA.

| * | The performance information for the Fund’s Investor Class shares (formerly Class A shares, were renamed Investor Class shares as of December 1, 2012) for periods prior to December 1, 2012 does not reflect the impact of the front-end and deferred sales charges (loads) that were in effect until December 1, 2012. |

| 1 | Total return equals income yield plus share price change and assumes reinvestment of all dividends and capital gain distributions. Returns are net of fees and may reflect offsets of Fund expenses as described in the Prospectus. No adjustment has been made for taxes payable by shareholders on their reinvested dividends and capital gain distributions. Returns for periods greater than one year are the average annual returns. The listed returns on the Fund are net of expenses and based on the published NAV as of October 31, 2013. All returns are in U.S. dollars ($). |

| 2 | From time to time, the Fund’s advisor has waived its fees and/or absorbed Fund expenses, which has resulted in higher returns. |

| 3 | The Fund invests in large-capitalization companies that may underperform other stock funds (such as funds that focus on small and medium capitalization companies) when stocks of large-capitalization companies are out of favor. Also, the Fund may invest in derivatives; the complexity and rapidly changing structure of derivatives markets may increase the possibility of market losses. |

| | |

4 | | The Russell 3000® Index is composed of the 3,000 largest U.S. companies as measured by market capitalization, and represents approximately 98% of the U.S. stock market. Unlike the Fund, the Russell 3000® Index is unmanaged, is not available for investment, and does not incur expenses. |

5 | | The date reflects the closest available index date to the Fund’s inception date. |

Not FDIC insured, nor bank guaranteed. May lose value. |

| |

| |

| |

| |

| |

| |

| |

|

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

10

Managers AMG FQ U.S. Equity Fund

Fund Snapshots

October 31, 2013

Portfolio Breakdown (unaudited)

| | | | | | | | |

Industry | | Managers AMG FQ U.S. Equity

Fund** | | | Russell 3000®

Index | |

Information Technology | | | 18.7 | % | | | 17.8 | % |

Financials | | | 18.3 | % | | | 17.3 | % |

Consumer Discretionary | | | 12.7 | % | | | 13.4 | % |

Industrials | | | 11.7 | % | | | 11.5 | % |

Health Care | | | 11.4 | % | | | 12.5 | % |

Consumer Staples | | | 8.9 | % | | | 8.8 | % |

Energy | | | 8.7 | % | | | 9.5 | % |

Materials | | | 3.8 | % | | | 3.8 | % |

Telecommunication Services | | | 3.3 | % | | | 2.2 | % |

Utilities | | | 1.6 | % | | | 3.2 | % |

Other Assets and Liabilities | | | 0.9 | % | | | 0.0 | % |

| ** | As a percentage of net assets |

Top Ten Holdings (unaudited)

| | | | |

Security Name | | % of

Net Assets | |

Exxon Mobil Corp.* | | | 2.7 | % |

Berkshire Hathaway, Inc., Class B | | | 2.1 | |

JPMorgan Chase & Co. | | | 2.0 | |

Microsoft Corp.* | | | 2.0 | |

AT&T, Inc.* | | | 1.9 | |

Chevron Corp.* | | | 1.9 | |

Apple, Inc.* | | | 1.9 | |

Medtronic, Inc. | | | 1.6 | |

Cisco Systems, Inc.* | | | 1.6 | |

Union Pacific Corp.* | | | 1.5 | |

Top Ten as a Group | | | 19.2 | % |

| * | Top Ten Holding at April 30, 2013 |

Any sectors, industries, or securities discussed should not be perceived as investment recommendations. Mention of a specific security should not be considered a recommendation to buy or solicitation to sell that security. Specific securities mentioned in this report may have been sold from the Fund’s portfolio of investments by the time you receive this report.

11

Managers AMG FQ U.S. Equity Fund

Schedule of Portfolio Investments

October 31, 2013

| | | | | | | | |

| | | Shares | | | Value | |

Common Stocks - 99.1% | | | | | | | | |

Consumer

Discretionary - 12.7% | | | | | | | | |

Bally Technologies, Inc.* | | | 9,200 | | | $ | 672,888 | |

Best Buy Co., Inc. | | | 1,800 | | | | 77,040 | |

Capella Education Co.* | | | 5,200 | | | | 316,784 | |

CBS Corp., Class B | | | 8,200 | | | | 484,948 | |

Comcast Corp., Class A | | | 14,600 | | | | 694,668 | |

Dana Holding Corp. | | | 27,500 | | | | 539,000 | |

Domino’s Pizza, Inc. | | | 1,900 | | | | 127,414 | |

Gap, Inc., The | | | 16,600 | | | | 614,034 | |

Home Depot, Inc., The4 | | | 9,600 | | | | 747,744 | |

Macy’s, Inc. | | | 13,200 | | | | 608,652 | |

Marcus Corp., The | | | 3,300 | | | | 47,388 | |

Marriott International Inc., Class A | | | 1,200 | | | | 54,096 | |

Mattel, Inc. | | | 12,200 | | | | 541,314 | |

News Corp., Class A* | | | 5,725 | | | | 100,760 | |

NIKE, Inc., Class B | | | 3,000 | | | | 227,280 | |

Pool Corp. | | | 500 | | | | 27,190 | |

Smith & Wesson Holding Corp.*,1 | | | 2,700 | | | | 29,106 | |

TJX Cos., Inc. | | | 5,700 | | | | 346,503 | |

Twenty-First Century Fox, Inc., Class A | | | 22,900 | | | | 780,432 | |

Viacom, Inc., Class B | | | 1,300 | | | | 108,277 | |

Visteon Corp.* | | | 900 | | | | 69,381 | |

Walt Disney Co., The | | | 6,000 | | | | 411,540 | |

Wynn Resorts, Ltd. | | | 700 | | | | 116,375 | |

Total Consumer Discretionary | | | | | | | 7,742,814 | |

Consumer Staple - 8.9% | | | | | | | | |

Altria Group, Inc. | | | 1,600 | | | | 59,568 | |

Archer-Daniels-Midland Co. | | | 5,900 | | | | 241,310 | |

Brown-Forman Corp., Class B | | | 450 | | | | 32,841 | |

Church & Dwight Co., Inc. | | | 600 | | | | 39,090 | |

Clorox Co., The | | | 1,500 | | | | 135,285 | |

CVS Caremark Corp. | | | 5,700 | | | | 354,882 | |

Energizer Holdings, Inc. | | | 500 | | | | 49,055 | |

Green Mountain Coffee Roasters, Inc.*,1 | | | 1,800 | | | | 113,058 | |

Hershey Co., The | | | 500 | | | | 49,620 | |

Ingredion, Inc. | | | 6,700 | | | | 440,592 | |

Kroger Co., The4 | | | 19,200 | | | | 822,528 | |

Pilgrim’s Pride Corp.* | | | 37,000 | | | | 524,290 | |

Procter & Gamble Co., The4 | | | 8,800 | | | | 710,600 | |

Safeway, Inc. | | | 11,900 | | | | 415,310 | |

Tyson Foods, Inc., Class A | | | 23,200 | | | | 641,944 | |

USANA Health Sciences, Inc.*,1 | | | 1,000 | | | | 68,230 | |

Walgreen Co. | | | 3,500 | | | | 207,340 | |

| | | | | | | | |

| | | Shares | | | Value | |

Wal-Mart Stores, Inc. | | | 6,900 | | | $ | 529,575 | |

Total Consumer Staples | | | | | | | 5,435,118 | |

Energy - 8.7% | | | | | | | | |

Chevron Corp.4 | | | 9,700 | | | | 1,163,612 | |

ConocoPhillips4 | | | 10,400 | | | | 762,320 | |

Dawson Geophysical Co.* | | | 2,200 | | | | 64,328 | |

Exxon Mobil Corp.4 | | | 18,200 | | | | 1,631,084 | |

Helmerich & Payne, Inc. | | | 1,900 | | | | 147,345 | |

HollyFrontier Corp. | | | 2,600 | | | | 119,756 | |

Marathon Petroleum Corp. | | | 500 | | | | 35,830 | |

Matrix Service Co.* | | | 7,700 | | | | 160,083 | |

Occidental Petroleum Corp.4 | | | 3,000 | | | | 288,240 | |

Oceaneering International, Inc. | | | 900 | | | | 77,292 | |

Schlumberger, Ltd. | | | 3,200 | | | | 299,904 | |

Valero Energy Corp. | | | 13,600 | | | | 559,912 | |

Total Energy | | | | | | | 5,309,706 | |

Financials - 18.3% | | | | | | | | |

Aflac, Inc. | | | 11,900 | | | | 773,262 | |

Alexander’s, Inc. | | | 200 | | | | 64,352 | |

Allstate Corp., The | | | 7,900 | | | | 419,174 | |

American Capital Agency Corp. | | | 3,400 | | | | 73,848 | |

American Express Co.4 | | | 8,400 | | | | 687,120 | |

American International Group, Inc. | | | 1,500 | | | | 77,475 | |

American Tower Corp. | | | 400 | | | | 31,740 | |

Arch Capital Group, Ltd.* | | | 8,200 | | | | 475,272 | |

Arlington Asset Investment Corp., Class A | | | 5,800 | | | | 143,086 | |

AvalonBay Communities, Inc. | | | 400 | | | | 50,020 | |

Axis Capital Holdings, Ltd. | | | 2,600 | | | | 123,292 | |

Bancfirst Corp. | | | 1,100 | | | | 61,127 | |

Bank of America Corp. | | | 58,900 | | | | 822,244 | |

Berkshire Hathaway, Inc., Class B* | | | 11,300 | | | | 1,300,404 | |

Capstead Mortgage Corp. | | | 5,800 | | | | 68,614 | |

Central Pacific Financial Corp. | | | 7,200 | | | | 132,624 | |

Citigroup, Inc. | | | 4,800 | | | | 234,144 | |

Discover Financial Services | | | 2,100 | | | | 108,948 | |

Dynex Capital, Inc. | | | 6,300 | | | | 54,432 | |

Eagle Bancorp, Inc.* | | | 2,400 | | | | 63,480 | |

Everest Re Group, Ltd. | | | 400 | | | | 61,496 | |

First Merchants Corp. | | | 3,200 | | | | 60,160 | |

First NBC Bank Holding Co.* | | | 2,400 | | | | 63,960 | |

Franklin Resources, Inc. | | | 3,300 | | | | 177,738 | |

GAMCO Investors, Inc., Class A | | | 1,000 | | | | 71,510 | |

Geo Group, Inc., The | | | 1,400 | | | | 49,378 | |

Goldman Sachs Group, Inc., The | | | 2,100 | | | | 337,806 | |

.

|

The accompanying notes are an integral part of these financial statements. 12 |

Managers AMG FQ U.S. Equity Fund

Schedule of Portfolio Investments (continued)

| | | | | | | | |

| | | Shares | | | Value | |

Financials - 18.3% (continued) | | | | | | | | |

Hanmi Financial Corp. | | | 6,200 | | | $ | 108,376 | |

Health Care REIT, Inc. | | | 700 | | | | 45,395 | |

Horace Mann Educators Corp. | | | 7,200 | | | | 199,440 | |

JPMorgan Chase & Co.4 | | | 24,000 | | | | 1,236,960 | |

Morgan Stanley | | | 4,500 | | | | 129,285 | |

Old National Bancorp | | | 1,800 | | | | 26,172 | |

Potlatch Corp. | | | 15,600 | | | | 636,948 | |

Republic Bancorp, Inc., Class A | | | 1,900 | | | | 43,738 | |

Silver Bay Realty Trust Corp. | | | 1 | | | | 5 | |

Simon Property Group, Inc. | | | 1,900 | | | | 293,645 | |

State Street Corp. | | | 1,900 | | | | 133,133 | |

TD Ameritrade Holding Corp. | | | 2,300 | | | | 62,698 | |

Travelers Cos., Inc., The | | | 1,400 | | | | 120,820 | |

United Community Banks, Inc.* | | | 13,800 | | | | 215,142 | |

Universal Insurance Holdings, Inc. | | | 29,800 | | | | 233,632 | |

Webster Financial Corp. | | | 4,300 | | | | 119,927 | |

Wells Fargo & Co.4 | | | 16,400 | | | | 700,116 | |

XL Group PLC | | | 9,000 | | | | 275,130 | |

Total Financials | | | | | | | 11,167,268 | |

Health Care - 11.4% | | | | | | | | |

Abbott Laboratories | | | 1,400 | | | | 51,170 | |

Albany Molecular Research, Inc.* | | | 11,200 | | | | 146,720 | |

Allergan, Inc. | | | 500 | | | | 45,305 | |

Amgen, Inc. | | | 2,300 | | | | 266,800 | |

AMN Healthcare Services, Inc.* | | | 3,100 | | | | 38,440 | |

ArthroCare Corp.* | | | 8,400 | | | | 314,496 | |

Cambrex Corp.* | | | 2,100 | | | | 35,322 | |

Cyberonics, Inc.* | | | 5,400 | | | | 311,904 | |

Emergent Biosolutions, Inc.* | | | 3,100 | | | | 60,543 | |

Johnson & Johnson | | | 3,600 | | | | 333,396 | |

Lannett Co., Inc.* | | | 6,900 | | | | 162,909 | |

Ligand Pharmaceuticals, Inc., Class B* | | | 2,300 | | | | 119,048 | |

Magellan Health Services, Inc.* | | | 3,900 | | | | 228,930 | |

Medtronic, Inc. | | | 16,800 | | | | 964,320 | |

Merck & Co., Inc. | | | 800 | | | | 36,072 | |

PDL BioPharma, Inc.1 | | | 84,400 | | | | 682,796 | |

Pfizer, Inc.4 | | | 29,100 | | | | 892,788 | |

Providence Service Corp., The* | | | 2,000 | | | | 59,780 | |

Questcor Pharmaceuticals, Inc.1 | | | 6,600 | | | | 405,042 | |

Repligen Corp.* | | | 28,900 | | | | 316,166 | |

Select Medical Holdings Corp. | | | 6,000 | | | | 50,880 | |

SurModics, Inc.* | | | 1,900 | | | | 44,802 | |

United Therapeutics Corp.* | | | 1,500 | | | | 132,780 | |

| | | | | | | | |

| | | Shares | | | Value | |

UnitedHealth Group, Inc.4 | | | 8,300 | | | $ | 566,558 | |

Zimmer Holdings, Inc. | | | 600 | | | | 52,482 | |

Zoetis, Inc. | | | 19,500 | | | | 617,370 | |

Total Health Care | | | | | | | 6,936,819 | |

Industrials - 11.7% | | | | | | | | |

Allegiant Travel Co. | | | 3,200 | | | | 333,664 | |

American Science & Engineering, Inc. | | | 1,100 | | | | 72,358 | |

Boeing Co., The | | | 3,400 | | | | 443,700 | |

Coleman Cable, Inc. | | | 2,500 | | | | 61,500 | |

Consolidated Graphics, Inc.* | | | 3,900 | | | | 249,951 | |

Delta Air Lines, Inc. | | | 2,800 | | | | 73,864 | |

Deluxe Corp. | | | 4,700 | | | | 221,323 | |

Emerson Electric Co. | | | 2,200 | | | | 147,334 | |

FedEx Corp.4 | | | 1,400 | | | | 183,400 | |

General Electric Co. | | | 5,400 | | | | 141,156 | |

Hyster-Yale Materials Handling, Inc. | | | 600 | | | | 47,064 | |

Lockheed Martin Corp. | | | 6,500 | | | | 866,710 | |

Matson, Inc. | | | 2,300 | | | | 62,307 | |

Northrop Grumman Corp. | | | 7,000 | | | | 752,570 | |

Oshkosh Corp.* | | | 2,900 | | | | 138,011 | |

Parker Hannifin Corp. | | | 300 | | | | 35,016 | |

Republic Airways Holdings, Inc.* | | | 15,500 | | | | 182,590 | |

Rockwell Automation, Inc. | | | 600 | | | | 66,246 | |

Southwest Airlines Co. | | | 42,200 | | | | 726,684 | |

Swift Transportation Co.*,1 | | | 30,800 | | | | 671,132 | |

UniFirst Corp. | | | 6,200 | | | | 637,484 | |

Union Pacific Corp. | | | 6,000 | | | | 908,400 | |

United Parcel Service, Inc., Class B | | | 1,000 | | | | 98,240 | |

United Technologies Corp.4 | | | 400 | | | | 42,500 | |

Total Industrials | | | | | | | 7,163,204 | |

Information

Technology - 18.7% | | | | | | | | |

AOL, Inc.* | | | 1,000 | | | | 36,240 | |

Apple, Inc.4 | | | 2,201 | | | | 1,149,692 | |

Arrow Electronics, Inc.* | | | 1,200 | | | | 57,624 | |

Benchmark Electronics, Inc.* | | | 29,100 | | | | 661,443 | |

Brocade Communications Systems, Inc.* | | | 8,900 | | | | 71,378 | |

CA, Inc. | | | 19,200 | | | | 609,792 | |

Cabot Microelectronics Corp.* | | | 2,900 | | | | 118,581 | |

Cisco Systems, Inc.4 | | | 42,600 | | | | 958,500 | |

Fabrinet* | | | 25,300 | | | | 423,522 | |

First Solar, Inc.* | | | 2,800 | | | | 140,756 | |

FLIR Systems, Inc. | | | 2,200 | | | | 62,656 | |

Google, Inc., Class A* | | | 124 | | | | 127,792 | |

Harris Corp. | | | 11,100 | | | | 687,756 | |

The accompanying notes are an integral part of these financial statements.

13

Managers AMG FQ U.S. Equity Fund

Schedule of Portfolio Investments (continued)

| | | | | | | | |

| | | Shares | | | Value | |

Information Technology -

18.7% (continued) | | | | | | | | |

Hewlett-Packard Co. | | | 14,000 | | | $ | 341,180 | |

Insight Enterprises, Inc.* | | | 2,900 | | | | 61,103 | |

Intel Corp. | | | 7,200 | | | | 175,896 | |

InterDigital, Inc. | | | 12,800 | | | | 496,000 | |

International Business Machines Corp.4 | | | 4,300 | | | | 770,603 | |

Intuit, Inc. | | | 600 | | | | 42,846 | |

LSI Corp. | | | 8,600 | | | | 72,928 | |

Microsoft Corp.4 | | | 34,400 | | | | 1,216,040 | |

NIC, Inc. | | | 11,100 | | | | 273,282 | |

Oracle Corp.4 | | | 12,200 | | | | 408,700 | |

PC Connection, Inc. | | | 5,000 | | | | 99,950 | |

Sanmina Corp.* | | | 3,300 | | | | 48,048 | |

ScanSource, Inc.* | | | 4,200 | | | | 161,532 | |

Silicon Image, Inc.* | | | 13,000 | | | | 68,250 | |

Stamps.com, Inc.* | | | 800 | | | | 36,352 | |

TiVo, Inc.* | | | 14,400 | | | | 191,376 | |

ValueClick, Inc.* | | | 2,700 | | | | 51,867 | |

VeriSign, Inc.* | | | 10,100 | | | | 548,228 | |

Visa, Inc., Class A4 | | | 2,700 | | | | 531,009 | |

VMware, Inc., Class A* | | | 1,100 | | | | 89,408 | |

WebMD Health Corp.* | | | 11,900 | | | | 419,118 | |

Xerox Corp. | | | 23,900 | | | | 237,566 | |

Total Information Technology | | | | | | | 11,447,014 | |

Materials - 3.8% | | | | | | | | |

CF Industries Holdings, Inc. | | | 1,100 | | | | 237,160 | |

LyondellBasell Industries N.V., Class A | | | 10,500 | | | | 783,300 | |

Monsanto Co. | | | 1,300 | | | | 136,344 | |

Myers Industries, Inc. | | | 15,300 | | | | 272,646 | |

Packaging Corp. of America | | | 11,500 | | | | 716,220 | |

Schweitzer-Mauduit International, Inc. | | | 1,000 | | | | 61,880 | |

Silgan Holdings, Inc. | | | 1,100 | | | | 49,577 | |

SunCoke Energy, Inc.* | | | 3,900 | | | | 78,000 | |

Total Materials | | | | | | | 2,335,127 | |

Telecommunication Services - 3.3% | | | | | | | | |

AT&T, Inc.4 | | | 33,000 | | | | 1,194,600 | |

Atlantic Tele-Network, Inc. | | | 2,600 | | | | 144,092 | |

United States Cellular Corp. | | | 7,000 | | | | 338,800 | |

Verizon Communications, Inc. | | | 6,100 | | | | 308,111 | |

Total Telecommunication Services | | | | | | | 1,985,603 | |

Utilities - 1.6% | | | | | | | | |

American Electric Power Co., Inc. | | | 5,900 | | | | 276,356 | |

DTE Energy Co. | | | 8,100 | | | | 560,034 | |

Duke Energy Corp. | | | 800 | | | | 57,384 | |

| | | | | | | | |

| | | Shares | | | Value | |

Public Service Enterprise Group, Inc. | | | 3,100 | | | $ | 103,850 | |

Total Utilities | | | | | | | 997,624 | |

Total Common Stocks

(cost $49,369,552) | | | | | | | 60,520,297 | |

| | | Number of

Contracts | | | | |

Purchased Options - 0.2% | | | | | | | | |

S&P 500 Puts, 1550 Strike Price, Expiration 01/18/14 | | | 141 | | | | 77,550 | |

S&P 500 Puts, 1550 Strike Price, Expiration 11/16/13 | | | 106 | | | | 4,770 | |

S&P 500 Puts, 1600 Strike Price, Expiration 01/18/14 | | | 11 | | | | 9,515 | |

S&P 500 Puts, 1610 Strike Price, Expiration 12/21/13 | | | 79 | | | | 35,945 | |

Total Purchased Options

(cost $558,805) | | | | | | | 127,780 | |

| | | Principal

Amount | | | | |

Short-Term Investments - 3.8% | | | | | | | | |

Repurchase Agreements - 2.5%2 | | | | | | | | |

BNP Paribas Securities Corp., dated 10/31/13, due 11/01/13, 0.090%, total to be received $522,692 (collateralized by various U.S. Government Agency Obligations, 0.250% - 3.125%, 02/28/14 - 02/15/43, totaling $533,145) | | $ | 522,691 | | | | 522,691 | |

Citigroup Global Markets, Inc., dated 10/31/13, due 11/01/13, 0.110%, total to be received $1,000,003 (collateralized by various U.S. Government Agency Obligations, 1.625% - 7.000%, 01/01/14 - 10/01/43, totaling $1,020,000) | | | 1,000,000 | | | | 1,000,000 | |

Total Repurchase Agreements | | | | | | | 1,522,691 | |

| | | Shares | | | | |

Other Investment Companies - 1.3%3 | | | | | | | | |

Dreyfus Institutional Cash Advantage Fund, Institutional Class Shares, 0.06% | | | 784,340 | | | | 784,340 | |

Total Short-Term Investments

(cost $2,307,031) | | | | | | | 2,307,031 | |

Total Investments - 103.1%

(cost $52,235,388) | | | | | | | 62,955,108 | |

Other Assets, less Liabilities - (3.1)% | | | | | | | (1,892,290 | ) |

Net Assets - 100.0% | | | | | | $ | 61,062,818 | |

The accompanying notes are an integral part of these financial statements.

14

Managers AMG FQ Global Alternatives Fund

Portfolio Manager’s Comments

THE YEAR IN REVIEW

The Managers AMG FQ Global Alternatives Fund (“Global Alternatives” or the “Fund”) delivered negative returns for the past fiscal year ended October 31, 2013. The Fund (Investor Class) returned -1.39% while the benchmark, the Citigroup 1-Month Treasury Bill Index, returned 0.04% during this time. Please refer to the tables beginning on page 38 for the returns of the other share classes.

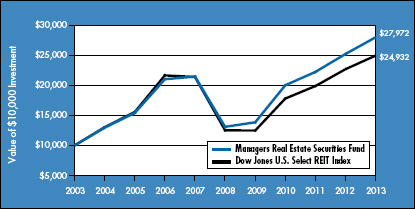

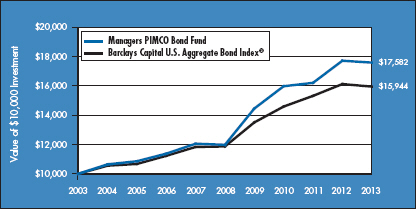

Global capital markets continued their multi-year rally over the prior fiscal year driven by risk-based assets as low interest rates and easy global central bank policy continued to push investors to these areas of the market. For the entire one-year period ended October 31, 2013, smaller-cap equities generally outperformed their larger-cap brethren with the Russell 1000® (large cap), Russell 2000® (small cap), Russell 3000® (all cap), and the Russell Microcap® Indices returning 28.40%, 36.28%, 28.99%, and 38.72%, respectively. International developed-market stocks modestly underperformed their domestic counterparts as the MSCI EAFE Index returned 26.88% during this period. Meanwhile, REITs sharply underperformed domestic U.S. equities returning 10.00% and were hurt during the selloff in May and June. Fixed-income securities struggled for the prior fiscal year as interest rates rose with the Barclays U.S. Aggregate and the Barclays Global Aggregate Indexes returning -1.08% and -1.54%, respectively. Lower-quality securities posted results much stronger than their higher-quality counterparts, returning 8.87% as measured by the Barclays U.S. Corporate High Yield Index.

During this period, the Global Alternatives Fund’s disappointing performance was primarily driven by losses within the stock country selection strategy in the fourth quarter of 2012 and April of this year. In the fourth quarter, losses were primarily driven by long exposure to U.S. equities. During April, the Fund’s anti “Euro Zone periphery” theme weighed heavily on results. The other three strategies had mixed results throughout the year. The Fund’s currency strategy added its most value towards the end of 2012 and amid the market volatility of May. In May, the Fund’s cross-sectional positioning was quite successful as currency markets rewarded fundamentally driven positions. The Fund’s bond country selection

strategy delivered positive results for the year including positive returns in five of the first six months. The Fund’s asset class selection strategy maintained a modest long position throughout the year which contributed positively to performance.

The Portfolio continues to be positioned relatively defensively in most sleeves as most of the sources of fundamental uncertainty present in the third quarter of 2013 continue to remain in place. We believe that the environment for the Fund has in general improved after the Fed’s decision not to taper. We expect the markets to gyrate less violently going forward, now that investors better understand the uncertainty surrounding a number of broad and country-specific events. We continue to monitor the signals and markets closely for those risks, including the consequences of the U.S. government shutdown and debt ceiling negotiations as well as central bank actions (or lack thereof).

This commentary reflects the viewpoints of the portfolio manager, First Quadrant L.P, as of October 31, 2013 and is not intended as a forecast or guarantee of future results, and is subject to change without notice.

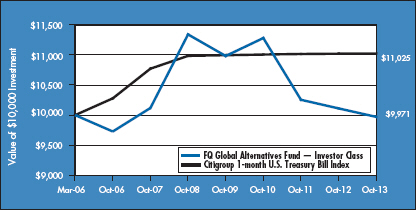

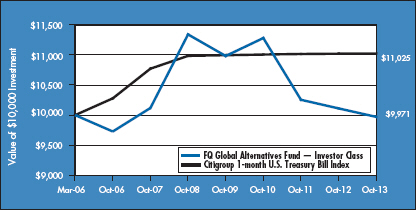

CUMULATIVE TOTAL RETURN PERFORMANCE

Managers AMG FQ Global Alternatives Fund’s cumulative total return is based on the daily change in net asset value (NAV), and assumes that all distributions were reinvested. This chart compares a hypothetical $10,000 investment made in the Investor Class of the Fund on March 30, 2006 (commencement of operations), to a $10,000 investment made in the 1-Month Treasury Index for the same time period. Figures include reinvestment of capital gains and dividends. The listed returns for the Fund are net of expenses and the returns for the index exclude expenses. Performance for periods longer than one year is annualized. The graph and table do not reflect the deduction of taxes that a shareholder would pay on a Fund distribution or redemption of shares. The listed returns for the Fund are net of expenses and the returns for the index exclude expenses. Past performance is not indicative of future results. Total returns would have been lower had certain expenses not been reduced.

15

Managers AMG FQ Global Alternatives Fund

Portfolio Manager’s Comments (continued)

CUMULATIVE TOTAL RETURN PERFORMANCE (continued)

The table below shows the average annual total returns for the Managers AMG FQ Global Alternatives Fund and the Citigroup 1-month U.S. Treasury Bill Index for the same time periods ended October 31, 2013.

| | | | | | | | | | | | | | | | |

| | | Average Annual Total Returns1 | |

| | | One Year | | | Five Years | | | Since

Inception | | | Inception

Date | |

Managers AMG FQ Global Alternative Fund 2,3,4,5,6 | |

Investor Class* | | | (1.39 | )% | | | (2.54 | )% | | | (0.04 | )% | | | 03/30/06 | |

Service Class** | | | (1.02 | )% | | | — | | | | (2.20 | )% | | | 01/01/10 | |

Institutional Class** | | | (0.88 | )% | | | — | | | | (2.08 | )% | | | 01/01/10 | |

Citigroup 1-month U.S. Treasury Bill Index7 | | | 0.04 | % | | | 0.07 | % | | | 1.34 | % | | | 03/31/06 | |

The performance data shown represents past performance. Past performance is not a guarantee of future results. Current performance may be lower or higher than the performance data quoted. The investment return and principal value of an investment in the Fund will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. For performance information through the most recent month end please call (800) 835-3879 or visit our Web site at www.managersinvest.com. Current net asset values per share for each Fund are available on the Fund’s Web site at www.managersinvest.com.

Investors should carefully consider the Fund’s investment objectives, risks, charges and expenses before investing. For this and other information, please call (800) 835-3879 or visit our Web site at www.managersinvest.com for a free prospectus. Read it carefully before investing or sending money. Funds are distributed by Managers Distributors, Inc., member FINRA.

| * | The performance information for the Fund’s Investor Class shares (formerly Class A shares, were renamed Investor Class shares as of December 1, 2012) for periods prior to December 1, 2012 does not reflect the impact of the front-end and deferred sales charges (loads) that were in effect until December 1, 2012. |

| ** | Service and Institutional Class shares commenced operations on January 1, 2010. |

| | |

1 Total return equals income yield plus share price change and assumes reinvestment of all dividends and capital gain distributions. Returns are net of fees and may reflect offsets of Fund expenses as described in the Prospectus. No adjustment has been made for taxes payable by shareholders on their reinvested dividends and capital gain distributions. Returns for periods greater than one year are the average annual returns. The listed returns on the Fund are net of expenses and based on the published NAV as of October 31, 2013. All returns are in U.S. dollars ($). |

2 From time to time, the Fund’s advisor has waived its fees and/or absorbed Fund expenses, which has resulted in higher returns. |

3 Changing interest rates may adversely affect the value of an investment. An increase in interest rates typically causes the value of bonds and other fixed-income securities to fall. |

4 The Fund may use derivative instruments for hedging purposes or as part of its investment strategy. There is a risk that a derivative intended as a hedge may not perform as expected. The main risk with derivatives is that some types can amplify a gain or loss, potentially earning or losing substantially more money than the actual cost of the derivative or that the counterparty may fail to honor its contract terms, causing a loss for the Fund. Use of these instruments may also involve certain costs and risks such as liquidity risk, interest rate risk, market risk, credit risk, management risk, and the risk that a fund could not close out a position when it would be most advantageous to do so. The Fund is subject to currency risk resulting from fluctuations in exchange rates that may affect the total loss or gain on a non- U.S. Dollar security when converted back to U.S. Dollars. |

5 Investments in foreign securities and currency instruments are subject to additional risks such as erratic market conditions, economic and political instability, and currency exchange rate fluctuations. |

6 Because the Fund invests in exchange traded funds (ETFs) which incur their own costs, investing in them could result in a higher cost to the investor. Additionally, the Fund will be indirectly exposed to all the risks of securities held by the ETFs. |

7 Performance for the Citigroup 1-month U.S. Treasury Bill Index reflects an inception date of March 31, 2006. The Citigroup 1-month U.S. Treasury Bill Index is a market value-weighted index of public obligations of the U.S. Treasury with maturities of one month. Unlike the Fund, the Citigroup 1-month U.S. Treasury Bill Index is unmanaged, is not available for investment, and does not incur expenses. |

| Not FDIC insured, nor bank guaranteed. May lose value. |

16

Managers AMG FQ Global Alternatives Fund

Schedule of Portfolio Investments

October 31, 2013

| | | | | | | | |

| | | Shares | | | Value | |

Exchange Traded Funds - 22.5% | | | | | | | | |

SPDR S&P 500 ETF Trust (cost $17,597,996) | | | 152,118 | | | $ | 26,731,696 | |

| | | Principal

Amount | | | | |

U.S. Government Obligations - 40.5% | | | | | | | | |

U.S. Treasury Bills, | | | | | | | | |

0.034%, 11/29/135,6 | | $ | 28,625,000 | | | | 28,624,227 | |

0.055%, 03/20/145,6 | | | 18,480,000 | | | | 18,476,082 | |

0.063%, 03/27/145,6 | | | 1,000,000 | | | | 999,747 | |

Total U.S. Government Obligations (cost $48,100,661) | | | | | | | 48,100,056 | |

| | | Shares | | | | |

Other Investment Companies - 39.4%3 | | | | | | | | |

Dreyfus Institutional Cash Advantage Fund, Institutional Class Shares, 0.06% | | | 21,985,804 | | | | 21,985,804 | |

JPMorgan Liquid Assets Money Market Fund, Capital Shares, 0.07% | | | 24,880,147 | | | | 24,880,147 | |

Total Other Investment Companies

(cost $46,865,951) | | | | | | | 46,865,951 | |

Total Investments - 102.4% (cost $112,564,608) | | | | | | | 121,697,703 | |

Other Assets, less Liabilities - (2.4)% | | | | | | | (2,859,319 | ) |

Net Assets - 100.0% | | | | | | $ | 118,838,384 | |

The accompanying notes are an integral part of these financial statements.

17

Managers AMG FQ Global Essentials Fund

Portfolio Manager’s Comments

THE YEAR IN REVIEW

The Managers AMG FQ Global Essentials Fund (“Global Essentials”) delivered positive absolute and relative returns for the past fiscal year ended October 31, 2013. The Fund (Investor Class shares) returned 1.16%, while its benchmark, which consists of 60% of the return of MSCI World (hedged) Index and 40% of the return of the Citigroup World Government Bond (hedged) Index, returned 15.18% during this time.

Global capital markets continued their multi-year rally over the prior fiscal year driven by risk-based assets as low interest rates and easy global central bank policy continued to push investors to these areas of the market. For the entire one-year period ended October 31, 2013, smaller-cap equities generally outperformed their larger-cap brethren with the Russell 1000® (large cap), Russell 2000® (small cap), Russell 3000® (all cap), and the Russell Microcap® Indices returning 28.40%, 36.28%, 28.99%, and 38.72%, respectively. International developed-market stocks modestly underperformed their domestic counterparts as the MSCI EAFE Index returned 26.88% during this period. Meanwhile, REITs sharply underperformed domestic U.S. equities returning 10.00% and were hurt during the sell-off in May and June. Fixed-income securities struggled for the prior fiscal year as interest rates rose with the Barclays U.S. Aggregate and the Barclays Global Aggregate Indexes returning -1.08% and -1.54%, respectively. Lower-quality securities posted results much stronger than their higher-quality counterparts, returning 8.87% as measured by the Barclays U.S. Corporate High Yield Index.

While the Fund delivered positive absolute performance for the year, May and June were a particularly tough performance period for the Fund. During that time, separate news events coincided to cause all three asset classes (equities, bonds and commodities) to decline together. Those independent events were the hints of the beginning of the end of the latest round of quantitative easing by the Federal Reserve and a darkening economic outlook in China and other emerging markets. Additional pressure also came from U.S. Dollar appreciation, as growth prospects in the U.S., while not vibrant, looked better than those of the rest of the world. A Fund like Global Essentials depends upon diversification to succeed. When correlations between asset classes temporarily increase due to a

coincidence of independent events, as they did during this period, the Fund can have a significant but, generally, short-lived draw down. The rise in correlations between stocks, bonds and commodities is usually not a long-term phenomenon and that proved to be the case this time as well. In the last four months of the fiscal year, the Fund performed well as the Fed tempered its statements and, coupled with improved Chinese growth data, caused the market to reflect and ultimately adjust expectations. This led to a bounce back in various asset classes and steady performance for the Fund through the end of the year.

The First Quadrant Market Risk Index, (one of First Quadrant’s proprietary investment tools) is currently measuring a “Very Low Risk” environment as of the end of the fiscal year driven by the low cost of hedging, narrow credit spreads and expansive monetary policy. This does not mean, however, that the world is without risk.

This commentary reflects the viewpoints of the portfolio manager, First Quadrant L.P,, as of October 31, 2013 and is not intended as a forecast or guarantee of future results, and is subject to change without notice.

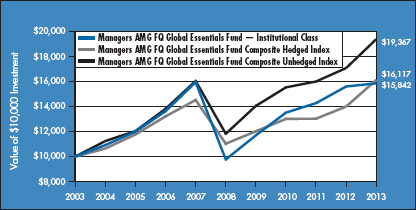

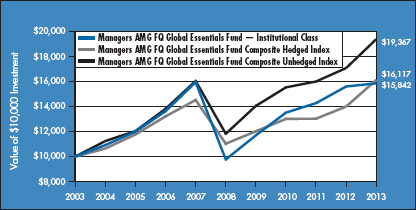

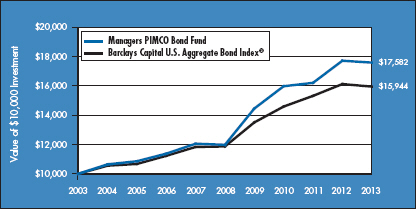

CUMULATIVE TOTAL RETURN PERFORMANCE

Managers AMG FQ Global Essentials Fund’s cumulative total return is based on the daily change in net asset value (NAV), and assumes that all distributions were reinvested. This chart compares a hypothetical $10,000 investment made in the Institutional Class Shares of the Fund on October 31, 2003, to a $10,000 investment made in the Hedged Index and the Unhedged Index for the same time period. Figures include reinvestment of capital gains and dividends. The listed returns for the Fund are net of expenses and the returns for the index exclude expenses. Performance for periods longer than one year is annualized. The graph and table do not reflect the deduction of taxes that a shareholder would pay on a Fund distribution or redemption of shares. The listed returns for the Fund are net of expenses and the returns for the index exclude expenses. Past performance is not indicative of future results. Total returns would have been lower had certain expenses not been reduced.

18

Managers AMG FQ Global Essentials Fund

Portfolio Manager’s Comments (continued)

CUMULATIVE TOTAL RETURN PERFORMANCE (continued)

The table below shows the average annual total returns for the Managers AMG FQ Global Essentials Fund and the Managers AMG FQ Global Essentials Fund Composite Hedged and Unhedged Indexes for the same time periods ended October 31, 2013.

| | | | | | | | | | | | | | | | | | | | |

| | | Average Annual Total Returns1 | |

| | | One Year | | | Five Years | | | Ten Years | | | Since

Inception | | | Inception Date | |

Managers AMG FQ Global Essentials Fund 2,3,4,5,6,7 | | | | | |

Investor Class* | | | 1.16 | % | | | — | | | | — | | | | 7.01 | % | | | 01/01/10 | |

Service Class* | | | 1.61 | % | | | — | | | | — | | | | 7.39 | % | | | 01/01/10 | |

Institutional Class | | | 1.61 | % | | | 10.14 | % | | | 4.71 | % | | | 6.22 | % | | | 11/18/88 | |

Managers AMG FQ Global Essentials Fund Composite Hedged Index8 | | | 15.18 | % | | | 7.88 | % | | | 4.89 | % | | | 5.76 | % | | | 11/30/88 | |

Managers AMG FQ Global Essentials Fund Composite Unhedged Index8 | | | 13.50 | % | | | 10.38 | % | | | 6.83 | % | | | 6.99 | % | | | 11/30/88 | |

The performance data shown represents past performance. Past performance is not a guarantee of future results. Current performance may be lower or higher than the performance data quoted. The investment return and principal value of an investment in the Fund will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. For performance information through the most recent month end please call (800) 835-3879 or visit our Web site at www.managersinvest.com. Current net asset values per share for each Fund are available on the Fund’s Web site at www.managersinvest.com.

Investors should carefully consider the Fund’s investment objectives, risks, charges and expenses before investing. For this and other information, please call (800) 835-3879 or visit our Web site at www.managersinvest.com for a free prospectus. Read it carefully before investing or sending money. Funds are distributed by Managers Distributors, Inc., member FINRA.

| * | Investor and Service Class shares commenced operations on January 1, 2010. |

| 1 | Total return equals income yield plus share price change and assumes reinvestment of all dividends and capital gain distributions. Returns are net of fees and may reflect offsets of Fund expenses as described in the Prospectus. No adjustment has been made for taxes payable by shareholders on their reinvested dividends and capital gain distributions. Returns for periods greater than one year are the average annual returns. The listed returns on the Fund are net of expenses and based on the published NAV as of October 31, 2013. All returns are in U.S. dollars ($). |

| 2 | From time to time, the Fund’s advisor has waived its fees and/or absorbed Fund expenses, which has resulted in higher returns. |

| 3 | Investments in foreign securities, even though publicly traded in the United States, may involve risks which are in addition to those inherent in domestic investments. The use of leverage in a Fund’s strategy can magnify relatively small market movements into relatively larger losses for the Fund. |

| | | | |

4 | | The Fund is subject to special risk considerations similar to those associated with the direct ownership of real estate. Real estate valuations may be subject to factors such as changing general and local economic, financial, competitive and environmental conditions. |

5 | | Because the Fund invests in exchange traded funds (ETFs) which incur their own costs, investing in them could result in a higher cost to the investor. Additionally, the Fund will be indirectly exposed to all the risks of securities held by the ETFs. |

6 | | Obligations of certain government agencies are not backed by the full faith and credit of the U.S. Government. If one of these agencies defaulted on a loan, there is no guarantee that the U.S. Government will provide financial support. Additionally, debt securities of the U.S. Government may be affected by changing interest rates and subject to prepayment risk. |