UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF

REGISTERED MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-06520

MANAGERS TRUST I

(Exact name of registrant as specified in charter)

| | |

| 800 Connecticut Avenue, Norwalk, Connecticut | | 06854 |

| (Address of principal executive offices) | | (Zip code) |

Managers Investment Group LLC

800 Connecticut Avenue, Norwalk, Connecticut 06854

(Name and address of agent for service)

Registrant’s telephone number, including area code: (203) 299-3500

Date of fiscal year end: OCTOBER 31

Date of reporting period: NOVEMBER 1, 2009 – OCTOBER 31, 2010

(Annual Shareholder Report)

| Item 1. | Reports to Shareholders |

ANNUAL REPORT

Managers AMG

October 31, 2010

FQ Tax-Managed U.S. Equity Fund

FQ U.S. Equity Fund

FQ Global Alternatives Fund

FQ Global Essentials Fund

Managers AMG FQ Funds

FQ Tax-Managed U.S. Equity, FQ U.S. Equity, FQ Global Alternatives, FQ Global Essentials

Annual Report—October 31, 2010

| | | | |

TABLE OF CONTENTS | | Page | |

| |

LETTER TO SHAREHOLDERS | | | 1 | |

| |

ABOUT YOUR FUND’S EXPENSES | | | 4 | |

| |

| INVESTMENT MANAGER’S COMMENTS, FUND SNAPSHOTS, AND SCHEDULES OF PORTFOLIO INVESTMENTS | | | | |

| |

FQ Tax-Managed U.S. Equity Fund | | | 5 | |

| |

FQ U.S. Equity Fund | | | 11 | |

| |

FQ Global Alternatives Fund | | | 18 | |

| |

FQ Global Essentials Fund | | | 20 | |

| |

FINANCIAL STATEMENTS: | | | | |

| |

Statements of Assets and Liabilities | | | 22 | |

| |

FQ Tax-Managed U.S. Equity and FQ U.S. Equity | | | | |

| |

Fund balance sheets, net asset value (NAV) per share computations and cumulative undistributed amounts | | | | |

| |

Statement of Net Assets | | | 23 | |

| |

FQ Global Alternatives and FQ Global Essentials | | | | |

| |

Portfolio of Investments, Fund balance sheet, net asset value (NAV) per share computations and cumulative undistributed amounts | | | | |

| |

Statements of Operations | | | 32 | |

| |

Detail of sources of income, Fund expenses, and realized and unrealized gains (losses) during the fiscal year | | | | |

| |

Statements of Changes in Net Assets | | | 33 | |

| |

Detail of changes in Fund assets for the past two fiscal years | | | | |

| |

FINANCIAL HIGHLIGHTS | | | 35 | |

| |

Historical net asset values per share, distributions, total returns, expense ratios, turnover ratios and net assets | | | | |

| |

NOTES TO FINANCIAL STATEMENTS | | | 42 | |

| |

Accounting and distribution policies, details of agreements and transactions with Fund management and affiliates, and descriptions of certain investment risks | | | | |

| |

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM | | | 50 | |

| |

TRUSTEES AND OFFICERS | | | 51 | |

| |

ANNUAL RENEWAL OF INVESTMENT ADVISORY AGREEMENTS | | | 52 | |

Nothing contained herein is to be considered an offer, sale or solicitation of an offer to buy shares of any series of the Managers Family of Funds. Such offering is made only by Prospectus, which includes details as to offering price and other material information.

Letter to Shareholders

Dear Shareholders:

Our foremost goal at Managers Investment Group (“MIG”) is to structure and manage mutual funds that will help our shareholders and clients successfully reach their investment goals and objectives.

Each of our Funds is geared to provide you with exposure to a specific asset class or style of investing. We believe investors tend to use our Funds as part of their broader portfolio in order to tailor their asset allocation to meet their individual needs. Most of our Funds, like those detailed in this report, are therefore designed to be building blocks.

At MIG, we have overall responsibility for the investment management and administration of the Funds. As a “manager of managers,” we work with external investment managers that make the day-to-day investment decisions in the Funds (the “Portfolio Managers”). We devote considerable resources to our disciplined process of identifying and selecting unaffiliated Portfolio Managers for the Funds. As a manager of managers, MIG performs many activities to monitor the ongoing investment, compliance, and administrative aspects of all of the Funds, which we believe gives our shareholders added confidence in their investments.

Our parent company, Affiliated Managers Group (“AMG”) is a global asset management company with ownership interests in a diverse group of boutique investment management firms (its “Affiliates”). MIG has the unique opportunity to access the investment skills and acumen of some of AMG’s Affiliates. The set of our Funds managed by these proprietary firms also benefits from our activities to monitor the investment, compliance, and administrative aspects of the Funds.

Below is a brief overview of the securities markets and the performance results of the Funds. Following this letter, we also provide the Portfolio Managers’ discussion of their investment management approach, performance results, and market outlook.

In anticipation of an enduring economic recovery, stocks and bonds posted strong gains over the past twelve months, especially in the U.S.; even after accounting for the weak results experienced during the second quarter when concerns over sovereign debt and the potential collapse of the Euro weighed heavily on the minds of investors. More specifically, riskier assets such as small-cap stocks and high yield bonds were among the performance leaders. After the brief setback during the second quarter, markets resumed their upward paths in the third quarter despite signs that economic growth had slowed, especially in the developed nations. Throughout the third quarter, investor optimism grew in anticipation of the next round of quantitative easing, also known as QE2. Then in mid-October during a speech in Boston, Federal Reserve Chairman, Ben Bernanke, provided a rather clear signal that the Fed is ready to engage in another round of quantitative easing in order to spur the U.S. economy. The Fed’s plan, while criticized by some well-known market participants, has apparently contributed to renewed strength in risk-based assets. Only time will tell as to whether this plan will achieve the Fed’s objectives.

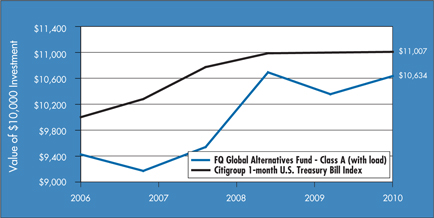

Against this backdrop, for the one-year period ended October 31, 2010, the Managers AMG FQ U.S. Equity Fund (“U.S. Equity Fund”) returned 16.75% and the Managers AMG FQ Tax-Managed U.S. Equity Fund (“Tax-Managed Fund”) returned 24.92%, compared to 18.34% for the benchmark Russell 3000® Index. The Managers AMG FQ Global Alternatives Fund (“Global Alternatives Fund”) returned 2.71% compared to a return of 0.11% for its benchmark, the Citigroup 1-Month U.S. Treasury Bill Index, for the one-year period that ended October 31, 2010. Finally, the Managers AMG FQ Global Essentials

1

Letter to Shareholders (continued)

Fund (“Global Essentials Fund”) returned 15.50%, compared with 8.25% for its benchmark, which consists of 60% of the return of MSCI World (hedged) Index and 40% of the return of the Citigroup World Government Bond (hedged) Index for this same one-year period. Performance stated above is for each Fund’s Institutional Class except for Global Alternatives Fund which is Class A at Net Asset Value. Other share classes would have experienced different results.

| | | | | | | | | | | | | | | | | | | | | | | | |

Periods Ended 10/31/10 | | 6 Months | | | 1 Year | | | 3 Years | | | 5 Years | | | 10 Years | | | Inception

Date | |

FQ Tax-Managed U.S. Equity, Institutional Class | | | 2.90 | % | | | 24.92 | % | | | (8.80 | )% | | | 1.45 | % | | | — | | | | 12/18/2000 | |

Russell 3000® Index | | | 0.60 | % | | | 18.34 | % | | | (5.96 | )% | | | 2.08 | % | | | 0.62 | % | | | 12/18/2000 | |

FQ U.S. Equity, Institutional Class | | | 1.47 | % | | | 16.75 | % | | | (7.81 | )% | | | 2.09 | % | | | 0.07 | % | | | 8/14/1992 | |

Russell 3000® Index | | | 0.60 | % | | | 18.34 | % | | | (5.96 | )% | | | 2.08 | % | | | 0.62 | % | | | 8/14/1992 | |

FQ Global Alternatives, Class A (No Load) | | | 0.59 | % | | | 2.71 | % | | | 3.69 | % | | | — | | | | — | | | | 3/30/2006 | |

Citigroup 1-Month U.S. Treasury Bill Index1 | | | 0.08 | % | | | 0.11 | % | | | 0.72 | % | | | — | | | | — | | | | 3/31/2006 | |

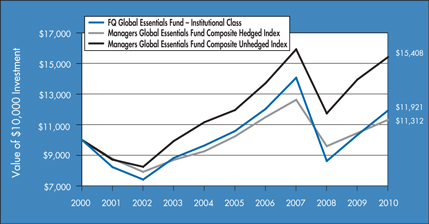

FQ Global Essentials Fund, Institutional Class | | | 7.67 | % | | | 15.50 | % | | | (5.35 | )% | | | 2.42 | % | | | 1.77 | % | | | 11/18/1988 | |

60% MSCI World Index (hedged) & 40% Citigroup World Government Bond Index (hedged) | | | 1.07 | % | | | 8.25 | % | | | (3.58 | )% | | | 2.03 | % | | | 1.24 | % | | | 11/18/1988 | |

Performance for all share classes and detailed Fund positioning reviews are included within this report.

For the 12 months ended October 31, 2010, the Managers AMG FQ U.S. Equity Fund (Institutional Class) returned 16.75%, compared with 18.34% for its benchmark, the Russell 3000® Index. For the 12 months ended October 31, 2010, the Managers AMG FQ Tax-Managed U.S. Equity Fund (Institutional Class) returned 24.92%, compared with 18.34% for its benchmark, the Russell 3000® Index. While the U.S. Equity Fund failed to keep pace with its benchmark, the Tax-Managed Fund managed strong outperformance for the year. Stock selection was the primary driver of performance in both portfolios, with the U.S. Equity Fund underperforming primarily due to weakness within the information technology sector. The Tax-Managed Fund, however, experienced solid stock selection across a number of sectors including the consumer discretionary, financials, health care, and materials sectors. In addition, relative sector positioning added value despite maintaining a near neutral weighting versus the benchmark across a majority of sectors throughout the course of the past year. In particular, the Fund added value through its overweight to the recovering consumer discretionary sector, which boasted the strongest sector returns during this period.

The Fund’s subadvisor, First Quadrant L.P. (“First Quadrant”) has become somewhat more optimistic about the global economy in recent months as economic data has not been as gloomy as feared, the Federal Reserve has initiated a second round of quantitative easing, and earnings have pleasantly surprised. However, some of this has already been reflected in the market. From a sector standpoint, the Fund remains fairly neutral to the benchmark although the portfolio has begun to take more active positions from a risk factor standpoint. For example, the Fund has increasingly favored more volatile stocks and this was beneficial towards the latter portion of the fiscal year when the U.S. equity market rallied. In addition, the Fund has increased its preference for equities with good valuations, especially with respect to earnings. That said, some of these top-down factor tilts have been reined in recently including the Fund’s tilt towards small-cap equities which look much more fairly valued versus their larger-capitalization counterparts after an extended period of outperformance.

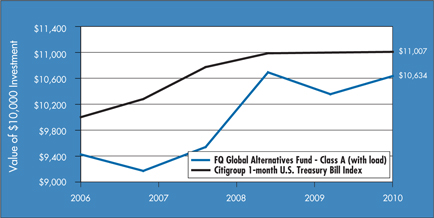

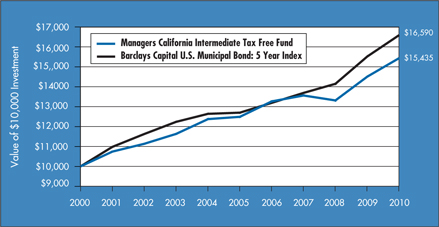

For the 12 months ended October 31, 2010, the Managers AMG FQ Global Alternatives Fund (Class A Shares at NAV) returned 2.71% while its benchmark, the Citigroup 1-Month U. S. Treasury Bill Index, returned 0.11%. During this period, the Global Alternatives Fund delivered positive performance while continuing to exhibit low correlation relative to broader markets. Within the Fund, solid performance was primarily driven by success within the bond country selection and currency selection strategies. The asset class selection strategy, along with the stock country selection strategy, offered mixed results throughout the last year.

2

Letter to Shareholders (continued)

The tactical risk allocation in the Fund currently finds the most compelling opportunity within the asset class selection strategy where it maintains a long position in global equities and a corresponding short position in global fixed income. This is driven by several factors within this particular strategy, including the more benign risk environment we recently entered into which should be more conducive to solid performance from equities. The currency selection strategy continues to have a significant weight within the Fund with its largest long positions to the U.K. Pound and U.S. Dollar and short positions to the Australian and Canadian Dollars. In the bond country selection strategy, the largest positions currently are a long to the U.S. bond market and shorts to the Australian and Canadian bond markets. Finally, the stock country selection strategy has the smallest risk allocation currently of the four strategies with its current largest active positions both on the short side (shorts to the Australian and Canadian equity markets).

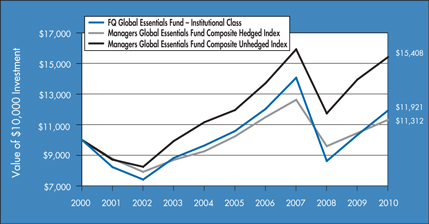

For the 12 months ended October 31, 2010, the Managers AMG FQ Global Essentials Fund (Institutional Class) returned 15.50% while the benchmark, which consists of 60% of the return of MSCI World (hedged) Index and 40% of the return of the Citigroup World Government Bond (hedged) Index, returned 8.25% during this period. Strong absolute performance by the Fund over the past year was driven by investments within all three major asset classes in the portfolio, which include equities, fixed income, and hard assets (commodities and TIPS). The Fund also outperformed a 60\40 balanced benchmark significantly over the last year. This was primarily driven by strong performance within the equity and commodity portion of the Fund as well as by the risk-balanced nature of investments within the portfolio as opposed to using a market capitalization weighting scheme. For example, within equities, the Fund boasted strong performance relative to a 60\40 balanced benchmark because of increased exposure to U.S. small caps and REITs which continued to outperform U.S. large-cap securities. The portfolio also marginally benefited from “regime switching” over the last fiscal year which is the tactical reallocation of assets in the Fund based upon the prevailing risk environment that is driven by First Quadrant’s proprietary Market Risk Index.

The First Quadrant Market Risk Index, (one of FQ’s proprietary investment tools) is currently measuring a “Median Risk” environment as of the end of the fiscal year as, more recently, the VIX, a popular measure of the implied volatility of the S&P 500 Index, has dropped and credit spreads have also come in below their trigger levels. This has led to a recent increase in exposure to both equities and commodities and a decrease in exposure to the sovereign debt portion of the Fund.

The following report covers the one-year period that ended October 31, 2010. Should you have any questions about this report, or if you’d like to receive a prospectus and additional information, including fees and expenses for these or any of the other Funds in our family, please feel free to contact us at 1-800-835-3879, or visit our Web site at www.managersinvest.com. As always, please read the prospectus carefully before you invest or send money.

If you are curious about how you can better diversify your investment program, visit the Knowledge Center on our Web site and view our articles in the investment strategies section. You can rest assured that under all market conditions our team is focused on delivering excellent investment management services for your benefit.

We thank you for your continued confidence and investment in The Managers Funds.

|

| Respectfully, |

|

|

| John H. Streur |

| Senior Managing Partner |

| Managers Investment Group LLC |

3

About Your Fund’s Expenses

As a shareholder of a Fund, you may incur two types of costs: (1) transaction costs, which may include sales charges (loads) on purchase payments; redemption fees; and exchange fees; and (2) ongoing costs, including management fees; distribution (12b-1) fees; and other Fund expenses. This example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds. The example is based on $1,000 invested at the beginning of the period and held for the entire period as indicated below.

Actual Expenses

The first line of the following table provides information about the actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

The second line of the following table provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed annual rate of return of 5% before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds by comparing this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as sales charges (loads), redemption fees, or exchange fees. Therefore, the second line of the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds.

| | | | | | | | | | | | | | | | |

Six Months Ended October 31, 2010 | | Expense

Ratio for

the Period | | | Beginning

Account Value

05/01/10 | | | Ending

Account Value

10/31/10 | | | Expenses

Paid During

the Period* | |

FQ Tax-Managed U.S. Equity Fund | | | | | | | | | | | | | | | | |

Class A Shares | | | | | | | | | | | | | | | | |

Based on Actual Fund Return | | | 1.24 | % | | $ | 1,000 | | | $ | 1,028 | | | $ | 6.34 | |

Hypothetical (5% return before expenses) | | | 1.24 | % | | $ | 1,000 | | | $ | 1,019 | | | $ | 6.31 | |

Class C Shares | | | | | | | | | | | | | | | | |

Based on Actual Fund Return | | | 1.99 | % | | $ | 1,000 | | | $ | 1,024 | | | $ | 10.15 | |

Hypothetical (5% return before expenses) | | | 1.99 | % | | $ | 1,000 | | | $ | 1,015 | | | $ | 10.11 | |

Institutional Class Shares | | | | | | | | | | | | | | | | |

Based on Actual Fund Return | | | 0.99 | % | | $ | 1,000 | | | $ | 1,029 | | | $ | 5.06 | |

Hypothetical (5% return before expenses) | | | 0.99 | % | | $ | 1,000 | | | $ | 1,020 | | | $ | 5.04 | |

FQ U.S. Equity Fund | | | | | | | | | | | | | | | | |

Class A Shares | | | | | | | | | | | | | | | | |

Based on Actual Fund Return | | | 1.04 | % | | $ | 1,000 | | | $ | 1,015 | | | $ | 5.28 | |

Hypothetical (5% return before expenses) | | | 1.04 | % | | $ | 1,000 | | | $ | 1,020 | | | $ | 5.30 | |

Class C Shares | | | | | | | | | | | | | | | | |

Based on Actual Fund Return | | | 1.79 | % | | $ | 1,000 | | | $ | 1,011 | | | $ | 9.07 | |

Hypothetical (5% return before expenses) | | | 1.79 | % | | $ | 1,000 | | | $ | 1,016 | | | $ | 9.10 | |

Institutional Class Shares | | | | | | | | | | | | | | | | |

Based on Actual Fund Return | | | 0.79 | % | | $ | 1,000 | | | $ | 1,015 | | | $ | 4.01 | |

Hypothetical (5% return before expenses) | | | 0.79 | % | | $ | 1,000 | | | $ | 1,021 | | | $ | 4.02 | |

FQ Global Alternatives Fund | | | | | | | | | | | | | | | | |

Class A Shares | | | | | | | | | | | | | | | | |

Based on Actual Fund Return | | | 1.92 | % | | $ | 1,000 | | | $ | 1,006 | | | $ | 9.71 | |

Hypothetical (5% return before expenses) | | | 1.92 | % | | $ | 1,000 | | | $ | 1,016 | | | $ | 9.76 | |

Class C Shares | | | | | | | | | | | | | | | | |

Based on Actual Fund Return | | | 2.49 | % | | $ | 1,000 | | | $ | 1,004 | | | $ | 12.58 | |

Hypothetical (5% return before expenses) | | | 2.49 | % | | $ | 1,000 | | | $ | 1,013 | | | $ | 12.63 | |

Service Class Shares | | | | | | | | | | | | | | | | |

Based on Actual Fund Return | | | 1.71 | % | | $ | 1,000 | | | $ | 1,008 | | | $ | 8.65 | |

Hypothetical (5% return before expenses) | | | 1.71 | % | | $ | 1,000 | | | $ | 1,017 | | | $ | 8.69 | |

Institutional Class Shares | | | | | | | | | | | | | | | | |

Based on Actual Fund Return | | | 1.49 | % | | $ | 1,000 | | | $ | 1,009 | | | $ | 7.55 | |

Hypothetical (5% return before expenses) | | | 1.49 | % | | $ | 1,000 | | | $ | 1,017 | | | $ | 7.58 | |

FQ Global Essentials Fund | | | | | | | | | | | | | | | | |

Investor Class Shares | | | | | | | | | | | | | | | | |

Based on Actual Fund Return | | | 1.49 | % | | $ | 1,000 | | | $ | 1,076 | | | $ | 7.80 | |

Hypothetical (5% return before expenses) | | | 1.49 | % | | $ | 1,000 | | | $ | 1,018 | | | $ | 7.58 | |

Service Class Shares | | | | | | | | | | | | | | | | |

Based on Actual Fund Return | | | 1.24 | % | | $ | 1,000 | | | $ | 1,074 | | | $ | 6.48 | |

Hypothetical (5% return before expenses) | | | 1.24 | % | | $ | 1,000 | | | $ | 1,019 | | | $ | 6.31 | |

Institutional Class Shares | | | | | | | | | | | | | | | | |

Based on Actual Fund Return | | | 0.99 | % | | $ | 1,000 | | | $ | 1,077 | | | $ | 5.18 | |

Hypothetical (5% return before expenses) | | | 0.99 | % | | $ | 1,000 | | | $ | 1,020 | | | $ | 5.04 | |

| * | Expenses are equal to the Fund’s annualized expense ratio multiplied by the average account value over the period, multiplied by the number of days in the most recent fiscal half-year (184), then divided by 365. |

4

Managers AMG FQ Tax-Managed U.S. Equity Fund

Portfolio Manager’s Comments

For the fiscal year ended October 31, 2010, the Managers AMG FQ Tax-Managed U.S. Equity Fund (Institutional Class) returned 24.92% compared to 18.34% for its benchmark, the Russell 3000® Index. Please refer to the table on page 6 for returns for various classes of shares.

The past twelve months saw a continuation of the market rally that began back in March 2009, although certainly with more stops and starts than witnessed at the beginning of the rally. The lower- quality nature of the equity rally leveled off during the fourth quarter of 2010, although high-quality stocks have yet to significantly outpace their lower-quality counterparts and the market has continued to be driven by headline and macroeconomic news as opposed to underlying fundamentals of individual companies. The early portion of the year was characterized by the relative strength of the U.S. Dollar (and its subsequent consequences for companies in the U.S. with different levels of exposure to the strength of the Dollar) as global investors found the reserve status of the Dollar particularly comforting in the wake of a weakening Euro amid the concern of potential default risk for several sovereign nations in continental Europe. The second quarter of 2010 was marked by renewed fears of financial contagion and slowing economic growth. The third quarter of 2010 was a perfect microcosm of the skittishness of the market and investors over the course of the past year. In July, solid earnings from a number of bell weather companies led to strong market results. August featured a renewed round of lukewarm economic data that led to a market pullback and increased risk aversion amongst investors. September and October, on the other hand, saw a sharp market bounce back and increased risk taking among investors who still have considerable cash waiting to be invested but are still hesitant among reentering equity markets.

The Fund delivered solid positive absolute and relative returns for the fiscal year. Relative to the benchmark, the Fund experienced solid stock selection across a number of sectors including the consumer discretionary, financials, health care, and materials sectors. In addition, relative sector positioning added value despite maintaining a near neutral weighting versus the benchmark across a majority of sectors throughout the course of the past year. In particular, the Fund added value via its overweight to the recovering consumer discretionary sector, which boasted the strongest sector returns during this period. In addition, the Fund was a beneficiary of its modest underweight to the energy sector which, despite having positive returns, was the worst performing sector during the past fiscal year.

The Fund’s subadvisor, First Quadrant L.P. (“First Quadrant”), has become somewhat more optimistic about the global economy in recent months as economic data has not been as gloomy as feared, the Federal Reserve has initiated a second round of quantitative easing, and earnings have pleasantly surprised. However, some of this has already been reflected in the market. From a sector standpoint, the Fund remains fairly neutral to the benchmark although the portfolio has begun to take more active positions from a risk factor standpoint. For example, the Fund has increasingly favored more volatile stocks and that was beneficial towards the latter portion of the fiscal year when the U.S. equity market rallied. In addition, the Fund has increased its preference for equities with good valuations, especially with respect to earnings. That said, some of these top-down factor tilts have been reined in recently including the Fund’s tilt towards small-cap equities, which look much more fairly valued versus their larger-capitalization counterparts after an extended period of outperformance.

Cumulative Total Return Performance

Managers AMG FQ Tax-Managed U.S. Equity Fund’s cumulative total return is based on the daily change in net asset value (NAV), and assumes that all distributions were reinvested. The Russell 3000® Index is composed of the 3000 largest U.S. companies as measured by market capitalization, and represents about 98% of the U.S. stock market. Unlike the Fund, the Russell 3000® Index is unmanaged, is not available for investment, and does not incur expenses. The chart on page 6 illustrates the performance of a hypothetical $10,000 investment made in the Institutional Class Shares of the Fund on December 18, 2000 (commencement of operations) to a $10,000 investment made in the Russell 3000® Index for the same time periods. Performance for periods longer than one year is annualized. Figures include reinvestment of capital gains and dividends. The listed returns for the Fund are net of expenses and the returns for the indices exclude expenses. Total returns for the Fund would have been lower had certain expenses not been reduced.

5

Managers AMG FQ Tax-Managed U.S. Equity Fund

Portfolio Manager’s Comments (continued)

Cumulative Total Return Performance

The table below shows the average annual total returns for the Managers AMG FQ Tax-Managed U.S. Equity Fund since inception and the Russell 3000® Index from December 18, 2000 to October 31, 2010.

| | | | | | | | | | | | | | | | |

Average Annual Total Returns1 | | One Year | | | Five Years | | | Since Inception | | | Inception Date | |

Managers AMG FQ Tax- Managed U.S. Equity Fund2,5,6 | | | | | | | | | | | | | | | | |

No Load Before Tax: | | | | | | | | | | | | | | | | |

Institutional Class | | | 24.92 | % | | | 1.45 | % | | | 2.75 | % | | | 12/18/00 | |

Class A* | | | 24.58 | % | | | — | | | | (0.57 | )% | | | 03/01/06 | |

Class C* | | | 23.71 | % | | | — | | | | (1.32 | )% | | | 03/01/06 | |

Russell 3000® Index4 | | | 18.34 | % | | | 2.08 | % | | | 1.45 | % | | | 12/18/00 | |

No Load After Tax on Distributions3 | | | | | | | | | | | | | | | | |

Institutional Class | | | 24.87 | % | | | 1.36 | % | | | 2.65 | % | | | 12/18/00 | |

Class A* | | | 24.58 | % | | | — | | | | (0.63 | )% | | | 03/01/06 | |

Class C* | | | 23.71 | % | | | — | | | | (1.32 | )% | | | 03/01/06 | |

No Load After Tax on Distributions & sale of shares3 | | | | | | | | | | | | | | | | |

Institutional Class | | | 16.26 | % | | | 1.22 | % | | | 2.34 | % | | | 12/18/00 | |

Class A* | | | 15.97 | % | | | — | | | | (0.50 | )% | | | 03/01/06 | |

Class C* | | | 15.41 | % | | | — | | | | (1.12 | )% | | | 03/01/06 | |

With Load Before Tax: | | | | | | | | | | | | | | | | |

Class A* | | | 17.42 | % | | | — | | | | (1.82 | )% | | | 03/01/06 | |

Class C* | | | 22.71 | % | | | — | | | | (1.32 | )% | | | 03/01/06 | |

With Load After Tax on Distributions3 | | | | | | | | | | | | | | | | |

Class A* | | | 17.42 | % | | | — | | | | (1.87 | )% | | | 03/01/06 | |

Class C* | | | 22.71 | % | | | — | | | | (1.32 | )% | | | 03/01/06 | |

With Load After Tax on Distributions & sale of shares3 | | | | | | | | | | | | | | | | |

Class A* | | | 11.32 | % | | | — | | | | (1.55 | )% | | | 03/01/06 | |

Class C* | | | 14.76 | % | | | — | | | | (1.12 | )% | | | 03/01/06 | |

| * | Class A and Class C shares commenced operations on March 1, 2006. |

The performance data shown represents past performance, which is not a guarantee of future results. Current performance may be lower or higher than the performance data quoted. The investment return and principal value of an investment in the Funds will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. For performance information through the most recent month end please call (800) 835-3879 or visit our website at www.managersinvest.com.

In choosing a Fund, investors should carefully consider the amount they plan to invest, their investment objectives, the Fund’s investment objectives, risks, charges and expenses before investing. For this and other information, please call (800) 835-3879 or visit www.managersinvest.com for a free prospectus. Read it carefully before investing or sending money. Distributed by Managers Distributors, Inc., member FINRA.

| 1 | Total return equals income yield plus share price change and assumes reinvestment of all dividends and capital gain distributions. Returns are net of fees and may reflect offsets of Fund expenses as described in the Prospectus. No adjustment has been made for taxes payable by shareholders on their reinvested dividends and capital gain distributions. Returns for periods greater than one year are annualized. The listed returns on the Fund are net of expenses and based on the published NAV as of October 31, 2010. All returns are in U.S. dollars($). |

| 2 | From time to time, the Fund’s advisor has waived its fees and/or absorbed Fund expenses, which has resulted in higher returns. |

| 3 | After-tax returns are calculated using the historical highest individual federal marginal income tax rates and do not reflect the impact of state and local taxes. Actual after-tax returns depend on an investor’s tax situation and may differ from those shown, and after-tax returns are not relevant to investors who hold their Fund shares through tax-deferred arrangements, such as 401(K) plans or individual retirement accounts. |

| 4 | The Russell 3000® Index is a market-capitalization weighted index that measures the performance of the largest 3,000 U.S. companies representing approximately 98% of the investable U.S. equity market. The returns shown for the Index reflect no deduction for fees, expenses, or taxes. Unlike the Fund, the Russell 3000® Index is unmanaged, is not available for investment, and does not incur expenses. |

| 5 | The Fund invests in large-capitalization companies that may underperform other stock funds (such as funds that focus on small and medium capitalization companies) when stocks of large-capitalization companies are out of favor. Although the Fund is managed to minimize taxable distributions, it may not be able to avoid taxable distributions. |

| 6 | Class C shares convert to an equal dollar value of Class A shares at the end of the tenth year after purchase. |

The Russell 3000® Index is a trademark of Russell Investments. Russell® is a trademark of Russell Investments.

Not FDIC insured, nor bank guaranteed. May lose value.

6

Managers AMG FQ Tax-Managed U.S. Equity Fund

Fund Snapshots

October 31, 2010

Portfolio Breakdown

| | | | | | | | |

Industry | | FQ Tax-Managed

U.S. Equity Fund** | | | Russell 3000®

Index | |

Information Technology | | | 21.8 | % | | | 18.9 | % |

Financials | | | 16.4 | % | | | 16.0 | % |

Consumer Discretionary | | | 13.7 | % | | | 11.5 | % |

Health Care | | | 12.3 | % | | | 11.6 | % |

Industrials | | | 8.6 | % | | | 11.4 | % |

Energy | | | 8.6 | % | | | 10.4 | % |

Consumer Staples | | | 7.6 | % | | | 9.5 | % |

Materials | | | 6.4 | % | | | 4.2 | % |

Utilities | | | 2.9 | % | | | 3.6 | % |

Telecommunication Services | | | 1.7 | % | | | 2.9 | % |

Other Assets and Liabilities | | | 0.0 | % | | | 0.0 | % |

| ** | As a percentage of net assets |

Top Ten Holdings

| | | | |

Security Name | | Percentage

of Net Assets | |

International Business Machines Corp.* | | | 3.3 | % |

Chevron Corp.* | | | 2.7 | |

Apple, Inc.* | | | 2.5 | |

JPMorgan Chase & Co.* | | | 2.2 | |

DIRECTV, Class A* | | | 1.9 | |

Hewlett-Packard Co.* | | | 1.8 | |

Dillard’s, Inc., Class A* | | | 1.8 | |

Berkshire Hathaway, Inc., Class B | | | 1.8 | |

Google, Inc. | | | 1.7 | |

Micron Technology, Inc. | | | 1.7 | |

| | | | |

Top Ten as a Group | | | 21.4 | % |

| | | | |

| * | Top Ten Holding at April 30, 2010 |

Any sectors, industries, or securities discussed should not be perceived as investment recommendations. Mention of a specific security should not be considered a recommendation to buy or solicitation to sell that security. Specific securities mentioned in this report may have been sold from the Fund’s portfolio of investments by the time you receive this report.

7

Managers AMG FQ Tax-Managed U.S. Equity Fund

Schedule of Portfolio Investments

October 31, 2010

| | | | | | | | |

| | | Shares | | | Value | |

Common Stocks - 100.0% | | | | | | | | |

Consumer Discretionary - 13.7% | | | | | | | | |

Destination Maternity Corp.* | | | 8,600 | | | $ | 314,158 | |

Dillard’s, Inc., Class A | | | 32,700 | 2 | | | 834,177 | |

DIRECTV, Class A* | | | 20,700 | | | | 899,622 | |

Discovery Communications, Inc., Class C* | | | 4,800 | | | | 186,528 | |

Domino’s Pizza, Inc.* | | | 41,000 | | | | 608,440 | |

Ford Motor Co.* | | | 35,400 | | | | 500,202 | |

Knology, Inc.* | | | 40,000 | | | | 582,000 | |

Lear Corp.* | | | 4,200 | | | | 371,280 | |

Liberty Global, Inc., Class A* | | | 18,400 | 2 | | | 695,336 | |

Mediacom Communications Corp.* | | | 24,400 | | | | 168,360 | |

Rent-A-Center, Inc. | | | 13,600 | | | | 341,904 | |

Target Corp. | | | 2,000 | | | | 103,880 | |

TRW Automotive Holdings Corp.* | | | 9,800 | | | | 447,762 | |

Yum! Brands, Inc. | | | 7,000 | | | | 346,920 | |

Total Consumer Discretionary | | | | | | | 6,400,569 | |

Consumer Staples - 7.6% | | | | | | | | |

Alliance One International, Inc.* | | | 15,800 | | | | 69,836 | |

Andersons, Inc., The | | | 1,000 | | | | 39,370 | |

Central Garden & Pet Co., Class A* | | | 34,400 | | | | 359,480 | |

Coca-Cola Co., The | | | 800 | | | | 49,056 | |

Constellation Brands, Inc., Class A* | | | 18,800 | 2 | | | 370,924 | |

CVS Caremark Corp. | | | 4,400 | | | | 132,528 | |

Del Monte Foods Co. | | | 11,000 | | | | 157,740 | |

Dr Pepper Snapple Group, Inc. | | | 7,800 | | | | 285,090 | |

Energizer Holdings, Inc.* | | | 4,800 | | | | 358,944 | |

John B. Sanfilippo & Son, Inc.* | | | 8,600 | | | | 115,412 | |

Prestige Brands Holdings, Inc.* | | | 8,000 | | | | 86,000 | |

Procter & Gamble Co., The | | | 4,800 | | | | 305,136 | |

Ralcorp Holdings, Inc.* | | | 5,800 | | | | 359,948 | |

Revlon, Inc., Class A* | | | 9,400 | | | | 107,348 | |

Tyson Foods, Inc., Class A | | | 25,600 | 2 | | | 398,080 | |

Wal-Mart Stores, Inc. | | | 6,000 | | | | 325,020 | |

Total Consumer Staples | | | | | | | 3,519,912 | |

Energy - 8.6% | | | | | | | | |

Apache Corp. | | | 5,000 | | | | 505,100 | |

Chevron Corp. | | | 15,000 | | | | 1,239,150 | |

ConocoPhillips Co. | | | 11,000 | | | | 653,400 | |

Exxon Mobil Corp. | | | 5,600 | | | | 372,232 | |

Hess Corp. | | | 6,600 | | | | 415,998 | |

Occidental Petroleum Corp. | | | 3,600 | | | | 283,068 | |

Oil States International, Inc.* | | | 3,800 | | | | 194,256 | |

Seacor Holdings, Inc.* | | | 3,800 | | | | 360,050 | |

Total Energy | | | | | | | 4,023,254 | |

Financials - 16.4% | | | | | | | | |

American Financial Group, Inc. | | | 6,400 | | | | 195,712 | |

American Safety Insurance Holdings, Ltd.* | | | 8,000 | | | | 148,560 | |

Aon Corp. | | | 3,600 | | | | 143,100 | |

Arch Capital Group, Ltd.* | | | 4,400 | | | | 380,116 | |

Bank of New York Mellon Corp. | | | 6,700 | 2 | | | 167,902 | |

Bank of the Ozarks, Inc. | | | 11,000 | | | | 418,110 | |

Berkshire Hathaway, Inc.* | | | 1 | | | | 119,300 | |

Berkshire Hathaway, Inc., Class B* | | | 10,287 | | | | 818,434 | |

Cardtronics, Inc.* | | | 2,800 | | | | 47,460 | |

Chubb Corp., The | | | 1,600 | 2 | | | 92,832 | |

Everest Re Group, Ltd. | | | 5,100 | | | | 429,828 | |

FBL Financial Group, Inc., Class A | | | 6,800 | | | | 177,888 | |

Financial Institutions, Inc. | | | 1,600 | | | | 28,880 | |

First Cash Financial Services, Inc.* | | | 5,200 | | | | 151,164 | |

First Citizens BancShares, Inc., Class A | | | 1,800 | | | | 336,204 | |

Goldman Sachs Group, Inc. | | | 2,000 | | | | 321,900 | |

JPMorgan Chase & Co. | | | 27,500 | | | | 1,034,825 | |

KeyCorp | | | 25,800 | | | | 211,302 | |

Loews Corp. | | | 4,000 | | | | 157,920 | |

Morgan Stanley Co. | | | 4,800 | | | | 119,376 | |

National Bankshares, Inc. | | | 1,000 | | | | 26,150 | |

Nelnet, Inc. | | | 9,200 | | | | 206,724 | |

Platinum Underwriter Holdings, Ltd. | | | 3,600 | | | | 154,980 | |

PNC Financial Services Group, Inc., The | | | 8,400 | | | | 452,760 | |

Prudential Financial, Inc. | | | 2,800 | | | | 147,224 | |

Resource Capital Corp. | | | 29,400 | | | | 186,102 | |

SunTrust Banks, Inc. | | | 15,600 | | | | 390,312 | |

Travelers Companies, Inc., The | | | 5,600 | | | | 309,120 | |

World Acceptance Corp.* | | | 6,800 | | | | 293,420 | |

Total Financials | | | | | | | 7,667,605 | |

Health Care - 12.3% | | | | | | | | |

Allergan, Inc. | | | 1,000 | | | | 72,410 | |

Amgen, Inc.* | | | 2,000 | | | | 114,380 | |

Atrion Corp. | | | 400 | | | | 65,152 | |

Biogen Idec, Inc.* | | | 6,800 | 2 | | | 426,428 | |

Celgene Corp.* | | | 5,800 | | | | 360,006 | |

The accompanying notes are an integral part of these financial statements.

8

Managers AMG FQ Tax-Managed U.S. Equity Fund

Schedule of Portfolio Investments (continued)

| | | | | | | | |

| | | Shares | | | Value | |

Health Care - 12.3% (continued) | | | | | | | | |

DaVita, Inc.* | | | 3,800 | | | $ | 272,650 | |

Express Scripts, Inc.* | | | 9,000 | | | | 436,680 | |

Gentiva Health Services, Inc.* | | | 5,200 | | | | 121,056 | |

HealthSouth Corp.* | | | 7,000 | | | | 126,630 | |

Humana, Inc.* | | | 7,800 | | | | 454,662 | |

Invacare Corp. | | | 13,400 | | | | 361,800 | |

Johnson & Johnson | | | 4,400 | | | | 280,148 | |

Kensey Nash Corp.* | | | 9,200 | | | | 248,032 | |

Medicis Pharmaceutical Corp., Class A | | | 6,400 | | | | 190,400 | |

Orthofix International NV* | | | 3,200 | | | | 89,632 | |

Par Pharmaceutical Co., Inc.* | | | 11,000 | | | | 357,610 | |

Pfizer, Inc. | | | 7,200 | | | | 125,280 | |

Providence Service Corp.* | | | 17,800 | | | | 292,454 | |

PSS World Medical, Inc.* | | | 12,200 | | | | 288,286 | |

Sirona Dental Systems, Inc.* | | | 5,200 | | | | 195,780 | |

Sun Healthcare Group, Inc.* | | | 12,800 | | | | 121,728 | |

Symmetry Medical, Inc.* | | | 50,000 | | | | 442,500 | |

UnitedHealth Group, Inc. | | | 8,200 | | | | 295,610 | |

Total Health Care | | | | | | | 5,739,314 | |

Industrials - 8.6% | | | | | | | | |

Alaska Airgroup, Inc.* | | | 6,600 | | | | 348,480 | |

AMERCO* | | | 4,400 | | | | 362,208 | |

Blount International, Inc.* | | | 9,800 | 2 | | | 147,000 | |

Delta Air Lines, Inc.* | | | 8,800 | | | | 122,232 | |

Esterline Technologies Corp.* | | | 1,600 | | | | 96,704 | |

FedEx Corp. | | | 4,700 | | | | 412,284 | |

Gencorp, Inc.* | | | 24,800 | | | | 120,776 | |

Hawaiian Holdings, Inc.* | | | 28,800 | | | | 210,816 | |

Kadant, Inc.* | | | 5,400 | | | | 106,164 | |

KBR, Inc. | | | 11,800 | | | | 299,720 | |

M&F Worldwide Corp.* | | | 15,000 | | | | 403,200 | |

Park-Ohio Holdings Corp.* | | | 16,800 | | | | 266,952 | |

Sauer-Danfoss, Inc.* | | | 3,000 | | | | 66,330 | |

Timken Co. | | | 8,600 | | | | 356,212 | |

TriMas Corp.* | | | 21,800 | | | | 345,094 | |

United Continental Holdings, Inc.* | | | 4,400 | | | | 127,776 | |

United Technologies Corp. | | | 3,000 | | | | 224,310 | |

Total Industrials | | | | | | | 4,016,258 | |

Information Technology - 21.8% | | | | | | | | |

Apple, Inc.* | | | 3,900 | | | | 1,173,393 | |

Cisco Systems, Inc.* | | | 3,500 | | | | 79,905 | |

Convergys Corp.* | | | 10,400 | | | | 117,728 | |

CoreLogic, Inc. | | | 15,500 | | | | 272,335 | |

CPI International, Inc.* | | | 8,200 | 2 | | | 115,784 | |

EMC Corp.* | | | 2,800 | | | | 58,828 | |

Google, Inc.* | | | 1,300 | | | | 796,887 | |

Harris Corp. | | | 8,200 | 2 | | | 370,558 | |

Hewlett-Packard Co. | | | 20,200 | | | | 849,612 | |

Intel Corp. | | | 29,000 | | | | 582,030 | |

International Business Machines Corp. | | | 10,600 | | | | 1,522,160 | |

Lam Research Corp.* | | | 8,400 | | | | 384,636 | |

Lexmark International, Inc., Class A* | | | 8,400 | | | | 319,452 | |

Micron Technology, Inc.* | | | 95,200 | 2 | | | 787,304 | |

Microsoft Corp. | | | 17,600 | | | | 468,864 | |

MIPS Technologies, Inc.* | | | 34,400 | | | | 505,680 | |

NCI, Inc., Class A* | | | 14,000 | | | | 260,960 | |

Newport Corp.* | | | 7,600 | | | | 110,428 | |

Texas Instruments, Inc. | | | 21,000 | 2 | | | 620,970 | |

TIBCO Software, Inc.* | | | 20,600 | | | | 395,932 | |

Vishay Intertechnology, Inc.* | | | 34,000 | | | | 384,200 | |

Total Information Technology | | | | | | | 10,177,646 | |

Materials - 6.4% | | | | | | | | |

Crown Holdings, Inc.* | | | 7,000 | | | | 225,330 | |

Domtar Corp. | | | 5,200 | | | | 412,672 | |

Freeport-McMoRan Copper & Gold, Inc., Class B | | | 7,600 | | | | 719,568 | |

Graphic Packaging Holding Co.* | | | 46,700 | | | | 170,922 | |

KapStone Paper and Packaging Corp.* | | | 12,200 | | | | 156,160 | |

Newmont Mining, Ltd. | | | 7,600 | | �� | | 462,612 | |

Walter Industries, Inc. | | | 2,800 | 2 | | | 246,288 | |

W.R. Grace & Co.* | | | 18,200 | | | | 583,492 | |

Total Materials | | | | | | | 2,977,044 | |

Telecommunication Services - 1.7% | | | | | | | | |

American Tower Corp., Class A* | | | 6,200 | 2 | | | 319,982 | |

AT&T, Inc. | | | 8,600 | | | | 245,100 | |

U.S. Cellular Corp.* | | | 4,600 | | | | 213,716 | |

Total Telecommunication Services | | | | | | | 778,798 | |

The accompanying notes are an integral part of these financial statements.

9

Managers AMG FQ Tax-Managed U.S. Equity Fund

Schedule of Portfolio Investments (continued)

| | | | | | | | |

| | | Shares | | | Value | |

Utilities - 2.9% | | | | | | | | |

Constellation Energy Group, Inc. | | | 7,800 | | | $ | 235,872 | |

El Paso Electric Co.* | | | 24,200 | | | | 595,320 | |

Southwest Gas Corp. | | | 15,400 | | | | 535,304 | |

Total Utilities | | | | | | | 1,366,496 | |

Total Common Stocks

(cost $38,308,112) | | | | | | | 46,666,896 | |

Short-Term Investments - 4.6%1 | | | | | | | | |

BNY Institutional Cash Reserves Fund, Series B*3,4 | | | 320,520 | | | | 254,895 | |

BNY Mellon Overnight Government Fund, 0.21%3 | | | 1,545,000 | | | | 1,545,000 | |

Dreyfus Cash Management Fund, Institutional Class Shares, 0.16% | | | 332,066 | | | | 332,066 | |

Total Short-Term Investments

(cost $2,197,586) | | | | | | | 2,131,961 | |

Total Investments - 104.6%

(cost $40,505,698) | | | | | | | 48,798,857 | |

Other Assets, less Liabilities - (4.6)% | | | | | | | (2,167,621 | ) |

Net Assets - 100.0% | | | | | | $ | 46,631,236 | |

Note: Based on the approximate cost of investments of $40,505,698 for Federal income tax purposes at October 31, 2010, the aggregate gross unrealized appreciation and depreciation were $8,730,045 and $436,886, respectively, resulting in net unrealized appreciation of investments of $8,293,159.

| * | Non-income-producing securities. |

| 1 | Yield shown for each investment company below represents the October 31, 2010, seven-day average yield, which refers to the sum of the previous seven days’ dividends paid, expressed as an annual percentage. |

| 2 | Some or all of these shares, amounting to a market value of $1,696,112, or 3.6% of net assets, were out on loan to various brokers. |

| 3 | Collateral received from brokers for securities lending was invested in these short-term investments. |

| 4 | On September 12, 2008, The Bank of New York Mellon established a separate sleeve of the BNY Institutional Cash Reserves Fund (Series B) to hold certain Lehman Brothers floating rate notes. The Fund’s position in Series B is being fair valued daily. (See Note 4 in the Notes to Financial Statements.) |

The following table summarizes the inputs used to value the Fund’s net assets by the fair value hierarchy levels as of October 31, 2010:

(See Note 1(a) in the Notes to Financial Statements.)

| | | | | | | | | | | | | | | | |

| | | Quoted Prices

in Active

Markets for

Identical

Investments

Level 1 | | | Significant

Other

Observable

Inputs

Level 2 | | | Significant

Unobservable

Inputs

Level 3 | | | Total | |

Tax-Managed | | | | | | | | | | | | | | | | |

Investments in Securities | | | | | | | | | | | | | | | | |

Common Stocks† | | $ | 46,666,896 | | | | — | | | | — | | | $ | 46,666,896 | |

Short-Term Investments | | | 1,877,066 | | | $ | 254,895 | | | | — | | | | 2,131,961 | |

| | | | | | | | | | | | | | | | |

Total Investments in Securities | | $ | 48,543,962 | | | $ | 254,895 | | | | — | | | $ | 48,798,857 | |

| | | | | | | | | | | | | | | | |

| † | All common stocks held in the Fund are Level 1 securities. For a detailed break-out of the common stocks by major industry classification, please refer to the Schedule of Portfolio Investments. |

As of October 31, 2010, the Fund had no significant transfers between Level 1 and Level 2 from the beginning of the reporting period.

The accompanying notes are an integral part of these financial statements.

10

Managers AMG FQ U.S. Equity Fund

Portfolio Manager’s Comments

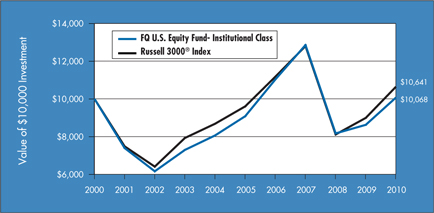

For the fiscal year ended October 31, 2010, the Managers AMG FQ U.S. Equity Fund (Institutional Class) returned 16.75% compared to 18.34% for its benchmark, the Russell 3000® Index. Please refer to the table on page 12 for returns for various classes of shares.

The past twelve months saw a continuation of the market rally that began back in March 2009, although certainly with more stops and starts than witnessed at the beginning of the rally. The lower-quality nature of the equity rally leveled off during the fourth quarter of 2010, although high-quality stocks have yet to significantly outpace their lower-quality counterparts and the market has continued to be driven by headline and macroeconomic news as opposed to underlying fundamentals of individual companies. The early portion of the year was characterized by the relative strength of the U.S. Dollar (and its subsequent consequences for companies in the U.S.. with different levels of exposure to the strength of the Dollar) as global investors found the reserve status of the Dollar particularly comforting in the wake of a weakening Euro amid the concern of potential default risk for several sovereign nations in continental Europe. The second quarter of 2010 was marked by renewed fears of financial contagion and slowing economic growth. The third quarter of 2010 was a perfect microcosm of the skittishness of the market and investors over the course of the past year. In July, solid earnings from a number of bell weather companies led to strong market results. August featured a renewed round of lukewarm economic data that led to a market pullback and increased risk aversion amongst investors. September and October, on the other hand, saw a sharp market bounce back and increased risk taking among investors who still have considerable cash waiting to be invested but are still hesitant about reentering equity markets.

The Fund delivered positive absolute returns for the fiscal year but failed to keep pace with its benchmark. Relative to the benchmark, the Fund experienced negative stock selection within several sectors although primarily concentrated within information technology. Relative sector positioning did not add or detract significant value, mainly due to the mostly neutral benchmark sector and style positioning the Fund maintained throughout the year.

The Fund’s subadvisor, First Quadrant L.P. (“First Quadrant”), has become somewhat more optimistic about the global economy in recent months as economic data has not been as gloomy as feared, the Federal Reserve has initiated a second round of quantitative easing, and earnings have pleasantly surprised. However, some of this has already been reflected in the market. From a sector standpoint, the Fund remains fairly neutral to the benchmark, although the portfolio has begun to take more active positions from a risk factor standpoint. For example, the Fund has increasingly favored more volatile stocks, and that was beneficial towards the latter portion of the fiscal year when the U.S. equity market rallied. In addition, the Fund has increased its preference for equities with good valuations, especially with respect to earnings. That said, some of these top-down factor tilts have been reined in recently, including the Fund’s tilt towards small-cap equities which look much more fairly valued versus their larger-capitalization counterparts after an extended period of out performance.

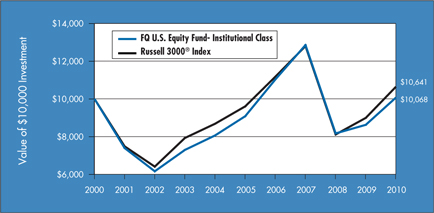

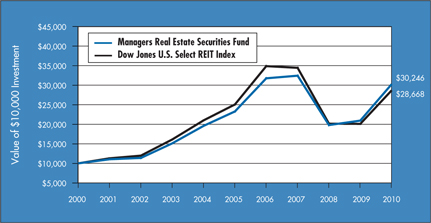

Cumulative Total Return Performance

Managers AMG FQ U.S. Equity Fund’s cumulative total return is based on the daily change in net asset value (NAV), and assumes that all distributions were reinvested. The Russell 3000® Index is composed of the 3000 largest U.S. companies as measured by market capitalization, and represents about 98% of the U.S. stock market. Unlike the Fund, the Russell 3000® Index is unmanaged, is not available for investment, and does not incur expenses. The chart on page 12 illustrates the performance of a hypothetical $10,000 investment made in the Institutional Class Shares of the Fund on October 31, 2000 to a $10,000 investment made in the Russell 3000® Index for the same time periods. Performance for periods longer than one year is annualized. Figures include reinvestment of capital gains and dividends. The listed returns for the Fund are net of expenses and the returns for the indices exclude expenses. Total returns for the Fund would have been lower had certain expenses not been reduced.

11

Managers AMG FQ U.S. Equity Fund

Portfolio Manager’s Comments (continued)

Cumulative Total Return Performance

The table below shows the average annual total returns for the Managers AMG FQ U.S. Equity Fund since inception and the Russell 3000® Index from October 31, 2000 to October 31, 2010.

| | | | | | | | | | | | | | | | | | | | |

Average Annual Total Returns1 | | One Year | | | Five Years | | | Ten Years | | | Since Inception | | | Inception Date | |

Managers AMG FQ U.S. Equity Fund2,4,5 | | | | | | | | | | | | | | | | | | | | |

No Load: | | | | | | | | | | | | | | | | | | | | |

Institutional Class | | | 16.75 | % | | | 2.09 | % | | | 0.07 | % | | | 6.96 | % | | | 08/14/92 | |

Class A* | | | 16.57 | % | | | — | | | | — | | | | (0.14 | )% | | | 03/01/06 | |

Class C* | | | 15.75 | % | | | — | | | | — | | | | (0.82 | )% | | | 03/01/06 | |

Russell 3000® Index3 | | | 18.34 | % | | | 2.08 | % | | | 0.62 | % | | | 8.14 | % | | | 08/14/92 | |

With Load: | | | | | | | | | | | | | | | | | | | | |

Class A* | | | 9.93 | % | | | — | | | | — | | | | (1.40 | )% | | | 03/01/06 | |

Class C* | | | 14.75 | % | | | — | | | | — | | | | (0.82 | )% | | | 03/01/06 | |

| * | Class A and Class C shares commenced operations on March 1, 2006. |

The performance data shown represents past performance, which is not a guarantee of future results. Current performance may be lower or higher than the performance data quoted. The investment return and principal value of an investment in the Funds will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. For performance information through the most recent month end please call (800) 835-3879 or visit our website at www.managersinvest.com.

In choosing a Fund, investors should carefully consider the amount they plan to invest, their investment objectives, the Fund’s investment objectives, risks, charges and expenses before investing. For this and other information, please call (800) 835-3879 or visit www.managersinvest.com for a free prospectus. Read it carefully before investing or sending money. Distributed by Managers Distributors, Inc., member FINRA.

| 1 | Total return equals income yield plus share price change and assumes reinvestment of all dividends and capital gain distributions. Returns are net of fees and may reflect offsets of Fund expenses as described in the Prospectus. No adjustment has been made for taxes payable by shareholders on their reinvested dividends and capital gain distributions. Returns for periods greater than one year are annualized. The listed returns on the Fund are net of expenses and based on the published NAV as of October 31, 2010. All returns are in U.S. dollars($). |

| 2 | From time to time, the Fund’s advisor has waived its fees and/or absorbed Fund expenses, which has resulted in higher returns. |

| 3 | The Russell 3000® Index is a market-capitalization weighted index that measures the performance of the largest 3,000 U.S. companies representing approximately 98% of the investable U.S. equity market. The returns shown for the Index reflect no deduction for fees, expenses, or taxes. Unlike the Fund, the Russell 3000® Index is unmanaged, is not available for investment, and does not incur expenses. |

| 4 | The Fund invests in large-capitalization companies that may underperform other stock funds (such as funds that focus on small and medium capitalization companies) when stocks of large-capitalization companies are out of favor. |

| 5 | Class C shares convert to an equal dollar value of Class A shares at the end of the tenth year after purchase. |

The Russell 3000® Index is a trademark of Russell Investments. Russell® is a trademark of Russell Investments.

Not FDIC insured, nor bank guaranteed. May lose value.

12

Managers AMG FQ U.S. Equity Fund

Fund Snapshots

October 31, 2010

Portfolio Breakdown

| | | | | | | | |

Industry | | FQ U.S. Equity

Fund** | | | Russell 3000®

Index | |

Information Technology | | | 21.6 | % | | | 18.9 | % |

Financials | | | 16.3 | % | | | 16.0 | % |

Consumer Discretionary | | | 11.3 | % | | | 11.5 | % |

Health Care | | | 11.0 | % | | | 11.6 | % |

Energy | | | 9.6 | % | | | 10.4 | % |

Consumer Staples | | | 9.2 | % | | | 9.5 | % |

Industrials | | | 8.6 | % | | | 11.4 | % |

Materials | | | 5.1 | % | | | 4.2 | % |

Utilities | | | 3.5 | % | | | 3.6 | % |

Telecommunication Services | | | 3.4 | % | | | 2.9 | % |

Other Assets and Liabilities | | | 0.4 | % | | | 0.0 | % |

| ** | As a percentage of net assets |

Top Ten Holdings

| | | | |

Security Name | | Percentage

of Net Assets | |

Exxon Mobil Corp.* | | | 2.3 | % |

Chevron Corp.* | | | 1.9 | |

JPMorgan Chase & Co.* | | | 1.8 | |

Microsoft Corp.* | | | 1.5 | |

Intel Corp.* | | | 1.5 | |

Google, Inc.* | | | 1.4 | |

Philip Morris International, Inc. | | | 1.4 | |

Apple, Inc. | | | 1.4 | |

ConocoPhillips Co.* | | | 1.4 | |

AT&T, Inc. | | | 1.4 | |

| | | | |

Top Ten as a Group | | | 16.0 | % |

| | | | |

| * | Top Ten Holding at April 30, 2010 |

Any sectors, industries, or securities discussed should not be perceived as investment recommendations. Mention of a specific security should not be considered a recommendation to buy or solicitation to sell that security. Specific securities mentioned in this report may have been sold from the Fund’s portfolio of investments by the time you receive this report.

13

Managers AMG FQ U.S. Equity Fund

Schedule of Portfolio Investments

October 31, 2010

| | | | | | | | |

| | | Shares | | | Value | |

Common Stocks - 99.6% | | | | | | | | |

Consumer Discretionary - 11.3% | | | | | | | | |

Advance Auto Parts, Inc. | | | 4,400 | | | $ | 285,912 | |

Autoliv, Inc. | | | 5,400 | 2 | | | 385,020 | |

Big 5 Sporting Goods Corp. | | | 4,400 | 2 | | | 59,488 | |

Brinker International, Inc. | | | 5,800 | | | | 107,532 | |

Comcast Corp., Class A | | | 30,200 | | | | 621,516 | |

Cracker Barrel Old Country Store, Inc. | | | 3,200 | | | | 172,448 | |

Dillard’s, Inc., Class A | | | 5,800 | | | | 147,958 | |

DIRECTV, Class A* | | | 12,400 | | | | 538,904 | |

Dollar Tree, Inc.* | | | 3,200 | | | | 164,192 | |

DSW, Inc.* | | | 1,200 | | | | 39,924 | |

H&R Block, Inc. | | | 20,800 | | | | 245,232 | |

Home Depot, Inc., The | | | 1,600 | | | | 49,408 | |

Lear Corp.* | | | 3,000 | | | | 265,200 | |

Libbey, Inc.* | | | 10,400 | | | | 138,216 | |

Macy’s, Inc. | | | 15,400 | | | | 364,056 | |

News Corp., Inc., Class A | | | 31,000 | | | | 448,260 | |

Oxford Industries, Inc. | | | 3,000 | | | | 69,090 | |

Pre-Paid Legal Services, Inc.* | | | 600 | | | | 36,108 | |

Ross Stores, Inc. | | | 2,800 | | | | 165,172 | |

Signet Jewelers, Ltd.* | | | 10,200 | | | | 358,836 | |

Target Corp. | | | 6,800 | | | | 353,192 | |

Time Warner Cable, Inc. | | | 2,000 | | | | 115,740 | |

TRW Automotive Holdings Corp.* | | | 8,400 | | | | 383,796 | |

Valassis Communications, Inc.* | | | 4,000 | | | | 132,000 | |

Wyndham Worldwide Corp. | | | 7,600 | | | | 218,500 | |

Total Consumer Discretionary | | | | | | | 5,865,700 | |

Consumer Staples - 9.2% | | | | | | | | |

Andersons, Inc., The | | | 7,600 | | | | 299,212 | |

Central Garden & Pet Co., Class A* | | | 17,800 | | | | 186,010 | |

Coca-Cola Co., The | | | 6,800 | | | | 416,976 | |

Coca-Cola Enterprises, Inc. | | | 7,200 | | | | 172,872 | |

Dr Pepper Snapple Group, Inc. | | | 10,000 | | | | 365,500 | |

Energizer Holdings, Inc.* | | | 4,400 | | | | 329,032 | |

Herbalife, Ltd. | | | 5,200 | | | | 332,072 | |

Nu Skin Enterprises, Inc., Class A | | | 10,600 | | | | 324,360 | |

PepsiCo, Inc. | | | 1,000 | | | | 65,300 | |

Philip Morris International, Inc. | | | 12,400 | | | | 725,400 | |

Procter & Gamble Co., The | | | 6,400 | | | | 406,848 | |

Revlon, Inc., Class A* | | | 4,600 | | | | 52,532 | |

Sanderson Farms, Inc. | | | 2,200 | | | | 92,356 | |

Tyson Foods, Inc., Class A | | | 21,000 | | | | 326,550 | |

USANA Health Sciences, Inc.* | | | 2,000 | | | | 87,840 | |

Wal-Mart Stores, Inc. | | | 10,600 | | | | 574,202 | |

Total Consumer Staples | | | | | | | 4,757,062 | |

Energy - 9.6% | | | | | | | | |

Apache Corp. | | | 1,200 | | | | 121,224 | |

Chevron Corp. | | | 12,200 | | | | 1,007,842 | |

Cimarex Energy Co. | | | 3,200 | | | | 245,600 | |

ConocoPhillips Co. | | | 12,000 | | | | 712,800 | |

Dresser-Rand Group, Inc.* | | | 5,000 | 2 | | | 171,100 | |

Exxon Mobil Corp. | | | 18,200 | | | | 1,209,754 | |

Hess Corp. | | | 5,200 | | | | 327,756 | |

Marathon Oil Corp. | | | 9,000 | | | | 320,130 | |

Occidental Petroleum Corp. | | | 6,800 | | | | 534,684 | |

Sunoco, Inc. | | | 8,400 | | | | 314,748 | |

Total Energy | | | | | | | 4,965,638 | |

Financials - 16.3% | | | | | | | | |

Advance America, Cash Advance Centers, Inc. | | | 15,600 | | | | 77,844 | |

Aflac, Inc. | | | 7,800 | | | | 435,942 | |

American Express Co. | | | 11,800 | | | | 489,228 | |

American Financial Group, Inc. | | | 11,000 | | | | 336,380 | |

Arch Capital Group, Ltd.* | | | 600 | | | | 51,834 | |

Assurant, Inc. | | | 6,800 | | | | 268,872 | |

Bank of America Corp. | | | 18,800 | | | | 215,072 | |

Bank of the Ozarks, Inc. | | | 1,200 | | | | 45,612 | |

Berkshire Hathaway, Inc., Class B* | | | 8,000 | | | | 636,480 | |

Cardtronics, Inc.* | | | 18,800 | | | | 318,660 | |

Chubb Corp., The | | | 6,400 | | | | 371,328 | |

FBL Financial Group, Inc., Class A | | | 1,800 | | | | 47,088 | |

First Financial Bancorp | | | 3,800 | | | | 63,992 | |

Franklin Resources, Inc. | | | 1,800 | | | | 206,460 | |

Getty Realty Corp. | | | 2,800 | | | | 79,828 | |

JPMorgan Chase & Co. | | | 24,200 | | | | 910,646 | |

KeyCorp | | | 40,800 | | | | 334,152 | |

Loews Corp. | | | 9,600 | | | | 379,008 | |

M&T Bank Corp. | | | 3,400 | | | | 254,150 | |

Metlife, Inc. | | | 8,800 | | | | 354,904 | |

Morgan Stanley Co. | | | 17,200 | | | | 427,764 | |

NASDAQ OMX Group, Inc., The* | | | 7,400 | | | | 155,548 | |

PNC Financial Services Group, Inc., The | | | 7,600 | | | | 409,640 | |

Rayonier, Inc. | | | 5,600 | | | | 292,320 | |

Reinsurance Group of America, Inc. | | | 1,800 | | | | 90,126 | |

Republic Bancorp, Inc., Class A | | | 2,400 | | | | 49,056 | |

Travelers Companies, Inc., The | | | 5,800 | | | | 320,160 | |

The accompanying notes are an integral part of these financial statements.

14

Managers AMG FQ U.S. Equity Fund

Schedule of Portfolio Investments (continued)

| | | | | | | | |

| | | Shares | | | Value | |

Financials - 16.3% (continued) | | | | | | | | |

U.S. Bancorp | | | 6,400 | | | $ | 154,752 | |

Vornado Realty Trust | | | 4,400 | | | | 384,516 | |

Wells Fargo & Co. | | | 8,000 | | | | 208,640 | |

World Acceptance Corp.* | | | 1,800 | | | | 77,670 | |

Total Financials | | | | | | | 8,447,672 | |

Health Care - 11.0% | | | | | | | | |

AMERIGROUP Corp.* | | | 2,600 | | | | 108,498 | |

Biogen Idec, Inc.* | | | 6,000 | | | | 376,260 | |

Bristol-Myers Squibb Co. | | | 19,600 | | | | 527,240 | |

Bruker Corp.* | | | 10,200 | | | | 152,898 | |

Cantel Medical Corp. | | | 3,600 | | | | 66,672 | |

Cardinal Health, Inc. | | | 10,400 | | | | 360,776 | |

Celgene Corp.* | | | 4,800 | | | | 297,936 | |

Cyberonics, Inc.* | | | 10,000 | | | | 275,100 | |

Eli Lilly and Co. | | | 12,000 | | | | 422,400 | |

Express Scripts, Inc.,* | | | 8,000 | | | | 388,160 | |

Hi-Tech Pharmacal Co., Inc.* | | | 1,800 | 2 | | | 38,934 | |

Humana, Inc.* | | | 6,200 | | | | 361,398 | |

Impax Laboratories, Inc.* | | | 17,600 | | | | 331,584 | |

Johnson & Johnson | | | 6,600 | | | | 420,222 | |

Kensey Nash Corp.* | | | 1,400 | | | | 37,744 | |

Merck & Co., Inc. | | | 4,000 | | | | 145,120 | |

Orthofix International NV* | | | 3,200 | | | | 89,632 | |

Pfizer, Inc. | | | 12,800 | | | | 222,720 | |

Providence Service Corp.* | | | 4,600 | | | | 75,578 | |

Sirona Dental Systems, Inc.* | | | 9,400 | | | | 353,910 | |

Symmetry Medical, Inc.* | | | 14,400 | | | | 127,440 | |

UnitedHealth Group, Inc. | | | 14,800 | | | | 533,540 | |

Total Health Care | | | | | | | 5,713,762 | |

Industrials - 8.6% | | | | | | | | |

A.O. Smith Corp. | | | 4,400 | | | | 246,532 | |

Alaska Airgroup, Inc.* | | | 6,400 | | | | 337,920 | |

Applied Industrial Technologies, Inc. | | | 10,600 | | | | 322,346 | |

Atlas Air Worldwide Holdings, Inc.* | | | 4,400 | 2 | | | 229,944 | |

Blount International, Inc.* | | | 5,200 | | | | 78,000 | |

CBIZ, Inc.* | | | 8,800 | | | | 52,096 | |

Ceradyne, Inc.* | | | 2,600 | | | | 61,906 | |

Crane Co. | | | 8,200 | | | | 313,732 | |

CSX Corp. | | | 3,400 | 2 | | | 208,930 | |

FedEx Corp. | | | 400 | | | | 35,088 | |

Gencorp, Inc.* | | | 27,800 | | | | 135,386 | |

General Electric Co. | | | 22,600 | | | | 362,052 | |

Graham Corp. | | | 2,400 | 2 | | | 40,728 | |

HEICO Corp. | | | 3,400 | | | | 169,252 | |

Joy Global, Inc. | | | 2,200 | | | | 156,090 | |

M&F Worldwide Corp.* | | | 8,400 | | | | 225,792 | |

NACCO Industries, Inc., Class A | | | 1,400 | | | | 138,964 | |

Northrop Grumman Corp. | | | 2,000 | | | | 126,420 | |

Powell Industries, Inc.* | | | 2,600 | | | | 80,236 | |

Sauer-Danfoss, Inc.* | | | 2,600 | | | | 57,486 | |

Thomas & Betts Corp.* | | | 600 | | | | 26,130 | |

Timken Co. | | | 7,800 | | | | 323,076 | |

TriMas Corp.* | | | 8,200 | | | | 129,806 | |

Union Pacific Corp. | | | 2,000 | 2 | | | 175,360 | |

US Airways Group, Inc.* | | | 33,400 | | | | 393,786 | |

Total Industrials | | | | | | | 4,427,058 | |

Information Technology - 21.6% | | | | | | | | |

Acxiom Corp.* | | | 7,000 | | | | 122,850 | |

Amdocs, Ltd.* | | | 11,600 | | | | 355,888 | |

Analog Devices, Inc. | | | 2,400 | | | | 80,808 | |

Apple, Inc.* | | | 2,400 | | | | 722,088 | |

Broadridge Financial Solutions, Inc. | | | 15,200 | | | | 334,400 | |

Cisco Systems, Inc.* | | | 10,200 | | | | 232,866 | |

Corning, Inc. | | | 23,000 | | | | 420,440 | |

CSG Systems International, Inc.* | | | 8,400 | | | | 163,296 | |

Dolby Laboratories, Inc., Class A* | | | 2,000 | | | | 123,360 | |

DST Systems, Inc. | | | 4,600 | | | | 199,042 | |

Google, Inc.* | | | 1,200 | | | | 735,588 | |

Harris Corp. | | | 7,000 | | | | 316,330 | |

Hewlett-Packard Co. | | | 13,800 | | | | 580,428 | |

Intel Corp. | | | 38,400 | | | | 770,688 | |

InterDigital, Inc.* | | | 9,000 | | | | 302,130 | |

International Business Machines Corp. | | | 3,000 | | | | 430,800 | |

Intuit, Inc.* | | | 4,800 | | | | 230,400 | |

Lam Research Corp.* | | | 7,600 | | | | 348,004 | |

Lexmark International, Inc., Class A* | | | 8,400 | | | | 319,452 | |

Littelfuse, Inc.* | | | 2,400 | | | | 101,832 | |

Marvell Technology Group, Ltd.* | | | 20,600 | | | | 397,786 | |

Micrel, Inc. | | | 9,200 | | | | 109,572 | |

Microsoft Corp. | | | 29,800 | | | | 793,872 | |

MIPS Technologies, Inc.* | | | 35,000 | | | | 514,500 | |

Netscout Systems, Inc.* | | | 4,000 | | | | 93,880 | |

Oracle Corp. | | | 2,600 | | | | 76,440 | |

OSI Systems, Inc.* | | | 2,600 | | | | 93,600 | |

Plantronics, Inc. | | | 5,000 | | | | 179,400 | |

Power-One, Inc.* | | | 29,800 | 2 | | | 310,218 | |

SanDisk Corp.* | | | 6,400 | 2 | | | 240,512 | |

The accompanying notes are an integral part of these financial statements.

15

Managers AMG FQ U.S. Equity Fund

Schedule of Portfolio Investments (continued)

| | | | | | | | |

| | | Shares | | | Value | |

Information Technology - 21.6% (continued) | | | | | | | | |

Seagate Technology* | | | 14,400 | | | $ | 210,960 | |

Texas Instruments, Inc. | | | 2,600 | | | | 76,882 | |

VeriFone Holdings, Inc.* | | | 10,200 | | | | 345,066 | |

Visa, Inc., Class A | | | 6,000 | | | | 469,020 | |

Vishay Intertechnology, Inc.* | | | 35,400 | | | | 400,020 | |

Total Information Technology | | | | | | | 11,202,418 | |

Materials - 5.1% | | | | | | | | |

Celanese Corp., Class A | | | 9,400 | | | | 335,110 | |

Domtar Corp. | | | 4,800 | | | | 380,928 | |

Freeport McMoRan Copper & Gold, Inc.,

Class B | | | 5,800 | | | | 549,144 | |

KapStone Paper and Packaging Corp.* | | | 7,600 | | | | 97,280 | |

Lubrizol Corp. | | | 3,600 | 2 | | | 368,964 | |

Neenah Paper, Inc. | | | 1,600 | | | | 24,560 | |

Newmont Mining, Ltd. | | | 4,400 | | | | 267,828 | |

Omnova Solutions, Inc.* | | | 11,600 | | | | 92,568 | |

PolyOne Corp.* | | | 10,000 | | | | 129,200 | |

Stepan Co. | | | 2,600 | | | | 175,344 | |

Walter Industries, Inc. | | | 2,600 | | | | 228,696 | |

Total Materials | | | | | | | 2,649,622 | |

Telecommunication Services - 3.4% | | | | | | | | |

AT&T, Inc. | | | 25,000 | | | | 712,500 | |

IDT Corp., Class B* | | | 2,800 | | | | 41,104 | |

Telephone & Data Systems, Inc. | | | 10,200 | | | | 355,266 | |

Verizon Communications, Inc. | | | 20,200 | | | | 655,894 | |

Total Telecommunication Services | | | | | | | 1,764,764 | |

Utilities - 3.5% | | | | | | | | |

Cleco Corp. | | | 1,600 | 2 | | | 50,032 | |

CMS Energy Corp. | | | 8,200 | | | | 150,716 | |

Constellation Energy Group, Inc. | | | 9,400 | | | | 284,256 | |

DTE Energy Co. | | | 3,200 | | | | 149,632 | |

Energen Corp. | | | 7,400 | | | | 330,336 | |

Entergy Corp. | | | 2,200 | 2 | | | 163,966 | |

Pepco Holdings, Inc. | | | 9,200 | 2 | | | 177,192 | |

Southwest Gas Corp. | | | 8,400 | | | | 291,984 | |

UGI Corp. | | | 3,600 | 2 | | | 108,324 | |

UniSource Energy Corp. | | | 2,400 | | | | 84,168 | |

Total Utilities | | | | | | | 1,790,606 | |

Total Common Stocks

(cost $47,378,291) | | | | | | | 51,584,302 | |

Short-Term Investments - 2.3%1 | | | | | | | | |

BNY Institutional Cash Reserves Fund, Series B*3,4 | | | 201,100 | | | | 159,926 | |

BNY Mellon Overnight Government Fund, 0.21%3 | | | 810,000 | | | | 810,000 | |

Dreyfus Cash Management Fund, Institutional Class Shares, 0.16% | | | 234,283 | | | | 234,283 | |

Total Short-Term Investments

(cost $1,245,383) | | | | | | | 1,204,209 | |

Total Investments - 101.9%

(cost $48,623,674) | | | | | | | 52,788,511 | |

Other Assets, less Liabilities - (1.9)% | | | | | | | (982,075 | ) |

Net Assets - 100.0% | | | | | | $ | 51,806,436 | |

Note: Based on the approximate cost of investments of $49,327,394 for Federal income tax purposes at October 31, 2010, the aggregate gross unrealized appreciation and depreciation were $5,780,437 and $2,319,320, respectively, resulting in net unrealized appreciation of investments of $3,461,117.

| * | Non-income-producing securities. |

| 1 | Yield shown for each investment company below represents the October 31, 2010, seven-day average yield, which refers to the sum of the previous seven days’ dividends paid, expressed as an annual percentage. |

| 2 | Some or all of these shares, amounting to a market value of $958,234, or 1.8% of net assets, were out on loan to various brokers. |

| 3 | Collateral received from brokers for securities lending was invested in these short-term investments. |

| 4 | On September 12, 2008, The Bank of New York Mellon established a separate sleeve of the BNY Institutional Cash Reserves Fund (Series B) to hold certain Lehman Brothers floating rate notes. The Fund’s position in Series B is being fair valued daily. (See Note 4 in the Notes to Financial Statements.) |

The accompanying notes are an integral part of these financial statements.

16

Managers AMG FQ U.S. Equity Fund

Notes to Schedules of Portfolio Investments

The Fund had the following open futures contracts as of October 31, 2010:

(See Note 9 in the Notes to Financial Statements.)

U.S. Equity

| | | | | | | | | | | | | | | | |

Type | | Number of

Contracts | | | Position | | | Expiration Date | | | Unrealized

Gain | |

S&P 500 E-Mini Index | | | 5 | | | | Long | | | | 12/17/2010 | | | $ | 19,722 | |

The following table summarizes the inputs used to value the Fund’s net assets by the fair value hierarchy levels as of October 31, 2010: (See Note 1(a) in the Notes to Financial Statements.)

| | | | | | | | | | | | | | | | |

| | | Quoted Prices

in Active

Markets for

Identical

Investments

Level 1 | | | Significant

Other

Observable

Inputs

Level 2 | | | Significant

Unobservable

Inputs

Level 3 | | | Total | |

U.S. Equity | | | | | | | | | | | | | | | | |

Investments in Securities | | | | | | | | | | | | | | | | |

Common Stocks† | | $ | 51,584,302 | | | | — | | | | — | | | $ | 51,584,302 | |

Short-Term Investments | | | 1,044,283 | | | $ | 159,926 | | | | — | | | | 1,204,209 | |

| | | | | | | | | | | | | | | | |

Total Investments in Securities | | $ | 52,628,585 | | | $ | 159,926 | | | | — | | | $ | 52,788,511 | |

| | | | | | | | | | | | | | | | |

Derivatives†† | | | | | | | | | | | | | | | | |

Equity Contracts | | $ | 19,722 | | | | — | | | | — | | | $ | 19,722 | |

| | | | | | | | | | | | | | | | |

| † | All common stocks held in the Funds are Level 1 securities. For a detailed break-out of the common stocks by major industry classification, please refer to the Schedule of Portfolio Investments. |

| †† | Derivative instruments, such as futures, forwards and swap contracts, are not reflected in the Schedule of Portfolio Investments, and are valued at the unrealized appreciation/depreciation of the instrument. |

As of October 31, 2010, the Funds had no significant transfers between Level 1 and Level 2 from the beginning of the reporting period.

The following schedule shows the fair value of derivative instruments at October 31, 2010:

(See Note 9 in the Notes to Financial Statements.)

| | | | | | | | | | | | | | |

| | | | | Asset Derivatives | | | Liability Derivatives | |

Fund | | Derivatives not accounted for as

hedging instruments | | Statement of Assets and Liabilities Location | | Fair Value | | | Statement of Assets and

Liabilities Location | | Fair Value | |

U.S. Equity | | Equity contracts | | Receivable for variation margin on futures | | $ | 100 | | | Payable for variation margin on futures | | | — | |

| | | | | | | | | | | | | | |

For the fiscal year ended October 31, 2010, the effect of derivative instruments on the Statement of Operations for the Fund and the amount of realized gain/(loss) on derivatives recognized in income was as follows:

| | | | | | | | | | | | | | |

Fund | | Derivatives not accounted for as hedging instruments | | Futures | | | Forward Currency

Contracts | | | Total | |

U.S. Equity | | Equity contracts | | $ | 18,308 | | | | — | | | $ | 18,308 | |

| | | | | | | | | | | | | | |

The change in unrealized gain/(loss) on derivatives recognized in income was as follows:

| | | | | | | | | | | | | | |

Fund | | Derivatives not accounted for as hedging instruments | | Futures | | | Forward Currency

Contracts | | | Total | |

U.S. Equity | | Equity contracts | | $ | 22,938 | | | | — | | | $ | 22,938 | |

| | | | | | | | | | | | | | |

The accompanying notes are an integral part of these financial statements.

17

Managers AMG FQ Global Alternatives Fund

Portfolio Manager’s Comments

The Managers AMG FQ Global Alternatives Fund delivered modestly positive returns for the past fiscal year ended October 31, 2010. The Fund (Class A Shares at NAV) returned 2.71% while the benchmark, the Citigroup 1-Month U.S. Treasury Bill Index, returned 0.11% during this time. Please refer to the table on page 19 for returns of various share classes.