UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act File Number: 811-06650

LORD ABBETT RESEARCH FUND, INC.

(Exact name of Registrant as specified in charter)

90 Hudson Street, Jersey City, NJ 07302

(Address of principal executive offices) (Zip code)

Thomas R. Phillips, Esq., Vice President & Assistant Secretary

90 Hudson Street, Jersey City, NJ 07302

(Name and address of agent for service)

Registrant’s telephone number, including area code: (800) 201-6984

Date of fiscal year end: 11/30

Date of reporting period: 11/30/11

| Item 1: | Report(s) to Shareholders. |

2011

LORD ABBETT

ANNUAL

REPORT

Lord Abbett Capital Structure Fund

For the fiscal year ended November 30, 2011

Lord Abbett Research Fund

Lord Abbett Capital Structure Fund

Annual Report

For the fiscal year ended November 30, 2011

From left to right: Robert S. Dow, Director and Chairman of the Lord Abbett Funds; E. Thayer Bigelow, Independent Lead Director of the Lord Abbett Funds; and Daria L. Foster, Director and President of the Lord Abbett Funds.

Dear Shareholders: We are pleased to provide you with this overview of the performance of the Lord Abbett Capital Structure Fund for the fiscal year ended November 30, 2011. On this page and the following pages, we discuss the major factors that influenced fiscal year performance. For detailed and more timely information about the Fund, please visit our Website at www.lordabbett.com, where you also can access the quarterly commentaries that provide updates on the Fund’s performance and other portfolio related updates.

Thank you for investing in Lord Abbett mutual funds. We value the trust that you place in us and look forward to serving your investment needs in the years to come.

Best regards,

Robert S. Dow

Chairman

For the fiscal year ended November 30, 2011, the Fund returned 4.03%, reflecting performance at the net asset value (NAV) of Class A shares, with all distributions reinvested, compared to its benchmark, the S&P 500® Index,1 which returned 7.83% over the same period.

For the 12-month period, the Fund’s Class A Shares ranked in the 34th percentile within the Lipper Mixed-Asset Target Allocation Growth Funds category.

During the 12-month period, markets were faced with the headwinds of the sovereign debt crisis in Europe and slower global economic growth. In addition, domestic equity markets (as represented by the S&P 500 Index) outperformed both the fixed-income markets (as represented by the Barclays Capital U.S. Aggregate Bond Index2) and foreign equity markets (as represented by the MSCI EAFE Index3 with Gross Dividends). Within the fixed-income markets, there was a general flight to

1

quality and an aversion to credit risk. As a result, Treasuries and municipal bonds were two of the best performing sectors of the bond market during the period. Despite strong credit fundamentals, the investment-grade and high-yield corporate bond markets underperformed Treasuries. At period-end, the portfolio’s asset allocation was approximately 61% equities, 19% high yield, 5% investment grade, 12% convertibles, 1% bank loans, and 2% cash.

Within the equity portion of the Fund, stock selection, mainly within the consumer discretionary, health care, and consumer staples sectors, detracted from performance. The Fund’s underweight in the consumer staples sector versus the index detracted from performance, as this sector was one of the stronger performers in the S&P 500® Index. Within the investment-grade bonds, the Fund maintained little to no allocation to U.S. Treasuries, as we continue to see better relative value in corporates. During the period, U.S. Treasuries outperformed investment-grade corporates during the flight to quality and aversion to credit risk, which hurt performance.

Although the convertibles market faced a difficult period, the convertibles allocation within the Fund contributed to performance overall. Security selection, particularly within the technology and software sectors, helped performance. Convertible securities are a unique asset class that provides an income stream through yield while also having the potential to participate in equity market upside.

Within the fixed-income portion, the Fund is more oriented to high-yield bonds rather than investment grade. Security selection within high-yield corporates contributed to performance. The breadth of advances was wide as the market continued to see improving fundamentals.

The Fund’s portfolio is actively managed and, therefore, its holdings and the weightings of a particular issuer or particular sector as a percentage of portfolio assets are subject to change. Sectors may include many industries.

1 The S&P 500® Index is widely regarded as the standard for measuring large-cap U.S. stock market performance and includes a representative sample of leading companies in leading industries.

2 The Barclays Capital U.S. Aggregate Bond Index is an unmanaged index composed of securities from the Barclays Capital Government/Corporate Bond Index, Mortgage-Backed Securities Index and the Asset-Backed Securities Index. Total return comprises price appreciation/depreciation and income as a percentage of the original investment. Indexes are rebalanced monthly by market capitalization.

3 The MSCI EAFE Index (Europe, Australasia, Far East) is a free float-adjusted market capitalization index that is designed to measure the equity market performance of developed markets, excluding the United States and Canada. As of May 30, 2011, the MSCI EAFE Index consisted of the following 22 developed market country indexes: Australia, Austria, Belgium, Denmark, Finland, France, Germany, Greece, Hong Kong, Ireland, Israel, Italy, Japan, the Netherlands, New Zealand, Norway, Portugal, Singapore, Spain, Sweden, Switzerland, and the United Kingdom.

2

The MSCI EAFE Index is calculated with both gross and net dividends. The MSCI EAFE Index with Gross Dividends approximates the maximum possible dividend reinvestment. The amount reinvested is the entire dividend distributed to individuals resident in the country of the company, but does not include tax credits. The MSCI EAFE Index with Net Dividends approximates the minimum possible dividend reinvestment. The dividend is reinvested after deduction of withholding tax, applying the rate to non-resident individuals who do not benefit from double taxation treaties. MSCI uses withholding tax rates applicable to Luxembourg holding companies, as Luxembourg applies the highest rates.

Unless otherwise specified, indexes reflect total return, with all dividends reinvested. Indexes are unmanaged, do not reflect the deduction of fees or expenses, and are not available for direct investment.

Important Performance and Other Information

Performance data quoted in the following pages reflect past performance and are no guarantee of future results. Current performance may be higher or lower than the performance quoted. The investment return and principal value of an investment in the Fund will fluctuate so that shares, on any given day or when redeemed, may be worth more or less than their original cost. You can obtain performance data current to the most recent month end by calling Lord Abbett at 888-522-2388 or referring to www.lordabbett.com.

Except where noted, comparative Fund performance does not account for the deduction of sales charges and would be different if sales charges were included. The Fund offers several classes of shares with distinct pricing options. For a full description of the differences in pricing alternatives, please see the Fund’s prospectus.

During certain periods shown, expense waivers and reimbursements were in place. Without such expense waivers and reimbursements, the Fund’s returns would have been lower.

The annual commentary above discusses the views of the Fund’s management and various portfolio holdings of the Fund as of November 30, 2011. These views and portfolio holdings may have changed after this date. Information provided in the commentary is not a recommendation to buy or sell securities. Because the Fund’s portfolio is actively managed and may change significantly, the Fund may no longer own the securities described above or may have otherwise changed its positions in the securities. For more recent information about the Fund’s portfolio holdings, please visit www.lordabbett.com.

A Note about Risk: See Notes to Financial Statements for a discussion of investment risks. For a more detailed discussion of the risks associated with the Fund, please see the Fund’s prospectus.

Mutual funds are not insured by the FDIC, are not deposits or other obligations of, or guaranteed by, banks, and are subject to investment risks including possible loss of principal amount invested.

3

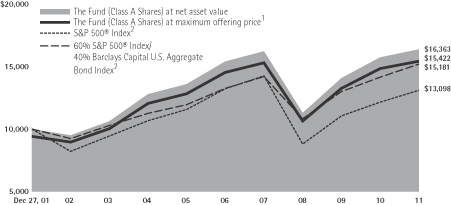

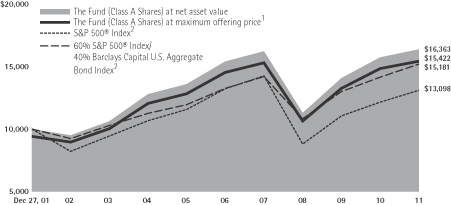

Investment Comparison

Below is a comparison of a $10,000 investment in Class A shares with the same investment in the S&P 500® Index and the 60% S&P 500® Index/40% Barclays Capital U.S. Aggregate Bond Index, assuming reinvestment of all dividends and distributions. The performance of other classes will be greater than or less than the performance shown in the graph below due to different sales loads and expenses applicable to such classes. The graph and performance table below do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. During certain periods, expenses of the Fund have been waived or reimbursed by Lord Abbett; without such waiver or reimbursement of expenses, the Fund’s returns would have been lower. Past performance is no guarantee of future results.

Average Annual Total Returns at Maximum Applicable

Sales Charge for the Periods Ended November 30, 2011

| | | | | | | | | | | | |

| | | 1 Year | | | 5 Years | | | Life of Class | |

Class A3 | | | -1.98% | | | | 0.02% | | | | 4.46% | |

Class B4 | | | -0.64% | | | | 0.39% | | | | 4.54% | |

Class C5 | | | 3.39% | | | | 0.56% | | | | 4.43% | |

Class F6 | | | 4.39% | | | | – | | | | -0.13% | |

Class I7 | | | 4.37% | | | | 1.58% | | | | 5.46% | |

Class P8 | | | 4.00% | | | | 1.13% | | | | 5.01% | |

Class R29 | | | 3.90% | | | | – | | | | -0.46% | |

Class R310 | | | 3.91% | | | | – | | | | -0.53% | |

1 Reflects the deduction of the maximum initial sales charge of 5.75%.

2 Performance for each unmanaged index does not reflect any fees or expenses. The performance of each index is not necessarily representative of the Fund’s performance. Performance of each index began on December 27, 2001.

3 Class A shares commenced operations and performance for the Class began on December 27, 2001. Total return, which is the percentage change in net asset value, after deduction of the maximum initial sales charge of 5.75% applicable to Class A shares, with all dividends and distributions reinvested for the periods shown ended November 30, 2011, is calculated using the SEC-required uniform method to compute such return.

4 Class B shares commenced operations and performance for the Class began on December 27, 2001. Performance reflects the deduction of a CDSC of 4% for 1 year, 1% for 5 years and 0% for Life of Class. Class B shares automatically convert to Class A shares after approximately 8 years. (There is no initial sales charge for automatic conversions.)

5 Class C shares commenced operations and performance for the Class began on December 27, 2001. The 1% CDSC for Class C shares normally applies before the first anniversary of the purchase date. Performance is at net asset value.

6 Class F shares commenced operations and performance for the Class began on September 28, 2007. Performance is at net asset value.

7 Class I shares commenced operations and performance for the Class began on December 27, 2001. Performance is at net asset value.

8 Class P shares commenced operations and performance for the Class began on December 27, 2001. Performance is at net asset value.

9 Class R2 shares commenced operations and performance for the Class began on September 28, 2007. Performance is at net asset value.

10 Class R3 shares commenced operations and performance for the Class began on September 28, 2007. Performance is at net asset value.

4

Expense Example

As a shareholder of the Fund, you incur two types of costs: (1) transaction costs, including sales charges (loads) on purchase payments (these charges vary among the share classes); and (2) ongoing costs, including management fees; distribution and service (12b-1) fees (these charges vary among the share classes); and other Fund expenses. This Example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds.

The Example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period (June 1, 2011 through November 30, 2011).

Actual Expenses

For each class of the Fund, the first line of the table on the following page provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading titled “Expenses Paid During Period 6/1/11 – 11/30/11” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

For each class of the Fund, the second line of the table on the following page provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

5

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as sales charges (loads). Therefore, the second line of the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

| | | | | | | | | | | | |

| | | Beginning

Account

Value | | | Ending

Account

Value | | | Expenses

Paid During

Period† | |

| | | 6/1/11 | | | 11/30/11 | | | 6/1/11 -

11/30/11 | |

Class A | | | | | | | | | | | | |

Actual | | $ | 1,000.00 | | | $ | 927.80 | | | $ | 6.28 | |

Hypothetical (5% Return Before Expenses) | | $ | 1,000.00 | | | $ | 1,018.50 | | | $ | 6.58 | |

Class B | | | | | | | | | | | | |

Actual | | $ | 1,000.00 | | | $ | 923.90 | | | $ | 9.40 | |

Hypothetical (5% Return Before Expenses) | | $ | 1,000.00 | | | $ | 1,015.22 | | | $ | 9.85 | |

Class C | | | | | | | | | | | | |

Actual | | $ | 1,000.00 | | | $ | 924.20 | | | $ | 9.41 | |

Hypothetical (5% Return Before Expenses) | | $ | 1,000.00 | | | $ | 1,015.27 | | | $ | 9.85 | |

Class F | | | | | | | | | | | | |

Actual | | $ | 1,000.00 | | | $ | 929.00 | | | $ | 5.08 | |

Hypothetical (5% Return Before Expenses) | | $ | 1,000.00 | | | $ | 1,019.75 | | | $ | 5.32 | |

Class I | | | | | | | | | | | | |

Actual | | $ | 1,000.00 | | | $ | 929.10 | | | $ | 4.59 | |

Hypothetical (5% Return Before Expenses) | | $ | 1,000.00 | | | $ | 1,020.21 | | | $ | 4.81 | |

Class P | | | | | | | | | | | | |

Actual | | $ | 1,000.00 | | | $ | 927.50 | | | $ | 6.76 | |

Hypothetical (5% Return Before Expenses) | | $ | 1,000.00 | | | $ | 1,017.99 | | | $ | 7.08 | |

Class R2 | | | | | | | | | | | | |

Actual | | $ | 1,000.00 | | | $ | 927.00 | | | $ | 7.49 | |

Hypothetical (5% Return Before Expenses) | | $ | 1,000.00 | | | $ | 1,017.34 | | | $ | 7.84 | |

Class R3 | | | | | | | | | | | | |

Actual | | $ | 1,000.00 | | | $ | 926.30 | | | $ | 7.00 | |

Hypothetical (5% Return Before Expenses) | | $ | 1,000.00 | | | $ | 1,017.78 | | | $ | 7.33 | |

| † | | For each class of the Fund, net expenses are equal to the annualized expense ratio for such class (1.30% for Class A, 1.95% for Classes B and C, 1.05% for Class F, 0.95% for Class I, 1.40% for Class P, 1.55% for Class R2 and 1.45% for Class R3) multiplied by the average account value over the period, multiplied by 183/365 (to reflect one-half year period). |

Portfolio Holdings Presented by Sector

November 30, 2011

| | | | | | | | | | | | |

| Sector* | | %** | | | | | Sector* | | %** | |

Consumer Discretionary | | | 11.35% | | | | | Information Technology | | | 14.58% | |

Consumer Staples | | | 6.79% | �� | | | | Materials | | | 7.76% | |

Energy | | | 16.04% | | | | | Telecommunication Services | | | 5.52% | |

Financials | | | 12.37% | | | | | Utilities | | | 2.54% | |

Health Care | | | 12.01% | | | | | Short-Term Investment | | | 0.39% | |

Industrials | | | 10.65% | | | | | Total | | | 100.00% | |

| * | | A sector may comprise several industries. |

| ** | | Represents percent of total investments. |

6

Schedule of Investments

November 30, 2011

| | | | | | | | |

| Investments | | Shares

(000) | | | Fair Value | |

| LONG-TERM INVESTMENTS 99.59% | | | | | | | | |

| | |

| COMMON STOCKS 57.70% | | | | | | | | |

| | |

| Aerospace & Defense 1.38% | | | | | | | | |

| DigitalGlobe, Inc.* | | | 35 | | | $ | 521,500 | |

| GeoEye, Inc.* | | | 38 | | | | 712,125 | |

| Hexcel Corp.* | | | 330 | | | | 8,223,600 | |

| Moog, Inc. Class A* | | | 65 | | | | 2,718,300 | |

| United Technologies Corp. | | | 40 | | | | 3,086,980 | |

| | | | | | | | |

| Total | | | | | | | 15,262,505 | |

| | | | | | | | |

| | |

| Airlines 0.26% | | | | | | | | |

| United Continental Holdings, Inc.* | | | 158 | | | | 2,830,275 | |

| | | | | | | | |

| | |

| Auto Components 0.47% | | | | | | | | |

| Cooper-Standard Holdings, Inc.* | | | 135 | | | | 5,197,500 | |

| | | | | | | | |

| | |

| Automobiles 0.26% | | | | | | | | |

| Honda Motor Co., Ltd. ADR | | | 91 | | | | 2,883,315 | |

| | | | | | | | |

| | |

| Beverages 0.72% | | | | | | | | |

| PepsiCo, Inc. | | | 125 | | | | 8,000,000 | |

| | | | | | | | |

| | |

| Biotechnology 0.82% | | | | | | | | |

| Celgene Corp.* | | | 120 | | | | 7,569,600 | |

| Human Genome Sciences, Inc.* | | | 200 | | | | 1,534,000 | |

| | | | | | | | |

| Total | | | | | | | 9,103,600 | |

| | | | | | | | |

| | |

| Capital Markets 0.70% | | | | | | | | |

| Franklin Resources, Inc. | | | 32 | | | | 3,226,240 | |

| State Street Corp. | | | 40 | | | | 1,586,000 | |

| T. Rowe Price Group, Inc. | | | 53 | | | | 3,008,280 | |

| | | | | | | | |

| Total | | | | | | | 7,820,520 | |

| | | | | | | | |

| | |

| Chemicals 2.76% | | | | | | | | |

| Celanese Corp. Series A | | | 85 | | | | 3,951,650 | |

| CF Industries Holdings, Inc. | | | 15 | | | | 2,097,000 | |

| Dow Chemical Co. (The) | | | 135 | | | | 3,740,850 | |

| LyondellBasell Industries NV Class A (Netherlands)(a) | | | 175 | | | | 5,717,250 | |

| Monsanto Co. | | | 80 | | | | 5,876,000 | |

See Notes to Financial Statements.

7

Schedule of Investments (continued)

November 30, 2011

| | | | | | | | |

| Investments | | Shares

(000) | | | Fair Value | |

| Chemicals (continued) | | | | | | | | |

| Mosaic Co. (The) | | | 40 | | | $ | 2,110,400 | |

| Rockwood Holdings, Inc.* | | | 160 | | | | 7,129,600 | |

| | | | | | | | |

| Total | | | | | | | 30,622,750 | |

| | | | | | | | |

| | |

| Commercial Banks 2.38% | | | | | | | | |

| Huntington Bancshares, Inc. | | | 350 | | | | 1,837,500 | |

| PNC Financial Services Group, Inc. (The) | | | 55 | | | | 2,981,550 | |

| Regions Financial Corp. | | | 400 | | | | 1,644,000 | |

| U.S. Bancorp | | | 300 | | | | 7,776,000 | |

| Wells Fargo & Co. | | | 400 | | | | 10,344,000 | |

| Zions Bancorporation | | | 115 | | | | 1,850,350 | |

| | | | | | | | |

| Total | | | | | | | 26,433,400 | |

| | | | | | | | |

| | |

| Communications Equipment 1.11% | | | | | | | | |

| Aruba Networks, Inc.* | | | 220 | | | | 4,642,000 | |

| QUALCOMM, Inc. | | | 140 | | | | 7,672,000 | |

| | | | | | | | |

| Total | | | | | | | 12,314,000 | |

| | | | | | | | |

| | |

| Computers & Peripherals 1.97% | | | | | | | | |

| Apple, Inc.* | | | 38 | | | | 14,523,600 | |

| Fortinet, Inc.* | | | 150 | | | | 3,598,500 | |

| International Business Machines Corp. | | | 20 | | | | 3,760,000 | |

| | | | | | | | |

| Total | | | | | | | 21,882,100 | |

| | | | | | | | |

| | |

| Consumer Finance 0.40% | | | | | | | | |

| Capital One Financial Corp. | | | 100 | | | | 4,466,000 | |

| | | | | | | | |

| | |

| Distributors 0.16% | | | | | | | | |

| Genuine Parts Co. | | | 30 | | | | 1,755,000 | |

| | | | | | | | |

| | |

| Diversified Financial Services 1.44% | | | | | | | | |

| Bank of America Corp. | | | 800 | | | | 4,352,000 | |

| Fannie Mae* | | | 182 | | | | 36,364 | |

| JPMorgan Chase & Co. | | | 375 | | | | 11,613,750 | |

| | | | | | | | |

| Total | | | | | | | 16,002,114 | |

| | | | | | | | |

| | |

| Diversified Telecommunication Services 2.55% | | | | | | | | |

| AT&T, Inc. | | | 335 | | | | 9,708,300 | |

| CenturyLink, Inc. | | | 200 | | | | 7,504,000 | |

| Verizon Communications, Inc. | | | 200 | | | | 7,546,000 | |

See Notes to Financial Statements.

8

Schedule of Investments (continued)

November 30, 2011

| | | | | | | | |

| Investments | | Shares

(000) | | | Fair Value | |

| Diversified Telecommunication Services (continued) | | | | | | | | |

| Windstream Corp. | | | 300 | | | $ | 3,528,000 | |

| | | | | | | | |

| Total | | | | | | | 28,286,300 | |

| | | | | | | | |

| | |

| Electric: Utilities 0.91% | | | | | | | | |

| UniSource Energy Corp. | | | 275 | | | | 10,142,000 | |

| | | | | | | | |

| | |

| Electrical Equipment 1.56% | | | | | | | | |

| A123 Systems, Inc.* | | | 220 | | | | 545,600 | |

| AMETEK, Inc. | | | 53 | | | | 2,270,520 | |

| Cooper Industries plc | | | 27 | | | | 1,499,310 | |

| Emerson Electric Co. | | | 155 | | | | 8,098,750 | |

| Rockwell Automation, Inc. | | | 65 | | | | 4,876,950 | |

| | | | | | | | |

| Total | | | | | | | 17,291,130 | |

| | | | | | | | |

| | |

| Energy Equipment & Services 0.89% | | | | | | | | |

| Cameron International Corp.* | | | 85 | | | | 4,589,150 | |

| Schlumberger Ltd. | | | 70 | | | | 5,273,100 | |

| | | | | | | | |

| Total | | | | | | | 9,862,250 | |

| | | | | | | | |

| | |

| Food & Staples Retailing 1.88% | | | | | | | | |

| CVS Caremark Corp. | | | 115 | | | | 4,466,600 | |

| Ingles Markets, Inc. Class A | | | 415 | | | | 6,399,300 | |

| Wal-Mart Stores, Inc. | | | 170 | | | | 10,013,000 | |

| | | | | | | | |

| Total | | | | | | | 20,878,900 | |

| | | | | | | | |

| | |

| Food Products 1.53% | | | | | | | | |

| Archer-Daniels-Midland Co. | | | 150 | | | | 4,518,000 | |

| H.J. Heinz Co. | | | 75 | | | | 3,948,750 | |

| Kellogg Co. | | | 85 | | | | 4,178,600 | |

| Kraft Foods, Inc. Class A | | | 120 | | | | 4,338,000 | |

| | | | | | | | |

| Total | | | | | | | 16,983,350 | |

| | | | | | | | |

| | |

| Hotels, Restaurants & Leisure 1.68% | | | | | | | | |

| Marriott International, Inc. Class A | | | 120 | | | | 3,674,400 | |

| Marriott Vacations Worldwide Corp.* | | | 13 | | | | 207,740 | |

| McDonald’s Corp. | | | 110 | | | | 10,507,200 | |

| Starwood Hotels & Resorts Worldwide, Inc. | | | 90 | | | | 4,291,200 | |

| | | | | | | | |

| Total | | | | | | | 18,680,540 | |

| | | | | | | | |

See Notes to Financial Statements.

9

Schedule of Investments (continued)

November 30, 2011

| | | | | | | | |

| Investments | | Shares

(000) | | | Fair Value | |

| Household Products 0.87% | | | | | | | | |

| Procter & Gamble Co. (The) | | | 150 | | | $ | 9,685,500 | |

| | | | | | | | |

| | |

| Industrial Conglomerates 0.60% | | | | | | | | |

| 3M Co. | | | 25 | | | | 2,026,000 | |

| General Electric Co. | | | 290 | | | | 4,613,900 | |

| | | | | | | | |

| Total | | | | | | | 6,639,900 | |

| | | | | | | | |

| | |

| Information Technology Services 0.54% | | | | | | | | |

| SAIC, Inc.* | | | 500 | | | | 6,025,000 | |

| | | | | | | | |

| | |

| Insurance 0.54% | | | | | | | | |

| MetLife, Inc. | | | 190 | | | | 5,981,200 | |

| | | | | | | | |

| | |

| Machinery 3.08% | | | | | | | | |

| Actuant Corp. Class A | | | 300 | | | | 6,876,000 | |

| Caterpillar, Inc. | | | 27 | | | | 2,642,760 | |

| Danaher Corp. | | | 180 | | | | 8,708,400 | |

| Dover Corp. | | | 35 | | | | 1,923,950 | |

| Pall Corp. | | | 100 | | | | 5,449,000 | |

| Parker Hannifin Corp. | | | 35 | | | | 2,897,300 | |

| Snap-on, Inc. | | | 110 | | | | 5,643,000 | |

| | | | | | | | |

| Total | | | | | | | 34,140,410 | |

| | | | | | | | |

| | |

| Media 1.91% | | | | | | | | |

| Belo Corp. Class A | | | 340 | | | | 1,989,000 | |

| Charter Communications, Inc. Class A* | | | 30 | | | | 1,586,100 | |

| Comcast Corp. Class A | | | 90 | | | | 2,040,300 | |

| Interpublic Group of Cos., Inc. (The) | | | 375 | | | | 3,517,500 | |

| Omnicom Group, Inc. | | | 65 | | | | 2,806,050 | |

| Time Warner, Inc. | | | 100 | | | | 3,482,000 | |

| Walt Disney Co. (The) | | | 160 | | | | 5,736,000 | |

| | | | | | | | |

| Total | | | | | | | 21,156,950 | |

| | | | | | | | |

| | |

| Metals & Mining 0.46% | | | | | | | | |

| Barrick Gold Corp. (Canada)(a) | | | 75 | | | | 3,966,000 | |

| Titanium Metals Corp. | | | 75 | | | | 1,168,500 | |

| | | | | | | | |

| Total | | | | | | | 5,134,500 | |

| | | | | | | | |

See Notes to Financial Statements.

10

Schedule of Investments (continued)

November 30, 2011

| | | | | | | | | | | | |

| Investments | | | | | | Shares

(000) | | | Fair Value | |

| Multi-Line Retail 1.17% | | | | | | | | | | | | |

| Kohl’s Corp. | | | | | | | 95 | | | $ | 5,111,000 | |

| Target Corp. | | | | | | | 150 | | | | 7,905,000 | |

| | | | | | | | | | | | |

| Total | | | | | | | | | | | 13,016,000 | |

| | | | | | | | | | | | |

| | | | |

| Oil, Gas & Consumable Fuels 9.73% | | | | | | | | | | | | |

| Chevron Corp. | | | | | | | 275 | | | | 28,275,500 | |

| ConocoPhillips | | | | | | | 300 | | | | 21,396,000 | |

| Continental Resources, Inc.* | | | | | | | 145 | | | | 10,235,550 | |

| EOG Resources, Inc. | | | | | | | 85 | | | | 8,817,900 | |

| Exxon Mobil Corp. | | | | | | | 250 | | | | 20,110,000 | |

| Hess Corp. | | | | | | | 100 | | | | 6,022,000 | |

| Marathon Oil Corp. | | | | | | | 125 | | | | 3,495,000 | |

| Petroleo Brasileiro SA ADR | | | | | | | 196 | | | | 4,911,213 | |

| Whiting Petroleum Corp.* | | | | | | | 100 | | | | 4,651,000 | |

| | | | | | | | | | | | |

| Total | | | | | | | | | | | 107,914,163 | |

| | | | | | | | | | | | |

| | | | |

| Pharmaceuticals 5.70% | | | | | | | | | | | | |

| Bristol-Myers Squibb Co. | | | | | | | 235 | | | | 7,689,200 | |

| Johnson & Johnson | | | | | | | 175 | | | | 11,326,000 | |

| Merck & Co., Inc. | | | | | | | 120 | | | | 4,290,000 | |

| Mylan, Inc.* | | | | | | | 893 | | | | 17,447,789 | |

| Pfizer, Inc. | | | | | | | 650 | | | | 13,045,500 | |

| Salix Pharmaceuticals Ltd.* | | | | | | | 70 | | | | 3,089,800 | |

| Teva Pharmaceutical Industries Ltd. ADR | | | | | | | 161 | | | | 6,377,923 | |

| | | | | | | | | | | | |

| Total | | | | | | | | | | | 63,266,212 | |

| | | | | | | | | | | | |

| | | | |

| Real Estate Investment Trusts 0.58% | | | | | | | | | | | | |

| Equity Residential | | | | | | | 32 | | | | 1,777,118 | |

| Plum Creek Timber Co., Inc. | | | | | | | 125 | | | | 4,605,000 | |

| | | | | | | | | | | | |

| Total | | | | | | | | | | | 6,382,118 | |

| | | | | | | | | | | | |

| | | | |

| Road & Rail 0.56% | | | | | | | | | | | | |

| Union Pacific Corp. | | | | | | | 60 | | | | 6,204,600 | |

| | | | | | | | | | | | |

| | | | |

| Semiconductors & Semiconductor Equipment 0.93% | | | | | | | | | | | | |

| Broadcom Corp. Class A* | | | | | | | 90 | | | | 2,731,050 | |

| Intel Corp. | | | | | | | 235 | | | | 5,853,850 | |

See Notes to Financial Statements.

11

Schedule of Investments (continued)

November 30, 2011

| | | | | | | | | | | | | | | | |

| Investments | | | | | | | | Shares

(000) | | | Fair Value | |

| Semiconductors & Semiconductor Equipment (continued) | | | | | | | | | |

| PMC-Sierra, Inc.* | | | | | | | | | | | 300 | | | $ | 1,677,000 | |

| | | | | | | | | | | | | | | | |

| Total | | | | | | | | | | | | | | | 10,261,900 | |

| | | | | | | | | | | | | | | | |

| | | | |

| Software 4.85% | | | | | | | | | | | | | | | | |

| Adobe Systems, Inc.* | | | | | | | | | | | 165 | | | | 4,524,300 | |

| Check Point Software Technologies Ltd. (Israel)*(a) | | | | | | | | | | | 30 | | | | 1,660,200 | |

| Citrix Systems, Inc.* | | | | | | | | | | | 40 | | | | 2,855,600 | |

| Informatica Corp.* | | | | | | | | | | | 80 | | | | 3,596,400 | |

| Microsoft Corp. | | | | | | | | | | | 585 | | | | 14,964,300 | |

| Nuance Communications, Inc.* | | | | | | | | | | | 220 | | | | 5,407,600 | |

| Oracle Corp. | | | | | | | | | | | 250 | | | | 7,837,500 | |

| Sourcefire, Inc.* | | | | | | | | | | | 140 | | | | 4,636,800 | |

| Synchronoss Technologies, Inc.* | | | | | | | | | | | 135 | | | | 4,035,150 | |

| Websense, Inc.* | | | | | | | | | | | 235 | | | | 4,255,850 | |

| | | | | | | | | | | | | | | | |

| Total | | | | | | | | | | | | | | | 53,773,700 | |

| | | | | | | | | | | | | | | | |

| | | | |

| Specialty Retail 0.35% | | | | | | | | | | | | | | | | |

| Home Depot, Inc. (The) | | | | | | | | | | | 100 | | | | 3,922,000 | |

| | | | | | | | | | | | | | | | |

| Total Common Stocks (cost $563,013,381) | | | | | | | | | | | | | | | 640,201,702 | |

| | | | | | | | | | | | | | | | |

| | | | |

| | | Exercise Price | | | Expiration

Date | | | | | | | |

| CONTINGENT VALUE RIGHT 0.01% | | | | | | | | | | | | | | | | |

| | | | |

| Pharmaceuticals | | | | | | | | | | | | | | | | |

| Sanofi* (cost $94,160) | | | – | (b) | | | 12/31/2020 | | | | 40 | | | | 52,000 | |

| | | | | | | | | | | | | | | | |

| | | | |

| | | Interest

Rate | | | Maturity

Date | | | Principal

Amount

(000) | | | | |

| CONVERTIBLE BONDS 6.83% | | | | | | | | | | | | | | | | |

| | | | |

| Automobiles 0.35% | | | | | | | | | | | | | | | | |

| Ford Motor Co. | | | 4.25% | | | | 11/15/2016 | | | | $2,750 | | | | 3,870,625 | |

| | | | | | | | | | | | | | | | |

| | | | |

| Biotechnology 1.57% | | | | | | | | | | | | | | | | |

| BioMarin Pharmaceutical, Inc. | | | 1.875% | | | | 4/23/2017 | | | | 3,100 | | | | 5,529,625 | |

| Gilead Sciences, Inc. | | | 0.625% | | | | 5/1/2013 | | | | 8,500 | | | | 9,785,625 | |

| Vertex Pharmaceuticals, Inc. | | | 3.35% | | | | 10/1/2015 | | | | 2,150 | | | | 2,117,750 | |

| | | | | | | | | | | | | | | | |

| Total | | | | | | | | | | | | | | | 17,433,000 | |

| | | | | | | | | | | | | | | | |

See Notes to Financial Statements.

12

Schedule of Investments (continued)

November 30, 2011

| | | | | | | | | | | | | | | | |

| Investments | | Interest

Rate | | | Maturity

Date | | | Principal

Amount

(000) | | | Fair

Value | |

| Computers & Peripherals 0.95% | | | | | | | | | | | | | | | | |

| EMC Corp. | | | 1.75% | | | | 12/1/2013 | | | $ | 2,600 | | | $ | 3,958,500 | |

| NetApp, Inc. | | | 1.75% | | | | 6/1/2013 | | | | 3,000 | | | | 3,840,000 | |

| SanDisk Corp. | | | 1.50% | | | | 8/15/2017 | | | | 2,300 | | | | 2,685,250 | |

| | | | | | | | | | | | | | | | |

| Total | | | | | | | | | | | | | | | 10,483,750 | |

| | | | | | | | | | | | | | | | |

| | | | |

| Electrical Equipment 0.59% | | | | | | | | | | | | | | | | |

| Roper Industries, Inc. | | | Zero Coupon | | | | 1/15/2034 | | | | 6,150 | | | | 6,572,812 | |

| | | | | | | | | | | | | | | | |

| | | | |

| Energy Equipment & Services 0.15% | | | | | | | | | | | | | | | | |

| SunPower Corp. | | | 4.75% | | | | 4/15/2014 | | | | 2,275 | | | | 1,700,563 | |

| | | | | | | | | | | | | | | | |

| | | | |

| Health Care Providers & Services 0.58% | | | | | | | | | | | | | | | | |

| Five Star Quality Care, Inc. | | | 3.75% | | | | 10/15/2026 | | | | 7,025 | | | | 6,463,000 | |

| | | | | | | | | | | | | | | | |

| | | | |

| Information Technology Services 0.21% | | | | | | | | | | | | | | | | |

| CACI International, Inc. | | | 2.125% | | | | 5/1/2014 | | | | 2,000 | | | | 2,370,000 | |

| | | | | | | | | | | | | | | | |

| | | | |

| Metals & Mining 0.91% | | | | | | | | | | | | | | | | |

| Newmont Mining Corp. | | | 1.25% | | | | 7/15/2014 | | | | 5,000 | | | | 7,806,250 | |

| Newmont Mining Corp. | | | 3.00% | | | | 2/15/2012 | | | | 1,500 | | | | 2,250,000 | |

| | | | | | | | | | | | | | | | |

| Total | | | | | | | | | | | | | | | 10,056,250 | |

| | | | | | | | | | | | | | | | |

| | | |

| Semiconductors & Semiconductor Equipment 0.84% | | | | | | | | | | | | | |

| Intel Corp. | | | 2.95% | | | | 12/15/2035 | | | | 4,500 | | | | 4,837,500 | |

| Xilinx, Inc. | | | 2.625% | | | | 6/15/2017 | | | | 3,500 | | | | 4,506,250 | |

| | | | | | | | | | | | | | | | |

| Total | | | | | | | | | | | | | | | 9,343,750 | |

| | | | | | | | | | | | | | | | |

| | | | |

| Software 0.39% | | | | | | | | | | | | | | | | |

| Symantec Corp. | | | 1.00% | | | | 6/15/2013 | | | | 3,750 | | | | 4,293,750 | |

| | | | | | | | | | | | | | | | |

| | | |

| Wireless Telecommunication Services 0.29% | | | | | | | | | | | | | |

| SBA Communications Corp. | | | 4.00% | | | | 10/1/2014 | | | | 2,175 | | | | 3,194,531 | |

| | | | | | | | | | | | | | | | |

| Total Convertible Bonds (cost $73,386,629) | | | | | | | | | | | | | | | 75,782,031 | |

| | | | | | | | | | | | | | | | |

| | | | |

| | | | | | | | | Shares

(000) | | | | |

| CONVERTIBLE PREFERRED STOCKS 5.39% | | | | | | | | | | | | | | | | |

| | | | |

| Auto Components 0.06% | | | | | | | | | | | | | | | | |

| Cooper-Standard Holdings, Inc. PIK | | | 7.00% | | | | | | | | 4 | | | | 651,840 | |

| | | | | | | | | | | | | | | | |

See Notes to Financial Statements.

13

Schedule of Investments (continued)

November 30, 2011

| | | | | | | | | | | | | | | | |

| Investments | | Interest

Rate | | | | | | Shares

(000) | | | Fair

Value | |

| Automobiles 0.23% | | | | | | | | | | | | | | | | |

| General Motors Co. | | | 4.75% | | | | | | | | 74 | | | $ | 2,509,290 | |

| | | | | | | | | | | | | | | | |

| | | | |

| Capital Markets 0.78% | | | | | | | | | | | | | | | | |

| AMG Capital Trust I | | | 5.10% | | | | | | | | 200 | | | | 8,625,000 | |

| | | | | | | | | | | | | | | | |

| | | | |

| Commercial Banks 0.91% | | | | | | | | | | | | | | | | |

| Fifth Third Bancorp | | | 8.50% | | | | | | | | 40 | | | | 5,638,800 | |

| Wells Fargo & Co. | | | 7.50% | | | | | | | | 4 | | | | 4,479,500 | |

| | | | | | | | | | | | | | | | |

| Total | | | | | | | | | | | | | | | 10,118,300 | |

| | | | | | | | | | | | | | | | |

| | | | |

| Communications Equipment 0.08% | | | | | | | | | | | | | | | | |

| Lucent Technologies Capital Trust I | | | 7.75% | | | | | | | | 1 | | | | 894,600 | |

| | | | | | | | | | | | | | | | |

| | | | |

| Diversified Financial Services 0.53% | | | | | | | | | | | | | | | | |

| Citigroup, Inc. | | | 7.50% | | | | | | | | 70 | | | | 5,897,500 | |

| | | | | | | | | | | | | | | | |

| | | | |

| Electric: Utilities 0.68% | | | | | | | | | | | | | | | | |

| NextEra Energy, Inc. | | | 8.375% | | | | | | | | 150 | | | | 7,575,000 | |

| | | | | | | | | | | | | | | | |

| | | | |

| Food Products 0.65% | | | | | | | | | | | | | | | | |

| Bunge Ltd. | | | 4.875% | | | | | | | | 75 | | | | 7,265,625 | |

| | | | | | | | | | | | | | | | |

| | | | |

| Insurance 0.57% | | | | | | | | | | | | | | | | |

| Hartford Financial Services Group, Inc. (The) | | | 7.25% | | | | | | | | 135 | | | | 2,639,250 | |

| MetLife, Inc. | | | 5.00% | | | | | | | | 61 | | | | 3,708,190 | |

| | | | | | | | | | | | | | | | |

| Total | | | | | | | | | | | | | | | 6,347,440 | |

| | | | | | | | | | | | | | | | |

| | | | |

| Oil, Gas & Consumable Fuels 0.90% | | | | | | | | | | | | | | | | |

| Apache Corp. | | | 6.00% | | | | | | | | 175 | | | | 9,954,000 | |

| | | | | | | | | | | | | | | | |

| Total Convertible Preferred Stocks (cost $61,818,280) | | | | | | | | | | | | 59,838,595 | |

| | | | | | | | | | | | | | | | |

| | | | |

| | | | | | Maturity

Date | | | Principal

Amount

(000) | | | | |

| FLOATING RATE LOANS(c) 0.54% | | | | | | | | | | | | | | | | |

| | | | |

| Diversified Financial Services 0.32% | | | | | | | | | | | | | | | | |

| Nuveen Investments, Inc. 2nd Lien Term Loan | | | 12.50% | | | | 7/31/2015 | | | $ | 3,350 | | | | 3,482,744 | |

| | | | | | | | | | | | | | | | |

| | | | |

| Software 0.22% | | | | | | | | | | | | | | | | |

| Nuance Communications, Inc. Term Loan C | | | 3.25% | | | | 3/31/2016 | | | | 2,468 | | | | 2,458,786 | |

| | | | | | | | | | | | | | | | |

| Total Floating Rate Loans (cost $5,549,809) | | | | | | | | | | | | | | | 5,941,530 | |

| | | | | | | | | | | | | | | | |

See Notes to Financial Statements.

14

Schedule of Investments (continued)

November 30, 2011

| | | | | | | | |

| Investments | | Shares

(000) | | | Fair

Value | |

| FOREIGN COMMON STOCKS(d) 4.23% | | | | | | | | |

| | |

| France 0.46% | | | | | | | | |

| | |

| Automobiles 0.21% | | | | | | | | |

| Renault SA | | | 63 | | | $ | 2,371,202 | |

| | | | | | | | |

| | |

| Electrical Equipment 0.25% | | | | | | | | |

| Alstom SA | | | 79 | | | | 2,747,810 | |

| | | | | | | | |

| Total France | | | | | | | 5,119,012 | |

| | | | | | | | |

| | |

| Germany 1.01% | | | | | | | | |

| | |

| Air Freight & Logistics 0.29% | | | | | | | | |

| Deutsche Post AG Registered Shares | | | 213 | | | | 3,226,576 | |

| | | | | | | | |

| | |

| Household Products 0.31% | | | | | | | | |

| Henkel KGaA | | | 70 | | | | 3,429,157 | |

| | | | | | | | |

| | |

| Software 0.41% | | | | | | | | |

| SAP AG | | | 76 | | | | 4,532,204 | |

| | | | | | | | |

| Total Germany | | | | | | | 11,187,937 | |

| | | | | | | | |

| | |

| Norway 0.40% | | | | | | | | |

| | |

| Commercial Banks | | | | | | | | |

| DnB NOR ASA | | | 432 | | | | 4,417,814 | |

| | | | | | | | |

| | |

| Switzerland 1.36% | | | | | | | | |

| | |

| Chemicals 0.40% | | | | | | | | |

| Syngenta AG Registered Shares* | | | 15 | | | | 4,472,950 | |

| | | | | | | | |

| | |

| Food Products 0.34% | | | | | | | | |

| Nestle SA Registered Shares | | | 68 | | | | 3,816,851 | |

| | | | | | | | |

| | |

| Pharmaceuticals 0.62% | | | | | | | | |

| Roche Holding Ltd. AG | | | 43 | | | | 6,813,783 | |

| | | | | | | | |

| Total Switzerland | | | | | | | 15,103,584 | |

| | | | | | | | |

| | |

| United Kingdom 1.00% | | | | | | | | |

| | |

| Metals & Mining 0.37% | | | | | | | | |

| Anglo American plc | | | 64 | | | | 2,456,230 | |

| Vedanta Resources plc | | | 101 | | | | 1,694,352 | |

| | | | | | | | |

| Total | | | | | | | 4,150,582 | |

| | | | | | | | |

See Notes to Financial Statements.

15

Schedule of Investments (continued)

November 30, 2011

| | | | | | | | | | | | | | | | |

| Investments | | | | | | | | Shares

(000) | | | Fair

Value | |

| United Kingdom (continued) | | | | | | | | | | | | | | | | |

| | | | |

| Wireless Telecommunication Services 0.63% | | | | | | | | | | | | | | | | |

| Vodafone Group plc | | | | | | | | | | | 2,582 | | | $ | 6,989,519 | |

| | | | | | | | | | | | | | | | |

| Total United Kingdom | | | | | | | | | | | | | | | 11,140,101 | |

| | | | | | | | | | | | | | | | |

| Total Foreign Common Stocks (cost $48,417,882) | | | | | | | | | | | | | | | 46,968,448 | |

| | | | | | | | | | | | | | | | |

| | | | |

| | | Interest

Rate | | | Maturity

Date | | | Principal

Amount

(000) | | | | |

| HIGH YIELD CORPORATE BONDS 24.84% | | | | | | | | | | | | | | | | |

| | | | |

| Airlines 0.29% | | | | | | | | | | | | | | | | |

| United Airlines, Inc.† | | | 9.875% | | | | 8/1/2013 | | | $ | 3,150 | | | | 3,236,625 | |

| | | | | | | | | | | | | | | | |

| | | | |

| Auto Components 0.04% | | | | | | | | | | | | | | | | |

| Tomkins LLC/Tomkins, Inc. | | | 9.00% | | | | 10/1/2018 | | | | 405 | | | | 439,425 | |

| | | | | | | | | | | | | | | | |

| | | | |

| Automobiles 0.43% | | | | | | | | | | | | | | | | |

| Chrysler Group LLC/CG Co-Issuer, Inc.† | | | 8.25% | | | | 6/15/2021 | | | | 2,500 | | | | 2,112,500 | |

| TRW Automotive, Inc.† | | | 8.875% | | | | 12/1/2017 | | | | 2,500 | | | | 2,687,500 | |

| | | | | | | | | | | | | | | | |

| Total | | | | | | | | | | | | | | | 4,800,000 | |

| | | | | | | | | | | | | | | | |

| | | | |

| Capital Markets 0.87% | | | | | | | | | | | | | | | | |

| Nuveen Investments, Inc. | | | 10.50% | | | | 11/15/2015 | | | | 7,000 | | | | 6,720,000 | |

| Raymond James Financial, Inc. | | | 8.60% | | | | 8/15/2019 | | | | 2,500 | | | | 2,956,272 | |

| | | | | | | | | | | | | | | | |

| Total | | | | | | | | | | | | | | | 9,676,272 | |

| | | | | | | | | | | | | | | | |

| | | | |

| Chemicals 0.49% | | | | | | | | | | | | | | | | |

| Chemtura Corp. | | | 7.875% | | | | 9/1/2018 | | | | 2,000 | | | | 2,055,000 | |

| INEOS Group Holdings Ltd. (United Kingdom)†(a) | | | 8.50% | | | | 2/15/2016 | | | | 4,250 | | | | 3,336,250 | |

| | | | | | | | | | | | | | | | |

| Total | | | | | | | | | | | | | | | 5,391,250 | |

| | | | | | | | | | | | | | | | |

| | | | |

| Commercial Banks 0.48% | | | | | | | | | | | | | | | | |

| SVB Financial Group | | | 5.375% | | | | 9/15/2020 | | | | 1,625 | | | | 1,645,272 | |

| Zions Bancorporation | | | 7.75% | | | | 9/23/2014 | | | | 3,500 | | | | 3,716,744 | |

| | | | | | | | | | | | | | | | |

| Total | | | | | | | | | | | | | | | 5,362,016 | |

| | | | | | | | | | | | | | | | |

| | | | |

| Commercial Services & Supplies 0.78% | | | | | | | | | | | | | | | | |

| First Data Corp.† | | | 8.25% | | | | 1/15/2021 | | | | 2,500 | | | | 2,175,000 | |

| First Data Corp. | | | 9.875% | | | | 9/24/2015 | | | | 302 | | | | 275,575 | |

| First Data Corp.† | | | 12.625% | | | | 1/15/2021 | | | | 1,349 | | | | 1,119,670 | |

| International Lease Finance Corp. | | | 6.25% | | | | 5/15/2019 | | | | 925 | | | | 823,777 | |

| International Lease Finance Corp. | | | 8.25% | | | | 12/15/2020 | | | | 650 | | | | 648,375 | |

See Notes to Financial Statements.

16

Schedule of Investments (continued)

November 30, 2011

| | | | | | | | | | | | | | | | |

| Investments | | Interest

Rate | | | Maturity

Date | | | Principal

Amount

(000) | | | Fair

Value | |

| Commercial Services & Supplies (continued) | | | | | | | | | | | | | | | | |

| International Lease Finance Corp. | | | 8.75% | | | | 3/15/2017 | | | $ | 2,200 | | | $ | 2,222,000 | |

| Iron Mountain, Inc. | | | 7.75% | | | | 10/1/2019 | | | | 1,375 | | | | 1,426,563 | |

| | | | | | | | | | | | | | | | |

| Total | | | | | | | | | | | | | | | 8,690,960 | |

| | | | | | | | | | | | | | | | |

| | | | |

| Communications Equipment 1.13% | | | | | | | | | | | | | | | | |

| Avaya, Inc.† | | | 7.00% | | | | 4/1/2019 | | | | 3,000 | | | | 2,700,000 | |

| Brocade Communications Systems, Inc. | | | 6.625% | | | | 1/15/2018 | | | | 3,500 | | | | 3,657,500 | |

| Brocade Communications Systems, Inc. | | | 6.875% | | | | 1/15/2020 | | | | 1,950 | | | | 2,076,750 | |

| CommScope, Inc.† | | | 8.25% | | | | 1/15/2019 | | | | 4,250 | | | | 4,122,500 | |

| | | | | | | | | | | | | | | | |

| Total | | | | | | | | | | | | | | | 12,556,750 | |

| | | | | | | | | | | | | | | | |

| | | | |

| Construction Materials 0.11% | | | | | | | | | | | | | | | | |

| New Enterprise Stone & Lime Co. | | | 11.00% | | | | 9/1/2018 | | | | 1,500 | | | | 1,196,250 | |

| | | | | | | | | | | | | | | | |

| | | | |

| Containers & Packaging 1.29% | | | | | | | | | | | | | | | | |

| AEP Industries, Inc. | | | 8.25% | | | | 4/15/2019 | | | | 3,000 | | | | 2,970,000 | |

| Ardagh Packaging Finance plc (Ireland)†(a) | | | 7.375% | | | | 10/15/2017 | | | | 1,200 | | | | 1,224,000 | |

| Ardagh Packaging Finance plc (Ireland)†(a) | | | 9.125% | | | | 10/15/2020 | | | | 1,350 | | | | 1,343,250 | |

| Crown Cork & Seal Co., Inc. | | | 7.375% | | | | 12/15/2026 | | | | 6,000 | | | | 6,150,000 | |

| Sealed Air Corp. | | | 7.875% | | | | 6/15/2017 | | | | 1,500 | | | | 1,569,370 | |

| Sealed Air Corp.† | | | 8.375% | | | | 9/15/2021 | | | | 1,000 | | | | 1,072,500 | |

| | | | | | | | | | | | | | | | |

| Total | | | | | | | | | | | | | | | 14,329,120 | |

| | | | | | | | | | | | | | | | |

| | | | |

| Diversified Financial Services 1.26% | | | | | | | | | | | | | | | | |

| Capital One Capital VI | | | 8.875% | | | | 5/15/2040 | | | | 3,445 | | | | 3,481,352 | |

| New York City Industrial Development Agency† | | | 11.00% | | | | 3/1/2029 | | | | 2,800 | | | | 3,553,928 | |

| RBS Global, Inc./Rexnord LLC | | | 8.50% | | | | 5/1/2018 | | | | 2,000 | | | | 2,060,000 | |

| RBS Global, Inc./Rexnord LLC | | | 11.75% | | | | 8/1/2016 | | | | 3,850 | | | | 4,023,250 | |

| Wachovia Capital Trust III | | | 5.57% | # | | | – | (e) | | | 1,000 | | | | 848,750 | |

| | | | | | | | | | | | | | | | |

| Total | | | | | | | | | | | | | | | 13,967,280 | |

| | | | | | | | | | | | | | | | |

| | | | |

| Diversified Telecommunication Services 1.16% | | | | | | | | | | | | | | | | |

| Clearwire Communications LLC/Clearwire Finance, Inc.† | | | 12.00% | | | | 12/1/2015 | | | | 1,075 | | | | 913,750 | |

| Intelsat Luxembourg SA (Luxembourg)(a) | | | 11.25% | | | | 2/4/2017 | | | | 4,150 | | | | 3,828,375 | |

| SBA Telecommunications, Inc. | | | 8.25% | | | | 8/15/2019 | | | | 2,500 | | | | 2,703,125 | |

| UPCB Finance V Ltd.† | | | 7.25% | | | | 11/15/2021 | | | | 1,600 | | | | 1,568,000 | |

| Windstream Corp. | | | 7.00% | | | | 3/15/2019 | | | | 4,000 | | | | 3,900,000 | |

| | | | | | | | | | | | | | | | |

| Total | | | | | | | | | | | | | | | 12,913,250 | |

| | | | | | | | | | | | | | | | |

See Notes to Financial Statements.

17

Schedule of Investments (continued)

November 30, 2011

| | | | | | | | | | | | | | | | |

| Investments | | Interest

Rate | | | Maturity

Date | | | Principal

Amount

(000) | | | Fair

Value | |

| Electric: Utilities 0.09% | | | | | | | | | | | | | | | | |

| Texas Competitive Electric Holdings Co. LLC/TCEH Finance, Inc.† | | | 11.50% | | | | 10/1/2020 | | | $ | 1,250 | | | $ | 1,043,750 | |

| | | | | | | | | | | | | | | | |

| | | | |

| Energy Equipment & Services 0.15% | | | | | | | | | | | | | | | | |

| Dresser-Rand Group, Inc.† | | | 6.50% | | | | 5/1/2021 | | | | 975 | | | | 962,813 | |

| Transocean, Inc. | | | 6.375% | | | | 12/15/2021 | | | | 700 | | | | 699,622 | |

| | | | | | | | | | | | | | | | |

| Total | | | | | | | | | | | | | | | 1,662,435 | |

| | | | | | | | | | | | | | | | |

| | | | |

| Food Products 0.16% | | | | | | | | | | | | | | | | |

| Blue Merger Sub, Inc.† | | | 7.625% | | | | 2/15/2019 | | | | 2,000 | | | | 1,800,000 | |

| | | | | | | | | | | | | | | | |

| | | | |

| Gas Utilities 0.16% | | | | | | | | | | | | | | | | |

| National Fuel Gas Co. | | | 4.90% | | | | 12/1/2021 | | | | 1,800 | | | | 1,800,693 | |

| | | | | | | | | | | | | | | | |

| | | | |

| Health Care Equipment & Supplies 0.78% | | | | | | | | | | | | | | | | |

| Bausch & Lomb, Inc. | | | 9.875% | | | | 11/1/2015 | | | | 2,500 | | | | 2,618,750 | |

| Bio-Rad Laboratories, Inc. | | | 8.00% | | | | 9/15/2016 | | | | 3,000 | | | | 3,300,000 | |

| Biomet, Inc. | | | 10.00% | | | | 10/15/2017 | | | | 2,500 | | | | 2,706,250 | |

| | | | | | | | | | | | | | | | |

| Total | | | | | | | | | | | | | | | 8,625,000 | |

| | | | | | | | | | | | | | | | |

| | | | |

| Health Care Providers & Services 1.74% | | | | | | | | | | | | | | | | |

| Community Health Systems, Inc.† | | | 8.00% | | | | 11/15/2019 | | | | 1,200 | | | | 1,167,000 | |

| Community Health Systems, Inc. | | | 8.875% | | | | 7/15/2015 | | | | 1,806 | | | | 1,860,180 | |

| HCA, Inc. | | | 7.50% | | | | 2/15/2022 | | | | 3,225 | | | | 3,184,687 | |

| STHI Holding Corp.† | | | 8.00% | | | | 3/15/2018 | | | | 2,500 | | | | 2,543,750 | |

| Tenet Healthcare Corp. | | | 9.25% | | | | 2/1/2015 | | | | 3,500 | | | | 3,635,625 | |

| United Surgical Partners International, Inc. PIK | | | 9.25% | | | | 5/1/2017 | | | | 4,000 | | | | 4,000,000 | |

| Vanguard Health Holding Co. II LLC/Vanguard Holding Co. II, Inc. | | | 8.00% | | | | 2/1/2018 | | | | 3,075 | | | | 2,936,625 | |

| | | | | | | | | | | | | | | | |

| Total | | | | | | | | | | | | | | | 19,327,867 | |

| | | | | | | | | | | | | | | | |

| | | | |

| Hotels, Restaurants & Leisure 1.00% | | | | | | | | | | | | | | | | |

| Caesar’s Entertainment Operating Co., Inc. | | | 5.625% | | | | 6/1/2015 | | | | 2,000 | | | | 1,170,000 | |

| Hyatt Hotels Corp.† | | | 5.75% | | | | 8/15/2015 | | | | 3,000 | | | | 3,207,261 | |

| Marina District Finance Co., Inc. | | | 9.875% | | | | 8/15/2018 | | | | 3,000 | | | | 2,692,500 | |

| River Rock Entertainment Authority (The)(f)(g) | | | 9.75% | | | | 11/1/2011 | | | | 1,700 | | | | 1,283,500 | |

| Station Casinos, Inc.(f) | | | 6.50% | | | | 2/1/2014 | | | | 4,000 | | | | 400 | |

| Wendy’s Co. (The) | | | 10.00% | | | | 7/15/2016 | | | | 1,500 | | | | 1,650,000 | |

| Wyndham Worldwide Corp. | | | 5.75% | | | | 2/1/2018 | | | | 1,000 | | | | 1,055,765 | |

| | | | | | | | | | | | | | | | |

| Total | | | | | | | | | | | | | | | 11,059,426 | |

| | | | | | | | | | | | | | | | |

See Notes to Financial Statements.

18

Schedule of Investments (continued)

November 30, 2011

| | | | | | | | | | | | | | | | |

| Investments | | Interest

Rate | | | Maturity

Date | | | Principal

Amount

(000) | | | Fair

Value | |

| Household Durables 0.17% | | | | | | | | | | | | | | | | |

| Armored AutoGroup, Inc.† | | | 9.25% | | | | 11/1/2018 | | | $ | 1,000 | | | $ | 805,000 | |

| Lennar Corp. | | | 12.25% | | | | 6/1/2017 | | | | 900 | | | | 1,071,000 | |

| | | | | | | | | | | | | | | | |

| Total | | | | | | | | | | | | | | | 1,876,000 | |

| | | | | | | | | | | | | | | | |

| | | |

| Independent Power Producers & Energy Traders 0.31% | | | | | | | | | | | | | |

| AES Corp. (The) | | | 8.00% | | | | 10/15/2017 | | | | 1,500 | | | | 1,620,000 | |

| Mirant Americas Generation LLC | | | 9.125% | | | | 5/1/2031 | | | | 2,000 | | | | 1,790,000 | |

| | | | | | | | | | | | | | | | |

| Total | | | | | | | | | | | | | | | 3,410,000 | |

| | | | | | | | | | | | | | | | |

| | | | |

| Industrial Conglomerates 0.33% | | | | | | | | | | | | | | | | |

| Park-Ohio Industries, Inc. | | | 8.125% | | | | 4/1/2021 | | | | 3,700 | | | | 3,626,000 | |

| | | | | | | | | | | | | | | | |

| | | | |

| Information Technology Services 0.75% | | | | | | | | | | | | | | | | |

| SunGard Data Systems, Inc. | | | 10.25% | | | | 8/15/2015 | | | | 8,000 | | | | 8,280,000 | |

| | | | | | | | | | | | | | | | |

| | | | |

| Internet Software & Services 0.09% | | | | | | | | | | | | | | | | |

| Equinix, Inc. | | | 7.00% | | | | 7/15/2021 | | | | 1,000 | | | | 1,033,750 | |

| | | | | | | | | | | | | | | | |

| | | | |

| Leisure Equipment & Products 0.30% | | | | | | | | | | | | | | | | |

| Speedway Motorsports, Inc. | | | 8.75% | | | | 6/1/2016 | | | | 3,000 | | | | 3,270,000 | |

| | | | | | | | | | | | | | | | |

| | | | |

| Machinery 0.14% | | | | | | | | | | | | | | | | |

| Oshkosh Corp. | | | 8.50% | | | | 3/1/2020 | | | | 1,500 | | | | 1,515,000 | |

| | | | | | | | | | | | | | | | |

| | | | |

| Media 1.84% | | | | | | | | | | | | | | | | |

| Affinion Group, Inc. | | | 11.50% | | | | 10/15/2015 | | | | 4,000 | | | | 3,500,000 | |

| AMC Networks, Inc.† | | | 7.75% | | | | 7/15/2021 | | | | 1,500 | | | | 1,593,750 | |

| CCO Holdings LLC/CCO Holdings Capital Corp. | | | 8.125% | | | | 4/30/2020 | | | | 2,500 | | | | 2,650,000 | |

| Cumulus Media, Inc.† | | | 7.75% | | | | 5/1/2019 | | | | 2,000 | | | | 1,740,000 | |

| DISH DBS Corp. | | | 6.75% | | | | 6/1/2021 | | | | 1,250 | | | | 1,225,000 | |

| EH Holding Corp.† | | | 7.625% | | | | 6/15/2021 | | | | 3,500 | | | | 3,456,250 | |

| Gray Television, Inc. | | | 10.50% | | | | 6/29/2015 | | | | 1,500 | | | | 1,402,500 | |

| Mediacom Communications Corp. | | | 9.125% | | | | 8/15/2019 | | | | 1,500 | | | | 1,571,250 | |

| WMG Acquisition Corp. | | | 9.50% | | | | 6/15/2016 | | | | 1,420 | | | | 1,498,100 | |

| WMG Acquisition Corp.† | | | 11.50% | | | | 10/1/2018 | | | | 1,750 | | | | 1,732,500 | |

| | | | | | | | | | | | | | | | |

| Total | | | | | | | | | | | | | | | 20,369,350 | |

| | | | | | | | | | | | | | | | |

| | | | |

| Metals & Mining 0.97% | | | | | | | | | | | | | | | | |

| Arch Coal, Inc.† | | | 7.25% | | | | 6/15/2021 | | | | 3,000 | | | | 2,925,000 | |

| Cliffs Natural Resources, Inc. | | | 5.90% | | | | 3/15/2020 | | | | 1,500 | | | | 1,580,590 | |

See Notes to Financial Statements.

19

Schedule of Investments (continued)

November 30, 2011

| | | | | | | | | | | | | | | | |

| Investments | | Interest

Rate | | | Maturity

Date | | | Principal

Amount

(000) | | | Fair

Value | |

| Metals & Mining (continued) | | | | | | | | | | | | | | | | |

| FMG Resources (August 2006) Pty Ltd. (Australia)†(a) | | | 6.875% | | | | 2/1/2018 | | | $ | 1,525 | | | $ | 1,406,813 | |

| Mirabela Nickel Ltd. (Australia)†(a) | | | 8.75% | | | | 4/15/2018 | | | | 1,875 | | | | 1,678,125 | |

| Noranda Aluminum Acquisition Corp. PIK | | | 4.659% | # | | | 5/15/2015 | | | | 3,406 | | | | 3,150,429 | |

| | | | | | | | | | | | | | | | |

| Total | | | | | | | | | | | | | | | 10,740,957 | |

| | | | | | | | | | | | | | | | |

| | | | |

| Multi-Utilities 0.38% | | | | | | | | | | | | | | | | |

| Black Hills Corp. | | | 9.00% | | | | 5/15/2014 | | | | 3,650 | | | | 4,175,100 | |

| | | | | | | | | | | | | | | | |

| | | | |

| Oil, Gas & Consumable Fuels 4.22% | | | | | | | | | | | | | | | | |

| Antero Resources Finance Corp.† | | | 7.25% | | | | 8/1/2019 | | | | 1,500 | | | | 1,507,500 | |

| Chaparral Energy, Inc. | | | 8.25% | | | | 9/1/2021 | | | | 5,000 | | | | 4,950,000 | |

| Concho Resources, Inc. | | | 7.00% | | | | 1/15/2021 | | | | 2,000 | | | | 2,090,000 | |

| CONSOL Energy, Inc. | | | 8.25% | | | | 4/1/2020 | | | | 2,500 | | | | 2,700,000 | |

| Continental Resources, Inc. | | | 8.25% | | | | 10/1/2019 | | | | 6,000 | | | | 6,660,000 | |

| El Paso Corp. | | | 7.00% | | | | 6/15/2017 | | | | 1,255 | | | | 1,370,455 | |

| Energy XXI Gulf Coast, Inc. | | | 7.75% | | | | 6/15/2019 | | | | 2,500 | | | | 2,412,500 | |

| Forest Oil Corp. | | | 7.25% | | | | 6/15/2019 | | | | 2,000 | | | | 1,990,000 | |

| IFM US Colonial Pipeline 2 LLC† | | | 6.45% | | | | 5/1/2021 | | | | 3,000 | | | | 3,196,710 | |

| Kodiak Oil & Gas Corp.† | | | 8.125% | | | | 12/1/2019 | | | | 760 | | | | 772,350 | |

| LINN Energy LLC/LINN Energy Finance Corp. | | | 7.75% | | | | 2/1/2021 | | | | 1,850 | | | | 1,859,250 | |

| MEG Energy Corp. (Canada)†(a) | | | 6.50% | | | | 3/15/2021 | | | | 2,200 | | | | 2,222,000 | |

| Oasis Petroleum, Inc. | | | 6.50% | | | | 11/1/2021 | | | | 900 | | | | 879,750 | |

| Oasis Petroleum, Inc.† | | | 7.25% | | | | 2/1/2019 | | | | 3,200 | | | | 3,280,000 | |

| OGX Petroleo e Gas Participacoes SA (Brazil)†(a) | | | 8.50% | | | | 6/1/2018 | | | | 2,775 | | | | 2,664,000 | |

| SandRidge Energy, Inc. | | | 7.50% | | | | 3/15/2021 | | | | 2,100 | | | | 1,932,000 | |

| SM Energy Co.† | | | 6.50% | | | | 11/15/2021 | | | | 1,000 | | | | 1,005,000 | |

| SM Energy Co.† | | | 6.625% | | | | 2/15/2019 | | | | 3,000 | | | | 3,045,000 | |

| Tennessee Gas Pipeline Co. | | | 7.00% | | | | 10/15/2028 | | | | 2,000 | | | | 2,291,000 | |

| | | | | | | | | | | | | | | | |

| Total | | | | | | | | | | | | | | | 46,827,515 | |

| | | | | | | | | | | | | | | | |

| | | | |

| Personal Products 0.20% | | | | | | | | | | | | | | | | |

| Elizabeth Arden, Inc. | | | 7.375% | | | | 3/15/2021 | | | | 2,150 | | | | 2,252,125 | |

| | | | | | | | | | | | | | | | |

| | | | |

| Pharmaceuticals 0.20% | | | | | | | | | | | | | | | | |

| Aristotle Holding, Inc.† | | | 4.75% | | | | 11/15/2021 | | | | 1,470 | | | | 1,488,009 | |

| Mylan, Inc.† | | | 7.875% | | | | 7/15/2020 | | | | 650 | | | | 695,500 | |

| | | | | | | | | | | | | | | | |

| Total | | | | | | | | | | | | | | | 2,183,509 | |

| | | | | | | | | | | | | | | | |

See Notes to Financial Statements.

20

Schedule of Investments (continued)

November 30, 2011

| | | | | | | | | | | | | | | | |

| Investments | | Interest

Rate | | | Maturity

Date | | | Principal

Amount

(000) | | | Fair

Value | |

| Real Estate Management & Development 0.15% | | | | | | | | | | | | | |

| ProLogis | | | 6.875% | | | | 3/15/2020 | | | $ | 1,500 | | | $ | 1,662,321 | |

| | | | | | | | | | | | | | | | |

| | | | |

| Road & Rail 0.29% | | | | | | | | | | | | | | | | |

| Florida East Coast Railway Corp. | | | 8.125% | | | | 2/1/2017 | | | | 2,600 | | | | 2,603,250 | |

| Kansas City Southern de Mexico SA de CV (Mexico)(a) | | | 6.125% | | | | 6/15/2021 | | | | 625 | | | | 646,875 | |

| | | | | | | | | | | | | | | | |

| Total | | | | | | | | | | | | | | | 3,250,125 | |

| | | | | | | | | | | | | | | | |

| | | |

| Semiconductors & Semiconductor Equipment 0.12% | | | | | | | | | | | | | |

| Sensata Technologies BV (Netherlands)†(a) | | | 6.50% | | | | 5/15/2019 | | | | 1,300 | | | | 1,267,500 | |

| | | | | | | | | | | | | | | | |

| | | | |

| Specialty Retail 0.53% | | | | | | | | | | | | | | | | |

| Brookstone Co., Inc.† | | | 13.00% | | | | 10/15/2014 | | | | 1,564 | | | | 1,259,020 | |

| Limited Brands, Inc. | | | 8.50% | | | | 6/15/2019 | | | | 4,000 | | | | 4,640,000 | |

| | | | | | | | | | | | | | | | |

| Total | | | | | | | | | | | | | | | 5,899,020 | |

| | | | | | | | | | | | | | | | |

| | | | |

| Textiles, Apparel & Luxury Goods 0.32% | | | | | | | | | | | | | | | | |

| Polymer Group, Inc.† | | | 7.75% | | | | 2/1/2019 | | | | 3,500 | | | | 3,561,250 | |

| | | | | | | | | | | | | | | | |

| | | | |

| Thrifts & Mortgage Finance 0.00% | | | | | | | | | | | | | | | | |

| Washington Mutual Bank(f) | | | 6.875% | | | | 6/15/2011 | | | | 4,350 | | | | 15,225 | |

| | | | | | | | | | | | | | | | |

| | | | |

| Tobacco 0.11% | | | | | | | | | | | | | | | | |

| Reynolds Group Issuer, Inc./Reynolds Group Issuer LLC/Reynolds Group Issuer Luxembourg SA† | | | 9.25% | | | | 5/15/2018 | | | | 1,375 | | | | 1,258,125 | |

| | | | | | | | | | | | | | | | |

| | | | |

| Transportation Infrastructure 0.13% | | | | | | | | | | | | | | | | |

| Asciano Finance Ltd. (Australia)†(a) | | | 4.625% | | | | 9/23/2020 | | | | 1,500 | | | | 1,435,007 | |

| | | | | | | | | | | | | | | | |

| | | | |

| Wireless Telecommunication Services 0.88% | | | | | | | | | | | | | | | | |

| Intelsat Jackson Holdings SA (Luxembourg)†(a) | | | 7.50% | | | | 4/1/2021 | | | | 2,300 | | | | 2,190,750 | |

| Intelsat Jackson Holdings SA (Luxembourg)(a) | | | 11.25% | | | | 6/15/2016 | | | | 1,000 | | | | 1,042,500 | |

| Sprint Capital Corp. | | | 6.90% | | | | 5/1/2019 | | | | 5,000 | | | | 3,887,500 | |

| Wind Acquisition Finance SA (Italy)†(a) | | | 11.75% | | | | 7/15/2017 | | | | 3,100 | | | | 2,689,250 | |

| | | | | | | | | | | | | | | | |

| Total | | | | | | | | | | | | | | | 9,810,000 | |

| | | | | | | | | | | | | | | | |

| Total High Yield Corporate Bonds (cost $284,056,967) | | | | | | | | | | | | 275,596,248 | |

| | | | | | | | | | | | | | | | |

See Notes to Financial Statements.

21

Schedule of Investments (continued)

November 30, 2011

| | | | | | | | | | | | | | | | |

| Investments | | Interest

Rate | | | | | | Shares

(000) | | | Fair

Value | |

| PREFERRED STOCK 0.02% | | | | | | | | | | | | | | | | |

| Thrifts & Mortgage Finance | | | | | | | | | | | | | | | | |

| Fannie Mae* (cost $3,071,479) | | | Zero Coupon | | | | | | | | 122 | | | $ | 238,485 | |

| | | | | | | | | | | | | | | | |

| | | | |

| | | Exercise Price | | | Expiration

Date | | | | | | | |

| WARRANTS 0.03% | | | | | | | | | | | | | | | | |

| | | | |

| Auto Components 0.02% | | | | | | | | | | | | | | | | |

| Cooper-Standard Holdings, Inc.* | | | $27.33 | | | | 11/27/2017 | | | | 15 | | | | 248,421 | |

| | | | | | | | | | | | | | | | |

| | | | |

| Media 0.01% | | | | | | | | | | | | | | | | |

| Charter Communications, Inc.* | | | 46.86 | | | | 11/30/2014 | | | | 9 | | | | 135,984 | |

| | | | | | | | | | | | | | | | |

| Total Warrants (cost $175,119) | | | | | | | | | | | | | | | 384,405 | |

| | | | | | | | | | | | | | | | |

| Total Long-Term Investments (cost $1,039,583,706) | | | | | | | | | | | | 1,105,003,444 | |

| | | | | | | | | | | | | | | | |

| | | | |

| | | | | | | | | Principal Amount (000) | | | | |

| SHORT-TERM INVESTMENT 0.39% | | | | | | | | | | | | | | | | |

| | | | |

| Repurchase Agreement | | | | | | | | | | | | | | | | |

| Repurchase Agreement dated 11/30/2011, 0.01% due 12/1/2011 with Fixed Income Clearing Corp. collateralized by $4,225,000 of U.S. Treasury Note at 1.75% due 1/31/2014; value: $4,383,438; proceeds: $4,296,839 (cost $4,296,838) | | | | | | | $ | 4,297 | | | | 4,296,838 | |

| | | | | | | | | | | | | | | | |

| Total Investments in Securities 99.98% (cost $1,043,880,544) | | | | | | | | 1,109,300,282 | |

| | | | | | | | | | | | | | | | |

| Foreign Cash and Other Assets in Excess of Liabilities 0.02% | | | | | | | | 261,759 | |

| | | | | | | | | | | | | | | | |

| Net Assets 100.00% | | | | | | | | | | | | | | $ | 1,109,562,041 | |

| | | | | | | | | | | | | | | | |

See Notes to Financial Statements.

22

Schedule of Investments (concluded)

November 30, 2011

| | |

| ADR | | American Depositary Receipt. |

| PIK | | Payment-in-kind. |

| * | | Non-income producing security. |

| † | | Security was purchased pursuant to Rule 144A under the Securities Act of 1933 and, unless registered under such Act or exempted from registration, may only be resold to qualified institutional buyers. |

| # | | Variable rate security. The interest rate represents the rate in effect at November 30, 2011. |

| (a) | | Foreign security traded in U.S. dollars. |

| (b) | | Contingent Value Right entitles the holder to receive cash payments if specified milestones are achieved. |

| (c) | | Floating Rate Loans in which the Fund invests generally pay interest at rates which are periodically re-determined at a margin above the London Interbank Offered Rate (“LIBOR”) or the prime rate offered by major U.S. banks. The rate shown is the rate in effect at November 30, 2011. |

| (d) | | Investment in non-U.S. dollar denominated securities. |

| (e) | | Security is perpetual in nature and has no stated maturity. |

| (f) | | Defaulted security. |

| (g) | | Subsequent to November 30, 2011, new Notes were issued as part of an exchange offer that matures in 2018. |

See Notes to Financial Statements.

23

Statement of Assets and Liabilities

November 30, 2011

| | | | |

ASSETS: | | | | |

Investments in securities, at fair value (cost $1,043,880,544) | | $ | 1,109,300,282 | |

Foreign cash, at value (cost $806,732) | | | 819,240 | |

Receivables: | | | | |

Investment securities sold | | | 31,506,165 | |

Interest and dividends | | | 10,084,970 | |

Capital shares sold | | | 1,101,358 | |

From advisor (See Note 3) | | | 11,216 | |

Prepaid expenses and other assets | | | 87,943 | |

Total assets | | | 1,152,911,174 | |

LIABILITIES: | | | | |

Payables: | | | | |

Investment securities purchased | | | 4,273,925 | |

Capital shares reacquired | | | 37,564,206 | |

Management fee | | | 702,539 | |

12b-1 distribution fees | | | 323,989 | |

Directors’ fees | | | 125,306 | |

Fund administration | | | 37,797 | |

To affiliates (See Note 3) | | | 24,452 | |

Accrued expenses and other liabilities | | | 296,919 | |

Total liabilities | | | 43,349,133 | |

NET ASSETS | | $ | 1,109,562,041 | |

COMPOSITION OF NET ASSETS: | | | | |

Paid-in capital | | $ | 1,245,656,277 | |

Undistributed net investment income | | | 5,567,227 | |

Accumulated net realized loss on investments, futures contracts and foreign currency related transactions | | | (207,091,796 | ) |

Net unrealized appreciation on investments, futures contracts and translation of assets and liabilities denominated in foreign currencies | | | 65,430,333 | |

Net Assets | | $ | 1,109,562,041 | |

See Notes to Financial Statements.

24

Statement of Assets and Liabilities (concluded)

November 30, 2011

| | | | |

| | | | |

Net assets by class: | | | | |

Class A Shares | | $ | 898,507,954 | |

Class B Shares | | $ | 39,643,311 | |

Class C Shares | | $ | 57,694,574 | |

Class F Shares | | $ | 8,251,198 | |

Class I Shares | | $ | 100,317,114 | |

Class P Shares | | $ | 1,910,470 | |

Class R2 Shares | | $ | 102,841 | |

Class R3 Shares | | $ | 3,134,579 | |

Outstanding shares by class: | | | | |

Class A Shares (300 million shares of common stock authorized, $.001 par value) | | | 78,604,581 | |

Class B Shares (30 million shares of common stock authorized, $.001 par value) | | | 3,497,569 | |

Class C Shares (20 million shares of common stock authorized, $.001 par value) | | | 5,081,146 | |

Class F Shares (30 million shares of common stock authorized, $.001 par value) | | | 722,121 | |

Class I Shares (100 million shares of common stock authorized, $.001 par value) | | | 8,722,203 | |

Class P Shares (20 million shares of common stock authorized, $.001 par value) | | | 166,637 | |

Class R2 Shares (30 million shares of common stock authorized, $.001 par value) | | | 8,947 | |

Class R3 Shares (30 million shares of common stock authorized, $.001 par value) | | | 274,878 | |

Net asset value, offering and redemption price per share

(Net assets divided by outstanding shares): | | | | |

Class A Shares-Net asset value | | | $11.43 | |

Class A Shares-Maximum offering price

(Net asset value plus sales charge of 5.75%) | | | $12.13 | |

Class B Shares-Net asset value | | | $11.33 | |

Class C Shares-Net asset value | | | $11.35 | |

Class F Shares-Net asset value | | | $11.43 | |

Class I Shares-Net asset value | | | $11.50 | |

Class P Shares-Net asset value | | | $11.46 | |

Class R2 Shares-Net asset value | | | $11.49 | |

Class R3 Shares-Net asset value | | | $11.40 | |

See Notes to Financial Statements.

25

Statement of Operations

For the Year Ended November 30, 2011

| | | | |

Investment income: | | | | |

Dividends (net of foreign withholding taxes of $377,936) | | $ | 23,549,397 | |

Interest | | | 28,972,198 | |

Total investment income | | | 52,521,595 | |

Expenses: | | | | |

Management fee | | | 10,359,066 | |

12b-1 distribution plan-Class A | | | 3,352,788 | |

12b-1 distribution plan-Class B | | | 462,494 | |

12b-1 distribution plan-Class C | | | 594,049 | |

12b-1 distribution plan-Class F | | | 8,857 | |

12b-1 distribution plan-Class P | | | 9,238 | |

12b-1 distribution plan-Class R2 | | | 264 | |

12b-1 distribution plan-Class R3 | | | 13,438 | |

Shareholder servicing | | | 1,527,871 | |

Fund administration | | | 563,375 | |

Subsidy (See Note 3) | | | 551,066 | |

Reports to shareholders | | | 141,942 | |

Registration | | | 137,081 | |

Professional | | | 54,800 | |

Directors’ fees | | | 9,705 | |

Custody | | | 41,134 | |

Other | | | 44,473 | |

Gross expenses | | | 17,871,641 | |

Expense reductions (See Note 7) | | | (1,133 | ) |

Management fee waived (See Note 3) | | | (49,219 | ) |

Net expenses | | | 17,821,289 | |

Net investment income | | | 34,700,306 | |

Net realized and unrealized gain (loss): | | | | |

Net realized gain on investments, futures contracts and foreign currency related transactions | | | 68,521,367 | |

Net change in unrealized appreciation/depreciation on investments, futures contracts and translation of assets and liabilities denominated in foreign currencies | | | (45,032,615 | ) |

Net realized and unrealized gain | | | 23,488,752 | |

Net Increase in Net Assets Resulting From Operations | | $ | 58,189,058 | |

See Notes to Financial Statements.

26

Statements of Changes in Net Assets

| | | | | | | | |

| DECREASE IN NET ASSETS | | For the Year Ended

November 30, 2011 | | | For the Year Ended

November 30, 2010 | |

Operations: | | | | | | | | |

Net investment income | | $ | 34,700,306 | | | $ | 36,717,619 | |

Net realized gain on investments, futures contracts and foreign currency related transactions | | | 68,521,367 | | | | 24,854,330 | |

Net change in unrealized appreciation/depreciation on investments, futures contracts and translation of assets and liabilities denominated in foreign currencies | | | (45,032,615 | ) | | | 93,553,768 | |

Net increase in net assets resulting from operations | | | 58,189,058 | | | | 155,125,717 | |

Distributions to shareholders from: | | | | | | | | |

Net investment income | | | | | | | | |

Class A | | | (23,181,717 | ) | | | (26,532,498 | ) |

Class B | | | (818,743 | ) | | | (1,130,938 | ) |

Class C | | | (1,076,186 | ) | | | (1,233,119 | ) |

Class F | | | (238,905 | ) | | | (168,005 | ) |

Class I | | | (9,533,991 | ) | | | (9,743,835 | ) |

Class P | | | (47,848 | ) | | | (67,250 | ) |

Class R2 | | | (678 | ) | | | (680 | ) |

Class R3 | | | (61,005 | ) | | | (31,016 | ) |

Total distributions to shareholders | | | (34,959,073 | ) | | | (38,907,341 | ) |

Capital share transactions (Net of share conversions) (See Note 11): | |

Net proceeds from sales of shares | | | 225,689,403 | | | | 179,592,332 | |

Reinvestment of distributions | | | 34,160,651 | | | | 38,022,779 | |

Cost of shares reacquired | | | (561,695,878 | ) | | | (350,504,539 | ) |

Net decrease in net assets resulting from capital share transactions | | | (301,845,824 | ) | | | (132,889,428 | ) |

Net decrease in net assets | | | (278,615,839 | ) | | | (16,671,052 | ) |

NET ASSETS: | | | | | | | | |

Beginning of year | | $ | 1,388,177,880 | | | $ | 1,404,848,932 | |

End of year | | $ | 1,109,562,041 | | | $ | 1,388,177,880 | |

Undistributed net investment income | | $ | 5,567,227 | | | $ | 4,523,522 | |

See Notes to Financial Statements.

27

Financial Highlights

| | | | | | | | | | | | | | | | | | | | |

| | | Class A Shares | |

| | | Year Ended 11/30 | |

| | | 2011 | | | 2010 | | | 2009 | | | 2008 | | | 2007 | |

Per Share Operating Performance | | | | | | | | | | | | | | | | | | | | |

Net asset value, beginning of year | | | $11.26 | | | | $10.35 | | | | $ 8.66 | | | | $13.49 | | | | $13.56 | |

| | | | | | | | | | | | | | | | | | | | |

| | | | | |

Investment operations: | | | | | | | | | | | | | | | | | | | | |

| | | | | |

Net investment income(a) | | | .29 | | | | .28 | | | | .34 | | | | .41 | | | | .37 | |

| | | | | |

Net realized and unrealized gain (loss) | | | .17 | | | | .93 | | | | 1.72 | | | | (4.26 | ) | | | .33 | |

| | | | | | | | | | | | | | | | | | | | |

| | | | | |

Total from investment operations | | | .46 | | | | 1.21 | | | | 2.06 | | | | (3.85 | ) | | | .70 | |

| | | | | | | | | | | | | | | | | | | | |

| | | | | |

Distributions to shareholders from: | | | | | | | | | | | | | | | | | | | | |

| | | | | |

Net investment income | | | (.29 | ) | | | (.30 | ) | | | (.37 | ) | | | (.44 | ) | | | (.35 | ) |

| | | | | |

Net realized gain | | | – | | | | – | | | | – | | | | (.54 | ) | | | (.42 | ) |

| | | | | | | | | | | | | | | | | | | | |

| | | | | |

Total distributions | | | (.29 | ) | | | (.30 | ) | | | (.37 | ) | | | (.98 | ) | | | (.77 | ) |

| | | | | | | | | | | | | | | | | | | | |

Net asset value, end of year | | | $11.43 | | | | $11.26 | | | | $10.35 | | | | $ 8.66 | | | | $13.49 | |

| | | | | | | | | | | | | | | | | | | | |

| | | | | |

Total Return(b) | | | 4.03 | % | | | 11.90 | % | | | 24.58 | % | | | (30.43 | )% | | | 5.27 | % |

| | | | | |

Ratios to Average Net Assets: | | | | | | | | | | | | | | | | | | | | |

| | | | | |

Expenses, excluding expense reductions and including management fee waived | | | 1.30 | % | | | 1.31 | % | | | 1.37 | % | | | 1.32 | % | | | 1.29 | % |

| | | | | |

Expenses, including expense reductions and management fee waived | | | 1.30 | % | | | 1.31 | % | | | 1.37 | % | | | 1.32 | % | | | 1.29 | % |

| | | | | |

Expenses, excluding expense reductions and management fee waived | | | 1.30 | % | | | 1.31 | % | | | 1.37 | % | | | 1.32 | % | | | 1.29 | % |

| | | | | |

Net investment income | | | 2.45 | % | | | 2.64 | % | | | 3.66 | % | | | 3.61 | % | | | 2.68 | % |

| | | | | |

| Supplemental Data: | | | | | | | | | | | | | | | |

Net assets, end of year (000) | | | $898,508 | | | | $933,371 | | | | $974,791 | | | | $852,774 | | | | $1,379,814 | |

| | | | | |