UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act File Number: 811-06650

LORD ABBETT RESEARCH FUND, INC.

(Exact name of Registrant as specified in charter)

90 Hudson Street, Jersey City, NJ 07302

(Address of principal executive offices) (Zip code)

Thomas R. Phillips, Esq., Vice President & Assistant Secretary

90 Hudson Street, Jersey City, NJ 07302

(Name and address of agent for service)

Registrant’s telephone number, including area code: (800) 201-6984

Date of fiscal year end: 11/30

Date of reporting period: 11/30/10

| Item 1: | Reports to Shareholders. |

2010

LORD ABBETT

ANNUAL

REPORT

Lord Abbett Capital Structure Fund

For the fiscal year ended November 30, 2010

Lord Abbett Research Fund

Lord Abbett Capital Structure Fund

Annual Report

For the fiscal year ended November 30, 2010

From left to right: Robert S. Dow, Director and Chairman of the Lord Abbett Funds; E. Thayer Bigelow, Independent Lead Director of the Lord Abbett Funds; and Daria L. Foster, Director and President of the Lord Abbett Funds.

Dear Shareholders: We are pleased to provide you with this overview of the performance of the Lord Abbett Capital Structure Fund for the fiscal year ended November 30, 2010. On this page and the following pages, we discuss the major factors that influenced performance. For detailed and more timely information about the Fund, please visit our Website at www.lordabbett.com, where you also can access the quarterly commentaries by the Fund’s portfolio managers.

Thank you for investing in Lord Abbett mutual funds. We value the trust that you place in us and look forward to serving your investment needs in the years to come.

Best regards,

Robert S. Dow

Chairman

For the fiscal year ended November 30, 2010, the Fund returned 11.90%, reflecting performance at the net asset value (NAV) of Class A shares, with all distributions reinvested, compared to its benchmark, the S&P 500® Index,1 which returned 9.94% over the same period.

While equity markets were characterized by wide swings in sentiment during much of the period, strong corporate earnings, an easing of the European sovereign debt crisis, and certain improving economic indicators ultimately benefited the performance of equities. Credit markets also benefited this year from improving fundamentals and investors’ continued reach for yield. With historically low yields on assets deemed to be free of credit risk, demand increased for securities with higher yields and, therefore, higher levels of credit risk. At year-end, the Fund’s asset allocation was approximately 60% equities, 17% high yield, 6% investment grade, and 16% convertibles. As of November 30, 2010, the Lord Abbett Capital Structure Fund (Class A shares) ranked 13th percentile within the Lipper Mixed-Asset Target Allocation Growth Funds category.

1

The Fund’s concentration in corporate bonds (versus Treasuries) proved beneficial during the year. Corporate spreads tightened as credit fundamentals improved and demand increased for higher-yielding securities, providing superior returns versus more traditional fixed-income securities. The Fund’s continued de-emphasis on Treasuries, agencies, and agency mortgage-backed securities (MBS) contributed substantially to the performance of the Fund.

The Fund increased its allocation to convertible securities throughout the year, adding to performance as the convertible market (as represented by the Bank of America Merrill Lynch All Convertible Index2) outperformed the benchmark S&P 500® Index. Convertible securities are a unique asset class that provide an income stream through yield, while also having the potential to participate in equity market upside. The Fund focused on opportunities in names generating above-average earnings growth and offering attractive yields.

Within the equity portion, the Fund continues to emphasize cyclical industries and names with good operating leverage that are benefiting from the economic recovery. Stock selection, especially in the industrials and health care industries, also added to performance. An area that lagged within the equity portfolio and the market overall was the financials industry, in which we are modestly underweight. Also detracting from Fund performance within the equity portion were the consumer staples and energy industries. The Fund holds certain consumer staples names that did not perform as well compared to the broader market, but we believe that they will eventually benefit from improving fundamentals and global growth opportunities.

The Fund’s portfolio is actively managed and, therefore, its holdings and the weightings of a particular issuer or particular sector as a percentage of portfolio assets are subject to change. Sectors may include many industries.

1 The S&P 500® Index is widely regarded as the standard for measuring large cap U.S. stock market performance and includes a representative sample of leading companies in leading industries.

2 The BofA Merrill Lynch All Convertible Index contains issues that have a greater than $50 million aggregate market value. The issues are U.S. dollar-denominated, sold into the U.S. market, and publicly traded in the United States.

Unless otherwise specified, indexes reflect total return, with all dividends reinvested. Indexes are unmanaged, do not reflect the deduction of fees or expenses, and are not available for direct investment.

Important Performance and Other Information

Performance data quoted in the following pages reflect past performance and are no guarantee of future results. Current performance may be higher or lower than the performance quoted. The investment return and principal value of an investment in the Fund will fluctuate so that shares, on any given day or when redeemed, may be worth more or less than their original cost. You can obtain performance data current to the most recent month end by calling Lord Abbett at 888-522-2388 or referring to www.lordabbett.com.

Except where noted, comparative Fund performance does not account for the deduction of sales charges and would be different if sales charges were included. The Fund offers several classes of shares with distinct pricing options. For a full description of the differences in pricing alternatives, please see the Fund’s prospectus.

2

During certain periods shown, expense waivers and reimbursements were in place. Without such expense waivers and reimbursements, the Fund’s returns would have been lower.

The views of the Fund’s management and the portfolio holdings described above are as of November 30, 2010; these views and portfolio holdings may have changed subsequent to this date, and they do not guarantee the future performance of the markets or the Fund. Information provided in this report should not be considered a recommendation to purchase or sell securities.

A Note about Risk: See Notes to Financial Statements for a discussion of investment risks. For a more detailed discussion of the risks associated with the Fund, please see the Fund’s prospectus.

Mutual funds are not insured by the FDIC, are not deposits or other obligations of, or guaranteed by, banks, and are subject to investment risks including possible loss of principal amount invested.

3

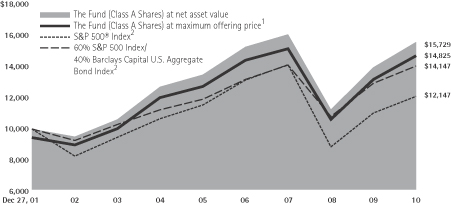

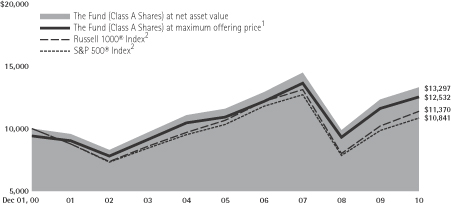

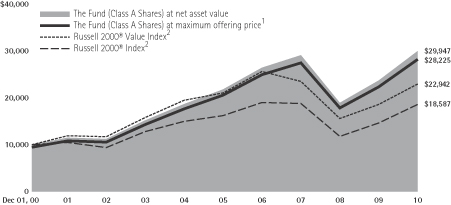

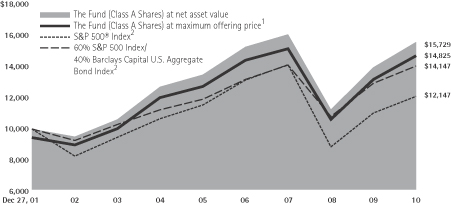

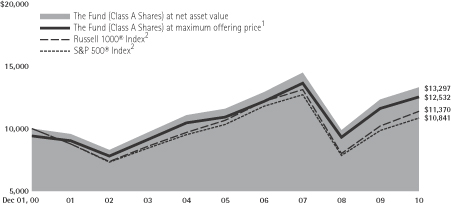

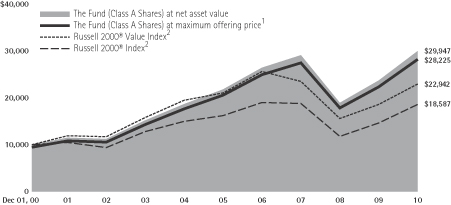

Investment Comparison

Below is a comparison of a $10,000 investment in Class A shares with the same investment in the S&P 500® Index and the 60% S&P 500 Index/40% Barclays Capital U.S. Aggregate Bond Index, assuming reinvestment of all dividends and distributions. The performance of other classes will be greater than or less than the performance shown in the graph below due to different sales loads and expenses applicable to such classes. The graph and performance table below do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. During certain periods, expenses of the Fund have been waived or reimbursed by Lord Abbett; without such waiver or reimbursement of expenses, the Fund’s returns would have been lower. Past performance is no guarantee of future results.

Average Annual Total Returns at Maximum Applicable

Sales Charge for the Periods Ended November 30, 2010

| | | | | | | | | | | | |

| | | 1 Year | | | 5 Years | | | Life of Class | |

Class A3 | | | 5.48% | | | | 1.76% | | | | 4.51% | |

Class B4 | | | 7.17% | | | | 2.13% | | | | 4.60% | |

Class C5 | | | 11.15% | | | | 2.30% | | | | 4.54% | |

Class F6 | | | 12.09% | | | | – | | | | -1.51% | |

Class I7 | | | 12.33% | | | | 3.34% | | | | 5.58% | |

Class P8 | | | 11.75% | | | | 2.87% | | | | 5.12% | |

Class R29 | | | 11.56% | | | | – | | | | -1.79% | |

Class R310 | | | 11.73% | | | | – | | | | -1.89% | |

1 Reflects the deduction of the maximum initial sales charge of 5.75%.

2 Performance for each unmanaged index does not reflect any fees or expenses. The performance of each index is not necessarily representative of the Fund’s performance. Performance of each index began on December 27, 2001.

3 Class A shares commenced operations and performance for the Class began on December 27, 2001. Total return, which is the percentage change in net asset value, after deduction of the maximum initial sales charge of 5.75% applicable to Class A shares, with all dividends and distributions reinvested for the periods shown ended November 30, 2010, is calculated using the SEC-required uniform method to compute such return.

4 Class B shares commenced operations and performance for the Class began on December 27, 2001. Performance reflects the deduction of a CDSC of 4% for 1 year, 1% for 5 years and 0% for Life of Class. Class B shares automatically convert to Class A shares after approximately 8 years. (There is no initial sales charge for automatic conversions.)

5 Class C shares commenced operations and performance for the Class began on December 27, 2001. The 1% CDSC for Class C shares normally applies before the first anniversary of the purchase date. Performance is at net asset value.

6 Class F shares commenced operations and performance for the Class began on September 28, 2007. Performance is at net asset value.

7 Class I shares commenced operations and performance for the Class began on December 27, 2001. Performance is at net asset value.

8 Class P shares commenced operations and performance for the Class began on December 27, 2001. Performance is at net asset value.

9 Class R2 shares commenced operations and performance for the Class began on September 28, 2007. Performance is at net asset value.

10 Class R3 shares commenced operations and performance for the Class began on September 28, 2007. Performance is at net asset value.

4

Expense Example

As a shareholder of the Fund, you incur two types of costs: (1) transaction costs, including sales charges (loads) on purchase payments (these charges vary among the share classes); and (2) ongoing costs, including management fees; distribution and service (12b-1) fees (these charges vary among the share classes); and other Fund expenses. This Example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds.

The Example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period (June 1, 2010 through November 30, 2010).

Actual Expenses

For each class of the Fund, the first line of the table on the following page provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading entitled “Expenses Paid During the Period 6/1/10 – 11/30/10” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

For each class of the Fund, the second line of the table on the following page provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

5

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as sales charges (loads). Therefore, the second line of the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

| | | | | | | | | | | | |

| | | Beginning

Account

Value | | | Ending

Account

Value | | | Expenses

Paid During

Period† | |

| | | 6/1/10 | | | 11/30/10 | | | 6/1/10 -

11/30/10 | |

Class A | | | | | | | | | | | | |

Actual | | $ | 1,000.00 | | | $ | 1,092.70 | | | $ | 6.82 | |

Hypothetical (5% Return Before Expenses) | | $ | 1,000.00 | | | $ | 1,018.55 | | | $ | 6.58 | |

Class B | | | | | | | | | | | | |

Actual | | $ | 1,000.00 | | | $ | 1,088.80 | | | $ | 10.21 | |

Hypothetical (5% Return Before Expenses) | | $ | 1,000.00 | | | $ | 1,015.29 | | | $ | 9.85 | |

Class C | | | | | | | | | | | | |

Actual | | $ | 1,000.00 | | | $ | 1,088.70 | | | $ | 10.21 | |

Hypothetical (5% Return Before Expenses) | | $ | 1,000.00 | | | $ | 1,015.29 | | | $ | 9.85 | |

Class F | | | | | | | | | | | | |

Actual | | $ | 1,000.00 | | | $ | 1,093.20 | | | $ | 5.51 | |

Hypothetical (5% Return Before Expenses) | | $ | 1,000.00 | | | $ | 1,019.81 | | | $ | 5.32 | |

Class I | | | | | | | | | | | | |

Actual | | $ | 1,000.00 | | | $ | 1,095.10 | | | $ | 4.99 | |

Hypothetical (5% Return Before Expenses) | | $ | 1,000.00 | | | $ | 1,020.31 | | | $ | 4.81 | |

Class P | | | | | | | | | | | | |

Actual | | $ | 1,000.00 | | | $ | 1,091.90 | | | $ | 7.34 | |

Hypothetical (5% Return Before Expenses) | | $ | 1,000.00 | | | $ | 1,018.05 | | | $ | 7.08 | |

Class R2 | | | | | | | | | | | | |

Actual | | $ | 1,000.00 | | | $ | 1,091.00 | | | $ | 8.12 | |

Hypothetical (5% Return Before Expenses) | | $ | 1,000.00 | | | $ | 1,017.32 | | | $ | 7.84 | |

Class R3 | | | | | | | | | | | | |

Actual | | $ | 1,000.00 | | | $ | 1,091.40 | | | $ | 7.60 | |

Hypothetical (5% Return Before Expenses) | | $ | 1,000.00 | | | $ | 1,017.82 | | | $ | 7.33 | |

| † | | For each class of the Fund, net expenses are equal to the annualized expense ratio for such class (1.30% for Class A, 1.95% for Classes B and C, 1.05% for Class F, 0.95% for Class I, 1.40% for Class P, 1.55% for Class R2 and 1.45% for Class R3) multiplied by the average account value over the period, multiplied by 183/365 (to reflect one-half year period). |

Portfolio Holdings Presented by Sector

November 30, 2010

| | | | | | | | | | | | |

| Sector* | | %** | | | | | Sector* | | %** | |

Consumer Discretionary | | | 13.61% | | | | | Information Technology | | | 13.65% | |

Consumer Staples | | | 7.30% | | | | | Materials | | | 6.67% | |

Energy | | | 11.85% | | | | | Telecommunication Services | | | 4.96% | |

Financials | | | 13.13% | | | | | Utilities | | | 3.20% | |

Health Care | | | 12.94% | | | | | Short-Term Investment | | | 0.14% | |

Industrials | | | 12.55% | | | | | Total | | | 100.00% | |

| * | | A sector may comprise several industries. |

| ** | | Represents percent of total investments. |

6

Schedule of Investments

November 30, 2010

| | | | | | | | |

| Investments | |

Shares

(000) | | | Value | |

| LONG-TERM INVESTMENTS 99.23% | |

|

| COMMON STOCKS 56.12% | |

|

| Aerospace & Defense 0.89% | |

| DigitalGlobe, Inc.* | | | 70 | | | $ | 2,067,100 | |

| Hexcel Corp.* | | | 335 | | | | 5,745,250 | |

| Moog, Inc. Class A* | | | 125 | | | | 4,607,500 | |

| | | | | | | | |

| Total | | | | | | | 12,419,850 | |

| | | | | | | | |

|

| Airlines 0.31% | |

| United Continental Holdings, Inc.* | | | 158 | | | | 4,359,600 | |

| | | | | | | | |

|

| Auto Components 0.40% | |

| Cooper-Standard Holdings, Inc.* | | | 19 | | | | 827,007 | |

| Cooper-Standard Holdings, Inc.*(a) | | | 112 | | | | 4,716,768 | |

| | | | | | | | |

| Total | | | | | | | 5,543,775 | |

| | | | | | | | |

|

| Automobiles 0.33% | |

| Honda Motor Co., Ltd. ADR | | | 125 | | | | 4,528,750 | |

| | | | | | | | |

|

| Beverages 0.70% | |

| PepsiCo, Inc. | | | 150 | | | | 9,694,500 | |

| | | | | | | | |

|

| Biotechnology 2.01% | |

| Amgen, Inc.* | | | 100 | | | | 5,269,000 | |

| BioMarin Pharmaceutical, Inc.* | | | 135 | | | | 3,655,800 | |

| Celgene Corp.* | | | 165 | | | | 9,797,700 | |

| Genzyme Corp.* | | | 60 | | | | 4,273,200 | |

| Human Genome Sciences, Inc.* | | | 200 | | | | 4,906,000 | |

| | | | | | | | |

| Total | | | | | | | 27,901,700 | |

| | | | | | | | |

|

| Capital Markets 1.19% | |

| BlackRock, Inc. | | | 8 | | | | 1,304,000 | |

| Franklin Resources, Inc. | | | 50 | | | | 5,704,500 | |

| Morgan Stanley | | | 100 | | | | 2,446,000 | |

| State Street Corp. | | | 75 | | | | 3,240,000 | |

| T. Rowe Price Group, Inc. | | | 65 | | | | 3,791,450 | |

| | | | | | | | |

| Total | | | | | | | 16,485,950 | |

| | | | | | | | |

|

| Chemicals 1.73% | |

| Celanese Corp. Series A | | | 60 | | | | 2,220,000 | |

See Notes to Financial Statements.

7

Schedule of Investments (continued)

November 30, 2010

| | | | | | | | |

| Investments | |

Shares

(000) | | | Value | |

| Chemicals (continued) | |

| Dow Chemical Co. (The) | | | 165 | | | $ | 5,144,700 | |

| LyondellBasell Industries NV Class A (Netherlands)*(b) | | | 100 | | | | 2,910,747 | |

| LyondellBasell Industries NV Class B (Netherlands)*(b) | | | 90 | | | | 2,626,715 | |

| Monsanto Co. | | | 75 | | | | 4,494,000 | |

| Rockwood Holdings, Inc.* | | | 175 | | | | 6,679,750 | |

| | | | | | | | |

| Total | | | | | | | 24,075,912 | |

| | | | | | | | |

|

| Commercial Banks 2.12% | |

| PNC Financial Services Group, Inc. (The) | | | 60 | | | | 3,231,000 | |

| SunTrust Banks, Inc. | | | 100 | | | | 2,336,000 | |

| U.S. Bancorp | | | 350 | | | | 8,323,000 | |

| Wells Fargo & Co. | | | 475 | | | | 12,924,750 | |

| Zions Bancorporation | | | 135 | | | | 2,625,750 | |

| | | | | | | | |

| Total | | | | | | | 29,440,500 | |

| | | | | | | | |

|

| Communications Equipment 1.02% | |

| Aruba Networks, Inc.* | | | 110 | | | | 2,332,000 | |

| JDS Uniphase Corp.* | | | 400 | | | | 4,748,000 | |

| QUALCOMM, Inc. | | | 150 | | | | 7,011,000 | |

| | | | | | | | |

| Total | | | | | | | 14,091,000 | |

| | | | | | | | |

|

| Computers & Peripherals 2.77% | |

| Apple, Inc.* | | | 60 | | | | 18,669,000 | |

| Hewlett-Packard Co. | | | 250 | | | | 10,482,500 | |

| International Business Machines Corp. | | | 35 | | | | 4,951,100 | |

| QLogic Corp.* | | | 240 | | | | 4,293,600 | |

| | | | | | | | |

| Total | | | | | | | 38,396,200 | |

| | | | | | | | |

|

| Consumer Finance 0.36% | |

| Capital One Financial Corp. | | | 135 | | | | 5,026,050 | |

| | | | | | | | |

|

| Distributors 0.69% | |

| Genuine Parts Co. | | | 200 | | | | 9,628,000 | |

| | | | | | | | |

|

| Diversified Financial Services 1.81% | |

| Bank of America Corp. | | | 935 | | | | 10,238,250 | |

| JPMorgan Chase & Co. | | | 400 | | | | 14,952,000 | |

| | | | | | | | |

| Total | | | | | | | 25,190,250 | |

| | | | | | | | |

See Notes to Financial Statements.

8

Schedule of Investments (continued)

November 30, 2010

| | | | | | | | |

| Investments | |

Shares

(000) | | | Value | |

| Diversified Telecommunication Services 2.54% | |

| AT&T, Inc. | | | 500 | | | $ | 13,895,000 | |

| CenturyLink, Inc. | | | 150 | | | | 6,448,500 | |

| Frontier Communications Corp. | | | 42 | | | | 382,255 | |

| Qwest Communications International, Inc. | | | 600 | | | | 4,200,000 | |

| Verizon Communications, Inc. | | | 200 | | | | 6,402,000 | |

| Windstream Corp. | | | 300 | | | | 3,912,000 | |

| | | | | | | | |

| Total | | | | | | | 35,239,755 | |

| | | | | | | | |

|

| Electric: Utilities 0.70% | |

| UniSource Energy Corp. | | | 275 | | | | 9,671,750 | |

| | | | | | | | |

|

| Electrical Equipment 1.91% | |

| AMETEK, Inc. | | | 40 | | | | 2,366,800 | |

| Baldor Electric Co. | | | 100 | | | | 6,331,000 | |

| Cooper Industries plc | | | 60 | | | | 3,270,000 | |

| Emerson Electric Co. | | | 175 | | | | 9,637,250 | |

| Rockwell Automation, Inc. | | | 75 | | | | 4,959,000 | |

| | | | | | | | |

| Total | | | | | | | 26,564,050 | |

| | | | | | | | |

|

| Food & Staples Retailing 1.59% | |

| CVS Caremark Corp. | | | 75 | | | | 2,325,000 | |

| Ingles Markets, Inc. Class A | | | 443 | | | | 8,269,652 | |

| SUPERVALU, INC. | | | 165 | | | | 1,491,600 | |

| Wal-Mart Stores, Inc. | | | 185 | | | | 10,006,650 | |

| | | | | | | | |

| Total | | | | | | | 22,092,902 | |

| | | | | | | | |

|

| Food Products 1.73% | |

| Campbell Soup Co. | | | 120 | | | | 4,068,000 | |

| H.J. Heinz Co. | | | 150 | | | | 7,240,500 | |

| Kellogg Co. | | | 135 | | | | 6,646,050 | |

| Kraft Foods, Inc. Class A | | | 200 | | | �� | 6,050,000 | |

| | | | | | | | |

| Total | | | | | | | 24,004,550 | |

| | | | | | | | |

|

| Hotels, Restaurants & Leisure 1.81% | |

| Carnival Corp. Unit | | | 120 | | | | 4,957,200 | |

| Marriott International, Inc. Class A | | | 140 | | | | 5,489,400 | |

| McDonald’s Corp. | | | 115 | | | | 9,004,500 | |

| Starwood Hotels & Resorts Worldwide, Inc. | | | 100 | | | | 5,684,000 | |

| | | | | | | | |

| Total | | | | | | | 25,135,100 | |

| | | | | | | | |

See Notes to Financial Statements.

9

Schedule of Investments (continued)

November 30, 2010

| | | | | | | | |

| Investments | |

Shares

(000) | | | Value | |

| Household Products 0.72% | |

| Colgate-Palmolive Co. | | | 35 | | | $ | 2,679,250 | |

| Procter & Gamble Co. (The) | | | 120 | | | | 7,328,400 | |

| | | | | | | | |

| Total | | | | | | | 10,007,650 | |

| | | | | | | | |

|

| Industrial Conglomerates 0.93% | |

| 3M Co. | | | 60 | | | | 5,038,800 | |

| General Electric Co. | | | 500 | | | | 7,915,000 | |

| | | | | | | | |

| Total | | | | | | | 12,953,800 | |

| | | | | | | | |

|

| Information Technology Services 0.86% | |

| SAIC, Inc.* | | | 500 | | | | 7,660,000 | |

| SRA International, Inc. Class A* | | | 220 | | | | 4,316,400 | |

| | | | | | | | |

| Total | | | | | | | 11,976,400 | |

| | | | | | | | |

|

| Insurance 0.55% | |

| MetLife, Inc. | | | 200 | | | | 7,630,000 | |

| | | | | | | | |

| | |

| Internet Software & Services 0.32% | | | | | | | | |

| GSI Commerce, Inc.* | | | 100 | | | | 2,385,000 | |

| Sohu.com, Inc. (China)*(b) | | | 30 | | | | 2,075,957 | |

| | | | | | | | |

| Total | | | | | | | 4,460,957 | |

| | | | | | | | |

| | |

| Machinery 3.67% | | | | | | | | |

| Actuant Corp. Class A | | | 350 | | | | 8,270,500 | |

| Caterpillar, Inc. | | | 50 | | | | 4,230,000 | |

| Danaher Corp. | | | 240 | | | | 10,380,000 | |

| Pall Corp. | | | 150 | | | | 6,790,500 | |

| Parker Hannifin Corp. | | | 100 | | | | 8,023,000 | |

| Snap-on, Inc. | | | 250 | | | | 13,232,500 | |

| | | | | | | | |

| Total | | | | | | | 50,926,500 | |

| | | | | | | | |

| | |

| Media 1.71% | | | | | | | | |

| Belo Corp. Class A* | | | 350 | | | | 2,030,000 | |

| Charter Communications, Inc. Class A*(c) | | | 68 | | | | 2,286,399 | |

| Interpublic Group of Cos., Inc. (The)* | | | 550 | | | | 5,857,500 | |

| Omnicom Group, Inc. | | | 90 | | | | 4,089,600 | |

| Time Warner, Inc. | | | 115 | | | | 3,391,350 | |

| Walt Disney Co. (The) | | | 165 | | | | 6,024,150 | |

| | | | | | | | |

| Total | | | | | | | 23,678,999 | |

| | | | | | | | |

See Notes to Financial Statements.

10

Schedule of Investments (continued)

November 30, 2010

| | | | | | | | |

| Investments | |

Shares

(000) | | | Value | |

| Metals & Mining 0.52% | | | | | | | | |

| Barrick Gold Corp. (Canada)(b) | | | 82 | | | $ | 4,228,844 | |

| Cliffs Natural Resources, Inc. | | | 25 | | | | 1,708,500 | |

| Titanium Metals Corp.* | | | 75 | | | | 1,295,250 | |

| | | | | | | | |

| Total | | | | | | | 7,232,594 | |

| | | | | | | | |

| | |

| Multi-Line Retail 1.73% | | | | | | | | |

| J.C. Penney Co., Inc. | | | 150 | | | | 4,990,500 | |

| Kohl’s Corp.* | | | 150 | | | | 8,463,000 | |

| Target Corp. | | | 185 | | | | 10,533,900 | |

| | | | | | | | |

| Total | | | | | | | 23,987,400 | |

| | | | | | | | |

| | |

| Oil, Gas & Consumable Fuels 8.02% | | | | | | | | |

| Chevron Corp. | | | 350 | | | | 28,339,500 | |

| ConocoPhillips | | | 360 | | | | 21,661,200 | |

| Continental Resources, Inc.* | | | 135 | | | | 7,215,750 | |

| Devon Energy Corp. | | | 60 | | | | 4,234,200 | |

| EOG Resources, Inc. | | | 100 | | | | 8,895,000 | |

| Exxon Mobil Corp. | | | 300 | | | | 20,868,000 | |

| Hess Corp. | | | 128 | | | | 8,945,385 | |

| Marathon Oil Corp. | | | 200 | | | | 6,694,000 | |

| Petroleo Brasileiro SA ADR | | | 152 | | | | 4,438,848 | |

| | | | | | | | |

| Total | | | | | | | 111,291,883 | |

| | | | | | | | |

| | |

| Pharmaceuticals 5.25% | | | | | | | | |

| Bristol-Myers Squibb Co. | | | 400 | | | | 10,096,000 | |

| Johnson & Johnson | | | 200 | | | | 12,310,000 | |

| Merck & Co., Inc. | | | 135 | | | | 4,653,450 | |

| Mylan, Inc.* | | | 1,268 | | | | 24,815,933 | |

| Pfizer, Inc. | | | 700 | | | | 11,403,000 | |

| Salix Pharmaceuticals Ltd.* | | | 50 | | | | 2,232,500 | |

| Teva Pharmaceutical Industries Ltd. ADR | | | 146 | | | | 7,305,840 | |

| | | | | | | | |

| Total | | | | | | | 72,816,723 | |

| | | | | | | | |

| | |

| Real Estate Investment Trusts 0.11% | | | | | | | | |

| Simon Property Group, Inc. | | | 15 | | | | 1,477,500 | |

| | | | | | | | |

| | |

| Road & Rail 0.65% | | | | | | | | |

| Union Pacific Corp. | | | 100 | | | | 9,011,000 | |

| | | | | | | | |

See Notes to Financial Statements.

11

Schedule of Investments (continued)

November 30, 2010

| | | | | | | | | | | | | | | | |

| Investments | | | | | | | |

Shares

(000) | | | Value | |

| Semiconductors & Semiconductor Equipment 0.71% | | | | | | | | | |

| Intel Corp. | | | | | | | | | | | 250 | | | $ | 5,280,000 | |

| PMC-Sierra, Inc.* | | | | | | | | | | | 250 | | | | 1,812,500 | |

| Taiwan Semiconductor Manufacturing Co., Ltd. ADR | | | | 251 | | | | 2,700,927 | |

| | | | | | | | | | | | | | | | |

| Total | | | | | | | | | | | | | | | 9,793,427 | |

| | | | | | | | | | | | | | | | |

| | | | |

| Software 3.16% | | | | | | | | | | | | | | | | |

| Adobe Systems, Inc.* | | | | | | | | | | | 200 | | | | 5,546,000 | |

| Blackboard, Inc.* | | | | | | | | | | | 60 | | | | 2,493,000 | |

| Citrix Systems, Inc.* | | | | | | | | | | | 40 | | | | 2,656,800 | |

| McAfee, Inc.* | | | | | | | | | | | 65 | | | | 3,045,250 | |

| Microsoft Corp. | | | | | | | | | | | 700 | | | | 17,647,000 | |

| Nuance Communications, Inc.* | | | | | | | | | | | 250 | | | | 4,418,750 | |

| Oracle Corp. | | | | | | | | | | | 300 | | | | 8,112,000 | |

| | | | | | | | | | | | | | | | |

| Total | | | | | | | | | | | | | | | 43,918,800 | |

| | | | | | | | | | | | | | | | |

| | | | |

| Specialty Retail 0.60% | | | | | | | | | | | | | | | | |

| Best Buy Co., Inc. | | | | | | | | | | | 100 | | | | 4,272,000 | |

| Home Depot, Inc. (The) | | | | | | | | | | | 135 | | | | 4,078,350 | |

| | | | | | | | | | | | | | | | |

| Total | | | | | | | | | | | | | | | 8,350,350 | |

| | | | | | | | | | | | | | | | |

| Total Common Stocks (cost $681,343,371) | | | | | | | | | | | | | | | 779,004,127 | |

| | | | | | | | | | | | | | | | |

| | | | |

| | | Interest

Rate | | | Maturity

Date | | | Principal

Amount

(000) | | | | |

| CONVERTIBLE BONDS 8.38% | | | | | | | | | | | | | | | | |

| | | | |

| Airlines 0.08% | | | | | | | | | | | | | | | | |

| United Continental Holdings, Inc. | | | 4.50% | | | | 6/30/2021 | | | $ | 1,100 | | | | 1,177,000 | |

| | | | | | | | | | | | | | | | |

| |

| Auto Components 0.21% | | | | | |

| TRW Automotive, Inc.† | | | 3.50% | | | | 12/1/2015 | | | | 1,630 | | | | 2,891,213 | |

| | | | | | | | | | | | | | | | |

| |

| Automobiles 0.46% | | | | | |

| Ford Motor Co. | | | 4.25% | | | | 11/15/2016 | | | | 3,325 | | | | 6,400,625 | |

| | | | | | | | | | | | | | | | |

| |

| Beverages 0.24% | | | | | |

| Molson Coors Brewing Co. | | | 2.50% | | | | 7/30/2013 | | | | 3,000 | | | | 3,386,250 | |

| | | | | | | | | | | | | | | | |

| |

| Biotechnology 1.26% | | | | | |

| BioMarin Pharmaceutical, Inc. | | | 2.50% | | | | 3/29/2013 | | | | 3,000 | | | | 5,133,750 | |

| Gilead Sciences, Inc. | | | 0.625% | | | | 5/1/2013 | | | | 8,000 | | | | 8,850,000 | |

| Vertex Pharmaceuticals, Inc. | | | 3.35% | | | | 10/1/2015 | | | | 3,500 | | | | 3,504,375 | |

| | | | | | | | | | | | | | | | |

| Total | | | | | | | | | | | | | | | 17,488,125 | |

| | | | | | | | | | | | | | | | |

See Notes to Financial Statements.

12

Schedule of Investments (continued)

November 30, 2010

| | | | | | | | | | | | | | | | |

| Investments | | Interest

Rate | | | Maturity

Date | | | Principal

Amount

(000) | | | Value | |

| Commercial Services & Supplies 0.15% | | | | | |

| CRA International, Inc. | | | 2.875% | | | | 6/15/2034 | | | $ | 2,000 | | | $ | 2,070,000 | |

| | | | | | | | | | | | | | | | |

| |

| Computers & Peripherals 0.24% | | | | | |

| SanDisk Corp. | | | 1.00% | | | | 5/15/2013 | | | | 3,500 | | | | 3,294,375 | |

| | | | | | | | | | | | | | | | |

| |

| Electrical Equipment 0.86% | | | | | |

| General Cable Corp. (2.25% after 11/15/19) | | | 4.50% | | | | 11/15/2029 | | | | 3,375 | | | | 3,868,594 | |

| Roper Industries, Inc. | | | Zero Coupon | | | | 1/15/2034 | | | | 9,000 | | | | 8,122,500 | |

| | | | | | | | | | | | | | | | |

| Total | | | | | | | | | | | | | | | 11,991,094 | |

| | | | | | | | | | | | | | | | |

| |

| Electronic Equipment, Instruments & Components 0.31% | | | | | |

| Itron, Inc. | | | 2.50% | | | | 8/1/2026 | | | | 4,000 | | | | 4,275,000 | |

| | | | | | | | | | | | | | | | |

| |

| Energy Equipment & Services 0.14% | | | | | |

| SunPower Corp. | | | 4.75% | | | | 4/15/2014 | | | | 2,275 | | | | 2,007,688 | |

| | | | | | | | | | | | | | | | |

| |

| Health Care Providers & Services 0.48% | | | | | |

| Five Star Quality Care, Inc. | | | 3.75% | | | | 10/15/2026 | | | | 7,025 | | | | 6,700,094 | |

| | | | | | | | | | | | | | | | |

| |

| Information Technology Services 0.34% | | | | | |

| Symantec Corp. | | | 0.75% | | | | 6/15/2011 | | | | 4,500 | | | | 4,730,625 | |

| | | | | | | | | | | | | | | | |

| |

| Media 0.25% | | | | | |

| Sinclair Broadcast Group, Inc. | | | 6.00% | | | | 9/15/2012 | | | | 3,500 | | | | 3,473,750 | |

| | | | | | | | | | | | | | | | |

| |

| Metals & Mining 0.55% | | | | | |

| Newmont Mining Corp. | | | 1.25% | | | | 7/15/2014 | | | | 4,000 | | | | 5,580,000 | |

| Newmont Mining Corp. | | | 3.00% | | | | 2/15/2012 | | | | 1,500 | | | | 2,021,250 | |

| | | | | | | | | | | | | | | | |

| Total | | | | | | | | | | | | | | | 7,601,250 | |

| | | | | | | | | | | | | | | | |

| |

| Pharmaceuticals 0.93% | | | | | |

| Allergan, Inc. | | | 1.50% | | | | 4/1/2026 | | | | 2,000 | | | | 2,235,000 | |

| Teva Pharmaceutical Finance Co. BV (Israel)(b) | | | 1.75% | | | | 2/1/2026 | | | | 10,000 | | | | 10,737,500 | |

| | | | | | | | | | | | | | | | |

| Total | | | | | | | | | | | | | | | 12,972,500 | |

| | | | | | | | | | | | | | | | |

| |

| Real Estate Investment Trusts 0.19% | | | | | |

| ERP Operating LP | | | 3.85% | | | | 8/15/2026 | | | | 2,500 | | | | 2,586,500 | |

| | | | | | | | | | | | | | | | |

| |

| Semiconductors & Semiconductor Equipment 0.66% | | | | | |

| Intel Corp. | | | 2.95% | | | | 12/15/2035 | | | | 5,000 | | | | 5,087,500 | |

| Xilinx, Inc.† | | | 2.625% | | | | 6/15/2017 | | | | 3,500 | | | | 4,003,125 | |

| | | | | | | | | | | | | | | | |

| Total | | | | | | | | | | | | | | | 9,090,625 | |

| | | | | | | | | | | | | | | | |

See Notes to Financial Statements.

13

Schedule of Investments (continued)

November 30, 2010

| | | | | | | | | | | | | | | | |

| Investments | | Interest

Rate | | | Maturity

Date | | | Principal

Amount

(000) | | | Value | |

| Software 0.88% | | | | | |

| EMC Corp. | | | 1.75% | | | | 12/1/2011 | | | $ | 3,000 | | | $ | 4,125,000 | |

| Informatica Corp. | | | 3.00% | | | | 3/15/2026 | | | | 3,900 | | | | 8,068,125 | |

| | | | | | | | | | | | | | | | |

| Total | | | | | | | | | | | | | | | 12,193,125 | |

| | | | | | | | | | | | | | | | |

| |

| Wireless Telecommunication Services 0.15% | | | | | |

| SBA Communications Corp. | | | 4.00% | | | | 10/1/2014 | | | | 1,400 | | | | 2,031,750 | |

| | | | | | | | | | | | | | | | |

| Total Convertible Bonds (cost $108,991,221) | | | | | | | | | | | | | | | 116,361,589 | |

| | | | | | | | | | | | | | | | |

| | | | |

| | | | | | | | | Shares

(000) | | | | |

| CONVERTIBLE PREFERRED STOCKS 7.39% | | | | | | | | | | | | | | | | |

| |

| Auto Components 0.33% | | | | | |

| Autoliv, Inc. (Sweden)(b) | | | 8.00% | | | | | | | | 40 | | | | 3,920,200 | |

| Cooper-Standard Holdings, Inc. PIK(a) | | | 7.00% | | | | | | | | 4 | | | | 679,000 | |

| | | | | | | | | | | | | | | | |

| Total | | | | | | | | | | | | | | | 4,599,200 | |

| | | | | | | | | | | | | | | | |

| |

| Automobiles 0.27% | | | | | |

| General Motors Co. | | | 4.75% | | | | | | | | 74 | | | | 3,726,450 | |

| | | | | | | | | | | | | | | | |

| |

| Capital Markets 0.78% | | | | | |

| AMG Capital Trust I | | | 5.10% | | | | | | | | 200 | | | | 9,425,000 | |

| Legg Mason, Inc. | | | 7.00% | | | | | | | | 45 | | | | 1,453,500 | |

| | | | | | | | | | | | | | | | |

| Total | | | | | | | | | | | | | | | 10,878,500 | |

| | | | | | | | | | | | | | | | |

| |

| Commercial Banks 0.80% | | | | | |

| Fifth Third Bancorp | | | 8.50% | | | | | | | | 33 | | | | 4,257,500 | |

| Wells Fargo & Co. | | | 7.50% | | | | | | | | 7 | | | | 6,859,650 | |

| | | | | | | | | | | | | | | | |

| Total | | | | | | | | | | | | | | | 11,117,150 | |

| | | | | | | | | | | | | | | | |

| | | | |

| Diversified Financial Services 1.00% | | | | | | | | | | | | | | | | |

| Bank of America Corp. | | | 7.25% | | | | | | | | 6 | | | | 5,115,000 | |

| Citigroup, Inc. | | | 7.50% | | | | | | | | 70 | | | | 8,750,000 | |

| | | | | | | | | | | | | | | | |

| Total | | | | | | | | | | | | | | | 13,865,000 | |

| | | | | | | | | | | | | | | | |

| | | | |

| Electric: Utilities 0.43% | | | | | | | | | | | | | | | | |

| NextEra Energy, Inc. | | | 8.375% | | | | | | | | 119 | | | | 5,921,220 | |

| | | | | | | | | | | | | | | | |

See Notes to Financial Statements.

14

Schedule of Investments (continued)

November 30, 2010

| | | | | | | | | | | | | | | | |

| Investments | | Interest

Rate | | | | | |

Shares

(000) | | | Value | |

| Food Products 1.03% | | | | | | | | | | | | | | | | |

| Archer Daniels Midland Co. | | | 6.25% | | | | | | | | 200 | | | $ | 7,546,000 | |

| Bunge Ltd. | | | 4.875% | | | | | | | | 75 | | | | 6,712,500 | |

| | | | | | | | | | | | | | | | |

| Total | | | | | | | | | | | | | | | 14,258,500 | |

| | | | | | | | | | | | | | | | |

| | | | |

| Insurance 0.64% | | | | | | | | | | | | | | | | |

| Hartford Financial Services Group, Inc. (The) | | | 7.25% | | | | | | | | 135 | | | | 3,122,550 | |

| XL Group plc (Ireland)(b) | | | 10.75% | | | | | | | | 200 | | | | 5,712,000 | |

| | | | | | | | | | | | | | | | |

| Total | | | | | | | | | | | | | | | 8,834,550 | |

| | | | | | | | | | | | | | | | |

| | | | |

| Oil, Gas & Consumable Fuels 1.71% | | | | | | | | | | | | | | | | |

| Apache Corp. | | | 6.00% | | | | | | | | 160 | | | | 9,704,000 | |

| El Paso Corp. | | | 4.99% | | | | | | | | 12 | | | | 14,058,000 | |

| | | | | | | | | | | | | | | | |

| Total | | | | | | | | | | | | | | | 23,762,000 | |

| | | | | | | | | | | | | | | | |

| | | | |

| Road & Rail 0.40% | | | | | | | | | | | | | | | | |

| Kansas City Southern | | | 5.125% | | | | | | | | 4 | | | | 5,561,500 | |

| | | | | | | | | | | | | | | | |

| | | | |

| Thrifts & Mortgage Finance 0.00% | | | | | | | | | | | | | | | | |

| Fannie Mae | | | 8.75% | | | | | | | | 100 | | | | 45,000 | |

| | | | | | | | | | | | | | | | |

| Total Convertible Preferred Stocks (cost $98,953,108) | | | | | | | | | | | | | | | 102,569,070 | |

| | | | | | | | | | | | | | | | |

| | | | |

| | | | | | Maturity

Date | | | Principal

Amount

(000) | | | | |

| FLOATING RATE LOANS(d) 0.44% | | | | | | | | | | | | | | | | |

| | | | |

| Diversified Financial Services 0.26% | | | | | | | | | | | | | | | | |

| Nuveen Investments, Inc. 2nd Lien Term Loan | | | 12.50% | | | | 7/31/2015 | | | $ | 3,350 | | | | 3,609,625 | |

| | | | | | | | | | | | | | | | |

| | | | |

| Software 0.18% | | | | | | | | | | | | | | | | |

| Nuance Communications, Inc. Incremental Term Loan | | | 2.01% | | | | 3/29/2013 | | | | 2,494 | | | | 2,460,051 | |

| | | | | | | | | | | | | | | | |

| Total Floating Rate Loans (cost $5,524,122) | | | | | | | | | | | | | | | 6,069,676 | |

| | | | | | | | | | | | | | | | |

| | | | |

| | | | | | | | | Shares

(000) | | | | |

| FOREIGN COMMON STOCKS(e) 4.02% | |

|

| China 0.22% | |

|

| Metals & Mining | |

| China Zhongwang Holdings Ltd. | | | | | | | | | | | 5,640 | | | | 3,079,407 | |

| | | | | | | | | | | | | | | | |

See Notes to Financial Statements.

15

Schedule of Investments (continued)

November 30, 2010

| | | | | | | | | | | | | | | | |

| Investments | | | | | | | |

Shares

(000) | | | Value | |

| France 0.47% | |

|

| Automobiles 0.24% | |

| Renault SA* | | | | | | | | | | | 63 | | | $ | 3,316,944 | |

| | | | | | | | | | | | | | | | |

|

| Electrical Equipment 0.23% | |

| Alstom SA | | | | | | | | | | | 79 | | | | 3,268,880 | |

| | | | | | | | | | | | | | | | |

| Total France | | | | | | | | | | | | | | | 6,585,824 | |

| | | | | | | | | | | | | | | | |

|

| Germany 0.80% | |

|

| Diversified Telecommunication Services 0.27% | |

| Deutsche Telekom AG Registered Shares | | | | | | | | | | | 293 | | | | 3,753,963 | |

| | | | | | | | | | | | | | | | |

|

| Household Products 0.31% | |

| Henkel KGaA | | | | | | | | | | | 85 | | | | 4,290,317 | |

| | | | | | | | | | | | | | | | |

|

| Software 0.22% | |

| SAP AG | | | | | | | | | | | 67 | | | | 3,121,714 | |

| | | | | | | | | | | | | | | | |

| Total Germany | | | | | | | | | | | | | | | 11,165,994 | |

| | | | | | | | | | | | | | | | |

|

| Japan 0.38% | |

|

| Household Durables | |

| Sony Corp. | | | | | | | | | | | 148 | | | | 5,243,359 | |

| | | | | | | | | | | | | | | | |

|

| Norway 0.38% | |

|

| Commercial Banks | |

| DnB NOR ASA | | | | | | | | | | | 432 | | | | 5,284,999 | |

| | | | | | | | | | | | | | | | |

|

| Switzerland 0.82% | |

|

| Chemicals 0.24% | |

| Syngenta AG | | | | | | | | | | | 12 | | | | 3,379,266 | |

| | | | | | | | | | | | | | | | |

|

| Food Products 0.30% | |

| Nestle SA Registered Shares | | | | | | | | | | | 76 | | | | 4,118,602 | |

| | | | | | | | | | | | | | | | |

| |

| Pharmaceuticals 0.28% | | | | | |

| Roche Holding Ltd. AG | | | | | | | | | | | 28 | | | | 3,843,819 | |

| | | | | | | | | | | | | | | | |

| Total Switzerland | | | | | | | | | | | | | | | 11,341,687 | |

| | | | | | | | | | | | | | | | |

See Notes to Financial Statements.

16

Schedule of Investments (continued)

November 30, 2010

| | | | | | | | | | | | | | | | |

| Investments | | | | | | | |

Shares

(000) | | | Value | |

| United Kingdom 0.95% | | | | | |

| | | | |

| Metals & Mining 0.55% | | | | | | | | | | | | | | | | |

| Anglo American plc | | | | | | | | | | | 102 | | | $ | 4,464,491 | |

| Vedanta Resources plc | | | | | | | | | | | 101 | | | | 3,120,693 | |

| | | | | | | | | | | | | | | | |

| Total | | | | | | | | | | | | | | | 7,585,184 | |

| | | | | | | | | | | | | | | | |

| | | | |

| Wireless Telecommunication Services 0.40% | | | | | | | | | | | | | | | | |

| Vodafone Group plc | | | | | | | | | | | 2,218 | | | | 5,545,596 | |

| | | | | | | | | | | | | | | | |

| Total United Kingdom | | | | | | | | | | | | | | | 13,130,780 | |

| | | | | | | | | | | | | | | | |

| Total Foreign Common Stocks (cost $57,829,457) | | | | | | | | | | | | | | | 55,832,050 | |

| | | | | | | | | | | | | | | | |

| | | | |

| | | Interest

Rate | | | Maturity

Date | | | Principal

Amount

(000) | | | | |

| HIGH YIELD CORPORATE BONDS 22.85% | | | | | | | | | | | | | | | | |

| |

| Aerospace & Defense 0.29% | | | | | |

| GeoEye, Inc. | | | 9.625% | | | | 10/1/2015 | | | $ | 3,550 | | | | 3,993,750 | |

| | | | | | | | | | | | | | | | |

| |

| Air Freight & Logistics 0.27% | | | | | |

| Park-Ohio Industries, Inc. | | | 8.375% | | | | 11/15/2014 | | | | 3,700 | | | | 3,737,000 | |

| | | | | | | | | | | | | | | | |

| |

| Airlines 0.28% | | | | | |

| United Air Lines, Inc.† | | | 9.875% | | | | 8/1/2013 | | | | 3,500 | | | | 3,832,500 | |

| | | | | | | | | | | | | | | | |

| |

| Automobiles 0.28% | | | | | |

| TRW Automotive, Inc.† | | | 8.875% | | | | 12/1/2017 | | | | 3,500 | | | | 3,920,000 | |

| | | | | | | | | | | | | | | | |

| |

| Building Products 0.18% | | | | | |

| Masco Corp. | | | 7.125% | | | | 3/15/2020 | | | | 1,000 | | | | 1,051,094 | |

| New Enterprise Stone & Lime Co., Inc.† | | | 11.00% | | | | 9/1/2018 | | | | 1,500 | | | | 1,447,500 | |

| | | | | | | | | | | | | | | | |

| Total | | | | | | | | | | | | | | | 2,498,594 | |

| | | | | | | | | | | | | | | | |

| |

| Capital Markets 0.80% | | | | | |

| Ameriprise Financial, Inc. | | | 5.30% | | | | 3/15/2020 | | | | 2,500 | | | | 2,706,130 | |

| Nuveen Investments, Inc. | | | 10.50% | | | | 11/15/2015 | | | | 4,900 | | | | 4,906,125 | |

| Pinafore LLC/Pinafore, Inc.† | | | 9.00% | | | | 10/1/2018 | | | | 450 | | | | 477,000 | |

| Raymond James Financial, Inc. | | | 8.60% | | | | 8/15/2019 | | | | 2,500 | | | | 2,976,390 | |

| | | | | | | | | | | | | | | | |

| Total | | | | | | | | | | | | | | | 11,065,645 | |

| | | | | | | | | | | | | | | | |

See Notes to Financial Statements.

17

Schedule of Investments (continued)

November 30, 2010

| | | | | | | | | | | | | | | | |

| Investments | | Interest

Rate | | | Maturity

Date | | | Principal

Amount

(000) | | | Value | |

| Chemicals 0.73% | | | | | |

| Chemtura Corp.† | | | 7.875% | | | | 9/1/2018 | | | $ | 2,000 | | | $ | 2,120,000 | |

| Dow Chemical Co. (The) | | | 8.55% | | | | 5/15/2019 | | | | 1,250 | | | | 1,580,888 | |

| INEOS Group Holdings plc (United Kingdom)†(b) | | | 8.50% | | | | 2/15/2016 | | | | 4,250 | | | | 3,708,125 | |

| Lyondell Chemical Co.† | | | 8.00% | | | | 11/1/2017 | | | | 2,500 | | | | 2,703,125 | |

| | | | | | | | | | | | | | | | |

| Total | | | | | | | | | | | | | | | 10,112,138 | |

| | | | | | | | | | | | | | | | |

| |

| Commercial Banks 0.38% | | | | | |

| SVB Financial Group | | | 5.375% | | | | 9/15/2020 | | | | 1,625 | | | | 1,626,100 | |

| Zions Bancorporation | | | 7.75% | | | | 9/23/2014 | | | | 3,500 | | | | 3,694,488 | |

| | | | | | | | | | | | | | | | |

| Total | | | | | | | | | | | | | | | 5,320,588 | |

| | | | | | | | | | | | | | | | |

| |

| Commercial Services & Supplies 0.54% | | | | | |

| Bunge NA Finance LP | | | 5.90% | | | | 4/1/2017 | | | | 1,625 | | | | 1,717,578 | |

| First Data Corp. | | | 9.875% | | | | 9/24/2015 | | | | 3,000 | | | | 2,565,000 | |

| International Lease Finance Corp.† | | | 8.75% | | | | 3/15/2017 | | | | 3,000 | | | | 3,165,000 | |

| Old AII, Inc.(f) | | | 10.00% | | | | 12/15/2016 | | | | 1,800 | | | | 18 | |

| | | | | | | | | | | | | | | | |

| Total | | | | | | | | | | | | | | | 7,447,596 | |

| | | | | | | | | | | | | | | | |

| |

| Communications Equipment 0.68% | | | | | |

| Brocade Communications Systems, Inc. | | | 6.625% | | | | 1/15/2018 | | | | 3,500 | | | | 3,710,000 | |

| Brocade Communications Systems, Inc. | | | 6.875% | | | | 1/15/2020 | | | | 1,950 | | | | 2,096,250 | |

| Hughes Network Systems LLC | | | 9.50% | | | | 4/15/2014 | | | | 3,500 | | | | 3,605,000 | |

| | | | | | | | | | | | | | | | |

| Total | | | | | | | | | | | | | | | 9,411,250 | |

| | | | | | | | | | | | | | | | |

| |

| Consumer Finance 0.49% | | | | | |

| Ally Financial, Inc. | | | 8.30% | | | | 2/12/2015 | | | | 1,775 | | | | 1,872,625 | |

| American General Finance Corp. | | | 6.90% | | | | 12/15/2017 | | | | 1,500 | | | | 1,196,250 | |

| Ford Motor Credit Co. LLC | | | 8.00% | | | | 6/1/2014 | | | | 3,500 | | | | 3,801,844 | |

| | | | | | | | | | | | | | | | |

| Total | | | | | | | | | | | | | | | 6,870,719 | |

| | | | | | | | | | | | | | | | |

| |

| Containers & Packaging 1.18% | | | | | |

| Ardagh Packaging Finance plc (Ireland)†(b) | | | 7.375% | | | | 10/15/2017 | | | | 1,200 | | | | 1,239,000 | |

| Ardagh Packaging Finance plc (Ireland)†(b) | | | 9.125% | | | | 10/15/2020 | | | | 1,350 | | | | 1,397,250 | |

| Ball Corp. | | | 7.375% | | | | 9/1/2019 | | | | 2,500 | | | | 2,731,250 | |

| Crown Cork & Seal Co., Inc. | | | 7.375% | | | | 12/15/2026 | | | | 6,000 | | | | 6,210,000 | |

| Graphic Packaging International Corp. | | | 9.50% | | | | 8/15/2013 | | | | 2,014 | | | | 2,064,350 | |

| Sealed Air Corp. | | | 7.875% | | | | 6/15/2017 | | | | 2,500 | | | | 2,746,668 | |

| | | | | | | | | | | | | | | | |

| Total | | | | | | | | | | | | | | | 16,388,518 | |

| | | | | | | | | | | | | | | | |

See Notes to Financial Statements.

18

Schedule of Investments (continued)

November 30, 2010

| | | | | | | | | | | | | | | | |

| Investments | | Interest

Rate | | | Maturity

Date | | | Principal

Amount

(000) | | | Value | |

| Diversified Financial Services 1.22% | | | | | |

| Capital One Capital VI | | | 8.875% | | | | 5/15/2040 | | | $ | 3,445 | | | $ | 3,625,862 | |

| New York City Industrial Development Agency† | | | 11.00% | | | | 3/1/2029 | | | | 2,800 | | | | 3,594,080 | |

| RBS Global, Inc./Rexnord LLC | | | 8.50% | | | | 5/1/2018 | | | | 3,000 | | | | 3,090,000 | |

| RBS Global, Inc./Rexnord LLC | | | 11.75% | | | | 8/1/2016 | | | | 2,850 | | | | 3,021,000 | |

| Wachovia Capital Trust III | | | 5.80% | | | | – | (g) | | | 1,000 | | | | 850,000 | |

| Wind Acquisition Finance SA (Italy)†(b) | | | 11.75% | | | | 7/15/2017 | | | | 1,500 | | | | 1,672,500 | |

| Wind Acquisition Finance SA (Italy)†(b) | | | 12.00% | | | | 12/1/2015 | | | | 1,000 | | | | 1,061,250 | |

| | | | | | | | | | | | | | | | |

| Total | | | | | | | | | | | | | | | 16,914,692 | |

| | | | | | | | | | | | | | | | |

| | | | |

| Diversified Telecommunication Services 1.15% | | | | | | | | | | | | | | | | |

| Cincinnati Bell, Inc. | | | 7.00% | | | | 2/15/2015 | | | | 5,000 | | | | 4,925,000 | |

| Intelsat Luxembourg SA (Luxembourg)(b) | | | 11.25% | | | | 2/4/2017 | | | | 4,150 | | | | 4,367,875 | |

| SBA Telecommunications, Inc. | | | 8.25% | | | | 8/15/2019 | | | | 2,500 | | | | 2,750,000 | |

| Windstream Corp. | | | 7.00% | | | | 3/15/2019 | | | | 4,000 | | | | 3,920,000 | |

| | | | | | | | | | | | | | | | |

| Total | | | | | | | | | | | | | | | 15,962,875 | |

| | | | | | | | | | | | | | | | |

| | | | |

| Electric: Utilities 0.57% | | | | | | | | | | | | | | | | |

| Ameren Illinois Co. | | | 9.75% | | | | 11/15/2018 | | | | 2,500 | | | | 3,296,160 | |

| Edison Mission Energy | | | 7.75% | | | | 6/15/2016 | | | | 1,500 | | | | 1,290,000 | |

| Texas Competitive Electric Holdings Co. LLC | | | 10.25% | | | | 11/1/2015 | | | | 5,500 | | | | 3,300,000 | |

| | | | | | | | | | | | | | | | |

| Total | | | | | | | | | | | | | | | 7,886,160 | |

| | | | | | | | | | | | | | | | |

| | | | |

| Electrical Equipment 0.29% | | | | | | | | | | | | | | | | |

| Baldor Electric Co. | | | 8.625% | | | | 2/15/2017 | | | | 3,600 | | | | 4,032,000 | |

| | | | | | | | | | | | | | | | |

| | | |

| Electronic Equipment, Instruments & Components 0.49% | | | | | | | | | | | | | |

| Agilent Technologies, Inc. | | | 5.50% | | | | 9/14/2015 | | | | 3,000 | | | | 3,343,584 | |

| Emerson Electric Co. | | | 5.25% | | | | 10/15/2018 | | | | 3,000 | | | | 3,458,250 | |

| | | | | | | | | | | | | | | | |

| Total | | | | | | | | | | | | | | | 6,801,834 | |

| | | | | | | | | | | | | | | | |

| | | | |

| Food & Staples Retailing 0.22% | | | | | | | | | | | | | | | | |

| Dunkin Finance Corp.† | | | 9.625% | | | | 12/1/2018 | | | | 3,000 | | | | 3,033,750 | |

| | | | | | | | | | | | | | | | |

| | | | |

| Food Products 0.10% | | | | | | | | | | | | | | | | |

| Corn Products International, Inc. | | | 4.625% | | | | 11/1/2020 | | | | 1,300 | | | | 1,345,847 | |

| | | | | | | | | | | | | | | | |

| | | | |

| Health Care Equipment & Supplies 1.23% | | | | | | | | | | | | | | | | |

| Bausch & Lomb, Inc. | | | 9.875% | | | | 11/1/2015 | | | | 2,000 | | | | 2,097,500 | |

| Bio-Rad Laboratories, Inc. | | | 8.00% | | | | 9/15/2016 | | | | 3,500 | | | | 3,841,250 | |

See Notes to Financial Statements.

19

Schedule of Investments (continued)

November 30, 2010

| | | | | | | | | | | | | | | | |

| Investments | | Interest

Rate | | | Maturity

Date | | | Principal

Amount

(000) | | | Value | |

| Health Care Equipment & Supplies (continued) | | | | | | | | | |

| Biomet, Inc. | | | 10.00% | | | | 10/15/2017 | | | $ | 3,000 | | | $ | 3,285,000 | |

| HCA, Inc. | | | 9.125% | | | | 11/15/2014 | | | | 7,450 | | | | 7,785,250 | |

| | | | | | | | | | | | | | | | |

| Total | | | | | | | | | | | | | | | 17,009,000 | |

| | | | | | | | | | | | | | | | |

| | | | |

| Health Care Providers & Services 1.32% | | | | | | | | | | | | | | | | |

| Community Health Systems, Inc. | | | 8.875% | | | | 7/15/2015 | | | | 7,000 | | | | 7,341,250 | |

| Tenet Healthcare Corp. | | | 9.25% | | | | 2/1/2015 | | | | 3,500 | | | | 3,745,000 | |

| United Surgical Partners International, Inc. PIK | | | 9.25% | | | | 5/1/2017 | | | | 4,000 | | | | 4,150,000 | |

| Vanguard Health Holding Co. II LLC/Vanguard Holding Co. II, Inc. | | | 8.00% | | | | 2/1/2018 | | | | 3,075 | | | | 3,121,125 | |

| | | | | | | | | | | | | | | | |

| Total | | | | | | | | | | | | | | | 18,357,375 | |

| | | | | | | | | | | | | | | | |

| | | | |

| Hotels, Restaurants & Leisure 1.20% | | | | | | | | | | | | | | | | |

| Hyatt Hotels Corp.† | | | 5.75% | | | | 8/15/2015 | | | | 3,000 | | | | 3,204,828 | |

| Marina District Finance Co., Inc.† | | | 9.875% | | | | 8/15/2018 | | | | 3,000 | | | | 2,887,500 | |

| McDonald’s Corp. | | | 5.00% | | | | 2/1/2019 | | | | 1,800 | | | | 2,046,947 | |

| River Rock Entertainment Authority (The) | | | 9.75% | | | | 11/1/2011 | | | | 1,700 | | | | 1,547,000 | |

| Seminole Indian Tribe of Florida† | | | 7.75% | | | | 10/1/2017 | | | | 850 | | | | 878,156 | |

| Starwood Hotels & Resorts Worldwide, Inc. | | | 7.875% | | | | 10/15/2014 | | | | 2,000 | | | | 2,292,500 | |

| Station Casinos, Inc.(f) | | | 6.50% | | | | 2/1/2014 | | | | 4,000 | | | | 1,600 | |

| Wendy’s/Arby’s Restaurants LLC | | | 10.00% | | | | 7/15/2016 | | | | 3,000 | | | | 3,285,000 | |

| Wyndham Worldwide Corp. | | | 5.75% | | | | 2/1/2018 | | | | 550 | | | | 567,648 | |

| | | | | | | | | | | | | | | | |

| Total | | | | | | | | | | | | | | | 16,711,179 | |

| | | | | | | | | | | | | | | | |

| | | | |

| Household Durables 0.39% | | | | | | | | | | | | | | | | |

| K. Hovnanian Enterprises, Inc. | | | 10.625% | | | | 10/15/2016 | | | | 1,675 | | | | 1,702,219 | |

| Lennar Corp. | | | 12.25% | | | | 6/1/2017 | | | | 2,500 | | | | 3,006,250 | |

| Viking Acquisition, Inc.† | | | 9.25% | | | | 11/1/2018 | | | | 725 | | | | 726,812 | |

| | | | | | | | | | | | | | | | |

| Total | | | | | | | | | | | | | | | 5,435,281 | |

| | | | | | | | | | | | | | | | |

| | | |

| Independent Power Producers & Energy Traders 0.90% | | | | | | | | | | | | | |

| AES Corp. (The) | | | 8.00% | | | | 10/15/2017 | | | | 2,500 | | | | 2,612,500 | |

| Dynegy Holdings, Inc. | | | 8.375% | | | | 5/1/2016 | | | | 5,000 | | | | 3,675,000 | |

| Mirant Americas Generation LLC | | | 9.125% | | | | 5/1/2031 | | | | 6,450 | | | | 6,192,000 | |

| | | | | | | | | | | | | | | | |

| Total | | | | | | | | | | | | | | | 12,479,500 | |

| | | | | | | | | | | | | | | | |

| | | | |

| Information Technology Services 0.66% | | | | | | | | | | | | | | | | |

| SunGard Data Systems, Inc.† | | | 7.375% | | | | 11/15/2018 | | | | 2,000 | | | | 1,990,000 | |

| SunGard Data Systems, Inc.† | | | 7.625% | | | | 11/15/2020 | | | | 900 | | | | 904,500 | |

See Notes to Financial Statements.

20

Schedule of Investments (continued)

November 30, 2010

| | | | | | | | | | | | | | | | |

| Investments | | Interest

Rate | | | Maturity

Date | | | Principal

Amount

(000) | | | Value | |

| Information Technology Services (continued) | | | | | | | | | | | | | | | | |

| SunGard Data Systems, Inc. | | | 10.25% | | | | 8/15/2015 | | | $ | 6,000 | | | $ | 6,240,000 | |

| | | | | | | | | | | | | | | | |

| Total | | | | | | | | | | | | | | | 9,134,500 | |

| | | | | | | | | | | | | | | | |

| | | | |

| Insurance 0.22% | | | | | | | | | | | | | | | | |

| Liberty Mutual Group, Inc.† | | | 10.75% | | | | 6/15/2058 | | | | 2,500 | | | | 3,075,000 | |

| | | | | | | | | | | | | | | | |

| | | | |

| Leisure Equipment & Products 0.38% | | | | | | | | | | | | | | | | |

| Expedia, Inc. | | | 8.50% | | | | 7/1/2016 | | | | 1,500 | | | | 1,653,750 | |

| Mattel, Inc. | | | 4.35% | | | | 10/1/2020 | | | | 425 | | | | 424,470 | |

| Speedway Motorsports, Inc. | | | 8.75% | | | | 6/1/2016 | | | | 3,000 | | | | 3,240,000 | |

| | | | | | | | | | | | | | | | |

| Total | | | | | | | | | | | | | | | 5,318,220 | |

| | | | | | | | | | | | | | | | |

| | | | |

| Machinery 0.20% | | | | | | | | | | | | | | | | |

| Oshkosh Corp. | | | 8.50% | | | | 3/1/2020 | | | | 2,500 | | | | 2,725,000 | |

| | | | | | | | | | | | | | | | |

| | | | |

| Media 1.18% | | | | | | | | | | | | | | | | |

| Affinion Group, Inc. | | | 11.50% | | | | 10/15/2015 | | | | 4,000 | | | | 4,050,000 | |

| CCO Holdings LLC/CCO Holdings Capital Corp.† | | | 8.125% | | | | 4/30/2020 | | | | 3,500 | | | | 3,692,500 | |

| Gray Television, Inc. | | | 10.50% | | | | 6/29/2015 | | | | 1,500 | | | | 1,507,500 | |

| Mediacom Broadband LLC | | | 8.50% | | | | 10/15/2015 | | | | 4,175 | | | | 4,185,437 | |

| Mediacom Communications Corp. | | | 9.125% | | | | 8/15/2019 | | | | 1,500 | | | | 1,522,500 | |

| WMG Acquisition Corp. | | | 9.50% | | | | 6/15/2016 | | | | 1,420 | | | | 1,487,450 | |

| | | | | | | | | | | | | | | | |

| Total | | | | | | | | | | | | | | | 16,445,387 | |

| | | | | | | | | | | | | | | | |

| | | | |

| Metals & Mining 0.90% | | | | | | | | | | | | | | | | |

| Cliffs Natural Resources, Inc. | | | 5.90% | | | | 3/15/2020 | | | | 3,500 | | | | 3,786,748 | |

| FMG Resources August 2006 Pty Ltd. (Australia)†(b) | | | 7.00% | | | | 11/1/2015 | | | | 450 | | | | 457,875 | |

| Freeport-McMoRan Copper & Gold, Inc. | | | 8.375% | | | | 4/1/2017 | | | | 3,500 | | | | 3,914,361 | |

| Noranda Aluminum Acquisition Corp. PIK | | | 5.193% | # | | | 5/15/2015 | | | | 3,320 | | | | 2,946,044 | |

| Teck Resources Ltd. (Canada)(b) | | | 9.75% | | | | 5/15/2014 | | | | 1,114 | | | | 1,376,512 | |

| | | | | | | | | | | | | | | | |

| Total | | | | | | | | | | | | | | | 12,481,540 | |

| | | | | | | | | | | | | | | | |

| | | | |

| Multi-Line Retail 0.21% | | | | | | | | | | | | | | | | |

| Macy’s Retail Holdings, Inc. | | | 8.375% | | | | 7/15/2015 | | | | 2,500 | | | | 2,925,000 | |

| | | | | | | | | | | | | | | | |

| | | | |

| Multi-Utilities 0.59% | | | | | | | | | | | | | | | | |

| Black Hills Corp. | | | 9.00% | | | | 5/15/2014 | | | | 3,650 | | | | 4,272,606 | |

| NiSource Finance Corp. | | | 10.75% | | | | 3/15/2016 | | | | 3,000 | | | | 3,969,474 | |

| | | | | | | | | | | | | | | | |

| Total | | | | | | | | | | | | | | | 8,242,080 | |

| | | | | | | | | | | | | | | | |

See Notes to Financial Statements.

21

Schedule of Investments (continued)

November 30, 2010

| | | | | | | | | | | | | | | | |

| Investments | | Interest

Rate | | | Maturity

Date | | | Principal

Amount

(000) | | | Value | |

| Oil, Gas & Consumable Fuels 1.90% | | | | | | | | | | | | | | | | |

| CONSOL Energy, Inc.† | | | 8.25% | | | | 4/1/2020 | | | $ | 3,500 | | | $ | 3,806,250 | |

| Continental Resources, Inc. | | | 8.25% | | | | 10/1/2019 | | | | 6,000 | | | | 6,690,000 | |

| El Paso Corp. | | | 7.00% | | | | 6/15/2017 | | | | 2,630 | | | | 2,784,228 | |

| El Paso Corp. | | | 7.25% | | | | 6/1/2018 | | | | 3,300 | | | | 3,532,874 | |

| Forest Oil Corp. | | | 7.25% | | | | 6/15/2019 | | | | 2,000 | | | | 2,050,000 | |

| Linn Energy LLC/Linn Energy Finance Corp.† | | | 7.75% | | | | 2/1/2021 | | | | 1,850 | | | | 1,887,000 | |

| Quicksilver Resources, Inc. | | | 8.25% | | | | 8/1/2015 | | | | 3,000 | | | | 3,082,500 | |

| Tennessee Gas Pipeline Co. | | | 7.00% | | | | 10/15/2028 | | | | 2,000 | | | | 2,157,752 | |

| Whiting Petroleum Corp. | | | 6.50% | | | | 10/1/2018 | | | | 450 | | | | 459,000 | |

| | | | | | | | | | | | | | | | |

| Total | | | | | | | | | | | | | | | 26,449,604 | |

| | | | | | | | | | | | | | | | |

| | | | |

| Personal Products 0.22% | | | | | | | | | | | | | | | | |

| Elizabeth Arden, Inc. | | | 7.75% | | | | 1/15/2014 | | | | 3,000 | | | | 3,063,750 | |

| | | | | | | | | | | | | | | | |

| | | | |

| Pharmaceuticals 0.10% | | | | | | | | | | | | | | | | |

| Mylan, Inc.† | | | 7.625% | | | | 7/15/2017 | | | | 650 | | | | 692,250 | |

| Mylan, Inc.† | | | 7.875% | | | | 7/15/2020 | | | | 650 | | | | 696,313 | |

| | | | | | | | | | | | | | | | |

| Total | | | | | | | | | | | | | | | 1,388,563 | |

| | | | | | | | | | | | | | | | |

| | | | |

| Real Estate Investment Trusts 0.12% | | | | | | | | | | | | | | | | |

| ProLogis | | | 6.875% | | | | 3/15/2020 | | | | 1,500 | | | | 1,643,706 | |

| | | | | | | | | | | | | | | | |

| | | | |

| Specialty Retail 0.44% | | | | | | | | | | | | | | | | |

| Brookstone Co., Inc.† | | | 13.00% | | | | 10/15/2014 | | | | 1,564 | | | | 1,431,060 | |

| Limited Brands, Inc. | | | 8.50% | | | | 6/15/2019 | | | | 4,000 | | | | 4,630,000 | |

| | | | | | | | | | | | | | | | |

| Total | | | | | | | | | | | | | | | 6,061,060 | |

| | | | | | | | | | | | | | | | |

| | | | |

| Thrifts & Mortgage Finance 0.00% | | | | | | | | | | | | | | | | |

| Washington Mutual Bank(f) | | | 6.875% | | | | 6/15/2011 | | | | 4,350 | | | | 16,313 | |

| | | | | | | | | | | | | | | | |

| | | | |

| Tobacco 0.10% | | | | | | | | | | | | | | | | |

| Reynolds Group Issuer, Inc./Reynolds Group Issuer LLC/Reynolds Group Issuer Luxembourg SA† | | | 8.50% | | | | 5/15/2018 | | | | 1,375 | | | | 1,375,000 | |

| | | | | | | | | | | | | | | | |

| | | | |

| Transportation Infrastructure 0.10% | | | | | | | | | | | | | | | | |

| Asciano Finance Ltd. (Australia)†(b) | | | 4.625% | | | | 9/23/2020 | | | | 1,500 | | | | 1,460,117 | |

| | | | | | | | | | | | | | | | |

| | | |

| Wireless Telecommunication Services 0.35% | | | | | | | | | | | | | |

| Sprint Capital Corp. | | | 6.90% | | | | 5/1/2019 | | | | 5,000 | | | | 4,812,500 | |

| | | | | | | | | | | | | | | | |

| Total High Yield Corporate Bonds (cost $310,838,965) | | | | | | | | | | | | 317,185,131 | |

| | | | | | | | | | | | | | | | |

See Notes to Financial Statements.

22

Schedule of Investments (continued)

November 30, 2010

| | | | | | | | | | | | | | | | |

| Investments | | Interest

Rate | | | | | | Shares

(000) | | | Value | |

| NON-CONVERTIBLE PREFERRED STOCK 0.00% | | | | | | | | | | | | | |

| | | | |

| Thrifts & Mortgage Finance | | | | | | | | | | | | | | | | |

| Fannie Mae* (cost $3,071,479) | | | 8.25% | | | | | | | | 122 | | | $ | 62,985 | |

| | | | | | | | | | | | | | | | |

| | | | |

| | | Exercise

Price | | | Expiration

Date | | | | | | | |

| WARRANTS 0.03% | | | | | | | | | | | | | | | | |

| | | | |

| Auto Components 0.02% | | | | | | | | | | | | | | | | |

| Cooper-Standard Holdings, Inc.* | | | $27.33 | | | | 11/27/2017 | | | | 8 | | | | 170,268 | |

| Cooper-Standard Holdings, Inc.*(a) | | | 27.33 | | | | 11/27/2017 | | | | 7 | | | | 136,605 | |

| | | | | | | | | | | | | | | | |

| Total | | | | | | | | | | | | | | | 306,873 | |

| | | | | | | | | | | | | | | | |

| | | | |

| Media 0.01% | | | | | | | | | | | | | | | | |

| Charter Communications, Inc.* | | | 46.86 | | | | 11/30/2014 | | | | 9 | | | | 44,585 | |

| | | | | | | | | | | | | | | | |

| Total Warrants (cost $175,119) | | | | | | | | | | | | | | | 351,458 | |

| | | | | | | | | | | | | | | | |

| Total Long-Term Investments (cost $1,266,726,842) | | | | | | | | | | | | 1,377,436,086 | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | Principal

Amount

(000) | | | | |

| | | | |

| SHORT-TERM INVESTMENT 0.13% | | | | | | | | | | | | | | | | |

| | | | |

| Repurchase Agreement | | | | | | | | | | | | | | | | |

| Repurchase Agreement dated 11/30/2010, 0.03% due 12/1/2010 with Fixed Income Clearing Corp. collateralized by $1,915,000 of Federal Home Loan Mortgage Corp. at 0.515% due 11/26/2012; value: $1,910,213; proceeds: $1,869,351 (cost $1,869,350) | | | | | | | | | | $ | 1,869 | | | | 1,869,350 | |

| | | | | | | | | | | | | | | | |

| Total Investments in Securities 99.36% (cost $1,268,596,192) | | | | | | | | 1,379,305,436 | |

| | | | | | | | | | | | | | | | |

| Foreign Cash and Other Assets in Excess of Liabilities(h) 0.64% | | | | | | | | | | | | | | | 8,872,444 | |

| | | | | | | | | | | | | | | | |

| Net Assets 100.00% | | | | | | | | | | | $ | 1,388,177,880 | |

| | | | | | | | | | | | | | | | |

| | |

| ADR | | American Depositary Receipt. |

| PIK | | Payment-in-kind. |

| Unit | | More than one class of securities traded together. |

| * | | Non-income producing security. |

| ~ | | Deferred interest debentures pay the stated rate, after which they pay a predetermined interest rate. |

| † | | Security was purchased pursuant to Rule 144A under the Securities Act of 1933 and, unless registered under the Act or exempted from registration, may only be resold to qualified institutional investors. Unless otherwise noted, 144A securities are deemed to be liquid. |

See Notes to Financial Statements.

23

Schedule of Investments (concluded)

November 30, 2010

| | |

| # | | Variable rate security. The interest rate represents the rate in effect at November 30, 2010. |

| (a) | | Restricted securities of Cooper Standard Holdings, Inc. acquired through private placement during the fiscal year ended November 30, 2010 are as follows: |

| | | | | | | | |

| Investment Type | | Acquisition

Date | | Acquired Shares | | Cost on Acquisition Date | | Fair value per share at

November 30, 2010 |

Common Stock | | May 24, 2010 | | 112,304 | | $2,473,355 | | $42.00 |

Convertible Preferred Stock | | May 24, 2010 | | 3,840 | | 384,000 | | 175.00 |

Convertible Preferred Stock | | July 19, 2010 | | 40 | | 4,000 | | 175.00 |

Warrant | | May 27, 2010 | | 6,505 | | – | | 21.00 |

| | |

| (b) | | Foreign security traded in U.S. dollars. |

| (c) | | Restricted security. The Fund acquired 68,210 shares in a private placement on June 11, 2009 for a cost of $1,278,938. The fair value price per share on November 30, 2010 is $33.52. |

| (d) | | Floating Rate Loans in which the Fund invests generally pay interest at rates which are periodically re-determined at a margin above the London Interbank Offered Rate (“LIBOR”) or the prime rate offered by major U.S. banks. The rate shown is the rate in effect at November 30, 2010. |

| (e) | | Investment in non-U.S. dollar denominated securities. |

| (f) | | Defaulted security. |

| (g) | | Security is perpetual in nature and has no stated maturity. |

| (h) | | Foreign Cash and Other Assets in Excess of Liabilities include net unrealized depreciation on open futures contracts as follows: |

Open Futures Contracts at November 30, 2010:

| | | | | | | | | | | | |

| Type | | Expiration | | Contracts | | Position | | Market

Value | | Unrealized

Depreciation | |

| U.S. 10-Year Treasury Note | | December 2010 | | 250 | | Short | | $(31,261,719) | | $ | (257,015) | |

See Notes to Financial Statements.

24

Statement of Assets and Liabilities

November 30, 2010

| | | | |

ASSETS: | | | | |

Investments in securities, at value (cost $1,268,596,192) | | | $1,379,305,436 | |

Deposits with broker for futures collateral | | | 350,000 | |

Foreign cash, at value (cost $800,434) | | | 808,981 | |

Receivables: | | | | |

Interest and dividends | | | 9,177,642 | |

Investment securities sold | | | 2,936,825 | |

Capital shares sold | | | 902,930 | |

Prepaid expenses and other assets | | | 78,695 | |

Total assets | | | 1,393,560,509 | |

LIABILITIES: | | | | |

Payables: | | | | |

Investment securities purchased | | | 2,383,550 | |

Capital shares reacquired | | | 1,227,277 | |

Management fee | | | 851,097 | |

12b-1 distribution fees | | | 345,966 | |

Directors’ fees | | | 147,123 | |

Fund administration | | | 46,286 | |

Variation margin | | | 42,938 | |

To affiliates (See Note 3) | | | 47,321 | |

Accrued expenses and other liabilities | | | 291,071 | |

Total liabilities | | | 5,382,629 | |

NET ASSETS | | | $1,388,177,880 | |

COMPOSITION OF NET ASSETS: | | | | |

Paid-in capital | | | $1,547,502,101 | |

Undistributed net investment income | | | 4,523,522 | |

Accumulated net realized loss on investments, futures contracts and foreign currency related transactions | | | (274,310,691 | ) |

Net unrealized appreciation on investments, futures contracts and translation of assets and liabilities denominated in foreign currencies | | | 110,462,948 | |

Net Assets | | | $1,388,177,880 | |

See Notes to Financial Statements.

25

Statement of Assets and Liabilities (concluded)

November 30, 2010

| | | | |

| | | | |

Net assets by class: | | | | |

Class A Shares | | $ | 933,371,216 | |

Class B Shares | | $ | 48,713,758 | |

Class C Shares | | $ | 56,383,218 | |

Class F Shares | | $ | 7,394,847 | |

Class I Shares | | $ | 337,977,733 | |

Class P Shares | | $ | 2,191,039 | |

Class R2 Shares | | $ | 30,144 | |

Class R3 Shares | | $ | 2,115,925 | |

Outstanding shares by class: | | | | |

Class A Shares (300 million shares of common stock authorized, $.001 par value) | | | 82,903,538 | |

Class B Shares (30 million shares of common stock authorized, $.001 par value) | | | 4,364,097 | |

Class C Shares (20 million shares of common stock authorized, $.001 par value) | | | 5,041,181 | |

Class F Shares (30 million shares of common stock authorized, $.001 par value) | | | 657,039 | |

Class I Shares (100 million shares of common stock authorized, $.001 par value) | | | 29,838,740 | |

Class P Shares (20 million shares of common stock authorized, $.001 par value) | | | 194,068 | |

Class R2 Shares (30 million shares of common stock authorized, $.001 par value) | | | 2,664,277 | |

Class R3 Shares (30 million shares of common stock authorized, $.001 par value) | | | 188,333 | |

Net asset value, offering and redemption price per share

(Net assets divided by outstanding shares): | | | | |

Class A Shares-Net asset value | | | $11.26 | |

Class A Shares-Maximum offering price (Net asset value plus sales charge of 5.75%) | | | $11.95 | |

Class B Shares-Net asset value | | | $11.16 | |

Class C Shares-Net asset value | | | $11.18 | |

Class F Shares-Net asset value | | | $11.25 | |

Class I Shares-Net asset value | | | $11.33 | |

Class P Shares-Net asset value | | | $11.29 | |

Class R2 Shares-Net asset value | | | $11.31 | |

Class R3 Shares-Net asset value | | | $11.24 | |

See Notes to Financial Statements.

26

Statement of Operations

For the Year Ended November 30, 2010

| | | | |

Investment income: | | | | |

Dividends (net of foreign withholding taxes of $215,414) | | $ | 22,468,767 | |

Interest | | | 31,859,761 | |

Total investment income | | | 54,328,528 | |

Expenses: | | | | |

Management fee | | | 10,148,166 | |

12b-1 distribution plan-Class A | | | 3,313,264 | |

12b-1 distribution plan-Class B | | | 520,067 | |

12b-1 distribution plan-Class C | | | 569,084 | |

12b-1 distribution plan-Class F | | | 5,757 | |

12b-1 distribution plan-Class P | | | 10,772 | |

12b-1 distribution plan-Class R2 | | | 164 | |

12b-1 distribution plan-Class R3 | | | 6,507 | |

Shareholder servicing | | | 1,547,809 | |

Subsidy (See Note 3) | | | 557,102 | |

Fund administration | | | 551,324 | |

Registration | | | 141,236 | |

Reports to shareholders | | | 136,503 | |

Professional | | | 53,820 | |

Directors’ fees | | | 48,767 | |

Custody | | | 36,989 | |

Other | | | 52,109 | |

Gross expenses | | | 17,699,440 | |

Expense reductions (See Note 7) | | | (1,270 | ) |

Management fee waived (See Note 3) | | | (87,261 | ) |

Net expenses | | | 17,610,909 | |

Net investment income | | | 36,717,619 | |

Net realized and unrealized gain: | | | | |

Net realized gain on investments, futures contracts and foreign currency related transactions | | | 24,854,330 | |

Net change in unrealized appreciation/depreciation on investments, futures contracts and translation of assets and liabilities denominated in foreign currencies | | | 93,553,768 | |

Net realized and unrealized gain | | | 118,408,098 | |

Net Increase in Net Assets Resulting From Operations | | $ | 155,125,717 | |

See Notes to Financial Statements.

27

Statements of Changes in Net Assets

| | | | | | | | |

| INCREASE (DECREASE) IN NET ASSETS | | For the Year Ended

November 30, 2010 | | | For the Year Ended

November 30, 2009 | |

Operations: | | | | | | | | |

Net investment income | | $ | 36,717,619 | | | $ | 45,411,440 | |

Net realized gain (loss) on investments, futures contracts and foreign currency related transactions | | | 24,854,330 | | | | (145,541,267 | ) |

Net change in unrealized appreciation/depreciation on investments, futures contracts and translation of assets and liabilities denominated in foreign currencies | | | 93,553,768 | | | | 380,215,139 | |

Net increase in net assets resulting from operations | | | 155,125,717 | | | | 280,085,312 | |

Distributions to shareholders from: | | | | | | | | |

Net investment income | | | | | | | | |

Class A | | | (26,532,498 | ) | | | (36,274,975 | ) |

Class B | | | (1,130,938 | ) | | | (1,647,951 | ) |

Class C | | | (1,233,119 | ) | | | (1,895,565 | ) |

Class F | | | (168,005 | ) | | | (114,438 | ) |

Class I | | | (9,743,835 | ) | | | (10,061,743 | ) |

Class P | | | (67,250 | ) | | | (100,533 | ) |

Class R2 | | | (680 | ) | | | (753 | ) |

Class R3 | | | (31,016 | ) | | | (5,287 | ) |

Total distributions to shareholders | | | (38,907,341 | ) | | | (50,101,245 | ) |

Capital share transactions (Net of share conversions) (See Note 11): | |

Net proceeds from sales of shares | | | 179,592,332 | | | | 312,953,012 | |

Reinvestment of distributions | | | 38,022,779 | | | | 48,870,715 | |

Cost of shares reacquired | | | (350,504,539 | ) | | | (339,821,891 | ) |

Net increase (decrease) in net assets resulting from capital share transactions | | | (132,889,428 | ) | | | 22,001,836 | |

Net increase (decrease) in net assets | | | (16,671,052 | ) | | | 251,985,903 | |

NET ASSETS: | | | | | | | | |

Beginning of year | | $ | 1,404,848,932 | | | $ | 1,152,863,029 | |

End of year | | $ | 1,388,177,880 | | | $ | 1,404,848,932 | |

Undistributed net investment income | | $ | 4,523,522 | | | $ | 5,827,995 | |

See Notes to Financial Statements.

28

Financial Highlights

| | | | | | | | | | | | | | | | | | | | |

| | | Class A Shares | |

| | | Year Ended 11/30 | |

| | | 2010 | | | 2009 | | | 2008 | | | 2007 | | | 2006 | |

Per Share Operating Performance | | | | | | | | | | | | | | | | | | | | |

Net asset value, beginning of year | | | $10.35 | | | | $ 8.66 | | | | $13.49 | | | | $13.56 | | | | $12.44 | |

| | | | | | | | | | | | | | | | | | | | |

| | | | | |

Investment operations: | | | | | | | | | | | | | | | | | | | | |

| | | | | |

Net investment income(a) | | | .28 | | | | .34 | | | | .41 | | | | .37 | | | | .33 | |

| | | | | |