| OMB APPROVAL |

OMB Number: 3235-0570 Expires: January 31, 2017 Estimated average burden hours per response: 20.6 |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

| Investment Company Act file number | 811-07148 | |

| Schwartz Investment Trust |

| (Exact name of registrant as specified in charter) |

| 801 W. Ann Arbor Trail, Suite 244 Plymouth, Michigan | 48170 |

| (Address of principal executive offices) | (Zip code) |

George P. Schwartz

| Schwartz Investment Counsel, Inc. 801 W. Ann Arbor Trail, Plymouth, MI 48170 |

| (Name and address of agent for service) |

| Registrant's telephone number, including area code: | (248) 644-8500 | |

| Date of fiscal year end: | December 31 | |

| | | |

| Date of reporting period: | December 31, 2015 | |

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget ("OMB") control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to the Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

| Item 1. | Reports to Stockholders. |

Schwartz Value Fund

Shareholder Services c/o Ultimus Fund Solutions, LLC P.O. Box 46707 Cincinnati, OH 45246 (888) 726-0753 | | Investment Adviser 801 W. Ann Arbor Trail Suite 244 Plymouth, Michigan 48170 |

Dear Fellow Shareowner:

The Schwartz Value Fund (the “Fund”) had a disappointing year in 2015, down 15.5%, as compared to the benchmark Russell 1000 Index which returned 0.9%. The primary reason for our underperformance was due to our energy-related holdings, which were negatively impacted by the drop in oil and natural gas prices during 2015. We underestimated the depth and duration of the energy glut. However, we believe our energy investments are in safe, high-quality companies that will survive the downturn and then thrive when energy prices rebound. Ironically, the cure for low energy prices is low energy prices (and time). Exploration and production at today’s depressed prices are uneconomic and unsustainable for a large swath of the industry. Consequently, capital spending budgets have been slashed which will curtail production, leading to reduced supplies. Meantime, demand for oil has been relatively stable and generally grows with GDP. Thus, we believe eventually the demand for oil will outstrip depleted supplies and prices will rise commensurately.

Another contributing factor to the Fund’s poor year was the continued underperformance of value stocks compared to growth stocks. Our value-oriented, disciplined approach of buying high-quality companies at prices below intrinsic value remained out-of-favor last year. In the S&P 500 Index (the “S&P 500”), the Value component stocks had a total return of -3.1% as compared to the Growth component stocks which had a total return of 5.5%. Further, while the S&P 500 eked out a positive return for the year, a closer look reveals that many stocks had astonishingly poor performance last year with more than 200 companies in the S&P 500 down at least 20% from their 52-week high. Further, a small number of large-cap, high-flying, high-priced tech stocks accounted for more than all of the S&P 500’s positive return. The high-flyers were the so-called FANG stocks (Facebook, Amazon, Netflix, Alphabet (formerly Google)) and a handful of others. Excluding this group of stocks, the S&P 500’s return was in the negative last year. Investors who did not own the FANG stocks most likely underperformed the broad market in 2015.

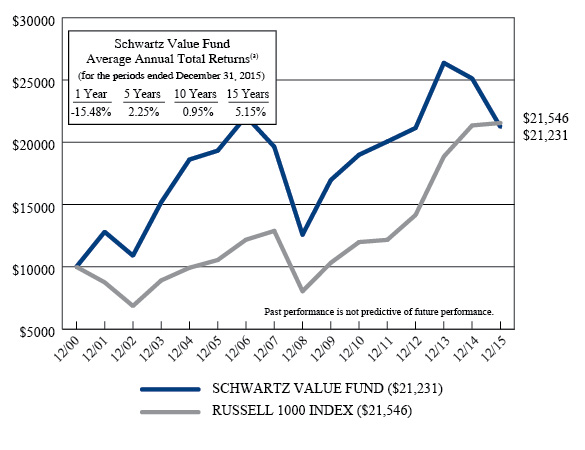

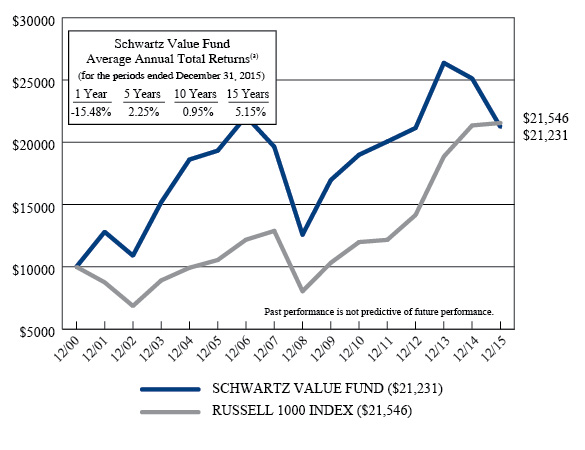

Despite the poor results in 2015, the Fund’s longer term track record is in line with the Russell 1000 and S&P 500 Indices. The Fund’s 1, 5, 10 and 15-year performance figures are as follows:

| | Average Annual Total Return

For the Periods Ended 12/31/15 |

| | 1 year | 5 years | 10 years | 15 years |

Schwartz Value Fund | -15.5% | 2.3% | 1.0% | 5.2% |

Russell 1000 Index | 0.9% | 12.4% | 7.4% | 5.3% |

S&P 500 Index | 1.4% | 12.6% | 7.3% | 5.0% |

1

Securities that had a positive impact on performance included ARRIS Group, Inc., Equinix, Inc., PNC Financial Services Group, Inc. (warrants), The Progressive Corporation, and Valeant Pharmaceuticals International, Inc. Equinix and Valeant were both sold from the portfolio during Q3 of 2015 due to their share prices reaching our estimate of intrinsic value. Another holding which was sold after it appreciated substantially was Precision Castparts Corporation, which received a takeover bid from Berkshire Hathaway. Negatively affecting performance were the aforementioned energy related stocks along with Apollo Education Group, Inc., Biglari Holdings, Inc., Graham Holdings Company, Ocwen Financial Corporation, and Unico American Corporation. Apollo and Ocwen were eliminated from the Fund during Q3 of 2015 due to deteriorating fundamentals. We continue to own Biglari, Graham Holdings, and Unico as we believe each company has unrealized value in their shares, with limited downside from these depressed prices.

As a reminder, our investment philosophy is predicated on the belief that the most attractive investment opportunities are those that are out-of-favor and under-owned. We believe Keynes had it right when he said “The central principle of investment is to go contrary to the general opinion on the grounds that if everyone agreed about its merits, the investment is inevitably too dear and therefore unattractive.” And even though the Fund had a disappointing 2015, we are optimistic about the future. We believe the Fund is conservatively invested with significant capital appreciation potential. Many of our companies made good fundamental progress in 2015 in their operations and improved their financial and competitive positions. As a result, the Fund holds a number of stocks that are selling at a large discount to our appraisal of intrinsic value.

Thank you for your continued patience. We believe our time in the sun is coming.

Sincerely,

|

|

Timothy S. Schwartz, CFA

Lead Portfolio Manager | George P. Schwartz, CFA

Co-Portfolio Manager |

December 31, 2015

Past performance is not predictive of future performance. Investment results and principal value will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. Current performance may be higher or lower than the performance data quoted. Performance data, current to the most recent month end, are available by calling the Fund at 1-888-726-0753.

An investor should consider the investment objectives, risks, charges and expenses of the Fund carefully before investing. The Fund’s prospectus contains this and other important information. To obtain a copy of the prospectus please visit our website at www.schwartzvaluefund.com or call 1-888-726-0753 and a copy will be sent to you free of charge. Please read the prospectus carefully before you invest.

The Letter to Shareholders seeks to describe some of the Adviser’s current opinions and views of the financial markets. Although the Adviser believes it has a reasonable basis for any opinions or views expressed, actual results may differ, sometimes significantly so, from those expected or expressed.

2

SCHWARTZ VALUE FUND

PERFORMANCE

(Unaudited)

Comparison of the Change in Value of a $10,000 Investment

in Schwartz Value Fund and the Russell 1000 Index

(a) | The returns shown do not reflect the deduction of taxes a shareholder would pay on Fund distributions or the redemption of Fund shares. |

Expense ratio as of 12-31-14 (as disclosed in May 1, 2015 prospectus) | 1.26%* |

Expense ratio for the year ended 12-31-15 | 1.35% |

* | Includes Acquired Fund Fees and Expenses. |

This report is for the information of shareholders, but it may also be used as sales literature when preceded or accompanied by a current prospectus, which gives details about charges, expenses, investment objectives and operating policies of the Fund.The Fund is distributed by Ultimus Fund Distributors, LLC.

3

SCHWARTZ VALUE FUND

ANNUAL TOTAL RATES OF RETURN

COMPARISON WITH MAJOR INDICES (Unaudited)

| SCHWARTZ VALUE

FUND(a) | RUSSELL

1000

INDEX | RUSSELL

2000

INDEX | NASDAQ COMPOSITE(b) | VALUE

LINE

COMPOSITE(c) | S&P 500

INDEX |

1984 | 11.1% | 4.8% | -7.3% | -11.2% | -8.4% | 6.1% |

1985 | 21.7% | 32.3% | 31.1% | 31.4% | 20.7% | 31.6% |

1986 | 16.4% | 17.9% | 5.7% | 7.4% | 5.0% | 18.7% |

1987 | -0.6% | 2.9% | -8.8% | -5.3% | -10.6% | 5.3% |

1988 | 23.1% | 17.3% | 24.9% | 15.4% | 15.4% | 16.8% |

1989 | 8.3% | 30.4% | 16.2% | 19.3% | 11.2% | 31.6% |

1990 | -5.3% | -4.2% | -19.5% | -17.8% | -24.3% | -3.2% |

1991 | 32.0% | 33.0% | 46.1% | 56.8% | 27.2% | 30.4% |

1992 | 22.7% | 8.9% | 18.4% | 15.5% | 7.0% | 7.6% |

1993 | 20.5% | 10.2% | 18.9% | 14.7% | 10.7% | 10.1% |

1994 | -6.8% | 0.4% | -1.8% | -3.2% | -6.0% | 1.3% |

1995 | 16.9% | 37.8% | 28.4% | 39.9% | 19.3% | 37.5% |

1996 | 18.3% | 22.5% | 16.5% | 22.7% | 13.4% | 22.9% |

1997 | 28.0% | 32.9% | 22.4% | 21.6% | 21.1% | 33.4% |

1998 | -10.4% | 27.0% | -2.5% | 39.6% | -3.8% | 28.6% |

1999 | -2.5% | 20.9% | 21.3% | 85.6% | -1.4% | 21.0% |

2000 | 9.3% | -7.8% | -3.0% | -39.3% | -8.7% | -9.1% |

2001 | 28.1% | -12.5% | 2.5% | -21.0% | -6.1% | -11.9% |

2002 | -14.9% | -21.7% | -20.5% | -31.5% | -28.6% | -22.1% |

2003 | 39.3% | 29.9% | 47.3% | 50.0% | 37.4% | 28.7% |

2004 | 22.6% | 11.4% | 18.3% | 8.6% | 11.5% | 10.9% |

2005 | 3.8% | 6.3% | 4.6% | 1.4% | 2.0% | 4.9% |

2006 | 14.3% | 15.5% | 18.4% | 9.5% | 11.0% | 15.8% |

2007 | -11.1% | 5.8% | -1.6% | 10.6% | -3.8% | 5.5% |

2008 | -35.9% | -37.6% | -33.8% | -40.0% | -48.7% | -37.0% |

2009 | 34.8% | 28.4% | 27.2% | 45.3% | 36.8% | 26.5% |

2010 | 12.0% | 16.1% | 26.9% | 18.0% | 20.5% | 15.1% |

2011 | 5.6% | 1.5% | -4.2% | -0.8% | -11.4% | 2.1% |

2012 | 5.4% | 16.4% | 16.4% | 17.5% | 9.5% | 16.0% |

2013 | 24.7% | 33.1% | 38.8% | 40.1% | 35.5% | 32.4% |

2014 | -4.7% | 13.2% | 4.9% | 14.8% | 2.7% | 13.7% |

2015 | -15.5% | 0.9% | -4.4% | 7.0% | -11.2% | 1.4% |

(a) | Schwartz Value Fund’s performance combines the performance of the Fund since its commencement of operations as a registered investment company on July 20, 1993, and the performance of RCM Partners Limited Partnership for periods prior thereto. |

(b) | Excluding dividends for the years ended 1984-2006. Effective 2007, the returns include dividends. |

4

SCHWARTZ VALUE FUND

AVERAGE ANNUAL TOTAL RETURNS

As of December 31, 2015 (Unaudited)

| SCHWARTZ

VALUE

FUND(a) | RUSSELL

1000

INDEX | RUSSELL

2000

INDEX | NASDAQ

COMPOSITE(b) | VALUE

LINE

COMPOSITE(c) | S&P 500

INDEX |

3 Years | 0.1% | 15.0% | 11.7% | 19.8% | 7.3% | 15.1% |

5 Years | 2.3% | 12.4% | 9.2% | 14.9% | 3.7% | 12.6% |

10 Years | 1.0% | 7.4% | 6.8% | 8.6% | 0.8% | 7.3% |

15 Years | 5.2% | 5.3% | 7.3% | 4.8% | 0.8% | 5.0% |

32 Years | 8.3% | 10.9% | 9.2% | 9.5% | 2.6% | 10.9% |

(a) | Schwartz Value Fund’s performance combines the performance of the Fund since its commencement of operations as a registered investment company on July 20, 1993, and the performance of RCM Partners Limited Partnership for periods prior thereto. |

(b) | Excluding dividends for the years ended 1984-2006. Effective 2007, the returns include dividends. |

5

SCHWARTZ VALUE FUND

TEN LARGEST EQUITY HOLDINGS

December 31, 2015 (Unaudited)

Shares | | Security Description | | Market

Value | | | % of

Net Assets | |

| | 180,000 | | Unico American Corporation | | $ | 1,785,600 | | | | 9.5 | % |

| | 30,000 | | ARRIS Group, Inc. | | | 917,100 | | | | 4.9 | % |

| | 20,000 | | Avnet, Inc. | | | 856,800 | | | | 4.6 | % |

| | 30,000 | | Liberty Interactive Corporation - Series A | | | 819,600 | | | | 4.4 | % |

| | 4 | | Berkshire Hathaway, Inc. - Class A | | | 791,200 | | | | 4.2 | % |

| | 25,000 | | PNC Financial Services Group, Inc. (The) - Warrants | | | 717,750 | | | | 3.8 | % |

| | 10,000 | | TJX Companies, Inc. (The) | | | 709,100 | | | | 3.8 | % |

| | 60,000 | | Goldcorp, Inc. | | | 693,600 | | | | 3.7 | % |

| | 1,400 | | Graham Holdings Company - Class B | | | 678,958 | | | | 3.6 | % |

| | 20,000 | | Progressive Corporation (The) | | | 636,000 | | | | 3.4 | % |

ASSET ALLOCATION (Unaudited)

Sector | % of

Net Assets |

Consumer Discretionary | 22.0% |

Energy | 10.6% |

Financials | 21.9% |

Industrials | 9.5% |

Information Technology | 16.9% |

Materials | 6.6% |

Warrants | 3.8% |

Open-End Funds | 0.1% |

Money Market Funds, Other Assets in Excess of Liabilities | 8.6% |

| | 100.0% |

6

SCHWARTZ VALUE FUND

SCHEDULE OF INVESTMENTS

December 31, 2015

| COMMON STOCKS — 87.5% | | Shares | | | Market Value | |

| Consumer Discretionary — 22.0% | | | | | | |

| Auto Components — 1.5% | | | | | | |

| Cie Générale des Établissements Michelin - ADR | | | 15,000 | | | $ | 285,975 | |

| | | | | | | | | |

| Diversified Consumer Services — 3.6% | | | | | | | | |

Graham Holdings Company - Class B | | | 1,400 | | | | 678,958 | |

| | | | | | | | | |

| Hotels, Restaurants & Leisure — 2.8% | | | | | | | | |

Biglari Holdings, Inc. * | | | 1,600 | | | | 521,312 | |

| | | | | | | | | |

| Household Durables — 2.0% | | | | | | | | |

Garmin Ltd. | | | 10,000 | | | | 371,700 | |

| | | | | | | | | |

| Internet & Catalog Retail — 4.4% | | | | | | | | |

Liberty Interactive Corporation - Series A * | | | 30,000 | | | | 819,600 | |

| | | | | | | | | |

| Media — 3.9% | | | | | | | | |

Discovery Communications, Inc. - Series A * | | | 20,000 | | | | 533,600 | |

Liberty Global plc - Series C * | | | 5,000 | | | | 203,850 | |

| | | | | | | | 737,450 | |

| Specialty Retail — 3.8% | | | | | | | | |

TJX Companies, Inc. (The) | | | 10,000 | | | | 709,100 | |

| | | | | | | | | |

| Energy — 10.6% | | | | | | | | |

| Energy Equipment & Services — 3.7% | | | | | | | | |

Rowan Companies plc - Class A | | | 10,000 | | | | 169,500 | |

Schlumberger Limited | | | 7,500 | | | | 523,125 | |

| | | | | | | | 692,625 | |

| Oil, Gas & Consumable Fuels — 6.9% | | | | | | | | |

Apache Corporation | | | 5,000 | | | | 222,350 | |

Devon Energy Corporation | | | 5,000 | | | | 160,000 | |

Exxon Mobil Corporation | | | 5,000 | | | | 389,750 | |

Noble Energy, Inc. | | | 16,260 | | | | 535,442 | |

| | | | | | | | 1,307,542 | |

| Financials — 21.9% | | | | | | | | |

| Banks — 1.0% | | | | | | | | |

Citigroup, Inc. | | | 3,500 | | | | 181,125 | |

| | | | | | | | | |

| Capital Markets — 2.0% | | | | | | | | |

Franklin Resources, Inc. | | | 10,063 | | | | 370,519 | |

| | | | | | | | | |

| Diversified Financial Services — 1.8% | | | | | | | | |

MasterCard, Inc. - Class A | | | 3,500 | | | | 340,760 | |

7

SCHWARTZ VALUE FUND

SCHEDULE OF INVESTMENTS

(Continued)

| COMMON STOCKS — 87.5% (Continued) | | Shares | | | Market Value | |

| Financials — 21.9% (Continued) | | | | | | |

| Insurance — 17.1% | | | | | | |

Berkshire Hathaway, Inc. - Class A * | | | 4 | | | $ | 791,200 | |

Progressive Corporation (The) | | | 20,000 | | | | 636,000 | |

Unico American Corporation * | | | 180,000 | | | | 1,785,600 | |

| | | | | | | | 3,212,800 | |

| Industrials — 9.5% | | | | | | | | |

| Aerospace & Defense — 1.0% | | | | | | | | |

United Technologies Corporation | | | 2,000 | | | | 192,140 | |

| | | | | | | | | |

| Electrical Equipment — 1.4% | | | | | | | | |

Eaton Corporation plc | | | 5,000 | | | | 260,200 | |

| | | | | | | | | |

| Machinery — 4.9% | | | | | | | | |

Colfax Corporation * | | | 15,000 | | | | 350,250 | |

Donaldson Company, Inc. | | | 20,000 | | | | 573,200 | |

| | | | | | | | 923,450 | |

| Trading Companies & Distributors — 2.2% | | | | | | | | |

W.W. Grainger, Inc. | | | 2,000 | | | | 405,180 | |

| | | | | | | | | |

| Information Technology — 16.9% | | | | | | | | |

Communications Equipment — 4.9% | | | | | | | | |

ARRIS Group, Inc. * | | | 30,000 | | | | 917,100 | |

| | | | | | | | | |

| Electronic Equipment, Instruments & Components — 6.6% | | | | | | | | |

Arrow Electronics, Inc. * | | | 7,000 | | | | 379,260 | |

Avnet, Inc. | | | 20,000 | | | | 856,800 | |

| | | | | | | | 1,236,060 | |

| IT Services — 2.5% | | | | | | | | |

International Business Machines Corporation | | | 3,500 | | | | 481,670 | |

| | | | | | | | | |

| Software — 1.0% | | | | | | | | |

ANSYS, Inc. * | | | 2,000 | | | | 185,000 | |

| | | | | | | | | |

| Technology Hardware, Storage & Peripherals — 1.9% | | | | | | | | |

HP, Inc. | | | 30,000 | | | | 355,200 | |

| | | | | | | | | |

| Materials — 6.6% | | | | | | | | |

| Chemicals — 0.9% | | | | | | | | |

Praxair, Inc. | | | 1,700 | | | | 174,080 | |

8

SCHWARTZ VALUE FUND

SCHEDULE OF INVESTMENTS

(Continued)

| COMMON STOCKS — 87.5% (Continued) | | Shares | | | Market Value | |

| Materials — 6.6% (Continued) | | | | | | |

| Metals & Mining — 5.7% | | | | | | |

Barrick Gold Corporation | | | 20,000 | | | $ | 147,600 | |

Goldcorp, Inc. | | | 60,000 | | | | 693,600 | |

Pan American Silver Corporation | | | 35,000 | | | | 227,500 | |

| | | | | | | | 1,068,700 | |

| | | | | | | | | |

Total Common Stocks (Cost $15,548,731) | | | | | | $ | 16,428,246 | |

WARRANTS — 3.8% | | Shares | | | Market Value | |

Financials — 3.8% | | | | | | |

Banks — 3.8% | | | | | | |

PNC Financial Services Group, Inc. (The) * (Cost $508,492) | | | 25,000 | | | $ | 717,750 | |

OPEN-END FUNDS — 0.1% | | Shares | | | Market Value | |

Sequoia Fund, Inc. * (Cost $9,255) | | | 67 | | | $ | 13,974 | |

MONEY MARKET FUNDS — 8.2% | | Shares | | | Market Value | |

Federated Government Obligations Tax-Managed Fund - Institutional Shares, 0.07% (a) | | | 862,759 | | | $ | 862,759 | |

Federated Treasury Obligations Fund - Institutional Shares, 0.07% (a) | | | 667,636 | | | | 667,636 | |

Total Money Market Funds (Cost $1,530,395) | | | | | | $ | 1,530,395 | |

| | | | | | | | | |

Total Investments at Market Value — 99.6%(Cost $17,596,873) | | | | | | $ | 18,690,365 | |

| | | | | | | | | |

Other Assets in Excess of Liabilities — 0.4% | | | | | | | 81,743 | |

| | | | | | | | | |

Net Assets — 100.0% | | | | | | $ | 18,772,108 | |

ADR - American Depositary Receipt. |

* | Non-income producing security. |

(a) | The rate shown is the 7-day effective yield as of December 31, 2015. |

See notes to financial statements. |

9

SCHWARTZ VALUE FUND

STATEMENT OF ASSETS AND LIABILITIES

December 31, 2015

| ASSETS | | | |

| Investments, at market value (cost of $17,596,873) (Note 1) | | $ | 18,690,365 | |

Receivable for capital shares sold | | | 100,000 | |

Dividends receivable | | | 8,583 | |

Other assets | | | 5,612 | |

TOTAL ASSETS | | | 18,804,560 | |

| | | | | |

| LIABILITIES | | | | |

Payable to Adviser (Note 2) | | | 19,804 | |

Payable to administrator (Note 2) | | | 3,000 | |

Other accrued expenses | | | 9,648 | |

TOTAL LIABILITIES | | | 32,452 | |

| | | | | |

NET ASSETS | | $ | 18,772,108 | |

| | | | | |

| NET ASSETS CONSIST OF: | | | | |

Paid-in capital | | $ | 18,217,090 | |

| Accumulated net realized losses from security transactions | | | (538,474 | ) |

Net unrealized appreciation on investments | | | 1,093,492 | |

NET ASSETS | | $ | 18,772,108 | |

| | | | | |

Shares of beneficial interest outstanding (unlimited number of shares authorized, no par value) | | | 886,217 | |

| | | | | |

| Net asset value, offering price and redemption price per share (Note 1) | | $ | 21.18 | |

See notes to financial statements.

10

SCHWARTZ VALUE FUND

STATEMENT OF OPERATIONS

For the Year Ended December 31, 2015

| INVESTMENT INCOME | | | |

Dividends (Net of foreign tax of $10,747) �� | | $ | 220,901 | |

| | | | | |

| EXPENSES | | | | |

Investment advisory fees (Note 2) | | | 222,464 | |

Trustees’ fees and expenses (Note 2) | | | 44,982 | |

| Administration, accounting and transfer agent fees (Note 2) | | | 36,300 | |

Legal and audit fees | | | 30,383 | |

Registration and filing fees | | | 11,813 | |

Custodian and bank service fees | | | 6,644 | |

Printing of shareholder reports | | | 6,363 | |

Postage and supplies | | | 4,533 | |

Insurance expense | | | 1,276 | |

Compliance service fees and expenses (Note 2) | | | 878 | |

Other expenses | | | 6,040 | |

TOTAL EXPENSES | | | 371,676 | |

Less fee reductions by the Adviser (Note 2) | | | (56,616 | ) |

NET EXPENSES | | | 315,060 | |

| | | | | |

NET INVESTMENT LOSS | | | (94,159 | ) |

| | | | | |

| REALIZED AND UNREALIZED LOSSES ON INVESTMENTS | | | | |

Net realized losses from security transactions | | | (538,474 | ) |

| Net change in unrealized appreciation/depreciation on investments | | | (2,972,967 | ) |

| NET REALIZED AND UNREALIZED LOSSES ON INVESTMENTS | | | (3,511,441 | ) |

| | | | | |

NET DECREASE IN NET ASSETS RESULTING FROM OPERATIONS | | $ | (3,605,600 | ) |

See notes to financial statements.

11

SCHWARTZ VALUE FUND

STATEMENTS OF CHANGES IN NET ASSETS

| | Year EndedDecember 31, 2015 | | | Year EndedDecember 31, 2014 | |

FROM OPERATIONS | | | | | | |

Net investment loss | | $ | (94,159 | ) | | $ | (84,929 | ) |

Net realized gains (losses) from security transactions | | | (538,474 | ) | | | 2,215,476 | |

Net change in unrealized appreciation/depreciation on investments | | | (2,972,967 | ) | | | (3,554,000 | ) |

Net decrease in net assets resulting from operations | | | (3,605,600 | ) | | | (1,423,453 | ) |

| | | | | | | | | |

FROM DISTRIBUTIONS TO SHAREHOLDERS | | | | | | | | |

From net realized gains on investments | | | — | | | | (2,215,542 | ) |

| | | | | | | | | |

FROM CAPITAL SHARE TRANSACTIONS | | | | | | | | |

Proceeds from shares sold | | | 1,244,396 | | | | 312,911 | |

Reinvestment of distributions to shareholders | | | — | | | | 2,116,221 | |

Payments for shares redeemed | | | (6,995,249 | ) | | | (2,691,911 | ) |

Net decrease in net assets from capital share transactions | | | (5,750,853 | ) | | | (262,779 | ) |

| | | | | | | | | |

TOTAL DECREASE IN NET ASSETS | | | (9,356,453 | ) | | | (3,901,774 | ) |

| | | | | | | | | |

NET ASSETS | | | | | | | | |

Beginning of year | | | 28,128,561 | | | | 32,030,335 | |

End of year | | $ | 18,772,108 | | | $ | 28,128,561 | |

| | | | | | | | | |

ACCUMULATED NET INVESTMENT LOSS | | $ | — | | | $ | — | |

| | | | | | | | | |

SUMMARY OF CAPITAL SHARE ACTIVITY | | | | | | | | |

Shares sold | | | 51,114 | | | | 11,229 | |

Shares issued in reinvestment of distributions to shareholders | | | — | | | | 84,077 | |

Shares redeemed | | | (287,195 | ) | | | (95,192 | ) |

Net increase (decrease) in shares outstanding | | | (236,081 | ) | | | 114 | |

Shares outstanding, beginning of year | | | 1,122,298 | | | | 1,122,184 | |

Shares outstanding, end of year | | | 886,217 | | | | 1,122,298 | |

See notes to financial statements.

12

SCHWARTZ VALUE FUND

FINANCIAL HIGHLIGHTS

Per Share Data for a Share Outstanding Throughout Each Year

| | Year

Ended

Dec. 31,

2015 | | | Year

Ended

Dec. 31,

2014 | | | Year

Ended

Dec. 31,

2013 | | | Year

Ended

Dec. 31,

2012 | | | Year

Ended

Dec. 31,

2011 | |

Net asset value at beginning of year | | $ | 25.06 | | | $ | 28.54 | | | $ | 23.31 | | | $ | 22.33 | | | $ | 21.21 | |

| | | | | | | | | | | | | | | | | | | | | |

Income (loss) from investment operations: | | | | | | | | | | | | | | | | | | | | |

Net investment income (loss) | | | (0.11 | ) | | | (0.08 | ) | | | (0.04 | ) | | | 0.23 | | | | 0.07 | |

Net realized and unrealized gains (losses) on investments | | | (3.77 | ) | | | (1.26 | ) | | | 5.80 | | | | 0.98 | | | | 1.12 | |

Total from investment operations | | | (3.88 | ) | | | (1.34 | ) | | | 5.76 | | | | 1.21 | | | | 1.19 | |

| | | | | | | | | | | | | | | | | | | | | |

Less distributions: | | | | | | | | | | | | | | | | | | | | |

From net investment income | | | — | | | | — | | | | — | | | | (0.23 | ) | | | (0.07 | ) |

From net realized gains on investments | | | — | | | | (2.14 | ) | | | (0.53 | ) | | | — | | | | — | |

Total distributions | | | — | | | | (2.14 | ) | | | (0.53 | ) | | | (0.23 | ) | | | (0.07 | ) |

| | | | | | | | | | | | | | | | | | | | | |

Net asset value at end of year | | $ | 21.18 | | | $ | 25.06 | | | $ | 28.54 | | | $ | 23.31 | | | $ | 22.33 | |

| | | | | | | | | | | | | | | | | | | | | |

Total return (a) | | | (15.5 | %) | | | (4.7 | %) | | | 24.7 | % | | | 5.4 | % | | | 5.6 | % |

| | | | | | | | | | | | | | | | | | | | | |

Ratios/Supplementary Data: | | | | | | | | | | | | | | | | | | | | |

Net assets at end of year (000’s) | | $ | 18,772 | | | $ | 28,129 | | | $ | 32,030 | | | $ | 30,573 | | | $ | 36,654 | |

| | | | | | | | | | | | | | | | | | | | | |

Ratio of total expenses to average net assets | | | 1.59 | % | | | 1.46 | % | | | 1.45 | % | | | 1.41 | % | | | 1.38 | % |

| | | | | | | | | | | | | | | | | | | | | |

Ratio of net expenses to average net assets | | | 1.35 | %(b) | | | 1.46 | % | | | 1.45 | % | | | 1.41 | % | | | 1.38 | % |

| | | | | | | | | | | | | | | | | | | | | |

Ratio of net investment income (loss) to average net assets | | | (0.40 | %)(b) | | | (0.28 | %) | | | (0.13 | %) | | | 0.90 | % | | | 0.32 | % |

| | | | | | | | | | | | | | | | | | | | | |

Portfolio turnover rate | | | 104 | % | | | 72 | % | | | 57 | % | | | 62 | % | | | 75 | % |

(a) | Total return is a measure of the change in value of an investment in the Fund over the years covered, which assumes any dividends or capital gains distributions are reinvested in shares of the Fund. Returns shown do not reflect the deduction of taxes a shareholder would pay on Fund distributions or the redemption of Fund shares. |

(b) | Ratio was determined after advisory fee reductions (Note 2). |

See notes to financial statements. |

13

SCHWARTZ VALUE FUND

NOTES TO FINANCIAL STATEMENTS

December 31, 2015

1. Significant Accounting Policies

Schwartz Value Fund (the “Fund”) is a diversified series of Schwartz Investment Trust (the “Trust”), an open-end management investment company established as an Ohio business trust under a Declaration of Trust dated August 31, 1992. Other series of the Trust are not incorporated in this report. The Fund is registered under the Investment Company Act of 1940 and commenced operations on July 20, 1993.

The investment objective of the Fund is to seek long-term capital appreciation. See the Prospectus for information regarding the principal investment strategies of the Fund.

Shares of the Fund are sold at net asset value. To calculate the net asset value, the Fund’s assets are valued and totaled, liabilities are subtracted, and the balance is divided by the number of shares outstanding. The offering price and redemption price per share are equal to the net asset value per share.

The following is a summary of significant accounting policies followed by the Fund. The policies are in conformity with accounting principles generally accepted in the United States of America (“GAAP”). As an investment company, as defined in Financial Accounting Standards Board (“FASB”) Accounting Standards Update 2013-08, the Fund follows accounting and reporting guidance under FASB Accounting Standards Codification Topic 946, “Financial Services – Investment Companies.”

(a) Valuation of investments — Securities which are traded on stock exchanges, other than NASDAQ, are valued at the closing sales price as of the close of the regular session of trading on the New York Stock Exchange on the day the securities are being valued, or, if not traded on a particular day, at the closing bid price. Securities which are quoted by NASDAQ are valued at the NASDAQ Official Closing Price or, if an official close price is not available, at the most recently quoted bid price. Securities traded in the over-the-counter market are valued at the last reported sales price or, if there is no reported sale on the valuation date, at the most recently quoted bid price. Securities which are traded both in the over-the-counter market and on a stock exchange are valued according to the broadest and most representative market. Investments representing shares of other open-end investment companies are valued at their net asset value as reported by such companies. Securities (and other assets) for which market quotations are not readily available are valued at their fair value as determined in good faith in accordance with consistently applied procedures established by and under the general supervision of the Board of Trustees, and will be classified as Level 2 or 3 within the fair value hierarchy (see below), depending on the inputs used. Fair value pricing may be used, for example, in situations where (i) a portfolio security is so thinly traded that there have been no transactions for that stock over an extended period of time; (ii) the exchange on which the portfolio security is principally traded closes early; or (iii) trading of the portfolio security is halted during the day and does not resume prior to the Fund’s net asset value calculation. A portfolio security’s “fair value” price may differ from the price next available for that portfolio security using the Fund’s normal pricing procedures.

14

SCHWARTZ VALUE FUND

NOTES TO FINANCIAL STATEMENTS

(Continued)

GAAP establishes a single authoritative definition of fair value, sets out a framework for measuring fair value and requires additional disclosures about fair value measurements.

Various inputs are used in determining the value of the Fund’s investments. These inputs are summarized in the three broad levels listed below:

● Level 1 – quoted prices in active markets for identical securities

● Level 2 – other significant observable inputs

● Level 3 – significant unobservable inputs

The inputs or methodology used for valuing securities are not necessarily an indication of the risks associated with investing in those securities. The inputs used to measure fair value may fall into different levels of the fair value hierarchy. In such cases, for disclosure purposes, the level in the fair value hierarchy within which the fair value measurement falls in its entirety is determined based on the lowest level input that is significant to the fair value measurement.

The following is a summary of the inputs used to value the Fund’s investments, by security type, as of December 31, 2015:

| | Level 1 | | | Level 2 | | | Level 3 | | | Total | |

Common Stocks | | $ | 16,428,246 | | | $ | — | | | $ | — | | | $ | 16,428,246 | |

Warrants | | | 717,750 | | | | — | | | | — | | | | 717,750 | |

Open-End Funds | | | 13,974 | | | | — | | | | — | | | | 13,974 | |

Money Market Funds | | | 1,530,395 | | | | — | | | | — | | | | 1,530,395 | |

Total | | $ | 18,690,365 | | | $ | — | | | $ | — | | | $ | 18,690,365 | |

Refer to the Fund’s Schedule of Investments for a listing of the securities by industry type. As of December 31, 2015, the Fund did not have any transfers into and out of any Level. There were no Level 2 or 3 securities or derivative instruments held by the Fund as of December 31, 2015. It is the Fund’s policy to recognize transfers into and out of any Level at the end of the reporting period.

(b) Income taxes — The Fund has qualified and intends to continue to qualify as a regulated investment company under the Internal Revenue Code of 1986 (the “Code”). Qualification generally will relieve the Fund of liability for federal income taxes to the extent 100% of its net investment income and net realized capital gains are distributed in accordance with the Code. Accordingly, no provision for income tax has been made.

In order to avoid imposition of the excise tax applicable to regulated investment companies, it is also the Fund’s intention to declare as dividends in each calendar year at least 98% of its net investment income and 98.2% of its net realized capital gains plus undistributed amounts from prior years.

15

SCHWARTZ VALUE FUND

NOTES TO FINANCIAL STATEMENTS

(Continued)

The following information is computed on a tax basis for each item as of December 31, 2015:

Federal income tax cost | | $ | 17,629,441 | |

Gross unrealized appreciation | | $ | 2,402,984 | |

Gross unrealized depreciation | | | (1,342,060 | ) |

Net unrealized appreciation | | | 1,060,924 | |

Capital loss carryforwards | | | (505,906 | ) |

Accumulated earnings | | $ | 555,018 | |

The difference between the federal income tax cost of portfolio investments and the financial statement cost of portfolio investments is due to certain timing differences in the recognition capital losses under income tax regulations and GAAP. These “book/tax” differences are temporary in nature and are due to the tax deferral of losses on wash sales.

As of December 31, 2015, the Fund has a short-term capital loss carryforward of $505,906 for federal income tax purposes. This capital loss carryforward, which does not expire, may be utilized in future years to offset net realized capital gains, if any, prior to distributing such gains to shareholders.

During the year ended December 31, 2015, the Fund reclassified $94,159 of net investment loss against paid-in-capital on the Statement of Assets and Liabilities. Such reclassification, the result of permanent differences between the financial statement and income tax reporting requirements, has no effect on the Fund’s net assets or net asset value per share.

The Fund recognizes the tax benefits or expenses of uncertain tax positions only when the position is “more-likely-than-not” to be sustained assuming examination by tax authorities. Management has reviewed the tax positions taken on federal income tax returns for all open tax years (tax years ended December 31, 2012 through December 31, 2015) and has concluded that no provision for unrecognized tax benefits or expenses is required in these financial statements.

(c) Security transactions and investment income — Security transactions are accounted for on the trade date. Dividend income is recorded on the ex-dividend date. Interest income is recognized on the accrual basis. Realized capital gains and losses on security transactions are determined on the identified cost basis. Withholding taxes on foreign dividends have been provided for in accordance with the Fund’s understanding of the appropriate country’s rules and tax rates.

(d) Dividends and distributions — Dividends from net investment income and distributions of net realized capital gains, if any, are declared and paid annually in December. Dividends and distributions to shareholders are recorded on the ex-dividend date. The tax character of distributions paid to shareholders during the period ended December 31, 2014 was long-term capital gains. There were no distributions paid to shareholders during the year ended December 31, 2015.

16

SCHWARTZ VALUE FUND

NOTES TO FINANCIAL STATEMENTS

(Continued)

(e) Estimates — The preparation of financial statements in conformity with GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities as of the date of the financial statements and the reported amounts of revenues and expenses during the reporting period. Actual results could differ from those estimates.

(f) Common expenses — Common expenses of the Trust are allocated among the Fund and the other series of the Trust based on relative net assets of each series or the nature of the services performed and the relative applicability to each series.

2. Investment Advisory Agreement and Transactions with Related Parties

The Chairman and President of the Trust is also the Chairman and Chief Executive Officer of Schwartz Investment Counsel, Inc. (the “Adviser”). Certain other officers of the Trust are officers of the Adviser, or of Ultimus Fund Solutions, LLC (“Ultimus”), the administrative, accounting and transfer agent for the Fund, or of Ultimus Fund Distributors, LLC (the “Distributor”), the Fund’s principal underwriter.

Pursuant to an Investment Advisory Agreement between the Trust and the Adviser, the Adviser is responsible for the management of the Fund and provides investment advice along with the necessary personnel, facilities, equipment and certain other services necessary to the operations of the Fund. The Adviser receives from the Fund a quarterly fee at the annual rate of 0.95% per annum of the Fund’s average daily net assets.

Effective May 1, 2015, the Adviser has contractually agreed to reduce its advisory fees or reimburse a portion of the Fund’s expenses until at least May 1, 2017 so that the ordinary operating expenses of the Fund do not exceed 1.25% per annum of average daily net assets. Accordingly, during the year ended December 31, 2015, the Adviser reduced its investment advisory fees by $56,616. Prior to May 1, 2015, the Fund did not have an expense limitation agreement.

Any fee reductions or expense reimbursements by the Adviser are subject to repayment by the Fund for a period of three years from the end of the fiscal year during which such reductions or reimbursements occurred, provided the Fund is able to effect such repayment and remain in compliance with any undertaking by the Adviser to limit expenses of the Fund. As of December 31, 2015, the Advisor may seek recoupment of investment advisory fee reductions totaling $56,616 no later than December 31, 2018.

The Chief Compliance Officer of the Trust (the “CCO”) is an employee of the Adviser. The Trust pays the Adviser a fee for providing CCO services, of which the Fund pays its proportionate share along with the other series of the Trust. In addition, the Trust reimburses the Adviser for out-of-pocket expenses incurred, if any, for providing these services.

17

SCHWARTZ VALUE FUND

NOTES TO FINANCIAL STATEMENTS

(Continued)

Pursuant to a Mutual Fund Services Agreement between the Trust and Ultimus, Ultimus supplies regulatory and compliance services, calculates the daily net asset value per share, maintains the financial books and records of the Fund, maintains the records of each shareholder’s account, and processes purchases and redemptions of the Fund’s shares. For these services Ultimus receives fees computed as a percentage of the average daily net assets of the Fund, subject to a minimum monthly fee.

Pursuant to a Distribution Agreement between the Trust and the Distributor, the Distributor serves as the Fund’s exclusive agent for the distribution of its shares. The Distributor is an affiliate of Ultimus.

Trustees and officers affiliated with the Adviser or Ultimus are not compensated by the Trust for their services. Each Trustee who is not an affiliated person of the Adviser or Ultimus (“Independent Trustee”) receives from the Trust an annual retainer of $30,000 (except that such fee is $38,000 for the Lead Independent Trustee), payable quarterly; a fee of $5,500 for attendance at each meeting of the Board of Trustees; plus reimbursement of travel and other expenses incurred in attending meetings. The Fund pays its proportionate share of Independent Trustees’ fees and expenses along with the other series of the Trust. Effective January 1, 2016, each Independent Trustee will receive from the Trust an annual retainer of $35,000 (except that such fee is $45,000 for the Lead Independent Trustee and $39,000 for the Chairman of the Audit Committee), payable quarterly; a fee of $5,500 for attendance at each meeting of the Board of Trustees; plus reimbursement of travel and other expenses incurred in attending meetings.

3. Investment Transactions

During the year ended December 31, 2015, cost of purchases and proceeds from sales and maturities of investment securities, excluding short-term investments and U.S. government securities, amounted to $21,871,503 and $25,738,353, respectively.

4. Contingencies and Commitments

The Fund indemnifies the Trust’s officers and Trustees for certain liabilities that might arise from their performance of their duties to the Fund. Additionally, in the normal course of business, the Fund enters into contracts that contain a variety of representations and warranties and which provide general indemnifications. The Fund’s maximum exposure under these arrangements is unknown, as this would involve future claims that may be made against the Fund that have not yet occurred. However, based on experience, the Fund expects the risk of loss to be remote.

5. Sector Risk

If a Fund has significant investments in the securities of issuers in industries within a particular sector, any development affecting that sector will have a greater impact on the value of the net assets of the Fund than would be the case if the Fund did not have significant investments in that sector. In addition, this may increase the risk of loss of an investment in the Fund and increase the volatility of the Fund’s net asset value per share. From time to time, circumstances may affect a particular sector and the companies within

18

SCHWARTZ VALUE FUND

NOTES TO FINANCIAL STATEMENTS

(Continued)

such sector. For instance, economic or market factors, regulation or deregulation, and technological or other developments may negatively impact all companies in a particular sector and therefore the value of the Fund’s portfolio will be adversely affected. As of December 31, 2015, the Fund had 25.7% of the value of its net assets invested in stocks within the financials sector.

6. Subsequent Events

The Fund is required to recognize in the financial statements the effects of all subsequent events that provide additional evidence about conditions that existed as of the date of the Statement of Assets and Liabilities. For non-recognized subsequent events that must be disclosed to keep the financial statements from being misleading, the Fund is required to disclose the nature of the event as well as an estimate of its financial effect, or a statement that such an estimate cannot be made. Management has evaluated subsequent events through the issuance of these financial statements and has noted no events.

19

SCHWARTZ VALUE FUND

REPORT OF INDEPENDENT REGISTERED

PUBLIC ACCOUNTING FIRM

Schwartz Value Fund

We have audited the accompanying statement of assets and liabilities, including the schedule of investments, of Schwartz Value Fund (the “Fund”), a series of Schwartz Investment Trust, as of December 31, 2015, and the related statement of operations for the year then ended, the statements of changes in net assets for each of the two years in the period then ended, and the financial highlights for each of the five years in the period then ended. These financial statements and financial highlights are the responsibility of the Fund’s management. Our responsibility is to express an opinion on these financial statements and financial highlights based on our audits.

We conducted our audits in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audits to obtain reasonable assurance about whether the financial statements and financial highlights are free of material misstatement. The Fund is not required to have, nor were we engaged to perform, an audit of internal control over financial reporting. Our audits included consideration of internal control over financial reporting as a basis for designing audit procedures that are appropriate in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of the Fund’s internal control over financial reporting. Accordingly, we express no such opinion. An audit also includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements, assessing the accounting principles used and significant estimates made by management, as well as evaluating the overall financial statement presentation. Our procedures included confirmation of securities owned as of December 31, 2015, by correspondence with the custodian and brokers. We believe that our audits provide a reasonable basis for our opinion.

In our opinion, the financial statements and financial highlights referred to above present fairly, in all material respects, the financial position of Schwartz Value Fund as of December 31, 2015, the results of its operations for the year then ended, the changes in its net assets for each of the two years in the period then ended, and the financial highlights for each of the five years in the period then ended, in conformity with accounting principles generally accepted in the United States of America.

Chicago, Illinois

February 16, 2016

20

SCHWARTZ VALUE FUND

BOARD OF TRUSTEES AND EXECUTIVE OFFICERS

(Unaudited)

Overall responsibility for management of the Trust rests with the Board of Trustees. The Trustees serve during the lifetime of the Trust and until its termination, or until death, resignation, retirement or removal. The Trustees, in turn, elect the officers of the Trust to actively supervise its day-to-day operations. The officers have been elected for an annual term. The following are the Trustees and executive officers of the Trust:

Trustee/Officer | Address | Year of

Birth | Position Held

with the Trust | Length of

Time Served |

Interested Trustees: |

* | George P. Schwartz, CFA | 801 W. Ann Arbor Trail

Plymouth, MI | 1944 | Chairman of the Board/President/Trustee | Since 1992 |

Independent Trustees: |

| | Louis C. Bosco, Jr. | 801 W. Ann Arbor Trail

Plymouth, MI | 1936 | Trustee | Since 2008 |

| | Donald J. Dawson, Jr. | 801 W. Ann Arbor Trail

Plymouth, MI | 1947 | Trustee | Since 1993 |

| | Joseph M. Grace | 801 W. Ann Arbor Trail

Plymouth, MI | 1936 | Trustee | Since 2007 |

| | John J. McHale, Jr. | 801 W. Ann Arbor Trail

Plymouth, MI | 1949 | Trustee | Since 2014 |

Executive Officers: |

* | Richard L. Platte, Jr., CFA | 801 W. Ann Arbor Trail

Plymouth, MI | 1951 | Vice President and Secretary | Since 1993 |

* | Robert C. Schwartz, CFP | 801 W. Ann Arbor Trail

Plymouth, MI | 1976 | Vice President | Since 2013 |

* | Timothy S. Schwartz, CFA | 5060 Annunciation Circle

Ave Maria, FL | 1971 | Treasurer | Since 2000 |

* | Cathy M. Stoner, CPA, IACCP | 801 W. Ann Arbor Trail

Plymouth, MI | 1970 | Chief Compliance Officer | Since 2010 |

* | George P. Schwartz, Richard L. Platte, Jr., Robert C. Schwartz, Timothy S. Schwartz and Cathy M. Stoner, as affiliated persons of Schwartz Investment Counsel, Inc., the Fund’s investment adviser, are “interested persons” of the Trust within the meaning of Section 2(a)(19) of the Investment Company Act of 1940. George P. Schwartz is the father of Robert C. Schwartz and Timothy S. Schwartz. |

21

SCHWARTZ VALUE FUND

BOARD OF TRUSTEES AND EXECUTIVE OFFICERS

(Unaudited) (Continued)

Each Trustee oversees six portfolios of the Trust: the Ave Maria Catholic Values Fund, the Ave Maria Growth Fund, the Ave Maria Rising Dividend Fund, the Ave Maria World Equity Fund, the Ave Maria Bond Fund and the Schwartz Value Fund. The principal occupations of the Trustees and executive officers of the Trust during the past five years and public directorships held by the Trustees are set forth below:

George P. Schwartz, CFA is Chairman and Chief Executive Officer of Schwartz Investment Counsel, Inc. and is the co-portfolio manager of the Fund.

Louis C. Bosco, Jr. retired in April 2012. Prior to his retirement, he was a partner in Bosco Development Company (a real estate firm).

Donald J. Dawson, Jr. retired in March 2015. Prior to retirement, he was Chairman of Payroll 1, Inc. (a payroll processing company) from Jan. 1986 – Feb. 2015.

Joseph M. Grace is retired Senior Vice President of National Bank of Detroit (renamed JPMorgan Chase & Company).

John J. McHale, Jr. is Special Assistant to Commissioner of Major League Baseball since 2015; Executive Vice President of Major League Baseball, 2000 – 2015.

Richard L. Platte, Jr., CFA is President and Chief Investment Officer of Schwartz Investment Counsel, Inc.

Robert C. Schwartz, CFP is Vice President and Secretary of Schwartz Investment Counsel, Inc.

Timothy S. Schwartz, CFA is Executive Vice President and Chief Financial Officer of Schwartz Investment Counsel, Inc. and is the co-portfolio manager of the Fund.

Cathy M. Stoner, CPA, IACCP is Vice President and Chief Compliance Officer of Schwartz Investment Counsel, Inc.

Additional information about members of the Board of Trustees and executive officers is available in the Statement of Additional Information (“SAI”). To obtain a free copy of the SAI, please call (888) 726-0753.

22

SCHWARTZ VALUE FUND

ABOUT YOUR FUND’S EXPENSES

(Unaudited)

We believe it is important for you to understand the impact of costs on your investment. As a shareholder of the Fund, you incur ongoing costs, including management fees and other Fund expenses. The following examples are intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds.

A mutual fund’s ongoing costs are expressed as a percentage of its average net assets. This figure is known as the expense ratio. The ongoing costs reflected in the table below are based on an investment of $1,000 made at the beginning of the most recent semi-annual period (July 1, 2015) and held until the end of the period (December 31, 2015).

The table below illustrates the Fund’s ongoing costs in two ways:

Actual fund return – This section helps you to estimate the actual expenses that you paid over the period. The “Ending Account Value” shown is derived from the Fund’s actual return, and the third column shows the dollar amount of operating expenses that would have been paid by an investor who started with $1,000 in the Fund. You may use the information here, together with the amount you invested, to estimate the expenses that you paid over the period.

To do so, simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number given for the Fund under the heading “Expenses Paid During Period.”

Hypothetical 5% return – This section is intended to help you compare the Fund’s ongoing costs with those of other mutual funds. It assumes that the Fund had an annual return of 5% before expenses during the period shown, but that the expense ratio is unchanged. In this case, because the return used is not the Fund’s actual return, the result does not apply to your investment. The example is useful in making comparisons because the Securities and Exchange Commission (“SEC”) requires all mutual funds to calculate expenses based on a 5% return. You can assess the Fund’s ongoing costs by comparing this hypothetical example with the hypothetical examples that appear in shareholder reports of other funds.

Note that expenses shown in the table are meant to highlight and help you compare ongoing costs only. The Fund does not charge sales loads or redemption fees.

The calculations assume no shares were bought or sold during the period. Your actual costs may have been higher or lower, depending on the amount of your investment and the timing of any purchases or redemptions.

More information about the Fund’s expenses, including historical annual expense ratios, can be found in this report. For additional information on operating expenses and other shareholder costs, please refer to the Fund’s Prospectus.

| Beginning Account Value July 1, 2015 | Ending

Account Value December 31, 2015 | Expenses Paid During Period* |

Based on Actual Fund Return | $1,000.00 | $874.50 | $5.91 |

Based on Hypothetical 5% Return (before expenses) | $1,000.00 | $1,018.90 | $6.36 |

* | Expenses are equal to the Fund’s annualized expense ratio of 1.25% for the period, multiplied by the average account value over the period, multiplied by 184/365 (to reflect the one-half year period). |

23

SCHWARTZ VALUE FUND

OTHER INFORMATION

(Unaudited)

A description of the policies and procedures the Fund uses to determine how to vote proxies relating to portfolio securities is available without charge upon request by calling toll-free (888) 726-0753, or on the SEC’s website at http://www.sec.gov. Information regarding how the Fund voted proxies relating to portfolio securities during the most recent 12-month period ended June 30 is also available without charge upon request by calling toll-free (888) 726-0753, or on the SEC’s website at http://www.sec.gov.

The Trust files a complete listing of portfolio holdings for the Fund with the SEC as of the end of the first and third quarters of each fiscal year on Form N-Q. The filings are available free of charge, upon request, by calling (888) 726-0753. Furthermore, you may obtain a copy of the filings on the SEC’s website at http://www.sec.gov. The Trust’s Forms N-Q may also be reviewed and copied at the SEC’s Public Reference Room in Washington, DC, and information on the operation of the Public Reference Room may be obtained by calling (800) SEC-0330.

INVESTMENT PHILOSOPHY (Unaudited)

Schwartz Value Fund (the “Fund”) seeks long-term capital appreciation through value investing – purchasing shares of strong, growing companies at reasonable prices. The Fund invests in companies of all sizes from large-caps to micro-caps. Fundamental analysis is used to identify companies with outstanding business characteristics. Sometimes the best values are issues not followed closely by Wall Street analysts.

Most value investors buy fair companies at an excellent price. The Fund attempts to buy excellent companies at a fair price. The essence of value investing is finding companies with great business characteristics, which by their nature offer a margin of safety. A truly fine business requires few assets to provide a consistently expanding stream of income. The Fund purchases shares which are temporarily out-of-favor and selling below intrinsic value.

A common thread in the Fund’s investments is that the market price is often below what a corporate or entrepreneurial buyer might be willing to pay for the entire business. The auction nature and the inefficiencies of the stock market are such that the Fund can sometimes buy a minority interest in a fine company at a small fraction of the price per share necessary to acquire the entire company.

24

Shareholder Services c/o Ultimus Fund Solutions, LLC P.O. Box 46707 Cincinnati, OH 45246 (888) 726-9331 |

| Corporate Offices 801 W. Ann Arbor Trail Suite 244 Plymouth, MI 48170 (734) 455-7777 Fax (734) 455-7720 |

Dear Fellow Shareholders of:

Ave Maria Catholic Values Fund (AVEMX)

Ave Maria Growth Fund (AVEGX)

Ave Maria Rising Dividend Fund (AVEDX)

Ave Maria World Equity Fund (AVEWX)

Ave Maria Bond Fund (AVEFX)

Ave Maria Money Market Account

As of January 1, 2016, Schwartz Investment Counsel, Inc., the investment adviser to the Ave Maria Mutual Funds, implemented some portfolio management reassignments. For the Ave Maria Catholic Values Fund, Timothy S. Schwartz, CFA was named Lead Portfolio Manager, Joseph W. Skornicka, CFA was named co-Portfolio Manager and George P. Schwartz, CFA remains co-Portfolio Manager. For the Ave Maria Growth Fund, Richard L. Platte, Jr., CFA was named Lead Portfolio Manager and Brian D. Milligan, CFA was named co-Portfolio Manager. For the Ave Maria Rising Dividend Fund, Richard L. Platte, Jr., CFA was named Lead Portfolio Manager and George P. Schwartz, CFA remains co-Portfolio Manager. For the Ave Maria World Equity Fund, Joseph W. Skornicka, CFA was named Lead Portfolio Manager and Robert C. Schwartz, CFP was named co-Portfolio Manager. For the Ave Maria Bond Fund, Brandon S. Scheitler was named Lead Portfolio Manager and Richard L. Platte, Jr., CFA remains co-Portfolio Manager.

As you will see in the enclosed report, investment performance was disappointing in 2015. It should be noted that a handful of stocks in the S&P 500 Index (hereafter referred to as the “S&P 500” or the “Index”) distorted its performance upward. The top 10 largest companies in the S&P 500 were up over 16% on average, and kept the Index from falling more than 5%, which it would have done without them. Over half the stocks in the Index were down more than 20% last year.

What can be expected in 2016 for the U.S. economy, the stock market and Ave Maria Mutual Funds? In my 40+ years of managing other peoples’ money, I’ve never seen a year when politics will be more important to investment success. I agree with those who say the upcoming election for president is monumentally

important, and the future of our democracy, freedom and economic prosperity hangs in the balance. In my opinion, the country badly needs serious policy changes from those of the current administration.

It goes without saying that I believe President Obama’s foreign policy endeavors have been rudderless and mind-boggling. Domestically, it’s no secret that Washington’s regulatory machinery is running wildly out of control and stifling productivity. In my view, the White House has generated unilateral regulations, which have severely limited economic freedom and done immeasurable damage to U.S. economic growth. But he has been successful in one respect. He has accomplished his campaign pledge of 2008 — “to fundamentally transform the country” — sadly for the worse.

Pivotal is the operative word for 2016 politics. Hopefully the Republican Party won’t break apart or see a third party emerge. Such a development would not only be historic, but likely chaotic. If by God’s grace we end up with a pro-growth (and pro-life) president, the outlook could get materially better. The heavy boot of government taxation and regulation could be removed from the neck of capitalism and real prosperity could emerge over time - not immediately, but steadily. What could come quickly though, is increased confidence - confidence in the system, confidence among business decision-makers, consumers and investors. Corporations would again invest in new plants and equipment and create full-time, permanent jobs. Consumer spending would escalate and there would likely be a renewed belief that wages could rise with sustainability. Investors would see corporate profits lifting and P/E’s expanding. Such is the potential.

Today, in a country devoid of effective leadership and with an election looming investors are jittery. Markets are likely to remain reactive. Keep your seatbelt fastened, it may be a bumpy ride with an upward bias, as the day approaches when President Obama leaves office. 2016 should indeed be an interesting and pivotal year. Stay tuned!

Sincerely,

George P. Schwartz, CFA

Chairman & CEO

December 31, 2015

Past performance is not predictive of future performance. Investment results and principal value will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. Current performance may be higher or lower than the performance data quoted. Performance data, current to the most recent month end, is available at the Ave Maria Mutual Funds website at www.avemariafunds.com or by calling 1-888-726-9331.

The Letter to Shareholders and the Portfolio Manager Commentaries that follow seek to describe some of the Adviser’s current opinions and views of the financial markets. Although the Adviser believes it has a reasonable basis for any opinions or views expressed, actual results may differ, sometimes significantly so, from those expected or expressed. Keep in mind that the information and opinions cover the period through the date of this report.

AVE MARIA MUTUAL FUNDS

TABLE OF CONTENTS

Ave Maria Catholic Values Fund: | |

Portfolio Manager Commentary | 2 |

Performance | 4 |

Annual Total Rates of Return Comparison with Major Indices | 5 |

Ten Largest Equity Holdings | 6 |

Asset Allocation | 6 |

Schedule of Investments | 7 |

| | |

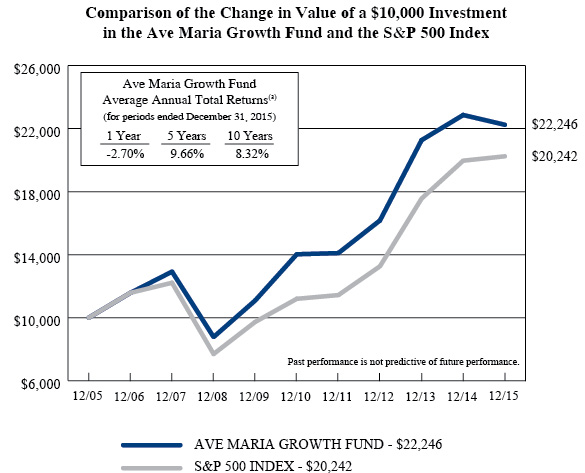

Ave Maria Growth Fund: | |

Portfolio Manager Commentary | 11 |

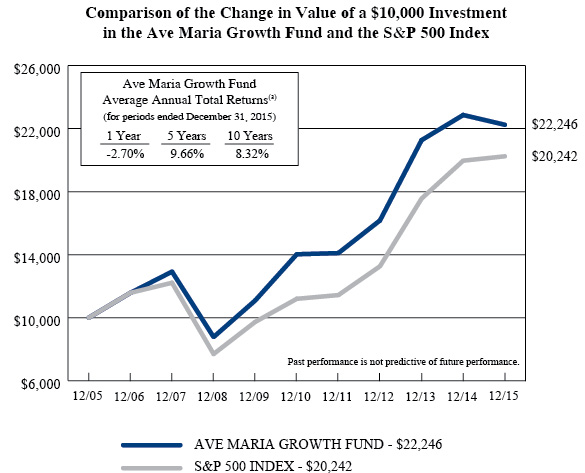

Performance | 13 |

Annual Total Rates of Return Comparison with Major Indices | 14 |

Ten Largest Equity Holdings | 15 |

Asset Allocation | 15 |

Schedule of Investments | 16 |

| | |

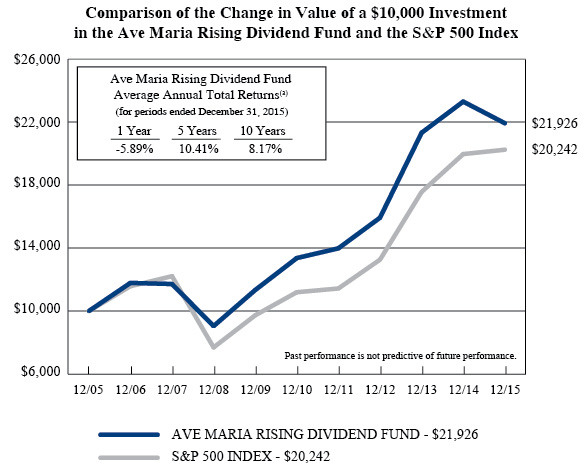

Ave Maria Rising Dividend Fund: | |

Portfolio Manager Commentary | 19 |

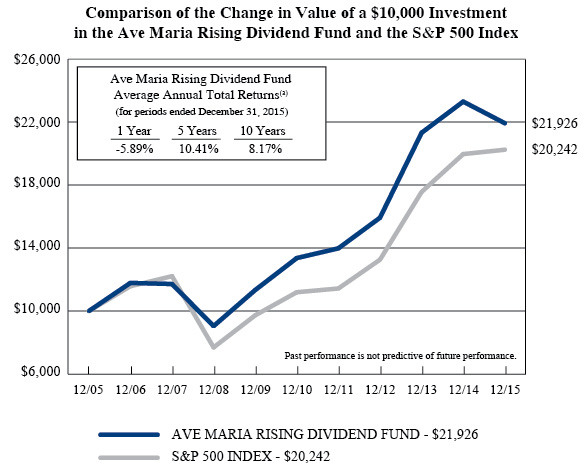

Performance | 21 |

Annual Total Rates of Return Comparison with Major Indices | 22 |

Ten Largest Equity Holdings | 23 |

Asset Allocation | 23 |

Schedule of Investments | 24 |

| | |

Ave Maria World Equity Fund: | |

Portfolio Manager Commentary | 27 |

Performance | 30 |

Annual Total Rates of Return Comparison with Major Indices | 31 |

Ten Largest Equity Holdings | 32 |

Asset Allocation | 32 |

Schedule of Investments | 33 |

Summary of Common Stocks by Country | 36 |

| | |

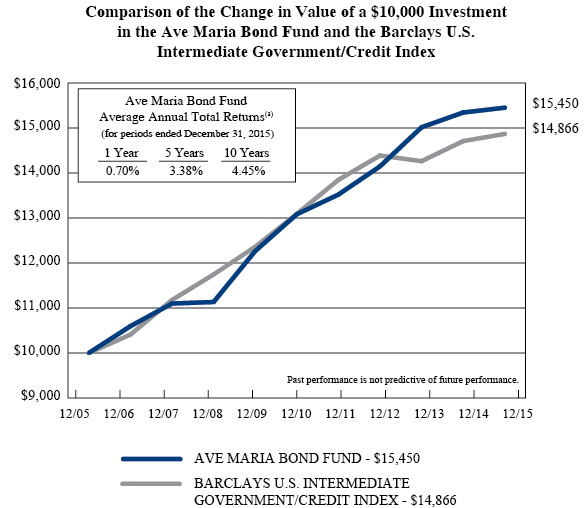

Ave Maria Bond Fund: | |

Portfolio Manager Commentary | 37 |

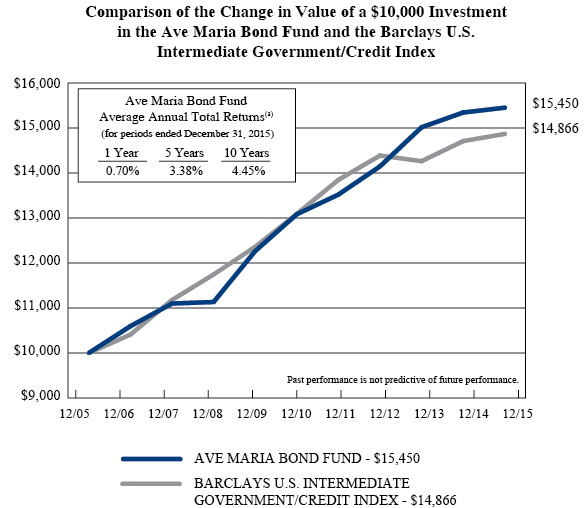

Performance | 39 |

Annual Total Rates of Return Comparison with Major Indices | 40 |

Ten Largest Holdings | 41 |

Asset Allocation | 41 |

Schedule of Investments | 42 |

AVE MARIA MUTUAL FUNDS

TABLE OF CONTENTS

(Continued)

Statements of Assets and Liabilities | 47 |

| | |

Statements of Operations | 49 |

| | |

Statements of Changes in Net Assets: | |

Ave Maria Catholic Values Fund | 51 |

Ave Maria Growth Fund | 52 |

Ave Maria Rising Dividend Fund | 53 |

Ave Maria World Equity Fund | 54 |

Ave Maria Bond Fund | 55 |

| | |

Financial Highlights: | |

Ave Maria Catholic Values Fund | 56 |

Ave Maria Growth Fund | 57 |

Ave Maria Rising Dividend Fund | 58 |

Ave Maria World Equity Fund | 59 |

Ave Maria Bond Fund | 60 |

| | |

Notes to Financial Statements | 61 |

| | |

Report of Independent Registered Public Accounting Firm | 73 |

| | |

Board of Trustees and Executive Officers | 74 |

| | |

Catholic Advisory Board | 76 |

| | |

About Your Funds’ Expenses | 77 |

| | |

Federal Tax Information | 79 |

| | |

Other Information | 80 |

This report is for the information of the shareholders of the Ave Maria Mutual Funds. To obtain a copy of the prospectus, please visit our website at www.avemariafunds.com or call 1-888-726-9331 and a copy will be sent to you free of charge. Please read the prospectus carefully before you invest. The Ave Maria Mutual Funds are distributed by Ultimus Fund Distributors, LLC.

Past performance is not predictive of future performance. Investment results and principal value will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. Current performance may be higher or lower than the performance data quoted. Performance data, current to the most recent month end, is available at the Ave Maria Mutual Funds website at www.avemariafunds.com or by calling 1-888-726-9331.

AVE MARIA CATHOLIC VALUES FUND

PORTFOLIO MANAGER COMMENTARY

(Unaudited)

Dear Fellow Shareowner:

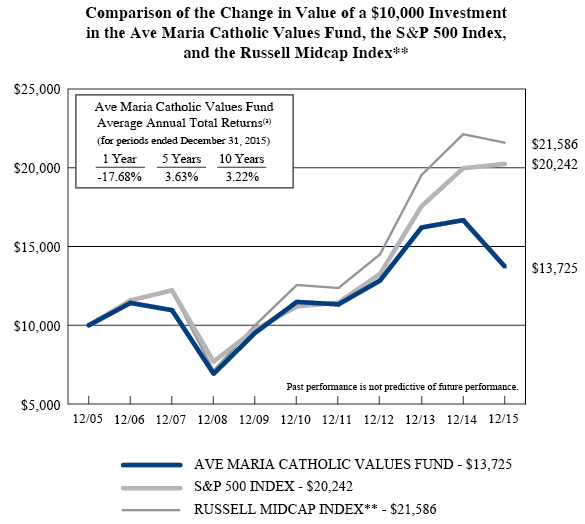

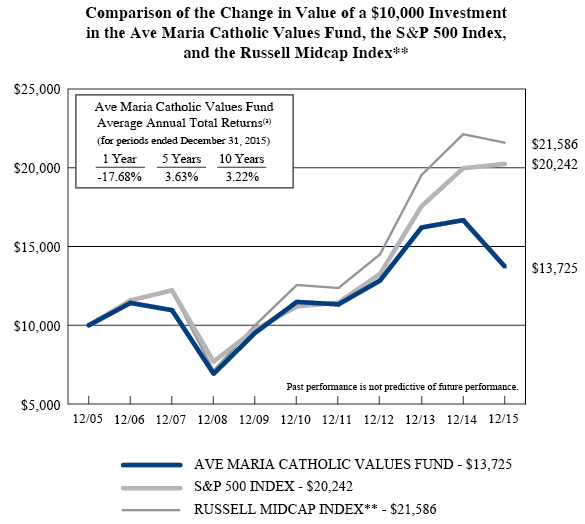

The Ave Maria Catholic Values Fund (the “Fund”) had a total return for 2015 of -17.68%, compared to 1.38% for the S&P 500 Index (the “S&P 500”) and -2.44% for the Russell Midcap Index. Since inception on May 1, 2001, the Fund’s returns verses its benchmarks are:

| | Since 5-01-01 Inception

through 12-31-15

Total Returns |

| | Cumulative | Annualized |

Ave Maria Catholic Values Fund (AVEMX) | 124.46% | 5.67% |

S&P 500 Index | 116.02% | 5.39% |

Russell Midcap Index | 231.18% | 8.51% |

Some investors have asked why the Fund performed so poorly last year in relation to the S&P 500. The best answer is that our disciplined, value-oriented approach of buying high-quality companies at prices below intrinsic value remained out-of-favor last year. The S&P 500 Growth Index returned 5.5% compared to the Value Index’s return of -3.1%. And while the S&P 500 eked out a positive return for the year, a closer look reveals that many stocks had astonishingly poor returns last year with more than 200 stocks in the S&P 500 down at least 20% from their 52-week high. A small number of large-cap, high-flying, high-priced stocks accounted for more than all of the S&P 500’s positive return. The high-flyers were the so-called FANG stocks (Facebook, Amazon, Netflix, Alphabet (formerly Google)) and a handful of others. Excluding this group of stocks, the S&P 500’s return was negative last year. Investors who did not own the FANG stocks most likely underperformed the S&P 500 in 2015.

In 2015, the Fund clearly had too many oil stocks and industrials, which got crushed when the price of oil collapsed. As the year progressed, we increased positions in many of these high quality companies, as their shares fell further below our estimates of intrinsic value. Today, we believe the Fund’s portfolio consists of beaten-down stocks of undervalued, well-managed companies, and no popular momentum stocks with inflated valuations.

Investments which contributed positively to performance in 2015 were: PNC Financial Services Group, Inc. (banking), Phillips 66 (energy), Valeant Pharmaceutical International, Inc. (health care), ANSYS, Inc. (software), Accenture plc (technology services) and Telecity Group plc - ADR (internet colocation facilities), which received a takeover bid from Equinix, Inc. Negatively affecting performance last year were GNC Holdings, Inc. (nutritional supplements), Chico’s FAS, Inc. (apparel retail), Polaris Industries, Inc. (recreational vehicles), Range Resources Corporation,

2

AVE MARIA CATHOLIC VALUES FUND

PORTFOLIO MANAGER COMMENTARY

(Unaudited) (Continued)

and Devon Energy Corporation. We underestimated the duration and depth of oil and natural gas price drops. But, low energy prices (and time) are the cure for low energy prices. Exploration and production at today’s depressed oil and gas prices are uneconomic and unsustainable. Companies are cutting capital spending which will result in production declines and higher prices. We believe the companies held by the Fund will weather the storm and enjoy profitable growth over time.

In the second half of 2015, the Fund eliminated from the portfolio: Anadarko Petroleum Corporation and Phillips 66 (energy); Abbott Laboratories and Valeant Pharmaceutical International, Inc. (health care); Caterpillar, Inc., Constellium N.V., and Eaton Corporation (industrials); Accenture plc, Knowles Corporation and Teradata Corporation (technology); Apollo Education Group, Inc. and the iShares Gold Trust. Some of these stocks were sold because of deteriorating fundamentals, namely: Anadarko, Caterpillar, Constellium, Eaton, Knowles, Teradata and Apollo, while others reached or exceeded our estimates of fair value, such as Abbott, Valeant and Accenture. New additions to the portfolio in the second half of 2015 were: HEICO Corporation (aerospace parts), Polaris Industries, Inc., Graham Holdings Company, (media), FMC Technologies, Inc. (energy equipment), Discover Financial Services (credit cards), Discovery Communications, Inc. (cable T.V. programing), Garmin Ltd. (GPS navigation devices), Graco, Inc (coating sprayers), and two industrial distributors: MSC Industrial Direct Company, Inc., and W.W. Grainger, Inc. All of these companies pass the Ave Maria Funds’ moral screens.

Even though the Fund had a disappointing 2015, we are optimistic about its future. Last year, most of our companies made good fundamental progress in their operations and improved their financial and competitive positions. As a result, the Fund holds a number of stocks selling at a large discount to our appraisal of intrinsic value.

Thank you for being a shareholder.

Sincerely,

|

|

Timothy S. Schwartz, CFA | George P. Schwartz, CFA |

Lead Portfolio Manager | Co-Portfolio Manager |

| |

Joseph W. Skornicka, CFA | |

Co-Portfolio Manager | |

3

AVE MARIA CATHOLIC VALUES FUND

PERFORMANCE

(Unaudited) |

(a) | The returns shown do not reflect the deduction of taxes a shareholder would pay on Fund distributions or the redemption of Fund shares. |

Expense ratio as of 12-31-14 (as disclosed in May 1, 2015 prospectus) | 1.19%* |

Expense ratio for the year ended 12-31-15 | 1.18% |

* | Includes Acquired Fund Fees and Expenses. |

** | Effective January 1, 2016, the Russell Midcap Index will be the Ave Maria Catholic Values Fund’s primary benchmark instead of the S&P 500 Index. The primary index for the Fund was changed to the Russell Midcap Index for two reasons. First, with the merger of the Ave Maria Opportunity Fund, the Fund has more small and mid-cap holdings than prior to the merger (Note 1). As a result, the Fund’s average weighted market cap has decreased. Secondly, going forward, the Fund will be primarily invested in mid-cap stocks with an average market capitalization comparable to the Russell Midcap Index. |

Past performance is not predictive of future performance. Investment results and principal value will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. Current performance may be higher or lower than the performance data quoted. Performance data, current to the most recent month end, is available at the Ave Maria Mutual Funds website at www.avemariafunds.com or by calling 1-888-726-9331.

4

AVE MARIA CATHOLIC VALUES FUND

ANNUAL TOTAL RATES OF RETURN

COMPARISON WITH MAJOR INDICES (Unaudited) |

| AVE MARIA

CATHOLIC

VALUES FUND | S&P 500

INDEX | RUSSELL

MIDCAP

INDEX | S&P 400

MIDCAP

INDEX | S&P 600

SMALL CAP

INDEX |

2001(a) | 5.3% | -8.5% | -3.5% | -0.5% | 5.0% |

2002 | -9.8% | -22.1% | -16.2% | -14.5% | -14.6% |

2003 | 35.6% | 28.7% | 40.1% | 35.6% | 38.8% |

2004 | 20.1% | 10.9% | 20.2% | 16.5% | 22.7% |

2005 | 5.8% | 4.9% | 12.7% | 12.6% | 7.7% |

2006 | 14.2% | 15.8% | 15.3% | 10.3% | 15.1% |

2007 | -4.0% | 5.5% | 5.6% | 8.0% | -0.3% |

2008 | -36.8% | -37.0% | -41.5% | -36.2% | -31.1% |

2009 | 37.6% | 26.5% | 40.5% | 37.4% | 25.6% |

2010 | 20.5% | 15.1% | 25.5% | 26.7% | 26.3% |

2011 | -1.3% | 2.1% | -1.6% | -1.7% | 1.0% |

2012 | 13.3% | 16.0% | 17.3% | 17.9% | 16.3% |

2013 | 26.2% | 32.4% | 34.8% | 33.5% | 41.3% |

2014 | 2.9% | 13.7% | 13.2% | 9.8% | 5.8% |

2015 | -17.7% | 1.4% | -2.4% | -2.2% | -2.0% |

AVERAGE ANNUAL TOTAL RETURNS

As of December 31, 2015 (Unaudited)

| AVE MARIA

CATHOLIC

VALUES FUND | S&P 500

INDEX | RUSSELL

MIDCAP

INDEX | S&P 400

MIDCAP

INDEX | S&P 600

SMALL CAP

INDEX |

3 Years | 2.3% | 15.1% | 14.2% | 12.8% | 13.6% |

5 Years | 3.6% | 12.6% | 11.4% | 10.7% | 11.5% |

10 Years | 3.2% | 7.3% | 8.0% | 8.2% | 8.0% |

Since Inception (b) | 5.7% | 5.4% | 8.5% | 8.5% | 9.0% |

(a) | Represents the period from the commencement of operations (May 1, 2001) through December 31, 2001. |

(b) | Represents the period from the commencement of operations (May 1, 2001) through December 31, 2015. |

5

AVE MARIA CATHOLIC VALUES FUND

TEN LARGEST EQUITY HOLDINGS

December 31, 2015 (Unaudited)

Shares | | Company | | Market Value | | | % of Net Assets | |

| | 50,000 | | Advance Auto Parts, Inc. | | $ | 7,525,500 | | | | 3.6 | % |

| | 85,000 | | Polaris Industries, Inc. | | | 7,305,750 | | | | 3.4 | % |

| | 350,000 | | Fifth Third Bancorp | | | 7,035,000 | | | | 3.3 | % |

| | 55,000 | | Laboratory Corporation of America Holdings | | | 6,800,200 | | | | 3.2 | % |

| | 100,000 | | St. Jude Medical, Inc. | | | 6,177,000 | | | | 2.9 | % |

| | 30,000 | | W.W. Grainger, Inc. | | | 6,077,700 | | | | 2.9 | % |

| | 183,740 | | Noble Energy, Inc. | | | 6,050,558 | | | | 2.9 | % |

| | 65,000 | | ANSYS, Inc. | | | 6,012,500 | | | | 2.8 | % |

| | 200,000 | | PNC Financial Services Group, Inc. (The) - Warrants | | | 5,742,000 | | | | 2.7 | % |

| | 100,000 | | MSC Industrial Direct Company, Inc. - Class A | | | 5,627,000 | | | | 2.6 | % |

ASSET ALLOCATION (Unaudited)

Sector | % of Net Assets |

Consumer Discretionary | 19.9% |

Energy | 13.5% |

Financials | 18.6% |

Health Care | 9.3% |

Industrials | 13.2% |

Information Technology | 15.5% |

Materials | 5.7% |

Warrants | 2.7% |

Money Market Funds, Liabilities in Excess of Other Assets | 1.6% |

| | 100.0% |

6

AVE MARIA CATHOLIC VALUES FUND

SCHEDULE OF INVESTMENTS

December 31, 2015

| COMMON STOCKS — 95.7% | | Shares | | | Market Value | |

| Consumer Discretionary — 19.9% | | | | | | |

| Diversified Consumer Services — 2.3% | | | | | | |

Graham Holdings Company - Class B | | | 10,000 | | | $ | 4,849,700 | |

| | | | | | | | | |

| Household Durables — 4.0% | | | | | | | | |

Garmin Ltd. | | | 85,000 | | | | 3,159,450 | |

PulteGroup, Inc. | | | 300,000 | | | | 5,346,000 | |

| | | | | | | | 8,505,450 | |

| Leisure Products — 3.4% | | | | | | | | |

Polaris Industries, Inc. | | | 85,000 | | | | 7,305,750 | |

| | | | | | | | | |

| Media — 0.6% | | | | | | | | |

Discovery Communications, Inc. - Series A * | | | 50,000 | | | | 1,334,000 | |

| | | | | | | | | |

| Specialty Retail — 8.4% | | | | | | | | |

Aaron's, Inc. | | | 20,000 | | | | 447,800 | |

Advance Auto Parts, Inc. | | | 50,000 | | | | 7,525,500 | |

Chico's FAS, Inc. | | | 375,000 | | | | 4,001,250 | |

GNC Holdings, Inc. - Class A | | | 100,000 | | | | 3,102,000 | |

Lowe's Companies, Inc. | | | 35,000 | | | | 2,661,400 | |

| | | | | | | | 17,737,950 | |

| Textiles, Apparel & Luxury Goods — 1.2% | | | | | | | | |

VF Corporation | | | 40,000 | | | | 2,490,000 | |

| | | | | | | | | |

| Energy — 13.5% | | | | | | | | |

| Energy Equipment & Services — 7.2% | | | | | | | | |

Baker Hughes Incorporated | | | 120,000 | | | | 5,538,000 | |

FMC Technologies, Inc. * | | | 120,000 | | | | 3,481,200 | |

Halliburton Company | | | 120,000 | | | | 4,084,800 | |

Rowan Companies plc - Class A | | �� | 130,000 | | | | 2,203,500 | |

| | | | | | | | 15,307,500 | |

| Oil, Gas & Consumable Fuels — 6.3% | | | | | | | | |

Devon Energy Corporation | | | 100,000 | | | | 3,200,000 | |

Noble Energy, Inc. | | | 183,740 | | | | 6,050,558 | |

Range Resources Corporation | | | 100,000 | | | | 2,461,000 | |

World Fuel Services Corporation | | | 40,000 | | | | 1,538,400 | |

| | | | | | | | 13,249,958 | |

| Financials — 18.6% | | | | | | | | |

| Banks — 4.9% | | | | | | | | |

Fifth Third Bancorp | | | 350,000 | | | | 7,035,000 | |

PNC Financial Services Group, Inc. (The) | | | 35,000 | | | | 3,335,850 | |

| | | | | | | | 10,370,850 | |

7

AVE MARIA CATHOLIC VALUES FUND

SCHEDULE OF INVESTMENTS

(Continued)

| COMMON STOCKS — 95.7% (Continued) | | Shares | | | Market Value | |

| Financials — 18.6% (Continued) | | | | | | |

| Capital Markets — 2.8% | | | | | | |

Dundee Corporation - Class A * | | | 284,200 | | | $ | 940,702 | |

Federated Investors, Inc. - Class B | | | 175,000 | | | | 5,013,750 | |

| | | | | | | | 5,954,452 | |

| Consumer Finance — 1.5% | | | | | | | | |

Discover Financial Services | | | 60,000 | | | | 3,217,200 | |

| | | | | | | | | |

| Diversified Financial Services — 2.1% | | | | | | | | |

Western Union Company (The) | | | 250,000 | | | | 4,477,500 | |

| | | | | | | | | |

| Insurance — 6.1% | | | | | | | | |