| | OMB APPROVAL |

| | OMB Number: 3235-0570 Expires: August 31, 2020 Estimated average burden hours per response: 20.6 |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

| Investment Company Act file number | 811-07148 | |

| Schwartz Investment Trust |

| (Exact name of registrant as specified in charter) |

| 801 W. Ann Arbor Trail, Suite 244 Plymouth, Michigan | 48170 |

| (Address of principal executive offices) | (Zip code) |

George P. Schwartz

| Schwartz Investment Counsel, Inc. 801 W. Ann Arbor Trail, Plymouth, MI 48170 |

| (Name and address of agent for service) |

| Registrant's telephone number, including area code: | (734) 455-7777 | |

| Date of fiscal year end: | December 31 | |

| | | |

| Date of reporting period: | December 31, 2018 | |

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget ("OMB") control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to the Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

| Item 1. | Reports to Stockholders. |

Beginning on January 1, 2021, as permitted by regulations adopted by the U.S. Securities and Exchange Commission, paper copies of the Fund’s shareholder reports like this one will no longer be sent by mail, unless you specifically request paper copies of the reports from the Fund or from your financial intermediary, such as a broker-dealer or bank. Instead, the reports will be made available on a website, and you will be notified by mail each time a report is posted and provided with a website link to access the report.

If you already elected to receive shareholder reports electronically, you will not be affected by this change and you need not take any action. You may elect to receive shareholder reports and other communications from the Fund electronically by contacting the Fund at 1-888-726-0753 or, if you own these shares through a financial intermediary, by contacting your financial intermediary.

You may elect to receive all future reports in paper free of charge. You can inform the Fund that you wish to continue receiving paper copies of your shareholder reports by contacting the Fund at 1-888-726-0753. If you own shares through a financial intermediary, you may contact your financial intermediary or follow instructions included with this document to elect to continue to receive paper copies of your shareholder reports. Your election to receive reports in paper will apply to all Funds held with the Fund complex or at your financial intermediary.

Schwartz Value Focused Fund

Shareholder Services c/o Ultimus Fund Solutions, LLC P.O. Box 46707 Cincinnati, OH 45246 (888) 726-0753 | | Investment Adviser Schwartz Investment Counsel, Inc.

801 W. Ann Arbor Trail Suite 244 Plymouth, MI 48170 |

Dear Fellow Shareowner:

2018 was a challenging year for investors around the globe. The U.S. stock market recorded its worst performance since 2008, with the S&P 500 down -4.4% for the year. Foreign stock markets fared worse, with Japan (Nikkei 225) down -12.1%, Germany (DAX) -20.6%, and China (Shanghai Composite) -27.0%. Moreover, nearly every asset class had a negative return for 2018, as shown in the table below.

ETF Total Returns

Asset Class | Ticker | 2018

Return |

Cash | BIL | 1.7% |

TIPS | TIP | -1.4% |

Long-Term Treasuries | TLT | -1.6% |

Gold | GLD | -1.9% |

High Yield Bonds | HYG | -2.0% |

Investment Grade Bonds | LQD | -3.8% |

U.S. Large Cap Stocks | SPY | -4.5% |

Emerging Market Bonds | EMB | -5.5% |

REITS | VNQ | -6.0% |

U.S. Small Cap Stocks | IWM | -11.1% |

Commodities | DBC | -11.6% |

EAFE Stocks | EFA | -13.8% |

Emerging Market Stocks | EEM | -15.3% |

The Schwartz Value Focused Fund (the “Fund”) was unable to avoid most of the wreckage, posting a total return of -8.14% for the year ended December 31, 2018, compared to -4.96% for the benchmark S&P 1500 Index. Despite trailing the benchmark, the Fund did outperform its Morningstar mid-blend category average return of -11.16%. For the year, the Fund’s performance placed it in the 21st percentile out of 464 funds in Morningstar’s mid-blend category, outpacing 79% of the funds in that peer group.

The multi-year cycle of growth stocks outperforming value stocks continued in 2018. The Russell 1000 Growth index finished the year down -1.51%, while the Russell 1000 Value index was down -8.27%. Likewise, large-cap stocks continued their outperformance over small-caps. According to Morningstar, the best performing fund category was large-cap growth down -2.1%. In contrast, the worst performing fund category was small-cap value down -15.6%. In the S&P 500, the best performing sectors were health care, utilities, and consumer discretionary, while the worst performing sectors were energy, materials, and industrials. In this environment of large-cap growth outperformance, the Fund’s mid-cap exposure, along with its value-oriented positions hurt relative performance.

1

The Fund owned several stocks that appreciated sharply during the year. The Fund’s five best performing stocks in 2018 were:

Company | Industry | 2018

Performance |

Avid Bioservices, Inc. | Biotechnology | +55.05% |

Texas Pacific Land Trust | Oil/Gas Royalties/Real Estate | +31.47% |

Interactive Brokers Group, Inc. | Investment Brokerage | +35.35% |

Mastercard Incorporated | Credit Services | +31.64% |

The Madison Square Garden Co. | Leisure and Entertainment | +21.24% |

On the negative side, Spectrum Brands was the Fund’s worst performing security last year. We initiated a position in Spectrum in early 2018. Unfortunately, shortly after our investment, the company experienced some operational problems that negatively impacted results, and we reduced our position.

The Fund’s energy related holdings performed poorly in the 4th quarter last year, as oil prices dropped sharply during the period, which we believe is temporary. Our two E&P companies (Devon Energy and Noble Energy) are high-quality companies, with manageable debt loads, and experienced management teams. The share prices of both companies are depressed, and as such, we purchased additional shares near year end.

The Fund’s five worst performing stocks in 2018 were:

Company | Industry | 2018

Performance |

Spectrum Brands Holdings, Inc. | Consumer Products | -60.69% |

Devon Energy Corporation | Oil/Gas Exploration & Production | -41.91% |

Noble Energy, Inc. | Oil/Gas Exploration & Production | -37.44% |

American Airlines Group, Inc. | Airlines | -38.76% |

Axalta Coating Systems Ltd. | Specialty Chemicals | -29.43% |

During the second half of 2018 the Fund liquidated its holdings of: Apache Corporation (due to deteriorating fundamentals), ARRIS International plc (company agreed to be acquired), Liberty Global plc (concerns about high debt load), Tractor Supply (share price reached our intrinsic value estimate), and Unico American Corporation (deteriorating fundamentals). Two new holdings to the portfolio are: Gildan Activewear (apparel manufacturing) and Rosetta Stone, Inc. (technology-based learning products).

During the last 3 months of 2018, it seems negative headlines dominated the capital markets. Investors were rattled by a myriad of issues including: the ongoing trade war with China, slowing global growth, widening credit spreads, the flattening yield curve, rising interest rates, and political dysfunction in Washington. Consequently, 2018 ended with December registering the worst month for the S&P 500 since 1931. Although stocks have suffered some jaw-dropping declines in recent months, astute investors know that a marvelous buying opportunity can arise when fear is widespread. So, when others are panicking and selling indiscriminately, we try to remain calm and search for bargains amidst the chaos. Such periods of short-term market turmoil can often create opportunities to acquire shares of great companies when they are on sale. That’s the essence of value investing.

2

In our opinion, the economic and market environment remains positive with a growing U.S. economy, rising corporate profits, strong employment measures, low inflationary pressures, and interest rates that remain accommodative. A resolution to any of the Washington political turmoil could give a boost to consumer sentiment and business confidence. As always, we remain diligent in our efforts to invest in high-quality companies, in sound financial condition, when they are selling at attractive valuations.

The year-end distribution of $0.66 per share consisted of $0.33 of long-term capital gains and $0.33 of short-term capital gains. The net asset value of the Fund ended the year at $23.62 per share.

Thank you for being a shareholder in the Schwartz Value Focused Fund.

|

|

Timothy S. Schwartz, CFA | George P. Schwartz, CFA |

Lead Portfolio Manager | Co-Portfolio Manager |

Morningstar Percentile Rankings is the Fund’s total-return percentile rank relative to all funds that have the same Morningstar Category. The highest (or most favorable) percentile rank is 1 and the lowest (or least favorable) percentile rank is 100.The top-performing fund in a category will always receive a rank of 1. Percentile rankings for other periods are as follows: 3 years (34th out of 382 funds), 5 years (94th out of 335 funds) and 10 years (98th out of 235 funds).

3

SCHWARTZ VALUE FOCUSED FUND

PERFORMANCE

(Unaudited)

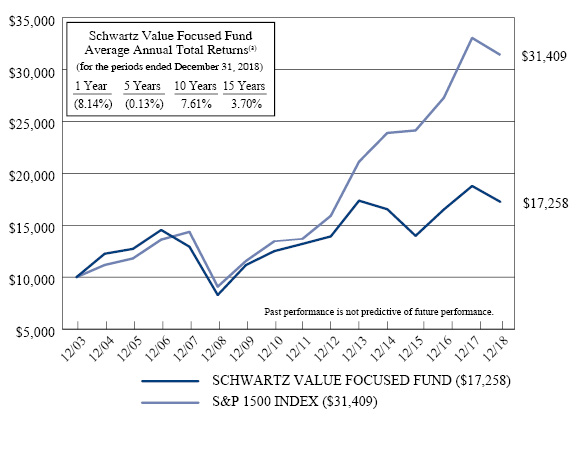

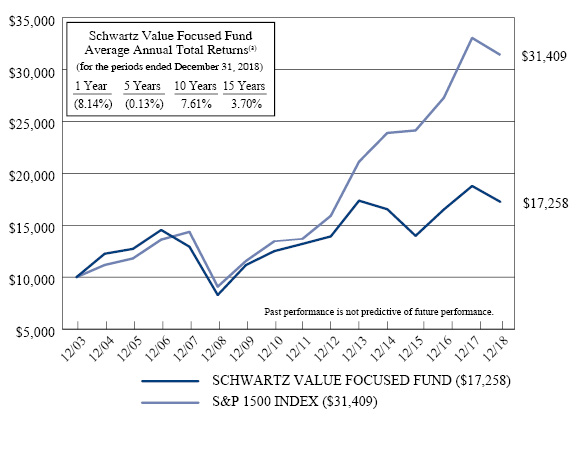

Comparison of the Change in Value of a $10,000 Investment

in Schwartz Value Focused Fund and the S&P 1500 Index

(a) | The returns shown do not reflect the deduction of taxes a shareholder would pay on Fund distributions or the redemption of Fund shares. |

Expense Ratio

Information as of: | Year Ended 12-31-17

(as disclosed in May 1, 2018

prospectus) | Year Ended 12-31-18 |

Gross | 1.80%* | 1.67% |

Net | 1.26%* | 1.25% |

* | Includes Acquired Fund Fees and Expenses. |

4

SCHWARTZ VALUE FOCUSED FUND

ANNUAL TOTAL RATES OF RETURN

COMPARISON WITH MAJOR INDICES (Unaudited)

| SCHWARTZ

VALUE

FOCUSED

FUND(a) | S&P 1500

INDEX(b) | VALUE

LINE

COMPOSITE(c) |

1984 | 11.1% | N/A | -8.4% |

1985 | 21.7% | N/A | 20.7% |

1986 | 16.4% | N/A | 5.0% |

1987 | -0.6% | N/A | -10.6% |

1988 | 23.1% | N/A | 15.4% |

1989 | 8.3% | N/A | 11.2% |

1990 | -5.3% | N/A | -24.3% |

1991 | 32.0% | N/A | 27.2% |

1992 | 22.7% | N/A | 7.0% |

1993 | 20.5% | N/A | 10.7% |

1994 | -6.8% | N/A | -6.0% |

1995 | 16.9% | 36.5% | 19.3% |

1996 | 18.3% | 22.4% | 13.4% |

1997 | 28.0% | 32.9% | 21.1% |

1998 | -10.4% | 26.4% | -3.8% |

1999 | -2.5% | 20.3% | -1.4% |

2000 | 9.3% | -7.0% | -8.7% |

2001 | 28.1% | -10.6% | -6.1% |

2002 | -14.9% | -21.3% | -28.6% |

2003 | 39.3% | 29.6% | 37.4% |

2004 | 22.6% | 11.8% | 11.5% |

2005 | 3.8% | 5.7% | 2.0% |

2006 | 14.3% | 15.3% | 11.0% |

2007 | -11.1% | 5.5% | -3.8% |

2008 | -35.9% | -36.7% | -48.7% |

2009 | 34.8% | 27.2% | 36.8% |

2010 | 12.0% | 16.4% | 20.5% |

2011 | 5.6% | 1.7% | -11.4% |

2012 | 5.4% | 16.2% | 9.5% |

2013 | 24.7% | 32.8% | 35.5% |

2014 | -4.7% | 13.1% | 2.7% |

2015 | -15.5% | 1.0% | -11.2% |

2016 | 18.1% | 13.0% | 13.5% |

2017 | 13.7% | 21.1% | 11.1% |

2018 | -8.1% | -5.0% | -16.0% |

(a) | Schwartz Value Focused Fund’s performance combines the performance of the Fund since its commencement of operations as a registered investment company on July 20, 1993, and the performance of RCM Partners Limited Partnership for periods prior thereto. |

(b) | Inception date of the S&P 1500 Index is December 30, 1994. |

(c) | Excluding dividends. |

5

SCHWARTZ VALUE FOCUSED FUND

AVERAGE ANNUAL TOTAL RETURNS

As of December 31, 2018 (Unaudited)

| SCHWARTZ

VALUE

FOCUSED

FUND(a) | S&P 1500

INDEX(b) | VALUE

LINE

COMPOSITE(c) |

3 Years | 7.3% | 9.2% | 2.0% |

5 Years | -0.1% | 8.3% | -0.7% |

10 Years | 7.6% | 13.2% | 7.7% |

15 Years | 3.7% | 7.9% | 1.8% |

35 Years | 8.2% | N/A | 2.6% |

(a) | Schwartz Value Focused Fund’s performance combines the performance of the Fund since its commencement of operations as a registered investment company on July 20, 1993, and the performance of RCM Partners Limited Partnership for periods prior thereto. |

(b) | Inception date of the S&P 1500 Index is December 30, 1994. |

(c) | Excluding dividends. |

6

SCHWARTZ VALUE FOCUSED FUND

TEN LARGEST EQUITY HOLDINGS

December 31, 2018 (Unaudited)

Shares | | | Security Description | | Market

Value | | | % of

Net Assets | |

| | 4,000 | | | Texas Pacific Land Trust | | $ | 2,166,520 | | | | 11.2% | |

| | 70,000 | | | Qurate Retail, Inc. | | | 1,366,400 | | | | 7.0% | |

| | 80,000 | | | Barrick Gold Corporation | | | 1,083,200 | | | | 5.6% | |

| | 3 | | | Berkshire Hathaway, Inc. - Class A | | | 918,000 | | | | 4.7% | |

| | 30,000 | | | Kroger Company (The) | | | 825,000 | | | | 4.2% | |

| | 3,000 | | | Madison Square Garden Company (The) - Class A | | | 803,100 | | | | 4.1% | |

| | 16,000 | | | Delta Air Lines, Inc. | | | 798,400 | | | | 4.1% | |

| | 45,000 | | | Rosetta Stone, Inc. | | | 738,000 | | | | 3.8% | |

| | 10,000 | | | Cognizant Technology Solutions Corporation - Class A | | | 634,800 | | | | 3.3% | |

| | 30,000 | | | Noble Energy, Inc. | | | 562,800 | | | | 2.9% | |

ASSET ALLOCATION (Unaudited)

Sector | % of

Net Assets |

Communication Services | 9.2% |

Consumer Discretionary | 15.6% |

Consumer Staples | 6.0% |

Energy | 16.1% |

Financials | 7.7% |

Health Care | 1.3% |

Industrials | 9.6% |

Information Technology | 8.6% |

Materials | 12.2% |

Money Market Funds, Liabilities in Excess of Other Assets | 13.7% |

| | 100.0% |

7

SCHWARTZ VALUE FOCUSED FUND

SCHEDULE OF INVESTMENTS

December 31, 2018

COMMON STOCKS — 86.3% | | Shares | | | Market Value | |

Communication Services — 9.2% | | | | | | | | |

Entertainment — 9.2% | | | | | | | | |

Liberty Media Corporation - Liberty Formula One - Series C* | | | 8,000 | | | $ | 245,600 | |

Madison Square Garden Company (The) - Class A* | | | 3,000 | | | | 803,100 | |

Rosetta Stone, Inc.* | | | 45,000 | | | | 738,000 | |

| | | | | | | | 1,786,700 | |

Consumer Discretionary — 15.6% | | | | | | | | |

Diversified Consumer Services — 1.7% | | | | | | | | |

Graham Holdings Company - Class B | | | 500 | | | | 320,290 | |

| | | | | | | | | |

Household Durables — 2.3% | | | | | | | | |

Garmin Ltd. | | | 7,000 | | | | 443,240 | |

| | | | | | | | | |

Internet & Direct Marketing Retail — 7.0% | | | | | | | | |

Qurate Retail, Inc.* | | | 70,000 | | | | 1,366,400 | |

| | | | | | | | | |

Specialty Retail — 2.3% | | | | | | | | |

TJX Companies, Inc. (The) | | | 10,000 | | | | 447,400 | |

| | | | | | | | | |

Textiles, Apparel & Luxury Goods — 2.3% | | | | | | | | |

Gildan Activewear, Inc. | | | 15,000 | | | | 455,400 | |

| | | | | | | | | |

Consumer Staples — 6.0% | | | | | | | | |

Beverages — 1.0% | | | | | | | | |

Brown-Forman Corporation - Class B | | | 4,000 | | | | 190,320 | |

| | | | | | | | | |

Food & Staples Retailing — 4.2% | | | | | | | | |

Kroger Company (The) | | | 30,000 | | | | 825,000 | |

| | | | | | | | | |

Household Products — 0.8% | | | | | | | | |

Spectrum Brands Holdings, Inc. | | | 3,500 | | | | 147,875 | |

| | | | | | | | | |

Energy — 16.1% | | | | | | | | |

Oil, Gas & Consumable Fuels — 16.1% | | | | | | | | |

Devon Energy Corporation | | | 18,000 | | | | 405,720 | |

Noble Energy, Inc. | | | 30,000 | | | | 562,800 | |

Texas Pacific Land Trust | | | 4,000 | | | | 2,166,520 | |

| | | | | | | | 3,135,040 | |

8

SCHWARTZ VALUE FOCUSED FUND

SCHEDULE OF INVESTMENTS

(Continued)

COMMON STOCKS — 86.3% (Continued) | | Shares | | | Market Value | |

Financials — 7.7% | | | | | | | | |

Capital Markets — 3.0% | | | | | | | | |

Interactive Brokers Group, Inc. - Class A | | | 3,000 | | | $ | 163,950 | |

Moody's Corporation | | | 3,000 | | | | 420,120 | |

| | | | | | | | 584,070 | |

Diversified Financial Services — 4.7% | | | | | | | | |

Berkshire Hathaway, Inc. - Class A* | | | 3 | | | | 918,000 | |

| | | | | | | | | |

Health Care — 1.3% | | | | | | | | |

Biotechnology — 1.3% | | | | | | | | |

Avid Bioservices, Inc.* | | | 60,000 | | | | 246,000 | |

| | | | | | | | | |

Industrials — 9.6% | | | | | | | | |

Airlines — 5.4% | | | | | | | | |

American Airlines Group, Inc. | | | 7,500 | | | | 240,825 | |

Delta Air Lines, Inc. | | | 16,000 | | | | 798,400 | |

| | | | | | | | 1,039,225 | |

Electrical Equipment — 1.7% | | | | | | | | |

AMETEK, Inc. | | | 5,000 | | | | 338,500 | |

| | | | | | | | | |

Road & Rail — 2.5% | | | | | | | | |

AMERCO | | | 1,500 | | | | 492,165 | |

| | | | | | | | | |

Information Technology — 8.6% | | | | | | | | |

Electronic Equipment, Instruments & Components — 3.4% | | | | | | | | |

Arrow Electronics, Inc.* | | | 7,000 | | | | 482,650 | |

Avnet, Inc. | | | 5,000 | | | | 180,500 | |

| | | | | | | | 663,150 | |

IT Services — 5.2% | | | | | | | | |

Cognizant Technology Solutions Corporation - Class A | | | 10,000 | | | | 634,800 | |

Mastercard, Inc. - Class A | | | 2,000 | | | | 377,300 | |

| | | | | | | | 1,012,100 | |

Materials — 12.2% | | | | | | | | |

Chemicals — 4.0% | | | | | | | | |

Axalta Coating Systems Ltd.* | | | 10,000 | | | | 234,200 | |

DowDuPont, Inc. | | | 10,000 | | | | 534,800 | |

| | | | | | | | 769,000 | |

Metals & Mining — 8.2% | | | | | | | | |

Barrick Gold Corporation | | | 80,000 | | | | 1,083,200 | |

9

SCHWARTZ VALUE FOCUSED FUND

SCHEDULE OF INVESTMENTS

(Continued)

COMMON STOCKS — 86.3% (Continued) | | Shares | | | Market Value | |

Materials — 12.2% (Continued) | | | | | | | | |

Metals & Mining — 8.2% (Continued) | | | | | | | | |

Pan American Silver Corporation | | | 35,000 | | | $ | 511,000 | |

| | | | | | | | 1,594,200 | |

| | | | | | | | | |

Total Common Stocks (Cost $13,921,833) | | | | | | $ | 16,774,075 | |

MONEY MARKET FUNDS — 13.8% | | Shares | | | Market Value | |

Federated Government Obligations Tax-Managed Fund - Institutional Shares, 2.18%(a) | | | 926,679 | | | $ | 926,679 | |

Federated Treasury Obligations Fund - Institutional Shares, 2.31%(a) | | | 926,680 | | | | 926,680 | |

Federated U.S. Treasury Cash Reserves Fund - Institutional Shares, 2.19%(a) | | | 827,972 | | | | 827,972 | |

Total Money Market Funds (Cost $2,681,331) | | | | | | $ | 2,681,331 | |

| | | | | | | | | |

Total Investments at Market Value — 100.1%(Cost $16,603,164) | | | | | | $ | 19,455,406 | |

| | | | | | | | | |

Liabilities in Excess of Other Assets— (0.1%) | | | | | | | (27,594 | ) |

| | | | | | | | | |

Net Assets — 100.0% | | | | | | $ | 19,427,812 | |

* | Non-income producing security. |

(a) | The rate shown is the 7-day effective yield as of December 31, 2018. |

See notes to financial statements. |

10

SCHWARTZ VALUE FOCUSED FUND

STATEMENT OF ASSETS AND LIABILITIES

December 31, 2018

ASSETS | | | | |

Investments, at market value (cost of $16,603,164) (Note 1) | | $ | 19,455,406 | |

Cash | | | 3,710 | |

Dividends receivable | | | 8,898 | |

Other assets | | | 8,820 | |

TOTAL ASSETS | | | 19,476,834 | |

| | | | | |

LIABILITIES | | | | |

Payable to Adviser (Note 2) | | | 34,683 | |

Payable to administrator (Note 2) | | | 3,000 | |

Other accrued expenses | | | 11,339 | |

TOTAL LIABILITIES | | | 49,022 | |

| | | | | |

NET ASSETS | | $ | 19,427,812 | |

| | | | | |

NET ASSETS CONSIST OF: | | | | |

Paid-in capital | | $ | 16,575,570 | |

Accumulated earnings | | | 2,852,242 | |

NET ASSETS | | $ | 19,427,812 | |

| | | | | |

Shares of beneficial interest outstanding (unlimited number of shares authorized, no par value) | | | 822,657 | |

| | | | | |

Net asset value, offering price and redemption price per share (Note 1) | | $ | 23.62 | |

See notes to financial statements. |

11

SCHWARTZ VALUE FOCUSED FUND

STATEMENT OF OPERATIONS

For the Year Ended December 31, 2018

INVESTMENT INCOME | | | | |

Dividends (Net of foreign tax of $3,267) | | $ | 213,876 | |

| | | | | |

EXPENSES | | | | |

Investment advisory fees (Note 2) | | | 215,209 | |

Trustees’ fees and expenses (Note 2) | | | 45,120 | |

Administration, accounting and transfer agent fees (Note 2) | | | 36,000 | |

Legal and audit fees | | | 24,518 | |

Registration and filing fees | | | 19,592 | |

Postage and supplies | | | 6,980 | |

Printing of shareholder reports | | | 5,679 | |

Custodian and bank service fees | | | 5,580 | |

Insurance expense | | | 2,458 | |

Pricing fees | | | 1,074 | |

Compliance service fees and expenses (Note 2) | | | 1,032 | |

Other expenses | | | 14,377 | |

TOTAL EXPENSES | | | 377,619 | |

Less fee reductions by the Adviser (Note 2) | | | (94,431 | ) |

NET EXPENSES | | | 283,188 | |

| | | | | |

NET INVESTMENT LOSS | | | (69,312 | ) |

| | | | | |

REALIZED AND UNREALIZED GAINS (LOSSES) ON INVESTMENTS | | | | |

Net realized gains from investment transactions | | | 598,304 | |

Net change in unrealized appreciation (depreciation) on investments | | | (2,199,588 | ) |

NET REALIZED AND UNREALIZED LOSSES ON INVESTMENTS | | | (1,601,284 | ) |

| | | | | |

NET DECREASE IN NET ASSETS RESULTING FROM OPERATIONS | | $ | (1,670,596 | ) |

See notes to financial statements. |

12

SCHWARTZ VALUE FOCUSED FUND

STATEMENTS OF CHANGES IN NET ASSETS

| | Year Ended

December 31,

2018 | | | Year Ended

December 31,

2017(a) | |

FROM OPERATIONS | | | | | | | | |

Net investment loss | | $ | (69,312 | ) | | $ | (112,007 | ) |

Net realized gains from investment transactions | | | 598,304 | | | | 2,239,114 | |

Net change in unrealized appreciation (depreciation) on investments | | | (2,199,588 | ) | | | 669,495 | |

Net increase (decrease) in net assets resulting from operations | | | (1,670,596 | ) | | | 2,796,602 | |

| | | | | | | | | |

FROM DISTRIBUTIONS TO SHAREHOLDERS (Note 1) | | | (529,689 | ) | | | (1,619,709 | ) |

| | | | | | | | | |

FROM CAPITAL SHARE TRANSACTIONS | | | | | | | | |

Proceeds from shares sold | | | 344,904 | | | | 328,864 | |

Reinvestment of distributions to shareholders | | | 514,383 | | | | 1,557,160 | |

Payments for shares redeemed | | | (1,822,743 | ) | | | (1,483,218 | ) |

Net increase (decrease) in net assets from capital share transactions | | | (963,456 | ) | | | 402,806 | |

| | | | | | | | | |

TOTAL INCREASE (DECREASE) IN NET ASSETS | | | (3,163,741 | ) | | | 1,579,699 | |

| | | | | | | | | |

NET ASSETS | | | | | | | | |

Beginning of year | | | 22,591,553 | | | | 21,011,854 | |

End of year | | $ | 19,427,812 | | | $ | 22,591,553 | |

| | | | | | | | | |

SUMMARY OF CAPITAL SHARE ACTIVITY | | | | | | | | |

Shares sold | | | 12,630 | | | | 12,584 | |

Shares issued in reinvestment of distributions to shareholders | | | 21,926 | | | | 58,584 | |

Shares redeemed | | | (66,475 | ) | | | (56,357 | ) |

Net increase (decrease) in shares outstanding | | | (31,919 | ) | | | 14,811 | |

Shares outstanding, beginning of year | | | 854,576 | | | | 839,765 | |

Shares outstanding, end of year | | | 822,657 | | | | 854,576 | |

(a) | The presentation of From Distributions to Shareholders has been updated to reflect the changes prescribed in amendments to Regulation S-X, effective November 5, 2018 (Note 1). For the year ended December 31, 2017, distributions to shareholders consisted of $1,619,709 from net realized gains on investments. As of December 31, 2017, undistributed net investment income was $0. |

See notes to financial statements.

13

SCHWARTZ VALUE FOCUSED FUND

FINANCIAL HIGHLIGHTS

Per Share Data for a Share Outstanding Throughout Each Year

| | Year

Ended

Dec. 31,

2018 | | | Year

Ended

Dec. 31,

2017 | | | Year

Ended

Dec. 31,

2016 | | | Year

Ended

Dec. 31,

2015 | | | Year

Ended

Dec. 31,

2014 | |

Net asset value at beginning of year | | $ | 26.44 | | | $ | 25.02 | | | $ | 21.18 | | | $ | 25.06 | | | $ | 28.54 | |

| | | | | | | | | | | | | | | | | | | | | |

Income (loss) from investment operations: | | | | | | | | | | | | | | | | | | | | |

Net investment loss | | | (0.08 | ) | | | (0.13 | ) | | | (0.08 | ) | | | (0.11 | ) | | | (0.08 | ) |

Net realized and unrealized gains (losses) on investments | | | (2.08 | ) | | | 3.57 | | | | 3.92 | | | | (3.77 | ) | | | (1.26 | ) |

Total from investment operations | | | (2.16 | ) | | | 3.44 | | | | 3.84 | | | | (3.88 | ) | | | (1.34 | ) |

| | | | | | | | | | | | | | | | | | | | | |

Less distributions: | | | | | | | | | | | | | | | | | | | | |

From net realized gains on investments | | | (0.66 | ) | | | (2.02 | ) | | | — | | | | — | | | | (2.14 | ) |

| | | | | | | | | | | | | | | | | | | | | |

Net asset value at end of year | | $ | 23.62 | | | $ | 26.44 | | | $ | 25.02 | | | $ | 21.18 | | | $ | 25.06 | |

| | | | | | | | | | | | | | | | | | | | | |

Total return(a) | | | (8.1 | %) | | | 13.7 | % | | | 18.1 | % | | | (15.5 | %) | | | (4.7 | %) |

| | | | | | | | | | | | | | | | | | | | | |

Ratios/Supplementary Data: | | | | | | | | | | | | | | | | | | | | |

Net assets at end of year (000’s) | | $ | 19,428 | | | $ | 22,592 | | | $ | 21,012 | | | $ | 18,772 | | | $ | 28,129 | |

| | | | | | | | | | | | | | | | | | | | | |

Ratio of total expenses to average net assets | | | 1.67 | % | | | 1.79 | % | | | 1.80 | % | | | 1.59 | % | | | 1.46 | % |

| | | | | | | | | | | | | | | | | | | | | |

Ratio of net expenses to average net assets | | | 1.25 | %(b) | | | 1.25 | %(b) | | | 1.25 | %(b) | | | 1.35 | %(b) | | | 1.46 | % |

| | | | | | | | | | | | | | | | | | | | | |

Ratio of net investment loss to average net assets | | | (0.31 | %)(b) | | | (0.52 | %)(b) | | | (0.35 | %)(b) | | | (0.40 | %)(b) | | | (0.28 | %) |

| | | | | | | | | | | | | | | | | | | | | |

Portfolio turnover rate | | | 34 | % | | | 48 | % | | | 48 | % | | | 104 | % | | | 72 | % |

(a) | Total return is a measure of the change in value of an investment in the Fund over the period covered, which assumes any dividends or capital gains distributions are reinvested in shares of the Fund. Returns shown do not reflect the deduction of taxes a shareholder would pay on Fund distributions or the redemption of Fund shares. |

| | |

(b) | Ratio was determined after advisory fee reductions (Note 2). |

| | |

See notes to financial statements. |

14

SCHWARTZ VALUE FOCUSED FUND

NOTES TO FINANCIAL STATEMENTS

December 31, 2018

1. Significant Accounting Policies

Schwartz Value Focused Fund (the “Fund”) is a series of Schwartz Investment Trust (the “Trust”), an open-end, non-diversified management investment company established as an Ohio business trust under a Declaration of Trust dated August 31, 1992. Other series of the Trust are not incorporated in this report. The Fund is registered under the Investment Company Act of 1940, as amended (the “1940 Act”).

The investment objective of the Fund is to seek long-term capital appreciation. See the Prospectus for information regarding the principal investment strategies of the Fund.

Shares of the Fund are sold at net asset value (“NAV”). To calculate the NAV, the Fund’s assets are valued and totaled, liabilities are subtracted, and the balance is divided by the number of shares outstanding. The offering price and redemption price per share are equal to the NAV per share.

In August 2018, the U.S. Securities and Exchange Commission (the “SEC”) adopted regulations that eliminated or amended disclosure requirements that were redundant or outdated in light of changes in SEC requirements, accounting principles generally accepted in the United States of America (“GAAP”), International Financial Reporting Standards or changes in technology or the business environment. These regulations were effective November 5, 2018, and the Fund is complying with them effective with these financial statements.

The Fund follows accounting and reporting guidance under Financial Accounting Standards Board (“FASB”) Accounting Standards Codification (“ASC”) Topic 946, “Financial Services – Investment Companies.” The following is a summary of the Fund’s significant accounting policies used in the preparation of its financial statements. These policies are in conformity with GAAP.

New Accounting Pronouncement – In August 2018, FASB issued Accounting Standards Update No. 2018-13 (“ASU 2018-13”), “Disclosure Framework – Changes to the Disclosure Requirements for Fair Value Measurement,” which amends the fair value measurement disclosure requirements of ASC Topic 820 (“ASC 820”), “Fair Value Measurement.” ASU 2018-13 includes new, eliminated, and modified disclosure requirements for ASC 820. In addition, ASU 2018-13 clarifies that materiality is an appropriate consideration when evaluating disclosure requirements. ASU 2018-13 is effective for fiscal years beginning after December 15, 2019, including interim periods therein. Early adoption is permitted and the Fund has adopted ASU 2018-13 with these financial statements.

(a) Valuation of investments — Securities which are traded on stock exchanges, other than NASDAQ, are valued at the closing sales price as of the close of the regular session of trading on the New York Stock Exchange on the day the securities are being valued, or, if not traded on a particular day, at the closing bid price. Securities which are quoted by NASDAQ are valued at the NASDAQ Official Closing Price or, if an Official Closing Price is not available, at the most recently quoted bid price. Securities traded in the over-the-counter market are valued at the last reported sales price or, if there is no reported sale on the valuation date, at the most recently quoted

15

SCHWARTZ VALUE FOCUSED FUND

NOTES TO FINANCIAL STATEMENTS

(Continued)

bid price. Securities which are traded both in the over-the-counter market and on a stock exchange are valued according to the broadest and most representative market. Investments representing shares of other open-end investment companies are valued at their NAV as reported by such companies. When using quoted prices and when the market for the securities are considered active, the securities will be classified as Level 1 within the fair value hierarchy (see below). Securities (and other assets) for which market quotations are not readily available are valued at their fair value as determined in good faith in accordance with consistently applied procedures established by and under the general supervision of the Board of Trustees, and will be classified as Level 2 or 3 within the fair value hierarchy, depending on the inputs used. Fair value pricing may be used, for example, in situations where (i) a portfolio security is so thinly traded that there have been no transactions for that stock over an extended period of time; (ii) the exchange on which the portfolio security is principally traded closes early; or (iii) trading of the portfolio security is halted during the day and does not resume prior to the Fund’s NAV calculation. A portfolio security’s “fair value” price may differ from the price next available for that portfolio security using the Fund’s normal pricing procedures.

GAAP establishes a single authoritative definition of fair value, sets out a framework for measuring fair value and requires additional disclosures about fair value measurements.

Various inputs are used in determining the value of the Fund’s investments. These inputs are summarized in the three broad levels listed below:

● Level 1 – quoted prices in active markets for identical securities

● Level 2 – other significant observable inputs

● Level 3 – significant unobservable inputs

The inputs or methodology used for valuing securities are not necessarily an indication of the risks associated with investing in those securities. The inputs used to measure fair value may fall into different levels of the fair value hierarchy. In such cases, for disclosure purposes, the level in the fair value hierarchy within which the fair value measurement falls in its entirety is determined based on the lowest level input that is significant to the fair value measurement.

The following is a summary of the inputs used to value the Fund’s investments, by security type, as of December 31, 2018:

| | Level 1 | | | Level 2 | | | Level 3 | | | Total | |

Common Stocks | | $ | 16,774,075 | | | $ | — | | | $ | — | | | $ | 16,774,075 | |

Money Market Funds | | | 2,681,331 | | | | — | | | | — | | | | 2,681,331 | |

Total | | $ | 19,455,406 | | | $ | — | | | $ | — | | | $ | 19,455,406 | |

Refer to the Fund’s Schedule of Investments for a listing of the common stocks by industry type. As of December 31, 2018, there were no Level 3 securities or derivative instruments held by the Fund.

16

SCHWARTZ VALUE FOCUSED FUND

NOTES TO FINANCIAL STATEMENTS

(Continued)

(b) Income taxes — The Fund has qualified and intends to continue to qualify as a regulated investment company under the Internal Revenue Code of 1986, as amended (the “Code”). Qualification generally will relieve the Fund of liability for federal income taxes to the extent 100% of its net investment income and net realized capital gains are distributed in accordance with the Code.

In order to avoid imposition of the excise tax applicable to regulated investment companies, it is also the Fund’s intention to declare as dividends in each calendar year at least 98% of its net investment income and 98.2% of its net realized capital gains plus undistributed amounts from prior years.

The following information is computed on a tax basis for each item as of December 31, 2018:

Federal income tax cost | | $ | 16,603,164 | |

Gross unrealized appreciation | | $ | 3,587,057 | |

Gross unrealized depreciation | | | (734,815 | ) |

Net unrealized appreciation | | | 2,852,242 | |

Accumulated earnings | | $ | 2,852,242 | |

During the year ended December 31, 2018, the Fund reclassified $697 of accumulated earnings against paid-in capital on the Statement of Assets and Liabilities. Such reclassification, the result of permanent differences between the financial statement and income tax reporting requirements, have no effect on the Fund’s net assets or NAV per share.

The Fund recognizes the tax benefits or expenses of uncertain tax positions only when the position is “more-likely-than-not” to be sustained assuming examination by tax authorities. Management has reviewed the tax positions taken on federal income tax returns for all open tax years (generally three years) and has concluded that no provision for unrecognized tax benefits or expenses is required in these financial statements.

(c) Investment transactions and investment income — Investment transactions are accounted for on the trade date. Dividend income is recorded on the ex-dividend date. Interest income is recognized on the accrual basis. Realized capital gains and losses on investment transactions are determined on the identified cost basis. Withholding taxes on foreign dividends have been recorded in accordance with the Fund’s understanding of the applicable country’s rules and tax rates.

(d) Dividends and distributions — Dividends from net investment income and distributions of net realized capital gains, if any, are declared and paid annually in December. Dividends and distributions to shareholders are recorded on the ex-dividend date. The tax character of the distributions paid to shareholders during the years ended December 31, 2018 and 2017 was as follows:

Years Ended | | Ordinary

Income | | | Long-Term

Capital Gains | | | Total

Distributions | |

December 31, 2018 | | $ | 261,488 | | | $ | 268,201 | | | $ | 529,689 | |

December 31, 2017 | | $ | — | | | $ | 1,619,709 | | | $ | 1,619,709 | |

17

SCHWARTZ VALUE FOCUSED FUND

NOTES TO FINANCIAL STATEMENTS

(Continued)

(e) Estimates — The preparation of financial statements in conformity with GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities as of the date of the financial statements and the reported amounts of revenues and expenses during the reporting period. Actual results could differ from those estimates.

(f) Common expenses — Common expenses of the Trust are allocated among the Fund and the other series of the Trust based on relative net assets of each series or the nature of the services performed and the relative applicability to each series.

2. Investment Advisory Agreement and Transactions with Related Parties

The Chairman and President of the Trust is also the Chairman and Chief Executive Officer of Schwartz Investment Counsel, Inc. (the “Adviser”). Certain other officers of the Trust are officers of the Adviser, or of Ultimus Fund Solutions, LLC (“Ultimus”), the administrative, accounting and transfer agent for the Fund, or of Ultimus Fund Distributors, LLC (the “Distributor”), the Fund’s principal underwriter.

Pursuant to an Investment Advisory Agreement between the Trust and the Adviser, the Adviser is responsible for the management of the Fund and provides investment advice along with the necessary personnel, facilities, equipment and certain other services necessary to the operations of the Fund. The Adviser receives from the Fund a quarterly fee at the annual rate of 0.95% per annum of the Fund’s average daily net assets.

The Adviser has contractually agreed to reduce its advisory fees or reimburse a portion of the Fund’s expenses until at least May 1, 2019 so that the ordinary operating expenses of the Fund do not exceed 1.25% per annum of average daily net assets. Accordingly, during the year ended December 31, 2018, the Adviser reduced its investment advisory fees by $94,431.

Any fee reductions or expense reimbursements by the Adviser are subject to repayment by the Fund for a period of three years after such fees and expenses were incurred, provided repayment to the Adviser does not cause the ordinary operating expenses of the Fund to exceed 1.25% per annum of average daily net assets. As of December 31, 2018, the Adviser may seek recoupment of investment advisory fee reductions totaling $316,783 no later than the dates stated below:

December 31, 2019 | | $ | 106,868 | |

December 31, 2020 | | | 115,484 | |

December 31, 2021 | | | 94,431 | |

Total | | $ | 316,783 | |

The Chief Compliance Officer of the Trust (the “CCO”) is an employee of the Adviser. The Trust pays the Adviser a fee for providing CCO services, of which the Fund pays its proportionate share along with the other series of the Trust. In addition, the Trust reimburses the Adviser for out-of-pocket expenses incurred, if any, for providing these services.

18

SCHWARTZ VALUE FOCUSED FUND

NOTES TO FINANCIAL STATEMENTS

(Continued)

Pursuant to a Mutual Fund Services Agreement between the Trust and Ultimus, Ultimus supplies regulatory and compliance services, calculates the daily NAV per share, maintains the financial books and records of the Fund, maintains the records of each shareholder’s account, and processes purchases and redemptions of the Fund’s shares. For these services Ultimus receives fees computed as a percentage of the average daily net assets of the Fund, subject to a minimum monthly fee.

Pursuant to a Distribution Agreement between the Trust and the Distributor, the Distributor serves as the Fund’s exclusive agent for the distribution of its shares. The Distributor is an affiliate of Ultimus.

Trustees and officers affiliated with the Adviser or Ultimus are not compensated by the Trust for their services. Each Trustee who is not an affiliated person of the Adviser or Ultimus (“Independent Trustee”) receives from the Trust an annual retainer of $46,000 (except that such fee is $56,000 for the Lead Independent Trustee/Chairman of the Governance Committee and $50,000 for the Chairman of the Audit Committee), payable quarterly; a fee of $6,000 for attendance at each meeting of the Board of Trustees; plus reimbursement of travel and other expenses incurred in attending meetings. The Fund pays its proportionate share of the Independent Trustees’ fees and expenses along with the other series of the Trust.

3. Investment Transactions

During the year ended December 31, 2018, cost of purchases and proceeds from sales and maturities of investment securities, excluding short-term investments and U.S. government securities, amounted to $7,216,290 and $10,208,011, respectively.

4. Contingencies and Commitments

The Fund indemnifies the Trust’s officers and Trustees for certain liabilities that might arise from their performance of their duties to the Fund. Additionally, in the normal course of business, the Fund enters into contracts that contain a variety of representations and warranties and which provide general indemnifications. The Fund’s maximum exposure under these arrangements is unknown, as this would involve future claims that may be made against the Fund that have not yet occurred. However, based on experience, the Fund expects the risk of loss to be remote.

5. Subsequent Events

The Fund is required to recognize in the financial statements the effects of all subsequent events that provide additional evidence about conditions that existed as of the date of the Statement of Assets and Liabilities. For non-recognized subsequent events that must be disclosed to keep the financial statements from being misleading, the Fund is required to disclose the nature of the event as well as an estimate of its financial effect, or a statement that such an estimate cannot be made. Management has evaluated subsequent events through the issuance of these financial statements and has noted no such events.

19

SCHWARTZ VALUE FOCUSED FUND

REPORT OF INDEPENDENT REGISTERED

PUBLIC ACCOUNTING FIRM

To the Shareholders and the Board of Trustees of Schwartz Investment Trust

Opinion on the Financial Statements and Financial Highlights

We have audited the accompanying statement of assets and liabilities, including the schedule of investments, of the Schwartz Value Focused Fund, one of the portfolios constituting the Schwartz Investment Trust (the “Fund”), as of December 31, 2018, the related statement of operations for the year then ended, the statement of changes in net assets for each of the two years in the period then ended, the financial highlights for each of the five years in the period then ended, and the related notes. In our opinion, the financial statements and financial highlights present fairly, in all material respects, the financial position of the Fund as of December 31, 2018, and the results of its operations for the year then ended, the changes in its net assets for each of the two years in the period then ended, and the financial highlights for each of the five years in the period then ended, in conformity with accounting principles generally accepted in the United States of America.

Basis for Opinion

These financial statements and financial highlights are the responsibility of the Fund’s management. Our responsibility is to express an opinion on the Fund’s financial statements and financial highlights based on our audits. We are a public accounting firm registered with the Public Company Accounting Oversight Board (United States) (PCAOB) and are required to be independent with respect to the Funds in accordance with the U.S. federal securities laws and the applicable rules and regulations of the Securities and Exchange Commission and the PCAOB.

We conducted our audits in accordance with the standards of the PCAOB. Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements and financial highlights are free of material misstatement, whether due to error or fraud. The Fund is not required to have, nor were we engaged to perform, an audit of internal control over financial reporting. As part of our audits we are required to obtain an understanding of internal control over financial reporting but not for the purpose of expressing an opinion on the effectiveness of the Fund’s internal control over financial reporting. Accordingly, we express no such opinion.

Our audits included performing procedures to assess the risks of material misstatement of the financial statements and financial highlights, whether due to error or fraud, and performing procedures that respond to those risks. Such procedures included examining, on a test basis, evidence regarding the amounts and disclosures in the financial statements and financial highlights. Our audits also included evaluating the accounting principles used and significant estimates made by management, as well as evaluating the overall presentation of the financial statements and financial highlights. Our procedures included confirmation of securities owned as of December 31, 2018, by correspondence with the

20

SCHWARTZ VALUE FOCUSED FUND

REPORT OF INDEPENDENT REGISTERED

PUBLIC ACCOUNTING FIRM (Continued)

custodian and brokers. We believe that our audits provide a reasonable basis for our opinion.

Chicago, Illinois

February 15, 2019

We have served as the auditor of one or more Schwartz Investment Trust investment companies since 1993.

21

SCHWARTZ VALUE FOCUSED FUND

BOARD OF TRUSTEES AND EXECUTIVE OFFICERS

(Unaudited)

Overall responsibility for management of the Trust rests with the Board of Trustees. The Trustees serve during the lifetime of the Trust and until its termination, or until death, resignation, retirement or removal. The Trustees, in turn, elect the officers of the Trust to actively supervise its day-to-day operations. The officers have been elected for an annual term. The following are the Trustees and executive officers of the Trust:

Trustee/Officer | Address | Year of

Birth | Position Held

with the Trust | Length of

Time Served |

Interested Trustees: |

* | George P. Schwartz, CFA | 801 W. Ann Arbor Trail

Plymouth, MI | 1944 | Chairman of the Board/President/ Trustee | Since 1992 |

Independent Trustees: |

| | Louis C. Bosco, Jr. | 801 W. Ann Arbor Trail

Plymouth, MI | 1936 | Trustee | Since 2008 |

| | Donald J. Dawson, Jr. | 801 W. Ann Arbor Trail

Plymouth, MI | 1947 | Trustee | Since 1993 |

| | Joseph M. Grace | 801 W. Ann Arbor Trail

Plymouth, MI | 1936 | Trustee | Since 2007 |

| | John J. McHale, Jr. | 801 W. Ann Arbor Trail

Plymouth, MI | 1949 | Trustee | Since 2014 |

| | Edward J. Miller | 801 W. Ann Arbor Trail

Plymouth, MI | 1946 | Trustee | Since 2017 |

| | William A. Morrow | 801 W. Ann Arbor Trail

Plymouth, MI | 1947 | Trustee | Since 2018 |

Executive Officers: |

* | Richard L. Platte, Jr., CFA | 801 W. Ann Arbor Trail

Plymouth, MI | 1951 | Vice President and Secretary | Since 1993 |

* | Robert C. Schwartz, CFP | 801 W. Ann Arbor Trail

Plymouth, MI | 1976 | Vice President | Since 2013 |

* | Timothy S. Schwartz, CFA | 5060 Annunciation Circle

Ave Maria, FL | 1971 | Treasurer | Since 2000 |

* | Cathy M. Stoner, CPA, IACCP | 801 W. Ann Arbor Trail

Plymouth, MI | 1970 | Chief Compliance Officer | Since 2010 |

* | George P. Schwartz, Richard L. Platte, Jr., Robert C. Schwartz, Timothy S. Schwartz and Cathy M. Stoner, as affiliated persons of Schwartz Investment Counsel, Inc., the Fund’s investment adviser, are “interested persons” of the Trust within the meaning of Section 2(a)(19) of the 1940 Act. George P. Schwartz is the father of Robert C. Schwartz and Timothy S. Schwartz. |

22

SCHWARTZ VALUE FOCUSED FUND

BOARD OF TRUSTEES AND EXECUTIVE OFFICERS

(Unaudited) (Continued)

Each Trustee oversees six portfolios of the Trust: the Ave Maria Value Fund, the Ave Maria Growth Fund, the Ave Maria Rising Dividend Fund, the Ave Maria World Equity Fund, the Ave Maria Bond Fund and the Fund. The principal occupations of the Trustees and executive officers of the Trust during the past five years and public directorships held by the Trustees are set forth below:

George P. Schwartz, CFA is Chairman and Chief Executive Officer of Schwartz Investment Counsel, Inc. and is the co-portfolio manager of the Fund.

Louis C. Bosco, Jr. retired in April 2012. Prior to his retirement, he was a partner in Bosco Development Company (a real estate firm).

Donald J. Dawson, Jr. retired in March 2015. Prior to retirement, he was Chairman of Payroll 1, Inc. (a payroll processing company) from 1986 – 2015.

Joseph M. Grace is retired Senior Vice President of National Bank of Detroit (renamed JPMorgan Chase & Company).

John J. McHale, Jr. is Special Assistant to Commissioner of Major League Baseball since 2015. He was Executive Vice President of Major League Baseball from 2000 – 2015.

Edward J. Miller is Vice Chairman and Director of Detroit Investment Fund since 2001 and Invest Detroit Foundation since 2010 (financiers for redevelopment of Detroit, Michigan).

William A. Morrow retired in 2017. Prior to his retirement, he was Senior Executive Vice President of Crain Communications, Inc. (business media) from 1985 – 2017.

Richard L. Platte, Jr., CFA is President and Chief Investment Officer of Schwartz Investment Counsel, Inc.

Robert C. Schwartz, CFP is Senior Vice President and Secretary of Schwartz Investment Counsel, Inc.

Timothy S. Schwartz, CFA is Executive Vice President and Chief Financial Officer of Schwartz Investment Counsel, Inc. and is the lead portfolio manager of the Fund.

Cathy M. Stoner, CPA, IACCP is Vice President, Chief Compliance Officer and Treasurer of Schwartz Investment Counsel, Inc.

Additional information about members of the Board of Trustees and executive officers is available in the Statement of Additional Information (“SAI”). To obtain a free copy of the SAI, please call (888) 726-0753.

23

SCHWARTZ VALUE FOCUSED FUND

ABOUT YOUR FUND’S EXPENSES

(Unaudited)

We believe it is important for you to understand the impact of costs on your investment. As a shareholder of the Fund, you incur ongoing costs, including management fees and other Fund expenses. The following examples are intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds.

A mutual fund’s ongoing costs are expressed as a percentage of its average net assets. This figure is known as the expense ratio. The ongoing costs reflected in the table below are based on an investment of $1,000 made at the beginning of the most recent semi-annual period (July 1, 2018) and held until the end of the period (December 31, 2018).

The table below illustrates the Fund’s ongoing costs in two ways:

Actual fund return – This section helps you to estimate the actual expenses that you paid over the period. The “Ending Account Value” shown is derived from the Fund’s actual return, and the third column shows the dollar amount of operating expenses that would have been paid by an investor who started with $1,000 in the Fund. You may use the information here, together with the amount you invested, to estimate the expenses that you paid over the period.

To do so, simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number given for the Fund under the heading “Expenses Paid During Period.”

Hypothetical 5% return – This section is intended to help you compare the Fund’s ongoing costs with those of other mutual funds. It assumes that the Fund had an annual return of 5% before expenses during the period shown, but that the expense ratio is unchanged. In this case, because the return used is not the Fund’s actual return, the result does not apply to your investment. The example is useful in making comparisons because the SEC requires all mutual funds to calculate expenses based on a 5% return. You can assess the Fund’s ongoing costs by comparing this hypothetical example with the hypothetical examples that appear in shareholder reports of other funds.

Note that expenses shown in the table are meant to highlight and help you compare ongoing costs only. The Fund does not charge sales loads or redemption fees.

The calculations assume no shares were bought or sold during the period. Your actual costs may have been higher or lower, depending on the amount of your investment and the timing of any purchases or redemptions.

More information about the Fund’s expenses, including historical annual expense ratios, can be found in this report. For additional information on operating expenses and other shareholder costs, please refer to the Fund’s Prospectus.

| Beginning

Account Value

July 1, 2018 | Ending

Account Value

December 31, 2018 | Expenses Paid

During Period* |

Based on Actual Fund Return | $1,000.00 | $865.90 | $5.88 |

Based on Hypothetical 5% Return (before expenses) | $1,000.00 | $1,018.90 | $6.36 |

* | Expenses are equal to the Fund’s annualized net expense ratio of 1.25% for the period, multiplied by the average account value over the period, multiplied by 184/365 (to reflect the one-half year period). |

24

SCHWARTZ VALUE FOCUSED FUND

FEDERAL TAX INFORMATION

(Unaudited)

For the fiscal year ended December 31, 2018, the Fund designated $268,201 as long-term capital gain distributions subject to a maximum tax rate of 20%.

Qualified Dividend Income – The Fund designates 68.62% of its ordinary income dividends, or up to the maximum amount of such dividends allowable pursuant to the Internal Revenue Code, as qualified dividend income eligible for the reduced tax rate of 15%.

Dividends Received Deduction – Corporate shareholders are generally entitled to take the dividends received deduction on the portion of the Fund’s dividend distributions that qualifies under tax law. For the fiscal year ended December 31, 2018, 59.95% of ordinary income dividends qualified for the corporate dividends received deduction.

OTHER INFORMATION

(Unaudited)

A description of the policies and procedures the Fund uses to determine how to vote proxies relating to portfolio securities is available without charge upon request by calling toll-free (888) 726-0753, or on the SEC’s website at http://www.sec.gov. Information regarding how the Fund voted proxies relating to portfolio securities during the most recent 12-month period ended June 30 is also available without charge upon request by calling toll-free (888) 726-0753, or on the SEC’s website at http://www.sec.gov.

The Trust files a complete listing of portfolio holdings for the Fund with the SEC as of the end of the first and third quarters of each fiscal year on Form N-Q. The filings are available free of charge, upon request, by calling (888) 726-0753. Furthermore, you may obtain a copy of the filings on the SEC’s website at http://www.sec.gov.

25

Beginning on January 1, 2021, as permitted by regulations adopted by the U.S. Securities and Exchange Commission, paper copies of the Funds’ shareholder reports like this one will no longer be sent by mail, unless you specifically request paper copies of the reports from the Funds or from your financial intermediary, such as a broker-dealer or bank. Instead, the reports will be made available on a website, and you will be notified by mail each time a report is posted and provided with a website link to access the report.

If you already elected to receive shareholder reports electronically, you will not be affected by this change and you need not take any action. You may elect to receive shareholder reports and other communications from the Funds electronically by contacting the Funds at 1-888-726-9331 or, if you own these shares through a financial intermediary, by contacting your financial intermediary.

You may elect to receive all future reports in paper free of charge. You can inform the Funds that you wish to continue receiving paper copies of your shareholder reports by contacting the Funds at 1-888-726-9331. If you own shares through a financial intermediary, you may contact your financial intermediary or follow instructions included with this document to elect to continue to receive paper copies of your shareholder reports. Your election to receive reports in paper will apply to all Funds held with the Fund complex or at your financial intermediary.

Shareholder Services c/o Ultimus Fund Solutions, LLC P.O. Box 46707 Cincinnati, OH 45246 (888) 726-9331 |

| Corporate Offices 801 W. Ann Arbor Trail Suite 244 Plymouth, MI 48170 (734) 455-7777 Fax (734) 455-7720 |

Dear Fellow Shareholders of:

Ave Maria Value Fund (AVEMX)

Ave Maria Growth Fund (AVEGX)

Ave Maria Rising Dividend Fund (AVEDX)

Ave Maria World Equity Fund (AVEWX)

Ave Maria Bond Fund (AVEFX)

Ave Maria Money Market Account

Despite the headlines, the U.S. economy looks strong.

The U.S. economic success of 2018 was aided by tax reform enacted in 2017 and a significant reduction in government regulations. The foot of the Federal Government was lifted from the neck of capitalism, when the current pro-growth (and pro-life) administration came into office. Currently, consumer confidence, CEO confidence, and small business optimism are near record highs. Based on our research, the economy and corporate profits are still expanding, but at a slower rate than 2018.

A recession doesn’t appear to be in the cards for 2019. We have been surprised at the extent to which many market participants are conflating the potential for a slowdown in economic and earnings growth this year with a recession. There was an unusual divergence in 2018 between S&P earnings, up 22%, and S&P 500 price performance, down 7%. Likely causes include: 1) trade tensions, 2) Fed tightening, 3) oil plunging, 4) global slowdown, 5) Trump uncertainty. In 2019, S&P Earnings should be up 5% to 10%, a slowdown in the rate of growth, not a recession. Unemployment is currently below 4% and at a multi-decade low. Gross Domestic Product growth is near 3%, much better than the sub 2% growth achieved in the prior Administration.

We remain optimistic on the long-term investment merits of the well-selected securities in the Ave Maria Mutual Funds. A growing economy, with rising corporate profits, strong employment and low inflation should support continued prosperity benefiting virtually all Americans. Resolution of any of the current political uncertainties could also further consumer and business confidence.

We remain focused in our efforts to invest in high-quality companies, in sound financial condition, selling at attractive valuations. As you know, investment decisions are guided by our Catholic Advisory Board, which provides the foundation for Morally Responsible Investing (MRI).

Thank you for investing in the Ave Maria Mutual Funds. We will continue to work hard to justify your confidence.

Respectfully,

George P. Schwartz, CFA

Chairman & CEO

January 1, 2019

AVE MARIA MUTUAL FUNDS

TABLE OF CONTENTS

Ave Maria Value Fund: | |

Portfolio Manager Commentary | 2 |

Performance | 6 |

Annual Total Rates of Return Comparison with Major Indices | 7 |

Ten Largest Equity Holdings | 8 |

Asset Allocation | 8 |

Schedule of Investments | 9 |

| | |

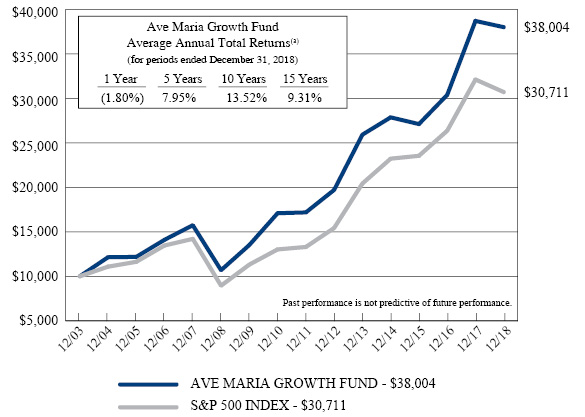

Ave Maria Growth Fund: | |

Portfolio Manager Commentary | 12 |

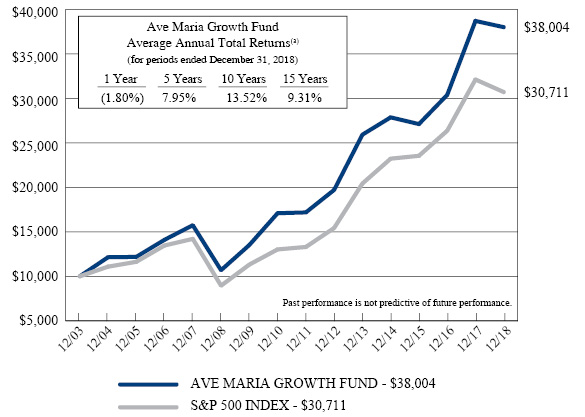

Performance | 14 |

Annual Total Rates of Return Comparison with Major Indices | 15 |

Ten Largest Equity Holdings | 16 |

Asset Allocation | 16 |

Schedule of Investments | 17 |

| | |

Ave Maria Rising Dividend Fund: | |

Portfolio Manager Commentary | 20 |

Performance | 22 |

Annual Total Rates of Return Comparison with Major Indices | 23 |

Ten Largest Equity Holdings | 24 |

Asset Allocation | 24 |

Schedule of Investments | 25 |

| | |

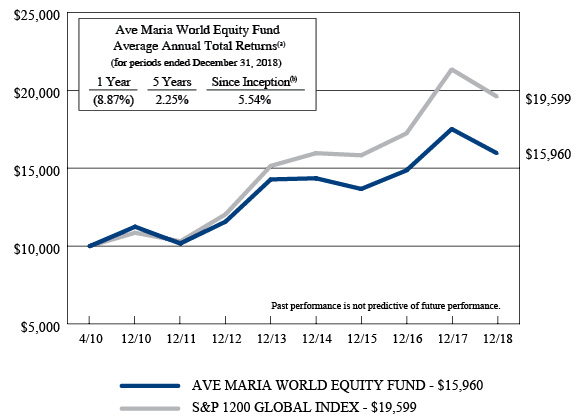

Ave Maria World Equity Fund: | |

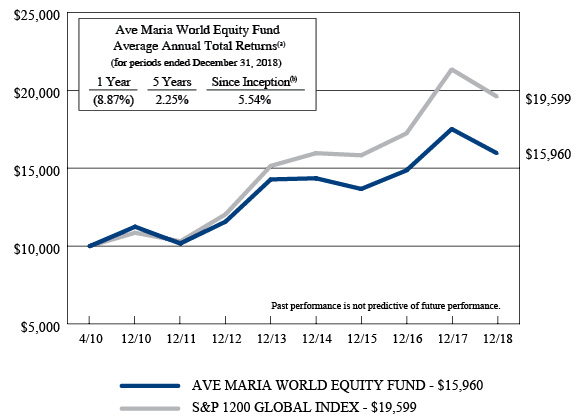

Portfolio Manager Commentary | 28 |

Performance | 31 |

Annual Total Rates of Return Comparison with Major Indices | 32 |

Ten Largest Equity Holdings | 33 |

Asset Allocation | 33 |

Schedule of Investments | 34 |

Summary of Common Stocks by Country | 37 |

| | |

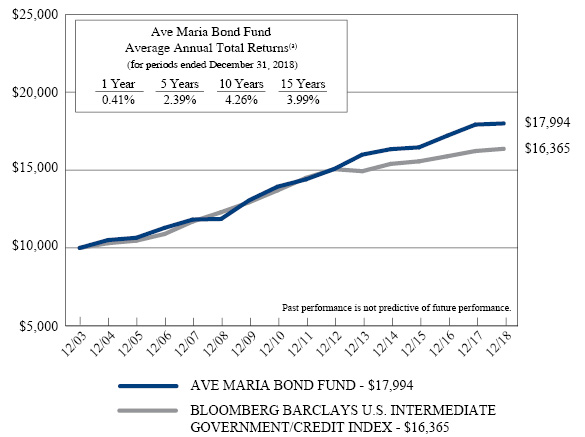

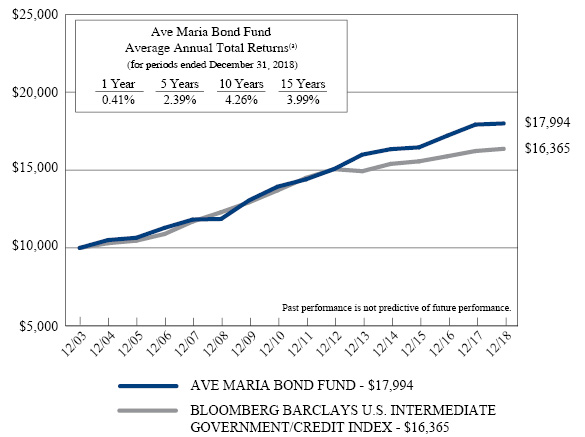

Ave Maria Bond Fund: | |

Portfolio Manager Commentary | 38 |

Performance | 39 |

Annual Total Rates of Return Comparison with Major Indices | 40 |

Ten Largest Holdings | 41 |

Asset Allocation | 41 |

Schedule of Investments | 42 |

AVE MARIA MUTUAL FUNDS

TABLE OF CONTENTS

(Continued)

Statements of Assets and Liabilities | 48 |

| | |

Statements of Operations | 50 |

| | |

Statements of Changes in Net Assets: | |

Ave Maria Value Fund | 52 |

Ave Maria Growth Fund | 53 |

Ave Maria Rising Dividend Fund | 54 |

Ave Maria World Equity Fund | 55 |

Ave Maria Bond Fund | 56 |

| | |

Financial Highlights: | |

Ave Maria Value Fund | 57 |

Ave Maria Growth Fund | 58 |

Ave Maria Rising Dividend Fund | 59 |

Ave Maria World Equity Fund | 60 |

Ave Maria Bond Fund | 61 |

| | |

Notes to Financial Statements | 62 |

| | |

Report of Independent Registered Public Accounting Firm | 73 |

| | |

Board of Trustees and Executive Officers | 75 |

| | |

Catholic Advisory Board | 77 |

| | |

About Your Funds’ Expenses | 79 |

| | |

Federal Tax Information | 81 |

| | |

Other Information | 81 |

This report is for the information of the shareholders of the Ave Maria Mutual Funds. To obtain a copy of the prospectus, please visit our website at www.avemariafunds.com or call 1-888-726-9331 and a copy will be sent to you free of charge. Please read the prospectus carefully before you invest. The Ave Maria Mutual Funds are distributed by Ultimus Fund Distributors, LLC.

Past performance is not predictive of future performance. Investment results and principal value will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. Current performance may be higher or lower than the performance data quoted. Performance data, current to the most recent month end, is available at the Ave Maria Mutual Funds website at www.avemariafunds.com or by calling 1-888-726-9331.

AVE MARIA VALUE FUND

PORTFOLIO MANAGER COMMENTARY

(Unaudited)

Dear Fellow Shareowner:

2018 was a challenging year for investors around the globe. The U.S. stock market recorded its worst performance since 2008, with the S&P 500 down -4.4% for the year. Foreign stock markets fared worse, with Japan (Nikkei 225) down -12.1%, Germany (DAX) -20.6%, and China (Shanghai Composite) -27.0%. Moreover, nearly every asset class had a negative return for 2018, as shown in the table below.

ETF Total Returns

Asset Class | Ticker | 2018

Return |

Cash | BIL | 1.7% |

TIPS | TIP | -1.4% |

Long-Term Treasuries | TLT | -1.6% |

Gold | GLD | -1.9% |

High Yield Bonds | HYG | -2.0% |

Investment Grade Bonds | LQD | -3.8% |

U.S. Large Cap Stocks | SPY | -4.5% |

Emerging Market Bonds | EMB | -5.5% |

REITS | VNQ | -6.0% |

U.S. Small Cap Stocks | IWM | -11.1% |

Commodities | DBC | -11.6% |

EAFE Stocks | EFA | -13.8% |

Emerging Market Stocks | EEM | -15.3% |

The Ave Maria Value Fund (the “Fund”) was unable to avoid most of the wreckage, posting a total return of -8.75% for the year ended December 31, 2018. However, the Fund outperformed its benchmark the S&P 400 Midcap Index which declined -11.08%, and its Morningstar mid-blend category average, which declined -11.16%. For the year, the Fund’s performance placed it in the top quartile out of 464 Funds in Morningstar’s mid-blend category, outpacing 75% of the funds in that peer group.

The multi-year cycle of growth stocks outperforming value stocks continued in 2018. The Russell 1000 Growth index finished the year down -1.51%, while the Russell 1000 Value index was down -8.27%. Likewise, large-cap stocks continued their outperformance over small-caps. According to Morningstar, the best performing fund category was large-cap growth down -2.1%. In contrast, the worst performing fund category was small-cap value down -15.6%. In the S&P 500, the best performing sectors were health care, utilities, and consumer discretionary, while the worst performing sectors were energy, materials,

2

AVE MARIA VALUE FUND

PORTFOLIO MANAGER COMMENTARY

(Unaudited) (Continued)

and industrials. In this environment of large-cap growth outperformance, the Fund’s mid-cap exposure, along with its value-oriented positions hurt relative performance.

The Fund owned a handful of stocks that appreciated sharply during the year. The Fund’s five best performing stocks in 2018 were:

Company | Industry | 2018

Performance |

Avid Bioservices, Inc. | Biotechnology | +69.71% |

The Madison Square Garden Co. | Leisure and Entertainment | +27.17% |

HEICO Corporation | Aerospace & Defense | +24.79% |

Texas Pacific Land Trust | Oil/Gas Royalties/Real Estate | +22.34% |

Coca-Cola European Partners | Beverages Distributor | +18.45% |

On the negative side, Spectrum Brands was the Fund’s worst performing security last year. We initiated a position in Spectrum in early 2018. Unfortunately, shortly after our investment, the company experienced some operational problems that negatively impacted results. We increased our position near year end, as we still believe the shares are undervalued with significant recovery potential and the catalyst for the recovery is expected to occur in the first half of 2019.

The Fund’s energy related holdings performed poorly in the 4th quarter last year, as oil prices dropped sharply during the period. We remain confident that our energy related holdings – Texas Pacific Land Trust, Noble Energy and Pioneer Natural Resources – are well managed, high-quality companies, in strong financial condition.

The Fund’s five worst performing stocks in 2018 were:

Company | Industry | 2018

Performance |

Spectrum Brands Holdings, Inc. | Consumer Products | -55.37% |

American Airlines Group, Inc. | Airlines | -38.61% |

KKR & Co., Inc. | Asset Management | -38.60% |

Noble Energy, Inc. | Oil/Gas Exploration & Production | -30.55% |

Axalta Coating Systems Ltd. | Specialty Chemicals | -29.71% |

3

AVE MARIA VALUE FUND

PORTFOLIO MANAGER COMMENTARY

(Unaudited) (Continued)

During the second half of 2018 the Fund liquidated its holdings of ARRIS International plc, as the company agreed to be acquired by a larger competitor, and Unico American Corporation due to deteriorating fundamentals. The following companies were also sold as their share prices reached our estimate of intrinsic value: Cognizant Technology Solutions Corp., Graco, Inc., Hexcel Corporation, Moody’s Corporation, and Tractor Supply Company. Four new holdings to the portfolio were: Gildan Activewear – an apparel manufacturing company; Rosetta Stone, Inc. – which provides technology-based learning products worldwide; DowDupont Inc. – which engages in agriculture, materials science, and specialty products businesses worldwide; and Valvoline, Inc. – which manufactures and markets automotive lubricants and provides maintenance services.

During the last 3 months of 2018, it seems negative headlines dominated the capitals markets. Investors were rattled by a myriad of issues including: the ongoing trade war with China, slowing global growth fears, widening credit spreads, the flattening yield curve, rising interest rates, and political dysfunction in Washington. Consequently, 2018 ended with December registering the worst month for the S&P 500 since 1931. Although stocks have suffered some jaw-dropping declines in recent months, astute investors know that a marvelous buying opportunity can arise when fear is widespread. So, when others are panicking and selling indiscriminately, we try to remain calm and search for bargains amidst the chaos. Such periods of short-term market turmoil often create opportunities to acquire shares of great companies when they are on sale. That’s the essence of value investing.

In our opinion, the economic and market environment remains positive with a growing U.S. economy, rising corporate profits, strong employment measures, low inflationary pressures, and interest rates that remain accommodative. A resolution to some of the Washington political turmoil could give a boost to consumer sentiment and business confidence. As always, we remain diligent in our efforts to invest in high-quality companies, in sound financial condition, when they are selling at attractive valuations.

4

AVE MARIA VALUE FUND

PORTFOLIO MANAGER COMMENTARY

(Unaudited) (Continued)

The year-end distribution of $1.85 per share consisted solely of long-term capital gains. The net asset value of the Fund ended the year at $17.19 per share.

Thank you for being a shareholder in the Ave Maria Value Fund.

|

|

Timothy S. Schwartz, CFA | Joseph W. Skornicka, CFA |

Lead Portfolio Manager | Co-Portfolio Manager |

|

Chadd M. Garcia, CFA |

Co-Portfolio Manager |

Morningstar Percentile Rankings is the Fund’s total-return percentile rank relative to all funds that have the same Morningstar Category. The highest (or most favorable) percentile rank is 1 and the lowest (or least favorable) percentile rank is 100. The top-performing fund in a category will always receive a rank of 1. Percentile rankings for other periods are as follows: 3 years (19th out of 382 funds), 5 years (90th out of 335 funds) and 10 years (88th out of 235 funds).

5

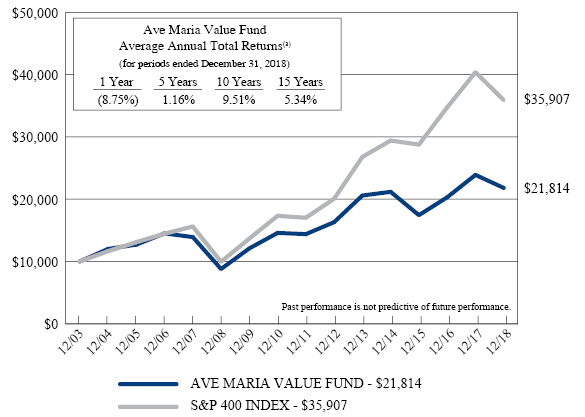

AVE MARIA VALUE FUND

PERFORMANCE

(Unaudited) |

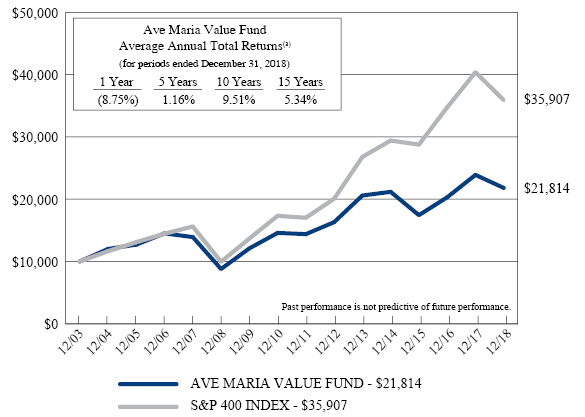

Comparison of the Change in Value of a $10,000 Investment

in the Ave Maria Value Fund and the S&P 400 Index

(a) | The returns shown do not reflect the deduction of taxes a shareholder would pay on Fund distributions or the redemption of Fund shares. |

Expense ratio as of 12-31-17 (as disclosed in May 1, 2018 prospectus) | 1.21%* |

Expense ratio for the year ended 12-31-18 | 1.18% |

* | Includes Acquired Fund Fees and Expenses. |

Past performance is not predictive of future performance. Investment results and principal value will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. Current performance may be higher or lower than the performance data quoted. Performance data, current to the most recent month end, is available at the Ave Maria Mutual Funds website at www.avemariafunds.com or by calling 1-888-726-9331.

6

AVE MARIA VALUE FUND

ANNUAL TOTAL RATES OF RETURN

COMPARISON WITH MAJOR INDICES (Unaudited) |

| AVE MARIA

VALUE FUND | S&P 400

INDEX | S&P 500

INDEX |

2001(a) | 5.3% | -0.5% | -8.5% |

2002 | -9.8% | -14.5% | -22.1% |

2003 | 35.6% | 35.6% | 28.7% |

2004 | 20.1% | 16.5% | 10.9% |

2005 | 5.8% | 12.6% | 4.9% |

2006 | 14.2% | 10.3% | 15.8% |

2007 | -4.0% | 8.0% | 5.5% |

2008 | -36.8% | -36.2% | -37.0% |

2009 | 37.6% | 37.4% | 26.5% |

2010 | 20.5% | 26.7% | 15.1% |

2011 | -1.3% | -1.7% | 2.1% |

2012 | 13.3% | 17.9% | 16.0% |

2013 | 26.2% | 33.5% | 32.4% |

2014 | 2.9% | 9.8% | 13.7% |

2015 | -17.7% | -2.2% | 1.4% |

2016 | 16.4% | 20.7% | 12.0% |

2017 | 17.7% | 16.2% | 21.8% |

2018 | -8.8% | -11.1% | -4.4% |

AVERAGE ANNUAL TOTAL RETURNS

As of December 31, 2018 (Unaudited)

| AVE MARIA

VALUE FUND | S&P 400

INDEX | S&P 500

INDEX |

3 Years | 7.8% | 7.7% | 9.3% |

5 Years | 1.2% | 6.0% | 8.5% |

10 Years | 9.5% | 13.7% | 13.1% |

15 Years | 5.3% | 8.9% | 7.8% |

Since Inception(b) | 6.0% | 8.4% | 6.0% |

(a) | Represents the period from the commencement of operations (May 1, 2001) through December 31, 2001. |

(b) | Represents the period from the commencement of operations (May 1, 2001) through December 31, 2018. |

7

AVE MARIA VALUE FUND

TEN LARGEST EQUITY HOLDINGS

December 31, 2018 (Unaudited)

Shares | | | Company | | Market Value | | | % of Net Assets | |

| | 25,500 | | | Texas Pacific Land Trust | | $ | 13,811,565 | | | | 6.5% | |

| | 195,312 | | | HEICO Corporation - Class A | | | 12,304,656 | | | | 5.8% | |

| | 175,000 | | | Delta Air Lines, Inc. | | | 8,732,500 | | | | 4.1% | |

| | 160,000 | | | InterXion Holding N.V. | | | 8,665,600 | | | | 4.1% | |

| | 150,000 | | | DowDuPont, Inc. | | | 8,022,000 | | | | 3.8% | |

| | 385,000 | | | Qurate Retail, Inc. | | | 7,515,200 | | | | 3.5% | |

| | 150,000 | | | Coca-Cola European Partners plc | | | 6,877,500 | | | | 3.3% | |

| | 10,536 | | | Alleghany Corporation | | | 6,567,300 | | | | 3.1% | |

| | 200,000 | | | Liberty Media Corporation - Liberty Formula One - Series C | | | 6,140,000 | | | | 2.9% | |

| | 200,000 | | | Gildan Activewear, Inc. | | | 6,072,000 | | | | 2.9% | |

ASSET ALLOCATION (Unaudited)

Sector | % of Net Assets |

Communication Services | 7.4% |

Consumer Discretionary | 12.6% |

Consumer Staples | 8.1% |

Energy | 9.3% |

Financials | 8.8% |

Health Care | 3.0% |

Industrials | 20.2% |

Information Technology | 8.0% |

Materials | 8.1% |

Money Market Funds, Liabilities in Excess of Other Assets | 14.5% |

| | 100.0% |

8

AVE MARIA VALUE FUND

SCHEDULE OF INVESTMENTS

December 31, 2018

COMMON STOCKS — 85.5% | | Shares | | | Market Value | |

Communication Services — 7.4% | | | | | | | | |

Entertainment — 7.4% | | | | | | | | |

Liberty Media Corporation - Liberty Formula One - Series C* | | | 200,000 | | | $ | 6,140,000 | |

Madison Square Garden Company (The) - Class A* | | | 15,000 | | | | 4,015,500 | |

Rosetta Stone, Inc.* | | | 336,018 | | | | 5,510,695 | |

| | | | | | | | 15,666,195 | |

Consumer Discretionary — 12.6% | | | | | | | | |

Diversified Consumer Services — 2.5% | | | | | | | | |

frontdoor, inc.* | | | 75,000 | | | | 1,995,750 | |

Graham Holdings Company - Class B | | | 5,000 | | | | 3,202,900 | |

| | | | | | | | 5,198,650 | |

Household Durables — 2.4% | | | | | | | | |

Garmin Ltd. | | | 80,000 | | | | 5,065,600 | |

| | | | | | | | | |

Internet & Direct Marketing Retail — 3.5% | | | | | | | | |

Qurate Retail, Inc.* | | | 385,000 | | | | 7,515,200 | |

| | | | | | | | | |

Specialty Retail — 1.3% | | | | | | | | |

AutoNation, Inc.* | | | 78,300 | | | | 2,795,310 | |

| | | | | | | | | |

Textiles, Apparel & Luxury Goods — 2.9% | | | | | | | | |

Gildan Activewear, Inc. | | | 200,000 | | | | 6,072,000 | |

| | | | | | | | | |

Consumer Staples — 8.1% | | | | | | | | |

Beverages — 6.1% | | | | | | | | |

Brown-Forman Corporation - Class B | | | 125,000 | | | | 5,947,500 | |

Coca-Cola European Partners plc | | | 150,000 | | | | 6,877,500 | |

| | | | | | | | 12,825,000 | |

Household Products — 2.0% | | | | | | | | |

Spectrum Brands Holdings, Inc. | | | 100,000 | | | | 4,225,000 | |

| | | | | | | | | |

Energy — 9.3% | | | | | | | | |

Oil, Gas & Consumable Fuels — 9.3% | | | | | | | | |

Noble Energy, Inc. | | | 100,000 | | | | 1,876,000 | |

Pioneer Natural Resources Company | | | 30,000 | | | | 3,945,600 | |

Texas Pacific Land Trust | | | 25,500 | | | | 13,811,565 | |

| | | | | | | | 19,633,165 | |

Financials — 8.8% | | | | | | | | |

Banks — 1.4% | | | | | | | | |