| OMB APPROVAL |

OMB Number: 3235-0570 Expires: August 31, 2020 Estimated average burden hours per response: 20.6 |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

| Investment Company Act file number | 811-07148 | |

| Schwartz Investment Trust |

| (Exact name of registrant as specified in charter) |

| 801 W. Ann Arbor Trail, Suite 244 Plymouth, Michigan | 48170 |

| (Address of principal executive offices) | (Zip code) |

George P. Schwartz

| Schwartz Investment Counsel, Inc. 801 W. Ann Arbor Trail, Plymouth, MI 48170 |

| (Name and address of agent for service) |

| Registrant's telephone number, including area code: | (734) 455-7777 | |

| Date of fiscal year end: | December 31 | |

| | | |

| Date of reporting period: | December 31, 2017 | |

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget ("OMB") control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to the Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

| Item 1. | Reports to Stockholders. |

Schwartz Value Focused Fund

Shareholder Services c/o Ultimus Fund Solutions, LLC P.O. Box 46707 Cincinnati, OH 45246 (888) 726-0753 | | Investment Adviser Schwartz Investment Counsel, Inc.

801 W. Ann Arbor Trail Suite 244 Plymouth, MI 48170 |

Dear Fellow Shareholders,

Schwartz Value Focused Fund (the “Fund”) was up 13.71% for the year ended December 31, 2017, compared to 21.13% for the benchmark S&P 1500 Index. Unlike 2016, when the Fund outperformed its benchmark by a wide margin, the investment climate in 2017 was tilted heavily in the favor of large-cap companies and growth stocks, as compared to small-caps and value stocks. Among U.S. equity mutual funds tracked by Morningstar, the top performing fund category was large-cap growth, up 27.64%. In contrast, the worst performing fund category was small-cap value, up only 8.56%. Further, in the S&P 500, the best performing sectors were growth-oriented technology, materials, and consumer discretionary. The value-oriented sectors such as consumer staples and energy were laggards. In this environment, our risk-averse, value-oriented holdings hurt our relative performance. The Fund did own several stocks that showed strong price appreciation during the year. The Fund’s five best performing stocks in 2017 were:

Company | Industry | 2017

Performance |

Interactive Brokers Group, Inc. | Investment Brokerage | +76.59% |

Moody’s Corporation | Business & Financial Services | +60.37% |

Brown-Forman Corporation | Consumer Goods | +51.39% |

Texas Pacific Land Trust | Oil/Gas Royalties/Real Estate | +50.64% |

AMETEK, Inc. | Diversified Machinery | +50.30% |

After a strong year of performance in 2016, the Fund’s energy related holdings performed poorly in 2017. Since peaking in January last year, oil and natural gas prices steadily declined throughout the year, due to several factors including increased U.S. shale production, tepid global demand, and moderate weather.

The Fund’s five worst performing stocks in 2017 were:

Company | Industry | 2017

Performance |

Apache Corporation | Oil/Gas Exploration & Production | -32.80% |

Schlumberger Limited | Oil/Gas Equipment and Services | -24.53% |

Noble Energy, Inc. | Oil/Gas Exploration & Production | -23.06% |

Avnet, Inc. | Technology Distributors | -20.42% |

Unico American Corporation | Specialty P&C Insurance | -20.30% |

1

During the second half of 2017 the Fund liquidated its position in Schlumberger Limited due to deteriorating fundamentals, realizing a small loss on the investment. Ubiquiti Networks, Inc. (communications equipment), was also liquidated based upon a reassessment of the company’s corporate governance practices, which we viewed as inadequate. We owned the stock for a few months and realized a 15% gain on the sale. New positions were established in three companies that meet our value investing criteria:

| | ● | American Airlines Group, Inc. (AAL) – is the world’s largest airline based on fleet size and destinations served. The U.S. airline industry has undergone positive fundamental and structural changes during the past decade, owing primarily to industry consolidation. Today, the four largest airlines have about 80% market share in the U.S., whereas 10 years ago it was 50%. This consolidation has resulted in numerous benefits to the airlines such as more rational pricing, increased ancillary revenue, flights with fewer empty seats and generally improved profitability. In our view, American Airlines has the best management in the industry and has produced strong profits and cash flow growth over the past several years. |

| | ● | The Kroger Company (KR) – Founded In 1883, Kroger is one of the oldest and largest grocery store operators in the U.S. with annual sales of $120 billion. The company has strong brand recognition, a loyal customer base, a dominant share in the markets they serve, and top-notch management with a demonstrated track record of creating shareholder value. Kroger’s share price came under pressure last fall, due to competitive concerns surrounding Amazon’s acquisition of Whole Foods. We viewed the sell-off as unwarranted and eagerly bought the depressed shares at 10x earnings. Subsequently, the company reported better than expected results with market-share gains, stable margins, and growth in its digital segment. Since our initial purchase a few months ago the stock is up 40%. |

| | ● | The Madison Square Garden Company (MSG) – owns and operates sports teams, entertainment productions, and various venues. Major holdings include the New York Knicks (NBA), the New York Rangers (NHL), Madison Square Garden arena in NYC, The Forum arena in L.A., and the Rockettes. With a cash-rich balance sheet sporting $1 billion in net cash, and a market cap of only $5 billion, we believe the shares are trading at a significant discount to our sum-of-the-parts valuation, based upon its diverse portfolio of its iconic and irreplaceable assets. |

The S&P 500 Index was up 21.83% in 2017, which was the 9th consecutive year of positive returns for that index, marking one of the longest running bull markets in history. While some commentators are writing the obituary for this bull, we remain generally optimistic. With an improving job market, moderate inflation, accommodative monetary policies globally, along with the recently enacted tax rate cuts, financial conditions appear conducive to robust economic growth, which should lead to rising corporate profits and higher stock prices over the long term. 2018 could be another good year for U.S. equity returns. According to the Wall Street Journal Market Data Group, when the S&P 500 total return exceeds 19% for the year, 68% of the time it rises again the following year. No guarantees!

As always, we believe our low-risk, value-oriented investment approach is a good way to achieve superior long-term investment returns. Despite stock market indices trading at or near all-time highs, the Fund owns many high-quality companies selling well below our estimate of intrinsic value. As such, we believe the Fund is well-positioned entering 2018.

2

The year-end distribution of $2.02 per share consisted solely of long-term capital gains. The net asset value of the Fund ended the year at $26.44 per share.

Thank you for being a shareholder in the Schwartz Value Focused Fund.

|

|

Timothy S. Schwartz, CFA | George P. Schwartz, CFA |

Lead Portfolio Manager | Co-Portfolio Manager |

3

SCHWARTZ VALUE FOCUSED FUND

PERFORMANCE

(Unaudited)

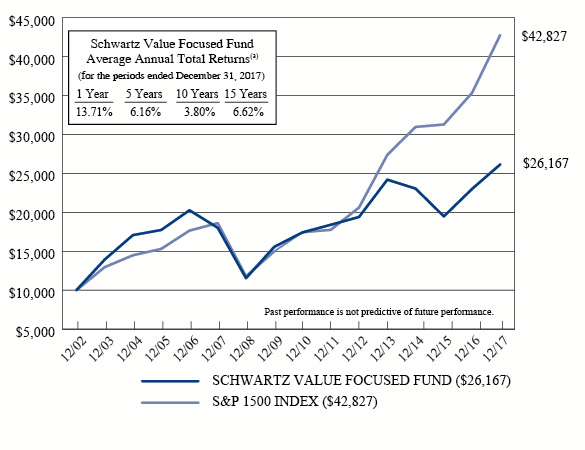

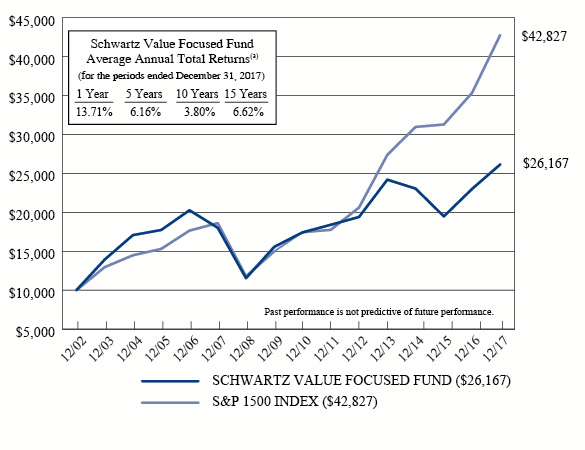

Comparison of the Change in Value of a $10,000 Investment

in Schwartz Value Focused Fund and the S&P 1500 Index

(a) | The returns shown do not reflect the deduction of taxes a shareholder would pay on Fund distributions or the redemption of Fund shares. |

Expense Ratio

Information as of: | Year Ended 12-31-16

(as disclosed in May 1, 2017 prospectus) | Year Ended 12-31-17 |

Gross | 1.82%* | 1.79% |

Net | 1.27%* | 1.25% |

* | Includes Acquired Fund Fees and Expenses. |

This report is for the information of shareholders, but it may also be used as sales literature when preceded or accompanied by a current prospectus, which gives details about charges, expenses, investment objectives and operating policies of the Fund. The Fund is distributed by Ultimus Fund Distributors, LLC.

4

SCHWARTZ VALUE FOCUSED FUND

ANNUAL TOTAL RATES OF RETURN

COMPARISON WITH MAJOR INDICES (Unaudited)

| SCHWARTZ

VALUE

FOCUSED

FUND(a) | S&P 1500

INDEX(b) | VALUE

LINE

COMPOSITE(c) |

1984 | 11.1% | N/A | -8.4% |

1985 | 21.7% | N/A | 20.7% |

1986 | 16.4% | N/A | 5.0% |

1987 | -0.6% | N/A | -10.6% |

1988 | 23.1% | N/A | 15.4% |

1989 | 8.3% | N/A | 11.2% |

1990 | -5.3% | N/A | -24.3% |

1991 | 32.0% | N/A | 27.2% |

1992 | 22.7% | N/A | 7.0% |

1993 | 20.5% | N/A | 10.7% |

1994 | -6.8% | N/A | -6.0% |

1995 | 16.9% | 36.5% | 19.3% |

1996 | 18.3% | 22.4% | 13.4% |

1997 | 28.0% | 32.9% | 21.1% |

1998 | -10.4% | 26.4% | -3.8% |

1999 | -2.5% | 20.3% | -1.4% |

2000 | 9.3% | -7.0% | -8.7% |

2001 | 28.1% | -10.6% | -6.1% |

2002 | -14.9% | -21.3% | -28.6% |

2003 | 39.3% | 29.6% | 37.4% |

2004 | 22.6% | 11.8% | 11.5% |

2005 | 3.8% | 5.7% | 2.0% |

2006 | 14.3% | 15.3% | 11.0% |

2007 | -11.1% | 5.5% | -3.8% |

2008 | -35.9% | -36.7% | -48.7% |

2009 | 34.8% | 27.2% | 36.8% |

2010 | 12.0% | 16.4% | 20.5% |

2011 | 5.6% | 1.7% | -11.4% |

2012 | 5.4% | 16.2% | 9.5% |

2013 | 24.7% | 32.8% | 35.5% |

2014 | -4.7% | 13.1% | 2.7% |

2015 | -15.5% | 1.0% | -11.2% |

2016 | 18.1% | 13.0% | 13.5% |

2017 | 13.7% | 21.1% | 11.1% |

(a) | Schwartz Value Focused Fund’s performance combines the performance of the Fund since its commencement of operations as a registered investment company on July 20, 1993, and the performance of RCM Partners Limited Partnership for periods prior thereto. |

(b) | Inception date of the S&P 1500 Index is December 30, 1994. |

(c) | Excluding dividends. |

5

SCHWARTZ VALUE FOCUSED FUND

AVERAGE ANNUAL TOTAL RETURNS

As of December 31, 2017 (Unaudited)

| SCHWARTZ

VALUE

FOCUSED

FUND(a) | S&P 1500

INDEX(b) | VALUE

LINE

COMPOSITE(c) |

3 Years | 4.3% | 11.4% | 3.8% |

5 Years | 6.2% | 15.7% | 9.3% |

10 Years | 3.8% | 8.7% | 2.5% |

15 Years | 6.6% | 10.2% | 5.2% |

34 Years | 8.8% | N/A | 3.2% |

(a) | Schwartz Value Focused Fund’s performance combines the performance of the Fund since its commencement of operations as a registered investment company on July 20, 1993, and the performance of RCM Partners Limited Partnership for periods prior thereto. |

(b) | Inception date of the S&P 1500 Index is December 30, 1994. |

(c) | Excluding dividends. |

6

SCHWARTZ VALUE FOCUSED FUND

TEN LARGEST EQUITY HOLDINGS

December 31, 2017 (Unaudited)

| Shares | | | Security Description | | Market

Value | | | % of

Net Assets | |

| | 4,500 | | | Texas Pacific Land Trust | | $ | 2,009,835 | | | | 8.9 | % |

| | 70,000 | | | Liberty Interactive Corporation QVC Group - Series A | | | 1,709,400 | | | | 7.6 | % |

| | 15,000 | | | Brown-Forman Corporation - Class B | | | 1,030,050 | | | | 4.6 | % |

| | 37,500 | | | Kroger Company (The) | | | 1,029,375 | | | | 4.5 | % |

| | 40,000 | | | ARRIS International plc | | | 1,027,600 | | | | 4.5 | % |

| | 30,000 | | | Axalta Coating Systems Ltd. | | | 970,800 | | | | 4.3 | % |

| | 3 | | | Berkshire Hathaway, Inc. - Class A | | | 892,800 | | | | 3.9 | % |

| | 96,467 | | | Unico American Corporation | | | 819,970 | | | | 3.6 | % |

| | 15,000 | | | American Airlines Group, Inc. | | | 780,450 | | | | 3.5 | % |

| | 60,000 | | | Goldcorp, Inc. | | | 766,200 | | | | 3.4 | % |

ASSET ALLOCATION (Unaudited)

Sector | % of

Net Assets |

Consumer Discretionary | 21.2% |

Consumer Staples | 9.1% |

Energy | 15.2% |

Financials | 13.3% |

Industrials | 8.4% |

Information Technology | 16.0% |

Materials | 11.4% |

Money Market Funds, Liabilities in Excess of Other Assets | 5.4% |

| | 100.0% |

7

SCHWARTZ VALUE FOCUSED FUND

SCHEDULE OF INVESTMENTS

December 31, 2017

| COMMON STOCKS — 94.6% | | Shares | | | Market Value | |

| Consumer Discretionary — 21.2% | | | | | | |

| Diversified Consumer Services — 2.4% | | | | | | |

| Graham Holdings Company - Class B | | | 500 | | | $ | 279,175 | |

| ServiceMaster Global Holdings, Inc. * | | | 5,000 | | | | 256,350 | |

| | | | | | | | 535,525 | |

| Household Durables — 2.6% | | | | | | | | |

| Garmin Ltd. | | | 10,000 | | | | 595,700 | |

| | | | | | | | | |

| Internet & Direct Marketing Retail — 7.6% | | | | | | | | |

| Liberty Interactive Corporation QVC Group - Series A * | | | 70,000 | | | | 1,709,400 | |

| | | | | | | | | |

| Media — 3.6% | | | | | | | | |

| Liberty Global plc - Series C * | | | 15,000 | | | | 507,600 | |

| Madison Square Garden Company (The) - Class A * | | | 1,500 | | | | 316,275 | |

| | | | | | | | 823,875 | |

| Specialty Retail — 5.0% | | | | | | | | |

| TJX Companies, Inc. (The) | | | 5,000 | | | | 382,300 | |

| Tractor Supply Company | | | 10,000 | | | | 747,500 | |

| | | | | | | | 1,129,800 | |

| Consumer Staples — 9.1% | | | | | | | | |

| Beverages — 4.6% | | | | | | | | |

| Brown-Forman Corporation - Class B | | | 15,000 | | | | 1,030,050 | |

| | | | | | | | | |

| Food & Staples Retailing — 4.5% | | | | | | | | |

| Kroger Company (The) | | | 37,500 | | | | 1,029,375 | |

| | | | | | | | | |

| Energy — 15.2% | | | | | | | | |

| Oil, Gas & Consumable Fuels — 15.2% | | | | | | | | |

| Apache Corporation | | | 6,000 | | | | 253,320 | |

| Devon Energy Corporation | | | 14,000 | | | | 579,600 | |

| Noble Energy, Inc. | | | 20,000 | | | | 582,800 | |

| Texas Pacific Land Trust | | | 4,500 | | | | 2,009,835 | |

| | | | | | | | 3,425,555 | |

| Financials — 13.3% | | | | | | | | |

| Capital Markets — 5.8% | | | | | | | | |

| Interactive Brokers Group, Inc. - Class A | | | 12,000 | | | | 710,520 | |

| Moody's Corporation | | | 4,000 | | | | 590,440 | |

| | | | | | | | 1,300,960 | |

8

SCHWARTZ VALUE FOCUSED FUND

SCHEDULE OF INVESTMENTS

(Continued)

| COMMON STOCKS — 94.6% (Continued) | | Shares | | | Market Value | |

| Financials — 13.3% (Continued) | | | | | | |

| Diversified Financial Services — 3.9% | | | | | | |

| Berkshire Hathaway, Inc. - Class A * | | | 3 | | | $ | 892,800 | |

| | | | | | | | | |

| Insurance — 3.6% | | | | | | | | |

Unico American Corporation * (a) | | | 96,467 | | | | 819,970 | |

| | | | | | | | | |

| Industrials — 8.4% | | | | | | | | |

| Airlines — 3.5% | | | | | | | | |

| American Airlines Group, Inc. | | | 15,000 | | | | 780,450 | |

| | | | | | | | | |

| Electrical Equipment — 1.6% | | | | | | | | |

| AMETEK, Inc. | | | 5,000 | | | | 362,350 | |

| | | | | | | | | |

| Road & Rail — 3.3% | | | | | | | | |

| AMERCO | | | 2,000 | | | | 755,820 | |

| | | | | | | | | |

| Information Technology — 16.0% | | | | | | | | |

| Communications Equipment — 4.5% | | | | | | | | |

| ARRIS International plc * | | | 40,000 | | | | 1,027,600 | |

| | | | | | | | | |

| Electronic Equipment, Instruments & Components — 4.3% | | | | | | | | |

| Arrow Electronics, Inc. * | | | 7,000 | | | | 562,870 | |

| Avnet, Inc. | | | 10,000 | | | | 396,200 | |

| | | | | | | | 959,070 | |

| IT Services — 5.5% | | | | | | | | |

| Cognizant Technology Solutions Corporation - Class A | | | 10,000 | | | | 710,200 | |

| MasterCard, Inc. - Class A | | | 3,500 | | | | 529,760 | |

| | | | | | | | 1,239,960 | |

| Semiconductors & Semiconductor Equipment — 1.7% | | | | | | | | |

| QUALCOMM Incorporated | | | 6,000 | | | | 384,120 | |

| | | | | | | | | |

| Materials — 11.4% | | | | | | | | |

| Chemicals — 4.3% | | | | | | | | |

| Axalta Coating Systems Ltd. * | | | 30,000 | | | | 970,800 | |

9

SCHWARTZ VALUE FOCUSED FUND

SCHEDULE OF INVESTMENTS

(Continued)

| COMMON STOCKS — 94.6% (Continued) | | Shares | | | Market Value | |

| Materials — 11.4% (Continued) | | | | | | |

| Metals & Mining — 7.1% | | | | | | |

| Barrick Gold Corporation | | | 20,000 | | | $ | 289,400 | |

| Goldcorp, Inc. | | | 60,000 | | | | 766,200 | |

| Pan American Silver Corporation | | | 35,000 | | | | 544,600 | |

| | | | | | | | 1,600,200 | |

| | | | | | | | | |

Total Common Stocks (Cost $16,321,550) | | | | | | $ | 21,373,380 | |

| MONEY MARKET FUNDS — 6.3% | | Shares | | | Market Value | |

Federated Government Obligations Tax-Managed Fund - Institutional Shares, 1.05% (b) | | | 1,069,905 | | | $ | 1,069,905 | |

Federated Treasury Obligations Fund - Institutional Shares, 1.13% (b) | | | 341,760 | | | | 341,760 | |

Total Money Market Funds (Cost $1,411,665) | | | | | | $ | 1,411,665 | |

| | | | | | | | | |

Total Investments at Market Value — 100.9% (Cost $17,733,215) | | | | | | $ | 22,785,045 | |

| | | | | | | | | |

Liabilities in Excess of Other Assets — (0.9%) | | | | | | | (193,492 | ) |

| | | | | | | | | |

Net Assets — 100.0% | | | | | | $ | 22,591,553 | |

* | Non-income producing security. |

(a) | Security value has been determined in good faith pursuant to procedures adopted by the Board of Trustees. The total value of such securities was $819,970 at December 31, 2017, representing 3.6% of net assets (Note 1). |

(b) | The rate shown is the 7-day effective yield as of December 31, 2017. |

See notes to financial statements. |

10

SCHWARTZ VALUE FOCUSED FUND

STATEMENT OF ASSETS AND LIABILITIES

December 31, 2017

| ASSETS | | | |

| Investments, at market value (cost of $17,733,215) (Note 1) | | $ | 22,785,045 | |

| Dividends receivable | | | 5,401 | |

| Other assets | | | 7,336 | |

| TOTAL ASSETS | | | 22,797,782 | |

| | | | | |

| LIABILITIES | | | | |

| Payable for investment securities purchased | | | 81,302 | |

| Payable for capital shares redeemed | | | 84,306 | |

| Payable to Adviser (Note 2) | | | 25,114 | |

| Payable to administrator (Note 2) | | | 3,000 | |

| Other accrued expenses | | | 12,507 | |

| TOTAL LIABILITIES | | | 206,229 | |

| | | | | |

NET ASSETS | | $ | 22,591,553 | |

| | | | | |

| NET ASSETS CONSIST OF: | | | | |

| Paid-in capital | | $ | 17,539,723 | |

| Net unrealized appreciation on investments | | | 5,051,830 | |

| NET ASSETS | | $ | 22,591,553 | |

| | | | | |

| Shares of beneficial interest outstanding (unlimited number of shares authorized, no par value) | | | 854,576 | |

| | | | | |

| Net asset value, offering price and redemption price per share (Note 1) | | $ | 26.44 | |

See notes to financial statements. |

11

SCHWARTZ VALUE FOCUSED FUND

STATEMENT OF OPERATIONS

For the Year Ended December 31, 2017

| INVESTMENT INCOME | | | |

| Dividends (Net of foreign tax of $1,665) | | $ | 156,264 | |

| | | | | |

| EXPENSES | | | | |

| Investment advisory fees (Note 2) | | | 203,886 | |

| Trustees’ fees and expenses (Note 2) | | | 60,555 | |

| Legal and audit fees | | | 38,556 | |

| Administration, accounting and transfer agent fees (Note 2) | | | 36,000 | |

| Registration and filing fees | | | 14,540 | |

| Postage and supplies | | | 7,545 | |

| Custodian and bank service fees | | | 5,982 | |

| Printing of shareholder reports | | | 5,308 | |

| Insurance expense | | | 1,277 | |

| Compliance service fees and expenses (Note 2) | | | 1,077 | |

| Other expenses | | | 9,029 | |

| TOTAL EXPENSES | | | 383,755 | |

| Less fee reductions by the Adviser (Note 2) | | | (115,484 | ) |

| NET EXPENSES | | | 268,271 | |

| | | | | |

| NET INVESTMENT LOSS | | | (112,007 | ) |

| | | | | |

| REALIZED AND UNREALIZED GAINS ON INVESTMENTS | | | | |

| Net realized gains from investment transactions | | | 2,239,114 | |

| Net change in unrealized appreciation (depreciation) on investments | | | 669,495 | |

| NET REALIZED AND UNREALIZED GAINS ON INVESTMENTS | | | 2,908,609 | |

| | | | | |

| NET INCREASE IN NET ASSETS RESULTING FROM OPERATIONS | | $ | 2,796,602 | |

See notes to financial statements. |

12

SCHWARTZ VALUE FOCUSED FUND

STATEMENTS OF CHANGES IN NET ASSETS

| | | Year Ended December 31, 2017 | | | Year Ended December 31, 2016 | |

| FROM OPERATIONS | | | | | | |

| Net investment loss | | $ | (112,007 | ) | | $ | (67,763 | ) |

| Net realized gains from investment transactions | | | 2,239,114 | | | | 29,217 | |

| Net change in unrealized appreciation (depreciation) on investments | | | 669,495 | | | | 3,288,843 | |

| Net increase in net assets resulting from operations | | | 2,796,602 | | | | 3,250,297 | |

| | | | | | | | | |

| FROM DISTRIBUTIONS TO SHAREHOLDERS (Note 1) | | | | | | | | |

| From net realized gains on investments | | | (1,619,709 | ) | | | — | |

| | | | | | | | | |

| FROM CAPITAL SHARE TRANSACTIONS | | | | | | | | |

| Proceeds from shares sold | | | 328,864 | | | | 1,533,951 | |

| Reinvestment of distributions to shareholders | | | 1,557,160 | | | | — | |

| Payments for shares redeemed | | | (1,483,218 | ) | | | (2,544,502 | ) |

| Net increase (decrease) in net assets from capital share transactions | | | 402,806 | | | | (1,010,551 | ) |

| | | | | | | | | |

| TOTAL INCREASE IN NET ASSETS | | | 1,579,699 | | | | 2,239,746 | |

| | | | | | | | | |

| NET ASSETS | | | | | | | | |

| Beginning of year | | | 21,011,854 | | | | 18,772,108 | |

| End of year | | $ | 22,591,553 | | | $ | 21,011,854 | |

| | | | | | | | | |

| ACCUMULATED NET INVESTMENT LOSS | | $ | — | | | $ | — | |

| | | | | | | | | |

| SUMMARY OF CAPITAL SHARE ACTIVITY | | | | | | | | |

| Shares sold | | | 12,584 | | | | 65,097 | |

| Shares issued in reinvestment of distributions to shareholders | | | 58,584 | | | | — | |

| Shares redeemed | | | (56,357 | ) | | | (111,549 | ) |

| Net increase (decrease) in shares outstanding | | | 14,811 | | | | (46,452 | ) |

| Shares outstanding, beginning of year | | | 839,765 | | | | 886,217 | |

| Shares outstanding, end of year | | | 854,576 | | | | 839,765 | |

See notes to financial statements. |

13

SCHWARTZ VALUE FOCUSED FUND

FINANCIAL HIGHLIGHTS

Per Share Data for a Share Outstanding Throughout Each Year

| | | Year

Ended

Dec. 31,

2017 | | | Year

Ended

Dec. 31,

2016 | | | Year

Ended

Dec. 31,

2015 | | | Year

Ended

Dec. 31,

2014 | | | Year

Ended

Dec. 31,

2013 | |

| Net asset value at beginning of year | | $ | 25.02 | | | $ | 21.18 | | | $ | 25.06 | | | $ | 28.54 | | | $ | 23.31 | |

| | | | | | | | | | | | | | | | | | | | | |

| Income (loss) from investment operations: | | | | | | | | | | | | | | | | | | | | |

| Net investment loss | | | (0.13 | ) | | | (0.08 | ) | | | (0.11 | ) | | | (0.08 | ) | | | (0.04 | ) |

| Net realized and unrealized gains (losses) on investments | | | 3.57 | | | | 3.92 | | | | (3.77 | ) | | | (1.26 | ) | | | 5.80 | |

| Total from investment operations | | | 3.44 | | | | 3.84 | | | | (3.88 | ) | | | (1.34 | ) | | | 5.76 | |

| | | | | | | | | | | | | | | | | | | | | |

| Less distributions: | | | | | | | | | | | | | | | | | | | | |

| From net realized gains on investments | | | (2.02 | ) | | | — | | | | — | | | | (2.14 | ) | | | (0.53 | ) |

| | | | | | | | | | | | | | | | | | | | | |

| Net asset value at end of year | | $ | 26.44 | | | $ | 25.02 | | | $ | 21.18 | | | $ | 25.06 | | | $ | 28.54 | |

| | | | | | | | | | | | | | | | | | | | | |

Total return (a) | | | 13.7 | % | | | 18.1 | % | | | (15.5 | %) | | | (4.7 | %) | | | 24.7 | % |

| | | | | | | | | | | | | | | | | | | | | |

| Ratios/Supplementary Data: | | | | | | | | | | | | | | | | | | | | |

| Net assets at end of year (000’s) | | $ | 22,592 | | | $ | 21,012 | | | $ | 18,772 | | | $ | 28,129 | | | $ | 32,030 | |

| | | | | | | | | | | | | | | | | | | | | |

| Ratio of total expenses to average net assets | | | 1.79 | % | | | 1.80 | % | | | 1.59 | % | | | 1.46 | % | | | 1.45 | % |

| | | | | | | | | | | | | | | | | | | | | |

| Ratio of net expenses to average net assets | | | 1.25 | %(b) | | | 1.25 | %(b) | | | 1.35 | %(b) | | | 1.46 | % | | | 1.45 | % |

| | | | | | | | | | | | | | | | | | | | | |

| Ratio of net investment loss to average net assets | | | (0.52 | %)(b) | | | (0.35 | %)(b) | | | (0.40 | %)(b) | | | (0.28 | %) | | | (0.13 | %) |

| | | | | | | | | | | | | | | | | | | | | |

| Portfolio turnover rate | | | 48 | % | | | 48 | % | | | 104 | % | | | 72 | % | | | 57 | % |

(a) | Total return is a measure of the change in value of an investment in the Fund over the period covered, which assumes any dividends or capital gains distributions are reinvested in shares of the Fund. Returns shown do not reflect the deduction of taxes a shareholder would pay on Fund distributions or the redemption of Fund shares. |

(b) | Ratio was determined after advisory fee reductions (Note 2). |

See notes to financial statements. |

14

SCHWARTZ VALUE FOCUSED FUND

NOTES TO FINANCIAL STATEMENTS

December 31, 2017

1. Significant Accounting Policies

Schwartz Value Focused Fund (the “Fund”) is a series of Schwartz Investment Trust (the “Trust”), an open-end, non-diversified management investment company established as an Ohio business trust under a Declaration of Trust dated August 31, 1992. Other series of the Trust are not incorporated in this report. The Fund is registered under the Investment Company Act of 1940, as amended (the “1940 Act”), and commenced operations on July 20, 1993.

The investment objective of the Fund is to seek long-term capital appreciation. See the Prospectus for information regarding the principal investment strategies of the Fund.

Shares of the Fund are sold at net asset value (“NAV”). To calculate the NAV, the Fund’s assets are valued and totaled, liabilities are subtracted, and the balance is divided by the number of shares outstanding. The offering price and redemption price per share are equal to the NAV per share.

The Fund follows accounting and reporting guidance under Financial Accounting Standards Board Accounting Standards Codification Topic 946, “Financial Services – Investment Companies.” The following is a summary of the Fund’s significant accounting policies used in the preparation of its financial statements. These policies are in conformity with accounting principles generally accepted in the United States of America (“GAAP”).

(a) Valuation of investments — Securities which are traded on stock exchanges, other than NASDAQ, are valued at the closing sales price as of the close of the regular session of trading on the New York Stock Exchange on the day the securities are being valued, or, if not traded on a particular day, at the closing bid price. Securities which are quoted by NASDAQ are valued at the NASDAQ Official Closing Price or, if an Official Closing Price is not available, at the most recently quoted bid price. Securities traded in the over-the-counter market are valued at the last reported sales price or, if there is no reported sale on the valuation date, at the most recently quoted bid price. Securities which are traded both in the over-the-counter market and on a stock exchange are valued according to the broadest and most representative market. Investments representing shares of other open-end investment companies are valued at their NAV as reported by such companies. When using quoted prices and when the market for the securities are considered active, the securities will be classified as Level 1 within the fair value hierarchy (see below). Securities (and other assets) for which market quotations are not readily available are valued at their fair value as determined in good faith in accordance with consistently applied procedures established by and under the general supervision of the Board of Trustees, and will be classified as Level 2 or 3 within the fair value hierarchy, depending on the inputs used. Fair value pricing may be used, for example, in situations where (i) a portfolio security is so thinly traded that there have been no transactions for that stock over an extended period of time; (ii) the exchange on which the portfolio security is principally traded closes early; or (iii) trading of the portfolio security is halted during the day and does not resume prior to the Fund’s NAV calculation. A portfolio

15

SCHWARTZ VALUE FOCUSED FUND

NOTES TO FINANCIAL STATEMENTS

(Continued)

security’s “fair value” price may differ from the price next available for that portfolio security using the Fund’s normal pricing procedures.

GAAP establishes a single authoritative definition of fair value, sets out a framework for measuring fair value and requires additional disclosures about fair value measurements.

Various inputs are used in determining the value of the Fund’s investments. These inputs are summarized in the three broad levels listed below:

| | ● | Level 1 – quoted prices in active markets for identical securities |

| | ● | Level 2 – other significant observable inputs |

| | ● | Level 3 – significant unobservable inputs |

The inputs or methodology used for valuing securities are not necessarily an indication of the risks associated with investing in those securities. The inputs used to measure fair value may fall into different levels of the fair value hierarchy. In such cases, for disclosure purposes, the level in the fair value hierarchy within which the fair value measurement falls in its entirety is determined based on the lowest level input that is significant to the fair value measurement.

The following is a summary of the inputs used to value the Fund’s investments, by security type, as of December 31, 2017:

| | | Level 1 | | | Level 2 | | | Level 3 | | | Total | |

| Common Stocks | | $ | 20,553,410 | | | $ | 819,970 | | | $ | — | | | $ | 21,373,380 | |

| Money Market Funds | | | 1,411,665 | | | | — | | | | — | | | | 1,411,665 | |

| Total | | $ | 21,965,075 | | | $ | 819,970 | | | $ | — | | | $ | 22,785,045 | |

Refer to the Fund’s Schedule of Investments for a listing of the securities by industry type. There were no Level 3 securities or derivative instruments held by the Fund as of December 31, 2017. It is the Fund’s policy to recognize transfers into or out of any Level at the end of the reporting period. Transfers that occurred between Level 1 and 2 on December 31, 2017 due to fair value procedures was as follows:

| | | Transfers

from Level 1

to Level 2 | |

| Common Stocks | | $ | 819,970 | |

(b) Income taxes — The Fund has qualified and intends to continue to qualify as a regulated investment company under the Internal Revenue Code of 1986, as amended (the “Code”). Qualification generally will relieve the Fund of liability for federal income taxes to the extent 100% of its net investment income and net realized capital gains are distributed in accordance with the Code.

16

SCHWARTZ VALUE FOCUSED FUND

NOTES TO FINANCIAL STATEMENTS

(Continued)

In order to avoid imposition of the excise tax applicable to regulated investment companies, it is also the Fund’s intention to declare as dividends in each calendar year at least 98% of its net investment income and 98.2% of its net realized capital gains plus undistributed amounts from prior years.

The following information is computed on a tax basis for each item as of December 31, 2017:

| Federal income tax cost | | $ | 17,733,215 | |

| Gross unrealized appreciation | | $ | 5,347,641 | |

| Gross unrealized depreciation | | | (295,811 | ) |

| Net unrealized appreciation | | | 5,051,830 | |

| Accumulated earnings | | $ | 5,051,830 | |

During the year ended December 31, 2017, the Fund utilized $509,257 of short-term capital loss carryforwards to offset current year gains.

During the year ended December 31, 2017, the Fund reclassified $110,148 and $1,859 of net investment loss against net realized gains and paid-in capital, respectively, on the Statement of Assets and Liabilities. Such reclassifications, the result of permanent differences between the financial statement and income tax reporting requirements, have no effect on the Fund’s net assets or NAV per share.

The Fund recognizes the tax benefits or expenses of uncertain tax positions only when the position is “more-likely-than-not” to be sustained assuming examination by tax authorities. Management has reviewed the tax positions taken on federal income tax returns for all open tax years (tax years ended December 31, 2014 through December 31, 2017) and has concluded that no provision for unrecognized tax benefits or expenses is required in these financial statements.

(c) Investment transactions and investment income — Investment transactions are accounted for on the trade date. Dividend income is recorded on the ex-dividend date. Interest income is recognized on the accrual basis. Realized capital gains and losses on security transactions are determined on the identified cost basis. Withholding taxes on foreign dividends have been recorded in accordance with the Fund’s understanding of the applicable country’s rules and tax rates.

(d) Dividends and distributions — Dividends from net investment income and distributions of net realized capital gains, if any, are declared and paid annually in December. Dividends and distributions to shareholders are recorded on the ex-dividend date. There were no distributions paid to shareholders during the year ended December 31, 2016. The tax character of the distributions paid to shareholders during the year ended December 31, 2017 was long-term capital gains.

(e) Estimates — The preparation of financial statements in conformity with GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities as of the date of the financial statements and the reported amounts of revenues and expenses during the reporting period. Actual results could differ from those estimates.

17

SCHWARTZ VALUE FOCUSED FUND

NOTES TO FINANCIAL STATEMENTS

(Continued)

(f) Common expenses — Common expenses of the Trust are allocated among the Fund and the other series of the Trust based on relative net assets of each series or the nature of the services performed and the relative applicability to each series.

2. Investment Advisory Agreement and Transactions with Related Parties

The Chairman and President of the Trust is also the Chairman and Chief Executive Officer of Schwartz Investment Counsel, Inc. (the “Adviser”). Certain other officers of the Trust are officers of the Adviser, or of Ultimus Fund Solutions, LLC (“Ultimus”), the administrative, accounting and transfer agent for the Fund, or of Ultimus Fund Distributors, LLC (the “Distributor”), the Fund’s principal underwriter.

Pursuant to an Investment Advisory Agreement between the Trust and the Adviser, the Adviser is responsible for the management of the Fund and provides investment advice along with the necessary personnel, facilities, equipment and certain other services necessary to the operations of the Fund. The Adviser receives from the Fund a quarterly fee at the annual rate of 0.95% per annum of the Fund’s average daily net assets.

The Adviser has contractually agreed to reduce its advisory fees or reimburse a portion of the Fund’s expenses until at least May 1, 2018 so that the ordinary operating expenses of the Fund do not exceed 1.25% per annum of average daily net assets. Accordingly, during the year ended December 31, 2017, the Adviser reduced its investment advisory fees by $115,484.

Any fee reductions or expense reimbursements by the Adviser are subject to repayment by the Fund for a period of three years after such fees and expenses were incurred, provided repayment to the Adviser does not cause the ordinary operating expenses of the Fund to exceed 1.25% per annum of average daily net assets. As of December 31, 2017, the Advisor may seek recoupment of investment advisory fee reductions totaling $278,968 no later than the dates stated below:

December 31, 2018 | December 31, 2019 | December 31, 2020 | Total |

$ 56,616 | $ 106,868 | $ 115,484 | $ 278,968 |

The Chief Compliance Officer of the Trust (the “CCO”) is an employee of the Adviser. The Trust pays the Adviser a fee for providing CCO services, of which the Fund pays its proportionate share along with the other series of the Trust. In addition, the Trust reimburses the Adviser for out-of-pocket expenses incurred, if any, for providing these services.

Pursuant to a Mutual Fund Services Agreement between the Trust and Ultimus, Ultimus supplies regulatory and compliance services, calculates the daily NAV per share, maintains the financial books and records of the Fund, maintains the records of each shareholder’s account, and processes purchases and redemptions of the Fund’s shares. For these services Ultimus receives fees computed as a percentage of the average daily net assets of the Fund, subject to a minimum monthly fee.

18

SCHWARTZ VALUE FOCUSED FUND

NOTES TO FINANCIAL STATEMENTS

(Continued)

Pursuant to a Distribution Agreement between the Trust and the Distributor, the Distributor serves as the Fund’s exclusive agent for the distribution of its shares. The Distributor is an affiliate of Ultimus.

Trustees and officers affiliated with the Adviser or Ultimus are not compensated by the Trust for their services. Each Trustee who is not an affiliated person of the Adviser or Ultimus (“Independent Trustee”) received from the Trust an annual retainer of $40,000 (except that such fee was $50,000 for the Lead Independent Trustee/Chairman of the Governance Committee and $44,000 for the Chairman of the Audit Committee), payable quarterly; a fee of $6,000 for attendance at each meeting of the Board of Trustees; plus reimbursement of travel and other expenses incurred in attending meetings. Effective January 1, 2018, each Independent Trustee will receive from the Trust an annual retainer of $46,000 (except that such fee is $56,000 for the Lead Independent Trustee/Chairman of the Governance Committee and $50,000 for the Chairman of the Audit Committee), payable quarterly; a fee of $6,000 for attendance at each meeting of the Board of Trustees; plus reimbursement of travel and other expenses incurred in attending meetings. The Fund pays its proportionate share of the Independent Trustees’ fees and expenses along with the other series of the Trust.

3. Investment Transactions

During the year ended December 31, 2017, cost of purchases and proceeds from sales and maturities of investment securities, excluding short-term investments and U.S. government securities, amounted to $9,619,180 and $10,351,971, respectively.

4. Contingencies and Commitments

The Fund indemnifies the Trust’s officers and Trustees for certain liabilities that might arise from their performance of their duties to the Fund. Additionally, in the normal course of business, the Fund enters into contracts that contain a variety of representations and warranties and which provide general indemnifications. The Fund’s maximum exposure under these arrangements is unknown, as this would involve future claims that may be made against the Fund that have not yet occurred. However, based on experience, the Fund expects the risk of loss to be remote.

5. Subsequent Events

The Fund is required to recognize in the financial statements the effects of all subsequent events that provide additional evidence about conditions that existed as of the date of the Statement of Assets and Liabilities. For non-recognized subsequent events that must be disclosed to keep the financial statements from being misleading, the Fund is required to disclose the nature of the event as well as an estimate of its financial effect, or a statement that such an estimate cannot be made. Management has evaluated subsequent events through the issuance of these financial statements and has noted no such events.

19

SCHWARTZ VALUE FOCUSED FUND

REPORT OF INDEPENDENT REGISTERED

PUBLIC ACCOUNTING FIRM

To the Shareholders and the Board of Trustees of Schwartz Investment Trust

Opinion on the Financial Statements and Financial Highlights

We have audited the accompanying statement of assets and liabilities, including the schedule of investments, of the Schwartz Value Focused Fund, one of the portfolios constituting the Schwartz Investment Trust (the “Fund”), as of December 31, 2017, the related statement of operations for the year then ended, the statement of changes in net assets for each of the two years in the period then ended, the financial highlights for each of the five years in the period then ended, and the related notes. In our opinion, the financial statements and financial highlights present fairly, in all material respects, the financial position of the Fund as of December 31, 2017, and the results of its operation for the year then ended, the changes in its net assets for each of the two years in the period then ended, and the financial highlights for each of the five years in the period then ended, in conformity with accounting principles generally accepted in the United States of America.

Basis for Opinion

These financial statements and financial highlights are the responsibility of the Fund’s management. Our responsibility is to express an opinion on the Fund’s financial statements and financial highlights based on our audits. We are a public accounting firm registered with the Public Company Accounting Oversight Board (United States) (PCAOB) and are required to be independent with respect to the Funds in accordance with the U.S. federal securities laws and the applicable rules and regulations of the Securities and Exchange Commission and the PCAOB.

We conducted our audits in accordance with the standards of the PCAOB. Those standards require that we plan and perform the audits to obtain reasonable assurance about whether the financial statements and financial highlights are free of material misstatement, whether due to error or fraud. The Funds is not required to have, nor were we engaged to perform, an audit of internal control over financial reporting. As part of our audits we are required to obtain an understanding of internal control over financial reporting but not for the purpose of expressing an opinion on the effectiveness of the Fund’s internal control over financial reporting. Accordingly, we express no such opinion.

Our audits included performing procedures to assess the risks of material misstatement of the financial statements and financial highlights, whether due to error or fraud, and performing procedures that respond to those risks. Such procedures included examining, on a test basis, evidence regarding the amounts and disclosures in the financial statements and financial highlights. Our audits also included evaluating the accounting principles used and significant estimates made by management, as well as evaluating the overall presentation of the financial statements and financial highlights. Our procedures included confirmation of securities owned as of December 31, 2017, by correspondence with the custodian and brokers; when replies were not received from brokers, we performed

20

SCHWARTZ VALUE FOCUSED FUND

REPORT OF INDEPENDENT REGISTERED

PUBLIC ACCOUNTING FIRM (Continued)

other auditing procedures. We believe that our audits provide a reasonable basis for our opinion.

Chicago, Illinois

February 16, 2018

We have served as the auditor of one or more Schwartz Investment Trust investment companies since 1993.

21

SCHWARTZ VALUE FOCUSED FUND

BOARD OF TRUSTEES AND EXECUTIVE OFFICERS

(Unaudited)

Overall responsibility for management of the Trust rests with the Board of Trustees. The Trustees serve during the lifetime of the Trust and until its termination, or until death, resignation, retirement or removal. The Trustees, in turn, elect the officers of the Trust to actively supervise its day-to-day operations. The officers have been elected for an annual term. The following are the Trustees and executive officers of the Trust:

Trustee/Officer | Address | Year of

Birth | Position Held

with the Trust | Length of

Time Served |

Interested Trustees: |

* | George P. Schwartz, CFA | 801 W. Ann Arbor Trail

Plymouth, MI | 1944 | Chairman of the Board/President/ Trustee | Since 1992 |

Independent Trustees: |

| | Louis C. Bosco, Jr. | 801 W. Ann Arbor Trail

Plymouth, MI | 1936 | Trustee | Since 2008 |

| | Donald J. Dawson, Jr. | 801 W. Ann Arbor Trail

Plymouth, MI | 1947 | Trustee | Since 1993 |

| | Joseph M. Grace | 801 W. Ann Arbor Trail

Plymouth, MI | 1936 | Trustee | Since 2007 |

| | John J. McHale, Jr. | 801 W. Ann Arbor Trail

Plymouth, MI | 1949 | Trustee | Since 2014 |

| | Edward J. Miller | 801 W. Ann Arbor Trail

Plymouth, MI | 1946 | Trustee | Since 2017 |

Executive Officers: |

* | Richard L. Platte, Jr., CFA | 801 W. Ann Arbor Trail

Plymouth, MI | 1951 | Vice President and Secretary | Since 1993 |

* | Robert C. Schwartz, CFP | 801 W. Ann Arbor Trail

Plymouth, MI | 1976 | Vice President | Since 2013 |

* | Timothy S. Schwartz, CFA | 5060 Annunciation Circle

Ave Maria, FL | 1971 | Treasurer | Since 2000 |

* | Cathy M. Stoner, CPA, IACCP | 801 W. Ann Arbor Trail

Plymouth, MI | 1970 | Chief Compliance Officer | Since 2010 |

* | George P. Schwartz, Richard L. Platte, Jr., Robert C. Schwartz, Timothy S. Schwartz and Cathy M. Stoner, as affiliated persons of Schwartz Investment Counsel, Inc., the Fund’s investment adviser, are “interested persons” of the Trust within the meaning of Section 2(a)(19) of the 1940 Act. George P. Schwartz is the father of Robert C. Schwartz and Timothy S. Schwartz. |

22

SCHWARTZ VALUE FOCUSED FUND

BOARD OF TRUSTEES AND EXECUTIVE OFFICERS

(Unaudited) (Continued)

Each Trustee oversees six portfolios of the Trust: the Ave Maria Value Fund, the Ave Maria Growth Fund, the Ave Maria Rising Dividend Fund, the Ave Maria World Equity Fund, the Ave Maria Bond Fund and the Schwartz Value Focused Fund. The principal occupations of the Trustees and executive officers of the Trust during the past five years and public directorships held by the Trustees are set forth below:

George P. Schwartz, CFA is Chairman and Chief Executive Officer of Schwartz Investment Counsel, Inc. and is the co-portfolio manager of the Fund.

Louis C. Bosco, Jr. retired in April 2012. Prior to his retirement, he was a partner in Bosco Development Company (a real estate firm).

Donald J. Dawson, Jr. retired in March 2015. Prior to retirement, he was Chairman of Payroll 1, Inc. (a payroll processing company) from 1986 – 2015.

Joseph M. Grace is retired Senior Vice President of National Bank of Detroit (renamed JPMorgan Chase & Company).

John J. McHale, Jr. is Special Assistant to Commissioner of Major League Baseball since 2015. He was Executive Vice President of Major League Baseball from 2000 – 2015.

Edward J. Miller is Vice Chairman and Director of Detroit Investment Fund since 2001 and Invest Detroit Foundation since 2010 (financiers for redevelopment of Detroit, Michigan).

Richard L. Platte, Jr., CFA is President and Chief Investment Officer of Schwartz Investment Counsel, Inc.

Robert C. Schwartz, CFP is Senior Vice President and Secretary of Schwartz Investment Counsel, Inc.

Timothy S. Schwartz, CFA is Executive Vice President and Chief Financial Officer of Schwartz Investment Counsel, Inc. and is the lead portfolio manager of the Fund.

Cathy M. Stoner, CPA, IACCP is Vice President, Chief Compliance Officer and Treasurer of Schwartz Investment Counsel, Inc.

Additional information about members of the Board of Trustees and executive officers is available in the Statement of Additional Information (“SAI”). To obtain a free copy of the SAI, please call (888) 726-0753.

23

SCHWARTZ VALUE FOCUSED FUND

ABOUT YOUR FUND’S EXPENSES

(Unaudited)

We believe it is important for you to understand the impact of costs on your investment. As a shareholder of the Fund, you incur ongoing costs, including management fees and other Fund expenses. The following examples are intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds.

A mutual fund’s ongoing costs are expressed as a percentage of its average net assets. This figure is known as the expense ratio. The ongoing costs reflected in the table below are based on an investment of $1,000 made at the beginning of the most recent semi-annual period (July 1, 2017) and held until the end of the period (December 31, 2017).

The table below illustrates the Fund’s ongoing costs in two ways:

Actual fund return – This section helps you to estimate the actual expenses that you paid over the period. The “Ending Account Value” shown is derived from the Fund’s actual return, and the third column shows the dollar amount of operating expenses that would have been paid by an investor who started with $1,000 in the Fund. You may use the information here, together with the amount you invested, to estimate the expenses that you paid over the period.

To do so, simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number given for the Fund under the heading “Expenses Paid During Period.”

Hypothetical 5% return – This section is intended to help you compare the Fund’s ongoing costs with those of other mutual funds. It assumes that the Fund had an annual return of 5% before expenses during the period shown, but that the expense ratio is unchanged. In this case, because the return used is not the Fund’s actual return, the result does not apply to your investment. The example is useful in making comparisons because the U.S. Securities and Exchange Commission (the “SEC”) requires all mutual funds to calculate expenses based on a 5% return. You can assess the Fund’s ongoing costs by comparing this hypothetical example with the hypothetical examples that appear in shareholder reports of other funds.

Note that expenses shown in the table are meant to highlight and help you compare ongoing costs only. The Fund does not charge sales loads or redemption fees.

The calculations assume no shares were bought or sold during the period. Your actual costs may have been higher or lower, depending on the amount of your investment and the timing of any purchases or redemptions.

More information about the Fund’s expenses, including historical annual expense ratios, can be found in this report. For additional information on operating expenses and other shareholder costs, please refer to the Fund’s Prospectus.

| Beginning

Account Value

July 1, 2017 | Ending

Account Value

December 31, 2017 | Expenses Paid

During Period* |

Based on Actual Fund Return | $1,000.00 | $1,119.20 | $6.68 |

Based on Hypothetical 5% Return (before expenses) | $1,000.00 | $1,018.90 | $6.36 |

* | Expenses are equal to the Fund’s annualized net expense ratio of 1.25% for the period, multiplied by the average account value over the period, multiplied by 184/365 (to reflect the one-half year period). |

24

SCHWARTZ VALUE FOCUSED FUND

FEDERAL TAX INFORMATION

(Unaudited)

For the fiscal year ended December 31, 2017, the Fund designated $1,619,709 as long-term capital gain distributions.

OTHER INFORMATION

(Unaudited)

A description of the policies and procedures the Fund uses to determine how to vote proxies relating to portfolio securities is available without charge upon request by calling toll-free (888) 726-0753, or on the SEC’s website at http://www.sec.gov. Information regarding how the Fund voted proxies relating to portfolio securities during the most recent 12-month period ended June 30 is also available without charge upon request by calling toll-free (888) 726-0753, or on the SEC’s website at http://www.sec.gov.

The Trust files a complete listing of portfolio holdings for the Fund with the SEC as of the end of the first and third quarters of each fiscal year on Form N-Q. The filings are available free of charge, upon request, by calling (888) 726-0753. Furthermore, you may obtain a copy of the filings on the SEC’s website at http://www.sec.gov. The Trust’s Forms N-Q may also be reviewed and copied at the SEC’s Public Reference Room in Washington, DC, and information on the operation of the Public Reference Room may be obtained by calling (800) SEC-0330.

25

This page intentionally left blank.

This page intentionally left blank.

This page intentionally left blank.

Shareholder Services c/o Ultimus Fund Solutions, LLC P.O. Box 46707 Cincinnati, OH 45246 (888) 726-9331 |

| Corporate Offices 801 W. Ann Arbor Trail Suite 244 Plymouth, MI 48170 (734) 455-7777 Fax (734) 455-7720 |

Dear Fellow Shareholders of:

Ave Maria Value Fund (AVEMX)

Ave Maria Growth Fund (AVEGX)

Ave Maria Rising Dividend Fund (AVEDX)

Ave Maria World Equity Fund (AVEWX)

Ave Maria Bond Fund (AVEFX)

Ave Maria Money Market Account

2017 — What a year (what a country)!

For many years, I have preached to anyone who would listen — “count your blessings.” 2017 was certainly a year of blessings for investors. Regarding 2018 and beyond, there is a lot of wisdom in the advice, “don’t try to outguess the near-term swings in the stock market.” I am optimistic on our country, economy and stock market. The long term is all that should really matter to serious investors.

Many factors point to the prospect of robust economic growth. For the first time in years, fiscal and monetary policy are leaning in the same direction. Monetary policy remains highly accommodative, while fiscal policy has stopped acting as a drag. Since the change of administration in Washington, the crusade against business has ended. Runaway regulation has been brought under control, and the tax code has been changed to make American corporations more competitive in global markets and encourage them to invest in America again. This is significantly positive for corporate profits and equity investors. As Catholic Advisory Board member, Larry Kudlow, is famous for saying, “corporate profits are the mother’s milk of stock prices.”

As you’ll see in the individual portfolio managers’ letters, each of our pro-life, pro-family mutual funds had notably positive years in 2017. With assets now exceeding $2 billion, owned by 100,000 plus shareholders, the Ave Maria Mutual Funds are the largest family of Catholic mutual funds in the country. It is indeed a privilege to offer Catholics and other like-minded investors these opportunities to invest in a manner consistent with our faith.

Thanks for your participation.

Sincerely,

George P. Schwartz, CFA

Chairman & CEO

January 31, 2018

AVE MARIA MUTUAL FUNDS

TABLE OF CONTENTS

Ave Maria Value Fund: | |

Portfolio Manager Commentary | 2 |

Performance | 5 |

Annual Total Rates of Return Comparison with Major Indices | 6 |

Ten Largest Equity Holdings | 7 |

Asset Allocation | 7 |

Schedule of Investments | 8 |

| | |

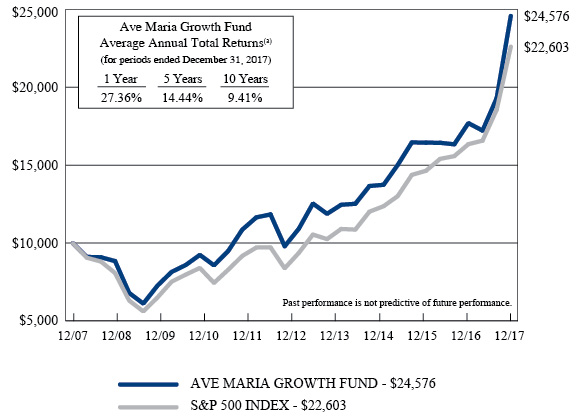

Ave Maria Growth Fund: | |

Portfolio Manager Commentary | 12 |

Performance | 14 |

Annual Total Rates of Return Comparison with Major Indices | 15 |

Ten Largest Equity Holdings | 16 |

Asset Allocation | 16 |

Schedule of Investments | 17 |

| | |

Ave Maria Rising Dividend Fund: | |

Portfolio Manager Commentary | 20 |

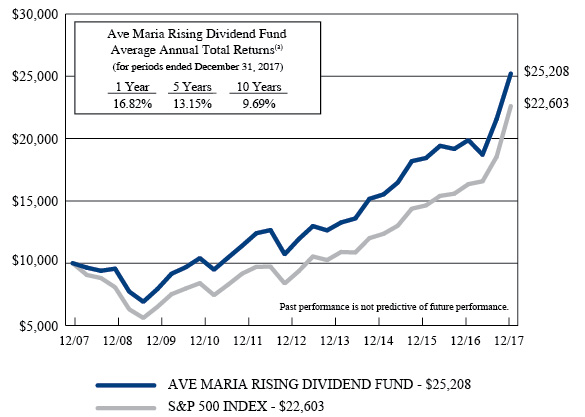

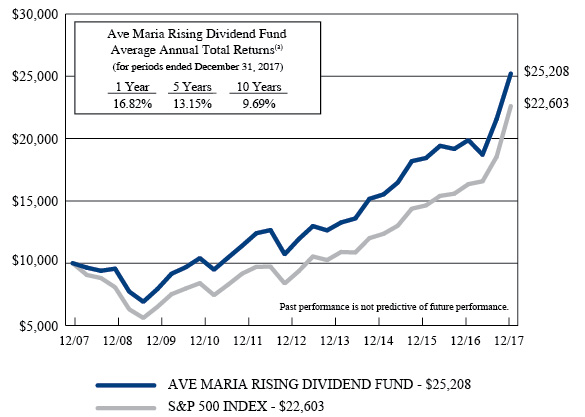

Performance | 22 |

Annual Total Rates of Return Comparison with Major Indices | 23 |

Ten Largest Equity Holdings | 24 |

Asset Allocation | 24 |

Schedule of Investments | 25 |

| | |

Ave Maria World Equity Fund: | |

Portfolio Manager Commentary | 28 |

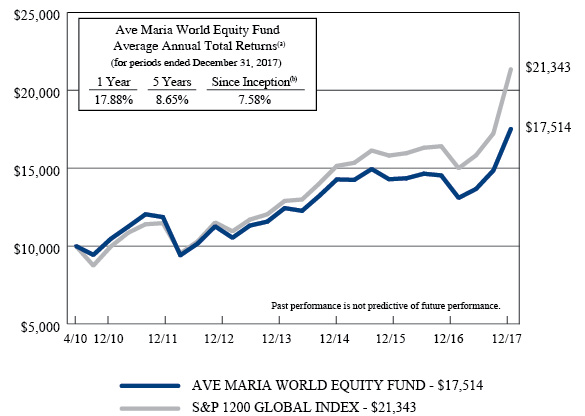

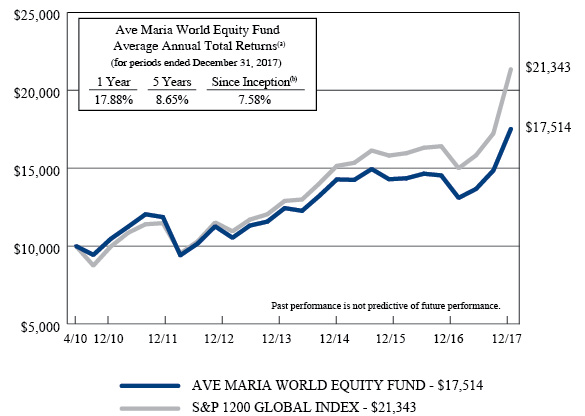

Performance | 30 |

Annual Total Rates of Return Comparison with Major Indices | 31 |

Ten Largest Equity Holdings | 32 |

Asset Allocation | 32 |

Schedule of Investments | 33 |

Summary of Common Stocks by Country | 36 |

| | |

Ave Maria Bond Fund: | |

Portfolio Manager Commentary | 37 |

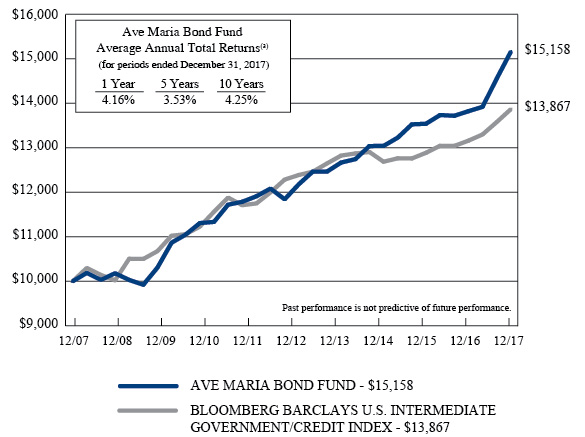

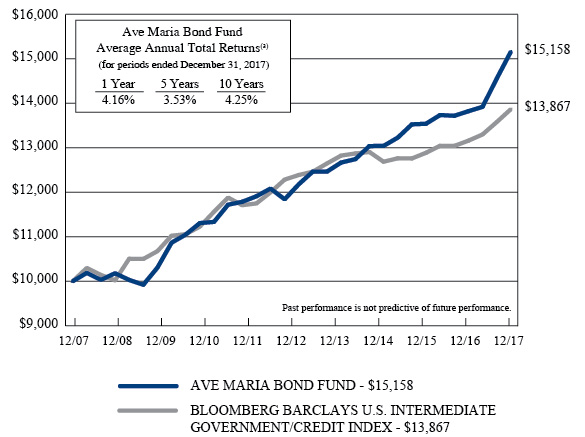

Performance | 39 |

Annual Total Rates of Return Comparison with Major Indices | 40 |

Ten Largest Holdings | 41 |

Asset Allocation | 41 |

Schedule of Investments | 42 |

AVE MARIA MUTUAL FUNDS

TABLE OF CONTENTS

(Continued)

Statements of Assets and Liabilities | 47 |

| | |

Statements of Operations | 49 |

| | |

Statements of Changes in Net Assets: | |

Ave Maria Value Fund | 51 |

Ave Maria Growth Fund | 52 |

Ave Maria Rising Dividend Fund | 53 |

Ave Maria World Equity Fund | 54 |

Ave Maria Bond Fund | 55 |

| | |

Financial Highlights: | |

Ave Maria Value Fund | 56 |

Ave Maria Growth Fund | 57 |

Ave Maria Rising Dividend Fund | 58 |

Ave Maria World Equity Fund | 59 |

Ave Maria Bond Fund | 60 |

| | |

Notes to Financial Statements | 61 |

| | |

Report of Independent Registered Public Accounting Firm | 72 |

| | |

Board of Trustees and Executive Officers | 74 |

| | |

Catholic Advisory Board | 76 |

| | |

About Your Funds’ Expenses | 78 |

| | |

Federal Tax Information | 80 |

| | |

Other Information | 80 |

This report is for the information of the shareholders of the Ave Maria Mutual Funds. To obtain a copy of the prospectus, please visit our website at www.avemariafunds.com or call 1-888-726-9331 and a copy will be sent to you free of charge. Please read the prospectus carefully before you invest. The Ave Maria Mutual Funds are distributed by Ultimus Fund Distributors, LLC.

Past performance is not predictive of future performance. Investment results and principal value will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. Current performance may be higher or lower than the performance data quoted. Performance data, current to the most recent month end, is available at the Ave Maria Mutual Funds website at www.avemariafunds.com or by calling 1-888-726-9331.

AVE MARIA VALUE FUND

PORTFOLIO MANAGER COMMENTARY

(Unaudited)

Dear Fellow Shareholders,

2017 was another good year for the Ave Maria Value Fund (the “Fund”) with a total return of 17.73%, compared to 16.24% for the S&P 400 MidCap Index. The Fund’s outperformance can be attributed to broad gains across the portfolio with 16 stocks, from a variety of industries, each gaining more than 30% for the year. The investment climate in 2017 was tilted heavily in favor of large-cap companies and growth stocks, as compared to small-caps and value stocks. Among U.S. equity mutual funds tracked by Morningstar, the top performing fund category was large-cap growth, up 27.64%. In contrast, the worst performing fund category was small-cap value, up only 8.56%. In the S&P 500, the best performing sectors were growth-oriented ones such as technology, materials, and consumer discretionary. The value-oriented sectors such as consumer staples, utilities, and energy were laggards. The five stocks which contributed the most to the Fund’s positive performance were:

Company | Industry | 2017

Performance |

Interactive Brokers Group, Inc. | Investment Brokerage | +72.53% |

InterXion Holding N.V. | Internet Software & Services | +68.04% |

Moody’s Corporation | Business & Financial Services | +60.07% |

Texas Pacific Land Trust | Oil/Gas Royalties/Real Estate | +50.35% |

HEICO Corporation | Aerospace Products | +45.70% |

After a strong year of performance in 2016, the Fund’s energy related holdings performed poorly in 2017. Since peaking in January last year, oil and natural gas prices steadily declined throughout the year, due to in part to increased U.S. shale production, tepid global demand, and moderate weather. The five stocks which detracted the most from the Fund’s 2017’s performance were:

Company | Industry | 2017

Performance |

Range Resources, Inc. | Oil/Gas Exploration & Production | -31.62% |

Unico American Corporation | Specialty P&C Insurance | -22.22% |

Noble Energy, Inc. | Oil/Gas Exploration & Production | -21.05% |

Avnet, Inc. | Technology Distributors | -21.91% |

ARRIS International plc | Communications Equipment | -13.98% |

2

AVE MARIA VALUE FUND

PORTFOLIO MANAGER COMMENTARY

(Unaudited) (Continued)

During the second half of 2017, the Fund sold several stocks that reached our estimate of intrinsic value: Donaldson Company, Inc. (diversified machinery), Varian Medical Systems, Inc. (medical appliances & equipment), The Western Union Company (money transfer services), and PNC Financial Services Group – warrants (regional banking). Ubiquiti Networks, Inc. (communications equipment), was also liquidated based upon our reassessment of the company’s corporate governance practices, which we viewed as inadequate. New positions were established in two companies that meet our value investing criteria:

| | ● | American Airlines Group, Inc. (AAL) – is the world’s largest airline based on fleet size and destinations served. The U.S. airline industry has undergone positive fundamental and structural changes during the past decade, owing primarily to industry consolidation. Today, the four largest airlines have about 80% market share in the U.S., whereas 10 years ago it was 50%. This consolidation has resulted in numerous benefits to the airlines such as more rational pricing, increased ancillary revenue, flights with fewer empty seats and generally improved profitability. In our view, American Airlines has the best management in the industry and has produced strong profits and cash flow growth over the past several years. |

| | ● | Madison Square Garden Company (MSG) – owns and operates sports teams, entertainment productions, and various venues. Major holdings include the New York Knicks (NBA), the New York Rangers (NHL), Madison Square Garden arena in New York City, the Forum arena in Los Angeles, and the Rockettes. With a cash-rich balance sheet sporting $1 billion in net cash, and a market cap of only $5 billion, we believe the shares are trading at a significant discount to our sum-of-the-parts valuation, based upon its diverse portfolio of iconic and irreplaceable assets. |

The S&P 500 Index was up 21.83% in 2017, which was the 9th consecutive year of positive returns for that index, marking one of the longest running bull markets in history. While some commentators are writing the obituary for this bull, we remain generally optimistic. With an improving job market, moderate inflation, accommodative monetary policies globally, along with the recently enacted tax rate cuts, financial conditions appear conducive to robust economic growth, which should lead to rising corporate profits and higher stock prices over the long term. We believe 2018 could be another good year for U.S. equity returns. According to the Wall Street Journal Market Data Group, when the S&P 500 total return exceeds 19% for the year, 68% of the time it rises again the following year. No guarantees!

3

AVE MARIA VALUE FUND

PORTFOLIO MANAGER COMMENTARY

(Unaudited) (Continued)

As always, we believe our low-risk, value-oriented investment approach is a good way to achieve superior long-term investment returns. Despite stock market indices trading at or near all-time highs, the Fund owns many high-quality companies selling well below our estimate of intrinsic value. As such, we believe the Fund is well-positioned.

The year-end distribution of $1.64 per share consisted of long-term capital gains of $1.62 per share and short-term capital gains of $0.02 per share. The net asset value of the Fund ended the year at $20.88 per share.

Thank you for being a shareholder in the Ave Maria Value Fund.

|

|

Timothy S. Schwartz, CFA | Joseph W. Skornicka, CFA |

Lead Portfolio Manager | Co-Portfolio Manager |

|

Chadd M. Garcia |

Co-Portfolio Manager |

4

AVE MARIA VALUE FUND

PERFORMANCE

(Unaudited) |

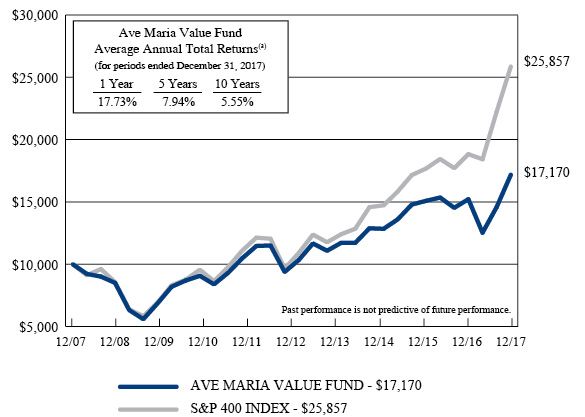

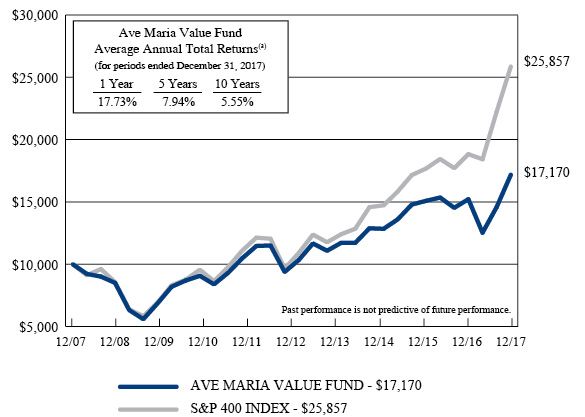

Comparison of the Change in Value of a $10,000 Investment

in the Ave Maria Value Fund and the S&P 400 Index

(a) | The returns shown do not reflect the deduction of taxes a shareholder would pay on Fund distributions or the redemption of Fund shares. |

Expense ratio as of 12-31-16 (as disclosed in May 1, 2017 prospectus) | 1.21%* |

Expense ratio for the year ended 12-31-17 | 1.19% |

* | Includes Acquired Fund Fees and Expenses. |

Past performance is not predictive of future performance. Investment results and principal value will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. Current performance may be higher or lower than the performance data quoted. Performance data, current to the most recent month end, is available at the Ave Maria Mutual Funds website at www.avemariafunds.com or by calling 1-888-726-9331.

5

AVE MARIA VALUE FUND

ANNUAL TOTAL RATES OF RETURN

COMPARISON WITH MAJOR INDICES (Unaudited) |

| AVE MARIA

VALUE FUND | S&P 400

INDEX | S&P 500

INDEX |

2001 (a) | 5.3% | -0.5% | -8.5% |

2002 | -9.8% | -14.5% | -22.1% |

2003 | 35.6% | 35.6% | 28.7% |

2004 | 20.1% | 16.5% | 10.9% |

2005 | 5.8% | 12.6% | 4.9% |

2006 | 14.2% | 10.3% | 15.8% |

2007 | -4.0% | 8.0% | 5.5% |

2008 | -36.8% | -36.2% | -37.0% |

2009 | 37.6% | 37.4% | 26.5% |

2010 | 20.5% | 26.7% | 15.1% |

2011 | -1.3% | -1.7% | 2.1% |

2012 | 13.3% | 17.9% | 16.0% |

2013 | 26.2% | 33.5% | 32.4% |

2014 | 2.9% | 9.8% | 13.7% |

2015 | -17.7% | -2.2% | 1.4% |

2016 | 16.4% | 20.7% | 12.0% |

2017 | 17.7% | 16.2% | 21.8% |

AVERAGE ANNUAL TOTAL RETURNS

As of December 31, 2017 (Unaudited)

| AVE MARIA

VALUE FUND | S&P 400

INDEX | S&P 500

INDEX |

3 Years | 4.1% | 11.1% | 11.4% |

5 Years | 7.9% | 15.0% | 15.8% |

10 Years | 5.6% | 10.0% | 8.5% |

Since Inception (b) | 7.0% | 9.7% | 6.7% |

(a) | Represents the period from the commencement of operations (May 1, 2001) through December 31, 2001. |

(b) | Represents the period from the commencement of operations (May 1, 2001) through December 31, 2017. |

6

AVE MARIA VALUE FUND

TEN LARGEST EQUITY HOLDINGS

December 31, 2017 (Unaudited)

| Shares | | | Company | | Market Value | | | % of Net Assets | |

| | 25,500 | | | Texas Pacific Land Trust | | $ | 11,389,065 | | | | 4.6 | % |

| | 125,000 | | | HEICO Corporation - Class A | | | 9,881,250 | | | | 4.0 | % |

| | 400,000 | | | Liberty Interactive Corporation QVC Group - Series A | | | 9,768,000 | | | | 3.9 | % |

| | 150,000 | | | InterXion Holding N.V. | | | 8,839,500 | | | | 3.5 | % |

| | 165,000 | | | American Airlines Group, Inc. | | | 8,584,950 | | | | 3.4 | % |

| | 105,000 | | | Arrow Electronics, Inc. | | | 8,443,050 | | | | 3.4 | % |

| | 50,000 | | | Laboratory Corporation of America Holdings | | | 7,975,500 | | | | 3.2 | % |

| | 65,000 | | | Zimmer Biomet Holdings, Inc. | | | 7,843,550 | | | | 3.1 | % |

| | 100,000 | | | Discover Financial Services | | | 7,692,000 | | | | 3.1 | % |

| | 100,000 | | | Tractor Supply Company | | | 7,475,000 | | | | 3.0 | % |

ASSET ALLOCATION (Unaudited)

Sector | % of Net Assets |

Consumer Discretionary | 18.8% |

Consumer Staples | 5.1% |

Energy | 9.7% |

Financials | 15.1% |

Health Care | 7.9% |

Industrials | 17.6% |

Information Technology | 13.8% |

Materials | 2.6% |

Real Estate | 0.9% |

Money Market Funds, Liabilities in Excess of Other Assets | 8.5% |

| | 100.0% |

7

AVE MARIA VALUE FUND

SCHEDULE OF INVESTMENTS

December 31, 2017

| COMMON STOCKS — 91.5% | | Shares | | | Market Value | |

| Consumer Discretionary — 18.8% | | | | | | |

| Diversified Consumer Services — 3.4% | | | | | | |

| Graham Holdings Company - Class B | | | 5,000 | | | $ | 2,791,750 | |

| ServiceMaster Global Holdings, Inc. * | | | 110,000 | | | | 5,639,700 | |

| | | | | | | | 8,431,450 | |

| Household Durables — 2.4% | | | | | | | | |

| Garmin Ltd. | | | 100,000 | | | | 5,957,000 | |

| | | | | | | | | |

| Internet & Direct Marketing Retail — 3.9% | | | | | | | | |

| Liberty Interactive Corporation QVC Group - Series A * | | | 400,000 | | | | 9,768,000 | |

| | | | | | | | | |

| Media — 0.8% | | | | | | | | |

| Madison Square Garden Company (The) - Class A * | | | 10,000 | | | | 2,108,500 | |

| | | | | | | | | |

| Specialty Retail — 4.0% | | | | | | | | |

| AutoNation, Inc. * | | | 50,000 | | | | 2,566,500 | |

| Tractor Supply Company | | | 100,000 | | | | 7,475,000 | |

| | | | | | | | 10,041,500 | |

| Textiles, Apparel & Luxury Goods — 4.3% | | | | | | | | |

| Gildan Activewear, Inc. | | | 100,000 | | | | 3,230,000 | |

| VF Corporation | | | 100,000 | | | | 7,400,000 | |

| | | | | | | | 10,630,000 | |

| Consumer Staples — 5.1% | | | | | | | | |

| Beverages — 5.1% | | | | | | | | |

| Brown-Forman Corporation - Class B | | | 100,000 | | | | 6,867,000 | |

| Coca-Cola European Partners plc | | | 150,000 | | | | 5,977,500 | |

| | | | | | | | 12,844,500 | |

| Energy — 9.7% | | | | | | | | |

| Oil, Gas & Consumable Fuels — 9.7% | | | | | | | | |

| Noble Energy, Inc. | | | 200,000 | | | | 5,828,000 | |

| Pioneer Natural Resources Company | | | 40,000 | | | | 6,914,000 | |

| Texas Pacific Land Trust | | | 25,500 | | | | 11,389,065 | |

| | | | | | | | 24,131,065 | |

| Financials — 15.1% | | | | | | | | |

| Banks — 1.5% | | | | | | | | |

| Fifth Third Bancorp | | | 125,000 | | | | 3,792,500 | |

| | | | | | | | | |

| Capital Markets — 7.0% | | | | | | | | |

| Federated Investors, Inc. - Class B | | | 100,000 | | | | 3,608,000 | |

| Interactive Brokers Group, Inc. - Class A | | | 110,000 | | | | 6,513,100 | |

| Moody's Corporation | | | 50,000 | | | | 7,380,500 | |

| | | | | | | | 17,501,600 | |

8

AVE MARIA VALUE FUND

SCHEDULE OF INVESTMENTS

(Continued)

| COMMON STOCKS — 91.5% (Continued) | | Shares | | | Market Value | |

| Financials — 15.1% (Continued) | | | | | | |

| Consumer Finance — 3.1% | | | | | | |

| Discover Financial Services | | | 100,000 | | | $ | 7,692,000 | |

| | | | | | | | | |

| Insurance — 3.5% | | | | | | | | |

| Alleghany Corporation * | | | 10,536 | | | | 6,280,404 | |

Unico American Corporation * # (a) | | | 280,000 | | | | 2,380,000 | |

| | | | | | | | 8,660,404 | |

| Health Care — 7.9% | | | | | | | | |

| Health Care Equipment & Supplies — 3.1% | | | | | | | | |

| Zimmer Biomet Holdings, Inc. | | | 65,000 | | | | 7,843,550 | |

| | | | | | | | | |

| Health Care Providers & Services — 3.2% | | | | | | | | |

| Laboratory Corporation of America Holdings * | | | 50,000 | | | | 7,975,500 | |

| | | | | | | | | |

| Life Sciences Tools & Services — 1.6% | | | | | | | | |

| Waters Corporation * | | | 20,000 | | | | 3,863,800 | |

| | | | | | | | | |

| Industrials — 17.6% | | | | | | | | |

| Aerospace & Defense — 5.9% | | | | | | | | |

| HEICO Corporation - Class A | | | 125,000 | | | | 9,881,250 | |

| Hexcel Corporation | | | 80,000 | | | | 4,948,000 | |

| | | | | | | | 14,829,250 | |

| Airlines — 3.4% | | | | | | | | |

| American Airlines Group, Inc. | | | 165,000 | | | | 8,584,950 | |

| | | | | | | | | |

| Electrical Equipment — 2.4% | | | | | | | | |

| AMETEK, Inc. | | | 70,000 | | | | 5,072,900 | |

| Eaton Corporation plc | | | 10,000 | | | | 790,100 | |

| | | | | | | | 5,863,000 | |

| Machinery — 3.6% | | | | | | | | |

| Colfax Corporation * | | | 75,000 | | | | 2,971,500 | |

| Graco, Inc. | | | 135,000 | | | | 6,104,700 | |

| | | | | | | | 9,076,200 | |

| Road & Rail — 2.3% | | | | | | | | |

| AMERCO | | | 15,000 | | | | 5,668,650 | |

| | | | | | | | | |

| Information Technology — 13.8% | | | | | | | | |

| Communications Equipment — 2.3% | | | | | | | | |

| ARRIS International plc * | | | 230,000 | | | | 5,908,700 | |

9

AVE MARIA VALUE FUND

SCHEDULE OF INVESTMENTS

(Continued)

| COMMON STOCKS — 91.5% (Continued) | | Shares | | | Market Value | |

| Information Technology — 13.8% (Continued) | | | | | | |

| Electronic Equipment, Instruments & Components — 4.5% | | | | | | |

| Arrow Electronics, Inc. * | | | 105,000 | | | $ | 8,443,050 | |

| Avnet, Inc. | | | 70,000 | | | | 2,773,400 | |

| | | | | | | | 11,216,450 | |

| IT Services — 5.2% | | | | | | | | |

| Cognizant Technology Solutions Corporation - Class A | | | 60,000 | | | | 4,261,200 | |

| InterXion Holding N.V. * | | | 150,000 | | | | 8,839,500 | |

| | | | | | | | 13,100,700 | |

| Software — 1.2% | | | | | | | | |

| ANSYS, Inc. * | | | 20,000 | | | | 2,951,800 | |

| | | | | | | | | |

| Technology Hardware, Storage & Peripherals — 0.6% | | | | | | | | |

| Hewlett Packard Enterprise Company | | | 100,000 | | | | 1,436,000 | |

| | | | | | | | | |

| Materials — 2.6% | | | | | | | | |

| Chemicals — 2.6% | | | | | | | | |

| Axalta Coating Systems Ltd. * | | | 200,000 | | | | 6,472,000 | |

| | | | | | | | | |

| Real Estate — 0.9% | | | | | | | | |

| Equity Real Estate Investment Trusts (REITs) — 0.9% | | | | | | | | |

| Equinix, Inc. | | | 4,948 | | | | 2,242,533 | |

| | | | | | | | | |

Total Common Stocks (Cost $163,620,249) | | | | | | $ | 228,591,602 | |

10

AVE MARIA VALUE FUND

SCHEDULE OF INVESTMENTS

(Continued)

| MONEY MARKET FUNDS — 9.0% | | Shares | | | Market Value | |

Federated Government Obligations Tax-Managed Fund - Institutional Shares, 1.05% (b) | | | 11,771,765 | | | $ | 11,771,765 | |

Federated Treasury Obligations Fund - Institutional Shares, 1.13% (b) | | | 10,811,643 | | | | 10,811,643 | |

Total Money Market Funds (Cost $22,583,408) | | | | | | $ | 22,583,408 | |

| | | | | | | | | |

Total Investments at Market Value — 100.5% (Cost $186,203,657) | | | | | | $ | 251,175,010 | |

| | | | | | | | | |

| Liabilities in Excess of Other Assets — (0.5%) | | | | | | | (1,283,435 | ) |

| | | | | | | | | |

| Net Assets — 100.0% | | | | | | $ | 249,891,575 | |

* | Non-income producing security. |

# | The Fund owns 5% or more of the company’s outstanding voting shares thereby making the company an affiliated company as that term is defined in the Investment Company Act of 1940 (Note 5). |

(a) | Security value has been determined in good faith pursuant to procedures adopted by the Board of Trustees. The total value of such securities was $2,380,000 at December 31, 2017, representing 1.0% of net assets (Note 1). |

(b) | The rate shown is the 7-day effective yield as of December 31, 2017. |

See accompanying notes to financial statements. |

11

AVE MARIA GROWTH FUND

PORTFOLIO MANAGER COMMENTARY

(Unaudited)

Dear Fellow Shareholders,