UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number (811-07168)

Hennessy Funds Trust

(Exact name of registrant as specified in charter)

7250 Redwood Blvd., Suite 200

Novato, CA 94945

(Address of principal executive offices) (Zip code)

Neil J. Hennessy

7250 Redwood Blvd., Suite 200

Novato, CA 94945

(Name and address of agent for service)

800-966-4354

Registrant’s telephone number, including area code

Date of fiscal year end: October 31, 2014

Date of reporting period: April 30, 2014

Item 1. Reports to Stockholders.

SEMI-ANNUAL REPORT

APRIL 30, 2014

HENNESSY CORNERSTONE

GROWTH FUND

Investor Class HFCGX

Institutional Class HICGX

hennessyfunds.com | 1-800-966-4354

(This Page Intentionally Left Blank.)

Contents

| Letter to Shareholders | 2 |

| Performance Overview | 4 |

| Financial Statements | |

| Schedule of Investments | 7 |

| Statement of Assets and Liabilities | 12 |

| Statement of Operations | 13 |

| Statements of Changes in Net Assets | 15 |

| Financial Highlights | 16 |

| Notes to the Financial Statements | 20 |

| Expense Example | 28 |

| Proxy Voting | 30 |

| Quarterly Filings on Form N-Q | 30 |

| Householding | 30 |

| Board Approval of Investment Advisory Agreement | 31 |

HENNESSY FUNDS 1-800-966-4354

Dear Shareholder:

The financial markets have provided strong returns over the past six-months ended April 30, 2014, with the Dow Jones Industrial Average (DJIA) and S&P 500 both returning approximately 8% during the period. The current valuation metrics of the major indices are solid; for example, the DJIA currently has a price-to-earnings ratio of 15x and a price-to-sales ratio of 1.75x. The DJIA also has a dividend yield of 2.2%, which is nearly as high as that of a 10-Year U.S. Treasury, which is currently yielding 2.6%. Investing in high-yielding, high-quality DJIA stocks have the potential to not only provide an income stream but also for stock price appreciation as well. Fixed income investing has run its course, in my opinion, and many individuals are currently benefiting from the return to investing in equities that possess strong fundamentals.

U.S. corporations continue to drive shareholder value by making acquisitions, initiating and raising dividends, investing in internal infrastructure, and buying back stock. However, lately I have begun to see a shift in those business strategies. The easier-to-execute acquisitions seem to be a thing of the past, and firms now have to be even more creative to execute accretive deals. I also believe that while firms may continue to initiate dividends, fewer firms will raise their dividends and fewer firms will participate in stock buyback programs going forward. So what will these cash-rich companies do with their capital if they are not raising dividends or buying back stock? I believe we will see companies begin to initiate capital expenditure programs.

Due to the continuing uncertainty from a lack of clear policies on taxes, healthcare, and regulations, I have observed that corporations would rather wait for clarity from our government leaders and defer any significant changes to their current business models. Up until this point, there has been no real cost for firms to defer spending their capital as they wait for anticipated guidance on policies that directly affect their businesses. But, this economic handcuffing from all of this uncertainty has gone on long enough. I believe there will now be firms who want to improve their margins and will begin spending money to expand their sales, and may even begin to hire. Once a competitor begins to move in this way, then the cost to defer becomes real for companies. This movement to expansion may well be a catalyst to propel the financial markets. I do believe this will be a slow shift, but one that will keep the economy improving, and should, in my opinion, help to generate reasonable market returns over the next few years.

With almost $3 trillion in cash sitting on the sidelines, this strategic shift by companies to begin spending their idle capital should help the economic recovery in the U.S. But that is only one part of the equation. Washington politics still play a role in how strong that recovery will be. The national political landscape will change in the next few years, and the future generation of elected officials will be faced with what I believe are fictitious unemployment figures (6.3% reported, when over 20 million Americans are looking for more work or a better job), a sluggish economy, and global competition in business. The next regime needs to provide real clarity on the issues that face all Americans and American corporations: taxation, regulation, and how to pay for our new healthcare system. I also believe that our government needs to regard business as a noble profession and to implement common sense and logic in their policy making instead of politics as usual. As Confucius is quoted as saying, “Life is really simple, but we insist on making it complicated.”

I am confident that even with all the hurdles facing corporate America, companies continue to provide good value for their shareholders, and I believe that means the financial markets are in good shape and should remain strong moving forward, I also believe that the next few months may be volatile. Fads come and go, and the current buzz on the Street is around investing in social media stocks. I believe that chasing hot products has contributed and will continue to contribute to the volatility of the markets this year. After over 35 years in the business, I still firmly believe the best way to position your portfolio is by investing in good companies over the long term, rather than trying to buy the next hot idea at exactly the right time. At Hennessy Funds, hunches and fads have no place in our investment process, and we understand that successful investing comes from time in the market, not timing the market.

We remain focused on investing based on proven fundamentals, and we are committed to managing money for the sole benefit of our shareholders. If you have any questions or want to speak with us directly, please don’t hesitate to call us at (800) 966-4354.

Best regards,

Neil J. Hennessy

President and Chief Investment Officer

Past performance does not guarantee future results.

Mutual fund investing involves risk. Principal loss is possible.

Opinions expressed are those of Neil Hennessy and are subject to change, are not guaranteed and should not be considered investment advice.

The Dow Jones Industrial Average and S&P 500 are unmanaged indices commonly used to measure the performance of U.S. stocks. One cannot invest directly in an index.

Price-to-sales ratio and price-to-earnings ratio are tools for calculating relative valuation. Price-to-sales ratio is calculated by dividing the market price by revenue per share. Price-to-earnings ratio is the market price per share divided by earnings per share.

HENNESSY FUNDS 1-800-966-4354

Performance Overview (Unaudited)

The opinions expressed in the following commentary reflect those of the Portfolio Managers as of the date written. Any such opinions are subject to change based on market or other conditions and are not guaranteed. These opinions may not be relied upon as investment advice. Investment decisions for the Fund are based on several factors, and may not be relied upon as an indication of trading intent on behalf of the Fund. Security positions can and do change.

AVERAGE ANNUAL TOTAL RETURN PERIODS ENDED APRIL 30, 2014*

| | Six | One | Five | Ten |

| | Months(1) | Year | Years | Years |

| Hennessy Cornerstone Growth Fund – | | | | |

| Investor Class (HFCGX) | 9.65% | 23.99% | 16.43% | 5.34% |

| Hennessy Cornerstone Growth Fund – | | | | |

Institutional Class (HICGX)(2) | 9.85% | 24.36% | 16.81% | 5.55% |

Russell 2000® Index | 3.08% | 20.50% | 19.84% | 8.67% |

| S&P 500 Index | 8.36% | 20.44% | 19.14% | 7.67% |

Expense ratios: 1.29% (Investor Class); Gross 1.11%, Net 0.98%(3) (Institutional Class)

Performance data quoted represents past performance; past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance of the Fund may be lower or higher than the performance quoted. Performance data current to the most recent month end may be obtained by visiting hennessyfunds.com.

The expense ratios presented are from the most recent prospectus.

| (1) | Periods less than one year are not annualized. |

| (2) | The inception date of the Institutional Class shares is March 3, 2008. Performance shown prior to the inception of the Institutional Class shares reflects the performance of the Investor Class shares and includes expenses that are not applicable to and are higher than those of the Institutional Class shares. |

| (3) | With regard to Institutional Class shares, the Fund’s investment advisor has contractually agreed to waive a portion of its expenses indefinitely. |

PERFORMANCE NARRATIVE

Portfolio Manager, Neil Hennessy, and Co-Portfolio Manager, Brian Peery

Over the previous six months, how did the Fund perform and what factors contributed to this performance?

For the six-month period ended April 30, 2014, the Investor Class of the Hennessy Cornerstone Growth Fund returned 9.65%, outperforming the Russell 2000® Index, the S&P 500 Index, and the Morningstar Small Blend Category Average, which returned 3.08%, 8.36%, and 4.48% for the same period, respectively.

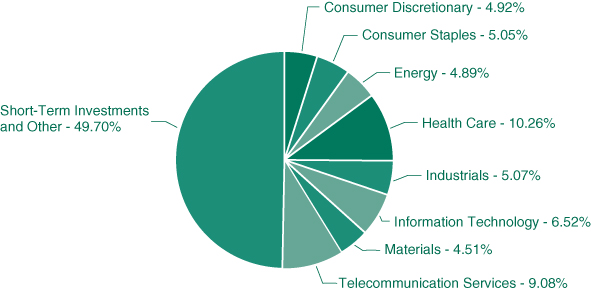

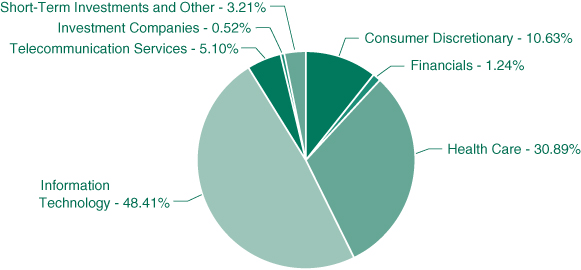

We are pleased with the overall performance of the Fund during the previous six months versus its benchmarks. The Fund’s relative outperformance was driven partly by allocation and performance in seven of the ten sectors in which the Fund was invested, but the primary driver of the Fund’s performance was underlying stock selection. The biggest contribution to the Fund’s outperformance versus its benchmarks was in the Industrial sector, where the Fund’s overweighting and stock selection amounted to roughly half of the

outperformance relative to the Russell 2000® Index. The largest detractor to the Fund’s performance was its cash holdings, which are targeted at less than 5% of the Fund’s total net assets and which averaged just under 2.5% for the six-month period.

Additional Portfolio Manager commentary and related investment outlook:

If you have watched the financial news or opened the investing section of a newspaper lately, you have probably heard or read about two things: the Russell 2000® Index has dropped below its 200-day moving average (bad) and high multiple stocks have dropped fairly precipitously (really bad if you own them). By adhering to our strict investment methodology, we have been largely able to sidestep the recent downturn in sectors like social media and biotechnology. By employing a strict price-to-sales ratio limit of 1.5, we invest in what we deem to be reasonably valued companies rather than those stocks whose price is predicated on expected future growth. This growth at a reasonable price approach has served us well, and we believe wholeheartedly in utilizing this methodology when investing. We anticipate investors will continue to migrate out of high risk, high multiple stocks and into stocks that will potentially do well as the economy expands.

During the six-month period ended April 30, 2014 the performance of the Fund was quite strong, yet the overall markets have generally been filled with uncertainty and mild upheaval, much like in previous months. We believe, however, that the economy has been progressing nicely and that there is even better news on the horizon.

Consumer spending, which is a large driver of Gross Domestic Product (approximately 70% of GDP) was and continues to be muted. The Christmas season proved to be a difficult time for a number of retailers as consumers opted to constrain spending. Not long after the holidays, the East Coast experienced particularly bad weather, and the consumer chose to defer purchases rather than battle the weather. The end result of the weather related issues, at least as far as the stock market was concerned, was a temporary lowering in the expectations for company earnings.

Today, although there are still lingering weather related issues, including the West Coast and Midwest droughts, the forecast for spending looks much more promising. Although we expect to see some moderation going forward, consumer spending ended the quarter on a high note, and we firmly believe it will increase as the year progresses. We also expect that not only will company earnings improve, but more importantly, revenues should start to improve with the overall strength of the economy.

In fact, we are seeing positive signs in both revenue growth and the all-important corporate capital expenditures levels. Over the last six months, we have seen a slight disconnect between earnings and revenues, with earnings showing healthy gains, largely due to cost containment, while revenue growth lagged. With few cost cuts seemingly left to be made, companies appear to be starting to utilize their healthy balance sheets to focus on organic growth, which we expect will drive corporate spending higher. In fact, we anticipate the U.S. economy should expand nicely over the next 12 to 18 months and that the markets should benefit from this flow of capital. While excess cash has largely been directed toward acquisitions, increasing dividends, and/or stock buybacks recently, we believe this shift in corporate spending has the potential to reward shareholders over the longer term.

We are confident that there are opportunities in the Small-Cap and Mid-Cap space, especially in some of the more cyclical sectors. We believe the cyclical companies, which are those companies most sensitive to economic growth, should do well as the economy continues to improve. The Fund is currently overweight cyclical stocks versus its benchmarks and will remain so until its portfolio is rebalanced later this year.

HENNESSY FUNDS 1-800-966-4354

The Russell 2000® Index is an unmanaged index commonly used to measure the performance of U.S. small-cap stocks. The S&P 500 is an index commonly used to measure the performance of U.S. stocks. You cannot invest directly in an index. Performance data for an index does not reflect any deductions for fees, expenses or taxes. The Fund invests in small- and medium-capitalization companies, which may have limited liquidity and greater price volatility than large-capitalization companies. Investments in foreign securities involve greater volatility and political, economic and currency risk and differences in accounting methods. Fund holdings and sector allocations are subject to change. Please refer to the Schedule of Investments included in this report for additional portfolio information.

Price-to-sales ratio is a tool for calculating a stock’s valuation relative to other companies. It is calculated by dividing a stock’s current price by its revenue per share.

Each Morningstar category average represents a universe of funds with similar investment objectives. ©Morningstar, Inc. All Rights Reserved. The information contained herein: 1) is proprietary to Morningstar; 2) may not be copied or distributed and 3) is not warranted to be accurate, complete or timely. Neither Morningstar nor its content providers are responsible for any damages or losses arising from any use of this information. Past performance does not guarantee future results.

Schedule of Investments

HENNESSY CORNERSTONE GROWTH FUND

As of April 30, 2014 (Unaudited)

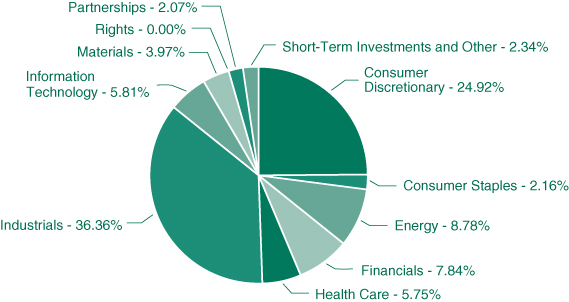

(% of Net Assets)

| | TOP TEN HOLDINGS (EXCLUDING CASH/CASH EQUIVALENTS) | % NET ASSETS |

| | Universal Insurance Holdings, Inc. | 2.36% |

| | Green Plains Renewable Energy, Inc. | 2.33% |

| | Exterran Holdings, Inc. | 2.31% |

| | Alaska Air Group, Inc. | 2.28% |

| | Delta Air Lines, Inc. | 2.26% |

| | Aceto Corp. | 2.23% |

| | Southwest Airlines Co. | 2.19% |

| | United Rentals, Inc. | 2.18% |

| | Targa Resources Corp. | 2.16% |

| | Tyson Foods, Inc., Class A | 2.16% |

Note: For presentation purposes, the Fund has grouped some of the industry categories. For purposes of categorizing securities for compliance with Section 8(b)(1) of the Investment Company Act of 1940, the Fund uses more specific industry classifications.

HENNESSY FUNDS 1-800-966-4354

| | COMMON STOCKS – 95.59% | | Number | | | | | | % of | |

| | | | of Shares | | | Value | | | Net Assets | |

| | Consumer Discretionary – 24.92% | | | | | | | | | |

| | Advance Auto Parts, Inc. | | | 37,200 | | | $ | 4,511,988 | | | | 1.85 | % |

| | Carmike Cinemas, Inc. (a) | | | 164,227 | | | | 4,870,973 | | | | 2.00 | % |

| | Core-Mark Holding Co., Inc. | | | 60,972 | | | | 4,910,685 | | | | 2.01 | % |

| | G-III Apparel Group, Ltd. (a) | | | 69,900 | | | | 5,016,723 | | | | 2.05 | % |

| | Jack in the Box, Inc. (a) | | | 89,400 | | | | 4,786,476 | | | | 1.96 | % |

| | Jarden Corp. (a) | | | 78,700 | | | | 4,497,705 | | | | 1.84 | % |

| | La-Z-Boy, Inc. | | | 171,800 | | | | 4,162,714 | | | | 1.71 | % |

| | MDC Partners, Inc. (b) | | | 187,197 | | | | 4,571,350 | | | | 1.87 | % |

| | New York Times Co. | | | 326,300 | | | | 5,246,904 | | | | 2.15 | % |

| | Papa Johns International, Inc. | | | 97,200 | | | | 4,263,192 | | | | 1.75 | % |

| | The Goodyear Tire & Rubber Co. | | | 174,400 | | | | 4,394,880 | | | | 1.80 | % |

| | Tuesday Morning Corp. (a) | | | 333,911 | | | | 4,668,076 | | | | 1.91 | % |

| | Visteon Corp. (a) | | | 56,700 | | | | 4,922,127 | | | | 2.02 | % |

| | | | | | | | | 60,823,793 | | | | 24.92 | % |

| | | | | | | | | | | | | | |

| | Consumer Staples – 2.16% | | | | | | | | | | | | |

| | Tyson Foods, Inc., Class A | | | 125,400 | | | | 5,263,038 | | | | 2.16 | % |

| | | | | | | | | | | | | | |

| | Energy – 8.78% | | | | | | | | | | | | |

| | Exterran Holdings, Inc. | | | 131,100 | | | | 5,639,922 | | | | 2.31 | % |

| | Green Plains Renewable Energy, Inc. | | | 190,200 | | | | 5,686,980 | | | | 2.33 | % |

| | Matrix Service Co. (a) | | | 156,327 | | | | 4,841,447 | | | | 1.98 | % |

| | Targa Resources Corp. | | | 48,800 | | | | 5,269,912 | | | | 2.16 | % |

| | | | | | | | | 21,438,261 | | | | 8.78 | % |

| | | | | | | | | | | | | | |

| | Financials – 7.84% | | | | | | | | | | | | |

| | BGC Partners, Inc. | | | 671,273 | | | | 4,813,028 | | | | 1.97 | % |

| | CNO Financial Group, Inc. | | | 257,600 | | | | 4,443,600 | | | | 1.82 | % |

| | LPL Financial Holdings, Inc. | | | 87,100 | | | | 4,124,185 | | | | 1.69 | % |

| | Universal Insurance Holdings, Inc. | | | 393,500 | | | | 5,756,905 | | | | 2.36 | % |

| | | | | | | | | 19,137,718 | | | | 7.84 | % |

| | | | | | | | | | | | | | |

| | Health Care – 5.75% | | | | | | | | | | | | |

| | Alere, Inc. (a) | | | 133,000 | | | | 4,442,200 | | | | 1.82 | % |

| | CIGNA Corp. | | | 61,700 | | | | 4,938,468 | | | | 2.02 | % |

| | MWI Veterinary Supply, Inc. (a) | | | 29,700 | | | | 4,652,208 | | | | 1.91 | % |

| | | | | | | | | 14,032,876 | | | | 5.75 | % |

The accompanying notes are an integral part of these financial statements.

| | COMMON STOCKS | | Number | | | | | | % of | |

| | | | of Shares | | | Value | | | Net Assets | |

| | Industrials – 36.36% | | | | | | | | | |

| | Aceto Corp. | | | 248,784 | | | $ | 5,443,394 | | | | 2.23 | % |

| | Alaska Air Group, Inc. | | | 59,100 | | | | 5,560,128 | | | | 2.28 | % |

| | Curtiss Wright Corp. | | | 73,800 | | | | 4,718,772 | | | | 1.93 | % |

| | Delta Air Lines, Inc. | | | 149,900 | | | | 5,520,817 | | | | 2.26 | % |

| | Engility Holdings, Inc. (a) | | | 115,346 | | | | 5,033,700 | | | | 2.06 | % |

| | Huntington Ingalls Industries, Inc. | | | 49,300 | | | | 5,077,900 | | | | 2.08 | % |

| | John Bean Technologies Corp. | | | 159,786 | | | | 4,632,196 | | | | 1.90 | % |

| | L-3 Communications Holdings, Inc. | | | 41,600 | | | | 4,799,392 | | | | 1.97 | % |

| | Lennox International, Inc. | | | 53,200 | | | | 4,459,756 | | | | 1.83 | % |

| | Lockheed Martin Corp. | | | 29,400 | | | | 4,825,716 | | | | 1.98 | % |

| | Northrop Grumman Corp. | | | 39,500 | | | | 4,799,645 | | | | 1.97 | % |

| | Orbital Sciences Corp. (a) | | | 171,896 | | | | 5,053,742 | | | | 2.07 | % |

| | Primoris Services Corp. | | | 143,000 | | | | 4,001,140 | | | | 1.64 | % |

| | Raytheon Co. | | | 49,300 | | | | 4,707,164 | | | | 1.93 | % |

| | Southwest Airlines Co. | | | 221,600 | | | | 5,356,072 | | | | 2.19 | % |

| | The Manitowoc Co., Inc. | | | 163,300 | | | | 5,189,674 | | | | 2.12 | % |

| | United Continental Holdings, Inc. (a) | | | 104,200 | | | | 4,258,654 | | | | 1.74 | % |

| | United Rentals, Inc. (a) | | | 56,800 | | | | 5,329,544 | | | | 2.18 | % |

| | | | | | | | | 88,767,406 | | | | 36.36 | % |

| | | | | | | | | | | | | | |

| | Information Technology – 5.81% | | | | | | | | | | | | |

| | CSG Systems International, Inc. | | | 175,000 | | | | 4,613,000 | | | | 1.89 | % |

| | Hewlett-Packard Co. | | | 157,500 | | | | 5,206,950 | | | | 2.13 | % |

| | Super Micro Computer, Inc. (a) | | | 214,900 | | | | 4,375,364 | | | | 1.79 | % |

| | | | | | | | | 14,195,314 | | | | 5.81 | % |

| | | | | | | | | | | | | | |

| | Materials – 3.97% | | | | | | | | | | | | |

| | AK Steel Holding Corp. (a) | | | 686,000 | | | | 4,802,000 | | | | 1.97 | % |

| | PolyOne Corp. | | | 130,600 | | | | 4,893,582 | | | | 2.00 | % |

| | | | | | | | | 9,695,582 | | | | 3.97 | % |

| | Total Common Stocks | | | | | | | | | | | | |

| | (Cost $207,900,555) | | | | | | | 233,353,988 | | | | 95.59 | % |

| | | | | | | | | | | | | | |

| | RIGHTS – 0.00% | | | | | | | | | | | | |

| | Forest Laboratories, Inc. (a)(c) | | | 5,500 | | | | 5,225 | | | | 0.00 | % |

| | | | | | | | | | | | | | |

| | Total Rights | | | | | | | | | | | | |

| | (Cost $0) | | | | | | | 5,225 | | | | 0.00 | % |

The accompanying notes are an integral part of these financial statements.

HENNESSY FUNDS 1-800-966-4354

| | PARTNERSHIPS – 2.07% | | Number | | | | | | % of | |

| | | | of Shares | | | Value | | | Net Assets | |

| | Energy – 2.07% | | | | | | | | | |

| | NGL Energy Partners LP | | | 130,579 | | | $ | 5,049,490 | | | | 2.07 | % |

| | | | | | | | | | | | | | |

| | Total Partnerships | | | | | | | | | | | | |

| | (Cost $4,581,811) | | | | | | | 5,049,490 | | | | 2.07 | % |

| | | | | | | | | | | | | | |

| | SHORT-TERM INVESTMENTS – 1.69% | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| | Money Market Funds – 1.69% | | | | | | | | | | | | |

| | Fidelity Government Portfolio – | | | | | | | | | | | | |

| | Institutional Class, 0.01% (d) | | | 4,116,133 | | | | 4,116,133 | | | | 1.69 | % |

| | | | | | | | | | | | | | |

| | Total Money Market Funds | | | | | | | | | | | | |

| | (Cost $4,116,133) | | | | | | | 4,116,133 | | | | 1.69 | % |

| | | | | | | | | | | | | | |

| | Total Short-Term Investments | | | | | | | | | | | | |

| | (Cost $4,116,133) | | | | | | | 4,116,133 | | | | 1.69 | % |

| | | | | | | | | | | | | | |

| | Total Investments | | | | | | | | | | | | |

| | (Cost $216,598,499) – 99.35% | | | | | | | 242,524,836 | | | | 99.35 | % |

| | | | | | | | | | | | | | |

| | Other Assets in | | | | | | | | | | | | |

| | Excess of Liabilities – 0.65% | | | | | | | 1,593,578 | | | | 0.65 | % |

| | TOTAL NET ASSETS – 100.00% | | | | | | $ | 244,118,414 | | | | 100.00 | % |

Percentages are stated as a percent of net assets.

| (a) | Non-income producing security. |

| (b) | U.S. traded security of a foreign corporation. |

| (c) | Security is fair valued in good faith. |

| (d) | The rate listed is the fund’s 7-day yield as of April 30, 2014. |

The accompanying notes are an integral part of these financial statements.

Summary of Fair Value Exposure at April 30, 2014

The following is a summary of the inputs used to value the Fund’s net assets as of April 30, 2014 (See Note 3 in the accompanying notes to the financial statements):

| Common Stock | | Level 1 | | | Level 2 | | | Level 3 | | | Total | |

| Consumer Discretionary | | $ | 60,823,793 | | | $ | — | | | $ | — | | | $ | 60,823,793 | |

| Consumer Staples | | | 5,263,038 | | | | — | | | | — | | | | 5,263,038 | |

| Energy | | | 21,438,261 | | | | — | | | | — | | | | 21,438,261 | |

| Financials | | | 19,137,718 | | | | — | | | | — | | | | 19,137,718 | |

| Health Care | | | 14,032,876 | | | | — | | | | — | | | | 14,032,876 | |

| Industrials | | | 88,767,406 | | | | — | | | | — | | | | 88,767,406 | |

| Information Technology | | | 14,195,314 | | | | — | | | | — | | | | 14,195,314 | |

| Materials | | | 9,695,582 | | | | — | | | | — | | | | 9,695,582 | |

| Total Common Stock | | $ | 233,353,988 | | | $ | — | | | $ | — | | | $ | 233,353,988 | |

| Rights | | $ | — | | | $ | — | | | $ | 5,225 | * | | $ | 5,225 | |

| Partnerships | | | | | | | | | | | | | | | | |

| Energy | | $ | 5,049,490 | | | $ | — | | | $ | — | | | $ | 5,049,490 | |

| Total Partnerships | | $ | 5,049,490 | | | $ | — | | | $ | — | | | $ | 5,049,490 | |

| Short-Term Investments | | | | | | | | | | | | | | | | |

| Money Market Funds | | $ | 4,116,133 | | | $ | — | | | $ | — | | | $ | 4,116,133 | |

| Total Short-Term Investments | | $ | 4,116,133 | | | $ | — | | | $ | — | | | $ | 4,116,133 | |

| Total Investments | | $ | 242,519,611 | | | $ | — | | | $ | 5,225 | | | $ | 242,524,836 | |

Transfers between levels are recognized at the end of the reporting period. During the six-month period ended April 30, 2014, the Fund recognized no transfers between levels.

* Acquired in merger.

Level 3 Reconciliation Disclosure

Following is a reconciliation of Level 3 assets for which significant unobservable inputs were used to determine fair value.

| | | Rights | |

| Balance as of October 31, 2013 | | $ | 5,225 | |

| Accrued discounts/premiums | | | — | |

| Realized gain (loss) | | | — | |

| Change in unrealized appreciation (depreciation) | | | — | |

| Purchases | | | — | |

| (Sales) | | | — | |

| Transfer in and/or out of Level 3 | | | — | |

| Balance as of April 30, 2014 | | $ | 5,225 | |

| | | | | |

| Net in unrealized appreciation/depreciation during | | | | |

| the year for Level 3 investments held at April 30, 2014 | | $ | 5,225 | |

The Level 3 investments as of April 30, 2014 represented 0.00% of net assets and did not warrant a disclosure of significant unobservable valuation inputs.

The accompanying notes are an integral part of these financial statements.

HENNESSY FUNDS 1-800-966-4354

Financial Statements

Statement of Assets and Liabilities as of April 30, 2014 (Unaudited) |

| ASSETS: | | | |

| Investments in securities, at value (cost $216,598,499) | | $ | 242,524,836 | |

| Dividends and interest receivable | | | 69,324 | |

| Receivable for fund shares sold | | | 32,450 | |

| Receivable for securities sold | | | 5,068,745 | |

| Prepaid expenses and other assets | | | 25,591 | |

| Total Assets | | | 247,720,946 | |

| | | | | |

| LIABILITIES: | | | | |

| Payable for securities purchased | | | 3,074,984 | |

| Payable for fund shares redeemed | | | 179,482 | |

| Payable to advisor | | | 148,829 | |

| Payable to administrator | | | 73,009 | |

| Payable to auditor | | | 16,816 | |

| Accrued service fees | | | 17,979 | |

| Accrued interest payable | | | 157 | |

| Accrued trustees fees | | | 4,992 | |

| Accrued expenses and other payables | | | 86,284 | |

| Total Liabilities | | | 3,602,532 | |

| NET ASSETS | | $ | 244,118,414 | |

| | | | | |

| NET ASSETS CONSIST OF: | | | | |

| Capital stock | | $ | 369,887,091 | |

| Accumulated net investment loss | | | (805,254 | ) |

| Accumulated net realized loss on investments | | | (150,889,760 | ) |

| Unrealized net appreciation on investments | | | 25,926,337 | |

| Total Net Assets | | $ | 244,118,414 | |

| | | | | |

| NET ASSETS | | | | |

| Investor Class: | | | | |

| Shares authorized (no par value) | | Unlimited | |

| Net assets applicable to outstanding Investor Class shares | | | 218,161,707 | |

| Shares issued and outstanding | | | 12,713,439 | |

| Net asset value, offering price and redemption price per share | | $ | 17.16 | |

| | | | | |

| Institutional Class: | | | | |

| Shares authorized (no par value) | | Unlimited | |

| Net assets applicable to outstanding Institutional Class shares | | | 25,956,707 | |

| Shares issued and outstanding | | | 1,482,282 | |

| Net asset value, offering price and redemption price per share | | $ | 17.51 | |

The accompanying notes are an integral part of these financial statements.

Financial Statements

Statement of Operations Six Months Ended April 30, 2014 (Unaudited) |

| INVESTMENT INCOME: | | | |

Dividend income(1) | | $ | 1,372,887 | |

| Interest income | | | 270 | |

| Total investment income | | | 1,373,157 | |

| | | | | |

| EXPENSES: | | | | |

| Investment advisory fees | | | 921,011 | |

| Administration, fund accounting, custody and transfer agent fees | | | 248,922 | |

| Sub-transfer agent expenses – Investor Class (See Note 5) | | | 162,743 | |

| Sub-transfer agent expenses – Institutional Class (See Note 5) | | | 14,430 | |

| Service fees – Investor Class (See Note 5) | | | 111,343 | |

| Reports to shareholders | | | 22,399 | |

| Federal and state registration fees | | | 18,893 | |

| Audit fees | | | 12,793 | |

| Compliance expense | | | 10,655 | |

| Trustees’ fees and expenses | | | 8,380 | |

| Legal fees | | | 2,480 | |

| Other expenses | | | 12,623 | |

| Total expenses before waiver | | | 1,546,672 | |

| Administration expense waiver (See Note 5) | | | (18,467 | ) |

| Net expenses | | | 1,528,205 | |

| NET INVESTMENT LOSS | | $ | (155,048 | ) |

| | | | | |

| REALIZED AND UNREALIZED GAINS (LOSSES): | | | | |

| Net realized gain on investments | | $ | 42,943,746 | |

| Change in unrealized appreciation on investments | | | (19,552,664 | ) |

| Net gain on investments | | | 23,391,082 | |

| NET INCREASE IN NET ASSETS RESULTING FROM OPERATIONS | | $ | 23,236,034 | |

(1) Net of foreign taxes withheld of $5,114.

The accompanying notes are an integral part of these financial statements.

HENNESSY FUNDS 1-800-966-4354

(This Page Intentionally Left Blank.)

Financial Statements

| Statements of Changes in Net Assets |

| | | Six Months Ended | | | | |

| | | April 30, 2014 | | | Year Ended | |

| | | (Unaudited) | | | October 31, 2013 | |

| OPERATIONS: | | | | | | |

| Net investment loss | | $ | (155,048 | ) | | $ | (632,613 | ) |

| Net realized gain on securities | | | 42,943,746 | | | | 51,423,472 | |

| Change in unrealized appreciation (depreciation) | | | | | | | | |

| on securities | | | (19,552,664 | ) | | | 16,444,675 | |

| Net increase in net assets resulting from operations | | | 23,236,034 | | | | 67,235,534 | |

| | | | | | | | | |

| CAPITAL SHARE TRANSACTIONS: | | | | | | | | |

| Proceeds from shares subscribed – Investor Class | | | 4,670,245 | | | | 41,940,983 | |

| Proceeds from shares subscribed – Institutional Class | | | 593,350 | | | | 3,016,344 | |

| Cost of shares redeemed – Investor Class | | | (28,092,327 | )(1) | | | (147,291,804 | ) |

| Cost of shares redeemed – Institutional Class | | | (3,345,198 | )(1) | | | (20,555,666 | ) |

| Net decrease in net assets derived | | | | | | | | |

| from capital share transactions | | | (26,173,930 | ) | | | (122,890,143 | ) |

| TOTAL DECREASE IN NET ASSETS | | | (2,937,896 | ) | | | (55,654,609 | ) |

| | | | | | | | | |

| NET ASSETS: | | | | | | | | |

| Beginning of period | | | 247,056,310 | | | | 302,710,919 | |

| End of period | | $ | 244,118,414 | | | $ | 247,056,310 | |

| Undistributed net investment loss, end of period | | $ | (805,254 | ) | | $ | (650,206 | ) |

| | | | | | | | | |

| CHANGES IN SHARES OUTSTANDING: | | | | | | | | |

| Shares sold – Investor Class | | | 279,052 | | | | 3,204,921 | |

| Shares sold – Institutional Class | | | 34,811 | | | | 216,262 | |

| Shares redeemed – Investor Class | | | (1,678,889 | ) | | | (10,550,825 | ) |

| Shares redeemed – Institutional Class | | | (197,699 | ) | | | (1,522,417 | ) |

| Net decrease in shares outstanding | | | (1,562,725 | ) | | | (8,652,059 | ) |

| (1) | Net of redemption fees of $34 and $46 for the Investor Class and Institutional Class shares, respectively, related to redemption fees imposed by the FBR Small Cap Fund (which was reorganized into the Fund) during a prior year but not received until the six-month period ended April 30, 2014. |

The accompanying notes are an integral part of these financial statements.

HENNESSY FUNDS 1-800-966-4354

Financial Highlights

| Hennessy Cornerstone Growth Fund |

For an Investor Class share outstanding throughout each period

| | | Six Months Ended | |

| | | April 30, 2014 | |

| | | (Unaudited) | |

| PER SHARE DATA: | | | |

| Net asset value, beginning of period | | $ | 15.65 | |

| | | | | |

| Income from investment operations: | | | | |

| Net investment loss | | | (0.02 | ) |

| Net realized and unrealized gains (losses) on securities | | | 1.53 | |

| Total from investment operations | | | 1.51 | |

| Net asset value, end of period | | $ | 17.16 | |

| | | | | |

| TOTAL RETURN | | | 9.65 | %(1) |

| | | | | |

| SUPPLEMENTAL DATA AND RATIOS: | | | | |

| Net assets, end of period (millions) | | $ | 218.16 | |

| Ratio of expenses to average net assets | | | 1.26 | %(2) |

| Ratio of net investment loss to average net assets | | | (0.08 | )%(2) |

Portfolio turnover rate(3) | | | 82 | %(1) |

| (1) | Not annualized. |

| (2) | Annualized. |

| (3) | Portfolio turnover is calculated on the basis of the Fund as a whole. |

The accompanying notes are an integral part of these financial statements.

| Year Ended October 31, | |

| 2013 | | | 2012 | | | 2011 | | | 2010 | | | 2009 | |

| | | | | | | | | | | | | | |

| $ | 12.38 | | | $ | 9.97 | | | $ | 10.28 | | | $ | 8.81 | | | $ | 8.80 | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| | (0.11 | ) | | | (0.07 | ) | | | (0.08 | ) | | | (0.10 | ) | | | (0.04 | ) |

| | 3.38 | | | | 2.48 | | | | (0.23 | ) | | | 1.57 | | | | 0.05 | |

| | 3.27 | | | | 2.41 | | | | (0.31 | ) | | | 1.47 | | | | 0.01 | |

| $ | 15.65 | | | $ | 12.38 | | | $ | 9.97 | | | $ | 10.28 | | | $ | 8.81 | |

| | | | | | | | | | | | | | | | | | | |

| | 26.41 | % | | | 24.17 | % | | | (3.02 | )% | | | 16.69 | % | | | 0.11 | % |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| $ | 220.83 | | | $ | 265.60 | | | $ | 184.40 | | | $ | 207.11 | | | $ | 228.96 | |

| | 1.29 | % | | | 1.34 | % | | | 1.33 | % | | | 1.34 | % | | | 1.36 | % |

| | (0.26 | )% | | | (0.66 | )% | | | (0.78 | )% | | | (0.89 | )% | | | (0.42 | )% |

| | 105 | % | | | 90 | % | | | 106 | % | | | 103 | % | | | 108 | % |

The accompanying notes are an integral part of these financial statements.

HENNESSY FUNDS 1-800-966-4354

Financial Highlights

| Hennessy Cornerstone Growth Fund |

For an Institutional Class share outstanding throughout each period

| | | Six Months Ended | |

| | | April 30, 2014 | |

| | | (Unaudited) | |

| PER SHARE DATA: | | | |

| Net asset value, beginning of period | | $ | 15.94 | |

| | | | | |

| Income from investment operations: | | | | |

| Net investment income (loss) | | | 0.03 | |

| Net realized and unrealized gains (losses) on securities | | | 1.54 | |

| Total from investment operations | | | 1.57 | |

| Net asset value, end of period | | $ | 17.51 | |

| | | | | |

| TOTAL RETURN | | | 9.85 | %(1) |

| | | | | |

| SUPPLEMENTAL DATA AND RATIOS: | | | | |

| Net assets, end of period (millions) | | $ | 25.96 | |

| Ratio of expenses to average net assets: | | | | |

| Before expense reimbursement | | | 1.12 | %(2) |

| After expense reimbursement | | | 0.98 | %(2) |

| Ratio of net investment income (loss) to average net assets: | | | | |

| Before expense reimbursement | | | (0.02 | )%(2) |

| After expense reimbursement | | | 0.12 | %(2) |

Portfolio turnover rate(3) | | | 82 | %(1) |

| (1) | Not annualized. |

| (2) | Annualized. |

| (3) | Portfolio turnover is calculated on the basis of the Fund as a whole. |

The accompanying notes are an integral part of these financial statements.

| Year Ended October 31, | |

| 2013 | | | 2012 | | | 2011 | | | 2010 | | | 2009 | |

| | | | | | | | | | | | | | |

| $ | 12.57 | | | $ | 10.09 | | | $ | 10.37 | | | $ | 8.86 | | | $ | 8.82 | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| | 0.01 | | | | (0.04 | ) | | | (0.05 | ) | | | (0.07 | ) | | | — | |

| | 3.36 | | | | 2.52 | | | | (0.23 | ) | | | 1.58 | | | | 0.04 | |

| | 3.37 | | | | 2.48 | | | | (0.28 | ) | | | 1.51 | | | | 0.04 | |

| $ | 15.94 | | | $ | 12.57 | | | $ | 10.09 | | | $ | 10.37 | | | $ | 8.86 | |

| | | | | | | | | | | | | | | | | | | |

| | 26.81 | % | | | 24.58 | % | | | (2.70 | )% | | | 17.04 | % | | | 0.45 | % |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| $ | 26.23 | | | $ | 37.11 | | | $ | 2.53 | | | $ | 3.12 | | | $ | 4.68 | |

| | | | | | | | | | | | | | | | | | | |

| | 1.11 | % | | | 1.11 | % | | | 1.09 | % | | | 1.09 | % | | | 1.11 | % |

| | 0.98 | % | | | 0.98 | % | | | 0.98 | % | | | 0.98 | % | | | 0.98 | % |

| | | | | | | | | | | | | | | | | | | |

| | (0.01 | )% | | | (0.51 | )% | | | (0.55 | )% | | | (0.64 | )% | | | (0.17 | )% |

| | 0.12 | % | | | (0.38 | )% | | | (0.44 | )% | | | (0.53 | )% | | | (0.04 | )% |

| | 105 | % | | | 90 | % | | | 106 | % | | | 103 | % | | | 108 | % |

The accompanying notes are an integral part of these financial statements.

HENNESSY FUNDS 1-800-966-4354

Notes to the Financial Statements

April 30, 2014 (Unaudited)

1). ORGANIZATION

The Hennessy Cornerstone Growth Fund (the “Fund”) is a series of Hennessy Funds Trust (the “Trust”), which was organized as a Delaware statutory trust on September 17, 1992. The Fund is an open-end management investment company registered under the Investment Company Act of 1940, as amended. The Fund is a successor to a fund with the same name (the “Predecessor Fund”) that was a series of Hennessy Mutual Funds, Inc., a Maryland corporation, pursuant to a reorganization that took place after the close of business on February 28, 2014. Prior to February 28, 2014, the Fund had no investment operations. As a result of the reorganization, holders of the Investor Class shares of the Predecessor Fund received Investor Class shares of the Fund (the Investor Class shares of the Fund are the successor to the accounting and performance information of the Predecessor Fund), and holders of the Institutional Class shares of the Predecessor Fund received Institutional Class shares of the Fund (the Institutional Class shares of the Fund are the successor to the accounting and performance information of the Predecessor Fund). The investment objective of the Fund is long-term growth of capital. The Fund is a diversified fund.

The Fund offers Investor Class and Institutional Class shares. Prior to October 26, 2012, the Investor Class shares were known as Original Class shares. Each class of shares differs principally in its respective administration, 12b-1 distribution and service fees, shareholder servicing, and transfer agent expenses and sales charges, if any. Each class has identical rights to earnings, assets, and voting privileges, except for class-specific expenses and exclusive rights to vote on matters affecting only individual classes.

2). SIGNIFICANT ACCOUNTING POLICIES

The following is a summary of significant accounting policies consistently followed by the Fund in the preparation of the financial statements. These policies are in conformity with U.S. generally accepted accounting principles (“GAAP”).

| a). | Investment Valuation – All investments in securities are recorded at their estimated fair value, as described in Note 3. |

| b). | Federal Income Taxes – Provision for Federal income taxes or excise taxes has not been made since the Fund has elected to be taxed as a “regulated investment company” and intends to distribute substantially all of its taxable income to its shareholders and otherwise comply with the provisions of the Internal Revenue Code of 1986, as amended, applicable to regulated investment companies. Net investment income or loss and realized gains and losses for federal income tax purposes may differ from that reported on the financial statements because of temporary book and tax basis differences. Temporary differences are primarily the result of the treatment of wash sales for tax reporting purposes. Distributions from net realized gains for book purposes may include short-term capital gains, which are included as ordinary income to shareholders for tax purposes. |

| c). | Income and Expenses – Dividend income is recognized on the ex-dividend date or as soon as information is available to the Fund. Interest income, which includes the amortization of premium and accretion of discount, is recognized on an accrual basis. The Fund is charged for those expenses that are directly attributable to the portfolio, |

| | such as advisory, administration, and certain shareholder service fees. Income, expenses (other than expenses attributable to a specific class), and realized and unrealized gains or losses on investments are allocated to each class of shares based on its respective net assets. |

| d). | Distributions to Shareholders – Dividends from net investment income for the Fund, if any, are declared and paid out annually, usually in November or December. Distributions of net realized capital gains, if any, are declared and paid annually, usually in November or December. |

| e). | Security Transactions – Investment and shareholder transactions are recorded on the trade date. The Fund determines the gain or loss realized from the investment transactions by comparing the original cost of the security lot sold with the net sale proceeds. Discounts and premiums on securities purchased are accreted/amortized over the life of the respective security. |

| f). | Use of Estimates – The preparation of financial statements in conformity with GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported change in net assets during the reporting period. Actual results could differ from those estimates. |

| g). | Share Valuation – The net asset value (“NAV”) per share of the Fund is calculated by dividing the sum of the value of the securities held by the Fund, plus cash or other assets, minus all liabilities (including estimated accrued expenses) by the total number of shares outstanding for the Fund, rounded to the nearest cent. The Fund’s shares will not be priced on days the New York Stock Exchange is closed for trading. The offering and redemption price per share for the Fund is equal to the Fund’s net asset value per share. |

| h). | Foreign Currency – Values of investments denominated in foreign currencies, if any, are converted into U.S. dollars using the spot market rate of exchange at the time of valuation. Purchases and sales of investments and income are translated into U.S. dollars using the spot market rate of exchange prevailing on the respective dates of such transactions. The Fund does not isolate the portion of the results of operations resulting from fluctuations in foreign exchange rates on investments from fluctuations resulting from changes in the market prices of securities held. Such fluctuations are included with the net realized and unrealized gain or loss on investments. Foreign investments present additional risks due to currency fluctuations, economic and political factors, lower liquidity, government regulations, differences in accounting standards, and other factors. |

| i). | Forward Contracts – The Fund may enter into forward currency contracts to reduce its exposure to changes in foreign currency exchange rates on its foreign holdings and to lock in the U.S. dollar cost of firm purchase and sale commitments for securities denominated in foreign currencies. A forward currency contract is a commitment to purchase or sell a foreign currency at a future date at a negotiated forward rate. The gain or loss arising from the difference between the U.S. dollar cost of the original contract and the value of the foreign currency in U.S. dollars upon closing of such contract is included in net realized gain or loss from foreign currency transactions. During the six months ended April 30, 2014, the Fund did not enter into any forward contracts. |

| j). | Repurchase Agreements – The Fund may enter into repurchase agreements with member banks or security dealers of the Federal Reserve Board whom the investment advisor deems creditworthy. The repurchase price generally equals the price paid by the Fund plus interest negotiated on the basis of current short-term rates. |

HENNESSY FUNDS 1-800-966-4354

| | Securities pledged as collateral for repurchase agreements are held by the custodian bank until the respective agreements mature. Provisions of the repurchase agreements ensure that the market value of the collateral, including accrued interest thereon, is sufficient in the event of default of the counterparty. If the counterparty defaults and the value of the collateral declines or if the counterparty enters an insolvency proceeding, realization of the collateral by the Fund may be delayed or limited. |

| k). | Accounting for Uncertainty in Income Taxes – The Fund has adopted accounting policies regarding recognition and measurement of tax positions taken or expected to be taken on a tax return. The Fund has reviewed all open tax years in major jurisdictions and concluded that there is no impact on the Fund’s net assets and no tax liability resulting from unrecognized tax benefits relating to uncertain income tax positions taken or expected to be taken on a tax return. The Fund’s major tax jurisdictions are U.S. Federal and Delaware. As of April 30, 2014, open Federal and state tax years for the Fund include the tax years ended October 31, 2011 through 2013. |

| l). | Derivatives – The Fund may invest in, or enter into, derivatives, such as options, futures contracts, options on futures contracts, and swaps, for a variety of reasons, including to hedge certain risks, to provide a substitute for purchasing or selling particular securities, or to increase potential income gain. Derivatives may provide a cheaper, quicker, or more specifically focused way for a Fund to invest than “traditional” securities would. The main purpose of utilizing these derivative instruments is for hedging purposes. |

| | The Fund has adopted the financial accounting reporting rules as required by the Derivatives and Hedging Topic of the Financial Accounting Standards Board Accounting Standards Codification. Under such rules, the Fund is required to include enhanced disclosure that enables investors to understand how and why an entity uses derivatives, how derivatives are accounted for, and how derivatives instruments affect an entity’s results of operations and financial position. During the six months ended April 30, 2014, the Fund did not hold any derivative instruments. |

| m). | Events Subsequent to the Fiscal Period End – The Fund has adopted financial reporting rules regarding subsequent events that require an entity to recognize in the financial statements the effects of all subsequent events that provide additional evidence about conditions that existed at the date of the balance sheet. Management has evaluated the Fund’s related events and transactions that occurred subsequent to April 30, 2014 through the date of issuance of the Fund’s financial statements. There were no events or transactions that occurred during this period that materially impacted the amounts or disclosures in the Fund’s financial statements. |

3). SECURITIES VALUATION

The Fund has adopted authoritative fair valuation accounting standards that establish an authoritative definition of fair value and set out a hierarchy for measuring fair value. These standards require additional disclosures about the various inputs and valuation techniques used to develop the measurements of fair value and a discussion in changes in valuation techniques and related inputs during the period. These inputs are summarized in the three broad levels listed below:

| | Level 1 – | Quoted unadjusted prices for identical instruments in active markets to which the Fund has access at the date of measurement. |

| | Level 2 – | Quoted prices for similar instruments in active markets; quoted prices for identical or similar instruments in markets that are not active; and model-derived valuations in which all significant inputs and significant value drivers are observable in active markets. Level 2 inputs are those in markets for which there are few transactions, the prices are not current, the prices are fair value adjusted due to post-market close subsequent events (foreign markets), little public information exists, or instances where prices vary substantially over time or among brokered market makers. These inputs may also include interest rates, prepayment speeds, credit risk curves, default rates, and similar data. |

| | Level 3 – | Model-derived valuations in which one or more significant inputs or significant value drivers are unobservable. Unobservable inputs are those inputs that reflect the Fund’s own assumptions about what market participants would use to price the asset or liability based on the best available information. |

Following is a description of the valuation techniques applied to the Fund’s major categories of assets and liabilities measured at fair value on a recurring basis.

Equity Securities – Equity securities, including common stocks, preferred stocks, foreign issued common stocks, exchange traded funds, closed-end mutual funds, and real estate investment trusts, that are traded on a securities exchange for which a last-quoted sales price is readily available will be valued at the last sales price as reported by the primary exchange on which the securities are listed. Securities listed on The NASDAQ Stock Market (“NASDAQ”) will be valued at the NASDAQ Official Closing Price, which may differ from the last sales price reported. Securities traded on a securities exchange for which a last-quoted sales price is not readily available will be valued at the mean between the bid and ask prices. To the extent these securities are actively traded and valuation adjustments are not applied, they are classified in Level 1 of the fair value hierarchy.

Investment Companies – Investments in investment companies (e.g., mutual funds and exchange traded funds) are generally priced at the ending NAV provided by the Fund’s service agent and will be classified in Level 1 of the fair value hierarchy.

Debt Securities – Debt securities, including corporate bonds, asset-backed securities, mortgage-backed securities, municipal bonds, U.S. Treasuries, and U.S. government agency issues, are valued at market on the basis of valuations furnished by an independent pricing service that utilizes both dealer-supplied valuations and formula-based techniques. The pricing service may consider recently executed transactions in securities of the issuer or comparable issuers, market price quotations (where observable), bond spreads, and fundamental data relating to the issuer. In addition, the model may incorporate market observable data such as reported sales of similar securities, broker quotes, yields, bids, offers, and reference data. Certain securities are valued principally using dealer quotations. These securities are generally classified in Level 2 of the fair value hierarchy.

Short-Term Securities – Short-term equity investments, including money market funds, are valued in the manner specified above. Short-term debt investments are valued at amortized cost, if their original maturity was 60 days or less, or by amortizing the values as of the 61st day prior to maturity, if their original term to maturity exceeded 60 days. Short-term securities are generally classified in Level 1 or Level 2 of the fair market hierarchy depending on the inputs used and market activity levels for specific securities.

The Board of Trustees of the Fund (the “Board”) has adopted fair value pricing procedures that are followed when a price for a security is not readily available or if a

HENNESSY FUNDS 1-800-966-4354

significant event has occurred that indicates the closing price of a security no longer represents the true value of that security. Fair value pricing determinations are made in good faith in accordance with these procedures. There are numerous criteria that will be given consideration in determining a fair value of a security. Some of these criteria are trading volume of security and markets, the value of other like securities, and news events with direct bearing to security or market. Fair value pricing results in an estimated price that reasonably reflects the current market conditions in order to rate the portfolio holdings such that shareholder transactions receive a fair net asset value. Depending on the relative significance of the valuation inputs, these securities may be classified in either Level 2 or Level 3 of the fair value hierarchy.

Fair valuing of foreign securities may be determined with the assistance of a pricing service using correlations between the movement of prices of such securities and indices of domestic securities and other appropriate indicators, such as closing market prices of relevant American Depositary Receipts or futures contracts. The effect of using fair value pricing is that the Fund’s NAV will reflect the affected portfolio securities’ value as determined in the judgment of the Board or its designee instead of being determined by the market. Using a fair value pricing methodology to price foreign securities may result in a value that is different from a foreign security’s most recent closing price and from the prices used by other investment companies to calculate their net asset values and are generally considered Level 2 prices in the fair valuation hierarchy. Because the Fund may invest in foreign securities, the value of the Fund’s portfolio securities may change on days when you will not be able to purchase or redeem your shares.

The Board has delegated day-to-day valuation matters to a Valuation Committee comprised of one or more representatives from Hennessy Advisors, Inc., the Fund’s investment advisor. The function of the Valuation Committee is to value securities where current and reliable market quotations are not readily available. All actions taken by the Valuation Committee are reviewed by the Board.

The Fund has performed an analysis of all existing investments to determine the significance and character of all inputs to their fair value determination. Various inputs are used in determining the value of the Fund’s investments. The inputs or methodology used for valuing securities are not necessarily an indication of the risk associated with investing in those securities. Details related to the fair valuation hierarchy of the Fund’s securities as of April 30, 2014 are included in the Fund’s Schedule of Investments.

4). INVESTMENT TRANSACTIONS

Purchases and sales of investment securities (excluding government and short-term investments) for the Fund during the six months ended April 30, 2014 were $201,983,346 and $231,661,329, respectively.

There were no purchases or sales/maturities of long-term U.S. Government Securities for the Fund during the six months ended April 30, 2014.

5). INVESTMENT MANAGEMENT FEE AND OTHER TRANSACTIONS WITH AFFILIATES

Hennessy Advisors, Inc. (the “Advisor”) is the investment advisor of the Fund. The Advisor provides the Fund with investment management services under an Investment Advisory Agreement. The Advisor furnishes all investment advice, office space, facilities, and provides most of the personnel needed by the Fund. As compensation for its services, the Advisor is entitled to a monthly fee from the Fund. The fee is based upon the average daily net assets of the Fund at the annual rate of 0.74%. The net investment advisory fees payable for the Fund as of April 30, 2014 were $148,829.

The Advisor has agreed to waive its fees and absorb expenses to the extent that the total annual operating expenses (excluding all Federal, state and local taxes, interest, brokerage commissions, acquired fund fees and expenses and other costs incurred in connection with the purchase and sale of securities and extraordinary items) exceed 0.98% of the Fund’s net assets for the Institutional Class shares of the Fund. The expense limitation agreement for the Institutional Class shares can only be terminated by the Board.

For a period of three years after the year in which the Advisor waives or reimburses expenses, the Advisor may seek reimbursement from the Fund to the extent that total annual fund operating expenses are less than the expense limitation in effect at the time of the reimbursement. During the three years ended October 31, 2013, no Advisor fees were waived and therefore no expenses are subject to potential recovery.

The Board has approved a Shareholder Servicing Agreement for the Investor Class shares of the Fund, which was instituted to compensate the Advisor for the non-investment management services it provides to the Fund. The Shareholder Servicing Agreement provides for a monthly fee paid to the Advisor at an annual rate of 0.10% of the average daily net assets of the Fund attributable to Investor Class shares. Shareholder servicing fees payable for the Fund as of April 30, 2014 were $17,979.

The Fund has entered into agreements with various brokers, dealers, and financial intermediaries in connection with the sale of shares of the Fund. The agreements provide for periodic payments by the Fund to the brokers, dealers, and financial intermediaries for providing certain shareholder maintenance services (sub-transfer agent expenses). These shareholder services include the pre-processing and quality control of new accounts, shareholder correspondence, answering customer inquiries regarding account status, and facilitating shareholder telephone transactions. Fees paid by the Fund to various brokers, dealers, and financial intermediaries for the six months ended April 30, 2014 were $177,173.

U.S. Bancorp Fund Services, LLC (“USBFS”) provides the Fund with administrative, fund accounting, and transfer agent services, including all regulatory reporting, and necessary office equipment and personnel. As administrator, USBFS prepares various federal and state regulatory filings, reports, and returns for the Fund; prepares reports and materials to be supplied to the Board; monitors the activities of the Fund’s custodian, transfer agent, and accountants; and coordinates the preparation and payment of the Fund’s expenses and reviews the Fund’s expense accruals. Fees paid to USBFS for the six months ended April 30, 2014 were $230,455.

USBFS has voluntarily waived all or a portion of its fees allocated to the Institutional Class shares of the Fund. The administration fees voluntarily waived by USBFS during the six months ended April 30, 2014 were $18,467.

U.S. Bank, N.A., an affiliate of USBFS, serves as the Fund’s custodian. Quasar Distributors, LLC acts as the Fund’s principal underwriter in a continuous public offering of the Fund’s shares. Quasar Distributors, LLC is an affiliate of USBFS and U.S. Bank, N.A.

6). LINE OF CREDIT

The Fund has a line of credit with the other funds in the Hennessy Funds family of funds (the “Hennessy Funds”) in the amount of the lesser of (i) $100,000,000 or (ii) 33.33% of each Hennessy Fund’s net assets, or 30% for the Hennessy Gas Utility Index Fund and 10% for the Hennessy Balanced Fund, intended to provide short-term financing, if necessary, subject to certain restrictions, in connection with shareholder redemptions. The

HENNESSY FUNDS 1-800-966-4354

7). FEDERAL TAX INFORMATION

As of October 31, 2013, the Fund’s most recent fiscal year end, the components of accumulated earnings (losses) for income tax purposes for the Fund were as follows:

| | Cost of investments for tax purposes | | $ | 201,929,450 | |

| | Gross tax unrealized appreciation | | $ | 49,734,271 | |

| | Gross tax unrealized depreciation | | | (4,414,906 | ) |

| | Net tax unrealized appreciation/depreciation | | $ | 45,319,365 | |

| | Undistributed ordinary income | | $ | — | |

| | Undistributed long-term capital gains | | | — | |

| | Total distributable earnings | | $ | — | |

| | Other accumulated gain (loss) | | $ | (194,324,076 | ) |

| | Total accumulated gain (loss) | | $ | (149,004,711 | ) |

The difference between book-basis and tax-basis unrealized appreciation is attributable primarily to capital loss carry overs, wash sales, and partnership adjustments.

At October 31, 2013, the Fund’s most recent fiscal year end, the Fund had capital loss carryforwards that expire as follows:

| | $ 10,518,607 | 10/31/16 |

| | $183,155,263 | 10/31/17 |

During the year ended October 31, 2013, the Fund’s most recent fiscal year end, the capital loss carry forwards utilized for the Fund were $50,322,514.

Capital losses sustained in the year ended October 31, 2012 and in future taxable years will not expire and may be carried over by the Fund without limitation; however, they will retain the character of the original loss. Furthermore, any losses incurred during those taxable years will be required to be utilized prior to the losses incurred in the pre-enactment taxable years. As a result of this ordering rule, pre-enactment capital loss carryforwards may be more likely to expire unused. Under pre-enactment law, capital losses could be carried forward for eight years, and carried forward as short-term capital losses, irrespective of the character of the original loss.

At October 31, 2013, the Fund deferred, on a tax basis, a post-December late year ordinary loss deferral of $(650,206) and the Fund did not defer, on a tax basis, any post-December loss deferrals.

The Fund did not pay any distributions during fiscal year 2014 (year-to-date) or fiscal year 2013.

8.) AGREEMENT AND PLAN OF REORGANIZATION

On December 11, 2013, the Board approved an Agreement and Plan of Reorganization (the “Agreement”), of the Hennessy Cornerstone Growth Fund (the “New Fund”), pursuant to which the New Fund would be a successor to the corresponding series of the same name of Hennessy Mutual Funds, Inc., a Maryland corporation (the “Predecessor Fund”). The Agreement provided for the transfer of assets of the Predecessor Fund to the New Fund and the assumption of the liabilities of the Predecessor Fund by the New

Fund. The New Fund had the same investment objective and substantially similar principal investment strategies as the Predecessor Fund. The reorganization was effective as of the close of business on February 28, 2014. The following table illustrates the specifics of the reorganization:

| | | Shares of the New Fund | | | |

| | Predecessor Fund | Issued to Shareholders of | New Fund | Combined | Tax Status |

| | Net Assets | the Predecessor Fund | Net Assets | Net Assets | of Transfer |

| | $252,177,309(1) | 14,754,804 | $252,177,309 | $252,177,309 | Non-taxable |

| | (1) | Included accumulated realized losses and unrealized appreciation in the amounts of $(152,482,828) and $24,938,411, respectively. |

HENNESSY FUNDS 1-800-966-4354

Expense Example (Unaudited)

April 30, 2014

As a shareholder of the Fund, you incur two types of costs: (1) transaction costs, including sales charges (loads) on purchase payments, reinvested dividends, or other distributions; redemption fees; and exchange fees; and (2) ongoing costs, including management fees; service fees; and other Fund expenses. This Example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds. The Example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period from November 1, 2013 through April 30, 2014.

Actual Expenses

The first line of the table below under the “Investor Class” and “Institutional Class” headings provides information about actual account values and actual expenses. Although the Fund charges no sales loads or transaction fees, you will be assessed fees for outgoing wire transfers, returned checks and stop payment orders at prevailing rates charged by U.S. Bancorp Fund Services, LLC, the Fund’s transfer agent. If you request that a redemption be made by wire transfer, currently a $15.00 fee is charged by the Fund’s transfer agent. IRA accounts will be charged a $15.00 annual maintenance fee. The example below includes, but is not limited to, management fees, shareholder servicing fees, fund accounting, custody, and transfer agent fees. However, the example below does not include portfolio trading commissions and related expenses, and other extraordinary expenses as determined under generally accepted accounting principles. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line of the table under the “Investor Class” and “Institutional Class” headings in the column entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

The second line of the table below under the “Investor Class” and “Institutional Class” headings provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratios and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds. Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as sales charges (loads), or exchange fees. Therefore, the second line of the table under the “Investor Class” and “Institutional Class” headings is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

| | | | Expenses Paid |

| | Beginning | Ending | During Period(1) |

| | Account Value | Account Value | November 1, 2013 – |

| | November 1, 2013 | April 30, 2014 | April 30, 2014 |

| Investor Class | | | |

| | | | |

| Actual | $1,000.00 | $1,096.50 | $6.55 |

| | | | |

| Hypothetical (5% return | | | |

| before expenses) | $1,000.00 | $1,018.55 | $6.31 |

| | | | |

| Institutional Class | | | |

| | | | |

| Actual | $1,000.00 | $1,098.50 | $5.10 |

| | | | |

| Hypothetical (5% return | | | |

| before expenses) | $1,000.00 | $1,019.93 | $4.91 |

| (1) | Expenses are equal to the Fund’s annualized expense ratio of 1.26% for Investor Class shares or 0.98% for Institutional Class shares, as applicable, multiplied by the average account value over the period, multiplied by 181/365 days (to reflect one-half year period). |

HENNESSY FUNDS 1-800-966-4354

Proxy Voting

A description of the policies and procedures the Fund uses to determine how to vote proxies relating to portfolio securities is available without charge: (1) by calling 1-800-966-4354; (2) on the Hennessy Funds’ website at hennessyfunds.com; or (3) on the U.S. Securities and Exchange Commission’s (the “SEC”) website at www.sec.gov. The Fund’s proxy voting record is available on both the Hennessy Funds’ website at hennessyfunds.com and the SEC’s website at www.sec.gov no later than August 31 for the prior 12 months ending June 30.

Quarterly Filings on Form N-Q

The Fund files its complete schedule of portfolio holdings with the SEC for the first and third quarters of each fiscal year on Form N-Q. The Fund’s Forms N-Q are available on the SEC’s website at www.sec.gov. The Fund’s Forms N-Q may be reviewed and copied at the SEC’s Public Reference Room in Washington, DC and information on the operation of the Public Reference Room may be obtained by calling 1-800-SEC-0330. Information included in the Fund’s Forms N-Q will also be available upon request by calling 1-800-966-4354.

Householding

To help keep the Fund’s costs as low as possible, we generally deliver a single copy of most financial reports and prospectuses to shareholders who share an address, even if the accounts are registered under different names. This process, known as “householding,” does not apply to account statements. You may, of course, request an individual copy of a prospectus or financial report at any time. If you would like to receive separate mailings, please call the Administrator at 1-800-261-6950 or 1-414-765-4124 and we will begin individual delivery within 30 days of your request. If your account is held through a financial institution or other intermediary, please contact them directly to request individual delivery.

Board Approval of Investment Advisory

Agreement

At its meeting on December 4, 2013, the Board of Trustees of the Fund (the “Board”) unanimously approved the investment advisory agreement of the Fund for an initial period of two years.

The Board reviewed a number of documents, including a memorandum provided by outside legal counsel that described the fiduciary duties of the Board with respect to approving the investment advisory agreement and the relevant factors for consideration, the Advisor’s most recent Form 10-K, a copy of the advisory agreement, a fund fact sheet, and peer expense and performance comparisons. The Board considered and discussed numerous factors, including the following:

| | • | The Board considered the services identified below that are provided by the Advisor: |

| | | • | The Advisor acts as portfolio manager for the Fund. In this capacity, the Advisor manages the composition of the portfolio of the Fund, including the purchase, retention, and disposition of portfolio securities in accordance with the Fund’s investment objectives, policies, and restrictions. The Advisor holds a perpetual, royalty-free, exclusive license to the formula used for the Fund. |

| | | • | The Advisor oversees distribution of the Fund through third-party broker/dealers and independent financial institutions such as Charles Schwab, Inc., Fidelity, TD Waterhouse, and Pershing. The Advisor participates in “no transaction fee” (“NTF”) programs with these companies on behalf of the Fund, which allows customers to purchase the Fund through third-party distribution channels without paying a transaction fee. The Advisor compensates a number of these third-party providers of NTF programs out of its own revenues and not those of the Fund. |

| | | • | The Advisor oversees service providers that support the Fund in providing fund accounting, fund administration, fund distribution, transfer agency, and custodial services. |

| | • | The Board considered that the advisory services to be provided by the Advisor are services required for the operation of the Fund. |

| | • | The Board considered the nature and quality of the advisory services offered by the Advisor to the Fund. |

| | • | The Board considered that the terms of the advisory agreement are fair and reasonable. |

| | • | The Board compared the performance of the Fund to benchmark indices over various periods of time and concluded that the positive performance of the Fund warranted the approval of the advisory agreement. |

| | • | The Board reviewed the Fund’s expense ratio and comparable expense ratios for funds comparable to the Fund. The Board used data from Morningstar showing funds similar in asset size and investment objective to the Fund and determined that the expense ratio of the Fund falls within the range of the ratios of other comparable funds and concluded that the expenses of the Fund were reasonable. |

| | • | The Board considered the fees charged by the Advisor to those of funds similar in asset size and investment objective to the Fund and concluded the advisory fee of the Fund was reasonable and warranted approval of the advisory agreement. |

HENNESSY FUNDS 1-800-966-4354

| | • | The Board considered the profitability of the Advisor with respect to the Fund and concluded the profits were reasonable and not excessive when compared to profitability guidelines set forth in relevant court cases. |

| | • | The Board considered the high level of professionalism and knowledge of the Advisor’s employees, along with an extremely low level of turnover of the employees of the Advisor, and concluded that this was beneficial to the Fund and its shareholders, as it ensures that the Fund is operated efficiently. |

All of the factors above were considered separately by the Board, including the Trustees who are not “interested persons” (as defined in the Investment Company Act of 1940, as amended) of the Fund (the “Independent Trustees”) meeting in an executive session. The factors were viewed in their totality by the Board, with no single factor being the principal or determinative factor in the Board’s determination of whether to approve the advisory agreement. Based on the factors discussed above, the Board, including all of the Independent Trustees, recommended approval of the advisory agreement.

(This Page Intentionally Left Blank.)

For information, questions or assistance, please call

The Hennessy Funds

1-800-966-4354 or 1-415-899-1555

INVESTMENT ADVISOR

Hennessy Advisors, Inc.

7250 Redwood Blvd., Suite 200

Novato, California 94945

ADMINISTRATOR,

TRANSFER AGENT,

DIVIDEND PAYING AGENT &

SHAREHOLDER SERVICING AGENT

U.S. Bancorp Fund Services, LLC

P.O. Box 701

Milwaukee, Wisconsin 53201-0701

CUSTODIAN

U.S. Bank N.A.

Custody Operations

1555 North River Center Dr., Suite 302

Milwaukee, Wisconsin 53212

TRUSTEES

Neil J. Hennessy

Robert T. Doyle

J. Dennis DeSousa

Gerald P. Richardson

COUNSEL

Foley & Lardner LLP

777 East Wisconsin Avenue

Milwaukee, Wisconsin 53202-5306

INDEPENDENT REGISTERED

PUBLIC ACCOUNTING FIRM

KPMG LLP

777 East Wisconsin Avenue

Milwaukee, Wisconsin 53202-5306

DISTRIBUTOR

Quasar Distributors, LLC

615 East Michigan Street

Milwaukee, Wisconsin 53202

hennessyfunds.com | 1-800-966-4354

This report has been prepared for shareholders and may be distributed to

others only if preceded or accompanied by a current prospectus.

SEMI-ANNUAL REPORT

APRIL 30, 2014

HENNESSY FOCUS FUND

Investor Class HFCSX

Institutional Class HFCIX

hennessyfunds.com | 1-800-966-4354

(This Page Intentionally Left Blank.)

Contents

| Letter to Shareholders | 2 |

| Performance Overview | 4 |

| Financial Statements | |

| Schedule of Investments | 7 |

| Statement of Assets and Liabilities | 11 |

| Statement of Operations | 12 |

| Statements of Changes in Net Assets | 13 |

| Financial Highlights | 14 |

| Notes to the Financial Statements | 18 |

| Expense Example | 25 |

| Proxy Voting | 27 |

| Quarterly Filings on Form N-Q | 27 |

| Householding | 27 |

| Board Approval of Investment Advisory Agreements | 28 |

HENNESSY FUNDS 1-800-966-4354

Dear Shareholder: