UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number (811-07168)

Hennessy Funds Trust

(Exact name of registrant as specified in charter)

7250 Redwood Blvd., Suite 200

Novato, CA 94945

(Address of principal executive offices) (Zip code)

Neil J. Hennessy

7250 Redwood Blvd., Suite 200

Novato, CA 94945

(Name and address of agent for service)

800-966-4354

Registrant's telephone number, including area code

Date of fiscal year end: October 31, 2013

Date of reporting period: April 30, 2013

Item 1. Reports to Stockholders.

SEMI-ANNUAL REPORT

APRIL 30, 2013

DOMESTIC EQUITY

Hennessy Cornerstone Growth Fund

Hennessy Focus Fund

Hennessy Cornerstone Mid Cap 30 Fund

Hennessy Cornerstone Large Growth Fund

Hennessy Cornerstone Value Fund

Hennessy Large Value Fund

Hennessy Total Return Fund

BALANCED & FIXED INCOME

Hennessy Equity and Income Fund

Hennessy Balanced Fund

Hennessy Core Bond Fund

SECTOR & SPECIALTY

Hennessy Gas Utility Index Fund

Hennessy Small Cap Financial Fund

Hennessy Large Cap Financial Fund

Hennessy Technology Fund

Hennessy Japan Fund

Hennessy Japan Small Cap Fund

www.hennessyfunds.com|1-800-966-4354

(This Page Intentionally Left Blank.)

Contents

| Letter to shareholders | 2 |

| Performance overview | 4-21 |

| Financial statements | |

| Schedules of investments | |

| Domestic Equity | |

| Hennessy Cornerstone Growth Fund | 22 |

| Hennessy Focus Fund | 26 |

| Hennessy Cornerstone Mid Cap 30 Fund | 29 |

| Hennessy Cornerstone Large Growth Fund | 32 |

| Hennessy Cornerstone Value Fund | 35 |

| Hennessy Large Value Fund | 38 |

| Hennessy Total Return Fund | 41 |

| Hennessy Total Return Fund – Schedule of Reverse Repurchase Agreements | 44 |

| Balanced & Fixed Income | |

| Hennessy Equity and Income Fund | 45 |

| Hennessy Balanced Fund | 51 |

| Hennessy Core Bond Fund | 54 |

| Sector & Specialty | |

| Hennessy Gas Utility Index Fund | 58 |

| Hennessy Small Cap Financial Fund | 61 |

| Hennessy Large Cap Financial Fund | 64 |

| Hennessy Technology Fund | 67 |

| Hennessy Japan Fund | 70 |

| Hennessy Japan Small Cap Fund | 73 |

| Statements of assets and liabilities | 76 |

| Statements of operations | 80 |

| Statements of changes in net assets | 84 |

| Statements of cash flows – Hennessy Total Return Fund | 92 |

| Financial highlights | 94-124 |

| Notes to the financial statements | 125 |

| Expense example | 136 |

| Proxy voting policy | 139 |

| Quarterly Filings on Form N-Q | 139 |

| Federal Tax Distribution Information | 139 |

| Householding | 140 |

| Board approval of continuation of investment advisory agreements | 141 |

HENNESSY FUNDS 1-800-966-4354

June, 2013

Dear Hennessy Funds Shareholder:

Over the past six months our economy and our world have gone through many changes. We’ve climbed over fiscal cliffs, wrung our hands worrying about tax rates, witnessed a Presidential inauguration, sighed relief that our home values were returning, watched our investment portfolios improve, and for some of us, shook our heads in disbelief when our hometown San Francisco 49ers were defeated in the Super Bowl.

Each day there are more sensational headlines in the financial news. How in the world can investors and financial professionals keep all of this straight? To keep on top of the securities industry, I read every kind of publication: our local newspaper, the Wall Street Journal, Barron’s, compliance publications, and my staff likes to tease me because yes, I even read the New York Post. I also watch the financial news on CNBC, Bloomberg and Fox Business. Once I assimilate all of this information, I call upon my 33 years of industry experience to cut through the din for nuggets of common sense and sanity. And it is those nuggets of common sense that I try to provide to the investing public, and you, the shareholders of the Hennessy Funds.

I am often interviewed by financial reporters, and I was recently asked, “Neil, when do you think we will get some ‘euphoria’ in this market?”

I had to pause. To me, euphoria is something that is short lived and not sustainable, and I believe this bull market is just the opposite. I answered the reporter’s question and said, “You know, we don’t really want ‘euphoria’ in this market. We want investors who believe in the fundamentals of this market. I know that many business leaders and investors are still awaiting clear direction from Washington on taxes, unemployment, regulation and healthcare, but once retail investors fully re-enter the equity market, it should continue to thrive.”

After this interview, I started to think about the history of the stock market and its correlation to euphoria. Here at Hennessy, we use history as our guide, so I have pondered the history of euphoria’s effect on the economy, and my conclusion is that rather than seeking euphoria, we want good old fashioned investor confidence, and here’s why.

In the early 1980’s, there was euphoria in the real estate market. I remember friends telling me I couldn’t lose if I invested in real estate. The stock market was providing reasonable returns, yet real estate was all the rage. The real estate market was oversold and it took a terrible tumble in 1987 to 1989. And most equity investors suffered from the euphoria surrounding that real estate downturn.

We then entered another market where euphoria reigned supreme. Remember the “dot com” bubble in the late 90’s? Investors were gobbling up anything that had a “dot com” at the end of its name in the hopes to become an instant millionaire. Another market fueled by euphoria that came to a dismal end.

And none of us will ever forget the euphoria that reigned again in real estate in 2004 to 2007. The returns of the stock market were strong, and yet they could not keep pace with real estate. And through that time, a real estate buyer didn’t even need a down payment to buy a piece of property. We all remember how that euphoria driven market faltered and fell so dramatically by 2008. All investors suffered in that downturn.

What does that mean for investors today? Well, as I write this letter, I am very confident that we are in a long-term secular bull market fueled by strong fundamentals. In fact, this market reminds me of the bull market from 1982 to 2000; when the Dow Jones Industrial Average provided a positive return every year except for 1990, where it was down just -0.5%. Today, much like during the long bull market in the 80’s and 90’s, many major American companies have strong balance sheets, respectable fundamentals and reasonable returns. U.S. corporations are saving money, initiating or increasing dividends, strategically reorganizing and making accretive acquisitions. In December’s annual shareholder letter, I told you that the major obstacle facing the U.S. economy and the stock market, in my opinion, was clarity from our leaders in Washington on taxes, regulation and healthcare. Those issues remain, but the stock market and the housing sector are showing signs of life because you can’t keep good fundamentals and smart long-term investors on the sidelines forever.

Already, year-to-date through the end of this semi-annual reporting period ended April 30, 2013, the Dow Jones Industrial Average was going strong, returning over 14%. Despite a slow economic growth environment, if investors return to equities, buy based on fundamentals and maintain reasonable returns expectations, this bull market should have a long way to go. So, let’s leave euphoria on the sideline, and allow solid investor confidence to fuel this sustainable market.

Japanese Market

Our positive view on the Japanese equity market remains unchanged. Much of the sentiment I shared with you about the U.S. financial markets is true for the Japanese market, with companies hoarding cash, paying dividends and making

strategic acquisitions. Corporate Japan has been focused on long term structural improvements, and those efforts appear to finally be paying off. Japan’s new prime minister, Shinzo Abe, and his cabinet support Japanese companies, want Japanese citizens to prosper and are making bold policy moves. Since the onset of “Abenomics”, we feel that consumers have gained tremendous confidence, which is leading to improved retail sales, especially consumer goods. Japan’s overall economy has been moving in a positive direction, and the Japanese equity market has been one of the strongest performers in the world in 2013.

High quality Japanese products are coveted throughout the world, particularly among emerging middle class Asian consumers. A weaker yen could result in higher revenue and profit for Japanese companies that derive a meaningful percentage of their operating results from exports. However, while the weakening of the yen may be a catalyst to attract investors to Japan, we have never believed that the Japanese equity market is simply a yen play. We believe that, much like in the U.S. equity markets, there are incredible values in good Japanese companies today and for the long-term.

At Hennessy Funds, we are committed to investing with fundamentals, not investing by reacting to headlines. We remain focused on our proven investment strategies. We will not compromise our long-standing commitment to manage our portfolios in the best interest of our shareholders. As investors regain their confidence and return to investing based on facts and fundamentals, I believe we should return to steady, long-term market gains.

I would like to take a moment to reach out to the victims of the terrible events at the Boston Marathon. Throughout history, Americans remain resilient through good and bad times, and through unspeakable tragedies. No words can express the sorrow we feel for those who lost their lives, those injured or the families who lost loved ones.

Thank you for your continued confidence and investment in the Hennessy Funds. If you have any questions or want to speak with us directly, please don’t hesitate to call us at (800) 966-4354.

Best regards,

Neil J. Hennessy

President and Chief Investment Officer

Past performance does not guarantee future results.

Mutual fund investing involves risk. Principal loss is possible. Small and medium-capitalization companies tend to have more limited liquidity and greater price volatility than large-capitalization companies. Investments in foreign securities may involve greater volatility and political, economic and currency risk and differences in accounting methods. A non-diversified fund, one that may concentrate its assets in fewer individual holdings than a diversified fund, is more exposed to individual stock volatility than a diversified fund. A fund that concentrates its investments within one or a small group of industries may be more volatile than a fund that invests in a broader range of industries. Real estate values (and the values of real estate-related securities) fluctuate with changes in general and local economic conditions and are particularly sensitive to economic downturns. IPO shares are subject to market risk and liquidity risk. The yields and principal values of debt securities will also fluctuate. Generally, values of debt securities change inversely with interest rates. Some of the Hennessy Funds may invest a portion of their assets in lower rated, high-yielding bonds (commonly known as “junk bonds”). Mortgage- and asset-backed securities are subject to prepayment risk, which is the risk that the borrower will prepay some or all of the principal owed to the issuer.

Opinions expressed are those of Neil Hennessy and are subject to change, are not guaranteed and should not be considered investment advice.

The Dow Jones Industrial Average is an unmanaged index of common stocks comprised of major U.S. companies. You cannot invest directly in an index.

Correlation is a statistical measure of how two securities move in relation to each other.

HENNESSY FUNDS 1-800-966-4354

Performance Overview (Unaudited)

The opinions expressed in the following commentaries reflect those of the Portfolio Managers as of the date written. Any such opinions are subject to change based on market or other conditions. These opinions may not be relied upon as investment advice. Investment decisions for the Hennessy Funds are based on several factors, and may not be relied upon as an indication of trading intent on behalf of any Hennessy Fund. Security positions can and do change.

Hennessy Cornerstone Growth Fund

AVERAGE ANNUAL TOTAL RETURN PERIODS ENDED APRIL 30, 2013*

| | Six Months | One Year | Five Years | Ten Years |

| Hennessy Cornerstone Growth Fund – Investor Class | 11.79% | 17.09% | 0.81% | 5.70% |

Hennessy Cornerstone Growth Fund – Institutional Class1 | 12.01% | 17.43% | 1.15% | 5.88% |

| Russell 2000 Index | 16.58% | 17.69% | 7.27% | 10.47% |

| S&P 500 Index | 14.42% | 16.89% | 5.21% | 7.88% |

| Expense ratio: 1.35% (Investor Class) | | | Expense ratio: Gross 1.12%, Net 0.99%2 (Institutional Class) |

Performance data quoted represents past performance; past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance of the Fund may be lower or higher than the performance quoted. Performance data current to the most recent month end may be obtained by visiting www.hennessyfunds.com.

The expense ratios presented are from the most recent prospectus.

| * | Periods less than one year are not annualized. |

| 1 | Represents the performance of the Institutional Class shares after March 3, 2008 (inception of the share class) and Investor Class for periods prior to that date. |

| 2 | With regard to Institutional Class shares, the investment advisor has contractually agreed to waive a portion of its expenses indefinitely. |

PERFORMANCE NARRATIVE

Portfolio Manager, Neil Hennessy, and Co-Portfolio Manager, Brian Peery

Over the previous six months, how did the Fund perform and what factors contributed to this performance?

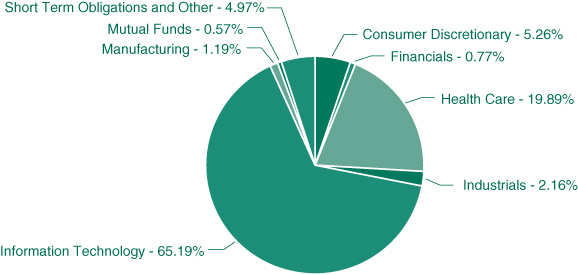

For the six-month period ended April 30, 2013, the Investor Class of the Hennessy Cornerstone Growth Fund returned 11.79%, underperforming the Russell 2000 Index, the S&P 500 Index and the Morningstar Small Blend Category Average, which returned 16.58%, 14.42% and 16.46% for the same period, respectively.

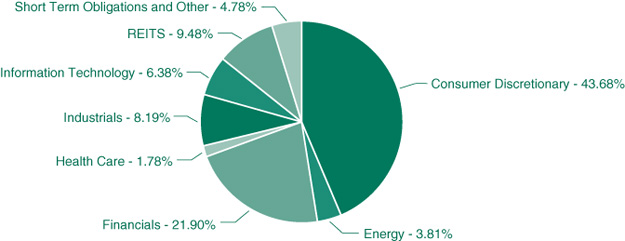

The Fund’s performance was hampered by both stock selection and asset allocation. Stock selection and relative overweighting in the Materials sector, combined with underperformance in stock selection in the Consumer Discretionary sector were the primary drivers of the Fund’s relative underperformance for the six–month period. The Fund’s single largest performance detractor was American Vanguard. The agricultural chemical manufacturer’s stock fell on earnings worries compounded by increased competition from other major agrichemical companies. The Fund no longer holds the stock. The biggest contributor to performance, and a stock still held in the Fund’s portfolio, was Hertz Global, which was up over 81% for the six-month period due to stronger than expected earnings and higher revenues.

Additional Portfolio Manager commentary and related investment outlook:

During the last six months, we saw a continuing trend of companies beating earnings expectations, but not quite meeting revenue targets. We believe that this trend is beginning to abate and we should see better earnings and revenue numbers as we progress through the rest of the year. While top line revenue growth is muted due to a slow growth environment, companies are still doing well. Corporate profits are hitting new highs as companies have deferred hiring, choosing to keep their costs down. This means any incremental gains in revenue can be impactful to a company’s bottom line earnings.

We are confident that there are opportunities in the Small-Cap and Mid-Cap space, especially in some of the more cyclical sectors. As the economy continues to improve we feel that the cyclical companies, those most sensitive to an economic recovery, should do well. The Fund is currently overweight cyclical stocks versus the benchmarks and will remain so until its portfolio is rebalanced in the winter.

The Russell 2000 Index and S&P 500 Index are unmanaged indices commonly used to measure the performance of U.S. stocks. You cannot invest directly in an index. Performance data for an index does not reflect any deductions for fees, expenses or taxes. The Fund may invest in small- and medium-capitalization companies which tend to have limited liquidity and greater price volatility than large-capitalization companies. Investments in foreign securities involve greater volatility and political, economic and currency risk and differences in accounting methods. References to specific securities should not be considered a recommendation to buy or sell any security. Fund holdings and sector allocations are subject to change. Please refer to the Schedule of Investments included in this report for additional portfolio information.

Each Morningstar category average represents a universe of funds with similar investment objectives. © Morningstar, Inc. All Rights Reserved. The information contained herein: 1) is proprietary to Morningstar; 2) may not be copied or distributed and 3) is not

warranted to be accurate, complete or timely. Neither Morningstar nor its content providers are responsible for any damages or losses arising from any use of this information. Past performance does not guarantee future results.

Hennessy Focus Fund

AVERAGE ANNUAL TOTAL RETURN PERIODS ENDED APRIL 30, 2013*

| | Six Months | One Year | Five Years | Ten Years |

| Hennessy Focus Fund – Investor Class | 18.56% | 20.54% | 10.69% | 13.10% |

Hennessy Focus Fund – Institutional Class1 | 18.71% | 20.89% | 11.04% | 13.29% |

| Russell 2000 Index | 16.58% | 17.69% | 7.27% | 10.47% |

| Russell Midcap Growth Index | 17.75% | 14.42% | 6.79% | 10.96% |

| Expense ratio: 1.43% (Investor Class) | | | Expense ratio: 1.14% (Institutional Class) |

Performance data quoted represents past performance; past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance of the Fund may be lower or higher than the performance quoted. Performance data current to the most recent month end may be obtained by visiting www.hennessyfunds.com. Performance for periods prior to October 26, 2012 is that of the FBR Focus Fund.

The expense ratios presented are from the most recent prospectus.

| * | Periods less than one year are not annualized. |

| 1 | Represents the performance of the Institutional Class shares after May 30, 2008 (inception of the share class) and Investor Class for periods prior to that date. |

PERFORMANCE NARRATIVE

BROAD RUN INVESTMENT MANAGEMENT, LLC, SUB-ADVISOR

Portfolio Managers Brian Macauley, CFA, David Rainey, CFA, and Ira Rothberg, CFA, Broad Run Investment Management, LLC (sub-advisor)

Over the previous six months, how did the Fund perform and what factors contributed to this performance?

For the six-month period ended April 30, 2013, the Investor Class of the Hennessy Focus Fund returned 18.56%, outperforming the Russell 2000 Index, Russell Midcap Growth Index and the Morningstar Mid-Cap Growth Category Average, which returned 16.58%, 17.75%, and 14.80% for the same period, respectively.

The Fund’s return during the period was the result of improved business prospects for its key holdings, owing to a better overall economic outlook and company specific developments. Leading contributors to the Fund’s performance were Penn National Gaming, Inc., CarMax, Inc., O’Reilly Automotive, Inc., News Corp, and American Tower Corp. The leading detractor from the Fund’s performance was Simpson Manufacturing Co., Inc. We continue to hold all these stocks in the Fund’s portfolio.

We invest with a long-term time horizon and encourage shareholders to do the same. Despite the discussion of six-month results referenced above, we urge investors to evaluate the Fund’s performance over three-, five-, and ten-year periods since shorter time frames can be influenced by many transitory issues unrelated to the growth in intrinsic value of the Fund’s holdings. Long-term performance metrics for the Fund can be found in the table above.

Additional Portfolio Manager commentary and related investment outlook:

We continue to have a positive long-term outlook for the Fund. We have this view not because of an ebullient macroeconomic or equity market forecast, but rather because we have a favorable view of the fundamental outlook for each of the Fund’s individual companies in the portfolio. We believe that if the companies in the Fund’s portfolio remain reasonably valued, our long-term investment outlook should be shaped by the prospects for growth in intrinsic value per share for each holding.

We believe that many of the Fund’s largest holdings are well positioned to potentially grow cash earnings per share over the next several years, even if we remain stuck in a low-growth economic environment. These companies have their own profit drivers that are largely independent of the overall economy. For example, American Tower’s growth is driven by the adoption of data intensive smartphones in the U.S. and a rapidly growing subscriber base across its international markets. CarMax’s growth is driven by geographic expansion and market share gains as it takes its no-haggle model nationwide. O’Reilly Automotive’s growth is driven by its continued consolidation of the aftermarket auto parts distribution industry.

Valuation multiples for the Fund’s holdings remain generally in-line with long-term historical levels. We think that these valuations are reasonable, particularly in today’s low interest rate environment. We believe that reasonable valuations, in combination with a positive outlook for the cash earnings per share growth of the Fund’s holdings, should allow for a favorable rate of capital appreciation over the long-term.

The Russell 2000 Index and Russell Midcap Growth Index are unmanaged indices commonly used to measure the performance of U.S. stocks. You cannot invest directly in an index. Performance data for an index does not reflect any deductions for fees, expenses or taxes. The Fund is non-diversified, meaning it concentrates its assets in fewer holdings than a diversified fund and is therefore more exposed to individual stock volatility than a diversified fund. The Fund may invest in small- and medium-capitalization companies, which involve additional risks such as more limited liquidity and greater volatility than large-capitalization companies. References

HENNESSY FUNDS 1-800-966-4354

to specific securities should not be considered a recommendation to buy or sell any security. Fund holdings and sector allocations are subject to change. Please refer to the Schedule of Investments included in this report for additional portfolio information.

Each Morningstar category average represents a universe of funds with similar investment objectives. © Morningstar, Inc. All Rights Reserved. The information contained herein: 1) is proprietary to Morningstar; 2) may not be copied or distributed and 3) is not warranted to be accurate, complete or timely. Neither Morningstar nor its content providers are responsible for any damages or losses arising from any use of this information. Past performance does not guarantee future results.

Hennessy Cornerstone Mid Cap 30 Fund

AVERAGE ANNUAL TOTAL RETURN PERIODS ENDED APRIL 30, 2013*

| | | | | Since Inception |

| | Six Months | One Year | Five Years | (9/17/03) |

| Hennessy Cornerstone Mid Cap 30 Fund – Investor Class | 17.43% | 20.78% | 6.81% | 11.23% |

Hennessy Cornerstone Mid Cap 30 Fund – Institutional Class1 | 17.55% | 21.10% | 7.19% | 11.44% |

| S&P Midcap 400 Index | 19.23% | 18.84% | 8.37% | 10.09% |

| S&P 500 Index | 14.42% | 16.89% | 5.21% | 6.87% |

| Expense ratio: 1.38% (Investor Class) | | | Expense ratio: Gross 1.17%, Net 0.99%2 (Institutional Class) |

Performance data quoted represents past performance; past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance of the Fund may be lower or higher than the performance quoted. Performance data current to the most recent month end may be obtained by visiting www.hennessyfunds.com.

The expense ratios presented are from the most recent prospectus.

| * | Periods less than one year are not annualized. |

| 1 | Represents the performance of the Institutional Class shares after March 3, 2008 (inception of the share class) and Investor Class for periods prior to that date. |

| 2 | With regard to Institutional Class shares, the investment advisor has contractually agreed to waive a portion of its expenses indefinitely. |

PERFORMANCE NARRATIVE

Portfolio Manager, Neil Hennessy, and Co-Portfolio Manager, Brian Peery

Over the previous six months, how did the Fund perform and what factors contributed to this performance?

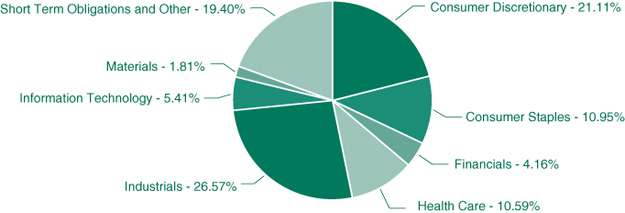

For the six-month period ended April 30, 2013, the Investor Class of the Hennessy Cornerstone Mid Cap 30 Fund returned 17.43%, underperforming the S&P Midcap 400 Index and the Morningstar Mid Cap Blend Category Average, which returned 19.23%, and 17.71% for the same period, respectively, but outperforming the S&P 500 Index, which returned 14.42%, for the same period.

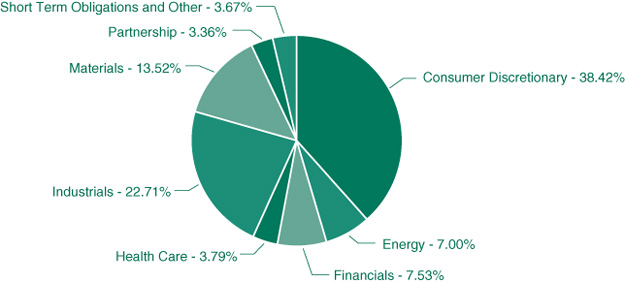

The Fund’s performance benefited from stock selection within the Energy and Materials sectors, but sector allocation to Utilities versus the benchmark indices (S&P Midcap 400 Index and Morningstar Mid Cap Blend Category Average) created the relative underperformance. The best performing stock in the portfolio was KB Homes, up 41% for the six-month period, as housing stocks continued to perform well during the emerging recovery in the Housing sector. Thor Industries was the single largest detractor to performance during the period, but has since recovered nicely. We continue to hold both stocks within the Fund’s portfolio.

Additional Portfolio Manager commentary and related investment outlook:

During the last six months, we witnessed a solid reemergence of the Housing sector, as well as improved performance of peripheral housing stocks. We remain confident that we are still in the very early stages of this economic recovery and that consumers are just now starting to put money back into the Housing sector after avoiding it for several years. The homebuilders are now poised to do well with the improvement of this beleaguered sector. But we’ve consistently believed that the last several years of deferred home maintenance has created a backlog of consumer spending and as that backlog begins to flow back into remodeling and maintenance, it will positively impact peripheral housing stocks.

We believe the attractiveness of stock prices in general, coupled with the low interest rate environment and quantitative easing from the Federal Reserve Board, have aligned to form an extremely attractive opportunity for equities going forward. We feel there are excellent opportunities in the Mid-Cap space, between $1 billion and $10 billion in market-capitalization, especially within some of the more cyclical sectors like the Consumer Discretionary and Industrial sectors. As the economy continues to improve, we feel that the cyclical companies, those most sensitive to economic recovery, will do well. The Fund is currently overweight cyclical stocks versus the benchmarks and will remain so until its portfolio is rebalanced in the fall.

The S&P Midcap 400 Index and S&P 500 Index are unmanaged indices commonly used to measure the performance of U.S. stocks. You cannot invest directly in an index. Performance data for an index does not reflect any deductions for fees, expenses or taxes. The Fund may invest in small- and medium-capitalization companies which tend to have more limited liquidity and greater price volatility than large-capitalization companies. References to specific securities should not be considered a recommendation to buy or sell any security. Fund holdings and sector allocations are subject to change. Please refer to the Schedule of Investments included in this report for additional portfolio information.

Each Morningstar category average represents a universe of funds with similar investment objectives. © Morningstar, Inc. All Rights Reserved. The information contained herein: 1) is proprietary to Morningstar; 2) may not be copied or distributed and 3) is not warranted to be accurate, complete or timely. Neither Morningstar nor its content providers are responsible for any damages or losses arising from any use of this information. Past performance does not guarantee future results.

Hennessy Cornerstone Large Growth Fund

AVERAGE ANNUAL TOTAL RETURN PERIODS ENDED APRIL 30, 2013*

| | | | | Since Inception |

| | Six Months | One Year | Three Years | (3/20/09) |

| Hennessy Cornerstone Large Growth Fund – Investor Class | 11.64% | 10.10% | 10.81% | 22.07% |

| Hennessy Cornerstone Large Growth Fund – Institutional Class | 11.77% | 10.35% | 11.11% | 22.42% |

| S&P 500 Index | 14.42% | 16.89% | 12.80% | 22.04% |

| Russell 1000 Index | 15.05% | 17.17% | 12.91% | 22.58% |

| Expense ratio: 1.27% (Investor Class) | | | Expense ratio: Gross 1.41%, Net 0.98%1 (Institutional Class) |

Performance data quoted represents past performance; past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance of the Fund may be lower or higher than the performance quoted. Performance data current to the most recent month end may be obtained by visiting www.hennessyfunds.com.

The expense ratios presented are from the most recent prospectus.

| * | Periods less than one year are not annualized. |

| 1 | With regard to Institutional Class shares, the investment advisor has contractually agreed to waive a portion of its expenses indefinitely. |

PERFORMANCE NARRATIVE

Portfolio Manager, Neil Hennessy, and Co-Portfolio Manager, Brian Peery

Over the previous six months, how did the Fund perform and what factors contributed to this performance?

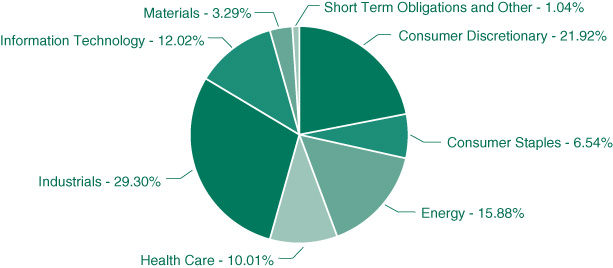

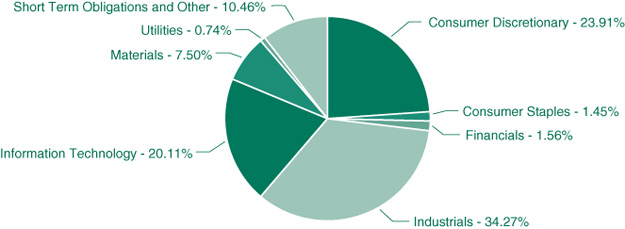

For the six-month period ended April 30, 2013, the Investor Class of the Hennessy Cornerstone Large Growth Fund returned 11.64%, underperforming the S&P 500 Index, the Russell 1000 Index and the Morningstar Large Blend Category Average, which returned 14.42, 15.05% and 14.54% for the same period, respectively.

The Fund’s performance benefited from stock selection within the Information Technology, Consumer Staples and Energy sectors, but the stock selection within the Consumer Discretionary and Materials sectors hampered overall performance. The single largest detractor to performance during the period was Freeport-McMoRan, the gold and copper miner. The company was hurt in December after it announced two acquisitions within the Oil and Gas sector, and the stock never recovered to previous levels. The best performing stock in the period was Western Digital, which posted a 63% gain amid a stabilizing pricing environment and improving margins, despite weak PC sales. We continue to hold both stocks within the Fund’s portfolio.

Additional Portfolio Manager commentary and related investment outlook:

While top line revenue growth was muted during the previous six-month period due to a slow growth environment, many companies are providing strong financial results. Corporate profits are hitting new highs as companies have deferred hiring, choosing to keep their costs down. This means any incremental gains in revenue can be impactful to a company’s bottom line earnings and has translated into many companies posting healthy profits.

We believe the attractiveness of equity prices in general, coupled with an extremely low interest rate environment have many investors seeking high quality, dividend-paying companies as a means of generating current income. Until the uncertainty surrounding fiscal policy, taxes, healthcare costs and the debacle in Europe lifts, we feel corporate capital expenditures are essentially in a holding pattern. We anticipate that excess cash will instead be used for buying back stock, paying dividends or accretive merger and acquisition (M&A) activity, all of which should have a positive effect for a company’s shareholders.

In our opinion, the financial markets are beginning to reward companies who return money to shareholders in the form of higher dividends and we expect this trend to continue. While not part of our selection process in the Fund’s portfolio, 45 out of the 50 stocks within its portfolio currently pay dividends. This is a trend we do not believe we would have seen just a few short years ago within this asset class.

We continue to believe being over invested in bonds and underinvested in equities is risky, especially since there are many companies whose stock yields are currently higher than that of a 10-Year U.S. Treasury. Investing in a high dividend-paying stock also allows for potential capital appreciation. As investors continue to seek out opportunities to generate income while having exposure to the upside potential of the equity markets, we believe that large capitalization, dividend-paying companies will continue to do well, especially if they continue the trend of rewarding shareholders by increasing dividends.

The S&P 500 Index and Russell 1000 Index are unmanaged indices commonly used to measure the performance of U.S. stocks. You cannot invest directly in an index. Performance data for an index does not reflect any deductions for fees, expenses or taxes. The Fund may invest in medium-capitalization companies, which tend to have more limited liquidity and greater price volatility than

HENNESSY FUNDS 1-800-966-4354

large-capitalization companies. References to specific securities should not be considered a recommendation to buy or sell any security. Fund holdings and sector allocations are subject to change. Please refer to the Schedule of Investments included in this report for additional portfolio information.

Each Morningstar category average represents a universe of funds with similar investment objectives. © Morningstar, Inc. All Rights Reserved. The information contained herein: 1) is proprietary to Morningstar; 2) may not be copied or distributed and 3) is not warranted to be accurate, complete or timely. Neither Morningstar nor its content providers are responsible for any damages or losses arising from any use of this information. Past performance does not guarantee future results.

Hennessy Cornerstone Value Fund

AVERAGE ANNUAL TOTAL RETURN PERIODS ENDED APRIL 30, 2013*

| | Six Months | One Year | Five Years | Ten Years |

| Hennessy Cornerstone Value Fund – Investor Class | 14.24% | 18.38% | 5.88% | 8.07% |

Hennessy Cornerstone Value Fund – Institutional Class1 | 14.38% | 18.69% | 6.20% | 8.23% |

| Russell 1000 Value Index | 16.31% | 21.80% | 4.17% | 8.42% |

| S&P 500 Index | 14.42% | 16.89% | 5.21% | 7.88% |

| Expense ratio: 1.26% (Investor Class) | | | Expense ratio: Gross 1.20%, Net 0.98%2 (Institutional Class) |

Performance data quoted represents past performance; past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance of the Fund may be lower or higher than the performance quoted. Performance data current to the most recent month end may be obtained by visiting www.hennessyfunds.com.

The expense ratios presented are from the most recent prospectus.

| * | Periods less than one year are not annualized. |

| 1 | Represents the performance of the Institutional Class shares after March 3, 2008 (inception of the share class) and Investor Class for periods prior to that date. |

| 2 | With regard to Institutional Class shares, the investment advisor has contractually agreed to waive a portion of its expenses indefinitely. |

PERFORMANCE NARRATIVE

Portfolio Manager, Neil Hennessy, and Co-Portfolio Manager, Brian Peery

Over the previous six months, how did the Fund perform and what factors contributed to this performance?

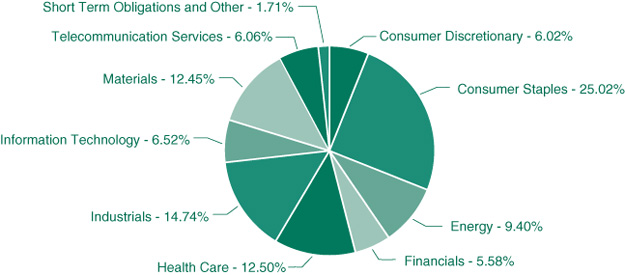

For the six-month period ended April 30, 2013, the Investor Class of the Hennessy Cornerstone Value Fund returned 14.24%, underperforming the Russell 1000 Index, the S&P 500 Index and the Morningstar Large Value Category Average, which returned 16.31%, 14.42% and 15.17% for the same period, respectively.

The Fund’s performance was aided by stock selection but hindered by asset allocation. Relative overweighting in the Materials sector and underweighting in the Financials sectors contributed to most of the underperformance. Stock selection within the Consumer Staples and Information Technology sectors was nearly offset by stock selection within the Energy and Consumer Discretionary sectors. DuPont (up nearly 25%) was a significant contributor to overall Fund performance. During the last six months, the company continued to buy back its stock, strengthen its balance sheet and increase its dividend. We believe DuPont’s desire to reward its shareholders aided in driving the stock price higher. The Fund’s performance was hampered by positions in Newmont Mining and Freeport-McMoRan (down 40% and 20%, respectively) as the stocks fell alongside gold’s significant downward move during the second week of April.

Additional Portfolio Manager commentary and related investment outlook:

What we are seeing in the economy and in the financial markets in general can be easily summed up by the actions of a company like DuPont. While top line revenue growth is muted due to a slow economic growth environment, many companies are still doing exceptionally well. Corporate profits continue to hit new highs as companies have deferred hiring, choosing to keep their costs down. This means any incremental gains in revenue can be impactful to a company’s bottom line earnings. So the question begs, what do you do with the profits?

Until the uncertainty surrounding fiscal policy, taxes, healthcare costs and the debacle in Europe subsides, we feel corporate capital expenditures are in a holding pattern. We anticipate that excess cash will instead be used for buying back stock, paying dividends or accretive mergers and acquisitions (M&A) activity, all of which should have a positive effect for a company’s shareholders.

We believe the attractiveness of equity prices in general, coupled with an extremely low interest rate environment, have many investors seeking high quality, dividend paying companies as a means of generating current income. We continue to believe being overly invested in bonds and under-invested in equities is risky, especially since there are many firms with dividend yields higher than that of a 10-Year U.S. Treasury. And investing in a high dividend-paying stock also allows for potential capital appreciation. As investors continue to seek out opportunities to generate income while having exposure to the upside potential of the equity markets, we believe that large capitalization, high dividend-paying companies should continue to do well, especially if they continue the trend of rewarding shareholders by increasing dividends.

The S&P 500 Index and Russell 1000 Value Index are unmanaged indices commonly used to measure the performance of U.S. stocks. You cannot invest directly in an index. Performance data for an index does not reflect any deductions for fees, expenses or taxes. The Fund may invest in medium-capitalization companies, which tend to have more limited liquidity and greater price volatility than large-capitalization companies. Investments in foreign securities involve greater volatility and political, economic and currency risk and differences in accounting methods. References to specific securities should not be considered a recommendation to buy or sell any security. Fund holdings and sector allocations are subject to change. Please refer to the Schedule of Investments included in this report for additional portfolio information.

Each Morningstar category average represents a universe of funds with similar investment objectives. © Morningstar, Inc. All Rights Reserved. The information contained herein: 1) is proprietary to Morningstar; 2) may not be copied or distributed and 3) is not warranted to be accurate, complete or timely. Neither Morningstar nor its content providers are responsible for any damages or losses arising from any use of this information. Past performance does not guarantee future results.

Hennessy Large Value Fund

AVERAGE ANNUAL TOTAL RETURN PERIODS ENDED APRIL 30, 2013*

| | Six Months | One Year | Five Years | Ten Years |

| Hennessy Large Value Fund – Investor Class | 15.28% | 18.35% | 3.07% | 6.71% |

Hennessy Large Value Fund – Institutional Class1 | 15.49% | 18.79% | 3.40% | 6.88% |

| Russell 1000 Value Index | 16.31% | 21.80% | 4.17% | 8.42% |

| S&P 500 Index | 14.42% | 16.89% | 5.21% | 7.88% |

| Expense ratio: 1.40% (Investor Class) | | | Expense ratio: Gross 1.22%, Net 0.98%2 (Institutional Class) |

Performance data quoted represents past performance; past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance of the Fund may be lower or higher than the performance quoted. Performance for periods prior to March 20, 2009 reflects the performance of the Tamarack Value Fund, the predecessor to the Hennessy Select Large Value Fund. Performance data current to the most recent month end may be obtained by visiting www.hennessyfunds.com.

The expense ratios presented are from the most recent prospectus.

| * | Periods less than one year are not annualized. |

| 1 | Represents the performance of the Institutional Class shares after March 20, 2009 (inception of the share class) and Investor Class for periods prior to that date. |

| 2 | With regard to Institutional Class shares, the investment advisor has contractually agreed to waive a portion of its expenses indefinitely. |

PERFORMANCE NARRATIVE

RBC GLOBAL ASSET MANAGEMENT (U.S.) INC., SUB-ADVISOR

Portfolio Managers Stuart Lippe, Barbara Browning, CFA, and Adam Scheiner, CFA, RBC Global Asset Management (U.S.) Inc. (sub-advisor)

Over the previous six months, how did the Fund perform and what factors contributed to this performance?

For the six-month period ended April 30, 2013, the Investor Class of the Hennessy Large Value Fund returned 15.28%, underperforming its benchmark the Russell 1000 Value Index, which returned 16.31% for the same period, but outperforming the S&P 500 Index and Morningstar Large Value Category Average, which returned 14.42% and 15.17% for the same period, respectively.

The Fund’s strong absolute performance was the result of stock selection across a number of sectors, led by Energy, Materials and Consumer Discretionary, while stock selection in Information Technology and Financials detracted from performance. Sector allocation decisions, when excluding the portfolio’s modest cash position (which can hinder performance in a significantly up market), detracted modestly from performance as the Fund’s sector neutral mandate, by design, limits the impact of sector weighting decisions. The Fund’s managers instead make investment decisions at the industry level.

The largest contributor to the Fund’s performance for the period was the Energy sector as the portfolio benefited from its significant underweight position to underperforming integrated oil company Exxon and overweight position to oil refiner Valero Energy Corp. Exxon shares declined in value due to softer than expected energy prices, while Valero benefited from declining feedstock prices/costs, in this case natural gas, a theme that contributed to strength across the refining industry.

Within the Materials sector, the portfolio benefited both from what it owned, coatings producer PPG, and what it successfully avoided, which was gold miner Newmont Mining Corp. Newmont sold off as the price of gold significantly weakened over the period while PPG’s residential paint business benefited from the ongoing housing recovery. PPG was also able to sell-off its commodity chemicals business, using the proceeds to strengthen its position in the housing paint market by acquiring AkzoNobel. The Fund no longer holds PPG in its portfolio.

Consumer Discretionary was led by retailer Abercrombie & Fitch, as well as media companies CBS and Time Warner. Abercrombie and Fitch reported better than expected comps signaling the early stages of a turnaround in the company’s domestic operations. CBS benefited from maintaining its position as the #1 rated broadcast network with an additional catalyst in the monetization of its outdoor advertising business. Time Warner benefited from improved ratings for the Turner Networks, which will drive higher affiliate fees as the company enters its renegotiation cycle.

HENNESSY FUNDS 1-800-966-4354

On the negative side of the ledger, Information Technology firm EMC detracted from the Fund’s performance for the period, as uncertainty surrounding future enterprise spending caused VMWare, of which EMC owns 80%, to announce a slowdown in its core business. This same theme also hurt EMC’s core businesses. Within Financials, the portfolio was negatively impacted by an underweight position in outperforming Bank of America and Berkshire Hathaway. The Fund has since used weakness in these names to selectively add to these positions.

Additional Portfolio Manager commentary and related investment outlook:

With markets having recouped virtually all of the losses resulting from the 2008 financial crisis and sitting at, or near, all time highs, we remain cautiously optimistic regarding performance going forward. Our near term cautious outlook is the result of a market that has the appearance of being slightly over bought following its rapid ascent, leaving us wary of the potential for a significant correction. Despite our near term call for caution, we believe any correction should be short lived and we remain confident in our stock selection driven process and our ability to find special situation stocks that will outperform regardless of market environment. While investment decisions are the result of bottoms up stock selection and our sector neutral mandate requires investment in all ten major economic sectors, there are a number of industry-based themes that we believe have the potential for outperformance in 2013, including the following: continued improvement in housing, which positively impacts our holdings in money center banks, chemical companies, and other second derivative housing names; property and casualty insurance companies benefiting from pricing power; HMO strength as “Obamacare” drives increased health care spending; a potential pickup in gas drilling activity off of a depressed base should gas prices rebound in the last half of 2013; and a pickup in corporate IT spending driven by increased storage demands, desktop virtualization, and proliferation of cloud computing.

The S&P 500 Index and Russell 1000 Value Index are unmanaged indices commonly used to measure the performance of U.S. stocks. The Russell 1000 Value measures large-cap, value-oriented stocks. You cannot invest directly in an index. Performance data for an index does not reflect any deductions for fees, expenses or taxes. The Fund may invest in medium-capitalization companies, which tend to have more limited liquidity and greater price volatility than large-capitalization companies. References to specific securities should not be considered a recommendation to buy or sell any security. Fund holdings and sector allocations are subject to change. Please refer to the Schedule of Investments included in this report for additional portfolio information.

Each Morningstar category average represents a universe of funds with similar investment objectives. © Morningstar, Inc. All Rights Reserved. The information contained herein: 1) is proprietary to Morningstar; 2) may not be copied or distributed and 3) is not warranted to be accurate, complete or timely. Neither Morningstar nor its content providers are responsible for any damages or losses arising from any use of this information. Past performance does not guarantee future results.

Hennessy Total Return Fund

AVERAGE ANNUAL TOTAL RETURN PERIODS ENDED APRIL 30, 2013*

| | Six Months | One Year | Five Years | Ten Years |

| Hennessy Total Return Fund | 11.31% | 14.50% | 4.97% | 6.39% |

| Dow Jones Industrial Average | 14.86% | 15.39% | 5.93% | 8.49% |

| S&P 500 Index | 14.42% | 16.89% | 5.21% | 7.88% |

Expense ratio: 1.38%

Performance data quoted represents past performance; past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance of the Fund may be lower or higher than the performance quoted. Performance data current to the most recent month end may be obtained by visiting www.hennessyfunds.com.

The expense ratio presented is from the most recent prospectus.

*Periods less than one year are not annualized.

PERFORMANCE NARRATIVE

Portfolio Manager, Neil Hennessy, and Co-Portfolio Manager, Brian Peery

Over the previous six months, how did the Fund perform and what factors contributed to this performance?

For the six-month period ended April 30, 2013, the Hennessy Total Return Fund returned 11.31%, underperforming the Dow Jones Industrial Average, the S&P 500 Index and the Morningstar Mid Large Value Category Average, which returned 14.86%, 14.42% and 15.17% for the same period, respectively.

The Fund’s roughly 25% weighting of U.S. Treasuries was detrimental to overall performance, as yields continued near historic lows. The Fund’s approximately 75% equity weighting was able to capture nearly the weighted return of the Dow Jones Industrial Average.

During the six months ended April 30, 2013, each of the Fund’s 17 equity positions had positive returns, with Hewlett-Packard and DuPont leading the way with returns of 47% and 21% for the six-month period, respectively. The two worst performers in the Fund for the period were Merck and General Electric, although both had positive returns (2% and 5%, respectively).

While the Fund’s portfolio may underperform the indices in periods where equities rise sharply, the strategy is geared to capture near market returns with a lower risk profile, since only three-quarters of the assets are invested in equities. Conversely, if equity markets were to fall sharply, we would expect the Fund to perform better than the indices due to its 25% exposure to short-term U.S. Treasuries that are held to maturity. Ultimately, the overall goal of this portfolio is to capture near-market upside performance while mitigating some of the potential market downside risk.

Additional Portfolio Manager commentary and related investment outlook:

We continue to believe that the Dow Jones Industrial Average stocks, and in particular the stocks that comprise the “Dogs of the Dow” (the methodology employed within the Hennessy Total Return Fund) provide an excellent way to gain equity exposure to the markets. With U.S. Treasury yields still trading near historic lows, many investors are seeking high quality, dividend-paying companies as a means of generating current income. We continue to believe the strategy of swapping out of bonds and into equities, where investors have historically received higher yields as well as the potential for capital appreciation, will continue.

As the market reaches new highs and investors become more wary of a potential pullback, we believe that a trend of moving some money away from more risky asset classes and into what we believe is the relative safety of very large dividend-paying companies will prevail. We believe the Fund is well positioned for the more moderately conservative investor as the equity portion of the portfolio holds what we would deem to be high quality, high dividend-paying companies, while the short duration of the Treasury component (all less than three months) will allow us the ability to roll into higher yielding treasuries, should U.S. Government yields rise.

The Dow Jones Industrial Average and S&P 500 Index are unmanaged indices commonly used to measure the performance of U.S. Stocks. You cannot invest directly in an index. Performance data for an index does not reflect any deductions for fees, expenses or taxes. The Fund is non-diversified, meaning it concentrates its assets in fewer individual holdings than a diversified fund and is therefore more exposed to individual stock volatility than a diversified fund. References to specific securities should not be considered a recommendation to buy or sell any security. Fund holdings and sector allocations are subject to change. Please refer to the Schedule of Investments included in this report for additional portfolio information.

The Dogs of the Dow are the ten highest dividend-yielding stocks in the Dow Jones Industrial Average.

Each Morningstar category average represents a universe of funds with similar investment objectives. © Morningstar, Inc. All Rights Reserved. The information contained herein: 1) is proprietary to Morningstar; 2) may not be copied or distributed and 3) is not warranted to be accurate, complete or timely. Neither Morningstar nor its content providers are responsible for any damages or losses arising from any use of this information. Past performance does not guarantee future results.

Hennessy Equity and Income Fund

AVERAGE ANNUAL TOTAL RETURN PERIODS ENDED APRIL 30, 2013*

| | Six Months | One Year | Five Years | Ten Years |

| Hennessy Equity and Income Fund – Investor Class | 9.81% | 10.73% | 6.82% | 9.32% |

| Hennessy Equity and Income Fund – Institutional Class | 9.98% | 11.06% | 7.10% | 9.58% |

Blended Balanced Index1 | 8.95% | 11.38% | 5.53% | 6.80% |

| S&P 500 Index | 14.42% | 16.89% | 5.21% | 7.88% |

| Expense ratio: 1.35% (Investor Class) | | | Expense ratio: 1.08% (Institutional Class) |

Performance data quoted represents past performance; past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance of the fund may be lower or higher than the performance quoted. Performance data current to the most recent month end may be obtained by visiting www.hennessyfunds.com. Performance for periods prior to October 26, 2012 is that of the FBR Balanced Fund from March 12, 2010 to October 25, 2012 and that of the AFBA 5 Star Balanced Fund for periods prior to March 12, 2010.

The expense ratios presented are from the most recent prospectus.

| * | Periods less than one year are not annualized. |

| 1 | The Blended Balanced Index consists of 60% common stocks represented by the S&P 500 Index and 40% bonds represented by the Barclays Capital Intermediate U.S. Government/Credit Index. |

PERFORMANCE NARRATIVE

THE LONDON COMPANY, SUB-ADVISOR (EQUITY PORTION)

FINANCIAL COUNSELORS, INC., SUB-ADVISOR (FIXED INCOME PORTION)

For the six-month period ended April 30, 2013, the Investor Class of the Hennessy Equity and Income Fund returned 9.81%, outperforming the Blended Balanced Index1 and the Morningstar Moderate Allocation Category Average, which returned 8.95% and 9.17% for the same period, respectively, but underperforming the S&P 500 Index, which returned 14.42% for the same period.

Portfolio Managers Stephen M. Goddard, CFA (Lead Portfolio Manager for the Fund), Jonathan T. Moody, CFA, J. Brian Campbell, CFA, Mark DeVaul, CFA, CPA, The London Company (sub-advisor of the equity portion of the Fund).

HENNESSY FUNDS 1-800-966-4354

What factors contributed to the performance of the equity portion of the Hennessy Equity and Income Fund?

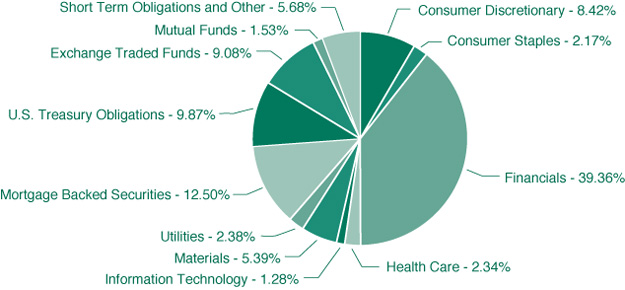

The focus on higher quality and generally less volatile companies within the Fund helped performance, and the equity portion of the portfolio outpaced the S&P 500 Index during the six-month period. The predominant driver of performance was stock selection. The top performing sectors for the market during the six-month period were Consumer Discretionary, Healthcare and Financials. The Fund was underweight the Consumer Discretionary and Healthcare sectors, but overweight the Financials sector. The bottom performing sectors were Information Technology, Energy and Materials, and the Fund was underweight the Information Technology and Energy sectors, but overweight the Materials sector. The combined effect of sector allocation was a detractor from performance during the period.

The weak sector allocation was, however, more than offset by strong stock selection, with notably strong stock selection in the Financials, Information Technology and Consumer Discretionary sectors. The top contributors to performance in the period were Eaton Vance, CarMax Inc., BlackRock, Inc., Energizer Holdings, Inc. and Berkshire Hathaway, Inc. The Fund still holds these stocks in its portfolio.

The top equity detractors to performance during the period were EMC Corporation, UDR Inc., Matson Inc., Hatteras Financial Corporation and ConocoPhillips. The Fund no longer owns UDR Inc. or Hatteras Financial Corporation in its portfolio.

Additional Portfolio Manager commentary on the equity portion of the Fund and related investment outlook:

We believe the Fund’s strong performance in the current period illustrates the perils of market timing and the benefits of our discipline to remain fully invested at all times.

At its core, investing of any sort requires overcoming some level of uncertainty, an actuality we have faced plenty of times in the last few years. Unfortunately, just believing in a better future doesn’t yield investment success. The current gains of the market have been achieved by increased clarity but also by tangible fundamental improvements. Simply put, Corporate America is doing well and operating profits are 13% higher than their pre-crisis peak. Leverage among the S&P 500 companies has been cut in half and historically low interest rates are slowly shifting assets into equities for income and capital appreciation. Free cash flow yields are at 50-year highs and the allocation of capital back to shareholders through dividends and stock repurchases continues to grow. Help from the Federal Reserve also creates a favorable investment environment. When easy monetary policy is both vast and transparent, it removes the typical ambiguity associated with policies of the Federal Reserve Board. Furthermore, central bankers around the world are now reading from the same playbook, and many global investors still portray the U.S. as the best house in a bad neighborhood.

On the negative side, organic growth is stagnant, both domestically and abroad. First quarter global GDP estimates are a meek 2.5%. Capital allocation, while improving, has a long way to go. The S&P 500 dividend payout ratio is still near its 60-year low at just 32%, and corporate balance sheets remain bloated with record high cash balances.

In a slow growth world with incredibly low interest rates, we believe efficient capital allocation will be vital to maximizing wealth. The valuation levels of companies are being influenced by whether management teams part with or hoard cash. Research suggests that large-capitalization companies with favorable capital use profiles have outperformed the market over the last ten years while those with the worst capital use profiles have lagged.

The other outlet for capital allocation is mergers and acquisitions (M&A) activity and leveraged buyouts. While we have been surprised by the slow uptake of deals, the transactions being completed are often instantly accretive, expressed by the unusual accompaniment of both the acquired and acquirer appreciating on the announcement.

Longer-term, we believe the over-arching landscape for equities remains favorable. When market sentiment changes in the short-term and uncertainty reappears, it offers us opportunities to actively select superior companies with shareholder-oriented management teams. By avoiding speculation and having a tangible sense of real risk, we remain optimistic in our ability to earn above average returns.

Portfolio Managers Gary B. Cloud, CFA, and Peter G. Greig, CFA, Financial Counselors, Inc. (sub-advisor of the fixed income portion of the Fund)

What factors contributed to the performance of the fixed income portion of the Hennessy Equity and Income Fund?

The fixed income portion of the Fund performed in-line with the Barclays Capital Intermediate U.S. Government/Credit Index over the previous six months. The main driver of this result was the Fund’s overweight position in investment grade credit. Corporate credit returned 1.49% over the last six months, compared to 0.79% from Treasuries. The portfolio’s modest allocation to the high yield sector also contributed positively to overall returns.

The Fund’s sector overweight position in corporate debt obligations, combined with the higher income component from these securities, were the two largest positive factors impacting relative performance. Security premium amortization and effective duration categories were the two most notable negative factors impacting performance compared to the benchmark.

Additional Portfolio Manager commentary on the fixed income portion of the Fund and related investment outlook:

The Treasury market has been in a trading range with 10-year yields bracketing 1.60% and 2.10% for the last six months. The global economic growth outlook on one hand seems to be slowing, while prospects for a sustained U.S. upturn look to be improving. That development may lead the Federal Reserve Board to begin adjusting its monthly outright Treasury and Mortgage purchases later this year. This could lead to higher 10-year Treasury yields that approach the higher 2012 level of 2.40%.

Higher relative bond yields in the U.S. should lead to a strengthening dollar, making U.S. exports less competitive and impacting multinational corporate sales and earnings. This could lead to slower U.S. growth, resulting in Treasury rates returning to their recent ranges with a slight upward bias. Therefore, we believe that the rates markets will remain well anchored and historically very low, with an upside skew. This type of environment historically has favored an out performance in investment grade and high yield credit and we remain overweight these sectors.

The Blended Balance Index (which consists of 60% common stocks represented by the S&P 500 Index and 40% bonds represented by the Barclays Capital Intermediate U.S. Government/Credit Index) and S&P 500 Index are unmanaged indices commonly used to measure the performance of U.S. stocks. The Barclays Capital Intermediate U.S. Government/Credit Index is an unmanaged index commonly used to measure the performance of U.S. bonds. You cannot invest directly in an index. Performance data for an index does not reflect any deductions for fees, expenses or taxes. The Fund may invest in debt securities, which typically decrease in value when interest rates rise. The risk is greater for longer term debt securities. Investments by the Fund in lower-rated and non-rated securities presents a greater risk of loss to principal and interest than higher-rated securities. Investments in Asset-Backed and Mortgage-Backed securities include additional risks that investors should be aware of, including credit risk, prepayment risk, possible illiquidity and default, as well as increased susceptibility to adverse economic developments. Investments in foreign securities may involve greater volatility and political, economic and currency risk and differences in accounting methods. The Fund may invest in IPOs, which may fluctuate considerably due to the absence of a prior public market and may have a magnified impact on the Fund. References to specific securities should not be considered a recommendation to buy or sell any security. Fund holdings and sector allocations are subject to change. Please refer to the Schedule of Investments included in this report for additional portfolio information.

Duration is a commonly used measure of the potential volatility of the price of a debt security or the aggregate market value of a portfolio of debt securities prior to maturity. Securities with a longer duration generally have more volatile prices than securities of comparable quality with a shorter duration.

Each Morningstar category average represents a universe of funds with similar investment objectives. © Morningstar, Inc. All Rights Reserved. The information contained herein: 1) is proprietary to Morningstar; 2) may not be copied or distributed and 3) is not warranted to be accurate, complete or timely. Neither Morningstar nor its content providers are responsible for any damages or losses arising from any use of this information. Past performance does not guarantee future results.

Hennessy Balanced Fund

AVERAGE ANNUAL TOTAL RETURN PERIODS ENDED APRIL 30, 2013*

| | Six Months | One Year | Five Years | Ten Years |

| Hennessy Balanced Fund | 7.00% | 8.80% | 3.84% | 4.39% |

| Dow Jones Industrial Average | 14.86% | 15.39% | 5.93% | 8.49% |

| S&P 500 Index | 14.42% | 16.89% | 5.21% | 7.88% |

Expense ratio: 1.55%

Performance data quoted represents past performance; past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance of the Fund may be lower or higher than the performance quoted. Performance data current to the most recent month end may be obtained by visiting www.hennessyfunds.com.

The expense ratio presented is from the most recent prospectus.

*Periods less than one year are not annualized.

PERFORMANCE NARRATIVE

Portfolio Manager, Neil Hennessy, and Co-Portfolio Manager, Brian Peery

Over the previous six months, how did the Fund perform and what factors contributed to this performance?

For the six-month period ended April 30, 2013, the Hennessy Balanced Fund returned 7.00%, underperforming the Dow Jones Industrial Average, the S&P 500 Index and the Morningstar Moderate Allocation Category Average, which returned 14.86%, 14.42% and 9.17% for the same period, respectively.

The Fund’s relative underperformance to its benchmarks is due primarily to the continued low yields on Treasury Bills. The Fund’s position of approximately 50% in U.S. Treasuries did not allow it to fully capture the performance of the equity markets over the year. While the portfolio may underperform the indices in periods where equities rise sharply, the strategy is geared to capture near market returns with a potentially lower risk profile, since only half of the assets are invested in equities. Conversely, if equity markets were to fall sharply, we would expect the Fund to perform better than the indices. Ultimately, the overall goal of this portfolio is to capture upside performance while mitigating downside risk.

During the six-month period ended April 30, 2013, each of the Fund’s 15 equity positions had positive returns, with Hewlett-Packard and DuPont leading the way with returns of 47% and 21%, respectively. The two worst performers in the Fund for the period were Merck and General Electric, although both had positive returns (2% and 5%, respectively).

HENNESSY FUNDS 1-800-966-4354

Additional Portfolio Manager commentary and related investment outlook:

We continue to believe that the Dow Jones Industrial Average stocks, and in particular the stocks that comprise the “Dogs of the Dow” (the methodology employed within the Hennessy Balanced Fund) provide an excellent way to gain equity exposure to the markets.

With U.S. Treasury yields still trading near historic lows, many investors are seeking high quality, dividend-paying companies as a means of generating current income. We continue to believe the strategy of swapping out of bonds and into equities, where investors have historically received higher yields as well as the potential for capital appreciation, will continue.

As the overall markets reach new highs and investors become more wary of a potential pullback, we believe that a trend of moving some money away from more risky asset classes and into the relative safety of very large dividend-paying companies will prevail. We believe the Fund is well positioned for the more conservative investor as the equity portion of the portfolio holds what we would deem to be high quality, high-dividend paying companies, while the relatively short duration of the Treasury component (all less than one year) should allow us the ability to roll into higher yielding treasuries in the event U.S. Government yields rise.

The Dow Jones Industrial Average and S&P 500 Index are unmanaged indices commonly used to measure the performance of U.S. stocks. You cannot invest directly in an index. Performance data for an index does not reflect any deductions for fees, expenses or taxes. The Fund is non-diversified, meaning it concentrates its assets in fewer individual holdings than a diversified fund and is therefore more exposed to individual stock volatility than a diversified fund. References to specific securities should not be considered a recommendation to buy or sell any security. Fund holdings and sector allocations are subject to change. Please refer to the Schedule of Investments included in this report for additional portfolio information.

The Dogs of the Dow are the ten highest dividend-yielding stocks in the Dow Jones Industrial Average.

Each Morningstar category average represents a universe of funds with similar investment objectives. © Morningstar, Inc. All Rights Reserved. The information contained herein: 1) is proprietary to Morningstar; 2) may not be copied or distributed and 3) is not warranted to be accurate, complete or timely. Neither Morningstar nor its content providers are responsible for any damages or losses arising from any use of this information. Past performance does not guarantee future results.

Hennessy Core Bond Fund

AVERAGE ANNUAL TOTAL RETURN PERIODS ENDED APRIL 30, 2013*

| | Six Months | One Year | Five Years | Ten Years |

| Hennessy Core Bond Fund – Investor Class | 1.38% | 5.29% | 5.92% | 6.26% |

| Hennessy Core Bond Fund – Institutional Class | 1.47% | 5.49% | 6.17% | 6.52% |

| Barclays Capital Intermediate U.S. Government/Credit Index | 1.09% | 3.23% | 4.90% | 4.48% |

Expense ratio: Gross 2.22%, Net 1.40%1 (Investor Class) | | | Expense ratio: Gross 1.41%, Net 1.15%1 (Institutional Class) |

Performance data quoted represents past performance; past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance of the fund may be lower or higher than the performance quoted. Performance data current to the most recent month end may be obtained by visiting www.hennessyfunds.com. Performance for periods prior to October 26, 2012 is that of the FBR Core Bond Fund from March 12, 2010 to October 25, 2012 and that of the AFBA 5 Star Total Return Bond Fund prior to March 12, 2010. Investment performance reflects fee waivers in effect. In the absence of such waivers, total return would be reduced.

The expense ratios presented are from the most recent prospectus.

| * | Periods less than one year are not annualized. |

| 1 | The investment advisor has contractually agreed to waive a portion of its expenses through February 28, 2015. |

PERFORMANCE NARRATIVE

FINANCIAL COUNSELORS, INC., SUB-ADVISOR

Portfolio Managers Gary B. Cloud, CFA, and Peter G. Greig, CFA, Financial Counselors, Inc. (sub-advisor)

Over the previous twelve months, how did the Fund perform and what factors contributed to this performance?

For the six-month period ended April 30, 2013, the Investor Class of the Hennessy Core Bond Fund returned 1.38%, outperforming the Barclays Capital Intermediate U.S. Government/Credit Index, which returned 1.09% for the same period, but underperforming the Morningstar Intermediate Term Bond Category Average, which returned 1.72% for the same period.

The Fund performed well over the previous six months compared to a representative mix of Intermediate Term Bond Indices. The main contributor to this performance was the Fund’s overweight position in investment grade credit. Corporate credit returned 1.49% over the last six months, compared to 0.79% from Treasuries. The portfolio’s modest allocation to the high yield sector also contributed positively to overall returns.

The sector overweight in corporate debt obligations, combined with the higher income component from these securities, were the two largest positive factors impacting relative performance. Security premium amortization and effective duration categories were the two most notable negative factors impacting Fund performance compared to the benchmark.

Additional Portfolio Manager commentary and related investment outlook:

The Treasury market has been in a trading range with 10-year yields bracketing 1.60% and 2.10% for the last six months. The global economic growth outlook on one hand seems to be slowing, while prospects for a sustained U.S. upturn look to be improving. That development may lead the Federal Reserve Board to begin adjusting its monthly outright Treasury and Mortgage purchases later this year. This could lead to higher 10-year Treasury yields that approach the higher 2012 level of 2.40%.

Higher relative bond yields in the U.S. should lead to a strengthening dollar, making U.S. exports less competitive and impacting multinational corporate sales and earnings. This could lead to slower U.S. growth resulting in Treasury rates returning to their recent ranges with a slight upward bias. Therefore, we believe that the rates markets will remain well anchored and historically very low, with an upside skew. This type of environment historically has favored an out performance in investment grade and high yield credit, and we remain overweight these sectors.

The Barclays Capital Intermediate U.S. Government/Credit Index is an unmanaged index commonly used to measure the performance of U.S. bonds. You cannot invest directly in an index. The Fund may invest in debt securities, which typically decrease in value when interest rates rise. The risk is greater for longer term debt securities. Investments by the Fund in lower-rated and non-rated securities presents a greater risk of loss to principal and interest than higher-rated securities. Investments in Asset-Backed and Mortgage-Backed securities include additional risks that investors should be aware of including credit risk, prepayment risk, possible illiquidity and default, as well as increased susceptibility to adverse economic developments. Investments in foreign securities may involve greater volatility and political, economic and currency risk and differences in accounting methods. The Fund may invest in IPOs, which may fluctuate considerably due to the absence of a prior public market and may have a magnified impact on the Fund. References to specific securities should not be considered a recommendation to buy or sell any security. Fund holdings and sector allocations are subject to change. Please refer to the Schedule of Investments included in this report for additional portfolio information.

Duration is a commonly used measure of the potential volatility of the price of a debt security, or the aggregate market value of a portfolio of debt securities, prior to maturity. Securities with a longer duration generally have more volatile prices than securities of comparable quality with a shorter duration.

Each Morningstar category average represents a universe of funds with similar investment objectives. © Morningstar, Inc. All Rights Reserved. The information contained herein: 1) is proprietary to Morningstar; 2) may not be copied or distributed and 3) is not warranted to be accurate, complete or timely. Neither Morningstar nor its content providers are responsible for any damages or losses arising from any use of this information. Past performance does not guarantee future results.

Hennessy Gas Utility Index Fund

AVERAGE ANNUAL TOTAL RETURN PERIODS ENDED APRIL 30, 2013*

| | Six Months | One Year | Five Years | Ten Years |

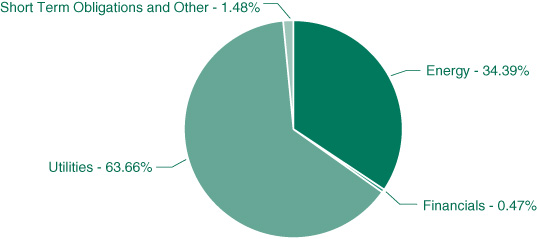

| Hennessy Gas Utility Index Fund – Investor Class | 17.91% | 23.43% | 10.64% | 13.98% |

AGA Stock Index1 | 18.39% | 23.36% | 9.69% | 13.01% |

| S&P 500 Index | 14.42% | 16.89% | 5.21% | 7.88% |

Expense ratio: 0.69%