Source: Bloomberg L.P.

We will say it again, after showing a chart like the one above: Past results are not predictive of the future. Instead, we look at where we are right now – in the economy, in the market, in the business cycle – to reflect on where we have come from and where we may be going. U.S. GDP is strong and growing, interest rates remain low, and earnings growth and profitability remain robust. We believe stocks are trading at reasonable valuations when viewed as a whole, with the S&P 500® Index at 21.0x estimated earnings for 2022. Furthermore, we believe corporate balance sheets are healthy, with high levels of excess cash, which could support growth, increases in dividends, more share buybacks, and future acquisitions. Uncertainty and volatility can manifest at any time in the stock market, and the current market is no different. Investors have questions about inflation, worldwide supply chain issues, and what could drive the next boost in earnings. While these concerns are warranted, we continue to believe that overall the positives outweigh the negatives, and here at Hennessy we continue to see opportunity in the market and in our Funds.

Overall, we are pleased with the performance of our mutual funds during the fiscal year. On an absolute basis, each of our 16 Funds achieved total returns greater than 10% and seven outperformed their primary benchmark. Ten of our 11 domestic equity-only Funds outperformed the S&P 500® Index and posted total returns of 45% or higher. Our four best-performing funds were concentrated in the Energy and Financials sectors. While some of our Funds certainly benefited from being in the “right” sector at the “right” time, we also believe this was a favorable period for our investment style of high-conviction investing and concentrated portfolio construction.

Thank you for your interest and for investing with us. We remain committed to managing our portfolios for long-term performance, ever mindful of downside risk. With so many investment options available to you, we are grateful for the trust you put in us and for your continued interest in our family of Funds. If you have any questions or would like to speak with us, please don’t hesitate to call us directly at (800) 966-4354.

Mutual fund investing involves risk. Principal loss is possible.

Opinions expressed are those of Ryan C. Kelley and are subject to change, are not guaranteed, and should not be considered investment advice.

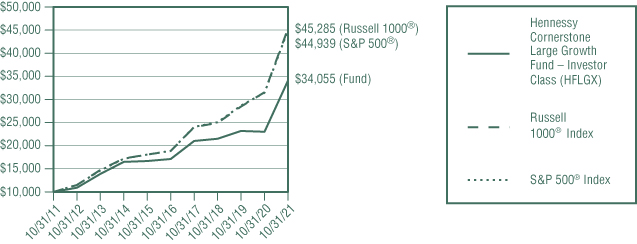

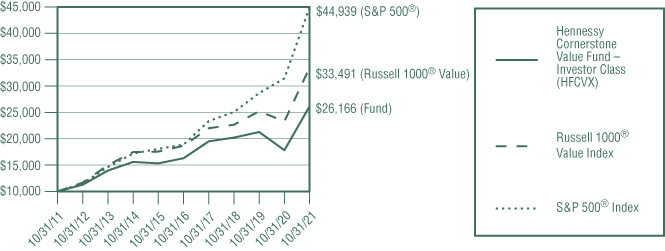

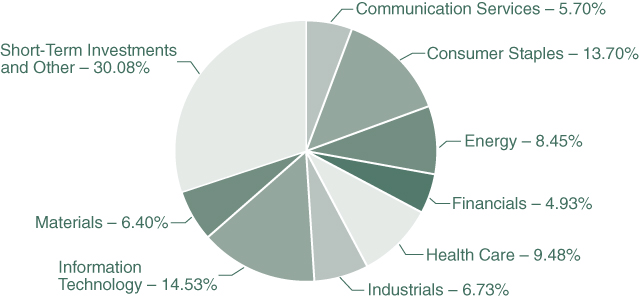

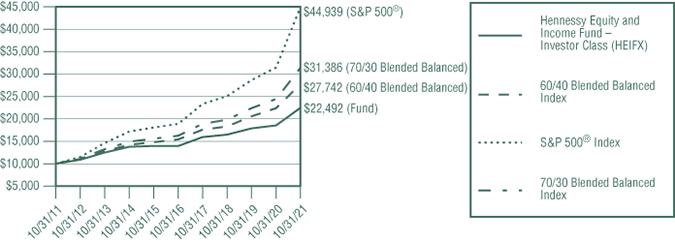

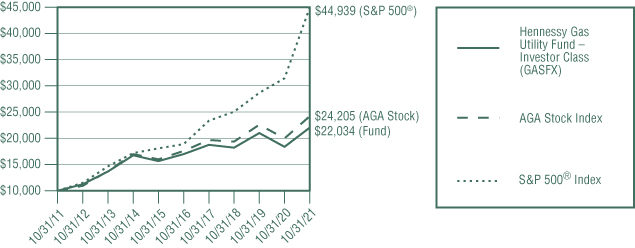

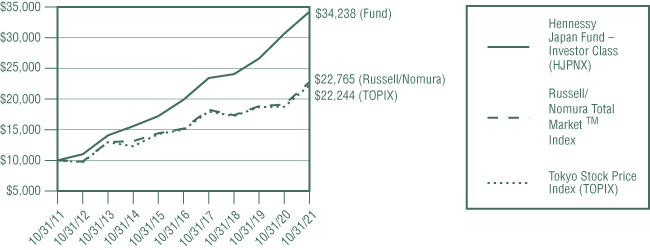

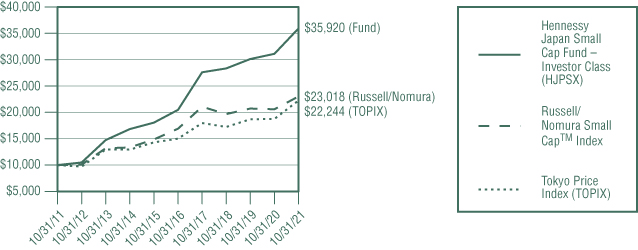

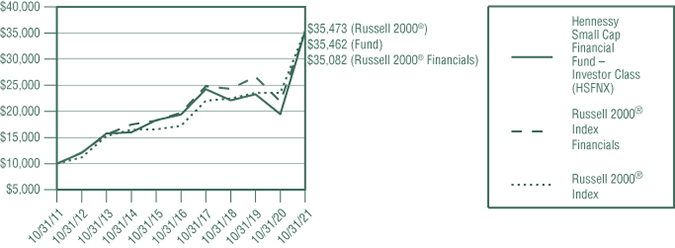

This graph illustrates the performance of an initial investment of $10,000 made in the Fund 10 years ago and assumes the reinvestment of dividends and capital gains.

Performance data quoted represents past performance; past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. The performance table does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Current performance of the Fund may be lower or higher than the performance quoted. Performance data current to the most recent month end may be obtained by visiting www.hennessyfunds.com.

The 50/50 Blended DJIA/Treasury Index consists of 50% common stocks represented by the Dow Jones Industrial Average and 50% short-duration Treasury securities represented by the ICE BofAML 1-Year U.S. Treasury Note Index, which comprises U.S. Treasury securities maturing in approximately one year. The Dow Jones Industrial Average is a price-weighted average of 30 significant stocks traded on the New York Stock Exchange or The Nasdaq Stock Market LLC. One cannot invest directly in an index. These indices are used for comparative purposes in accordance with Securities and Exchange Commission regulations.

The expense ratio presented is from the most recent prospectus. The expense ratio for the current reporting period is available in the Financial Highlights section of this report.

Portfolio Managers Neil J. Hennessy, Ryan C. Kelley, CFA, and L. Joshua Wein, CAIA

For the one-year period ended October 31, 2021, the Hennessy Balanced Fund returned 14.62%, underperforming both the 50/50 Blended DJIA/Treasury Index (the Fund’s

primary benchmark) and the Dow Jones Industrial Average, which returned 17.83% and 37.73%, respectively, for the same period.

The Fund underperformed its primary benchmark predominantly as a result of stock selection in the Communication Services and Industrials sectors, with investments in Verizon Communications, Inc. and 3M Company detracting the most from relative performance. In addition, relative fund performance was negatively affected by not owning certain companies in the Financials sector that contributed strongly to the benchmark’s performance, namely The Goldman Sachs Group, Inc. Investments that contributed most to Fund performance included a financial, an energy, and a consumer staples company, namely JPMorgan Chase & Company, Chevron Corporation, and Walgreens Boots Alliance, Inc.

The Fund owns the companies mentioned except Goldman Sachs and JPMorgan.

The Fund invests approximately 50% of its assets in the “Dogs of the Dow,” the 10 highest dividend-yielding Dow stocks, and 50% of its assets in U.S. Treasuries. As a result of this “blended” strategy, we expect the Fund to underperform equities in periods when equity markets rise and outperform in periods when equity markets fall. The Fund is designed to allow its investors to gain exposure to the equity market while maintaining a significant percentage of its investment in fixed income securities. We believe the Fund is well positioned for the more conservative investor because the equity portion of the portfolio is invested in what we deem to be high-quality companies, each of which pays a quarterly dividend, while the balance of the Fund is invested in lower-risk, short-duration U.S. Treasuries.

After a tumultuous 2020 and a strong 2021, we believe that the outlook for U.S. stocks remains positive. After a sharp contraction in economic activity as a result of the COVID-19 pandemic, the U.S. economy is growing steadily and demonstrating incredible resilience. We are benefiting from increased employment, rapid wage gains, and robust economic activity. Corporate earnings are on the rise, interest rates remain low, and Federal Reserve policies continue to accommodate a strong economy.

If the market experiences a correction, we would expect our more defensive holdings to perform well relative to the market. The relatively short duration of the 50% weighting of U.S. Treasuries in the portfolio (all less than one year) may allow us the ability to roll into higher-yielding Treasuries in the event interest-rates rise.

Opinions expressed are those of the Portfolio Managers as of the date written and are subject to change, are not guaranteed, and should not be considered investment advice or an indication of trading intent.

The Fund is non-diversified, meaning it may concentrate its assets in fewer individual holdings than a diversified fund, making it more exposed to individual stock volatility than a diversified fund. The Fund’s formula-based strategy may cause the Fund to buy or sell securities at times when it may not be advantageous. Please see the Fund’s prospectus for a more complete discussion of these and other risks.

References to specific securities should not be considered a recommendation to buy or sell any security. Fund holdings and sector allocations are subject to change. Please refer to the Schedule of Investments included in this report for additional portfolio information.

Earnings growth is not a measure of the Fund’s future performance.

Note: For presentation purposes, the Fund has grouped some of the industry categories. For purposes of categorizing securities for compliance with Section 8(b)(1) of the Investment Company Act of 1940, as amended, the Fund uses more specific industry classifications.

The accompanying notes are an integral part of these financial statements.

Percentages are stated as a percent of net assets.

The following is a summary of the inputs used to value the Fund’s net assets as of October 31, 2021 (see Note 3 in the accompanying Notes to the Financial Statements):

The accompanying notes are an integral part of these financial statements.

The accompanying notes are an integral part of these financial statements.

The accompanying notes are an integral part of these financial statements.

The accompanying notes are an integral part of these financial statements.

The accompanying notes are an integral part of these financial statements.

The accompanying notes are an integral part of these financial statements.

The Hennessy Balanced Fund (the “Fund”) is a series of Hennessy Funds Trust (the “Trust”), which was organized as a Delaware statutory trust on September 17, 1992. The Fund is an open-end management investment company registered under the Investment Company Act of 1940, as amended. The investment objective of the Fund is a combination of capital appreciation and current income. The Fund is a non-diversified fund and offers Investor Class shares.

As an investment company, the Fund follows the investment company accounting and reporting guidance of the Financial Accounting Standards Board (“FASB”) Accounting Standard Codification Topic 946 “Financial Services—Investment Companies.”

The following is a summary of significant accounting policies consistently followed by the Fund in the preparation of the financial statements. These policies conform to U.S. generally accepted accounting principles (“GAAP”).

The Fund follows its valuation policies and procedures in determining its net asset value and, in preparing these financial statements, the fair value accounting standards that establish an authoritative definition of fair value and set out a hierarchy for measuring fair value. These standards require additional disclosures about the various inputs and valuation techniques used to develop the measurements of fair value and a discussion of changes in valuation techniques and related inputs during the period. These inputs are summarized in the three broad levels listed below:

The following is a description of the valuation techniques applied to the Fund’s major categories of assets and liabilities on a recurring basis:

The Board of Trustees of the Fund (the “Board”) has adopted fair value pricing procedures that are followed when a price for a security is not readily available or if a significant event has occurred that indicates the closing price of a security no longer represents the true value of that security. Fair value pricing determinations are made in good faith in accordance with these procedures. There are numerous criteria considered in determining a fair value of a security, such as the trading volume of a security and markets, the values of other similar securities, and news events with direct bearing on a security or markets. Fair value pricing results in an estimated price for a security that reflects the amount the Fund might reasonably expect to receive in a current sale. Depending on the relative significance of the valuation inputs, these securities may be classified in either Level 2 or Level 3 of the fair value hierarchy.

The Board has delegated day-to-day valuation matters to the Valuation and Liquidity Committee comprising representatives from Hennessy Advisors, Inc., the Fund’s investment advisor (the “Advisor”). The function of the Valuation and Liquidity Committee, among other things, is to value securities where current and reliable market quotations are not readily available. All actions taken by the Valuation and Liquidity Committee are reviewed by the Board.

The Fund has performed an analysis of all existing investments to determine the significance and character of all inputs to their fair value determinations. Various inputs are used to determine the value of the Fund’s investments. The inputs or methodology used for valuing securities are not necessarily an indication of the risk associated with investing in those securities. Details related to the fair value hierarchy of the Fund’s securities as of October 31, 2021, are included in the Schedule of Investments.

Purchases and sales of investment securities (excluding government and short-term investments) for the Fund during fiscal year 2021 were $2,002,249 and $2,594,038, respectively.

There were no purchases or sales/maturities of long-term U.S. government securities for the Fund during fiscal year 2021.

The Advisor provides the Fund with investment advisory services under an Investment Advisory Agreement. The Advisor furnishes all investment advice, office space, and facilities and most of the personnel needed by the Fund. As compensation for its services, the Advisor is entitled to a monthly fee from the Fund. The fee is based on the average daily net assets of the Fund at an annual rate of 0.60%. The net investment advisory fees expensed by the Fund during fiscal year 2021 are included in the Statement of Operations.

The Board has approved a Shareholder Servicing Agreement for the Fund, which compensates the Advisor for the non-investment advisory services it provides to the Fund. The Shareholder Servicing Agreement provides for a monthly fee paid to the Advisor at an annual rate of 0.10% of the average daily net assets of the Fund. The shareholder service fees expensed by the Fund during fiscal year 2021 are included in the Statement of Operations.

The Fund has adopted a plan pursuant to Rule 12b-1 under the Investment Company Act of 1940, as amended, that authorizes payments in connection with the distribution of Fund shares at an annual rate of up to 0.25% of the Fund’s average daily net assets. Even though the authorized rate is up to 0.25%, the Fund is currently only using up to 0.15% of its average daily net assets for such purpose. Amounts paid under the plan may be spent on any activities or expenses primarily intended to result in the sale of shares, including, but not limited to, advertising, shareholder account servicing, printing and mailing of prospectuses to other than current shareholders, printing and mailing of sales literature, and compensation for sales and marketing activities or to financial institutions and others, such as dealers and distributors. The distribution fees expensed by the Fund during fiscal year 2021 are included in the Statement of Operations.

The Fund has entered into agreements with various brokers, dealers, and financial intermediaries in connection with the sale of Fund shares. The agreements provide for periodic payments of sub-transfer agent expenses by the Fund to the brokers, dealers, and financial intermediaries for providing certain shareholder maintenance services. These shareholder services include the pre-processing and quality control of new accounts, shareholder correspondence, answering customer inquiries regarding account status, and facilitating shareholder telephone transactions. The sub-transfer agent fees expensed by the Fund during fiscal year 2021 are included in the Statement of Operations.

U.S. Bancorp Fund Services, LLC, d/b/a U.S. Bank Global Fund Services (“Fund Services”) provides the Fund with administrative, accounting, and transfer agent services. As administrator, Fund Services is responsible for activities such as (i) preparing various federal and state regulatory filings, reports, and returns for the Fund, (ii) preparing reports and materials to be supplied to the Board, (iii) monitoring the activities of the Fund’s custodian, transfer agent, and accountants, and (iv) coordinating the preparation and payment of the Fund’s expenses and reviewing the Fund’s expense accruals. U.S. Bank N.A., an affiliate of Fund Services, serves as the Fund’s custodian. The servicing agreements between the Trust, Fund Services, and U.S. Bank N.A. contain a fee schedule that is inclusive of administrative, accounting, custody, and transfer agent fees. The administrative, accounting, custody, and transfer agent fees expensed by the Fund during fiscal year 2021 are included in the Statement of Operations.

Quasar Distributors, LLC (“Quasar”), a wholly owned broker-dealer subsidiary of Foreside Financial Group, LLC (“Foreside”), acts as the Fund’s principal underwriter in a continuous public offering of Fund shares. Effective September 30, 2021, Genstar Capital, a private equity firm specializing in financial and related business service companies, acquired a majority interest in Foreside. The Board approved a new Distribution Agreement to enable Quasar to continue serving as the Fund’s distributor following the change in control of Foreside.

The officers of the Fund are affiliated with the Advisor. With the exception of the Chief Compliance Officer and the Senior Compliance Officer, such officers receive no compensation from the Fund for serving in their respective roles. The Fund, along with the other funds in the Hennessy Funds family (collectively, the “Hennessy Funds”), makes reimbursement payments on an equal basis to the Advisor for a portion of the salary and benefits associated with the office of the Chief Compliance Officer and for all of the salary and benefits associated with the office of the Senior Compliance Officer. The compliance fees expensed by the Fund during fiscal year 2021 are included in the Statement of Operations.

Under the Hennessy Funds’ organizational documents, their officers and trustees are indemnified by the Hennessy Funds against certain liabilities arising out of the performance of their duties to the Hennessy Funds. Additionally, in the normal course of business, the Hennessy Funds enter into contracts with service providers that contain general indemnification clauses. The Fund’s maximum exposure under these arrangements is unknown as this would involve future claims that may be made against the Fund that have not yet occurred. Currently, the Fund expects the risk of loss to be remote.

The Fund has an uncommitted line of credit with the other Hennessy Funds in the amount of the lesser of (i) $100,000,000 or (ii) 33.33% of each Hennessy Fund’s net assets, or 30% for the Hennessy Gas Utility Fund and 10% for the Fund. The line of credit is intended to provide any necessary short-term financing in connection with shareholder redemptions, subject to certain restrictions. The credit facility is with the Hennessy Funds’ custodian bank, U.S. Bank N.A. Borrowings under this arrangement bear interest at the bank’s prime rate and are secured by all of the Fund’s assets (as to its own borrowings only). During fiscal year 2021, the Fund had an outstanding average daily balance and a weighted average interest rate of $868 and 3.25%, respectively. The interest expensed by the Fund during fiscal year 2021 is included in the Statement of Operations. The maximum amount outstanding for the Fund during fiscal year 2021 was $53,000. As of October 31, 2021, the Fund did not have any borrowings outstanding under the line of credit.

As of October 31, 2021, the components of accumulated earnings (losses) for income tax purposes were as follows:

The difference between book-basis unrealized appreciation/depreciation and tax-basis unrealized appreciation/depreciation (as shown above) is attributable primarily to wash sales.

As of October 31, 2021, the Fund had no tax-basis capital losses to offset future capital gains. During fiscal year 2021, the capital losses utilized by the Fund were $27,785.

Capital losses sustained in or after fiscal year 2012 can be carried forward indefinitely, but any such loss retains the character of the original loss and must be utilized prior to any loss incurred before fiscal year 2012. As a result of this ordering rule, capital loss carryforwards incurred prior to fiscal year 2012 may be more likely to expire unused. Capital losses sustained prior to fiscal year 2012 can be carried forward for eight years and can be carried forward as short-term capital losses regardless of the character of the original loss.

As of October 31, 2021, the Fund did not defer, on a tax basis, any late-year ordinary losses. Late-year ordinary losses are net ordinary losses incurred after December 31, 2020, but within the taxable year, that are deemed to arise on the first day of the Fund’s next taxable year.

During fiscal years 2021 and 2020, the tax character of distributions paid by the Fund was as follows:

Management has evaluated the Fund’s related events and transactions that occurred subsequent to October 31, 2021, through the date of issuance of the Fund’s financial statements. Other than as disclosed below, management has determined that there were no subsequent events requiring recognition or disclosure in the financial statements.

On December 7, 2021, capital gains were declared and paid to shareholders of record on December 6, 2021, as follows:

We have audited the accompanying statement of assets and liabilities of the Hennessy Balanced Fund (the “Fund”), a series of Hennessy Funds Trust, including the schedule of investments, as of October 31, 2021, the related statement of operations for the year then ended, the statements of changes in net assets for each of the two years in the period then ended, the financial highlights for each of the five years in the period then ended, and the related notes (collectively referred to as the “financial statements”). In our opinion, the financial statements present fairly, in all material respects, the financial position of the Fund as of October 31, 2021, the results of its operations for the year then ended, the changes in its net assets for each of the two years in the period then ended, and the financial highlights for each of the five years in the period then ended in conformity with accounting principles generally accepted in the United States of America.

These financial statements are the responsibility of the Fund’s management. Our responsibility is to express an opinion on the Fund’s financial statements based on our audits. We are a public accounting firm registered with the Public Company Accounting Oversight Board (United States) (“PCAOB”) and are required to be independent with respect to the Fund in accordance with the U.S. federal securities laws and the applicable rules and regulations of the Securities and Exchange Commission and the PCAOB. We have served as the auditor of one or more of the funds in the Trust since 2002.

We conducted our audits in accordance with the standards of the PCAOB. Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement, whether due to error or fraud. The Fund is not required to have, nor were we engaged to perform, an audit of its internal control over financial reporting. As part of our audits we are required to obtain an understanding of internal control over financial reporting, but not for the purpose of expressing an opinion on the effectiveness of the Fund’s internal control over financial reporting. Accordingly, we express no such opinion.

Our audits included performing procedures to assess the risks of material misstatement of the financial statements, whether due to error or fraud, and performing procedures that respond to those risks. Such procedures included examining, on a test basis, evidence regarding the amounts and disclosures in the financial statements. Our audits also included evaluating the accounting principles used and significant estimates made by management, as well as evaluating the overall presentation of the financial statements. Our procedures included confirmation of securities owned as of October 31, 2021 by correspondence with the custodian. We believe that our audits provide a reasonable basis for our opinion.

The business and affairs of the Funds are managed under the direction of the Board of Trustees of the Trust, and the Board of Trustees elects the officers of the Trust. From time to time, the Board of Trustees also has appointed advisers to the Board of Trustees (“Advisers”) with the intention of having qualified individuals serve in an advisory capacity to garner experience in the mutual fund and asset management industry and be considered as potential Trustees in the future. There are currently two Advisers, Brian Alexander and Doug Franklin. As Advisers, Mr. Alexander and Mr. Franklin attend meetings of the Board of Trustees and act as non-voting participants. Information pertaining to the Trustees, Advisers, and the officers of the Trust is set forth below. The Trustees and officers serve until their successors are duly elected and qualified or until their earlier death, resignation, or removal. Each Trustee oversees all 16 Hennessy Funds. Unless otherwise indicated, the address of all persons listed below is 7250 Redwood Boulevard, Suite 200, Novato, CA 94945. The Fund’s Statement of Additional Information includes more information about the persons listed below and is available without charge by calling 1-800-966-4354 or by visiting www.hennessyfunds.com.

As a shareholder of the Fund, you incur ongoing costs, including management fees, service fees, and other Fund expenses. This Example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds. The Example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period from May 1, 2021, through October 31, 2021.

The first line of the table below provides information about actual account values and actual expenses. You may use this information, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading “Expenses Paid During Period” to estimate the expenses you paid on your account during this period. Although the Fund charges no sales loads or transaction fees, you will be assessed fees for outgoing wire transfers, returned checks, and stop payment orders at prevailing rates charged by U.S. Bank Global Fund Services, the Fund’s transfer agent. If you request that a redemption be made by wire transfer, the Fund’s transfer agent charges a $15 fee. IRAs are charged a $15 annual maintenance fee (up to $30 maximum per shareholder for shareholders with multiple IRAs). The example below includes, but is not limited to, management, shareholder servicing, accounting, custody, and transfer agent fees. However, the example below does not include portfolio trading commissions and related expenses.

The second line of the table below provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds. Please note that the expenses shown in the table are meant to highlight your ongoing costs only. Therefore, the second line is useful in comparing ongoing costs only and will not help you determine the relative total costs of owning different funds.

A description of the policies and procedures the Fund uses to determine how to vote proxies relating to portfolio securities is available without charge (1) by calling 1-800-966-4354, (2) on the Hennessy Funds’ website at www.hennessyfunds.com/proxy-voting/voting-policy, or (3) on the U.S. Securities and Exchange Commission’s (the “SEC”) website at www.sec.gov. The Fund’s proxy voting record is available without charge on both the Hennessy Funds’ website at www.hennessyfunds.com/proxy-voting/voting-record and the SEC’s website at www.sec.gov no later than August 31 for the prior 12 months ending June 30.

The Fund files a complete schedule of portfolio holdings with the SEC for the first and third quarters of each fiscal year as an exhibit to its reports on Form N-PORT. The Fund’s Form N-PORT reports are available on the SEC’s website at www.sec.gov or on request by calling 1-800-966-4354.

For fiscal year 2021, certain dividends paid by the Fund may be subject to a maximum tax rate of 23.8%, as provided for by the Jobs and Growth Tax Relief Reconciliation Act of 2003. The percentage of dividends declared from ordinary income designated as qualified dividend income was 100.00%.

For corporate shareholders, the percent of ordinary income distributions that qualified for the corporate dividends received deduction for fiscal year 2021 was 100.00%.

The percentage of taxable ordinary income distributions that were designated as short-term capital gain distributions under Section 871(k)(2)(C) of the Internal Revenue Code of 1986, as amended, for the Fund was 28.96%.

To help keep the Fund’s costs as low as possible, we generally deliver a single copy of shareholder reports, proxy statements, and prospectuses to shareholders who share an address and have the same last name. This process does not apply to account statements. You may request an individual copy of a shareholder document at any time. If you would like to receive separate mailings of shareholder documents, please call U.S. Bank Global Fund Services at 1-800-261-6950 or 1-414-765-4124, and individual delivery will begin within 30 days of your request. If your account is held through a financial institution or other intermediary, please contact such intermediary directly to request individual delivery.

As permitted by SEC regulations, the Fund’s shareholder reports are made available on a website, and unless you sign up for eDelivery or elect to receive paper copies as detailed below, you will be notified by mail each time a report is posted and provided with a website link to access the report.

The Fund also offers shareholders the option to receive all notices, account statements, prospectuses, tax forms, and shareholder reports online. To sign up for eDelivery or change your delivery preference, please visit www.hennessyfunds.com/account.

To elect to receive paper copies of all future reports free of charge, please call U.S. Bank Global Fund Services at 1-800-261-6950 or 1-414-765-4124.

Subscribe to receive our team’s unique market and sector insights delivered to your inbox

In accordance with Rule 22e-4 under the Investment Company Act of 1940, as amended (the “Liquidity Rule”), we have adopted and implemented a liquidity risk management program (the “Liquidity Program”). The purpose of the Liquidity Program is to assess and manage the Fund’s liquidity risk, which is the risk that the Fund would not be able to meet requests to redeem Fund shares without significant dilution of the remaining shareholders’ interests in the Fund. The Board of Trustees of the Fund (the “Board”) designated a committee comprising representatives of Hennessy Advisors, Inc., the investment adviser to the Fund, as the administrator of the Liquidity Program (the “Program Administrator”).

The Program Administrator provided a written report regarding the Liquidity Program to the Board in advance of its meeting on June 2, 2021. The report covered the period from June 1, 2020, through May 31, 2021. The report addressed the operation of the Liquidity Program, assessed the adequacy and effectiveness of its implementation, and described any material changes to the Liquidity Program during the review period. The Trust’s chief compliance officer presented the report to the Board at the meeting and provided additional information regarding the Liquidity Program. The Board reviewed the Liquidity Program and considered, among other items, the following:

We collect this information directly from you, indirectly in the course of providing services to you, directly and indirectly from your activity on our website, from broker dealers, marketing agencies, and other third parties that interact with us in connection with the services we perform and products we offer, and from anonymized and aggregated consumer information.

We use this information to fulfill the reason you provided the information to us, to provide you with other relevant products that you request from us, to provide you with information about products that may interest you, to improve our website or present our website’s contents to you, and as otherwise described to you when collecting your personal information.

We do not disclose any personal information to unaffiliated third parties, except as permitted by law. We may disclose your personal information to our affiliates, vendors, and service providers for a business purpose. For example, we are permitted by law to disclose all of the information we collect, as described above, to our transfer agent to process your transactions. When disclosing your personal information to third parties, we enter into a contract with each third party describing the purpose of such disclosure and requiring that such personal information be kept confidential and not used for any purpose except to perform the services contracted or respond to regulatory or law enforcement requests.

Furthermore, we restrict access to your personal information to those persons who require such information to provide products or services to you. As a result, we do not provide a means for opting out of our limited sharing of your information. We maintain physical, electronic, and procedural safeguards that comply with federal standards to guard your personal information.

If you hold shares of the Funds through a financial intermediary, including, but not limited to, a broker-dealer, bank, or trust company, the privacy policy of your financial intermediary governs how your personal information is shared with unaffiliated third parties.

The California Consumer Privacy Act of 2018 (the “CCPA”) provides you, as a California resident, with certain additional rights relating to your personal information.

Under the CCPA, you have the right to request that we disclose to you the categories of personal information we have collected about you over the past 12 months, the categories of sources of such information, our business purpose for collecting the information, the categories of third parties, if any, with whom we shared the information, and the specific information we have collected about you. You also have the right to request that we delete any of your personal information, and, unless an exception applies, we will delete such information upon receiving and confirming your request. To make a request, call us at 1-800-966-4354, email us at privacy@hennessyfunds.com, or go to www.hennessyfunds.com/contact. We will not discriminate against you for exercising your rights under the CCPA. Further, we will not collect additional categories of your personal information or use the personal information we collected for materially different, unrelated, or incompatible purposes without providing you notice.

Hennessy Advisors, Inc.

U.S. Bancorp Fund Services, LLC

d/b/a U.S. Bank Global Fund Services

P.O. Box 701

U.S. Bank N.A.

Neil J. Hennessy

Robert T. Doyle

J. Dennis DeSousa

Gerald P. Richardson

others only if preceded or accompanied by a current prospectus.

ANNUAL REPORT

OCTOBER 31, 2021

HENNESSY BP ENERGY TRANSITION FUND

Investor Class HNRGX

Institutional Class HNRIX

www.hennessyfunds.com | 1-800-966-4354

(This Page Intentionally Left Blank.)

Contents

| Letter to Shareholders | 2 |

| Performance Overview | 4 |

| Financial Statements | |

| Schedule of Investments | 8 |

| Statement of Assets and Liabilities | 12 |

| Statement of Operations | 13 |

| Statements of Changes in Net Assets | 15 |

| Financial Highlights | 16 |

| Notes to the Financial Statements | 20 |

| Report of Independent Registered Public Accounting Firm | 28 |

| Trustees and Officers of the Fund | 29 |

| Expense Example | 32 |

| Proxy Voting Policy and Proxy Voting Records | 34 |

| Availability of Quarterly Portfolio Schedule | 34 |

| Important Notice Regarding Delivery of Shareholder Documents | 34 |

| Electronic Delivery | 34 |

| Liquidity Risk Management Program | 35 |

| Privacy Policy | 35 |

| HENNESSY FUNDS | 1-800-966-4354 | |

December 2021

Dear Hennessy Funds Shareholder:

What a year this has been. While it doesn’t feel that we are out of the “pandemic” phase of the coronavirus crisis, we look forward to a day when we will eventually see fewer cases and potentially less severe variants. We feel extremely grateful to the many healthcare workers who have continued to work tirelessly during the recent surge. As we move through the next year, we hope that new U.S. cases will decline and that many other parts of the world will see improvements as well.

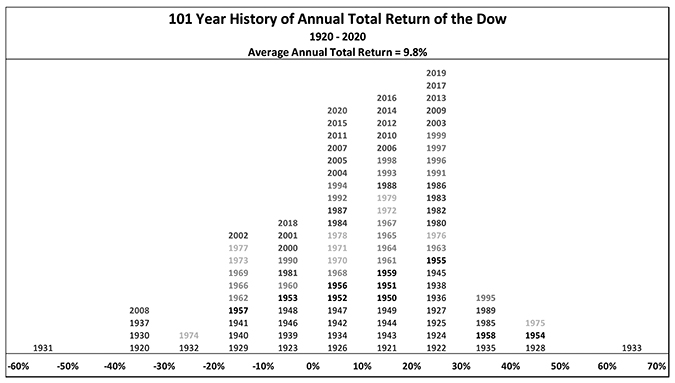

What a year this has been! As measured by the total return of the S&P 500® Index, as of October 31, 2021, the market was up 24.04% calendar year to date. This comes in the wake of a tumultuous 2020 in which the market plunged in the beginning of the pandemic and recovered dramatically to end the year up 18.40%. Interestingly, 18% appears to be a repeating number in the past dozen years. From the low point of the Financial Crisis (March 9, 2009) to the high point reached just prior to the COVID-19 pandemic (February 12, 2020), the S&P 500® Index was up 18.27% per year. We are well aware that past results are not predictive of the future, and we find ourselves naturally skeptical of such strong returns. But, as shown in the chart below, we find that the most common annual total returns of the market over the past 102 years range between 20% and 30% with the second most common being between 10% and 20%:

Source: Bloomberg L.P.

We will say it again, after showing a chart like the one above: Past results are not predictive of the future. Instead, we look at where we are right now – in the economy, in the market, in the business cycle – to reflect on where we have come from and where we may be going. U.S. GDP is strong and growing, interest rates remain low, and earnings growth and profitability remain robust. We believe stocks are trading at reasonable valuations when viewed as a whole, with the S&P 500® Index at 21.0x estimated earnings for 2022. Furthermore, we believe corporate balance sheets are healthy, with high levels of excess cash, which could support growth, increases in dividends, more share buybacks, and future acquisitions. Uncertainty and volatility can manifest at any time in the stock market, and the current market is no different. Investors have questions about inflation, worldwide supply chain issues, and what could drive the next boost in earnings. While these concerns are warranted, we continue to believe that overall the positives outweigh the negatives, and here at Hennessy we continue to see opportunity in the market and in our Funds.

What a (fiscal) year this has been!!! For our fiscal year ended October 31, 2021, the S&P 500® Index rose 42.91% on a total return basis, setting a new all-time high on the final day of the period. Except for a short 21-trading-day period that began on September 2 during which the market fell 5.13% only to rebound to new highs just 13 trading days later, the market has been on a continuous march higher. We saw a dramatic shift in market leadership as many of the sectors that underperformed during our last fiscal year soared in fiscal year 2021. Small-caps beat mid-caps, which in turn beat large-caps. The Energy and Financials sectors skyrocketed during the 12-month period, as reflected by the S&P 500® Energy Sector’s total return of 111.29% and the Russell 1000® Index Financials’ total return of 70.87%. Both of these sectors were among the worst performing in our fiscal year 2020, so a bounce back in our fiscal year 2021, while not a foregone conclusion, was a distinct possibility.

Overall, we are pleased with the performance of our mutual funds during the fiscal year. On an absolute basis, each of our 16 Funds achieved total returns greater than 10% and seven outperformed their primary benchmark. Ten of our 11 domestic equity-only Funds outperformed the S&P 500® Index and posted total returns of 45% or higher. Our four best-performing funds were concentrated in the Energy and Financials sectors. While some of our Funds certainly benefited from being in the “right” sector at the “right” time, we also believe this was a favorable period for our investment style of high-conviction investing and concentrated portfolio construction.

What will the coming year bring? As mentioned in our last shareholder letter (June 2021), we understand that even the greatest bull markets experience corrections along the way, and the last time the S&P 500® Index dropped over 10% was in February/March of 2020. Whether or not a correction occurs sooner or later, we believe the market as a whole has more room to run. We see many factors that could drive the market higher from here: strong GDP growth and increasing corporate earnings, a potentially lower-for-longer interest rate environment, accommodative fiscal and monetary policies, a healthy and robust financial system, low unemployment and solid wage growth, and strong corporate balance sheets with plenty of cash.

Thank you for your interest and for investing with us. We remain committed to managing our portfolios for long-term performance, ever mindful of downside risk. With so many investment options available to you, we are grateful for the trust you put in us and for your continued interest in our family of Funds. If you have any questions or would like to speak with us, please don’t hesitate to call us directly at (800) 966-4354.

Best regards,

| |

| |

| |

| |

|

| Ryan C. Kelley |

| Chief Investment Officer |

Past performance does not guarantee future results. To obtain current standardized performance for the Hennessy Funds, visit https://www.hennessyfunds.com/funds/price-performance.

Mutual fund investing involves risk. Principal loss is possible.

Opinions expressed are those of Ryan C. Kelley and are subject to change, are not guaranteed, and should not be considered investment advice.

The Dow Jones Industrial Average and S&P 500® Index are commonly used to measure the performance of U.S. stocks. The S&P 500® Energy Index comprises those companies included in the S&P 500® Index that are classified in the Energy sector. The Russell 1000® Index Financials is a subset of the Russel 1000® Index that measures the performance of securities classified in the Financials sector of the large-capitalization U.S. equity market. The indices are used herein for comparative purposes in accordance with SEC regulations. One cannot invest directly in an index. All returns are shown on a total return basis.

| HENNESSY FUNDS | 1-800-966-4354 | |

Performance Overview (Unaudited)

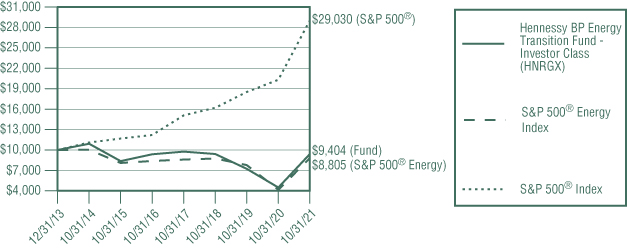

CHANGE IN VALUE OF $10,000 INVESTMENT

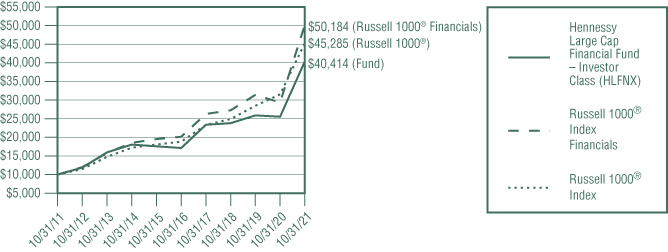

This graph illustrates the performance of an initial investment of $10,000 made in the Fund on its inception date and assumes the reinvestment of dividends and capital gains.

AVERAGE ANNUAL TOTAL RETURN FOR PERIODS ENDED OCTOBER 31, 2021

| | | One | Five | Since Inception |

| | | Year

| Years

| (12/31/13)

|

| | Hennessy BP Energy Transition Fund – | | | |

| | Investor Class (HNRGX) | 109.50% | 0.08% | -0.78% |

| | Hennessy BP Energy Transition Fund – | | | |

| | Institutional Class (HNRIX) | 110.17% | 0.36% | -0.53% |

| | S&P 500® Energy Index | 111.29% | 0.98% | -1.61% |

| | S&P 500® Index | 42.91% | 18.93% | 14.57% |

Expense ratios: 2.59% (Investor Class); 2.01% (Institutional Class)

Performance data quoted represents past performance; past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. The performance table does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Current performance of the Fund may be lower or higher than the performance quoted. Performance data current to the most recent month end may be obtained by visiting www.hennessyfunds.com. Performance for periods including or prior to October 26, 2018, is that of the BP Capital TwinLine Energy Fund.

The S&P 500® Energy Index comprises those companies included in the S&P 500® that are classified in the Energy sector. The S&P 500® Index is a capitalization-weighted index that is designed to represent the broad domestic economy through changes in the aggregate market value of 500 stocks across all major industries. One cannot invest directly in an index. These indices are used for comparative purposes in accordance with Securities and Exchange Commission regulations.

Standard & Poor’s Financial Services is the source and owner of the S&P® and S&P 500® trademarks.

The expense ratios presented are from the most recent prospectus. The expense ratios for the current reporting period are available in the Financial Highlights section of this report.

PERFORMANCE NARRATIVE

Portfolio Managers Ben Cook, CFA, and Kevin Gallagher, CFA

BP Capital Fund Advisors, LLC (sub-advisor)

Performance:

For the one-year period ended October 31, 2021, the Investor Class of the Hennessy BP Energy Transition Fund returned 109.50%, underperforming the S&P 500® Energy Index (the Fund’s primary benchmark), which returned 111.29% for the same period, but outperforming the S&P 500® Index, which returned 42.91% for the same period.

The Fund’s strong performance was primarily due to its overweight position in traditional hydrocarbon energy equities. Additionally, Fund performance benefited from holding companies in the end user category, namely materials, which performed well as improving prospects for global economic recovery provided support to economically sensitive sectors. The Fund’s holdings in renewable energy-oriented companies detracted from relative performance during the period, as operating issues in key supply chain markets presented headwinds for many companies to achieve operating and financial targets.

Portfolio Strategy:

The Fund seeks to invest in companies across the energy value chain, including both hydrocarbons and renewable energy sources. This investible universe includes crude oil and natural gas exploration and production companies, oilfield service providers, midstream companies, refiners, and energy end users. The renewable energy value chain comprises materials producers, machinery and equipment manufacturers, service providers, and utilities. We believe the inclusion of energy end users, such as industrials and transportation companies, differentiates the Fund from traditional energy funds that do not include such companies. We believe including such companies in the investment universe enables the Fund to benefit from a broader range of energy-related themes and provides greater flexibility to adjust sub-sector weightings based on our investment outlook. The Fund typically owns 25 to 40 securities and historically has had little overlap with the top holdings of commonly used energy and commodity equity benchmarks.

Investment Commentary:

Energy market conditions improved dramatically at the beginning of the one-year period as certainty afforded by the U.S. Presidential election outcome and promising results from Pfizer’s COVID-19 vaccine trial, These events signaled an encouraging outlook for rising energy demand on the expectation for accommodative fiscal stimulus as well the gradual easing of pandemic related economic headwinds. At the same time, coordinated restraint by OPEC+ member countries and spending discipline by U.S. shale producers kept crude oil supplies limited, which caused global inventories of crude oil to fall to pre-pandemic levels by summer’s end. Storm disruption during the month of August added further support to crude oil price gains during the period, as damage to offshore Gulf of Mexico facilities hampered the restart of both crude oil and natural gas production. The price of NYMEX WTI crude oil more than doubled over the period, finishing at $83.28 per barrel (bbl).

Natural gas markets also strengthened considerably on tightening global supplies following an historic bout of cold weather in the southcentral U.S. during February and an extended period of cooler than normal winter temperatures in western Europe that ultimately left inventories of natural gas in both markets well below historical seasonal norms. By early fall, natural gas pricing in both southeast Asia and northwestern Europe spiked to multi-year highs as storage operators raced to secure liquefied natural gas (“LNG”) cargos required to refill regional storage facilities ahead of the upcoming winter

| HENNESSY FUNDS | 1-800-966-4354 | |

heating season. In the United States, a key source of global LNG supply, natural gas prices remained firm through period-end reflecting healthy market demand for LNG export cargo as well as the volume necessary for domestic storage fill ahead of the coming winter. During the period, NYMEX Henry Hub natural gas prices rose considerably from a range of $2.50 to $3.00 per thousand cubic feet (mcf) to over $5.00 per mcf at the end of October 2021.

Relative energy equity performance during the period generally tracked the directional influence of commodity prices, but also reflected a comparative investor preference for companies in hydrocarbon-oriented energy businesses. Companies engaged in the production, transportation, refining, and export of hydrocarbons of all sorts enjoyed meaningful outperformance relative to renewables-oriented peers.

Following President Biden’s election victory in November 2020, investor enthusiasm for renewable-energy-oriented equities pushed valuations across the sector to very high levels into year end. In contrast, hydrocarbon-oriented equity valuations reflected little potential associated with a rebounding economy and newly embraced shareholder friendly management practices that, in our opinion, offered meaningful upside. Accordingly, we pivoted renewable energy equity exposure toward hydrocarbon-oriented equities by adding U.S. exploration and production companies and oil field service providers. By period end, portfolio exposure to hydrocarbon-oriented equities remained high relative to historical levels.

We have been encouraged by the U.S. energy industry’s resiliency during the COVID-19 pandemic-related contraction. Hydrocarbon-oriented companies have reduced capital spending and emphasized cost efficiency in order to preserve financial flexibility. Across the sector, corporate behavior continues to reflect an alignment with shareholders that is increasingly shifting the rewards of surplus free cash flow away from growth reinvestment and back to investors in the form of accelerated debt repayment, dividend hikes, and share repurchases. Though the need for hydrocarbon supply growth will eventually return, we are optimistic that the industry will continue to operate in the interest of investors, emphasizing capital efficiency, productivity improvement, and continued prudent focus on shareholder return.

As the world pursues greenhouse gas emission reduction targets, we believe policy, technology, and consumer and investor preference will continue to drive change in the world’s primary fuel mix. In this environment, we believe that wind, solar, hydrogen, and other renewable technologies will expand at the expense of more carbon intensive fuels, namely coal and heavy fuel oil. Despite this, we expect critical impediments in the form of policy gaps, reliability issues, and simple cost disadvantages will continue to hamper the pace of the transition toward renewables, and we see these drivers prolonging the dependence upon hydrocarbons. As a consequence, we envision a landscape that reflects the coexistence and need of both hydrocarbons and renewables, which should provide investment opportunity for investors for decades to come.

_______________

Opinions expressed are those of the Portfolio Managers as of the date written and are subject to change, are not guaranteed, and should not be considered investment advice or an indication of trading intent.

The Fund’s triple digit performance was attributable to unusually favorable market conditions resulting from the COVID-19 pandemic and to supply declines. Such conditions may not continue to exist and the Fund’s performance may not be repeated in the future.

The Fund invests in small-capitalization and medium-capitalization companies, which involves additional risks such as limited liquidity and greater volatility. Funds that concentrate in a single sector may be subject to a higher degree of risk. Energy-related companies are subject to specific risks, including fluctuations in commodity prices and consumer demand, substantial government regulation, and depletion of reserves. Investments in lower-rated and non-rated securities present a greater risk of loss to principal and interest than higher-rated securities. Use of derivatives can increase the volatility of the Fund.

MLPs and MLP investments have unique characteristics. The Fund does not receive the same tax benefits as a direct investment in an MLP.

The prices of MLP units may fluctuate abruptly and trading volume may be low, making it difficult for the Fund to sell its units at a favorable price. MLP general partners have the power to take actions that adversely affect the interests of unit holders. Most MLPs do not pay U.S. federal income tax at the partnership level, but an adverse change in tax laws could result in MLPs being treated as corporations for federal income tax purposes, which could reduce or eliminate distributions paid by MLPs to the Fund. If the Fund’s MLP investments exceed 25% of its assets, the Fund may not qualify for treatment as a regulated investment company under the Internal Revenue Code. The Fund would be taxed as an ordinary corporation, which could substantially reduce the Fund’s net assets and its distributions to shareholders. Please see the Fund’s prospectus for a more complete discussion of these and other risks.

References to specific securities should not be considered a recommendation to buy or sell any security. Fund holdings and sector allocations are subject to change. Please refer to the Schedule of Investments included in this report for additional portfolio information.

Free cash flow is a measure of financial performance calculated as operating cash flow minus capital expenditures.

| HENNESSY FUNDS | 1-800-966-4354 | |

Financial Statements

Schedule of Investments as of October 31, 2021 |

HENNESSY BP ENERGY TRANSITION FUND

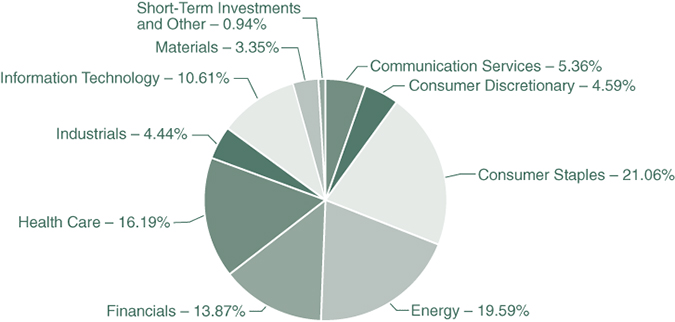

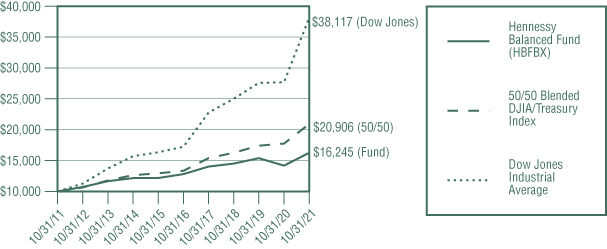

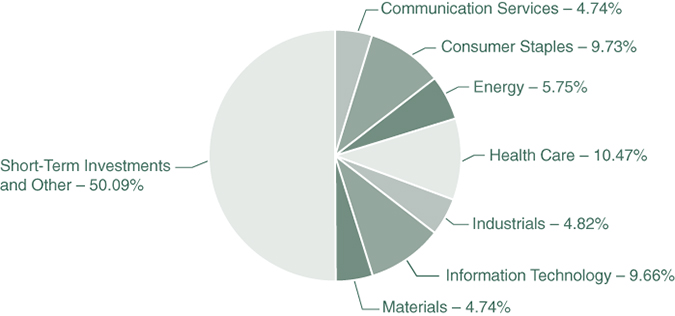

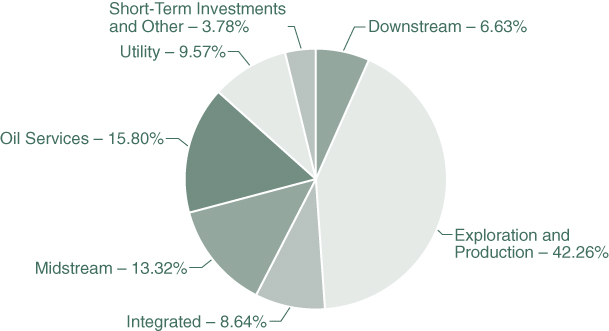

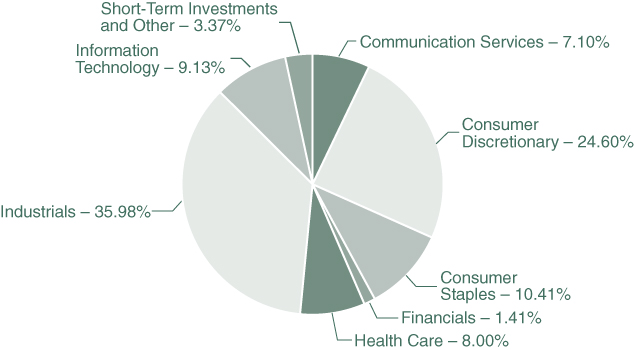

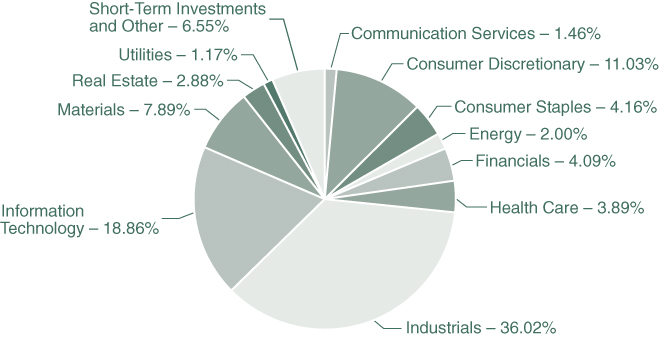

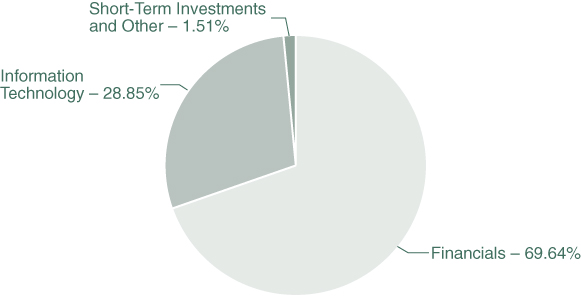

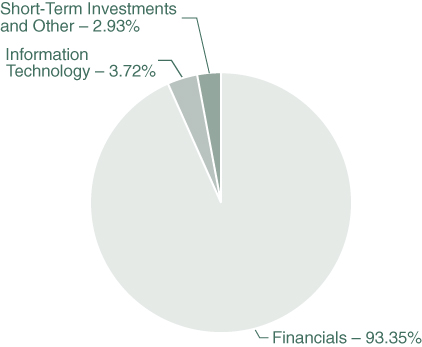

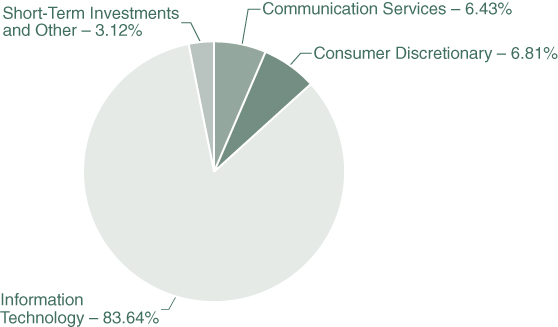

(% of Total Assets)

| TOP TEN HOLDINGS (EXCLUDING MONEY MARKET FUNDS) | % TOTAL ASSETS |

| Diamondback Energy, Inc. | 4.98% |

| EOG Resources, Inc. | 4.90% |

| PDC Energy, Inc. | 4.88% |

| Plains All American Pipeline LP | 4.86% |

| Cheniere Energy, Inc. | 4.48% |

| Exxon Mobil Corp. | 4.44% |

| Suncor Energy, Inc. | 4.33% |

| Chevron Corp. | 4.19% |

| ConocoPhillips | 4.16% |

| Pioneer Natural Resources Co. | 4.16% |

Note: The Fund concentrates its investments in the Energy industry. For presentation purposes, the Fund uses custom categories.

| COMMON STOCKS – 88.13% | | Number | | | | | | % of | |

| | | of Shares | | | Value | | | Net Assets | |

| Downstream – 6.69% | | | | | | | | | |

| Marathon Petroleum Corp. | | | 6,900 | | | $ | 454,917 | | | | 2.80 | % |

| Valero Energy Corp. | | | 8,170 | | | | 631,786 | | | | 3.89 | % |

| | | | | | | | 1,086,703 | | | | 6.69 | % |

| | | | | | | | | | | | | |

| Exploration & Production – 42.62% | | | | | | | | | | | | |

| Antero Resources Corp. (a) | | | 32,000 | | | | 635,840 | | | | 3.91 | % |

| Comstock Resources, Inc. (a) | | | 39,640 | | | | 391,247 | | | | 2.41 | % |

| ConocoPhillips | | | 9,145 | | | | 681,211 | | | | 4.19 | % |

| Coterra Energy, Inc. | | | 26,510 | | | | 565,193 | | | | 3.48 | % |

| Diamondback Energy, Inc. | | | 7,620 | | | | 816,788 | | | | 5.03 | % |

| EOG Resources, Inc. | | | 8,680 | | | | 802,553 | | | | 4.94 | % |

| EQT Corp. (a) | | | 24,500 | | | | 487,795 | | | | 3.00 | % |

| Magnolia Oil & Gas Corp. | | | 17,000 | | | | 354,960 | | | | 2.18 | % |

| PDC Energy, Inc. | | | 15,290 | | | | 799,820 | | | | 4.92 | % |

| Pioneer Natural Resources Co. | | | 3,650 | | | | 682,477 | | | | 4.20 | % |

| Suncor Energy, Inc. (b) | | | 26,960 | | | | 709,048 | | | | 4.36 | % |

| | | | | | | | 6,926,932 | | | | 42.62 | % |

| | | | | | | | | | | | | |

| Integrated – 8.71% | | | | | | | | | | | | |

| Chevron Corp. | | | 6,000 | | | | 686,940 | | | | 4.23 | % |

| Exxon Mobil Corp. | | | 11,300 | | | | 728,511 | | | | 4.48 | % |

| | | | | | | | 1,415,451 | | | | 8.71 | % |

| | | | | | | | | | | | | |

| Midstream – 4.52% | | | | | | | | | | | | |

| Cheniere Energy, Inc. (a) | | | 7,100 | | | | 734,140 | | | | 4.52 | % |

| | | | | | | | | | | | | |

| Oil Services – 15.93% | | | | | | | | | | | | |

| Halliburton Co. | | | 20,250 | | | | 506,047 | | | | 3.11 | % |

| Newpark Resources, Inc. (a) | | | 125,950 | | | | 428,230 | | | | 2.63 | % |

| Schlumberger Ltd. (b) | | | 17,810 | | | | 574,550 | | | | 3.54 | % |

| Select Energy Services, Inc. (a) | | | 52,660 | | | | 316,487 | | | | 1.95 | % |

| Solaris Oilfield Infrastructure, Inc. | | | 37,320 | | | | 283,259 | | | | 1.74 | % |

| TechnipFMC PLC (a)(b) | | | 65,240 | | | | 480,819 | | | | 2.96 | % |

| | | | | | | | 2,589,392 | | | | 15.93 | % |

The accompanying notes are an integral part of these financial statements.

| HENNESSY FUNDS | 1-800-966-4354 | |

| COMMON STOCKS | | Number | | | | | | % of | |

| | | of Shares | | | Value | | | Net Assets | |

| Utility – 9.66% | | | | | | | | | |

| Freeport-McMoRan, Inc. | | | 14,820 | | | $ | 559,011 | | | | 3.44 | % |

| NextEra Energy, Inc. | | | 5,970 | | | | 509,420 | | | | 3.14 | % |

| OGE Energy Corp. | | | 14,700 | | | | 500,829 | | | | 3.08 | % |

| | | | | | | | 1,569,260 | | | | 9.66 | % |

| | | | | | | | | | | | | |

| Total Common Stocks | | | | | | | | | | | | |

| (Cost $11,629,182) | | | | | | | 14,321,878 | | | | 88.13 | % |

| | | | | | | | | | | | | |

| PARTNERSHIPS & TRUSTS – 8.92% | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| Midstream – 8.92% | | | | | | | | | | | | |

| Enterprise Products Partners LP | | | 8,729 | | | | 197,974 | | | | 1.22 | % |

| MPLX LP | | | 15,104 | | | | 454,932 | | | | 2.80 | % |

| Plains All American Pipeline LP | | | 78,710 | | | | 796,545 | | | | 4.90 | % |

| | | | | | | | | | | | | |

| Total Partnerships & Trusts | | | | | | | | | | | | |

| (Cost $1,681,920) | | | | | | | 1,449,451 | | | | 8.92 | % |

| | | | | | | | | | | | | |

| SHORT-TERM INVESTMENTS – 3.51% | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| Money Market Funds – 3.51% | | | | | | | | | | | | |

| First American Government Obligations Fund, | | | | | | | | | | | | |

| Institutional Class, 0.03% (c) | | | 570,411 | | | | 570,411 | | | | 3.51 | % |

| | | | | | | | | | | | | |

| Total Short-Term Investments | | | | | | | | | | | | |

| (Cost $570,411) | | | | | | | 570,411 | | | | 3.51 | % |

| | | | | | | | | | | | | |

| Total Investments | | | | | | | | | | | | |

| (Cost $13,881,513) – 100.56% | | | | | | | 16,341,740 | | | | 100.56 | % |

| Liabilities in Excess of Other Assets – (0.56)% | | | | | | | (90,966 | ) | | | (0.56 | )% |

| | | | | | | | | | | | | |

TOTAL NET ASSETS – 100.00% | | | | | | $ | 16,250,774 | | | | 100.00 | % |

Percentages are stated as a percent of net assets.

| (a) | Non-income-producing security. |

| (b) | U.S.-traded security of a foreign corporation. |

| (c) | The rate listed is the fund’s seven-day yield as of October 31, 2021. |

The accompanying notes are an integral part of these financial statements.

Summary of Fair Value Exposure as of October 31, 2021

The following is a summary of the inputs used to value the Fund’s net assets as of October 31, 2021 (see Note 3 in the accompanying Notes to the Financial Statements):

| Common Stocks | | Level 1 | | | Level 2 | | | Level 3 | | | Total | |

| Downstream | | $ | 1,086,703 | | | $ | — | | | $ | — | | | $ | 1,086,703 | |

| Exploration & Production | | | 6,926,932 | | | | — | | | | — | | | | 6,926,932 | |

| Integrated | | | 1,415,451 | | | | — | | | | — | | | | 1,415,451 | |

| Midstream | | | 734,140 | | | | — | | | | — | | | | 734,140 | |

| Oil Services | | | 2,589,392 | | | | — | | | | — | | | | 2,589,392 | |

| Utility | | | 1,569,260 | | | | — | | | | — | | | | 1,569,260 | |

| Total Common Stocks | | $ | 14,321,878 | | | $ | — | | | $ | — | | | $ | 14,321,878 | |

| Partnerships & Trusts | | | | | | | | | | | | | | | | |

| Midstream | | $ | 1,449,451 | | | $ | — | | | $ | — | | | $ | 1,449,451 | |

| Total Partnerships & Trusts | | $ | 1,449,451 | | | $ | — | | | $ | — | | | $ | 1,449,451 | |

| Short-Term Investments | | | | | | | | | | | | | | | | |

| Money Market Funds | | $ | 570,411 | | | $ | — | | | $ | — | | | $ | 570,411 | |

| Total Short-Term Investments | | $ | 570,411 | | | $ | — | | | $ | — | | | $ | 570,411 | |

| Total Investments | | $ | 16,341,740 | | | $ | — | | | $ | — | | | $ | 16,341,740 | |

The accompanying notes are an integral part of these financial statements.

| HENNESSY FUNDS | 1-800-966-4354 | |

Financial Statements

Statement of Assets and Liabilities as of October 31, 2021 |

| ASSETS: | | | |

| Investments in securities, at value (cost $13,881,513) | | $ | 16,341,740 | |

| Dividends and interest receivable | | | 5,327 | |

| Receivable for fund shares sold | | | 16,425 | |

| Return of capital receivable | | | 18,096 | |

| Prepaid expenses and other assets | | | 8,363 | |

| Total assets | | | 16,389,951 | |

| | | | | |

| LIABILITIES: | | | | |

| Payable for fund shares redeemed | | | 81,355 | |

| Payable to advisor | | | 16,461 | |

| Payable to auditor | | | 23,108 | |

| Accrued distribution fees | | | 1,557 | |

| Accrued service fees | | | 545 | |

| Accrued trustees fees | | | 6,596 | |

| Accrued expenses and other payables | | | 9,555 | |

| Total liabilities | | | 139,177 | |

| NET ASSETS | | $ | 16,250,774 | |

| | | | | |

| NET ASSETS CONSISTS OF: | | | | |

| Capital stock | | $ | 54,597,413 | |

| Accumulated deficit | | | (38,346,639 | ) |

| Total net assets | | $ | 16,250,774 | |

| | | | | |

| NET ASSETS: | | | | |

| Investor Class | | | | |

| Shares authorized (no par value) | | Unlimited | |

| Net assets applicable to outstanding shares | | $ | 6,802,285 | |

| Shares issued and outstanding | | | 371,536 | |

| Net asset value, offering price, and redemption price per share | | $ | 18.31 | |

| | | | | |

| Institutional Class | | | | |

| Shares authorized (no par value) | | Unlimited | |

| Net assets applicable to outstanding shares | | $ | 9,448,489 | |

| Shares issued and outstanding | | | 508,093 | |

| Net asset value, offering price, and redemption price per share | | $ | 18.60 | |

The accompanying notes are an integral part of these financial statements.

| STATEMENT OF ASSETS AND LIABILITIES/STATEMENT OF OPERATIONS |

Financial Statements

Statement of Operations for the year ended October 31, 2021 |

| INVESTMENT INCOME: | | | |

| Distributions received from master limited partnerships | | $ | 107,506 | |

| Return of capital on distributions received | | | (107,506 | ) |

Dividend income from common stock(1) | | | 320,838 | |

| Interest income | | | 42 | |

| Total investment income | | | 320,880 | |

| | | | | |

| EXPENSES: | | | | |

| Investment advisory fees (See Note 5) | | | 135,718 | |

| Federal and state registration fees | | | 30,632 | |

| Compliance expense (See Note 5) | | | 27,445 | |

| Administration, accounting, custody, and transfer agent fees (See Note 5) | | | 24,086 | |

| Audit fees | | | 23,108 | |

| Trustees’ fees and expenses | | | 18,463 | |

| Sub-transfer agent expenses – Investor Class (See Note 5) | | | 8,551 | |

| Sub-transfer agent expenses – Institutional Class (See Note 5) | | | 5,423 | |

| Reports to shareholders | | | 7,999 | |

| Distribution fees – Investor Class (See Note 5) | | | 7,146 | |

| Service fees – Investor Class (See Note 5) | | | 4,764 | |

| Interest expense (See Note 7) | | | 1,193 | |

| Legal fees | | | 192 | |

| Other expenses | | | 5,163 | |

| Total expenses before waivers | | | 299,883 | |

| Service provider expense waiver (See Note 5) | | | (24,086 | ) |

| Net expenses | | | 275,797 | |

| NET INVESTMENT INCOME | | $ | 45,083 | |

| | | | | |

| REALIZED AND UNREALIZED GAINS (LOSSES): | | | | |

| Net realized gain on investments | | $ | 1,234,155 | |

| Net change in unrealized appreciation/depreciation on investments | | | 5,107,361 | |

| Net gain on investments | | | 6,341,516 | |

| NET INCREASE IN NET ASSETS RESULTING FROM OPERATIONS | | $ | 6,386,599 | |

(1) | Net of foreign taxes withheld and issuance fees of $1,955. |

The accompanying notes are an integral part of these financial statements.

| HENNESSY FUNDS | 1-800-966-4354 | |

(This Page Intentionally Left Blank.)

| STATEMENTS OF CHANGES IN NET ASSETS |

Financial Statements

| Statements of Changes in Net Assets |

| | | Year Ended | | | Year Ended | |

| | | October 31, 2021 | | | October 31, 2020 | |

| OPERATIONS: | | | | | | |

| Net investment income | | $ | 45,083 | | | $ | 195,908 | |

| Net realized gain (loss) on investments | | | 1,234,155 | | | | (19,552,986 | ) |

| Net change in unrealized | | | | | | | | |

| appreciation/depreciation on investments | | | 5,107,361 | | | | 3,844,502 | |

| Net increase (decrease) in net | | | | | | | | |

| assets resulting from operations | | | 6,386,599 | | | | (15,512,576 | ) |

| | | | | | | | | |

| DISTRIBUTIONS TO SHAREHOLDERS: | | | | | | | | |

| Distributable earnings – Institutional Class | | | — | | | | (79,003 | ) |

| Total distributions | | | — | | | | (79,003 | ) |

| | | | | | | | | |

| CAPITAL SHARE TRANSACTIONS: | | | | | | | | |

| Proceeds from shares subscribed – Investor Class | | | 7,710,426 | | | | 2,364,355 | |

| Proceeds from shares subscribed – Institutional Class | | | 5,598,042 | | | | 2,010,096 | |

| Dividends reinvested – Institutional Class | | | — | | | | 77,299 | |

| Cost of shares redeemed – Investor Class | | | (6,158,757 | ) | | | (4,505,031 | ) |

| Cost of shares redeemed – Institutional Class | | | (3,599,017 | ) | | | (29,242,373 | ) |

| Net increase (decrease) in net assets | | | | | | | | |

| derived from capital share transactions | | | 3,550,694 | | | | (29,295,654 | ) |

| TOTAL INCREASE (DECREASE) IN NET ASSETS | | | 9,937,293 | | | | (44,887,233 | ) |

| | | | | | | | | |

| NET ASSETS: | | | | | | | | |

| Beginning of year | | | 6,313,481 | | | | 51,200,714 | |

| End of year | | $ | 16,250,774 | | | $ | 6,313,481 | |

| | | | | | | | | |

| CHANGES IN SHARES OUTSTANDING: | | | | | | | | |

| Shares sold – Investor Class | | | 521,054 | | | | 265,356 | |

| Shares sold – Institutional Class | | | 329,240 | | | | 207,448 | |

| Shares issued to holders as reinvestment | | | | | | | | |

| of dividends – Institutional Class | | | — | | | | 5,019 | |

| Shares redeemed – Investor Class | | | (435,171 | ) | | | (464,633 | ) |

| Shares redeemed – Institutional Class | | | (252,362 | ) | | | (2,892,945 | ) |

| Net increase (decrease) in shares outstanding | | | 162,761 | | | | (2,879,755 | ) |

The accompanying notes are an integral part of these financial statements.

| HENNESSY FUNDS | 1-800-966-4354 | |

Financial Statements

For an Investor Class share outstanding throughout each period

PER SHARE DATA:

Net asset value, beginning of period

Income from investment operations:

Net investment income (loss)(2)

Net realized and unrealized gains (losses) on investments

Total from investment operations

Net asset value, end of period

TOTAL RETURN

SUPPLEMENTAL DATA AND RATIOS:

Net assets, end of period (millions)

Ratio of expenses to average net assets:

Before expense reimbursement

After expense reimbursement

Ratio of net investment income (loss) to average net assets:

Before expense reimbursement

After expense reimbursement

Portfolio turnover rate(7)

(1) | The period ended October 31, 2018, consists of 11 months due to the Fund’s fiscal year end change from November 30 to October 31, effective October 26, 2018. |

(2) | Calculated using the average shares outstanding method. |

(3) | Not annualized. |

(4) | Annualized. |

(5) | The Fund had an expense limitation agreement in place through October 25, 2020. |

(6) | Certain service provider expenses were voluntarily waived during the fiscal year. |

(7) | Calculated on the basis of the Fund as a whole. |

The accompanying notes are an integral part of these financial statements.

| FINANCIAL HIGHLIGHTS — INVESTOR CLASS |

| Year Ended October 31, | | | Period Ended | | | Year Ended November 30, | |

| | | October 31, | | | |

| 2021 | | | 2020 | | | 2019 | | | 2018(1) | | | 2017 | | | 2016 | |

| | | | | | | | | | | | | | | | | |

| $ | 8.74 | | | $ | 14.08 | | | $ | 18.32 | | | $ | 19.47 | | | $ | 20.54 | | | $ | 16.41 | |

| | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | |

| | 0.06 | | | | 0.04 | | | | (0.07 | ) | | | (0.20 | ) | | | (0.23 | ) | | | (0.15 | ) |

| | 9.51 | | | | (5.38 | ) | | | (4.17 | ) | | | (0.95 | ) | | | (0.84 | ) | | | 4.28 | |

| | 9.57 | | | | (5.34 | ) | | | (4.24 | ) | | | (1.15 | ) | | | (1.07 | ) | | | 4.13 | |

| $ | 18.31 | | | $ | 8.74 | | | $ | 14.08 | | | $ | 18.32 | | | $ | 19.47 | | | $ | 20.54 | |

| | | | | | | | | | | | | | | | | | | | | | | |

| | 109.50 | % | | | -37.93 | % | | | -23.14 | % | | | -5.91 | %(3) | | | -5.21 | % | | | 25.17 | % |

| | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | |

| $ | 6.80 | | | $ | 2.50 | | | $ | 6.83 | | | $ | 18.16 | | | $ | 22.66 | | | $ | 19.64 | |

| | | | | | | | | | | | | | | | | | | | | | | |

| | 2.96 | % | | | 2.59 | % | | | 1.97 | % | | | 1.82 | %(4) | | | 1.87 | % | | | 1.89 | % |

| | 2.74 | %(6) | | | 2.03 | %(5)(6) | | | 1.97 | % | | | 1.82 | %(4) | | | 1.87 | % | | | 1.89 | % |

| | | | | | | | | | | | | | | | | | | | | | | |

| | 0.16 | % | | | (0.18 | )% | | | (0.46 | )% | | | (1.05 | )%(4) | | | (1.21 | )% | | | (0.92 | )% |

| | 0.38 | % | | | 0.38 | % | | | (0.46 | )% | | | (1.05 | )%(4) | | | (1.21 | )% | | | (0.92 | )% |

| | 74 | % | | | 73 | % | | | 87 | % | | | 72 | %(3) | | | 84 | % | | | 83 | % |

The accompanying notes are an integral part of these financial statements.

| HENNESSY FUNDS | 1-800-966-4354 | |

Financial Statements

For an Institutional Class share outstanding throughout each period

PER SHARE DATA:

Net asset value, beginning of period

Income from investment operations:

Net investment income (loss)(2)

Net realized and unrealized gains (losses) on investments

Total from investment operations

Less distributions:

Dividends from net investment income

Total distributions

Net asset value, end of period

TOTAL RETURN

SUPPLEMENTAL DATA AND RATIOS:

Net assets, end of period (millions)

Ratio of expenses to average net assets:

Before expense reimbursement

After expense reimbursement

Ratio of net investment income (loss) to average net assets:

Before expense reimbursement

After expense reimbursement

Portfolio turnover rate(7)

(1) | The period ended October 31, 2018, consists of 11 months due to the Fund’s fiscal year end change from November 30 to October 31, effective October 26, 2018. |

(2) | Calculated using the average shares outstanding method. |

(3) | Not annualized. |

(4) | Annualized. |

(5) | The Fund had an expense limitation agreement in place through October 25, 2020. |

(6) | Certain service provider expenses were voluntarily waived during the fiscal year. |

(7) | Calculated on the basis of the Fund as a whole. |

The accompanying notes are an integral part of these financial statements.

| FINANCIAL HIGHLIGHTS — INSTITUTIONAL CLASS |

| Year Ended October 31, | | | Period Ended | | | Year Ended November 30, | |

| | | October 31, | | | |

| 2021 | | | 2020 | | | 2019 | | | 2018(1) | | | 2017 | | | 2016 | |

| | | | | | | | | | | | | | | | | |

| $ | 8.85 | | | $ | 14.26 | | | $ | 18.50 | | | $ | 19.61 | | | $ | 20.64 | | | $ | 16.46 | |

| | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | |

| | 0.07 | | | | 0.12 | | | | (0.02 | ) | | | (0.15 | ) | | | (0.19 | ) | | | (0.11 | ) |

| | 9.68 | | | | (5.50 | ) | | | (4.22 | ) | | | (0.96 | ) | | | (0.84 | ) | | | 4.32 | |

| | 9.75 | | | | (5.38 | ) | | | (4.24 | ) | | | (1.11 | ) | | | (1.03 | ) | | | 4.21 | |

| | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | |

| | — | | | | (0.03 | ) | | | — | | | | — | | | | — | | | | (0.03 | ) |

| | — | | | | (0.03 | ) | | | — | | | | — | | | | — | | | | (0.03 | ) |

| $ | 18.60 | | | $ | 8.85 | | | $ | 14.26 | | | $ | 18.50 | | | $ | 19.61 | | | $ | 20.64 | |

| | | | | | | | | | | | | | | | | | | | | | | |

| | 110.17 | % | | | -37.80 | % | | | -22.92 | % | | | -5.66 | %(3) | | | -4.99 | % | | | 25.61 | % |

| | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | |

| $ | 9.45 | | | $ | 3.82 | | | $ | 44.37 | | | $ | 78.81 | | | $ | 122.45 | | | $ | 126.92 | |

| | | | | | | | | | | | | | | | | | | | | | | |

| | 2.61 | % | | | 2.01 | % | | | 1.66 | % | | | 1.57 | %(4) | | | 1.62 | % | | | 1.60 | % |

| | 2.39 | %(6) | | | 1.77 | %(5)(6) | | | 1.66 | % | | | 1.57 | %(4) | | | 1.62 | % | | | 1.60 | % |

| | | | | | | | | | | | | | | | | | | | | | | |

| | 0.22 | % | | | 0.79 | % | | | (0.12 | )% | | | (0.79 | )%(4) | | | (0.98 | )% | | | (0.65 | )% |

| | 0.44 | % | | | 1.03 | % | | | (0.12 | )% | | | (0.79 | )%(4) | | | (0.98 | )% | | | (0.65 | )% |

| | 74 | % | | | 73 | % | | | 87 | % | | | 72 | %(3) | | | 84 | % | | | 83 | % |

The accompanying notes are an integral part of these financial statements.

| HENNESSY FUNDS | 1-800-966-4354 | |

Financial Statements

Notes to the Financial Statements October 31, 2021 |

1). ORGANIZATION

The Hennessy BP Energy Transition Fund (the “Fund”) is a series of Hennessy Funds Trust (the “Trust”), which was organized as a Delaware statutory trust on September 17, 1992. The Fund is an open-end management investment company registered under the Investment Company Act of 1940, as amended. The investment objective of the Fund is to seek total return. The Fund is a diversified fund.

The Fund offers Investor Class and Institutional Class shares. Each class of shares differs principally in its respective 12b-1 distribution and service, shareholder servicing, and sub-transfer agent expenses. There are no sales charges. Each class has identical rights to earnings, assets, and voting privileges, except for class-specific expenses and exclusive rights to vote on matters affecting only one class.

As an investment company, the Fund follows the investment company accounting and reporting guidance of the Financial Accounting Standards Board (“FASB”) Accounting Standard Codification Topic 946 “Financial Services—Investment Companies.”

2). SIGNIFICANT ACCOUNTING POLICIES

The following is a summary of significant accounting policies consistently followed by the Fund in the preparation of the financial statements. These policies conform to U.S. generally accepted accounting principles (“GAAP”).

| a). | Securities Valuation – All investments in securities are valued in accordance with the Fund’s valuation policies and procedures, as described in Note 3. |

| | |