UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number | 811-7762 |

|

First Eagle High Yield Fund |

(Exact name of registrant as specified in charter) |

|

1345 Avenue of the Americas New York, NY | | 10105-4300 |

(Address of principal executive offices) | | (Zip code) |

|

Robert Bruno First Eagle Funds 1345 Avenue of the Americas New York, NY 10105-4300 |

(Name and address of agent for service) |

|

Registrant’s telephone number, including area code: | 1-212-632-2700 | |

|

Date of fiscal year end: | March 31 | |

|

Date of reporting period: | March 31, 2012 | |

| | | | | | | | |

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

Item 1. | Reports to Stockholders. |

Annual Report

MARCH 31, 2012

High Yield Fund

ADVISED BY FIRST EAGLE INVESTMENT MANAGEMENT, LLC

Forward-Looking Statement Disclosure

One of our most important responsibilities as mutual fund managers is to communicate with shareholders in an open and direct manner. Some of our comments in our letters to shareholders are based on current management expectations and are considered "forward-looking statements". Actual future results, however, may prove to be different from our expectations. You can identify forward-looking statements by words such as "may", "will", "believe", "attempt", "seem", "think", "ought", "try" and other similar terms. We cannot promise future returns. Our opinions are a reflection of our best judgment at the time this report is compiled, and we disclaim any obligation to update or alter forward-looking statements as a result of new information, future events, or otherwise.

Table of Contents

| Letter from the President | | | 4 | | |

|

| Letter from the High Yield Team Portfolio Managers | | | 6 | | |

|

| Management's Discussion of Fund Performance | | | 8 | | |

|

| Fund Overview | | | 12 | | |

|

| Schedule of Investments | | | 14 | | |

|

| Statement of Assets and Liabilities | | | 24 | | |

|

| Statement of Operations | | | 26 | | |

|

| Statements of Changes in Net Assets | | | 27 | | |

|

| Financial Highlights | | | 28 | | |

|

| Notes to Financial Statements | | | 30 | | |

|

| Report of Independent Registered Public Accounting Firm | | | 43 | | |

|

| Fund Expenses | | | 44 | | |

|

| General Information | | | 46 | | |

|

| Tax Information | | | 47 | | |

|

| Privacy Notice | | | 48 | | |

|

| Additional Information | | | 50 | | |

|

| Consideration of Investment Advisory Agreement | | | 56 | | |

|

Letter from the President

John P. Arnhold

Dear Fellow Shareholders,

I would like to welcome our new high yield shareholders to First Eagle Investment Management.

On December 30, 2011 we launched the First Eagle High Yield Fund, our first new fund in over a decade. At First Eagle, we believe that we should only offer investment products that meet a stringent set of investment guidelines. When we launch a new fund, we must believe that the investment approach can offer investors the potential of preserving their principal and the prospect of absolute returns over time. In addition, we must have confidence that the investment team has the right philosophical approach to seek superior long-term performance. Finally, we must be prepared to invest our own money in the new fund.

After a two-year search for a like-minded fixed income investment team, we are delighted to welcome Portfolio Managers Edward Meigs and Sean Slein and their seasoned team of analysts to First Eagle Investment Management. The four senior members of the team have worked together for almost ten years, through two credit cycles. With a similar absolute return philosophy, fundamental bottom-up investment process, and prudent approach to risk, we believe this team is a natural fit for the firm.

This Fund seeks to provide a high level of current income. The team strives to achieve this investment objective by focusing on managing downside risks—avoiding the permanent impairment of capital by investing in high yield securities with what they deem to be an appropriate margin of safety. This focus is central to the value philosophy of our firm and extends across our investment products.

Although this is a new fund, high yield investing is not new to First Eagle. We have long been investors in high yield securities. Our exposure to this investment class has varied over time. We are now pleased to be able to offer investors a dedicated high yield investment vehicle.

FIRST EAGLE HIGH YIELD FUND | ANNUAL REPORT | MARCH 31, 2012

4

Letter from the President (continued)

As always, we have substantial investments in the Fund alongside yours, and we are grateful for your continued confidence.

Sincerely,

John P. Arnhold

President

May 2012

Past performance is no guarantee of future results. The portfolio is actively managed. The portfolio and opinions expressed herein are subject to change. Current and future portfolio holdings are subject to risk. All investments involve the risk of loss of principal. High yield securities involve greater risk than higher rated securities and portfolios that invest in them may be subject to greater levels of credit and liquidity risk than portfolios that do not.

FIRST EAGLE HIGH YIELD FUND | ANNUAL REPORT | MARCH 31, 2012

5

Letter from the High Yield Team Portfolio Managers

The year ended March 31, 2012 was a tale of two halves. Systemic concerns out of the European periphery re-emerged last summer, and coupled with budgetary brinksmanship out of Washington, took the collective wind out of the market's sails in the first half. As a result, spreads ballooned wider into early autumn, pushing yields over 10% for the first time since late 2009—mere weeks following the setting of an all-time low yield in May. In contrast, towards the latter half, the market's focus returned to sound corporate fundamentals benefited by improving economic numbers. Risk appetite returned as a healthy primary market and stable investor interest forged a constructive credit environment.

Primary market activity slowed to a trickle in late summer but resumed at a heady pace by late autumn. In fact, new issuance set a record in the quarter ended March 31, 2012 and fell $2 billion shy of eclipsing the $100 billion mark. Deal quality remained above average and continued to be dominated by refinancing activity. Certainly, issuance tends to be pro-cyclical as investor demand is a key driver. Issuances increased early in the year, fell off midyear and then gained momentum again in the latter part of the year following the aforementioned better economic news and reduced risk aversion.

We expect conditions to remain constructive for the leveraged credit markets, given where we are in the credit cycle. Virtually every company throughout the credit spectrum enjoys access to the primary market and many have taken advantage of this by terming out shorter maturities. Refinancing has provided the ability to extend the optionality of the enterprise as well as reduce debt servicing costs. Many companies remain cautioned by near death experiences in 2008 and are actively reducing cost structures as they manage balance sheet exposure. Consequently, refinancing activity is generally lowering default risk. We expect default activity to remain well below historical averages and approximate 2% or lower over the coming year.

Given our expectations of a continuing benign default environment, we believe high yield is positioned to perform well relative to other asset classes in the coming quarters. Several factors point to attractive risk-adjusted opportunities for leveraged credit. The Federal Reserve remains committed to an accommodative monetary policy for the foreseeable future. Easier Fed policy provides a tangible incentive to move down the credit spectrum to pick up incremental yield in a steady to improving economic environment. Moreover, refinancing activity continues to be the dominant form of issuance and serves to lower overall market risk through the extension of maturities. Lastly, given our

FIRST EAGLE HIGH YIELD FUND | ANNUAL REPORT | MARCH 31, 2012

6

Letter from the High Yield Team Portfolio Managers (continued)

expectations for low default activity, market spreads remain attractive at around 580 basis points1—factoring in default levels that are well above current and expected levels.

As a result, we remain optimistic as market conditions today appear stable. In contrast to years when defaults were elevated, many companies today are delevering, cutting costs, and have consequently boosted productivity. Moreover, equity friendly corporate activity remains lower than average as a share of primary issuance. Lower market leverage and accommodative Federal Reserve policy supports today's healthier market conditions. All of these factors collectively paint a positive fundamental picture for high yield and, in our view, should underpin the asset class even in a tepid growth environment.

We appreciate your confidence and thank you for your support.

Sincerely,

| |  | |

|

| Edward Meigs, | | Sean Slein, | |

|

| Portfolio Manager | | Portfolio Manager | |

|

May 2012

1 Barclays Capital U.S. Corporate High Yield Index option-adjusted spread as of March 31, 2012.

FIRST EAGLE HIGH YIELD FUND | ANNUAL REPORT | MARCH 31, 2012

7

Management's Discussion of Fund Performance

Despite choppy quarterly performance, the high yield market posted positive returns for the twelve-months ended March 31, 2012. The net asset value ("NAV") of First Eagle High Yield Fund Class I Shares* rose 6.11% for the year, while the Barclays Capital U.S. Corporate High Yield Index increased 6.45%.

Throughout the past fiscal year, the Fund remained significantly overweight single-B rated issues and underweight triple-C rated issues. This weighting had a clear impact on performance in each of the four quarters. The Fund outperformed marginally in the first quarter, returning 1.14% versus the Index return of 1.09%. The market continued to weaken and second quarter returns were negative for both the Fund, down -5.97%, and the Index, down -6.06%. In the second quarter triple-C rated issues underperformed with a return of -13.5%, clearly dragging down overall Index performance, as double-B issues returned -4.20% and single-B issues returned -5.90%. This trend reversed in the third quarter as the market's appetite for risk shifted and triple-C issues returned over 8.00%. As a result, the Fund significantly underperformed with a return of 4.94% for the third quarter, while the Index returned 6.46%. The Fund made up a good amount of the shortfall in the fourth quarter with a return of 6.33% while the Index was up 5.34%. Single-B issues outperformed double-B issues by over 50 basis points, contributing to the Fund's outperformance for the quarter.

The five largest contributors to the performance of the Fund for the year were Bon-Ton Department Stores Inc. (retail apparel and furniture chain operator), PVH Corporation (apparel company whose brands include Tommy Hilfiger and ARROW), Rhodia S.A. (chemicals manufacturer located in France), Shea Homes L.P. (homebuilding construction firm), and Bi-Lo (Southeastern domestic supermarket chain), collectively accounting for 1.17 percentage points of the year's performance.

The five largest detractors were CMA CGM SA (European container shipping company), Midwest Vanadium Pty Limited (Western Australian iron ore and vanadium producer), Mashantucket Western Pequot Tribe (resort and casino operator), Thompson Creek Metals Co., Inc. (North American mining company), and FCC Holdings, Inc. (commercial financial services firm). Their combined negative performance over the twelve month period subtracted 1.99 percentage points from the Fund's performance.

As of March 31, 2012 the Fund was approximately 100% hedged against the Euro, which is the Fund's only foreign currency exposure. The Fund has always been involved to varying degrees in Yankee issuance of primarily western

FIRST EAGLE HIGH YIELD FUND | ANNUAL REPORT | MARCH 31, 2012

8

Management's Discussion of Fund Performance (continued)

European and NAFTA companies. European banks have traditionally been the major intermediaries of credit, but balance sheet weakness and solvency concerns along the periphery have led to the continued development of the European capital markets. Accordingly, there has been greater European issuance in the high yield market in both U.S. Dollar and Euro terms. As a result, the Fund participated in several U.S. Dollar and Euro issues, which in many cases have come with what we consider to be attractive price and/or structural concessions. The Fund is expected to remain involved as the European capital markets continue to evolve.

We appreciate your confidence and thank you for your support.

| |  | |

|

| Edward Meigs | | Sean Slein | |

|

| Portfolio Manager | | Portfolio Manager | |

|

May 2012

The performance data quoted herein represents past performance and does not guarantee future results. Market volatility can dramatically impact the Fund's short-term performance. Current performance may be lower or higher than figures shown. The investment return and principal value will fluctuate so that an investor's shares, when redeemed, may be worth more or less than their original cost. Past performance data through the most recent month end is available at firsteaglefunds.com or by calling 800.334.2143.

*Class I Shares require $1mm minimum investment, and are offered without sales charge. Had fees not been waived and/or expenses reimbursed, the performance would have been lower. The Adviser has contractually agreed to limit operating expenses of the Fund to an annual rate of 0.80% for I Shares, 1.25% for A Shares, and 2.00% for C Shares, with gross operating expenses of 1.05%, 1.12%, and 1.83% respectively. Gross operating expenses are the actual fund operating expenses prior to the application of fee waivers and/or expense reimbursements. This limitation excludes certain expenses as described in the Fees and Expenses section of the prospectus. This limitation will continue until 2013 for I-Shares, and until 2012 for A and C Shares. The expense limitation may be terminated by the Adviser in future years.

The Fund commenced operations in its present form on or about December 30, 2011, and is successor to another mutual fund pursuant to a reorganization on December 30, 2011. Information prior to December 30, 2011 is for the predecessor fund. Immediately after the reorganization, changes in net asset value of the Class I shares were partially impacted by differences in how the Fund and the predecessor fund price portfolio securities.

FIRST EAGLE HIGH YIELD FUND | ANNUAL REPORT | MARCH 31, 2012

9

Management's Discussion of Fund Performance (continued)

The Fund invests in high yield, fixed income securities that, at the time of purchase, are non-investment grade. High yield, lower rated securities involve greater price volatility and present greater risks than high rated fixed income securities. High yield securities are rated lower than investment-grade securities because there is a greater possibility that the issuer may be unable to make interest and principal payments on those securities. High yield securities involve greater risk than higher rated securities and portfolios that invest in them may be subject to greater levels of credit and liquidity risk than portfolios that do not.

There are risks associated with investing in securities of non-U.S. countries such as erratic market conditions, economic and political instability and fluctuations in currency exchange rates.

The Fund's investment strategies may result in high turnover rates. This may increase the Fund's brokerage commission costs, which would reduce performance. Rapid portfolio turnover also exposes shareholders to a higher current realization of short-term gains.

All investments involve the risk of loss.

Hedging can reduce exposure to currency exchange movements, but cannot eliminate that exposure. It is possible to lose money under a hedge. Results from hedging transactions, which for the Fund is primarily currency forward contracts, are further described in the financial statements that follow this commentary.

The portfolio is actively managed. The portfolio and opinions expressed herein are subject to change. Current and future portfolio holdings are subject to risk.

The Barclays Capital U.S. Corporate High Yield Bond Index is composed of fixed-rate, publicly issued, non-investment grade debt, is unmanaged, with dividends reinvested, and is not available for purchase. The index includes both corporate and non-corporate sectors. The corporate sectors are Industrial, Utility, and Finance, which include both U.S. and non-U.S. corporations. The index is presented here for comparison purposes only. One cannot invest directly in an index.

The commentary represents the opinion of the First Eagle High Yield Fund Portfolio Managers as of May 2012 and is subject to change based on market and other conditions. The opinions expressed are not necessarily those of the firm. These materials are provided for informational purpose only. These opinions are not intended to be a forecast of future events, a guarantee of future results, or investment advice. Any statistics contained herein have been obtained from sources believed to be reliable, but the accuracy of this information cannot be guaranteed. The views expressed herein may change at any time subsequent to the date of issue hereof. The information provided is not to be construed as a recommendation or an offer to buy or sell or the solicitation of an offer to buy or sell any fund or security.

FIRST EAGLE HIGH YIELD FUND | ANNUAL REPORT | MARCH 31, 2012

10

This page was intentionally left blank.

Fund Overview | Data as of March 31, 2012 (unaudited)

INVESTMENT OBJECTIVE

First Eagle High Yield Fund seeks to provide investors with a high level of current income. The Fund will invest at least 80% of its net assets under normal market conditions in high yield, below investment-grade instruments, or other instruments.

Average Annual Returns*

| | | ONE-YEAR | | THREE-YEARS | | SINCE

INCEPTION

(11/19/07) | |

First Eagle High

Yield Fund I Shares | | | 6.11 | % | | | 24.73 | % | | | 13.40 | % | |

Barclays Capital

U.S. Corporate High

Yield Bond Index | | | 6.45 | | | | 23.87 | | | | 9.71 | | |

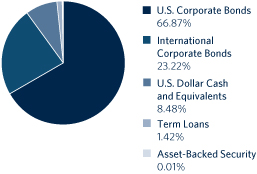

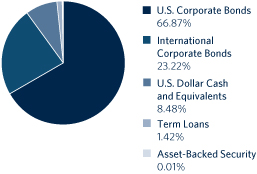

Asset Allocation**

Countries**

| United States | | | 68.30 | % | |

| United Kingdom | | | 4.16 | | |

| Ireland | | | 3.21 | | |

| Cayman Islands | | | 2.74 | | |

| Netherlands | | | 2.71 | | |

| Canada | | | 2.01 | | |

| Bermuda | | | 1.75 | | |

| Australia | | | 1.54 | | |

| France | | | 1.31 | | |

| Norway | | | 1.21 | | |

| Sweden | | | 1.15 | | |

| Malaysia | | | 1.01 | | |

| Austria | | | 0.22 | | |

| Luxembourg | | | 0.20 | | |

*If the Adviser had not waived fees, returns would have been lower.

**Asset allocation percentages are based on total investments in the portfolio. Country allocations exclude short term investments.

The Fund's portfolio composition is subject to change at any time.

FIRST EAGLE HIGH YIELD FUND | ANNUAL REPORT | MARCH 31, 2012

12

High Yield Fund

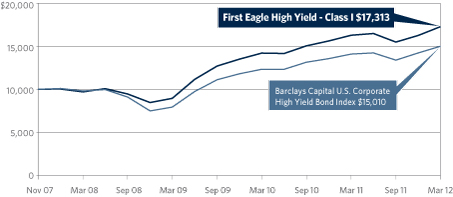

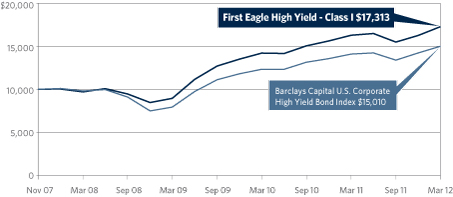

Growth of a $10,000 Initial Investment

Performance data quoted herein represents past performance and should not be considered indicative of future results. Performance data quoted herein does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the sale of Fund shares. The average annual returns shown above are historical and reflect changes in share price, reinvested dividends and are net of expenses. The average annual returns for Class I Shares do not give effect to the deduction of a maximum sales charge. The Fund commenced operations in its present form on or about December 30, 2011 and is the successor to the Old Mutual High Yield Fund (the "Predecessor Fund") pursuant to reorganization on or about the same date. The Predecessor Fund had similar investment objectives and strategies as the Fund, but was managed by another investment adviser. Information prior to December 30, 2011 is for the Predecessor Fund. The chart above illustrates a hypothetical investment in Class I shares without the effect of sales charges and assumes all distributions have been reinvested and if a sales charge was included values would be lower. Had fees not been waived and/or expenses reimbursed, the performance would have been lower. Class I Shares require $1mm minimum investment, and are offered without sales charge. Class A and C Shares have maximum sales charges of 4.50% and 1.00% respectively, and 12b-1 fees, which reduce performance. The Barclays Capital U.S. Corporate High Yield Bond Index is composed of fixed-rate, publicly issued, non-investment grade debt, is unmanaged, with dividends reinvested, and is not available for purchase. The index includes both corporate and non-corporate sectors. The corporate sectors are Industrial, Utility, and Finance, which include both U.S. and non-U.S. corporations. The index is presented here for comparison purposes only. One cannot invest directly in an index.

Top 10 Holdings*

| Citgo Petroleum Corporation (U.S. refiner and marketer of transportation fuels) | | | 2.16 | % | |

| HeidelbergCement Finance BV (German manufacturer of cement, concrete, and building materials) | | | 2.01 | | |

| Allied Irish Banks PLC (Irish retail and commercial banking) | | | 1.92 | | |

| Bon-Ton Department Stores, Inc. (U.S. retail department store) | | | 1.69 | | |

| AM Castle & Company (U.S. metal and plastic products distributor) | | | 1.69 | | |

| Midwest Gaming Borrower (U.S. gaming & entertainment company) | | | 1.66 | | |

| RDS Ultra-Deepwater Limited (Cayman Islands drilling company) | | | 1.65 | | |

| Manitowoc Company, Inc. (U.S. capital goods manufacturing company) | | | 1.63 | | |

| Jaguar Land Rover PLC (United Kingdom automobile manufacturer) | | | 1.57 | | |

| Atwood Oceanics, Inc. (U.S. drilling company) | | | 1.53 | | |

| Total | | | 17.51 | % | |

*Holdings in cash and commercial paper have been excluded. Percentages are based on total net assets.

FIRST EAGLE HIGH YIELD FUND | ANNUAL REPORT | MARCH 31, 2012

13

First Eagle High Yield Fund

| PRINCIPAL | | DESCRIPTION | | COST (NOTE 1) | | VALUE (NOTE 1) | |

| Bonds — 91.01% | | | |

| U.S. Corporate Bonds — 67.56% | | | |

| $ | 945,000 | | | Accuride Corporation

9.50% due 08/01/18 | | $ | 963,088

| | | $ | 996,975

| | |

| | 1,847,000 | | | Air Lease Corporation

5.625% due 04/01/17 (a) | | | 1,845,757

| | | | 1,849,309

| | |

| | 2,800,000 | | | AK Steel Corporation

8.375% due 04/01/22 | | | 2,811,399

| | | | 2,730,000

| | |

| | 2,456,000 | | | Alliance One International, Inc.

10.00% due 07/15/16 | | | 2,399,521

| | | | 2,480,560

| | |

| | 500,000 | | | Alpha Natural Resources, Inc.

6.00% due 06/01/19 | | | 492,684

| | | | 455,000

| | |

| | 3,150,000 | | | AM Castle & Company

12.75% due 12/15/16 (a) | | | 3,327,062

| | | | 3,425,625

| | |

| | 1,249,000 | | | American Axle & Manufacturing, Inc.

7.875% due 03/01/17 | | | 1,296,911

| | | | 1,292,715

| | |

| | 2,100,000 | | | AMGH Merger Sub, Inc.

9.25% due 11/01/18 (a) | | | 2,264,287

| | | | 2,194,500

| | |

| | 2,975,000 | | | Appleton Papers, Inc.

10.50% due 06/15/15 (a) | | | 3,049,741

| | | | 3,101,437

| | |

| | 2,950,000 | | | Atwood Oceanics, Inc.

6.50% due 02/01/20 | | | 3,099,815

| | | | 3,112,250

| | |

| | 2,406,000 | | | Basic Energy Services, Inc.

7.125% due 04/15/16 | | | 2,445,672

| | | | 2,454,120

| | |

| | 688,000 | | | Basic Energy Services, Inc.

7.75% due 02/15/19 | | | 699,981

| | | | 708,640

| | |

| | 1,200,000 | | | Berry Petroleum Company

6.375% due 09/15/22 | | | 1,200,559

| | | | 1,236,000

| | |

| | 2,725,000 | | | Bi-Lo

9.25% due 02/15/19 (a) | | | 2,874,900

| | | | 2,902,125

| | |

| | 3,910,000 | | | Bon-Ton Department Stores, Inc.

10.25% due 03/15/14 | | | 2,717,767

| | | | 3,431,025

| | |

| | 625,000 | | | Brickman Group Holdings, Inc.

9.125% due 11/01/18 (a) | | | 596,203

| | | | 606,250

| | |

| | 75,000 | | | Briggs & Stratton Corporation

6.875% due 12/15/20 | | | 75,000

| | | | 77,625

| | |

| | 500,000 | | | Carrizo Oil & Gas, Inc.

8.625% due 10/15/18 | | | 502,698

| | | | 528,750

| | |

| | 441,000 | | | CCO Holdings

6.625% due 01/31/22 | | | 458,586

| | | | 459,742

| | |

| | 2,400,000 | | | CCO Holdings

7.375% due 06/01/20 | | | 2,592,730

| | | | 2,616,000

| | |

| | 2,700,000 | | | Chesapeake Energy Corporation

6.775% due 03/15/19 | | | 2,695,487

| | | | 2,683,125

| | |

| | 485,500 | | | Chesapeake Midstream Partners

6.125% due 07/15/22 (a) | | | 485,500

| | | | 491,569

| | |

See Notes to Financial Statements.

FIRST EAGLE HIGH YIELD FUND | ANNUAL REPORT | MARCH 31, 2012

14

Schedule of Investments | Year Ended March 31, 2012

| PRINCIPAL | | DESCRIPTION | | COST (NOTE 1) | | VALUE (NOTE 1) | |

| Bonds — 91.01% — (continued) | | | |

| U.S. Corporate Bonds — 67.56% — (continued) | | | |

| $ | 3,904,000 | | | Citgo Petroleum Corporation

11.50% due 07/01/17 (a) | | $ | 4,370,405

| | | $ | 4,392,000

| | |

| | 2,200,000 | | | Clear Channel Worldwide

Holdings, Inc. Series B

9.25% due 12/15/17 | | | 2,398,006

| | | | 2,422,750

| | |

| | 2,714,000 | | | Cleaver-Brooks, Inc.

12.25% due 05/01/16 (a) | | | 2,824,676

| | | | 2,849,700

| | |

| | 2,150,000 | | | Cloud Peak Energy Resources

8.25% due 12/15/17 | | | 2,305,799

| | | | 2,203,750

| | |

| | 110,000 | | | Cloud Peak Energy Resources

8.50% due 12/15/19 | | | 110,904

| | | | 115,225

| | |

| | 112,000 | | | Columbus McKinnon Corporation

7.875% due 02/01/19 | | | 111,554

| | | | 117,040

| | |

| | 1,678,000 | | | CommScope, Inc.

8.25% due 01/15/19 (a) | | | 1,738,719

| | | | 1,795,460

| | |

| | 280,000 | | | Delphi Corporation

6.125% due 05/15/21 (a) | | | 287,190

| | | | 299,600

| | |

| | 1,450,000 | | | DriveTime Automotive Group, Inc.

12.625% due 06/15/17 | | | 1,559,053

| | | | 1,591,375

| | |

| | 1,800,000 | | | E*Trade Financial Corporation

6.75% due 06/01/16 | | | 1,808,451

| | | | 1,849,500

| | |

| | 2,671,000 | | | Equinox Holdings, Inc.

9.50% due 02/01/16 (a) | | | 2,837,108

| | | | 2,869,656

| | |

| | 77,000 | | | FCC Holdings, Inc.

12.00% due 12/15/15 (a) | | | 78,309

| | | | 69,878

| | |

| | 336,000 | | | FGI Operating Company, Inc.

10.25% due 08/01/15 | | | 354,736

| | | | 362,074

| | |

| | 1,550,000 | | | Fiesta Restaurant Group

8.875% due 08/15/16 (a) | | | 1,614,454

| | | | 1,643,000

| | |

| | 2,050,000 | | | Frontier Communications Corporation

8.50% due 04/15/20 | | | 2,159,081

| | | | 2,167,875

| | |

| | 1,150,000 | | | Goodman Networks, Inc.

12.125% due 07/01/18 (a) | | | 1,156,600

| | | | 1,158,625

| | |

| | 840,000 | | | Goodyear Tire & Rubber Company

7.00% due 05/15/22 | | | 840,000

| | | | 821,100

| | |

| | 1,970,000 | | | Headwaters, Inc.

7.625% due 04/01/19 | | | 1,887,570

| | | | 1,925,675

| | |

| | 1,550,000 | | | Hughes Satellite Systems Corporation

6.50% due 06/15/19 | | | 1,610,193

| | | | 1,627,500

| | |

| | 2,287,000 | | | Huntington Ingalls Industries, Inc.

7.125% due 03/15/21 | | | 2,405,629

| | | | 2,461,384

| | |

| | 1,187,000 | | | Interface, Inc.

7.625% due 12/01/18 | | | 1,295,863

| | | | 1,290,862

| | |

See Notes to Financial Statements.

FIRST EAGLE HIGH YIELD FUND | ANNUAL REPORT | MARCH 31, 2012

15

High Yield Fund

| PRINCIPAL | | DESCRIPTION | | COST (NOTE 1) | | VALUE (NOTE 1) | |

| Bonds — 91.01% — (continued) | | | |

| U.S. Corporate Bonds — 67.56% — (continued) | | | |

| $ | 2,260,000 | | | International Lease Finance

Corporation

6.25% due 05/15/19 | | $ | 2,241,471

| | | $ | 2,231,364

| | |

| | 1,885,000 | | | JMC Steel Group

8.25% due 03/15/18 (a) | | | 1,956,173

| | | | 1,969,825

| | |

| | 2,554,000 | | | Kemet Corporation

10.50% due 05/01/18 (a) | | | 2,697,636

| | | | 2,758,320

| | |

| | 2,946,000 | | | Kraton Polymers

6.75% due 03/01/19 | | | 3,019,309

| | | | 3,056,475

| | |

| | 750,000 | | | Lamar Media Corporation

5.875% due 02/01/22 (a) | | | 752,834

| | | | 766,875

| | |

| | 1,070,000 | | | Landry's, Inc.

11.625% due 12/01/15 | | | 1,143,576

| | | | 1,197,062

| | |

| | 255,000 | | | Limited Brands, Inc.

8.50% due 06/15/19 | | | 299,168

| | | | 302,812

| | |

| | 2,300,000 | | | Linn Energy

6.25% due 11/01/19 (a) | | | 2,254,913

| | | | 2,233,875

| | |

| | 2,970,000 | | | Manitowoc Company, Inc.

9.50% due 02/15/18 | | | 3,284,580

| | | | 3,296,700

| | |

| | 700,000 | | | Mashantucket Western Pequot Tribe

8.50% due 11/15/15 (a)(b) | | | 508,046

| | | | 52,500

| | |

| | 200,000 | | | Maxim Crane Works

12.25% due 04/15/15 (a) | | | 196,330

| | | | 191,000

| | |

| | 3,000,000 | | | Midwest Gaming Borrower

11.625% due 04/15/16 (a) | | | 3,355,024

| | | | 3,371,250

| | |

| | 1,684,000 | | | Navistar International Corporation

8.25% due 11/01/21 | | | 1,805,969

| | | | 1,843,980

| | |

| | 240,000 | | | Nexeo Solutions

8.375% due 03/01/18 (a) | | | 243,042

| | | | 238,800

| | |

| | 311,000 | | | Omega Healthcare Investors, Inc.

6.75% due 10/15/22 | | | 309,747

| | | | 331,215

| | |

| | 1,500,000 | | | Omega Healthcare Investors, Inc.

7.50% due 02/15/20 | | | 1,637,208

| | | | 1,620,000

| | |

| | 1,765,000 | | | OSI Restaurant Partners

10.00% due 06/15/15 | | | 1,824,208

| | | | 1,835,600

| | |

| | 750,000 | | | PBF Holding Company

8.25% due 02/15/20 (a) | | | 739,375

| | | | 768,750

| | |

| | 2,544,000 | | | PHH Corporation

9.25% due 03/01/16 | | | 2,552,690

| | | | 2,598,060

| | |

| | 1,600,000 | | | Polypore International, Inc.

7.50% due 11/15/17 | | | 1,673,725

| | | | 1,696,000

| | |

| | 1,750,000 | | | Post Holdings, Inc.

7.375% due 02/15/22 (a) | | | 1,806,067

| | | | 1,837,500

| | |

See Notes to Financial Statements.

FIRST EAGLE HIGH YIELD FUND | ANNUAL REPORT | MARCH 31, 2012

16

Schedule of Investments | Year Ended March 31, 2012

| PRINCIPAL | | DESCRIPTION | | COST (NOTE 1) | | VALUE (NOTE 1) | |

| Bonds — 91.01% — (continued) | | | |

| U.S. Corporate Bonds — 67.56% — (continued) | | | |

| $ | 600,000 | | | PVH Corporation

7.375% due 05/15/20 | | $ | 655,253

| | | $ | 664,500

| | |

| | 100,000 | | | Quality Distribution

9.875% due 11/01/18 | | | 100,000

| | | | 110,250

| | |

| | 95,000 | | | Rain CII Carbon

8.00% due 12/01/18 (a) | | | 95,842

| | | | 99,988

| | |

| | 2,950,000 | | | Samson Investment Company

9.75% due 02/15/20 (a) | | | 3,037,780

| | | | 2,990,562

| | |

| | 1,690,000 | | | Shea Homes L.P.

8.625% due 05/15/19 (a) | | | 1,695,606

| | | | 1,761,825

| | |

| | 1,118,518 | | | Sheridan Group, Inc.

12.50% due 04/15/14 | | | 987,312

| | | | 959,129

| | |

| | 2,332,000 | | | STHI Holding Corporation

8.00% due 03/15/18 (a) | | | 2,484,176

| | | | 2,483,580

| | |

| | 2,017,000 | | | Sugarhouse HSP Gaming Prop Mezz

8.625% due 04/15/16 (a) | | | 2,117,431

| | | | 2,148,105

| | |

| | 2,560,000 | | | Taminco Global Chemical Corporation

9.75% due 03/31/20 (a) | | | 2,649,993

| | | | 2,675,200

| | |

| | 2,426,000 | | | Taylor Morrison

7.75% due 04/15/20 (a) | | | 2,459,075

| | | | 2,459,074

| | |

| | 435,000 | | | Terex Corporation

6.50% due 04/01/20 | | | 435,000

| | | | 439,350

| | |

| | 661,000 | | | Tower Automotive Holdings USA

10.625% due 09/01/17 (a) | | | 672,907

| | | | 720,490

| | |

| | 1,910,000 | | | Toys R Us Property Company I

10.75% due 07/15/17 | | | 2,101,146

| | | | 2,101,000

| | |

| | 1,200,000 | | | Toys R Us Property Company II

8.50% due 12/01/17 | | | 1,270,467

| | | | 1,258,500

| | |

| | 1,350,000 | | | Toys R Us, Inc.

7.375% due 10/15/18 | | | 1,194,988

| | | | 1,218,375

| | |

| | 45,175 | | | United Air Lines, Inc.

12.75% due 07/15/12 | | | 44,662

| | | | 46,531

| | |

| | 1,907,000 | | | United Maritime Group

11.75% due 06/15/15 | | | 1,986,226

| | | | 1,990,431

| | |

| | 500,000 | | | United Rentals North America, Inc.

10.875% due 06/15/16 | | | 557,227

| | | | 568,750

| | |

| | 1,650,000 | | | UR Financing Escrow Corporation

7.375% due 05/15/20 (a) | | | 1,680,825

| | | | 1,691,250

| | |

| | 200,000 | | | UR Financing Escrow Corporation

7.625% due 04/15/22 (a) | | | 200,000

| | | | 206,000

| | |

| | 2,339,000 | | | YCC Holdings

10.25% due 02/15/16 | | | 2,315,847

| | | | 2,394,551

| | |

| Total U.S. Corporate Bonds | | | 135,692,502 | | | | 137,052,775 | | |

See Notes to Financial Statements.

FIRST EAGLE HIGH YIELD FUND | ANNUAL REPORT | MARCH 31, 2012

17

High Yield Fund

| PRINCIPAL | | DESCRIPTION | | COST (NOTE 1) | | VALUE (NOTE 1) | |

| Bonds — 91.01% — (continued) | | | |

| International Corporate Bonds — 23.45% | | | |

| Australia 1.56% | | | |

| 2,700,000

USD | | | FMG Resources

8.25% due 11/01/19 (a) | | $ | 2,941,939

| | | $ | 2,848,500

| | |

| 450,000

USD | | | Midwest Vanadium Pty Limited

11.50% due 02/15/18 (a) | | | 386,282

| | | | 312,750

| | |

| | | | | | | | 3,328,221 | | | | 3,161,250 | | |

| Austria 0.22% | | | |

| 440,000

USD | | | OGX Austria GmbH

8.375% due 04/01/22 (a) | | | 440,000

| | | | 445,500

| | |

| Bermuda 1.76% | | | |

| 2,000,000

USD | | | Aircastle Limited

7.625% due 04/15/20 (a) | | | 2,015,000

| | | | 2,015,000

| | |

| 729,000

USD | | | Aircastle Limited

9.75% due 08/01/18 | | | 806,819

| | | | 816,480

| | |

| 451,000

USD | | | Aircastle Limited

9.75% due 08/01/18 (a) | | | 485,063

| | | | 502,865

| | |

| 212,000

USD | | | NCL Corporation Limited

11.75% due 11/15/16 | | | 229,439

| | | | 246,450

| | |

| | | | | | | | 3,536,321 | | | | 3,580,795 | | |

| Canada 2.03% | | | |

| 1,800,000

USD | | | Lone Pine Resources Canada Limited

10.375% due 02/15/17 (a) | | | 1,832,279

| | | | 1,892,250

| | |

| 560,000

USD | | | Novelis, Inc.

8.75% due 12/15/20 | | | 595,597

| | | | 616,000

| | |

| 600,000

USD | | | Precision Drilling Corporation

6.50% due 12/15/21 (a) | | | 608,159

| | | | 630,000

| | |

| 1,050,000

USD | | | Thompson Creek Metals Company, Inc.

7.375% due 06/01/18 | | | 1,003,604

| | | | 981,750

| | |

| | | | | | | | 4,039,639 | | | | 4,120,000 | | |

| Cayman Islands 2.77% | | | |

| 2,475,000

USD | | | Marfrig Overseas Limited

9.50% due 05/04/20 (a) | | | 2,253,614

| | | | 2,278,980

| | |

| 3,010,000

USD | | | RDS Ultra-Deepwater Limited

11.875% due 03/15/17 (a) | | | 3,306,607

| | | | 3,341,100

| | |

| | | | | | | | 5,560,221 | | | | 5,620,080 | | |

| France 1.32% | | | |

| 1,430,000

USD | | | CMA CGM SA

8.50% due 04/15/17 (a) | | | 852,590

| | | | 906,262

| | |

| 1,740,000

USD | | | Rexel SA

6.125% due 12/15/19 (a) | | | 1,750,862

| | | | 1,768,275

| | |

| | | | | | | | 2,603,452 | | | | 2,674,537 | | |

See Notes to Financial Statements.

FIRST EAGLE HIGH YIELD FUND | ANNUAL REPORT | MARCH 31, 2012

18

Schedule of Investments | Year Ended March 31, 2012

| PRINCIPAL | | DESCRIPTION | | COST (NOTE 1) | | VALUE (NOTE 1) | |

| Bonds — 91.01% — (continued) | | | |

| International Corporate Bonds — 23.45% — (continued) | | | |

| Ireland 3.24% | | | |

| 3,000,000

EUR | | | Allied Irish Banks PLC

4.50% due 10/01/12 | | $ | 3,874,778

| | | $ | 3,899,319

| | |

| 2,550,000

USD | | | Ardagh Packaging Finance PLC

9.125% due 10/15/20 | | | 2,625,546

| | | | 2,683,875

| | |

| | | | | | | | 6,500,324 | | | | 6,583,194 | | |

| Luxembourg 0.20% | | | |

| 390,000

USD | | | Dematic SA

8.75% due 05/01/16 (a) | | | 391,362

| | | | 407,550

| | |

| Malaysia 1.02% | | | |

| 2,000,000

USD | | | MMI International Limited

8.00% due 03/01/17 (a) | | | 2,056,553

| | | | 2,080,000

| | |

| Netherlands 2.74% | | | |

| 2,700,000

EUR | | | HeidelbergCement Finance BV

8.50% due 10/31/19 | | | 4,075,596

| | | | 4,076,288

| | |

| 188,000

USD | | | Schaeffler Finance BV

8.50% due 02/15/19 (a) | | | 188,000

| | | | 201,630

| | |

| 900,000

EUR | | | Schaeffler Finance BV

8.75% due 02/15/19 (a) | | | 1,226,580

| | | | 1,274,777

| | |

| | | | | | | | 5,490,176 | | | | 5,552,695 | | |

| Norway 1.23% | | | |

| 2,800,000

USD | | | Eksportfinans ASA

2.00% due 09/15/15 | | | 2,462,466

| | | | 2,486,294

| | |

| Sweden 1.16% | | | |

| 600,000

USD | | | Eileme 1 AB

14.25% due 08/15/20 (a) | | | 570,222

| | | | 553,550

| | |

| 1,300,000

EUR | | | Eileme 2 AB

11.75% due 01/31/20 | | | 1,752,877

| | | | 1,793,687

| | |

| | | | | | | | 2,323,099 | | | | 2,347,237 | | |

| United Kingdom 4.20% | | | |

| 240,000

USD | | | Hanson Limited

6.125% due 08/15/16 | | | 240,571

| | | | 258,600

| | |

| 2,400,000

USD | | | Ineos Finance PLC

8.375% due 02/15/19 (a) | | | 2,506,759

| | | | 2,544,000

| | |

| 3,100,000

USD | | | Jaguar Land Rover PLC

8.125% due 05/15/21 (a) | | | 3,155,311

| | | | 3,193,000

| | |

| 2,700,000

USD | | | Viridian Group FundCo II

11.125% due 04/01/17 | | | 2,640,500

| | | | 2,524,500

| | |

| | | | 8,543,141 | | | | 8,520,100 | | |

| Total International Corporate Bonds | | | 47,274,975 | | | | 47,579,232 | | |

| Total Bonds | | | 182,967,477 | | | | 184,632,007 | | |

See Notes to Financial Statements.

FIRST EAGLE HIGH YIELD FUND | ANNUAL REPORT | MARCH 31, 2012

19

High Yield Fund

| PRINCIPAL | | DESCRIPTION | | COST (NOTE 1) | | VALUE (NOTE 1) | |

| Term Loans — 1.43% | | | |

| $ | 2,500,000 | | | Morton's Restaurant Group

Term Loan B due 02/01/17 | | $ | 2,483,750

| | | $ | 2,500,000

| | |

| | 400,000 | | | Roundy's Supermarkets, Inc.

Term Loan B due 02/13/19 | | | 394,000

| | | | 403,000

| | |

| Total Term Loans | | | 2,877,750 | | | | 2,903,000 | | |

| Asset-Backed Security — 0.01% | | | |

| | 244,860 | | | Countrywide Asset-Backed

Certificates Series 2003-2, Class M2

2.717% due 03/26/33 | | | 240,543

| | | | 23,501

| | |

| Commercial Paper — 8.57% | | | |

| International Commercial Paper — 1.97% | | | |

| Italy 1.97% | | | |

| 4,000,000

USD | | | Eni S.p.A.

0.21% due 04/02/12 | | | 3,999,977

| | | | 3,999,977

| | |

| U.S. Commercial Paper — 6.60% | | | |

| $ | 3,385,000 | | | Avery Dennison Corporation

0.35% due 04/02/12 | | | 3,384,967

| | | | 3,384,967

| | |

| | 2,000,000 | | | Northern Illinois Gas Company

0.32% due 04/02/12 | | | 1,999,982

| | | | 1,999,982

| | |

| | 4,000,000 | | | Safeway, Inc.

0.66% due 04/02/12 | | | 3,999,928

| | | | 3,999,928

| | |

| | 4,000,000 | | | Western Union Company

0.30% due 04/02/12 | | | 3,999,967

| | | | 3,999,967

| | |

| Total U.S. Commercial Paper | | | 13,384,844 | | | | 13,384,844 | | |

| Total Commercial Paper | | | 17,384,821 | | | | 17,384,821 | | |

| Total Investments — 101.02% | | $ | 203,470,591 | | | | 204,943,329 | | |

| Liabilities in Excess of Other Assets — (1.02)% | | | | | (2,062,743 | ) | |

| Net Assets — 100.00% | | | | $ | 202,880,586 | | |

(a) All or a portion of the security is exempt from registration under the Securities Act of 1933. Rule 144A securities may only be sold to qualified institutional buyers, pursuant to Rule 144A under the Securities Act of 1933.

(b) Issuer is in default.

At March 31, 2012, aggregate cost for federal income tax purposes was $203,473,053. Net unrealized appreciation consisted of:

| Gross unrealized appreciation | | $ | 2,950,206 | | |

| Gross unrealized depreciation | | | (1,479,930 | ) | |

| Net unrealized appreciation | | $ | 1,470,276 | | |

See Notes to Financial Statements.

FIRST EAGLE HIGH YIELD FUND | ANNUAL REPORT | MARCH 31, 2012

20

Schedule of Investments | Year Ended March 31, 2012

Abbreviations used in this schedule include:

PLC — Public Limited Company

PTY — Proprietary Limited Company

Currencies

EUR — Euro

USD — United States Dollar

| Foreign Currency Exchange Contracts — Sales | |

SETTLEMENT

DATES

THROUGH | | FOREIGN CURRENCY

TO BE DELIVERED | | U.S. $

TO BE

RECEIVED | | U.S. $ VALUE

AT MARCH 31,

2012 | | UNREALIZED

APPRECIATION

AT MARCH 31,

2012 | | UNREALIZED

DEPRECIATION

AT MARCH 31,

2012 | |

| 10/09/12 | | | 7,900,000 | | | Euro | | $ | 10,471,903 | | | $ | 10,543,649 | | | $ | — | | | $ | (71,746 | ) | |

| INDUSTRY DIVERSIFICATION FOR PORTFOLIO HOLDINGS | | PERCENT OF

NET ASSETS | |

| U.S. Corporate Bonds | |

| Consumer Discretionary | | | 18.84 | % | |

| Consumer Staples | | | 5.86 | | |

| Energy | | | 11.64 | | |

| Financials | | | 5.33 | | |

| Health Care | | | 1.22 | | |

| Industrials | | | 13.54 | | |

| Materials | | | 7.80 | | |

| Telecommunication Services | | | 3.33 | | |

| Total U.S. Corporate Bonds | | | 67.56 | | |

| International Corporate Bonds | |

| Consumer Discretionary | | | 1.69 | | |

| Energy | | | 3.11 | | |

| Financials | | | 5.82 | | |

| Industrials | | | 3.37 | | |

| Materials | | | 7.06 | | |

| Telecommunication Services | | | 1.16 | | |

| Utilities | | | 1.24 | | |

| Total International Corporate Bonds | | | 23.45 | | |

| Term Loans | | | 1.43 | | |

| Asset-Backed Security | | | 0.01 | | |

See Notes to Financial Statements.

FIRST EAGLE HIGH YIELD FUND | ANNUAL REPORT | MARCH 31, 2012

21

High Yield Fund

| INDUSTRY DIVERSIFICATION FOR PORTFOLIO HOLDINGS — (CONTINUED) | | PERCENT OF

NET ASSETS | |

| Commercial Paper | |

| International Commercial Paper | | | 1.97 | % | |

| U.S. Commercial Paper | | | 6.60 | | |

| Total Commercial Paper | | | 8.57 | | |

| Total Investments | | | 101.02 | % | |

See Notes to Financial Statements.

FIRST EAGLE HIGH YIELD FUND | ANNUAL REPORT | MARCH 31, 2012

22

This page was intentionally left blank.

Statement of Assets and Liabilities

| | | FIRST EAGLE

HIGH YIELD FUND | |

| Assets | |

| Investments, at Cost (Note 1) | |

| Investments | | $ | 203,470,591 | | |

| Foreign currency | | | 2,604,069 | | |

| Total Investments, at Cost | | | 206,074,660 | | |

| Investments, at Value (Note 1) | |

| Investments | | | 204,943,329 | | |

| Foreign currency | | | 2,645,849 | | |

| Total Investments, at Value | | | 207,589,178 | | |

| Cash | | | 245,091 | | |

| Receivable for Fund shares sold | | | 9,167,414 | | |

| Accrued interest and dividends receivable | | | 3,667,300 | | |

| Other assets | | | 37,594 | | |

| Total Assets | | | 220,706,577 | | |

| Liabilities | |

| Payable for Fund shares redeemed | | | 274,843 | | |

| Payable for investment securities purchased | | | 17,252,387 | | |

| Payable for forward currency contracts held, at value (Note 1) | | | 71,746 | | |

| Payable for income distribution | | | 86,199 | | |

| Investment advisory fees payable (Note 2) | | | 72,849 | | |

| Distribution fees payable (Note 3) | | | 21,933 | | |

| Services fees payable (Note 3) | | | 4,324 | | |

| Trustee fees payable | | | 91 | | |

| Accrued expenses and other liabilities | | | 41,619 | | |

| Total Liabilities | | | 17,825,991 | | |

| Net Assets | | $ | 202,880,586 | | |

See Notes to Financial Statements.

FIRST EAGLE HIGH YIELD FUND | ANNUAL REPORT | March 31, 2012

24

March 31, 2012

| | | FIRST EAGLE

HIGH YIELD FUND | |

| Net Assets Consist of | |

| Capital stock (par value, $0.001 per share) | | $ | 20,810 | | |

| Capital surplus | | | 201,308,203 | | |

| Net unrealized appreciation (depreciation) on: | |

| Investments | | | 1,472,738 | | |

| Foreign currency and forward contract related translation | | | (14,991 | ) | |

| Undistributed net realized gains on investments | | | 113,438 | | |

| Undistributed net investment income | | | (19,612 | ) | |

| Net Assets | | $ | 202,880,586 | | |

| Class A | |

| Net assets | | $ | 60,438,664 | | |

| Shares outstanding | | | 6,197,705 | | |

| Net asset value per share and redemption proceeds per share | | $ | 9.75 | | |

| Offering price per share (NAV per share plus maximum sales charge)1 | | $ | 10.21 | | |

| Class C | |

| Net assets | | $ | 27,671,528 | | |

| Shares outstanding | | | 2,840,551 | | |

| Net asset value per share | | $ | 9.74 | | |

Redemption proceeds per share (NAV per share less maximum

contingent deferred sale charge)2 | | $ | 9.64 | | |

| Class I | |

| Net assets | | $ | 114,770,394 | | |

| Shares outstanding | | | 11,771,951 | | |

| Net asset value per share and redemption proceeds per share | | $ | 9.75 | | |

1 The maximum sales charge is 4.50% for Class A shares. Classes C and I have no front-end sales charges.

2 The maximum CDSC (Contingent Deferred Sales Charge) is 1.00% for Class C shares, which is charged on the lesser of the offering price or the net asset value at the time of sale by shareholder. This pertains to investments of one year or less.

See Notes to Financial Statements.

FIRST EAGLE HIGH YIELD FUND | ANNUAL REPORT | March 31, 2012

25

Statement of Operations Year Ended March 31, 2012

| | | FIRST EAGLE

HIGH YIELD FUND | |

| Investment Income | |

| Interest | | $ | 2,321,034 | | |

| Other Income | | | 20,880 | | |

| Total Income | | | 2,341,914 | | |

| Expenses | |

| Investment advisory fees (Note 2) | | | 216,063 | | |

| Distribution fees (Note 3) | |

| Class A | | | 12,552 | | |

| Class C | | | 17,067 | | |

| Service fees - Class C (Note 3) | | | 5,689 | | |

| Professional fees | | | 30,135 | | |

| Registration and filing fees | | | 30,060 | | |

| Shareholder reporting fees | | | 18,531 | | |

| Shareholder servicing agent fees | | | 4,477 | | |

| Custodian and accounting fees | | | 4,103 | | |

| Trustees' fees | | | 2,036 | | |

| Other Expenses | | | 13,944 | | |

| Total Expenses | | | 354,657 | | |

| Investment Advisory Fee Waiver (Note 2) | | | (72,599 | ) | |

| Net Expenses | | | 282,058 | | |

| Net Investment Income (Note 1) | | | 2,059,856 | | |

Realized and Unrealized Gains (Losses) on Investments and Foreign

Currency Related Transactions (Note 1) | |

| Net realized gains (losses) from: | |

| Investment transactions | | | 369,783 | | |

| Foreign currency related transactions | | | (49,154 | ) | |

| | | | 320,629 | | |

| Changes in unrealized appreciation (depreciation) of: | |

| Investment transactions | | | 1,573,567 | | |

| Foreign currency and forward contract related translation | | | (14,991 | ) | |

| | | | 1,558,576 | | |

Net realized and unrealized gains (losses) on investments, foreign currency

and forward contract related transactions | | | 1,879,205 | | |

| Net Increase in Net Assets Resulting from Operations | | $ | 3,939,061 | | |

See Notes to Financial Statements.

FIRST EAGLE HIGH YIELD FUND | ANNUAL REPORT | March 31, 2012

26

Statements of Changes in Net Assets

| | | FIRST EAGLE

HIGH YIELD FUND | |

| | | YEAR ENDED MARCH 31, | |

| | | 2012 | | 2011 | |

| Operations | |

| Net investment income | | $ | 2,059,856 | | | $ | 917,373 | | |

Net realized gain from investments, foreign

currency and forward contract related transactions | | | 320,629 | | | | 631,187 | | |

Change in unrealized appreciation (depreciation) of

investments, foreign currency and forward contract

related transactions | | | 1,558,576 | | | | (179,372 | ) | |

| Net increase in net assets resulting from operations | | | 3,939,061 | | | | 1,369,188 | | |

| Distribution to Shareholders | |

| Dividends paid from net investment income | |

| Class A | | | (277,672 | ) | | | — | | |

| Class C | | | (107,973 | ) | | | — | | |

| Class I | | | (1,664,694 | ) | | | (914,365 | ) | |

Distributions paid from net realized gains from

investment transactions | |

| Class I | | | (579,534 | ) | | | (754,658 | ) | |

| Decrease in net assets resulting from distributions | | | (2,629,873 | ) | | | (1,669,023 | ) | |

| Fund Share Transactions (Note 6) | |

| Net proceeds from shares sold | | | 202,495,554 | | | | 2,265,250 | | |

Net asset value of shares issued for reinvested dividends

and distributions | | | 2,480,994 | | | | 1,669,125 | | |

| Cost of shares redeemed | | | (14,567,403 | ) | | | (2,472,677 | ) | |

| Increase in net assets from Fund share transactions | | | 190,409,145 | | | | 1,461,698 | | |

| Net increase in net assets | | | 191,718,333 | | | | 1,161,863 | | |

| Net Assets (Note 1) | |

| Beginning of year | | | 11,162,253 | | | | 10,000,390 | | |

| End of year | | $ | 202,880,586 | | | $ | 11,162,253 | | |

| Undistributed net investment income | | $ | (19,612 | ) | | $ | 20,120 | | |

See Notes to Financial Statements.

FIRST EAGLE HIGH YIELD FUND | ANNUAL REPORT | March 31, 2012

27

Financial Highlights

| | | YEAR ENDED MARCH 31, | |

| | | 2012^ | | 2011 | | 2010 | | 2009 | | 2008^^ | |

| | | CLASS A^^^ | | CLASS C^^^ | | CLASS I | | CLASS I | | CLASS I | | CLASS I | | CLASS I | |

Selected data for a share of beneficial interest

outstanding throughout each year is presented below:* | |

Net asset value,

beginning of year ($) | | | 9.40 | | | | 9.40 | | | | 10.29 | | | | 10.67 | | | | 7.72 | | | | 9.29 | | | | 10.00 | | |

| Income (loss) from investment operations: | |

| Net investment income ($) | | | 0.13 | | | | 0.11 | | | | 0.68 | | | | 0.98 | | | | 1.31 | | | | 0.85 | | | | 0.36 | | |

Net realized and unrealized

gains (losses) on investments | | | 0.35 | | | | 0.34 | | | | –0.11 | | | | 0.47 | | | | 3.07 | | | | –1.55 | | | | –0.69 | | |

Total income (loss) from

investment operations | | | 0.48 | | | | 0.45 | | | | 0.57 | | | | 1.45 | | | | 4.38 | | | | –0.70 | | | | –0.33 | | |

| Less distributions: | |

Distributions from net

investment income ($) | | | –0.13 | | | | –0.11 | | | | –0.83 | | | | –0.98 | | | | –1.28 | | | | –0.87 | | | | –0.38 | | |

| Distributions from capital gains | | | — | | | | — | | | | –0.28 | | | | –0.85 | | | | –0.15 | | | | — | | | | — | | |

| Total distributions | | | –0.13 | | | | –0.11 | | | | –1.11 | | | | –1.83 | | | | –1.43 | | | | –0.87 | | | | –0.38 | | |

| Net asset value, end of year ($) | | | 9.75 | | | | 9.74 | | | | 9.75 | | | | 10.29 | | | | 10.67 | | | | 7.72 | | | | 9.29 | | |

| Total Return(a)(%) | | | 5.11 | | | | 4.78 | | | | 6.11 | | | | 14.81 | | | | 59.30 | | | | –7.78 | | | | –3.39 | | |

| Ratios and supplemental data | |

| Net assets, end of year (millions) ($) | | | 60 | | | | 28 | | | | 115 | | | | 11 | | | | 10 | | | | 9 | | | | 9 | | |

Ratio of operating expenses to

average net assets including

Fee Waivers and Reimbursements (%) | | | 0.95 | (b) | | | 1.66 | (b) | | | 0.80 | | | | 0.80 | | | | 0.80 | | | | 0.80 | | | | 0.80 | (b) | |

Ratio of operating expenses to

average net assets excluding

Fee Waivers and Reimbursements (%) | | | 1.12 | (b) | | | 1.83 | (b) | | | 1.05 | | | | 1.21 | | | | 1.04 | | | | 1.05 | | | | 1.86 | (b) | |

Ratio of net investment income to

average net assets including

Fee Waivers and Reimbursements (%) | | | 5.48 | (b) | | | 4.74 | (b) | | | 6.98 | | | | 9.33 | | | | 13.34 | | | | 10.04 | | | | 10.90 | (b) | |

Ratio of net investment income

to average net assets excluding

Fee Waivers and Reimbursements (%) | | | 5.31 | (b) | | | 4.57 | (b) | | | 6.73 | | | | 8.92 | | | | 13.10 | | | | 9.79 | | | | 9.84 | | |

| Portfolio turnover rate (%) | | | 45.21 | | | | 45.21 | | | | 45.21 | | | | 145.96 | | | | 292.11 | | | | 74.19 | | | | 10.78 | | |

^ The Fund commenced operations in its present form on December 30, 2011.

^^ The predecessor Fund, Old Mutual High Yield Fund, commenced operations on November 19, 2007.

^^^ Class A and Class C commenced investment operations on January 3, 2012.

* Per share amounts have been calculated using the average shares method.

(a) Does not take into account the sales charge of 4.50% for Class A and the CDSC (Contingent Deferred Sales Charge) of 1.00% for Class C shares.

(b) Annualized

See Notes to Financial Statements.

FIRST EAGLE HIGH YIELD FUND | ANNUAL REPORT | March 31, 2012

28

This page was intentionally left blank.

Notes to Financial Statements

Note 1 — Significant Accounting Policies

First Eagle High Yield Fund (the "Fund") is an open-end, diversified management investment company registered under the Investment Company Act of 1940, as amended ("1940 Act"). The Fund is one of the seven portfolios of First Eagle Funds (the "Trust"). The Fund commenced investment operations in its present form on January 3, 2012 and, pursuant to a reorganization, is the successor to the Old Mutual High Yield Fund (the "Predecessor Fund").

A Plan of Reorganization between the Predecessor Fund and the Fund, a series of First Eagle Funds, was approved by the Predecessor Fund's shareholders at a special meeting of shareholders held on December 28, 2011. The reorganization was effective after the close of business on December 30, 2011. The Fund acquired all of the assets and liabilities of the Predecessor Fund. The transaction was structured to qualify as a tax-free reorganization under the Internal Revenue Code.

The Fund seeks to provide investors with a high level of current income.

The following is a summary of significant accounting policies adhered to by the Fund and are in conformity with U.S. generally accepted accounting principles ("GAAP").

a) Investment valuation — The Fund computes its net asset value once daily as of the close of trading on each day the New York Stock Exchange ("NYSE") is open for trading. The net asset value per share is computed by dividing the total current value of the assets of the Fund, less its liabilities, by the total number of shares outstanding at the time of such computation.

All bonds, whether listed on an exchange or traded in the over-the-counter market (and except for short-term investments as described in the next sentence), for which market quotations are readily available are valued at the mean between the last bid and asked prices received from dealers in the over-the-counter market in the United States or abroad, except that when no asked price is available, bonds are valued at the bid price. Broker-Dealers or pricing services use multiple valuation techniques to determine value. In instances where sufficient market activity exists, dealers or pricing services may utilize a market-based approach through which quotes from market makers are used to determine fair value. In instances where sufficient market activity may not exist or is limited, the dealers or pricing services also utilize proprietary valuation models which may consider market transactions in comparable securities and the various relationships between securities in determining value and/or market characteristics such as benchmark yield

FIRST EAGLE HIGH YIELD FUND | ANNUAL REPORT | MARCH 31, 2012

30

(continued)

curves, option-adjusted spreads, credit spreads, estimated default rates, coupon-rates, anticipated timing of principal repayments, underlying collateral, and other unique security features in order to estimate the relevant cash flows, which are then discounted to calculate the fair values. Short-term investments maturing in sixty days or less are valued at cost plus interest earned (or discount amortized, as the case may be), which is deemed to approximate value.

The 2:00 p.m. E.S.T. exchange rates typically are used to convert foreign security prices into U.S. dollars. Any security that is listed or traded on more than one exchange (or traded in multiple markets) is valued at the relevant quotation on the exchange or market deemed to be the primary trading venue for that security. In the absence of such a quotation, a quotation from the exchange or market deemed by the Adviser to be the secondary trading venue for the particular security shall be used. The Fund uses pricing services to identify the market prices of publicly traded securities in their portfolios. When market prices are determined to be "stale" as a result of limited market activity for a particular holding, or in other circumstances when market prices are unavailable, such as for private placements, or determined to be unreliable for a particular holding, such holdings may be "fair valued" in accordance with procedures approved by the Board of Trustees ("Board").

Forward contracts are valued as the current cost of covering or offsetting such contracts.

The Fund adopted provisions surrounding fair value measurements and disclosures that define fair value, establishes a framework for measuring fair value in generally accepted accounting principles and expands disclosures about fair value measurements. This applies to fair value measurements that are already required or permitted by other accounting standards and is intended to increase consistency of those measurements and applies broadly to securities and other types of assets and liabilities.

The Fund discloses the fair value of their investments in a hierarchy that prioritizes the inputs or assumptions to valuation techniques used to measure fair value. These inputs are used in determining the value of the Fund's investments and are summarized in the following fair value hierarchy:

Level 1 — Quoted prices in active markets for identical securities.

Level 2 — Other significant observable inputs (including quoted prices for similar securities, interest rates, prepayment speeds, credit risk, etc.).

Level 3 — Other significant unobservable inputs (including Fund's own assumption in determining the fair value of investments).

FIRST EAGLE HIGH YIELD FUND | ANNUAL REPORT | MARCH 31, 2012

31

Notes to Financial Statements

The following is a summary of the Fund's inputs used to value the Fund's investments as of March 31, 2012:

| First Eagle High Yield Fund | |

| DESCRIPTION | | LEVEL 1 | | LEVEL 2 | | LEVEL 3 | | TOTAL | |

| Assets: | |

| U.S. Corporate Bonds | | $ | — | | | $ | 137,052,775 | | | $ | — | | | $ | 137,052,775 | | |

International

Corporate Bonds | | | — | | | | 47,579,232 | | | | — | | | | 47,579,232 | | |

| Term Loans | | | — | | | | 2,903,000 | | | | — | | | | 2,903,000 | | |

| Asset-Backed Security | | | — | | | | 23,501 | | | | — | | | | 23,501 | | |

International

Commercial Paper | | | — | | | | 3,999,977 | | | | — | | | | 3,999,977 | | |

| U.S. Commercial Paper | | | — | | | | 13,384,844 | | | | — | | | | 13,384,844 | | |

| Total | | $ | — | | | $ | 204,943,329 | | | $ | — | | | $ | 204,943,329 | | |

| Liabilities: | |

Foreign Currency

Contracts** | | $ | — | | | $ | 71,746 | | | $ | — | | | $ | 71,746 | | |

| Total | | $ | — | | | $ | 71,746 | | | $ | — | | | $ | 71,746 | | |

** Foreign currency contracts are valued at net unrealized depreciation on the investment.

For the year ended March 31, 2012, there was no security transfer activity from Level 1 to Level 2 and no security transfer activity from Level 2 to Level 1.

FIRST EAGLE HIGH YIELD FUND | ANNUAL REPORT | MARCH 31, 2012

32

(continued)

b) Investment transactions and income — Investment transactions are accounted for on a trade date basis. The specific identification method is used in determining realized gains and losses from investment transactions. Interest income is recorded daily on the accrual basis. In computing investment income, the Fund accretes discounts and amortizes premiums on debt obligations using the effective yield method.

c) Expenses — Expenses arising in connection with the Fund are charged directly to the Fund. Expenses common to all First Eagle Funds are generally allocated to each Fund in proportion to its relative net assets. Certain expenses are shared with the First Eagle Variable Funds, an affiliated fund group. Such costs are generally allocated using the ratio of the Fund's average daily net assets related to the total average daily net assets of the First Eagle Variable Funds. Earning credits may reduce shareholder servicing agent fees by the amount of interest earned on balances with such service provider.

d) Foreign currency translation — The books and records of the Fund are maintained in U.S. dollars. The market values of securities which are not traded in U.S. currency are recorded in the financial statements after translation to U.S. dollars based on the applicable exchange rates at the end of the period. The costs of such securities are translated at exchange rates prevailing when acquired. Related interest, dividends and withholding taxes are accrued at the rates of exchange prevailing on the respective dates of such transactions.

The net assets of the Fund are presented at the foreign exchange rates and market values at the close of the period. The Fund does not isolate that portion of gains and losses on investments which is due to changes in foreign exchange rates from that which is due to changes in market prices of the securities. However, for federal income tax purposes the Fund does isolate the effect of changes in foreign exchange rates from the changes in market prices for realized gains and losses on debt obligations.

e) Forward currency contracts — In connection with portfolio purchases and sales of securities denominated in foreign currencies, the Fund has entered into forward currency contracts. The Fund enters into foreign exchange contracts primarily to manage and/or gain exposure to certain foreign currencies. The Fund's currency transactions include portfolio hedging on portfolio positions. Portfolio hedging is the use of a forward contract (or other cash management position) with respect to one or more portfolio

FIRST EAGLE HIGH YIELD FUND | ANNUAL REPORT | MARCH 31, 2012

33

Notes to Financial Statements

security positions denominated or quoted in a particular currency. Currency exchange transactions involve currencies of different countries that the Fund invests in and serve as hedges against possible variations in the exchange rates between these currencies and the U.S. dollar. The Fund engages in portfolio hedging with respect to the currency of a particular country in amounts approximating actual or anticipated positions in securities denominated in that currency. Hedging can reduce exposure to currency exchange movements, but cannot eliminate that exposure. It is possible to lose money under a hedge.

The Fund could be exposed to risk if the value of the currency changes unfavorably, if the counterparties to the contracts are unable to meet the terms of their contracts or if the Fund is unable to enter into a closing position. Forward currency contracts outstanding at period end, if any, are listed after the Fund's portfolio. Outstanding contracts at period-end are indicative of the volume of activity from the commencement of entering into such forward contracts to the end of period.

The Fund adopted provisions surrounding disclosures and derivative instruments and hedging activities which require qualitative disclosures about objectives and strategies for using derivatives, quantitative disclosures about fair value amounts of gains and losses on derivative instruments, and disclosures about currency-risk-related contingent features in derivative agreements.

At March 31, 2012, the Fund had the following foreign forward currency contracts grouped into appropriate risk categories illustrated below:

| | |

| | GAIN OR (LOSS) ON DERIVATIVES

RECOGNIZED IN INCOME | |

| RISK TYPE | | LIABILITY

DERIVATIVE

FAIR VALUE1 | |

REALIZED

GAIN (LOSS) | |

CHANGE IN

DEPRECIATION2 | |

| Foreign Currency | | $ | 71,746 | | | $ | — | | | $ | 71,746 | | |

1 Statement of Assets and Liabilities location: Payable for forward currency contracts held, at value.

2 Statement of Operations location: Changes in unrealized depreciation of: foreign currency and forward contract related translation.

FIRST EAGLE HIGH YIELD FUND | ANNUAL REPORT | MARCH 31, 2012

34

(continued)

f) Term Loans — The Fund may invest in term loans, which usually take the form of loan participations and assignments. Loan participations and assignments are agreements to make money available to U.S. or foreign corporations, partnerships or other business entities (the "Borrower") in a specified amount, at a specified rate and within a specified time. A loan is typically originated, negotiated and structured by a U.S. or foreign bank, insurance company or other financial institution (the "Agent") for a group of loan investors ("Loan Investors"). The Agent typically administers and enforces the loan on behalf of the other Loan Investors in the syndicate and may hold any collateral on behalf of the Loan Investors. Such loan participations and assignments are typically senior, secured and collateralized in nature. The Fund records an investment when the Borrower withdraws money and records interest as earned. The Fund generally has no right to enforce compliance with the terms of the loan agreement with the Borrower. As a result, the Fund assumes the credit risk of the Borrower, the selling participant and any intermediary between the Fund and the Borrower ("Intermediate Participants"). In the event that the Borrower, selling participant or Intermediate Participants become insolvent or enters into bankruptcy, each Fund may incur certain costs and delays in realizing payment or may suffer a loss of principal and/or interest.

g) Restricted Securities — The Fund may invest in securities that are subject to legal or contractual restrictions on resale. These securities generally may be resold in transactions exempt from registration or to the public if the securities are registered. Disposal of these securities may involve time-consuming negotiations and expenses, and prompt sale at an acceptable price may be difficult. Information regarding restricted securities, if any, is included at the end of the Fund's Schedule of Investments.

h) United States income taxes — No provision has been made for U.S. federal income taxes since it is the intention of the Fund to distribute to shareholders all taxable net investment income and net realized gains on investments, if any, within the allowable time limit, and to comply with the provisions of the Code for a Regulated Investment Company. Dividends from net investment income are declared daily and paid monthly. Distributions from net realized capital gains are made annually, if available.

The Fund adopted provisions surrounding income taxes, which require the tax effects of certain tax positions to be recognized. These tax positions must

FIRST EAGLE HIGH YIELD FUND | ANNUAL REPORT | MARCH 31, 2012

35

Notes to Financial Statements

meet a "more likely than not" standard that based on their technical merits, have a more than 50% likelihood of being sustained upon examination. Management of the Trust has analyzed the Fund's tax positions taken on federal and state income tax returns for all open tax years (the current and the prior three tax years) and has concluded that no provision for income tax is required in the Fund's financial statements.

At March 31, 2012, the components of accumulated earnings on a tax basis were as follows:

| Undistributed net investment income | | $ | 148,391 | | |

| Undistributed net realized gains | | | — | | |

| Net unrealized appreciation | | | 1,489,381 | | |

| Capital loss carryforward | | | — | | |

The differences between the components of distributable earnings on a tax basis and the amounts reflected in the Statements of Changes in Net Assets are primarily due to the treatment of foreign currencies, wash sales and defaulted securities.

As of March 31, 2012, the Fund had no estimated capital loss carryforwards for federal income tax purposes.

i) Reclassification of capital accounts — As a result of certain differences in the computation of net investment income and net realized capital gains under federal income tax rules and regulations versus generally accepted accounting principles, a reclassification has been made on the Statement of Assets and Liabilities to decrease undistributed net investment income in the amount of $49,249 and increase undistributed net realized gains on investments in the amount of $49,249.

The primary permanent difference causing such reclassification includes the tax treatment of foreign currency gains and losses.

j) Distributions to shareholders — Distributions to shareholders during the fiscal year ended March 31, 2012, which are determined in accordance with income tax regulations, are recorded on ex-dividend date.

For the years ended March 31, 2012 and 2011, the Fund distributed ordinary income dividends of $2,433,849 and $1,669,023 respectively.

For the years ended March 31, 2012 and 2011, the Fund distributed long-term capital gains dividends of $196,024 and $0 respectively.

FIRST EAGLE HIGH YIELD FUND | ANNUAL REPORT | MARCH 31, 2012

36

(continued)

k) Use of estimates — The preparation of financial statements in conformity with generally accepted accounting principles requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities at the date of the financial statements and the reported amounts of revenues and expenses during the reporting period. Actual results could differ from those estimates.

l) Foreign Taxes — The Fund may be subject to foreign taxes on income, gains on investments or currency purchases/repatriation, a portion of which may be recoverable. The Fund will accrue such taxes and recoveries as applicable, based upon its current interpretation of tax rules and regulations that exist in the markets in which it invests.

Note 2 — Investment Advisory, Custody and Administration Agreements; Transactions with Related Persons

First Eagle Investment Management, LLC (the "Adviser"), a subsidiary of Arnhold and S. Bleichroeder Holdings, Inc. ("ASB Holdings"), manages the Fund. For its services, the Adviser receives, pursuant to an Investment Advisory Agreement between the Fund and the Adviser (the "Advisory Agreement") an annual advisory fee at an annual rate of 0.70% of the average daily net assets of the Fund. Prior to December 30, 2011, the Predecessor Fund had an advisory agreement with Old Mutual Capital, Inc. ("Old Mutual").

Old Mutual was entitled to receive a management fee, calculated daily and paid monthly, at an annual rate based on the average daily net assets of the Predecessor Fund as follows: 0.70% for average daily net assets between $0 to less than $500 million, 0.675% for average daily net assets between $500 million to less than $1.0 billion, 0.65% for average daily net assets $1.0 billion or greater.

Old Mutual also entered into a sub-advisory agreement ("Sub-Advisory Agreement") with Dwight Asset Management Company LLC ("Sub-Adviser") for the Predecessor Fund prior to September 30, 2011. For the services provided and expenses incurred pursuant to the Sub-Advisory Agreement, the Sub-Adviser was entitled to receive from Old Mutual a sub-advisory fee with respect to the average daily net assets of the Predecessor Fund, less 50% of any waivers, reimbursement payments, supermarket fees and alliance fees waived, reimbursed or paid by Old Mutual. The fee was calculated as follows: 0.35% for average daily net assets

FIRST EAGLE HIGH YIELD FUND | ANNUAL REPORT | MARCH 31, 2012

37

Notes to Financial Statements

between $0 to less than $500 million, 0.338% for average daily net assets between $500 million to less than $1.0 billion and 0.325% for average daily net assets $1.0 billion or greater.

Effective October 1, 2011, the Board of Trustees of Old Mutual Funds II approved an interim sub-advisory agreement with the Adviser on behalf of the Old Mutual Dwight High Yield Fund in connection with the transition of the Predecessor Fund's portfolio managers from Dwight Asset Management Company, LLC to First Eagle. The Board of Trustees of Old Mutual Funds II also determined to change the name of the Predecessor Fund to the Old Mutual High Yield fund.

The Adviser has contractually agreed to waive its management fee and/or reimburse expenses, as allowed by law, so that the total annual operating expenses (excluding certain items) of Class A and Class C shares do not exceed 1.25% and 2.00%, respectively, through December 31, 2012, and those of Class I shares do not exceed 0.80% through December 31, 2013.

The Adviser may seek reimbursement for fees waived and other expenses paid by the Adviser pursuant to the Fee Waiver and Expense Reimbursement Agreement ("Agreement"). A repayment should be payable only to the extent it can be made during the thirty-six months following the applicable period during which the Adviser waived fees or reimbursed operating expenses under the Agreement. As of March 31, 2012, the Adviser may seek reimbursement of previously waived and reimbursed fees as follows;

| EXPIRATION | | AMOUNT | |

| March 31, 2013 | | $ | 33,000 | | |

| March 31, 2014 | | | 38,000 | | |

| March 31, 2015 | | | 72,599 | | |