UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-8194

FINANCIAL INVESTORS TRUST

(Exact name of registrant as specified in charter)

1290 Broadway, Suite 1100, Denver, Colorado 80203

(Address of principal executive offices) (Zip code)

David T. Buhler, Secretary

Financial Investors Trust

1290 Broadway, Suite 1100

Denver, Colorado 80203

(Name and address of agent for service)

Registrant’s telephone number, including area code: 303-623-2577

Date of fiscal year end: April 30

Date of reporting period: April 30, 2015

1

| Item 1. | Reports to Stockholders. |

TABLE OF CONTENTS

| | |

Aspen Managed Futures Strategy Fund | | Manager Commentary |

| | April 30, 2015 (Unaudited) |

May 7, 2015

Performance Results

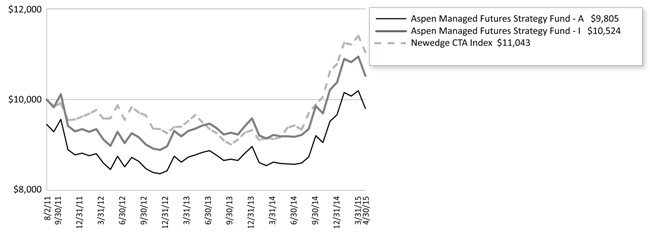

For the one-year period ending April 30, 2015, the Class I shares of the Aspen Managed Futures Strategy Fund (the “Fund”) posted a gain of 14.51%. Per its mandate, the Fund maintained very tight correlation1 to the Aspen Managed Futures Beta Index (“Aspen MFBI” or the “Index”)2. The Index uses a combination of trend and counter-trend algorithms to determine exposures to 23 futures markets. In following the Index, the Fund can take long or short exposures to each of the eligible markets. A long position in a futures market should profit if the price of the futures contract rises, and a short position should profit if the price of the futures contract falls.

The Newedge CTA Index3, a managed futures benchmark, returned 20.44% in the same timeframe. Another benchmark, the BTOP50 Index4, returned 15.6%. It is important to note that there are substantive differences between the Fund and these indices in terms of construction. There were no significant changes to the Fund strategy during this period.

Explanation of Fund Performance

The Fund was flat in May (0.00%) and slightly down in June (-0.11%). These months perpetuated an extremely low volatility market backdrop that had been evident since early spring. Because the Index that is tracked by the Fund does not have a volatility target, Fund returns joined underlying asset returns in their low volatility state. In fact, the Fund’s daily returns represented a one-penny or zero-penny change in Fund NAV (approximately +/-0.1%) on about 55% of all days over this two-month period.

July (+0.44%), August (+1.43%), and September (+5.42%) represented the strongest quarter for the Fund since its launch, with September in particular being the best month in the Fund’s history. The primary driver of Fund returns was a strengthening US dollar which manifested itself as strongly positive returns for short trends in the currency and commodity asset classes. (The markets in both asset classes were almost exclusively short for most of the quarter, representing a rising dollar bet.) Interestingly, the Fund outperformed most managed futures benchmarks in July and September—down months for equities—and underperformed the benchmarks in August—an up month for equities. This reinforces a pattern, now noticeable for at least the past two years, of Fund returns being less beholden to equities than are the returns of many competing managed futures products.

The early days of October witnessed a continued downtrend in equity returns, leading the Fund to adopt a portfolio that was positioned as a strong hedge against further risk asset losses. However, equities rallied mid-month, and US equities in particular managed to rise back to near-record highs, after hitting a nearly 10% drawdown prior to the rally. This caused a whipsaw reversal in the Fund through much of the month. After attenuating negative-risk positions, the Fund benefitted the last two days of the month from the end of the Fed’s Quantitative5 Easing policies, which caused currencies and commodities to resume their strong decline against the US dollar. Gains on those days reduced Fund losses to -1.64% for the entire month.

With a return of +5.33%, November was the second-best month in Fund history, and January (+4.99%) was not far behind. While December’s return (+1.62%) was not as strong, it was still positive, leading the November-January period to be easily the strongest 3-month period in fund history (at +12.37%). The story in all three months was largely the same. Strong, broad downtrends in currencies and commodities and strong uptrends in fixed income drove returns throughout the three-month period; only equities provided mixed results.

In February, a strong trend resumption in equities offset losses due to trend reversals in the three other asset classes. The result was a small loss for the Fund overall (-0.66%). Due to the strength of the trends leading into the month, the reversals in February did not cause meaningful trend position attenuation, which proved fortunate, as March saw a resumption of strong downtrends in currency and commodity positions, leading to a +1.15% return for the fund that month.

While it may be early to proclaim the end of the downtrends in currencies and commodities that drove the majority of the +19.26% Fund return for the three quarters ending March, 2015, the whipsaw behavior in April (which resulted in a monthly return of -3.88% for the Fund) was finally strong enough to cause the Aspen MFBI model to reduce and, in a few cases, reverse trend positions in those asset classes. However, should April prove to be the turning point for the prevailing downtrends in those asset classes, the difference between the +19.26% and -3.88% returns demonstrates the ability of a trend-following model to generate sizable profits over the full lifecycle of a strong trend, despite the inevitable losses taken as the trend expires.

Outlook

Looking ahead to the second quarter and rest of 2015, we see three broad themes developing. First, it is likely that we will see a continuation of higher market volatility. It is not difficult to envision this scenario, considering the significant political and economic uncertainty being played out on the global stage. The effects of continuing quantitative easing in Europe and Japan may well exacerbate extreme market movements, owing to such a large scale of the effort.

We continue to think that the potential for a rate increase in the U.S. is overblown. It is hard to fathom why the Federal Reserve would threaten the seemingly fragile economic recovery by boosting rates even by a small amount. We expect the market to react to higher rates the same way that it reacted when crude prices dropped so dramatically, with equal parts confusion and fear. Once the dust settles, we believe it’s likely we’ll see money flow from debt to equity.

Speaking of crude oil, the last broad theme revolves around market perception. In the next few quarters, we believe that investors will finally adjust to lower energy costs. There has been considerable nervousness about the effect of oil prices on employment in the energy patch, but overall lower energy prices are a net positive to the economy. Most estimates peg the benefit at around 0.50% of additional GDP6 growth.

| | |

Annual Report | April 30, 2015 | | 1 |

| | |

Aspen Managed Futures Strategy Fund | | Manager Commentary |

| | April 30, 2015 (Unaudited) |

It is important that investors maintain adequate diversification during periods of uncertainty. The potential of managed futures to profit as volatility increases underscores its importance in a portfolio of equity and fixed income securities.

Sincerely,

Bryan R. Fisher (Managing Director)

William Ware Bush (Director)

Performance data quoted represents past performance. Past performance does not guarantee future results. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when sold or redeemed, may be worth more or less than the original cost. Current performance data may be higher or lower than actual data quoted. For the most current month-end performance data please call 1-855-845-9444.

The views and information discussed in this commentary are as of the date of publication, are subject to change, and may not reflect the writers’ current views. The views expressed represent an assessment of market conditions at a specific point in time, are opinions only and should not be relied upon as investment advice regarding a particular investment or markets in general. Such information does not constitute a recommendation to buy or sell specific securities or investment vehicles. It should not be assumed that any investment will be profitable or will equal the performance of the portfolios or any securities or any sectors mentioned in this letter. The subject matter contained in this letter has been derived from several sources believed to be reliable and accurate at the time of compilation. Neither Aspen Partners Ltd. nor the Fund accepts any liability for losses either direct or consequential caused by the use of this information.

The Aspen Managed Futures Strategy Fund is distributed by ALPS Distributors, Inc.

Diversification does not eliminate the risk of experiencing investment losses.

| 1 | Correlation – a statistical measure of how two securities move in relation to each other. |

| 2 | Aspen Managed Futures Beta Index (Aspen MFBI) is constructed using a quantitative, rules-based model designed to replicate the trend-following and counter-trend exposure of futures markets by allocating assets to liquid futures contracts of certain financial and commodities futures markets. The Index therefore seeks to reflect the performance of strategies and exposures common to a broad universe of futures markets, i.e., managed futures beta. The Index is not actively managed and does not reflect any deduction for fees, expenses or taxes. An investor cannot invest directly in the Index. |

| 3 | The Newedge CTA Index provides the market with a reliable daily performance benchmark of major commodity trading advisors (CTAs). The Newedge CTA Index calculates the daily rate of return for a pool of CTAs selected from the larger managers that are open to new investment. Selection of the pool of qualified CTAs used in construction of the Index will be conducted annually, with re-balancing on January 1st of each year. A committee of industry professionals has been established to monitor the methodology of the index on a regular basis. The Index is not actively managed and does not reflect any deduction for fees, expenses or taxes. An investor cannot invest directly in the Index. |

| 4 | Barclay BTOP50 Index is an index of the largest investable CTA programs as measured by assets under management. The Index is not actively managed and does not reflect any deduction for fees, expenses or taxes. An investor cannot invest directly in the Index. |

| 5 | Quantitative Easing – An unconventional monetary policy in which a central bank purchases government securities or other securities from the market in order to lower interest rates and increase the money supply. |

| 6 | GDP – Gross Domestic Product is an aggregate measure of production equal to the sum of the gross values added of all resident, institutional units engaged in production (plus any taxes, and minus any subsidies, on products not included in the value of their outputs). |

| | |

2 | | www.aspenfuturesfund.com |

| | |

Aspen Managed Futures Strategy Fund | | Manager Commentary |

| | April 30, 2015 (Unaudited) |

Cumulative Total Return Performance as of April 30, 2015

| | | | | | | | | | | | | | |

Aspen Managed Futures Strategy

Fund | | Calendar

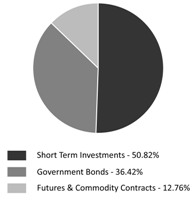

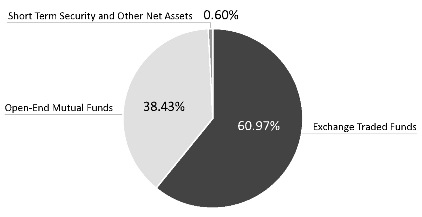

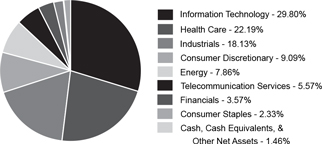

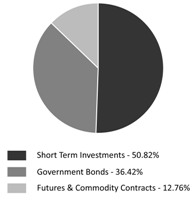

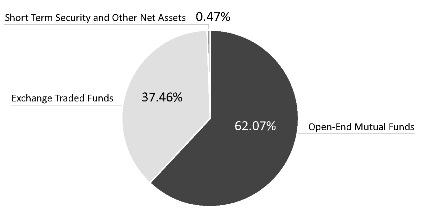

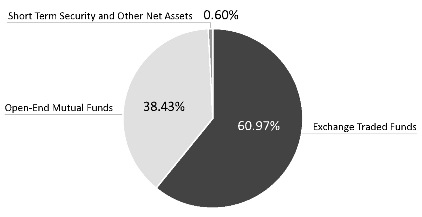

Year-to-Date | | 1 Year | | | 3 Year | | Since Inception* | | | | Portfolio Composition as of April 30, 2015 As a percentage of Net Assets

|

| | |

Aspen Managed Futures Strategy Fund - Class A (NAV)(1) | | 1.42% | | | 14.00 | % | | 5.04% | | 0.98% | | |

| | |

Aspen Managed Futures Strategy Fund - Class A (MOP)(2) | | -4.21% | | | 7.76 | % | | 3.08% | | -0.52% | | |

| | |

Aspen Managed Futures Strategy Fund - Class I | | 1.40% | | | 14.51 | % | | 5.43% | | 1.37% | | |

| | |

Newedge CTA Index(3) | | 2.37% | | | 20.44 | % | | 4.82% | | 2.68% | | |

| | |

Aspen Managed Futures Beta Index(4) | | 2.17% | | | 15.01 | % | | 5.84% | | 1.90% | | |

| | |

Performance data quoted represents past performance. Past performance does not guarantee future results. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when sold or redeemed, may be worth more or less than the original cost. Current performance data may be higher or lower than actual data quoted. For the most current month-end performance data please call 1-855-845-9444. The table does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. * Fund Inception date of August 2, 2011. (1) Net Asset Value (NAV) is the share price without sales charges. (2) Maximum Offering Price (MOP) includes sales charges. Class A returns include effects of the Fund’s maximum sales charge of 5.50%. (3) The Newedge CTA Index provides the market with a reliable daily performance benchmark of major commodity trading advisors (CTAs). The Newedge CTA Index calculates the daily rate of return for a pool of CTAs selected from the larger managers that are open to new investment. Selection of the pool of qualified CTAs used in construction of the Index will be conducted annually, with re-balancing on January 1st of each year. A committee of industry professionals has been established to monitor the methodology of the index on a regular basis. The index is not actively managed and does not reflect any deductions for fees, expense or taxes. An investor may not invest directly in an index. (4) Aspen Managed Futures Beta Index – The Managed Futures Beta Index is constructed using a quantitative, rules-based model designed to replicate the trend-following and counter-trend exposure of futures markets by allocating assets to liquid futures contracts of certain financial and commodities futures markets. The Index therefore seeks to reflect the performance of strategies and exposures common to a broad universe of futures markets, i.e., managed futures beta. The index is not actively managed and does not reflect any deductions for fees, expense or taxes. An investor may not invest directly in an index. | | |

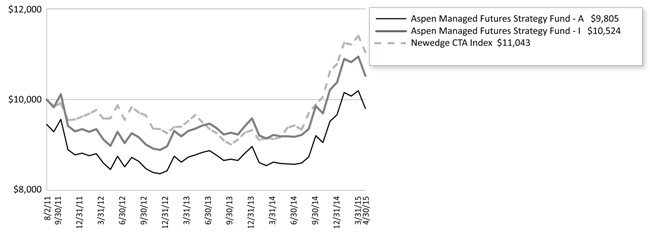

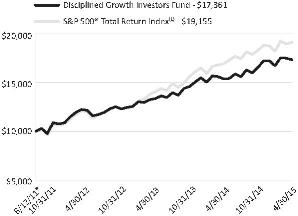

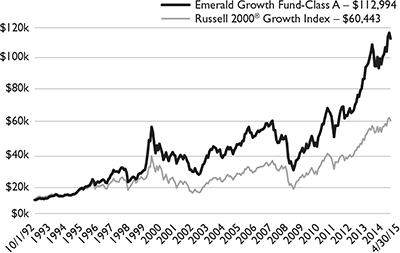

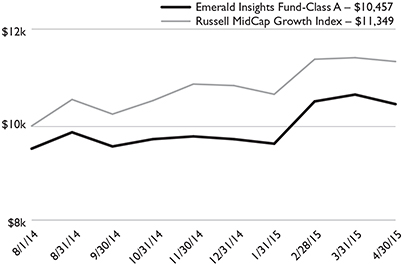

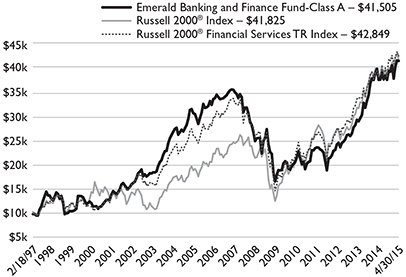

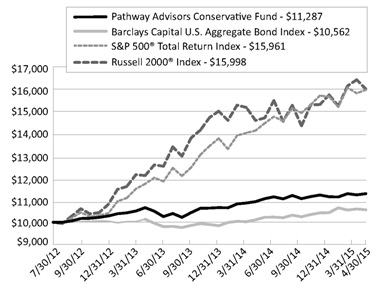

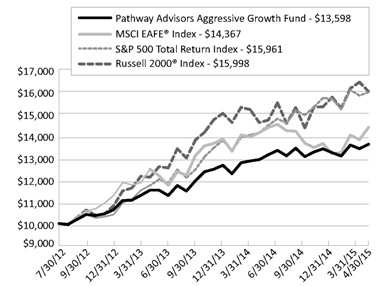

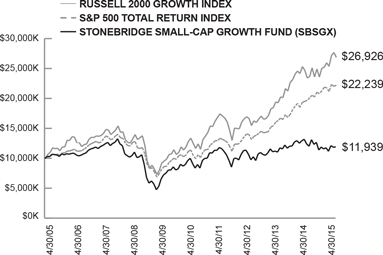

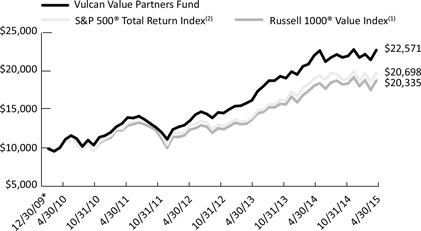

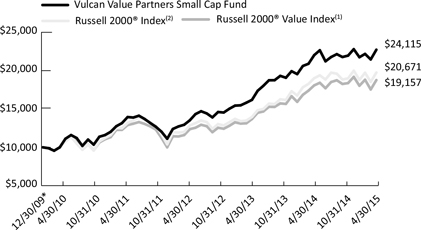

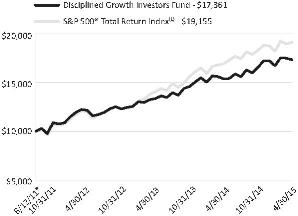

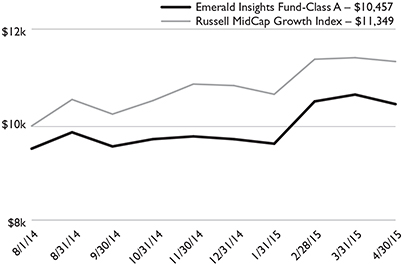

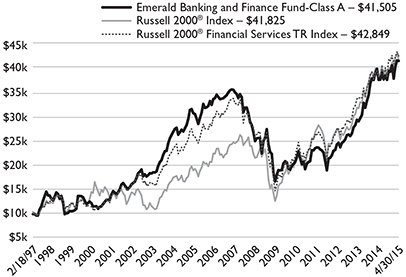

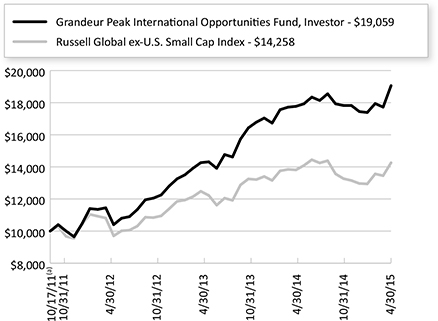

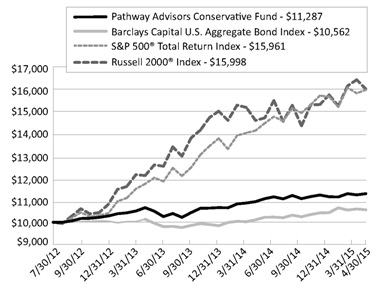

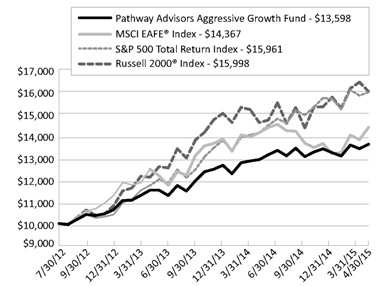

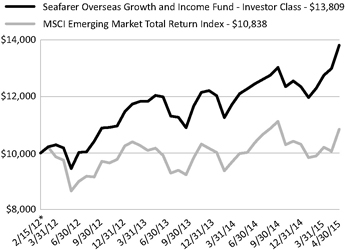

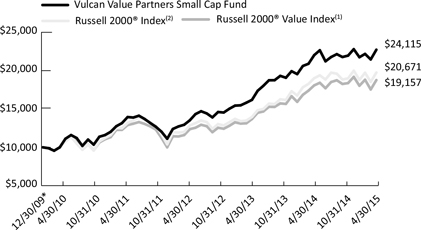

Performance of $10,000 Initial Investment (as of April 30, 2015)

Comparison of change in value of a $10,000 investment (includes applicable sales loads)

The chart represents historical performance of a hypothetical investment of $10,000 in the Fund since inception. Past performance does not guarantee future results. This chart does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

| | |

Annual Report | April 30, 2015 | | 3 |

| | |

Aspen Managed Futures Strategy Fund | | Consolidated Disclosure of Fund Expenses |

| | April 30, 2015 (Unaudited) |

As a shareholder of a Fund, you incur two types of costs: (1) transaction costs, including applicable sales charges (loads), redemption fees, wire fees and low balance fees; and (2) ongoing costs, including management fees, distribution and service (12b-1) fees, shareholder services fees and other Fund expenses. This example is intended to help you understand your indirect costs, also referred to as “ongoing costs” (in dollars), of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds.

This example is based on an investment of $1,000 invested at the beginning of the period and held for the entire six-month period of November 1, 2014 through April 30, 2015.

Actual Expenses The first line of the table below provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested at the beginning of the period, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes The second line of the table provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as applicable sales charges (loads), redemption fees, wire fees and low balance fees. Therefore, the second line of the table is useful in comparing ongoing costs only and will not help you determine the relative total costs of owning different funds. In addition, if these transaction costs were included, your costs would be higher.

| | | | | | | | |

| | | Beginning

Account Value

11/1/14 | | Ending

Account Value

4/30/15 | | Expense Ratio(a) | | Expenses Paid During period

11/1/14 - 4/30/15(b) |

Class A | | | | | | | | |

Actual | | $ 1,000.00 | | $ 1,082.10 | | 1.65% | | $ 8.52 |

Hypothetical (5% return before expenses) | | $ 1,000.00 | | $ 1,016.61 | | 1.65% | | $ 8.25 |

Class I | | | | | | | | |

Actual | | $ 1,000.00 | | $ 1,085.30 | | 1.23% | | $ 6.36 |

Hypothetical (5% return before expenses) | | $ 1,000.00 | | $ 1,018.70 | | 1.23% | | $ 6.16 |

| (a) | The Fund’s expense ratios have been based on the Fund’s most recent fiscal half-year expenses. |

| (b) | Expenses are equal to the Fund’s annualized expense ratio multiplied by the average account value over the period, multiplied by the number of days in the most recent fiscal half-year (181)/365 (to reflect the half-year period). |

| | |

4 | | www.aspenfuturesfund.com |

| | |

Aspen Managed Futures Strategy Fund | | Consolidated Schedule of Investments |

| | April 30, 2015 |

| | | | | | | | |

| | | Principal Amount/

Shares | | | Value (Note 2) | |

GOVERNMENT BONDS (36.42%) | | | | | | | | |

U.S. TREASURY NOTES (36.42%) | | | | | | | | |

0.250%, 10/31/2015 | | | $ 5,000,000 | | | | $ 5,004,295 | |

0.250%, 11/30/2015 | | | 12,086,000 | | | | 12,097,337 | |

0.250%, 12/31/2015 | | | 9,029,000 | | | | 9,033,235 | |

0.375%, 01/31/2016 | | | 6,006,000 | | | | 6,014,913 | |

0.375%, 01/31/2016 | | | 3,325,000 | | | | 3,329,934 | |

0.250%, 02/29/2016 | | | 16,019,000 | | | | 16,025,263 | |

0.375%, 03/31/2016 | | | 5,042,000 | | | | 5,048,696 | |

0.375%, 03/31/2016 | | | 3,300,000 | | | | 3,304,382 | |

0.250%, 04/15/2016 | | | 10,000,000 | | | | 10,002,340 | |

0.375%, 04/30/2016 | | | 10,034,000 | | | | 10,046,542 | |

0.375%, 05/31/2016 | | | 7,029,000 | | | | 7,036,690 | |

0.500%, 08/31/2016 | | | 5,042,000 | | | | 5,049,482 | |

0.375%, 10/31/2016 | | | 5,041,000 | | | | 5,035,485 | |

TOTAL GOVERNMENT BONDS | | | | | | | | |

| | | | | | | | |

(Cost $96,936,347) | | | | | | | 97,028,594 | |

| | | | | | | | |

| | |

SHORT TERM INVESTMENTS (50.82%) | | | | | | | | |

MONEY MARKET FUND (8.27%) | | | | | | | | |

Dreyfus Treasury & Agency Cash Management Fund - Institutional Shares, 7-day yield, 0.010% | | | 22,039,791 | | | | 22,039,791 | |

| | | | | | | | |

| | |

U.S. TREASURY BILLS (42.55%) | | | | | | | | |

0.066%, 05/28/2015(a) | | | $ 10,500,000 | | | | 10,499,476 | |

0.059%, 06/25/2015(a) | | | 10,500,000 | | | | 10,499,050 | |

0.066%, 07/23/2015(a) | | | 6,750,000 | | | | 6,749,959 | |

0.090%, 08/20/2015(a) | | | 5,750,000 | | | | 5,749,954 | |

0.063%, 09/17/2015(a) | | | 4,000,000 | | | | 3,999,808 | |

0.075%, 10/08/2015(a) | | | 3,350,000 | | | | 3,349,554 | |

0.088%, 10/15/2015(a) | | | 7,500,000 | | | | 7,498,867 | |

0.151%, 11/12/2015(a) | | | 5,000,000 | | | | 4,998,510 | |

0.156%, 12/10/2015(a) | | | 9,300,000 | | | | 9,295,676 | |

0.159%, 01/07/2016(a) | | | 10,000,000 | | | | 9,991,460 | |

0.179%, 02/04/2016(a) | | | 10,000,000 | | | | 9,989,150 | |

0.212%, 03/03/2016(a) | | | 10,500,000 | | | | 10,487,463 | |

0.190%, 03/31/2016(a) | | | 5,000,000 | | | | 4,990,925 | |

0.222%, 04/28/2016(a) | | | 15,300,000 | | | | 15,266,830 | |

| | | | | | | | |

| | | | | | | 113,366,682 | |

| | | | | | | | |

| | |

TOTAL SHORT TERM INVESTMENTS (Cost $135,380,422) | | | | | | | 135,406,473 | |

| | | | | | | | |

| | |

TOTAL INVESTMENTS (87.24%) (Cost $232,316,769) | | | | | | $ | 232,435,067 | |

| | | | | | | | |

| | |

Other Assets In Excess Of Liabilities (12.76%) | | | | | | | 33,989,832(b) | |

| | | | | | | | |

| | |

NET ASSETS (100.00%) | | | | | | $ | 266,424,899 | |

| | | | | | | | |

| (a) | Rate shown represents the bond equivalent yield to maturity at date of purchase. |

| (b) | Includes cash which is being held as collateral for futures contracts. |

| | |

See Notes to Consolidated Financial Statements. | | |

Annual Report | April 30, 2015 | | 5 |

| | |

Aspen Managed Futures Strategy Fund | | Consolidated Schedule of Investments |

| | April 30, 2015 |

FUTURES CONTRACTS

At April 30, 2015, the Fund had outstanding futures contracts:

| | | | | | | | | | | | | | |

| Description | | Position | | Contracts | | Expiration

Date | | Underlying Face

Amount at Value | | | Unrealized

Appreciation | |

Commodity Contracts | | | | | | | | | | | | | | |

Silver Future | | Short | | 77 | | 07/30/2015 | | $ | (6,218,905) | | | $ | 208,078 | |

Soybean Future | | Short | | 65 | | 07/15/2015 | | | (3,172,000) | | | | 3,259 | |

WTI Crude Future | | Long | | 57 | | 05/20/2015 | | | 3,398,910 | | | | 59,387 | |

Equity Contracts | | | | | | | | | | | | | | |

FTSE® 100 Index Future | | Long | | 203 | | 06/22/2015 | | | 21,591,137 | | | | 95,217 | |

Nikkei 225 Index Future | | Long | | 215 | | 06/12/2015 | | | 20,898,000 | | | | 335,295 | |

Foreign Currency Contracts | | | | | | | | | | | | | | |

New Zealand Dollar Currency Future | | Long | | 231 | | 06/16/2015 | | | 17,551,380 | | | | 64,184 | |

| | | | | | | | | | |

| | | | | | | | $ | 54,048,522 | | | $ | 765,420 | |

| | | | | | | | | | |

| | | | | |

| Description | | Position | | Contracts | | Expiration

Date | | Underlying Face

Amount at Value | | | Unrealized

Depreciation | |

Commodity Contracts | | | | | | | | | | | | | | |

Copper Future | | Short | | 45 | | 07/30/2015 | | $ | (3,247,313) | | | $ | (230,882) | |

Corn Future | | Short | | 353 | | 07/15/2015 | | | (6,464,313) | | | | (19,522) | |

Gold 100 Oz Future | | Long | | 28 | | 06/29/2015 | | | 3,310,720 | | | | (77,650) | |

New York Harbor ULSD Future | | Short | | 41 | | 06/01/2015 | | | (3,410,421) | | | | (171,979) | |

Sugar No. 11 (World) Future | | Short | | 434 | | 07/01/2015 | | | (6,406,534) | | | | (15,744) | |

Equity Contracts | | | | | | | | | | | | | | |

Euro STOXX 50® Index Future | | Long | | 535 | | 06/22/2015 | | | 21,433,857 | | | | (218,741) | |

S&P 500® E-Mini Future | | Long | | 203 | | 06/22/2015 | | | 21,100,835 | | | | (136,258) | |

Fixed Income Contracts | | | | | | | | | | | | | | |

Canadian 10 Year Bond Future | | Long | | 109 | | 06/22/2015 | | | 12,668,935 | | | | (242,440) | |

Euro-Bund Future | | Long | | 219 | | 06/09/2015 | | | 38,533,176 | | | | (422,470) | |

Long Gilt Future | | Long | | 138 | | 06/29/2015 | | | 25,021,390 | | | | (517,853) | |

U.S. 10 Year Treasury Note Future | | Long | | 97 | | 06/22/2015 | | | 12,452,375 | | | | (91,125) | |

Foreign Currency Contracts | | | | | | | | | | | | | | |

Australian Dollar Currency Future | | Long | | 49 | | 06/16/2015 | | | 3,869,040 | | | | (57,555) | |

Canadian Dollar Currency Future | | Short | | 170 | | 06/17/2015 | | | (14,055,600) | | | | (549,721) | |

Euro FX Currency Future | | Short | | 332 | | 06/16/2015 | | | (46,753,900) | | | | (2,176,165) | |

Japanese Yen Currency Future | | Long | | 134 | | 06/16/2015 | | | 14,033,150 | | | | (51,938) | |

Swiss Franc Currency Future | | Short | | 134 | | 06/16/2015 | | | (18,017,975) | | | | (637,225) | |

| | | | | | | | | | |

| | | | | | | | $ | 54,067,422 | | | $ | (5,617,268) | |

| | | | | | | | | | |

Common Abbreviations:

FTSE - Financial Times and the London Stock Exchange

FX - Foreign

No. - Number

Oz - Ounce

S&P - Standard and Poor’s

ULSD - Ultra Low Sulfur Diesel

Holdings are subject to change.

For Fund compliance purposes, the Fund’s industry classifications refer to any one or more of the industry sub-classifications used by one or more widely recognized market indexes or ratings group indexes, and/or as defined by Fund management. This definition may not apply for purposes of this report, which may combine industry sub-classifications for reporting ease. Industries are shown as a percentage of net assets.

| | |

See Notes to Consolidated Financial Statements. | | |

6 | | www.aspenfuturesfund.com |

| | |

| Aspen Managed Futures Strategy Fund Consolidated Statement of Assets & Liabilities |

| | April 30, 2015 |

| | | | |

ASSETS: | | | | |

Investments, at value | | $ | 232,435,067 | |

Cash | | | 11,565,750 | |

Deposit with broker for futures contracts, foreign currency (Cost $8,325,749) (Note 3) | | | 8,335,500 | |

Deposit with broker for futures contracts (Note 3) | | | 28,135,299 | |

Receivable for shares sold | | | 1,495,565 | |

Variation margin receivable | | | 765,420 | |

Interest receivable | | | 55,870 | |

Prepaid and other assets | | | 12,740 | |

| |

Total assets | | | 282,801,211 | |

| |

| |

LIABILITIES: | | | | |

Payable to advisor | | | 164,153 | |

Payable for investments purchased | | | 10,026,242 | |

Variation margin payable | | | 5,617,268 | |

Payable for shares redeemed | | | 413,022 | |

Payable for administration fees | | | 19,897 | |

Payable for distribution and service fees | | | | |

Class A | | | 13,373 | |

Payable for transfer agency fees | | | 12,631 | |

Payable for trustee fees and expenses | | | 1,902 | |

Payable for professional fees | | | 33,804 | |

Payable for chief compliance officer fees | | | 2,894 | |

Payable for principal financial officer fees | | | 417 | |

Payable for licensing fees | | | 54,718 | |

Accrued expenses and other liabilities | | | 15,991 | |

| |

Total liabilities | | | 16,376,312 | |

| |

NET ASSETS | | $ | 266,424,899 | |

| |

| |

NET ASSETS CONSIST OF: | | | | |

| |

Paid-in capital (Note 5) | | $ | 244,987,744 | |

Accumulated net investment income | | | 5,144,673 | |

Accumulated net realized gain on investments, futures contracts and foreign currency transactions | | | 21,016,281 | |

Net unrealized depreciation on investments, futures contracts and foreign currency translations | | | (4,723,799) | |

| |

NET ASSETS | | $ | 266,424,899 | |

| |

| |

INVESTMENTS, AT COST | | $ | 232,316,769 | |

| |

PRICING OF SHARES: | | | | |

Class A: | | | | |

Net Asset Value, offering and redemption price per share | | $ | 10.01 | |

Net Assets | | $ | 23,849,913 | |

Shares of beneficial interest outstanding | | | 2,381,761 | |

Maximum offering price per share (NAV/0.9450), based on maximum sales charge of 5.50% of the offering price | | $ | 10.59 | |

| |

Class I: | | | | |

Net Asset Value, offering and redemption price per share | | $ | 10.17 | |

Net Assets | | $ | 242,574,986 | |

Shares of beneficial interest outstanding | | | 23,844,450 | |

| | |

See Notes to Consolidated Financial Statements. | | |

Annual Report | April 30, 2015 | | 7 |

| | |

Aspen Managed Futures Strategy Fund | | Consolidated Statement of Operations |

| | For the Year Ended April 30, 2015 |

| | | | |

| |

INVESTMENT INCOME: | | | | |

Interest | | $ | 290,043 | |

Dividends | | | 1,349 | |

| |

Total Investment Income | | | 291,392 | |

| |

| |

EXPENSES: | | | | |

Investment advisory fees (Note 6) | | | 1,594,295 | |

Administrative fees | | | 232,640 | |

Distribution and service fees | | | | |

Class A | | | 53,339 | |

Transfer agency fees | | | 125,054 | |

Professional fees | | | 43,098 | |

Custodian fees | | | 11,506 | |

Trustee fees and expenses | | | 19,684 | |

Principal financial officer fees | | | 5,000 | |

Chief compliance officer fees | | | 33,217 | |

Licensing fees | | | 531,432 | |

Other | | | 64,298 | |

| |

Total Net Expenses | | | 2,713,563 | |

| |

NET INVESTMENT LOSS | | | (2,422,171) | |

| |

| |

Net realized gain on investments | | | 22,808 | |

Net realized gain on futures contracts | | | 36,480,798 | |

Net realized loss on foreign currency transactions | | | (182,329) | |

Net change in unrealized appreciation of investments | | | 39,024 | |

Net change in unrealized depreciation on futures contracts | | | (7,069,889) | |

Net change in unrealized appreciation on translation of assets and liabilities denominated in foreign currency transactions | | | 10,656 | |

| |

NET REALIZED AND UNREALIZED GAIN ON INVESTMENTS | | | 29,301,068 | |

| |

NET INCREASE IN NET ASSETS RESULTING FROM OPERATIONS | | $ | 26,878,897 | |

| |

| | |

See Notes to Consolidated Financial Statements. | | |

8 | | www.aspenfuturesfund.com |

| | |

Aspen Managed Futures Strategy Fund | | Consolidated Statements of Changes in Net Assets |

| | | | | | | | |

| | | For the | | | For the | |

| | | Year Ended | | | Year Ended | |

| | | April 30, 2015 | | | April 30, 2014 | |

OPERATIONS: | | | | | | | | |

Net investment loss | | $ | (2,422,171) | | | $ | (1,929,841) | |

Net realized gain/(loss) on investments, futures contracts and foreign currency transactions | | | 36,321,277 | | | | (2,925,094) | |

Net change in unrealized appreciation/(depreciation) on investments, futures contracts and foreign currency translations | | | (7,020,209) | | | | 1,557,404 | |

Net increase/(decrease) in net assets resulting from operations | | | 26,878,897 | | | | (3,297,531) | |

| | |

DISTRIBUTIONS TO SHAREHOLDERS (Note 4): | | | | | | | | |

From net realized gains on investments | | | | | | | | |

Class A | | | (309,900) | | | | (162,261) | |

Class I | | | (4,218,836) | | | | (2,158,924) | |

Net decrease in net assets from distributions | | | (4,528,736) | | | | (2,321,185) | |

| | |

SHARE TRANSACTIONS (Note 5): | | | | | | | | |

Class A | | | | | | | | |

Proceeds from sales of shares | | | 13,068,693 | | | | 13,615,924 | |

Distributions reinvested | | | 298,289 | | | | 160,468 | |

Cost of shares redeemed | | | (3,700,970) | | | | (3,784,081) | |

Redemption fees | | | 531 | | | | 7,725 | |

Class I | | | | | | | | |

Proceeds from sales of shares | | | 75,913,390 | | | | 67,455,247 | |

Distributions reinvested | | | 3,994,682 | | | | 2,022,776 | |

Cost of shares redeemed | | | (25,671,930) | | | | (17,814,123) | |

Redemption fees | | | 1,186 | | | | 5,843 | |

Net increase from share transactions | | | 63,903,871 | | | | 61,669,779 | |

| | |

Net increase in net assets | | | 86,254,032 | | | | 56,051,063 | |

| | |

NET ASSETS: | | | | | | | | |

Beginning of period | | | 180,170,867 | | | | 124,119,804 | |

End of period* | | $ | 266,424,899 | | | $ | 180,170,867 | |

| | |

*Includes accumulated net investment income/(loss) of: | | $ | 5,144,673 | | | $ | (710,695) | |

| | |

Other Information: | | | | | | | | |

SHARE TRANSACTIONS: | | | | | | | | |

Class A | | | | | | | | |

Sold | | | 1,300,095 | | | | 1,473,235 | |

Distributions reinvested | | | 30,594 | | | | 17,310 | |

Redeemed | | | (388,614) | | | | (411,560) | |

Net increase in shares outstanding | | | 942,075 | | | | 1,078,985 | |

| | |

| | |

Class I | | | | | | | | |

Sold | | | 7,614,314 | | | | 7,251,376 | |

Distributions reinvested | | | 403,911 | | | | 216,109 | |

Redeemed | | | (2,608,713) | | | | (1,932,582) | |

Net increase in shares outstanding | | | 5,409,512 | | | | 5,534,903 | |

| | |

| | |

See Notes to Consolidated Financial Statements. | | |

Annual Report | April 30, 2015 | | 9 |

| | |

Aspen Managed Futures Strategy Fund – Class A | | Consolidated Financial Highlights |

| | For a share outstanding throughout the periods presented. |

| | | | | | | | |

| | | | | | | | | For the Period |

| | | For the | | For the | | For the | | August 2, 2011 |

| | | Year Ended | | Year Ended | | Year Ended | | (Inception) to |

| | | April 30, 2015 (a) | | April 30, 2014 (a) | | April 30, 2013 (a) | | April 30, 2012 (a) |

NET ASSET VALUE, BEGINNING OF PERIOD | | $ 8.97 | | $ 9.29 | | $ 8.95 | | $ 10.00 |

INCOME/(LOSS) FROM OPERATIONS: | | | | | | | | |

Net investment loss(b) | | (0.14) | | (0.16) | | (0.16) | | (0.13) |

Net realized and unrealized gain/(loss) on investments | | 1.39 | | (0.05) | | 0.50 | | (0.92) |

Total from investment operations | | 1.25 | | (0.21) | | 0.34 | | (1.05) |

LESS DISTRIBUTIONS: | | | | | | | | |

Distributions from net realized gain on investments | | (0.21) | | (0.12) | | – | | – |

Total distributions | | (0.21) | | (0.12) | | – | | – |

REDEMPTION FEES ADDED TO PAID IN CAPITAL | | 0.00(c) | | 0.01 | | 0.00(c) | | – |

INCREASE/(DECREASE) IN NET ASSET VALUE | | 1.04 | | (0.32) | | 0.34 | | (1.05) |

NET ASSET VALUE, END OF PERIOD | | $ 10.01 | | $ 8.97 | | $ 9.29 | | $ 8.95 |

| |

| | | | |

TOTAL RETURN(d) | | 14.00% | | (2.15%) | | 3.80% | | (10.50%)(e) |

| | | | |

RATIOS AND SUPPLEMENTAL DATA: | | | | | | | | |

Net assets, end of period (000’s) | | $ 23,850 | | $ 12,914 | | $ 3,350 | | $ 1,254 |

| | | | |

RATIOS TO AVERAGE NET ASSETS: | | | | | | | | |

Operating expenses excluding fee waivers/reimbursements | | 1.64% | | 1.83% | | 1.80% | | 2.53%(f) |

Operating expenses including fee waivers/reimbursements | | 1.64% | | 1.83% | | 1.80% | | 1.80%(f) |

Net investment loss including fee waivers/reimbursements | | (1.50%) | | (1.72%) | | (1.75%) | | (1.79%)(f) |

| | | | |

PORTFOLIO TURNOVER RATE | | 38% | | 90% | | 0% | | 0%(e) |

| (a) | Per share amounts and ratios to average net assets include income and expenses of the Aspen Futures Fund Ltd. (subsidiary), exclusive of the subsidiary’s management fee. |

| (b) | Per share numbers have been calculated using the average shares method. |

| (c) | Less than $0.005 per share. |

| (d) | Total return does not reflect the effect of sales charges. |

| | |

See Notes to Consolidated Financial Statements. | | |

10 | | www.aspenfuturesfund.com |

| | |

Aspen Managed Futures Strategy Fund – Class I | | Consolidated Financial Highlights |

| | For a share outstanding throughout the periods presented. |

| | | | | | | | | | | | | | | | |

| | | For the

Year Ended

April 30, 2015 (a) | | | For the

Year Ended

April 30, 2014 (a) | | | For the

Year Ended

April 30, 2013 (a) | | | For the Period

August 2, 2011

(Inception) to

April 30, 2012 (a) | |

NET ASSET VALUE, BEGINNING OF PERIOD | | | $ 9.07 | | | | $ 9.36 | | | | $ 8.98 | | | | $ 10.00 | |

INCOME/(LOSS) FROM OPERATIONS: | | | | | | | | | | | | | | | | |

Net investment loss(b) | | | (0.11) | | | | (0.11) | | | | (0.11) | | | | (0.11) | |

Net realized and unrealized gain/(loss) on investments | | | 1.42 | | | | (0.06) | | | | 0.49 | | | | (0.91) | |

Total from investment operations | | | 1.31 | | | | (0.17) | | | | 0.38 | | | | (1.02) | |

LESS DISTRIBUTIONS: | | | | | | | | | | | | | | | | |

Distributions from net realized gain on investments | | | (0.21) | | | | (0.12) | | | | – | | | | – | |

Total distributions | | | (0.21) | | | | (0.12) | | | | – | | | | – | |

REDEMPTION FEES ADDED TO PAID IN CAPITAL | | | 0.00 | (c) | | | 0.00 | (c) | | | 0.00 | (c) | | | 0.00 | (c) |

INCREASE/(DECREASE) IN NET ASSET VALUE | | | 1.10 | | | | (0.29) | | | | 0.38 | | | | (1.02) | |

NET ASSET VALUE, END OF PERIOD | | | $ 10.17 | | | | $ 9.07 | | | | $ 9.36 | | | | $ 8.98 | |

| | |

| | | | |

TOTAL RETURN | | | 14.51% | | | | (1.81%) | | | | 4.23% | | | | (10.20%) | (d) |

| | | | |

RATIOS AND SUPPLEMENTAL DATA: | | | | | | | | | | | | | | | | |

Net assets, end of period (000’s) | | | $ 242,575 | | | | $ 167,258 | | | | $ 120,769 | | | | $ 90,450 | |

| | | | |

RATIOS TO AVERAGE NET ASSETS: | | | | | | | | | | | | | | | | |

Operating expenses excluding fee waivers/reimbursements | | | 1.25% | | | | 1.30% | | | | 1.25% | | | | 1.75% | (e) |

Operating expenses including fee waivers/reimbursements | | | 1.25% | | | | 1.30% | | | | 1.25% | | | | 1.55% | (e) |

Net investment loss including fee waivers/reimbursements | | | (1.11%) | | | | (1.20%) | | | | (1.20%) | | | | (1.54%) | (e) |

| | | | |

PORTFOLIO TURNOVER RATE | | | 38% | | | | 90% | | | | 0% | | | | 0% | (d) |

| (a) | Per share amounts and ratios to average net assets include income and expenses of the Aspen Futures Fund Ltd. (subsidiary), exclusive of the subsidiary’s management fee. |

| (b) | Per share numbers have been calculated using the average shares method. |

| (c) | Less than $0.005 per share. |

| | |

See Notes to Consolidated Financial Statements. | | |

Annual Report | April 30, 2015 | | 11 |

| | |

Aspen Managed Futures Strategy Fund | | Notes to Consolidated Financial Statements |

| | April 30, 2015 |

1. ORGANIZATION

Financial Investors Trust (the “Trust”), a Delaware statutory trust, is an open-end management investment company registered under the Investment Company Act of 1940, as amended (“1940 Act”). As of April 30, 2015, the Trust had 30 registered funds. This annual report describes the Aspen Managed Futures Strategy Fund (the “Fund”). The Fund seeks investment results that replicate as closely as possible, before fees and expenses, the price and yield performance of the Aspen Managed Futures Beta Index (the “MFBI” or “Index”). The Aspen Managed Futures Strategy Fund offers Class A and Class I shares.

Basis of Consolidation for the Aspen Futures Fund, Ltd.

Aspen Futures Fund, Ltd. (the “Subsidiary”), a Cayman Islands exempted company, is a wholly owned subsidiary of the Fund. The Subsidiary’s investment objective is designed to enhance the ability of the Fund to obtain exposure to equities, financial, currency and commodities markets consistent with the limits of the U.S. federal tax law requirements applicable to registered investment companies. The Subsidiary is subject to substantially the same investment policies and investment restrictions as the Fund. The Subsidiary acts as an investment vehicle for the Fund in order to effect certain commodity-related investments on behalf of the Fund. Investments in the Subsidiary are expected to provide the Fund with exposure to the commodity markets within the limitations of Subchapter M of the Internal Revenue Code of 1986, as amended (the “Code”), and recent IRS revenue rulings, as discussed below under “Federal Income Taxes”. The Fund is the sole shareholder of the Subsidiary pursuant to a subscription agreement dated as of August 2, 2011, and it is intended that the Fund will remain the sole shareholder and will continue to control the Subsidiary. Under the Articles of Association of the Subsidiary, shares issued by the Subsidiary confer upon a shareholder the right to wholly own and vote at general meetings of the Subsidiary and certain rights in connection with any winding-up or repayment of capital, as well as the right to participate in the profits or assets of the Subsidiary. The Fund may invest up to 25% of its total assets in shares of the Subsidiary. As a wholly owned subsidiary of the Fund, all assets and liabilities, income and expenses of the Subsidiary are consolidated in the financial statements and financial highlights of the Fund. All investments held by the Subsidiary are disclosed in the accounts of the Fund. As of April 30, 2015, net assets of the Fund were $266,424,899, of which $27,573,271 or 10.35%, represented the Fund’s ownership of all issued shares and voting rights of the Subsidiary.

2. SIGNIFICANT ACCOUNTING POLICIES

The accompanying financial statements were prepared in accordance with accounting principles generally accepted in the United States of America (“U.S. GAAP”). The preparation of financial statements in conformity with U.S. GAAP requires management to make certain estimates and assumptions that affect the reported amounts of assets and liabilities and disclosures of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenue and expenses during the period. Actual results could differ from those estimates. The Fund is considered an investment company for financial reporting purposes under U.S. GAAP. The following is a summary of significant accounting policies consistently followed by the Fund and subsidiary in preparation of the financial statements.

Investment Valuation: The Fund generally values its securities based on market prices determined at the close of regular trading on the New York Stock Exchange (“NYSE”), normally 4:00 p.m. Eastern Time, on each day the NYSE is open for trading.

For equity securities and mutual funds that are traded on an exchange, the market price is usually the closing sale or official closing price on that exchange. In the case of equity securities not traded on an exchange, or if such closing prices are not otherwise available, the securities are valued at the mean of the most recent bid and ask prices on such day. Redeemable securities issued by open-end registered investment companies are valued at the investment company’s applicable net asset value, with the exception of exchange-traded open-end investment companies, which are priced as equity securities.

The market price for debt obligations is generally the price supplied by an independent third-party pricing service approved by the Board of Trustees (the “Board”), which may use a matrix, formula or other objective method that takes into consideration quotations from dealers, market transactions in comparable investments, market indices and yield curves. If vendors are unable to supply a price, or if the price supplied is deemed to be unreliable, the market price may be determined using quotations received from one or more brokers–dealers that make a market in the security. Short–term debt obligations that will mature in 60 days or less are valued at amortized cost, unless it is determined that using this method would not reflect an investment’s fair value.

Futures contracts that are listed or traded on a national securities exchange, commodities exchange, contract market or comparable over-the-counter market, and that are freely transferable, are valued at their closing settlement price on the exchange on which they are primarily traded or based upon the current settlement price for a like instrument acquired on the day on which the instrument is being valued. A settlement price may not be used if the market makes a limit move with respect to a particular commodity.

Forward currency exchange contracts have a market value determined by the prevailing foreign currency exchange daily rates and current foreign currency exchange forward rates. The foreign currency exchange forward rates are calculated using an automated system that estimates rates on the basis of the current day foreign currency exchange rates and forward foreign currency exchange rates supplied by a pricing service.

| | |

12 | | www.aspenfuturesfund.com |

| | |

Aspen Managed Futures Strategy Fund | | Notes to Consolidated Financial Statements |

| | April 30, 2015 |

Investment securities that are primarily traded on foreign securities exchanges are valued at the preceding closing values of such securities on their respective exchanges, except when an occurrence subsequent to the time a value was so established is likely to have changed such value. In such an event, the fair value of those securities are determined in good faith through consideration of other factors in accordance with procedures established by and under the general supervision of the Board.

When such prices or quotations are not available, or when the Fair Value Committee appointed by the Board believes that they are unreliable, securities may be priced using fair value procedures approved by the Board.

Fair Value Measurements: The Fund discloses the classification of its fair value measurements following a three-tier hierarchy based on the inputs used to measure fair value. Inputs refer broadly to the assumptions that market participants would use in pricing the asset or liability, including assumptions about risk. Inputs may be observable or unobservable. Observable inputs reflect the assumptions market participants would use in pricing the asset or liability that are developed based on market data obtained from sources independent of the reporting entity. Unobservable inputs reflect the reporting entity’s own assumptions about the assumptions market participants would use in pricing the asset or liability that are developed based on the best information available.

Various inputs are used in determining the value of the Fund’s investments as of the end of the reporting period. When inputs used fall into different levels of the fair value hierarchy, the level in the hierarchy within which the fair value measurement falls is determined based on the lowest level input that is significant to the fair value measurement in its entirety. The designated input levels are not necessarily an indication of the risk or liquidity associated with these investments. These inputs are categorized in the following hierarchy under applicable financial accounting standards:

| | | | |

Level 1 | | – | | Unadjusted quoted prices in active markets for identical investments, unrestricted assets or liabilities that the Fund has the ability to access at the measurement date; |

| | |

Level 2 | | – | | Quoted prices which are not active, quoted prices for similar assets or liabilities in active markets or inputs other than quoted prices that are observable (either directly or indirectly) for substantially the full term of the asset or liability; and |

| | |

Level 3 | | – | | Significant unobservable prices or inputs (including the Fund’s own assumptions in determining the fair value of investments) where there is little or no market activity for the asset or liability at the measurement date. The following is a summary of each input used to value the Fund as of April 30, 2015: |

| | | | | | | | | | | | | | | | |

| Investments in Securities at Value | | Level 1 -

Quoted Prices | | | Level 2 -

Other Significant

Observable Inputs | | | Level 3 -

Significant Unobservable

Inputs | | | Total | |

Government Bonds | | $ | – | | | $ | 97,028,594 | | | $ | – | | | $ | 97,028,594 | |

Short Term Investments | | | | | | | | | | | | | | | | |

Money Market Fund | | | 22,039,791 | | | | – | | | | – | | | | 22,039,791 | |

U.S. Treasury Bills | | | – | | | | 113,366,682 | | | | – | | | | 113,366,682 | |

TOTAL | | $ | 22,039,791 | | | $ | 210,395,276 | | | $ | – | | | $ | 232,435,067 | |

| | | | | | | | | | | | | | | | | |

Other Financial Instruments | | | | | | | | | | | | | | | | |

Assets: | | | | | | | | | | | | | | | | |

Futures Contracts | | | | | | | | | | | | | | | | |

Commodity Contracts | | $ | 270,724 | | | $ | – | | | $ | – | | | $ | 270,724 | |

Equity Contracts | | | 430,512 | | | | – | | | | – | | | | 430,512 | |

Foreign Currency Contracts | | | 64,184 | | | | – | | | | – | | | | 64,184 | |

Liabilities: | | | | | | | | | | | | | | | | |

Futures Contracts | | | | | | | | | | | | | | | | |

Commodity Contracts | | | (515,777) | | | | – | | | | – | | | | (515,777) | |

Equity Contracts | | | (354,999) | | | | – | | | | – | | | | (354,999) | |

Fixed Income Contracts | | | (1,273,888) | | | | – | | | | – | | | | (1,273,888) | |

Foreign Currency Contracts | | | (3,472,604) | | | | – | | | | – | | | | (3,472,604) | |

TOTAL | | $ | (4,851,848) | | | $ | – | | | $ | – | | | $ | (4,851,848) | |

| | | | | | | | | | | | | | | | | |

The Fund recognizes transfers between levels as of the end of the period. For the year ended April 30, 2015, the Fund did not have any transfers between Level 1 and Level 2 securities. For the year ended April 30, 2015, the Fund did not have any securities that used significant unobservable inputs (Level 3) in determining fair value.

| | |

Annual Report | April 30, 2015 | | 13 |

| | |

Aspen Managed Futures Strategy Fund | | Notes to Consolidated Financial Statements |

| | April 30, 2015 |

Investment Transactions and Investment Income: Investment transactions are accounted for on the date the investments are purchased or sold (trade date). Realized gains and losses from investment transactions are reported on an identified cost basis. Interest income, which includes accretion of discounts, is accrued and recorded as earned. Dividend income is recognized on the ex-dividend date or for certain foreign securities, as soon as information is available to the Fund. All of the realized and unrealized gains and losses and net investment income, are allocated daily to each class in proportion to its average daily net assets.

Foreign Securities: The Fund may directly purchase securities of foreign issuers. Investing in securities of foreign issuers involves special risks not typically associated with investing in securities of U.S. issuers. The risks include possible reevaluation of currencies, the inability to repatriate foreign currency, less complete financial information about companies and possible future adverse political and economic developments. Moreover, securities of many foreign issuers and their markets may be less liquid and their prices more volatile than those of securities of comparable U.S. issuers.

Foreign Currency Translation: The books and records of the Fund are maintained in U.S. dollars. Investment valuations and other assets and liabilities initially expressed in foreign currencies are converted each business day into U.S. dollars based upon current exchange rates. Prevailing foreign exchange rates may generally be obtained at the close of the NYSE (normally, 4:00 p.m. Eastern Time). The portion of realized and unrealized gains or losses on investments due to fluctuations in foreign currency exchange rates is not separately disclosed and is included in realized and unrealized gains or losses on investments, when applicable.

Foreign Currency Spot Contracts: The Fund may enter into foreign currency spot contracts to facilitate transactions in foreign securities or to convert foreign currency receipts into U.S. dollars. A foreign currency spot contract is an agreement between two parties to buy and sell currencies at the current market rate, for settlement generally within two business days. The U.S. dollar value of the contracts is determined using current currency exchange rates supplied by a pricing service. The contract is marked-to-market daily for settlements beyond one day and any change in market value is recorded as an unrealized gain or loss. When the contract is closed, the Fund records a realized gain or loss equal to the difference between the value on the open and close date. Losses may arise from changes in the value of the foreign currency, or if the counterparties do not perform under the contract’s terms. The maximum potential loss from such contracts is the aggregate face value in U.S. dollars at the time the contract was opened.

Trust Expenses: Some expenses of the Trust can be directly attributed to the Fund. Expenses which cannot be directly attributed to the Fund are apportioned among all funds in the Trust based on average net assets of each fund.

Fund and Class Expenses: Expenses that are specific to a class of shares of the Fund are charged directly to that share class. All expenses of the Fund, other than class specific expenses, are allocated daily to each class in proportion to its average daily net assets. Fees provided under the distribution (Rule 12b-1) and the shareholder service plan for a particular class of the Fund are charged to the operations of such class.

Federal Income Taxes: The Fund complies with the requirements under Subchapter M of the Internal Revenue Code of 1986, as amended, applicable to regulated investment companies and intends to distribute substantially all of their net taxable income and net capital gains, if any, each year so that it will not be subject to excise tax on distributed income and gains. The Fund is not subject to income taxes to the extent such distributions are made.

As of and during the year ended April 30, 2015, the Fund did not have a liability for any unrecognized tax benefits. The Fund files U.S. federal, state, and local tax returns as required. The Fund’s tax returns are subject to examination by the relevant tax authorities until expiration of the applicable statute of limitations, which is generally three years after the filing of the tax return for federal purposes and four years for most state returns. Tax returns for open years have incorporated no uncertain tax positions that require a provision for income taxes.

Distributions to Shareholders: The Fund normally pays dividends and distributes capital gains, if any, on an annual basis. Income dividend distributions are derived from interest and other income the Fund receives from its investments, including short term capital gains. Long term capital gains distributions are derived from gains realized when the Fund sells a security it has owned for more than a year. The Fund may make additional distributions and dividends at other times if the portfolio manager believes doing so may be necessary for the Fund to avoid or reduce taxes.

3. DERIVATIVE INSTRUMENTS

The Fund uses derivatives (including futures) to pursue its investment objective. The Fund’s use of derivative instruments involves risks different from, or possibly greater than, the risks associated with investing directly in securities and other traditional investments. These risks may include (i) the risk that the counterparty to a derivative transaction may not fulfill its contractual obligations, (ii) risk of mispricing or improper valuation, and (iii) the risk that changes in the value of the derivative may not correlate perfectly with the underlying asset, rate or index. These risks could cause

| | |

14 | | www.aspenfuturesfund.com |

| | |

Aspen Managed Futures Strategy Fund | | Notes to Consolidated Financial Statements |

| | April 30, 2015 |

the Fund to lose more than the principal amount invested. In addition, investments in derivatives involve leverage, which means a small percentage of assets invested in derivatives can have a disproportionately large impact on the Fund.

The Fund’s use of derivatives can result in losses due to unanticipated changes in the market risk factors and the overall market. In instances where the Fund is using derivatives to decrease, or hedge, exposures to market risk factors for securities held by the Fund, there are also risks that those derivatives may not perform as expected resulting in losses for the combined or hedged positions. Derivatives may have little or no initial cash investment relative to their market value exposure and therefore can produce significant gains or losses in excess of their cost. This use of embedded leverage allows the Fund to increase its market value exposure relative to its net assets and can substantially increase the volatility of the Fund’s performance.

In addition, use of derivatives may increase or decrease exposure to the following risk factors:

| | • | | Equity Risk: Equity risk relates to the change in value of equity securities as they relate to increases or decreases in the general market. |

| | • | | Fixed Income Risk: When the Fund invests in fixed-income securities or derivatives, the value of an investment in the Fund will fluctuate with changes in interest rates. Typically, a rise in interest rates causes a decline in the value of fixed-income securities or derivatives owned by the Fund. In general, the market price of debt securities with longer maturities will increase or decrease more in response to changes in interest rates than shorter-term securities. Other risk factors include credit risk (the debtor may default) and prepayment risk (the debtor may pay its obligation early, reducing the amount of interest payments). |

| | • | | Foreign Currency Risk: Currency trading involves significant risks, including market risk, interest rate risk, country risk, counterparty credit risk and short sale risk. Market risk results from the price movement of foreign currency values in response to shifting market supply and demand. Interest rate risk arises whenever a country changes its stated interest rate target associated with its currency. Country risk arises because virtually every country has interfered with international transactions in its currency. Counterparty credit risk arises when the counterparty will not fulfill its obligations to the Fund. Short sale risk arises from the sale of a security that is not owned, or any sale that is completed by the delivery of a security borrowed. |

| | • | | Commodity Risk: Exposure to the commodities markets may subject the Fund to greater volatility than investments in traditional securities. Commodity prices are influenced by unfavorable weather, animal and plant disease, geologic and environmental factors, as well as changes in government regulation such as tariffs, embargoes or burdensome production rules and restrictions. |

Futures: The Fund and the Subsidiary may enter into futures contracts. Futures contracts are agreements between two parties to buy and sell a particular commodity, instrument or index for a specified price on a specified future date. When the Fund or the Subsidiary enters into a futures contract, it is required to deposit with (or for the benefit of) its broker an amount of cash or short-term high-quality securities as “initial margin”. The margin requirements are set by the exchange on which the contract is traded and may be modified during the term of the contract. The initial margin is in the nature of a performance bond or good faith deposit on the futures contract that is returned to the Fund upon termination of the contract, assuming all contractual obligations have been satisfied. As the value of the contract changes, the value of the futures contract position increases or declines. Subsequent payments, known as “variation margin”, are made or received by the Fund or the Subsidiary, depending on the price fluctuations in the fair value of the contract and the value of cash or securities on deposit with the broker. The aggregate principal amounts of the contracts are not recorded in the financial statements. Fluctuations in the value of the contracts are recorded in the Consolidated Statements of Assets and Liabilities as an asset (liability) and in the Consolidated Statements of Operations as unrealized appreciation (depreciation) until the contracts are closed, when they are recorded as realized gains (losses). Realized gain or loss on a futures position is equal to the difference between the value of the contract at the time it was opened and the value at the time it was closed, minus brokerage commissions. When the Fund or the Subsidiary enters into a futures contract certain risks may arise, such as illiquidity in the futures market, which may limit the Fund’s or the Subsidiary’s ability to close out a futures contract prior to settlement date, and unanticipated movements in the value of securities, commodities or interest rates. Futures contracts are exchange-traded. Exchange-traded futures are standardized contracts and are settled through a clearing house with fulfillment supported by the credit of the exchange. Therefore, counterparty credit risk to the Fund and the Subsidiary is reduced. In addition, the Fund could be exposed to risk if the counterparties to the contracts are unable to meet the terms of their contracts. With exchange traded futures, there is minimal counterparty credit risk to the Funds since futures are exchange traded and the exchange’s clearinghouse, as a counterparty to all exchange traded futures, guarantees the futures against default.

| | |

Annual Report | April 30, 2015 | | 15 |

| | |

Aspen Managed Futures Strategy Fund | | Notes to Consolidated Financial Statements |

| | April 30, 2015 |

Consolidated Balance Sheet – Fair Value of Derivative Instruments as of April 30, 2015(a):

| | | | | | | | | | | | |

| Risk Exposure | | Asset Derivatives Balance Sheet Location | | Fair Value | | | Liabilities Derivatives Balance Sheet Location | | Fair Value | |

| |

Futures Contracts | | Variation margin receivable | | $ | 765,420 | | | Variation margin payable | | $ | 5,617,268 | |

| |

| | | | $ | 765,420 | | | | | $ | 5,617,268 | |

| |

| | | | |

| | Risk Exposure to Fund | | | | | | | | | | |

| | Commodity Contracts | | $ | 270,724 | | | | | $ | 515,777 | |

| | Equity Contracts | | | 430,512 | | | | | | 354,999 | |

| | Fixed Income Contracts | | | – | | | | | | 1,273,888 | |

| | Foreign Currency Contracts | | | 64,184 | | | | | | 3,472,604 | |

| | | | | | |

| | | | $ | 765,420 | | | | | $ | 5,617,268 | |

| | | | | | |

| (a) | The number of futures contracts held at April 30, 2015 is representative of activity during the year ended April 30, 2015. |

Consolidated Statement of Operations – The effect of Derivative Instruments for the year ended April 30, 2015:

| | | | | | | | | | |

| Derivatives Instruments | | Location of Gain/(Loss) on Derivatives Recognized in Income | | Realized Gain/(Loss) on Derivatives Recognized in Income | | | Change in Unrealized Gain/(Loss) on Derivatives Recognized in Income |

|

Futures Contracts | | Net realized gain on futures contracts/Net | | | | | | |

| | change in unrealized depreciation on | | | | | | |

| | futures contracts | | $ | 36,480,798 | | | $ (7,069,889) |

| | | | | |

| | | | $ | 36,480,798 | | | $ (7,069,889) |

| | | | | |

| | Risk Exposure to Fund | | | | | | |

| | Commodity Contracts | | $ | 6,597,595 | | | $ (875,750) |

| | Equity Contracts | | | (791,236) | | | (445,066) |

| | Fixed Income Contracts | | | 9,329,556 | | | (1,466,856) |

| | Foreign Currency Contracts | | | 21,344,883 | | | (4,282,217) |

| | | | | |

| | | | $ | 36,480,798 | | | $ (7,069,889) |

| | | | | |

4. TAX BASIS INFORMATION

Reclassifications: Reclassifications to paid-in capital relate primarily to differing book/tax treatment of net investment losses, foreign currency transactions, and income from a controlled foreign corporation. For the year ended April 30, 2015, the following reclassifications, which had no impact on results of operations or net assets, were recorded to reflect tax character:

| | | | | | | | | | | | |

| Fund | | Paid-in Capital | | | Accumulated Net Investment Gain | | | Accumulated Net Realized Loss | |

Aspen Managed Futures Strategy Fund | | $ | 875,750 | | | $ | 8,277,539 | | | $ | (9,153,289) | |

Tax Basis of Investments: As of April 30, 2015, the aggregate cost of investments, gross unrealized appreciation/(depreciation) and net unrealized depreciation for Federal tax purposes was as follows:

| | | | | | | | | | | | | | | | | | | | |

| | | Cost of

Investments | | | Gross Appreciation (excess of value

over tax cost) | | | Gross Depreciation (excess of tax cost

over value ) | | | Net Depreciation on Futures Contracts

and Foreign Currencies | | | Net Depreciation

on Investments | |

Aspen Managed Futures Strategy Fund | | $ | 232,316,769 | | | $ | 1,061,672 | | | $ | (943,374) | | | $ | (4,842,097) | | | $ | (4,723,799) | |

| | |

16 | | www.aspenfuturesfund.com |

| | |

Aspen Managed Futures Strategy Fund | | Notes to Consolidated Financial Statements |

| | April 30, 2015 |

Components of Distributable Earnings: At April 30, 2015, components of distributable earnings were on a tax basis as follows:

| | | | |

| | | Aspen Managed Futures Strategy Fund | |

Undistributed ordinary income | | $ | 13,114,296 | |

Accumulated net capital gains | | | 8,439,863 | |

Net unrealized depreciation on futures contracts | | | (4,723,799) | |

Other cumulative effect of timing differences | | | 4,606,795 | |

Total distributable earnings | | $ | 21,437,155 | |

| | |

Capital Losses: As of April 30, 2015, the Fund has no accumulated capital loss carryforwards.

During the year ended April 30, 2015, the Fund utilized capital loss carryforwards in the amount of $35,626.

Tax Basis of Distributions to Shareholders: Distributions are determined in accordance with federal income tax regulations, which differ from GAAP, and, therefore, may differ significantly in amount or character from net investment income and realized gains for financial reporting purposes. Financial reporting records are adjusted for permanent book/tax differences to reflect tax character but are not adjusted for temporary differences.

The tax character of distributions paid during the year ending April 30, 2015 were as follows:

| | | | | | | | |

| | | Ordinary Income | | | Long-Term Capital Gain | |

Aspen Managed Futures Strategy Fund | | $ | 399,962 | | | $ | 4,128,774 | |

|

The tax character of distributions paid during the year ending April 30, 2014 were as follows: | |

| | |

| | | Ordinary Income | | | Long-Term Capital Gain | |

Aspen Managed Futures Strategy Fund | | $ | – | | | $ | 2,321,185 | |

5. SHARES OF BENEFICIAL INTEREST

The capitalization of the Trust consists of an unlimited number of shares of beneficial interest with no par value per share. Holders of the shares of the Fund of the Trust have one vote for each share held and a proportionate fraction of a vote for each fractional share. All shares issued and outstanding are fully paid and are transferable and redeemable at the option of the shareholder. Purchasers of the shares do not have any obligation to make payments to the Trust or its creditors (other than the purchase price for the shares) or make contributions to the Trust or its creditors solely by reason of the purchasers’ ownership of the shares. Shares have no pre-emptive rights.

Fund shares redeemed within 30 days of purchase may incur a 2% short-term redemption fee deducted from the redemption amount. The amount of redemption fees received during the period are presented in the Consolidated Statement of Changes in Net Assets.

6. MANAGEMENT AND RELATED-PARTY TRANSACTIONS

Aspen Partners Ltd. (the “Adviser” or “Aspen”), subject to the authority of the Board, is responsible for the overall management and administration of the Fund’s business affairs. The Adviser manages the investments of the Fund in accordance with the Fund’s investment objective, policies and limitations and investment guidelines established jointly by the Adviser and the Board. Pursuant to the Investment Advisory Agreement, (the “Advisory Agreement”), the Fund will pay the Adviser an annual management fee of 0.75%, based on the Fund’s average daily net assets. The management fee is paid on a monthly basis.

The Subsidiary has entered into a separate advisory agreement (the “Subsidiary Advisory Agreement”) with Aspen, the Subsidiary’s investment adviser and the Fund’s investment adviser, for the management of the Subsidiary’s portfolio pursuant to which the Subsidiary is obligated to pay the Adviser a management fee at the same rate that the Fund pays the Adviser for investment advisory services provided to the Fund. The Adviser has agreed to waive the advisory fee it receives from the Fund in an amount equal to the management fee paid by the Subsidiary. This waiver may not be terminated or modified without the consent of the Board.

| | |

Annual Report | April 30, 2015 | | 17 |

| | |

Aspen Managed Futures Strategy Fund | | Notes to Consolidated Financial Statements |

| | April 30, 2015 |

The Adviser has contractually agreed to waive and/or reimburse fees or expenses in order to limit total annual fund operating expenses after fee waiver/expense reimbursements (excluding distribution and service (12b-1) fees, shareholder services fees, acquired fund fees and expenses, brokerage expenses, interest expenses, taxes and extraordinary expenses) to 1.55% of the Fund’s average daily net assets. This agreement is in effect through August 31, 2016. This agreement may not be terminated or modified prior to this date except with the approval of the Board.

Pursuant to this agreement, the Fund will reimburse the Adviser for any fee waivers and expense reimbursements made by the Adviser, provided that any such reimbursements made by the Fund to the Adviser will not cause the Fund’s expense limitation to exceed expense limitations in existence at the time the expense was incurred, or at the time of the reimbursement, whichever is lower, and the reimbursement is made within three years after the expenses were incurred.

Fund Accounting Fees and Expenses

ALPS Fund Services, Inc. (“ALPS”) serves as administrator to the Fund and the Fund has agreed to pay expenses incurred in connection with their administrative activities. Pursuant to an Administrative Agreement, ALPS provides operational services to the Fund including, but not limited to, fund accounting and fund administration and generally assists in the Fund’s operations. Officers of the Trust are employees of ALPS. The Fund’s administration fee is accrued on a daily basis and paid monthly. Administration fees paid by the Fund for the year ended April 30, 2015 are disclosed in the Consolidated Statement of Operations.

ALPS is reimbursed by the Fund for certain out-of-pocket expenses.

Transfer Agent

ALPS serves as transfer, dividend paying and shareholder servicing agent for the Fund. ALPS receives an annual minimum fee, a fee based upon the number of shareholder accounts, and is also reimbursed by the Fund for certain out-of-pocket expenses.

Compliance Services

ALPS provides services that assist the Trust’s chief compliance officer in monitoring and testing the policies and procedures of the Trust in conjunction with requirements under Rule 38a-1 under the 1940 Act and receives an annual base fee. ALPS is reimbursed for certain out-of-pocket expenses by the Fund.

Principal Financial Officer

ALPS receives an annual fee for providing principal financial officer services to the Fund.

Distributor

ALPS Distributors, Inc. (“ADI” or the “Distributor”) (an affiliate of ALPS) acts as the distributor of the Fund’s shares pursuant to a Distribution Agreement with the Trust. Shares are sold on a continuous basis by ADI as agent for the Fund, and ADI has agreed to use its best efforts to solicit orders for the sale of the Fund’s shares, although it is not obliged to sell any particular amount of shares. ADI is not entitled to any compensation for its services as Distributor. ADI is registered as a broker-dealer with the Securities and Exchange Commission.

The Fund has adopted a plan of distribution for Class A shares pursuant to Rule 12b-1 under the 1940 Act (the “Plan”). The Plan allows the Fund to use Class A assets to pay fees in connection with the distribution and marketing of Class A shares and/or the provision of shareholder services to Class A shareholders. The Plan permits payment for services in connection with the administration of plans or programs that use Class A shares as their funding medium and for related expenses. The Plan permits the Fund to use its Class A assets to make total payments at an annual rate of up to 0.25% of the Fund’s average daily net assets attributable to its Class A shares. The expenses of the plan are reflected as distribution and service fees in the Consolidated Statement of Operations.

The Fund has adopted a shareholder service plan (a “Shareholder Services Plan”) for Class A shares. Under the Shareholder Services Plan the Fund is authorized to pay banks and their affiliates and other institutions, including broker-dealers and Fund affiliates (“Participating Organizations”), an aggregate fee in an amount not to exceed on an annual basis 0.15% for Class A shares of the average daily net asset value of the Class A shares, respectively, attributable to or held in the name of a Participating Organization for its clients as compensation for providing shareholder service activities, which do not include distribution services, pursuant to an agreement with a Participating Organization. Any amount of such payment not paid during the Fund’s fiscal year for such service activities shall be reimbursed to the Fund. Shareholder Services Plan fees are included with distribution and service fees on the Consolidated Statement of Operations.

Index Licensing Services

The Fund has adopted an Index Licensing Agreement with Quantitative Equity Strategies, LLC (“QES”) and the Adviser, joint owners of the Index, pursuant to which the Fund pays QES a monthly annualized licensing fee of 0.25%, based on the Fund’s average daily net assets for the right to use the Index in connection with the Fund.

| | |

18 | | www.aspenfuturesfund.com |

| | |

Aspen Managed Futures Strategy Fund | | Notes to Consolidated Financial Statements |

| | April 30, 2015 |

7. SECURITIES TRANSACTIONS

The cost of purchases and proceeds from sales of U.S. Government securities (excluding short-term securities) during the year ended April 30, 2015 were as follows:

| | | | |

| Aspen Managed Futures Strategy Fund | | | |

Cost of Investments Purchased | | $ | 58,838,468 | |

Proceeds from Investments Sold | | $ | 23,760,410 | |

8. INDEMNIFICATIONS

Under the Trust’s organizational documents, its officers and Trustees are indemnified against certain liability arising out of the performance of their duties to the Trust. Additionally, in the normal course of business, the Trust enters into contracts with service providers that may contain general indemnification clauses, which may permit indemnification to the extent permissible under applicable law. The Trust’s maximum exposure under these arrangements is unknown, as this would involve future claims that may be made against the Trust that have not yet occurred.

| | |

Annual Report | April 30, 2015 | | 19 |

| | |

Aspen Managed Futures Strategy Fund | | Report of Independent Registered Public Accounting Firm |

| | |

To the Shareholders and Board of Trustees of Financial Investors Trust:

We have audited the accompanying consolidated statement of assets and liabilities, including the consolidated schedule of investments, of Aspen Managed Futures Strategy Fund and subsidiary (the “Fund”), one of the portfolios constituting Financial Investors Trust, as of April 30, 2015, the related consolidated statement of operations for the year then ended, the consolidated statements of changes in net assets for each of the two years in the period then ended, and the consolidated financial highlights for each of the three years in the period then ended and the period from August 2, 2011 (inception) to April 30, 2012. These financial statements and financial highlights are the responsibility of the Fund’s management. Our responsibility is to express an opinion on these financial statements and financial highlights based on our audits.