UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-8194

FINANCIAL INVESTORS TRUST

(Exact name of registrant as specified in charter)

1290 Broadway, Suite 1100, Denver, Colorado 80203

(Address of principal executive offices) (Zip code)

David T. Buhler, Secretary

Financial Investors Trust

1290 Broadway, Suite 1100

Denver, Colorado 80203

(Name and address of agent for service)

Registrant’s telephone number, including area code: 303-623-2577

Date of fiscal year end: April 30

Date of reporting period: May 1, 2013 - April 30, 2014

| Item 1. | Reports to Stockholders. |

TABLE OF CONTENTS

| | |

Seafarer Overseas Growth and Income Fund | | Letter to Shareholders |

April 30, 2014 |

LETTER TO SHAREHOLDERS

May 12, 2014

Dear Fellow Shareholders,

I am pleased to address you once again on behalf of the Seafarer Overseas Growth and Income Fund. This annual report encompasses the Fund’s most recent fiscal year, which ran from May 1, 2013 to April 30, 2014.

During the twelve month period, the Fund gained 2.12%1, while the Fund’s benchmark, the MSCI Emerging Markets Total Return Index, fell -1.49%. By way of broader comparison, the S&P 500 Index increased 20.44%.

The Fund began the fiscal year with a net asset value of $11.91 per share. During the ensuing twelve months, the Fund paid two distributions, worth $0.552 in aggregate. Those payments brought the cumulative distributions per share, as measured from the Fund’s inception, to $0.674.2 The Fund then finished the fiscal year with a value of $11.59 per share.3

We are proud of the Fund’s performance during this period, whether measured relative to peers, relative to the benchmark index, or in absolute. Emerging markets were highly volatile during the past twelve months, and we are pleased the Fund dampened a bit of that volatility, in line with the Fund’s investment objective.

Frankly, though, it was a tough time to be an investor in the Fund, or the emerging markets more broadly. Equity markets swung around a great deal, and the Fund did not go unscathed. Sometimes the emerging markets and the Fund moved higher together, but mostly they moved either sideways or lower. In the end, the Fund’s returns for the fiscal year were meager, and while positive, hardly seem worth the intervening drama. It was a frustrating time, and we are happy it is behind us.

However, while we are looking back: what a year it was! The emerging markets were beset by myriad troubles, with very few positive events to offset. The woes were numerous:

| | • | | “Tapering,” or the end to the U.S. Federal Reserve’s quantitative easing policy.4 |

| | • | | A mini-currency panic, led by the “fragile five” countries, which were deemed by some to be susceptible to funding gaps and therefore to financial crisis.5 |

| | • | | A rout in emerging market local currency bonds. |

| | • | | A material deceleration in China’s economic growth, accompanied by several bouts of distress within that country’s rickety financial system, including the country’s first recorded corporate bond default. |

| | • | | A collapse in commodity prices, which weighed heavily on Latin American and South African equities. |

| | • | | The implosion and final death throes of a Brazilian magnate’s empire, in which Seafarer estimates over $30 billion worth of Brazilian equity and bond capitalization evaporated during the preceding 24 months.6 |

| | • | | Episodic bouts of aggression and hostility on the part of North Korea. |

| | • | | Political instability in Brazil, Turkey, and Thailand, culminating in riots and protracted protests. |

| | • | | Cross-border conflict, instability and secession in Ukraine. |

When I review the list above, I am struck by the breadth and severity of the difficulties that have weighed on the emerging markets during the past twelve months. I am also struck by the performance of the benchmark index, when viewed in this context: a decline of only -1.49% is remarkable.

Last April, who would have imagined one year could deliver so many troubling events? And if you possessed such foreknowledge, would you have predicted the index would end the year roughly where it began? I, for one, would not have done so. If I somehow had advance notice of the list above, I would have cautioned clients to shelter from the market collapse that would inevitably follow. Yet the

| | |

Annual Report | April 30, 2014 | | 1 |

| | |

Seafarer Overseas Growth and Income Fund | | Letter to Shareholders |

April 30, 2014 |

market was nearly flat! With the benefit of hindsight, it is natural to view the index’s return as disappointing; yet I would assert that it was remarkably resilient in light of what could have happened.

The resilience of the emerging markets, in the face of so much bad news, likely conveys a basic but important message: stocks in the developing world are inexpensive. I cannot conclusively determine whether stocks are truly “cheap,” or “cheap enough” – those are loaded phrases that hold different meanings for different investors, and anyway, the markets are too broad to offer a simple, binary assessment as to their “cheapness.” However, I can state that in my experience, when stocks absorb a great deal of bad news, and yet their prices are materially unchanged, the simplest (and most likely) explanation is that prices were already low enough to compensate investors for additional risks – even big, unforeseen ones. Expensive stocks tend to exhibit the opposite behavior: a reduced tolerance for bad news, with prices swooning after a minor negative shock. The one-year return from the emerging markets was nearly flat, despite all that occurred – and I submit it was probably because stocks were inexpensive, with valuations that could accommodate bad news.

Performance Review

Amid this challenging year, the Fund’s performance was bolstered by its exposure to China, Vietnam, India and Poland. Chile, Turkey and Thailand weighed on returns. The Fund benefited from banks, health care, industrials, and utilities; it made absolute gains in technology shares, but on a relative basis it underperformed the index, which did much better in that sector; and the Fund was especially impaired by its exposure to commodity stocks.

Latin America was particularly challenging for the Fund throughout much of the fiscal year; the Fund’s holdings in Mexico, Chile and Brazil were all weak during the bulk of the period. However, we were pleased to see most of the Fund’s holdings in Brazil recover much of their lost ground near the close of the fiscal year, such that the Fund position in Brazil finished nearly flat. The Fund’s holdings in Mexico declined a bit during the period, but this was mainly because the positions had been so successful during the prior year – effectively, the valuations of the Fund’s holdings “cooled off” a bit, after substantial prior gains. We remain comfortable with the Fund’s holdings in that market.

Chile was a different story, though: at the outset of the year, the Fund’s holdings there were mostly centered on the commodity sector. A collapse in prices for raw materials undermined the Fund’s chief holding there, and for a variety of reasons – both related and unrelated to the price decline – we had the Fund exit the position.7 The Fund retains one position in Chile – Corpbanca, a mid-sized bank that is currently merging with Itau, one of Brazil’s largest financial institutions.

Regarding banks, and other financial institutions: the financial sector made the single largest contribution to the Fund’s outperformance versus the benchmark index. The Fund generated gains from the sector in several markets – Poland, Brazil, South Korea and Vietnam – while the benchmark produced sharply negative returns. Seafarer’s focus on bottom-up stock selection helped during the fiscal period, as there was no common theme or geography to otherwise unite these positions. The banks in Poland and Brazil are large capitalization stocks, acquired when their shares were depressed; the Fund benefited from the subsequent recovery in the valuation of those shares. In Korea, the Fund acquired the heavily discounted preferred shares of a commercial insurance company; happily for the Fund, the discount subsequently eased. In Vietnam, the Fund benefited from its exposure to a small capitalization stock associated with the country’s largest commercial re-insurer.

As mentioned above, the Fund’s performance was weak, on a relative basis, within the technology sector – the Fund produced gains, but it was outpaced by the benchmark index. The index’s gains were spurred mostly by its exposure to internet stocks, particularly those based in China and Korea. Since its inception, the Fund has lacked exposure to internet-focused companies (e.g. social media, search engines, entertainment). The Fund’s strategy does not prohibit exposure to the internet; however, such stocks typically fail to meet the Fund’s valuation and dividend criteria. We recognize there are some excellent internet-driven businesses, and if valuations ever become sufficiently attractive, the Fund will likely seek exposure.

| | |

| 2 | | (855) 732-9220 | seafarerfunds.com |

| | |

Seafarer Overseas Growth and Income Fund | | Letter to Shareholders |

April 30, 2014 |

The Fund performed well within India, generating gains and avoiding the worst of the volatility that impacted Indian shares and the local currency last autumn. The Fund’s exposure to Poland also proved successful: the Fund’s holdings were relatively steady amid the gyrations of the past year, and the holdings experienced growth that outpaced market expectations, which lifted share prices a bit.

The most surprising source of returns for the Fund was China. The country suffered from declining stock markets and widely publicized fears over slow growth and systemic risks within its financial sector. So perhaps it is surprising, but nonetheless true, that the Fund’s exposure to China was one of the largest sources of its absolute and relative gains, and the majority of the Fund’s Chinese holdings had positive returns during the fiscal year. The Fund’s success was due to its avoidance of large capitalization banks and energy companies – those sectors arguably are most affected by China’s current problems; and it was aided by its exposure to small and mid-sized industrial, technology and health care companies.

If you wish to review a more detailed discussion of the Fund’s performance and holdings, Seafarer publishes four portfolio reviews per year on its website. Each corresponds to a standard calendar quarter. Please visit www.seafarerfunds.com/archives for further information.

Peering Over China’s Great Wall of Worry

Returning to the topic of China: among investors focused on the emerging markets, the country is regarded with skepticism and trepidation. The global financial media is rife with reports of failings within the country’s financial system. Every release of economic data, no matter how trivial, receives a ridiculous degree of scrutiny, as if it were a tealeaf on which the Middle Kingdom’s future was written. I suppose there is a rational basis for this, as China is undergoing a major economic transition. The immediate outlook is not encouraging, and fraught with risk. There is plenty that can go wrong.

Yet if there is one surprising aspect to the current cloud that hangs over China, it is the near-total absence of discussion of all that could go right. The present debate around China’s investment merits is so unbalanced that it strikes me as absurd.

Please do not mistake me for a naive optimist about the country: for the past five years, I have written about the economy’s decelerating growth; its need for a revised economic model; troubles within its banking sector; potential imbalances that might undermine its currency, the renminbi; and the possibility that the country might instigate armed conflict with its neighbors. I am concerned about all of these issues, and more.

However, to dwell solely on the country’s well-known weaknesses is to ignore the important, broad-based reform efforts that are underway. China’s new leadership, installed in the fall of 2012, has launched a major overhaul of the country’s economic and political structure. Here is a partial list of what is taking place:

| | • | | A substantial (but unfortunately not exhaustive) anti-corruption drive. |

| | • | | Liberalization of the local currency and of interest rates within the banking system. Both are “backdoor” reforms of the domestic banking sector. |

| | • | | Recapitalization of the domestic banking system to address financial weaknesses. |

| | • | | Major stock market reforms, including: enhanced access for foreign investors via the “through train” policy,8 new mechanisms for companies to issue capital, and a liberalized market for initial public offerings (IPOs). |

| | • | | Major reforms to reduce excess capacities within state-owned enterprises. |

| | • | | Modernization of provincial governments’ finances, possibly culminating in the authority to levy local taxes (i.e. property and sales taxes), and the authority to issue municipal-style bonds. |

| | • | | Liberalization of most key input prices, especially energy and natural resources. |

| | • | | Environmental regulation, targeting sharp reduction in carbon emissions, with severe penalties for polluters. |

| | • | | Reformed property and land use rights. |

| | |

Annual Report | April 30, 2014 | | 3 |

| | |

Seafarer Overseas Growth and Income Fund | | Letter to Shareholders |

April 30, 2014 |

| | • | | Reform of the hukou (“household registration”) system. Hukou is a set of identification documents, somewhat like a domestic passport. Hukou defines a household’s civil, economic and legal rights within a given local municipality. It confers access (or lack thereof) to various government services, health care, education, housing and employment. If a family attempts to move from the countryside to the city, it will not be entitled to such services in the new urban residence because the family’s hukou remains tied to the original rural home. In my opinion, the system is broadly analogous to social entitlements in the U.S. – and its reform is just as politically contentious. |

| | • | | A major overhaul of the national healthcare delivery system. |

| | • | | Relaxation of the “one child” policy. |

Make no mistake: this is an impressive list. Apparently, China has listened to its external advisors, and to some of its detractors. The list makes it clear that China is not shying away from difficult change. No other developing nation has undertaken a reform program so comprehensive or bold. Imagine if the U.S. simultaneously tackled several sensitive issues. Envision a coordinated effort to reform healthcare, banking regulations, the tax code, and social entitlement programs. The project would be sweeping in its scale; it would meet with considerable resistance from vested interests; it would stand a significant risk of outright failure; and it would certainly rile every corner of our economy.

This is analogous to what is now taking place in China: the country is engaged in an extensive overhaul of the political and economic landscape. I cannot predict the extent to which it will be successful, but the country does not lack ambition. Nor does the leadership lack understanding about the urgency or nature of the challenges ahead. Admittedly, the most sensitive political reforms – those that might undermine the communist party’s authority – are absent. Nevertheless, any one of the initiatives above has the potential to impact the entire domestic economy for the better. If the reforms mostly meet with success, I believe China’s growth has the capacity to impress for many years to come. The team at Seafarer is eager to watch China’s progress unfold – and we will keep you informed regarding the results.

A Few Announcements

Please note: This section of the letter was written jointly by Andrew Foster and Michelle Foster, managing members of Seafarer Capital Partners, LLC.

The past fiscal year has been a good one for Seafarer Capital Partners, despite the difficulties that have weighed on the emerging markets. We have been privileged to welcome new shareholders to the Fund, and we have seen our relationships with clients grow. We made further investments in Seafarer’s resources – in personnel and technology – so as to ensure the firm’s steady growth and development. We recently expanded our investment team with the addition of Paul Espinosa, Senior Analyst, to our firm. Paul is a veteran investor in the emerging markets, and his arrival both broadens and deepens the team’s global research capabilities. We plan to further expand Seafarer’s team in the coming year.

Shortly after we founded Seafarer three years ago, we had the opportunity to write a brief essay on the firm’s goals.9 In that essay, we noted that our abiding goal as an investment adviser is to deliver superior long-term performance to our clients. However, we also noted three ancillary objectives: to increase the transparency associated with investment in developing countries; to mitigate a portion of the volatility that is inherent to the emerging markets; and to deliver lower costs to our clients, over time and with scale. We continue to work toward these three objectives, and we are happy to declare a bit of progress with respect to the third.

We are pleased to announce that effective September 1, 2014, the Fund will undertake an expense reduction on behalf of its shareholders. Seafarer Capital Partners, LLC (our firm) will contractually commit to lower the expenses of the Fund for the ensuing twelve months, with the intent to renew the same obligation for the foreseeable future.10 The Investor class net expenses will be reduced to 1.25% by way of this “expense cap,” and the Institutional class net expenses will be reduced to 1.05%.11 This new cap constitutes the second reduction in fees enacted by the Fund since its inception (the first reduction occurred in January 2013).

| | |

| 4 | | (855) 732-9220 | seafarerfunds.com |

| | |

Seafarer Overseas Growth and Income Fund | | Letter to Shareholders |

April 30, 2014 |

In addition, Seafarer Capital Partners will reduce its management fee for the Fund from 0.85% to 0.75%. Seafarer’s management fee constitutes a portion of the Fund’s overall expenses, and therefore such fees are subject to the aforementioned expense cap.

We are able to achieve these expense reductions because the Fund’s growth over the past year has afforded some basic economies of scale. Subscriptions from new and existing shareholders have increased the Fund’s operating efficiencies. The resulting economies, combined with the momentum we believe exists in our business, give us the confidence to drive expenses lower. We are pleased to achieve progress toward our goal of lower costs, though we are by no means finished. We will strive to further reduce expenses to shareholders, with additional time and with scale.

While we are pleased to be undertaking an expense reduction that benefits both share classes, it is our sincere wish that more shareholders could take advantage of the lower expenses afforded by the Institutional class. In truth, we would prefer to call it the “universal class,” because we hope that every shareholder could make use of it. We want to offer the lowest possible expenses to everyone. The problem is that certain distribution platforms (i.e., brokers, dealers, and other financial intermediaries) impose a minimum initial investment of $100,000 on the Institutional class. Those same platforms also restrict Seafarer’s ability to distribute the share class with a lower minimum on a direct basis – in other words, the $100,000 minimum applies everywhere, regardless of whether you purchase the Fund’s Institutional class directly from Seafarer, or from a platform or intermediary. This is not our preference. We are acutely aware that many shareholders cannot afford or would not choose to invest so much capital in the Fund. We are frustrated by the situation, as it drives a wedge between shareholders and the lower costs we would like to offer them.

Given that we would like to encourage broader usage of the Institutional class, we will describe three ways that certain shareholders might gain access to this share class, even if they are unable to immediately meet the investment minimum. First, financial advisers might discover that their platform will waive the minimum if the adviser invests with the intention to reach the minimum. Every platform evaluates waiver requests differently, and Seafarer has no influence over whether a particular platform will entertain such requests. Platforms that do grant waivers may require that Seafarer submit the request on behalf of the adviser. We are happy to help with such waiver requests. Advisers can contact us at (415) 578-9075 or contact@seafarerfunds.com.

Second, advisers can meet the investment minimum for the Institutional class by aggregating Fund holdings across multiple client accounts, if permitted by the platform.12 If you are an adviser and you encounter difficulty with aggregation at the platform, please let us know; we will try to resolve the issue with the platform.

Third, our firm has some influence over the application of the minimum as it pertains to shareholders who subscribe to the Fund on a direct basis via an automatic investment plan (“AIP”). We will do our utmost to waive the Institutional class minimum for accounts that satisfy all of the following criteria:

| | 1. | The account must be established directly with the Fund, not with a platform or intermediary. |

| | 2. | The account must activate an AIP. |

| | 3. | The account holder must request a waiver from the Fund’s transfer agent. The applicant must request the waiver in good faith, with the intent to eventually meet the Institutional class minimum via a program of sustained investment over time. The transfer agent can be reached at (855) 732-9220 or seafarerfunds@alpsinc.com. |

Also, we will do our best to ensure that existing AIP participants can convert from the Investor class to the Institutional class (known as a “share class transfer”), provided they satisfy all three criteria above. Ultimately, it is our hope that more shareholders make use of this “universal” share class, regardless of what its official name might convey. For our part, we will work to extend the benefit of lower expenses to those who undertake the extra effort required to invest directly with the Fund, on a sustained basis.

| | |

Annual Report | April 30, 2014 | | 5 |

| | |

Seafarer Overseas Growth and Income Fund | | Letter to Shareholders |

April 30, 2014 |

Thank you for entrusting us with your patience and your capital. It is an honor to serve as your investment adviser in the emerging markets.

Sincerely,

Andrew Foster, Chief Investment Officer

Michelle Foster, President

Seafarer Capital Partners, LLC

The MSCI Emerging Markets Total Return Index, Standard (Large+Mid Cap) Core, Gross (dividends reinvested), USD is a free float-adjusted market capitalization index designed to measure equity market performance of emerging markets. Index code: GDUEEGF.

The S&P 500 Total Return Index is a stock market index based on the market capitalizations of 500 large companies with common stock listed on the NYSE or NASDAQ. The index is not actively managed and does not reflect any deductions for fees, expense or taxes. An investor may not invest directly in an index.

The views and information discussed in this commentary are as of the date of publication, are subject to change, and may not reflect the writer’s current views. The views expressed represent an assessment of market conditions at a specific point in time, are opinions only and should not be relied upon as investment advice regarding a particular investment or markets in general. Such information does not constitute a recommendation to buy or sell specific securities or investment vehicles. It should not be assumed that any investment will be profitable or will equal the performance of the portfolios or any securities or any sectors mentioned herein. The subject matter contained herein has been derived from several sources believed to be reliable and accurate at the time of compilation. Seafarer does not accept any liability for losses either direct or consequential caused by the use of this information.

| 1 | References to the “Fund” pertain to the Fund’s Institutional share class (ticker: SIGIX). The Investor share class (ticker: SFGIX) returned 1.93% during the fiscal year. |

| 2 | The Fund’s inception date was February 15, 2012. |

| 3 | The Fund’s Investor share class began the fiscal year with a net asset value of $11.91 per share; it paid two distributions, worth $0.540 in aggregate; and it finished the fiscal year with a value of $11.58 per share. |

| 4 | Quantitative easing is the attempt by a central bank to inject more money into the economy and to keep long-term interest rates low through the purchase of large amounts of assets, often held by financial institutions. (Source: MITnews, “Explained: Quantitative Easing,” August 17, 2010) |

| 5 | The “fragile five” countries consist of Brazil, India, Indonesia, South Africa, and Turkey. |

| 6 | Bloomberg, “Batista’s Losers Shout and Sue as OGX Meltdown Casts Pall,” 31 December 2013 (www.bloomberg.com/news/2013-12-31/batista-s-losers-shout-and-sue-as-ogx-meltdown-casts-pall.html). |

| 7 | For more details regarding the Fund’s exposure to the commodity sector, please see the Fund’s portfolio review for the third quarter of 2013 (www.seafarerfunds.com/fund/portfolio-review/2013/09/Q3). |

| 8 | In April 2014 the China Securities Regulatory Commission (CSRC) and Hong Kong Securities and Futures Commission (SFC) announced the development of a pilot program called “Shanghai-Hong Kong Stock Connect” (informally known as the “through train”) that will establish mutual stock market access between mainland China and Hong Kong. The program will allow mainland Chinese and Hong Kong investors to access each other’s equity markets, and will enhance foreign investors’ access to mainland listed stocks as well. |

| 9 | The essay on the firm’s goals is available at www.seafarerfunds.com/ask-seafarer/#what-are-the-firms-goals. |

| 10 | Though it is Seafarer’s intent to renew this expense cap for the foreseeable future, Seafarer is under no obligation to renew the expense cap beyond the twelve month contractual term ending August 31, 2015. |

| 11 | Gross expense ratio as of the prospectus dated August 31, 2013: 2.79% for Investor class; 2.69% for Institutional class. |

| 12 | Similarly, individual investors can reach the investment minimum for the Institutional class by aggregating multiple accounts within the Fund, if permitted by the platform. |

| | |

| 6 | | (855) 732-9220 | seafarerfunds.com |

| | |

Seafarer Overseas Growth and Income Fund | | Portfolio Review |

April 30, 2014 |

Seafarer Overseas Growth and Income Fund Performance

| | | | | | |

Total Return (As of April 30, 2014) | | 1 Year | | Since

Inception* -

Annualized | | Net Expense

Ratio** |

Investor Class (SFGIX) | | 1.93% | | 9.72% | | 1.40% |

Institutional Class (SIGIX) | | 2.12% | | 9.85% | | 1.25% |

MSCI Emerging Markets Total Return Index^ | | -1.49% | | 0.09% | | |

Gross expense ratio: 2.79% for Investor Class; 2.69% for Institutional Class. Ratios as of the Prospectus dated August 31, 2013**

All performance is in U.S. dollars with gross (pre-tax) dividends and/or distributions reinvested. The performance data quoted represents past performance and does not guarantee future results. Future returns may be lower or higher. The investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than the original cost. Shares of the Fund redeemed or exchanged within 90 days of purchase are subject to a 2% redemption fee. Performance does not reflect this fee, which if deducted would reduce an individual’s return. To obtain the Fund’s most recent month-end performance, visit seafarerfunds.com or call (855) 732-9220.

| * | Inception Date: February 15, 2012. |

| ** | Seafarer Capital Partners, LLC has agreed contractually to waive and/or reimburse fees or expenses in order to limit Total Annual Fund Operating Expenses After Fee Waiver/Expense Reimbursements (excluding brokerage expenses, interest expenses, taxes and extraordinary expenses) to 1.40% and 1.25% of the Fund’s average daily net assets for the Investor and Institutional share classes, respectively. This agreement is in effect through August 31, 2014. |

| ^ | The MSCI Emerging Markets Total Return Index, Standard (Large+Mid Cap) Core, Gross (dividends reinvested), USD is a free float-adjusted market capitalization index designed to measure equity market performance of emerging markets. Index code: GDUEEGF. The index is not actively managed and does not reflect any deductions for fees, expense or taxes. An investor may not invest directly in an index. |

| | |

Annual Report | April 30, 2014 | | 7 |

| | |

Seafarer Overseas Growth and Income Fund | | Portfolio Review |

April 30, 2014 |

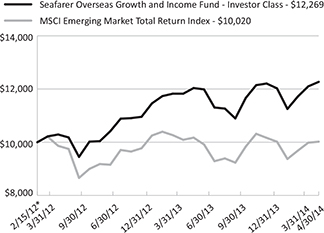

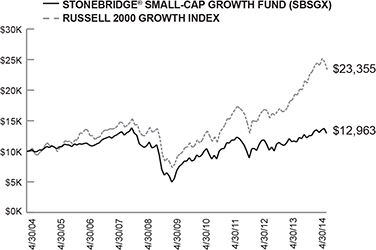

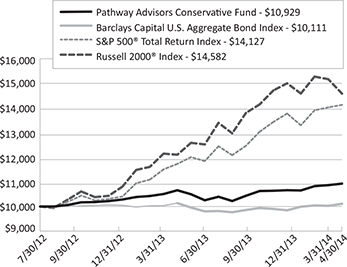

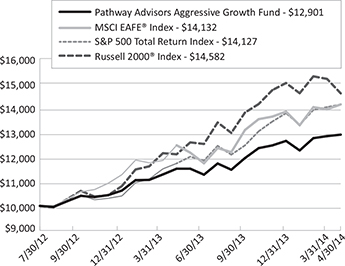

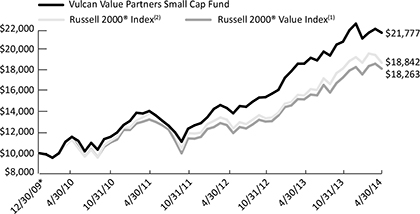

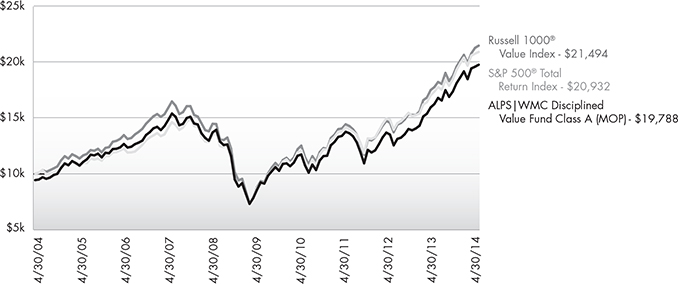

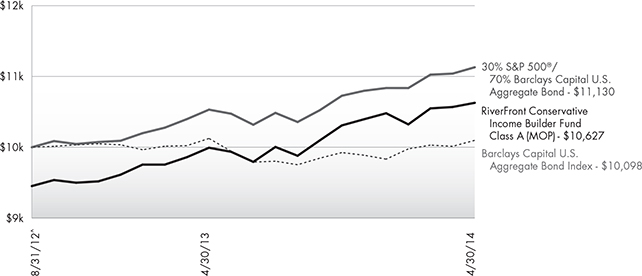

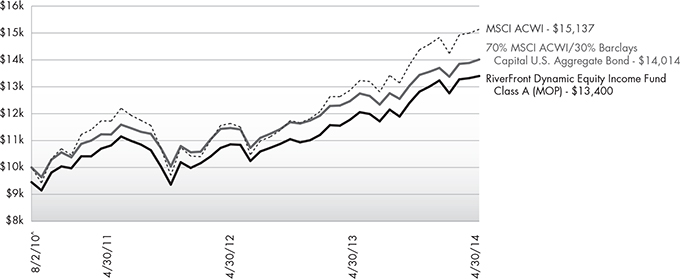

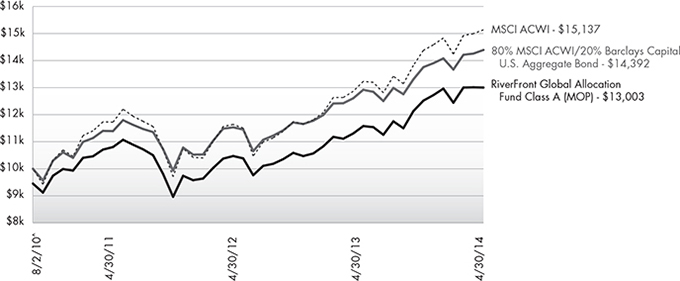

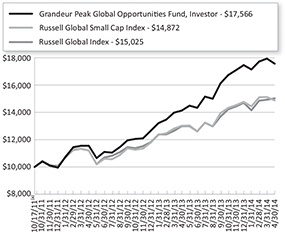

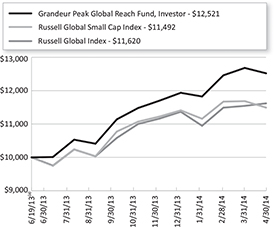

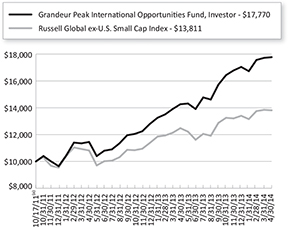

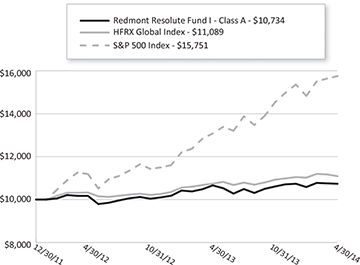

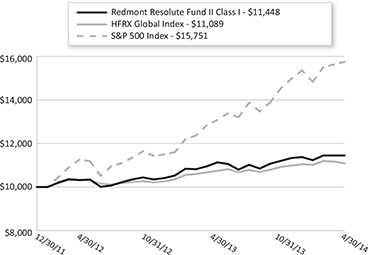

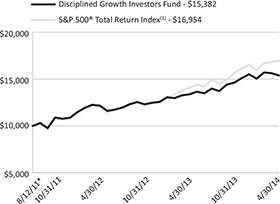

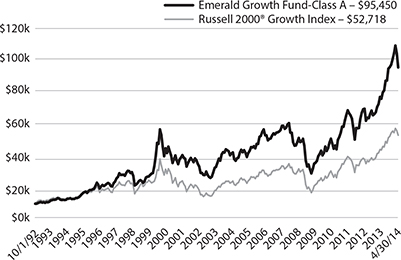

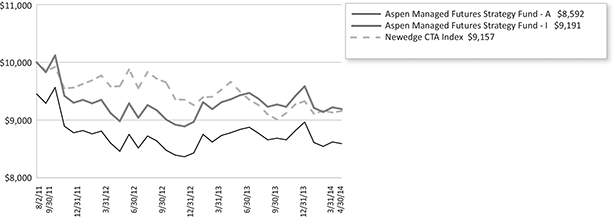

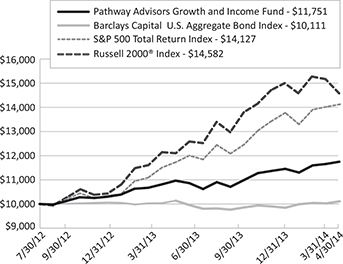

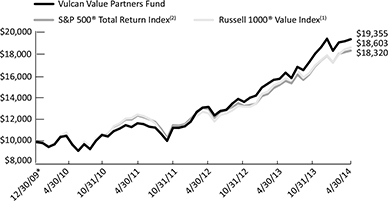

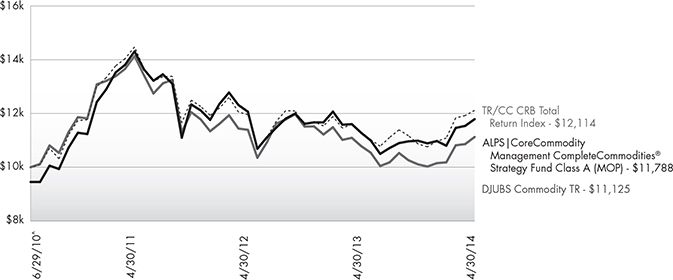

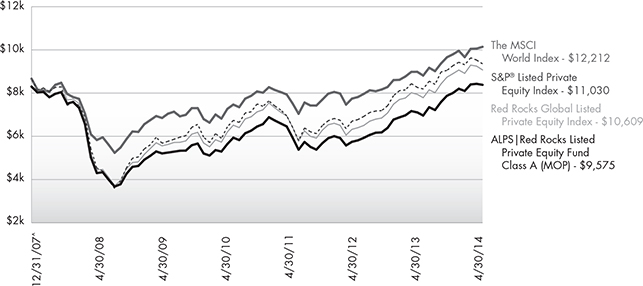

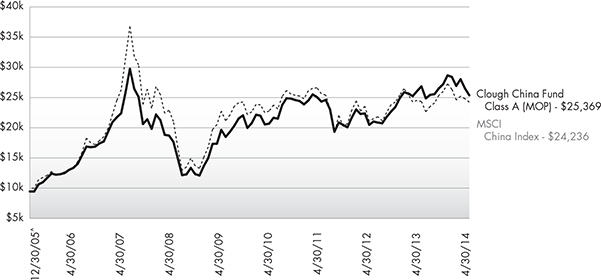

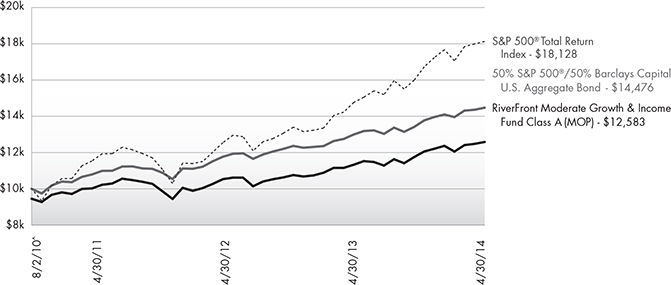

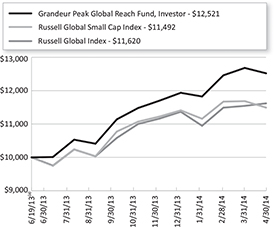

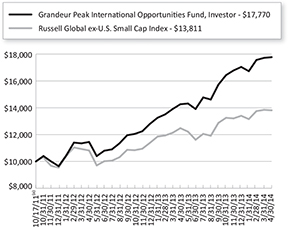

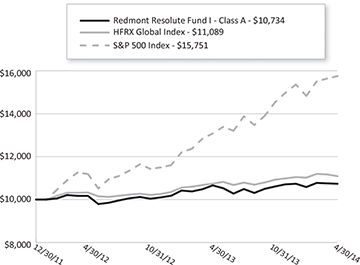

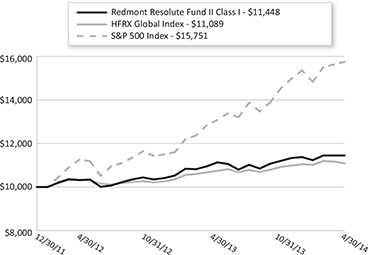

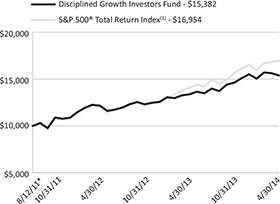

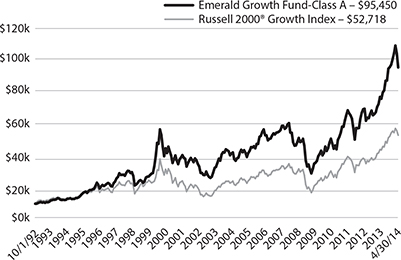

Performance of a $10,000 Investment Since Inception

* Inception Date: February 15, 2012.

The chart shown above represents historical performance of a hypothetical investment of $10,000 in the Fund’s Investor Class shares for the period from inception to April 30, 2014. All returns reflect reinvested dividends and/or distributions, but do not reflect the deduction of taxes that an investor would pay on distributions or redemptions.

The Fund also offers Institutional Class shares, performance for which is not reflected in the chart above. The performance of Institutional Class shares may be higher or lower than the performance of the Investor Class shares shown above based upon differences in fees paid by shareholders investing in the Investor Class shares and Institutional Class shares.

Investment Objective

The Fund seeks to provide long-term capital appreciation along with some current income. The Fund seeks to mitigate adverse volatility in returns as a secondary objective.

Strategy

The Fund invests primarily in the securities of companies located in developing countries. The Fund invests in several asset classes including dividend-paying common stocks, preferred stocks, convertible bonds, and fixed-income securities.

The Fund seeks to offer investors a relatively stable means of participating in a portion of developing countries’ growth prospects, while providing some downside protection compared to a portfolio that invests only in the common stocks of those countries.

| | |

| 8 | | (855) 732-9220 | seafarerfunds.com |

| | |

Seafarer Overseas Growth and Income Fund | | Portfolio Review |

April 30, 2014 |

Fund Characteristics

| | | | |

Inception Date | | | February 15, 2012 | |

Net Assets | | | $73.8M | |

Portfolio Turnover1 | | | 51% | |

| | | | | | | | | | |

| | | Investor Class | | Institutional Class |

Ticker | | | | SFGIX | | | | | SIGIX | |

NAV | | | | $11.58 | | | | | $11.59 | |

30-Day SEC Yield | | | | 1.80% | | | | | 1.95% | |

Fund Distribution Yield | | | | 1.62% | | | | | 1.71% | |

Net Expense Ratio | | | | 1.40% | | | | | 1.25% | |

Redemption Fee (within 90 calendar days) | | | | 2.00% | | | | | 2.00% | |

Minimum Initial Investment | | | | $2,500 | | | | | $100,000 | |

Minimum Initial Investment (Retirement Account) | | | | $1,000 | | | | | $100,000 | |

Underlying Portfolio Holdings

| | | | |

Number of Holdings | | | 47 | |

% of Net Assets in Top 10 Holdings | | | 31% | |

Weighted Average Market Cap | | | $14.8B | |

Market Cap of Portfolio Median | | | $4.2B | |

Gross Portfolio Yield2,3 | | | 3.2% | |

Price / Book Value2 | | | 1.8 | |

Price / Earnings2,4 | | | 11.3 | |

Earnings Per Share Growth2,4 | | | 11% | |

| 1 | For the year ended April 30, 2014. |

| 2 | Calculated as a harmonic average of the underlying portfolio holdings. |

| 3 | Gross Portfolio Yield = gross yield for the underlying portfolio, estimated based on the dividend yield for common and preferred stocks and yield to maturity for bonds. This measure of yield does not account for offsetting Fund expenses and other costs, and consequently it should not be construed as the yield that an investor in the Fund would receive. |

| 4 | Based on consensus earnings estimates for next year. Excludes securities for which consensus earnings estimates are not available. |

Past performance does not guarantee future results.

Sources: ALPS Fund Services, Inc., Bloomberg, Seafarer.

Price / Book Value: the value of a company’s common shares, divided by the company’s book value.

Price / Earnings: the market price of a company’s common shares divided by the earnings per common share as forecast for next year.

Earnings Per Share (EPS) Growth: forecast growth rate of earnings per common share next year, expressed as a percentage.

The “Underlying Portfolio Holdings” table presents indicative values only; Seafarer does not warrant the data’s accuracy, and disclaims any responsibility for its use for investment purposes.

| | |

Annual Report | April 30, 2014 | | 9 |

| | |

Seafarer Overseas Growth and Income Fund | | Portfolio Review |

April 30, 2014 |

Top 10 Holdings

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| Holding | | Sector | | Country | | % Net

Assets | | | Issuer Mkt

Cap ($B) | | Yield1 | | | Price /

Book | | | Price /

Earnings2 | | | EPS

Growth2 | |

Singapore Telecommunications Ltd. | | Telecom.

Services | | Singapore | | | 3.7% | | | $48.1 | | | 4.4% | | | | 2.7 | | | | 15 | | | | 7% | |

Hang Lung Properties, Ltd. | | Financials | | China /

Hong Kong | | | 3.5% | | | $13.5 | | | 3.2% | | | | 0.8 | | | | 16 | | | | 12% | |

Valid Solucoes | | Industrials | | Brazil | | | 3.3% | | | $0.9 | | | 2.6% | | | | 3.5 | | | | 12 | | | | 15% | |

Sindoh Co. Ltd.3 | | Information

Technology | | South

Korea | | | 3.1% | | | $0.7 | | | 3.4% | | | | 0.8 | | | | – | | | | – | |

Keppel Corp. Ltd. | | Industrials | | Singapore | | | 3.1% | | | $15.3 | | | 3.8% | | | | 1.9 | | | | 11 | | | | 7% | |

NTT DOCOMO, Inc. | | Telecom.

Services | | Japan | | | 3.0% | | | $69.7 | | | 3.7% | | | | 1.2 | | | | 13 | | | | 4% | |

Cia Vale do Rio Doce, Pfd. | | Materials | | Brazil | | | 3.0% | | | $68.7 | | | 6.4% | | | | 0.9 | | | | 6 | | | | 2% | |

Sun Pharma Advanced Research Co., Ltd.3,4 | | Health Care | | India | | | 3.0% | | | $0.7 | | | – | | | | 38.3 | | | | – | | | | – | |

Dongsuh Co. Inc.3 | | Consumer

Staples | | South

Korea | | | 2.7% | | | $1.5 | | | 3.5% | | | | 1.8 | | | | – | | | | – | |

Dongfang Electric Corp. Ltd. | | Industrials | | China /

Hong Kong | | | 2.7% | | | $3.7 | | | 1.0% | | | | 1.1 | | | | 9 | | | | 4% | |

| | | | | | |

Cumulative Weight of Top 10 Holdings: | | | 31% | | | | | | | | | | | | | | | | | | | |

Total Number of Holdings: | | | 47 | | | | | | | | | | | | | | | | | | | |

| 1 | Yield = dividend yield for common and preferred stocks and yield to maturity for bonds. |

| 2 | Based on consensus earnings estimates for next year. |

| 3 | Consensus estimates for earnings and EPS growth are not available for this security. |

| 4 | Non-income producing security. |

Portfolio holdings are subject to change.

Sources: ALPS Fund Services, Inc., Bloomberg, Seafarer.

The table above presents indicative values only; Seafarer does not warrant the data’s accuracy and disclaims any responsibility for its use for investment purposes.

| | |

| 10 | | (855) 732-9220 | seafarerfunds.com |

| | |

Seafarer Overseas Growth and Income Fund | | Portfolio Review |

April 30, 2014 |

Portfolio Composition

| | | | | |

| Region/Country | | % Net Assets |

East & South Asia | | | | 61 | |

China / Hong Kong | | | | 13 | |

India | | | | 7 | |

Indonesia | | | | 4 | |

Japan | | | | 5 | |

Malaysia | | | | 4 | |

Singapore | | | | 11 | |

South Korea | | | | 8 | |

Taiwan | | | | 4 | |

Vietnam | | | | 6 | |

Eastern Europe | | | | 14 | |

Poland | | | | 6 | |

Turkey | | | | 8 | |

Latin America | | | | 21 | |

Brazil | | | | 14 | |

Chile | | | | 2 | |

Mexico | | | | 5 | |

Middle East & Africa | | | | 2 | |

South Africa | | | | 2 | |

Cash and Other Assets,

Less Liabilities | | | | 2 | |

Total | | | | 100 | |

| |

| Asset Class | | % Net Assets |

Common Stock | | | | 81 | |

ADR | | | | 6 | |

Preferred Stock | | | | 5 | |

Foreign Currency Government Bond | | | | 4 | |

USD Convertible Bond | | | | 1 | |

Cash and Other Assets, Less Liabilities | | | | 2 | |

Total | | | | 100 | |

| |

| Market Capitalization of Issuer | | % Net Assets |

Large Cap (over $10 billion) | | | | 37 | |

Mid Cap ($1 - $10 billion) | | | | 38 | |

Small Cap (under $1 billion) | | | | 19 | |

Not Applicable | | | | 4 | |

Cash and Other Assets,

Less Liabilities | | | | 2 | |

Total | | | | 100 | |

| | | | | |

| Sector | | % Net Assets |

Consumer Discretionary | | | | 9 | |

Consumer Staples | | | | 11 | |

Energy | | | | 1 | |

Financials* | | | | 19 | |

Government | | | | 4 | |

Health Care | | | | 9 | |

Industrials | | | | 16 | |

Information Technology | | | | 15 | |

Materials | | | | 5 | |

Telecommunication Services | | | | 7 | |

Utilities | | | | 2 | |

Cash and Other Assets,

Less Liabilities | | | | 2 | |

Total | | | | 100 | |

| * | The Fund’s concentration in the Financials sector includes holdings in property-related stocks, which are classified within the “Financials sector” according to the Global Industry Classification Standard (GICS) methodology utilized herein. Property-related holdings comprised 7% of the Fund’s net assets as of April 30, 2014. |

Percentage values may not sum to 100% due to rounding.

| | |

Annual Report | April 30, 2014 | | 11 |

| | |

Seafarer Overseas Growth and Income Fund | | Portfolio Review |

April 30, 2014 |

Greatest Performance Contributors and Detractors

For the twelve months ended April 30, 2014

| | | | | |

| Contributors | | % Net Assets1 |

Samsung Fire & Marine Insurance Co., Ltd., Pfd. 2 | | | | – | |

Kingdee International Software Group Co. Ltd. 2 | | | | – | |

Bank Pekao SA | | | | 2.2 | |

PGE Polska Grupa Energetyczna SA | | | | 2.1 | |

Valid Solucoes | | | | 3.3 | |

| |

| Detractors | | % Net Assets1 |

Sociedad Quimica y Minera de Chile SA ADR2 | | | | – | |

Netas Telekomunikasyon AS2 | | | | – | |

Digital China Holdings, Ltd. | | | | 1.8 | |

Thai Reinsurance PCL2 | | | | – | |

Aliansce Shopping Centers SA | | | | 1.5 | |

| 2 | As of April 30, 2014, the Fund had no economic interest in this security. |

Source: Bloomberg.

The table above presents estimated values only; Seafarer does not warrant the data’s accuracy and disclaims any responsibility for its use for investment purposes.

| | |

| 12 | | (855) 732-9220 | seafarerfunds.com |

| | |

Seafarer Overseas Growth and Income Fund | | Disclosure of Fund Expenses |

April 30, 2014 (Unaudited) |

As a shareholder of the Fund you will incur two types of costs: (1) transaction costs, including applicable redemption fees; and (2) ongoing costs, including management fees and other Fund expenses. The following examples are intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds. The examples are based on an investment of $1,000 invested on November 1, 2013 and held until April 30, 2014.

Actual Expenses. The first line of each table below provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes. The second line of the table below provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other mutual funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds. The expenses shown in the table are meant to highlight ongoing Fund costs only and do not reflect transaction fees, such as redemption fees or exchange fees. Therefore, the second line of each table below is useful in comparing ongoing costs only, and may not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

| | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Beginning

Account Value

11/01/13 | | Ending

Account Value

04/30/14 | | Expense

Ratio(a) | | Expenses Paid

During Period

11/01/13 - 04/30/14(b) | | |

Investor Class | | | | | | | | | | | | | | | | | | | | | | |

Actual | | | $ | 1,000.00 | | | | $ | 1,010.20 | | | | | 1.40 | % | | | $ | 6.98 | | | |

Hypothetical | | | | | | | | | | | | | | | | | | | | | | |

(5% return before expenses) | | | $ | 1,000.00 | | | | $ | 1,017.85 | | | | | 1.40 | % | | | $ | 7.00 | | | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Institutional Class | | | | | | | | | | | | | | | | | | | | | | |

Actual | | | $ | 1,000.00 | | | | $ | 1,011.10 | | | | | 1.25 | % | | | $ | 6.23 | | | |

Hypothetical | | | | | | | | | | | | | | | | | | | | | | |

(5% return before expenses) | | | $ | 1,000.00 | | | | $ | 1,018.60 | | | | | 1.25 | % | | | $ | 6.26 | | | |

| (a) | Annualized, based on the Fund’s most recent fiscal half year expenses. |

| (b) | Expenses are equal to the Fund’s annualized expense ratio multiplied by the average account value over the period, multiplied by the number of days in the most recent fiscal half-year (181)/365 (to reflect the half-year period). |

| | |

Annual Report | April 30, 2014 | | 13 |

| | |

Seafarer Overseas Growth and Income Fund | | Portfolio of Investments |

April 30, 2014 |

| | | | | | | | | | |

| | | Currency | | Shares | | | Value | |

COMMON STOCKS (84.9%) | | | | | | | | | | |

Brazil (7.5%) | | | | | | | | | | |

Valid Solucoes e Servicos de Seguranca em Meios de Pagamento e Identificacao SA | | BRL | | | 160,000 | | | $ | 2,466,286 | |

Odontoprev SA | | BRL | | | 475,000 | | | | 1,917,255 | |

Aliansce Shopping Centers SA | | BRL | | | 136,000 | | | | 1,107,030 | |

| | | | | | | | | | |

| | | |

Total Brazil | | | | | | | | | 5,490,571 | |

| | | | | | | | | | |

| | | |

Chile (2.1%) | | | | | | | | | | |

Corpbanca SA | | CLP | | | 136,535,716 | | | | 1,572,839 | |

| | | | | | | | | | |

| | | |

Total Chile | | | | | | | | | 1,572,839 | |

| | | | | | | | | | |

| | | |

China / Hong Kong (13.3%) | | | | | | | | | | |

Hang Lung Properties, Ltd. | | HKD | | | 860,000 | | | | 2,565,079 | |

Dongfang Electric Corp., Ltd. | | HKD | | | 1,260,000 | | | | 1,970,642 | |

Beijing Enterprises Holdings, Ltd. | | HKD | | | 175,000 | | | | 1,523,995 | |

SinoMedia Holding, Ltd. | | HKD | | | 1,729,000 | | | | 1,520,439 | |

Digital China Holdings, Ltd. | | HKD | | | 1,470,000 | | | | 1,361,522 | |

Shandong Weigao Group Medical Polymer Co., Ltd., Class H | | HKD | | | 877,222 | | | | 888,792 | |

| | | | | | | | | | |

| | | |

Total China / Hong Kong | | | | | | | | | 9,830,469 | |

| | | | | | | | | | |

| | | |

India (6.8%) | | | | | | | | | | |

Sun Pharma Advanced Research Co., Ltd.(a) | | INR | | | 770,000 | | | | 2,185,110 | |

Infosys, Ltd. ADR | | USD | | | 35,000 | | | | 1,879,850 | |

Navneet Education, Ltd. | | INR | | | 968,880 | | | | 964,623 | |

| | | | | | | | | | |

| | | |

Total India | | | | | | | | | 5,029,583 | |

| | | | | | | | | | |

| | | |

Indonesia (2.6%) | | | | | | | | | | |

Astra International Tbk PT | | IDR | | | 3,000,000 | | | | 1,932,877 | |

| | | | | | | | | | |

| | | |

Total Indonesia | | | | | | | | | 1,932,877 | |

| | | | | | | | | | |

| | | |

Japan (4.8%) | | | | | | | | | | |

NTT DOCOMO, Inc. | | JPY | | | 140,000 | | | | 2,233,076 | |

Ajinomoto Co., Inc. | | JPY | | | 90,000 | | | | 1,324,607 | |

| | | | | | | | | | |

| | | |

Total Japan | | | | | | | | | 3,557,683 | |

| | | | | | | | | | |

| | |

| 14 | | (855) 732-9220 | seafarerfunds.com |

| | |

Seafarer Overseas Growth and Income Fund | | Portfolio of Investments |

April 30, 2014 |

| | | | | | | | | | |

| | | Currency | | Shares | | | Value | |

Malaysia (3.7%) | | | | | | | | | | |

Hartalega Holdings Bhd | | MYR | | | 759,960 | | | $ | 1,475,470 | |

AMMB Holdings Bhd | | MYR | | | 550,000 | | | | 1,210,513 | |

| | | | | | | | | | |

| | | |

Total Malaysia | | | | | | | | | 2,685,983 | |

| | | | | | | | | | |

| | | |

Mexico (4.8%) | | | | | | | | | | |

Grupo Herdez SAB de CV | | MXN | | | 630,470 | | | | 1,884,748 | |

Grupo Financiero Banorte SAB de CV | | MXN | | | 250,000 | | | | 1,660,392 | |

| | | | | | | | | | |

| | | |

Total Mexico | | | | | | | | | 3,545,140 | |

| | | | | | | | | | |

| | | |

Poland (5.8%) | | | | | | | | | | |

Bank Pekao SA | | PLN | | | 25,000 | | | | 1,604,511 | |

PGE SA | | PLN | | | 225,000 | | | | 1,563,481 | |

Asseco Poland SA | | PLN | | | 75,000 | | | | 1,116,774 | |

| | | | | | | | | | |

| | | |

Total Poland | | | | | | | | | 4,284,766 | |

| | | | | | | | | | |

| | | |

Singapore (9.3%) | | | | | | | | | | |

Singapore Telecommunications, Ltd. | | SGD | | | 900,000 | | | | 2,756,807 | |

Keppel Corp., Ltd. | | SGD | | | 270,000 | | | | 2,271,789 | |

SIA Engineering Co., Ltd. | | SGD | | | 477,000 | | | | 1,824,073 | |

| | | | | | | | | | |

| | | |

Total Singapore | | | | | | | | | 6,852,669 | |

| | | | | | | | | | |

| | | |

South Africa (1.5%) | | | | | | | | | | |

EOH Holdings, Ltd. | | ZAR | | | 140,000 | | | | 1,117,818 | |

| | | | | | | | | | |

| | | |

Total South Africa | | | | | | | | | 1,117,818 | |

| | | | | | | | | | |

| | | |

South Korea (5.8%) | | | | | | | | | | |

Sindoh Co., Ltd. | | KRW | | | 35,000 | | | | 2,297,343 | |

Dongsuh Co., Inc. | | KRW | | | 130,000 | | | | 1,992,953 | |

| | | | | | | | | | |

| | | |

Total South Korea | | | | | | | | | 4,290,296 | |

| | | | | | | | | | |

| | | |

Taiwan (4.4%) | | | | | | | | | | |

Taiwan Hon Chuan Enterprise Co., Ltd. | | TWD | | | 650,000 | | | | 1,340,833 | |

Taiwan Semiconductor Manufacturing Co., Ltd. | | TWD | | | 325,000 | | | | 1,277,041 | |

| | |

Annual Report | April 30, 2014 | | 15 |

| | |

Seafarer Overseas Growth and Income Fund | | Portfolio of Investments |

April 30, 2014 |

| | | | | | | | | | |

| | | Currency | | Shares | | | Value | |

Taiwan (continued) | | | | | | | | | | |

Taiwan Semiconductor Manufacturing Co., Ltd. ADR | | USD | | | 30,000 | | | $ | 603,000 | |

| | | | | | | | | | |

| | | |

Total Taiwan | | | | | | | | | 3,220,874 | |

| | | | | | | | | | |

| | | |

Turkey (7.0%) | | | | | | | | | | |

Ulker Biskuvi Sanayi AS | | TRY | | | 250,000 | | | | 1,915,832 | |

Arcelik AS | | TRY | | | 300,000 | | | | 1,854,362 | |

Aselsan Elektronik Sanayi Ve Ticaret AS | | TRY | | | 305,000 | | | | 1,358,068 | |

| | | | | | | | | | |

| | | |

Total Turkey | | | | | | | | | 5,128,262 | |

| | | | | | | | | | |

| | | |

Vietnam (5.5%) | | | | | | | | | | |

Nam Long Investment Corp. | | VND | | | 1,508,990 | | | | 1,402,879 | |

Bao Viet Holdings | | VND | | | 550,000 | | | | 957,429 | |

PetroVietnam Drilling and Well Services JSC | | VND | | | 205,739 | | | | 829,917 | |

Vietnam National Reinsurance Corp. | | VND | | | 325,800 | | | | 455,881 | |

Dry Cell & Storage Battery JSC | | VND | | | 400,000 | | | | 438,278 | |

| | | | | | | | | | |

| | | |

Total Vietnam | | | | | | | | | 4,084,384 | |

| | | | | | | | | | |

| | | |

TOTAL COMMON STOCKS (Cost $59,651,728) | | | | | | | | | 62,624,214 | |

| | | |

PREFERRED STOCKS (7.7%) | | | | | | | | | | |

Brazil (5.4%) | | | | | | | | | | |

Vale SA | | BRL | | | 185,000 | | | | 2,197,018 | |

Banco Bradesco SA, ADR | | USD | | | 120,000 | | | | 1,784,400 | |

| | | | | | | | | | |

| | | |

Total Brazil | | | | | | | | | 3,981,418 | |

| | | | | | | | | | |

| | | |

South Korea (2.3%) | | | | | | | | | | |

Samsung Electronics Co., Ltd. | | KRW | | | 1,700 | | | | 1,709,485 | |

| | | | | | | | | | |

| | | |

Total South Korea | | | | | | | | | 1,709,485 | |

| | | | | | | | | | |

| | | |

TOTAL PREFERRED STOCKS (Cost $5,645,586) | | | | | | | | | 5,690,903 | |

| | |

| 16 | | (855) 732-9220 | seafarerfunds.com |

| | |

Seafarer Overseas Growth and Income Fund | | Portfolio of Investments |

April 30, 2014 |

| | | | | | | | | | | | | | | | |

| | | Currency | | Rate | | | Maturity Date | | Principal Amount | | | Value | |

FOREIGN CURRENCY GOVERNMENT BONDS (3.6%) | | | | | | | | | | | | | | | | |

Brazil (1.3%) | | | | | | | | | | | | | | | | |

Brazilian Government International Bond | | BRL | | | 10.25% | | | 01/10/28 | | | 2,000,000 | | | $ | 959,749 | |

| | | | | | | | | | | | | | | | |

| | | | | |

Total Brazil | | | | | | | | | | | | | | | 959,749 | |

| | | | | | | | | | | | | | | | |

| | | | | |

Indonesia (1.1%) | | | | | | | | | | | | | | | | |

Indonesia Treasury Bond, Series FR70 | | IDR | | | 8.38% | | | 03/15/24 | | | 9,000,000,000 | | | | 798,101 | |

| | | | | | | | | | | | | | | | |

| | | | | |

Total Indonesia | | | | | | | | | | | | | | | 798,101 | |

| | | | | | | | | | | | | | | | |

| | | | | |

Turkey (1.2%) | | | | | | | | | | | | | | | | |

Turkey Government Bond | | TRY | | | 8.80% | | | 09/27/23 | | | 2,000,000 | | | | 924,818 | |

| | | | | | | | | | | | | | | | |

| | | | | |

Total Turkey | | | | | | | | | | | | | | | 924,818 | |

| | | | | | | | | | | | | | | | |

| | | |

TOTAL FOREIGN CURRENCY GOVERNMENT BONDS (Cost $2,391,632) | | | | | | | | | | 2,682,668 | |

| | | | | |

USD CONVERTIBLE BONDS (1.5%) | | | | | | | | | | | | | | | | |

Singapore (1.5%) | | | | | | | | | | | | | | | | |

Olam International, Ltd. | | USD | | | 6.00% | | | 10/15/16 | | $ | 1,000,000 | | | | 1,076,250 | |

| | | | | | | | | | | | | | | | |

| | | | | |

Total Singapore | | | | | | | | | | | | | | | 1,076,250 | |

| | | | | | | | | | | | | | | | |

| | | | | |

TOTAL USD CONVERTIBLE BONDS (Cost $1,042,555) | | | | | | | | | | | | | | | 1,076,250 | |

| | | | | |

TOTAL INVESTMENTS (Cost $68,731,501) (97.7%) | | | | | | | | | | | | | | $ | 72,074,035 | |

| | | | | |

Cash and Other Assets, Less Liabilities (2.3%) | | | | | | | | | | | | | | | 1,730,636 | |

NET ASSETS (100.0%) | | | | | | | | | | | | | | $ | 73,804,671 | |

| | |

| (a) | Non-income producing security. |

Certain securities were fair valued in good faith through consideration of other factors in accordance with procedures established by and under the general supervision of the Board of Trustees (Note 2).

| | |

Annual Report | April 30, 2014 | | 17 |

| | |

Seafarer Overseas Growth and Income Fund | | Portfolio of Investments |

April 30, 2014 |

| | | | |

Currency Abbreviations |

BRL | | - | | Brazil Real |

CLP | | - | | Chile Peso |

HKD | | - | | Hong Kong Dollar |

IDR | | - | | Indonesia Rupiah |

INR | | - | | India Rupee |

JPY | | - | | Japan Yen |

KRW | | - | | South Korea Won |

MXN | | - | | Mexico Peso |

MYR | | - | | Malaysia Ringgit |

PLN | | - | | Poland Zloty |

SGD | | - | | Singapore Dollar |

TRY | | - | | Turkey Lira |

TWD | | - | | Taiwan New Dollar |

USD | | - | | United States Dollar |

VND | | - | | Vietnam Dong |

ZAR | | - | | South Africa Rand |

| | | | |

Common Abbreviations: |

ADR | | - | | American Depositary Receipt. |

AS | | - | | Andonim Sirketi, Joint Stock Company in Turkey. |

Bhd | | - | | Berhad, Public Limited Company in Malaysia. |

JSC | | - | | Joint Stock Company. |

Ltd. | | - | | Limited. |

SA | | - | | Generally designates corporations in various countries, mostly those employing the civil law. This translates literally in all languages mentioned as anonymous company. |

SAB de CV | | - | | A variable capital company. |

Tbk PT | | - | | Terbuka is the Indonesian term for limited liability company. |

Holdings are subject to change.

For Fund compliance purposes, the Fund’s geographical classifications refer to any one or more of the sub-classifications used by one or more widely recognized market indexes or ratings group indexes, and/or as defined by Fund management. This definition may not apply for purposes of this report, which may combine sub-classifications for reporting ease. Geographical regions are shown as a percentage of net assets.

See Accompanying Notes to Financial Statements.

| | |

| 18 | | (855) 732-9220 | seafarerfunds.com |

| | |

Seafarer Overseas Growth and Income Fund | | Statement of Assets and Liabilities |

April 30, 2014 |

| | | | |

ASSETS: | | | | |

| |

Investments, at value | | $ | 72,074,035 | |

Cash | | | 948,828 | |

Foreign currency, at value (Cost $186,991) | | | 188,982 | |

Receivable for investments sold | | | 971,531 | |

Receivable for shares sold | | | 394,373 | |

Interest and dividends receivable | | | 324,043 | |

Prepaid expenses and other assets | | | 15,000 | |

Total Assets | | | 74,916,792 | |

LIABILITIES: | | | | |

Payable for investments purchased | | | 918,866 | |

Foreign capital gains tax | | | 73,114 | |

Administrative fees payable | | | 14,456 | |

Shareholder service plan fees payable | | | 16,449 | |

Payable for shares redeemed | | | 4,602 | |

Investment advisory fees payable | | | 35,660 | |

Trustee fees and expenses payable | | | 492 | |

Audit and tax fees payable | | | 16,489 | |

Accrued expenses and other liabilities | | | 31,993 | |

Total Liabilities | | | 1,112,121 | |

NET ASSETS | | $ | 73,804,671 | |

| | |

NET ASSETS CONSIST OF: | | | | |

Paid-in capital (Note 5) | | $ | 70,566,085 | |

Accumulated net investment loss | | | (233,636) | |

Accumulated net realized gain on investments and foreign currency transactions | | | 200,019 | |

Net unrealized appreciation on investments and translation of assets and liabilities in foreign currencies | | | 3,272,203 | |

NET ASSETS | | $ | 73,804,671 | |

| | |

INVESTMENTS, AT COST | | $ | 68,731,501 | |

PRICING OF SHARES | | | | |

Investor Class: | | | | |

Net Asset Value, offering and redemption price per share | | $ | 11.58 | |

Net Assets | | $ | 27,180,720 | |

Shares of beneficial interest outstanding | | | 2,347,204 | |

Institutional Class: | | | | |

Net Asset Value, offering and redemption price per share | | $ | 11.59 | |

Net Assets | | $ | 46,623,951 | |

Shares of beneficial interest outstanding | | | 4,022,993 | |

See Accompanying Notes to Financial Statements.

| | |

Annual Report | April 30, 2014 | | 19 |

| | |

Seafarer Overseas Growth and Income Fund | | Statement of Operations |

For the Year Ended April 30, 2014 |

| | | | |

INVESTMENT INCOME: | | | | |

Dividends | | $ | 1,446,249 | |

Foreign taxes withheld on dividends | | | (123,162) | |

Interest and other income | | | 70,570 | |

Foreign taxes withheld on interest | | | (5,121) | |

Total investment income | | | 1,388,536 | |

| |

EXPENSES: | | | | |

Investment advisory fees (Note 6) | | | 380,980 | |

Administrative and transfer agency fees | | | 201,230 | |

Co-administrative and shareholder servicing fees | | | | |

Investor Class | | | 8,054 | |

Institutional Class | | | 2,043 | |

Trustee fees and expenses | | | 1,730 | |

Registration/filing fees | | | 36,531 | |

Shareholder service plan fees | | | | |

Investor Class | | | 34,654 | |

Institutional Class | | | 8,779 | |

Legal fees | | | 2,902 | |

Audit fees | | | 17,493 | |

Reports to shareholders and printing fees | | | 6,977 | |

Custody fees | | | 49,860 | |

Miscellaneous | | | 14,453 | |

Total expenses | | | 765,686 | |

Less fees waived/reimbursed by investment advisor (Note 6) | | | | |

Investor Class | | | (95,961) | |

Institutional Class | | | (71,701) | |

Total net expenses | | | 598,024 | |

NET INVESTMENT INCOME: | | | 790,512 | |

Net realized gain on investments | | | 583,856 | |

Net realized loss on foreign currency transactions | | | (111,089) | |

Net change in unrealized appreciation on investments (net of foreign capital gains tax of $13,032) | | | 471,616 | |

Net change in unrealized appreciation on translation of assets and liabilities in foreign currency transactions | | | 2,720 | |

NET REALIZED AND UNREALIZED GAIN ON INVESTMENTS AND FOREIGN CURRENCY TRANSLATIONS | | | 947,103 | |

NET INCREASE IN NET ASSETS RESULTING FROM OPERATIONS | | $ | 1,737,615 | |

| | |

See Accompanying Notes to Financial Statements.

| | |

| 20 | | (855) 732-9220 | seafarerfunds.com |

| | |

Seafarer Overseas Growth and Income Fund | | Statements of Changes in Net Assets |

|

| | | | | | | | |

| | | Year Ended | | | Year Ended | |

| | | April 30, 2014 | | | April 30, 2013 | |

OPERATIONS: | | | | | | | | |

Net investment income | | $ | 790,512 | | | $ | 193,701 | |

Net realized gain on investments and foreign currency transactions | | | 472,767 | | | | 691,065 | |

Net change in unrealized appreciation on investments and foreign currency translations | | | 474,336 | | | | 2,787,668 | |

Net increase in net assets resulting from operations | | | 1,737,615 | | | | 3,672,434 | |

DISTRIBUTIONS TO SHAREHOLDERS (NOTE 3): | | | | | | | | |

From net investment income | | | | | | | | |

Investor Class | | $ | (585,611) | | | $ | (112,900) | |

Institutional Class | | | (308,771) | | | | (49,868) | |

From net realized gains on investments | | | | | | | | |

Investor Class | | | (654,807) | | | | (867) | |

Institutional Class | | | (316,013) | | | | (254) | |

Net decrease in net assets from distributions | | | (1,865,202) | | | | (163,889) | |

BENEFICIAL INTEREST TRANSACTIONS (NOTE 5): | | | | | | | | |

Shares sold | | | | | | | | |

Investor | | $ | 18,789,915 | | | $ | 28,091,620 | |

Institutional | | | 41,977,026 | | | | 9,669,354 | |

Dividends reinvested | | | | | | | | |

Investor | | | 1,190,349 | | | | 110,846 | |

Institutional | | | 611,803 | | | | 46,662 | |

Shares Redeemed, net of redemption fees | | | | | | | | |

Investor | | | (18,143,918) | | | | (5,803,722) | |

Institutional | | | (8,326,537) | | | | (579,535) | |

Net increase in net assets derived from beneficial interest transactions | | | 36,098,638 | | | | 31,535,225 | |

| | |

Net increase in net assets | | $ | 35,971,051 | | | $ | 35,043,770 | |

| | |

NET ASSETS: | | | | | | | | |

Beginning of period | | $ | 37,833,620 | | | $ | 2,789,850 | |

End of period (including accumulated net investment income/(loss) of $(233,636) and $60,497, respectively) | | $ | 73,804,671 | | | $ | 37,833,620 | |

| | |

| | |

Annual Report | April 30, 2014 | | 21 |

| | |

Seafarer Overseas Growth and Income Fund | | Statements of Changes in Net Assets |

|

| | | | | | | | |

| | | Year Ended | | | Year Ended | |

| | | April 30, 2014 | | | April 30, 2013 | |

Other Information: | | | | | | | | |

SHARE TRANSACTIONS: | | | | | | | | |

Investor Class | | | | | | | | |

Sold | | | 1,651,517 | | | | 2,566,567 | |

Distributions reinvested | | | 105,435 | | | | 10,140 | |

Redeemed | | | (1,622,659) | | | | (505,665) | |

Net increase in shares outstanding | | | 134,293 | | | | 2,071,042 | |

| | |

Institutional Class | | | | | | | | |

Sold | | | 3,748,511 | | | | 878,414 | |

Distributions reinvested | | | 54,211 | | | | 4,298 | |

Redeemed | | | (743,914) | | | | (50,808) | |

Net increase in shares outstanding | | | 3,058,808 | | | | 831,904 | |

| | |

See Accompanying Notes to Financial Statements.

| | |

| 22 | | (855) 732-9220 | seafarerfunds.com |

| | |

| Seafarer Overseas Growth and Income Fund | | Financial Highlights |

| For a share outstanding through the periods presented |

| | | | | | | | | | | | |

| Investor Class | | Year Ended

April 30, 2014 | | | Year Ended

April 30, 2013 | | | For the Period

February 15, 2012

(Inception) to

April 30, 2012 | |

NET ASSET VALUE, BEGINNING OF PERIOD | | $ | 11.91 | | | $ | 10.18 | | | $ | 10.00 | |

INCOME FROM OPERATIONS: | | | | | | | | | | | | |

Net investment income(a) | | | 0.19 | | | | 0.10 | | | | 0.05 | |

Net realized and unrealized gain on investments | | | 0.02 | | | | 1.74 | | | | 0.13 | |

Total from investment operations | | | 0.21 | | | | 1.84 | | | | 0.18 | |

| | | |

LESS DISTRIBUTIONS: | | | | | | | | | | | | |

From net investment income | | | (0.26) | | | | (0.11) | | | | – | |

From net realized gains on investments | | | (0.28) | | | | (0.00) | (b) | | | – | |

Total distributions | | | (0.54) | | | | (0.11) | | | | – | |

REDEMPTION FEES ADDED TO PAID IN CAPITAL | | | 0.00 | (c) | | | 0.00 | (c) | | | – | |

NET INCREASE/(DECREASE) IN NET ASSET VALUE | | | (0.33) | | | | 1.73 | | | | 0.18 | |

NET ASSET VALUE, END OF PERIOD | | $ | 11.58 | | | $ | 11.91 | | | $ | 10.18 | |

| | |

| | | |

TOTAL RETURN(d) | | | 1.93% | | | | 18.24% | | | | 1.80% | |

SUPPLEMENTAL DATA: | | | | | | | | | | | | |

Net assets, end of period (in 000s) | | $ | 27,181 | | | $ | 26,348 | | | $ | 1,443 | |

RATIOS TO AVERAGE NET ASSETS: | | | | | | | | | | | | |

Operating expenses excluding reimbursement/waiver | | | 1.78% | | | | 2.82% | | | | 18.96% ( | e) |

Operating expenses including reimbursement/waiver | | | 1.40% | | | | 1.49% | | | | 1.60% ( | e) |

Net investment income including reimbursement/waiver | | | 1.66% | | | | 0.90% | | | | 2.61% ( | e) |

PORTFOLIO TURNOVER RATE(f) | | | 51% | | | | 39% | | | | 5% | |

| (a) | Calculated using the average shares method. |

| (b) | Less than $(0.005) per share. |

| (c) | Less than $0.005 per share. |

| (d) | Total returns are for the period indicated and have not been annualized. Total returns would have been lower had certain expenses not been waived during the period. Returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. |

| (f) | Portfolio turnover rate for periods less than one full year have not been annualized. |

See Accompanying Notes to Financial Statements.

| | |

Annual Report | April 30, 2014 | | 23 |

| | |

Seafarer Overseas Growth and Income Fund | | Financial Highlights |

For a share outstanding through the periods presented |

| | | | | | | | | | | | |

| Institutional Class | | Year Ended

April 30, 2014 | | | Year Ended

April 30, 2013 | | | For the Period

February 15, 2012

(Inception) to

April 30, 2012 | |

NET ASSET VALUE, BEGINNING OF PERIOD | | $ | 11.91 | | | $ | 10.18 | | | $ | 10.00 | |

INCOME FROM OPERATIONS: | | | | | | | | | | | | |

Net investment income(a) | | | 0.21 | | | | 0.14 | | | | 0.04 | |

Net realized and unrealized gain on investments | | | 0.02 | | | | 1.71 | | | | 0.14 | |

Total from investment operations | | | 0.23 | | | | 1.85 | | | | 0.18 | |

| | | |

LESS DISTRIBUTIONS: | | | | | | | | | | | | |

From net investment income | | | (0.27) | | | | (0.12) | | | | – | |

From net realized gains on investments | | | (0.28) | | | | (0.00) | (b) | | | – | |

Total distributions | | | (0.55) | | | | (0.12) | | | | – | |

REDEMPTION FEES ADDED TO PAID IN CAPITAL | | | 0.00 | (c) | | | 0.00 | (c) | | | – | |

NET INCREASE/(DECREASE) IN NET ASSET VALUE | | | (0.32) | | | | 1.73 | | | | 0.18 | |

NET ASSET VALUE, END OF PERIOD | | $ | 11.59 | | | $ | 11.91 | | | $ | 10.18 | |

| | |

| | | |

TOTAL RETURN(d) | | | 2.12% | | | | 18.33% | | | | 1.80% | |

SUPPLEMENTAL DATA: | | | | | | | | | | | | |

Net assets, end of period (in 000s) | | $ | 46,624 | | | $ | 11,486 | | | $ | 1,346 | |

RATIOS TO AVERAGE NET ASSETS: | | | | | | | | | | | | |

Operating expenses excluding reimbursement/waiver | | | 1.61% | | | | 2.88% | | | | 21.65% | (e) |

Operating expenses including reimbursement/waiver | | | 1.25% | | | | 1.35% | | | | 1.45%( | e) |

Net investment income including reimbursement/waiver | | | 1.89% | | | | 1.28% | | | | 2.00%( | e) |

PORTFOLIO TURNOVER RATE(f) | | | 51% | | | | 39% | | | | 5% | |

| (a) | Calculated using the average shares method. |

| (b) | Less than $(0.005) per share. |

| (c) | Less than $0.005 per share. |

| (d) | Total returns are for the period indicated and have not been annualized. Total returns would have been lower had certain expenses not been waived during the period. Returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. |

| (f) | Portfolio turnover rate for periods less than one full year have not been annualized. |

See Accompanying Notes to Financial Statements.

| | |

| 24 | | (855) 732-9220 | seafarerfunds.com |

| | |

Seafarer Overseas Growth and Income Fund | | Notes to Financial Statements |

| | April 30, 2014 |

1. ORGANIZATION

Financial Investors Trust (the “Trust”), a Delaware statutory trust, is an open-end management investment company registered under the Investment Company Act of 1940, as amended (“1940 Act”). As of April 30, 2014, the Trust had 30 registered funds. This annual report describes the Seafarer Overseas Growth and Income Fund (the “Fund”). The Fund seeks to provide long-term capital appreciation along with some current income; it also seeks to mitigate adverse volatility in returns. The Fund offers Investor Class and Institutional Class shares. All classes of shares have identical rights to earnings, assets and voting privileges, except for class specific expenses and exclusive rights to vote on matters affecting only individual classes.

2. SIGNIFICANT ACCOUNTING POLICIES

The accompanying financial statements were prepared in accordance with accounting principles generally accepted in the United States of America (“U.S. GAAP”). The preparation of financial statements in conformity with U.S. GAAP requires management to make certain estimates and assumptions that affect the reported amounts of assets and liabilities and disclosures of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenue and expenses during the period. Actual results could differ from those estimates. The following is a summary of significant accounting policies consistently followed by the Fund in preparation of its financial statements.

Investment Valuation: The Fund generally values its securities based on market prices determined at the close of regular trading on the New York Stock Exchange (“NYSE”), normally 4:00 p.m. Eastern Time, on each day the NYSE is open for trading.

For equity securities and mutual funds that are traded on an exchange, the market price is usually the closing sale or official closing price on that exchange. In the case of equity securities not traded on an exchange, or if such closing prices are not otherwise available, the securities are valued at the mean of the most recent bid and ask prices on such day. Redeemable securities issued by open-end registered investment companies are valued at the investment company’s applicable net asset value, with the exception of exchange-traded open-end investment companies, which are priced as equity securities.

Equity securities that are primarily traded on foreign securities exchanges are valued at the closing values of such securities on their respective foreign exchanges, except when an event occurs subsequent to the close of the foreign exchange but before the close of the NYSE, such that the securities’ value would likely change. In such an event, the fair values of those securities are determined in good faith through consideration of other factors in accordance with procedures established by and under the general supervision of the Board of Trustees (the “Board”). The Fund will use a fair valuation model provided by an independent pricing service, which is intended to reflect fair value when a security’s value or a meaningful portion of the Fund’s portfolio is believed to have been materially affected by a valuation event that has occurred between the close of the exchange or market on which the security is traded and the close of the regular trading day on the NYSE. The Fund’s valuation procedures set forth certain triggers that inform the Fund when to use the fair valuation model.

The market price for debt obligations is generally the price supplied by an independent third-party pricing service approved by the Board which may use a matrix, formula or other objective method that takes into consideration quotations from dealers, market transactions in comparable investments, market indices and yield curves. If vendors are unable to supply a price, or if the price supplied is deemed to be

| | |

Annual Report | April 30, 2014 | | 25 |

| | |

Seafarer Overseas Growth and Income Fund | | Notes to Financial Statements |

April 30, 2014 |

unreliable, the market price may be determined using quotations received from one or more broker–dealers that make a market in the security. Short–term debt obligations that will mature in 60 days or less are valued at amortized cost, unless it is determined that using this method would not reflect an investment’s fair value.

Forward currency exchange contracts have a market value determined by the prevailing foreign currency exchange daily rates and current foreign currency exchange forward rates. The foreign currency exchange forward rates are calculated using an automated system that estimates rates on the basis of the current day foreign currency exchange rates and forward foreign currency exchange rates supplied by a pricing service.

When such prices or quotations are not available, or when the Fair Value Committee appointed by the Board believes that they are unreliable, securities may be priced using fair value procedures approved by the Board.

Certain foreign countries impose a tax on capital gains which is accrued by the Fund based on unrealized appreciation, if any, on affected securities. The tax is paid when the gain is realized.

Fair Value Measurements: The Fund discloses the classification of its fair value measurements following a three-tier hierarchy based on the inputs used to measure fair value. Inputs refer broadly to the assumptions that market participants would use in pricing the asset or liability, including assumptions about risk. Inputs may be observable or unobservable. Observable inputs reflect the assumptions market participants would use in pricing the asset or liability. Such inputs are developed based on market data obtained from sources independent of the reporting entity. Unobservable inputs reflect the reporting entity’s own assumptions about the assumptions market participants would use in pricing the asset or liability, which are developed based on the information available and the reporting entity’s best efforts to interpret such information.

Various inputs are used in determining the value of the Fund’s investments as of the end of the reporting period. When inputs used fall into different levels of the fair value hierarchy, the level in the hierarchy within which the fair value measurement falls is determined based on the lowest level input that is significant to the fair value measurement in its entirety. The designated input levels are not necessarily an indication of the risk or liquidity associated with these investments. These inputs are categorized in the following hierarchy under applicable financial accounting standards:

| Level 1 – | Unadjusted quoted prices in active markets for identical investments, unrestricted assets or liabilities that a Fund has the ability to access at the measurement date; |

| Level 2 – | Quoted prices which are not active, quoted prices for similar assets or liabilities in active markets or inputs other than quoted prices that are observable (either directly or indirectly) for substantially the full term of the asset or liability; and |

| Level 3 – | Significant unobservable prices or inputs (including the Fund’s own assumptions in determining the fair value of investments) where there is little or no market activity for the asset or liability at the measurement date. |

| | |

| 26 | | (855) 732-9220 | seafarerfunds.com |

| | |

Seafarer Overseas Growth and Income Fund | | Notes to Financial Statements |

April 30, 2014 |

The following is a summary of each input used to value the Fund as of April 30, 2014:

| | | | | | | | | | | | | | | | |

| | | | | | Level 2 - | | | Level 3 - | | | | |

| | | | | | Other Significant | | | Significant | | | | |

| Investments in Securities at | | Level 1 - | | | Observable | | | Unobservable | | | | |

| Value(a) | | Quoted Prices | | | Inputs | | | Inputs | | | Total | |

Common Stocks | | | | | | | | | | | | | | | | |

Brazil | | $ | 5,490,571 | | | $ | – | | | $ | – | | | $ | 5,490,571 | |

Chile | | | 1,572,839 | | | | – | | | | – | | | | 1,572,839 | |

China / Hong Kong | | | – | | | | 9,830,469 | | | | – | | | | 9,830,469 | |

India | | | 2,844,473 | | | | 2,185,110 | | | | – | | | | 5,029,583 | |

Indonesia | | | – | | | | 1,932,877 | | | | – | | | | 1,932,877 | |

Japan | | | – | | | | 3,557,683 | | | | – | | | | 3,557,683 | |

Malaysia | | | 1,475,470 | | | | 1,210,513 | | | | – | | | | 2,685,983 | |

Mexico | | | 3,545,140 | | | | – | | | | – | | | | 3,545,140 | |

Poland | | | – | | | | 4,284,766 | | | | – | | | | 4,284,766 | |

Singapore | | | – | | | | 6,852,669 | | | | – | | | | 6,852,669 | |

South Africa | | | 1,117,818 | | | | – | | | | – | | | | 1,117,818 | |

South Korea | | | – | | | | 4,290,296 | | | | – | | | | 4,290,296 | |

Taiwan | | | 603,000 | | | | 2,617,874 | | | | – | | | | 3,220,874 | |

Turkey | | | – | | | | 5,128,262 | | | | – | | | | 5,128,262 | |

Vietnam | | | 4,084,384 | | | | – | | | | – | | | | 4,084,384 | |

Preferred Stocks | | | 3,981,418 | | | | 1,709,485 | | | | – | | | | 5,690,903 | |

Foreign Currency | | | | | | | | | | | | | | | | |

Government Bonds | | | – | | | | 2,682,668 | | | | – | | | | 2,682,668 | |

USD Convertible Bonds | | | – | | | | 1,076,250 | | | | – | | | | 1,076,250 | |

Total | | $ | 24,715,113 | | | $ | 47,358,922 | | | $ | – | | | $ | 72,074,035 | |

| | |

| (a) | For detailed descriptions of countries, see the accompanying Portfolio of Investments. |

The Fund recognizes transfers between levels as of the end of the period. For the year ended April 30, 2014, the Fund did not have any securities that used significant unobservable inputs (Level 3) in determining fair value.