UNITED STATES

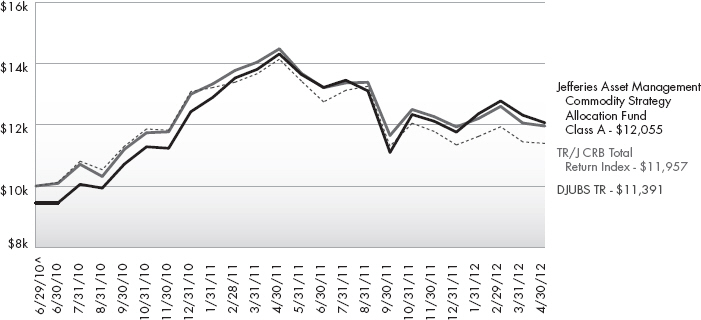

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-8194

FINANCIAL INVESTORS TRUST

(Exact name of registrant as specified in charter)

1290 Broadway, Suite 1100, Denver, Colorado 80203

(Address of principal executive offices) (Zip code)

JoEllen L. Legg, Secretary

Financial Investors Trust

1290 Broadway, Suite 1100

Denver, Colorado 80203

(Name and address of agent for service)

Registrant’s telephone number, including area code: 303-623-2577

Date of fiscal year end: April 30

Date of reporting period: May 1, 2011 - April 30, 2012

Item 1. Reports to Stockholders.

ALPS | Kotak India Growth Fund

ALPS | Red Rocks Listed Private Equity Fund

ALPS | WMC Value Intersection Fund

Clough China Fund

Jefferies Asset Management Commodity Strategy Allocation Fund

RiverFront Global Allocation Series

ALPS Advisors, Inc. Solutions

| | |

Table of Contents April 30, 2012 |

ALPS | Kotak India Growth Fund

| | |

| |

| Management Commentary | | April 30, 2012 (Unaudited) |

Performance

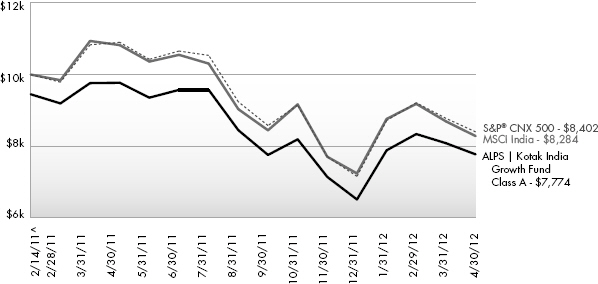

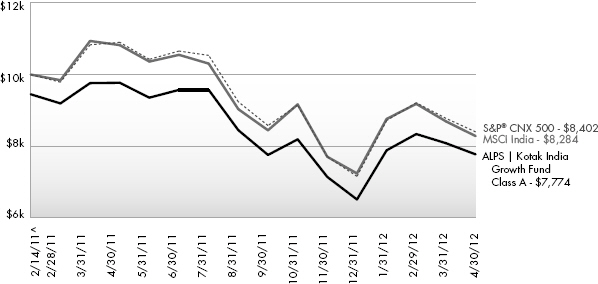

ALPS | Kotak India Growth Fund (the “Fund”) was launched on February 14, 2011. During the 12-month period ended 04/30/2012, the Fund’s Class A Shares, INDAX, delivered a net return of -20.44% at Net Asset Value (Class A delivered a net return of -24.81% at MOP, Class C, INFCX, was -20.97% with CDSC, Class I, INDIX, was -21.76%). The Fund’s performance was above that of the S&P CNX 500 Index (“CNX 500”)

(-22.91%), over the same period, without taking into account sales charges for Class A and C Shares.

During the period, the Indian equity markets fell along with the global markets with broader Indian indices like CNX 500 returning -22.91%, S&P CNX Nifty Index (“Nifty”) 5 returning -23.39% and S&P CNX Midcap Index (“CNX MIDCAP”) 6 returning -23.55% (all in United States Dollar (“USD”) terms). The investment environment during this period was impacted by the factors described below, with November and January marking the worst and best monthly change respectively (CNX 500 returned -4.34% in May, 2.22% in June, -1.14% in July, -12.31% in August, -7.15% in September, 6.62% in October, -15.72% in November, -7.11% in December, 21.75% in January, 5.69% in February, -4.74% in March, and -4.29% in April).

| | » | Sovereign rating downgrades in the US and in Europe, corporate rating downgrades across the banking sector in the US and Europe, worsening debt situations in Euro-area countries, and deteriorating global economic growth have impacted investor sentiment, resulting in a sell off in equity markets worldwide in 2011. In the first four months of 2012, global equity markets rallied on the back of increasing liquidity in the system although last month saw deteriorating sentiment in the market led by the European sovereign crisis. On the domestic side, the Indian market has performed badly in 2011 on account of a persistently high inflation number, weakening GDP growth, increasing interest rate, and lack of significant reforms activities. In the first four months of 2012, the Indian market reversed its course and became one of the best performing markets with inflation trending down, improving liquidity, strong FII (Foreign Institutional Investor) flow, and expectation of a cut in the interest rate. |

| | » | Currency has been a big spoiler for international investors investing in India. The Indian Rupee (“INR”) depreciated 18.34% during the 12-month period against the USD. India’s twin deficits, current account deficit & fiscal deficit, are hurting both the Indian currency and economy. Historically, the current account deficit has been funded by the capital flows but given the deteriorating environment during 2011, capital flows to India have been limited. The worsening fiscal deficit also remained the biggest challenge with the fiscal deficit for FY12 (ending 30th March 2012) standing at 5.9% v/s 4.6% estimated in the budget. |

| | » | In its monetary policy meeting on 17th April 2012, RBI (Reserve Bank of India) cut rates for the first time in more than 2 years by 50 basis point (“bps”) 7 (versus our expectation of 25bps), bringing the repo8 and reverse repo9 rate to 8% and 7% respectively. The move came as a positive surprise to the market after the cumulative 400bps increase in interest rates since March 2010 to October 2011. The RBI also raised borrowing limits under MSF (Marginal Standing Facility)11 to 2% to increase liquidity in the system. In the policy note RBI clearly indicated that the room for further aggressive rate cuts is limited. While we expect another 25bps rate cut for the remainder of the year, the timing of the rate cut will not be in the near term and will depend on the inflation trajectory. |

Moreover, the RBI also expects Gross Domestic Product (“GDP”) growth for FY12 and FY13 at 6.9% and 7.3% respectively. On the inflation front, RBI expects inflation for FY12 at 6.5%. During the period, the RBI also cut CRR (Credit Reserve Ratio)10 by accumulative 125bps through its January 2012 (50bps) and March 2012 (75bps) credit policy, bringing CRR at 4.75%.

| | » | For the quarter ending December 2011 (Q3FY12), real GDP growth came in at 6.1%, lower than previous quarter number of 6.9% and the Bloomberg consensus expectation of 6.3%. Service growth remained strong at growth rate of 8.9% Year over Year (“YoY”). On the expenditure side, consumption expenditure improved significantly from last quarter while gross fixed capital formation remained negative as a result of policy inaction by the government. |

| | » | After persistently staying at around 9% for most of 2011, the inflation number started to decline in the month of December 2011 to around 7%. In 2012, the inflation number continued to stay at the same level with January, February, and March inflation standing at 6.9%, 7.0%, and 6.9% respectively. The decline can be attributed to primary articles and manufactured inflation which has declined substantially while fuel and power inflation remained at high levels given still high global crude price and deteriorating Indian currency (India is a major importer of oil). In addition, the food inflation number has also declined substantially over the last few months on account of a good monsoon season. |

| | » | The Finance Minister announced the Union Budget in March 2012, which fell short of announcing any major economic reforms although it did acknowledge the widening fiscal and trade deficit which remained the major obstacles in India. The government targeted a fiscal deficit of 5.1% for FY13 which is a more realistic figure than the 4.6% estimate given for FY12 in the previous budget. On the expenditure side, the budget estimated lower subsidies with subsidies being capped at 2% of GDP. The General Anti Avoidance Rule (GAAR)12 was introduced in the budget and has been deferred by 1 year, creating a lot of uncertainty on the taxation front for international investors. |

| | » | The Indian Corporate earnings during the period were mixed. The Consumption lead sectors like FMCG (Fast Moving Consumer Goods), Automobiles, Paints, and Pharmaceuticals saw both topline and earnings momentum continued whereas interest rate sensitive sectors of the economy saw margin squeeze. In the Banking & Finance sector, the private sector banks saw protection of their Net Interest Margin (NIM) with lower Non Performing Assets (NPA) whereas the public banks clearly saw asset quality deterioration. The Information Technology sector revenue growth has come under pressure though the depreciating Rupee had a positive effect on the USD earnings. Overall, in the last 12 months positive cash flow companies with lower gearing have seen better earnings. |

Portfolio Composition

The portfolio is constructed to potentially benefit from the strong macro-economic growth in the Indian economy across four broad themes in India – consumption led by favourable demographics, financial services, infrastructure and outsourcing. The Fund has the flexibility to invest across market capitalizations

– depending on market conditions, valuation differential, earnings growth, liquidity, etc.

1 | April 30, 2012

ALPS | Kotak India Growth Fund

| | |

| |

Management Commentary | | April 30, 2012 (Unaudited) |

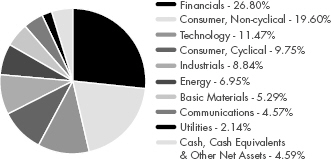

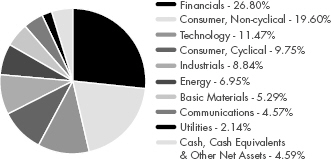

For the 12-month period ending 30th April 2012, sectorally the key changes to the portfolio have been in FMCG (added 400 bps), Banking & Finance (added 335 bps), Pharmaceutical (added 320 bps), Capital Goods & Engineering (reduced 160 bps), Fertilizers (reduced 140 bps), and Infrastructure (reduced 130 bps). Thematically, Consumption (at about 30%) and Financials (at about 26%) are the largest themes in the portfolio while infrastructure exposure is less than 9% due to poor policy initiatives by the government. Over the last 12 months, exposure to midcap and small-cap companies in the fund has moved from 17.21% in April 2011 to 20.76% in October 2011 and 26.25% in April 2012.

Sectorally, the portfolio is overweight Pharmaceutical, Infrastructure, and Media while underweight Oil & Gas, Capital Goods & Engineering, Auto & Auto Ancillary, and FMCG as of 30th April 2012.

Outlook

For international investors in CY2011, Indian equities have been one of the worst performing markets, with depressed equity returns exacerbated by weak currency. The major reasons of this under-performance can be attributed to:

» Persistence of high inflation and

subsequent tightening of interest rates

» High oil prices impacting on Indian fiscal

deficit

» Policy paralysis by the government

» Global concerns on sovereign debt

While inflation has begun to ease off and the RBI has signaled its intent on focusing on growth rather than inflation, the government continues to be bound by political compulsions. While monetary policy will increasingly become more accommodative towards growth, participants will be watchful of government policy initiatives.

The broad indices like S&P CNX Nifty and S&P CNX500 index are trading at 12.89x and 12.08x FY13 Earnings Per Share (“EPS”) respectively and the midcap indices, CNX MIDCAP Index, are trading at 9.99x FY13 EPS (Bloomberg). These are attractive levels and hence provide valuation support in case of near term market volatility.

While there are many near-term challenges that are likely to sway investment sentiment to India, it is equally important to consider the longer-term characteristics of India. A young population, falling dependency ratios, high savings rates, low penetration of almost all products and services, coupled with rising income make India, in our view, a very attractive destination in the long-term and thus, current valuations provide for reasonably attractive entry opportunity.

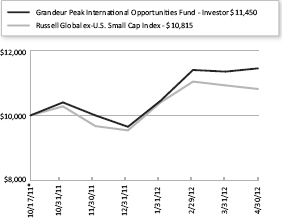

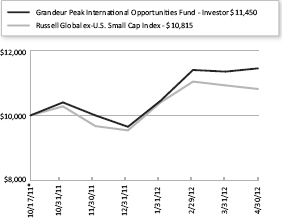

Performance of $10,000 Initial Investment (for the period ended April 30, 2012)

Comparison of change in value of a $10,000 investment (includes applicable sales loads of 5.50%)

The chart above represents historical performance of a hypothetical investment of $10,000 in the Fund since inception. Past performance does not guarantee future results. This chart does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

2 | April 30, 2012

ALPS | Kotak India Growth Fund

| | |

| |

| Management Commentary | | April 30, 2012 (Unaudited) |

Average Annual Total Returns (as of April 30, 2012)

| | | | | | | | |

| | | 1 Year | | Since Inception ^ | | Total Expense Ratio | | What you Pay * |

| Class A (NAV) 1 | | -20.44% | | -14.95% | | 69.97% | | 2.01% |

| Class A (MOP) 2 | | -24.81% | | -18.84% | | |

| Class C (NAV) 1 | | -20.97% | | -15.56% | | 69.65% | | 2.61% |

| Class C (CDSC) 2 | | -21.76% | | -15.56% | | |

| Class I | | -20.23% | | -14.70% | | 96.68% | | 1.61% |

| S&P® CNX 500 Index3 | | -22.91% | | -13.42% | | | | |

| MSCI India Index Total Return4 | | -23.45% | | -14.46% | | | | |

Performance data quoted represents past performance. Past performance does not guarantee future results. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when sold or redeemed, may be worth more or less than the original cost. Current performance data may be higher or lower than actual data quoted. The Fund imposes a 2.00% redemption fee on shares held for less than 30 days. The Fund imposes a maximum Contingent Deferred Sales Charge (“CDSC”) of 1.00% to shares redeemed within the first 12 months after a purchase, and on Class A shares redeemed within the first 12 months after a purchase in excess of $1 million. Performance shown does not reflect the redemption fee or the CDSC, which if reflected would reduce the performance quoted. For the most current month-end performance data please call 1.866.759.5679.

Investing in the Fund is subject to investment risks, including possible loss of the principal amount invested. Derivatives generally are more sensitive to changes in economic or market conditions than other types of investments; this could result in losses that significantly exceed the funds original investment.

| 1 | Net Asset Value (NAV) is the share price without sales charges. |

| 2 | Maximum Offering Price (MOP) includes sales charges. Class A returns include effects of the Fund’s maximum sales charge of 5.50%; Class C returns include the 1.00% CDSC. |

| 3 | S&P® CNX 500 – India’s first broad based benchmark of the Indian capital market. The S&P® CNX 500 companies are disaggregated into 72 industry indices. Industry weightages in the market. The index is not actively managed and does not reflect any deduction for fees, expenses or taxes. An investor may not invest directly in an index. |

| 4 | MSCI India Index – a free float weighted equity index. It was developed with a base value of 100 as-of December 31, 1992. The index is not actively managed and does not reflect any deduction for fees, expenses or taxes. An investor may not invest directly in an index. |

| 5 | The S&P CNX Nifty is the headline index on the National Stock Exchange of India Ltd. (NSE). It is a diversified 50 stock index comprising large and highly liquid securities, covering 25 sectors of the economy. The index was created for those interested in trading and investing in Indian equities. |

| 6 | The S&P CNX Midcap represents the medium capitalised segment of the stock market is being increasingly perceived as an attractive investment segment with high growth potential. The primary objective of the CNX Midcap Index is to capture the movement and be a benchmark of the midcap segment of the market. |

| 7 | Basis Point – A unit that is equal to 1/100th of 1%, and is used to denote the change in a financial instrument. |

| 8 | Repurchase Agreements – REPO – A form of short-term borrowing for dealers in government securities. The dealer sells the government securities to investors, usually on an overnight basis, and buys them back the following day. |

| 9 | Reverse Repurchase Agreements – The purchase of securities with the agreement to sell them at a higher price at a specific future date. For the party selling the security (and agreeing to repurchase it in the future) it is a repo; for the party on the other end of the transaction (buying the security and agreeing to sell in the future) it is a reverse repurchase agreement. |

| 10 | Credit reserve Ratio – The portion (expressed as a percent) of depositors’ balances banks must have on hand as cash. This is a requirement determined by the country’s central bank, which in the U.S. is the Federal Reserve. The reserve ratio affects the money supply in a country. |

This is also referred to as the “cash reserve ratio” (CRR).

| 11 | Marginal Standing Facility (MSF) is the rate at which banks can borrow overnight from the Reserve Bank of India (RBI). This was introduced in the monetary policy of RBI for the year 2011-2012. The MSF is pegged 100bps or a % above the repo rate. Banks can borrow funds through MSF when there is a considerable shortfall of liquidity. This measure has been introduced by RBI to regulate short-term asset liability mismatches more effectively. |

| 12 | General Anti-Avoidance Rule (GAAR) is a set of broad and general principles-based rules enacted in the tax code aimed at counteracting avoidance of tax. |

| ^ | Fund inception date of February 14, 2011. |

What You Pay reflects the Adviser’s and Sub-Adviser’s decision to contractually limit expenses through August 31, 2012. Please see the prospectus for additional information.

The table does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

This Fund is not suitable for all investors. Subject to investment risks, including possible loss of the principal amount invested.

Investing in India involves risk and considerations not present when investing in more established securities markets. The Fund may be more susceptible to economic, market, political and local risks of the region than a fund that is more geographically diversified.

Top Ten Long Holdings (as a % of Net Assets) †

| | | | |

ITC, Ltd. | | | 5.59 | % |

Infosys, Ltd. | | | 4.96 | % |

HDFC Bank, Ltd. | | | 4.69 | % |

ICICI Bank, Ltd. | | | 4.58 | % |

Reliance Industries, Ltd. | | | 4.18 | % |

Tata Consultancy Services, Ltd. | | | 2.53 | % |

Larsen & Toubro, Ltd. | | | 2.36 | % |

Housing Development Finance Corp. | | | 2.09 | % |

IndusInd Bank, Ltd. | | | 2.08 | % |

Tata Motors, Ltd. | | | 2.04 | % |

Top Ten Holdings | | | 35.10 | % |

†Holdings are subject to change.

Industry Sector Allocation

(Long Positions as a % of Net Assets)

3 | April 30, 2012

ALPS | Kotak India Growth Fund

| | |

| |

| Consolidated Statement of Investments | | April 30, 2012 |

| | | | | | | | |

| | | Shares | | | Value (Note 2) | |

COMMON STOCKS (95.41%) | | | | | | | | |

Basic Materials (5.29%) | | | | | | | | |

Iron & Steel (1.58%) | | | | | | | | |

Jindal Steel & Power, Ltd. | | | 7,355 | | | $ | 70,244 | |

| | | | | | | | |

| | |

Mining (3.71%) | | | | | | | | |

Hindalco Industries, Ltd. | | | 23,532 | | | | 53,748 | |

Hindustan Zinc, Ltd. | | | 21,530 | | | | 52,104 | |

Sterlite Industries India, Ltd. | | | 29,435 | | | | 59,323 | |

| | | | | | | | |

| | | | | | | 165,175 | |

| | | | | | | | |

| | |

TOTAL BASIC MATERIALS | | | | | | | 235,419 | |

| | | | | | | | |

| | |

Communications (4.57%) | | | | | | | | |

Media (2.66%) | | | | | | | | |

DB Corp., Ltd. | | | 6,406 | | | | 25,244 | |

Dish TV India, Ltd.(a) | | | 39,850 | | | | 45,016 | |

Jagran Prakashan, Ltd. | | | 25,699 | | | | 47,764 | |

| | | | | | | | |

| | | | | | | 118,024 | |

| | | | | | | | |

| | |

Telecommunications (1.91%) | | | | | | | | |

Bharti Airtel, Ltd. | | | 14,471 | | | | 85,040 | |

| | | | | | | | |

| | |

TOTAL COMMUNICATIONS | | | | | | | 203,064 | |

| | | | | | | | |

| | |

Consumer, Cyclical (9.75%) | | | | | | | | |

Apparel (1.41%) | | | | | | | | |

Bata India, Ltd. | | | 3,765 | | | | 62,622 | |

| | | | | | | | |

| | |

Auto Manufacturers (3.55%) | | | | | | | | |

Mahindra & Mahindra, Ltd. | | | 5,025 | | | | 67,527 | |

Tata Motors, Ltd. | | | 15,150 | | | | 90,553 | |

| | | | | | | | |

| | | | | | | 158,080 | |

| | | | | | | | |

| | |

Auto Parts&Equipment (1.80%) | | | | | | | | |

Motherson Sumi Systems, Ltd. | | | 23,640 | | | | 80,117 | |

| | | | | | | | |

| | |

Home Builders (1.04%) | | | | | | | | |

Sobha Developers, Ltd. | | | 7,356 | | | | 46,075 | |

| | | | | | | | |

| | |

Leisure Time (0.99%) | | | | | | | | |

Bajaj Auto, Ltd. | | | 1,439 | | | | 44,234 | |

| | | | | | | | |

| | |

Textiles (0.96%) | | | | | | | | |

Raymond, Ltd. | | | 5,580 | | | | 42,568 | |

| | | | | | | | |

| | |

TOTAL CONSUMER, CYCLICAL | | | | | | | 433,696 | |

| | | | | | | | |

| | |

Consumer, Non-cyclical (19.60%) | | | | | | | | |

Agriculture (5.59%) | | | | | | | | |

ITC, Ltd. | | | 53,390 | | | | 248,451 | |

| | | | | | | | |

| | | | | | | | |

| | | Shares | | | Value

(Note 2) | |

Commercial Services (2.60%) | | | | | | | | |

Adani Ports and Special Economic Zone | | | 29,050 | | | | $70,366 | |

Gujarat Pipavav Port, Ltd.(a) | | | 39,400 | | | | 45,475 | |

| | | | | | | | |

| | | | | | | 115,841 | |

| | | | | | | | |

| | |

Food (1.35%) | | | | | | | | |

GlaxoSmithKline Consumer Healthcare, Ltd. | | | 1,133 | | | | 60,213 | |

| | | | | | | | |

| | |

Household Products & Wares

(2.23%) | | | | | | | | |

Hindustan Unilever, Ltd. | | | 7,152 | | | | 56,600 | |

Marico, Ltd. | | | 12,669 | | | | 42,471 | |

| | | | | | | | |

| | | | | | | 99,071 | |

| | | | | | | | |

| | |

Pharmaceuticals (7.83%) | | | | | | | | |

Cadila Healthcare, Ltd. | | | 3,422 | | | | 47,415 | |

Cipla, Ltd. | | | 7,900 | | | | 46,693 | |

Divi’s Laboratories, Ltd. | | | 4,485 | | | | 72,794 | |

Dr. Reddy’s Laboratories, Ltd. | | | 2,129 | | | | 71,271 | |

Ipca Laboratories, Ltd. | | | 6,722 | | | | 46,080 | |

Lupin, Ltd. | | | 6,093 | | | | 63,796 | |

| | | | | | | | |

| | | | | | | 348,049 | |

| | | | | | | | |

| | |

TOTAL CONSUMER,

NON-CYCLICAL | | | | | | | 871,625 | |

| | | | | | | | |

| | |

Energy (6.95%) | | | | | | | | |

Oil & Gas (6.95%) | | | | | | | | |

Hindustan Petroleum Corp., Ltd. | | | 9,585 | | | | 54,827 | |

Oil & Natural Gas Corp., Ltd. | | | 13,435 | | | | 68,736 | |

Reliance Industries, Ltd. | | | 13,170 | | | | 185,789 | |

| | | | | | | | |

| | | | | | | 309,352 | |

| | | | | | | | |

| | |

TOTAL ENERGY | | | | | | | 309,352 | |

| | | | | | | | |

| | |

Financials (26.80%) | | | | | | | | |

Banks (20.01%) | | | | | | | | |

Allahabad Bank | | | 18,585 | | | | 58,301 | |

Axis Bank, Ltd. | | | 2,016 | | | | 42,212 | |

Bank of Baroda | | | 3,749 | | | | 54,722 | |

HDFC Bank, Ltd. | | | 20,258 | | | | 208,597 | |

ICICI Bank, Ltd. | | | 12,179 | | | | 203,895 | |

IndusInd Bank, Ltd. | | | 14,755 | | | | 92,725 | |

Standard Chartered PLC, IDR | | | 26,453 | | | | 49,392 | |

State Bank of India | | | 1,628 | | | | 65,877 | |

Union Bank of India | | | 11,654 | | | | 49,488 | |

Yes Bank, Ltd. | | | 9,800 | | | | 64,885 | |

| | | | | | | | |

| | | | | | | 890,094 | |

| | | | | | | | |

| | |

Diversified Financial Services

(4.94%) | | | | | | | | |

Bajaj Finance, Ltd. | | | 4,511 | | | | 74,642 | |

Housing Development Finance Corp. | | | 7,305 | | | | 93,119 | |

Power Finance Corp., Ltd. | | | 16,140 | | | | 51,948 | |

| | | | | | | | |

| | | | | | | 219,709 | |

| | | | | | | | |

4 | April 30, 2012

ALPS | Kotak India Growth Fund

| | |

| |

| Consolidated Statement of Investments | | April 30, 2012 |

| | | | | | | | |

| | | Shares | | | Value (Note 2) | |

Insurance (1.25%) | | | | | | | | |

MAX India, Ltd.(a) | | | 14,784 | | | | $55,595 | |

| | | | | | | | |

| | |

Real Estate (0.60%) | | | | | | | | |

Phoenix Mills, Ltd. | | | 6,751 | | | | 26,851 | |

| | | | | | | | |

| | |

TOTAL FINANCIALS | | | | | | | 1,192,249 | |

| | | | | | | | |

| | |

Industrials (8.84%) | | | | | | | | |

Building Materials (3.57%) | | | | | | | | |

Ambuja Cements, Ltd. | | | 21,500 | | | | 61,317 | |

Century Textiles & Industries, Ltd. | | | 7,045 | | | | 43,666 | |

Shree Cement, Ltd. | | | 1,000 | | | | 53,776 | |

| | | | | | | | |

| | | | | | | 158,759 | |

| | | | | | | | |

| |

Electrical Components & Equipment (1.20%) | | | | | |

V-Guard Industries, Ltd. | | | 14,800 | | | | 53,495 | |

| | | | | | | | |

| |

Engineering & Construction (2.36%) | | | | | |

Larsen & Toubro, Ltd. | | | 4,526 | | | | 105,097 | |

| | | | | | | | |

| |

Environmental Control (1.08%) | | | | | |

VA Tech Wabag, Ltd. | | | 5,836 | | | | 47,842 | |

| | | | | | | | |

| |

Machinery Diversified (0.63%) | | | | | |

Thermax, Ltd. | | | 3,300 | | | | 27,892 | |

| | | | | | | | |

| | |

TOTAL INDUSTRIALS | | | | | | | 393,085 | |

| | | | | | | | |

| | |

Technology (11.47%) | | | | | | | | |

Computers (10.50%) | | | | | | | | |

Infosys, Ltd. | | | 4,751 | | | | 220,589 | |

MindTree, Ltd. | | | 4,485 | | | | 50,131 | |

Redington India, Ltd. | | | 26,254 | | | | 43,700 | |

Tata Consultancy Services, Ltd. | | | 4,772 | | | | 112,544 | |

Wipro, Ltd. | | | 5,225 | | | | 40,082 | |

| | | | | | | | |

| | | | | | | 467,046 | |

| | | | | | | | |

| | |

Software (0.97%) | | | | | | | | |

Oracle Financial Services Software, Ltd.(a) | | | 872 | | | | 43,297 | |

| | | | | | | | |

| | |

TOTAL TECHNOLOGY | | | | | | | 510,343 | |

| | | | | | | | |

| | |

Utilities (2.14%) | | | | | | | | |

Electric (2.14%) | | | | | | | | |

CESC, Ltd. | | | 10,675 | | | | 51,633 | |

| | | | | | | | |

| | | Shares | | | Value (Note 2) | |

Electric (continued) | | | | | | | | |

Power Grid Corp. of India, Ltd. | | | 20,690 | | | | $43,594 | |

| | | | | | | | |

| | | | | | | 95,227 | |

| | | | | | | | |

| | |

TOTAL UTILITIES | | | | | | | 95,227 | |

| | | | | | | | |

| | |

TOTAL COMMON STOCKS (Cost $4,369,319) | | | | | | | 4,244,060 | |

| | | | | | | | |

| | | | | | | | | | | | |

| | | 7-Day

Yield | | | Shares | | | Value (Note 2) | |

SHORT TERM INVESTMENTS (0.37%) | | | | | |

Money Market Fund (0.37%) | | | | | |

Dreyfus Cash Advantage Fund, Institutional Class | | | 0.131 | % | | | 16,668 | | | | 16,668 | |

| | | | | | | | | | | | |

| |

TOTAL SHORT TERM INVESTMENTS (Cost $16,668) | | | | 16,668 | |

| | | | | | | | | | | | |

| |

TOTAL INVESTMENTS (95.78%) (Cost $4,385,987) | | | | $4,260,728 | |

| |

Other Assets In Excess Of Liabilities (4.22%) | | | | 187,613 | |

| | | | | | | | | | | | |

| |

NET ASSETS (100.00%) | | | | $4,448,341 | |

| | | | | | | | | | | | |

| (a) | Non-Income Producing Security. |

Common Abbreviations:

IDR - Indian Depository Receipt.

Ltd. - Limited.

PLC - Public Limited Company.

For Fund compliance purposes, the Fund’s industry classifications refer to any one or more of the industry sub-classifications used by one or more widely recognized market indexes or ratings group indexes, and/or as defined by Fund management. This definition may not apply for purposes of this report, which may combine industry sub-classifications for reporting ease. Industries are shown as a percent of net assets. These industry classifications are based on third party definitions and are unaudited. The definitions are industry terms and do not reflect the legal status of any of the investments or the companies in which the Fund has invested.

See Notes to Financial Statements.

ALPS | Kotak India Growth Fund

| | |

| Consolidated Statement of Assets and Liabilities | | April 30, 2012 |

| | | | |

ASSETS | | | | |

Investments, at value | | $ | 4,260,728 | |

Cash | | | 56,719 | |

Foreign currency, at value (Cost $101,998) | | | 101,123 | |

Foreign currency held at broker for futures contracts (Cost $38,713) | | | 36,702 | |

Receivable for investments sold | | | 13,405 | |

Receivable for shares sold | | | 8,000 | |

Dividends and interest receivable | | | 384 | |

Receivable due from adviser | | | 46,172 | |

Prepaid expenses and other assets | | | 21,180 | |

Total Assets | | | 4,544,413 | |

LIABILITIES | | | | |

Payable for investments purchased | | | 114 | |

Payable for shares redeemed | | | 6,457 | |

Administration and transfer agency fees payable | | | 22,443 | |

Distribution and services fees payable | | | 1,130 | |

Directors’ fees and expenses payable | | | 281 | |

Accrued expenses and other liabilities | | | 65,647 | |

Total Liabilities | | | 96,072 | |

NET ASSETS | | $ | 4,448,341 | |

| | |

NET ASSETS CONSIST OF | | | | |

Paid-in capital | | $ | 5,154,772 | |

Accumulated net investment loss | | | (34,534) | |

Accumulated net realized loss on investments | | | (543,574) | |

Net unrealized depreciation on investments and translation of assets and liabilities denominated in foreign currencies | | | (128,323) | |

NET ASSETS | | $ | 4,448,341 | |

| | | | | |

INVESTMENTS, AT COST | | $ | 4,385,987 | |

| | | | |

PRICING OF SHARES | | | | |

Class A: | | | | |

Net Asset Value, offering and redemption price per share(a) | | $ | 8.22 | |

Net Assets | | $ | 2,404,363 | |

Shares of beneficial interest outstanding (unlimited number of shares, no par value common stock authorized) | | | 292,390 | |

Maximum offering price per share ((NAV/0.9450), based on maximum sales charge of 5.50% of the offering price) | | $ | 8.70 | |

Class C: | | | | |

Net Asset Value, offering and redemption price per share(a) | | $ | 8.15 | |

Net Assets | | $ | 435,266 | |

Shares of beneficial interest outstanding (unlimited number of shares, no par value common stock authorized) | | | 53,398 | |

Class I: | | | | |

Net Asset Value, offering and redemption price per share | | $ | 8.25 | |

Net Assets | | $ | 1,608,712 | |

Shares of beneficial interest outstanding (unlimited number of shares, no par value common stock authorized) | | | 194,901 | |

| (a) | Redemption price per share may be reduced for any applicable contingent deferred sales charge. For a description of a possible sales charge, please see the Fund’s Prospectus. |

See Notes to Financial Statements.

6 | April 30, 2012

ALPS | Kotak India Growth Fund

| | |

| Consolidated Statement of Operations | | For the Year Ended April 30, 2012 |

| | | | |

INVESTMENT INCOME | | | | |

Dividends | | $ | 39,959 | |

Total Investment Income | | | 39,959 | |

| |

EXPENSES | | | | |

Investment advisory fees | | | 44,843 | |

Administrative and transfer agency fees | | | 134,553 | |

Distribution and service fees | | | | |

Class A | | | 6,265 | |

Class C | | | 5,175 | |

Legal fees | | | 91 | |

Audit fees | | | 53,600 | |

Reports to shareholders and printing fees | | | 3,300 | |

State registration fees | | | 17,590 | |

Insurance fees | | | 104 | |

Custody fees | | | 72,891 | |

Directors’ fees and expenses | | | 5,066 | |

Offering costs (See Note 2) | | | 73,523 | |

Miscellaneous expenses | | | 28,073 | |

Total Expense | | | 445,074 | |

Less fees waived/reimbursed by investment advisor | | | | |

Class A | | | (163,189) | |

Class C | | | (55,857) | |

Class I | | | (157,189) | |

Net Expenses | | | 68,839 | |

Net Investment Loss | | | (28,880) | |

Net realized loss on investments | | | (492,942) | |

Net realized loss on futures contracts | | | (35,820) | |

Net realized loss on foreign currency transactions | | | (52,435) | |

Net change in unrealized depreciation on investments | | | (160,724) | |

Net change in unrealized appreciation on futures contracts | | | 5,225 | |

Net change in unrealized depreciation on translation of assets and liabilities denominated in foreign currencies | | | (3,524) | |

NET REALIZED AND UNREALIZED LOSS ON INVESTMENTS | | | (740,220) | |

NET DECREASE IN NET ASSETS RESULTING FROM OPERATIONS | | $ | (769,100) | |

| | |

See Notes to Financial Statements.

7 | April 30, 2012

ALPS | Kotak India Growth Fund

| | |

| |

Consolidated Statements of Changes in Net Assets | | |

| | | | | | | | |

| | | For the

Year Ended

April 30, 2012 | | | For the Period

February 14,

2011

(Inception) to

April 30, 2011 | |

OPERATIONS | | | | | | | | |

Net investment loss | | $ | (28,880) | | | $ | (3,001) | |

Net realized gain/(loss) on investments, futures contracts and foreign currency transactions | | | (581,197) | | | | 2,518 | |

Net change in unrealized appreciation/(depreciation) on investments, futures contracts and translation of assets and liabilities denominated in foreign currencies | | | (159,023) | | | | 30,700 | |

Net Increase/(Decrease) in Net Assets Resulting from Operations | | | (769,100) | | | | 30,217 | |

| | |

DISTRIBUTIONS | | | | | | | | |

Dividends to shareholders from net realized gains | | | | | | | | |

Class A | | | (1,040) | | | | 0 | |

Class C | | | (511) | | | | 0 | |

Class I | | | (1,048) | | | | 0 | |

Net Decrease in Net Assets from Distributions | | | (2,599) | | | | 0 | |

| | |

BENEFICIAL INTEREST TRANSACTIONS (NOTE 6) | | | | | | | | |

Shares sold | | | | | | | | |

Class A | | | 2,225,793 | | | | 920,378 | |

Class C | | | 604,159 | | | | 452,986 | |

Class I | | | 1,530,305 | | | | 568,500 | |

Dividends reinvested | | | | | | | | |

Class A | | | 923 | | | | 0 | |

Class C | | | 505 | | | | 0 | |

Class I | | | 964 | | | | 0 | |

Shares redeemed | | | | | | | | |

Class A | | | (455,302) | | | | (3,827) | |

Class C | | | (439,459) | | | | 0 | |

Class I | | | (216,102) | | | | 0 | |

Net Increase in Net Assets Derived from Beneficial Interest Transactions | | | 3,251,786 | | | | 1,938,037 | |

| | |

Net increase in net assets | | | 2,480,087 | | | | 1,968,254 | |

| | |

NET ASSETS | | | | | | | | |

Beginning of year | | | 1,968,254 | | | | 0 | |

End of year * | | $ | 4,448,341 | | | $ | 1,968,254 | |

| | |

*Including accumulated net investment loss of: | | $ | (34,534) | | | $ | (3,343) | |

See Notes to Financial Statements.

8 | April 30, 2012

ALPS | Kotak India Growth Fund – Class A

| | |

|

Consolidated Financial Highlights Selected data for a share of beneficial interest outstanding throughout the periods indicated: |

| | | | |

| | | For the Year Ended

April 30, 2012 (a) | | For the Period

February 14, 2011 (Inception) to April 30, 2011 (a) |

Net asset value, beginning of period | | $10.35 | | $10.00 |

| | |

INCOME/(LOSS) FROM INVESTMENT OPERATIONS: | | | | |

Net investment loss(b) | | (0.08) | | (0.04) |

Net realized and unrealized gain/(loss) | | (2.04) | | 0.39 |

Total from investment operations | | (2.12) | | 0.35 |

| | |

DISTRIBUTIONS: | | | | |

From net realized gains | | (0.01) | | – |

Total distributions | | (0.01) | | – |

| | |

REDEMPTION FEES ADDED TO PAID-IN CAPITAL (NOTE 6) | | 0.00(c) | | 0.00(c) |

Net increase/(decrease) in net asset value | | (2.13) | | 0.35 |

Net asset value, end of year | | $8.22 | | $10.35 |

| |

TOTAL RETURN(d) | | (20.44)% | | 3.40% |

| | |

RATIOS/SUPPLEMENTAL DATA: | | | | |

Net assets, end of year (000s) | | $2,404 | | $935 |

Ratio of net investment loss to average net assets | | (0.89)% | | (1.82)%(e) |

Ratio of expenses to average net assets including fee waivers and reimbursements | | 2.00% | | 2.00%(e) |

Ratio of expenses to average net assets excluding fee waivers and reimbursements | | 12.42% | | 69.96%(e) |

Portfolio turnover rate(f) | | 114% | | 9% |

| (a) | Per share amounts and ratios to average net assets include income and expenses of the Kotak Mauritius Portfolio (wholly owned subsidiary). |

| (b) | Calculated using the average shares method. |

| (c) | Less than $0.005 per share. |

| (d) | Total returns are for the period indicated and have not been annualized. Total returns would have been lower had certain expenses not been waived during the period. Returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Returns shown exclude any applicable sales charges. |

| (f) | Portfolio turnover rate for periods less than one full year have not been annualized. |

See Notes to Financial Statements.

9 | April 30, 2012

ALPS | Kotak India Growth Fund – Class C

| | |

|

Consolidated Financial Highlights Selected data for a share of beneficial interest outstanding throughout the periods indicated: |

| | | | |

| | | For the Year Ended

April 30, 2012 (a) | | For the Period

February 14, 2011

(Inception) to

April 30, 2011 (a) |

Net asset value, beginning of period | | $10.32 | | $10.00 |

| |

INCOME/(LOSS) FROM INVESTMENT OPERATIONS: | | |

Net investment loss(b) | | (0.13) | | (0.05) |

Net realized and unrealized gain/(loss) | | (2.03) | | 0.37 |

Total from investment operations | | (2.16) | | 0.32 |

| | |

DISTRIBUTIONS: | | | | |

From net realized gains | | (0.01) | | – |

Total distributions | | (0.01) | | – |

| | |

REDEMPTION FEES ADDED TO PAID-IN CAPITAL (NOTE 6) | | 0.00(c) | | – |

Net increase/(decrease) in net asset value | | (2.17) | | 0.32 |

Net asset value, end of year | | $8.15 | | $10.32 |

| |

|

TOTAL RETURN(d) | | (20.97)% | | 3.20% |

| | |

RATIOS/SUPPLEMENTAL DATA: | | | | |

Net assets, end of year (000s) | | $435 | | $466 |

Ratio of net investment loss to average net assets | | (1.49)% | | (2.42)% (e) |

Ratio of expenses to average net assets including fee waivers and reimbursements | | 2.60% | | 2.60%(e) |

Ratio of expenses to average net assets excluding fee waivers and reimbursements | | 13.39% | | 69.64%(e) |

Portfolio turnover rate(f) | | 114% | | 9% |

| (a) | Per share amounts and ratios to average net assets include income and expenses of the Kotak Mauritius Portfolio (wholly owned subsidiary). |

| (b) | Calculated using the average shares method. |

| (c) | Less than $0.005 per share. |

| (d) | Total returns are for the period indicated and have not been annualized. Total returns would have been lower had certain expenses not been waived during the period. Returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Returns shown exclude any applicable sales charges. |

| (f) | Portfolio turnover rate for periods less than one full year have not been annualized. |

See Notes to Financial Statements.

10 | April 30, 2012

ALPS | Kotak India Growth Fund – Class I

| | |

|

Consolidated Financial Highlights Selected data for a share of beneficial interest outstanding throughout the periods indicated: |

| | | | |

| | | For the Year Ended

April 30, 2012 (a) | | For the Period

February 14, 2011

(Inception) to

April 30, 2011 (a) |

Net asset value, beginning of period | | $10.34 | | $10.00 |

| | |

INCOME/(LOSS) FROM INVESTMENT OPERATIONS: | | | | |

Net investment loss(b) | | (0.04) | | (0.03) |

Net realized and unrealized gain/(loss) | | (2.04) | | 0.37 |

Total from investment operations | | (2.08) | | 0.34 |

| | |

DISTRIBUTIONS: | | | | |

From net realized gains | | (0.01) | | – |

Total distributions | | (0.01) | | – |

| | |

REDEMPTION FEES ADDED TO PAID-IN CAPITAL (NOTE 6) | | 0.00(c) | | – |

Net increase/(decrease) in net asset value | | (2.09) | | 0.34 |

Net asset value, end of year | | $8.25 | | $10.34 |

| |

TOTAL RETURN(d) | | (20.23)% | | 3.50% |

| | |

RATIOS/SUPPLEMENTAL DATA: | | | | |

Net assets, end of year (000s) | | $1,609 | | $568 |

Ratio of net investment loss to average net assets | | (0.49)% | | (1.36)%(e) |

Ratio of expenses to average net assets including fee waivers and reimbursements | | 1.60% | | 1.60%(e) |

Ratio of expenses to average net assets excluding fee waivers and reimbursements | | 12.05% | | 96.67%(e) |

Portfolio turnover rate(f) | | 114% | | 9% |

| (a) | Per share amounts and ratios to average net assets include income and expenses of the Kotak Mauritius Portfolio (wholly owned subsidiary). |

| (b) | Calculated using the average shares method. |

| (c) | Less than $0.005 per share. |

| (d) | Total returns are for the period indicated and have not been annualized. Total returns would have been lower had certain expenses not been waived during the period. Returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. |

| (f) | Portfolio turnover rate for periods less than one full year have not been annualized. |

See Notes to Financial Statements.

11 | April 30, 2012

ALPS | Red Rocks Listed Private Equity Fund

| | |

| |

| Management Commentary | | April 30, 2012 (Unaudited) |

Overview

When I last penned the Semi-Annual Overview in October 2011, all was doom and gloom. The global equity markets had one of their worst and most volatile quarters in history. Europe was in particularly dire straits with the Greece crisis (the Greek tragedy still continues and unfortunately it’s not a play), and the potential for contagion throughout the region. The US federal government couldn’t agree on a budget (and still can’t), and China was slowing down. While Q4 2011 wasn’t a whole lot better, things took a turn for the better in Q1 2012; a big turn. The Euro-zone has somewhat stabilized (although it has recently showed signs of stress with anti-austerity movements and national elections), US economic growth has been mildly positive in spite of the dysfunction in Washington, and businesses around the globe appear to be on better footing than most had anticipated.

So how have the equity markets reacted over the past six months? They reacted the same way they have historically reacted when people realize the world isn’t coming to an end: they’ve performed very well, with most markets showing strong gains.

And the listed private equity asset class; how did it fare? Pretty well. Returns were very strong, with most listed private equity companies appreciating 15% to 30%+ during the six month period. What was behind the strong showing? Was it big uplifts in underlying asset values? Significant mergers and acquisitions activity? A strong IPO market? Actually, none of the above. Outside of a few notable exceptions, the real driver of returns was the rebound from what happened to share prices in Q3 and Q4 of 2011. Put differently, the price depreciation pendulum in Q3 and Q4 2011 had swung too far.

Why did this happen in the later part of 2011? Outside of general capital market fears, we’re not sure. In hindsight, clearly the fundamentals didn’t back-up this price movement.

Over the past several years many listed private equity companies have been trading at a discount to their internally generated Net Asset Value (NAV). During 2011, such discounts widened to 35%-45%+ for many vehicles; incredibly wide based on historical metrics and underlying company fundamentals. While the price depreciation pendulum didn’t have to swing back over the past six months, it certainly was poised to, assuming that all of the doom and gloom didn’t come to fruition...and it didn’t. Discounts to NAV narrowed during Q1, albeit they’re still at historically wide levels; now at 25%-35%+.

Those wide discounts to NAV continue to perplex us. Contrary to share performance (down 10% to 30% for 2011 and up 10% to 20% for the first four months of 2012), asset values for most private equity companies increased throughout 2011 and into 2012. Private equity portfolio companies did well, realizations continued at uplifts to most recent valuations, and balance sheets were strong. Most listed private equity companies showed 6%-9% NAV appreciation for the year, and are flat to up 4% in 2012. The only conclusion we can reach is that most investors don’t fully understand listed private equity...or they just don’t care/believe. The listed private equity market is still a very inefficient market.

The widening of the discounts in 2011 brings us to our other point. We’ve been saying for several years that discounts in excess of 20% can’t go on forever. They attract too many questions. And those questions are typically asked by smart investors...deep value investors, some of which are activists*. That is what we are now

witnessing in the listed private equity space; activist investors who have done their homework and realize that these vehicles hold valuable assets that aren’t being recognized for what they’re worth. The activists have targeted several listed private equity vehicles, demanding that the managers overseeing them realize value for their shareholders. This has made for a fairly uncomfortable set of shareholder meetings and proxy voting situations. Managers of listed private equity vehicles that are trading on wide discounts have been put on notice: fix the discount, and quickly, or wind down the vehicle. Stay tuned, there’s more to come.

In summary, the past six months has been a volatile period. Performance towards the end of 2011 was flat to positive, with 2012 off to a very good start.

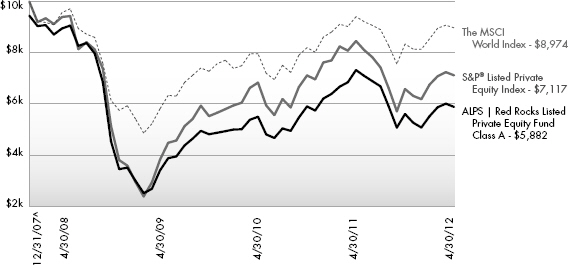

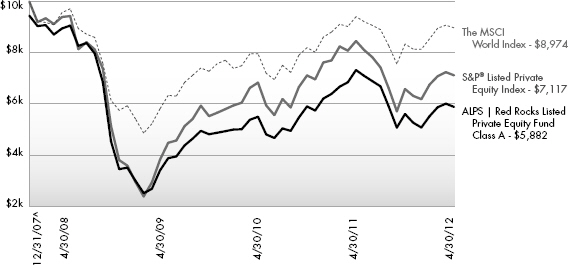

Portfolio Review

For the annual period ended April 30, 2012, the Fund’s Class A shares, LPEFX, returned -19.68%, (Class A delivered a net return of -24.04% at MOP), compared with -4.63% and -17.26% for the MSCI World Index and the S&P® Listed Private Equity Index, respectively.

During the year we made a number of changes to the portfolio. We exited fourteen holdings and we added five new holdings. While the total number of portfolio holdings shrank during the year (from 46 down to 37), the Fund is still highly diversified with exposure to some of the top performing private equity firms/funds around the globe.

From a fundamentals perspective, the underlying performance of the listed private equity vehicles that the Fund holds continues to do well; uplifts to valuations, strong balance sheets, access to the debt markets (both new and re-financings) and ongoing liquidity.

Net contributors to performance for the year included:

| | • | | Brookfield Infrastructure PA |

Net detractors to performance for the year were:

Outlook

Stability on a global macro basis will do more to prove out the value of the private equity asset class and potentially create organic growth opportunities than most anything else that we can see. Will that happen? We’re not sure... but we do see signs that give us hope.

As always, we appreciate your continued support and interest in Red Rocks and the Listed Private Equity strategy.

Adam Goldman, Co-Portfolio Manager

| * | An activist shareholder uses an equity stake in a corporation to put public pressure on its management. The goals of activist shareholders range from financial (increase of shareholder value through changes in corporate policy, financing structure, cost cutting, etc.) to non-financial (disinvestment from particular countries, adoption of environmentally friendly policies, etc.). |

| Diversification | cannot guarantee gain or prevent loses. |

ALPS | Red Rocks Listed Private Equity Fund

| | |

| |

Management Commentary | | April 30, 2012 (Unaudited) |

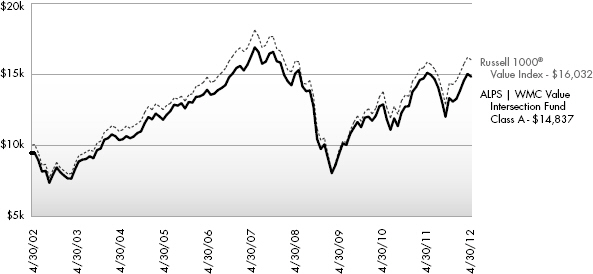

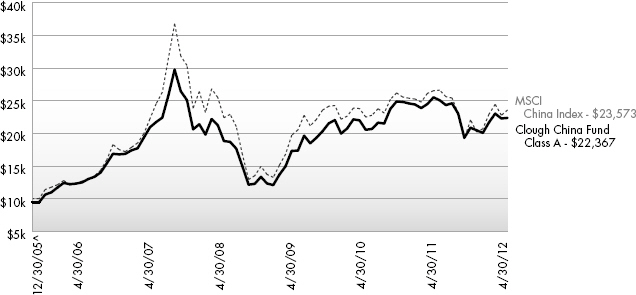

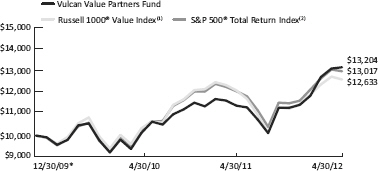

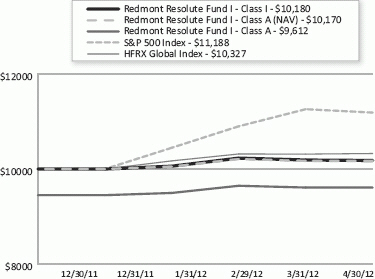

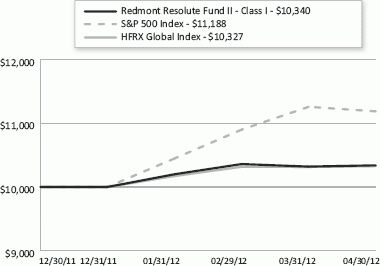

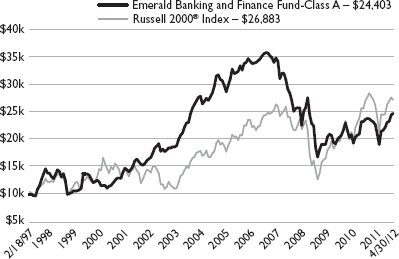

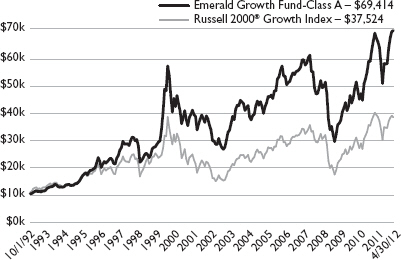

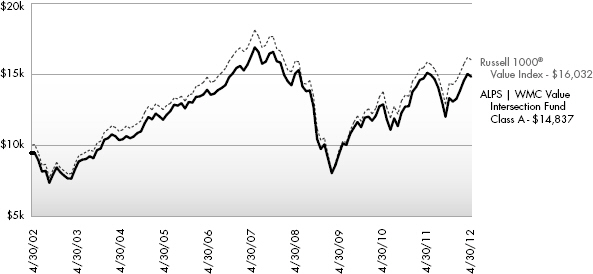

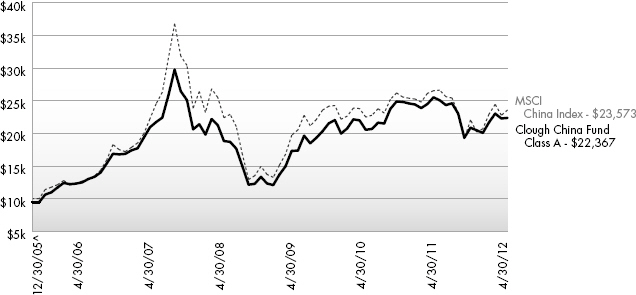

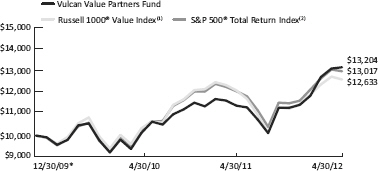

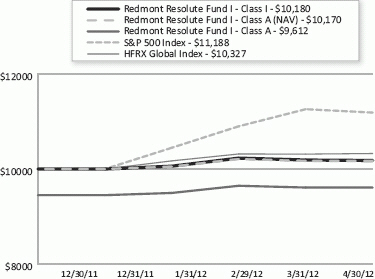

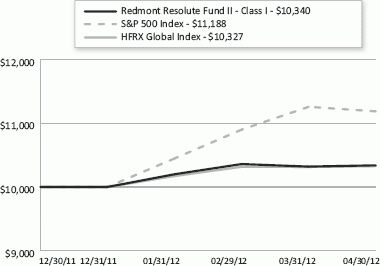

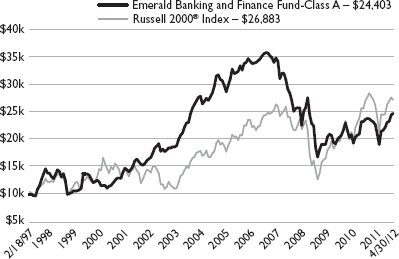

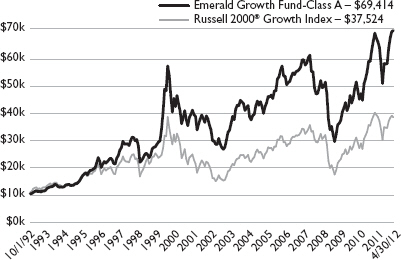

Performance of $10,000 Initial Investment (for the period ended April 30, 2012)

Comparison of change in value of a $10,000 investment (includes applicable sales loads of 5.50%)

The chart above represents historical performance of a hypothetical investment of $10,000 in the Fund since inception. Past performance does not guarantee future results. This chart does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

13 | April 30, 2012

ALPS | Red Rocks Listed Private Equity Fund

| | |

| |

Management Commentary | | April 30, 2012 (Unaudited) |

Average Annual Total Returns (as of April 30, 2012)

| | | | | | | | |

| | | 1 Year | | Since Inception ^ | | Total Expense Ratio | | What you Pay * |

| Class A (NAV)1 | | -19.68% | | -10.37% | | 1.71% | | 1.51% |

| Class A (MOP) 2 | | -24.04% | | -11.53% | | |

| Class C (NAV) 1 | | -20.33% | | -11.14% | | 2.32% | | 2.26% |

| Class C (CDSC) 2 | | -21.05% | | -11.14% | | |

| Class I | | -19.52% | | -10.12% | | 1.37% | | 1.26% |

| Class R | | -19.93% | | -10.78% | | 1.88% | | 1.76% |

| MSCI World Index3 | | -4.63% | | -2.47% | | | | |

| S&P® LPE Total Return Index4 | | -15.85% | | -7.55% | | | | |

Performance data quoted represents past performance. Past performance does not guarantee future results. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when sold or redeemed, may be worth more or less than the original cost. Current performance data may be higher or lower than actual data quoted. The Fund imposes a 2.00% redemption fee on shares held for less than 90 days. The Fund imposes a maximum Contingent Deferred Sales Charge (“CDSC”) of 1.00% on Class C shares redeemed within the first 12 months after a purchase, and on Class A shares redeemed within the first 12 months after a purchase in excess of $1 million. Performance data does not reflect the redemption fee or the CDSC, which if reflected would reduce the performance quoted. For the most current month-end performance data, please call (866) 759-5679.

Performance shown for Class C shares prior to June 30, 2010 reflects the historical performance of the Fund’s Class A shares, calculated using the fees and expenses of Class C shares.

| 1 | Net Asset Value (NAV) is the share price without sales charges. The performance data shown does not reflect the decution of the sales load or the redemption fee or CDSC, and that, if reflected, the load or fee would reduce the performance quoted. |

| 2 | Maximum Offering Price (MOP) for Class A shares includes the Fund’s maximum sales charge of 5.50%. CDSC performance for Class C shares includes a 1% contingent deferred sales charge (CDSC) on C shares redeemed within 12 months of purchase. Performance shown at NAV does not include these sales charges and would have been lower had it been taken into account. |

| 3 | MSCI World Index: Morgan Stanley Capital International’s market capitalization weighted index is composed of companies representative of the market structure of 22 developed market countries in North America, Europe and the Asia/Pacific Region. The index is not actively managed and does not reflect any deduction for fees, expenses or taxes. An investor may not invest directly in an index. |

| 4 | S&P® Listed Private Equity Index: The S&P® Listed Private Equity Index is comprised of 30 leading listed private equity companies that meet size, liquidity, exposure, and activity requirements. The index is designed to provide tradable exposure to the leading publicly listed companies in the private equity space. The index is not actively managed and does not reflect any deduction for fees, expenses or taxes. An investor may not invest directly in an index. |

| ^ | Fund inception date of December 31, 2007. |

| * | What You Pay reflects the Adviser’s and Sub-Adviser’s decision to contractually limit expenses through August 31, 2012. Please see the prospectus for additional information. |

The table does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

Listed Private Equity Companies are subject to various risks depending on their underlying investments, which could include, but are not limited to, additional liquidity risk, industry risk, non-U.S. security risk, currency risk, credit risk, managed portfolio risk and derivatives risk (derivatives risk is the risk that the value of the Listed Private Equity Companies’ derivative investments will fall because of pricing difficulties or lack of correlation with the underlying investment).

There are inherent risks in investing in private equity companies, which encompass financial institutions or vehicles whose principal business is to invest in and lend capital to privately held companies. Generally, little public information exists for private and thinly traded companies, and there is a risk that investors may not be able to make a fully informed investment decision.

Listed Private Equity Companies may have relatively concentrated investment portfolios, consisting of a relatively small number of holdings. A consequence of this limited number of investments is that the aggregate returns realized may be adversely impacted by the poor performance of a small number of investments, or even a single investment, particularly if a company experiences the need to write down the value of an investment.

Certain of the Fund’s investments may be exposed to liquidity risk due to low trading volume, lack of a market maker or legal restrictions limiting the ability of the Fund to sell particular securities at an advantageous price and/or time. As a result, these securities may be more difficult to value. Foreign investing involves special risks, such as currency fluctuations and political uncertainty. The Fund invests in derivatives and is subject to the risk that the value of those derivative investments will fall because of pricing difficulties or lack of correlation with the underlying investment.

14 | April 30, 2012

ALPS | Red Rocks Listed Private Equity Fund

| | |

| |

Management Commentary | | April 30, 2012 (Unaudited) |

Top Ten Holdings (as a % of Net Assets) †

| | | | |

Conversus Capital LP | | | 5.07 | % |

Onex Corp. | | | 4.76 | % |

SVG Capital PLC | | | 4.76 | % |

Electra Private Equity PLC | | | 4.68 | % |

Eurazeo | | | 4.35 | % |

KKR & Co. LP | | | 4.34 | % |

Blackstone Group LP | | | 4.24 | % |

Wendel Investissement | | | 4.15 | % |

Apollo Global Management LLC, Class A | | | 3.64 | % |

Graphite Enterprise Trust PLC | | | 3.32 | % |

Top Ten Holdings | | | 43.31 | % |

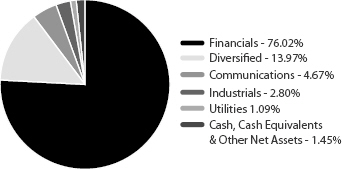

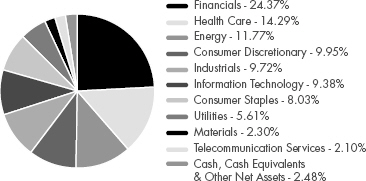

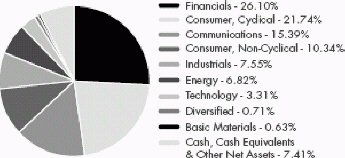

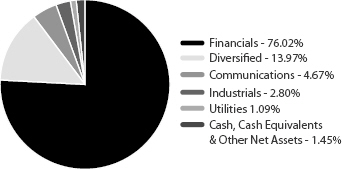

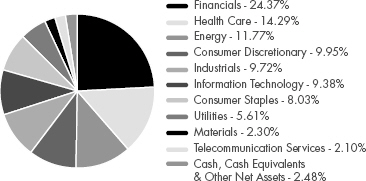

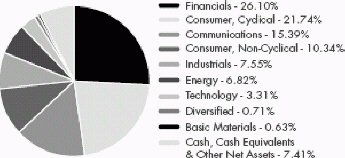

Industry Sector Allocation (as a % of Net Assets)

† Holdings are subject to change.

15 | April 30, 2012

ALPS | Red Rocks Listed Private Equity Fund

| | |

| |

Statement of Investments | | April 30, 2012 |

| | | | | | | | |

| | | Shares | | | Value (Note 2) | |

COMMON STOCKS (98.55%) | | | | | |

Communications (4.67%) | | | | | |

Internet (4.67%) | | | | | | | | |

Internet Capital Group, Inc.(a) | | | 391,500 | | | | $3,711,420 | |

Safeguard Scientifics, Inc.(a) | | | 248,100 | | | | 4,058,916 | |

| | | | | | | | |

| | | | | | | 7,770,336 | |

| | | | | | | | |

| |

TOTAL COMMUNICATIONS | | | | 7,770,336 | |

| | | | | | | | |

| | |

Diversified (13.97%) | | | | | | | | |

Holding Companies-Diversified Operations (13.97%) | | | | | |

Ackermans & van Haaren N.V. | | | 63,493 | | | | 5,442,786 | |

Leucadia National Corp. | | | 165,700 | | | | 4,119,302 | |

Remgro, Ltd. | | | 144,100 | | | | 2,440,673 | |

Schouw & Co. | | | 191,669 | | | | 4,348,208 | |

Wendel Investissement | | | 92,300 | | | | 6,905,456 | |

| | | | | | | | |

| | | | | | | 23,256,425 | |

| | | | | | | | |

| |

TOTAL DIVERSIFIED | | | | 23,256,425 | |

| | | | | | | | |

| | |

Financials (76.02%) | | | | | | | | |

Closed-End Funds (35.40%) | | | | | |

AP Alternative Assets LP | | | 517,779 | | | | 5,203,679 | |

Candover Investments PLC(a) | | | 201,687 | | | | 1,358,371 | |

Castle Private Equity, Ltd.(a) | | | 245,983 | | | | 3,008,220 | |

Conversus Capital LP | | | 421,000 | | | | 8,445,260 | |

Electra Private Equity PLC(a) | | | 287,985 | | | | 7,786,410 | |

Graphite Enterprise Trust PLC | | | 836,923 | | | | 5,528,054 | |

HarbourVest Global Private Equity Ltd.(a) | | | 400,400 | | | | 2,842,840 | |

HBM BioVentures AG, Class A(a) | | | 55,142 | | | | 2,566,793 | |

HgCapital Trust PLC(a) | | | 57,520 | | | | 47,608 | |

HgCapital Trust PLC | | | 190,593 | | | | 2,941,575 | |

Pantheon International Participations PLC(a) | | | 129,000 | | | | 1,601,561 | |

Pantheon International Participations PLC(a) | | | 260,082 | | | | 3,233,192 | |

Princess Private Equity Holding, Ltd. | | | 564,900 | | | | 4,546,359 | |

Standard Life European Private Equity Trust PLC | | | 826,751 | | | | 1,891,848 | |

SVG Capital PLC(a) | | | 1,765,956 | | | | 7,921,553 | |

| | | | | | | | |

| | | | | | | 58,923,323 | |

| | | | | | | | |

| |

Diversified Financial Services (15.84%) | | | | | |

Blackstone Group LP | | | 520,300 | | | | 7,055,268 | |

Intermediate Capital Group PLC | | | 999,001 | | | | 4,163,450 | |

KKR & Co. LP | | | 511,000 | | | | 7,215,320 | |

Onex Corp. | | | 199,500 | | | | 7,922,645 | |

| | | | | | | 26,356,683 | |

| | | | | | | | |

| |

Investment Companies (1.35%) | | | | | |

Ratos AB, B Shares | | | 192,000 | | | | 2,248,136 | |

| | | | | | | | |

| | | | | | | | |

| | | Shares | | | Value (Note 2) | |

Private Equity (20.55%) | | | | | |

3i Group PLC | | | 1,079,000 | | | | $3,346,374 | |

Altamir Amboise | | | 370,325 | | | | 3,318,641 | |

Apollo Global Management LLC, Class A | | | 472,100 | | | | 6,061,764 | |

Aurelius AG | | | 75,948 | | | | 3,342,693 | |

Bure Equity AB | | | 577,000 | | | | 1,596,745 | |

Deutsche Beteiligungs AG | | | 111,921 | | | | 2,484,467 | |

Eurazeo | | | 141,435 | | | | 7,248,109 | |

GIMV N.V. | | | 101,445 | | | | 4,971,135 | |

IP Group PLC(a) | | | 777,117 | | | | 1,835,024 | |

| | | | | | | | |

| | | | | | | 34,204,952 | |

| | | | | | | | |

| |

Real Estate (2.88%) | | | | | |

Brookfield Asset Management, Inc., Class A | | | 145,200 | | | | 4,788,696 | |

| | | | | | | | |

| |

TOTAL FINANCIALS | | | | 126,521,790 | |

| | | | | | | | |

| | |

Industrials (2.80%) | | | | | | | | |

Miscellaneous Manufacturers (2.80%) | | | | | | | | |

Fosun International, Ltd. | | | 7,800,000 | | | | 4,664,729 | |

| | | | | | | | |

| |

TOTAL INDUSTRIALS | | | | 4,664,729 | |

| | |

Utilities (1.09%) | | | | | | | | |

Electric (1.09%) | | | | | | | | |

Brookfield Infrastructure Partners LP | | | 57,400 | | | | 1,810,396 | |

| | | | | | | | |

| |

TOTAL UTILITIES | | | | 1,810,396 | |

| | | | | | | | |

| |

TOTAL COMMON STOCKS (Cost $153,861,705) | | | | 164,023,676 | |

| | | | | | | | |

| | | | | | | | | | | | |

| | | 7-Day

Yield | | | Shares | | | Value (Note 2) | |

SHORT TERM INVESTMENTS (1.44%) | | | | | |

Money Market Fund (1.44%) | | | | | |

Dreyfus Treasury Prime Cash Management, Investor Shares | | | 0.00004 | % | | | 2,403,422 | | | | 2,403,422 | |

| | | | | | | | | | | | |

| |

TOTAL SHORT TERM INVESTMENTS (Cost $2,403,422) | | | | 2,403,422 | |

| | | | | | | | | | | | |

16 | April 30, 2012

ALPS | Red Rocks Listed Private Equity Fund

| | |

| |

Statement of Investments | | April 30, 2012 |

| | | | |

| | | Value (Note 2) | |

TOTAL INVESTMENTS (99.99%) (Cost $156,265,127) | | $ | 166,427,098 | |

| |

Other Assets In Excess Of Liabilities (0.01%) | | | 14,336 | |

| | | | |

| |

NET ASSETS (100.00%) | | $ | 166,441,434 | |

| | | | | |

| | | | |

| (a) | Non-Income Producing Security. |

Common Abbreviations:

AB - Aktiebolag is the Swedish equivalent of the term corporation.

AG - Aktiengesellschaft is a German term that refers to a corporation that is limited by shares, i.e., owned by shareholders.

LLC - Limited Liability Company.

LP - Limited Partnership.

Ltd. - Limited.

N.V. - Naamloze Vennootschap is the Dutch term for a public limited liability corporation.

PLC - Public Limited Company.

For Fund compliance purposes, the Fund’s industry classifications refer to any one or more of the industry sub-classifications used by one or more widely recognized market indexes or ratings group indexes, and/or as defined by Fund management. This definition may not apply for purposes of this report, which may combine industry subclassifications for reporting ease. Industries are shown as a percent of net assets. These industry classifications are based on third party definitions and are unaudited. The definitions are industry terms and do not reflect the legal status of any of the investments or the companies in which the Fund has invested.

See Notes to Financial Statements.

17 | April 30, 2012

ALPS | Red Rocks Listed Private Equity Fund

| | |

| |

Statement of Assets and Liabilities | | April 30, 2012 |

| | | | |

ASSETS | | | | |

Investments, at value | | $ | 166,427,098 | |

Foreign currency, at value (Cost $282,005) | | | 281,908 | |

Receivable for investments sold | | | 560,836 | |

Receivable for shares sold | | | 204,614 | |

Dividends and interest receivable | | | 193,260 | |

Prepaid expenses and other assets | | | 34,084 | |

Total Assets | | | 167,701,800 | |

LIABILITIES | | | | |

Payable for investments purchased | | | 796,021 | |

Payable for shares redeemed | | | 163,269 | |

Investment advisory fees payable | | | 100,820 | |

Administration and transfer agency fees payable | | | 26,120 | |

Distribution and services fees payable | | | 30,856 | |

Directors’ fees and expenses payable | | | 5,098 | |

Accrued expenses and other liabilities | | | 138,182 | |

Total Liabilities | | | 1,260,366 | |

NET ASSETS | | $ | 166,441,434 | |

| | | | | |

NET ASSETS CONSIST OF | | | | |

Paid-in capital | | $ | 191,636,590 | |

Accumulated net investment loss | | | (10,542,204) | |

Accumulated net realized loss on investments and foreign currency transactions | | | (24,810,191) | |

Net unrealized appreciation on investments and translation of assets and liabilities denominated in foreign currencies | | | 10,157,239 | |

NET ASSETS | | $ | 166,441,434 | |

| | | | | |

INVESTMENTS, AT COST | | $ | 156,265,127 | |

| |

PRICING OF SHARES | | | | |

Class A: | | | | |

Net Asset Value, offering and redemption price per share(a) | | $ | 4.67 | |

Net Assets | | $ | 85,806,967 | |

Shares of beneficial interest outstanding (unlimited number of shares, no par value common stock authorized) | | | 18,368,372 | |

Maximum offering price per share ((NAV/0.9450), based on maximum sales charge of 5.50% of the offering price) | | $ | 4.94 | |

Class C: | | | | |

Net Asset Value, offering and redemption price per share(a) | | $ | 4.59 | |

Net Assets | | $ | 2,838,285 | |

Shares of beneficial interest outstanding (unlimited number of shares, no par value common stock authorized) | | | 618,665 | |

Class I: | | | | |

Net Asset Value, offering and redemption price per share | | $ | 4.69 | |

Net Assets | | $ | 77,749,988 | |

Shares of beneficial interest outstanding (unlimited number of shares, no par value common stock authorized) | | | 16,580,048 | |

Class R: | | | | |

Net Asset Value, offering and redemption price per share | | $ | 4.17 | |

Net Assets | | $ | 46,194 | |

Shares of beneficial interest outstanding (unlimited number of shares, no par value common stock authorized) | | | 11,089 | |

| (a) | Redemption price per share may be reduced for any applicable contingent deferred sales charge. For a description of a possible sales charge, please see the Fund's Prospectus. |

See Notes to Financial Statements.

18 | April 30, 2012

ALPS | Red Rocks Listed Private Equity Fund

��

| | |

| |

Statement of Operations | | For the Year Ended April 30, 2012 |

| | | | |

INVESTMENT INCOME | | | | |

Dividends | | $ | 4,812,144 | |

Foreign taxes withheld on dividends | | | (333,725) | |

Interest and other income | | | 7,381 | |

Total Investment Income | | | 4,485,800 | |

| |

EXPENSES | | | | |

Investment advisory fees | | | 1,342,368 | |

Administrative and transfer agency fees | | | 253,390 | |

Distribution and service fees | | | | |

Class A | | | 368,773 | |

Class C | | | 27,846 | |

Class R | | | 470 | |

Legal fees | | | 7,789 | |

Audit fees | | | 37,366 | |

Networking fees | | | | |

Class A | | | 31,046 | |

Class C | | | 2,048 | |

Class I | | | 78,101 | |

Class R | | | 89 | |

Reports to shareholders and printing fees | | | 47,063 | |

State registration fees | | | 67,337 | |

Insurance fees | | | 11,171 | |

Custody fees | | | 193,043 | |

Directors’ fees and expenses | | | 26,574 | |

Repayment of previously waived fees | | | 3,417 | |

Miscellaneous expenses | | | 31,889 | |

Total Expense | | | 2,529,780 | |

Less fees waived/reimbursed by investment advisor | | | | |

Class A | | | (191,693) | |

Class C | | | (3,476) | |

Class I | | | (101,570) | |

Class R | | | (127) | |

Net Expenses | | | 2,232,914 | |

Net Investment Income | | | 2,252,886 | |

Net realized loss on investments | | | (1,815,081) | |

Net realized loss on foreign currency transactions | | | (181,975) | |

Net change in unrealized depreciation on investments | | | (40,067,349) | |

Net change in unrealized depreciation on translation of assets and liabilities denominated in foreign currencies | | | (12,263) | |

NET REALIZED AND UNREALIZED LOSS ON INVESTMENTS | | | (42,076,668) | |

NET DECREASE IN NET ASSETS RESULTING FROM OPERATIONS | | $ | (39,823,782) | |

| | | | | |

See Notes to Financial Statements.

19 | April 30, 2012

ALPS | Red Rocks Listed Private Equity Fund

| | |

| |

Statements of Changes in Net Assets | | |

| | | | | | | | |

| | | For the Year Ended

April 30, 2012 | | | For the Year Ended

April 30, 2011 | |

OPERATIONS | | | | | | | | |

Net investment income | | $ | 2,252,886 | | | $ | 981,581 | |

Net realized gain/(loss) on investments and foreign currency transactions | | | (1,997,056) | | | | 13,298,911 | |

Net change in unrealized appreciation/(depreciation) on investments and translation of assets and liabilities denominated in foreign currencies | | | (40,079,612) | | | | 29,987,149 | |

Net Increase/(Decrease) in Net Assets Resulting from Operations | | | (39,823,782) | | | | 44,267,641 | |

| | |

DISTRIBUTIONS | | | | | | | | |

Dividends to shareholders from net investment income | | | | | | | | |

Class A | | | (7,773,831) | | | | (5,899,806) | |

Class C | | | (232,203) | | | | (94,035) | |

Class I | | | (5,228,944) | | | | (3,002,644) | |

Class R | | | (9,179) | | | | (3,513) | |

Net Decrease in Net Assets from Distributions | | | (13,244,157) | | | | (8,999,998) | |

| | |

BENEFICIAL INTEREST TRANSACTIONS (NOTE 6) | | | | | | | | |

Shares sold | | | | | | | | |

Class A | | | 55,043,701 | | | | 43,946,883 | |

Class C | | | 1,787,116 | | | | 2,116,008 | |

Class I | | | 50,688,416 | | | | 31,556,257 | |

Class R | | | 41,342 | | | | 133,223 | |

Dividends reinvested | | | | | | | | |

Class A | | | 6,987,024 | | | | 5,477,003 | |

Class C | | | 172,533 | | | | 68,533 | |

Class I | | | 1,952,666 | | | | 1,434,792 | |

Class R | | | 8,650 | | | | 3,513 | |

Shares redeemed | | | | | | | | |

Class A | | | (67,995,564) | | | | (14,394,569) | |

Class C | | | (718,469) | | | | (5,350) | |

Class I | | | (22,792,481) | | | | (23,491,255) | |

Class R | | | (85,079) | | | | (47,561) | |

Net Increase in Net Assets Derived from Beneficial Interest Transactions | | | 25,089,855 | | | | 46,797,477 | |

| | |

Net increase/(decrease) in net assets | | | (27,978,084) | | | | 82,065,120 | |

| | |

NET ASSETS | | | | | | | | |

Beginning of year | | | 194,419,518 | | | | 112,354,398 | |

End of year * | | $ | 166,441,434 | | | $ | 194,419,518 | |

| | | | | | | | | |

*Including accumulated net investment loss of: | | $ | (10,542,204) | | | $ | (7,510,989) | |

See Notes to Financial Statements.

20 | April 30, 2012

ALPS | Red Rocks Listed Private Equity Fund – Class A

| | |

| |

Financial Highlights | | Selected data for a share of beneficial interest outstanding throughout the periods indicated: |

| | | | | | | | | | | | | | | | | | | | |

| | | For the

Year Ended

April 30, 2012 | | | For the

Year Ended

April 30, 2011 | | | For the

Year Ended

April 30, 2010 | | | For the

Year Ended

April 30, 2009 | | | For the Period

December 31, 2007

(Inception) to

April 30, 2008 | |

Net asset value, beginning of period | | | $6.44 | | | | $5.17 | | | | $3.56 | | | | $9.47 | | | | $10.00 | |

|

INCOME/(LOSS) FROM INVESTMENT OPERATIONS: | |

Net investment income | | | 0.07(a) | | | | 0.04(a) | | | | 0.14 | | | | 0.08 (a) | | | | 0.11 | |

Net realized and unrealized gain/(loss) | | | (1.41) | | | | 1.61 | | | | 1.99 | | | | (5.97) | | | | (0.64) | |

Total from investment operations | | | (1.34) | | | | 1.65 | | | | 2.13 | | | | (5.89) | | | | (0.53) | |

|

DISTRIBUTIONS: | |

From net investment income | | | (0.43) | | | | (0.38) | | | | (0.52) | | | | (0.03) | | | | – | |

From net realized gains | | | – | | | | – | | | | – | | | | (0.00)(b) | | | | – | |

Total distributions | | | (0.43) | | | | (0.38) | | | | (0.52) | | | | (0.03) | | | | – | |

| | | | | |

REDEMPTION FEES ADDED TO

PAID-IN CAPITAL (NOTE 6) | | | 0.00(b) | | | | 0.00(b) | | | | 0.00(b) | | | | 0.01 | | | | – | |

Net increase/(decrease) in net asset value | | | (1.77) | | | | 1.27 | | | | 1.61 | | | | (5.91) | | | | (0.53) | |

Net asset value, end of year | | | $4.67 | | | | $6.44 | | | | $5.17 | | | | $3.56 | | | | $9.47 | |

| | | | | | | | | | | | | | | | | | | | | |

TOTAL RETURN(c) | | | (19.68)% | | | | 33.22% | | | | 61.68% | | | | (62.01)% | | | | (5.30)% | |

|

RATIOS/SUPPLEMENTAL DATA: | |

Net assets, end of year (000s) | | | $85,807 | | | | $124,874 | | | | $67,192 | | | | $27,860 | | | | $832 | |

Ratio of net investment income to average net assets | | | 1.34% | | | | 0.67% | | | | 0.42% | | | | 2.16% | | | | 4.68%(d) | |

Ratio of expenses to average net assets including fee

waivers and

reimbursements | | | 1.50% | | | | 1.50% | | | | 1.44%(e) | | | | 1.25% | | | | 1.25%(d) | |

Ratio of expenses to average net assets excluding fee waivers and reimbursements | | | 1.71% | | | | 1.70% | | | | 1.71% | | | | 2.08% | | | | 39.07%(d) | |

Portfolio

turnover rate(f) | | | 72 | % | | | 43 | % | | | 54 | % | | | 59 | % | | | 15 | % |

| (a) | Calculated using the average shares method. |

| (b) | Less than $0.005 and ($0.005) per share. |

| (c) | Total returns are for the period indicated and have not been annualized. Total returns would have been lower had certain expenses not been waived during the period. Returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Returns shown exclude any applicable sales charges. |

| (e) | Effective September 1, 2009, the net expense ratio limitation changed from 1.25% to 1.50%. |

| (f) | Portfolio turnover rate for periods less than one full year have not been annualized. |

See Notes to Financial Statements.

21 | April 30, 2012

ALPS | Red Rocks Listed Private Equity Fund – Class C

| | |

| |

Financial Highlights | | Selected data for a share of beneficial interest outstanding throughout the periods indicated: |

| | | | | | | | | | |

| | | For the Year Ended

April 30, 2012 | | For the Period

July 2, 2010

(Inception) to

April 30, 2011 |

Net asset value, beginning of period | | $6.37 | | $4.39 |

| | |

INCOME/(LOSS) FROM INVESTMENT OPERATIONS: | | | | |

Net investment income/(loss)(a) | | 0.03 | | (0.01) |

Net realized and unrealized gain/(loss) | | (1.39) | | 2.36 |

Total from investment operations | | (1.36) | | 2.35 |

| | |

DISTRIBUTIONS: | | | | |

From net investment income | | (0.42) | | (0.37) |

Total distributions | | (0.42) | | (0.37) |

| | |

REDEMPTION FEES ADDED TO PAID-IN CAPITAL (NOTE 6) | | 0.00(b) | | 0.00(b) |

Net increase/(decrease) in net asset value | | (1.78) | | 1.98 |

Net asset value, end of year | | $4.59 | | $6.37 |

TOTAL RETURN(c) | | (20.33)% | | 55.32% |

| | |

RATIOS/SUPPLEMENTAL DATA: | | | | |

Net assets, end of year (000s) | | $2,838 | | $2,566 |

Ratio of net investment income/(loss) to average net assets | | 0.59% | | (0.19)%(d) |

Ratio of expenses to average net assets including fee waivers and reimbursements | | 2.25% | | 2.25%(d) |

Ratio of expenses to average net assets excluding fee waivers and reimbursements | | 2.37% | | 2.31%(d) |

Portfolio turnover rate(e) | | 72% | | 43%(f) |

| (a) | Calculated using the average shares method. |

| (b) | Less than $0.005 per share. |

| (c) | Total returns are for the period indicated and have not been annualized. Total returns would have been lower had certain expenses not been waived during the period. Returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Returns shown exclude any applicable sales charges. |

| (e) | Portfolio turnover rate for periods less than one full year have not been annualized. |

| (f) | Portfolio turnover rate is calculated at the Fund Level and represents the year ended April 30, 2011. |

See Notes to Financial Statements.

22 | April 30, 2012

ALPS | Red Rocks Listed Private Equity Fund – Class I

| | |

| |

Financial Highlights | | Selected data for a share of beneficial interest outstanding throughout the periods indicated: |

| | | | | | | | | | |

| | | For the

Year Ended

April 30, 2012 | | For the

Year Ended

April 30, 2011 | | For the

Year Ended

April 30, 2010 | | For the

Year Ended

April 30, 2009 | | For the Period

Ended

April 30, 2008 (a) |

Net asset value, beginning of period | | $6.47 | | $5.19 | | $3.57 | | $9.47 | | $10.00 |

|

INCOME/(LOSS) FROM INVESTMENT OPERATIONS: |

Net investment income | | 0.08(b) | | 0.05(b) | | 0.28 | | 0.10(b) | | 0.13 |

Net realized and unrealized gain/(loss) | | (1.42) | | 1.62 | | 1.87 | | (5.97) | | (0.66) |

Total from investment operations | | (1.34) | | 1.67 | | 2.15 | | (5.87) | | (0.53) |

| | | | | |

DISTRIBUTIONS: | | | | | | | | | | |

From net investment income | | (0.44) | | (0.39) | | (0.53) | | (0.05) | | – |

From net realized gains | | – | | – | | – | | (0.00)(c) | | – |

Total distributions | | (0.44) | | (0.39) | | (0.53) | | (0.05) | | – |

| | | | | |

REDEMPTION FEES ADDED TO PAID-IN

CAPITAL (NOTE 6) | | 0.00(c) | | 0.00(c) | | 0.00(c) | | 0.02 | | – |

Net increase/(decrease) in net asset value | | (1.78) | | 1.28 | | 1.62 | | (5.90) | | (0.53) |

Net asset value, end of year | | $4.69 | | $6.47 | | $5.19 | | $3.57 | | $9.47 |

TOTAL RETURN(d) | | (19.52)% | | 33.47% | | 62.09% | | (61.79)% | | (5.30)% |

|

RATIOS/SUPPLEMENTAL DATA: |

Net assets, end of year (000s) | | $77,750 | | $66,854 | | $45,144 | | $12,938 | | $21 |

Ratio of net investment income to average net assets | | 1.60% | | 0.91% | | 0.78% | | 2.56% | | 6.11%(e) |

Ratio of expenses to average net assets including fee waivers and reimbursements | | 1.25% | | 1.25% | | 1.19%(f) | | 1.00% | | 1.00%(e) |

Ratio of expenses to average net assets excluding fee waivers and reimbursements | | 1.41% | | 1.36% | | 1.47% | | 2.05% | | 35.33%(e) |

Portfolio turnover rate(g) | | 72% | | 43% | | 54% | | 59% | | 15% |

| (a) | The Fund commenced operations on December 31, 2007. |

| (b) | Calculated using the average shares method. |

| (c) | Less than $0.005 and ($0.005) per share. |

| (d) | Total returns are for the period indicated and have not been annualized. Total returns would have been lower had certain expenses not been waived during the period. Returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. |

| (f) | Effective September 1, 2009, the net expense ratio limitation changed from 1.00% to 1.25%. |

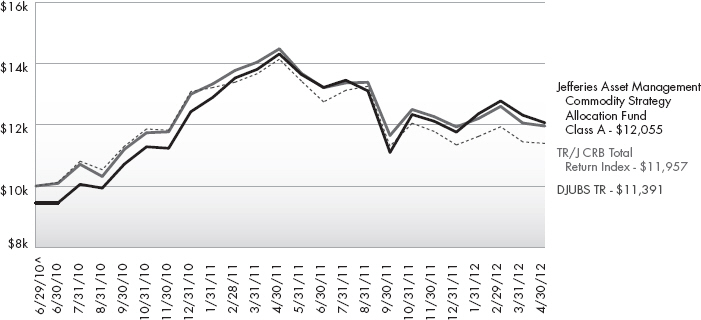

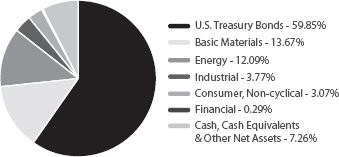

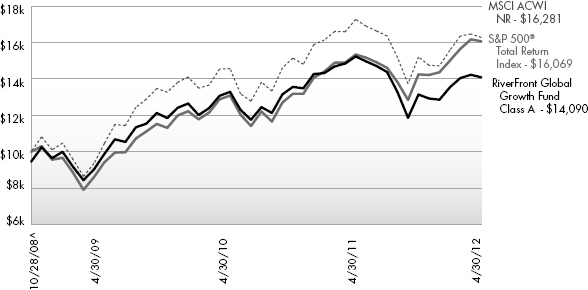

| (g) | Portfolio turnover rate for periods less than one full year have not been annualized. |