UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-8194

FINANCIAL INVESTORS TRUST

(Exact name of registrant as specified in charter)

1290 Broadway, Suite 1100, Denver, Colorado 80203

(Address of principal executive offices) (Zip code)

JoEllen L. Legg, Secretary

Financial Investors Trust

1290 Broadway, Suite 1100

Denver, Colorado 80203

(Name and address of agent for service)

Registrant’s telephone number, including area code: 303-623-2577

Date of fiscal year end: April 30

Date of reporting period: May 1, 2009 - April 30, 2010

Item 1. Reports to Stockholders.

Table of Contents

| | | | |

Activa Value Fund | | | | |

Management Commentary ––––––––––––––––––––––––––– | | 1 | | |

Disclosure of Fund Expenses ––––––––––––––––––––––––– | | 4 | | |

Statement of Investments –––––––––––––––––––––––––––– | | 5 | | |

| | |

ALPS | GNI Long-Short Fund | | | | |

Management Commentary ––––––––––––––––––––––––––– | | 8 | | |

Disclosure of Fund Expenses ––––––––––––––––––––––––– | | 12 | | |

Statement of Investments –––––––––––––––––––––––––––– | | 13 | | |

| | |

ALPS | Red Rocks Listed Private Equity Fund | | | | |

Management Commentary ––––––––––––––––––––––––––– | | 15 | | |

Disclosure of Fund Expenses ––––––––––––––––––––––––– | | 18 | | |

Statement of Investments –––––––––––––––––––––––––––– | | 19 | | |

| | |

Clough China Fund | | | | |

Management Commentary ––––––––––––––––––––––––––– | | 21 | | |

Disclosure of Fund Expenses ––––––––––––––––––––––––– | | 24 | | |

Statement of Investments –––––––––––––––––––––––––––– | | 25 | | |

| | |

Statement of Assets and Liabilities –––––––––––––––– | | 28 | | |

| | |

Statement of Operations –––––––––––––––––––––––– | | 30 | | |

| | |

Statement of Changes in Net Assets –––––––––––––— | | 31 | | |

| | |

Financial Highlights ––––––––––––––––––––––––––— | | 34 | | |

| | |

Notes to Financial Statements ––––––––––––––––––– | | 44 | | |

| | |

Report of Independent Registered Public Accounting Firm –––––––––––––––––––––––– | | 54 | | |

| | |

Additional Information –––––––––––––––––––––––––– | | 55 | | |

| | |

Trustees and Officers –––––––––––––––––––––––––– | | 60 | | |

| | | | | | |

| Activa Value Fund | | |

| | | Management Commentary | | April 30, 2010 (Unaudited) |

Market Comment

Amid concerns of government spending run amuck, talk of double-dip recessions, and anemic consumers, the markets were sanguine in the first quarter of 2010 as healthy fundamentals among corporations ruled the day. Past cost saving actions set the stage for robust cash flow, high net cash levels, and near unprecedented operating leverage.

Within the Russell 1000 Value Index, eight of ten sectors recorded positive absolute returns during the period. Consumer Discretionary, Industrials, and Financials led the Index higher, while Telecommunication Services and Health Care were the only sectors to post negative returns.

Fund Review

The Portfolio underperformed its benchmark for the period as the Portfolio posted negative relative results in seven of the ten broad market sectors. Stock selection within Financials, Information Technology, and Materials detracted the most relative to the Russell 1000 Value Index.

Among the top relative detractors to performance were Citigroup (Financials), Boeing (Industrials), and The Mosaic Company (Materials). Citigroup, which was not held in the Portfolio during the period, was a drag on relative performance as the stock gained on acquisition news. We continue to have a negative quantitative assessment of Citigroup’s balance sheet and a poor fundamental outlook for the company overall. Aircraft manufacturer Boeing started to outperform coincident with successful flight tests of its new models, the 787 and 747-8. Investors started to factor in earnings and cash flow potential from the 787 Dreamliner program, boosting expectations for future years. Not holding this security in the Portfolio detracted from relative results. The Mosaic Company, a large North American producer of potash and phosphate fertilizers, performed poorly during the period as it reported lower than expected earnings in April due to lessened demand for potash over year end.

Among the top relative contributors to performance were Verizon Communications (Telecommunication Services), Time Warner Cable (Consumer Discretionary), and Wells Fargo (Financials). Communications services provider Verizon Communications’ shares fell during the period as fourth quarter 2009 earnings results disappointed. The company’s wireline business showed declines in revenue and despite net new additions of wireless subscribers, its wireless business showed flat service revenues further adding to the stock’s decline. Not holding this stock benefited relative results. Cable operator Time Warner Cable’s shares rose steadily over the period helped by a pick up in advertising and expansion in its business segment growth as it looks to increase its platform, products, and salesforce. Shares of Wells Fargo, a diversified financial services company, rose on revenue and earnings that beat expectations, driven by strength in the company’s mortgage banking business. We believe that the company’s solid franchise across financial markets will continue to drive earnings power going forward.

Outlook

We continue to expect that inexpensive stocks with improving fundamentals will outperform as long as the economic backdrop remains constructive. While it is likely the US economy will see only modest growth in 2010, it is possible to find attractive opportunities including companies poised to take market share from weaker competitors and businesses where cost discipline is paying off with improved margins. On the longer term we remain cautious on potential headwinds to US economic growth, especially the need to pay for fiscal deficits and the potential negative impact on consumption, and believe that in this environment focusing on valuation and quality will be increasingly important.

“The Shareholder Letter included in this shareholder report contains certain forward-looking statements about the factors that may affect the performance of the Funds in the future. These statements are based on Fund management’s predictions and expectations concerning certain future events and their expected impact on the Funds, such as performance of the economy as a whole and of specific industry sectors, changes in the levels of interest rates, the impact of developing world events, and other factors that may influence the future performance of the Funds. Management believes these forward-looking statements to be reasonable, although they are inherently uncertain and difficult to predict. Actual events may cause adjustments in portfolio management strategies from those currently expected to be employed.”

1 | April 30, 2010

| | | | | | |

| Activa Value Fund | | |

| | | Management Commentary | | April 30, 2010 (Unaudited) |

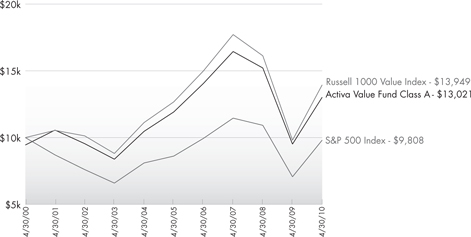

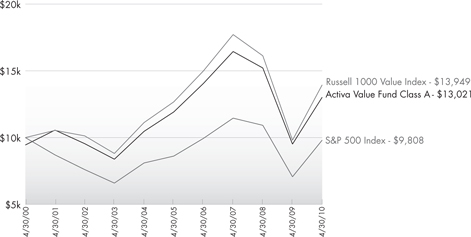

Performance of $10,000 Initial Investment (as of April 30, 2010)

Comparison of change in value of a $10,000 investment (includes applicable sales loads)

Source: Morningstar

The chart above represents historical performance of a hypothetical investment of $10,000 in the Fund since inception. Past performance does not guarantee future results. This chart does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

2 | April 30, 2010

| | | | | | |

| Activa Value Fund | | |

| | | Management Commentary | | April 30, 2010 (Unaudited) |

Average Annual Total Returns (as of April 30, 2010)

| | | | | | | | | | |

| | | 1 Year | | 5 Year | | 10 Year | | Gross Expense

Ratio | | Net Expense

Ratio* |

Activa Class A - NAV1 | | 36.91% | | 1.78% | | 3.26% | | 1.95% | | 1.40% |

Activa Class A - MOP2 | | 29.36% | | 0.64% | | 2.67% | | |

Activa Class I† | | 37.44% | | 2.02% | | 3.51% | | 1.58% | | 1.15% |

Russell 1000 Value Index3 | | 42.28% | | 1.93% | | 3.38% | | | | |

S&P 500 Index4 | | 38.84% | | 2.63% | | -0.19% | | | | |

Performance data quoted represents past performance. Past performance does not guarantee future results. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when sold or redeemed, may be worth more or less than the original cost. Current performance data may be higher or lower than actual data quoted. The Fund imposes a maximum Contingent Deferred Sales Charge (“CDSC”) of 1.00% to shares redeemed within the first 12 months after a purchase in excess of $1 million. Performance data does not reflect the redemption fee or the CDSC, which if reflected would reduce the performance quoted. For the most current month-end performance data please call (866) 759-5679.

On August 28, 2009 the Activa Value Fund (the “Predecessor Fund”) was reorganized into the Activa Value Fund, a series of Financial Investors Trust (the “Fund”). The Fund commenced operations on 8/28/09. Performance shown for the Fund for periods prior to 8/28/09, is derived from the performance of the Predecessor Fund, adjusted to reflect the current fees and expenses of the Activa Value Fund, net of waivers. Without these adjustments the fund’s performance would have been lower. Further information is available in the Fund prospectus.

| | 1 | Net Asset Value (NAV) is the share price without sales charges. |

| | 2 | Maximum Offering Price (MOP) includes sales charges. Class A returns include effects of the Fund’s maximum sales charge of 5.50%. |

| | 3 | The Russell 1000 Value Index measures the performance of those Russell 1000 companies with lower price-to-book ratios and lower forecasted growth values. You cannot invest directly in an index. |

| | 4 | The S&P 500 Index is the Standard & Poor’s composite index of 500 stocks, a widely recognized, unmanaged index of common stock prices. You cannot invest directly in the index. |

| | † | Prior to close of business on August 28, 2009, Class I was known as Class R of the Predecessor Fund. |

| | * | ALPS Advisors, Inc. (the “Adviser”) has given a contractual agreement to the Fund to limit the amount of the Fund’s total annual expenses, exclusive of Distribution and Service (12b-1) Fees, brokerage expenses, interest expense, taxes and extraordinary expenses, to 1.15% of the Fund’s average daily net assets. This agreement is in effect through August 31, 2011. The Adviser will be permitted to recover, on a class-by-class basis, expenses it has borne through the agreement described above to the extent that the Fund’s expenses in later periods fall below the annual rates set forth in the relevant agreement. The Fund will not be obligated to pay any such deferred fees and expenses more than one year after the end of the fiscal year in which the fee and expense was deferred. The Adviser may not discontinue this waiver without the approval by the Board of Trustees of the Fund. |

The table does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of fund shares.

Mutual funds, annuities, and other investments are not insured or guaranteed by the FDIC or by any other government agency or government sponsored agency of the federal government or any state, not deposits, obligations, or guaranteed by any bank or its affiliates and are subject to investment risks, including possible loss of the principal amount invested.

There is no guarantee that the fund will continue to hold any one particular security or stay invested in any one particular company. The composition of the fund’s top holdings is subject to change. Performance figures are historical and reflect the change in share price, reinvested distributions, changes in net asset value, sales charges and capital gains distributions, if any.

Subject to investment risks, including possible loss of the principal amount invested. Derivatives generally are more sensitive to changes in economic or market conditions than other types of investments; this could result in losses that significantly exceed the funds original investment.

3 | April 30, 2010

| | | | | | |

| Activa Value Fund | | |

| | | Disclosure of Fund Expenses | | April 30, 2010 (Unaudited) |

As a shareholder of Activa Value Fund (the “Fund”), you will incur two types of costs: (1) transaction costs, including applicable sales charges (loads); and (2) ongoing costs, including management fees, distribution and service (12b-1) fees, shareholder service fees and other Fund expenses. The following examples are intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds. The examples are based on an investment of $1,000 invested on January 1, 2010 and held until April 30, 2010.

Actual Expenses. The first line of the table on the next page provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes. The second line of the table on the next page provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other mutual funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

The expenses shown in the table are meant to highlight ongoing Fund costs only and do not reflect transaction fees, such as sales charges or exchange fees. Therefore, the second line of the table on the next page is useful in comparing ongoing costs only, and may not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

The examples are based on an investment of $1,000 invested on January 1, 2010 and held until April 30, 2010.

| | | | | | | | |

| | | Beginning Account

Value 1/1/10 | | Ending Account

Value 4/30/10 | | Expense Ratio | | Expense Paid

During Period(a)

1/1/10-4/30/10 |

Class A | | | | | | | | |

Actual | | $ 1,000.00 | | $ 1,072.20 | | 1.40% | | $ 4.77 |

Hypothetical (5% return before expenses) | | $ 1,000.00 | | $ 1,011.84 | | 1.40% | | $ 4.63 |

| | | | |

Class I | | | | | | | | |

Actual | | $ 1,000.00 | | $ 1,074.70 | | 1.15% | | $ 3.92 |

Hypothetical (5% return before expenses) | | $ 1,000.00 | | $ 1,012.66 | | 1.15% | | $ 3.80 |

| | (a) | Expenses are equal to the Fund’s annualized expense ratio multiplied by the average account value over the period, multiplied by the number of days in the most recent fiscal period (120), then divided by 365. |

4 | April 30, 2010

| | | | | | |

| Activa Value Fund | | |

| | | Statement of Investments | | April 30, 2010 |

| | | | | |

| | | Shares | | Value (Note 1) |

| |

COMMON STOCKS (99.44%) | | | |

Consumer Discretionary (10.22%) | | | |

Automobiles & Components (2.31%) | | | |

Ford Motor Co.(a) | | 75,200 | | $ | 979,104 |

TRW Automotive Holdings Corp.(a) | | 14,100 | | | 454,161 |

| | | | | |

| | | | | 1,433,265 |

| | | | | |

| |

Consumer Durables & Apparel (0.63%) | | | |

Whirlpool Corp. | | 3,600 | | | 391,932 |

| | | | | |

| |

Consumer Services (0.55%) | | | |

Apollo Group, Inc., Class A(a) | | 5,900 | | | 338,719 |

| | | | | |

| |

Media (3.31%) | | | |

CBS Corp., Class B | | 27,700 | | | 449,017 |

Gannett Co., Inc. | | 20,800 | | | 354,016 |

Time Warner Cable, Inc. | | 15,939 | | | 896,569 |

Time Warner, Inc. | | 10,800 | | | 357,264 |

| | | | | |

| | | | | 2,056,866 |

| | | | | |

| |

Retailing (3.42%) | | | |

The Gap, Inc. | | 47,500 | | | 1,174,675 |

Kohl’s Corp.(a) | | 4,800 | | | 263,952 |

Lowe’s Cos, Inc. | | 11,100 | | | 301,032 |

Office Depot, Inc.(a) | | 56,300 | | | 386,218 |

| | | | | |

| | | | | 2,125,877 |

| | | | | |

| |

TOTAL CONSUMER DISCRETIONARY | | | 6,346,659 |

| | | | | |

| | |

Consumer Staples (4.76%) | | | | | |

Food Beverage & Tobacco (3.85%) | | | |

Altria Group, Inc. | | 19,500 | | | 413,205 |

Archer-Daniels-Midland Co. | | 17,500 | | | 488,950 |

Dr Pepper Snapple Group, Inc. | | 9,300 | | | 304,389 |

Philip Morris International, Inc. | | 14,225 | | | 698,163 |

Smithfield Foods, Inc.(a) | | 25,900 | | | 485,366 |

| | | | | |

| | | | | 2,390,073 |

| | | | | |

| |

Household & Personal Products (0.91%) | | | |

Kimberly-Clark Corp. | | 9,200 | | | 563,592 |

| | | | | |

| | |

TOTAL CONSUMER STAPLES | | | | | 2,953,665 |

| | | | | |

| | |

Energy (17.98%) | | | | | |

Energy (17.98%) | | | | | |

Apache Corp. | | 1,400 | | | 142,464 |

Baker Hughes, Inc. | | 10,500 | | | 522,480 |

Cabot Oil & Gas Corp. | | 6,700 | | | 242,071 |

Chevron Corp. | | 18,019 | | | 1,467,467 |

| | | | | |

| | | Shares | | Value (Note 1) |

| | |

Energy (continued) | | | | | |

ConocoPhillips | | 29,500 | | $ | 1,746,105 |

EOG Resources, Inc. | | 3,600 | | | 403,632 |

Exxon Mobil Corp. | | 36,864 | | | 2,501,223 |

Hess Corp. | | 10,000 | | | 635,500 |

Marathon Oil Corp. | | 33,000 | | | 1,060,950 |

National Oilwell Varco, Inc. | | 17,500 | | | 770,525 |

Occidental Petroleum Corp. | | 13,700 | | | 1,214,642 |

XTO Energy, Inc. | | 9,700 | | | 460,944 |

| | | | | |

| | | | | 11,168,003 |

| | | | | |

| | |

TOTAL ENERGY | | | | | 11,168,003 |

| | | | | |

| |

Financials (25.89%) | | | |

Banks (6.99%) | | | |

Comerica, Inc. | | 12,360 | | | 519,120 |

PNC Financial Services Group, Inc. | | 9,900 | | | 665,379 |

US Bancorp | | 21,800 | | | 583,586 |

Wells Fargo & Co. | | 77,800 | | | 2,575,958 |

| | | | | |

| | | | | 4,344,043 |

| | | | | |

| |

Diversified Financials (10.33%) | | | |

Ameriprise Financial, Inc. | | 23,200 | | | 1,075,552 |

Bank of America Corp. | | 106,312 | | | 1,895,543 |

The Goldman Sachs Group, Inc. | | 7,500 | | | 1,089,000 |

JPMorgan Chase & Co. | | 47,700 | | | 2,031,066 |

SLM Corp.(a) | | 26,600 | | | 325,584 |

| | | | | |

| | | | | 6,416,745 |

| | | | | |

| | |

Insurance (7.11%) | | | | | |

ACE, Ltd. | | 15,200 | | | 808,488 |

Allied World Assurance Co. Holdings, Ltd. | | 7,800 | | | 339,846 |

Axis Capital Holdings, Ltd. | | 15,000 | | | 467,550 |

Everest Re Group, Ltd. | | 4,300 | | | 329,595 |

Genworth Financial, Inc.(a) | | 23,600 | | | 389,872 |

Hartford Financial Services Group, Inc. | | 24,100 | | | 688,537 |

Prudential Financial, Inc. | | 9,300 | | | 591,108 |

The Travelers Cos. Inc. | | 8,500 | | | 431,290 |

Unum Group | | 15,200 | | | 371,944 |

| | | | | |

| | | | | 4,418,230 |

| | | | | |

| | |

Real Estate (1.46%) | | | | | |

Annaly Capital Management, Inc. | | 27,200 | | | 461,040 |

Forest City Enterprises, Inc.(a) | | 29,000 | | | 448,050 |

| | | | | |

| | | | | 909,090 |

| | | | | |

| | |

TOTAL FINANCIALS | | | | | 16,088,108 |

| | | | | |

5 | April 30, 2010

| | | | | | |

| Activa Value Fund | | |

| | | Statement of Investments | | April 30, 2010 |

| | | | | |

| | | Shares | | Value (Note 1) |

| |

Health Care (10.10%) | | | |

Health Care Equipment & Services (2.63%) | | | |

McKesson Corp. | | 7,600 | | $ | 492,556 |

UnitedHealth Group, Inc. | | 17,700 | | | 536,487 |

WellPoint, Inc.(a) | | 11,200 | | | 602,560 |

| | | | | |

| | | | | 1,631,603 |

| | | | | |

|

Pharmaceuticals, Biotechnology & Life Sciences (7.47%) |

Amgen, Inc.(a) | | 11,600 | | | 665,376 |

Eli Lilly & Co. | | 24,100 | | | 842,777 |

Forest Laboratories, Inc.(a) | | 9,828 | | | 267,911 |

Merck & Co., Inc. | | 17,900 | | | 627,216 |

Pfizer, Inc. | | 105,523 | | | 1,764,345 |

Watson Pharmaceuticals, Inc.(a) | | 11,100 | | | 475,302 |

| | | | | |

| | | | | 4,642,927 |

| | | | | |

| | |

TOTAL HEALTH CARE | | | | | 6,274,530 |

| | | | | |

| | |

Industrials (13.06%) | | | | | |

Capital Goods (11.16%) | | | | | |

3M Co. | | 3,800 | | | 336,946 |

Caterpillar, Inc. | | 8,400 | | | 571,956 |

Dover Corp. | | 13,500 | | | 704,970 |

General Dynamics Corp. | | 9,400 | | | 717,784 |

General Electric Co. | | 72,800 | | | 1,373,008 |

Joy Global, Inc. | | 5,300 | | | 301,093 |

Northrop Grumman Corp. | | 9,700 | | | 657,951 |

Oshkosh Corp.(a) | | 7,000 | | | 270,340 |

Parker Hannifin Corp. | | 8,500 | | | 588,030 |

Raytheon Co. | | 8,400 | | | 489,720 |

United Technologies Corp. | | 12,300 | | | 921,885 |

| | | | | |

| | | | | 6,933,683 |

| | | | | |

|

Commercial & Professional Services (0.49%) |

RR Donnelley & Sons Co. | | 14,100 | | | 303,009 |

| | | | | |

| | |

Transportation (1.41%) | | | | | |

Delta Air Lines, Inc.(a) | | 28,300 | | | 341,864 |

FedEx Corp. | | 5,900 | | | 531,059 |

| | | | | |

| | | | | 872,923 |

| | | | | |

| | |

TOTAL INDUSTRIALS | | | | | 8,109,615 |

| | | | | |

| |

Information Technology (5.47%) | | | |

Semiconductors & Semiconductor Equipment (1.04%) |

Xilinx, Inc. | | 25,100 | | | 647,078 |

| | | | | |

| | | | | |

| | | Shares | | Value (Note 1) |

| | |

Software & Services (3.19%) | | | | | |

Accenture PLC | | 14,400 | | $ | 628,416 |

Automatic Data Processing, Inc. | | 7,200 | | | 312,192 |

eBay, Inc.(a) | | 17,800 | | | 423,818 |

Microsoft Corp. | | 20,300 | | | 619,962 |

| | | | | |

| | | | | 1,984,388 |

| | | | | |

|

Technology Hardware & Equipment (1.24%) |

Lexmark International, Inc.(a) | | 12,500 | | | 463,125 |

Seagate Technology(a) | | 16,600 | | | 304,942 |

| | | | | |

| | | | | 768,067 |

| | | | | |

| |

TOTAL INFORMATION TECHNOLOGY | | | 3,399,533 |

| | | | | |

| | |

Materials (3.73%) | | | | | |

Materials (3.73%) | | | | | |

Freeport-McMoRan Copper & | | | | | |

Gold, Inc. | | 6,500 | | | 490,945 |

International Paper Co. | | 18,900 | | | 505,386 |

The Mosaic Co. | | 7,000 | | | 357,980 |

Owens-Illinois, Inc.(a) | | 8,700 | | | 308,328 |

Reliance Steel & Aluminum Co. | | 6,800 | | | 331,908 |

Valspar Corp. | | 10,200 | | | 319,464 |

| | | | | |

| | | | | 2,314,011 |

| | | | | |

| | |

TOTAL MATERIALS | | | | | 2,314,011 |

| | | | | |

|

Telecommunication Services (3.33%) |

Telecommunication Services (3.33%) |

AT&T, Inc. | | 79,445 | | | 2,070,336 |

| | | | | |

| |

TOTAL TELECOMMUNICATION SERVICES | | | 2,070,336 |

| | | | | |

| | |

Utilities (4.90%) | | | | | |

Utilities (4.90%) | | | | | |

CenterPoint Energy, Inc. | | 22,800 | | | 327,408 |

DPL, Inc. | | 8,500 | | | 239,530 |

Entergy Corp. | | 3,500 | | | 284,515 |

FPL Group, Inc. | | 4,900 | | | 255,045 |

PG&E Corp. | | 11,900 | | | 521,220 |

UGI Corp. | | 36,000 | | | 989,640 |

Xcel Energy, Inc. | | 19,700 | | | 428,475 |

| | | | | |

| | | | | 3,045,833 |

| | | | | |

| | |

TOTAL UTILITIES | | | | | 3,045,833 |

| | | | | |

| | |

TOTAL COMMON STOCKS | | | | | |

(Cost $53,030,774) | | | | | 61,770,293 |

| | | | | |

6 | April 30, 2010

| | | | | | |

| Activa Value Fund | | |

| | | Statement of Investments | | April 30, 2010 |

| | | | | | |

| 7-Day Yield | | Shares | | Value (Note 1) | |

SHORT-TERM INVESTMENTS (0.61%) | | | | |

Money Market Fund (0.61%) | | | | |

Fidelity Institutional Money Market - Money Market Portfolio - Class I 0.21% | | 377,135 | | $ | 377,135 | |

| | | | | | |

| |

TOTAL SHORT-TERM INVESTMENTS (Cost $377,135) | | | 377,135 | |

| | | | | | |

| |

TOTAL INVESTMENTS - (100.05%) (Cost $53,407,909) | | $ | 62,147,428 | |

| |

Liabilities in Excess of Other Assets (-0.05%) | | | (33,166 | ) |

| | | | | | |

| |

NET ASSETS (100.00%) | | $ | 62,114,262 | |

| | | | | | |

| (a) | Non-Income Producing Security. |

For Fund compliance purposes, the Fund’s industry classifications refer to any one or more of the industry sub-classifications used by one or more widely recognized market indexes or ratings group indexes, and/or as defined by Fund management. This definition may not apply for purposes of this report, which may combine industry subclassifications for reporting ease. Industries are shown as a percent of net assets. These industry classifications are based on third-party definitions. The definitions are industry terms and do not reflect the legal status of any of the investments or the companies in which the Fund has invested.

See Notes to Financial Statements.

Top Ten Holdings (as a % of Net Assets) †

| | |

Wells Fargo & Co. | | 4.15% |

Exxon Mobil Corp. | | 4.03% |

AT&T, Inc. | | 3.33% |

JPMorgan Chase & Co. | | 3.27% |

Bank of America Corp. | | 3.05% |

Pfizer, Inc. | | 2.84% |

ConocoPhillips | | 2.81% |

Chevron Corp. | | 2.36% |

General Electric Co. | | 2.21% |

Occidental Petroleum Corp. | | 1.96% |

Top Ten Holdings | | 30.01% |

† Holdings are subject to change.

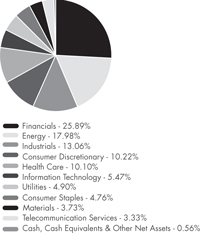

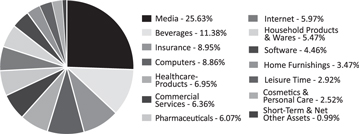

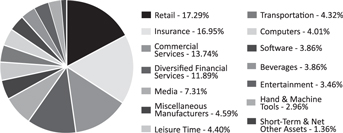

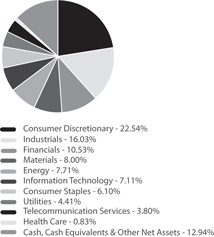

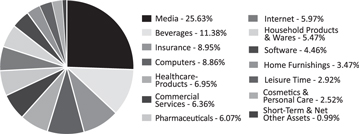

Industry Sector Allocation (as a % of Net Assets)

7 | April 30, 2010

| | | | | | |

| ALPS | GNI Long-Short Fund | | |

| | | Management Commentary | | April 30, 2010 (Unaudited) |

In the simplest of terms, risk is the measurable possibility of loss, or, perhaps more accurately, it’s the uncertainty that an investment will earn its required rate of return. We thought it would be useful to start off our letter with that reminder because, frankly, the concept of risk is something that has been wholly unfamiliar to investors over the past year as a carefree, happy-go-lucky mindset propelled high beta, a measure of volatility, pro-cyclical stocks on a nearly vertical course.

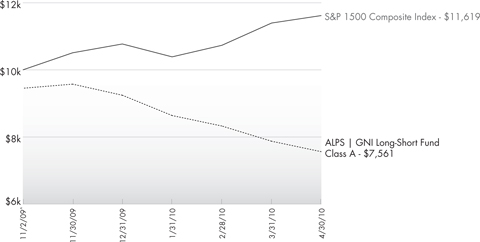

We should also acknowledge right up front that we could stand to learn a thing or two about upside risk, having completely underestimated the ease with which the nightmare of recent years has been wished away and the willingness of investors to bury their heads in the sand to the many threats still lurking. Specifically, during the period covered in this report, from inception through April 30, 2010, the Fund Class A shares lost -24.48% while the S&P 1500 Index gained 16.19%. The performance was negatively impacted by our cautious view during this episode of exuberance, which was expressed through very low net exposure to the market. Given the worrisome conditions described below, this position seemed both warranted and prudent. In fact, beginning in late April, the market began slowly re-pricing risk as investors started to recognize some of the risks that we outline below; while this process is now well underway, it is incomplete, in our opinion. Besides being too hedged, performance was also encumbered by a few short-term, event-driven trades that did not go our way within the biotech and defense sectors in companies like InterMune, Inc. and Oshkosh Corp. While we intend to put lessons learned from this period to work, we believe our disciplined, analysis-based approach will continue to serve us well, as it has over the past 11 years that we have managed similar portfolios.

Although it may be true that the economy has stopped contracting and some sort of tenuous recovery is underway, the rebound has been almost entirely manufactured by temporary growth drivers like extraordinary levels of government stimulus and inventory rebalancing. Real final demand that’s required to power a durable, self-sustaining economic expansion has been nearly undetectable. The upturn itself has been rather anemic – not a single data point is back to its prior, pre-crisis high – especially considering the trillion-dollar sum spent to generate it and the severity of the contraction preceding it. Now, as inventory restocking and government support begin to fade over the coming quarters, whether the economy can ride on without its training wheels is still a very big question mark.

For one thing, the recovery is hobbled by a labor market that is still exceptionally weak, especially relative to most other post-recession expansions. While layoffs finally seem to be easing, jobs remain

elusive, as businesses are still too wary to add to payrolls. Many jobs from the old bubble sectors, like construction or finance, might not surface again for some time. The number of underemployed workers, including those that have simply surrendered and left the workforce altogether, has crept back up to over 17%. A frightening 6.7 million people have been jobless for over six months, and, with their skills wasting away, the long-term unemployed are more likely to garner a lower wage whenever it is that they’re able to get one.1

Taken together, the large supply-demand imbalance in the labor market – about six job seekers jostling for every opening– has weighed down income growth. Transfer payments, government handouts to subsidize income, account for over 20% of personal income.2

Housing, too, is still a problem. As a classic leading indicator of the economy – and as the match that helped light, and then burn, the financial system only a few years ago – housing activity should be booming if the broader recovery were as rigorous as equity investors would have you believe. But it’s not.

Home prices nationwide remain depressed. Mortgage delinquencies are soaring as many homeowners are still distressed. Job losses have, of course, made it tough for borrowers to keep up with mortgage payments, but the stigma of reneging on one’s debt obligations has also faded, with the notion of “strategic default”– purposefully defaulting on a mortgage to save money – quickly gaining in popularity. Further threatening to hasten the pace of delinquencies: Several hundred billion dollars’ worth of adjustable rate mortgages offered at the height of the housing frenzy that are now resetting (on a schedule that’s expected to accelerate in coming months and quarters), causing monthly payments to balloon.

Foreclosures, currently at a record high, are expected to hit 4.5 million this year, up from 2.8 million in 2009, according to RealtyTrac.3 The very large inventory of bank-possessed properties– combined with softer demand as tax credits disappear – could cut home values further still, causing even more homeowners to owe more than their home is worth.

Home loans aside, the contraction in consumer credit is intense as the borrowing binge from bygone days is purged. American households don’t have much of an appetite for more debt, and bank lending standards are tighter, too, making credit harder to come by anyhow. This contraction in credit availability also impacts the ability for small businesses to fund themselves and add payrolls. The odds are stacked against a lasting expansion in today’s modern economy without credit growth.

8 | April 30, 2010

| | | | | | |

| ALPS | GNI Long-Short Fund | | |

| | | Management Commentary | | April 30, 2010 (Unaudited) |

We believe a bleak labor market, less housing wealth, contracting credit availability and nonexistent income growth outside of government transfers all point to a fragile consumer whose spending is likely to be constrained for some time. With a debt burden that’s still high relative to income, especially given the shaky job market, households are liable to focus on debt service more than spending as the deleveraging process carries on.

U.S. consumers are clearly strained, their spending habits structurally changed by the balance-sheet scars of years past. But when it comes to financial worries, they are in good company.

Through an endless series of costly bailouts and guarantees, the stresses in the private sector have been transferred to the public sector, proving once again that there is no free lunch. Many governments around the world find themselves overleveraged, struggling with bloated budgets requiring some combination of government-spending cuts or tax hikes – both of which could smother still-fragile growth – while diminishing creditworthiness drives up borrowing costs. No doubt, sovereign credit risk is palpable and currently one of our primary concerns.

The vulnerable euro zone economies of Greece, Portugal, Ireland and Spain are far from the only highly indebted, advanced nations facing unsustainable fiscal pressures. According to the International Monetary Fund (“IMF”), by 2014, all members of the G7, the finance ministers of Canada, France, Germany, Italy, Japan, United Kingdom and United States, (with the exception of Canada and Germany) will have debt levels at least as large as, if not in excess of, their entire economic output.4 Dramatic austerity measures are in order, tough medicine for a still-delicate recovery that’s heavily dependent on government support. The fiscal cuts required for the weaker nations in the European Union (“EU”) to receive a bailout will, in our opinion, put much of Europe back into contraction mode.

Here at home, all of Uncle Sam’s generous check writing, accompanied by a swift collapse in tax revenue, produced a record $1.4 trillion budget deficit last year.5 Taxes are headed dramatically higher and spending programs must be controlled. Even then, the U.S. government’s borrowing needs are considerable and entirely reliant on a buyer of its ever-growing pile of obligations.

State and local governments, facing a similar crunch but without the luxury of being able to maintain a shortfall indefinitely, are swiftly addressing gaping, billion-dollar holes in their own budgets by firing public employees, slashing services, or deferring payments to pension plans while also raising taxes to increase revenue. As states boldly reduce services and boost taxes to repair their broken balance sheets – fighting estimated budget gaps totaling a whopping $136 billion through fiscal year 2012 – they risk muting the stimulative effects of federal aid.6

Now, contrast these realities with the perception of equity investors. Excessively optimistic and enormously complacent, investors are largely taking for granted an orderly withdrawal of government support and a vigorous, organically–driven recovery – as if the patient was completely cured – while trivializing downside risk and the possibility of a relapse. We continue to expect the healing process to be a prolonged one after such a massive financial-system accident and maintain that genuine risks to the recovery are currently underappreciated and mispriced. Investors could be disappointed as the trajectory of earnings and economic activity turns out to be more moderate than is now widely expected. We imagine, in the coming months and quarters, as downside risk is reassessed, there will be a convergence between our view and the one currently discounted in the marketplace. It appears that this process has already started but it is incomplete.

Bear in mind that even after the recent surge in stock prices, impressive as it’s been, the S&P 500 Index7 is down over the past decade, even with the benefit dividend income. Speculative fervor and mindless risk-taking can sometimes lead to impressive short-term results, but invariably, over a complete market cycle, valuations do matter in determining an investor’s long-term returns: Rich valuations are inevitably followed by lower returns.

Though select pockets of value exist today, by nearly every measure, prevailing broad-market equity valuations seem excessive. Yale University economics professor Robert Shiller’s data, for example, indicates that the S&P 500 is currently trading at 21.7 times trailing, cyclically adjusted earnings compared to its long-term average valuation of 16.4 times, suggesting the market is quite overvalued.8

| | 1 | Bureau of Labor Statistics (BLS) |

| | 2 | Bureau of Economic Analysis (BEA) |

| | 3 | Bloomberg News, “Mortgage Modifications Rise as U.S. Program Grows,” by Theo Francis, Feb. 17, 2010 |

| | 4 | Speech by John Lipsky, IMF on March 21, 2010 (http://www.imf.org/external/np/speeches/2010/032110.htm) |

| | 5 | Congressional Budget Office |

| | 6 | State Fiscal Update, February 2010, National Association of State Budget Officers and National Governors Association |

| | 7 | The S&P 500 Index is the Standard & Poor’s composite index of 500 stocks, a widely recognized, unmanaged index of common stock prices. You cannot invest directly in an index. |

| | 8 | Robert Shiller, http://www.econ.yale.edu/~shiller/data.htm |

9 | April 30, 2010

| | | | | | |

| ALPS | GNI Long-Short Fund | | |

| | | Management Commentary | | April 30, 2010 (Unaudited) |

After a dizzying rally that has carried valuations to extreme levels – and with yields possibly on the rise – the equity market’s longer-term forward return from this point is likely to be inadequate. As a result, we believe a less-correlated, defensive posture will be greatly rewarded.

As to the current portfolio, we remain bullish on the long-term prospects for gold; the production of the shiny metal has been largely dormant over the past decade but the demand for it from the world’s central banks is intensifying. We’re also finding opportunities on the long side in higher quality, larger companies, mostly within the health care, technology and consumer staples areas. We’re particularly keen on certain themes like the Internet, precious metals, defensive high yielders and large cap outperformance relative to small cap. On the short side, we are carefully looking at cyclical companies or broken-momentum stories that are popular, over-owned and expensive, complemented by broad index-related short exposure.

As a result of our cautious view stemming from the toxic combination of high valuations, an overbought and universally loved

market, and a misperception that there is zero risk in owning risky assets, our net exposure has recently been below its historical range of 20-60% net long.

GNI is dedicated to creating long-term value in a variety of different market environments in a deliberate and methodical fashion, while always remaining mindful of the risks and challenges that we face. We believe that our disciplined approach, which eschews jumping into a hazardous, frenzy-driven rally, has positioned us to weather– and, ideally, profit from – the more difficult setting we envision. In over 11 years of managing long/short equity assets, we believe that philosophy has served our clients well. Thank you for entrusting us with the management of your assets. It is both an honor and a great privilege.

Sincerely,

Charles L. Norton, CFA | Principal

Allen R. Gillespie, CFA | Principal

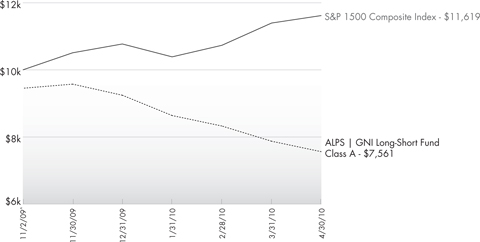

Performance of $10,000 Initial Investment (as of April 30, 2010)

Comparison of change in value of a $10,000 investment (includes applicable sales loads)

The chart above represents historical performance of a hypothetical investment of $10,000 in the Fund since inception. Past performance does not guarantee future results. This chart does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

10 | April 30, 2010

| | | | | | |

| ALPS | GNI Long-Short Fund | | |

| | | Management Commentary | | April 30, 2010 (Unaudited) |

Cumulative Return (as of April 30, 2010)

| | | | | | |

| | | Since Inception^ | | Gross Expense Ratio | | Net Expense Ratio* |

Class A (NAV)1 | | -20.10% | | 3.58% | | 2.25% |

Class A (MOP)2 | | -24.48% | | |

Class I | | -19.90% | | 3.33% | | 2.00% |

S&P 1500 Composite Index3 | | 16.19% | | | | |

Performance data quoted represents past performance. Past performance does not guarantee future results. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when sold or redeemed, may be worth more or less than the original cost. Current performance data may be higher or lower than actual data quoted. The Fund imposes a 2.00% redemption fee on shares held for less than 90 days. The Fund imposes a maximum Contingent Deferred Sales Charge (“CDSC”) of 1.00% to shares redeemed within the first 12 months after a purchase in excess of $1 million. Performance data does not reflect the redemption fee or the CDSC, which if reflected would reduce the performance quoted. For the most current month-end performance data please call (866) 759-5679.

Subject to investment risks, including possible loss of the principal amount invested. Derivatives generally are more sensitive to changes in economic or market conditions than other types of investments; this could result in losses that significantly exceed the funds original investment.

| | 1 | Net Asset Value (NAV) is the share price without sales charges. |

| | 2 | Maximum Offering Price (MOP) includes sales charges. Class A returns include effects of the Fund’s maximum sales charge of 5.50%. |

| | 3 | S&P Composite 1500: an equity benchmark that combines three leading indices, the S&P 500®, the S&P MidCap 400, and the S&P SmallCap 600 to cover approximately 90% of the U.S. market capitalization. It is designed for investors seeking to replicate the performance of the U.S. equity market or benchmark against a representative universe of tradable stocks. You cannot invest directly in the index. |

| | ^ | Fund inception date of 11/02/09. |

| | * | The Adviser has given a contractual agreement to the Fund to limit the amount of the Fund’s total annual expenses, exclusive of Distribution and Service (12b-1) Fees, brokerage expenses, interest expense, taxes and extraordinary expenses, to 2.00% of the Fund’s average daily net assets. This agreement is in effect through October 31, 2010 and is reevaluated on an annual basis. Without this agreement, expenses could be higher. The Adviser will be permitted to recover, on a class-by-class basis, expenses it has borne through the agreement described above to the extent that the Fund’s expenses in later periods fall below the annual rates set forth in the relevant agreement. The Fund will not be obligated to pay any such deferred fees and expenses more than one year after the end of the fiscal year in which the fee and expense was deferred. |

The Fund enters into a short sale by selling a security it has borrowed. If the market price of a security increases after the Fund borrows the security, the Fund will suffer a potentially unlimited loss when it replaces the borrowed security at the higher price. Short sales also involve transaction and other costs that will reduce potential Fund gains and increase potential Fund losses. Please refer to the prospectus for complete information regarding all risks associated with the fund.

The Fund is less than a year old and has limited operating history. This fund is not suitable for all investors. Subject to investment risks, including possible loss of the principal amount invested.

Derivatives generally are more sensitive to changes in economic or market conditions than other types of investments; this could result in losses that significantly exceed the Fund’s original investment.

11 | April 30, 2010

| | | | | | |

| ALPS | GNI Long-Short Fund | | |

| | | Disclosure of Fund Expenses | | April 30, 2010 (Unaudited) |

As a shareholder of ALPS | GNI Long-Short Fund (the “Fund”), you will incur two types of costs: (1) transaction costs, including applicable sales charges (loads); and (2) ongoing costs, including management fees, distribution and service (12b-1) fees, shareholder service fees and other Fund expenses. The following examples are intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds. The examples are based on an investment of $1,000 invested on November 2, 2009 and held until April 30, 2010.

Actual Expenses. The first line of the table on the next page provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes. The second line of the table on the next page provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other mutual funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

The expenses shown in the table are meant to highlight ongoing Fund costs only and do not reflect transaction fees, such as sales charges or exchange fees. Therefore, the second line of the table on the next page is useful in comparing ongoing costs only, and may not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

The examples are based on an investment of $1,000 invested on November 2, 2009 (Inception) and held until April 30, 2010.

| | | | | | | | |

| | | Beginning Account

Value 11/2/09 | | Ending Account

Value 4/30/10 | | Expense Ratio | | Expense Paid

During Period(a)

11/2/09-4/30/10 |

Class A | | | | | | | | |

Actual | | $ 1,000.00 | | $ 799.00 | | 2.90% | | $ 12.72 |

Hypothetical (5% return before expenses) | | $ 1,000.00 | | $ 1,010.24 | | 2.90% | | $ 14.21 |

| | | | |

Class I | | | | | | | | |

Actual | | $ 1,000.00 | | $ 801.00 | | 2.78% | | $ 12.21 |

Hypothetical (5% return before expenses) | | $ 1,000.00 | | $ 1,010.83 | | 2.78% | | $ 13.63 |

| | (a) | Expenses are equal to the Fund’s annualized expense ratio multiplied by the average account value over the period, multiplied by the number of days in the most recent fiscal half year (178), then divided by 365. |

12 | April 30, 2010

| | | | | | |

| ALPS | GNI Long-Short Fund | | |

| | | Statement of Investments | | April 30, 2010 |

| | | | | |

| | | Shares | | Value (Note 1) |

| |

COMMON STOCKS (71.43%) | | | |

Basic Materials (7.94%) | | | |

Mining (7.94%) | | | |

Newmont Mining Corp.(a) | | 13,000 | | $ | 729,040 |

| | | | | |

| |

TOTAL BASIC MATERIALS | | | 729,040 |

| | | | | |

| |

Communications (5.18%) | | | |

Internet (5.18%) | | | |

Drugstore.Com, Inc.(a)(b) | | 130,000 | | | 475,800 |

| | | | | |

| |

TOTAL COMMUNICATIONS | | | 475,800 |

| | | | | |

| |

Consumer, Cyclical (4.56%) | | | |

Retail (4.56%) | | | |

J Crew Group, Inc.(b) | | 9,000 | | | 418,230 |

| | | | | |

| |

TOTAL CONSUMER, CYCLICAL | | | 418,230 |

| | | | | |

|

Consumer, Non-Cyclical (25.48%) |

Agriculture (14.53%) | | | | | |

Lorillard, Inc. | | 4,500 | | | 352,665 |

Philip Morris International, Inc.(a) | | 20,000 | | | 981,600 |

| | | | | |

| | | | | 1,334,265 |

| | | | | |

Biotechnology (10.95%) | | | | | |

Dendreon Corp.(b) | | 5,000 | | | 271,100 |

Human Genome Sciences, Inc.(a)(b) | | 26,500 | | | 733,785 |

| | | | | |

| | | | | 1,004,885 |

| | | | | |

| |

TOTAL CONSUMER, NON-CYCLICAL | | | 2,339,150 |

| | | | | |

| | |

Energy (3.52%) | | | | | |

Oil&Gas Services (3.52%) | | | |

Baker Hughes, Inc. | | 6,500 | | | 323,440 |

| | | | | |

| |

TOTAL ENERGY | | | 323,440 |

| | | | | |

| | |

Financials (4.66%) | | | | | |

Diversified Financial Services (4.66%) |

Legg Mason, Inc. | | 13,500 | | | 427,815 |

| | | | | |

| | |

TOTAL FINANCIALS | | | | | 427,815 |

| | | | | |

| | |

Industrial (5.25%) | | | | | |

Electrical Components & Equipment (5.25%) |

Harbin Electric, Inc.(a)(b) | | 22,000 | | | 482,020 |

| | | | | |

| | |

TOTAL INDUSTRIAL | | | | | 482,020 |

| | | | | |

| | | | | | | | | |

| | | Shares | | Value

(Note 1) |

| |

Technology (14.84%) | | | |

Software (14.84%) | | | |

Bottomline Technologies, Inc.(b) | | 30,000 | | $ | 522,000 |

Oracle Corp. | | 32,500 | | | 839,800 |

| | | | | | | | | |

| | | | | 1,361,800 |

| | | | | | | | | |

| | |

TOTAL TECHNOLOGY | | | | | 1,361,800 |

| | | | | | | | | |

| |

TOTAL COMMON STOCKS (Cost $6,506,772) | | | 6,557,295 |

| | | | | | | | | |

|

Exchange Traded Funds (5.03%) |

SPDR Gold Trust(b) | | 4,000 | | | 461,520 |

| | | | | | | | | |

| |

TOTAL EXCHANGE TRADED FUNDS (Cost $450, 784) | | | 461,520 |

| | | | | | | | | |

| | | Expiration

Date | | Exercise

Price | | Number of

Contracts | | Value

(Note 1) |

|

Purchased Put Options (b) (6.09%) |

Harbin Electric, Inc. |

| | June, 2010 | | $20.00 | | 220 | | | 19,250 |

Human Genome Science |

| | July, 2010 | | 30.00 | | 270 | | | 108,675 |

Intuitive Surgical |

| | July, 2010 | | 340.00 | | 20 | | | 24,000 |

iShares Russell 2000 Index Fund |

| | May, 2010 | | 71.00 | | 125 | | | 17,500 |

iShares Russell 2000 Index Fund |

| | June, 2010 | | 70.00 | | 600 | | | 140,400 |

SPDR DJIA Trust |

| | May, 2010 | | 110.00 | | 600 | | | 105,000 |

SPDR S&P 500 ETF Trust |

| | May, 2010 | | 120.00 | | 450 | | | 116,550 |

Toyota Motor Corp. |

| | July, 2010 | | 75.00 | | 100 | | | 27,500 |

| | | | | | | | | |

| |

TOTAL PURCHASED PUT OPTIONS (Cost $487,169) | | | 558,875 |

| | | | | | | | | |

| | | |

| | | 7-Day Yield | | Shares/Principal

Amount | | Value

(Note 1) |

|

SHORT-TERM INVESTMENTS (36.69%) |

U.S. Government & Agency Obligations (21.79%) |

U.S. Treasury Bill DN |

5/27/10(a) | | 0.08% | | $2,000,000 | | | 1,999,884 |

| | | | | | | | | |

|

Money Market Fund (14.90%) |

Dreyfus Treasury Prime Cash Management, Investor Shares |

| | 0.00004% | | 1,367,947 | | | 1,367,947 |

| | | | | | | | | |

| | | | | | |

| ALPS | GNI Long-Short Fund | | |

| | | Statement of Investments | | April 30, 2010 |

| | | | | | | | | | |

| | | | | | | | | Value (Note 1) |

| |

TOTAL SHORT-TERM INVESTMENTS (Cost $3,367,831) | | $ | 3,367,831 |

| | | | | | | | | | |

| |

TOTAL INVESTMENTS - (119.24%) (Cost $10,812,556) | | | 10,945,521 |

| |

Liabilities in Excess of Other Assets (-19.24%) | | | (1,766,447) |

| | | | | | | | | | |

| |

NET ASSETS (100.00%) | | $ | 9,179,074 |

| | | | | | | | | | |

|

| SCHEDULE OF OPTIONS WRITTEN |

| | | | |

| | | Expiration

Date | | Exercise

Price | | Number of

Contracts | | Value

(Note 1) |

|

PUT OPTIONS WRITTEN (b) |

Human Genome Science |

| | July, 2010 | | $ | 23.00 | | 65 | | $ | (6,370) |

SPDR DJIA Trust |

| | May, 2010 | | | 108.00 | | 600 | | | (66,600) |

SPDR S&P 500 ETF Trust |

| | May, 2010 | | | 117.00 | | 250 | | | (36,250) |

| | | | | | | | | | |

| |

TOTAL PUT OPTIONS WRITTEN (Premiums received $66,510) | | | (109,220) |

| | | | | | | | | | |

| |

TOTAL OPTIONS WRITTEN (Premiums received $66,510) | | $ | (109,220) |

| | | | | | | | | | |

| | | | | |

| | | Value

Shares | | (Note 1) |

|

SCHEDULE OF SECURITIES SOLD SHORT |

|

COMMON STOCKS (b) |

Abercrombie & Fitch Co., Class A | | (3,000) | | $ | (131,190) |

Advanced Micro Devices, Inc. | | (7,500) | | | (67,950) |

Boyd Gaming Corp. | | (10,000) | | | (127,000) |

Cliffs Natural Resources, Inc. | | (750) | | | (46,898) |

Diamond Offshore Drilling, Inc. | | (2,000) | | | (158,200) |

First Solar, Inc. | | (1,400) | | | (200,970) |

Freeport-McMoRan Copper & Gold, Inc. | | (3,000) | | | (226,590) |

Reynolds American, Inc. | | (3,300) | | | (176,286) |

T Rowe Price Group, Inc. | | (3,300) | | | (189,783) |

United States Steel Corp. | | (2,500) | | | (136,650) |

| | | | | |

| |

TOTAL SECURITIES SOLD SHORT (Proceeds $1,495,832) | | $ | (1,461,517) |

| | | | | |

Common Abbreviations:

DN - Discount Note

ETF - Exchange Traded Fund

SPDR - Standard & Poor’s Depositary Receipt

| (a) | All or portion of the security is pledged as collateral on written options and/or short sales as of April 30, 2010. Aggregate collateral segregated to cover margin or segregation requirements on options contracts and short sales as of April 30, 2010 was $2,862,174. |

| (b) | Non-Income Producing Security/Securities. |

For Fund compliance purposes, the Fund’s industry classifications refer to any one or more of the industry sub-classifications used by one or more widely recognized market indexes or ratings group indexes, and/ or as defined by Fund management. This definition may not apply for purposes of this report, which may combine industry subclassifications for reporting ease. Industries are shown as a percent of net assets. These industry classifications are based on third-party definitions. The definitions are industry terms and do not reflect the legal status of any of the investments or the companies in which the Fund has invested.

See Notes to Financial Statements.

Top Ten Long Holdings (as a % of Net Assets) †

| | | |

Philip Morris International, Inc. | | 10.69 | % |

Oracle Corp. | | 9.15 | % |

Human Genome Sciences, Inc. | | 7.99 | % |

Newmont Mining Corp. | | 7.94 | % |

Bottomline Technologies, Inc. | | 5.69 | % |

Harbin Electric, Inc. | | 5.25 | % |

Drugstore.Com, Inc. | | 5.18 | % |

SPDR Gold Trust | | 5.03 | % |

Legg Mason, Inc. | | 4.66 | % |

J Crew Group, Inc. | | 4.56 | % |

Top Ten Long Holdings | | 66.14 | % |

| | † | Holdings are subject to change. |

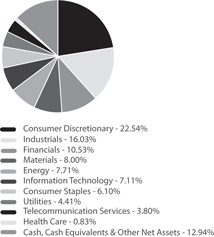

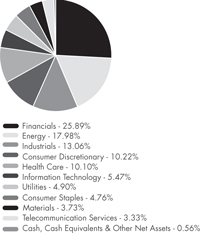

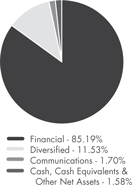

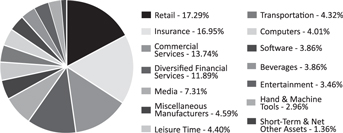

Industry Sector Allocation (Long Positions as a % of Net Assets)

| | | | | | |

| ALPS | Red Rocks Listed Private Equity Fund | | |

| | | Management Commentary | | April 30, 2010 (Unaudited) |

Overview

It’s hard to believe that 12 months ago the world financial markets were in a state of crisis; equity indices had fallen to levels not witnessed in almost 15 years, the banking system was hemorrhaging, and private equity funds were contemplating some of the largest write-downs that they had ever experienced. To say that the financial world was at a tipping point would have been no exaggeration.

Fortunately March 2009 marked the bottom of a very long and painful decline. The pendulum had swung too far. We believe the markets had priced in the worst, or at least a scenario that didn’t come to pass…a worldwide economic depression.

Over the past 12 months the investment world has breathed a collective sigh of relief. Many prognosticators were predicting the demise of the private equity industry. We believe the commonly heard refrain was that the private equity industry was sitting on too many highly-levered portfolio companies that would break financial covenants or be unable to satisfy or refinance upcoming debt obligations. As it turned out the private equity industry, and their portfolio companies, weathered the storm reasonably well. The high yield market, which caters to private equity backed companies, had record issuances in 2009. The debt markets were all too happy to re-finance many of the private equity loans. And the private equity industry took advantage of this wherever possible.

With this as a backdrop, 2010 has gotten off to a good start. Private equity deal activity has picked up significantly, both on the sell side (sales of portfolio companies along with initial public offerings (“IPOs”)) and on the buy side (investing in new companies). Existing portfolio companies are showing signs of revenue growth, although muted and only in selective sectors. Banks are even starting to lend to established businesses of size. We believe confidence is slowly returning.

Portfolio Review

For the year ended April 30, 2010, the ALPS | Red Rocks Listed Private Equity Fund - Class A shares returned 52.68% net of fees and sales loads, compared with 78.98% and 37.02% for the S&P Listed Private Equity Index and the MSCI World Index, respectively.

During the year, we made a moderate number of changes to the Fund. We added twelve companies to the Fund and parted ways with eight companies. The reason for the moderate turnover in actual holdings is that the majority of the companies

within the Fund are performing well and meeting, or in some cases, beating expectations. We expect that if the economic backdrop continues to stabilize, the Fund will benefit.

Net contributors to performance for the year included: KKR & CO. L.P. (US), Conversus Capital L.P. (US) and Onex Corp. (Canada). Recently, KKR & Co. filed to trade on the NYSE, hoping to increase the liquidity in the stock along with increasing its investor base. The management of Conversus Capital continues to impress us with its ability to oversee a large global portfolio of primary and secondary fund investments while managing their own liquidity position. Onex Corp. announced that it was acquiring sporting goods and uniform supplier Sport Supply Group, Inc. for $170 million. In total, these three companies contributed over 18% to the overall return of the Fund during the year.

Net detractors to performance for the year included: Babcock & Brown Infrastructure Group (Australia), KTB Securities CO. LTD (S. Korea) and IP Group PLC (UK). While the overall performance for the year was very good, several our holdings did not fare well Babcock & Brown Infrastructure Group went through a significant balance sheet restructuring which severely hurt the equity shareholders of the company. IP Group had several positive results. However, the market has not rewarded the company with any sustainable increase in the price of its stock. And last, KTB Securities continued to experience challenges as they modified their business model in ways with which we were not comfortable. All told, these three companies detracted approximately 1.40% from the overall return of the Fund during the year.

The Fund continues to be very well diversified from a geographic, industry, vintage and stage of investment perspective, which provides our investors broad exposure to the private equity asset class without having to make specific bets in any one area. This theme of broad diversification is one that we do not see ourselves deviating from significantly anytime in the near future. Diversification does not eliminate risks.

Looking Ahead

2010 looks to be a year of stabilization and re-grouping. Private equity funds are still sitting on record amounts of cash that they hope to put to work, albeit in a much more conservative leverage environment. M&A activity has picked up meaningfully and private equity expects to play a major role, both on the buy side and the sell side of transactions. Balance sheet restructurings continue, with lenders assuming the role of the new equity owners in some cases.

| | | | | | |

| ALPS | Red Rocks Listed Private Equity Fund | | |

| | | Management Commentary | | April 30, 2010 (Unaudited) |

The challenge: finding investment growth opportunities. We believe certain parts of the world are well positioned for this; the BRIC countries (Brazil, Russia, India and China) to name a few. Other parts are not; most of Western Europe and the United States. While our universe of eligible publicly traded private equity companies is still trading at a steep discount to the underlying value of their private investments, those discounts are contracting as the fear of a global depression continues to fade. We would not suggest that we are out of the woods yet. However, assuming

the healing continues and small pockets of growth emerge, we expect that the patient investor will be rewarded by having well diversified exposure to the private equity asset class.

As always, we appreciate your continued support and interest in the ALPS/Red Rocks Listed Private Equity Fund.

Adam Goldman, Co-Portfolio Manager

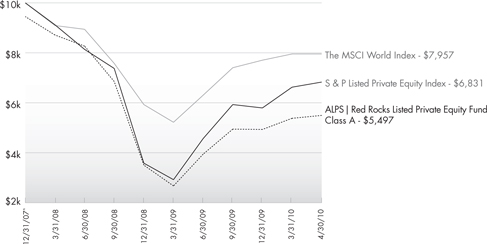

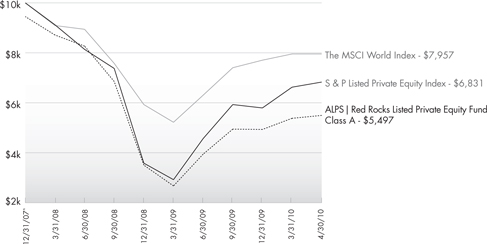

Performance of $10,000 Initial Investment (as of April 30, 2010)

Comparison of change in value of a $10,000 investment (includes applicable sales loads)

Source: Morningstar

The chart above represents historical performance of a hypothetical investment of $10,000 in the Fund since inception. Past performance does not guarantee future results. This chart does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

16 | April 30, 2010

| | | | | | |

| ALPS | Red Rocks Listed Private Equity Fund |

| | | | | | | |

| | |

| Management Commentary | | April 30, 2010 (Unaudited) |

|

| Average Annual Total Returns (as of April 30, 2010) |

| | | | | | | | |

| | | 1 Year | | Since Inception^ | | Gross Expense Ratio | | Net Expense Ratio* |

Class A (NAV)1 | | 61.68% | | -20.74% | | 2.53% | | 1.80% |

Class A (MOP)2 | | 52.68% | | -22.63% | | |

Class I | | 62.09% | | -20.45% | | 2.35% | | 1.55% |

Class R | | 60.92% | | -21.11% | | 6.38% | | 2.05% |

S&P LPE Index3 | | 78.98% | | -15.07% | | | | |

MSCI World Index4 | | 37.02% | | -9.33% | | | | |

|

Performance data quoted represents past performance. Past performance does not guarantee future results. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when sold or redeemed, may be worth more or less than the original cost. Current performance data may be higher or lower than actual data quoted. The fund imposes a 2.00% redemption fee on shares held for less than 90 days. The fund imposes a maximum Contingent Deferred Sales Charge (“CDSC”) of 1.00% to shares redeemed within the first 12 months after a purchase in excess of $1 million. Performance data does not reflect the redemption fee or the CDSC, which if reflected would reduce the performance quoted. For the most current month-end performance data please call (866) 759-5679. 1 Net Asset Value (NAV) is the share price without sales charges. The performance data shown does not reflect the deduction of the sales load or the redemption fee or Contingent Deferred Sales Charge (“CDSC”), and that, if reflected, the load or fee would reduce the performance quoted. 2 Maximum Offering Price (MOP) includes sales charges. Returns include effects of the Fund’s maximum sales charge of 5.50% for ALPS/Red Rocks Listed Private Equity Fund – A Shares. ^ Fund inception date of 12/31/2007. The Fund began trading on 1/2/2008. * Effective September 1, 2009 through August 31, 2010, the Adviser and the Sub-Adviser have given a contractual agreement to the Fund to limit the amount of the Fund’s total annual expenses, exclusive of Distribution and service (12b-1) fees, Acquired Fund Fees and Expenses, brokerage expenses, interest expense, taxes and extraordinary expenses, to 1.25% of the Fund’s average daily net assets. This agreement is reevaluated on an annual basis. Without this agreement expenses could be higher. 3 S&P Listed Private Equity Index: The S&P Listed Private Equity Index is comprised of 30 leading listed private equity companies that meet size, liquidity, exposure, and activity requirements. The index is designed to provide tradable exposure to the leading publicly listed companies in the private equity space. 4 MSCI World Index: Morgan Stanley Capital International’s market capitalization weighted index is composed of companies representative of the market structure of 22 developed market countries in North America, Europe, and the Asia/Pacific Region. You cannot invest directly in an index. Listed Private Equity Companies are subject to various risks depending on their underlying investments, which could include, but are not limited to, additional liquidity risk, industry risk, non-U.S. security risk, currency risk, credit risk, managed portfolio risk and derivatives risk (derivatives risk is the risk that the value of the Listed Private Equity Companies’ derivative investments will fall because of pricing difficulties or lack of correlation with the underlying investment). There are inherent risks in investing in private equity companies, which encompass financial institutions or vehicles whose principal business is to invest in and lend capital to privately–held companies. Generally, little public information exists for private and thinly traded companies, and there is a risk that investors may not be able to make a fully informed investment decision. Listed Private Equity Companies may have relatively concentrated investment portfolios, consisting of a relatively small number of holdings. A consequence of this limited number of investments is that the aggregate returns realized may be adversely impacted by the poor performance of a small number of investments, or even a single investment, particularly if a company experiences the need to write down the value of an investment. Certain of the Fund’s investments may be exposed to liquidity risk due to low trading volume, lack of a market maker or legal restrictions limiting the ability of the Fund to sell particular securities at an advantageous price and/or time. As a result these securities may be more difficult to value. Foreign investing involves special risks such as currency fluctuations and political uncertainty. The fund invests in derivatives and is subject to the risk that the value of those derivative investments will fall because of pricing difficulties or lack of correlation with the underlying investment. |

17 | April 30, 2010

| | | | | | |

| ALPS | Red Rocks Listed Private Equity Fund |

| | | | | | | |

| | |

| Disclosure of Fund Expenses | | April 30, 2010 (Unaudited) |

|

As a shareholder of ALPS | Red Rocks Listed Private Equity Fund (the “Fund”), you will incur two types of costs: (1) transaction costs, including applicable sales charges (loads) and redemption fees; and (2) ongoing costs, including management fees, distribution and service (12b-1) fees, shareholder service fees and other Fund expenses. The following examples are intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds. The examples are based on an investment of $1,000 invested on November 1, 2009 and held until April 30, 2010. Actual Expenses. The first line of the table on the next page provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading “Expenses Paid During Period” to estimate the expenses you paid on your account during this period. Hypothetical Example for Comparison Purposes. The second line of the table on the next page provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other mutual funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds. The expenses shown in the table are meant to highlight ongoing Fund costs only and do not reflect transaction fees, such as sales charges, redemption fees, or exchange fees. Therefore, the second line of the table on the next page is useful in comparing ongoing costs only, and may not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher. The examples are based on an investment of $1,000 invested on November 1, 2009 and held until April 30, 2010. |

| | | | | | | | | | | | |

| | | Beginning

Account Value

11/1/09 | | Ending

Account Value

4/30/10 | | Expense

Ratio | | | Expenses Paid

During Period(a)

11/1/09-4/30/10 |

Class A | | | | | | | | | | | | |

Actual | | $ | 1,000.00 | | $ | 1,142.00 | | 1.50 | % | | $ | 7.98 |

Hypothetical (5% return before expenses) | | $ | 1,000.00 | | $ | 1,017.35 | | 1.50 | % | | $ | 7.51 |

| | | | |

Class I | | | | | | | | | | | | |

Actual | | $ | 1,000.00 | | $ | 1,145.80 | | 1.25 | % | | $ | 6.66 |

Hypothetical (5% return before expenses) | | $ | 1,000.00 | | $ | 1,018.59 | | 1.25 | % | | $ | 6.27 |

| | | | |

Class R | | | | | | | | | | | | |

Actual | | $ | 1,000.00 | | $ | 1,142.00 | | 1.75 | % | | $ | 9.29 |

Hypothetical (5% return before expenses) | | $ | 1,000.00 | | $ | 1,016.12 | | 1.75 | % | | $ | 8.75 |

|

(a) Expenses are equal to the Fund’s annualized expense ratio multiplied by the average account value over the period, multiplied by the number of days in the most recent fiscal half year (181), then divided by 365. |

18 | April 30, 2010

| | | | | | |

| ALPS | Red Rocks Listed Private Equity Fund | | |

| | | Statement of Investments | | April 30, 2010 |

| | | | | |

| | | Shares | | Value (Note 1) |

COMMON STOCKS (98.42%) | | | |

Communications (1.70%) | | | |

Internet (1.70%) | | | |

Internet Capital Group, Inc.(a) | | 193,000 | | $ | 1,908,770 |

| | | | | |

| |

TOTAL COMMUNICATIONS | | | 1,908,770 |

| | | | | |

| | |

Diversified (11.53%) | | | | | |

Diversified Operations (2.12%) | | | |

Wendel Investissement | | 36,500 | | | 2,381,544 |

| | | | | |

|

Holding Companies-Diversified (9.41%) |

Ackermans & van Haaren N.V. | | 34,150 | | | 2,363,937 |

HAL Trust | | 30,400 | | | 3,223,923 |

Leucadia National Corp.(a) | | 197,000 | | | 4,986,070 |

| | | | | |

| | | | | 10,573,930 |

| | | | | |

| | |

TOTAL DIVERSIFIED | | | | | 12,955,474 |

| | | | | |

| | |

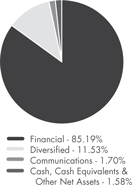

Financial (85.19%) | | | | | |

Closed-End Funds (25.71%) | | | |

AP Alternative Assets LP(a) | | 409,314 | | | 2,791,521 |

ARC Capital Holdings, Ltd.(a) | | 2,305,000 | | | 2,581,600 |

Candover Investments PLC(a) | | 238,237 | | | 3,091,099 |

Electra Private Equity PLC(a) | | 157,294 | | | 3,403,059 |

Graphite Enterprise Trust PLC | | 572,357 | | | 2,924,970 |

HBM BioVentures AG, Class A(a) | | 56,452 | | | 2,565,166 |

HgCapital Trust PLC(a) | | 47,670 | | | 37,198 |

HgCapital Trust PLC | | 230,050 | | | 2,935,595 |

Macquarie International Infrastructure Fund, Ltd. | | 4,390,000 | | | 1,649,894 |

Princess Private Equity Holding, Ltd.(a) | | 387,882 | | | 2,504,763 |

Private Equity Investor PLC(a) | | 460,100 | | | 879,975 |

SVG Capital PLC(a) | | 1,407,541 | | | 3,521,168 |

| | | | | |

| | | | | 28,886,008 |

| | | | | |

|

Diversified Financial Services (26.42%) |

Blackstone Group LP | | 153,800 | | | 2,150,124 |

Conversus Capital LP(a) | | 298,800 | | | 4,894,344 |

GP Investments, Ltd.(a) | | 718,600 | | | 3,270,028 |

Intermediate Capital Group PLC | | 627,000 | | | 2,706,316 |

KKR & Co. Guernsey LP | | 864,100 | | | 10,524,738 |

Onex Corp. | | 212,000 | | | 6,142,115 |

| | | | | |

| | | | | 29,687,665 |

| | | | | |

| |

Investment Companies (16.16%) | | | |

China Merchants China Direct Investments, Ltd.(a) | | 1,294,000 | | | 3,083,274 |

DeA Capital SpA(a) | | 761,000 | | | 1,267,556 |

Eurazeo | | 29,000 | | | 2,027,135 |

Investor AB, Class B | | 137,400 | | | 2,613,999 |

MVC Capital, Inc. | | 180,700 | | | 2,553,291 |

Prospect Capital Corp. | | 66,949 | | | 778,617 |

Ratos AB | | 117,000 | | | 3,682,903 |

RHJ International(a) | | 250,000 | | | 2,143,637 |

| | | | | |

| | | | | 18,150,412 |

| | | | | |

| | | | | | | | |

| | | | | Shares | | | | Value (Note 1) |

Venture Capital (16.90%) |

3i Group PLC | | 1,000,000 | | | | $ 4,166,348 |

3i Infrastructure PLC | | 1,017,292 | | | | 1,775,984 |

Altamir Amboise(a) | | 410,691 | | | | 3,412,127 |

Deutsche Beteiligungs AG | | 82,689 | | | | 1,922,283 |

Dinamia Capital Privado S.C.R., SA | | 118,778 | | | | 1,587,797 |

GIMV N.V. | | 74,700 | | | | 4,055,956 |

IP Group PLC(a) | | 1,266,800 | | | | 814,076 |

JAFCO Co., Ltd. | | 40,600 | | | | 1,256,879 |

| | | | | | | | |

| | | | | | | | 18,991,450 |

| | | | | | | | |

| | | |

TOTAL FINANCIAL | | | | | | 95,715,535 |

| | | | | | | | |

| | |

TOTAL COMMON STOCKS (Cost $90,328,740) | | | | 110,579,779 |

| | | | | | | | |

| | | | |

| | | 7-Day Yield | | Shares | | | | Value (Note 1) |

SHORT-TERM INVESTMENTS (1.27%) |

Money Market Fund (1.27%) | | | | |

Dreyfus Treasury Prime Cash Management, Investor Shares | | | | | | |

| | 0.00004% | | 1,429,972 | | $ | | 1,429,972 |

| | | | | | | | |

| | |

TOTAL SHORT-TERM INVESTMENTS (Cost $1,429,972) | | | | 1,429,972 |

| | | | | | | | |

| | |

TOTAL INVESTMENTS - (99.69%) (Cost $91,758,712) | | $ | | 112,009,751 |

| | | |

Assets in Excess of Other Liabilities (0.31%) | | | | | | 344,647 |

| | | | | | | | |

| | | |

NET ASSETS (100.00%) | | | | $ | | 112,354,398 |

| | | | | | | | |

Common Abbreviations:

AB- Aktiebolag is the Swedish equivalent of the term corporation

AG - Aktiengesellschaft is a German term that refers to a corporation that is limited by shares, i.e., owned by shareholders.

N.V. - Naamloze Vennootschap is the Dutch term for a public limited liability corporation.

SA -Generally designates corporations in various countries, mostly those employing the civil law. This translates literally in all languages mentioned as anonymous company.

SpA - Società Per Azioni is an Italian shared company.

| (a) | Non-Income Producing Security. |

For Fund compliance purposes, the Fund’s industry classifications refer to any one or more of the industry sub-classifications used by one or more widely recognized market indexes or ratings group indexes, and/or as defined by Fund management. This definition may not apply for purposes of this report, which may combine industry subclassifications for reporting ease. Industries are shown as a percent of net assets. These industry classifications are based on third-party definitions. The definitions are industry terms and do not reflect the legal status of any of the investments or the companies in which the Fund has invested.

See Notes to Financial Statements.

| | | | | | |

| ALPS | Red Rocks Listed Private Equity Fund | | |

| | | Statement of Investments | | | | April 30, 2010 |

Top Ten Holdings (as a % of Net Assets) †

| | | |

KKR & Co. Guernsey LP | | 9.37 | % |

Onex Corp. | | 5.47 | % |

Leucadia National Corp. | | 4.44 | % |

Conversus Capital LP | | 4.36 | % |

3i Group PLC | | 3.71 | % |

GIMV N.V. | | 3.61 | % |

Ratos AB, B Shares | | 3.28 | % |

SVG Capital PLC | | 3.13 | % |

Altamir Amboise | | 3.04 | % |

Electra Private Equity PLC | | 3.03 | % |

Top Ten Holdings | | 43.44 | % |

| | † | Holdings are subject to change. |