UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-8194

FINANCIAL INVESTORS TRUST

(Exact name of registrant as specified in charter)

1290 Broadway, Suite 1100, Denver, Colorado 80203

(Address of principal executive offices) (Zip code)

JoEllen L. Legg, Secretary

Financial Investors Trust

1290 Broadway, Suite 1100

Denver, Colorado 80203

(Name and address of agent for service)

Registrant’s telephone number, including area code: 303-623-2577

Date of fiscal year end: April 30

Date of reporting period: May 1, 2010 - April 30, 2011

Item 1. Reports to Stockholders.

Table of Contents

| | | | |

ALPS | Kotak India Growth Fund |

| | | Management Commentary | | April 30, 2011 (Unaudited) |

Performance

ALPS | Kotak India Growth Fund (the “Fund”) was launched on February 14, 2011. The Fund’s Class A Shares, INDAX, delivered a net return of 3.40% at Net Asset Value (Class A delivered a net return of -2.27% at MOP, Class C, INFCX, was +2.20% with CDSC, Class I, INDIX, was +3.50%). The Fund’s performance was below that of the S&P CNX 500 Index(1) (“CNX 500”) (+5.72%), without taking into account sales charges for Class A and C Shares. As the Fund was in the portfolio build-up phase, the portfolio was significantly in cash the first few weeks of launch during which Indian markets rallied.

During the four-month period ended 4/30/2011, Indian equity markets underperformed most equity markets by a wide margin – broader Indian indices like CNX 500 returned -9.78% during this period compared to the Dow Jones Industrial Average(2) return of 8.57%. The investment environment during this period was impacted by the following, with January 2011 marking the worst monthly decline since October 2008 (CNX 500 down -12.80% in January, February CNX 500 down -2.66%, while in March the CNX 500 was up 10.60% and in April down -4.47%).

| | » | While global cues like ratings downgrade of Japan by S&P and a threat by Moody’s(3) to downgrade US debt rating added to market participant woes, the fall in Indian markets was mainly attributed to local factors like high inflation, tightening interest rates and a paralysis by the government on policy and worries that this might slow investments and hence overall growth. |

| | » | January also witnessed corporate India report earnings for the quarter ending December 2010. While there have been a few sectors which reported earnings reports impacted by higher commodity prices, on an aggregate corporate earnings was in-line with expectations, the fall in markets therefore reflective of change in macro-environment than in the micro-functioning of corporate India. |

| | » | With macro-economic environment dominating market behaviour, the key event during the quarter was the credit policy meeting of Reserve Bank of India (“RBI”). As expected, the RBI raised Repurchases(4) and Reverse Repurchases(5) by 25 basis points(6) (“bps”) each to 6.5 and 5.5%, respectively, in its credit policy in January. As expected, the RBI also upped the inflation forecast to 7% from 5.5% while keeping the Gross Domestic Product (“GDP”) estimate unchanged at 8.5%, albeit with an upward bias. With inflation persisting at elevated levels, RBI in its May credit policy increased the key rates by 50 bps – hinting that RBI has moved to controlling inflation as its primary target at this point of time. |

| | » | The Union Budget(7) presented on February 28, 2011 by Mr. Pranab Mukherjee, was devoid of any significant populist measures but can at best be described as a pragmatic one in an environment where the government is faced with |

| | multiple deficits – that of governance, fiscal and current account. A budget should be judged for its role in creating an environment for sustained growth rather than the short term impact on individuals and that’s what the Finance Minister has done – choosing a path for sustained growth rather than committing to overtly populist measures. |

| | » | For the markets, the announcement of a reduced fiscal deficit target of 4.6% against 4.8% was below industry expectations and a reason to cheer. Fuelled by a buoyant economy estimated in the budget to grow at 9%, the government’s reduced borrowing targets for the year were also below market expectations. Although this figure is likely to please the markets it is highly dependent on global oil prices and the government’s commitment to subsidies in this space. The budget also provided a big boost to equity and mutual fund markets by allowing foreign individual investors to access Indian funds. |

| | » | The sharp rise in crude (Brent Crude up 23.24% and NYMEX WTI Crude up 16.79%) during this period was another significant headwind for the markets. As the fourth-largest consumer of oil in the world, most of India’s oil energy needs are met through imports (around 93%) making India the world’s 5th largest oil-importing nation. Increasing oil price have major impact on BoP (Balance of payment), leading to increasing fiscal deficit and current account deficit. An estimate from Citi showed that a US$1/bbl increase in oil prices would impact India’s trade deficit by US$800mn (approx 0.4% of GDP). |

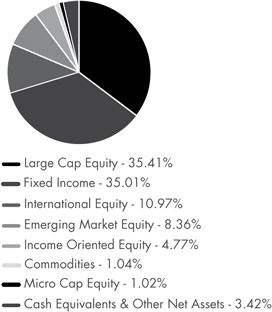

Portfolio Composition

The portfolio is constructed to potentially benefit from the strong macro-economic growth in Indian economy across four broad themes in India – consumption lead by favourable demographics, financial services, infrastructure and outsourcing. The Fund has flexibility to invest across market capitalizations – depending on market conditions, valuation differential, earnings growth, liquidity etc.

Sectorally, the portfolio is overweight financials, information technology, healthcare, while the portfolio is underweight energy, utilities, consumer discretionary. With risk averseness increasing in the first quarter of 2011, the Fund had relatively low exposure to midcaps on an average (10-15%), However, close to the end of the quarter, this had increased marginally to about 20% due to favourable valuation discount.

Outlook

Indian markets, after underperforming most global markets for the first two months in 2011, have bounced back strongly in March 2011. While we have seen some positives in the budget, reform agenda, environment clearances, moderation of food

1 | April 30, 2011

| | | | |

ALPS | Kotak India Growth Fund |

| | | Management Commentary | | April 30, 2011 (Unaudited) |

inflation, many other macro variables remain challenging, particularly crude oil prices, and now rising core inflation. On the policy front, while we have seen some movements in recent weeks, we see an increased thrust post the state elections in April and May 2011.

After the recent run up, valuations at 15x fiscal year-end 2012 earnings per share(8) and 12.9x fiscal year-end 2013 earnings

per share are reasonable but not cheap. We expect markets to consolidate before making a fresh upmove. In addition, midcaps, after underperforming for last few months, are seeing renewed interest. Given the valuation gap and liquidity improvement, we believe midcaps are now likely to outperform. Reforms are key for the next leg of sustainable growth and the market will likely be disappointed without critical reforms post five state elections. Lastly, oil prices continue to remain a key risk for the market.

| (1) | India’s first broad based benchmark of the Indian capital market. The S&P CNX 500 companies are disaggregated into 72 industry indices. Industry weightages in the index reflect the industry weightages in the market. An investor may not invest directly in an index. |

| (2) | The most widely used indicator of the overall condition of the stock market, a price-weighted average of 30 actively traded blue chip stocks, primarily industrials. An investor may not invest directly in an index. |

| (3) | Standard & Poor’s (S&P) and Moody’s ratings are based on statistical calculations of a company’s likelihood of default. |

| (4) | A form of short-term borrowing for dealers in government securities. The dealer sells the government securities to investors, usually on an overnight basis, and buys them back the following day. |

| (5) | The purchase of securities with the agreement to sell them at a higher price at a specific future date. For the party selling the security (and agreeing to repurchase it in the future) it is a repurchase agreement; for the party on the other end of the transaction (buying the security and agreeing to sell in the future) it is a reverse repurchase agreement. |

| (6) | A unit that is equal to 1/100th of 1%. |

| (7) | The annual budget of the Republic of India, presented each year on the last working day of February by the Finance Minister of India in Parliament. |

| (8) | The portion of a company’s profit allocated to each outstanding share of common stock. Earnings per share serves as an indicator of a company’s profitability. |

Past performance does not guarantee future results.

2 | April 30, 2011

| | | | |

ALPS | Kotak India Growth Fund |

| | | Management Commentary | | April 30, 2011 (Unaudited) |

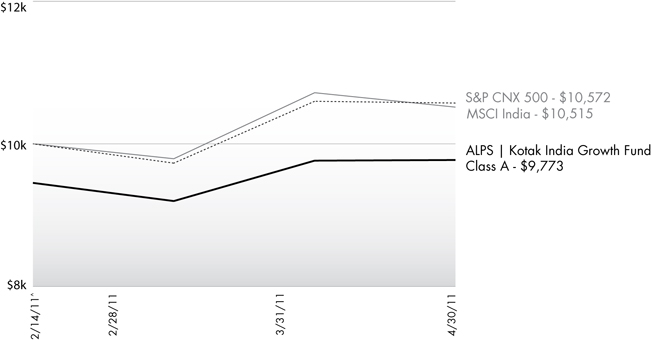

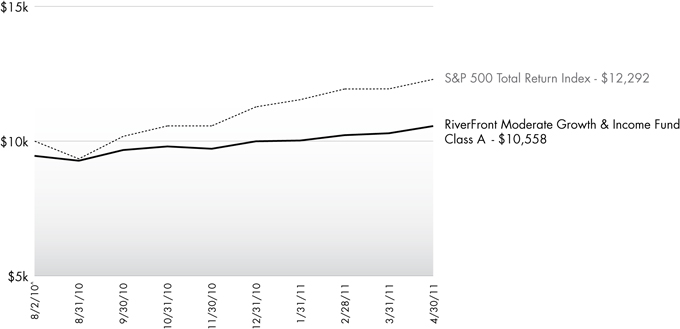

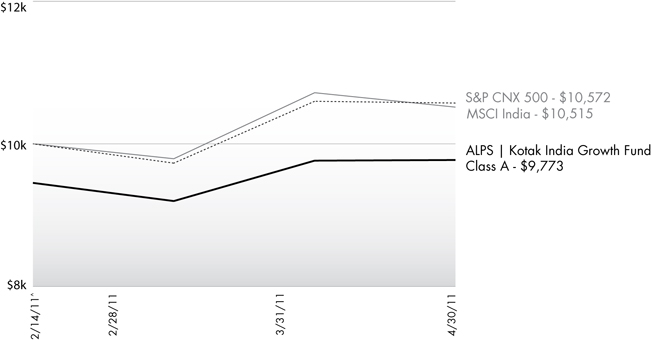

Performance of $10,000 Initial Investment (as of April 30, 2011)

Comparison of change in value of a $10,000 investment (includes applicable sales loads)

The chart above represents historical performance of a hypothetical investment of $10,000 in the Fund since inception. Past performance does not guarantee future results. This chart does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

3 | April 30, 2011

| | | | |

ALPS | Kotak India Growth Fund |

| | | Management Commentary | | April 30, 2011 (Unaudited) |

Cumulative Return (as of April 30, 2011)

| | | | | | |

| | | Since Inception^ | | Total Expense Ratio | | What You Pay* |

Class A (NAV)1 | | 3.40% | | 4.16% | | 2.00% |

Class A (MOP)2 | | -2.27% | | |

Class C (NAV)1 | | 3.20% | | 4.76% | | 2.60% |

Class C (CDSC)2 | | 2.20% | | |

Class I | | 3.50% | | 3.76% | | 1.60% |

S&P CNX 500 Index3 | | 5.72% | | | | |

MSCI India Index4 | | 5.06% | | | | |

Performance data quoted represents past performance. Past performance does not guarantee future results. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when sold or redeemed, may be worth more or less than the original cost. Current performance data may be higher or lower than actual data quoted. The Fund imposes a 2.00% redemption fee on shares held for less than 90 days. The Fund imposes a maximum Contingent Deferred Sales Charge (“CDSC”) of 1.00% to shares redeemed within the first 12 months after a purchase in excess of $1 million. Performance data does not reflect the redemption fee or the CDSC, which if reflected would reduce the performance quoted. For the most current month-end performance data please call (866) 759-5679.

Investing in the Fund is subject to investment risks, including possible loss of the principal amount invested. Derivatives generally are more sensitive to changes in economic or market conditions than other types of investments; this could result in losses that significantly exceed the funds original investment.

| 1 | Net Asset Value (NAV) is the share price without sales charges. |

| 2 | Maximum Offering Price (MOP) includes sales charges. Class A returns include effects of the Fund’s maximum sales charge of 5.50%; Class C returns include the 1.00% CDSC. |

| 3 | S&P CNX 500 - India’s first broad based benchmark of the Indian capital market. The S&P CNX 500 companies are disaggregated into 72 industry indices. Industry weightages in the market. An investor may not invest directly in an index. |

| 4 | MSCI India Index-a free float weighted equity index. It was developed with a base value of 100 as-of December 31, 1992. An investor may not invest directly in an index. |

| ^ | Fund inception date of 2/14/2011. |

| * | What You Pay reflects the Adviser and Sub-Adviser’s decision to contractually limit expenses through August 31, 2012. Please see the prospectus for additional information. |

The table does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

The Fund is less than a year old and has limited operating history. This Fund is not suitable for all investors. Subject to investment risks, including possible loss of the principal amount invested.

Investing in India involves risk and considerations not present when investing in more established securities markets. The Fund may be more susceptible to economic, market, political and local risks of the region than a fund that is more geographically diversified.

| | | | |

Top Ten Long Holdings (as a % of Net Assets) † | |

ICICI Bank, Ltd. | | | 4.30 | % |

Infosys Technologies, Ltd. | | | 4.25 | % |

Reliance Industries, Ltd. | | | 3.72 | % |

Tata Consultancy Services, Ltd. | | | 3.22 | % |

Larsen & Toubro, Ltd. | | | 2.13 | % |

ITC, Ltd. | | | 1.92 | % |

HDFC Bank, Ltd. | | | 1.82 | % |

Bharti Airtel, Ltd. | | | 1.74 | % |

State Bank of India | | | 1.70 | % |

Union Bank of India | | | 1.47 | % |

Top Ten Long Holdings | | | 26.27 | % |

| |

† Holdings are subject to change. | | | | |

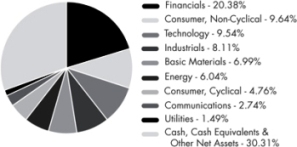

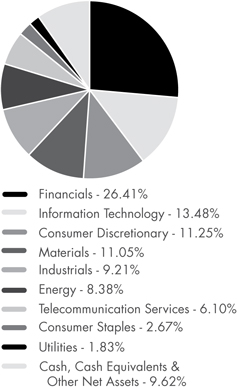

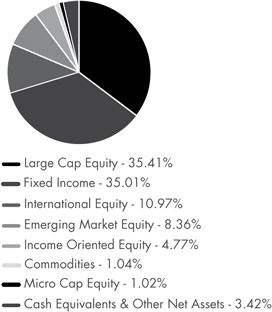

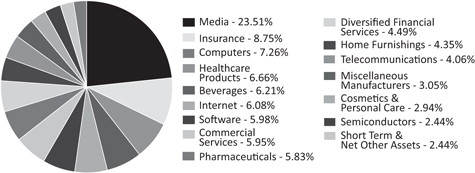

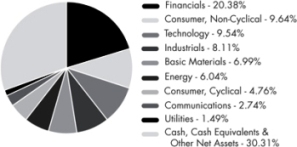

Industry Sector Allocation (Long Positions as a % of Net Assets)

4 | April 30, 2011

| | | | |

ALPS | Kotak India Growth Fund |

| | | Disclosure of Fund Expenses | | April 30, 2011 (Unaudited) |

As a shareholder of the Fund, you will incur two types of costs: (1) transaction costs, including applicable sales charges (loads); and (2) ongoing costs, including management fees, distribution and service (12b-1) fees, shareholder service fees and other Fund expenses. The following examples are intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds. The examples are based on an investment of $1,000 invested on February 14, 2011 and held until April 30, 2011.

Actual Expenses. The first line of the table on the next page provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading “Expense Paid During Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes. The second line of the table on the next page provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other mutual funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

The expenses shown in the table are meant to highlight ongoing Fund costs only and do not reflect transaction fees, such as sales charges or exchange fees. Therefore, the second line of the table on the next page is useful in comparing ongoing costs only, and may not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

| | | | | | | | |

| | | Beginning Account Value

2/14/11 | | Ending Account Value

4/30/11 | | Expense

Ratio(a) | | Expense Paid

During Period(b)

2/14/11 - 4/30/11 |

Class A(c) | | | | | | | | |

Actual | | $1,000.00 | | $1,034.00 | | 2.00% | | $4.18 |

Hypothetical (5% return before expenses) | | $1,000.00 | | $1,006.16 | | 2.00% | | $9.95 |

| | | | |

Class C(c) | | | | | | | | |

Actual | | $1,000.00 | | $1,032.00 | | 2.60% | | $5.43 |

Hypothetical (5% return before expenses) | | $1,000.00 | | $1,004.93 | | 2.60% | | $12.92 |

| | | | |

Class I(c) | | | | | | | | |

Actual | | $1,000.00 | | $1,035.00 | | 1.60% | | $3.35 |

Hypothetical (5% return before expenses) | | $1,000.00 | | $1,006.99 | | 1.60% | | $7.96 |

| (a) | The Fund’s expense ratios have been based on the period from Fund’s inception date of February 14, 2011 through April 30, 2011. |

| (b) | Expenses are equal to the Fund’s annualized expense ratio multiplied by the average account value over the period, multiplied by the number of days in the most recent fiscal half year (181), then divided by 365. |

| (c) | Shares commenced operations on February 14, 2011. |

5 | April 30, 2011

| | | | |

ALPS | Kotak India Growth Fund |

| | | Consolidated Statement of Investments | | April 30, 2011 |

| | | | | | | | |

| | | Shares | | | Value

(Note 1) | |

COMMON STOCKS (69.69%) | | | | | | | | |

Basic Materials (6.99%) | | | | | | | | |

Chemicals (2.28%) | | | | | | | | |

Asian Paints, Ltd. | | | 316 | | | $ | 19,853 | |

Gujarat State Fertilisers & Chemicals, Ltd. | | | 2,975 | | | | 25,128 | |

| | | | | | | | |

| | | | | | | 44,981 | |

| | | | | | | | |

| | |

Iron & Steel (2.41%) | | | | | | | | |

Jindal Steel & Power, Ltd. | | | 1,471 | | | | 21,826 | |

Tata Steel, Ltd. | | | 1,833 | | | | 25,615 | |

| | | | | | | | |

| | | | | | | 47,441 | |

| | | | | | | | |

| | |

Mining (2.30%) | | | | | | | | |

Hindalco Industries, Ltd. | | | 4,130 | | | | 20,217 | |

Sterlite Industries India, Ltd. | | | 6,072 | | | | 25,022 | |

| | | | | | | | |

| | | | | | | 45,239 | |

| | | | | | | | |

| | |

TOTAL BASIC MATERIALS | | | | | | | 137,661 | |

| | | | | | | | |

| | |

Communications (2.74%) | | | | | | | | |

Media (1.00%) | | | | | | | | |

Jagran Prakashan, Ltd. | | | 6,985 | | | | 19,710 | |

| | | | | | | | |

| | |

Telecommunications (1.74%) | | | | | | | | |

Bharti Airtel, Ltd. | | | 3,981 | | | | 34,253 | |

| | | | | | | | |

| | |

TOTAL COMMUNICATIONS | | | | | | | 53,963 | |

| | | | | | | | |

| | |

Consumer, Cyclical (4.76%) | | | | | | | | |

Airlines (0.91%) | | | | | | | | |

Jet Airways India, Ltd.(a) | | | 1,647 | | | | 17,828 | |

| | | | | | | | |

| | |

Auto Manufacturers (1.79%) | | | | | | | | |

Mahindra & Mahindra, Ltd. | | | 1,345 | | | | 23,039 | |

Tata Motors, Ltd. | | | 790 | | | | 12,159 | |

| | | | | | | | |

| | | | | | | 35,198 | |

| | | | | | | | |

| | |

Leisure Time (1.13%) | | | | | | | | |

Bajaj Auto, Ltd. | | | 669 | | | | 22,345 | |

| | | | | | | | |

| | |

Retail (0.93%) | | | | | | | | |

Titan Industries, Ltd. | | | 200 | | | | 18,237 | |

| | | | | | | | |

| |

TOTAL CONSUMER, CYCLICAL | | | | 93,608 | |

| | | | | | | | |

| | |

Consumer, Non-cyclical (9.64%) | | | | | | | | |

Agriculture (1.92%) | | | | | | | | |

ITC, Ltd. | | | 8,680 | | | | 37,834 | |

| | | | | | | | |

| | |

Commercial Services (1.12%) | | | | | | | | |

Mundra Port and Special Economic Zone, Ltd. | | | 6,715 | | | | 21,966 | |

| | | | | | | | |

| | | | | | | | |

| | | Shares | | | Value

(Note 1) | |

Food (1.44%) | | | | | | | | |

GlaxoSmithKline Consumer Healthcare, Ltd. | | | 225 | | | $ | 12,433 | |

Shree Renuka Sugars, Ltd. | | | 9,950 | | | | 15,876 | |

| | | | | | | | |

| | | | | | | 28,309 | |

| | | | | | | | |

| | |

Household Products & Wares (1.08%) | | | | | | | | |

Godrej Consumer Products, Ltd. | | | 2,500 | | | | 21,320 | |

| | | | | | | | |

| | |

Pharmaceuticals (4.08%) | | | | | | | | |

Dr Reddy’s Laboratories, Ltd. | | | 623 | | | | 23,577 | |

Lupin, Ltd. | | | 2,021 | | | | 20,176 | |

Ranbaxy Laboratories, Ltd. | | | 400 | | | | 4,145 | |

Strides Arcolab, Ltd. | | | 2,067 | | | | 18,085 | |

Sun Pharmaceutical Industries, Ltd. | | | 1,350 | | | | 14,237 | |

| | | | | | | | |

| | | | | | | 80,220 | |

| | | | | | | | |

| | |

TOTAL CONSUMER, NON-CYCLICAL | | | | | | | 189,649 | |

| | | | | | | | |

| | |

Energy (6.04%) | | | | | | | | |

Oil & Gas (6.04%) | | | | | | | | |

Hindustan Petroleum Corp., Ltd. | | | 3,400 | | | | 28,736 | |

Oil & Natural Gas Corp., Ltd. | | | 2,450 | | | | 17,081 | |

Reliance Industries, Ltd. | | | 3,290 | | | | 73,161 | |

| | | | | | | | |

| | | | | | | 118,978 | |

| | | | | | | | |

| | |

TOTAL ENERGY | | | | | | | 118,978 | |

| | | | | | | | |

| | |

Financials (20.38%) | | | | | | | | |

Banks (14.51%) | | | | | | | | |

Allahabad Bank | | | 5,660 | | | | 26,298 | |

Axis Bank, Ltd. | | | 925 | | | | 26,938 | |

Bank of Baroda | | | 200 | | | | 4,133 | |

HDFC Bank, Ltd. | | | 690 | | | | 35,825 | |

ICICI Bank, Ltd. | | | 3,348 | | | | 84,609 | |

IndusInd Bank, Ltd. | | | 4,380 | | | | 25,781 | |

State Bank of India | | | 526 | | | | 33,425 | |

Union Bank of India | | | 3,988 | | | | 28,869 | |

Yes Bank, Ltd. | | | 2,850 | | | | 19,729 | |

| | | | | | | | |

| | | | | | | 285,607 | |

| | | | | | | | |

| | |

Diversified Financial Services (4.92%) | | | | | | | | |

Bajaj Finance, Ltd. | | | 1,200 | | | | 19,019 | |

Housing Development Finance Corp. | | | 1,685 | | | | 26,955 | |

IFCI, Ltd. | | | 13,380 | | | | 15,743 | |

Mahindra & Mahindra Financial Services, Ltd. | | | 1,357 | | | | 22,502 | |

Power Finance Corp., Ltd. | | | 2,400 | | | | 12,587 | |

| | | | | | | | |

| | | | | | | 96,806 | |

| | | | | | | | |

| | |

Real Estate (0.95%) | | | | | | | | |

Phoenix Mills, Ltd. | | | 4,026 | | | | 18,662 | |

| | | | | | | | |

| | |

TOTAL FINANCIALS | | | | | | | 401,075 | |

| | | | | | | | |

6 | April 30, 2011

| | | | |

ALPS | Kotak India Growth Fund |

| | | Consolidated Statement of Investments | | April 30, 2011 |

| | | | | | | | |

| | | Shares | | | Value (Note 1) | |

Industrials (8.11%) | | | | | | | | |

Building Materials (1.12%) | | | | | | | | |

Grasim Industries, Ltd. | | | 85 | | | $ | 4,715 | |

Shree Cement, Ltd. | | | 382 | | | | 17,378 | |

| | | | | | | | |

| | | | | | | 22,093 | |

| | | | | | | | |

| | |

Electrical Components & Equipment (3.68%) | | | | | | | | |

Bharat Heavy Electricals, Ltd. | | | 418 | | | | 18,934 | |

Crompton Greaves, Ltd. | | | 3,763 | | | | 21,491 | |

Exide Industries, Ltd. | | | 4,000 | | | | 13,808 | |

Havells India, Ltd. | | | 2,025 | | | | 18,195 | |

| | | | | | | | |

| | | | | | | 72,428 | |

| | | | | | | | |

| | |

Engineering & Construction (3.31%) | | | | | | | | |

IRB Infrastructure Developers, Ltd. | | | 5,825 | | | | 23,217 | |

Larsen & Toubro, Ltd. | | | 1,161 | | | | 41,951 | |

| | | | | | | | |

| | | | | | | 65,168 | |

| | | | | | | | |

| | |

TOTAL INDUSTRIALS | | | | | | | 159,689 | |

| | | | | | | | |

| | |

Technology (9.54%) | | | | | | | | |

Computers (8.57%) | | | | | | | | |

Infosys Technologies, Ltd. | | | 1,272 | | | | 83,623 | |

Redington India, Ltd. | | | 10,800 | | | | 21,555 | |

Tata Consultancy Services, Ltd. | | | 2,407 | | | | 63,474 | |

| | | | | | | | |

| | | | | | | 168,652 | |

| | | | | | | | |

| | |

Software (0.97%) | | | | | | | | |

HCL Technologies, Ltd. | | | 1,617 | | | | 19,092 | |

| | | | | | | | |

| | |

TOTAL TECHNOLOGY | | | | | | | 187,744 | |

| | | | | | | | |

| | |

Utilities (1.49%) | | | | | | | | |

Electric (0.78%) | | | | | | | | |

Tata Power Co., Ltd. | | | 519 | | | | 15,324 | |

| | | | | | | | |

| | |

Oil & Gas (0.71%) | | | | | | | | |

GAIL India, Ltd. | | | 1,297 | | | | 13,960 | |

| | | | | | | | |

| | |

TOTAL UTILITIES | | | | | | | 29,284 | |

| | | | | | | | |

| | |

TOTAL COMMON STOCKS (Cost $1,336,186) | | | | | | | 1,371,651_ | |

| | | | | | | | |

| | | | | | | | |

7-Day Yield | | Shares | | | Value (Note 1) | |

SHORT TERM INVESTMENTS (0.48%) | | | | | | | | |

Money Market Fund (0.48%) | | | | | | | | |

Dreyfus Cash Management Fund, Institutional Class 0.129% | | | 9,568 | | | $ | 9,568 | |

| | | | | | | | |

| | |

TOTAL SHORT TERM INVESTMENTS (Cost $9,568) | | | | | | | 9,568 | |

| | | | | | | | |

| | |

TOTAL INVESTMENTS (Cost $1,345,754) (70.17%) | | | | | | $ | 1,381,219 | |

| | |

Other Assets In Excess Of Liabilities (29.83%) | | | | | | | 587,035 | |

| | | | | | | | |

| | |

NET ASSETS (100.00%) | | | | | | $ | 1,968,254 | |

| | | | | | | | |

| (a) | Non-Income Producing Security. |

Common Abbreviations:

Ltd. - Limited.

S&P - Standard & Poor’s.

For Fund compliance purposes, the Fund’s industry classifications refer to any one or more of the industry sub-classifications used by one or more widely recognized market indexes or ratings group indexes, and/or as defined by Fund management. This definition may not apply for purposes of this report, which may combine industry sub-classifications for reporting ease. Industries are shown as a percent of net assets. These industry classifications are based on third party definitions and are unaudited. The definitions are industry terms and do not reflect the legal status of any of the investments or companies in which the Fund has invested.

FUTURES CONTRACTS

At April 30, 2011, the Fund had outstanding futures contracts:

| | | | | | | | | | | | | | | | |

| Description | | Position | | Contracts | | Expiration

Date | | | Value (Note 1) | | | Unrealized

Depreciation | |

Bank of Baroda | | Long | | 4 | | | 5/26/11 | | | | $915,600 | | | | $(1,585) | |

Grasim Industries | | Long | | 2 | | | 5/26/11 | | | | 613,500 | | | | (194) | |

S&P CNX NIFTY Future | | Long | | 48 | | | 5/26/11 | | | | 13,809,120 | | | | (3,446) | |

| | | | | | | | | | | | |

| | | | | | | | | | | $15,338,220 | | | | $(5,225) | |

| | | | | | | | | | | | |

See Notes to Financial Statements.

7 | April 30, 2011

| | | | |

ALPS | Red Rocks Listed Private Equity Fund |

| | | Management Commentary | | April 30, 2011 (Unaudited) |

Overview

The current fiscal year for the ALPS | Red Rocks Listed Private Equity Fund has ended on a very good note. The world economy continues to improve at a slow but steady rate. Many sectors are experiencing business expansion and increases in revenue. Companies have selectively added head count. Materials and labor costs, while increasing, are manageable. And the ability of companies to meet their debt obligations, service their debt and in most cases refinance their debt obligations with equal or better terms has improved. Consumers have responded accordingly; spending has loosened up a bit, especially among those who feel they have job security. The bad news is that the “I” word (as in Inflation with a capital I) has been creeping back into the vernacular. Will it be a problem? No one really knows at this time, but it is something to keep an eye on.

The experience of our portfolio companies and their underlying businesses has been no different. They too have witnessed an uplift in revenue in most cases. Their increase in input costs has been modest. And their ability to refinance debt on very favorable terms is as good as it’s been in years. In essence, their prospects continue to improve in a meaningful way.

The last item of note is mergers and acquisitions activity. In a word, it’s been “robust”. Private equity firms have taken advantage of the favorable confluence of events (as noted above) and have monetized select investments from their portfolio at strong valuations through sales or an Initial Public Offering.

While not everything has been perfect (such as the Middle East unrest, the corresponding increase in oil prices, the Japan earthquake, the tragic tsunami, and the ongoing nuclear disaster), the world feels to us like a more stable place; especially the financial markets. That’s not to say that near term challenges don’t exist. They do. The US government spending and deficit issue, the Euro zone financial institution/sovereign debt situation, and the Chinese currency valuation, coupled with accelerating inflation are examples of fundamental problems that will need to be addressed sooner rather than later.

On balance, we think things feel better than worse, businesses continue to adapt and grow under the new regime, and private equity is benefiting overall.

Portfolio Review

For the annual period ended April 30, 2011, the Fund’s Class A Shares, LPEFX, returned 33.22% at Net Asset Value, (Class A delivered a net return of 25.92% at MOP), compared with 23.82% and 18.25% for the MSCI World Index and the S&P Listed Private Equity Index, respectively.*

* Past Performance does not guarantee future results.

We made a few more changes than usual to the portfolio during the second half of the period, expanding the number of holdings in the portfolio. We exited four holdings: American Capital Ltd, DEA Capital S.P.A., MVC Capital Inc. and RHJ International SA. These amounted to approximately 4.7% of the portfolio’s total holdings. We added ten companies to the portfolio during the quarter: Aker ASA, Apollo Global Management, Bure Equity, LMS Capital, Marfin Investment Group, Pantheon International Participation, Partners Group Holding, Remgro, Safeguard Scientifics Inc. and Schouw. Hence, turnover was a bit higher than in the past. Our focus though has not changed: being long term investors in sponsors of private equity funds where we see good underlying private businesses that have performed well and have the potential to grow in value.

We continue to be pleased with how the portfolio has performed, exceeding our expectations in most instances.

| | | | | | |

Net contributors to performance for the year included: |

KKR & CO LP | | | 2.65 | % | | |

Blackstone Group LP | | | 2.41 | % | | |

Wendel | | | 2.16 | % | | |

|

| Net detractors to performance for the year included: |

Candover Investments PLC | | | -0.53 | % | | |

GP Investments Ltd | | | -0.29 | % | | |

Marfin Investment Group SA | | | -0.19 | % | | |

The Fund has seen little to no deviation in its underlying investments from a diversification standpoint: geographic, industry, vintage and stage of investment. We believe the ALPS | Red Rocks Listed Private Equity Fund continues to provide investors institutional exposure to high quality private equity funds and managers, the cornerstone of our strategy.

Looking Ahead

Before we can look forward, it’s helpful to look back. Six months ago we discussed how uncertainty surrounding the future was THE topic that we heard over and over again. Questions that we posed, and the ensuing answers (assuming they can be believed) have unfolded as follows:

| | » | Are we entering a period of prolonged deflation? We think probably not, unless you’re focused on housing prices and wages in the developed world; two very significant areas when it comes to the health of the consumer. Inflation looks to be more of an issue in basic commodities and foodstuffs. Once again, two very significant areas when it comes to the health of the consumer most everywhere. This has the potential to set up an unpleasant squeeze in the future. |

8 | April 30, 2011

| | | | |

ALPS | Red Rocks Listed Private Equity Fund |

| | | Management Commentary | | April 30, 2011 (Unaudited) |

| | » | When will the consumer come back? Although somewhat tepid, in our view the consumer is slowly coming back, particularly for those who have decent, steady jobs with good credit history/personal balance sheets. |

| | » | What about government spending and taxes? We believe this issue is being addressed, and in some cases (the UK) action is being taken. We are not out of the woods yet, but the discussion (the first step) is taking place. |

| | » | What’s going to happen with China, trade and their currency? This issue is unresolved. We suspect that this will be an ongoing set of issues for years to come. |

| | » | Are Portugal, Italy, Ireland, Greece and Spain real problems that can take the EU down (and the rest of the world?) or just a set of hiccups? So far they appear to us to be hiccups that are contained and manageable. Hopefully it stays this way. |

| | » | How is the developed world going to pay for the ever growing amounts of government debt and unfunded liabilities? This is the elephant in the living room as we like |

| | » | Is the banking system truly fixed and on sustainable ground? With a few notable exceptions, this one appears to us to be “yes”. A good thing. |

»

So far we believe these issues and outcomes have had a minimal, to mostly positive, effect on the Listed Private Equity Fund. We continue to focus not so much on what can go right in the portfolio (that is fairly well defined in our mind), but what can go wrong. While I know we don’t have all of the answers, we have positioned the portfolio to potentially benefit from a world that continues to heal while keeping a watchful eye on the uncertainty that exists.

As always, we appreciate your continued support and interest in Red Rocks and the Listed Private Equity strategy.

Adam Goldman, Co_Portfolio Manager

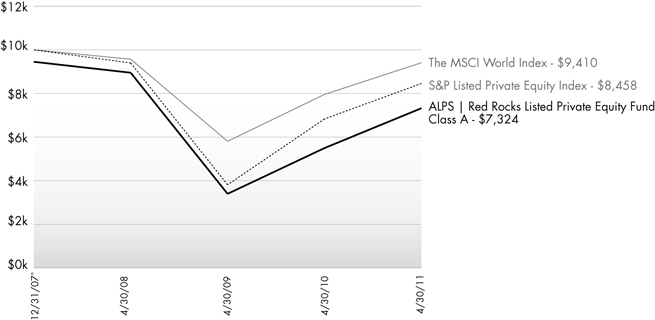

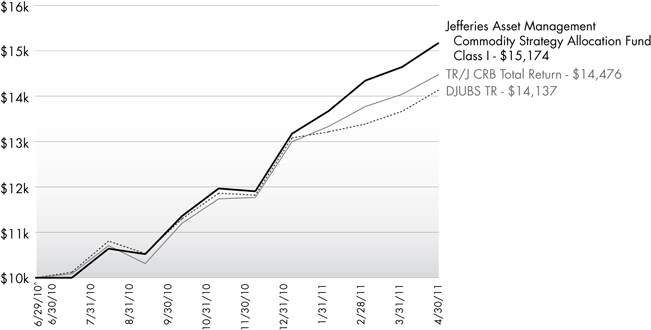

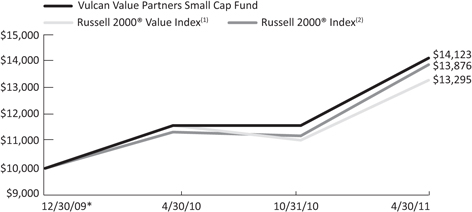

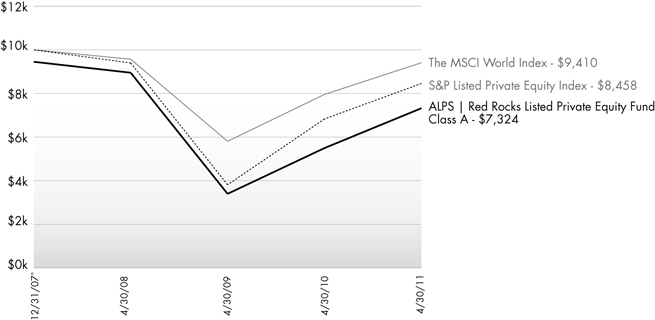

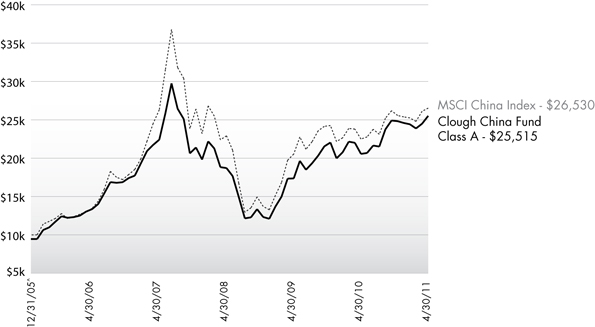

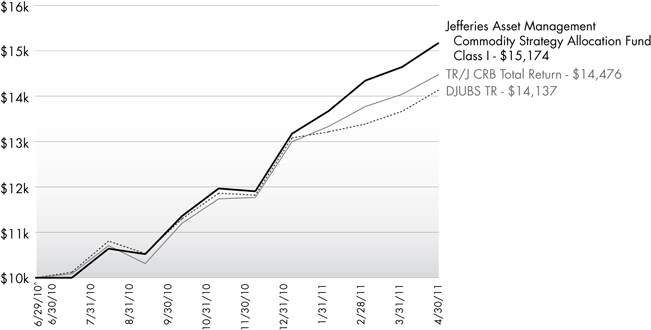

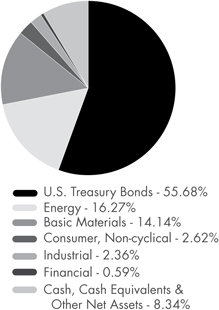

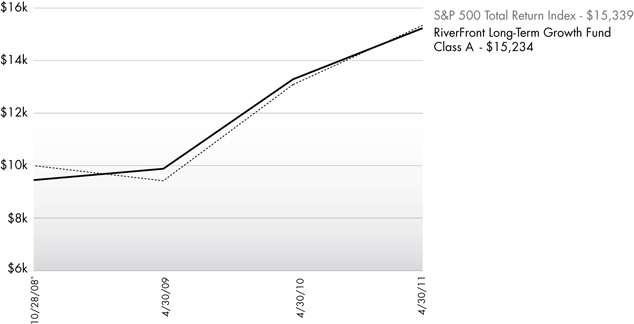

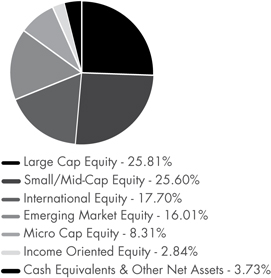

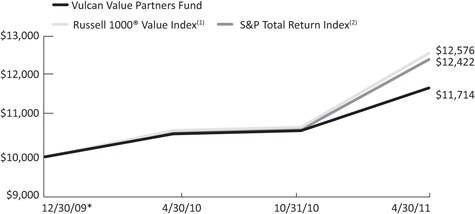

Performance of $10,000 Initial Investment (as of April 30, 2011)

Comparison of change in value of a $10,000 investment (includes applicable sales loads)

Source: Morningstar

The chart above represents historical performance of a hypothetical investment of $10,000 in the Fund since inception. Past performance does not guarantee future results. This chart does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

9 | April 30, 2011

| | | | |

ALPS | Red Rocks Listed Private Equity Fund |

| | | Management Commentary | | April 30, 2011 (Unaudited) |

Average Annual Total Returns (as of April 30, 2011)

| | | | | | | | | | |

| | | 1 Year | | | | Since Inception^ | | Total Expense Ratio | | What You Pay* |

Class A (NAV)1 | | 33.22% | | | | -7.37% | | 1.86% | | 1.65% |

Class A (MOP)2 | | 25.92% | | | | -8.93% | | | | |

Class C (NAV)1 | | 31.72% | | | | -8.17% | | 2.46% | | 2.40% |

Class C (CDSC)2 | | 30.72% | | | | -8.17% | | |

Class I | | 33.47% | | | | -7.09% | | 1.62% | | 1.40% |

Class R | | 32.47% | | | | -7.83% | | 2.42% | | 1.90% |

MSCI World Index3 | | 23.82% | | | | -1.81% | | | | |

S&P LPE Index4 | | 18.25% | | | | -4.90% | | | | |

Performance data quoted represents past performance. Past performance does not guarantee future results. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when sold or redeemed, may be worth more or less than the original cost. Current performance data may be higher or lower than actual data quoted. The Fund imposes a 2.00% redemption fee on shares held for less than 90 days. The Fund imposes a maximum Contingent Deferred Sales Charge (“CDSC”) of 1.00% to shares redeemed within the first 12 months after a purchase in excess of $1 million. Performance data does not reflect the redemption fee or the CDSC, which if reflected would reduce the performance quoted. For the most current month-end performance data, please call (866) 759-5679.

Maximum Offering Price (MOP) for Class A shares includes the Fund’s maximum sales charge of 5.50%. CDSC performance for Class C shares includes a 1% contingent deferred sales charge (CDSC) on C shares redeemed within 12 months of purchase. Performance shown at NAV does not include these sales charges and would have been lower had it been taken into account.

Performance shown for Class C shares prior to June 30, 2010 reflects the historical performance of the Fund’s Class A shares, calculated using the fees and expenses of Class C shares.

| 1 | Net Asset Value (NAV) is the share price without sales charges. The performance data shown does not reflect the decution of the sales load or the redemption fee or CDSC, and that, if reflected, the load or fee would reduce the performance quoted. |

| 2 | Maximum Offering Price (MOP) includes sales charges. Returns include effects of the Fund’s maximum sales charge of 5.50% for ALPS/Red Rocks Listed Private Equity Fund - A Shares. |

| 3 | MSCI World Index: Morgan Stanley Capital International’s market capitalization weighted index is composed of companies representative of the market structure of 22 developed market countries in North America, Europe and the Asia/Pacific Region. You cannot invest directly in an index. |

| 4 | S&P Listed Private Equity Index: The S&P Listed Private Equity Index is comprised of 30 leading listed private equity companies that meet size, liquidity, exposure, and activity requirements. The index is designed to provide tradable exposure to the leading publicly listed companies in the private equity space. You cannot invest directly in an index. |

| ^ | Fund inception date of 12/31/2007. |

| * | What You Pay reflects the Adviser and Sub-Adviser’s decision to contractually limit expenses through August 31, 2011. Please see the prospectus for additional information. |

The table does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

Listed Private Equity Companies are subject to various risks depending on their underlying investments, which could include, but are not limited to, additional liquidity risk, industry risk, non-U.S. security risk, currency risk, credit risk, managed portfolio risk and derivatives risk (derivatives risk is the risk that the value of the Listed Private Equity Companies’ derivative investments will fall because of pricing difficulties or lack of correlation with the underlying investment).

There are inherent risks in investing in private equity companies, which encompass financial institutions or vehicles whose principal business is to invest in and lend capital to privately held companies. Generally, little public information exists for private and thinly traded companies, and there is a risk that investors may not be able to make a fully informed investment decision.

Listed Private Equity Companies may have relatively concentrated investment portfolios, consisting of a relatively small number of holdings. A consequence of this limited number of investments is that the aggregate returns realized may be adversely impacted by the poor performance of a small number of investments, or even a single investment, particularly if a company experiences the need to write down the value of an investment.

Certain of the Fund’s investments may be exposed to liquidity risk due to low trading volume, lack of a market maker or legal restrictions limiting the ability of the Fund to sell particular securities at an advantageous price and/or time. As a result, these securities may be more difficult to value. Foreign investing involves special risks, such as currency fluctuations and political uncertainty. The Fund invests in derivatives and is subject to the risk that the value of those derivative investments will fall because of pricing difficulties or lack of correlation with the underlying investment.

10 | April 30, 2011

| | | | |

ALPS | Red Rocks Listed Private Equity Fund |

| | | Management Commentary | | April 30, 2011 (Unaudited) |

Top Ten Holdings (as a % of Net Assets) †

| | | | | | |

KKR & Co. LP | | | | | 4.79 | % |

Eurazeo | | | | | 4.64 | % |

Onex Corp. | | | | | 4.59 | % |

Blackstone Group LP | | | | | 4.34 | % |

Conversus Capital LP | | | | | 4.17 | % |

3i Group PLC | | | | | 4.10 | % |

Leucadia National Corp. | | | | | 3.96 | % |

SVG Capital PLC | | | | | 3.71 | % |

Investor AB, Class B | | | | | 3.69 | % |

Electra Private Equity PLC | | | | | 3.64 | % |

Top Ten Holdings | | | | | 41.63 | % |

| † | Holdings are subject to change. |

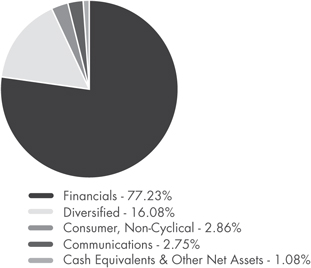

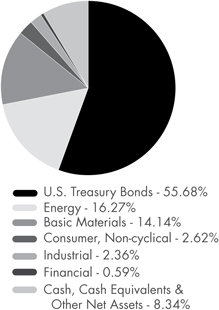

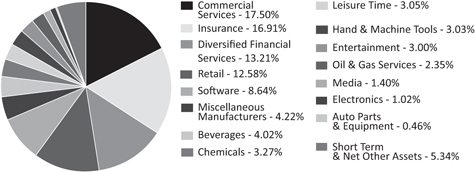

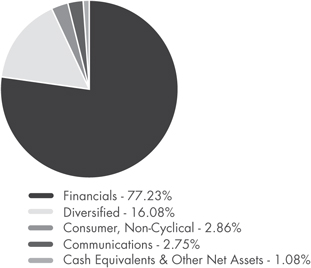

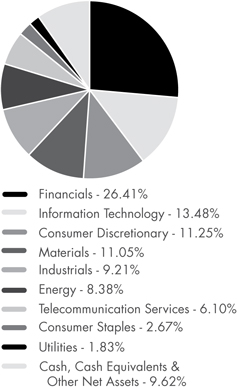

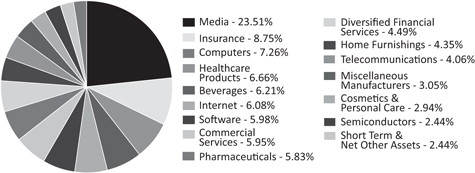

Industry Sector Allocation (as a % of Net Assets)

11 | April 30, 2011

| | | | |

ALPS | Red Rocks Listed Private Equity Fund |

| | | Disclosure of Fund Expenses | | April 30, 2011 (Unaudited) |

As a shareholder of the Fund, you will incur two types of costs: (1) transaction costs, including applicable sales charges (loads) and redemption fees; and (2) ongoing costs, including management fees, distribution and service (12b-1) fees, shareholder service fees and other Fund expenses. The following examples are intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds. The examples are based on an investment of $1,000 invested on November 1, 2010 and held until April 30, 2011.

Actual Expenses. The first line of the table on the next page provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading “Expense Paid During Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes. The second line of the table on the next page provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other mutual funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

The expenses shown in the table are meant to highlight ongoing Fund costs only and do not reflect transaction fees, such as sales charges, redemption fees, or exchange fees. Therefore, the second line of the table on the next page is useful in comparing ongoing costs only, and may not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

| | | | | | | | | | | | | | | | |

| | | Beginning Account Value

11/1/10 | | | Ending Account Value

4/30/11 | | | Expense

Ratio(a) | | | Expense Paid During Period(b)

11/1/10 - 4/30/11 | |

Class A | | | | | | | | | | | | | | | | |

Actual | | | $1,000.00 | | | | $1,241.00 | | | | 1.50% | | | | $8.33 | |

Hypothetical (5% return before expenses) | | | $1,000.00 | | | | $1,017.36 | | | | 1.50% | | | | $7.50 | |

| | | | |

Class C | | | | | | | | | | | | | | | | |

Actual | | | $1,000.00 | | | | $1,237.50 | | | | 2.25% | | | | $12.48 | |

Hypothetical (5% return before expenses) | | | $1,000.00 | | | | $1,013.64 | | | | 2.25% | | | | $11.23 | |

| | | | |

Class I | | | | | | | | | | | | | | | | |

Actual | | | $1,000.00 | | | | $1,243.70 | | | | 1.25% | | | | $6.95 | |

Hypothetical (5% return before expenses) | | | $1,000.00 | | | | $1,018.60 | | | | 1.25% | | | | $6.26 | |

| | | | |

Class R | | | | | | | | | | | | | | | | |

Actual | | | $1,000.00 | | | | $1,240.80 | | | | 1.75% | | | | $9.72 | |

Hypothetical (5% return before expenses) | | | $1,000.00 | | | | $1,016.12 | | | | 1.75% | | | | $8.75 | |

| (a) | The Fund’s expense ratios have been based on the Fund’s most recent fiscal half-year expenses. |

| (b) | Expenses are equal to the Fund’s annualized expense ratio multiplied by the average account value over the period, multiplied by the number of days in the most recent fiscal half year (181), then divided by 365. |

12 | April 30, 2011

| | | | |

ALPS | Red Rocks Listed Private Equity Fund |

| | | Statement of Investments | | April 30, 2011 |

| | | | | | | | |

| | | Shares | | | Value (Note 1) | |

COMMON STOCKS (98.92%) | | | | | |

Communications (2.75%) | | | | | | | | |

Internet (2.75%) | | | | | | | | |

Internet Capital Group, Inc.(a) | | | 199,000 | | | $ | 2,764,110 | |

Safeguard Scientifics, Inc.(a) | | | 131,797 | | | | 2,576,632 | |

| | | | | | | | |

| | | | | | | 5,340,742 | |

| | | | | | | | |

| | |

TOTAL COMMUNICATIONS | | | | | | | 5,340,742 | |

| | | | | | | | |

| | |

Consumer, Non-Cyclical (2.86%) | | | | | | | | |

Food (2.86%) | | | | | | | | |

Orkla ASA | | | 549,000 | | | | 5,561,573 | |

| | | | | | | | |

| | | | | | | | |

TOTAL CONSUMER, NON-CYCLICAL | | | | | | | 5,561,573 | |

| | | | | | | | |

| | |

Diversified (16.08%) | | | | | | | | |

Holding Companies-Diversified Operations (16.08%) | | | | | | | | |

Ackermans & van Haaren N.V. | | | 50,000 | | | | 5,231,430 | |

Aker ASA, Class A | | | 116,000 | | | | 3,537,529 | |

HAL Trust | | | 35,997 | | | | 5,643,609 | |

Leucadia National Corp. | | | 199,000 | | | | 7,693,340 | |

Remgro, Ltd. | | | 115,000 | | | | 1,994,851 | |

Schouw & Co. | | | 46,603 | | | | 1,383,716 | |

Wendel Investissement | | | 46,200 | | | | 5,787,061 | |

| | | | | | | | |

| | | | | | | 31,271,536 | |

| | | | | | | | |

| | |

TOTAL DIVERSIFIED | | | | | | | 31,271,536 | |

| | | | | | | | |

| | |

Financials (77.23%) | | | | | | | | |

Closed-End Funds (25.35%) | | | | | | | | |

AP Alternative Assets LP | | | 405,000 | | | | 5,240,700 | |

ARC Capital Holdings, Ltd.(a) | | | 2,179,000 | | | | 2,407,795 | |

Candover Investments PLC(a) | | | 149,452 | | | | 1,532,140 | |

Castle Private Equity, Ltd.(a) | | | 88,876 | | | | 893,897 | |

Conversus Capital LP(a) | | | 350,000 | | | | 8,116,500 | |

Electra Private Equity PLC(a) | | | 242,000 | | | | 7,069,854 | |

Graphite Enterprise Trust PLC | | | 496,801 | | | | 3,074,510 | |

HBM BioVentures AG, Class A(a) | | | 53,000 | | | | 2,971,676 | |

HgCapital Trust PLC(a) | | | 47,670 | | | | 141,733 | |

HgCapital Trust PLC | | | 200,932 | | | | 3,792,563 | |

Pantheon International Participations PLC(a) | | | 129,000 | | | | 1,486,771 | |

Pantheon International Participations PLC(a) | | | 71,000 | | | | 844,391 | |

Princess Private Equity Holding, Ltd.(a) | | | 458,365 | | | | 4,338,225 | |

Standard Life European Private Equity Trust PLC | | | 60,671 | | | | 160,626 | |

SVG Capital PLC(a) | | | 1,574,724 | | | | 7,217,616 | |

| | | | | | | | |

| | | | | | | 49,288,997 | |

| | | | | | | | |

Diversified Financial Services (21.09%) | | | | | | | | |

Blackstone Group LP | | | 445,075 | | | | 8,429,720 | |

GP Investments, Ltd.(a) | | | 1,141,000 | | | | 4,699,771 | |

Intermediate Capital Group PLC | | | 1,039,080 | | | | 5,727,541 | |

| | | | | | | | |

| | | Shares | | | Value (Note 1) | |

Diversified Financial Services (Continued) | | | | | | | | |

KKR & Co. LP | | | 491,000 | | | $ | 9,309,360 | |

Onex Corp. | | | 238,000 | | | | 8,929,874 | |

Partners Group Holding AG | | | 18,400 | | | | 3,907,607 | |

| | | | | | | | |

| | | | | | | 41,003,873 | |

| | | | | | | | |

Investment Companies (9.36%) | | | | | | | | |

Bure Equity AB(a) | | | 260,000 | | | | 1,475,891 | |

China Merchants China | | | | | | | | |

Direct Investments, Ltd. | | | 515,600 | | | | 1,129,955 | |

Investor AB, Class B | | | 288,000 | | | | 7,173,249 | |

LMS Capital PLC(a) | | | 745,023 | | | | 785,492 | |

Ratos AB, B Shares | | | 146,000 | | | | 6,033,348 | |

THL Credit, Inc. | | | 110,790 | | | | 1,586,513 | |

| | | | | | | | |

| | | | | | | 18,184,448 | |

| | | | | | | | |

Private Equity (18.56%) | | | | | | | | |

3i Group PLC | | | 1,705,000 | | | | 7,977,058 | |

Altamir Amboise(a) | | | 269,011 | | | | 3,307,104 | |

Apollo Global Management LLC, Class A(a) | | | 194,000 | | | | 3,507,520 | |

Deutsche Beteiligungs AG | | | 65,670 | | | | 1,925,892 | |

Dinamia Capital Privado S.C.R., SA | | | 20,761 | | | | 252,152 | |

Eurazeo | | | 108,300 | | | | 9,021,391 | |

GIMV N.V. | | | 76,018 | | | | 5,039,718 | |

IP Group PLC(a) | | | 1,320,000 | | | | 1,143,656 | |

JAFCO Co., Ltd. | | | 82,000 | | | | 2,077,421 | |

Marfin Investment Group SA(a) | | | 1,742,535 | | | | 1,832,481 | |

| | | | | | | | |

| | | | | | | 36,084,393 | |

| | | | | | | | |

Real Estate (2.87%) | | | | | | | | |

Brookfield Asset Management, Inc., Class A | | | 166,000 | | | | 5,580,920 | |

| | | | | | | | |

| | | | | | | _ | |

TOTAL FINANCIALS | | | | | | | 150,142,631 | |

| | | | | | | | |

| | |

TOTAL COMMON STOCKS (Cost $142,087,162) | | | | | | | 192,316,482 | |

| | | | | | | | |

| | | | | | | | |

| | |

| 7-Day Yield | | Shares | | | Value (Note 1) | |

SHORT TERM INVESTMENTS (1.47%) | | | | | | | | |

Money Market Fund (1.47%) | | | | | | | | |

Dreyfus Treasury Prime Cash Management, Investor Shares 0.00004% | | | 2,865,261 | | | | 2,865,261 | |

| | | | | | | | |

| | |

TOTAL SHORT TERM INVESTMENTS (Cost $2,865,261) | | | | | | | 2,865,261 | |

| | | | | | | | |

| | |

TOTAL INVESTMENTS (100.39%) (Cost $144,952,423) | | | | | | $ | 195,181,743 | |

| | |

Liabilities In Excess Of Other Assets (-0.39%) | | | | | | | (762,225 | ) |

| | | | | | | | |

| | |

NET ASSETS (100.00%) | | | | | | $ | 194,419,518 | |

| | | | | | | | |

13 | April 30, 2011

| | | | |

ALPS | Red Rocks Listed Private Equity Fund |

| | | Statement of Investments | | April 30, 2011 |

(a) Non-Income Producing Security.

Common Abbreviations:

| | |

AB - | | Aktiebolag is the Swedish equivalent of the term corporation. |

AG - | | Aktiengesellschaft is a German term that refers to a corporation that is limited by shares, i.e., owned by shareholders. |

ASA - | | Allmennaksjeselskap is the Norwegian term for a public company. |

LLC - | | Limited Liability Company. |

LP - | | Limited Partnership. |

Ltd. - | | Limited. |

N.V. - | | Naamloze Vennootschap is the Dutch term for a public limited liability corporation. |

PLC - | | Public Limited Company. |

SA - | | Generally designates corporations in various countries, mostly those employing the civil law. This translates literally in all languages mentioned as anonymous company. |

SpA - | | Societá per Azioni is an Italian shared company. |

For Fund compliance purposes, the Fund’s industry classifications refer to any one or more of the industry sub-classifications used by one or more widely recognized market indexes or ratings group indexes, and/or as defined by Fund management. This definition may not apply for purposes of this report, which may combine industry sub-classifications for reporting ease. Industries are shown as a percent of net assets. These industry classifications are based on third party definitions and are unaudited. The definitions are industry terms and do not reflect the legal status of any of the investments or the companies in which the Fund has invested.

See Notes to Financial Statements.

14 | April 30, 2011

| | | | |

ALPS | WMC Value Intersection Fund |

| | | Management Commentary | | April 30, 2011 (Unaudited) |

Market Comment

Markets rose in the second half of 2010 and continued their ascent into 2011 as the first part of the new year was characterized by resilient, upbeat equity markets that shrugged off geopolitical uncertainties and the devastating earthquake and tsunami in Japan. Investors embraced news of strong corporate earnings, robust merger-and-acquisition activity, and ample global liquidity to push equities higher.

Within the Russell 1000 Value Index, all ten sectors posted a positive return with nine of ten sectors recording double-digit gains. Energy, Telecommunication Services, and Materials performed the best. Financials was the only sector to post a single-digit return.

Fund Review

The Portfolio outperformed its benchmark for the period, posting positive results in eight out of ten broad market sectors. Overall, stock selection was positive relative to the Russell 1000 Value Index, with the strongest results coming from the Health Care, Energy, and Financials sectors. This was partially offset by negative relative returns in the Materials, Telecommunication Services, and Consumer Discretionary sectors.

Among the top contributors to relative performance were Marathon Oil (Energy), Caterpillar (Industrials), and TRW Automotive (Consumer Discretionary). Large integrated oil and refining company Marathon Oil’s shares gained after the company announced a plan to separate their refining and oil production businesses. Shares of Caterpillar, a US-based construction and mining equipment firm, rallied in reaction to strong revenue results in their machine, engine, and mining businesses. Auto parts supplier TRW’s shares rose as new business wins, successful cost reductions, and higher levels of vehicle production boosted the firm’s results and guidance. Not holding poor performing benchmark component Berkshire Hathaway (Financials) also contributed to relative results. The stock of this conglomerate lagged during a volatile year, which ended with a high-profile key member of the company resigning.

Verizon Communications (Telecommunication Services), which was not held in the Portfolio during the period, detracted the most from relative results as the stock gained on news that the company would offer the iPhone on its network. Other top detractors from relative performance included The Gap (Consumer Discretionary) and Wells Fargo (Financials). Shares of specialty retailer The Gap declined early in the period after the company issued guidance below analysts’ estimates. Although shares recovered later in the period on strong sales numbers, the stock still underperformed. Wells Fargo, a diversified financial services and bank holding company, retreated early in the period on concerns that weak home-buying activity and new financial regulations would weaken revenue within the Banking industry. Shares rallied later in the period after the company announced strong mortgage banking revenue results and anticipated increases in margins driven by both improving credit quality and synergies from the Wachovia merger.

Outlook

Government spending and inventories accounted for roughly two thirds of the US economy’s growth over the past four quarters. Going forward, we believe that private sector demand will contribute more to growth, primarily spurred by an improving job market. We also see fiscal policy providing additional stimulus to the economy next year as evidenced by the recent tax package which was passed by Congress.

We believe labor market should improve more in 2011 than it did in 2010, providing an important boost to wage and salary income across the economy and supporting consumer spending. The pace of layoffs has slowed with unemployment claims edging decidedly lower; the number of job openings has picked up, and even small businesses are planning to add workers. We believe that the pace of job growth will be sufficient to push the unemployment rate down, but gradually. We also expect the jobless rate to fall by year-end as well as in 2012. Additionally, we see a recovering economy with solid corporate profit growth (and lots of cash on the balance sheet) slated to bring accelerating capital spending in 2011. Improving business confidence, an easier credit environment, the recently legislated 100% depreciation allowance for capital goods purchases in 2012, and a likelihood of significant pent up demand should all add to this positive story.

15 | April 30, 2011

| | | | |

ALPS | WMC Value Intersection Fund |

| | | Management Commentary | | April 30, 2011 (Unaudited) |

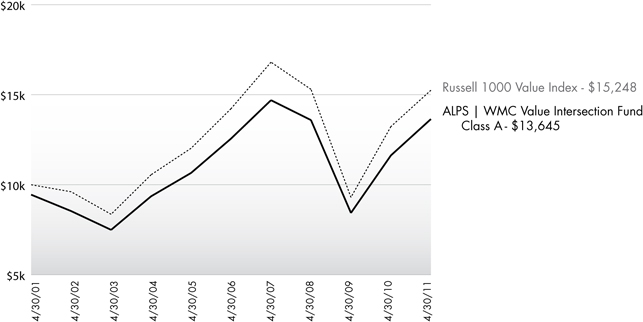

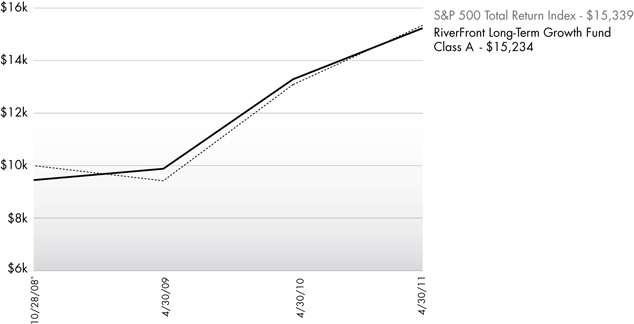

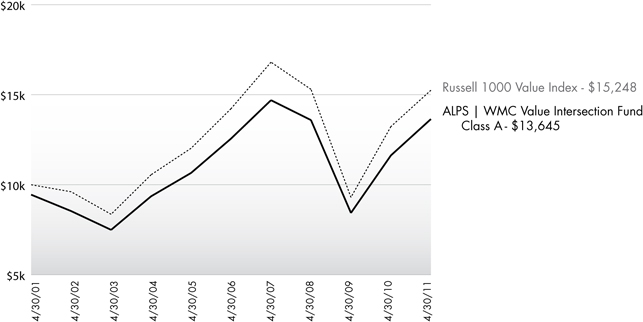

Performance of $10,000 Initial Investment (as of April 30, 2011)

Comparison of change in value of a $10,000 investment (includes applicable sales loads)

Source: Morningstar

The chart above represents historical performance of a hypothetical investment of $10,000 in the Fund since inception. Past performance does not guarantee future results. This chart does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

16 | April 30, 2011

| | | | |

ALPS | WMC Value Intersection Fund |

| | | Management Commentary | | April 30, 2011 (Unaudited) |

Average Annual Total Returns (as of April 30, 2011)

| | | | | | | | | | |

| | | 1 Year | | 5 Year | | 10 Year | | Total

Expense Ratio | | What You Pay^ |

Class A (NAV)1* | | 17.34% | | 1.67% | | 3.75% | | 1.71% | | 1.41% |

Class A (MOP)2* | | 10.92% | | 0.52% | | 3.16% | | |

Class C (NAV)1* | | 16.52% | | 0.92% | | 2.98% | | 2.46% | | 2.16% |

Class C (CDSC)2* | | 15.52% | | 0.92% | | 2.98% | | |

Class I* | | 17.67% | | 1.86% | | 3.91% | | 1.50% | | 1.16% |

Russell 1000 Value Index3 | | 15.24% | | 1.40% | | 4.31% | | | | |

S&P 500 Index4 | | 17.22% | | 2.95% | | 2.82% | | | | |

Performance data quoted represents past performance. Past performance does not guarantee future results. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when sold or redeemed, may be worth more or less than the original cost. Current performance data may be higher or lower than actual data quoted. The Fund imposes a maximum Contingent Deferred Sales Charge (“CDSC”) of 1.00% to shares redeemed within the first 12 months after a purchase in excess of $1 million. Performance data does not reflect the redemption fee or the CDSC, which if reflected would reduce the performance quoted. For the most current month-end performance data, please call (866) 759-5679.

Maximum Offering Price (MOP) for Class A shares includes the Fund’s maximum sales charge of 5.50%. CDSC performance for Class C shares includes a 1% CDSC on C shares redeemed within 12 months of purchase. Performance shown at NAV does not include these sales charges and would have been lower had it been taken into account.

Performance shown for Class C shares prior to June 30, 2010 reflects the historical performance of the Fund’s Class A shares, calculated using the fees and expenses of Class C shares.

The performance shown for the ALPS | WMC Value Intersection Fund (the “Fund”) for periods prior to August 29, 2009, reflects the performance of the Activa Mutual Funds Trust – Activa Value Fund (as result of a prior reorganization of Activa Mutual Funds Trust – Activa Value Fund into the Fund).

| 1 | Net Asset Value (NAV) is the share price without sales charges. |

| 2 | Maximum Offering Price (MOP) includes sales charges. Class A returns include effects of the Fund’s maximum sales charge of 5.50%. |

| 3 | The Russell 1000 Value Index measures the performance of those Russell 1000 companies with lower price-to-book ratios and lower forecasted growth values. You cannot invest directly in the index. |

| 4 | The S&P 500 Index is the Standard & Poor’s composite index of 500 stocks, a widely recognized, unmanaged index of common stock prices. You cannot invest directly in the index. |

| ^ | What You Pay reflects the Adviser’s decision to contractually limit expenses through August 31, 2011. Please see the prospectus for additional information. |

| * | Fund inception date of 8/10/1971. |

The table does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

Mutual funds, annuities and other investments are not insured or guaranteed by the FDIC or by any other government agency or government sponsored agency of the federal government or any state, not deposits, obligations or guaranteed by any bank or its affiliates and are subject to investment risks, including possible loss of the principal amount invested.

There is no guarantee that the Fund will continue to hold any one particular security or stay invested in any one particular company. The composition of the Fund’s top holdings is subject to change. Performance figures are historical and reflect the change in share price, reinvested distributions, changes in net asset value, sales charges and capital gains distributions, if any.

Investing in the Fund is subject to investment risks, including possible loss of the principal amount invested. Derivatives generally are more sensitive to changes in economic or market conditions than other types of investments; this could result in losses that significantly exceed the Fund’s original investment.

17 | April 30, 2011

| | | | |

ALPS | WMC Value Intersection Fund |

| | | Management Commentary | | April 30, 2011 (Unaudited) |

| | |

Top Ten Holdings (as a % of Net Assets) † |

| | | | |

Chevron Corp. | | | 3.85% | |

JPMorgan Chase & Co. | | | 3.26% | |

Wells Fargo & Co. | | | 2.91% | |

Pfizer, Inc. | | | 2.90% | |

AT&T, Inc. | | | 2.39% | |

Bank of America Corp. | | | 2.13% | |

Occidental Petroleum Corp. | | | 2.03% | |

Merck & Co., Inc. | | | 1.96% | |

General Electric Co. | | | 1.79% | |

Marathon Oil Corp. | | | 1.71% | |

Top Ten Holdings | | | 24.93% | |

|

† Holdings are subject to change. | |

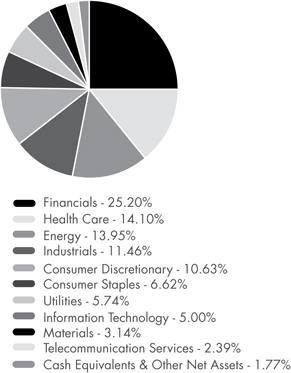

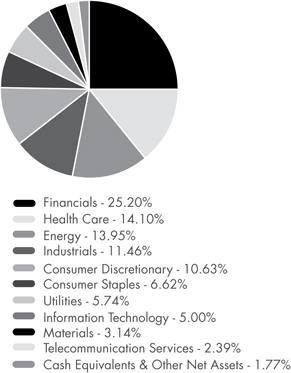

Industry Sector Allocation (as a % of Net Assets)

18 | April 30, 2011

| | | | |

ALPS | WMC Value Intersection Fund |

| | | Disclosure of Fund Expenses | | April 30, 2011 (Unaudited) |

As a shareholder of the Fund, you will incur two types of costs: (1) transaction costs, including applicable sales charges (loads); and (2) ongoing costs, including management fees, distribution and service (12b-1) fees, shareholder service fees and other Fund expenses. The following examples are intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds. The examples are based on an investment of $1,000 invested on November 1, 2010 and held until April 30, 2011.

Actual Expenses. The first line of the table on the next page provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading “Expense Paid During Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes. The second line of the table on the next page provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other mutual funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

The expenses shown in the table are meant to highlight ongoing Fund costs only and do not reflect transaction fees, such as sales charges or exchange fees. Therefore, the second line of the table on the next page is useful in comparing ongoing costs only, and may not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

| | | | | | | | | | | | | | | | |

| | | Beginning Account Value

11/1/10 | | | Ending Account Value

4/30/11 | | | Expense

Ratio(a) | | | Expense Paid During Period(b) 11/1/10 - 4/30/11 | |

Class A | | | | | | | | | | | | | | | | |

Actual | | | $1,000.00 | | | | $1,187.80 | | | | 1.40% | | | | $7.59 | |

Hypothetical (5% return before expenses) | | | $1,000.00 | | | | $1,017.85 | | | | 1.40% | | | | $7.00 | |

| | | | |

Class C | | | | | | | | | | | | | | | | |

Actual | | | $1,000.00 | | | | $1,182.60 | | | | 2.15% | | | | $11.64 | |

Hypothetical (5% return before expenses) | | | $1,000.00 | | | | $1,014.13 | | | | 2.15% | | | | $10.74 | |

| | | | |

Class I | | | | | | | | | | | | | | | | |

Actual | | | $1,000.00 | | | | $1,189.40 | | | | 1.15% | | | | $6.24 | |

Hypothetical (5% return before expenses) | | | $1,000.00 | | | | $1,019.09 | | | | 1.15% | | | | $5.76 | |

| (a) | The Fund’s expense ratios have been based on the Fund’s most recent fiscal half-year expenses. |

| (b) | Expenses are equal to the Fund’s annualized expense ratio multiplied by the average account value over the period, multiplied by the number of days in the most recent fiscal half year (181), then divided by 365. |

19 | April 30, 2011

| | | | |

ALPS | WMC Value Intersection Fund |

| | | Statement of Investments | | April 30, 2011 |

| | | | | | | | |

| | | Shares | | | Value (Note 1) | |

COMMON STOCKS (98.23%) | |

Consumer Discretionary (10.63%) | |

Automobiles & Components (2.70%) | | | | | | | | |

Ford Motor Co. (a) | | | 55,200 | | | $ | 853,944 | |

General Motors Co. (a) | | | 14,800 | | | | 474,932 | |

TRW Automotive Holdings Corp. (a) | | | 13,700 | | | | 781,722 | |

| | | | | | | | |

| | | | | | | 2,110,598 | |

| | | | | | | | |

| | |

Consumer Durables & Apparel (0.65%) | | | | | | | | |

Whirlpool Corp. | | | 5,900 | | | | 508,462 | |

| | | | | | | | |

| | |

Consumer Services (0.64%) | | | | | | | | |

Carnival Corp. | | | 13,100 | | | | 498,717 | |

| | | | | | | | |

| | |

Media (3.57%) | | | | | | | | |

CBS Corp., Class B | | | 31,800 | | | | 801,996 | |

News Corp., Class A | | | 41,500 | | | | 739,530 | |

Time Warner Cable, Inc. | | | 16,039 | | | | 1,253,127 | |

| | | | | | | | |

| | | | | | | 2,794,653 | |

| | | | | | | | |

| | |

Retailing (3.07%) | | | | | | | | |

Abercrombie & Fitch Co., Class A | | | 9,900 | | | | 700,920 | |

Guess? Inc | | | 9,000 | | | | 386,910 | |

Kohl’s Corp. | | | 15,690 | | | | 827,020 | |

Lowe’s Cos., Inc. | | | 18,400 | | | | 483,000 | |

| | | | | | | | |

| | | | | | | 2,397,850 | |

| | | | | | | | |

| |

TOTAL CONSUMER DISCRETIONARY | | | | 8,310,280 | |

| | | | | | | | |

| |

Consumer Staples (6.62%) | | | | | |

Food & Staples Retailing (0.62%) | | | | | | | | |

Wal-Mart Stores, Inc. | | | 8,760 | | | | 481,625 | |

| | | | | | | | |

| | |

Food Beverage & Tobacco (4.89%) | | | | | | | | |

Altria Group, Inc. | | | 34,600 | | | | 928,664 | |

Constellation Brands, Inc., Class A (a) | | | 22,600 | | | | 506,014 | |

Dr Pepper Snapple Group, Inc. | | | 14,800 | | | | 580,160 | |

Lorillard, Inc. | | | 7,700 | | | | 820,050 | |

Philip Morris International, Inc. | | | 14,225 | | | | 987,784 | |

| | | | | | | | |

| | | | | | | 3,822,672 | |

| | | | | | | | |

| | |

Household & Personal Products (1.11%) | | | | | | | | |

Kimberly-Clark Corp. | | | 13,200 | | | | 871,992 | |

| | | | | | | | |

| |

TOTAL CONSUMER STAPLES | | | | 5,176,289 | |

| | | | | | | | |

| | | | | | | | |

| | | Shares | | | Value (Note 1) | |

Energy (13.95%) | | | | | |

Energy (13.95%) | | | | | | | | |

Anadarko Petroleum Corp. | | | 13,200 | | | $ | 1,042,008 | |

Apache Corp. | | | 1,600 | | | | 213,392 | |

Baker Hughes, Inc. | | | 12,000 | | | | 928,920 | |

Chesapeake Energy Corp. | | | 21,500 | | | | 723,905 | |

Chevron Corp. | | | 27,519 | | | | 3,011,679 | |

Exxon Mobil Corp. | | | 12,564 | | | | 1,105,632 | |

Hess Corp. | | | 11,100 | | | | 954,156 | |

Marathon Oil Corp. | | | 24,700 | | | | 1,334,788 | |

Occidental Petroleum Corp. | | | 13,900 | | | | 1,588,631 | |

| | | | | | | | |

| | |

TOTAL ENERGY | | | | | | | 10,903,111 | |

| | | | | | | | |

| | |

Financials (25.20%) | | | | | | | | |

Banks (5.99%) | | | | | | | | |

BB&T Corp. | | | 27,610 | | | | 743,261 | |

PNC Financial Services Group, Inc. | | | 13,400 | | | | 835,356 | |

US Bancorp | | | 32,000 | | | | 826,240 | |

Wells Fargo & Co. | | | 78,200 | | | | 2,276,402 | |

| | | | | | | | |

| | | | | | | 4,681,259 | |

| | | | | | | | |

| | |

Diversified Financials (11.45%) | | | | | | | | |

Ameriprise Financial, Inc. | | | 20,400 | | | | 1,266,024 | |

Bank of America Corp. | | | 135,312 | | | | 1,661,631 | |

BlackRock, Inc. | | | 1,900 | | | | 372,286 | |

The Goldman Sachs Group, Inc. | | | 7,700 | | | | 1,162,777 | |

Invesco Ltd. | | | 28,200 | | | | 701,334 | |

JPMorgan Chase & Co. | | | 55,900 | | | | 2,550,717 | |

The NASDAQ OMX Group, Inc. (a) | | | 12,300 | | | | 333,330 | |

NYSE Euronext | | | 9,880 | | | | 395,694 | |

SLM Corp. (a) | | | 30,500 | | | | 505,995 | |

| | | | | | | | |

| | | | | | | 8,949,788 | |

| | | | | | | | |

| | |

Insurance (6.56%) | | | | | | | | |

ACE, Ltd. | | | 15,300 | | | | 1,028,925 | |

Allied World Assurance Co. Holdings, Ltd. | | | 8,900 | | | | 578,233 | |

Everest Re Group, Ltd. | | | 4,900 | | | | 446,488 | |

Genworth Financial, Inc., Class A (a) | | | 35,750 | | | | 435,793 | |

Hartford Financial Services Group, Inc. | | | 29,900 | | | | 866,203 | |

MetLife, Inc. | | | 14,000 | | | | 655,060 | |

Prudential Financial, Inc. | | | 11,400 | | | | 722,988 | |

Unum Group | | | 14,800 | | | | 391,904 | |

| | | | | | | | |

| | | | | | | 5,125,594 | |

| | | | | | | | |

20 | April 30, 2011

| | | | |

ALPS | WMC Value Intersection Fund |

| | | Statement of Investments | | April 30, 2011 |

| | | | | | | | |

| | | Shares | | | Value (Note 1) | |

Real Estate (1.20%) | | | | | | | | |

Forest City Enterprises, Inc., Class A (a) | | | 49,100 | | | $ | 943,211 | |

| | | | | | | | |

| |

TOTAL FINANCIALS | | | | 19,699,852 | |

| | | | | | | | |

| |

Health Care (14.10%) | | | | | |

Health Care Equipment & Services (3.87%) | | | | | | | | |

Aetna, Inc. | | | 17,400 | | | | 720,012 | |

McKesson Corp. | | | 7,700 | | | | 639,177 | |

UnitedHealth Group, Inc. | | | 23,500 | | | | 1,156,905 | |

WellPoint, Inc. | | | 6,610 | | | | 507,582 | |

| | | | | | | | |

| | | | | | | 3,023,676 | |

| | | | | | | | |

Pharmaceuticals, Biotechnology & Life Sciences (10.23%) | | | | | | | | |

Agilent Technologies, Inc. (a) | | | 16,900 | | | | 843,479 | |

Amgen, Inc. (a) | | | 17,950 | | | | 1,020,458 | |

Forest Laboratories,

Inc. (a) | | | 11,228 | | | | 372,320 | |

Gilead Sciences, Inc. (a) | | | 8,700 | | | | 337,908 | |

Merck & Co., Inc. | | | 42,720 | | | | 1,535,784 | |

Pfizer, Inc. | | | 108,123 | | | | 2,266,258 | |

Thermo Fisher Scientific, Inc. (a) | | | 15,110 | | | | 906,449 | |

Watson Pharmaceuticals,

Inc. (a) | | | 11,500 | | | | 713,230 | |

| | | | | | | | |

| | | | | | | 7,995,886 | |

| | | | | | | | |

| |

TOTAL HEALTH CARE | | | | 11,019,562 | |

| | | | | | | | |

| |

Industrials (11.46%) | | | | | |

Capital Goods (10.93%) | | | | | | | | |

3M Co. | | | 4,400 | | | | 427,724 | |

The Boeing Co. | | | 4,900 | | | | 390,922 | |

Caterpillar, Inc. | | | 8,700 | | | | 1,004,067 | |

Dover Corp. | | | 15,000 | | | | 1,020,600 | |

General Dynamics Corp. | | | 10,400 | | | | 757,328 | |

General Electric Co. | | | 68,600 | | | | 1,402,870 | |

Joy Global, Inc. | | | 6,100 | | | | 615,795 | |

Northrop Grumman Corp. | | | 10,400 | | | | 661,544 | |

Parker Hannifin Corp. | | | 9,800 | | | | 924,336 | |

The Timken Co. | | | 9,100 | | | | 513,149 | |

United Technologies Corp. | | | 9,200 | | | | 824,136 | |

| | | | | | | | |

| | | | | | | 8,542,471 | |

| | | | | | | | |

| | |

Transportation (0.53%) | | | | | | | | |

Delta Air Lines, Inc. (a) | | | 39,800 | | | | 413,124 | |

| | | | | | | | |

| |

TOTAL INDUSTRIALS | | | | 8,955,595 | |

| | | | | | | | |

| | | | | | | | |

| | | Shares | | | Value (Note 1) | |

Information Technology (5.00%) | | | | | |

Semiconductors & Semiconductor Equipment (0.72%) | | | | | | | | |

Xilinx, Inc. | | | 16,100 | | | $ | 561,246 | |

| | | | | | | | |

| | |

Software & Services (4.28%) | | | | | | | | |

Accenture PLC, Class A | | | 21,700 | | | | 1,239,721 | |

eBay, Inc. (a) | | | 28,800 | | | | 990,720 | |

Teradata Corp. (a) | | | 10,200 | | | | 570,384 | |

The Western Union Co. | | | 25,600 | | | | 544,000 | |

| | | | | | | | |

| | | | | | | 3,344,825 | |

| | | | | | | | |

| |

TOTAL INFORMATION TECHNOLOGY | | | | 3,906,071 | |

| | | | | | | | |

| |

Materials (3.14%) | | | | | |

Materials (3.14%) | | | | | | | | |

CF Industries Holdings, Inc. | | | 3,160 | | | | 447,298 | |

The Dow Chemical Co. | | | 21,000 | | | | 860,790 | |

Freeport-McMoRan Copper & Gold, Inc. | | | 7,200 | | | | 396,216 | |

Newmont Mining Corp. | | | 5,000 | | | | 293,050 | |

Valspar Corp. | | | 11,700 | | | | 459,927 | |

| | | | | | | | |

| |

TOTAL MATERIALS | | | | 2,457,281 | |

| | | | | | | | |

| | |

Telecommunication Services (2.39%) | | | | | | | | |

Telecommunication Services (2.39%) | | | | | | | | |

AT&T, Inc. | | | 59,945 | | | | 1,865,488 | |

| | | | | | | | |

| |

TOTAL TELECOMMUNICATION SERVICES | | | | 1,865,488 | |

| | | | | | | | |

| | |

Utilities (5.74%) | | | | | | | | |

Utilities (5.74%) | | | | | | | | |

CenterPoint Energy, Inc. | | | 26,200 | | | | 487,320 | |

NextEra Energy, Inc. | | | 14,300 | | | | 808,951 | |

Northeast Utilities | | | 21,600 | | | | 768,960 | |

PG&E Corp. | | | 17,300 | | | | 797,184 | |

UGI Corp. | | | 25,400 | | | | 845,820 | |

Xcel Energy, Inc. | | | 32,000 | | | | 778,560 | |

| | | | | | | | |

| |

TOTAL UTILITIES | | | | 4,486,795 | |

| | | | | | | | |

| |

TOTAL COMMON STOCKS (Cost $60,239,254) | | | | 76,780,324 | |

| | | | | | | | |

| |

EXCHANGE TRADED FUNDS (1.19%) | | | | | |

iShares Russell 1000 Value Index Fund | | | 13,170 | | | | 927,827 | |

| | | | | | | | |

| |

TOTAL EXCHANGE TRADED FUNDS (Cost $847,862) | | | | 927,827 | |

| | | | | | | | |

21 | April 30, 2011

| | | | |

ALPS | WMC Value Intersection Fund |

| | | Statement of Investments | | April 30, 2011 |

| | | | | | | | |

| 7-Day Yield | | Shares | | | Value (Note 1) | |

SHORT TERM INVESTMENTS (0.62%) | | | | | |

Money Market Fund (0.62%) | | | | | |

Fidelity Institutional Money Market - Money Market Portfolio - Class I 0.187% | | | 488,304 | | | $ | 488,304 | |

| | | | | | | | |

| |

TOTAL SHORT TERM INVESTMENTS (Cost $488,304) | | | | 488,304 | |

| | | | | | | | |

| |

TOTAL INVESTMENTS (100.04%) (Cost $61,575,420) | | | $ | 78,196,455 | |

| |

Liabilities In Excess Of Other Assets (-0.04%) | | | | (32,443 | ) |

| | | | | | | | |

| |

NET ASSETS (100.00%) | | | $ | 78,164,012 | |

| | | | | | | | |

| (a) | Non-Income Producing Security. |

Common Abbreviations:

Ltd. - Limited.

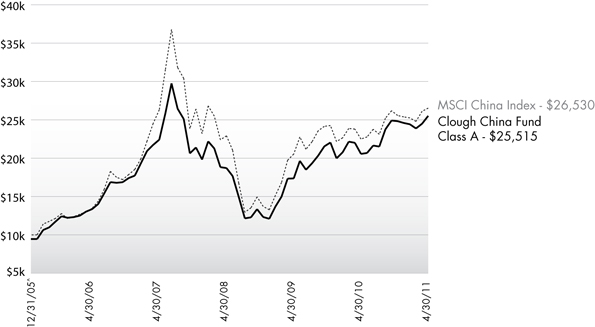

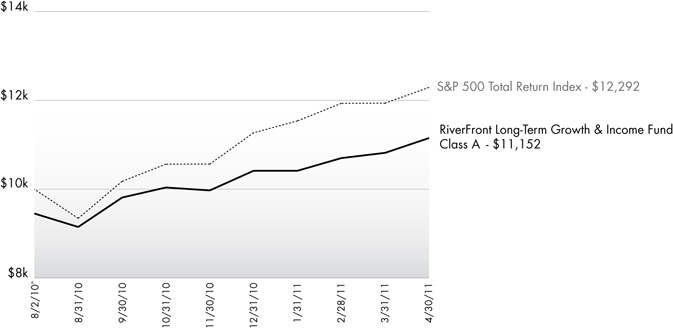

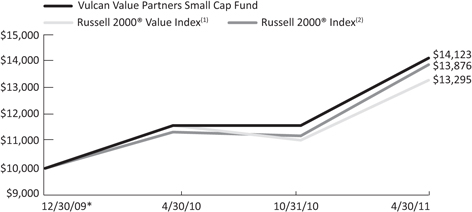

PLC - Public Limited Company.