UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-8194

FINANCIAL INVESTORS TRUST

(Exact name of registrant as specified in charter)

1290 Broadway, Suite 1100, Denver, Colorado 80203

(Address of principal executive offices) (Zip code)

David T. Buhler, Secretary

Financial Investors Trust

1290 Broadway, Suite 1100

Denver, Colorado 80203

(Name and address of agent for service)

Registrant’s telephone number, including area code: 303-623-2577

Date of fiscal year end: April 30

Date of reporting period: May 1, 2012 - April 30, 2013

| Item 1. | Reports to Stockholders. |

| | |

| Disclosure of Fund Expenses | | |

| | April 30, 2013 (Unaudited) |

As a shareholder of the Funds, you will incur two types of costs: (1) transaction costs, including applicable sales charges (loads) and redemption fees; and (2) ongoing costs, including management fees, distribution and service (12b-1) fees, shareholder service fees and other Fund expenses. The following examples are intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds. The examples are based on an investment of $1,000 invested on November 1, 2012 and held until April 30, 2013.

Actual Expenses. The first line of the table on the next page provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading “Expense Paid During Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes. The second line of the table on the next page provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other mutual funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

The expenses shown in the table are meant to highlight ongoing Fund costs only and do not reflect transaction fees, such as sales charges, redemption fees, or exchange fees. Therefore, the second line of the table on the next page is useful in comparing ongoing costs only, and may not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

| | |

| Disclosure of Fund Expenses | | |

| | April 30, 2013 (Unaudited) |

| | | | | | | | |

| | | Beginning Account Value

November 1, 2012 | | Ending Account Value

April 30, 2013 | | Expense Ratio(a) | | Expense Paid During Period November 1, 2012 -

April 30, 2013(b) |

ALPS | Alerian MLP Infrastructure Index Fund |

Class A | | | | | | | | |

Actual(c) | | $ 1,000.00 | | $ 1,126.80 | | 1.25% | | $ 4.37 |

Hypothetical (5% return before expenses) | | $ 1,000.00 | | $ 1,018.60 | | 1.25% | | $ 6.26 |

Class C | | | | | | | | |

Actual(c) | | $ 1,000.00 | | $ 1,125.80 | | 1.85% | | $ 6.46 |

Hypothetical (5% return before expenses) | | $ 1,000.00 | | $ 1,015.62 | | 1.85% | | $ 9.25 |

Class I | | | | | | | | |

Actual(c) | | $ 1,000.00 | | $ 1,127.80 | | 0.85% | | $ 2.97 |

Hypothetical (5% return before expenses) | | $ 1,000.00 | | $ 1,020.58 | | 0.85% | | $ 4.26 |

ALPS | CoreCommodity Management CompleteCommoditiesSM Strategy Fund(d) |

Class A | | | | | | | | |

Actual | | $ 1,000.00 | | $ 971.00 | | 1.36% | | $ 6.65 |

Hypothetical (5% return before expenses) | | $ 1,000.00 | | $ 1,018.05 | | 1.36% | | $ 6.81 |

Class C | | | | | | | | |

Actual | | $ 1,000.00 | | $ 968.00 | | 2.05% | | $ 10.00 |

Hypothetical (5% return before expenses) | | $ 1,000.00 | | $ 1,014.63 | | 2.05% | | $ 10.24 |

Class I | | | | | | | | |

Actual | | $ 1,000.00 | | $ 972.70 | | 1.15% | | $ 5.62 |

Hypothetical (5% return before expenses) | | $ 1,000.00 | | $ 1,019.09 | | 1.15% | | $ 5.76 |

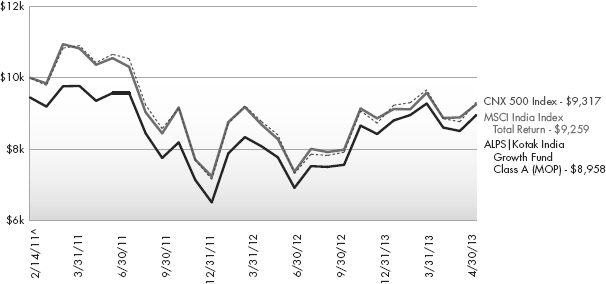

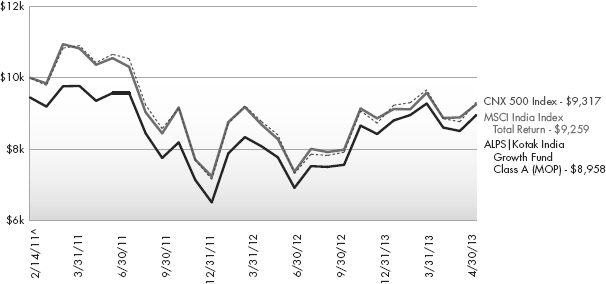

ALPS | Kotak India Growth Fund(e) |

Class A | | | | | | | | |

Actual | | $ 1,000.00 | | $ 1,062.80 | | 2.00% | | $ 10.23 |

Hypothetical (5% return before expenses) | | $ 1,000.00 | | $ 1,014.88 | | 2.00% | | $ 9.99 |

Class C | | | | | | | | |

Actual | | $ 1,000.00 | | $ 1,061.40 | | 2.60% | | $ 13.29 |

Hypothetical (5% return before expenses) | | $ 1,000.00 | | $ 1,011.90 | | 2.60% | | $ 12.97 |

Class I | | | | | | | | |

Actual | | $ 1,000.00 | | $ 1,065.80 | | 1.60% | | $ 8.20 |

Hypothetical (5% return before expenses) | | $ 1,000.00 | | $ 1,016.86 | | 1.60% | | $ 8.00 |

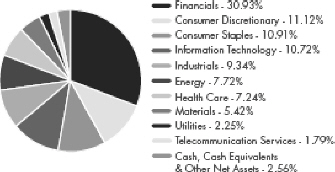

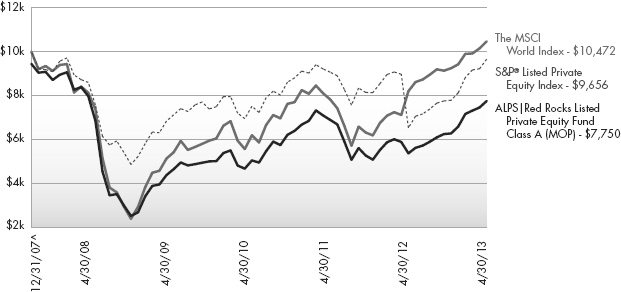

ALPS | Red Rocks Listed Private Equity Fund |

Class A | | | | | | | | |

Actual | | $ 1,000.00 | | $ 1,240.40 | | 1.48% | | $ 8.22 |

Hypothetical (5% return before expenses) | | $ 1,000.00 | | $ 1,017.46 | | 1.48% | | $ 7.40 |

Class C | | | | | | | | |

Actual | | $ 1,000.00 | | $ 1,235.50 | | 2.25% | | $ 12.47 |

Hypothetical (5% return before expenses) | | $ 1,000.00 | | $ 1,013.64 | | 2.25% | | $ 11.23 |

Class I | | | | | | | | |

Actual | | $ 1,000.00 | | $ 1,243.00 | | 1.25% | | $ 6.95 |

Hypothetical (5% return before expenses) | | $ 1,000.00 | | $ 1,018.60 | | 1.25% | | $ 6.26 |

Class R | | | | | | | | |

Actual | | $ 1,000.00 | | $ 1,245.80 | | 1.75% | | $ 9.74 |

Hypothetical (5% return before expenses) | | $ 1,000.00 | | $ 1,016.12 | | 1.75% | | $ 8.75 |

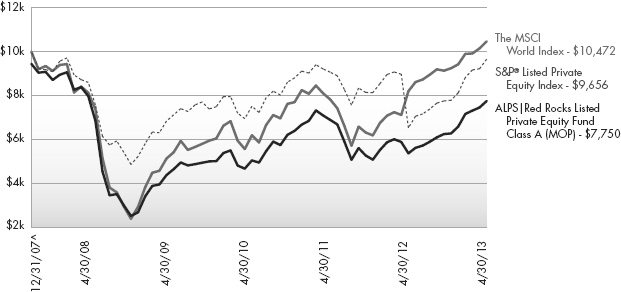

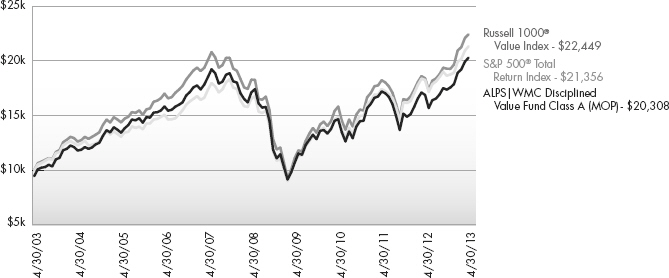

ALPS | WMC Disciplined Value Fund |

Class A | | | | | | | | |

Actual | | $ 1,000.00 | | $ 1,168.40 | | 1.40% | | $ 7.53 |

Hypothetical (5% return before expenses) | | $ 1,000.00 | | $ 1,017.85 | | 1.40% | | $ 7.00 |

Class C | | | | | | | | |

Actual | | $ 1,000.00 | | $ 1,161.70 | | 2.15% | | $ 11.52 |

Hypothetical (5% return before expenses) | | $ 1,000.00 | | $ 1,014.13 | | 2.15% | | $ 10.74 |

Class I | | | | | | | | |

Actual | | $ 1,000.00 | | $ 1,168.50 | | 1.15% | | $ 6.18 |

Hypothetical (5% return before expenses) | | $ 1,000.00 | | $ 1,019.09 | | 1.15% | | $ 5.76 |

| | |

| Disclosure of Fund Expenses | | |

| | April 30, 2013 (Unaudited) |

| | | | | | | | |

| | | Beginning Account Value

November 1, 2012 | | Ending Account Value April 30, 2013 | | Expense Ratio(a) | | Expense Paid

During Period

November 1, 2012 -

April 30, 2013(b) |

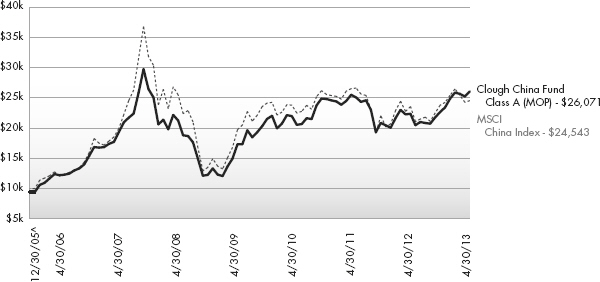

Clough China Fund |

Class A | | | | | | | | |

Actual | | $ 1,000.00 | | $ 1,150.40 | | 1.94% | | $ 10.34 |

Hypothetical (5% return before expenses) | | $ 1,000.00 | | $ 1,015.17 | | 1.94% | | $ 9.69 |

Class C | | | | | | | | |

Actual | | $ 1,000.00 | | $ 1,146.10 | | 2.70% | | $ 14.37 |

Hypothetical (5% return before expenses) | | $ 1,000.00 | | $ 1,011.41 | | 2.70% | | $ 13.47 |

Class I | | | | | | | | |

Actual | | $ 1,000.00 | | $ 1,152.90 | | 1.71% | | $ 9.13 |

Hypothetical (5% return before expenses) | | $ 1,000.00 | | $ 1,016.31 | | 1.71% | | $ 8.55 |

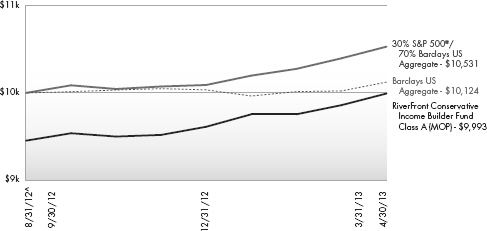

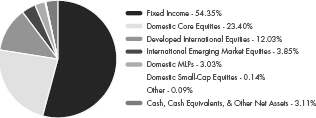

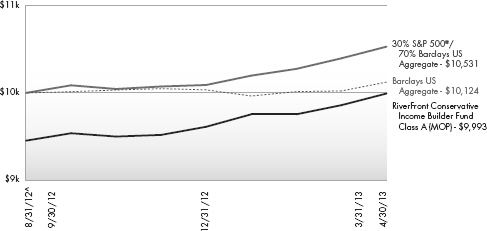

RiverFront Conservative Income Builder Fund |

Class A | | | | | | | | |

Actual(f) | | $ 1,000.00 | | $ 1,052.00 | | 1.15% | | $ 5.85 |

Hypothetical (5% return before expenses) | | $ 1,000.00 | | $ 1,019.09 | | 1.15% | | $ 5.76 |

Class C | | | | | | | | |

Actual(f) | | $ 1,000.00 | | $ 1,048.70 | | 1.90% | | $ 9.65 |

Hypothetical (5% return before expenses) | | $ 1,000.00 | | $ 1,015.37 | | 1.90% | | $ 9.49 |

Class I | | | | | | | | |

Actual(f) | | $ 1,000.00 | | $ 1,053.20 | | 0.90% | | $ 4.58 |

Hypothetical (5% return before expenses) | | $ 1,000.00 | | $ 1,020.33 | | 0.90% | | $ 4.51 |

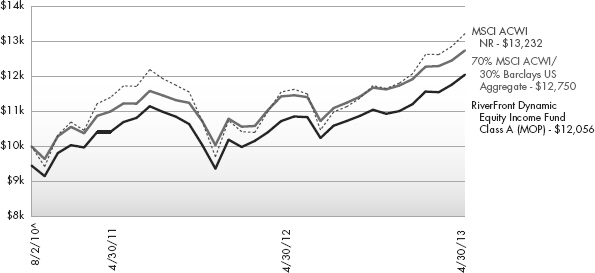

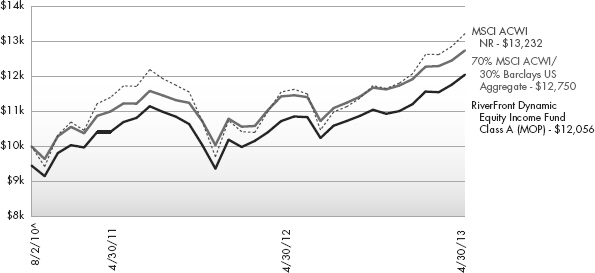

RiverFront Dynamic Equity Income Fund |

Class A | | | | | | | | |

Actual | | $ 1,000.00 | | $ 1,102.50 | | 1.15% | | $ 6.00 |

Hypothetical (5% return before expenses) | | $ 1,000.00 | | $ 1,019.09 | | 1.15% | | $ 5.76 |

Class C | | | | | | | | |

Actual | | $ 1,000.00 | | $ 1,097.60 | | 1.90% | | $ 9.88 |

Hypothetical (5% return before expenses) | | $ 1,000.00 | | $ 1,015.37 | | 1.90% | | $ 9.49 |

Class I | | | | | | | | |

Actual | | $ 1,000.00 | | $ 1,103.80 | | 0.90% | | $ 4.69 |

Hypothetical (5% return before expenses) | | $ 1,000.00 | | $ 1,020.33 | | 0.90% | | $ 4.51 |

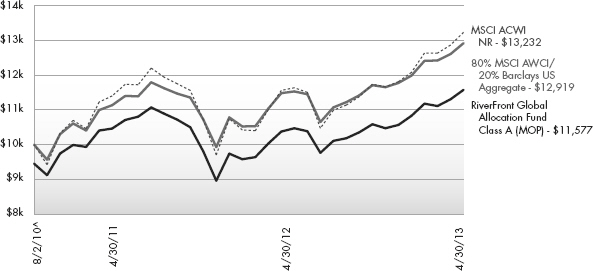

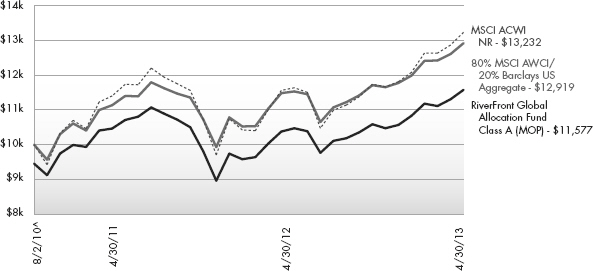

RiverFront Global Allocation Fund |

Class A | | | | | | | | |

Actual | | $ 1,000.00 | | $ 1,105.50 | | 1.15% | | $ 6.00 |

Hypothetical (5% return before expenses) | | $ 1,000.00 | | $ 1,019.09 | | 1.15% | | $ 5.76 |

Class C | | | | | | | | |

Actual | | $ 1,000.00 | | $ 1,101.80 | | 1.90% | | $ 9.90 |

Hypothetical (5% return before expenses) | | $ 1,000.00 | | $ 1,015.37 | | 1.90% | | $ 9.49 |

Class I | | | | | | | | |

Actual | | $ 1,000.00 | | $ 1,107.90 | | 0.90% | | $ 4.70 |

Hypothetical (5% return before expenses) | | $ 1,000.00 | | $ 1,020.33 | | 0.90% | | $ 4.51 |

| | |

| Disclosure of Fund Expenses | | |

| | April 30, 2013 (Unaudited) |

| | | | | | | | |

| | | Beginning Account Value November 1, 2012 | | Ending Account Value April 30, 2013 | | Expense Ratio(a) | | Expense Paid

During Period

November 1, 2012 - April 30, 2013(b) |

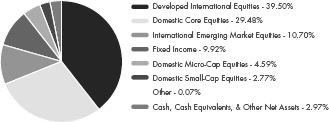

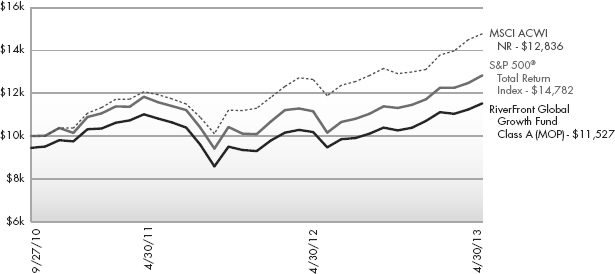

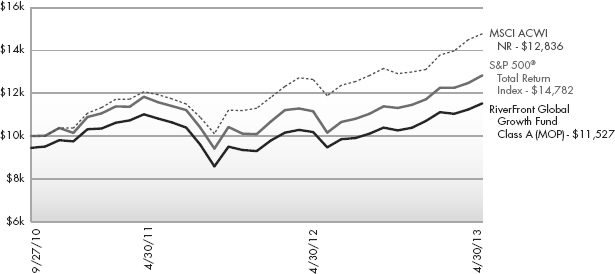

RiverFront Global Growth Fund |

Class A | | | | | | | | |

Actual | | $ 1,000.00 | | $ 1,122.20 | | 1.03% | | $ 5.42 |

Hypothetical (5% return before expenses) | | $ 1,000.00 | | $ 1,019.69 | | 1.03% | | $ 5.16 |

Class C | | | | | | | | |

Actual | | $ 1,000.00 | | $ 1,117.30 | | 1.81% | | $ 9.50 |

Hypothetical (5% return before expenses) | | $ 1,000.00 | | $ 1,015.82 | | 1.81% | | $ 9.05 |

Class I | | | | | | | | |

Actual | | $ 1,000.00 | | $ 1,122.70 | | 0.80% | | $ 4.21 |

Hypothetical (5% return before expenses) | | $ 1,000.00 | | $ 1,020.83 | | 0.80% | | $ 4.01 |

Class L | | | | | | | | |

Actual | | $ 1,000.00 | | $ 1,123.40 | | 0.81% | | $ 4.26 |

Hypothetical (5% return before expenses) | | $ 1,000.00 | | $ 1,020.78 | | 0.81% | | $ 4.06 |

Investor Class | | | | | | | | |

Actual | | $ 1,000.00 | | $ 1,121.40 | | 1.06% | | $ 5.58 |

Hypothetical (5% return before expenses) | | $ 1,000.00 | | $ 1,019.54 | | 1.06% | | $ 5.31 |

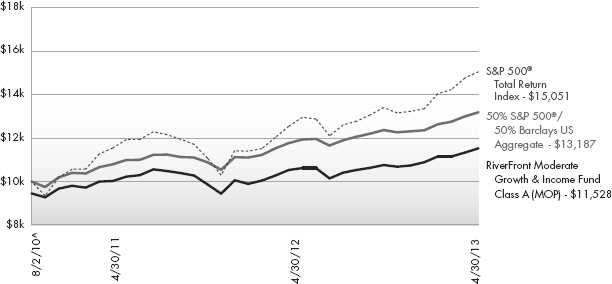

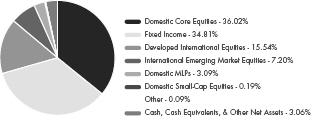

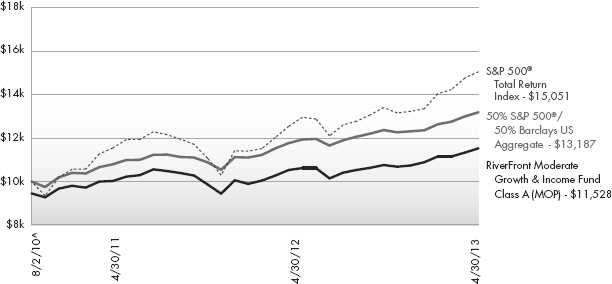

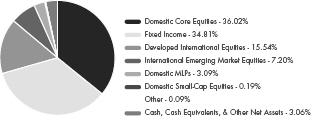

RiverFront Moderate Growth & Income Fund |

Class A | | | | | | | | |

Actual | | $ 1,000.00 | | $ 1,079.40 | | 1.15% | | $ 5.93 |

Hypothetical (5% return before expenses) | | $ 1,000.00 | | $ 1,019.09 | | 1.15% | | $ 5.76 |

Class C | | | | | | | | |

Actual | | $ 1,000.00 | | $ 1,075.00 | | 1.90% | | $ 9.78 |

Hypothetical (5% return before expenses) | | $ 1,000.00 | | $ 1,015.37 | | 1.90% | | $ 9.49 |

Class I | | | | | | | | |

Actual | | $ 1,000.00 | | $ 1,080.00 | | 0.90% | | $ 4.64 |

Hypothetical (5% return before expenses) | | $ 1,000.00 | | $ 1,020.33 | | 0.90% | | $ 4.51 |

| (a) | Annualized, based on the Fund’s most recent fiscal half year expenses. |

| (b) | Expenses are equal to the Fund’s annualized expense ratio multiplied by the average account value over the period, multiplied by the number of days in the most recent fiscal half year (181), divided by 365. |

| (c) | The Fund commenced operations on January 2, 2013. For purposes of calculating the “Actual” figures on page 2, actual number of days from commencement of operations through April 30, 2013 were used (120 days). |

| (d) | Includes expenses of the Jefferies Asset Management Cayman Trust (wholly-owned subsidiary), exclusive of the subsidiary’s management fee. |

| (e) | Includes expenses of the Kotak Mauritius Portfolio (wholly-owned subsidiary), exclusive of subsidiary’s management fee. |

| (f) | The Fund commenced operations on September 4, 2012. |

| | |

| ALPS | Alerian MLP Infrastructure Index Fund |

| Management Commentary | | April 30, 2013 (Unaudited) |

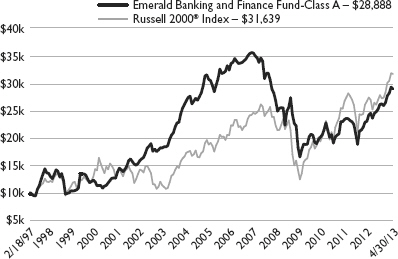

Performance

Since the Fund’s inception on December 31, 2012, the Alerian MLP Infrastructure Index Fund, the Fund’s Class A Shares delivered a net return of 12.68% at Net Asset Value (Class A delivered a net return of 6.50% at MOP, Class C was 11.58% with CDSC, and Class I was 12.78%). Master limited partnerships benefited from strong gains in early 2013 as uncertainty surrounding the fiscal cliff and tax changes during the latter part of 2012 ended.

Distribution growth1 for the asset class continues to remain strong. The weighted average distribution growth2 on a year-over-year basis for the first quarter of 2013 was 8.54%.

The International Energy Agency (IEA) notes that the global energy map is being redrawn by the resurgence in oil and gas production in the United States. The United States is one of the leading producers of natural gas and within this decade, it may overtake Saudi Arabia as the world’s largest oil producer. This surge in production has boosted the economy with investment capital inflows, the creation of thousands of jobs, and more importantly, the need for adequate energy infrastructure to move, store, and process such production.

Because of new supply and shifting demand areas, the US is in the process of being re-piped. In 2013 alone, industry analysts expect MLPs will invest $30 billion in infrastructure growth projects to address takeaway constraints. Such projects include converting existing natural gas pipelines to transport crude oil from Canada or the Bakken Shale in North Dakota, as well as building ethane or natural gas liquid (NGL) pipelines from the Marcellus Shale in the Northeast to major NGL hubs such as Mont Belvieu, Texas. They also include investments in response to new energy trends, such as expanding rail terminal facilities because more crude oil is being transported by railroad, or building out liquefied petroleum gas (LPG) export facilities because there is increased demand to ship cost-advantaged feedstock such as propane, butane, and isobutene to overseas customers.

Mergers and Acquisitions and Initial Public Offering activity thrived in 2012 and in early 2013 as the MLP structure has historically been an optimal way for corporations and private firms to monetize assets while simultaneously providing investors access to stable cash flow and distributions, in our view. During 2013, several companies with major infrastructure assets have announced intentions to form MLPs, many of which may come to market late 2013 or early 2014.

Significant changes in the North American production profile have created vast opportunities for MLPs to participate in the energy infrastructure build-out of North America. These opportunities, along with cash flow underpinned with toll-road business models and long-term contracts have made MLPs a compelling opportunity for investors seeking after-tax yield.

The views and information discussed in this commentary are as of the date of publication, are subject to change, and may not reflect the writer’s current views. The views expressed represent an assessment of market conditions at a specific point in time, are opinions only and should not be relied upon as investment advice regarding a particular investment or markets in general. Such information does not constitute a recommendation to buy or sell specific securities or investment vehicles. It should not be assumed that any investment will be profitable or will equal the performance of the fund(s) or any securities or any sectors mentioned herein. The subject matter contained herein has been derived from several sources believed to be reliable and accurate at the time of compilation. Alerian does not accept any liability for losses either direct or consequential caused by the use of this information.

| 1 | Distribution growth is the amount by which a partnership increases its quarterly or annual distributions; the MLP terminology for distributions is similar to C corporation terminology for dividends. |

| 2 | Weighted average distribution growth is calculated by multiplying the weight of each constituent in the AMZI (Alerian MLP Infrastructure Index- the index is not actively managed and does not reflect any deductions for fees, expenses or taxes; an investor may not invest directly in an index) at March 31, 2013 by the constituent’s year-over-year distribution growth percentage. |

| | |

| ALPS | Alerian MLP Infrastructure Index Fund |

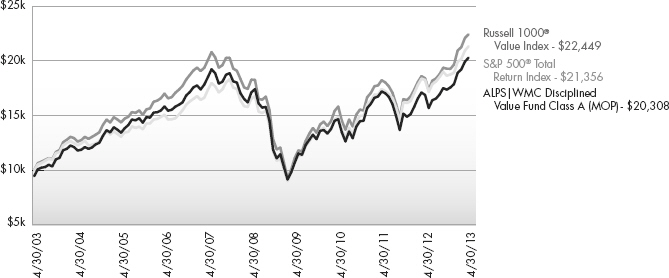

| Performance Update | | April 30, 2013 (Unaudited) |

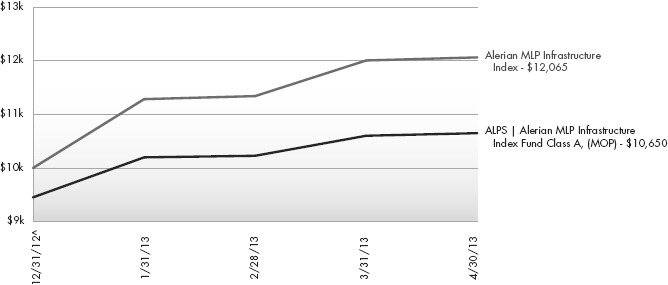

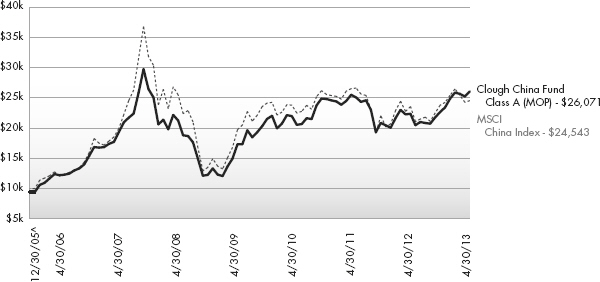

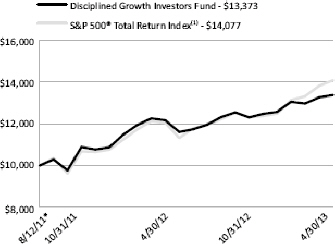

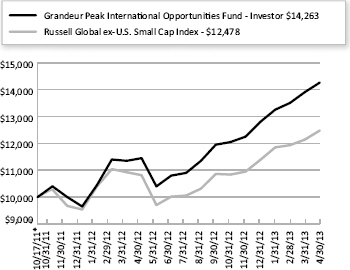

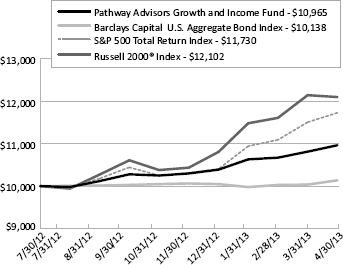

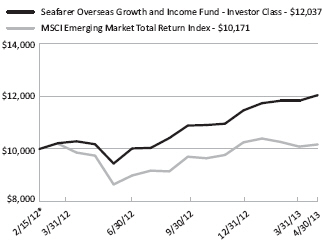

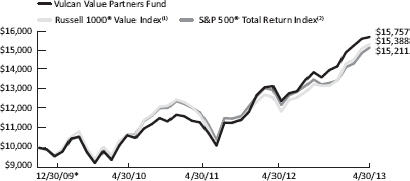

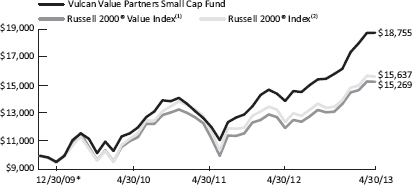

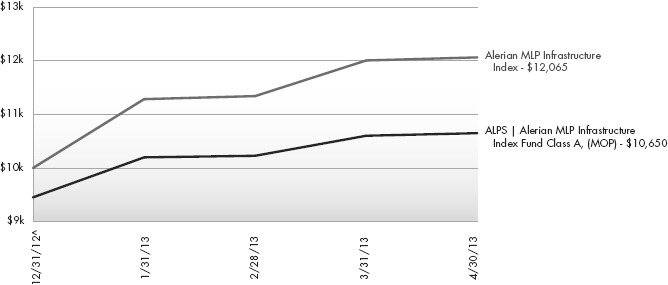

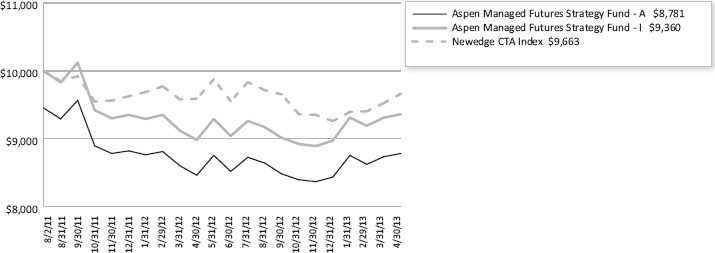

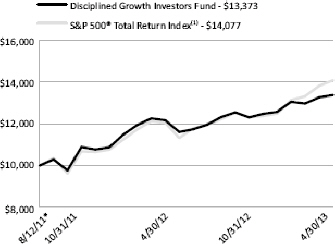

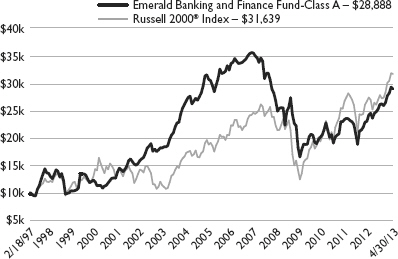

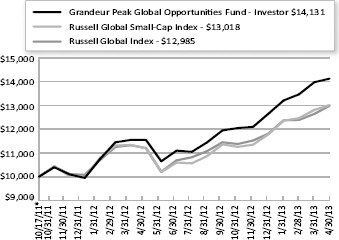

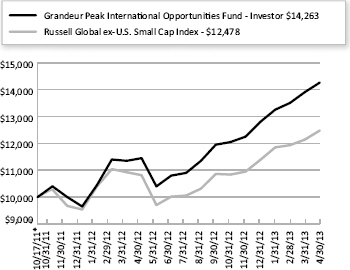

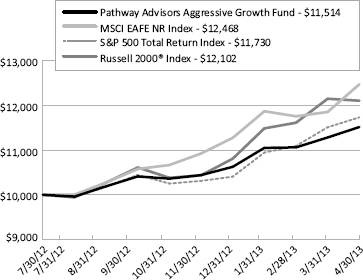

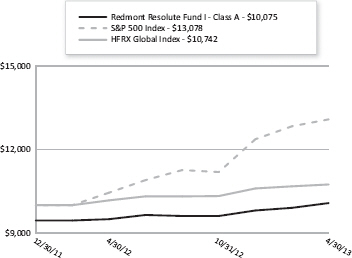

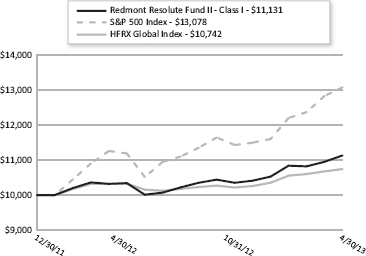

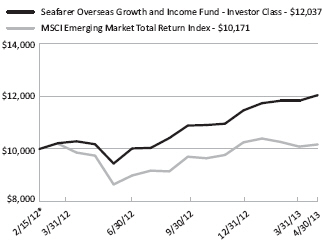

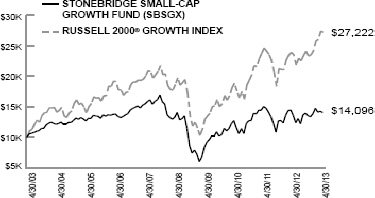

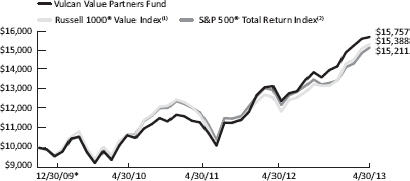

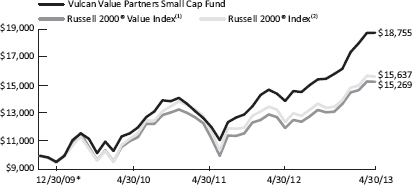

Performance of $10,000 Initial Investment (as of April 30, 2013)

Comparison of change in value of a $10,000 investment (includes maximum sales charges of 5.50%)

The chart above represents historical performance of a hypothetical investment of $10,000 in the Fund since inception. Past performance does not guarantee future results. This chart does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

Average Annual Total Returns (as of April 30, 2013)

| | | | | | | | |

| | | 3 Month | | Since Inception ^ | | Total Expense Ratio * | | What You Pay ** |

Class A (NAV)1 | | 4.43% | | 12.68% | | 1.49% | | 1.25% |

Class A (MOP)2 | | -1.33% | | 6.50% | | |

Class C (NAV)1 | | 4.34% | | 12.58% | | 2.09% | | 1.85% |

Class C (CDSC)2 | | 3.34% | | 11.58% | | |

Class I | | 4.43% | | 12.78% | | 1.09% | | 0.85% |

Alerian MLP Infrastructure Index3 | | 6.91% | | 20.65% | | | | |

Performance data quoted represents past performance. Past performance does not guarantee future results. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when sold or redeemed, may be worth more or less than the original cost. Current performance data may be higher or lower than actual data quoted. The Fund imposes a 2.00% redemption fee on shares held for less than 30 days. The Fund imposes a maximum Contingent Deferred Sales Charge (“CDSC”) of 1.00% to shares redeemed within the first 12 months after a purchase, and on Class A shares redeemed within the first 12 months after a purchase in excess of $1 million. Performance shown does not reflect the redemption fee or the CDSC, which if reflected would reduce the performance quoted. For the most current month-end performance data please call 1-866-759-5679.

Investments in securities of MLPs involve risks that differ from an investment in common stock. MLPs are controlled by their general partners, which generally have conflicts of interest and limited fiduciary duties to the MLP, which may permit the general partner to favor its own interests over the MLPs. The benefit you are expected to derive from the Fund’s investment in MLPs depends largely on the MLPs being treated as partnerships for federal income tax purposes. As a partnership, an MLP has no federal income tax liability at the entity level. Therefore, treatment of one or more MLPs as a corporation for federal income tax purposes could affect the Fund’s ability to meet its investment objective and would reduce the amount of cash available to pay or distribute to you. Legislative, judicial, or administrative changes and differing interpretations, possibly on a retroactive basis, could negatively impact the value of an investment in MLPs and therefore the value of your investment in the Fund.

| | |

| ALPS | Alerian MLP Infrastructure Index Fund |

| Performance Update | | April 30, 2013 (Unaudited) |

| 1 | Net Asset Value (NAV) is the share price without sales charges. |

| 2 | Maximum Offering Price (MOP) includes sales charges. Class A returns include effects of the Fund’s maximum sales charge of 5.50%; Class C returns include the 1.00% CDSC. |

| 3 | Alerian MLP Infrastructure Index is comprised of 25 midstream energy Master Limited Partnerships. The index is not actively managed and does not reflect any deductions for fees, expenses or taxes. An investor may not invest directly in an index. |

| ^ | Fund inception date of December 31, 2012. The Fund commenced operations on January 2, 2013. |

| * | Excludes current and deferred income tax expense. |

| ** | What You Pay reflects the Advisor’s and Sub-Advisor’s decision to contractually limit expenses through August 31, 2013. Please see the prospectus for additional information. |

The table does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

This Fund is not suitable for all investors and is subject to investment risks, including possible loss of the principal amount invested.

There is no guarantee that the Fund will continue to hold any one particular security or stay invested in any one particular company. The composition of the Fund’s top holdings is subject to change. Performance figures are historical and reflect the change in share price, reinvested distributions, changes in net asset value, sales charges and capital gains distributions, if any.

Mutual funds are not insured or guaranteed by the FDIC or by any other government agency or government sponsored agency of the federal government or any state, not deposits, obligations or guaranteed by any bank or its affiliates and are subject to investment risks, including possible loss of the principal amount invested.

Top Ten Long Holdings (as a % of Net Assets) †

| | | | | |

Enterprise Products Partners LP | | | | 10.08% | |

Kinder Morgan Energy Partners LP | | | | 9.94% | |

Magellan Midstream Partners LP | | | | 7.48% | |

Energy Transfer Partners LP | | | | 7.47% | |

Plains All American Pipeline LP | | | | 7.47% | |

MarkWest Energy Partners LP | | | | 6.48% | |

Enbridge Energy Partners LP | | | | 4.92% | |

Williams Partners LP | | | | 4.92% | |

Buckeye Partners LP | | | | 4.86% | |

ONEOK Partners LP | | | | 4.80% | |

Top Ten Holdings | | | | 68.42% | |

| † | Holdings are subject to change. Table presents indicative values only. |

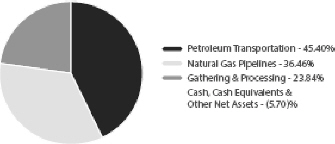

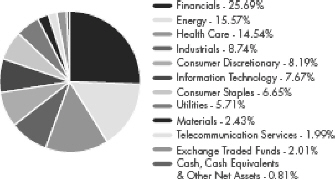

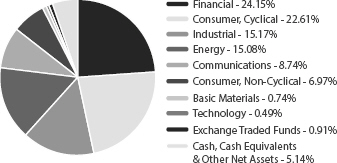

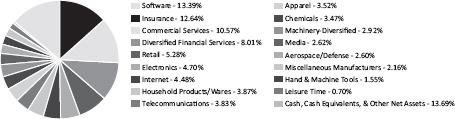

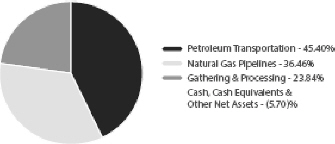

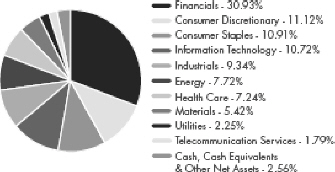

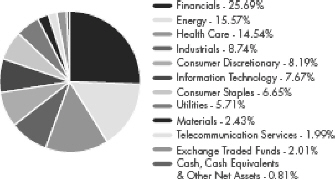

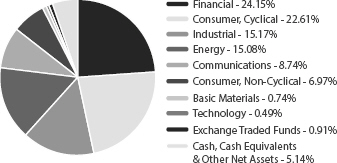

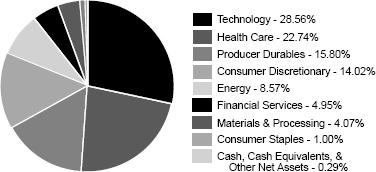

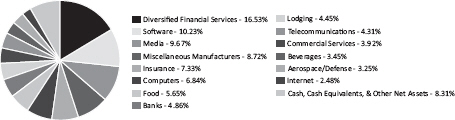

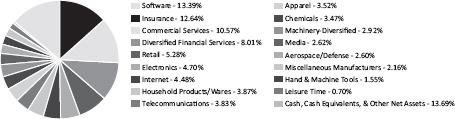

Industry Sector Allocation (as a % of Net Assets)

| | |

| ALPS | Alerian MLP Infrastructure Index Fund | | |

Statement of Investments | | April 30, 2013 |

| | | | | | | | |

| | | Shares | | | Value (Note 2) | |

| |

MASTER LIMITED PARTNERSHIPS (105.70%) | |

Gathering & Processing (23.84%) | |

Pipelines (23.84%) | | | | | | | | |

Copano Energy LLC | | | 2,339 | | | $ | 94,004 | |

DCP Midstream Partners LP | | | 1,674 | | | | 82,227 | |

MarkWest Energy Partners LP | | | 3,839 | | | | 242,625 | |

PVR Partners LP | | | 2,884 | | | | 72,100 | |

Targa Resources Partners LP | | | 2,638 | | | | 119,765 | |

Western Gas Partners LP | | | 1,625 | | | | 98,248 | |

Williams Partners LP | | | 3,372 | | | | 184,280 | |

| | | | | | | | |

| | | | | | | 893,249 | |

| | | | | | | | |

| |

TOTAL GATHERING & PROCESSING | | | | 893,249 | |

| | | | | | | | |

|

Natural Gas Pipelines (36.46%) | |

Pipelines (36.46%) | | | | | | | | |

Atlas Pipeline Partners LP | | | 1,758 | | | | 63,886 | |

Boardwalk Pipeline Partners LP | | | 3,126 | | | | 94,499 | |

El Paso Pipeline Partners LP | | | 3,735 | | | | 160,007 | |

Energy Transfer Partners LP | | | 5,621 | | | | 279,869 | |

Enterprise Products Partners LP | | | 6,224 | | | | 377,486 | |

ONEOK Partners LP | | | 3,327 | | | | 179,991 | |

Regency Energy Partners LP | | | 4,329 | | | | 112,987 | |

Spectra Energy Partners LP | | | 1,216 | | | | 46,135 | |

TC Pipelines LP | | | 1,084 | | | | 50,948 | |

| | | | | | | | |

| | | | | | | 1,365,808 | |

| | | | | | | | |

| |

TOTAL NATURAL GAS PIPELINES | | | | 1,365,808 | |

| | | | | | | | |

| |

Petroleum Transportation (45.40%) | | | | | |

Pipelines (45.40%) | | | | | | | | |

Access Midstream Partners LP | | | 1,896 | | | | 78,248 | |

Buckeye Partners LP | | | 2,945 | | | | 181,942 | |

Enbridge Energy Partners LP | | | 6,191 | | | | 184,492 | |

Genesis Energy LP | | | 2,010 | | | | 96,621 | |

Kinder Morgan Energy Partners LP | | | 4,208 | | | | 372,198 | |

Magellan Midstream Partners LP | | | 5,282 | | | | 280,104 | |

NuStar Energy LP | | | 1,943 | | | | 97,305 | |

Plains All American Pipeline LP | | | 4,872 | | | | 279,750 | |

Sunoco Logistics Partners LP | | | 2,092 | | | | 129,934 | |

| | | | | | | | |

| | | | | | | 1,700,594 | |

| | | | | | | | |

| |

TOTAL PETROLEUM TRANSPORTATION | | | | 1,700,594 | |

| | | | | | | | |

| |

TOTAL MASTER LIMITED PARTNERSHIPS

(Cost $3,325,728) | | | | 3,959,651 | |

| | | | | | | | |

| | | | | | | | | | | | |

| | | 7-Day

Yield | | | Shares | | | Value (Note 2) | |

| |

SHORT TERM INVESTMENTS (0.41%) | |

Money Market Fund (0.41%) | |

Dreyfus Treasury Prime Cash Management Fund, Institutional Shares | | | 0.00004 | % | | | 15,384 | | | $ | 15,384 | |

| | | | | | | | | | | | |

| |

TOTAL SHORT TERM INVESTMENTS (Cost $15,384) | | | | 15,384 | |

| | | | | | | | | | | | |

| |

TOTAL INVESTMENTS (106.11%) (Cost $3,341,112) | | | $ | 3,975,035 | |

| |

Liabilities In Excess Of Other

Assets (-6.11%) | | | | (228,965) | |

| | | | | | | | | | | | |

| |

NET ASSETS (100.00%) | | | $ | 3,746,070 | |

| | | | | | | | | | | | |

Common Abbreviations:

LLC - Limited Liability Company.

LP - Limited Partnerships.

For Fund compliance purposes, the Fund’s industry classifications refer to any one or more of the industry sub-classifications used by one or more widely recognized market indexes or ratings group indexes, and/or as defined by Fund management. This definition may not apply for purposes of this report, which may combine industry sub-classifications for reporting ease. Industries are shown as a percent of net assets.

See Notes to Financial Statements.

| | |

| ALPS | Alerian MLP Infrastructure Index Fund | | |

| Statement of Assets and Liabilities | | April 30, 2013 |

| | | | |

ASSETS | | | | |

Investments, at value | | $ | 3,975,035 | |

Receivable for shares sold | | | 2,500 | |

Dividends receivable | | | 19,026 | |

Prepaid offering costs | | | 46,017 | |

Prepaid expenses and other assets | | | 3,182 | |

| |

Total Assets | | | 4,045,760 | |

| |

LIABILITIES | | | | |

Payable for investments purchased | | | 31,546 | |

Deferred tax liability | | | 225,947 | |

Investment advisory fees payable | | | 16,736 | |

Administration and transfer agency fees payable | | | 926 | |

Distribution and services fees payable | | | 973 | |

Trustees’ fees and expenses payable | | | 49 | |

Legal fees payable | | | 128 | |

Audit and tax fees payable | | | 18,000 | |

Accrued expenses and other liabilities | | | 5,385 | |

| |

Total Liabilities | | | 299,690 | |

| |

NET ASSETS | | $ | 3,746,070 | |

| |

NET ASSETS CONSIST OF | | | | |

Paid-in capital | | $ | 3,351,285 | |

Accumulated net investment loss, net of deferred income taxes | | | (7,626 | ) |

Accumulated net realized loss on investments, net of deferred income taxes | | | (764 | ) |

Net unrealized appreciation on investments, net of deferred income taxes | | | 403,175 | |

| |

NET ASSETS | | $ | 3,746,070 | |

| |

INVESTMENTS, AT COST | | $ | 3,341,112 | |

| |

| |

PRICING OF SHARES | | | | |

Class A: | | | | |

Net Asset Value, offering and redemption price per share(a) | | $ | 11.10 | |

Net Assets | | $ | 927,816 | |

Shares of beneficial interest outstanding (unlimited number of shares, no par value common stock authorized) | | | 83,576 | |

Maximum offering price per share ((NAV/0.9450), based on maximum sales charge of 5.50% of the offering price) | | $ | 11.75 | |

Class C: | | | | |

Net Asset Value, offering and redemption price per share(a) | | $ | 11.09 | |

Net Assets | | $ | 562,725 | |

Shares of beneficial interest outstanding (unlimited number of shares, no par value common stock authorized) | | | 50,758 | |

Class I: | | | | |

Net Asset Value, offering and redemption price per share | | $ | 11.11 | |

Net Assets | | $ | 2,255,529 | |

Shares of beneficial interest outstanding (unlimited number of shares, no par value common stock authorized) | | | 203,031 | |

| (a) | Redemption price per share may be reduced for any applicable contingent deferred sales charge. For a description of a possible sales charge, please see the Fund’s Prospectus. |

See Notes to Financial Statements.

| | |

| ALPS | Alerian MLP Infrastructure Index Fund | | |

| Statement of Operations For the Period January 2, 2013 (Commencement) to April 30, 2013 |

| | | | |

INVESTMENT INCOME | | | | |

Distributions from master limited partnerships | | $ | 69,393 | |

Less return of capital distributions | | | (69,393) | |

| |

Total Investment Income | | | – | |

| |

| |

EXPENSES | | | | |

Investment advisory fees | | | 7,698 | |

Administrative and transfer agency fees | | | 1,876 | |

Distribution and service fees | | | | |

Class A | | | 892 | |

Class C | | | 1,753 | |

Legal fees | | | 147 | |

Audit and tax fees | | | 18,000 | |

Reports to shareholders and printing fees | | | 274 | |

State registration fees | | | 218 | |

SEC registration fees | | | 609 | |

Custody fees | | | 4,102 | |

Trustees’ fees and expenses | | | 94 | |

Offering costs | | | 25,068 | |

State registration fees | | | 1,737 | |

NASDAQ fees | | | 1,500 | |

Miscellaneous expenses | | | 2,762 | |

| |

Total Expense | | | 66,730 | |

Less fees waived/reimbursed by investment advisor (Note 7) | | | | |

Class A | | | (9,499) | |

Class C | | | (9,045) | |

Class I | | | (36,196) | |

| |

Net Expenses | | | 11,990 | |

| |

Net Investment Loss, Before Deferred Income Taxes | | | (11,990) | |

Deferred income tax benefit | | | 4,364 | |

| |

Net Investment Loss, Net of Deferred Income Taxes | | | (7,626) | |

| |

| |

REALIZED AND UNREALIZED GAIN/(LOSS) | | | | |

Net realized loss on investments, before deferred income taxes | | | (1,201) | |

Deferred income tax benefit | | | 437 | |

| |

Net Realized Loss on investments, Net of Deferred Income Taxes | | | (764) | |

| |

| |

Net change in unrealized appreciation on investment, before deferred income taxes | | | 633,923 | |

Deferred income tax expense | | | (230,748) | |

| |

Net Change in Unrealized Appreciation on Investments | | | 403,175 | |

| |

NET REALIZED AND UNREALIZED GAIN ON INVESTMENTS, NET OF DEFERRED INCOME TAXES | | | 402,411 | |

| |

NET INCREASE IN NET ASSETS RESULTING FROM OPERATIONS | | $ | 394,785 | |

| |

See Notes to Financial Statements.

| | |

| ALPS | Alerian MLP Infrastructure Index Fund | | |

| Statement of Changes in Net Assets | | |

| | | | |

| | | For the Period

January 2, 2013

(Commencement) to April 30, 2013 | |

| |

OPERATIONS | | | | |

Net investment loss, net of deferred income taxes | | $ | (7,626) | |

Net realized loss on investments, net of deferred income taxes | | | (764) | |

Net change in unrealized appreciation on investments, net of deferred income taxes | | | 403,175 | |

| |

Net Increase in Net Assets Resulting from Operations | | | 394,785 | |

| |

| |

DISTRIBUTIONS | | | | |

Dividends to shareholders from tax return of capital | | | | |

Class A | | | (8,653) | |

Class C | | | (8,137) | |

Class I | | | (32,548) | |

| |

Net Decrease in Net Assets from Distributions | | | (49,338) | |

| |

| |

BENEFICIAL INTEREST TRANSACTIONS (NOTE 6) | | | | |

Shares sold | | | | |

Class A | | | 851,295 | |

Class C | | | 500,010 | |

Class I | | | 2,000,010 | |

Dividends reinvested | | | | |

Class A | | | 8,653 | |

Class C | | | 8,137 | |

Class I | | | 32,548 | |

Shares redeemed | | | | |

Class A | | | (10) | |

Class C | | | (10) | |

Class I | | | (10) | |

| |

Net Increase in Net Assets Derived from Beneficial Interest Transactions | | | 3,400,623 | |

| |

| |

Net increase in net assets | | | 3,746,070 | |

| |

NET ASSETS | | | | |

Beginning of period | | | – | |

| |

End of year * | | $ | 3,746,070 | |

| |

| *Including accumulated net investment loss, net of deferred income taxes of: | | $ | (7,626) | |

See Notes to Financial Statements.

| | |

| ALPS | Alerian MLP Infrastructure Index Fund – Class A |

Financial Highlights Selected data for a share of beneficial interest outstanding throughout the period indicated: |

| | |

| | | For the Period

January 2, 2013

(Commencement) to April 30, 2013 |

|

Net asset value, beginning of period | | $10.00 |

| |

INCOME/(LOSS) FROM INVESTMENT OPERATIONS: | | |

Net investment loss(a) | | (0.03) |

Net realized and unrealized gain | | 1.29 |

|

Total from investment operations | | 1.26 |

|

| |

DISTRIBUTIONS: | | |

From tax return of capital | | (0.16) |

|

Total distributions | | (0.16) |

|

| |

Net increase in net asset value | | 1.10 |

|

Net asset value, end of year | | $11.10 |

|

TOTAL RETURN(b) | | 12.68% |

| |

RATIOS/SUPPLEMENTAL DATA: | | |

Net assets, end of year (000s) | | $928 |

| |

Ratio of expenses to average net assets before waivers and income tax expense | | 5.51%(c)(g) |

Ratio of expense waivers to average net assets | | (4.26%)(c)(g) |

|

Ratio of expenses to average net assets net of waivers and before income tax expense | | 1.25%(c)(g) |

Ratio of deferred income tax expense to average net assets(d) | | 20.55%(c) |

|

Ratio of total expenses to average net assets | | 21.80%(c) |

|

| |

Ratio of investment loss to average net assets before waivers and income tax expense | | (5.51%)(c)(g) |

Ratio of expense waivers to average net assets | | (4.26%)(c)(g) |

|

Ratio of investment loss to average net assets net of waivers and before income tax expense | | (1.25%)(c)(g) |

Ratio of deferred income tax benefit to average net assets(e) | | 0.40%(c) |

|

Ratio of net investment loss to average net assets | | (0.85%)(c) |

|

| |

Portfolio turnover rate(f) | | 3% |

|

| (a) | Calculated using the average shares method. |

| (b) | Total returns are for the period indicated and have not been annualized. Total returns would have been lower had certain expenses not been waived during the period. Returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Returns shown exclude any applicable sales charges. |

| (d) | Deferred income tax expense estimate for the ratio calculation is derived from the net investment loss, and realized and unrealized gains/losses. |

| (e) | Deferred income tax benefit for the ratio calculation is derived from net investment loss only. |

| (f) | Portfolio turnover rate for periods less than one full year have not been annualized. |

| (g) | Expense ratios before reductions for startup periods may not be representative of longer term operating periods. |

See Notes to Financial Statements.

| | |

| ALPS | Alerian MLP Infrastructure Index Fund – Class C |

| Financial Highlights | | |

| Selected data for a share of beneficial interest outstanding throughout the period indicated: |

| | |

| | | For the Period

January 2, 2013

(Commencement) to April 30, 2013 |

|

Net asset value, beginning of period | | $10.00 |

| |

INCOME/(LOSS) FROM INVESTMENT OPERATIONS: | | |

Net investment loss(a) | | (0.05) |

Net realized and unrealized gain | | 1.30 |

|

Total from investment operations | | 1.25 |

|

| |

DISTRIBUTIONS: | | |

From tax return of capital | | (0.16) |

|

Total distributions | | (0.16) |

|

| |

Net increase in net asset value | | 1.09 |

|

Net asset value, end of year | | $11.09 |

|

TOTAL RETURN(b) | | 12.58% |

| |

RATIOS/SUPPLEMENTAL DATA: | | |

Net assets, end of year (000s) | | $563 |

| |

Ratio of expenses to average net assets before waivers and income tax expense | | 7.01%(c)(g) |

Ratio of expense waivers to average net assets | | (5.16%)(c)(g) |

|

Ratio of expenses to average net assets net of waivers and before income tax expense | | 1.85%(c)(g) |

Ratio of deferred income tax expense to average net assets(d) | | 20.55%(c) |

|

Ratio of total expenses to average net assets | | 22.40%(c) |

|

| |

Ratio of investment loss to average net assets before waivers and income tax expense | | (7.01%)(c)(g) |

Ratio of expense waivers to average net assets | | (5.16%)(c)(g) |

|

Ratio of investment loss to average net assets net of waivers and before income tax expense | | (1.85%)(c)(g) |

Ratio of deferred income tax benefit to average net assets(e) | | 0.40%(c) |

|

Ratio of net investment loss to average net assets | | (1.45%)(c) |

|

| |

Portfolio turnover rate(f) | | 3% |

|

| (a) | Calculated using the average shares method. |

| (b) | Total returns are for the period indicated and have not been annualized. Total returns would have been lower had certain expenses not been waived during the period. Returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Returns shown exclude any applicable sales charges. |

| (d) | Deferred income tax expense estimate for the ratio calculation is derived from the net investment loss, and realized and unrealized gains/losses. |

| (e) | Deferred income tax benefit for the ratio calculation is derived from net investment loss only. |

| (f) | Portfolio turnover rate for periods less than one full year have not been annualized. |

| (g) | Expense ratios before reductions for startup periods may not be representative of longer term operating periods. |

See Notes to Financial Statements.

| | |

| ALPS | Alerian MLP Infrastructure Index Fund – Class I |

| Financial Highlights | | |

Selected data for a share of beneficial interest outstanding throughout the period indicated:

| | |

| | | For the Period January 2, 2013 (Commencement) to April 30, 2013 |

|

Net asset value, beginning of period | | $10.00 |

| |

INCOME/(LOSS) FROM INVESTMENT OPERATIONS: | | |

Net investment loss(a) | | (0.02) |

Net realized and unrealized gain | | 1.29 |

|

Total from investment operations | | 1.27 |

|

| |

DISTRIBUTIONS: | | |

From tax return of capital | | (0.16) |

|

Total distributions | | (0.16) |

|

| |

Net increase in net asset value | | 1.11 |

|

Net asset value, end of year | | $11.11 |

|

TOTAL RETURN(b) | | 12.78% |

| |

RATIOS/SUPPLEMENTAL DATA: | | |

Net assets, end of year (000s) | | $2,256 |

| |

Ratio of expenses to average net assets before waivers and income tax expense | | 6.01%(c)(g) |

Ratio of expense waivers to average net assets | | (5.16%)(c)(g) |

|

Ratio of expenses to average net assets net of waivers and before income tax expense | | 0.85%(c)(g) |

Ratio of deferred income tax expense to average net assets(d) | | 20.55%(c) |

|

Ratio of total expenses to average net assets | | 21.40%(c) |

|

| |

Ratio of investment loss to average net assets before waivers and income tax expense | | (6.01%)(c)(g) |

Ratio of expense waivers to average net assets | | (5.16%)(c)(g) |

|

Ratio of investment loss to average net assets net of waivers and before income tax expense | | (0.85%)(c)(g) |

Ratio of deferred income tax benefit to average net assets(e) | | 0.40%(c) |

|

Ratio of net investment loss to average net assets | | (0.45%)(c) |

|

| |

Portfolio turnover rate(f) | | 3% |

|

| (a) | Calculated using the average shares method. |

| (b) | Total returns are for the period indicated and have not been annualized. Total returns would have been lower had certain expenses not been waived during the period. Returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. |

| (d) | Deferred income tax expense estimate for the ratio calculation is derived from the net investment loss, and realized and unrealized gains/losses. |

| (e) | Deferred income tax benefit for the ratio calculation is derived from net investment loss only. |

| (f) | Portfolio turnover rate for periods less than one full year have not been annualized. |

| (g) | Expense ratios before reductions for startup periods may not be representative of longer term operating periods. |

|

See Notes to Financial Statements. 14 | April 30, 2013 |

| | |

ALPS | CoreCommodity Management CompleteCommoditiesSM Strategy Fund |

| Management Commentary | | April 30, 2013 (Unaudited) |

The twelve months ended April 30, 2013 produced modestly negative results for the commodity markets. Commodity futures, as measured by the diversified Thomson Reuters/Jefferies CRB Total Return Index1 (CRYTR), were down marginally, -5.74%. Commodity equities, evaluated against the Standard & Poor’s® Global Natural Resources Total Return Index2 (SPGNRN), were also down, -1.74%. ALPS | CoreCommodity Management CompleteCommoditiesSM Strategy Fund (which prior to April 30, 2013 was known as the Jefferies Asset Management Commodity Strategy Allocation Fund) (JCRIX) delivered a net negative return of -6.16% for the period (JCRAX was -11.58% at MOP and JCRCX was down -8.02% with CDSC).

The Fund underperformed its benchmark, the Thomson Reuters/Jefferies CRB Index, by approximately 51 basis points3 in the twelve month period ending April 30, 2013 (measured against the performance of the “I” shares). The Fund employs a strategy that combines an actively managed portfolio of commodity futures related exposure (collateralized by Treasury Inflation Protected Securities – TIPS), commodity equities, and physical commodity ETF’s. While the exact composition of the fund changes from time to time in response to structural and value opportunities identified by the Fund Policy Committee, the Fund allocated approximately 65% of its assets toward commodity futures related investments and approximately 35% of its assets in commodity equities on average throughout the year. The Fund was about 97.5% invested by the end of April.

With a few exceptions, commodity prices were subdued for the year. Some of the performance can be explained by the relative strength of the US Dollar. The Dollar was up approximately 3.77% for the previous twelve months (April 30, 2012 – April 30, 2013) as measured by the US Dollar Index. Banking worries in Cyprus and a more concerted effort to stimulate the Japanese economy through massive quantitative easing policies pressured the value of the Euro and Yen respectively. Since most commodities are priced in Dollars, an increase in the value of the Dollar usually translates into lower commodity prices, excluding other factors.

Certain sectors and specific commodities fared better than others during the period. Energy prices were mixed. Natural gas posted a 27.44% gain for the year. The relative low cost of gas versus coal prompted a number of power generation plants to switch to gas for fuel. This demand helped to reduce some of the natural gas supply overhang. Crude oil (West Texas Intermediate - WTI) prices declined, -10.09% for the year. Gasoline (reformulated blendstock for oxygenate blending – RBOB) was down 4.02%. Prices for the refined product declined in the month of April 2013 after retail prices of gasoline hit historic seasonal highs in the month of February.

Agricultural commodity prices exhibited sharp contrasts. Crops with a higher degree of North American production displayed better price performance. Residual concerns about crop yields and low levels of stocks caused by last summer’s drought kept some prices relatively buoyant. Corn and soybean prices, as measured by futures contracts maturing in July 2013, gained 13.99% and 4.83%, respectively. Cotton futures with the same maturity lost -1.51% for the twelve

months ending in April 2013. Lean hog prices, as measured by the June 2013 futures contract, went up 5.56% for the year. On the other hand, exceptional growing conditions in South America led to sizable price declines in other commodities. As measured by their July 2013 futures contracts, Sugar fell by 20.97% and coffee prices dropped 29.71% for the year.

Base and precious metals prices declined noticeably this past year. August 2013 Gold futures prices dipped,

-12.27%. July 2013 Silver and July 2013 COMEX copper were down 22.44% and 16.73% respectively. Dollar strength played a role in metals prices, in our opinion. Additionally, concern about diminished global industrial activity weighed on base metal prices. Short term technical pressure was probably a major factor pushing precious metals down. Leverage and overconcentration may have also contributed to the significant downward move gold and silver experienced in mid-April 2013.

{The Fund’s top equity holdings at the end of April 2013 included Monsanto (MON) +42.38%, Exxon/Mobil (XOM) +5.80%, Syngenta AG (SYNN) +24.61%, Potash (POT) +1.11%, Deere & Company (DE) +10.91%, Chevron Corporation (CVX) +18.39%, Archer Daniels Midland Co. (ADM) +12.87%, The Mosaic Company (MOS) +18.90%, Royal Dutch Shell PLC (RDSA) +.72%, CF Industries (CF) -2.60%, and Agrium Inc. (AGU) +5.95%}

U.S. Treasury Inflation Protected Bonds or TIPS are held by the fund to invest excess cash and as collateral for commodity futures related investments held in our Cayman Island subsidiary. Nominal yields on the benchmark 10 year note began the year at 1.91%. Rates moved lower, to 1.67%, at the end of April. The most recent announcements from the Japanese central bank relating to their large quantitative easing package helped to lower rates globally as currency flows from Tokyo accelerated and found new homes in US fixed income amongst other yield seeking maneuvers. Despite the efforts by the Federal Reserve and other central banks to maintain historically low interest rates, we believe we may be nearing the end of what has been a significant multi-year rally in US treasury prices. As a result, we continue to invest in TIPS with limited duration exposure. At the end of April, our weighted average maturity was approximately 2.6 years in our TIPS portfolio.

We strongly believe that the long term fundamental drivers of commodity demand and ultimately higher prices are still in place. The recent underperformance of commodity prices relative to the Standard and Poor’s 500 Index® (S&P)4 may be a temporary phenomenon. Population growth is likely to remain unabated regardless of the economic environment in the US and Europe. A billion more people will probably be added to the world population over the next decade. The trend of wealth distribution to the developing world as those economies grow at rapid rates relative to the slow or negative growth occurring in the developed countries is contributing to ever increasing demand for raw materials and food. Incremental gains in disposable income in the developing nations have led to competition for the commodities needed for more complex and costly lifestyles. In a world with limited supplies of food, fuel, building materials, and other necessities of life, price may

| | |

ALPS | CoreCommodity Management CompleteCommoditiesSM Strategy Fund |

| Management Commentary | | April 30, 2013 (Unaudited) |

become the ultimate allocator. Additionally, the aggressively accommodative central bank monetary policies recently announced coupled with measures already in place globally are likely to make commodities and other real assets more attractive over time as currencies, including the US Dollar, may decline in value.

The views and information discussed in this commentary are as of the date of publication, are subject to change, and may not reflect the writer’s current views. The views expressed represent an assessment of market conditions at a specific point in time, are opinions only and should not be relied upon as investment advice regarding a particular investment or markets in general. Such information does not constitute a recommendation to buy or sell specific securities or investment vehicles. It should not be assumed that any investment will be profitable or will equal the performance of the fund(s) or any securities or any sectors mentioned herein. The subject matter contained herein has been derived from several sources believed to be reliable and accurate at the time of compilation. CoreCommodity Management, LLC does not accept any liability for losses either direct or consequential caused by the use of this information.

| 1 | Thomson Reuters/Jefferies CRB Total Return Index – is comprised of a basket of 19 commodities, with 39% allocated to energy contracts; 41% to agriculture; 7% to precious metals and 13% to industrial metals. The index acts as a representative indicator or today’s global commodity markets. The index is not actively managed and does not reflect any deductions for fees, expenses or taxes. An investor may not invest directly in an index. |

| 2 | Standard & Poor’s (S&P) Global Natural Resources Total Return Index – is comprised of 90 of the largest publicly traded companies, based on capitalization, in global natural resources and commodities businesses that meet certain investability requirements, offering investors diversified, liquid and investable equity exposure across 3 primary commodity-related sectors: Agribusiness, Energy, and Metals & Mining. The index is not actively managed and does not reflect any deductions for fees, expenses or taxes. An investor may not invest directly in an index. |

| 3 | Basis Points or bps is a unit that is equal to 1/100th of 1%, and is used to denote the change in a financial instrument. |

| 4 | Standard & Poor’s (S&P) 500® Index – measures the performance of 500 large cap stocks, which together represent about 75% of the total U.S. equities market. The index is not actively managed and does not reflect any deductions for fees, expenses or taxes. An investor may not invest directly in an index. |

| | |

ALPS | CoreCommodity Management CompleteCommoditiesSM Strategy Fund |

| Performance Update | | April 30, 2013 (Unaudited) |

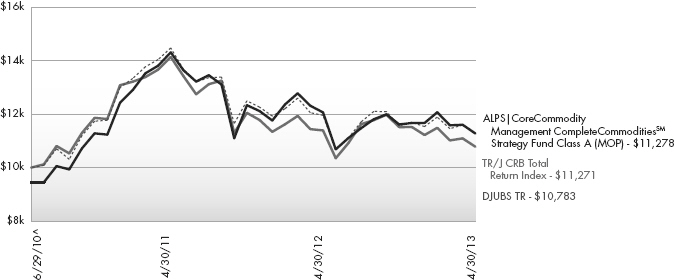

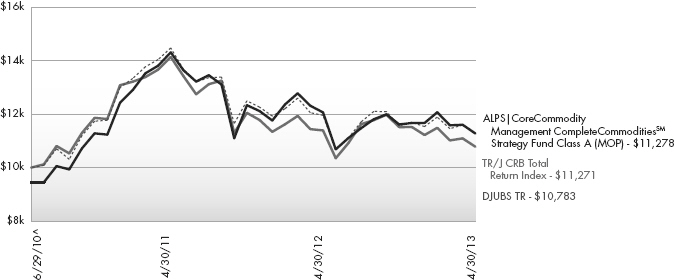

Performance of $10,000 Initial Investment (as of April 30, 2013)

Comparison of change in value of a $10,000 investment (includes maximum sales charges of 5.50%)

The chart above represents historical performance of a hypothetical investment of $10,000 in the Fund since inception. Past performance does not guarantee future results. This chart does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

Average Annual Total Returns (as of April 30, 2013)

| | | | | | | | |

| | | 1 Year | | Since Inception ^ | | Total Expense Ratio | | What You Pay * |

Class A (NAV)1 | | -6.44% | | 6.43% | | 1.66% | | 1.47% |

Class A (MOP)2 | | -11.58% | | 4.33% | | |

Class C (NAV)1 | | -7.10% | | 5.85% | | 2.26% | | 2.07% |

Class C (CDSC)2 | | -8.02% | | 5.85% | | |

Class I | | -6.16% | | 6.75% | | 1.36% | | 1.17% |

TR/J CRB Total Return Index3 | | -5.74% | | 4.31% | | | | |

DJUBS Commodity TR3 | | -5.34% | | 2.70% | | | | |

Performance data quoted represents past performance. Past performance does not guarantee future results. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when sold or redeemed, may be worth more or less than the original cost. Current performance data may be higher or lower than actual data quoted. The Fund imposes a 2.00% redemption fee on shares held for less than 30 days. The Fund imposes a maximum Contingent Deferred Sales Charge (“CDSC”) of 1.00% to shares redeemed within the first 12 months after a purchase, and on Class A shares redeemed within the first 12 months after a purchase in excess of $1 million. Performance data does not reflect the redemption fee or the CDSC, which if reflected would reduce the performance quoted. For the most current month-end performance data, please call 1-866-759-5679.

| | |

ALPS | CoreCommodity Management CompleteCommoditiesSM Strategy Fund |

| Performance Update | | April 30, 2013 (Unaudited) |

| 1 | Net Asset Value (NAV) is the share price without sales charges. |

| 2 | Maximum Offering Price (MOP) includes sales charges. Class A returns include effects of the Fund’s maximum sales charge of 5.50%; Class C returns include the 1.00% CDSC. |

| 3 | Thomson Reuters / Jefferies CRB Index and the Dow Jones-UBS Commodity Index are unmanaged indices used as a measurement of change in commodity market conditions based on the performance of a basket of different commodities. The indices are not actively managed and do not reflect any deduction for fees, expenses or taxes. An investor may not invest directly in an index. |

| ^ | Fund inception date of June 29, 2010. |

| * | What You Pay reflects the Sub-Advisor’s decision to contractually limit expenses through August 31, 2013. Please see the prospectus for additional information. |

The table does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

There is no guarantee that the Fund will continue to hold any one particular security or stay invested in any one particular company. The composition of the Fund’s top holdings is subject to change. Performance figures are historical and reflect the change in share price, reinvested distributions, changes in net asset value, sales charges and capital gains distributions, if any.

Mutual funds are not insured or guaranteed by the FDIC or by any other government agency or government sponsored agency of the federal government or any state, not deposits, obligations or guaranteed by any bank or its affiliates and are subject to investment risks, including possible loss of the principal amount invested.

This Fund is not suitable for all investors, and is subject to investment risks, including possible loss of the principal amount invested.

Investing in commodity-related securities involves risk and considerations not present when investing in more conventional securities. The Fund may be more susceptible to high volatility of commodity markets.

Derivatives generally are more sensitive to changes in economic or market conditions than other types of investments; this could result in losses that significantly exceed the Fund’s original investment.

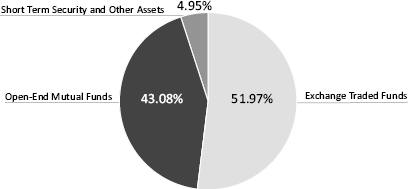

Commodity Futures Related Investments: 50.79%

(as a % of Net Assets)*

| | | | |

WTI Crude Oil | | | 10.42 | % |

Gold** | | | 5.99 | % |

Coffee | | | 5.25 | % |

Brent Crude Oil | | | 5.06 | % |

Corn | | | 4.33 | % |

Soybeans | | | 4.08 | % |

Live Cattle | | | 4.08 | % |

Aluminum | | | 4.04 | % |

Copper | | | 3.87 | % |

Cocoa | | | 3.67 | % |

Commodity-Equities: 17.93%

(as a % of Net Assets)

| | | | |

Monsanto Co. (MON) | | | 3.16 | % |

Exxon Mobil Corp. (XOM) | | | 2.94 | % |

Syngenta AG (SYNN) | | | 2.25 | % |

Potash Corp. of Saskatchewan, Inc. (POT) | | | 2.13 | % |

Deere & Co. (DE) | | | 1.68 | % |

Chevron Corp. (CVX) | | | 1.66 | % |

Archer-Daniels-Midland Co. (ADM) | | | 1.11 | % |

The Mosaic Co. (MOS) | | | 1.06 | % |

BP PLC (BP) | | | 1.01 | % |

Royal Dutch Shell PLC (RDSA) | | | 0.93 | % |

| * | Participation in commodities is generally achieved through investments in over-the-counter commodity swap contracts. |

| ** | Participation in Gold can be achieved through investments in ETFs that hold physical gold, and/or futures or other derivative contracts that are directly tied to the price performance of Gold. |

As of April 30, 2013 the portfolio composition data presented above is an estimate and may not include, among other things, investment expenses, dividends or interest payments, advisory fees or other expenses incurred by the Fund.

| | |

ALPS | CoreCommodity Management CompleteCommoditiesSM Strategy Fund |

| Consolidated Statement of Investments | | April 30, 2013 |

| | | | | | | | |

| | | Shares | | | Value (Note 2) | |

| |

COMMON STOCKS (37.50%) | | | | | | | | |

Australia (0.49%) | | | | | | | | |

Fortescue Metals Group, Ltd. | | | 31,313 | | | $ | 113,618 | |

Iluka Resources, Ltd. | | | 7,779 | | | | 72,177 | |

Incitec Pivot, Ltd. | | | 254,126 | | | | 761,377 | |

Newcrest Mining, Ltd. | | | 11,624 | | | | 202,570 | |

Woodside Petroleum, Ltd. | | | 9,366 | | | | 364,697 | |

| | | | | | | | |

| | | | | | | 1,514,439 | |

| | | | | | | | |

| | |

Brazil (0.44%) | | | | | | | | |

Cia Siderurgica Nacional SA, ADR | | | 1,580 | | | | 6,320 | |

Gerdau SA, ADR | | | 10,527 | | | | 82,637 | |

Petroleo Brasileiro SA, ADR | | | 23,163 | | | | 443,572 | |

Vale SA, ADR | | | 48,193 | | | | 823,618 | |

| | | | | | | | |

| | | | | | | 1,356,147 | |

| | | | | | | | |

| | |

Canada (4.87%) | | | | | | | | |

Agnico-Eagle Mines, Ltd. | | | 8,452 | | | | 272,915 | |

Agrium, Inc. | | | 24,076 | | | | 2,207,047 | |

Barrick Gold Corp. | | | 14,607 | | | | 287,904 | |

Cameco Corp. | | | 5,892 | | | | 114,953 | |

Canadian Natural Resources, Ltd. | | | 5,377 | | | | 157,761 | |

Eldorado Gold Corp. | | | 15,540 | | | | 123,077 | |

Encana Corp. | | | 19,209 | | | | 354,406 | |

First Quantum Minerals, Ltd. | | | 16,847 | | | | 294,147 | |

Goldcorp, Inc. | | | 24,178 | | | | 715,185 | |

IAMGOLD Corp. | | | 20,363 | | | | 109,349 | |

Kinross Gold Corp. | | | 77,002 | | | | 418,891 | |

New Gold, Inc.(a) | | | 18,238 | | | | 145,539 | |

Osisko Mining Corp.(a) | | | 19 | | | | 80 | |

Pan American Silver Corp. | | | 28,778 | | | | 379,870 | |

Potash Corp. of Saskatchewan, Inc. | | | 153,857 | | | | 6,477,380 | |

Silver Wheaton Corp. | | | 23,234 | | | | 569,930 | |

Suncor Energy, Inc. | | | 32,817 | | | | 1,022,249 | |

Teck Resources, Ltd., Class B | | | 14,026 | | | | 372,671 | |

TransCanada Corp. | | | 12,731 | | | | 631,085 | |

Turquoise Hill Resources, Ltd.(a) | | | 20,919 | | | | 147,061 | |

Yamana Gold, Inc. | | | 27,176 | | | | 334,265 | |

| | | | | | | | |

| | | | | | | 15,135,765 | |

| | | | | | | | |

| | |

Chile (0.17%) | | | | | | | | |

Sociedad Quimica y Minera de Chile SA, ADR | | | 10,655 | | | | 527,316 | |

| | | | | | | | |

| | |

China (0.48%) | | | | | | | | |

China Petroleum & Chemical Corp., Class H | | | 245,224 | | | | 268,287 | |

China Shenhua Energy Co., Ltd., Class H | | | 58,216 | | | | 205,928 | |

CNOOC, Ltd. | | | 250,001 | | | | 466,488 | |

Jiangxi Copper Co., Ltd., Class H | | | 27,185 | | | | 52,687 | |

PetroChina Co., Ltd., Class H | | | 330,045 | | | | 419,778 | |

| | | | | | | | |

| | | Shares | | | Value (Note 2) | |

| |

China (continued) | | | | | | | | |

Zijin Mining Group Co., Ltd., Class H | | | 214,020 | | | $ | 63,157 | |

| | | | | | | | |

| | | | | | | 1,476,325 | |

| | | | | | | | |

| | |

France (0.58%) | | | | | | | | |

Total SA | | | 35,634 | | | | 1,795,943 | |

| | | | | | | | |

| | |

Germany (0.51%) | | | | | | | | |

K+S AG | | | 34,170 | | | | 1,510,656 | |

ThyssenKrupp AG(a) | | | 3,937 | | | | 71,214 | |

| | | | | | | | |

| | | | | | | 1,581,870 | |

| | | | | | | | |

| | |

India (0.13%) | | | | | | | | |

Reliance Industries, Ltd., GDR(b) | | | 13,626 | | | | 401,558 | |

Sterlite Industries India, Ltd., ADR | | | 2,057 | | | | 14,872 | |

| | | | | | | | |

| | | | | | | 416,430 | |

| | | | | | | | |

| | |

Israel (0.33%) | | | | | | | | |

Israel Chemicals, Ltd. | | | 55,718 | | | | 662,710 | |

The Israel Corp., Ltd. | | | 574 | | | | 369,057 | |

| | | | | | | | |

| | | | | | | 1,031,767 | |

| | | | | | | | |

| | |

Italy (0.60%) | | | | | | | | |

Eni SpA, ADR | | | 39,236 | | | | 1,875,873 | |

| | | | | | | | |

| | |

Japan (0.15%) | | | | | | | | |

Inpex Corp. | | | 85 | | | | 409,807 | |

Nippon Steel & Sumitomo Metal Corp. | | | 20,342 | | | | 54,045 | |

| | | | | | | | |

| | | | | | | 463,852 | |

| | | | | | | | |

| | |

Jersey (0.07%) | | | | | | | | |

Randgold Resources, Ltd., ADR | | | 2,744 | | | | 224,404 | |

| | | | | | | | |

| | |

Luxembourg (0.14%) | | | | | | | | |

ArcelorMittal | | | 19,466 | | | | 243,130 | |

Tenaris SA, ADR | | | 4,150 | | | | 184,634 | |

| | | | | | | | |

| | | | | | | 427,764 | |

| | | | | | | | |

| | |

Mexico (0.26%) | | | | | | | | |

Grupo Mexico SAB de CV, Series B | | | 54,387 | | | | 195,245 | |

Industrias Penoles SAB de CV | | | 14,794 | | | | 621,316 | |

| | | | | | | | |

| | | | | | | 816,561 | |

| | | | | | | | |

| | |

Netherlands (1.21%) | | | | | | | | |

CNH Global N.V. | | | 13,138 | | | | 540,366 | |

Nutreco N.V. | | | 4,220 | | | | 400,531 | |

Royal Dutch Shell PLC, ADR | | | 41,488 | | | | 2,819,940 | |

| | | | | | | | |

| | | | | | | 3,760,837 | |

| | | | | | | | |

| | |

Norway (0.57%) | | | | | | | | |

Norsk Hydro ASA | | | 17,863 | | | | 83,638 | |

| | |

ALPS | CoreCommodity Management CompleteCommoditiesSM Strategy Fund |

| Consolidated Statement of Investments | | April 30, 2013 |

| | | | | | | | |

| | | Shares | | | Value (Note 2) | |

| |

Norway (continued) | | | | | | | | |

Yara International ASA | | | 36,159 | | | $ | 1,693,043 | |

| | | | | | | | |

| | | | | | | 1,776,681 | |

| | | | | | | | |

| | |

Peru (0.10%) | | | | | | | | |

Cia de Minas Buenaventura SA, ADR | | | 15,310 | | | | 306,506 | |

| | | | | | | | |

| | |

Russia (2.03%) | | | | | | | | |

Gazprom OAO, ADR | | | 159,410 | | | | 1,264,918 | |

LUKOIL OAO, ADR | | | 18,380 | | | | 1,165,292 | |

Mechel Steel Group, ADR | | | 16,800 | | | | 68,544 | |

MMC Norilsk Nickel OJSC, ADR(a) | | | 90,197 | | | | 1,381,818 | |

NovaTek OAO, GDR(c) | | | 1,817 | | | | 183,880 | |

Rosneft Oil Co. OAO, GDR(c) | | | 53,474 | | | | 365,495 | |

Severstal OAO, GDR(c) | | | 7,314 | | | | 61,840 | |

Uralkali OJSC, GDR(c) | | | 50,441 | | | | 1,825,460 | |

| | | | | | | | |

| | | | | | | 6,317,247 | |

| | | | | | | | |

| | |

Singapore (0.51%) | | | | | | | | |

Golden Agri-Resources, Ltd. | | | 780,586 | | | | 335,886 | |

Olam International, Ltd. | | | 258,948 | | | | 352,146 | |

Wilmar International, Ltd. | | | 330,439 | | | | 893,368 | |

| | | | | | | | |

| | | | | | | 1,581,400 | |

| | | | | | | | |

| | |

South Africa (0.47%) | | | | | | | | |

Anglo Platinum, Ltd.(a) | | | 435 | | | | 16,501 | |

AngloGold Ashanti, Ltd., ADR | | | 16,970 | | | | 330,915 | |

Gold Fields, Ltd., ADR | | | 33,120 | | | | 247,075 | |

Harmony Gold Mining Co., Ltd., ADR | | | 34,631 | | | | 177,657 | |

Impala Platinum Holdings, Ltd. | | | 17,765 | | | | 242,436 | |

Kumba Iron Ore, Ltd. | | | 1,186 | | | | 62,552 | |

Sasol, Ltd. | | | 7,880 | | | | 340,570 | |

Sibanye Gold, Ltd., ADR(a) | | | 8,280 | | | | 31,878 | |

| | | | | | | | |

| | | | | | | 1,449,584 | |

| | | | | | | | |

| | |

South Korea (0.15%) | | | | | | | | |

POSCO, ADR | | | 6,322 | | | | 455,121 | |

| | | | | | | | |

| | |

Switzerland (2.64%) | | | | | | | | |

Glencore International PLC | | | 53,696 | | | | 264,364 | |

Syngenta AG | | | 15,982 | | | | 6,830,767 | |

Transocean, Ltd. | | | 5,923 | | | | 304,857 | |

Weatherford International, Ltd.(a) | | | 20,498 | | | | 262,169 | |

Xstrata PLC | | | 36,382 | | | | 544,512 | |

| | | | | | | | |

| | | | | | | 8,206,669 | |

| | | | | | | | |

| | |

United Kingdom (2.28%) | | | | | | | | |

Anglo American PLC | | | 27,213 | | | | 661,546 | |

Antofagasta PLC | | | 7,696 | | | | 107,292 | |

BG Group PLC | | | 55,192 | | | | 929,769 | |

BHP Billiton PLC, ADR | | | 19,473 | | | | 1,100,809 | |

BP PLC, ADR | | | 70,011 | | | | 3,052,479 | |

Kazakhmys PLC | | | 4,437 | | | | 23,868 | |

Lonmin PLC(a) | | | 5,780 | | | | 24,152 | |

| | | | | | | | |

| | | Shares | | | Value (Note 2) | |

| |

United Kingdom (continued) | | | | | | | | |

Petropavlovsk PLC | | | 10,162 | | | $ | 22,888 | |

Rio Tinto PLC, ADR | | | 25,578 | | | | 1,178,123 | |

| | | | | | | | |

| | | | | | | 7,100,926 | |

| | | | | | | | |

| | |

United States (18.32%) | | | | | | | | |

AGCO Corp. | | | 21,171 | | | | 1,127,356 | |

Alcoa, Inc. | | | 15,849 | | | | 134,717 | |

Allegheny Technologies, Inc. | | | 2,193 | | | | 59,167 | |

Allied Nevada Gold Corp.(a) | | | 5,428 | | | | 58,080 | |

Anadarko Petroleum Corp. | | | 8,568 | | | | 726,224 | |

Apache Corp. | | | 6,230 | | | | 460,272 | |

Archer-Daniels-Midland Co. | | | 99,128 | | | | 3,364,404 | |

Baker Hughes, Inc. | | | 10,070 | | | | 457,077 | |

Bunge, Ltd. | | | 13,968 | | | | 1,008,629 | |

Cameron International Corp.(a) | | | 3,864 | | | | 237,829 | |

CF Industries Holdings, Inc. | | | 13,489 | | | | 2,515,833 | |

Chevron Corp. | | | 41,377 | | | | 5,048,408 | |

Cliffs Natural Resources, Inc. | | | 7,741 | | | | 165,193 | |

Coeur d’Alene Mines Corp.(a) | | | 7,051 | | | | 107,457 | |

ConocoPhillips | | | 17,965 | | | | 1,085,984 | |

Deere & Co. | | | 57,208 | | | | 5,108,674 | |

Detour Gold Corp.(a) | | | 299 | | | | 3,597 | |

Devon Energy Corp. | | | 7,294 | | | | 401,608 | |

Ensco PLC, Class A | | | 402 | | | | 23,187 | |

EOG Resources, Inc. | | | 3,313 | | | | 401,403 | |

Exxon Mobil Corp. | | | 100,178 | | | | 8,914,840 | |

Freeport-McMoRan Copper & Gold, Inc. | | | 12,421 | | | | 377,971 | |

Halliburton Co. | | | 17,195 | | | | 735,430 | |

Hecla Mining Co. | | | 32,478 | | | | 110,425 | |

Hess Corp. | | | 3,917 | | | | 282,729 | |

Ingredion, Inc. | | | 17,065 | | | | 1,228,851 | |

Intrepid Potash, Inc. | | | 15,406 | | | | 283,625 | |

Kinder Morgan, Inc. | | | 8,702 | | | | 340,248 | |

Marathon Oil Corp. | | | 29,459 | | | | 962,426 | |

Marathon Petroleum Corp. | | | 5,700 | | | | 446,652 | |

Monsanto Co. | | | 89,728 | | | | 9,584,745 | |

The Mosaic Co. | | | 52,099 | | | | 3,208,778 | |

National Oilwell Varco, Inc. | | | 6,952 | | | | 453,410 | |

Newmont Mining Corp. | | | 19,590 | | | | 634,716 | |

Noble Energy, Inc. | | | 4,608 | | | | 522,040 | |

Nucor Corp. | | | 4,606 | | | | 200,914 | |

Occidental Petroleum Corp. | | | 17,874 | | | | 1,595,433 | |

Peabody Energy Corp. | | | 5,399 | | | | 108,304 | |

Phillips 66 | | | 7,700 | | | | 469,315 | |

Pioneer Natural Resources Co. | | | 2,572 | | | | 314,376 | |

Royal Gold, Inc. | | | 1,944 | | | | 108,048 | |

Schlumberger, Ltd. | | | 24,045 | | | | 1,789,669 | |

Southern Copper Corp. | | | 3,937 | | | | 131,220 | |

Southwestern Energy Co.(a) | | | 7,208 | | | | 269,723 | |

Spectra Energy Corp. | | | 697 | | | | 21,976 | |

Valero Energy Corp. | | | 22,250 | | | | 897,120 | |

| | |

ALPS | CoreCommodity Management CompleteCommoditiesSM Strategy Fund |

| Consolidated Statement of Investments | | April 30, 2013 |

| | | | | | | | |

| | | Shares | | | Value (Note 2) | |

| |

United States (continued) | | | | | | | | |

The Williams Co., Inc. | | | 12,274 | | | $ | 468,008 | |

| | | | | | | | |

| | | | | | | 56,956,091 | |

| | | | | | | | |

| |

TOTAL COMMON STOCKS | | | | | |

(Cost $116,740,633) | | | | | | | 116,555,518 | |

| | | | | | | | |

| |

EXCHANGE TRADED FUNDS (1.82%) | | | | | |

iShares® Gold Trust(a) | | | 218,898 | | | | 3,141,186 | |

SPDR® Gold Trust(a) | | | 17,688 | | | | 2,525,316 | |

| | | | | | | | |

| |

TOTAL EXCHANGE TRADED FUNDS | | | | | |

(Cost $6,391,017) | | | | | | | 5,666,502 | |

| | | | | | | | |

| | |

WARRANTS (0.00%)(d) | | | | | | | | |

Canada (0.00%)(d) | | | | | | | | |

Kinross Gold Corp., Strike Price $21.30, Expires 9/17/14(a) | | | 19 | | | | 3 | |

| | | | | | | | |

| | |

United States (0.00%)(d) | | | | | | | | |

Magnum Hunter Resources Corp., Strike Price $10.50, Expires 10/14/13(a) | | | 629 | | | | 88 | |

| | | | | | | | |

| |

TOTAL WARRANTS | | | | | |

(Cost $69) | | | | | | | 91 | |

| | | | | | | | |

| | |

| | | Principal Amount | | | Value (Note 2) | |

| |

GOVERNMENT BONDS (55.08%) | | | | | |

U.S. Treasury Bonds (55.08%) | | | | | |

United States Treasury Inflation Indexed Bonds | | | | | |

1.875%, 7/15/13(e)(f) | | $ | 5,800,521 | | | | 5,830,428 | |

2.000%, 1/15/14(f) | | | 6,249,297 | | | | 6,374,770 | |

1.250%, 4/15/14(e) | | | 8,718,924 | | | | 8,895,343 | |

2.000%, 7/15/14 | | | 11,389,895 | | | | 11,884,649 | |

1.625%, 1/15/15(e)(f) | | | 13,644,549 | | | | 14,340,639 | |

0.500%, 4/15/15(f) | | | 11,700,894 | | | | 12,125,051 | |

1.875%, 7/15/15 | | | 8,651,208 | | | | 9,353,443 | |

2.000%, 1/15/16 | | | 9,063,005 | | | | 9,950,192 | |

0.125%, 4/15/16 | | | 21,556,365 | | | | 22,592,084 | |

2.500%, 7/15/16 | | | 11,208,698 | | | | 12,771,784 | |

2.375%, 1/15/17(f) | | | 10,070,725 | | | | 11,582,119 | |

0.125%, 4/15/17(e)(f) | | | 14,817,405 | | | | 15,781,692 | |

2.625%, 7/15/17(f) | | | 14,278,470 | | | | 16,946,759 | |

1.625%, 1/15/18 | | | 11,079,100 | | | | 12,765,206 | |

| | | | | | | | |

| | | | | | | 171,194,159 | |

| | | | | | | | |

TOTAL GOVERNMENT BONDS | | | | | | | | |

(Cost $170,654,312) | | | | | | | 171,194,159 | |

| | | | | | | | |

| | | | | | | | |

| | | 7-Day Yield | | Shares | | Value (Note 2) | |

| |

SHORT TERM INVESTMENTS (8.85%) | |

Money Market Fund (8.85%) | |

Dreyfus Treasury Prime Cash Management Fund, Institutional Shares | | 0.00004% | | 27,503,104 | | $ | 27,503,104 | |

| | | | | | | | |

| |

TOTAL SHORT TERM INVESTMENTS | | | | |

(Cost $27,503,104) | | | | | 27,503,104 | |

| | | | | | | | |

| |

TOTAL INVESTMENTS (103.25%) | | | | |

(Cost $321,289,135) | | $ | 320,919,374 | |

| |

Liabilities in Excess of Other Assets (-3.25%) | | | (10,095,587 | ) |

| |

NET ASSETS - 100.00% | | $ | 310,823,787 | |

| |

| (a) | Non-Income Producing Security. |

| (b) | Security exempt from registration under rule 144A of the securities act of 1933. This security may be resold in transactions exempt from registration, normally to qualified institutional buyers. At period end, the market value of those securities was $401,558, representing 0.13% of the Fund’s net assets. |

| (c) | These securities initially sold to other parties pursuant to Regulation S under the 1933 Act and subsequently resold to the Fund. At period end, the aggregate market value of those securities was $2,436,675, representing 0.78% of the Fund’s net assets. |

| (e) | Security, or portion of security, is being held as collateral for futures contracts. |

| (f) | Security, or portion of security, is being held as collateral for total return swap contracts. |

Common Abbreviations:

|

ADR - American Depositary Receipt. |

AG - Aktiengesellschaft is a German term that refers to a corporation that is limited by shares, i.e., owned by shareholders. |

ASA - Allmennaksjeselskap is the Norwegian term for public limited company. |

GDR - Global Depositary Receipt. |

Ltd. - Limited. |

N.V. - Naamloze vennootschap is the Dutch term for a public limited liability corporation. |

OAO - Russian open joint stock company. |

OJSC - Open joint stock company. |

PLC - Public Limited Co. |

SA - Generally designated corporations in various countries, mostly those employing the civil law. |

SAB de CV - A variable capital company. |

SPDR - Standard & Poor’s Depository Receipt. |

| | |

ALPS | CoreCommodity Management CompleteCommoditiesSM Strategy Fund |

| Consolidated Statement of Investments | | April 30, 2013 |

For Fund compliance purposes, the Fund’s industry and geographical classifications refer to any one or more of the industry sub-classifications used by one or more widely recognized market indexes or ratings group indexes, and/or as defined by Fund management. This definition may not apply for purposes of this report, which may combine sub-classifications for reporting ease. Industries and regions are shown as a percent of net assets.

See Notes to Financial Statements.

| | |

ALPS | CoreCommodity Management CompleteCommoditiesSM Strategy Fund |

| Consolidated Statement of Investments | | April 30, 2013 |

FUTURES CONTRACTS

| | | | | | | | | | | | | | | | |

| Description | | Position | | Contracts | | Expiration Date | | | Value (Note 2) | | | Unrealized Appreciation | |

| |

Silver Future | | Short | | (1) | | | 12/30/13 | | | $ | (121,510 | ) | | $ | 52,978 | |

WTI Crude Future | | Long | | 4 | | | 5/21/13 | | | | 373,840 | | | | 114 | |

WTI Crude Future | | Short | | (4) | | | 5/22/13 | | | | (373,840 | ) | | | 19,552 | |

WTI Crude Future | | Short | | (55) | | | 7/22/13 | | | | (5,151,850 | ) | | | 178,789 | |

| | | | | | | | | | | | |

| | | | | | | | | | $ | (5,273,360 | ) | | $ | 251,433 | |

| | | | | | | | | | | | |

| | | | | |

| Description | | Position | | Contracts | | Expiration Date | | | Value (Note 2) | | | Unrealized Depreciation | |

| |

Brent Crude Future | | Long | | 150 | | | 5/17/13 | | | $ | 15,355,500 | | | $ | (798,361 | ) |

Gold 100 Oz. Future | | Long | | 48 | | | 6/27/13 | | | | 7,066,080 | | | | (438,128 | ) |

S&P 500® Mini Future | | Short | | (190) | | | 6/24/13 | | | | (15,125,900 | ) | | | (421,894 | ) |

Silver Future | | Long | | 1 | | | 12/30/14 | | | | 122,445 | | | | (51,122 | ) |

WTI Crude Future | | Short | | (185) | | | 8/20/13 | | | | (17,280,850 | ) | | | (214,742 | ) |

WTI Crude Future | | Long | | 70 | | | 11/20/13 | | | | 6,447,700 | | | | (242,113 | ) |

| | | | | | | | | | | | |

| | | | | | | | | | $ | (3,415,025 | ) | | $ | (2,166,360 | ) |

| | | | | | | | | | | | |

TOTAL RETURN SWAP CONTRACTS(a)

| | | | | | | | | | | | | | |

| Swap Counterparty | | Reference Obligation | | Notional Dollars | | | Rate Paid by

the Fund | | Termination Date | | Unrealized Appreciation | |

| |

| Bank of America - Merrill Lynch | | ML Index Robusta | | $ | (5,800,000 | ) | | 0.10% | | 6/28/13 | | $ | 0 | |

| Bank of America - Merrill Lynch | | MLCS Coffee J-F3 | | | (3,847,086 | ) | | 0.10% | | 6/28/13 | | | 136,221 | |

| Bank of America - Merrill Lynch | | MLCS Copper J-F3 | | | (5,777,117 | ) | | 0.10% | | 6/28/13 | | | 399,502 | |

| Bank of America - Merrill Lynch | | MLCS Silver J-F3 | | | (925,492 | ) | | 0.10% | | 6/28/13 | | | 136,825 | |

| Bank of America - Merrill Lynch | | MLCX Aluminum J-F3 | | | (5,224,011 | ) | | 0.10% | | 6/28/13 | | | 95,575 | |

| Bank of America - Merrill Lynch | | MLCX GoldT-F3 | | | (6,234,777 | ) | | 0.10% | | 6/28/13 | | | 484,657 | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | $ | 1,252,780 | |

| | | | | | | | | | | | | | |

| | | | | |

| Swap Counterparty | | Reference Obligation | | Notional

Dollars | | | Rate Paid

by the Fund | | Termination

Date | | Unrealized

Depreciation | |

| |

Bank of America - Merrill Lynch | | CRB 3 Month Forward Total Return Index | | $ | 80,838,741 | | | 0.48% | | 6/28/13 | | $ | (1,890,216 | ) |