UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-8194

FINANCIAL INVESTORS TRUST

(Exact name of registrant as specified in charter)

1290 Broadway, Suite 1100, Denver, Colorado 80203

(Address of principal executive offices) (Zip code)

JoEllen L. Legg, Secretary

Financial Investors Trust

1290 Broadway, Suite 1100

Denver, Colorado 80203

(Name and address of agent for service)

Registrant’s telephone number, including area code: 303-623-2577

Date of fiscal year end: December 31

Date of reporting period: January 1, 2010 – December 31, 2010

Item 1. Reports to Stockholders.

| | | | |

Table of Contents | | | | |

| | | December 31, 2010 | |

| | | | | | |

| RiverFront Long-Term Growth Fund | | | | |

| | | | |

| | | Management Commentary | | | December 31, 2010 (Unaudited) | |

For the year ending December 31, 2010, the RiverFront Long-Term Growth Fund’s (the “Fund”) Class A Shares, RLTAX, delivered a net return of +12.81% at NAV (Class A delivered a net return of +6.60% at market offering price (“MOP”), Class C, RLTCX, was +10.86% with CDSC, Class I, RLFIX, was +12.92% with CDSC, Class L, RLTIX, was +12.87%, and Investor Class, RLTSX, was +12.58%) for the year1. The Fund’s performance was below that of the broad based S&P 500 Index (+15.06%), without taking into account sales charges for Class A and C Shares.

Our assessment of financial market as we entered 2010 was that equity markets were priced to offer strong returns if everything went well but did not have much of a margin of safety if events turn out less favorably than expected. In that environment, our strategy concentrated the portfolio in those asset classes, securities and tactical strategies that offered, in our view, the best tradeoff between potential risk and potential reward. We were particularly cautious in balancing upside potential with downside risk for our lower risk portfolios, since these Riverfront investors enjoyed good returns across the 2008/2009 period, and we felt that their risk tolerance and point in life could not tolerate giving back those gains.

Market volatility and sudden mood swings characterized financial markets throughout 2010. Early in the year markets expected the US economy to enjoy the period of strong growth that typically occurs after a recession. Equity markets soared as the growth associated with accelerating government stimulus spending and inventory rebuilding seemed to confirm those expectations. As we moved into the second quarter these temporary boosts to growth began to fade just as the sovereign debt2 problems in Europe became more acute. As the market’s mood dramatically reversed toward expecting a double dip recession, equity prices plummeted along with expected economic growth and markets threatened to collapse back toward crises levels. The final mood swing of 2010 occurred in the third quarter as the economy proved neither as strong as was hoped early in the year nor as weak as was feared during the summer. This realization, combined with renewed quantitative easing purchases on the part of the Federal Reserve and Republican electoral victories, sparked a dramatic rally that continued through year end, leaving the S&P 500 up about 15.0% for the year.

In this volatile environment marked by several sharp turns in market direction and sentiment, our longer term allocation strategies performed well across the year. We substantially increased micro cap and emerging markets weightings and our new asset allocation strategies benefited from strong performance in these asset classes, while a sharp sell-off in the bond market toward year end finally validated our decision to remove long maturity bonds from our portfolios. That, along with an allocation to foreign currencies and an emphasis on

credit risk allowed our fixed income portfolios to perform well despite having far less interest rate risk than the overall market.

From a tactical perspective, our performance suffered from buying insurance that we ultimately did not need. During the market collapse in May and June major technical support levels were breached and markets were threatening to break down to levels not seen since the crises of 2008/2009. Although our fundamental view remained positive, our risk management disciplines remained a focus in our lower risk portfolios. This defensive posture was augmented by our large cap equity strategy, which emphasized higher quality, lower valuation companies with global franchises. This quality emphasis was predicated on the simple notion that low quality might work if everything went as expected, but high quality would almost certainly work in any of our potential economic and market scenarios. The only risk was that it might not work as well as higher risk alternatives.

As the market gained confidence toward the end of the summer, we had to quickly switch from defense to offense and get those cash balances invested and increase the beta3 in our equity positioning.

Although we believe performance would have been even better in 2010 had we not implemented our defensive tactical strategy and quality bias in our equity holdings, Riverfront’s investment discipline occasionally requires risking a bit of upside participation if it allows us to potentially mitigate downside in the portfolios. This focus on balancing upside opportunities with downside risks has helped our investors successfully navigate the tumultuous markets of the past decade and we believe will continue to serve them well in 2011.

As we move into 2011, we believe that continuing the bull market of 2010 is likely to require global policy makers to go beyond merely buying time with deficit spending and aggressive money printing and actually addressing underlying economic problems. We see three key signposts that can signal concrete progress is being made on these issues:

| 1. | China allows increases in the pace of appreciation in their currency. |

| 2. | The European Central Bank becomes more aggressive in countering the deflationary pressures arising from the debt crises in Greece, Ireland, Portugal, etc. |

| 3. | The US emulates the UK by putting in place a credible plan that reduces its budget deficit to a sustainable level. |

Substantial progress on all three issues would create an extraordinarily bullish outlook for equity markets. However, our expected scenario is a “muddle through” outcome in which sufficient progress is made to keep markets rising but at a slower

| | | | | | |

| RiverFront Long-Term Growth Fund | | | | |

| | | | |

| | | Management Commentary | | | December 31, 2010 (Unaudited) | |

pace than that of 2010. Our portfolio strategy will become more aggressive if we are surprised by the decisiveness of policy makers in addressing these issues. We believe that the weight of economic and political pressures (inflation in China, elections in Europe, etc.) will help ensure that some progress is made on these issues, but if we are wrong and policy makers continue to avoid these tough decisions, then our portfolios will shift to a more defensive posture.

| 1 | The Class A, C, I, and L shares performance shown for periods prior to September 27, 2010, reflects the performance of the Baird Funds, Inc. – RiverFront Long-Term Growth Fund’s Institutional Class shares (as result of the reorganization of the Baird Funds, Inc. – RiverFront Long-Term Growth Fund into the Fund). The Investor Class performance shown for periods prior to September 27, 2010, reflects the performance of the Baird Funds, Inc. – RiverFront Long-Term Growth Fund’s Investor Class shares (as result of the reorganization of the Baird Funds, Inc. – RiverFront Long-Term Growth Fund into the Fund). |

| 2 | Financial liabilities of a national government. |

| 3 | A mathmatical measure of the sensitivity of rates of return on a portfolio or a given stock compared with rates of return on the market as a whole. |

The Management Commentaries included in this shareholder report contains certain forward-looking statements about the factors that may affect the performance of the Funds in the future. These statements are based on Fund management’s predictions and expectations concerning certain future events and their expected impact on the Funds, such as performance of the economy as a whole and of specific industry sectors, changes in the levels of interest rates, the impact of developing world events, and other factors that may influence the future performance of the Funds. Management believes these forward-looking statements to be reasonable, although they are inherently uncertain and difficult to predict. Actual events may cause adjustments in portfolio management strategies from those currently expected to be employed.

| | | | | | |

| RiverFront Long-Term Growth Fund | | | | |

| | | | |

| | | Management Commentary | | | December 31, 2010 (Unaudited) | |

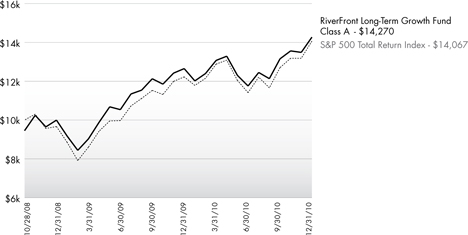

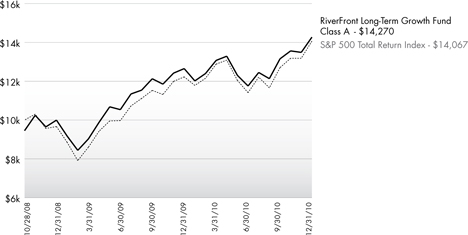

Performance of $10,000 Initial Investment (as of December 31, 2010)

Comparison of change in value of a $10,000 investment (includes applicable sales loads)

The chart above represents historical performance of a hypothetical investment of $10,000 in the Fund since inception. Past performance does not guarantee future results. This chart does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

Annualized Return (as of December 31, 2010)

| | | | | | | | |

| | | 1 Year | | Since Inception^ | | Gross Expense Ratio | | Net Expense Ratio* |

Investor (NAV)1 | | 12.58% | | 20.71% | | 1.70% | | 1.15% |

Class L (NAV)1,3 | | 12.87% | | 21.04% | | 1.45% | | 0.90% |

Class A (NAV)1 | | 12.81% | | 20.85% | | 1.70% | | 1.15% |

Class A (MOP)2 | | 6.60% | | 17.76% | | |

Class C (NAV)1 | | 11.86% | | 19.89% | | 2.45% | | 1.90% |

Class C (CDSC)2 | | 10.86% | | 19.89% | | |

Class I | | 12.92% | | 21.07% | | 1.45% | | 0.90% |

S&P 500 Total Return Index4 | | 15.06% | | 16.98% | | | | |

Performance data quoted represents past performance. Past performance does not guarantee future results. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when sold or redeemed, may be worth more or less than the original cost. Current performance data may be higher or lower than actual data quoted. For the most current month-end performance data, please call (866) 759-5679.

| 1 | Net Asset Value (NAV) is the share price without sales charges. |

| 2 | Maximum Offering Price (MOP) includes sales charges. Class A returns include effects of the Fund’s maximum sales charge of 5.50%; Class C returns include the 1.00% CDSC. |

| 3 | Prior to close of business on September 24, 2010, Class L was known as Institutional Class of the RiverFront Long-Term Growth Fund, a former series of Baird Funds, Inc. (the “Predecessor Fund”). |

| 4 | S&P 500 Total Return Index is the Standard & Poor’s composite index of 500 stocks, a widely recognized, unmanaged index of common stock prices. An investor may not invest directly in the index. |

| ^ | Fund inception date of October 28, 2008. |

| * | ALPS Advisors, Inc. (the “Adviser”) and RiverFront Investment Group, LLC (“RiverFront” or the “Sub-Adviser”) have contractually agreed to limit the total annual expenses of the Fund (including acquired fund fees and expenses) to 0.90% of the average daily net assets for each Class of the Fund. This obligation excludes distribution and service 12b-1 fees, shareholder services fees, brokerage commissions, taxes and extraordinary expenses. This agreement is in effect through December 31, 2012 and is reevaluated on an annual basis. Without this agreement, expenses could be higher. |

The Class A, C, I and L shares’ performance within the annualized returns shown for periods prior to close of business on September 24, 2010, reflects the performance of the Baird Funds, Inc. – RiverFront Long-Term Growth Fund’s Institutional Class shares (as a result of the reorganization of the Baird Funds, Inc. – RiverFront Long-Term Growth Fund into the Fund).

The Investor Class performance within the annualized returns shown for periods prior to close of business on September 24, 2010, reflects the performance of the Baird Funds, Inc. – RiverFront Long-Term Growth Fund’s Investor Class shares (as a result of the reorganization of the Baird Funds, Inc. – RiverFront Long-Term Growth Fund into the Fund).

The table does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. This Fund is not suitable for all investors. Subject to investment risks, including possible loss of the principal amount invested.

| | | | | | |

| RiverFront Long-Term Growth Fund | | | | |

| | | | |

| | | Disclosure of Fund Expenses | | | December 31, 2010 (Unaudited) | |

As a shareholder of the Fund you will incur two types of costs: (1) transaction costs, including applicable sales charges (loads) and redemption fees; and (2) ongoing costs, including management fees, distribution and service (12b-1) fees, shareholder service fees and other Fund expenses. The following examples are intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds. The examples are based on an investment of $1,000 invested on July 1, 2010 and held until December 31, 2010.

Actual Expenses. The first line of the table on the next page provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading “Expense Paid During Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes. The second line of the table on the next page provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other mutual funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

The expenses shown in the table are meant to highlight ongoing Fund costs only and do not reflect transaction fees, such as sales charges, redemption fees or exchange fees. Therefore, the second line of the table on the next page is useful in comparing ongoing costs only, and may not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

The examples are based on an investment of $1,000 invested on July 1, 2010 and held until December 31, 2010.

| | | | | | | | | | | | | | |

| | | Beginning Account Value 7/1/10 | | | Ending Account Value 12/31/10 | | | Expenses Paid During Period 7/1/10-12/31/10 | | | Expense Ratio |

Class A(a) | | | | | | | | | | | | | | |

| | | | |

Actual Fund Return(b) | | | $ 1,000.00 | | | | $ 1,092.20 | | | | $ 3.13 | | | 1.15% |

Hypothetical Fund Return(c) | | | $ 1,000.00 | | | | $ 1,010.02 | | | | $ 5.83 | | | 1.15% |

| | | | |

Class C(a) | | | | | | | | | | | | | | |

| | | | |

Actual Fund Return(b) | | | $ 1,000.00 | | | | $ 1,089.10 | | | | $ 5.17 | | | 1.90% |

Hypothetical Fund Return(c) | | | $ 1,000.00 | | | | $ 1,008.07 | | | | $ 9.62 | | | 1.90% |

| | | | |

Class I(a) | | | | | | | | | | | | | | |

| | | | |

Actual Fund Return(b) | | | $ 1,000.00 | | | | $ 1,091.20 | | | | $ 2.45 | | | 0.90% |

Hypothetical Fund Return(c) | | | $ 1,000.00 | | | | $ 1,010.67 | | | | $ 4.56 | | | 0.90% |

| | | | |

Class L(d) | | | | | | | | | | | | | | |

| | | | |

Actual Fund Return(b) | | | $ 1,000.00 | | | | $ 1,213.10 | | | | $ 5.02 | | | 0.90% |

Hypothetical Fund Return(c) | | | $ 1,000.00 | | | | $ 1,020.67 | | | | $ 4.58 | | | 0.90% |

| | | | |

Investor Class | | | | | | | | | | | | | | |

| | | | |

Actual Fund Return(b) | | | $ 1,000.00 | | | | $ 1,212.20 | | | | $ 6.41 | | | 1.15% |

Hypothetical Fund Return(c) | | | $ 1,000.00 | | | | $ 1,019.41 | | | | $ 5.85 | | | 1.15% |

| (a) | Shares commenced operations on September 27, 2010. |

| (b) | The “Actual” example in the table above is equal to the Class’s annualized expense ratio multiplied by the average account value over the period, multiplied by the number of days in the most recent fiscal half year (95 days for Class A, Class C and I, 184 days for Class L and Investor Class), then divided by 365. |

| (c) | The “Hypothetical” example in the table above is equal to the Class’s annualized expense ratio multiplied by the average account value over the period, multiplied by the number of days in the most recent fiscal half year (184), then divided by 365. |

| (d) | Prior to close of business on September 24, 2010, Class L was known as Institutional Class of the Predecessor Fund. |

| | | | | | | | |

| | | RiverFront Long-Term Growth Fund | |

| | | | | | |

| | | | | Statement of Investments | | | December 31, 2010 | |

| | | | | | | | |

| | | Shares | | | Value | |

|

COMMON STOCKS (34.48%) | |

Advertising (0.55%) | |

Omnicom Group, Inc. | | | 8,771 | | | $ | 401,712 | |

| | | | | | | | |

|

Aerospace & Defense (2.63%) | |

Esterline Technologies Corp.(a) | | | 9,187 | | | | 630,136 | |

L-3 Communications Holdings, Inc. | | | 4,759 | | | | 335,462 | |

Lockheed Martin Corp. | | | 6,107 | | | | 426,941 | |

United Technologies Corp. | | | 6,736 | | | | 530,258 | |

| | | | | | | | |

| | | | | | | 1,922,797 | |

| | | | | | | | |

|

Agriculture (0.53%) | |

Altria Group, Inc. | | | 15,778 | | | | 388,454 | |

| | | | | | | | |

| | |

Banks (1.37%) | | | | | | | | |

East West Bancorp, Inc. | | | 27,083 | | | | 529,472 | |

State Street Corp. | | | 10,149 | | | | 470,305 | |

| | | | | | | | |

| | | | | | | 999,777 | |

| | | | | | | | |

| | |

Chemicals (1.88%) | | | | | | | | |

Monsanto Co. | | | 6,553 | | | | 456,351 | |

The Scotts Miracle-Gro Co., Class A | | | 10,156 | | | | 515,620 | |

Sensient Technologies Corp. | | | 10,842 | | | | 398,227 | |

| | | | | | | | |

| | | | | | | 1,370,198 | |

| | | | | | | | |

|

Commercial Banks (0.48%) | |

Cullen/Frost Bankers, Inc. | | | 5,686 | | | | 347,528 | |

| | | | | | | | |

|

Commercial Services (1.15%) | |

Automatic Data Processing, Inc. | | | 9,086 | | | | 420,500 | |

Iron Mountain, Inc. | | | 16,903 | | | | 422,744 | |

| | | | | | | | |

| | | | | | | 843,244 | |

| | | | | | | | |

|

Commercial Services & Supplies (0.46%) | |

Manpower, Inc. | | | 5,368 | | | | 336,896 | |

| | | | | | | | |

|

Communications Equipment (0.61%) | |

Harris Corp. | | | 9,780 | | | | 443,034 | |

| | | | | | | | |

|

Computers & Peripherals (2.08%) | |

Apple, Inc.(a) | | | 2,701 | | | | 871,235 | |

International Business Machines Corp. | | | 4,411 | | | | 647,358 | |

| | | | | | | | |

| | | | | | | 1,518,593 | |

| | | | | | | | |

|

Containers & Packaging (0.94%) | |

Ball Corp. | | | 10,084 | | | | 686,216 | |

| | | | | | | | |

| | | | | | | | |

| | | Shares | | | Value | |

|

Diversified Financial Services (0.49%) | |

The NASDAQ OMX Group, Inc.(a) | | | 15,185 | | | $ | 360,036 | |

| | | | | | | | |

| | |

Electric (0.50%) | | | | | | | | |

DPL, Inc. | | | 14,110 | | | | 362,768 | |

| | | | | | | | |

|

Energy Equipment & Services (0.99%) | |

Diana Shipping, Inc.(a) | | | 19,371 | | | | 232,839 | |

Superior Energy Services, Inc.(a) | | | 14,039 | | | | 491,225 | |

| | | | | | | | |

| | | | | | | 724,064 | |

| | | | | | | | |

|

Food & Staples Retailing (1.65%) | |

CVS Caremark Corp. | | | 9,400 | | | | 326,838 | |

NIKE, Inc., Class B | | | 6,707 | | | | 572,912 | |

Wal-Mart Stores, Inc. | | | 5,730 | | | | 309,019 | |

| | | | | | | | |

| | | | | | | 1,208,769 | |

| | | | | | | | |

|

Health Care Providers & Services (2.65%) | |

CareFusion Corp.(a) | | | 20,583 | | | | 528,983 | |

DaVita, Inc.(a) | | | 4,381 | | | | 304,436 | |

Express Scripts, Inc.(a) | | | 4,711 | | | | 254,629 | |

Henry Schein, Inc.(a) | | | 7,349 | | | | 451,155 | |

PSS World Medical, Inc.(a) | | | 17,538 | | | | 396,359 | |

| | | | | | | | |

| | | | | | | 1,935,562 | |

| | | | | | | | |

|

Healthcare Products (0.59%) | |

Becton Dickinson and Co. | | | 5,105 | | | | 431,475 | |

| | | | | | | | |

|

Hotels, Restaurants & Leisure (0.99%) | |

Darden Restaurants, Inc. | | | 6,709 | | | | 311,566 | |

Penn National Gaming, Inc.(a) | | | 11,642 | | | | 409,216 | |

| | | | | | | | |

| | | | | | | 720,782 | |

| | | | | | | | |

|

Insurance (1.20%) | |

Chubb Corp. | | | 5,405 | | | | 322,354 | |

HCC Insurance Holdings, Inc. | | | 19,236 | | | | 556,690 | |

| | | | | | | | |

| | | | | | | 879,044 | |

| | | | | | | | |

|

IT Services (0.76%) | |

Fiserv, Inc.(a) | | | 9,472 | | | | 554,680 | |

| | | | | | | | |

|

Leisure Equipment & Products (0.44%) | |

Hasbro, Inc. | | | 6,773 | | | | 319,550 | |

| | | | | | | | |

|

Media (0.42%) | |

DreamWorks Animation SKG, Inc., Class A(a) | | | 10,453 | | | | 308,050 | |

| | | | | | | | |

|

Multiline Retail (0.80%) | |

Dollar Tree, Inc.(a) | | | 10,396 | | | | 583,008 | |

| | | | | | | | |

| | | | | | |

| | | RiverFront Long-Term Growth Fund |

| | | | | |

| | | | | Statement of Investments | | December 31, 2010 |

| | | | | | | | |

| | | Shares | | | Value | |

| | |

Oil & Gas (3.46%) | | | | | | | | |

Chevron Corp. | | | 8,429 | | | $ | 769,146 | |

Cimarex Energy Co. | | | 4,377 | | | | 387,496 | |

Exxon Mobil Corp. | | | 7,511 | | | | 549,205 | |

Forest Oil Corp.(a) | | | 13,626 | | | | 517,379 | |

Petrohawk Energy

Corp.(a) | | | 16,509 | | | | 301,289 | |

| | | | | | | | |

| | | | | | | 2,524,515 | |

| | | | | | | | |

|

Pharmaceuticals (1.33%) | |

Abbott Laboratories | | | 4,330 | | | | 207,450 | |

Omnicare, Inc. | | | 20,492 | | | | 520,292 | |

PerkinElmer, Inc. | | | 9,411 | | | | 242,992 | |

| | | | | | | | |

| | | | | | | 970,734 | |

| | | | | | | | |

|

Real Estate Investment Trusts (1.94%) | |

American Campus Communities, Inc. | | | 13,527 | | | | 429,618 | |

Corporate Office Properties Trust | | | 11,892 | | | | 415,625 | |

DuPont Fabros Technology, Inc. | | | 12,982 | | | | 276,127 | |

Weingarten Realty Investors | | | 12,585 | | | | 299,020 | |

| | | | | | | | |

| | | | | | | 1,420,390 | |

| | | | | | | | |

|

Semiconductors & Semiconductor Equipment (1.13%) | |

Microchip Technology, Inc. | | | 12,700 | | | | 434,467 | |

Skyworks Solutions,

Inc.(a) | | | 13,718 | | | | 392,746 | |

| | | | | | | | |

| | | | | | | 827,213 | |

| | | | | | | | |

| | |

Software (0.37%) | | | | | | | | |

BMC Software, Inc.(a) | | | 5,687 | | | | 268,085 | |

| | | | | | | | |

|

Telecommunications (0.86%) | |

QUALCOMM, Inc. | | | 5,715 | | | | 282,836 | |

Verizon Communications, Inc. | | | 9,686 | | | | 346,565 | |

| | | | | | | | |

| | | | | | | 629,401 | |

| | | | | | | | |

| | |

Tobacco (0.54%) | | | | | | | | |

Philip Morris International, Inc. | | | 6,729 | | | | 393,849 | |

| | | | | | | | |

| | |

Transportation (0.69%) | | | | | | | | |

United Parcel Service, Inc., Class B 6,990 | | | | | | | 507,334 | |

| | | | | | | | |

| |

TOTAL COMMON STOCKS (Cost $21,097,877) | | | | 25,187,758 | |

| | | | | | | | |

|

EXCHANGE TRADED FUNDS (56.12%) | |

Commodity Fund (3.90%) | | | | | | | | |

PowerShares DB Oil Fund(a) | | | 51,465 | | | | 1,452,342 | |

SPDR Gold Shares(a) | | | 10,087 | | | | 1,399,269 | |

| | | | | | | | |

| | | | | | | 2,851,611 | |

| | | | | | | | |

| | | | | | | | |

| | | Shares | | | Value | |

| |

Emerging Markets (11.89%) | | | | | |

iShares MSCI All Country Asia ex Japan Index Fund | | | 27,926 | | | $ | 1,778,886 | |

iShares MSCI Chile Investable Market Index Fund | | | 6,036 | | | | 480,466 | |

iShares MSCI Emerging Markets Index Fund | | | 20,605 | | | | 981,210 | |

Vanguard Emerging Markets ETF | | | 113,179 | | | | 5,449,569 | |

| | | | | | | | |

| | | | | | | 8,690,131 | |

| | | | | | | | |

| | |

Equity Fund (3.97%) | | | | | | | | |

Global X China Consumer ETF | | | 17,630 | | | | 318,927 | |

iShares MSCI United Kingdom Index Fund | | | 40,953 | | | | 711,353 | |

Materials Select Sector SPDR ETF(b) | | | 16,498 | | | | 635,173 | |

PowerShares Dynamic Building & Construction Portfolio | | | 30,941 | | | | 402,295 | |

PowerShares S&P Small-Cap Industrials Portfolio | | | 14,551 | | | | 426,490 | |

SPDR S&P Oil & Gas Equipment & Services ETF | | | 11,154 | | | | 409,463 | |

| | | | | | | | |

| | | | | | | 2,903,701 | |

| | | | | | | | |

| |

Financial Services (1.30%) | | | | | |

PowerShares Dynamic Banking Portfolio | | | 21,215 | | | | 281,523 | |

SPDR KBW Capital Markets ETF | | | 17,485 | | | | 671,249 | |

| | | | | | | | |

| | | | | | | 952,772 | |

| | | | | | | | |

| |

Growth (3.97%) | | | | | |

Wilshire Micro-Cap ETF | | | 151,553 | | | | 2,900,724 | |

| | | | | | | | |

| |

Growth Mid Cap (1.90%) | | | | | |

SPDR S&P Mid-Cap 400 ETF Trust | | | 8,429 | | | | 1,388,088 | |

| | | | | | | | |

| |

Growth Small Cap (3.80%) | | | | | |

Powershares Zacks Micro-Cap Portfolio | | | 187,548 | | | | 2,252,451 | |

Vanguard Small-Cap ETF | | | 7,187 | | | | 521,992 | |

| | | | | | | | |

| | | | | | | 2,774,443 | |

| | | | | | | | |

| |

Health & Biotechnology (0.60%) | | | | | |

PowerShares S&P Small-Cap Health Care Portfolio | | | 15,542 | | | | 439,994 | |

| | | | | | | | |

| | | | | | |

| | | RiverFront Long-Term Growth Fund |

| | | | | |

| | | | | Statement of Investments | | December 31, 2010 |

| | | | | | | | |

| | | Shares | | | Value | |

| | |

|

International Equity (9.87%) | |

iShares MSCI Canada Index Fund | | | 46,064 | | | $ | 1,427,984 | |

iShares MSCI Singapore Index Fund | | | 150,871 | | | | 2,089,564 | |

Vanguard Europe Pacific ETF | | | 102,102 | | | | 3,690,987 | |

| | | | | | | | |

| | | | | | | 7,208,535 | |

| | | | | | | | |

|

Large Cap (1.62%) | |

iShares S&P North American Technology-Software Index Fund(a) | | | 20,237 | | | | 1,182,245 | |

| | | | | | | | |

|

Micro Cap (2.92%) | |

First Trust Dow Jones Select MicroCap Index Fund | | | 96,285 | | | | 2,132,713 | |

| | | | | | | | |

| | |

Mid Cap (0.60%) | | | | | | | | |

SPDR KBW Bank ETF | | | 17,005 | | | | 440,600 | |

| | | | | | | | |

|

Small Cap (8.30%) | |

PowerShares Dynamic Food & Beverage Portfolio | | | 21,585 | | | | 393,494 | |

PowerShares Dynamic Leisure & Entertainment Portfolio | | | 28,742 | | | | 530,865 | |

SPDR S&P Emerging Small-Cap ETF | | | 90,100 | | | | 5,136,601 | |

| | | | | | | | |

| | | | | | | 6,060,960 | |

| | | | | | | | |

|

Technology (0.63%) | |

PowerShares S&P Small-Cap Information Technology Portfolio | | | 15,541 | | | | 456,750 | |

| | | | | | | | |

| | |

Value (0.85%) | | | | | | | | |

PowerShares Dividend Achievers Portfolio | | | 44,140 | | | | 618,843 | |

| | | | | | | | |

| |

TOTAL EXCHANGE TRADED FUNDS (Cost $34,668,639) | | | | 41,002,110 | |

| | | | | | | | |

|

EXCHANGE TRADED NOTES (2.76%) | |

Equity Fund (2.76%) | | | | | | | | |

JPMorgan Alerian MLP Index ETN | | | 37,006 | | | | 1,345,168 | |

UBS E-TRACS Alerian MLP Infrastructure ETN | | | 22,187 | | | | 667,829 | |

| | | | | | | | |

| | | | | | | 2,012,997 | |

| | | | | | | | |

| |

TOTAL EXCHANGE TRADED NOTES (Cost $1,779,791) | | | | 2,012,997 | |

| | | | | | | | |

| | | | | | | | |

| | |

| 7-Day Yield | | Shares | | | Value | |

| | |

|

SHORT TERM INVESTMENTS (4.27%) | |

Dreyfus Cash Management Fund, Institutional Class 0.14% | | | 3,121,083 | | | $ | 3,121,083 | |

| | | | | | | | |

| |

TOTAL SHORT TERM INVESTMENTS (Cost $3,121,083) | | | | 3,121,083 | |

| | | | | | | | |

| |

TOTAL INVESTMENTS (97.63%) (Cost $60,667,390) | | | $ | 71,323,948 | |

| |

Other Assets In Excess of

Liabilities (2.37%) | | | | 1,735,113 | |

| | | | | | | | |

| |

NET ASSETS (100.00%) | | | $ | 73,059,061 | |

| | | | | | | | |

Common Abbreviations:

ETF - Exchange Traded Fund

ETN - Exchange Traded Note

E-TRACS - Exchange Traded Access Securities

MLP - Master Limited Partnership

MSCI - Morgan Stanley Capital International

S&P - Standard & Poor’s

SPDR - Standard & Poor’s Depository Receipt

| (a) | Non-Income Producing Security. |

| (b) | Affiliated Company. See Note 6 to Financial Statements. |

See Notes to Financial Statements.

| | | | | | |

| RiverFront Long-Term Growth Fund | | | | |

| | | | |

| | | Statement of Investments | | | December 31, 2010 (Unaudited) | |

Top Ten Holdings (as a % of Net Assets) †

| | | | |

Vanguard Emerging Markets ETF | | | 7.46 | % |

SPDR S&P Emerging SmallCap ETF | | | 7.03 | % |

Vanguard Europe Pacific ETF | | | 5.05 | % |

Wilshire Micro-Cap ETF | | | 3.97 | % |

Powershares Zacks Micro-Cap Portfolio | | | 3.08 | % |

First Trust Dow Jones Select MicroCap Index Fund | | | 2.92 | % |

iShares MSCI Singapore Index Fund | | | 2.86 | % |

iShares MSCI All Country Asia ex Japan Index Fund | | | 2.43 | % |

PowerShares DB Oil Fund | | | 1.99 | % |

iShares MSCI Canada Index Fund | | | 1.95 | % |

Top Ten Holdings | | | 38.74 | % |

| † | Future holdings are subject to change. |

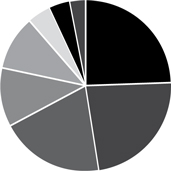

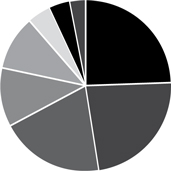

Portfolio Composition (as a % of Net Assets)

| | | | |

Sector | | | % | |

Small/Mid-Cap Equity | | | 24.65 | % |

Large Cap Equity | | | 23.00 | % |

Emerging Market Equity | | | 19.83 | % |

International Equity | | | 11.10 | % |

Micro Cap Equity | | | 10.22 | % |

Cash | | | 4.38 | % |

Currency and Other | | | 4.00 | % |

Income Oriented Equities | | | 2.82 | % |

| | | | | | | | |

| | | Statement of Assets and Liabilities | |

| | | | | | |

| | | | | | | | December 31, 2010 | |

| | | | |

ASSETS | | | | |

Investments, at value (Cost $60,126,460) | | $ | 70,688,775 | |

Investments in affiliates, at value (Cost $540,930) | | | 635,173 | |

Receivable for shares sold | | | 1,665,876 | |

Dividends and interest receivable | | | 39,674 | |

Receivable due from adviser | | | 66,015 | |

Prepaid expenses and other assets | | | 15,456 | |

| | |

Total Assets | | | 73,110,969 | |

| | |

| |

LIABILITIES | | | | |

Administration and transfer agency fees payable | | | 6,336 | |

Distribution and services fees payable | | | 6,851 | |

Directors’ fees and expenses payable | | | 3,152 | |

Legal fees payable | | | 8,154 | |

Custody fees payable | | | 2,000 | |

Report to shareholders and printing fees payable | | | 6,114 | |

Accrued expenses and other liabilities | | | 19,301 | |

| | |

Total Liabilities | | | 51,908 | |

| | |

NET ASSETS | | $ | 73,059,061 | |

| | |

| |

NET ASSETS CONSIST OF | | | | |

Paid-in capital | | $ | 61,681,884 | |

Undistributed net investment income | | | 12,313 | |

Accumulated net realized gain on investments | | | 708,306 | |

Net unrealized appreciation on investments | | | 10,656,558 | |

| | |

NET ASSETS | | $ | 73,059,061 | |

| | |

See Notes to Financial Statements.

| | | | | | | | |

| | | Statement of Assets and Liabilities | |

| | | | | | |

| | | | | | | | December 31, 2010 | |

| | | | |

PRICING OF SHARES | | | | |

Class A: | | | | |

Net Asset Value, offering and redemption price per share(a) | | $ | 14.66 | |

Net Assets | | $ | 1,934,030 | |

Shares of beneficial interest outstanding (unlimited number of shares, no par value common stock authorized) | | | 131,950 | |

Maximum offering price per share (NAV/0.9450), based on maximum sales charge of 5.50% of the offering price) | | $ | 15.51 | |

| |

Class C: | | | | |

Net Asset Value, offering and redemption price per share(a) | | $ | 14.63 | |

Net Assets | | $ | 2,049,698 | |

Shares of beneficial interest outstanding (unlimited number of shares, no par value common stock authorized) | | | 140,119 | |

| |

Class I: | | | | |

Net Asset Value, offering and redemption price per share | | $ | 14.65 | |

Net Assets | | $ | 2,279,925 | |

Shares of beneficial interest outstanding (unlimited number of shares, no par value common stock authorized) | | | 155,636 | |

| |

Class L: | | | | |

Net Asset Value, offering and redemption price per share | | $ | 14.63 | |

Net Assets | | $ | 43,239,595 | |

Shares of beneficial interest outstanding (unlimited number of shares, no par value common stock authorized) | | | 2,955,362 | |

| |

Investor Class: | | | | |

Net Asset Value, offering and redemption price per share | | $ | 14.59 | |

Net Assets | | $ | 23,555,813 | |

Shares of beneficial interest outstanding (unlimited number of shares, no par value common stock authorized) | | | 1,614,688 | |

| (a) | Redemption price per share may be reduced for any applicable contingent deferred sales charge. For a description of a possible sales charge, please see the Fund’s Prospectus. |

See Notes to Financial Statements.

| | | | | | | | |

| | | Statement of Operations | |

| | | | | | |

| | | | | | | | For the Year Ended December 31, 2010 | |

| | | | |

INVESTMENT INCOME | | | | |

Dividends from unaffiliated securities | | $ | 1,028,056 | |

Dividends from affiliated securities | | | 18,340 | |

Interest and other income | | | 47,256 | |

| | |

Total Investment Income | | | 1,093,652 | |

| | |

| |

EXPENSES | | | | |

Investment advisory fees | | | 403,220 | |

Administrative and transfer agency fee | | | 65,485 | |

Distribution and service fees | | | | |

Class A | | | 546 | |

Class C | | | 2,140 | |

Investor Class | | | 49,477 | |

Legal fees | | | 78,098 | |

Reports to shareholders and printing fees | | | 19,455 | |

State registration fees | | | 25,407 | |

Insurance | | | 500 | |

Custody fees | | | 13,255 | |

Directors’ fees and expenses | | | 54,411 | |

Miscellaneous | | | 17,157 | |

| | |

Total Expenses | | | 729,151 | |

Less fees waived/reimbursed by investment adviser and sub-adviser | | | | |

Class A | | | (2,709) | |

Class C | | | (2,631) | |

Class I | | | (1,245) | |

Class L | | | (195,927) | |

Investor Class | | | (110,797) | |

| | |

Net Expenses | | | 415,842 | |

| | |

Net Investment Income | | | 677,810 | |

| | |

| |

Net realized gain on investments | | | 1,387,125 | |

Net realized loss on investments - affiliated securities | | | (410) | |

Net change in unrealized appreciation of investments | | | 5,485,730 | |

| | |

NET REALIZED AND UNREALIZED GAIN ON INVESTMENTS | | | 6,872,445 | |

| | |

NET INCREASE IN NET ASSETS RESULTING FROM OPERATIONS | | $ | 7,550,255 | |

| | |

See Notes to Financial Statements.

| | | | | | |

| | | Statements of Changes in Net Assets |

| | | | | |

| | | | | | | |

| | | | | | | | |

| | | For the Year Ended December 31, 2010 | | | For the Year Ended December 31, 2009 | |

| | |

OPERATIONS | | | | | | | | |

Net investment income | | $ | 677,810 | | | $ | 256,209 | |

Net realized gain on investments | | | 1,387,125 | | | | 83,824 | |

Net realized loss on investments - affiliated securities | | | (410) | | | | – | |

Net change in unrealized appreciation on investments | | | 5,485,730 | | | | 5,035,621 | |

| | |

Net Increase in Net Assets Resulting from Operations | | | 7,550,255 | | | | 5,375,654 | |

| | |

| | |

DISTRIBUTIONS | | | | | | | | |

Dividends to shareholders from net investment income | | | | | | | | |

Class A | | | (17,765) | | | | N/A | |

Class C | | | (16,050) | | | | N/A | |

Class I | | | (7,114) | | | | N/A | |

Class L | | | (433,125) | | | | (183,786) | |

Investor Class | | | (189,956) | | | | (79,120) | |

Dividends to shareholders from net realized gains | | | | | | | | |

Class A | | | (17,553) | | | | N/A | |

Class C | | | (17,494) | | | | N/A | |

Class I | | | (6,746) | | | | N/A | |

Class L | | | (401,355) | | | | – | |

Investor Class | | | (221,742) | | | | – | |

| | |

Net Decrease in Net Assets from Distributions | | | (1,328,900) | | | | (262,906) | |

| | |

| | |

BENEFICIAL INTEREST TRANSACTIONS (NOTE 4) | | | | | | | | |

Shares sold | | | | | | | | |

Class A | | | 1,873,880 | | | | N/A | |

Class C | | | 1,977,787 | | | | N/A | |

Class I | | | 2,241,130 | | | | N/A | |

Class L | | | 17,118,139 | | | | 19,773,680 | |

Investor Class | | | 10,282,445 | | | | 12,871,509 | |

Dividends reinvested | | | | | | | | |

Class A | | | 30,821 | | | | N/A | |

Class C | | | 32,260 | | | | N/A | |

Class I | | | 10,823 | | | | N/A | |

Class L | | | 803,434 | | | | 176,343 | |

Investor Class | | | 372,558 | | | | 75,986 | |

Shares redeemed | | | | | | | | |

Class A | | | (8,866) | | | | N/A | |

Class C | | | – | | | | N/A | |

Class I | | | – | | | | N/A | |

Class L | | | (6,407,084) | | | | (3,570,027) | |

Investor Class | | | (3,134,097) | | | | (660,468) | |

| | |

Net Increase in Net Assets Derived from Beneficial Interest Transactions | | | 25,193,230 | | | | 28,667,023 | |

| | |

| | |

Net increase in net assets | | | 31,414,585 | | | | 33,779,771 | |

| | |

Net Assets | | | | | | | | |

Beginning of year | | | 41,644,476 | | | | 7,864,705 | |

| | |

End of year* | | $ | 73,059,061 | | | $ | 41,644,476 | |

| | |

| | |

* Includes undistributed net investment income of: | | $ | 12,313 | | | $ | – | |

See Notes to Financial Statements.

| | | | | | |

| | | Financial Highlights |

| | | | | |

| | | | | Selected data for a share of beneficial interest outstanding throughout the period indicated: | | |

| | |

| | | RiverFront Long-Term Growth Fund [Class A] |

| |

| | | For the Period September 27, 2010 (Inception) to December 31, 2010 |

| |

| |

Net asset value, beginning of period | | $13.68 |

| |

INCOME FROM INVESTMENT OPERATIONS: | | |

Net investment income after reimbursements (a) | | 0.23 |

Net realized and unrealized gain | | 1.03 |

| |

Total from investment operations | | 1.26 |

| |

| |

DISTRIBUTIONS: | | |

From net investment income after reimbursements | | (0.14) |

From net realized gains | | (0.14) |

| |

Total distributions | | (0.28) |

| |

| |

Net increase in net asset value | | 0.98 |

| |

Net asset value, end of year | | $14.66 |

| |

TOTAL RETURN (b) | | 9.22% |

| |

RATIOS/SUPPLEMENTAL DATA: | | |

Net assets, end of year (000s) | | $1,934 |

Ratio of net investment income after reimbursements to average net assets | | 6.20%(c) |

Ratio of expenses to average net assets including fee waivers and reimbursements (includes acquired fund fee reimbursement) | | 0.91%(c) |

Ratio of expenses to average net assets including fee waivers and reimbursements (excludes acquired fund fee reimbursement) | | 1.15%(c) |

Ratio of expenses to average net assets excluding fee waivers and reimbursements | | 2.15%(c) |

Portfolio turnover rate | | 99%(d) |

| (a) | Calculated using average shares outstanding during the period. |

| (b) | Total returns are for the period indicated and have not been annualized. Total returns would have been lower had certain expenses not been waived during the period. Returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Returns shown exclude any applicable sales charges. |

| (d) | Portfolio turnover rate for periods less than one full year have not been annualized. |

See Notes to Financial Statements.

| | | | | | |

| | | Financial Highlights |

| | | | | |

| | | | | Selected data for a share of beneficial interest outstanding throughout the period indicated: | | |

| | |

| | | RiverFront Long-Term Growth Fund [Class C] |

| |

| | | For the Period September 27, 2010 (Inception) to December 31, 2010 |

| |

| |

Net asset value, beginning of period | | $13.68 |

| |

INCOME FROM INVESTMENT OPERATIONS: | | |

Net investment income after reimbursements (a) | | 0.20 |

Net realized and unrealized gain | | 1.02 |

| |

Total from investment operations | | 1.22 |

| |

| |

DISTRIBUTIONS: | | |

From net investment income after reimbursements | | (0.13) |

From net realized gains | | (0.14) |

| |

Total distributions | | (0.27) |

| |

| |

Net increase in net asset value | | 0.95 |

| |

Net asset value, end of year | | $14.63 |

| |

TOTAL RETURN (b) | | 8.91% |

| |

RATIOS/ SUPPLEMENTAL DATA: | | |

Net assets, end of year (000s) | | $2,050 |

Ratio of net investment income after reimbursements to average net assets | | 5.36% (c) |

Ratio of expenses to average net assets including fee waivers and reimbursements (includes acquired fund fee reimbursement) | | 1.66% (c) |

Ratio of expenses to average net assets including fee waivers and reimbursements (excludes acquired fund fee reimbursement) | | 1.90% (c) |

Ratio of expenses to average net assets excluding fee waivers and reimbursements | | 2.89% (c) |

Portfolio turnover rate | | 99% (d) |

| (a) | Calculated using average shares outstanding during the period. |

| (b) | Total returns are for the period indicated and have not been annualized. Total returns would have been lower had certain expenses not been waived during the period. Returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Returns shown exclude any applicable sales charges. |

| (d) | Portfolio turnover rate for periods less than one full year have not been annualized. |

See Notes to Financial Statements.

| | | | | | |

| | | Financial Highlights |

| | | | | |

| | | | | Selected data for a share of beneficial interest outstanding throughout the period indicated: | | |

| | |

| | | RiverFront Long-Term Growth Fund [Class I] |

| |

| | | For the Period September 27, 2010 (Inception) to December 31, 2010 |

| |

| |

Net asset value, beginning of period | | $13.68 |

| |

INCOME FROM INVESTMENT OPERATIONS: | | |

Net investment income after reimbursements (a) | | 0.17 |

Net realized and unrealized gain | | 1.09 |

| |

Total from investment operations | | 1.26 |

| |

| |

DISTRIBUTIONS: | | |

From net investment income after reimbursements | | (0.15) |

From net realized gains | | (0.14) |

| |

Total distributions | | (0.29) |

| |

| |

Net increase in net asset value | | 0.97 |

| |

Net asset value, end of year | | $14.65 |

| |

TOTAL RETURN (b) | | 9.12% |

| |

RATIOS/ SUPPLEMENTAL DATA: | | |

Net assets, end of year (000s) | | $2,280 |

Ratio of net investment income after reimbursements to average net assets | | 4.70% (c) |

Ratio of expenses to average net assets including fee waivers and reimbursements (includes acquired fund fee reimbursement) | | 0.66% (c) |

Ratio of expenses to average net assets including fee waivers and reimbursements (excludes acquired fund fee reimbursement) | | 0.90% (c) |

Ratio of expenses to average net assets excluding fee waivers and reimbursements | | 1.74% (c) |

Portfolio turnover rate | | 99% (d) |

| (a) | Calculated using average shares outstanding during the period. |

| (b) | Total returns are for the period indicated and have not been annualized. Total returns would have been lower had certain expenses not been waived during the period. Returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. |

| (d) | Portfolio turnover rate for periods less than one full year have not been annualized. |

See Notes to Financial Statements.

| | | | | | | | |

| Financial Highlights | | | | |

| | | | | | |

| | | | | Selected data for a share of beneficial interest outstanding throughout the periods indicated: | | | | |

| | | | | | | | | | | | |

| | | RiverFront Long-Term Growth Fund [Class L^] | |

| | |

| | | For the Year Ended December 31, 2010 | | | For the Year Ended December 31, 2009 | | | For the Period October 28, 2008 (Inception) to December 31, 2008 | |

| | |

| | | |

Net asset value, beginning of period | | | $13.22 | | | | $10.49 | | | | $10.00 | |

| | |

INCOME FROM INVESTMENT OPERATIONS: | | | | | | | | | |

Net investment income after reimbursements (a) | | | 0.18 | | | | 0.16 | | | | 0.12 | |

Net realized and unrealized gain | | | 1.52 | | | | 2.66 | | | | 0.46 | |

| | |

Total from investment operations | | | 1.70 | | | | 2.82 | | | | 0.58 | |

| | |

| | | |

DISTRIBUTIONS: | | | | | | | | | | | | |

From net investment income after reimbursements | | | (0.15) | | | | (0.09) | | | | (0.09) | |

From net realized gains | | | (0.14) | | | | – | | | | – | |

| | |

Total distributions | | | (0.29) | | | | (0.09) | | | | (0.09) | |

| | |

| | | |

Net increase in net asset value | | | 1.41 | | | | 2.73 | | | | 0.49 | |

| | |

Net asset value, end of year | | | $14.63 | | | | $13.22 | | | | $10.49 | |

| | |

TOTAL RETURN (b) | | | 12.87% | | | | 26.86% | | | | 5.81% | |

| | | |

RATIOS/ SUPPLEMENTAL DATA: | | | | | | | | | | | | |

Net assets, end of year (000s) | | | $43,240 | | | | $27,763 | | | | $7,439 | |

Ratio of net investment income after reimbursements to average net assets | | | 1.33% | | | | 1.34% | | | | 7.55% (c) | |

Ratio of expenses to average net assets including fee waivers and reimbursements (includes acquired fund fee reimbursement) | | | 0.66% | | | | N/A | | | | N/A | |

Ratio of expenses to average net assets including fee waivers and reimbursements (excludes acquired fund fee reimbursement) | | | 0.90% | | | | 0.90% | | | | 0.90% (c) | |

Ratio of expenses to average net assets excluding fee waivers and reimbursements | | | 1.22% | | | | 1.53% | | | | 4.97% (c) | |

Portfolio turnover rate (d) | | | 99% | | | | 67% | | | | 13% | |

| ^ | Prior to close of business on September 24, 2010, Class L was known as Institutional Class of the Predecessor Fund. |

| (a) | Calculated using average shares outstanding during the period. |

| (b) | Total returns are for the period indicated and have not been annualized. Total returns would have been lower had certain expenses not been waived during the period. Returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. |

| (d) | Portfolio turnover rate for periods less than one full year have not been annualized. |

See Notes to Financial Statements.

| | | | | | | | |

| Financial Highlights | | | | |

| | | | | | |

| | | | | Selected data for a share of beneficial interest outstanding throughout the periods indicated: | | | | |

| | | | | | | | | | | | |

| | | RiverFront Long-Term Growth Fund [Investor Class] | |

| | |

| | | For the Year Ended December 31, 2010 | | | For the Year Ended December 31, 2009 | | | For the Period October 28, 2008 (Inception) to December 31, 2008 | |

| | |

| | | |

Net asset value, beginning of period | | | $13.19 | | | | $10.49 | | | | $10.00 | |

| | | |

INCOME FROM INVESTMENT OPERATIONS: | | | | | | | | | | | | |

Net investment income after reimbursements (a) | | | 0.12 | | | | 0.13 | | | | 0.12 | |

Net realized and unrealized gain | | | 1.54 | | | | 2.65 | | | | 0.46 | |

| | |

Total from investment operations | | | 1.66 | | | | 2.78 | | | | 0.58 | |

| | |

| | | |

DISTRIBUTIONS: | | | | | | | | | | | | |

From net investment income after reimbursements | | | (0.12) | | | | (0.08) | | | | (0.09) | |

From net realized gains | | | (0.14) | | | | – | | | | – | |

| | |

Total distributions | | | (0.26) | | | | (0.08) | | | | (0.09) | |

| | |

| | | |

Net increase in net asset value | | | 1.40 | | | | 2.70 | | | | 0.49 | |

| | |

Net asset value, end of year | | | $14.59 | | | | $13.19 | | | | $10.49 | |

| | |

TOTAL RETURN (b) | | | 12.58% | | | | 26.58% | | | | 5.68% | |

| | | |

RATIOS/ SUPPLEMENTAL DATA: | | | | | | | | | | | | |

Net assets, end of year (000s) | | | $23,556 | | | | $13,882 | | | | $425,980 | |

Ratio of net investment income after reimbursements to average net assets | | | 0.93% | | | | 1.09% | | | | 7.30% (c) | |

Ratio of expenses to average net assets including fee waivers and reimbursements (includes acquired fund fee reimbursement) | | | 0.91% | | | | N/A | | | | N/A | |

Ratio of expenses to average net assets including fee waivers and reimbursements (excludes acquired fund fee reimbursement) | | | 1.15% | | | | 1.15% | | | | 1.15% (c) | |

Ratio of expenses to average net assets excluding fee waivers and reimbursements | | | 1.47% | | | | 1.78% | | | | 5.22% (c) | |

Portfolio turnover rate (d) | | | 99% | | | | 67% | | | | 13% | |

| (a) | Calculated using average shares outstanding during the period. |

| (b) | Total returns are for the period indicated and have not been annualized. Total returns would have been lower had certain expenses not been waived during the period. Returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. |

| (d) | Portfolio turnover rate for periods less than one full year have not been annualized. |

See Notes to Financial Statements.

| | | | | | |

| Notes to Financial Statements | | | | |

| | | | |

| | | | | | December 31, 2010 | |

1. ORGANIZATION

Financial Investors Trust (the “Trust”) was organized as a Delaware statutory trust on November 30, 1993 and registered as an open-end management investment company under the Investment Company Act of 1940, as amended (“1940 Act”). As of December 31, 2010, the Trust consists of 11 separate portfolios which include multiple series of shares, with differing investment objectives and policies. This report pertains to the RiverFront Long-Term Growth Fund (the “Fund”). The Fund’s objective is to achieve long-term capital appreciation.

The Fund offers multiple series of shares. Each class differs as to sales and redemption charges and ongoing fees. All classes of shares have identical rights to earnings, assets and voting privileges, except for class-specific expenses and exclusive rights to vote on matters affecting only individual classes. Class A shares of the Fund are subject to an initial sales charge of up to 5.50%. Class A shares and Class C shares of the Fund, as applicable, for which no initial sales charge was paid are subject to a contingent deferred sales charge of 1% if the shares are sold within twelve months after a purchase in excess of $1 million.

Each class has equal rights as to class and voting privileges. The classes differ principally in the applicable distribution and shareholder service fees. Shareholders of each class also bear certain expenses that pertain to that particular class. All shareholders bear the common expenses of the Fund and earn income and realized gains/losses from the Fund pro rata based on the average daily net assets of each class, without distinction between share classes. Dividends are determined separately for each class based on income and expenses allocable to each class. Realized gain distributions are allocated to each class pro rata based on the shares outstanding of each class on the date of distribution. Differences in per share dividend rates generally result from differences in separate class expenses, including distribution and shareholder service fees, if applicable.

On September 24, 2010, RiverFront Long-Term Growth Fund (the “Predecessor Fund”), a series of Baird Funds, Inc., participated in a tax-free reorganization whereby the Predecessor Fund merged into the newly created RiverFront Long-Term Growth Fund, a series of the Financial Investors Trust. For financial reporting purposes, the Predecessor Fund was considered the acquirer and as such the Fund has carried over the historic performance and financial results of the Predecessor Fund. The Predecessor Fund commenced operations on October 28, 2008.

2. SIGNIFICANT ACCOUNTING POLICIES

The following is a summary of significant accounting policies consistently followed by the Fund in the preparation of its financial statements. The accompanying financial statements were prepared in accordance with accounting principles generally accepted in

the United States of America (“U.S. GAAP”). The preparation of financial statements in conformity with U.S. GAAP requires management to make certain estimates and assumptions that affect the reported amounts of assets and liabilities and disclosures of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenue and expenses during the period. Actual results could differ from those estimates.

Investment Valuation

The Fund generally values its securities based on market prices determined at the close of regular trading on the New York Stock Exchange (“NYSE”), normally 4:00 p.m. Eastern Time, on each day the NYSE is open for trading. The Fund’s net asset value (“NAV”) is computed by dividing the value of all assets of the Fund (including accrued interest and dividends), less all liabilities (including accrued expenses and dividends declared but unpaid), by the total number of shares outstanding.

For equity securities and funds that are traded on an exchange, the market price is usually the closing sale or official closing price on that exchange. In the case of equity securities not traded on an exchange, or if such closing prices are not otherwise available, the market price is typically determined by independent third party pricing vendors approved by the Board using a variety of pricing techniques and methodologies. The market price for debt obligations is generally the price supplied by an independent third-party pricing service approved by the Board, which may use a matrix, formula or other objective method that takes into consideration market indices, yield curves and other specific adjustments. Short–term debt obligations that will mature in 60 days or less are valued at amortized cost, unless it is determined that using this method would not reflect an investment’s fair value. If vendors are unable to supply a price, or if the price supplied is deemed to be unreliable, the market price may be determined using quotations received from one or more brokers–dealers that make a market in the security. Investments in non-exchange traded funds are fair valued at their respective net asset values.

When such prices or quotations are not available, or when the Fair Value Committee appointed by the Board of Trustees (the “Board”) believes that they are unreliable, securities may be priced using fair value procedures approved by the Board. The Fund may also use fair value procedures if the Fair Value Committee determines that a significant event has occurred between the time at which a market price is determined and the time at which the Fund’s NAV is calculated. In particular, the value of non-U.S. securities may be materially affected by events occurring after the close of the foreign exchange on which they are traded, but before the Fund prices its shares. The Fund held no fair valued securities on December 31, 2010.

The Fund discloses the classification of its fair value measurements following a three-tier hierarchy based on the inputs used to

| | | | | | |

| Notes to Financial Statements | | | | |

| | | | |

| | | | | | December 31, 2010 | |

measure fair value. Inputs refer broadly to the assumptions that market participants would use in pricing the asset or liability, including assumptions about risk. Inputs may be observable or unobservable. Observable inputs reflect the assumptions market participants would use in pricing the asset or liability that are developed based on market data obtained from sources independent of the reporting entity. Unobservable inputs reflect the reporting entity’s own assumptions about the assumptions market participants would use in pricing the asset or liability that are developed based on the best information available.

Various inputs are used in determining the value of the Fund’s investments as of the end of the reporting period. When inputs used fall into different levels of the fair value hierarchy, the level in the hierarchy within which the fair value measurement falls is

determined based on the lowest level input that is significant to the fair value measurement in its entirety. The designated input levels are not necessarily an indication of the risk or liquidity associated with these investments. These inputs are categorized in the following hierarchy under applicable financial accounting standards:

| | | | |

| Level 1 – | | | | unadjusted quoted prices in active markets for identical investments |

| Level 2 – | | | | other significant observable inputs (including quoted prices for similar securities, interest rates, prepayment speeds, credit risk, etc.) |

| Level 3 – | | | | significant unobservable inputs (including the Fund’s own assumptions in determining the fair value of investments) |

| | | | | | | | |

Investments in Securities at Value* | | Level 1 – Unadjusted Quoted Prices | | Level 2 – Other Significant Observable Inputs | | Level 3 – Significant Unobservable Inputs | | Total |

Common Stocks | | $ 25,187,758 | | $ – | | $ – | | $ 25,187,758 |

Exchange Traded Funds | | 41,002,110 | | – | | – | | 41,002,110 |

Exchange Traded Notes | | 2,012,997 | | – | | – | | 2,012,997 |

Short Term Investments | | 3,121,083 | | – | | – | | 3,121,083 |

Total | | $ 71,323,948 | | $ – | | $ – | | $ 71,323,948 |

| | | | | | | | | |

| * | For detailed descriptions of industries, see the accompanying Statement of Investments. |

Investment Transactions

Investment and shareholder transactions are accounted for on the date the investments are purchased or sold (trade date). Realized gains and losses from investment transactions are reported on an identified cost basis. Interest income, which includes accretion of discounts, is accrued and recorded as earned. Dividend income is recognized on the ex-dividend date or for certain foreign securities, as soon as information is available to the Fund.

Trust Expenses

Some expenses of the Trust can be directly attributed to the Fund. Expenses which cannot be directly attributed are apportioned among all funds in the Trust based on average net assets.

Federal Income Taxes

The Fund complies with the requirements under Subchapter M of the Internal Revenue Code applicable to regulated investment companies and intends to distribute substantially all of its net taxable income and net capital gains, if any, each year. The Fund is not subject to income taxes to the extent such distributions are made.

As of and during the fiscal year ended December 31, 2010, the Fund did not have a liability for any unrecognized tax benefits in the accompanying financial statements. The Fund

files income tax returns in the U.S. federal jurisdiction and Colorado. For the periods ended December 31, 2008 through December 31, 2010, the Fund’s returns are still open to examination by the appropriate taxing authority.

Distributions to Shareholders

The Fund normally pays dividends and distributes capital gains, if any, on an annual basis. Income dividend distributions are derived from interest and other income the Fund receives from its investments, including distributions of short-term capital gains. Capital gain distributions are derived from gains realized when the Fund sells a security it has owned for more than a year. The Fund may make additional distributions and dividends at other times if the portfolio manager believes doing so may be necessary for the Fund to avoid or reduce taxes. Net investment income/(loss) and net realized gain/(loss) may differ for financial statement and tax purposes. The character of distributions made during the year from net investment income or net realized gains may differ from its ultimate characterization for federal income tax purposes. Also, due to the timing of dividend distributions, the fiscal year in which amounts are distributed may differ from the fiscal year in which the income or realized gain were recorded by the Fund.

| | | | | | |

| Notes to Financial Statements | | | | |

| | | | |

| | | | | | December 31, 2010 | |

The tax character of distributions paid by the Fund for the period ended December 31, 2010 is as follows:

| | | | | | |

Distributions paid from: | | | | | | |

Ordinary income | | | | $ | 780,256 | |

Long-term capital gain | | | | $ | 548,644 | |

Components of Earnings

For the period ended December 31, 2010, permanent differences in book and tax accounting were reclassified. These differences had no effect on net assets and were primarily attributed to differences in the treatment of commodity related ETFs and certain other investments. The reclassifications were as follows:

| | | | |

Undistributed Net Investment Income | | Accumulated Net Realized Gain | | Paid-in Capital |

$ (1,487) | | $ 1,495 | | $ (8) |

Post October Losses

Under current tax law, capital and currency losses realized after October 31 may be deferred and treated as occurring on the first day of the following fiscal year. No capital or currency losses were deferred for the year ending December 31, 2010.

As of December 31, 2010, the components of distributable earnings on a tax basis were as follows:

| | | | |

Accumulated Capital Gains Undistributed | | Ordinary Income Undistributed | | Net Unrealized Appreciation |

$ 451,234 | | $ 369,172 | | $ 10,556,771 |

Capital Loss Carry Forwards

Accumulated capital losses noted below represent net capital loss carryovers as of December 31, 2010 that may be available to offset future realized capital gains and thereby reduce future taxable gains distributions. The Fund had no capital loss carryovers as of December 31, 2010.

Unrealized Appreciation and Depreciation on Investments

As of December 31, 2010, the costs of investments for federal income tax purposes and accumulated net unrealized appreciation/(depreciation) on investments were as follows:

| | | | | | |

Gross Appreciation

(excess of value over tax cost) | | | | $ | 10,965,966 | |

Gross Depreciation

(excess of tax cost over value) | | | | | (409,195 | ) |

Net unrealized appreciation/

(depreciation) | | | | $ | 10,556,771 | |

Cost of investments for income tax purposes | | | | $ | 60,767,177 | |

3. SECURITY TRANSACTIONS

Purchases and sales of securities, excluding short–term securities during the period ended December 31, 2010 were $72,319,951 and $51,123,689, respectively.

4. CAPITAL SHARE TRANSACTIONS

Transactions in shares of capital stock for the last two full fiscal years were as follows:

| | | | | | | | |

| | | For the Year Ended December 31, 2010 | | | For the Year Ended December 31, 2009 | |

Class A | | | | | | | | |

Shares sold | | | 130,462 | | | | N/A | |

Dividends reinvested | | | 2,115 | | | | N/A | |

Shares redeemed | | | (627 | ) | | | N/A | |

Net increase in shares outstanding | | | 131,950 | | | | N/A | |

| | | | | | | | | |

Class C | | | | | | | | |

Shares sold | | | 137,900 | | | | N/A | |

Dividends reinvested | | | 2,219 | | | | N/A | |

Net increase in shares outstanding | | | 140,119 | | | | N/A | |

| | | | | | | | | |

Class I | | | | | | | | |

Shares sold | | | 154,892 | | | | N/A | |

Dividends reinvested | | | 744 | | | | N/A | |

Net increase in shares outstanding | | | 155,636 | | | | N/A | |

| | | | | | | | | |

Class L | | | | | | | | |

Shares sold | | | 1,286,522 | | | | 1,709,014 | |

Dividends reinvested | | | 55,257 | | | | 13,072 | |

Shares redeemed | | | (486,215 | ) | | | (331,302) | |

Net increase in shares outstanding | | | 855,564 | | | | 1,390,784 | |

| | | | | | | | | |

| | | | | | |

| Notes to Financial Statements | | | | |

| | | | |

| | | | | | December 31, 2010 | |

| | | | | | | | |

| | | For the Year Ended December 31, 2010 | | | For the Year Ended December 31, 2009 | |

Investor Class | | | | | | | | |

Shares sold | | | 771,332 | | | | 1,060,950 | |

Dividends reinvested | | | 25,694 | | | | 5,717 | |

Shares redeemed | | | (234,795 | ) | | | (54,832) | |

Net increase in shares outstanding | | | 562,231 | | | | 1,011,835 | |

| | | | | | | | | |

| 5. | MANAGEMENT AND RELATED-PARTY TRANSACTIONS |

ALPS Advisors, Inc. (“AAI” or “Adviser”), subject to the authority of the Board, is responsible for the overall management and administration of the Fund’s business affairs. AAI has delegated daily management of the Fund to RiverFront Investment Group, LLC (the “Sub-Adviser”). The Sub-Adviser manages the investments of the Fund in accordance with its investment objective, policies and limitations and investment guidelines established jointly by the Adviser and the Board.

Pursuant to the Investment Advisory Agreement (the “Advisory Agreement”), the Fund pays the Adviser an annual management fee of 0.90% based on the Fund’s average daily net assets. The management fee is paid on a monthly basis. The Adviser pays the Sub-Adviser an annual sub-advisory management fee of 0.60% based on the Fund’s average daily net assets. The management fee is paid on a monthly basis.

Prior to close of business on September 24, 2010, the Predecessor Fund had an Investment Advisory Agreement with Baird Funds, Inc. for the provision of investment advisory services. Pursuant to that agreement, Baird Funds, Inc. was entitled to receive a fee, calculated daily and payable monthly, at the annual rate of 0.65% of the Predecessor Fund’s average daily net assets. Baird Funds, Inc. also maintained a Sub-Advisory Agreement with RiverFront Investment Group, LLC under which the Sub-Adviser was responsible for daily management of the Predecessor Fund. Pursuant to that Sub-Advisory Agreement, Baird Funds, Inc. was responsible for paying a sub-advisory fee at an annual rate of 0.45% of the Predecessor Fund’s average daily net assets.

The Adviser and the Sub-Adviser have contractually agreed to waive and/or reimburse fund expenses (including Acquired Fund Fees and Expenses) in order to limit the net annual operating expenses of the Fund to 0.90% of the average daily net assets for each Class of the Fund. This obligation excludes distribution and service (12b-1) fees, shareholder service fees, brokerage commissions, taxes and extraordinary expenses. Acquired Fund Fees and Expenses are expected to be indirecty incurred by the Fund as a result of its investments in investment companies and exchange-traded funds. This agreement was in effect with

Baird Funds, Inc. until September 24, 2010 and is currently in effect with the Adviser and the Sub-Adviser through December 31, 2012 and will be reevaluated on an annual basis thereafter. Each of the Adviser and the Sub-Adviser will be permitted to recover expenses it has waived or reimbursed, on a class-by-class basis, through this agreement to the extent that expenses in later periods fall below the annual limits set forth in this agreement. The Fund will not be obligated to pay any such waived or reimbursed fees and expenses more than three years after the end of the fiscal year in which the fees or expenses were waived or reimbursed. At December 31, 2010, the Adviser may seek reimbursement of previously waived and reimbursed fees as follows:

ALPS Distributors, Inc. (an affiliate of ALPS and AAI) (“ADI” or the “Distributor”) acts as the distributor of the Fund’s shares pursuant to a Distribution Agreement with the Trust. Shares are sold on a continuous basis by ADI as agent for the Fund, and ADI has agreed to use its best efforts to solicit orders for the sale of Fund shares, although it is not obliged to sell any particular amount of shares. ADI is not entitled to any compensation for its services as Distributor. ADI is registered as a broker-dealer with the Securities and Exchange Commission.

The Fund has adopted a Distribution and Services Plan (the “Plan”) pursuant to Rule 12b-1 of the 1940 Act for the Class A, Class C and Investor Class shares. The Plan allows the Fund to use Class A, Class C and Investor Class assets to pay fees in connection with the distribution and marketing of Class A, Class C and Investor Class shares and/or the provision of shareholder services to Class A, Class C and Investor Class shareholders. The Plan permits payment for services in connection with the administration of plans or programs that use Class A, Class C and Investor Class shares of the Fund, if any, as their funding medium and for related expenses. The Plan permits the Fund to make total payments at an annual rate of up to 0.25% of the Fund’s average daily net assets attributable to its Class A and Investor Class shares, if any, and 0.75% of the Fund’s average daily net assets attributable to its Class C shares. Because these fees are paid out of the Fund’s Class A, Class C and Investor Class assets, if any, on an ongoing basis, over time they will increase the cost of an investment in Class A, Class C and Investor Class shares, if any, and Plan fees may cost an investor more than other types of sales charges.

Prior to the close of business on September 24, 2010, the Predecessor Fund had a Distribution and Services Plan with Robert W. Baird & Co. Inc. that allowed it to use Investor Class assets to pay fees of up to 0.25% of the Predecessor Fund’s Investor Class average net assets in connection with the distribution and marketing of Investor Class shares and/or the provision of shareholder services to Investor Class shareholders.

| | | | | | |

| Notes to Financial Statements | | | | |

| | | | |

| | | | | | December 31, 2010 | |

The Fund has adopted a shareholder services plan (a “Shareholder Services Plan”) with respect to the Fund’s Class C shares. Under the Shareholder Services Plan, the Fund is authorized to pay banks and their affiliates and other institutions, including broker-dealers and Fund affiliates (“Participating Organizations”), an aggregate fee in an amount not to exceed on an annual basis 0.25% for Class C shares of the average daily net asset value of the Class C shares of the Fund attributable to or held in the name of a Participating Organization for its clients as compensation for providing shareholder service activities, which do not include distribution services, pursuant to an agreement with a Participating Organization.

ALPS Fund Services, Inc. (“ALPS”) (an affiliate of ADI and AAI) serves as administrator to the Fund and the Fund has agreed to pay expenses incurred in connection with its administrative activities. Pursuant to an Administrative Agreement, ALPS provides operational services to the Fund including, but not limited to fund accounting and fund administration and generally assists in the Fund’s operations. The Annual Administrative Fee is based on the Fund’s average daily net assets, annualized, and will be billed monthly, at the rate of 0.10%.

6. TRANSACTIONS WITH AFFILIATES

For the year ended December 31, 2010, the Fund recorded distributions from affiliated investment companies as affiliated dividend income, and had the following affiliated purchases and sales:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Security Name | | Share Balance January 1, 2010 | | | Purchases | | | Sales | | | Share Balance December 31, 2010 | | | Dividend Income | | | Realized Loss | | | Market Value December 31, 2010 | |

| | |

Materials Select Sector SPDR ETF | | | – | | | | 16,498 | | | | – | | | | 16,498 | | | $ | 15,319 | | | $ | – | | | $ | 635,173 | |

Utilities Select Sector SPDR ETF | | | – | | | | 9,882 | | | | 9,882 | | | | – | | | | 3,021 | | | | (410 | ) | | | – | |

| | |

| | | | | | | | | | | | | | | | | | $ | 18,340 | | | $ | (410 | ) | | $ | 635,173 | |

| | |

The above securities are deemed affiliated investment companies because the Fund’s Distributor is also the distributor of the Select Sector SPDR exchange traded funds (the “Underlying Sector ETFs”). As required by exemptive relief obtained by the Underlying Sector ETFs, the Adviser will reimburse the Fund an amount equal to the distribution fee received by ADI from the Underlying Sector ETFs attributable to the Fund’s investment in the Underlying Sector ETFs, for so long as ADI acts as the distributor to the Fund and the Underlying Sector ETFs.

7. INDEMNIFICATIONS

Under the Trust’s organizational documents, its officers and Trustees are indemnified against certain liability arising out of the performance of their duties to the Trust. Additionally, in the normal course of business, the Trust enters into contracts with service providers that contain general indemnification clauses. The Trust’s maximum exposure under these arrangements is unknown, as this would involve future claims that may be made against the Trust that have not yet occurred.

| | | | | | |

| Report of Independent Registered Public Accounting Firm | | | | |

| | | | |

| | | | | | | |

To the Board of Trustees and Shareholders of Financial Investors Trust:

We have audited the accompanying statement of assets and liabilities of RiverFront Long-Term Growth Fund of Financial Investors Trust (the “Fund”), including the statement of investments, as of December 31, 2010, and the related statements of operations and changes in net assets, and the financial highlights for the year then ended. These financial statements and financial highlights are the responsibility of the Fund’s management. Our responsibility is to express an opinion on these financial statements and financial highlights based on our audit. The statement of changes in net assets for the year ended December 31, 2009 and the financial highlights for the year ended December 31, 2009 and the period October 28, 2008 (inception) through December 31, 2008, were audited by other auditors whose report, dated February 26, 2010, expressed an unqualified opinion on such statement of changes in net assets and financial highlights.