UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-08194

FINANCIAL INVESTORS TRUST

(Exact name of registrant as specified in charter)

1290 Broadway, Suite 1100, Denver, Colorado 80203

(Address of principal executive offices) (Zip code)

JoEllen L. Legg, Esq., Secretary

Financial Investors Trust

1290 Broadway, Suite 1100

Denver, Colorado 80203

(Name and address of agent for service)

Registrant’s telephone number, including area code: 303-623-2577

Date of fiscal year end: April 30

Date of reporting period: May 1, 2015 – April 30, 2016

| Item 1. | Reports to Stockholders. |

2

TABLE OF CONTENTS

| | |

| Aspen Managed Futures Strategy Fund | | Manager Commentary |

| | April 30, 2016 (Unaudited) |

May 7, 2016

Performance Results

For the one-year period ending April 30, 2016, the Class I shares of the Aspen Managed Futures Strategy Fund (the “Fund”) posted a return of -4.97%. Per its mandate, the Fund maintained a tight correlation1 to the Aspen Managed Futures Beta Index (“Aspen MFBI” or the “Index”)2. The Index uses a combination of trend and counter-trend algorithms to determine exposures to 23 futures markets. In following the Index, the Fund can take long or short positions in each of the eligible markets. A long position in a futures market will profit if the price of the futures contract rises, whereas a short position will profit if the price of the futures contract falls.

The SG CTA Index (formerly, the Newedge CTA Index)3, a managed futures benchmark, returned -0.7% over same time period. Another benchmark, the BTOP50 Index4, returned -2.7%. It is important to note that there are substantive differences between the Fund and these two indices in terms of construction. There were no significant changes to the Fund strategy during this period.

Explanation of Fund Performance

The Fund gained 0.49% in May 2015. U.S. equities rose during the month, while overseas bourses were mostly negative. Macroeconomic events continued to dominate headlines, as contrasting central bank commentary resulted in an uptick in market volatility.

The fixed income sector fell in the first two weeks of the month, as investors continued the selling spree that began in April. Buyers returned to the markets at mid-month after the release of weaker than expected economic data. The change in sentiment created a number of crosscurrents in the interest rate markets, and most trend-based managers experienced losses in May.

The Fund lost 1.66% in June 2015. The month was dominated by the Greek crises, which caused an increase in market volatility and numerous trend reversals. As a result, the SG CTA Index and the BTOP50 Index, two of the most often-cited managed futures benchmarks, lost 4% or more during the month.

Equities closely tracked the ongoing drama in Europe. Greece’s decision to postpone debt repayments until the end of June caused stocks to lose ground until about mid-month. The markets recovered when discussions between the EU and Greece turned friendlier, however, in the last week of June selling pressure intensified. The S&P 500 Index5 dropped nearly 2% in June. Trading in equity futures resulted in slight losses for the Fund.

The Fund gained 1.99% in July 2015. Against a volatile economic backdrop, a number of macro trends re-emerged leading to significant gains. The most important theme (and the most profitable for the Fund) was the decline in commodity prices. Crude oil lost more than 20%, its worst monthly showing in nearly seven years. Precious metals dropped precipitously due to a stronger dollar. Copper and other industrial metals likewise faltered due to reduced demand from China.

The Fund lost 4.00% in August 2015. The month was punctuated by a dramatic sell-off in the Chinese equity market. The pullback in China began on August 10th, when the country announced it was devaluing the yuan in response to disappointing Chinese retail sales. The market interpreted this move to be a lack of conviction in the strength of the economy, resulting in a sizable market decline. The Shanghai Stock Exchange Composite Index6, which appreciated 154% between July 2014 and June 2015, ended August 39% under its June peak. This unexpected move caused a reversal in a number of established market trends.

The Fund gained 1.02% in September 2015. Market conditions were turbulent, with global and domestic equity indices posting significant losses. The previous three months’ market pullback resulted in the worst calendar quarter since 2011 for stocks, as the S&P 500 Index fell 6.5% and the Shanghai Composite dropped nearly 25%. Equity markets provided the biggest boost for the Fund. Trading in FTSE7, Euro Stoxx8, Nikkei9 and S&P Futures all resulted in gains. Profits were capped due to numerous one-session rallies, most notably the 2% rally on the last day of the September.

The Fund lost 2.72% in October 2015. The month saw stocks rocket higher, with all ten sectors in the S&P 500 showing gains. It was the best month for equities in four years, and marked a dramatic turnaround for the market after the 3rd quarter’s turbulent conditions.

The Fund gained 2.38% in November 2015. Gains were broad-based, with profits generated in both the trend and counter-trend modules. Stocks continued higher in the U.S., but fell slightly elsewhere, while fixed income suffered losses. The currency markets were the biggest contributor to the Fund. Buoyed by strong employment data and the promise of higher rates by the Federal Reserve (the “Fed”), the U.S. dollar continued its ascent, creating trading opportunities in the Euro, Japanese yen, and Swiss franc. The stronger greenback contributed to declines in the energy market, while disappointing news regarding China’s economic recovery weighed heavily on raw materials prices.

The Fund recorded a loss of 1.07% in December 2015. Stocks lost ground in the U.S., but continued to outpace foreign bourses. Fixed income markets were mostly lower, especially in the high yield bond sectors, which experienced significant outflows.

The Fund lost 0.77% in January 2016, a month of extreme volatility in the equities markets. European stocks, technology issues, and small caps experienced significant pullbacks during the month, while fixed income posted modest gains as investors sought the relative safety of bonds.

The Fund gained 1.88% in February 2016. Capital flows favored safe haven assets due to increasing volatility. Equities markets fell early in the month and at one point were down double digits for 2016. A rally in the last two weeks of February limited losses in stock indices. The Fund was short foreign and domestic equities throughout February and, even with the rally, that sector proved to be the most profitable.

| | |

| Annual Report | April 30, 2016 | | 1 |

| | |

| Aspen Managed Futures Strategy Fund | | Manager Commentary |

| | April 30, 2016 (Unaudited) |

The Fund lost 2.17% in March 2016. The month proved to be a difficult period for managed futures as a number of well-established trends reversed. A broad-based reduction in market volatility added to the challenges, as new trends failed to materialize.

Outlook

In the U.S., a return to normalcy from quantitative easing took a detour when other central banks embraced a negative interest rate policy (NIRP). The concept of depositors paying banks for the privilege of holding their money is so new no one really knows what the unintended consequences might be. Take the Bank of Japan’s (BoJ) move to cut its benchmark interest rate below zero on January 29th. Since that day, the yen has appreciated 12%, even though the policy was originally intended to depress the value of the currency.

We have long been a proponent of a rising rate policy in the U.S., which would signal an end to the Fed’s backstop of the stock market. It would diminish many unintended consequences of Quantitative Easing10, including the increased possibility of asset bubbles and distortion of capital markets brought about by investment decisions that in normal conditions would never be made. Considering the strategy of other central banks, this policy will likely be delayed.

In the world of negative rates, alternative investments certainly deserve a seat at the table. In spite of the fact that the past year was particularly difficult for the managed futures sector and our Fund, there are two reasons why managed futures exposure is especially relevant. First, the ability to generate profits during periods of market volatility – which also coincides with the perpetuation of price trends – gives the asset class a unique benefit of negative correlation to stocks during down periods and flat to slightly positive correlation to stocks during favorable equity market periods. Second, managed futures has also been shown to be effective in capturing price trends in raw materials, such as crude oil and precious metals, a source of return that is completely unrelated to either the stock or bond markets.

Sincerely,

Bryan R. Fisher

William Ware Bush

Performance data quoted represents past performance. Past performance does not guarantee future results. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when sold or redeemed, may be worth more or less than the original cost. Current performance data may be higher or lower than actual data quoted. For the most current month-end performance data please call 1-855-845-9444.

The views of Aspen Partners, Ltd. and information discussed in this commentary are as of the date of publication, are subject to change, and may not reflect the writers’ current views. The views expressed are those of the Fund’s adviser only, and represent an assessment of market conditions at a specific point in time, are opinions only and should not be relied upon as investment advice regarding a particular investment or markets in general. Such information does not constitute a recommendation to buy or sell specific securities or investment vehicles. It should not be assumed that any investment will be profitable or will equal the performance of the portfolios or any securities or any sectors mentioned in this letter. The subject matter contained in this letter has been derived from several sources believed to be reliable and accurate at the time of compilation. Neither Aspen Partners Ltd. nor the Fund accepts any liability for losses either direct or consequential caused by the use of this information.

The Aspen Managed Futures Strategy Fund is distributed by ALPS Distributors, Inc.

The Fund is subject to investment risks, including possible loss of the principal amount invested and therefore is not suitable for all investors. The Fund may not achieve its objectives.

| Diversification | does not eliminate the risk of experiencing investment losses |

| 1 | Correlation - a statistical measure of how two securities move in relation to each other. |

| 2 | Aspen Managed Futures Beta Index (Aspen MFBI) is constructed using a quantitative, rules-based model designed to replicate the trend-following and counter-trend exposure of futures markets by allocating assets to liquid futures contracts of certain financial and commodities futures markets. The Index therefore seeks to reflect the performance of strategies and exposures common to a broad universe of futures markets, i.e., managed futures beta. The Index is not actively managed and does not reflect any deduction for fees, expenses or taxes. An investor cannot invest directly in the Index. |

| 3 | The SG CTA Index (formerly, the Newedge CTA Index) provides the market with a reliable daily performance benchmark of major commodity trading advisors (CTAs). The SG CTA Index calculates the daily rate of return for a pool of CTAs selected from the larger managers that are open to new investment. Selection of the pool of qualified CTAs used in construction of the Index will be conducted annually, with re-balancing on January 1st of each year. A committee of industry professionals has been established to monitor the methodology of the index on a regular basis. The Index is not actively managed and does not reflect any deduction for fees, expenses or taxes. An investor cannot invest directly in the Index. |

| 4 | Barclay BTOP50 Index is an index of the largest investable CTA programs as measured by assets under management. The index is not actively managed and does not reflect any deduction for fees, expenses or taxes. The Index is not actively managed and does not reflect any deduction for fees, expenses or taxes. An investor cannot invest directly in the Index. |

| 5 | The S&P 500® Total Return Index is an unmanaged index of 500 common stocks chosen for the market size, liquidity and industry group representation. It is a market-value weighted index. The Index is not actively managed and does not reflect any deduction for fees, expenses or taxes. An investor may not invest directly into the Index. |

| | |

| 2 | | www.aspenfuturesfund.com |

| | |

| Aspen Managed Futures Strategy Fund | | Manager Commentary |

| | April 30, 2016 (Unaudited) |

| 6 | The Shanghai Stock Exchange Composite Index is a capitalization-weighted index. The index tracks the daily price performance of all A-shares and B-shares listed on the Shanghai Stock Exchange. The index was developed on December 19, 1990 with a base value of 100. Index trade volume on Q is scaled down by a factor of 1000. The Index is not actively managed and does not reflect any deduction for fees, expenses or taxes. An investor may not invest directly into the Index. |

| 7 | The Financial Times Stock Exchange 100 Index, also called the FTSE 100 Index, FTSE 100, FTSE, or, informally, the “Footsie” /‘f℧tsi:/, is a share index of the 100 companies listed on the London Stock Exchange with the highest market capitalization. |

| 8 | The EURO STOXX 50 is a stock index of Eurozone stocks designed by STOXX, an index provider owned by Deutsche Börse Group and SIX Group. |

| 9 | Nikkei is short for Japan’s Nikkei 225 Stock Average. It is a price-weighted index comprised of Japan’s top 225 blue-chip companies traded on the Tokyo Stock Exchange. The Nikkei is equivalent to the Dow Jones Industrial Average Index in the United States. |

| 10 | Quantitative Easing – A monetary policy in which a central bank purchases government securities or other securities from the market in order to lower interest rates and increase the money supply. |

| | |

| Annual Report | April 30, 2016 | | 3 |

| | |

| Aspen Managed Futures Strategy Fund | | Manager Commentary |

| | April 30, 2016 (Unaudited) |

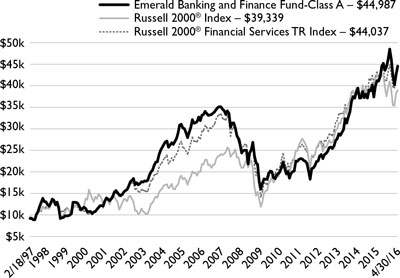

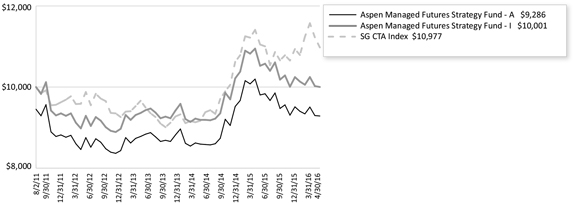

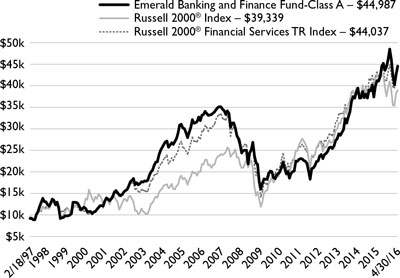

Cumulative Total Return Performance as of April 30, 2016

| | | | | | | | | | | | |

| Aspen Managed Futures Strategy Fund | | Calendar

Year-to-Date | | | 1 Year | | | | 3 Year | | | Since Inception* |

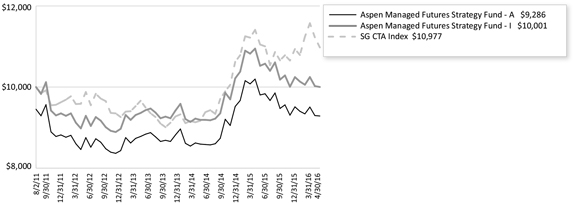

Aspen Managed Futures Strategy Fund - Class A (NAV)(1) | | -1.23% | | | -5.20% | | | | 1.88% | | | -0.37% |

Aspen Managed Futures Strategy Fund - Class A (MOP)(2) | | -6.66% | | | -10.39% | | | | -0.02% | | | -1.55% |

Aspen Managed Futures Strategy Fund - Class I | | -1.32% | | | - 4.97% | | | | 2.23% | | | 0.00% |

SG CTA Index(3) | | 1.73% | | | - 0.65% | | | | 4.35% | | | 1.98% |

Aspen Managed Futures Beta Index(4) | | -0.61% | | | - 3.26% | | | | 4.13% | | | 2.01% |

Performance data quoted represents past performance. Past performance does not guarantee future results. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when sold or redeemed, may be worth more or less than the original cost. Current performance data may be higher or lower than actual data quoted. For the most current month-end performance data please call 1-855-845-9444. The table does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. |

* Fund Inception date of August 2, 2011. (1) Net Asset Value (NAV) is the share price without sales charges. (2) Maximum Offering Price (MOP) includes sales charges. Class A returns include effects of the Fund’s maximum sales charge of 5.50%. (3) The SG CTA Index (formerly, the Newedge CTA Index) provides the market with a reliable daily performance benchmark of major commodity trading advisors (CTAs). The SG CTA Index calculates the daily rate of return for a pool of CTAs selected from the larger managers that are open to new investment. Selection of the pool of qualified CTAs used in construction of the Index will be conducted annually, with re-balancing on January 1st of each year. A committee of industry professionals has been established to monitor the methodology of the index on a regular basis. The Index is not actively managed and does not reflect any deduction for fees, expenses or taxes. An investor cannot invest directly in the Index. (4) Aspen Managed Futures Beta Index – The Managed Futures Beta Index is constructed using a quantitative, rules-based model designed to replicate the trend-following and counter-trend exposure of futures markets by allocating assets to liquid futures contracts of certain financial and commodities futures markets. The Index therefore seeks to reflect the performance of strategies and exposures common to a broad universe of futures markets, i.e., managed futures beta. The index is not actively managed and does not reflect any deductions for fees, expense or taxes. An investor may not invest directly in an index. |

| | |

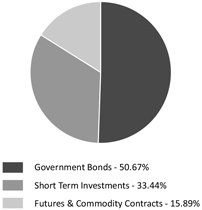

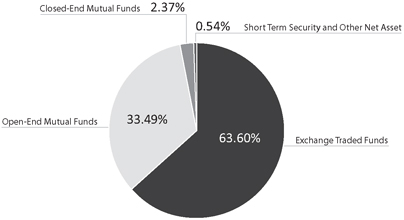

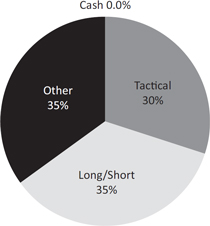

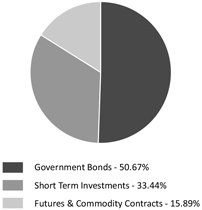

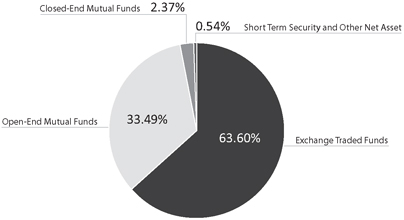

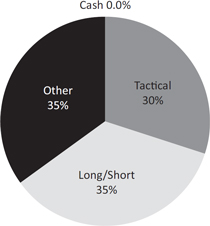

| | | Portfolio Composition as of April 30, 2016 As a percentage of Net Assets^  ^ Holdings subject to change, and may not reflect the current or future position of the portfolio. |

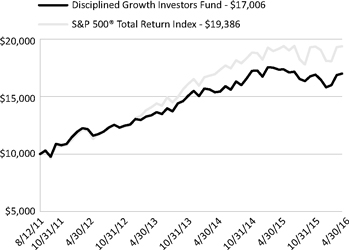

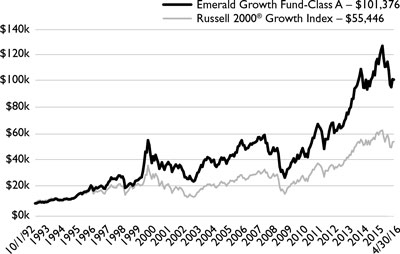

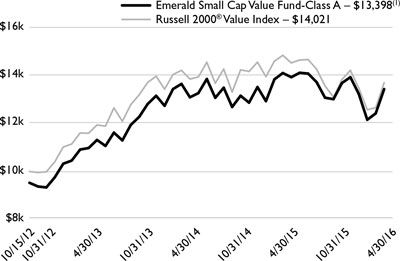

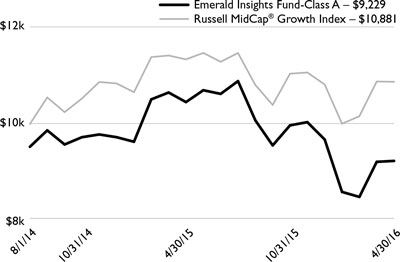

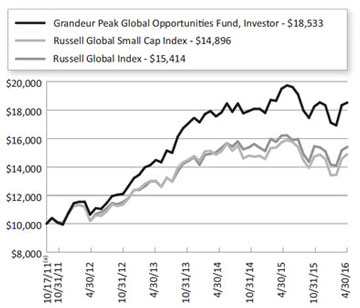

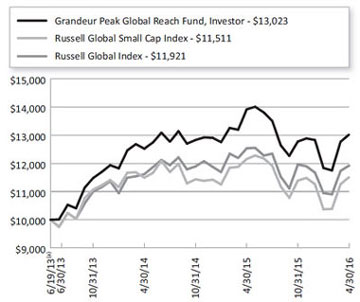

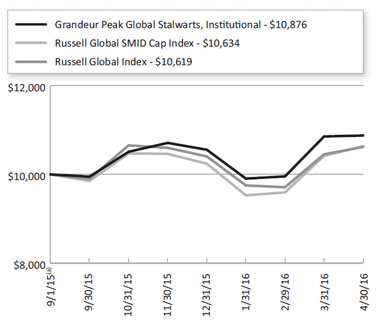

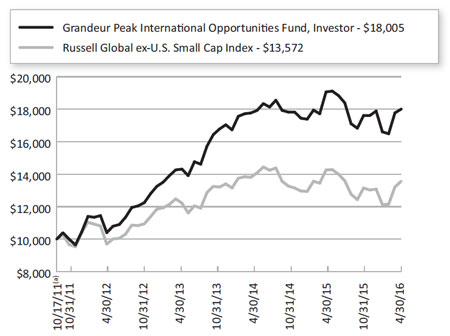

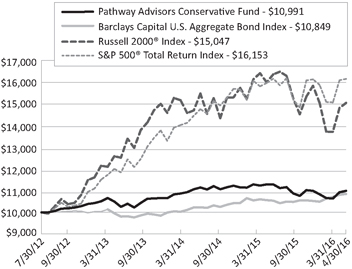

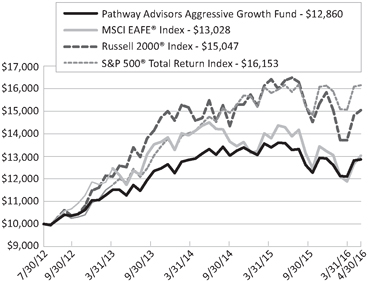

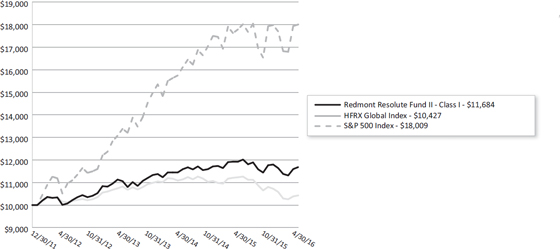

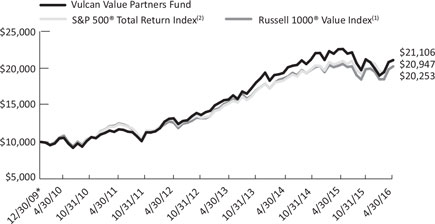

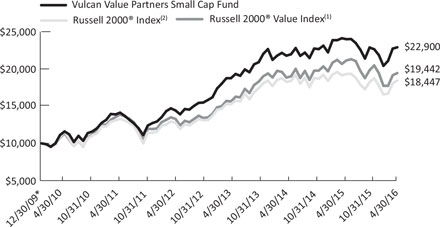

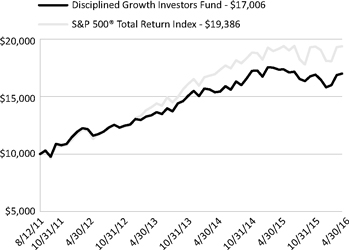

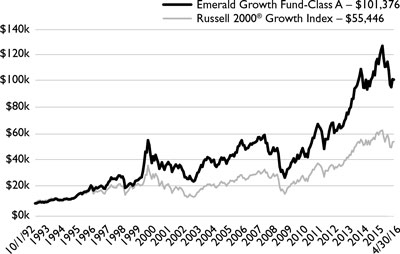

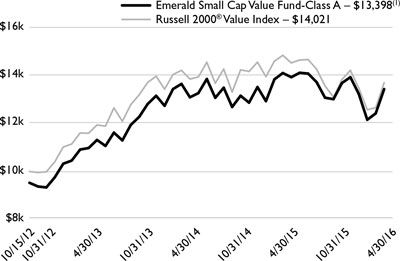

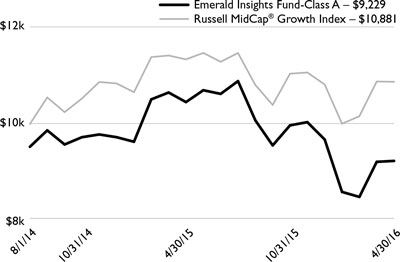

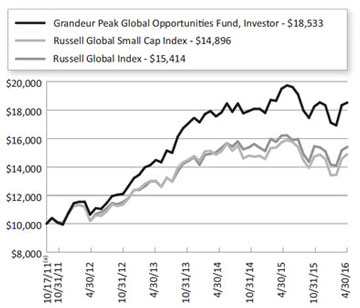

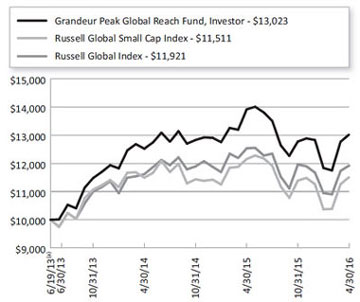

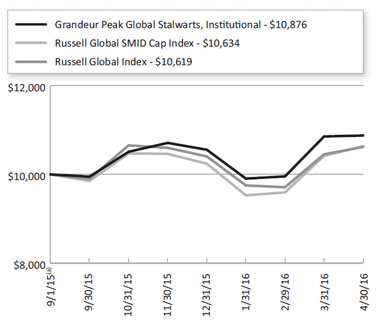

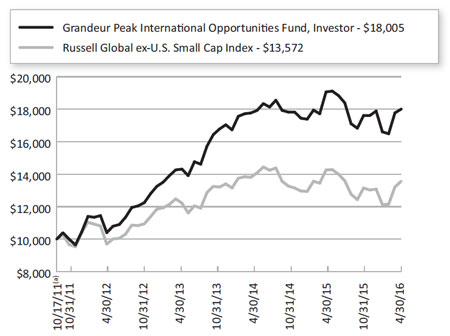

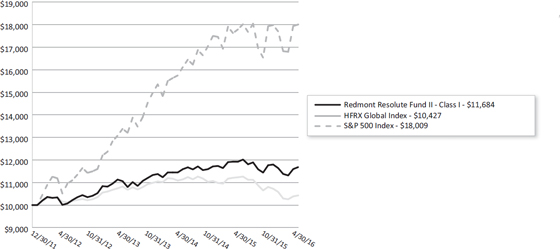

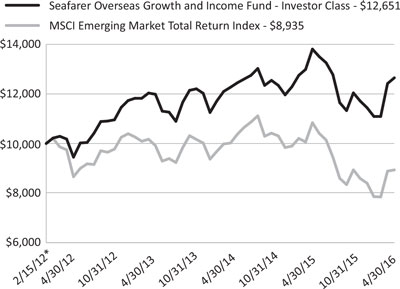

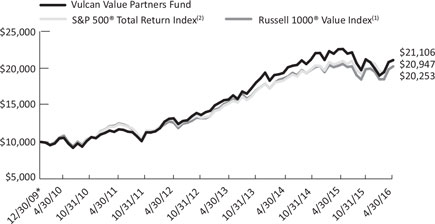

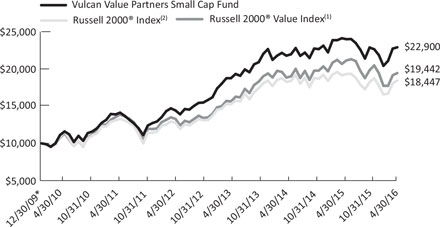

Performance of $10,000 Initial Investment (as of April 30, 2016)

Comparison of change in value of a $10,000 investment (includes applicable sales loads)

The chart represents historical performance of a hypothetical investment of $10,000 in the Fund since inception. Past performance does not guarantee future results. This chart does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

| | |

| 4 | | www.aspenfuturesfund.com |

| | |

| Aspen Managed Futures Strategy Fund | | Consolidated Disclosure of Fund Expenses |

| | April 30, 2016 (Unaudited) |

As a shareholder of the Fund, you incur two types of costs: transaction costs, including sales charges (loads) on purchase payments, reinvested dividends, or other distributions; redemption fees; and exchange fees; and (2) ongoing costs, including management fees; distribution and/or service (12b-1) fees; shareholder servicing fees; and other fund operating expenses. This example is intended to help you understand your ongoing costs (in dollars), of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds.

This example is based on an investment of $1,000 invested at the beginning of the period and held for the entire six-month period of November 1, 2015 through April 30, 2016.

Actual Expenses The first line of the table below provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes The second line of the table below provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of other mutual funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as applicable sales charges (loads), redemption fees, or exchange fees. Therefore, the second line of the table is useful in comparing ongoing costs only and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

| | | | | | | | | | | | | | | | | | | | |

| | | Beginning

Account Value

11/1/15 | | Ending

Account Value

4/30/16 | | Expense Ratio(a) | | Expenses Paid

During period

11/1/15 - 4/30/16(b) |

| | | | |

Class A | | | | | | | | | | | | | | | | | | | | |

Actual | | | $ | 1,000.00 | | | | $ | 997.90 | | | | | 1.60% | | | | $ | 7.95 | |

Hypothetical (5% return before expenses) | | | $ | 1,000.00 | | | | $ | 1,016.91 | | | | | 1.60% | | | | $ | 8.02 | |

Class I | | | | | | | | | | | | | | | | | | | | |

Actual | | | $ | 1,000.00 | | | | $ | 999.40 | | | | | 1.24% | | | | $ | 6.16 | |

Hypothetical (5% return before expenses) | | | $ | 1,000.00 | | | | $ | 1,018.70 | | | | | 1.24% | | | | $ | 6.22 | |

| (a) | The Fund’s expense ratios have been based on the Fund’s most recent fiscal half-year expenses. |

| (b) | Expenses are equal to the Fund’s annualized expense ratio multiplied by the average account value over the period, multiplied by the number of days in the most recent fiscal half-year (182)/366 (to reflect the half-year period). |

| | |

| Annual Report | April 30, 2016 | | 5 |

| | |

| Aspen Managed Futures Strategy Fund | | Consolidated Schedule of Investments |

| | April 30, 2016 |

| | | | | | | | |

| | | Principal Amount/

Shares | | | Value (Note 2) | |

| |

GOVERNMENT BONDS (50.67%) | | | | | | | | |

U.S. TREASURY NOTES (50.67%) | | | | | | | | |

0.250%, 05/15/2016 | | $ | 5,000,000 | | | $ | 5,000,160 | |

0.375%, 05/31/2016 | | | 7,029,000 | | | | 7,030,005 | |

0.500%, 06/30/2016 | | | 5,000,000 | | | | 5,001,970 | |

0.500%, 07/31/2016 | | | 5,000,000 | | | | 5,002,250 | |

0.500%, 08/31/2016 | | | 15,042,000 | | | | 15,049,130 | |

0.500%, 09/30/2016 | | | 7,500,000 | | | | 7,503,383 | |

0.500%, 09/30/2016 | | | 3,350,000 | | | | 3,351,511 | |

0.375%, 10/31/2016 | | | 8,071,000 | | | | 8,069,741 | |

0.500%, 11/30/2016 | | | 19,050,000 | | | | 19,054,458 | |

0.500%, 01/31/2017 | | | 13,000,000 | | | | 12,998,726 | |

0.500%, 03/31/2017 | | | 15,014,000 | | | | 15,007,844 | |

0.625%, 05/31/2017 | | | 10,065,000 | | | | 10,065,201 | |

0.625%, 07/31/2017 | | | 19,823,000 | | | | 19,818,738 | |

0.625%, 08/31/2017 | | | 5,045,000 | | | | 5,042,341 | |

0.625%, 09/30/2017 | | | 6,050,000 | | | | 6,045,626 | |

| | |

TOTAL GOVERNMENT BONDS | | | | | | | | |

| | | | | | | | |

(Cost $143,993,513) | | | | | | | 144,041,084 | |

| | | | | | | | |

| | |

SHORT TERM INVESTMENTS (33.44%) | | | | | | | | |

MONEY MARKET FUND (4.16%) | | | | | | | | |

Dreyfus Treasury & Agency Cash Management Fund - Institutional Shares, 7-day yield, 0.162% | | | 11,829,203 | | | | 11,829,203 | |

| | | | | | | | |

| | |

U.S. TREASURY BILLS (29.28%) | | | | | | | | |

0.243%, 05/26/2016(a) | | | 10,600,000 | | | | 10,598,210 | |

0.285%, 06/23/2016(a) | | | 10,500,000 | | | | 10,495,600 | |

0.333%, 07/21/2016(a) | | | 10,000,000 | | | | 9,995,800 | |

0.418%, 08/18/2016(a) | | | 4,000,000 | | | | 3,997,048 | |

0.413%, 09/15/2016(a) | | | 5,000,000 | | | | 4,995,245 | |

0.575%, 10/13/2016(a) | | | 9,400,000 | | | | 9,385,336 | |

0.496%, 11/10/2016(a) | | | 10,000,000 | | | | 9,981,620 | |

0.563%, 12/08/2016(a) | | | 13,350,000 | | | | 13,322,085 | |

0.565%, 01/05/2017(a) | | | 10,500,000 | | | | 10,471,388 | |

| | | | | | | | |

| | | | | | | 83,242,332 | |

| | | | | | | | |

| | |

TOTAL SHORT TERM INVESTMENTS (Cost $95,024,319) | | | | | | | 95,071,535 | |

| | | | | | | | |

| | |

TOTAL INVESTMENTS (84.11%) (Cost $239,017,832) | | | | | | $ | 239,112,619 | |

| | | | | | | | |

| | |

Other Assets In Excess Of Liabilities (15.89%) | | | | | | | 45,167,783(b) | |

| | | | | | | | |

| | |

NET ASSETS (100.00%) | | | | | | $ | 284,280,402 | |

| | | | | | | | |

| (a) | Rate shown represents the bond equivalent yield to maturity at date of purchase. |

| (b) | Includes cash which is being held as collateral for futures contracts. |

| | |

| See Notes to Consolidated Financial Statements. | | |

6 | | www.aspenfuturesfund.com |

| | |

| Aspen Managed Futures Strategy Fund | | Consolidated Schedule of Investments |

| | April 30, 2016 |

FUTURES CONTRACTS

At April 30, 2016, the Fund had outstanding futures contracts:

| | | | | | | | | | | | | | | | | | |

| Description | | Position | | | | Contracts | | Expiration

Date | | Underlying Face

Amount at Value | | | Unrealized

Appreciation | | | |

|

Commodity Contracts | | | | | | | | | | | | | | | | | | |

Copper Future(a) | | Long | | | | 64 | | 07/28/2016 | | $ | 3,653,600 | | | $ | 94,195 | | | |

Corn Future(a) | | Long | | | | 551 | | 07/15/2016 | | | 10,792,713 | | | | 190,806 | | | |

Gold 100 Oz Future(a) | | Long | | | | 85 | | 06/29/2016 | | | 10,969,250 | | | | 456,217 | | | |

New York Harbor ULSD Future(a) | | Long | | | | 64 | | 06/01/2016 | | | 3,725,568 | | | | 6,784 | | | |

Silver Future(a) | | Long | | | | 123 | | 07/28/2016 | | | 10,958,685 | | | | 304,885 | | | |

Soybean Future(a) | | Long | | | | 208 | | 07/15/2016 | | | 10,709,400 | | | | 12,228 | | | |

Sugar No. 11 (World) Future(a) | | Long | | | | 398 | | 07/01/2016 | | | 7,274,803 | | | | 212,468 | | | |

WTI Crude Future(a) | | Long | | | | 81 | | 05/23/2016 | | | 3,719,520 | | | | 234,280 | | | |

Foreign Currency Contracts | | | | | | | | | | | | | | | | | | |

Australian Dollar Currency Future | | Long | | | | 1,251 | | 06/14/2016 | | | 94,913,370 | | | | 581,297 | | | |

Canadian Dollar Currency Future | | Long | | | | 415 | | 06/15/2016 | | | 33,092,100 | | | | 1,656,186 | | | |

Japanese Yen Currency Future | | Long | | | | 441 | | 06/14/2016 | | | 51,696,225 | | | | 2,586,168 | | | |

New Zealand Dollar Currency Future | | Long | | | | 924 | | 06/14/2016 | | | 64,347,360 | | | | 2,189,395 | | | |

Interest Rate Contracts | | | | | | | | | | | | | | | | | | |

Canadian 10 Year Bond Future | | Short | | | | 314 | | 06/22/2016 | | | (34,826,046) | | | | 21,112 | | | |

| | | | | | | | | | | |

| | | | | | | | | | $ | 271,026,548 | | | $ | 8,546,021 | | | |

| | | | | | | | | | | |

| | | | | | | |

| Description | | Position | | | | Contracts | | Expiration

Date | | Underlying Face

Amount at Value | | | Unrealized

Depreciation | | | |

|

Equity Contracts | | | | | | | | | | | | | | | | | | |

Euro STOXX 50® Index Future | | Long | | | | 195 | | 06/20/2016 | | $ | 6,647,189 | | | $ | (194,722) | | | |

FTSE® 100 Index Future | | Long | | | | 148 | | 06/20/2016 | | | 13,433,471 | | | | (194,952) | | | |

Nikkei 225 Index Future | | Short | | | | 76 | | 06/10/2016 | | | (6,051,500) | | | | (50,176) | | | |

S&P 500® E-Mini Future | | Long | | | | 127 | | 06/20/2016 | | | 13,075,285 | | | | (173,937) | | | |

Foreign Currency Contracts | | | | | | | | | | | | | | | | | | |

Euro FX Currency Future | | Short | | | | 97 | | 06/14/2016 | | | (13,901,313) | | | | (179,170) | | | |

Swiss Franc Currency Future | | Short | | | | 496 | | 06/14/2016 | | | (64,752,800) | | | | (2,054,904) | | | |

Interest Rate Contracts | | | | | | | | | | | | | | | | | | |

Euro-Bund Future | | Long | | | | 93 | | 06/09/2016 | | | 17,238,551 | | | | (215,268) | | | |

Long Gilt Future | | Long | | | | 102 | | 06/29/2016 | | | 17,824,872 | | | | (284,169) | | | |

U.S. 10 Year Treasury Note Future | | Long | | | | 136 | | 06/22/2016 | | | 17,688,500 | | | | (78,806) | | | |

| | | | | | | | | | | |

| | | | | | | | | | $ | 1,202,255 | | | $ | (3,426,104) | | | |

| | | | | | | | | | | |

Common Abbreviations:

FTSE - Financial Times and the London Stock Exchange

S&P - Standard and Poor’s

ULSD - Ultra Low Sulfur Diesel

| (a) | Owned by an entity that is owned by the Fund and is consolidated as described in Note 1 of the Notes to the Consolidated Financial Statements. |

For Fund compliance purposes, the Fund’s industry classifications refer to any one or more of the industry sub-classifications used by one or more widely recognized market indexes or ratings group indexes, and/or as defined by Fund management. This definition may not apply for purposes of this report, which may combine industry sub-classifications for reporting ease. Industries are shown as a percentage of net assets.

| | |

| See Notes to Consolidated Financial Statements. | | |

Annual Report | April 30, 2016 | | 7 |

| | |

| Aspen Managed Futures Strategy Fund | | Consolidated Statement of Assets & Liabilities |

| | April 30, 2016 |

| | | | |

ASSETS: | | | | |

Investments, at value | | $ | 239,112,619 | |

Cash | | | 13,897,984 | |

Deposit with broker for futures contracts (Note 3) | | | 34,293,921 | |

Receivable for shares sold | | | 284,803 | |

Variation margin receivable | | | 671,792 | |

Interest receivable | | | 181,663 | |

Prepaid and other assets | | | 19,566 | |

| |

Total assets | | | 288,462,348 | |

| |

| |

LIABILITIES: | | | | |

Foreign cash due to broker for futures contracts (Note 3)(Cost $2,597,264) | | | 2,637,965 | |

Payable to advisor | | | 175,956 | |

Variation margin payable | | | 660,725 | |

Payable for shares redeemed | | | 521,262 | |

Payable for administration fees | | | 19,266 | |

Payable for distribution and service fees | | | | |

Class A | | | 22,175 | |

Payable for transfer agency fees | | | 9,336 | |

Delegated transfer agent equivalent services fees | | | | |

Class A | | | 1,058 | |

Class I | | | 25,559 | |

Payable for trustee fees and expenses | | | 1,680 | |

Payable for professional fees | | | 32,454 | |

Payable for chief compliance officer fees | | | 2,894 | |

Payable for principal financial officer fees | | | 417 | |

Payable for licensing fees | | | 58,652 | |

Accrued expenses and other liabilities | | | 12,547 | |

| |

Total liabilities | | | 4,181,946 | |

| |

NET ASSETS | | $ | 284,280,402 | |

| |

| |

NET ASSETS CONSIST OF: | | | | |

| |

Paid-in capital (Note 5) | | $ | 297,577,676 | |

Accumulated net investment income | | | 2,217,954 | |

Accumulated net realized loss | | | (20,689,231) | |

Net unrealized appreciation | | | 5,174,003 | |

| |

NET ASSETS | | $ | 284,280,402 | |

| |

| |

INVESTMENTS, AT COST | | $ | 239,017,832 | |

| |

PRICING OF SHARES: | | | | |

Class A: | | | | |

Net Asset Value, offering and redemption price per share | | $ | 8.83 | |

Net Assets | | $ | 19,682,046 | |

Shares of beneficial interest outstanding | | | 2,229,960 | |

Maximum offering price per share (NAV/0.9450), based on maximum sales charge of 5.50% of the offering price | | $ | 9.34 | |

| |

Class I: | | | | |

Net Asset Value, offering and redemption price per share | | $ | 8.98 | |

Net Assets | | $ | 264,598,356 | |

Shares of beneficial interest outstanding | | | 29,451,202 | |

| | |

| See Notes to Consolidated Financial Statements. | | |

8 | | www.aspenfuturesfund.com |

| | |

| Aspen Managed Futures Strategy Fund | | Consolidated Statement of Operations |

| | For the Year Ended April 30, 2016 |

| | | | |

| |

INVESTMENT INCOME: | | | | |

Interest | | $ | 811,329 | |

Dividends | | | 8,982 | |

| |

Total investment income | | | 820,311 | |

| |

| |

EXPENSES: | | | | |

Investment advisory fees (Note 6) | | | 2,176,587 | |

Investment advisory fees - subsidiary (Note 6) | | | 230,237 | |

Administrative fees | | | 222,375 | |

Distribution and service fees | | | | |

Class A | | | 79,491 | |

Transfer agency fees | | | 70,973 | |

Delegated transfer agent equivalent services fees | | | | |

Class A | | | 6,627 | |

Class I | | | 130,458 | |

Professional fees | | | 49,931 | |

Custodian fees | | | 11,859 | |

Trustee fees and expenses | | | 20,663 | |

Principal financial officer fees | | | 5,000 | |

Chief compliance officer fees | | | 34,729 | |

Licensing fees | | | 725,529 | |

Other | | | 72,713 | |

| |

Total expenses before waiver/reimbursement | | | 3,837,172 | |

Waiver of investment advisory fees - subsidiary (Note 6) | | | (230,237) | |

| |

Total net expenses | | | 3,606,935 | |

| |

NET INVESTMENT LOSS | | | (2,786,624) | |

| |

| |

Net realized gain on investments | | | 14,041 | |

Net realized loss on futures contracts | | | (21,958,420) | |

Net realized loss on foreign currency transactions | | | (103,475) | |

| |

Total net realized loss | | | (22,047,854) | |

| |

Net change in unrealized depreciation of investments | | | (23,511) | |

Net change in unrealized appreciation on futures contracts | | | 9,971,765 | |

Net change in unrealized depreciation on translation of assets and liabilities denominated in foreign currency transactions | | | (50,452) | |

| |

Net change in unrealized appreciation | | | 9,897,802 | |

| |

NET REALIZED AND UNREALIZED LOSS ON INVESTMENTS | | | (12,150,052) | |

| |

NET DECREASE IN NET ASSETS RESULTING FROM OPERATIONS | | $ | (14,936,676) | |

| |

| | |

| See Notes to Consolidated Financial Statements. | | |

Annual Report | April 30, 2016 | | 9 |

| | |

| Aspen Managed Futures Strategy Fund | | Consolidated Statements of Changes in Net Assets |

| | | | | | | | |

| | | For the

Year Ended

April 30, 2016 | | | For the Year Ended April 30, 2015 | |

| |

OPERATIONS: | | | | | | | | |

Net investment loss | | $ | (2,786,624) | | | $ | (2,422,171) | |

Net realized gain/(loss) | | | (22,047,854) | | | | 36,321,277 | |

Net change in unrealized appreciation/(depreciation) | | | 9,897,802 | | | | (7,020,209) | |

| |

Net increase/(decrease) in net assets resulting from operations | | | (14,936,676) | | | | 26,878,897 | |

| |

| | |

DISTRIBUTIONS TO SHAREHOLDERS (Note 4): | | | | | | | | |

From net investment income | | | | | | | | |

Class A | | | (290,384) | | | | – | |

Class I | | | (4,854,577) | | | | – | |

From net realized gains on investments | | | | | | | | |

Class A | | | (1,080,184) | | | | (309,900) | |

Class I | | | (15,329,525) | | | | (4,218,836) | |

| |

Net decrease in net assets from distributions | | | (21,554,670) | | | | (4,528,736) | |

| |

| | |

SHARE TRANSACTIONS (Note 5): | | | | | | | | |

Class A | | | | | | | | |

Proceeds from sales of shares | | | 17,757,620 | | | | 13,068,693 | |

Distributions reinvested | | | 1,314,015 | | | | 298,289 | |

Cost of shares redeemed | | | (20,727,211) | | | | (3,700,970) | |

Redemption fees | | | 5,100 | | | | 531 | |

Class I | | | | | | | | |

Proceeds from sales of shares | | | 83,806,547 | | | | 75,913,390 | |

Distributions reinvested | | | 16,756,950 | | | | 3,994,682 | |

Cost of shares redeemed | | | (44,568,213) | | | | (25,671,930) | |

Redemption fees | | | 2,041 | | | | 1,186 | |

| |

Net increase from share transactions | | | 54,346,849 | | | | 63,903,871 | |

| |

| | |

Net increase in net assets | | | 17,855,503 | | | | 86,254,032 | |

| |

| | |

NET ASSETS: | | | | | | | | |

Beginning of period | | | 266,424,899 | | | | 180,170,867 | |

| |

End of period* | | $ | 284,280,402 | | | $ | 266,424,899 | |

| |

*Includes accumulated net investment income of: | | $ | 2,217,954 | | | $ | 5,144,673 | |

| | |

Other Information: | | | | | | | | |

SHARE TRANSACTIONS: | | | | | | | | |

Class A | | | | | | | | |

Sold | | | 1,836,531 | | | | 1,300,095 | |

Distributions reinvested | | | 146,490 | | | | 30,594 | |

Redeemed | | | (2,134,823) | | | | (388,614) | |

| |

Net increase/(decrease) in shares outstanding | | | (151,802) | | | | 942,075 | |

| |

| | |

Class I | | | | | | | | |

Sold | | | 8,468,843 | | | | 7,614,314 | |

Distributions reinvested | | | 1,837,385 | | | | 403,911 | |

Redeemed | | | (4,699,475) | | | | (2,608,713) | |

| |

Net increase in shares outstanding | | | 5,606,753 | | | | 5,409,512 | |

| |

| | |

| See Notes to Consolidated Financial Statements. | | |

10 | | www.aspenfuturesfund.com |

| | |

| Aspen Managed Futures Strategy Fund – Class A | | Consolidated Financial Highlights |

| | For a share outstanding throughout the periods presented. |

| | | | | | | | | | | | | | | | | | | | |

| | | For the

Year Ended

April 30, 2016 (a) | | | For the

Year Ended

April 30, 2015 (a) | | | For the

Year Ended

April 30, 2014 (a) | | | For the

Year Ended

April 30, 2013 (a) | | | For the Period

August 2, 2011

(Inception) to

April 30, 2012 (a) | |

| |

NET ASSET VALUE, BEGINNING OF PERIOD | | $ | 10.01 | | | $ | 8.97 | | | $ | 9.29 | | | $ | 8.95 | | | $ | 10.00 | |

INCOME/(LOSS) FROM OPERATIONS: | | | | | | | | | | | | | | | | | | | | |

Net investment loss(b) | | | (0.12) | | | | (0.14) | | | | (0.16) | | | | (0.16) | | | | (0.13) | |

Net realized and unrealized gain/(loss) on investments | | | (0.39) | | | | 1.39 | | | | (0.05) | | | | 0.50 | | | | (0.92) | |

| |

Total from investment operations | | | (0.51) | | | | 1.25 | | | | (0.21) | | | | 0.34 | | | | (1.05) | |

| |

LESS DISTRIBUTIONS: | | | | | | | | | | | | | | | | | | | | |

From net investment income | | | (0.14) | | | | – | | | | – | | | | – | | | | – | |

Distributions from net realized gain on investments | | | (0.53) | | | | (0.21) | | | | (0.12) | | | | – | | | | – | |

| |

Total distributions | | | (0.67) | | | | (0.21) | | | | (0.12) | | | | – | | | | – | |

| |

REDEMPTION FEES ADDED TO PAID IN CAPITAL | | | 0.00(c) | �� | | | 0.00(c) | | | | 0.01 | | | | 0.00(c) | | | | – | |

| |

INCREASE/(DECREASE) IN NET ASSET VALUE | | | (1.18) | | | | 1.04 | | | | (0.32) | | | | 0.34 | | | | (1.05) | |

| |

NET ASSET VALUE, END OF PERIOD | | $ | 8.83 | | | $ | 10.01 | | | $ | 8.97 | | | $ | 9.29 | | | $ | 8.95 | |

| |

| | | | | |

TOTAL RETURN(d) | | | (5.20%) | | | | 14.00% | | | | (2.15%) | | | | 3.80% | | | | (10.50%)(e) | |

| | | | | |

RATIOS AND SUPPLEMENTAL DATA: | | | | | | | | | | | | | | | | | | | | |

Net assets, end of period (000’s) | | $ | 19,682 | | | $ | 23,850 | | | $ | 12,914 | | | $ | 3,350 | | | $ | 1,254 | |

| | | | | |

RATIOS TO AVERAGE NET ASSETS: | | | | | | | | | | | | | | | | | | | | |

Operating expenses excluding fee waivers/reimbursements | | | 1.56%(g) | | | | 1.64% | | | | 1.83% | | | | 1.80% | | | | 2.53%(f) | |

Operating expenses including fee waivers/reimbursements | | | 1.56% | | | | 1.64% | | | | 1.83% | | | | 1.80% | | | | 1.80%(f) | |

Net investment loss including fee waivers/reimbursements | | | (1.24%) | | | | (1.50%) | | | | (1.72%) | | | | (1.75%) | | | | (1.79%)(f) | |

| | | | | |

PORTFOLIO TURNOVER RATE | | | 58% | | | | 38% | | | | 90% | | | | 0% | | | | 0%(e) | |

| (a) | Per share amounts and ratios to average net assets include income and expenses of the Aspen Futures Fund Ltd. (subsidiary), exclusive of the subsidiary’s management fee. |

| (b) | Per share numbers have been calculated using the average shares method. |

| (c) | Less than $0.005 per share. |

| (d) | Total return does not reflect the effect of sales charges. |

| (g) | The ratio of operating expenses excluding fee waivers/reimbursements to average net assets is calculated excluding the waived Subsidiary management fee (see Note 6 for additional detail). The ratio inclusive of that fee would be 1.64%. |

| | |

| See Notes to Consolidated Financial Statements. | | |

Annual Report | April 30, 2016 | | 11 |

| | |

| Aspen Managed Futures Strategy Fund – Class I | | Consolidated Financial Highlights |

| | For a share outstanding throughout the periods presented. |

| | | | | | | | | | | | | | | | | | | | |

| | | For the

Year Ended

April 30, 2016 (a) | | | For the

Year Ended

April 30, 2015 (a) | | | For the

Year Ended

April 30, 2014 (a) | | | For the

Year Ended

April 30, 2013 (a) | | | For the Period

August 2, 2011

(Inception) to

April 30, 2012 (a) | |

| |

NET ASSET VALUE, BEGINNING OF PERIOD | | $ | 10.17 | | | $ | 9.07 | | | $ | 9.36 | | | $ | 8.98 | | | $ | 10.00 | |

INCOME/(LOSS) FROM OPERATIONS: | | | | | | | | | | | | | | | | | | | | |

Net investment loss(b) | | | (0.09) | | | | (0.11) | | | | (0.11) | | | | (0.11) | | | | (0.11) | |

Net realized and unrealized gain/(loss) on investments | | | (0.40) | | | | 1.42 | | | | (0.06) | | | | 0.49 | | | | (0.91) | |

| |

Total from investment operations | | | (0.49) | | | | 1.31 | | | | (0.17) | | | | 0.38 | | | | (1.02) | |

| |

LESS DISTRIBUTIONS: | | | | | | | | | | | | | | | | | | | | |

From net investment income | | | (0.17) | | | | – | | | | – | | | | – | | | | – | |

Distributions from net realized gain on investments | | | (0.53) | | | | (0.21) | | | | (0.12) | | | | – | | | | – | |

| |

Total distributions | | | (0.70) | | | | (0.21) | | | | (0.12) | | | | – | | | | – | |

| |

REDEMPTION FEES ADDED TO PAID IN CAPITAL | | | 0.00(c) | | | | 0.00(c) | | | | 0.00(c) | | | | 0.00(c) | | | | 0.00(c) | |

| |

INCREASE/(DECREASE) IN NET ASSET VALUE | | | (1.19) | | | | 1.10 | | | | (0.29) | | | | 0.38 | | | | (1.02) | |

| |

NET ASSET VALUE, END OF PERIOD | | $ | 8.98 | | | $ | 10.17 | | | $ | 9.07 | | | $ | 9.36 | | | $ | 8.98 | |

| |

| | | | | |

TOTAL RETURN | | | (4.97%) | | | | 14.51% | | | | (1.81%) | | | | 4.23% | | | | (10.20%)(d) | |

| | | | | |

RATIOS AND SUPPLEMENTAL DATA: | | | | | | | | | | | | | | | | | | | | |

Net assets, end of period (000’s) | | $ | 264,598 | | | $ | 242,575 | | | $ | 167,258 | | | $ | 120,769 | | | $ | 90,450 | |

| | | | | |

RATIOS TO AVERAGE NET ASSETS: | | | | | | | | | | | | | | | | | | | | |

Operating expenses excluding fee waivers/reimbursements | | | 1.22%(f) | | | | 1.25% | | | | 1.30% | | | | 1.25% | | | | 1.75%(e) | |

Operating expenses including fee waivers/reimbursements | | | 1.22% | | | | 1.25% | | | | 1.30% | | | | 1.25% | | | | 1.55%(e) | |

Net investment loss including fee waivers/reimbursements | | | (0.94%) | | | | (1.11%) | | | | (1.20%) | | | | (1.20%) | | | | (1.54%)(e) | |

| | | | | |

PORTFOLIO TURNOVER RATE | | | 58% | | | | 38% | | | | 90% | | | | 0% | | | | 0%(d) | |

| (a) | Per share amounts and ratios to average net assets include income and expenses of the Aspen Futures Fund Ltd. (subsidiary), exclusive of the subsidiary’s management fee. |

| (b) | Per share numbers have been calculated using the average shares method. |

| (c) | Less than $0.005 per share. |

| (f) | The ratio of operating expenses excluding fee waivers/reimbursements to average net assets is calculated excluding the waived Subsidiary management fee (see Note 6 for additional detail). The ratio inclusive of that fee would be 1.30%. |

| | |

| See Notes to Consolidated Financial Statements. | | |

12 | | www.aspenfuturesfund.com |

| | |

| Aspen Managed Futures Strategy Fund | | Notes to Consolidated Financial Statements |

| | April 30, 2016 |

1. ORGANIZATION

Financial Investors Trust (the “Trust”), a Delaware statutory trust, is an open-end management investment company registered under the Investment Company Act of 1940, as amended (“1940 Act”). As of April 30, 2016, the Trust had 34 registered funds. This annual report describes the Aspen Managed Futures Strategy Fund (the “Fund”). The Fund seeks investment results that replicate as closely as possible, before fees and expenses, the price and yield performance of the Aspen Managed Futures Beta Index (the “MFBI” or “Index”). The Aspen Managed Futures Strategy Fund offers Class A and Class I shares.

Basis of Consolidation for the Aspen Futures Fund, Ltd.

Aspen Futures Fund, Ltd. (the “Subsidiary”), a Cayman Islands exempted company, is a wholly owned subsidiary of the Fund. The Subsidiary’s investment objective is designed to enhance the ability of the Fund to obtain exposure to equities, financial, currency and commodities markets consistent with the limits of the U.S. federal tax law requirements applicable to registered investment companies. The Subsidiary is subject to substantially the same investment policies and investment restrictions as the Fund. The Subsidiary acts as an investment vehicle for the Fund in order to effect certain commodity-related investments on behalf of the Fund. Investments in the Subsidiary are expected to provide the Fund with exposure to the commodity markets within the limitations of Subchapter M of the Internal Revenue Code of 1986, as amended (the “Code”), and recent IRS revenue rulings, as discussed below under “Federal Income Taxes”. The Fund is the sole shareholder of the Subsidiary pursuant to a subscription agreement dated as of August 2, 2011, and it is intended that the Fund will remain the sole shareholder and will continue to control the Subsidiary. Under the Articles of Association of the Subsidiary, shares issued by the Subsidiary confer upon a shareholder the right to wholly own and vote at general meetings of the Subsidiary and certain rights in connection with any winding-up or repayment of capital, as well as the right to participate in the profits or assets of the Subsidiary. The Fund may invest up to 25% of its total assets in shares of the Subsidiary. As a wholly owned subsidiary of the Fund, all assets and liabilities, income and expenses of the Subsidiary are consolidated in the financial statements and financial highlights of the Fund. All investments held by the Subsidiary are disclosed in the accounts of the Fund. As of April 30, 2016, net assets of the Fund were $284,280,402, of which $23,654,939 or 8.32%, represented the Fund’s ownership of all issued shares and voting rights of the Subsidiary.

2. SIGNIFICANT ACCOUNTING POLICIES

The accompanying financial statements were prepared in accordance with accounting principles generally accepted in the United States of America (“U.S. GAAP”). The preparation of financial statements in conformity with U.S. GAAP requires management to make certain estimates and assumptions that affect the reported amounts of assets and liabilities and disclosures of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenue and expenses during the period. Actual results could differ from those estimates. The Fund is considered an investment company for financial reporting purposes under U.S. GAAP. The following is a summary of significant accounting policies consistently followed by the Fund and subsidiary in preparation of the financial statements.

Investment Valuation: The Fund generally values its securities based on market prices determined at the close of regular trading on the New York Stock Exchange (“NYSE”), normally 4:00 p.m. Eastern Time, on each day the NYSE is open for trading.

For equity securities and mutual funds that are traded on an exchange, the market price is usually the closing sale or official closing price on that exchange. In the case of equity securities not traded on an exchange, or if such closing prices are not otherwise available, the securities are valued at the mean of the most recent bid and ask prices on such day. Redeemable securities issued by open-end registered investment companies are valued at the investment company’s applicable net asset value, with the exception of exchange-traded open-end investment companies, which are priced as equity securities.

The market price for debt obligations is generally the price supplied by an independent third-party pricing service approved by the Board of Trustees (the “Board”), which may use a matrix, formula or other objective method that takes into consideration quotations from dealers, market transactions in comparable investments, market indices and yield curves. If vendors are unable to supply a price, or if the price supplied is deemed to be unreliable, the market price may be determined using quotations received from one or more brokers–dealers that make a market in the security.

Futures contracts that are listed or traded on a national securities exchange, commodities exchange, contract market or comparable over-the-counter market, and that are freely transferable, are valued at their closing settlement price on the exchange on which they are primarily traded or based upon the current settlement price for a like instrument acquired on the day on which the instrument is being valued. A settlement price may not be used if the market makes a limit move with respect to a particular commodity.

Forward currency exchange contracts have a fair value determined by the prevailing foreign currency exchange daily rates and current foreign currency exchange forward rates. The foreign currency exchange forward rates are calculated using an automated system that estimates rates on the basis of the current day foreign currency exchange rates and forward foreign currency exchange rates supplied by a pricing service.

| | |

| Annual Report | April 30, 2016 | | 13 |

| | |

| Aspen Managed Futures Strategy Fund | | Notes to Consolidated Financial Statements |

| | April 30, 2016 |

Investment securities that are primarily traded on foreign securities exchanges are valued at the preceding closing values of such securities on their respective exchanges, except when an occurrence subsequent to the time a value was so established is likely to have changed such value. In such an event, the fair value of those securities are determined in good faith through consideration of other factors in accordance with procedures established by and under the general supervision of the Board.

When such prices or quotations are not available, or when Aspen Partners, Ltd. (the “Adviser”) believes that they are unreliable, securities may be priced using fair value procedures approved by the Board.

Fair Value Measurements: The Fund discloses the classification of its fair value measurements following a three-tier hierarchy based on the inputs used to measure fair value. Inputs refer broadly to the assumptions that market participants would use in pricing the asset or liability, including assumptions about risk. Inputs may be observable or unobservable. Observable inputs reflect the assumptions market participants would use in pricing the asset or liability that are developed based on market data obtained from sources independent of the reporting entity. Unobservable inputs reflect the reporting entity’s own assumptions about the assumptions market participants would use in pricing the asset or liability that are developed based on the best information available.

Various inputs are used in determining the value of the Fund’s investments as of the end of the reporting period. When inputs used fall into different levels of the fair value hierarchy, the level in the hierarchy within which the fair value measurement falls is determined based on the lowest level input that is significant to the fair value measurement in its entirety. The designated input levels are not necessarily an indication of the risk or liquidity associated with these investments. These inputs are categorized in the following hierarchy under applicable financial accounting standards:

| | | | |

Level 1 | | – | | Unadjusted quoted prices in active markets for identical investments, unrestricted assets or liabilities that the Fund has the ability to access at the measurement date; |

| | |

Level 2 | | – | | Quoted prices which are not active, quoted prices for similar assets or liabilities in active markets or inputs other than quoted prices that are observable (either directly or indirectly) for substantially the full term of the asset or liability; and |

| | |

Level 3 | | – | | Significant unobservable prices or inputs (including the Fund’s own assumptions in determining the fair value of investments) where there is little or no market activity for the asset or liability at the measurement date. |

The following is a summary of each input used to value the Fund as of April 30, 2016:

| | | | | | | | | | | | | | | | |

| Investments in Securities at Value | | Level 1 -

Quoted Prices | | | Level 2 - Other Significant

Observable Inputs | | | Level 3 - Significant Unobservable

Inputs | | | Total | |

| |

Government Bonds | | $ | – | | | $ | 144,041,084 | | | $ | – | | | $ | 144,041,084 | |

Short Term Investments | | | | | | | | | | | | | | | | |

Money Market Fund | | | 11,829,203 | | | | – | | | | – | | | | 11,829,203 | |

U.S. Treasury Bills | | | – | | | | 83,242,332 | | | | – | | | | 83,242,332 | |

| |

TOTAL | | $ | 11,829,203 | | | $ | 227,283,416 | | | $ | – | | | $ | 239,112,619 | |

| |

Other Financial Instruments | | | | | | | | | | | | | | | | |

Assets: | | | | | | | | | | | | | | | | |

Futures Contracts | | | | | | | | | | | | | | | | |

Commodity Contracts | | $ | 1,511,863 | | | $ | – | | | $ | – | | | $ | 1,511,863 | |

Foreign Currency Contracts | | | 7,013,046 | | | | – | | | | – | | | | 7,013,046 | |

Interest Rate Contracts | | | 21,112 | | | | – | | | | – | | | | 21,112 | |

Liabilities: | | | | | | | | | | | | | | | | |

Futures Contracts | | | | | | | | | | | | | | | | |

Equity Contracts | | | (613,787) | | | | – | | | | – | | | | (613,787) | |

Foreign Currency Contracts | | | (2,234,074) | | | | – | | | | – | | | | (2,234,074) | |

Interest Rate Contracts | | | (578,243) | | | | – | | | | – | | | | (578,243) | |

| |

TOTAL | | $ | 5,119,917 | | | $ | – | | | $ | – | | | $ | 5,119,917 | |

| |

The Fund recognizes transfers between levels as of the end of the period. For the year ended April 30, 2016, the Fund did not have any transfers between Level 1 and Level 2 securities. For the year ended April 30, 2016, the Fund did not have any securities that used significant unobservable inputs (Level 3) in determining fair value.

| | |

| 14 | | www.aspenfuturesfund.com |

| | |

| Aspen Managed Futures Strategy Fund | | Notes to Consolidated Financial Statements |

| | April 30, 2016 |

Investment Transactions and Investment Income: Investment transactions are accounted for on the date the investments are purchased or sold (trade date). Realized gains and losses from investment transactions are reported on an identified cost basis. Interest income, which includes accretion of discounts, is accrued and recorded as earned. Dividend income is recognized on the ex-dividend date or for certain foreign securities, as soon as information is available to the Fund. All of the realized and unrealized gains and losses and net investment income, are allocated daily to each class in proportion to its average daily net assets.

Foreign Securities: The Fund may directly purchase securities of foreign issuers. Investing in securities of foreign issuers involves special risks not typically associated with investing in securities of U.S. issuers. The risks include possible reevaluation of currencies, the inability to repatriate foreign currency, less complete financial information about companies and possible future adverse political and economic developments. Moreover, securities of many foreign issuers and their markets may be less liquid and their prices more volatile than those of securities of comparable U.S. issuers.

Foreign Currency Translation: The books and records of the Fund are maintained in U.S. dollars. Investment valuations and other assets and liabilities initially expressed in foreign currencies are converted each business day into U.S. dollars based upon current exchange rates. Prevailing foreign exchange rates may generally be obtained at the close of the NYSE (normally, 4:00 p.m. Eastern Time). The portion of realized and unrealized gains or losses on investments due to fluctuations in foreign currency exchange rates is not separately disclosed and is included in realized and unrealized gains or losses on investments, when applicable.

Foreign Currency Spot Contracts: The Fund may enter into foreign currency spot contracts to facilitate transactions in foreign securities or to convert foreign currency receipts into U.S. dollars. A foreign currency spot contract is an agreement between two parties to buy and sell currencies at the current market rate, for settlement generally within two business days. The U.S. dollar value of the contracts is determined using current currency exchange rates supplied by a pricing service. The contract is marked-to-market daily for settlements beyond one day and any change in market value is recorded as an unrealized gain or loss. When the contract is closed, the Fund records a realized gain or loss equal to the difference between the value on the open and close date. Losses may arise from changes in the value of the foreign currency, or if the counterparties do not perform under the contract’s terms. The maximum potential loss from such contracts is the aggregate face value in U.S. dollars at the time the contract was opened.

Trust Expenses: Some expenses of the Trust can be directly attributed to the Fund. Expenses which cannot be directly attributed to the Fund are apportioned among all funds in the Trust based on average net assets of each fund.

Fund and Class Expenses: Expenses that are specific to a class of shares of the Fund, including distribution fees (Rule 12b-1 fees) and shareholder servicing fees, are charged directly to that share class. All expenses of the Fund, other than class specific expenses, are allocated daily to each class in proportion to its average daily net assets.

Federal Income Taxes: The Fund complies with the requirements under Subchapter M of the Internal Revenue Code of 1986, as amended, applicable to regulated investment companies and intends to distribute substantially all of their net taxable income and net capital gains, if any, each year so that it will not be subject to excise tax on distributed income and gains. The Fund is not subject to income taxes to the extent such distributions are made.

As of and during the year ended April 30, 2016, the Fund did not have a liability for any unrecognized tax benefits. The Fund files U.S. federal, state, and local tax returns as required. The Fund’s tax returns are subject to examination by the relevant tax authorities until expiration of the applicable statute of limitations, which is generally three years after the filing of the tax return for federal purposes and four years for most state returns. Tax returns for open years have incorporated no uncertain tax positions that require a provision for income taxes.

Distributions to Shareholders: The Fund normally pays dividends and distributes capital gains, if any, on an annual basis. Income dividend distributions are derived from interest and other income the Fund receives from its investments, including short term capital gains. Long term capital gains distributions are derived from gains realized when the Fund sells a security it has owned for more than a year. The Fund may make additional distributions and dividends at other times if the portfolio manager believes doing so may be necessary for the Fund to avoid or reduce taxes.

3. DERIVATIVE INSTRUMENTS

The Fund uses derivatives (including futures) to pursue its investment objective. The Fund’s use of derivative instruments involves risks different from, or possibly greater than, the risks associated with investing directly in securities and other traditional investments. These risks may include (i) the risk that the counterparty to a derivative transaction may not fulfill its contractual obligations, (ii) risk of mispricing or improper valuation, and (iii) the risk that changes in the value of the derivative may not correlate perfectly with the underlying asset, rate or index. These risks could cause

| | |

| Annual Report | April 30, 2016 | | 15 |

| | |

| Aspen Managed Futures Strategy Fund | | Notes to Consolidated Financial Statements |

| | April 30, 2016 |

the Fund to lose more than the principal amount invested. In addition, investments in derivatives involve leverage, which means a small percentage of assets invested in derivatives can have a disproportionately large impact on the Fund.

The Fund’s use of derivatives can result in losses due to unanticipated changes in the market risk factors and the overall market. In instances where the Fund is using derivatives to decrease, or hedge, exposures to market risk factors for securities held by the Fund, there are also risks that those derivatives may not perform as expected resulting in losses for the combined or hedged positions. Derivatives may have little or no initial cash investment relative to their market value exposure and therefore can produce significant gains or losses in excess of their cost. This use of embedded leverage allows the Fund to increase its market value exposure relative to its net assets and can substantially increase the volatility of the Fund’s performance.

In addition, use of derivatives may increase or decrease exposure to the following risk factors:

| | ● | | Equity Risk: Equity risk relates to the change in value of equity securities as they relate to increases or decreases in the general market. |

| | ● | | Interest Rate Risk: When the Fund invests in fixed-income securities or derivatives, the value of an investment in the Fund will fluctuate with changes in interest rates. Typically, a rise in interest rates causes a decline in the value of fixed-income securities or derivatives owned by the Fund. In general, the market price of debt securities with longer maturities will increase or decrease more in response to changes in interest rates than shorter-term securities. Other risk factors include credit risk (the debtor may default) and prepayment risk (the debtor may pay its obligation early, reducing the amount of interest payments). |

| | ● | | Foreign Currency Risk: Currency trading involves significant risks, including market risk, interest rate risk, country risk, counterparty credit risk and short sale risk. Market risk results from the price movement of foreign currency values in response to shifting market supply and demand. Interest rate risk arises whenever a country changes its stated interest rate target associated with its currency. Country risk arises because virtually every country may interfer with international transactions in its currency. Counterparty credit risk arises when the counterparty will not fulfill its obligations to the Fund. Short sale risk arises from the sale of a security that is not owned, or any sale that is completed by the delivery of a security borrowed. |

| | ● | | Commodity Risk: Exposure to the commodities markets may subject the Fund to greater volatility than investments in traditional securities. Commodity prices are influenced by unfavorable weather, animal and plant disease, geologic and environmental factors, as well as changes in government regulation such as tariffs, embargoes or burdensome production rules and restrictions. |

Futures: The Fund and the Subsidiary may enter into futures contracts. Futures contracts are agreements between two parties to buy and sell a particular commodity, instrument or index for a specified price on a specified future date. When the Fund or the Subsidiary enters into a futures contract, it is required to deposit with (or for the benefit of) its broker an amount of cash or short-term high-quality securities as “initial margin”. The margin requirements are set by the exchange on which the contract is traded and may be modified during the term of the contract. The initial margin is in the nature of a performance bond or good faith deposit on the futures contract that is returned to the Fund upon termination of the contract, assuming all contractual obligations have been satisfied. As the value of the contract changes, the value of the futures contract position increases or declines. Subsequent payments, known as “variation margin”, are made or received by the Fund or the Subsidiary each day, depending on the price fluctuations in the fair value of the contract and the value of cash or securities on deposit with the broker. Such payments or receipts are recorded for financial statement purposes as unrealized gains or losses by the Fund. Variation margin does not represent a borrowing or loan by the Fund but is instead a settlement between the Fund and the broker of the amount one would owe the other if the futures contract expired. When the contract is closed, the Fund record a realized gain or loss equal to the difference between the value of the contract at the time it was opened and the value at the time it was closed. When the Fund or the Subsidiary enters into a futures contract certain risks may arise, such as illiquidity in the futures market, which may limit the Fund’s or the Subsidiary’s ability to close out a futures contract prior to settlement date, and unanticipated movements in the value of securities, commodities or interest rates. Futures contracts are exchange-traded. Exchange-traded futures are standardized contracts and are settled through a clearing house with fulfillment supported by the credit of the exchange. Therefore, counterparty credit risk to the Fund and the Subsidiary is reduced. With exchange traded futures, there is minimal counterparty credit risk to the Funds since futures are exchange traded and the exchange’s clearinghouse, as a counterparty to all exchange traded futures, guarantees the futures against default.

| | |

| 16 | | www.aspenfuturesfund.com |

| | |

| Aspen Managed Futures Strategy Fund | | Notes to Consolidated Financial Statements |

| | April 30, 2016 |

Consolidated Balance Sheet – Fair Value of Derivative Instruments as of April 30, 2016:

| | | | | | | | | | | | |

| Risk Exposure | | Asset Derivatives Balance Sheet Location | | Fair Value | | | Liabilities Derivatives Balance Sheet Location | | Fair Value | |

| |

Futures Contracts | | Unrealized appreciation on futures contracts(a) | | $ | 8,546,021 | | | Unrealized depreciation on futures contracts (a) | | $ | (3,426,104) | |

| |

| | | | $ | 8,546,021 | | | | | $ | (3,426,104) | |

| |

| | | | |

| | Risk Exposure to Fund | | | | | | | | | | |

| | Commodity Contracts | | $ | 1,511,863 | | | | | $ | – | |

| | Equity Contracts | | | – | | | | | | 613,787 | |

| | Foreign Currency Contracts | | | 7,013,046 | | | | | | 2,234,074 | |

| | Interest Rate Contracts | | | 21,112 | | | | | | 578,243 | |

| | | | | | |

| | | | $ | 8,546,021 | | | | | $ | 3,426,104 | |

| | | | | | |

| (a) | Represents cumulative appreciation/(depreciation) of futures contracts as reported in the Consolidated Statement of Investments. Only the current day’s net variation margin is reported within the Consolidated Statement of Assets and Liabilities. |

Consolidated Statement of Operations – The effect of Derivative Instruments for the year ended April 30, 2016:

| | | | | | | | | | |

| Derivatives Instruments | | Location of Gain/(Loss) on Derivatives Recognized in Income | | Realized Gain/(Loss) on Derivatives Recognized in Income | | | Change in Unrealized

Appreciation/(Depreciation) on

Derivatives Recognized in Income | |

| |

Futures Contracts | | Net realized loss on futures contracts/Net change in unrealized appreciation on futures contracts | | $ | (21,958,420) | | | $ | 9,971,765 | |

| | | | | | |

| | | | $ | (21,958,420) | | | $ | 9,971,765 | |

| | | | | | |

| | | |

| | Risk Exposure to Fund | | | | | | | | |

| | Commodity Contracts | | $ | 3,352,059 | | | $ | 1,756,916 | |

| | Equity Contracts | | | (6,746,395) | | | | (689,300) | |

| | Foreign Currency Contracts | | | (12,030,276) | | | | 8,187,392 | |

| | Interest Rate Contracts | | | (6,533,808) | | | | 716,757 | |

| | | | | | |

| | | | $ | (21,958,420) | | | $ | 9,971,765 | |

| | | | | | |

The average number of net futures contracts held by the fund during the period was 924.

4. TAX BASIS INFORMATION

Reclassifications: Reclassifications to paid-in capital relate primarily to differing book/tax treatment of foreign currency transactions and income from a controlled foreign corporation. For the year ended April 30, 2016, the following reclassifications, which had no impact on results of operations or net assets, were recorded to reflect tax character:

| | | | | | | | | | | | |

| Fund | | Paid-in Capital | | | Accumulated Net

Investment Income | | | Accumulated Net

Realized Loss | |

| |

Aspen Managed Futures Strategy Fund | | $ | (1,756,917) | | | $ | 5,004,866 | | | $ | (3,247,949) | |

Tax Basis of Investments: As of April 30, 2016, the aggregate cost of investments, gross unrealized appreciation/(depreciation) and net unrealized depreciation for Federal tax purposes was as follows:

| | | | | | | | | | | | | | | | | | | | |

| | | Cost of Investments | | | Gross Appreciation

(excess of value over

tax cost) | | | Gross Depreciation

(excess of tax cost

over value) | | | Net Appreciation on

Futures Contracts

and Foreign

Currencies | | | Net Appreciation on

Investments | |

| |

Aspen Managed Futures Strategy Fund | | $ | 239,017,832 | | | $ | 347,476 | | | $ | (252,689) | | | $ | 5,079,216 | | | $ | 5,174,003 | |

| | |

| Annual Report | April 30, 2016 | | 17 |

| | |

| Aspen Managed Futures Strategy Fund | | Notes to Consolidated Financial Statements |

| | April 30, 2016 |

Components of Distributable Earnings: At April 30, 2016, components of distributable earnings were on a tax basis as follows:

| | | | |

| | | Aspen Managed Futures Strategy Fund | |

Undistributed ordinary income | | $ | 2,217,954 | |

Accumulated net capital losses | | | (17,081,177) | |

Net unrealized appreciation on futures contracts | | | 5,174,003 | |

Other cumulative effect of timing differences | | | (3,608,054) | |

| |

Total distributable earnings | | $ | (13,297,274) | |

| |

Capital Losses: As of April 30, 2016, the Fund has available for Federal income tax purposes unused capital losses that may be used to offset future realized capital gains. The Fund has $5,251,829 in short-term losses and $7,866,509 in long-term losses that will be carried forward indefinitely to offset future realized gains.

The Fund elects to defer $3,962,839 to the period ending April 30, 2017, capital losses recognized during the period November 1, 2015 to April 30, 2016.

Tax Basis of Distributions to Shareholders: Distributions are determined in accordance with federal income tax regulations, which differ from GAAP, and, therefore, may differ significantly in amount or character from net investment income and realized gains for financial reporting purposes. Financial reporting records are adjusted for permanent book/tax differences to reflect tax character but are not adjusted for temporary differences.

The tax character of distributions paid during the year ending April 30, 2016 were as follows:

| | | | | | | | |

| | | Ordinary Income | | | Long-Term Capital Gain | |

| |

Aspen Managed Futures Strategy Fund | | $ | 13,114,807 | | | $ | 8,439,863 | |

The tax character of distributions paid during the year ending April 30, 2015 were as follows:

| | | | | | | | |

| | | Ordinary Income | | | Long-Term Capital Gain | |

| |

Aspen Managed Futures Strategy Fund | | $ | 399,962 | | | $ | 4,128,774 | |

5. SHARES OF BENEFICIAL INTEREST

The capitalization of the Trust consists of an unlimited number of shares of beneficial interest with no par value per share. Holders of the shares of the Fund of the Trust have one vote for each share held and a proportionate fraction of a vote for each fractional share. All shares issued and outstanding are fully paid and are transferable and redeemable at the option of the shareholder. Purchasers of the shares do not have any obligation to make payments to the Trust or its creditors solely by reason of the purchasers’ ownership of the shares. Shares have no pre-emptive rights.

Fund shares redeemed within 30 days of purchase may incur a 2% short-term redemption fee deducted from the redemption amount. The amount of redemption fees received during the period are presented in the Consolidated Statement of Changes in Net Assets.

6. MANAGEMENT AND RELATED-PARTY TRANSACTIONS

The Adviser, subject to the authority of the Board, is responsible for the overall management and administration of the Fund’s business affairs. The Adviser manages the investments of the Fund in accordance with the Fund’s investment objective, policies and limitations and investment guidelines established jointly by the Adviser and the Board. Pursuant to the Investment Advisory Agreement, (the “Advisory Agreement”), the Fund will pay the Adviser an annual management fee of 0.75%, based on the Fund’s average daily net assets. The management fee is paid on a monthly basis.

The Subsidiary has entered into a separate advisory agreement (the “Subsidiary Advisory Agreement”) with the Adviser for the management of the Subsidiary’s portfolio pursuant to which the Subsidiary is obligated to pay the Adviser a management fee at the same rate that the Fund pays the Adviser for investment advisory services provided to the Fund. The Adviser has agreed to waive the advisory fee it receives from the Fund in an amount equal to the management fee paid by the Subsidiary. This waiver may not be terminated or modified without the consent of the Board.

| | |

| 18 | | www.aspenfuturesfund.com |

| | |

| Aspen Managed Futures Strategy Fund | | Notes to Consolidated Financial Statements |

| | April 30, 2016 |

This agreement may not be terminated or modified prior to this date except with the approval of the Board. For the period ended April 30, 2016, this amount equaled $230,237 and is disclosed in the Consolidated Statement of Operations. These waivers are not subject to reimbursement/recoupment.

The Adviser has agreed to waive and/or reimburse fees or expenses in order to limit total annual Fund operating expenses after fee waiver/expense reimbursements (excluding distribution and service (12b-1) fees, shareholder services fees, acquired fund fees and expenses, brokerage expenses, interest expenses, taxes and extraordinary expenses) to 1.55% of the Fund’s average daily net asset for each of Class A and Class I shares. This agreement is in effect from April 1, 2013 through August 31, 2016. The management fee is paid on a monthly basis.

The Adviser will be permitted to recover on a class-by-class basis, expenses it has borne through the agreement to the extent that the Fund’s expenses in later periods fall below the expense cap in effect at the time of waiver or reimbursement. Notwithstanding the foregoing, the Fund will not be obligated to pay any such deferred fees and expenses more than three years after the end of the fiscal year in which the fees and expenses were deferred. The Expense Agreement may not be terminated or modified prior to August 31, 2016 except with the approval of the Board.

Fund Administrator Fees and Expenses

ALPS Fund Services, Inc. (“ALPS”) serves as administrator to the Fund and the Fund has agreed to pay expenses incurred in connection with its administrative activities. Pursuant to an Administration Agreement, ALPS provides operational services to the Fund including, but not limited to, fund accounting and fund administration and generally assist in the Fund’s operations. Officers of the Trust are employees of ALPS. The Fund’s administration fee is accrued on a daily basis and paid monthly. Administration fees paid by the Fund for the year ended April 30, 2016 are disclosed in the Consolidated Statement of Operations.

ALPS is reimbursed by the Fund for certain out-of-pocket expenses.

Transfer Agent