TABLE OF

CONTENTS

| Disclosure of Fund Expenses | 1 |

| ALPS | Alerian MLP Infrastructure Index Fund | |

| Management Commentary | 6 |

| Performance Update | 7 |

| Statement of Investments | 9 |

| Statement of Assets and Liabilities | 10 |

| Statement of Operations | 11 |

| Statements of Changes in Net Assets | 12 |

| Financial Highlights | 13 |

ALPS | CoreCommodity Management CompleteCommodities® Strategy Fund | |

| Management Commentary | 19 |

| Performance Update | 21 |

| Consolidated Statement of Investments | 23 |

| Consolidated Statement of Assets and Liabilities | 30 |

| Consolidated Statement of Operations | 31 |

| Consolidated Statements of Changes in Net Assets | 32 |

| Consolidated Financial Highlights | 33 |

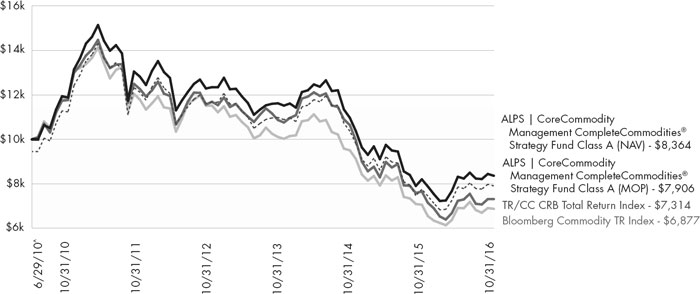

| ALPS | Kotak India Growth Fund | |

| Management Commentary | 36 |

| Performance Update | 39 |

| Consolidated Statement of Investments | 41 |

| Consolidated Statement of Assets and Liabilities | 43 |

| Consolidated Statement of Operations | 44 |

| Consolidated Statements of Changes in Net Assets | 45 |

| Consolidated Financial Highlights | 46 |

| ALPS | Metis Global Micro Cap Fund | |

| Management Commentary | 49 |

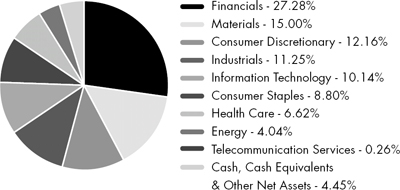

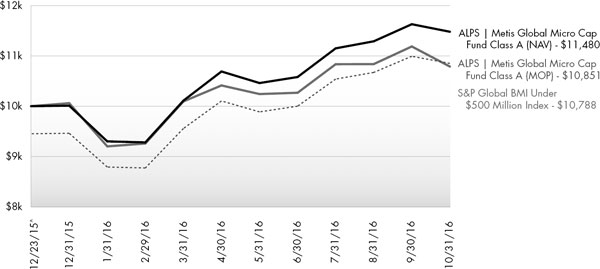

| Performance Update | 51 |

| Statement of Investments | 53 |

| Statement of Assets and Liabilities | 57 |

| Statement of Operations | 58 |

| Statement of Changes in Net Assets | 59 |

| Financial Highlights | 60 |

| ALPS | Red Rocks Listed Private Equity Fund | |

| Management Commentary | 63 |

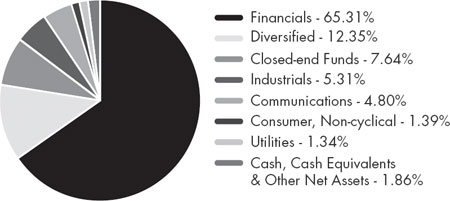

| Performance Update | 65 |

| Statement of Investments | 68 |

| Statement of Assets and Liabilities | 70 |

| Statement of Operations | 71 |

| Statements of Changes in Net Assets | 72 |

| Financial Highlights | 73 |

| ALPS | Sterling ETF Tactical Rotation Fund | |

| Management Commentary | 77 |

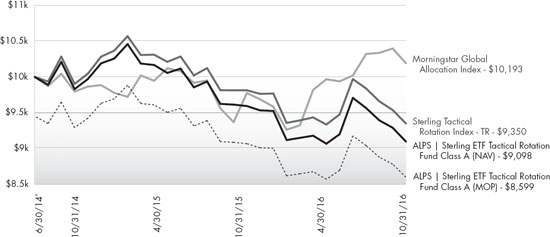

| Performance Update | 78 |

| Statement of Investments | 80 |

| Statement of Assets and Liabilities | 81 |

| Statement of Operations | 82 |

| Statements of Changes in Net Assets | 83 |

| Financial Highlights | 84 |

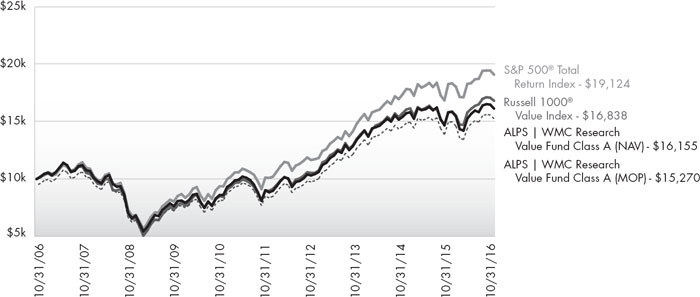

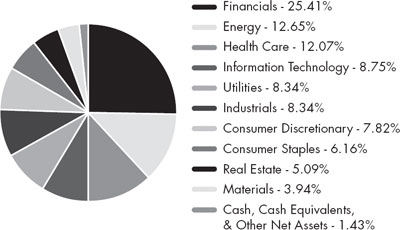

| ALPS | WMC Research Value Fund | |

| Management Commentary | 87 |

| Performance Update | 89 |

| Statement of Investments | 91 |

| Statement of Assets and Liabilities | 95 |

| Statement of Operations | 96 |

| Statements of Changes in Net Assets | 97 |

| Financial Highlights | 98 |

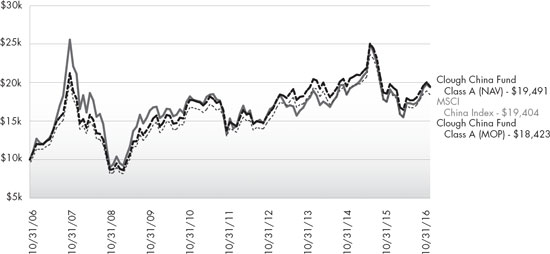

| Clough China Fund | |

| Management Commentary | 101 |

| Performance Update | 104 |

| Statement of Investments | 106 |

| Statement of Assets and Liabilities | 109 |

| Statement of Operations | 110 |

| Statements of Changes in Net Assets | 111 |

| Financial Highlights | 112 |

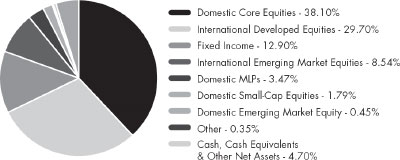

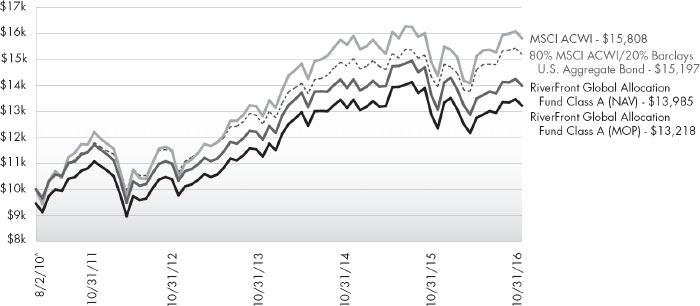

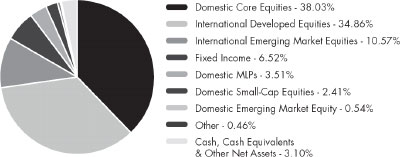

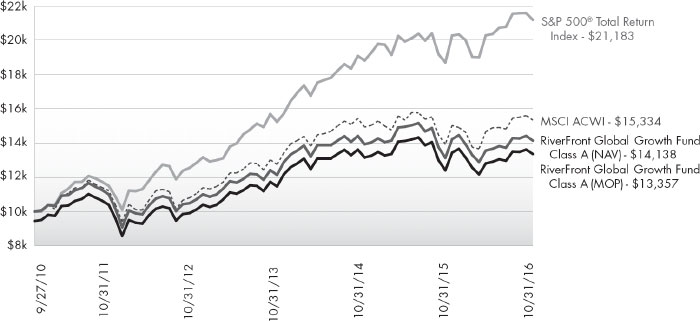

| RiverFront Global Allocation Series | |

| Management Commentary | 115 |

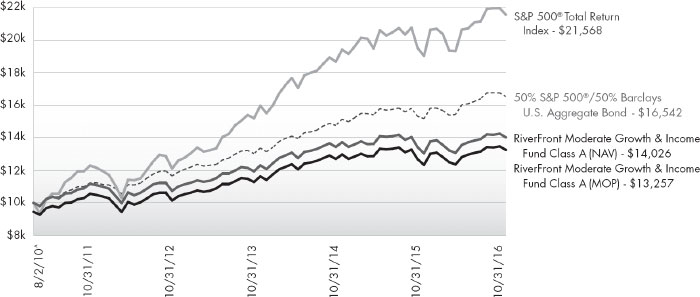

| Performance Update | 118 |

| Statements of Investments | 128 |

| Statements of Assets and Liabilities | 138 |

| Statements of Operations | 140 |

| Statements of Changes in Net Assets | 141 |

| Financial Highlights | 146 |

| Notes to Financial Statements | 163 |

| Report of Independent Registered Public Accounting Firm | 197 |

| Additional Information | 198 |

| Trustees and Officers | 214 |

alpsfunds.com

Disclosure of Fund Expenses

October 31, 2016 (Unaudited)

Examples. As a shareholder of the Funds, you incur two types of costs: (1) transaction costs, including applicable sales charges (loads) and redemption fees; and (2) ongoing costs, including management fees, distribution and service (12b‐1) fees, shareholder service fees and other Fund expenses. The following examples are intended to help you understand your ongoing costs (in dollars) of investing in the Funds and to compare these costs with the ongoing costs of investing in other mutual funds. The examples are based on an investment of $1,000 invested on May 1, 2016 and held until October 31, 2016.

Actual Expenses. The first line under each class in the table below provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading “Expenses Paid During Period May 1, 2016 – October 31, 2016” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes. The second line under each class in the table below provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Funds and other mutual funds. To do so, compare these 5% hypothetical examples with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as sales charges or redemption fees. Therefore, the second line under each class in the table below is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

1 | October 31, 2016

Disclosure of Fund Expenses

October 31, 2016 (Unaudited)

| | Beginning Account Value May 1, 2016 | Ending Account Value October 31, 2016 | Expense Ratio(a) | Expenses Paid During Period May 1, 2016 - October 31, 2016(b) |

| ALPS | Alerian MLP Infrastructure Index Fund | | | | |

| Class A | | | | |

| Actual | $1,000.00 | $1,043.20 | 1.25% | $6.42 |

| Hypothetical (5% return before expenses) | $1,000.00 | $1,018.85 | 1.25% | $6.34 |

| Class C | | | | |

| Actual | $1,000.00 | $1,040.70 | 1.85% | $9.49 |

| Hypothetical (5% return before expenses) | $1,000.00 | $1,015.84 | 1.85% | $9.37 |

| Class I | | | | |

| Actual | $1,000.00 | $1,044.20 | 0.85% | $4.37 |

| Hypothetical (5% return before expenses) | $1,000.00 | $1,020.86 | 0.85% | $4.32 |

ALPS | CoreCommodity Management CompleteCommodities® Strategy Fund(c) | | | |

| Class A | | | | |

| Actual | $1,000.00 | $1,005.50 | 1.45% | $7.31 |

| Hypothetical (5% return before expenses) | $1,000.00 | $1,017.85 | 1.45% | $7.35 |

| Class C | | | | |

| Actual | $1,000.00 | $1,002.80 | 2.05% | $10.32 |

| Hypothetical (5% return before expenses) | $1,000.00 | $1,014.83 | 2.05% | $10.38 |

| Class I | | | | |

| Actual | $1,000.00 | $1,008.30 | 1.15% | $5.81 |

| Hypothetical (5% return before expenses) | $1,000.00 | $1,019.36 | 1.15% | $5.84 |

ALPS | Kotak India Growth Fund(d) | | | | |

| Class A | | | | |

| Actual | $1,000.00 | $1,180.10 | 1.69% | $9.26 |

| Hypothetical (5% return before expenses) | $1,000.00 | $1,016.64 | 1.69% | $8.57 |

| Class C | | | | |

| Actual | $1,000.00 | $1,175.60 | 2.50% | $13.67 |

| Hypothetical (5% return before expenses) | $1,000.00 | $1,012.57 | 2.50% | $12.65 |

| Class I | | | | |

| Actual | $1,000.00 | $1,181.20 | 1.50% | $8.22 |

| Hypothetical (5% return before expenses) | $1,000.00 | $1,017.60 | 1.50% | $7.61 |

| ALPS | Metis Global Micro Cap Fund | | | | |

| Class A | | | | |

| Actual | $1,000.00 | $1,073.90 | 2.10% | $10.95 |

| Hypothetical (5% return before expenses) | $1,000.00 | $1,014.58 | 2.10% | $10.63 |

| Class C | | | | |

| Actual | $1,000.00 | $1,068.40 | 2.70% | $14.04 |

| Hypothetical (5% return before expenses) | $1,000.00 | $1,011.56 | 2.70% | $13.65 |

| Class I | | | | |

| Actual | $1,000.00 | $1,074.80 | 1.70% | $8.87 |

| Hypothetical (5% return before expenses) | $1,000.00 | $1,016.59 | 1.70% | $8.62 |

2 | October 31, 2016

Disclosure of Fund Expenses

October 31, 2016 (Unaudited)

| | Beginning Account Value May 1, 2016 | Ending Account Value October 31, 2016 | Expense Ratio(a) | Expenses Paid During Period May 1, 2016 - October 31, 2016(b) |

| ALPS | Red Rocks Listed Private Equity Fund | | | | |

| Class A | | | | |

| Actual | $1,000.00 | $1,031.10 | 1.52% | $7.76 |

| Hypothetical (5% return before expenses) | $1,000.00 | $1,017.50 | 1.52% | $7.71 |

| Class C | | | | |

| Actual | $1,000.00 | $1,029.00 | 2.17% | $11.07 |

| Hypothetical (5% return before expenses) | $1,000.00 | $1,014.23 | 2.17% | $10.99 |

| Class I | | | | |

| Actual | $1,000.00 | $1,034.00 | 1.19% | $6.08 |

| Hypothetical (5% return before expenses) | $1,000.00 | $1,019.15 | 1.19% | $6.04 |

| Class R | | | | |

| Actual | $1,000.00 | $1,032.00 | 1.64% | $8.38 |

| Hypothetical (5% return before expenses) | $1,000.00 | $1,016.89 | 1.64% | $8.31 |

| ALPS | Sterling ETF Tactical Rotation Fund | | | | |

| Class A | | | | |

| Actual | $1,000.00 | $1,002.20 | 1.31% | $6.59 |

| Hypothetical (5% return before expenses) | $1,000.00 | $1,018.55 | 1.31% | $6.65 |

| Class C | | | | |

| Actual | $1,000.00 | $997.70 | 2.15% | $10.80 |

| Hypothetical (5% return before expenses) | $1,000.00 | $1,014.33 | 2.15% | $10.89 |

| Class I | | | | |

| Actual | $1,000.00 | $1,004.50 | 1.15% | $5.79 |

| Hypothetical (5% return before expenses) | $1,000.00 | $1,019.36 | 1.15% | $5.84 |

| ALPS | WMC Research Value Fund | | | | |

| Class A | | | | |

| Actual | $1,000.00 | $1,029.50 | 1.15% | $5.87 |

| Hypothetical (5% return before expenses) | $1,000.00 | $1,019.36 | 1.15% | $5.84 |

| Class C | | | | |

| Actual | $1,000.00 | $1,025.40 | 1.90% | $9.67 |

| Hypothetical (5% return before expenses) | $1,000.00 | $1,015.58 | 1.90% | $9.63 |

| Class I | | | | |

| Actual | $1,000.00 | $1,030.10 | 0.90% | $4.59 |

| Hypothetical (5% return before expenses) | $1,000.00 | $1,020.61 | 0.90% | $4.57 |

| Clough China Fund | | | | |

| Class A | | | | |

| Actual | $1,000.00 | $1,100.80 | 1.95% | $10.30 |

| Hypothetical (5% return before expenses) | $1,000.00 | $1,015.33 | 1.95% | $9.88 |

| Class C | | | | |

| Actual | $1,000.00 | $1,096.60 | 2.70% | $14.23 |

| Hypothetical (5% return before expenses) | $1,000.00 | $1,011.56 | 2.70% | $13.65 |

| Class I | | | | |

| Actual | $1,000.00 | $1,102.00 | 1.70% | $8.98 |

| Hypothetical (5% return before expenses) | $1,000.00 | $1,016.59 | 1.70% | $8.62 |

3 | October 31, 2016

Disclosure of Fund Expenses

October 31, 2016 (Unaudited)

| | Beginning Account Value May 1, 2016 | Ending Account Value October 31, 2016 | Expense Ratio(a) | Expenses Paid During Period May 1, 2016 - October 31, 2016(b) |

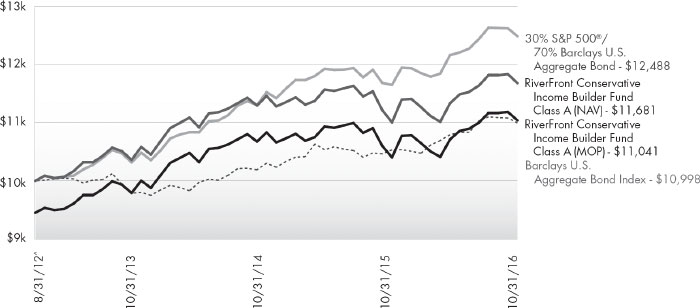

| RiverFront Conservative Income Builder Fund | | | | |

| Class A | | | | |

| Actual | $1,000.00 | $1,016.80 | 1.15% | $5.83 |

| Hypothetical (5% return before expenses) | $1,000.00 | $1,019.36 | 1.15% | $5.84 |

| Class C | | | | |

| Actual | $1,000.00 | $1,013.50 | 1.90% | $9.62 |

| Hypothetical (5% return before expenses) | $1,000.00 | $1,015.58 | 1.90% | $9.63 |

| Class I | | | | |

| Actual | $1,000.00 | $1,018.60 | 0.90% | $4.57 |

| Hypothetical (5% return before expenses) | $1,000.00 | $1,020.61 | 0.90% | $4.57 |

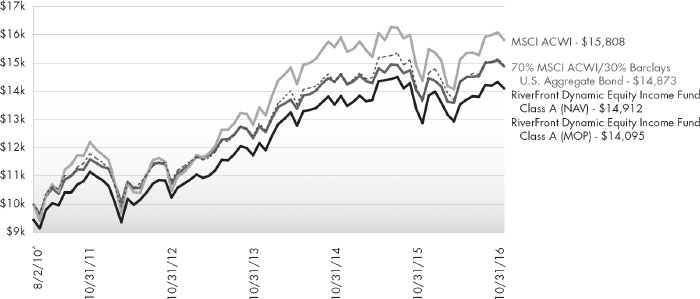

| RiverFront Dynamic Equity Income Fund | | | | |

| Class A | | | | |

| Actual | $1,000.00 | $1,029.00 | 1.15% | $5.87 |

| Hypothetical (5% return before expenses) | $1,000.00 | $1,019.36 | 1.15% | $5.84 |

| Class C | | | | |

| Actual | $1,000.00 | $1,025.10 | 1.90% | $9.67 |

| Hypothetical (5% return before expenses) | $1,000.00 | $1,015.58 | 1.90% | $9.63 |

| Class I | | | | |

| Actual | $1,000.00 | $1,029.70 | 0.90% | $4.59 |

| Hypothetical (5% return before expenses) | $1,000.00 | $1,020.61 | 0.90% | $4.57 |

| RiverFront Global Allocation Fund | | | | |

| Class A | | | | |

| Actual | $1,000.00 | $1,027.60 | 1.15% | $5.86 |

| Hypothetical (5% return before expenses) | $1,000.00 | $1,019.36 | 1.15% | $5.84 |

| Class C | | | | |

| Actual | $1,000.00 | $1,022.90 | 1.90% | $9.66 |

| Hypothetical (5% return before expenses) | $1,000.00 | $1,015.58 | 1.90% | $9.63 |

| Class I | | | | |

| Actual | $1,000.00 | $1,028.00 | 0.90% | $4.59 |

| Hypothetical (5% return before expenses) | $1,000.00 | $1,020.61 | 0.90% | $4.57 |

| RiverFront Global Growth Fund | | | | |

| Class A | | | | |

| Actual | $1,000.00 | $1,035.20 | 1.15% | $5.88 |

| Hypothetical (5% return before expenses) | $1,000.00 | $1,019.36 | 1.15% | $5.84 |

| Class C | | | | |

| Actual | $1,000.00 | $1,030.50 | 1.90% | $9.70 |

| Hypothetical (5% return before expenses) | $1,000.00 | $1,015.58 | 1.90% | $9.63 |

| Class I | | | | |

| Actual | $1,000.00 | $1,036.40 | 0.90% | $4.61 |

| Hypothetical (5% return before expenses) | $1,000.00 | $1,020.61 | 0.90% | $4.57 |

| Class L | | | | |

| Actual | $1,000.00 | $1,035.70 | 0.90% | $4.61 |

| Hypothetical (5% return before expenses) | $1,000.00 | $1,020.61 | 0.90% | $4.57 |

| Investor Class | | | | |

| Actual | $1,000.00 | $1,035.40 | 1.15% | $5.88 |

| Hypothetical (5% return before expenses) | $1,000.00 | $1,019.36 | 1.15% | $5.84 |

4 | October 31, 2016

Disclosure of Fund Expenses

October 31, 2016 (Unaudited)

| | Beginning Account Value May 1, 2016 | Ending Account Value October 31, 2016 | Expense Ratio(a) | Expenses Paid During Period May 1, 2016 - October 31, 2016(b) |

| RiverFront Moderate Growth & Income Fund | | | | |

| Class A | | | | |

| Actual | $1,000.00 | $1,022.40 | 1.15% | $5.85 |

| Hypothetical (5% return before expenses) | $1,000.00 | $1,019.36 | 1.15% | $5.84 |

| Class C | | | | |

| Actual | $1,000.00 | $1,018.00 | 1.90% | $9.64 |

| Hypothetical (5% return before expenses) | $1,000.00 | $1,015.58 | 1.90% | $9.63 |

| Class I | | | | |

| Actual | $1,000.00 | $1,023.00 | 0.90% | $4.58 |

| Hypothetical (5% return before expenses) | $1,000.00 | $1,020.61 | 0.90% | $4.57 |

| (a) | Annualized, based on the Fund's most recent fiscal half year expenses. |

| (b) | Expenses are equal to the Fund's annualized expense ratio multiplied by the average account value over the period, multiplied by the number of days in the most recent fiscal half year (184), divided by 366. |

| (c) | Includes expenses of the CoreCommodity Management Cayman Commodity Fund Ltd. (wholly-owned subsidiary), exclusive of the subsidiary's management fee. |

| (d) | Includes expenses of the Kotak Mauritius Portfolio (wholly-owned subsidiary). |

5 | October 31, 2016

ALPS | Alerian MLP Infrastructure Index Fund

| Management Commentary | October 31, 2016 (Unaudited) |

During the twelve-month period of November 1, 2015 to October 31, 2016 the Alerian MLP Infrastructure Index Fund’s (“Fund”) Class A shares delivered a net return of -0.63% at Net Asset Value. Class A delivered a net return of -6.06% at MOP, Class C was -1.94% with CDSC, and Class I was -0.48%. This compares to the Fund’s index, the Alerian MLP Infrastructure Index (“AMZI”), which fell -7.7% on a price-return and -0.1% on a total-return basis. The difference in performance between the AMZI and the Fund is primarily attributable to the Fund’s operating expenses and the impact of the Fund’s C Corporation tax election.

Top performers in the AMZI during the period include ONEOK Partners (OKS) and DCP Midstream Partners (DPM), both generating over 15% in price return. Laggards during the period include Energy Transfer Partners (ETP) and Shell Midstream Partners (SHLX), both falling over 20%.

Antero Midstream Partners (AM), Boardwalk Pipeline Partners (BWP), Phillips 66 Partners (PSXP), and Tallgrass Energy Partners (TEP) were added to the index during the period. Targa Resource Partners (NGLS) was removed during a special rebalancing due to its merger with Targa Resources Corp (TRGP).

For distributions reflecting the third calendar quarter of 2016, 14 of the 25 constituents in the AMZI increased their distribution, 10 MLPs maintained their distribution, and one MLP lowered its distribution.

After falling 40% from November 1, 2015, the index hit a near-term low on February 11, 2016. Since then, until period end on October 31, 2016, the index recovered over 54%. There has been a marked difference for MLPs over the past year. Capital markets have eased, MLPs have begun announcing organic growth projects again, and the sector even saw its first MLP IPO after a fourteen-month pause. In addition, a handful of major M&A activity has been either announced or completed. Certain areas such as the Permian in West Texas, Marcellus in the Northeast, and SCOOP/STACK plays in Oklahoma continue to see strong producer activity.

Despite the sector turning around since over a year ago, energy infrastructure MLPs and companies are facing new difficulties. While federal agencies have been supportive of the build-out of energy infrastructure, certain state regulatory agencies in the Northeast and East have made the process of securing pipeline customer commitments and/or right of way more difficult for MLPs. Not to mention, environmental protests have weighed on the ability for certain MLPs to proceed with newbuild pipeline construction. As a function of a more challenging build-out environment, not only are existing infrastructure assets now more valuable, the rights of way that come alongside pipelines also have greater value.

Relative to a year ago, the oil market is headed more in the direction towards balancing, but short term volatility is still to be expected. Uncertainty continues to be the enemy of premium valuations. As uncertainty lessens around the direction of commodity prices, MLP access to capital markets, infrastructure growth opportunities, and even the political climate, energy infrastructure MLPs may begin trading more on their fundamentals, and less on sentiment. With the long-term fundamentals for energy infrastructure MLPs to support the domestic supply of energy resources still intact, we continue to believe that MLPs represent a potentially compelling investment opportunity for investors seeking after-tax yield and access to real assets.

The views of the author and information discussed in this commentary are as of the date of publication, are subject to change, and may not reflect the writer’s current views. The views expressed are those of the author only, and represent an assessment of market conditions at a specific point in time, are opinions only and should not be relied upon as investment advice regarding a particular investment or markets in general. Such information does not constitute a recommendation to buy or sell specific securities or investment vehicles. It should not be assumed that any investment will be profitable or will equal the performance of the fund(s) or any securities or any sectors mentioned in this letter. The subject matter contained in this letter has been derived from several sources believed to be reliable and accurate at the time of compilation. Neither ALPS Advisors, Inc., Alerian, nor the Fund accept any liability for losses either direct or consequential caused by the use of this information.

Diversification cannot guarantee gain or prevent losses.

ALPS | Alerian MLP Infrastructure Index Fund (NYSE: ALERX) delivers exposure to the Alerian MLP Infrastructure Index (NYSE: AMZI), a capped, float-adjusted, capitalization-weighted composite of energy infrastructure Master Limited Partnerships that earn the majority of their cash flow from the transportation, storage, and processing of energy commodities.

ALPS | Alerian MLP Infrastructure Index Fund

| Performance Update | October 31, 2016 (Unaudited) |

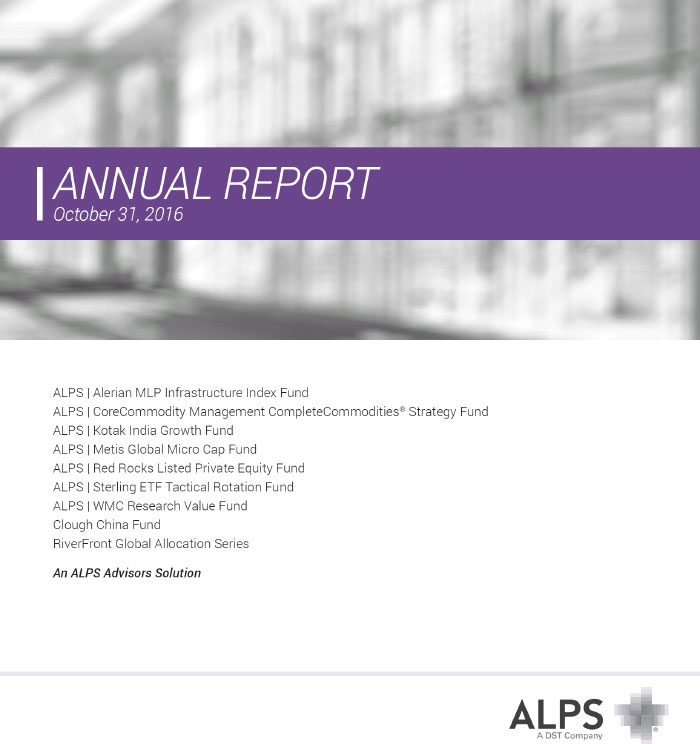

Performance of $10,000 Initial Investment (as of October 31, 2016)

Comparison of change in value of a $10,000 investment (includes maximum sales charges of 5.50%)

The chart above represents historical performance of a hypothetical investment of $10,000 in the Fund since inception. Past performance does not guarantee future results. This chart does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

Average Annual Total Returns (as of October 31, 2016)

| | 6 Month | 1 Year | 3 Year | Since Inception^ | Total Expense Ratio | What You Pay* |

| Class A (NAV) | 4.32% | -0.63% | -7.33% | -1.99% | 1.78% | 1.25% |

| Class A (MOP) | -1.46% | -6.06% | -9.06% | -3.42% |

| Class C (NAV) | 4.07% | -1.04% | -7.55% | -2.27% | 2.38% | 1.85% |

| Class C (CDSC) | 3.08% | -1.94% | -7.55% | -2.27% |

| Class I | 4.42% | -0.48% | -7.12% | -1.77% | 1.38% | 0.85% |

Alerian MLP Infrastructure Index1 | 4.96% | -0.11% | -6.12% | 1.42% | | |

Performance data quoted represents past performance. Past performance does not guarantee future results. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when sold or redeemed, may be worth more or less than the original cost. Current performance data may be higher or lower than actual data quoted. For the most current month-end performance data please call 1-866-759-5679.

Maximum Offering Price (MOP) for Class A shares includes the Fund’s maximum sales charge of 5.50%. Performance shown at NAV does not include these sales charges and would have been lower had it been taken into account. If you invest $1 million or more, either as a lump sum or through the Fund’s accumulation or letter of intent programs, you can purchase Class A shares without an initial sales charge (load). A Contingent Deferred Sales Charge (“CDSC”) of 1.00% may apply to Class C shares redeemed within the first 12 months after a purchase, and on Class A shares redeemed within the first 18 months after a purchase in excess of $1 million.

Performance less than 1 year is cumulative.

7 | October 31, 2016

ALPS | Alerian MLP Infrastructure Index Fund

| Performance Update | October 31, 2016 (Unaudited) |

| 1 | Alerian MLP Infrastructure Index is comprised of midstream energy Master Limited Partnerships. The index is not actively managed and does not reflect any deductions for fees, expenses or taxes. An investor may not invest directly in an index. |

| ^ | Fund inception date of December 31, 2012. |

| * | What You Pay reflects the Advisor’s and Sub-Advisor’s decision to contractually limit expenses through February 28, 2017. Please see the prospectus for additional information. |

Investments in securities of MLPs involve risks that differ from an investment in common stock. MLPs are controlled by their general partners, which generally have conflicts of interest and limited fiduciary duties to the MLP, which may permit the general partner to favor its own interests over the MLPs. The benefit you are expected to derive from the Fund’s investment in MLPs depends largely on the MLPs being treated as partnerships for federal income tax purposes. As a partnership, an MLP has no federal income tax liability at the entity level. Therefore, treatment of one or more MLPs as a corporation for federal income tax purposes could affect the Fund’s ability to meet its investment objective and would reduce the amount of cash available to pay or distribute to you. Legislative, judicial, or administrative changes and differing interpretations, possibly on a retroactive basis, could negatively impact the value of an investment in MLPs and therefore the value of your investment in the Fund.

The table does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

This Fund is not suitable for all investors and is subject to investment risks, including possible loss of the principal amount invested.

There is no guarantee that the Fund will continue to hold any one particular security or stay invested in any one particular company. The composition of the Fund’s top holdings is subject to change. Performance figures are historical and reflect the change in share price, reinvested distributions, changes in net asset value, sales charges and capital gains distributions, if any.

Not FDIC Insured – No Bank Guarantee – May Lose Value

Top Ten Holdings (as a % of Net Assets) †

| Enterprise Products Partners LP | 9.92% |

| Magellan Midstream Partners LP | 9.92% |

| Energy Transfer Partners LP | 9.09% |

| Plains All American Pipeline LP | 8.54% |

| Williams Partners LP | 6.60% |

| MPLX LP | 6.40% |

| Buckeye Partners LP | 6.23% |

| ONEOK Partners LP | 4.65% |

| Sunoco Logistics Partners LP | 4.37% |

| Enbridge Energy Partners LP | 3.93% |

| Top Ten Holdings | 69.65% |

| † | Holdings are subject to change, and may not reflect the current or future position of the Portfolio. Table presents approximate values only. |

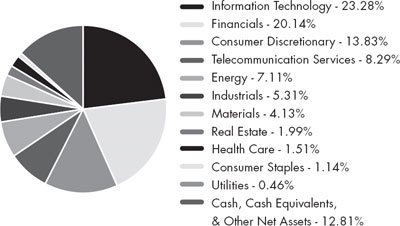

Industry Sector Allocation (as a % of Total Investments)

ALPS | Alerian MLP Infrastructure Index Fund

| Statement of Investments | October 31, 2016 |

| | | Shares | | | Value (Note 2) | |

| MASTER LIMITED PARTNERSHIPS (100.53%) | | | | |

| Gathering & Processing (26.38%) | | | | | | | |

| Oil & Gas (1.45%) | | | | | | | |

| Antero Midstream Partners LP | | | 20,194 | | | $ | 588,453 | |

| | | | | | | | | |

| Pipelines (24.93%) | | | | | | | | |

| DCP Midstream Partners LP | | | 27,247 | | | | 908,688 | |

| EnLink Midstream Partners LP | | | 45,929 | | | | 761,962 | |

| MPLX LP | | | 76,525 | | | | 2,603,381 | |

| ONEOK Partners LP | | | 47,614 | | | | 1,892,180 | |

| Western Gas Partners LP | | | 23,440 | | | | 1,292,716 | |

| Williams Partners LP | | | 75,009 | | | | 2,686,822 | |

| | | | | | | | 10,145,749 | |

| | | | | | | | | |

| TOTAL GATHERING & PROCESSING | | 10,734,202 | |

| | | | | | | | | |

Pipeline Transportation | Natural Gas (28.00%) | | | | | |

| Pipelines (continued) (28.00%) | | | | | | | | |

| Boardwalk Pipeline Partners LP | | | 37,482 | | | | 645,065 | |

| Energy Transfer Partners LP | | | 105,705 | | | | 3,697,561 | |

| Enterprise Products Partners LP | | | 159,909 | | | | 4,036,103 | |

| EQT Midstream Partners LP | | | 17,665 | | | | 1,322,578 | |

| Spectra Energy Partners LP | | | 21,670 | | | | 924,009 | |

| TC PipeLines LP | | | 14,698 | | | | 766,648 | |

| | | | | | | | 11,391,964 | |

| | | | | | | | | |

| TOTAL PIPELINE TRANSPORTATION | NATURAL GAS | | | | 11,391,964 | |

| | | | | | | | | |

| Pipeline Transportation | Petroleum (46.15%) | | | | | | | | |

| Pipelines (continued) (46.15%) | | | | | | | | |

| Buckeye Partners LP | | | 39,307 | | | | 2,536,874 | |

| Enbridge Energy Partners LP | | | 64,920 | | | | 1,600,278 | |

| Genesis Energy LP | | | 30,967 | | | | 1,081,677 | |

| Magellan Midstream Partners LP | | | 60,025 | | | | 4,035,481 | |

| NGL Energy Partners LP | | | 29,024 | | | | 516,627 | |

| NuStar Energy LP | | | 19,392 | | | | 915,109 | |

| Phillips 66 Partners LP | | | 12,922 | | | | 571,152 | |

| Plains All American Pipeline LP | | | 114,401 | | | | 3,473,214 | |

| Shell Midstream Partners LP | | | 26,578 | | | | 721,061 | |

| Sunoco Logistics Partners LP | | | 69,279 | | | | 1,776,314 | |

| Tallgrass Energy Partners LP | | | 12,717 | | | | 575,190 | |

| Tesoro Logistics LP | | | 20,498 | | | | 978,575 | |

| | | | | | | | 18,781,552 | |

| | | | | | | | | |

| TOTAL PIPELINE TRANSPORTATION | PETROLEUM | | | | 18,781,552 | |

| | | | | | | | | |

TOTAL MASTER LIMITED PARTNERSHIPS

(Cost $36,837,557) | | | | 40,907,718 | |

| | | Shares | | | Value (Note 2) | |

TOTAL INVESTMENTS (100.53%) (Cost $36,837,557) | $ | 40,907,718 | |

| | | | | | | | |

| Liabilities In Excess Of Other Assets (-0.53%) | | (214,951 | ) |

| | | | | | | | | |

| NET ASSETS (100.00%) | $ | 40,692,768 | |

For Fund compliance purposes, the Fund’s industry classifications refer to any one or more of the industry sub-classifications used by one or more widely recognized market indexes or ratings group indexes, and/or as defined by Fund management. This definition may not apply for purposes of this report, which may combine industry sub-classifications for reporting ease. Industries are shown as a percent of net assets.

See Notes to Financial Statements.

9 | October 31, 2016

ALPS | Alerian MLP Infrastructure Index Fund

| Statement of Assets and Liabilities | October 31, 2016 |

| ASSETS | | | |

| Investments, at value | | $ | 40,907,718 | |

| Receivable for investments sold | | | 323,231 | |

| Receivable for shares sold | | | 35,810 | |

| Dividends receivable | | | 313,838 | |

Deferred tax asset(a) | | | – | |

| Receivable due from advisor | | | 8,092 | |

| Income tax receivable | | | 6,904 | |

| Prepaid expenses and other assets | | | 3,719 | |

| Total Assets | | | 41,599,312 | |

| LIABILITIES | | | | |

| Franchise tax payable | | | 7,409 | |

| Payable for shares redeemed | | | 550,213 | |

| Payable due to custodian ‐ overdraft | | | 303,097 | |

| Administration and transfer agency fees payable | | | 4,282 | |

| Distribution and services fees payable | | | 16,548 | |

| Professional fees payable | | | 13,989 | |

| Accrued expenses and other liabilities | | | 11,006 | |

| Total Liabilities | | | 906,544 | |

| NET ASSETS | | $ | 40,692,768 | |

| NET ASSETS CONSIST OF | | | | |

| Paid‐in capital | | $ | 48,370,329 | |

| Accumulated net investment loss, net of deferred income taxes | | | (1,186,085 | ) |

| Accumulated net realized loss, net of deferred income taxes | | | (10,558,573 | ) |

| Net unrealized appreciation, net of deferred income taxes | | | 4,067,097 | |

| NET ASSETS | | $ | 40,692,768 | |

| INVESTMENTS, AT COST | | $ | 36,837,557 | |

| PRICING OF SHARES | | | | |

| Class A: | | | | |

| Net Asset Value, offering and redemption price per share | | $ | 6.90 | |

| Net Assets | | $ | 11,122,450 | |

| Shares of beneficial interest outstanding (unlimited number of shares, no par value common stock authorized) | | | 1,611,977 | |

| Maximum offering price per share ((NAV/0.9450), based on maximum sales charge of 5.50% of the offering price) | | $ | 7.30 | |

| Class C: | | | | |

Net Asset Value, offering and redemption price per share(b) | | $ | 6.81 | |

| Net Assets | | $ | 9,078,114 | |

| Shares of beneficial interest outstanding (unlimited number of shares, no par value common stock authorized) | | | 1,333,153 | |

| Class I: | | | | |

| Net Asset Value, offering and redemption price per share | | $ | 6.97 | |

| Net Assets | | $ | 20,492,204 | |

| Shares of beneficial interest outstanding (unlimited number of shares, no par value common stock authorized) | | | 2,939,761 | |

| (a) | Any net tax benefit was fully offset by a 100% valuation allowance recorded as of October 31, 2016. See Note 4 for additional information. |

| (b) | Redemption price per share may be reduced for any applicable contingent deferred sales charge. For a description of a possible sales charge, please see the Fund's Prospectus. |

See Notes to Financial Statements.

10 | October 31, 2016

ALPS | Alerian MLP Infrastructure Index Fund

| Statement of Operations | For the Year Ended October 31, 2016 |

| INVESTMENT INCOME | | | |

| Dividends | | $ | 720 | |

| Distributions from master limited partnerships | | | 2,640,231 | |

| Less return of capital distributions | | | (2,640,231 | ) |

| Total Investment Income | | | 720 | |

| | | | | |

| EXPENSES | | | | |

| Investment advisory fees | | | 237,589 | |

| Administrative fees | | | 35,831 | |

| Transfer agency fees | | | 940 | |

| Distribution and service fees | | | | |

| Class A | | | 33,296 | |

| Class C | | | 79,103 | |

| Professional fees | | | 96,419 | |

| Reports to shareholders and printing fees | | | 4,764 | |

| State registration fees | | | 44,780 | |

| SEC registration fees | | | 66 | |

| Insurance fees | | | 286 | |

| Franchise tax expenses | | | 5,409 | |

| Custody fees | | | 15,292 | |

| Trustees' fees and expenses | | | 898 | |

| Miscellaneous expenses | | | 20,032 | |

| Total Expenses | | | 574,705 | |

| Less fees waived/reimbursed by investment advisor (Note 8) | | | | |

| Class A | | | (46,940 | ) |

| Class C | | | (39,470 | ) |

| Class I | | | (82,786 | ) |

| Net Expenses | | | 405,509 | |

| Net Investment Loss, before deferred income taxes | | | (404,789 | ) |

| Income tax benefit | | | – | |

| Net Investment Loss, net of deferred income taxes | | | (404,789 | ) |

| | | | | |

| REALIZED AND UNREALIZED GAIN/(LOSS) | | | | |

| Net realized loss on investments, before deferred income taxes | | | (8,137,420 | ) |

| Income tax benefit | | | – | |

| Net Realized Loss on investments, net of deferred income taxes | | | (8,137,420 | ) |

| | | | | |

| Net change in unrealized appreciation on investment, before deferred income taxes | | | 8,857,590 | |

| Income tax benefit | | | – | |

| Net Change in Unrealized Appreciation on Investments, net of deferred income taxes | | | 8,857,590 | |

| NET REALIZED AND UNREALIZED GAIN ON INVESTMENTS, NET OF DEFERRED INCOME TAXES | | | 720,170 | |

| NET INCREASE IN NET ASSETS RESULTING FROM OPERATIONS | | $ | 315,381 | |

See Notes to Financial Statements.

11 | October 31, 2016

ALPS | Alerian MLP Infrastructure Index Fund

Statements of Changes in Net Assets

| | | For the Year Ended October 31, 2016 | | | For the Year Ended October 31, 2015 | |

| OPERATIONS | | | | | | |

| Net investment loss, net of deferred income taxes | | $ | (404,789 | ) | | $ | (489,210 | ) |

| Net realized loss on investments, net of deferred income taxes | | | (8,137,420 | ) | | | (2,052,229 | ) |

| Net change in unrealized appreciation/(depreciation) on investments, net of deferred income taxes | | | 8,857,590 | | | | (7,014,615 | ) |

| Net Increase/(Decrease) in Net Assets Resulting from Operations | | | 315,381 | | | | (9,556,054 | ) |

| | | | | | | | | |

| DISTRIBUTIONS | | | | | | | | |

| Distributions to shareholders from net investment income | | | | | | | | |

| Class A | | | (35,289 | ) | | | (4,150 | ) |

| Class C | | | (29,661 | ) | | | (2,627 | ) |

| Class I | | | (64,431 | ) | | | (1,614 | ) |

| Distributions to shareholders from tax return of capital | | | | | | | | |

| Class A | | | (821,410 | ) | | | (1,160,636 | ) |

| Class C | | | (690,411 | ) | | | (734,478 | ) |

| Class I | | | (1,499,725 | ) | | | (451,330 | ) |

| Net Decrease in Net Assets from Distributions | | | (3,140,927 | ) | | | (2,354,835 | ) |

| | | | | | | | | |

| BENEFICIAL INTEREST TRANSACTIONS (NOTE 6) | | | | | | | | |

| Shares sold | | | | | | | | |

| Class A | | | 9,184,684 | | | | 12,474,282 | |

| Class C | | | 4,730,039 | | | | 8,002,639 | |

| Class I | | | 19,959,806 | | | | 7,103,832 | |

| Distributions reinvested | | | | | | | | |

| Class A | | | 783,421 | | | | 1,105,212 | |

| Class C | | | 705,911 | | | | 721,890 | |

| Class I | | | 1,469,292 | | | | 448,126 | |

| Shares redeemed, net of redemption fees | | | | | | | | |

| Class A | | | (12,504,205 | ) | | | (4,057,509 | ) |

| Class C | | | (3,582,134 | ) | | | (3,615,264 | ) |

| Class I | | | (4,384,484 | ) | | | (7,165,800 | ) |

| Net Increase in Net Assets Derived from Beneficial Interest Transactions | | | 16,362,330 | | | | 15,017,408 | |

| | | | | | | | | |

| Net increase in net assets | | | 13,536,784 | | | | 3,106,519 | |

| | | | | | | | | |

| NET ASSETS | | | | | | | | |

| Beginning of year | | | 27,155,984 | | | | 24,049,465 | |

| End of year * | | $ | 40,692,768 | | | $ | 27,155,984 | |

| *Including accumulated net investment loss, net of deferred income taxes, of: | | $ | (1,186,085 | ) | | $ | (651,915 | ) |

See Notes to Financial Statements.

12 | October 31, 2016

ALPS | Alerian MLP Infrastructure Index Fund – Class A

Financial Highlights

Selected data for a share of beneficial interest outstanding throughout the periods indicated:

| | | For the Year Ended October 31, 2016 | | | For the Year Ended October 31, 2015 | | | For the Fiscal Period Ended October 31, 2014 (a) | | | For the Year Ended April 30, 2014 | | | For the Period January 2, 2013 (Commencement) to April 30, 2013 | |

| Net asset value, beginning of period | | $ | 7.60 | | | $ | 11.32 | | | $ | 11.23 | | | $ | 11.10 | | | $ | 10.00 | |

| | | | | | | | | | | | | | | | | | | | | |

| INCOME/(LOSS) FROM INVESTMENT OPERATIONS: |

Net investment loss(b) | | | (0.08 | ) | | | (0.15 | ) | | | (0.05 | ) | | | (0.09 | ) | | | (0.03 | ) |

| Net realized and unrealized gain/(loss) | | | (0.02 | ) | | | (2.83 | ) | | | 0.67 | | | | 0.90 | | | | 1.29 | |

| Total from investment operations | | | (0.10 | ) | | | (2.98 | ) | | | 0.62 | | | | 0.81 | | | | 1.26 | |

| | | | | | | | | | | | | | | | | | | | | |

| DISTRIBUTIONS: | | | | | | | | | | | | | | | | | | | | |

| From net investment income | | | (0.02 | ) | | | (0.00 | )(c) | | | (0.03 | ) | | | (0.36 | ) | | | – | |

| From tax return of capital | | | (0.58 | ) | | | (0.74 | ) | | | (0.50 | ) | | | (0.32 | ) | | | (0.16 | ) |

| Total distributions | | | (0.60 | ) | | | (0.74 | ) | | | (0.53 | ) | | | (0.68 | ) | | | (0.16 | ) |

| | | | | | | | | | | | | | | | | | | | | |

| REDEMPTION FEES ADDED TO PAID‐IN CAPITAL (NOTE 6) | | | 0.00 | (c) | | | – | | | | – | | | | – | | | | – | |

| Net increase/(decrease) in net asset value | | | (0.70 | ) | | | (3.72 | ) | | | 0.09 | | | | 0.13 | | | | 1.10 | |

| Net asset value, end of year | | $ | 6.90 | | | $ | 7.60 | | | $ | 11.32 | | | $ | 11.23 | | | $ | 11.10 | |

TOTAL RETURN(d) | | | (0.63 | )% | | | (27.23 | )% | | | 5.61 | % | | | 7.59 | % | | | 12.68 | % |

| | | | | | | | | | | | | | | | | | | | | |

| RATIOS/SUPPLEMENTAL DATA: | | | | | | | | | | | | | | | | | | | | |

| Net assets, end of year (000s) | | $ | 11,122 | | | $ | 14,393 | | | $ | 10,619 | | | $ | 8,223 | | | $ | 928 | |

| | | | | | | | | | | | | | | | | | | | | |

| Ratio of expenses to average net assets before waivers, franchise tax expense and income tax expense/benefit | | | 1.71 | % | | | 1.77 | % | | | 2.20 | %(e) | | | 3.09 | % | | | 5.51 | %(e)(f) |

| Ratio of expense waivers to average net assets | | | (0.50 | %) | | | (0.53 | %) | | | (0.97 | %)(e) | | | (1.84 | %) | | | (4.26 | %)(e)(f) |

| Ratio of expenses to average net assets net of waivers before franchise tax expense and income tax expense/benefit | | | 1.21 | %(g) | | | 1.24 | %(g) | | | 1.23 | %(e)(g) | | | 1.25 | % | | | 1.25 | %(e)(f) |

Ratio of franchise tax expense and income tax expense/(benefit) to average net assets(h) | | | (0.02 | %) | | | (4.03 | %) | | | 4.49 | %(e) | | | 5.38 | % | | | 20.55 | %(e) |

| Ratio of total expenses to average net assets | | | 1.19 | % | | | (2.79 | %) | | | 5.72 | %(e) | | | 6.63 | % | | | 21.80 | %(e) |

| | | | | | | | | | | | | | | | | | | | | |

| Ratio of investment loss to average net assets before waivers, franchise tax expense and income tax expense/benefit | | | (1.71 | %) | | | (1.77 | %) | | | (2.20 | %)(e) | | | (3.09 | %) | | | (5.51 | %)(e)(f) |

| Ratio of expense waivers to average net assets | | | (0.50 | %) | | | (0.53 | %) | | | (0.97 | %)(e) | | | (1.84 | %) | | | (4.26 | %)(e)(f) |

| Ratio of investment loss to average net assets net of waivers before franchise tax expense and income tax expense/benefit | | | (1.21 | %)(g) | | | (1.24 | %)(g) | | | (1.23 | %)(e)(g) | | | (1.25 | %) | | | (1.25 | %)(e)(f) |

Ratio of franchise tax expense and income tax (expense)/benefit to average net assets(i) | | | (0.02 | %) | | | (0.34 | %) | | | 0.43 | %(e) | | | 0.43 | % | | | 0.40 | %(e) |

| Ratio of net investment loss to average net assets | | | (1.23 | %) | | | (1.58 | %) | | | (0.80 | %)(e) | | | (0.82 | %) | | | (0.85 | %)(e) |

| | | | | | | | | | | | | | | | | | | | | |

Portfolio turnover rate(j) | | | 63 | % | | | 52 | % | | | 7 | % | | | 63 | % | | | 3 | % |

See Notes to Financial Statements.

13 | October 31, 2016

ALPS | Alerian MLP Infrastructure Index Fund – Class A

Financial Highlights

Selected data for a share of beneficial interest outstanding throughout the periods indicated:

| (a) | Effective May 1, 2014, the Board approved changing the fiscal year-end of the Funds from April 30 to October 31. |

| (b) | Calculated using the average shares method. |

| (c) | Less than $0.005 per share. |

| (d) | Total returns are for the period indicated and have not been annualized. Total returns would have been lower had certain expenses not been waived during the period. Returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Returns shown exclude any applicable sales charges. |

| (f) | Expense ratios before reductions for startup periods may not be representative of longer term operating periods. |

| (g) | According to the Fund's shareholder services plan with respect to the Fund's Class A shares, any amount of such payment not paid during the Fund's fiscal year for such service activities shall be reimbursed to the Fund as soon as practical after the end of the fiscal year. Fees were reimbursed to the Fund during the period ended October 31, 2016, October 31, 2015 and October 31, 2014, for the prior fiscal year in the amount of 0.04%, 0.01% and 0.02% (annualized) of average net assets of Class A shares respectively. |

| (h) | Adjustment for income tax expense estimate for the ratio calculation is derived from the net investment loss, and realized and unrealized gains/losses. |

| (i) | Adjustment for income tax benefit for the ratio calculation is derived from net investment loss only. |

| (j) | Portfolio turnover rate for periods less than one full year have not been annualized. |

See Notes to Financial Statements.

14 | October 31, 2016

ALPS | Alerian MLP Infrastructure Index Fund – Class C

Financial Highlights

Selected data for a share of beneficial interest outstanding throughout the periods indicated:

| | | For the Year Ended October 31, 2016 | | | For the Year Ended October 31, 2015 | | | For the Fiscal Period Ended October 31, 2014(a) | | | For the Year Ended April 30, 2014 | | | For the Period January 2, 2013 (Commencement) to April 30, 2013 | |

| Net asset value, beginning of period | | $ | 7.54 | | | $ | 11.23 | | | $ | 11.17 | | | $ | 11.09 | | | $ | 10.00 | |

| | | | | | | | | | | | | | | | | | | | | |

| INCOME/(LOSS) FROM INVESTMENT OPERATIONS: |

Net investment loss(b) | | | (0.12 | ) | | | (0.22 | ) | | | (0.07 | ) | | | (0.13 | ) | | | (0.05 | ) |

| Net realized and unrealized gain/(loss) | | | (0.01 | ) | | | (2.73 | ) | | | 0.66 | | | | 0.89 | | | | 1.30 | |

| Total from investment operations | | | (0.13 | ) | | | (2.95 | ) | | | 0.59 | | | | 0.76 | | | | 1.25 | |

| | | | | | | | | | | | | | | | | | | | | |

| DISTRIBUTIONS: | | | | | | | | | | | | | | | | | | | | |

| From net investment income | | | (0.02 | ) | | | (0.00 | )(c) | | | (0.08 | ) | | | (0.35 | ) | | | – | |

| From tax return of capital | | | (0.58 | ) | | | (0.74 | ) | | | (0.45 | ) | | | (0.33 | ) | | | (0.16 | ) |

| Total distributions | | | (0.60 | ) | | | (0.74 | ) | | | (0.53 | ) | | | (0.68 | ) | | | (0.16 | ) |

| | | | | | | | | | | | | | | | | | | | | |

| Net increase/(decrease) in net asset value | | | (0.73 | ) | | | (3.69 | ) | | | 0.06 | | | | 0.08 | | | | 1.09 | |

| Net asset value, end of year | | $ | 6.81 | | | $ | 7.54 | | | $ | 11.23 | | | $ | 11.17 | | | $ | 11.09 | |

TOTAL RETURN(d) | | | (1.04 | )% | | | (27.18 | )% | | | 5.37 | % | | | 7.13 | % | | | 12.58 | % |

| | | | | | | | | | | | | | | | | | | | | |

| RATIOS/SUPPLEMENTAL DATA: | | | | | | | | | | | | | | | | | | | | |

| Net assets, end of year (000s) | | $ | 9,078 | | | $ | 8,291 | | | $ | 6,773 | | | $ | 3,429 | | | $ | 563 | |

| | | | | | | | | | | | | | | | | | | | | |

| Ratio of expenses to average net assets before waivers, franchise tax expense and income tax expense/benefit | | | 2.35 | % | | | 2.38 | % | | | 2.82 | %(e) | | | 3.71 | % | | | 7.01 | %(e)(f) |

| Ratio of expense waivers to average net assets | | | (0.50 | %) | | | (0.53 | %) | | | (0.97 | %)(e) | | | (1.86 | %) | | | (5.16 | %)(e)(f) |

| Ratio of expenses to average net assets net of waivers before franchise tax expense and income tax expense/benefit | | | 1.85 | % | | | 1.85 | % | | | 1.85 | %(e) | | | 1.85 | % | | | 1.85 | %(e)(f) |

Ratio of franchise tax expense and income tax expense/(benefit) to average net assets(g) | | | (0.02 | %) | | | (4.09 | %) | | | 4.27 | %(e) | | | 5.16 | % | | | 20.55 | %(e) |

| Ratio of total expenses to average net assets | | | 1.83 | % | | | (2.24 | %) | | | 6.12 | %(e) | | | 7.01 | % | | | 22.40 | %(e) |

| | | | | | | | | | | | | | | | | | | | | |

| Ratio of investment loss to average net assets before waivers, franchise tax expense and income tax expense/benefit | | | (2.35 | %) | | | (2.38 | %) | | | (2.82 | %)(e) | | | (3.71 | %) | | | (7.01 | %)(e)(f) |

| Ratio of expense waivers to average net assets | | | (0.50 | %) | | | (0.53 | %) | | | (0.97 | %)(e) | | | (1.86 | %) | | | (5.16 | %)(e)(f) |

| Ratio of investment loss to average net assets net of waivers before franchise tax expense and income tax expense/benefit | | | (1.85 | %) | | | (1.85 | %) | | | (1.85 | %)(e) | | | (1.85 | %) | | | (1.85 | %)(e)(f) |

Ratio of franchise tax expense and income tax (expense)/benefit to average net assets(h) | | | (0.02 | %) | | | (0.40 | %) | | | 0.65 | %(e) | | | 0.65 | % | | | 0.40 | %(e) |

| Ratio of net investment loss to average net assets | | | (1.87 | %) | | | (2.25 | %) | | | (1.20 | %)(e) | | | (1.20 | %) | | | (1.45 | %)(e) |

| | | | | | | | | | | | | | | | | | | | | |

Portfolio turnover rate(i) | | | 63 | % | | | 52 | % | | | 7 | % | | | 63 | % | | | 3 | % |

See Notes to Financial Statements.

15 | October 31, 2016

ALPS | Alerian MLP Infrastructure Index Fund – Class C

Financial Highlights

Selected data for a share of beneficial interest outstanding throughout the periods indicated:

(a) | Effective May 1, 2014, the Board approved changing the fiscal year-end of the Funds from April 30 to October 31. |

(b) | Calculated using the average shares method. |

(c) | Less than $0.005 per share. |

(d) | Total returns are for the period indicated and have not been annualized. Total returns would have been lower had certain expenses not been waived during the period. Returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Returns shown exclude any applicable sales charges. |

(f) | Expense ratios before reductions for startup periods may not be representative of longer term operating periods. |

(g) | Adjustment for income tax expense estimate for the ratio calculation is derived from the net investment loss, and realized and unrealized gains/losses. |

(h) | Adjustment for income tax benefit for the ratio calculation is derived from net investment loss only. |

(i) | Portfolio turnover rate for periods less than one full year have not been annualized. |

See Notes to Financial Statements.

16 | October 31, 2016

ALPS | Alerian MLP Infrastructure Index Fund – Class I

Financial Highlights

Selected data for a share of beneficial interest outstanding throughout the periods indicated:

| | | For the Year Ended October 31, 2016 | | | For the Year Ended October 31, 2015 | | | For the Fiscal Period Ended October 31, 2014(a) | | | For the Year Ended April 30, 2014 | | | For the Period January 2, 2013 (Commencement) to April 30, 2013 | |

| Net asset value, beginning of period | | $ | 7.66 | | | $ | 11.36 | | | $ | 11.25 | | | $ | 11.11 | | | $ | 10.00 | |

| | | | | | | | | | | | | | | | | | | | | |

| INCOME/(LOSS) FROM INVESTMENT OPERATIONS: |

Net investment loss(b) | | | (0.06 | ) | | | (0.11 | ) | | | (0.03 | ) | | | (0.06 | ) | | | (0.02 | ) |

| Net realized and unrealized gain/(loss) | | | (0.03 | ) | | | (2.85 | ) | | | 0.67 | | | | 0.88 | | | | 1.29 | |

| Total from investment operations | | | (0.09 | ) | | | (2.96 | ) | | | 0.64 | | | | 0.82 | | | | 1.27 | |

| | | | | | | | | | | | | | | | | | | | | |

| DISTRIBUTIONS: | | | | | | | | | | | | | | | | | | | | |

| From net investment income | | | (0.02 | ) | | | (0.00 | )(c) | | | (0.04 | ) | | | (0.27 | ) | | | – | |

| From tax return of capital | | | (0.58 | ) | | | (0.74 | ) | | | (0.49 | ) | | | (0.41 | ) | | | (0.16 | ) |

| Total distributions | | | (0.60 | ) | | | (0.74 | ) | | | (0.53 | ) | | | (0.68 | ) | | | (0.16 | ) |

| | | | | | | | | | | | | | | | | | | | | |

| Net increase/(decrease) in net asset value | | | (0.69 | ) | | | (3.70 | ) | | | 0.11 | | | | 0.14 | | | | 1.11 | |

| Net asset value, end of year | | $ | 6.97 | | | $ | 7.66 | | | $ | 11.36 | | | $ | 11.25 | | | $ | 11.11 | |

TOTAL RETURN(d) | | | (0.48 | )% | | | (26.95 | )% | | | 5.78 | % | | | 7.68 | % | | | 12.78 | % |

| | | | | | | | | | | | | | | | | | | | | |

| RATIOS/SUPPLEMENTAL DATA: | | | | | | | | | | | | | | | | | | | | |

| Net assets, end of year (000s) | | $ | 20,492 | | | $ | 4,472 | | | $ | 6,658 | | | $ | 1,507 | | | $ | 2,256 | |

| | | | | | | | | | | | | | | | | | | | | |

| Ratio of expenses to average net assets before waivers, franchise tax expense and income tax expense/benefit | | | 1.35 | % | | | 1.38 | % | | | 1.81 | %(e) | | | 3.03 | % | | | 6.01 | %(e)(f) |

| Ratio of expense waivers to average net assets | | | (0.50 | %) | | | (0.53 | %) | | | (0.96 | %)(e) | | | (2.18 | %) | | | (5.16 | %)(e)(f) |

| Ratio of expenses to average net assets net of waivers before franchise tax expense and income tax expense/benefit | | | 0.85 | % | | | 0.85 | % | | | 0.85 | %(e) | | | 0.85 | % | | | 0.85 | %(e)(f) |

Ratio of franchise tax expense and income tax expense/(benefit) to average net assets(g) | | | (0.02 | %) | | | (3.92 | %) | | | 4.63 | %(e) | | | 5.53 | % | | | 20.55 | %(e) |

| Ratio of total expenses to average net assets | | | 0.83 | % | | | (3.07 | %) | | | 5.48 | %(e) | | | 6.38 | % | | | 21.40 | %(e) |

| | | | | | | | | | | | | | | | | | | | | |

| Ratio of investment loss to average net assets before waivers, franchise tax expense and income tax expense/benefit | | | (1.35 | %) | | | (1.38 | %) | | | (1.81 | %)(e) | | | (3.03 | %) | | | (6.01 | %)(e)(f) |

| Ratio of expense waivers to average net assets | | | (0.50 | %) | | | (0.53 | %) | | | (0.96 | %)(e) | | | (2.18 | %) | | | (5.16 | %)(e)(f) |

| Ratio of investment loss to average net assets net of waivers before franchise tax expense and income tax expense/benefit | | | (0.85 | %) | | | (0.85 | %) | | | (0.85 | %)(e) | | | (0.85 | %) | | | (0.85 | %)(e)(f) |

Ratio of franchise tax expense and income tax (expense)/benefit to average net assets(h) | | | (0.02 | %) | | | (0.23 | %) | | | 0.28 | %(e) | | | 0.29 | % | | | 0.40 | %(e) |

| Ratio of net investment loss to average net assets | | | (0.87 | %) | | | (1.08 | %) | | | (0.57 | %)(e) | | | (0.56 | %) | | | (0.45 | %)(e) |

| | | | | | | | | | | | | | | | | | | | | |

Portfolio turnover rate(i) | | | 63 | % | | | 52 | % | | | 7 | % | | | 63 | % | | | 3 | % |

See Notes to Financial Statements.

17 | October 31, 2016

ALPS | Alerian MLP Infrastructure Index Fund – Class I

Financial Highlights

Selected data for a share of beneficial interest outstanding throughout the periods indicated:

(a) | Effective May 1, 2014, the Board approved changing the fiscal year-end of the Funds from April 30 to October 31. |

(b) | Calculated using the average shares method. |

(c) | Less than $0.005 per share. |

(d) | Total returns are for the period indicated and have not been annualized. Total returns would have been lower had certain expenses not been waived during the period. Returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. |

(f) | Expense ratios before reductions for startup periods may not be representative of longer term operating periods. |

(g) | Adjustment for income tax expense estimate for the ratio calculation is derived from the net investment loss, and realized and unrealized gains/losses. |

(h) | Adjustment for income tax benefit for the ratio calculation is derived from net investment loss only. |

(i) | Portfolio turnover rate for periods less than one full year have not been annualized. |

See Notes to Financial Statements.

18 | October 31, 2016

ALPS | CoreCommodity Management

CompleteCommodities® Strategy Fund

| Management Commentary | October 31, 2016 (Unaudited) |

The twelve month period ending on October 31, 2016 produced modestly negative returns for commodities, as measured by the diversified Bloomberg Commodities Total Return Index, down (2.62%). On the other hand, commodity equities appreciated during the period, up 13.62% as measured by the Standard and Poor’s Global Natural Resources Net Total Return Index. Commodity equities outperformed the broader Standard & Poor’s 500 Total Return Index for the period which posted 4.51% gains. The ALPS CoreCommodity Complete Commodities Strategy Fund (JCRIX) delivered a net positive return of 2.24% (JCRAX was -3.70% at MOP and JCRCX was up +0.29% with CDSC).

The Fund outperformed its benchmark, the Bloomberg Commodity Total Return Index, by 485 basis points, net of expenses, during this period (measured against the performance of the “I” shares). The Fund employs a strategy that combines an actively managed portfolio of commodity futures related exposure (collateralized by Treasury Inflation Protected Securities – TIPS), commodity equities, and physical commodity ETF’s. At the end of October, the Fund allocated approximately 72% of its assets toward commodity futures related investments and approximately 28% of its assets in commodity equities. The Fund was more than 99% invested at the end of the period.

Commodity futures prices struggled throughout the last twelve month period. As mentioned previously, the Bloomberg Commodity Total Return Index (BCOMTR) slipped by just (2.62%) for the year ending October 30, 2016. Energy prices were amongst the most notable detractors from performance in the time frame. The corrosive effects of contango were evident in both crude oil and natural gas. Contango is defined as the variable cost of rolling futures price exposure from active month to the next contract. Costs include storage, insurance, interest charges, transportation, etc. They contribute to the changeable amount of contango the futures are subjected to. For the trailing twelve months, energy prices declined by (18.22%), as measured by the Bloomberg Commodity Index Energy Sub-Index Total Return. We observed crude oil prices bottoming in the early part of Q1 2016 as West Texas Intermediate (WTI) approached $26/barrel. Rational producer response has taken portions of crude oil production offline and more than $1.1 trillion in capital expenditures have been deferred or cancelled. Natural gas has experienced similar evaluations. We feel that the energy sector is in the early stages of what may be a more sustained price recovery.

Livestock prices also declined for the year ending in October 2016. Cattle prices fell (27.09%) while hog prices dropped (19.08%). Benign weather and nearly ideal feeding situations led to a significant decline in herd losses and increased the animal weights. More supply weighed on prices.

Grain price performance was mixed for the 12 months ending in October. Soybean prices rose 14.23%. Weather inconsistencies in South America led to higher prices. On the other hand, calmer conditions prevailed for most of the primary growing regions for corn and wheat. Yields were high and harvests exceeded expectations. Corn prices declined (7.19%) for the year and wheat fell by (20.26%).

Precious metal prices produced gains for the year. Despite a modest increase in the price of the US Dollar which can sometimes impede precious metal prices from advancing, gold rose 11.54% while silver added 14.32%. Continued geo-political tension prevailed in many parts of the world. The so-called “Brexit” vote to separate the United Kingdom from the European Union surprised many observers and provided a boost to precious metals.

Industrial metals produced a mixed result for the year. Copper prices slid by (4.85%). Lackluster global GDP growth translated into decelerating copper demand. Meanwhile, producer response in aluminum and nickel helped to support and raise prices for the 12 month period. Aluminum climbed 18.31% while nickel advanced by 4.05%. Marginal production and fabrication facilities were idled to stem losses suffered by protracted low prices.

The best performing sector within the Fund was in the “soft” commodity area. Orange juice prices led all commodities with a 59.74 percent year-over-year advance. Insect infestation and disease curtailed crops especially in Florida. Sugar prices jumped by 48.55%. Poor crops in Southeast Asia and Brazil pressured the supply side. Coffee prices benefitted from difficult conditions in Brazil and Vietnam. Coffee was up 35.72%. Cotton prices bounced from last year, up 8.75%. The only commodity in the “soft” category which did not move higher was cocoa. Ample supplies, mainly from the key growing regions of Africa, pressured cocoa prices lower, down (16.08%) for the year.

At the close of October 2016, the Fund maintained a slight overweight bias toward energy and precious metals while the agricultural sector was underweighted by similar amounts. We kept the weighting of our industrial metals at or very close to our neutral weighting within the portfolio. Roughly, we allocated 42% toward energy, 36% in agriculture, 13% in industrial metals, and 9% in precious metals.

The US Dollar strengthened modestly during the year ending in October, up 1.54% as measured by the US Dollar Index (DXY). Since most commodities are priced in Dollars, commodity prices tend to be inversely related to Dollar moves. Because of this tendency, the positive results for many commodities this year is particularly noteworthy. Our opinion is that commodity supply/demand fundamentals are becoming more important than contributing factors including the strength of the US Dollar or interest rates.

The Fund’s top equity holdings at the end of October 2016 included Yara International (YAR NO) (19.94%) YTD, Cal-Maine Foods (CALM) (14.55%) YTD, Sanderson Farms Inc (SAFM) 18.46% YTD, Monsanto (MON) 4.61% YTD, CIA Saneamento Basico De-ADR (SBS) 131.13% YTD, Marine Harvest NO (MHG NO) 31.55 % YTD, Hormel Foods Corp. (HRL) (1.55%) YTD, Inpex Corp (1605 JP) (15.12%) YTD, Sociedad Quimica Minera de Chile (SQM) 58.63% YTD, Syngenta (SYNN VX) +3.69%YTD

U.S. Treasury Inflation Protected Bonds or TIPS and nominal US Treasuries are held by the fund to invest excess cash and as collateral for commodity futures related investments held in our Cayman Island subsidiary. Nominal yields on the benchmark 10 year note were at 2.14% at the end of October 2015 and ended the twelve month period lower, 1.83%. Committee members of the FOMC, including Chair Yellen, have recently voiced their desire to begin to raise and to attempt to normalize interest rates, if certain data justifies the move. We believe we may be nearing the end of what has been a significant multi-year rally in US treasury prices. As a result, we continue to invest in TIPS with limited duration exposure. At the end of October, our weighted average maturity was approximately 0.9 years in our TIPS and nominal US Treasury portfolio.

19 | October 31, 2016

ALPS | CoreCommodity Management

CompleteCommodities® Strategy Fund

| Management Commentary | October 31, 2016 (Unaudited) |

We strongly believe that the long term fundamental drivers of commodity demand and ultimately higher prices are still in place. Population growth is likely to remain unabated regardless of the economic environment in the US and Europe. A billion more people are likely to be added to the world population over the next decade or so. The trend of wealth distribution is tipping toward the developing world as those economies grow at faster rates relative to the slow or negative growth occurring in the developed countries. The improving global quality of life is contributing to ever increasing demand for raw materials and food. Incremental gains in disposable income in the developing nations have led to competition for the commodities needed for more complex and costly lifestyles.

The recent significant decline in prices of many commodities has resulted in serious curtailment of capital expenditures of global sovereign and corporate producers. Profits for these producers have been dramatically reduced and in some cases prices do not support marginal or ongoing operations. As a result, future supplies may be negatively impacted. In a world with limited supplies of food, fuel, building materials, and other necessities of life, price may become the ultimate allocator of these commodities. Additionally, the aggressively accommodative central bank monetary policies recently announced coupled with measures already in place globally are likely to make commodities and other real assets more attractive over time as currencies, including the US Dollar, may decline in value.

Robert Hyman

Portfolio Manager

The Bloomberg Commodity Spot Index (BCOMSP) measures the price movements of commodities included in the Bloomberg CI and select subindexes. It does not account for the effects of rolling futures contracts or the costs associated with holding physical commodities.

The Standard & Poor’s Global Natural Resources Index includes 90 of the largest publicly-traded companies in natural resources and commodities businesses that meet specific investability requirements, offering investors diversified and investable equity exposure across 3 primary commodity-related sectors: agribusiness, energy, and metals & mining.

The Standard & Poor’s 500® Index is a composite index of 500 stocks, a widely recognized, unmanaged index of common stock prices which does not reflect any deduction for fees, expenses, or taxes.

An investor may not invest directly in an index.

The views of the author and information discussed in this commentary are as of the date of publication, are subject to change, and may not reflect the writer's current views. The views expressed are those of the author only, and represent an assessment of market conditions at a specific point in time, are opinions only and should not be relied upon as investment advice regarding a particular investment or markets in general. Such information does not constitute a recommendation to buy or sell specific securities or investment vehicles. It should not be assumed that any investment will be profitable or will equal the performance of the fund(s) or any securities or any sectors mentioned in this letter. The subject matter contained in this letter has been derived from several sources believed to be reliable and accurate at the time of compilation. Neither ALPS Advisors, Inc., CoreCommodity Management, LLC, nor the Fund accepts any liability for losses either direct or consequential caused by the use of this information.

Diversification cannot guarantee gain or prevent losses.

20 | October 31, 2016

ALPS | CoreCommodity Management

CompleteCommodities® Strategy Fund

| Performance Update | October 31, 2016 (Unaudited) |

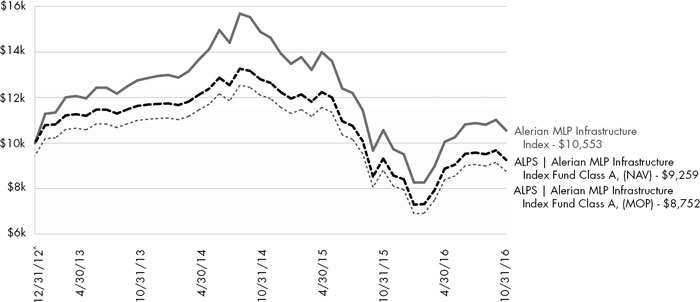

Performance of $10,000 Initial Investment (as of October 31, 2016)

Comparison of change in value of a $10,000 investment (includes maximum sales charges of 5.50%)

The chart above represents historical performance of a hypothetical investment of $10,000 in the Fund since inception. Past performance does not guarantee future results. This chart does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

Average Annual Total Returns (as of October 31, 2016)

| | 6 Month | 1 Year | 3 Year | 5 Year | Since Inception^ | Total Expense Ratio | What You Pay* |

| Class A (NAV) | 0.55% | 1.96% | -10.39% | -8.51% | -2.78% | 1.47% | 1.45% |

| Class A (MOP) | -4.95% | -3.70% | -12.06% | -9.55% | -3.64% |

| Class C (NAV) | 0.28% | 1.29% | -10.94% | -9.09% | -3.35% | 2.07% | 2.05% |

| Class C (CDSC) | -0.72% | 0.29% | -10.94% | -9.09% | -3.35% |

| Class I | 0.83% | 2.24% | -10.08% | -8.23% | -2.48% | 1.17% | 1.15% |

TR/CC CRB Total Return Index1 | 1.06% | -4.50% | -12.38% | -10.16% | -4.81% | | |

Bloomberg Commodity TR Index1 | -0.57% | -2.62% | -12.05% | -10.61% | -5.74% | | |

Performance data quoted represents past performance. Past performance does not guarantee future results. Investment return and principal value of an investment will fluctuate so that an investor's shares, when sold or redeemed, may be worth more or less than the original cost. Current performance data may be higher or lower than actual data quoted. For the most current month-end performance data, please call 1-866-759-5679.

Maximum Offering Price (MOP) for Class A shares includes the Fund’s maximum sales charge of 5.50%. Performance shown at NAV does not include these sales charges and would have been lower had it been taken into account. If you invest $1 million or more, either as a lump sum or through the Fund’s accumulation or letter of intent programs, you can purchase Class A shares without an initial sales charge (load). A Contingent Deferred Sales Charge (“CDSC”) of 1.00% may apply to Class C shares redeemed within the first 12 months after a purchase, and on Class A shares redeemed within the first 18 months after a purchase in excess of $1 million. The Fund imposes a 2.00% redemption fee on shares held for less than 30 days.

Performance less than 1 year is cumulative.

21 | October 31, 2016

ALPS | CoreCommodity Management

CompleteCommodities® Strategy Fund

| Performance Update | October 31, 2016 (Unaudited) |

1 | Thomson Reuters/CC CRB Total Return Index and the Bloomberg Commodity TR Index (formerly the Dow Jones-UBS Commodity Index) are unmanaged indices used as a measurement of change in commodity market conditions based on the performance of a basket of different commodities. Each index is composed of a different basket of commodities, a different weighting of the commodities in the basket, and a different re-balancing schedule. The indices are not actively managed and do not reflect any deduction for fees, expenses or taxes. An investor may not invest directly in an index. |

^ | Fund Inception date of June 29, 2010. |

| * | What You Pay reflects the Advisor’s decision to contractually limit expenses through February 28, 2017. Please see the prospectus for additional information. |

Investments in securities of MLPs involve risks that differ from an investment in common stock. MLPs are controlled by their general partners, which generally have conflicts of interest and limited fiduciary duties to the MLP, which may permit the general partner to favor its own interests over the MLPs. The benefit you are expected to derive from the Fund’s investment in MLPs depends largely on the MLPs being treated as partnerships for federal income tax purposes. As a partnership, an MLP has no federal income tax liability at the entity level. Therefore, treatment of one or more MLPs as a corporation for federal income tax purposes could affect the Fund’s ability to meet its investment objective and would reduce the amount of cash available to pay or distribute to you. Legislative, judicial, or administrative changes and differing interpretations, possibly on a retroactive basis, could negatively impact the value of an investment in MLPs and therefore the value of your investment in the Fund.

Investing in commodity-related securities involves risk and considerations not present when investing in more conventional securities. The Fund may be more susceptible to high volatility of commodity markets.

Derivatives generally are more sensitive to changes in economic or market conditions than other types of investments; this could result in losses that significantly exceed the Fund's original investment.

The table does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

This Fund is not suitable for all investors, and is subject to investment risks, including possible loss of the principal amount invested.

There is no guarantee that the Fund will continue to hold any one particular security or stay invested in any one particular company. The composition of the Fund's top holdings is subject to change. Performance figures are historical and reflect the change in share price, reinvested distributions, changes in net asset value, sales charges and capital gains distributions, if any.

Not FDIC Insured – No Bank Guarantee – May Lose Value

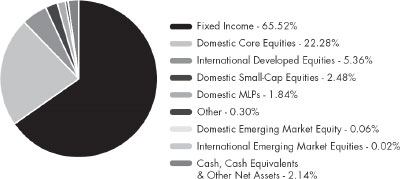

Asset Type Allocation (as a % of Net Assets)†

| Government Bonds | 62.95% |

| Common Stocks | 27.44% |

| Master Limited Partnerships | 0.22% |

| Warrants | 0.00% |

| Short Term Investments and Other Assets | 9.39% |

| Total | 100.00% |

† | Holdings are subject to change, and may not reflect the current or future position of the portfolio. Table presents approximate values only. |

22 | October 31, 2016

ALPS | CoreCommodity Management

CompleteCommodities® Strategy Fund

| Consolidated Statement of Investments | October 31, 2016 |

| | | Shares | | | Value (Note 2) | |

| COMMON STOCKS (27.44%) | | | | | | |

| Argentina (0.17%) | | | | | | |

Adecoagro SA(a) | | | 42,714 | | | $ | 469,854 | |

| YPF SA, Sponsored ADR | | | 21,316 | | | | 378,572 | |

| | | | | | | | 848,426 | |

| | | | | | | | | |

| Australia (1.25%) | | | | | | | | |

| Alumina, Ltd. | | | 306,469 | | | | 368,347 | |

| BHP Billiton, Ltd. | | | 3,582 | | | | 62,862 | |

| BlueScope Steel, Ltd. | | | 27,028 | | | | 160,370 | |

| Fortescue Metals Group, Ltd. | | | 71,255 | | | | 298,120 | |

| GrainCorp, Ltd., Class A | | | 65,827 | | | | 420,627 | |

| Iluka Resources, Ltd. | | | 60,429 | | | | 265,237 | |

| Incitec Pivot, Ltd. | | | 199,218 | | | | 447,058 | |

| Independence Group NL | | | 77,396 | | | | 250,219 | |

| Newcrest Mining, Ltd. | | | 2,493 | | | | 42,783 | |

| Northern Star Resources, Ltd. | | | 104,622 | | | | 331,077 | |

| Nufarm, Ltd. | | | 97,624 | | | | 657,966 | |

| Oil Search, Ltd. | | | 8,556 | | | | 43,347 | |

| OZ Minerals, Ltd. | | | 79,710 | | | | 406,257 | |

| Regis Resources, Ltd. | | | 42,843 | | | | 105,920 | |

| Rio Tinto, Ltd. | | | 15,101 | | | | 622,383 | |

| South32, Ltd. | | | 276,844 | | | | 541,230 | |

St Barbara, Ltd.(a) | | | 119,176 | | | | 238,428 | |

| Woodside Petroleum, Ltd. | | | 47,197 | | | | 1,018,561 | |

| | | | | | | | 6,280,792 | |

| | | | | | | | | |

| Austria (0.15%) | | | | | | | | |

| OMV AG | | | 15,986 | | | | 499,697 | |

| Voestalpine AG | | | 6,748 | | | | 238,748 | |

| | | | | | | | 738,445 | |

| | | | | | | | | |

| Bermuda (0.10%) | | | | | | | | |

Kosmos Energy, Ltd.(a) | | | 67,844 | | | | 353,468 | |

| Nabors Industries, Ltd. | | | 11,916 | | | | 141,800 | |

| | | | | | | | 495,268 | |

| | | | | | | | | |

| Brazil (0.78%) | | | | | | | | |

| BRF SA, ADR | | | 83,747 | | | | 1,400,250 | |

| Cia de Saneamento Basico do Estado de Sao Paulo, ADR | | | 210,386 | | | | 2,213,260 | |

| Vale SA, Sponsored ADR | | | 42,979 | | | | 297,415 | |

| | | | | | | | 3,910,925 | |

| | | | | | | | | |

| Canada (4.02%) | | | | | | | | |

Advantage Oil & Gas, Ltd.(a) | | | 35,400 | | | | 238,850 | |

Agnico‐Eagle Mines, Ltd. | | | 8,624 | | | | 438,099 | |

| Agrium, Inc. | | | 3,115 | | | | 286,019 | |

| Alamos Gold, Inc., Class A | | | 25,182 | | | | 197,679 | |

| ARC Resources, Ltd. | | | 40,787 | | | | 692,403 | |

| Barrick Gold Corp. | | | 5,870 | | | | 103,253 | |

Baytex Energy Corp.(a) | | | 74,800 | | | | 287,757 | |

Birchcliff Energy, Ltd.(a) | | | 25,600 | | | | 162,994 | |

| Cameco Corp. | | | 27,826 | | | | 214,260 | |

| Canadian Natural Resources, Ltd. | | | 14,848 | | | | 470,830 | |

Canadian Solar, Inc.(a) | | | 2,763 | | | | 39,898 | |

| | | Shares | | | Value (Note 2) | |

| Canada (continued) | | | | | | |

| Cenovus Energy, Inc. | | | 83,500 | | | $ | 1,204,595 | |

| Centerra Gold, Inc. | | | 106,000 | | | | 535,809 | |

| Crescent Point Energy Corp. | | | 75,078 | | | | 893,906 | |

| Dominion Diamond Corp. | | | 21,401 | | | | 182,123 | |

Eldorado Gold Corp.(a) | | | 20,618 | | | | 65,153 | |

| Encana Corp. | | | 8,286 | | | | 79,048 | |

| Enerplus Corp. | | | 54,700 | | | | 368,255 | |

| Ensign Energy Services, Inc. | | | 27,700 | | | | 167,071 | |

First Majestic Silver Corp.(a) | | | 8,644 | | | | 69,584 | |

| First Quantum Minerals, Ltd. | | | 43,300 | | | | 411,274 | |

Franco‐Nevada Corp. | | | 506 | | | | 33,123 | |

| Freehold Royalties, Ltd. | | | 22,900 | | | | 215,120 | |

| Goldcorp, Inc. | | | 23,499 | | | | 357,185 | |

Guyana Goldfields, Inc.(a) | | | 10,300 | | | | 60,588 | |

| HudBay Minerals, Inc. | | | 38,900 | | | | 163,860 | |

Husky Energy, Inc.(a) | | | 66,913 | | | | 719,865 | |

IAMGOLD Corp.(a) | | | 77,368 | | | | 310,246 | |

| Imperial Oil, Ltd. | | | 25,700 | | | | 833,482 | |

Kirkland Lake Gold, Inc.(a) | | | 9,200 | | | | 63,789 | |

Lundin Mining Corp.(a) | | | 50,600 | | | | 198,054 | |

| Mullen Group, Ltd. | | | 20,800 | | | | 288,282 | |

New Gold, Inc.(a) | | | 47,087 | | | | 186,465 | |

| OceanaGold Corp. | | | 160,500 | | | | 490,606 | |

| Osisko Gold Royalties, Ltd. | | | 29,369 | | | | 309,170 | |

Parex Resources, Inc.(a) | | | 43,000 | | | | 494,662 | |

| Pason Systems, Inc. | | | 13,400 | | | | 152,352 | |

| Peyto Exploration & Development Corp. | | | 34,600 | | | | 888,926 | |

| Potash Corp. of Saskatchewan, Inc. | | | 5,216 | | | | 84,916 | |

| PrairieSky Royalty, Ltd. | | | 18,136 | | | | 394,416 | |

| Precision Drilling Corp. | | | 89,606 | | | | 398,747 | |

Pretium Resources, Inc.(a) | | | 28,723 | | | | 281,198 | |

Raging River Exploration, Inc.(a) | | | 83,800 | | | | 671,625 | |

| Secure Energy Services, Inc. | | | 42,200 | | | | 258,618 | |

SEMAFO, Inc.(a) | | | 124,800 | | | | 489,412 | |

Seven Generations Energy, Ltd., Class A(a) | 20,800 | | | | 443,510 | |

| ShawCor, Ltd. | | | 12,700 | | | | 317,666 | |

Silver Standard Resources, Inc.(a) | | | 7,693 | | | | 84,315 | |

| Silver Wheaton Corp. | | | 7,341 | | | | 176,992 | |

| Suncor Energy, Inc. | | | 22,430 | | | | 673,084 | |

| Tahoe Resources, Inc. | | | 1,300 | | | | 15,585 | |

| TORC Oil & Gas, Ltd. | | | 40,900 | | | | 231,440 | |

Tourmaline Oil Corp.(a) | | | 23,600 | | | | 618,460 | |

Turquoise Hill Resources, Ltd.(a) | | | 71,705 | | | | 222,286 | |

| Vermilion Energy, Inc. | | | 30,800 | | | | 1,207,842 | |

| Whitecap Resources, Inc. | | | 74,400 | | | | 594,623 | |

| Yamana Gold, Inc. | | | 16,330 | | | | 58,135 | |

| | | | | | | | 20,097,505 | |

| | | | | | | | | |

| Chile (0.34%) | | | | | | | | |

| Sociedad Quimica y Minera de Chile SA, Sponsored ADR | | | 58,982 | | | | 1,725,813 | |

23 | October 31, 2016

ALPS | CoreCommodity Management

CompleteCommodities® Strategy Fund

| Consolidated Statement of Investments | October 31, 2016 |

| | | Shares | | | Value (Note 2) | |

| China (0.40%) | | | | | | |

| China Petroleum & Chemical Corp., Class H | | | 528,358 | | | $ | 384,914 | |

| CNOOC, Ltd., Sponsored ADR | | | 10,234 | | | | 1,284,163 | |

| PetroChina Co., Ltd., ADR | | | 4,087 | | | | 276,813 | |

Trina Solar, Ltd., Sponsored ADR(a) | | | 3,830 | | | | 39,755 | |

| | | | | | | | 1,985,645 | |

| | | | | | | | | |

| Colombia (0.13%) | | | | | | | | |

Ecopetrol SA, Sponsored ADR(a) | | | 76,906 | | | | 668,313 | |

| | | | | | | | | |

| Denmark (0.05%) | | | | | | | | |

| FLSmidth & Co. A/S | | | 6,011 | | | | 218,411 | |

| Vestas Wind Systems A/S | | | 500 | | | | 40,106 | |

| | | | | | | | 258,517 | |

| | | | | | | | | |

| Finland (0.14%) | | | | | | | | |

| Kemira OYJ | | | 14,463 | | | | 172,422 | |